Considerations for U.S. Residents.” Each U.S. shareholder should consult his or her own tax advisor regarding the U.S. federal, U.S. state and local, and foreign tax consequences of the PFIC rules and the acquisition, ownership, and disposition of Common Shares.

Certain directors and officers may serve as directors and officers of other companies in the natural resources sector.

While there are no known existing or potential conflicts of interest between Vista and any of its directors or officers, certain of the directors and officers do or may serve as directors and officers of other natural resource companies and therefore it is possible that a conflict may arise between their duties as a director or officer of Vista and their duties as a director or officer of such other companies. The directors and officers of Vista are aware of the existence of laws governing accountability of directors and officers for corporate opportunity and disclosure of conflicts of interest. Should any director or officer breach the duties imposed upon them by applicable laws, such actions or inactions could have a material adverse effect on our business prospects, results of operations, cash flows, financial position, and corporate reputation.

Industry Risks

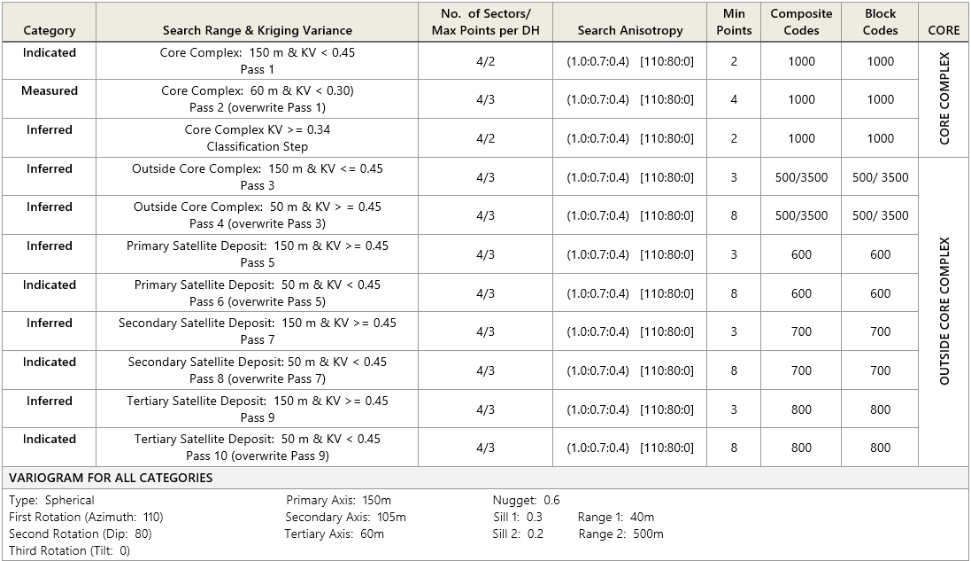

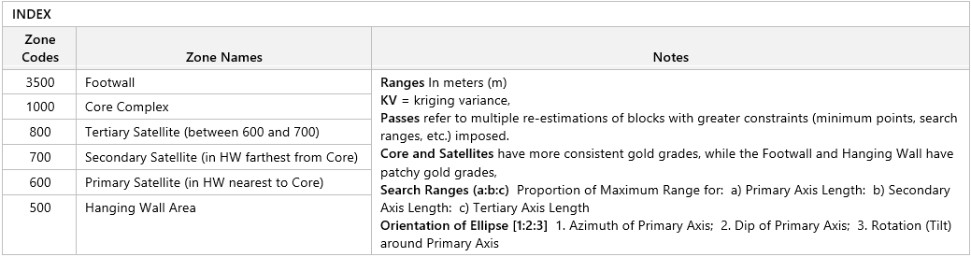

Calculations of mineral resources and mineral reserves are estimates only and subject to uncertainty.

Estimation of mineral resources and mineral reserves is an imprecise process and the accuracy of such estimates is a function of the quantity and quality of available data, assumptions used, and judgments made in interpreting geological information and estimating future capital and operating costs. There is significant uncertainty in mineral resources and mineral reserves estimates, and the economic results of mining a mineral deposit may differ materially from the estimates as additional data develops, interpretations change, or actual economic conditions vary from the estimates used.

