Exhibit 99.2

CENTRAL FUND OF CANADA LIMITED

INFORMATION CIRCULAR

as of January 8, 2016

The information contained in this Information Circular (hereinafter called the “Circular”) is furnished in connection with the solicitation of proxies on behalf of the Senior Executive Officers in their capacity as management of Central Fund of Canada Limited (hereinafter called the “Corporation”) for use at the annual meeting of the holders of Common shares of the Corporation to be held at the offices of Parlee McLaws LLP, 3300 TD Canada Trust Tower, 421-7th Avenue S.W., Calgary, Alberta, on Monday the 22nd day of February, 2016, at the hour of 10:30 a.m. (Mountain Standard Time) and at any adjournment or adjournments thereof (hereinafter collectively called the “Meeting”). The Meeting has been called for the purposes set forth in the accompanying notice of the Meeting.

SOLICITATION OF PROXIES

Solicitation of proxies will be primarily by mail but proxies may also be solicited personally or by telephone by Officers or Directors of the Corporation at nominal cost. The cost of solicitation will be borne by the Corporation.

Proxies, to be used at the Meeting must be deposited with the Corporation or with CST Trust Company at Calgary, Montreal, Toronto or Vancouver in Canada or American Stock Transfer & Trust Company at New York, NY no later than 48 hours (excluding Saturday and Sunday) preceding the Meeting or any adjournment or adjournments thereof.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

As at the date hereof, the Corporation has outstanding 40,000 Common shares without nominal or par value, each carrying the right to one vote per share at the Meeting and 254,432,713 Class A shares, the holders of which are entitled to notice of, but not to vote at, the Meeting.

Holders of Common shares of record on January 8, 2016 are entitled to vote at the Meeting. Only Common shares entitle the holders thereof or their proxyholders to vote at the Meeting.

The names of the only persons who, to the knowledge of the Directors or Officers of the Corporation, beneficially own, directly or indirectly, or exercise control or direction over Common shares carrying more than ten percent (10%) of the voting rights attached to all Common shares of the Corporation as at January 8, 2016 are the family of J.C. Stefan Spicer and the number of such shares, and of Class A shares, beneficially owned, directly or indirectly, or over which control or direction is exercised by the family and the percentage of outstanding shares of each class of the Corporation represented by the number of such shares so owned, controlled or directed are as follows:

| Shareholder | | Number of

Class A

shares | | | % of

Outstanding

Class A

shares | | | Number

of

Common

Shares | | | % of

Outstanding

Common Shares | |

| Philip M. Spicer | | | 9,800 | | | | | | | | | 7,588 | | | | 18.97 | |

| Joanne Spicer | | | 7,200 | | | | | | | | | 2,000 | | | | 5.00 | |

| J. L. Michele Spicer | | | 18,824 | | | | | | | | | 2,000 | | | | 5.00 | |

| J. C. Stefan Spicer | | | 20,000 | | | | | | | | | 4,200 | | | | 10.50 | |

| Accrete Corporation Limited(1) | | | 12,225 | | | | | 0.03 | | | | 2,000 | | | | 5.00 | |

| FutureFunds Inc.(2) | | | - | | | | | | | | | 2,000 | | | | 5.00 | |

| The Central Group Alberta Ltd.(3) | | | 14,000 | | | | | | | | | - | | | | - | |

Notes:

| (1) | Accrete Corporation Limited is owned by J. L. Michele Spicer. |

| (2) | FutureFunds Inc. is owned by the family of J.C. Stefan Spicer. |

| (3) | The Central Group Alberta Ltd. is owned 60% by Philip M. Spicer and 40% by J.C. Stefan Spicer. |

INFORMATION ON VOTING

Voting Matters

At the Meeting, holders of Common shares will vote on the election of Directors, on the re-appointment of Auditors including authorizing the Board of Directors to fix their remuneration and on confirmation of the Advance Notice By-law.

Record Date for Notice of Meeting

The Board of Directors of the Corporation (the “Board”) has fixed January 8, 2016 as the record date (the “Record Date”) for the purpose of determining shareholders entitled to receive notice of the Meeting.

Voting by Proxy

Registered Owners

Registered holders of Common shares may vote in person at the Meeting or may give another person authority to vote at the Meeting on their behalf by appointing a proxy holder. Please complete, sign, date and return the accompanying proxy form solicited by this Circular in the envelope provided or by facsimile to CST Trust Company at (416) 368-2502, so that it arrives no later than 12:30 p.m. (Eastern Standard Time) on Thursday, February 18, 2016 or, in the case of an adjournment or postponement, no later than 48 hours (excluding Saturday, Sunday and a statutory holiday) before any reconvened Meeting. The Chairman of the Meeting may waive or extend the proxy cut-off time at his discretion without notice.

Beneficial Owners

The Corporation will provide proxy materials to brokers and other custodians, intermediaries, nominees and fiduciaries (each being an “Intermediary”) and will request that such materials be forwarded to each beneficial owner of Common shares shown in their records. If Common shares are listed in your account statement provided by any such institution, then, in almost all cases, those Common shares will not be registered in your name on the records of the Corporation. Such Common shares will likely be registered under the name of your broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co., the registration name for CDS Clearing and Depository Services Limited, which acts as nominee for many Canadian brokerage firms that are CDS participants. In the United States, registrations are often under the registration name for Depository Trust Company.

You are a non-registered shareholder or “beneficial owner” if your Common shares are held by an institution as referred to above. Under applicable securities legislation, a beneficial owner of securities is a “non-objecting beneficial owner”(or “NOBO”) if such beneficial owner has, or is deemed to have, provided instructions to the Intermediary holding the securities on such beneficial owner’s behalf not objecting to the Intermediary disclosing ownership information about the beneficial owner in accordance with said legislation, or a beneficial owner is an “objecting beneficial owner” (or “OBO”) if such beneficial owner has or is deemed to have provided instructions objecting to same.

If you are a NOBO, and CST Trust Company or American Stock Transfer & Trust Company has sent the proxy related materials directly to you, your name and address and information about your holdings of Common shares have been obtained in accordance with applicable securities legislation from the Intermediary holding on your behalf. By choosing to send the proxy related materials to you directly, as applicable,the Corporation (and not the Intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please provide your voting instructions as specified in the voting instruction form.

However, if you wish to vote in person at the Meeting, you must insert your own name in the space provided on the voting instruction form you received and return the completed form to CST Trust Company or American Stock Transfer & Trust Company.

If you are an OBO, you received these materials from your intermediary or its agent, and your intermediary is required to seek your instructions as to the manner in which to exercise the voting rights attached to your Common shares. The Corporation has agreed to pay for intermediaries to deliver to OBOs the proxy-related materials and the relevant voting instruction form. The voting instruction form that is sent to an OBO by the intermediary or its agent should contain an explanation as to how you can exercise the voting rights attached to your shares, including how to attend and vote directly at the Meeting. Please read such instructions carefully in order to ensure that your Common shares are voted at the Meeting.

Therefore, beneficial holders of Common shares should ensure that instructions respecting the voting of their Common shares are communicated to the appropriate party.

Appointing a Proxy Holder

A proxy holder is the person you appoint to act on your behalf at the Meeting and to vote your shares in your name.You may choose anyone to be your proxy holder – the person does not have to be a shareholder of the Corporation. Simply insert the person’s name in the blank space provided on the proxy form (registered shareholders) or the voting instruction form (beneficial shareholders). You should be sure that this person is attending the Meeting and is aware that he or she has been appointed to vote your shares. If you do not insert a name in the blank space, then the persons named on the form, being J.C. Stefan Spicer or John S. Elder, each of whom is a Director or Officer of the Corporation, will be appointed to act as your proxy holder.

