UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file Number _811-04471

Value Line Aggressive Income Trust

(Exact name of registrant as specified in charter)

220 East 42nd Street, New York, N.Y. 10017

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 212-907-1500

Date of fiscal year end: January 31, 2010

Date of reporting period: July 31, 2009

Item I. Reports to Stockholders.

A copy of the Semi -Annual Report to Stockholders for the period ended 7/31/09

is included with this Form.

| INVESTMENT ADVISER | | EULAV Asset Management, LLC | | S E M I - A N N U A L R E P O R T |

| | | 220 East 42nd Street | | J u l y 3 1 , 2 0 0 9 |

| | | New York, NY 10017-5891 | | |

| | | | | |

| DISTRIBUTOR | | EULAV Securities, Inc. | | |

| | | 220 East 42nd Street | | |

| | | New York, NY 10017-5891 | | |

| | | | | |

| CUSTODIAN BANK | | State Street Bank and Trust Co. | | |

| | | 225 Franklin Street | | |

| | | Boston, MA 02110 | | |

| | | | | |

| SHAREHOLDER | | State Street Bank and Trust Co. | | |

| SERVICING AGENT | | c/o BFDS | | |

| | | P.O. Box 219729 | | |

| | | Kansas City, MO 64121-9729 | | Value Line Aggressive Income Trust |

| | | | |

| INDEPENDENT | | PricewaterhouseCoopers LLP | |

| REGISTERED PUBLIC | | 300 Madison Avenue | |

| ACCOUNTING FIRM | | New York, NY 10017 | |

| | | | |

| LEGAL COUNSEL | | Peter D. Lowenstein, Esq. | |

| | | 496 Valley Road | |

| | | Cos Cob, CT 06807-0272 | |

| | | | |

| DIRECTORS | | Joyce E. Heinzerling | |

| | | Francis C. Oakley | |

| | | David H. Porter | |

| | | Paul Craig Roberts | |

| | | Thomas T. Sarkany | | |

| | | Nancy-Beth Sheerr | | |

| | | Daniel S. Vandivort | | |

| | | | | |

| OFFICERS | | Mitchell E. Appel | | |

| | | President | | |

| | | Howard A. Brecher | | |

| | | Vice President and Secretary | | |

| | | Emily D. Washington | | |

| | | Treasurer | | |

| | | | | |

| This unaudited report is issued for information to shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by a currently effective prospectus of the Trust (obtainable from the Distributor). |

| |

| #00068207 |

Value Line Aggressive Income Trust | |

| | |

| | To Our Value Line Aggressive |

To Our Shareholders:

Enclosed is your semi-annual report for the period ended July 31, 2009. I encourage you to carefully review this report, which includes economic observations, your Trust’s performance data and highlights, schedules of investment holdings, and financial statements.

For the six months ended July 31, 2009, the total return of the Value Line Aggressive Income Trust was 17.83%. The first part of the year saw a strong rebound in the high yield security sector after a dramatic fall in prices at the end of last year. In fact, despite the recession and a roughly 10% default rate for corporate securities over the past year, 2009 is shaping up to be the best year on record for this asset class. Yield spreads between US Treasuries and high-yield corporate debt have fallen from record high levels as investors have priced in an economic turnaround. While the economy looks set to start growing again, the effects of too much leverage are still likely to be felt in the year ahead. Standard & Poor’s forecasts that the high rates of defaults will continue and peak in the mid-teens next year. While the Federal Reserve has significantly reduced the overnight lending rate in the past year, in an effort to jump start the economy, US Treasury yields may begin to rise as the economy recovers, which could put downward pressure on the high yield arena.

Given the challenging economic times, the Trust has limited its investment holdings in the lowest rated securities (CCC) to roughly 5% of the fund versus the mid-teen level of the industry indexes, since these securities have a historically high rate of default. The Trust has also maintained a relatively high cash position in the upper-single digits, given liquidity concerns. These two factors have led the Trust to trail the returns of the average High-Yield Bond Fund(1), as measured by Lipper Inc., which gained 24.10%, and the Barclay’s U.S. Corporate High Yield Index(2), a proxy for the overall high-yield market, which rose 30.55% for the same period.

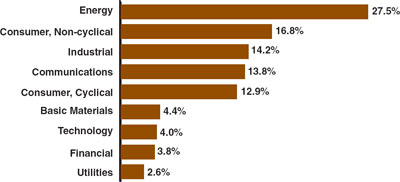

We continue to focus our investments in the more liquid and stronger credits available in the high-yield sector and will invest some of our cash reserves as attractive opportunities present themselves. Energy-related securities continue to account for the largest sector weighting of the Trust. While commodity prices in this sector can be volatile, we still like the prospects of this investment segment considering its strong earnings growth potential.

Preserving capital in difficult market environments, while allowing for an attractive dividend yield, remains our goal. We thank you for your continued investment with us.

| | |

| | Sincerely, |

| | |

| | /s/ Mitchell Appel |

| | Mitchell Appel, President |

| | |

| | September 17, 2009 |

| | |

| (1) | The Lipper High Current Yield Bond Funds Average aims at high (relative) current yield from fixed income securities, has no quality or maturity restrictions, and tends to invest in lower grade debt issues. An investment cannot be made in Peer Group Average. |

| | |

| (2) | The Barclays U.S. Corporate High Yield Index is representative of the broad based fixed-income market. It includes non-investment grade corporate bonds. The returns for the Index do not reflect charges, expenses, or taxes, and it is not possible to directly invest in this unmanaged Index. |

| | Value Line Aggressive Income Trust |

| | |

| Income Trust Shareholders | |

Economic Observations

The deep and prolonged recession, which commenced during the latter part of 2007, has run its course. Specifically, the downturn, which had produced steep declines of 5.4% and 6.4% in the nation’s gross domestic product in the fourth quarter of 2008 and the first quarter of this year, respectively, appears to have ended in the now concluding third quarter. For example, following a more limited business setback in the second quarter, when GDP eased by just 1.0%, the economy snapped back over the summer, producing growth that may well have averaged 2%-3% in the third quarter. GDP should move ahead at a similar measured pace over the final three months of 2009, underpinned by further, uneven gains in consumer spending and industrial activity. It is worth noting that this prospective rate of GDP growth would be below the historical norm of 3%-4%. The problem is that there is just too much aggregate weakness in certain core business sectors, notably home prices and employment growth, to generate the higher level of consumer activity needed for more significant rates of GDP growth, in our opinion.

The now apparently ended recession was traceable to several events, beginning with sharp declines in housing construction, home sales, and real estate prices. We also experienced a large reduction in credit availability, a high level of bank failures, increasing foreclosure rates, surging unemployment, slumping retail activity, and weak manufacturing. Unfortunately, some of these problems are likely to remain with us for several quarters more—most notably the decline in home prices and the increase in unemployment. Such ongoing difficulties underscore why we still expect somewhat below-trend rates of economic growth though 2010. Encouragingly, though, the majority of economic indicators are either stabilizing or improving selectively. It is much the same overseas, where severe business declines had earlier been seen across Europe and Asia. Those setbacks, which generally got under way several months after our own reversal commenced, have also largely run their course. Following this initially modest business recovery, which we expect to continue through much of 2010, we would look for enough brightening in both the housing and the employment pictures to underpin a more definitive global economic recovery in 2011.

Inflation, which had moved sharply higher in this country last year, following dramatic increases in oil, food, and commodity prices, has proceeded in a largely uneven fashion in more recent months, reflecting rapid, but often shortlived, gyrations in key pricing categories. We expect pricing to remain quite volatile, with further sharp up and down swings in oil and commodities being the norm as the economy transitions from recession to recovery. Overall, we think that prices will increase less sharply going forward over the next year or two than they did before the recent downward spiral in the 2007-2009 recession. Looking further out, we anticipate some pricing pressures will evolve with the accompanying sustained expansion in economic strength over the next several years. The Federal Reserve, meanwhile, is unlikely to start raising interest rates for another several months. Clearly, the risks to the sustainability of the formative, and still tenuous, economic up cycle would seem too great for the central bank to consider tightening the credit reins at this time.

| Value Line Aggressive Income Trust | |

| | |

TRUST EXPENSES (unaudited):

Example

As a shareholder of the Trust, you incur ongoing costs, including management fees, distribution and service (12b-1) fees, and other Trust expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (February 1, 2009 through July 31, 2009).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

| | | Beginning account value 2/1/09 | | Ending account value 7/31/09 | | Expenses paid during period 2/1/09 thru 7/31/09* | |

| | | | | | | | |

| Actual | | $1,000.00 | | $1,178.52 | | $5.51 | |

| Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.74 | | $5.11 | |

| | |

| * | Expenses are equal to the Trust’s annualized expense ratio of 1.02% multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period. This expense ratio may differ from the expense ratio shown in the Financial Highlights. |

