January 14, 2016 – NYSE Analyst Day 2016 NYSE: WTR Exhibit 99.1

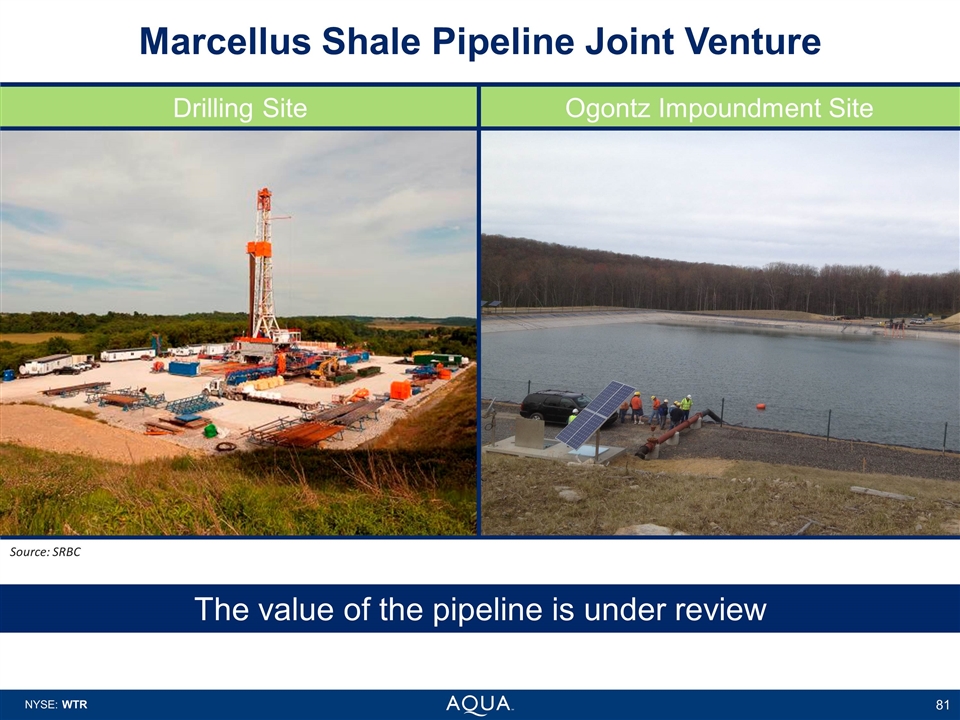

Forward Looking Statement This presentation contains in addition to historical information, forward looking statements based on assumptions made by management regarding future circumstances over which the company may have little or no control, that involve risks, uncertainties and other factors that may cause actual results to be materially different from any future results expressed or implied by such forward-looking statements. These factors include, among others, the following: general economic and business conditions; weather conditions affecting customers’ water usage or the company’s cost of operations; the success of cost containment initiatives, including costs arising from changes in regulations; regulatory treatment of rate increase requests; changes in the valuation of our investment in our joint venture in the Marcellus shale region; availability and cost of capital; the success of growth initiatives, including pending acquisitions; the effect of regulation on consolidation of the industry; the ability to generate earnings from capital investment; and other factors discussed in our Form 10-K for the fiscal year ended December 31, 2014, which is on file with the SEC. We undertake no obligation to publicly update or revise any forward-looking statement. Non-GAAP Reconciliation For reconciliation of non-GAAP financial measures, see the Investor Relations section of the company’s Web site at www.aquaamerica.com

Presentation Agenda Overview of Aqua America – Christopher Franklin Operations Overview – Rick Fox Financial Update – Dave Smeltzer Regulatory Update – Kim Joyce Strategic Growth – Dan Schuller Summary and Outlook – Christopher Franklin Q&A Session

Thank You for Joining Us

Today’s Objectives Senior Leadership Team Introduction Company Overview Transparency and Guidance Growth Strategy

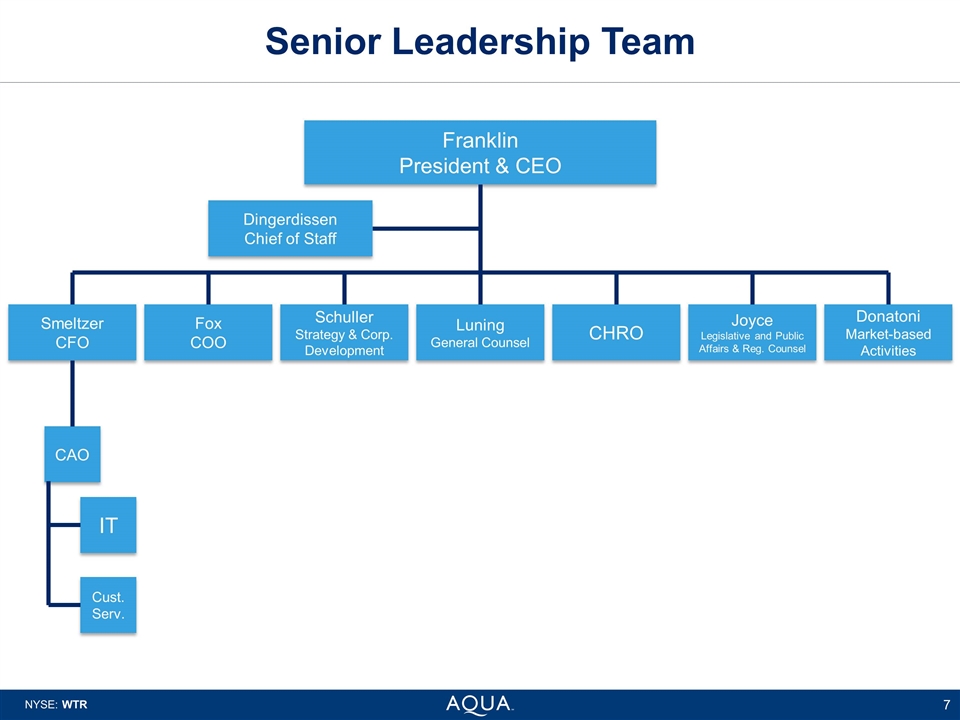

Today’s Presenters Christopher Franklin President and CEO Dave Smeltzer EVP, CFO Richard Fox EVP and COO Regulated Operations Dan Schuller, Ph.D. EVP, Strategy and Corporate Development Brian Dingerdissen Chief of Staff Kim Joyce Director, Legislative and Public Affairs and Regulatory Counsel

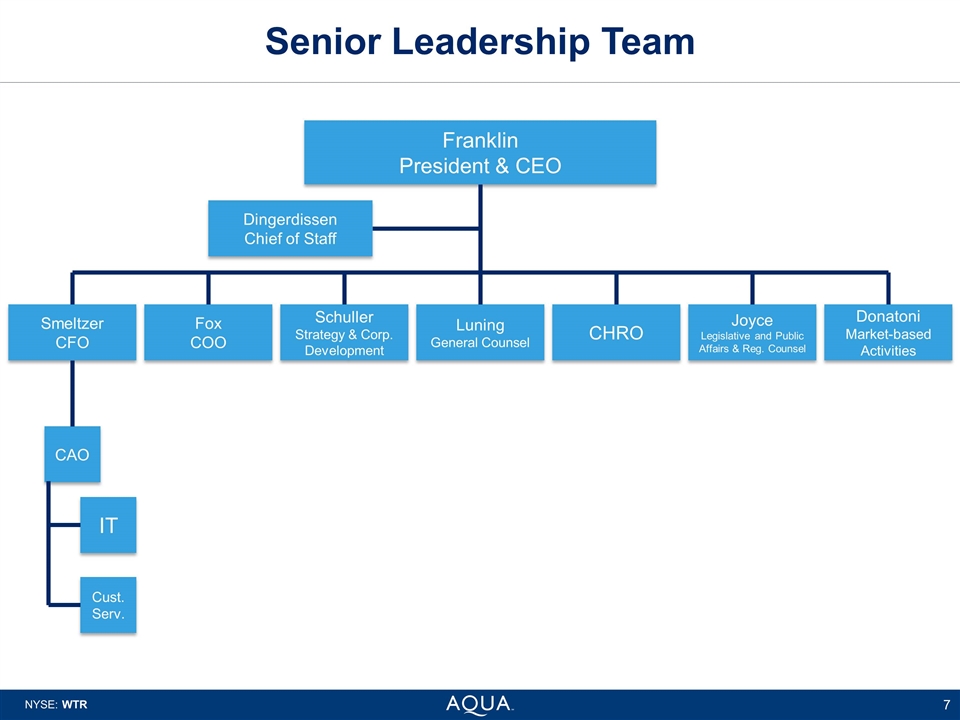

Senior Leadership Team Franklin President & CEO Dingerdissen Chief of Staff Smeltzer CFO CAO Donatoni Market-based Activities Joyce Legislative and Public Affairs & Reg. Counsel CHRO Luning General Counsel Schuller Strategy & Corp. Development Fox COO Cust. Serv. IT

Christopher Franklin President and Chief Executive Officer Overview NYSE: WTR

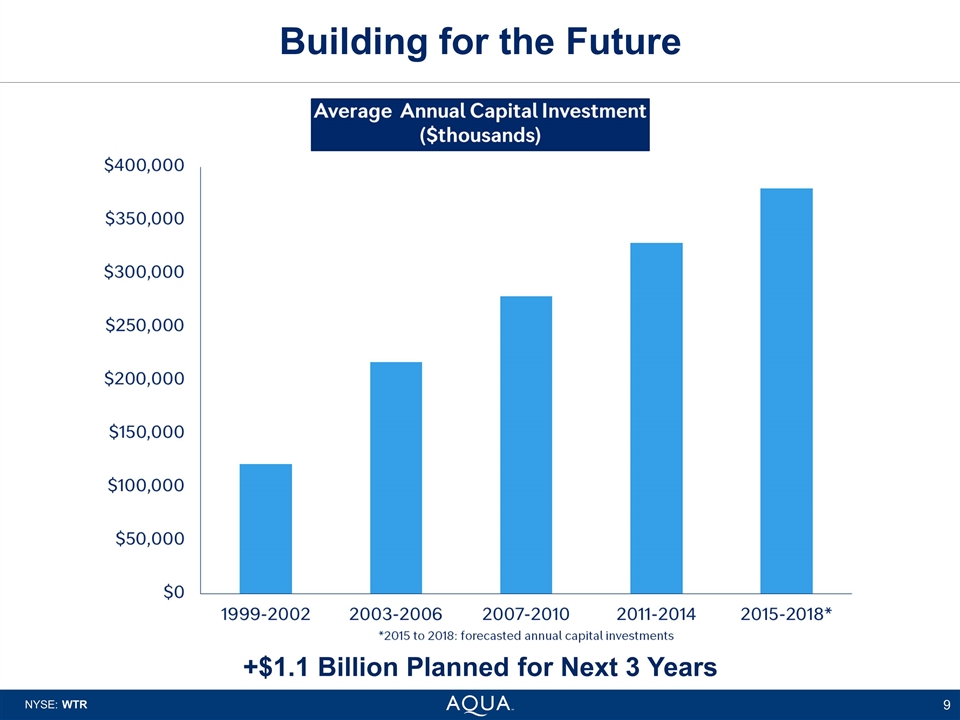

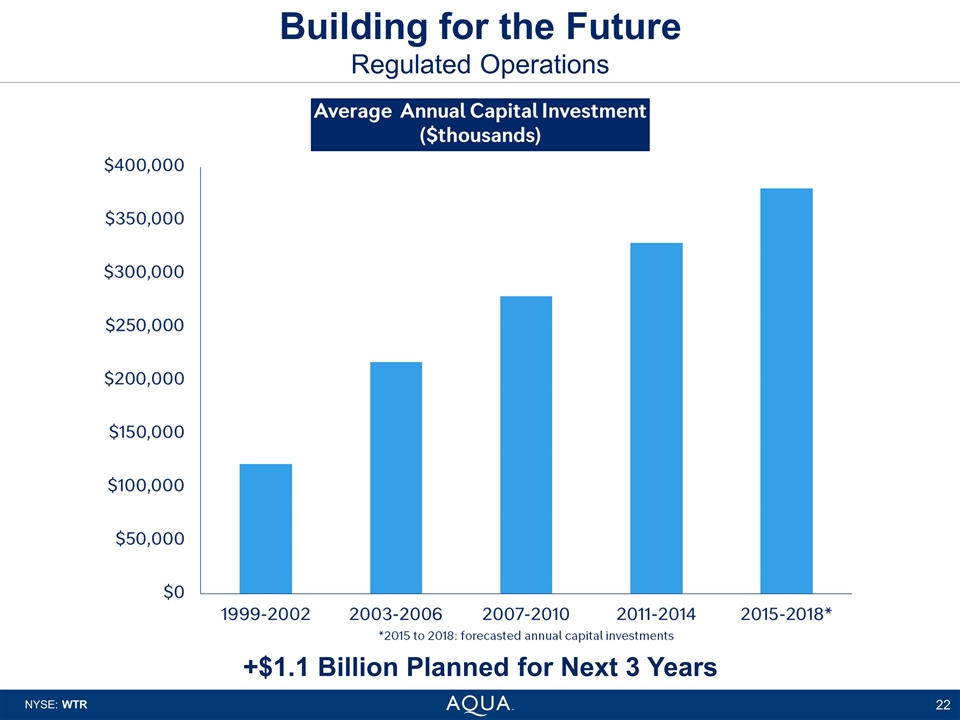

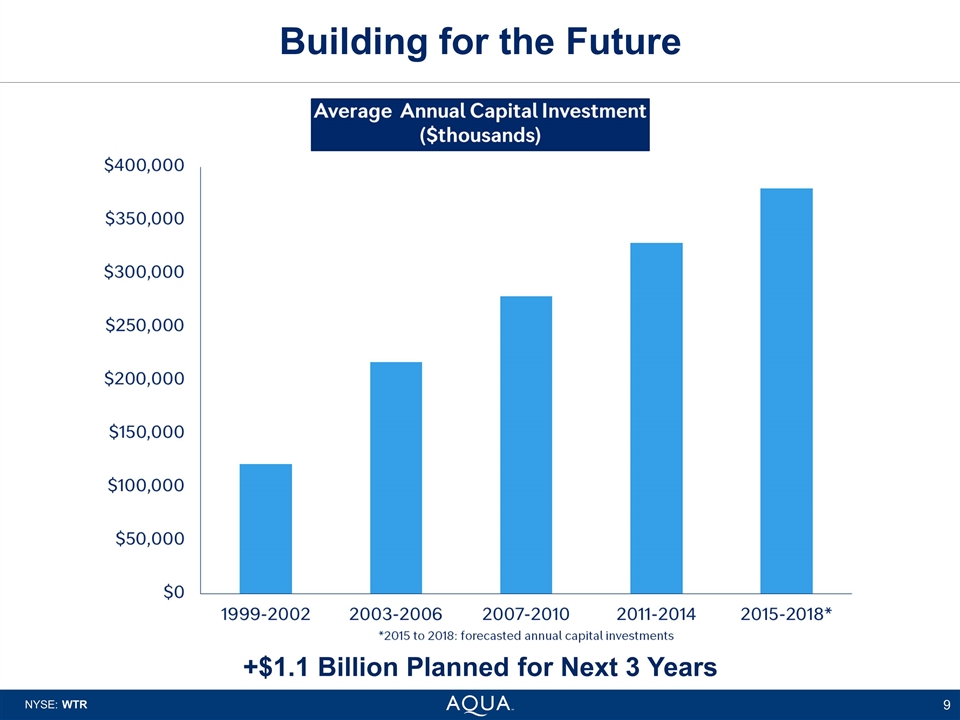

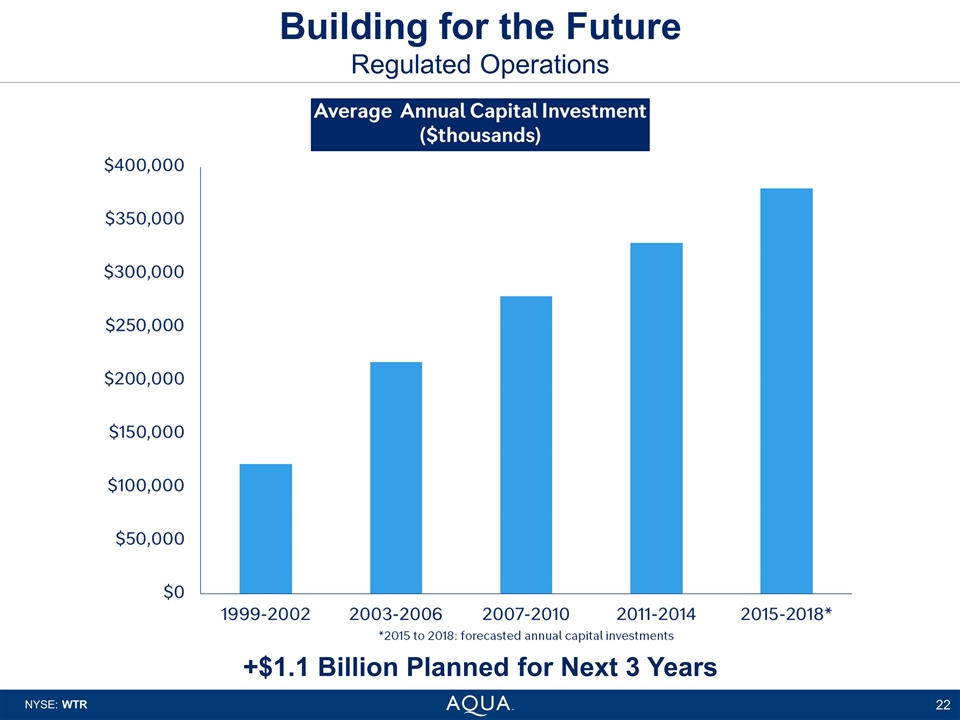

Building for the Future +$1.1 Billion Planned for Next 3 Years

Regulatory Affairs

Operational Excellence

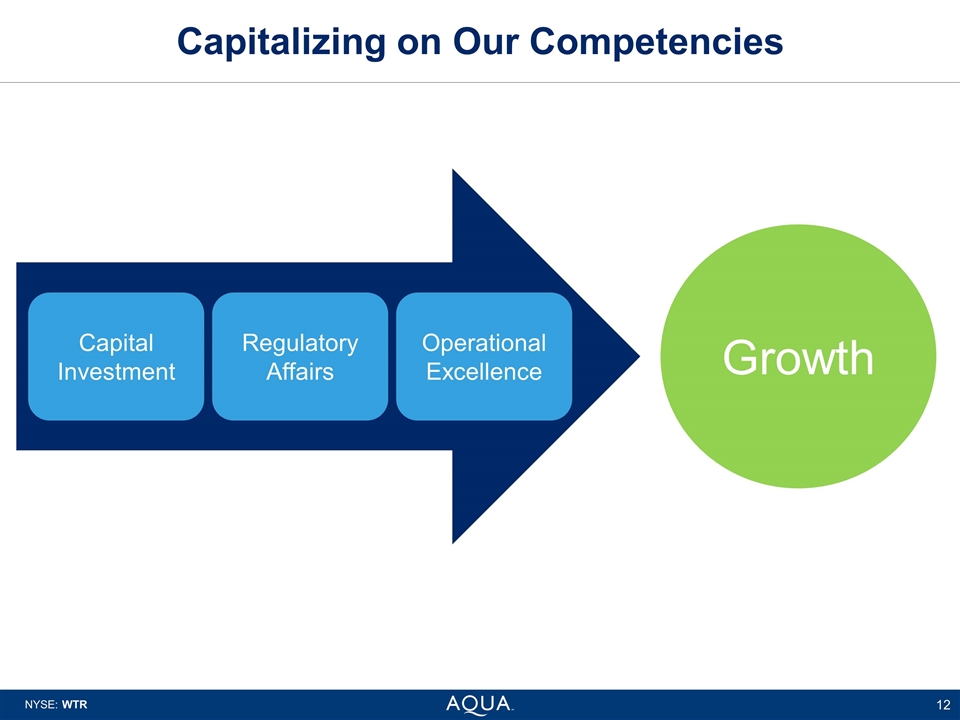

Capitalizing on Our Competencies Capital Investment Operational Excellence Regulatory Affairs Growth

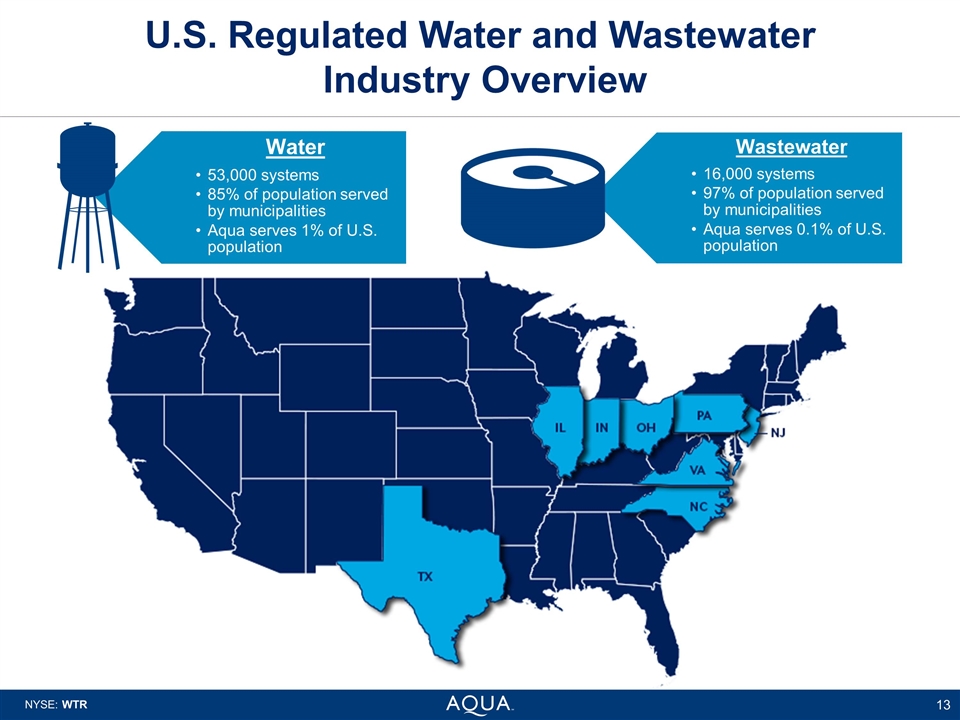

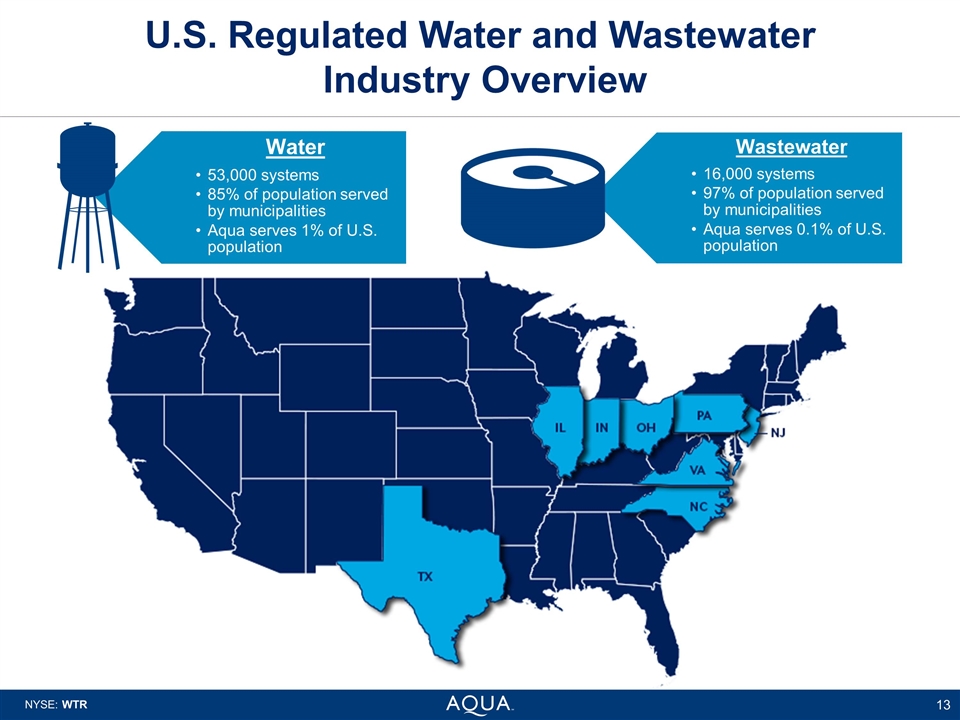

U.S. Regulated Water and Wastewater Industry Overview Water 53,000 systems 85% of population served by municipalities Aqua serves 1% of U.S. population Aqua serves 0.1% of U.S. population 97% of population served by municipalities 16,000 systems Wastewater

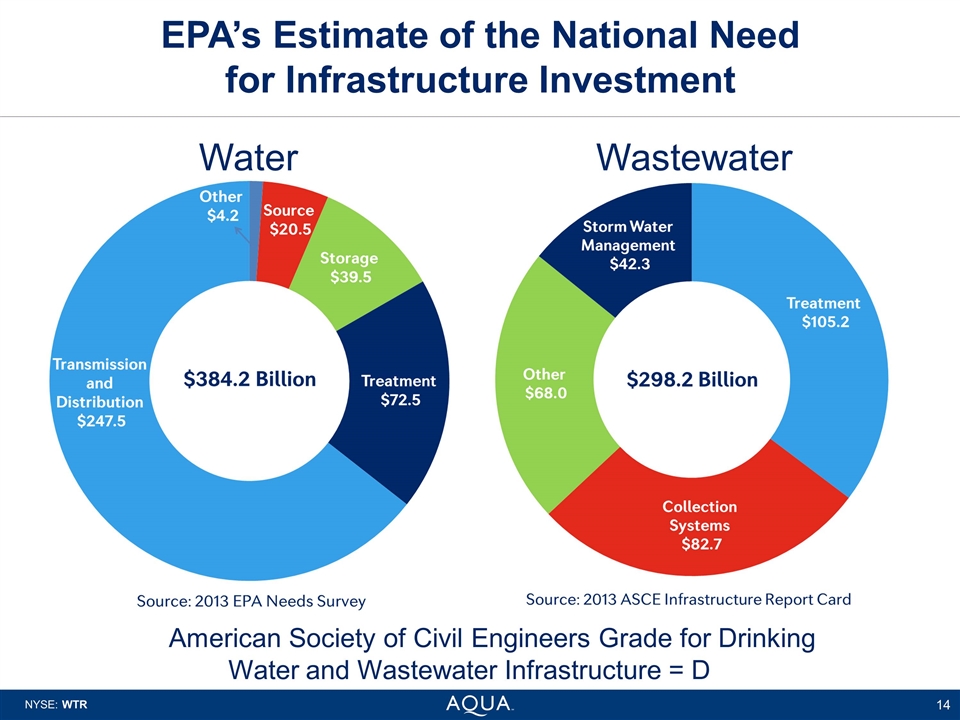

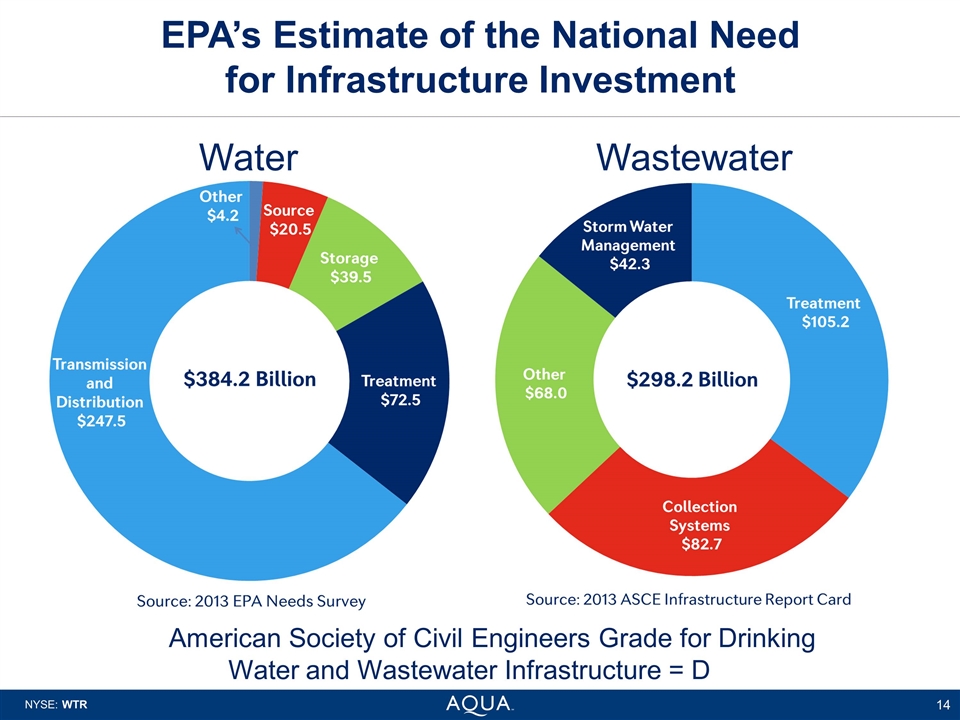

EPA’s Estimate of the National Need for Infrastructure Investment Water Wastewater American Society of Civil Engineers Grade for Drinking Water and Wastewater Infrastructure = D

Company Overview 130 years of history Large multi-state water & wastewater company Proven growth model Strong balance sheet History of industry leading profitability Above average dividend growth

Mission: Protecting and Providing Earth’s Most Essential Resource Communities Shareholders Employees Customers Sustainability Regulatory Innovation Civic Involvement Steward of Environment Rebuild Infrastructure Promote Economic Growth Compliance Near 100% Reliability Responsible Rate Increases Trusted Partner Top of Class Customer Service Concern for Work Life Balance Ensure a Safe Working Environment Demonstrate Fair Pay / Benefits Growth and Development Opportunities Utilize Technology to Improve Efficiency Labor/ Mgmt Partnership Above Industry Average Long-term Growth Stable (Utility) Risk Profile Above Average Dividend Growth Buyback Opportunities

Aqua’s Growth Platform Capital Investment Acquisitions and Organic Customer Growth Market-based Activities

Why Invest in Aqua? Aqua is one of the largest, publicly traded water and wastewater companies, poised to address the nation’s significant infrastructure needs Aqua is a balanced growth investment with a long track-record of dividend growth and strong performance Aqua’s commitment to a strategic approach to growth

