UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04474

Name of Registrant: | Vanguard California Tax-Free Funds |

Address of Registrant: | P.O. Box 2600 |

| Valley Forge, PA 19482 |

| |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| P.O. Box 876 |

| Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2017—November 30, 2018

Item 1: Reports to Shareholders

Annual Report | November 30, 2018 Vanguard California Tax-Exempt Funds |

Vanguard California Municipal Money Market Fund Vanguard California Intermediate-Term Tax-Exempt Fund Vanguard California Long-Term Tax-Exempt Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Contents

A Note From Our CEO | 1 |

Your Fund’s Performance at a Glance | 2 |

Advisor’s Report | 3 |

About Your Fund’s Expenses | 7 |

California Municipal Money Market Fund | 9 |

California Intermediate-Term Tax-Exempt Fund | 32 |

California Long-Term Tax-Exempt Fund | 177 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our CEO

Tim Buckley

President and Chief Executive Officer

Dear Shareholder,

Over the years, I’ve found that prudent investors exhibit a common trait: discipline. No matter how the markets move or what new investing fad hits the headlines, those who stay focused on their goals and tune out the noise are set up for long-term success.

The prime gateway to investing is saving, and you don’t usually become a saver without a healthy dose of discipline. Savers make the decision to sock away part of their income, which means spending less and delaying gratification, no matter how difficult that may be.

Of course, disciplined investing extends beyond diligent saving. The financial markets, in the short term especially, are unpredictable; I have yet to meet the investor who can time them perfectly. It takes discipline to resist the urge to go all-in when markets are frothy or to retreat when things look bleak.

Staying put with your investments is one strategy for handling volatility. Another, rebalancing, requires even more discipline because it means steering your money away from strong performers and toward poorer performers.

Patience—a form of discipline—is also the friend of long-term investors. Higher returns are the potential reward for weathering the market’s turbulence and uncertainty.

It’s important to be prepared for that turbulence, whenever it appears. Don’t panic. Don’t chase returns or look for answers outside the asset classes you trust. And be sure to rebalance periodically, even when there’s turmoil.

Whether you’re a master of self-control, get a boost from technology, or work with a professional advisor, know that discipline is necessary to get the most out of your investment portfolio. And know that Vanguard is with you for the entire ride.

Thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

President and Chief Executive Officer

December 18, 2018

1

Your Fund’s Performance at a Glance

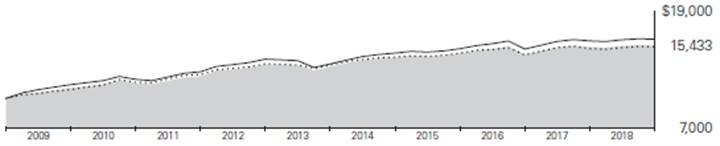

· For the 12 months ended November 30, 2018, Vanguard California Intermediate-Term Tax-Exempt Fund returned 1.00% for Investor Shares and 1.08% for Admiral™ Shares, a bit below its benchmark index, which returned 1.34%.

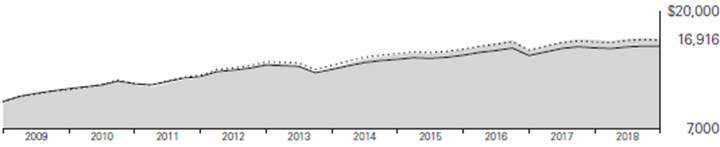

· Vanguard California Long-Term Tax-Exempt Fund returned 0.71% for Investor Shares and 0.80% for Admiral Shares. Its benchmark index returned 1.10%.

· Vanguard California Municipal Money Market Fund returned 1.18%, ahead of the 0.77% average return of its peer group.

· While fundamentals remained solid, municipal bonds hit a rough patch early on amid tax-law changes that affected both supply and demand. With yields rising, prices of municipal bonds finished the period down across the maturity spectrum, but particularly toward the intermediate and long end.

· An underweight to state general obligation bonds helped relative performance for both the Long-Term and Intermediate-Term Funds. The Long-Term Fund was held back by our tilt toward bonds with maturities longer than 10 years.

Market Barometer

| Average Annual Total Returns |

| Periods Ended November 30, 2018 |

| One Year | Three Years | Five Years |

Stocks | | | |

Russell 1000 Index (Large-caps) | 5.92% | 11.94% | 10.89% |

Russell 2000 Index (Small-caps) | 0.57 | 10.08 | 7.50 |

Russell 3000 Index (Broad U.S. market) | 5.53 | 11.80 | 10.62 |

FTSE All-World ex US Index (International) | -7.98 | 5.59 | 2.17 |

| | | |

Bonds | | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | | |

(Broad taxable market) | -1.34% | 1.33% | 2.03% |

Bloomberg Barclays Municipal Bond Index | | | |

(Broad tax-exempt market) | 1.13 | 2.13 | 3.52 |

FTSE Three-Month U.S. Treasury Bill Index | 1.76 | 0.92 | 0.55 |

| | | |

CPI | | | |

Consumer Price Index | 2.18% | 2.02% | 1.58% |

2

Advisor’s Report

For the 12 months ended November 30, 2018, Vanguard California Intermediate-Term Tax-Exempt Fund returned 1.00% for Investor Shares and 1.08% for Admiral Shares. California Long-Term Tax-Exempt Fund returned 0.71% for Investor Shares and 0.80% for Admiral Shares. Both funds finished a bit behind their benchmark indexes.

Vanguard California Municipal Money Market Fund returned 1.18%; the average return of peer funds was 0.77%.

With municipal bond prices losing ground during the 12 months, the Intermediate-Term Fund’s 30-day SEC yield rose from 1.79% to 2.50% for Investor Shares and from 1.89% to 2.57% for Admiral Shares. The yield for the Long-Term Fund rose from 2.21% to 2.94% for Investor Shares and from 2.31% to 3.00% for Admiral Shares. The Money Market Fund’s 7-day SEC yield rose from 0.77% to 1.49%.

The investment environment

Macroeconomic fundamentals remained beneficial throughout the period. The U.S. economy continued to expand at a robust pace, boosted by tax cuts and more government spending. The unemployment rate dropped to 3.7%, nearly a 50-year low, and inflation rose to hover near the Federal Reserve’s target of 2%.

Yields of Tax-Exempt Municipal Securities

(AAA-Rated General Obligation Issues)

| November 30, | November 30, |

Maturity | 2017 | 2018 |

2 years | 1.57% | 1.98% |

5 years | 1.76 | 2.16 |

10 years | 2.15 | 2.55 |

30 years | 2.79 | 3.27 |

Source: Vanguard.

3

Given the strength of the economy, the Fed continued to normalize monetary policy during the fiscal period through further cuts to its balance sheet and four additional increases to the federal funds target rate, putting it at 2%—2.25% as of November 30. (The Fed raised the rate another quarter-percentage point in December, just after the close of the period under review.)

Despite the economic backdrop, the markets experienced periods of volatility. They swooned in late January on concerns that wage gains might push inflation higher and lead the Fed to raise rates more aggressively. October was another rough patch. Trade tensions with China intensified and investors reacted to comments from Fed Chairman Jerome Powell about how much higher rates might go, although he tamped down expectations in late November.

The municipal bond market also had to contend with the federal tax package, which was passed in December 2017. The package had a significant effect on the supply of municipal bonds. One major change is that municipalities can no longer issue bonds to advance-refund outstanding tax-exempt debt. The tax bill also included a provision—which was dropped just before passage—to eliminate the tax exemption for private activity bonds issued for airports and not-for-profit hospitals and colleges. The uncertainty about this provision resulted in a surge of private activity bond issuance at year-end.

The reduction in the statutory federal corporate tax rate to 21% also affected demand for munis. It made their tax-equivalent yields a little less attractive to a fairly narrow segment of the market composed of nontraditional buyers such as banks and insurance companies. Municipalities responded by structuring issuance more for traditional buyers, which boosted usable supply for retail investors and mutual funds. In addition, a cap on deductions for state and local taxes and mortgage interest payments has made muni bonds more attractive for residents of states with high property or other local taxes.

Bouts of volatility aside, muni bond yields largely took their cues from the U.S. Treasury market, where yields across the maturity spectrum ended the period higher.

California’s economy grew faster than the U.S. economy as a whole, according to a gauge of current economic conditions published monthly by the Federal Reserve Bank of Philadelphia. The bank’s index for California increased about 3.6% between November 2017 and October 2018, while the national index rose about 2.6%. (Each state’s index incorporates data on nonfarm payroll employment, the jobless rate, average hours worked in manufacturing, and inflation-adjusted wage and salary payments.)

The overall credit trends for the state remain solid. Once again, the state legislature approved and Governor Jerry

4

Brown signed a budget on time, with $5.8 billion earmarked for the state’s rainy-day fund. Very few programs received spending increases in the current budget. California voters’ rejection in November of Proposition 6, which would have eliminated last year’s gas tax increase, also added to the state’s reputation for fiscal responsibility. These moves prompted Moody’s Investors Service to assign a positive outlook for the state.

