February 2013 Exhibit 99.1

2 Cautionary Statement Regarding Forward-Looking Information Much of the information contained in this presentation is forward-looking information based upon management’s current expectations and projections that involve risks and uncertainties. Forward-looking information includes, among other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow, dividend growth and dividend payout ratios, share repurchases, construction costs and capital expenditures, investment opportunities, rate base, and future electric sales. Readers are cautioned not to place undue reliance on this forward-looking information. Forward-looking information is not a guarantee of future performance and actual results may differ materially from those set forth in the forward-looking information. In addition to the assumptions and other factors referred to in connection with the forward-looking information, factors that could cause Wisconsin Energy's actual results to differ materially from those contemplated in any forward-looking information or otherwise affect our future results of operations and financial condition include, among others, the following: general economic conditions, including business and competitive conditions in the company’s service territories; timing, resolution and impact of future rate cases and other regulatory decisions; availability of the company’s generating facilities and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes; varying weather conditions; cyber-security threats; construction risks; equity and bond market fluctuations; the impact of recent and future federal, state and local legislative and regulatory changes; current and future litigation and regulatory investigations; changes in accounting standards; and other factors described under the heading “Factors Affecting Results, Liquidity and Capital Resources” in Management’s Discussion and Analysis of Financial Condition and Results of Operations and under the headings “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors” contained in Wisconsin Energy's Form 10-K for the year ended December 31, 2011 and in subsequent reports filed with the Securities and Exchange Commission. Wisconsin Energy expressly disclaims any obligation to publicly update or revise any forward-looking information.

