Exhibit 99.1

December 2011

Cautionary Statement Regarding Forward-Looking Information Much of the information contained in this presentation is forward-looking information based expectations and projections that involve risks and uncertainties. Forward-looking information includes, among other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow, dividend payouts and dividend payout ratios, debt repayment, share repurchases, construction costs and capital expenditures, investment opportunities, rate base and the capital structure. Readers are cautioned not to place undue reliance on this forward-looking information. Forward-looking information is not a guarantee of future performance and actual results may differ materially from those set forth in the forward-looking information. In addition to the assumptions and other factors referred to in connection with the forward-looking information, including, without limitation, rate recovery of any costs above the PSCW approved amount for the Oak Creek expansion; PSCW approval of utility construction projects, including infrastructure upgrades; and continued growth in earnings from ATC, factors that could cause Wisconsin Energy’s actual results to differ materially from those contemplated in any forward-looking information or otherwise affect our future results of operations and financial condition include, among others, the following: general economic conditions; business, competitive and regulatory conditions in the deregulating and consolidating energy industry, in general, and, in particular, in the company’s service territories; timing, regulatory decisions; availability of the company’s unanticipated changes in coal or natural gas prices and supply and transportation availability; key personnel changes; the ability to recover fuel and purchased power costs; varying weather conditions; catastrophic weather-related or terrorism-related damage; construction risks, including those associated with the construction of new environmental controls and renewable generation; adverse interpretation or enforcement of permit conditions by permitting agencies; equity and bond market fluctuations; the investment performance -retirement benefit plans; of the impact of recent and future federal, state and local legislative and regulatory changes; current and future litigation, regulatory investigations, proceedings or inquiries, FERC matters, and IRS audits and other tax matters; the effect of accounting pronouncements issued periodically by standard setting bodies, including any requirement for U.S. registrants to follow International Financial Reporting Standards instead of GAAP; foreign, governmental, economic, political and currency risks; and other factors described under the heading “Factors Affecting Results, Liquidity of Financial Condition and Results of Operations and—Looking Information” and “Risk Factors” contained in Wisconsin Energy’s Form 10-K for the contained year ended December in 31, 2010 and in subsequent reports filed with the Securities and Exchange Commission. Wisconsin Energy expressly disclaims any obligation to publicly update or revise any forward-looking information.

Key Areas to be Covered Overview of Wisconsin Energy Retail Electric and Gas Utilities Power the Future Wholesale Electric Transmission Earnings Outlook

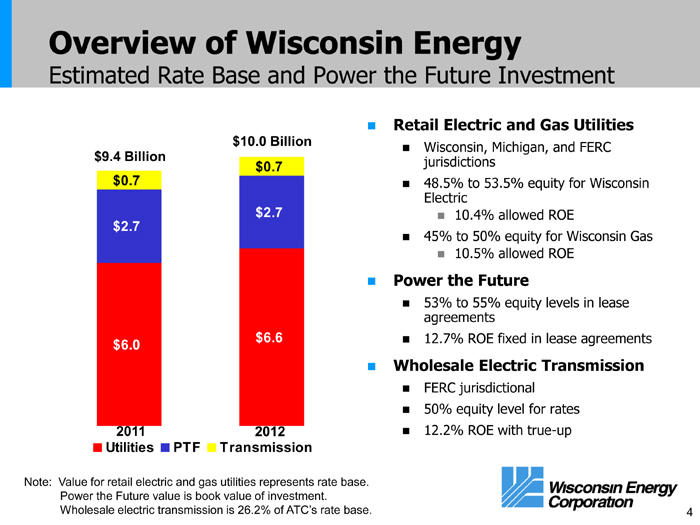

Overview of Wisconsin Energy Estimated Rate Base and Power the Future Investment Note: Value for retail electric and gas utilities represents rate base. Power the Future value is book value of investment. Wholesale electric transmission Retail Electric and Gas Utilities Wisconsin, Michigan, and FERC jurisdictions 48.5% to 53.5% equity for Wisconsin Electric 10.4% allowed ROE 45% to 50% equity for Wisconsin Gas 10.5% allowed ROE Power the Future 53% to 55% equity levels in lease agreements 12.7% ROE fixed in lease agreements Wholesale Electric Transmission FERC jurisdictional 50% equity level for rates 12.2% ROE with true-up