The state’s cities, counties, and school districts continue to operate in an environment conducive to fiscal strength and stability. School districts continue to receive their state funding on time, and cities and counties haven’t had fiscal problems for several years. One exception, which we are monitoring, is the Los Angeles Unified School District. Moody’s assigned it a negative outlook in September because of long-term structural deficits and labor issues that could lead to a teachers strike early next year and exacerbate the deficits.

Muni issuance was down significantly over the past 12 months primarily because of the elimination of advance refundings. This has contributed to a tightening of spreads. State supply is down 33% compared with only a 19% reduction at the national level. Demand for California paper remains strong particularly among individual investors. The reduction in the state and local tax deduction in last year’s federal tax legislation has made bonds issued by the state more attractive.

Management of the funds

We strive to add value through a mix of strategies that include duration, yield-curve positioning, credit-quality decisions, and security selection. Vanguard’s experienced team of credit analysts performs objective, independent bond analyses. Our investment process relies on robust risk management to monitor the funds’ positioning.

An underweight to state general obligation bonds helped relative performance in both the Long-Term and Intermediate-Term Funds while an overweight to hospital revenue bonds hurt relative performance in both funds. The Long-Term Fund was held back by our tilt toward bonds with maturities longer than 10 years.

During the period, we increased exposure in the Intermediate-Term Fund to higher-quality bonds. In the Long-Term Fund, we made several tactical shifts. These included increased exposure to 4% and other lower-coupon bonds for AA-rated bonds, increased exposure to water and sewer and public education bonds, reduced exposure to redevelopment agency and public power bonds, and a tilt toward bonds with longer maturities.

The funds are permitted to invest in securities that can generate income distributions subject to the alternative

5

minimum tax (AMT). During the fiscal year, however, only the Money Market Fund owned such securities.

The outlook

In the absence of external shocks, the U.S. economy is on pace to break above its long-term potential growth rate in 2018 and 2019—given the front-loaded effects of tax cuts and increased government spending on top of solid fundamentals—before dropping back toward 2%. That growth, along with some upward pressure on wages that reflects the tight labor market, may push the U.S. core personal consumption expenditures price index higher through the first part of 2019. Against this backdrop, the Fed is likely to keep raising rates and trimming the amount of Treasuries and mortgage-backed securities on its balance sheet this year and into 2019.

We see this bounce as cyclical, however, and still expect long-term structural pressures from an aging population, global sourcing of goods and labor, and technological disruptions to result in moderate long-run growth and inflation.

We may continue to see bouts of volatility in the bond market related to shifting expectations for inflation and interest rates. Other potential volatility triggers we’ll be watching include an intensification of trade disputes, flare-ups in geopolitical tensions, uncertainty over Brexit, and government spending in Italy.

We are anticipating a convergence in global monetary policy, with central banks in developed countries adopting less accommodative stances—some raising rates, some planning to do so, some reducing quantitative easing. Withdrawing that accommodation unexpectedly or too quickly could rattle the markets.

As always, our experienced team of portfolio managers, credit analysts, and traders will continue to seek opportunities to add to the funds’ performance whatever the markets may bring.

Paul M. Malloy, CFA, Principal,

Head of Municipal Bond Group

John M. Carbone, Principal,

Portfolio Manager

James M. D’Arcy, CFA, Portfolio Manager

Adam Ferguson, CFA, Portfolio Manager

Vanguard Fixed Income Group

December 18, 2018

6

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

7

Six Months Ended November 30, 2018

| | Beginning

Account Value

5/31/2018 | | Ending

Account Value

11/30/2018 | | Expenses

Paid During

Period |

Based on Actual Fund Return | | | | | | |

California Municipal Money Market Fund | | $1,000.00 | | $1,006.24 | | $0.80 |

California Intermediate-Term Tax-Exempt Fund | | | | | | |

Investor Shares | | $1,000.00 | | $1,002.88 | | $0.75 |

Admiral Shares | | 1,000.00 | | 1,003.20 | | 0.45 |

California Long-Term Tax-Exempt Fund | | | | | | |

Investor Shares | | $1,000.00 | | $999.04 | | $0.80 |

Admiral Shares | | 1,000.00 | | 999.37 | | 0.45 |

Based on Hypothetical 5% Yearly Return | | | | | | |

California Municipal Money Market Fund | | $1,000.00 | | $1,024.27 | | $0.81 |

California Intermediate-Term Tax-Exempt Fund | | | | | | |

Investor Shares | | $1,000.00 | | $1,024.32 | | $0.76 |

Admiral Shares | | 1,000.00 | | 1,024.62 | | 0.46 |

California Long-Term Tax-Exempt Fund | | | | | | |

Investor Shares | | $1,000.00 | | $1,024.27 | | $0.81 |

Admiral Shares | | 1,000.00 | | 1,024.62 | | 0.46 |

The calculations are based on expenses incurred in the most recent six-month period. The funds’ annualized six-month expense ratios for that period are: for the California Municipal Money Market Fund, 0.16%; for the California Intermediate-Term Tax-Exempt Fund, 0.15% for Investor Shares and 0.09% for Admiral Shares; and for the California Long-Term Tax-Exempt Fund, 0.16% for Investor Shares and 0.09% for Admiral Shares. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (183/365).

8

California Municipal Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. The fund is only available to retail investors (natural persons). You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1 per share, it cannot guarantee it will do so. The fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

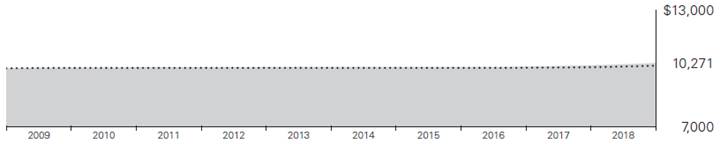

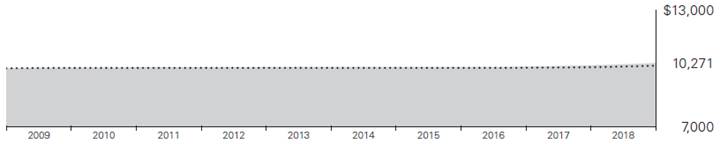

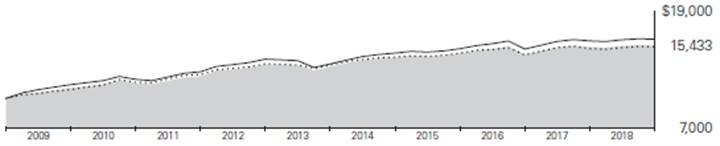

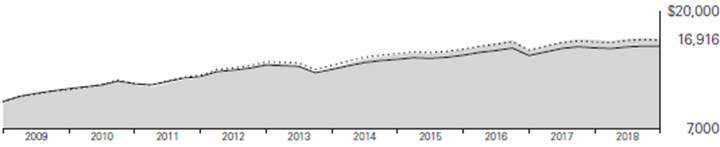

Cumulative Performance: November 30, 2008, Through November 30, 2018

Initial Investment of $10,000

| | Average Annual Total Returns

Periods Ended November 30, 2018 | | Final Value

of a $10,000 Investment | |

| | One

Year | Five

Years |

Ten

Years

| |

| California Municipal Money Market Fund | | 1.18% | 0.42% | 0.27% | | $10,271 | |

| California Tax-Exempt Money Market Funds Average | | 0.77 | 0.22 | 0.13 | | 10,132 | |

California Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Average Annual Total Returns: Periods Ended September 30, 2018

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

California Municipal Money Market Fund | 6/1/1987 | 1.07% | 0.37% | 0.28% |

See Financial Highlights for dividend information.

9

California Municipal Money Market Fund

Distribution by Issuer

As of November 30, 2018

Tax-Exempt Securities | 100% |

10

California Municipal Money Market Fund

Financial Statements

Statement of Net Assets

As of November 30, 2018

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov.

