Portland General Electric Earnings Conference call Fourth quarter and full-year 2018

Cautionary statement Information Current as of February 15, 2019 Except as expressly noted, the information in this presentation is current as of February 15, 2019 — the date on which PGE filed its Annual Report on Form 10-K for the year ended December 31, 2018 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update this presentation, except as may be required by law. Forward-Looking Statements Statements in this news release that relate to future plans, objectives, expectations, performance, events and the like may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding earnings guidance; statements regarding future load, hydro conditions and operating and maintenance costs; statements concerning implementation of the company’s integrated resource plan; statements concerning future compliance with regulations limiting emissions from generation facilities and the costs to achieve such compliance; as well as other statements containing words such as “anticipates,” “believes,” “intends,” “estimates,” “promises,” “expects,” “should,” “conditioned upon,” and similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including reductions in demand for electricity; the sale of excess energy during periods of low demand or low wholesale market prices; operational risks relating to the company’s generation facilities, including hydro conditions, wind conditions, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; failure to complete capital projects on schedule or within budget, or the abandonment of capital projects, which could result in the company’s inability to recover project costs; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy markets conditions, which could affect the availability and cost of purchased power and fuel; changes in capital market conditions, which could affect the availability and cost of capital and result in delay or cancellation of capital projects; the outcome of various legal and regulatory proceedings; and general economic and financial market conditions. As a result, actual results may differ materially from those projected in the forward-looking statements. All forward-looking statements included in this news release are based on information available to the company on the date hereof and such statements speak only as of the date hereof. The company expressly disclaims any current intention to update publicly any forward-looking statement after the distribution of this release, whether as a result of new information, future events, changes in assumptions or otherwise. Prospective investors should also review the risks, assumptions and uncertainties listed in the company’s most recent annual report on form 10-K and in other documents that we file with the United States Securities and Exchange Commission, including management’s discussion and analysis of financial condition and results of operations and the risks described therein from time to time. 2

Leadership presenting today Maria Pope President and CEO On today's call • Financial performance • Economic update • Renewable RFP • 2019 general rate case Jim Lobdell • Financial update Senior VP • Earnings guidance of Finance, CFO & Treasurer 3

