MANAGEMENT INFORMATION CIRCULAR

May 21, 2007

PROXY INFORMATION

This Circular is furnished in connection with the solicitation of proxies for use at the annual and special meeting of shareholders of the Company to be held on Friday, June 22, 2007 at 10:00 a.m. (Toronto time) (the “Meeting”) at the Design Exchange located at 234 Bay Street, Toronto-Dominion Centre, Toronto, Ontario and at any adjournments thereof for the purposes set out in the accompanying notice of meeting.

SOLICITATION OF PROXIES

The enclosed proxy is being solicited by the management of the Company. This solicitation of proxies will be done primarily by mail but proxies may also be solicited personally, by facsimile or by telephone by officers, directors or employees of the Company for which no additional compensation will be paid. The cost of the solicitation will be borne by the Company. The Company may also retain, and pay a fee to, one or more professional proxy solicitation firms to solicit proxies from shareholders of the Company.

APPOINTMENT OF PROXIES

The persons named as proxyholders in the enclosed form of proxy are directors and/or officers of the Company. Each shareholder is entitled to appoint a person, other than the person designated in the enclosed form of proxy, as a proxy. In order to appoint such other person who need not be a shareholder of the Company, the shareholder should insert such person’s name in the blank space provided on the form of proxy and delete the names printed thereon, sign and date the form of proxy and return the completed proxy to the office of the Registrar and Transfer Agent of the Company, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 no later than 5:00 p.m. (Toronto time) on Wednesday, June 20, 2007. In the absence of any such specifications, the management nominees, if named as proxy, will vote IN FAVOUR of all the matters set out herein.

REVOCATION OF PROXY

A shareholder executing the enclosed form of proxy has the right to revoke the proxy by instrument in writing, including another completed form of proxy, executed by the shareholder or his or her agent duly authorized in writing or, if the shareholder is a corporation, by an officer thereof duly authorized in writing, and deposited with Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 no later than 5:00 p.m. (Toronto time) on Wednesday, June 20, 2007, or any adjournment thereof, or in any other manner permitted by law. Non-registered shareholders must contact their broker, other agent or intermediary in order to revoke a proxy.

EXERCISE OF DISCRETION BY PROXIES

The shares represented by proxies in favour of management nominees will be voted in accordance with the instructions of the shareholder on any ballot that may be called for and, if a shareholder specifies a choice with respect to any matter to be acted upon at the Meeting, the shares represented by proxy shall be voted accordingly. In the absence of specific direction on any matter referred to in the proxy, the proxy will confer discretionary authority and such Common Shares will be voted IN FAVOUR of all matters set out in the Notice of the Meeting. The enclosed form of proxy also confers discretionary authority upon the persons named therein to vote with respect to any amendments or variations to the matters identified in the notice of meeting and with respect to any other matters which may properly come before the Meeting in such manner as the nominee in his judgment may determine. At the date hereof, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 3 of 47 |

VOTING OF SHARES

A holder of Common Shares of the Company (the “Common Shares”) may own such shares in one or both of the following ways. If a shareholder is in possession of a physical share certificate, such shareholder is a “registered” shareholder and his or her name and address are maintained by the Company through its transfer agent, Computershare Investor Services Inc. Only a registered shareholder may vote a proxy in his or her own name in accordance with the instructions appearing on the enclosed form of proxy and/or a registered shareholder may attend the Meeting and vote in person. Because a registered shareholder is known to the Company and its transfer agent, his or her account can be confirmed and his or her vote recorded or changed if such registered shareholder has previously voted. This procedure prevents a shareholder from voting his or her shares more than once. Accordingly, only the registered shareholder’s latest dated proxy will be valid.

Shareholders who are not registered shareholders should refer to the section below entitled “Notice to Beneficial Shareholders.”

NOTICE TO BENEFICIAL SHAREHOLDERS

The information set forth in this section is of significant importance to many shareholders of the Company, as a substantial number of shareholders do not hold Common Shares of the Company in their own name, and thus are considered non-registered shareholders. Shareholders who do not hold their Common Shares in their own name ("Beneficial Shareholders") should note that only proxies deposited by shareholders whose names appear on the records of the Company as the registered holders of Common Shares can be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a shareholder by a broker, then, in almost all cases, those Common Shares will not be registered in the shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker or another similar entity (called an “Intermediary”). Common Shares held by an Intermediary can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, an Intermediary is prohibited from voting shares. Beneficial Shareholders should ensure that instructions respecting the voting of their Common Shares are communicated in a timely manner and in accordance with the instructions provided by their Intermediary.

In accordance with the requirements of National Instrument 54-101, arrangements have been made with Intermediaries to forward the notice of meeting, this Circular and the form of proxy to the Beneficial Shareholders. Applicable regulatory rules require Intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every Intermediary has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of their Intermediary, a Beneficial Shareholder may attend at the Meeting as proxyholder for the Intermediary and vote the Common Shares in that capacity. Beneficial Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as a proxyholder should enter their own names in the blank space on the form of proxy provided to them by their Intermediary and return, in a timely fashion, the same to their Intermediary in accordance with the instructions provided by their Intermediary, well in advance of the Meeting.

All references to shareholders in the Circular and the form of proxy and the Notice are to registered shareholders unless specifically stated otherwise.

Unless otherwise indicated, the information in this circular is as of May 21, 2007.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 4 of 47 |

VOTING SECURITIES AND PRINCIPAL HOLDER THEREOF

The Company is authorized to issue an unlimited number of Common Shares and 200,000,000 preferred shares, issuable in series. There are no preferred shares outstanding.

As at May 21, 2007 there were 417,993,960 Common Shares outstanding. Each Common Share entitles the holder of record thereof to one vote at all meetings of shareholders of the Company.

As at May 21, 2007, to the knowledge of the directors and officers of the Company, no other person or company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities of the Company carrying more than 10% of the voting rights attaching to any class of voting securities of the Company except the following principal holder:

| Name and Municipality of Residence | Number of Common Shares | Percentage Holding |

Dundee Corporation Toronto, Ontario | 101,880,061 (1) | 24.4% |

(1) 101,695,061 Common Shares are held directly and 185,000 are held indirectly through a wholly-owned subsidiary of Dundee Corporation.

RECORD DATE

Registered holders of Common Shares of the Company as at the close of business (Toronto time) on May 23, 2007, being the date set by the Company for the determination of the registered holders of Common Shares who are entitled to receive the notice of meeting (the “Record Date”), will be entitled to exercise the voting rights attaching to the Common Shares in respect of which they are so registered at the Meeting, or any adjournment thereof, if present or represented by proxy thereat.

BUSINESS OF THE MEETING

I) ANNUAL MATTERS

A) ELECTION OF DIRECTORS

Under the Company’s articles and the Canada Business Corporations Act, directors are elected by a majority of the votes cast at the Meeting, in person or by proxy. The by-laws of the Company provide that the mandate of directors will be for the term of one year which will end on the date of the next annual meeting or when their successors are elected or appointed.

Management of the Company proposes nine persons named hereinafter as nominees for election as directors for the ensuing year. Six of the nominees are current directors of the Company and have been directors since the dates indicated below and three are new nominees.

The individuals listed below have been nominated by Management for election as directors of the Company at the Meeting. Unless otherwise indicated, it is intended that the Common Shares represented by proxies solicited hereby, will be voted IN FAVOUR of electing the following nominees as directors of the Company.

