GRAND PEAK CAPITAL CORP.

NOTICE OF MEETING

AND

MANAGEMENT INFORMATION CIRCULAR

FOR

AN ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

IN RESPECT OF AN ARRANGEMENT

BETWEEN

GRAND PEAK CAPITAL CORP.

AND

LUCKY MINERALS INC.

February 23, 2009

TABLE OF CONTENTS

| | Page |

| NOTICE TO UNITED STATES SHAREHOLDERS | 1 |

| INFORMATION CONCERNING FORWARD–LOOKING STATEMENTS | 2 |

| INFORMATION CONTAINED IN THIS CIRCULAR | 2 |

| GLOSSARY OF TERMS | 4 |

| GLOSSARY OF MINING TERMS | 6 |

| SUMMARY | 10 |

| The Meeting | 10 |

| The Arrangement | 10 |

| Effect of the Arrangement on Grand Peak Warrants | 10 |

| Recommendation and Approval of the Board of Directors | 11 |

| Reasons for the Arrangement | 11 |

| Conduct of Meeting and Shareholder Approval | 11 |

| Court Approval | 11 |

| Income Tax Considerations | 12 |

| Right to Dissent | 12 |

| Stock Exchange Listings | 12 |

| Information Concerning the Company and Lucky Minerals After the Arrangement | 12 |

| Selected Unaudited Pro–Forma Consolidated Financial Information For The Company | 13 |

| Selected Unaudited Pro–Forma Consolidated Financial Information for Lucky Minerals | 13 |

| Risk Factors | 13 |

| GENERAL PROXY INFORMATION | 15 |

| Solicitation of Proxies | 15 |

| Currency | 15 |

| Record Date | 15 |

| Appointment of Proxyholders | 15 |

| Voting by Proxyholder | 15 |

| Registered Shareholders | 16 |

| Beneficial Shareholders | 16 |

| Revocation of Proxies | 17 |

| INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON | 17 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 17 |

| VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES | 18 |

| Outstanding Grand Peak Shares | 18 |

| Principal Holders of Grand Peak Shares | 18 |

| VOTES NECESSARY TO PASS RESOLUTIONS | 18 |

| ELECTION OF DIRECTORS | 18 |

| EXECUTIVE COMPENSATION | 19 |

| Long Term Incentive Plan ("Ltip") Awards | 20 |

| Option/Stock Appreciation Rights ("Sar") Grants During the Most Recently Completed Financial Year | 20 |

| Aggregated Option/Sar Exercises During the Most Recently Completed Financial Year | 20 |

| Termination of Employment, Change in Responsibility and Employment Contracts | 20 |

| Compensation of Directors | 20 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 20 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 21 |

| MANAGEMENT CONTRACTS | 21 |

| APPOINTMENT OF AUDITOR | 21 |

| AUDIT COMMITTEE | 21 |

| Composition of The Audit Committee | 21 |

| Audit Committee Oversight | 22 |

| Reliance on Certain Exemptions | 22 |

| Pre–Approval Policies and Procedures | 22 |

| External Auditor Service Fees (By Category) | 22 |

| CORPORATE GOVERNANCE | 22 |

| Board Of Directors | 22 |

| Directorships | 23 |

| Orientation And Continuing Education | 23 |

| Ethical Business Conduct | 23 |

| Nomination Of Directors | 23 |

| Compensation | 23 |

| Assessments | 23 |

| THE ARRANGEMENT | 23 |

| General | 23 |

| Reasons For The Arrangement | 24 |

| Recommendation Of Directors | 24 |

| Fairness Of The Arrangement | 24 |

| Details Of The Arrangement | 25 |

| Authority Of The Board | 28 |

| Conditions To The Arrangement | 28 |

| Shareholder Approval | 28 |

| Court Approval Of The Arrangement | 29 |

| Proposed Timetable For Arrangement | 29 |

| Lucky Minerals Share Certificates And Certificates For New Shares | 29 |

| Relationship Between The Company And Lucky Minerals After The Arrangement | 29 |

| Effect Of Arrangement On Outstanding Grand Peak Warrants | 30 |

| Resale Of New Shares And Lucky Minerals Shares | 30 |

| Expenses Of Arrangement | 31 |

| INCOME TAX CONSIDERATIONS | 31 |

| Certain Canadian Federal Income Tax Considerations | 31 |

| Certain U.S. Federal Income Tax Considerations | 35 |

| RIGHTS OF DISSENT | 42 |

| Dissenters' Rights | 42 |

| RISK FACTORS | 44 |

| Economics Of Developing Mineral Properties | 44 |

| Securities Of Lucky Minerals And Dilution | 44 |

| Title Matters | 44 |

| Competition | 44 |

| Conflicts Of Interest | 45 |

| No History Of Earnings Or Dividends | 45 |

| Potential Profitability Depends Upon Factors Beyond The Control Of Lucky Minerals | 45 |

| Environmental Risks And Other Regulatory Requirements | 45 |

| Dependency On A Small Number Of Management Personnel | 46 |

| Uninsurable Risks | 46 |

| Foreign Countries And Regulatory Requirements | 46 |

| Currency Fluctuations | 46 |

| APPROVAL OF THE COMPANY'S STOCK OPTION PLAN | 46 |

| APPROVAL OF THE LUCKY MINERALS STOCK OPTION PLAN | 47 |

| Stock Option Plan Of Lucky Minerals | 47 |

| Purpose Of The Lucky Minerals Option Plan | 47 |

| General Description And Exchange Policies | 47 |

| THE COMPANY AFTER THE ARRANGEMENT | 48 |

| Name And Exchange Listing | 48 |

| Directors And Officers | 48 |

| Business Of The Company Following The Arrangement | 48 |

| Business Overview | 49 |

| Description Of Share Capital | 49 |

| Changes In Share Capital | 50 |

| Trading Price And Volume | 50 |

| Selected Unaudited Pro–Forma Consolidated Financial Information Of The Company | 51 |

| The Company's Year–End Audited Financial Statements | 52 |

| LUCKY MINERALS AFTER THE ARRANGEMENT | 52 |

| Name, Address And Incorporation | 52 |

| Intercorporate Relationships | 52 |

| General Development Of Lucky Minerals' Business | 52 |

| Lucky Minerals' Business History | 52 |

| Trends | 53 |

| Selected Unaudited Pro–Forma Financial Information Of Lucky Minerals | 53 |

| Dividends | 54 |

| Business Of Lucky Minerals | 54 |

| Summary Of Property Commitments | 55 |

| The Nico Property | 55 |

| Available Funds | 64 |

| Administration Expenses | 65 |

| Share And Loan Capital Of Lucky Minerals | 65 |

| Fully Diluted Share Capital Of Lucky Minerals | 65 |

| Prior Sales Of Securities Of Lucky Minerals | 66 |

| Options And Warrants | 66 |

| Principal Shareholders Of Lucky Minerals | 66 |

| Directors And Officers Of Lucky Minerals | 66 |

| Management Of Lucky Minerals | 67 |

| Corporate Cease Trade Orders Or Bankruptcies | 68 |

| Penalties Or Sanctions | 68 |

| Personal Bankruptcies | 69 |

| Conflicts Of Interest | 69 |

| Executive Compensation Of Lucky Minerals | 69 |

| Indebtedness Of Directors And Executive Officers Of Lucky Minerals | 69 |

| Lucky Mineral's Auditor | 69 |

| Lucky Mineral's Material Contracts | 69 |

| Promoters | 70 |

| TRANSFER AGENT AND REGISTRAR | 70 |

| LEGAL PROCEEDINGS | 70 |

| ADDITIONAL INFORMATION | 70 |

| EXPERTS | 70 |

| OTHER MATTERS | 71 |

| APPROVAL OF INFORMATION CIRCULAR | 71 |

| CERTIFICATE OF THE CORPORATION | 72 |

| AUDITORS' CONSENT | 73 |

| Schedule A: | Form of Resolutions |

| Schedule B: | The Arrangement Agreement |

| Schedule C: | The Interim Order |

| Schedule D: | Dissent Procedures |

| Schedule E: | Pro–Forma Unaudited Consolidated Balance Sheet of Grand Peak Capital Corp. as at September 30, 2008 |

| Schedule F: | Pro–Forma Unaudited Consolidated Balance Sheet of Lucky Minerals Inc. as at September 30, 2008 |

| Schedule G: | Consolidated Audited Financial Statements of Grand Peak Capital Corp. for the Year Ended September 30, 2008 |

| Schedule H: | Grand Peak Stock Option Plan |

| Schedule I: | Grand Peak Audit Committee Charter |

| Schedule J: | Nico Property Claim Lists |

| Schedule K: | Grand Peak Change of Auditor Notices |

GRAND PEAK CAPITAL CORP.

