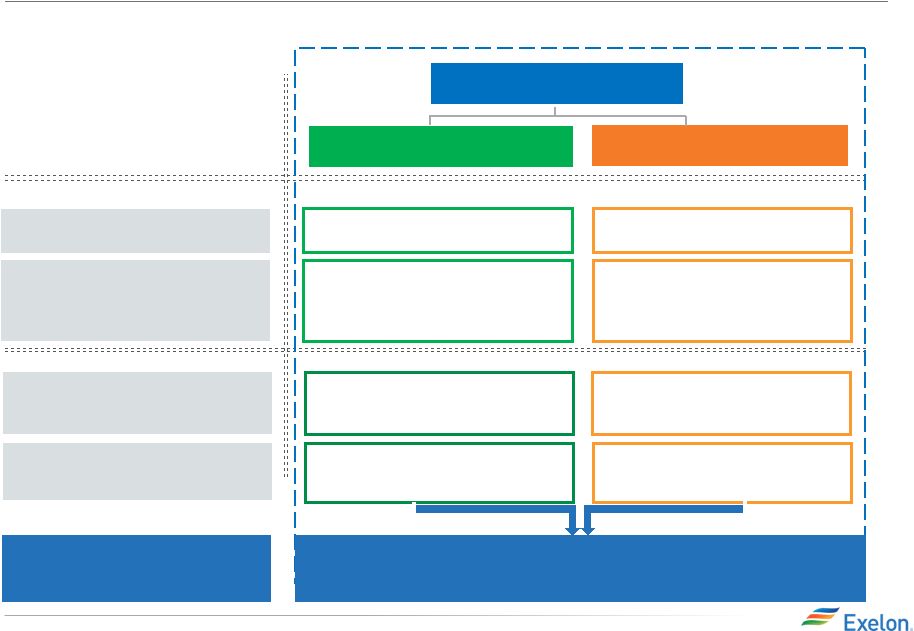

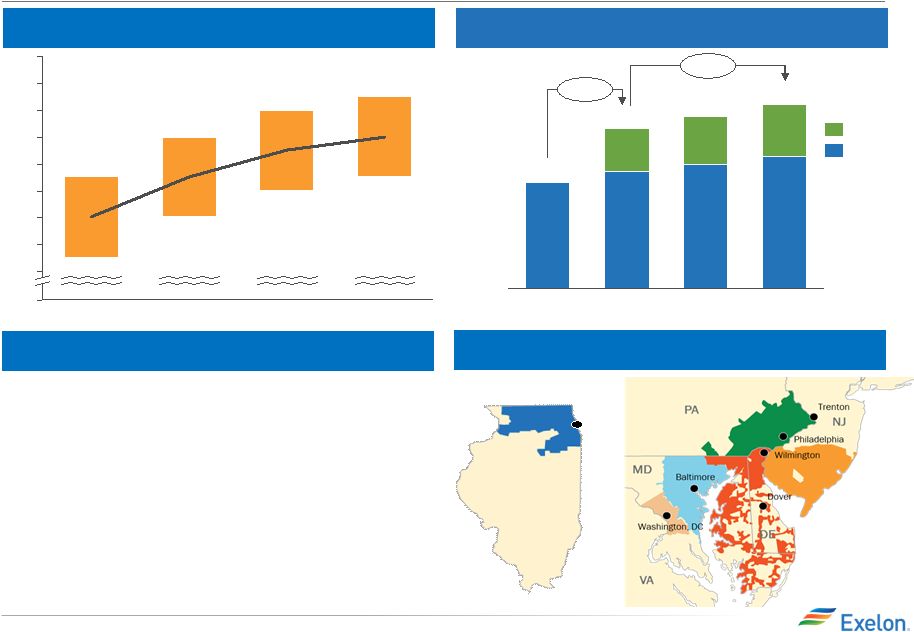

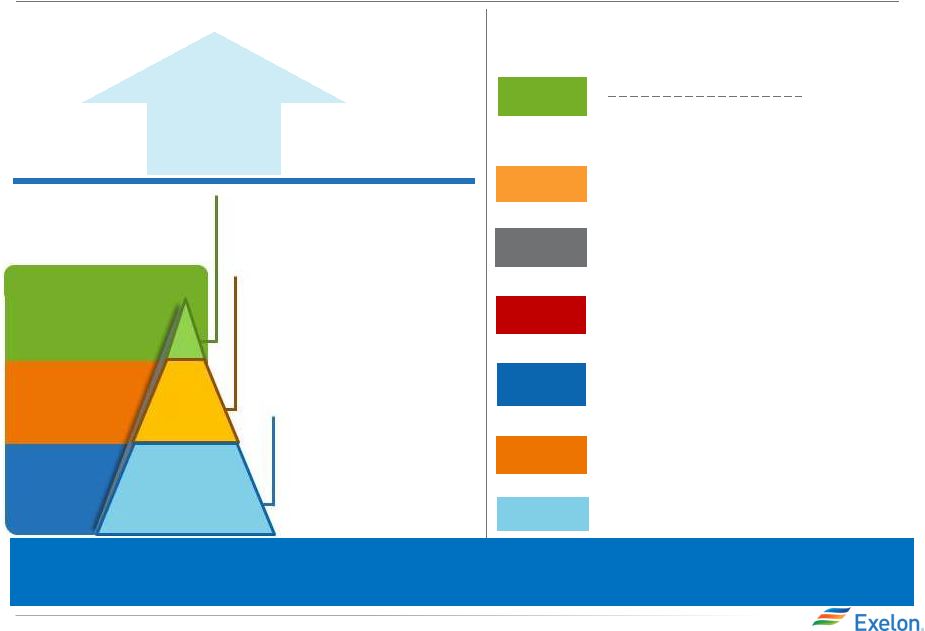

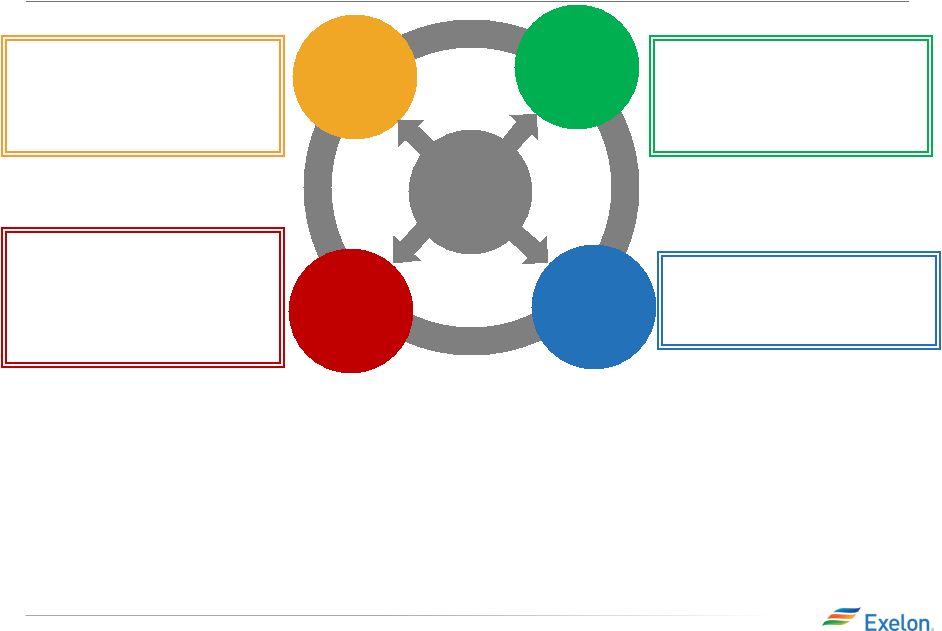

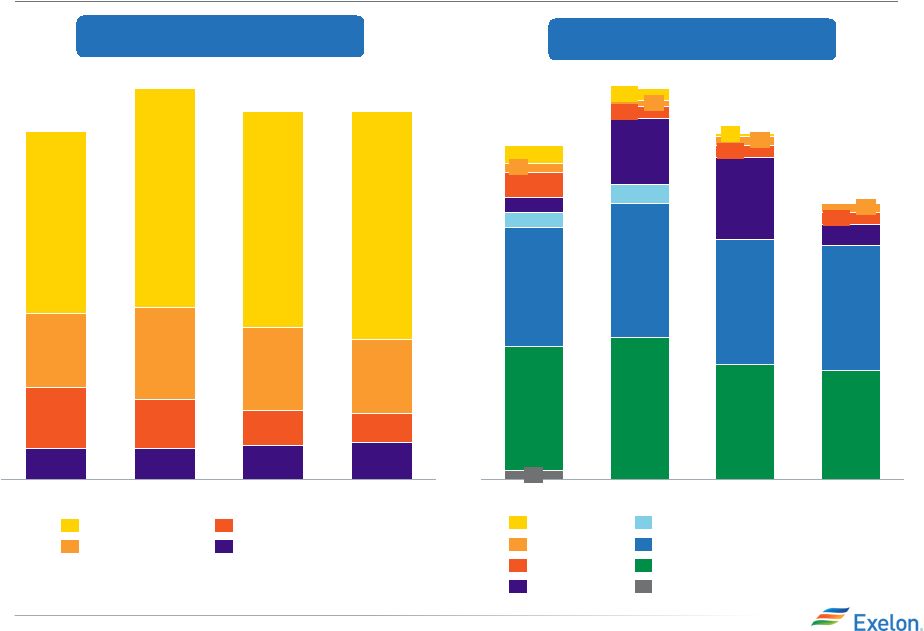

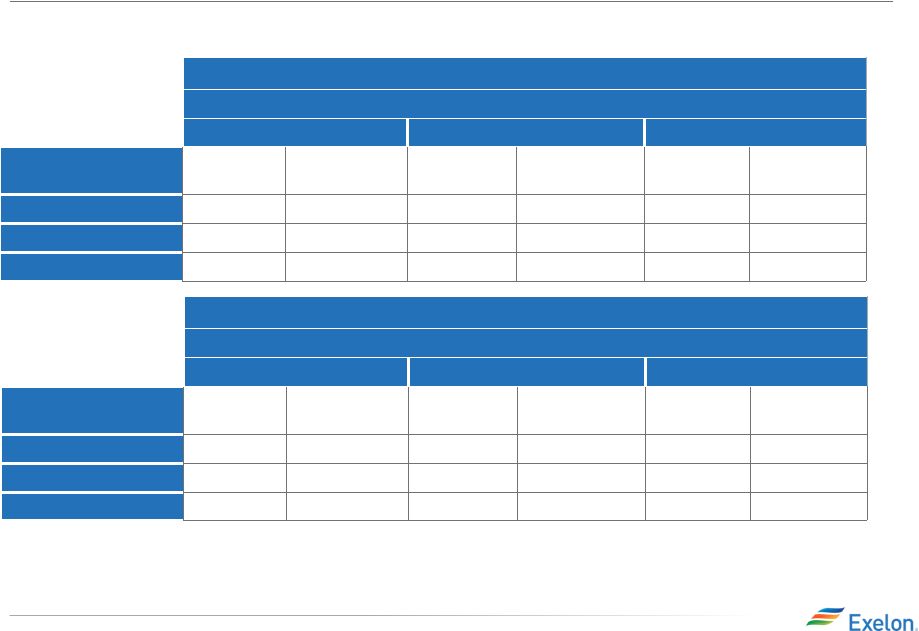

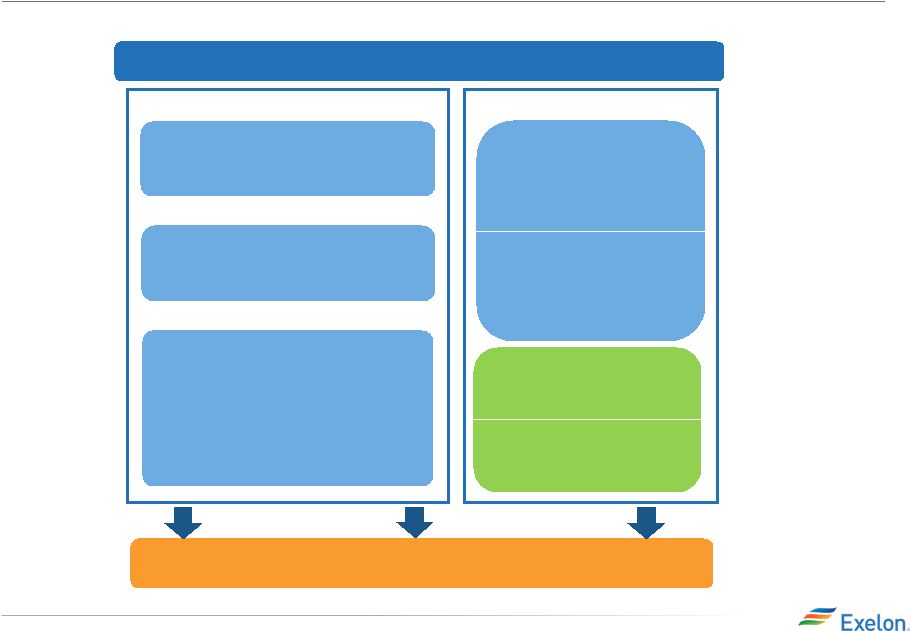

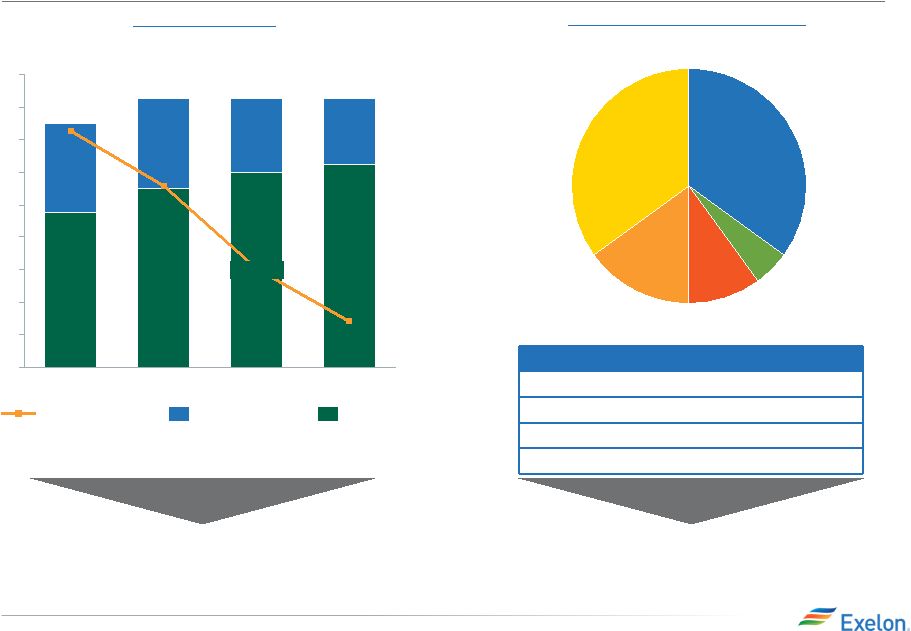

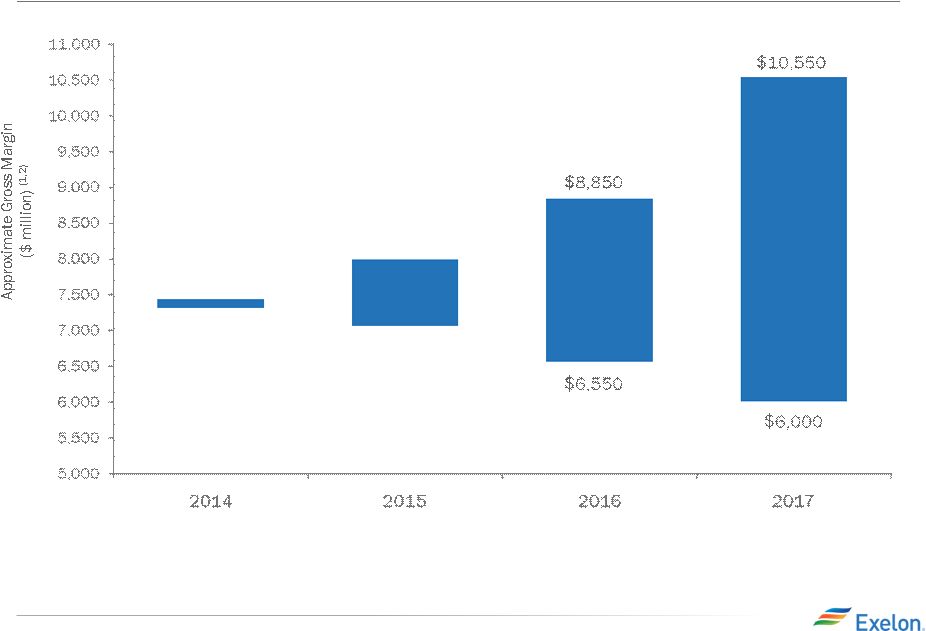

12 2014 EEI Financial Conference 2014 EEI Financial Conference Distributed Energy Platform Distributed Energy is a Fast Growing Business • On-site generation, including solar, quadrupled since 2006 (Wall Street Journal 2013) • US C&I customers