EXHIBIT 99.1

| EXHIBIT 99.1 2nd Quarter INTERIM REPORT TO SHAREHOLDERS for the three and six months ended April 30, 2017 |

|

The Role of Central Fund

To serve investors as “The Sound Monetary Fund”.

To hold gold and silver bullion on a secure basis for the

convenience of investors in the shares of Central Fund.

Investment Policies & Restrictions | The investment policy set by the Board of Directors requires Central Fund of Canada Limited (“Central Fund” or the “Company”) to maintain a minimum of 90% of its net assets in gold and silver bullion of which at least 85% must be in physical form. On April 30, 2017, 99.9% of Central Fund’s net assets were held in gold and silver bullion. Of this bullion, 99.5% was in physical form and 0.5% was in certificate form.

Central Fund’s physical gold and silver bullion holdings may not be loaned, subjected to options or otherwise encumbered in any way.

| |

| Safeguards | Central Fund’s bullion is stored on an allocated and fully segregated basis in the highest rated (Class 3) underground vaults located in Canada, which are controlled by its Custodian, the Canadian Imperial Bank of Commerce (the “Bank”), one of the major Canadian banks.

The Bank may only release any portion of Central Fund’s physical bullion holdings upon receipt of an authorizing resolution of Central Fund's Board of Directors.

Bullion holdings and Bank vault security are inspected twice annually by Directors and/or Officers of Central Fund. On every occasion, inspections are required to be performed in the presence of both Central Fund's external auditors and Bank personnel.

Central Fund is subject to the extensive regulations and reporting requirements of the United States Securities and Exchange Commission, two stock exchanges and Canadian provincial securities regulatory authorities.

| |

| Conveniences | Central Fund's Class A non-voting shares are listed on the NYSE MKT (CEF) and on the Toronto Stock Exchange (CEF.A in Canadian dollars and CEF.U in U.S. dollars). Making a gold and silver bullion investment through Central Fund is as easy as calling one's stockbroker or investment dealer or processing the purchase through one’s online trading account.

The stock exchange listings provide liquid markets for the Class A non-voting shares of Central Fund. The bid/ask spread is usually considerably less than the buying and selling prices of outright bullion purchases, especially for small transactions.

Unlike most other forms of gold and silver bullion investment, there are no ownership costs, such as handling, storage and insurance, paid directly by the investor. As well, there are no bullion assay charges to a shareholder upon the sale or redemption of Class A non-voting shares of Central Fund. |

| 1 |

|

Second Quarter Report

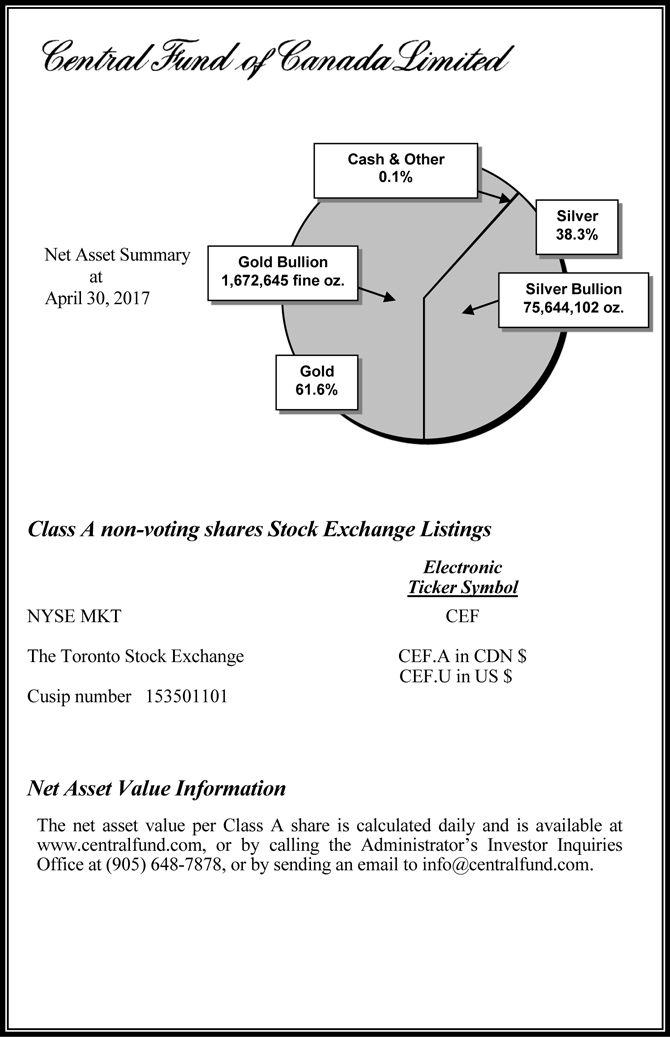

Central Fund currently holds 99.9% of its net assets in gold and silver bullion. At April 30, 2017, Central Fund’s gold holdings consisted of 1,663,332 fine ounces of physical gold bullion and 9,313 fine ounces of gold bullion certificates for a total of 1,672,645 fine ounces. Silver holdings consisted of 75,336,953 ounces of physical silver bullion and 307,149 ounces of silver bullion certificates for a total of 75,644,102 ounces. Central Fund continues to fulfill its mandate as “The Sound Monetary Fund”.

| On behalf of the Board of Directors: | |

| J.C. Stefan Spicer, Chairman, President & CEO |

May 29, 2017

Management’s Discussion and Analysis (“MD&A”)

The interim financial statements of Central Fund of Canada Limited (“Central Fund” or the “Company”) are prepared and reported in United States (“U.S.”) dollars in accordance with International Accounting Standards (“IAS”) 34 “Interim Financial Reporting” and may not include all of the information required for full annual financial statements. Notes to the interim financial statements on pages 11 to 19 should be referred to as supplementary information in this MD&A.

Central Fund is a specialized investment holding company which invests primarily in long-term holdings of unencumbered, allocated and physically segregated gold and silver bullion and it does not speculate in gold and silver prices. Central Fund is not an operating entity nor does it have any employees, office facilities or the potential risks thereof. Central Fund retains The Central Group Alberta Ltd (the “Administrator”) to attend to all administrative duties as delegated by the Administrative and Consulting Agreement and as guided by the Board of Directors.

There are no off-balance sheet items, arrangements, contingencies or obligations. All accounts are fully disclosed and itemized in the interim financial statements.

