QuickLinks -- Click here to rapidly navigate through this documentDPAC TECHNOLOGIES CORP.

7321 Lincoln Way

Garden Grove, California 92841

June 20, 2002

TO THE SHAREHOLDERS OF DPAC TECHNOLOGIES CORP.

The Annual Meeting of Shareholders of DPAC Technologies Corp. (the "Company" or "DPAC") will be held at the Company's offices located at 7321 Lincoln Way, Garden Grove, California on August 9, 2002 at 10:00 a.m., California time.

The Annual Report for the Fiscal Year ended February 28, 2002 is enclosed. At the stockholders' meeting, we will discuss in more detail the subjects covered in the Annual Report as well as other matters of interest to stockholders.

The enclosed proxy statement explains the items of business to come formally before the Annual Meeting. As a stockholder, it is in your best interest to express your views regarding these matters by signing and returning your proxy. This will ensure the voting of your shares if you do not attend the Annual Meeting.

Your vote is important regardless of the number of shares of the Company's Stock you own, and all stockholders are cordially invited to attend the Annual Meeting. To ensure your representation at the Annual Meeting, please mark, sign, date and mail the enclosed proxy card promptly in the return envelope provided, which requires no postage if mailed in the United States. The giving of a proxy will not affect your right to vote in person if you attend the Annual Meeting. Please note, however, that if a broker, bank or other nominee holds your shares of record and you wish to vote at the Annual Meeting, you must obtain from the record holder a proxy issued in your name.

1

DPAC TECHNOLOGIES CORP.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on August 9, 2002

To The Shareholders of DPAC Technologies Corp.:

Notice is hereby given that the Annual Meeting of Shareholders of DPAC Technologies Corp. will be held on Friday, August 9, 2002 at 10:00 a.m. at the Company's offices located at 7321 Lincoln Way, Garden Grove, California for the following purposes:

- 1.

- To elect five directors for the ensuing year to serve until the next annual meeting of shareholders and until their successors are chosen.

- 2.

- Other business may properly come before the Meeting and any adjournments thereof: however, we know of no such other matters at this time.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business, June 10, 2002, as the record date for determination of shareholders entitled to notice of and to vote at the Annual Meeting.

Even though you may expect to be personally present at the Meeting, please be sure that the enclosed proxy card is properly completed, dated, signed and returned without delay in the accompanying envelope. No postage need be affixed if mailed in the United States.

WILLIAM M. STOWELL

Secretary

2

DPAC TECHNOLOGIES CORP.

7321 Lincoln Way

Garden Grove, California 92841

PROXY STATEMENT

For

Annual Meeting of Shareholders

August 9, 2002

GENERAL INFORMATION

Solicitation, Revocation and Voting of Proxies

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of DPAC Technologies Corp. (the "Company" or "DPAC"), for use at the Annual Meeting of Shareholders to be held at 10:00 a.m. local time on August 9, 2002, at the Company's offices located at 7321 Lincoln Way, Garden Grove, California, and at any and all adjournments thereof (the "Annual Meeting"). It is anticipated that this Proxy Statement and accompanying proxy will first be mailed to shareholders on or about June 25, 2002. Such proxies will be used for the following purposes:

To consider and vote upon the following matters described in this Proxy Statement:

- 1.

- To elect five directors for the ensuing year to serve until the next annual meeting of shareholders and until their successors are chosen.

Other business may properly come before the Meeting and any adjournments thereof. As to any other matters or business which may be brought before the Meeting, a vote may be cast pursuant to the accompanying proxy in accordance with the judgment of the persons voting the shares, but management does not know of any such other matter or business to come before the meeting. A shareholder may revoke his or her proxy at any time prior to the voting of shares by voting in person at the Meeting or by filing with the Secretary of the Company a duly executed proxy bearing a later date or an instrument revoking the proxy.

The Company will pay the costs of solicitation of proxies. In addition to soliciting proxies by mail, the Company's officers, directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. Banks, brokers, fiduciaries and other custodians and nominees who forward proxy soliciting material to their principals will be reimbursed their customary and reasonable out-of-pocket expenses.

Record Date and Voting Rights

Only shareholders of record of the Company's Common Stock as of the close of business on June 10, 2002 will be entitled to vote at the Annual Meeting. On June 10, 2002, there were outstanding 21,044,029 shares of Common Stock, which constituted all of the outstanding voting securities of the Company, each of which is entitled to one vote per share. A majority of the shares entitled to vote, represented in person or by proxy, constitutes a quorum at the Annual Meeting. Abstentions and broker non-votes are counted as present for purposes of determining the existence of a quorum.