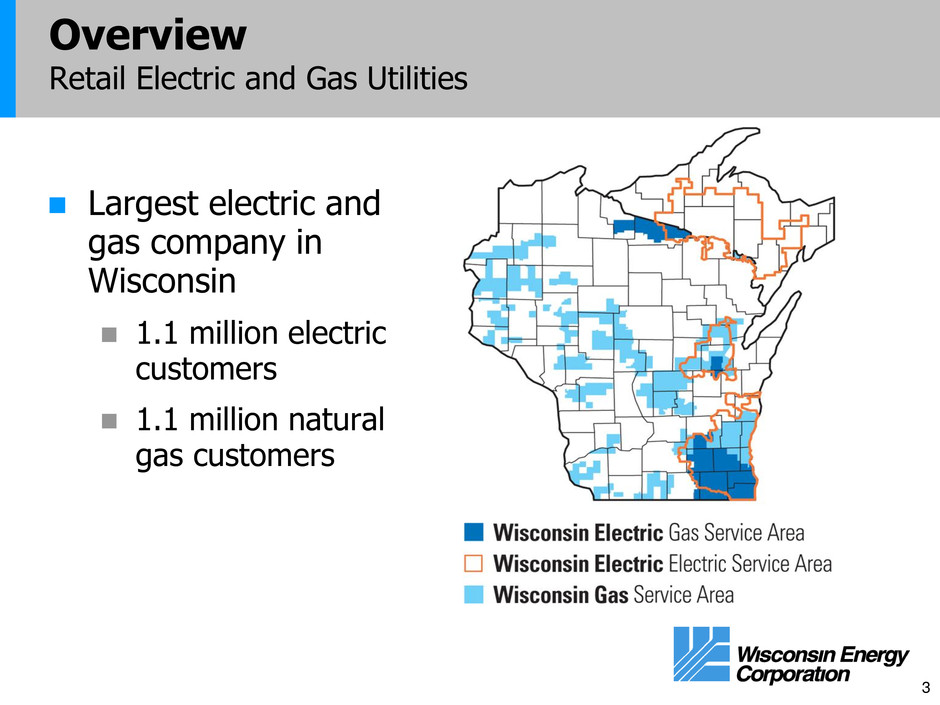

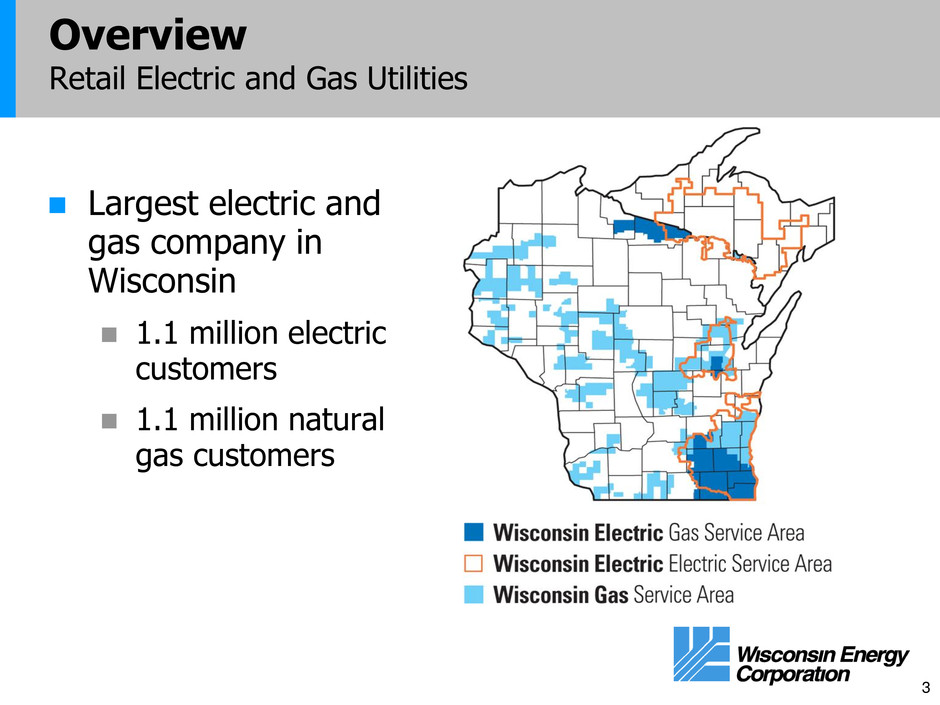

3 Largest electric and gas company in Wisconsin 1.1 million electric customers 1.1 million natural gas customers Overview Retail Electric and Gas Utilities

4 Investment Thesis An “Earn and Return” Company with a Low Risk Profile Positive free cash flow Targeted EPS growth of 4%-6% Best in class dividend growth - moving to a 60% dividend payout ratio in 2014 and targeting 65%-70% in 2017 Implies 7%-10% dividend growth each year $300 million share buyback program authorized through 2013 $151.8 million completed through 2012 Proven management team that has delivered strong financial results and operational excellence Constructive regulatory climate

5 Wisconsin Energy is the only company in the S&P Electric Index S&P Utilities Index Philadelphia Utility Index Dow Jones Utilities Average that has grown earnings per share and dividends per share every year since 2003 A Track Record of Performance Consistent Earnings and Dividend Growth

