Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

ý |

|

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the fiscal year ended December 31, 2012 |

—or— |

o |

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the transition period from to

|

Commission file number: 014140

GLEACHER & COMPANY, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 22-2655804

(I.R.S. Employer

Identification No.) |

1290 Avenue of the Americas, New York, New York

(Address of principal executive offices) |

|

10104

(Zip Code) |

Registrant's telephone number, including area code:(212) 273-7100

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Name of each exchange on which registered |

|---|

| Common stock, par value $.01 per share | | The NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large Accelerated Filer o | | Accelerated Filer ý | | Non-accelerated Filer o

(Do not check if a

smaller reporting company) | | Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the shares of common stock of the Registrant held by non-affiliates based upon the closing price of Registrant's shares as reported on The NASDAQ Global Market on June 30, 2012, which was $0.80 per share, was $100,584,912. This calculation is based on the number of shares of the Registrant's common stock outstanding as of June 30, 2012, excluding shares of the Registrant's common stock held by any officer or director of the Company or by any person known by the Company to own 5% or more of the Registrant's outstanding shares of common stock. Exclusion of shares held by any person should not be construed as a conclusion by the Company, or an admission by any such person, that such person is an "affiliate" of the Company, as defined by applicable securities laws.

As of February 28, 2013, 123,242,192 shares of common stock, par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement for the 2013 annual meeting of stockholders to be filed with the Securities and Exchange Commission are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein.

Table of Contents

TABLE OF CONTENTS

| | | | |

| |

| | Page |

|---|

PART I | | | | |

Item 1. | | Business | | 1 |

Item 1A. | | Risk Factors | | 10 |

Item 1B. | | Unresolved Staff Comments | | 23 |

Item 2. | | Properties | | 23 |

Item 3. | | Legal Proceedings | | 23 |

Item 4. | | Mine Safety Disclosures | | 23 |

PART II | | | | |

Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 24 |

Item 6. | | Selected Financial Data | | 26 |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 28 |

Item 7A. | | Quantitative and Qualitative Disclosures about Market Risk | | 60 |

Item 8. | | Financial Statements and Supplementary Data | | 67 |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 126 |

Item 9A. | | Controls and Procedures | | 126 |

Item 9B. | | Other Information | | 126 |

PART III | | | | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | 127 |

Item 11. | | Executive Compensation | | 127 |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 127 |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 127 |

Item 14. | | Principal Accountant Fees and Services | | 127 |

PART IV | | | | |

Item 15. | | Exhibits, Financial Statement Schedule | | 128 |

Table of Contents

PART I

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. These statements are not historical facts but instead represent the Company's belief or plans regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company's control. The Company often, but not always, identifies forward-looking statements by using words or phrases such as "anticipate," "estimate," "plan," "project," "target," "expect," "continuing," "ongoing," "believe" and "intend." The Company's forward-looking statements are based on facts as the Company understands them at the time the Company makes any such statement as well as estimates and judgments based on these facts. The Company's forward-looking statements may turn out to be inaccurate for a variety of reasons, many of which are outside of its control. Factors that could render the Company's forward-looking statements subsequently inaccurate include the conditions of the securities markets, generally, and demand for the Company's services within those markets, the risk of further credit rating downgrades of the U.S. government by major credit rating agencies, the impact of international and domestic sovereign debt uncertainties, the possibilities of localized or global economic recession and other risks and factors identified from time to time in the Company's filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake to update any of its forward-looking statements.

You should review the "Risk Factors" section of this Report for a discussion of the important factors that could cause actual results to differ materially from those described in or implied by the forward-looking statements contained in this Report.

In particular, the Company has recently experienced several adverse events that have significantly affected our business operations and have resulted in a recent and serious decline in our financial results. In order to address these issues, the Company is seeking, and may continue to seek a strategic transaction with a third party that could result, for example, in an acquisition of the Company or sale of all or substantially all of our assets. Whether the Company can effect such a transaction, and if so, the terms of any such transaction, will greatly affect the Company's future and, as a result, the ultimate accuracy of our forward-looking statements.

As used herein, the terms "Company," "Gleacher," "we," "us," or "our" refer to Gleacher & Company, Inc. and its subsidiaries.

Item 1. Business

Overview

Gleacher & Company, Inc. (the "Parent," and together with its subsidiaries, the "Company") is an independent investment bank that provides corporate and institutional clients with strategic and financial advisory services. The Company also provides capital raising, research-based investment analysis, and securities brokerage services. The Company offers a range of products through its Investment Banking, Mortgage Backed Securities & Rates ("MBS & Rates") and Credit Products divisions. The Company was originally incorporated in 1985 in the state of New York and re-incorporated under the laws of the state of Delaware in 2010 and its common stock is traded on The NASDAQ Global Market ("NASDAQ") under the symbol "GLCH."

The Company also provided residential mortgage lending services through its subsidiary, ClearPoint Funding Inc. ("ClearPoint"). On February 14, 2013, the Company entered into an agreement to sell substantially all of the assets of ClearPoint to Homeward Residential, Inc. (the "Homeward Transaction"). This transaction closed on February 22, 2013, and all remaining business activities of ClearPoint are being wound down. Refer to Note 29 within the footnotes to the

1

Table of Contents

consolidated financial statements contained in Item 8 of this Annual Report on Form 10-K for additional information.

In recent years, we have incurred losses and experienced significant turnover, including among our senior management and business leaders of our operating segments, as well as a number of departures, generally, throughout the ranks of our organization. Recently we have experienced several events that have adversely affected our business operations and resulted in a further deterioration in our financial results. In August 2012 we announced that we were engaged in exploring and evaluating strategic alternatives for the Company, including partnering with one or more equity investors, strategic acquisitions and divestitures or a business combination involving the Company. In this process we explored a wide variety of potential strategic transactions. By February 2013, we had not yet been presented with a suitable strategic alternative. We intended, however, to continue to examine strategic alternatives should appropriate opportunities arise. We announced this update on February 15, 2013. As would be expected, our strategic review introduced uncertainty with our trading partners and employees and consumed significant amounts of our senior management's time and attention. This uncertainty increased after our February 15 update.

In January 2013, Eric J. Gleacher, our then-chairman and a significant stockholder, resigned as a director and executive officer of the Company.

In mid-February, 20 sales and trading professionals from our Credit Products group left together to join another securities firm, reducing the headcount of this group to approximately 70. As a result, revenues from this group have declined significantly.

In a letter dated February 23, 2013, four current directors of the Company, Henry S. Bienen, Robert A. Gerard, Bruce Rohde and Robert S. Yingling, informed the Company that they do not intend to stand for re-election at the Company's 2013 Annual Meeting of Stockholders, to be held on May 23, 2013 (the "Annual Meeting"). These directors stated that their decision was based on communications from MatlinPatterson FA Acquisition LLC, a significant holder of the Company's common stock ("MatlinPatterson"), indicating that MatlinPatterson would oppose their re-election. These directors further stated that they had reason to believe that Mr. Gleacher would also vote his shares against them were they to run and that, as a result, it is a virtual certainty that if they were to stand for re-election, they would not be re-elected. The letter also stated that, should the situation change in the interim, they may be willing to reconsider their decision not to stand. The directors' decision not to stand for re-election was not the result of any disagreement with the Company relating to the Company's operations, policies or practices.

