Earnings Conference Call Third Quarter 2012 1 Exhibit 99.2

Cautionary Statement 2 Information Current as of November 8, 2012 Except as expressly noted, the information in this presentation is current as of November 8, 2012 — the date on which PGE filed its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2012 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update the presentation, except as may be required by law. Forward-Looking Statements Statements in this presentation that relate to future plans, objectives, expectations, performance, events and the like may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding earnings guidance, statements regarding future load, hydro conditions and operating and maintenance costs; statements concerning implementation of the Company’s Integrated Resource Plan and related future capital expenditures, statements concerning future compliance with regulations limiting emissions from generation facilities and the costs to achieve such compliance; statements regarding the outcome of any legal or regulatory proceeding; as well as other statements containing words such as “anticipates,” “believes,” “intends,” “estimates,” “promises,” “expects,” “should,” “conditioned upon,” and similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including the reductions in demand for electricity and the sale of excess energy during periods of low wholesale market prices; operational risks relating to the Company’s generation facilities, including hydro conditions, wind conditions, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy markets conditions, which could affect the availability and cost of purchased power and fuel; changes in capital market conditions, which could affect the availability and cost of capital and result in delay or cancellation of capital projects; failure to complete projects on schedule and within budget, or the abandonment of capital projects, which could result in the Company’s inability to recover project costs; the outcome of various legal and regulatory proceedings; and general economic and financial market conditions. As a result, actual results may differ materially from those projected in the forward-looking statements. All forward-looking statements included in this presentation are based on information available to the Company on the date hereof and such statements speak only as of the date hereof. The Company assumes no obligation to update any such forward-looking statement. Prospective investors should also review the risks and uncertainties listed in the Company’s most recent Annual Report on Form 10-K and the Company’s reports on Forms 8-K and 10-Q filed with the United States Securities and Exchange Commission, including Management’s Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time.

Leadership Presenting Today 3 Maria Pope Senior Vice President, Finance, CFO & Treasurer Jim Piro President & CEO

Q3 2012 Earnings Results 4 in millions Q3 2011 Q3 2012 YTD Q3 2011 YTD Q3 2012 Net Income $27 $38 $118 $113 Q1 $0.92 Q1 $0.65 Q2 $0.29 Q2 $0.34 Q3 $0.36 Q3 $0.50 Q4 $0.38 Q4 $0.36- $0.51 2011 EPS 2012 EPS $1.95 $1.85-$2.00

On Today’s Call 5 Economic Outlook Operational Excellence Business Growth Financial Update Q&A Session

Economic Outlook 6 Growth in Operating Area • High-technology – Intel’s D1X fab – Data centers • Parts manufacturing and health care sector • 4,500 new customers since September 30, 2011 September 2011 September 2012 Oregon 9.5% 8.7% PGE’s operating area 8.3% 7.6% Unemployment Rate Economy Continues to Improve

