UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-22418

ITRON, INC.

(Exact name of registrant as specified in its charter)

| | |

| Washington | | 91-1011792 |

| (State of Incorporation) | | (I.R.S. Employer Identification Number) |

2818 North Sullivan Road

Spokane, Washington 99216-1897

(509) 924-9900

(Address and telephone number of registrant’s principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of October 31, 2005, there were outstanding 24,782,504 shares of the registrant’s common stock, no par value, which is the only class of common stock of the registrant.

Table of Contents

PART I: FINANCIAL INFORMATION

Item 1: Financial Statements (Unaudited)

ITRON, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30,

| | | Nine Months Ended

September 30,

| |

| | | 2005

| | | 2004

| | | 2005

| | | 2004

| |

| | | (in thousands, except per share data) | |

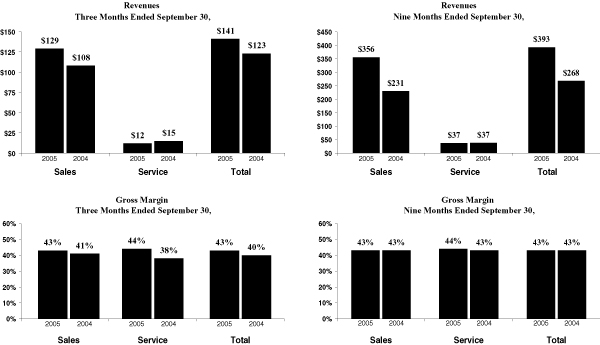

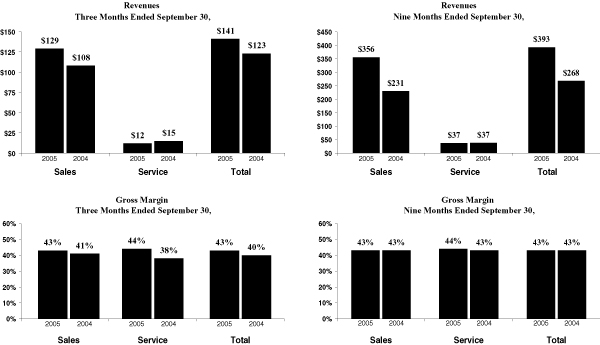

Revenues | | | | | | | | | | | | | | | | |

Sales | | $ | 128,683 | | | $ | 107,327 | | | $ | 355,696 | | | $ | 230,358 | |

Service | | | 12,462 | | | | 15,177 | | | | 37,042 | | | | 37,390 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total revenues | | | 141,145 | | | | 122,504 | | | | 392,738 | | | | 267,748 | |

| | | | |

Cost of revenues | | | | | | | | | | | | | | | | |

Sales | | | 73,179 | | | | 63,534 | | | | 203,188 | | | | 130,993 | |

Service | | | 6,936 | | | | 9,485 | | | | 20,783 | | | | 21,140 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total cost of revenues | | | 80,115 | | | | 73,019 | | | | 223,971 | | | | 152,133 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 61,030 | | | | 49,485 | | | | 168,767 | | | | 115,615 | |

Operating expenses | | | | | | | | | | | | | | | | |

Sales and marketing | | | 13,688 | | | | 12,045 | | | | 40,456 | | | | 31,971 | |

Product development | | | 11,807 | | | | 11,893 | | | | 35,135 | | | | 32,669 | |

General and administrative | | | 11,645 | | | | 9,201 | | | | 33,381 | | | | 24,479 | |

Amortization of intangible assets | | | 9,712 | | | | 7,217 | | | | 29,143 | | | | 11,271 | |

Restructurings | | | — | | | | 1,571 | | | | 390 | | | | 4,005 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total operating expenses | | | 46,852 | | | | 41,927 | | | | 138,505 | | | | 104,395 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income | | | 14,178 | | | | 7,558 | | | | 30,262 | | | | 11,220 | |

Other income (expense) | | | | | | | | | | | | | | | | |

Interest income | | | 69 | | | | 24 | | | | 167 | | | | 152 | |

Interest expense | | | (4,328 | ) | | | (5,147 | ) | | | (15,280 | ) | | | (8,162 | ) |

Other income (expense), net | | | (535 | ) | | | 261 | | | | 20 | | | | (474 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other income (expense) | | | (4,794 | ) | | | (4,862 | ) | | | (15,093 | ) | | | (8,484 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes | | | 9,384 | | | | 2,696 | | | | 15,169 | | | | 2,736 | |

Income tax (provision) benefit | | | (3,382 | ) | | | (1,026 | ) | | | 963 | | | | (986 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income | | $ | 6,002 | | | $ | 1,670 | | | $ | 16,132 | | | $ | 1,750 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Earnings per share | | | | | | | | | | | | | | | | |

Basic net income per share | | $ | 0.25 | | | $ | 0.08 | | | $ | 0.70 | | | $ | 0.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Diluted net income per share | | $ | 0.23 | | | $ | 0.08 | | | $ | 0.66 | | | $ | 0.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Weighted average number of shares outstanding | | | | | | | | | | | | | | | | |

Basic | | | 24,441 | | | | 20,978 | | | | 22,912 | | | | 20,827 | |

Diluted | | | 25,919 | | | | 22,050 | | | | 24,471 | | | | 22,005 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

ITRON, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | |

| | | September 30,

2005

| | | December 31,

2004

| |

| | | (in thousands) | |

| ASSETS | | | | | | | | |

Current assets | | | | | | | | |

Cash and cash equivalents | | $ | 11,896 | | | $ | 11,624 | |

Accounts receivable, net | | | 94,983 | | | | 90,097 | |

Inventories | | | 50,658 | | | | 45,459 | |

Deferred income taxes, net | | | 8,018 | | | | 22,733 | |

Other | | | 9,530 | | | | 5,477 | |

| | |

|

|

| |

|

|

|

Total current assets | | | 175,085 | | | | 175,390 | |

| | |

Property, plant and equipment, net | | | 55,411 | | | | 59,690 | |

Intangible assets, net | | | 132,996 | | | | 162,137 | |

Goodwill | | | 116,079 | | | | 117,471 | |

Deferred income taxes, net | | | 58,426 | | | | 27,252 | |

Other | | | 11,963 | | | | 15,211 | |

| | |

|

|

| |

|

|

|

Total assets | | $ | 549,960 | | | $ | 557,151 | |

| | |

|

|

| |

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | |

Current liabilities | | | | | | | | |

Accounts payable and accrued expenses | | $ | 38,000 | | | $ | 37,439 | |

Wages and benefits payable | | | 21,569 | | | | 13,947 | |

Current portion of debt | | | 2,139 | | | | 35,647 | |

Current portion of warranty | | | 5,323 | | | | 7,243 | |

Unearned revenue | | | 20,256 | | | | 22,991 | |

| | |

|

|

| |

|

|

|

Total current liabilities | | | 87,287 | | | | 117,267 | |

| | |

Long-term debt | | | 150,871 | | | | 239,361 | |

Project financing debt | | | 2,588 | | | | 3,227 | |

Warranty | | | 5,928 | | | | 6,331 | |

Other obligations | | | 5,706 | | | | 6,535 | |

| | |

|

|

| |

|

|

|

Total liabilities | | | 252,380 | | | | 372,721 | |

| | |

Commitments and contingencies (Notes 7 and 10) | | | | | | | | |

| | |

Shareholders’ equity | | | | | | | | |

Preferred stock | | | — | | | | — | |

Common stock | | | 308,841 | | | | 211,920 | |

Accumulated other comprehensive income, net | | | 1,051 | | | | 954 | |

Accumulated deficit | | | (12,312 | ) | | | (28,444 | ) |

| | |

|

|

| |

|

|

|

Total shareholders’ equity | | | 297,580 | | | | 184,430 | |

| | |

|

|

| |

|

|

|

Total liabilities and shareholders’ equity | | $ | 549,960 | | | $ | 557,151 | |

| | |

|

|

| |

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

ITRON, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | |

| | | Nine Months Ended

September 30,

| |

| | | 2005

| | | 2004

| |

| | | (in thousands) | |

Operating activities | | | | | | | | |

Net income | | $ | 16,132 | | | $ | 1,750 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 38,785 | | | | 19,260 | |

