UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Portland General Electric Company

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which the transaction applies:

(2) Aggregate number of securities to which the transaction applies:

(3) Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined);

(4) Proposed maximum aggregate value of the transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, schedule or Registration Statement No.

(3) Filing Party:

(4) Date Filed:

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | |

| | | | | | | |

| | Jim Torgerson Board Chair | | | Message to our Shareholders from our Board Chair and our CEO | |

| | | | |

| | | | |

| | | | |

| | | | | | |

| | | | | DEAR FELLOW SHAREHOLDERS, We are pleased to invite you to attend Portland General Electric’s (PGE) Annual Meeting of Shareholders to be held virtually on Friday, April 18, 2025 at 8:00 a.m. Pacific. At the heart of PGE's work is an enduring commitment to our responsibility to provide safe, reliable and affordable energy to every customer and community we serve. Our independent Board provides critical oversight as we remain focused on our core strategy to decarbonize, electrify and perform. We achieved strong financial performance in 2024 and increased our dividend. This performance reflects the hard work and commitment of our incredible team at PGE. Our performance in 2024 and continued success in 2025 is anchored on five key priorities: •Supporting our region's economic development plans, particularly in the high technology sector; •Continuing our focus on sustainability and clean energy in support of customer goals and values; •Keeping customer prices as low as possible through cost discipline and efficiency; •Investing in a stronger, more resilient grid to better withstand extreme weather and protect against the risk of wildfires; and •Ensuring that our returns are competitive, and we are creating an investable energy future for Oregon. Last year, PGE saw strong demand growth, particularly from data centers and semiconductor manufacturing, and we won back two large customers representing nearly 27 MW of load. We brought new renewable energy resources from the Clearwater Wind Energy Center online and added 292 MW of battery storage capacity. This helped PGE progress toward our customer-driven clean energy goals with 45% of the energy our Company generated and procured coming from clean, non-carbon emitting sources. | |

| | Maria Pope President and CEO | | | |

| | | | | |

| | | | | |

| | | | | |

| | |

| | | |

| 2025 Proxy Statement | Portland General Electric | i | |

| | |

| | | | | | | | | | | |

| | | |

| |

| 2024 also saw strong performance across our operations. PGE invested $1.262 billion in capital projects to support customer growth and strengthen our grid. We continued to modernize, adopting technologies that are making our Company more efficient and smarter. We have reduced wildfire risk through system hardening, vegetation management and year-round work with local first responders and community leaders. PGE works at the intersection of important changes in society from the onshoring of manufacturing to the transition to clean energy and the risk of extreme weather events, especially wildfires. The decisions we make and the results we achieve help shape the future of the Pacific Northwest and the country. Looking ahead, we are inspired by the tremendous opportunities for Portland General Electric. On behalf of the Board, thank you for your investment in PGE. Sincerely, | |

|

Jim Torgerson Board Chair | Maria Pope President and CEO |

| |

| |

| |

|

|

|

| | |

| ii | Portland General Electric | 2025 Proxy Statement | |

| | | |

Notice of Virtual Annual Meeting of Shareholders

| | |

|

| Date & Time |

| Friday, April 18, 2025 at 8:00 a.m. Pacific |

| | |

|

| Virtual meeting Location |

| https://virtualshareholdermeeting.com/POR2025 |

|

| There will be no physical location for shareholders to attend. |

| | |

|

| Record Date |

| February 18, 2025 |

|

You can vote if you were a shareholder of record on February 18, 2025. |

ITEMS OF BUSINESS

| | | | | | | | | | | | | | | | | |

| 1 | Election to our Board of Directors of the 9 nominees identified in the Proxy Statement. | | Your vote is important to us. Please exercise your shareholder right to vote as soon as possible, regardless of whether you plan to attend the meeting. |

| | | | |

| 2 | Advisory vote to approve the compensation of our named executive officers. | |

| | | | |

| 3 | Ratification of the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for fiscal year 2025. | |

| | | | |

| 4 | Other business matters properly brought before our 2025 Annual Meeting. | |

WAYS TO VOTE

| | | | | | | | | | | | | | | | | | | | |

Online Vote online in advance of the meeting: proxyvote.com | | By Phone Vote by phone from the US or Canada: 1-800-690-6903 | | By Mail If you have received a printed version of our proxy materials, you may vote by mail. | | By Ballot Attend our virtual Annual Meeting and vote by following the instructions on the meeting website. |

For the Board of Directors,

Sujata Pagedar

Corporate Secretary

| | |

Annual Meeting of Shareholders to be held on April 18, 2025 As permitted under SEC rules, we are mailing our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials and submit proxy votes online. Our Proxy Statement and 2024 Annual Report are available on our website at https://investors.portlandgeneral.com/financial-information/annual-reports. You may also access our proxy materials at https://proxyvote.com. We are making the Proxy Statement and the form of proxy first available on or about March 5, 2025. |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | iii |

Table of Contents to the Proxy Statement

| | | | | | | | | | | |

| |

| |

| |

| |

| |

| Environmental, Social and Governance | |

| |

| |

| |

| Item 1: Election of Directors | |

| 16 |

| 23 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Proxy Statement Summary

This summary highlights selected information to assist you in your review of this Proxy Statement. It does not contain all of the information you should consider, and you should read the entire Proxy Statement carefully before voting. Information regarding our performance is available in our 2024 Annual Report, which accompanies this Proxy Statement and is available on our website at https://investors.portlandgeneral.com/financial-information/annual-reports. For additional information about the Annual Meeting and voting, please see the Questions and Answers section. This Proxy Statement and the accompanying form of proxy card or voting instruction form are first being made available to shareholders on or about March 5, 2025. All website references in our proxy materials are inactive textual references, and the information on, or that can be accessed through, such websites does not constitute a part of these materials.

SHAREHOLDER VOTING MATTERS

| | | | | | | | | | | | | | |

| Item One | Board Recommendation | For More Information |

| Election to our Board of Directors of the 9 Nominees named in the Proxy Statement | FOR Each Director | |

| | | | | | | | |

| The Board, acting upon the recommendation of the Nominating, Governance and Sustainability Committee, has nominated each of the 9 directors for election to our Board. |

|

| James Torgerson | Kathryn Jackson, PhD | John O'Leary |

| Dawn Farrell | Michael Lewis | Patricia Salas Pineda |

| Marie Oh Huber | Michael Millegan | Maria Pope |

|

•The Board believes its members encompass a range of talents, skills, expertise and qualifications to sufficiently provide sound and prudent oversight of PGE's business and oversee its operations, risks and long-term strategy. The directors reflect the diversity of PGE's shareholders, employees, customers and the communities that we serve. •Shareholders are being asked to elect each director to serve until the 2026 Annual Meeting of Shareholders. |