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

Tax-Exempt Municipal Bonds (97.5%) | | | | | | | | | | |

California (97.5%) | | | | | | | | | | |

| ABAG Finance Authority for Nonprofit Corps. California Revenue (Computer History Museum) VRDO | | 1.700% | | 12/7/18 | LOC | | 7,000 | | 7,000 | |

| ABAG Finance Authority for Nonprofit Corps. California Revenue (Lakeside Village Apartments) VRDO | | 1.380% | | 12/7/18 | LOC | | 29,560 | | 29,560 | |

| ABAG Finance Authority for Nonprofit Corps. California Revenue (Public Policy Institute) VRDO | | 1.420% | | 12/7/18 | LOC | | 12,705 | | 12,705 | |

1 | Agency Enhanced Affordable Housing Trust CA TOB VRDO | | 1.760% | | 12/7/18 | | | 50,000 | | 50,000 | |

1 | Alameda CA Unified School District TOB VRDO | | 1.740% | | 12/7/18 | | | 4,000 | | 4,000 | |

| Alameda County CA CP | | 1.710% | | 12/5/18 | LOC | | 7,500 | | 7,500 | |

| Anaheim CA Housing Finance Agency Home Mortgage Revenue VRDO | | 1.690% | | 12/7/18 | LOC | | 5,485 | | 5,485 | |

1 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) TOB VRDO | | 1.670% | | 12/7/18 | | | 13,330 | | 13,330 | |

1 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) TOB VRDO | | 1.680% | | 12/7/18 | | | 6,710 | | 6,710 | |

1 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) TOB VRDO | | 1.680% | | 12/7/18 | | | 6,060 | | 6,060 | |

1 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) TOB VRDO | | 1.680% | | 12/7/18 | | | 8,435 | | 8,435 | |

1 | Burbank CA Unified School District GO TOB VRDO | | 1.660% | | 12/7/18 | | | 5,520 | | 5,520 | |

1 | California Coast Community College District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 4,750 | | 4,750 | |

| California Department of Water Resources Water System Revenue (Central Valley Project) | | 5.000% | | 12/1/18 | | | 1,890 | | 1,890 | |

| California Department of Water Resources Water System Revenue (Central Valley Project) | | 5.000% | | 12/1/18 | | | 2,040 | | 2,040 | |

1 | California Department of Water Resources Water System Revenue (Central Valley Project) TOB VRDO | | 1.640% | | 12/1/18 | (Prere.) | | 3,985 | | 3,985 | |

11

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

| California Department of Water Resources Water System Revenue CP | | 1.710% | | 12/4/18 | | | 5,000 | | 5,000 | |

| California Department of Water Resources Water System Revenue CP | | 1.700% | | 12/5/18 | | | 14,800 | | 14,800 | |

| California Department of Water Resources Water System Revenue CP | | 1.700% | | 12/6/18 | | | 7,000 | | 7,000 | |

| California Department of Water Resources Water System Revenue CP | | 1.700% | | 12/11/18 | | | 15,086 | | 15,086 | |

| California Department of Water Resources Water System Revenue CP | | 1.720% | | 12/12/18 | | | 18,400 | | 18,400 | |

| California Department of Water Resources Water System Revenue CP | | 1.700% | | 12/18/18 | | | 17,755 | | 17,755 | |

| California Department of Water Resources Water System Revenue CP | | 1.700% | | 12/19/18 | | | 42,029 | | 42,029 | |

| California Department of Water Resources Water System Revenue CP | | 1.740% | | 1/2/19 | | | 2,581 | | 2,581 | |

| California Department of Water Resources Water System Revenue CP | | 1.750% | | 1/2/19 | | | 38,632 | | 38,632 | |

| California Department of Water Resources Water System Revenue CP | | 1.700% | | 1/4 /19 | | | 27,025 | | 27,025 | |

| California Department of Water Resources Water System Revenue CP | | 1.720% | | 1/10/19 | | | 25,119 | | 25,119 | |

| California Department of Water Resources Water System Revenue CP | | 1.730% | | 1/15/19 | | | 22,354 | | 22,354 | |

| California Economic Recovery GO | | 5.250% | | 7/1/19 | (Prere.) | | 15,805 | | 16,135 | |

| California Educational Facilities Authority Revenue (Stanford Hospital) CP | | 1.650% | | 1/4/19 | | | 42,050 | | 42,050 | |

| California Educational Facilities Authority Revenue (Stanford Hospital) CP | | 1.750% | | 2/6/19 | | | 14,300 | | 14,300 | |

| California Educational Facilities Authority Revenue (Stanford University) CP | | 1.530% | | 12/4/18 | | | 42,600 | | 42,600 | |

| California Educational Facilities Authority Revenue (Stanford University) CP | | 1.780% | | 1/4/19 | | | 50,000 | | 50,000 | |

| California Educational Facilities Authority Revenue (Stanford University) CP | | 1.750% | | 4/2/19 | | | 3,625 | | 3,625 | |

| California Educational Facilities Authority Revenue (Stanford University) CP | | 1.750% | | 4/4/19 | | | 6,250 | | 6,250 | |

| California Educational Facilities Authority Revenue (Stanford University) CP | | 1.810% | | 5/2/19 | | | 37,950 | | 37,950 | |

| California Educational Facilities Authority Revenue (Stanford University) CP | | 1.810% | | 5/2/19 | | | 1,200 | | 1,200 | |

1 | California Educational Facilities Authority Revenue (Stanford University) TOB VRDO | | 1.640% | | 12/7/18 | | | 8,000 | | 8,000 | |

1 | California Educational Facilities Authority Revenue (Stanford University) TOB VRDO | | 1.720% | | 12/7/18 | | | 3,000 | | 3,000 | |

1 | California Educational Facilities Authority Revenue (Stanford University) TOB VRDO | | 1.720% | | 12/7/18 | | | 3,590 | | 3,590 | |

2 | California GO | | 2.690% | | 5/1/19 | | | 4,000 | | 4,000 | |

| California GO CP | | 1.760% | | 1/23/19 | | | 39,030 | | 39,030 | |

| California GO CP A6 | | 1.780% | | 2/4/19 | | | 50,000 | | 50,000 | |

1 | California GO TOB VRDO | | 1.650% | | 12/7/18 | | | 5,300 | | 5,300 | |

1 | California GO TOB VRDO | | 1.650% | | 12/7/18 | | | 3,000 | | 3,000 | |

1 | California GO TOB VRDO | | 1.650% | | 12/7/18 | | | 8,365 | | 8,365 | |

1 | California GO TOB VRDO | | 1.690% | | 12/7/18 | | | 2,220 | | 2,220 | |

12

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

1 | California GO TOB VRDO | | 1.690% | | 12/7/18 | LOC | | 4,000 | | 4,000 | |

1 | California GO TOB VRDO | | 1.690% | | 12/7/18 | LOC | | 5,000 | | 5,000 | |

1 | California GO TOB VRDO | | 1.690% | | 12/7/18 | | | 3,375 | | 3,375 | |

1 | California GO TOB VRDO | | 1.700% | | 12/7/18 | | | 4,500 | | 4,500 | |

1 | California GO TOB VRDO | | 1.700% | | 12/7/18 | | | 3,335 | | 3,335 | |

| California GO VRDO | | 1.380% | | 12/3/18 | LOC | | 7,200 | | 7,200 | |

| California GO VRDO | | 1.400% | | 12/3/18 | LOC | | 1,200 | | 1,200 | |

| California GO VRDO | | 1.440% | | 12/3/18 | LOC | | 7,000 | | 7,000 | |

1 | California GO VRDO | | 1.690% | | 12/7/18 | LOC | | 2,825 | | 2,825 | |

1 | California GO VRDO | | 1.690% | | 12/7/18 | (4)LOC | | 5,005 | | 5,005 | |

1 | California Health Facilities Financing Authority (Providence St. Joseph Health Obligated Group) TOB VRDO | | 1.690% | | 12/7/18 | | | 2,295 | | 2,295 | |

| California Health Facilities Financing Authority Revenue (Catholic Healthcare West) VRDO | | 1.250% | | 12/7/18 | LOC | | 18,300 | | 18,300 | |

| California Health Facilities Financing Authority Revenue (Catholic Healthcare West) VRDO | | 1.430% | | 12/7/18 | LOC | | 35,000 | | 35,000 | |

| California Health Facilities Financing Authority Revenue (Catholic Healthcare West) VRDO | | 1.470% | | 12/7/18 | LOC | | 50,530 | | 50,530 | |

| California Health Facilities Financing Authority Revenue (Children’s Hospital of Orange County) VRDO | | 1.350% | | 12/7/18 | LOC | | 24,350 | | 24,350 | |

| California Health Facilities Financing Authority Revenue (Children’s Hospital of Orange County) VRDO | | 1.350% | | 12/7/18 | LOC | | 36,850 | | 36,850 | |

1,2 | California Health Facilities Financing Authority Revenue (Kaiser Credit Group) PUT | | 1.840% | | 5/1/19 | LOC | | 2,500 | | 2,500 | |

1 | California Health Facilities Financing Authority Revenue (Kaiser Credit Group) TOB VRDO | | 1.690% | | 12/7/18 | | | 18,040 | | 18,040 | |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) CP | | 1.450% | | 12/6/18 | | | 13,320 | | 13,319 | |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) CP | | 1.450% | | 12/6/18 | | | 18,800 | | 18,799 | |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) CP | | 1.400% | | 12/13/18 | | | 28,165 | | 28,165 | |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) CP | | 1.450% | | 1/8/19 | | | 9,600 | | 9,595 | |

| California Health Facilities Financing Authority Revenue (Kaiser Permanente) CP | | 1.700% | | 2/5/19 | | | 3,400 | | 3,400 | |

| California Health Facilities Financing Authority Revenue (Memorial Health Services) VRDO | | 1.400% | | 12/7/18 | | | 25,200 | | 25,200 | |

| California Health Facilities Financing Authority Revenue (Scripps Health) VRDO | | 1.340% | | 12/7/18 | | | 10,190 | | 10,190 | |

| California Health Facilities Financing Authority Revenue (Stanford Hospital) | | 5.000% | | 8/15/19 | | | 2,000 | | 2,046 | |

1 | California Health Facilities Financing Authority Revenue (Sutter Health) TOB VRDO | | 1.650% | | 12/7/18 | | | 2,592 | | 2,592 | |