Also on February 23, 2013, the Company received a submission by MatlinPatterson of a slate of eight nominees for election to the Company's Board of Directors at the Annual Meeting. In their proposal, MatlinPatterson nominated current directors Marshall Cohen, Mark R. Patterson and Christopher Pechock, as well as nominees Carl McKinzie, Jaime Lifton, Edwin Banks, Keith B. Hall and Nasir A. Hasan.

Uncertainties regarding the implications of our net losses and management and employee turnover have been aggravated by these more recent events, resulting in further questions regarding the stability and strategic direction of the Company and adversely affecting relations with both our clients and our employees. A number of our trading customers have reduced or suspended trading activities with us. Moreover, at least in part because of the perceived instability of our business, new investment banking mandates have dwindled. These events have weakened employee morale, which may lead to additional resignations. As a result, we have experienced a significant decline in revenue in the first quarter of 2013, and we cannot predict when, or if, we will be able to reduce or reverse this decline and associated losses.

In order to address these issues and preserve value for our stockholders, the Company is seeking, and may continue to seek, a strategic transaction with a third party that could result, for example, in an

2

Table of Contents

acquisition of the Company or the sale of all or substantially all of our assets. Subsequent to our February 15 update on our review of strategic alternatives, we have been approached by third parties regarding potential strategic alternatives. If we are unable to consummate a strategic transaction, we will consider such alternatives, if any, as may be available to us at such time. In doing so, we will consider all relevant factors, including our financial condition and operating results, our access to financial resources, the market environment and our financial and operational prospects. Depending on the circumstances, courses of action could consist of expeditious reduction of operating and overhead expenses and/or monetization of assets, among other steps.

As of March 15, 2013, the Company had approximately 220 employees.

The Company's Gleacher & Company Securities, Inc. ("Gleacher Securities") and Gleacher Partners, LLC ("Gleacher Partners") subsidiaries are registered as broker-dealers with the Securities and Exchange Commission ("SEC") and are members of the Financial Industry Regulatory Authority, Inc. ("FINRA") and various exchanges. Gleacher Securities is also a member of the National Futures Association ("NFA"). ClearPoint remains under the regulatory oversight of the Department of Housing and Urban Development ("HUD"), as well as various regulatory bodies in the states in which it conducts business until it's business activities are wound down.

The Company's headquarters are located at 1290 Avenue of the Americas, New York, NY 10104. The telephone number at that address is (212) 273-7100, and our internet address is www.gleacher.com.

Business Segments

As of December 31, 2012 we operated through the following four business segments:

- •

- Investment Banking

This division provides financial advisory and capital raising services in connection with mergers, acquisitions and other strategic matters. The division is being realigned around existing M&A expertise, expanded capital markets capabilities and key industry verticals, including real estate, leveraged finance, financial services, aerospace and defense, technology, media and telecom, paper and packaging, general industrial and financial sponsor coverage.

- •

- MBS & Rates

This division provides sales, trading, research and advisory services on a wide range of mortgage and asset-backed securities, U.S. Treasury and government agency securities, structured products such as CLOs and CDOs, whole loans, and other securities. Revenues are currently generated from spreads on principal transactions executed to facilitate trades for clients, including on a riskless principal basis. Revenues are also generated from changes in fair value and interest income on securities held in inventory. In addition, this division is integrating its advanced analytics and quantitative research capabilities through its platform acquired from RangeMark Financial Services, Inc. ("RangeMark"). RangeMark's integration may also provide for revenues earned through advisory services.

- •

- Credit Products

This division provides analysis, sales and trading on a wide range of debt securities including bank debt and loans, investment grade debt, high-yield debt, treasuries, convertibles, distressed debt, preferred debt, emerging market debt and reorganization equities to corporate and institutional investor clients. The division also provides trade execution services, liability management, corporate debt repurchase programs and new issue distributions. Revenues are generated primarily from spreads on riskless principal transactions, and to a lesser extent, principal trading and commissions on trades executed on behalf of clients. In addition, revenues are also generated on a smaller scale from interest income on securities held in inventory.

3

Table of Contents

This division originated, processed and underwrote single and multi-family residential mortgage loans within a number of states across the country. The loans were underwritten using standards prescribed by conventional mortgage lenders and loan buyers such as the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation. Revenues were generated primarily from the sale of the residential mortgage loans with servicing released. On February 14, 2013, the Company entered into the Homeward Transaction, an agreement to sell substantially all of ClearPoint's assets to Homeward Residential, Inc. ("Homeward"). This transaction closed on February 22, 2013, and all remaining business activities of ClearPoint are being wound down.

Other Activities

The Company also recognizes investment gains/(losses) and earns fees related to the Company's investment in and management of FA Technology Ventures L.P. ("FATV" or the "Partnership") a fund that holds investments in privately held companies. The Company's results also include expenses not directly associated with specific reportable segments, including goodwill impairment charges, costs related to corporate overhead and support, such as various fees associated with financing, legal and consulting expenses and amortization of certain intangible assets from business acquisitions not reported within discontinued operations.

Sources of Revenues

Set forth in the table below is information regarding the amount and percentage of net revenues derived from each of our principal revenue sources (excluding net revenues from discontinued operations) for the years ended December 31:

| | | | | | | | | | | | | | | | | | | |

| | 2012 | | 2011 | | 2010 | |

|---|

(Dollars in thousands) | | Amount | | Percent | | Amount | | Percent | | Amount | | Percent | |

|---|

Principal transactions | | $ | 52,771 | | | 25.9 | % | $ | 89,108 | | | 34.1 | % | $ | 79,433 | | | 32.0 | % |

Commissions | | | 71,418 | | | 35.1 | % | | 71,347 | | | 27.3 | % | | 76,817 | | | 30.9 | % |

Investment banking | | | 30,553 | | | 15.0 | % | | 33,069 | | | 12.7 | % | | 43,400 | | | 17.5 | % |

Investment banking revenues from related party | | | — | | | 0.0 | % | | — | | | 0.0 | % | | 1,947 | | | 0.8 | % |

Investment gains, net | | | 1,233 | | | 0.6 | % | | 2,996 | | | 1.1 | % | | 7 | | | 0.0 | % |

Interest income | | | 48,796 | | | 24.0 | % | | 66,194 | | | 25.3 | % | | 57,292 | | | 23.0 | % |

Gain from bargain purchase—ClearPoint Funding, Inc. acquisition | | | — | | | 0.0 | % | | 2,330 | | | 0.9 | % | | — | | | 0.0 | % |

