QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2005

CENTRAL FUND OF CANADA LIMITED

(Translation of registrant's name into English)

Suite 805, 1323 - 15th Avenue S.W., Calgary, Alberta, Canada T3C 0X8

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F o Form 40-F ý

[Indicate by check mark whether the registrant by furnishing the information in this Form is also hereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under theSecurities Exchange Act of 1934.

YES o NO ý

[If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | CENTRAL FUND OF CANADA LIMITED

(Registrant) |

Date August 9, 2005 |

|

By: |

|

(Signed) "J.C. STEFAN SPICER"

|

*Print the name and title under the signature of the signing officer | | | | (Signature)*

J.C. Stefan Spicer, President & CEO |

EXHIBIT INDEX

CENTRAL FUND OF CANADA LIMITED

Exhibits to Form 6-K 3rd Quarter Report at July 31, 2005

| Exhibit A: | | Form 52-109F2 — Certification of Disclosure in Issuers' Annual and Interim Filings, Chief Executive Officer. |

Exhibit B: |

|

Form 52-109F2 — Certification of Disclosure in Issuers' Annual and Interim Filings, Chief Financial Officer. |

| |  |

Portfolio

at

July 31, 2005 | |  |

Corporate Information

|

Investor Inquiries

| | Head Office

| | Stock Exchange Listings

|

The Central Group (Alberta) Ltd.

|

|

|

|

Electronic

Ticker Symbol

|

|

Newspaper

Quote Symbol

|

55 Broad Leaf Crescent

P.O. Box 7319

Ancaster, Ontario

Canada L9G 3N6

Telephone: (905) 648-7878

Fax: (905) 648-4196

Website: www.centralfund.com

E-mail: info@centralfund.com | | Hallmark Estates

805, 1323-15th Avenue S.W.

Calgary, Alberta

Canada T3C 0X8

Telephone: (403) 228-5861

Fax: (403) 228-2222 | |

AMEX:

Class A shares

TSX:

Class A shares | |

CEF

CEF.NV.A and CEF.NV.U | |

CFCda

CFund A |

Net Asset Value Information

The net asset value per Class A share is available daily by calling Investor Inquiries.

The Thursday net asset value is published in financial newspapers in the United States and Canada.

In Canada, the net asset value is also published daily in theGlobe and Mail Report on Business Fund Asset Values table.

|

3RD QUARTER |

|

INTERIM REPORT TO SHAREHOLDERS

for the nine months ended July 31, 2005 |

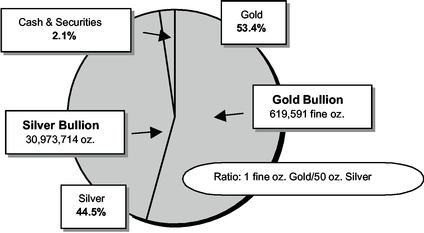

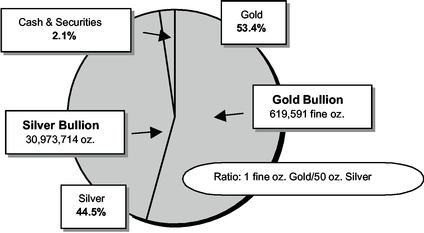

3rd QUARTER REPORT

Central Fund is currently 97.9% invested in gold and silver bullion. At July 31, 2005 Central Fund's gold holdings were 614,242 fine oz. of physical bullion and 5,349 fine oz. of gold bullion certificates. Silver holdings were 30,728,142 oz. of physical bullion and 245,572 oz. of silver bullion certificates. The physical bullion is insured and held in safekeeping by a Canadian chartered bank in segregated vault storage. Central Fund continues to fulfil its mandate as "The Sound Monetary Fund".

On behalf of the Board of Directors:

| | | J.C. Stefan Spicer, President |

MANAGEMENT'S DISCUSSION & ANALYSIS

Selected Financial Information

The following table summarizes quarterly financial information:

| | Quarter ended (US$)

|

|---|

| | Jul. 31, 2005

| | Apr. 30, 2005

| | Jan. 31, 2005

| | Oct. 31, 2004

|

|---|

| Unrealized appreciation (depreciation) of investments (in millions) | | $ | 1.0 | | $ | 16.4 | | $ | (16.7 | ) | $ | 37.3 |

| Net income (loss) for the period (in millions) | | $ | 0.3 | | $ | 15.6 | | $ | (17.5 | ) | $ | 36.7 |

| Net income (loss) per share | | $ | 0.00 | | $ | 0.17 | | $ | (0.19 | ) | $ | 0.53 |

|

|

Jul. 31, 2004

|

|

Apr. 30, 2004

|

|

Jan. 31, 2004

|

|

Oct. 31, 2003

|

|---|

| Unrealized appreciation (depreciation) of investments (in millions) | | $ | 13.8 | | $ | (26.7 | ) | $ | 21.8 | | $ | 10.2 |

| Net income (loss) for the period (in millions) | | $ | 13.2 | | $ | (27.3 | ) | $ | 21.3 | | $ | 9.8 |

| Net income (loss) per share | | $ | 0.20 | | $ | (0.39 | ) | $ | 0.41 | | $ | 0.23 |

