Emmis Communications Corporation

One Emmis Plaza

40 Monument Circle, Suite 700

Indianapolis, Indiana 46204

Tel. (317) 266-0100

Fax (317) 631-3750

March 2, 2012

VIA EDGAR

United States Securities and Exchange Commission

Mail Stop 3720

100 F St. NE

Washington, D.C. 20549

Attention: Larry Spirgel, Assistant Director

Emmis Communications Corporation

Form 10-K for the Fiscal Year Ended February 28, 2011, Filed May 10, 2011, and

Form 10-Q for the Nine-Months Ended November 30, 2011, Filed January 12, 2012

File No. 000-23264

Dear Mr. Spirgel:

I am writing in response to the comments of the Staff contained in the Staff’s letter to Jeffrey H. Smulyan, Chief Executive Officer of Emmis Communications Corporation (“Emmis” or the “Company”) dated February 17, 2012 (the “Comment Letter”) regarding the above-referenced Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

Set forth below are the Staff’s comments conveyed in the Comment Letter and the Company’s responses thereto.

Form 10-Q, November 30, 2011

Financial Statements

Equity method investments and Cost method investments, page 13

| | 1. | We understand from the second paragraph of page 13 that you retained substantial influence over Merlin Media LLC. We note from the third paragraph of page 26 that your preferred equity interests in Merlin Media LLC are non-redeemable perpetual equity interests that are also junior to $87 million of non-redeemable perpetual preferred interests held by other investors and junior to $60 million of senior secured notes issued to an affiliate of Merlin Holdings. We also note that distributions on “Merlin Media’s common and preferred interests are made when declared by Merlin Media’s board of managers.” Explain to us your consideration of whether or not your preferred equity interests in Merlin Media LLC are in substance common stock. Please address the accounting guidance of ASC 323-10-15-13 through ASC 323-10-15-19 and tell us why you believe it is appropriate to use the cost method to account for your investment in Merlin Media LLC non-redeemable perpetual equity interests. |

Response to Comment 1

The Company evaluated the guidance in ASC 323-10-15-13 through ASC 323-10-15-19 in its accounting for the Merlin Media LLC non-redeemable perpetual preferred equity interests and concluded that such preferred interests were not in-substance common stock.

ASC 323-10-15-13 defines in-substance common stock as “an investment in an entity that has risk and reward characteristics that are substantially similar to that entity’s common stock”. ASC 323-10-15-13 describes characteristics that should be evaluated in order to determine if the investment is in-substance common stock. If any one of the characteristics indicates that the investment is not substantially similar to an investment in that entity’s common stock, the investment is not in-substance common stock. The characteristics are:

| | a. | Subordination. An investor shall determine whether the investment has subordination characteristics that are substantially similar to that entity’s common stock. If an investment has a substantive liquidation preference over common stock, it is not substantially similar to the common stock. However, certain liquidation preferences are not substantive. An investor shall determine whether a liquidation preference is substantive. For example, if the investment has a stated liquidation preference that is not significant in relation to the purchase price of the investment, the liquidation preference is not substantive. Further, a stated liquidation preference is not substantive if the investee has little or no subordinated equity (for example, common stock) from a fair value perspective. A liquidation preference in an investee that has little or no subordinated equity from a fair value perspective is nonsubstantive because, in the event of liquidation, the investment will participate in substantially all of the investee’s losses. |

| | b. | Risks and rewards of ownership. An investor shall determine whether the investment has risks and rewards of ownership that are substantially similar to an investment in that entity’s common stock. If an investment is not expected to participate in the earnings (and losses) and capital appreciation (and depreciation) in a manner that is substantially similar to common stock, the investment is not substantially similar to common stock. If the investee pays dividends on its common stock and the investment participates currently in those dividends in a manner that is substantially similar to common stock, then that is an indicator that the investment is substantially similar to common stock. Likewise, if the investor has the ability to convert the investment into that entity’s common stock without any significant restrictions or contingencies that prohibit the investor from participating in the capital appreciation of the investee in a manner that is substantially similar to that entity’s common stock, the conversion feature is an indicator that the investment is substantially similar to the common stock. The right to convert certain investments to common stock (such as the exercise of deep-in-the-money warrants) enables the interest to participate in the investee’s earnings (and losses) and capital appreciation (and depreciation) on a substantially similar basis to common stock. |

