Earnings Conference Call 3 rd Quarter 2013 October 30 th , 2013 * * * * Exhibit 99.2 |

Cautionary Statements Regarding Forward-Looking Information 1 2013 3Q Earnings Release Slides This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results to differ materially from the forward-looking statements made by Exelon Corporation, Commonwealth Edison Company, PECO Energy Company, Baltimore Gas and Electric Company and Exelon Generation Company, LLC (Registrants) include those factors discussed herein, as well as the items discussed in (1) Exelon’s 2012 Annual Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) ITEM 8. Financial Statements and Supplementary Data: Note 19; (2) Exelon’s Second Quarter 2013 Quarterly Report on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b) Part 1, Financial Information, ITEM 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (c) Part I, Financial Information, ITEM 1. Financial Statements: Note 18; and (3) other factors discussed in filings with the SEC by the Registrants. Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Registrants undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. |

2013 3Q Earnings Release Slides 2 3Q13 In Review 3Q Highlights Narrowing 2013 Full-Year Guidance • Strong quarter with results higher than expected 3Q earnings of $0.78/share • Strong fleet operations 94.8% nuclear capacity factor 99.1% fossil and hydro dispatch match • Continental Wind financing Regulatory Update • Rate cases for BGE and ComEd • PJM stakeholder process on capacity markets • LCAPP decision in New Jersey $0.35 - $0.45 $0.35 - $0.45 $0.15 - $0.25 HoldCo ExGen ComEd PECO BGE ExGen ComEd PECO BGE 2013 Revised Guidance $2.40 - $2.60 (1) $1.40 - $1.50 $0.45 - $0.50 $0.40 - $0.45 $0.20 - $0.25 2013 Initial Guidance $2.35 - $2.65 (1) $1.40 - $1.60 LCAPP = Long-Term Capacity Pilot Project (1) Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non GAAP) operating EPS to GAAP EPS. |

Exelon Generation: Gross Margin Update September 30, 2013 Change from June 30, 2013 Gross Margin Category ($M) (1) (2) 2013 2014 2015 2013 2014 2015 Open Gross Margin (3) (including South, West, Canada hedged gross margin) 5,600 5,650 5,800 (150) (50) (100) Mark-to-Market of Hedges (3,4) 1,700 900 450 250 50 50 Power New Business / To Go 50 500 750 (150) (50) - Non-Power Margins Executed 400 200 100 50 50 50 Non-Power New Business / To Go (5) 200 400 500 (50) (50) (50) Total Gross Margin 7,950 7,650 7,600 (50) (50) (50) Key Changes in 3Q 2013 • Continue to execute behind ratable and utilize cross-commodity hedges as our fundamental view shows upside in 2015. • 2013: Reduction of $50M due to lower expected margin from our Commercial group; offsets below gross margin make this a negligible impact to EPS • 2014 & 2015: $50M reduction due to prices and a reduction in expected output from our wind assets. 2013 3Q Earnings Release Slides 3 1) Gross margin rounded to nearest $50M. 2) Gross margin does not include revenue related to decommissioning, gross receipts tax, Exelon Nuclear Partners and entities consolidated solely as a result of the application of FIN 46R. 3) Includes CENG Joint Venture. 4) Mark to Market of Hedges assumes mid-point of hedge percentages. 5) Any changes to new business estimates for our non-power business are presented as revenue less costs of sales. |

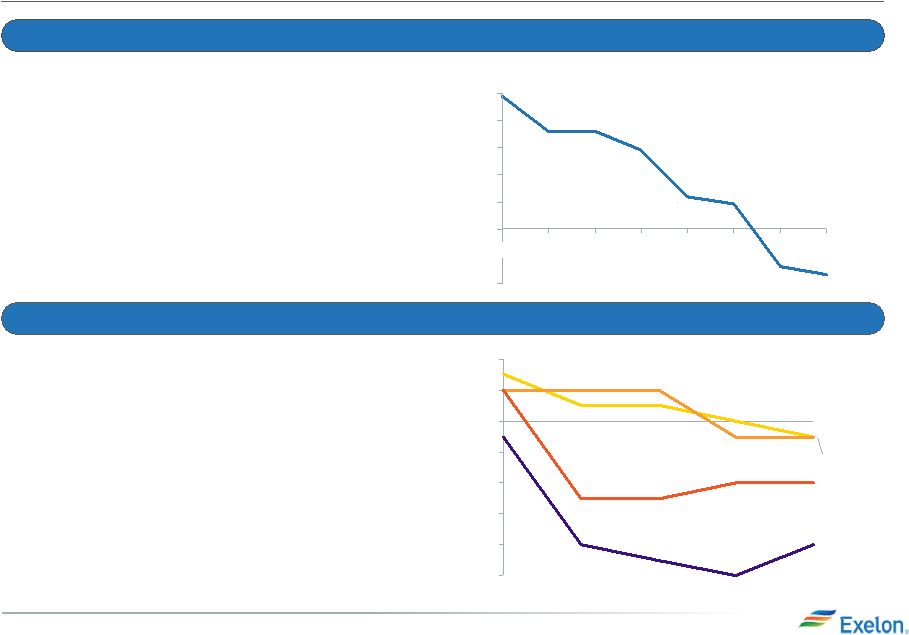

• Our hedging profile in PJM East has tracked at or ahead of ratable, limiting the impact of the basis move on our portfolio • We continue to stay behind ratable in our PJM Midwest power portfolio due to our view that heat rates will expand • Increases in Mid-Atlantic natural gas production and weak spot prices pressuring forward Mid-Atlantic basis prices • We expect Mid-Atlantic basis prices will stabilize as infrastructure is put in place to export natural gas from the Mid-Atlantic production area • Although Chicago city gate basis has also seen recent declines, PJM power price impact is smaller. We expect basis in the Midwest will not reach discounts seen in the East Natural Gas Basis Impact on Portfolio Management 4 2013 3Q Earnings Release Slides Structural Change That Has Developed Over Years; Should Stabilize Over the Coming Years Dynamic Hedging to Address Natural Gas Basis Concerns -10% -8% -6% -4% -2% 0% 2% 4% NiHub 2015 NiHub 2014 PJM-W - 2015 PJM-W - 2014 Q3-2013 Q2-2013 Q1-2013 Q4-2012 Q3-2012 -0.4 -0.2 0.0 0.2 0.4 0.6 0.8 1.0 2008 2009 2010 2011 2012 2013 2014 2015 Hedging Deviations to Ratable Realized and Forward Basis Prices (M3) $/Mmbtu |