Employee stock plan income tax benefits | | | 14,399 | | | | 1,366 | |

Amortization of prepaid debt fees | | | 4,330 | | | | 1,165 | |

Realized currency translation gains | | | (391 | ) | | | (279 | ) |

Deferred income tax benefit | | | (16,313 | ) | | | (1,278 | ) |

Other, net | | | 2,178 | | | | 1,560 | |

Changes in operating assets and liabilities, net of acquisitions: | | | | | | | | |

Accounts receivable | | | (4,738 | ) | | | 25,711 | |

Inventories | | | (5,199 | ) | | | (9,013 | ) |

Accounts payable and accrued expenses | | | 360 | | | | (860 | ) |

Wages and benefits payable | | | 7,605 | | | | 437 | |

Unearned revenue | | | (3,085 | ) | | | (1,130 | ) |

Warranty | | | (194 | ) | | | (9,211 | ) |

Other long-term obligations | | | (436 | ) | | | (808 | ) |

Other, net | | | (3,879 | ) | | | (1,126 | ) |

| | |

|

|

| |

|

|

|

Cash provided by operating activities | | | 49,554 | | | | 27,544 | |

| | |

Investing activities | | | | | | | | |

Proceeds from the sale of property, plant and equipment | | | 2,627 | | | | 12 | |

Acquisition of property, plant and equipment | | | (10,264 | ) | | | (10,001 | ) |

Acquisitions, net of cash and cash equivalents | | | — | | | | (251,829 | ) |

Payment of contingent purchase price for acquisition | | | — | | | | (1,957 | ) |

Other, net | | | (847 | ) | | | 525 | |

| | |

|

|

| |

|

|

|

Cash used by investing activities | | | (8,484 | ) | | | (263,250 | ) |

| | |

Financing activities | | | | | | | | |

New borrowings | | | — | | | | 309,081 | |

Change in short-term borrowings, net | | | — | | | | (10,000 | ) |

Payments on debt | | | (122,704 | ) | | | (49,591 | ) |

Issuance of common stock | | | 82,269 | | | | 4,776 | |

Prepaid debt fees | | | (391 | ) | | | (13,470 | ) |

Other, net | | | 28 | | | | (6 | ) |

| | |

|

|

| |

|

|

|

Cash provided (used) by financing activities | | | (40,798 | ) | | | 240,790 | |

| | |

Increase in cash and cash equivalents | | | 272 | | | | 5,084 | |

Cash and cash equivalents at beginning of period | | | 11,624 | | | | 6,240 | |

| | |

|

|

| |

|

|

|

Cash and cash equivalents at end of period | | $ | 11,896 | | | $ | 11,324 | |

| | |

|

|

| |

|

|

|

Non-cash transactions: | | | | | | | | |

Taxes on contingent purchase price payable for acquisition | | $ | — | | | $ | 113 | |

Reclassification of prepaid debt fees | | | — | | | | 485 | |

| | |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Income taxes | | $ | 1,536 | | | $ | 431 | |

Interest | | | 8,986 | | | | 4,396 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

ITRON, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2005

(Unaudited)

In this Quarterly Report on Form 10-Q, the terms “we,” “us,” “our,” “Itron” and the “Company” refer to Itron, Inc.

Note 1: Summary of Significant Accounting Policies

Basis of Consolidation

The condensed consolidated financial statements presented in this Quarterly Report on Form 10-Q are unaudited and reflect entries necessary for the fair presentation of the Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2005 and 2004, Condensed Consolidated Balance Sheets as of September 30, 2005 and December 31, 2004 and Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, 2005 and 2004, of Itron and our wholly owned subsidiaries. All entries required for the fair presentation of the financial statements are of a normal recurring nature. Inter-company transactions and balances are eliminated upon consolidation.

We consolidate all entities in which we have a greater than 50% ownership interest. We also consolidate entities in which we have a 50% or less investment and over which we have control. We account for entities in which we have a 50% or less investment and exercise significant influence under the equity method of accounting. Entities in which we have less than a 20% investment and do not exercise significant influence are accounted for under the cost method. We consider for consolidation any variable interest entity of which we are the primary beneficiary. We are not the primary beneficiary of any variable interest entities.

Certain information and note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (GAAP) have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission (SEC) regarding interim results. These condensed consolidated financial statements should be read in conjunction with the 2004 audited financial statements and notes included in our Annual Report on Form 10-K, as filed with the SEC on March 11, 2005. The results of operations for the three and nine months ended September 30, 2005 are not necessarily indicative of the results expected for the full fiscal year or for any other fiscal period.

Cash and Cash Equivalents

We consider all highly liquid instruments with original maturities of three months or less to be cash equivalents. Cash equivalents are recorded at cost, which approximates fair value.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are recorded for invoices issued to customers in accordance with our contractual arrangements. Unbilled receivables are recorded when revenues are recognized upon product shipment or service delivery and invoicing occurs at a later date. The allowance for doubtful accounts is based on our historical experience of bad debts and is increased if the estimated uncollectible amount is greater. Accounts receivable are written-off against the allowance when we believe an account, or a portion thereof, is no longer collectible.

Inventories

Inventories are stated at the lower of cost or market using the first-in, first-out method. Cost includes raw materials and labor, plus applied direct and indirect costs. Service inventories consist primarily of sub-assemblies and components necessary to support post-sale maintenance. A large portion of our low-volume manufacturing and all of our repair services for our domestic handheld meter reading units are provided by an outside vendor in which we have a 30% equity interest. Consigned inventory at the outside vendor affiliate was $2.7 million at September 30, 2005 and $1.9 million at December 31, 2004.

4

Property, Plant and Equipment and Equipment used in Outsourcing

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets, generally thirty years for buildings and three to five years for equipment, computers and furniture, or over the term of the applicable lease, if shorter. Project management costs incurred in connection with installation and equipment used in outsourcing contracts are depreciated using the straight-line method over the shorter of the useful life or the term of the contract. Costs related to internally developed software and software purchased for internal uses are capitalized based on Statement of Position 98-1,Accounting for Costs of Computer Software Developed or Obtained for Internal Use. Repair and maintenance costs are expensed as incurred. We have no major planned maintenance activities.

We review long-lived assets for impairment whenever events or circumstances indicate the carrying amount of an asset may not be recoverable. There were no significant impairments in the three and nine months ended September 30, 2005 and 2004. If there were an indication of impairment, management would prepare an estimate of future cash flows (undiscounted and without interest charges) expected to result from the use of the asset and its eventual disposition. If these cash flows were less than the carrying amount of the assets, an impairment loss would be recognized to write down the assets to their estimated fair value.

Debt Issue Costs

Debt issue costs represent direct costs incurred in connection with the issuance of long-term debt and are recorded in other noncurrent assets. These costs are amortized to interest expense over the lives of the respective debt issues using the effective interest method. When debt is repaid early, the portion of unamortized debt issue costs related to the early principal repayment is written-off and included in interest expense in the Condensed Consolidated Statements of Operations.

Acquisitions

In accordance with Statement of Financial Accounting Standards (SFAS) No. 141,Business Combinations, we utilize the purchase method of accounting for business combinations. Business combinations accounted for under the purchase method include the results of operations of the acquired business from the date of acquisition. Net assets of the company acquired and intangible assets that arise from contractual/legal rights, or are capable of being separated, are recorded at their fair values at the date of acquisition. The balance of the purchase price after fair value allocations represents goodwill. Amounts allocated to in-process research and development (IPR&D) are expensed in the period of acquisition.