Fees and other | | | 11,651 | | | 5.7 | % | | 8,041 | | | 3.1 | % | | 1,004 | | | 0.4 | % |

| | | | | | | | | | | | | | |

Total revenues | | $ | 216,422 | | | 106.3 | % | $ | 273,085 | | | 104.6 | % | $ | 259,900 | | | 104.6 | % |

| | | | | | | | | | | | | | |

Interest expense | | | 12,827 | | | 6.3 | % | | 11,913 | | | 4.6 | % | | 11,318 | | | 4.6 | % |

| | | | | | | | | | | | | | |

Net revenues | | $ | 203,595 | | | 100.0 | % | $ | 261,172 | | | 100.0 | % | $ | 248,582 | | | 100.0 | % |

| | | | | | | | | | | | | | |

The financial results set forth in the foregoing table may not be representative of future results due to recent developments described in Item 1, "Business—Overview" and elsewhere in this Annual Report on Form 10-K. For information regarding the Company's reportable segments, refer to Note 27 within the footnotes to the consolidated financial statements contained in Item 8 of this Annual Report on Form 10-K.

4

Table of Contents

Principal Transactions

For the periods presented, principal transactions revenues were generated primarily by the Company's MBS & Rates and ClearPoint divisions, and to a lesser extent, the Credit Products division. The MBS & Rates division generates revenues from spreads on customer trading activities and changes in fair value on financial instruments held in inventory, including agency mortgage-backed securities, debt issued by U.S. Government and federal agency obligations, commercial mortgage-backed debt, residential mortgage-backed debt, other debt obligations, CDOs, corporate debt securities, equity securities, preferred stock and derivatives. The Company's ClearPoint division originated mortgage loans and entered into related hedging instruments in connection with its residential lending activities. Changes in the fair value of such loans and hedging are also reflected in principal transactions.

Commissions

Commission income is primarily comprised of commission equivalents earned on riskless principal transactions generated in both the Company's Credit Products and MBS & Rates divisions.

Investment Banking

Investment banking fees are generated from financial advisory services in regards to mergers and acquisitions, restructurings and recapitalizations and from acting as an underwriter or placement agent in debt, equity and convertible securities offerings.

Set forth in the table below is information regarding investment banking revenues by area for the periods indicated:

| | | | | | | | | | |

| | For the years ended December 31, | |

|---|

(In thousands) | | 2012 | | 2011 | | 2010 | |

|---|

Investment banking transactions | | | | | | | | | | |

Advisory services | | $ | 24,388 | | $ | 24,341 | | $ | 32,383 | |

Capital markets | | | 6,165 | | | 8,728 | | | 12,964 | |

| | | | | | | | |

Total Investment banking revenues | | $ | 30,553 | | $ | 33,069 | | $ | 45,347 | |

| | | | | | | | |

Investment gains (losses)

Investment gains (losses) primarily represent the changes in fair value of the Company's investment in FATV, which is comprised of 19 holdings primarily in 7 privately held companies. Refer to Note 10 within the footnotes to the consolidated financial statements contained in Item 8 of this Annual Report on Form 10-K.

Interest Income & Expense

Interest income is recognized principally within the Company's MBS & Rates division on its portfolio of fixed income securities. The Company incurs interest expense primarily as a result of funding its trading portfolio through its clearing broker and, to a lesser extent, through the repurchase markets. The Company's ClearPoint division recognized interest income in connection with its residential mortgage lending activities and incurred interest expense on its short-term secured mortgage warehouse lines of credit. The decrease in net interest income during the year ending December 31, 2012 compared to the prior years is primarily due to reduced inventory levels.

Fees and Other

Fees and other revenues generally relate to miscellaneous fees earned in connection with ClearPoint's residential mortgage lending activities and to investment management fees earned by FA Technology Ventures Corporation. Fees and other revenues, during the year ended December 31, 2012,

5

Table of Contents

also include $2.6 million related to the clawback of certain stock-based compensation grants subject to non-competition provisions (Refer to Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" herein for additional information).

Bargain Purchase Gain

The Company recorded a bargain purchase gain during the year ended December 31, 2011 related to its acquisition of ClearPoint on January 3, 2011.

Recent Developments

Departure of Executive Officer

Effective January 28, 2013, Mr. Gleacher resigned as a director and executive officer of the Company. Mr. Gleacher agreed to continue to provide services to the Company in connection with a pending investment banking transaction. In return for these continued services, Mr. Gleacher will receive a payment in an amount determined in accordance with an existing formula for payments to employees relating to advisory fees that may be received by the Company in respect of the client transaction, as well as related costs and expenses.

Departure of Professionals in the Credit Products Division

On February 20, 2013, the Company confirmed the departure of approximately 20 professionals previously employed in the Company's Credit Products division, reducing this division's headcount to approximately 70. As a result, revenues from this group have declined significantly.

Prospective Departure of Certain Members of the Board of Directors

In a letter dated February 23, 2013, four current directors of the Company, Henry S. Bienen, Robert A. Gerard, Bruce Rohde and Robert S. Yingling, informed the Company that they do not intend to stand for re-election at the Company's Annual Meeting. These directors stated that their decision was based on communications from MatlinPatterson indicating that MatlinPatterson would oppose their re-election. These directors further stated that they had reason to believe that Mr. Gleacher would also vote his shares against them were they to run and that, as a result, it is a virtual certainty that if they were to stand for re-election, they would not be re-elected. The letter also stated that should the situation change in the interim, they may be willing to reconsider their decision not to stand. The directors' decision not to stand for re-election was not the result of any disagreement with the Company relating to the Company's operations, policies or practices.

Director Nominations by MatlinPatterson

Also on February 23, 2013, the Company received a submission by MatlinPatterson of a slate of eight nominees for election to the Company's Board of Directors at the Annual Meeting. In their proposal, MatlinPatterson nominated current directors Marshall Cohen, Mark R. Patterson and Christopher Pechock, as well as nominees Carl McKinzie, Jaime Lifton, Edwin Banks, Keith B. Hall and Nasir A. Hasan.

Decline in Business Operations and Revenue

We have recently experienced a significant decline in our business operations and revenue. We cannot predict when, or if, we will be able to reduce or reverse this decline and associated losses. See Item 7, "Management Discussion and Analysis of Financial Condition and Results of Operations" and Note 1 of the footnotes to the consolidated financial statements contained in Item 8 to this Annual Report on Form 10-K.

6

Table of Contents

Operations

The Company's broker-dealer subsidiaries clear customers' securities transactions primarily through a third party under a clearing agreement. Under this agreement, transactions are deemed to be either receive versus payment, delivery versus payment or cash transactions. Gleacher Securities self-clears its trading activities in U.S. government securities (the "Rates business"), and as a result became a member of the Depository Trust and Clearing Corporation, Government Securities Clearing Corporation and Fixed Income Securities Clearing Corporation ("FICC").