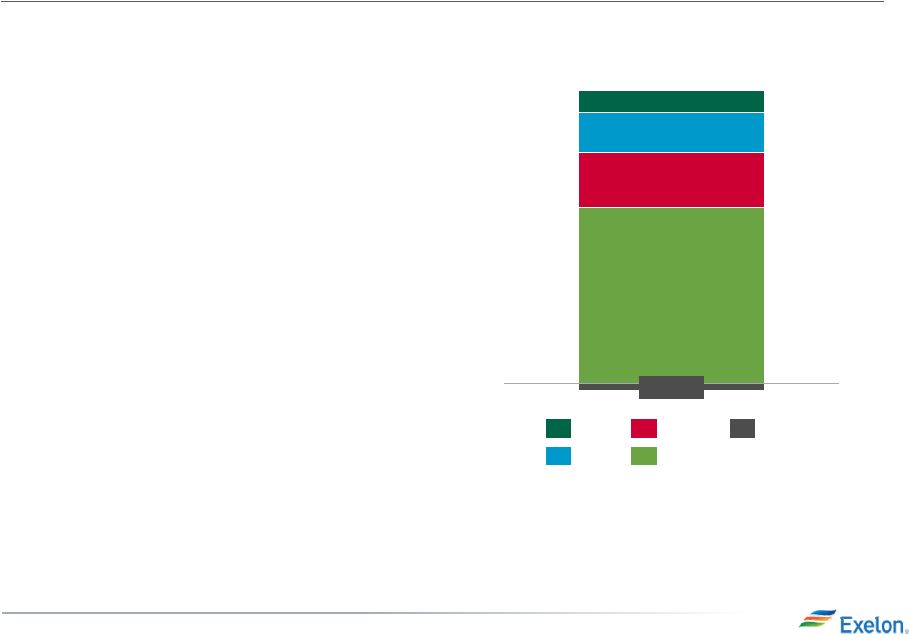

Key Financial Messages 5 2013 3Q Earnings Release Slides • Delivered non-GAAP operating earnings (1) in 3Q of $0.78/share; higher than guidance range provided of $0.60 - $0.70/share 3Q 2013 vs. Guidance • Higher earnings at utilities primarily driven by lower storm costs • Higher ExGen earnings primarily driven by lower O&M Full-Year 2013 Guidance • Strong YTD performance reflected in raising the bottom of guidance range • Gross margin reduction at ExGen • Delay in AVSR tax credits $0.78 ($0.02) $0.48 $0.15 $0.11 $0.06 HoldCo ExGen ComEd PECO BGE 2013 3Q Results (1) Refer to Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. |

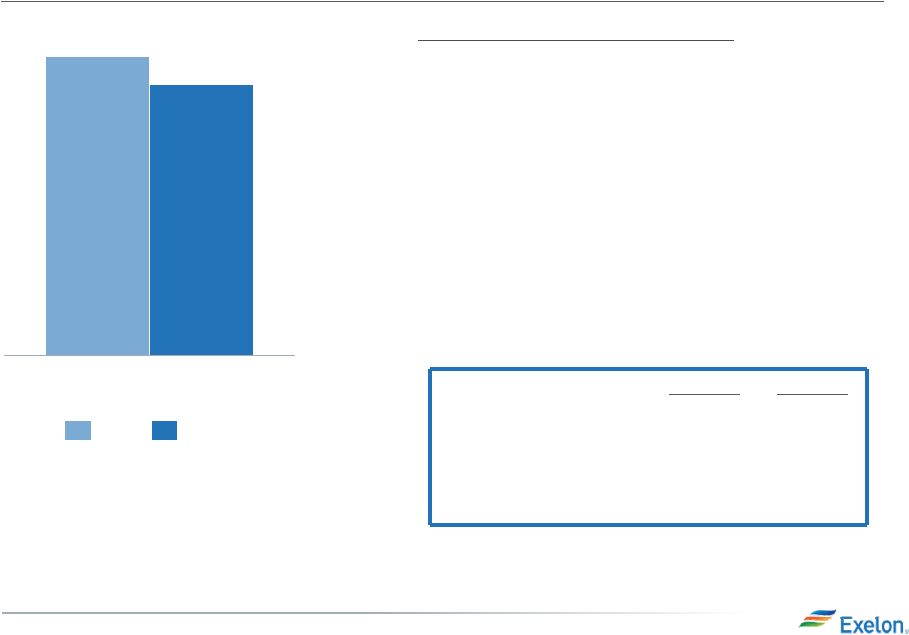

ExGen Operating EPS Contribution 6 2013 3Q Earnings Release Slides $0.53 $0.48 3Q 2013 2012 RNF = Revenue Net Fuel. (1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (excludes Salem and CENG) 3Q12 Actual 3Q13 Actual Planned Refueling Outage Days 43 43 Non-refueling Outage Days 40 5 Nuclear Capacity Factor 90.7% 94.8% Key Drivers – 3Q13 vs. 3Q12 (1) • Lower RNF, primarily due to lower realized energy prices, partially offset by higher capacity pricing and increased nuclear volumes: $(0.18) • Increased depreciation expense: $(0.02) • Higher Nuclear Decommissioning Trust (NDT) fund gains: $0.02 • Lower O&M costs, primarily due to merger synergies: $0.05 • Lower income tax, primarily driven by AVSR investment tax credit benefits: $0.06 |