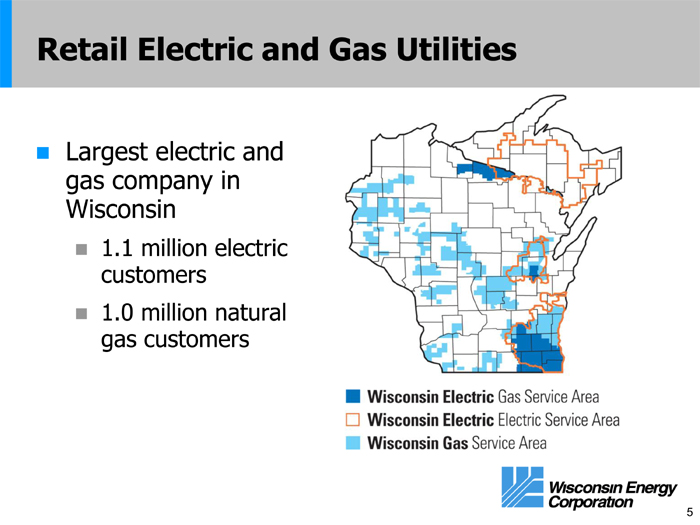

Retail Electric and Gas Utilities Largest electric and gas company in Wisconsin 1.1 million electric customers 1.0 million natural gas customers

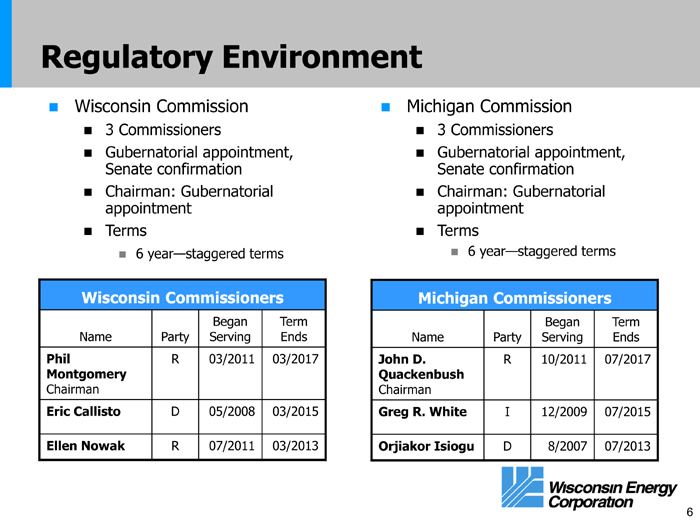

Regulatory Environment Wisconsin Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Wisconsin Commissioners Began Term Name Party Serving Ends Phil R 03/2011 03/2017 Montgomery Chairman Eric Callisto D 05/2008 03/2015 Ellen Nowak R 07/2011 03/2013 Michigan Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Michigan Commissioners Began Term Name Party Serving Ends John D. R 10/2011 07/2017 Quackenbush Chairman Greg R. White I 12/2009 07/2015 Orjiakor Isiogu D 8/2007 07/2013

Rate Case Activity Wisconsin Jurisdiction Filed an application with the Wisconsin Public Service Commission requesting no net increase in base rates in 2012 Authorizes the company to suspend amortization of $148M of regulatory costs in 2012 Authorizes $148M of carrying costs and depreciation on air quality controls at Oak Creek and the Glacier Hills Wind Park Authorizes the company to reopen the rate proceeding in 2012 for rates effective in 2013 Authorizes accepted as filed on October 6th

