Portland General Electric EARNINGS CONFERENCE CALL FOURTH QUARTER AND FULL YEAR 2022 Exhibit 99.2

Cautionary statement Information Current as of February 16, 2023 Except as expressly noted, the information in this presentation is current as of February 16, 2023 — the date on which PGE filed its Annual Report on Form 10-K for the year ended December 31, 2022 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update this presentation, except as may be required by law. Forward-Looking Statements Statements in this presentation that relate to future plans, objectives, expectations, performance, events and the like may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward- looking statements represent our estimates and assumptions as of the date of this report. The Company assumes no obligation to update or revise any forward-looking statement as a result of new information, future events or other factors. Forward-looking statements include statements regarding the Company's full-year earnings guidance (including expectations regarding annual retail deliveries, average hydro conditions, wind generation, normal thermal plant operations, operating and maintenance expense and depreciation and amortization expense) as well as other statements containing words such as "anticipates," “based on,” "believes," "conditioned upon," “considers,” "estimates," "expects," “forecast,” “goals,” "impacts", “intends,” “needs,” “plans,” “predicts,” “projects,” “promises,“ “seeks,” "should," “subject to,” “targets,” or similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including, without limitation: the timing or outcome of various legal and regulatory actions; changing customer expectations and choices that may reduce demand for electricity; the sale of excess energy during periods of low demand or low wholesale market prices; operational risks relating to the Company's generation and battery storage facilities, including hydro conditions, wind conditions, disruption of transmission and distribution, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; delays in the supply chain and increased supply costs (including application of tariffs impacting solar module imports), failure to complete capital projects on schedule or within budget, failure of counterparties to perform under agreement, or the abandonment of capital projects, which could result in the Company's inability to recover project costs, or impact our competitive position, market share, revenues and project margins in materials ways; default or nonperformance of counterparties from whom PGE purchases capacity or energy, which require the purchase of replacement power and renewable attributes at increased costs; complications arising from PGE’s jointly-owned plant, including ownership changes, regulatory outcomes or operational failures; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric and energy market conditions, which could affect the availability and cost of purchased power and fuel; the development of alternative technologies; changes in capital and credit market conditions, including volatility of equity markets, reductions in demand for investment-grade commercial paper or interest rates, which could affect the access to and availability or cost of capital and result in delay or cancellation of capital projects or execution of the Company’s strategic plan as currently envisioned; general economic and financial market conditions, including inflation; the effects of climate change, whether global or local in nature; unseasonable or severe weather conditions, wildfires, and other natural phenomena and natural disasters that could result in operational disruptions, unanticipated restoration costs, third party liability or that may affect energy costs or consumption; the effectiveness of PGE’s risk management policies and procedures; PGE’s ability to effectively implement a PSPS and de-energize its system in the event of heightened wildfire risk; cyber security breaches of the Company's customer information system or operating systems, data security breaches, or acts of terrorism, which could disrupt operations, require significant expenditures, or result in claims against the Company; employee workforce factors, including potential strikes, work stoppages, transitions in senior management, and the ability to recruit and retain key employees and other talent and turnover due to macroeconomic trends; PGE business activities are concentrated in one region and future performance may be affected by events and factors unique to Oregon; widespread health emergencies or outbreaks of infectious diseases such as COVID-19, which may affect our financial position, results of operations and cash flows; failure to achieve the Company’s greenhouse gas emission goals or being perceived to have either failed to act responsibly with respect to the environment or effectively responded to legislative requirements concerning greenhouse gas emission reductions; and risks and uncertainties related to 2021 All-Source RFP final shortlist projects. As a result, actual results may differ materially from those projected in the forward-looking statements. Risks and uncertainties to which the Company are subject are further discussed in the reports that the Company has filed with the United States Securities and Exchange Commission (SEC). These reports are available through the EDGAR system free-of-charge on the SEC’s website, www.sec.gov and on the Company’s website, investors.portlandgeneral.com. Investors should not rely unduly on any forward-looking statements. 2

Topics for today’s call 3 Business Update Maria Pope, President and CEO • Year in review • Strategic priorities • 2023 outlook Financial Update Jim Ajello, Senior VP of Finance, CFO, Treasurer and CCO • Economy and load growth • 2022 earnings drivers • 2024 general rate case • RFP update and capital investments • Liquidity and financing • 2023 earnings guidance