Discontinued Operations

The Company has classified the results of the Equities division as discontinued operations due to the exit of this business on August 22, 2011.

Competition

As an investment bank, all aspects of the Company's business are intensely competitive. The Company competes with other investment banks, commercial banks or bank holding companies, brokerage firms, merchant banks and financial advisory firms. The Company competes with firms nationally as well as on a regional, product or business line basis. Many of the Company's competitors have substantially greater capital and resources and offer a broader range of financial products. The Company believes that the principal factors affecting competition in its businesses include client relationships, reputation, quality and price of our products and services, market focus and the ability of our professionals. Competition is intense for the recruitment and retention of qualified professionals. The Company's ability to compete effectively in its businesses will depend upon its continued ability to retain and motivate its existing professionals and attract new professionals.

Regulation

The securities industry in the United States is subject to extensive regulation under federal and state laws. The SEC is the federal agency charged with administration of the federal securities laws. Much of the direct oversight of broker-dealers, however, has been delegated to self-regulatory organizations, principally FINRA, NFA and the U.S. securities exchanges. These self-regulatory organizations adopt rules (subject to approval by the SEC) that govern the securities industry and conduct periodic examinations of member broker-dealers. Securities firms are also subject to substantial regulation by state securities authorities in the U.S. jurisdictions in which they are registered. Gleacher Securities and Gleacher Partners are registered as broker-dealers in all 50 states, the District of Columbia and Puerto Rico. Gleacher Securities is also registered in the U.S. Virgin Islands.

The U.S. regulations to which broker-dealers are subject cover many aspects of the securities business, including sales and trading practices and financial responsibility, the safekeeping of customers' funds and securities, the capital structure of securities firms, books and record keeping, and the conduct of associated persons. Salespeople, traders, investment bankers and others are required to pass examinations administered by FINRA and all principal exchanges as well as state securities authorities in order to both obtain and maintain their securities license registrations. Certain employees of our broker-dealer subsidiaries are required to be registered with FINRA and to participate annually in the firm's continuing education program.

As a mortgage originator, ClearPoint is licensed and authorized to conduct lending activities in a number of states. Its activities included the origination, processing and underwriting of single and multi-family mortgage loans. ClearPoint is under the regulatory oversight of the HUD, as well as various regulatory bodies in the states in which it conducts business. In connection with the Homeward Transaction, ClearPoint will be winding down its operations, including surrendering its licenses to conduct business and voluntarily withdrawing from HUD related activities.

7

Table of Contents

Regulatory scrutiny of the financial services industry has increased in recent years, including through the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank") which was signed into law in July 2010. Dodd-Frank was passed to address (i) the perceived insufficient oversight and regulation of the U.S. financial system, (ii) the unregulated over-the-counter derivatives market and (iii) the lack of a consumer protection authority. Dodd-Frank covers a broad spectrum of reforms aimed at bringing accountability to the U.S. financial system and limiting those risks considered to have contributed to the economic crisis of 2008-2009. This legislation, as well as other federal and state laws, changes in rules promulgated by the SEC and by self-regulatory organizations as well as changes by state securities authorities, and/or changes in the interpretation or enforcement of existing laws and rules often directly affect the method of operation and profitability of broker-dealers. In light of the uncertainty of future regulatory developments, the full extent of the impact of any new requirements on our Company's business is unknown at this time. Any new or amendments to existing regulations resulting from Dodd-Frank may impact the Company's profitability, business practices or activities, obligations concerning capital, liquidity or leverage, and potential liabilities. Any changes in the regulatory requirements may also necessitate changes to the Company's policies, procedures or practices in order to comply with new requirements, which may require additional capital investment and attention from Company management. The SEC, self-regulatory organizations, and state securities regulators have broad authority to conduct examinations and inspections and to initiate administrative proceedings which can result in censure, fine, suspension, or expulsion of a broker-dealer, its officers, or employees. The principal purpose of U.S. broker-dealer regulation is the protection of customers and the securities markets rather than protection of stockholders of broker-dealers.

Regulatory Requirements

As broker-dealers, Gleacher Securities and Gleacher Partners are subject to the net capital requirements of Rule 15c3-1 promulgated under the Exchange Act. Gleacher Securities is also subject to the net capital requirements promulgated under the Commodity Futures Trading Commissions (Regulation 1.16). These net capital rules are designed to measure the general financial condition and liquidity of a broker-dealer, and they impose a required minimum amount of net capital deemed necessary to meet a broker-dealer's continuing commitments to its customers.

Compliance with these net capital rules may limit those operations that require the use of capital, such as trading in securities and underwriting securities. Net capital changes from day to day, based in part on the Company's inventory positions and the portion of the inventory value that the net capital rules require the firm to exclude from its capital. (Refer to Note 22 within the footnotes to the consolidated financial statements contained in Item 8 of this Annual Report on Form 10-K.)

At December 31, 2012, net capital and excess net capital of the Company's broker-dealer subsidiaries were as follows:

| | | | | | | |

(In millions) | | Net Capital | | Excess

Net Capital | |

|---|

Gleacher Securities | | $ | 56.2 | | $ | 55.9 | |

Gleacher Partners | | $ | 0.8 | | $ | 0.5 | |

ClearPoint is subject to net worth requirements mandated by HUD. At December 31, 2012, minimum net worth required and adjusted net worth of ClearPoint was as follows:

| | | | | | | |

(In millions) | | Net Worth | | Net Worth

above amount

Required | |

|---|

ClearPoint | | $ | 10.3 | | $ | 9.3 | |

8

Table of Contents

Business Continuity Plan

The Company maintains a Business Continuity Plan ("BCP") to allow for an effective response to a significant business disruption, either internal or external, in order to (i) safeguard our employees' lives and Company property, (ii) make a financial and operational assessment and quickly recover and resume operations, (iii) protect the Company's books and records, and (iv) allow our customers to continue to transact business.

The BCP provides for the following:

- •

- alternative physical locations for employees,

- •

- internal and external communication channels,

- •

- customers' access to trade execution, funds and securities,

- •

- Company access to liquidity, and

- •

- recovery of books and records.

In addition, many of the Company's mission-critical systems, which are those that ensure prompt and accurate processing of securities transactions, are external. These include systems through which the Company clears its customers securities transactions and our contracts with these clearing firms provide that they also maintain a business continuity plan.

The Company reviews the BCP at least annually and updates it whenever there is a material change to our operations, structure and /or business.

Available Information

The Company files with the SEC current, annual and quarterly reports, proxy statements and other information as required by the Securities Exchange Act of 1934, as amended (the "Exchange Act"). You may read and copy any document we file with the SEC at the SEC's Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an internet website at www.sec.gov from which interested persons can electronically access the Company's SEC filings.

The Company will make available free of charge, through its internet site www.gleacher.com, its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and other information. These filings and information will become available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC.

