The Role of Central Fund

To serve investors as "The Sound Monetary Fund".

To hold gold and silver bullion on a secure basis for the

convenience of investors in the shares of Central Fund.

| Investment Policies & Restrictions | The articles of incorporation require that at least 75% of Central Fund's non-cash assets be invested in gold and silver bullion investments. This cannot be changed without shareholder approval. | |

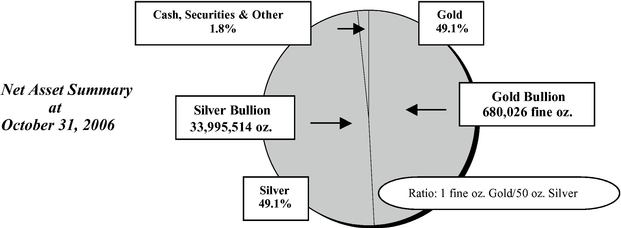

The stated investment policy of the Board of Directors requires Central Fund to maintain a minimum of 90% of its net assets in gold and silver bullion of which at least 85% must be in physical form. On October 31, 2006, 98.2% of Central Fund's net assets were invested in gold and silver bullion. Of this bullion, 99.2% was in physical form and 0.8% was in certificate form. | ||

Central Fund's physical gold and silver bullion holdings may not be loaned, subjected to options or otherwise encumbered in any way. | ||

Safeguards | Central Fund's bullion is stored on a fully segregated basis in the underground vaults of the Canadian Imperial Bank of Commerce, one of the largest banks in North America in terms of total assets. | |

The Bank may only release physical bullion holdings upon receipt of an authorizing resolution of Central Fund's Board of Directors. | ||

Insurance is carried on the physical gold and silver bullion holdings against destruction, disappearance or wrongful abstraction. | ||

Bullion holdings and bank vault security are inspected twice annually by directors and/or officers of Central Fund. On every occasion, inspections are required to be performed in the presence of both Central Fund's external auditors and bank personnel. | ||

Central Fund is subject to the extensive regulations and reporting requirements of the United States Securities and Exchange Commission, two stock exchanges and various Canadian provincial securities regulatory authorities. | ||

Conveniences | Central Fund's Class A shares are listed on the American Stock Exchange (CEF) and on the Toronto Stock Exchange (CEF.A in Canadian dollars and CEF.U in U.S. dollars). Making a gold and silver bullion investment through Central Fund is as easy as calling one's stockbroker or investment dealer. | |

The stock exchange listings provide readily quoted, liquid markets for the Class A shares of Central Fund. The bid/ask spread is considerably less than the buying and selling prices of outright bullion purchases, especially for small transactions. | ||

All expenses of handling, storage and insurance of bullion are paid by Central Fund. Unlike most other forms of bullion investment, there are no ownership costs paid directly by the investor. As well, there are no bullion assay charges to the shareholder upon the sale, redemption or liquidation of the Class A shares of Central Fund. |

1

Directors' 45th Report to Shareholders

Central Fund of Canada Limited is a low-cost, convenient facility for investment ownership of gold and silver bullion. At October 31, 2006, 98.2% of Central Fund's net assets consisted of unencumbered, segregated, insured, passive holdings of gold and silver bullion.

Central Fund's Class A shares are listed on both the American Stock Exchange and the Toronto Stock Exchange, providing investors with a convenient precious metals investment alternative to the high costs of bullion buying or selling, handling, recording, storage, insurance and assay charges at time of sale.

Central Fund is also a desirable alternative to bullion coins that often include additional shipping and handling charges and are subject to sales tax costs in many North American jurisdictions.

Central Fund shares serve as a stock exchange tradeable bullion proxy and qualify for various "regulated capital accounts" such as IRAs, Keoghs, RRSPs, insurance, mutual and pension funds where direct holdings of physical commodities may be restricted or are very cumbersome to handle, maintain and secure. The role of Central Fund is more thoroughly described on page 1.

Net assets increased by $295,327,163 or 54.6% during the year. Of this amount, $84,192,981 was the result of two public offerings totalling 10,358,212 Class A shares, bringing the total number of Class A shares outstanding to 104,654,532 at year end. Both of these issues of additional shares were at premiums to net asset value assuring no dilution of existing Class A shareholders' equity interests. Details of these Class A share issues are provided in note 3 to the accompanying financial statements. The balance of the increase in net assets was primarily attributable to increased gold and silver prices at October 31, 2006. These increases were offset nominally by the operating expenses incurred during the year and payment of the annual U.S. $0.01 dividend on the Class A shares.

The resulting significant increase in net assets should benefit all shareholders going forward by reducing expenses on a per share basis due to the declining scale of administration and consulting fees and economies of scale on other operating expenses. See note 5 to the financial statements where it is reported that the schedule of administration and consulting fees was further reduced by the Administrator, effective on November 1, 2005.

