Earnings Conference Call 4 Quarter 2012 February 7 , 2013 th th Exhibit 99.2 |

Cautionary Statements Regarding Forward-Looking Information 1 2012 4Q Earnings Release Slides This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Exelon Corporation, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company and Exelon Generation Company, LLC (Registrants) include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2011 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 18; (2) Constellation Energy Group’s 2011 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 12; (3) the Registrants’ Third Quarter 2012 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 16; and (4) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. 2012 4Q Earnings Release Slides |

• Realized $170M of O&M synergies and on track to achieve $550M in O&M synergies starting in 2014 • Closed on Maryland asset divestitures related to merger commitments in 4Q 2012 • ICC re-hearing in October granted recovery on pension asset; ComEd appeal ongoing for other disallowed items • Worked with PJM and stakeholders to propose MOPR modifications • Rate case progressing at BGE • Exemplary storm restoration efforts at PECO and BGE in response to Hurricane Sandy • 2012 nuclear capacity factor of 92.7% • Q4 2012 operating EPS of $0.64 per share (1) • 2012 operating EPS of $2.85 per share (1) in line with expectations • Challenging power market conditions 2012 4Q Earnings Release Slides 2 2012 In Review 2013 Expectations: • Expect to deliver full-year 2013 operating earnings within guidance range of $2.35 - $2.65/share (1) • Expect 1Q 2013 operating earnings within guidance range of $0.60 - $0.70/share (1) • Strengthen credit metrics and balance sheet • Complete remaining integration activities, primarily IT related Regulatory Process Financial Summary Merger Execution Operating Excellence (1) Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. |

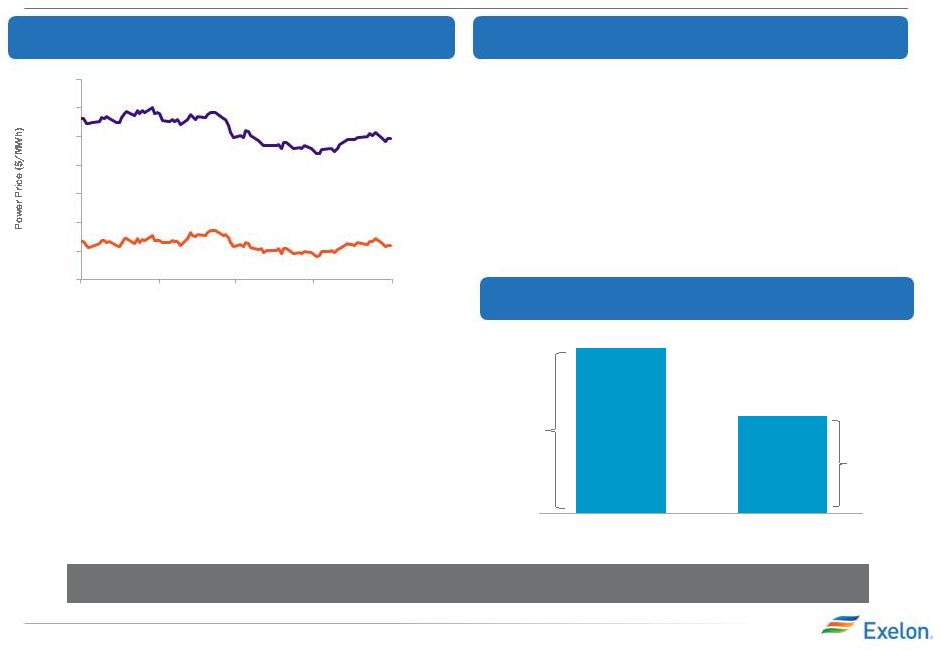

Exelon’s Revised Dividend • Continue to believe in $3-$6/MWh upside in PJM but timing of upside is difficult to predict • Expected heat rate upside from coal retirements not yet reflected in forward prices 2012 4Q Earnings Release Slides 3 Power market upside has not yet materialized Sizing dividend to align with business mix • Continue to pay a healthy, sustainable dividend • Provide balance sheet strength to remain investment-grade through stressed commodity cycles • Provide capacity to invest in growth • Provide flexibility to hedging to better align with market liquidity Sustainable dividend of $1.24/share on an annualized basis $0.31 Starting in 2Q 2013 1Q 2013 $0.525 Dividend rate change beginning in 2Q 2013 Dividend per share payable on March 8, 2013 to holders as of February 19, 2013 Quarterly dividend per share rate beginning 2Q 2013 (1) (1) Dividend declaration is subject to Board of Directors approval. $44.00 $42.00 $40.00 $38.00 $36.00 $34.00 $32.00 $30.00 2/1/2013 1/1/2013 12/1/2012 11/1/2012 10/1/2012 2015 PJM-W 2015 NiHub $32.41 $32.66 $39.87 $41.28 |

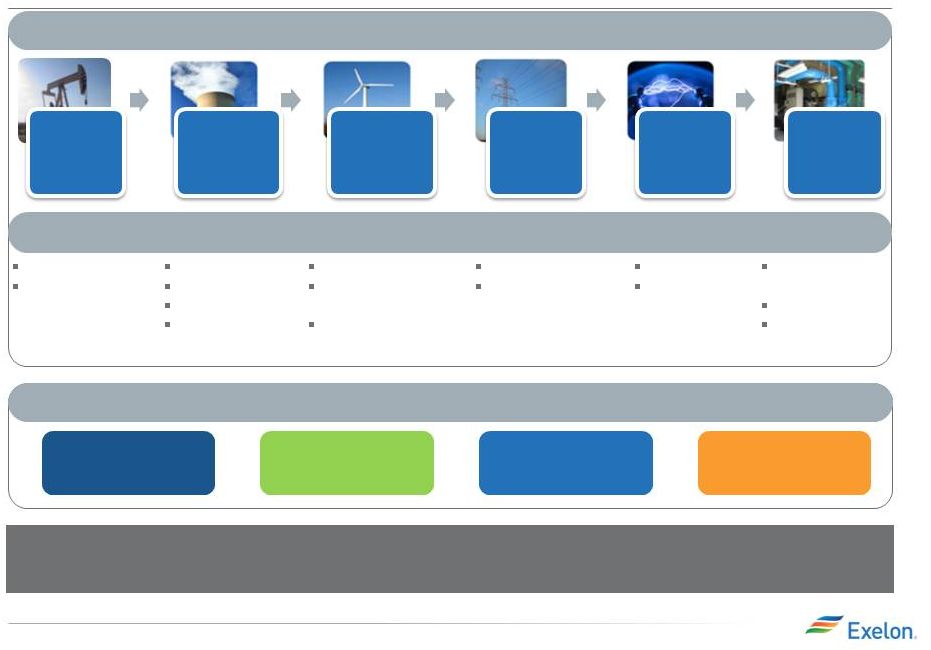

Presence across the entire energy value chain Unique Combination of Scale, Scope and Flexibility to Invest Across The Value Chain with Metrics Oriented Operational Model Operational Excellence Regulatory Advocacy Disciplined Growth & Investment Financial Discipline Leverage platform to create value through core competencies 2012 4Q Earnings Release Slides 4 Upstream Gas Downstream Gas (Pipelines and Storage) Wolf Hollow Navasota Boston Gen Nuclear Uprates AVSR1 ~750 MW of John Deere Wind Greater than 500 MW of organic build Smart Grid Chicago West Loop Transmission MX Energy StarTex Demand Response Energy Efficiency Rooftop solar Available cash to be opportunistically invested across the value chain in sustainable growth Track record of successful investment Fuels Conventional Generation Renewable Generation Electric & Gas Utilities Retail Beyond The Meter |