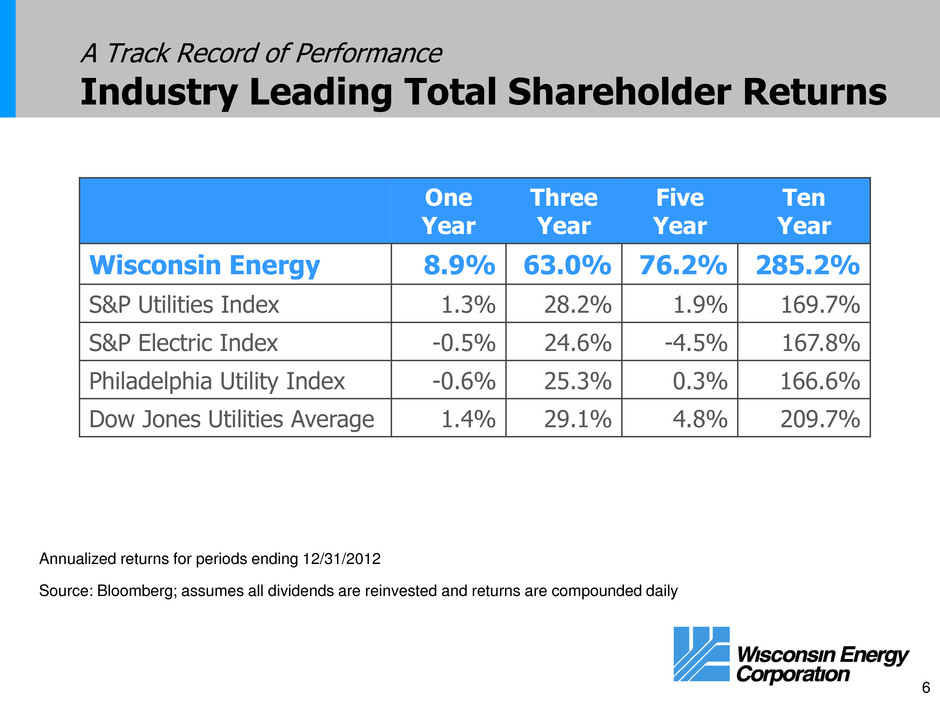

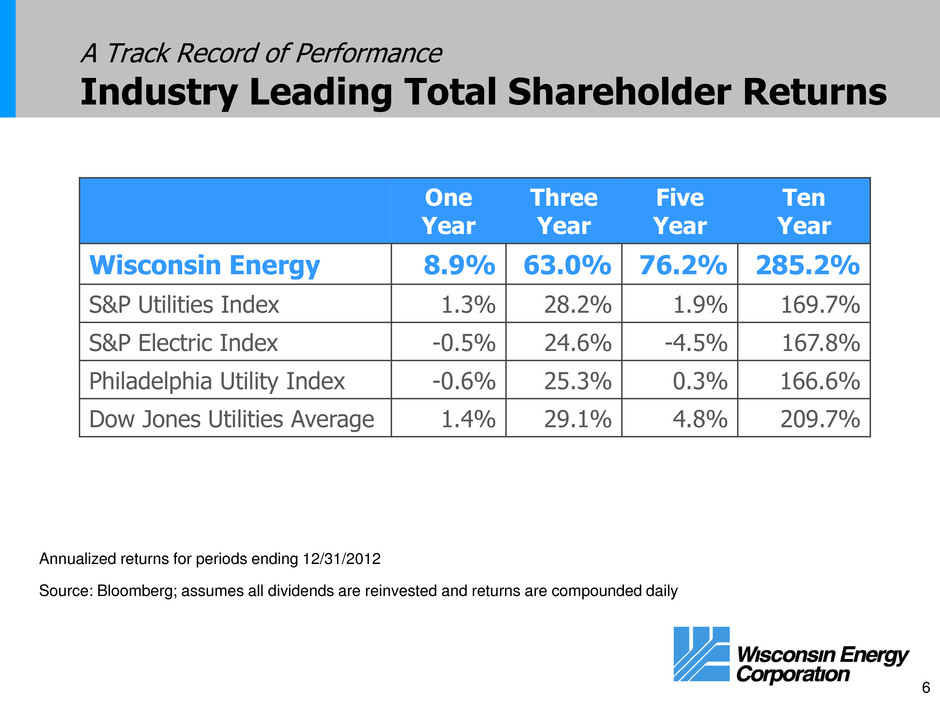

6 A Track Record of Performance Industry Leading Total Shareholder Returns One Year Three Year Five Year Ten Year Wisconsin Energy 8.9% 63.0% 76.2% 285.2% S&P Utilities Index 1.3% 28.2% 1.9% 169.7% S&P Electric Index -0.5% 24.6% -4.5% 167.8% Philadelphia Utility Index -0.6% 25.3% 0.3% 166.6% Dow Jones Utilities Average 1.4% 29.1% 4.8% 209.7% Annualized returns for periods ending 12/31/2012 Source: Bloomberg; assumes all dividends are reinvested and returns are compounded daily

