Exhibit 99.1

Exhibit 99.1

44th EEI Financial Conference

Portland General Electric

November 1 – 4, 2009

Copyright © 2009 Portland General Electric. All Rights Reserved.

Cautionary Statement

Information Current as of October 29, 2009

Except as expressly noted, the information in this presentation is current as of October 29, 2009 — the date on which PGE filed its Quarterly Report on Form 10-Q for the quarter ended September 30, 2009 — and should not be relied upon as being current as of any subsequent date. PGE undertakes no duty to update the presentation, except as may be required by law.

Forward-Looking Statements

This presentation contains statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding earnings guidance, statements regarding growth prospects, statements regarding future financing activities and capital expenditures, statements regarding the cost and completion of capital projects, such as the smart meter project and the Biglow Canyon Wind Farm, as well as other statements containing words such as “will,” “anticipates,” “believes,” “intends,” “estimates,” “promises,” “expects,” “should,” “conditioned upon” and similar expressions. Investors are cautioned that any such forward-looking statements are subject to risks and uncertainties, including the effects of the economic downturn in the state of Oregon, including reductions in demand for electricity and the sale of excess energy into a declining wholesale market; final regulatory review and approval of the deferral of excess power costs related to Boardman’s outage; regulatory approval and rate treatment of the smart meter and Biglow Canyon Wind Farm projects; operational risks relating to the Company’s generation facilities, including unscheduled plant outages, which may result in unanticipated operating, maintenance and repair costs, as well as replacement power costs; the costs of compliance with environmental laws and regulations, including those that govern emissions from thermal power plants; changes in weather, hydroelectric, and energy market conditions, which could affect the availability and cost of purchased power and fuel; and the outcome of various legal and regulatory proceedings; and general economic and financial market conditions. As a result, actual results may differ materially from those projected in the forward-looking statements. All forward-looking statements included in this news release are based on information available to the Company on the date hereof and such statements speak only as of the date hereof. The Company assumes no obligation to update any such forward-looking statement. Prospective investors should also review the risks and uncertainties listed in the Company’s most recent Annual Report on Form 10-K and the Company’s reports on Forms 8-K and 10-Q filed with the United States Securities and Exchange Commission, including Management’s Discussion and Analysis of Financial Condition and Results of Operation and the risks described therein from time to time. Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, PGE undertakes no obligation to update any forward-looking statement.

2

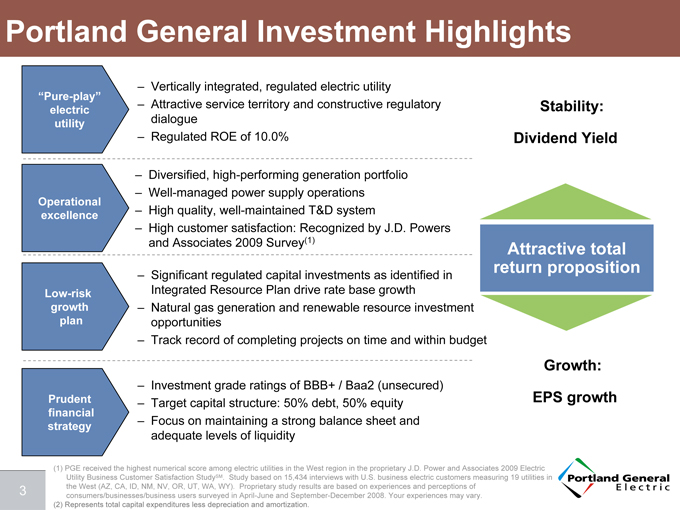

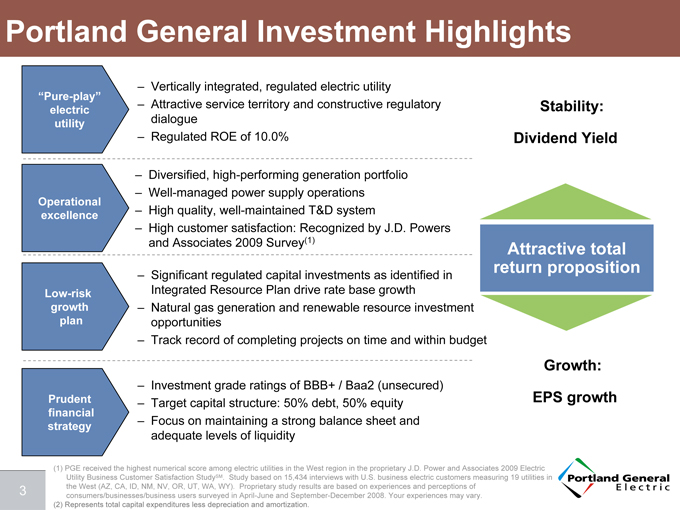

Portland General Investment Highlights

“Pure-play” electric utility

– Vertically integrated, regulated electric utility

– Attractive service territory and constructive regulatory dialogue

– Regulated ROE of 10.0%

Operational excellence

– Diversified, high-performing generation portfolio

– Well-managed power supply operations

– High quality, well-maintained T&D system

– High customer satisfaction: Recognized by J.D. Powers and Associates 2009 Survey(1)

Low-risk growth plan

– Significant regulated capital investments as identified in Integrated Resource Plan drive rate base growth

– Natural gas generation and renewable resource investment opportunities

– Track record of completing projects on time and within budget

– Investment grade ratings of BBB+ / Baa2 (unsecured)

Prudent financial strategy

– Target capital structure: 50% debt, 50% equity

– Focus on maintaining a strong balance sheet and adequate levels of liquidity

Stability:

Dividend Yield

Attractive total

return proposition

Growth:

EPS growth

( 1) PGE received the highest numerical score among electric utilities in the West region in the proprietary J.D. Power and Associates 2009 Electric Utility Business Customer Satisfaction StudySM. Study based on 15,434 interviews with U.S. business electric customers measuring 19 utilities in the West (AZ, CA, ID, NM, NV, OR, UT, WA, WY). Proprietary study results are based on experiences and perceptions of consumers/businesses/business users surveyed in April-June and September-December 2008. Your experiences may vary.

(2) Represents total capital expenditures less depreciation and amortization.

3

Portland General Strategic Direction

Mission: To be a company our customers and communities can depend upon to provide electric service in a safe, responsible and reliable manner, with excellent customer service, at a reasonable price.

Operational Excellence

Customer satisfaction

Operational efficiency

Power supply, system reliability and service quality

Achieve allowed ROE

Engage and develop our people

Business Growth

Strategic system investments

Encourage economic vitality

Capitalize on emerging technologies

Corporate Responsibility

Listen and lead in public policy

Trusted convener for customers and

stakeholders

Continued commitment to the

Oregon community

Deliver Value to Customers and Shareholders

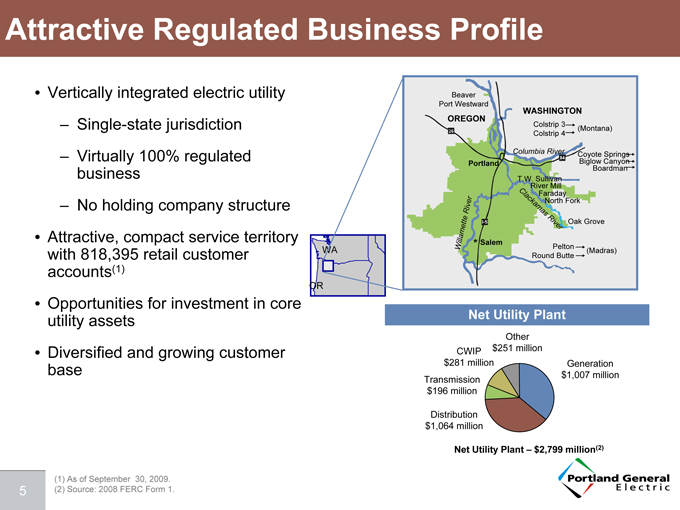

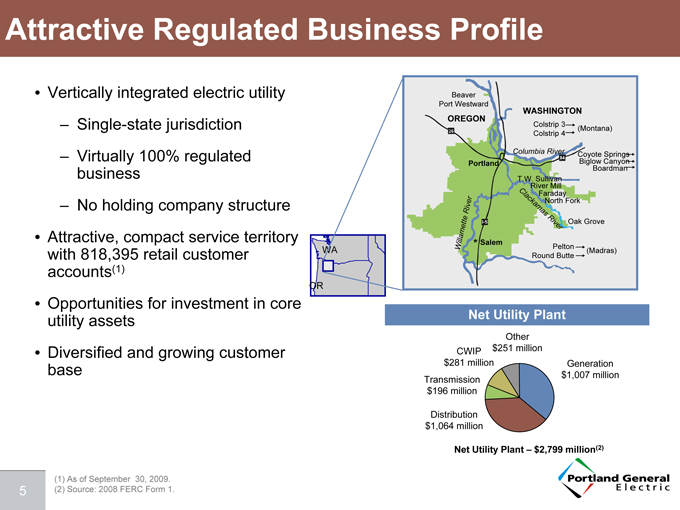

Attractive Regulated Business Profile

• Vertically integrated electric utility

– Single-state jurisdiction

– Virtually 100% regulated business

– No holding company structure

• Attractive, compact service territory with 818,395 retail customer accounts (1)

• Opportunities for investment in core utility assets

• Diversified and growing customer base

Beaver

Port Westward

OREGON

WASHINGTON

Colstrip 3 (Montana)

Colstrip 4

Portland

Columbia River

CoyoteBiglow

Canyon Springs

Boardman

T.W. Sullivan

River Mill

Faraday

North Fork

Clackamas River

Oak Grove

Willamette River

Salem

Pelton

Round Butte

(Madras)

Net Utility Plant

Other $251 million

CWIP $281 million

Transmission $196 million

Distribution $1,064 million

Generation $1,007 million

Net Utility Plant – $2,799 million (2)

(1) As of September 30, 2009.

(2) Source: 2008 FERC Form 1.