Your appointed proxy holder is authorized to vote and act for you at the Meeting, including any continuation after an adjournment of the Meeting. On the form you should indicate how you want your proxy holder to vote your Common shares. You may vote FOR or WITHHOLD your vote on the proposed nominees for election as Directors and on the appointment of the auditors including authorizing the Board of Directors to fix their remuneration and may vote FOR or AGAINST confirmation of the Advance Notice By-law. Alternatively, you can let your proxy holder decide for you.

All Common shares represented by properly executed and deposited forms of proxy will be voted or withheld from voting or voted for or against, as the case may be, on the matters identified in the Notice of Meeting in accordance with the instructions of the respective shareholder.

Voting Discretion of Proxy Holder

If you give directions on how to vote your Common shares, your proxy holder must vote such shares according to your instructions. If your proxy form or voting instruction form does not specify how to vote on a particular issue, then your proxy holder can vote your Common shares as he or she sees fit. If your proxy holder does not attend the Meeting and vote in person, your shares will not be voted.

If you have appointed a person designated by the Corporation as proxy holder as provided in the enclosed form of proxy and you do not provide any instructions concerning a matter identified in the Notice of Meeting, the Common shares represented by such proxy will be voted as follows:

FOR the election of each of the persons nominated for election as Directors; and

FOR the re-appointment of Ernst & Young LLP, as Auditors and the authorization of the Board of Directors to set their remuneration; and

FOR the confirmation of the Advance Notice By-law.

The accompanying form of proxy confers discretionary authority on the persons named therein with respect to amendments or variations to matters identified in the notice of the Meeting and with respect to other business which may properly be brought before the Meeting. At the date of this Circular, the Senior Executive Officers of the Corporation know of no such amendments, variations or other business to be brought before the Meeting.

Revoking your Proxy

A holder of Common shares of the Corporation may revoke such holder’s proxy before it is exercised by completing and signing a new proxy form bearing a later date and sending it or depositing it with CST Trust Company. The new proxy form must be received no later than the required date and time specified in the proxy form. A holder of Common shares can also send a written statement indicating a wish to have the original proxy revoked. This written statement must be executed by such holder or by his or her attorney authorized in writing, or, if the holder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized and received; (i) at the registered office of the Corporation at 3300 TD Canada Trust Tower, 421-7th Avenue, S.W., Calgary, Alberta at any time up to and including the close of business on the last business day preceding the day of the Meeting or any adjournment thereof; or (ii) with the Chairman of the Meeting on the day of such Meeting or any adjournment thereof; or (iii) in any other manner permitted by law.

MATTERS TO BE CONSIDERED AT THE MEETING

| (a) | 2015 Financial Statements |

The first item of business at the Meeting will be to receive and consider the financial statements of the Corporation for the fiscal year ended October 31, 2015 together with the Auditors’ report thereon, copies of which financial statements and Auditors’ report accompany this Circular.

Election Details

The next item of business to be dealt with at the Meeting is the election of Directors to hold office until the next annual meeting or until their successors are duly elected or appointed. The Board of Directors has fixed the authorized number of Directors to be elected at the Meeting at seven.

The term of each person elected as a Director will be until the termination of the next annual meeting or until his successor is duly elected, unless his office is earlier vacated in accordance with the by-laws of the Corporation.

The persons named in the accompanying form of proxy intend to vote to elect as Directors the seven persons named as nominees below. The Senior Executive Officers are not presently aware that any such person would be unwilling or unable to serve as a Director if elected. However, if this should occur for any reason prior to the Meeting, it is intended that the persons so named in the form of proxy will have discretionary authority to vote the proxy for the election of any other person or persons as Directors.

Majority Voting for Directors

The Board of Directors has a policy which requires that if any nominee for Director fails to receive a majority of the number of votes cast for his or her election, treating for such purpose a “withheld” vote as a vote against such election, then he or she shall promptly tender his or her resignation to the Board following the meeting at which he or she is elected, which resignation will become effective upon its acceptance by the Board. The Corporate Governance Committee will consider the proffered resignation offer and will make a recommendation to the Board as to whether to accept it. The Board of Directors will disclose its decision, via press release, within 90 days of the applicable meeting at which the election took place. A Director who tenders his or her resignation pursuant to this policy will not participate at any meeting of the Corporate Governance Committee or the Board of Directors at which the resignation is considered. This policy only applies to uncontested elections, meaning elections where the number of nominees for Directors is equal to the number of Directors to be elected upon such election as determined by the Board. A copy of the full policy can be found on the Corporation’s website atwww.centralfund.com .

Background of Nominees:

The ensuing subsections provide information concerning the nominees to the Board of Directors, their background and qualifications, duration of their involvement with the Corporation, their shareholdings and their compensation. Information as to how their performance is evaluated is set out later under“Corporate Governance-Corporate Governance Committee“.

The following table sets out certain of such information with respect to each of the seven nominees as Directors, all of whom are Canadian citizens currently serving as Directors of the Corporation.

Information Concerning Nominees As Directors

Name of Director, Office with

Corporation and

Other Information | | No. of Common shares beneficially

owned directly or indirectly, or

controlled or directed by the

Nominees

at January 1, 2016, and Background Information | | No. of Class A shares

beneficially owned directly

or indirectly, or controlled

or directed by the

Nominees

at January 1, 2016, and Background Information |

| Barry R. Cooper BSc, MBA | | Nil | | Nil |

| Director | | | | |

Age 63 Director since 2015

Member of Audit Committee | Mr. Cooper is a retired Mining Analyst, specializing in precious metals companies. From 1996 to 2013, he was variously Director, Executive Director and Managing Director of CIBC Mining Equities Research. He achieved Brendon Woods first place ranking for 2011 and 2012, following second place rankings in 2008-2010 and third place rankings in 2005-2007 within a peer group of over 50 precious metals analysts in North America. Prior to that, he worked as a geologist. |

| |

| He also serves as a director of Kirkland Lake Gold Inc., Chairs its ad hoc Special Committee and is a member of the Compensation, the Audit and the Health Safety and Environment Committees. |

| | |

| Glenn C. Fox BSc (Agr), MSc, PhD | | Nil | | Nil |

| Director | | | | |

Rockwood, Ontario

Age 61

Director since 2015

Lead Director and Chair of Corporate Governance Committee | Dr. Fox is an agricultural and natural resource economist. He has been a member of the faculty in the Department of Food, Agricultural and Resource Economics at the University of Guelph since 1985. His teaching and research interests include Austrian economics, the economics of property rights and the theory of the firm. He was named a senior research fellow of the Fraser Institute in 2013.

He is a past editor of the Canadian Journal of Agricultural Economics and also of Current Agricultural, Food and Rural Issues, both published by the Canadian Agricultural Economics Society. He is a member of the editorial board of the International Journal of Markets and Prices. |

| | |

| |

| | He also serves on the Boards of the Canadian Constitution Foundation and the Energy Probe Research Foundation. |

| |

| | |

| Bruce D. Heagle BA, MBA, ICD.D | | 1,900 | | 7,200 |

| Director | |

Ancaster, Ontario Age: 58 Director since 2011 | Mr. Heagle has an MBA from the Richard Ivey Business School. He has been an officer since 1982 and President and a director of National System of Baking Ltd. since 1991 and is President of its division, NSBL International (private capital investments). |

| | |

| Chair of Audit Committee and member of Corporate Governance Committee | He also serves as a Trustee and Chair of the Audit Committee of Silver Bullion Trust as well as a member of its Corporate Governance and Nominating Committee. Mr. Heagle has been a director of the Bakery Council of Canada and Chair of the Board of Governors as well as Chair of the Finance Committee of Hillfield Strathallan College. |

| | | | | |

| Michael A. Parente CPA, CMA, CFP | | 1700 | | 1,000 |

| Director | |

Hamilton, Ontario Age: 59 Director since 1992 Member of Corporate Governance

Committee | Mr. Parenteis a Certified Professional Accountant, Certified Management Accountant and Certified Financial Planner in Canada. He has been President of M.A.P. Consulting and Financial Services as an independent consultant since February, 2009. Prior to that, he was the Director of Finance for First Ontario Credit Union from March, 2004 to January, 2009. From February, 1990 to August, 2002, Mr. Parente was Vice-President Finance of Central Fund. Previously, for over 15 years prior to 2004, he was Chief Financial Officer for a mutual fund management company. |