During the fiscal year, the net asset value per Class A share, as reported in U.S. dollars, increased by 39.2% from $5.74 to $7.99. Gold prices increased by 28.3% during the fiscal year while silver prices increased by 55.6%. The net asset value per Class A share, as reported in Canadian dollars, while subject to the same effects described above, increased by a lesser amount of 32.5% primarily as a result of the 4.9% decrease in the exchange value of the U.S. dollar relative to the Canadian dollar.

Expenses (which exclude taxes) as a percentage of the average of the month-end net assets during the 2006 fiscal year were 0.48% compared to 0.51% in 2005.

The Company employed the bulk of the proceeds from the Class A share issuances referred to above to purchase gold and silver bullion in the ratio of approximately 50 ounces of silver to each 1 fine ounce of gold. Thus, the long-standing policy for the ratio of bullion holdings, as mandated by the Board of Directors, has been maintained.

As a result of the share issue related bullion purchases during the year, there has been a fractional change in the respective holdings of physical bars and bullion certificates. The comparative breakdown in physical bars at October 31, 2006 is: gold bars 99.2% (2005: 99.1%) and silver bars 99.3% (2005: 99.2%). The precise weight of delivered bars can vary slightly from the purchased weights. Such variances are then adjusted by the bank dealer and in Central Fund's accounts.

Securities regulatory authorities require that a detailed analysis of Central Fund's results be provided in a "Management's Discussion and Analysis of Financial Condition and Results of Operations".

2

Since Central Fund has an Administrator and is a passive holding company without any operations, or employees, a separate document entitled "Management's Discussion and Analysis" ("MD&A") is provided by Central Fund's Administrative Officers to meet regulatory requirements and should be read in conjunction with this Annual Report.

Gold and silver have a long demonstrated history as monetary instruments, officially and unofficially. Gold and silver derive intrinsic value from their unique characteristics of scarcity, consistency of quality, durability, resistance to corrosion, and convenience of use. Unlike fiat currencies, gold and silver do not fade away over the years with ever decreasing purchasing power. An ounce of gold or silver is a physical asset, not a negotiable or renegotiable promise, and most closely fits the true definition of "money" as a recognized medium of exchange and a store of value.

Prudence and history suggest that a portion of everyone's savings should be invested in physical gold and silver or their secure share equivalent as insurance for their own ultimate financial and economic well-being.

Upon this philosophical foundation, Central Fund of Canada Limited now enters its 46th year since inception and its 24th year of stewardship since its conversion in 1983 to "The Sound Monetary Fund". Central Fund holds only unencumbered, segregated, insured, long-term, passive holdings of true money in the form of gold and silver bullion. Central Fund continues to fulfill its mandate of providing a sound, secure, low-cost, convenient, exchange-tradable monetary alternative for conservative investors in its role as "The Sound Monetary Fund".

| Respectfully submitted, on behalf of the Board of Directors | ||

| "J.C. STEFAN SPICER" | ||

| December 18, 2006 | J.C. Stefan Spicer, President & CEO |

3

Financial Highlights

| | 2006 | As at October 31, 2005 | 2004 | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | U.S.$ | | Cdn.$ | U.S. $ | | Cdn.$ | U.S.$ | | Cdn.$ | |||||||||

| Total net assets (in millions) $ | 836.3 | 938.9 | 541.0 | 638.4 | 418.3 | 510.7 | ||||||||||||

| Net asset value per Class A share $ | 7.99 | 8.97 | 5.74 | 6.77 | 5.27 | 6.44 | ||||||||||||

| Net assets: | ||||||||||||||||||

| Gold bullion | 49.1% | 53.9% | 53.9% | |||||||||||||||

| Silver bullion | 49.1% | 44.5% | 44.8% | |||||||||||||||

| Cash, securities & other | 1.8% | 1.6% | 1.9% | |||||||||||||||

| 100.0% | 100.0% | 100.0% | ||||||||||||||||

| Gold — per fine ounce U.S. $ | 603.75 | 470.75 | 425.55 | |||||||||||||||

| Silver — per ounce U.S. $ | 12.08 | 7.765 | 7.160 | |||||||||||||||

| Exchange Rate $1.00 U.S. = Cdn. $ | 1.1227 | 1.1801 | 1.2207 | |||||||||||||||

4

Management's Responsibility for Financial Reporting

The accompanying financial statements of Central Fund of Canada Limited and all the information in this Annual Report are the responsibility of management and have been approved by the Board of Directors and its Audit Committee.