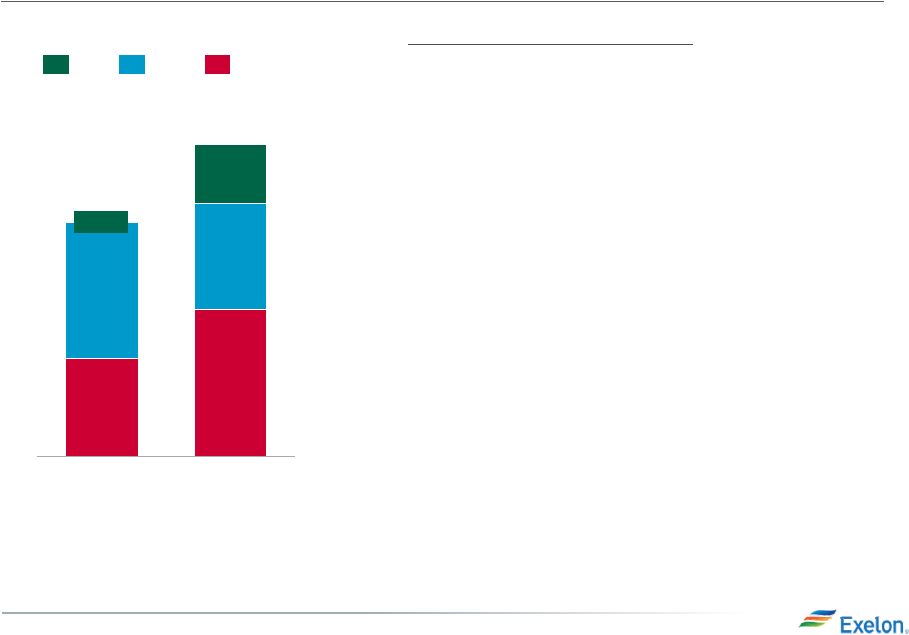

Exelon Utilities Operating EPS Contribution 7 2013 3Q Earnings Release Slides 3Q 2013 3Q 2012 $0.10 $0.15 $0.11 $0.24 $0.14 $0.00 $0.06 $0.32 BGE PECO ComEd Numbers may not add due to rounding. (1) Refer to the Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS. (2) Due to the distribution formula rate, changes in ComEd’s earnings are driven primarily by changes in 30-year U.S. Treasury rates (allowed ROE), rate base and capital structure in addition to weather, load and changes in customer mix. Key Drivers – 3Q13 vs. 3Q12 (1): BGE (+$0.06): • Electric and gas distribution rates: $0.02 • Decreased storm costs: $0.03 PECO (-$0.03): • Weather: $(0.02) • Higher income tax, primarily due to gas distribution tax repairs deduction: $(0.02) ComEd (+$0.05): • Weather (2) : $(0.02) • Customer mix (2) : $0.01 • Higher distribution revenue due to increased recovery of costs and capital investments and higher allowed ROE (2) : $0.05 |

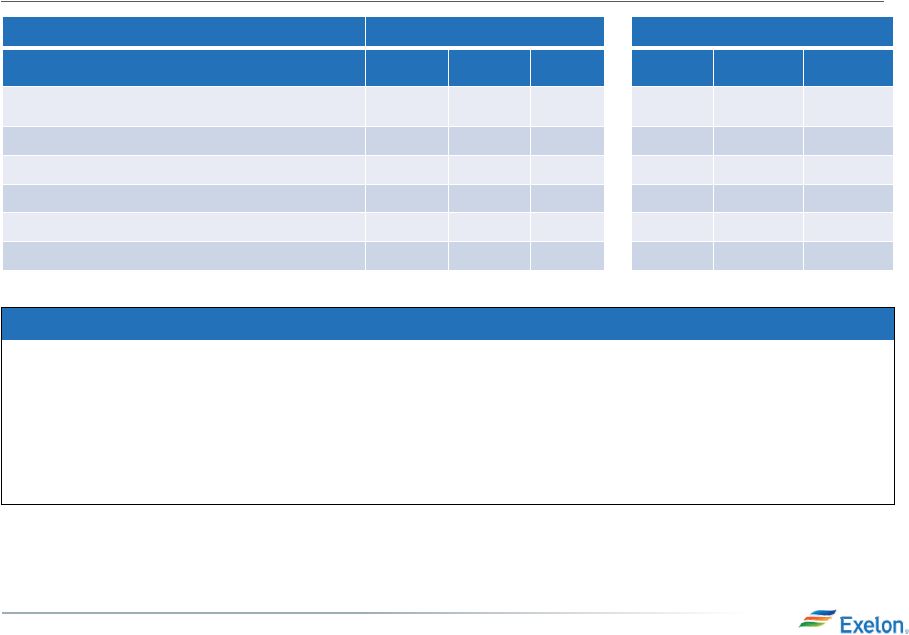

2013 Cash Flow Summary and Key Drivers Cash from operations of $5,775M less capex of ($5,450M) and financing of ($475M) • $75M lower projected Capex than 2Q13 Update $50M AVSR construction delays $25M Lower investment at the utilities ($25M) Wind and Solar projects increased spend (2) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. • $225M higher than 2Q13 Update $200M Primarily working capital changes at ExGen Projected Sources and Uses Summary 1 (1) A more detailed view of the Sources and Uses table can be found on slide 22 2013 3Q Earnings Release Slides 8 • ($150M) lower than 2Q13 Update ($150M) Related to reduced AVSR DoE loan draw due to milestone delays ($25M) Reduced sizing of Continental Wind debt $50M Increase in projected year-end commercial paper at ComEd ($ in millions) BGE ComEd PECO ExGen Exelon (2) As of 2Q13 Delta 1,575 1,575 – Cash Flow from Operations 575 1,075 650 3,550 5,775 5,550 225 Capital Expenditures (625) (1,450) (550) (2,725) (5,450) (5,525) 75 Net Financing (excluding items below): (100) 100 50 (450) (400) (400) – Dividend (1,250) (1,250) – Project Finance n/a n/a n/a 850 850 1,025 (175) Other 75 350 (75) (125) 325 300 25 1,425 1,275 150 Beginning Year Cash Balance: Ending Year Cash Balance: |

Continental Wind Financing 9 2013 3Q Earnings Release Slides • Issued $613M of 20-year project finance debt with coupon of 6% Non-recourse to parent Financing based on long-term contracted cash flows of wind portfolio • Largest ever domestic wind project finance transaction • Debt rated as investment-grade by all three rating agencies • Rating agencies treat debt as “non- recourse” Project financing is an attractive vehicle to grow the business in a credit supportive manner OR 1 project 20.0 MW NM 1 project 27.3 MW TX 1 project 91.2 MW KS 2 projects 116.5 MW MI 4 projects 283.8 MW ID 4 projects 128.1 MW Financing backed by 667 MW wind portfolio across six states |