WA

OR

5

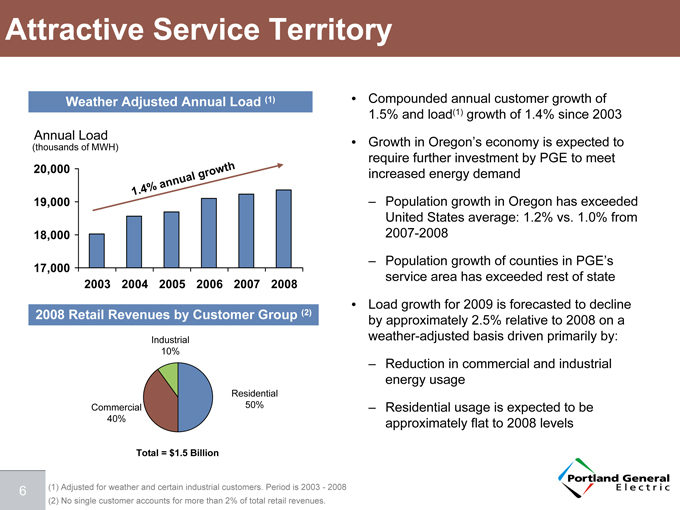

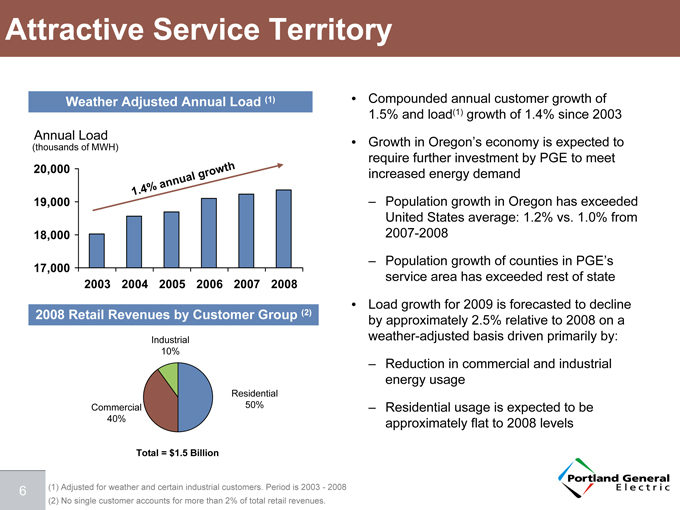

Attractive Service Territory

Weather Adjusted Annual Load (1)

Annual Load

(thousands of MWH)

20,000 19,000 18,000 17,000

1.4% annual growth

2003 2004 2005 2006 2007 2008

2008 Retail Revenues by Customer Group (2)

Industrial 10%

Commercial 40%

Residential 50%

Total = $1.5 Billion

Compounded annual customer growth of 1.5% and load(1) growth of 1.4% since 2003

Growth in Oregon’s economy is expected to require further investment by PGE to meet increased energy demand

Population growth in Oregon has exceeded United States average: 1.2% vs. 1.0% from 2007-2008

Population growth of counties in PGE’s service area has exceeded rest of state

Load growth for 2009 is forecasted to decline by approximately 2.5% relative to 2008 on a weather-adjusted basis driven primarily by:

Reduction in commercial and industrial energy usage

Residential usage is expected to be approximately flat to 2008 levels

(1) Adjusted for weather and certain industrial customers. Period is 2003 - 2008

(2) No single customer accounts for more than 2% of total retail revenues.

6

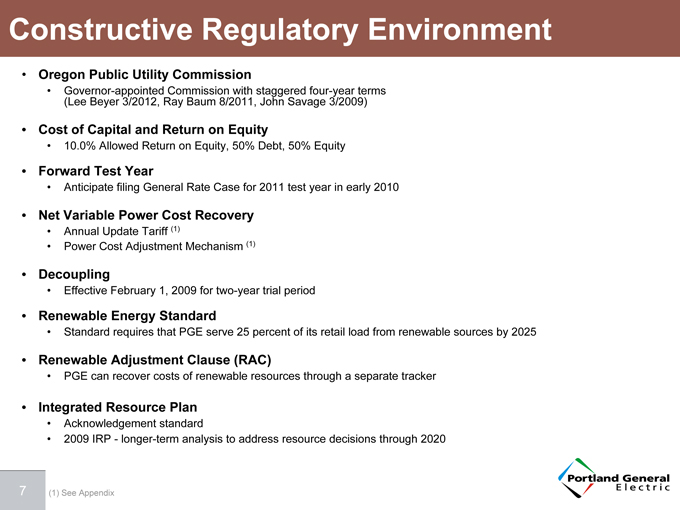

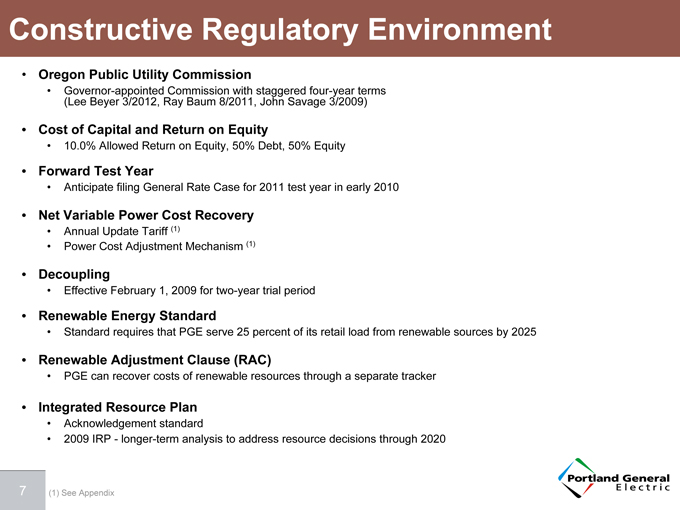

Constructive Regulatory Environment

Oregon Public Utility Commission

Governor-appointed Commission with staggered four-year terms (Lee Beyer 3/2012, Ray Baum 8/2011, John Savage 3/2009)

Cost of Capital and Return on Equity

10.0% Allowed Return on Equity, 50% Debt, 50% Equity

Forward Test Year

Anticipate filing General Rate Case for 2011 test year in early 2010

Net Variable Power Cost Recovery

Annual Update Tariff (1)

Power Cost Adjustment Mechanism (1)

Decoupling

Effective February 1, 2009 for two-year trial period

Renewable Energy Standard

Standard requires that PGE serve 25 percent of its retail load from renewable sources by 2025

Renewable Adjustment Clause (RAC)

PGE can recover costs of renewable resources through a separate tracker

Integrated Resource Plan

Acknowledgement standard

2009 IRP - longer-term analysis to address resource decisions through 2020

(1) See Appendix

7

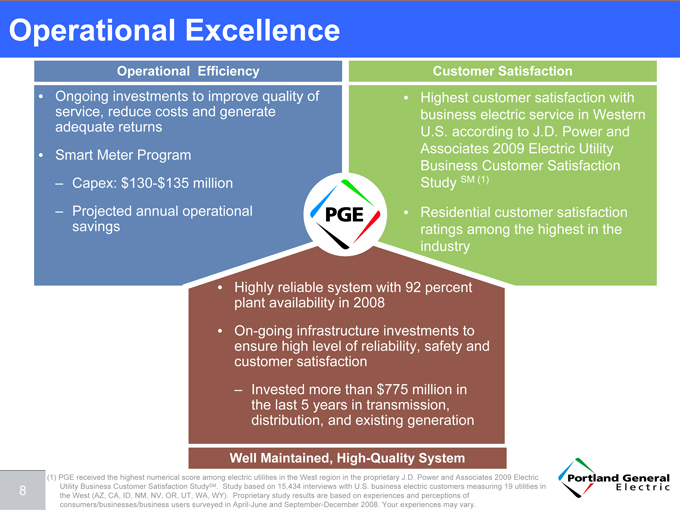

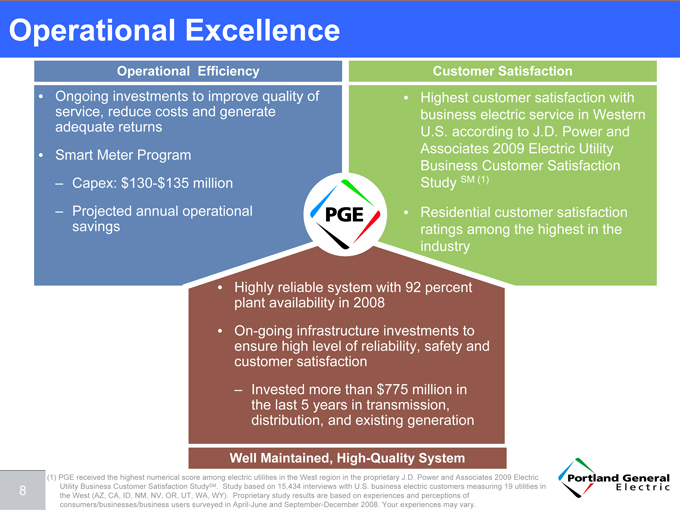

Operational Excellence

Operational Efficiency

Ongoing investments to improve quality of service, reduce costs and generate adequate returns

Smart Meter Program

Capex: $130-$135 million

Projected annual operational savings

Highly reliable system with 92 percent plant availability in 2008

On-going infrastructure investments to ensure high level of reliability, safety and customer satisfaction

Invested more than $775 million in the last 5 years in transmission, distribution, and existing generation

Well Maintained, High-Quality System

Customer Satisfaction

Highest customer satisfaction with business electric service in Western U.S. according to J.D. Power and Associates 2009 Electric Utility Business Customer Satisfaction Study SM (1)

Residential customer satisfaction ratings among the highest in the industry

(1) PGE received the highest numerical score among electric utilities in the West region in the proprietary J.D. Power and Associates 2009 Electric Utility Business Customer Satisfaction StudySM. Study based on 15,434 interviews with U.S. business electric customers measuring 19 utilities in the West (AZ, CA, ID, NM, NV, OR, UT, WA, WY). Proprietary study results are based on experiences and perceptions of consumers/businesses/business users surveyed in April-June and September-December 2008. Your experiences may vary.

