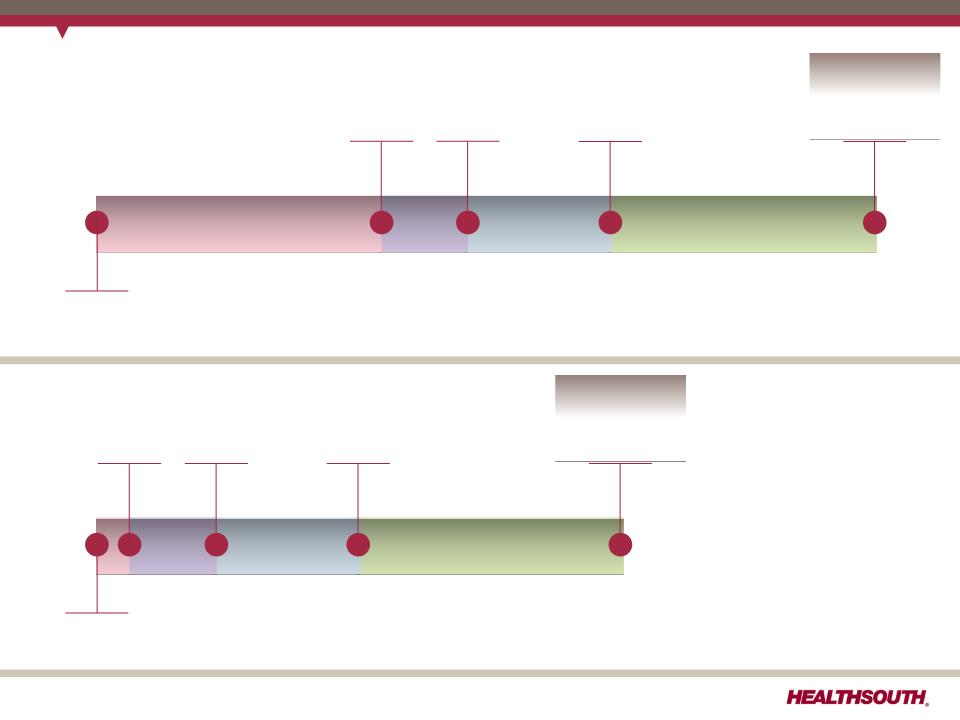

2011 Guidance - EPS (as of May 16, 2011)

Diluted Earnings per Share from

Continuing Operations Attributable

to HealthSouth (2)

$1.28 to $1.33 (5)

Considerations:

ü Includes $0.27 per diluted share benefit for Q1

2011 and assumes provision for income tax of

40% for the remainder of 2011; cash taxes

expected to be $7-$10 million.

üGuidance does not include the EPS effect that will

result from calling $335 million of the 10.75% senior

notes in June 2011.

• Interest expense is expected to be approx.

$70 million in first half of 2011and approx. $57

million in the second half of 2011.

• Loss on early extinguishment of debt is expected

to be approx. $26 million.

üDepreciation is estimated to be higher as a result

of capital expenditures in prior periods.