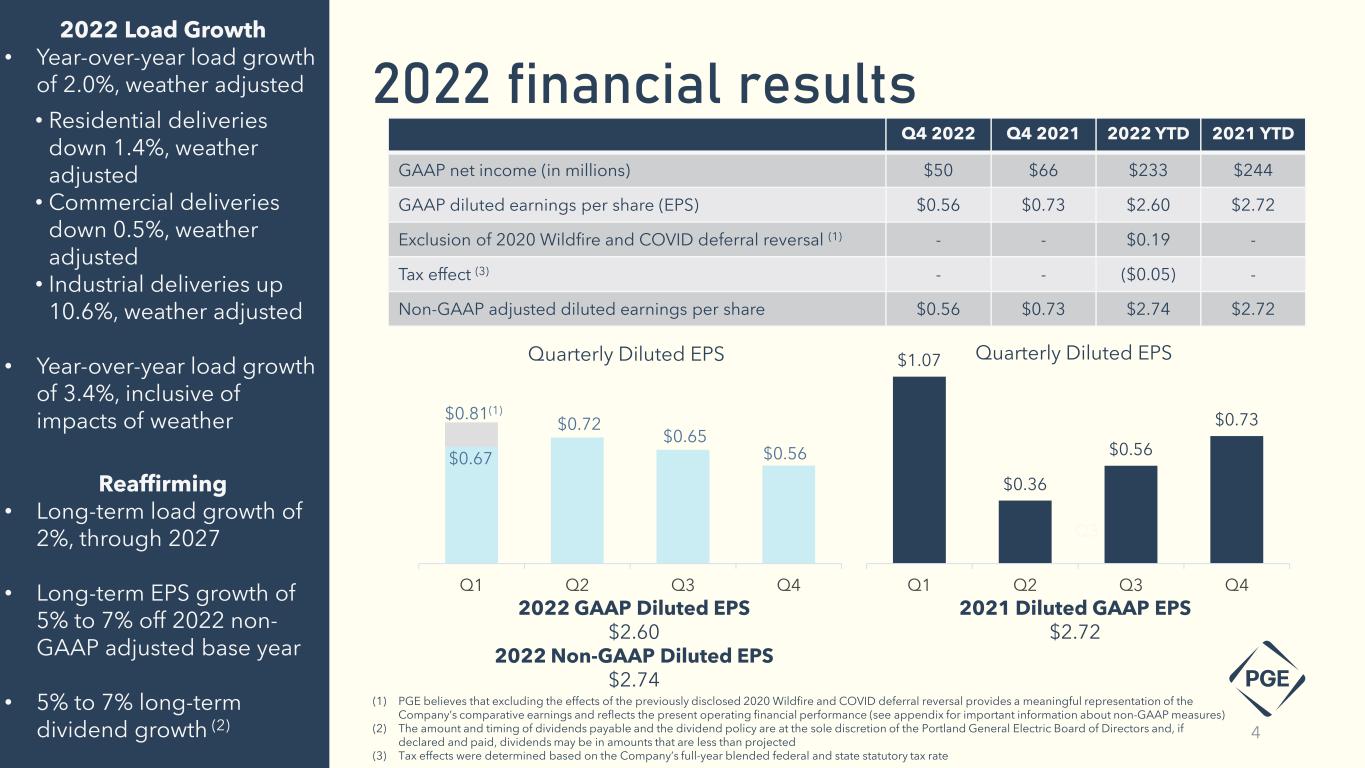

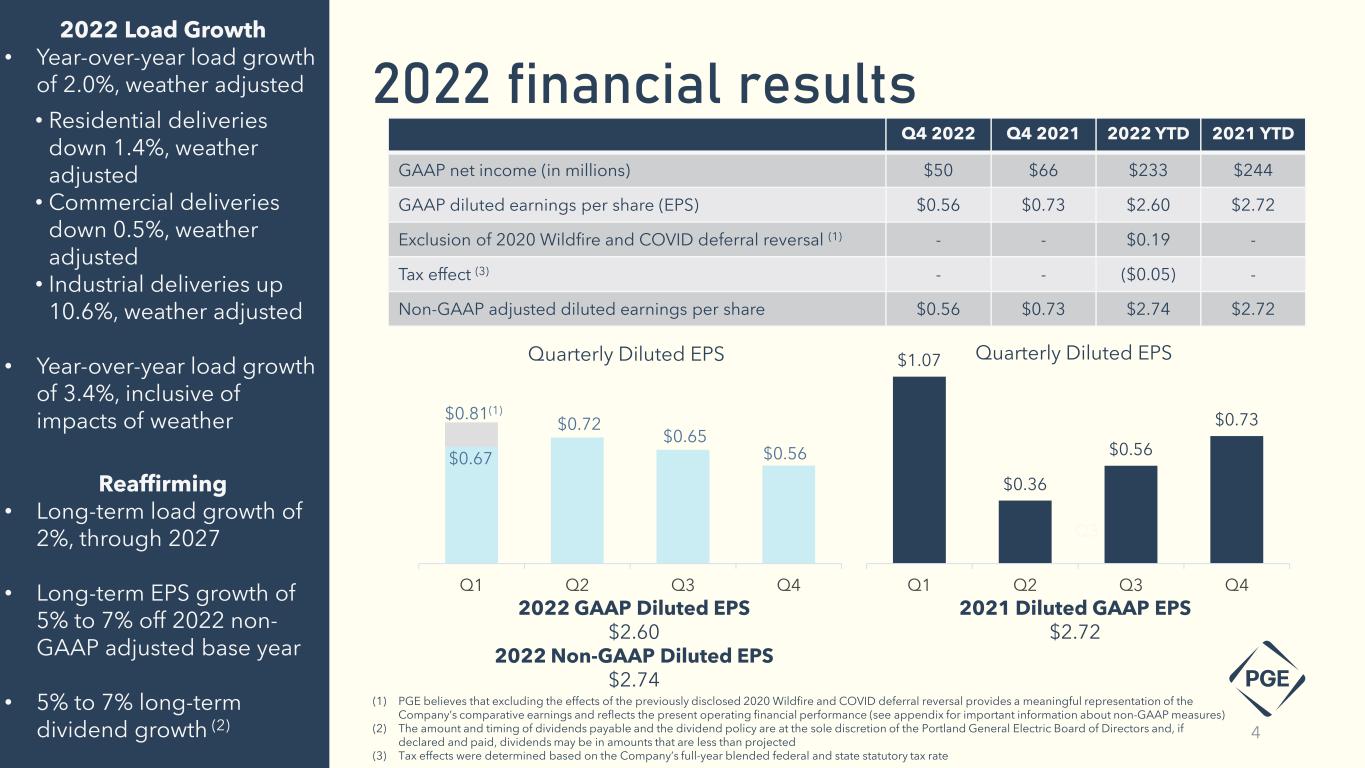

Q4 2022 Q4 2021 2022 YTD 2021 YTD GAAP net income (in millions) $50 $66 $233 $244 GAAP diluted earnings per share (EPS) $0.56 $0.73 $2.60 $2.72 Exclusion of 2020 Wildfire and COVID deferral reversal (1) - - $0.19 - Tax effect (3) - - ($0.05) - Non-GAAP adjusted diluted earnings per share $0.56 $0.73 $2.74 $2.72 (1) PGE believes that excluding the effects of the previously disclosed 2020 Wildfire and COVID deferral reversal provides a meaningful representation of the Company’s comparative earnings and reflects the present operating financial performance (see appendix for important information about non-GAAP measures) (2) The amount and timing of dividends payable and the dividend policy are at the sole discretion of the Portland General Electric Board of Directors and, if declared and paid, dividends may be in amounts that are less than projected (3) Tax effects were determined based on the Company’s full-year blended federal and state statutory tax rate 2022 financial results 4 2022 Load Growth • Year-over-year load growth of 2.0%, weather adjusted • Residential deliveries down 1.4%, weather adjusted • Commercial deliveries down 0.5%, weather adjusted • Industrial deliveries up 10.6%, weather adjusted • Year-over-year load growth of 3.4%, inclusive of impacts of weather Reaffirming • Long-term load growth of 2%, through 2027 • Long-term EPS growth of 5% to 7% off 2022 non- GAAP adjusted base year • 5% to 7% long-term dividend growth (2) $0.67 $0.72 $0.65 $0.56 Q1 Q2 Q3 Q4 Quarterly Diluted EPS $0.81(1) Q3 $1.07 $0.36 $0.56 $0.73 Q1 Q2 Q3 Q4 Quarterly Diluted EPS 2021 Diluted GAAP EPS $2.72 2022 GAAP Diluted EPS $2.60 2022 Non-GAAP Diluted EPS $2.74

Our strategic priorities Performance Driving operational efficiencies through disciplined execution and management Risk Management Focusing on high-return initiatives to enhance resiliency in the face of growing climate risks Value Creation for Stakeholders Growth Building the clean energy future and a more resilient and reliable grid 5