Rick Fox Executive Vice President and Chief Operating Officer, Regulated Operations Regulated Operations NYSE: WTR

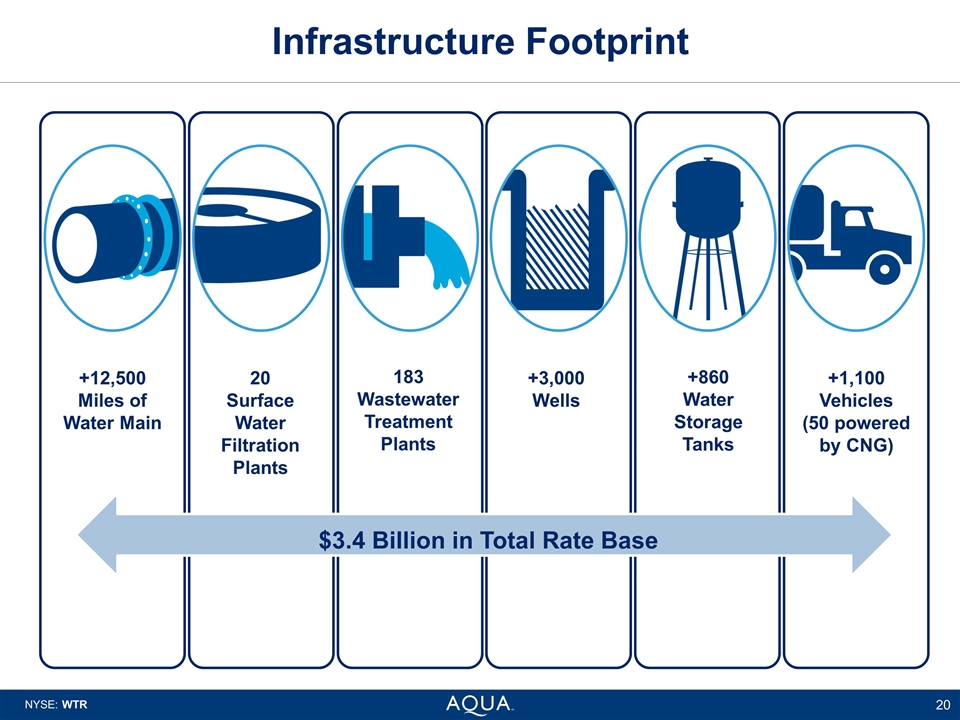

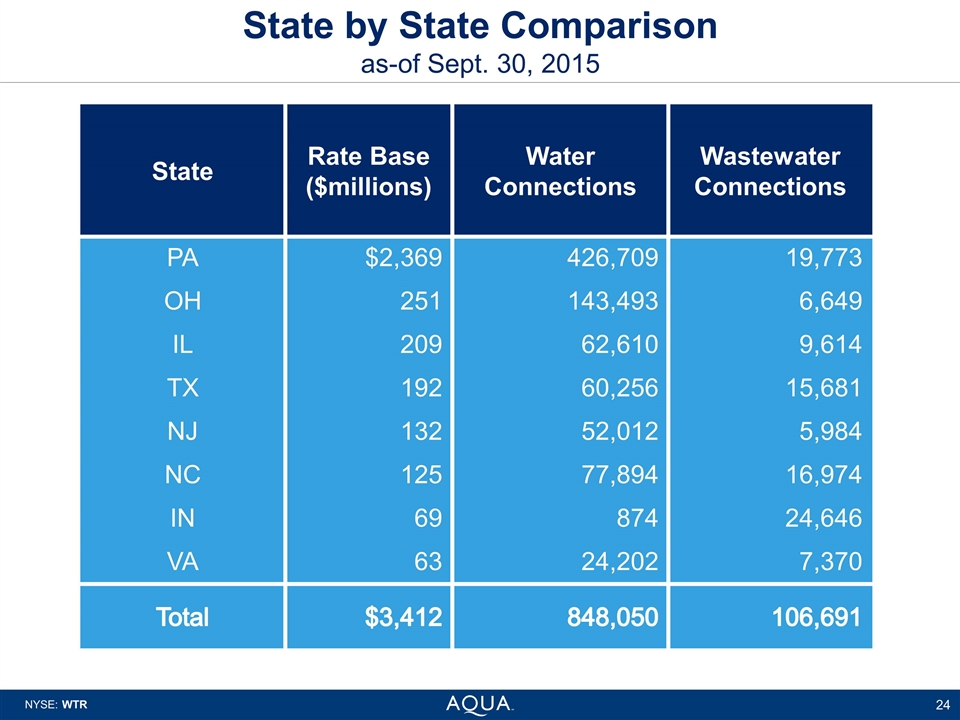

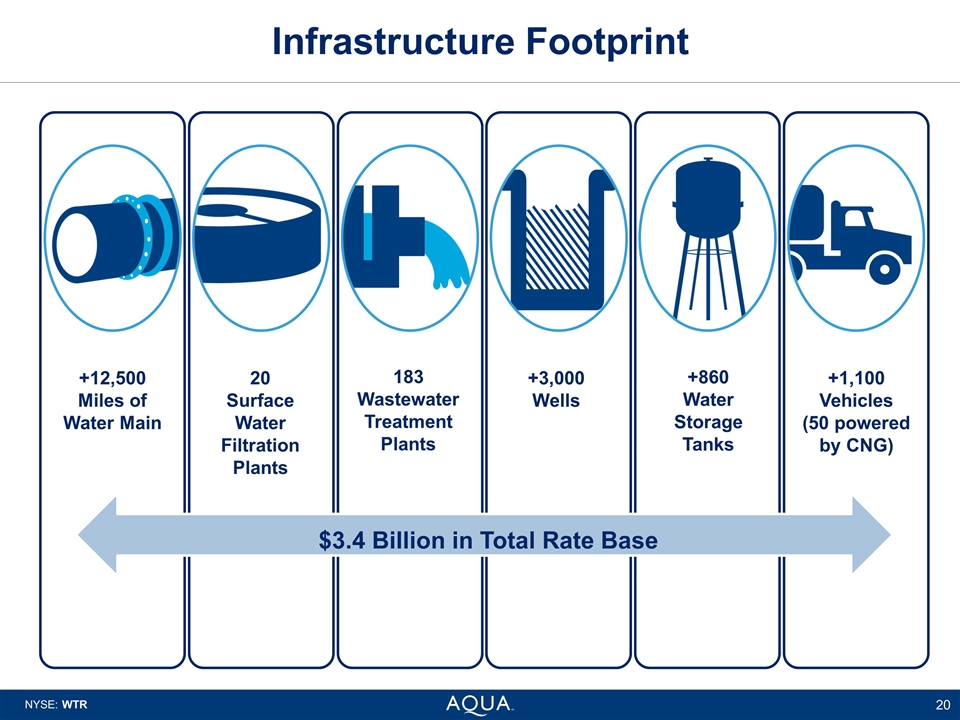

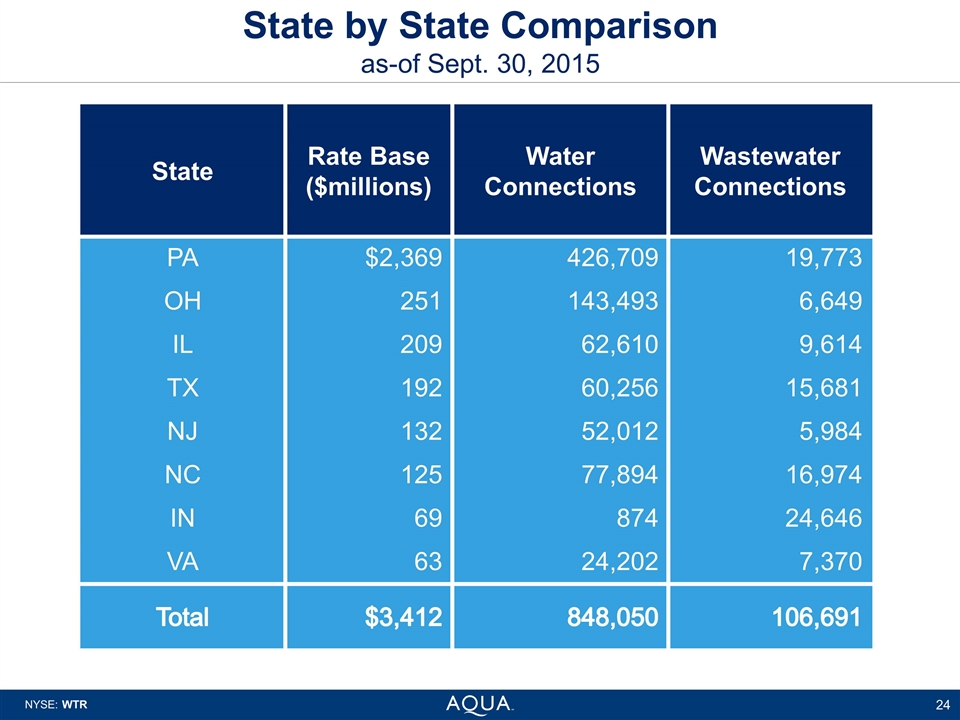

Infrastructure Footprint $3.4 Billion in Total Rate Base +12,500 Miles of Water Main 183 Wastewater Treatment Plants 20 Surface Water Filtration Plants +3,000 Wells +860 Water Storage Tanks +1,100 Vehicles (50 powered by CNG)

Infrastructure Investments Proactive Reactive

Building for the Future Regulated Operations +$1.1 Billion Planned for Next 3 Years

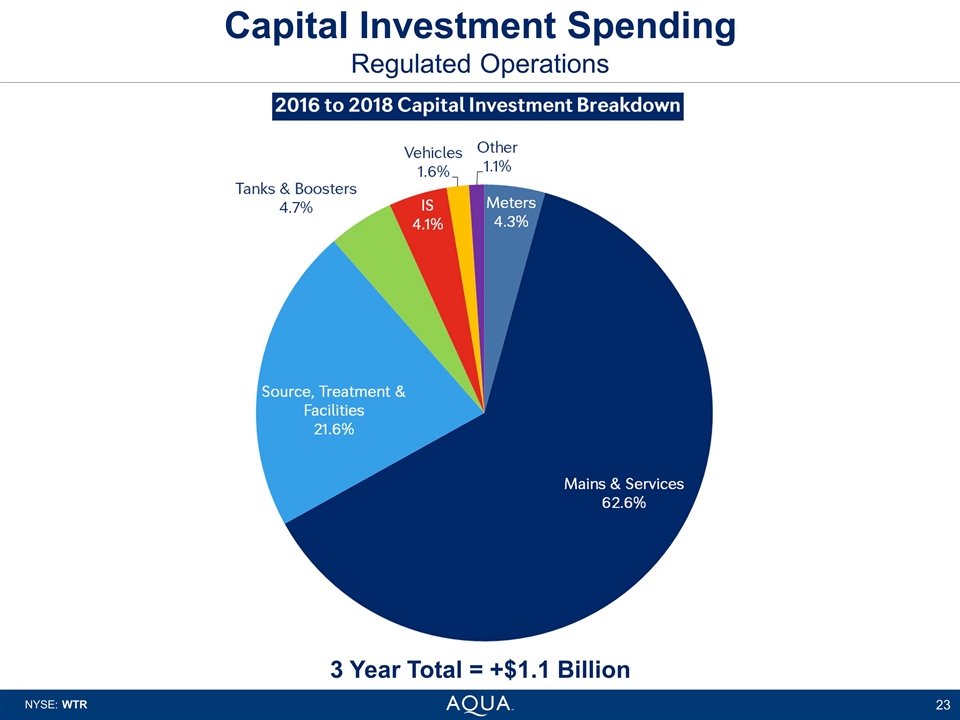

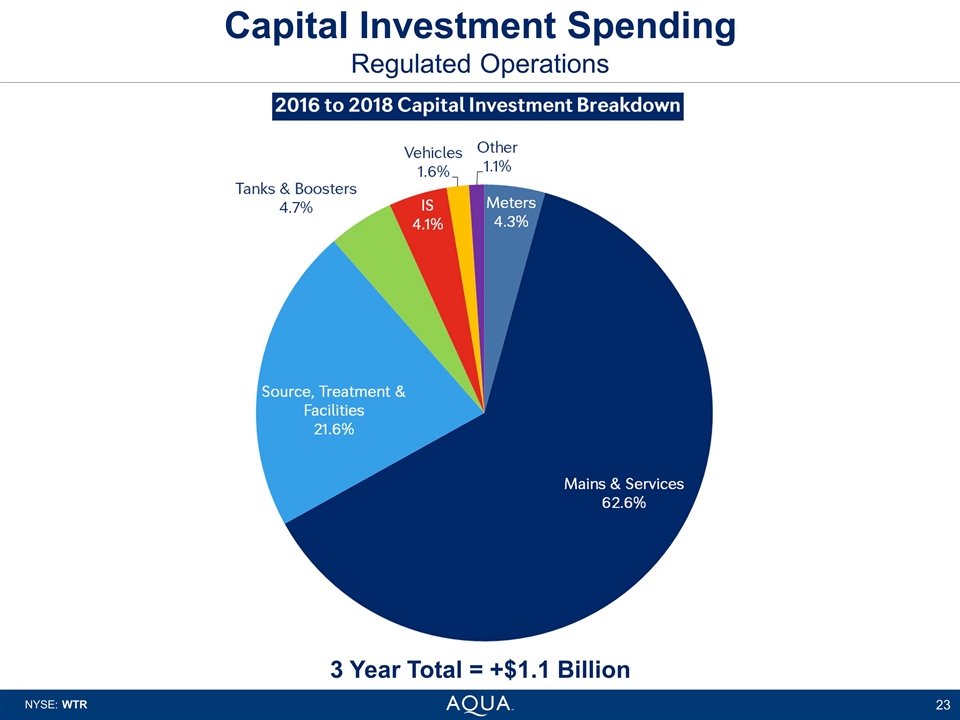

Capital Investment Spending Regulated Operations 3 Year Total = +$1.1 Billion

State by State Comparison as-of Sept. 30, 2015 State Rate Base ($millions) Water Connections Wastewater Connections PA $2,369 426,709 19,773 OH 251 143,493 6,649 IL 209 62,610 9,614 TX 192 60,256 15,681 NJ 132 52,012 5,984 NC 125 77,894 16,974 IN 69 874 24,646 VA 63 24,202 7,370 Total $3,412 848,050 106,691

Efficiently Serving our Customers an Essential Product 7:1 Business Model Examples Purchased water reduction Eliminating costly outside services Conversion to CNG powered fleet

Purchased Water Reduction Contract expires in 2017 3.5 mgd of high cost purchased water Capital investment: $17M Source Pumping Transmission facilities Annual expense savings: $7.3M Ratio: 2.4 to 1

Outside Services Aqua North Carolina historically used an outside contractor to clean wastewater lift stations and grinder pump tanks for maintenance Capital investment : $292k Pumper truck Drying pads (4) Annual expense savings: $54k Ratio: 5.4 to 1

Compressed Natural Gas (CNG) Vehicles Initiated in 2011 Fleet of 50 vans, dump trucks & bi-fuel pickups (all OEM) Constructed 3 “time-fill” stations in PA 90 CNG vehicles planned by 2020 Received grants totaling $383,000 (PA Act 13, AFIG & ACE programs) Ongoing fuel savings Ratio: 4-7 to 1

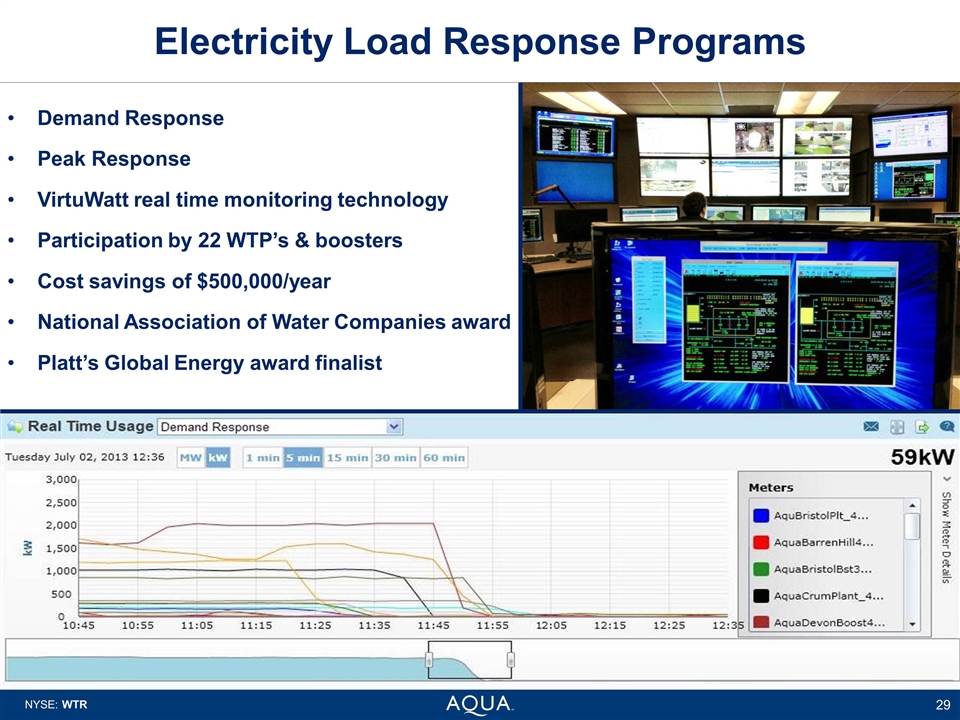

Electricity Load Response Programs Demand Response Peak Response VirtuWatt real time monitoring technology Participation by 22 WTP’s & boosters Cost savings of $500,000/year National Association of Water Companies award Platt’s Global Energy award finalist

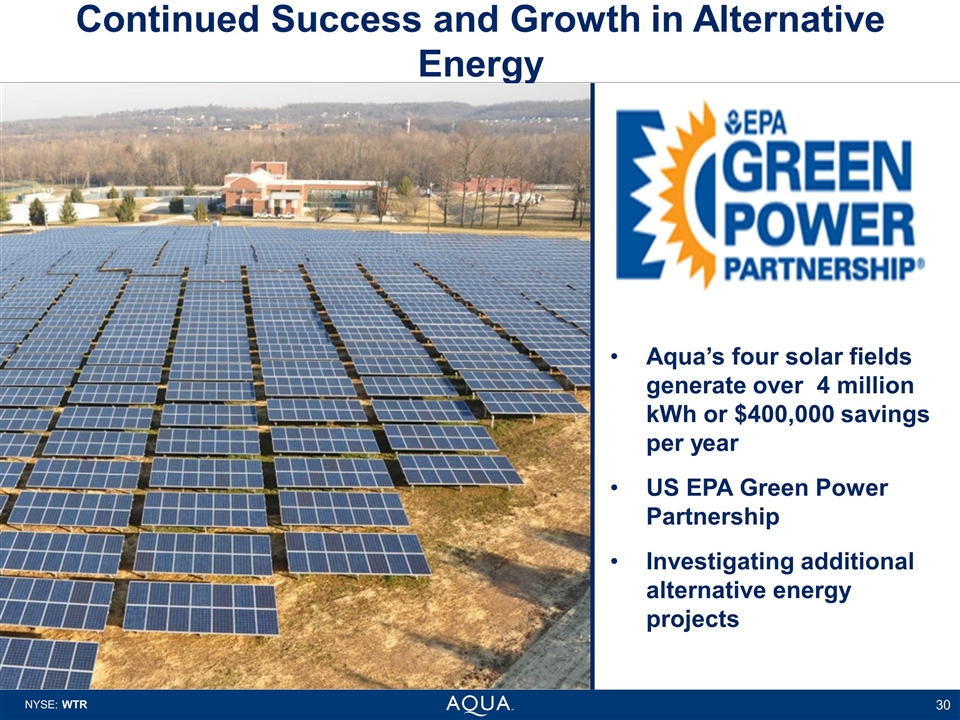

Continued Success and Growth in Alternative Energy Aqua’s four solar fields generate over 4 million kWh or $400,000 savings per year US EPA Green Power Partnership Investigating additional alternative energy projects

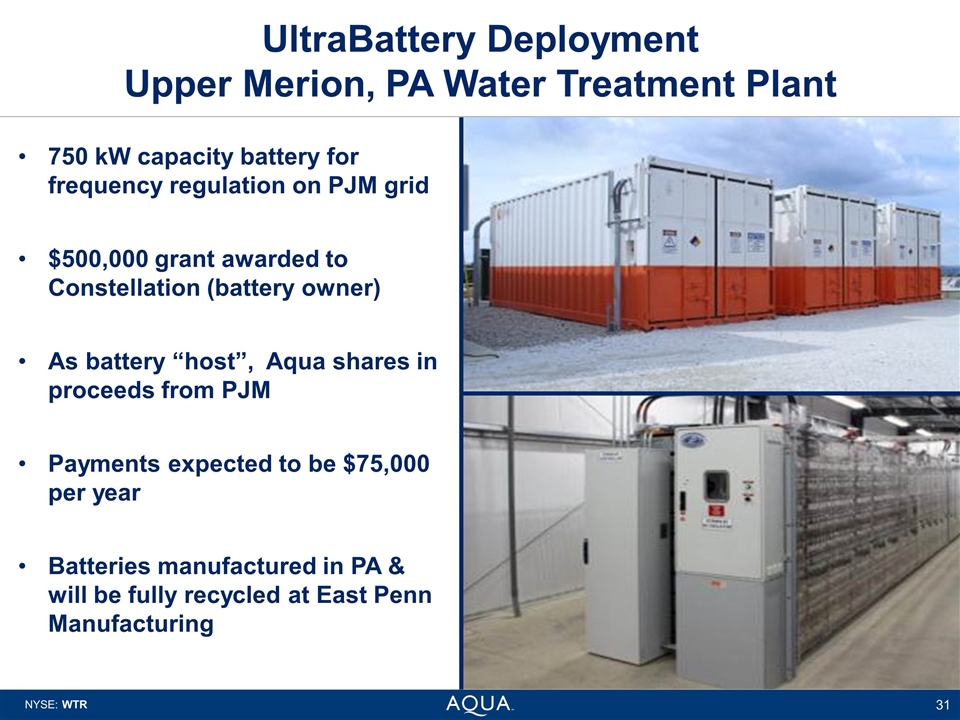

UltraBattery Deployment Upper Merion, PA Water Treatment Plant 750 kW capacity battery for frequency regulation on PJM grid $500,000 grant awarded to Constellation (battery owner) As battery “host”, Aqua shares in proceeds from PJM Payments expected to be $75,000 per year Batteries manufactured in PA & will be fully recycled at East Penn Manufacturing

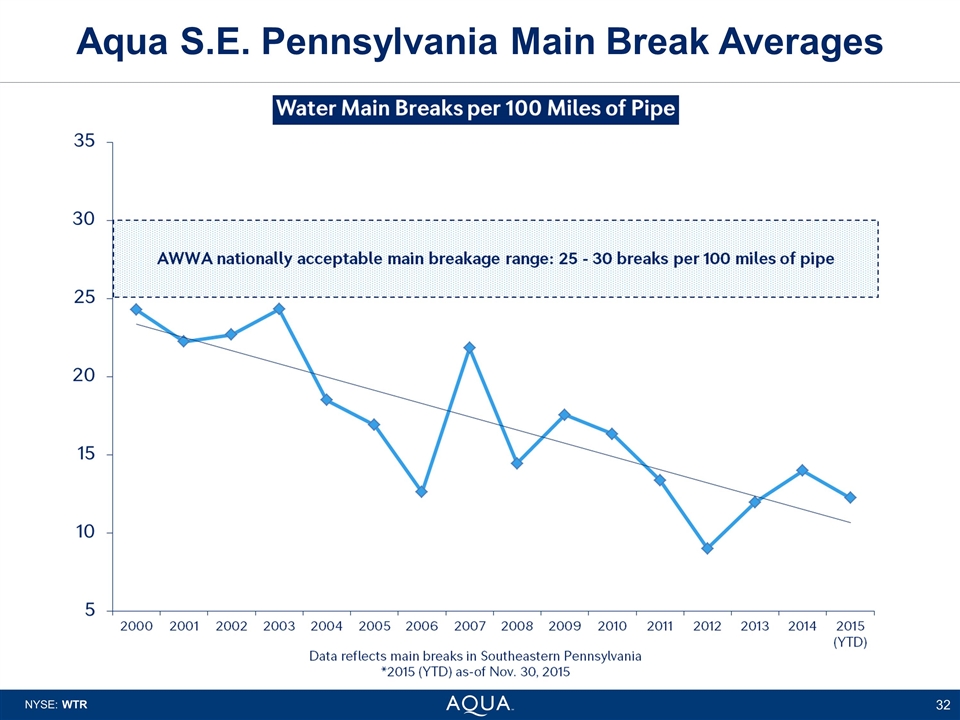

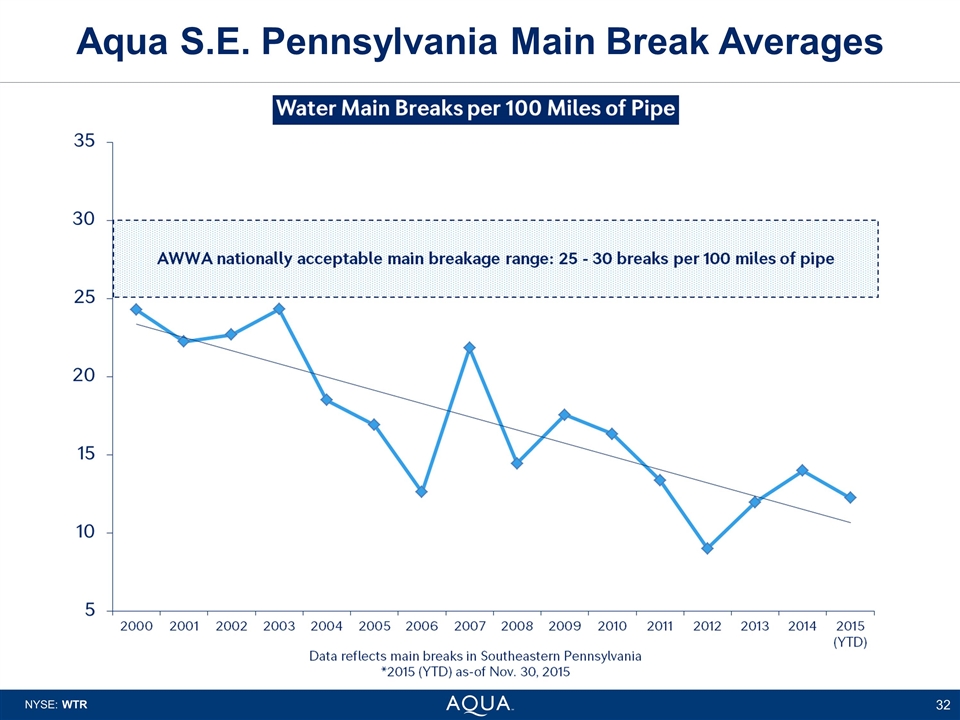

Aqua S.E. Pennsylvania Main Break Averages

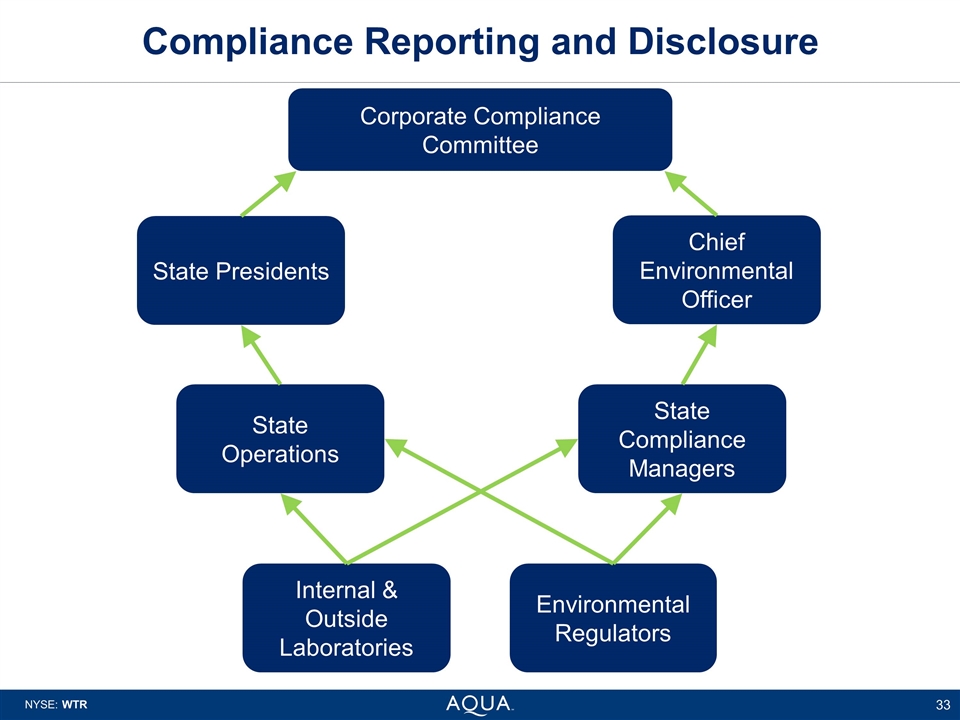

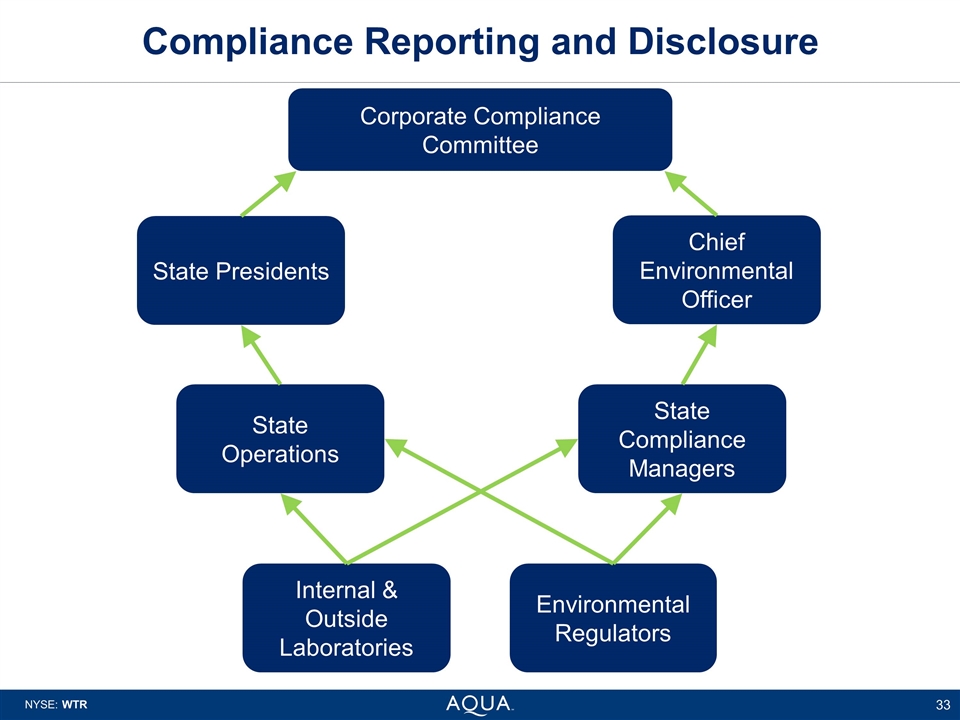

Compliance Reporting and Disclosure Corporate Compliance Committee State Presidents Chief Environmental Officer State Compliance Managers State Operations Environmental Regulators Internal & Outside Laboratories