7 A Track Record of Performance Leading Reliability and Customer Satisfaction Named the most reliable utility in the Midwest Eighth time in the past 11 years During 2012, achieved highest customer satisfaction ratings in past decade … likely best ever More than 350,000 proactive customer interactions annually

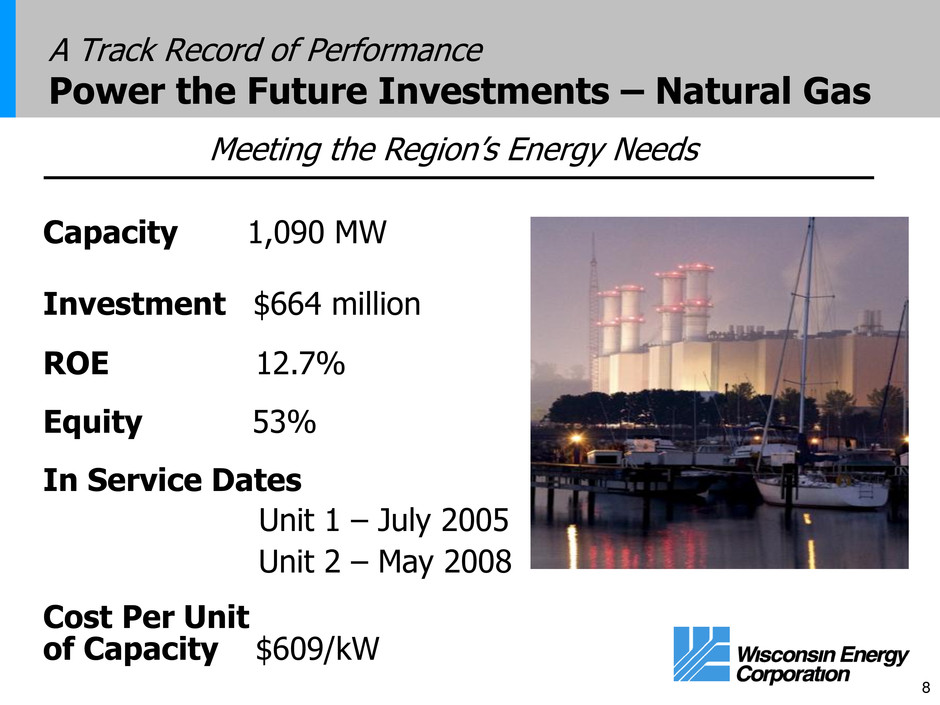

8 A Track Record of Performance Power the Future Investments – Natural Gas Capacity 1,090 MW Investment $664 million ROE 12.7% Equity 53% In Service Dates Unit 1 – July 2005 Unit 2 – May 2008 Cost Per Unit of Capacity $609/kW Meeting the Region’s Energy Needs