Goodwill and Intangible Assets

Goodwill is tested for impairment each year as of October 1 or more frequently if a significant event occurs under the guidance of SFAS No. 142,Goodwill and Other Intangible Assets. Intangible assets with a finite life are amortized based on estimated discounted cash flows over estimated useful lives and tested for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. We use estimates in determining the value of goodwill and intangible assets, including estimates of useful lives of intangible assets, discounted future cash flows and fair values of the related operations. We forecast discounted future cash flows at the reporting unit level based on estimated future revenues and operating costs, which take into consideration factors such as existing backlog, expected future orders, supplier contracts and general market conditions.

Warranty

We offer industry standard warranties on our hardware products and large application software products. Standard warranty accruals represent the estimated cost of projected warranty claims and are based on historical and projected product performance trends, business volume assumptions, supplier information and other business and economic projections. Thorough testing of new products in the development stage helps identify and correct potential warranty issues prior to manufacturing. Continuing quality control efforts during manufacturing limit our exposure to warranty claims. If our quality control efforts fail to detect a fault in one of our products, we could experience an increase in warranty claims. We track warranty claims to identify potential warranty trends. If an unusual trend is noted, an additional warranty accrual may be assessed and recorded when a failure event is probable and the cost can be reasonably estimated. Management continually evaluates the sufficiency of the warranty provisions and makes adjustments when necessary. The warranty allowances may fluctuate due to changes in estimates for material, labor and other costs we may incur to replace projected product failures, and we may incur additional warranty and related expenses in the future with respect to new or established product. The long-term warranty balance includes estimated warranty claims beyond one year.

5

A summary of the warranty accrual account activity is as follows:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30,

| | | Nine Months Ended

September 30,

| |

| | | 2005

| | | 2004

| | | 2005

| | | 2004

| |

| | | (in thousands) | |

Beginning balance | | $ | 11,264 | | | $ | 11,763 | | | $ | 13,574 | | | $ | 17,475 | |

SEM acquisition - opening balance adjustment | | | — | | | | 5,022 | | | | (2,128 | ) | | | 5,022 | |

New warranty accruals | | | 1,570 | | | | 267 | | | | 3,038 | | | | 1,261 | |

Adjustments to pre-existing items | | | 914 | | | | 1,839 | | | | 2,403 | | | | 2,336 | |

Claims activity | | | (2,497 | ) | | | (5,605 | ) | | | (5,636 | ) | | | (12,808 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Ending balance | | | 11,251 | | | | 13,286 | | | | 11,251 | | | | 13,286 | |

Less: current portion of warranty | | | 5,323 | | | | 6,950 | | | | 5,323 | | | | 6,950 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Long-term warranty | | $ | 5,928 | | | $ | 6,336 | | | $ | 5,928 | | | $ | 6,336 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total warranty expense, which consists of new warranty accruals for product warranties issued and adjustments to pre-existing items, totaled approximately $2.5 million and $2.1 million for the three months ended September 30, 2005 and 2004 and approximately $5.4 million and $3.6 million for the nine months ended September 30, 2005 and 2004, respectively. Warranty expense is classified within cost of sales.

In 2003, we established a warranty accrual for the product replacement of an electric automatic meter reading (AMR) module due to the failure of a specific component from a supplier. Product replacement work was substantially completed for this specific AMR module during 2004, resulting in a decline in claims activity for the 2005 periods. The increase in new warranty accruals in 2005, compared with 2004, is primarily due to our Electricity Metering business.

Health Benefits

We are self insured for a substantial portion of the cost of employee group health insurance. We purchase insurance from a third party, which provides individual and aggregate stop loss protection for these costs. Each reporting period, we record the costs of our health insurance plan including paid claims, the change in the estimate of incurred but not reported (IBNR) claims, taxes and administrative fees (collectively the Plan Costs). Plan Costs were approximately $1.7 million and $2.4 million in the three months ended September 30, 2005 and 2004, respectively. Plan Costs were approximately $5.3 million and $6.5 million in the nine months ended September 30, 2005 and 2004, respectively. The IBNR accrual, which is included in wages and benefits payable, was $1.1 million and $1.8 million at September 30, 2005 and December 31, 2004, respectively.

Contingencies

An estimated loss for a contingency is charged to income if it is probable that an asset has been impaired or a liability has been incurred and the amount of the loss can be reasonably estimated. We evaluate, among other factors, the degree of probability of an unfavorable outcome and the ability to make a reasonable estimate of the amount of loss. Changes in these factors could materially affect our financial position, results of operations and cash flows.

Income Taxes

We account for income taxes using the asset and liability method. Under this method, deferred income taxes are recorded for the temporary differences between the financial reporting basis and tax basis of our assets and liabilities. These deferred taxes are measured using the tax rates expected to be in effect when the temporary differences reverse. We establish a valuation allowance for a portion of the deferred tax asset when we believe it is more likely than not the deferred tax asset will not be utilized.

6

Deferred tax liabilities have been recorded on undistributed earnings of foreign subsidiaries. The American Jobs Creation Act of 2004 introduced a special one-time dividends-received deduction on the repatriation of certain foreign earnings to a U.S. taxpayer, provided certain criteria are met. We do not expect to repatriate foreign earnings under the provision of this Act.

Foreign Exchange

Our condensed consolidated financial statements are prepared in U.S. dollars. Assets and liabilities of foreign subsidiaries are denominated in foreign currencies and are translated to U.S. dollars at the exchange rates in effect on the balance sheet date. Revenues, costs of revenues and expenses for these subsidiaries are translated using a weighted average rate for the relevant reporting period. Translation adjustments resulting from this process are included, net of tax, in other comprehensive income (loss) in shareholders’ equity. Gains and losses that arise from exchange rate fluctuations for balances that are not denominated in the local currency are included in results of operations unless those balances arose from intercompany transactions deemed to be long-term in nature. Currency gains and losses for this exception are included, net of tax, in other comprehensive income (loss) in shareholders’ equity.

Revenue Recognition

Sales consist of hardware, software license fees, custom software development, field and project management service and engineering, consulting and installation service revenues. Service revenues include post-sale maintenance support and outsourcing services. Outsourcing services encompass installation, operation and maintenance of meter reading systems to provide meter information to a customer for billing and management purposes. Outsourcing services can be provided for systems we own as well as those owned by our customers.

Revenue arrangements with multiple deliverables are divided into separate units of accounting if the delivered item(s) have value to the customer on a standalone basis, there is objective and reliable evidence of fair value of the undelivered item(s) and delivery/performance of the undelivered item(s) is probable. The total arrangement consideration is allocated among the separate units of accounting based on their relative fair values and the applicable revenue recognition criteria considered for each unit of accounting. For our standard contract arrangements that combine deliverables such as hardware, meter reading system software, installation and maintenance services, each deliverable is generally considered a single unit of accounting. The amount allocable to a delivered item is limited to the amount that we are entitled to bill and collect and is not contingent upon the delivery/performance of additional items.

Revenues are recognized when (1) persuasive evidence of an arrangement exists, (2) delivery has occurred or services have been rendered, (3) the sales price is fixed or determinable and (4) collectibility is reasonably assured. Hardware revenues are generally recognized at the time of shipment, receipt by customer, or, if applicable, upon completion of customer acceptance provisions. For software arrangements with multiple elements, the timing of revenue recognition is dependent upon vendor-specific objective evidence (VSOE) of fair value for each of the elements. The availability of VSOE affects the timing of revenue recognition, which can vary from recognizing revenue at the time of delivery of each element, to the percentage of completion method or ratably over the performance period. If the implementation services are essential to the software arrangement, revenue is recognized using the percentage of completion methodology. Hardware and software post-sale maintenance support fees are recognized ratably over the life of the related service contract. Under outsourcing arrangements, revenue is recognized as services are provided.

Unearned revenue is recorded for products or services that have not been provided but have been invoiced under contractual agreements or paid for by a customer, or when products or services have been provided but the criteria for revenue recognition have not been met.

Product and Software Development Expenses

Product and software development expenses primarily include payroll and other employee benefit costs. For software to be marketed or sold, financial accounting standards require the capitalization of development costs after technological feasibility is established. Due to the relatively short period between technological feasibility and the completion of product development, the insignificance of related costs and the immaterial nature of these costs, we do not capitalize software development costs. All product and software development costs are expensed when incurred.