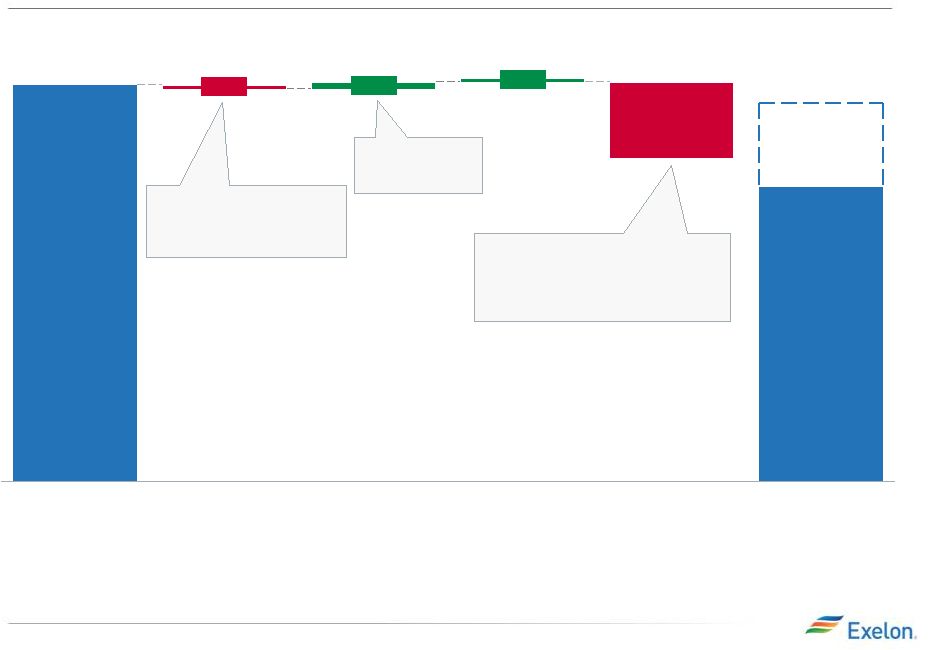

Sizing Exelon’s Dividend to Fit the Business Model Financial Priorities #1: Remain investment grade • Maintain key credit metrics above target ranges under both market and stress conditions to maintain investment grade ratings • Shareholder value of maintaining investment grade: • Increases ability to participate in commercial business opportunities • Lowers collateral requirements • Reliable and cost efficient access to the capital markets • Increases business and financial flexibility #2: Creating value for shareholders (less) (less) equals Cash from Operations Base CapEx / Nuclear Fuel Dividend Available Cash and Balance Sheet Capacity Use remaining cash flow and capacity to invest in growth and return value to shareholders 5 2012 4Q Earnings Release Slides Dividend sized to satisfy key financial priorities under a range of market outcomes 2012 4Q Earnings Release Slides |

6 Dividend Policy Enables Exelon and its operating companies to maintain investment grade credit ratings Is sustainable through all points in the commodity cycle, particularly the stress cases Is supported and funded by cash flows from both the regulated utilities and unregulated business Provides room to grow the company through investments in value-enhancing growth opportunities Provides opportunities to grow the dividend over time, supported largely by investments and associated growth in the earnings power of the regulated utilities (subject to Board discretion) Allows for a competitive value proposition that, coupled with earnings growth, delivers compelling shareholder returns over time (1) Free cash flow defined as Cash from Operations less Capex and Dividend. 2012 4Q Earnings Release Slides Stress Scenario Considerations Dividend Sizing Objectives • Constant $3/mmbtu natural gas o Power prices at or below those experienced during August 2012 • Commercial and new business risks • Other one-time significant financial or operational risks • Utilities: Long-term payout target of 65-70%, which is in-line with regulated utility peers • ExGen: o Credit metrics supportive of mid to high BBB rating o Free Cash Flow positive (1) |

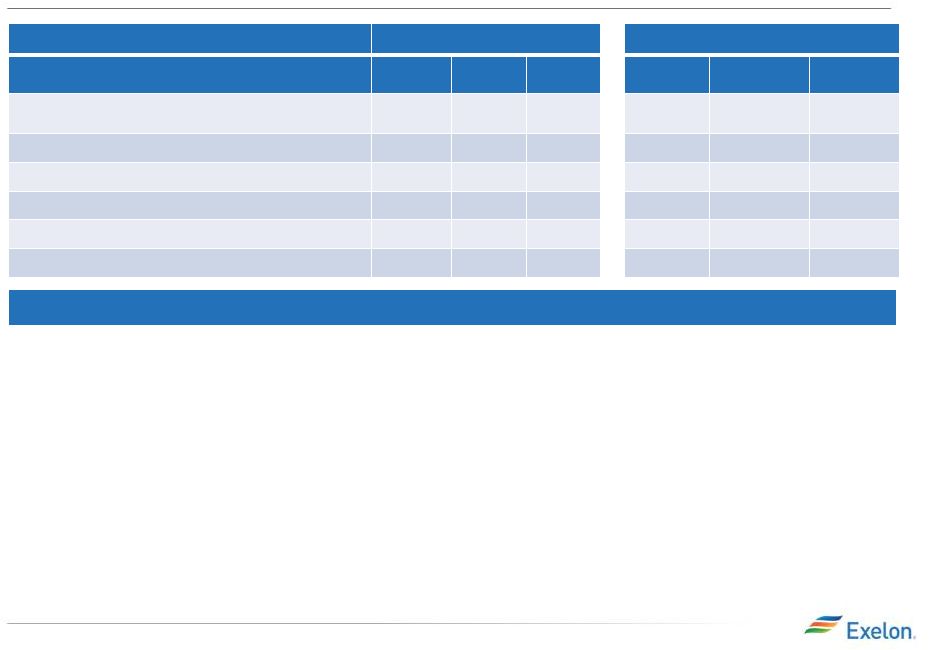

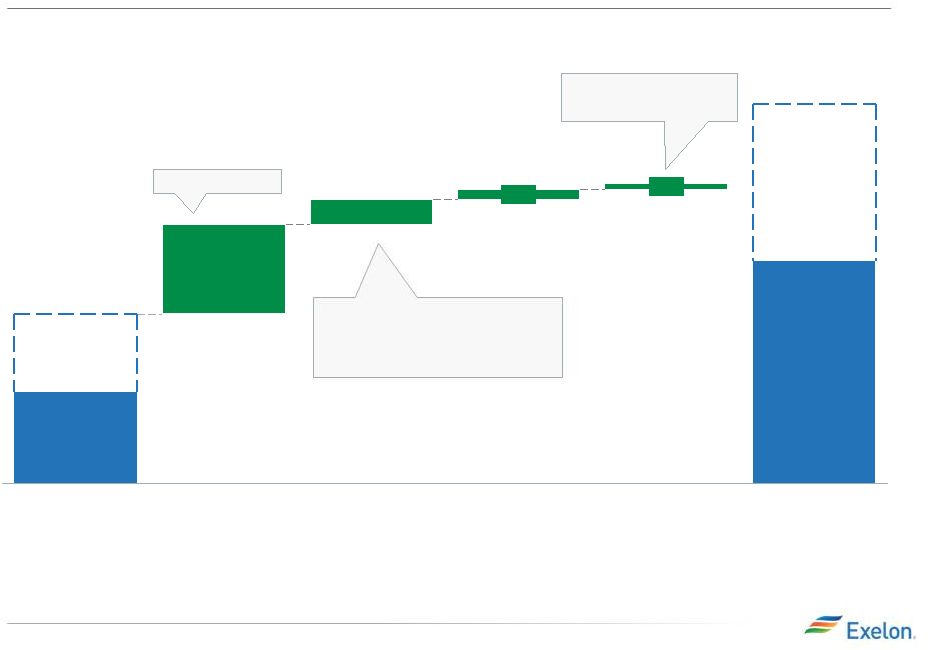

2013 Operating Earnings Guidance Key Year-over-Year Drivers • 2012 Stub Earnings: $0.12 • Lower ExGen RNF primarily due to prices, offset by non-power revenue, capacity revenue and growth projects: $(0.27) • Higher ComEd RNF primarily from DST revenues due to formula rate: $0.05 • Higher BGE RNF: $0.06 • Higher O&M primarily at ExGen driven by inflation, pension, and non-power cost of sales, offset by synergies: $(0.10) • Higher depreciation primarily at ExGen due to new projects placed in service: $(0.08) • Share dilution (3) : $(0.13) 7 2012 4Q Earnings Release Slides PECO BGE ExGen ComEd PECO BGE 2013 Guidance $2.35 - $2.65 (2) $1.40 - $1.60 $0.35 - $0.45 $0.35 - $0.45 $0.15 - $0.25 HoldCo ExGen ComEd 2012 Actual $2.85 (1) 1.89 $0.47 $0.47 $0.06 (1) 2012 results include Constellation Energy and BGE earnings for March 12 – December 31. Based on expected 2012 average outstanding shares of 819M.Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (2) 2013 earnings guidance based on expected average outstanding shares of 860M. Earnings guidance for OpCos may not add up to consolidated EPS guidance. (3) Shares Outstanding (diluted) are 819M in 2012 and 860M in 2013. 2013 represents full-year of shares outstanding resulting from March 2012 merger with Constellation. |