Certain statements contained in this MD&A constitute forward-looking statements. All forward-looking statements are based on the Company's beliefs and assumptions based on information available at the time the assumption was made. The use of any of the words "anticipate", "continue", "estimate", "expect", "may", "will", "project", "should", "believe" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in these forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct. Such forward-looking statements included in this MD&A should not be unduly relied upon. These statements speak only as of the date of this MD&A.

| 2 |

|

In particular, but without limiting the foregoing, this MD&A contains forward-looking statements pertaining to the expectation that income tax will not be payable by the Company on a partial sale of gold and silver bullion, and steps that may be taken by the Company relative to the Class A Shareholder’s Proceedings.

The material factors and assumptions used to develop these forward-looking statements include, but are not limited to, those referred to in Note 3 of the financial statements under “Estimates and Assumptions”.

Actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors described in “Risk Factors” in the Company’s 2016 annual MD&A as well as Notes 10 and 13 of the financial statements set forth in this Interim Report.

Financial Results – Changes in Net Assets

Total equity (also referred to as “net assets”) increased by $95.7 million or 2.9% during the three months ended April 30, 2017 primarily as a result of a 4.4% increase in the price of gold per fine ounce and a 0.7% increase in the price of silver per ounce during the period.

Total equity decreased by $62.4 million or 1.8% during the six months ended April 30, 2017. Approximately one-half of this decrease was a result of a 0.4% decrease in the price of gold per fine ounce and a 2.0% decrease in the price of silver per ounce during the period, and to a lesser extent, the purchase and cancellation of Class A shares under the NCIB program.

The following table summarizes selected interim financial information (amounts in millions except where stated on a per share or per ounce basis):

| Quarter ended (U.S.$) | ||||||||||||||||

Apr. 30, 2017 | Jan. 31, 2017 | Oct. 31, 2016 | July 31, 2016 | |||||||||||||

| Change in unrealized appreciation of holdings | $ | 98.8 | $ | (134.6 | ) | $ | (289.6 | ) | $ | 259.5 | ||||||

| Net income (loss) inclusive of the change in unrealized appreciation of holdings | $ | 95.7 | $ | (137.3 | ) | $ | (292.6 | ) | $ | 256.7 | ||||||

| Net income (loss) per Class A share inclusive of the change in unrealized appreciation of holdings | $ | 0.38 | $ | (0.54 | ) | $ | (1.15 | ) | $ | 1.01 | ||||||

| Total net assets | $ | 3,439.0 | $ | 3,343.3 | $ | 3,501.4 | $ | 3,805.0 | ||||||||

| Gold price (per fine ounce) | $ | 1,266.45 | $ | 1,212.80 | $ | 1,272.00 | $ | 1,342.00 | ||||||||

| Silver price (per ounce) | $ | 17.41 | $ | 17.29 | $ | 17.76 | $ | 20.04 | ||||||||

| 3 |

|

Apr. 30, 2016 | Jan. 31, 2016 | Oct. 31, 2015 | July 31, 2015 | |||||||||||||

| Change in unrealized appreciation of holdings | $ | 567.5 | $ | (171.1 | ) | $ | 156.8 | $ | (289.6 | ) | ||||||

| Net income (loss) inclusive of the change in unrealized appreciation of holdings | $ | 580.3 | $ | (174.0 | ) | $ | 152.9 | $ | (292.6 | ) | ||||||

| Net income (loss) per Class A share inclusive of the change in unrealized appreciation of holdings | $ | 2.28 | $ | (0.69 | ) | $ | 0.60 | $ | (1.15 | ) | ||||||

| Total net assets | $ | 3,548.2 | $ | 2,968.0 | $ | 3,142.0 | $ | 2,991.7 | ||||||||

| Gold price (per fine ounce) | $ | 1,285.65 | $ | 1,111.80 | $ | 1,142.35 | $ | 1,098.40 | ||||||||

| Silver price (per ounce) | $ | 17.86 | $ | 14.08 | $ | 15.63 | $ | 14.56 | ||||||||

Financial highlights

Three months ended April 30 | Six months ended April 30 | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Gold price (per fine ounce) | $ | 1,266.45 | $ | 1,285.65 | $ | 1,266.45 | $ | 1,285.65 | ||||||||

| Silver price (per ounce) | $ | 17.41 | $ | 17.86 | $ | 17.41 | $ | 17.86 | ||||||||

| Class A share - NAV performance: | ||||||||||||||||

| Net asset value per share at beginning of period | $ | 13.26 | $ | 11.66 | $ | 13.79 | $ | 12.35 | ||||||||

| Increase (decrease): | ||||||||||||||||

| Net income (loss) before the change in unrealized appreciation of holdings | (0.01 | ) | 0.05 | (0.02 | ) | 0.04 | ||||||||||

| Change in unrealized appreciation of holdings - gold | 0.35 | 1.12 | (0.04 | ) | 0.91 | |||||||||||

| - silver | 0.04 | 1.11 | (0.10 | ) | 0.64 | |||||||||||

| Total increase (decrease)(1) | 0.38 | 2.28 | (0.16 | ) | 1.59 | |||||||||||

| Net asset value per share at end of period | $ | 13.64 | $ | 13.94 | $ | 13.64 | $ | 13.94 | ||||||||

| Total return for period | 2.9 | % | 19.6 | % | 1.1 | % | 12.9 | % | ||||||||

| Percentages and supplemental data: | ||||||||||||||||

| Ratios as a percentage of average net assets: | ||||||||||||||||

| Expenses(2) | 0.09 | % | 0.09 | % | 0.18 | % | 0.19 | % | ||||||||

Net income (loss) before the change in unrealized appreciation of holdings (2) | 0.09 | % | 0.38 | % | 0.17 | % | 0.32 | % | ||||||||

The increase (decrease) per share is based on the weighted average number of total shares outstanding during the period. The net asset values per share are based on the actual number of total shares outstanding at the end of the relevant reporting period.

(1)This table is not meant to be a reconciliation of beginning to end of period net asset value per share.

(2)Ratios not annualized.

| 4 |

|

Disclosure Controls and Procedures

The senior executive officers (“Senior Officers”) have established and implemented disclosure controls and procedures in order to provide reasonable assurance that material information relating to the Company is disclosed on a timely basis. They believe these disclosure controls and procedures have been effective during the six months ended April 30, 2017.