| | c. | Obligation to transfer value. An investment is not substantially similar to common stock if the investee is expected to transfer substantive value to the investor and the common shareholders do not participate in a similar manner. For example, if the investment has a substantive redemption provision (for example, a mandatory redemption provision or a non-fair-value put option) that is not available to common shareholders, the investment is not substantially similar to common stock. An obligation to transfer value at a specious future date, such as preferred stock with a mandatory redemption in 100 years, shall not be considered an obligation to transfer substantive value. |

After carefully considering each of these characteristics, Emmis concluded that its retained preferred interests in Merlin Media LLC are not “in-substance common stock” and the equity method of accounting was not appropriate. This conclusion is supported by the following characteristics of the preferred instrument:

| | 1. | The subordination characteristics of the preferred shares are not substantially similar to the common shares. The preferred shares receive a cumulative preferred return that accretes quarterly at a rate of 8% per annum. The waterfall of distributions requires that, after receiving the 8% cumulative preferred return, the preferred holders must receive a distribution equal to their entire preferred capital account (par value) before any distributions flow to the holders of common shares. |

| | 2. | As required in paragraph (a) above, Merlin Media LLC does have substantial subordinated equity in the form of common shares. The fair value of Merlin Media LLC’s common shares as of September 1, 2011 were $30.5 million, which represented approximately 25% of the total equity value of Merlin Media LLC on a fair value basis. Therefore, we believe that the liquidation preference of the preferred shares is substantive. |

| | 3. | The preferred shares are not convertible into common shares. The preferred shares do not share in the risks and rewards of ownership in a manner that is substantially similar to the common shares. |

Emmis also considered the provisions of ASC 320-10 to determine if they apply to the preferred shares of Merlin Media LLC. ASC 320-10 defines a debt security as “Any security representing a creditor relationship with an entity. The term debt security also includes…preferred stock that by its terms either must be redeemed by the issuing entity or is redeemable at the option of the investor.”

The preferred shares of Merlin Media LLC held by Emmis are not redeemable under any circumstances and they are also not convertible. Because the preferred stock is non-redeemable, it is considered an equity security under ASC 320. However, equity securities are only accounted for under ASC 320 if those securities have a readily determinable fair value. Since there is no active market for the preferred interest in Merlin Media LLC and the operating agreement of Merlin Media LLC severely restricts the transfer of the interests, there is no readily determinable fair value. Thus, Emmis accounted for its investment in the preferred stock of Merlin Media LLC under the cost method as described in ASC 325-20.

| | 2. | Refer to the penultimate paragraph of page 26, which indicates that you used the Black/Scholes method to determine the value of your preferred interest in Merlin Media LLC. Provide us with your Black/Scholes calculations and tell us how you determined the input factors without an active trading market in Merlin Media preferred shares. |

Response to Comment 2

Merlin Media LLC engaged a third-party independent appraiser, Valuation Research Company, to assist management in the valuation of the tangible assets, intangible assets, and equity interests of Merlin Media LLC as of September 1, 2011, which was the date of acquisition. Emmis used the methodology employed by Valuation Research Company to assist the Company in determining the fair value of its retained common and preferred equity interest. A copy of the applicable pages from the appraisal performed by Valuation Research Company is provided at the end of this correspondence.

To determine the fair value of our retained preferred and common equity interests in Merlin Media LLC, we used an option-pricing method, which treats common stock and preferred stock as call options on the fair value of the enterprise, with exercise prices based on the liquidation preference of the preferred stock.