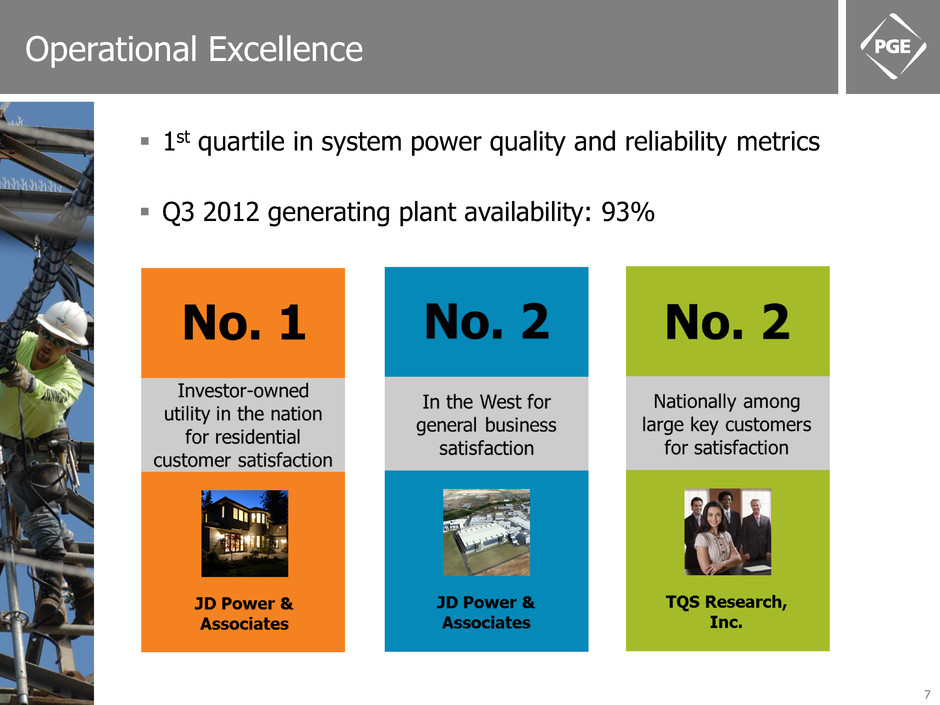

Operational Excellence 7 1st quartile in system power quality and reliability metrics Q3 2012 generating plant availability: 93%

Capacity and Energy RFP 8 Capacity 200 MW year-round flexible resource 200 MW bi-seasonal peaker 150 MW winter-only peaker Energy 300-500 MW base load resource November 2012 Identify initial short list December 2012 Identify final short list Q4 2012 - Q1 2013 Begin negotiations with bidders on final short list Q1 2013 Independent Evaluator issues final closing report to OPUC Q1-Q2 2013 Final resource selection Next Steps