Outstanding Shares

There were 252,116,003 Class A non-voting shares issued and outstanding at May 29, 2017, April 30, 2017 (October 31, 2016: 253,803,391), and 40,000 Common shares issued and outstanding at May 29, 2017, April 30, 2017; and October 31, 2016.

Financial Results – Net Income

Central Fund’s earned income objective is secondary to its purpose of holding almost all of its net assets in gold and silver bullion. Generally, Central Fund seeks only to maintain adequate cash reserves to enable it to pay expenses and Class A share dividends. Because gold and silver bullion are not loaned to generate income, and in the absence of bullion sales, Central Fund’s realized income is typically a nominal percentage of its net assets.

Net income, inclusive of the change in unrealized appreciation of holdings, for the three months ended April 30, 2017 was $95.7 million compared to $580.3 million for the comparable period in 2016. Net loss, inclusive of the change in unrealized appreciation of holdings, for the six months ended April 30, 2017 was $41.6 million compared to net income of $406.3 million for the comparable period in 2016. Normally, the net income (loss) for the three and six-month periods ended April 30, 2017 and 2016 would be a result of the change in prices of gold and silver bullion during the respective periods. This was primarily the case for 2017. However, on April 25, 2016, the Company sold 22,000 fine ounces of gold bullion (1.30% of holdings) at $1,248.30 per ounce and 1,320,000 ounces of silver bullion (1.72% of holdings) at $16.9875 per ounce for total proceeds of $49,886,100 and net gains of $15.8 million. A portion of the proceeds was used to purchase and cancel 1,750,320 shares at a discount, and on an accretive basis to shareholders, since the NCIB was first granted. The gold and silver sales were made proportionately so as to maintain the current weightings of gold and silver.

Certain expenses, such as administration fees and safekeeping fees, vary relative to net asset levels or the quantities and values of the gold and silver bullion held. Administration fees, which are scaled and are calculated monthly based on the total net assets at each month-end, increased by $42,940 and $179,783 respectively during the three and six-month periods ended April 30, 2017 as compared to the same periods in 2016. Safekeeping fees increased by $38,602 and $148,586 during the same respective periods. The change in administration fees was directly due to the change in the levels of average net assets under administration, while the change in safekeeping fees was directly due to the changes in the prices of gold and silver during these periods.

| 5 |

|

Expenses as a percentage of average month-end net assets (the “expense ratio”) for the three-month period ended April 30, 2017 remained unchanged at 0.09% compared to the comparable three-month period in 2016. For the six-month period ended April 30, 2017, the expense ratio was 0.18% compared to 0.19% for the comparable six-month period in 2016. For the twelve-month period ended April 30, 2017, the expense ratio was 0.34% compared to 0.41% for the comparable twelve-month period ended April 30, 2016. The

costs incurred to address issues related to the Class A Shareholder’s Proceedings for the three months ended April 30, 2017 were $286,015 (2016: $118,194). For the six months ended April 30, 2017 costs were $363,453 (2016: $631,871). For the twelve months ended April 30, 2017 costs were $597,838 (2016: $2,514,916). If not for these costs, the expense ratios would have been 0.08% (2016: 0.08%) for the three-month period, 0.17% (2016: 0.17%) for the six-month period and 0.32% (2016: 0.33%) for the twelve-month period ended April 30, 2017.

Liquidity and Capital Resources

All of Central Fund’s assets are liquid. The Company’s liquidity objective is to hold cash and cash equivalents in a safe and conservative manner to generate income primarily to be applied towards expenses and Class A share dividends. The ability of Central Fund to have sufficient cash for expenses and dividend payments, the re-purchase of Class A non-voting shares, and to meet demands for redemptions (if any), is primarily dependent upon its ability to realize cash flow from its cash equivalents. Should Central Fund not have sufficient cash to meet those needs identified above, portions of Central Fund's bullion holdings may be sold. Sales of bullion holdings could result in Central Fund realizing either capital gains or losses.

For the six months ended April 30, 2017, Central Fund’s cash and cash equivalents decreased by $29.3 million to $5.0 million. This decrease was a result of $20.7 million paid for the re-purchase and cancellation of Class A non-voting shares pursuant to the Company’s normal course issuer bid, $2.5 million paid for the 2016 year-end Class A share dividend, and amounts used to pay expenses, including the costs of the Class A Shareholder’s Proceedings. The Board of Directors and Senior Officers monitor Central Fund’s cash position with an emphasis on maintaining its mandate to hold maximum amounts of gold and silver bullion at all times.

Administrator and Other Related Party Information

Please refer to Note 9 of the interim financial statements.

Class A Shareholder’s Proceedings

During 2015 and 2016, the Company successfully defended certain actions instituted by 1891868 Alberta Ltd. ("SAM Alberta") in the Court of Queen's Bench of Alberta (the "Class A Shareholder’s Proceedings"), including an application (the "Application") seeking relief under theBusiness Corporations Act of Alberta ( the “Act”) on the ground of oppression, as described in the Company's annual MD&A for the year ended October 31, 2015. On September 10, 2015, SAM Alberta sought to amend the Application (the “Amended Application”) to add further respondents, to seek leave of the Court to commence a derivative action on behalf of the Company, as described in the Company’s 3rd Quarter, 2016 interim MD&A, and for other interim relief. On September 23, 2015, the Court dismissed SAM Alberta's oppression claim and its application for the interim relief sought, but granted some of the requested amendments to allow for a hearing on whether leave should be granted to bring a derivative action (the “Leave Application”). A hearing date of March 8, 2017 was set for consideration of the

| 6 |

|

Leave Application and an application by the Company (the “Strike Application”) to strike the Leave Application.

On March 7, 2017, SAM Alberta filed an application ("Plan Application") for an order approving a proposed arrangement pursuant to section 193 of the Act, involving Central Fund, its shareholders and Sprott Physical Gold and Silver Trust, a trust to be newly formed ("Trust") managed by Sprott Asset Management LP, a wholly owned subsidiary of Sprott Inc. Dates of September 7-8, 2017 have been set for the interim hearing of the Plan Application. If SAM Alberta is successful at the interim hearing, it could result in Central Fund's shareholders being asked to vote on a Plan of Arrangement which, if approved, would result in such shareholders having their shares exchanged for trust units of the newly formed Trust.

As a result of the filing of the Plan Application, the Strike Application and Leave Application were adjourned by the Court.

The costs associated with the Class A Shareholder’s Proceedings were primarily for legal and advisory work. These costs will be reduced by virtue of a partial recovery of costs as awarded to the Company by the Court. The recovery of costs will be recognized in the financial statements as the quantum of such costs is determined.