| | | | | | | | | | | | | | |

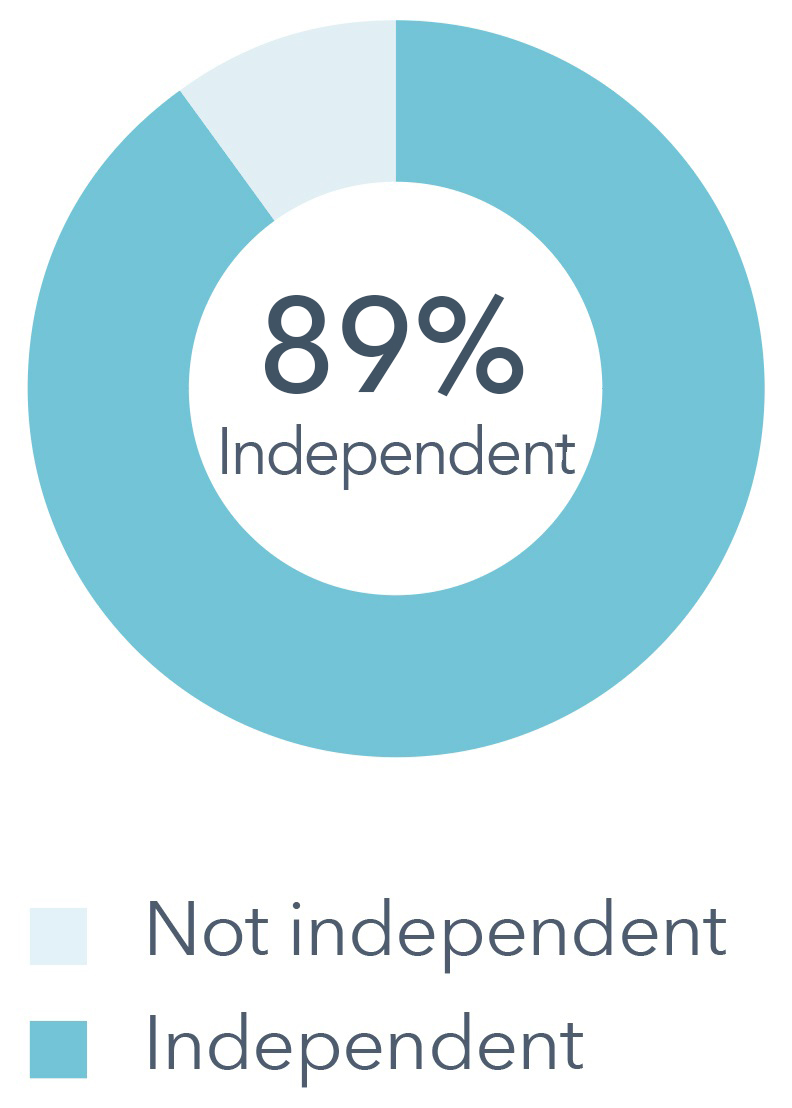

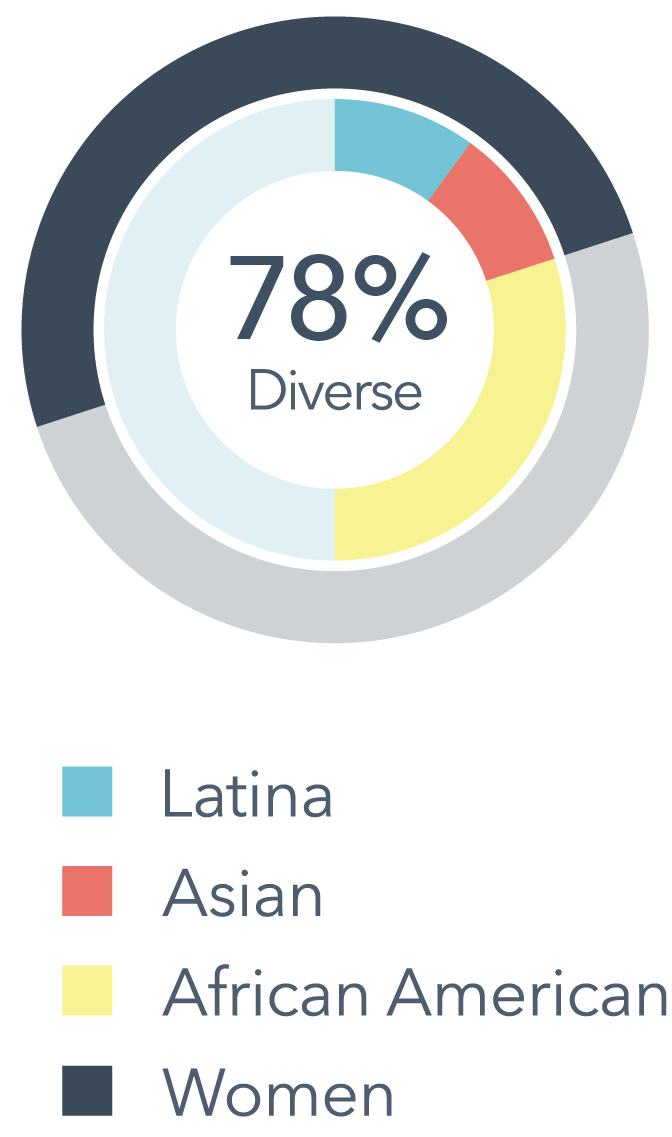

| Top Skills and Backgrounds of Board Members | | Independent Directors on Board | Women/Ethnically Diverse Board Members |

| | | | |

| | |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 1 |

| | | | | | | | | | | | | | |

| Item Two | Board Recommendation | For More Information |

| Advisory vote to approve the compensation of our named executive officers | FOR | |

|

•Our executive compensation program is described in the Compensation Discussion and Analysis section of the Proxy Statement. •The Compensation, Culture and Talent Committee and the Board believe our executive compensation structure is competitive, rewards performance and aligns compensation with shareholder value and serves stakeholders well. •Shareholders are being asked for an advisory vote to approve the compensation of our named executive officers described in the Compensation Discussion and Analysis section and related compensation tables. |

Compensation Best Practices

| | | | | | | | | | | | | | | | | | | | | | | |

| What We Do | | What We Do Not Do | |

| | | | | | | |

| ü | Meaningful stock ownership guidelines | | | û | No long-term employment contracts | |

| ü | Appropriate compensation peer group | | | û | No excise tax gross-ups on change in control payments | |

| ü | Annual compensation program risk assessment | | | û | No significant perquisites to executive officers other than relocation support for newly hired officers | |

| ü | Robust incentive compensation clawback policy in the event of financial misstatements and in the event of misconduct | | | û | No short sales, transactions in derivatives, hedging or pledging of Company securities by directors or executive officers | |

| ü | Independent compensation consultant that performs no services for the Company other than services for the Compensation, Culture and Talent Committee | | | û | No single-trigger change in control payouts | |

| | | û | No dividends on unvested equity | |

| | | | | |

| ü | Incentive award payouts are based on a balanced mix of short-term and long-term Company performance | | | | | |

| ü | Double-trigger change in control provisions for equity award vesting | | | | | |

| ü | Significant performance-based compensation aligned with strategy | | | | | |