are spending ~$5-6 billion per year on self- generation and energy efficiency programs (Bloomberg 2013) • Revenues from Distributed Generation are expected to reach $12.7 billion by 2018 (Pike Research, Navigant, 2012) Distributed Energy Supports Exelon’s Strategy: Grow Organically & Through M&A Participate in Emerging Trends & Technologies Commercializing emerging and potentially disruptive energy technologies to diversify existing technology base Acquiring long term retail customers through a PPA or other long-term agreement Attract and acquire new customers with unique offering Provides adaptive growth in an emerging market sector Bolstering existing relationships with customers to help achieve reliability or sustainability objectives Integrating supply & demand side solutions Key Attributes of Financial Value Backup Generation Battery Storage Co-Generation Fuel Cell CNG Solar Energy Efficiency • Provide equity financing for 21 MW of Bloom Energy fuel cell projects at 75 commercial facilities including AT&T • Provides renewable energy value or credits, if applicable • Provides tax incentives, if applicable • Own and operate CNG facilities • Leverage retail gas supply and risk management expertise • Long-term customer off-take agreement(s) • ~ 200 MW of Retail Solar Projects in operation or under construction • Long-term customer PPA (usually @ fixed price) • Provides renewable energy value or credits, if applicable • Provides tax incentives, if applicable • Over 1,000 energy saving projects implemented • ~ 50 MW conserved by customers • More than $1 billion in projects 3rd party customer financed • Own and operate energy assets as a service to retail customers • Bundled service offering with long-term customer agreements through grid power supply & LR programs • Load Response market -based value creation (e.g., LR Programs) • Own and operate energy assets as a service to retail customers • Bundled service offering with long-term customer agreements through grid power supply & LR programs • Load Response market based value creation (e.g., ancillary services) • Design, build and operate energy assets • Provides renewable energy value or credits, if applicable • Long-term O&M agreements Owned Assets – additional attributes: • Long-term customer PPA (usually @ fixed price) • Provides tax incentives, if applicable Invested more than $1 billion of capital with projects averaging returns of 8% - 12%, and well positioned for growth Preserve Value |