Under this method, the common stock has value only if the funds available for distribution to shareholders exceed the value of the liquidation preference at the time of a liquidity event (for example, merger or sale), assuming the enterprise has funds available to make a liquidation preference meaningful and collectable by the shareholders. The common stock is modeled as a call option that gives its owner the right but not the obligation to buy the underlying enterprise value at a predetermined or exercise price. In the model, the exercise price is based on a comparison with the enterprise value rather than, as in the case of a “regular” call option, a comparison with a per-share stock price. Thus, common stock is considered to be a call option with a claim on the enterprise at an exercise price equal to the remaining value immediately after the preferred stock is liquidated. We used the Black/Scholes model to price the call option for our option-pricing method.

To apply the option-pricing method, the rights and preferences of the various securities that make up the capital structure of Merlin Media LLC were established. Next, the various strike prices, or points at which the sharing percentages changed among Merlin Media LLC’s securities, were calculated. A five-year term was assumed for purposes of the calculation. Volatility was determined by examining the two-year historical volatility of comparable public companies.

Summary of the input factors:

| | September 30, |

Selected Volatility | | 40.0% |

Risk Free Rate | | 0.90% |

Term (in years) | | 5.00 |

Stock Price (Equity Value) | | $121.5 million |

Strike Price | | Various, as discussed above |

Note 11. Issuance of ECC Senior Unsecured Notes and Preferred Stock Transactions

Preferred Stock Transactions, page 30

| | 3. | The circumstance under which your preferred stock is subject to mandatory redemption, or whose redemption is outside your control are unclear. Please clarify and include the disclosures required by Rule 5-02.27 of Regulation S-X. Specify the terms of the redemption features of your preferred shares under which your preferred shares can be redeemed, when redemption is mandatory and/or when redemption is outside your control. Clearly disclose the redemption amount. Tell us and disclose the accounting treatment for differences between the carrying amount of the preferred stock and its redemption amount, if any. |

Response to Comment 3

Our preferred shares are not mandatorily redeemable. We may be compelled to redeem our preferred shares only upon the occurrence of one situation, described below, which we have concluded is outside of our control. If Mr. Jeffrey H. Smulyan, our Chairman and CEO, participates in a going private transaction (independently or through his affiliates), the holders of our preferred stock are able to redeem their shares for the liquidation preference (plus accrued and unpaid dividends, if any) one year later. While such a going private transaction is under the control of Mr. Smulyan, we concluded it was outside of the control of the Company and thus necessitated classification of the preferred shares outside of permanent equity.

On the face of our balance sheet, we disclose the stated liquidation preference of the preferred stock, which is $50 per share. Our carrying value is the liquidation preference per share multiplied by the number of shares then outstanding. We disclose the amount of accrued and unpaid dividends, but we do not include them in our carrying amount because we believe the sole condition under which the preferred shares would become redeemable is not probable of occurring. We subtract current period dividends from consolidated net income to determine net income attributable to common shareholders.

In future filings, we will parenthetically disclose the redemption amount on the face of our balance sheet and we will disclose the reason for the difference between the carrying amount and the redemption amount in the notes to our financial statements.

| | 4. | Refer to the third paragraph of page 30, which states that while preferred shares have not been retired they are considered extinguished for accounting purposes and therefore you have recorded a $55.8 million gain. Explain to us the basis for this accounting treatment. In this regard tell us the following: |

| | • | | Address the pertinent swap agreements such as the confirmation filed as exhibit 99.1 to Schedule TO-I filed and amended December 2, 2011 and explain to us how the contractual terms of your agreements transfer “all of the economic rights of (the shareholder’s) shares (of) Preferred Stock to Emmis”, |

| | • | | Explain for the settlement terms and how “all of the economic rights” of the preferred shares have been transferred when the swap agreements are scheduled to terminate on November 28, 2016, and |

| | • | | Please refer to all pertinent authoritative accounting literature in your response. |

Response to Comment 4

Emmis has acquired rights in 1,484,679 shares of its currently outstanding preferred stock. In each case, in exchange for cash consideration, the holder of the preferred shares entered into two separate contracts with Emmis: a total return swap and a voting agreement. Pursuant to these two contracts, the preferred shares remain legally issued and outstanding under Indiana law and the holder of the preferred shares maintains legal title to the shares, but the holder has relinquished all of its economic interests in the preferred shares and granted Emmis the right to direct the holder’s vote of the preferred shares. Below is a summary of the total return swap and voting agreement:

Total Return Swap (“TRS”). Under the TRS, Emmis paid (and the counterparty received) an agreed-upon amount of cash per share at the inception of the TRS, the counterparty retains legal ownership of the shares as specifically noted in the TRS (Section 5) and voting agreement (Section 2.2), and the counterparty agrees to surrender the shares to Emmis upon the earlier to occur of (i) written notice of termination by Emmis, (ii) any other applicable disruption or termination event as described in the TRS, or (iii) November 28, 2016. In the interim, the counterparty has granted Emmis a first priority security interest in the shares as security for the performance of the counterparty’s obligations under the TRS and Emmis holds such shares in a fiduciary capacity on behalf of the counterparty. Thus, the counterparty does not have the right to sell or otherwise transfer the shares, to enter into any other transactions relating to the shares, or to re-acquire the shares under any circumstance. The terms of the TRS obligate the counterparty to return to Emmis 100% of any economic value received by virtue of the counterparty’s continued legal ownership of the shares. For example, if Emmis were to declare and pay a dividend on these shares, the counterparty would be required, pursuant to the terms of the TRS, to return such dividend to Emmis. The same would apply for the proceeds from any redemption as discussed above in Comment 3. The only possible settlement of the TRS arrangement is the receipt by Emmis of the physical shares subject to the arrangement. While the shares subject to the TRS have no further economic value to the counterparty, they are considered outstanding under Indiana law since the counterparty remains the holder of record, and the counterparty retains the legal authority to vote the shares.

Voting Agreement. Pursuant to a voting agreement that remains in effect during the entire term of the TRS, the counterparty agrees to vote its shares in accordance with Emmis’ instructions as and when directed by Emmis. Like the TRS, the voting agreement also contains prohibitions on any sale or other transfer of the subject shares by the counterparty.

Given the contracts outlined above, we disclosed that the counterparties will receive no economic benefit by virtue of their continued record ownership of these shares beyond the purchase price we already paid. However, until they do surrender the shares, the preferred shares held by the counterparty pursuant to the TRS and voting agreements remain legally outstanding under Indiana law.

In determining the appropriate accounting treatment for this transaction, Emmis first considered whether the TRS and voting agreement were “Freestanding Financial Instruments”, as defined in ASC 480-10. Given that neither the TRS nor the voting agreement qualifies under ASC 480-10 as “legally detachable” or “separately exercisable” from the preferred shares, we concluded they were not freestanding financial instruments. Therefore, Emmis treated the TRS and voting agreement as having “in substance modified” the preferred shares for accounting purposes, with the terms of the TRS and voting agreement deemed to be “embedded” therein.

Next, Emmis evaluated whether this deemed modification for accounting purposes should be treated for accounting purposes as an “extinguishment” of the preferred shares. While there is detailed guidance on how to evaluate whether a transaction that is treated for accounting purposes as a modification of debt results in extinguishment accounting, we found limited guidance with respect to a transaction that is treated for accounting purposes as a modification of preferred shares. However, the scope paragraph of ASC 260-10-S99-2 certainly contemplates that a modification of preferred shares can be accounted for as an extinguishment. Since the TRS and voting agreement eliminated all of the counterparties’ economic rights in the preferred shares (the counterparties no longer retain the economic benefits or risks associated with ownership of the preferred shares) and Emmis would have no further obligations with respect to the preferred shares, we concluded that for accounting purposes this transaction was a substantial modification that should be accounted for as the extinguishment of the existing preferred shares. Accordingly, under ASC 260-10-S99, Emmis recorded the difference between the carrying value of the preferred shares that were deemed to be extinguished for accounting purposes and the fair value of the consideration transferred to the holder of the preferred shares as an equity transaction (to accumulated deficit). This amount was also reflected as an adjustment to net income (loss) to arrive at income (loss) available to common shareholders. The fair value of the consideration transferred to the holder of the preferred shares amounted to the sum of the cash payment and the fair value of the preferred shares, which were deemed to have been modified for accounting purposes by the embedded TRS and the voting agreement, and as discussed below, the fair value of such shares was $0.