Normal Course Issuer Bid

On February 27, 2016 and again on February 27, 2017, the Company received approval from the Toronto Stock Exchange (“TSX”) for a normal course issuer bid (“NCIB”) program enabling it to repurchase and cancel up to 12.6 million of its Class A non-voting shares, representing approximately 5% of the total number of issued and outstanding shares at that time. For the six months ended April 30, 2017, 1,687,388 Class A non-voting shares have been repurchased at a total cost of $20,724,160. All shares were repurchased on an accretive basis, at a discount to the net asset value per share at the time of such purchases and all such shares have been cancelled.

Additional Information

This MD&A is dated May 29, 2017. Additional information relating to the Company, including its Annual Information Form and 2016 Annual Report, is available on the SEDAR website atwww.sedar.com and Central Fund’s website atwww.centralfund.com.

| 7 |

Statements of Financial Position

(expressed in U.S. dollars, unaudited)

| April 30, | October 31, | |||||||

| 2017 | 2016 | |||||||

| $ | $ | ||||||

| Net assets: | ||||||||

| Gold bullion at market (Notes 2(a) and 5) | 2,118,320,492 | 2,127,603,668 | ||||||

| Silver bullion at market (Notes 2(a) and 5) | 1,316,963,819 | 1,343,439,255 | ||||||

| Cash and cash equivalents (Notes 2(b) and 6) | 5,028,414 | 34,363,862 | ||||||

| Other receivables and prepayments (Note 2(c)) | 406,157 | 337,256 | ||||||

| Total assets: | 3,440,718,882 | 3,505,744,041 | ||||||

Liabilities: | ||||||||

| Dividends payable | - | 2,538,034 | ||||||

| Accrued liabilities (Notes 2(c), 7 and 9) | 1,689,668 | 1,812,230 | ||||||

| Total liabilities | 1,689,668 | 4,350,264 | ||||||

| Equity: | ||||||||

| Capital stock (Notes 2(d) and 8) Class A non-voting shares | 2,397,737,714 | 2,411,333,702 | ||||||

| Common shares | 19,458 | 19,458 | ||||||

| Retained earnings inclusive of unrealized appreciation of holdings | 1,041,272,042 | 1,090,040,617 | ||||||

| Total equity | 3,439,029,214 | 3,501,393,777 | ||||||

| Total liabilities and equity | 3,440,718,882 | 3,505,744,041 | ||||||

| Total equity per share: | ||||||||

| Note 2(h) | ||||||||

| Class A non-voting shares | 13.64 | 13.79 | ||||||

| Common shares | 10.64 | 10.79 | ||||||

| Exchange rate: U.S. $1.00 = Cdn. | 1.3665 | 1.3403 | ||||||

| Total equity per share expressed in Canadian dollars: | ||||||||

| Class A non-voting shares | 18.64 | 18.49 | ||||||

| Common shares | 14.54 | 14.47 | ||||||

See accompanying notes to the financial statements.

On behalf of the Board:

| “Bruce D. Heagle” | “Glenn C. Fox” |

| Director | Director |

| 8 |

Statements of Comprehensive Income (Loss)

(expressed in U.S. dollars, unaudited)

| Three months ended April 30, | Six months ended April 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| $ | $ | $ | $ | |||||||||||||

| Income: | ||||||||||||||||

| Interest | 11,989 | 113 | 35,052 | 2,593 | ||||||||||||

| Total income | 11,989 | 113 | 35,052 | 2,593 | ||||||||||||

| Expenses: | ||||||||||||||||

| Administration fees (Note 9) | 1,598,774 | 1,555,834 | 3,116,170 | 2,936,387 | ||||||||||||

| Safekeeping fees and bank charges | 961,333 | 922,731 | 1,889,827 | 1,741,241 | ||||||||||||

| Shareholder information | 97,250 | 62,047 | 151,097 | 103,768 | ||||||||||||

| Directors’ fees and expenses | 64,290 | 62,682 | 150,362 | 124,793 | ||||||||||||

| Legal fees (Note 9) | 33,647 | 79,354 | 76,605 | 137,662 | ||||||||||||

| Stock exchange fees | 32,675 | 35,127 | 67,640 | 70,577 | ||||||||||||

| Audit and related regulatory fees | 27,431 | 27,624 | 60,343 | 55,322 | ||||||||||||

| Registrar and transfer agent fees | 15,900 | 22,874 | 30,563 | 36,082 | ||||||||||||

| Class A Shareholder’s Proceedings | 286,015 | 118,194 | 363,453 | 631,871 | ||||||||||||

| Foreign exchange loss (gain) | - | - | 161 | (6,470 | ) | |||||||||||

| Total expenses | 3,117,315 | 2,886,467 | 5,906,221 | 5,831,233 | ||||||||||||

| Net income (loss) from administrative activities | (3,105,326 | ) | (2,886,354 | ) | (5,871,169 | ) | (5,828,640 | ) | ||||||||

| Realized gain on sale of bullion | - | 15,758,511 | - | 15,758,511 | ||||||||||||

| Change in unrealized appreciation of holdings | 98,804,366 | 567,453,812 | (35,769,234 | ) | 396,362,237 | |||||||||||

| Net income (loss) and comprehensive income (loss) inclusive of the change in unrealized appreciation of holdings | 95,699,040 | 580,325,969 | (41,640,403 | ) | 406,292,108 | |||||||||||

Seeaccompanying notes to the financial statements.

| 9 |

Statements of Changes in Equity

(expressed in U.S. dollars, unaudited)

Number of Outstanding | Share Capital | Retained Earnings | Total Equity | |||||||||||||

| $ | $ | $ | ||||||||||||||

| November 1, 2015 | 254,472,713 | 2,419,790,136 | 722,205,822 | 3,141,995,958 | ||||||||||||

| Net income (loss) for the period | 406,292,108 | 406,292,108 | ||||||||||||||

| April 30, 2016 | 254,472,713 | 2,419,790,136 | 1,128,497,930 | 3,548,288,066 | ||||||||||||

| November 1, 2016 | 253,843,391 | 2,411,353,160 | 1,090,040,617 | 3,501,393,777 | ||||||||||||

| Net income (loss) for the period | (41,640,403 | ) | (41,640,403 | ) | ||||||||||||

| Repurchase of Class A non-voting shares (Note 8) | (1,687,388 | ) | (13,595,988 | ) | (7,128,172 | ) | (20,724,160 | ) | ||||||||

| April 30, 2017 | 252,156,003 | 2,397,757,172 | 1,041,272,042 | 3,439,029,214 | ||||||||||||

Seeaccompanying notes to the financial statements.

