- PHI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

PLDT (PHI) 6-KCurrent report (foreign)

Filed: 10 May 18, 9:43am

Exhibit 99.1

EXHIBITS

Exhibit Number |

| Page |

99.1

|

Press release regarding the Company’s unaudited consolidated financial results for the three months ended March 31, 2018;

|

|

May 10, 2018

Philippine Stock Exchange

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: | Mr. Jose Valeriano B. Zuño III |

|

OIC - Head, Disclosure Department

Gentlemen:

In accordance with Section 17.1 (b) and Section 17.3 of the Securities Regulation Code, we submit herewith a copy of SEC Form 17-C with a press release attached thereto regarding the Company’s unaudited consolidated financial results for the three (3) months ended March 31, 2018.

This shall also serve as the disclosure letter for the purpose of complying with PSE Revised Disclosure Rules.

Very truly yours,

/s/Ma. Lourdes C. Rausa-Chan

MA. LOURDES C. RAUSA-CHAN

Corporate Secretary

May 10, 2018

Securities & Exchange Commission

Secretariat Building, PICC Complex

Roxas Boulevard, Pasay City

Attention: | Mr. Vicente Graciano P. Felizmenio, Jr. |

Director – Markets and Securities Regulation Dept.

Gentlemen:

In accordance with Section 17.1 (b) of Securities Regulation Code and SRC Rule 17.1.1.1.3(a), we submit herewith two (2) copies of SEC Form 17-C with a press release attached thereto regarding the Company’s unaudited consolidated financial results for the three (3) months ended March 31, 2018.

Very truly yours,

/s/Ma. Lourdes C. Rausa-Chan

MA. LOURDES C. RAUSA-CHAN

Corporate Secretary

COVER SHEET

SEC Registration Number | ||||||||||||

P | W | - | 5 | 5 |

|

|

|

|

|

| ||

Company Name

P | L | D | T |

| I | N | C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(F | O | R | M | E | R | L | Y |

| P | H | I | L | I | P | P | I | N | E |

| L | O | N | G |

|

|

|

|

|

|

D | I | S | T | A | N | C | E |

| T | E | L | E | P | H | O | N | E |

| C | O | M | P | A | N | Y) |

|

|

|

|

| |||||||||||||||||||||||||||||

Principal Office (No./Street/Barangay/City/Town/Province)

R | A | M | O | N |

| C | O | J | U | A | N | G | C | O |

| B | U | I | L | D | I | N | G |

|

|

|

|

|

| ||

| |||||||||||||||||||||||||||||||

M | A | K | A | T | I |

| A | V | E | N | U | E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

| |||||||||||||||||||||||||||||||

M | A | K | A | T | I |

| C | I | T | Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

| |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Form Type |

|

|

| Department requiring the report |

|

|

| Secondary License Type, If Applicable | |||||||||||||||||||||

|

| 17 | - | C |

|

|

|

|

|

|

|

| M | S | R | D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

| Company’s Email Address |

| Company’s Telephone Number/s |

| Mobile Number |

|

|

|

| 8168534 |

|

|

|

| No. of Stockholders |

| Annual Meeting |

| Fiscal Year |

|

| 11,693 As of March 31, 2018 |

| Every 2nd Tuesday of June |

| December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

Name of Contact Person |

| Email Address |

| Telephone Number/s |

| Mobile Number | ||||||||

Ma. Lourdes C. Rausa-Chan |

| lrchan@pldt.com.ph |

| 8168553 |

|

| ||||||||

Name of Contact Person |

| Email Address |

| Telephone Number/s |

| Mobile Number | ||||||||

Contact Person’s Address | ||

MGO Building, Legaspi St. corner Dela Rosa St., Makati City | ||

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

1. | May 10, 2018 | |

| Date of Report (Date of earliest event reported) | |

|

|

|

2. | SEC Identification Number PW-55 | |

|

|

|

3. | BIR Tax Identification No. 000-488-793 | |

|

|

|

4. | PLDT Inc. | |

| Exact name of issuer as specified in its charter | |

|

|

|

5. | PHILIPPINES | 6. ____________ (SEC Use Only) |

| Province, country or other jurisdiction of Incorporation | Industry Classification Code |