The names and jurisdictions of residence of the nominees, their position with the Company, their principal occupations, the dates upon which they became directors of the Company and the number of Common Shares beneficially owned by them, directly or indirectly, or over which control or direction is exercised by them as of May 21, 2007 are as follows:

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 5 of 47 |

Name and Jurisdiction of Residence | Principal Occupation | Number of Common Shares Owned | Director Since |

Garth A.C. MacRae (1)(4)(5)(6)(8) Ontario, Canada | Chairman of the Board Also, a Governor of Dynamic Mutual Funds and a director of Dundee Corporation, GeneNews Ltd. (formerly, “ChondroGene Limited”); Dundee Precious Metals Inc., Dundee Wealth Management Inc., Eurogas Corporation, Torque Energy Inc., Great Plains Exploration Inc. and Uranium Participation Corporation | 500,000 | 1993 |

George E. Pirie (3)(6)(7) Ontario, Canada | President and Chief Executive Officer of the Company Also, a director of Paladin Resources Ltd. | 17,169 | 2005 |

Ned Goodman (2) Ontario, Canada and Québec, Canada | Director, President and Chief Executive Officer, Dundee Corporation; Director, Chairman, President and Chief Executive Officer, Dundee Wealth Management Inc.; Chairman of Goodman & Company, Investment Counsel Ltd. and Chairman Goodman Private Wealth Management. He is also Chairman, Emiritus of the Canadian Council of Christians and Jews, a Governor of Junior Achievement of Canada and a director of Dundee Precious Metals Inc., Dundee Realty Corporation, Eurogas Corporation, Valdez Gold Inc. and Cogitore Resources Inc. (formerly, “Woodruff Capital”) and Chairman of the Board of Trustees of Dundee REIT | 1,376,937 | 1993 |

Jonathan C. Goodman (7) Ontario, Canada | Director, President and Chief Executive Officer of Dundee Precious Metals Inc.; a director of Dundee Corporation, Dundee Resources Limited, Eurogas Corporation, Odyssey Resources Ltd., Major Drilling Group International, Inc., Tahera Diamond Corporation (formerly, “Tahera Corporation”), Frontier Pacific Mining Corporation and Cogitore Resources Inc. (formerly, “Woodruff Capital”) | 221,236 | 2001 |

Grant A. Edey (5)(7) Ontario, Canada | Chief Financial Officer of IAMGOLD Corporation. Also a director of Khan Resources Inc. | 10,000(9) | 2005 |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 6 of 47 |

Name and Jurisdiction of Residence | Principal Occupation | Number of Common Shares Owned | Director Since |

A. Murray Sinclair, Jr. (4)(5)(8) British Columbia, Canada | Managing Director of Quest Capital Corp. since 2003; Director of Quest Management Corp. (management company wholly-owned by Quest Capital Corp.) since 1996; and also a director of the following companies: Allied Nevada Gold Corp. Arapaho Capital Corp., Bannockburn Resources Limited, Choice Resources Corp., Dexit Inc., Gabriel Resources Ltd., General Minerals Corporation, GTO Resources Inc., Jura Energy Corporation, Pearl Exploration and Production Ltd., Premier Gold Mines Limited, Quest Capital Corp. and Western Geopower Corp. | Nil | 1992 |

W. Murray John(10) Ontario, Canada | President and Chief Executive Officer of Dundee Resources Limited and President, Chief Executive Officer and Director of Corona Gold Corporation and is also a director of the following companies: Iberian Minerals Corp., Dundee Precious Metals Inc., Canada Dominion Resources 2006 Corporation, CMP 2006 Corporation, Canada Dominion Resources 2006 II Corporation, Canada Dominion Resources 2007 Corporation, Canada Dominion Resources 2007 II Corporation and CMP 2007 Corporation. | Nil | 2007 |

John W. Ivany(11) Alberta, Canada | Retired Executive. | Nil | 2007 |

Joanne Ferstman Ontario, Canada | Executive Vice President, Chief Financial Officer and Corporate Secretary of Dundee Corporation, Executive Vice President and Chief Financial Officer of Dundee Wealth Management Inc. | 94,600 | 2007 |

(1) Mr. MacRae was reappointed as the Chairman of the Board on June 8, 2006 and has been Chairman since June 23, 2005. He was previously Chairman from September 6, 1993 to August 1, 1997 and November 30, 2001 to November 29, 2004. He was also interim President and Chief Executive Officer from December 23, 2004 to June 23, 2005; Chief Executive Officer from September 6, 1993 to November 12, 1993 and Vice-Chairman from August 1, 1997 to November 30, 2001.

(2) Mr. Goodman was previously a director from May 21, 1993 to June 19, 2001 and was re-elected November 29, 2004. He was also the Chairman from November 29, 2004 to June 23, 2005.

(3) Mr. Pirie was appointed as a director on June 23, 2005 and the President and Chief Executive Officer of the Company on June 23, 2005. Prior to joining the Company on July 4, 2005, was an Executive Vice President with Placer Dome Inc. and the President and Chief Executive Officer of Place Dome Canada until December 31, 2004.

(4) Member of the Compensation Committee.

(5) Member of the Audit Committee.

(6) Member of the Hedging Committee.

(7) Member of Environmental, Health and Safety Committee.

(8) Member of Corporate Governance and Nominating Committee.

(9) Held by a family member.

(10) Prior to September 2004, Mr. John was an investment banker with Dundee Securities Corporation.

(11) Prior thereto, Mr. Ivany was Executive Vice President of Kinross Gold Corporation (“Kinross”) from June 1995 to May 2006 and served as a director of Viceroy Exploration Ltd. from June 2006 to November 2006.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 7 of 47 |

The following table sets forth information regarding attendance of each director at the meetings of the Board of Directors and its Committees:

| | | Committee Meetings Attended During 2006 |

Director | Board | Audit | Compensation | Hedging | Corporate

Governance

and

Nominating | Environmental,

Health &

Safety(2) |

| Garth A.C. MacRae | 6/6 | 4/4 | 2/2 | N/A | 2/2 | N/A |

| George E. Pirie | 6/6 | N/A | N/A | N/A | N/A | N/A |

| Ned Goodman | 5/6 | N/A | N/A | N/A | N/A | N/A |

| Donald K. Charter(1) | 6/6 | N/A | 2/2 | N/A | 2/2 | N/A |

| Jonathan C. Goodman | 6/6 | N/A | N/A | N/A | N/A | N/A |

| Grant A. Edey | 6/6 | 4/4 | N/A | N/A | N/A | N/A |

| A. Murray Sinclair, Jr. | 5/6 | 2/4 | 2/2 | N/A | 2/2 | N/A |

| W. Murray John | N/A | N/A | N/A | N/A | N/A | N/A |

| John W. Ivany | N/A | N/A | N/A | N/A | N/A | N/A |

| Joanne Ferstman | N/A | N/A | N/A | N/A | N/A | N/A |

(1) Mr. Charter resigned as a director of the Company on March 29, 2007.

(2) The Environmental, Health & Safety committee was formally constituted as a standing committee on December 18, 2006.

From time to time, ad hoc committees of the Board of Directors are formed as necessary to address specific matters affecting the Company.

B) CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS

A. Murray Sinclair Jr.

PetroFalcon Corporation (formerly Pretium Industries Inc.)

On February 27, 2002 the British Columbia Securities Commission delivered an order relating to an application by Mercury Partners & Company Inc. to overturn a decision of the Canadian Venture Exchange Inc. (as it then was), namely an approval to close a private placement of 4,000,000 common shares of the corporation which was completed in November 2001 (the “BCSC Order”). Subsequent to the private placement, Mr. A. Murray Sinclair was appointed a director of PetroFalcon Corporation. Pursuant to the BCSC Order, PetroFalcon Corporation was required to place the matter before its shareholders and, in order that the status quo be maintained to the greatest extent possible until the occurrence of the shareholders meeting, the British Columbia Securities Commission considered it to be in the public interest to remove the applicability of exemptions from prospectus and registration requirements for PetroFalcon until the shareholders meeting was held. In addition, the British Columbia Securities Commission, during that time period, removed the applicability of exemptions from prospectus and registration requirements for Quest Ventures Ltd. (as subscriber to the private placement referred to above) in respect of the 4,000,000 common shares received pursuant to the private placement referred to above. During this time, A. Murray Sinclair was also a principal of Quest Ventures Ltd. The approval of shareholders was sought and received in May 2002 at a meeting of shareholders.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 8 of 47 |

Katanga Mining Limited (formerly Balloch Resources Ltd. and New Inca Gold Ltd.)