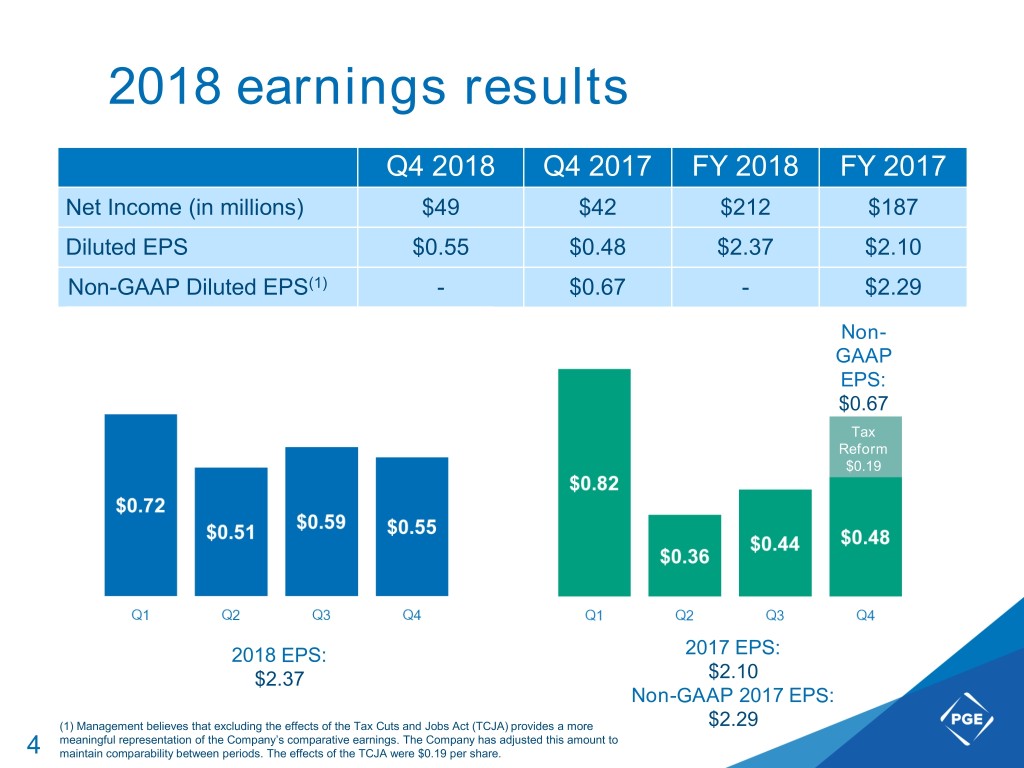

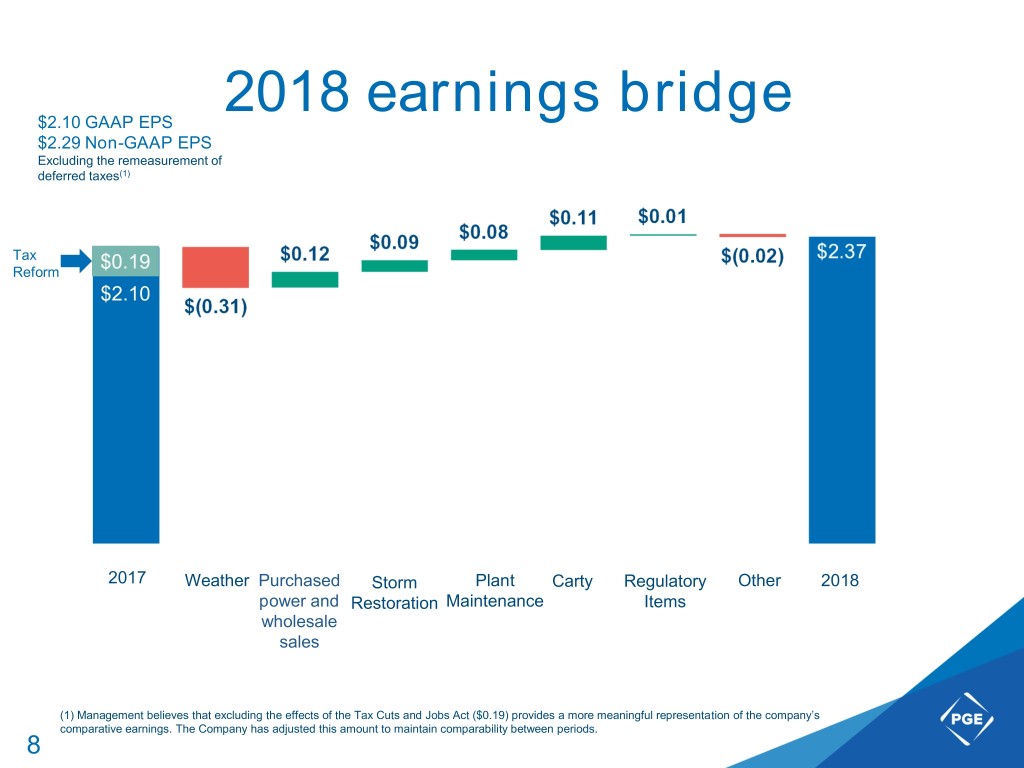

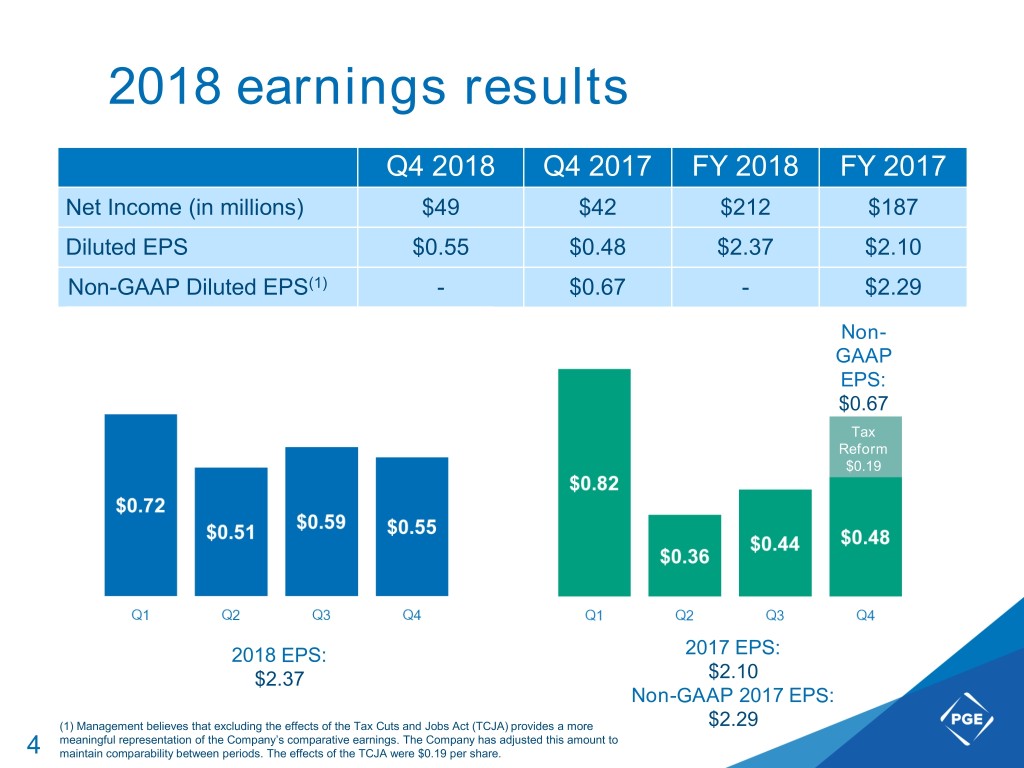

2018 earnings results Q4 2018 Q4 2017 FY 2018 FY 2017 Net Income (in millions) $49 $42 $212 $187 Diluted EPS $0.55 $0.48 $2.37 $2.10 Non-GAAP Diluted EPS(1) - $0.67 - $2.29 Non- GAAP EPS: $0.67 Tax Reform $0.19 2018 EPS: 2017 EPS: $2.37 $2.10 Non-GAAP 2017 EPS: (1) Management believes that excluding the effects of the Tax Cuts and Jobs Act (TCJA) provides a more $2.29 meaningful representation of the Company’s comparative earnings. The Company has adjusted this amount to 4 maintain comparability between periods. The effects of the TCJA were $0.19 per share.