| | | | | | | |

| | | | | |

| |

2 | Portland General Electric | 2025 Proxy Statement |

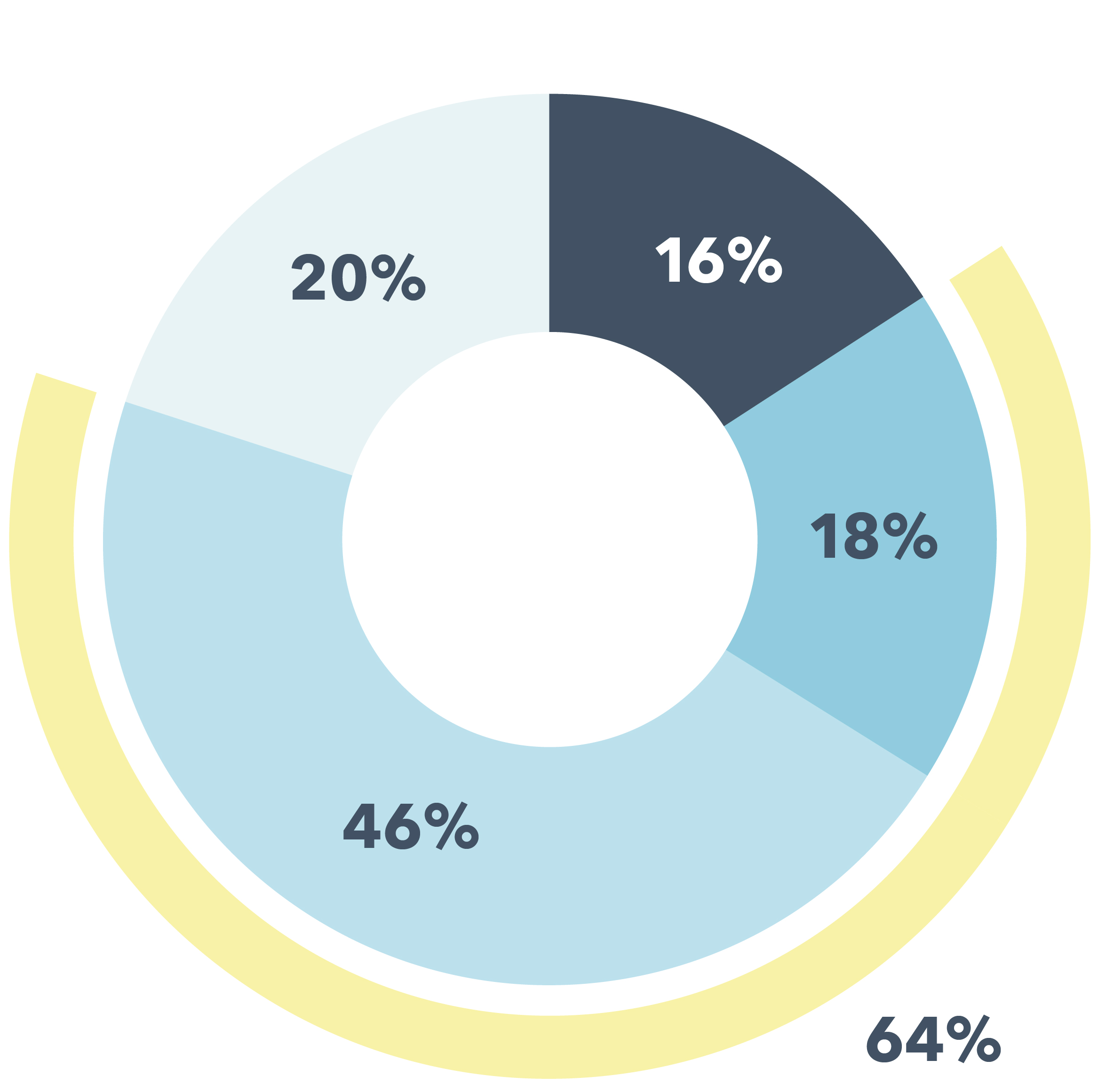

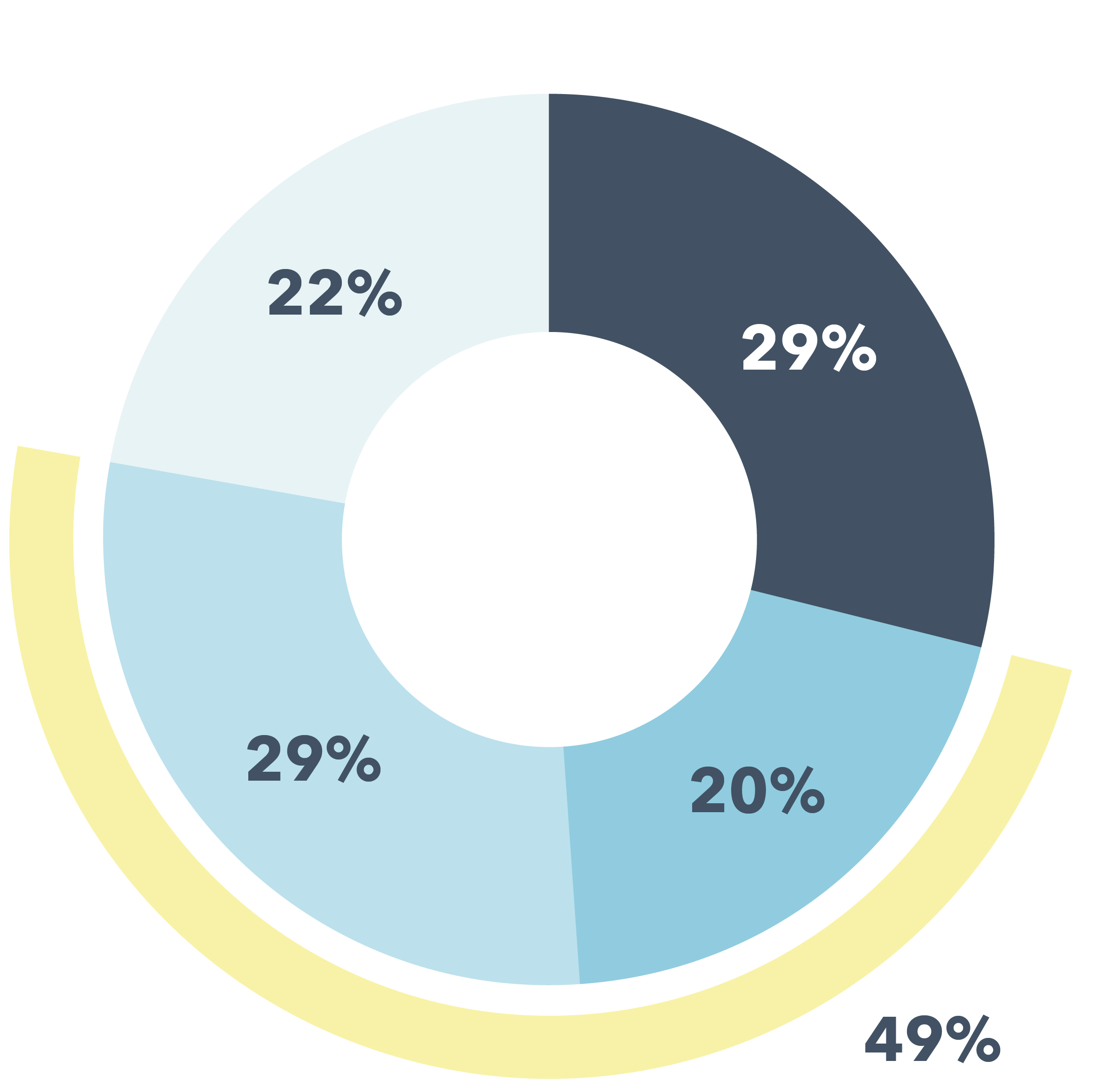

Pay for Performance

| | | | | | | | |

| 2024 Target Direct Compensation for Chief Executive Officer |

|

| n Base Salary n Annual Cash Incentive n Performance Share Units n Restricted Share Units n Performance-Conditioned | |

| | | | | | | | |

| 2024 Target Direct Compensation for Named Executive Officers other than the CEO |

|

| n Base Salary n Annual Cash Incentive n Performance Share Units n Restricted Share Units n Performance-Conditioned | |

| | | | | | | | | | | | | | |

| Item Three | Board Recommendation | For More Information |

| Ratification of the appointment of independent registered public accounting firm for fiscal year 2025 | FOR | |

|

•Shareholders are being asked to ratify the Audit and Risk Committee's selection of Deloitte & Touche LLP (Deloitte) as our independent registered public accounting firm for fiscal year 2025. •The Audit and Risk Committee and the Board believe the continued retention of Deloitte is in the best interest of PGE and its shareholders. |

| | | | | | | | |

| | |

| Cautionary Note Regarding Forward-Looking Statements | |

| | |

| | |

| This Proxy Statement contains forward-looking statements, including those regarding implementation of our business plans, technology transitions, our business, strategies and financial performance, our offerings of new services and other statements that are not historical fact. Actual results could differ materially from these forward-looking statements. Risk factors that could cause actual results to differ are set forth in the “Risk Factors” section, as well as other sections of our 2024 Annual Report on Form 10-K, available on our website at https://investors.portlandgeneral.com/financial-information/sec-filings, as well as, or in addition to, other filings with the SEC. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date of this Proxy Statement, and we undertake no obligation to update any such statements. | |

| | |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 3 |

Strategy, Performance and Sustainability

OREGON'S CLEAN ENERGY FUTURE

Portland General Electric exists to power the advancement of society. We energize lives, strengthen communities and foster energy solutions that promote social, economic and environmental progress. We are making progress decarbonizing our system and increasing electrification, doing so with the competence and credibility earned over our 136-year history. Together with customers, communities, partners and investors, we are creating a safe, reliable, increasingly clean and accessible energy future. We are actively reducing greenhouse gas (GHG) emissions from our system over time, supporting sustainable livelihoods, electrifying the economy from transportation to homes and buildings and offering products and services that put customers in control of their energy journey. Our customers remain at the forefront of our priorities, driving us to continuously innovate, deploy new technologies, reduce environmental impacts from operations, simplify processes and reduce costs as we deliver exceptional value for our customers.

Customers count on us to power their lives with safe, reliable and affordable clean energy. We are working towards making our energy supply cost-effective and diverse, while delivering the reliability our customers expect. At the same time, we are building an increasingly smart, resilient, integrated and interconnected grid, partnering with customers, communities and organizations across the West and beyond to enable a reliable and affordable clean energy future benefiting all.

| | | | | | | | | | | | | | |

| Advancing Our Clean Energy Future |

| | | | |

| Strategic Goals |

| | | | |

| |

| Decarbonize Power | | Electrify the Economy | | Advance our Performance |

| | | | |

| Reduce greenhouse gas emissions associated with electricity served to retail customers by at least 80% by 2030 and 100% by 2040 | | Increase beneficial electricity use to capture the benefits of new technologies while building an increasingly clean, flexible and reliable grid | | Improve efficiency, safety, and system and equipment reliability while maintaining affordable energy service and growing earnings per share 5% to 7% annually |

|

| How We Will Achieve Our Goals |

| | | | |

| Elevate customer engagement | | Advance Grid Readiness | | Drive enterprise operational excellence |

| | | | |

| | | | | |

| |

4 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Strategy, Performance and Sustainability |

| |

STRATEGIC PERFORMANCE HIGHLIGHTS

| | | | | | | | | | | | | | |

| | | | |

| Decarbonize Power | | Electrify the Economy | | Advance our Performance |

| | | | |

•45% of PGE's total system load came from non-emitting energy resources •Our 311 MW Clearwater Wind facility and 292 MW of battery storage achieved commercial operation in 2024, advancing our clean energy goals •A new 79 MW contract added to our over 500 MW of hydro contracts, increasing capacity and management capabilities •We signed an agreement for 120 MW of solar power for our Green Future Impacts program, delivering clean energy to support our customers' goals •Customer actions reduced load by over 100 MW at the hottest time of day, avoiding outages and increasingly volatile power markets during a record heat event | | •Energy usage grew 3.1% and overall customer count grew 1.6% as large data center and semi-conductor companies rapidly expanded •We maintained our position as the #1 ranked renewable power program in the United States by the National Renewable Energy Lab •We advanced our digital tools and programs to rank #1 in Forrester's Customer Experience Index, and achieved a record performance for customer effort, which measures how easily customers interact with us during the new connection process •We continued to expand energy efficiency and other customer programs like Smart Thermostats that provide customers with tools to manage their energy costs. 24% of residential households participate in voluntary programs to shift energy use •We advanced the installation of public or semi-public EV charging, worked with our customers to provide data on fleet electrification and increased the electrification of our own fleet to almost 20% | | •Through the introduction of a comprehensive injury prevention and management program, we decreased our OSHA recordable incidents by 24% •We made capital investments of $1.262 billion, prioritizing system hardening and resiliency infrastructure, designed for transmission, distribution and grid modernization •We implemented technology tools to manage and respond to grid outages more effectively, and redesigned our outage restoration work processes to be responsive to customer needs •We reduced wildfire risk in High Fire Risk Zones through our Advanced Wildfire Risk Reduction initiatives and our Wildfire Mitigation Plan •We completed the modernization of our Beaver Unit 1 facility, reducing unit emissions by 90% |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 5 |

| | | | | |

| Strategy, Performance and Sustainability | |

| |

2024 PERFORMANCE

We are focused on leading the clean energy future and our business is centered on three long-term imperatives: Decarbonize, Electrify and Perform. We reflect our customers, Oregon's values and our Guiding Behaviors of customer focus, valuing differences, always learning, accountability, collaboration and instilling trust. Our #1 focus is to deliver safe, reliable, affordable and clean electricity. We are enhancing our electric grid to improve reliability and integrate new, clean technologies.

