| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| A | $19 | 0.37% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

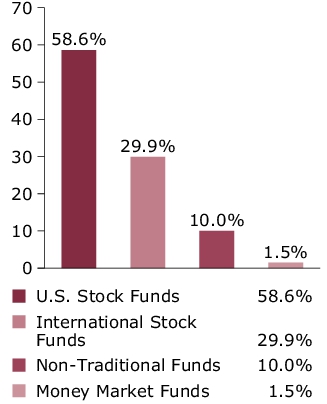

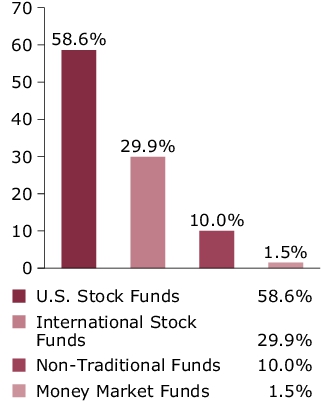

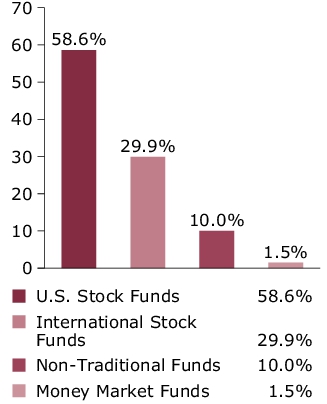

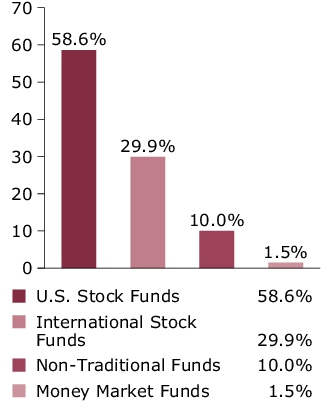

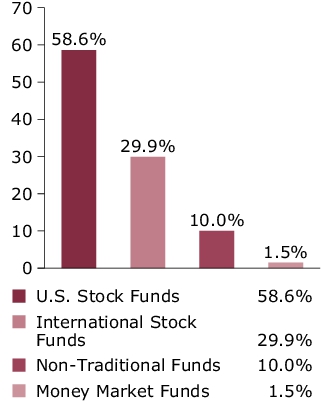

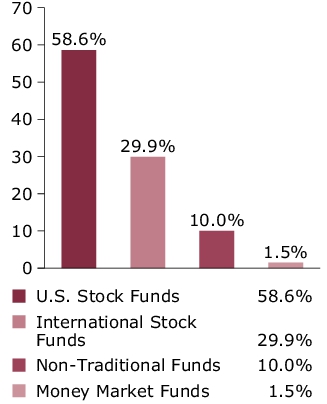

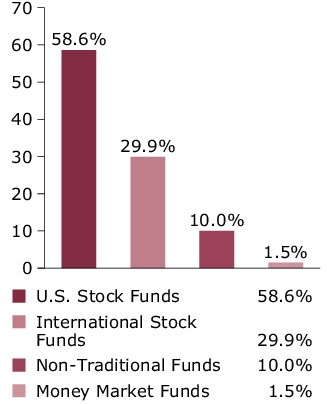

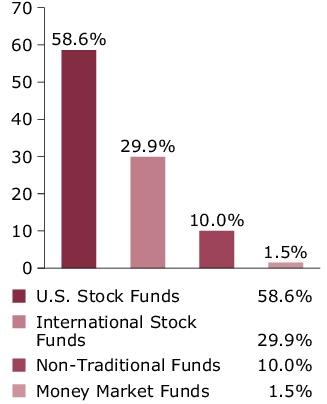

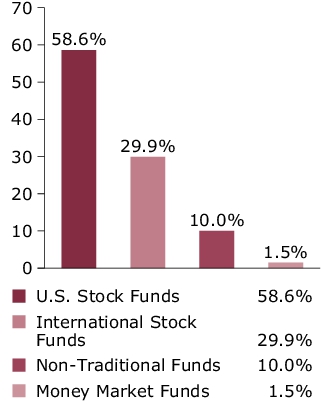

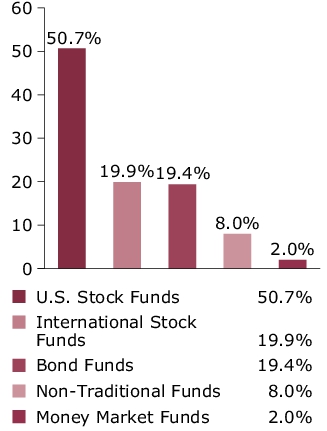

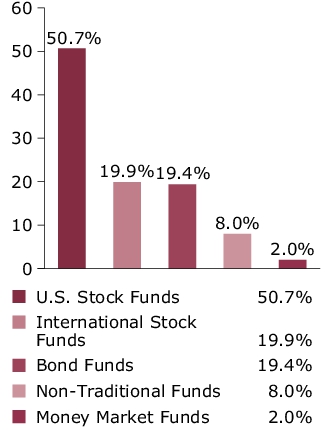

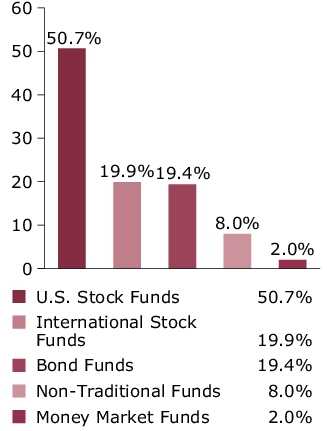

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| B | $58 | 1.12% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| C | $58 | 1.12% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| I | $6 | 0.12% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R1 | $58 | 1.12% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R2 | $32 | 0.62% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R3 | $19 | 0.37% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R4 | $6 | 0.12% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R6 | $2 | 0.04% |

| Net Assets ($): | 2,940,855,570 | Portfolio Turnover Rate (%): | 3 | |

| Total Number of Holdings: | 16 |

| MFS Value Fund | 12.0% |

| MFS Growth Fund | 11.2% |

| MFS Research Fund | 10.2% |

| MFS Mid Cap Growth Fund | 10.1% |

| MFS Mid Cap Value Fund | 10.1% |

| MFS Research International Fund | 8.0% |

| MFS Global Real Estate Fund | 5.0% |

| MFS Commodity Strategy Fund | 5.0% |

| MFS International Intrinsic Value Fund | 5.0% |

| MFS International Large Cap Value Fund | 5.0% |

| MFS International Growth Fund | 5.0% |

| MFS International New Discovery Fund | 4.0% |

| MFS Emerging Markets Equity Fund | 2.9% |

| MFS New Discovery Value Fund | 2.5% |

| MFS New Discovery Fund | 2.5% |

| MFS Institutional Money Market Portfolio | 1.5% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| A | $18 | 0.34% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