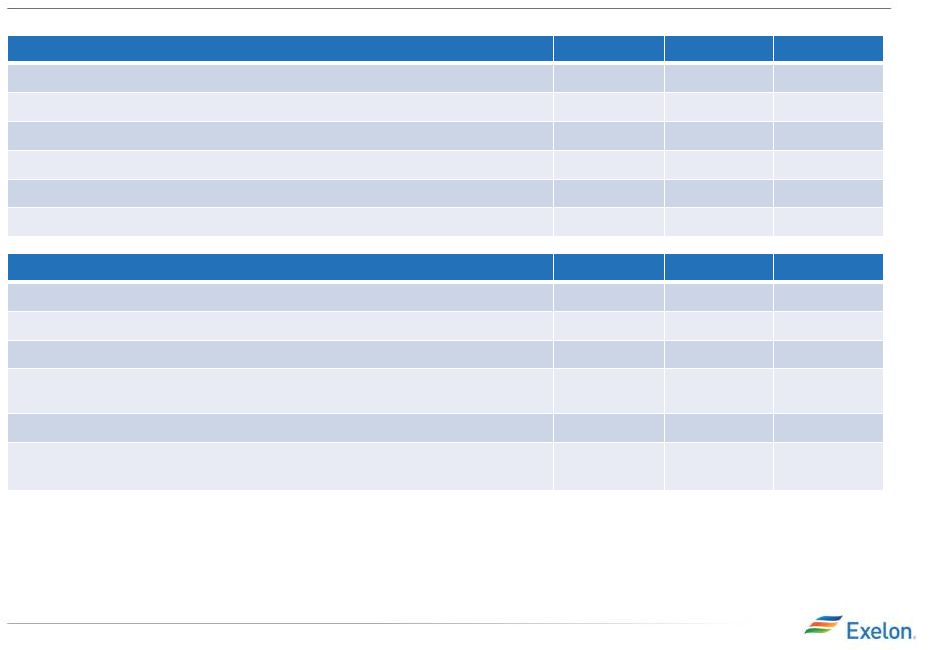

8 Exelon Generation: Gross Margin Update December 31, 2012 September 30, 2012 Gross Margin Category ($M) (1) (2) 2013 2014 2015 2013 2014 2015 Open Gross Margin (3) (including South, West, Canada hedged gross margin) $5,550 $5,900 $6,050 $5,750 $6,050 $6,200 Mark-to-Market of Hedges (3,4) $1,650 $650 $300 $1,350 $500 $250 Power New Business / To Go $400 $650 $850 $500 $750 $950 Non-Power Margins Executed $200 $100 $50 $150 $100 $50 Non-Power New Business / To Go $400 $500 $550 $450 $500 $550 Total Gross Margin $8,200 $7,800 $7,800 $8,200 $7,900 $8,000 Key Highlights of 4Q 2012 • Forward power markets experienced further downward pressure during the 4 quarter – Forward power prices still do not reflect the upside that we are forecasting – Continue to optimize our hedging of the portfolio by falling behind ratable in the Midwest and utilizing cross-commodity and option hedges • Power New Business To-Go has been lowered by a combination of executing on targets and further reductions to our retail load volumes and margins, the result of heightened competition and low market volatility 2012 4Q Earnings Release Slides 1) Gross margin rounded to nearest $50M. 2) Gross margin does not include revenue related to decommissioning, gross receipts tax, Exelon Nuclear Partners and entities consolidated solely as a result of the application of FIN 46R. 3) Includes CENG Joint Venture. 4) Mark to Market of Hedges assumes mid-point of hedge percentages. th |

9 2013 Cash Flow Summary • Expect Cash from Operations of ~$6.0B in 2013 – Includes $550M for pension/OPEB contribution • CapEx in line with estimates provided at 2012 EEI Conference – Higher nuclear fuel CapEx of $75M in 2013 related to discounted buying opportunity accelerated from 2014 – ExGen CapEx includes ~$350M of Fukushima- related costs for 2013-2017. Does not include estimate of $15 - 20 million per unit for filtered vents at eleven mark 1 and 2 units, if required. • Financing plan for utilities comprised of debt refinancing • ExGen financing plan includes retirement of $450M hybrid security, DOE loan draws for AVSR1 and project financing for existing wind assets 2012 4Q Earnings Release Slides |

10 Exelon Generation Disclosures December 31, 2012 2012 4Q Earnings Release Slides |

11 Portfolio Management Strategy Protect Balance Sheet Ensure Earnings Stability Create Value Exercising Market Views Purely ratable Actual hedge % Market views on timing, product allocation and regional spreads reflected in actual hedge % High End of Profit Low End of Profit % Hedged Open Generation with LT Contracts Portfolio Management & Optimization Portfolio Management Over Time Align Hedging & Financials Establishing Minimum Hedge Targets 2012 4Q Earnings Release Slides Strategic Policy Alignment •Aligns hedging program with financial policies and financial outlook •Establish minimum hedge targets to meet financial objectives of the company (dividend, credit rating) •Hedge enough commodity risk to meet future cash requirements under a stress scenario Three-Year Ratable Hedging •Ensure stability in near-term cash flows and earnings •Disciplined approach to hedging •Tenor aligns with customer preferences and market liquidity •Multiple channels to market that allow us to maximize margins •Large open position in outer years to benefit from price upside Bull / Bear Program Ability to exercise fundamental market views to create value within the ratable framework •Modified timing of hedges versus purely ratable •Cross-commodity hedging (heat rate positions, options, etc.) •Delivery locations, regional and zonal spread relationships Credit Rating Capital & Operating Expenditure Dividend Capital Structure • |