Value Line Aggressive Income Trust

| |

| Portfolio Highlights at July 31, 2009 (unaudited) |

Ten Largest Holdings

| | | | | | | | | | |

| Issue | | Principal Amount | | | Value | | | Percentage of Net Assets | |

| Williams Companies, Inc., 7.13%, 9/1/11 | | $ | 600,000 | | | $ | 629,845 | | | | 1.6% | |

| Noble Energy, Inc., 8.25%, 3/1/19 | | $ | 500,000 | | | $ | 593,032 | | | | 1.5% | |

| Gulfmark Offshore, Inc., 7.75%, 7/15/14 | | $ | 600,000 | | | $ | 561,000 | | | | 1.4% | |

| Ferrellgas Escrow LLC/Ferrellgas Finance Escrow Corp., 6.75%, 5/1/14 | | $ | 600,000 | | | $ | 546,000 | | | | 1.4% | |

| Principal Financial Group, Inc., 7.88%, 5/15/14 | | $ | 500,000 | | | $ | 528,459 | | | | 1.4% | |

| Best Buy Co, Inc., 6.75%, 7/15/13 | | $ | 500,000 | | | $ | 523,681 | | | | 1.4% | |

| Citizens Communications Co., 9.25%, 5/15/11 | | $ | 500,000 | | | $ | 515,625 | | | | 1.3% | |

| Whiting Petroleum Corp., 7.25%, 5/1/13 | | $ | 500,000 | | | $ | 500,000 | | | | 1.3% | |

| Elan Finance PLC, 7.75%, 11/15/11 | | $ | 500,000 | | | $ | 496,250 | | | | 1.3% | |

| Plains Exploration & Production Co., 7.75%, 6/15/15 | | $ | 500,000 | | | $ | 496,250 | | | | 1.3% | |

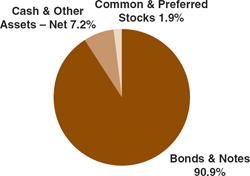

| Asset Allocation — Percentage of Total Net Assets |

| |

| |

| Sector Weightings — Percentage of Total Investment Securities |

| Value Line Aggressive Income Trust |

| |

| Schedule of Investments (unaudited) |

Principal Amount | | | | Value | |

| CORPORATE BONDS & NOTES (85.1%) | | | | |

| | | | AEROSPACE/DEFENSE (1.8%) | | | | |

| $ | 350,000 | | Alliant Techsystems, Inc., Senior Subordinated Notes, 6.75%, 4/1/16 | | $ | 332,500 | |

| | 400,000 | | L-3 Communications Corp., Senior Subordinated Notes, 5.88%, 1/15/15 | | | 379,000 | |

| | | | | | | 711,500 | |

| | | | AUTO & TRUCK (1.7%) | | | | |

| | 500,000 | | Ford Motor Co., Global Landmark Securities, Senior Notes, 7.45%, 7/16/31 | | | 375,000 | |

| | 300,000 | | Ford Motor Credit Co. LLC, Senior Notes, 8.00%, 12/15/16 | | | 268,897 | |

| | | | | | | 643,897 | |

| | | | BEVERAGE - ALCOHOLIC (1.0%) | | | | |

| | 400,000 | | Constellation Brands, Inc., Senior Notes, 7.25%, 5/15/17 | | | 391,000 | |

| | | | CABLE TV (1.9%) | | | | |

| | 350,000 | | DirecTV Holdings LLC/DirecTV Financing Co., Senior Notes, 6.38%, 6/15/15 | | | 335,125 | |

| | 400,000 | | MediaCom LLC, Senior Notes, 9.50%, 1/15/13 | | | 398,000 | |

| | | | | | | 733,125 | |

| | | | CHEMICAL - BASIC (1.1%) | | | | |

| | 400,000 | | Dow Chemical Co. (The), Senior Notes, 8.55%, 5/15/19 | | | 438,838 | |

| | | | COAL (1.0%) | | | | |

| | 400,000 | | Peabody Energy Corp., Senior Notes, 7.38%, 11/1/16 | | | 404,000 | |

| | | | | | | | |

| | | | DRUG (2.2%) | | | | |

| | 500,000 | | Elan Finance PLC, Senior Notes, 7.75%, 11/15/11 | | | 496,250 | |

| | 350,000 | | Warner Chilcott Corp., Senior Subordinated Notes, 8.75%, 2/1/15 | | | 350,000 | |

| | | | | | | 846,250 | |

Principal Amount | | | | Value | |

| | | | ELECTRICAL EQUIPMENT (2.0%) | | | | |

| $ | 400,000 | | Baldor Electric Co., Senior Notes, 8.63%, 2/15/17 | | $ | 401,000 | |

| | 400,000 | | General Cable Corp., Senior Notes, 7.13%, 4/1/17 | | | 380,000 | |

| | | | | | | 781,000 | |

| | | | ELECTRICAL UTILITY - CENTRAL (0.6%) | | | | |

| | 300,000 | | Texas Competitive Electric Holdings Co. LLC, 10.25%, 11/1/15 | | | 235,500 | |

| | | | ELECTRICAL UTILITY - EAST (1.0%) | | | | |

| | 400,000 | | NRG Energy, Inc., Senior Notes, 7.38%, 2/1/16 | | | 387,000 | |

| | | | ENTERTAINMENT (2.3%) | | | | |

| | 500,000 | | EchoStar DBS Corp., Senior Notes, 6.63%, 10/1/14 | | | 480,000 | |

| | 400,000 | | Hughes Network Systems LLC, Senior Notes, 9.50%, 4/15/14 | | | 400,000 | |

| | | | | | | 880,000 | |

| | | | ENVIRONMENTAL (1.1%) | | | | |

| | 400,000 | | Allied Waste North America, Inc., Senior Notes, 7.88%, 4/15/13 | | | 415,500 | |

| | | | FINANCIAL SERVICES - DIVERSIFIED (3.4%) | | | | |

| | 350,000 | | Arch Western Finance LLC, Guaranteed Senior Notes, 6.75%, 7/1/13 | | | 339,500 | |

| | 81,000 | | Broadridge Financial Solutions, Inc., Senior Notes, 6.13%, 6/1/17 | | | 68,562 | |

| | 350,000 | | First Data Corp., Senior Notes, 9.88%, 9/24/15 | | | 295,313 | |

| | 500,000 | | Motors Liquidation Co., Senior Notes, 8.38%, 7/15/33 (1) | | | 76,250 | |

| | 500,000 | | Principal Financial Group, Inc., Senior Notes, 7.88%, 5/15/14 | | | 528,459 | |

| | | | | | | 1,308,084 | |

See Notes to Financial Statements.

6

| Value Line Aggressive Income Trust |

| |

| July 31, 2009 |

Principal Amount | | | | Value | |

| | | | FOOD PROCESSING (2.4%) | | | | |

| $ | 300,000 | | Chiquita Brands International, Inc., Senior Notes, 7.50%, 11/1/14 | | $ | 273,750 | |

| | 300,000 | | Dean Foods Co., Senior Notes, 7.00%, 6/1/16 | | | 282,750 | |

| | 350,000 | | Tyson Foods, Inc., Senior Notes, 6.60%, 4/1/16 | | | 355,250 | |

| | | | | | | 911,750 | |

| | | | GROCERY (1.0%) | | | | |

| | 400,000 | | SUPERVALU, Inc., Senior Notes, 7.50%, 11/15/14 | | | 387,000 | |

| | | | HOTEL/GAMING (2.1%) | | | | |

| | 500,000 | | Boyd Gaming Corp., Senior Subordinated Notes, 6.75%, 4/15/14 | | | 446,250 | |

| | 400,000 | | Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp., Senior Mortgage Notes, 6.63%, 12/1/14 | | | 372,000 | |

| | | | | | | 818,250 | |

| | | | MACHINERY (2.8%) | | | | |

| | 400,000 | | Black & Decker Corp. (The), Senior Notes, 8.95%, 4/15/14 | | | 439,703 | |

| | 350,000 | | Case New Holland, Inc., Senior Notes, 7.13%, 3/1/14 | | | 329,000 | |

| | 400,000 | | Terex Corp., Senior Subordinated Notes, 8.00%, 11/15/17 | | | 331,000 | |

| | | | | | | 1,099,703 | |

| | | | MEDICAL SERVICES (2.7%) | | | | |

| | 450,000 | | Community Health Systems, Inc., Senior Notes, 8.88%, 7/15/15 | | | 463,500 | |

| | 300,000 | | Humana, Inc., Senior Notes, 6.45%, 6/1/16 | | | 268,187 | |

| | 350,000 | | Psychiatric Solutions, Inc., Senior Subordinated Notes, 7.75%, 7/15/15 | | | 331,625 | |

| | | | | | | 1,063,312 | |

| | | | MEDICAL SUPPLIES (2.8%) | | | | |

| | 400,000 | | Bausch & Lomb, Inc., Senior Notes, 9.88%, 11/1/15 | | | 399,000 | |

| | 310,000 | | Fisher Scientific International, Inc., Senior Subordinated Notes, 6.13%, 7/1/15 | | | 316,200 | |