Source Water Vulnerability Tools Centralized GIS-based source water assessment tools Dynamic multi-source database Risk planning Support for emergency response In-stream toxicity sensor

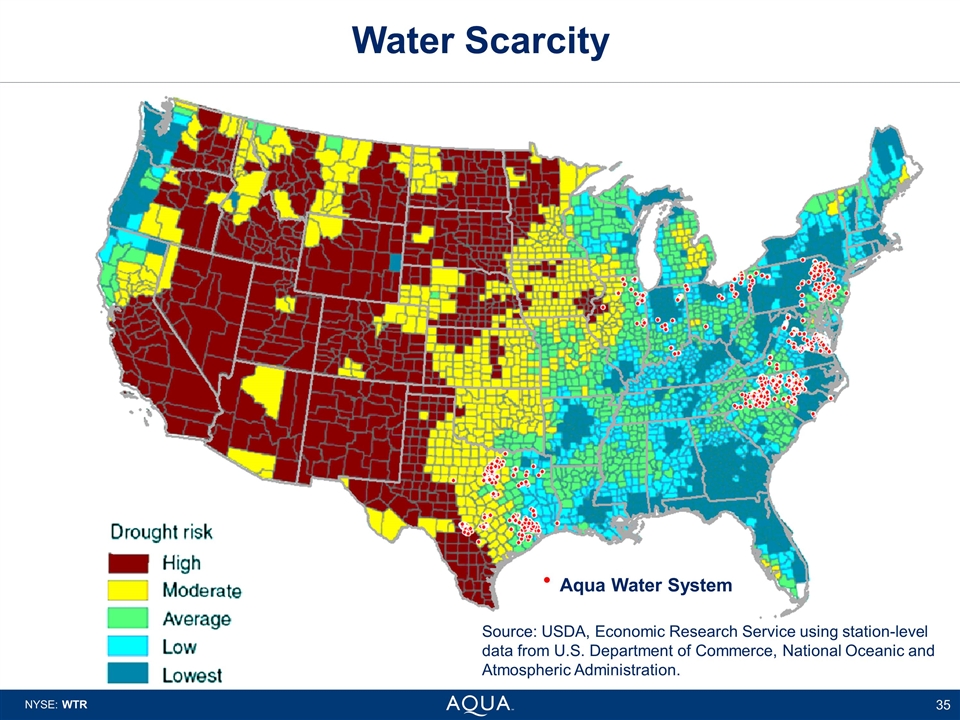

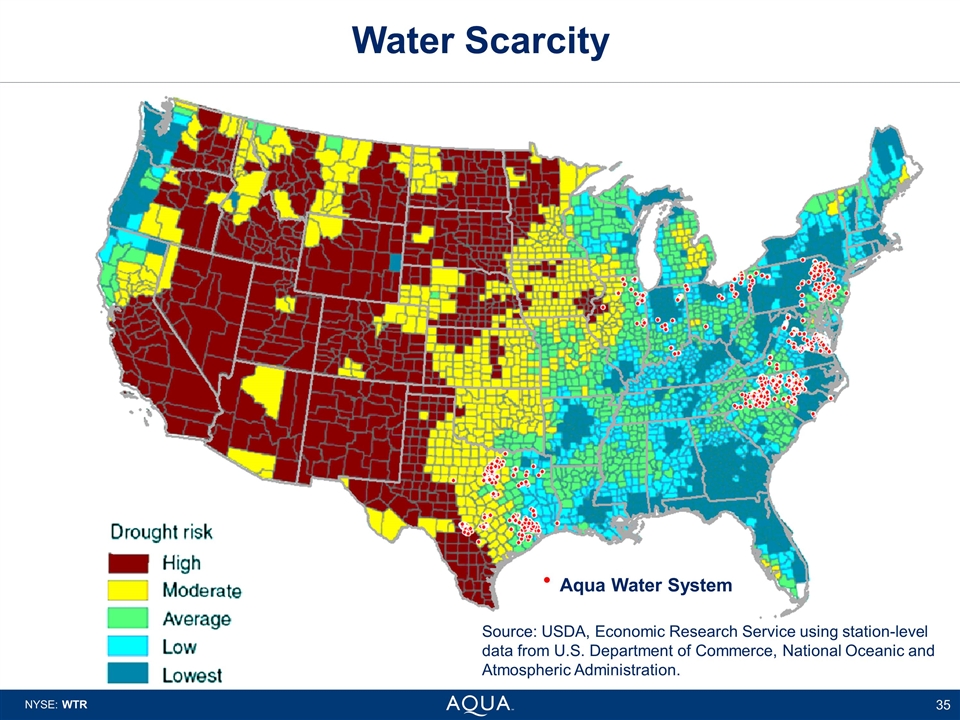

Water Scarcity Source: USDA, Economic Research Service using station-level data from U.S. Department of Commerce, National Oceanic and Atmospheric Administration. Aqua Water System

Employees More than 1,600 employees 435 licensed operators Employee development Licensing “Aqua University” Tuition reimbursement

Safety is Non-negotiable Defensive Driving Course Equipment Safety Safety Day WAVE Recognition Personal Protective Equipment Trench Safety

Dave Smeltzer Executive Vice President and Chief Financial Officer Financial Update NYSE: WTR

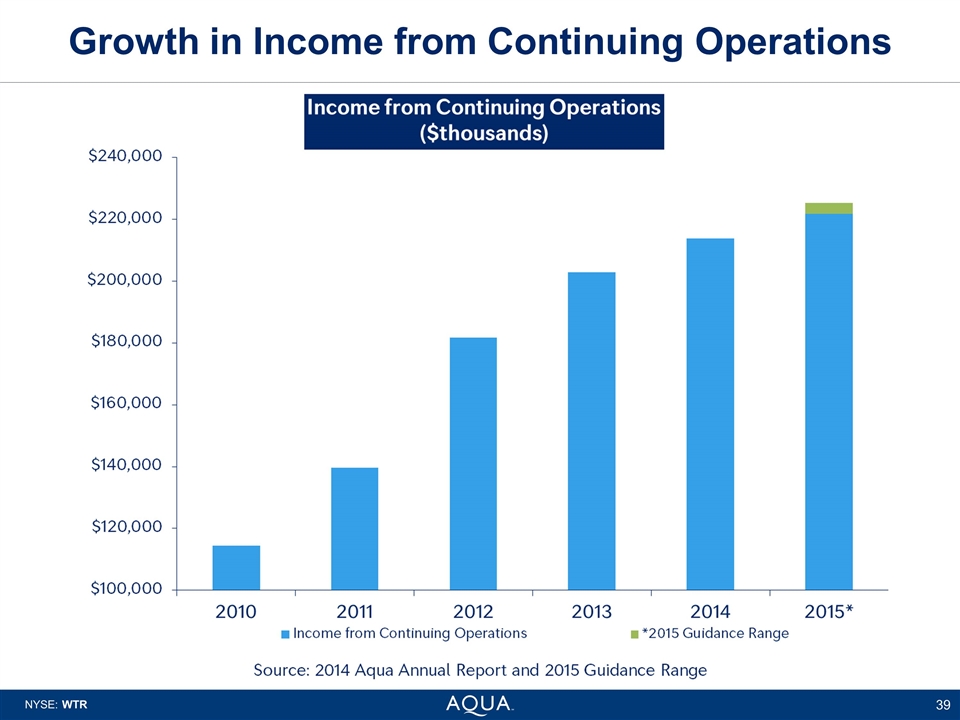

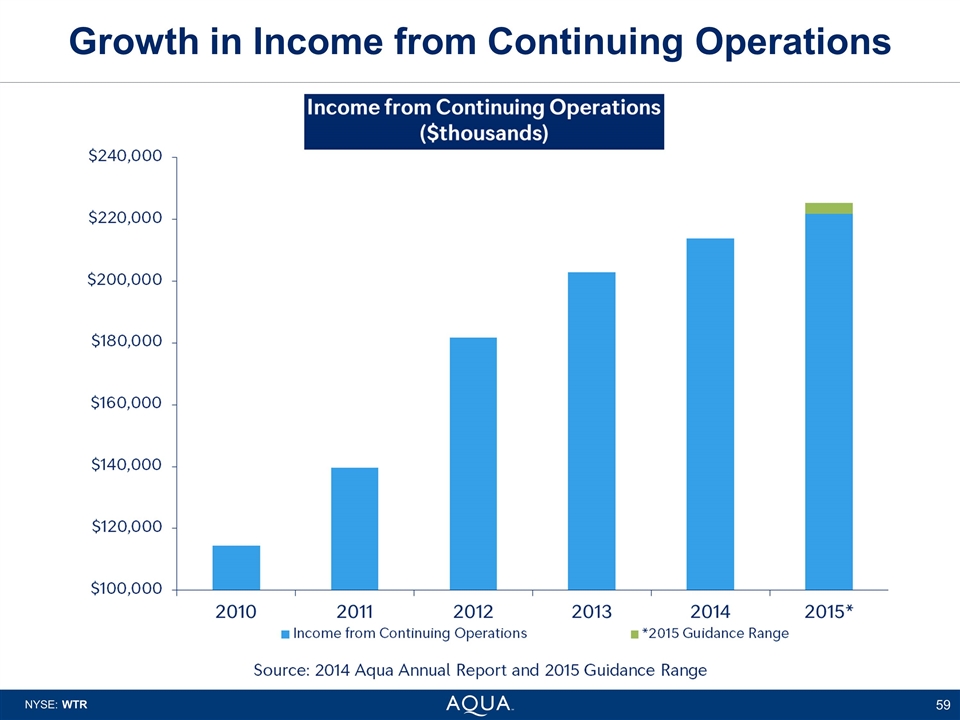

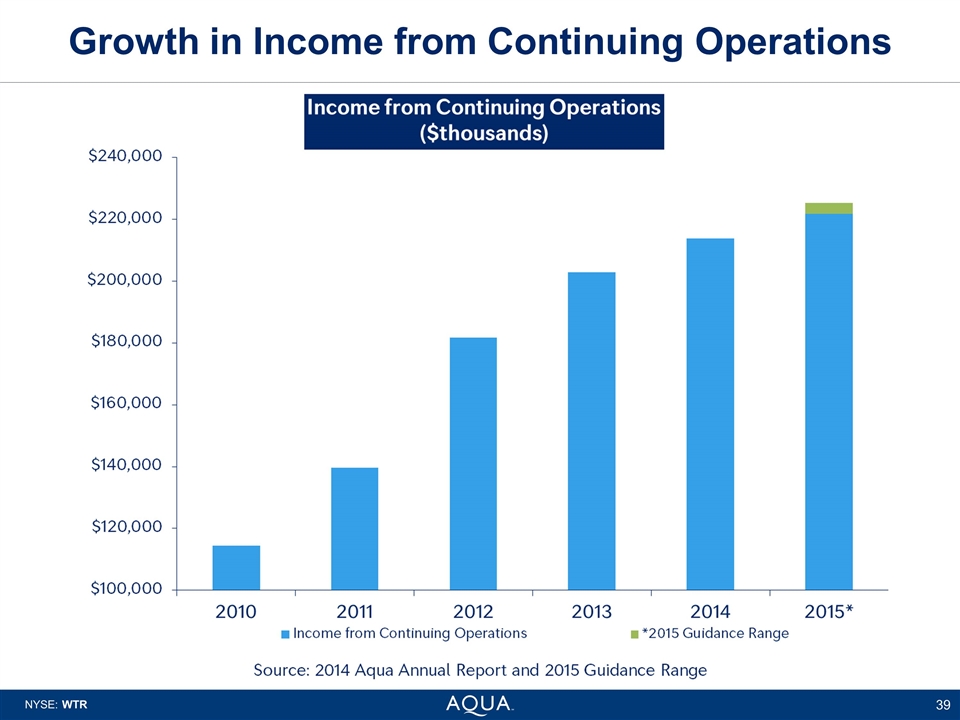

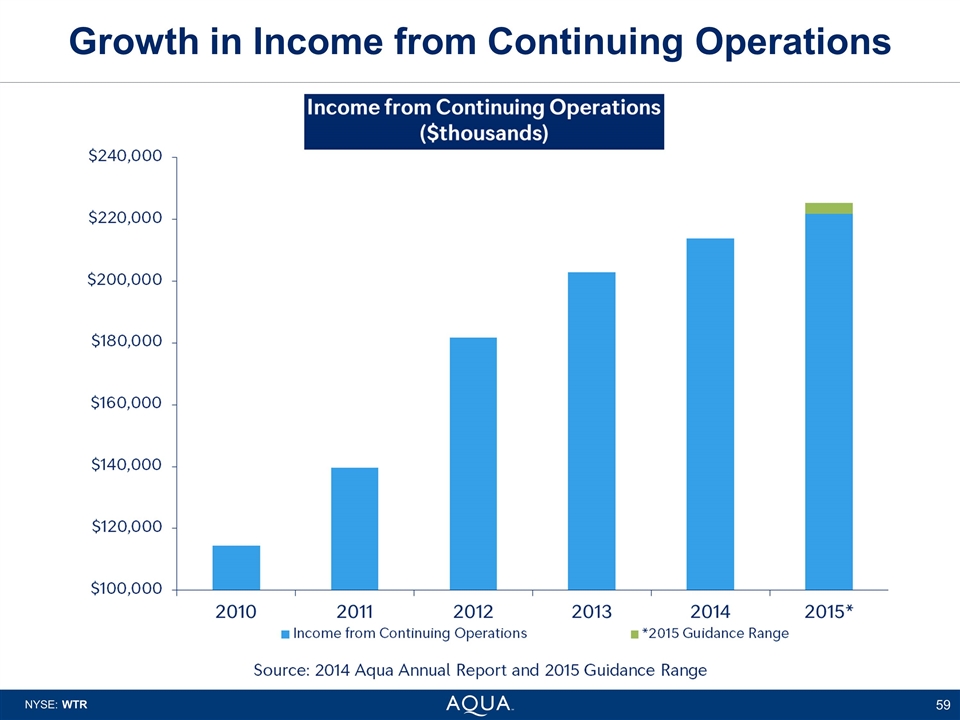

Growth in Income from Continuing Operations

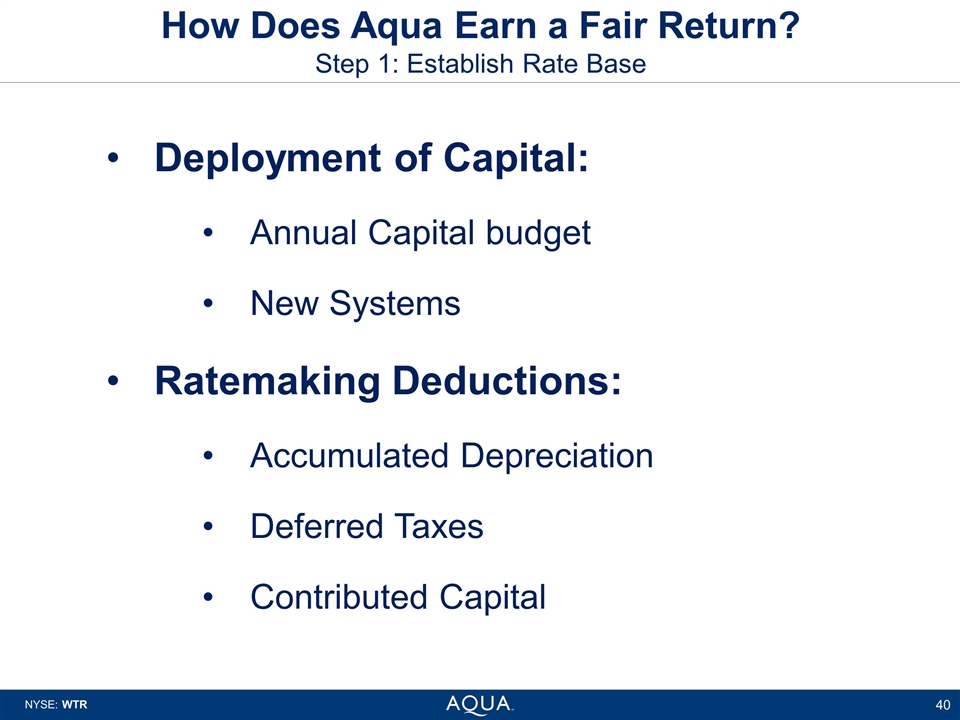

How Does Aqua Earn a Fair Return? Step 1: Establish Rate Base Deployment of Capital: Annual Capital budget New Systems Ratemaking Deductions: Accumulated Depreciation Deferred Taxes Contributed Capital

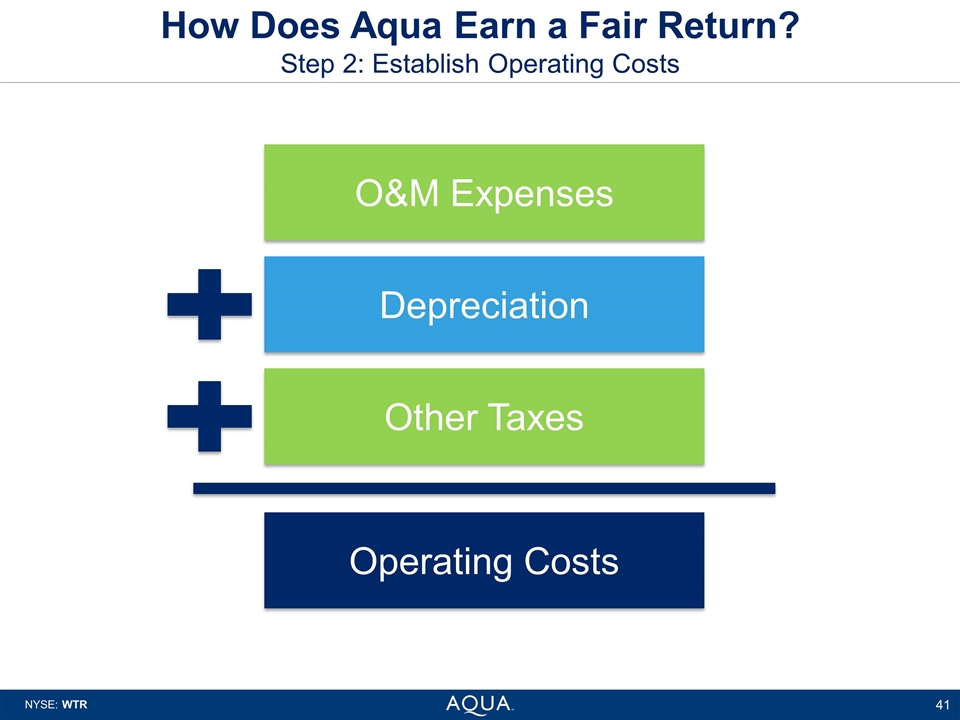

How Does Aqua Earn a Fair Return? Step 2: Establish Operating Costs O&M Expenses Depreciation Other Taxes Operating Costs

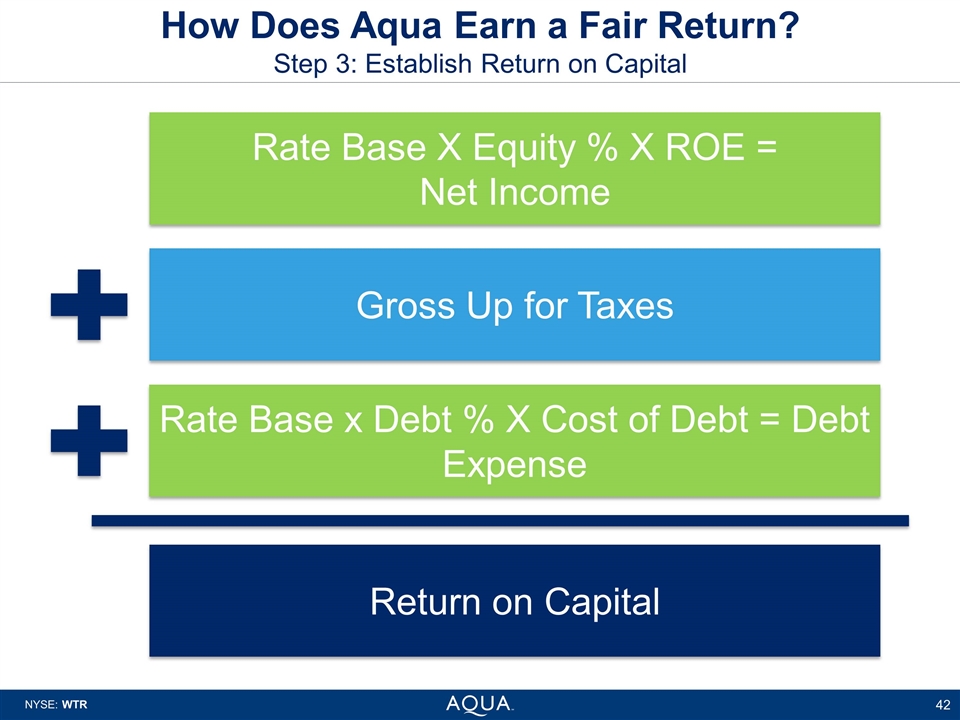

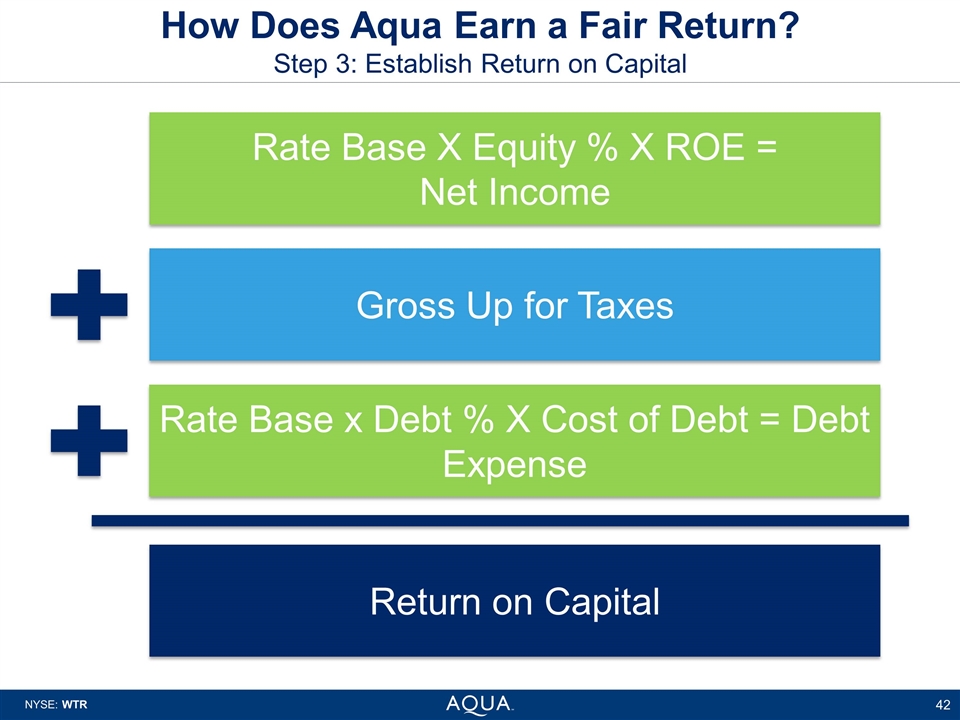

How Does Aqua Earn a Fair Return? Step 3: Establish Return on Capital Rate Base X Equity % X ROE = Net Income Gross Up for Taxes Rate Base x Debt % X Cost of Debt = Debt Expense Return on Capital

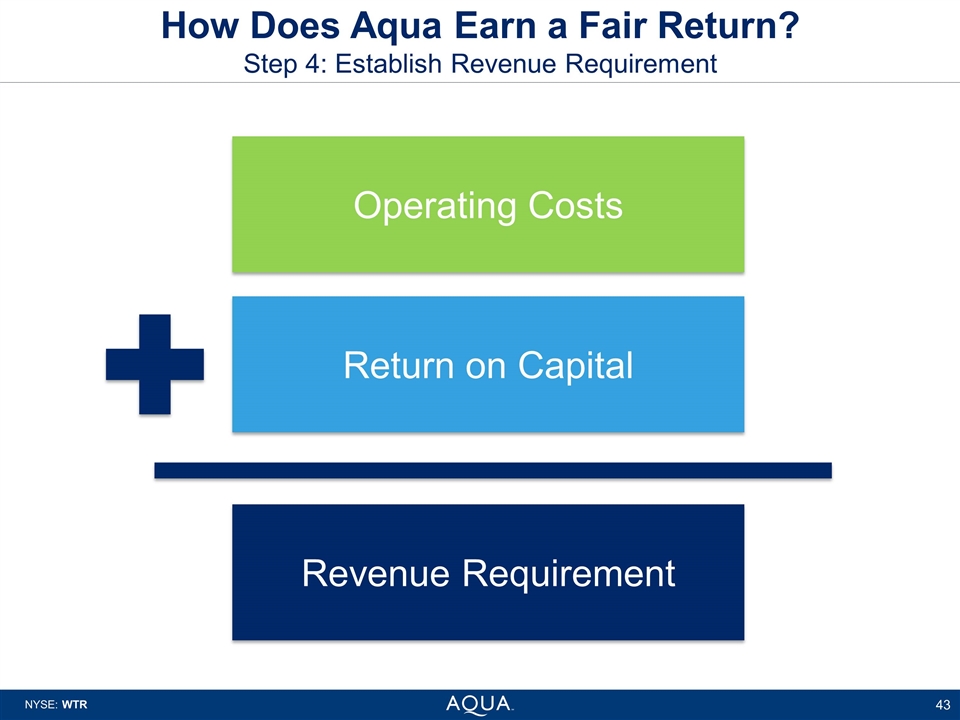

How Does Aqua Earn a Fair Return? Step 4: Establish Revenue Requirement Operating Costs Return on Capital Revenue Requirement

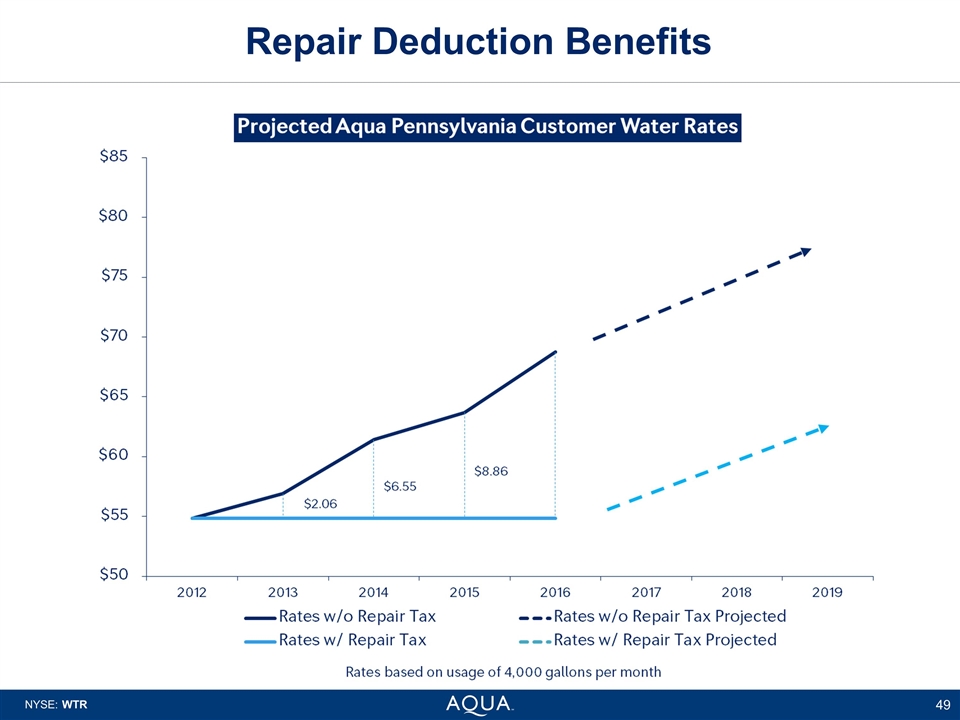

Implementation of the IRS Repair Tax Deduction Evolved from a FedEx case in 2005 Deduction for jet engine replacement denied Supreme court decision A new tax deduction was created Typically done via deferred tax accounting