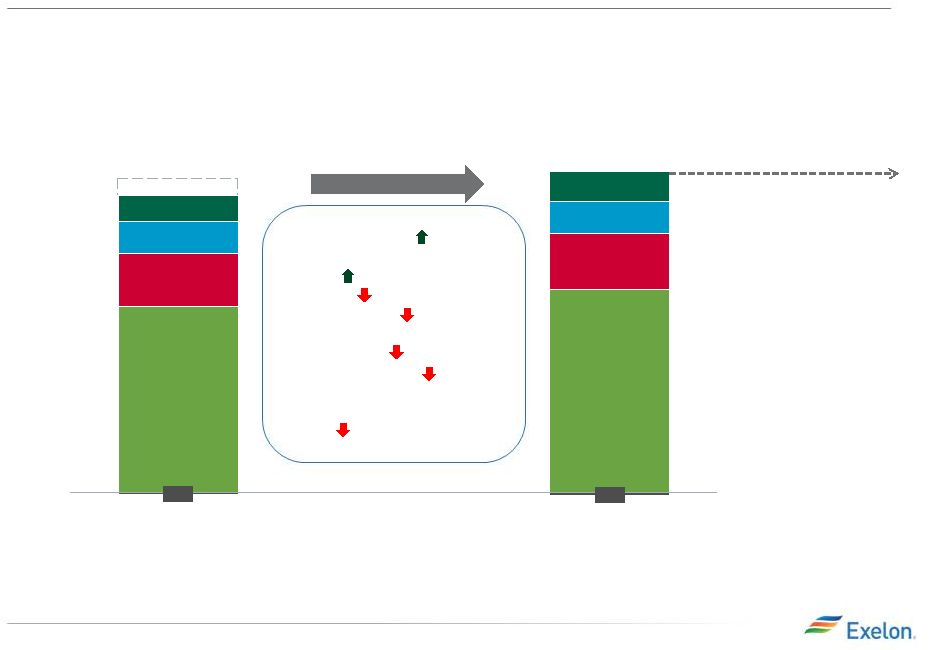

12 Components of Gross Margin Categories Margins move from new business to MtM of hedges over the course of the year as sales are executed Margins move from “Non power new business” to “Non power executed” over the course of the year Gross margin linked to power production and sales Gross margin from other business activities 2012 4Q Earnings Release Slides Open Gross Margin •Generation Gross Margin at current market prices, including capacity & ancillary revenues, nuclear fuel amortization and fossils fuels expense •Exploration and Production •PPA Costs & Revenues •Provided at a consolidated level for all regions (includes hedged gross margin for South, West & Canada (1) ) MtM of Hedges (2) •MtM of power, capacity and ancillary hedges, including cross commodity, retail and wholesale load transactions •Provided directly at a consolidated level for five major regions. Provided indirectly for each of the five major regions via EREP, reference price, hedge %, expected generation “Power” New Business •Retail, Wholesale planned electric sales •Portfolio Management new business •Mid marketing new business “Non Power” Executed •Retail, Wholesale executed gas sales •Load Response •Energy Efficiency •BGE Home •Distributed Solar “Non Power” New Business •Retail, Wholesale planned gas sales •Load Response •Energy Efficiency •BGE Home •Distributed Solar •Portfolio Management / origination fuels new business •Proprietary trading (3) (1) Hedged gross margins for South, West & Canada region will be included with Open Gross Margin, and no expected generation, hedge %, EREP or reference prices provided for this region. (2) MtM of hedges provided directly for the five larger regions. MtM of hedges is not provided directly at the regional level but can be easily estimated using EREP, reference price and hedged MWh. (3) Proprietary trading gross margins will remain within “Non Power” New Business category and not move to “Non Power” Executed category. |

13 ExGen Disclosures Gross Margin Category ($M) (1,2) 2013 2014 2015 Open Gross Margin (including South, West & Canada hedged GM) (3) $5,550 $5,900 $6,050 Mark to Market of Hedges (3,4) $1,650 $650 $300 Power New Business / To Go $400 $650 $850 Non-Power Margins Executed $200 $100 $50 Non-Power New Business / To Go $400 $500 $550 Total Gross Margin $8,200 $7,800 $7,800 2012 4Q Earnings Release Slides (1) Gross margin does not include revenue related to decommissioning, gross receipt tax, Exelon Nuclear Partners and entities consolidated solely as a result of the application of FIN 46R. (2) Gross margin rounded to nearest $50M. (3) Includes CENG Joint Venture. (4) Mark to Market of Hedges assumes mid-point of hedge percentages. (5) Based on December 31, 2012 market conditions. Reference Prices (5) 2013 2014 2015 Henry Hub Natural Gas ($/MMbtu) $3.54 $4.03 $4.23 Midwest: NiHub ATC prices ($/MWh) $30.12 $30.94 $31.87 Mid-Atlantic: PJM-W ATC prices ($/MWh) $36.88 $38.00 $39.17 ERCOT-N ATC Spark Spread ($/MWh) HSC Gas, 7.2HR, $2.50 VOM $6.80 $7.82 $8.05 New York: NY Zone A ($/MWh) $34.22 $34.96 $35.66 New England: Mass Hub ATC Spark Spread($/MWh) ALQN Gas, 7.5HR, $0.50 VOM $4.61 $3.46 $3.18 |

14 ExGen Disclosures Generation and Hedges 2013 2014 2015 Exp. Gen (GWh) (1) 218,000 211,100 207,300 Midwest 97,500 97,400 97,000 Mid-Atlantic (2) 74,900 72,300 70,600 ERCOT 17,400 16,600 16,600 New York (2) 14,000 11,000 9,300 New England 14,200 13,800 13,800 % of Expected Generation Hedged (3) 94-97% 62-65% 27-30% Midwest 92-95% 61-64% 25-28% Mid-Atlantic (2) 97-100% 66-69% 33-36% ERCOT 90-93% 67-70% 36-39% New York (2) 92-95% 57-60% 23-26% New England 92-95% 53-56% 12-15% Effective Realized Energy Price ($/MWh) (4) Midwest $38.50 $35.50 $35.00 Mid-Atlantic (2) $48.00 $46.00 $48.50 ERCOT (5) $10.00 $6.50 $5.50 New York (2) $35.00 $35.00 $47.50 New England (5) $7.00 $4.50 $3.50 2012 4Q Earnings Release Slides (1) Expected generation represents the amount of energy estimated to be generated or purchased through owned or contracted for capacity. Expected generation is based upon a simulated dispatch model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products, and options. Expected generation assumes 12 refueling outages in 2013 and 14 refueling outages in 2014 and 2015 at Exelon-operated nuclear plants ,Salem and CENG. Expected generation assumes capacity factors of 93.5%, 93.8%, and 93.3% in 2013, 2014 and 2015 at Exelon-operated nuclear plants excluding Salem and CENG. These estimates of expected generation in 2013, 2014 and 2015 do not represent guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. (2) Includes CENG Joint Venture. (3) Percent of expected generation hedged is the amount of equivalent sales divided by expected generation. Includes all hedging products, such as wholesale and retail sales of power, options and swaps. Uses expected value on options. (4) Effective realized energy price is representative of an all-in hedged price, on a per MWh basis, at which expected generation has been hedged. It is developed by considering the energy revenues and costs associated with our hedges and by considering the fossil fuel that has been purchased to lock in margin. It excludes uranium costs and RPM capacity revenue, but includes the mark-to-market value of capacity contracted at prices other than RPM clearing prices including our load obligations. It can be compared with the reference prices used to calculate open gross margin in order to determine the mark-to-market value of Exelon Generation's energy hedges. (5) Spark spreads shown for ERCOT and New England. |

15 ExGen Hedged Gross Margin Sensitivities Gross Margin Sensitivities (With Existing Hedges) (1, 2) 2013 2014 2015 Henry Hub Natural Gas ($/Mmbtu) $10 $305 $590 $(15) $(230) $(520) NiHub ATC Energy Price $30 $245 $410 $(30) $(240) $(410) PJM-W ATC Energy Price $15 $130 $260 $0 $(125) $(250) NYPP Zone A ATC Energy Price $5 $25 $35 $(5) $(25) $(35) Nuclear Capacity Factor (3) +/- $40 +/- $45 +/- $45 2012 4Q Earnings Release Slides + $1/Mmbtu + $5/MWh - $5/MWh + $5/MWh - $5/MWh + $5/MWh - $5/MWh +/- 1% - $1/Mmbtu 2012 4Q Earnings Release Slides (1) Based on December 31, 2012 market conditions and hedged position. Gas price sensitivities are based on an assumed gas-power relationship derived from an internal model that is updated periodically. Power prices sensitivities are derived by adjusting the power price assumption while keeping all other prices inputs constant. Due to correlation of the various assumptions, the hedged gross margin impact calculated by aggregating individual sensitivities may not be equal to the hedged gross margin impact calculated when correlations between the various assumptions are also considered. (2) Sensitivities based on commodity exposure which includes open generation and all committed transactions. (3) Includes CENG Joint Venture. |