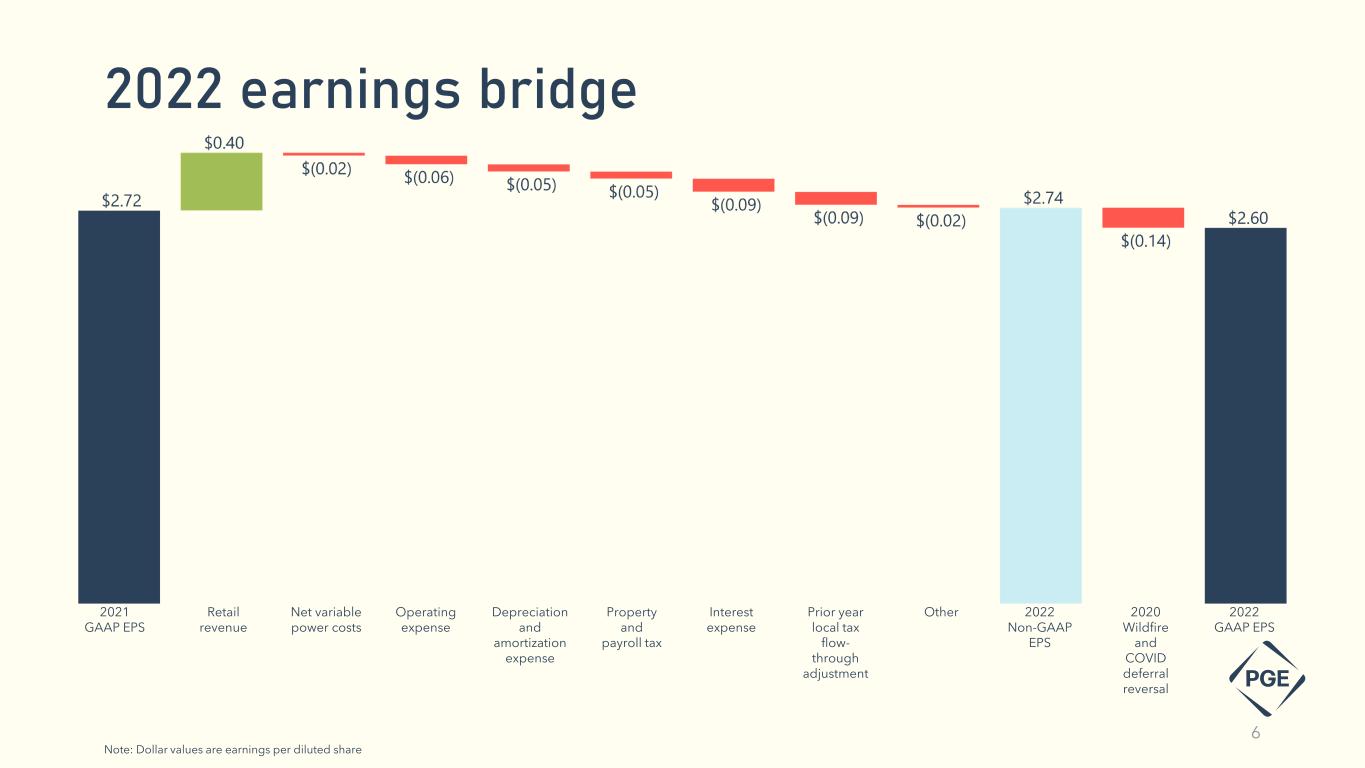

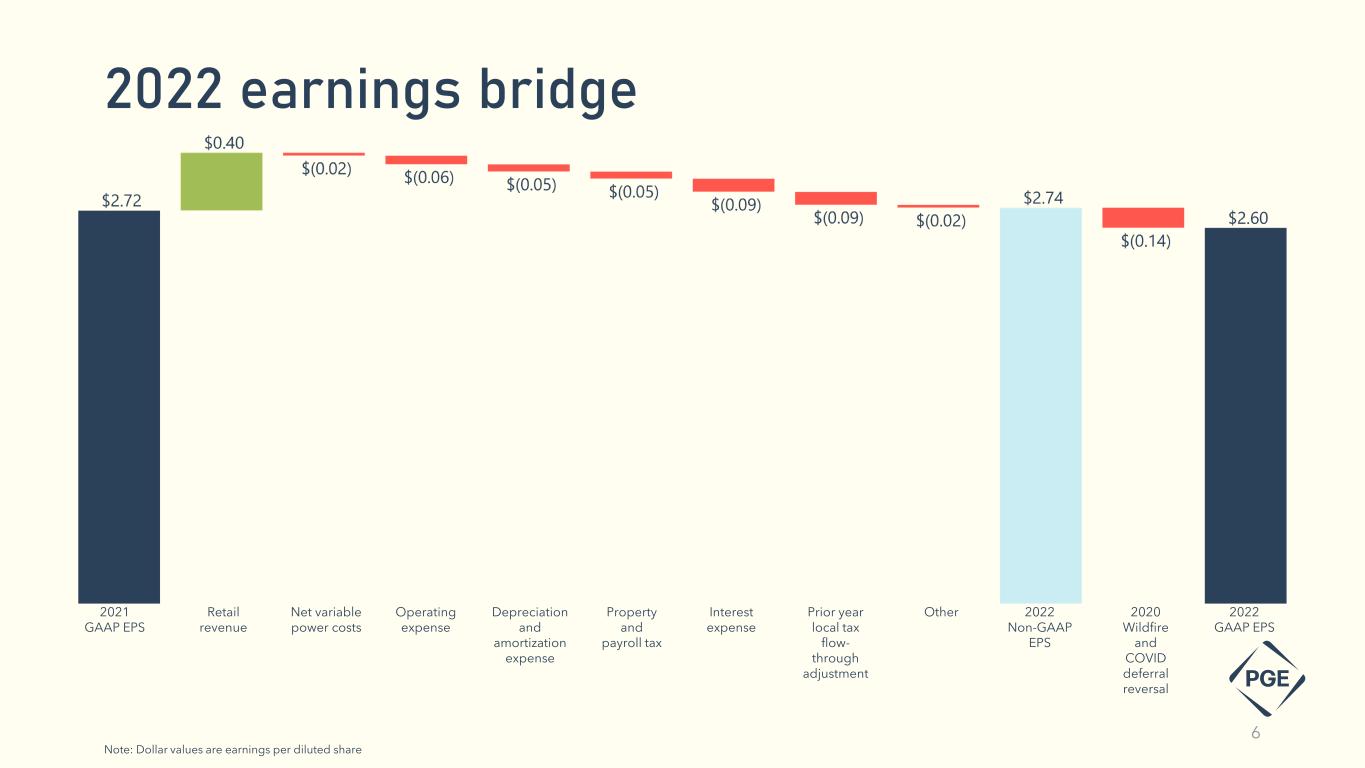

2022 earnings bridge 6 2021 GAAP EPS Retail revenue Net variable power costs 2022 GAAP EPS Note: Dollar values are earnings per diluted share Depreciation and amortization expense 2020 Wildfire and COVID deferral reversal Operating expense Interest expense Prior year local tax flow- through adjustment Property and payroll tax Other 2022 Non-GAAP EPS

2024 General Rate Case Rate Case Key Terms Rate Base $6.3 billion Rate Base Increase $859 million, 16% ROE 9.8% Capital Structure 50/50 Cost of Debt 4.32% Cost of Capital 7.06% Revenue Requirement Increase $338 million Key Proposals • Modify Power Cost Adjustment Mechanism (PCAM) structure • Remove deadbands with 90/10 sharing of cost variances • Provide for full cost recovery during reliability contingency events • +/- 2.5% rolling cap on customer price changes year-over-year for cost variances, amounts beyond cap roll to the next year • Update forecast modeling to reflect new market and climate dynamics • Clarify associated battery storage will be included in Renewable Adjustment Clause filings 7 Management cannot predict the outcome of the rate case and all items are subject to OPUC approval