Economic update • Total customer base increased 1.3% over the past year • Industrial growth in data centers, high tech manufacturing contributed to a 2.2% increase in industrial energy deliveries • Unemployment of 3.5% in PGE's service territory(1) • Oregon ranked 2nd nationwide for percentage of inbound moves(2) (1) State of Oregon Employment Department 2018 (Three County Average) 5 (2) United Van Lines 2018 National Movers Study

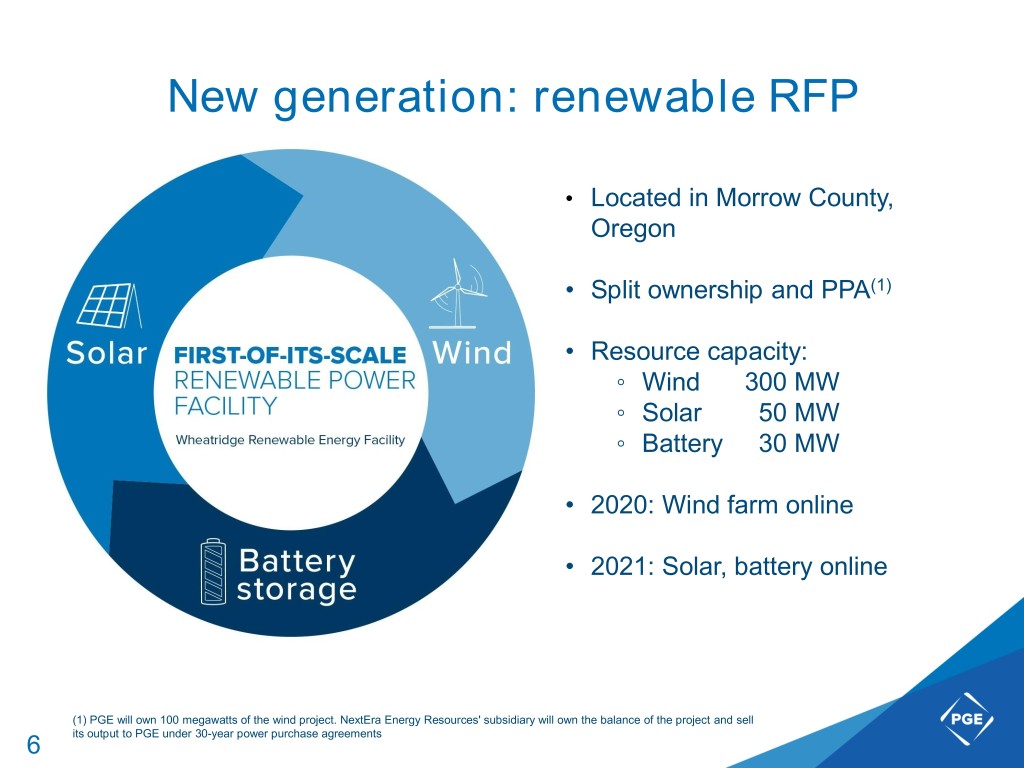

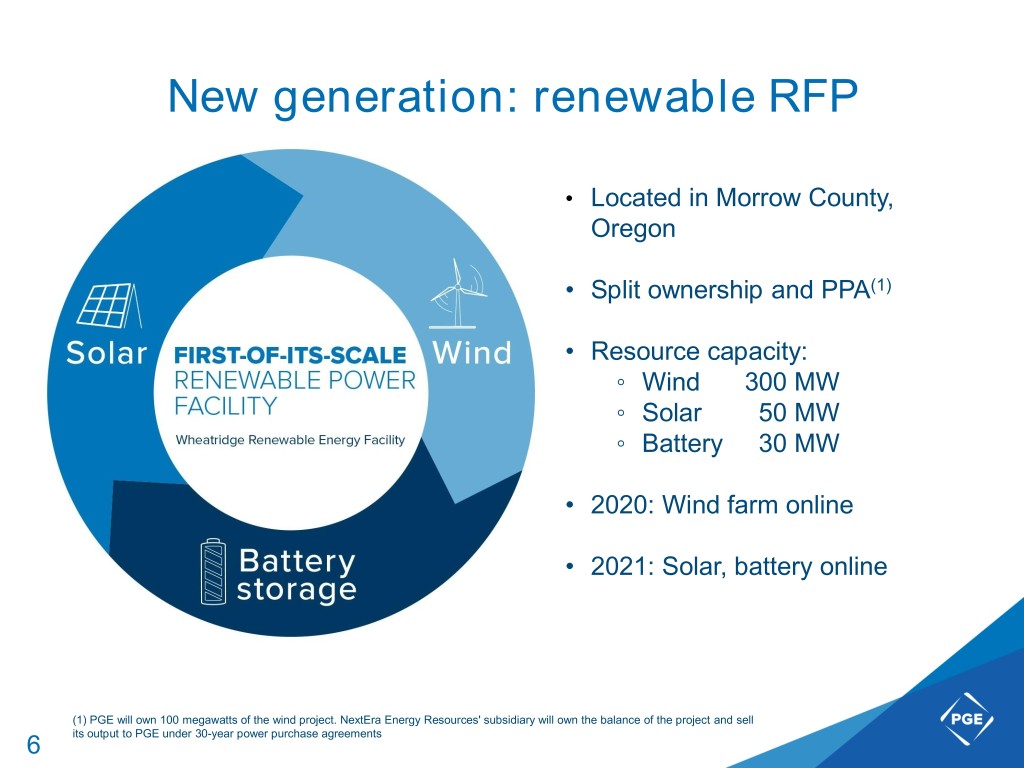

New generation: renewable RFP • Located in Morrow County, Oregon • Split ownership and PPA(1) • Resource capacity: ◦ Wind 300 MW ◦ Solar 50 MW ◦ Battery 30 MW • 2020: Wind farm online • 2021: Solar, battery online (1) PGE will own 100 megawatts of the wind project. NextEra Energy Resources' subsidiary will own the balance of the project and sell 6 its output to PGE under 30-year power purchase agreements