The Company also makes available, on the Corporate Governance page of its website, (i) its Corporate Governance Guidelines, (ii) its Code of Business Conduct and Ethics, (iii) the charters of the Audit, Executive Compensation, and Directors and Corporate Governance Committees of its Board of Directors, and (iv) its Procedures for Reporting Violations of Compliance Standards. These documents are also available in print without charge to any person who requests them by writing or telephoning: Gleacher & Company, Inc., 1290 Avenue of the Americas, New York, NY 10104, U.S.A., Attn: Investor Relations, telephone number (212) 273-7100.

9

Table of Contents

Item 1A. Risk Factors

Our business and operations face a variety of serious risks and uncertainties. You should carefully consider the risk factors described below and in our other public reports. If any of the following risks actually occur, or if our underlying assumptions prove to be incorrect, our actual results may vary from what we projected and our financial condition or results of operations could be materially and adversely affected. These risk factors are intended to highlight factors that may affect our business, financial condition and results of operations and are not meant to be an exhaustive discussion. Additional risks and uncertainties of which we are currently unaware or that we currently believe to be immaterial may also adversely affect us.

We have organized the risk factor discussion below around certain categories, although there is some overlap of specific risk factor disclosure between categories. The order of the categories set forth below, and the order of particular risk factors within each category, is not necessarily indicative of the likelihood of the occurrence of any of the risks described below or the magnitude of the effect on us in the event any such risks should occur.

Risks Specific to our Company

Recent developments have adversely affected our relations with customers and employees, and relations may worsen. We have experienced several events in the recent past that have adversely affected relations with both our clients and our employees. As discussed above under Item 1, "Business—Overview," uncertainties regarding the implications of our net losses and management and employee turnover have been aggravated by the absence of a strategic transaction, the departure of Mr. Gleacher, the departures of key personnel and a prospective turnover on our Board, resulting in further questions regarding the stability and strategic direction of the Company. For example, a number of our clients have reduced or suspended trading operations with us. Moreover, at least in part because of the perceived instability of our business, new investment banking mandates have dwindled. Employee morale has also been weakened. These uncertainties may exacerbate themselves by causing additional employees to resign or additional customers to reduce or suspend trading activities with us. The Company's ability to recruit new personnel, build new or strengthen existing customer relations and generally conduct business are also greatly impaired by these circumstances, which could result in further significant declines in the level of the Company's business operations despite the efforts of management to restore confidence and recruit personnel.

We have a history of losses and may not return to profitability in the near future or at all. We have incurred losses in recent years, including net losses of approximately $77.7 million, $82.1 million and $20.6 million for the years ended December 31, 2012, 2011 and 2010, respectively. Moreover, the recent events described above have resulted in a further decline in our business operations and resulting revenue. This decline will result in significantly greater losses than we had previously anticipated. We cannot predict with certainty when or if we will be able to reduce or reverse these losses and return to profitable operations. If we are not successful in eliminating our recurring losses and achieving profitable operations, or are not able to consummate a strategic transaction, we would need to wind down our business and, ultimately, cease operations. There can be no assurance that we will be able to reduce or reverse our operating losses or consummate a strategic transaction.

Our ability to hire and retain our senior professionals is critical to the success of our business. In order to operate our business successfully, we rely heavily on key professionals. Their personal reputation, judgment, business generation capabilities and project execution skills are a critical element in obtaining and executing client engagements. Any loss of professionals, particularly key senior professionals or groups of related professionals, could impair our ability to secure or successfully complete engagements, result in loss of sales and trading business, materially and adversely affect our revenues and make it more difficult to operate profitably.

10

Table of Contents

In the past, we have lost investment banking, brokerage, research, and other senior professionals and executives. For example, in February 2013, approximately 20 professionals previously employed in our Credit Products division resigned and began working for a competitor. We also experienced approximately 70 departures in our MBS & Rates division since April 2012, which were subsequently replaced by the hiring of approximately 50 professionals. In addition, over the past three years, we have experienced significant turnover of senior management, including multiple chief executive and chief financial officers, as well as the heads of our divisions. The several events in the recent past discussed above under Item 1, "Business—Overview" have weakened employee morale, which may lead to additional resignations. Such turnover can result, and has resulted, in disruptions and inefficiencies in our business. As a result, we have experienced a significant decline in revenue in the first quarter of 2013, and we cannot predict when, or if, we will be able to reduce or reverse this decline in associated losses. Moreover, this type of turnover forces us to commit greater amounts of resources to recruiting. These factors have adversely impacted our stock price, our client relationships, our business and operating results, and may make recruiting for future management positions more difficult.

We also encounter intense competition to recruit qualified employees. Companies with which we compete for employees include those in the investment banking industry as well as from businesses outside the investment banking industry, such as hedge funds, private equity funds and venture capital funds. At any time, there could be a shortage of qualified personnel whom we could hire. Recent adverse developments and publicity involving the Company have made hiring particularly challenging. These challenges may hinder our ability to expand or cause a backlog in our ability to conduct our business, including the handling of investment banking transactions and the processing of brokerage orders.

Our financial results may fluctuate substantially from period to period, which may impact our stock price. In recent years, we have incurred losses and experienced significant turnover, including among our senior management and business leaders of our operating segments, as well as a number of departures, generally, throughout the ranks of our organization. Recently, as discussed under Item 1, "Business—Overview," we have experienced several events that have adversely affected our business operations and resulted in a further deterioration of our financial results. We cannot predict when, or if, we will be able to reduce or reverse this decline in our results.

In addition, variations in our financial results are also attributed in part to trading activity and the fact that our investment banking revenues are typically earned upon the successful completion of a transaction, the timing of which is uncertain and beyond our control. Our business is highly dependent on market conditions and the interest in the market for the products and services we trade and offer, as well as the decisions and actions of our clients and interested third parties. This risk may be intensified by focusing on companies in specific industries or sectors. For example, our investment banking segment focuses on companies in the real estate, leveraged finance, financial services, aerospace and defense, technology, media and telecom, paper and packaging, general industrial and financial sponsor coverage industries. Concentrating in a specific sector or industry exposes us to volatility in that area that may not affect the broader markets. In addition, our results of operations experience some seasonality, with the third quarter typically being less robust than other quarters, because of typical summer month activity slow-down in July and August of each year for our sales and trading operations, as well as the impact of the holiday season on fourth quarter operating results.

Our business is subject to significant credit risk, and the financial difficulty of another prominent financial institution could adversely affect financial markets. In the normal course of our businesses, we are involved in the execution and settlement of various customer transactions and financing of various principal securities transactions. These activities are transacted on a cash or delivery-versus-payment basis and are subject to the risk of counterparty or customer nonperformance. Although transactions are generally collateralized by the underlying security or other securities, we still face the risks associated with changes in the market value of securities that we may be obligated to purchase or have

11

Table of Contents

purchased in principal or riskless principal trades where a counterparty or customer fails to perform. We may also incur credit risk in our derivative transactions to the extent such transactions result in uncollateralized credit exposure to our counterparties. We seek to control the risk associated with these transactions by establishing and periodically monitoring credit limits, collateral and transaction levels.