In the election of directors only, each shareholder has the right to cumulate his or her votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares he or she is entitled to vote, or to distribute his or her votes on the same principle among as many candidates as he or she sees fit. No shareholder is entitled to cumulate votes unless the name of every candidate for whom such votes would be cast has been placed in nomination prior to the voting and any shareholder has given notice at the meeting prior to the voting of such shareholder's intention to cumulate his or her votes.

3

If voting for directors is conducted by cumulative voting, the persons named on the enclosed proxy will have discretionary authority to cumulate votes among the nominees with respect to which authority was not withheld or, if the proxy either was not marked or was marked for all nominees, among all nominees. In any case, the proxies may be voted for less than the entire number of nominees if any situation arises which, in the opinion of the proxy holders, makes such action necessary or desirable.

Required Votes

As to Proposal 1, the election of directors, the candidates receiving the highest number of votes, up to the number of directors to be elected, will be elected directors. Abstentions, broker non-votes and votes withheld have no legal effect.

ELECTION OF DIRECTORS

(Proposal 1)

The five directors to be elected at the Annual Meeting will hold office until the next Annual Meeting of Shareholders and until the election and qualification of their respective successors. All proxies received by the Board of Directors will be voted for the nominees listed below if no direction to the contrary is given. In the event that any nominee is unable or declines to serve, an event that is not anticipated, the proxies will be voted for the election of any replacement nominee who may be designated by the Board of Directors.

Set forth below is information concerning the nominees for director:

Name and Year First Became a Director

| | Age

| | Principal Occupation During the Past Five Years

|

|---|

Richard J. Dadamo

1999 | | 74 | | Mr. Dadamo has been the principal of RJD Associates, Inc., a management-consulting firm, since 1981. Mr. Dadamo served as interim CEO of the Company from August 11, 1998 to January 29, 1999 and is currently Chairman of the Board. He had previously held top-level positions at The Earth Technology Corporation, American International Devices, TRW, Inc. and Electronic Memories and Magnetics. He has written three books on management, holds management seminars, has a monthly newsletter and is currently on the board of directors of three private companies. |

Ted Bruce

1999 |

|

44 |

|

Mr. Bruce joined the Company as its president in 1999 and was elected its CEO a month later. Prior to joining DPAC Technologies, Mr. Bruce was with Toshiba America Electronic Components from 1989, where he served as Senior Manager of North America Manufacturing. He also served as the Product Line Manager for the Card, SRAM and Nonvolatile departments and as a Product Marketing Engineer of the standard speed SRAM. He is a 15-year veteran of manufacturing, engineering, sales and marketing within the semiconductor industry, in both commercial and military markets. |

|

|

|

|

|

4

Samuel W. Tishler

2000 |

|

63 |

|

Mr. Tishler, an independent consultant recently retired as vice president for Corporate Development for Acterna Corporation, (Nasdaq:ACTR), a manufacturer of telecommunications communications test equipment, and is an experienced strategic planning and venture investment professional. He was a vice president of Arthur D. Little Enterprises, Inc., and a founder of Arthur D. Little Ventures. He also was a vice president of Raytheon Ventures, and in that capacity was responsible for its venture capital portfolio. Mr. Tishler has also served on many of the Boards of the venture-backed companies, including Viewlogic Systems and Kloss Video Corporation. Mr. Tishler's broad strategic planning background includes the early development of technology concepts from planning to development and execution. |

Gordon M. Watson

2000 |

|

63 |

|

Mr. Watson is the founder of Watson Consulting, LLC, founded in 1998, a management consultant firm to small technology companies based in California. Before that Mr. Watson was a Western Regional Director for Lotus Consulting a division of Lotus Development Corp. He was also vice president of business development for Platinum Technologies, Inc., from 1988 until 1996. Prior to joining Platinum, he served in various senior management positions overseeing operations and sales for technology equipment manufacturing concerns. Mr. Watson also taught engineering at the University of California, Irvine and spent one year conducting national lectures for Data Tech Institute. He holds a Bachelor of Science degree in engineering from UCLA. |

Richard H. Wheaton

2000 |

|

66 |

|

Mr. Wheaton, a certified management consultant, spent the greater part of his career with Price Waterhouse, LLP where he also consulted to the Japanese, Asian and European markets. Previously he worked for TRW and IBM. He was awarded a Bachelor of Science degree in business administration from UCLA and an MBA in industrial management from the University of Southern California. |

5

Directors' Compensation

The Company pays its non-employee directors $1,500 for each Board meeting attended and $500 for the Committee Chairman, for a meeting held which is not held on the same day as a Board meeting, and reimburses out-of-pocket expenses for attending such meetings. New directors are awarded 40,000 stock options, vesting over a three year period. In Fiscal Year 2002, the Company awarded stock options to a non-employee director as follows:

Name

| | Number of Securities

Underlying Options Granted

| | Date of Grant

| | Exercise

Price/Share

| | Expiration

Date

|

|---|

| Gordon Watson | | 20,000 | | 3-22-01 | | $ | 1.50 | | 3-22-11 |

| Samuel Tishler | | 20,000 | | 3-22-01 | | $ | 1.50 | | 3-22-11 |

| Richard Wheaton | | 20,000 | | 3-22-01 | | $ | 1.50 | | 3-22-11 |

Information Concerning Board and Committee Meetings

The Company's Board of Directors held five meetings during the fiscal year ended February 28, 2002. Each director attended or participated in at least 75% of the aggregate number of Board meetings and committee meetings (held during the period when he was a member thereof).