Rate Case Activity Wisconsin Jurisdiction Schedule for fuel case established with decision expected by the end of 2011 or early 2012 Requests the refund of $26 million from Wisconsin Electric’s nuclear fuel litigation with the U.S. Department of Energy Expect to file a full rate case proceeding in Spring of 2012

Rate Case Activity Michigan Jurisdiction Filed rate case on July 5 Requested $17.5 million annually — a 9.9% increase Expect to self-implement $7.7 million in January 2012 If approved by the commission, this 4.4% increase could be offset by the Michigan portion of the DOE settlement This would result in a net interim increase of 2.8% Filed for a 10.4% ROE Final rates effective July 2012

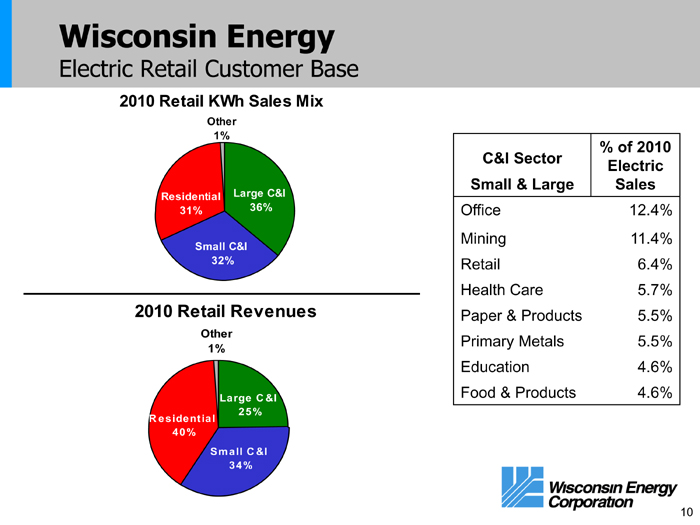

Wisconsin Energy Electric Retail Customer Base 2010 Retail KWh Sales Mix Other 1% Residential Large C&I 31% 36% Small C&I 32% 2010 Retail Revenues Other 1% Large C &I 25% R esidential 40% Small C &I 34% % of 2010 C&I Sector Electric Small & Large Sales Office 12.4% Mining 11.4% Retail 6.4% Health Care 5.7% Paper & Products 5.5% Primary Metals 5.5% Education 4.6% Food & Products 4.6%

Updated Capital Spending Plan On December 1, the board of directors reviewed a new 5-year capital spending program Management’s plan calls for an investment of $3.5 billion in our core business over the period 2012 through 2016 ?Driven by spending on network reliability projects

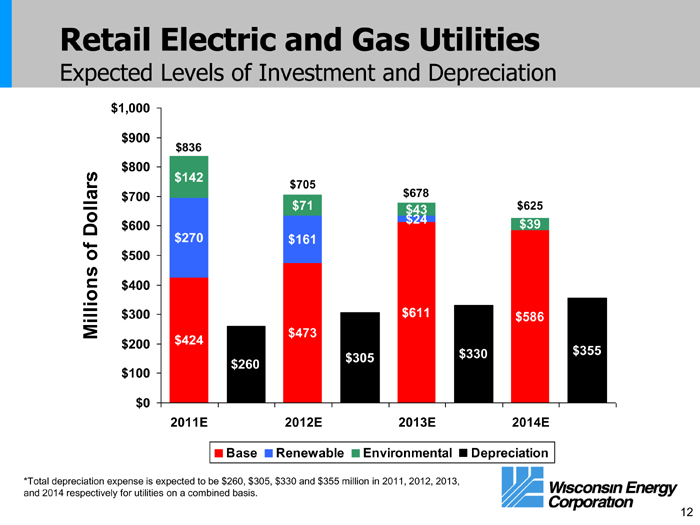

Retail Electric and Gas Utilities Expected Levels of Investment and Depreciation $1,000 $900 $836 $800 $142 $705 $700 $678 $71 $43 $625 $24 $39 Dollars $600 $270 $161 of $500 $400 $300 $611 $586 Millions $473 $200 $424 $330 $355 $305 $260 $100 $0 2011E 2012E 2013E 2014E Base Renewable Environmental Depreciation *Total depreciation expense is expected to be $260, $305, $330 and $355 million in 2011, 2012, 2013, and 2014 respectively for utilities on a combined basis.