A. Murray Sinclair, Jr. was a director of Balloch Resources Ltd. from May 1, 1998 to July 10, 2006. On February 25, 2002 New Inca Gold Ltd. was issued a cease trade order from the British Columbia Securities Commission, the Alberta Securities Commission and the Ontario Securities Commission for failure to file financial statements within the prescribed period of time and pay the filing fees. New Inca Gold Ltd. has since filed the financial statements and paid the filing fees as required by those securities commissions. Effective October 21, 2003, trading of the securities of New Inca Gold Ltd. resumed. The Alberta Order was rescinded on October 23, 2003 and the Ontario Order was rescinded on March 6, 2003 and the British Columbia Order was rescinded on October 21, 2003.

John W. Ivany

John W. Ivany was the subject of enforcement proceedings by the Alberta Securities Commission In Re Cartaway Resources Corp. In its order dated February 22, 2001, the Alberta Securities Commission found that Mr. Ivany, as Chief Executive Officer of Cartaway Resources Corp., had allowed the issuance of a press release that contained a material factual error in violation of the securities laws of the Province of Alberta. As a result, Mr. Ivany was prohibited from acting as a director or officer of any “junior issuer” for a period of five years and ordered to pay costs in the amount of Cdn.$20,000.

On April 14, 2005, the Ontario Securities Commission issued a definitive management cease trade order which superseded a temporary management cease trade order dated April 1, 2005 against all the directors and officers of Kinross in connection with the Kinross’ failure to file its audited financial statements for the year ended December 31, 2004. The management cease trade order was lifted on February 22, 2006.

C) APPOINTMENT OF AUDITORS

PricewaterhouseCoopers LLP will be nominated at the shareholders’ annual meeting to be held on June 22, 2007 for appointment as auditor of the Company at a remuneration to be fixed by the Board of Directors. PricewaterhouseCoopers LLP has been the Company’s auditor since June 9, 2006. Prior to that date, Deloitte & Touche LLP had been the Company’s auditor.

Unless otherwise directed by the shareholder, the persons named in the enclosed form of proxy intend to vote IN FAVOUR of the appointment of PricewaterhouseCoopers LLP, Chartered Accountants, as auditors of the Company until the next annual meeting of shareholders or until their successor is appointed and to authorize the directors to fix their remuneration.

II) PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

A) AMENDMENT TO THE SHARE INCENTIVE PLAN

As at May 21, 2007, 417,993,960 Common Shares were issued and outstanding. The aggregate number of Common Shares approved for issuances under the Share Incentive Plan of the Corporation (the “Plan”) is 54.5 million Common Shares. The three components of the Plan are (a) the Share Bonus Plan - current maximum reserve is 5 million Common Shares of which 1.2 million Common Shares have been issued and 3.8 million remain available for issuance; (b) the Share Option Plan - current maximum reserve is 41 million of which as at May 21 2007, approximately 9.7 million Common Shares were issued upon the exercise of stock options; approximately 8.5 million options to purchase Common Shares remained outstanding; 0.5 million Common Shares previously subject to options under the Share Option Plan are no longer available by virtue of the exercise by the optionees of their right to terminate their options and to receive cash or Common Shares equal in value to the difference between the fair market value of the Common Shares subject to their option and exercise price of their option, a right no longer available to optionees; and approximately 22.3 million Common Shares are available for issuance; and (c) the Share Purchase Plan: Current maximum reserve is 8.5 million of which approximately 5.3 million Common Shares have been issued and approximately 3.1 million Common Shares are available for further issuances.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 9 of 47 |

The Board of Directors has approved certain amendments to the Plan, subject to shareholder approval. The Toronto Stock Exchange (the “TSX”) has conditionally approved the proposed amendments to the Plan, subject to receipt from the Corporation of, among other things, evidence of such shareholder approval. The following summary of the proposed amendments to the Plan is qualified in its entirety by the provisions of the Plan, underlined to show the proposed changes, attached to this Circular as Exhibit III. Please refer to the underlined Plan for the complete proposed amendments and for the provisions of the amended and restated share incentive plan (the “Amended Plan”).

Under the current Share Option Plan, the Board of Directors may, subject to regulatory approval, amend or discontinue the Share Option Plan at any time, provided, however, that no such amendment may materially and adversely affect any option rights previously granted to an optionee under the Share Option Plan without the consent of the optionee, except to the extent required by law or by the regulations, rules, by-laws or policies of any regulatory authority or stock exchange.

The TSX recently advised that, effective June 30, 2007, TSX issuers with general amendment provisions in their security based compensation plans will no longer be able to make amendments to their plans or to outstanding awards under the plans, including amendments considered to be of a "housekeeping" nature, without shareholder approval.

Regarding the amendment procedures, the Board of Directors propose to replace the current amendment provision with one permitting the Board of Directors to amend the Share Option Plan:

| | (a) | without the approval of the shareholders of the Corporation, to |

| | (i) | suspend or terminate (and to re-instate) the Share Purchase Plan, the Share Option Plan or the Share Bonus Plan, and |

| | (ii) | make the following amendments to the Plan |

| | (A) | any amendment of a “housekeeping” nature, including, without limitation, amending the wording of any provision of the Plan for the purpose of clarifying the meaning of existing provisions or to correct or supplement any provision of the Plan that is inconsistent with any other provision of the Plan, correcting grammatical or typographical errors and amending the definitions contained within the Plan, |

| | (B) | any amendment to comply with the rules, policies, instruments and notices of any regulatory authority to which the Corporation or its securities are subject, including the Toronto Stock Exchange, or to otherwise comply with any applicable law or regulation, |

| | (C) | any amendment to the vesting provisions of the Share Purchase Plan and the Share Option Plan, |

| | (D) | other than changes to the expiration date and Option Price as described in paragraph 6.02(b)(iv) and paragraph 6.02(b)(v) of the Plan, any amendment, with the consent of the Optionee, to the terms of any Option previously granted to such Optionee under the Share Option Plan, |

| | (E) | any amendment to the provisions concerning the effect of the termination of a Participant’s employment on such Participant’s status under the Share Purchase Plan, |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 10 of 47 |

| | (F) | any amendment to the provisions concerning the effect of the termination of an Optionee as a Director, Officer, Consultant or employee of the Corporation or of any Subsidiary on such Optionee’s status under the Share Option Plan, |

| | (G) | any amendment to the provisions concerning loans to Optionees, the pledge of Shares and the consequences of a termination or cessation of employment on such loans or pledges under the Share Option Plan, |

| | (H) | any amendment to the categories of persons who are Participants or Eligible Persons, |

| | (I) | any amendment to the contribution mechanics of the Share Purchase Plan, |

| | (J) | any amendment respecting the administration of the Plan, and |

| | (K) | any amendment to provide a cashless exercise feature to any Option or the Share Option Plan, provided that such amendment ensures the full deduction of the number of underlying Shares from the total number of Shares subject to the Share Option Plan; |

and

| | (b) | with the approval of the shareholders of the Corporation by ordinary resolution, to make any amendment to the Plan not contemplated by subsection 6.02(a) of the Plan, including, but not limited to |

| | (i) | any amendment to the number of Shares issuable under the Plan, including an increase to a fixed maximum number of securities or a change from a fixed maximum number of Shares to a fixed maximum percentage, other than an adjustment pursuant to section 3.04, section 4.06 or section 5.04 of the Plan, |

| | (ii) | any amendment which would change the manner of determining the minimum Option Price, |

| | (iii) | any amendment which would change the number of days set out in subsection 4.03(g) of the Plan with respect to the extension of the expiration date of Options expiring during or immediately following a Blackout Period, |

| | (iv) | any amendment which reduces the Option Price of any Option, other than pursuant to section 4.03(g) the Plan, |

| | (v) | any amendment which extends the expiry of an Option other than as permitted under the Share Option Plan, |

| | (vi) | any amendment which cancels any Option and replaces such Option with an Option which has a lower Option Price other than pursuant to section 4.06 of the Plan, |

| | (vii) | any amendment which would permit Options to be transferred or assigned by any Eligible Person other than as allowed by subsection 4.03(f) of the Plan, |

| | (viii) | any amendment to increase the maximum limit of the number of securities that may be: |

| | (a) | issued to insiders of the listed issuer within any one year period, or |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 11 of 47 |

| | (b) | issuable to insiders of the listed issuer, at any time; |

under the arrangement, or when combined with all of the listed issuer’s other security based compensation arrangements, which could exceed 10% of the listed issuer’s total issued and outstanding securities, respectively, and

| | (ix) | amendments to an amending provision within a security based compensation arrangement. |