The financial statements have been prepared by management in accordance with Canadian generally accepted accounting principles. When alternative accounting methods exist, management has chosen those it deems most appropriate in the circumstances. Financial statements include certain amounts based on estimates and judgments. Management has determined such amounts on a reasonable basis in order to ensure that the financial statements are presented fairly, in all material respects. Management has prepared the financial information presented elsewhere in the Annual Report and has ensured that it is consistent with that in the financial statements.

Central Fund maintains systems of internal accounting and backup as well as administrative and regulatory compliance controls of high quality, for a reasonable cost. Hard copies of transactions and monthly statements are retained in the Company's files. Such systems are designed to provide reasonable assurance that the financial information is relevant, reliable, retrievable and accurate and that the Company's assets are appropriately accounted for and adequately safeguarded.

The Board of Directors is responsible for ensuring that management fulfills its responsibilities for financial reporting and is ultimately responsible for reviewing and approving the financial statements. The Board carries out this responsibility principally through its Audit Committee.

The Audit Committee appointed by the Board consists solely of non-related and independent directors. In accordance with its charter, the Committee meets at least annually with management and the external auditors to discuss the independence of the external auditors; the scope of the annual audit; the audit plan; access granted to the Corporation's records; co-operation of management in the audit and review function; the need for internal auditing; the financial reporting process; related internal controls; the quality and adequacy of the Corporation's or Administrator's accounting and financial personnel; and other resources and financial risk management to satisfy itself that each party is properly discharging its responsibilities. The Committee also reviews the Annual Report, the Annual Information Form, the annual and quarterly financial statements, Management's Discussion and Analysis and the external auditors' report. The Committee reports its findings to the Board for consideration when approving the financial statements for issuance to the shareholders. The Committee also reviews the external auditors' remuneration and considers, for review by the Board and approval by the shareholders, the re-appointment and terms of engagement and, in appropriate circumstances, the replacement of the external auditors. It also pre-approves all non-audit services proposed to be provided by the external auditors. The charter of the Audit Committee is set out on Central Fund's website.

The financial statements have been audited by Ernst & Young LLP, the external auditors, in accordance with Canadian generally accepted auditing standards on behalf of the shareholders. Ernst & Young LLP has full and free access to the Audit Committee.

| "J.C. STEFAN SPICER" President | ||

| December 18, 2006 | ||

| "CATHERINE A. SPACKMAN" Treasurer |

5

Central Fund of Canada Limited

Statement of Net Assets

(expressed in U.S. dollars)

| | As at October 31 | ||||||

|---|---|---|---|---|---|---|---|

| Net assets: | |||||||

| 2006 | 2005 | ||||||

| Gold bullion, at market (note 2) | $ | 410,565,912 | 291,672,631 | ||||

| Silver bullion, at market (note 2) | 410,665,810 | 240,510,890 | |||||

| Marketable securities, at market average cost — $nil (2005: $89,430) | — | 65,954 | |||||

| Interest-bearing cash deposits (note 3) | 16,636,587 | 10,195,379 | |||||

| Prepaid bullion insurance | 62,500 | 62,500 | |||||

| Interest receivable and other (note 7) | 265,004 | 13,977 | |||||

| 838,195,813 | 542,521,331 | ||||||

| Accrued liabilities (note 6) | (820,662 | ) | (576,925 | ) | |||

| Dividends payable (note 4) | (1,046,545 | ) | (942,963 | ) | |||

| Net assets representing shareholders' equity | $ | 836,328,606 | 541,001,443 | ||||

Represented by: | |||||||

| Capital stock (note4) | $ | 536,866,529 | 452,673,548 | ||||

| Contributed surplus (note 5) | 15,294,173 | 19,595,783 | |||||

| Retained earnings inclusive of unrealized appreciation of holdings | 284,167,904 | 68,732,112 | |||||

| $ | 836,328,606 | 541,001,443 | |||||

Net asset value per share (note 1(c)(ii)): | |||||||

| Class A shares | $ | 7.99 | 5.74 | ||||

| Common shares | $ | 4.99 | 2.74 | ||||

Net asset value per share expressed in Canadian dollars | |||||||

| Class A shares | $ | 8.97 | 6.77 | ||||

| Common shares | $ | 5.60 | 3.23 | ||||

| Exchange rate year end: U.S. $1.00 = Cdn. | $ | 1.1227 | 1.1801 | ||||

See accompanying notes to financial statements.