10 Exelon Generation Disclosures September 30, 2013 2013 3Q Earnings Release Slides |

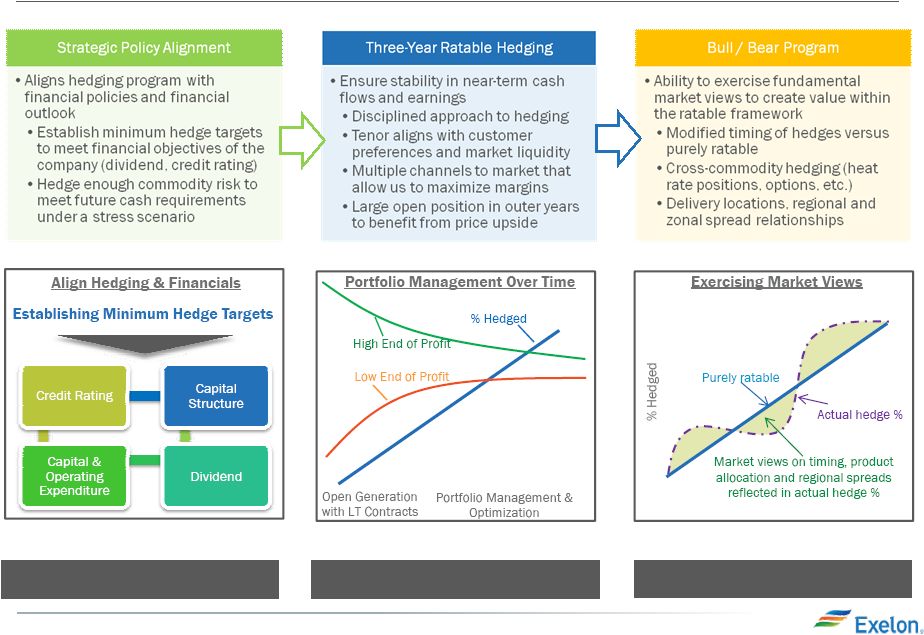

11 Portfolio Management Strategy Protect Balance Sheet Ensure Earnings Stability Create Value 2013 3Q Earnings Release Slides |

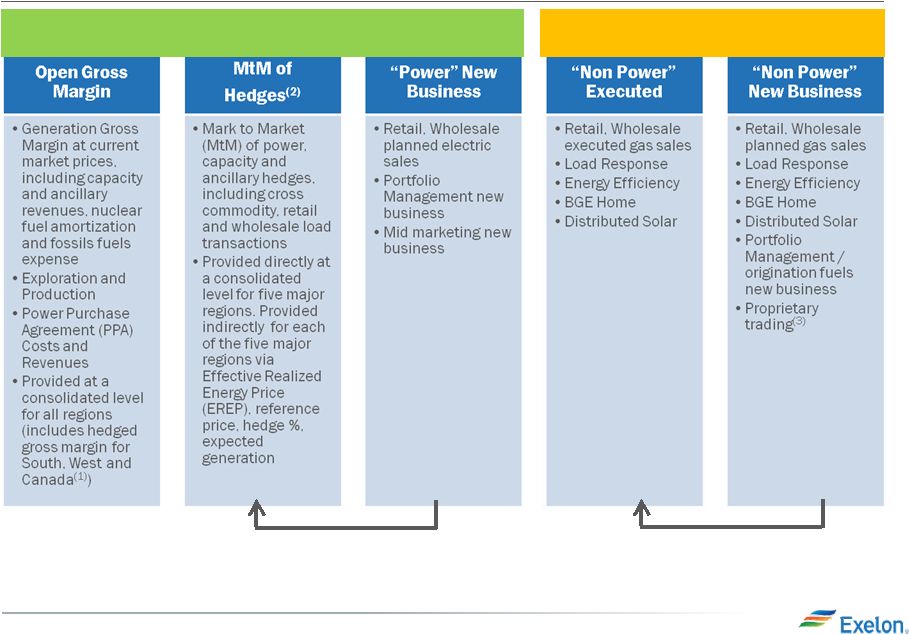

12 Components of Gross Margin Categories Margins move from new business to MtM of hedges over the course of the year as sales are executed Margins move from “Non power new business” to “Non power executed” over the course of the year Gross margin linked to power production and sales Gross margin from other business activities (1) Hedged gross margins for South, West and Canada region will be included with Open Gross Margin, and no expected generation, hedge %, EREP or reference prices provided for this region. (2) MtM of hedges provided directly for the five larger regions. MtM of hedges is not provided directly at the regional level but can be easily estimated using EREP, reference price and hedged MWh. (3) Proprietary trading gross margins will remain within “Non Power” New Business category and not move to “Non Power” Executed category. 2013 3Q Earnings Release Slides |

13 ExGen Disclosures Gross Margin Category ($M) (1,2) 2013 2014 2015 Open Gross Margin (including South, West & Canada hedged GM) (3) 5,600 5,650 5,800 Mark to Market of Hedges (3,4) 1,700 900 450 Power New Business / To Go 50 500 750 Non-Power Margins Executed 400 200 100 Non-Power New Business / To Go (5) 200 400 500 Total Gross Margin 7,950 7,650 7,600 Reference Prices (6) 2013 2014 2015 Henry Hub Natural Gas ($/MMbtu) $3.65 $3.86 $4.06 Midwest: NiHub ATC prices ($/MWh) $31.18 $30.25 $30.47 Mid-Atlantic: PJM-W ATC prices ($/MWh) $37.58 $37.19 $37.53 ERCOT-N ATC Spark Spread ($/MWh) HSC Gas, 7.2HR, $2.50 VOM $1.09 $6.30 $8.18 New York: NY Zone A ($/MWh) $37.07 $35.54 $35.70 New England: Mass Hub ATC Spark Spread($/MWh) ALQN Gas, 7.5HR, $0.50 VOM $3.70 $4.88 $3.69 2013 3Q Earnings Release Slides (1) Gross margin rounded to nearest $50M. (2) Gross margin does not include revenue related to decommissioning, gross receipts tax, Exelon Nuclear Partners and entities consolidated solely as a result of the application of FIN 46R. (3) Includes CENG Joint Venture. (4) Mark to Market of Hedges assumes mid-point of hedge percentages. (5) Any changes to new business estimates for our non-power business are presented as revenue less costs of sales. (6) Based on September 30, 2013 market conditions. |