16 Exelon Generation Hedged Gross Margin Upside/Risk 2015 $9,700 2014 $8,650 2013 $8,450 2012 4Q Earnings Release Slides 2012 4Q Earnings Release Slides Note: Due to a clerical error, the top end of the 2015 Exelon Generation Hedge Gross Margin shown in the graph on slide 20 of the 3rd Quarter 2012 Earnings Conference Call presentation dated November 1, 2012 should have been $10,350M, and is comparable to the $9,700M value in the chart above. No other values or estimates in the 3rd Quarter 2012 presentation were impacted as a result of this error. (1) Represents an approximate range of expected gross margin, taking into account hedges in place, between the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot market. Approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market inputs, future transactions and potential modeling changes. These ranges of approximate gross margin in 2014 and 2015 do not represent earnings guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. The price distributions that generate this range are calibrated to market quotes for power, fuel, load following products, and options as of December 31, 2012 (2) Gross Margin Upside/Risk based on commodity exposure which includes open generation and all committed transactions. $7,050 $6,000 $6,500 $7,000 $7,500 $8,000 $8,500 $9,000 $9,500 $10,000 $7,900 $6,300 |

17 Illustrative Example of Modeling Exelon Generation 2014 Gross Margin Row Item Midwest Mid- Atlantic ERCOT New England New York South, West & Canada (A) Start with fleet-wide open gross margin $5.9 billion (B) Expected Generation (TWh) 97.4 72.3 16.6 13.8 11.0 (C) Hedge % (assuming mid-point of range) 62.5% 67.5% 68.5% 54.5% 58.5% (D=B*C) Hedged Volume (TWh) 60.9 48.8 11.4 7.5 6.4 (E) Effective Realized Energy Price ($/MWh) $35.50 $46.00 $6.50 $4.50 $35.00 (F) Reference Price ($/MWh) $30.94 $38.00 $7.82 $3.46 $34.96 (G=E-F) Difference ($/MWh) $4.56 $8.00 ($1.32) $1.04 $0.04 (H=D*G) Mark-to-market value of hedges ($ million) $280 million $390 million ($15) million $10 million $0 million (I=A+H) Hedged Gross Margin ($ million) $6,550 million (J) Power New Business / To Go ($ million) $650 million (K) Non-Power Margins Executed ($ million) $100 million (L) Non- Power New Business / To Go ($ million) $500 million (N=I+J+K+L) Total Gross Margin $7,800 million (1) Mark-to-market rounded to the nearest $5 million. 2012 4Q Earnings Release Slides 2012 4Q Earnings Release Slides (1) |

18 Additional Disclosures December 31, 2012 2012 4Q Earnings Release Slides 2012 4Q Earnings Release Slides |

Operating O&M Forecast • 2013 O&M forecast of $6.9B – Includes merger synergies of $355M – Excludes costs to achieve which are considered non-operating • Expect O&M CAGR of ~0.5% for 2013-2015 $375 2013E $6,900 (2) -$75 $4,425 $1,200 $700 $650 2012 Actuals $6,775 (1) (2) -$50 $4,050 $1,150 $700 $550 (in $M) ExGen ComEd ComEd PECO PECO BGE Corp ~0.5% CAGR for 2013-2015 ExGen BGE Stub O&M 19 Key Year-over-Year Drivers • Merger synergies: $185M • PECO and BGE Storm Costs: $80M • Inflation: $150M • Pension/OPEB: $25M • ExGen Non-Power Costs, offset in RNF: $70M • Other ExGen O&M: $55M • Other Utilities O&M, including BGE Reliability and ComEd EIMA: $90M 2012 4Q Earnings Release Slides (1) O&M for 2012 includes CEG and BGE costs from merger close date. (2) O&M for utilities excludes regulatory O&M that are P&L neutral. ExGen O&M excludes P&L neutral decommissioning costs and the impact from O&M related to entities consolidated solely as a result of the application of FIN 46R. |

Capital Expenditure Expectations 275 225 25 100 100 100 50 25 75 100 950 975 175 2013 2,850 1,025 1,000 575 2015 2,500 1,000 975 225 2014 2,275 2012 (1) 3,700 950 1,150 650 600 Base Capex (3) Nuclear Fuel (2) MD Commitments Wind Solar Upstream Gas Nuclear Uprates 325 2014 2,575 1,450 525 225 375 2013 2,650 1,425 625 200 2015 2,750 1,550 650 225 400 2012 (1) 2,200 1,425 375 200 200 Electric Distribution Electric Transmission Gas Delivery Smart Grid/Smart Meter (in $M) (in $M) 20 2012 4Q Earnings Release Slides Exelon Utilities Exelon Generation (1) 2012 CapEx includes CEG and BGE from merger close date. (2) Nuclear fuel is at ownership and includes Salem. (3) ExGen base capex includes $350 million of Fukushima response costs for 2013-2017. Does not include estimate of $15-20 million per unit, at eleven Mark 1 and 2 units, cost for filtered vents, if required. |

2013 Projected Sources and Uses of Cash (1) Exelon beginning cash balance as of 12/31/12. Excludes counterparty collateral activity. (2) Cash Flow from Operations primarily includes net cash flows provided by operating activities and net cash flows used in investing activities other than capital expenditures. (3) Dividends are subject to declaration by the Board of Directors. (4) Excludes PECO’s $210 million Accounts Receivable (A/R) Agreement with Bank of Tokyo. PECO’s A/R Agreement was extended in accordance with its terms through August 30, 2013. (5) “Other” includes proceeds from options and expected changes in short-term debt. (6) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. ($ in millions) 2012 4Q Earnings Release Slides 21 Beginning Cash Balance (1) $1,575 Cash Flow from Operations (2) 550 1,225 625 3,600 5,950 CapEx (excluding other items below): (550) (1,300) (400) (1,025) (3,325) Nuclear Fuel n/a n/a n/a (1,000) (1,000) Dividend (3) (1,250) Nuclear Uprates n/a n/a n/a (225) (225) Wind n/a n/a n/a -- 0 Solar n/a n/a n/a (575) (575) Upstream n/a n/a n/a (25) (25) Utility Smart Grid/Smart Meter (125) (100) (175) n/a (400) Net Financing (excluding Dividend): Debt Issuances (4) 350 250 250 -- 850 Debt Retirements (400) (250) (300) (450) (1,400) Project Finance/Federal Financing Bank Loan n/a n/a n/a 1,000 1,000 Other (5) 75 275 -- -- 400 Ending Cash Balance (1) $1,575 (6) |