Suite 900 — 555 Burrard Street

Vancouver, British Columbia V7X 1M8

Telephone No. (604) 443–5059 / Fax No. (604) 692–2801

Email: info@grandpeakcapital.com

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS

To: The Shareholders of Grand Peak Capital Corp.

TAKE NOTICE that pursuant to an order of the Supreme Court of the Yukon Territory dated December 18, 2008, an annual general and special meeting (the "Meeting") of shareholders (the "Grand Peak Shareholders") of Grand Peak Capital Corp. (the "Company") will be held at Suite 900 – 555 Burrard Street, Vancouver, British Columbia, on March 31, 2009, at 10:00 a.m. (Vancouver time), for the following purposes:

| 1. | to receive and consider the consolidated financial statements of the Company for the fiscal year ended September 30, 2008, and the report of the auditor thereon; |

| 2. | to elect directors of the Company for the ensuing year; |

| 3. | to appoint an auditor for the Company for the ensuing year and to authorize the directors to fix the auditor's remuneration; |

| 4. | to consider and, if thought fit, pass, with or without variation, an ordinary resolution to affirm, ratify and approve the Company's stock option plan; |

| 5. | to consider and, if thought fit, pass, with or without variation, a special resolution approving an arrangement (the "Plan of Arrangement") under section 195 of the Business Corporations Act (Yukon Territory) (the "Act") which involves, among other things, the distribution to the Grand Peak Shareholders shares of Lucky Minerals Inc. ("Lucky Minerals"), currently a wholly–owned subsidiary of the Company, all as more fully set forth in the accompanying management information circular (the "Circular") of the Company; |

| 6. | to consider and, if thought fit, pass, with or without variation, an ordinary resolution to affirm, ratify and approve a stock option plan for Lucky Minerals; and |

| 7. | to transact such other business as may properly come before the Meeting or at any adjournment(s) or postponement(s) thereof. |

AND TAKE NOTICE that Grand Peak Shareholders who validly dissent from the Arrangement will be entitled to be paid the fair value of their Grand Peak Shares subject to strict compliance with the provisions of the interim order (as set forth herein), the Plan of Arrangement and section 193 of the Act. The dissent rights are described in Schedule "D" of the Circular. Failure to comply strictly with the requirements set forth in the Plan of Arrangement and Section 193 of the Act may result in the loss of any right of dissent.

The Circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this Notice. Also accompanying this Notice and the Circular is a form of proxy for use at the Meeting. Any adjourned meeting resulting from an adjournment of the Meeting will be held at a time and place to be specified at the Meeting. Only Grand Peak Shareholders of record at the close of business on February 20, 2009, will be entitled to receive notice of and vote at the Meeting.

Registered Grand Peak Shareholders unable to attend the Meeting are requested to date, sign and return the enclosed form of proxy and deliver it in accordance with the instructions set out in the proxy and in the Circular. If you are a non–registered Grand Peak Shareholder and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or the other intermediary. Failure to do so may result in your Shares of Grand Peak not being voted at the Meeting.

Dated at Vancouver, British Columbia, this 23rd day of February, 2009.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ "Navchand Jagpal"

Navchand Jagpal

President and Chief Executive Officer

S.C. No. 08-A0144

SUPREME COURT OF YUKON

IN THE MATTER OF AN APPLICATION FOR APPROVAL OF

AN ARRANGEMENT UNDER SECTION 195 OF THE BUSINESS

CORPORATIONS ACT, R.S.Y. 2002, c.20

AND IN THE MATTER OF A PROPOSED ARRANGEMENT INVOLVING

GRAND PEAK CAPITAL CORP., ITS SHAREHOLDERS AND LUCKY

MINERALS INC.

NOTICE OF APPLICATION FOR FINAL ORDER

TO: ALL SHAREHOLDERS OF GRAND PEAK CAPITAL CORP.

NOTICE IS HEREBY GIVEN that a Petition has been filed by Grand Peak Capital Corp. ("Grand Peak") for approval of an arrangement (the "Arrangement") pursuant to section 195 of the Yukon Business Corporations Act, R.S.Y. 2002, c.20 (the "Act") involving Grand Peak, its shareholders and Lucky Minerals.

AND NOTICE IS FURTHER GIVEN that the Court, by an interim Order dated December 18, 2008 has given directions as to the calling of a meeting of the holders of the common shares of Grand Peak for the purpose of considering and voting upon the Arrangement and matters relating thereto.

AND NOTICE IS FURTHER GIVEN that pursuant to the interim Order, if the Arrangement is approved by the requisite vote of the shareholders of Grand Peak, Grand Peak will seek a final Order approving the Arrangement at a final hearing to be held before a Justice of the Supreme Court of Yukon at The Law Courts, 2134 Second Avenue, in the City of Whitehorse, in the Yukon Territory, on April 7, 2009 at 3:00 p.m. (pacific standard time), or so soon thereafter as counsel may be heard.

At the final hearing of the Petition, Grand Peak intends to seek:

| (a) | a final Order approving the Arrangement pursuant to the provisions of Section 195 of the Act; and |

| (b) | such other and further orders, declarations and directions as the Court may deem just. |

AND NOTICE IS FURTHER GIVEN that the final Order of the Court approving the Arrangement, if granted, will constitute the basis for an exemption from the registration requirements under the United States Securities Act of 1933, as amended, with respect to the securities which may be issued in exchange for the common shares of Grand Peak pursuant to the Arrangement.

AND NOTICE IS FURTHER GIVEN that the interim Order provides that this Notice of Application shall advise, and it hereby does advise, that on the final hearing of this Petition the Court will hear and consider written or oral testimony from any person entitled to vote on the Arrangement (or any person who will become a shareholder, warrant holder or holder of a right to acquire a security of Grand Peak prior to the final hearing on this Petition) desiring to be present personally or through counsel. Any shareholder, warrant holder or holder of a right to acquire a security of Grand Peak desiring to support or oppose the making of a final Order on the said application may be heard at the final hearing of the application by filing and delivering an "Appearance" as set forth below and any affidavit material upon which the shareholder, warrant holder or holder of a right to acquire a security may wish to rely.

IF YOU WISH TO BE HEARD AT THE FINAL HEARING OF THE APPLICATION OF THE PETITIONER OR WISH TO BE NOTIFIED OF ANY FURTHER PROCEEDINGS, YOU MUST GIVE NOTICE OF YOUR INTENTION by filing a form entitled "Appearance" at the Registry of the Supreme Court of the Yukon Territory (the "Registry") prior to the date of final hearing and YOU MUST ALSO DELIVER a copy of the "Appearance" to the Petitioner's address for delivery, which is set out below.

YOU OR YOUR SOLICITOR may file the "Appearance". You may obtain a form of "Appearance" at the Registry. If you wish to file an affidavit it must be sworn to before an officer commissioned to take oaths and must be filed with the Court prior to the date set forth for the final hearing. A properly completed form of Appearance must accompany or precede any such affidavit.

The address of the Registry is: The Supreme Court of the Yukon Territory, the Law Courts, 2134 Second Avenue, Whitehorse, Yukon Territory Y1A 5H6, Phone: (867) 667-5441, Fax: (867) 393-6212.