1 | California Health Facilities Financing Authority Revenue (Sutter Health) TOB VRDO | | 1.690% | | 12/7/18 | | | 11,890 | | 11,890 | |

1 | California Health Facilities Financing Authority Revenue (Sutter Health) TOB VRDO | | 1.690% | | 12/7/18 | | | 3,100 | | 3,100 | |

1 | California Health Facilities Financing Authority Revenue (Sutter Health) TOB VRDO | | 1.700% | | 12/7/18 | | | 3,750 | | 3,750 | |

13

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

1 | California Health Facilities Financing Authority Revenue (Sutter Health) TOB VRDO | | 1.700% | | 12/7/18 | | | 14,305 | | 14,305 | |

1 | California Health Facilities Financing Authority Revenue (Sutter Health) TOB VRDO | | 1.710% | | 12/7/18 | | | 250 | | 250 | |

1 | California Health Facilities Financing Authority Revenue (Sutter Health) TOB VRDO | | 1.710% | | 12/7/18 | | | 9,715 | | 9,715 | |

| California Infrastructure & Economic Development Bank Revenue (Pacific Gas & Electric Co.) VRDO | | 2.060% | | 12/3/18 | LOC | | 14,360 | | 14,360 | |

1 | California Infrastructure & Economic Development Bank Revenue (University of California) TOB VRDO | | 1.670% | | 12/7/18 | | | 7,500 | | 7,500 | |

1 | California Infrastructure & Economic Development Bank Revenue TOB VRDO | | 1.710% | | 12/7/18 | | | 6,970 | | 6,970 | |

| California Municipal Finance Authority Recovery Zone Revenue (Chevron USA Inc. Project) VRDO | | 1.380% | | 12/3/18 | | | 76,615 | | 76,615 | |

1 | California Municipal Finance Authority Revenue (Pomona College) TOB VRDO | | 1.700% | | 12/7/18 | | | 3,750 | | 3,750 | |

| California Pollution Control Financing Authority Revenue (ExxonMobil Project) VRDO | | 1.520% | | 12/3/18 | | | 1,645 | | 1,645 | |

| California Pollution Control Financing Authority Revenue (Pacific Gas & Electric Co.) VRDO | | 2.050% | | 12/3/18 | LOC | | 139,650 | | 139,650 | |

| California Pollution Control Financing Authority Revenue (Pacific Gas & Electric Co.) VRDO | | 2.050% | | 12/3/18 | LOC | | 43,220 | | 43,220 | |

| California Pollution Control Financing Authority Revenue (Recology Inc.) VRDO | | 1.730% | | 12/7/18 | LOC | | 19,750 | | 19,750 | |

1 | California Public Finance Authority Revenue (Sharp Healthcare Obligated Group) TOB VRDO | | 1.650% | | 12/7/18 | | | 3,750 | | 3,750 | |

1 | California Public Finance Authority Revenue (Sharp Healthcare Obligated Group) TOB VRDO | | 1.670% | | 12/7/18 | | | 4,000 | | 4,000 | |

| California Public Finance Authority Revenue (Sharp Healthcare Obligated Group) VRDO | | 1.400% | | 12/3/18 | LOC | | 4,900 | | 4,900 | |

| California Public Finance Authority Revenue (Sharp Healthcare Obligated Group) VRDO | | 1.400% | | 12 /3/18 | LOC | | 7,400 | | 7,400 | |

| California Public Works Board Lease Revenue (Various Capital Projects) | | 5.000% | | 10/1/19 | | | 5,000 | | 5,132 | |

| California State University Institute CP | | 1.750% | | 1/8/19 | LOC | | 1,980 | | 1,980 | |

| California State University Institute CP | | 1.750% | | 2/5/19 | | | 2,967 | | 2,967 | |

1 | California State University Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 2,240 | | 2,240 | |

1 | California State University Systemwide Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 7,160 | | 7,160 | |

| California Statewide Communities Development Authority Multifamily Housing Revenue (Canyon Springs Apartments Project) VRDO | | 1.720% | | 12/7/18 | LOC | | 10,695 | | 10,695 | |

| California Statewide Communities Development Authority Multifamily Housing Revenue (Crossing Senior Apartments) VRDO | | 1.710% | | 12/7/18 | LOC | | 8,000 | | 8,000 | |

| California Statewide Communities Development Authority Multifamily Housing Revenue (Ridgeway Apartments) VRDO | | 1.400% | | 12/7/18 | LOC | | 26,525 | | 26,525 | |

| California Statewide Communities Development Authority Multifamily Housing Revenue (Steadfast River Run LP) VRDO | | 1.710% | | 12/7/18 | LOC | | 13,405 | | 13,405 | |

14

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

| California Statewide Communities Development Authority Multifamily Housing Revenue (Wilshire Court Project) VRDO | | 1.710% | | 12/7/18 | LOC | | 11,900 | | 11,900 | |

| California Statewide Communities Development Authority Multifamily Revenue VRDO | | 1.730% | | 12/3/18 | LOC | | 7,400 | | 7,400 | |

| California Statewide Communities Development Authority Revenue (Heritage Park Apartments) VRDO | | 1.710% | | 12/7/18 | LOC | | 30,000 | | 30,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Foundation Hospitals) PUT | | 1.790% | | 2/6/19 | | | 8,000 | | 8,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Foundation Hospitals) PUT | | 1.800% | | 2/14/19 | | | 7,000 | | 7,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Foundation Hospitals) PUT | | 1.840% | | 3/13/19 | | | 8,000 | | 8,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.550% | | 12/11/18 | | | 22,000 | | 22,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.400% | | 12/13/18 | | | 5,200 | | 5,200 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.450% | | 1/8/19 | | | 29,500 | | 29,500 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.700% | | 2/5/19 | | | 11,000 | | 11,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.700% | | 2/5/19 | | | 21,090 | | 21,090 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.650% | | 2/7/19 | | | 20,000 | | 20,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.780% | | 2/14/19 | | | 25,000 | | 25,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.790% | | 2/14/19 | | | 20,000 | | 20,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.790% | | 2/14/19 | | | 30,000 | | 30,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.800% | | 2/19/19 | | | 17,000 | | 17,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.800% | | 2/19/19 | | | 30,000 | | 30,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.770% | | 3/6/19 | | | 7,600 | | 7,600 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.840% | | 3/6/19 | | | 33,750 | | 33,750 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.830% | | 3/14/19 | | | 25,000 | | 25,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.840% | | 3/25/19 | | | 40,000 | | 40,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.920% | | 4/2/19 | | | 16,250 | | 16,250 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) CP | | 1.810% | | 4/4/19 | | | 4,790 | | 4,790 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) VRDO | | 1.540% | | 12/7/18 | | | 10,980 | | 10,980 | |

15

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) VRDO | | 1.580% | | 12/7/18 | | | 2,400 | | 2,400 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) VRDO | | 1.620% | | 12/7/18 | | | 6,310 | | 6,310 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) VRDO | | 1.620% | | 12/7/18 | | | 5,000 | | 5,000 | |

| California Statewide Communities Development Authority Revenue (Kaiser Permanente) VRDO | | 1.620% | | 12/7/18 | | | 15,055 | | 15,055 | |

1 | California Statewide Communities Development Authority Revenue (Sutter Health) TOB VRDO | | 1.690% | | 12/7/18 | | | 3,330 | | 3,330 | |

1 | California Statewide Communities Development Authority Revenue (Trinity Health) TOB VRDO | | 1.650% | | 12/7/18 | | | 2,175 | | 2,175 | |

1 | Campbell Union High School District CA GO TOB VRDO | | 1.690% | | 12/7/18 | | | 9,000 | | 9,000 | |

| Chula Vista CA Multifamily Housing Revenue (Teresina Apartments) VRDO | | 1.630% | | 12/7/18 | LOC | | 14,940 | | 14,940 | |

1 | Coast Community College District CA GO TOB VRDO | | 1.690% | | 12/7/18 | LOC | | 5,000 | | 5,000 | |

| Contra Costa CA Municipal Water District Revenue (Extendible) CP | | 1.790% | | 8/23/19 | | | 17,000 | | 17,000 | |

| Contra Costa County CA Multifamily Housing Revenue (Park Regency) VRDO | | 1.630% | | 12/7/18 | LOC | | 60,000 | | 60,000 | |

1 | Corona-Norco Unified School District CA GO TOB VRDO | | 1.690% | | 12/7/18 | LOC | | 4,315 | | 4,315 | |

1 | Cupertino CA Union School District GO TOB VRDO | | 1.680% | | 12/7/18 | | | 8,870 | | 8,870 | |

1 | Desert CA Community College District GO TOB VRDO | | 1.660% | | 12/7/18 | | | 6,000 | | 6,000 | |

1,2 | Dublin CA Unified School District GO TOB PUT | | 1.660% | | 12/6/18 | | | 12,000 | | 12,000 | |

| East Bay CA Municipal Utility District Water System Revenue CP | | 1.720% | | 12/3/18 | | | 20,700 | | 20,700 | |

| East Bay CA Municipal Utility District Water System Revenue CP | | 1.700% | | 12/4/18 | | | 20,000 | | 20,000 | |

| East Bay CA Municipal Utility District Water System Revenue CP | | 1.730% | | 1/3/19 | | | 10,000 | | 10,000 | |

| East Bay CA Municipal Utility District Water System Revenue CP | | 1.720% | | 1/4/19 | | | 21,700 | | 21,700 | |

| East Bay CA Municipal Utility District Water System Revenue CP | | 1.760% | | 2/4/19 | | | 12,000 | | 12,000 | |