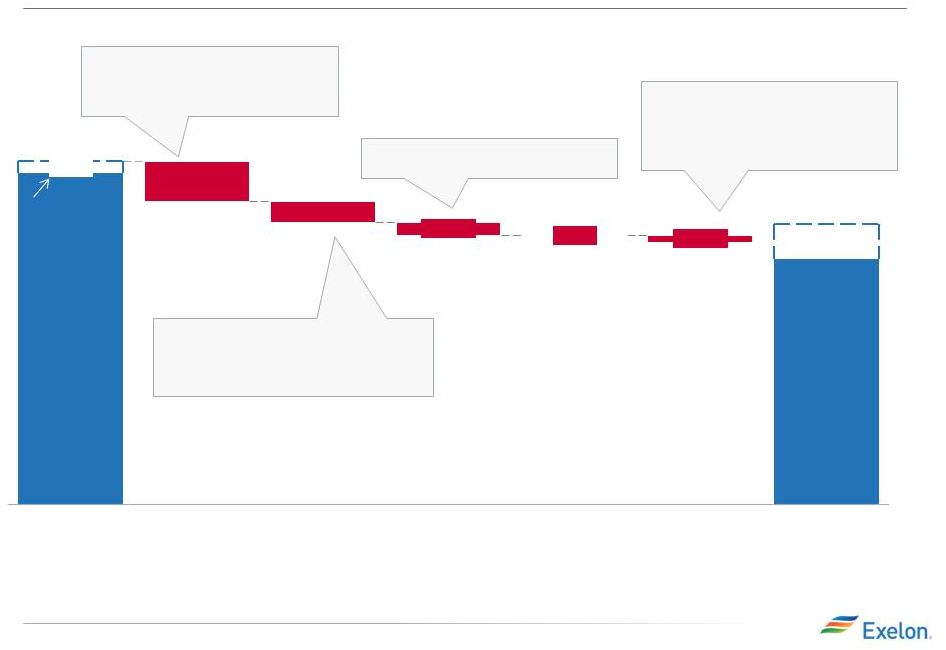

ExGen Operating EPS Bridge 2012 to 2013 ($0.39) Lower Generation RNF primarily due to prices as well as lower retail unit margins, offset by growth projects $0.06 Non-power revenue $0.05 Capacity revenue $0.11 Primarily ITC and PTC tax credits ($0.03) 2012 decommissioning realized gains due to rebalancing ($0.08) Share Dilution $1.96 $1.89 $0.07 2013 $1.40-$1.60 Other ($0.01) Interest $0.00 Depreciation & Amortization ($0.08) O&M ($0.10) RNF ($0.27) 2012 Stub 22 2012 4Q Earnings Release Slides Note: Drivers add up to mid-point of 2013 EPS range. RNF = Revenue Net Fuel (1) Financials exclude P&L neutral items (including decommissioning costs, gross receipts tax and entities consolidated solely as a result of the application of FIN 46R). (2) Shares Outstanding (diluted) are 819M in 2012 and 860M in 2013. 2013 represents full-year of shares outstanding resulting from March 2012 merger with Constellation. ($0.07) Inflation ($0.05) Higher cost of sales related to non-power revenue ($0.02) Pension and OPEB ($0.05) Other $0.09 Synergies ($0.08) Primarily new wind projects, portions of AVSR and other assets in service |

2013 Other Depreciation & Amortization O&M (1) ($0.03) RNF $0.05 2012 ComEd Operating EPS Bridge 2012 to 2013 $0.07 DST Revenue primarily due to formula rate ($0.02) Weather ($0.02) Depreciation Expense ($0.02) Share Dilution (2) $0.35 - $0.45 Interest ($0.02) EIMA O&M ($0.02) Inflation $0.02 Synergies 23 2012 4Q Earnings Release Slides $0.47 Note: Drivers add up to mid-point of 2013 EPS range. RNF = Revenue Net Fuel (1) Financials exclude regulatory items that are P&L neutral. (2) Shares Outstanding (diluted) are 819M in 2012 and 860M in 2013. 2013 represents full-year of shares outstanding resulting from March 2012 merger with Constellation. ($0.01) Effective Tax Rate Change ($0.02) ($0.05) ($0.02) |

$0.47 2013 $0.35 - $0.45 Other ($0.09) Interest $0.01 O&M $0.01 RNF $0.00 2012 PECO Operating EPS Bridge 2012 to 2013 $0.02 Weather ($0.01) Load Growth/Customer mix ($0.01) Transmission $0.01 Storm $0.01 Synergies ($0.01) Inflation ($0.03) Electric and Gas Tax Repairs ($0.02) Share Dilution (2) ($0.01) Taxes Other Than Income in 2012 ($0.01) Other Effective Tax Rate Change 24 2012 4Q Earnings Release Slides Note: Drivers add up to mid-point of 2013 EPS range. RNF = Revenue Net Fuel (1) Financials exclude regulatory items that are P&L neutral. (2) Shares Outstanding (diluted) are 819M in 2012 and 860M in 2013. 2013 represents full-year of shares outstanding resulting from March 2012 merger with Constellation. 2012 4Q Earnings Release Slides |

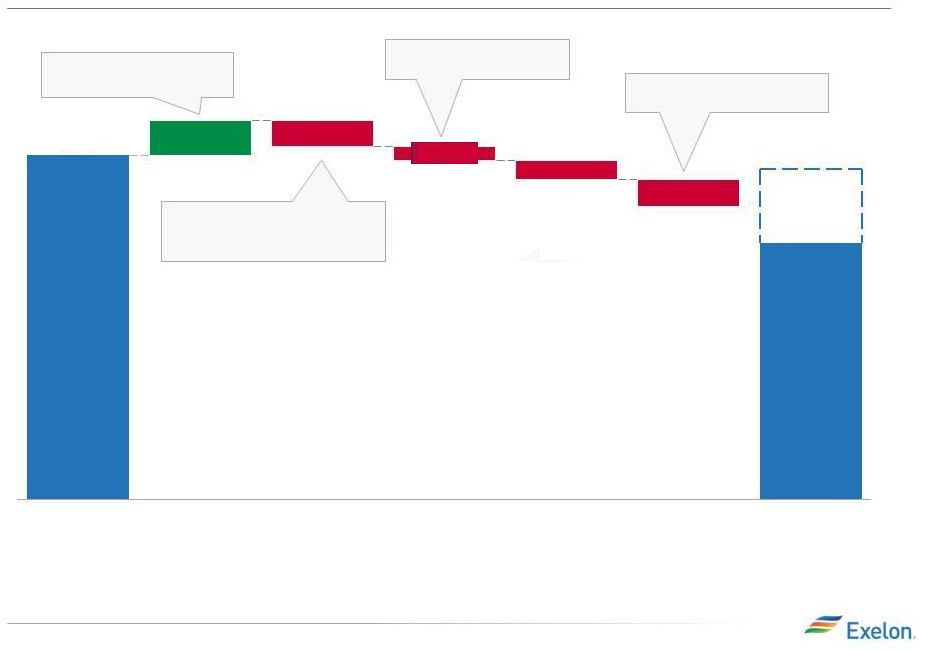

Depreciation & Amortization 0.01 O&M 0.02 RNF 0.06 2012 $0.11 $0.06 Stub: $0.05 2013 $0.15- $0.25 Other 0.00 BGE Operating EPS Bridge 2012 to 2013 ($0.01) PSC Mandated Reliability Spend ($0.01) Inflation $0.04 Storm $0.01 Synergies ($0.01) Share Dilution (2) $0.01 Other including tax rate changes $0.06 Higher RNF 25 2012 4Q Earnings Release Slides 2012 4Q Earnings Release Slides Note: Drivers add up to mid-point of 2013 EPS range. RNF = Revenue Net Fuel (1) Financials exclude regulatory items that are P&L neutral. (2) Shares Outstanding (diluted) are 819M in 2012 and 860M in 2013. 2013 represents full-year of shares outstanding resulting from March 2012 merger with Constellation. |