If you do not file and deliver an "Appearance" as aforesaid and attend either in person or by counsel at the time of such final hearing, the Court may approve the Arrangement, as presented, or may approve it subject to such terms and conditions as the Court shall deem fit. IF YOU DO NOT FILE AN APPEARANCE, you may not be permitted to present written or oral testimony, and any action in the proceedings may be taken without further notice to you. If the Arrangement is approved, it will significantly affect the legal rights of the shareholders of Grand Peak.

A copy of the said Petition and other documents in the proceedings will be furnished to any shareholder of Grand Peak upon request in writing addressed to the solicitors for the Petitioner at its address for delivery set out below.

Grand Peak's address for delivery is c/o Lackowicz, Shier & Hoffman, Barristers & Solicitors, 300-204 Black Street, Whitehorse, Yukon Territory Y1A 2M9, phone (867) 668-5252, fax (867) 668-5251, Attention: Paul W. Lackowicz.

DATED at the City of Whitehorse, in the Yukon Territory, this 23rd day of February, 2009.

"Lackowicz, Shier & Hoffman"

Lackowicz, Shier & Hoffman

Solicitors for the Petitioner

S. C. No. 08-A0144

SUPREME COURT OF YUKON

IN THE MATTER OF AN APPLICATION FOR APPROVAL OF AN

ARRANGEMENT UNDER SECTION 195 OF THE BUSINESS

CORPORATIONS ACT, R.S.Y. 2002, c.20

AND IN THE MATTER OF A PROPOSED ARRANGEMENT INVOLVING

GRAND PEAK CAPITAL CORP., ITS SHAREHOLDERS AND LUCKY

MINERALS INC.

ORDER

Paul W. Lackowicz

LACKOWICZ, SHIER & HOFFMAN

Barristers & Solicitors

300-204 Black Street

Whitehorse, Yukon Territory

Y1A 2M9

File No. 35540

GRAND PEAK CAPITAL CORP.

Suite 900 – 555 Burrard Street

Vancouver, British Columbia V7X 1M8

Telephone No. (604) 443–5059 / Fax No. (604) 692–2801

Email: info@grandpeakcapital.com

This Circular is furnished in connection with the solicitation of proxies by management of Grand Peak for use at the annual general and special meeting of shareholders of the Company to be held on March 31, 2009.

Unless the context otherwise requires, capitalized terms used herein and not otherwise defined shall have the meanings set forth in the Glossary of Terms in this Circular.

NOTICE TO UNITED STATES SHAREHOLDERS

THE SECURITIES ISSUABLE IN CONNECTION WITH THE ARRANGEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY IN ANY STATE, NOR HAS THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY OF ANY STATE PASSED ON THE ADEQUACY OR ACCURACY OF THIS CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Lucky Minerals Shares to be issued under the Arrangement have not been registered under the U.S. Securities Act and are being issued in reliance on the exemption from registration set forth in Section 3(a)(10) thereof on the basis of the approval of the Court as described under "The Arrangement — Resale of New Shares and Lucky Minerals Shares" in this Circular. The solicitation of proxies is not subject to the requirements of Section 14(a) of the U.S. Exchange Act by virtue of an exemption applicable to proxy solicitations by foreign private issuers as defined in Rule 3b–4 of the U.S. Exchange Act. Accordingly, this Circular has been prepared in accordance with applicable Canadian disclosure requirements. Residents of the United States should be aware that such requirements differ from those of the United States applicable to proxy statements under the U.S. Exchange Act.

Information concerning any properties and operations of the Company, including those that will be transferred to Lucky Minerals as part of the Arrangement, has been prepared in accordance with Canadian standards under applicable Canadian securities laws, and may not be comparable to similar information for United States companies. The terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" used in this Circular are Canadian mining terms as defined in accordance with National Instrument 43-101 – "Standards of Disclosure for Mineral Projects" under guidelines set out in the CIM Standards on Mineral Resources and Mineral Reserves definitions and guidelines adopted by the CIM Council on August 20, 2000, as amended.

While the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. As such, certain information contained in this Circular concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC. "Inferred Mineral Resources" have a great amount of uncertainty as to their existence and there is great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "Inferred Mineral Resource" will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of an "Inferred Mineral Resource" exists, or is economically or legally mineable.

In addition, the definitions of "Proven Mineral Reserves" and "Probable Mineral Reserves" under CIM standards differ in certain respects from the SEC standards.

Financial statements included or incorporated by reference herein have been prepared in accordance with generally accepted accounting principles in Canada and are subject to auditing and auditor independence standards in Canada, and reconciled to accounting principles generally accepted in the United States. Grand Peak Shareholders should be aware that the reorganization of the Company pursuant to the Plan of Arrangement as described herein may have tax consequences in both the United States and Canada. Such consequences for Grand Peak Shareholders who are resident in, or citizens of, the United States may not be described fully herein. See "Income Tax Considerations — Certain Canadian Federal Income Tax Considerations" and "Income Tax Considerations — Certain United States Federal Income Tax Considerations" in this Circular.

- 2 - -

The enforcement by Grand Peak Shareholders of civil liabilities under the United States federal securities laws may be affected adversely by the fact that Grand Peak and Lucky Minerals are incorporated or organized under the laws of a foreign country, that some or all of their officers and directors and the experts named herein are residents of a foreign country and that all of the assets of the Company and Lucky Minerals are located outside the United States.

INFORMATION CONCERNING FORWARD–LOOKING STATEMENTS

Except for statements of historical fact contained herein, the information presented in this Circular constitutes "forward–looking statements" or "information" (collectively "statements") as such terms are used in the Private Securities Litigation Reform Act of 1995 and similar Canadian laws. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Statements concerning Mineral Reserves and Mineral Resource estimates may also be deemed to constitute forward–looking statements to the extent that they involve estimates of the mineralization that will be encountered if a property is developed, and in the case of Mineral Reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans, "estimates" or "intends", or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward–looking statements". Such forward–looking statements, including but not limited to those with respect to the price of metals, the timing and amount of estimated future mineralization and economic viability of properties, capital expenditures, costs and timing of exploration projects, permitting timelines, title to properties, the timing and possible outcome of pending exploration projects and other factors and events described in this Circular involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of each of the Company and Lucky Minerals to be materially different from any future results, performance or achievements expressed or implied by such forward–looking statements. Such risks and other factors include, among others, the actual results of exploration activities; the estimation or realization of Mineral Reserves and Resources; variations in the underlying assumptions associated with conclusions of economic evaluations, including the timing and amount of estimated future production, costs of production, capital expenditures, the failure of plant, equipment or processes to operate as anticipated and possible variations in ore grade or recovery rates; costs and timing of the acquisition of and development of new deposits; availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares; significant and increasing competition for mineral properties; accidents, labour disputes and other risks of the mining industry, including, without limitation, those associated with the environment, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, title disputes or claims limitations on insurance coverage and risks associated with international mineral exploration and development activities. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in the forward–looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward–looking statements contained in this Circular and in any documents incorporated into this Circular.

Forward–looking statements are made based on management's beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update any forward–looking statement if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law.

INFORMATION CONTAINED IN THIS CIRCULAR

The information contained in this Circular is given as at February 23, 2009, unless otherwise noted.

- 3 - -

No person has been authorized to give any information or to make any representation in connection with the Arrangement and other matters described herein other than those contained in this Circular and, if given or made, any such information or representation should be considered not to have been authorized by the Company.

This Circular does not constitute the solicitation of an offer to purchase any securities or the solicitation of a proxy by any person in any jurisdiction in which such solicitation is not authorized or in which the person making such solicitation is not qualified to do so or to any person to whom it is unlawful to make such solicitation.

Information contained in this Circular should not be construed as legal, tax or financial advice and Grand Peak Shareholders are urged to consult their own professional advisers in connection therewith.