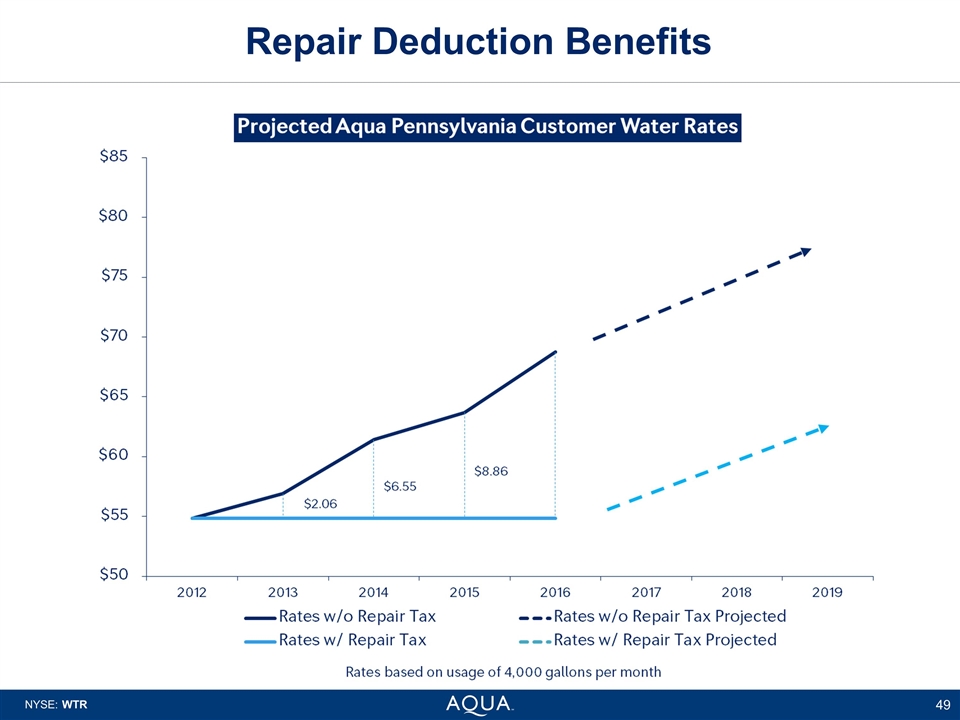

Pennsylvania Repair Tax Repair tax deduction introduced in PA 2011 rate filing PA is one of several “flow through” states Flow through method required in final order (2012) 10 year amortization of catch up deduction required Requirements for amortization established Key stakeholders understood benefit to customers: Longer stay-out Incorporation into next PA rate filing Lower rates for customers for many years Aqua PA implemented repair deduction in Q4 2012

Aqua PA Adoption of the Repair Deduction On a water main network of 5,600 miles, replacements of minor portions (generally less than 1 mile) are considered expense (not capital) for tax purposes Primarily Infrastructure Rehabilitation Related Mains & Services Valves Hydrants

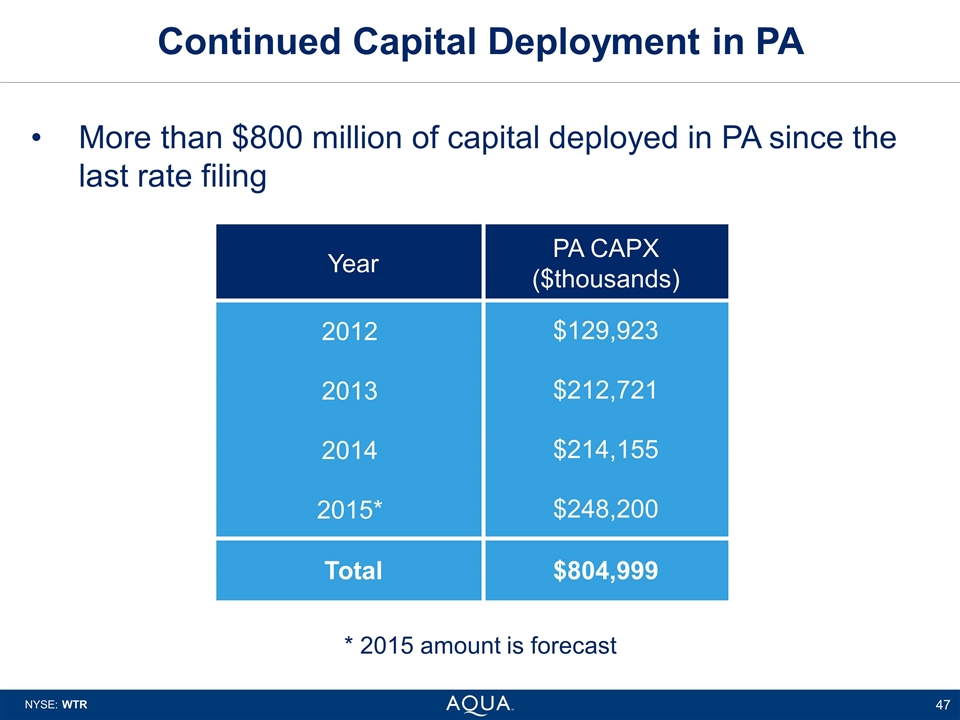

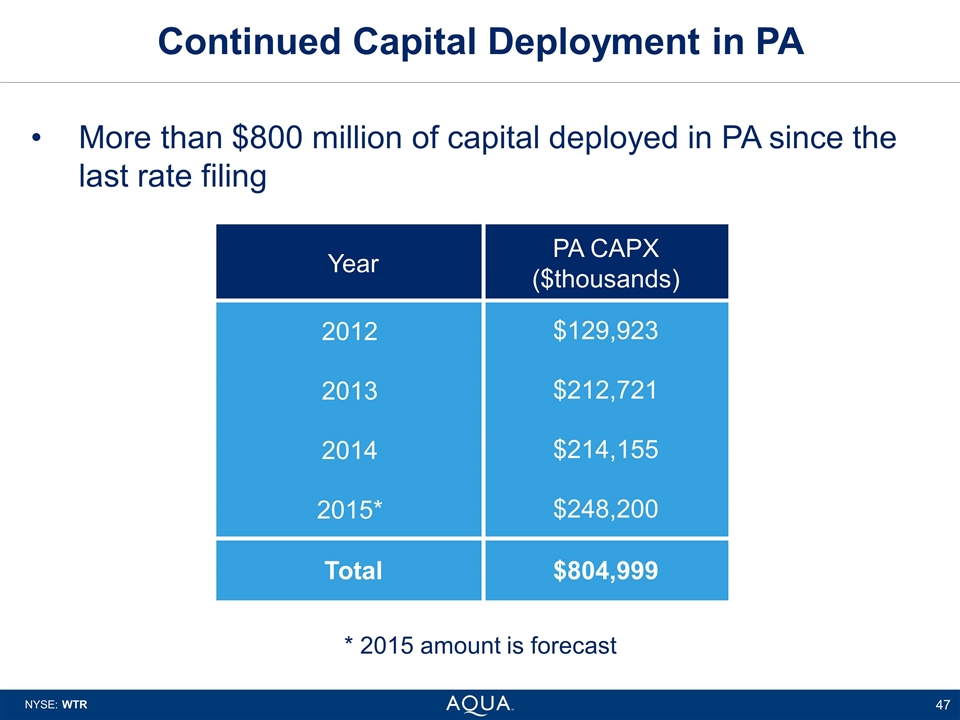

Continued Capital Deployment in PA * 2015 amount is forecast More than $800 million of capital deployed in PA since the last rate filing Year PA CAPX ($thousands) 2012 $129,923 2013 $212,721 2014 $214,155 2015* $248,200 Total $804,999

PA DSIC & Rates PA DSIC / rate case timing Rate base increase of over $1 billion from 2011 filing Typically require revenue increase of 45% Expect increases of DSIC + 5 – 10% rate increase Full incorporation of repair benefit into rates

Repair Deduction Benefits

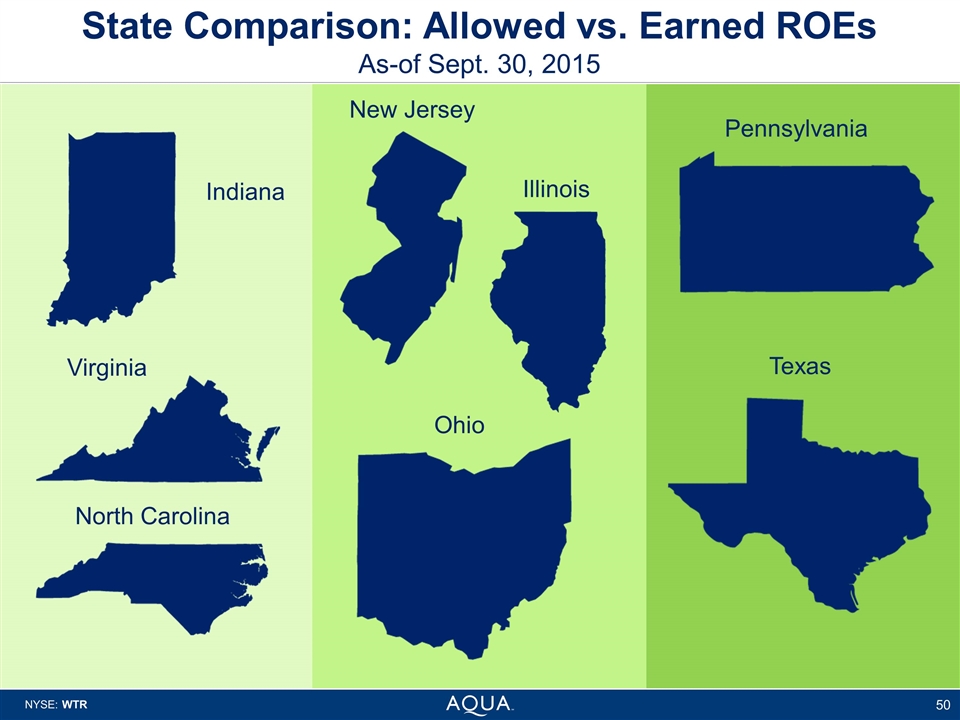

State Comparison: Allowed vs. Earned ROEs As-of Sept. 30, 2015 New Jersey Illinois Ohio Indiana Virginia North Carolina Pennsylvania Texas

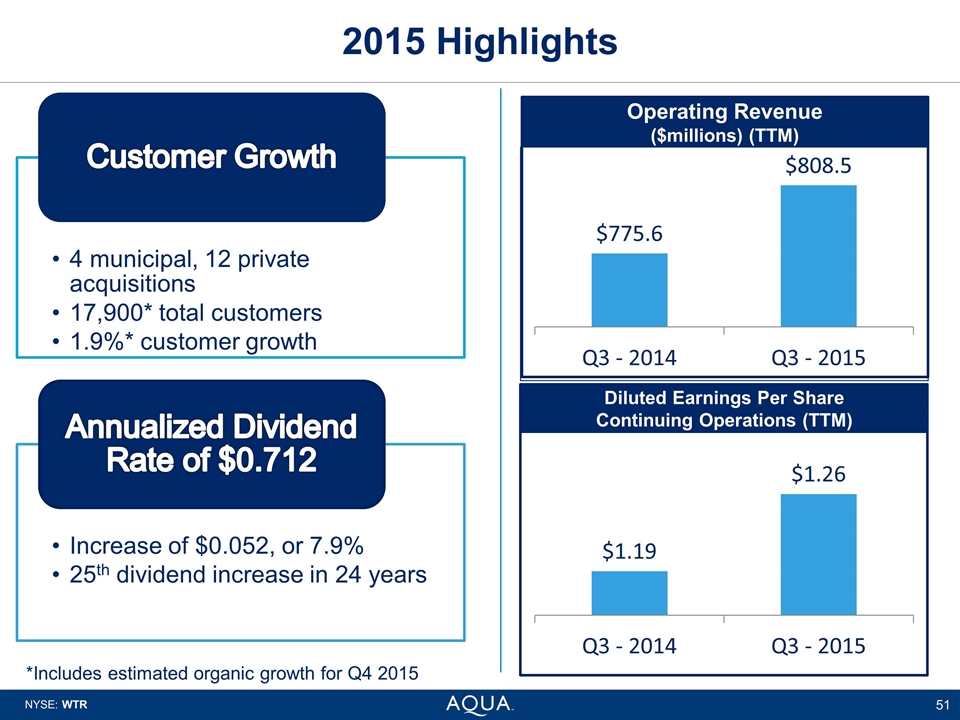

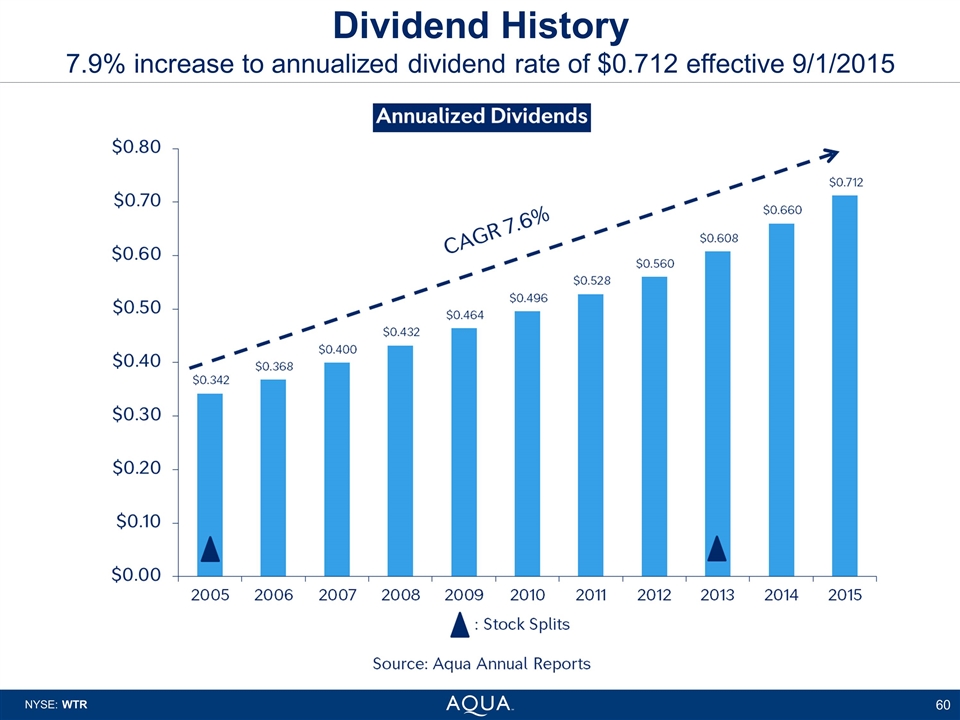

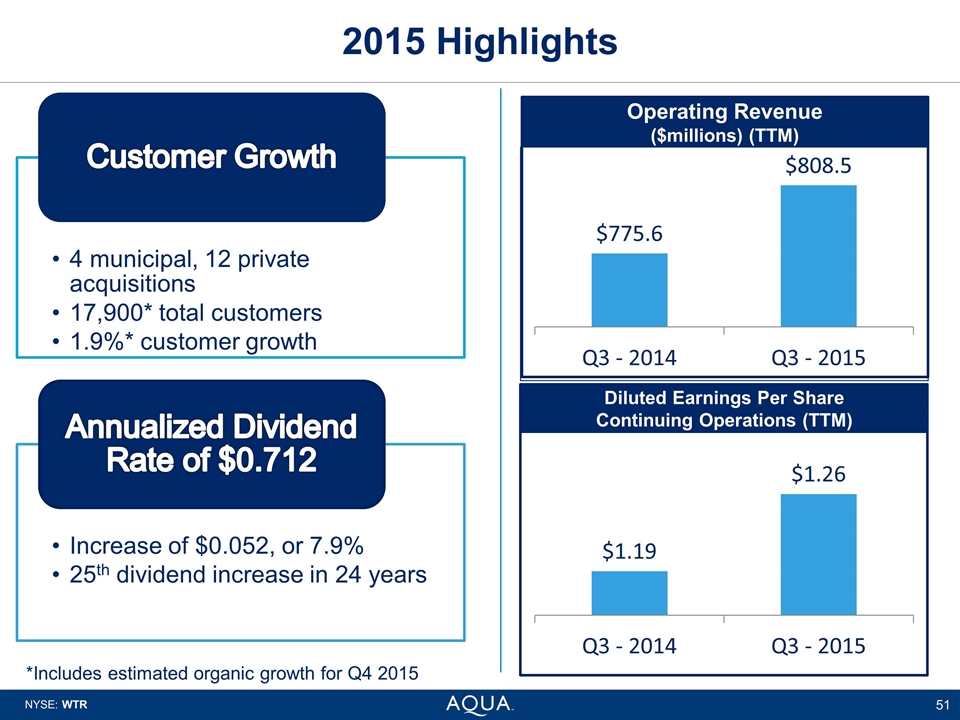

2015 Highlights Diluted Earnings Per Share Continuing Operations (TTM) *Includes estimated organic growth for Q4 2015 Customer Growth 4 municipal, 12 private acquisitions 17,900* total customers Annualized Dividend Rate of $0.712 Increase of $0.052, or 7.9% 25 th dividend increase in 24 years 1.9%* customer growth

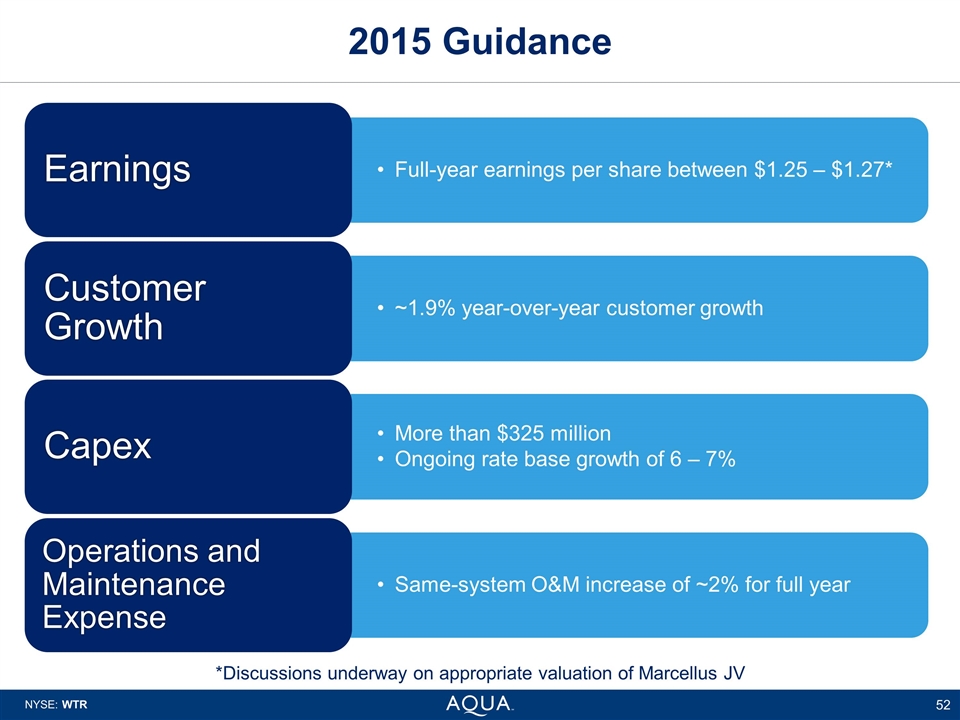

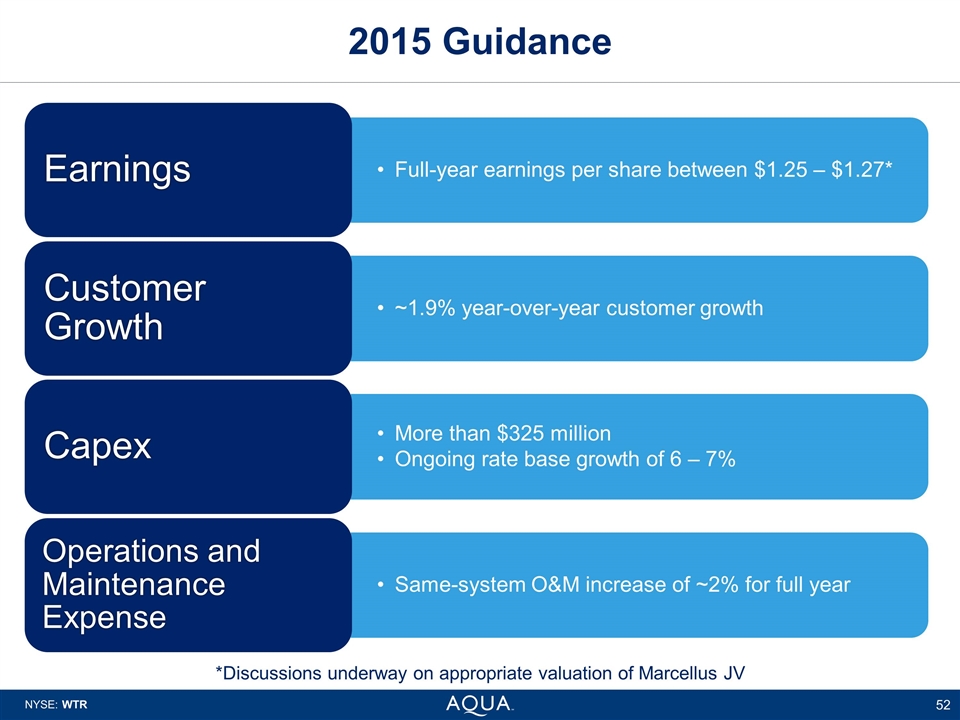

2015 Guidance *Discussions underway on appropriate valuation of Marcellus JV Earnings Full-year earnings per share between $1.25 – $1.27* Customer Growth Operations and Maintenance Expense Same-system O&M increase of ~2% for full year Ongoing rate base growth of 6 – 7% More than $325 million Capex ~1.9% year-over-year customer growth

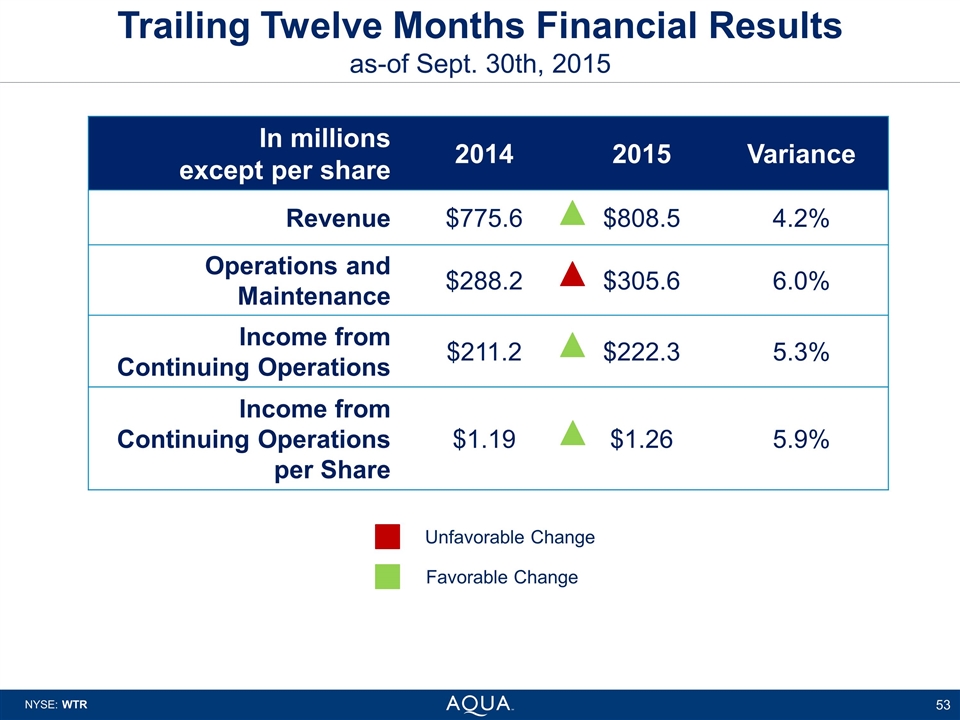

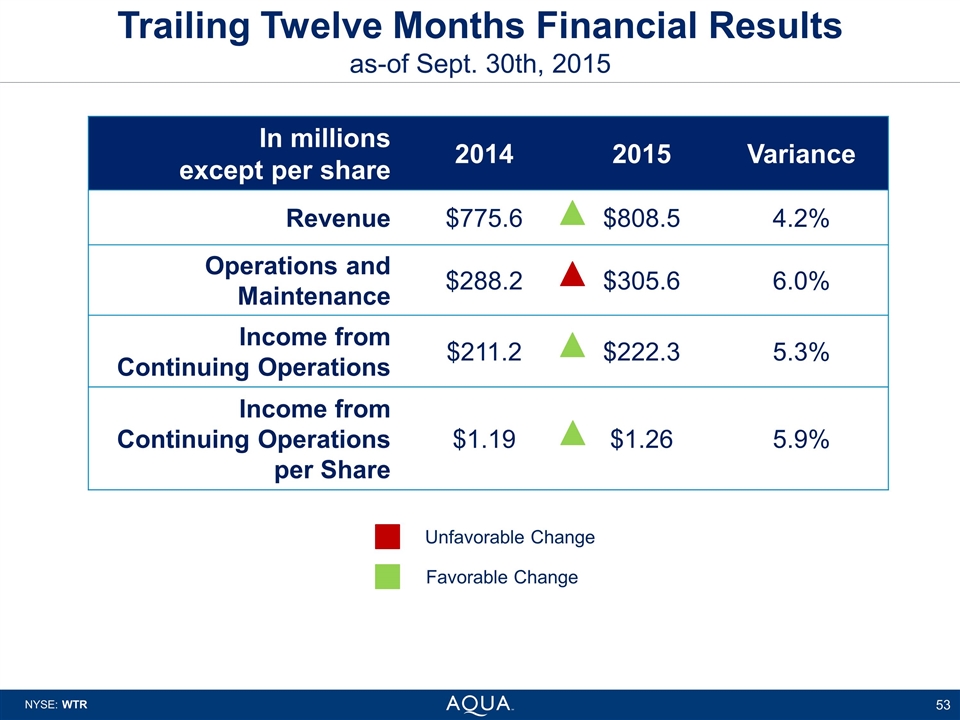

Trailing Twelve Months Financial Results as-of Sept. 30th, 2015 In millions except per share 2014 2015 Variance Revenue $775.6 $808.5 4.2% Operations and Maintenance $288.2 $305.6 6.0% Income from Continuing Operations $211.2 $222.3 5.3% Income from Continuing Operations per Share $1.19 $1.26 5.9% Unfavorable Change Favorable Change