6

AUDIT COMMITTEE REPORT

The following report will not be deemed to be incorporated by reference into any of DPAC's previous or future filings under the Securities Act or the Exchange Act, notwithstanding anything to the contrary in any filing.

The members of the Audit Committee in Fiscal Year 2002 were Richard Wheaton, Sam Tishler and Gordon Watson, each of whom is a member of our Board of Directors and qualifies as "independent" as defined under Rule 4200(a)(15) of the National Associations of Securities Dealers' listing standards. The Audit Committee is responsible for, among other things, periodically reviewing the financial condition and the results of audit examinations of the Company with its independent accountants. The Audit Committee met three times during the last Fiscal Year.

The Company's Board of Directors has adopted a written charter for the Audit Committee. The charter was included as an appendix to the Company's Proxy Statement as filed with the Securities and Exchange Commission on June 13, 2001.

The primary function of the Audit Committee is to provide advice with respect to DPAC's financial matters and to assist our Board of Directors in fulfilling its oversight responsibilities regarding finance, accounting, tax and legal compliance. The Audit Committee's primary duties and responsibilities are to:

- •

- serve as an independent and objective party to monitor DPAC's financial reporting process and internal system;

- •

- review and appraise the audit efforts of DPAC's independent accountants;

- •

- evaluate DPAC's quarterly financial performance as well as its compliance with laws and regulations;

- •

- oversee management's establishment and enforcement of financial policies and business practices; and

- •

- provide an open avenue of communications among the independent accountants, financial and senior management, counsel, and our board of Directors.

REVIEW OF DPAC'S AUDITED FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDED FEBRUARY 28, 2002

The audit committee has reviewed and discussed DPAC's audited financial statements for the fiscal year ended February 28, 2002 with DPAC's management. The Audit Committee has discussed with Deloitte & Touche, LLP, DPAC's independent public accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee has also received the written disclosures and the letter from Deloitte & Touche, LLP required by Independence Standards Board Standard #1 (Independence Discussion with Audit Committee) and the audit committee has discussed the independence of Deloitte & Touche with them.

Based on the Audit Committee's review and discussions noted above, the Audit Committee recommended to our Board of Directors that DPAC's audited financial statements be included in our Annual report on Form 10-K for the fiscal year ended February 28, 2002 for filing with the SEC.

7

COMPENSATION COMMITTEE REPORT

The Compensation Committee reviews general programs of compensation and benefits for all employees and makes recommendations to our Board of Directors concerning compensation paid to our executive officers, directors and certain key employees. The Compensation Committee also administers our stock-based compensation plans, including our 1996 Stock Option Plan, which allows the Compensation Committee to grant incentive stock options to eligible key employees, officers, directors and consultants. The members of the Compensation Committee were Gordon Watson and Richard Wheaton. The Compensation Committee met twice during the last Fiscal Year.

COMPENSATION PHILOSOPHY AND OBJECTIVES. The overall philosophy underlying the decisions and recommendations of the Compensation Committee is to recognize and reward results and achievements at both the individual and company level by linking compensation to such achievement. Consistent with this philosophy, the Compensation Committee has the following objectives for our executive compensation program:

- •

- Encourage the achievement of desired individual and company performance goals by rewarding such achievements.

- •

- Provide a program of compensation that is competitive with comparable companies to enable us to attract and retain key executive talent.

- •

- Align the interests of our executives with the interests of our shareholders by linking compensation to company opportunities for long-term ownership.

In making recommendations to our Board of Directors, the Compensation Committee considers factors such as company performance, both in isolation and in comparison to companies of comparable profitability, complexity and size; the individual performance of each executive officer; our historical compensation levels; the overall competitive environment for executives and the level of compensation necessary to attract and retain the level of key executive talent that we desire. In analyzing these factors, the Compensation Committee may from time to time review competitive compensation data gathered in comparative surveys or collected by independent consultants.