8

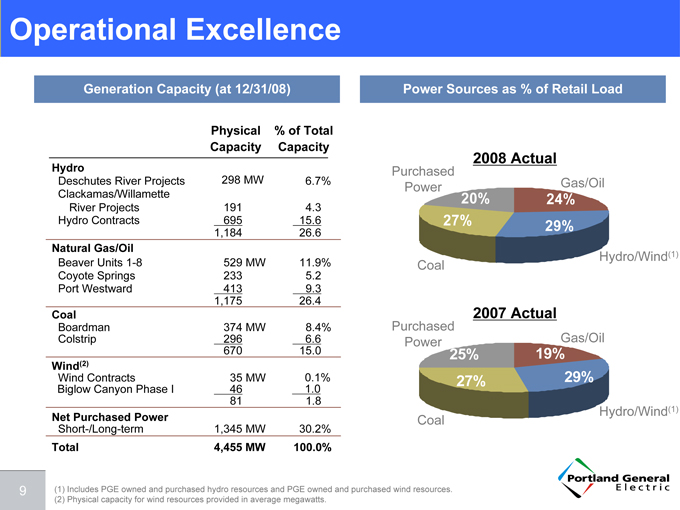

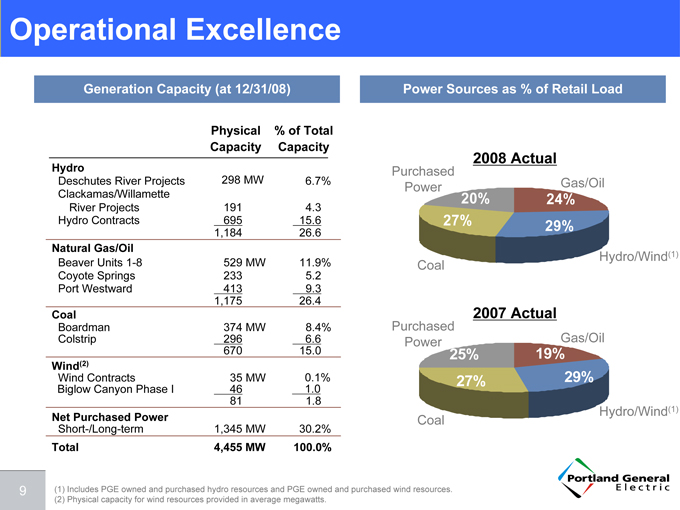

Operational Excellence

Generation Capacity (at 12/31/08)

Physical Capacity% of Total Capacity

Hydro

Deschutes River Projects 298 MW 6.7%

Clackamas/Willamette

River Projects 191 4.3

Hydro Contracts 695 15.6

1,184 26.6

Natural Gas/Oil

Beaver Units 1-8 529 MW 11.9%

Coyote Springs 233 5.2

Port Westward 413 9.3

1,175 26.4

Coal

Boardman 374 MW 8.4%

Colstrip 296 6.6

670 15.0

Wind(2)

Wind Contracts 35 MW 0.1%

Biglow Canyon Phase I 46 1.0

81 1.8

Net Purchased Power

Short-/Long-term 1,345 MW 30.2%

Total 4,455 MW 100.0%

Power Sources as % of Retail Load

Purchased Power

20% 24% 27% 29%

2008 Actual

Gas/Oil

Hydro/Wind (1)

Coal

2007 Actual

Purchased Power

Gas/Oil

25% 19% 29% 27%

Coal

Hydro/Wind (1)

(1) Includes PGE owned and purchased hydro resources and PGE owned and purchased wind resources.

(2) Physical capacity for wind resources provided in average megawatts.

9

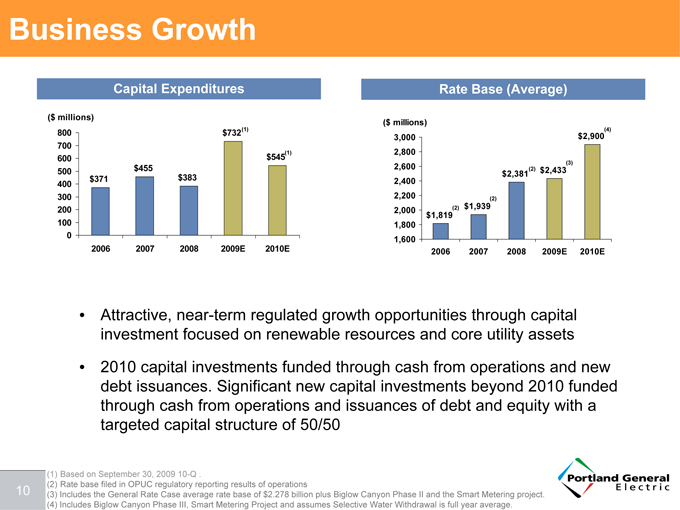

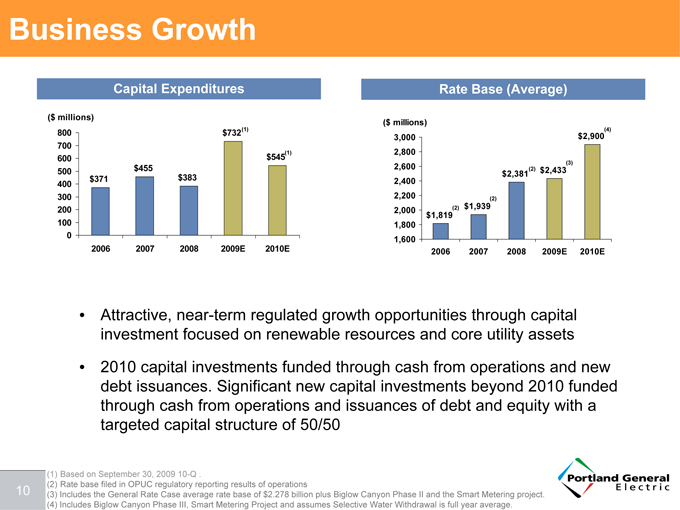

Business Growth

Capital Expenditures

($ millions)

800 700 600 500 400 300 200 100 0

$732(1)

$545(1)

$455

$371 $383

2006 2007 2008 2009E 2010E

Rate Base (Average)

($ millions)

3,000 2,800 2,600 2,400 2,200 2,000 1,800 1,600

$2,900(4)

$2,381(2) $2,433(3)

$1,939(2)

$1,819(2)

2006 2007 2008 2009E 2010E

Attractive, near-term regulated growth opportunities through capital investment focused on renewable resources and core utility assets

2010 capital investments funded through cash from operations and new debt issuances. Significant new capital investments beyond 2010 funded through cash from operations and issuances of debt and equity with a targeted capital structure of 50/50

(1) Based on September 30, 2009 10-Q .

(2) Rate base filed in OPUC regulatory reporting results of operations

(3) Includes the General Rate Case average rate base of $2.278 billion plus Biglow Canyon Phase II and the Smart Metering project.

(4) Includes Biglow Canyon Phase III, Smart Metering Project and assumes Selective Water Withdrawal is full year average.

10

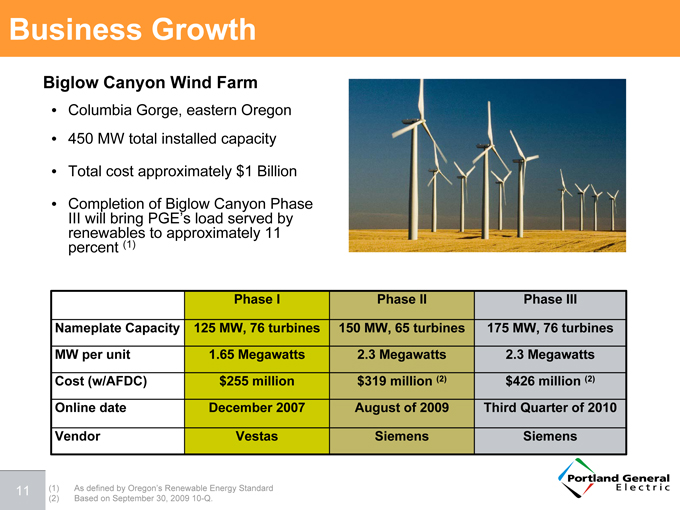

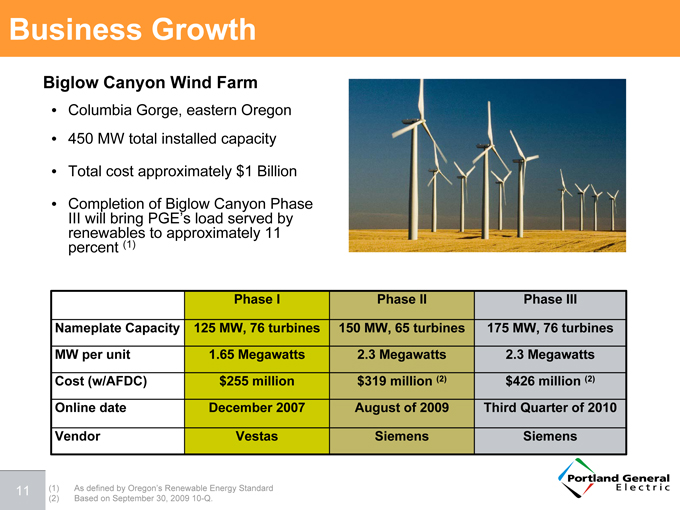

Business Growth

Biglow Canyon Wind Farm

Columbia Gorge, eastern Oregon

450 MW total installed capacity

Total cost approximately $1 Billion

Completion of Biglow Canyon Phase III will bring PGE’s load served by renewables to approximately 11 percent (1)

Nameplate Capacity

MW per unit

Cost (w/AFDC)

Online date

Vendor 125

Phase I

MW, 76 turbines

1.65 Megawatts

$255 million

December 2007

Vestas

Phase II

150 MW, 65 turbines

2.3 Megawatts

$319 million (2)

August of 2009

Siemens

Phase III

175 MW, 76 turbines

2.3 Megawatts

$426 million (2)

Third Quarter of 2010

Siemens

(1) As defined by Oregon’s Renewable Energy Standard

(2) Based on September 30, 2009 10-Q.