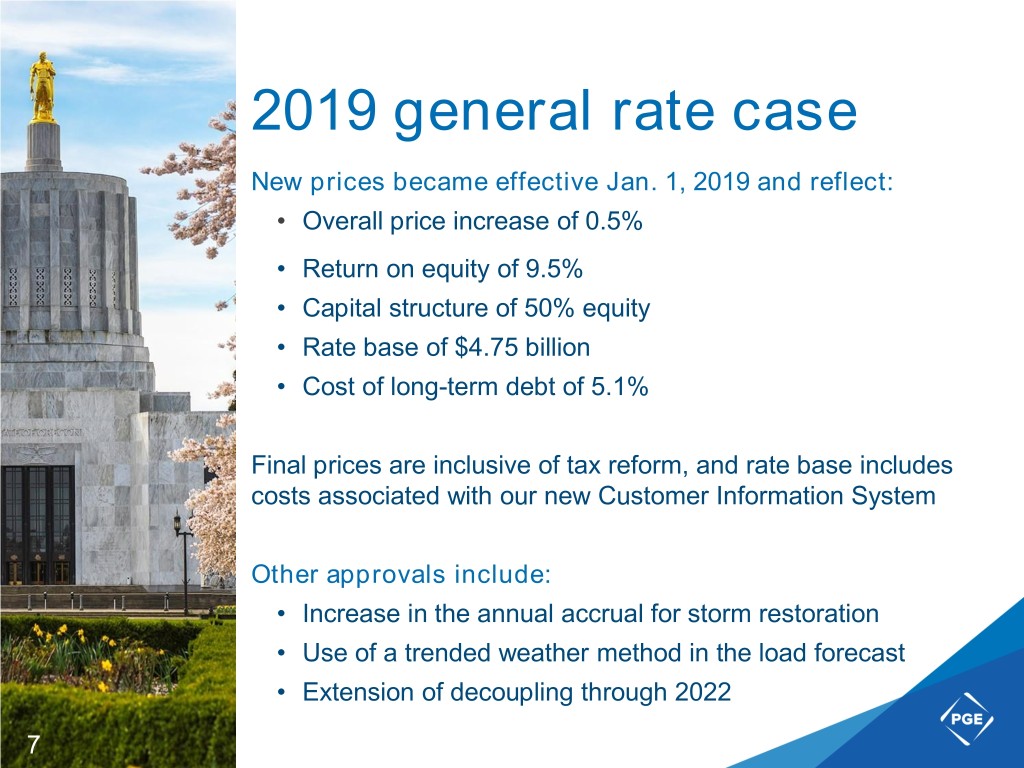

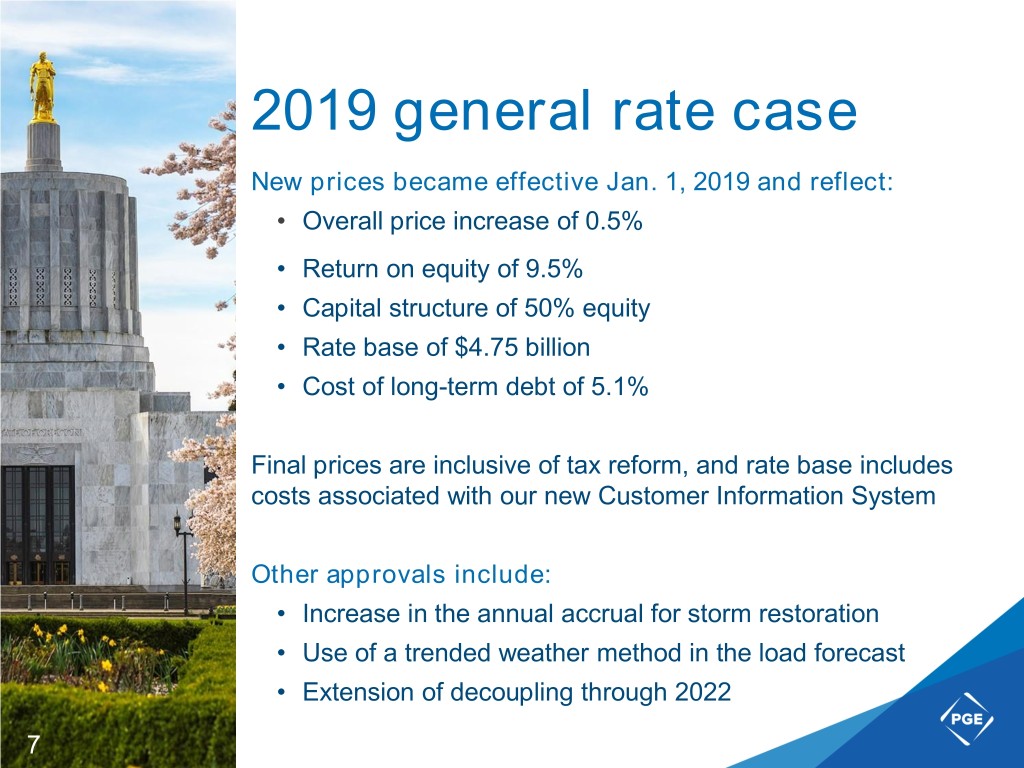

2019 general rate case New prices became effective Jan. 1, 2019 and reflect: • Overall price increase of 0.5% • Return on equity of 9.5% • Capital structure of 50% equity • Rate base of $4.75 billion • Cost of long-term debt of 5.1% Final prices are inclusive of tax reform, and rate base includes costs associated with our new Customer Information System Other approvals include: • Increase in the annual accrual for storm restoration • Use of a trended weather method in the load forecast • Extension of decoupling through 2022 7

