Second Quarter 2010

Earnings Call

Supplemental Slides

Supplemental Slides

Exhibit 99-2

Exhibit 99-2

Page 2

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events and financial performance.

These estimates, projections and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between

such estimates and actual results, and those differences may be material.

looking information that reflect our current views with respect to future events and financial performance.

These estimates, projections and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between

such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for

the year ended December 31, 2009, our Form 10-Q for the quarters ended March 31, 2010, and June 30,

2010, when filed, and in other documents we previously filed with the SEC, many of which are beyond our

control, that may cause actual results to differ materially from the views, beliefs and estimates expressed

herein.

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for

the year ended December 31, 2009, our Form 10-Q for the quarters ended March 31, 2010, and June 30,

2010, when filed, and in other documents we previously filed with the SEC, many of which are beyond our

control, that may cause actual results to differ materially from the views, beliefs and estimates expressed

herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated August 2, 2010, to which the following supplemental slides are attached as

Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial

measures and should be read in conjunction with these supplemental slides.

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated August 2, 2010, to which the following supplemental slides are attached as

Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial

measures and should be read in conjunction with these supplemental slides.

Forward-Looking Statements

Exhibit 99-2

Page 3

Table of Contents

Exhibit 99-2

Page 4

Q2 2010 Highlights

ü Discharge growth of 2.2%

– Same-store discharge growth = 1.3%

– Sequential discharge growth = 3.6%

ü Revenue growth of 3.2%

– Driven by pricing and volume growth

ü Adjusted Consolidated EBITDA growth of 10.3%

– Continued emphasis on quality outcomes

– Continued disciplined expense management and labor productivity gains

ü Adjusted EPS growth of 12.8%

ü Leverage ratio reduced to 4.1x (1) from 4.3x at year-end

– Net debt leverage ratio is 3.7x (1) (2)

ü Disciplined growth:

– Purchased Desert Canyon Rehabilitation Hospital, a 50-bed inpatient rehabilitation hospital located

in southwest Las Vegas, NV, on June 1, 2010.

in southwest Las Vegas, NV, on June 1, 2010.

– Began accepting patients at HealthSouth Rehabilitation Hospital of Northern Virginia, a 40-bed

inpatient rehabilitation hospital located in Aldie, VA, on June 14, 2010.

inpatient rehabilitation hospital located in Aldie, VA, on June 14, 2010.

(1) Based on trailing, four-quarter Adjusted Consolidated EBITDA of $400.7 million; reconciliation to GAAP provided on slides 28 through 29.

(2) Net debt leverage ratio = total debt minus cash and cash equivalents of $172.6 million divided by Adjusted Consolidated EBITDA.

Exhibit 99-2

Page 5

FIM Gain

LOS Efficiency

LOS Efficiency = Functional gain

divided by length of stay

divided by length of stay

Source: UDSmr Database - On Demand

Report: Q2 2010 Report

Report: Q2 2010 Report

FIM Gain = Change in Functional

Independent Measurement (based

Independent Measurement (based

on an 18 point assessment) from

Admission to Discharge

Admission to Discharge

** Average = Expected, Risk-adjusted LOS Efficiency

High-Quality Care

* Average = Expected, Risk-adjusted FIM Change Average

Exhibit 99-2

Page 6

Revenues (Q2 2010 vs. Q2 2009)

• Inpatient revenue growth was driven by:

– 2.25% Medicare price increase

– Discharge growth of 2.2% quarter over quarter

• Outpatient revenue declined primarily as a result of six fewer outpatient rehabilitation

satellite clinics quarter over quarter.

satellite clinics quarter over quarter.

Exhibit 99-2

Page 7

Expenses (Q2 2010 vs. Q2 2009)