7

Earnings Per Share

Basic earnings per share (EPS) is calculated using net income divided by the weighted average common shares outstanding during the period. Diluted EPS is similar to basic EPS except that the weighted average common shares outstanding are increased to include the number of additional common shares that would have been outstanding if dilutive stock-based awards had been exercised. Diluted EPS assumes that common shares were issued upon the exercise of stock-based awards for which the market price exceeded the exercise price, less shares that could have been repurchased with the related proceeds (treasury stock method). In periods when we report a net loss, diluted net loss per share is the same as basic net loss per share. In such circumstances, we exclude all outstanding stock-based awards from the calculation of diluted net loss per common share because including such awards among the weighted average shares outstanding would be anti-dilutive.

Stock-Based Compensation

We have granted stock-based awards to purchase shares of our common stock to directors and employees at fair market value on the date of grant. SFAS No. 123,Accounting for Stock-Based Compensation, allows companies to either expense the estimated fair value of stock-based awards or to continue to follow the intrinsic value method set forth in Accounting Principles Board (APB) Opinion No. 25,Accounting for Stock Issued to Employees, but disclose the pro forma effects on net income (loss) had the fair value of the awards been expensed. We elected to continue to apply APB Opinion No. 25 in accounting for our stock-based compensation plans and disclose the pro forma effects of applying the fair value provisions of SFAS No. 123.

Had the compensation cost for our stock-based compensation plans been determined based on the fair value at the grant dates for awards under those plans consistent with the method prescribed in SFAS No. 123, our net income (loss) and net income (loss) per share would have been reduced to the pro forma amounts indicated below:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30,

| | | Nine Months Ended

September 30,

| |

| | | 2005

| | | 2004

| | | 2005

| | | 2004

| |

| | | (in thousands, except per share data) | |

Net income (loss) | | | | | | | | | | | | | | | | |

As reported | | $ | 6,002 | | | $ | 1,670 | | | $ | 16,132 | | | $ | 1,750 | |

Deduct: Stock-based compensation, net of tax | | | (1,009 | ) | | | (1,803 | ) | | | (4,078 | ) | | | (4,038 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma net income (loss) | | $ | 4,993 | | | $ | (133 | ) | | $ | 12,054 | | | $ | (2,288 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Basic net income (loss) per share | | | | | | | | | | | | | | | | |

As reported | | $ | 0.25 | | | $ | 0.08 | | | $ | 0.70 | | | $ | 0.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma | | $ | 0.20 | | | $ | (0.01 | ) | | $ | 0.53 | | | $ | (0.11 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Diluted net income (loss) per share | | | | | | | | | | | | | | | | |

As reported | | $ | 0.23 | | | $ | 0.08 | | | $ | 0.66 | | | $ | 0.08 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma | | $ | 0.19 | | | $ | (0.01 | ) | | $ | 0.50 | | | $ | (0.11 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

8

The weighted average fair value of awards granted was $50.29 and $22.64 during the three months ended September 30, 2005 and 2004, respectively. The weighted average fair value of awards granted was $36.59 and $21.00 during the nine months ended September 30, 2005 and 2004, respectively. The fair value of each option is estimated on the date of grant using the Black-Scholes option-pricing model using the following assumptions:

| | | | | | | | | | | | |

| | | Three Months Ended

September 30,

| | | Nine Months Ended

September 30,

| |

| | | 2005

| | | 2004

| | | 2005

| | | 2004

| |

Dividend yield | | — | | | — | | | — | | | — | |

Expected volatility | | 58.0 | % | | 71.1 | % | | 59.0 | % | | 72.4 | % |

Risk-free interest rate | | 4.1 | % | | 4.3 | % | | 3.7 | % | | 4.1 | % |

Expected life (years) | | 3.4 | | | 4.5 | | | 3.4 | | | 4.5 | |

Volatility measures the amount that a stock price has fluctuated or is expected to fluctuate during a period. The risk-free interest rate is the rate available as of the option date on zero-coupon U.S. government issues with a remaining term equal to the expected life of the option. The expected life is the weighted average expected life for the entire award based on the fixed period of time between the date the option is granted and the date the award is fully exercised. Factors to be considered in estimating the expected life are the vesting period of the award and the average period of time similar awards have remained outstanding in the past. The decreases in the expected life and volatility assumptions are the result of increased option activity in 2005.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Because of various factors affecting future costs and operations, actual results could differ from estimates.

Reclassifications

Certain amounts in 2004 have been reclassified to conform to the 2005 presentation.

New Accounting Pronouncements

In November 2004, the Financial Accounting Standards Board (FASB) issued Statement No. 151,Inventory Costs—an amendment of ARB No. 43, Chapter 4, which clarifies the accounting for abnormal amounts of idle facility expense, freight, handling costs and wasted material (spoilage). This Statement requires that those items be recognized as current-period charges regardless of whether they meet the criterion of “so abnormal.” In addition, this Statement requires that an allocation of fixed production overheads to the costs of conversion be based on the normal capacity of the production facilities. The provisions of this Statement are effective for inventory costs incurred on or after January 1, 2006. While we believe this Statement is not likely to have a material effect on our financial statements, the impact of adopting the new rule is dependent on events in future periods, and as such, an estimate of the impact cannot be determined.

On December 16, 2004, the FASB issued SFAS No. 123 (revised 2004),Share-Based Payment (SFAS 123R), which requires companies to expense the fair value of equity awards over the required service period. We have not yet quantified the effects of the adoption of SFAS 123R, but the adoption of SFAS 123R will decrease gross profit, increase operating expenses, affect the tax rate and materially affect net income. The pro forma effects on net income (loss) and EPS if we had applied the fair value recognition provisions of the original SFAS No. 123 on stock compensation awards are disclosed above. Such pro forma effects of applying the original SFAS No. 123 may not be indicative of the effects of adopting SFAS 123R, since the provisions of the two statements differ.

SFAS 123R will be effective for our fiscal year beginning January 1, 2006. The Statement will be implemented on a prospective basis for new awards, awards modified, repurchased or cancelled after January 1, 2006 and unvested options previously granted.

9

Note 2: Earnings Per Share and Capital Structure

The following table sets forth the computation of basic and diluted EPS:

| | | | | | | | | | | | |

| | | Three Months Ended

September 30,

| | Nine Months Ended

September 30,

|

| | | 2005

| | 2004

| | 2005

| | 2004

|

| | | (in thousands, except per share data) |

Basic earnings per share: | | | | | | | | | | | | |

Net income available to common shareholders | | $ | 6,002 | | $ | 1,670 | | $ | 16,132 | | $ | 1,750 |

Weighted average number of shares outstanding | | | 24,441 | | | 20,978 | | | 22,912 | | | 20,827 |

| | |

|

| |

|

| |

|

| |

|

|

Basic net income per share | | $ | 0.25 | | $ | 0.08 | | $ | 0.70 | | $ | 0.08 |

| | |

|

| |

|

| |

|

| |

|

|

Diluted earnings per share: | | | | | | | | | | | | |

Net income available to common shareholders | | $ | 6,002 | | $ | 1,670 | | $ | 16,132 | | $ | 1,750 |

| | |

|

| |

|

| |

|

| |

|

|

Weighted average number of shares outstanding | | | 24,441 | | | 20,978 | | | 22,912 | | | 20,827 |

Effect of dilutive securities: | | | | | | | | | | | | |

Employee stock-based awards | | | 1,478 | | | 1,072 | | | 1,559 | | | 1,178 |

| | |

|

| |

|

| |

|

| |

|

|

Adjusted weighted average number of shares outstanding | | | 25,919 | | | 22,050 | | | 24,471 | | | 22,005 |

| | |

|

| |

|

| |

|

| |

|

|

Diluted net income per share | | $ | 0.23 | | $ | 0.08 | | $ | 0.66 | | $ | 0.08 |

| | |

|

| |

|

| |

|

| |

|

|

The dilutive effect of stock-based awards is calculated using the treasury stock method. Under this method, EPS is computed as if the awards were exercised at the beginning of the period (or at time of issuance, if later) and as if the funds obtained thereby were used to repurchase common stock at the average market price during the period. Weighted average common shares outstanding, assuming dilution, include the incremental shares that would be issued upon the assumed exercise of stock-based awards. At September 30, 2005 and 2004, we had stock-based awards outstanding of approximately 2.5 million and 4.1 million at average option exercise prices of $20.88 and $12.73, respectively. Approximately 11,000 and 1.6 million stock-based awards were excluded from the calculation of diluted EPS for the three months ended September 30, 2005 and 2004, respectively, because they were anti-dilutive. Approximately 316,000 and 1.2 million stock-based awards were excluded from the calculation of diluted EPS for the nine months ended September 30, 2005 and 2004, respectively, because they were anti-dilutive. These stock-based awards could be dilutive in future periods.

