Portland General Electric EARNINGS CONFERENCE CALL FOURTH QUARTER AND FULL YEAR 2024 Exhibit 99.2

Cautionary statement Information Current as of February 14, 2025 Except as expressly noted, the information in this presentation is current as of February 14, 2025 – the date on which PGE filed its Annual Report on Form 10-K for the year ended December 31, 2024 - and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update this presentation, except as may be required by law. Forward-Looking Statement Statements in this presentation that relate to future plans, objectives, expectations, performance, events and the like may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent our estimates and assumptions as of the date of this report. The Company assumes no obligation to update or revise any forward-looking statement as a result of new information, future events or other factors. Forward-looking statements include statements regarding the Company's full-year earnings guidance (including assumptions and expectations regarding annual retail deliveries, average hydro conditions, wind generation, normal thermal plant operations, operating and maintenance expense and depreciation and amortization expense) as well as other statements containing words such as "anticipates," "assumptions," "based on," "believes," "conditioned upon," "considers," "could," "estimates," "expects," “expected,” "forecast," "goals," "intends," "needs," "plans," "predicts," "projects," "promises," "seeks," "should," "subject to," "targets," "will continue," "will likely result," or similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including, without limitation: the timing or outcome of various legal and regulatory actions; governmental policies, legislative action, and regulatory audits, investigations and actions with respect to allowed rates of return, financings, electricity pricing and price structures, acquisition and disposal of facilities and other assets, construction and operation of plant facilities, transmission of electricity, recovery of power costs, operating expenses, deferrals, timely recovery of costs, and capital investments, energy trading activities, and current or prospective wholesale and retail competition; changing customer expectations and choices that may reduce demand for electricity; the sale of excess energy during periods of low demand or low wholesale market prices; impaired financial stability of vendors and service providers and elevated levels of uncollectible customer accounts; uncertainties associated with energy demand to new data centers, including the concentration of data centers, and the ability to obtain regulatory approvals, environmental, and other permits to construct new facilities in a timely manner; operational risks relating to the Company's generation and battery storage facilities, including hydro conditions, wind conditions, disruption of transmission and distribution, disruption of fuel supply, and unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; delays in the supply chain and increased supply costs (including application of tariffs), failure to complete capital projects on schedule or within budget, failure of counterparties to perform under agreement, or the abandonment of capital projects, which could result in the Company's inability to recover project costs, or impact our competitive position, market share, revenues and project margins in material ways; default or nonperformance of counterparties from whom PGE purchases capacity or energy, which require the purchase of replacement power and renewable attributes at increased costs; complications arising from PGE’s jointly-owned plant, including ownership changes, regulatory outcomes or operational failures; changes in, and compliance with, environmental laws and policies, including those related to threatened and endangered species, fish, and wildfire; future laws, regulations, and proceedings that could increase the Company’s costs of operating its thermal generating plants, or affect the operations of such plants by imposing requirements for additional emissions controls or significant emissions fees or taxes, particularly with respect to coal-fired generating facilities, in order to mitigate carbon dioxide, mercury, and other gas emissions; volatility in wholesale power and natural gas prices that could require PGE to post additional collateral or issue additional letters of credit pursuant to power and natural gas purchase agreements; changes in the availability and price of wholesale power and fuels; changes in customer growth, or demographic patterns, including changes in load resulting in future transmission constraints, in PGE’s service territory; changes in capital and credit market conditions, including volatility of equity markets as well as changes in PGE’s credit ratings and outlook on such credit ratings, reductions in demand for investment-grade commercial paper or interest rates, which could affect the access to and availability or cost of capital and result in delay or cancellation of capital projects or execution of the Company’s strategic plan as currently envisioned; inflation and volatility in interest rates; the effects of climate change, whether global or local in nature; unseasonable or severe weather conditions, wildfires, and other natural phenomena and natural disasters that could result in operational disruptions, unanticipated restoration costs, third party liability or that may affect energy costs or consumption; the effectiveness of PGE’s risk management policies and procedures; ignitions caused by PGE assets or PGE’s ability to effectively implement a Public Safety Power Shutoffs (PSPS) and de-energize its system in the event of heightened wildfire risk or implement effective system hardening programs; cybersecurity attacks, data security breaches, physical attacks and security breaches, or other malicious acts against the Company or against Company vendors, which could disrupt operations, require significant expenditures, or result in the release of confidential customer, vendor, employee, or Company information; employee workforce factors, including potential strikes, work stoppages, transitions in senior management, and the ability to recruit and retain key employees and other talent and turnover due to macroeconomic trends or if efforts around diversity, equity and inclusion are perceived to be insufficient or overdone; widespread health emergencies or outbreaks of infectious diseases, which may affect our financial position, results of operations and cash flows; failure to achieve the Company’s greenhouse gas emission goals or being perceived to have either failed to act responsibly with respect to the environment or effectively responded to legislative requirements concerning greenhouse gas emission reductions; social attitudes regarding the electric utility and power industries; political and economic conditions; acts of war or terrorism; changes in financial or regulatory accounting principles or policies imposed by governing bodies; new federal, state, and local laws that could have adverse effects on operating results; and risks and uncertainties related to generation and transmission projects, including, but not limited to, regulatory processes, transmission capabilities, system interconnections, permitting and construction delays, legislative uncertainty, inflationary impacts, supply costs and supply chain constraints. As a result, actual results may differ materially from those projected in the forward-looking statements. Risks and uncertainties to which the Company are subject are further discussed in the reports that the Company has filed with the United States Securities and Exchange Commission (SEC). These reports are available through the EDGAR system free-of-charge on the SEC’s website, www.sec.gov and on the Company’s website, investors.portlandgeneral.com. Investors should not rely unduly on any forward-looking statements. 2