Review of Operations

Central Fund's earned income objective is secondary to its investment objective of holding the vast majority of its net assets in gold and silver bullion. Generally, Central Fund only seeks to maintain adequate cash reserves to enable it to pay operating expenses, taxes and Class A share dividends. Because gold and silver bullion do not generate revenue, Central Fund's actual revenues are a miniscule percentage of its net assets. However, CICA Accounting Guideline 18, requires Central Fund to record unrealized appreciation (depreciation) of investments in income.

The net loss (inclusive of unrealized depreciation of investments) for the nine months ended July 31, 2005 was $1,612,077 compared to net income of $7,267,038 for the same period in 2004. Since July 31, 2004, net assets have increased by $115,348,075 or 30%. The Company has used the bulk of the proceeds of the Class A share issue in November 2004 to purchase gold and silver bullion, primarily in bar form. Certain expenses, such as administration fees are scaled and, together with income taxes, vary in proportion to net asset levels, or, in the case of stock exchange fees (included in shareholder information), with the number of Class A shares issued. Safekeeping fees and bullion insurance costs increased as a result of the purchases of additional physical gold and silver bullion and increases in storage fees. Administration fees remitted to The Central Group Alberta Limited for the nine months increased to $1,154,645 from $787,100, such increase being at the rate of one-quarter of one percent per annum on the increased assets under administration. The Company incurred fees totaling $55,311 (2004: $11,806) to a legal firm of which one of the Company's directors is a partner. Professional fees increased as a result of legal and audit work required to adopt recently imposed accounting guidelines and corporate governance rules and regulations as well as preparations for the Special Meeting of Class A Shareholders in February 2005.

Operating expenses (which exclude income taxes) as a percentage of average net assets, were 0.39% for the nine months ended July 31, 2005 compared to 0.38% for the same nine-month period in 2004. For the twelve months ended July 31, 2005, the operating expense ratio was 0.50% compared to 0.51% for the prior twelve-month period.

Liquidity and Capital Resources

All of Central Fund's assets are immediately marketable and highly liquid.

Central Fund's dollar liquidity objective is to hold cash reserves primarily for the payment of operating expenses, taxes and Class A share dividends. Should Central Fund not have sufficient cash to meet its needs, a nominal portion of Central Fund's bullion holdings may be sold to fund tax and dividend payments, provide working capital, and pay for redemptions, if any, of Class A shares.

For the nine months ended July 31, 2005, Central Fund's cash reserves increased by $1,683,791 as amounts used to pay operating expenses, taxes and the Class A share dividend were more than offset by amounts retained in interest-bearing cash deposits for working capital purposes from the public offering completed in November 2004. Management monitors Central Fund's cash position with an emphasis on maintaining its mandate to hold maximum amounts of gold and silver bullion.

Forward-looking Observations

Changes in the market prices of gold and silver have an impact on the net asset value per Class A share. Assuming as a constant exchange rate, the rate which existed on July 31, 2005 of $1.2259 Cdn. for each U.S. dollar together with holdings of gold and silver bullion which existed on that date, a 10% change in the price of gold would increase or decrease the net asset value per share by approximately $0.28 per share or Cdn. $0.34 per share. On the same basis, a 10% change in the price of silver would increase or decrease the net asset value per share by approximately $0.23 per share or Cdn. $0.28 per share. If both gold and silver prices were to change by 10% simultaneously in the same direction, the net asset value per share would increase or decrease by approximately $0.51 per share or Cdn. $0.63 per share.

