QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2003

CENTRAL FUND OF CANADA LIMITED

(Translation of registrant's name into English)

Suite 805, 1323 - 15th Avenue S.W., Calgary, Alberta, Canada T3C 0X8

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-Fo Form 40-Fý

[Indicate by check mark whether the registrant by furnishing the information in this Form is also hereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under theSecurities Exchange Act of 1934.

YESo NOý

[If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CENTRAL FUND OF CANADA LIMITED |

| | | (Registrant) |

Date JUNE 5, 2003 |

|

By: |

"(Signed)" J.C. STEFAN SPICER |

| | |

|

| | | | (Signature)* |

*Print the name and title under the

signature of the signing officer | | | J.C. Stefan Spicer, President & CEO |

|

Portfolio

at

April 30, 2003 |

|

Corporate Information

|

|

|

| Investor Inquiries | | Head Office |

|

P.O. Box 7319

55 Broad Leaf Crescent

Ancaster, Ontario

Canada L9G 3N6 | | Hallmark Estates

805, 1323-15th Avenue S.W.

Calgary, Alberta

Canada T3C 0X8 |

Telephone: 905/648-7878

Fax: 905/648-4196 |

|

Telephone: 403/228-5861

Fax: 403/228-2222 |

| Website: www.centralfund.com |

| E-mail: info@centralfund.com |

|

Stock Exchange Listings |

|

| | Electronic

Ticker Symbol

| | Newspaper

Quote Symbol

|

|---|

|

| AMEX: | | | | |

| Class A shares | | CEF | | CFCda |

TSE: |

|

|

|

|

| Class A shares | | CEF.A | | CFund A |

|

Net Asset Value Information

The net asset value per Class A share is available daily by calling Central.

The Thursday net asset value is published in financial newspapers in the United States and Canada.

In Canada it is also published daily in theGlobe and Mail Report on BusinessFund Asset Values table.

2ndQUARTER |

|

INTERIM REPORT TO SHAREHOLDERS

for the six months ended April 30, 2003 |

2nd QUARTER REPORT

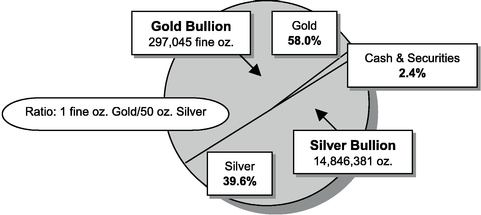

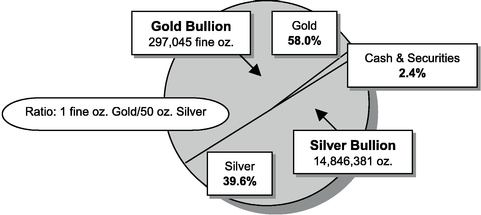

Central Fund is currently 97.2% invested in gold and silver bullion. At April 30, 2003 Central Fund's gold holdings were 292,056 fine oz. of physical bullion and 4,989 fine oz. of gold bullion certificates. Silver holdings were 14,600,865 oz. of physical bullion and 245,516 oz. of silver bullion certificates. The physical bullion is insured and held in safekeeping by a Canadian chartered bank in segregated vault storage. Central Fund continues to fulfil its mandate as "The Sound Monetary Fund".

On behalf of the Board of Directors:

"J.C. STEFAN SPICER"

J.C. Stefan Spicer, President & CEO

FINANCIAL REVIEW

Results of Operations — Change in Net Assets

Net assets increased by approximately $40,770,000 during the six months ended April 30, 2003, and by approximately $9,747,000 during the three months then ended. Of this amount, $37,753,154 (six months) and $23,194,954 (three months) were the result of the issuance of 3,500,000 Class A shares in January 2003 and 5,448,800 Class A shares in February 2003 through private placements. In both cases, these shares were issued at a premium to net asset value such that there was no dilution of existing Class A shareholders' interests. Details of the private placements are provided in Note 3 to the accompanying financial statements. The balance of this increase in net assets was primarily the result of higher gold and silver prices at April 30, 2003 compared to October 31, 2002 as described below.