|

|

|

7. | Ramon Cojuangco Building, Makati Avenue, Makati City | 1200 |

| Address of principal office | Postal Code |

|

|

|

8. | (632) 816-8553 |

|

| Issuer's telephone number, including area code | |

|

|

|

9. | Not Applicable |

|

| Former name or former address, if changed since last report | |

|

|

|

10. | Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act | |

Title of Each Class | Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

|

|

|

|

|

|

PLDT FINANCIAL STATEMENTS REFLECT NEW ACCOUNTING STANDARDS -PFRS 15 AND PFRS 9 - STARTING 1 JANUARY 2018

REPORTED NET INCOME IN 1Q18 UP 39% TO P6.9 BILLION

FROM P5.0 BILLION IN 1Q17

CORE INCOME ROSE 13% TO P6.0 BILLION IN 1Q18

EXCLUDING VOYAGER, CORE INCOME AT P6.6 BILLION

ON PRO-FORMA BASIS:

SERVICE REVENUES FOR 1Q18 3% HIGHER YEAR-ON-YEAR AT P36.7 BILLION EXCLUDING ILD/NLD, CONSOLIDATED SERVICE REVENUES ROSE 5%,

FIXED LINE SERVICE REVENUES GREW 12% AND

WIRELESS SERVICE REVENUES WERE STABLE

DATA REVENUES GREW 13% TO P18.3 BILLION

NOW 50% OF TOTAL REVENUES, UP FROM 45% A YEAR AGO

SERVICE REVENUES (EXCLUDING INTERNATIONAL AND VOYAGER) OF

P32.9 BILLION, OR 89% OF SERVICE REVENUES,

6% HIGHER VERSUS 1Q17

HOME AND ENTERPRISE REVENUES GREW BY 14% AND 7%, RESPECTIVELY AND NOW ACCOUNT FOR 49% OF TOTAL SERVICE REVENUES

INDIVIDUAL WIRELESS REVENUES UP 2%, VERSUS 18% DECLINE A YEAR AGO

MANILA, Philippines 10th May 2018 – PLDT Inc. (“PLDT”) (PSE: TEL) (NYSE: PHI) today announced its unaudited financial and operating results for the first quarter of 2018 with Consolidated Service Revenues (net of interconnection costs) amounting to P35.9 billion, following the new accounting standard PFRS 15 adopted starting 1 January 2018.

On the same basis, Reported Net Income rose 39% to P6.9 billion for the first quarter of 2018. Excluding one-time gains and exceptional charges, Consolidated Core Income grew by 13% to P6.0 billion, while Consolidated EBITDA amounted to P16.5 billion. Consolidated EBITDA margin was 44%.

The impact of the adoption of PFRS 15 on the Company’s first quarter 2018 income statement is summarized in Table 1 below:

|

| |||||

Table 1:

|

|

| ||||

(Php in millions) | 1Q2018 | Change vs Pro-forma | Y-o-Y | |||

(PFRS15) | Change | |||||

|

|

|

| |||

Total Revenues* | 38,633 | (206) | 4% | |||

Service Revenues* | 35,871 | (869) | 1% | |||

Non-Service Revenues | 2,762 | 663 | 86% | |||

|

|

|

| |||

EBITDA | 16,533 | (206) | --- | |||

EBITDA Margin | 44% |

|

| |||

|

|

|

| |||

Interest Income | 477 | 73 | 54% | |||

|

|

|

| |||

Core Income | 6,003 | (70) | 13% | |||

|

|

|

| |||

Reported Net Income | 6,900 | (70) | 39% | |||

*Net of Interconnection costs

For analysis purposes, we also provide a comparison of our first quarter 2018 results on pro-forma basis vis-à-vis the same quarter in 2017, as shown in Table 2.

On this basis, Consolidated Service Revenues amounted to P36.7 billion, up P1.1 billion or 3% higher than the first quarter of 2017. Though relatively modest, the increase in service revenues posted in the first quarter of 2018 represents a P3.8 billion swing over the past two years when set against the P2.7 billion decline registered in the first quarter of 2017 versus the previous year.