Emmis then considered whether the preferred shares that were deemed to be modified for accounting purposes by the embedded TRS and voting agreements constituted a liability under ASC 480. Emmis concluded that the preferred shares did not constitute a liability primarily because Emmis has no further obligation to transfer any consideration and can simply require surrender of the shares. Emmis also considered whether these shares were subject to any derivative accounting. After reviewing the definition of a derivative in ASC 815-10-15-83, we concluded that these shares do not represent a derivative in their entirety. Emmis did conclude that the TRS, as a feature deemed for accounting purposes to be embedded in the preferred shares, met the definition of a derivative in ASC 815-10-15-83, so we evaluated the TRS to determine if it qualified for the scope exception from the requirements of ASC 815 by virtue of ASC 815-10-15-74. After careful analysis, we concluded the TRS feature met the scope exception from ASC 815 and qualified for equity classification. Therefore, the TRS did not require bifurcation from the preferred shares for accounting purposes, and consideration of further accounting for the TRS was unnecessary.

Since the preferred shares with the TRS and voting agreement that are deemed for accounting purposes to be embedded therein qualified for equity classification and did not require bifurcation, these shares were recorded at fair value. Emmis concluded the fair value of these shares was $0 because Emmis has the right to require surrender of the shares for no additional consideration at any time and the counterparties have no economic risks or benefits of ownership.

In conclusion, Emmis will never be obligated to transfer any additional economic consideration to the counterparties of the TRS and voting agreements. The ISDA terms governing the swap agreement provide for a total return of all economic interests that could possibly accrue to the counterparty by virtue of its continued legal ownership of the shares. While the preferred shares are treated as having been extinguished for accounting purposes, the shares still remain legally issued and outstanding under Indiana law. Thus, on the face of our balance sheet, we disclosed the number of preferred shares outstanding (inclusive of the preferred shares subject to the TRS and voting agreements) as well as the number of these shares that are subject to a TRS and voting agreement.

Additionally, per your request, the Company hereby acknowledges that

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| | • | | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

If you have any questions, please do not hesitate to call me at (317) 684-6535.

|

| Sincerely, |

|

| /s/ Patrick M. Walsh |

Patrick M. Walsh Executive Vice President, Chief Financial Officer and Chief Operating Officer |

Merlin Media, LLC

Exhibit 18Equity Allocation—Option-Pricing Method

$ in thousands, except per share data

Methodology

We allocated the implied post-money equity value of the Company using the Option-Pricing Method, as described in the AICPA Practice Aid entitled,Valuation of Privately-Held-Company Equity Securities Issued as Compensation. Please see Appendix 8 for a complete description of the Option-Pricing Method.

The Option-Pricing Method treats common stock and preferred stock as call options on the total equity value of the Company, with exercise prices based on the value thresholds at which the allocation among the various holders of the Company’s securities changes. Under this method, the common stock has value only if the funds available for distribution to shareholders exceed the value of the liquidation preference at the time of a liquidity event (for example, a strategic sale or merger), assuming the enterprise has funds available to make a liquidation preference meaningful and collectable by the preferred shareholders.

To apply the Option-Pricing Method, we first established the rights and preferences of the various securities that make up the capital structure of the Company. We then calculated the various strike prices, or points at which the sharing percentages changed among the Company’s securities. We determined the volatility of the Company’s equity by examining the standard deviation of several comparable companies. Finally, we established the term of the options through discussions with Company management and calculated the value of the securities in the Company’s capital structure.