Our assets include illiquid investments in private equity funds, which we may not be able to monetize in the near term or at all. We have made principal investments in private equity funds and may make additional investments in future funds. These investments are typically made in securities that are not publicly traded and therefore are subject to an inherent liquidity risk. At December 31, 2012, $20.4 million of our total assets consisted of relatively illiquid private equity investments. (Refer to Note 10 within the footnotes to the consolidated financial statements contained in Item 8 of this Annual Report on Form 10-K.) Our interests in these private equity funds are susceptible to changes in the financial condition or prospects of the portfolio companies in which investments are made, changes in national or international economic conditions or changes in laws, regulations, fiscal policies or political conditions of countries in which investments are made. It takes a substantial period of time to identify attractive investment opportunities and then to realize the cash value of the investments through resale. Even if a private equity investment proves to be profitable, it may be several years or longer before any profits can be realized in cash. If we choose or are required to accelerate an exit in one or more of these investments, we would likely realize substantially less in proceeds than if we had sold any such investment at a more opportune time.

We may be unable to fully capture the expected value from acquisitions and investments and personnel. To the extent that we make acquisitions or enter into business combinations, we face numerous risks and uncertainties. We might not be able to complete an announced business combination, and even if completed the acquisition or combination might not provide sufficient earnings power or other value to justify its cost. Moreover, we could experience expensive and time-consuming problems integrating the relevant operations, accounting and data processing systems, management controls, relationships with clients and business partners and other systems and operations of the acquired or combined business. In addition, acquisitions may involve the issuance of shares of our common stock, which would dilute our stockholders' ownership of our firm, or we may borrow funds or use cash on hand, which may impact our funding and liquidity. Furthermore, acquisitions entail a number of risks or other problems, including the inability to maintain key pre-acquisition business relationships, increased operating costs, exposure to unanticipated liabilities and difficulties in realizing projected efficiencies, synergies and cost savings. If we are not able to integrate acquisitions successfully, our results of operations may be materially and adversely affected. Also, expansions or acquisitions divert our management's attention from our other operations.

Our trading in mortgage backed securities exposes us to prepayment risk. The majority of our securities owned are related to our MBS & Rates division and are primarily comprised of agency mortgage backed securities. Our holdings in these securities are subject to prepayment risk, which have resulted and may continue to result in losses or lower returns than originally anticipated. The low interest rate environment and government initiatives to help underwater homeowners refinance their mortgages subject us to prepayment risk. In addition, other industry developments such as delinquent loan buy-backs at par, or modifications to mortgage loans, including those that may reduce the principal balance owed, could have an adverse impact on our trading revenues.

Certain of our businesses focus principally on specific sectors of the economy. Deterioration in the business environment in these sectors generally or decline in the market for securities of companies within these sectors could materially and adversely affect our business. Our investment banking business focuses principally on the real estate, leveraged finance, financial services, aerospace and defense, technology, media and telecom, paper and packaging, general industrial and financial sponsor coverage industries. Volatility in the business environment in these sectors, or in the market for securities of companies within these sectors, could substantially affect our financial results and the market value of our

12

Table of Contents

common stock. The market for securities in each of our target sectors may also be subject to industry-specific risks. Underwriting transactions, strategic advisory engagements and trading activities in our target sectors represent a significant portion of our business. This concentration exposes us to the risk of substantial declines in revenues in the event of downturns in these sectors of the economy. Any future downturns in our target sectors could materially and adversely affect our business and results of operations.

Our principal trading and investments expose us to risk of loss. We maintain securities trading positions primarily in our MBS & Rates division and may incur significant losses from these positions due to market fluctuations. For example, to the extent that we own securities, a downturn in the value of those securities would result in losses. Conversely, to the extent that we have sold securities we do not own, an upturn in value could expose us to potentially unlimited losses. We seek to minimize market risk associated with these positions by trading out of them as quickly as possible and/or through hedging strategies. Certain positions, however, may be held by us for longer periods of time while we are seeking buyers for those positions, thereby exposing us to greater risk of loss. The risk of loss is accentuated, both in terms of likelihood and amount, in times of market volatility such as experienced over the past few years. In addition, our hedging strategies may not successfully mitigate losses in our principal positions. If our hedging strategies are not successful, we could suffer significant losses.

Our risk management policies and procedures may leave us exposed to unidentified or unanticipated financial risk. Our risk management strategies and techniques may not be fully effective in mitigating our risk exposure in all market environments or against all types of risk.

Our risk-hedging strategies also expose us to the risk that counterparties that owe us money, securities or other assets will not perform on their obligations. These counterparties may default on their obligations to us due to bankruptcy, lack of liquidity, operational failure, breach of contract or other reasons. Although we review credit exposures to specific clients and counterparties and to specific industries and regions that we believe may present credit concerns, default risk may arise from events or circumstances that are difficult to detect or foresee. In addition, concerns about, or a default by, one institution could lead to significant liquidity problems, losses or defaults by other institutions, which in turn could adversely affect us. If any of the strategies we utilize to manage our exposure to risk are not effective, we may incur significant losses.

Our operations and infrastructure may malfunction or fail. Our businesses are highly dependent on our ability to process, on a daily basis, a large number of transactions across diverse markets, and the transactions we process have become increasingly complex and involve many different types of securities with a wide variety of terms. Our financial, accounting or other data processing systems may fail to operate properly or become disabled as a result of events that are wholly or partially beyond our control, including a disruption of electrical or communications services or our inability to occupy one or more of our buildings. The inability of our systems to accommodate an increasing volume of transactions could also constrain our ability to expand our businesses. If any of these systems do not operate properly or are disabled or if there are other shortcomings or failures in our internal processes, people or systems, we could suffer impairment to our liquidity, financial loss, a disruption of our businesses, liability to clients, regulatory intervention or reputational damage.

We also face the risk of operational failure or termination of any of the clearing agents, exchanges, clearing houses or other financial intermediaries we use to facilitate our securities transactions. Any such failure or termination could adversely affect our ability to execute transactions and to manage our exposure to risk.

In addition, our ability to conduct business may be adversely impacted by a disruption in the infrastructure that supports our businesses and the communities in which we are located. This may include a disruption involving electrical, communications, transportation or other services used by us or third parties, including our customers, with which we conduct business, whether due to fire, other

13

Table of Contents

natural disaster, power or communications failure, act of terrorism or war or otherwise. Nearly all of our employees in our primary locations, including New York, NY and Roseland, NJ, work in close proximity to each other. If a disruption occurs in one location and our employees in that location are unable to communicate with or travel to other locations, our ability to service and interact with our clients may suffer and we may not be able to implement successfully contingency plans that depend on communication or travel.