| | |

| | He also serves as a Trustee, and member of the Audit and the Corporate Governance and Nominating Committees of Silver Bullion Trust. |

| | | | | |

| Jason A. Schwandt P. Eng, MBA | | 450(1) | | 1,000 |

| Director | |

Ancaster, Ontario Age 43 Director since 2015 Member of Audit Committee | Mr. Schwandt holds an Electrical Engineering and Management degree and an MBA (Management of Innovation) from McMaster University. He is currently President of J.A. Schwandt Engineering Inc. and was formerly a Vice President and owner of Techcentive Services Inc., a tax and corporate cost reduction consultancy. Prior to that, Mr. Schwandt was employed for over ten years in various management roles in engineering, program office, operations and corporate strategy at Celestica Inc., a global contract electronics manufacturer and former manufacturing arm of IBM. |

| | |

| | Mr. Schwandt is also the Lead Trustee and member of the Audit and the Corporate Governance and Nominating Committees of Silver Bullion Trust. |

| | | | | |

| Dale R. Spackman, Q. C. | | 100 | | 2,050 |

| Director and Vice-Chairman | |

Calgary, Alberta Age: 61 Director since 1990 | Mr. Spackman holds a science degree from the University of Calgary and a law degree from the University of Alberta. He has been a partner of Parlee McLaws LLP, an Alberta law firm, since 1986 where his practice concentrates on aviation, banking and finance and corporate and commercial law. |

| | |

| | He previously served as a Bencher (Director) of The Law Society of Alberta and member of its Executive Committee and is a past Chair of, among others, its Audit, Finance and Governance Committees and is a past director and chair of the Governance Committee of the Calgary Minor Soccer Association. Since July 1, 2014, Mr. Spackman has been on the Advisory Board, Corporate Secretary and a member of the Audit Committee of the Alberta Lawyers Insurance Exchange, a reciprocal insurance exchange that provides insurance products, including mandatory professional liability and trust safety insurance, to Alberta lawyers. |

| | | | | |

| J. C. Stefan Spicer | | (2) | | (2) |

| Director, Chairman, President | |

and Chief Executive Officer Lynden, Ontario Age: 50 Director since 1995 | Mr. Spicer is also a Trustee and the President and Chief Executive Officer of Central GoldTrust, the Units of which are listed on the NYSE MKT and the Toronto Stock Exchange, and the Chairman, President and Chief Executive Officer of Silver Bullion Trust, the Units of which are listed on the Toronto Stock Exchange. |

| | |

| | He has in excess of 30 years of investment industry experience. |

Composition of Board

The Board has a policy of ensuring that a majority of the seven Directors are “independent”. This creates good alignment of the interests of the Board with the interests of the Corporation’s shareholders. In this context, the Board considers a Director to be independent if he or she is independent within the definitions set forth in National Instruments58-101 and 52-110 as having no material relationship with the Corporation which could in the view of the Board of Directors be reasonably expected to interfere with the exercise of his or her judgment. The Corporate Governance Committee annually reviews the independence of the Directors and advises the Board accordingly.

Messrs. Cooper, Fox, Heagle, Parente and Schwandt, current Directors, are regarded by the Board as being independent in accordance with the foregoing. Mr. Parente provides periodic limited consulting services to the Administrator and others.

With respect to the other nominees for election at the Meeting, Mr. Stefan Spicer, the Chairman, President and Chief Executive Officer is a significant shareholder of the Corporation (see “Voting Shares and Principal Holders Thereof’). Mr. Spackman is the spouse of Ms. Catherine Spackman, the Treasurer and Chief Financial Officer of the Corporation, and is a partner of Parlee McLaws LLP which provides periodic legal services to The Central Group Alberta Ltd. (the “Administrator”) and to the Corporation (see “Interest of Administrator and Others in Material Transactions”). The other five nominees as Directors do not have interests or relationships with the principal shareholders referred to above and, as a consequence of such measure of independence and their diverse backgrounds and experience, such Directors may be regarded as in a position to reflect the interests of the shareholders of the Corporation other than the principal shareholders. Each of the current Directors being nominated for re-election at the Meeting (other than Messrs. Cooper and Fox) is a shareholder of Central Fund in his own right.

Board Chairman

The Board Chairman is a duly elected member of the Board of Directors and is appointed as Chairman by the Board each year for a one-year term, with such appointment being (except when a vacancy is being filled) at the first meeting of the Board following the annual meeting of shareholders. As reflected in the Board Chairman Position Description, the Board Chairman provides leadership to the Board. He or she sets the “tone” for the Board and the Directors to foster effective, ethical and responsible decision-making, appropriate oversight of Senior Officers and the Administrator and strong corporate governance practices.

In addition to individual Director responsibilities, responsibilities set out in the Board Charter and specific duties assigned by the Board from time to time, the Board Chairman will generally: oversee Board direction and administration, ensuring that the Board works as a cohesive team and builds a strong governance culture; provide guidance and leadership to the Board, the Board Committees and individual Directors in support of Central Fund’s commitment to corporate responsibility and its Code of Conduct and Ethics; and foster effective, ethical and responsible decision-making by the Board, the Board Committees and individual Directors. In the context of leadership, the Board Chairman will; provide overall leadership to enhance the effectiveness of the Board; provide advice and counsel to the Committee Chairs and fellow Directors; ensure that the responsibilities of the Board, Board Committees and individual Directors, as set out in the Board Charter, are well understood by them and work with other Officers to monitor progress on forward planning and policy implementation. Among other things, the Board Chairman will, with the Corporate Secretary and the Lead Director, establish the agenda for and will chair most Board meetings; ensure that Directors are receiving information that is timely, in a useful format and of high quality; chair, or assign the Vice-Chairman to chair, all annual meetings and special meetings of shareholders; and work with and assist the Chief Financial Officer and Corporate Secretary in representing Central Fund’s interests to its external stakeholders such as shareholders, regulators and the investment community.

Shareholdings

The Board of Directors believes that Directors can be seen to more effectively represent the interests of shareholders if they have a meaningful investment or "at risk" amount in shares of the Corporation. In 2004, the Board established a policy to the effect that each then Director should own at least 1,000 common and/or Class A shares of the Corporation. In December, 2015, that policy was amended to increase the shareholding requirement to 2,000 common and/or Class A shares of the Corporation with Directors (three of whom were only elected to that position in 2015) having up to three years to meet such requirement. Four of the Directors in office already meet the higher requirement.

The Board has not granted any share options and does not intend to create any deferred share units for the benefit of its Directors or Officers.

The following table sets out the number of shares of the Corporation, by class, held by each current Director as of January 1, 2015 and January 1, 2016.

| | | Number of Shares of the Corporation Beneficially Owned or over which

Control or Direction is Exercised | |

| Name of Director | | Common

Jan. 1, 2015 | | | Common

Jan. 1, 2016 | | | Class A

Jan. 1, 2015 | | | Class A Jan. 1, 2016 | |

| Barry R. Cooper | | | N/A | | | | Nil | | | | N/A | | | | Nil | |

| Glenn C. Fox | | | N/A | | | | Nil | | | | N/A | | | | Nil | |

| Bruce D. Heagle | | | 1,900 | | | | 1,900 | | | | 7,200 | | | | 7,200 | |

| Ian M. T. McAvity | | | 400 | | | | 400 | | | | 4,200 | | | | 4,200 | |

| Michael A. Parente | | | 1,700 | | | | 1,700 | | | | 1,000 | | | | 1,000 | |

| Jason A. Schwandt | | | 450 | (1) | | | 450 | (1) | | | 1,000 | | | | 1,000 | |

| Dale R. Spackman | | | 100 | | | | 100 | | | | 2,050 | | | | 2,050 | |

| J. C. Stefan Spicer | | | (2 | ) | | | (2 | ) | | | (2 | ) | | | (2 | ) |

Note (1): Beneficial ownership through a trust.