Statements of Cash Flows

(expressed in U.S. dollars, unaudited)

| Six months ended April 30, | ||||||||

| 2017 | 2016 | |||||||

| $ | $ | |||||||

| Cash flows from operating activities | ||||||||

| Net income (loss) | (41,640,403 | ) | 406,292,108 | |||||

| Adjustment to reconcile net income (loss) to net cash used in operating activities: | ||||||||

| Change in unrealized appreciation of holdings | 35,769,234 | (396,362,237 | ) | |||||

| Realized gain on sale of bullion | - | (15,758,511 | ) | |||||

| Net changes in operating assets and liabilities: | ||||||||

| Decrease (increase) in other receivables and prepayments | (68,901 | ) | (132,527 | ) | ||||

| Increase (decrease) in accrued liabilities | (122,562 | ) | 514,145 | |||||

| Effect of exchange rate change | (10,622 | ) | (118 | ) | ||||

| Net cash used in operating activities | (6,073,254 | ) | (5,447,140 | ) | ||||

| Cash flows from investing activities | ||||||||

| Purchase and cancellation of Class A non-voting shares | (20,724,160 | ) | - | |||||

| Proceeds from sale of bullion | - | 49,886,100 | ||||||

| Dividends paid | (2,538,034 | ) | (2,544,327 | ) | ||||

| Net increase (decrease) in cash and cash equivalents | (29,335,448 | ) | 41,894,633 | |||||

| Beginning of period cash and cash equivalents | 34,363,862 | 7,437,644 | ||||||

| Cash and cash equivalents at April 30 | 5,028,414 | 49,332,277 | ||||||

See accompanying notes to the financial statements.

| 10 |

Notes to Financial Statements

For the six months ended April 30, 2017

(amounts expressed in U.S. dollars unless otherwise stated)

| 1. | Organization of the Company: |

Central Fund of Canada Limited (“Central Fund” or the “Company”) was incorporated under the Business Corporations Act, 1961 (Ontario), and was continued under the Business Corporations Act (Alberta) on April 5, 1990.

Central Fund is a specialized, passive holding company and a low-cost, convenient facility for the investment ownership of gold and silver bullion. At April 30, 2017, over 99.9% (October 31, 2016: 99.2%) of its net assets were held in the form of gold and silver bullion.

The Company is authorized to issue an unlimited number of Class A non-voting shares. All Class A non-voting shares are listed and traded on the New York Stock Exchange MKT (symbol CEF) and the Toronto Stock Exchange (symbol CEF.A in Canadian dollars and CEF.U in U.S. dollars).

The purpose of Central Fund is to acquire, hold and secure gold and silver bullion on behalf of its shareholders. All gold and silver bullion bars are “Good Delivery Bars” as defined by the London Bullion Market Association (“LBMA”), and are stored on an allocated and physically segregated basis in the highest rated (Class 3) underground treasury vaults of its Custodian, the Canadian Imperial Bank of Commerce, one of the major Canadian banks.

The Company’s head office is located at 1323 – 15th Avenue S.W., Suite 805, Calgary, Alberta, Canada, T3C 0X8.

The Central Group Alberta Ltd. (the “Administrator”) acts as the administrator of the Company pursuant to an Administrative and Consulting Agreement with the Company.

The financial statements of the Company as at and for the three and six months ended April 30, 2017 were authorized for issue by the Board of Directors of the Company on May 29, 2017.

| 2. | Summary of significant accounting policies: |

Basis of Preparation

The Company’s interim financial statements have been prepared in accordance with International Accounting Standards (“IAS”) 34 “Interim Financial Reporting”. The interim financial statements may not include all of the information required for full annual financial statements.

These interim financial statements have been prepared on a historical cost basis, except for gold and silver bullion, financial assets and financial liabilities held at fair value through income or loss, and have been measured at fair value. The financial statements are presented in U.S. dollars and all values are rounded to the nearest dollar unless otherwise indicated.

| 11 |

| (a) | Gold and silver holdings: |

Gold and silver bullion, and gold and silver certificates, are measured at fair value by reference to the final daily London Bullion Market Association fixing rates, with realized gains and losses and unrealized appreciation or depreciation of holdings recorded in income based on the IAS 40 Investment Property fair value model, as IAS 40 is the most relevant standard to apply. Investment transactions are accounted for on the trade date.

| (b) | Cash and cash equivalents: |

Cash and cash equivalents consist of deposits with the Company’s banker, which are not subject to restrictions.

| (c) | Other receivables, prepayments and accrued liabilities: |

| i) | Other receivables and prepayments include all financial assets other than cash and cash equivalents and gold and silver bullion. Prepaid expenses and accrued interest receivable would be included in this category. |

| ii) | Accrued liabilities include all financial liabilities. Administration fees payable, safekeeping fees payable and other accounts payable would be included in this category. |

| (d) | Share capital: |

The Company has Class A non-voting shares, which are retractable, as well as Common shares, which are not retractable. Due to the discount at which a holder is permitted to retract the shares, as well as the limitations on the circumstances in which retraction is permissible, the Company has determined that the retraction feature should not be included in the assessment of equity classification under IAS 32 Financial Instruments – Presentation. Accordingly, the Company has classified both the Class A non-voting shares and the Common shares as equity in these financial statements.

| (e) | Fees and other expenses: |

Fees and other expenses are recognized on an accrual basis.

| (f) | Income taxes: |

Central Fund is taxed as a "Mutual Fund Corporation" for income tax purposes. The Company intends to distribute all net realized taxable capital gains and all other taxable income (net of any costs applied to such amounts and any loss carryforwards available) directly earned by Central Fund to its shareholders and to deduct such distributions for income tax purposes. Accordingly, there is no provision for income taxes.

| 12 |

| (g) | Net loss from administrative activities: |

The Company exists for the purpose of holding gold and silver bullion, on an allocated and physically segregated basis, on behalf of its shareholders. Gold and silver holdings are intended to be permanent assets of the Company and the unrealized appreciation of the gold and silver holdings does not represent distributable earnings. There generally is no intention to sell any of the Company’s gold or silver holdings unless it becomes necessary to generate cash to meet ongoing expenses or to pay for redemptions (if any) or the repurchase of shares under the normal course issuer bid (“NCIB”). The Company currently does not loan, lease or otherwise utilize its gold and silver bullion holdings to generate income and, consequently, the Company expects to incur a net loss from its administration activities.