14 ExGen Disclosures Generation and Hedges 2013 2014 2015 Exp. Gen (GWh) (1) 214,700 215,500 209,400 Midwest 97,200 96,900 96,400 Mid-Atlantic (2) 74,500 73,600 70,100 ERCOT 13,200 17,800 19,600 New York (2) 14,000 12,500 9,300 New England 15,800 14,700 14,000 % of Expected Generation Hedged (3) 97-100% 84-87% 48-51% Midwest 97-100% 85-88% 47-50% Mid-Atlantic (2) 97-100% 90-93% 56-59% ERCOT 92-95% 81-84% 38-41% New York (2) 99-101% 87-90% 54-57% New England 94-97% 49-52% 22-25% Effective Realized Energy Price ($/MWh) (4) Midwest $37.00 $33.50 $33.00 Mid-Atlantic (2) $49.00 $45.00 $45.00 ERCOT (5) $24.00 $11.00 $9.50 New York (2) $32.00 $37.00 $42.50 New England (5) $6.00 $3.50 $2.00 (1) Expected generation represents the amount of energy estimated to be generated or purchased through owned or contracted for capacity. Expected generation is based upon a simulated dispatch model that makes assumptions regarding future market conditions, which are calibrated to market quotes for power, fuel, load following products, and options. Expected generation assumes 12 refueling outages in 2013 and 14 refueling outages in 2014 and 2015 at Exelon-operated nuclear plants, Salem and CENG. Expected generation assumes capacity factors of 94.1%, 93.7%, and 93.3% in 2013, 2014 and 2015 at Exelon-operated nuclear plants excluding Salem and CENG. These estimates of expected generation in 2014 and 2015 do not represent guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. (2) Includes CENG Joint Venture. (3) Percent of expected generation hedged is the amount of equivalent sales divided by expected generation. Includes all hedging products, such as wholesale and retail sales of power, options and swaps. Uses expected value on options. (4) Effective realized energy price is representative of an all-in hedged price, on a per MWh basis, at which expected generation has been hedged. It is developed by considering the energy revenues and costs associated with our hedges and by considering the fossil fuel that has been purchased to lock in margin. It excludes uranium costs and RPM capacity revenue, but includes the mark-to market value of capacity contracted at prices other than RPM clearing prices including our load obligations. It can be compared with the reference prices used to calculate open gross margin in order to determine the mark-to-market value of Exelon Generation's energy hedges. (5) Spark spreads shown for ERCOT and New England. 2013 3Q Earnings Release Slides |

15 ExGen Hedged Gross Margin Sensitivities (1) Based on September 30, 2013 market conditions and hedged position. Gas price sensitivities are based on an assumed gas-power relationship derived from an internal model that is updated periodically. Power prices sensitivities are derived by adjusting the power price assumption while keeping all other prices inputs constant. Due to correlation of the various assumptions, the hedged gross margin impact calculated by aggregating individual sensitivities may not be equal to the hedged gross margin impact calculated when correlations between the various assumptions are also considered. (2) Sensitivities based on commodity exposure which includes open generation and all committed transactions. (3) Includes CENG Joint Venture. Gross Margin Sensitivities (With Existing Hedges) (1, 2) 2013 2014 2015 Henry Hub Natural Gas ($/Mmbtu) + $1/Mmbtu $10 $110 $370 - $1/Mmbtu $0 $(45) $(305) NiHub ATC Energy Price + $5/MWh $0 $65 $325 - $5/MWh $0 $(60) $(325) PJM-W ATC Energy Price + $5/MWh $0 $35 $175 - $5/MWh $0 $(35) $(170) NYPP Zone A ATC Energy Price + $5/MWh $0 $5 $20 - $5/MWh $0 $(10) $(20) Nuclear Capacity Factor (3) +/- 1% +/- $10 +/- $40 +/- $45 2013 3Q Earnings Release Slides |

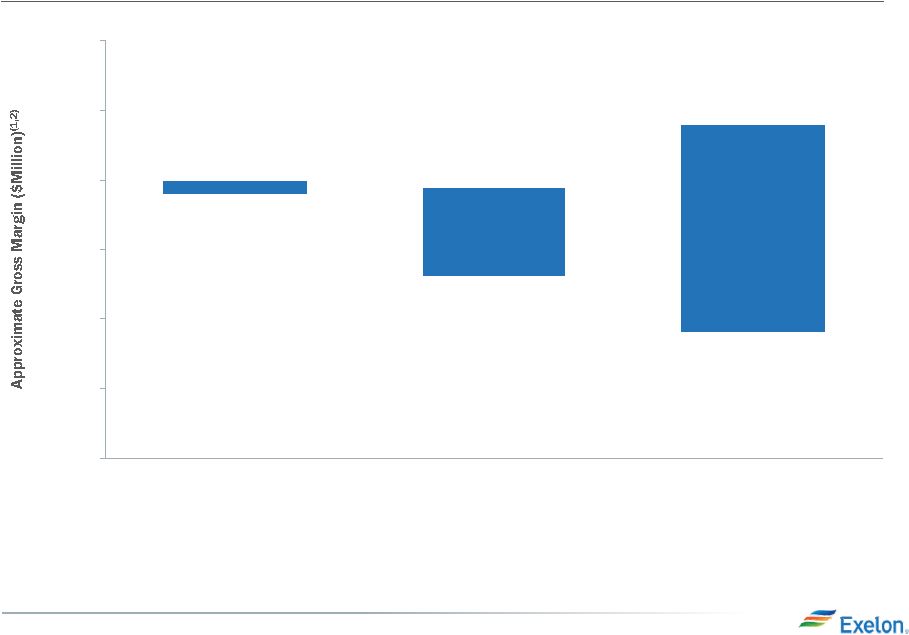

16 Exelon Generation Hedged Gross Margin Upside/Risk (1) Represents an approximate range of expected gross margin, taking into account hedges in place, between the 5th and 95th percent confidence levels assuming all unhedged supply is sold into the spot market. Approximate gross margin ranges are based upon an internal simulation model and are subject to change based upon market inputs, future transactions and potential modeling changes. These ranges of approximate gross margin in 2014 and 2015 do not represent earnings guidance or a forecast of future results as Exelon has not completed its planning or optimization processes for those years. The price distributions that generate this range are calibrated to market quotes for power, fuel, load following products, and options as of September 30, 2013 (2) Gross Margin Upside/Risk based on commodity exposure which includes open generation and all committed transactions. $6,000 $6,500 $7,000 $7,500 $8,000 $8,500 $9,000 2015 $8,400 2014 $7,950 2013 $8,000 $7,900 $7,300 $6,900 2013 3Q Earnings Release Slides |