The $0.17 or 4.6% increase in net assets per Class A share expressed in U.S. dollar terms during the past six months was due primarily to the 6.3% increase in the price of gold and the 2.9% increase in the price of silver during the period. In contrast, net assets per Class A share as expressed in Canadian dollar terms decreased by $0.22, or 3.8%, as the increases described above were more than offset by the 8.1% decrease in the U.S. dollar relative to the Canadian dollar. The components of the change in net asset value per Class A share in U.S. and Canadian dollars are summarized in the adjacent table. |

| Net Asset Value per Class A Share | |

| |

|---|

| | U.S.$ Terms

| | Cdn. $ Terms

| |

|---|

| October 31, 2002 | | $ | 3.70 | | $ | 5.77 | |

| Changes due to: | | | | | | | |

| | Gold price | | | .14 | | | .21 | |

| | Silver price | | | .04 | | | .06 | |

| | Stronger Cdn. $ | | | N/A | | | (.47 | ) |

| | Other | | | (.01 | ) | | (.02 | ) |

| |

| Total changes | | | .17 | | | (.22 | ) |

| |

| April 30, 2003 | | $ | 3.87 | | $ | 5.55 | |

Results of Operations��— Net Loss

The net losses for the three and the six-month periods ended April 30, 2003 were higher in total than the net losses for the same periods in 2002, but resulted in substantially the same small net loss per share as for those corresponding periods of the prior year. The net proceeds from the Class A share issuances completed by the Company over the past thirteen months, (approximately $101,400,615) have, as expected, had an impact on both income and expenses. The Company has used the bulk of the proceeds from these Class A share issuances to purchase gold and silver bullion, primarily in bar form. The balance has been retained in interest-bearing cash deposits. As such, interest income has increased as a result of maintaining higher average cash balances.

Certain expenses vary in proportion to net asset levels, such as administration fees (that are scaled) and income taxes. These expenses rose as a result of increased net assets. The increase in shareholder information costs reflects higher levels of activity brought about by the increased number of shareholders. Safekeeping fees and bullion insurance costs increased as a result of the purchases of physical gold and silver discussed above. Professional fees increased as a result of legal and audit work required to comply with new corporate governance rules and regulations.

Despite an increase in overall expense levels, the operating expenses (before income taxes) as a percentage of average of the month end net assets declined significantly, being 0.35% for the six months ended April 30, 2003 compared to 0.49% for the same six-month period in 2002. The issuances of Class A shares during the past 13 months resulting in increased net asset levels have been instrumental in substantially reducing the ongoing operating expenses on a per-share basis. Each of these share issuances was priced on a non-dilutive and accretive basis thereby protecting and enhancing the existing shareowners' interests.

Liquidity and Capital Resources

Central Fund's dollar liquidity objective is to hold cash reserves primarily for the payment of operating expenses, taxes and Class A share dividends. Should Central Fund not have sufficient cash to meet its needs, a nominal portion of Central Fund's bullion holdings may be sold to fund tax and dividend payments, provide working capital, and pay for redemptions of Class A shares (if any).

For the six months ended April 30, 2003, Central Fund's cash reserves increased by $1,141,062 as amounts used to pay operating expenses, taxes and the Class A share dividend were more than offset by amounts retained in interest-bearing cash deposits for working capital purposes from the private placements completed in January and February 2003. Management monitors Central Fund's cash position with an emphasis on maintaining its mandate to hold maximum amounts of gold and silver bullion.

Statements of Net Assets

(expressed in U.S. dollars, unaudited)(note 1)

| | April 30

2003

| | October 31 2002

| |

|---|

| | |

| |

| |

| Net Assets: | | | | | | |

| Gold bullion at market, average cost $111,164,364 (2002: $89,697,793) (note 2) | | $ | 100,029,804 | | 75,716,165 | |

| Silver bullion at market, average cost $103,068,226 (2002: $89,046,426) (note 2) | | | 68,367,586 | | 53,460,056 | |

| Marketable securities at market, average cost $89,430 | | | 44,432 | | 41,486 | |

| Interest — bearing cash deposits | | | 5,039,511 | | 3,898,449 | |

| Prepaid insurance, interest receivable and other | | | 10,285 | | 33,557 | |

| | |

| |

| |

|

|

|

173,491,618 |

|

133,149,713 |

|

| Accrued liabilities | | | (273,826 | ) | (344,138 | ) |

| Dividends payable | | | — | | (357,975 | ) |

| | |

| |

| |

Net assets representing shareholders' equity |

|

$ |

173,217,792 |

|

132,447,600 |

|

| | |

| |

| |

| Represented by: | | | | | | |

| Capital Stock (note 3): | | | | | | |

| | 44,746,320 (2002: 35,797,520) Class A shares issued | | $ | 191,102,209 | | 153,349,055 | |