Our operations also rely on the secure processing, storage and transmission of confidential and other information in our computer systems and networks. Although we take protective measures and endeavor to modify them as circumstances warrant, our computer systems, software and networks may be vulnerable to unauthorized access, computer viruses or other malicious code and other events that could have a security impact. If one or more of such events occur, this could potentially jeopardize our clients' or our counterparties' confidential and other information processed and stored in, and transmitted through, our computer systems and networks, or otherwise cause interruptions or malfunctions in the operations of our clients, our counterparties or third parties. We may be required to expend significant additional resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures, and we may be subject to litigation and financial losses that are either not insured against or not fully covered through any insurance maintained by us.

We seek to manage these risks through our Business Continuity Plan. See Item 1 under the heading "Business Continuity" for additional information.

Our exposure to legal liability is significant. Damages that we may be required to pay and the reputational harm that could result from legal action against us could materially adversely affect our businesses. Due to the nature of the Company's business, the Company and its subsidiaries are exposed to risks associated with a variety of legal proceedings and claims. These include litigations, arbitrations and other proceedings initiated by private parties and arising from underwriting, financial advisory, securities trading or other transactional activities, client account activities, mortgage lending, employment matters and stockholder claims. Third parties who assert claims may do so for monetary damages that are substantial, particularly relative to the Company's financial position. These proceedings and claims typically involve associated legal costs incurred by the Company in connection with defending against these matters, which could be significant. We face significant legal risks in our businesses and, in recent years, the volume of claims and amount of damages sought in litigation and regulatory proceedings against financial institutions have been increasing. We have been in the past, and are currently, subject to a variety of litigation arising from our business, most of which we consider to be routine. Risks in our business include potential liability under securities, mortgage lending or other laws. We are also subject to claims by employees alleging discrimination, harassment or wrongful discharge, among other things, and seeking recoupment of compensation claimed to be owed (whether for cash or forfeited equity awards), and other damages. These risks often may be difficult to assess or quantify, and their existence and magnitude often remain unknown for substantial periods of time.

As a brokerage and investment banking firm, we depend on our reputation to help attract and retain clients. As a result, an unsatisfied client could be more damaging to us than if we operated in other industries. Moreover, our role as underwriter on underwritings or as advisor for mergers and acquisitions and other transactions involves complex analysis and the exercise of professional judgment, including rendering "fairness opinions" in connection with mergers and other transactions. Therefore, our activities may subject us to the risk of significant legal liabilities to our clients and aggrieved third parties, including stockholders of our clients who could bring securities class action lawsuits against us. As a result, we may incur significant legal and other expenses in defending against litigation and may be required to pay substantial damages for settlements and adverse judgments. Substantial legal liability or significant regulatory action against us could have a material adverse effect on our results of operations or cause significant reputational harm to us, which could seriously harm our business and prospects.

See also—Item 3, "Legal Proceedings."

14

Table of Contents

Risks Common to Companies in the Financial Services Industry

Operating in the financial services industry exposes us to particular risks unlike those attendant to operating in other segments of the economy. We summarize the most significant of these risks below.

Difficult market conditions have adversely affected and may continue to adversely affect our business in many ways. Our businesses, by their nature, do not produce predictable earnings and are materially affected by conditions in the financial markets and economic and geopolitical conditions generally, both in the U.S. and around the world. Ongoing events relating to the European debt crisis and the budget debates in Congress, combined with continuing uncertainties about the global economic outlook, have led to volatile global markets and challenging economic conditions. Market volatility can lead to unanticipated, severe and rapid depreciation in asset values accompanied by a reduction in asset liquidity. Market uncertainty and unfavorable economic conditions may also cause clients to curtail their investment activities or even cease doing business. Such adverse conditions could also negatively affect our ability to retain our clients and attract new clients. It is impossible to predict the long-term impact of this market and economic environment, whether it will persist or recur, or the extent to which our markets, products and businesses will be adversely affected. In addition, the passing and implementation of Dodd-Frank has and will continue to result in various programs, initiatives and actions being implemented in the U.S. and other markets in order to stabilize the markets, increase liquidity and restore investor confidence. It is unclear whether such initiatives will in fact be positive or negative for the financial markets over either the short or long-term.

If the economic recovery remains weak and uncertain, our operations, including sales and trading and investment banking, could be negatively impacted by a reduction of trading volumes, continued tightening of spreads, fewer completed investment banking transactions, a reduced backlog and decreased size of transactions, and our diminished role in these businesses, resulting in reduced principal transactions and investment banking revenues. In the event of extreme market events, such as a recurrence of the global credit crisis, we could incur substantial loss on the value of our securities due to market volatility.

Our business is also significantly affected by interest rates, which can change suddenly and unexpectedly. The Federal Reserve (the "Fed") continues to implement programs designed to further stimulate the economy by keeping interest rates low. However, the long-term impact of such programs, and the extent to which the Fed will continue these programs, remains uncertain. These programs, as well as other possible changes to the Fed's monetary policy, could significantly impact interest rates. An increase in interest rates could decrease the level of customer activity, increase our cost of funding, likely decrease new issues in the debt capital markets, decrease the value of securities owned by us and create a business environment in which mergers and acquisitions activity decreases.

Any or all of these conditions could adversely affect our financial condition and results of operations.

The financial services industry and the markets in which we operate are subject to systemic risk that could adversely affect our business and results. Participants in the financial services industry and markets increasingly are closely interrelated as a result of credit, trading, clearing, technology and other relationships. A significant adverse development with one participant (such as a bankruptcy or default) may spread to others and lead to significant concentrated or market-wide problems (such as defaults, liquidity problems or losses) for other participants, including the clearing organizations, clearing houses, banks, exchanges and other intermediaries with which we conduct business. This was evident during the credit crisis of 2008-2009, and the resulting events had a negative impact on many other industry participants. Dodd-Frank and other legislation, intended to prevent or minimize another financial crisis as a result of systemic risk, may not be effective in doing so. Systemic risk is inherently difficult to assess and quantify, and its form and magnitude can remain unknown for significant periods of time and could have a negative impact on us.

15

Table of Contents

The volume of anticipated investment banking transactions may differ from actual results. Our investment banking revenues are typically earned upon the completion of a transaction. In most cases, we receive little or no payment for investment banking engagements that are not successfully completed. Furthermore, the completion of investment banking transactions for which we have been engaged is uncertain and beyond our control. For example, a client's transaction may be delayed or terminated because of a failure to agree upon final terms with the counterparty, failure to obtain necessary regulatory consents or board or stockholder approvals, failure to secure necessary financing, adverse market conditions or unexpected financial or other problems in the client's or counterparty's business. If parties fail to complete a transaction on which we are advising or an offering in which we are participating, we earn little or no revenue but may incur significant expenses (for example, travel and legal expenses) associated with the transaction. Accordingly, our business is highly dependent on market conditions as well as the decisions and actions of our clients and third parties, many of which have no interest in, or are adverse to, the completion of a given transaction. The number of transactions for which we have been engaged is subject to change and is not necessarily indicative of future revenues.