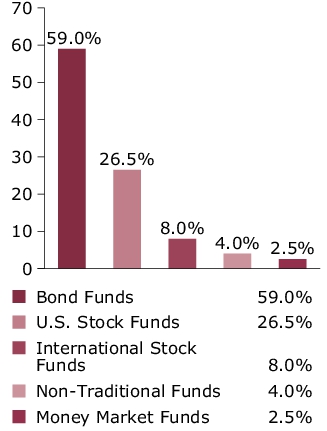

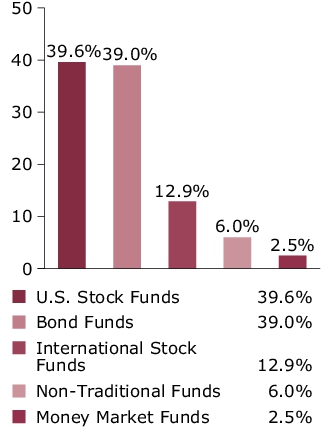

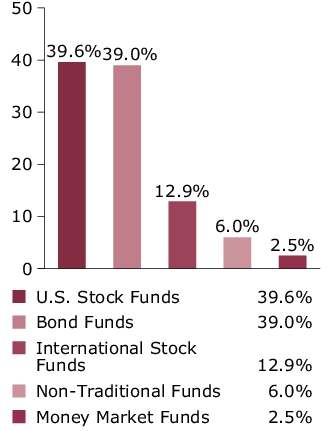

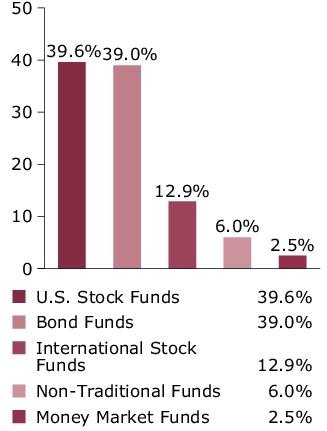

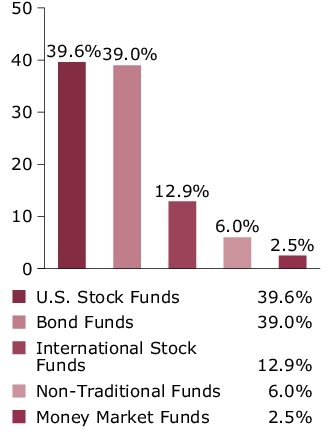

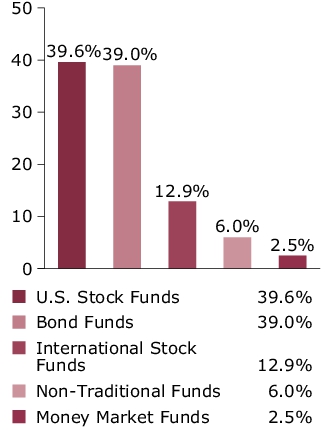

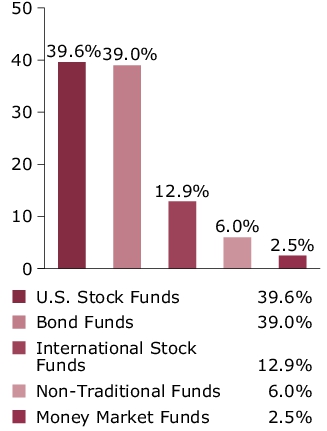

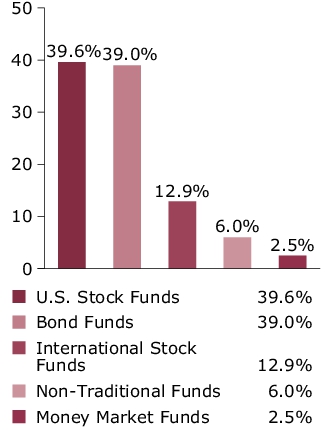

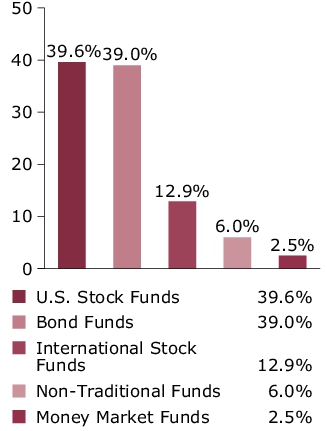

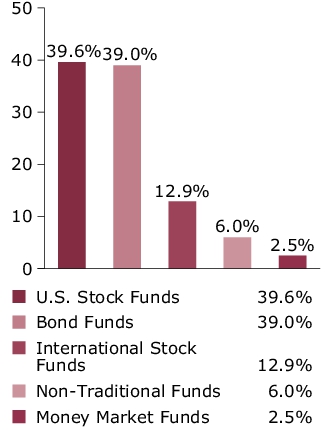

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| B | $56 | 1.09% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| C | $56 | 1.09% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| I | $5 | 0.09% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R1 | $56 | 1.09% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R2 | $30 | 0.59% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R3 | $18 | 0.34% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R4 | $5 | 0.09% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