| (h) | Per share calculation: |

The calculation of total equity (or the net asset value) per share is based on the number of shares outstanding at the end of the reporting period. Central Fund has no dilutive instruments.

| (i) | Functional and presentation currency: |

The Company’s functional and presentation currency is the U.S. dollar. The Company’s performance is evaluated, and its liquidity is managed, in U.S. dollars. Therefore, the U.S. dollar is considered to be the currency that best represents the economic effects of the underlying transactions, events and conditions of the Company.

| 3. | Significant accounting judgments, estimates and assumptions: |

The preparation of the Company’s financial statements requires the senior executive officers (the “Senior Officers”) to make judgments, estimates and assumptions that affect the amounts recognized in the financial statements. Uncertainty about these assumptions and estimates could result in outcomes that may require a material adjustment to the carrying amount of the asset or liability affected in future periods.

Judgments

In the process of applying the Company’s accounting policies, the Senior Officers have made the following judgments, which have the most significant effect on the amounts in the financial statements:

Going concern

The Company’s Senior Officers have made an assessment of the Company’s ability to continue as a going concern and are satisfied that the Company has the resources to continue in business for the foreseeable future. Furthermore, the Senior Officers are not aware of any material uncertainties that may cast significant doubt upon the Company’s ability to continue as a going concern. Therefore, the financial statements continue to be prepared on a going concern basis.

| 13 |

Estimates and assumptions

Estimation uncertainties in accounting assumptions at the reporting date that could cause material adjustment to carrying amounts of assets and liabilities within the next financial year are discussed below. The Company based its assumptions and estimates on information available when the financial statements were prepared. However, existing circumstances and assumptions about future developments may change due to market changes or circumstances arising beyond the control of the Company. Such changes are reflected in the assumptions when they occur.

For tax purposes, the Company’s policy is to treat any gains (or losses) from the disposition of gold and silver bullion as capital gains (or losses), rather than income (or loss), as the Company is, and intends to continue to be, a long-term passive holder of gold and silver bullion, and generally would only dispose of a portion of its holdings in gold and silver bullion when forced to do so for the purposes of meeting redemptions (if any), share repurchases, or to pay expenses. The Canada Revenue Agency has, however, expressed its opinion that gains (or losses) of mutual fund corporations resulting from transactions in commodities should generally be treated for tax purposes as ordinary income rather than as capital gains, although the treatment in each particular case remains a question of fact to be determined having regard to all the circumstances.

The Company has also applied judgment in concluding that the retraction feature of the Class A non-voting shares should not be included in the assessment referred to in note 2(d).

| 4. | Segment information: |

For administrative purposes, the Company is organized into one main segment, being the passive, long-term holding of gold and silver bullion. It is not an active operating entity, and does not exist primarily to earn income. All of the Company’s activities are interrelated, and each activity is dependent on the others. Accordingly, all significant administrative decisions are based upon an analysis of the Company as one segment. The financial results from this segment are equivalent to the financial statements of the Company as a whole. The Company’s income (or loss) is almost entirely made up of the changes in the value of its gold and silver holdings.

| 14 |

| 5. | Gold and silver bullion: |

Details of gold and silver bullion holdings are as follows:

| April 30, 2017 | October 31, 2016 | |||||||||

| Gold bullion: | ||||||||||

| Fine ounces | - 400 oz. bars | 1,653,990 | 1,654,851 | |||||||

| - 100 oz. bars | 9,342 | 9,359 | ||||||||

| - bank certificates | 9,313 | 8,435 | ||||||||

| Total fine ounces | 1,672,645 | 1,672,645 | ||||||||

| Average cost | - per fine ounce | $ | 799.66 | $ | 799.66 | |||||

| Cost | $ | 1,337,553,042 | $ | 1,337,553,042 | ||||||

| Market | - per fine ounce | $ | 1,266.45 | $ | 1,272.00 | |||||

| Market value | $ | 2,118,320,492 | $ | 2,127,603,668 | ||||||

| Silver bullion: | ||||||||||

| Ounces | - 1,000 oz. bars | 75,336,953 | 75,336,953 | |||||||

| - bank certificates | 307,149 | 307,149 | ||||||||

| Total ounces | 75,644,102 | 75,644,102 | ||||||||

| Average cost | - per ounce | $ | 12.53 | $ | 12.53 | |||||

| Cost | $ | 947,556,383 | $ | 947,556,383 | ||||||

| Market | - per ounce | $ | 17.41 | $ | 17.76 | |||||

| Market value | $ | 1,316,963,819 | $ | 1,343,439,255 | ||||||

| 6. | Cash and cash equivalents: |

As at April 30, 2017, cash deposits of $5,028,414 were held in a Canadian bank at a variable interest rate of 0.50% per annum.

As at October 31, 2016, cash deposits of $34,363,862 were held in a Canadian bank at a variable interest rate of 0.50% per annum.

| 7. | Fair value of financial instruments: |

As at April 30, 2017 and October 31, 2016, due to the short-term nature of financial assets and financial liabilities recorded at cost, it is assumed that the carrying amount of those instruments approximates their fair value.

| 8. | Share capital: |

The authorized share capital consists of an unlimited number of Class A non-voting shares without nominal or par value and 50,000 Common shares without nominal or par value. There were 252,116,003 Class A non-voting shares, which are retractable, issued and outstanding at April 30, 2017 (October 31, 2016: 253,803,391) and 40,000 Common shares issued and outstanding at April 30, 2017 and October 31, 2016. The Class A non-voting shares are entitled to U.S. $3.00 per share on liquidation, before any remaining net assets are attributed equally to each Class A share and Common share then outstanding.

| 15 |

Since October 1989, holders of the Company’s Class A non-voting shares have had the option to require the Company to redeem their Class A non-voting shares on the last day of each fiscal quarter of the Company (each a “Retraction Date”) for 80% of the Company’s net asset value per Class A share on the Retraction Date. Class A shareholders who wish to exercise this retraction right must submit their written redemption request at least 90 days prior to the desired Retraction Date. Since adoption of this redemption feature, no shareholders have submitted redemption requests.