On behalf of the Board:

"Douglas E. Heagle" Director | "Philip M. Spicer" Director |

6

Central Fund of Canada Limited

Statement of Income

(expressed in U.S. dollars)

| | Years ended October 31, | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| | 2006 | 2005 | 2004 | ||||||

| Income: Interest | $ | 546,537 | 327,407 | 96,264 | |||||

| Dividends | 420 | 1,024 | 498 | ||||||

| Loss on sale of marketable securities | (3,153 | ) | — | — | |||||

| Unrealized appreciation of holdings | 215,435,792 | 45,791,898 | 46,221,551 | ||||||

| 215,979,596 | 46,120,329 | 46,318,313 | |||||||

Expenses: | |||||||||

| Administration fees (note 6) | 2,013,322 | 1,553,660 | 1,108,851 | ||||||

| Safekeeping, insurance and bank charges | 893,118 | 467,226 | 214,901 | ||||||

| Shareholder information | 216,738 | 157,368 | 105,341 | ||||||

| Legal fees | 111,029 | 107,950 | 27,769 | ||||||

| Directors' fees and expenses | 103,986 | 110,320 | 60,576 | ||||||

| Stock exchange fees | 90,740 | 70,171 | 53,695 | ||||||

| Audit fees | 71,826 | 36,026 | 28,976 | ||||||

| Registrar and transfer agent fees | 71,038 | 63,116 | 43,749 | ||||||

| Miscellaneous | 1,798 | 1,161 | 1,698 | ||||||

| Foreign exchange loss | 389 | 31,651 | 15,920 | ||||||

| 3,573,984 | 2,598,649 | 1,661,476 | |||||||

| Income before income taxes | 212,405,612 | 43,521,680 | 44,656,837 | ||||||

| Income taxes (note 7) | (224,885 | ) | (869,549 | ) | (740,684 | ) | |||

| Net income | $ | 212,180,727 | 42,652,131 | 43,916,153 | |||||

Basic and diluted net income per share (note 1 (c)(i)): | |||||||||

| Class A shares | $ | 2.17 | 0.45 | 0.64 | |||||

| Common shares | $ | 2.16 | 0.44 | 0.63 | |||||

Statement of Changes in Net Assets

(expressed in U.S. dollars)

| | Years ended October 31, | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| | 2006 | 2005 | 2004 | ||||||

| Net assets at beginning of year | $ | 541,001,443 | 418,349,579 | 194,663,349 | |||||

Add (deduct): | |||||||||

| Net income | 212,180,727 | 42,652,131 | 43,916,153 | ||||||

| Net issuance of Class A shares (note 4) | 84,192,981 | 80,942,696 | 180,563,040 | ||||||

| Dividends on Class A shares | (1,046,545 | ) | (942,963 | ) | (792,963 | ) | |||

| Increase in net assets during the year | 295,327,163 | 122,651,864 | 223,686,230 | ||||||

| Net assets at end of year | $ | 836,328,606 | 541,001,443 | 418,349,579 | |||||

See accompanying notes to financial statements.

7

Central Fund of Canada Limited

Statement of Shareholders' Equity

(expressed in U.S. dollars)

| | Years ended October 31, | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| | 2006 | 2005 | 2004 | ||||||

| Capital stock (note 4): 104,654,532 (2005: 94,296,320; 2004: 79,296,320) | |||||||||

| Class A retractable shares issued | $ | 536,847,071 | 452,654,090 | 371,711,394 | |||||

| 40,000 Common shares issued | 19,458 | 19,458 | 19,458 | ||||||

| 536,866,529 | 452,673,548 | 371,730,852 | |||||||

Contributed surplus: | |||||||||

| Balance at beginning of year | 19,595,783 | 23,678,513 | 26,776,874 | ||||||

| Transfer to retained earnings (note 5) | (4,301,610 | ) | (4,082,730 | ) | (3,098,361 | ) | |||

| Balance at end of year | 15,294,173 | 19,595,783 | 23,678,513 | ||||||

Retained earnings: | |||||||||

| Balance at beginning of year | 68,732,112 | 22,940,214 | (23,281,337 | ) | |||||

| Net income | 212,180,727 | 42,652,131 | 43,916,153 | ||||||

| Dividends on Class A shares | (1,046,545 | ) | (942,963 | ) | (792,963 | ) | |||

| 279,866,294 | 64,649,382 | 19,841,853 | |||||||

| Transfer from contributed surplus (note 5) | 4,301,610 | 4,082,730 | 3,098,361 | ||||||

| Balance at end of year | 284,167,904 | 68,732,112 | 22,940,214 | ||||||

| Shareholders' equity | $ | 836,328,606 | 541,001,443 | 418,349,579 | |||||

See accompanying notes to financial statements.

8

Central Fund of Canada Limited

Notes to Financial Statements

October 31, 2006, 2005 and 2004

(amounts expressed in U.S. dollars unless otherwise stated)

1. Summary of significant accounting policies:

- (a)

- Foreign exchange translation:

Central Fund of Canada Limited ("Central Fund" or the "Company") was incorporated under the Business Corporations Act, 1961 (Ontario), and was continued under the Business Corporations Act (Alberta) on April 5, 1990. The Company is a specialized, self-governing, passive holding company with most of its assets held in gold and silver bullion.