1 | East Bay CA Municipal Utility District Water System Revenue TOB VRDO | | 1.640% | | 12/7/18 | | | 6,775 | | 6,775 | |

1 | East Bay CA Municipal Utility District Water System Revenue TOB VRDO | | 1.690% | | 12/7/18 | (Prere.) | | 10,445 | | 10,445 | |

1 | East Bay CA Municipal Utility District Water System Revenue TOB VRDO | | 1.700% | | 12/7/18 | | | 2,500 | | 2,500 | |

1 | Eastern Municipal Water District CA Financing Authority CA TOB VRDO | | 1.710% | | 12/7/18 | | | 9,000 | | 9,000 | |

1 | Elk Grove CA Unified School District GO TOB VRDO | | 1.660% | | 12/3/18 | | | 3,200 | | 3,200 | |

1 | Elk Grove CA Unified School District GO TOB VRDO | | 1.700% | | 12/7/18 | | | 2,120 | | 2,120 | |

| Escondido CA Community Development Multifamily Revenue (Heritage Park Apartments) VRDO | | 1.690% | | 12/7/18 | LOC | | 4,250 | | 4,250 | |

16

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

1 | Folsom Cordova CA Unified School District School Facilities Improvement Dist. No. 5 TOB VRDO | | 1.650% | | 12/7/18 | | | 3,750 | | 3,750 | |

1 | Fremont CA Union High School District TOB VRDO | | 1.690% | | 12/7/18 | | | 3,425 | | 3,425 | |

1 | Hartnell CA Community College GO TOB VRDO | | 1.710% | | 12/7/18 | | | 1,245 | | 1,245 | |

1 | Hayward CA Area Recreation & Park District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 5,000 | | 5,000 | |

1 | Huntington Beach CA City School District GO TOB VRDO | | 1.660% | | 12/3/18 | | | 3,000 | | 3,000 | |

1 | Imperial CA Irrigation District Electric Revenue TOB VRDO | | 1.700% | | 12/7/18 | | | 3,590 | | 3,590 | |

2 | Irvine CA Ranch Water District Revenue PUT | | 1.680% | | 3/8/19 | | | 17,540 | | 17,540 | |

2 | Irvine CA Ranch Water District Revenue PUT | | 1.680% | | 3/8/19 | | | 14,360 | | 14,360 | |

| Irvine CA Unified School District Community Facilities District No. 09-1 Special Tax Revenue VRDO | | 1.400% | | 12/3/18 | LOC | | 7,040 | | 7,040 | |

1 | Irvine Ranch CA Water District COP TOB VRDO | | 1.690% | | 12/7/18 | | | 3,220 | | 3,220 | |

1 | Irvine Ranch CA Water District Revenue TOB VRDO | | 1.670% | | 12/7/18 | | | 4,160 | | 4,160 | |

| Kings County CA Housing Authority (Edgewater Isle Apartments) Revenue VRDO | | 1.550% | | 12/7/18 | LOC | | 11,380 | | 11,380 | |

| Livermore CA Redevelopment Agency Multi-Family Housing Revenue (Richards Manor) VRDO | | 1.690% | | 12/7/18 | LOC | | 4,770 | | 4,770 | |

1 | Long Beach CA Harbor Revenue TOB VRDO | | 1.650% | | 12/7/18 | | | 4,000 | | 4,000 | |

1 | Long Beach CA Unified School District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 21,060 | | 21,060 | |

1 | Long Beach CA Unified School District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 2,500 | | 2,500 | |

1 | Los Angeles CA Community College District GO TOB VRDO | | 1.690% | | 12/7/18 | (Prere.) | | 15,940 | | 15,940 | |

| Los Angeles CA Community Redevelopment Agency Multifamily Housing Revenue (Academy Village Apartments) VRDO | | 1.630% | | 12/7/18 | LOC | | 8,300 | | 8,300 | |

| Los Angeles CA Community Redevelopment Agency Multifamily Housing Revenue (Hollywood & Vine Apartments) VRDO | | 1.690% | | 12/7/18 | LOC | | 92,900 | | 92,900 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.670% | | 12/7/18 | | | 4,700 | | 4,700 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 7,500 | | 7,500 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 3,700 | | 3,700 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.710% | | 12/7/18 | | | 9,160 | | 9,160 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.720% | | 12/7/18 | | | 2,500 | | 2,500 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.750% | | 12/7/18 | | | 4,720 | | 4,720 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.750% | | 12/7/18 | | | 2,940 | | 2,940 | |

17

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.750% | | 12/7/18 | | | 5,200 | | 5,200 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.750% | | 12/7/18 | | | 7,545 | | 7,545 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.750% | | 12/7/18 | | | 6,665 | | 6,665 | |

1 | Los Angeles CA Department of Airports International Airport Revenue TOB VRDO | | 1.750% | | 12/7/18 | | | 5,020 | | 5,020 | |

1 | Los Angeles CA Department of Airports Revenue TOB VRDO | | 1.650% | | 12/7/18 | | | 12,060 | | 12,060 | |

1 | Los Angeles CA Department of Airports Revenue TOB VRDO | | 1.720% | | 12/7/18 | | | 6,830 | | 6,830 | |

1 | Los Angeles CA Department of Airports Revenue TOB VRDO | | 1.740% | | 12/7/18 | | | 2,500 | | 2,500 | |

1 | Los Angeles CA Department of Airports Revenue TOB VRDO | | 1.740% | | 12/7/18 | | | 2,245 | | 2,245 | |

1 | Los Angeles CA Department of Airports TOB VRDO | | 1.740% | | 12/7/18 | | | 2,520 | | 2,520 | |

1 | Los Angeles CA Department of Airports TOB VRDO | | 1.750% | | 12/7/18 | | | 2,125 | | 2,125 | |

1 | Los Angeles CA Department of Water & Power Revenue TOB VRDO | | 1.650% | | 12/7/18 | | | 7,310 | | 7,310 | |

1 | Los Angeles CA Department of Water & Power Revenue TOB VRDO | | 1.650% | | 12/7/18 | | | 1,150 | | 1,150 | |

1 | Los Angeles CA Department of Water & Power Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 7,500 | | 7,500 | |

1 | Los Angeles CA Department of Water & Power Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 4,350 | | 4,350 | |

1 | Los Angeles CA Department of Water & Power Revenue TOB VRDO | | 1.700% | | 12/7/18 | | | 10,835 | | 10,835 | |

1 | Los Angeles CA Department of Water & Power Revenue TOB VRDO | | 1.720% | | 12/7/18 | | | 10,900 | | 10,900 | |

1 | Los Angeles CA Department of Water & Power Revenue TOB VRDO | | 1.720% | | 12/7/18 | | | 2,000 | | 2,000 | |

| Los Angeles CA Department of Water & Power Revenue VRDO | | 1.390% | | 12/3/18 | | | 9,865 | | 9,865 | |

| Los Angeles CA Department of Water & Power Revenue VRDO | | 1.450% | | 12/3/18 | | | 9,800 | | 9,800 | |

| Los Angeles CA Department of Water & Power Revenue VRDO | | 1.450% | | 12/3/18 | | | 903 | | 903 | |

| Los Angeles CA Department of Water & Power Revenue VRDO | | 1.290% | | 12/7/18 | | | 1,350 | | 1,350 | |

1 | Los Angeles CA Department of Water & Power System Revenue TOB VRDO | | 1.650% | | 12/7/18 | | | 3,665 | | 3,665 | |

1 | Los Angeles CA Department of Water & Power System Revenue TOB VRDO | | 1.650% | | 12/7/18 | | | 4,800 | | 4,800 | |

| Los Angeles CA GO | | 5.000% | | 9/1/19 | | | 5,000 | | 5,122 | |

1 | Los Angeles CA Harbor Department Revenue TOB VRDO | | 1.690% | | 12/7/18 | (Prere.) | | 8,150 | | 8,150 | |

1 | Los Angeles CA Harbor Department Revenue TOB VRDO | | 1.750% | | 12/7/18 | | | 2,220 | | 2,220 | |

| Los Angeles CA International Airport Revenue CP | | 1.710% | | 12/5/18 | LOC | | 7,317 | | 7,317 | |