11

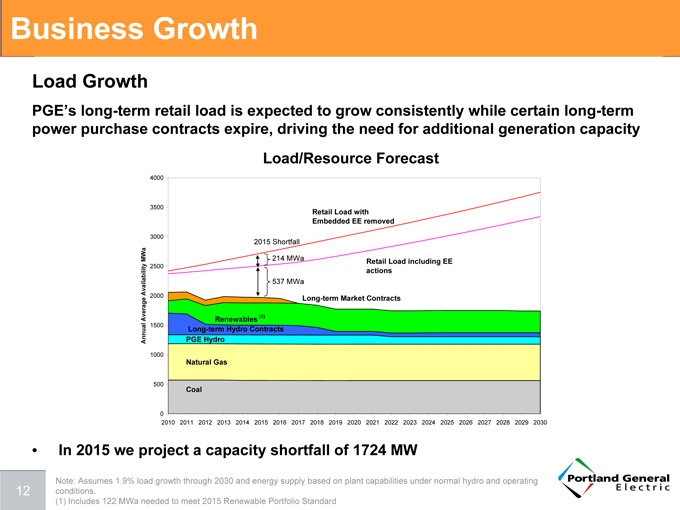

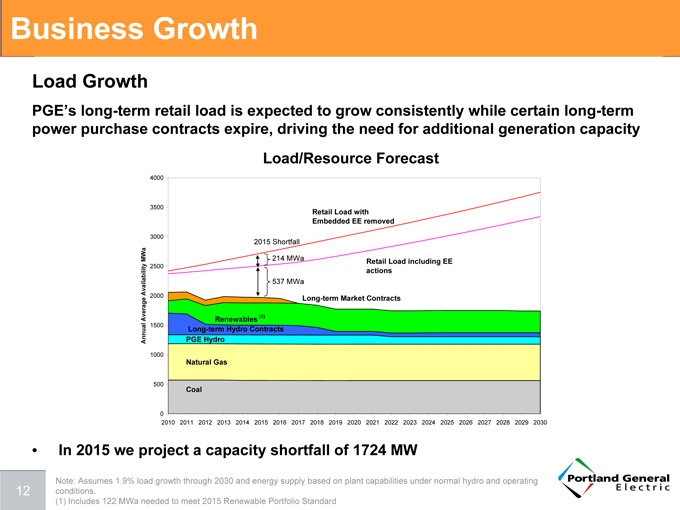

Business Growth

Load Growth

PGE’s long-term retail load is expected to grow consistently while certain long-term power purchase contracts expire, driving the need for additional generation capacity

Load/Resource Forecast

4000 3500 3000 2500 2000 1500 1000 500 0

Retail Load with

Embedded EE removed

2015 Shortfall

MWa 214 MWa Retail Load including EE

actions

Availability 537 MWa

Long-term Market Contracts

Average Renewables (1)

Long-term Hydro Contracts

Annual PGE Hydro

Natural Gas

Coal

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

In 2015 we project a capacity shortfall of 1724 MW

Note: Assumes 1.9% load growth through 2030 and energy supply based on plant capabilities under normal hydro and operating conditions.

(1) Includes 122 MWa needed to meet 2015 Renewable Portfolio Standard

12

Business Growth

Integrated Resource Planning Process

Under OPUC guidelines, PGE is required to file an Integrated Resource Plan (IRP) within two years of acknowledgment of the previous plan.

The IRP requires that the primary goal must be the selection of a portfolio of resources with the best combination of expected costs and associated risks and uncertainties for the utility and its customers.

Goal is Commission acknowledgement of the IRP Action Plan. Acknowledgement is not approval for ratemaking purposes but the Commission has stated that it will give “considerable weight” to utility actions that are consistent with the acknowledged IRP.

This is an open public planning process.

Schedule:

Early September 2009: Draft plan filed

November 2009: Final plan filed

First Quarter 2010: OPUC acknowledge action plan

13

Business Growth

Draft filing of the 2009 Integrated Resource Plan (IRP) includes:

A long-term analysis of resource requirements to serve customers

Expected resource requirements to include expansion of energy efficiency, additional renewable resources, purchase power agreements and new facilities to meet energy and capacity needs.

Potential Capital Projects :

New energy resources

300 – 500 MW natural gas facility (1)

Approximate capital cost is between $1,300 and $1,400/kW

Earliest date available - 2015

122 MWa of renewable resources (1) (2)

Approximate capital cost is between $2,200 and $4,100/kW

Earliest date available 2012

New capacity resources

Up to 200 MW natural gas facility (1)

Approximate capital cost is between $1,100 and $1,400/kW

Earliest date available 2013

Emissions controls at Boardman Coal Plant

Capital cost estimated to be $520 - $560 million (3) (2011 – 2017)

Transmission (1)

Cascade Crossing – 200 mile, 500-kV transmission line

Approximate capital cost $610 million for single circuit line

Approximate capital cost $825 million for double circuit line

Completed by 2015

(1) Per draft IRP filing capital cost are in 2009 dollars

(2) Needed to meet 2015 Renewable Portfolio Standard

(3) Nominal dollars

14

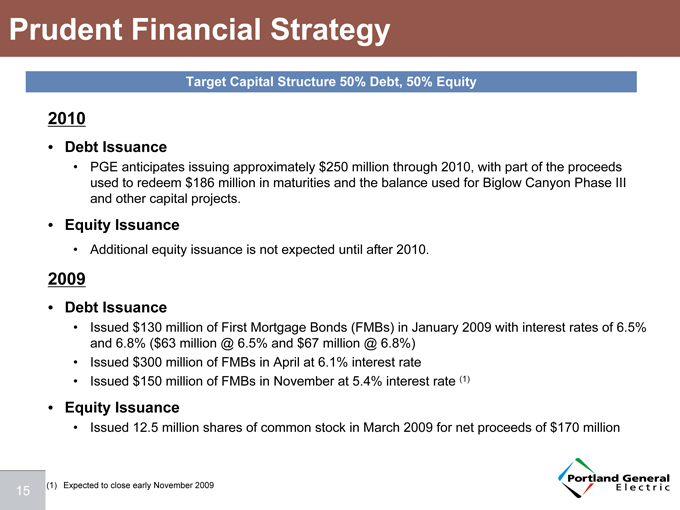

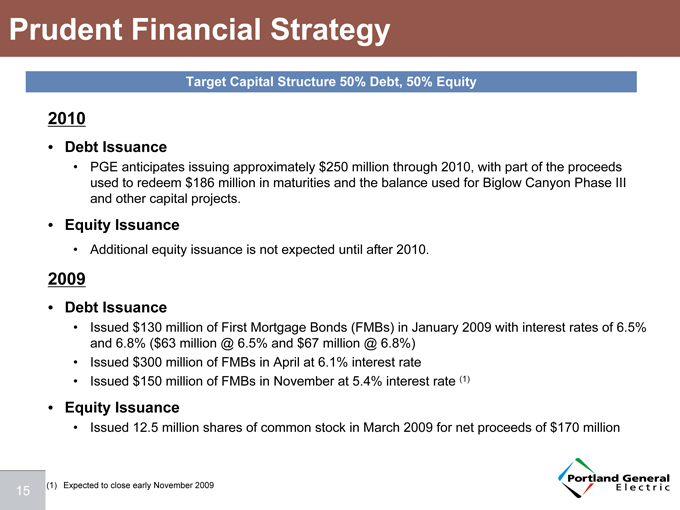

Prudent Financial Strategy

Target Capital Structure 50% Debt, 50% Equity

2010

Debt Issuance

PGE anticipates issuing approximately $250 million through 2010, with part of the proceeds used to redeem $186 million in maturities and the balance used for Biglow Canyon Phase III and other capital projects.

Equity Issuance

Additional equity issuance is not expected until after 2010.

2009

Debt Issuance

Issued $130 million of First Mortgage Bonds (FMBs) in January 2009 with interest rates of 6.5% and 6.8% ($63 million @ 6.5% and $67 million @ 6.8%)

Issued $300 million of FMBs in April at 6.1% interest rate

Issued $150 million of FMBs in November at 5.4% interest rate (1)

Equity Issuance

Issued 12.5 million shares of common stock in March 2009 for net proceeds of $170 million

(1) Expected to close early November 2009

15

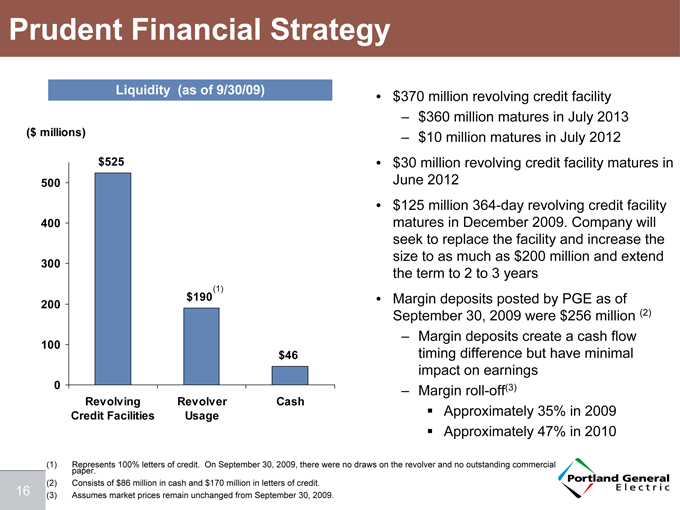

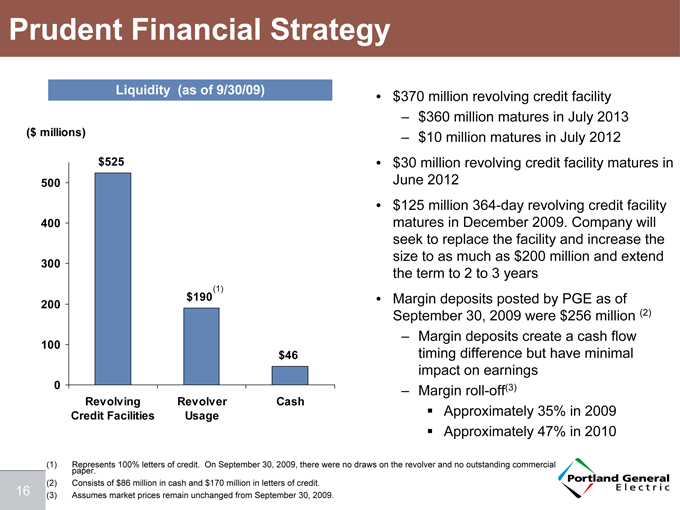

Prudent Financial Strategy

Liquidity (as of 9/30/09)

($ millions)

$525

500

400

300

200

100 $190(1) $46

0

Revolving Credit Facilities

Revolver Usage

Cash

$370 million revolving credit facility

– $360 million matures in July 2013

– $10 million matures in July 2012

$30 million revolving credit facility matures in June 2012

$125 million 364-day revolving credit facility matures in December 2009. Company will seek to replace the facility and increase the size to as much as $200 million and extend the term to 2 to 3 years

Margin deposits posted by PGE as of September 30, 2009 were $256 million (2)

– Margin deposits create a cash flow timing difference but have minimal impact on earnings

– Margin roll-off(3)

Approximately 35% in 2009

Approximately 47% in 2010

(1) Represents 100% letters of credit. On September 30, 2009, there were no draws on the revolver and no outstanding commercial paper.

(2) Consists of $86 million in cash and $170 million in letters of credit.

(3) Assumes market prices remain unchanged from September 30, 2009.