Principal Amount | | | | Value | |

| $ | 350,000 | | Inverness Medical Innovations, Inc., Senior Subordinated Notes, 9.00%, 5/15/16 | | $ | 350,000 | |

| | | | | | | 1,065,200 | |

| | | | METALS & MINING DIVERSIFIED (2.1%) | | | | |

| | 250,000 | | Alcoa, Inc., Senior Notes, 6.00%, 7/15/13 | | | 248,267 | |

| | 250,000 | | Freeport-McMoRan Copper & Gold, Inc., Senior Notes, 6.88%, 2/1/14 | | | 258,844 | |

| | 300,000 | | Freeport-McMoRan Copper & Gold, Inc., Senior Notes, 8.25%, 4/1/15 | | | 317,250 | |

| | | | | | | 824,361 | |

| | | | NATURAL GAS - DISTRIBUTION (2.3%) | | | | |

| | 350,000 | | AmeriGas Partners L.P., Senior Notes, 7.25%, 5/20/15 | | | 343,000 | |

| | | | | | | | |

| | 600,000 | | Ferrellgas Escrow LLC/Ferrellgas Finance Escrow Corp., Senior Notes, 6.75%, 5/1/14 | | | 546,000 | |

| | | | | | | 889,000 | |

| | | | NATURAL GAS - DIVERSIFIED (5.1%) | | | | |

| | 300,000 | | Chesapeake Energy Corp., Senior Notes, 7.50%, 6/15/14 | | | 296,250 | |

| | 350,000 | | Dynegy Holdings, Inc., Senior Notes, 7.50%, 6/1/15 | | | 306,250 | |

| | 400,000 | | Newfield Exploration Co., Senior Notes, 6.63%, 9/1/14 | | | 386,000 | |

| | 300,000 | | ONEOK Partners L.P., Senior Notes, 8.63%, 3/1/19 | | | 356,671 | |

| | 600,000 | | Williams Companies, Inc., Senior Notes, 7.13%, 9/1/11 | | | 629,845 | |

| | | | | | | 1,975,016 | |

See Notes to Financial Statements.

7

| Value Line Aggressive Income Trust |

| |

| Schedule of Investments (unaudited) |

Principal Amount | | | | Value | |

| | | | OFFICE EQUIPMENT & SUPPLIES (0.8%) | | | | |

| $ | 250,000 | | Staples, Inc., Senior Notes, 9.75%, 1/15/14 | | $ | 293,150 | |

| | | | OILFIELD SERVICES/EQUIPMENT (6.0%) | | | | |

| | 400,000 | | Complete Production Services, Inc., Senior Notes, 8.00%, 12/15/16 | | | 342,000 | |

| | 600,000 | | Gulfmark Offshore, Inc., Guaranteed Notes, 7.75%, 7/15/14 | | | 561,000 | |

| | 495,000 | | Nabors Industries, Inc., Guaranteed Senior Notes, 6.15%, 2/15/18 | | | 475,966 | |

| | 250,000 | | North American Energy Partners, Inc., Senior Notes, 8.75%, 12/1/11 | | | 223,750 | |

| | 250,000 | | W&T Offshore, Inc., Senior Notes, 8.25%, 6/15/14 (2) | | | 207,500 | |

| | 500,000 | | Whiting Petroleum Corp., Senior Notes, 7.25%, 5/1/13 | | | 500,000 | |

| | | | | | | 2,310,216 | |

| | | | PETROLEUM - INTEGRATED (1.5%) | | | | |

| | 300,000 | | McMoRan Exploration Co., Senior Notes, 11.88%, 11/15/14 | | | 275,250 | |

| | 350,000 | | Tesoro Corp., Notes, 6.50%, 6/1/17 | | | 306,250 | |

| | | | | | | 581,500 | |

| | | | PETROLEUM - PRODUCING (11.7%) | | | | |

| | 250,000 | | Anadarko Petroleum Corp., Senior Notes, 7.63%, 3/15/14 | | | 280,970 | |

| | 350,000 | | Cimarex Energy Co., Senior Notes, 7.13%, 5/1/17 | | | 318,500 | |

| | 500,000 | | Encore Acquisition Co., Senior Subordinated Notes, 6.25%, 4/15/14 | | | 445,000 | |

| | 300,000 | | Frontier Oil Corp., 8.50%, 9/15/16 | | | 306,750 | |

| | 500,000 | | KCS Energy, Inc., Senior Notes, 7.13%, 4/1/12 | | | 491,250 | |

| | 500,000 | | Noble Energy, Inc., Senior Notes, 8.25%, 3/1/19 | | | 593,032 | |

| | 300,000 | | PetroHawk Energy Corp., Senior Notes, 7.88%, 6/1/15 | | | 292,500 | |

| | 428,000 | | PetroQuest Energy, Inc., Senior Notes, 10.38%, 5/15/12 | | | 376,640 | |

| | 500,000 | | Plains Exploration & Production Co., Senior Notes, 7.75%, 6/15/15 | | | 496,250 | |

| | 325,000 | | Regency Energy Partners L.P./Regency Energy Finance Corp., Senior Notes, 8.38%, 12/15/13 | | | 326,625 | |

| | 300,000 | | Stone Energy Corp., Senior Subordinated Notes, 8.25%, 12/15/11 | | | 255,000 | |

Principal Amount | | | | Value | |

| $ | 350,000 | | Swift Energy Co., Senior Notes, 7.63%, 7/15/11 | | $ | 343,000 | |

| | | | | | | 4,525,517 | |

| | | | POWER (0.8%) | | | | |

| | 350,000 | | RRI Energy, Inc., Senior Notes, 7.63%, 6/15/14 | | | 325,500 | |

| | | | R.E.I.T. (0.9%) | | | | |

| | 300,000 | | Simon Property Group L.P., Senior Notes, 10.35%, 4/1/19 | | | 359,428 | |

| | | | RAILROAD (1.2%) | | | | |

| | 400,000 | | CSX Corp., Senior Notes., 7.38%, 2/1/19 | | | 454,869 | |

| | | | RECREATION (0.7%) | | | | |

| | 300,000 | | Royal Caribbean Cruises Ltd., Senior Notes, 6.88%, 12/1/13 | | | 265,500 | |

| | | | RETAIL - SPECIAL LINES (3.0%) | | | | |

| | 500,000 | | Best Buy Co., Inc., Senior Notes, 6.75%, 7/15/13 | | | 523,681 | |

| | 300,000 | | NBTY, Inc., Senior Subordinated Notes, 7.13%, 10/1/15 | | | 288,000 | |

| | 350,000 | | Phillips-Van Heusen Corp., Senior Notes, 7.25%, 2/15/11 | | | 351,313 | |

| | | | | | | 1,162,994 | |

| | | | RETAIL STORE (0.5%) | | | | |

| | 210,000 | | Dillard’s, Inc., Senior Notes, 7.85%, 10/1/12 | | | 182,700 | |

| | | | SEMICONDUCTOR (1.3%) | | | | |

| | 350,000 | | Freescale Semiconductor, Inc., Senior Notes, 8.88%, 12/15/14 | | | 234,500 | |

| | 300,000 | | Seagate Technology HDD Holdings, 6.80%, 10/1/16 | | | 282,000 | |

| | | | | | | 516,500 | |

| | | | SHOE (1.3%) | | | | |

| | 500,000 | | Payless ShoeSource, Inc., Senior Subordinated Notes, 8.25%, 8/1/13 | | | 485,000 | |

| | | | STEEL - INTEGRATED (0.8%) | | | | |

| | 346,000 | | United States Steel Corp., Senior Notes, 5.65%, 6/1/13 | | | 328,499 | |

See Notes to Financial Statements.