• Disciplined expense management

• Solid labor productivity as reflected in lower EPOB

Exhibit 99-2

Page 8

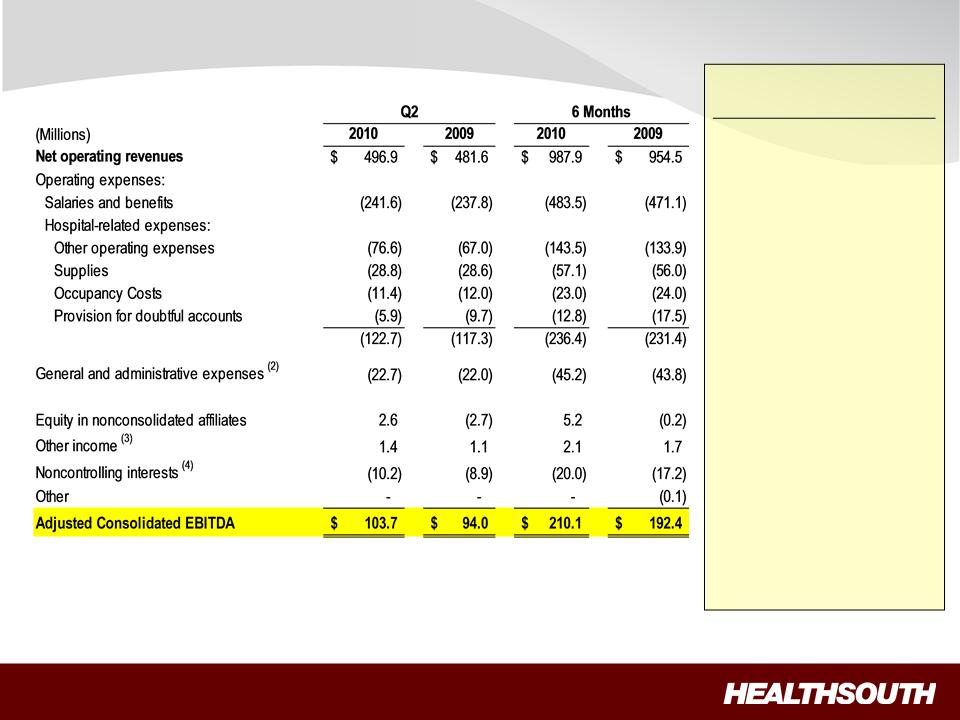

Adjusted Consolidated EBITDA (1)

(1) Reconciliation to GAAP provided on slides 28 through 29.

In arriving at Adjusted Consolidated EBITDA, the following were excluded from line items:

(2) Stock-based compensation expense of $4.0, $2.9, $7.8 and $6.6 million, respectively, reduced general and administrative expenses.

(3) Impairments related to investments of $0.0, $0.1, $0.0 and $0.9 million, respectively, increased other income.

(4) Noncontrolling interests related to discontinued operations of $0.0, $0.2, $0.0 and $0.5 million, respectively, reduced noncontrolling interests.

Adjusted Consolidated

EBITDA Change

EBITDA Change

Q2 6 Months

+$9.7M +$17.7M

+10.3% +9.2%

Improvements driven

by:

by:

•pricing;

•volume; and

•disciplined expense

management.

management.

Improvements benefited

from:

from:

•lower bad debt expense

• $4.9 million charge to

equity in net income of

nonconsolidated affiliates

in Q2 2009

equity in net income of

nonconsolidated affiliates

in Q2 2009

Offset by:

•$4.6 million increase in

professional liability

reserves

professional liability

reserves

Exhibit 99-2

Page 9

Adjusted Income per Diluted Share (1)

(1) Reconciliation to GAAP provided on slides 28 through 29.

Adjusted EPS Change

Q2 6 Months

+$0.05 +$0.13

+12.8% +16.5%

Improvements driven by:

• Higher Adjusted Consolidated

EBITDA

EBITDA

• Lower interest expense

Offset by:

•5 million shares issued on

September 30, 2009, related to

the 2006 securities litigation

settlement

September 30, 2009, related to

the 2006 securities litigation

settlement

•Higher provision for income tax

Exhibit 99-2

Page 10

(1) Notes on page 29.

Net Cash Provided by Operating Activities

Exhibit 99-2

Page 11

Adjusted Free Cash Flow

Exhibit 99-2

Page 12

Debt to

EBITDA 6.3x 6.3x 5.3x 4.3x 4.1x (1)

($ Billions)

Year-End 2010 Goal: 3.75x to 4.00x

Liquidity

Debt Outstanding, Liquidity and Swaps

(1) Based on trailing, four-quarter Adjusted Consolidated EBITDA of $400.7 million; reconciliation to GAAP provided on slides 28 and 29.

(2) Cash settlements flow through investing activities for swaps that do not qualify for hedge accounting. Notional amount of $884 million receives

3-month LIBOR and pays 5.22% fixed until expiration in March of 2011.

3-month LIBOR and pays 5.22% fixed until expiration in March of 2011.

(3) Forward-starting interest rate swaps (designated as cash flow hedges). Cash settlements will flow through operating activities as part of interest

expense. Notional amounts of $100 million and $100 million receive LIBOR and pay 2.6% and 2.9% fixed, respectively.

expense. Notional amounts of $100 million and $100 million receive LIBOR and pay 2.6% and 2.9% fixed, respectively.