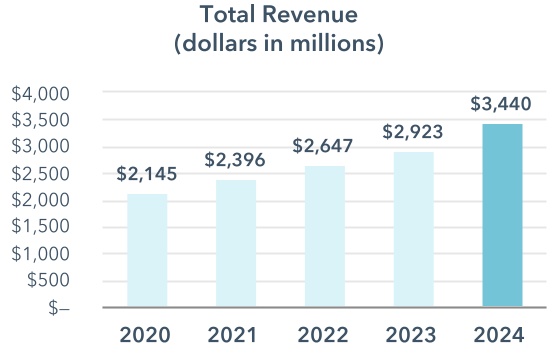

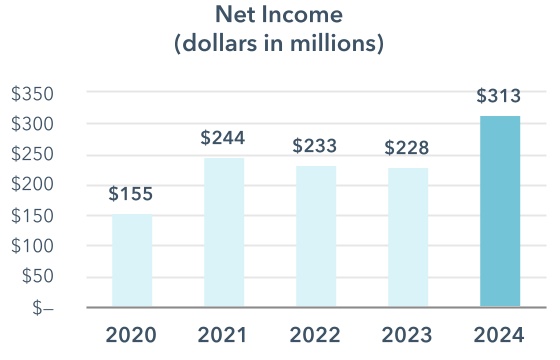

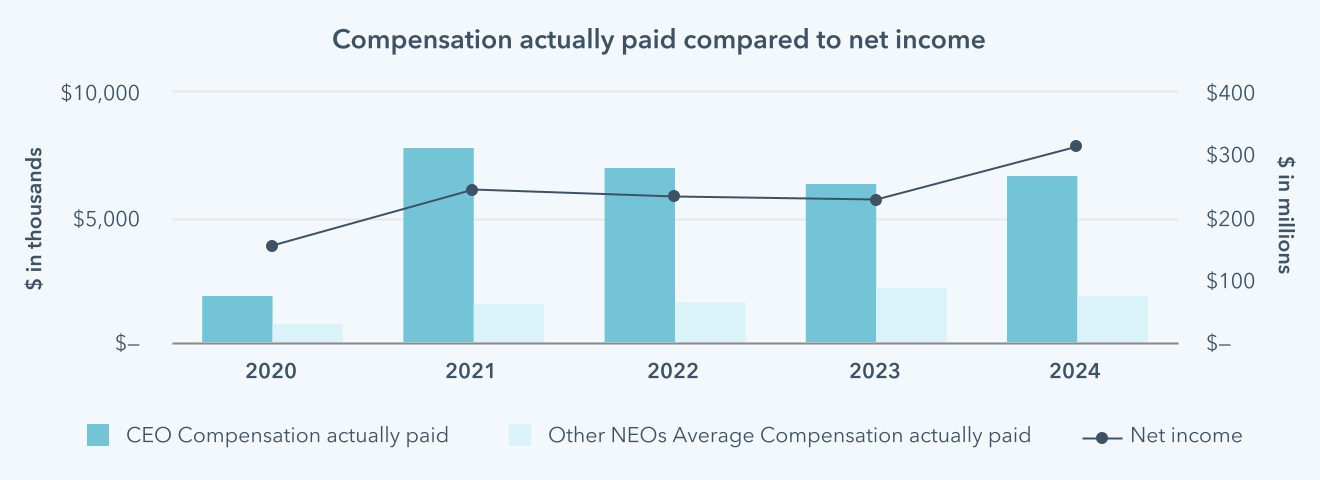

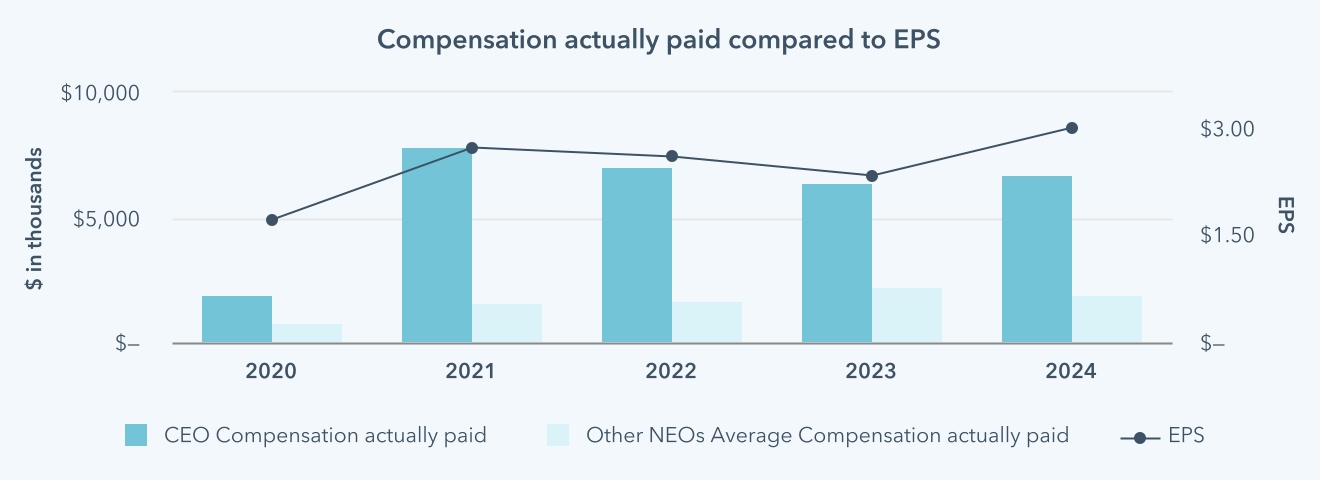

Our 2024 results reflect growth from new and returning customers, enhanced operational reliability and resilience, strong safety performance and the addition of new clean energy resources and battery storage, resulting in solid earnings results. We invested over $1.26 billion in capital assets targeting customer growth, grid resiliency and decarbonization. Consistent execution during the year enabled us to deliver at the high end of both our near and long-term earnings expectations. We remain confident in our growth trajectory of 5% to 7% long-term EPS growth and we continue to provide returns to shareholders by growing our annual common stock dividend, which has increased from $1.59 to $1.98 per common share from 2020 through 2024, a compound annual growth rate (CAGR) of 5.6%.

| | | | | |

| |

6 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Strategy, Performance and Sustainability |

| |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

Sustainability is an integral part of our strategy to achieve an increasingly clean and reliable energy future, which is aligned with Oregon's ambitious, economy-wide goal to combat climate change. We believe our strategy is aligned with the following stakeholder interests:

•Clean and renewable energy

•Contribution to economic growth and community development

•Increasing grid security, resiliency and reliability in the face of extreme weather, cyber and physical threats

•Effective operations and ability to meet short-term and long-term objectives

We are taking a holistic approach that balances our commitment to reducing greenhouse gas (GHG) emissions with core values that define our culture, and high standards of operations, financial management and corporate governance. We continue to implement our strategic goals: Decarbonize Power, Electrify the Economy, and Advance Our Performance to address broader sustainability commitments which are reflected in our priorities and practices, described in our 2024 Environmental, Social and Governance Report.

Our 2024 Environmental, Social and Governance Report also describes and illustrates our progress on our long-term commitments including 1) clean and renewable energy and GHG emission reductions; 2) workforce engagement and development; 3) community support; 4) environmental stewardship; and 5) sustainable green financing. Our Environmental, Social and Governance Report includes our Scopes 1, 2 and certain Scope 3 emissions, as well as disclosures referencing the Sustainability Accounting Standards Board (SASB), Edison Electric Institute (EEI) Template, Task Force on Climate-related Financial Disclosures (TCFD) framework and United Nation Sustainable Development Goals (UN SDGs).

Our Focus Areas and Priorities

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Affordability | | | Reliability |

| | | | | | |

| •Work to keep prices as low as possible for customers •Design innovative customer programs and solutions to promote energy savings •Leverage all available tax credits incentives, and public funding to reduce costs for customers | | | •Enhance the reliability and resiliency of our grid to withstand extreme weather, growing peak customer demand, facilitate electrification and integrate renewable and distributed energy resources •Maintain a comprehensive risk management program, including data security, cybersecurity, physical security wildfire and climate-related risks |

| | |

| | | | | | |

| | | | | | |

| Decarbonization | | | Community |

| | | | | | |

| •Transition from fossil fuel generation to non-emitting energy and capacity resources to support our customers' climate and clean energy goals by 2040 •Achieve net zero emissions across all of our operations by 2040 | | | •Provide excellent service to the customers and communities we serve •Attract and develop a talented and diverse workforce •Support local communities through partnerships, philanthropy, employee giving and volunteerism |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 7 |

| | | | | |

| Strategy, Performance and Sustainability | |

| |

Our top sustainability priorities have been informed by an extensive stakeholder-centered and inclusive analysis. The priorities are not listed in accordance to their relative importance or the impact that they have on PGE.

| | | | | | | | |

| | |

| Our Environmental, Social and Governance Report and additional sustainability information and reports are available at https://investors.portlandgeneral.com/esg. These reports and any other information on our website are not part of, nor incorporated by reference into, this Proxy Statement. Additional information about how we will execute on our strategy can be found on our website at https://portlandgeneral.com/about/who-we-are. | |

| | |

Highlights

| | |

OUR CLEAN ENERGY AND GHG EMISSIONS REDUCTION GOALS •We continue to work towards our goals to reduce emissions across our company, including our goal to reduce emissions associated with power generation and supply by at least 80% by 2030 •We support decarbonization through: •Increasing non-emitting energy resources and capacity in our portfolio. In 2024, 292 MW of battery storage came online, and our 311 MW Clearwater Wind Facility achieved commercial operation. Nearly 230,000 residential and small commercial customers are enrolled in PGE's Green Future Program •In order to meet our regulatory, legislative and reliability requirements, we continue to evaluate the continuation of our ownership in Colstrip •Supporting decarbonization in other sectors of the economy through energy efficiency, electrification and smart energy use •Investing in our generation facilities to reduce emissions •We support our customers’ call for clean energy through our voluntary customer programs. For the 15th year, PGE has held the U.S. Department of Energy’s National Renewable Energy Laboratory’s No. 1 ranking for the largest participation of business and residential renewable energy customers in a renewables program of any U.S. electric utility1 1. NREL did not release rankings in 2011 |

| | | | | |

| |

8 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Strategy, Performance and Sustainability |

| |

| | |

WORKFORCE ENGAGEMENT AND DEVELOPMENT •We are committed to pay equity, and offer a wide range of market-competitive benefits to our over 2,900 full-time employees •We provide employees with benefits that address their needs holistically and support their wellness, including competitive salary, medical, dental and vision insurance, ongoing training opportunities, mentorship and professional development programs, paid vacation, retirement savings with company match and tuition reimbursement •Our Guiding Behaviors give everyone a single set of standards to follow, and define our culture as customer-centric, purpose-driven and results-oriented •Our pay equity practices, training, and development opportunities for women and people of color to advance into management are hallmarks of our commitment to an inclusive workforce •Our Business Resource Groups (BRGs) allow employees to form connections, build professional networks and learn, including opportunities to meet with members of the Board of Directors •We received a $750,000 grant on behalf of the Oregon Clean Energy Workforce Coalition to support training programs and energy career resources for job seekers •We provided development programs focused on Leadership Excellence to 49 top leaders |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| 2,900+ full-time employees | | BRGs allowing employees to form connections and network | | $750K grant from the Oregon Clean Energy Workforce Coalition | | 49 top leaders provided development programs |

| | | |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 9 |

| | | | | |

| Strategy, Performance and Sustainability | |

| |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| $31M awarded to community organizations by the PGE Foundation | | 23,000 volunteer hours contributed by PGE employees and retirees |

| |

| | |

MAKING A DIFFERENCE FOR OUR COMMUNITIES •Project Zero, an innovative and award winning program that empowers young adults and students to create cleaner, greener and more equitable communities, reached over 83,000 local K-12 students, celebrated its 5th year of the green jobs internship program and began partnering with the Portland Opportunities Industrialization Center who will manage day-to-day operations going forward •The PGE Foundation, employee/retiree donations and PGE contributed over $5 million to non-profits. The PGE Foundation improves the quality of life for Oregonians and has awarded approximately $31 million to community organizations across the state since its inception in 1997 •Our employees and retirees volunteered in the community, contributing close to 23,000 volunteer hours •We invested in event sponsorships, like the Portland Winter Light Festival, attracting more than 200,000 visitors to Portland's downtown and boosting the local business economy by over $10 million •We granted 55 scholarships through the PGE Foundation and our Board of Directors Scholarship program, focused on access to higher education for children of employees, students of color and students with demonstrated financial need •The Community Benefits and Impacts Advisory Group (CBIAG) continued to build understanding of our clean energy goals and engage with community members as collaborators on issues of energy equity and access. The CBIAG meets monthly and includes members within our service area including low income and environmental justice communities •We partner with community organizations to inform our customers about our clean energy programs, bill assistance and to connect our customers with resources to manage their energy and savings. Our website as well as PGE's mobile app are available in both English and Spanish, while our call center offers customer support in over 200 languages |