8

Value Line Aggressive Income Trust

Principal Amount | | | | Value | |

| | | | TELECOMMUNICATION SERVICES (7.1%) | | | | |

| $ | 400,000 | | American Tower Corp., Senior Notes, 7.00%, 10/15/17 | | $ | 393,500 | |

| | 500,000 | | Citizens Communications Co., Senior Notes, 9.25%, 5/15/11 | | | 515,625 | |

| | 350,000 | | Cricket Communications, Inc., 9.38%, 11/1/14 | | | 355,250 | |

| | 350,000 | | MetroPCS Wireless, Inc., Senior Notes, 9.25%, 11/1/14 | | | 362,250 | |

| | 400,000 | | Qwest Corp., Senior Notes, 8.88%, 3/15/12 | | | 415,000 | |

| | 350,000 | | Sprint Capital Corp., 8.38%, 3/15/12 | | | 354,375 | |

| | 350,000 | | Windstream Corp., Senior Notes, 8.13%, 8/1/13 | | | 353,500 | |

| | | | | | | 2,749,500 | |

| | | | TIRE & RUBBER (1.0%) | | | | |

| | 350,000 | | Goodyear Tire & Rubber Co. (The), Senior Notes, 10.50%, 5/15/16 | | | 375,375 | |

| | | | TOBACCO (0.8%) | | | | |

| | 300,000 | | Reynolds American, Inc., Senior Secured Notes, 6.75%, 6/15/17 | | | 301,673 | |

| | | | TRUCKING (0.5%) | | | | |

| | 200,000 | | Ryder System, Inc., Senior Notes, 4.63%, 4/1/10 | | | 201,591 | |

| | | | WIRELESS NETWORKING (0.8%) | | | | |

| | 300,000 | | Crown Castle International Corp., Senior Notes, 9.00%, 1/15/15 | | | 316,875 | |

| | | | TOTAL CORPORATE BONDS & NOTES

(Cost $32,087,369) | | | 32,945,673 | |

| CONVERTIBLE CORPORATE BONDS & NOTES (5.8%) | | | | |

| | | | COMPUTER & PERIPHERALS (0.8%) | | | | |

| | 100,000 | | Maxtor Corp., Senior Notes, 2.38%, 8/15/12 | | | 95,250 | |

Principal Amount | | | | Value | |

| | | | | | | | |

| $ | 300,000 | | SanDisk Corp., Senior Notes, 1.00%, 5/15/13 | | $ | 210,000 | |

| | | | | | | 305,250 | |

| | | | MACHINERY (1.0%) | | | | |

| | 400,000 | | AGCO Corp., Senior Subordinated Notes, 1.25%, 12/15/36 | | | 385,000 | |

| | | | MEDICAL SERVICES (1.0%) | | | | |

| | 250,000 | | LifePoint Hospitals, Inc., Senior Subordinated Debentures, 3.50%, 5/15/14 | | | 212,812 | |

| | 200,000 | | LifePoint Hospitals, Inc., Senior Subordinated Debentures, 3.25%, 8/15/25 | | | 170,000 | |

| | | | | | | 382,812 | |

| | | | MEDICAL SUPPLIES (1.6%) | | | | |

| | 250,000 | | Charles River Laboratories International, Inc., Senior Notes, 2.25%, 6/15/13 | | | 228,750 | |

| | 400,000 | | Medtronic, Inc., Senior Notes, 1.63%, 4/15/13 | | | 385,500 | |

| | | | | | | 614,250 | |

| | | | OILFIELD SERVICES/EQUIPMENT (0.2%) | | | | |

| | 100,000 | | Helix Energy Solutions Group, Inc., Senior Notes, 3.25%, 12/15/25 | | | 80,500 | |

| | | | SEMICONDUCTOR (0.7%) | | | | |

| | 350,000 | | Micron Technology, Inc., Senior Notes, 1.88%, 6/1/14 | | | 248,500 | |

| | | | TELECOMMUNICATION SERVICES (0.5%) | | | | |

| | 250,000 | | NII Holdings, Inc. 3.13%, 6/15/12 | | | 208,438 | |

| | | | TOTAL CONVERTIBLE CORPORATE BONDS & NOTES

(Cost $1,949,928) | | | 2,224,750 | |

See Notes to Financial Statements.

9

Value Line Aggressive Income Trust

| |

| Schedule of Investments (unaudited) |

| Shares | | | | Value | |

| COMMON STOCKS (1.7%) | | | | |

| | | | DRUG (0.2%) | | | | |

| $ | 5,000 | | Pfizer, Inc. (4) | | $ | 79,650 | |

| | | | ELECTRICAL EQUIPMENT (0.2%) | | | | |

| | 5,000 | | General Electric Co. (4) | | | 67,000 | |

| | | | MACHINERY (0.3%) | | | | |

| | 4,000 | | Ingersoll-Rand Co., Ltd. Class A (4) | | | 115,520 | |

| | | | OIL/GAS DISTRIBUTION (0.6%) | | | | |

| | 2,500 | | Energy Transfer Partners L.P. (4) | | | 115,325 | |

| | 2,000 | | Plains All American Pipeline, L.P. (4) | | | 96,720 | |

| | | | | | | 212,045 | |

| | | | R.E.I.T. (0.3%) | | | | |

| | 1,000 | | AvalonBay Communities, Inc. (4) | | | 58,200 | |

| | 3,000 | | Equity Residential (4) | | | 72,000 | |

| | 35 | | Simon Property Group, Inc. (4) | | | 1,950 | |

| | | | | | | 132,150 | |

| | | | TELECOMMUNICATION SERVICES (0.1%) | | | | |

| | 2,000 | | AT&T, Inc. (4) | | | 52,460 | |

| | | | TOTAL COMMON STOCKS

(Cost $545,814) | | | 658,825 | |

| PREFERRED STOCK (0.2%) | | | | |

| | | | R.E.I.T. (0.2%) | | | | |

| | 3,000 | | Health Care REIT, Inc. Series F 7.625% (4) | | | 69,750 | |

| | | | TOTAL PREFERRED STOCKS

(Cost $75,000) | | | 69,750 | |

| | | | TOTAL INVESTMENT SECURITIES (92.8%)

(Cost $34,658,111) (5) | | | 35,898,998 | |

Principal Amount | | | | Value | |

| REPURCHASE AGREEMENT (3) (6.4%) | | | | |

| $ | 2,500,000 | | With Morgan Stanley, 0.15%, dated 7/31/09, due 8/3/09, delivery value $2,500,031 (collateralized by $2,590,000 U.S. Treasury Notes 2.625%, due 02/29/16, with a value of $2,553,517) (5) | | $ | 2,500,000 | |

| | | | TOTAL REPURCHASE AGREEMENTS

(Cost $2,500,000) | | | 2,500,000 | |

| CASH AND OTHER ASSETS IN EXCESS OF LIABILITIES (0.8%) | | | 292,444 | |

| NET ASSETS (100%) | | $ | 38,691,442 | |

NET ASSET VALUE OFFERING AND REDEMPTION PRICE, PER OUTSTANDING SHARE

($38,691,442 ÷ 8,726,081 shares outstanding) | | $ | 4.43 | |

| (1) | Security currently in default. |

| (2) | Pursuant to Rule 144A under the Securities Act of 1933, this security can only be sold to qualified institutional investors. |

| (3) | The Fund’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Fund’s policy to mark-to-market the collateral on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings. |

| (4) | Value determined based on Level 1 inputs established by FAS 157. (Note 1B) |

| (5) | Unless otherwise indicated, the values of the securities of the Portfolio are determined based on Level 2 inputs established by FAS 157. (Note 1B) |

See Notes to Financial Statements.