The Company's accounting policies, which conform with Canadian and U.S. generally accepted accounting principles, are summarized below:

- (b)

- Holdings:

Canadian dollar cash deposits are translated at the rates of exchange prevailing at year end. Any difference between the year-end exchange rate and the exchange rate at the time such deposits were acquired is recorded in the statement of income as a foreign exchange loss (gain).

Purchases and sales of holdings traded in foreign currencies and the related income are translated at the rates of exchange prevailing when the transactions occur. Market values of holdings quoted in foreign currencies are translated at the rates of exchange prevailing at year end.

- (c)

- Per share amounts:

- (i)

- Net income per share:

- (ii)

- Net asset value per share:

Bullion and marketable securities are valued at market value. Gold bullion is valued at the afternoon London fixing and silver bullion is valued at the daily London fixing. Marketable securities are valued at prices as reported at the close of trading on recognized stock exchanges or over-the-counter markets. As at October 31, 2006, Central Fund has sold all of its nominal holdings of marketable securities.

Unrealized appreciation/depreciation of holdings represents the difference between the market value and average cost of holdings.

Transactions are accounted for on the trade date. Realized gains and losses and unrealized appreciation or depreciation are calculated on the average cost basis.

Dividend income is recorded on the ex-dividend date.

The calculation of net income per share is based on the weighted average number of Class A and Common shares outstanding during the year. The net income per Common share is reduced by U.S. $0.01 as the Class A shares are entitled to receive a U.S. $0.01 per share preferential non-cumulative annual dividend. The remaining income for the year is attributed equally to each Class A share and Common share, without preference or distinction.

The calculation of net asset value per share is based on the number of Class A and Common shares outstanding at the end of the year and gives effect to the Class A shares' entitlement to U.S. $3.00 per share on liquidation, before any remaining net assets are attributed equally to each Class A share and Common share then outstanding.

2. Gold and silver bullion:

| Holdings at October 31: | 2006 | 2005 | 2004 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gold bullion: | ||||||||||

| Fine ounces | — 100 and 400 oz. bars | 674,348 | 614,242 | 518,309 | ||||||

| — bank certificates | 5,678 | 5,349 | 5,282 | |||||||

| 680,026 | 619,591 | 523,591 | ||||||||

| Cost | — | $ | 284,691,854 | 246,833,606 | 206,043,206 | |||||

| Market | — per fine ounce | $ | 603.75 | 470.75 | 425.55 | |||||

| Market value | — | $ | 410,565,912 | 291,672,631 | 222,814,301 | |||||

| Silver bullion: | ||||||||||

| Ounces | — 1,000 oz. bars | 33,749,942 | 30,728,142 | 25,928,142 | ||||||

| — bank certificates | 245,572 | 245,572 | 245,572 | |||||||

| 33,995,514 | 30,973,714 | 26,173,714 | ||||||||

| Cost | — | $ | 252,354,197 | 216,589,467 | 181,213,467 | |||||

| Market | — per ounce | $ | 12.080 | 7.765 | 7.160 | |||||

| Market value | — | $ | 410,665,810 | 240,510,890 | 187,403,793 | |||||

9

3. Short term cash deposits:

As at October 31, 2006, the Company held two U.S. dollar fixed deposits, at a rate of 5.26%, in the amount of $10,000,000 with a maturity date of January 30, 2007 and $4,500,000 with a maturity date of November 30, 2006.

4. Capital stock:

The authorized share capital consists of an unlimited number of Class A non-voting shares without nominal or par value and 50,000 Common shares without nominal or par value.

At the meeting of the Class A and Common shareholders held on February 28, 2005 in Calgary, Alberta, the holders of the Class A non-voting shares and the holders of common shares of the Corporation, voting as separate classes, passed a special resolution to approve the increase in the authorized Class A share capital of the Corporation from 100,000,000 to an unlimited number of Class A shares.

Since October 1989, holders of the Company's Class A shares have had the option to require the Company to redeem their Class A shares on the last day of each fiscal quarter of the Company (each a "Retraction Date") for 80% of the Company's net asset value per Class A share on the Retraction Date (as calculated in accordance with note 1(c)(ii)). Class A shareholders who wish to exercise this retraction right must submit their written redemption request at least 90 days prior to the desired Retraction Date. The Articles of the Company provide for the suspension of redemptions during specified unusual circumstances, such as suspensions of normal trading on certain stock exchanges or the London bullion market, or to comply with applicable laws or regulations.