During May 2005, we sold 1.7 million shares of common stock at a price of $36.50 per share in an underwritten public offering. Proceeds to the Company totaled approximately $59.6 million after payment of the underwriting discount and approximately $200,000 in other expenses. The proceeds of the public offering were used to pay down borrowings under our senior secured term loan.

10

Note 3: Certain Balance Sheet Components

| | | | | | | | |

| | | At September 30,

2005

| | | At December 31,

2004

| |

| | | (in thousands) | |

Accounts receivable, net | | | | | | | | |

Trade (net of allowance for doubtful accounts of $627 and $1,312) | | $ | 88,154 | | | $ | 83,977 | |

Unbilled revenue | | | 6,829 | | | | 6,120 | |

| | |

|

|

| |

|

|

|

Total accounts receivable, net | | $ | 94,983 | | | $ | 90,097 | |

| | |

|

|

| |

|

|

|

Inventories | | | | | | | | |

Materials | | $ | 23,168 | | | $ | 20,574 | |

Work in process | | | 5,303 | | | | 5,150 | |

Finished goods | | | 20,524 | | | | 17,904 | |

| | |

|

|

| |

|

|

|

Total manufacturing inventories | | | 48,995 | | | | 43,628 | |

Service inventories | | | 1,663 | | | | 1,831 | |

| | |

|

|

| |

|

|

|

Total inventories | | $ | 50,658 | | | $ | 45,459 | |

| | |

|

|

| |

|

|

|

Property, plant and equipment, net | | | | | | | | |

Machinery and equipment | | $ | 45,994 | | | $ | 43,551 | |

Equipment used in outsourcing | | | 16,042 | | | | 16,094 | |

Computers and purchased software | | | 33,201 | | | | 36,529 | |

Buildings, furniture and improvements | | | 27,984 | | | | 28,979 | |

Land | | | 2,255 | | | | 3,460 | |

| | |

|

|

| |

|

|

|

Total cost | | | 125,476 | | | | 128,613 | |

Accumulated depreciation | | | (70,065 | ) | | | (68,923 | ) |

| | |

|

|

| |

|

|

|

Property, plant and equipment, net | | $ | 55,411 | | | $ | 59,690 | |

| | |

|

|

| |

|

|

|

Depreciation expense was $3.0 million and $3.3 million during the three months ended September 30, 2005 and 2004, respectively. Depreciation expense was $9.7 million and $8.0 million during the nine months ended September 30, 2005 and 2004, respectively.

A summary of the allowance for doubtful accounts activity is as follows:

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30,

| | | Nine Months Ended

September 30,

| |

| | | 2005

| | | 2004

| | | 2005

| | | 2004

| |

| | | (in thousands) | |

Beginning balance | | $ | 711 | | | $ | 693 | | | $ | 1,312 | | | $ | 695 | |

Provision (benefit) for doubtful accounts | | | (79 | ) | | | (196 | ) | | | (236 | ) | | | (34 | ) |

Recoveries | | | — | | | | — | | | | 30 | | | | — | |

Accounts charged off | | | (5 | ) | | | 44 | | | | (479 | ) | | | (120 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Ending balance | | $ | 627 | | | $ | 541 | | | $ | 627 | | | $ | 541 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

11

Note 4: Business Combinations

On July 1, 2004, we completed the acquisition of our Electricity Metering business. This acquisition added electricity meter manufacturing and sales to our operations, and now represents our Hardware Solutions—Electricity Metering operating segment.

During the fourth quarter of 2004, we expensed $6.4 million of IPR&D, which consisted primarily of next generation technology, valued at $5.7 million. At September 30, 2005, we estimate the research and development to be approximately 85% complete with a cost to complete the development of approximately $400,000 over the next three to six months.

In 2004, we accrued approximately $800,000 as an adjustment to goodwill for the employee severance costs associated with the relocation of our Quebec, Canada facility acquired with the acquisition of our Electricity Metering business. As of September 30, 2005, approximately $700,000 had been paid to employees, leaving a remaining accrual of approximately $100,000, which will be completely paid by the end of the second quarter of 2006.

Note 5: Identified Intangible Assets

The gross carrying amount and accumulated amortization of our intangible assets, other than goodwill, were as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | At September 30, 2005

| | At December 31, 2004

|

| | | Gross

Assets

| | Accumulated

Amortization

| | | Net

| | Gross

Assets

| | Accumulated

Amortization

| | | Net

|

| | | (in thousands) |

Core-developed technology | | $ | 154,330 | | $ | (46,644 | ) | | $ | 107,686 | | $ | 154,330 | | $ | (24,386 | ) | | $ | 129,944 |

Patents | | | 7,088 | | | (4,598 | ) | | | 2,490 | | | 7,088 | | | (4,321 | ) | | | 2,767 |

Capitalized software | | | 5,065 | | | (5,065 | ) | | | — | | | 5,065 | | | (5,065 | ) | | | — |

Distribution and production rights | | | 3,935 | | | (3,172 | ) | | | 763 | | | 3,935 | | | (2,992 | ) | | | 943 |

Customer contracts | | | 8,750 | | | (6,193 | ) | | | 2,557 | | | 8,750 | | | (3,688 | ) | | | 5,062 |

Trademarks and tradenames | | | 25,710 | | | (6,412 | ) | | | 19,298 | | | 25,710 | | | (2,748 | ) | | | 22,962 |

Other | | | 6,450 | | | (6,248 | ) | | | 202 | | | 6,450 | | | (5,991 | ) | | | 459 |

| | |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Total identified intangible assets | | $ | 211,328 | | $ | (78,332 | ) | | $ | 132,996 | | $ | 211,328 | | $ | (49,191 | ) | | $ | 162,137 |

| | |

|

| |

|

|

| |

|

| |

|

| |

|

|

| |

|

|

Intangible asset amortization expense was approximately $9.7 million and $7.2 million for the three months ended September 30, 2005 and 2004 and approximately $29.1 million and $11.3 million for the nine months ended September 30, 2005 and 2004, respectively. Estimated annual amortization expense is as follows:

| | | |

| | | Estimated Annual

Amortization

|

| | | (in thousands) |

2005 | | $ | 38,846 |

2006 | | | 29,251 |

2007 | | | 24,363 |

2008 | | | 20,904 |

2009 | | | 17,323 |

Beyond 2009 | | | 31,450 |

12

Note 6: Goodwill

We test goodwill for impairment as of October 1 of each year. On July 1, 2004, we completed the acquisition of our Electricity Metering business and recorded a preliminary allocation of the purchase price based on estimated fair values of assets and liabilities at September 30, 2004. Goodwill decreased in the fourth quarter of 2004 after a more comprehensive valuation analysis was completed, resulting in a significantly higher amount allocated to identifiable intangible assets, with a significantly lower amount allocated to goodwill. We continued to make adjustments to the purchase price through June 2005 as the valuations of assets and liabilities were finalized. Goodwill decreased in 2005 primarily due to $2.1 million specifically related to changes in the estimated warranty liability at July 1, 2004. Goodwill balances can also increase or decrease, with a corresponding change in other comprehensive income (loss), as a result of changes in foreign currency exchange rates. The change in goodwill for the nine months ended September 30, 2005 and 2004 is as follows:

| | | | | | | |

| | | Nine Months Ended

September 30,

|

| | | 2005

| | | 2004

|

| | | (in thousands) |

Goodwill balance, January 1 | | $ | 117,471 | | | $ | 90,385 |

Goodwill adjustments | | | (1,758 | ) | | | 101,148 |

Effect of change in exchange rates | | | 366 | | | | 179 |

| | |

|

|

| |

|

|

Goodwill balance, September 30 | | $ | 116,079 | | | $ | 191,712 |

| | |

|

|

| |

|

|

The following table reflects changes in goodwill for each reporting segment during the first nine months of 2005:

| | | | | | | | | | | | | | |

| | | Hardware Solutions

| | | Software

Solutions

| | Total

Company

| |

| | | Meter Data

Collection

| | Electricity

Metering

| | | |

| | | (in thousands) | |

Goodwill balance, January 1, 2005 | | $ | 73,337 | | $ | 26,236 | | | $ | 17,898 | | $ | 117,471 | |

Goodwill adjustments | | | — | | | (1,758 | ) | | | — | | | (1,758 | ) |

Effect of change in exchange rates | | | 221 | | | 91 | | | | 54 | | | 366 | |

| | |

|

| |

|

|

| |

|

| |

|

|

|

Goodwill balance, September 30, 2005 | | $ | 73,558 | | $ | 24,569 | | | $ | 17,952 | | $ | 116,079 | |

| | |

|

| |

|

|

| |

|

| |

|

|

|

13

Note 7: Debt

The components of our borrowings are as follows:

| | | | | | | | |

| | | At September 30,

2005

| | | At December 31,

2004

| |

| | | (in thousands) | |

Senior Secured Credit Facility | | | | | | | | |

Term Loan | | $ | 27,964 | | | $ | 150,075 | |

Revolving Credit Line | | | — | | | | — | |

Senior Subordinated Notes | | | 124,203 | | | | 124,136 | |

Project Financing | | | 3,431 | | | | 4,024 | |

| | |

|

|

| |

|

|

|

| | | | 155,598 | | | | 278,235 | |

Current Portion of Debt | | | (2,139 | ) | | | (35,647 | ) |

| | |

|

|

| |

|

|

|

Total Long-term Debt | | $ | 153,459 | | | $ | 242,588 | |

| | |

|

|

| |

|

|

|

Senior Secured Credit Facility

Our senior secured credit facility (credit facility) consists of an original $185 million seven-year senior secured term loan (term loan or term debt) and a $55 million five-year senior secured revolving credit line (revolver). The outstanding term loan balance at September 30, 2005 was $28.0 million while the revolver had no outstanding borrowings. The credit facility is guaranteed by all of our operating subsidiaries (except our foreign subsidiaries and an outsourcing project financing subsidiary), all of which are wholly owned. Debt issuance costs are amortized over the life of the credit facility using the effective interest method. Unamortized debt issuance costs were approximately $9.6 million and $13.5 million at September 30, 2005 and December 31, 2004, respectively.

In April 2005, we completed two amendments to our credit facility. The amendments included a 50 basis point reduction in the term loan interest rate and increases to our maximum consolidated leverage and senior debt ratios. In addition, we obtained the ability to increase our revolver commitment from $55 million to $75 million at a future date, as defined in the April 2005 amendment. We also increased our letter of credit limit to $55 million and added the ability to increase it to $65 million at a future date. Our required minimum quarterly principal payments are $324,000 for the next 17 quarters ($1.3 million annually) with the remaining balance to be paid in four installments over the last six quarters, maturing in 2011. Optional repayments of the term loan are permitted without penalty or premium. Additional mandatory prepayments, based on 75% of defined excess cash flows, the issuance of capital stock or the sale of assets as defined by the borrowing agreement, would all decrease the minimum payments at maturity. Interest rates on the term loan are based on the London InterBank Offering Rate (LIBOR) plus 1.75% or the Wells Fargo Bank, National Association’s prime rate (Prime) plus 0.75%. We had no mandatory prepayment requirement during 2004. We made optional prepayments on the term loan of $121.0 million during the first nine months of 2005 and $34.0 million during the second half of 2004.

At September 30, 2005, $1.3 million of the $28.0 million in term debt was classified as current, based on the mandatory principal payments defined in the amended borrowing agreement. At December 31, 2004, $34.9 million of the $150.1 million outstanding balance on the term loan was classified as current and $115.2 million was classified as long-term. The classification between current and long-term debt at December 31, 2004 was based on the mandatory principal payments defined in the borrowing agreement, as well as an additional $33.0 million of optional prepayments we expected to make during the first six months of 2005 in order to remain in compliance with our debt covenants. We were in compliance with all of our debt covenants at September 30, 2005, which require us to maintain certain consolidated leverage and coverage ratios on a quarterly basis, as well as customary covenants that place restrictions on the incurrence of debt, the payment of dividends, certain investments and mergers.

Interest rates on the revolver vary depending on our consolidated leverage ratio and are based on LIBOR plus 2.0% to 3.0%, or Prime plus 1.0% to 2.0%, payable at various intervals depending on the term of the borrowing. The annual commitment fee on the unused portion of the revolver varies from 0.375% to 0.50%. We incur annual letter of credit fees based on (a) a fronting fee of 0.125% and (b) a letter of credit fee that varies from 2.0% to 3.0%. Revolver borrowings can be made at any time through June 2009, at which time any borrowings outstanding must be repaid. At September 30, 2005 there were no borrowings outstanding under the revolver and $22.7 million was utilized by outstanding standby letters of credit resulting in $32.3 million available for additional borrowings.

14

In June 2005, we terminated an interest rate swap and cap that we placed in the fourth quarter of 2004 for approximately $416,000 and $48,000, respectively, compared with fair market values of approximately $224,000 and $69,000, respectively at December 31, 2004. The derivative instruments were initially designated as cash flow hedges; however, as a result of the optional prepayments on our term loan in the fourth quarter of 2004, we determined the cash flow hedges were ineffective in the same quarter as they were purchased, resulting in the recognition through interest expense of the changes in fair value. At September 30, 2005, we held no derivative instruments.

Senior Subordinated Notes

On May 10, 2004, we completed a private placement of $125 million aggregate principal amount of 7.75% notes, due in 2012. The notes are discounted to a price of 99.265 to yield 7.875%, with a balance of $124.2 million at September 30, 2005. On February 17, 2005, we completed an exchange of the notes for substantially identical registered notes, except that the new notes are generally transferable and do not contain certain terms with respect to registration rights and liquidation damages. The discount on the notes will be accreted and the debt issuance costs will be amortized over the life of the notes. Fixed interest payments of approximately $4.8 million are required every six months, in May and November. The notes are subordinated to our senior secured credit facility and are guaranteed by all of our operating subsidiaries (except our foreign subsidiaries and an outsourcing project financing subsidiary), all of which are wholly owned. The notes contain covenants, which place restrictions on the incurrence of debt, the payment of dividends, certain investments and mergers. Some or all of the notes may be redeemed at our option at any time on or after May 15, 2008, at certain specified premium prices. At any time prior to May 15, 2007, we may, at our option, redeem up to 35% of the notes with the proceeds of certain sales of our common stock.

Project Financing

In conjunction with project financing for one of our outsourcing contracts, we issued a note secured by the assets of the project with monthly interest payments at an annual interest rate of 7.6%, maturing May 31, 2009. The project financing loan had an outstanding balance of $3.4 million at September 30, 2005.