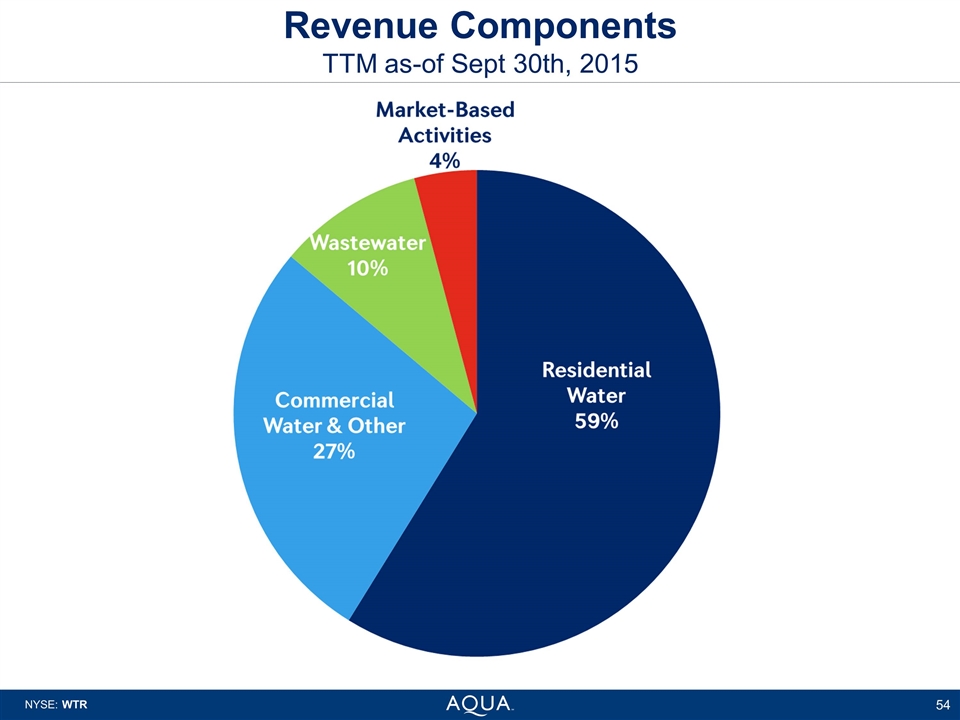

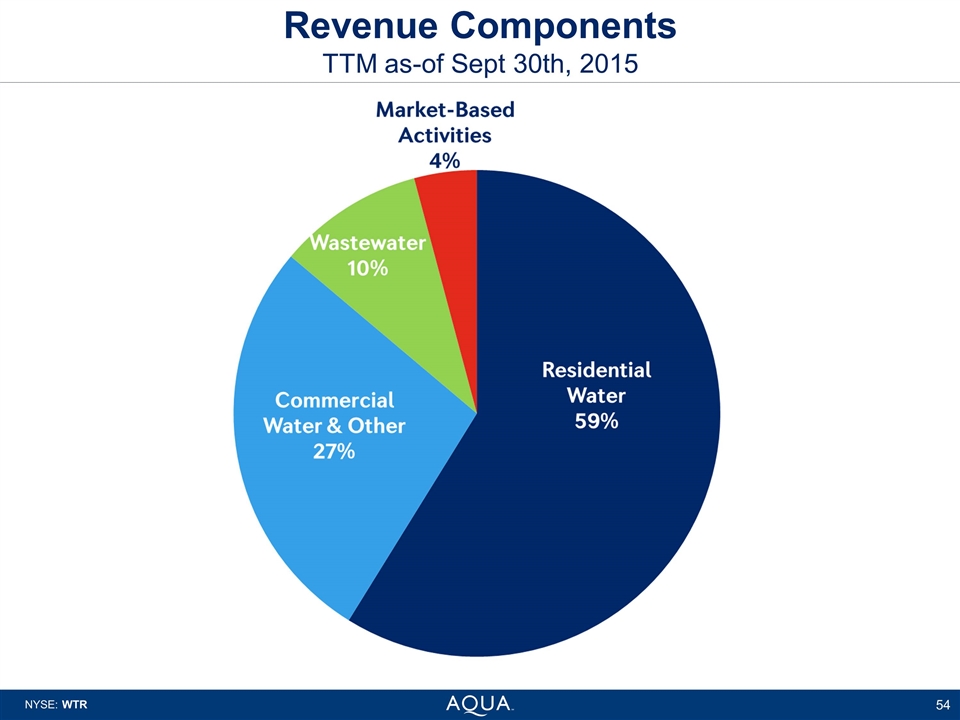

Revenue Components TTM as-of Sept 30th, 2015

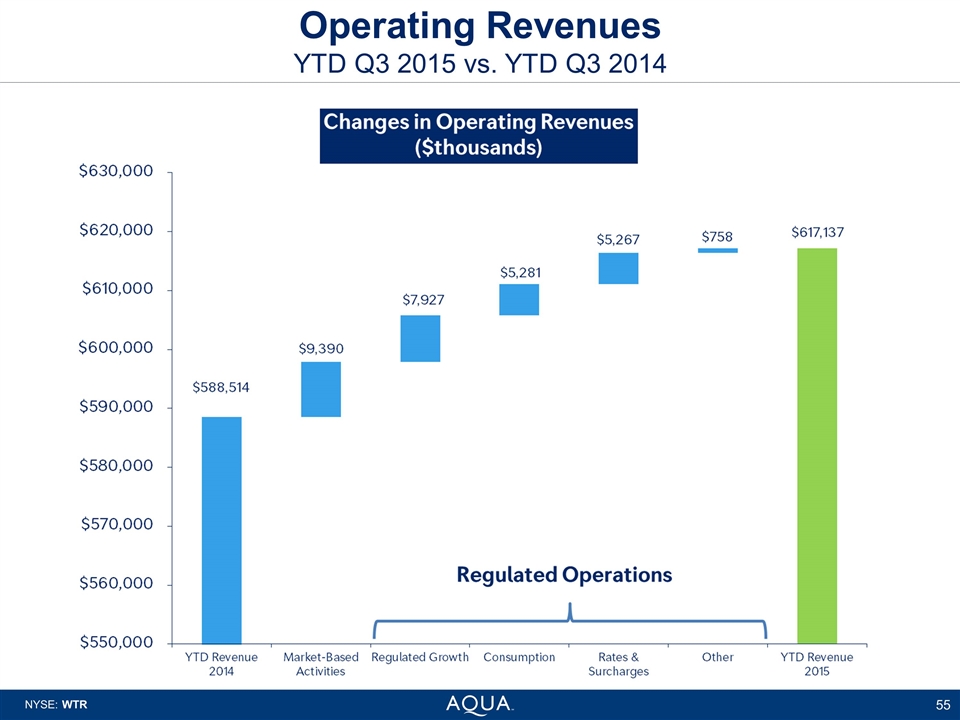

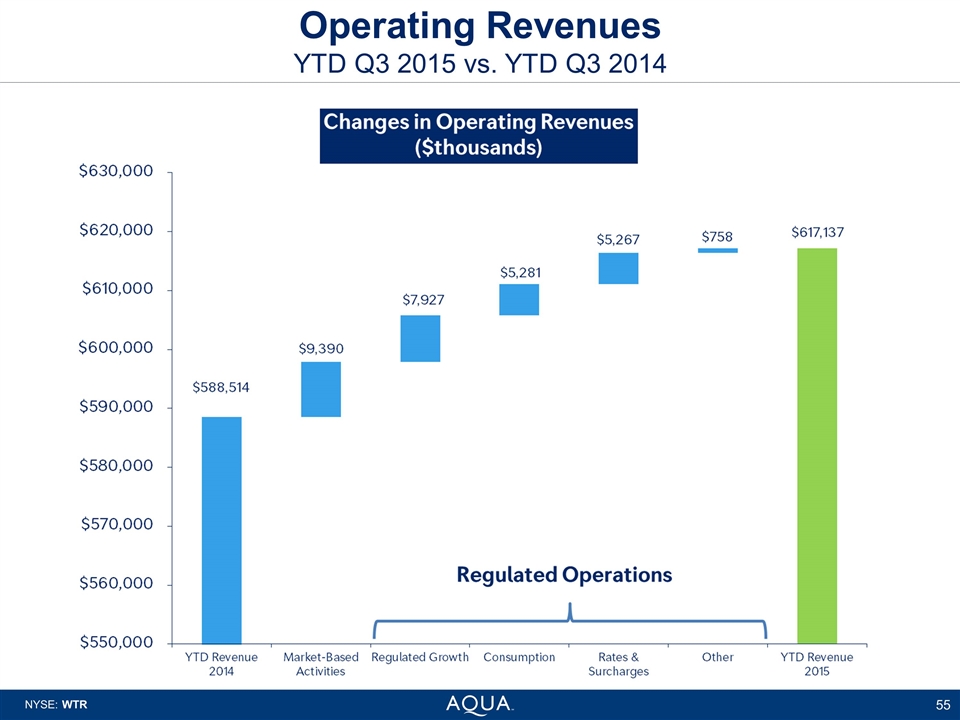

Operating Revenues YTD Q3 2015 vs. YTD Q3 2014

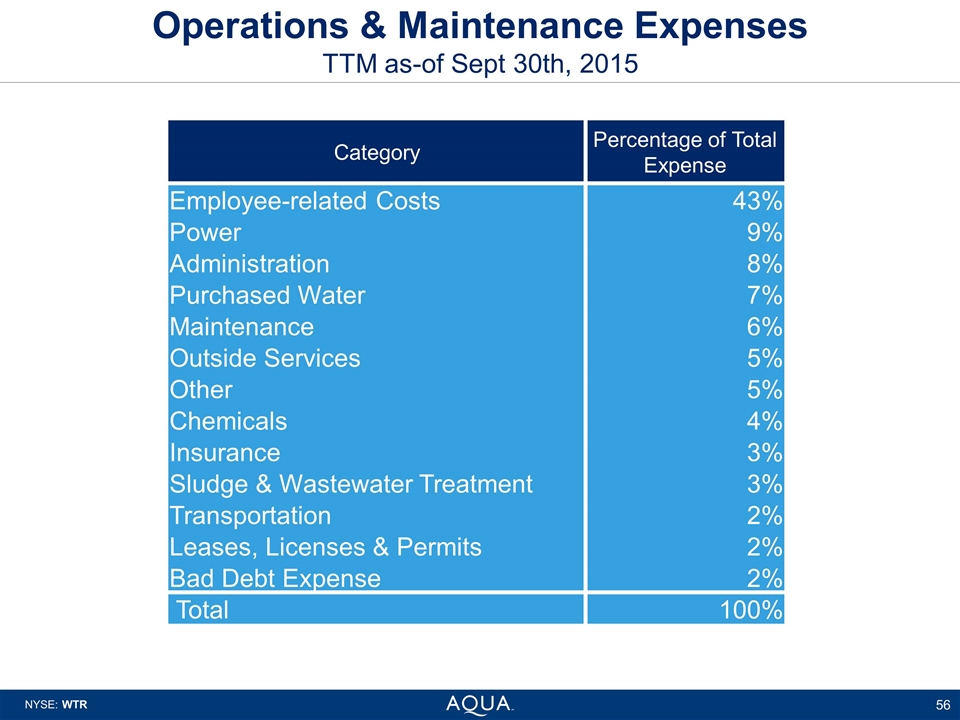

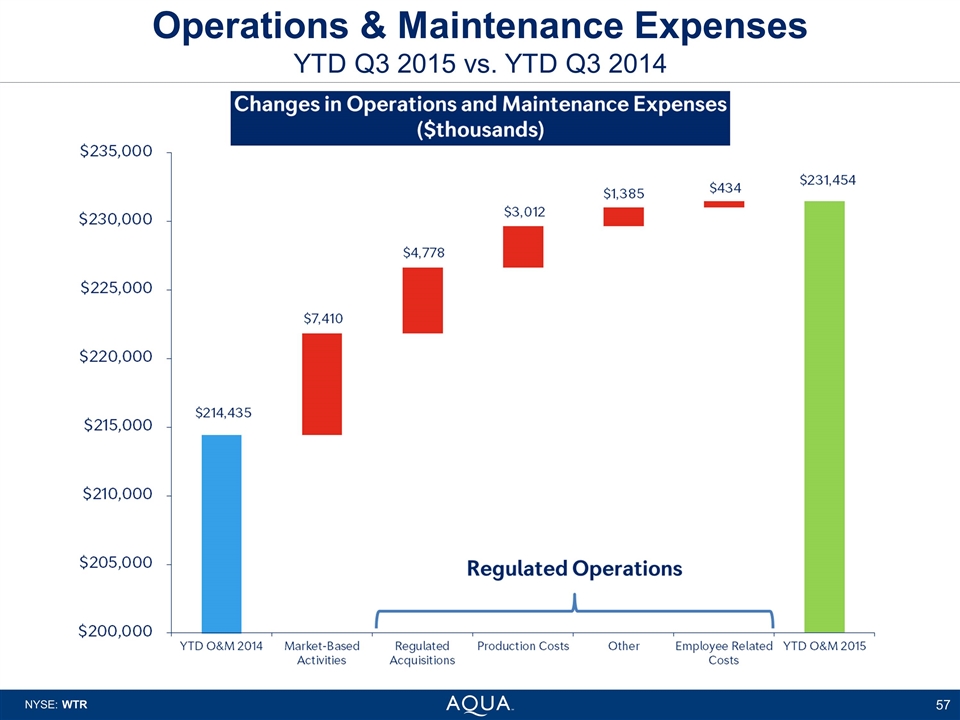

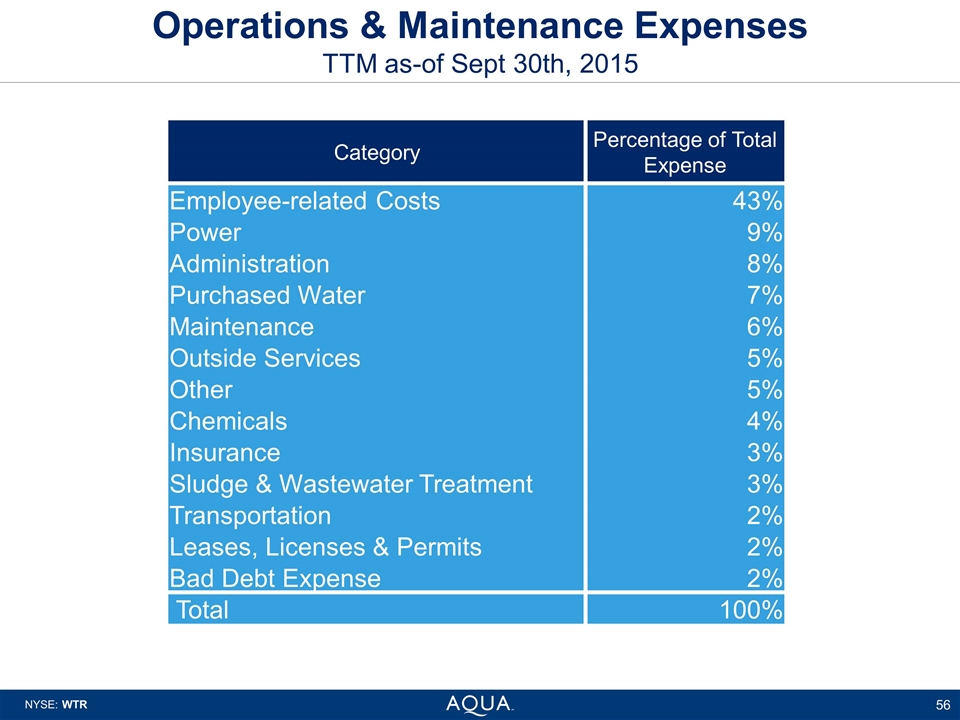

Operations & Maintenance Expenses TTM as-of Sept 30th, 2015 Category Percentage of Total Expense Employee-related Costs 43% Power 9% Administration 8% Purchased Water 7% Maintenance 6% Outside Services 5% Other 5% Chemicals 4% Insurance 3% Sludge & Wastewater Treatment 3% Transportation 2% Leases, Licenses & Permits 2% Bad Debt Expense 2% Total 100%

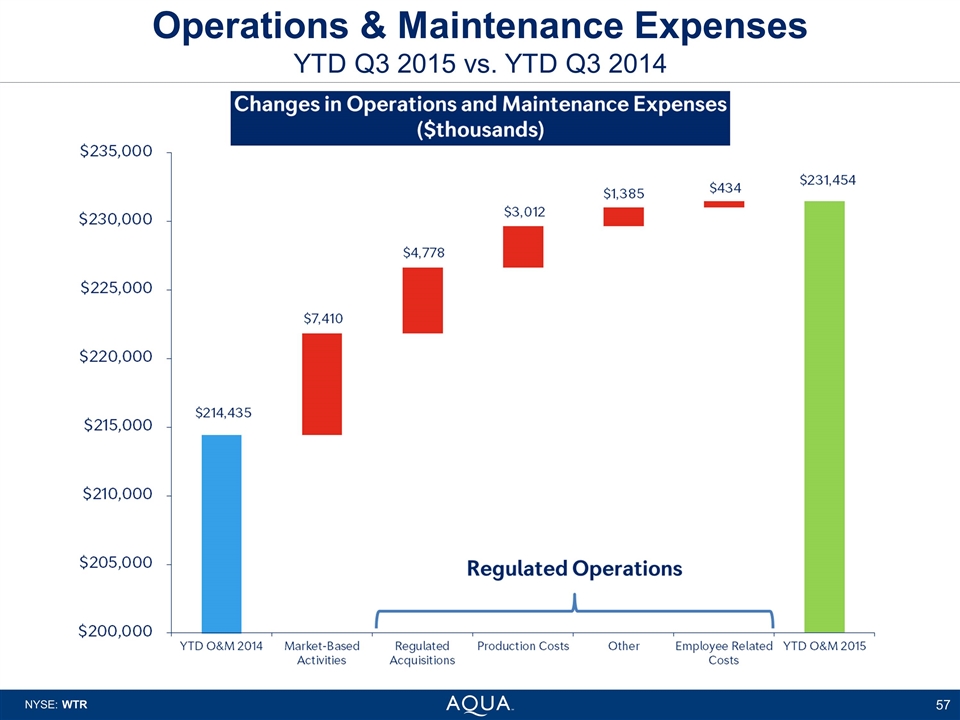

Operations & Maintenance Expenses YTD Q3 2015 vs. YTD Q3 2014

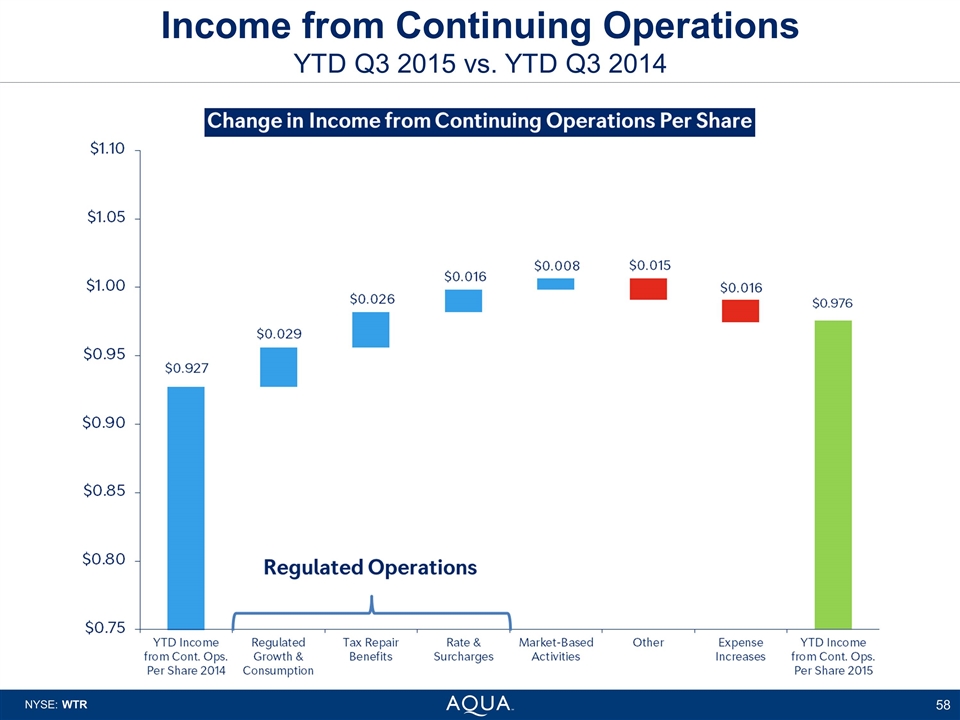

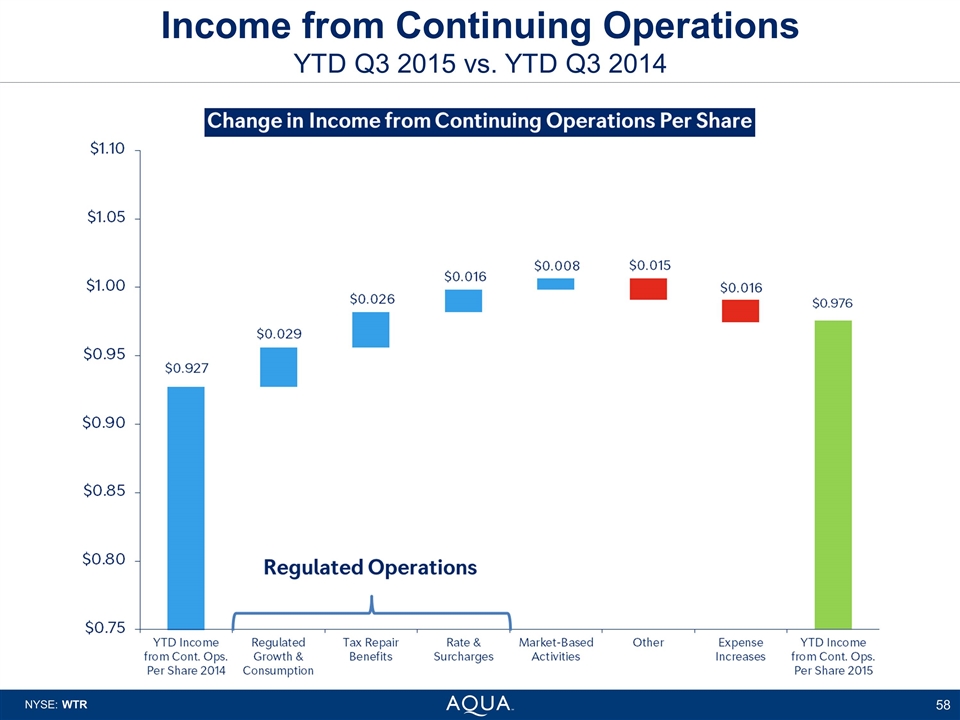

Income from Continuing Operations YTD Q3 2015 vs. YTD Q3 2014

Growth in Income from Continuing Operations

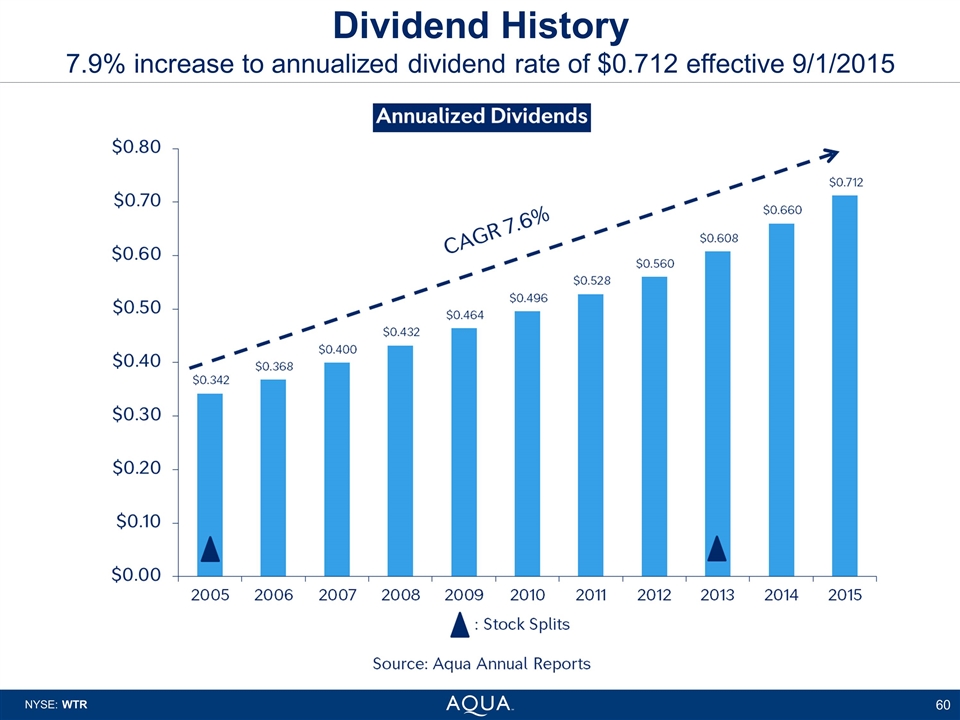

Dividend History 7.9% increase to annualized dividend rate of $0.712 effective 9/1/2015

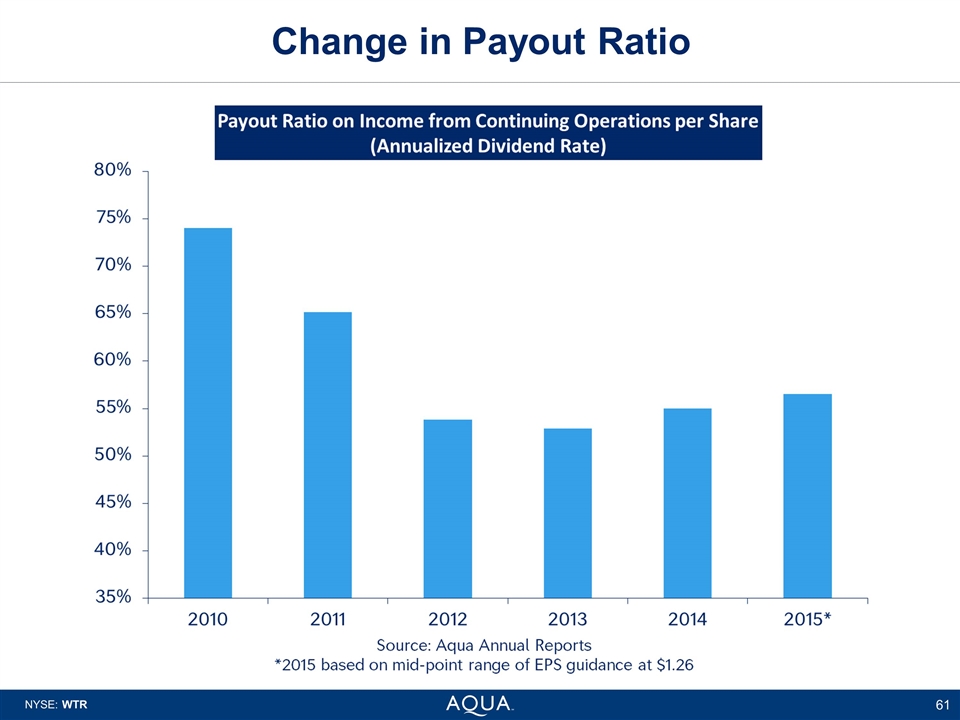

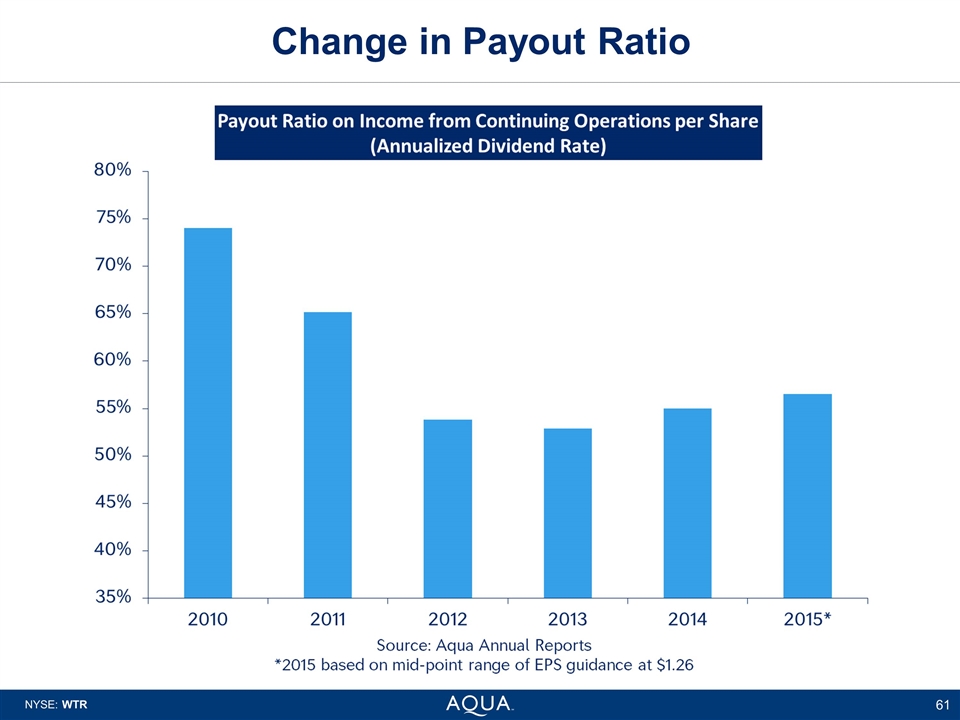

Change in Payout Ratio

Financial Strength Strong Balance Sheet A+ S&P Rating (Aqua PA) Capital structure 50:50 Substantial Debt Capacity Room on balance sheet for growth Plan to repurchase dilutive shares Shares used for acquisitions and/or employee equity awards

Kim Joyce Director, Legislative and Public Affairs and Regulatory Counsel Regulatory Update NYSE: WTR

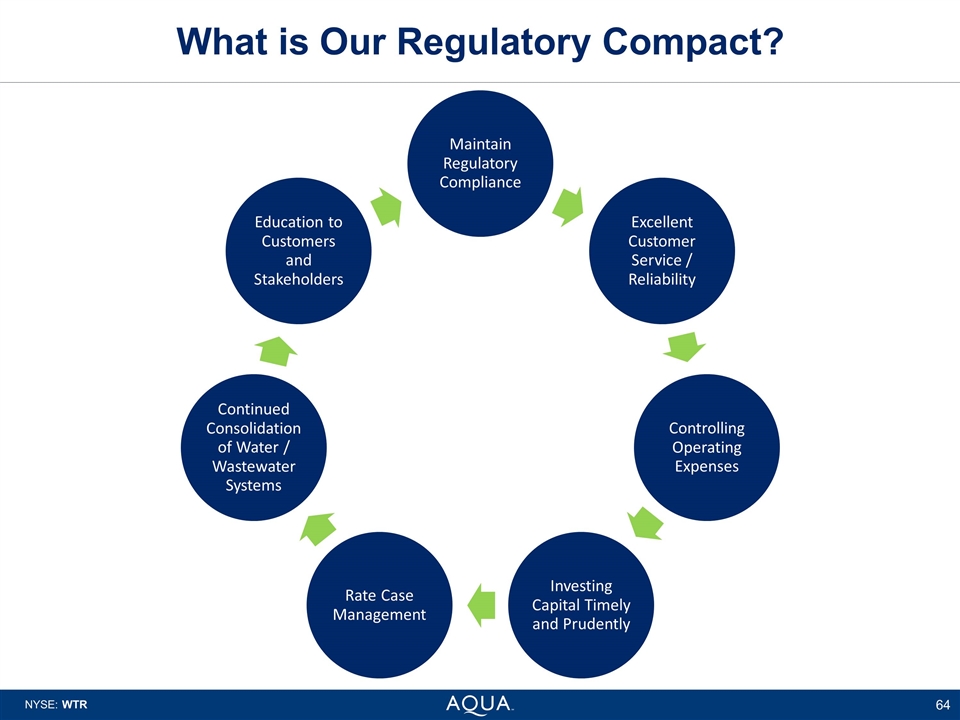

What is Our Regulatory Compact? Maintain Regulatory Compliance Excellent Customer Service / Reliability Controlling Operating Expenses Investing Capital Timely and Prudently Rate Case Management Continued Consolidation of Water / Wastewater Systems Education to Customers and Stakeholders

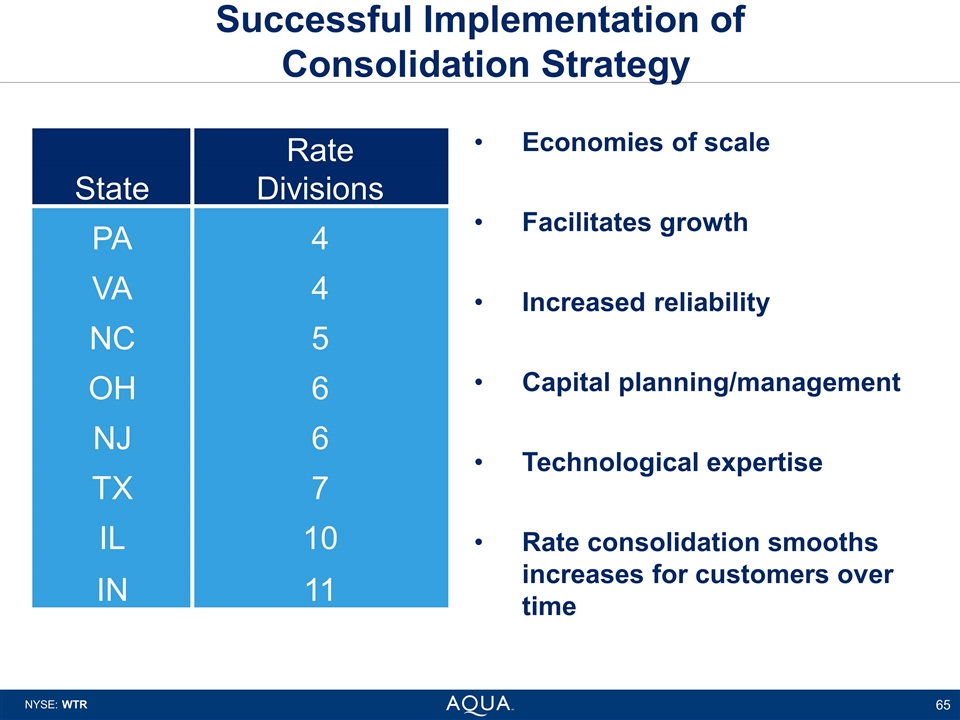

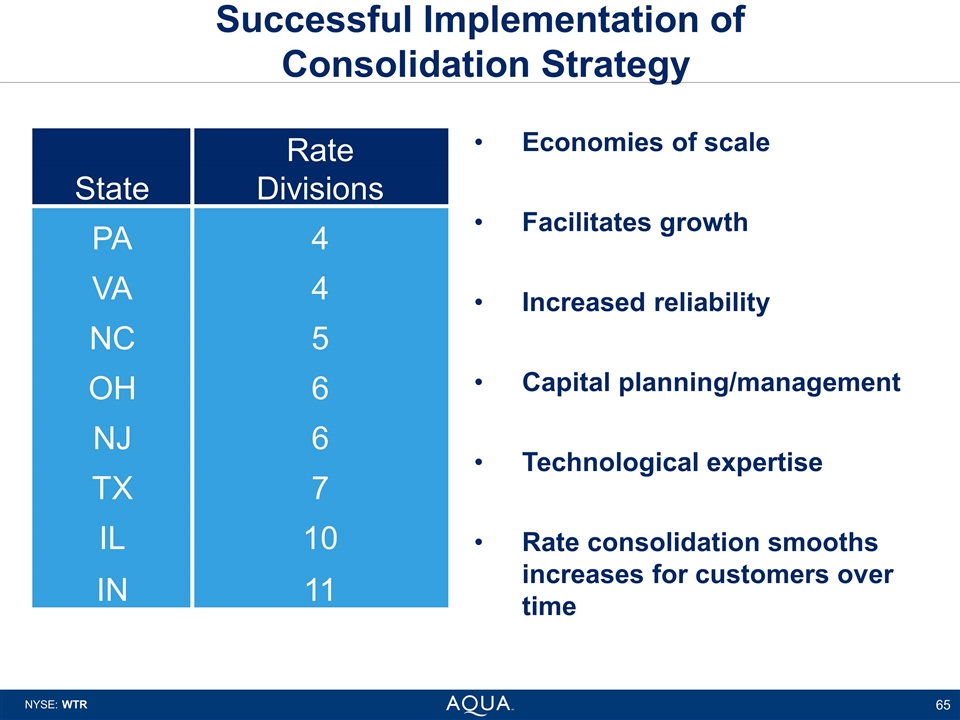

Successful Implementation of Consolidation Strategy Economies of scale Facilitates growth Increased reliability Capital planning/management Technological expertise Rate consolidation smooths increases for customers over time State Rate Divisions PA 4 VA 4 NC 5 OH 6 NJ 6 TX 7 IL 10 IN 11