| | | | | |

| |

10 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Strategy, Performance and Sustainability |

| |

| | | | | | | | | | | |

| |

|

| | | |

| | Invested in Habitat Restoration PGE is committed to caring for natural habitat and creating conditions that are safe and restorative for fish and wildlife in the 11,000+ acres of wildlife habitat that we manage under various project licenses and site certificates | |

| | | |

| | | |

| | |

ENVIRONMENTAL STEWARDSHIP •We have worked for over 18 years with our partners in the Clackamas River Basin to enhance habitat for fish and wildlife that depend on a thriving river ecosystem. Fish returns have increased by 501% on the Deschutes River and 185% on the Clackamas River over our 10 year average •Our Avian Protection Plan, which includes partnerships with the U.S. Fish and Wildlife Service and the Avian Power Line Interaction Committee, works to make our infrastructure safer for birds and increases reliability for our customers. In 2024, we added or replaced more than 8,200 poles and more than 4,500 transformers with versions that feature avian-safe protective covers or design features •We continue to transform historical PGE properties. Our restoration of our Harborton property continues to see significant native wildlife gains, and we are redeveloping brownfield property for the development of a battery storage project |

| | |

ENERGY AFFORDABILITY •We launched PGE+, an online platform that helps customers choose and install electrical equipment for their homes, as well as usage dashboards, rebates and incentives for energy efficiency •Our energy management programs such as Smart Thermostat, Time of Day, EV Smart Charging, Peak Time Rebates and Equal Pay allow customers to manage their energy usage and bills •We had nearly 90,000 customers enrolled in our Income Qualified Bill Discount Program, which offers discounts of 15%, 20% or 25% based on household size and total household income. Beginning in 2024, we offer discounts of 40% and 60% based on the same criteria •PGE has participated in federal clean energy grant programs totaling more than $2 billion, of which PGE has directly received nearly $470 million in grant funding, to offset the costs of clean energy projects, including grants for critical transmission upgrades, a regional clean energy hydrogen hub and for investments in grid edge computing to help maintain resilient grid operations |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 11 |

| | | | | |

| Strategy, Performance and Sustainability | |

| |

| | | | | | | | |

Larry Bekkedahl Senior Vice President, Strategy and Advanced Energy Delivery Executive Sponsor of Innovation Programs at PGE | | INNOVATION •Senior Vice President Larry Bekkedahl leads our Strategic Innovation team, bringing a centralized approach to managing innovation, allowing us to explore new pathways to helping our customers achieve their decarbonization goals in a cost effective way. Our Strategic Innovation team deploys an industry-leading process to track and accelerate innovative ideas. The program ties to Electric Power Research Institute, Energy Impact Partners, Stanford Bits and Watts, MIT CEEPR and Pacific Northwest National Labs. •In 2024, we launched several successful innovative projects, including satellite imagery analysis for vegetation management and advancing transmission dynamic line rating technology. We demonstrated technology allowing customers with heat pumps to participate in demand response and load control programs, so customers can take control of energy costs while reducing peak usage, and we piloted the use of an electric school bus to provide energy to the grid in times of need. •Innovation has also enabled the use of advanced computing practices to create our own closed-system bots that augment the way we do work, and improve the accuracy of forecasting models providing grid awareness, optimization and planning. AI-driven bots have enhanced our ability to gain information about outage areas and centralize data visibility during storm season, expediting the restoration process. •Awards and recognitions include: EPRI Technology Transfer Award for EV planning and distributed energy resource management systems and the Utility 2030 Collaborative SPARK award for innovation management, as well as Top Innovator in Generation by Public Utilities Fortnightly for steam casing leak repair. Mr. Bekkedahl was honored with the Grid Innovator Award for 2024 by GridForward. |

| | | | | |

| |

12 | Portland General Electric | 2025 Proxy Statement |

Corporate Governance

CORPORATE GOVERNANCE HIGHLIGHTS

We are committed to maintaining sound corporate governance policies and practices that create long-term value for our shareholders and other stakeholders. The Nominating, Governance and Sustainability Committee regularly reviews our key corporate governance policies to ensure that they reflect best practices and comply with legal and regulatory requirements. Our governance policies reflect our values of independence, accountability and building sustainable value for all stakeholders.

| | | | | | | | |

| Strong independent oversight | | •Independent Board Chair •Fully independent membership on all standing Board committees •All directors are independent other than the CEO •Executive sessions of non-management directors at all regularly scheduled Board meetings |

| | |

Accountability

| | •Annual election of directors by majority vote of the shareholders •One class of voting stock •No "poison pill" anti-takeover defenses •No supermajority voting requirements •Robust Board and executive stock ownership guidelines (see pages 27 and 65 for details) •Annual Advisory Vote on Executive Compensation |

| | |

| Building sustainable value | | •Regular discussion of strategy at Board meetings and at annual Board strategy session •Oversight of risks, both strategic and operational •Continuous evaluation of sustainability goals and strategy •Regular review of performance metrics, including between meetings |

| | |

| Ensuring Leadership quality | | •Active Board refreshment (5 new directors since 2021) •Annual review of succession planning and talent development for senior leaders •Board training focused on business risks and opportunities •Directors' orientation and continuing education |

| | |

Find our Corporate Governance Guidelines and other governance documents online. The Board has adopted Corporate Governance Guidelines, which, together with our articles of incorporation and bylaws, establish the governance framework for the management of the Company. Our Corporate Governance Guidelines address, among other matters, the role of our Board, Board membership criteria, director retirement policies, director independence criteria, director and officer stock ownership requirements, Board committees and leadership development. Our Corporate Governance Guidelines, Board committee charters, and certain other corporate governance policies are available on our website at https://investors.portlandgeneral.com/corporate-governance. These documents are also available in print to shareholders, without charge, upon request to Portland General Electric Company at its principal executive offices at 121 SW Salmon Street, 1WTC1301, Portland, Oregon 97204, Attention: Corporate Secretary. |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 13 |

SHAREHOLDER AND STAKEHOLDER ENGAGEMENT

We believe in proactive engagement with shareholders, including participation of independent directors as appropriate. The Board chair serves as the point of contact for shareholders and others to communicate with the Board, including meeting with investors as appropriate. Executive management and members of our Investor Relations team engage regularly with our shareholders to seek their input on a variety of matters. In 2024, we had over 225 investor engagements. In addition, in 2024, we conducted proactive outreach with the governance teams of our top 20 largest shareholders representing over 36% of shares outstanding. Topics included:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Strategy and value

proposition | | | Financial operation and performance | | | Board leadership, composition, and refreshment | |

| | | | | | | | |

| | | | | | | | |

| Progress on

decarbonization goals | | | Executive compensation | | | Regulatory and legislative developments | |

| | | | | | | | |

We communicate with shareholders through routine forums, including quarterly earnings presentations and other significant events, as well as direct communications.

In addition, our management and Board regularly engage with other stakeholders, including representatives of local communities and organizations, political bodies and our regulators. When the Board is not a direct participant, we relay the feedback we obtain through these conversations to the Board and its committees, and work to adequately address the concerns of our stakeholders.

Our Engagement Strategy

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| 1. Engage •Customers •Shareholders and Governance Teams •Communities and local organizations •Regulators •Employees | | | | 2. Seek Input •Company Strategy •Decarbonization Goals •Board Governance •Operational Issues and Risk Management | | | | 3. Inform •Discuss with Board to ensure feedback is addressed •Reflect feedback in strategy and governance practices | |

| | | | | | | | | | |

| | | | | |

| |

14 | Portland General Electric | 2025 Proxy Statement |

| | | | | | | | | | | | | | |

| | | | Item 1: Election of Directors OUR BOARD IS EXPERIENCED, DIVERSE AND INDEPENDENT The Board, acting upon the recommendation of the Nominating, Governance and Sustainability Committee, has nominated the following 9 directors for election to our Board. All elected directors will serve until the 2026 Annual Meeting, or until their successors are elected and qualified, except in the case of earlier death, resignation or removal. All of the nominees were elected by shareholders at the 2024 Annual Meeting. Our Board reflects the diversity of skills, experience, perspectives and personal characteristics needed to provide effective oversight of PGE. Our nominees have held senior leadership roles at public companies or other large organizations and have extensive experience in a variety of fields, including utility operations and regulation, technology, finance and accounting, corporate governance, law, public policy, and consulting. All of our nominees have a reputation for integrity, honesty and adherence to high ethical standards. We have a strong track record of board refreshment. Five of our independent directors have been added since the beginning of 2021: two in 2021, two in 2022 and one in 2024. This board refreshment brings a variety of perspectives to strategic, financial, operational and sustainability deliberations. If any of the nominees becomes unable to serve or for good cause will not serve as a director, it is intended that votes will be cast for a substitute nominee designated by the Board, or the Board may elect to reduce its size. The Board has no reason to believe that nominees named in this proxy will be unable to serve if elected. Each of the nominees has consented to being named in this proxy statement and to serve if elected. The Board selected our director nominees based on their demonstration of the core attributes described above and the belief that each director can make substantial contributions to our Board and to PGE. See pages 16 to 23 for more information about the backgrounds and qualifications of our nominees. |

| What are you voting on? We are asking shareholders to elect 9 directors to hold office until the 2026 Annual Meeting. | | |

| | | |

| | | |

| "FOR" The Board of Directors unanimously recommends a vote "FOR" the re-election of the nominated directors, as disclosed in this Proxy Statement. | | |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 15 |

| | | | | |

| Item 1: Election of Directors | |

| |

OUR BOARD OF DIRECTORS

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Industry/Experience | Diversity | Committee Assignments | Other Public Boards |

| Dawn Farrell

Independent | 65 | 2022 | Utilities/ Energy | White/Woman | •Finance •Governance | 2 |

| Marie Oh Huber

Independent | 63 | 2019 | Law/Technology/ Customer Experience | Asian/Woman | •Compensation •Governance, Chair | 0 |

| Kathryn Jackson

Independent | 67 | 2014 | Technology/Environmental | White/Woman | •Audit and Risk •Governance | 2 |

| Michael Lewis

Independent | 62 | 2021 | Utilities | African American/Man | •Compensation •Finance, Chair | 2 |

| Michael Millegan

Independent | 66 | 2019 | Communications/Technology | African American/Man | •Audit and Risk, Chair •Compensation | 1 |

| John O'Leary

Independent | 64 | 2024 | Automotive/Clean Transportation | White/Man | •Audit and Risk •Finance | 1 |

| Patricia Salas Pineda

Independent | 73 | 2022 | Human Resources/Consumer Products | Latina/Woman | •Compensation, Chair •Finance | 2 |

| Maria Pope

President and CEO | 60 | 2018 | Utilities/Finance | White/Woman | | 1 |

| James Torgerson

Independent Chair | 72 | 2021 | Energy/Finance | White/Man | •Audit and Risk •Governance | 0 |