Descriptions in the body of this Circular of the terms of the Arrangement Agreement and the Plan of Arrangement are merely summaries of the terms of those documents. Grand Peak Shareholders should refer to the full text of the Arrangement Agreement and the Plan of Arrangement for complete details of those documents. The full text of the Arrangement Agreement is attached to this Circular as Schedule "B" and the Plan of Arrangement is attached as Exhibit II to the Arrangement Agreement.

GLOSSARY OF TERMS

The following is a glossary of general terms and abbreviations used in this Circular:

"Act" means the Business Corporations Act (Yukon Territory), R.S.Y. 2002, c.20, as may be amended or replaced from time to time;

"Arrangement" means the arrangement under the Arrangement Provisions pursuant to which the Company proposes to reorganize its business and assets, and which is set out in detail in the Plan of Arrangement;

"Arrangement Agreement" means the agreement dated effective December15, 2008 between the Company and Lucky Minerals, a copy of which is attached as Schedule "B" to this Circular, and any amendment(s) or variation(s) thereto;

"Arrangement Provisions" means Section 195 of Part 15 – "Corporate Reorganization and Arrangements" of the Act;

"Arrangement Resolution" means the special resolution to be considered by the Grand Peak Shareholders to approve the Arrangement, the full text of which is set out in Schedule "A" to this Circular;

"Asset" means the option of the Company to acquire a 100% interest in the minerals claims comprising the Nico Property, which option is to be transferred to Lucky Minerals under the Arrangement;

"Beneficial Shareholder" means a Grand Peak Shareholder who is not a Registered Shareholder;

"Board" means the board of directors of the Company;

"Business Day" means a day which is not a Saturday, Sunday or statutory holiday in Vancouver, British Columbia;

"CBCA" means the Canada Business Corporations Act, R.S.C. 1985, c. C–44, as may be amended or replaced from time to time;

"Ciesielski Justino Report" means the technical report of Andre Ciesielski and Mario Justino dated February 23, 2009, described in "Lucky Minerals After the Arrangement – The Nico Property";

"CIM" means the Canadian Institute of Mining, Metallurgy and Petroleum;

"Circular" means this management information circular;

"Company" means Grand Peak Capital Corp.;

"Computershare" means Computershare Trust Company of Canada;

"Court" means the Supreme Court of the Yukon Territory;

"Dissenting Shareholder" means a Grand Peak Shareholder who validly exercises rights of dissent under the Arrangement and who will be entitled to be paid fair value for his, her or its Grand Peak Shares in accordance with the Interim Order and the Plan of Arrangement;

"Dissenting Shares" means the Grand Peak Shares in respect of which Dissenting Shareholders have exercised a right of dissent;

"Effective Date" means the date upon which the Arrangement becomes effective;

"Exchange" means the TSX Venture Exchange;

"Exchange Factor" means the number arrived at by dividing 20,950,053 by the number of issued Grand Peak Shares as of the close of business on the Share Distribution Record Date;

- 5 - -

"Final Order" means the final order of the Court approving the Arrangement;

"Grand Peak" means Grand Peak Capital Corp.;

"Grand Peak Class A Shares" means the renamed and redesignated Grand Peak Shares described in §3.1(b)(i) of the Plan of Arrangement;

"Grand Peak Class B Preferred Shares" means the class "B" preferred shares without par value which will be created and issued pursuant to §3.1(b)(iii) of the Plan of Arrangement;

"Grand Peak Shareholder" means a holder of Grand Peak Shares;

"Grand Peak Shares" means the common shares without par value in the authorized share structure of the Company, as constituted on the date of the Arrangement Agreement;

"Grand Peak Stock Option Plan" means the share purchase option plan of the Company dated May 18, 2004;

"Grand Peak Warrants" means the common share purchase warrants of the Company outstanding on the Effective Date;

"Interim Order" means the interim order of the Court pursuant to the Act in respect of the Arrangement dated December 18, 2008, a copy of which is attached to this Circular as Schedule "C";

"Intermediaries" refers to brokers, investment firms, clearing houses and similar entities that own securities on behalf of Beneficial Shareholders;

"Listing Date" means the date the Lucky Minerals Shares are listed on the Exchange;

"Lucky Minerals" means Lucky Minerals Inc., a private company incorporated under the CBCA and a wholly–owned subsidiary of the Company;

"Lucky Minerals Commitment" means the covenant of Lucky Minerals to issue Lucky Minerals Shares to the holders of Grand Peak Warrants who exercise their rights thereunder after the Effective Date, and are entitled pursuant to the corporate reorganization provisions thereof to receive New Shares and Lucky Minerals Shares upon such exercise;

"Lucky Minerals Option Plan" means the proposed share purchase option plan of Lucky Minerals, which is subject to Exchange acceptance and Grand Peak Shareholder approval;

"Lucky Minerals Option Plan Resolution" means an ordinary resolution which will be considered by the Grand Peak Shareholders to approve the Lucky Minerals Option Plan, the full text of which is set out in Schedule "A" to this Circular;

"Lucky Minerals Shareholder" means a holder of Lucky Minerals Shares;

"Lucky Minerals Shares" means the common shares without par value in the authorized share structure of Lucky Minerals as constituted on the date of the Arrangement Agreement;

"Meeting" means the annual general and special meeting of the Grand Peak Shareholders to be held on March 31, 2009, and any adjournment(s) or postponement(s) thereof;

"New Shares" means the new class of common shares without par value which the Company will create pursuant to §3.1(b)(ii) of the Plan of Arrangement and which, immediately after the Effective Date, will be identical in every relevant respect to the Grand Peak Shares;

"NI 43–101" means National Instrument 43–101 – "Standards of Disclosure for Mineral Projects" of the Canadian Securities Administrators;

- 6 - -

"Nico East" means the area within the Moizerets Township, comprised of 17 claims totaling 714 hectares extending approximately 3.2 kilometers north and 3.7 kilometers east;

"Nico Property" means the gold–nickel–copper–platinum group elements potential property located north of the town of Amos, in the Abitibi Regional County Municipality, approximately 500 kilometers northwest of Montreal, Québec, comprising 51 claims totaling 2083 hectares in two non–contiguous blocks, being Nico West and Nico East;

"Nico West" means the boundary between the Moizerets and Dalet Townships, comprised of 34 claims totaling 1369 hectares, extending approximately 4.9 kilometers north and 4.4 kilometers east;

"Notice of Meeting" means the notice of annual general and special meeting of the Grand Peak Shareholders in respect of the Meeting;

"Plan of Arrangement" means the plan of arrangement attached as Exhibit II to the Arrangement Agreement, which Arrangement Agreement is attached as Schedule "B" to this Circular, and any amendment(s) or variation(s) thereto;

"Property" means the Nico Property;

"Proxy" means the form of proxy accompanying this Circular;

"Qualified Person" or "QP" means an individual who is a "qualified person" within the meaning of NI 43–101;

"Registered Shareholder" means a registered holder of Grand Peak Shares as recorded in the shareholder register of the Company maintained by Computershare;

"Registrar" means the Registrar of Corporations under the Act;

"SEC" means the United States Securities and Exchange Commission;

"SEDAR" means the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators;

"Share Distribution Record Date" means the close of business on the day which is four Business Days after the date of the Meeting or such other day as agreed to by the Company and Lucky Minerals, which date establishes the Grand Peak Shareholders who will be entitled to receive Lucky Minerals Shares pursuant to the Plan of Arrangement;

"Tax Act" means the Income Tax Act (Canada), as may be amended, or replaced, from time to time;

"U.S. Exchange Act" means the United States Securities Exchange Act of 1934, as may be amended, or replaced, from time to time; and

"U.S. Securities Act" means the United States Securities Act of 1933, as may be amended, or replaced, from time to time.