(2): Reference is made to Page 2 in the table under "Voting Shares and Principal Holders Thereof".

Attendance Record

The following table sets forth the exemplary attendance of each current Director at Board and Committee meetings during the last fiscal year.

| Name of Director | | Board Meetings Attended | | Committee Meetings

Attended(1) |

| Glenn C. Fox(1) | | 11 of 11 | | | 100 | % | | 12 of 12 | | | 100 | % |

| Bruce D. Heagle(1) | | 13 of 13 | | | 100 | % | | 18 of 18 | | | 100 | % |

| Ian. M. T. McAvity | | 13 of 13 | | | 100 | % | | 1 of 1 | | | 100 | % |

| Michael A. Parente | | 13 of 13 | | | 100 | % | | 6 of 6 | | | 100 | % |

| Jason A. Schwandt | | 11 of 11 | | | 100 | % | | 12 of 12 | | | 100 | % |

| Dale R. Spackman | | 13 of 13 | | | 100 | % | | — | | | — | |

| J. C. Stefan Spicer | | 13 of 13 | | | 100 | % | | — | | | — | |

Note (1): Includes Special Committee meetings.

| (c) | Re-Appointment and Remuneration of Auditors |

The next matter to be considered at the Meeting is the appointment and remuneration of Auditors of the Corporation. It is intended to vote the proxies solicited at the Meeting to re-appoint as Auditors of the Corporation the firm of Ernst & Young LLP, and to authorize the Board of Directors to fix their remuneration.

Ernst & Young LLP have been the Auditors of Central Fund since 1989 and their re-appointment at the meeting has been recommended by the Audit Committee. The Corporation recently adopted a policy of conducting a comprehensive review of the Auditors not less often than every five years and conducting a more intensive review than the regular annual review for a year or two in advance of the comprehensive review.

The aggregate fees in U.S. dollars for professional services charged by Ernst & Young LLP for the 2014 and 2015 fiscal years of the Corporation were as follows:

| | | 2014 | | | 2015 | |

| | | | | | | |

| Audit and audit related services | | $ | 125,307 | (1) | | $ | 89,798 | |

| Other assurance services | | | — | | | | — | |

| Non-audit services | | | — | | | | — | |

| Total | | $ | 125,307 | | | $ | 89,798 | |

Note(1): Includes audit and review of financial statements for statutory and regulatory filings of the Corporation.

| (d) | Confirmation of Advance Notice By-law |

The final matter to be considered at the Meeting is confirmation of the Advance Notice By-law.

Background

On December 7, 2015, the Board of Directors, in consultation with its legal advisors, enacted, with effect on the following day, By-law No. 3, being the Advance Notice By-law. The purpose of the Advance Notice By-law is to require any holder of Common shares (that is not proceeding by way of requisition or proposal under the Alberta Business Corporations Act) to give to the Corporation advance notice of any Director or Directors that such holder proposes to nominate. The notice would have to include certain prescribed information concerning such nominee or nominees and be accompanied by a consent to act on the part of each nominee. The intention is to ensure that all holders of Common shares (including those who may be participating by way of proxy) receive adequate information about nominated Directors in a timely manner so that they can make informed decisions at a meeting at which Directors are to be elected. The Advance Notice By-law will also help to ensure orderly meetings of the holders of Common shares by providing a structured and transparent framework for the nomination of Directors by any such holders.

A copy of the Advance Notice By-law is annexed as Schedule A to this Circular.

The purpose of the Advance Notice By-law is not to discourage nominations by holders of Common shares, but rather to facilitate proper advance information concerning nominees as Directors and an efficient meeting process.

Required Information About Nominees

The Advance Notice By-law requires that certain information be provided concerning proposed nominees as Directors. This is generally similar to the information that is disclosed about nominees in this Circular, such as information about their name, age and citizenship; the number of shares of the Corporation controlled or owned beneficially, directly or indirectly, or of record by the nominee; and any other information that would be required to be disclosed in a dissident’s proxy circular in connection with solicitations of proxies for the election of Directors under applicable securities laws.. This is intended to ensure that all holders of Common shares have sufficient information about proposed nominees in a timely manner in order to make an informed voting decision.

Required Notice Periods

Under the Advance Notice By-law, for an annual meeting of holders of Common shares, the Corporation must receive notice of Director nominees from the nominating holder not less than 30 days prior to the date of such annual meeting; provided that if such annual meeting is to be held on a date which is less than 50 days after the date (the “Notice Date”) on which the first public announcement of the date of such meeting was made, notice from the nominating holder may be made not later than the 10th day following the Notice Date.

For a special meeting (which is not also an annual meeting) called for the purpose of electing Directors, the Corporation must receive notice from the nominating holder not later than the close of business on the 15th day following the day of the first public announcement of the date of such special meeting.

In the case of an annual or special meeting, should the Corporation be using “notice-and-access” for delivery of proxy-related materials, the Corporation must receive the notice not less than 40 days prior to the date of the annual or special meeting. The Corporation does not currently use “notice and access” for delivery of proxy-related materials.

The Directors may, in their discretion, amend the time periods for the giving of a nominating holder’s notice as set forth above in order to comply with applicable laws or recommended best practices.

It is intended to vote the proxies solicited at the Meeting in favour of confirmation of the Advance Notice By-law. For such confirmation to be effective, it requires the favourable vote of at least a majority of the Common shares voted in person or by proxy at the Meeting. In the event that the Advance Notice By-law does not receive the requisite level of support of the holders of Common shares, it is expected that the Board of Directors will review and amend the provisions of the Advance Notice By-law or rescind the By-law.

Unless the holder of Common shares has specifically instructed in the enclosed blue form of proxy that the Common shares represented by such proxy are to be voted against confirmation of the Advance Notice By-law, the persons named in the accompanying blue form of proxy will vote FOR the confirmation of the Advance Notice By-law.

CORPORATE GOVERNANCE

Overview

Central Fund’s corporate governance practices are designed to ensure that the business and affairs of the Corporation are governed effectively. These practices generally accord with National Instrument 58-101; “Disclosure of Corporate Governance Practices” and National Policy 58-201; “Corporate Governance Guidelines” (collectively the “Governance Rules”) and with National Instrument 52-110; “Audit Committees” and Companion Policy 52-110CP (collectively the “Audit Committee Rules”), all of which are rules of the Canadian Securities Administrators.

Central Fund’s corporate governance practices are designed with a view to ensuring that the affairs of the Corporation are effectively stewarded in the interests of the shareholders as a whole.

The Board is the author of its own policies, procedures and practices concerning the direction and administration of the Corporation. It fulfils these duties with independence from the Senior Executive Officers of the Corporation.

Board Mandate and Code of Ethics

The Board of Directors is, as set forth in its mandate, responsible for the direction and supervision of the administration of the affairs of the Corporation pursuant to its powers and obligations under the Alberta Business Corporations Act, its articles and by-laws and other statutory and legal requirements generally applicable to directors of a corporation that is also a reporting issuer. Prime stewardship responsibility of the Board is to ensure the viability of the Corporation and its function as a passive holder of gold and silver bullion. The balance of the text of the mandate is set out below:

| “2. | Composition and Organization of Board |

The Corporate Governance Committee of the Board periodically reviews the desired size and composition of the Board, the need for recruitment of new Board members and the appropriateness of the competencies, skills and experience of nominees. After seeking input and suggestions, the Committee assesses any proposal for a new member prior to the proposal being submitted to the Board and, in turn, for election to the holders of common shares.

All new members are briefed on the unique structure of the Corporation, its administration, its financial affairs, the securities and regulatory environment, reporting requirements and affairs as a whole. A Directors’ Manual is provided to each new member.