SECTION 162 (m). Section 162 (m) of the Internal Revenue Code limits our ability to deduct certain compensation in excess of one million dollars paid to our chief executive officer and each of our four most highly compensated executives. In fiscal year 2002, we did not pay "compensation" within the meaning of Section 162 (m) in excess of one million dollars to our executive officers, and we do not believe that we will do so in the near future. As a result, we have not established a policy for qualifying compensation paid to our executive officers for deductibility under Section 162 (m), but will formulate such a policy if compensation levels ever approach one million dollars.

Other Committees

The Company currently does not have a nominating committee or any committee performing a similar function.

8

Compensation Committee Interlocks and Insider Participation

No interlocking relationship exists between any of our executive officers or any member of our compensation committee and any member of any other company's board of directors or compensation committee.

EXECUTIVE MANAGEMENT

The following information is provided with respect to the Company's current executive officers.

Ted Bruce, age 44, was elected Chief Executive Officer in February 1999. See "Election of Directors" for his background.

John P. Sprint, age 40, has served as Chief Operating Officer since March 2000. Mr. Sprint joined the Company in 1990, where he has served in several management positions; including Vice President of Manufacturing, Vice President of Operations from January 1998 until June 1999 and Executive Vice President of Operations from June 1999 until March 2000. From 1986 until joining the Company in 1990 Mr. Sprint was a manager in the test, manufacturing and thick film departments at Northrop Electronics Division.

Kevin E. Perry, age 50, has served as Vice President Sales and Marketing since joining the Company in January 2001. Mr. Perry recently served as Executive Director of Marketing and Business Development for the removable storage solutions division at Seagate from 1994 to 2000. Prior to Seagate, Mr. Perry served in similar roles for Microtech International, Inc.

William M. Stowell, age 46, has served as Vice President, Finance and Chief Financial Officer of the Company since 1987. Mr. Stowell is a CPA with a Bachelor of Science degree in accounting from the University of Southern California and has a teaching credential in accounting and management information systems. Prior to joining the Company, he served as Chief Financial Officer for Hughes Enterprises and prior to that he served as an audit manager at Price Waterhouse & Co.

Officers serve at the discretion of the Board of Directors.

FEES PAID TO THE INDEPENDENT ACCOUNTANTS

The Company's independent auditor is the firm of Deloitte & Touche, LLP. A representative of Deloitte & Touche is expected to be present at the Annual Meeting and to be available to respond to appropriate questions, and will have the opportunity to make a statement.

Audit Fees

Deloitte & Touche, LLP, the member firm of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, "Deloitte") billed DPAC aggregate fees of $79,000 for professional services rendered for the audit of the Company's annual financial statements for fiscal year 2002 and for the reviews of the financial statements included in the Company's Quarterly reports on Form 10-Q for the first three quarters for fiscal year 2002.

Financial Information Systems Design and Implementation

Deloitte did not bill DPAC for financial information systems design and implementation fees for fiscal year 2002.

All Other Fees

Deloitte billed DPAC aggregate fees of $69,000 for other professional services rendered in fiscal year 2002.

9

EXECUTIVE COMPENSATION

The following tables provide information concerning the compensation of each person who served as chief executive officer during the last Fiscal Year and other executives whose total salary and bonus exceeded $100,000 in Fiscal Year 2002 (the "Named Executives").

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term Compensation

|

|---|

Name and

Principal Position

| | Fiscal Year

| | Salary

| | Bonus

| | Securities Underlying

Options(#)

| | All Other

Compensation(1)

|

|---|

Ted Bruce

Chief Executive Officer,

President | | 2002

2001

2000 | | $

| 220,000

200,000

150,000 | | $

$

$ | 220,000

57,000

253,500 | | 160,000

- -0-

250,000 | | $

$

$ | 3,000

3,000

3,000 |

Richard J. Dadamo

Chairman of the Board |

|

2002

2001

2000 |

|

$

|

107,000

72,000

72,000 |

|

$

$

$ |

25,000

110,000

50,000 |

|

60,000

- -0-

75,000 |

|

$

$

$ |

3,000

3,000

3,000 |

John P. Sprint

Chief Operating Officer |

|

2002

2001

2000 |

|

$

|

164,000

154,750

136,500 |

|

$

$

$ |

85,000

31,000

127,000 |

|

76,000

60,000

80,000 |

|

$

$

$ |

3,000

3,000

3,000 |

Kevin E. Perry

Vice President, Sales &

Marketing (2) |

|

2002

2001 |

|

$

|

150,000

8,077 |

|

$

|

90,000

- -0- |

|

36,000

40,000 |

|

$ |

3,000 |

William M. Stowell

Chief Financial Officer |

|

2002

2001

2000 |

|

$

|

157,000

153,500

147,000 |

|

$

$

$ |

55,000

23,250

113,000 |

|

60,000

50,000

48,000 |

|

$

$

$ |

3,000

3,000

3,000 |

- (1)

- Fiscal Year 2002 includes Company contributions to the 401(k) Plan for each named officer with a maximum contribution of $3,000. Other perquisites for each of the employees listed in the table were less than $50,000 and 10% of the total of annual salary and bonus for such individual.