Excluding revenues from the International segment and Voyager Innovations, service revenues representing 89% of total service revenues grew 6% year-on-year to P32.9 billion. The improvement of P1.9 billion in 1Q2018 follows a decline of P1.4 billion registered in the same period last year.

Consolidated EBITDA amounted to P16.7 billion, up 2%. Excluding Voyager, EBITDA grew 4% to P17.3 billion with EBITDA margin of 45%.

Consolidated Core Income reached P6.1 billion, up 14% from the prior year. Excluding Voyager, Core Income rose 23% year-on-year to P6.7 billion, which if annualized would put us ahead of our guidance of P23-24 billion for 2018.

Reported Net Income rose 41% to P7.0 billion. This reflects the impact of the P3.4 billion revaluation gain on our Rocket Internet investment recognized at the end of the quarter; and the non-core accelerated depreciation expense of P2.4 billion arising from the shortened useful life of network assets in connection with the company’s aggressive network modernization.

In May, Rocket Internet bought back PLDT Online’s 6.8 million shares at €24/share - a total of €163.2 million or P10.5 billion. The realized gain from this transaction is estimated at P1.4 billion which will be booked in the second quarter. Post this transaction, PLDT Online continues to hold 3.3 million shares of Rocket Internet.

PLDT FINANCIAL HIGHLIGHTS

Table 2:

(Php in millions) | 1Q2018 | 1Q2017 | Y-o-Y |

(Pro-forma) | Change | ||

|

|

|

|

Total Revenues* | 38,839 | 37,097 | 5% |

Service Revenues* | 36,740 | 35,610 | 3% |

Non-Service Revenues | 2,099 | 1,487 | 41% |

|

|

|

|

EBITDA | 16,739 | 16,467 | 2% |

ex-Voyager | 17,333 | 16,642 | 4% |

|

|

|

|

EBITDA Margin | 43% | 44% |

|

ex-Voyager | 45% | 45% |

|

|

|

|

|

Interest Income | 404 | 309 | 31% |

|

|

|

|

Core Income | 6,073 | 5,329 | 14% |

ex-Voyager | 6,650 | 5,418 | 23% |

|

|

|

|

Reported Net Income | 6,970 | 4,951 | 41% |

*Net of Interconnection costs

Consolidated Net Debt totaled US$2.6 billion as of end-March 2018 and Net Debt to EBITDA was 2.04x. Gross Debt amounted to US$3.3 billion, of which 18% is US$-denominated versus 20% a year ago. Only 8% of total debt is unhedged, taking into account available US$ cash and hedges. Fixed-rate loans accounted for 92% of total debt.

“We are building on the gains of 2017, leveraging on the strength of our Home and Enterprise businesses, which achieved record high revenues in the first quarter this year. Both now account for nearly half of our total service revenues.

“At the same time, we are stabilizing and raising the trajectory of our Wireless Individual business which registered two sequential quarters of top line growth,” said Manuel V. Pangilinan, PLDT Chairman and CEO.

Home and Enterprise still set the pace

In terms of the contributions of the major business segments, PLDT Home took the lead, growing revenues (net of interconnection costs) by 14% year-on-year to P8.9 billion, driven by robust subscriber take up of our home broadband services. The Enterprise Group followed, posting revenues of P9.2 billion, up 7%. Growth continued to be underpinned by revenues from wireless data and ICT services which rose 22% and 15%, respectively.

The Wireless Individual business of Smart, TNT and Sun contributed P14.8 billion in service revenues for 1Q2018, contributing 40% to consolidated revenues on pro-forma basis. Though a modest 2% rise year on year, driven largely by increasing data revenues, this represents a sharp contrast from the previous year, when the business suffered an 18% decline.

The combined revenues from Home, Enterprise and the Individual Wireless segment accounted for 89% of total service revenues, which grew 6% to P32.9 billion in 1Q18.