On June 6, 2006, the TSX published a Staff Notice respecting security based compensation arrangements, such as the Share Option Plan, relating to the amendment procedures and the extension of option expiry dates which falls within or soon after a blackout period. Accordingly, the Board of Directors believe that it is in the best interests of the Company to make, and has approved, corresponding amendments to the Share Option Plan.

Regarding the extension of option expiry dates which fall within or soon after a blackout period, the Board of Directors propose to amend the Plan by adding a provision which states the expiration date of the Option will be the date which is ten business days after the Blackout Period Expiry Date.

Pursuant to section 613 of the Company Manual of the TSX, insiders of the Corporation may be restricted from voting in respect of amendments to a share incentive plan unless certain limits with respect to awards which may be granted to insiders are complied with. Under the proposed amendments to the Plan, the following limitations would be added to ensure that insiders of the Corporation are entitled to vote in respect of future amendments to the Amended Plan:

| | (a) | the number of Common Shares issuable from treasury to insiders of the Corporation (within the meaning set out in the applicable rules of the TSX), at any time, under all security based compensation arrangements of the Corporation, may not exceed ten per cent of the total number of Common Shares then issued and outstanding; and |

| | (b) | the number of Common Shares issued from treasury to insiders, within any one year period, under all security based compensation arrangements of the Corporation, may not exceed ten per cent of the total number of Common Shares then issued and outstanding. |

The full text of the resolution approving the amendments to the Plan and approving the Amended Plan is attached to this Circular as Exhibit II. The Plan, underlined to show the proposed changes, is attached to this Circular as Exhibit III.

To be effective, the approval of the amendments must be given by resolution of the shareholders. Unless instructed to vote against in the accompanying form of proxy, it is the intention of the persons named therein to vote the shares represented thereby IN FAVOUR of approval of the amendments to the Plan.

EXECUTIVE COMPENSATION

The following table contains information about the compensation paid to, or earned by, the Company’s Chief Executive Officer, Chief Financial Officers and each of the other most highly compensated executive officers of the Company who earned more than $150,000 in total salary and bonus as at December 31, 2006 (the “Named Executive Officers”) and in each of the Company’s two most recently completed financial years prior to that date. Specific aspects of the compensation of the Named Executive Officers are dealt with in further detail in subsequent tables.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 12 of 47 |

SUMMARY COMPENSATION TABLE

Annual Compensation |

Name and Principal Position | Yea r | Salary ($) | Bonus ($) | Other Annual Compensation

($)(1) | Long-term Compensation Awards

Options Under Share Incentive Plan Granted | All Other Compensation ($) |

| George E. Pirie | 2006 | 500,000 | 400,000 | Nil | Nil | Nil |

| President and | 2005 | 200,000 | 325,000 | Nil | 1,000,000 | 6,750 |

| Chief Executive Officer | 2004 | N/A | N/A | N/A | N/A | N/A |

David C. Langille(2) | 2006 | 158,441 | 140,000 | Nil | 250,000 | Nil |

| Vice-President, Finance | 2005 | N/A | N/A | N/A | N/A | N/A |

and Chief Financial Officer | 2004 | N/A | N/A | N/A | N/A | N/A |

Richard Godfrey(3) | 2006 | 151,916 | Nil | Nil | Nil | Nil |

| Vice President, Finance | 2005 | 255,000 | 295,000(4) | Nil | Nil | 18,482 |

and Chief Financial Officer | 2004 | 214,580 | 85,000 | Nil | 75,000 | 19,035 |

| William M. Heath | 2006 | 275,000 | 250,000 | Nil | Nil | Nil |

| Executive Vice President | 2005 | 240,000 | 401,500(5) | Nil | 250,000 | 14,108 |

| | 2004 | 222,500 | 139,750 | Nil | 200,000 | 14,000 |

Bertrand Boivin(6) | 2006 | 250,000 | 200,000 | Nil | 150,000 | Nil |

| Vice President, Canada | 2005 | 225,000 | 342,500(6) | Nil | Nil | 16,500 |

| | 2004 | N/A | N/A | N/A | 100,000 | N/A |

| J. Steven Hayes | 2006 | 220,000 | 240,000 | Nil | Nil | Nil |

Vice President, Commercial | 2005 | 195,000 | 282,500(7) | Nil | 100,000 | 17,960 |

| | 2004 | 185,000 | 99,500 | Nil | 100,000 | 19,000 |

(1) Perquisites and other personal benefits are not shown if they did not exceed the applicable disclosure threshold of the lesser of $50,000 and 10% of the total annual salary and bonus of the Named Executive Officer for the financial year.

(2) Mr. Langille was appointed Chief Financial Officer and Vice-President, Finance on June 5, 2006.

(3) Mr. Godfrey ceased to be an officer of the Company on June 5, 2006.

(4) The deferral of bonuses was eliminated and 2004 deferred bonus of $85,000 relating to the 2004 bonus was paid with the 2005 bonus.

(5) The deferral of bonuses was eliminated and 2004 deferred bonus of $109,000 relating to the 2004 bonus was paid with the 2005 bonus.

(6) Mr. Boivin was appointed Vice President, Canada on November 8, 2005. Includes a 2004 deferred bonus of $67,500 which was paid with the 2005 bonus.

(7) The deferral of bonuses was eliminated and the 2004 deferred bonus of $72,500 relating to the 2004 bonus was paid with the 2005 bonus.

The following table sets forth information regarding options granted during the financial year of the Company ended December 31, 2006 to the Named Executive Officers.

OPTION GRANTS TO THE NAMED EXECUTIVE OFFICERS

DURING THE YEAR ENDED DECEMBER 31, 2006

Name | Stock Options Granted | Percent of Total Options Granted to Employees in Financial Year | Exercise Price ($/security) | Market Value of Securities Underlying Options on the Date of Grant(1) ($/security) | Expiration Date |

| George E. Pirie | Nil | N/A | N/A | N/A | N/A |

David C. Langille(2) | 250,000 | 9.8% | $1.13 | $1.13 | June 8, 2011 |

Richard Godfrey(3) | Nil | N/A | N/A | N/A | N/A |

| William M. Heath | Nil | N/A | N/A | N/A | N/A |

| Bertrand Boivin | 150,000 | 5.9% | $1.02 | $1.02 | March 5, 2011 |

| J. Steven Hayes | Nil | N/A | N/A | N/A | N/A |

(1) Reflects the closing price of the Common Shares on the TSX two trading days after the date of grant.

(2) Mr. Langille became an officer of the Company on June 5, 2006.

(3) Mr. Godfrey ceased to be an officer of the Company on June 5, 2006.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 13 of 47 |

The following table sets forth information regarding exercises of options during the financial year of the Company ended December 31, 2006 by the Named Executive Officers and the value as at December 31, 2006 of unexercised options held by the Named Executive Officers on an aggregate basis.