- (2)

- Mr. Perry joined DPAC in January 2001.

Employment Agreements and Change in Control Arrangements

The Company is party to employment agreements and change in control arrangements with Mr. Bruce, Mr. Sprint and Mr. Stowell. These agreements were entered into on June 7, 2001. The initial term of each agreement was two years, and each agreement renews from year to year thereafter unless notice on non-renewal is give at least 120 days prior to expiration. The employment contracts generally require each employee to devote all of his working time and attention to our business. In addition, the agreements contain non-competition restrictions and covenants, including the employee from competing with us during employment and for a period thereafter. In addition, each employee has entered into a non-disclosure agreement relating to our intellectual property and proprietary information pursuant to which he has agreed to assign to us all intellectual property rights developed during the course of his employment.

The compensation of the executives under these agreements is subject to annual review and adjustment by our compensation committee. The compensation of each executive under these agreements includes participation in option grants, reimbursement for all reasonable business expenses incurred by him on behalf of the Company, fringe benefits such as life and disability insurance, health

10

insurance plans, pension, retirement and accident plans and an automobile allowance of $500 per month.

Under these agreements, if such employee's employment is terminated by his death, he shall receive a lump sum payment of his salary through the expiration the of his employment agreement as then in effect. If his employment is terminated by his permanent disability, he will receive his salary in installments through the date of expiration of his employment agreement. If his employment is terminated by the Company without "cause" as defined in the employment agreement, or if the employment agreement is not automatically renewed, the employee will receive his salary and other benefits through the expiration of the employment agreement and for a period ranging between 12 and 24 months after the expiration date and 100% of all unvested options issued under any of the Company's stock plans to such employee will vest as of the termination date, and all such vested options will immediately become exercisable and remain exercisable as if the executive had continued to be an employee for the period through the expiration date of the agreement and for a period ranging between 12 and 24 months thereafter.

These employment agreements also contain provisions relating to termination in the event of a change in control of the Company. If a change of control (as defined in the agreement) occurs and such employee's employment was or is terminated during the period 6 months prior to such change of control or the period of 18 months following a change of control, other then for cause as defined in the agreement, then the Company shall pay such employee a lump sum amount equal to his salary for the period from the termination date through the expiration date of the agreement then in effect and continue to extend all of the other benefits until the expiration date of the agreement as then in effect and in addition the Company shall pay such employee as severance, his salary and other benefits commencing on the expiration date of the employment agreement and for a period of 24 months after the expiration date. Also upon a change of control, 100% of all unvested options issued under any of the Company's stock plans to such employee shall immediately vest, and all such vested options shall immediately become exercisable.

These agreements differ as to job title, salary and certain other terms as described below:

Mr. Bruce is employed as president and chief executive officer. The agreement provided for an annual base salary of $220,000 per annum. By amendment to the agreement, Mr. Bruce's compensation was adjusted to $235,400 on March 1, 2002. The compensation for Mr. Bruce also includes 25 days of personal time and sick time off with pay per annum.

Mr. Sprint is employed as chief operating officer. The agreement provided for an annual base salary of $155,000 per annum. By amendment to the agreement, Mr. Sprint's compensation was adjusted to $185,000 on March 1, 2002. The compensation for Mr. Sprint also includes 21 days of personal time and sick time off with pay per annum.

Mr. Stowell is employed as chief financial officer. The agreement provided for an annual base salary of $155,000 per annum. By amendment to the agreement, Mr. Stowell's compensation was adjusted to $170,000 on March 1, 2002. The compensation for Mr. Stowell also includes 21 days of personal time and sick time off with pay per annum.

11

Option Grants In Last Fiscal Year

The following table sets forth certain information with respect to stock options granted to each of the Named Executive Officers in fiscal year 2002, including the potential realizable value over the ten-year term of the options, based on assumed rates of stock appreciation of 5% and 10%, compounded annually. These assumed rates of appreciation comply with the rules of the SEC and do not represent our estimate of future stock price. Actual gains, if any, on stock option exercises will be dependent on the future performance of our common Stock.

| |

| |

| |

| |

| | Potential realizable

Value at assumed

annual rates of stock

price appreciation for

option term

|

|---|

| |

| | % of Total

Options

Granted to

Employees

in Fiscal

Year

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted(1)

| |

| |

|

|---|

| | Exercise

Price

Per

Share(2)

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Ted Bruce | | 100,000

24,000

16,000

20,000 | (3)