9 Capacity 1,030 MW1 Investment $2 billion1 ROE 12.7% Equity 55% In Service Dates Unit 1 – February 2010, Unit 2 – January 2011 Cost Per Unit Approximately of Capacity $1,950/kW 1 All capacity and investment amounts reflect WEC ownership only. Demonstrated capacity for the coal units is 1,056 MW – value shown in table is amount guaranteed in lease agreement. Meeting the Region’s Energy Needs A Track Record of Performance Power the Future Investments – Coal

10 A Track Record of Performance Dramatic Change in Environmental Performance From 2000 to 2013... Power plant capacity up 50% Emissions of nitrogen oxide sulfur dioxide down 80% mercury particulate matter

11 A Track Record of Performance State of the Art Emission Controls

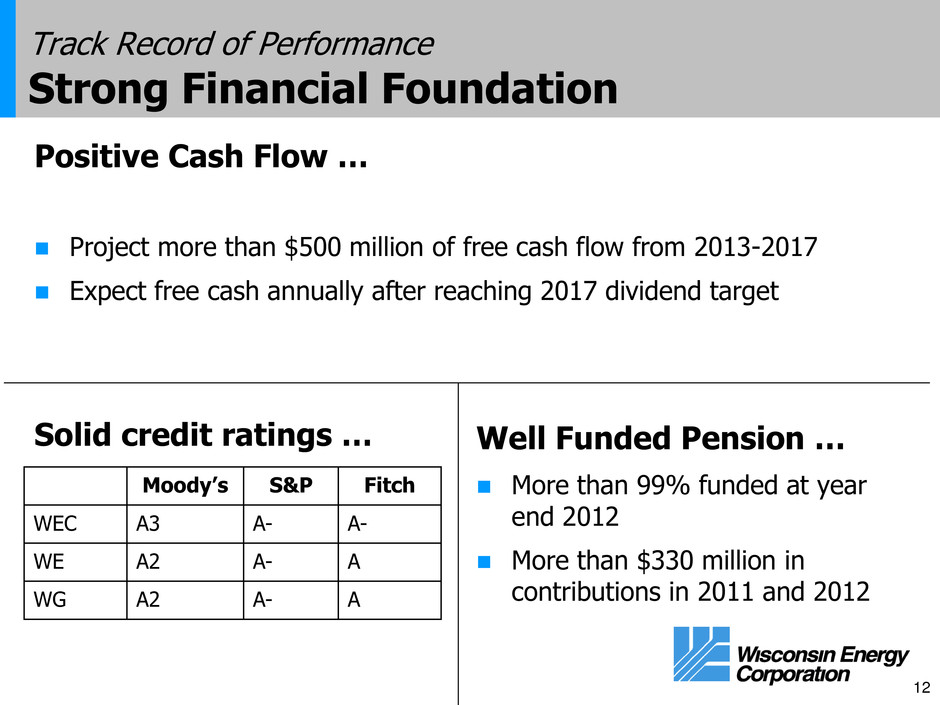

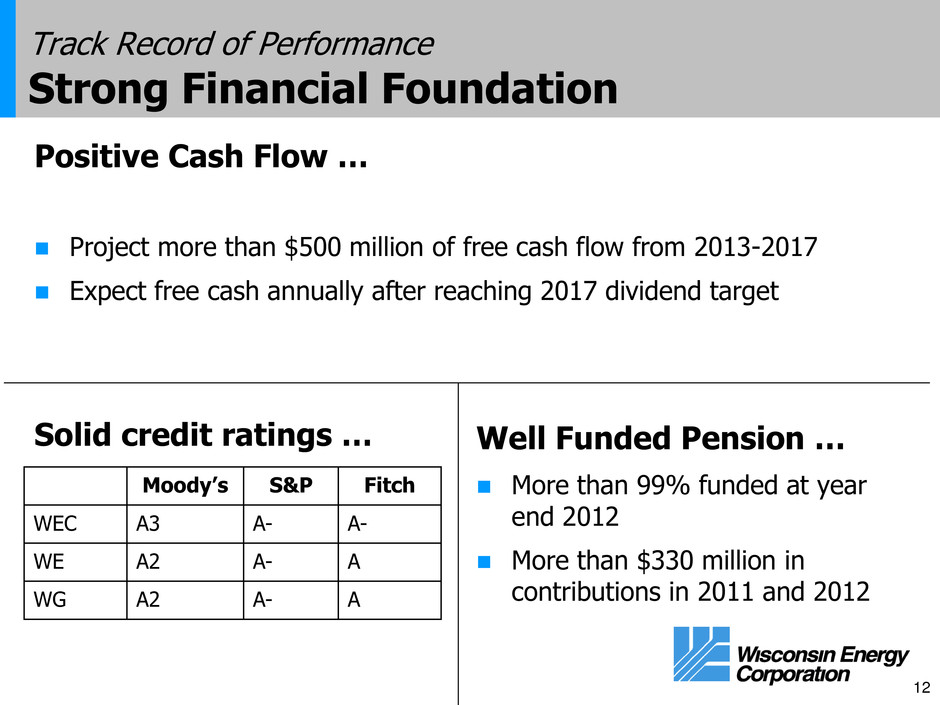

12 Track Record of Performance Strong Financial Foundation Moody’s S&P Fitch WEC A3 A- A- WE A2 A- A WG A2 A- A Well Funded Pension … More than 99% funded at year end 2012 More than $330 million in contributions in 2011 and 2012 Solid credit ratings … Positive Cash Flow … Project more than $500 million of free cash flow from 2013-2017 Expect free cash annually after reaching 2017 dividend target

13 A Track Record of Performance Summary of our Core Business Retail Electric and Gas Utilities Wisconsin, Michigan, and FERC jurisdictions 48.5% to 53.5% equity for Wisconsin Electric 10.4% allowed ROE 45% to 50% equity for Wisconsin Gas 10.5% allowed ROE Power the Future 53% to 55% equity levels in lease agreements 12.7% ROE fixed in lease agreements Wholesale Electric Transmission FERC jurisdictional 50% equity level for rates 12.2% ROE with true-up $2.7 $5.7 Note: Value for retail electric and gas utilities represents rate base. Power the Future value is book value of investment. Wholesale electric transmission is 26.2% of ATC’s rate base. $9.8 Billion Rate Base and Power the Future Investment at 12/31/12

14 Where We Go From Here Major Segment Earnings for 2011 – 2013 2011A 2012A 2013E Electric and Gas Utilities $1.44 $1.55 $1.55 to $1.65 Power the Future (1) $0.66 $0.69 $0.71 Wholesale Electric Transmission (2) $0.16 $0.17 $0.18 Unallocated holding company debt (3) ($0.08) ($0.06) ($0.06) $2.18 $2.35 $2.38 to $2.48 (1)Includes allocation of approximately $375 million of 6.25% rate holding company debt (2)26.2% investment in ATC (3) Includes unallocated holding company debt and other miscellaneous corporate costs Projecting earnings per share growth of 4-6% annually from the 2011 base

15 Where We Go From Here Delivering the Future From 2013 through 2017, our plan is to invest $3.2 to $3.5 billion in needed infrastructure projects that will: Renew and modernize our grid Meet new environmental standards Add clean, renewable energy to our fleet

16 Between now and 2017, we plan to: Rebuild 2,000 miles of electric distribution lines that are more than 50 years old Replace: 18,500 power poles 20,000 transformers Hundreds of substation components Where We Go From Here Delivering the Future – Electric Overview

17 Between now and 2017, we also plan to: Replace: 1,250 miles of fiberglass, plastic and steel gas mains 83,000 individual gas distribution lines 233,000 meter sets Where We Go From Here Delivering the Future – Gas Overview