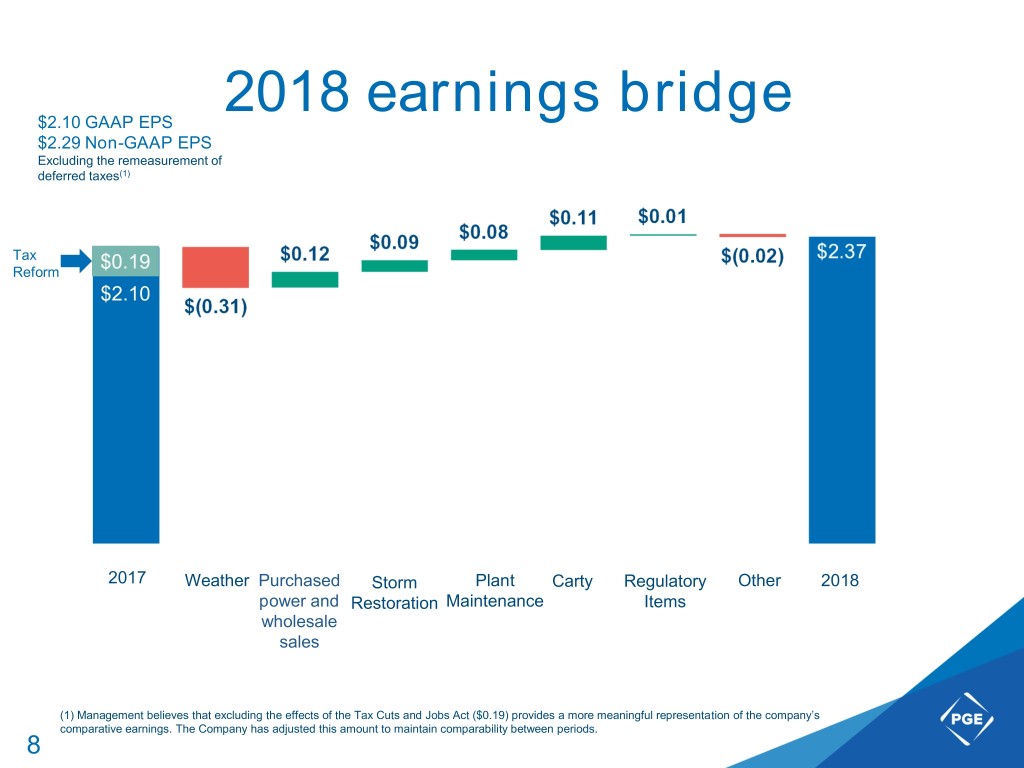

2018 earnings bridge $2.10 GAAP EPS $2.29 Non-GAAP EPS Excluding the remeasurement of deferred taxes(1) Tax $0.19 Reform $2.10 2017 Weather Purchased Storm Plant Carty Regulatory Other 2018 power and Restoration Maintenance Items wholesale sales (1) Management believes that excluding the effects of the Tax Cuts and Jobs Act ($0.19) provides a more meaningful representation of the company’s comparative earnings. The Company has adjusted this amount to maintain comparability between periods. 8