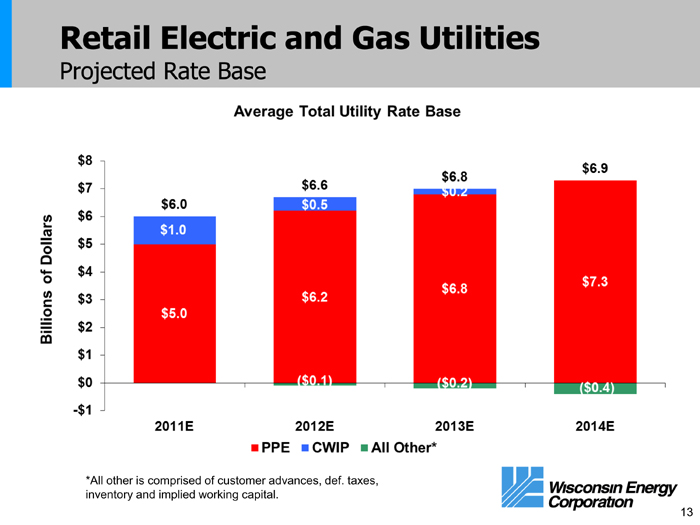

Retail Electric and Gas Utilities Projected Rate Base *All other is comprised of customer advances, def. taxes, inventory and implied working capital.

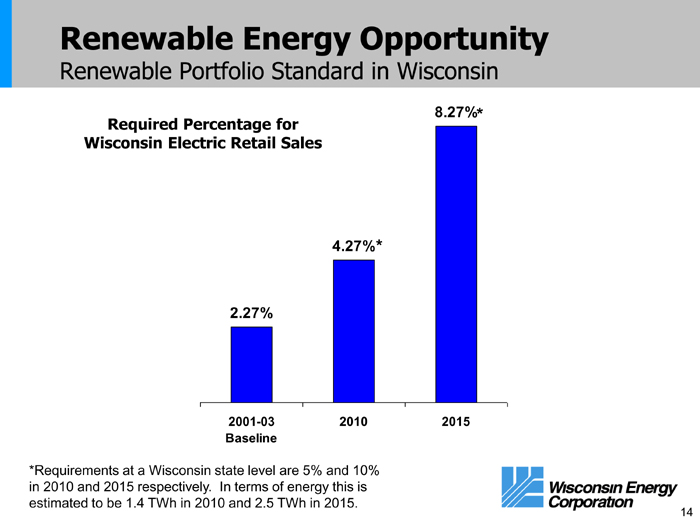

Renewable Energy Opportunity Renewable Portfolio Standard in Wisconsin 8.27%* Required Percentage for Wisconsin Electric Retail Sales 4.27%* 2.27% 2001-03 2010 2015 Baseline *Requirements at a Wisconsin state level are 5% and 10% in 2010 and 2015 respectively. In terms of energy this is estimated to be 1.4 TWh in 2010 and 2.5 TWh in 2015.

Renewable Energy Opportunity Glacier Hills 162 MW Estimated investment of $361 million Expected completion December of 2011 Biomass 50MW Estimated investment of $255 million Approved by PSCW and Domtar Inc. Expected completion by the end of 2013 Wisconsin Electric has executed 165MW of renewable energy transactions to help achieve compliance with the Wisconsin Renewable Portfolio Standard We expect to be in compliance with the Standard through 2016