Estimated mineral resources and mineral reserves may be materially affected by other factors.

In addition to uncertainties inherent in estimating mineral resources and mineral reserves, other factors may adversely affect estimated mineral resources and mineral reserves. Such factors may include but are not limited to metallurgical, environmental, permitting, legal, title, taxation, socio-economic, marketing, political, gold prices, and capital and operating costs. Any of these or other adverse factors may reduce or eliminate estimated mineral reserves and mineral resources and could have a material adverse effect on our business prospects, results of operations, cash flows, financial position, and corporate reputation.

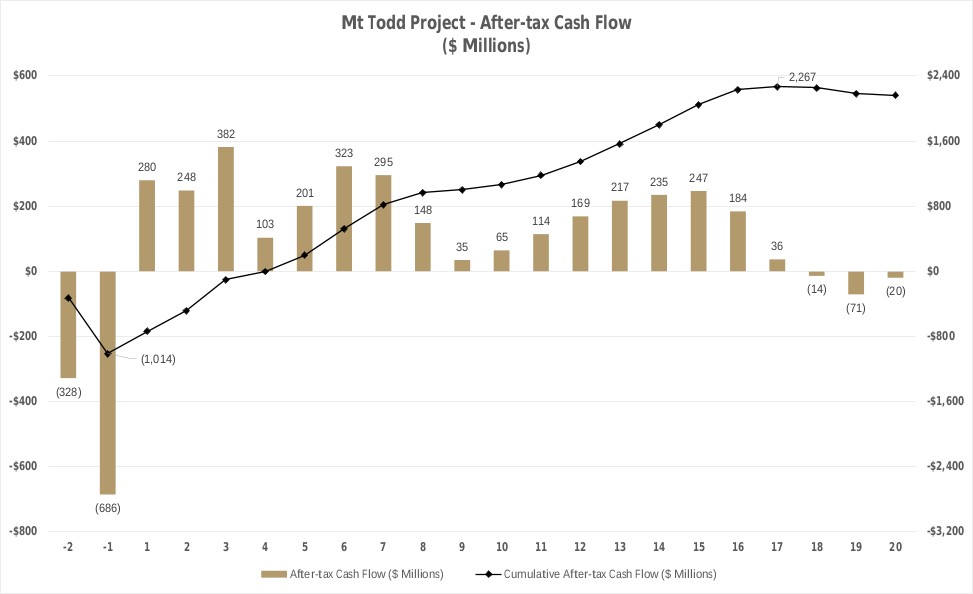

Feasibility studies and other technical studies are estimates only and subject to uncertainty.

Feasibility studies, such as our Mt Todd FS, and other technical studies are used to estimate the economic viability of an ore deposit, as are preliminary feasibility studies, preliminary economic assessments, and scoping studies. Feasibility studies are the most detailed studies and reflect higher levels of confidence in estimated production rates, and capital and operating costs. Accepted levels of confidence required to meet the standards set out in S-K 1300 are plus or minus 15% for feasibility studies, plus or minus 25-30% for preliminary feasibility studies and plus or minus 35-40% for preliminary economic assessments. Confidence levels for scoping studies may vary, but generally provide less confidence than preliminary economic assessments. These thresholds reflect the levels of confidence that exist at the time the study is completed. Subsequent changes to metal prices, foreign exchange rates (if applicable), reclamation requirements, operating and capital costs, and other variables may cause actual results of economic viability to differ materially from these estimates. Results of any subsequent Mt Todd feasibility study may be less favorable than the current Mt Todd FS.

Mining companies are increasingly required to consider and provide benefits to the communities, regions, and countries in which they operate, and are subject to extensive environmental, health and safety laws and regulations.

As a result of public concern about the real or perceived detrimental effects of economic globalization, global climate impacts, and other adverse environmental effects resulting from the operation of extractive industries, businesses in general and the mining industry in particular face increasing public scrutiny of their activities. These businesses are under pressure to demonstrate that as they seek to generate satisfactory returns on investment to shareholders, other stakeholders including employees, governments, Aboriginal peoples, communities surrounding operations, adjacent regions, and the countries in