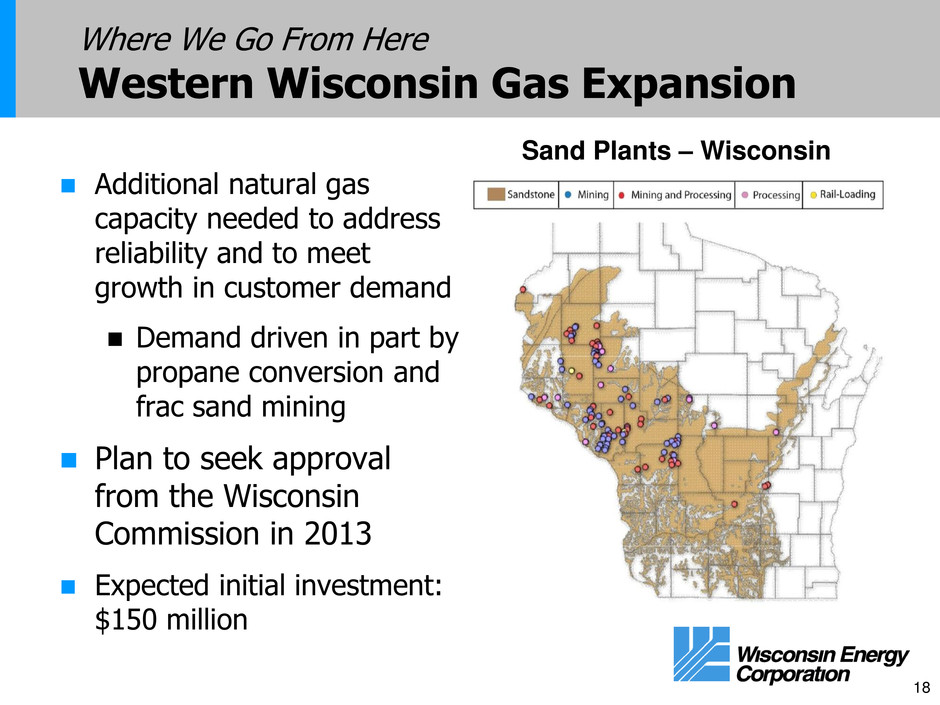

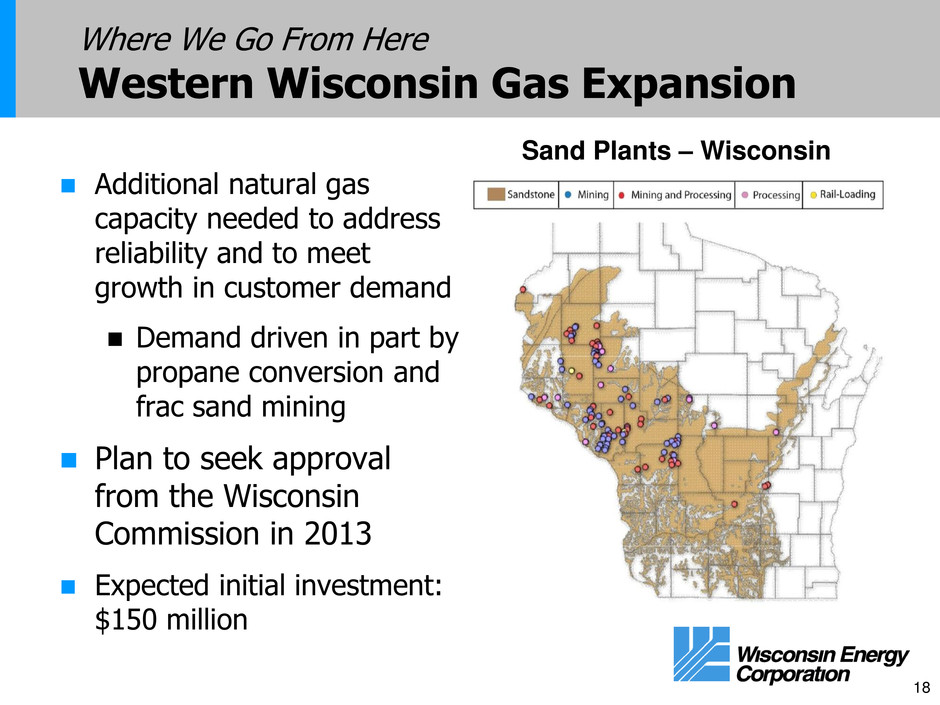

18 Where We Go From Here Western Wisconsin Gas Expansion Additional natural gas capacity needed to address reliability and to meet growth in customer demand Demand driven in part by propane conversion and frac sand mining Plan to seek approval from the Wisconsin Commission in 2013 Expected initial investment: $150 million Sand Plants – Wisconsin

19 In 2012 announced plans to convert Valley from coal to natural gas Targeting completion of the conversion for late 2015 or early 2016 Follows completion of a $26 million gas pipeline upgrade project expected to begin in 2013 and complete in 2014 Where We Go From Here Valley Power Plant Conversion cost estimated at $60 to $65 million Included in our 2013–2017 capital budget

20 Where We Go From Here Renewable Energy Investments Biomass Plant 50MW Projected investment of $245-$255 million Approved by Wisconsin commission and Domtar Inc. Targeting completion by the end of 2013 Montfort Wind Energy Center 30MW Purchased from a subsidiary of NextEra Energy, Inc. Purchase price of $27 million Approved by Wisconsin Commission and completed in December 2012 We’ve also completed several renewable energy transactions. We expect to be in compliance with the Wisconsin renewable portfolio standard through 2019

21 Where We Go From Here Wolverine Joint Venture at Presque Isle Power Plant Signed joint venture agreement with Wolverine Power Cooperative for environmental upgrades at the Presque Isle Power Plant Wolverine will invest $130-$140 million for sulphur dioxide and NOx controls In return, Wolverine will receive a pro rata ownership share in the plant We will continue to be the majority owner and operator of the facility Joint Venture would reduce our ownership in the plant, but would not reduce rate base Plan to seek regulatory approvals in 2013 Work is scheduled to begin in 2014 and be completed by 2016