10

Value Line Aggressive Income Trust

| |

Statement of Assets and Liabilities

at July 31, 2009 (unaudited) |

| Assets: | | | | |

| Investment securities, at value | | | | |

| (Cost - $34,658,111) | | $ | 35,898,998 | |

| Repurchase agreement | | | | |

| (Cost - $2,500,000) | | | 2,500,000 | |

| Cash | | | 60,864 | |

| Interest and dividends receivable | | | 685,020 | |

| Receivable for trust shares sold | | | 43,449 | |

| Prepaid expenses | | | 15,977 | |

| Other | | | 120 | |

| Total Assets | | | 39,204,428 | |

| Liabilities: | | | | |

| Payable for securities purchased | | | 377,637 | |

| Payable for trust shares repurchased | | | 75,012 | |

| Dividends payable to shareholders | | | 36,606 | |

| Accrued expenses: | | | | |

| Advisory fee | | | 14,467 | |

| Service and distribution plan fees | | | 4,822 | |

| Trustees’ fees and expenses | | | 677 | |

| Other | | | 3,765 | |

| Total Liabilities | | | 512,986 | |

| Net Assets | | $ | 38,691,442 | |

| Net assets consist of: | | | | |

| Shares of beneficial interest, at $0.01 par value (authorized unlimited, outstanding 8,726,081 shares) | | $ | 87,261 | |

| Additional paid-in capital | | | 67,641,172 | |

| Distributions in excess of net investment income | | | (28,479 | ) |

| Accumulated net realized loss on investments and foreign currency | | | (30,249,399 | ) |

| Net unrealized appreciation of investments | | | 1,240,887 | |

| Net Assets | | $ | 38,691,442 | |

| Net Asset Value, Offering and Redemption Price per Outstanding Share ($38,691,442 ÷ 8,726,081 shares outstanding) | | $ | 4.43 | |

Statement of Operations

for the Six Months Ended July 31, 2009 (unaudited) |

| Investment Income: | | | | |

| Interest (net of foreign withholding tax of $516) | | $ | 1,270,519 | |

| Dividends (net of foreign withholding tax of $561) | | | 26,089 | |

| Total Income | | | 1,296,608 | |

| Expenses: | | | | |

| Advisory fee | | | 121,144 | |

| Service and distribution plan fees | | | 40,381 | |

| Printing and postage | | | 17,814 | |

| Transfer agent fees | | | 17,492 | |

| Registration and filing fees | | | 14,656 | |

| Custodian fees | | | 13,094 | |

| Auditing and legal fees | | | 9,282 | |

| Trustees’ fees and expenses | | | 1,821 | |

| Insurance | | | 1,405 | |

| Other | | | 2,881 | |

| | | | | |

| Total Expenses Before Custody Credits and Fees Waived | | | 239,970 | |

| Less: Advisory Fee Waived | | | (58,422 | ) |

| Less: Service and Distribution Plan Fees Waived | | | (16,153 | ) |

| Less: Custody Credits | | | (6 | ) |

| Net Expenses | | | 165,389 | |

| Net Investment Income | | | 1,131,219 | |

| Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Exchange Transactions: | | | | |

| Net Realized Loss | | | (2,564,905 | ) |

| Change in Net Unrealized Appreciation/(Depreciation) | | | 7,129,984 | |

| Increase from payment by affiliate | | | 4,043 | |

| Net Realized Loss and Change in Net Unrealized Appreciation/(Depreciation) on Investments and Foreign Exchange Transactions | | | 4,569,122 | |

| Net Increase in Net Assets from Operations | | $ | 5,700,341 | |

See Notes to Financial Statements.

11

Value Line Aggressive Income Trust

| |

Statement of Changes in Net Assets for the Six Months Ended July 31, 2009 (unaudited) and for the Year Ended January 31, 2009 |

| | | Six Months Ended July 31, 2009 (unaudited) | | | Year Ended January 31, 2009 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 1,131,219 | | | $ | 2,094,843 | |

| Net realized loss on investments and foreign currency | | | (2,564,905 | ) | | | (1,051,210 | ) |

| Change in net unrealized appreciation/(depreciation) | | | 7,129,984 | | | | (5,295,392 | ) |

| Increase from payment by affiliate | | | 4,043 | | | | — | |

| Net increase/(decrease) in net assets from operations | | | 5,700,341 | | | | (4,251,759 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Net investment income | | | (1,122,780 | ) | | | (2,074,111 | ) |

| | | | | | | | | |

| Trust Share Transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 11,556,087 | | | | 3,664,679 | |

| Proceeds from reinvestment of dividends to shareholders | | | 908,568 | | | | 1,585,465 | |

Cost of shares repurchased* | | | (4,274,869 | ) | | | (5,459,613 | ) |

| Net increase/(decrease) in net assets from Trust share transactions | | | 8,189,786 | | | | (209,469 | ) |

| Total Increase/(Decrease) in Net Assets | | | 12,767,347 | | | | (6,535,339 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 25,924,095 | | | | 32,459,434 | |

| End of period | | $ | 38,691,442 | | | $ | 25,924,095 | |

| Distributions in excess of net investment income, at end of period | | $ | (28,479 | ) | | $ | (36,918 | ) |

| * | Net of redemption fees (see Note 1K and Note 2). |

See Notes to Financial Statements.

12

Value Line Aggressive Income Trust

| |

| Notes to Financial Statements (unaudited) |

1. Significant Accounting Policies

Value Line Aggressive Income Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The primary investment objective of the Trust is to maximize current income through investment in a diversified portfolio of high-yield fixed-income securities. As a secondary investment objective, the Trust will seek capital appreciation, but only when consistent with its primary objective. Lower rated or unrated (i.e., high-yield) securities are more likely to react to developments affecting market risk (general market liquidity) and credit risk (issuers’ inability to meet principal and interest payments on their obligations) than are more highly rated securities, which react primarily to movements in the general level of interest rates. The ability of issuers of debt securities held by the Trust to meet their obligations may be affected by economic developments in a specific industry. The following significant accounting principles are in conformity with generally accepted accounting principles for investment companies. Such policies are consistently followed by the Trust in the preparation of its financial statements. Generally accepted accounting principles may require management to make estimates and assumptions that affect the reported amounts and disclosure in the financial statements. Actual results may differ from those estimates.

(A) Security Valuation: The Trustees have determined that the value of bonds and other fixed income corporate securities be calculated on the valuation date by reference to valuations obtained from an independent pricing service that determines valuations for normal institutional-size trading units of debt securities, without exclusive reliance upon quoted prices. This service takes into account appropriate factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data in determining valuations. Securities, other than bonds and other fixed income securities, not priced in this manner are valued at the midpoint between the latest available and representative bid and asked prices or, when stock valuations are used, at the latest quoted sale price as of the regular close of business of the New York Stock Exchange on the valuation date. Other assets and securities for which market valuations are not readily available are valued at their fair value as the Trustees may determine. In addition, the Trust may use the fair value of a security when the closing price on the primary exchange where the security is traded no longer reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer. Short term instruments with maturities of 60 days or less, at the date of purchase, are valued at amortized cost which approximates market value.

(B) Fair Value Measurements: The Trust adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”), effective February 1, 2008. In accordance with FAS 157, fair value is defined as the price that the Trust would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. FAS 157 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

| | |

| ● | Level 1 — quoted prices in active markets for identical investments |

| ● | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 — significant unobservable inputs (including the Trust’s own assumptions in determining the fair value of investments) |

Value Line Aggressive Income Trust

In April 2009, the FASB issued FASB Staff Position No. 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly” (“FSP 157-4”). FSP 157-4 provides additional guidance for estimating fair value in accordance with FAS 157 when the volume and level of activity for the asset or liability have significantly decreased as well as guidance on identifying circumstances that indicate a transaction is not orderly. The type of inputs used to value each security is identified in the Schedule of Investments, which also includes a breakdown of the Schedule’s investments by category.

The following is a summary of the inputs used as of July 31, 2009 in valuing the Trust’s investments carried at value:

| | | | | |

| Valuation Inputs | | Investments in Securities | |

| Level 1 – Quoted Prices | | $ | 728,575 | |

| Level 2 – Other Significant Observable Inputs | | | 37,670,423 | |

| Level 3 – Significant Unobservable Inputs | | | 0— | |

| Total | | $ | 38,398,998 | |

For the six months ended July 31, 2009, there were no Level 3 investments.

(C) Repurchase Agreements: In connection with repurchase agreements, the Trust’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Trust’s policy to mark-to-market the collateral on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Trust has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

(D) Distributions: It is the policy of the Trust to distribute all of its net investment income to shareholders. Dividends from net investment income will be declared daily and paid monthly. Net realized capital gains, if any, are distributed to shareholders annually or more frequently if necessary to comply with the Internal Revenue Code. Income dividends and capital gains distributions are automatically reinvested in additional shares of the Trust unless the shareholder has requested otherwise. Income earned by the Trust on weekends, holidays and other days on which the Trust is closed for business is declared as a dividend on the next day on which the Trust is open for business.

(E) Federal Income Taxes: It is the Trust’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, including the distribution requirements of the Tax Reform Act of 1986, and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

| Value Line Aggressive Income Trust |

| |

| Notes to Financial Statements (unaudited) |

(F) Foreign Currency Translation: The books and records of the Trust are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. The Trust does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Trust and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/ depreciation on investments.

(G) Representations and Indemnifications: In the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

(H) Security Transactions: Securities transactions are recorded on a trade date basis. Realized gains and losses from security transactions are recorded on the identified-cost basis. Interest income, adjusted for amortization of discount and premium, is earned from settlement date and recognized on the accrual basis. Dividend income is recorded on the ex-dividend date.