GLOSSARY OF MINING TERMS

The following is a glossary of technical terms and abbreviations used in this Circular:

"alteration" means any change in the mineralogical composition of a rock that is brought about by physical or chemical means;

"Au" means gold;

"breccia/brecciated" means a rock consisting of fragments of one or more rock types;

- 7 - -

"°C" means degree centigrade;

"CARDS" means Diagnos' proprietary Computer Aided Resource Detection System;

"calcite" means calcium carbonate, CaCO3, with hexagonal crystallization, a mineral found in limestone, chalk and marble;

"carbonate" means a rock composed principally of calcium carbonate (CaCO3);

"claim (mineral/mining)" means the area that confers mineral exploration/exploitation rights to the registered holder under the laws of the governing jurisdiction;

"Cu" means copper;

"concentrate" means the valuable fraction of an ore that is left while the worthless material is removed in processing;

"conductor" means an area of rock with very high electric conductivity relative to the surrounding rocks. High conductivity in rock may be caused by a number of factors including the presence of sulphide minerals, graphite, clay minerals and water–filled fracture zones;

"diamond drilling/drill hole" means a method of obtaining a cylindrical core of rock by drilling with a diamond impregnated bit;

"diorite" means an igneous rock that is of a "salt and pepper" appearance and is composed primarily of sodium/calcium feldspar and mafic minerals with little or no quartz;

"disseminated/dissemination" means distribution of mineralization usually as small grains or blebs homogeneously throughout the host rock;

"fault" means a fracture in a rock along which there has been relative movement between the two sides either vertically or horizontally;

"feasibility study" means a comprehensive study of a deposit in which all geological, engineering, operating, economic and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production;

"feldspar" means a group of common sodium–potassium–calcium al umino silicate rock–forming minerals;

"felsic" means igneous rock composed principally of feldspar and quartz;

"fold" means a bend in strata or any planar structure;

"formation" means a body of rock identified by lithological characteristics and stratigraphic position;

"fracture" means breaks in rocks due to intensive folding or faulting;

"fragmental" means designation of rocks formed of the fragments of older rocks;

"geology/geological" means the study of the Earth's history and life, mainly as recorded in rocks;

"geophysics/geophysical" means the study of the earth by quantitative physical methods, either by surveys conducted on the ground, in the air (by fixed wing aircraft or helicopter) or in a drillhole;

"g/t" means gram per metric ton;

"hectare" means a square of 100 meters on each side;

- 8 - -

"host" means a rock or mineral that is older than rocks or minerals introduced into it;

"igneous" means a classification of rocks formed from the solidification from a molten state;

"inclusion" means any size fragment of another rock enclosed in an igneous rock;

"Indicated Mineral Resource"1 means that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed;

"induced polarization" means the geophysical method of applying an electrical charge to the ground and measuring the electrical chargeability of the minerals in the rocks and the decay of the induced electrical charge to define the presence of sulphide and other minerals;

"Inferred Mineral Resource"1 means that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes;

"intrusive/intrusions" means an igneous rock that invades older rocks;

"km" means kilometre;

"limestone" means carbonate–rich sedimentary rock;

"m" means metre;

"mafic" means an igneous rock composed chiefly of dark iron and manganese silicate minerals;

"magma" means a naturally occurring molten rock material;

"magmatic" means pertaining to magma;

"Measured Mineral Resource"1 that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity;

"metamorphism" means a process whereby the composition of rock is adjusted by heat and pressure;

"Mineral Reserve"2 means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined;

"Mineral Resource"1 means a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal and industrial minerals in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge;

| 1 | Cautionary Note to U.S. Shareholders. While the terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" are recognized and required by Canadian regulations, they are not defined terms under standards in the United States. As such, certain information contained in this Circular concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC. "Inferred Mineral Resource" have a great amount of uncertainty as to their existence and there is great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "Inferred Mineral Resource" will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of an "Inferred Mineral Resource" exists, or is economically or legally mineable. |

| 2 | The term "Mineral Reserve" is a Canadian mining term as defined in accordance with Nl 43–101 under the guidelines set out in the CIM standards. In the United States, a mineral reserve is defined as part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made. |

"mineralization" means the concentration of metals and their chemical compounds within a body of rock;

"Net Smelter Return" or "NSR" means a term used to determine the net proceeds from the sale of ores, concentrates, dore or other minerals to a smelter, concentrator, refinery or other mineral processor, commonly less deductions for freight and transportation, insurance, penalties and deductions, processing fees, mineral and other taxes, and sales and marketing fees. The term is generally used to define royalty interests on production of minerals;

"Ni" means nickel;

"ore" means rock containing mineral(s) or metals that can be economically extracted to produce a profit;

"outcrop" means an exposure of bedrock at the surface;

"PGE" means platinum group elements;

"ppm" means parts per million;

"preliminary assessment" means a study that includes an economic evaluation, which uses inferred mineral resources;

"pyrite/pyritization" means a common iron sulphide (FeS2) mineral;

"quartz" means a mineral composed of silicon dioxide (Si02);

"sediment" means solid material that has settled down from a state of suspension in a liquid. More generally, solid fragmental material transported and deposited by wind, water or ice, chemically precipitated from solution, or secreted by organisms, and that forms in layers in loose unconsolidated form;

"sedimentary" means pertaining to or containing sediment or formed by its deposition;

"silica/silicified" means the mineral quartz comprised of silicon and oxygen and the addition of quartz or silica as an alteration of a pre–existing rock;

"soil sampling" means systematic collection of soil samples at a series of different locations in order to study the distribution of soil geochemical values;

"structure/structural" means pertaining to geological structure; i.e. folds, faults, shears, etc.;

"sulphide" means a group of minerals in which one or more metals are found in combination with sulphur;

"tons" means dry short tons (2,000 pounds);

"vein" means a thin sheet–like intrusion into a fissure or crack, commonly bearing quartz and other minerals; and

"volcanic" means descriptive of rocks originating from volcanic activity.

- 10 -

SUMMARY

The following is a summary of the information contained elsewhere in this Circular, concerning a proposed reorganization of the Company by way of the Arrangement. This Circular also deals with the election of directors, the appointment of an auditor and the approval of the Grand Peak Stock Option Plan and the Lucky Minerals Option Plan, which matters are not summarized in this summary. Certain capitalized words and terms used in this summary are defined in the Glossary of Terms above. This summary is qualified in its entirety by the more detailed information and financial statements appearing or referred to elsewhere in this Circular and the schedules attached hereto.

The Meeting

The Meeting will be held at Suite 900, 555 Burrard Street, Vancouver, British Columbia, on March 31, 2009 at 10:00 a.m. (Vancouver time). At the Meeting, the Grand Peak Shareholders will be asked, in addition to voting on the election of directors, the appointment of an auditor and the approval of the Grand Peak Stock Option Plan, to consider and, if thought fit, to pass the Arrangement Resolution approving the Arrangement among the Company, Lucky Minerals and the Grand Peak Shareholders. The Arrangement will consist of the distribution of Lucky Minerals Shares to the Grand Peak Shareholders. Grand Peak Shareholders will also be requested to consider and, if thought fit, to pass the Lucky Minerals Option Plan Resolution approving the Lucky Minerals Option Plan.

By passing the Arrangement Resolution, the Grand Peak Shareholders will also be giving authority to the Board to use its best judgment to proceed with and cause the Company to complete the Arrangement without any requirement to seek or obtain any further approval of the Grand Peak Shareholders.