The stated capital and recorded capital of the Company as at April 30, 2017 and October 31, 2016 was as follows:

| April 30, 2017 | October 31, 2016 | |||||||

| Stated capital | ||||||||

| Class A non-voting shares: | ||||||||

| 252,116,003 (2016: 253,803,391) | $ | 2,405,554,004 | $ | 2,426,278,164 | ||||

| Share issue costs | (14,944,462 | ) | (14,944,462 | ) | ||||

| Recorded capital | ||||||||

| Class A non-voting shares: | ||||||||

| 252,116,003 (2016: 253,803,391) | 2,397,737,714 | 2,411,333,702 | ||||||

| 40,000 Common shares | 19,458 | 19,458 | ||||||

| Share capital | $ | 2,397,757,172 | $ | 2,411,353,160 | ||||

| Weighted average Class A and | ||||||||

| Common shares outstanding | 252,299,679 | 254,406,117 | ||||||

Normal Course Issuer Bid

On February 27, 2016, and again on February 27, 2017, the Company received approval from the Toronto Stock Exchange (“TSX”) to commence a normal course issuer bid (“NCIB”) program enabling it to repurchase and cancel up to 12.6 million of its Class A non-voting shares, representing approximately 5% of the total number of issued and outstanding Class A non-voting shares at that time. Any NCIB purchases may be made over the course of a twelve month period and will be subject to the applicable TSX and NYSE rules and securities laws. The timing of purchases, and actual number of Class A non-voting shares to be repurchased, will be determined by the Corporation and will be subject to market conditions, share prices and regulatory requirements. For the six months ended April 30, 2017, 1,687,388 Class A non-voting shares have been repurchased at a total cost of $20,724,160. All shares were repurchased on an accretive basis to shareholders, at a discount to the net asset value per share at the time of such purchases and all such shares have also been cancelled. A shareholder may obtain a copy of the Notice of Intention to make the NCIB, without charge, by contacting the Company at its head office, Attention: Shareholder and Investor Inquiries.

Funding for the purchase of Class A non-voting shares, which will only occur when such shares are trading at a discount to their net asset value per share, will come from existing cash balances, and, to the extent necessary, sales of existing gold and silver bullion holdings. The Company may suspend or discontinue this program at any time.

| 16 |

|

9. Related party transactions and fees:

Central Fund has no employees. It is party to an Administrative and Consulting Agreement with The Central Group Alberta Ltd., which is related to the Company through three of its officers and directors. The Central Group Alberta Ltd., which acts as Administrator, is a private company that has operating offices with employees, advisors and consultants who provide administrative and consulting services to the Company. For such services, the Company pays an administrative and consulting fee, payable monthly, until at least October 31, 2018, at an annual rate of: 0.30% on the first $400 million of total net assets; 0.20% on the next $600 million of total net assets; and 0.15% on total net assets exceeding one billion dollars.

Mr. Michael A. Parente, a member of the Board of Directors, is not an Officer of the Company, nor a director, officer or employee of the Administrator. He is engaged by the Administrator for the benefit of the Company to provide services in respect of ongoing analysis and compliance with the financial reporting requirements of International Financial Reporting Standards and internal control related matters. Fees paid by the Administrator to Mr. Parente, for the three and six months ended April 30, 2017 were $9,396 and $18,876 respectively (2016: $9,691 and $18,906 respectively.)

Included in accrued liabilities at April 30, 2017 is $530,123 (October 31, 2016: $538,224), which relates to that month’s administration fee payable to the Administrator.

For the three and six months ended April 30, 2017, administration fees of $1,598,774 and $3,116,170 respectively (2016: $1,555,834 and $2,936,387) were incurred, payable to the Administrator.

For the three and six months ended April 30, 2017, the Company incurred fees totaling $31,342 and $66,862 respectively (2016: $54,327 and $114,144) to legal firms of which one of the Company’s directors is a partner and one of the Company’s officers is the principal. In addition, during the three and six months ended April 30, 2017, $23,745 and $36,804 respectively (2016: $9,848 and $113,198) of legal fees were payable to the same legal firms regarding the Class A Shareholder’s Proceedings as described in Note 13. The Board of Directors is of the view that these services were undertaken under similar terms and conditions as services with unrelated parties.

10. Management of financial risks:

The Company has risk management policies and procedures in place to identify risks related to financial instruments and physical assets. The objectives of these policies and procedures are to identify and mitigate risk. The Company’s compliance with these policies and procedures is monitored by the Senior Officers, the Audit Committee and the Board of Directors of the Company. Market fluctuations are unpredictable and outside the control of the Company. New risk factors may emerge from time to time and it is not possible for the Company to predict all such risk factors. The market price for the Class A non-voting shares may be above or below the net asset value per Class A share at any time due to market conditions.

| 17 |

|

Price risk

Price risk is the risk that the price of a security or physical asset may decline. It is possible to calculate the impact that changes in the market prices of gold and silver bullion will have on the Company’s net asset value per Class A share both in U.S. dollars and Cdn. dollars. Assuming as a constant exchange rate the rate which existed on April 30, 2017 of Cdn. $1.3665 for each U.S. dollar together with the holdings of gold and silver bullion which existed on that date, a 10% change in the price of gold would increase or decrease the net asset value per Class A share by approximately U.S. $0.84 per share or Cdn. $1.15 per share. A 10% change in the price of silver would increase or decrease the net asset value per Class A share by approximately U.S. $0.52 per share or Cdn. $0.71 per share. If both gold and silver prices were to change by 10% simultaneously in the same direction, the net asset value per Class A share would increase or decrease by approximately U.S. $1.36 per share or Cdn. $1.86 per share.

Currency risk

Currency risk is the risk that the value of an asset or liability will fluctuate due to changes in foreign currency exchange rates.

When expressed in U.S. dollars, Central Fund’s net asset value per Class A share is largely unaffected by changes in the U.S./Cdn. dollar exchange rate due to the fact that nearly all of Central Fund’s net assets are priced in U.S. dollars. For this same reason, an increase or decrease in the value of the U.S dollar relative to the Cdn. dollar would change the net asset value per Class A share as expressed in Cdn. dollars in the same direction by approximately the same percentage change in the value of the U.S. dollar.

Due to the limited value of transactions initiated in Cdn. dollars throughout the period, a strengthening or weakening of the Cdn. dollar relative to the U.S. dollar applied to balances outstanding at April 30, 2017 would not have had any material impact on the net loss for the six months then ended, assuming that all other variables, in particular interest rates, remained constant.