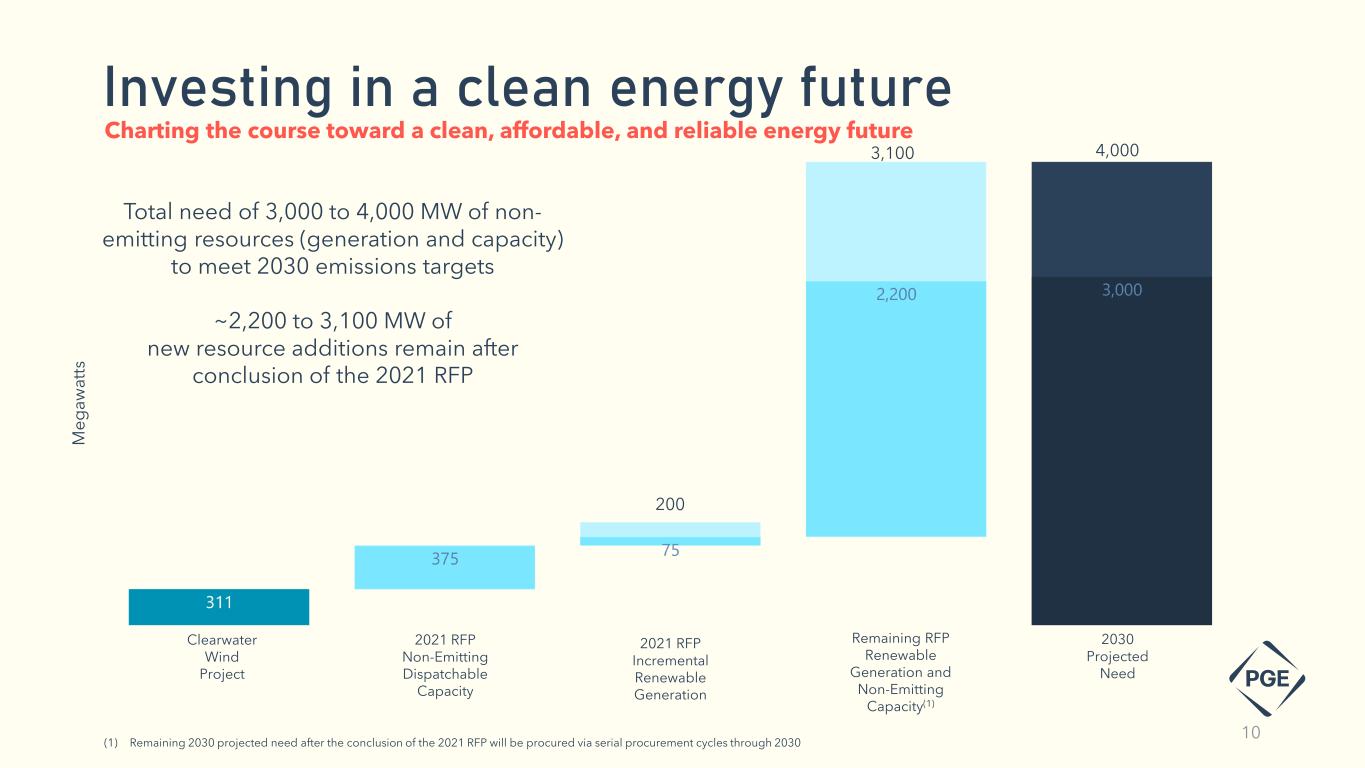

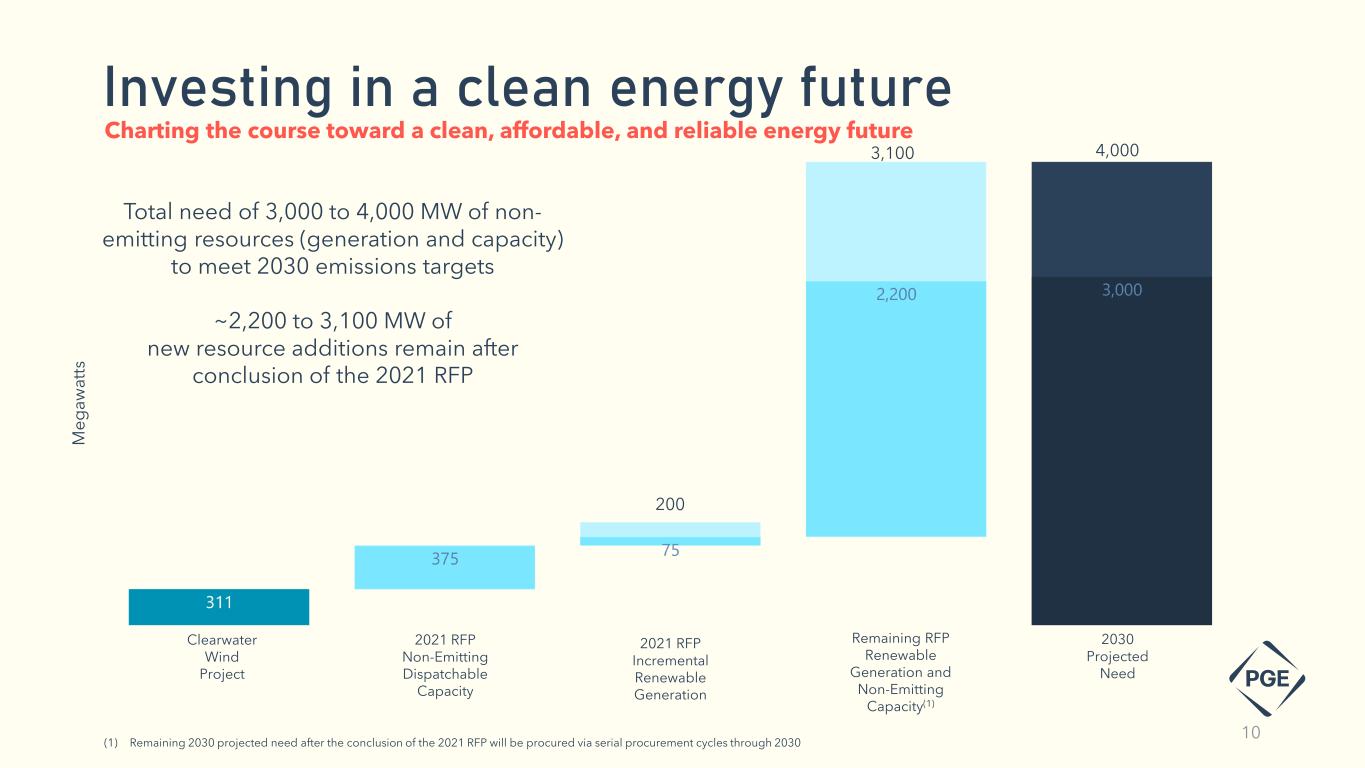

Update on RFP processes 8 Remaining 2021 RFP Milestones 1H 2023 Expected execution of final contracts with additional winning bidders With the execution of the Clearwater Wind project in Q4 2022, PGE is still seeking approximately: • 375 MW of non-emitting dispatchable capacity resources that can be used to meet peak customer demand • 75-200 MW of renewable resources • 100 MW of renewable energy in support of the Green Future Impact program’s PGE supply option PGE expects to announce winning bids for additional projects in the first half of 2023 If the above targets are not achieved in the 2021 RFP, the 2023 RFP would look to procure the remaining 2021 RFP amounts in addition to the stated need coming from the upcoming 2023 Integrated Resource Plan and Clean Energy Plan Year-end 2024 Projects expected to be in-service 2023 Resource Procurement Plan January 2023 Filed notice with the OPUC that an RFP in 2023 is needed March 2023 Filing IRP and PGE’s first Clean Energy Plan, outlining PGE’s strategy to meet decarbonization targets under Oregon law (1) Fall 2023 Issuance of 2023 All-Source Request for Proposal Year-end 2023 Final shortlist selection and submission for shortlist acknowledgement to the OPUC (1) ORS 469A.410 is an Oregon statute that sets a timetable for Oregon’s electricity providers to eliminate emissions associated with power used to serve retail customers in Oregon by 80% by 2030, 90% by 2035 and 100% by 2040