Topics for today’s call 3 Business Update Maria Pope, President and CEO • Year in review • 2024 highlights • 2025 outlook Financial Update Joe Trpik, Senior VP of Finance and CFO • Load growth • 2024 earnings drivers • Capital investments and resource planning update • Liquidity and financing • 2025 earnings guidance

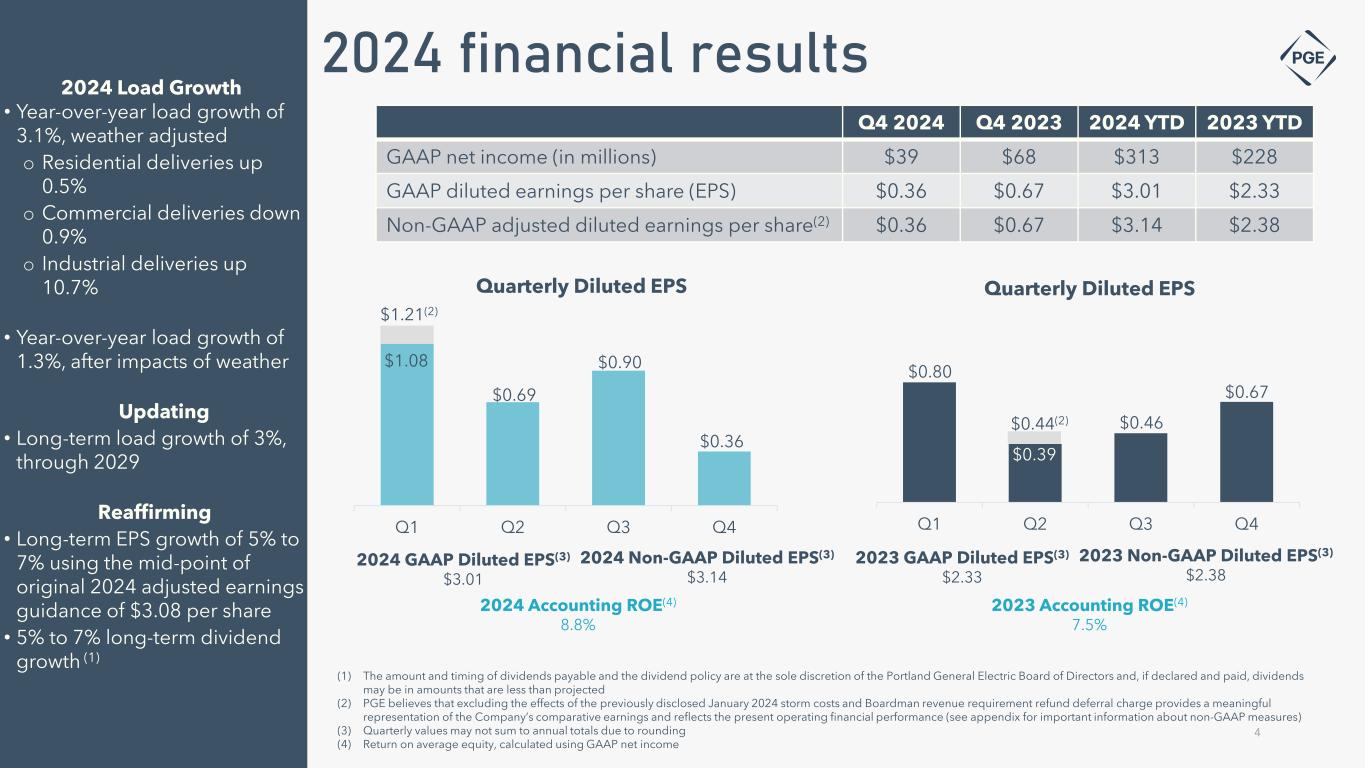

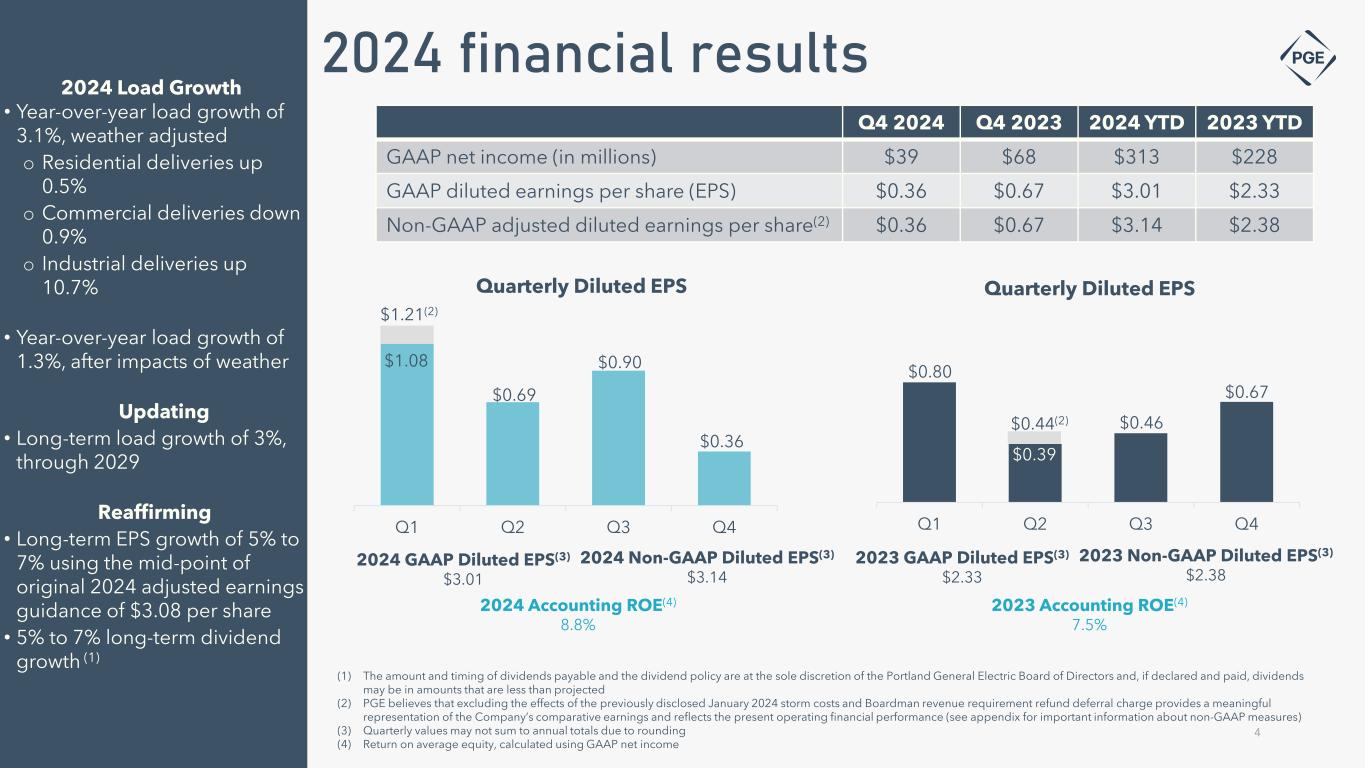

$0.80 $0.39 $0.46 Q1 Q2 Q3 Q4 Quarterly Diluted EPS $0.44(2) $0.67 Q4 2024 Q4 2023 2024 YTD 2023 YTD GAAP net income (in millions) $39 $68 $313 $228 GAAP diluted earnings per share (EPS) $0.36 $0.67 $3.01 $2.33 Non-GAAP adjusted diluted earnings per share(2) $0.36 $0.67 $3.14 $2.38 (1) The amount and timing of dividends payable and the dividend policy are at the sole discretion of the Portland General Electric Board of Directors and, if declared and paid, dividends may be in amounts that are less than projected (2) PGE believes that excluding the effects of the previously disclosed January 2024 storm costs and Boardman revenue requirement refund deferral charge provides a meaningful representation of the Company’s comparative earnings and reflects the present operating financial performance (see appendix for important information about non-GAAP measures) (3) Quarterly values may not sum to annual totals due to rounding (4) Return on average equity, calculated using GAAP net income 2024 financial results 4 2024 Load Growth • Year-over-year load growth of 3.1%, weather adjusted o Residential deliveries up 0.5% o Commercial deliveries down 0.9% o Industrial deliveries up 10.7% • Year-over-year load growth of 1.3%, after impacts of weather Updating • Long-term load growth of 3%, through 2029 Reaffirming • Long-term EPS growth of 5% to 7% using the mid-point of original 2024 adjusted earnings guidance of $3.08 per share • 5% to 7% long-term dividend growth (1) 2023 GAAP Diluted EPS(3) $2.33 $1.08 Q1 Q2 Q3 Q4 Quarterly Diluted EPS $1.21(2) $0.36 $0.69 $0.90 2023 Non-GAAP Diluted EPS(3) $2.38 2024 Accounting ROE(4) 8.8% 2023 Accounting ROE(4) 7.5% 2024 GAAP Diluted EPS(3) $3.01 2024 Non-GAAP Diluted EPS(3) $3.14