AGGREGATED OPTION EXERCISES DURING THE FINANCIAL YEAR ENDED

DECEMBER 31, 2006 AND OPTION VALUES AS AT DECEMBER 31, 2006

Name | Securities Acquired on Exercise | Aggregate Value Realized ($) | Unexercised Options as at December 31, 2006 | Value of Unexercised in-the-money Options as at December 31, 2006(1) |

| | | | Exercisable | Unexercisable | Exercisable | Unexercisable |

| George E. Pirie | N/A | N/A | 666,667 | 333,333 | $970,001 | $485,000 |

| David C. Langille | N/A | N/A | 83,333 | 166,667 | $59,166 | $118,334 |

Richard Godfrey(2) | 275,000 | $258,000(3) | Nil | Nil | Nil | Nil |

| William M. Heath | N/A | N/A | 766,667 | 233,333 | $930,750 | $121,250 |

| Bertrand Boivin | N/A | N/A | 450,000 | 50,000 | $429,500 | $41,000 |

| J. Steven Hayes | 49,400 | $41,002(3) | 416,667 | 33,333 | $430,446 | $46,833 |

(1) Based upon the closing price of the Common Shares on the TSX on December 29, 2006 of $1.84, less the exercise price of the in-the-money stock options. These options have not been, and may never be, exercised and actual gain, if any, on exercise will depend on the value of the common shares on the date of exercise.

(2) Mr. Godfrey ceased to be an officer of the Company on June 5, 2006.

(3) The calculation is based on the difference between the market value of the securities on the date of exercise and the exercise price on the grant date.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER THE SHARE INCENTIVE PLAN

The following table sets forth information with respect to compensation plans under which Common Shares are authorized for issue for the financial year ended December 31, 2006.

Plan Category | Number of securities to be issued upon exercise of outstanding options (a) | Weighted-average exercise price of outstanding options ($) (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

| Share Option Plan component of the Share Incentive Plan Approved by Securityholders | 9,535,100 | 0.70 | 22,624,800 |

| Share Incentive Plan not Approved by Securityholders | N/A | N/A | N/A |

| Total | 9,535,100 | 0.70 | 22,624,800 |

TERMINATION OF EMPLOYMENT,

CHANGE IN RESPONSIBILITIES AND EMPLOYMENT CONTRACTS

The Company entered into an employment agreement with William M. Heath in July 2004 which Agreement expired on December 31, 2006; however, the agreement automatically renewed for a one year term as the agreement called for an automatic renewal for two-year terms beyond the termination date unless Mr. Heath’s employment with the Company was terminated. The Agreement provides that in the event of termination of Mr. Heath’s employment without cause, not associated with a change of control, he will be entitled to either 24 months’ written notice of termination or pay in lieu of notice, as well as benefits continuation for the 24 month period. If Mr. Heath elects to resign his employment with the Company, he will be required to provide no less

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 14 of 47 |

than one months’ written notice of his decision. The agreement defines a “change of control” as the acquisition by any group, other than Dundee Corporation (“Dundee”) or an affiliate of Dundee, of sufficient security that the acquiring group establishes the right to cast more than 30 percent of the votes that may be cast to elect directors of the Company, and the exercise of such voting rights causes the incumbent directors of the Company to cease to be the majority. In the event of a change of control, Mr. Heath has the unilateral right to terminate his employment by providing notice to the Company, at which time he will be paid a lump sum equal to 200% of his base annual salary at the time notice is given plus an amount equal to 200% of the average of any bonuses paid to Mr. Heath in the prior three financial years. In the event that Mr. Heath’s employment is terminated without cause following a change of control, he will be entitled to these two payments plus payment in lieu of benefits.

COMPOSITION OF THE COMPENSATION COMMITTEE

The members of the Compensation Committee during the financial year ended December 31, 2006, were Donald K. Charter1 , A. Murray Sinclair, Jr. and Garth A.C. MacRae. No member of the Compensation Committee was an officer or employee of the Company or any of its subsidiaries during the year ended December 31, 2006.

The Compensation Committee makes determinations and recommendations to the directors of the Company concerning the cash and incentive compensation of the executive officers of the Company. The Compensation Committee, which met twice in 2006, furnished the following report on executive compensation.

REPORT ON EXECUTIVE COMPENSATION

The primary goal of the Compensation Committee is to ensure that the compensation provided to the executive officers of the Company is determined with regard to the business strategies and objectives of the Company, such that the financial interest of the executive officers of the Company is consistent with the financial interest of the shareholders of the Company. The Compensation Committee strives to ensure that the executive officers of the Company are paid fairly and commensurate with their contributions to furthering the strategic direction and objectives of the Company. The Compensation Committee reviews, recommends and/or determines all elements of the compensation of the executive officers of the Company on an annual basis and may periodically retain an independent consultant to evaluate the compensation levels and policies relative to the market for executives in positions similar to those of the executive officers of the Company. The Compensation Committee has developed the following executive compensation philosophy and policies to meet the foregoing objectives.

Base Salaries. The Compensation Committee recommends base salaries for each of the executive officers of the Company on an individual basis, taking into consideration the individual's performance and contributions to the success of the Company, tenure in the job, competitive industry pay practices for comparable positions and internal equities among positions.

Annual Incentives. The executive officers of the Company have an opportunity to earn annual bonuses. Award opportunities vary based on the individual's position and contributions to the performance of the Company. Bonuses are paid based on the performance of the individual and the results of the Company measured against its annual budget.

Long-Term Incentives. The Compensation Committee believes that options to purchase Common Shares encourage the executive officers of the Company to own and hold Common Shares and tie their long-term interests directly to those of the shareholders of the Company. Under the terms of the share option plan portion of the share incentive plan of the Company, the directors of the Company, acting on the recommendations of the Compensation Committee, may designate employees, including executive officers, eligible to receive options

1 Mr. Charter resigned as a director of the Company on March 29, 2007.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 15 of 47 |

to acquire such numbers of Common Shares as the directors determine at the then current trading price of the Common Shares on the TSX.

When granting options, consideration is given to the exercise price of the aggregate options that would be held by the executive officer of the Company after the grant under consideration is made. In determining individual grants of options, the Compensation Committee considers the following factors, among others, the performance and contributions to the success of the Company of the executive officer, the relative position of the executive officer, the years of service of the executive officer and past grants of options to the executive officer.

Compensation of the Chief Executive Officer. The components of the total compensation of Mr. Pirie, the Chief Executive Officer of the Company and the manner in which they were reviewed and evaluated by the Compensation Committee were similar to those for other executive officers of the Company. Mr. Pirie received a base salary and annual incentive compensation based on the performance of the Company and his individual performance. The review of Mr. Pirie’s performance included achieving production targets, strategy and financial performance of the Company. For his contribution during 2006, Mr. Pirie was granted a bonus of $400,000 which was paid in 2007.

Summary. The Compensation Committee will continue to evaluate the executive compensation programs of the Company on an ongoing basis to ensure that the compensation practices and philosophies of the Company are consistent with the objective of enhancing shareholder value.

Submitted on behalf of the Compensation Committee:

Donald K. Charter (Chair)1, A. Murray Sinclair, Jr. and Garth A.C. MacRae, each of whom served on the Compensation Committee during all of 2006. Mr. MacRae was appointed to the Committee on January 19, 2006.

1 Mr. Charter resigned as a director of the Company on March 29, 2007.

COMPENSATION OF DIRECTORS

Non-management directors are paid a retainer fee of $20,000 per annum and $1,000 per meeting of the Board of Directors or a Committee attended. Additionally, any non-management chair of a committee of the directors is paid $5,000 per annum, except for the Audit Committee chair who is paid $15,000 per annum. The directors of the Company are eligible to participate in the share incentive plan of the Company.