Nominees must have qualifications prescribed for directors under applicable corporate and securities law of the Province of Alberta. They should have an appropriate mix of skills, knowledge and experience in business. Nominees selected should be able to commit sufficient time for the business of the Board.

All directors are required to act honestly and in good faith and with loyalty in the interests of the Corporation and in the interests of its shareholders generally.

Except for a transitional period following retirement of an independent Director, a majority of the Board shall be composed of Directors who, in the reasonable opinion of the Board, are "independent" under the provisions of National Instrument 58-101 of the Canadian Securities Administrators.

The Board shall, until otherwise determined, appoint a Chairman from among the Directors. In the event that the Chairman is a director or executive of the Administrator, the Board shall also appoint a Lead Director from among the non-administrative or non-related Directors who may chair the Board meetings where the Chairman and Vice-Chairman are absent, who shall chair in camera sessions of the Board and who shall assume such other functions as are appropriate to the role of a Lead Director.

A Director who has attained 78 years of age prior to the annual meeting of shareholders in any year, shall retire from office at such annual meeting, except as decided otherwise by the Board.

The Directors are elected by the holders of Common shares at each annual meeting and the term of office expires at the next annual meeting of the shareholders or when a successor is elected.

(a) In order to carry out its mandate, the Board holds regular meetings on a quarterly basis and additional meetings as required to consider particular issues or strategic planning or deal with specific matters between quarterly meetings whenever appropriate;

(b) Subject to applicable law and policy, the Board is the master of its own policies, procedures, practices and deliberations concerning the affairs of the Corporation;

(c) Distribution of materials and financial and other information important to the Directors’ understanding of agenda items is generally effected in advance of a meeting. The Board will often invite officers of the Administrator and its advisors to attend part of Board meetings to make presentations so as to allow Directors to gain additional understanding and insight into the affairs of the Corporation;

(d) The Directors regularly meetin camerawithout any member of the Administrator present to ensure free and open discussion and communication among the non-related Directors.

In order to carry out such responsibilities, the Board of Directors:

(a) approves, and oversees the implementation of the Corporation’s forward planning and strategy including the stewardship of the Corporation, entering into of administrative, safekeeping, transfer agency and other service agreements and any significant divestitures of assets by the Corporation;

(b) reviews, with input from the Audit Committee, the financial performance and financial reporting of the Corporation and assesses the scope, implementation and integrity of the Corporation’s internal control and information systems;

(c) identifies and assesses the principal risks of the affairs of the Corporation;

(d) oversees the public communications policy and shareholder relations activities of the Corporation including any measures for shareholder feedback;

(e) appoints the Officers of the Corporation, ensuring that they are of the calibre and integrity required for their roles and planning their succession as appropriate from time to time;

(f) reviews and approves on an annual basis, the overall strategy of the Corporation, all of which is developed in the first instance for consideration by the Senior Executive Officers of the Corporation;

(g) assesses and selects nominees for election as Directors;

(h) ensures that new Directors are provided with adequate orientation;

(i) develops, through the Corporate Governance Committee, the Corporation’s approach to corporate governance issues;

(j) establishes and oversees sub-committees of the Board as appropriate, approves their mandates and approves the compensation of their members; and

(k) reviews the performance of Officers of the Corporation and of the Administrator in line with corporate policies in effect from time to time and fulfilment of the Corporation’s objectives; and

(l) establishes the expectations and responsibilities of, and assesses the performance of, the Directors.

In carrying out its responsibilities, the Board shall adopt a Code of Ethics to govern behaviour of Officers of the Corporation and officers and employees of the Administrator. The Board shall monitor the compliance with such Code and, should any material waivers be granted to Directors or Officers of the Corporation, the Board should as a matter of policy cause this to be disclosed in the next ensuing quarterly or annual report on the finances of the Corporation.

The Board shall meet on at least a quarterly basis and shall hold additional meetings as required or appropriate to deal with financing or other issues. Directors shall all be encouraged to attend meetings in person wherever feasible. Attendance at or participation in meetings shall be recorded.

Each of the Directors is expected to agree to an evaluation of his or her individual performance as well as to a review of the collective performance of the Board of Directors as a whole. Directors shall be encouraged to exercise their duties and responsibilities in a manner that is consistent with this mandate and with the best interests of the Corporation and its shareholders generally.

The Board of Directors shall have the authority to retain legal, accounting and other consultants to advise it. The Board may request any Officer of the Corporation or any officer or employee of the Administrator or its outside counsel or the external/internal auditors to attend any meeting of the Board or to meet with any members of, or consultants to, the Board.

An individual Director shall be permitted to engage an outside advisor at the expense of the Corporation where, for example, he or she is placed in a conflict position through activities of the Corporation, but any such engagement shall be subject to the prior approval of the Board or the Chairman of the Audit Committee.”

In carrying out its duties, the Board holds regular meetings on at least a quarterly basis and additional meetings to deal with particular matters as appropriate. Supported by two standing Committees of the Board and ad hoc Committees as needed, the Board stewards the Corporation, including the activities of the Administrator and, in summary, oversees corporate strategy and its implementation; identifies and assesses the principal risks of the affairs of the Corporation; reviews financial performance and reporting and disclosure; assesses the internal control and information systems; assesses and selects nominees for election as Directors; appoints the Officers of the Corporation, ensures their integrity and reviews their performance; deals with succession planning; reviews and approves actions of the Committees; oversees public communications policies and shareholder relations; and annually reviews the effectiveness of the Board and Committees, including each Director’s contribution. These duties and responsibilities are consistent with the Governance Rules.

An individual Director is permitted to engage an outside advisor at the expense of the Corporation in specific circumstances such as where such Director is placed in a conflict position through activities of the Corporation, but any such engagement is subject to prior approval as referred to above. No circumstance for any such engagement has arisen to date.

Code of Ethics

The Board has adopted a Code of Ethics which governs the behaviour of its Directors and Officers. The Code is reviewed annually and recommended changes, if any, are brought to the Board. Compliance with the Code is monitored by the Board and, should any waiver be granted to a Director or Officer, the policy is to disclose this in the next ensuing quarterly or annual report. The Board has also adopted a formal mandate that sets out its responsibilities for stewardship of the Corporation. The Code of Conduct and Ethics and the Board Mandate are set out on the Corporation’s website atwww.centralfund.com .

Tenure of Office

The Board has also adopted an individual Director’s mandate setting forth the duties and responsibilities of each Director. As a matter of policy, unless otherwise determined by the Board, a Director shall retire from office at the next annual meeting following attainment of 78 years of age. However, the Board membership is refreshed periodically. Five years ago, the average age of the Board members was 60.6 years. The average age of the current nominees as Directors is 56.4 years.

As recommended in the Guidelines and the Governance Rules, formal position descriptions have been developed for the Board, the Chairman of the Audit Committee and the Chairman of the Corporate Governance Committee as well as for the CEO, thereby defining the limits of the Senior Executive Officers’ responsibilities and the CEO’s corporate objectives.

The Code of Conduct and Ethics is complemented by a Whistleblower Policy which, as the Corporation has no employees, is primarily focused on the few employees and officers of the Administrator. The Policy defines whether designated Officers of the Corporation or the Audit Committee should investigate complaints, defines procedures to be followed and provides protection for a whistleblower.

Lead Director

Dr. Glenn Fox, the Chair of the Corporate Governance Committee and an independent Director, is currently designated as the “Lead Director”. As such, he has taken on the responsibility of overseeing the operation of the Board and its effectiveness, of ensuring that the Board functions independently of the Administrator and of leading discussions of the Board when it meets in private session without the Senior Executive Officers or representatives of the Administrator present. Thesein camera sessions are held at the conclusion of each regular Board meeting and at each regular Audit or Corporate Governance Committee meeting so as to promote full and open discussion among the Directors who are not owners of the Administrator. The Lead Director is appointed annually by the Board.