Financing and advisory services engagements are singular in nature and do not generally provide for subsequent engagements. Even though we work to represent our clients at every stage of their lifecycle, we are typically retained on a short-term, engagement-by-engagement basis in connection with specific capital markets, mergers and acquisitions, or advisory engagements. As a result, high activity levels in any period are not necessarily predictive of continued high levels of activity in any subsequent period. If we are unable to generate a substantial number of new engagements and generate fees from the successful completion of those transactions, our business and results of operations will likely be adversely affected.

Pricing pressures may negatively impact the revenues and profitability of our brokerage business. In recent years, we have experienced pricing pressures on commissions and trading margins. The Dodd-Frank legislation may result in further pricing pressures and even lower margins. We believe that pricing pressures in these and other areas will continue as institutional investors continue to implement cost-reduction strategies, including reducing the number of brokerage firms they use, and some of our competitors seek to obtain market share by reducing fees, commissions, spreads or other margins.

Increases in capital commitments in our trading, underwriting and other businesses increases the potential for significant losses. Capital commitment needs in the capital markets industry may result in larger and more frequent commitments of capital by financial services firms in many of their activities. Relative to many of our competitors, we have limited access to additional capital, which could put us at a competitive disadvantage. As a result, we may be forced to commit greater percentages of capital, relative to our competitors, to facilitate our business activities.

Our underwriting activities may place our capital at risk. We may incur losses and be subject to reputational harm to the extent that, for any reason, we are unable to sell at anticipated price levels, securities we purchase as an underwriter. As an underwriter, we also are subject to heightened standards regarding liability for material misstatements or omissions in prospectuses and other offering documents relating to offerings we underwrite.

Increased competition, including from larger firms, may adversely affect our revenues and profitability. The brokerage and investment banking industries are intensely competitive, and we expect them to remain so. We compete directly with other investment firms, brokers and dealers, and commercial banks, many of which are much larger. In addition to competition from firms currently in the securities business, there has been increased competition from others offering financial services, including automated trading and other services based on technological innovations.

We compete on the basis of a number of factors, including client relationships, reputation, the abilities of our professionals, market focus and the relative quality and price of our services and

16

Table of Contents

products. We have experienced price competition in our MBS & Rates and Credit Products divisions, particularly in the form of compression in trading commissions and spreads. In addition, pricing and other competitive pressures in investment banking, have continued and could adversely affect our revenues. We will likely experience competitive pressures in these and other areas in the future, as competitors seek to obtain market share by competing on the basis of price.

Many of our competitors in the brokerage and investment banking industries have a broader range of products and services, greater financial and marketing resources, larger client bases, greater name recognition, more professionals to serve their clients' needs, greater global reach and more established relationships with clients than we have. These larger and better-capitalized competitors may be better able to respond to changes in the brokerage and investment banking industries, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally. They also have the ability to support investment banking with commercial banking, insurance and other financial services in an effort to gain market share, which has resulted, and could further result, in pricing pressure in our businesses. For example, many of our larger competitors have in the past provided bridge lending and equity participation and otherwise committed their own capital to facilitate transactions. The ability to provide financing is an important advantage for some of our larger competitors, and if this trend continues, it would adversely affect us competitively because we do not regularly provide such financing. Additionally, these broader, more robust investment banking and financial services platforms may be more appealing to investment banking professionals than our business, making it more difficult for us to recruit new employees and retain those we have.

If we are unable to compete effectively in our markets, our business, financial condition and results of operations will be adversely affected.

Financial services firms have been subject to increased scrutiny and enforcement activity over the last several years, increasing the risk of financial liability and reputational harm resulting from adverse regulatory actions. The financial services industry has experienced increased scrutiny and enforcement activity from a variety of regulators, including the SEC, Commodity Futures Trading Commission, FINRA, NYSE, NFA, NASDAQ, HUD, the state securities commission and state attorneys general. This regulatory environment has created uncertainty with respect to a number of transactions that had historically been entered into by financial services firms and that were generally believed to be permissible and appropriate. We may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities and self-regulatory organizations. We also may be adversely affected as a result of new or revised legislation or regulations imposed by Congress, individual state legislatures, the SEC, other U.S. or foreign governmental regulatory authorities or self-regulatory organizations that supervise the financial markets, such as the Dodd-Frank legislation, as well as proposals that have been made both domestically and internationally, including additional capital and liquidity requirements. For example, we could be fined, prohibited from engaging in some of our business activities or subject to limitations or conditions on our business activities. Moreover, penalties and fines sought by regulatory authorities have increased substantially over the last several years.

We are also involved, from time to time, in other reviews, investigations, examinations and proceedings (both formal and informal) by governmental and self-regulatory agencies regarding our business, including, among other things, accounting and operational matters, certain of which may result in adverse judgments, settlements, fines, penalties, injunctions or other relief. The Company's broker-dealer subsidiaries are subject to routine audits by FINRA and the NFA. If these audits result in any adverse findings by FINRA or the NFA, we may incur fines or other censure. In the ordinary course of business, the Company and its subsidiaries receive inquiries and subpoenas from the SEC, state securities regulators and self-regulatory organizations. The Company does not always know the purpose behind these communications or the status or target of any related investigation. The responses to these communications have in the past resulted in the Company and/or its subsidiaries

17

Table of Contents

being cited for regulatory deficiencies, although to date these communications have not had a material adverse effect on the Company's business. Substantial legal liability or significant regulatory action against us could have material adverse financial effects or cause significant reputational harm to us, which could seriously harm our business prospects.

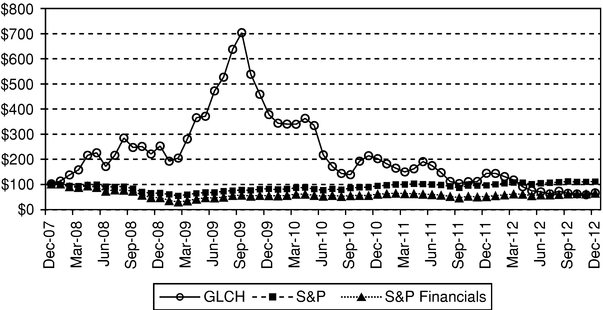

In addition, financial services firms are subject to numerous conflicts or perceived conflicts of interests. The SEC and other federal and state regulators have increased their scrutiny of potential conflicts of interest. We have adopted various policies, controls and procedures to address or limit actual or perceived conflicts and regularly seek to review and update our policies, controls and procedures. However, appropriately dealing with conflicts of interest is complex and difficult, and our reputation could be damaged if we fail, or appear to fail, to deal appropriately with conflicts of interest. Our policies and procedures to address conflicts may also result in increased costs, additional operational personnel and increased regulatory risk. Failure to adhere to these policies and procedures may result in regulatory sanctions or client litigation.