Key to Committees

Finance: Finance and Operations Committee

Compensation: Compensation, Culture and Talent Committee

Governance: Nominating, Governance and Sustainability Committee

DIVERSITY

78% Diverse

| | | | | | | | | | | | | | |

| g | Latina | | g | African American |

| g | Asian | | g | Women |

| | | | | |

| |

16 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

| |

SKILLS, EXPERIENCE AND BACKGROUNDS

Our Board of Directors brings diverse skills, experiences and backgrounds to inform and enrich their oversight functions and deliberations. On an annual basis, the Nominating, Governance and Sustainability Committee recommends to the Board skills that are needed to provide effective oversight of the Company. The following chart lists the skills identified and why they are important to our strategy.

| | | | | |

| Skills | Why they matter to our strategy to "DECARBONIZE, ELECTRIFY, PERFORM" |

| Corporate Governance | Our success depends on enhancing stakeholder interests and maintaining board and management accountability |

| Customer Experience | Customers, customer-facing programs and safe, reliable and affordable electric service are at the center of our strategy |

| Environmental and Sustainability | Our business operations can be impacted by environmental regulations |

| Finance and Accounting | Execution of our strategy will require complex financial management, access to capital, capital allocation and financial reporting |

| Human Capital Management and Culture | PGE needs a strong workforce and aligned culture to successfully execute on our strategy |

| Industrial and Utility Operations | Health and safety, operating performance and engineering are core to our strategy |

| Infrastructure Development | Serving our customers' growth needs will require improving existing and the development of new transmission and generation facilities |

| Innovation and Transformation | Our strategy requires adaptation to a rapidly changing energy world and extreme weather |

| Regulatory and Public Policy | Our strategy requires deep engagement with regulators and a strong understanding of energy policy |

| Risk Management and Compliance | Understanding and mitigating risks, and compliance with laws and regulations is a key part of our business |

| Senior Executive Leadership | Our strategy requires the ability to balance priorities and lead a complex business |

| Strategic Planning, Business Development and/or M&A | Corporate strategies and long-term business plans play an important role in our business |

| Technology, Cybersecurity and Information Security | Decarbonization and electrification require investment in technology, as well as the need to keep our systems reliable and resilient |

We considered these skills, experiences and backgrounds, together with the biographical information provided on pages 19 to 23, in determining the nominees to our Board.

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 17 |

| | | | | |

| Item 1: Election of Directors | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skill | | Farrell | Huber | Jackson | Lewis | Millegan | O'Leary | Pineda | Pope | Torgerson |

| Corporate Governance | | | | | | | | | |

| • | • | • | | | • | • | • |

| | | | | | | | |

| Customer Experience | | | | | | | | | |

| • | | • | • | • | • | • | |

| | | | | | | | |

| Environmental and Sustainability | | | | | | | | | |

| • | | • | • | | • | • | • | |

| | | | | | | | |

| Finance and Accounting | | | | | | | | | |

| • | • | | | • | • | • | • | • |

| | | | | | | | |

| Human Capital Management and Culture | | | | | | | | | |

| • | • | • | | • | • | • | | • |

| | | | | | | | |

| Industrial and Utility Operations | | | | | | | | | |

| • | | • | • | • | • | | • | • |

| | | | | | | | |

| Infrastructure Development | | | | | | | | | |

| • | | • | | • | • | | | |

| | | | | | | | |

| Innovation and Transformation | | | | | | | | | |

| • | • | • | • | • | | • | |

| | | | | | | | |

| Regulatory and Public Policy | | | | | | | | | |

| • | • | • | • | • | | • | • | • |

| | | | | | | | |

| Risk Management and Compliance | | | | | | | | | |

| • | • | • | • | | • | • | • |

| | | | | | | | |

| Senior Executive Leadership | | | | | | | | | |

| • | • | • | • | • | • | • | • | • |

| | | | | | | | |

| Strategic Planning, Business Development and/or M&A | | | | | | | | | |

| • | • | • | • | • | • | • | • | • |

| | | | | | | | |

| Technology, Cybersecurity and Information Security | | | | | | | | | |

| • | • | | • | | | | • |

| | | | | | | | |

| | | | | |

| |

18 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

| |

NOMINEES FOR ELECTION

A biography of each director is presented below. Each biography includes the experience, qualifications, attributes and skills that led the Board to conclude that the nominee should serve as a director. While each nominee’s entire range of experience and skills is important, particular experience and skills that contribute to the effectiveness of the Board are identified below. The biographical information is current as of March 5, 2025.

| | | | | | | | | | | | | | |

| | | | |

| | Dawn Farrell INDEPENDENT DIRECTOR SINCE 2022 COMMITTEES Finance and Operations

Nominating, Governance and Sustainability | | EDUCATION MA Economics, Bachelor of Commerce, University of Calgary AMP, Harvard University SELECTED DIRECTORSHIPS AND MEMBERSHIPS Chair, Trans Mountain Corporation Chair, The Chemours Company Board member, ATCO, Ltd. Chancellor, Mount Royal University SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Board member, Business Council of Canada Board member, Alberta Business Council Board member, Canadian Natural Resources Limited Board member, Fording Coal Income Fund |

BACKGROUND AND QUALIFICATIONS Ms. Farrell has more than 39 years of energy experience, most recently as the President and CEO of Trans Mountain Corporation from 2022-2024. She currently serves as Board Chair of the Trans Mountain Corporation after successfully bringing the pipeline online. She has held a variety of executive leadership positions in TransAlta, including serving as CEO from 2012 to 2021, and British Columbia Hydro & Power Authority (BC Hydro) including leading commercial operations and development at TransAlta and generation and engineering at BC Hydro. Ms. Farrell’s qualifications to serve on our Board include her in-depth knowledge of the western energy markets, generation operations, energy trading, her leadership in transforming a carbon-based company into a leading clean and renewable focused company and her extensive leadership experience gained in senior executive positions at energy companies. | |

| | | | | | | | | | | | | | |

| | | | |

| | Marie Oh Huber INDEPENDENT DIRECTOR SINCE 2019 COMMITTEES Compensation, Culture and Talent

Chair, Nominating, Governance and Sustainability | | EDUCATION BA, Economics, Yale University JD, Northwestern University, Pritzker School of Law SELECTED DIRECTORSHIPS AND MEMBERSHIPS Fellow, Stanford Rock Center for Corporate Governance University Council, Yale University Law Board, Northwestern Pritzker School of Law SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Board member, James Campbell Company LLC Board member, Adevinta Board member, Silicon Valley Community Foundation

|

BACKGROUND AND QUALIFICATIONS Ms. Huber has over 30 years of strategic business, legal, regulatory and public policy experience in large global public technology companies. Until 2024, for nine years she served as the Senior Vice President and Chief Legal Officer of eBay, Inc. Ms. Huber joined eBay in 2015 from Agilent Technologies, where she served as Senior Vice President and General Counsel since 2009. At Agilent she was also responsible for government affairs, communications, regulatory affairs and quality assurance, government affairs and philanthropy. Prior to Agilent, Ms. Huber held leadership roles at Hewlett-Packard Company. Ms. Huber's qualifications to serve on our Board include her extensive track record as a business leader in advising boards of directors and her C-suite executive leadership, including legal and operational matters, M&A, corporate governance, enterprise risk management, government affairs and public policy, regulatory, compliance, public policy, IP, litigation, privacy and cybersecurity matters. | |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 19 |

| | | | | |

| Item 1: Election of Directors | |

| |

| | | | | | | | | | | | | | |

| | | | |

| | Kathryn Jackson, PhD INDEPENDENT DIRECTOR SINCE 2014 COMMITTEES Audit and Risk

Nominating, Governance and Sustainability | | EDUCATION BS, Physics, Grove City College MS, Industrial Engineering Management, University of Pittsburgh MS and PhD, Engineering and Public Policy, Carnegie Mellon University SELECTED DIRECTORSHIPS AND MEMBERSHIPS Board member, Cameco Corporation Board member, EQT Corporation Advisory Board, Carnegie Mellon University Advisory Board, University of Pittsburgh Swanson School Senior Advisor, Energy Impact Partners SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Board member, Duquesne Light Holdings, Inc., and Duquesne Light Company, Inc. Member, National Academy of Engineering |