Exhibit 99-2

Page 13

2010 Guidance - Revised

(1) Reconciliation to GAAP provided on slides 28 and 29.

(2) Adjusted income from continuing operations per diluted share.

Considerations:

ü IT “pilot” investment

ü Integration of acquisitions

ü Start-up costs at two new hospitals

ü TeamWorks investment

ü 2nd half 2010 bad debt = 1.5% to 1.8%

Considerations:

ü $3 million of additional stock-based

compensation expense

compensation expense

ü 5 million more diluted shares

(2006 Securities Litigation Settlement)

(2006 Securities Litigation Settlement)

Exhibit 99-2

Page 14

Business Outlook

Business Model:

• 5 - 8 % annual Adjusted Consolidated EBITDA growth (1)

• 15 - 20% annual Adjusted EPS growth (1) (2)

Strategy

(1) Reconciliation to GAAP provided on slides 28 and 29.

(2) Adjusted income from continuing operations per diluted share.

(3) Exclusive of any E&Y recovery.

Exhibit 99-2

Page 15

Appendix

Exhibit 99-2

Page 16

Future Regulatory Risk | IRF | SNF | LTCH | HH | |

1. Re-basing payment system | No | Yes; RUGS IV and MDS 3.0 being implemented FY 2011/2012 | No | Yes; would be required as part of PPACA starting in 2014 | |

2. Major outlier payment adjustments | No | No | Yes; will occur when MMSEA relief expires (short stay outliers) | Yes; 10% cap per agency; 2.5% taken out of outlier pool (per PPACA) | |

3. Upcoding adjustments | No | Yes; occurring in FY 2010 | Yes; occurring in FY 2010 and proposed (-2.5%) for FY 2011 | Yes; occurring in CYs 2010 (-2.75%), and proposed (-3.79%) for 2011 and 2012 | |

4. Patient criteria | No; 60% Rule already in place | No | Study dictated as part of MMSEA | PPACA requires a patient - physician “face-to-face” encounter; new therapy coverage proposed | |

5. Healthcare Reform | |||||

– Market basket update reductions | – Known | – Known | – Known | – Known | |

– Productivity adjustments | – Begins 2012 | – Begins 2012 | – Begins 2012 | – Begins 2015 | |

– Bundling | – Pilot to be established by 2013 | – Pilot to be established by 2013 | – Pilot to be established by 2013 | – Pilot to be established by 2013 | |

– Independent Payment Advisory Board | – FY 2019 | – FY 2015 | – FY 2019 | – CY 2015 | |

– New quality reporting requirements | – Begins 2014 | – N/A | – Begins 2014 | – N/A | |

– Value based purchasing | – Pilot begins 2016 | – Post 2012 | – Pilot begins 2016 | – Post 2012 | |

6. Other | N/A | Forecast error being implemented in FY 2011 | 25% Rule regulatory relief expires in 2012/2013; prohibition on new LTCHs through 2012 | Limits on transfer of ownership |

Regulatory Uncertainty

Sources: Healthcare Reform Bill (PPACA, HERA),CMS Regulatory published rules and MMSEA

Exhibit 99-2

Page 17

Cost-Effective Care

CMS Fiscal Year 2010 IRF Rate Setting File Analysis (1)

Freestanding (2) | Units (2) | Total | HealthSouth | ||

Hospitals (2) | |||||

Number of IRFs | 228 | 953 | 1,181 | 94 | |

Average # of Discharges per IRF | 649 | 237 | 316 | 822 | |

Outlier Payments as % of Total Payments | 1.32% | 4.08% | 3.00% | 0.43% | |

Average Estimated Total Payment per Discharge for FY 2010 | $16,452 | $16,741 | $16,626 | $15,996 | |

Average Estimated Cost per Discharge for FY 2010 | $14,021 | $17,207 | $15,945 | $12,633 |

Notes:

(1) All data provided was filtered and compiled from the Centers for Medicare and Medicaid Services (CMS) Fiscal Year 2010 IRF rate

setting final rule file found at http://www.cms.hhs.gov/InpatientRehabFacPPS/07_DataFiles.asp#TopOfPage. The data presented was developed

entirely by CMS and is based on its definitions which are different in form and substance from the criteria HealthSouth uses for external reporting

purposes. Because CMS does not provide its detailed methodology, HealthSouth is not able to reconstruct the CMS projections or the calculation.

setting final rule file found at http://www.cms.hhs.gov/InpatientRehabFacPPS/07_DataFiles.asp#TopOfPage. The data presented was developed

entirely by CMS and is based on its definitions which are different in form and substance from the criteria HealthSouth uses for external reporting

purposes. Because CMS does not provide its detailed methodology, HealthSouth is not able to reconstruct the CMS projections or the calculation.