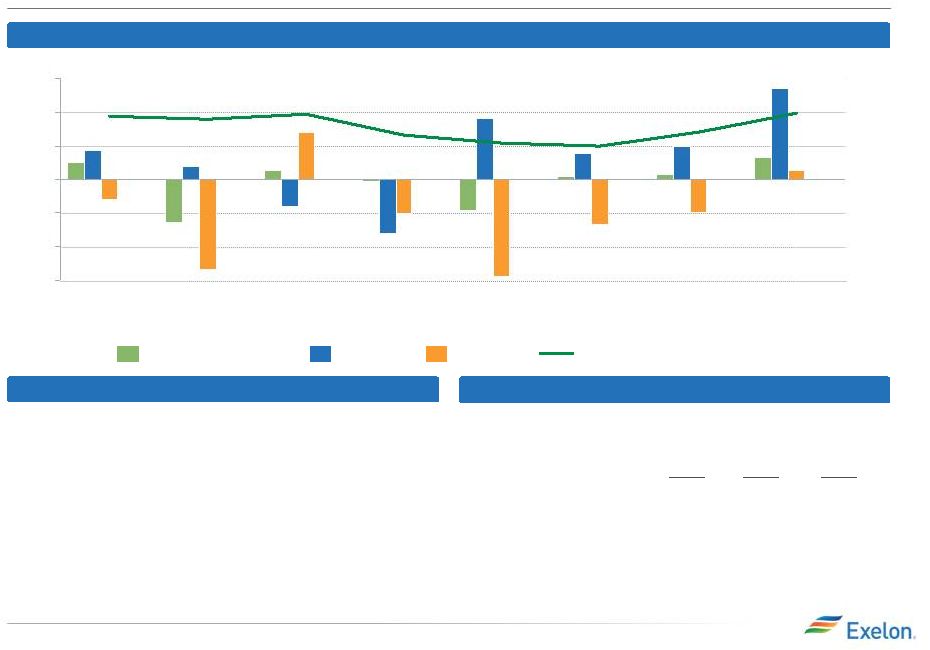

ComEd Load Trends 4Q13 3Q13 2Q13 1Q13 4Q12 3Q12 2Q12 1Q12 Gross Metro Product Residential Large C&I All Customer Classes Notes: C&I = Commercial & Industrial. ComEd load activity impacts net income to the extent that it does not result in an ROE outside of the collar, which ensures that the earned ROE is within 0.5% of the allowed ROE. Weather-Normalized Electric Load Year-over-Year Key Economic Indicators Weather-Normalized Electric Load (1) Source: U.S. Dept. of Labor (December 2012) and Illinois Department of Security (December 2012) (2) Source: Global Insight (November 2012) (3) Not adjusted for leap year Chicago U.S. Unemployment rate (1) 8.9% 2012 annualized growth in gross domestic/metro product (2) 1.8% 26 2012 4Q Earnings Release Slides 4Q12 2012 (3) 2013E (3) Average Customer Growth 0.3% 0.3% 0.4% Average Use-Per-Customer (1.3)% (0.9)% (1.7)% Total Residential (1.0)% (0.6)% (1.2)% Small C&I 1.8% 0.2% (0.5)% Large C&I (1.6)% (0.3)% 1.6% All Customer Classes (0.1)% (0.1)% (0.0)% -3% -2% -1% 0% 1% 2% 3% 2.1% 7.8% |

27 PECO Load Trends -5% -4% -3% -2% -1% 0% 1% 2% 3% 4Q13 3Q13 2Q13 1Q13 4Q12 3Q12 2Q12 1Q12 Gross Metro Product Residential Large C&I All Customer Classes Note: C&I = Commercial & Industrial. Weather-Normalized Electric Load Year-over-Year Key Economic Indicators Weather-Normalized Electric Load (1) Source: U.S. Dept. of Labor (December 2012) - US US Dept of Labor prelim. data (October 2012) - Philadelphia (2) Source: Global Insight (November 2012) (3) 4Q12 LCI does not include 64 GWh for a change in prior period estimates. (4) Not adjusted for leap year Philadelphia U.S. Unemployment rate (1) 8.0% 2012 annualized growth in gross domestic/metro product (2) 1.9% 2.1% 2012 4Q Earnings Release Slides 4Q12 (3) 2012 (4) 2013E (4) Average Customer Growth 0.2% 0.3% 0.2% Average Use-Per-Customer 0.5% (2.0)% (0.7)% Total Residential 0.7% (1.7)% (0.5)% Small C&I (0.5)% (2.3)% (1.3)% Large C&I (0.3)% (2.7)% (0.1)% All Customer Classes (0.1)% (2.2)% (0.5)% 7.8% |

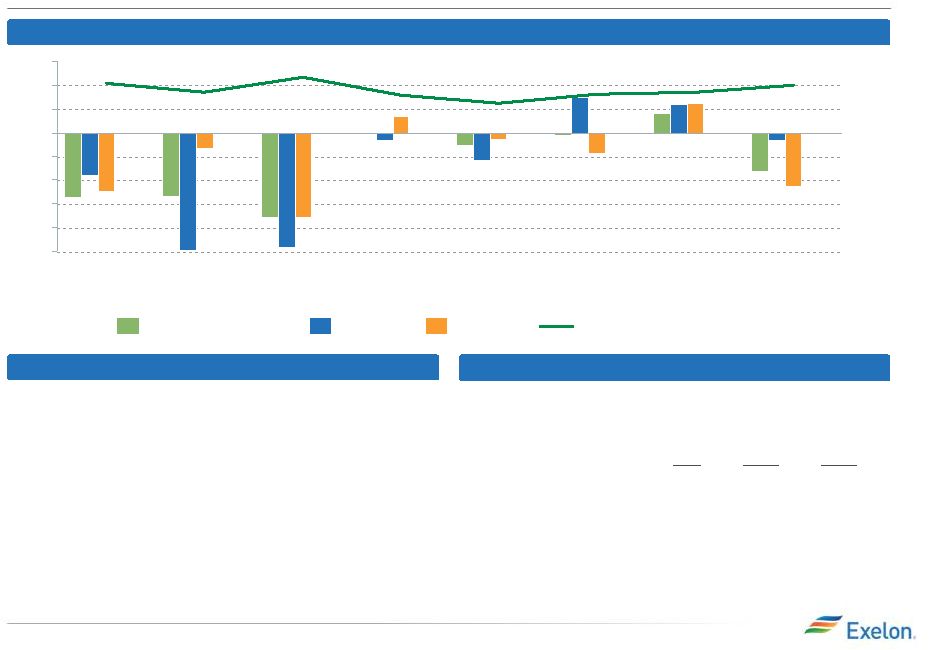

28 BGE Load Trends -5% -4% -3% -2% -1% 0% 1% 2% 3% 4Q13 3Q13 2Q13 1Q13 4Q12 3Q12 2Q12 1Q12 Gross Metro Product Residential Large C&I All Customer Classes Weather-Normalized Electric Load Year-over-Year Key Economic Indicators Weather-Normalized Electric Load (1) Source: U.S. Dept. of Labor (December 2012) - US US Dept of Labor prelim. data (November 2012) - Baltimore (2) Source: Global Insight (November 2012) (3) Not adjusted for leap year Baltimore U.S. Unemployment rate (1) 6.8% 2012 annualized growth in gross domestic/metro product (2) 1.4% 2.1% 2012 4Q Earnings Release Slides 4Q12 2012 (3) 2013E (3) Average Customer Growth 0.0% 0.0% 0.6% Average Use-Per-Customer (1.9)% (3.4)% (2.3)% Total Residential (1.9)% (3.4)% (1.7)% Small C&I (0.6)% (3.0)% (1.1)% Large C&I 2.1% 1.5% 1.2% All Customer Classes (3.3)% (2.2)% (1.7)% 7.8% Note: C&I = Commercial & Industrial. 2012 quarterly and full year data is adjusted for timing of PJM settlements. Impact of RG Steel is only reflected in “All Customer Classes” and not in “Large C&I” amounts. |

29 Additional 2013 ExGen and CENG Modeling P&L Item 2013 Estimate ExGen Model Inputs (1) O&M $4,425M Taxes Other Than Income (TOTI) $300M Depreciation & Amortization (4) $825M Interest Expense $375M CENG Model Inputs (at ownership) (5) Gross Margin Included in ExGen Disclosures O&M / TOTI $400M-$450M Depreciation & Amortization / Accretion $100M-$150M 2012 4Q Earnings Release Slides 2012 4Q Earnings Release Slides (1) ExGen amounts for O&M, TOTI and Depreciation & Amortization exclude the impacts of CENG. CENG impact is reflected in “Equity earnings of unconsolidated affiliates” in the Income Statement. (2) ExGen O&M excludes P&L neutral decommissioning costs and the impact from O&M related to entities consolidated solely as a result of the application of FIN 46R. (3) TOTI excludes gross receipts tax for retail. (4) ExGen Depreciation & Amortization excludes the impact of P&L neutral decommissioning. (5) CENG has not concluded its financial planning process for 2013. The CENG model inputs are intended to support ExGen’s guidance range and do not represent CENG’s final estimates. (3) (2) |

2013 Key Assumptions Utility Statistics 2013 Estimate Electric Delivery Growth (%) (3) ComEd (0.0)% PECO (0.5)% BGE (1.7)% Effective Tax Rate - Operating (%) 2013 Estimate ComEd 40.0% PECO 31.0% BGE 38.7% ExGen 33.4% Exelon 34.4% 30 (1) Excludes Salem and CENG. (2) Reflects forward market prices as of December 31, 2012. (3) Weather-normalized load growth. (4) O&M rounded to the nearest $25M. (5) ExGen O&M excludes P&L neutral decommissioning costs and the impact from O&M related to entities consolidated solely as a result of the application of FIN 46R. . Generation Statistics 2013 Estimate (2) Nuclear Capacity Factor (%) (1) 93.5% Total Expected Generation(GWh) 218,000 Henry Hub Natural Gas ($/MMbtu) $3.54 Midwest: NiHub ATC Price $30.12 Mid-Atlantic: PJM-W ATC Price $36.88 ERCOT-N ATC Spark Spread $6.80 New York: NY Zone A ATC Price $34.22 New England: Mass Hub Spark Spread $4.61 2013 O&M (4) Reconciliation (in $M) ExGen ComEd PECO BGE Other Exelon GAAP O&M $4,550 $1,400 $825 $650 $(75) $7,350 Decommissioning and FIN 46R O&M (5) $(50) - - - - $(50) Regulatory O&M - $(200) $(125) - - $(325) Merger/Integration costs $(75) - - - - $(75) Operating O&M (as shown on slide 19) $4,425 $1,200 $700 $650 $(75) $6,900 2012 4Q Earnings Release Slides 2012 4Q Earnings Release Slides |