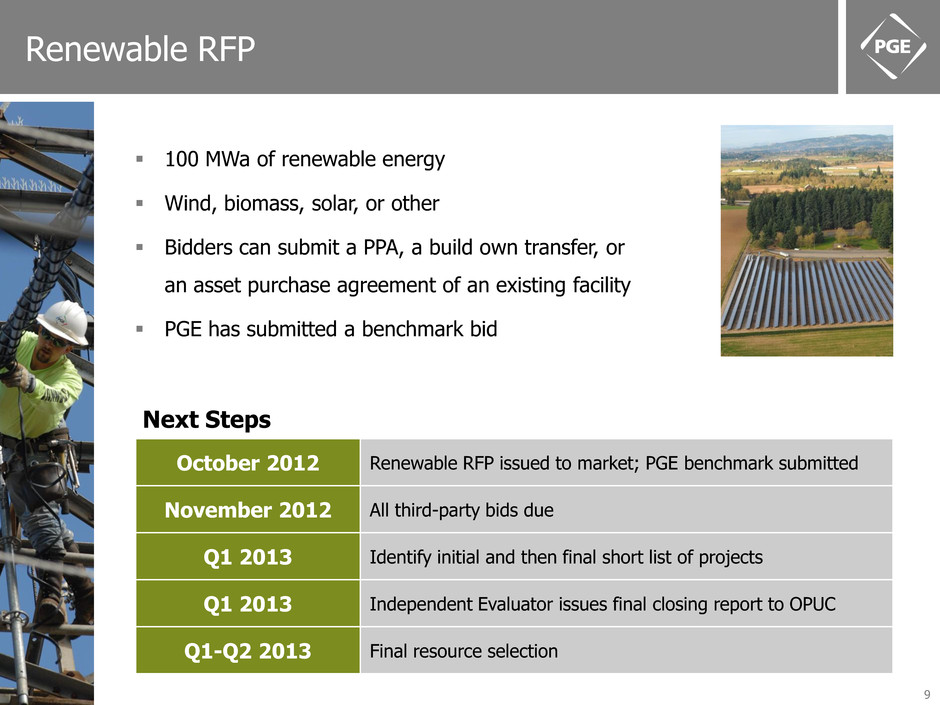

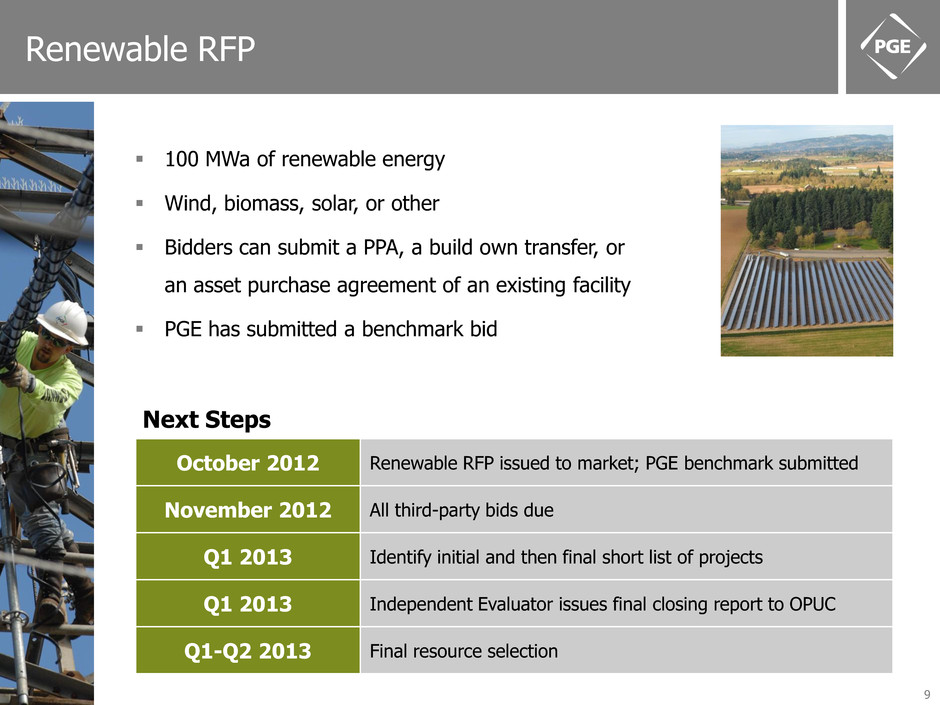

Renewable RFP 9 100 MWa of renewable energy Wind, biomass, solar, or other Bidders can submit a PPA, a build own transfer, or an asset purchase agreement of an existing facility PGE has submitted a benchmark bid Next Steps October 2012 Renewable RFP issued to market; PGE benchmark submitted November 2012 All third-party bids due Q1 2013 Identify initial and then final short list of projects Q1 2013 Independent Evaluator issues final closing report to OPUC Q1-Q2 2013 Final resource selection