(2) The CMS file contains data for each of the 1,181 inpatient rehabilitation facilities used to estimate the policy updates for the FY 2010 Final IRF-

PPS Rule. Most of the data represents historical information from the CMS fiscal year 2008 period and does not reflect the same HealthSouth

hospitals in operation today. The data presented was separated into three categories: Freestanding, Units, and HealthSouth. HealthSouth is a

subset of Freestanding and the Total.

PPS Rule. Most of the data represents historical information from the CMS fiscal year 2008 period and does not reflect the same HealthSouth

hospitals in operation today. The data presented was separated into three categories: Freestanding, Units, and HealthSouth. HealthSouth is a

subset of Freestanding and the Total.

Exhibit 99-2

Page 18

Readmission Rates

Note: Use of home health care and hospice is based on care that starts within three days of discharge. Other PAC care starts within one day

of 0discharge. Home health use includes episodes that overlap an inpatient stay.

of 0discharge. Home health use includes episodes that overlap an inpatient stay.

Source: Medicare Payment Advisory Commission, “A Data Book: Healthcare spending and the Medicare program,” Chart 9-3 (June 2008)

Exhibit 99-2

Page 19

Organic Growth

•Capacity Expansions:

Ø ~ 100+ beds in 2010

• De novos:

Acquisitions/Joint Ventures

Portfolio Growth

6 - 7 years (2)

2 - 4 years (1)

(1) Assumes average investment per bed: $100K to $250K.

(2) Assumes average investment per bed: ~ $450K.

6 - 7 years

Target Cash pay-back

Exhibit 99-2

Page 20

(1) Data provided by UDSMR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry, including 89 HealthSouth sites.

(2) Includes 89 consolidated HealthSouth inpatient rehab hospitals and six long-term acute-care hospitals.

Discharge Growth - Trend

ü HealthSouth’s volume

growth has outpaced

competitors’

growth has outpaced

competitors’

ü TeamWorks =

standardized sales &

marketing

standardized sales &

marketing

ü Capacity expansions will

help facilitate organic

growth:

help facilitate organic

growth:

• ~ 100+ beds will be added

in 2010

in 2010

(1)

(2)

Exhibit 99-2

Page 21

Exhibit 99-2

Page 22

Exhibit 99-2

Page 23

Payment Sources

(1) Managed Medicare revenues represent ~ 8%, 9%, 8%, 8% and 8% of total revenues for Q2 2010, Q2 2009, 6 months 2010, 6 months 2009 and

2009, respectively, and are included in “Managed care and other discount plans.”

2009, respectively, and are included in “Managed care and other discount plans.”

Exhibit 99-2

Page 24

Operational and Labor Metrics (1)

(2) Represents discharges from HealthSouth’s 92 consolidated hospitals and 6 LTCHs in Q2 2010 and 90 consolidated hospitals and 6 LTCHs prior

to Q2 2010.

to Q2 2010.

(3) Excludes approximately 400 full-time equivalents, who are considered part of corporate overhead with their salaries and benefits included in

general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the above table

represent HealthSouth employees who participate in or support the operations of the Company’s hospitals.

general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the above table

represent HealthSouth employees who participate in or support the operations of the Company’s hospitals.

(4) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time

equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined

by multiplying the number of licensed beds by the Company’s occupancy percentage.

equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined

by multiplying the number of licensed beds by the Company’s occupancy percentage.

Exhibit 99-2

Page 25

= Term Loan maturities

= 10.75% Fixed

= 8.125% Fixed

= Capital leases & term

loan amortization

loan amortization

3 month

LIBOR

plus

225 bps

3 month

LIBOR

plus

375 bps

Call Schedule

Date Price

June 15, 2011 105.375

June 15, 2012 103.583

June 15, 2013 101.792

June 15, 2014 100.000

and thereafter

$400.0

Exhibit 99-2

Page 26

Non-Operating Cash/Tax Position

Cash Refunds as of June 30, 2010

• Federal tax recoveries virtually complete.

• State tax refunds in progress.

– Approx. $3.1 million received in Q2

2010.

2010.

– Approx. $5.7 million net receivable on

the balance sheet.

Future Cash Tax Payments

• Expect to pay about $5-7 million per year of income

tax.

tax.

– State income tax.

– Alternative Minimum Tax (AMT).