The holders of the Class A shares are entitled to receive a preferential non-cumulative annual dividend of U.S. $0.01 per share. Any further dividends declared are to be paid rateably on the Class A shares and Common shares then outstanding, without preference or distinction. The Company has adopted a policy that any dividends declared shall be paid to shareholders of record at the close of business each October 31, with payment of such dividends being made during November of the same year.

On December 19, 2003, the Company, through a public offering, issued 15,050,000 Class A shares for proceeds of $71,951,040 net of underwriting fees of $2,997,960. Costs relating to this public offering were $500,000 and net proceeds were $71,451,040. The Company used the net proceeds from this public offering to purchase 98,386 fine ounces of gold at a cost of $40,328,690 and 4,919,333 ounces of silver at a cost of $28,015,600, both in physical bar form. The balance of $3,106,750 was retained by the Company in interest-bearing cash deposits for working capital purposes.

On April 8, 2004, the Company, through a public offering, issued 19,500,000 Class A shares for proceeds of $109,512,000 net of underwriting fees of $4,563,000. Costs relating to this public offering were $400,000 and net proceeds were $109,112,000. The Company used the net proceeds from this public offering to purchase 128,160 fine ounces of gold at a cost of $54,550,152 and 6,408,000 ounces of silver at a cost of $50,129,641, both in physical bar form. The balance of $4,432,207 was retained by the Company in interest-bearing cash deposits for working capital purposes.

On November 3, 2004, the Company, through a public offering, issued 15,000,000 Class A shares for proceeds of $81,504,000 net of underwriting fees of $3,396,000. Costs relating to this public offering were $561,303 and net proceeds were $80,942,696. The Company used the net proceeds from this public offering to purchase 96,000 fine ounces of gold at a cost of $40,790,400 and 4,800,000 ounces of silver at a cost of $35,376,000, in physical bar form except for 67 ounces of gold which were received in certificate form. The balance of $4,776,296 was retained by the Company in interest-bearing cash deposits for working capital.

On April 27, 2006, the Company, through a public offering, issued 3,208,212 Class A shares for proceeds of $26,948,981 net of underwriting fees of $1,122,874. Costs relating to this public offering were approximately $500,000 and net proceeds were approximately $26,448,981. The Company used the net proceeds from this public offering to purchase 17,475 fine ounces of gold at a cost of $10,462,625 and 873,800 ounces of silver at a cost of $11,215,730, both in physical bar form. The balance of $4,770,626 was retained by the Company in interest-bearing cash deposits for working capital purposes.

On August 3, 2006, the Company, through a public offering, issued 7,150,000 Class A shares for proceeds of $58,344,000 net of underwriting fees of $2,431,000. Costs relating to this public offering were approximately $600,000 and net proceeds were approximately $57,744,000. The Company used the net proceeds from this public offering to purchase 42,960 fine ounces of gold at a cost of $27,395,623 and 2,148,000 ounces of silver at a cost of $24,549,000, primarily in physical bar form. The balance of $5,799,377 was retained by the Company in interest-bearing cash deposits for working capital purposes.

10

The stated capital and recorded capital of the Company as at and for the years ended October 31, 2006, 2005 and 2004 are as follows:

| | | 2006 | 2005 | 2004 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Stated capital | ||||||||||

| Class A shares 104,654,532 (2005: 94,296,320; 2004: 79,296,320) | $ | 547,388,654 | 462,095,673 | 380,591,674 | ||||||

| Share issue costs | (10,541,583 | ) | (9,441,583 | ) | (8,880,280 | ) | ||||

| Recorded capital | — Class A shares | 536,847,071 | 452,654,090 | 371,711,394 | ||||||

| — 40,000 Common shares | 19,458 | 19,458 | 19,458 | |||||||

| Capital stock | $ | 536,866,529 | 452,673,548 | 371,730,852 | ||||||

| Weighted average Class A and Common shares outstanding | 97,751,783 | 94,254,128 | 68,891,238 | |||||||

5. Contributed surplus and retained earnings:

In 1985, the shareholders authorized a reduction in stated capital which resulted in the creation of a contributed surplus account to facilitate payment of ongoing annual dividends and the board authorized a transfer each year from contributed surplus of an amount equal to net losses before unrealized appreciation (depreciation) of investments and payment of the Class A shares' stated dividend per share. Accordingly, $4,301,610, $4,082,730 and $3,098,361 were transferred from contributed surplus to retained earnings on October 31, 2006, 2005 and 2004, respectively. The balance of contributed surplus was $15,294,174 at October 31, 2006.

| | 2006 | 2005 | 2004 | ||||

|---|---|---|---|---|---|---|---|

| Transfer from contributed surplus to retained earnings | |||||||

| Net loss before unrealized appreciation | $ | 3,255,065 | 3,139,767 | 2,305,398 | |||

| Add: Dividend on Class A shares | 1,046,545 | 942,963 | 792,963 | ||||

| $ | 4,310,610 | 4,082,730 | 3,098,361 | ||||

This change did not affect the net asset value of the Company.