$135 $125 $120 $120 $120 $530 $505 $530 $555 $580 $130 $100 $100 $100 $100 $415 2023 2024 2025 2026 2027 Capital expenditures forecast(1) Generation Transmission and Distribution General Business and Technology Clearwater Wind $750$730 $800$775 Note: Dollar values in millions. Capital expenditures exclude allowance for funds used under construction. These are projections based on assumptions of future investment. Actual amounts expended will depend on various factors and may differ materially from the amounts reflected in this capital expenditure forecast (1) Values presented do not include incremental potential RFP investments for the 2021 RFP or future RFP cycles Reliability and resiliency investments 9 $1,210 with Clearwater $795

Investing in a clean energy future 10 Clearwater Wind Project 2021 RFP Non-Emitting Dispatchable Capacity 2021 RFP Incremental Renewable Generation Charting the course toward a clean, affordable, and reliable energy future 200 4,000 Remaining RFP Renewable Generation and Non-Emitting Capacity(1) 2030 Projected Need Total need of 3,000 to 4,000 MW of non- emitting resources (generation and capacity) to meet 2030 emissions targets ~2,200 to 3,100 MW of new resource additions remain after conclusion of the 2021 RFP (1) Remaining 2030 projected need after the conclusion of the 2021 RFP will be procured via serial procurement cycles through 2030 3,100 M eg aw at ts

(1) Base + Clearwater scenario illustrates the potential impact of the following assumptions: a) 2023 earnings power rate base is assumed consistent with the 2022 GRC value ($6.3B) plus $415M spend for the Clearwater wind project in 2023; b) annual capital expenditures from 2024-2027 consistent with current capital expenditures forecast on slide 9; and c) 2023 depreciation and amortization of $455M (mid-point of 2023 earnings guidance assumption) and 25-year useful life for new asset additions thereafter (2) The incremental opportunity from RFPs illustrates the potential impact of the following assumptions: a) a total IRP opportunity of 3,500 MW (mid-point of total resource need of 3,000 to 4,000 MW, including both energy and capacity resources); b) 25% ownership of the midpoint 3,500 MW opportunity; c) $2,000 installed cost per KW (based on indicative values for Clearwater); d) RFP projects procured in serial cycles and with evenly spread project spend through 2027 (Note: This is illustrative and actual RFP opportunity spend may be unevenly distributed); and e) 25-year useful life for RFP asset additions (3) 2022 rate base value based on UE 394 2022 GRC Rate Base amount, inclusive of Colstrip (4) 2024 base rate base value based on UE 416 2024 GRC Rate Base initial filing value Illustrative rate base growth 11 • PGE’s five-year base plus Clearwater Wind capital expenditure forecast of $4.3 billion drives 5.8% rate base growth from 2022 base year • Illustrative incremental RFP opportunities(1) potentially increase rate base growth to 8.5%, from 2022 base year • Amounts presented below are for illustrative purposes and represents potential values based on the assumptions outlined below. Amounts do not represent guidance and actual amounts may differ materially $ B ill io ns $ B ill io ns $5.6 $6.7 $6.9 $7.1 $7.4 2022 2023E 2024E 2025E 2026E 2027E Rate Base: Base Capital + Clearwater (Illustrative)(1) (3) (4) $5.6 $7.0 $7.4 $7.9 $8.4 2022 2023E 2024E 2025E 2026E 2027E Rate Base: Base Capital + Clearwater + RFP Opportunity(2) (Illustrative) (3) (4)