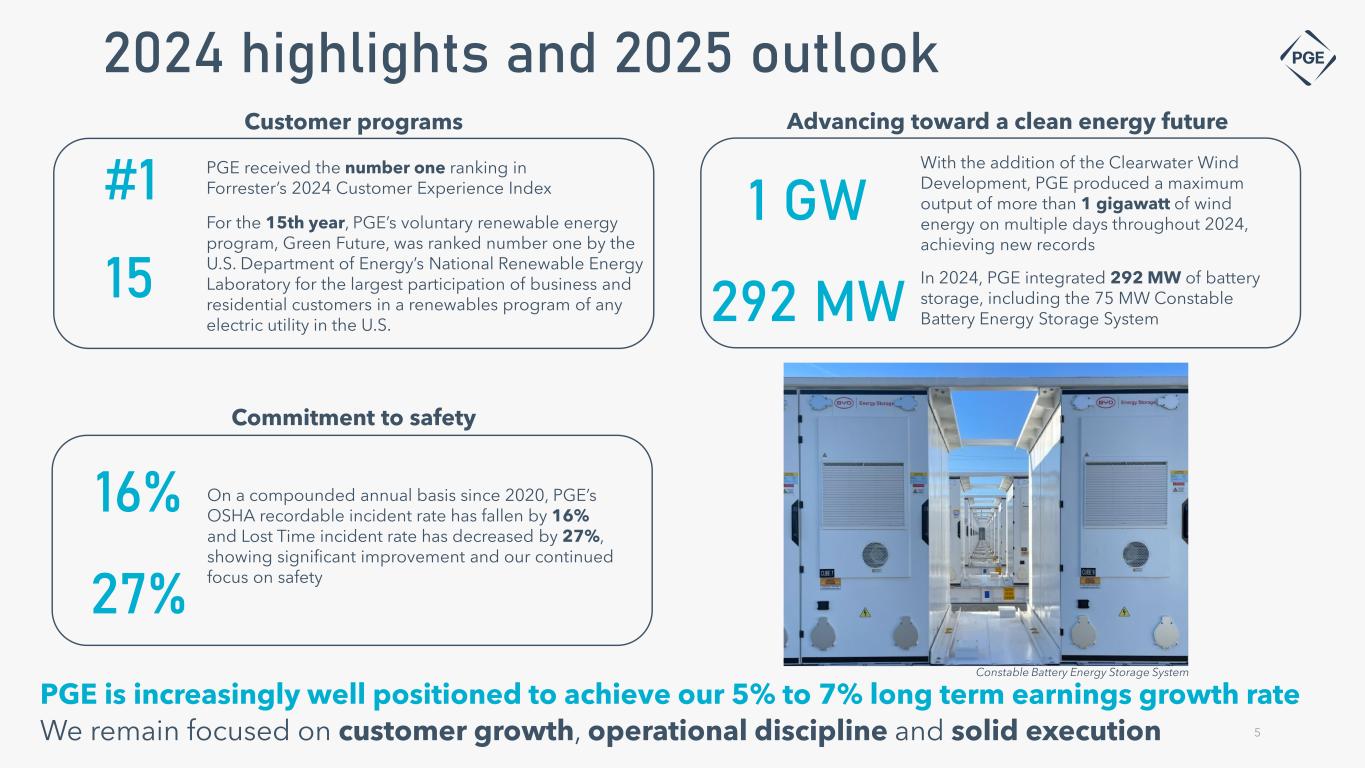

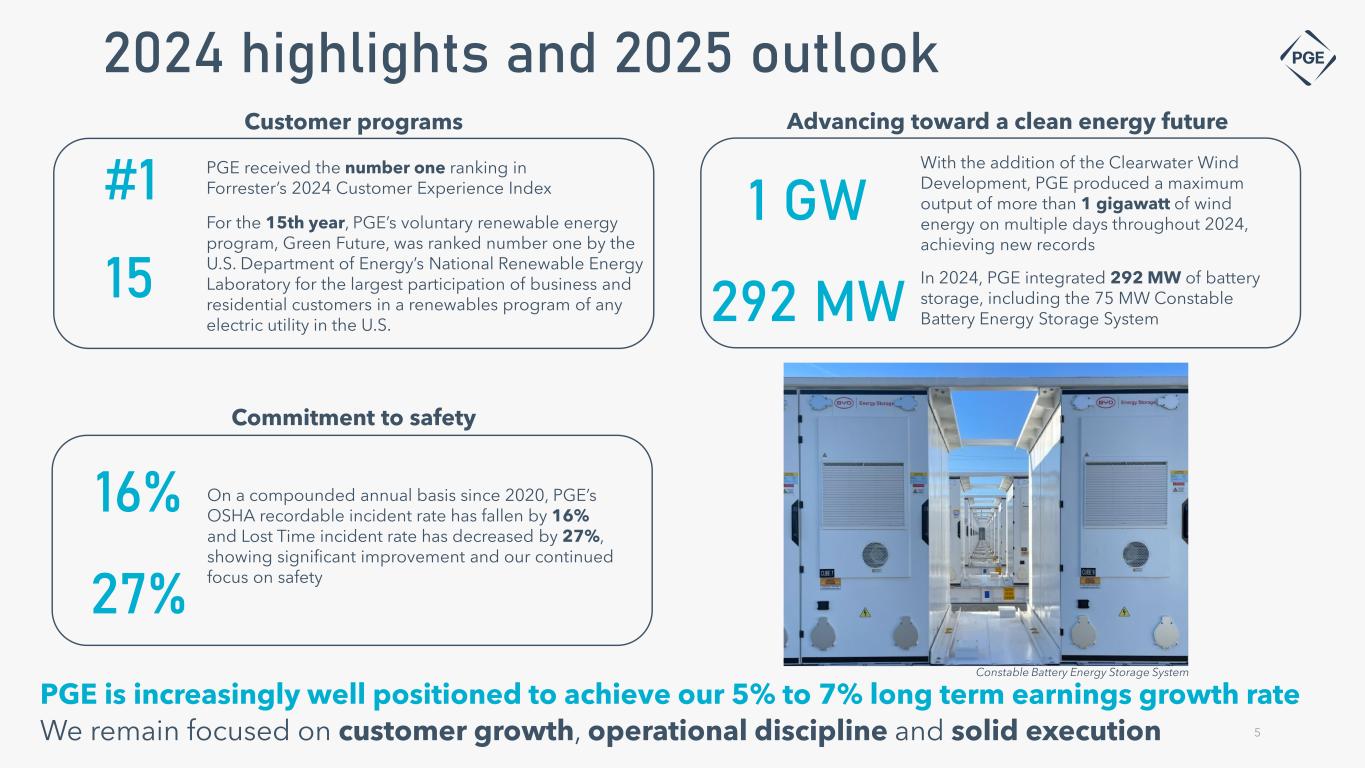

2024 highlights and 2025 outlook 5 Customer programs Commitment to safety Advancing toward a clean energy future With the addition of the Clearwater Wind Development, PGE produced a maximum output of more than 1 gigawatt of wind energy on multiple days throughout 2024, achieving new records 1 GW 292 MW In 2024, PGE integrated 292 MW of battery storage, including the 75 MW Constable Battery Energy Storage System For the 15th year, PGE’s voluntary renewable energy program, Green Future, was ranked number one by the U.S. Department of Energy’s National Renewable Energy Laboratory for the largest participation of business and residential customers in a renewables program of any electric utility in the U.S. #1 15 PGE received the number one ranking in Forrester’s 2024 Customer Experience Index PGE is increasingly well positioned to achieve our 5% to 7% long term earnings growth rate We remain focused on customer growth, operational discipline and solid execution 27% 16% On a compounded annual basis since 2020, PGE’s OSHA recordable incident rate has fallen by 16% and Lost Time incident rate has decreased by 27%, showing significant improvement and our continued focus on safety Constable Battery Energy Storage System