6. Administration fees:

Central Fund has no employees. It is party to an Administration and Consulting Agreement with The Central Group Alberta Ltd., which is related to the Company through four of its officers and directors. The Central Group Alberta Ltd., which acts as Administrator, has operating offices with employees, advisors and consultants which provide administrative and consulting services to the Company. For such services, the Company pays an administrative and consulting fee, payable monthly, that was from 1996 to October 31, 2005 at an annual rate of1/2 of one percent based on the Company's net assets up to $50,000,000,3/8 of one percent on the next $50,000,000 in net assets and1/4 of one percent on any excess over $100,000,000 in net assets.

Effective November 1, 2005, an Amended and Restated Administration and Consulting Agreement reduced the annual administration and consulting fee schedule for at least the next ten-year term to 0.30% on the first $400 million of total net assets, 0.20% on the next $600 million of total net assets and 0.15% on total net assets exceeding one billion dollars. The approval of the reduced schedule followed Board Committees' requests on August 8, 2005 for review of agreements of the Administrator.

Of the $820,662 balance in accrued liabilities at October 31, 2006, $183,051 (2005: $137,272) relates to the October administration fee payable to The Central Group Alberta Ltd.

11

7. Income taxes:

Although Central Fund is not a mutual fund as designated by securities regulators, the Company qualifies and intends to continue to qualify as a mutual fund corporation under theIncome Tax Act (Canada). As a result thereof, and after deduction of issue costs in computing taxable income, the Company does not anticipate that it will be subject to any material non-refundable income tax liability other than the large corporations tax. The Company was subject to Canadian Federal large corporations tax based on its taxable capital employed in Canada at the end of its 2005 fiscal year. The Canadian Federal 2006 Budget eliminated the Federal large corporations capital tax retroactive to January 1, 2006. The Company has paid instalments up to June 2006. For the year ended October 31, 2006, the Company's large corporations tax expense was $224,885. A portion of this liability can be refunded if the Company earns federal surtax credits in subsequent years. These financial statements reflect an estimated tax recoverable of $249,673 for advance payments made to June 2006, which is included with interest receivable and other, in the Statement of Net Assets.

The Company has net capital losses of $1,640,000 available to offset future net capital gains realized and non-capital losses available to offset future income for tax purposes, for both of which no benefit has been recognized in these financial statements. The non-capital loss amounts by year of expiry are as follows: $474,000 in 2007, $671,000 in 2008, $355,000 in 2009, $2,622,000 in 2010, $2,883,000 in 2014, $3,275,000 in 2015 and $3,242,000 in 2026 for a total of $13,522,000.

The Company is a long-term holder of bullion and believes that, as a mutual fund corporation for tax purposes, realized gains upon a disposition of bullion holdings, should such arise in the future, should be treated as capital gains for tax purposes and would be distributable as capital gains to shareholders. Deferred income tax liabilities resulting from unrealized capital appreciation of holdings are offset by the refundable mechanisms available to the Company. The Canada Revenue Agency has, however, expressed its opinion that gains (or losses) of mutual funds resulting from transactions in commodities should generally be treated for tax purposes as ordinary income rather than as capital gains, although the treatment in each particular case remains a question of fact to be determined having regard to all the circumstances.

8. Subsequent event:

On November 30, 2006, the Company, through a public offering issued 8,640,000 Class A shares for proceeds of $77,967,360, net of underwriting fees of $3,248,640. Costs relating to this public offering were approximately $600,000 and net proceeds were approximately $77,367,360. The Company used the net proceeds from this public offering to purchase 52,690 fine ounces of gold at a cost of $33,932,360 and 2,634,540 ounces of silver at a cost of $36,817,696, in physical bar form. The balance of approximately $6,617,304 was retained by the Company in interest-bearing cash deposits for working capital.

12

Auditors' Report to the Shareholders

We have audited the statements of net assets of Central Fund of Canada Limited as at October 31, 2006 and 2005 and the statements of income, changes in net assets and shareholders' equity for each of the years in the three-year period ended October 31, 2006. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards and the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, these financial statements present fairly, in all material respects, the financial position of the Company as at October 31, 2006 and 2005 and the results of its operations and the changes in its net assets for each of the years in the three-year period ended October 31, 2006 in accordance with Canadian generally accepted accounting principles.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of the Company's internal control over financial reporting as of October 31, 2006, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated December 18, 2006 expressed an unqualified opinion.