(4) | 15.1

3.6

2.4

3.0 | %

%

%

% | 1.50

1.78

1.97

2.12 | | 3/22/11

6/01/11

10/22/11

12/03/11 | | $

| 94,330

44,780

19,830

26,670 | | $

| 239,000

68,080

50,240

67,580 |

| Richard J. Dadamo | | 50,000

10,000 | (3)

| 7.6

1.5 | %

% | 1.50

1.97 | | 3/22/11

10/22/11 | | | 47,170

12,390 | | | 119,530

31,400 |

| John P. Sprint | | 36,000

20,000

10,000

10,000 | (3)

(4) | 4.1

3.0

1.5

1.5 | %

%

%

% | 1.50

1.78

1.97

2.12 | | 3/22/11

6/01/11

10/22/11

12/03/11 | | | 33,970

22,390

12,390

13,300 | | | 86,060

56,740

31,400

33,800 |

| Kevin E. Perry | | 20,000

10,000

6,000 |

(4) | 4.1

1.5

...9 | %

%

% | 1.78

1.97

2.12 | | 6/01/11

10/22/11

12/03/11 | | | 22,390

12,390

8,000 | | | 56,740

31,400

20,280 |

| William M. Stowell | | 26,000

16,000

10,000

8,000 | (3)

(4) | 3.9

2.4

1.5

1.2 | %

%

%

% | 1.50

1.78

1.97

2.12 | | 3/22/11

6/01/11

10/22/11

12/03/11 | | | 24,530

12,910

12,390

10,670 | | | 62,160

45,390

31,400

27,030 |

- (1)

- Unless otherwise indicated, the options vest in 25% installments beginning one year after the grant date and are subject to earlier termination in the event of termination of employment, death and certain corporate events. Under the terms of the Company's Stock Option Plans, the Stock Option Committee may modify the terms of outstanding options, including the exercise price and vesting schedule.

- (2)

- Exercise price is fair market value of the Common Stock on the grant date.

- (3)

- Vesting of option is 50% on grant and 50% in one year.

- (4)

- Vesting of option is 50% in one year and 50% in two years.

12

Aggregated Option Exercises In Last Fiscal Year and Fiscal Year-End Option Values

| |

| |

| | Number of Securities

Underlying

Options at

Fiscal Year-End

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-the-Money Options

at Fiscal Year-End(2)

|

|---|

Name

| | Shares

Acquired

on Exercise

| | Value

Realized(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Richard J. Dadamo | | 12,000 | | $ | 32,500 | | 153,000 | | 60,000 | | $ | 212,000 | | $ | 54,100 |

| Ted Bruce | | 10,000 | | $ | 6,600 | | 340,000 | | 190,000 | | $ | 342,700 | | $ | 158,200 |

| John P. Sprint | | -0- | | | -0- | | 95,500 | | 161,750 | | $ | 138,400 | | $ | 125,500 |

| Kevin E. Perry | | -0- | | | -0- | | 10,000 | | 66,000 | | $ | 11,800 | | $ | 81,900 |

| William M. Stowell | | 14,500 | | $ | 29,500 | | 156,250 | | 127,250 | | $ | 178,600 | | $ | 142,300 |

- (1)

- Represents the difference between the aggregate market value on the date of exercise and the aggregate exercise price.

- (2)

- Represents the difference between the aggregate market value on February 28, 2002 ($3.18 share) and the aggregate exercise price.

13

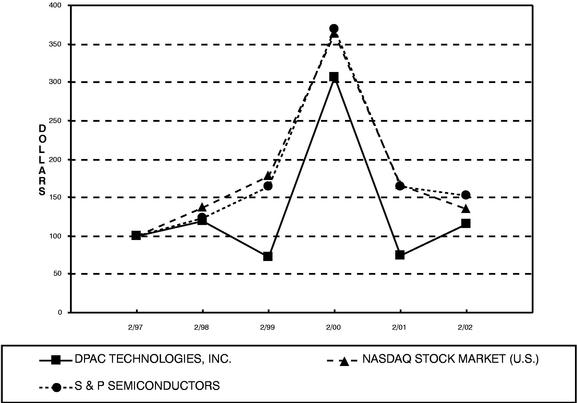

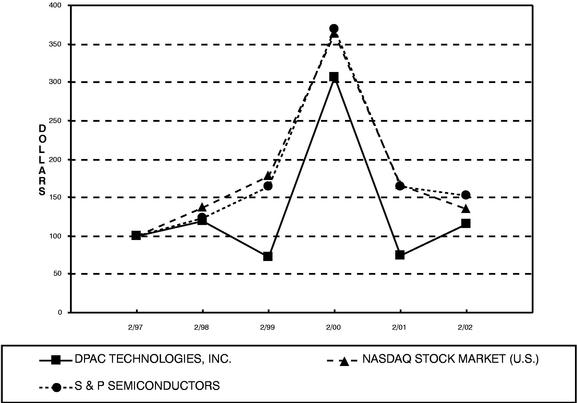

PERFORMANCE GRAPH

The following graph compares the five-year cumulative total return on the Company's Common Stock to the total returns of 1) NASDAQ Stock Market Index and 2) Standard & Poors Semiconductor Index. This comparison assumes in each case that $100 was invested on or about February 28, 1997 and all dividends were reinvested. The Company's fiscal year ends on or about February 28 each year.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG DPAC TECHNOLOGIES, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE S & P SEMICONDUCTORS INDEX