Sufficient Liquidity (1) Excludes commitments from Exelon’s Community and Minority Bank Credit Facility. (2) Available Capacity Under Facilities represents the unused commitments under the borrower’s credit agreements net of outstanding letters of credit and facility draws. The amount of commercial paper outstanding does not reduce the available capacity under the credit agreements. ($ in Millions) Available Capacity Under Bank Facilities as of January 30, 2013 Exelon Corp, ExGen, PECO and BGE facilities were amended and extended on August 10, 2012 to align maturities of facilities and secure liquidity and pricing through 2017 31 2012 4Q Earnings Release Slides Aggregate Bank Commitments (1) 600 1,000 600 5,675 8,375 Outstanding Facility Draws – – – – Outstanding Letters of Credit (1) (1,729) (1,732) Available Capacity Under Facilities (2) 600 1,000 599 3,946 6,643 Outstanding Commercial Paper Available Capacity Less Outstanding Commercial Paper 600 1,000 599 3,946 6,643 – – – – – – – – |

ComEd Operating EPS Contribution Key Drivers – 4Q12 vs. 4Q11 (1) Share differential: $(0.04) Impact of the 2011 allowed recovery of certain storm costs pursuant to EIMA (2): : $(0.04) Lower distribution revenue primarily due to lower allowed ROE (3): $(0.02) Lower income tax: $0.01 Lower interest expense primarily due to the settlement of the 1999-2001 income tax returns: $0.02 Other impacts of EIMA, primarily related to the 2012 ICC rehearing order for the allowed recovery of pension asset costs: $0.07 4Q12 Heating Degree-Days 1,832 2,030 2,293 Cooling Degree-Days 14 3 11 4Q11 Full Year 4Q 2012 2011 32 2012 4Q Earnings Release Slides 2012 4Q Earnings Release Slides (1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (2) The Energy Infrastructure Modernization Act. (3) Due to the true-up mechanism in the distribution formula rate, the primary driver of year-over-year change in earnings will be due to changes in the allowed ROE, rate base and capital structure. $0.61 $0.18 $0.47 $0.19 Normal Actual Actual |

PECO Operating EPS Contribution Key Drivers – 4Q12 vs. 4Q11 (1) Increased storm costs: $(0.04) Share differential: $(0.02) Weather: $0.02 Lower income tax primarily due to gas distribution tax repairs deduction: $0.02 4Q12 Heating Degree-Days 1,302 1,482 1,629 Cooling Degree-Days 14 31 19 4Q11 33 2012 4Q Earnings Release Slides Full Year 4Q 2012 2011 2012 4Q Earnings Release Slides (1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. $0.58 $0.11 $0.47 $0.09 Normal Actual Actual |

4Q GAAP EPS Reconciliation NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not add due to rounding. 2012 4Q Earnings Release Slides 34 Three Months Ended December 31, 2012 ExGen ComEd PECO BGE Other Exelon 2012 Adjusted (non-GAAP) Operating Earnings Per Share $0.33 $0.19 $0.09 $0.02 $0.00 $0.64 Mark-to-market impact of economic hedging activities 0.17 - - - (0.03) 0.14 Plant retirements and divestitures (0.05) - - - - (0.05) Asset retirement obligation 0.01 - - - - 0.01 Constellation merger and integration costs (0.04) (0.00) (0.00) (0.00) (0.00) (0.05) Amortization of commodity contract intangibles (0.24) - - - - (0.24) Non-cash remeasurement of deferred income taxes (0.01) - - - 0.01 0.00 Midwest Generation bankruptcy charges (0.01) - - - - (0.01) 4Q 2012 GAAP Earnings (Loss) Per Share $0.16 $0.19 $0.09 $0.02 $(0.02) $0.44 Three Months Ended December 31, 2011 ExGen ComEd PECO Other Exelon 2011 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $0.54 $0.18 $0.11 $(0.02) $0.82 Mark-to-market impact of economic hedging activities 0.07 - - - 0.07 Unrealized gains related to nuclear decommissioning trust funds 0.07 - - - 0.07 Plant retirements and divestitures (0.01) - - - (0.01) Constellation merger and integration costs (0.01) - (0.00) (0.02) (0.03) Non-cash remeasurement of deferred income taxes 0.01 - - (0.02) (0.01) 4Q 2011 GAAP Earnings (Loss) Per Share $0.67 $0.18 $0.11 $(0.05) $0.91 |

Full Year GAAP EPS Reconciliation NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not add due to rounding. 2012 4Q Earnings Release Slides 35 Twelve Months Ended December 31, 2012 ExGen ComEd PECO BGE Other Exelon 2012 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $1.89 $0.47 $0.47 $0.06 $(0.04) $2.85 Mark-to-market impact of economic hedging activities 0.38 - - - 0.00 0.38 Unrealized gains related to nuclear decommissioning trust funds 0.07 - - - - 0.07 Plant retirements and divestitures (0.29) - - - - (0.29) Constellation merger and integration costs (0.20) (0.00) (0.01) (0.01) (0.09) (0.31) Maryland commitments (0.03) - - (0.10) (0.15) (0.28) Amortization of commodity contract intangibles (0.93) - - - - (0.93) FERC settlement (0.21) - - - - (0.21) Reassessment of state deferred income taxes 0.00 - - - 0.14 0.14 Amortization of the fair value of certain debt 0.01 - - - - 0.01 Midwest Generation bankruptcy charges (0.01) - - - (0.01) FY 2012 GAAP Earnings (Loss) Per Share $0.69 $0.46 $0.46 $(0.05) $(0.14) $1.42 Twelve Months Ended December 31, 2011 ExGen ComEd PECO Other Exelon 2011 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $3.01 $0.61 $0.58 $(0.05) $4.16 Mark-to-market impact of economic hedging activities (0.27) - - - (0.27) Plant retirements and divestitures (0.05) - - - (0.05) Asset retirement obligation (0.03) - 0.00 - (0.02) Constellation merger and integration costs (0.01) - (0.00) (0.06) (0.07) Other acquisitions costs (0.01) - - - (0.01) Wolf Hollow acquisition 0.03 - - - 0.03 Recovery of costs pursuant to the 2011 distribution rate case order - 0.03 - - 0.03 Non-cash remeasurement of deferred income taxes 0.01 - - (0.02) (0.01) Non-cash charge resulting from Illinois tax rate change legislation (0.03) (0.01) - (0.00) (0.04) FY 2011 GAAP Earnings (Loss) Per Share $2.66 $0.63 $0.58 $(0.12) $3.75 |

GAAP to Operating Adjustments • Exelon’s 2013 adjusted (non-GAAP) operating earnings outlook excludes the earnings effects of the following: – Mark-to-market adjustments from economic hedging activities – Financial impacts associated with the planned retirement of fossil generating units and the sale in the fourth quarter of 2012 of three generating stations as required by the merger – Certain costs incurred related to the Constellation merger and integration initiatives – Non-cash amortization of intangible assets, net, related to commodity contracts recorded at fair value at the merger date – Non-cash amortization of certain debt recorded at fair value at the merger date expected to be retired in 2013 – Significant impairments of assets, including goodwill – Other unusual items – Significant changes to GAAP 2012 4Q Earnings Release Slides 36 |