Toronto, Canada | Ernst & Young LLP | |

| December 18, 2006 | Chartered Accountants |

13

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of Central Fund of Canada Limited

We have audited management's assessment, included in the accompanying annual report, that Central Fund of Canada Limited maintained effective internal control over financial reporting as of October 31, 2006, based on criteria established in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the COSO criteria). Central Fund of Canada Limited's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting. Our responsibility is to express an opinion on management's assessment and an opinion on the effectiveness of the Company's internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, evaluating management's assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, management's assessment that Central Fund of Canada Limited maintained effective internal control over financial reporting as of October 31, 2006, is fairly stated, in all material respects, based on the COSO criteria. Also, in our opinion, Central Fund of Canada Limited, maintained, in all material respects, effective internal control over financial reporting as of October 31, 2006, based on the COSO criteria.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the 2006 financial statements of Central Fund of Canada Limited and our report dated December 18, 2006 expressed an unqualified opinion thereon.

"Ernst & Young LLP" | ||

| Toronto, Canada December 18, 2006 |

14

Class A Shares Stock Exchange Listings

| | Electronic Ticker Symbol | Newspaper Quote Symbol | ||

|---|---|---|---|---|

| American Stock Exchange | CEF | CFCda | ||

| The Toronto Stock Exchange | CEF.A in CDN$ | CFund A |

Net Asset Value Information

The net asset value per Class A share is calculated daily and is available atwww.centralfund.com or by calling the Administrator's Investor Inquiries office at (905) 648-7878 or by sending an email to info@centralfund.com. The Thursday net asset value is published on a regular basis in several financial newspapers among which are the following:

In the United States (figures published in U.S. $):

- •

- Barrons.

- •

- New York Times.

- •

- Wall Street Journal.

In Canada (figures published in Canadian $):

- •

- National Post: Financial Post section

- •

- The Globe and Mail: Report on Business.

Form 40-F

Central Fund's S.E.C. Form 40-F is posted on EDGAR (Electronic Data Gathering, Analysis and Retrieval System)www.sec.gov/edgar.shtml. Copies are available, free of charge, by contacting Central Fund of Canada Limited or its Administrator.

Postings on SEDAR (System for Electronic Document Analysis and Retrieval)

Annual & Quarterly Reports

Management's Discussion and Analysis

Annual Information Forms

Prospectuses

Material Change Reports

Press Releases

Proxies and executive's certifications

Board and Committee Charters

All of these filings may be found atwww.sedar.com

15

Corporate Information

Directors John S. Elder Q.C. (C) Douglas E. Heagle (A)(C)(I)(L) Ian M.T. McAvity (E)(I) Michael A. Parente CMA, CFP (A)(I) Robert R. Sale (A)(C)(I) Dale R. Spackman Q.C. (E) J.C. Stefan Spicer (E) Philip M. Spicer (E) Malcolm A. Taschereau (A)(C)(I) | Officers Philip M. Spicer, Chairman Dale R. Spackman Q.C., Vice-Chairman J.C. Stefan Spicer, President & CEO John S. Elder Q.C., Secretary Catherine A. Spackman CMA, Treasurer Teresa E. Poper, Assistant Treasurer Advisors to the Administrator Ian M.T. McAvity, Toronto, Ontario — Market Analyst Dr. Hans F. Sennholz, Grove City, PA — Monetary Advisor |

- (A)

- — Member of Audit Committee

- (C)

- — Member of Corporate Governance Committee

- (E)

- — Member of Executive Committee

- (I)

- — May be regarded as an independent director under Canadian securities administrators' guidelines.

- (L)

- — Lead Director

| Administrator The Central Group Alberta Ltd. Calgary, Alberta | Auditors Ernst & Young LLP | |

Banker Canadian Imperial Bank of Commerce | Custodian Canadian Imperial Bank of Commerce | |

Legal Counsel Fraser Milner Casgrain LLP, Toronto, Ontario Parlee McLaws LLP, Calgary, Alberta | Registrar and Transfer Agents Mellon Investor Services LLC, New York CIBC Mellon Trust Company at Calgary, Montreal, Toronto and Vancouver |

Share Ownership Certificates

Certificates of share ownership registered in shareholders' names at their own addresses for delivery to them for their own safekeeping may be obtained upon the request of holders and payment of any applicable fees to the relevant Registrar and Transfer Agent of the Company.

| Head Office Hallmark Estates Suite 805, 1323-15th Avenue S.W. Calgary, Alberta T3C 0X8 Telephone (403) 228-5861 Fax (403) 228-2222 | Shareholder and Investor Inquiries Administrator, P.O. Box 7319 Ancaster, Ontario L9G 3N6 Telephone (905) 648-7878 Fax (905) 648-4196 | |

Website: www.centralfund.com E-mail: info@centralfund.com | ||

16