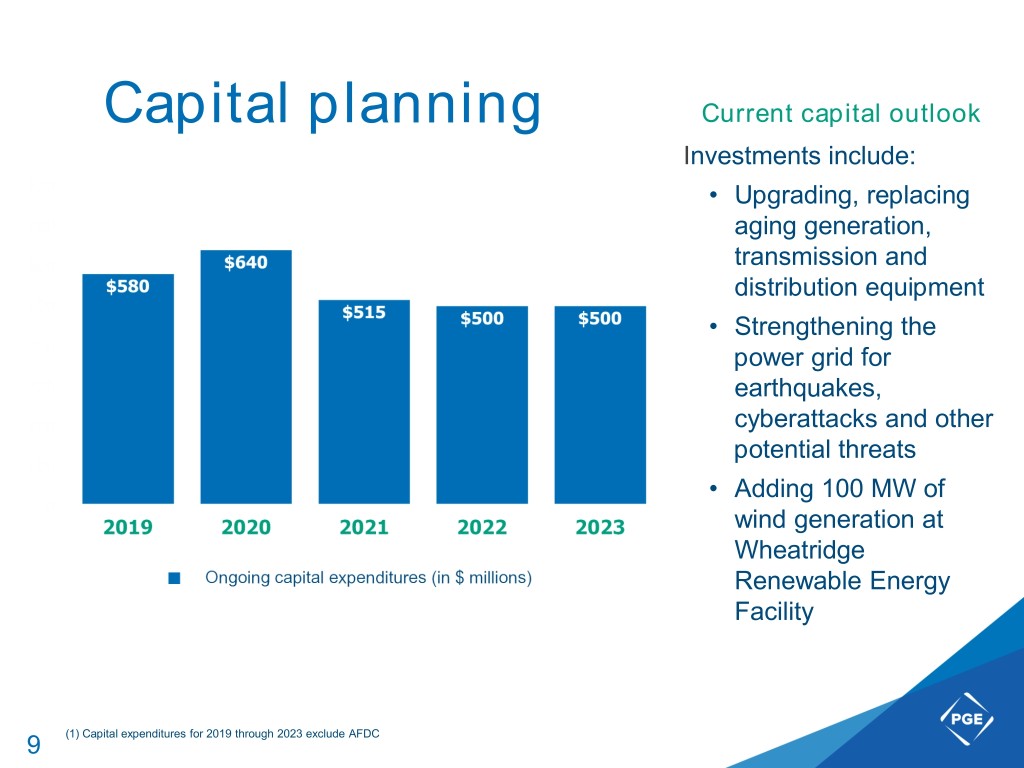

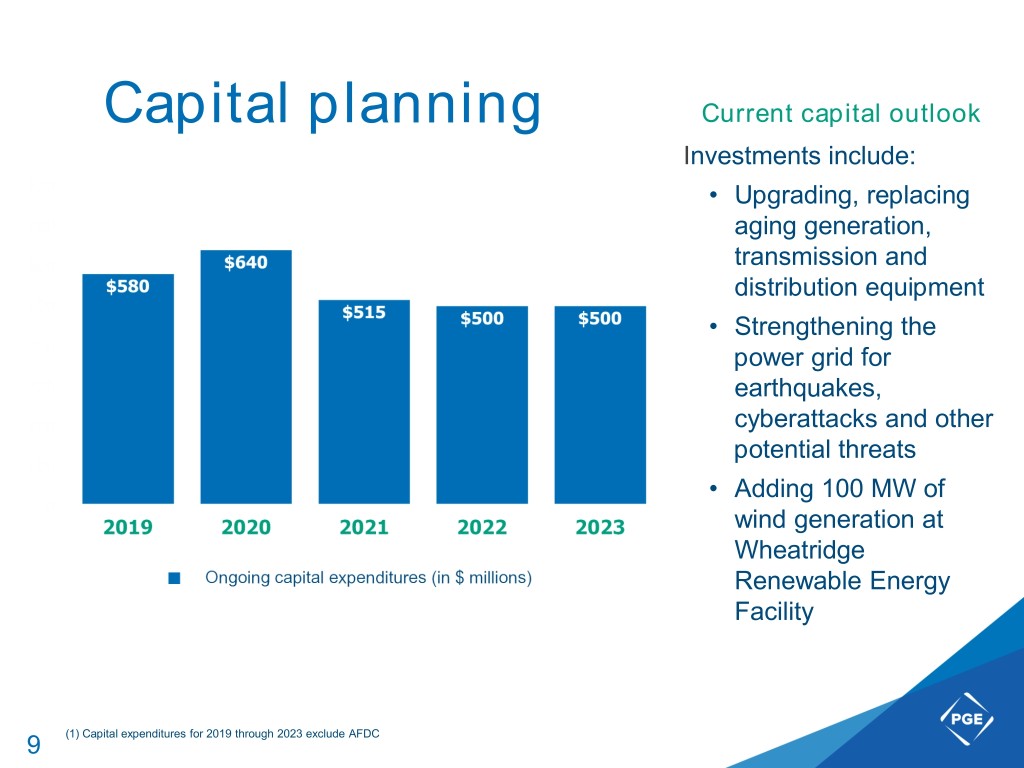

Capital planning Current capital outlook Investments include: • Upgrading, replacing aging generation, transmission and distribution equipment • Strengthening the power grid for earthquakes, cyberattacks and other potential threats • Adding 100 MW of wind generation at Wheatridge Renewable Energy Facility 9 (1) Capital expenditures for 2019 through 2023 exclude AFDC