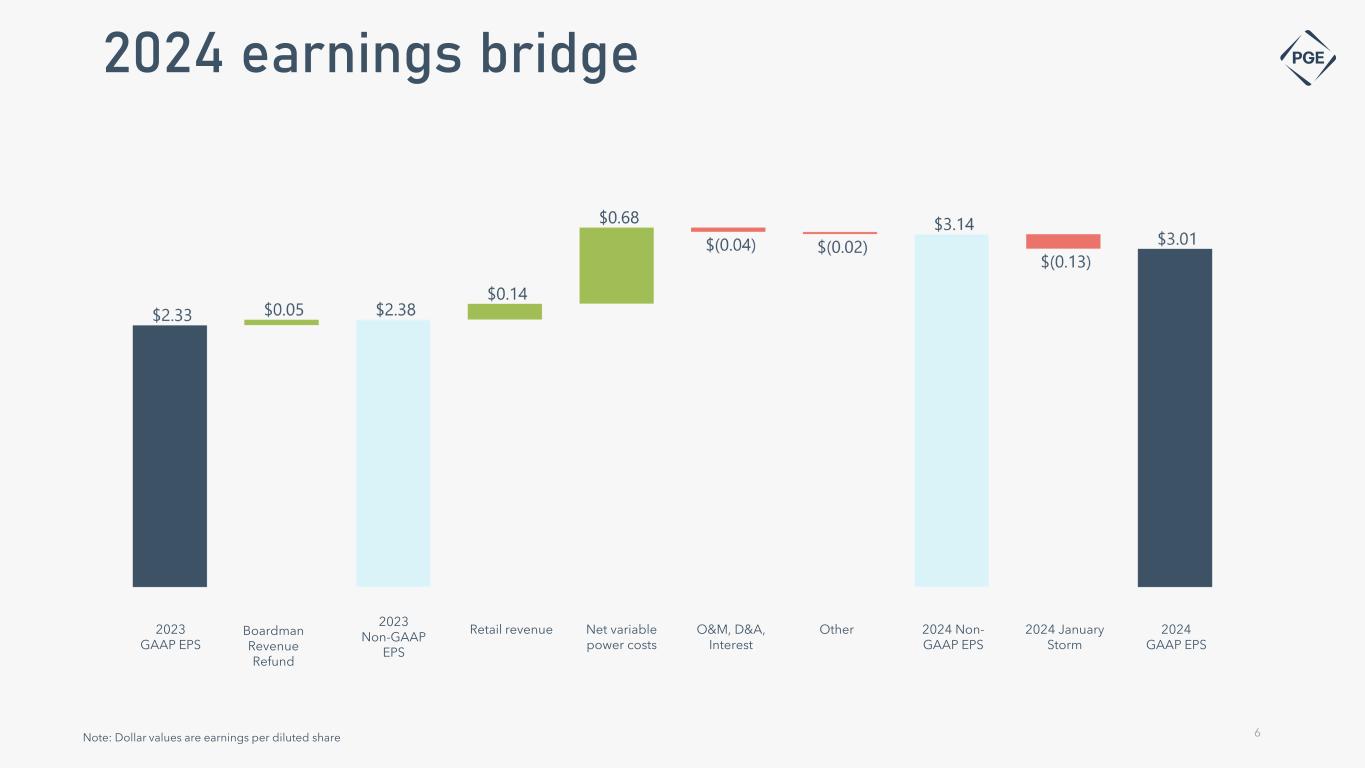

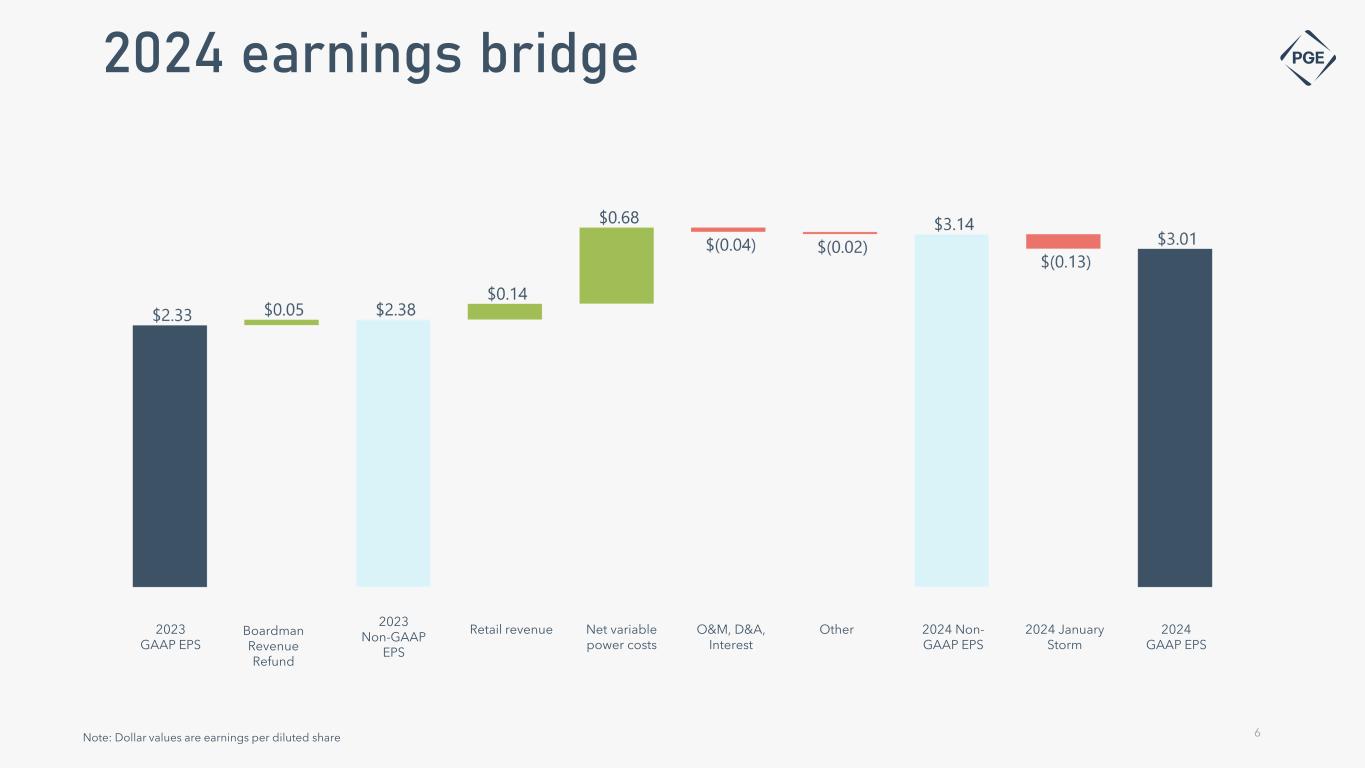

2024 earnings bridge 6 2023 GAAP EPS Note: Dollar values are earnings per diluted share OtherNet variable power costs Retail revenue 2024 GAAP EPS O&M, D&A, Interest 2024 January Storm 2024 Non- GAAP EPS Boardman Revenue Refund 2023 Non-GAAP EPS

Note: Dollar values in millions. Capital expenditures exclude allowance for funds used during construction. These are projections based on assumptions of future investment. Actual amounts expended will depend on various factors, including, but not limited to, siting and permitting, and may differ materially from the amounts reflected in this capital expenditure forecast (1) Values presented do not include incremental potential investments for future RFP cycles Reliability and resiliency investments Capital expenditures forecast(1) $160 $165 $170 $175 $175 $580 $610 $600 $625 $615 $125 $120 $120 $120 $130 $165 $240 $255 $390 $420 $515 2025 2026 2027 2028 2029 Generation Distribution General, Technology, Strategic BESS Projects Transmission $1,340 $1,280 $1,435 $1,270 $1,150 7

Ratings S&P Moody’s Senior Secured A A1 Senior Unsecured BBB+ A3 Commercial Paper A-2 P-2 Outlook Stable Negative Credit Facilities $750 Letters of Credit $235 Total Liquidity: $997 million as of December 31, 2024 Cash $12 Liquidity and financing Expected 2025 debt financings(1) (dollars in millions) Q1 Q2 Q3 Q4 Long-term debt $400 $150 8 (1) PGE expects 2025 debt financing up to the amounts presented in each quarter above. Actual amounts may vary (2) PGE entered into an at-the-market offering program in the second quarter of 2023. In March 2024, the Company issued 