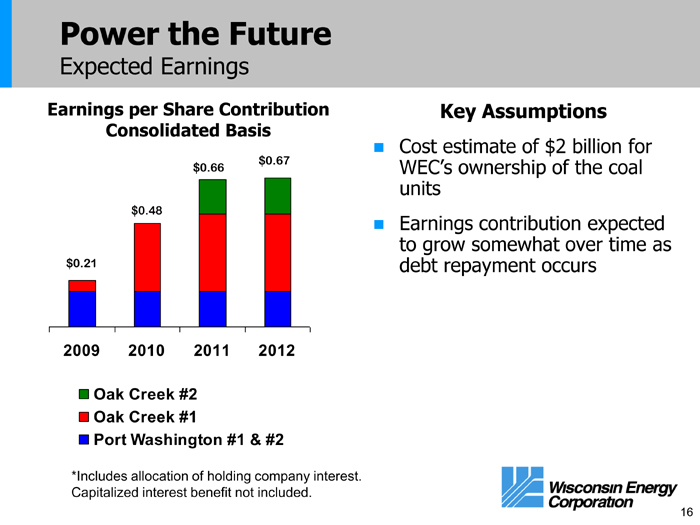

Power the Future Expected Earnings Earnings per Share Contribution Key Assumptions Consolidated Basis $0.67 Cost estimate of $2 billion for $0.66 WEC’s ownership units $0.48 Earnings contribution expected to grow somewhat over time as $0.21 debt repayment occurs 2009 2010 2011 2012 Oak Creek #2 Oak Creek #1 Port Washington #1 & #2 *Includes allocation of holding company interest. Capitalized interest benefit not included.

Wholesale Electric Transmission Wisconsin Energy owns 26.2% of American Transmission Company (ATC) ATC is projected to contribute approximately 16 cents to our EPS this year Represents almost 8% of consolidated earnings ATC’s projected capital is $3.8—$4.4 billion ATC rate base at year end 2012 is projected to be about $2.7 billion Regulated by FERC for purposes of rates and returns 12.2% return on equity with true-up mechanism Transmission siting is under state jurisdiction

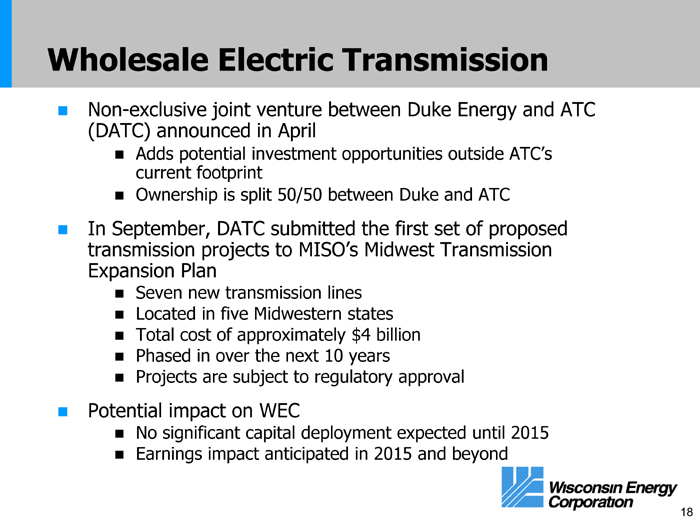

Wholesale Electric Transmission Non-exclusive joint venture between Duke Energy and ATC (DATC) announced in April Adds potential investment current footprint Ownership is split 50/50 between Duke and ATC In September, DATC submitted the first set of proposed transmission projects to Expansion Plan Seven new transmission lines Located in five Midwestern states Total cost of approximately $4 billion Phased in over the next 10 years Projects are subject to regulatory approval Potential impact on WEC No significant capital deployment expected until 2015 Earnings impact anticipated in 2015 and beyond