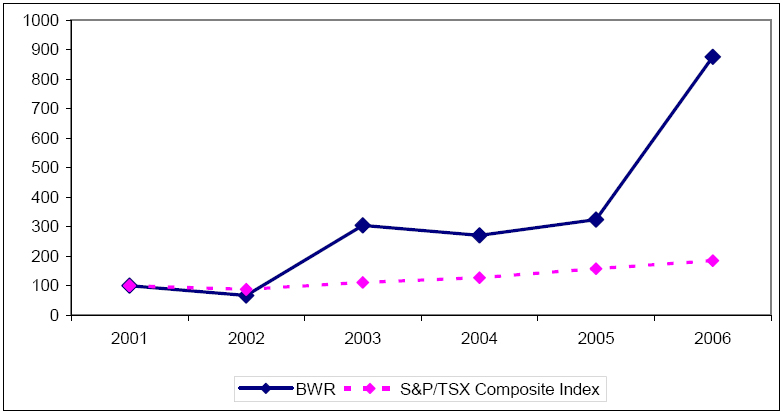

SHAREHOLDER RETURN PERFORMANCE GRAPH

The following table shows the yearly percentage change in the cumulative shareholder return on the Common Shares compared with the cumulative total return of the S&P/TSX Composite for the past five years assuming an investment of $100 on December 31, 2001. A graphical depiction follows the table.

| | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 |

| Stock Closing Price at December 31 (C$) | 0.21 | 0.14 | 0.64 | 0.57 | 0.68 | 1.84 |

| Corporation Total Return - Base 2001 | 100 | 67 | 305 | 271 | 324 | 876 |

| Total Return Index - S&P/TSX Composite | 16,882 | 14,782 | 18,732 | 21,445 | 26,619 | 31,213 |

| Total Return Index - Base 2001 | 100 | 88 | 111 | 127 | 158 | 185 |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 16 of 47 |

FIVE YEAR CUMULATIVE TOTAL RETURNS

DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE AND INDEMNIFICATION

The Company maintains directors’ and officers’ liability insurance for the directors and officers of the Company providing coverage in the amount of $25,000,000 in each policy year. The deductible amount on the policy is $250,000 and the total annual premium in 2006 was $254,000.

INDEBTEDNESS OF DIRECTORS AND SENIOR OFFICERS

None of the executive officers, directors, or other employees and former executive officers, directors and employees of the Company or its subsidiaries, the proposed nominees for election to the Board of Directors of the Company, or associates or affiliates of such persons, are or have been indebted to the Company at any time since the beginning of the last completed fiscal year of the Company.

INTERESTS OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

No material transactions were entered into in 2006.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Disclosure required under Multilateral Instrument 52-110 is included in the Annual Information Form of the Company under the heading “Audit Committee Disclosure” filed on SEDAR at www.sedar.com.

The Board of Directors of the Company believes that sound and appropriate corporate governance practices are important for the effective and efficient operation of the Company. To maintain high standards of corporate governance, the Company’s governance processes are subject to ongoing review and assessment by the Corporate Governance and Nominating Committee and the Compensation Committee of the Board of Directors. In accordance with National Instrument 58-101, the Corporate Governance practices of the Company are set out below:

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 17 of 47 |

Board of Directors: | All the directors, other than Mr. Pirie, are independent. Mr. Pirie is not independent as he is the Company’s President and Chief Executive Officer. |

| | |

| | The independent directors, as defined above, hold regularly scheduled meetings at which non-independent directors and members of management are not in attendance (“Independent Director Meetings”). In 2006, two Independent Director Meetings were held. |

| | |

| | More information about each director can be found under the heading “Election of Directors”. |

| | |

Board Mandate: | The Board of Directors has adopted a Board of Directors’ Mandate, the full text of which is included as Exhibit I to this Circular. |

| | |

Position Descriptions: | Written position descriptions have been developed by the Board of Directors for the Chairman of the Board, Chief Executive Officer, Audit Committee Chairman, Corporate Governance and Nominating Committee Chairman, Compensation Committee Chairman and Environmental, Health and Safety Chairman. |

| | |

Orientation and Continuing Education: | The Company has a practice with respect to the orientation and education of new directors of the Company. New directors of the Company are given the opportunity to meet with senior management and other directors of the Company to familiarize themselves with the business and activities of the Company and their responsibilities as directors of the Company. Commencing in mid-2007, the Directors will be provided with a Directors’ Information Guide updated on a periodic basis which contains information about the Company and its affiliates, the Company’s recent regulatory filings such as its annual information form and proxy material, the regulatory environment applicable to the Company and its subsidiaries, the reporting requirements of the directors of the Company, information with respect to the committees of the Board of Directors and the written mandates of each such committee and certain policies and procedures of the Board of Directors. The Company makes available to its directors, at its expense, certain third-party professional development courses to further enhance the education of the Company’s directors. |

| | |

Code of Business Conduct and Ethics: | The Board of Directors has adopted a Code of Business Conduct and Ethics (the “Code”) for its directors, officers and employees. The Corporate Governance and Nominating Committee has responsibility for monitoring compliance with the Code by ensuring all directors, officers and employees receive and become thoroughly familiar with the Code and acknowledge their support and understanding of the Code. Any non-compliance with the Code is to be reported immediately to a member of management or the Audit Committee. A copy of the Code was filed on SEDAR at www.sedar.com and on the Company’s website at www.breakwater.ca. |

| | |

| | The directors of the Company are responsible for monitoring compliance with this Code, for regularly assessing its adequacy, for interpreting this Code in any particular situation and for approving any changes to this Code from time to time. |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 18 of 47 |

Nomination of Directors: | The Corporate Governance and Nominating Committee, which is composed entirely of independent directors, is responsible for identifying and recruiting new candidates for nomination to the Board of Directors. The Board of Directors, in conjunction with the Corporate Governance and Nominating Committee, and each of the committees of the Board of Directors will conduct a self-evaluation at least annually to assess their effectiveness. In addition, the Corporate Governance and Nominating Committee should periodically consider the mix of skills and experience that Directors bring to the Board of Directors and assess, on an ongoing basis, whether the Board of Directors has the necessary composition to perform its oversight function effectively. |

| | |

Other Board Committees: | Hedging Committee:

The Hedging Committee is responsible for assisting the Company’s Board of Directors in fulfilling its oversight responsibilities in relation to risk management relative to exposures to commodity price and foreign exchange rate fluctuations. |

| | |

| | Environmental, Health and Safety Committee: It is the policy of the Company to establish and maintain an environmental, health and safety committee to assist the Board of Directors of the Company in carrying out its oversight responsibility for the environmental, health and safety policies and activities of the Company and monitoring and reviewing the performance of the Company in respect of environmental, health and safety matters. The Environmental, Health and Safety Committee will be provided with the resources commensurate with the duties and responsibilities assigned to it by the Board of Directors, including appropriate administrative support. |

| | |

Assessments: | The Board of Directors are committed to regular assessments of the effectiveness of the Board of Directors, the Chairman of the Board, the Committees of the Board and the individual directors. The Corporate Governance and Nominating Committee annually reviews and makes recommendations to the Board of Directors regarding evaluations of the Board of Directors, the Chairman of the Board, the Committees of the Board of Directors and the individual directors. |

ADDITIONAL INFORMATION

Additional information relating to the Company is available on SEDAR at www.sedar.com and on the website of the Company at www.breakwater.ca. The Company will provide to any person, upon request to its Investor Relations Department, a copy of its most recent annual information form, annual report, which includes the MD&A and financial statements for the year ended December 31, 2006 and subsequent interim reports which include interim MD&A and interim financial statements of the Company may be obtained by accessing the disclosure documents of the Company available at www.sedar.com or upon request, from the Investor Relations Department of the Company, Suite 950, 95 Wellington Street West, Toronto, Ontario M5J 2N7, telephone: 416-363-4798, email: investorinfo@breakwater.ca. The Company may require the payment of a reasonable fee in respect of a request therefor made by a person who is not a shareholder of the Company.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 19 of 47 |

The contents of this Circular and the sending thereof to the shareholders of the Company have been approved by the directors of the Company.