1,714,972 shares pursuant to the agreements and received net proceeds of $78 million. In 2024, PGE entered into additional forward sale agreements with forward counterparties, exhausting the $300 million facility. In the third quarter of 2024, the Company issued 2,351,070 shares pursuant to the agreements and received net proceeds of $100 million. In October 2024, the Company issued 2,788,431 shares pursuant to the additional forward sale agreements, settling the transaction, and received net proceeds of $119 million (3) On July 26, 2024, PGE entered into an equity distribution agreement under which it could sell up to $400 million of its common stock through at-the-market offering programs. In the fourth quarter the Company entered into forward sale agreements for 1,420,049 shares. In December 2024, the Company issued 1,066,549 shares pursuant to the forward sale agreements and received net proceeds of $50 million. The Company could have physically settled the remaining amount by delivering 353,500 shares in exchange for cash of $17 million as of December 31, 2024. Any proceeds from the issuances of common stock will be used for general corporate purposes and investments in renewables and non-emitting dispatchable capacity Estimated equity financings 2025 - 2026 Base equity ~$300 million/year Equity for potential RFP ownership Financed in line with 50/50 capital structure ATM Programs • Settled $300 million(2) of the previously established ATM facility to meet 2024 base equity needs • Entered into a new ATM facility for up to $400 million(3) to support future base and potential RFP ownership equity needs, with $50 million settled to date dollars in millions