The Arrangement

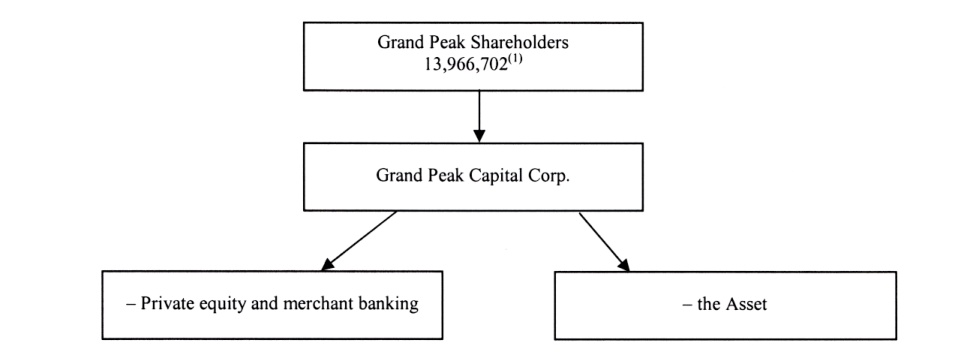

The Company is a publicly traded financial services company engaging primarily in private equity and merchant banking activities in Canada and the U.S. The Arrangement has been proposed to facilitate the separation of the Company's primary business activities from development of the Nico Property in the Abitibi region of Québec. The Company believes that separating Grand Peak into two public companies offers a number of benefits to shareholders. First, the Company believes that after the separation each company will be better able to pursue its own specific operating strategies without being subject to the financial constraints of the other business. After the separation, each company will also have the flexibility to implement its own unique growth strategies, allowing both organizations to refine and refocus their business mix. Additionally, because the resulting businesses will be focused in their respective industries, they will be more readily understood by public investors, allowing each company to be in a better position to raise capital and align management and employee incentives with the interests of shareholders.

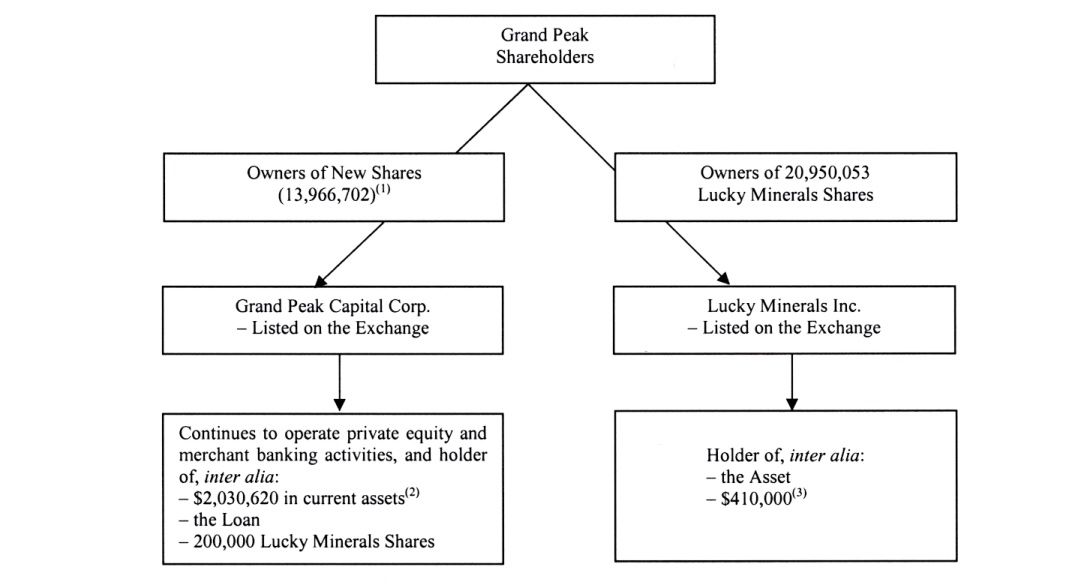

Pursuant to the Arrangement, Lucky Minerals will acquire all of the Company's interest in the Nico Property located north of the town of Amos, in the Abitibi Regional County Municipality, some 500 kilometers northwest of Montreal, Québec, in exchange for 20,950,053 Lucky Minerals Shares, which shares will be distributed to the Grand Peak Shareholders who hold Grand Peak Shares on the Share Distribution Record Date. In connection with the Arrangement and to assist Lucky Minerals with its business activities, Grand Peak and Lucky Minerals entered into a loan agreement (the "Loan Agreement") dated December 15, 2008, pursuant to which Grand Peak loaned to Lucky Minerals USD$200,000 (the "Loan") on the terms and conditions set forth in the Loan Agreement. See "Lucky Minerals After the Arrangement – Business of Lucky Minerals – Liquidity and Capital Resources".

Each Grand Peak Shareholder as of the Share Distribution Record Date, other than a Dissenting Shareholder, will, immediately after the Arrangement, hold one New Share in the capital of the Company and its pro–rata share of the Lucky Minerals Shares to be distributed under the Arrangement for each currently held Grand Peak Share. The New Shares will be identical in every respect to the present Grand Peak Shares. See "The Arrangement – Details of the Arrangement".

Effect of the Arrangement on Grand Peak Warrants

As of the Effective Date, the Grand Peak Warrants will be exercisable, in accordance with the corporate reorganization provisions of such securities, into New Shares and Lucky Minerals Shares on the basis that the holder will receive, upon exercise, a number of New Shares that equals the number of Grand Peak Shares that would have been received upon the exercise of the Grand Peak Warrants prior to the Effective Date, and a number of Lucky Minerals Shares that is equal to the number of New Shares so acquired multiplied by the Exchange Factor. Lucky Minerals has agreed, pursuant to the Lucky Minerals Commitment, to issue Lucky Minerals Shares upon exercise of the Grand Peak Warrants and the Company is obligated, as the agent of Lucky Minerals, to collect and pay to Lucky Minerals a portion of the proceeds received for each Grand Peak Warrant so exercised, with the balance of the exercise price to be retained by Grand Peak. Any entitlement to a fraction of a Lucky Minerals Share resulting from the exercise of Grand Peak Warrants will be cancelled without compensation.

- 11 - -

Recommendation and Approval of the Board of Directors

The directors of the Company have concluded that the terms of the Arrangement are fair and reasonable to, and in the best interests of, the Company and the Grand Peak Shareholders. The Board has therefore approved the Arrangement and authorized the submission of the Arrangement to the Grand Peak Shareholders and the Court for approval. The Board recommends that Grand Peak Shareholders vote FOR the approval of the Arrangement. See "The Arrangement – Recommendation of Directors".

Reasons for the Arrangement

The decision to proceed with the Arrangement was based on the following primary determinations:

| 1. | the Company is primarily engaged in private equity and merchant banking activities in Canada and the U.S. This focus has and will continue to hamper the exploration and development of the Nico Property; |

| 2. | the formation of Lucky Minerals to hold the Asset will facilitate separate fund–raising, exploration and development strategies for the Nico Property required to move the Property forward; |

| 3. | following the Arrangement, management of the Company will be free to focus entirely on its primary business, and new management for Lucky Minerals will be established which has knowledge and expertise specific to Lucky Minerals' industry; and |

| 4. | the formation of Lucky Minerals will give Grand Peak Shareholders a direct interest in a new exploration company that will focus on and pursue the exploration and development of the Nico Property as well as potentially acquiring and exploring new properties in districts and areas with known potential for high margin deposits. |

See "The Arrangement – Reasons for the Arrangement".

Conduct of Meeting and Shareholder Approval

The Interim Order provides that in order for the Arrangement to proceed, the Arrangement Resolution must be passed, with or without variation, by at least 66 and 2/3rds of the eligible votes cast with respect to the Arrangement Resolution by Grand Peak Shareholders present in person or by proxy at the Meeting. See "The Arrangement – Shareholder Approval".

Court Approval

The Arrangement, as structured, requires the approval of the Court. Prior to the mailing of this Circular, the Company obtained the Interim Order authorizing the calling and holding of the Meeting and providing for certain other procedural matters. The Interim Order does not constitute approval of the Arrangement or the contents of this Circular by the Court.

The Notice of Application for the Final Order is attached to the Notice of Meeting. Counsel to the Company has advised that in hearing the petition for the Final Order, the Court will consider, among other things, the fairness of the Arrangement to the Grand Peak Shareholders. The Court will also be advised that based on the Court's approval of the Arrangement, the Company and Lucky Minerals will rely on an exemption from registration pursuant to Section 3(a)(10) of the U.S. Securities Act for the issuance of the New Shares and Lucky Minerals Shares to any United States based Grand Peak Shareholders. Assuming approval of the Arrangement by the Grand Peak Shareholders at the Meeting, the hearing for the Final Order is scheduled to take place at 3:00 p.m. (Yukon Territory time) on April 7, 2009, at the Law Courts, 2134 Second Avenue, in the City of Whitehorse, in the Yukon Territory, or at such other date and time as the Court may direct. At this hearing, any Grand Peak Shareholder or director, creditor, auditor or other interested party of the Company who wishes to participate or to be represented or who wishes to present evidence or argument may do so, subject to filing an appearance and satisfying certain other requirements. See "The Arrangement – Court Approval of the Arrangement".