Shifting more to Data

Data, broadband and digital platforms continue to power overall revenue growth with combined revenues having grown by 13% to P18.3 billion at the end of March 2018, and accounting for 50% of total service revenues in the first quarter of 2018, up from 45% a year ago.

Data and broadband revenues accounted for 64%, 61% and 44% of the Home, Enterprise and Individual Wireless business groups, respectively.

Mobile internet revenues jumped 29% to P5.9 billion. Home broadband revenues rose 18% to P5.6 billion, while corporate data and data center revenues grew by 6% to P5.2 billion.

“The contribution from data and digital to our total business continues to grow steadily. And we shall accelerate this further as our fixed and mobile networks are progressively transformed into powerful platforms for delivering digital services and solutions. This will enable us to more effectively pursue our goal of becoming the preferred digital partner of our customers – both individual and enterprise,” said Ernesto R. Alberto, PLDT and Smart Executive Vice President and Chief Revenue Officer.

Network Roll out: Upping the Ante

Increasingly, revenue growth is being boosted by the accelerated and focused roll out of PLDT’s fixed and mobile networks.

In the first quarter of 2018, PLDT broadened the coverage of its fiber-powered broadband network to 4.4 million homes passed, up from 4.0 million at end-2017. In the same period, PLDT also increased its capacity to 1.4 million lines from about 1.0 million. It raised its total fiber footprint to about 187,000 kms.

PLDT’s fiber roll out includes both fiber-to-the-home (FTTH) and hybrid fiber technologies that will deliver fiber-speed broadband to virtually all DSL subscribers by 2019.

In mobile, the focus has been to roll out more LTE base stations in various parts of the country. Smart installed over 1,300 more LTE base stations in the first quarter of 2018, raising the total count to over 10,000. These base stations are using various radio frequency bands, specifically the 700 Mhz band for coverage and indoor penetration and 1800 Mhz and 2100 Mhz bands for additional capacity.

As per Smart’s roll out plan, the installation of multiple LTE base stations in existing cell sites, is laying the ground for the activation of LTE-Advanced (LTE-A) which will deliver significantly faster mobile data services for its customers.

To support the network buildup and modernization, PLDT and Smart concluded multi-year agreements with global technology leaders Huawei Technologies and Amdocs to modernize and manage the IT systems and platforms that support their network management and business operations. This transformation will enable PLDT and Smart to significantly improve service delivery and customer experience.

The modernization and expansion of PLDT’s fixed and mobile networks are being supported by a massive capital expenditures (“capex”) program amounting to P58 billion for 2018. Aside from its historic levels, what sets this capex program apart is its very targeted approach. Working closely with the key business groups, the network teams of PLDT and Smart have developed roll out plans guided by clearly defined business priorities. These priorities were based on insights drawn from business analytics and from on-the-ground information generated by PLDT and Smart sales teams and trade partners. As a result, PLDT’s fixed and mobile networks are being built where there are ready markets for their services.

In PLDT Home, for example, revenue growth in 1Q2018 has been driven by the 11% year-on-year growth in subscriptions which added over 420,000 new customers year on year. The subscriber take up was driven largely by fiber broadband which also increased revenues per customer by encouraging them to sign up for more services like video streaming and home security.

Meantime, the mobile phone customers of Smart have started to feel the significant improvements in mobile data services made possible by its stepped up wireless network roll out. Its internal tests have been corroborated by the findings of third-party organizations such as the mobile analytics firm, OpenSignal. In a report released in March, OpenSignal cited Smart for having the fastest LTE network and having the lowest latency in LTE and 3G in the Philippines.

In the first quarter of 2018, Smart upped the ante by accelerating the activation of LTE-Advanced (LTE-A) as it installed multiple LTE base stations in more cell sites. With LTE-A, Smart is utilizing carrier aggregation which provides much higher mobile data speeds by combining the capacity of two up to five frequency bands.

In Quezon City, for example, where Smart activated carrier aggregation combining up to five frequency bands – called 5 component carrier (5CC) aggregation – internal tests show customers enjoying download speeds ranging from about 30 Mbps to over 200 Mbps, depending on the density of traffic and on the capability of the handsets they use. As a result, average daily data revenue in Quezon City increased by 23% while LTE device usage grew 33% between September 2017 and March 2018.