Allocation Summary

| | | September 30, | | | | September 30, | |

| | | | | | Per Share | |

Security | | Total Value1 | | | Value2 | |

Class A Units | | $ | 80.253 | | | $ | 0.92 | |

Class B Units | | $ | 10.773 | | | $ | 0.37 | |

Class C Units | | $ | 27.204 | | | $ | 5.33 | |

Class D Units | | $ | 3.278 | | | $ | 5.33 | |

| | | | | | | | |

Total | | $ | 121.508 | | | | | |

| | | | | | | | |

Notes:

| 1 | Based on values presented in the Option Bands section of the equity allocation analysis |

| 2 | Calculated based on shares outstanding in the Capital Structure section of the equity allocation analysis |

73 |

Merlin Media, LLC

Exhibit 18Equity Allocation—Option-Pricing Method

$ in thousands, except per share data

Capital Structure

| | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | |

| | | Fully- | | | | | | Per Share | | | | | | | |

| | | Diluted | | | % | | | Liq Pref/ | | | Liq Pref/ | | | | |

Equity Securities | | Shares | | | Ownership | | | Strike | | | Proceeds | | | Rank | |

Units A | | | 87,055.2 | | | | 71.6 | % | | $ | 1.49 | | | $ | 129,359.5 | | | | 1st | |

Units B | | | 28,733.3 | | | | 23.6 | % | | | 1.49 | | | | 42,696.2 | | | | na | |

Units C | | | 5,104.4 | | | | 4.2 | % | | | na | | | | na | | | | na | |

Units D | | | 615.0 | | | | 0.5 | % | | | na | | | | na | | | | na | |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 121,507.9 | | | | 100.0 | % | | | | | | | | | | | | |

Black-Scholes Option Inputs

| | | September 30, | |

Option Inputs | | | |

Selected Volatility1 | | | 40.0 | % |

Risk Free Rate | | | 0.90 | % |

Term (in Years) | | | 5.00 | |

Stock Price (Equity Value) | | $ | 121.5 | |

Strike Price | | | Per Strike Price Derivation | |

Strike Price Derivation

| | | September 30, | | | | September 30, | | | September 30, |

| | | Strike | | | Option | | | |

| | | Price | | | Value | | | Notes |

Strike 1 | | $ | 0.0 | | | $ | 121.5 | | | By definition, Strike Price 1 is zero. Value of Option 1 is equal to the value of the total equity of the Company. |

Strike 2 | | $ | 42.3 | | | $ | 84.2 | | | Value equal to the initial liquidation preference of Class A Units Unpaid Yield |

Strike 3 | | $ | 129.4 | | | $ | 41.3 | | | Value equal to the initial liquidation preference of Class A Units Unreturned Capital |

Strike 4 | | $ | 143.3 | | | $ | 37.3 | | | Value equal to the initial liquidation preference of Class B Units Unpaid Yield |

Strike 5 | | $ | 172.1 | | | $ | 30.5 | | | Value equal to the initial liquidation preference of Class B Units Unreturned Capital |

Notes:

| 1 | Based on 2-year historical asset volatility of comparable public companies |

74 |

Merlin Media, LLC

Exhibit 18Equity Allocation—Option-Pricing Method

$ in thousands, except per share data

Option Bands

| | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | | | | September 30, | |

| | | Units A | | | Units B | | | Units C | | | Units D | | | Total | |

(% Allocation) | | | | | | | | | | | | | | | | | | | | |

Option 1-2 | | | 100.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Option 2-3 | | | 100.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Option 3-4 | | | 0.0 | % | | | 100.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Option 4-5 | | | 0.0 | % | | | 100.0 | % | | | 0.0 | % | | | 0.0 | % | | | 100.0 | % |

Option 5 | | | 0.0 | % | | | 0.0 | % | | | 89.2 | % | | | 10.8 | % | | | 100.0 | % |

| | | | | |

($ Allocation) | | | | | | | | | | | | | | | | | | | | |

Option 1-2 | | $ | 37.4 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 37.4 | |

Option 2-3 | | $ | 42.9 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 42.9 | |

Option 3-4 | | $ | 0.0 | | | $ | 4.0 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 4.0 | |

Option 4-5 | | $ | 0.0 | | | $ | 6.8 | | | $ | 0.0 | | | $ | 0.0 | | | $ | 6.8 | |