- 12 - -

Income Tax Considerations

Canadian Federal income tax considerations for Grand Peak Shareholders who participate in the Arrangement or who dissent from the Arrangement are set out in the summary herein entitled "Income Tax Considerations – Certain Canadian Federal Income Tax Considerations", and certain United States Federal income tax considerations for Grand Peak Shareholders who participate in the Arrangement or who dissent from the Arrangement are set out in the summary entitled "Income Tax Considerations – Certain U.S. Federal Income Tax Considerations".

Grand Peak Shareholders should carefully review the tax considerations applicable to them under the Arrangement and are urged to consult their own legal, tax and financial advisors in regard to their particular circumstances.

Right to Dissent

The Interim Order provides that Grand Peak Shareholders will have the right to dissent from the Plan of Arrangement as provided in Section 193 of the Act. Any Grand Peak Shareholder who dissents will be entitled to be paid in cash the fair value for their Grand Peak Shares held so long as such Dissenting Shareholder (i) does not vote any of his Grand Peak Shares in favour of the Arrangement Resolution, (ii) provides to the Company written objection to the Plan of Arrangement at the Meeting, or to the Company's head office at Suite 900 – 555 Burrard Street, Vancouver, British Columbia V7X 1M8, before the Meeting or at or before any postponement(s) or adjournment(s) thereof, and (iii) otherwise complies with the requirements of the Plan of Arrangement and Section 193 of the Act. See "Rights of Dissent".

Stock Exchange Listings

The Grand Peak Shares are currently listed and traded on the Exchange and will continue to be listed on the Exchange following completion of the Arrangement. The closing of the Arrangement is conditional on the Exchange approving the listing of the Lucky Minerals Shares on the Exchange.

Information Concerning the Company and Lucky Minerals After the Arrangement

Following completion of the Arrangement, the Company will continue to carry on its primary business activities. The Company's common shares will continue to be listed on the Exchange. Each Grand Peak Shareholder will continue to be a shareholder of the Company with each currently held Grand Peak Share representing one New Share in the capital of the Company, and each Grand Peak Shareholder on the Share Distribution Record Date will receive its pro–rata share of the 20,950,053 Lucky Minerals Shares to be distributed to such Grand Peak Shareholders under the Arrangement. See "The Company After the Arrangement" for a summary description of the Company, assuming completion of the Arrangement, including selected pro–forma unaudited financial information for the Company.

Following completion of the Arrangement, Lucky Minerals will be a public company, the shareholders of which will be the holders of Grand Peak Shares on the Share Distribution Record Date, as well as Grand Peak and the subscribers to the intended Private Placement (as hereinafter defined) of Lucky Minerals. See "Lucky Minerals After the Arrangement – Share and Loan Capital of Lucky Minerals". Lucky Minerals will hold the Asset and will have USD$410,000 in cash. Closing of the Arrangement is conditional upon the Lucky Minerals Shares being listed on the Exchange. See "Lucky Minerals After the Arrangement" for a description of the Property, corporate structure and business, including selected pro–forma unaudited financial information of Lucky Minerals assuming completion of the Arrangement.

- 13 - -

Selected Unaudited Pro–Forma Consolidated Financial Information for the Company

The following selected unaudited pro–forma consolidated financial information for the Company is based on the assumptions described in the notes to the Company's unaudited pro–forma consolidated balance sheet as at September 30, 2008, attached to this Circular as Schedule "E". The pro–forma consolidated balance sheet has been prepared based on the assumption that, among other things, the Arrangement occurred on September 30, 2008.

| | | Pro–forma as at September 30, 2008 on completion of the Arrangement (US$) | |

| | | (unaudited) | |

| Cash and cash equivalents | | $ | 422,471 | |

| Other current assets | | | 1,038,130 | |

| Deposits on asset | | | 209,417 | |

| Equipment | | | 19,180 | |

| Mineral properties | | | 60,193 | |

| Deferred exploration and development expenses | | | 80,800 | |

| Long term investment | | | 200,000 | |

| Other | | | 429 | |

| Total assets | | $ | 2,030,620 | |

| | | | | |

| Current liabilities | | $ | 651,507 | |

| Shareholders' equity | | | 1,379,113 | |

| Total liabilities and shareholders' equity | | $ | 2,030,620 | |

Selected Unaudited Pro–Forma Consolidated Financial Information for Lucky Minerals

The following selected unaudited pro–forma consolidated financial information for Lucky Minerals is based on the assumptions described in the notes to the Lucky Minerals unaudited pro–forma consolidated balance sheet as at September 30, 2008, attached to this Circular as Schedule "F". The pro–forma consolidated balance sheet has been prepared based on the assumption, among other things, that the Arrangement had occurred on September 30, 2008.

| | | As of September 30, 2008 (US$) | | | Pro–forma as at September 30, 2008 on completion of the Arrangement (US$) | |

| | | (unaudited) | | | (unaudited) | |

| Cash | | $ | 10,000 | | | $ | 410,000 | |

| Mineral properties | | Nil | | | | 20,200 | |

| Deferred exploration and development expenses | | Nil | | | | 180,043 | |

| Total assets | | $ | 10,000 | | | $ | 610,243 | |

Risk Factors

In considering whether to vote for the approval of the Arrangement, Grand Peak Shareholders should be aware that there are various risks, including those summarized below and described elsewhere in this Circular. Grand Peak Shareholders should carefully consider these risk factors, together with other information included in this Circular, before deciding whether to approve the Arrangement.

Lucky Minerals will not have, upon completion of the Arrangement, any producing property. There is no assurance that commercial quantities of gold, copper, nickel or PGE will be discovered on the Property, nor is there any guarantee that Lucky Mineral's exploration program on the Property will yield positive results. Lucky Minerals has no source of revenue and will fund its exploration activities primarily from its working capital. Exploration, development and mining operations involve a high degree of risk that even a combination of experience, knowledge and careful evaluation may not be able to overcome. It will be necessary for Lucky Minerals to raise additional funds to carry out further exploration and development of the Property and to enable Lucky Minerals to acquire any additional mineral properties. Lucky Minerals may not be able to raise such funds on terms acceptable to it or at all, and if it does, the holders of Lucky Minerals Shares may be diluted in their percentage share holding in Lucky Minerals. Lucky Mineral's operations will be subject to regulatory and environmental control by, and require licenses, permits and approvals from, governmental bodies over which Lucky Minerals has no control. See "Risk Factors".

GENERAL PROXY INFORMATION

Solicitation of Proxies

The solicitation of proxies will be primarily by mail, but proxies may be solicited personally or by telephone by directors or officers of the Company. The Company will bear all costs of this solicitation. The Company has arranged for Intermediaries to forward the meeting materials to Beneficial Shareholders held of record by those Intermediaries and the Company may reimburse the Intermediaries for their reasonable fees and disbursements in that regard.

Currency

In this Circular, except where otherwise indicated, all dollar amounts are expressed in the lawful currency of the United States.

Record Date

The Board has fixed February 20, 2009 as the record date (the "Record Date") for determination of persons entitled to receive notice of and to vote at the Meeting. Only Grand Peak Shareholders of record at the close of business on the Record Date who either attend the Meeting personally or complete, sign and deliver a form of proxy in the manner and subject to the provisions described herein will be entitled to vote or to have their Grand Peak Shares voted at the Meeting.

Appointment of Proxyholders

The individual(s) named in the accompanying form of proxy are management's representatives. If you are a shareholder entitled to vote at the Meeting, you have the right to appoint a person or company other than the person(s) designated in the Proxy, who need not be a shareholder of the Company, to attend and act for you and on your behalf at the Meeting. You may do so either by inserting the name of that other person in the blank space provided in the Proxy or by completing and delivering another proper proxy and, in either case, delivering the completed Proxy to the office of Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1, not less than 48 hours (excluding Saturdays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof.