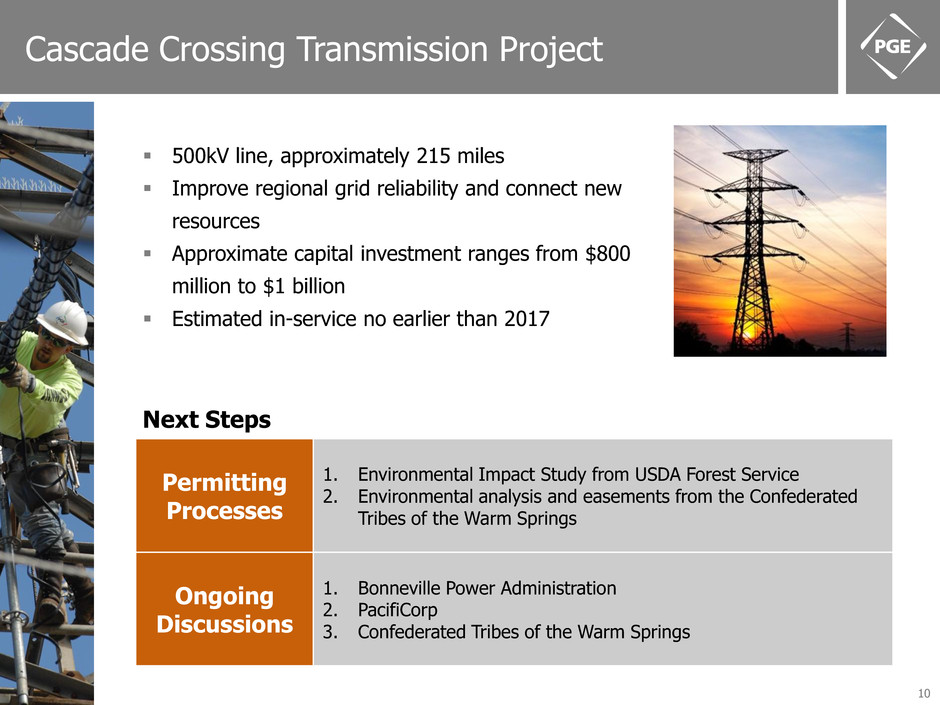

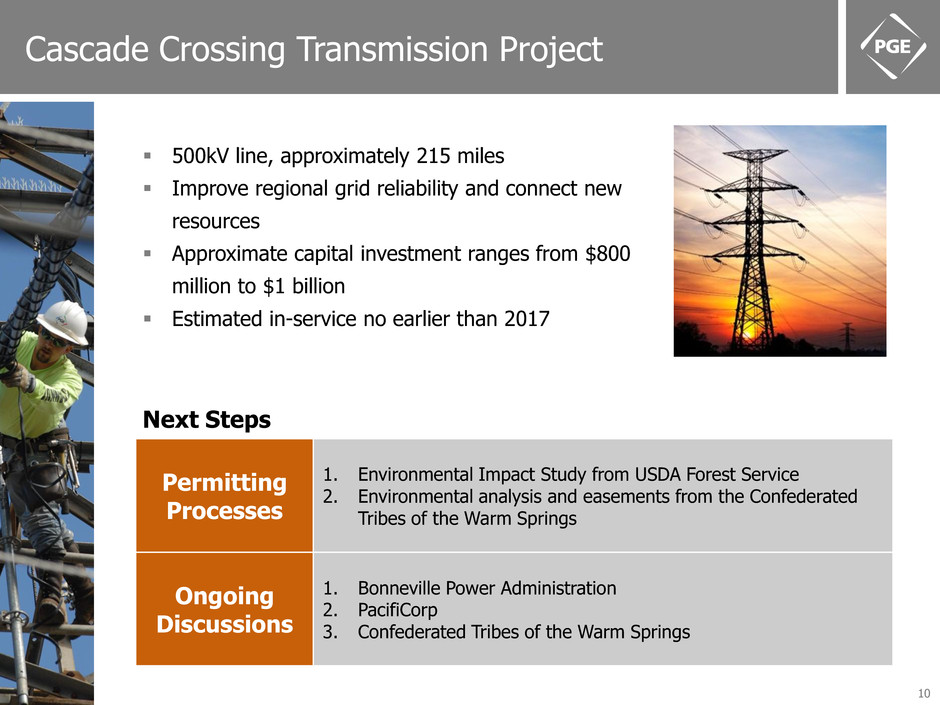

Cascade Crossing Transmission Project 10 Permitting Processes 1. Environmental Impact Study from USDA Forest Service 2. Environmental analysis and easements from the Confederated Tribes of the Warm Springs Ongoing Discussions 1. Bonneville Power Administration 2. PacifiCorp 3. Confederated Tribes of the Warm Springs 500kV line, approximately 215 miles Improve regional grid reliability and connect new resources Approximate capital investment ranges from $800 million to $1 billion Estimated in-service no earlier than 2017 Next Steps