| | By Order of the Board |

| |  |

| Date: May 21, 2007 | Chairman of the Board |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 20 of 47 |

EXHIBIT I

BOARD OF DIRECTORS’ MANDATE

The primary function of the directors (individually a "Director" and collectively the "Board") of Breakwater Resources Ltd. (the "Corporation") is to supervise the management of the business and affairs of the Corporation. The Board has the responsibility to supervise the management of the Corporation which is responsible for the day-to-day conduct of the business of the Corporation. The fundamental objectives of the Board are to enhance and preserve long-term shareholder value and to ensure that the Corporation conducts business in an ethical and safe manner. In performing its functions, the Board should consider the legitimate interests that stakeholders, such as employees, customers and communities, may have in the Corporation. In carrying out its stewardship responsibility, the Board, through the Chief Executive Officer (the "CEO"), should set the standards of conduct for the Corporation.

| 2. | Procedure and Organization |

The Board operates by delegating certain responsibilities and duties set out below to management or committees of the Board and by reserving certain responsibilities and duties for the Board. The Board retains the responsibility for managing its affairs, including selecting its chairman and constituting committees of the Board.

| 3. | Responsibilities and Duties |

The principal responsibilities and duties of the Board fall into a number of categories which are summarized below.

| | (i) | The Board has the overall responsibility to ensure that applicable legal requirements are complied with and documents and records have been properly prepared, approved and maintained. |

| | (ii) | The Board has the statutory responsibility to, among other things: |

| | A. | manage, or supervise the management of, the business and affairs of the Corporation; |

| | B. | act honestly and in good faith with a view to the best interests of the Corporation; |

| | C. | exercise the care, diligence and skill that reasonably prudent people would exercise in comparable circumstances; and |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 21 of 47 |

| | D. | act in accordance with the obligations contained in the Canada Business Corporations Act (the "CBCA"), the regulations thereunder, the articles and by-laws of the Corporation, applicable securities laws and policies and other applicable legislation and regulations. |

| | (iii) | The Board has the statutory responsibility for considering the following matters as a Board which in law may not be delegated to management or to a committee of the Board: |

| | A. | any submission to the shareholders of any question or matter requiring the approval of the shareholders; |

| | B. | the filling of a vacancy among the directors or in the office of auditor and the appointing or removing of any of the chief executive officer, the chairman of the Board or the president of the Corporation; |

| | C. | the issue of securities except as authorized by the Board; |

| | D. | the declaration of dividends; |

| | E. | the purchase, redemption or any other form of acquisition of shares issued by the Corporation; |

| | F. | the payment of a commission to any person in consideration of the person purchasing or agreeing to purchase shares of the Corporation from the Corporation or from any other person, or procuring or agreeing to procure purchasers for any such shares except as authorized by the Board; |

| | G. | the approval of a management proxy circular; |

| | H. | the approval of a take-over bid circular, directors' circular or issuer bid circular; |

| | I. | the approval of an amalgamation of the Corporation; |

| | J. | the approval of an amendment to the articles of the Corporation; |

| | K. | the approval of annual financial statements of the Corporation; and |

| | L. | the adoption, amendment or repeal of any by-law of the Corporation. |

In addition to those matters which at law cannot be delegated, the Board must consider and approve all major decisions affecting the Corporation, including all material acquisitions and dispositions, material capital expenditures, material debt financings, issue of shares and granting of options.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 22 of 47 |

The Board has the responsibility to ensure that there are long-term goals and a strategic planning process in place for the Corporation and to participate with management directly or through committees in developing and approving the strategy by which the Corporation proposes to achieve these goals (taking into account, among other things, the opportunities and risks of the business of the Corporation).

The Board has the responsibility to safeguard the assets and business of the Corporation, identify and understand the principal risks of the business of the Corporation and to ensure that there are appropriate systems in place which effectively monitor and manage those risks with a view to the long-term viability of the Corporation.

| | (d) | Appointment, Training and Monitoring Senior Management |

The Board has the responsibility to:

| | (i) | appoint the CEO, and together with the CEO, to develop a position description for the CEO; |

| | (ii) | with the advice of the compensation committee of the Board (the "Compensation Committee"), develop corporate goals and objectives that the CEO is responsible for meeting and to monitor and assess the performance of the CEO in light of those corporate goals and objectives and to determine the compensation of the CEO; |

| | (iii) | provide advice and counsel to the CEO in the execution of the duties of the CEO; |

| | (iv) | develop, to the extent considered appropriate, position descriptions for the chairman of the Board and the chairman of each committee of the Board; |

| | (v) | approve the appointment of all corporate officers; |

| | (vi) | consider, and if considered appropriate, approve, upon the recommendation of the Compensation Committee and the CEO, the remuneration of all corporate officers; |

| | (vii) | consider, and if considered appropriate, approve, upon the recommendation of the Compensation Committee, incentive-compensation plans and equity-based plans of the Corporation; and |

| | (viii) | ensure that adequate provision has been made to train and develop management and members of the Board and for the orderly succession of management, including the CEO. |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 23 of 47 |

| | (e) | Ensuring Integrity of Management |

The Board has the responsibility, to the extent considered appropriate, to satisfy itself as to the integrity of the CEO and other senior officers of the Corporation and to ensure that the CEO and such other senior officers are creating a culture of integrity throughout the Corporation.

| | (f) | Policies, Procedures and Compliance |

The Board is responsible for the oversight and review of the following matters and may rely on management of the Corporation to the extent appropriate in connection with addressing such matters:

| | (i) | ensuring that the Corporation operates at all times within applicable laws and regulations and to appropriate ethical and moral standards; |

| | (ii) | approving and monitoring compliance with significant policies and procedures by which the business of the Corporation is conducted; |

| | (iii) | ensuring that the Corporation sets appropriate environmental standards for its operations and operates in material compliance with environmental laws and legislation; |

| | (iv) | ensuring that the Corporation has a high regard for the health and safety of its employees in the workplace and has in place appropriate programs and policies relating thereto; |

| | (v) | developing the approach of the Corporation to corporate governance, including to the extent appropriate developing a set of governance principals and guidelines that are specifically applicable to the Corporation; and |

| | (vi) | examining the corporate governance practices within the Corporation and altering such practices when circumstances warrant. |

| | (g) | Reporting and Communication |

The Board is responsible for the oversight and review of the following matters and may rely on management of the Corporation to the extent appropriate in connection with addressing such matters:

| | (i) | ensuring that the Corporation has in place policies and programs to enable the Corporation to communicate effectively with management, shareholders, other stakeholders and the public generally; |

| | (ii) | ensuring that the financial results of the Corporation are adequately reported to shareholders, other security holders and regulators on a timely and regular basis; |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 24 of 47 |

| | (iii) | ensuring that the financial results are reported fairly and in accordance with applicable generally accepted accounting standards; |

| | (iv) | ensuring the timely and accurate reporting of any developments that could have a significant and material impact on the value of the Corporation; and |

| | (v) | reporting annually to the shareholders of the Corporation on the affairs of the Corporation for the preceding year. |

The Board is responsible for the oversight and review of the following matters and may rely on management of the Corporation to the extent appropriate in connection with addressing such matters:

| | (i) | monitoring the Corporation's progress in achieving its goals and objectives and revise and, through management, altering the direction of the Corporation in response to changing circumstances; |

| | (ii) | considering taking action when performance falls short of the goals and objectives of the Corporation or when other special circumstances warrant; |

| | (iii) | reviewing and approving material transactions involving the Corporation; |

| | (iv) | ensuring that the Corporation has implemented adequate internal control and management information systems; |

| | (v) | assessing the individual performance of each Director and the collective performance of the Board; and |

| | (vi) | oversee the size and composition of the Board as a whole to facilitate more effective decision-making by the Corporation. |

| 4. | Board’s Expectations of Management |

The Board expects each member of management to perform such duties, as may be reasonably assigned by the Board from time to time, faithfully, diligently, to the best of his or her ability and in the best interests of the Corporation. Each member of management is expected to devote substantially all of his or her business time and efforts to the performance of such duties. Management is expected to act in compliance with and to ensure that the Corporation is in compliance with all laws, rules and regulations applicable to the Corporation.