In the first quarter of 2018, Smart has also brought LTE and LTE-A to other parts of the country such as Baguio, Sagada, Tagbilaran, Dumaguete, Dapitan, Puerto Princesa and most recently in Batanes in the far north. This is in line with Smart’s commitment to the National Telecommunications Commission to bring high-speed mobile data using LTE, LTE-A and 3G to over 90% of the country’s cities and municipalities.

Complementing the fiber and LTE/LTE-A deployments, Smart is also deploying more carrier-grade WiFi hotspots in high traffic public places such as airports, seaports and bus terminals, schools, malls and government buildings. In 1Q2018, Smart fired up 72 additional hotspots raising the total number of areas being served to nearly 400. Its growing base of customers enjoying hi-speed WiFi service reached 3 million unique latchers monthly. Adding further value to the service, Smart WiFi launched its ad service featuring local and global brands.

“Fiber-powered broadband, carrier-grade WiFi and LTE-Advanced – these are the platforms for delivering world-class internet service to our customers. On mobile, as shown by the experience of other countries, the network roll out must be accompanied by the adoption of LTE-Advanced-capable mobile phones and devices,” said Mario G. Tamayo, Senior Vice President for network planning and engineering of PLDT and Smart.

Stimulating Data and Digital Adoption

With increasingly powerful fixed and mobile data networks, both PLDT and Smart have stepped up their efforts to promote compelling data services among their customers.

On mobile, the centerpiece of these efforts was the launch in April of a path-breaking partnership with YouTube to offer one hour of free viewing every day for prepaid customers of Smart, TNT and Sun. Early results of this promotion indicate it is achieving the objective of giving existing Smart, TNT and Sun customers a taste of viewing via mobile data the rich content of the world’s most popular video streaming service.

“We want to give our customers a chance to try out video streaming using their mobile phones on the country’s fastest mobile data network. YouTube is the ideal partner for this initiative because they offer an unmatched library of compelling content on everything from entertainment to information and education,” said Oscar A. Reyes, Jr., Senior Vice President of Consumer Market Development for PLDT and Smart.

Smart set the stage of this initiative by launching earlier new postpaid and prepaid service packages with rich data offerings. Smart’s enhanced GigaX postpaid plans for example offer up to 15 Gb of open-access data plus an additional 10 Gb video streaming package

for a wider range of services like YouTube, Netflix, iFlix, HBO Go, iWanTV, Cignal Play, ESPN and Discovery Kids.

Smart, TNT and Sun prepaid customers also enjoy various load products offering different packs of video streaming content. In an initiative launched in March, Smart’s GigaSurf 50 (which provides 1Gb of open access data plus 300 Mb for YouTube access for 3 days) was also offered to TNT customers. As a result, video streaming and data usage increased among both old and new TNT subscribers, both existing data users and new ones.

For PLDT Home, the thrust has been converged service offers. In April, it launched a new Best Buy Bundle offering an Unlimited Fibr Plan 2899 plus a Cignal Plan 990 and a Smart GigaX Plan 2399 with a Huawei Mate 10 Pro handset for P5,345/mo – a bundled price discount of 15%. This is a follow up to the first Best Buy Bundle offered in December 2017 as a Christmas promo.

To ensure that customers get the full benefit of its fiber-powered service, PLDT has also been pushing its Whole Home WiFi solution so that the entire house is blanketed with strong WiFi signal.

PLDT has also promoting its home security solutions in the light of changing lifestyles of Filipino families. The need for security solutions has heightened because of the growing number of families where both parents are working while the number of homes with employed house help has declined. Its FamCam solution enables working parents to monitor their homes.

Pursuing Convergence

To advance its convergence thrust more effectively, PLDT Home and the Wireless Individual business groups have been placed under a single Consumer Organization with two pillars. The first is led by the Consumer Market Development Group which handles product development, marketing and loyalty, customer experience and consumer analytics. The second is run by the Consumer Customer Development Group, which handles revenue generation from all consumer sales channels. Through this, PLDT and Smart will be better able to align their efforts to serve Home and Wireless Individual customers.