16

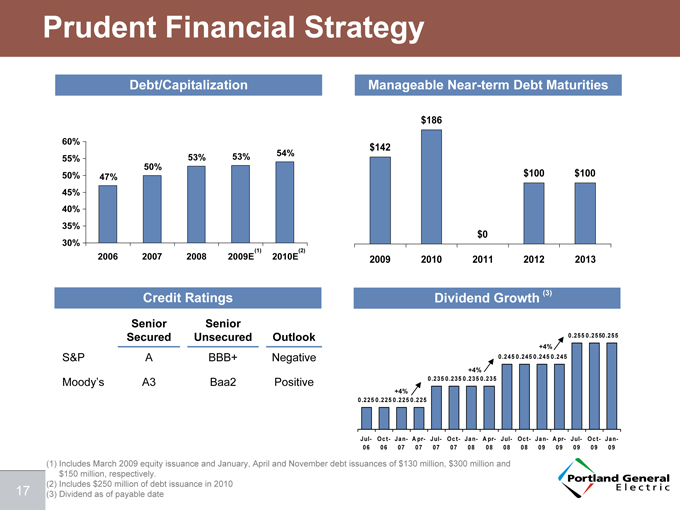

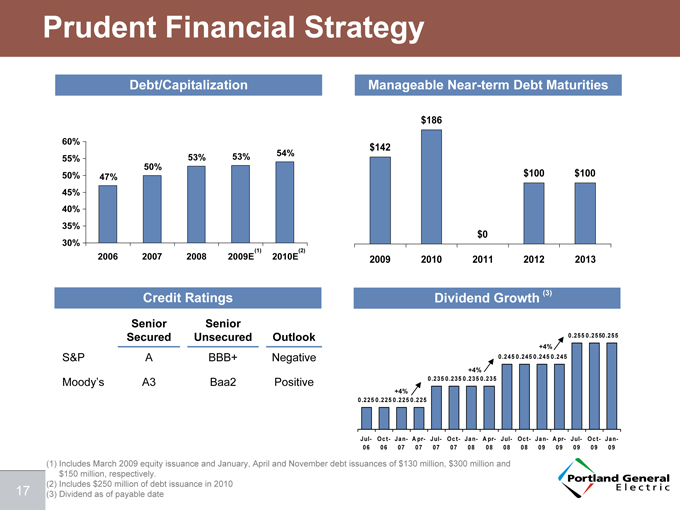

Prudent Financial Strategy

Debt/Capitalization

60%

55% 53% 53% 54%

50%

50% 47%

45%

40%

35%

30%

2006 2007 2008 2009E(1) 2010E(2)

Manageable Near-term Debt Maturities

$186

$142

$100 $100

$0

2009 2010 2011 2012 2013

Credit Ratings

Dividend Growth (3)

Senior Secured

Senior Unsecured

Outlook

S&P A BBB+ Negative

Moody’s A3 Baa2 Positive

0.255 0.2550.255

+4%

0.245 0.245 0.245 0.245

+4%

0.235 0.235 0.235 0.235

+4%

0.225 0.225 0.225 0.225

Jul- Oct- Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct- Jan-

06 06 07 07 07 07 08 08 08 08 09 09 09 09 09

(1) Includes March 2009 equity issuance and January, April and November debt issuances of $130 million, $300 million and $150 million, respectively.

(2) Includes $250 million of debt issuance in 2010 (3) Dividend as of payable date

17

Portland General Investment Highlights

“Pure-play” electric utility

Operational excellence

Low-risk growth plan

Stability:

Dividend Yield

Attractive total return proposition

Prudent financial strategy

Growth:

EPS Growth

18

Investor Relations Contact Information

William J. Valach Director, Investor Relations 503-464-7395 William. Valach@pgn. com

Shane Johnston Analyst, Investor Relations 503-464-8586 Shane. Johnston@pgn. com

Portland General Electric Company 121 S.W. Salmon Street Suite 1WTC0403 Portland, OR 97204

www.PortlandGeneral. com

19

Appendix

Table of Contents

• Recent Financial Results p.21

• Power Cost Adjustment Mechanism (PCAM) p.22

• Decoupling Mechanism p.23-24

• Senate Bill 408 p.25

• Regulatory, Legal and Other Considerations p.26

• 2009 IRP Energy Action Plan p.27

• 2009 IRP Capacity Action Plan p.28

• Renewable Energy Standard p.29

• Estimated RPS Position by year p.30

• Smart Grid p.31

• Boardman BART p.32

20

Recent Financial Results

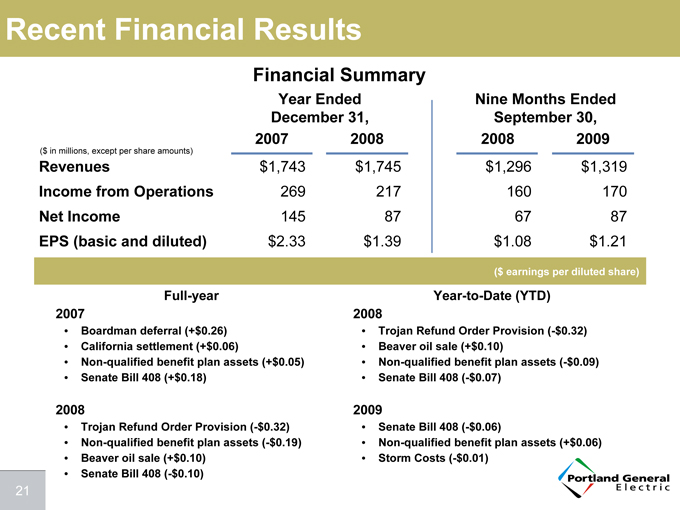

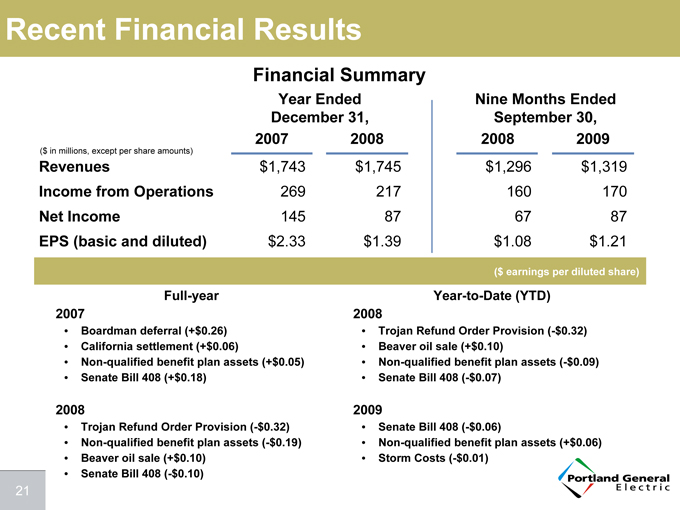

Financial Summary

Year Ended

December 31,

2007 2008

Nine Months Ended

September 30,

2008 2009

($ in millions, except per share amounts)

Revenues $1,743 $1,745 $1,296 $1,319

Income from Operations 269 217 160 170

Net Income 145 87 67 87

EPS (basic and diluted) $2.33 $1.39 $1.08 $1.21

($ earnings per diluted share)

Full-year

2007

Boardman deferral (+$0.26)

California settlement (+$0.06)

Non-qualified benefit plan assets (+$0.05)

Senate Bill 408 (+$0.18)

2008

Trojan Refund Order Provision (-$0.32)

Non-qualified benefit plan assets (-$0.19)

Beaver oil sale (+$0.10)

Senate Bill 408 (-$0.10)

Year-to-Date (YTD)

2008

Trojan Refund Order Provision (-$0.32)

Beaver oil sale (+$0.10)

Non-qualified benefit plan assets (-$0.09)

Senate Bill 408 (-$0.07)

2009

Senate Bill 408 (-$0.06)

Non-qualified benefit plan assets (+$0.06)

Storm Costs (-$0.01)

21

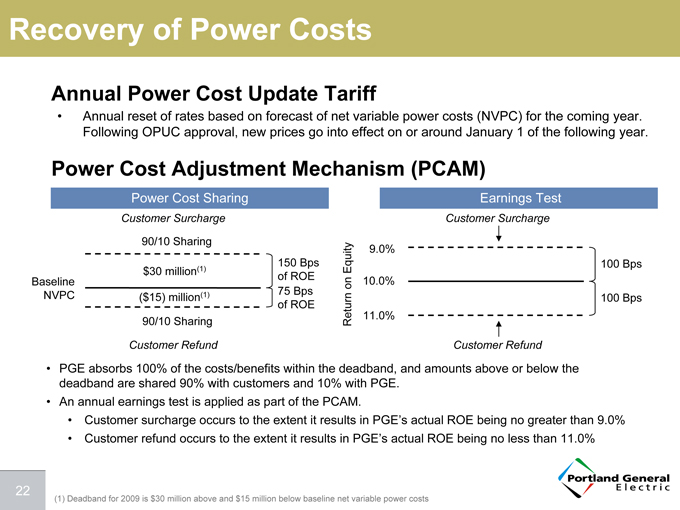

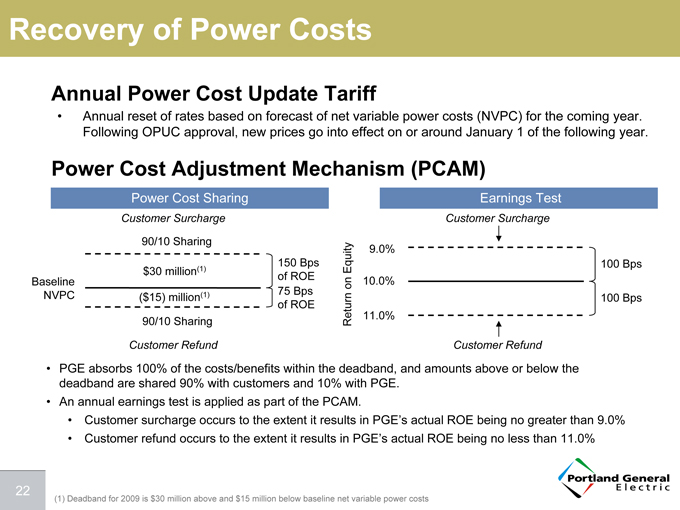

Recovery of Power Costs

Annual Power Cost Update Tariff

Annual reset of rates based on forecast of net variable power costs (NVPC) for the coming year. Following OPUC approval, new prices go into effect on or around January 1 of the following year.

(1) Deadband for 2009 is $30 million above and $15 million below baseline net variable power costs

Power Cost Adjustment Mechanism (PCAM)

Power Cost Sharing

Customer Surcharge

90/10 Sharing

$30 million(1)

($15) million(1)

90/10 Sharing

Baseline

NVPC

150 Bps of ROE

75 Bps of ROE

Customer Refund

Equity on Return

Earnings Test

Customer Surcharge

9.0%

100 Bps

10.0%

100 Bps

11.0%

Customer Refund

PGE absorbs 100% of the costs/benefits within the deadband, and amounts above or below the deadband are shared 90% with customers and 10% with PGE.