- *

- $100 invested on 2/28/97 in stock or index-including reinvestment of dividends. Fiscal year ending February 28.

| | Cumulative Total Return

|

|---|

| | 2/97

| | 2/98

| | 2/99

| | 2/00

| | 2/01

| | 2/02

|

|---|

| DPAC TECHNOLOGIES, INC. | | 100.00 | | 118.60 | | 72.09 | | 305.81 | | 74.42 | | 115.35 |

| NASDAQ STOCK MARKET (U.S.) | | 100.00 | | 136.64 | | 177.96 | | 363.60 | | 165.62 | | 134.68 |

| S & P SEMICONDUCTORS | | 100.00 | | 122.04 | | 164.22 | | 369.59 | | 163.50 | | 152.24 |

14

OWNERSHIP OF COMMON STOCK

The following table sets forth certain information as of June 1, 2002, with respect to ownership of the Company's Common Stock by each person who is known by the Company to own beneficially 5% or more of the Common Stock, each Named Officer, each director of the Company, each nominee for director, and all executive officers and directors of the Company as a group.

Name *

| | Shares

Beneficially

Owned

| | Percentage

Ownership

| |

|---|

EBTB II B.V.

Euroventures Benelux Team B.V.

Julianaplein 10

NL-5211 BC's Hertogenbosch

The Netherlands | | 2,368,300 | (1&2) | 11.3 | % |

| | Ownership in the separate funds: | | | | | |

| | —Euroventures Benelux I B.V. (76,500 — **) | | | | | |

| | —Euroventures Benelux II B.V. (2,291,800 — 10.9%) | | | | | |

| Current directors, director nominees, and executive officers: | | | | | |

| Richard J. Dadamo | | 131,000 | (3) | ** | |

| Ted Bruce | | 341,000 | (4) | 1.6 | % |

| John P. Sprint | | 181,000 | (5) | ** | |

| William M. Stowell | | 216,250 | (6) | 1.0 | % |

| Kevin E. Perry | | 25,000 | (7) | ** | |

| Gordon Watson | | 30,000 | (8) | ** | |

| Richard Wheaton | | 30,000 | (9) | ** | |

| Samuel Tishler | | 31,000 | (7) | ** | |

| All executive officers and directors as a group (eight) | | 985,250 | (10) | 4.7 | % |

- *

- Includes address of 5% or more shareholders.

- **

- Less than 1%.

- 1)

- Includes the shares owned by Euroventures Benelux I B.V. and Euroventures Benelux II B.V., which are widely held venture capital funds. According to filings made with the Securities and Exchange Commission pursuant to Section 13(d) of the Securities Exchange Act of 1934, Euroventures Benelux Team B.V. is the investment manager of both such funds and has voting and dispositive power over their shares of the Company's Common Stock, and EBTB II B.V. is an indirect beneficial owner of such shares. Under the rules set forth pursuant to the Securities Exchange Act of 1934, more than one person may be deemed to be a beneficial owner of the same securities.

- 2)

- Mr. Claes is managing director of Euroventures Benelux I B.V. and a partner and managing director of Euroventures Benelux Team B.V. and EBTB II B.V. Mr. Claes was a member of the Board of Directors of DPAC through August 10, 2001. See Note (1).

- 3)

- Includes 123,000 shares subject to options that are exercisable within 60 days.

- 4)

- Includes 236,000 shares subject to options that are exercisable within 60 days.

- 5)

- Includes 151,000 shares subject to options that are exercisable within 60 days.

- 6)

- Represents 184,250 shares subject to options that are exercisable within 60 days.

- 7)

- Includes 25,000 shares subject to options that are exercisable within 60 days.

15

- 8)

- Includes 30,000 shares subject to options that are exercisable within 60 days.

- 9)

- Includes 10,000 shares subject to options that are exercisable within 60 days.

- 10)

- See Notes (2) through (9) above.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

During Fiscal Year 2002, to the Company's knowledge, no persons filed late reports under Section 16(a) of the Securities Exchange Act of 1934.

In making these disclosures, the Company has relied solely on written representations of its directors, executive officers and 10% shareholders and copies of the reports that they have filed with the Securities and Exchange Commission.