Aligned with this, PLDT launched in February 2018 its Most Valuable Partner (MVP) Rewards Program. Under this program, PLDT, Smart and Sun customers earn reward points by paying their bills on time and buying load for their prepaid mobile phones. The points earned by customers are automatically converted to cash and placed in a virtual PayMaya prepaid wallet that customers can use to pay for online purchases or buy prepaid load. MVP program members also have the option to get a physical MVP Rewards Visa Card linked to their PayMaya wallet.

PLDT Enterprise continued its focus on building its data and ICT businesses through partnerships and convergence initiatives. In April, PLDT subsidiary ePLDT, launched the

most advanced and extensive portfolio of cyber safety and security solutions for local enterprises. The launch was co-presented with global IT security provider Check Point Software Technologies and was attended by over 500 customers and partners from various industry associations in retail, business outsourcing, semiconductor, banking and finance, manufacturing, healthcare, and government sectors.

In February, PLDT Enterprise partnered with Voyager Innovations (Voyager) and entrepreneurship advocate Go Negosyo to launch a program designed to help the country’s micro, small and medium entrepreneurs (MSME) engage in e-commerce through an end-to-end enablement program that includes not only providing digital online tools but also logistics support. This will enable MSMEs to broaden their market and sell their products nationwide.

“We are moving from being the preferred managed infrastructure provider to a trusted managed services provider where we serve clients more effectively through our integrated tools, skills-based expertise, global-practice methodologies, and broad ecosystem of partners,” said PLDT Senior Vice President and Head of Enterprise Business Juan Victor Hernandez.

Advancing Digital Inclusion

Voyager Innovations stepped up its initiatives to promote digital inclusion in the areas of financial services, commerce, and marketing technologies.

In support of the initiative led by the Bangko Sentral ng Pilipinas (BSP) to increase the share of electronic payments in the country’s total transactions from 1% today to 20% by 2020, PayMaya recently enabled instant 24/7 money transfers from InstaPay participating banks and financial institutions. This is one of the first electronic money issuer (EMI) to participate in the Bangko Sentral initiative.

To accelerate adoption of cashless technologies, PayMaya has been equipping businesses to accept digital payments via PayMaya QR or card payments through its PayMaya Business solutions. For the first quarter of 2018, PayMaya deployed and launched consumer promos for PayMaya QR with major retail establishments such as the SM Store, brands under Robinsons Specialty Store, Mercury Drug Store, Super8 Grocery and Megaworld Cinemas as well as big food chains including McDonald's and Chooks-to-Go.

Voyager's FINTQnologies (FINTQ) stepped up its programs to help Filipinos access the services of over 100 partner banks and financial institutions. To date, it has helped disbursed over P34-billion worth of loans through its Lendr platform since the service was launched in 2015. It has introduced trailblazing digital lending services in the grassroots sector including a tie-up with the Department of Trade and Industry's P1-billion Pondo sa Pagbabago at Pag-asenso (P3) lending program for micro, small and medium enterprises (MSMEs) and a digital halal microfinancing pilot for Islamic banking through a P5-million donation through the PLDT-Smart Foundation to Tindig Marawi.

FINTQ, through KasamaKA, recently announced that it is providing 1 million free micro-insurance policies to unbanked and underserved Filipinos across the 42,000 barangays nationwide, in cooperation with the Liga Ng mga Barangay sa Pilipinas, through its KasamaKA Microinsurance program.

Conclusion

“In the first quarter of 2018, we maintained the strong growth of our Home and Enterprise businesses and succeeded in posting modest gains in revenues for the Individual Wireless business. After several quarters of challenged revenues, this upswing is definitely encouraging. But we are keenly aware that it has taken great efforts and historic investments to get this far. And that it will take persistence and perseverance to keep PLDT firmly on the growth path,” Pangilinan said.

“The different factors for recovery are coming together. Our network transformation has made much headway and our customers are feeling the difference. PLDT and Smart are coming together like never before to develop and deliver data and digital services that delight customers and help them improve their lives. These are the key success factors,” he added.