2025 Guidance • An increase in energy deliveries between 2.5% and 3.5%, weather adjusted • Execution of power cost and financing plans and operating cost controls • Normal temperatures in its utility service territory • Hydro conditions for the year that reflect current estimates • Wind generation based on five years of historical levels or forecast studies when historical data is not available • Normal thermal plant operations • Operating and maintenance expense between $795 million and $815 million which includes approximately $135 million of expenses that are offset in other income statement lines • Depreciation and amortization expense between $550 million and $575 million • Effective tax rate of 15% to 20% • Cash from operations of $900 to $1,000 million • Capital expenditures of $1,270 million • Average construction work in progress balance of $575 million 9 Reaffirming • 5% to 7% long-term EPS growth, using the mid-point of original 2024 adjusted earnings guidance of $3.08 per share • 5% to 7% long-term dividend growth Updating • Long-term load growth of 3%, through 2029 PGE is initiating full-year 2025 adjusted earnings guidance of $3.13 to $3.33 per diluted share based on the following assumptions:

Appendix

This presentation contains certain non-GAAP measures, such as adjusted earnings, adjusted EPS and adjusted earnings guidance. These non-GAAP financial measures exclude significant items that are generally not related to our ongoing business activities, are infrequent in nature, or both. PGE believes that excluding the effects of these items provides a meaningful representation of the Company’s comparative earnings per share and enables investors to evaluate the Company’s ongoing operating financial performance. Management utilizes non-GAAP measures to assess the Company’s current and forecasted performance, and for communications with shareholders, analysts and investors. Non-GAAP financial measures are supplementary information that should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP. Items in the periods presented, which PGE believes impact the comparability of comparative earnings and do not represent ongoing operating financial performance, include the following: • 2024: Non-deferrable Reliability Contingency Event (RCE) costs resulting from the January 2024 winter storm • 2023: Boardman revenue requirement settlement charge associated with the year ended 2020, resulting from the OPUC’s 2022 GRC Final Order Due to the forward-looking nature of PGE’s non-GAAP adjusted earnings guidance, and the inherently unpredictable nature of items and events which could lead to the recognition of non-GAAP adjustments (such as, but not limited to, regulatory disallowances or extreme weather events), management is unable to estimate the occurrence or value of specific items requiring adjustment for future periods, which could potentially impact the Company’s GAAP earnings. Therefore, management cannot provide a reconciliation of non-GAAP adjusted earnings per share guidance to the most comparable GAAP financial measure without unreasonable effort. For the same reasons, management is unable to address the probable significance of unavailable information. PGE’s reconciliation of non-GAAP earnings for the three months ended March 31, 2024, the three months ended June 30, 2023, and the years ended December 31, 2024 and December 31, 2023 are on the following slide. 11 Non-GAAP financial measures