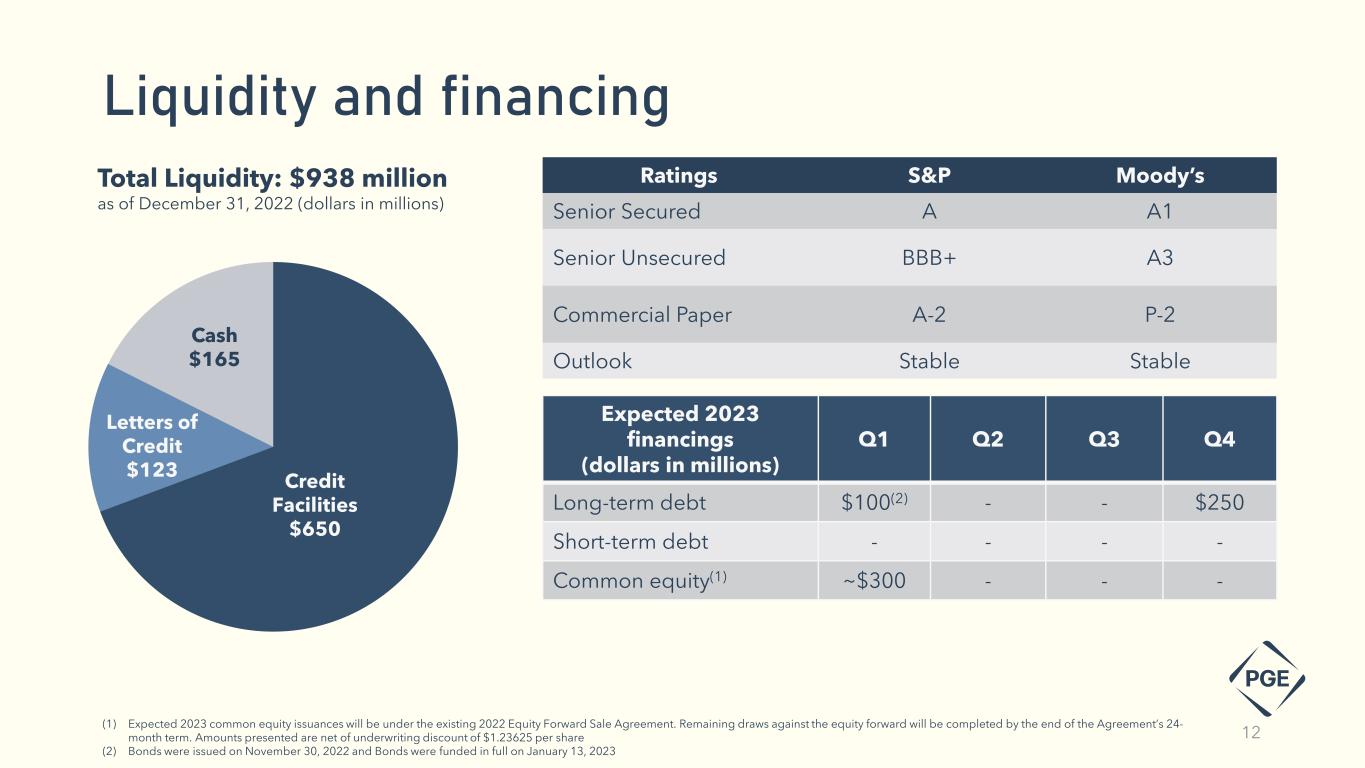

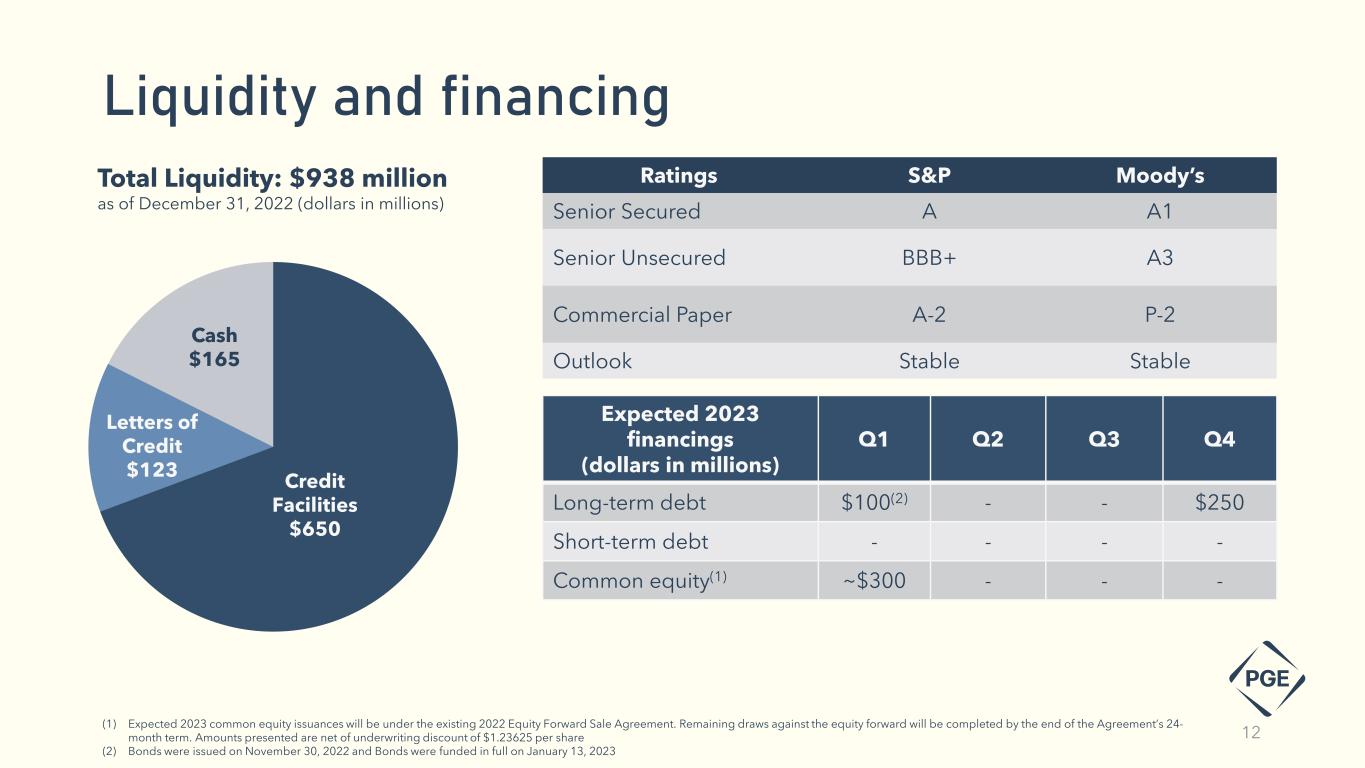

Ratings S&P Moody’s Senior Secured A A1 Senior Unsecured BBB+ A3 Commercial Paper A-2 P-2 Outlook Stable Stable Credit Facilities $650 Letters of Credit $123 Total Liquidity: $938 million as of December 31, 2022 (dollars in millions) Cash $165 Liquidity and financing Expected 2023 financings (dollars in millions) Q1 Q2 Q3 Q4 Long-term debt $100(2) - - $250 Short-term debt - - - - Common equity(1) ~$300 - - - 12 (1) Expected 2023 common equity issuances will be under the existing 2022 Equity Forward Sale Agreement. Remaining draws against the equity forward will be completed by the end of the Agreement’s 24- month term. Amounts presented are net of underwriting discount of $1.23625 per share (2) Bonds were issued on November 30, 2022 and Bonds were funded in full on January 13, 2023