Option 5 | | $ | 0.0 | | | $ | 0.0 | | | $ | 27.2 | | | $ | 3.3 | | | $ | 30.5 | |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 80.3 | | | $ | 10.8 | | | $ | 27.2 | | | $ | 3.3 | | | $ | 121.5 | |

% Allocation | | | 66.0 | % | | | 8.9 | % | | | 22.4 | % | | | 2.7 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | |

75 |

Merlin Media, LLC

Appendix 7Accounting Guidance

AICPA Audit and Accounting Practice Aid Series: Valuation of Privately-Held-Company Equity Securities Issued as Compensation

The purpose of this Practice Aid is to provide guidance to privately held enterprises regarding the valuation of and disclosures related to their issuance of equity securities as compensation. This Practice Aid is not intended to focus on determining the value of the enterprise as a whole but rather the value of individual common shares that constitute a minority of the outstanding securities. The guidance is intended to provide assistance to management and boards of directors of enterprises that issue securities, valuation specialists, auditors, and other interested parties such as creditors.

Definition of Value

The relevant standard of value for financial reporting purposes is fair value as defined by U.S. generally accepted accounting principles (“GAAP”). Fair value is defined as the amount for which an asset or liability could be exchanged in a current transaction between knowledgeable, unrelated willing parties when neither party is acting under compulsion.

The relevant standard of value for tax purposes is fair market value. Fair market value is defined as the price at which property would exchange hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of the relevant facts. This concept of value is supported by definitions set forth by the Internal Revenue Service and has been further established and elaborated upon in numerous court decisions addressing the concept of fair market value.

Internal Revenue Code:

Section 409A and Notice 2005-1

The American Jobs Creation Act of 2004 (“the Act”) contains provisions that significantly affects the operation of nonqualified deferred compensation plans by limiting the flexibility available for participants to alter the form and timing of the distribution of their benefits, as well as timing of deferral elections and funding mechanisms. Companies should be aware of the potential impact of this legislation to their non qualified deferred compensation plans and equity compensation plans, including stock options, in addition to traditional deferred compensation plans. Section 409A generally applies to amounts deferred after December 31, 2004. However, the rules in 409A would also apply to any amounts deferred prior to that time if a “material modification” is made to the plan after October 3, 2004.

Section 409A states that vested deferred compensation will be taxed on a current basis unless the grant meets certain requirements. In addition to immediate taxation on vested deferred compensation, participants will be required to pay a 20 percent additional income tax and, potentially, interest at the IRS underpayment rate plus one percent. To avoid this treatment under the Act, a nonqualified deferred compensation plan must meet certain requirements.

On December 20, 2004, the IRS and U.S. Department of the Treasury issued Notice 2005-1 providing initial guidance on transition rules for Section 409A of the Internal Revenue Code. The initial guidance also provides guidance on a number of key questions under 409A. Section 409A became effective January 1, 2005, and requires documentary compliance by December 31, 2008.

83 |

Merlin Media, LLC

Appendix 8Valuation Methodologies

Valuation Approaches

Income Approach

The Income Approach measures the value of an asset by the present value of its future economic benefits. These benefits can include earnings, cost savings, tax deductions, and proceeds from its disposition. When applied to equity interests, value indications are developed by discounting expected cash flows to their present value at a rate of return that incorporates the risks associated with the particular investment. The discount rate selected is generally based on rates of return available from alternative investments of similar type and quality as of the date of value.

Market Approach

The Market Approach measures the value of an asset through the analysis of recent sales or offerings of comparable property. When applied to the valuation of equity interests, consideration is given to the financial conditions and operating performance of the company being valued relative to publicly traded companies operating in the same or similar industry, potentially subject to corresponding market factors and considered to be reasonable investment alternatives.