Credit risk

Credit risk on financial instruments is the risk of loss occurring as a result of the default of an issuer on its obligation to Central Fund. Credit risk is monitored on an ongoing basis and is managed by the Senior Officers and the Board of Directors dealing only with issuers that are believed to be creditworthy.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to generate adequate cash resources to fulfill its payment obligations. The Board of Directors and the Senior Officers regard all of Central Fund’s assets as liquid. Central Fund traditionally has maintained sufficient cash reserves to enable it to pay expenses and dividends on its Class A non-voting shares.

Furthermore, 99.9% of the Company’s net assets are in the form of gold and silver bullion which are readily marketable.

11. Capital stewardship:

The capital of the Company is represented by the issued and outstanding Class A non-voting and Common shares and the retained earnings, which comprise the net asset value attributable to participating shareholders. The Board of Directors direct the Administrator to administer the capital of the Company in accordance with the Company’s stated objectives and restrictions stipulated in the Articles of Incorporation as amended, while maintaining sufficient cash to pay the expenses of maintaining the Company, to pay Class A dividends and to meet demands for redemption (if any) of Class A non-voting shares. The Company does not have any externally imposed capital requirements.

| 18 |

|

12. Personnel:

The Company did not employ any personnel during the period, as its affairs were administered by the personnel of the Administrator, Senior Officers and the Board of Directors, as applicable.

13. Class A Shareholder’s Proceedings:

During 2015 and 2016, the Company successfully defended certain actions instituted by 1891868 Alberta Ltd. ("SAM Alberta") in the Court of Queen's Bench of Alberta (the "Class A Shareholder’s Proceedings"), including an application (the "Application") seeking relief under theBusiness Corporations Act of Alberta (the “Act”) on the ground of oppression, as described in the Company's annual MD&A for the year ended October 31, 2015. On September 10, 2015, SAM Alberta sought to amend the Application (the “Amended Application”) to add further respondents, to seek leave of the Court to commence a derivative action on behalf of the Company, as described in the Company’s 3rd Quarter 2016 interim MD&A, and for other interim relief. On September 23, 2015, the Court dismissed SAM Alberta's oppression claim and its application for the interim relief sought, but granted some of the requested amendments to allow for a hearing on whether leave should be granted to bring a derivative action (the "Leave Application”). A hearing date of March 8, 2017 was set for consideration of the Leave Application and an application by the Company (the “Strike Application”) to strike the Leave Application.

On March 7, 2017, SAM Alberta filed an application ("Plan Application") for an order approving a proposed arrangement pursuant to section 193 of the Act, involving Central Fund, its shareholders and Sprott Physical Gold and Silver Trust, a trust to be newly formed ("Trust") managed by Sprott Asset Management LP, a wholly owned subsidiary of Sprott Inc. Dates of September 7-8, 2017 have been set for the interim hearing of the Plan Application. If SAM Alberta is successful at the interim hearing, it could result in Central Fund's shareholders being asked to vote on a Plan of Arrangement which, if approved, would result in such shareholders having their shares exchanged for trust units of the newly formed Trust.

As a result of the filing of the Plan Application, the Strike Application and Leave Application were adjourned by the Court.

The costs incurred by the Company on account of the Class A Shareholder’s Proceedings for the three and six months ended April 30, 2017 were $286,015 and $363,453 respectively, (2016: $118,194 and $631,871 respectively) primarily for legal and advisory work in relation to the Class A Shareholder’s Proceedings. These costs will be reduced by virtue of a partial recovery of costs as awarded to the Company by the Court. The recovery of costs will be recognized in the financial statements as the quantum of such costs is determined.

| 19 |

|

Corporate Information

| Directors | Officers |

| Barry R. Cooper (A)(I) | J.C. Stefan Spicer, Chairman, President & CEO |

| Glenn C. Fox (C)(I)(L) | Catherine A. Spackman CPA, CMA, Treasurer & CFO |

| Bruce D. Heagle (A)(C)(I) | Teresa E. Poper CB, Assistant Treasurer |

| Michael A. Parente (C)(I) | John S. Elder, Q.C., Secretary and Counsel |

| Jason A. Schwandt (A)(I) | |

| Dale R. Spackman, Q.C.(V) | Consultants |

| J.C. Stefan Spicer | Douglas E. Heagle, Retired Director |

| (A) | - Member of Audit Committee |

| (C) | - Member of Corporate Governance Committee |

| (I) | - May be regarded as an independent director under Canadian securities administrators’ guidelines |

| (L) | - Lead Director |

| (V) | - Vice-Chairman of Board |

| Administrator | Auditors |

| The Central Group Alberta Ltd. | Ernst & Young LLP |

| Calgary, Alberta | Canada |

| Banker | Custodian |

| Canadian Imperial Bank of Commerce | Canadian Imperial Bank of Commerce |

| Legal Counsel | Registrars and Transfer Agents |

| Parlee McLaws LLP, Calgary | CST Trust Company, Canada |

| Dentons Canada LLP, Toronto | American Stock Transfer |

| Dorsey & Whitney LLP, Seattle | & Trust Company LLC, New York |

Marketing and Investor Relations Consultant

EMN Consulting, Toronto, Ontario

Share Ownership Certificates

Certificates of share ownership registered in shareholders' names at their own addresses for delivery to them for their own safekeeping may be obtained upon the request of holders and payment of any applicable fees to the relevant Registrar and Transfer Agent of the Company.

| Head Office | Shareholder and |

| Hallmark Estates | Investor Inquiries |

| Suite 805, 1323-15th Avenue S.W. | Administrator, P.O. Box 10050 |

| Calgary, Alberta T3C 0X8 | Ancaster, Ontario L9K 1P2 |

| Telephone (403) 228-5861 | Telephone (905) 648-7878 |

| Fax (403) 228-2222 | Fax (905) 648-4196 |

Website: www.centralfund.com

E-mail: info@centralfund.com

| 20 |

Class A non-voting shares Stock Exchange Listings

| Electronic | |

| Ticker Symbol | |

| NYSE MKT | CEF |

| The Toronto Stock Exchange | CEF.A in CDN $ |

| CEF.U in US $ | |

| Cusip number 153501101 |

Net Asset Value Information

The net asset value per Class A share is calculated daily and is available at www.centralfund.com, or by calling the Administrator’s Investor Inquiries Office at (905) 648-7878, or by sending an email to info@centralfund.com.