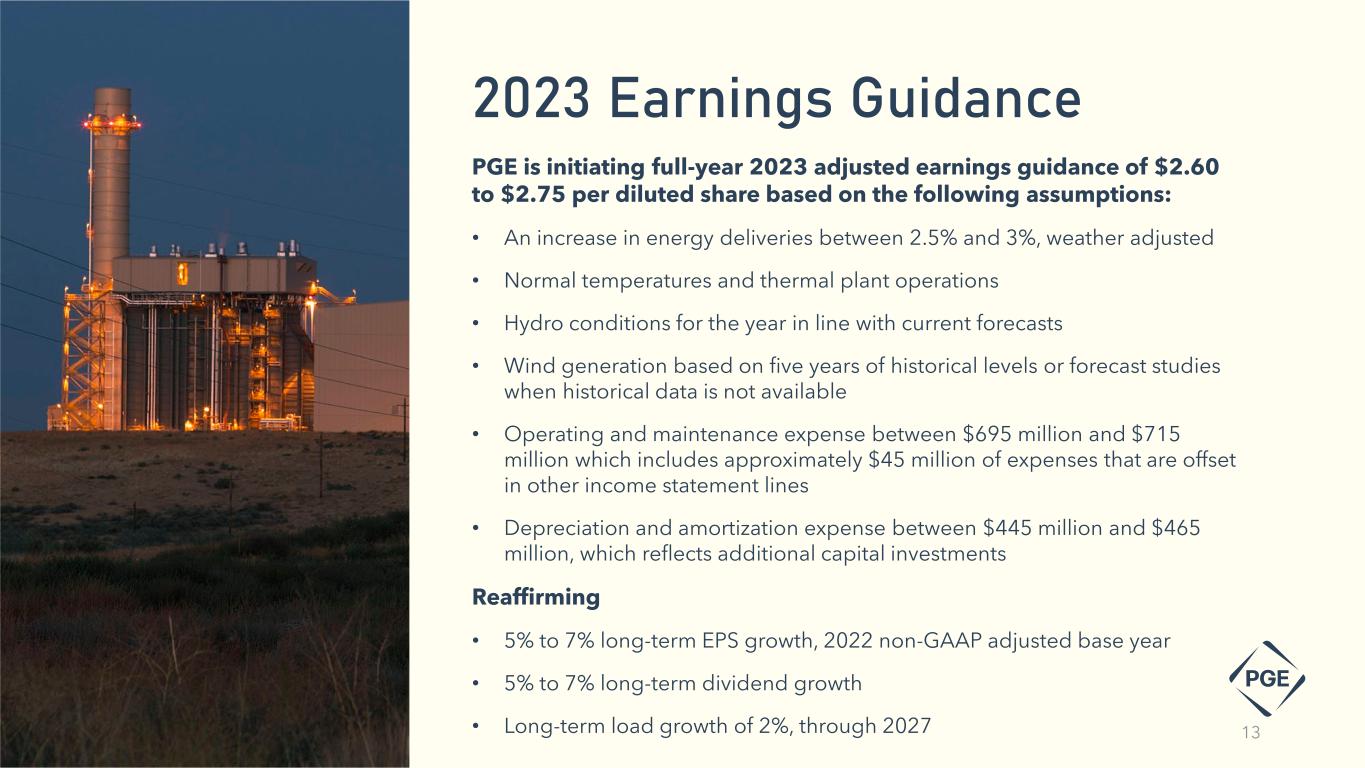

PGE is initiating full-year 2023 adjusted earnings guidance of $2.60 to $2.75 per diluted share based on the following assumptions: • An increase in energy deliveries between 2.5% and 3%, weather adjusted • Normal temperatures and thermal plant operations • Hydro conditions for the year in line with current forecasts • Wind generation based on five years of historical levels or forecast studies when historical data is not available • Operating and maintenance expense between $695 million and $715 million which includes approximately $45 million of expenses that are offset in other income statement lines • Depreciation and amortization expense between $445 million and $465 million, which reflects additional capital investments Reaffirming • 5% to 7% long-term EPS growth, 2022 non-GAAP adjusted base year • 5% to 7% long-term dividend growth • Long-term load growth of 2%, through 2027 2023 Earnings Guidance 13

Appendix

This presentation contains certain non-GAAP measures, such as adjusted earnings, adjusted EPS and adjusted earnings guidance. These non-GAAP financial measures exclude significant items that are generally not related to our ongoing business activities, are infrequent in nature, or both. PGE believes that excluding the effects of these items provides a meaningful representation of the Company’s comparative earnings per share and enables investors to evaluate the Company’s ongoing operating financial performance. Management utilizes non-GAAP measures to assess the Company’s current and forecasted performance, and for communications with shareholders, analysts and investors. Non-GAAP financial measures are supplementary information that should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Items in the periods presented, which PGE believes impact the comparability of comparative earnings and do not represent ongoing operating financial performance, include the following: • Non-cash Wildfire and COVID deferral reversal charge associated with the year ended 2020, resulting from the OPUC’s 2022 GRC Final Order earnings test Due to the forward-looking nature of PGE’s non-GAAP adjusted earnings guidance, management is unable to estimate specific items requiring adjustment, which could potentially impact the Company’s GAAP earnings (such as potential adjustments described above) for future periods and therefore cannot provide a reconciliation of non-GAAP adjusted earnings per share guidance to the most comparable GAAP financial measure without unreasonable effort. PGE’s reconciliation of non-GAAP earnings for the three months ended March 31, 2022, the year ended December 31, 2022. 15 Non-GAAP financial measures

Non-GAAP Earnings Reconciliation for the quarter ended March 31, 2022 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the quarter ended March 31, 2022 $60 $0.67 Exclusion of released deferrals related to 2020 17 0.19 Tax effect (1) (5) (0.05) Non-GAAP as reported for the quarter ended March 31, 2022 $72 $0.81 Non-GAAP Earnings Reconciliation for the year ended December 31, 2022 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the year ended December 31, 2022 $233 $2.60 Exclusion of released deferrals related to 2020 17 0.19 Tax effect (1) (5) (0.05) Non-GAAP as reported for the year ended December 31, 2022 $245 $2.74 Non-GAAP financial measures (1) Tax effects were determined based on the Company’s full-year blended federal and state statutory tax rate 16