BACKGROUND AND QUALIFICATIONS Dr. Jackson served as the Director of Energy and Technology Consulting at KeySource, Inc. from 2016 to 2021, where she provided strategic consulting services to clients in business growth, technology development and energy services. From 2014 to 2015, Dr. Jackson was Chief Technology Officer and Senior Vice President at RTI International Metals, Inc., a leading U.S. producer of titanium mill products. She served as Chief Technology Officer and Senior Vice President of Research and Technology at Westinghouse Electric Company, LLC, from 2009 to 2014; and as Vice President of Strategy, Research and Technology from 2008 to 2009. Prior to joining Westinghouse Electric Company, LLC, Dr. Jackson served for 17 years at the Tennessee Valley Authority where she held executive positions including Executive Vice President of River System Operations and Environment, and was the Corporate Environmental Officer. Dr. Jackson’s qualifications to serve on our Board include her background in engineering, her experience as a senior executive and as chair of the board of the Independent System Operator of New England, and her knowledge and experience in the areas of technology, large capital projects, risk management, generation facilities and energy trading operations, research and development and environmental health and safety. | |

| | | | | | | | | | | | | | |

| | | | |

| | Michael Lewis INDEPENDENT DIRECTOR SINCE 2021 COMMITTEES Compensation, Culture and Talent

Chair, Finance and Operations

| | EDUCATION BS, Electrical Engineering, University of Florida MBA, Nova Southeastern University AMP, Duke University EMP, University of Pennsylvania Wharton School SELECTED DIRECTORSHIPS AND MEMBERSHIPS Board member, NPK International Board member, Kinross Gold Corp. Board member, Osmose Utilities Service Senior Advisor, TRC Consulting, Engineering and Construction SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Pacific Gas & Electric Interim President; Board member, Association of Edison Illuminating Companies Member, California Governor's Earthquake Advisory Commission |

BACKGROUND AND QUALIFICATIONS Mr. Lewis is a retired executive with more than 35 years of experience in electric utility operations. He served as Interim President of Pacific Gas and Electric Company (PG&E) from August to December 2020. During that time, he oversaw PG&E's gas and electric operations including wildfire prevention and response efforts, grid resiliency initiatives, vegetation management programs and emergency preparedness. Prior to that, Mr. Lewis served as PG&E's Senior Vice President of Electric Operations and Vice President of Electric Distribution. Before joining PG&E in 2018, Mr. Lewis held a number of executive positions at Duke Energy, including Senior Vice President and Chief Distribution Officer from 2016 to 2018, covering distribution operations across six states, and Senior Vice President and Chief Transmission Officer from 2015 to 2016. Before the Duke Energy and Progress Energy merger in 2012, he was Senior Vice president of energy delivery for Progress Energy Florida, where he was responsible for hurricane preparedness and grid hardening initiatives. Mr. Lewis’s qualifications to serve on our Board include his executive leadership experience and in-depth knowledge of utility operations, including electric transmission and distribution, wildfire prevention and response, disaster preparedness, grid resiliency, large capital projects and risk management and safety programs. | |

| | | | | |

| |

20 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

| |

| | | | | | | | | | | | | | |

| | | | |

| | Michael Millegan INDEPENDENT DIRECTOR SINCE 2019 COMMITTEES Chair, Audit and Risk

Compensation, Culture and Talent | | EDUCATION BA, MBA, Angelo State University SELECTED DIRECTORSHIPS AND MEMBERSHIPS Board member, Axis Capital Holdings Board member, Network Wireless Solutions, Inc. Board member, Virginia Mason Foundation Strategic advisor and investor, Windpact, Inc., and Vettd, Inc. SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Board member, CoreSite Realty Corp. Board member, Wireless Telecom Group, Inc. |

BACKGROUND AND QUALIFICATIONS Mr. Millegan is the Founder and CEO of Millegan Advisory Group 3 LLC where he advises early-stage companies on strategies that drive technology innovation and shareholder value since 2018. Previously, he held a variety of executive leadership and management positions within Verizon, where he led large-scale and scope business units. As President of Verizon Global Wholesale Group, he was responsible for $11 billion in sales revenue, 13,000 employees and $1 billion in annual capital spending. Mr. Millegan’s qualifications to serve on our Board include his experience overseeing significant business units within a large corporate group, his experience in executive and management roles, his background in industrial operations in a regulated industry, global sales and marketing, digital media platforms, network infrastructure deployment, cloud computing, cybersecurity, supply chain management and communications infrastructure. | |

| | | | | | | | | | | | | | |

| | | | |

| | John O'Leary INDEPENDENT DIRECTOR SINCE 2024 COMMITTEES Audit and Risk

Finance and Operations | | EDUCATION BA, Business Administration - Accounting, Seattle University Executive Development Program, Northwestern University SELECTED DIRECTORSHIPS AND MEMBERSHIPS Board member, Daimler Truck North America LLC and Daimler Truck Holding AG Board member, Greenlane Board member, Torc Robotics |

BACKGROUND AND QUALIFICATIONS Mr. O’Leary has three decades of experience in the transportation and mobility sector. As the current President and Chief Executive Officer of Daimler Truck North America LLC, Mr. O’Leary has strong ties to the Portland, Oregon business community. He has served in a variety of leadership roles at Daimler throughout his over 20-year tenure there, including Senior Vice President and Chief Financial Officer for eight years, as well as serving as Chief Transformation Officer for Mercedes-Benz Trucks in Stuttgart, Germany. As CEO, Mr. O’Leary spearheads Daimler’s electrification and zero-emission technology initiatives in North America. Mr. O’Leary currently serves on the board of Daimler Truck Holding AG, the German parent company of Daimler Truck North America LLC, and is chairman of the board of Greenlane, a joint venture started by Daimler, BlackRock, and NextEra Energy to develop zero-emission infrastructure in the United States. Mr. O'Leary's qualifications to serve on our Board include his expertise in accounting and finance, his leadership in clean energy transformation, his experience as a senior executive and his deep knowledge of industrial operations. | |

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 21 |

| | | | | |

| Item 1: Election of Directors | |

| |

| | | | | | | | | | | | | | |

| | | | |

| | Patricia Salas Pineda INDEPENDENT DIRECTOR SINCE 2022 COMMITTEES Chair, Compensation, Culture and Talent

Finance and Operations | | EDUCATION BA, Government, Mills College JD, University of California at Berkeley SELECTED DIRECTORSHIPS AND MEMBERSHIPS Board member, Omnicom Group Board member, Frontier Group Holdings SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Board member, Earthjustice, Levi Strauss & Co., California Air Resources Board The Congressional Hispanic Caucus Institute |

BACKGROUND AND QUALIFICATIONS Ms. Pineda has held diverse leadership roles in human resources, marketing, legal, communications, philanthropy and stakeholder relations. Prior to her retirement, Ms. Pineda was the Group Vice President, Hispanic Business Strategy Group at Toyota Motor North America, Inc. Before that, Ms. Pineda was the Group Vice President, national Philanthropy and also Group Vice President Corporate Communications/ Administration and General Counsel. Ms. Pineda began her career at New United Motor Manufacturing Inc., where she held leadership positions in Human Resources, Legal, Government and Environmental Affairs. Ms. Pineda is the founder and Chair emeritus of the Latino Corporate Directors Association and is fluent in both Spanish and English. Ms. Pineda's qualifications to serve on our Board include her experience and knowledge of customer strategy, customer expectations and communications, her knowledge of human capital management issues and compensation, her extensive Board experience and her deep understanding of stakeholder relations and policy issues. | |

| | | | | | | | | | | | | | |

| | | | |

| | Maria Pope President and Chief Executive Officer, Portland General Electric Company DIRECTOR SINCE 2018 | | EDUCATION BA, College of Arts and Sciences, Georgetown University MBA, Stanford Graduate School of Business SELECTED DIRECTORSHIPS AND MEMBERSHIPS Chair, Edison Electric Institute Chair, Oregon Business Council Executive committee, Electric Power Research Institute Board member, Columbia Banking System, Inc. Board member, Georgetown University SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Board member, US Secretary of Energy Advisory Board Chair, OHSU Governing Board, Chair, Canadian Council of Forest Industries Lead independent director, Premera Blue Cross Chair, Oregon Symphony |

BACKGROUND AND QUALIFICATIONS Ms. Pope is President and CEO of Portland General Electric Company. She was appointed President on October 1, 2017 and Chief Executive Officer on January 1, 2018. She served from 2013 to 2017 as Senior Vice President of Power Supply, Operations and Resource Strategy, overseeing PGE's generation plants, energy supply portfolio and long-term resource strategy. Ms. Pope joined PGE in 2009 as Senior Vice President of Finance, Chief Financial Officer and Treasurer. She served on PGE's Board of Directors from 2006 to 2008. Prior to joining PGE, she served as Chief Financial Officer for Mentor Graphics Corporation and held senior operating and finance positions within the forest products and consumer products industries. She began her career in banking with Morgan Stanley. Ms. Pope’s qualifications to serve on our Board include her current role as President and CEO, her extensive knowledge of the Company and the utility industry, her experience as Chief Financial Officer of three publicly traded companies, her diverse leadership experience in business and financial roles, her strong local ties and her corporate and civic board experience. | |

| | | | | |

| |

22 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

| |

| | | | | | | | | | | | | | |

| | | | |

| | James Torgerson Board Chair

INDEPENDENT DIRECTOR SINCE 2021 COMMITTEES Audit and Risk

Nominating, Governance and Sustainability | | EDUCATION BBA, Accounting, Cleveland State University SELECTED DIRECTORSHIPS AND MEMBERSHIPS Board of Trustees, Yale-New Haven Hospital and Health System Advisory Board member, Noteworthy AI Inc. SELECTED FORMER DIRECTORSHIPS, MEMBERSHIPS AND POSITIONS Executive committee, Edison Electric Institute (EEI) Co-Chair, EEI Committee on Reliability, Security and Business Continuity Chair, American Gas Association Board member, Archaea Energy, Inc. |

BACKGROUND AND QUALIFICATIONS Mr. Torgerson served as CEO of AVANGRID, Inc., an energy company with approximately $30 billion in assets and operations in 24 states from 2015 until his retirement in 2020. Previously, he was President and CEO of UIL Holdings Corporation from 2006 to 2015, when it merged with Iberdrola USA to form AVANGRID. During his time at UIL Holdings, he oversaw its expansion from a regional electric utility to a diversified energy delivery company and one of the largest generators of wind electricity in the U.S., serving natural gas and electric utility customers across multiple states. Before joining UIL Holdings, he was President, CEO and Director of the Midwest Independent Transmission System Operator, Inc. from 2000 to 2006. He also previously served as Chief Financial Officer for several natural gas and electric utilities including Puget Sound Energy and Washington Energy Company. Before transitioning to the utility industry, he served as Vice President of Development for Diamond Shamrock Corporation, where he also held various finance and strategic planning positions. Mr. Torgerson’s qualifications to serve on our Board include his executive leadership experience and extensive knowledge of the utility industry, including clean energy development, finance and accounting, energy markets, regulation, risk management and strategic planning. | |

ROLE OF THE BOARD OF DIRECTORS

Our Board is elected by our shareholders to oversee management in its operation of PGE. In exercising its fiduciary duties, the Board’s goal is to build long-term value for our shareholders and other stakeholders and to ensure the vitality of PGE for our customers, employees and the other individuals and organizations who depend on us.