| | 40,000 Common shares issued | | | 19,458 | | 19,458 | |

| | |

| |

| |

|

|

|

191,121,667 |

|

153,368,513 |

|

| Contributed surplus (note 4) | | | 27,976,323 | | 28,695,029 | |

| Unrealized depreciation of investments | | | (45,880,198 | ) | (49,615,942 | ) |

| | |

| |

| |

|

|

$ |

173,217,792 |

|

132,447,600 |

|

| | |

| |

| |

| Net Asset Value Per Share (expressed in U.S. dollars): | | | | | | |

| Class A shares | | $ | 3.87 | | 3.70 | |

| Common shares | | $ | 0.87 | | 0.70 | |

| | |

| |

| |

| Net Asset Value Per Share (expressed in Canadian dollars): | | | | | | |

| Class A shares | | $ | 5.55 | | 5.77 | |

| Common shares | | $ | 1.25 | | 1.09 | |

| | |

| |

| |

| Exchange rate: U.S. $1.00 = Cdn | | $ | 1.4335 | | 1.5603 | |

| | |

| |

| |

Notes:

- 1.

- The accounting policies used in the preparation of these unaudited interim financial statements conform with those presented in Central Fund's October 31, 2002 audited annual financial statements. These interim financial statements do not include all of the disclosures included in the annual financial statements and accordingly should be read in conjunction with the annual financial statements.

- 2.

- Details of gold and silver bullion holdings at April 30, 2003, are as follows:

|

|---|

Holdings

| | Gold

| |

| | Silver

|

|---|

| 100 & 400 fine oz bars | | 292,056 | | 1000 oz bars | | 14,600,865 |

| Certificates | | 4,989 | | Certificates | | 245,516 |

| | |

| | | |

|

| Total fine ounces | | 297,045 | | Total ounces | | 14,846,381 |

|

|

|

|---|

Market Value:

| | Per Fine Ounce

| | Per Ounce

|

|---|

| October 31, 2002 | | U.S. $316.90 | | U.S. $4.4750 |

| April 30, 2003 | | U.S. $336.75 | | U.S. $4.6050 |

|

|

- 3.

- On January 30, 2003, the Company, through a private placement, issued 3,500,000 Class A shares for gross proceeds, net of underwriting fees of $611,800, of $14,683,200. Costs relating to this private placement were approximately $125,000 and net proceeds were approximately $14,558,200. These costs are $180,900 lower than that estimated and disclosed in the first quarter report.

The Company used the net proceeds from this private placement to purchase 22,517 fine ounces of gold at a cost of $8,110,651 and 1,120,000 ounces of silver at a cost of $5,488,000, both in physical bar form. The balance of the net proceeds, approximately $959,549, was retained by the Company in interest-bearing cash deposits for working capital purposes.

On February 14, 2003, the Company, through a private placement, issued 5,448,800 Class A shares for gross proceeds, net of underwriting fees of $1,039,767, of $23,425,345. Costs relating to this private placement were approximately $230,391 and net proceeds were approximately $23,194,954. Combined with the downward adjustment to share issue costs relating to the January 30, 2003 private placement of $180,900, the net proceeds for the three months ended April 30, 2003 total $23,375,854.

Statements of Changes in Net Assets

(expressed in U.S. dollars, unaudited)(note 1)

| | Six months ended April 30

| | Three months ended April 30

| |

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| |

|---|

| | |

| |

| |

| |

| |

| Net assets at beginning of period | | $ | 132,447,600 | | 66,351,795 | | $ | 163,470,861 | | 66,638,054 | |

| | |

| |

| |

| |

| |

| Add (deduct): | | | | | | | | | | | |

| | Unrealized appreciation (depreciation) of investments during the period | | | 3,735,744 | | 5,883,533 | | | (13,244,550 | ) | 5,412,831 | |

| | Net loss | | | (718,706 | ) | (431,017 | ) | | (384,373 | ) | (246,574 | ) |

| | Net issuance of Class A Shares | | | 37,753,154 | | 15,600,000 | | | 23,375,854 | | 15,600,000 | |