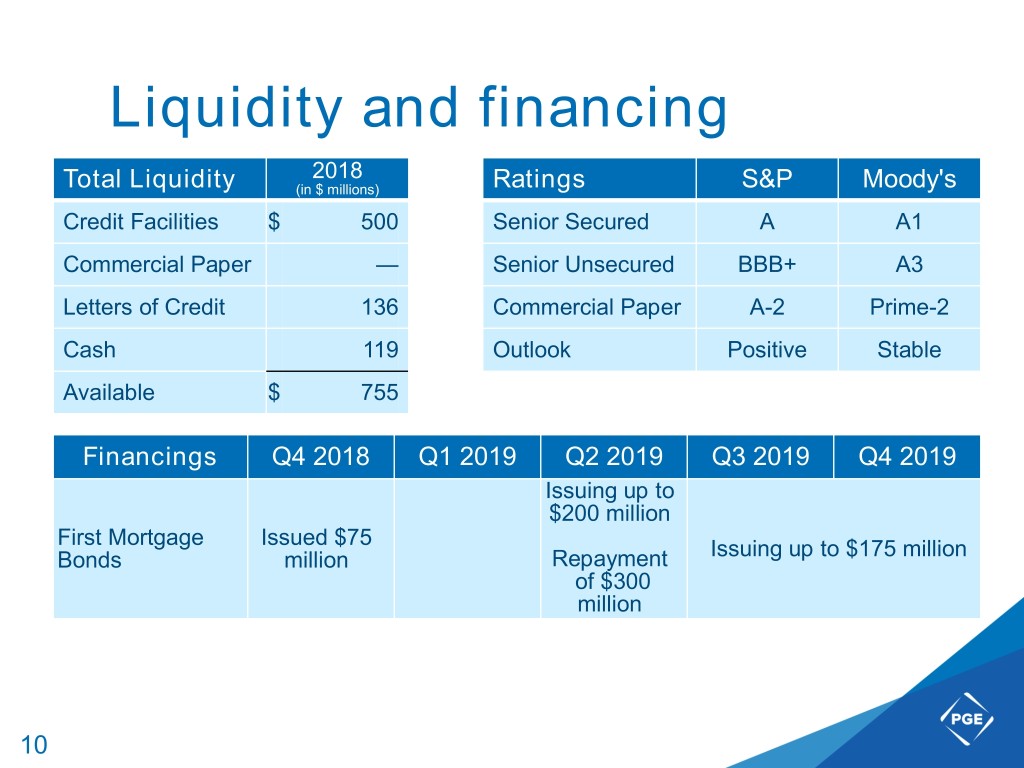

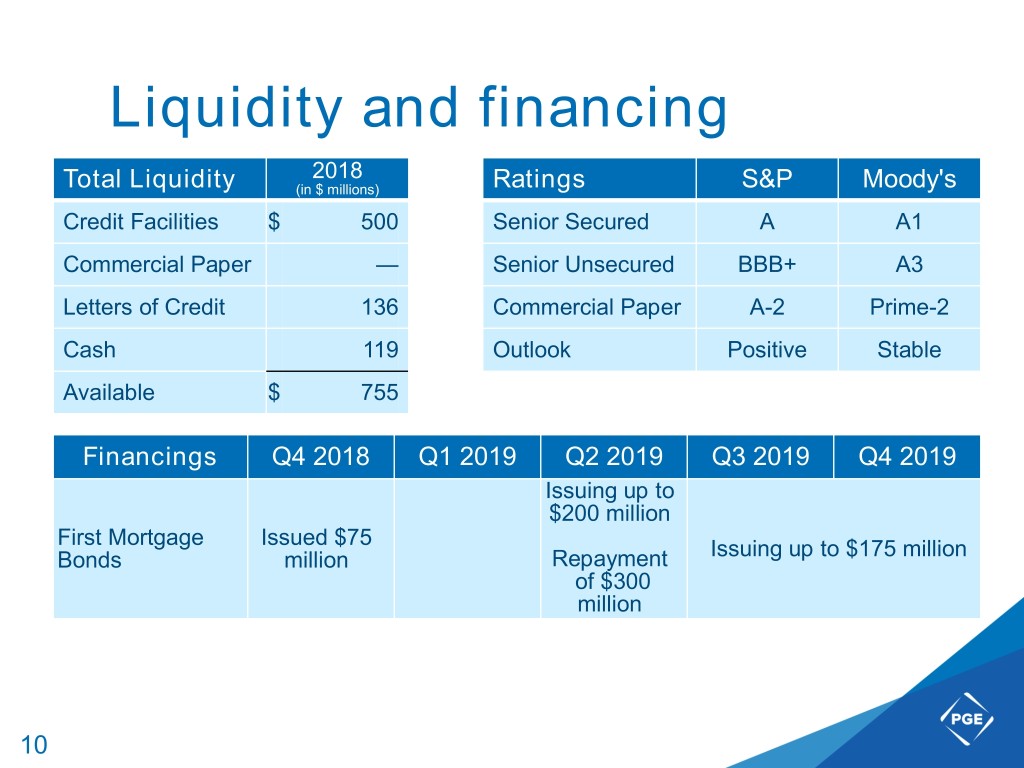

Liquidity and financing 2018 Total Liquidity (in $ millions) Ratings S&P Moody's Credit Facilities $ 500 Senior Secured A A1 Commercial Paper — Senior Unsecured BBB+ A3 Letters of Credit 136 Commercial Paper A-2 Prime-2 Cash 119 Outlook Positive Stable Available $ 755 Financings Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Issuing up to $200 million First Mortgage Issued $75 Issuing up to $175 million Bonds million Repayment of $300 million 10