Voting by Proxyholder

The person(s) named in the Proxy will vote or withhold from voting the Grand Peak Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Grand Peak Shares will be voted accordingly. The Proxy confers discretionary authority on the person(s) named therein with respect to:

| | (a) | each matter or group of matters identified therein for which a choice is not specified, other than the appointment of an auditor and the election of directors; |

| | (b) | any amendment to or variation of any matter identified therein; and |

| | (c) | any other matter that properly comes before the Meeting. |

As at the date hereof, the Board knows of no such amendments, variations or other matters to come before the Meeting, other than the matters referred to in the Notice of Meeting. However, if other matters should properly come before the Meeting, the Proxy will be voted on such matters in accordance with the best judgment of the person(s) voting the Proxy.

In respect of a matter for which a choice is not specified in the Proxy, the person(s) named in the Proxy will vote the Grand Peak Shares represented by the Proxy for the approval of such matter.

- 15 - -

Registered Shareholders

Registered Shareholders may wish to vote by Proxy whether or not they are able to attend the Meeting in person. Registered Shareholders electing to submit a Proxy may do so by completing, dating and signing the enclosed form of Proxy and returning it to the Company's transfer agent Computershare Investor Services Inc. by fax at 1-866-249-7775 or by mail to Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 not less than 48 hours (excluding Saturdays and holidays) before the time fixed for the Meeting or any adjournment(s) or postponement(s) thereof.

Beneficial Shareholders

The following information is of significant importance to shareholders who do not hold Grand Peak Shares in their own name. Beneficial Shareholders should note that the only Proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders (those whose names appear on the records of the Company as the registered holders of Grand Peak Shares).

If Grand Peak Shares are listed in an account statement provided to a shareholder by a broker, then in almost all such cases those Grand Peak Shares will not be registered in the shareholder's name on the records of the Company. Such Grand Peak Shares will more likely be registered under the names of the shareholder's broker or an agent of that broker. In the United States, the vast majority of such Grand Peak Shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

Intermediaries are required to seek voting instructions from Beneficial Shareholders in advance of shareholders' meetings. Every intermediary has its own mailing procedures and provides its own return instructions to clients.

If you are a Beneficial Shareholder:

There are two kinds of Beneficial Shareholders, those who object to their name being made known to the issuers of securities which they own (called "OBOs" for objecting beneficial owners) and those who do not object to the issuers of the securities they own knowing who they are (called "NOBOs" for non – objecting beneficial owners).

The Company is taking advantage of those provisions of National Instrument 54–101 – "Communication of Beneficial Owners of Securities" of the Canadian Securities Administrators, which permits it to deliver proxy–related materials directly to its NOBOs. As a result, NOBOs can expect to receive a scannable voting instruction form ("VIF"). These VIFs are to be completed and returned to Computershare in the envelope provided or by facsimile to the number provided in the VIF. In addition, Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the Grand Peak Shares represented by the VIFs it receives.

This Circular, with related material, is being sent to both Registered and Beneficial Shareholders. If you are a Beneficial Shareholder and the Company or its agent has sent these materials directly to you, your name and address and information about your Grand Peak Shares have been obtained in accordance with applicable securities regulatory requirements from the Intermediary who holds your Grand Peak Shares on your behalf.

By choosing to send these materials to you directly, the Company (and not the Intermediary holding your Grand Peak Shares on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your VIF as specified in your request for voting instructions that you receive.

Beneficial Shareholders who are OBOs should carefully follow the instructions of their Intermediary in order to ensure that their Grand Peak Shares are voted at the Meeting.

The form of proxy that will be supplied to Beneficial Shareholders by the Intermediaries will be similar to the Proxy provided to Registered Shareholders by the Company. However, its purpose is limited to instructing the Intermediary on how to vote on behalf of the Beneficial Shareholder. Most Intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. in the United States and Broadridge Financial Solutions Inc., Canada, in Canada (collectively "BFS"). BFS mails a VIF in lieu of a Proxy provided by the Company. The VIF will name the same person(s) as the Proxy to represent Beneficial Shareholders at the Meeting. Beneficial Shareholders have the right to appoint a person (who need not be a Beneficial Shareholder of the Company), other than the person(s) designated in the VIF, to represent them at the Meeting. To exercise this right, Beneficial Shareholders should insert the name of the desired representative in the blank space provided in the VIF. The completed VIF must then be returned to BFS in the manner specified and in accordance with BFS's instructions. BFS then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Grand Peak Shares to be represented at the Meeting. If you receive a VIF from BFS, you cannot use it to vote Grand Peak Shares directly at the Meeting. The VIF must be completed and returned to BFS in accordance with its instructions, well in advance of the Meeting in order to have the Grand Peak Shares voted.

- 16 - -

Although as a Beneficial Shareholder you may not be recognized directly at the Meeting for the purposes of voting Grand Peak Shares registered in the name of your Intermediary, you, or a person designated by you, may attend at the Meeting as proxyholder for your Intermediary and vote your Grand Peak Shares in that capacity. If you wish to attend the Meeting and indirectly vote your Grand Peak Shares as proxyholder for your Intermediary, or have a person designated by you to do so, you should enter your own name, or the name of the person you wish to designate, in the blank space on the VIF provided to you and return the same to your Intermediary in accordance with the instructions provided by such Intermediary, well in advance of the Meeting.

Alternatively, you can request in writing that your broker send you a legal proxy which would enable you, or a person designated by you, to attend the Meeting and vote your Grand Peak Shares.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a proxy may revoke it by:

| | (a) | executing a proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder's authorized attorney in writing, or if the Registered Shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the Proxy bearing a later date to Computershare or at the registered office of the Company at Suite 1000 – 925 West Georgia Street, Vancouver, British Columbia V6C 3L2, at any time up to and including the last Business Day that precedes the date of the Meeting or, if the Meeting is adjourned or postponed, the last Business Day that precedes any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law; or |

| | (b) | personally attending the Meeting and voting the Registered Shareholder's Grand Peak Shares. |

A revocation of a proxy will not affect a matter on which a vote is taken before the revocation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

No director or executive officer of the Company, or any person who has held such a position since the beginning of the last completed financial year–end of the Company, nor any nominee for election as a director of the Company, nor any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting, other than the election of directors, the appointment of the auditor and as may be otherwise set out herein.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein, no informed person of the Company, proposed director of the Company or any associate or affiliate of an informed person or proposed director, has any material interest, direct or indirect, in any transaction since the commencement of the Company's most recently completed financial year or in any proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries.

- 17 - -

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

Outstanding Grand Peak Shares

The Company is authorized to issue an unlimited number of Grand Peak Shares. As of February 23, 2009, there were 13,966,702 Grand Peak Shares issued and outstanding, each carrying the right to one vote. The Company is also authorized to issue an unlimited number of class A preferred shares, having the preferences, rights, conditions, restrictions, limitations and prohibitions set forth in the Company's Articles. There were no class A preferred shares issued and outstanding as at February 23, 2009.

Principal Holders of Grand Peak Shares

To the knowledge of the directors and executive officers of the Company, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, Grand Peak Shares carrying more than 10% of the voting rights attached to all outstanding Grand Peak Shares.

VOTES NECESSARY TO PASS RESOLUTIONS

A simple majority of affirmative votes cast in person or by proxy at the Meeting is required to pass the resolution(s) described herein as ordinary resolutions and an affirmative vote of 66 and 2/3rds of the votes cast in person or by proxy at the Meeting is required to pass the resolution(s) described herein as special resolutions.

If there are more nominees for election as directors than there are vacancies to fill, those nominees receiving the greatest number of votes will be elected. If the number of nominees for election as directors is equal to the number of vacancies to be filled, all such nominees will be declared elected.

ELECTION OF DIRECTORS