Board Activities

The Board is in a position to conduct its meetings and to make appropriate decisions effectively. Financial and other information is made available to Board members several days in advance of meetings. Directors are generally encouraged to attend meetings in person. Directors are asked to advise the Corporation if they are unable to attend meetings and attendance at meetings is recorded. The Board held four regular meetings and nine special meetings during the past fiscal year. All of the Directors have agreed to an evaluation of their collective as well as their individual performance. All of the Directors are encouraged to exercise their responsibilities in the best interests of Central Fund and its shareholders generally.

Director Nominees

The Board has not adopted a formal policy for the recruitment of new Directors as recommended by the Governance Rules. However, as the need for new Directors arises, the responsibility for identifying or reviewing a nominee or nominees and recommending them to the Board is assigned to the Corporate Governance Committee, all of the members of which are independent Directors. This Committee advises the Board on the appropriate size of the Board and the competencies, skills and experience that the Board as a whole, and individual nominees, should possess in the context of the Corporation’s activities. The Committee Chair elicits suggestions for new or replacement Directors and assesses the qualities and experience of nominees including diversity and other factors. When considering diversity, the Committee considers personal characteristics such as age, gender, education and integrity.

For competencies and skills of the current nominees for Directors, please see the background information set out under “Election of Directors-Background of Nominees”.

The Committee’s assessment of candidates includes their overall suitability for the Board and one or more of its Committees, their integrity and their ability to devote sufficient time as a Board or Committee member. The Committee’s recommendations are discussed with the Senior Executive Officers and then go to the Board for approval. Mr. Cooper was recommended by the Corporate Governance Committee to the Board and duly appointed to the Board in December, 2015.

Representation of Women

No women serve as Directors at the present time (0%). The Corporation has not, at this time, adopted a written policy relating to the identification and nomination of women as Directors, nor has it adopted a target for representation of women by a fixed date. Recommendations are made by the Corporate Governance Committee on the basis of broad criteria such as skills and experience of candidates relating to the activities of the Corporation, its needs and diversity on the Board, and the Committee emphasizes merit as an important factor. The Corporate Governance Committee has just been through this process in the past three months. The possibility of adoption of a formal written policy is expected to be discussed at a major meeting of the Committee mid-year. The Directors are mindful of the benefit of diversity on a board of directors.

The Corporation has not adopted as yet a written policy relating to the identification and nomination of women as executive officers (as defined in the Governance Rules), nor has it adopted a target for representation of women in executive officer roles by a fixed date. However, of the five current officers of the Corporation, two positions, being the Chief Financial Officer and Treasurer and the Assistant Treasurer, or 40% of the officer roles are held by women.

Orientation of New Directors

Any new Director receives an extensive orientation. Before agreeing to be nominated for the Board, he or she is advised as to the role of the Board, its Committees and Directors, on the objective and status of the Corporation and on the Corporation’s structure, financial position, listings and regulatory environment as well as on other aspects of the Corporation’s activities. He or she is briefed on the anticipated workload and time commitment. A Director’s manual is also provided which contains, among other things, the structure of the Board and its Committees, a current list of Officers and Directors, the charters of the Board and Committees, and insider trading, communications and other policies as well as the Code of Conduct and Ethics. In addition, the individual Director mandate is provided. This is consistent with the Governance Rules and enables a new Director to better understand the Corporation and his or her role and responsibilities.

Continuing Education

The Board encourages its members to attend or participate in seminars or information sessions that relate to their responsibilities as Board or Committee members. In addition, the President and Chief Executive Officer provides a quarterly briefing on the status and outlook for the Corporation, the Corporate Secretary provides at least a semi-annual briefing on regulatory changes and corporate governance developments that may be of interest and the external Auditors and others provide materials and offer seminars on subjects of interest such as changes in accounting policies or in International Financial Reporting Standards.

Committees

The Board is responsible for establishing and overseeing the performance of all Committees and for the appointing of members to serve on such Committees and approving their compensation. Two standing Committees have been appointed.

TheAudit Committeeis currently comprised of three Directors, all of whom are unrelated and independent Directors as contemplated by the Audit Committee Rules. Each of the members of the Committee is “financially literate” in having the ability to read and understand a set of financial statements and the accompanying notes that present a breadth and level of complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements. Each of the members of the Committee is regarded by the Board, by virtue of his respective education and/or business background, as well as experience with Central Fund, as having: (a) a basis for understanding the accounting principles used by the Corporation to prepare its financial statements; (b) the ability to assess the general application of such accounting principles in connection with the accounting for estimates, accruals and reserves; (c) experience analyzing or evaluating financial statements of the type referred to above; and, (d) an understanding of internal controls and procedures for financial reporting.

Mr. Cooper has been a highly ranked precious metals analyst for many years, which work has, among other things, involved review of innumerable financial statements as part of his assessment of mining equities and advisory work on valuations and risk analysis. Mr. Heagle is a graduate of the Richard Ivey Business School. He has been an officer since 1982 and President and a director of National System of Baking Ltd. since 1991 and is President of its division, NSBL International (private capital investments). Mr. Schwandt is a Professional Engineer who holds an MBA degree, has previously owned a tax credit and cost-reduction consultancy and has held various managerial roles.

The charter for the Audit Committee reflects the requirements of the Audit Committee Rules. The Audit Committee fulfils its responsibilities within the context of the following guidelines:

| · | the Committee communicates its expectations to the Senior Executive Officers and the external Auditors with respect to the nature, extent and timing of its information needs. The Committee expects that draft financial statements and other written materials will be received from the Senior Executive Officers several days in advance of Committee meeting dates; |

| · | the Committee, in consultation with the Senior Executive Officers and the external Auditors, develops an Audit Committee agenda which is responsive to the Committee’s needs as set out in its charter; |

| · | the Committee, in consultation with the Senior Executive Officers and the external Auditors, reviews important financial issues and emerging audit, accounting and governance standards which may impact the Corporation’s financial disclosure and presentation; |

| · | the Chair of the Committee and other Audit Committee members have direct, open and frank discussions during the year with the Senior Executive Officers, other Board members and the external Auditors as required; |

| · | to assist the Committee in fulfilling its responsibilities, it may, at the expense of the Corporation and after consultation with the President, engage an outside advisor with special expertise; |

| · | as the external Auditor’s responsibility is not only to the Board of Directors but to the Audit Committee as representatives of the shareholders, the Committee expects the external Auditors to report to it all material issues arising out of their services or relationship with the Corporation; and |

| · | the Committee pre-approves both audit and non-audit services. |

The Audit Committee meets on at least a quarterly basis with one or more Officers of the Corporation and with the external Auditors to discuss the independence of the external Auditors, the scope of the annual audit and of quarterly reviews, the audit plan, access granted to the accounting system and related internal controls, cooperation of the Senior Executive Officers in the audit and review function, internal controls, the financial reporting process and related internal controls, the quality and adequacy of the Corporation’s or the Administrator’s accounting and financial personnel and other resources and financial risk management so as to satisfy itself that each party is properly discharging its responsibilities. The Committee also reviews the quarterly and annual financial statements, the Annual Information Form, the Annual Report including the external Auditors’ report, the required Management’s Discussion and Analysis and financial press releases. The Committee further reviews the remuneration of and recommends, for review by the Board and approval by the shareholders, the re-appointment and terms of engagement of the external Auditors.

The Committee also pre-approves all non-audit services proposed to be provided by the external Auditors. The conduct of the Committee is reviewed annually by the Committee and the Board. The charter of the Audit Committee is set out on the Corporation’s website atwww.centralfund.com and in the Corporation’s Annual Information Form.

Mr. Bruce Heagle currently chairs the Audit Committee which meets at least four times per year and which met six times during the last fiscal year. The Committee meets in camera at each regular meeting without any Senior Executive Officers or owners of the Administrator present.

TheCorporate Governance Committeeis currently comprised of three Directors, all of whom are independent.