(I) Accounting for Real Estate Investment Trusts: The Trust owns shares of Real Estate Investment Trusts (“REITs”) which report information on the source of their distributions annually. Distributions received from REITs during the year which represent a return of capital are recorded as a reduction of cost and distributions which represent a capital gain dividend are recorded as a realized long-term capital gain on investments.

(J) Foreign Taxes: The Trust may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Trust will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

(K) Redemption Fees: The Trust charges a 2% redemption fee on shares held for less than 120 days. Such fees are retained by the Trust and accounted for as paid in capital.

(L) Subsequent Event: In accordance with the provision set forth in the FAS 165 Subsequent Events, management has evaluated the possibility of subsequent events existing in the Trust’s financial statements through September 29, 2009. Management has determined that there are no material events that would require disclosure in the Trust’s financial statements through this date.

Value Line Aggressive Income Trust

| 2. | Trust Share Transactions and Distributions to Shareholders |

Transactions in shares of beneficial interest in the Trust were as follows:

| | | Six Months Ended July 31, 2009 (unaudited) | | | Year Ended January 31, 2009 | |

| Shares sold | | | 2,892,188 | | | | 860,199 | |

| Shares issued to shareholders in reinvestment of dividends | | | 221,224 | | | | 366,094 | |

| Shares repurchased | | | (1,053,484 | ) | | | (1,275,156 | ) |

| Net increase/(decrease) | | | 2,059,928 | | | | (48,863 | ) |

| Dividends per share from net investment income | | $ | 0.1404 | | | $ | 0.3140 | |

Redemption fees of $9,913 and $5,692 were retained by the Trust for the six months ended July 31, 2009 and the year ended January 31, 2009, respectively.

| | |

| 3. | Purchases and Sales of Securities |

Purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | | |

| | | Six Months Ended July 31, 2009 (unaudited) | |

| Purchases: | | | | |

| Investment Securities | | $ | 16,512,611 | |

| Sales: | | | | |

| Investment Securities | | $ | 7,231,807 | |

At July 31, 2009, information on the tax components of capital is as follows:

| | | | | |

| Cost of investments for tax purposes | | $ | 37,158,111 | |

| Gross tax unrealized appreciation | | $ | 2,044,377 | |

| Gross tax unrealized depreciation | | ($ | 803,490 | ) |

| Net tax unrealized appreciation on investments | | $ | 1,240,887 | |

| 5. | Investment Advisory Fee, Service and Distribution Fees and Transactions With Affiliates |

An advisory fee of $121,144 was paid or payable to EULAV Asset Management, LLC. (the “Adviser”) for the six months ended July 31, 2009. This was computed at an annual rate of 0.75 of 1% per year on the first $100 million of the Trust’s average daily net assets during the period, and 0.50 of 1% on the average daily net assets in excess thereof. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services and office space. The Adviser also provides persons, satisfactory to the Trust’s Trustees, to act as officers of the Trust and pays their salaries. Direct expenses of the Trust are charged to the Trust while common expenses of the Value Line Funds are allocated proportionately based upon the Funds’ respective net assets. The Trust bears all other costs and expenses. Effective June 1, 2007 and 2008, the Adviser contractually agreed to reduce the Trust’s advisory fee by 0.40% for one year periods. Effective June 1, 2009 the adviser contractually agreed to reduce the Trust’s advisory fee by 0.30% for a one year period. The fees waived amounted to $58,422 for the six months ended July 31, 2009. The Adviser has no right to recoup previously waived amounts.

| Value Line Aggressive Income Trust |

| |

| Notes to Financial Statements (unaudited) |

The Trust has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, compensates EULAV Securities, Inc. (the “Distributor”), formerly Value Line Securities, Inc. prior to May 5, 2009, a wholly-owned subsidiary of Value Line, for advertising, marketing and distributing the Trust’s shares and for servicing the Trust’s shareholders at an annual rate of 0.25% of the Trust’s average daily net assets. Fees amounting to $40,381 before fee waivers were accrued under the Plan for the six months ended July 31, 2009. Effective June 1, 2007, 2008 and 2009, the Distributor contractually agreed to reduce the 12b-1 fee by 0.10% for one year periods. The fees waived amounted to $16,153 for the six months ended July 31, 2009. The Distributor has no right to recoup previously waived amounts.

Certain officers, employees and a director of Value Line and/or affiliated companies are also officers and a Trustee of the Trust. At July 31, 2009, the officers and Trustee as a group owned 930 shares of beneficial interest in the Trust, representing less than 1% of the outstanding shares.

As previously disclosed, the Securities and Exchange Commission (“SEC”) conducted an investigation regarding whether the Distributor’s brokerage charges and related expense reimbursements from the Value Line Funds (“Funds”) during periods prior to 2005 were excessive and whether adequate disclosure was made to the SEC and the Boards of Directors and shareholders of the Funds. Value Line, Inc. (“Value Line”), the parent company of both the Distributor and the Adviser, has made an offer to settle the investigation. The settlement offer, in which Value Line neither admits nor denies the investigation’s findings, provides that, if accepted by the SEC, approximately $43.7 million would be paid by Value Line into a Fair Fund to reimburse shareholders who owned shares in the affected mutual funds in the period covered by the settlement. In addition, under the settlement offer, Value Line’s CEO and former CCO would be barred from serving as an officer or director of a public company and from association with an investment adviser, broker-dealer or registered investment company subject, in the case of the CEO, to a limited exception from the associational bar for a period of one year from the entry of the settlement order in order to enable steps to be taken that will terminate her association with the Value Line mutual funds, asset management and distribution businesses. The settlement offer will not be effective unless approved by the SEC and no assurance can be given that such approval will be obtained. Value Line management ended the Value Line Funds use of affiliated brokerage in 2004. Value Line has informed the Trust’s management of its belief that there are no loss or gain contingencies that should be accrued or disclosed in the Trust’s financial statements and that the settlement of the SEC investigation is not likely to have a material adverse effect on the ability of the Adviser or the Distributor to perform their respective contracts with the Trust.

| Value Line Aggressive Income Trust |

| |

| Financial Highlights |

Selected data for a share of beneficial interest outstanding throughout each period:

| | | Six Months Ended July 31, 2009 (unaudited) | | | |

| | | | | |

| | | | Years Ended January 31, | |

| | | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

| Net asset value, beginning of period | | $ | 3.89 | | $ | 4.83 | | $ | 5.06 | | $ | 5.01 | | $ | 5.16 | | $ | 5.06 | |

| | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.14 | | | 0.32 | | | 0.34 | | | 0.32 | | | 0.31 | | | 0.33 | |

Net gains or (losses) on securities (both realized and unrealized) | | | 0.54 | | | (0.95 | ) | | (0.23 | ) | | 0.05 | | | (0.15 | ) | | 0.09 | |

| Total from investment operations | | | 0.68 | | | (0.63 | ) | | 0.11 | | | 0.37 | | | 0.16 | | | 0.42 | |

| Redemption fees | | | 0.00 | (3) | | 0.00 | (3) | | 0.00 | (3) | | 0.00 | (3) | | 0.00 | (3) | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.14 | ) | | (0.31 | ) | | (0.34 | ) | | (0.32 | ) | | (0.31 | ) | | (0.33 | ) |

| Net asset value, end of period | | $ | 4.43 | | $ | 3.89 | | $ | 4.83 | | $ | 5.06 | | $ | 5.01 | | $ | 5.16 | |

| Total return | | | 17.85 | %(4) | | (13.42 | )% | | 2.14 | % | | 7.80 | % | | 3.32 | % | | 8.55 | % |

| | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 38,691 | | $ | 25,924 | | $ | 32,459 | | $ | 37,340 | | $ | 43,761 | | $ | 59,919 | |

Ratio of expenses to average net assets(1) | | | 1.49 | %(5) | | 1.50 | % | | 1.28 | % | | 1.50 | % | | 1.45 | % | | 1.39 | % |

Ratio of expenses to average net assets(2) | | | 1.02 | %(5) | | 0.98 | % | | 0.77 | % | | 1.04 | % | | 1.45 | % | | 1.39 | % |

Ratio of net investment income to average net assets | | | 7.00 | %(5) | | 7.17 | % | | 6.76 | % | | 6.54 | % | | 6.19 | % | | 6.28 | % |

| Portfolio turnover rate | | | 25 | %(4) | | 39 | % | | 30 | % | | 31 | % | | 27 | % | | 69 | % |

| (1) | Ratio reflects expenses grossed up for custody credit arrangement and grossed up for the waiver of a portion of the advisory fee by the Adviser and a portion of the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets, net of custody credits, but exclusive of the waiver of a portion of the advisory fee by the Adviser and the waiver of the service and distribution plan fees by the Distributor, would have been 1.48% for the year ended January 31, 2009, 1.27% for the year ended January 31, 2008, 1.49% for the year ended January 31, 2007 and would not have changed for the other years shown. |

| | |

| (2) | Ratio reflects expenses net of the waiver of a portion of the advisory fee by the Adviser and a portion of the service and distribution plan fees by the Distributor and net of the custody credit arrangement. |

| | |

| (3) | Amount is less than $.01 per share. |

| | |

| (4) | Not annualized. |

| | |

| (5) | Annualized. |

See Notes to Financial Statements.