Allocation Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R6 | $2 | 0.03% |

| Net Assets ($): | 3,813,437,829 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Total Return Bond Fund | 14.5% |

| MFS Inflation-Adjusted Bond Fund | 10.0% |

| MFS Limited Maturity Fund | 10.0% |

| MFS Government Securities Fund | 9.5% |

| MFS Global Opportunistic Bond Fund | 7.0% |

| MFS Value Fund | 6.0% |

| MFS Research Fund | 5.3% |

| MFS Growth Fund | 5.2% |

| MFS Mid Cap Growth Fund | 4.0% |

| MFS Mid Cap Value Fund | 4.0% |

| MFS High Income Fund | 4.0% |

| MFS Research International Fund | 3.5% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS Global Real Estate Fund | 2.0% |

| MFS Emerging Markets Debt Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Commodity Strategy Fund | 2.0% |

| MFS International Intrinsic Value Fund | 1.5% |

| MFS International Large Cap Value Fund | 1.5% |

| MFS International Growth Fund | 1.5% |

| MFS New Discovery Value Fund | 1.0% |

| MFS New Discovery Fund | 1.0% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| A | $18 | 0.34% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

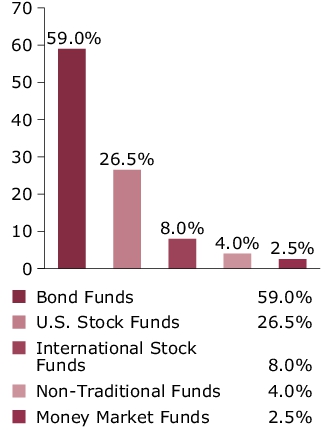

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| B | $57 | 1.09% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| C | $57 | 1.09% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| I | $5 | 0.09% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R1 | $57 | 1.09% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R2 | $31 | 0.59% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R3 | $18 | 0.34% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R4 | $5 | 0.09% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R6 | $1 | 0.02% |

| Net Assets ($): | 6,793,417,247 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 22 |

| MFS Value Fund | 10.0% |

| MFS Research Fund | 9.2% |

| MFS Growth Fund | 9.2% |

| MFS Mid Cap Growth Fund | 9.2% |

| MFS Mid Cap Value Fund | 9.1% |

| MFS Research International Fund | 7.0% |

| MFS Inflation-Adjusted Bond Fund | 5.0% |

| MFS Global Real Estate Fund | 4.0% |

| MFS Commodity Strategy Fund | 4.0% |

| MFS High Income Fund | 3.9% |

| MFS Global Opportunistic Bond Fund | 3.0% |

| MFS International Intrinsic Value Fund | 3.0% |

| MFS International Large Cap Value Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS International Growth Fund | 3.0% |

| MFS Total Return Bond Fund | 2.5% |

| MFS New Discovery Value Fund | 2.0% |

| MFS New Discovery Fund | 2.0% |

| MFS International New Discovery Fund | 2.0% |

| MFS Institutional Money Market Portfolio | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS Emerging Markets Equity Fund | 1.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| A | $18 | 0.34% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