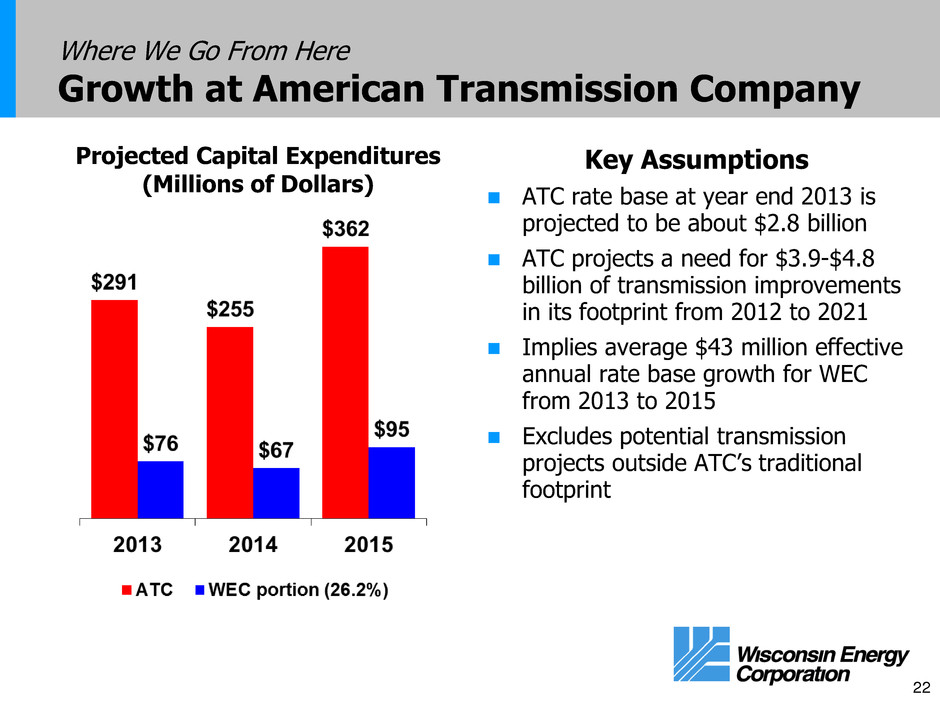

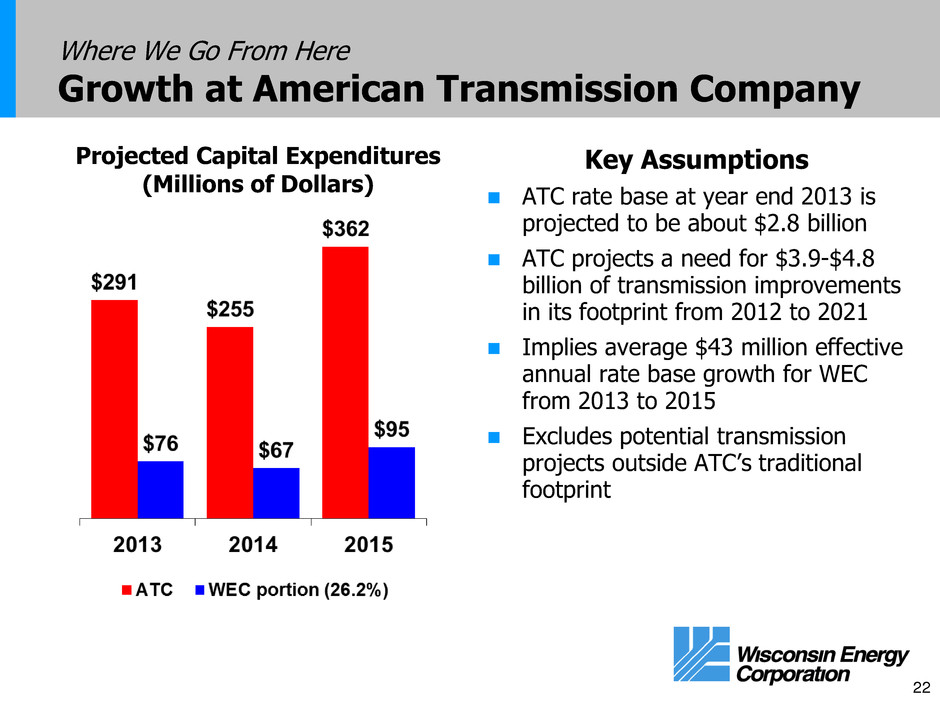

22 Where We Go From Here Growth at American Transmission Company Key Assumptions ATC rate base at year end 2013 is projected to be about $2.8 billion ATC projects a need for $3.9-$4.8 billion of transmission improvements in its footprint from 2012 to 2021 Implies average $43 million effective annual rate base growth for WEC from 2013 to 2015 Excludes potential transmission projects outside ATC’s traditional footprint Projected Capital Expenditures (Millions of Dollars)