18

| Value Line Aggressive Income Trust |

| |

| Factors Considered by the Board in Approving the Investment Advisory Agreement for Value Line Aggressive Income Trust |

The Investment Company Act of 1940 (the “1940 Act”) requires the Board of Trustees, including a majority of Trustees who are not “interested persons” of Value Line Aggressive Income Trust (the “Trust”), as that term is defined in the 1940 Act (the “Independent Trustees”), annually to consider the investment advisory agreement (the “Agreement”) between the Trust and its investment adviser, EULAV Asset Management, LLC1 (the “Adviser”). As required by the 1940 Act, the Board requested and the Adviser provided such information as the Board deemed to be reasonably necessary to evaluate the terms of the Agreement. At meetings held throughout the year, including the meeting specifically focused upon the review of the Agreement, the Independent Trustees met in executive sessions separately from the non-Independent Trustee of the Trust and any officers of the Adviser. In selecting the Adviser and approving the continuance of the Agreement, the Independent Trustees relied upon the assistance of counsel to the Independent Trustees.

Both in the meetings which specifically addressed the approval of the Agreement and at other meetings held during the course of the year, the Board, including the Independent Trustees, received materials relating to the Adviser’s investment and management services under the Agreement. These materials included information on: (i) the investment performance of the Trust, compared to a peer group of funds consisting of the Trust and all retail and institutional high current yield funds regardless of asset size or primary channel of distribution (the “Performance Universe”), and its benchmark index, each as classified by Lipper Inc., an independent evaluation service (“Lipper”); (ii) the investment process, portfolio holdings, investment restrictions, valuation procedures, and financial statements for the Trust; (iii) sales and redemption data with respect to the Trust; (iv) the general investment outlook in the markets in which the Trust invests; (v) arrangements with respect to the distribution of the Trust’s shares; (vi) the allocation and cost of the Trust’s brokerage (none of which was effected through any affiliate of the Adviser); and (vii) the overall nature, quality and extent of services provided by the Adviser.

1 On June 30, 2008, Value Line, Inc., the Trust’s former investment adviser, reorganized its investment management division into EULAV Asset Management, LLC, a newly formed wholly-owned subsidiary located at 220 East 42nd Street, New York, NY 10017. As part of the reorganization, the Trust’s investment advisory agreement was transferred from Value Line, Inc. to EULAV Asset Management, LLC, and EULAV Asset Management, LLC replaced Value Line, Inc. as the Trust’s investment adviser. For periods prior to June 30, 2008, the term “Adviser” refers to Value Line, Inc.

| Value Line Aggressive Income Trust |

| |

As part of the review of the continuance of the Agreement, the Board requested, and the Adviser provided, additional information in order to evaluate the quality of the Adviser’s services and the reasonableness of its fees under the Agreement. In a separate executive session, the Independent Trustees reviewed information, which included data comparing: (i) the Trust’s management fee rate, transfer agent and custodian fee rates, service fee (including 12b-1 fees) rates, and the rate of the Trust’s other non-management fees, to those incurred by a peer group of funds consisting of the Trust and 14 other retail no-load high current yield funds, as selected objectively by Lipper (“Expense Group”), and a peer group of funds consisting of the Trust, the Expense Group and all other retail no-load high current yield funds (excluding outliers), as selected objectively by Lipper (“Expense Universe”); (ii) the Trust’s expense ratio to those of its Expense Group and Expense Universe; and (iii) the Trust’s investment performance over various time periods to the average performance of the Performance Universe as well as the appropriate Lipper Index, as selected objectively by Lipper (the “Lipper Index”). In the separate executive session, the Independent Trustees also reviewed information regarding: (a) the Adviser’s financial results and condition, including the Adviser’s and certain of its affiliates’ profitability from the services that have been performed for the Trust as well as the Value Line family of funds; (b) the Trust’s current investment management staffing; and (c) the Trust’s potential for achieving economies of scale. In support of its review of the statistical information, the Board was provided with a detailed description of the methodology used by Lipper to determine the Expense Group, the Expense Universe and the Performance Universe to prepare its information. The Independent Trustees also requested and reviewed information provided by the Adviser relating to an investigation by the Securities and Exchange Commission in the matter of Value Line Securities, Inc.2, the Trust’s principal underwriter and affiliate of the Adviser (the “Distributor”), and a representation by Value Line, Inc. that the resolution of this matter is not likely to have a materially adverse effect on the ability of the Adviser or the Distributor to perform their respective contracts with the Trust.

The following summarizes matters considered by the Board in connection with its renewal of the Agreement. However, the Board did not identify any single factor as all-important or controlling, and the summary does not detail all the matters that were considered.

Investment Performance. The Board reviewed the Trust’s overall investment performance and compared it to its Performance Universe and the Lipper Index. The Board noted that the Trust outperformed both the Performance Universe average and the Lipper Index for the one-year, three-year and five-year period ended December 31, 2008. The Board also noted that the Trust’s performance for the ten-year period ended December 31, 2008 was below the performance of the Performance Universe average and above the Lipper Index.

The Adviser’s Personnel and Methods. The Board reviewed the background of the portfolio manager responsible for the daily management of the Trust’s portfolio, seeking to achieve the Trust’s investment objectives and adhering to the Trust’s investment strategies. The Independent Trustees also engaged in discussions with the Adviser’s senior management responsible for the overall functioning of the Trust’s investment operations. The Board concluded that the Trust’s management team and the Adviser’s overall resources were adequate and that the Adviser had investment management capabilities and personnel essential to performing its duties under the Agreement.

Management Fee and Expenses. The Board considered the Adviser’s fee under the Agreement relative to the management fees charged by its Expense Group and Expense Universe averages. The Board noted that, effective March 7, 2006, the Adviser voluntarily agreed to waive a portion of the Trust’s management fee, thereby reducing the management fee rate from 0.75% to 0.35% of the Trust’s average daily net assets. In addition, the Board noted that the Adviser and the Board previously agreed that the Trust’s management fee waiver, as described above, would be contractually imposed for each of the one-year periods ended May 31, 2008 and May 31, 2009, so that such waiver could not be changed without the Board’s approval during such periods. The Board also noted that, effective June 1, 2009 through May 31, 2010, the Board and the Adviser contractually agreed to waive a portion of the Trust’s management fee, thereby reducing the management fee rate from 0.75% to 0.45% of the Trust’s average daily net assets. The Board noted that, for the most recent fiscal year, the Trust’s management fee rate after giving effect to the contractual management fee waiver was less than that of both the Expense Group average and the Expense Universe average.

2 On May 6, 2009, Value Line Securities, Inc. changed its name to EULAV Securities, Inc. No other change was made to the Distributor’s organization, including its operations and personnel.

| Value Line Aggressive Income Trust |

| |

The Board also considered the Trust’s total expense ratio relative to its Expense Group and Expense Universe averages. The Board noted that, effective March 7, 2006, the Distributor voluntarily agreed to waive a portion of the Trust’s Rule 12b-1 fee, thereby reducing the Trust’s Rule 12b-1 fee rate from 0.25% to 0.15% of the Trust’s average daily net assets. In addition, the Board noted that the Distributor and the Board previously agreed that the Trust’s Rule 12b-1 fee waiver, as described above, would be contractually imposed for each of the one-year periods ended May 31, 2008 and May 31, 2009, so that such waiver could not be changed without the Board’s approval during such periods, and that the Distributor and the Board have currently agreed to extend this contractual 12b-1 fee waiver through May 31, 2010. As a result of these Rule 12b-1 fee waivers and the management fee waivers, the Board noted that the Trust’s total expense ratio after giving effect to these waivers was less than that of the Expense Group average and the Expense Universe average. The Board concluded that the average expense ratio was satisfactory for the purpose of approving the continuance of the Agreement for the coming year.

Nature and Qualitv of Other Services. The Board considered the nature, quality, cost and extent of other services provided by the Adviser and the Distributor. At meetings held throughout the year, the Board reviewed the effectiveness of the Adviser’s overall compliance program, as well as the services provided by the Distributor. The Board also reviewed the services provided by the Adviser and its affiliates in supervising third party service providers. Based on this review, the Board concluded that the nature, quality, cost and extent of such other services provided by the Adviser and its affiliates were satisfactory, reliable and beneficial to the Trust’s shareholders.