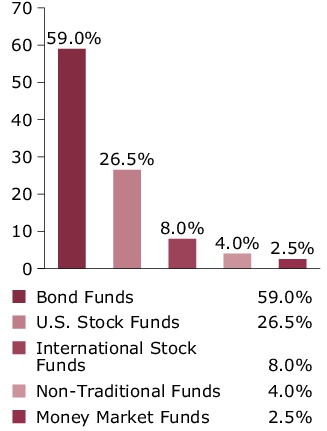

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| B | $57 | 1.09% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| C | $57 | 1.09% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| I | $5 | 0.09% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R1 | $57 | 1.09% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R2 | $31 | 0.59% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R3 | $18 | 0.34% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R4 | $5 | 0.09% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment ~ | Costs paid as a percentage of a $10,000 investment (annualized) ~ |

| R6 | $1 | 0.02% |

| Net Assets ($): | 6,807,643,144 | Portfolio Turnover Rate (%): | 2 | |

| Total Number of Holdings: | 23 |

| MFS Government Securities Fund | 9.5% |

| MFS Total Return Bond Fund | 8.5% |

| MFS Value Fund | 8.0% |

| MFS Research Fund | 7.2% |

| MFS Growth Fund | 7.2% |

| MFS Mid Cap Growth Fund | 7.1% |

| MFS Mid Cap Value Fund | 7.1% |

| MFS Inflation-Adjusted Bond Fund | 7.0% |

| MFS Global Opportunistic Bond Fund | 5.0% |

| MFS Research International Fund | 5.0% |

| MFS High Income Fund | 4.0% |

| MFS Global Real Estate Fund | 3.0% |

| MFS Commodity Strategy Fund | 3.0% |

| MFS Emerging Markets Debt Fund | 3.0% |

| MFS Institutional Money Market Portfolio | 2.5% |

| MFS International Intrinsic Value Fund | 2.0% |

| MFS International Large Cap Value Fund | 2.0% |

| MFS Emerging Markets Debt Local Currency Fund | 2.0% |

| MFS International Growth Fund | 2.0% |

| MFS New Discovery Value Fund | 1.5% |

| MFS New Discovery Fund | 1.5% |

| MFS International New Discovery Fund | 1.0% |

| MFS Emerging Markets Equity Fund | 0.9% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| A | $46 | 0.84% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| B | $86 | 1.59% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| C | $86 | 1.59% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| I | $32 | 0.59% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R1 | $72 | 1.32% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R2 | $59 | 1.09% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R3 | $46 | 0.84% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R4 | $32 | 0.59% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Mid Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R6 | $26 | 0.48% |

| Net Assets ($): | 956,869,646 | Portfolio Turnover Rate (%): | 30 | |

| Total Number of Holdings: | 147 |

| Equities | 99.1% |

| Money Market Funds | 0.9% |

| Financials | 17.4% |

| Industrials | 16.7% |

| Information Technology | 12.7% |

| Consumer Discretionary | 10.5% |

| Health Care | 10.4% |

| Real Estate | 7.8% |

| Utilities | 7.3% |

| Energy | 4.5% |

| Materials | 4.4% |

| Communication Services | 3.9% |

| Consumer Staples | 3.5% |

| Ameriprise Financial, Inc. | 2.0% |

| M&T Bank Corp. | 1.8% |

| Spotify Technology S.A. | 1.7% |

| Vistra Corp. | 1.6% |

| Wabtec Corp. | 1.6% |

| AppLovin Corp. | 1.6% |

| Hartford Financial Services Group, Inc. | 1.6% |

| Veeva Systems, Inc. | 1.6% |

| Datadog, Inc., "A" | 1.5% |

| Verisk Analytics, Inc., "A" | 1.5% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| A | $53 | 0.99% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| B | $92 | 1.74% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| C | $92 | 1.74% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| I | $39 | 0.74% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R1 | $92 | 1.74% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R2 | $66 | 1.24% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R3 | $53 | 0.99% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R4 | $39 | 0.74% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Small Cap Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R6 | $34 | 0.63% |