Cost Approach

The Cost Approach measures the value of an asset by the cost to reconstruct or replace it with another of like utility. When applied to the valuation of equity interests, value is based on the net aggregate fair market value of the entity’s underlying assets. The technique entails a restatement of the entity’s balance sheet by substituting the fair value of its assets and liabilities for their book values. The resulting equity value is reflective of a 100% ownership interest in the business. This approach is frequently used in valuing holding companies or capital intensive firms. It is not necessarily an appropriate valuation approach for companies providing goods or services or having significant intangible value.

Allocation Methodology1

The Current-Value Method

The current value method is based on determining enterprise value, then allocating that value to the various series of preferred stock based on their liquidation preferences or conversion values, whichever would be greater. The current value method involves a two-step process, which distinguishes it from the other two methods described below that combine valuation and allocation into a single step. It is easy to understand and relatively easy to apply, thus making it a method frequently encountered in practice. But the taskforce believes its use is appropriate only in two limited circumstances; (1) when a liquidity event in the form of an acquisition or dissolution of the enterprise is imminent, and expectations about the future of the enterprise as a going concern are virtually irrelevant, and (2) when an enterprise is at such an early stage of its development that (a) no material progress has been made on the enterprise’s business plan, (b) no significant common equity value has been created in the business above the liquidation preference on the preferred shares, and (c) there is no reasonable basis for estimating the amount and timing of any common equity value above the liquidation preference that might be created in the future.

The Probability-Weighted Expected Return Method

Under a probability-weighted expected return method, the value of the common stock is estimated based upon an analysis of future values of the enterprise assuming various future outcomes. Share value is based upon the probability-weighted present value of expected future investment returns, considering each of the possible future outcomes available to the enterprise, as well as the rights of each share class. Although the future outcomes considered in any given valuation model will vary based upon the enterprise’s facts and circumstances, common future outcomes modeled might include an IPO, merger or sale, dissolution, or continued operation as a viable private enterprise.

| (1) | As determined in the AICPA Practice Aid entitledValuation of Privately-Held-Company Equity Securities Issued as Compensation |

84 |

Merlin Media, LLC

Appendix 8Valuation Methodologies

The Option-Pricing Method

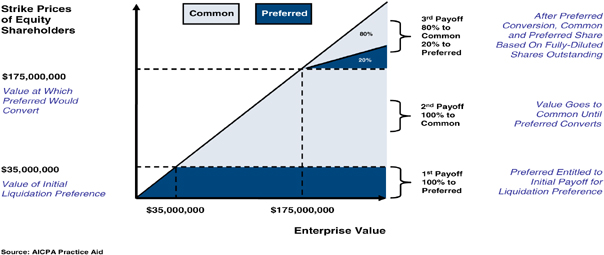

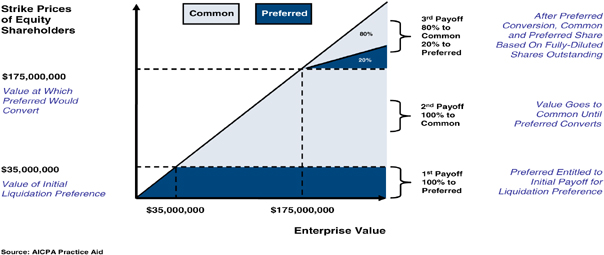

The option-pricing method treats common stock and preferred stock as call options on the enterprise’s value, with exercise prices based on the liquidation preference of the preferred stock. Under this method, the common stock has value only if the funds available for distribution to shareholders exceed the value of the liquidation preference at the time of a liquidity event (for example, merger or sale), assuming the enterprise has funds available to make a liquidation preference meaningful and collectable by the shareholders. The common stock is modeled as a call option that gives its owner the right but not the obligation to buy the underlying enterprise value at a predetermined or exercise price. In the model, the exercise price is based on a comparison with the enterprise value rather than, as in the case of a “regular” call option, a comparison with a per-share stock price. Thus, common stock is considered to be a call option with a claim on the enterprise at an exercise price equal to the remaining value immediately after the preferred stock is liquidated. The option-pricing method has commonly used Black-Scholes model to price the call option. See illustrative example below.

Option-Pricing Method Illustrative Example

85 |