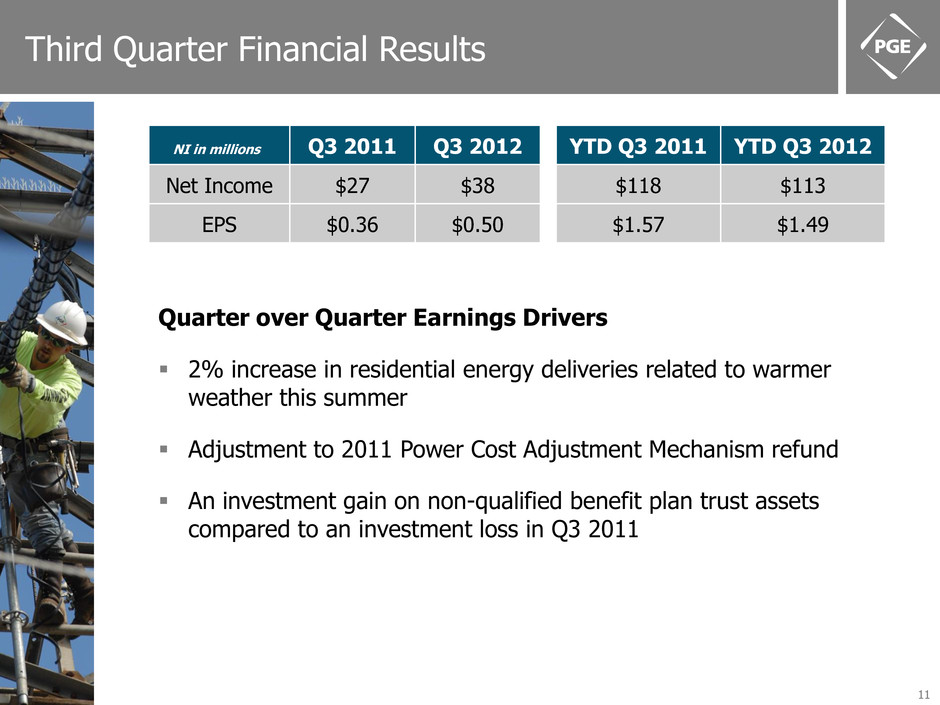

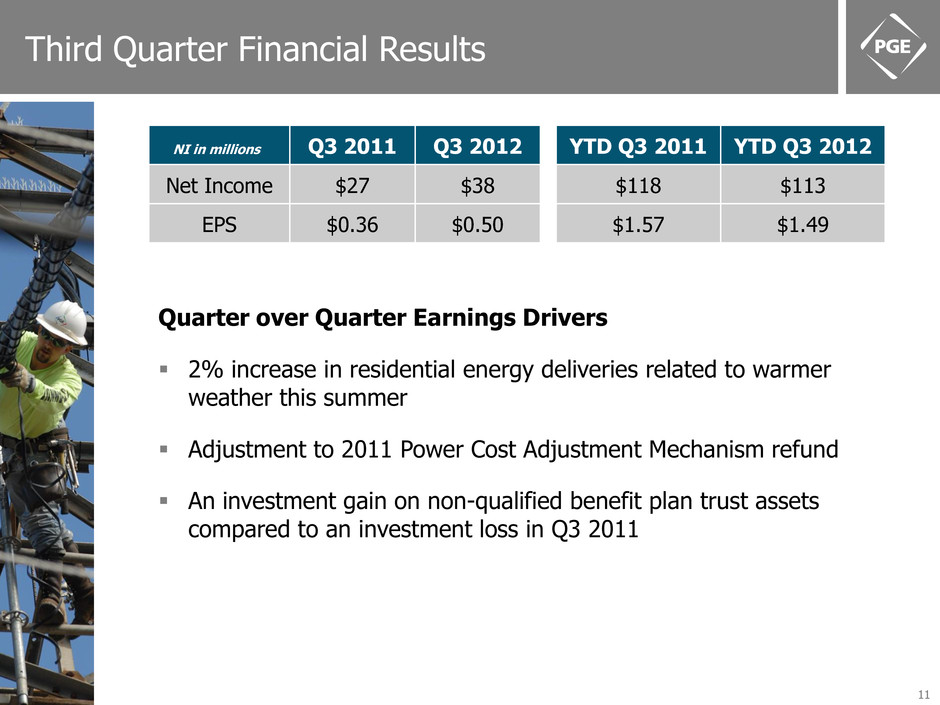

Third Quarter Financial Results 11 Quarter over Quarter Earnings Drivers 2% increase in residential energy deliveries related to warmer weather this summer Adjustment to 2011 Power Cost Adjustment Mechanism refund An investment gain on non-qualified benefit plan trust assets compared to an investment loss in Q3 2011 NI in millions Q3 2011 Q3 2012 YTD Q3 2011 YTD Q3 2012 Net Income $27 $38 $118 $113 EPS $0.36 $0.50 $1.57 $1.49

Retail Revenues and Load 12 Q3 YTD Q3 Full Year Forecast -0.4% 0.5% 0.5% $406 $422 2011 2012 Q3 Retail Revenues (in millions) Quarter over Quarter Drivers of Retail Revenue Weather-Adjusted Load Growth: 2012 over 2011(1) (1) Excludes certain industrial customers that have little impact on margin Adjustment to the 2011 PCAM Refund 1% decrease in average price Increase in number of customers purchasing power from an energy service supplier

Purchased Power and Fuel 13 Q3 2011 Q3 2012 YTD Q3 2011 YTD Q3 2012 $182 $182 $545 $533 Net Variable Power Costs (in millions) NVPC Baseline Q1 2012: $5 million below baseline Q2 2012: $5 million below baseline YTD 2012: $14 million below baseline Q3 2012: $4 million below baseline Lower Deadband $15M below baseline Power cost savings greater than $15 million are shared with customers if PGE’s regulated earnings are greater than 11%

O&M, Depreciation and Capital Expenditures 14 Q3 2011 Q3 2012 YTD 2011 YTD 2012 Production & Distribution $50 $49 $147 $153 Administrative & General $55 $50 $158 $160 Total O&M $105 $99 $305 $313 Depreciation & Amortization $59 $63 $170 $188 $69 $68 $81 $110 Q4 (Estimated) Q3 Q2 Q1 2012 Capital Expenditures in millions $328 in millions