| Net Assets ($): | 364,265,504 | Portfolio Turnover Rate (%): | 32 | |

| Total Number of Holdings: | 183 |

| Equities | 99.3% |

| Money Market Funds | 0.7% |

| Financials | 20.4% |

| Health Care | 17.6% |

| Industrials | 15.9% |

| Information Technology | 12.8% |

| Consumer Discretionary | 11.1% |

| Energy | 5.4% |

| Real Estate | 5.2% |

| Materials | 5.0% |

| Communication Services | 2.9% |

| Utilities | 1.6% |

| Consumer Staples | 1.4% |

| Prestige Consumer Healthcare, Inc. | 1.7% |

| Newell Brands, Inc. | 1.7% |

| Encompass Health Corp. | 1.6% |

| SLM Corp. | 1.5% |

| Columbia Banking System, Inc. | 1.5% |

| Armstrong World Industries, Inc. | 1.5% |

| Piedmont Office Realty Trust, Inc., REIT | 1.5% |

| Element Solutions, Inc. | 1.4% |

| Grand Canyon Education, Inc. | 1.4% |

| Cathay General Bancorp, Inc. | 1.4% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| A | $39 | 0.74% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| B | $78 | 1.49% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| C | $78 | 1.49% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| I | $26 | 0.49% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R1 | $39 | 0.74% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R2 | $52 | 0.99% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R3 | $39 | 0.74% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R4 | $26 | 0.49% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Value Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| R6 | $22 | 0.42% |

| Net Assets ($): | 303,323,916 | Portfolio Turnover Rate (%): | 25 | |

| Total Number of Holdings: | 108 |

| Equities | 99.5% |

| Money Market Funds | 0.5% |

| Financials | 22.4% |

| Health Care | 15.2% |

| Industrials | 14.0% |

| Information Technology | 8.3% |

| Consumer Staples | 8.1% |

| Energy | 7.2% |

| Consumer Discretionary | 6.2% |

| Utilities | 5.2% |

| Real Estate | 4.9% |

| Materials | 4.1% |

| Communication Services | 3.9% |

| JPMorgan Chase & Co. | 3.2% |

| Johnson & Johnson | 2.6% |

| Wells Fargo & Co. | 2.4% |

| NextEra Energy, Inc. | 1.9% |

| Berkshire Hathaway, Inc., "B" | 1.9% |

| Eaton Corp. PLC | 1.8% |

| American Express Co. | 1.8% |

| T-Mobile USA, Inc. | 1.8% |

| Fiserv, Inc. | 1.7% |

| Pfizer, Inc. | 1.7% |

Growth Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| A | $40 | 0.74% |

| Net Assets ($): | 390,772,112 | Portfolio Turnover Rate (%): | 24 | |

| Total Number of Holdings: | 73 |

| Equities | 99.2% |

| Money Market Funds | 0.8% |

| Information Technology | 48.8% |

| Consumer Discretionary | 13.9% |

| Communication Services | 13.3% |

| Health Care | 7.8% |

| Financials | 6.5% |

| Industrials | 3.5% |

| Consumer Staples | 2.4% |

| Real Estate | 1.4% |

| Utilities | 1.2% |

| Materials | 0.4% |

| NVIDIA Corp. | 12.0% |

| Apple, Inc. | 10.9% |

| Microsoft Corp. | 9.7% |

| Amazon.com, Inc. | 6.9% |

| Meta Platforms, Inc., "A" | 4.5% |

| Alphabet, Inc., "A" | 4.3% |

| Alphabet, Inc., "C" | 2.8% |

| ServiceNow, Inc. | 2.0% |

| AppLovin Corp. | 2.0% |

| Booking Holdings, Inc. | 1.7% |

Growth Equity Fund

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment (annualized) |

| B | $81 | 1.49% |

| Net Assets ($): | 390,772,112 | Portfolio Turnover Rate (%): | 24 | |

| Total Number of Holdings: | 73 |

| Equities | 99.2% |

| Money Market Funds | 0.8% |