SHAREHOLDER PROPOSALS

Any shareholder intending to submit to the Company a proposal for inclusion in the Company's Proxy Statement and proxy for the 2003 Annual Meeting must submit such proposal so that the Company receives it no later than March 12, 2003.

ANNUAL REPORT

A copy of the Annual Report on Form 10-K for the 2002 Fiscal Year, including the financial statements and the financial statements schedules required to be filed with the U.S. Securities and Exchange Commission, may be obtained by each stockholder of record and each beneficial holder on the record date, without charge. Copies of exhibits to the Form 10-K are available for a reasonable fee. All such requests should be made in writing to the Company at 7321 Lincoln Way, Garden Grove, California 92841, attention William M. Stowell, Chief Financial Officer.

DISCRETIONARY AUTHORITY

While the Notice of Annual Meeting of Shareholders calls for the transaction of such other business as may properly come before the meeting, the Board of Directors has no knowledge of any matters to be presented for action by the shareholders other than as set forth above. The enclosed proxy gives discretionary authority, however, to vote such proxy as the proxy holder determines in the event any additional matters should be presented.

WILLIAM M. STOWELL

Secretary

Date June 10, 2002

16

- DETACH PROXY CARD HERE -

DPAC TECHNOLOGIES CORP.

PROXY FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD AUGUST 9, 2002

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Ted Bruce and William M. Stowell, and each of them, the attorneys, agents and proxies of the undersigned, with full powers of substitution to each, to attend and act as proxy or proxies of the undersigned at the Annual Meeting of Shareholders of DPAC Technologies Corp., to be held at DPAC Technologies Corp. on August 9, 2002 at 10:00 a.m., and at any and all adjournments thereof, and to vote as specified herein the number of shares which the undersigned, if personally present, would be entitled to vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE ELECTION OF DIRECTORS NOMINATED BY THE BOARD OF DIRECTORS.

PLEASE SIGN AND DATE ON REVERSE SIDE

DPAC TECHNOLOGIES CORP.

Two New Ways to Vote

VOTE BY INTERNET OR TELEPHONE

24 Hours a Day - 7 Days a Week

It's Fast and Convenient

| | | INTERNET | OR | | | TELEPHONE | OR | | | MAIL |

| | | www.proxyvoting.com/DPAC | | | | 1-888-426-7035 | | | | |

• |

|

Go to the website listed above. |

|

• |

|

Use any touch-tone telephone. |

|

• |

|

Mark, sign and date your proxy card. |

• |

|

Have your proxy card ready. |

|

• |

|

Have your proxy card ready. |

|

• |

|

Detach your proxy card. |

• |

|

Enter your Control Number located above your name and address. |

|

• |

|

Enter your Control Number above your name and address. |

|

• |

|

Return your proxy card in the postage paid envelope provided. |

• |

|

Follow the simple instructions on the website. |

|

• |

|

Follow the simple recorded instructions. |

|

|

|

|

- DETACH PROXY CARD HERE IF YOU ARE NOT VOTING BY THE INTERNET OR TELEPHONE -

| 1. Board of Directors recommends a vote FOR the nominees. | | | | | | |

ELECTION OF DIRECTORS |

o |

|

FOR all nominees listed below |

|

o |

|

WITHHOLD AUTHORITY to vote for all nominees listed below |

|

o |

|

*EXCEPTIONS |

Nominees: 01 Richard J. Dadamo, 02 Ted Bruce, 03 Samuel W. Tishler, 04 Gordon M. Watson and 05 Richard H. Wheaton. |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee mark the "Exceptions" box and write that nominee's name on the space provide below.) |

EXCEPTIONS |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

|

|

|

|

|

|

|

If you wish to vote in accordance with the recommendations of management, all you need to do is sign and return this card. The Trustee cannot vote your shares unless you sign and return the card. |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

|

|

|

|

|

|

|

Please sign exactly as name appears hereon. Joint owners should each sign. Where applicable, indicate position or representative capacity. |

|

|

|

|

|

|

|

Dated: �� , 2002 |

|

|

|

|

|

|

|

|

| | | | | | | | Signature |

|

|

|

|

|

|

|

|

| | | | | | | | Signature |

| | | | | | | | | | | | |

| | | | | | | | | | | |

Please Detach Here

- You Must Detach This Portion of the Proxy Card -

Before Returning it in the Enclosed Envelope

QuickLinks

PROXY STATEMENTELECTION OF DIRECTORS(Proposal 1)EXECUTIVE MANAGEMENTFEES PAID TO THE INDEPENDENT ACCOUNTANTSEXECUTIVE COMPENSATIONEmployment Agreements and Change in Control ArrangementsAggregated Option Exercises In Last Fiscal Year and Fiscal Year-End Option ValuesPERFORMANCE GRAPHOWNERSHIP OF COMMON STOCK