The Corporate Governance Committee is responsible for developing the Corporation’s approach to governance issues; reviewing the effectiveness of the Board’s practices in light of emerging and changing regulatory requirements; assessing new nominees for the Board and planning education programs for them; and assessing the size, composition and effectiveness of the Board as a whole and of the Committees as well as assessing the contribution of individual Board members. The Committee’s responsibility extends to ensuring that the Board can function independently of the Senior Executive Officers and monitoring the Board’s relationship to the Senior Executive Officers. It reviews the communications policy of the Corporation to ensure that communications to shareholders, regulators and the investing public are factual and timely, are broadly disseminated in accordance with applicable policy and law and treat all shareholders fairly with respect to disclosure. The Committee recommends topics of interest or importance for discussion and/or action by the Board. It annually reviews the charters, mandates and policies of the Corporation, the timing and adequacy of materials provided to Directors or Committee members, the continuing qualifications and contribution of individual members as well as any conflicts of interest and time commitments. It also reviews the adequacy and form of the compensation of Directors to ensure that the compensation realistically reflects the responsibilities and risks involved in being an effective Director. The Committee is also responsible for approving the engagement by one or more Directors of an outside legal or other advisor at the expense of the Corporation should such extraordinary circumstances ever arise.

The charter of the Corporate Governance Committee is set out on the Corporation’s website atwww.centralfund.com. Its content, as well as that of all other charters, mandates and policies, are reviewed annually by the Committee and the Board.

Dr. Fox currently chairs the Corporate Governance Committee which generally meets twice per year. The Committee meets in camera at each regular meeting without any Senior Executive Officers or representatives of the owners of the Administrator present.

Anad hoc Special Committee, initially comprised of three, and currently four, independent Directors, was established by the Board of Directors in June, 2015 in response to a requisition (the “Requisition”) from 1891868 Alberta Ltd. (“SAM Alberta”), an affiliate of Sprott Asset Management LP, and five other registered and/or beneficial holders of Class A non-voting shares of the Company representing an aggregate of approximately 5.4% of the issued Class A shares. The Requisition proposed that a special meeting of the Class A non-voting shareholders be held to consider certain advisory resolutions, ordinary resolutions and a special resolution which would have the effect of terminating the Administrative and Consulting Agreement with The Central Group Alberta Ltd. effective as of October 31, 2015, enabling some Class A shareholders to have their Class A shares redeemed for physical bullion at 100% of net asset value, amending the Company’s articles to add a general voting right to each Class A share and removing the incumbent Directors of the Company and replacing them with nominees put forward by the requisitioning shareholders. The Requisition also contemplated that Sprott Asset Management LP would take over administration of the Company’s affairs.

The Board of Directors formed the Special Committee primarily to consider the Requisition and an application (the “Application”) subsequently filed by SAM Alberta in the Court of Queen’s Bench of Alberta (the “Court”) seeking certain relief under the Business Corporations Act of Alberta including on the ground of oppression. The Application was later amended to seek additional relief against the current and certain former Directors of the Corporation in the form of leave to commence a derivative action in the name and on behalf of the Corporation. The Requisition and the claim for relief from oppression were subsequently dismissed by the Courts in Alberta and the application for leave to commence a derivative action was adjourned sine die. The Special Committee is continuing with the balance of its mandate.

In view of the amendments to the Application seeking leave to commence a derivative action on behalf of the Corporation and the demand by SAM Alberta that the Corporation itself pursue such an action, a subcommittee of the Special Committee (the “Special Subcommittee”) was created to address the allegations advanced by SAM Alberta. The allegations arose generally in relation to an agreement between the Administrator and Mr. McAvity, the performance of the Administrator over time, the amounts paid to the Administrator relative to its services, and the knowledge and handling of those issues by certain of the Corporation’s Directors and former Directors.

After conducting its investigation with the assistance of its independent legal counsel, the Special Subcommittee concluded that the claims advanced by SAM Alberta in the Application relative to the derivative action have no merit. In the circumstances, the Special Subcommittee has now recommended that no action be brought by the Corporation against the proposed defendants. The Board is currently reviewing the report and recommendation of the Special Subcommittee.

Expectations of Senior Executive Officers

The Board expects the Senior Executive Officers of the Corporation to report in a timely, comprehensive and accurate manner on the affairs of the Corporation generally and on specific matters of significant consequence to Central Fund and the shareholders, to take timely action and decisions consistent with corporate policies in effect, to identify, in conjunction with the Board, the principal risks facing the Corporation and take appropriate measures to deal with risks and to review on an ongoing basis the strategies of the Corporation with a view to facilitating the Board’s review of same and their implementation by the Senior Executive Officers.

The Board has developed, in concert with the Lead Director and the President and Chief Executive Officer, a detailed position description for the President and Chief Executive Officer and the matters for which he is responsible.

Risk Management

The Board has an ongoing responsibility for risk assessment and oversight of controls as they relate to risks to which the Corporation is subject. As indicated in its charter, the Audit Committee reviews, at least annually, the financial risks affecting the Corporation, discusses, in concert with the Senior Executive Officers, the extent of the exposure and enquires to ensure that existing policies and controls are in place to identify and control these risks. The Board seeks to develop a good understanding of the significant risks to which the Corporation is subject and to ensure that the Senior Executive Officers are maintaining adequate internal controls as well as effectiveness in risk management.

Communications Policy

The objective of the Corporation’s communication policy is to ensure that its communications to shareholders, regulators and the investing public are factual, accurate and timely, are broadly disseminated in accordance with applicable policy and law and treat all shareholders fairly with respect to disclosure. The policy identifies material information in relation to the affairs of the Corporation particularly where the information can reasonably be expected to have a significant effect on the market price or value of the securities of the Corporation. It also deals with timeliness of communications, use of electronic communications, forward-looking information, quiet periods and other matters. In order to facilitate the effective and timely dissemination of information to all shareholders and the investment community, the Corporation releases its disclosed information through newswire services and mailings to shareholders.

Shareholder Feedback

The Board encourages communications feedback from shareholders generally through the Senior Executive Officers. Individual queries, comments or suggestions can be made orally or in writing directly to the Investor Relations Office. Shareholder comments, observations from analysts, writers or the public on comments received at the Investor Relations Office are considered and, where appropriate, brought to the attention of the Board.

aDMINISTRATIVE CONTRACTS

The Corporation’s administrative services, including the services of the President, Chief Executive Officer and Chief Financial Officer are provided by an external third party, the Administrator, through the Administrative and Consulting Services. The Administrator is controlled by Philip and Stefan Spicer and its registered address is Suite 805, 1323-15th Avenue S.W. Calgary, Alberta, T3C 0X8.

For a description of the material terms of the Administrative and Consulting Agreement, including fees payable to the Administrator thereunder, see "Interests of Certain Persons in Material Transactions".

EXECUTIVE COMPENSATION

The purpose of this section is to describe the compensation of certain executive officers of the Corporation (the "Named Executive Officers" or "NEOs") and the Directors for the most recently completed financial year of the Corporation in accordance with Form 51-102F6 – Statement of Executive Compensation published by the Canadian Securities Administrators. The Named Executive Officers during the financial year of the Corporation ended October 31, 2015 were J. C. Stefan Spicer (Chairman, President and Chief Executive Officer) and Catherine A. Spackman CPA, CMA (Treasurer and Chief Financial Officer).

Compensation Discussion and Analysis

Overview

There are no executive officers of the Corporation who receive remuneration from the Corporation. The officers and Directors of the Corporation who are also officers and directors of the Administrator receive no remuneration as officers and Directors of the Corporation from the Corporation.

However, the Administrator, under the Administrative and Consulting Agreement generally oversees day-to-day administration of the Corporation’s affairs. While it does not separately remunerate its personnel who also serve as officers and Directors of the Corporation for those services, the Administrator has advised that the Chairman, President and Chief Executive Officer and the Chief Financial Officer of the Corporation do receive remuneration from the Administrator for services that might be regarded as rendered specifically in their capacities as Officers and/or Directors of the Corporation for the fiscal year of the Corporation ended October 31, 2015.