An annual earnings test is applied as part of the PCAM.

Customer surcharge occurs to the extent it results in PGE’s actual ROE being no greater than 9.0%

Customer refund occurs to the extent it results in PGE’s actual ROE being no less than 11.0%

22

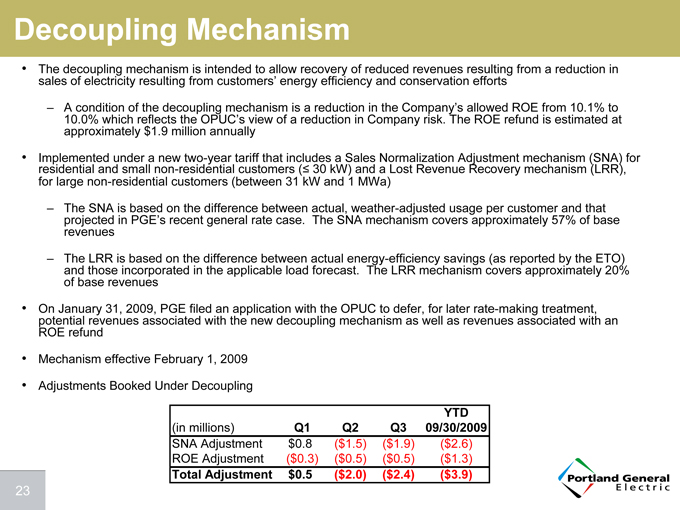

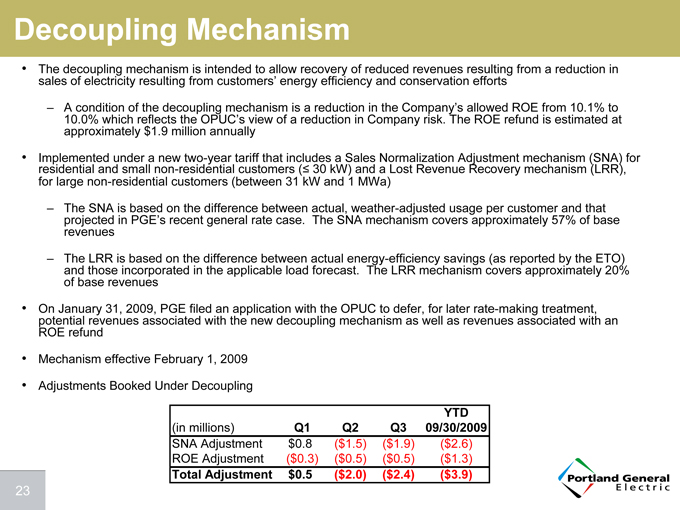

Decoupling Mechanism

The decoupling mechanism is intended to allow recovery of reduced revenues resulting from a reduction in sales of electricity resulting from customers’ energy efficiency and conservation efforts

A condition of the decoupling mechanism is a reduction in the Company’s allowed ROE from 10.1% to 10.0% which reflects the OPUC’s view of a reduction in Company risk. The ROE refund is estimated at approximately $1.9 million annually

Implemented under a new two-year tariff that includes a Sales Normalization Adjustment mechanism (SNA) for residential and small non-residential customers ( 30 kW) and a Lost Revenue Recovery mechanism (LRR), for large non-residential customers (between 31 kW and 1 MWa)

The SNA is based on the difference between actual, weather-adjusted usage per customer and that projected in PGE’s recent general rate case. The SNA mechanism covers approximately 57% of base revenues

The LRR is based on the difference between actual energy-efficiency savings (as reported by the ETO) and those incorporated in the applicable load forecast. The LRR mechanism covers approximately 20% of base revenues

On January 31, 2009, PGE filed an application with the OPUC to defer, for later rate-making treatment, potential revenues associated with the new decoupling mechanism as well as revenues associated with an ROE refund

Mechanism effective February 1, 2009

Adjustments Booked Under Decoupling

YTD

(in millions) Q1 Q2 Q3 09/30/2009

SNA Adjustment $0.8($1.5)($1.9)($2.6)

ROE Adjustment($0.3)($0.5)($0.5)($1.3)

Total Adjustment $0.5($2.0)($2.4)($3.9)

23

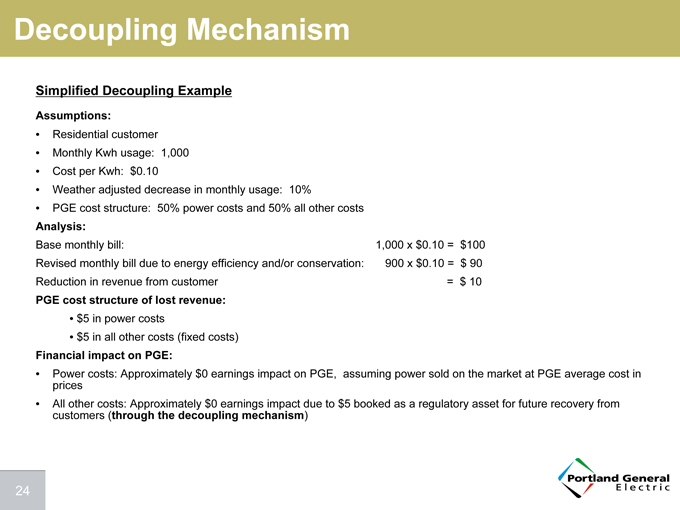

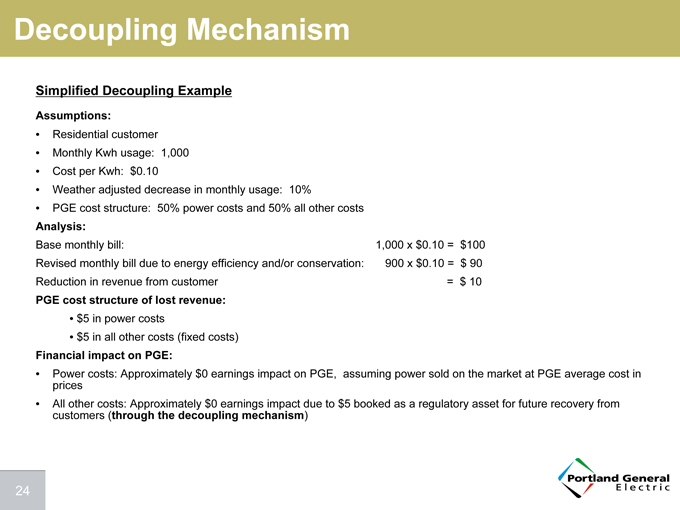

Decoupling Mechanism

Simplified Decoupling Example

Assumptions:

Residential customer Monthly Kwh usage: 1,000 Cost per Kwh: $0.10

Weather adjusted decrease in monthly usage: 10%

PGE cost structure: 50% power costs and 50% all other costs

Analysis:

Base monthly bill: 1,000 x $0.10 = $100

Revised monthly bill due to energy efficiency and/or conservation: 900 x $0.10 = $ 90 Reduction in revenue from customer = $ 10

PGE cost structure of lost revenue: $5 in power costs $5 in all other costs (fixed costs)

Financial impact on PGE:

Power costs: Approximately $0 earnings impact on PGE, assuming power sold on the market at PGE average cost in prices All other costs: Approximately $0 earnings impact due to $5 booked as a regulatory asset for future recovery from customers (through the decoupling mechanism)

24

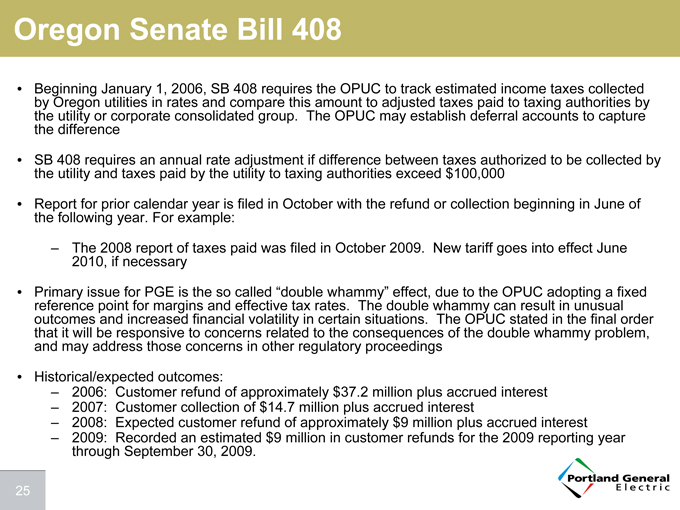

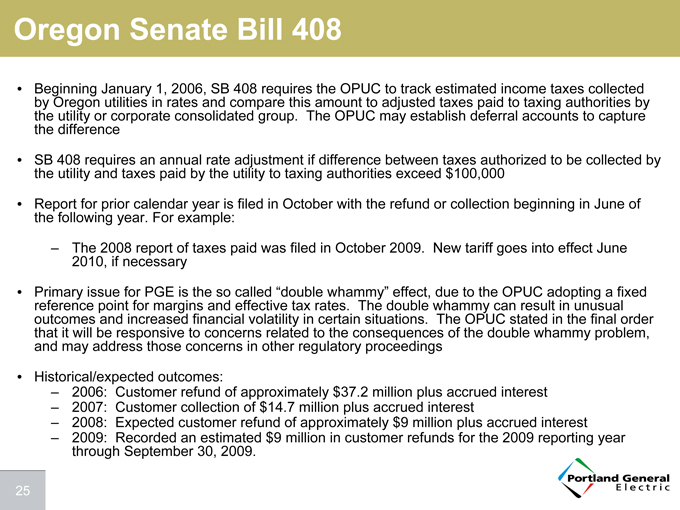

Oregon Senate Bill 408

Beginning January 1, 2006, SB 408 requires the OPUC to track estimated income taxes collected by Oregon utilities in rates and compare this amount to adjusted taxes paid to taxing authorities by the utility or corporate consolidated group. The OPUC may establish deferral accounts to capture the difference

SB 408 requires an annual rate adjustment if difference between taxes authorized to be collected by the utility and taxes paid by the utility to taxing authorities exceed $100,000

Report for prior calendar year is filed in October with the refund or collection beginning in June of the following year. For example:

The 2008 report of taxes paid was filed in October 2009. New tariff goes into effect June 2010, if necessary

Primary issue for PGE is the so called “double whammy” effect, due to the OPUC adopting a fixed reference point for margins and effective tax rates. The double whammy can result in unusual outcomes and increased financial volatility in certain situations. The OPUC stated in the final order that it will be responsive to concerns related to the consequences of the double whammy problem, and may address those concerns in other regulatory proceedings

Historical/expected outcomes:

2006: Customer refund of approximately $37.2 million plus accrued interest

2007: Customer collection of $14.7 million plus accrued interest

2008: Expected customer refund of approximately $9 million plus accrued interest

2009: Recorded an estimated $9 million in customer refunds for the 2009 reporting year through September 30, 2009.