Minimum Payments on Debt

The senior secured credit facility, notes and project financing agreements stipulate a minimum repayment schedule at September 30, 2005 as follows:

| | | |

| | | Minimum Payments

|

| | | (in thousands) |

2005 | | $ | 528 |

2006 | | | 2,156 |

2007 | | | 2,223 |

2008 | | | 2,296 |

2009 | | | 1,736 |

Beyond 2009 | | | 146,659 |

| | |

|

|

| | | $ | 155,598 |

| | |

|

|

15

Note 8: Restructurings

During 2004, we implemented a new internal organizational structure, which resulted in several actions to reduce spending and eliminate certain unprofitable activities. As a result, we reduced our staffing by approximately 260 employees and incurred restructuring expenses of $7.7 million. Approximately $13,000 in severance costs remained to be paid to employees at September 30, 2005. Accrued liabilities associated with restructuring efforts were approximately $79,000 and $2.5 million at September 30, 2005 and December 31, 2004, respectively, and consisted of the following:

| | | | | | | | |

| | | Severance and

Related Costs

| | | Lease Termination

and Related Costs

| |

| | | (in thousands) | |

Accrual balance at December 31, 2004 | | $ | 2,317 | | | $ | 175 | |

Addition/adjustments to accruals | | | 390 | | | | (109 | ) |

Cash payments | | | (2,694 | ) | | | — | |

| | |

|

|

| |

|

|

|

Accrual balance at September 30, 2005 | | $ | 13 | | | $ | 66 | |

| | |

|

|

| |

|

|

|

Accrual balance at December 31, 2003 | | $ | 28 | | | $ | 125 | |

Addition/adjustments to accruals | | | 3,977 | | | | 73 | |

Cash payments | | | (3,870 | ) | | | (10 | ) |

| | |

|

|

| |

|

|

|

Accrual balance at September 30, 2004 | | $ | 135 | | | $ | 188 | |

| | |

|

|

| |

|

|

|

The liability for lease terminations is recorded within accrued expenses and the liability for employee severance is recorded within wages and benefits payable. Lease termination and related costs are dependent on our ability to sublease vacant space and are reported as general and administrative. Severance and lease termination costs are not allocated to the reporting segments.

Note 9: Income Taxes

We estimate our 2005 annual effective income tax rate will be approximately 34%. Our effective income tax rate differs from the federal statutory rate of 35% and can vary from period to period due to fluctuations in operating results, new or revised tax legislation, changes in the level of business performed in domestic and international jurisdictions, research credits, expirations of research credits and loss carryforwards, IPR&D charges, state income taxes and extraterritorial income exclusion tax benefits. In the second quarter of 2005, we completed a study of federal research tax credits for the years 1997 through 2004, recognizing a $5.9 million net tax benefit. The Working Families Tax Relief Act of 2004 and the American Jobs Creation Act of 2004 were signed into law in October 2004. The only provision that had a significant income tax effect on the Company was the extension of research credits through December 31, 2005. We estimate the 2005 net benefit will be approximately $1.2 million. Due primarily to these credits, we had a net tax benefit of $963,000 for the nine months ended September 30, 2005

Our effective income tax rate of 38% for the three months ended September 30, 2004 was higher than the full year 2004 effective income tax rate of 36%, as a result of changes in estimated taxes due in future periods, partially offset by tax credit adjustments in the third quarter.

Note 10: Commitments and Contingencies

Guarantees and Indemnifications

Under FASB Interpretation 45,Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others, we will record a liability for certain types of guarantees and indemnifications for agreements entered into or amended subsequent to December 31, 2002. No liabilities were required to be recorded as of September 30, 2005 and December 31, 2004.

16

We maintain bid and performance bonds for certain customers. Bonds in force were $8.0 million and $7.3 million at September 30, 2005 and December 31, 2004, respectively. Bid bonds guarantee that we will enter into a contract consistent with the terms of the bid. Performance bonds provide a guarantee to the customer for future performance, which usually covers the installation phase of a contract and may on occasion cover the operations and maintenance phase of outsourcing contracts.

We also have standby letters of credit to guarantee our performance under certain contracts. The outstanding amounts of standby letters of credit were $22.7 million and $23.3 million at September 30, 2005 and December 31, 2004, respectively.

We generally provide an indemnification related to the infringement of any patent, copyright, trademark or other intellectual property right on software or equipment within our sales contracts, which indemnifies the customer from and pays the resulting costs, damages and attorneys’ fees awarded against a customer with respect to such a claim provided that (a) the customer promptly notifies us in writing of the claim and (b) we have the sole control of the defense and all related settlement negotiations. The terms of the indemnification normally do not limit the maximum potential future payments. We also provide an indemnification for third party claims resulting from damages caused by the negligence or willful misconduct of our employees/agents in connection with the performance of certain contracts. The terms of the indemnification generally do not limit the maximum potential payments.

Legal Matters

We are subject to various legal proceedings and claims of which the outcomes are subject to significant uncertainty. Our policy is to assess the likelihood of any adverse judgments or outcomes related to legal matters, as well as ranges of probable losses. A determination of the amount of the liability required, if any, for these contingencies is made after an analysis of each known issue in accordance with SFAS No. 5,Accounting for Contingencies, and related pronouncements. In accordance with SFAS No. 5, a liability is recorded when we determine that a loss is probable and the amount can be reasonably estimated. Additionally, we disclose contingencies for which a material loss is reasonably possible, but not probable. At September 30, 2005, there were no contingencies requiring accrual or disclosure.

Note 11: Segment Information

We have two operating groups (Hardware Solutions and Software Solutions) and three operating segments. Software Solutions is a single segment, whereas Hardware Solutions is comprised of two segments, Meter Data Collection and Electricity Metering. For these three operating segments, management has three primary measures of segment performance: revenue, gross profit (margin) and operating income (loss). Revenues for each operating segment are reported according to product lines. There are no inter-operating segment revenues. Within Hardware Solutions, costs of sales are based on standard costs, which include materials, direct labor, warranty expense and an overhead allocation, as well as variances from standard costs. Software cost of sales include distribution and documentation costs for applications sold, along with other labor and operating costs for custom software development, project management, consulting and systems support. Hardware and software cost of services include materials, labor and overhead. Operating expenses directly associated with each operating segment may include sales, marketing, product development or administrative expenses.

Corporate operating expenses, interest revenue, interest expense, equity in the income (loss) of investees accounted for by the equity method, amortization expense and income tax expense (benefit) are not allocated to the operating segments, nor included in the measure of segment profit or loss. Assets and liabilities are not allocated to the operating segments, except for the Electricity Metering operating segment, which is individually maintained and reviewed. At September 30, 2005, Electricity Metering had total assets of $263.6 million. Approximately 60% of depreciation expense was allocated to the operating segments, with the remaining portion unallocated at September 30, 2005 and 2004.

We classify sales in the United States and Canada as domestic revenues. International revenues were $10.3 million and $5.8 million for the three months ended September 30, 2005 and 2004 and $28.2 million and $13.5 million for the nine months ended September 30, 2005 and 2004, respectively. The increase in international revenues for the third quarter of 2005 was due to higher handheld system sales.