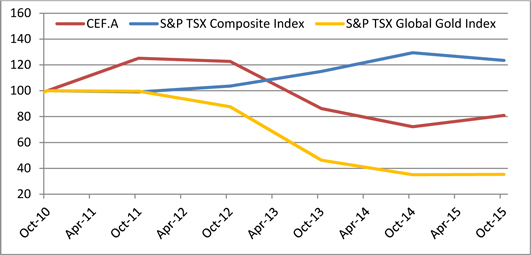

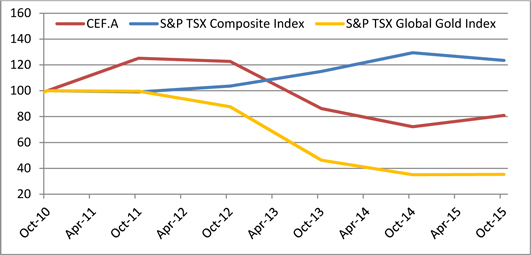

Performance Graph

The following graph compares the yearly percentage change in the cumulative total Shareholder return for $100 invested in Class A shares against the cumulative total shareholder return of the S&P/TSX Composite Index for the five most recently completed financial years of the Corporation.

The remuneration received by the Chief Executive Officer and Chief Financial Officer of the Corporation is indirect and neither the Directors nor the officers, other than the President and Chief Executive Officer, are aware of the specific basis on which such compensation is determined. The Directors understand that any indirect remuneration received by the Chief Executive Officer and Chief Financial Officer in connection with their services as such to the Corporation is not in any way dependent on the performance of the Class A shares of the Corporation on the stock exchanges on which such shares are listed for trading.

The Corporation does not have a formal compensation policy, with respect to its officers and has no other personnel. The sole remuneration paid in respect of any such personnel is comprised at this time in the administration fee paid by the Corporation See "Management Contracts" and "Interests of Certain Persons in Material Transactions."

Short-Term and Long-Term Incentive Compensation

The Board of Directors has not granted and do not foresee granting any options on shares and have not created and do not foresee creating any deferred share plan for the benefit of the Directors or officers of the Corporation.

The Corporation does not anticipate paying any other long-term incentive awards to the executive officers, including the NEOs. Further, the Corporation does not anticipate establishing any supplemental executive retirement plans, pension plans, defined contribution plans, deferred compensation plans or disability benefits for the Directors or the executive officers, including the NEOs.

Summary Compensation Table

The following table sets forth information concerning the annual and long-term compensation for services rendered to the Corporation for the financial years ended October 31, 2015, 2014 and 2013 respectively, in respect of the NEOs during each such financial year.

| | | | | | | | | Unit- | | Option- | | Non-Equity Incentive Plan

Compensation | | | | | | | | | |

Name and Principal

Position | | Period

ended

October 31 | | | Salary

($) | | | Based

Awards

($) | | Based

Awards

($) | | Annual

Incentive

Plans ($) | | Long-Term

Incentive

Plans ($) | | Pension

Value ($) | | | All Other

Compensation(1)

($) | | | Total

Compensation

($) | |

| (A) | | (B) | | | (C) | | | (D) | | (E) | | (F1) | | (F2) | | (G) | | | (H) | | | (I) | |

| J. C. Stefan Spicer | | | 2015 | | | | Nil | | | Nil | | Nil | | Nil | | Nil | | | Nil | | | $ | 200,000 | | | $ | 200,000 | |

| (President and Chief | | | 2014 | | | | Nil | | | Nil | | Nil | | Nil | | Nil | | | Nil | | | $ | 200,000 | | | $ | 200,000 | |

| Executive Officer) | | | 2013 | | | | Nil | | | Nil | | Nil | | Nil | | Nil | | | Nil | | | $ | 200,000 | | | $ | 200,000 | |

| Catherine | | | 2015 | | | | Nil | | | Nil | | Nil | | Nil | | Nil | | | Nil | | | $ | 42,000 | | | $ | 42,000 | |

| A.Spackman. (Treasurer | | | 2014 | | | | Nil | | | Nil | | Nil | | Nil | | Nil | | | Nil | | | $ | 42,000 | | | $ | 42,000 | |

| and CFO) | | | 2013 | | | | Nil | | | Nil | | Nil | | Nil | | Nil | | | Nil | | | $ | 42,000 | | | $ | 42,000 | |

Notes:

(1)Represents compensation paid to the applicable NEO by the Administrator, which the Administrator has advised the Corporation is in respect of services provided by each NEO that might be regarded as rendered specifically in their capacities as officers of the Corporation. The Directors and officers, other than the President and Chief Executive Officer, are not aware of the basis upon which the Administrator compensates its personnel, including such personnel that serve in NEO capacities of the Corporation, nor of the basis upon which the Administrator allocates portions of any such compensation to the services such NEOs provide to the Corporation.

The Corporation does not provide retirement or pension benefits for Directors or executive officers.

Named Executive Officer Employment Agreements and Termination and Change of Control Benefits

Neither of the NEOs provide services to the Corporation through an employment agreement. The Administrative and Consulting Agreement through which the Administrator provides the services of the NEOs to the Corporation does not confer any change of control benefits on the NEOs.

Directors’ Remuneration

The Directors’ remuneration is intended to provide modest compensation for the risks and responsibilities undertaken by a Director of Central Fund.

Each of the Directors, other than the Chairman, CEO and President who is an employee of the Administrator, The Central Group Alberta Ltd., effective as and from November 1, 2013 has been paid an annual fee of U.S. $20,000 for service as a Director and a fee of U.S. $1,800 per meeting for all Board and Committee meetings attended in person or by conference telephone. The Committee Chairs and the Lead Director and Vice-Chairman of the Corporation receive a further annual fee of U.S. $4,000. Independent Directors who attend at and assist with bullion audit inspections receive a fee of U.S. $1,800 for each attendance.

The aggregate fees paid by the Corporation to the Directors of the Corporation, who are not employees of The Central Group Alberta Ltd., for the fiscal year ended October 31, 2015 were U.S. $219,333.

The following table shows the total amount in U.S. dollars received by each Director for the year ended October 31, 2015.

| Name of Director | | Annual

Fee | | | Attendance

Fees | | | Committee

Chair | | | Vice-

Chairman

or Lead

Director | | | Total | |

| Brian E. Felske | | $ | 6,667 | | | $ | 9,000 | | | | | | | | | | | $ | 15,667 | |

| Glenn C. Fox | | $ | 13,333 | | | $ | 10,800 | | | $ | 1,000 | | | $ | 1,000 | | | $ | 26,133 | |

| Bruce D. Heagle | | $ | 20,000 | | | $ | 18,000 | | | $ | 4,000 | | | | | | | $ | 42,000 | |

| Ian M. T. McAvity | | $ | 20,000 | | | $ | 9,000 | | | $ | 3,000 | | | $ | 3,000 | | | $ | 35,000 | |

| Michael A. Parente | | $ | 20,000 | | | $ | 27,000 | | | | | | | | | | | $ | 47,000 | |

| Jason Schwandt | | $ | 13,333 | | | $ | 9,000 | | | | | | | | | | | $ | 22,333 | |

| Dale R. Spackman | | $ | 20,000 | | | $ | 7,200 | | | | | | | $ | 4,000 | | | $ | 31,200 | |

| | | | | | | | | | | | | | | | | | | $ | 219,333 | |

In addition, Messrs. Fox, Heagle and Schwandt received $33,850, $40,850. and $33,850 respectively for Special Committee services from June to October, 2015 consequent on the actions instituted by SAM Alberta and certain other holders of Class A shares

No directors' and officers' liability insurance is carried by the Corporation. No Director or Officer of the Corporation or any associate or affiliate of any such Director or Officer is or has been indebted to the Corporation.

INTEREST OF ADMINISTRATOR AND OTHERS IN MATERIAL TRANSACTIONS