25

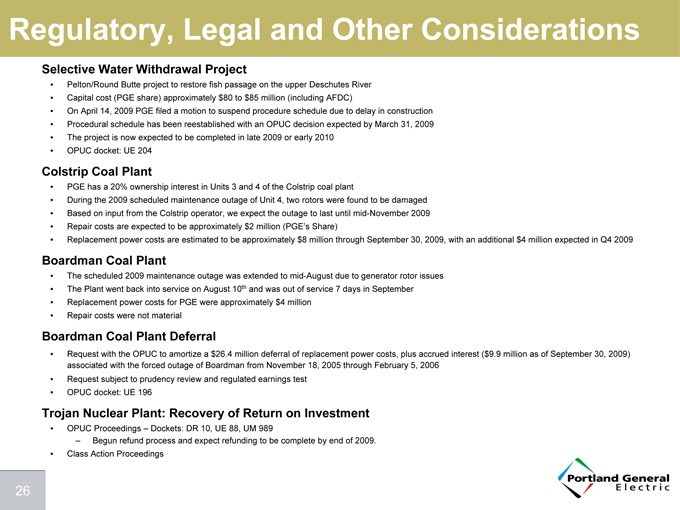

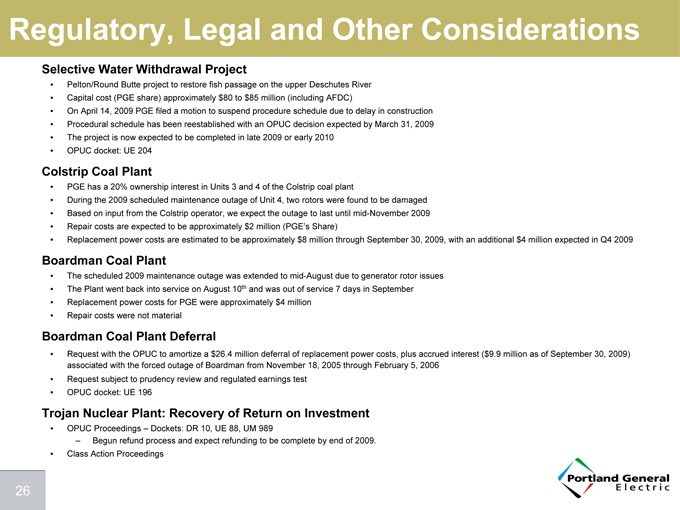

Regulatory, Legal and Other Considerations

Selective Water Withdrawal Project

Pelton/Round Butte project to restore fish passage on the upper Deschutes River

Capital cost (PGE share) approximately $80 to $85 million (including AFDC)

On April 14, 2009 PGE filed a motion to suspend procedure schedule due to delay in construction

Procedural schedule has been reestablished with an OPUC decision expected by March 31, 2009

The project is now expected to be completed in late 2009 or early 2010

OPUC docket: UE 204

Colstrip Coal Plant

PGE has a 20% ownership interest in Units 3 and 4 of the Colstrip coal plant

During the 2009 scheduled maintenance outage of Unit 4, two rotors were found to be damaged

Based on input from the Colstrip operator, we expect the outage to last until mid-November 2009

Repair costs are expected to be approximately $2 million (PGE’s Share)

Replacement power costs are estimated to be approximately $8 million through September 30, 2009, with an additional $4 million expected in Q4 2009

Boardman Coal Plant

The scheduled 2009 maintenance outage was extended to mid-August due to generator rotor issues

The Plant went back into service on August 10th and was out of service 7 days in September

Replacement power costs for PGE were approximately $4 million

Repair costs were not material

Boardman Coal Plant Deferral

Request with the OPUC to amortize a $26.4 million deferral of replacement power costs, plus accrued interest ($9.9 million as of September 30, 2009) associated with the forced outage of Boardman from November 18, 2005 through February 5, 2006

Request subject to prudency review and regulated earnings test

OPUC docket: UE 196

Trojan Nuclear Plant: Recovery of Return on Investment

OPUC Proceedings – Dockets: DR 10, UE 88, UM 989

– Begun refund process and expect refunding to be complete by end of 2009.

Class Action Proceedings

26

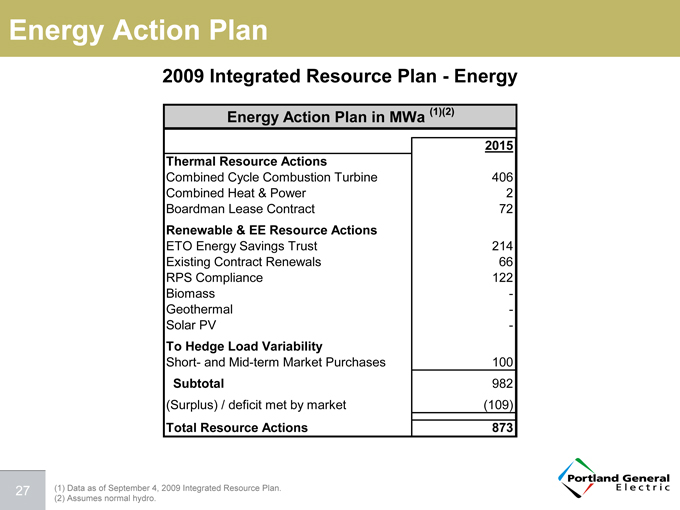

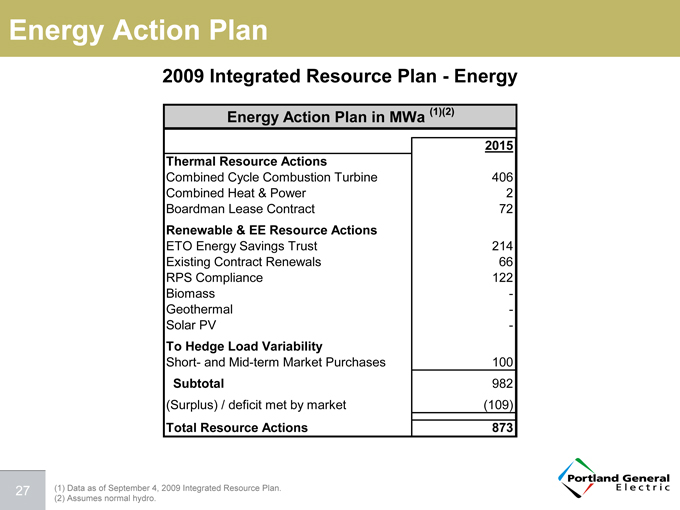

Energy Action Plan

2009 Integrated Resource Plan - Energy

Energy Action Plan in MWa (1)(2)

2015

Thermal Resource Actions

Combined Cycle Combustion Turbine 406

Combined Heat & Power 2

Boardman Lease Contract 72

Renewable & EE Resource Actions

ETO Energy Savings Trust 214

Existing Contract Renewals 66

RPS Compliance 122

Biomass -

Geothermal -

Solar PV -

To Hedge Load Variability

Short- and Mid-term Market Purchases 100

Subtotal 982

(Surplus) / deficit met by market (109)

Total Resource Actions 873

(1) Data as of September 4, 2009 Integrated Resource Plan.

(2) Assumes normal hydro.

27

Capacity Action Plan

2009 Integrated Resource Plan - Capacity

Capacity Action Plan in MW (1)(2)(3)

2015

Thermal Resource Actions

Combined Cycle Combustion Turbine 441

Combined Heat & Power 2

Boardman Lease Contract 86

Renewable Resource Actions

Existing Contract Renewals 167

RPS Compliance 18

Biomass -

Geothermal -

Solar PV -

To Hedge Load Variability

Short- and Mid-term Market Purchases 100

Capacity Only Resources

Flexible Peaking Supply 200

Customer-Based Solutions (Capacity Only)

Dispatchable Standby Generation 52

Demand Response 60

Seasonally Targeted Resources

ETO Capacity Savings Target 315

Bi-seasonal Capacity 123

Winter-only Capacity 160

Total Incremental Resources 1724

(1) Data as of September 4, 2009 Integrated Resource Plan. (2) Assumes normal hydro.

(3) Based on winter peak. Summer peak is 1460 MW for 2015.

28

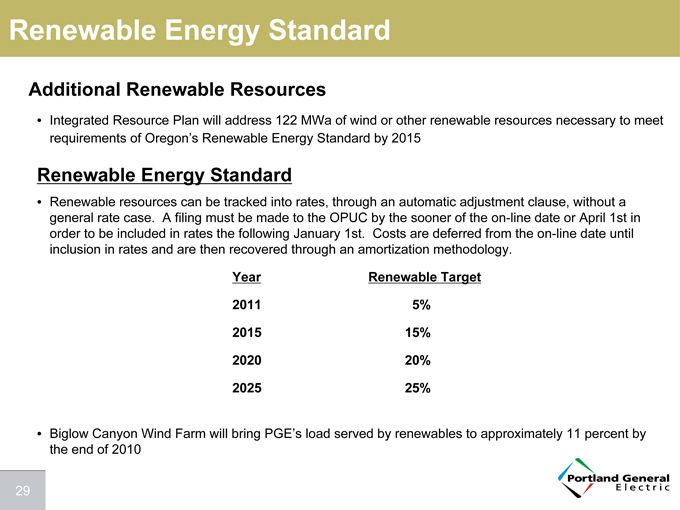

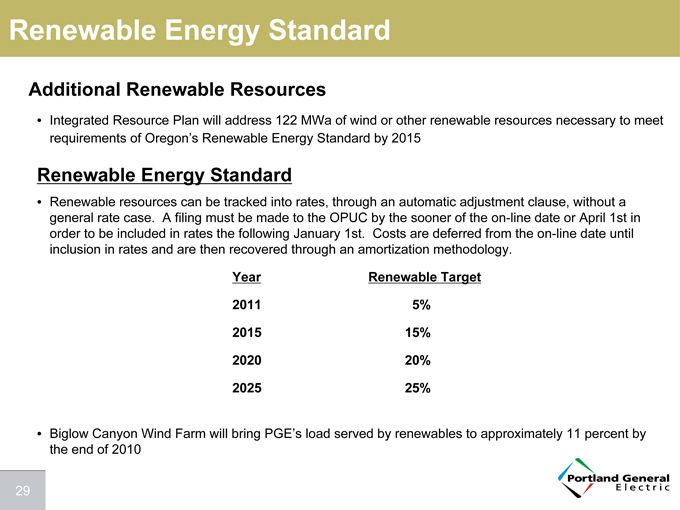

Renewable Energy Standard

Additional Renewable Resources

Integrated Resource Plan will address 122 MWa of wind or other renewable resources necessary to meet requirements of Oregon’s Renewable Energy Standard by 2015

Renewable Energy Standard

Renewable resources can be tracked into rates, through an automatic adjustment clause, without a general rate case. A filing must be made to the OPUC by the sooner of the on-line date or April 1st in order to be included in rates the following January 1st. Costs are deferred from the on-line date until inclusion in rates and are then recovered through an amortization methodology.