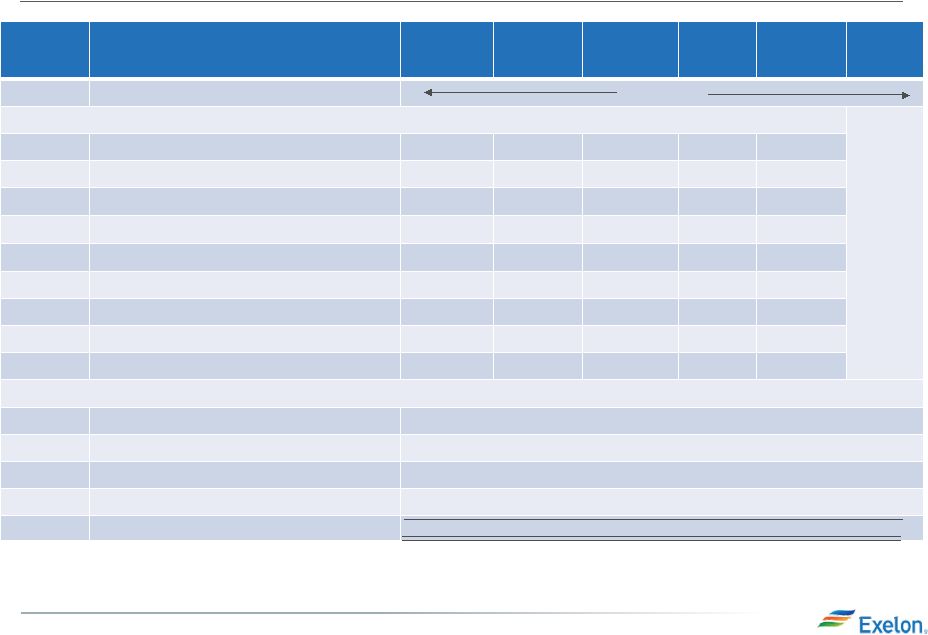

17 Illustrative Example of Modeling Exelon Generation 2014 Gross Margin Row Item Midwest Mid- Atlantic ERCOT New York New England South, West & Canada (A) Start with fleet-wide open gross margin $5.65 billion (B) Expected Generation (TWh) 96.9 73.6 17.8 12.5 14.7 (C) Hedge % (assuming mid-point of range) 85.5% 91.5% 82.5% 88.5% 50.5% (D=B*C) Hedged Volume (TWh) 82.8 67.3 14.7 11.1 7.4 (E) Effective Realized Energy Price ($/MWh) $33.50 $45.00 $11.00 $37.00 $3.50 (F) Reference Price ($/MWh) $30.25 $37.19 $6.30 $35.54 $4.88 (G=E-F) Difference ($/MWh) $3.25 $7.81 $4.70 $1.46 $(1.38) (H=D*G) Mark-to-market value of hedges ($ million) (1) $270 million $525 million $70 million $15 million $(10) million (I=A+H) Hedged Gross Margin ($ million) $6,550 million (J) Power New Business / To Go ($ million) $500 million (K) Non-Power Margins Executed ($ million) $200 million (L) Non- Power New Business / To Go ($ million) $400 million (N=I+J+K+L) Total Gross Margin $7,650 million (1) Mark-to-market rounded to the nearest $5 million. 2013 3Q Earnings Release Slides |

18 Additional Disclosures 2013 3Q Earnings Release Slides |

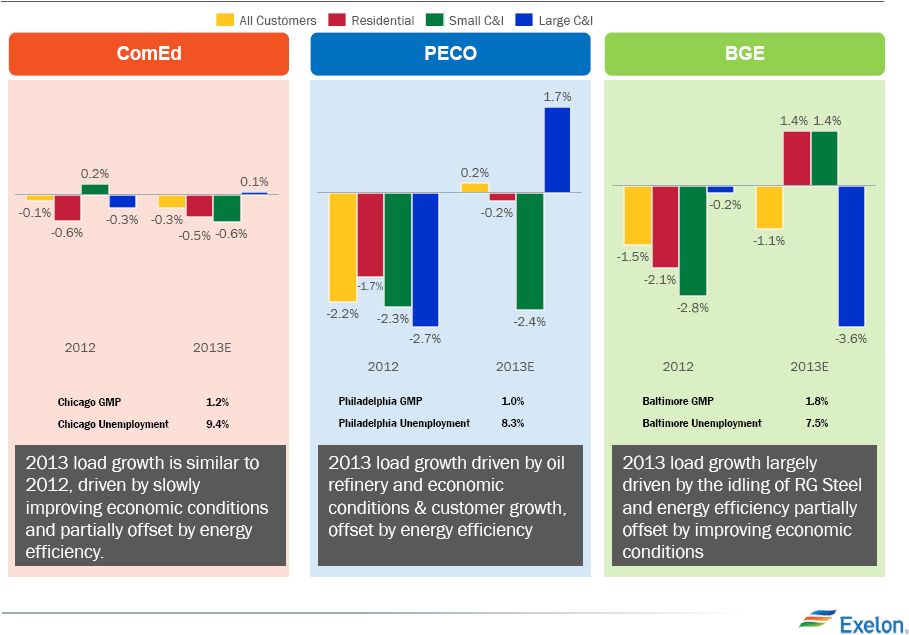

19 Exelon Utilities Weather-Normalized Load 2013 3Q Earnings Release Slides Notes: Data is not adjusted for leap year. Source of 2013 economic outlook data is Global Insight (August 2013). Assumes 2013 GDP of 1.5% and U.S unemployment of 7.3%. ComEd has the ROE collar as part of the distribution formula rate and BGE is decoupled which mitigates the load risk. QTD and YTD actual data can be found in earnings release tables. BGE amounts have been adjusted for unbilled / true-up load from prior quarters. |