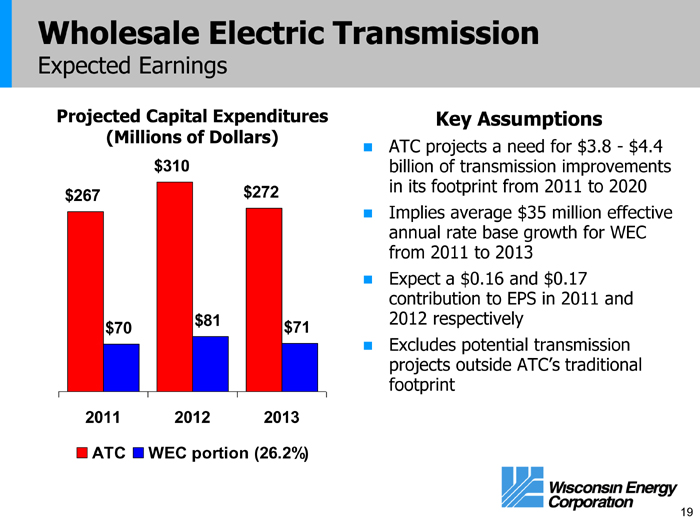

Wholesale Electric Transmission Expected Earnings Projected Capital Expenditures Key Assumptions (Millions of Dollars) ATC projects a need for $3.8—$4.4 $310 billion of transmission improvements $272 in its footprint from 2011 to 2020 $267 Implies average $35 million effective annual rate base growth for WEC from 2011 to 2013 Expect a $0.16 and $0.17 contribution to EPS in 2011 and $81 2012 respectively $70 $71 Excludes potential ? transmission projects outside footprint 2011 2012 2013 ATC WEC portion (26.2%)

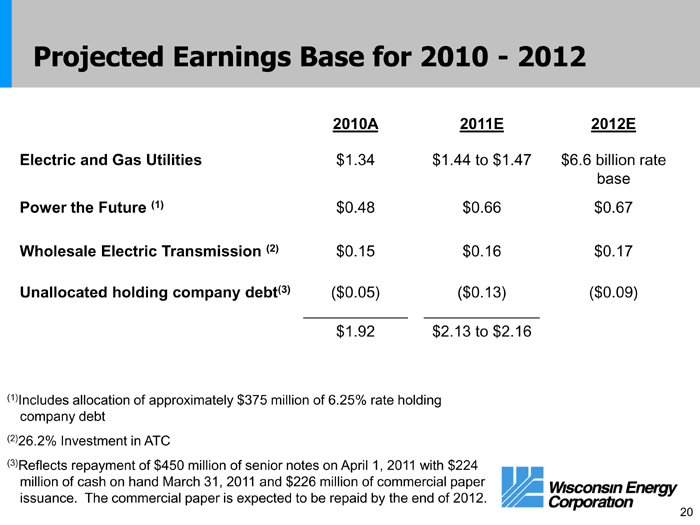

Projected Earnings Base for 2010—2012 2010A 2011E 2012E Electric and Gas Utilities $1.34 $1.44 to $1.47 $6.6 billion rate base Power the Future (1) $0.48 $0.66 $0.67 Wholesale Electric Transmission (2) $0.15 $0.16 $0.17 Unallocated holding company debt(3) ($0.05) ($0.13) ($0.09) $1.92 $2.13 to $2.16 (1)Includes allocation of approximately $375 million of 6.25% rate holding company debt (2)26.2% Investment in ATC (3)Reflects repayment of $450 million of senior notes on April 1, 2011 with $224 million of cash on hand March 31, 2011 and $226 million of commercial paper issuance. The commercial paper is expected to be repaid by the end of 2012.