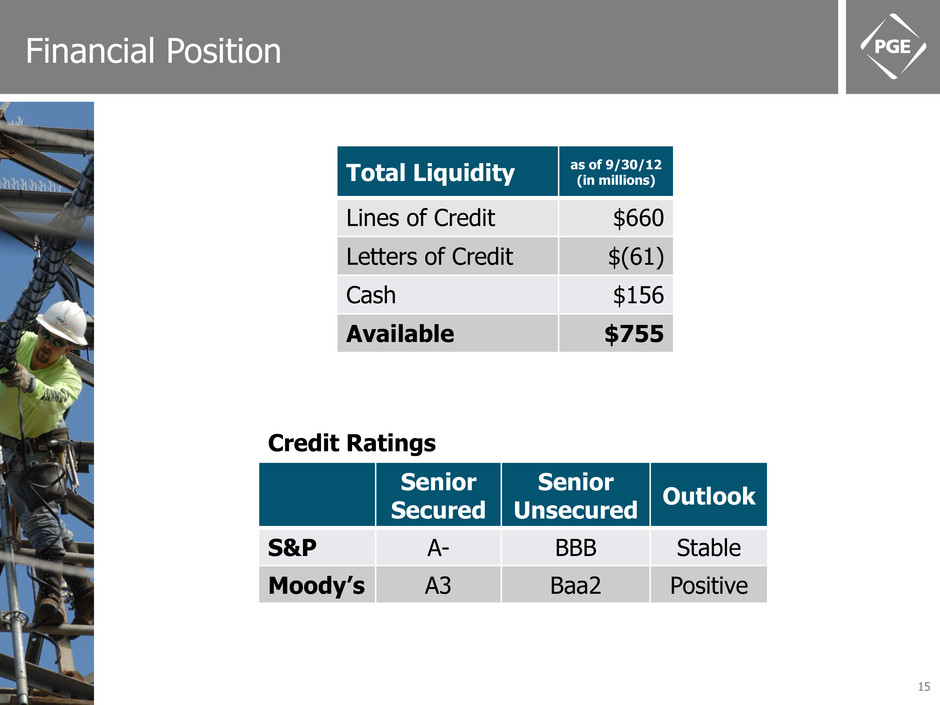

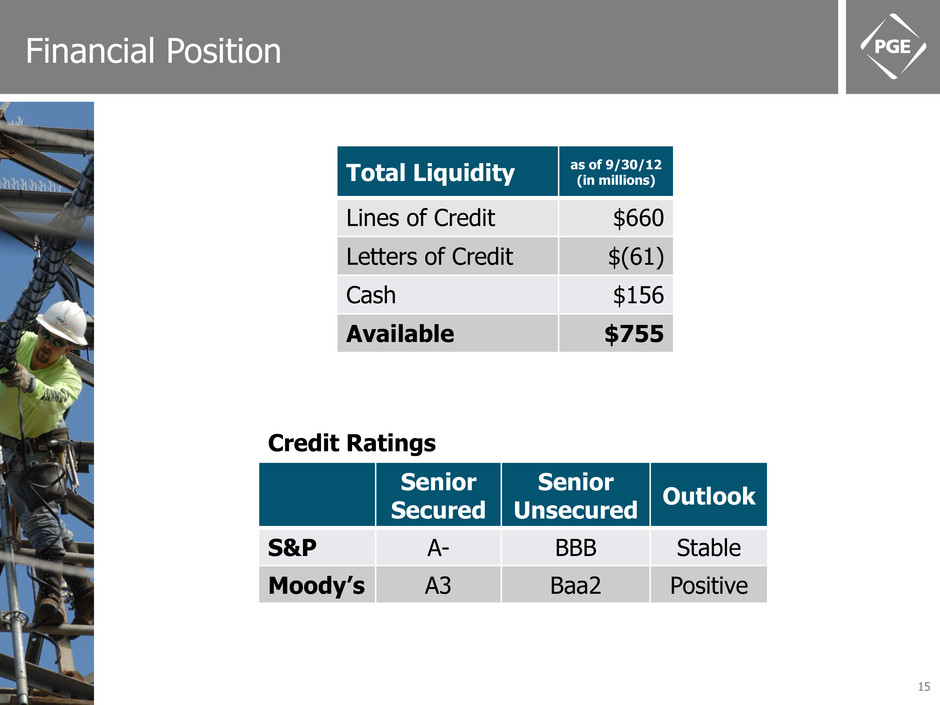

Financial Position 15 Senior Secured Senior Unsecured Outlook S&P A- BBB Stable Moody’s A3 Baa2 Positive Credit Ratings Total Liquidity as of 9/30/12 (in millions) Lines of Credit $660 Letters of Credit $(61) Cash $156 Available $755

2012 Earnings Guidance 16 Weather-adjusted load growth of 0.5% Favorable power supply operations Capital projects: $16 million deferral in 2012 O&M quarterly run rate of $105 to $110 million 2012 EPS on track with guidance - $1.85 to $2.00 per share Current Assumptions for FY 2012 Change from Initial Assumptions