18

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

| Los Angeles CA International Airport Revenue CP | | 1.770% | | 1/ 17/19 | LOC | | 8,972 | | 8,972 | |

| Los Angeles CA Metro Trans Tax Revenue CP | | 1.720% | | 1/8/19 | LOC | | 3,600 | | 3,600 | |

| Los Angeles CA Metro Trans Tax Revenue CP | | 1.740% | | 1/8/19 | LOC | | 3,900 | | 3,900 | |

| Los Angeles CA Metro Trans Tax Revenue CP | | 1.740% | | 1/17/19 | | | 11,940 | | 11,940 | |

| Los Angeles CA Metro Trans Tax Revenue CP | | 1.730% | | 1/29/19 | | | 9,445 | | 9,445 | |

| Los Angeles CA Metro Trans Tax Revenue CP | | 1.750% | | 2/7/19 | | | 3,967 | | 3,967 | |

| Los Angeles CA Multifamily Housing Revenue (Queen Portfolio Apartments Project) VRDO | | 1.630% | | 12/7/18 | LOC | | 6,050 | | 6,050 | |

| Los Angeles CA Municipal Improvement Corp. Lease Revenue CP | | 1.700% | | 12/5/18 | LOC | | 24,475 | | 24,475 | |

| Los Angeles CA Municipal Improvement Corp. Lease Revenue CP | | 1.770% | | 1/29/19 | LOC | | 2,000 | | 2,000 | |

| Los Angeles CA Municipal Improvement Corp. Lease Revenue CP | | 1.760% | | 2/5/19 | | | 5,000 | | 5,000 | |

| Los Angeles CA Municipal Improvement Corp. Lease Revenue CP | | 1.770% | | 2/14/19 | | | 5,000 | | 5,000 | |

| Los Angeles CA Municipal Improvement Corp. Lease Revenue CP | | 1.830% | | 2/26/19 | LOC | | 7,000 | | 7,000 | |

| Los Angeles CA Municipal Improvement Corp. Lease Revenue CP | | 1.830% | | 2/26/19 | LOC | | 11,000 | | 11,000 | |

| Los Angeles CA TRAN | | 4.000% | | 6/27/19 | | | 85,895 | | 87,050 | |

1 | Los Angeles CA Unified School District GO TOB VRDO | | 1.650% | | 12/7/18 | | | 4,000 | | 4,000 | |

1 | Los Angeles CA Unified School District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 10,000 | | 10,000 | |

1 | Los Angeles CA Unified School District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 6,665 | | 6,665 | |

1 | Los Angeles CA Unified School District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 5,200 | | 5,200 | |

1,2 | Los Angeles CA Wastewater System Revenue TOB PUT | | 1.840% | | 12/3/18 | LOC | | 5,000 | | 5,000 | |

| Los Angeles CA Wastewater System Revenue VRDO | | 1.400% | | 12/7/18 | LOC | | 28,860 | | 28,860 | |

| Los Angeles County CA Capital Asset Leasing Corp. CP | | 1.710% | | 12/4/18 | LOC | | 25,165 | | 25,165 | |

| Los Angeles County CA Capital Asset Leasing Corp. CP | | 1.690% | | 12/12/18 | LOC | | 27,935 | | 27,935 | |

| Los Angeles County CA Capital Asset Leasing Corp. CP | | 1.740% | | 1/10/19 | | | 5,000 | | 5,000 | |

| Los Angeles County CA Schools Pooled Financing Program Revenue | | 4.000% | | 6/3/19 | | | 7,000 | | 7,086 | |

| Los Angeles County CA TRAN | | 4.000% | | 6/28/19 | | | 49,280 | | 49,917 | |

1 | Lucia Mar CA Unified School District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 4,990 | | 4,990 | |

1 | Madera CA Unified School District GO TOB VRDO | | 1.660% | | 12/7/18 | | | 6,400 | | 6,400 | |

| Manteca CA Redevelopment Agency Tax Allocation Revenue VRDO | | 1.630% | | 12/3/18 | LOC | | 21,040 | | 21,040 | |

1 | Marin CA Community College District GO VRDO | | 1.690% | | 12/7/18 | LOC | | 3,125 | | 3,12 5 | |

1 | Marin CA Healthcare District GO TOB VRDO | | 1.700% | | 12/7/18 | | | 1,600 | | 1,600 | |

1 | Marin CA Healthcare District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 9,335 | | 9,335 | |

1 | Marin CA Water District Financing Authority Revenue TOB VRDO | | 1.720% | | 12/7/18 | | | 6,105 | | 6,105 | |

19

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

2 | Metropolitan Water District of Southern California Revenue PUT | | 1.660% | | 7/25/19 | | | 30,000 | | 30,000 | |

2 | Metropolitan Water District of Southern California Revenue PUT | | 1.660% | | 7/25/19 | | | 26,500 | | 26,500 | |

2 | Metropolitan Water District of Southern California Revenue PUT | | 1.660% | | 7/25/19 | | | 76,930 | | 76,923 | |

| Metropolitan Water District of Southern California Revenue VRDO | | 1.450% | | 12/3/18 | | | 19,700 | | 19,700 | |

| Metropolitan Water District of Southern California Revenue VRDO | | 1.450% | | 12/3/18 | | | 59,230 | | 59,230 | |

| Metropolitan Water District of Southern California Revenue VRDO | | 1.290% | | 12/7/18 | | | 22,800 | | 22,800 | |

1 | Morgan Hill CA Unified School District GO TOB VRDO | | 1.670% | | 12/7/18 | | | 8,000 | | 8,000 | |

1 | Newhall CA School District GO TOB VRDO | | 1.660% | | 12/3/18 | | | 3,400 | | 3,400 | |

1 | Nuveen California AMT-Free Quality Municipal Income Fund VRDP VRDO | | 1.700% | | 12/7/18 | LOC | | 87,000 | | 87,000 | |

1 | Nuveen California AMT-Free Quality Municipal Income Fund VRDP VRDO | | 1.700% | | 12/7/18 | LOC | | 40,000 | | 40,000 | |

1 | Nuveen California AMT-Free Quality Municipal Income Fund VRDP VRDO | | 1.720% | | 12/7/18 | LOC | | 16,200 | | 16,200 | |

1 | Nuveen California Dividend Advantage Municipal Fund VRDP VRDO | | 1.830% | | 12/7/18 | LOC | | 13,600 | | 13,600 | |

1 | Nuveen California Dividend Advantage Municipal Fund VRDP VRDO | | 1.830% | | 12/7/18 | LOC | | 9,100 | | 9,100 | |

1 | Nuveen California Dividend Advantage Municipal Fund VRDP VRDO | | 1.840% | | 12/7/18 | LOC | | 1,000 | | 1,000 | |

1 | Nuveen California Dividend Advantage Municipal Fund VRDP VRDO | | 1.840% | | 12/7/18 | LOC | | 34,000 | | 34,000 | |

1 | Oakland CA GO TOB VRDO | | 1.660% | | 12/3/18 | | | 2,485 | | 2,485 | |

| Oceanside CA Multifamily Housing Revenue (Shadow Way Apartments Project) VRDO | | 1.630% | | 12/7/18 | LOC | | 15,000 | | 15,000 | |

1 | Oxnard CA School District GO TOB VRDO | | 1.690% | | 12/7/18 | (15)LOC | | 3,000 | | 3,000 | |

1 | Oxnard CA Union High School District GO TOB VRDO | | 1.680% | | 12/7/18 | | | 7,200 | | 7,200 | |

1 | Palomar CA Community College District GO TOB VRDO | | 1.650% | | 12/7/18 | | | 2,880 | | 2,880 | |

1 | Palomar CA Community College District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 6,400 | | 6,400 | |

| Pasadena CA COP VRDO | | 1.540% | | 12/7/18 | LOC | | 18,920 | | 18,920 | |

| Pleasanton CA Multifamily Housing Revenue VRDO | | 1.710% | | 12/7/18 | LOC | | 13,360 | | 13,360 | |

1 | Regents of the University of California Revenue TOB VRDO | | 1.670% | | 12/7/18 | | | 5,125 | | 5,125 | |

1 | Regents of the University of California Revenue TOB VRDO | | 1.720% | | 12/7/18 | | | 4,109 | | 4,109 | |

| Richmond CA Multifamily Housing Revenue (Baycliff Apartments Project) VRDO | | 1.710% | | 12/7/18 | LOC | | 26,490 | | 26,490 | |

1 | Riverside CA Electric Revenue TOB VRDO | | 1.720% | | 12/7/18 | | | 8,580 | | 8,580 | |

| Riverside County CA Asset Leasing Corp. Leasehold Revenue (Southwest Justice Center) VRDO | | 1.400% | | 12/7/18 | (12)LOC | | 16,940 | | 16,940 | |

| Riverside County CA Teeter Revenue | | 4.000% | | 10/24/19 | | | 20,000 | | 20,378 | |

20

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

1 | Riverside County CA Transportation Commission TOB VRDO | | 1.720% | | 12/7/18 | (Prere.) | | 12,730 | | 12,730 | |

1 | Sacramento CA Area Flood Control Agency Special Assessment Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 10,000 | | 10,000 | |