| | |

| |

| |

| |

| |

| | Increase in net assets during the period | | | 40,770,192 | | 21,052,516 | | | 9,746,931 | | 20,766,257 | |

| | |

| |

| |

| |

| |

| Net assets at end of period | | $ | 173,217,792 | | 87,404,311 | | $ | 173,217,792 | | 87,404,311 | |

| | |

| |

| |

| |

| |

Statements of Loss

(expressed in U.S. dollars, unaudited)(note 1)

| | Six months ended April 30

| | Three months ended April 30

| |

|---|

| | 2003

| | 2002

| | 2003

| | 2002

| |

|---|

| | |

| |

| |

| |

| |

| Income: | | | | | | | | | | | |

| | Interest | | $ | 23,542 | | 9,592 | | $ | 13,861 | | 4,683 | |

| | Dividends | | | 115 | | 199 | | | 60 | | 83 | |

| | |

| |

| |

| |

| |

| | | | 23,657 | | 9,791 | | | 13,921 | | 4,766 | |

| | |

| |

| |

| |

| |

| Expenses: | | | | | | | | | | | |

| Administration fees | | | 313,106 | | 176,553 | | | 165,711 | | 93,207 | |

| | Shareholder information | | | 71,597 | | 62,155 | | | 40,651 | | 40,336 | |

| | Safekeeping, insurance and bank charges | | | 69,454 | | 44,215 | | | 37,450 | | 22,050 | |

| | Professional fees | | | 37,440 | | 15,209 | | | 19,446 | | 8,193 | |

| | Directors' fees and expenses | | | 25,518 | | 26,519 | | | 11,982 | | 11,945 | |

| | Registrar and transfer agents' fees | | | 24,334 | | 22,576 | | | 17,575 | | 16,228 | |

| | Miscellaneous | | | 789 | | 706 | | | 449 | | 368 | |

| | Foreign currency exchange loss | | | 12,530 | | 1,682 | | | 5,703 | | 932 | |

| | |

| |

| |

| |

| |

| | | | 554,768 | | 349,615 | | | 298,967 | | 193,259 | |

| | |

| |

| |

| |

| |

| | Loss from operations before income taxes | | | (531,111 | ) | (339,824 | ) | | (285,046 | ) | (188,493 | ) |

| | Income taxes | | | (187,595 | ) | (91,193 | ) | | (99,327 | ) | (58,081 | ) |

| | |

| |

| |

| |

| |

| Net loss (note 5) | | $ | (718,706 | ) | (431,017 | ) | $ | (384,373 | ) | (246,574 | ) |

| | |

| |

| |

| |

| |

| Net loss per share: | | | | | | | | | | | |

| | Class A shares | | $ | (.02 | ) | (.02 | ) | $ | (.01 | ) | (.01 | ) |

| | Common shares | | $ | (.02 | ) | (.02 | ) | $ | (.01 | ) | (.01 | ) |

| | |

| |

| |

| |

| |

Notes:

The Company used the net proceeds from this private placement to purchase 35,600 fine ounces of gold (34,000 ounces in physical bar form and 1,600 ounces in certificate form) at a cost of $13,355,920, and 1,780,000 ounces of silver (1,700,000 ounces in physical bar form and 80,000 ounces in certificate form) at a cost of $8,533,800.

The balance of the net proceeds, approximately $1,305,234, was retained by the Company in interest-bearing cash deposits for working capital purposes.

- 4.

- In 1985 the shareholders authorized the use of contributed surplus to eliminate any deficit that may arise from losses and on the payment of the Class A shares' stated dividend. Accordingly, $718,706 (2002, $431,017) has been transferred from contributed surplus on April 30, 2003 and 2002 representing the net loss for the six months then ended. This change did not affect the net asset value of the Company.

- 5.

- Under Canadian generally accepted accounting principles, the Company records the unrealized appreciation (depreciation) of its investments as a component of shareholders' equity. Under accounting principles generally accepted for investment companies in the United States, these amounts are reflected in the statements of loss. Net income for the six months ending April 30, 2003 would be $3,017,038; (2002, $5,452,516) under United States principles. The net assets of the Company are identical under both Canadian and United States generally accepted accounting principles.

QuickLinks

Net Asset Value Information