Key responsibilities of our Board include:

•Establishing a corporate governance framework;

•Overseeing and advising management on Company strategy;

•Overseeing the Company's risk management programs;

•Overseeing the Company's financial reporting;

•Overseeing the Company's human capital management and corporate culture; and

•Conducting Board and executive succession planning.

In the pages that follow we provide information about how our Board fulfills these responsibilities, as well as other important policies and practices of our Board.

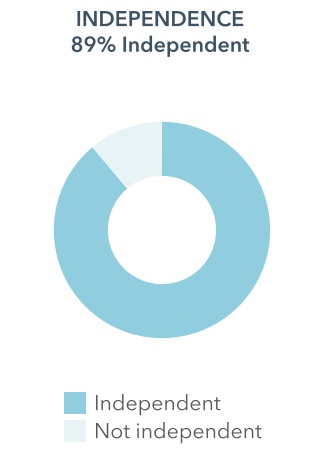

DIRECTOR INDEPENDENCE

The NYSE listing standards require a majority of our directors and each member of our Audit and Risk Committee, Compensation, Culture and Talent Committee, and Nominating, Governance and Sustainability Committee to be independent. For a director to be considered independent, the Board must affirmatively determine that the director does not have any direct or indirect material relationship with PGE, including any of the relationships specifically prohibited by the NYSE independence standards.

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 23 |

| | | | | |

| Item 1: Election of Directors | |

| |

Our Corporate Governance Guidelines require at least 75% of our directors to be independent under NYSE independence standards. To assist us in determining the independence of Board members and candidates, the Board has adopted Director Independence Standards, which identify types of relationships that could exist between PGE and a director that would prevent the director from being independent. Our Director Independence Standards are contained in our Corporate Governance Guidelines, published on our website at https://investors. portlandgeneral.com/corporate-governance.

During its annual review of director independence in 2024, the Board considered whether there were any transactions or relationships between PGE and any director or any member of his or her immediate family (or any entity of which a director or an immediate family member is an executive officer, general partner or significant equity holder) and whether there were charitable contributions to not-for-profit organizations for which a director or an immediate family member of a director serves as a board member or executive officer.

As a result of this review, the Board affirmatively determined that other than Ms. Pope, all current members of the Board and its standing committees are independent under NYSE listing standards and our Director Independence Standards.

GOVERNANCE STRUCTURE AND PROCESSES

Board Leadership Structure

Our Board believes that PGE is best served by maintaining the flexibility to determine its leadership structure based on our evolving needs. Our Corporate Governance Guidelines call for the appointment of a Board Chair and require the appointment of a Lead Independent Director if the Board Chair is not independent. The duties of our Board Chair include:

•Calling and presiding over meetings of the Board;

•Serving as the principal liaison between management and other non-management directors;

•Providing formal input into Board agendas, working closely with the Committees in fulfilling their charter obligations, including risk oversight, the annual Board evaluation and the annual CEO performance review;

•With the Nominating, Governance and Sustainability Committee, overseeing the composition of the Board;

•Advising senior management on strategy and significant matters as appropriate; and

•Representing the Board at PGE's Annual Meeting of Shareholders, and in communications with shareholders and other stakeholders.

We currently separate the roles of CEO and Board Chair. Jim Torgerson, our Board Chair, is independent as defined in the NYSE listing standards and our own Director Independence Standards, which are described in our Corporate Governance Guidelines.

Our Board periodically reviews our leadership structure to determine whether it continues to serve the interests of the Company. We believe our current leadership structure promotes strong independent Board oversight and management accountability and allows our CEO to focus her time and efforts on establishing our strategic direction and managing the affairs of the Company.

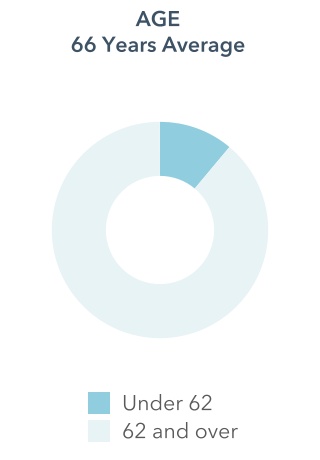

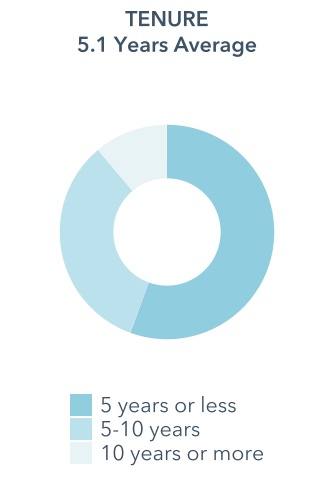

BOARD REFRESHMENT

Under our director retirement and tenure policy, which is contained in our Corporate Governance Guidelines, candidates will not be nominated for election after age 75, and will not be nominated to serve on the Board for more than 12 years, unless the Board determines that such director’s continued service would be in the best interests of PGE. Our retirement policy is anchored on the need for Board refreshment and balanced tenure at the Board. We have an active board refreshment program with 5 new directors since 2021 and an average tenure of 5.1 years for the 2025 director nominees.

| | | | | |

| |

24 | Portland General Electric | 2025 Proxy Statement |

| | | | | |

| Item 1: Election of Directors |

| |

The Nominating, Governance and Sustainability Committee recommends director candidates to the Board. The Nominating, Governance and Sustainability Committee carries out this responsibility through a year-round process described below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| 1 | | à | | 2 | | à | | 3 | | à | | 4 | |

| Evaluation of Board Composition | | | Candidate Recruitment | | | Candidate Evaluation | | | Recommendation to Board | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| The Nominating, Governance and Sustainability Committee evaluates the Board's membership needs. | | | If the Nominating, Governance and Sustainability Committee determines that there is a need for new candidates, individuals are identified through a variety of methods, including shareholder recommendations. | | | Candidates are evaluated on whether they exhibit core attributes that our Nominating, Governance and Sustainability Committee looks for in all candidates, as well as Board membership needs. | | | The Nominating, Governance and Sustainability Committee recommends selected candidates to the Board for nomination or appointment to the Board. | |

| | | | | | | | | | | | | | |

Evaluation of Board Composition. Each year the Nominating, Governance and Sustainability Committee evaluates the size and composition of the Board to assess whether they are appropriate, considering our evolving needs. In making this evaluation, the Nominating, Governance and Sustainability Committee considers PGE's strategic direction, current director qualifications, experience and perspectives, the results of Board and committee self-assessments and legal and regulatory requirements. The Nominating, Governance and Sustainability Committee also considers whether there may be a need to fill a future Board vacancy considering our director retirement and tenure policy. If the Nominating, Governance and Sustainability Committee identifies a need to fill a future Board vacancy or add to the mix of skills and qualifications represented on the Board, the Nominating, Governance and Sustainability Committee oversees the director recruitment process.

Candidate Recruitment. The Nominating, Governance and Sustainability Committee identifies new Board candidates through a variety of methods, including the use of third-party search firms, suggestions from current directors, shareholders, or employees and self-nominations. In addition to evaluating a candidate’s individual qualifications, the Board and the Nominating, Governance and Sustainability Committee consider how a candidate would contribute to the overall mix of experience, qualifications and other attributes represented on our Board. We believe it is important that the Board exhibit diversity across a variety of parameters, including age, perspectives, experience, gender and race, and we actively seek out diverse candidates. The criteria used naturally results in a diverse board as evidenced by the current Board's composition. The Board has, therefore, not felt the need to adopt a formal Board diversity policy.

The Nominating, Governance and Sustainability Committee considers candidates recommended by shareholders. The recommendation and information about the recommended candidate should be sent to the Chair of the Nominating, Governance and Sustainability Committee, in care of our Corporate Secretary, at Portland General Electric Company, 121 SW Salmon Street, 1WTC1301, Portland, Oregon 97204.

The Nominating, Governance and Sustainability Committee will use the same process to evaluate a candidate regardless of the source of the recommendation.

| | | | | |

| |

| 2025 Proxy Statement | Portland General Electric | 25 |

| | | | | |

| Item 1: Election of Directors | |

| |

Candidate Evaluation. In evaluating director candidates and in the consideration of existing directors for renomination , the Nominating, Governance and Sustainability Committee considers the following:

| | | | | |

| Personal Characteristics | Reputation for honesty, ethical conduct and sound business judgment |

| Skills | Possession of skills necessary to provide effective oversight of strategy and risks |

| Time Commitment and Outside Board Affiliations | Availability and willingness to fulfill the responsibilities of Board membership; free from potential conflicts of interest |

| Attendance | For current directors, attendance and contributions at Board and Committee meetings |

| Board Evaluations | For current directors, feedback received during the annual Board evaluation process |

| Shareholder Feedback | Feedback received from shareholders including support received during the most recent annual shareholder meeting |

Recommendation to the Board of Directors: Each year in advance of our Annual Meeting of Shareholders, the Nominating, Governance and Sustainability Committee recommends a group of nominees to be presented to the shareholders for election to the Board. As appropriate, the Nominating, Governance and Sustainability Committee also recommends candidates for appointment to the Board between annual meetings. Directors who are appointed by the Board between annual meetings stand for election at the next Annual Meeting of Shareholders.