17

Operating Segment Products

| | |

Operating Segment

| | Major Products

|

Hardware Solutions—Meter Data Collection: | | Residential and commercial AMR standalone and OEM (original equipment manufacturer) modules, contract manufacturing of our AMR technology for other electricity meter vendors, mobile and network AMR data collection technologies, SmartSynch meter systems, handheld computers for meter data collection or mobile workforce applications and related installation and implementation services. |

| |

Hardware Solutions—Electricity Metering: | | Residential solid-state and electromechanical electricity meters, AMR enabled meters, commercial and industrial solid-state electricity meters and generation, SmartSynch meter systems, transmission and distribution meters and related installation and implementation services. |

| |

Software Solutions: | | Software applications for commercial, industrial and residential meter data collection and management, distribution systems design and optimization, energy and water management, asset optimization, mobile workforce solutions, forecasting and related implementation consulting services. |

Operating Segment Information

| | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30,

| | | Nine Months Ended September 30,

| |

| | | 2005

| | | 2004

| | | 2005

| | | 2004

| |

| | | (in thousands) | |

Revenues | | | | | | | | | | | | | | | | |

Hardware Solutions | | | | | | | | | | | | | | | | |

Meter Data Collection | | $ | 70,638 | | | $ | 56,798 | | | $ | 182,506 | | | $ | 178,714 | |

Electricity Metering | | | 58,598 | | | | 54,195 | | | | 173,326 | | | | 54,195 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Hardware Solutions | | | 129,236 | | | | 110,993 | | | | 355,832 | | | | 232,909 | |

Software Solutions | | | 11,909 | | | | 11,511 | | | | 36,906 | | | | 34,839 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Company | | $ | 141,145 | | | $ | 122,504 | | | $ | 392,738 | | | $ | 267,748 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | | | | | | | | | | | | | | |

Hardware Solutions | | | | | | | | | | | | | | | | |

Meter Data Collection | | $ | 32,091 | | | $ | 24,129 | | | $ | 80,418 | | | $ | 82,215 | |

Electricity Metering | | | 24,236 | | | | 21,183 | | | | 73,223 | | | | 21,183 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Hardware Solutions | | | 56,327 | | | | 45,312 | | | | 153,641 | | | | 103,398 | |

Software Solutions | | | 4,703 | | | | 4,173 | | | | 15,126 | | | | 12,217 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Company | | $ | 61,030 | | | $ | 49,485 | | | $ | 168,767 | | | $ | 115,615 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income (loss) | | | | | | | | | | | | | | | | |

Hardware Solutions | | | | | | | | | | | | | | | | |

Meter Data Collection | | $ | 26,667 | | | $ | 18,878 | | | $ | 64,607 | | | $ | 66,605 | |

Electricity Metering | | | 20,178 | | | | 17,322 | | | | 60,504 | | | | 17,322 | |

Other unallocated costs | | | (5,938 | ) | | | (5,291 | ) | | | (18,143 | ) | | | (12,696 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Hardware Solutions | | | 40,907 | | | | 30,909 | | | | 106,968 | | | | 71,231 | |

Software Solutions | | | (3,007 | ) | | | (5,119 | ) | | | (8,576 | ) | | | (17,011 | ) |

Corporate unallocated | | | (23,722 | ) | | | (18,232 | ) | | | (68,130 | ) | | | (43,000 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total Company | | | 14,178 | | | | 7,558 | | | | 30,262 | | | | 11,220 | |

Total other income (expense) | | | (4,794 | ) | | | (4,862 | ) | | | (15,093 | ) | | | (8,484 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes | | $ | 9,384 | | | $ | 2,696 | | | $ | 15,169 | | | $ | 2,736 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

18

No customer represented more than 10% of total Company revenues for the three and nine months ended September 30, 2005 and 2004. One customer accounted for approximately 13% of Electricity Metering revenues and 6% of total Company revenues for the third quarter of 2005. A different customer accounted for approximately 11% of Meter Data Collection revenues and 7% of total Company revenues for the nine months ended September 30, 2004.

Note 12: Comprehensive Income (Loss)

Comprehensive income (loss) adjustments are reflected as an increase (decrease) to shareholders’ equity and are not reflected in results of operations. Operating results adjusted to reflect comprehensive income (loss) items during the period, net of tax, were as follows:

| | | | | | | | | | | | |

| | | Three Months Ended

September 30,

| | Nine Months Ended September 30,

|

| | | 2005

| | 2004

| | 2005

| | 2004

|

| | | (in thousands) |

Net income | | $ | 6,002 | | $ | 1,670 | | $ | 16,132 | | $ | 1,750 |

Change in foreign currency translation adjustments, net of tax | | | 559 | | | 558 | | | 97 | | | 230 |

| | |

|

| |

|

| |

|

| |

|

|

Total comprehensive income, net | | $ | 6,561 | | $ | 2,228 | | $ | 16,229 | | $ | 1,980 |

| | |

|

| |

|

| |

|

| |

|

|

Accumulated other comprehensive income, net of tax, was approximately $1.1 million and $954,000 at September 30, 2005 and December 31, 2004, respectively, and consisted of adjustments for foreign currency translation only.

19

Note 13: Condensed Consolidating Financial Information

The senior secured credit facility and the notes are guaranteed by all of our operating subsidiaries (except for our foreign subsidiaries and an outsourcing project financing subsidiary), all of which are wholly owned. The guarantees are joint and several, full, complete and unconditional. There are currently no restrictions on the ability of the subsidiary guarantors to transfer funds to the parent company. The following condensed consolidating financial information has been prepared and presented pursuant to SEC Regulation S-X Rule 3-10, “Financial Statements of Guarantors and Issuers of Guaranteed Securities Registered or Being Registered.”

Condensed Consolidating Statement of Operations

Three Months Ended September 30, 2005

| | | | | | | | | | | | | | | | | | | | |

| | | Parent

Company

| | | Combined

Guarantor

Subsidiaries

| | | Combined

Non-guarantor

Subsidiaries

| | | Eliminations

| | | Consolidated

| |

| | | (in thousands) | |

Revenues | | | | | | | | | | | | | | | | | | | | |

Sales | | $ | 75,517 | | | $ | 56,505 | | | $ | 9,342 | | | $ | (12,681 | ) | | $ | 128,683 | |

Service | | | 11,305 | | | | 408 | | | | 1,790 | | | | (1,041 | ) | | | 12,462 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total revenues | | | 86,822 | | | | 56,913 | | | | 11,132 | | | | (13,722 | ) | | | 141,145 | |

| | | | | |

Cost of revenues | | | | | | | | | | | | | | | | | | | | |

Sales | | | 43,502 | | | | 35,413 | | | | 6,823 | | | | (12,559 | ) | | | 73,179 | |

Service | | | 6,114 | | | | 322 | | | | 1,245 | | | | (745 | ) | | | 6,936 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total cost of revenues | | | 49,616 | | | | 35,735 | | | | 8,068 | | | | (13,304 | ) | | | 80,115 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 37,206 | | | | 21,178 | | | | 3,064 | | | | (418 | ) | | | 61,030 | |

Operating expenses | | | | | | | | | | | | | | | | | | | | |

Sales and marketing | | | 10,770 | | | | 1,354 | | | | 1,559 | | | | 5 | | | | 13,688 | |

Product development | | | 9,298 | | | | 2,431 | | | | 517 | | | | (439 | ) | | | 11,807 | |

General and administrative | | | 10,343 | | | | 825 | | | | 477 | | | | — | | | | 11,645 | |

Amortization of intangible assets | | | 1,445 | | | | 8,267 | | | | — | | | | — | | | | 9,712 | |

Restructurings | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total operating expenses | | | 31,856 | | | | 12,877 | | | | 2,553 | | | | (434 | ) | | | 46,852 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income | | | 5,350 | | | | 8,301 | | | | 511 | | | | 16 | | | | 14,178 | |

Other income (expense) | | | | | | | | | | | | | | | | | | | | |

Interest income | | | 276 | | | | — | | | | 98 | | | | (305 | ) | | | 69 | |

Interest expense | | | (1,054 | ) | | | (3,295 | ) | | | (284 | ) | | | 305 | | | | (4,328 | ) |

Other income (expense), net | | | (175 | ) | | | (157 | ) | | | (187 | ) | | | (16 | ) | | | (535 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other income (expense) | | | (953 | ) | | | (3,452 | ) | | | (373 | ) | | | (16 | ) | | | (4,794 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income taxes | | | 4,397 | | | | 4,849 | | | | 138 | | | | — | | | | 9,384 | |

Income tax provision | | | (1,083 | ) | | | (2,067 | ) | | | (232 | ) | | | — | | | | (3,382 | ) |

Equity in earnings of guarantor and non-guarantor subsidiaries | | | 2,688 | | | | 29 | | | | — | | | | (2,717 | ) | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | 6,002 | | | $ | 2,811 | | | $ | (94 | ) | | $ | (2,717 | ) | | $ | 6,002 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|