1 | Sacramento CA Area Flood Control Agency Special Assessment Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 6,000 | | 6,000 | |

| Sacramento CA Housing Authority Multifamily Housing Revenue AMT VRDO | | 1.710% | | 12/7/18 | LOC | | 14,270 | | 14,270 | |

| Sacramento CA Municipal Utility District Revenue CP | | 1.720% | | 12/3/18 | LOC | | 35,000 | | 35,000 | |

| Sacramento CA Municipal Utility District Revenue CP | | 1.740% | | 12/4/18 | LOC | | 8,800 | | 8,800 | |

| Sacramento CA Municipal Utility District Revenue CP | | 1.720% | | 12/11/18 | LOC | | 25,000 | | 25,000 | |

| Sacramento CA Municipal Utility District Revenue CP | | 1.710% | | 1/8/19 | | | 7,500 | | 7,500 | |

| Sacramento CA Transportation Authority Sales Tax Revenue VRDO | | 1.330% | | 12/7/18 | | | 64,900 | | 64,900 | |

| Sacramento County CA Housing Authority Revenue (Ashford Heights LP) VRDO | | 1.710% | | 12/7/18 | LOC | | 12,255 | | 12,255 | |

| Sacramento County CA Housing Authority Revenue (Hasting at Antelope LP) VRDO | | 1.710% | | 12/7/18 | LOC | | 16,300 | | 16,300 | |

| Sacramento County CA Multifamily Housing Revenue (River Pointe Apartments) VRDO | | 1.690% | | 12/7/18 | LOC | | 9,700 | | 9,700 | |

1 | San Bernardino CA Community College District GO TOB VRDO | | 1.670% | | 12/7/18 | | | 4,620 | | 4,620 | |

1 | San Bernardino County CA Transportation Authority Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 12,100 | | 12,100 | |

1 | San Diego CA Community College District GO TOB VRDO | | 1.690% | | 12/7/18 | (Prere.) | | 6,445 | | 6,445 | |

1 | San Diego CA Community College District GO TOB VRDO | | 1.740% | | 12/7/18 | (Prere.) | | 3,490 | | 3,490 | |

| San Diego CA Housing Authority Multifamily Housing Revenue (Bay Vista Apartments Project) VRDO | | 1.710% | | 12/7/18 | LOC | | 24,190 | | 24,190 | |

| San Diego CA Public Facilities CP | | 1.700% | | 12/17/18 | | | 14,676 | | 14,676 | |

| San Diego CA Public Facilities CP | | 1.710% | | 12/17/18 | | | 53,968 | | 53,968 | |

| San Diego CA Public Facilities CP | | 1.730% | | 12/17/18 | | | 22,759 | | 22,759 | |

1 | San Diego CA Public Facilities Financing Authority Sewer Revenue TOB VRDO | | 1.730% | | 12/7/18 | (Prere.) | | 6,230 | | 6,230 | |

1 | San Diego CA Public Facilities Financing Authority Water Revenue TOB VRDO | | 1.690% | | 12/7/18 | (Prere.) | | 3,800 | | 3,800 | |

1 | San Diego CA Unified School District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 4,000 | | 4,000 | |

1 | San Diego CA Unified School District GO TOB VRDO | | 1.690% | | 12/7/18 | LOC | | 4,500 | | 4,500 | |

1 | San Diego CA Unified School District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 2,500 | | 2,500 | |

1 | San Diego CA Unified School District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 2,500 | | 2,500 | |

| San Diego County & School Districts CA Tax and Revenue Anticipation Note Program Revenue | | 4.000% | | 6/28/19 | | | 3,000 | | 3,041 | |

| San Diego County CA Regional Transportation Authority Sales Tax Revenue VRDO | | 1.320% | | 12/7/18 | | | 20,000 | | 20,000 | |

21

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

1 | San Diego County CA Regional Transportation Commission Sales Tax Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 4,445 | | 4,445 | |

| San Diego County CA Regional Transportation Commission Sales Tax Revenue VRDO | | 1.300% | | 12/7/18 | | | 59,230 | | 59,230 | |

| San Diego County CA Regional Transportation Commission Sales Tax Revenue VRDO | | 1.370% | | 12/7/18 | | | 11,030 | | 11,030 | |

| San Diego County CA Water Authority Revenue (Extendible) CP | | 1.830% | | 8/2/19 | | | 17,500 | | 17,500 | |

| San Diego County CA Water Authority Revenue (Extendible) CP | | 1.720% | | 8 /23/19 | | | 12,500 | | 12,500 | |

| San Diego County CA Water Authority Revenue CP | | 1.720% | | 12/5/18 | | | 13,100 | | 13,100 | |

| San Diego County CA Water Authority Revenue P | | 1.720% | | 12/5/18 | | | 35,000 | | 35,000 | |

| San Diego County CA Water Authority Revenue CP | | 1.730% | | 12/6/18 | | | 21,000 | | 21,000 | |

| San Diego County CA Water Authority Revenue CP | | 1.700% | | 12/7/18 | | | 15,000 | | 15,000 | |

| San Diego County CA Water Authority Revenue CP | | 1.750% | | 2 /4/19 | | | 22,000 | | 22,000 | |

1 | San Francisco CA Bay Area Rapid Transit District Sales Tax Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 3,750 | | 3,750 | |

| San Francisco CA City & County Finance Corp. Lease Revenue (Moscone Center Expansion) VRDO | | 1.380% | | 12/7/18 | LOC | | 8,720 | | 8,720 | |

1 | San Francisco CA City & County GO TOB VRDO | | 1.690% | | 12/7/18 | | | 11,450 | | 11,450 | |

| San Francisco CA City & County International Airport Revenue CP | | 1.720% | | 12/6/18 | LOC | | 1,575 | | 1,575 | |

| San Francisco CA City & County International Airport Revenue CP | | 1.770% | | 12/6/18 | LOC | | 1,250 | | 1,250 | |

| San Francisco CA City & County International Airport Revenue CP | | 1.720% | | 1/15/19 | | | 25,235 | | 25,235 | |

| San Francisco CA City & County International Airport Revenue CP | | 1.770% | | 1/15/19 | LOC | | 30,000 | | 30,000 | |

| San Francisco CA City & County International Airport Revenue CP | | 1.790% | | 1/15/19 | LOC | | 40,000 | | 40,000 | |

| San Francisco CA City & County International Airport Revenue VRDO | | 1.440% | | 12/7/18 | LOC | | 3,395 | | 3,395 | |

| San Francisco CA City & County International Airport Revenue VRDO | | 1.450% | | 12/7/18 | LOC | | 26,345 | | 26,345 | |

| San Francisco CA City & County International Airport Revenue VRDO | | 1.500% | | 12/7/18 | LOC | | 14,800 | | 14,799 | |

| San Francisco CA City & County Lease Revenue CP | | 1.700% | | 12/6/18 | LOC | | 16,750 | | 16,750 | |

| San Francisco CA City & County Multifamily Housing Revenue (City Heights Apartments) VRDO | | 1.750% | | 12/7/18 | LOC | | 11,700 | | 11,700 | |

| San Francisco CA City & County Public Utilities Commission CP | | 1.680% | | 12/13/18 | | | 11, 336 | | 11,336 | |

| San Francisco CA City & County Public Utilities Commission Sewer Revenue CP | | 1.760% | | 1/29/19 | | | 11,708 | | 11,708 | |

| San Francisco CA City & County Public Utilities Commission Sewer Revenue CP | | 1.760% | | 1/29/19 | | | 21,499 | | 21,499 | |

22

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

| San Francisco CA City & County Public Utilities Commission Wastewater Revenue CP | | 1.760% | | 1/29/19 | | | 22,246 | | 22,246 | |

1 | San Francisco CA City & County Public Utilities Commission Wastewater Revenue TOB VRDO | | 1.710% | | 12/7/18 | | | 6,900 | | 6,900 | |

1 | San Francisco CA City & County Public Utilities Commission Water Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 5,555 | | 5,555 | |

1 | San Francisco CA City & County Public Utilities Commission Water Revenue TOB VRDO | | 1.690% | | 12/7/18 | (Prere.) | | 47,850 | | 47,850 | |

| San Francisco CA City & County Redevelopment Agency Multifamily Housing Revenue (Third & Mission Streets) VRDO | | 1.670% | | 12/7/18 | LOC | | 40,850 | | 40,850 | |

1 | San Joaquin Delta CA Community College District GO TOB VRDO | | 1.790% | | 12/7/18 | | | 4,835 | | 4,835 | |

| San Jose CA Multifamily Housing Revenue (Cinnabar Commons) VRDO | | 1.710% | | 12/7/18 | LOC | | 15,000 | | 15,000 | |

1 | San Jose CA Redevelopment Agency Successor Agency Tax Allocation TOB VRDO | | 1.660% | | 12/7/18 | | | 9,415 | | 9,415 | |

1 | San Jose CA Unified School District GO TOB VRDO | | 1.650% | | 12/7/18 | | | 2,120 | | 2,120 | |

1 | San Mateo CA County Community College District GO TOB VRDO | | 1.700% | | 12/7/18 | | | 2,235 | | 2,235 | |

1 | San Rafael City High School District CA GO TOB VRDO | | 1.700% | | 12/7/18 | | | 3,000 | | 3,000 | |

| Santa Clara CA Electric Revenue VRDO | | 1.390% | | 12/7/18 | LOC | | 13,255 | | 13,255 | |