Statement of Net Assets

(expressed in U.S. dollars, unaudited)(note 1)

| | July 31,

2005

| | October 31,

2004

| |

|---|

| Net assets: | | | | | | |

| Gold bullion at market, average cost $246,833,606 (2004: $206,043,206) (note 2) | | $ | 265,804,692 | | 222,814,301 | |

| Silver bullion at market, average cost $216,589,466 (2004: $181,213,467) (note 2) | | | 221,307,187 | | 187,403,793 | |

| Marketable securities at market, average cost $89,430 (2004: $89,430) | | | 56,883 | | 68,221 | |

| Interest-bearing cash deposits | | | 11,166,327 | | 9,482,536 | |

| Prepaid insurance, interest receivable and other | | | 100,743 | | 81,351 | |

| | |

| |

| |

| | | | 498,435,832 | | 419,850,202 | |

| Accrued liabilities | | | (794,330 | ) | (707,660 | ) |

| Dividends payable | | | — | | (792,963 | ) |

| | |

| |

| |

| Net assets representing shareholders' equity | | $ | 497,641,502 | | 418,349,579 | |

| | |

| |

| |

| Represented by: | | | | | | |

| Capital stock (note 3): | | | | | | |

| | 94,296,320 (2004: 79,296,320) Class A shares issued | | $ | 452,615,394 | | 371,711,394 | |

| | 40,000 Common shares issued | | | 19,458 | | 19,458 | |

| | |

| |

| |

| | | | 452,634,852 | | 371,730,852 | |

| Contributed surplus (note 4) | | | 21,350,390 | | 23,678,513 | |

| Retained earnings inclusive of unrealized appreciation of investments | | | 23,656,260 | | 22,940,214 | |

| | |

| |

| |

| | | $ | 497,641,502 | | 418,349,579 | |

| | |

| |

| |

Net asset value per share (expressed in U.S. dollars): |

|

|

|

|

|

|

| Class A shares | | $ | 5.28 | | 5.27 | |

| Common shares | | $ | 2.28 | | 2.27 | |

| | |

| |

| |

Net asset value per share (expressed in Canadian dollars): |

|

|

|

|

|

|

| Class A shares | | $ | 6.47 | | 6.44 | |

| Common shares | | $ | 2.79 | | 2.78 | |

| | |

| |

| |

Exchange rate: U.S. $1.00 = Cdn. |

|

$ |

1.2259 |

|

1.2207 |

|

| | |

| |

| |

Notes:

- 1.

- The accounting policies used in the preparation of these unaudited interim financial statements conform with those presented in Central Fund's October 31, 2004 audited annual financial statements. These interim financial statements do not include all of the disclosures included in the annual financial statements and accordingly should be read in conjunction with the annual financial statements.

- 2.

- Details of gold and silver bullion holdings at July 31, 2005, are as follows:

| | Holdings

| | Gold

| |

| | Silver

|

|---|

| | | 100 & 400 fine oz bars | | 614,242 | | 1000 oz bars | | 30,728,142 |

| | | Certificates | | 5,349 | | Certificates | | 245,572 |

| | | | |

| | | |

|

| | | Total fine ounces | | 619,591 | | Total ounces | | 30,973,714 |

| | | | |

| | | |

|

| | Market Value:

| | Per Fine Ounce

| | Per Ounce

|

|---|

| | | October 31, 2004 | | U.S. $425.55 | | U.S. $7.160 |

| | | July 31, 2005 | | U.S. $429.00 | | U.S. $7.145 |

| | |

| |

| |

|

- 3.

- On November 3, 2004, the Company, through a public offering, issued 15,000,000 Class A shares for proceeds of $81,504,000 net of underwriting fees of $3,396,000. Costs relating to this public offering were approximately $600,000 and net proceeds were approximately $80,904,000.

The Company used the net proceeds from this public offering to purchase 96,000 fine ounces of gold at a cost of $40,790,400 and 4,800,000 ounces of silver at a cost of $35,376,000, both in physical bar form except for 67 ounces of gold which were received in certificate form. The balance of approximately $4,737,600, was retained by the Company in interest-bearing cash deposits for working capital purposes.

- 4.

- Contributed surplus is used to eliminate any deficit that may arise from net losses before unrealized appreciation (depreciation) of investments and on the payment of the Class A shares' stated dividend per share. Accordingly, $2,328,123 (2004, $1,696,316) has been transferred from contributed surplus on July 31, 2005 and 2004 representing the net loss before unrealized appreciation (depreciation) of investments for the nine months then ended. This change does not affect the net asset value of the Company.

- 5.

- For the nine months ended July 31, 2005, the Company incurred fees totaling $55,311 (2004: $11,806) to a legal firm of which one of the Company's directors is a partner, and to the administrator $1,154,645 (2004: $787,700).