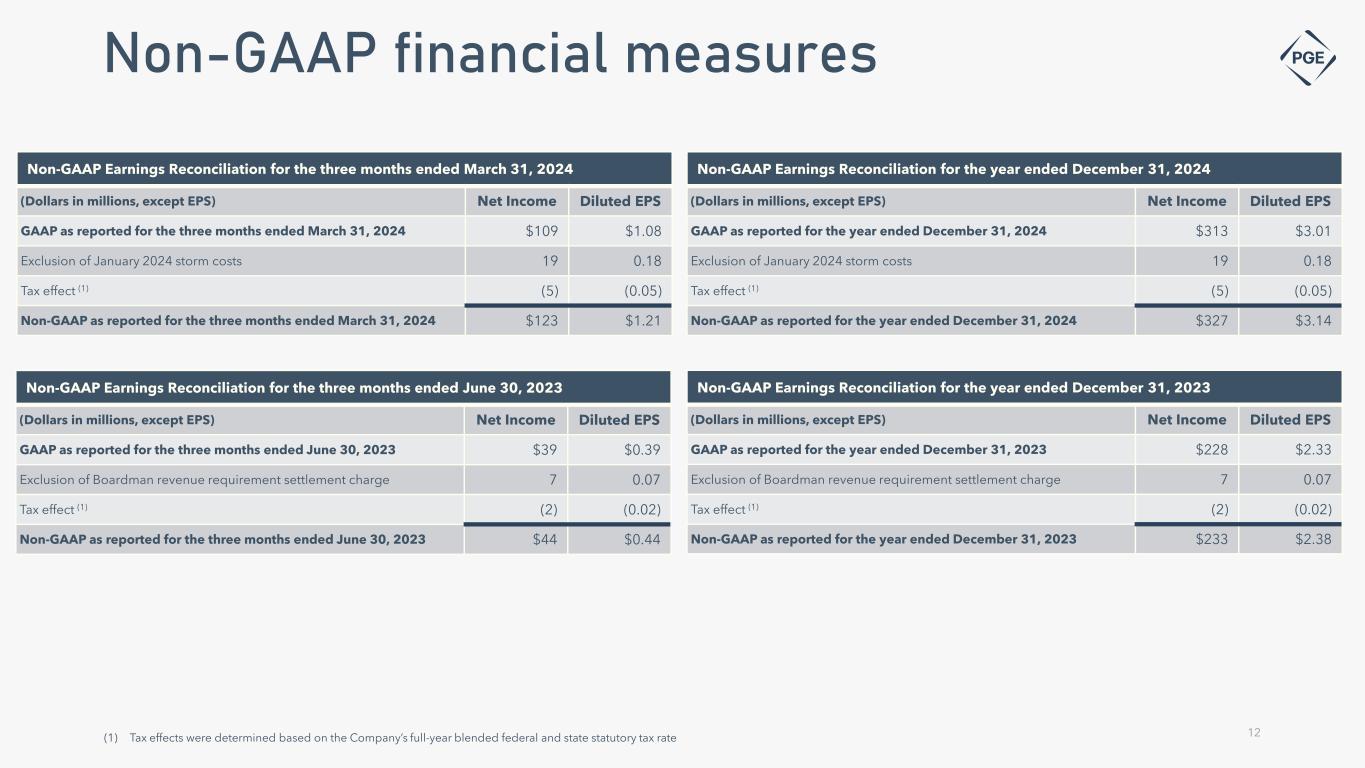

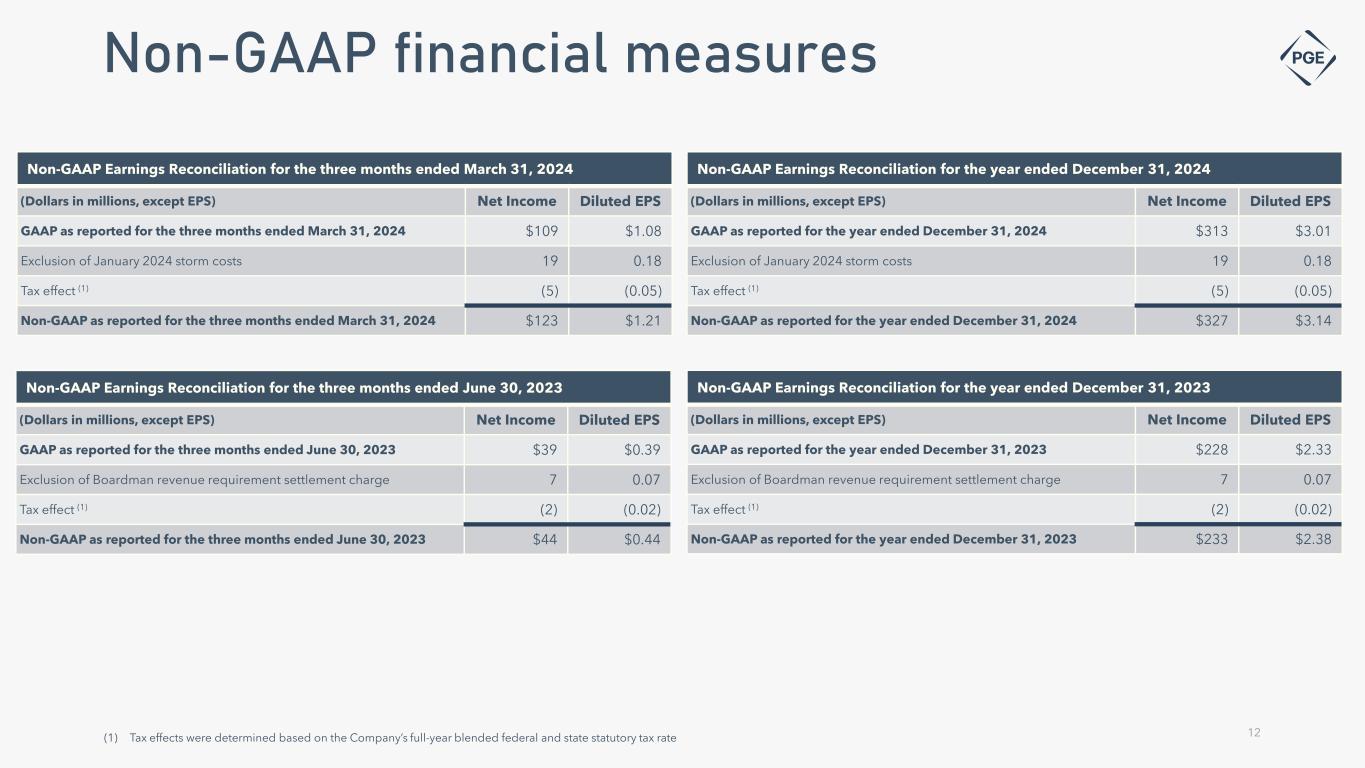

Non-GAAP Earnings Reconciliation for the three months ended March 31, 2024 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the three months ended March 31, 2024 $109 $1.08 Exclusion of January 2024 storm costs 19 0.18 Tax effect (1) (5) (0.05) Non-GAAP as reported for the three months ended March 31, 2024 $123 $1.21 Non-GAAP financial measures (1) Tax effects were determined based on the Company’s full-year blended federal and state statutory tax rate 12 Non-GAAP Earnings Reconciliation for the three months ended June 30, 2023 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the three months ended June 30, 2023 $39 $0.39 Exclusion of Boardman revenue requirement settlement charge 7 0.07 Tax effect (1) (2) (0.02) Non-GAAP as reported for the three months ended June 30, 2023 $44 $0.44 Non-GAAP Earnings Reconciliation for the year ended December 31, 2023 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the year ended December 31, 2023 $228 $2.33 Exclusion of Boardman revenue requirement settlement charge 7 0.07 Tax effect (1) (2) (0.02) Non-GAAP as reported for the year ended December 31, 2023 $233 $2.38 Non-GAAP Earnings Reconciliation for the year ended December 31, 2024 (Dollars in millions, except EPS) Net Income Diluted EPS GAAP as reported for the year ended December 31, 2024 $313 $3.01 Exclusion of January 2024 storm costs 19 0.18 Tax effect (1) (5) (0.05) Non-GAAP as reported for the year ended December 31, 2024 $327 $3.14