“Given these developments, we maintain our guidance that full-year recurring core income for 2018 excluding Voyager will reach P23-24 billion and that our capex will increase to P58 billion this year,” he added.

END

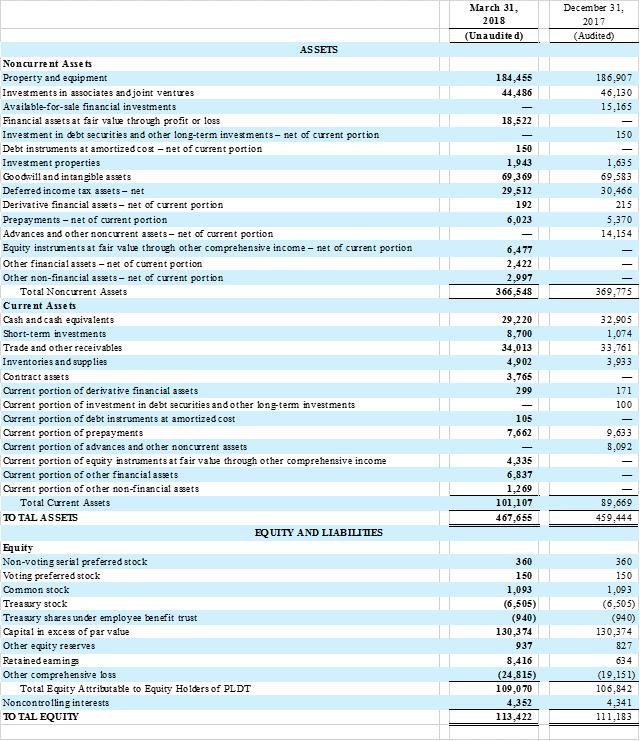

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(in million pesos)

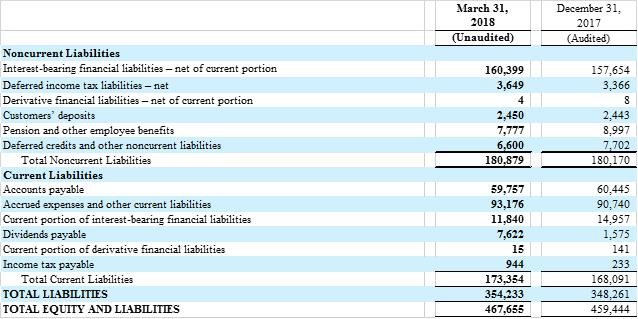

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (continued)

(in million pesos)

CONSOLIDATED INCOME STATEMENTS

For the Three Months Ended March 31, 2018 and 2017

(in million pesos, except earnings per common share amounts which are in pesos)

This press release may contain some statements which constitute “forward-looking statements” that are subject to a number of risks and uncertainties that could affect PLDT’s business and results of operations. Although PLDT believes that expectations reflected in any forward-looking statements are reasonable, it can give no guarantee of future performance, action or events.

For further information, please contact:

Anabelle L. Chua | Melissa V. Vergel de Dios | Ramon R. Isberto |

Tel. No: 816-8213 | Tel. No: 816-8024 | Tel. No: 511-3101 |

Fax No: 844-9099 | Fax No: 810-7138 | Fax No: 893-5174 |

About PLDT

PLDT is the leading telecommunications provider in the Philippines. Through its principal business groups – fixed line and wireless– PLDT offers a wide range of telecommunications services across the Philippines’ most extensive fiber optic backbone and fixed line, and mobile network.

PLDT is listed on the Philippine Stock Exchange (PSE: TEL) and its American Depositary Shares are listed on the New York Stock Exchange (NYSE:PHI). PLDT has one of the largest market capitalizations among Philippine listed companies.

Further information can be obtained by visiting the web at www.pldt.com.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| PLDT Inc.

|

By | : | /s/ Ma. Lourdes C. Rausa-Chan |

Name | : | Ma. Lourdes C. Rausa-Chan |

Title | : | Senior Vice President and Corporate Secretary |

Date: May 10, 2018