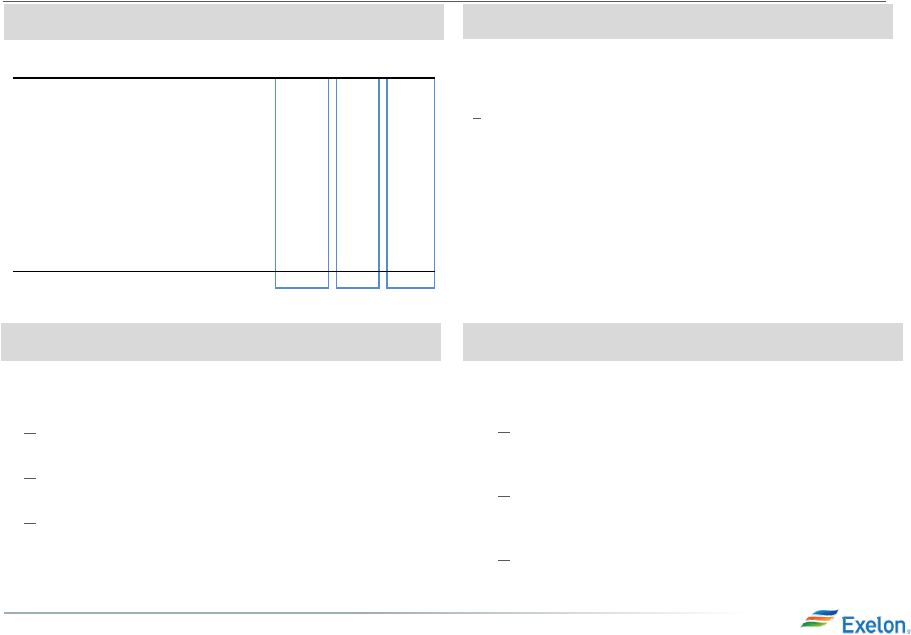

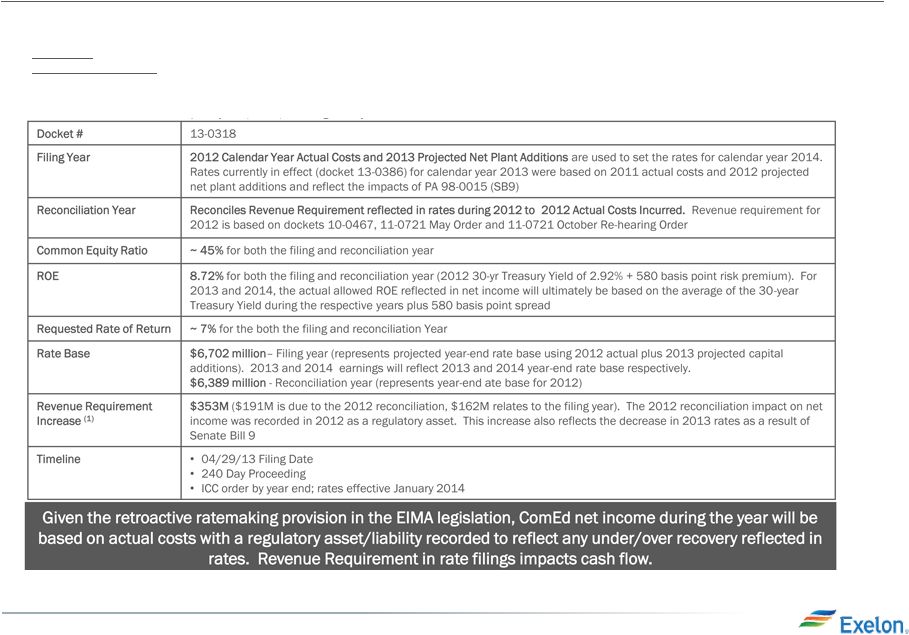

2013 3Q Earnings Release Slides 20 ComEd April 2013 Distribution Formula Rate Updated Filing Note: Disallowance of any items in the 2013 distribution formula rate filing could impact 2013 earnings in the form of a regulatory asset adjustment. Amounts above as of surrebuttal testimony. The 2013 distribution formula rate filing establishes the net revenue requirement used to set the rates that will take effect in January 2014 after the ICC’s review. The filing was updated to reflect the impact of Senate Bill 9. There are two components to the annual distribution formula rate filing: • Filing Year: Based on prior year costs (2012) and current year (2013) projected plant additions. • Annual Reconciliation: For the prior calendar year (2012), this amount reconciles the revenue requirement reflected in rates during the prior year (2012) in effect to the actual costs for that year. The annual reconciliation impacts cash flow in the following year (2014) but the earnings impact has been recorded in the prior year (2012) as a regulatory asset. |

21 BGE Rate Case 2013 3Q Earnings Release Slides Rate Case Request Electric Gas Docket # 9326 Test Year August 2012 – July 2013 Common Equity Ratio 51.1% Requested Returns ROE: 10.5%; ROR: 7.87% ROE: 10.35%; ROR: 7.79% Rate Base $2.8B $1.0B Revenue Requirement Increase $82.6M $24.4M Proposed Distribution Price Increase as % of overall bill 2% 3% Timeline •5/17/13: BGE filed application with the MDPSC seeking increases in gas & electric distribution base rates •8/5/13: Staff/Intervenors file direct testimony •8/23/13: Update 8 months actual/4 month estimated test period data with actuals for last 4 months (March - July 2013) •9/17/13: BGE and staff/intervenors file rebuttal testimony •10/3/13: Staff/Intervenors and BGE file surrebuttal testimony •10/18/13 – 11/1/13: Hearings •11/12/13: Initial Briefs •11/22/13: Reply Briefs •12/13/13: Final Order •New rates are in effect shortly after the final order |