• The Company does not expect to pay significant

federal income taxes for the next 10-12 years due to

approximately $905 million in deferred tax assets as

of 12/31/09 outlined in the 2009 Form 10-K. The

majority of the deferred tax assets is related to

NOLs.

federal income taxes for the next 10-12 years due to

approximately $905 million in deferred tax assets as

of 12/31/09 outlined in the 2009 Form 10-K. The

majority of the deferred tax assets is related to

NOLs.

– At this time, we do not believe the use

of NOLs will be limited before they

expire, however, no assurances can

be provided.

• HealthSouth is not currently subject to an annual

use limitation (AUL) under Internal Revenue Code

section 382.

use limitation (AUL) under Internal Revenue Code

section 382.

• If we experienced a “change of ownership” as

defined by Internal Revenue Code section 382, we

would be subject to an AUL, which is equal to the

value of the company at the time of the “change of

ownership” multiplied by the long-term tax exempt

rate.

defined by Internal Revenue Code section 382, we

would be subject to an AUL, which is equal to the

value of the company at the time of the “change of

ownership” multiplied by the long-term tax exempt

rate.

GAAP Considerations

• HealthSouth’s balance sheet currently

reflects a valuation allowance for the

potential value of NOLs and future

deductions. The valuation allowance is

approximately $888 million.

reflects a valuation allowance for the

potential value of NOLs and future

deductions. The valuation allowance is

approximately $888 million.

• GAAP tax rate will net to small amount as

there will be a reduction in the valuation

allowance when NOLs are utilized.

there will be a reduction in the valuation

allowance when NOLs are utilized.

Exhibit 99-2

Page 27

Outstanding Share Summary

(Millions)

(Millions)

Notes:

(1) Does not include 2.0 million warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In connection with this

transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term of ten years from the

date of issuance and an exercise price of $32.50 per share. The warrants were not assumed exercised for dilutive shares outstanding because

they were antidilutive in the periods presented.

transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term of ten years from the

date of issuance and an exercise price of $32.50 per share. The warrants were not assumed exercised for dilutive shares outstanding because

they were antidilutive in the periods presented.

(2) The agreement to settle our class action securities litigation received final court approval in January 2007. These shares of common stock and

warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares. The warrants at a

strike price of $41.40 were not assumed exercised for the dilutive shares outstanding because they are anti-dilutive in the periods presented.

warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares. The warrants at a

strike price of $41.40 were not assumed exercised for the dilutive shares outstanding because they are anti-dilutive in the periods presented.

(3) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock.

Exhibit 99-2

Page 28

Exhibit 99-2

Page 29

Reconciliation Notes

1. Adjusted income from continuing operations and Adjusted Consolidated EBITDA are

non-GAAP financial measures. The Company’s leverage ratio (total consolidated debt to

Adjusted Consolidated EBITDA for the trailing four quarters) is, likewise, a non-GAAP

financial measure. Management and some members of the investment community

utilize adjusted income from continuing operations as a financial measure and Adjusted

Consolidated EBITDA and the leverage ratio as liquidity measures on an ongoing basis.

These measures are not recognized in accordance with GAAP and should not be

viewed as an alternative to GAAP measures of performance or liquidity. In evaluating

these adjusted measures, the reader should be aware that in the future HealthSouth

may incur expenses similar to the adjustments set forth above.

non-GAAP financial measures. The Company’s leverage ratio (total consolidated debt to

Adjusted Consolidated EBITDA for the trailing four quarters) is, likewise, a non-GAAP

financial measure. Management and some members of the investment community

utilize adjusted income from continuing operations as a financial measure and Adjusted

Consolidated EBITDA and the leverage ratio as liquidity measures on an ongoing basis.

These measures are not recognized in accordance with GAAP and should not be

viewed as an alternative to GAAP measures of performance or liquidity. In evaluating

these adjusted measures, the reader should be aware that in the future HealthSouth

may incur expenses similar to the adjustments set forth above.

2. Per share amounts for each period presented are based on basic weighted average

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares outstanding

is primarily related to our convertible perpetual preferred stock.

common shares outstanding for all amounts except adjusted income from continuing

operations per diluted share, which is based on diluted weighted average shares

outstanding. The difference in shares between the basic and diluted shares outstanding

is primarily related to our convertible perpetual preferred stock.

3. Adjusted income from continuing operations per diluted share and Adjusted

Consolidated EBITDA are two components of our guidance.

Consolidated EBITDA are two components of our guidance.

4. The Company’s credit agreement allows certain other items to be added to arrive at

Adjusted Consolidated EBITDA, and there may be certain other deductions required.

Adjusted Consolidated EBITDA, and there may be certain other deductions required.