| 5. | Responsibilities and Expectations of Directors |

The responsibilities and expectations of each Director are as follows:

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 25 of 47 |

| | (a) | Commitment and Attendance |

All Directors should make every effort to attend all meetings of the Board and meetings of committees of which they are members. Members may attend by telephone.

| | (b) | Participation in Meetings |

Each Director should be sufficiently familiar with the business of the Corporation, including its financial position and capital structure and the risks and competition it faces, to actively and effectively participate in the deliberations of the Board and of each committee on which he or she is a member. Upon request, management should make appropriate personnel available to answer any questions a Director may have about any aspect of the business of the Corporation. Directors should also review the materials provided by management and the Corporation's advisors in advance of meetings of the Board and committees and should arrive prepared to discuss the matters presented.

| | (c) | Code of Business Conduct and Ethics |

The Corporation has adopted a Code of Business Conduct and Ethics to deal with the business conduct of Directors and officers of the Corporation. Directors should be familiar with the provisions of the Code of Business Conduct and Ethics.

The Corporation values the experience Directors bring from other boards on which they serve, but recognizes that those boards may also present demands on a Director's time and availability, and may also present conflicts issues. Directors should consider advising the chairman of the Corporate Governance and Nominating Committee before accepting any new membership on other boards of directors or any other affiliation with other businesses or governmental bodies which involve a significant commitment by the Director.

| | (e) | Contact with Management |

All Directors may contact the CEO at any time to discuss any aspect of the business of the Corporation. Directors also have complete access to other members of management. The Board expects that there will be frequent opportunities for Directors to meet with the CEO and other members of management in Board and committee meetings and in other formal or informal settings.

The proceedings and deliberations of the Board and its committees are, and shall remain, confidential. Each Director should maintain the confidentiality of information received in connection with his or her services as a director of the Corporation.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 26 of 47 |

| | (g) | Evaluating Board Performance |

The Board, in conjunction with the Corporate Governance and Nominating Committee, and each of the committees of the Board should conduct a self-evaluation at least annually to assess their effectiveness. In addition, the Corporate Governance and Nominating Committee should periodically consider the mix of skills and experience that Directors bring to the Board and assess, on an ongoing basis, whether the Board has the necessary composition to perform its oversight function effectively.

| 6. | Qualifications and Directors' Orientation |

Directors should have the highest personal and professional ethics and values and be committed to advancing the interests of the Corporation. They should possess skills and competencies in areas that are relevant to the business of the Corporation. The CEO is responsible for the provision of an orientation and education program for new Directors.

The Board should meet on at least a quarterly basis and should hold additional meetings as required or appropriate to consider other matters. In addition, the Board should meet as it considers appropriate to consider strategic planning for the Corporation. Financial and other appropriate information should be made available to the Directors in advance of Board meetings. Attendance at each meeting of the Board should be recorded.

Management may be asked to participate in any meeting of the Board. The Board should meet separately from management as considered appropriate to ensure that the Board functions independently of management. The Directors independent of management should meet with no members of management of the Corporation present as considered appropriate.

The Board has established an Audit Committee, a Compensation Committee, an Environmental Health and Safety Committee, Governance and Nominating Committee and a Hedging Committee to assist the Board in discharging its responsibilities. Special committees of the Board may be established from time to time to assist the Board in connection with specific matters. The chairman of each committee should report to the Board following meetings of the committee. The charter of each standing committee should be reviewed annually by the Board.

Each Director will be subject to an annual evaluation of his or her individual performance. The collective performance of the Board and of each committee of the Board will also be subject to annual review. Directors should be encouraged to exercise their duties and responsibilities in a manner that is consistent with this mandate and with the best interests of the Corporation and its shareholders generally.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 27 of 47 |

The Board has the authority to retain independent legal, accounting and other consultants. The Board may request any officer or employee of the Corporation or outside counsel or the external/internal auditors to attend a meeting of the Board or to meet with any member of, or consultant to, the Board.

Directors are permitted to engage an outside legal or other adviser at the expense of the Corporation where for example he or she is placed in a conflict position through activities of the Corporation, but any such engagement shall be subject to the prior approval of the Corporate Governance and Nominating Committee.

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 28 of 47 |

EXHIBIT II

RESOLUTION - AMENDMENTS TO SHARE INCENTIVE PLAN

Upon motion, duly proposed and seconded, it was resolved:

| 1. | THAT the proposed amendments to the Plan of the Company substantially in the form attached as Exhibit III to the Circular of the Company prepared for the purpose of the Meeting be and are hereby approved, ratified and confirmed; |

| 2. | THAT the amended and restated share incentive plan, attached in underlined form be, and it hereby is approved; |

| 3. | THAT any officer or director of the Company be, and each is hereby, authorized and directed, for and on behalf of the Company, to sign and execute all documents, to conclude any agreements and to do and perform all acts and things deemed necessary or advisable in order to give effect to this Resolution, including compliance with all securities laws and regulations; and |

| 4. | THAT the Board of Directors of the Company be, and it is hereby, authorized to cause all measures to be taken, such further agreements to be entered into and such further documents to be executed as may be deemed necessary or advisable to give effect to and fully carry out the intent of this Resolution. |

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 29 of 47 |

BREAKWATER RESOURCES LTD.

SHARE INCENTIVE PLAN

AMENDED AND RESTATED AS OF JUNE 8, 200622, 2007

ARTICLE ONE

Section 1.01 Purpose of Share Incentive Plan: The purpose of this Share Incentive Plan is to attract, retain and motivate persons as directors, officers, employees and consultants of the Corporation and the Subsidiaries and to advance the interests of the Corporation by providing such persons with the opportunity, through share options, the share purchase plan and the share bonus plan, to acquire an increaseda proprietary interest in the Corporation.

ARTICLE TWO

DEFINITIONS

Section 2.01 Defined Terms:

Where used herein, the following terms shall have the following meanings, respectively:

| (a) | “Act” means the Canada Business Corporations Act or its successor, as amended from time to time; |

| (b) | “Aggregate Contribution” means the aggregate of a Participant’s Contribution and the related Corporation’s Contribution; |

| (c) | “Basic Annual Salary” means the basic annual remuneration of a Participant from the Employer exclusive of any overtime pay, bonuses or allowances of any kind whatsoever or such other amount as may be determined by the Board from time to time as the Basic Annual Salary of the Participant; |

(d) | “Blackout Period” means an interval of time during which (i) the trading guidelines of the Corporation, as amended or replaced from time to time, restrict one or more Eligible Persons from trading in securities of the Corporation or (ii) the Corporation has determined that one or more Eligible Persons may not trade any securities of the Corporation; |

(e) | “Blackout Period Expiry Date” means the date on which a Blackout Period expires; |

(f) | (d) “Board” means the board of Directors of the Corporationdirectors or, if established and duly authorised to act, the ExecutiveCompensation Committee or another committee appointed for such purpose by the board of directors of the CorporationDirectors;

|

(g) | (e) “Business Day” means any day, other than a Saturday or a Sunday, on which the Exchange is open for trading;

|

Breakwater Resources Ltd. Management Information Circular Annual and Special Shareholder Meeting - 2007 | Page 30 of 47 |

(h) | “Compensation Committee” means the committee appointed by the Directors to, among other things, assist the Directors in the administration of this Share Incentive Plan; |

(i) | (f) “Consultant” means a person with whom the Corporation or any Subsidiary has a contract for substantial services;

|

(j) | (g) “Corporation” means Breakwater Resources Ltd. and includes any successor corporation thereto;

|

(k) | (h) “Corporation’s Contribution” means the amount the Corporation credits a Participant under Section 3.05section 3.06 hereof;

|