2013 Projected Sources and Uses of Cash 2013 3Q Earnings Release Slides 22 ($ in millions) BGE ComEd PECO ExGen Exelon (6) As of 2Q13 Delta 1,575 1,575 -- Cash Flow from Operations (2) 575 1,075 650 3,550 5,775 5,550 225 CapEx (excluding other items below): (500) (1,300) (375) (1,000) (3,275) (3,300) 25 Nuclear Fuel n/a n/a n/a (1,000) (1,000) (1,000) -- Dividend (3) (1,250) (1,250) -- Nuclear Uprates n/a n/a n/a (150) (150) (150) -- Wind n/a n/a n/a (25) (25) (25) -- Solar n/a n/a n/a (500) (500) (550) 50 Upstream n/a n/a n/a (50) (50) (50) -- Utility Smart Grid/Smart Meter (125) (150) (175) n/a (450) (450) -- Net Financing (excluding Dividend): Debt Issuances 300 350 550 -- 1,200 1,200 -- Debt Retirements (4) (400) (250) (500) (450) (1,600) (1,600) -- Project Finance/Federal Financing Bank Loan n/a n/a n/a 850 850 1,025 (175) Other (5) 75 350 (75) (125) 325 300 25 1,425 1,275 150 (1) Exelon beginning cash balance as of 1/1/13. Excludes counterparty collateral activity. (2) Cash Flow from Operations primarily includes net cash flows provided by operating activities and net cash flows used in investing activities other than capital expenditures. (3) Dividends are subject to declaration by the Board of Directors. (4) Includes PECO’s $210 million Accounts Receivable (A/R) Agreement with Bank of Tokyo and excludes BGE’s current portion of its rate stabilization bonds (5) “Other” includes proceeds from options, redemption of PECO preferred stock and expected changes in short-term debt, including money pool activity. (6) Includes cash flow activity from Holding Company, eliminations, and other corporate entities. Beginning Cash Balance (1) Ending Cash Balance (1) |

3Q GAAP EPS Reconciliation Three Months Ended September 30, 2013 ExGen ComEd PECO BGE Other Exelon 2013 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $0.47 $0.15 $0.11 $0.06 $(0.02) $0.78 Mark-to-market impact of economic hedging activities 0.18 - - - - 0.17 Unrealized gains related to NDT fund investments 0.03 - - - - 0.03 Asset retirement obligation (0.01) - - - - (0.01) Constellation merger and integration costs (0.02) - (0.00) - - (0.03) Amortization of commodity contract intangibles (0.05) - - - - (0.05) Long-lived asset impairment (0.03) - - - - (0.03) 3Q 2013 GAAP Earnings (Loss) Per Share $0.57 $0.15 $0.11 $0.06 $(0.02) $0.86 NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not add due to rounding. Three Months Ended September 30, 2012 ExGen ComEd PECO BGE Other Exelon 2012 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $0.54 $0.11 $0.14 $0.00 $(0.01) $0.77 Mark-to-market impact of economic hedging activities 0.01 - - - 0.01 0.02 Unrealized losses related to NDT fund investments 0.04 - - - - 0.04 Plant retirements and divestitures (0.22) - - - - (0.22) Asset retirement obligation (0.01) - - - - (0.01) Constellation merger and integration costs (0.04) - - - - (0.04) Amortization of commodity contract intangibles (0.21) - - - - (0.21) 3Q 2012 GAAP Earnings (Loss) Per Share $0.11 $0.11 $0.14 $0.00 $0.00 $0.35 2013 3Q Earnings Release Slides 23 |

Nine Months Ended September 30, 2013 ExGen ComEd PECO BGE Other Exelon 2013 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $1.18 $0.36 $0.34 $0.16 $(0.06) $2.00 Mark-to-market impact of economic hedging activities 0.20 - - - (0.00) 0.21 Unrealized gains related to NDT fund investments 0.04 - - - - 0.04 Plant retirements and divestitures 0.02 - - - - 0.01 Asset retirement obligation (0.01) - - - - (0.01) Constellation merger and integration costs (0.07) - (0.01) 0.00 (0.00) (0.08) Amortization of commodity contract intangibles (0.32) - - - - (0.32) Amortization of the fair value of certain debt 0.01 - - - - 0.01 Remeasurement of like kind exchange tax position - (0.20) - - (0.11) (0.31) Long-lived asset impairment (0.12) - - - (0.01) (0.13) YTD 2013 GAAP Earnings (Loss) Per Share $0.93 $0.16 $0.33 $0.17 $(0.18) $1.42 Nine Months Ended September 30, 2012 ExGen ComEd PECO BGE Other Exelon 2012 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share $1.57 $0.27 $0.38 $0.03 $(0.05) $2.21 Mark-to-market impact of economic hedging activities 0.21 - - - 0.02 0.23 Unrealized gains related to NDT fund investments 0.07 - - - - 0.07 Plant retirements and divestitures (0.25) - - - - (0.25) Asset retirement obligation (0.01) - - - - (0.01) Constellation merger and integration costs (0.16) - (0.01) - (0.08) (0.26) Maryland commitments (0.03) - (0.10) (0.15) (0.28) Amortization of commodity contract intangibles (0.68) - - - - (0.68) Amortization of the fair value of certain debt 0.01 - - - - 0.01 FERC Settlement (0.22) - - - - (0.22) Reassessment of state deferred income taxes 0.02 - - - 0.13 0.15 YTD 2012 GAAP Earnings (Loss) Per Share $0.53 $0.27 $0.37 (0.07) $(0.13) $0.97 NOTE: All amounts shown are per Exelon share and represent contributions to Exelon's EPS. Amounts may not add due to rounding. 2013 3Q Earnings Release Slides 24 3Q YTD GAAP EPS Reconciliation |

GAAP to Operating Adjustments 2013 3Q Earnings Release Slides • Exelon’s 2013 adjusted (non-GAAP) operating earnings excludes the earnings effects of the following: Mark-to-market adjustments from economic hedging activities Unrealized gains and losses from NDT fund investments to the extent not offset by contractual accounting as described in the notes to the consolidated financial statements Financial impacts associated with the sale or retirement of generating stations Financial impacts associated with the increase in certain decommissioning obligations for retired fossil power plants Certain costs incurred associated with the Constellation merger and integration initiatives Non-cash amortization of intangible assets, net, related to commodity contracts recorded at fair value at the merger date Non-cash amortization of certain debt recorded at fair value at the merger date, which was retired in the second quarter of 2013 Non-cash charge to earnings resulting from the remeasurement of Exelon’s like-kind exchange tax position Non-cash charge to earnings related to the cancellation of previously capitalized nuclear uprate projects and the impairment of certain wind generating assets Other unusual items 25 |