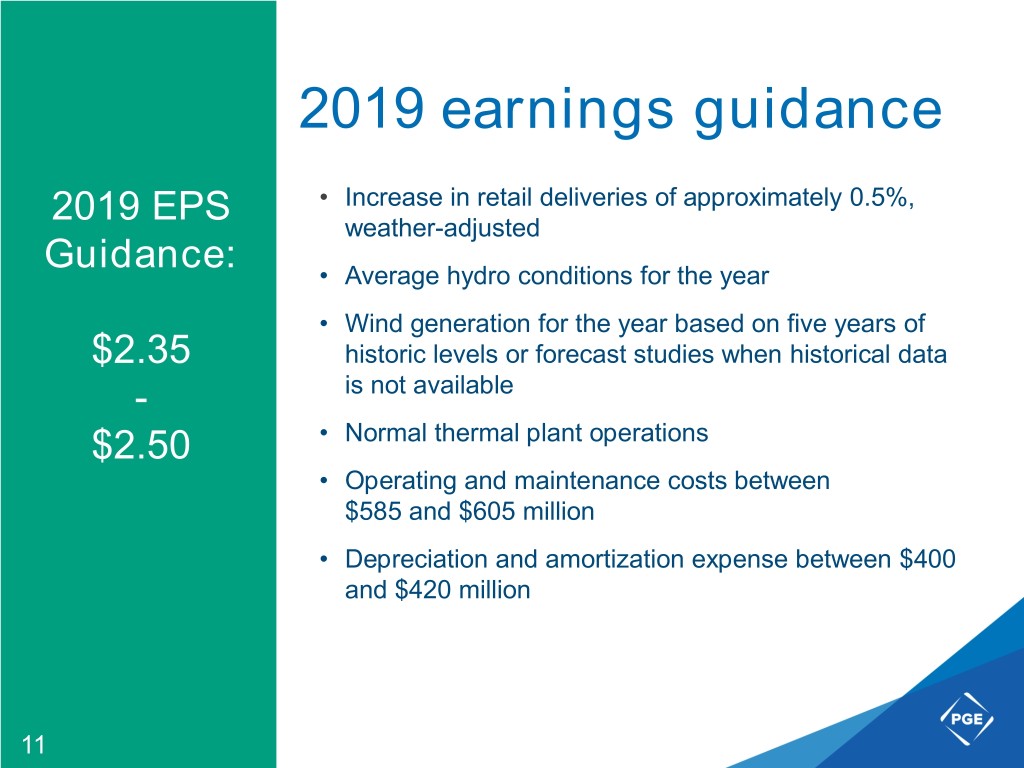

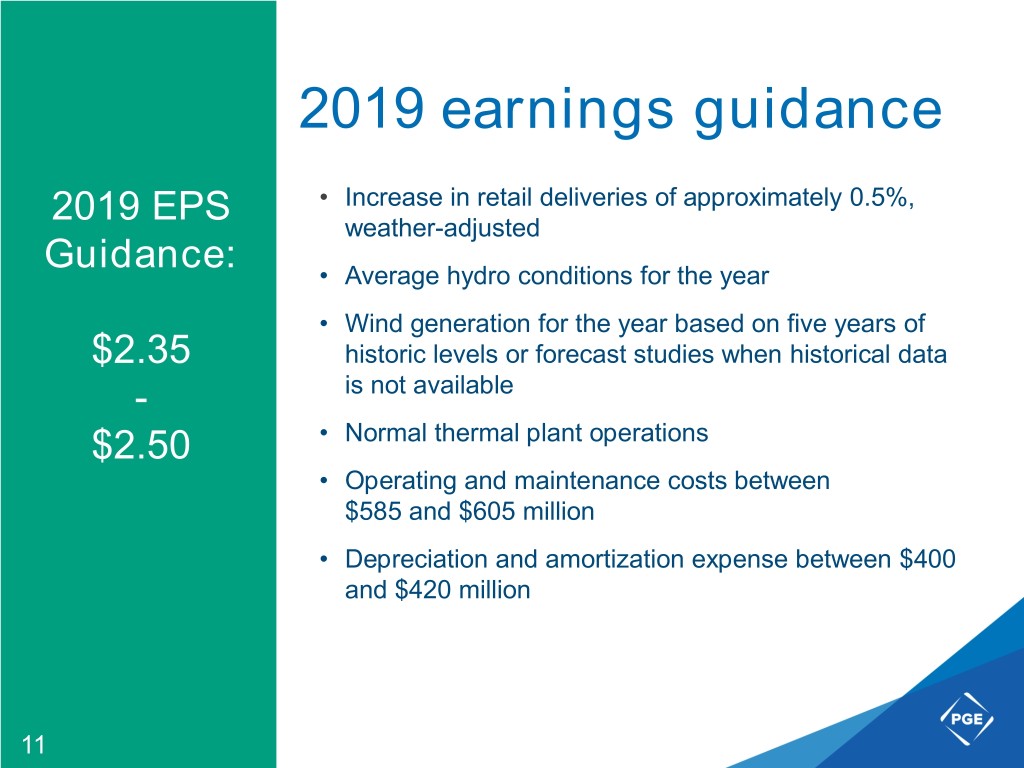

2019 earnings guidance 2019 EPS • Increase in retail deliveries of approximately 0.5%, weather-adjusted Guidance: • Average hydro conditions for the year • Wind generation for the year based on five years of $2.35 historic levels or forecast studies when historical data - is not available $2.50 • Normal thermal plant operations • Operating and maintenance costs between $585 and $605 million • Depreciation and amortization expense between $400 and $420 million 11

2019 focus Advancing clean energy through: • Our collaboration with NextEra Energy Resources on the Wheatridge facility • Continued investment in a smarter, more integrated grid • Cost-effective focus on enhanced reliability and resilience 12