23 Where We Go From Here Multiple Opportunities Being Evaluated Additional capital for fuel blending at the Oak Creek Expansion units Divestiture of energy assets by the State of Wisconsin New transmission projects outside of Wisconsin and Michigan through our 26.2 percent ownership of American Transmission Company Investment required to meet future EPA rules

24 Where We Go From Here Industry Leading Dividend Growth The directors raised the quarterly dividend in January to 34 cents a share – equivalent to an annual rate of $1.36 a share 13.3 percent increase over the 2012 amount We’re targeting a 60 percent payout ratio in 2014 Supports a double digit increase next year The directors also approved a target payout ratio of 65-70 percent in 2017 Supports 7-8 percent increases from 2015-2017

25 Where We Go From Here Financial Flexibility for Share Repurchases Board has authorized management to purchase up to $300 million of Wisconsin Energy common stock through end of 2013 Buyback program was 50% complete at the end of 2012 Repurchased 4.65 million shares at an average price of $32.63 a share Spent $151.8 million

26 Key Takeaways on Wisconsin Energy An “Earn and Return” Company with a Low Risk Profile Power the Future program now complete Highly visible earnings and strong cash flow Have received final regulatory approvals and rate treatment is in place Well managed utility franchises with rate base growth Investment in American Transmission Company provides an additional regulated growth opportunity Positioned to deliver among the best risk-adjusted returns in the industry Positive free cash flow Best in class dividend growth story

Appendix

28 Where We Go From Here Wisconsin Jurisdiction Rate Case Summary Public Service Commission of Wisconsin (PSCW) authorized 2.6% increase in net customer bills in 2013 and 2014 (after applying expected proceeds from a renewable energy tax grant) Non-fuel rate increase prior to credits: 4.8% or $133 million in 2013 and 1.0% or $28 million in 2014 Final costs approved for Oak Creek Expansion Over 99.5% of total actual project costs recovered $24 million for fuel flexibility deferred 2013 fuel cost plan approved Next Cases: 2014 – fuel cost plan 2015 – base rate case

29 Where We Go From Here Reconciliation of 2013 O&M to 2012 Reinstatement of amortization holiday adds $148 million to O&M for 2013 However, the 2013 Wisconsin rate order includes several offsets to O&M: Extension of recovery period for certain regulatory assets Significant reduction of escrowed bad debt expense Overall, we expect our 2013 O&M costs to be flat to approximately 2 percent higher than our actual O&M for 2012

30 Where We Go From Here Projected Rate Base *All other is comprised of customer advances, def. taxes, inventory and implied working capital.

31 Where We Go From Here Strong capital investment in the retail utility $137 $141 $151 $163 $225 $251 $245 $253 $172 $192 $193 $325 $163 $72 $305 $325 $345 $360 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 2012A 2013E 2014E 2015E M ill io ns o f D ol la rs Generation Delivery - Electric Delivery - Gas Renewable Depreciation $697 $656 $589 $741 Expected investment of $3.2 - $3.5 billion from 2013-2017

32 Non-exclusive joint venture between Duke Energy and ATC (DATC) announced in April 2011 Adds potential investment opportunities outside ATC’s current footprint Ownership is split 50/50 between Duke and ATC DATC has proposed transmission projects to MISO’s Midwest Transmission Expansion Plan Seven new transmission lines, located in five Midwestern states Total cost of approximately $4 billion Phased in over the next 10 years FERC has approved an ROE at the MISO rate of 12.38% Projects are subject to MISO and regulatory approval Potential impact on WEC No significant capital deployment expected until 2015 Earnings impact anticipated in 2015 and beyond Where We Go From Here DATC

33 Where We Go From Here Forecast of Electric Sales 2013 Forecast vs. 2012 Actual 2013 Forecast vs. 2012 Normalized Residential -2.3% 0.1% Small C&I 0.2% 0.3% Large C&I (ex. Mines) -0.9% 0.2% Total Large C&I -3.2% -2.4% Total Retail -1.8% -0.7%

34 A Track Record of Performance Electric Retail Customer Base C&I Sector Small & Large % of 2012 Electric C&I Sales Office 12.1% Mining 11.1% Retail 6.4% Primary Metals 6.0% Health Care 5.7% Food 5.0% Paper & Products 4.7% Education 4.6%

35 Regulatory Environment Wisconsin Commissioners Name Party Began Serving Term Ends Phil Montgomery Chairman R 03/2011 03/2017 Eric Callisto D 05/2008 03/2015 Ellen Nowak R 07/2011 03/2019 Wisconsin Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Michigan Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Michigan Commissioners Name Party Began Serving Term Ends John D. Quackenbush Chairman R 10/2011 07/2017 Greg R. White I 12/2009 07/2015 Orjiakor Isiogu D 8/2007 07/2013