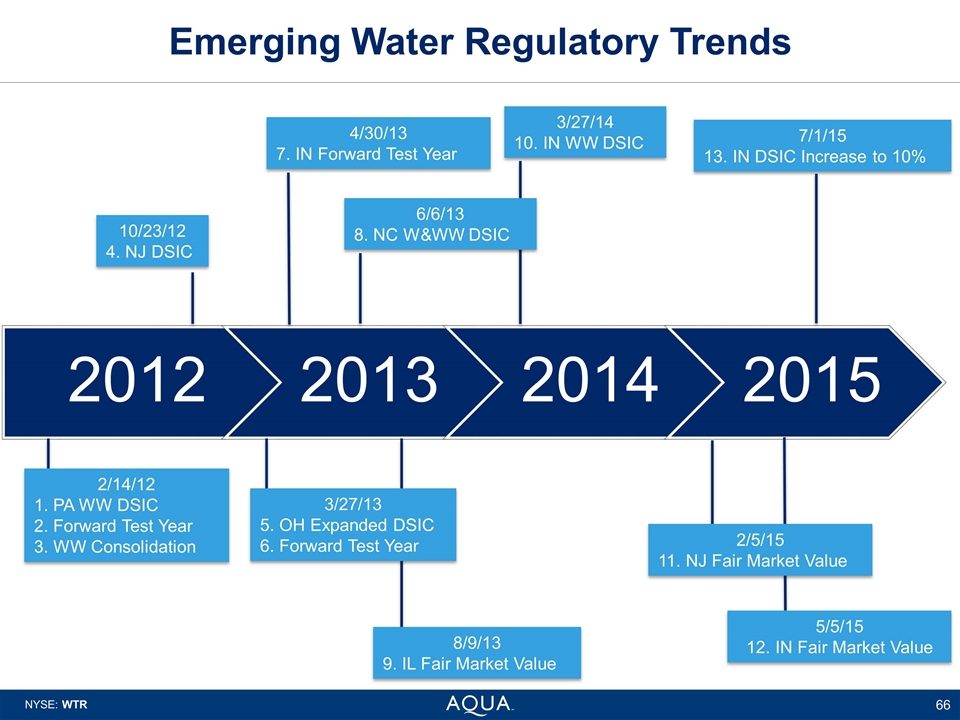

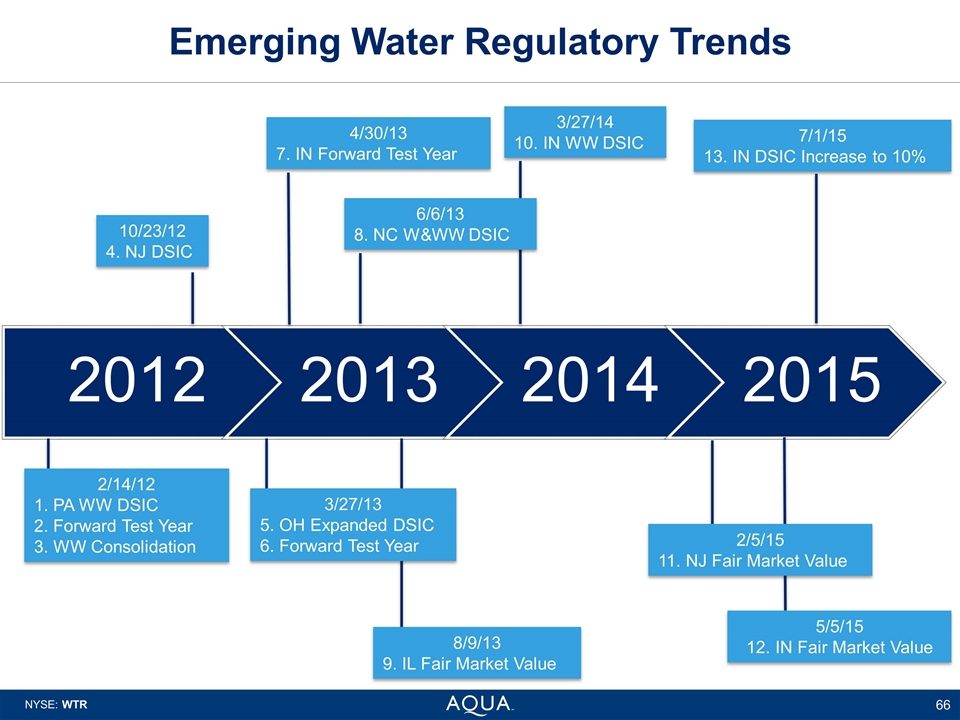

Emerging Water Regulatory Trends 2/14/12 1. PA WW DSIC 2. Forward Test Year 3. WW Consolidation 10/23/12 4. NJ DSIC 6/6/13 8. NC W&WW DSIC 3/27/14 10. IN WW DSIC 3/27/13 5. OH Expanded DSIC 6. Forward Test Year 7/1/15 13. IN DSIC Increase to 10% 8/9/13 9. IL Fair Market Value 2/5/15 11. NJ Fair Market Value 5/5/15 12. IN Fair Market Value 4/30/13 7. IN Forward Test Year 2013 2012 2014 2015

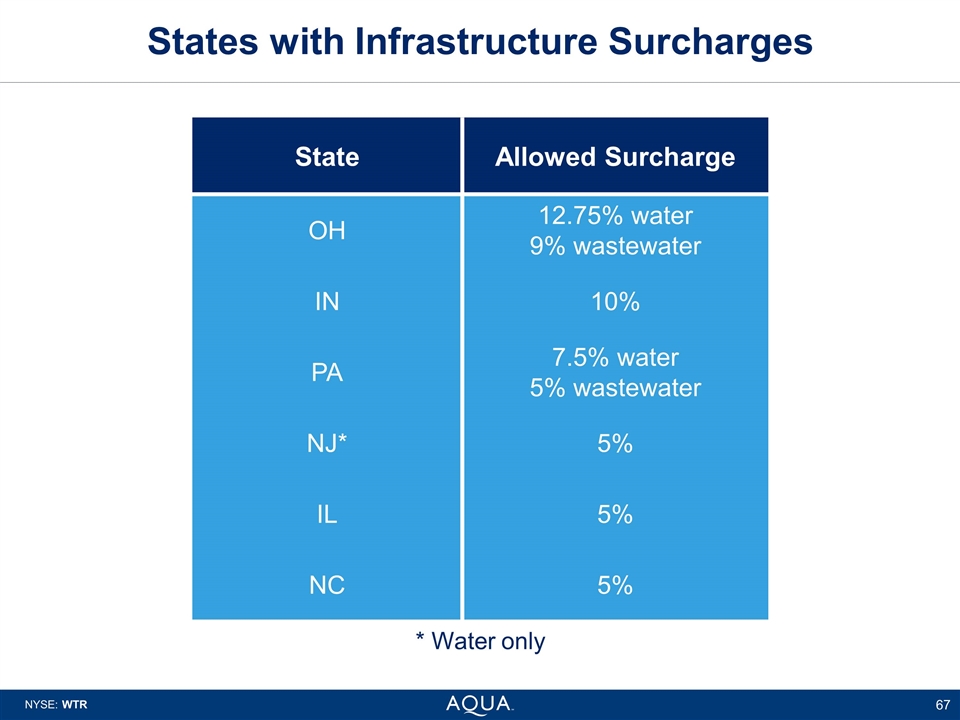

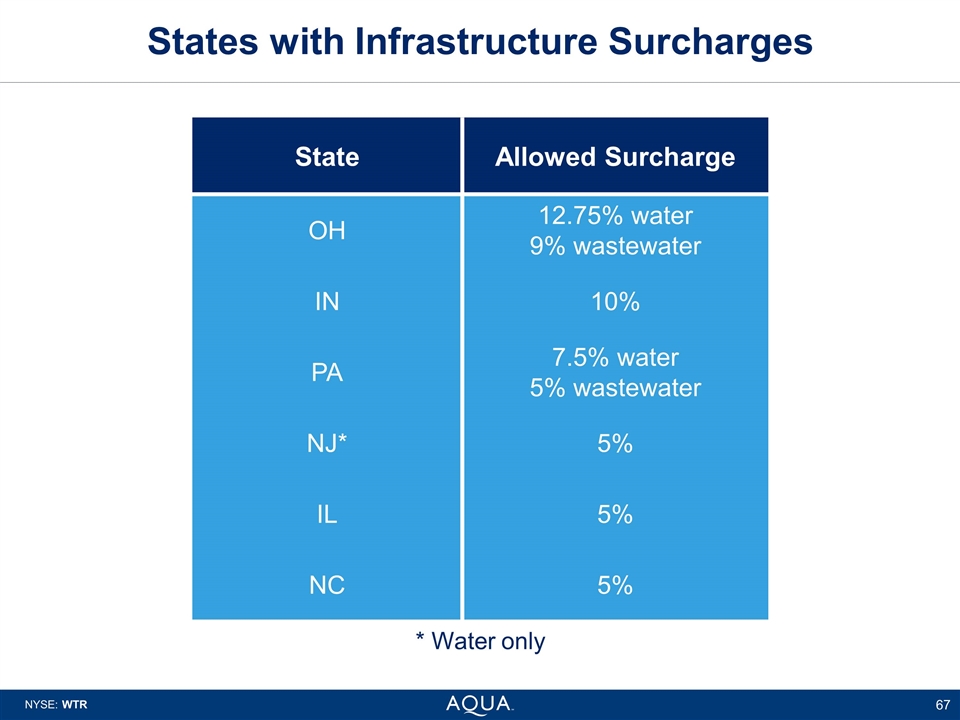

States with Infrastructure Surcharges State Allowed Surcharge OH 12.75% water 9% wastewater IN 10% PA 7.5% water 5% wastewater NJ* 5% IL 5% NC 5% * Water only

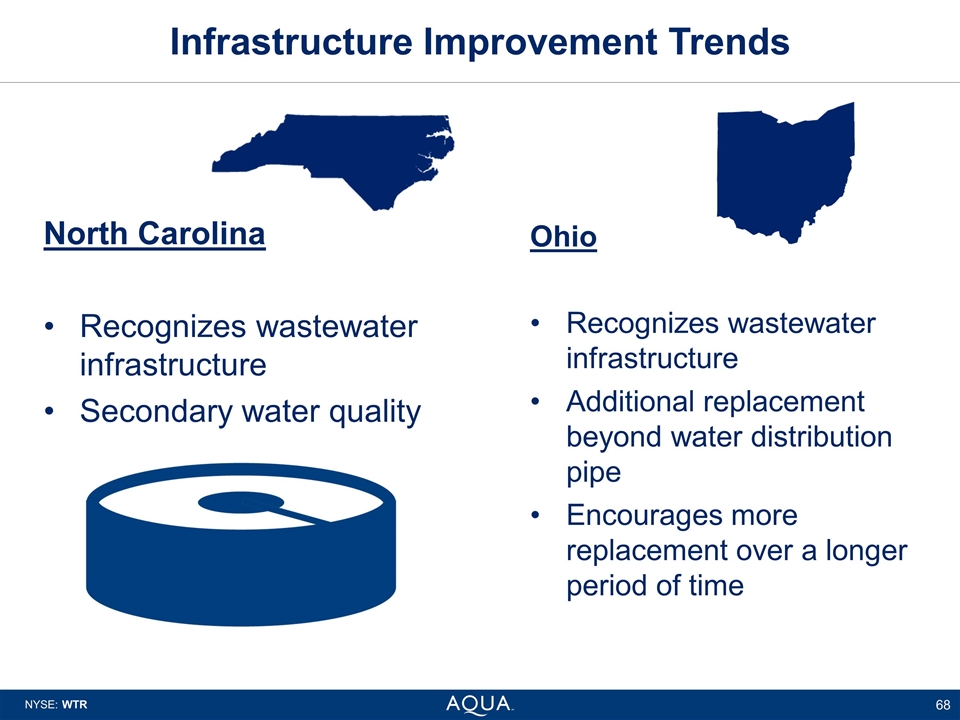

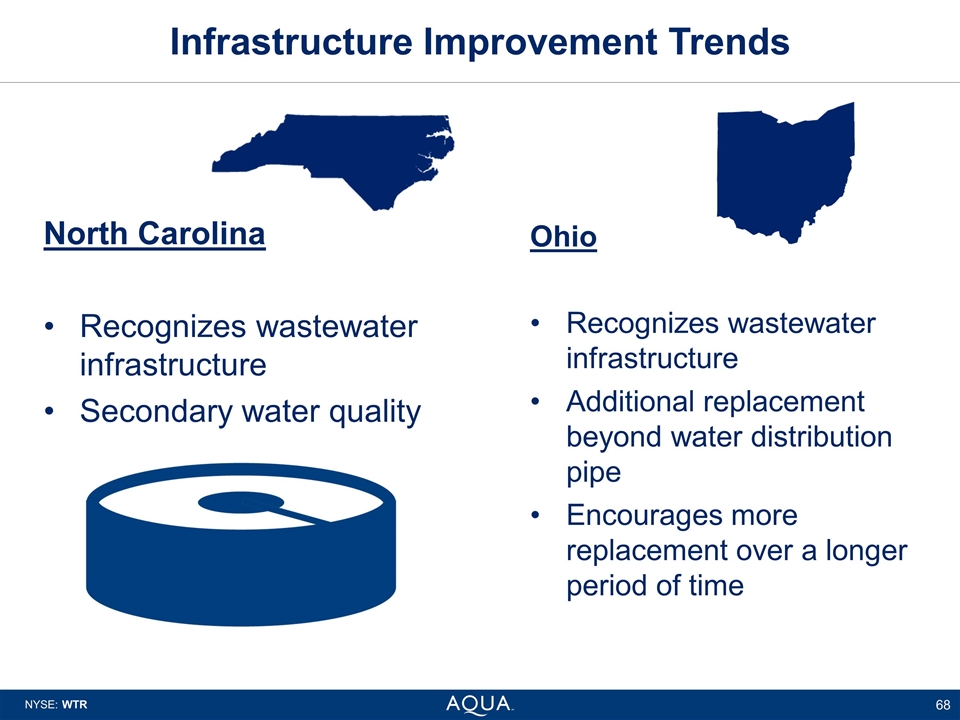

Infrastructure Improvement Trends North Carolina Recognizes wastewater infrastructure Secondary water quality Ohio Recognizes wastewater infrastructure Additional replacement beyond water distribution pipe Encourages more replacement over a longer period of time

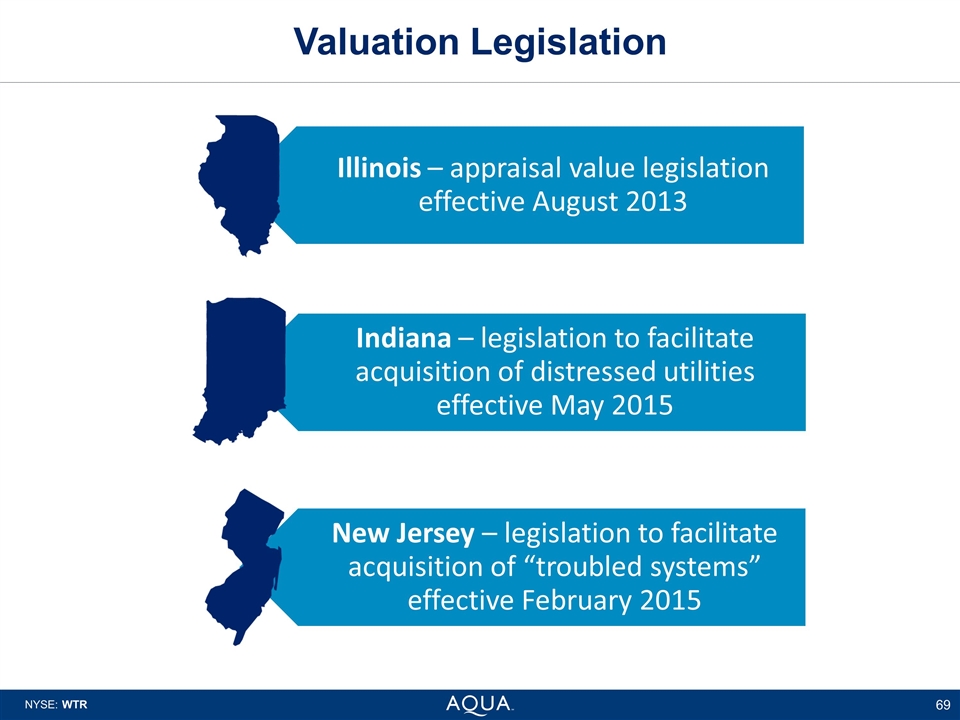

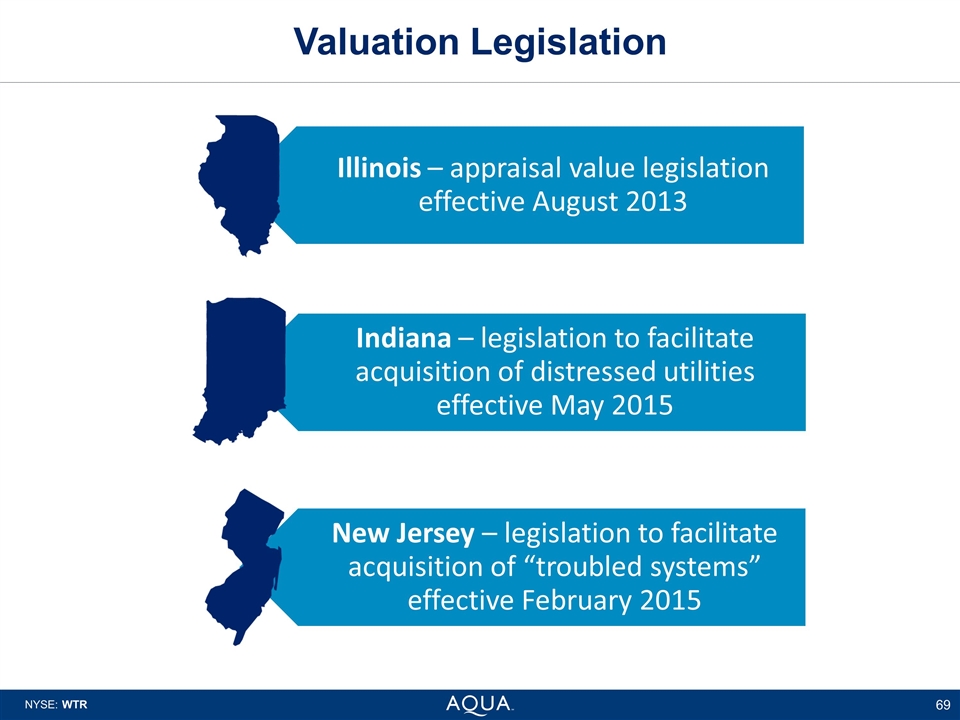

Valuation Legislation Illinois – appraisal value legislation effective August 2013 Indiana – legislation to facilitate acquisition of distressed utilities effective May 2015 New Jersey – legislation to facilitate acquisition of “troubled systems” effective February 2015

Dan Schuller Executive Vice President, Strategy and Corporate Development Strategic Growth NYSE: WTR

Strategy & Corporate Development Our team functions as the strategic thought-partner for the senior leadership team Analysis-based Growth-focused Long-term Mindset Sustainability Fiduciary Integrity Rooted in Core Competencies Process-oriented & Disciplined

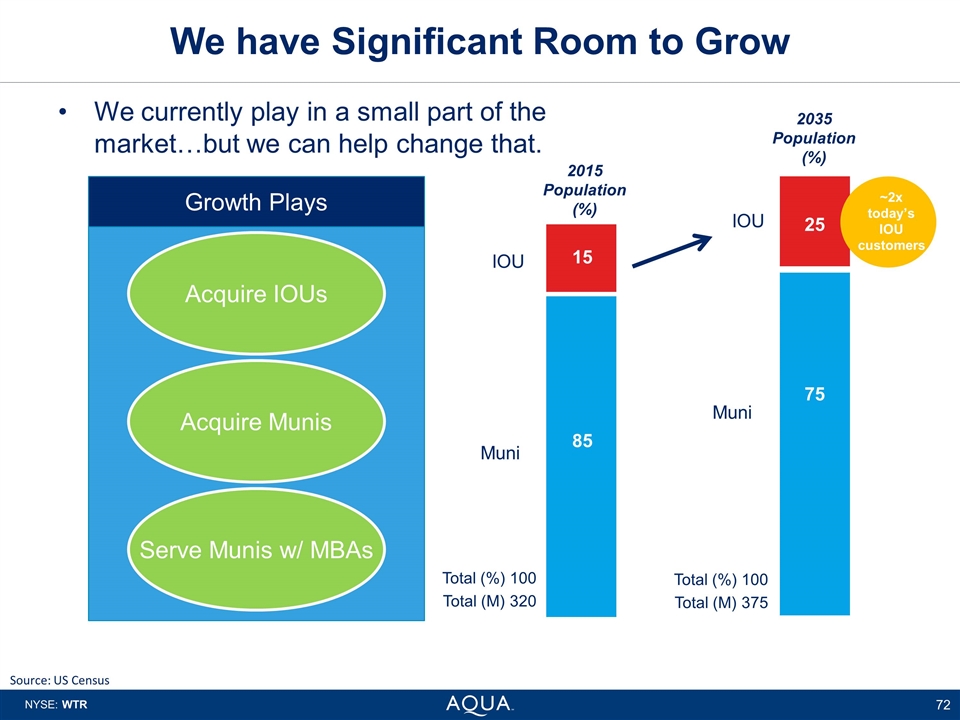

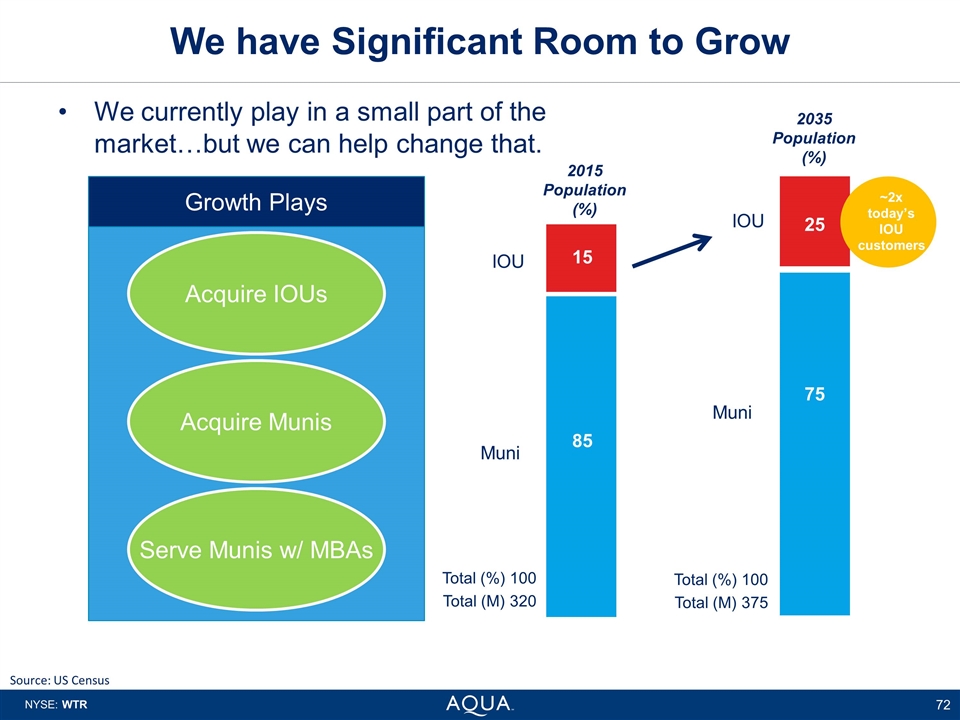

2035 Population (%) 25 75 IOU Muni We have Significant Room to Grow We currently play in a small part of the market…but we can help change that. IOU Muni 15 85 2015 Population (%) Total (%) 100 Total (M) 320 Total (%) 100 Total (M) 375 Source: US Census Acquire IOUs Acquire Munis Growth Plays Serve Munis w/ MBAs ~2x today’s IOU customers

Refining Our Growth Focus Establishing new organization with increased focus on strategy and corporate development Maintaining a growth-focused dialogue amongst the management team Training state presidents and BD managers Providing targets Developing frameworks to identify and evaluate municipals and market-based businesses Improving processes Concrete Actions

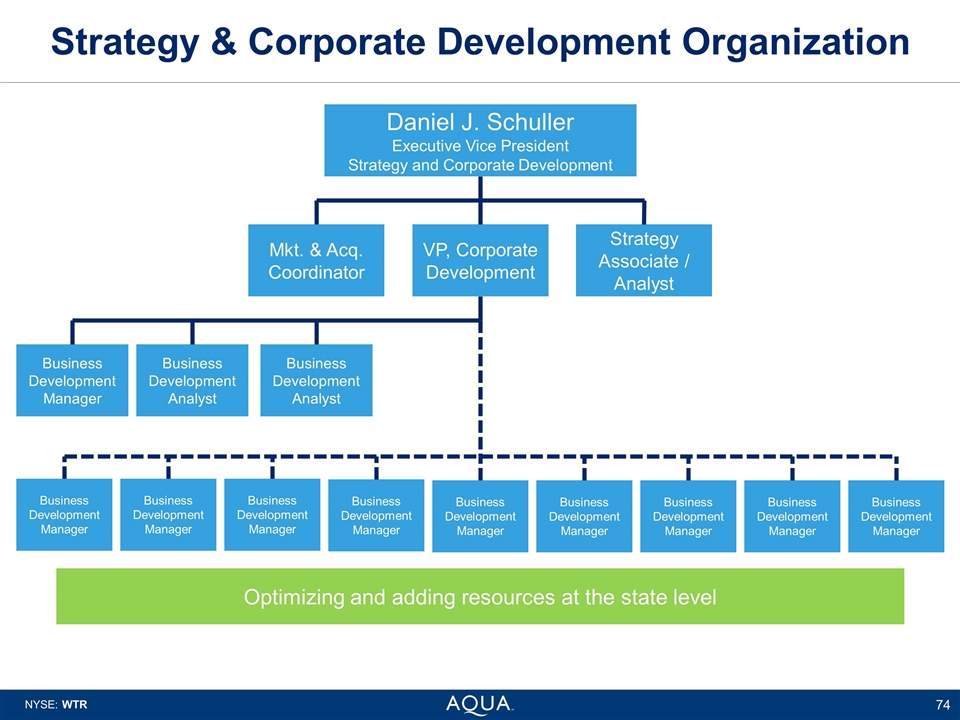

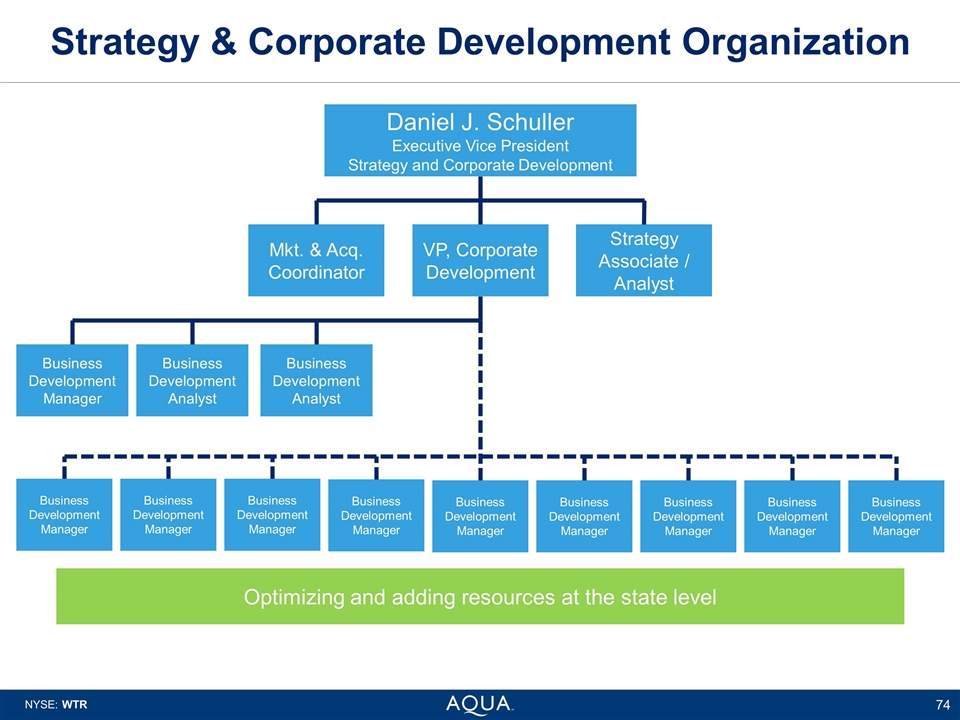

Strategy & Corporate Development Organization Daniel J. Schuller Executive Vice President Strategy and Corporate Development Mkt. & Acq. Coordinator Strategy Associate / Analyst VP, Corporate Development Business Development Manager Business Development Analyst Business Development Analyst Business Development Manager Business Development Manager Business Development Manager Business Development Manager Business Development Manager Business Development Manager Business Development Manager Business Development Manager Business Development Manager Optimizing and adding resources at the state level