Statement of Changes in Net Assets

(expressed in U.S. dollars, unaudited)(note 1)

| | Nine months ended July 31

| | Three months ended July 31

|

|---|

| | 2005

| | 2004

| | 2005

| | 2004

|

|---|

| Net assets at beginning of period | | $ | 418,349,579 | | 194,663,349 | | $ | 497,367,329 | | 369,046,249 |

| | |

| |

| |

| |

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

| | Net income (loss) | | | (1,612,077 | ) | 7,267,038 | | | 274,173 | | 13,247,178 |

| | Net issuance of Class A shares | | | 80,904,000 | | 180,363,040 | | | — | | — |

| | |

| |

| |

| |

|

| | Increase in net assets during the period | | | 79,291,923 | | 187,630,078 | | | 274,173 | | 13,247,178 |

| | |

| |

| |

| |

|

| Net assets at end of period | | $ | 497,641,502 | | 382,293,427 | | $ | 497,641,502 | | 382,293,427 |

| | |

| |

| |

| |

|

Statement of Income (Loss)

(expressed in U.S. dollars, unaudited)(note 1)

| | Nine months ended July 31

| | Three months ended July 31

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

Income: |

|

|

|

|

|

|

|

|

|

|

|

| | Interest | | $ | 234,144 | | 37,908 | | $ | 129,942 | | 15,668 | |

| | Dividends | | | 894 | | 390 | | | 130 | | 109 | |

| Unrealized appreciation of investments | | | 716,046 | | 8,963,354 | | | 962,155 | | 13,822,086 | |

| | |

| |

| |

| |

| |

| | | | 951,084 | | 9,001,652 | | | 1,092,227 | | 13,837,863 | |

| | |

| |

| |

| |

| |

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

| | Administration fees | | | 1,154,645 | | 787,100 | | | 381,843 | | 302,592 | |

| | Safekeeping, insurance and bank charges | | | 310,400 | | 147,241 | | | 156,336 | | 47,082 | |

| | Shareholders' information | | | 210,294 | | 145,029 | | | 23,539 | | 18,067 | |

| | Professional fees | | | 109,556 | | 39,854 | | | 20,521 | | 10,311 | |

| | Directors' fees and expenses | | | 72,942 | | 42,035 | | | 25,108 | | 15,766 | |

| | Registrar and transfer agents' fees | | | 57,917 | | 37,448 | | | 10,642 | | 9,228 | |

| | Miscellaneous | | | 886 | | 1,364 | | | 275 | | 393 | |

| | Foreign exchange (gain) loss | | | 29,530 | | 17,581 | | | (1,602 | ) | 2,795 | |

| | |

| |

| |

| |

| |

| | | | 1,946,170 | | 1,217,652 | | | 616,662 | | 406,234 | |

| | |

| |

| |

| |

| |

| Income (loss) before income taxes | | | (995,086 | ) | 7,784,000 | | | 475,565 | | 13,431,629 | |

| Income taxes | | | (616,991 | ) | (516,962 | ) | | (201,392 | ) | (184,451 | ) |

| | |

| |

| |

| |

| |

| Net income (loss) | | $ | (1,612,077 | ) | 7,267,038 | | $ | 274,173 | | 13,247,178 | |

| | |

| |

| |

| |

| |

Net income (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

| | Class A shares | | $ | (.02 | ) | .09 | | $ | .00 | | .20 | |

| Common shares | | $ | (.02 | ) | .09 | | $ | .00 | | .20 | |

| | |

| |

| |

| |

| |

Statement of Retained Earnings

(expressed in U.S. dollars, unaudited)(note 1)

| | Nine months ended July 31

| | Three months ended July 31

| |

|---|

| | 2005

| | 2004

| | 2005

| | 2004

| |

|---|

| Balance at beginning of period | | $ | 22,940,214 | | (23,281,337 | ) | $ | 22,694,105 | | (28,140,069 | ) |

| | Net income (loss) | | | (1,612,077 | ) | 7,267,038 | | | 274,173 | | 13,247,178 | |

| | |

| |

| |

| |

| |

| | | | 21,328,137 | | (16,014,299 | ) | | 22,968,278 | | (14,892,891 | ) |

| | Transfer from contributed surplus (note 4) | | | 2,328,123 | | 1,696,316 | | | 687,982 | | 574,908 | |

| | |

| |

| |

| |

| |

| Balance at end of period | | $ | 23,656,260 | | (14,317,983 | ) | $ | 23,656,260 | | (14,317,983 | ) |

| | |

| |

| |

| |

| |

QuickLinks

SIGNATURESEXHIBIT INDEX3rd QUARTER REPORTMANAGEMENT'S DISCUSSION AND ANALYSISStatement of Net AssetsStatement of Changes in Net Assets