Year Renewable Target

2011 5%

2015 15%

2020 20%

2025 25%

Biglow Canyon Wind Farm will bring PGE’s load served by renewables to approximately 11 percent by the end of 2010

29

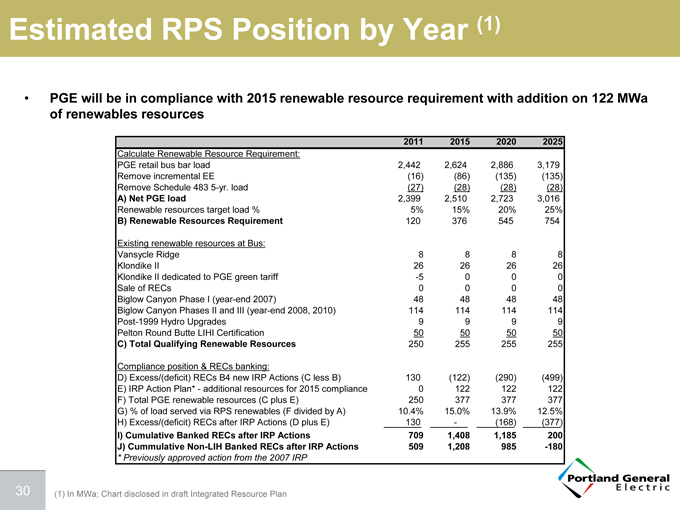

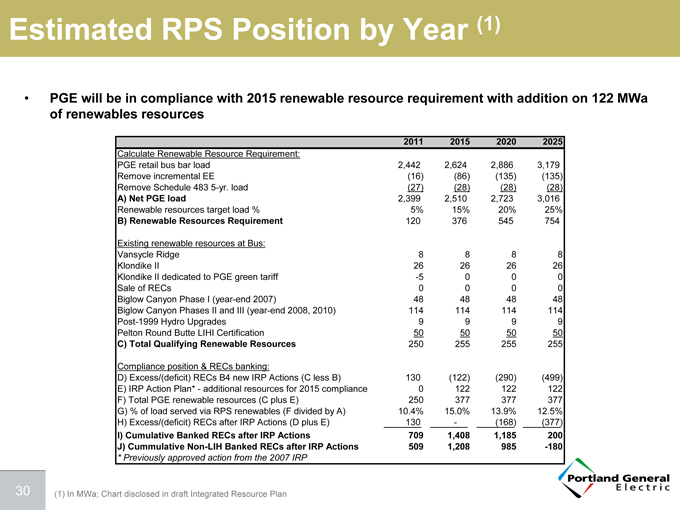

Estimated RPS Position by Year (1)

PGE will be in compliance with 2015 renewable resource requirement with addition on 122 MWa of renewables resources

2011 2015 2020 2025

Calculate Renewable Resource Requirement:

PGE retail bus bar load 2,442 2,624 2,886 3,179

Remove incremental EE(16)(86)(135)(135)

Remove Schedule 483 5-yr. load(27)(28)(28)(28)

A) Net PGE load 2,399 2,510 2,723 3,016

Renewable resources target load % 5% 15% 20% 25%

B) Renewable Resources Requirement 120 376 545 754

Existing renewable resources at Bus:

Vansycle Ridge 8 8 8 8

Klondike II 26 26 26 26

Klondike II dedicated to PGE green tariff -5 0 0 0

Sale of RECs 0 0 0 0

Biglow Canyon Phase I (year-end 2007) 48 48 48 48

Biglow Canyon Phases II and III (year-end 2008, 2010) 114 114 114 114

Post-1999 Hydro Upgrades 9 9 9 9

Pelton Round Butte LIHI Certification 50 50 50 50

C) Total Qualifying Renewable Resources 250 255 255 255

Compliance position & RECs banking:

D) Excess/(deficit) RECs B4 new IRP Actions (C less B) 130(122)(290)(499)

E) IRP Action Plan* - additional resources for 2015 compliance 0 122 122 122

F) Total PGE renewable resources (C plus E) 250 377 377 377

G) % of load served via RPS renewables (F divided by A) 10.4% 15.0% 13.9% 12.5%

H) Excess/(deficit) RECs after IRP Actions (D plus E) 130 -(168)(377)

I) Cumulative Banked RECs after IRP Actions 709 1,408 1,185 200

J) Cummulative Non-LIH Banked RECs after IRP Actions 509 1,208 985 -180

* Previously approved action from the 2007 IRP

(1) In MWa; Chart disclosed in draft Integrated Resource Plan

30

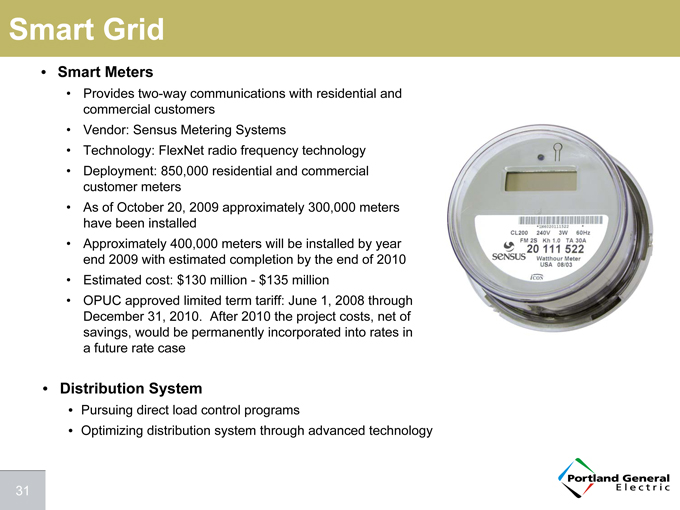

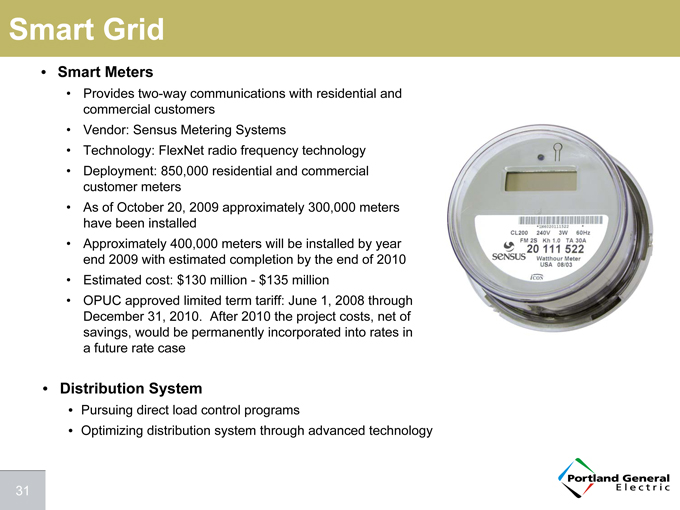

Smart Grid

Smart Meters

Provides two-way communications with residential and commercial customers

Vendor: Sensus Metering Systems

Technology: FlexNet radio frequency technology

Deployment: 850,000 residential and commercial customer meters

As of October 20, 2009 approximately 300,000 meters have been installed

Approximately 400,000 meters will be installed by year end 2009 with estimated completion by the end of 2010

Estimated cost: $130 million - $135 million

OPUC approved limited term tariff: June 1, 2008 through December 31, 2010. After 2010 the project costs, net of savings, would be permanently incorporated into rates in a future rate case

Distribution System

Pursuing direct load control programs

Optimizing distribution system through advanced technology

31

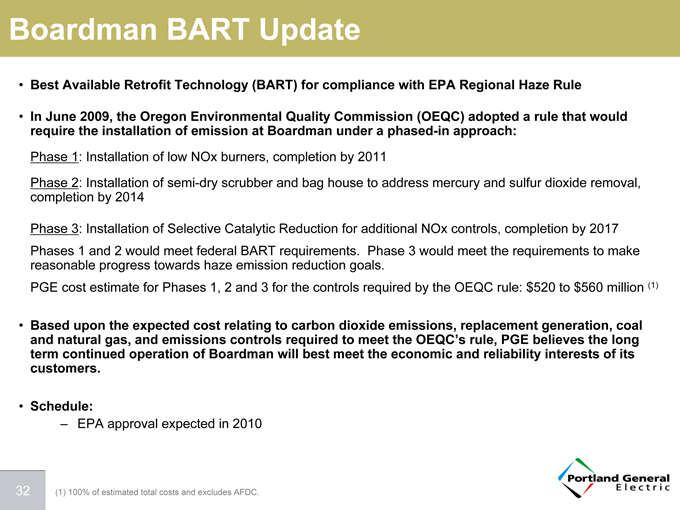

Boardman BART Update

Best Available Retrofit Technology (BART) for compliance with EPA Regional Haze Rule

In June 2009, the Oregon Environmental Quality Commission (OEQC) adopted a rule that would require the installation of emission at Boardman under a phased-in approach:

Phase 1: Installation of low NOx burners, completion by 2011

Phase 2: Installation of semi-dry scrubber and bag house to address mercury and sulfur dioxide removal, completion by 2014

Phase 3: Installation of Selective Catalytic Reduction for additional NOx controls, completion by 2017

Phases 1 and 2 would meet federal BART requirements. Phase 3 would meet the requirements to make reasonable progress towards haze emission reduction goals.

PGE cost estimate for Phases 1, 2 and 3 for the controls required by the OEQC rule: $520 to $560 million (1)

Based upon the expected cost relating to carbon dioxide emissions, replacement generation, coal and natural gas, and emissions controls required to meet the OEQC’s rule, PGE believes the long term continued operation of Boardman will best meet the economic and reliability interests of its customers.

Schedule:

– EPA approval expected in 2010

(1) | | 100% of estimated total costs and excludes AFDC. |

32

Portland General Electric

33