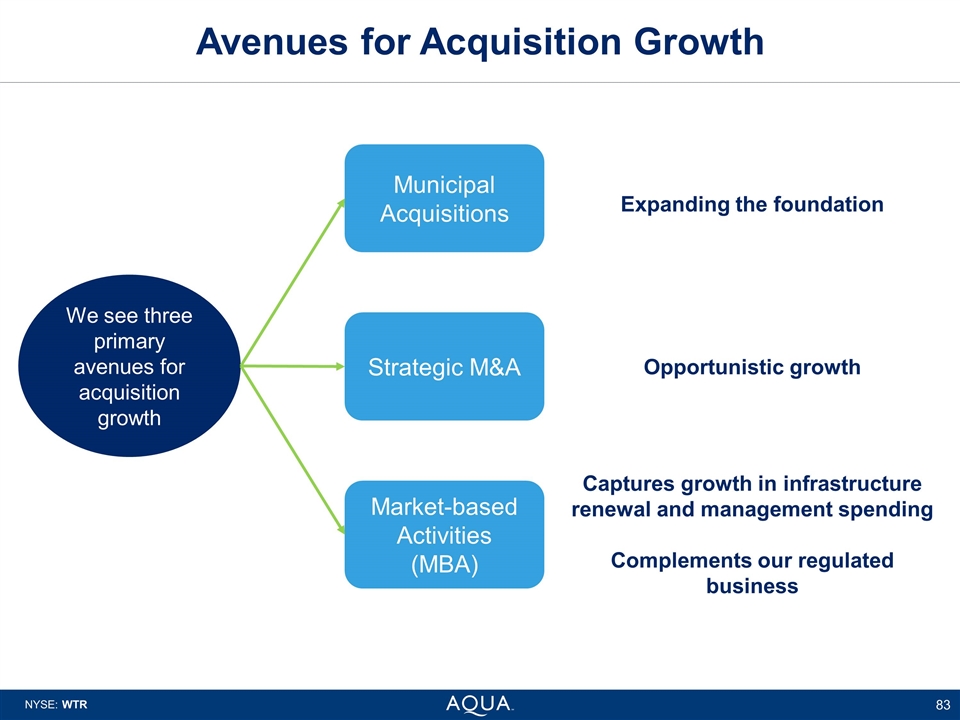

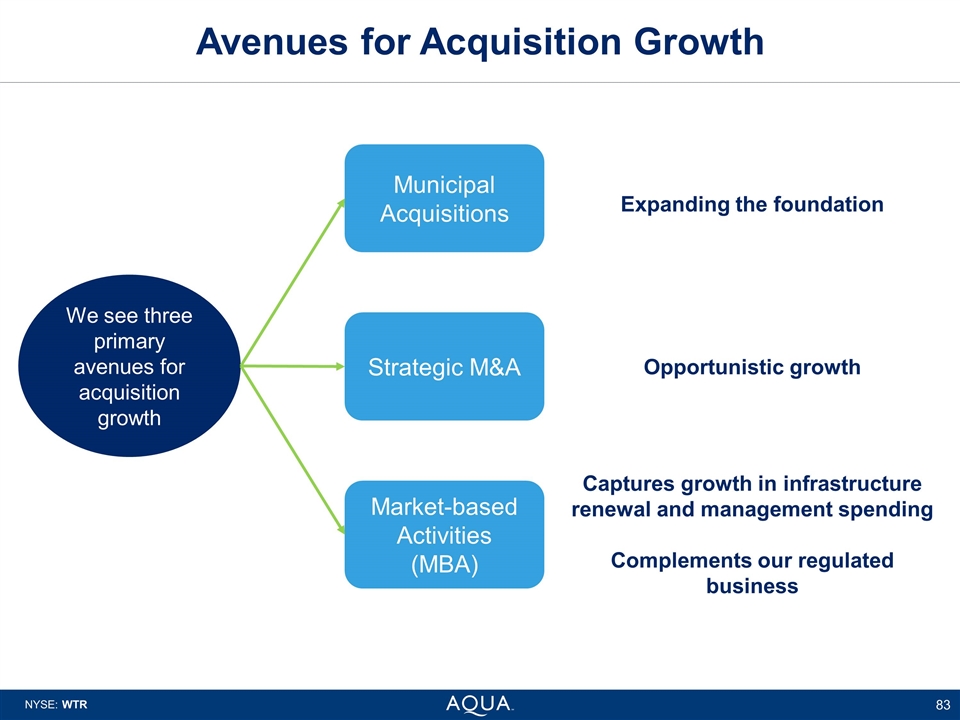

Avenues for Acquisition Growth We see three primary avenues for acquisition growth Market-based Activities (MBA) Strategic M&A Municipal Acquisitions

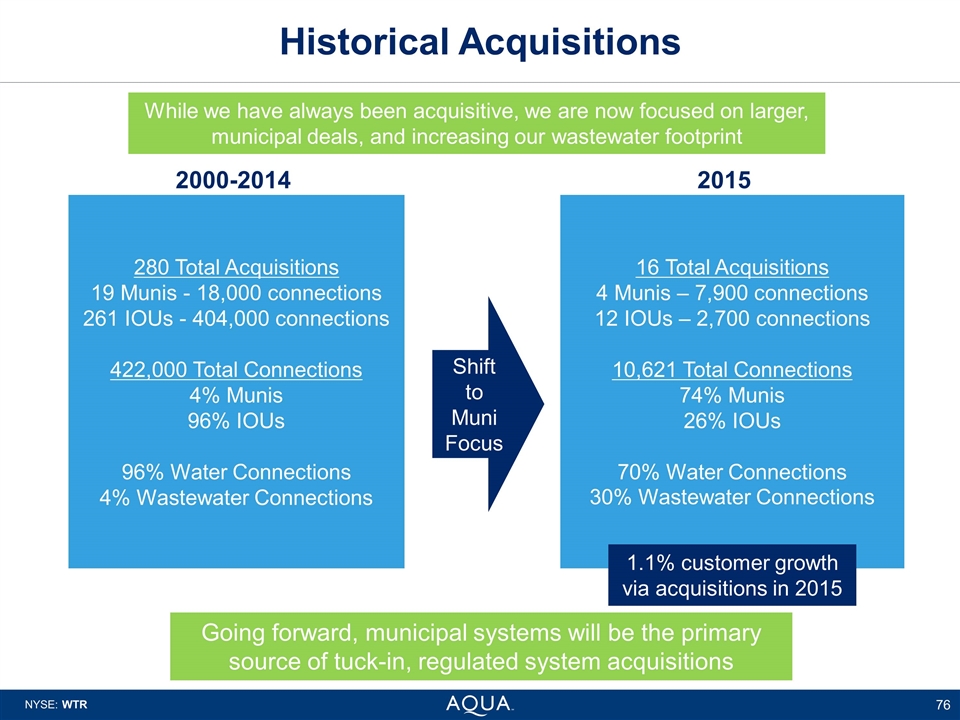

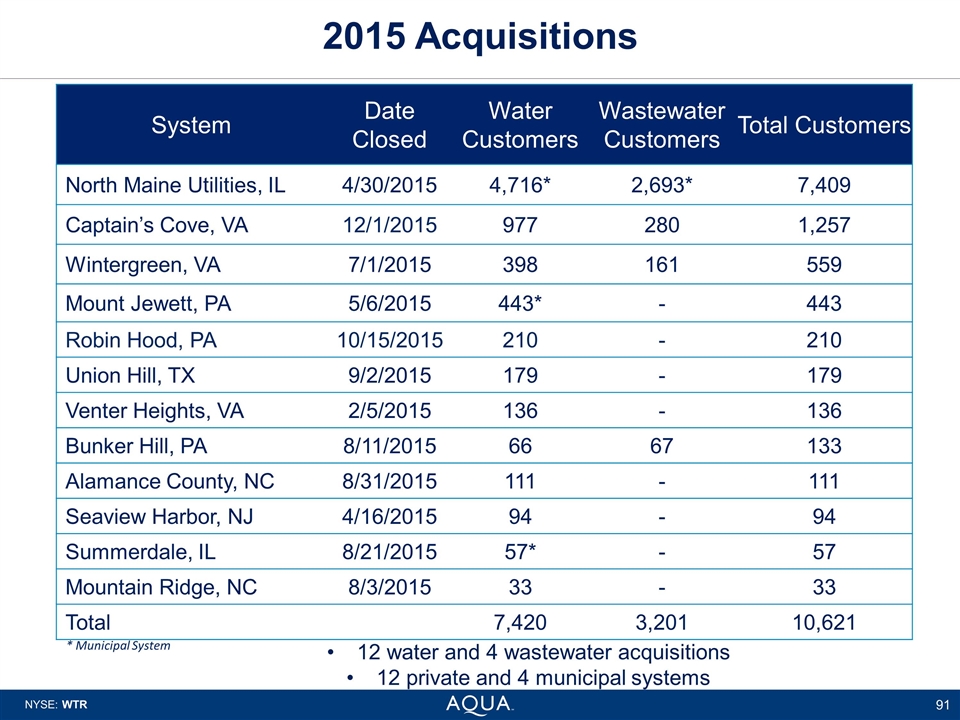

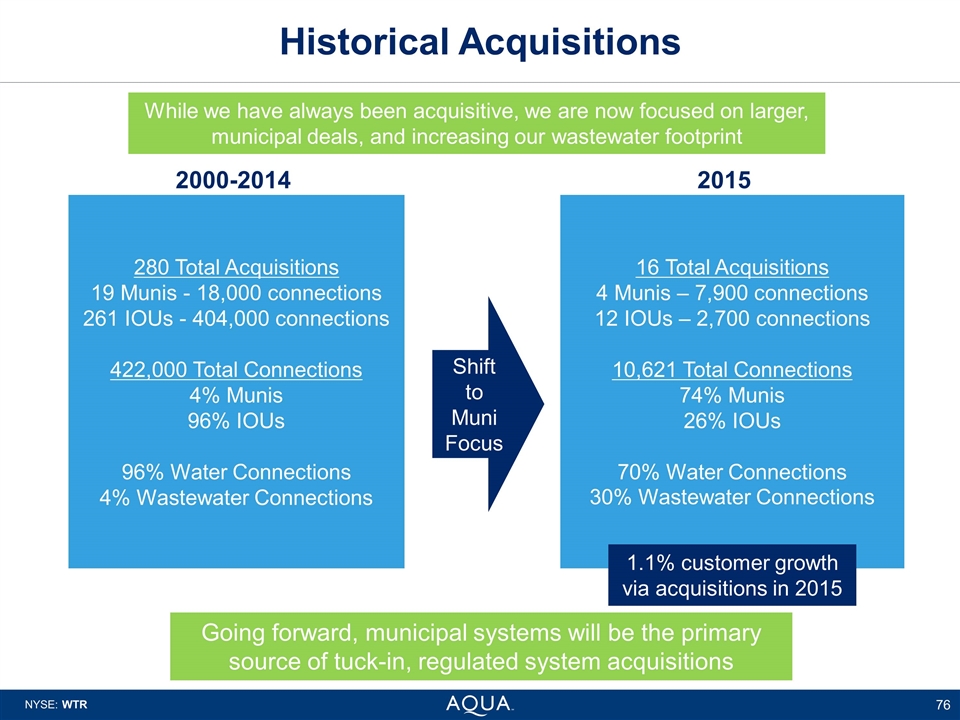

Historical Acquisitions 280 Total Acquisitions 19 Munis - 18,000 connections 261 IOUs - 404,000 connections 422,000 Total Connections 4% Munis 96% IOUs 96% Water Connections 4% Wastewater Connections 2000-2014 16 Total Acquisitions 4 Munis – 7,900 connections 12 IOUs – 2,700 connections 10,621 Total Connections 74% Munis 26% IOUs 70% Water Connections 30% Wastewater Connections 2015 Shift to Muni Focus 1.1% customer growth via acquisitions in 2015 While we have always been acquisitive, we are now focused on larger, municipal deals, and increasing our wastewater footprint Going forward, municipal systems will be the primary source of tuck-in, regulated system acquisitions

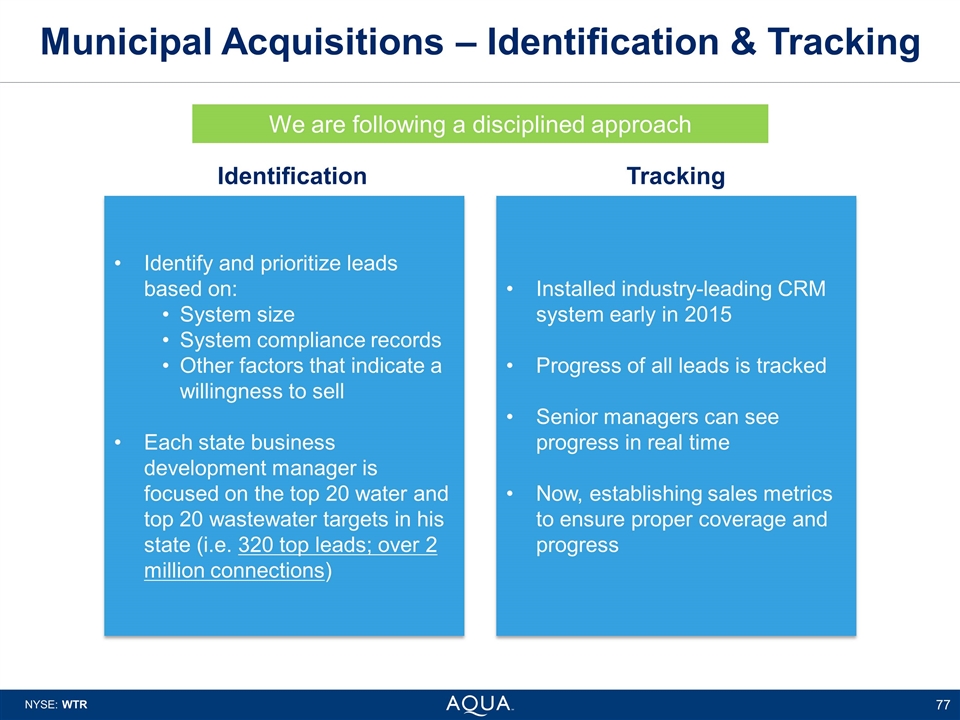

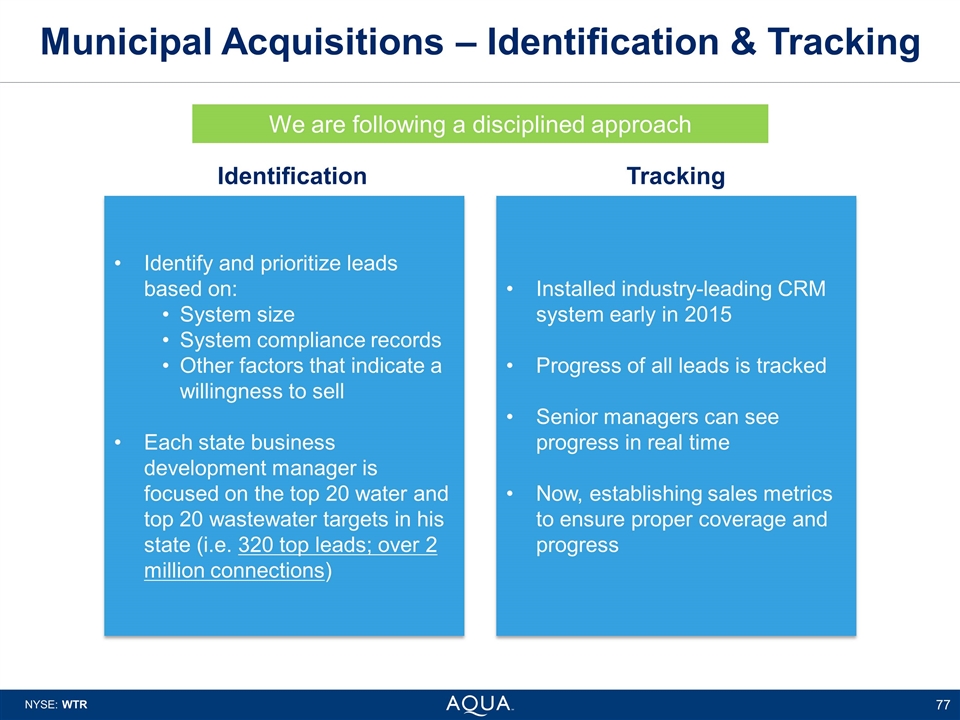

Municipal Acquisitions – Identification & Tracking Identify and prioritize leads based on: System size System compliance records Other factors that indicate a willingness to sell Each state business development manager is focused on the top 20 water and top 20 wastewater targets in his state (i.e. 320 top leads; over 2 million connections) Installed industry-leading CRM system early in 2015 Progress of all leads is tracked Senior managers can see progress in real time Now, establishing sales metrics to ensure proper coverage and progress Tracking Identification We are following a disciplined approach

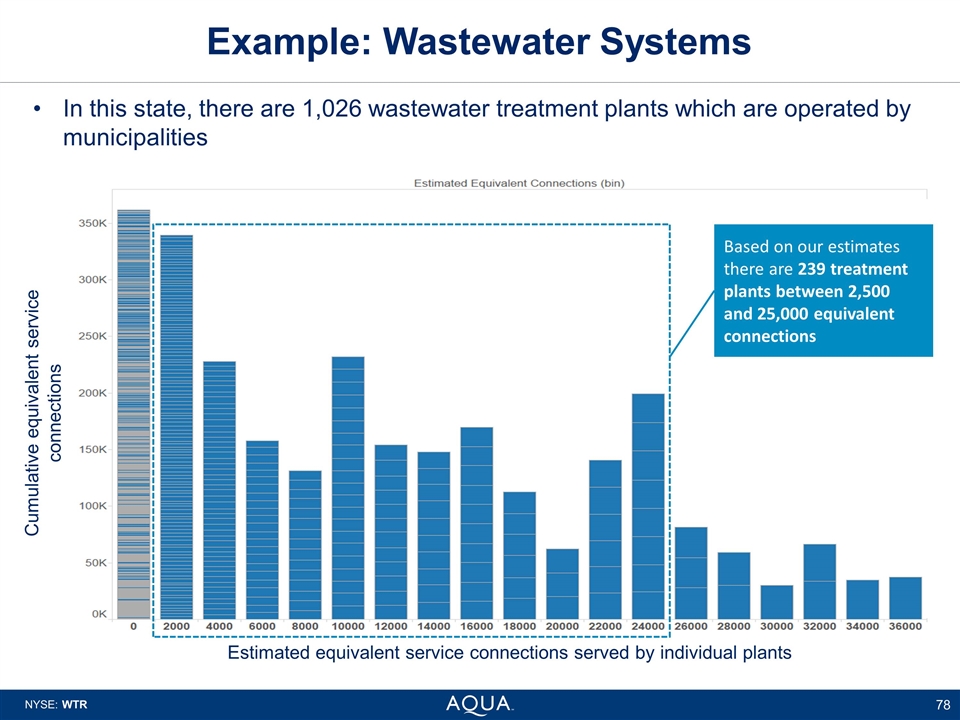

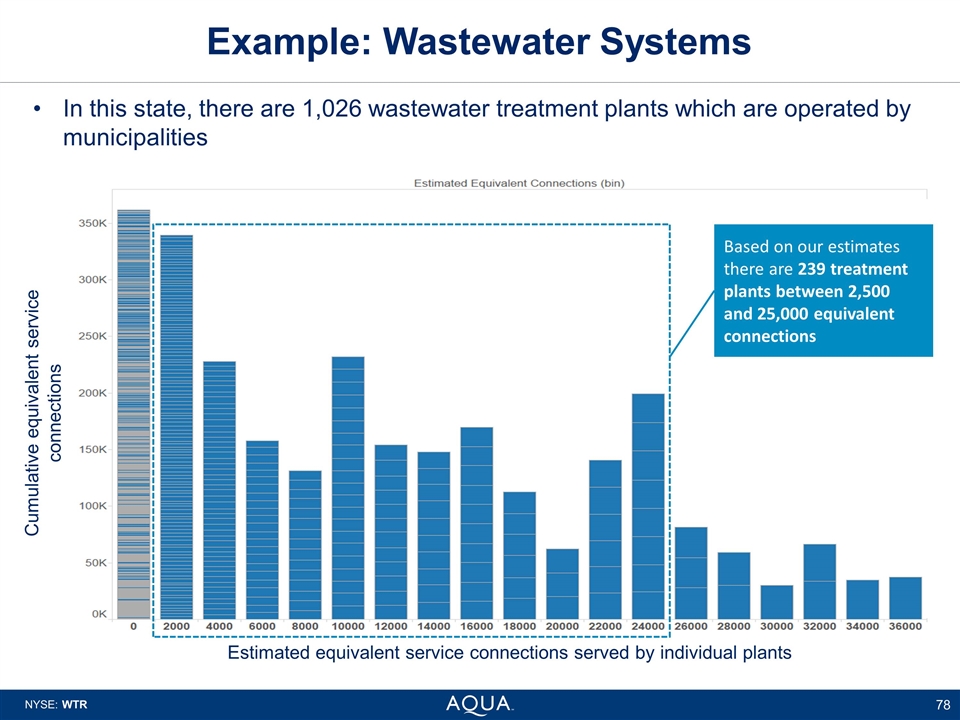

Example: Wastewater Systems Estimated equivalent service connections served by individual plants Cumulative equivalent service connections Based on our estimates there are 239 treatment plants between 2,500 and 25,000 equivalent connections In this state, there are 1,026 wastewater treatment plants which are operated by municipalities

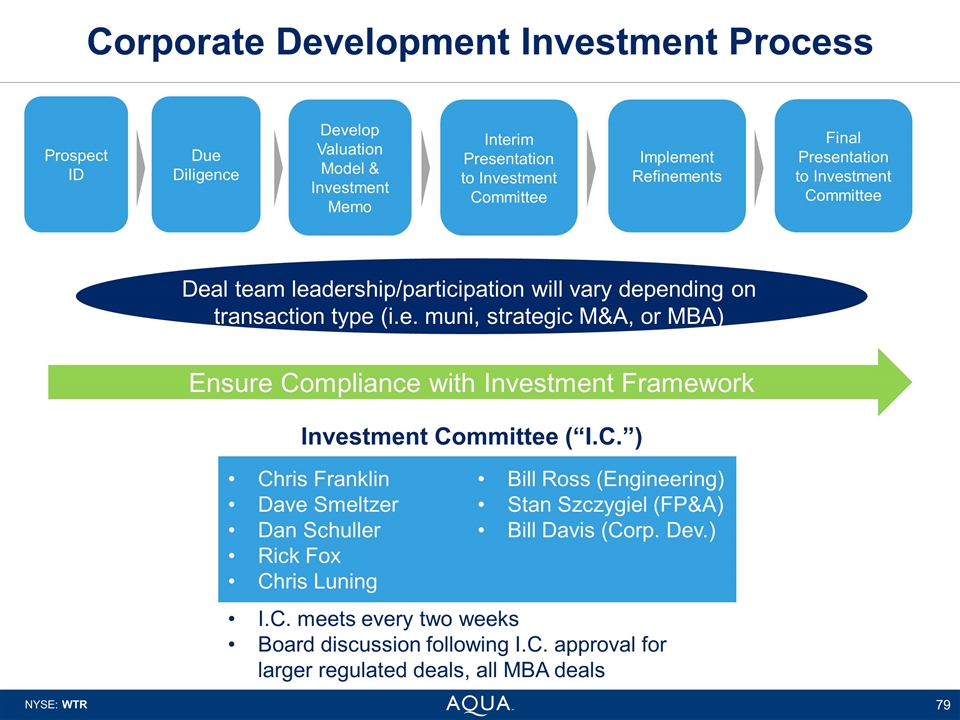

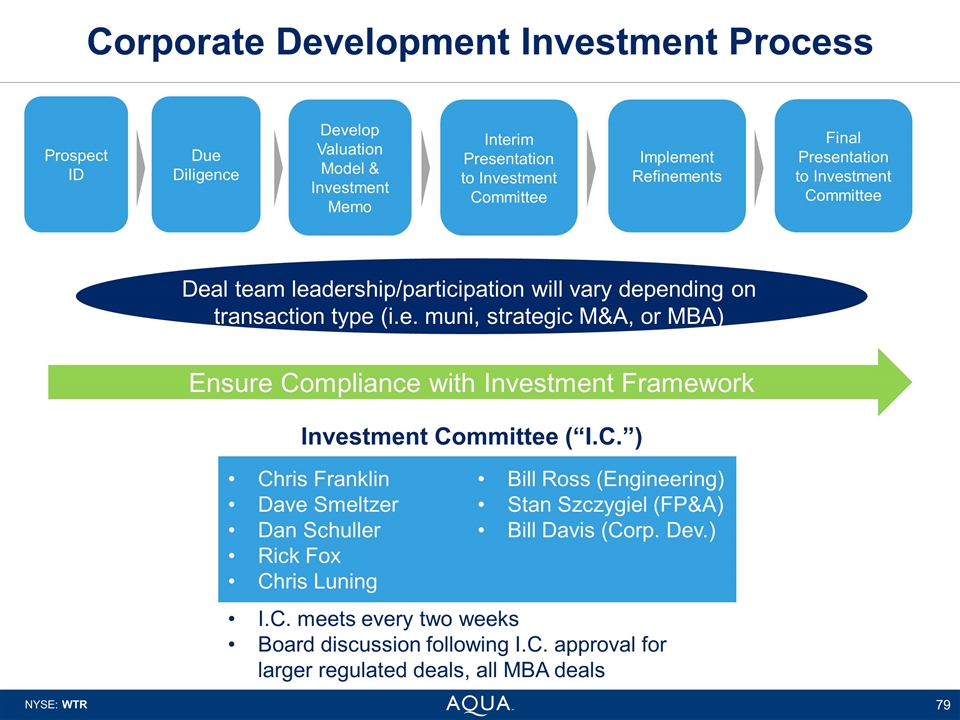

Corporate Development Investment Process I.C. meets every two weeks Board discussion following I.C. approval for larger regulated deals, all MBA deals Chris Franklin Dave Smeltzer Dan Schuller Rick Fox Chris Luning Bill Ross (Engineering) Stan Szczygiel (FP&A) Bill Davis (Corp. Dev.) Prospect ID Due Diligence Develop Valuation Model & Investment Memo Interim Presentation to Investment Committee Implement Refinements Final Presentation to Investment Committee Ensure Compliance with Investment Framework Investment Committee (“I.C.”) Deal team leadership/participation will vary depending on transaction type (i.e. muni, strategic M&A, or MBA)

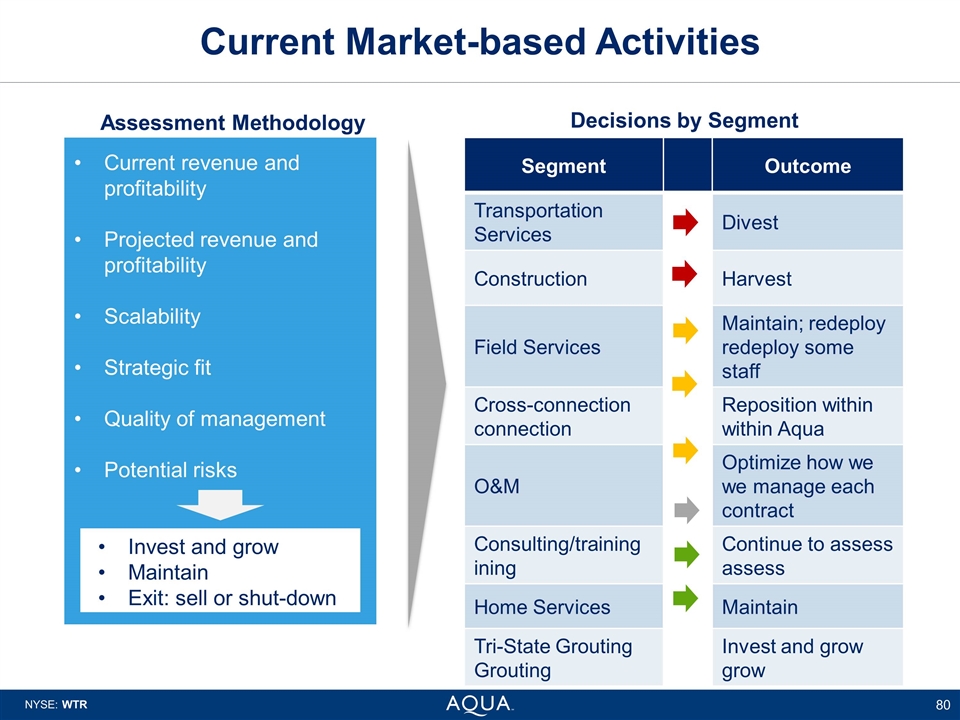

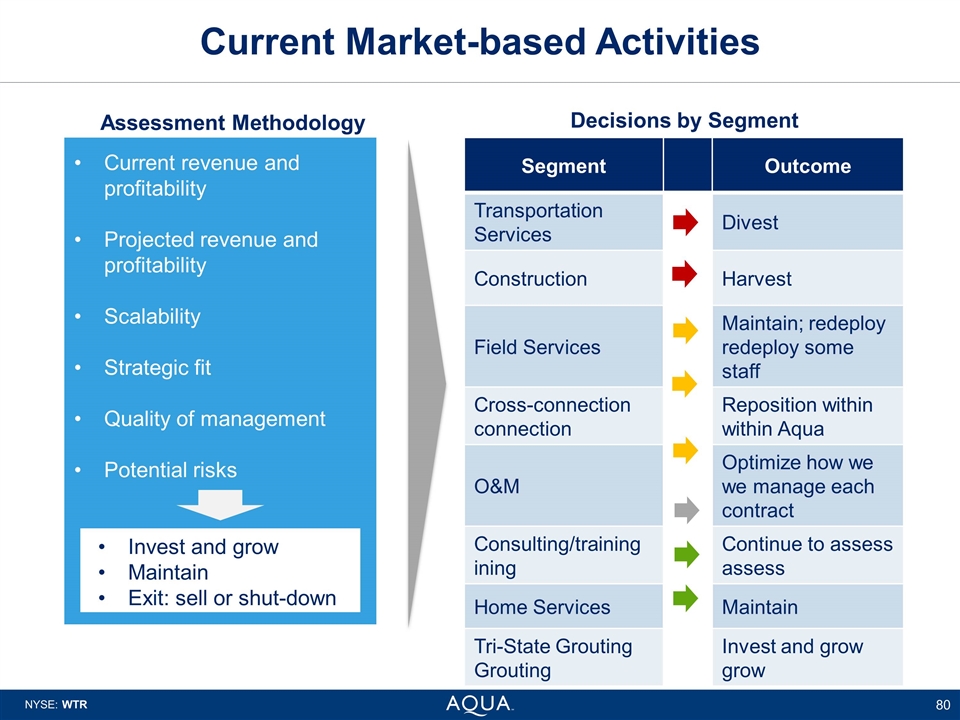

Current Market-based Activities Segment Outcome Transportation Services Divest Construction Harvest Field Services Maintain; redeploy some staff Cross-connection Reposition within Aqua O&M Optimize how we manage each contract Consulting/training Continue to assess Home Services Maintain Tri-State Grouting Invest and grow Decisions by Segment Current revenue and profitability Projected revenue and profitability Scalability Strategic fit Quality of management Potential risks Assessment Methodology Invest and grow Maintain Exit: sell or shut-down

