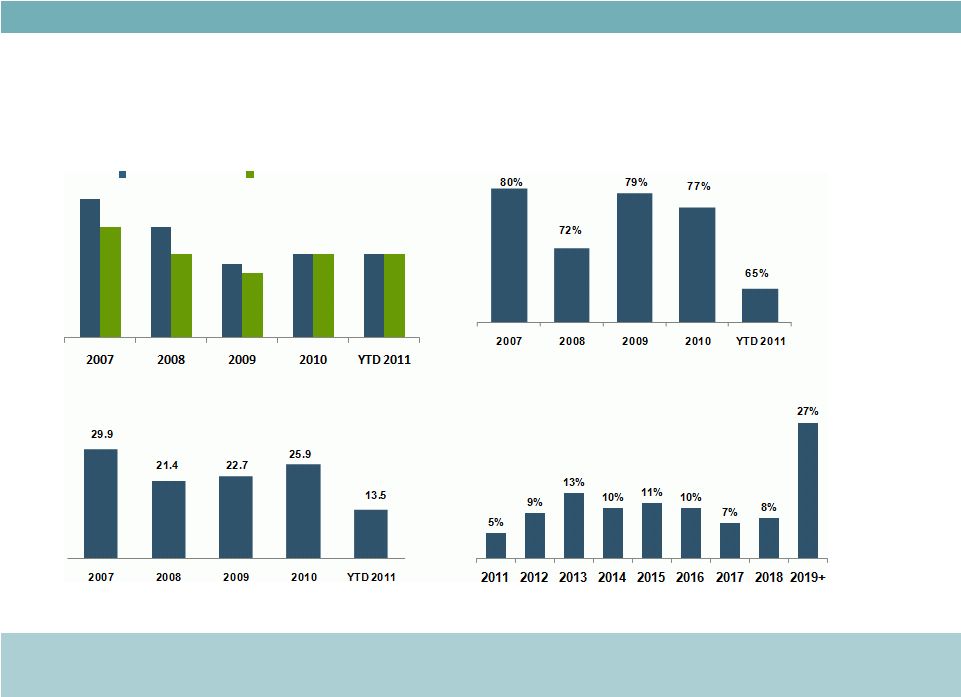

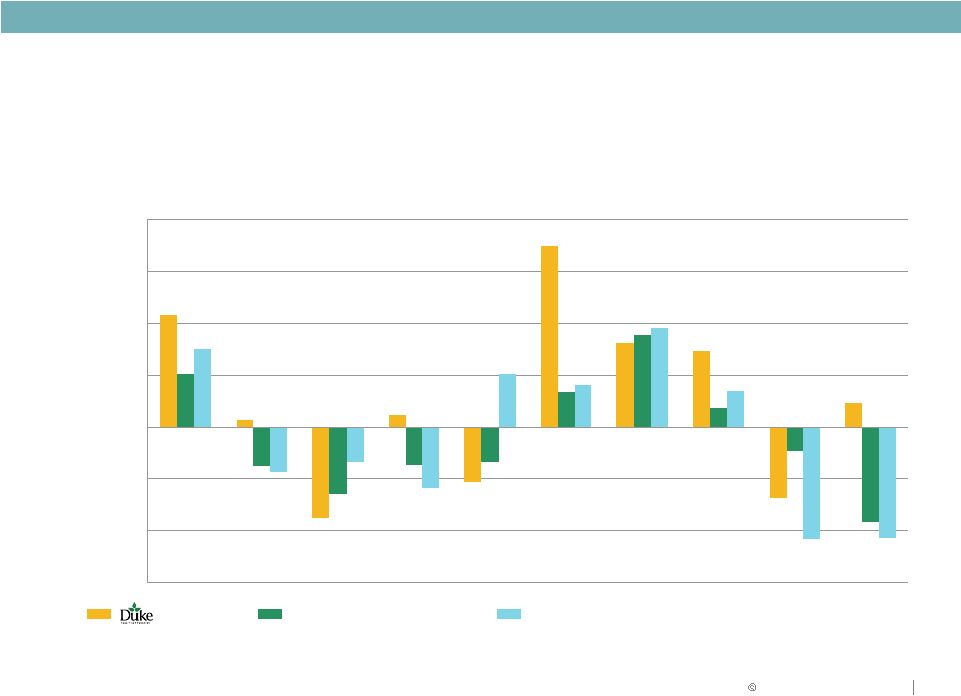

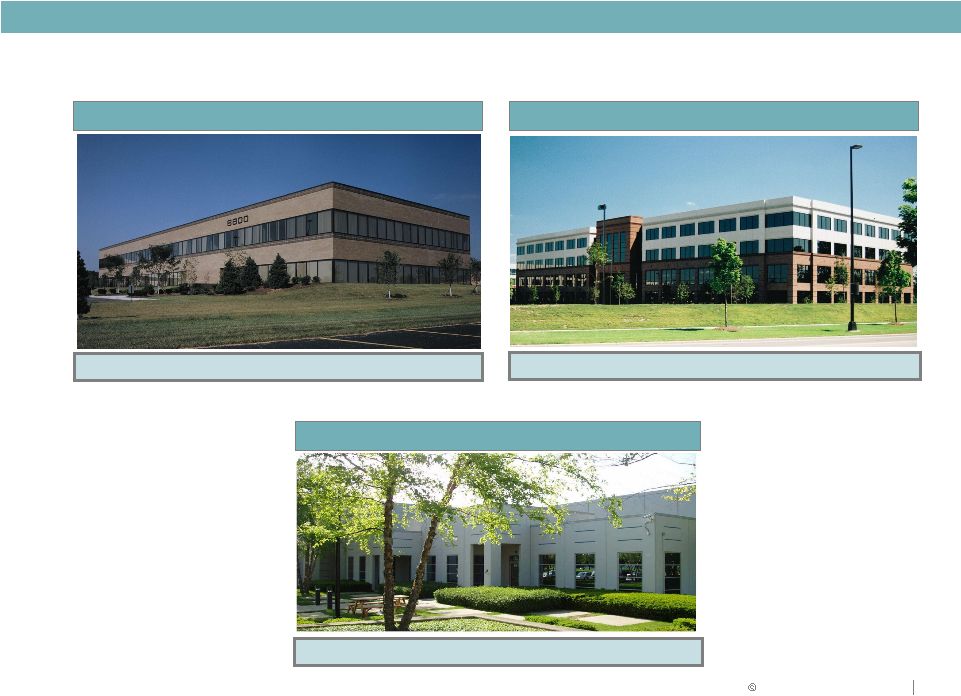

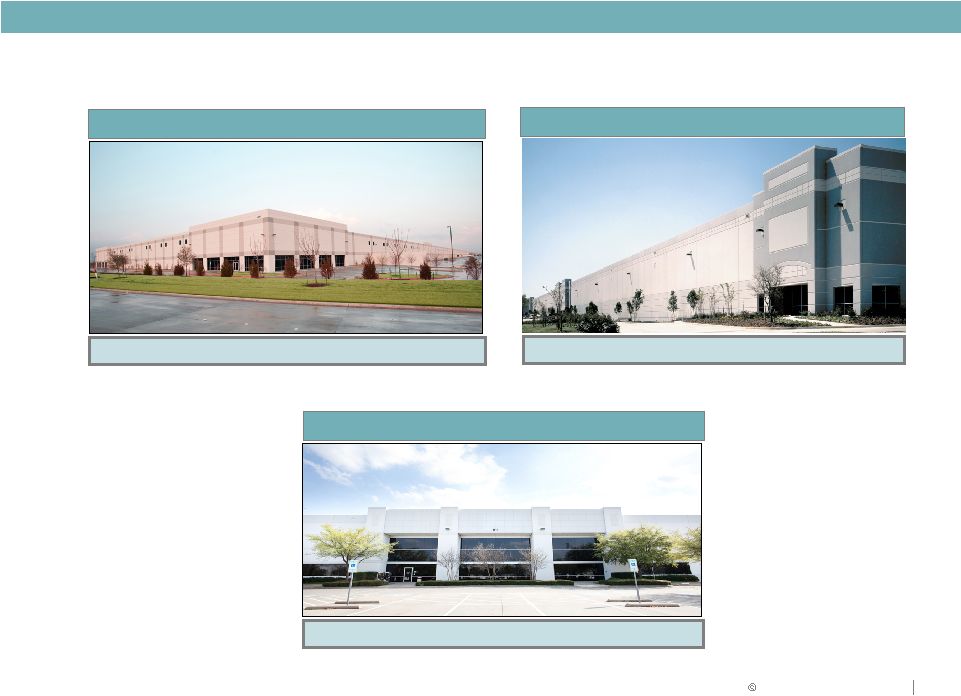

RELIABLE. ANSWERS. 2011 Duke Realty Corporation Strategic Focus 2011 Goals and Objectives Q2 2011 Update • Lease-up portfolio, manage cap ex; reach positive same property income growth • Balance execution with capital strategy relative to level and quality of cash flow and same property NOI; Debt to EBITDA <7.0x • Development starts of $100 to $200 million focus on medical office and Build-to-Suit • Total portfolio occupancy as of June 30, 2011 of 89.3%; industrial portfolio at 90.6% • More than 8.1 million square feet of leases completed; significant increase over Q2 2010 volume of 6.0 million square feet • Debt to EBITDA @ 6.7x;1.5% Same Property NOI growth • One 405,000sf expansion of an existing 100% leased industrial property in Phoenix, AZ started during the quarter. • Continue strong momentum from 2010 on repositioning of portfolio • Pursue acquisitions of medical and industrial assets • Planned asset dispositions of primarily Midwest office • Closed on over $116 million of acquisitions during the quarter, including our first operating asset in Southern California. • $62 million in dispositions of non-core assets. • Opportunistically access capital markets . . . push out maturity schedule further • Continue improving our coverage ratios • Maintain minimal balance on line of credit • Fixed charge ratio of 1.82x • Zero balance outstanding on line of credit, $118 million cash • Announced redemption of Series N Preferred shares Asset Strategy Operations Strategy Capital Strategy 5 Executing across all three aspects of our strategy |