Profitability. The Board considered the level of profitability of the Adviser and its affiliates with respect to the Trust individually and in the aggregate for all the funds within the Value Line group of funds, including the impact of certain actions taken during prior years. These actions included the Adviser’s reduction (voluntary in some instances and contractual in other instances) of management and/or Rule 12b-1 fees for certain funds, the Adviser’s termination of the use of soft dollar research, and the cessation of trading through the Distributor. The Board concluded that the profitability of the Adviser and its affiliates with respect to the Trust, including the financial results derived from the Trust’s Agreement, were within a range the Board considered reasonable.

Other Benefits. The Board also considered the character and amount of other direct and incidental benefits received by the Adviser and its affiliates from their association with the Trust. The Board concluded that potential “fall-out” benefits that the Adviser and its affiliates may receive, such as greater name recognition, appear to be reasonable, and may in some cases benefit the Trust.

Economies of Scale. The Board noted that, given the current and anticipated size of the Trust, any perceived and potential economies of scale were not yet a significant consideration for the Trust and the addition of break points was determined not to be necessary at this time.

Fees and Services Provided for Other Comparable Funds/Accounts Managed by the Adviser and its Affiliates. In addition to comparing the Trust’s management fee rate to unaffiliated mutual funds included in the Trust’s Expense Group and Expense Universe, the Board was informed by the Adviser that the Adviser and its affiliates do not manage any investment companies or other institutional accounts comparable to the Trust.

| Value Line Aggressive Income Trust |

| |

Conclusion. The Board, in light of the Adviser’s overall performance, considered it appropriate to continue to retain the Adviser as the Trust’s investment adviser. Based on their evaluation of all material factors deemed relevant, and with the advice of independent counsel, the Board determined that the Trust’s management fee rate payable to the Adviser under the Agreement does not constitute fees that are so disproportionately large as to bear no reasonable relationship to the services rendered and that could not have been the product of arm’s-length bargaining, and concluded that the management fee rate under the Agreement is fair and reasonable. Further, the Board concluded that the Trust’s Agreement is fair and reasonable and approved the continuation of the Agreement for another year.

| Value Line Aggressive Income Trust |

| |

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Trust voted these proxies for the 12-month period ended June 30 is available through the Value Line Funds website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.

| Value Line Aggressive Income Trust |

| |

| Management of the Trust |

MANAGEMENT INFORMATION

The business and affairs of the Trust are managed by the Trust’s officers under the direction of the Board of Trustees. The following table sets forth information on each Trustee and Officer of the Trust. Each Trustee serves as a director or trustee of each of the 14 Value Line Funds. Each Trustee serves until his or her successor is elected and qualified.

| | | | | | | | | |

| Name, Address, and Age | | Position | | Length of Time Served | | Principal Occupation During the Past 5 Years | | Other Directorships Held by Trustee |

| Interested Director* | | | | | | | | |

Thomas T. Sarkany Age 63 | | Trustee | | Since 2008 | | Mutual Fund Marketing Director of EULAV Securities, Inc. (the “Distributor”), formerly Value Line Securities, Inc. | | None |

| Non-Interested Directors | | | | | | | | |

Joyce E. Heinzerling 500 East 77th Street New York, NY 10162 Age 53 | | Trustee | | Since 2008 | | President, Meridian Fund Advisers LLC. (consultants) since April 2009; General Counsel, Archery Capital LLC (private investment fund) until April 2009. | | Burnham Investors Trust, since 2004 (4 funds). |

Francis C. Oakley 54 Scott Hill Road Williamstown, MA 01267 Age 77 | | Trustee (Lead Independent Director since 2008) | | Since 1993 | | Professor of History, Williams College, (1961-2002). Professor Emeritus since 2002; President Emeritus since 1994 and President, (1985-1994) Chairman (1993-1997) and Interim President (2002-2003) of the American Council of Learned Societies. Trustee since 1997 and Chairman of the Board since 2005, National Humanities Center. | | None |

David H. Porter 5 Birch Run Drive Saratoga Springs, NY 12866 Age 73 | | Trustee | | Since 1997 | | Professor, Skidmore College, since 2008; Visiting Professor of Classics, Williams College, (1999-2008); President Emeritus, Skidmore College since 1999 and President, (1987-1998). | | None |

Paul Craig Roberts 169 Pompano St. Panama City Beach, FL 32413 Age 70 | | Trustee | | Since 1983 | | Chairman, Institute for Political Economy. | | None |

Nancy-Beth Sheerr 1409 Beaumont Drive Gladwyne, PA 19035 Age 60 | | Director | | Since 1996 | | Senior Financial Advisor, Veritable L.P. (Investment Adviser) since 2004; Senior Financial Advisor, Hawthorn, (2001-2004). | | None |

| Value Line Aggressive Income Trust |

| |

| Management of the Trust |

| Name, Address, and Age | | Position | | Length of Time Served | | Principal Occupation During the Past 5 Years | | Other Directorships Held by Trustee |

Daniel S. Vandivort 59 Indian Head Road Riverside, CT 06878 Age 55 | | Trustee | | Since 2008 | | President, Chief Investment Officer, Weiss, Peck and Greer/Robeco Investment Management 2005-2007; Managing Director, Weiss, Peck and Greer, 1995-2005. | | None |

| Officers | | | | | | | | |

Mitchell E. Appel Age 39 | | President | | Since 2008 | | President of each of the Value Line Funds since June 2008; Chief Financial Officer of Value Line since April 2008 and from September 2005 to November 2007; Treasurer from June 2005 to September 2005; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008; Chief Financial Officer of Circle Trust Company from 2003 through May 2005; Chief Financial Officer of the Distributor since April 2008 and President since February 2009; President of the Adviser since February 2009. | | |

Howard A. Brecher Age 55 | | Vice President and Secretary | | Since 2008 | | Vice President and Secretary of each of the Value Line Funds since June 2008; Vice President, Secretary and a Director of Value Line; Secretary and Treasurer of the Adviser since February 2009; Vice President, Secretary, Treasurer, General Counsel and a Director of Arnold Bernhard & Co., Inc. | | |

Emily D. Washington Age 30 | | Treasurer | | Since 2008 | | Treasurer and Chief Financial Officer (Principal Financial and Accounting Officer) of each of the Value Line Funds since August 2008; Associate Director of Mutual Fund Accounting at Value Line until August 2008. | | |

| * | Mr. Sarkany is an “interested person” as defined in the Investment Company Act of 1940 by virtue of his position with the Distributor. |

Unless otherwise indicated, the address for each of the above officers is c/o Value Line Funds, 220 East 42nd Street, New York, NY 10017.

| The Trust’s Statement of Additional Information (SAI) includes additional information about the Trust’s Trustees and is available, without charge, upon request by calling 1-800-243-2729 or on the Trust’s website, www.vlfunds.com. |

| Value Line Aggressive Income Trust |

| |

[This Page Intentionally Left Blank.]

| Value Line Aggressive Income Trust |

| |

[This Page Intentionally Left Blank.]

| Value Line Aggressive Income Trust |

| |

| The Value Line Family of Funds |

1950 — The Value Line Fund seeks long-term growth of capital. Current income is a secondary objective.

1952 — Value Line Income and Growth Fund’s primary investment objective is income, as high and dependable as is consistent with reasonable risk. Capital growth to increase total return is a secondary objective.

1956 — Value Line Premier Growth Fund seeks long-term growth of capital. No consideration is given to current income in the choice of investments.

1972 — Value Line Larger Companies Fund’s sole investment objective is to realize capital growth.

1979 — The Value Line Cash Fund, a money market fund, seeks to secure as high a level of current income as is consistent with maintaining liquidity and preserving capital. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1981 — Value Line U.S. Government Securities Fund seeks maximum income without undue risk to capital. Under normal conditions, at least 80% of the value of its net assets will be invested in securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities.

1983 — Value Line Centurion Fund* seeks long-term growth of capital.

1984 — The Value Line Tax Exempt Fund seeks to provide investors with the maximum income exempt from federal income taxes while avoiding undue risk to principal. The fund may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1985 — Value Line Convertible Fund seeks high current income together with capital appreciation primarily from convertible securities ranked 1 or 2 for year-ahead performance by the Value Line Convertible Ranking System.

1986 — Value Line Aggressive Income Trust seeks to maximize current income.

1987 — Value Line New York Tax Exempt Trust seeks to provide New York taxpayers with the maximum income exempt from New York State, New York City and federal income taxes while avoiding undue risk to principal. The Trust may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).