Marcellus Shale Pipeline Joint Venture Source: SRBC The value of the pipeline is under review Drilling Site Ogontz Impoundment Site

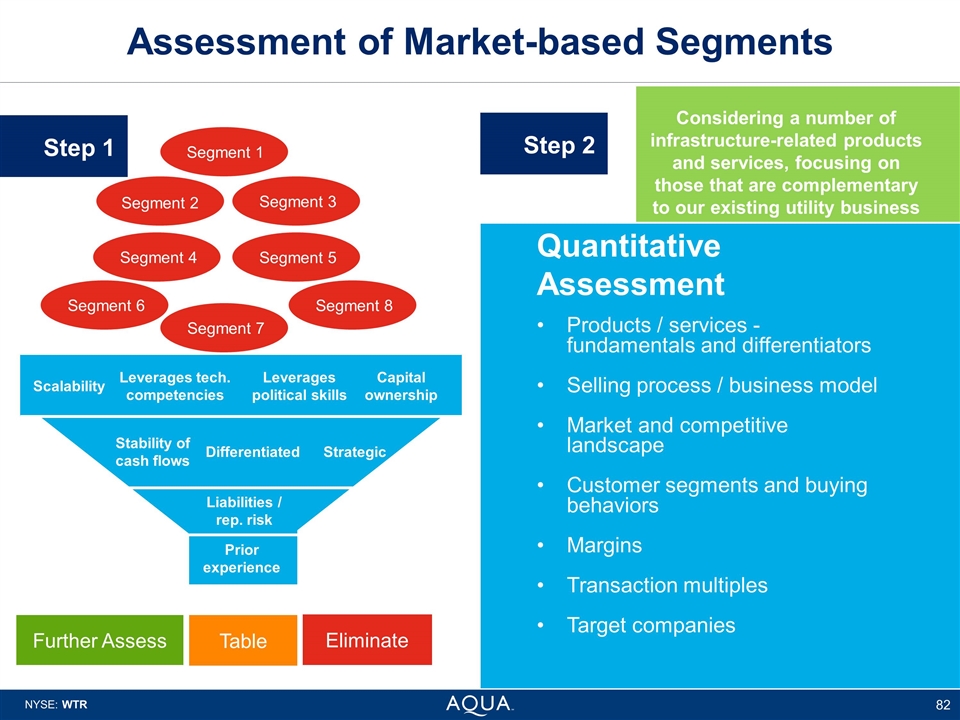

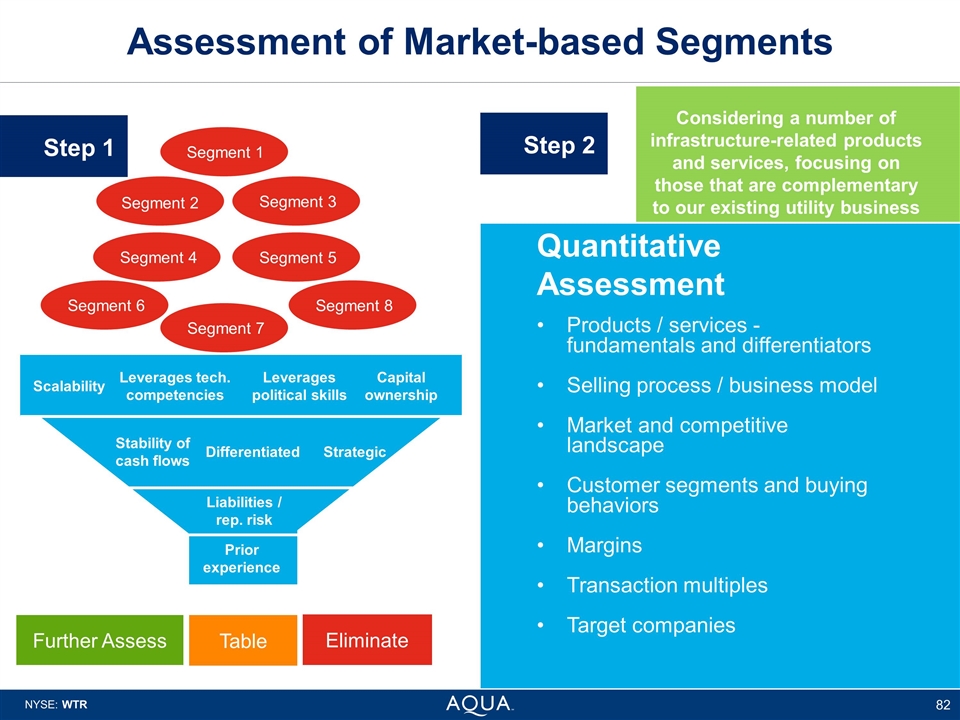

Assessment of Market-based Segments Further Assess Table Quantitative Assessment Step 1 Products / services - fundamentals and differentiators Selling process / business model Market and competitive landscape Customer segments and buying behaviors Margins Transaction multiples Target companies Step 2 Considering a number of infrastructure-related products and services, focusing on those that are complementary to our existing utility business Segment 1 Eliminate Scalability Leverages tech. competencies Leverages political skills Capital ownership Stability of cash flows Differentiated Strategic Liabilities / rep. risk Prior experience Segment 2 Segment 3 Segment 5 Segment 4 Segment 6 Segment 7 Segment 8

Avenues for Acquisition Growth Expanding the foundation Opportunistic growth Captures growth in infrastructure renewal and management spending Complements our regulated business We see three primary avenues for acquisition growth Market-based Activities (MBA) Strategic M&A Municipal Acquisitions

Christopher Franklin President and Chief Executive Officer Outlook and Summary NYSE: WTR

Today’s Objectives Senior Leadership Team Introduction Company Overview Transparency and Guidance Growth Strategy

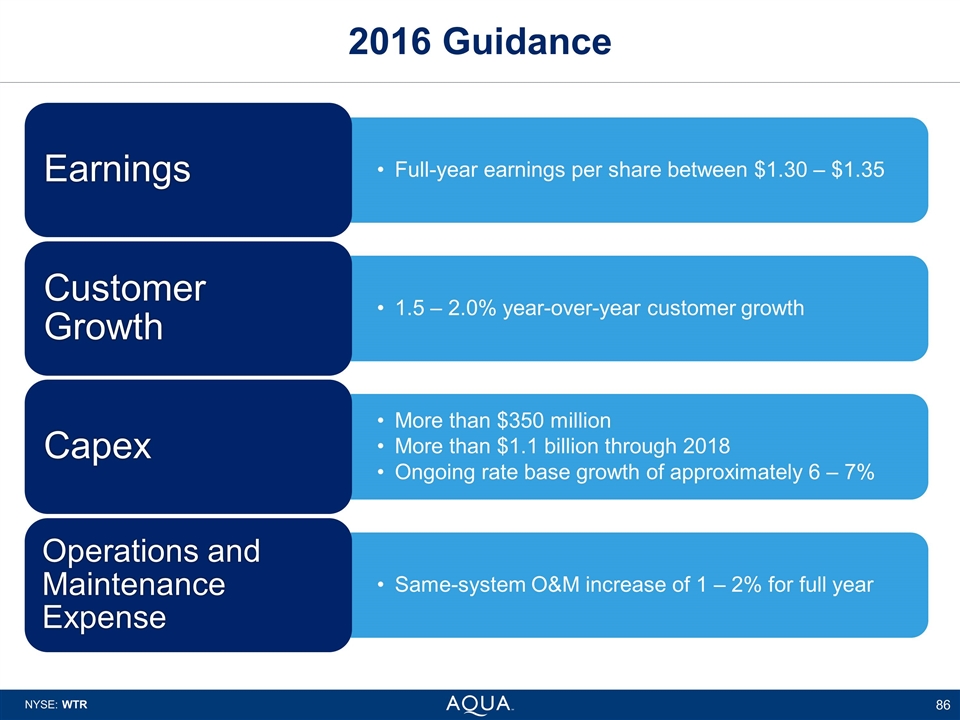

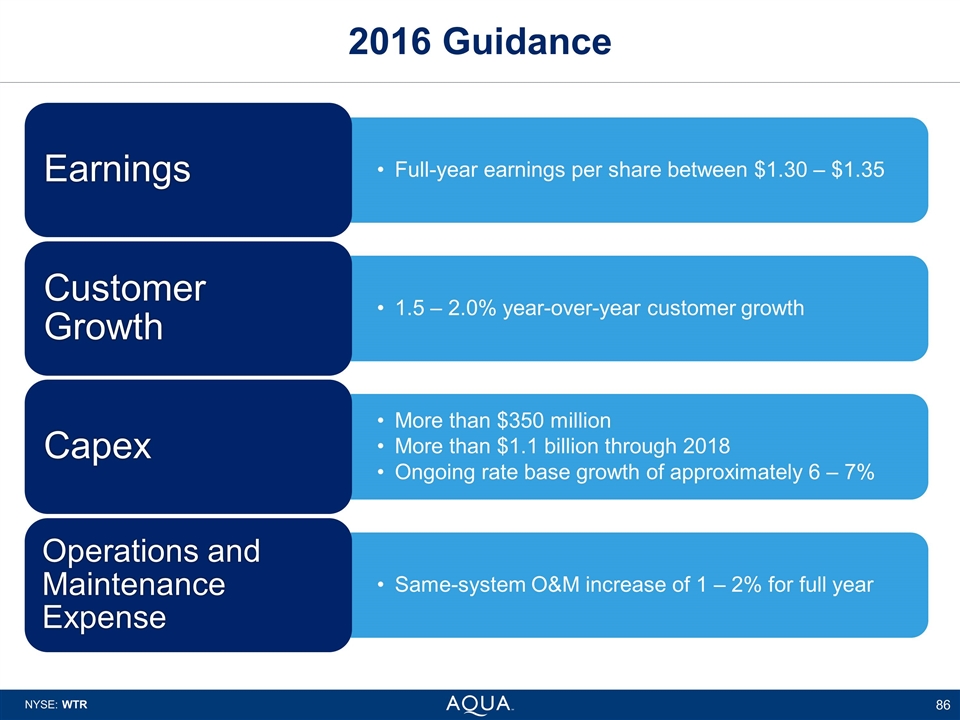

2016 Guidance Earnings Full-year earnings per share between $1.30 – $1.35 Customer Growth 1.5 – 2.0% year-over-year customer growth Capex More than $350 million Ongoing rate base growth of approximately 6 – 7% Operations and Maintenance Expense Same-system O&M increase of 1 – 2% for full year More than $1.1 billion through 2018

Q&A Session NYSE: WTR

For more information contact: Brian Dingerdissen Chief of Staff 610.645.1191 bjdingerdissen@aquaamerica.com Thank You for Attending Aqua America’s 2016 Analyst Day

Appendix NYSE: WTR

Aqua’s Board of Directors Nicholas DeBenedictis William Hankowsky Non-executive Chairman Director since 1992 Committees: Executive Risk Mitigation Director since 2011 Committees: Corporate Governance Risk Mitigation Director since 2005 Director since 2004 Committees: Executive Audit Lon Greenberg Committees: Wendell Holland Executive Audit Executive Compensation Corporate Governance Christopher Franklin Ellen Ruff Director since 2006 Committees: Executive Corporate Governance Executive Compensation Director since 2015 Committees: Risk Mitigation Richard Glanton Lead Independent Director Director since 1995 Committees: Executive Risk Mitigation Director since 2013 Committees: Audit Executive Compensation Michael Browne

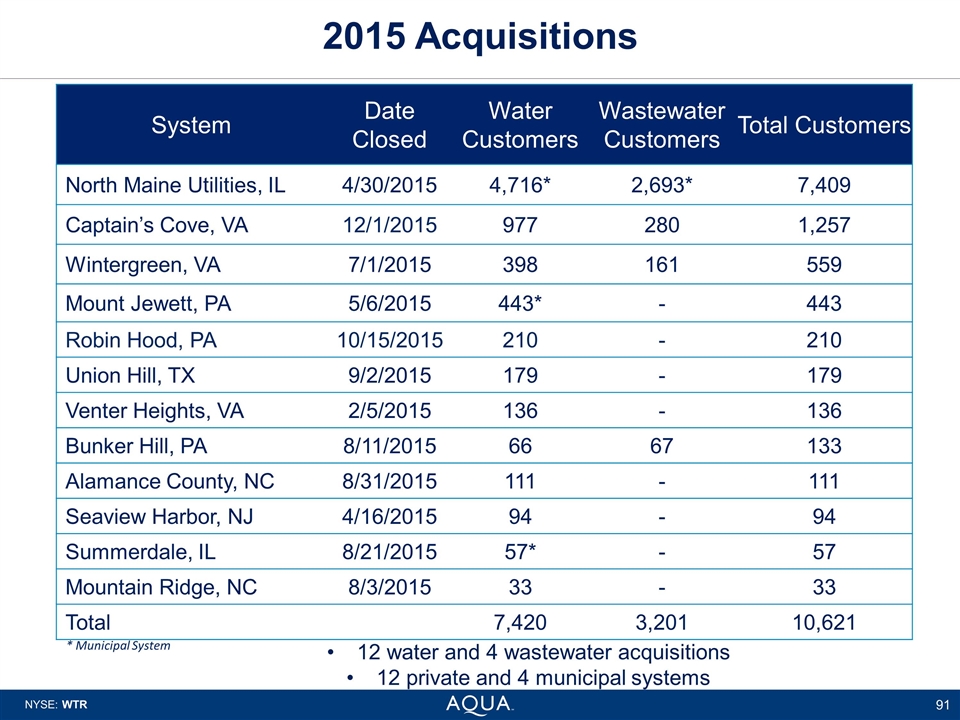

2015 Acquisitions 12 water and 4 wastewater acquisitions 12 private and 4 municipal systems * Municipal System System Date Closed Water Customers Wastewater Customers Total Customers North Maine Utilities, IL 4/30/2015 4,716* 2,693* 7,409 Captain’s Cove, VA 12/1/2015 977 280 1,257 Wintergreen, VA 7/1/2015 398 161 559 Mount Jewett, PA 5/6/2015 443* - 443 Robin Hood, PA 10/15/2015 210 - 210 Union Hill, TX 9/2/2015 179 - 179 Venter Heights, VA 2/5/2015 136 - 136 Bunker Hill, PA 8/11/2015 66 67 133 Alamance County, NC 8/31/2015 111 - 111 Seaview Harbor, NJ 4/16/2015 94 - 94 Summerdale, IL 8/21/2015 57* - 57 Mountain Ridge, NC 8/3/2015 33 - 33 Total 7,420 3,201 10,621

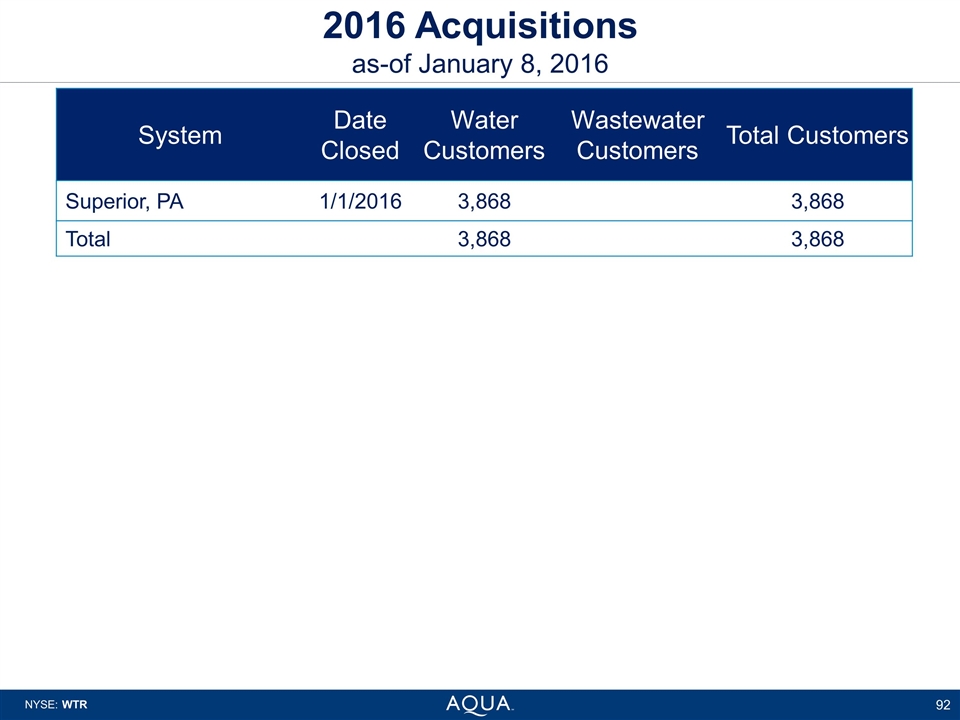

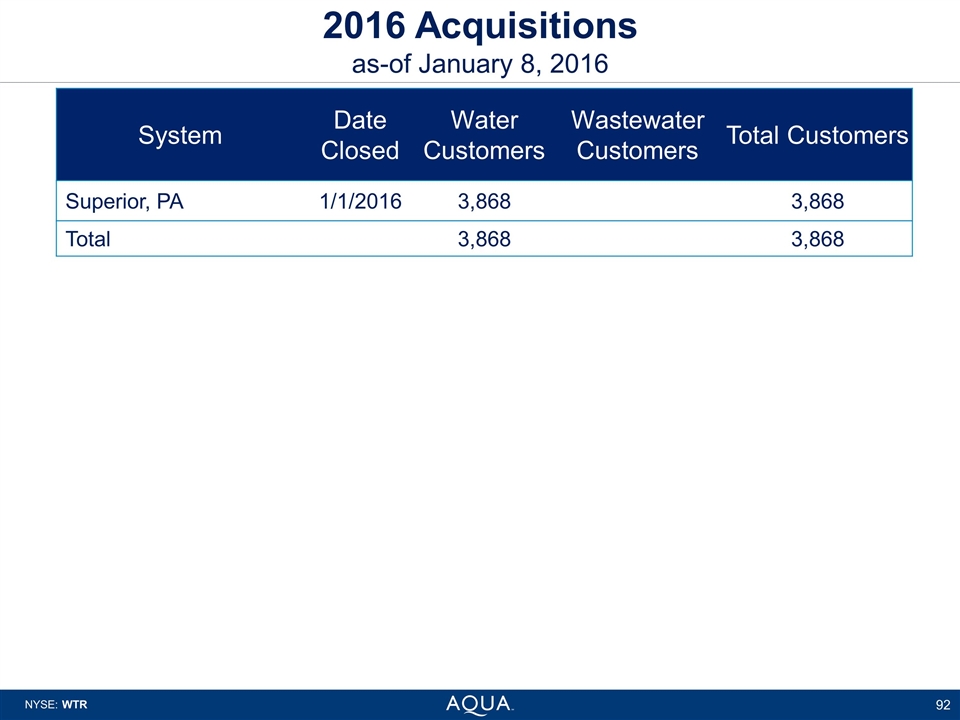

2016 Acquisitions as-of January 8, 2016 System Date Closed Water Customers Wastewater Customers Total Customers Superior, PA 1/1/2016 3,868 3,868 Total 3,868 3,868

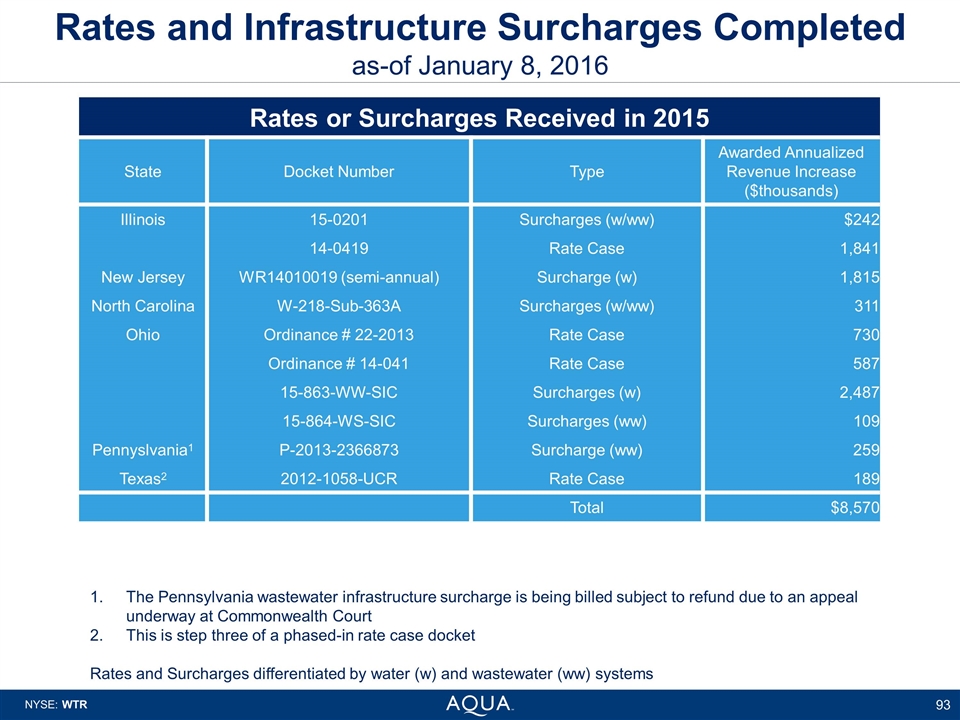

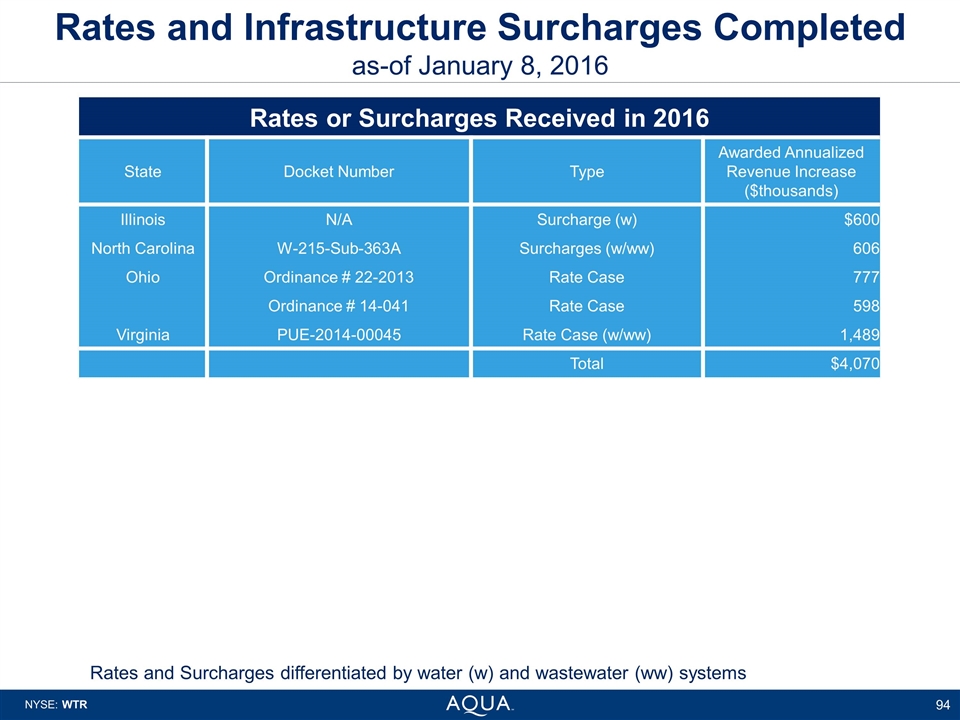

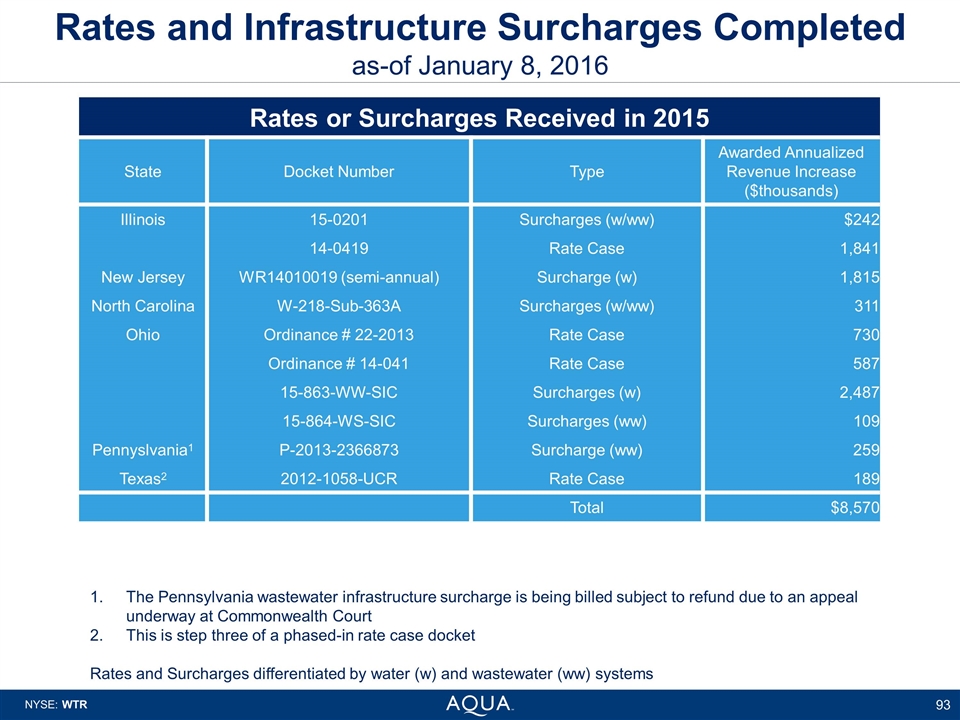

Rates and Infrastructure Surcharges Completed as-of January 8, 2016 The Pennsylvania wastewater infrastructure surcharge is being billed subject to refund due to an appeal underway at Commonwealth Court This is step three of a phased-in rate case docket Rates and Surcharges differentiated by water (w) and wastewater (ww) systems Rates or Surcharges Received in 2015 State Docket Number Type Awarded Annualized Revenue Increase ($thousands) Illinois 15-0201 Surcharges (w/ww) $242 14-0419 Rate Case 1,841 New Jersey WR14010019 (semi-annual) Surcharge (w) 1,815 North Carolina W-218-Sub-363A Surcharges (w/ww) 311 Ohio Ordinance # 22-2013 Rate Case 730 Ordinance # 14-041 Rate Case 587 15-863-WW-SIC Surcharges (w) 2,487 15-864-WS-SIC Surcharges (ww) 109 Pennyslvania1 P-2013-2366873 Surcharge (ww) 259 Texas2 2012-1058-UCR Rate Case 189 Total $8,570

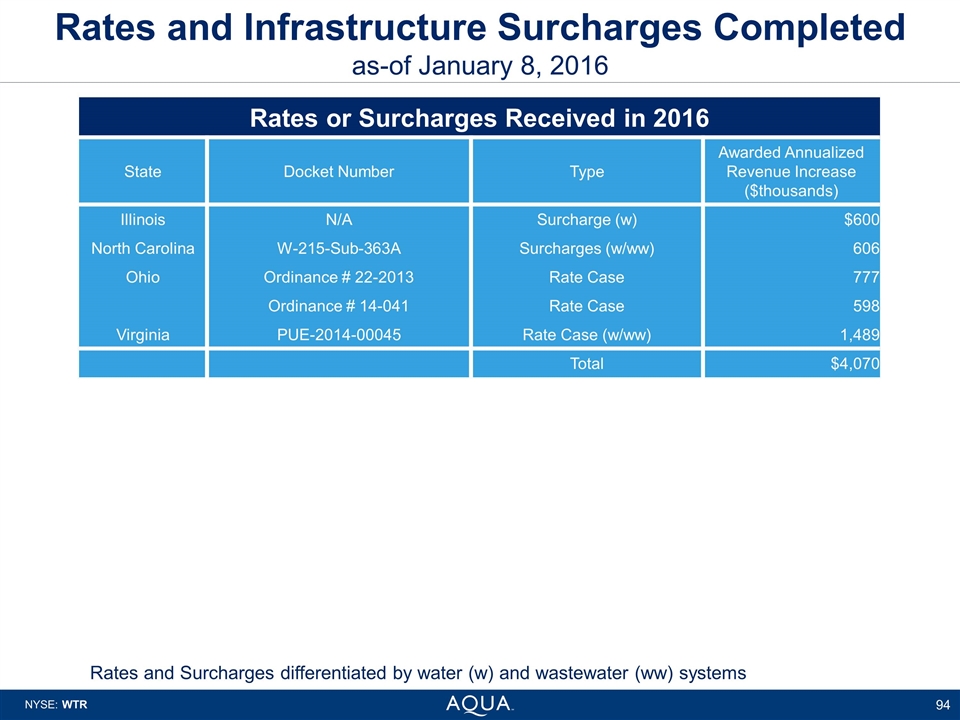

Rates and Infrastructure Surcharges Completed as-of January 8, 2016 Rates and Surcharges differentiated by water (w) and wastewater (ww) systems Rates or Surcharges Received in 2016 State Docket Number Type Awarded Annualized Revenue Increase ($thousands) Illinois N/A Surcharge (w) $600 North Carolina W-215-Sub-363A Surcharges (w/ww) 606 Ohio Ordinance # 22-2013 Rate Case 777 Ordinance # 14-041 Rate Case 598 Virginia PUE-2014-00045 Rate Case (w/ww) 1,489 Total $4,070