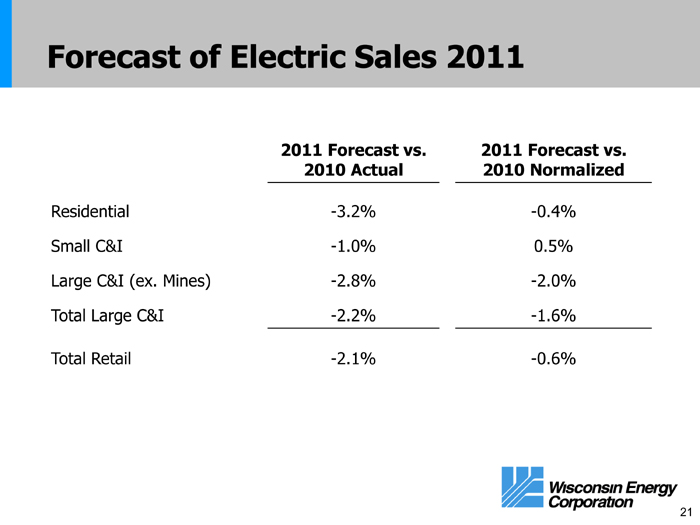

Forecast of Electric Sales 2011 2011 Forecast vs. 2011 Forecast vs. 2010 Actual 2010 Normalized Residential -3.2% -0.4% Small C&I -1.0% 0.5% Large C&I (ex. Mines) -2.8% -2.0% Total Large C&I -2.2% -1.6% Total Retail -2.1% -0.6%

Financing Policy Capital Structure Goals Maintain debt to capital below 55% by the end of 2013 Actual ratio was 54.1% at the end of 2010 Assumes half of hybrid securities are treated as common equity

Dividend Move to a dividend payout ratio that is competitive with our peers The directors plan to raise the quarterly dividend in January to 30 cents a share – equivalent to an annual rate of $1.20 a share 15.4 percent increase over the 2011 amount Our policy is to trend to a 60 percent payout ratio over the period 2012 to 2015 This policy should support annual dividend increases of approximately 8 percent from 2013 to 2015

Share Repurchases To maintain appropriate financial strength and provide value to our investors, we have: Implemented a share repurchase plan – through the end of 2013 – that calls for us to buy back up to $300 million of Wisconsin Energy common stock through open market purchases or privately negotiated transactions Final size of the program will be based on actual capital spending We do not expect to issue any additional shares

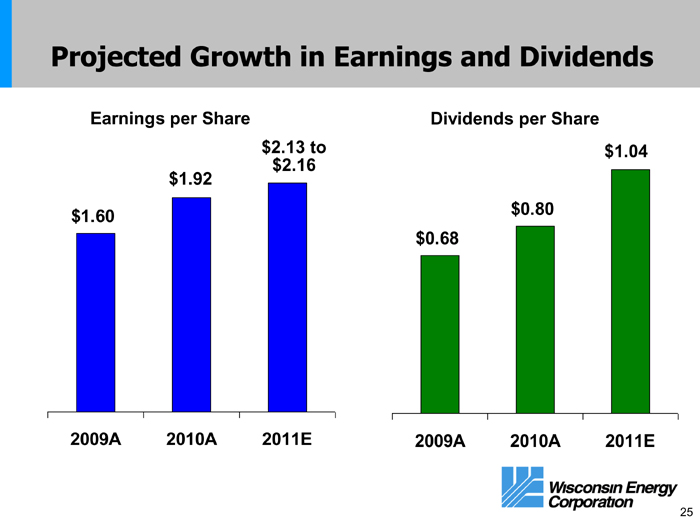

Projected Growth in Earnings and Dividends Earnings per Share Dividends per Share $2.13 to $1.04 $2.16 $1.92 $1.60 $0.80 $0.68 2009A 2010A 2011E 2009A 2010A 2011E

Potential Investment Opportunities Divestiture of energy assets by the State of Wisconsin Investment in fuel flexibility at new Oak Creek coal units Investment in aging gas and electric distribution infrastructure Renewable energy investments beyond 2016 Investment in aging generation facilities such as hydro rebuilds Investment required to meet future EPA rules

Key Takeaways on Wisconsin Energy Power the Future program now complete Highly visible earnings and strong cash flow Solid utility franchises with rate base growth Investment in American Transmission Company provides an additional regulated growth opportunity Positioned to deliver among the best risk-adjusted returns in the industry Positive free cash flow Strong dividend growth story