1 | Santa Clara CA TOB VRDO | | 1.690% | | 12/7/18 | | | 2,985 | | 2,985 | |

1 | Santa Clara CA TOB VRDO | | 1.690% | | 12/7/18 | | | 2,500 | | 2,500 | |

1 | Santa Clara County CA GO TOB VRDO | | 1.690% | | 12/7/18 | | | 8,250 | | 8,250 | |

| Santa Clara Valley CA Water District CP | | 1.700% | | 12/4/18 | | | 9,000 | | 9,000 | |

| Santa Clara Valley CA Transportation Authority Sales Tax Revenue VRDO | | 1.380% | | 12/7/18 | | | 7,200 | | 7,200 | |

1 | Santa Monica CA Community College District GO TOB VRDO | | 1.660% | | 12/7/18 | | | 1,200 | | 1,200 | |

1 | Santa Monica CA Community College District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 5,000 | | 5,000 | |

1 | Santa Monica CA Community College District GO TOB VRDO | | 1.690% | | 12/7/18 | | | 6,530 | | 6,530 | |

1 | Solano County CA Community College District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 3,000 | | 3,000 | |

1 | Sonoma County Junior College District CA GO TOB VRDO | | 1.690% | | 12/7/18 | LOC | | 5,000 | | 5,000 | |

| Southern California Public Power Authority Revenue VRDO | | 1.400% | | 12/3/18 | LOC | | 23,545 | | 23,545 | |

1 | Southwestern California Community College District GO TOB VRDO | | 1.650% | | 12/7/18 | | | 6,010 | | 6,010 | |

1 | Southwestern California Community College District GO TOB VRDO | | 1.710% | | 12/7/18 | | | 3,200 | | 3,200 | |

| Turlock CA Irrigation District Revenue CP | | 1.720% | | 12/20/18 | LOC | | 4,443 | | 4,443 | |

| Turlock CA Irrigation District Revenue CP | | 1.780% | | 2/12/19 | | | 44,900 | | 44,900 | |

1 | University of California Revenue TOB VRDO | | 1.680% | | 12/7/18 | | | 1,500 | | 1,500 | |

1 | University of California Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 5,000 | | 5,000 | |

1 | University of California Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 10,945 | | 10,945 | |

1 | University of California Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 10,135 | | 10,135 | |

1 | University of California Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 5,000 | | 5,000 | |

1 | University of California Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 2,500 | | 2,500 | |

23

California Municipal Money Market Fund

| | | | | | | | Face | | Market | |

| | | | | Maturity | | | Amount | | Value· | |

| | | Coupon | | Date | | | ($000 | ) | ($000 | ) |

1 | University of California Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 2,585 | | 2,585 | |

1 | University of California Revenue TOB VRDO | | 1.690% | | 12/7/18 | | | 4,125 | | 4,125 | |

1 | University of California Revenue TOB VRDO | | 1.710% | | 12/7/18 | | | 20,870 | | 20,870 | |

1 | University of California Revenue TOB VRDO | | 1.710% | | 12/7/18 | | | 15,000 | | 15,000 | |

| University of California Revenue VRDO | | 1.470% | | 12/3/18 | | | 84,875 | | 84,875 | |

| University of California Revenue VRDO | | 1.490% | | 12/3/18 | | | 96,950 | | 96,950 | |

| University of California Revenue VRDO | | 1.500% | | 12/3/18 | | | 80,900 | | 80,900 | |

Total Tax-Exempt Municipal Bonds (Cost $5,215,635) | | | | | | | 5,215,635 | |

| | | | | | | | | | |

| | | | | | | | | Amount

($000 | ) |

Other Assets and Liabilities (2.5%) | | | | | | | | | | |

Other Assets | | | | | | | | | | |

Investment in Vanguard | | | | | | | | | 273 | |

Receivables for Investment Securities Sold | | | | | | | | | 59,650 | |

Receivables for Accrued Income | | | | | | | | | 13,550 | |

Receivables for Capital Shares Issued | | | | | | | | | 90,455 | |

Other Assets | | | | | | | | | 6,901 | |

Total Other Assets | | | | | | | | | 170,829 | |

Liabilities | | | | | | | | | | |

Payables for Investment Securities Purchased | | | | | | | | | (20,595 | ) |

Payables for Capital Shares Redeemed | | | | | | | | | (15,885 | ) |

Payables for Distributions | | | | | | | | | (579 | ) |

Payables to Vanguard | | | | | | | | | (390 | ) |

Total Liabilities | | | | | | | | | (37,449 | ) |

Net Assets (100%) | | | | | | | | | | |

Applicable to 5,348,388,103 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | | | 5,349,015 | |

Net Asset Value Per Share | | | | | | | | | $1.00 | |

| | | | | | | | | | |

| | | | | | | | | | |

At November 30, 2018, net assets consisted of: | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | Amount

($000 | ) |

Paid-in Capital | | | | | | | | | 5,349,079 | |

Total Distributable Earnings (Loss) | | | | | | | | | (64 | ) |

Net Assets | | | | | | | | | 5,349,015 | |

· See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2018, the aggregate value of these securities was $1,190,846,000, representing 22.3% of net assets.

2 Adjustable-rate security based upon SIFMA Municipal Swap Index Yield plus spread.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

24

California Municipal Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PILOT—Payments in Lieu of Taxes.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) AGC (Assured Guaranty Corporation).

(13) BHAC (Berkshire Hathaway Assurance Corporation).

(14) NPFG (National Public Finance Guarantee Corporation).

(15) BAM (Build America Mutual Assurance Company).

(16) MAC (Municipal Assurance Corporation).

(17) RAA (Radian Asset Assurance Inc.).

(18) SBLF (Michigan School Bond Loan Fund).

(19) TPSF (Texas Permanent School Fund).

The insurance does not guarantee the market value of the municipal bonds.

LOC — Scheduled principal and interest payments are guaranteed by bank letter of credit.

25

California Municipal Money Market Fund

Statement of Operations

| | Year Ended

November 30, 2018 | |

| | ($000 | ) |

Investment Income | | | |

Income | | | |

Interest | | 63,343 | |

Total Income | | 63,343 | |

Expenses | | | |

The Vanguard Group—Note B | | | |

Investment Advisory Services | | 1,203 | |

Management and Administrative | | 5,262 | |

Marketing and Distribution | | 1,004 | |

Custodian Fees | | 41 | |

Auditing Fees | | 29 | |

Shareholders’ Reports and Proxy | | 30 | |

Trustees’ Fees and Expenses | | 3 | |

Total Expenses | | 7,572 | |

Expenses Paid Indirectly | | (22 | ) |

Net Expenses | | 7,550 | |

Net Investment Income | | 55,793 | |

Realized Net Gain (Loss) on Investment Securities Sold | | (69 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | 55,724 | |

See accompanying Notes, which are an integral part of the Financial Statements.

26

California Municipal Money Market Fund

Statement of Changes in Net Assets

| | Year Ended November 30, | |

| | 2018

($000 | ) | 2017

($000 | ) |

Increase (Decrease) in Net Assets | | | | | |

Operations | | | | | |

Net Investment Income | | 55,793 | | 24,428 | |

Realized Net Gain (Loss) | | (69 | ) | 11 | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | 55,724 | | 24,439 | |

Distributions | | | | | |

Net Investment Income | | (55,737 | ) | (24,427 | ) |

Realized Capital Gain | | — | | — | |

Total Distributions | | (55,737 | ) | (24,427 | ) |

Capital Share Transactions (at $1.00 per share) | | | | | |

Issued | | 4,073,264 | | 2,470,709 | |

Issued in Lieu of Cash Distributions | | 51,607 | | 22,934 | |

Redeemed | | (2,818,436 | ) | (1,956,129 | ) |

Net Increase (Decrease) from Capital Share Transactions | | 1,306,435 | | 537,514 | |

Total Increase (Decrease) | | 1,306,422 | | 537,526 | |

Net Assets | | | | | |

Beginning of Period | | 4,042,593 | | 3,505,067 | |

End of Period | | 5,349,015 | | 4,042,593 | |

See accompanying Notes, which are an integral part of the Financial Statements.

27

California Municipal Money Market Fund

Financial Highlights

For a Share Outstanding

Throughout Each Period | | Year Ended November 30, | |

| 2018 | | 2017 | | 2016 | | 2015 | | 2014 | |

Net Asset Value, Beginning of Period | | $1.00 | | $1.00 | | $1.00 | | $1.00 | | $1.00 | |

Investment Operations | | | | | | | | | | | |

Net Investment Income | | .012 | 1 | .006 | 1 | .002 | | .0001 | | .0001 | |

Net Realized and Unrealized Gain (Loss) on Investments | | — | | — | | — | | — | | — | |

Total from Investment Operations | | .012 | | .006 | | .002 | | .0001 | | .0001 | |

Distributions | | | | | | | | | | | |

Dividends from Net Investment Income | | (.012 | ) | (.006 | ) | (.002 | ) | (.0001 | ) | (.0001 | ) |

Distributions from Realized Capital Gains | | — | | — | | — | | — | | — | |

Total Distributions | | (.012 | ) | (.006 | ) | (.002 | ) | (.0001 | ) | (.0001 | ) |

Net Asset Value, End of Period | | $1.00 | | $1.00 | | $1.00 | | $1.00 | | $1.00 | |

| | | | | | | | | | | |