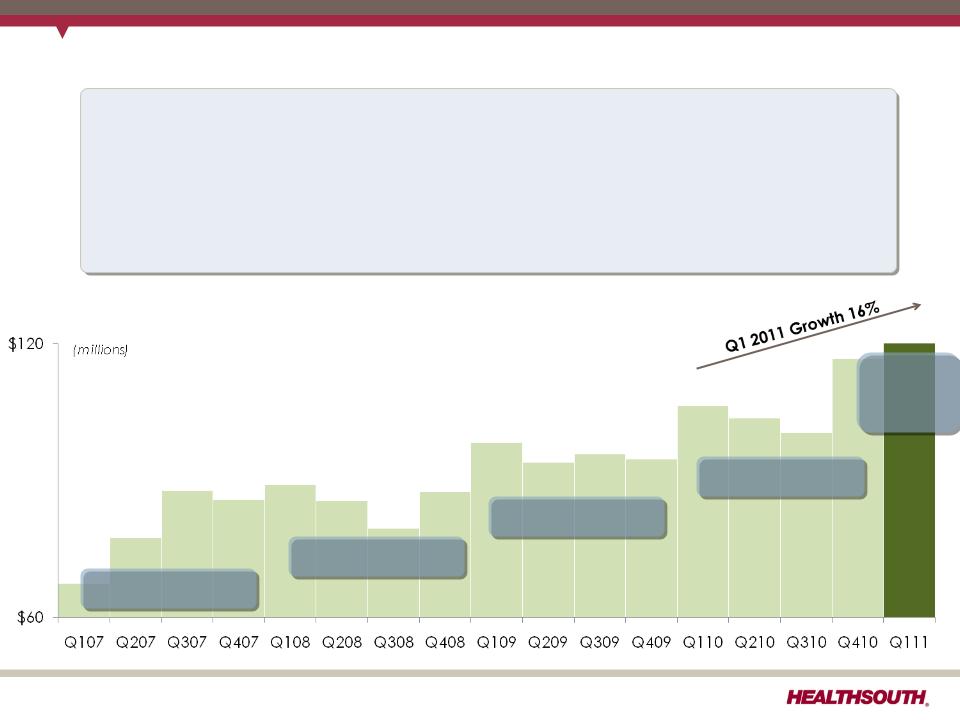

Based on strong results for Q1 2011,

HealthSouth expects its 2011 full-year

results to be at the high end of, or

greater than, this guidance range.

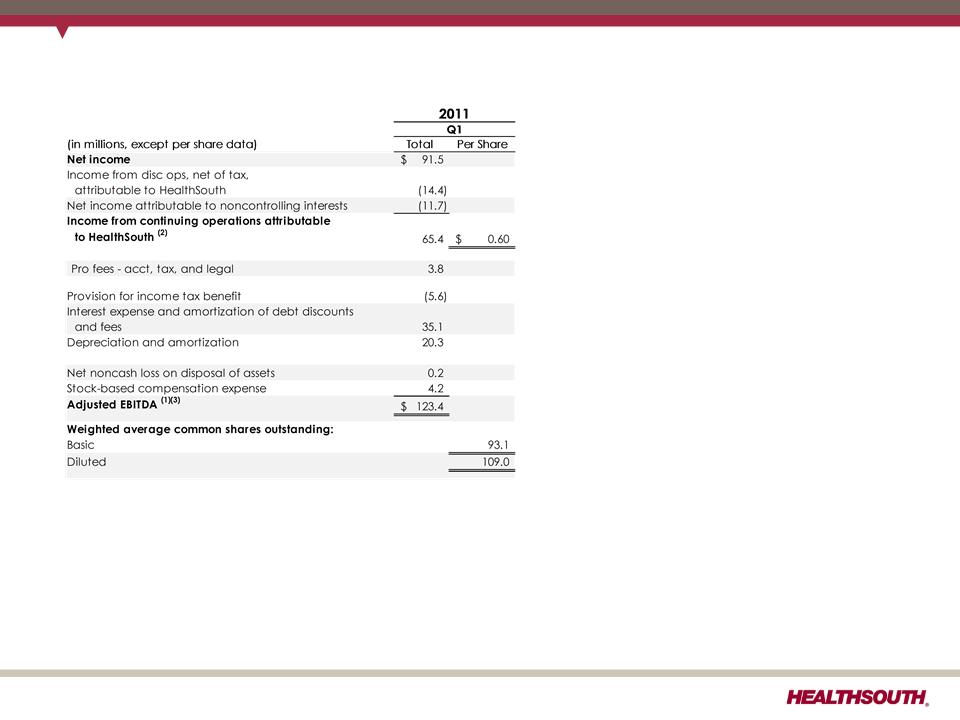

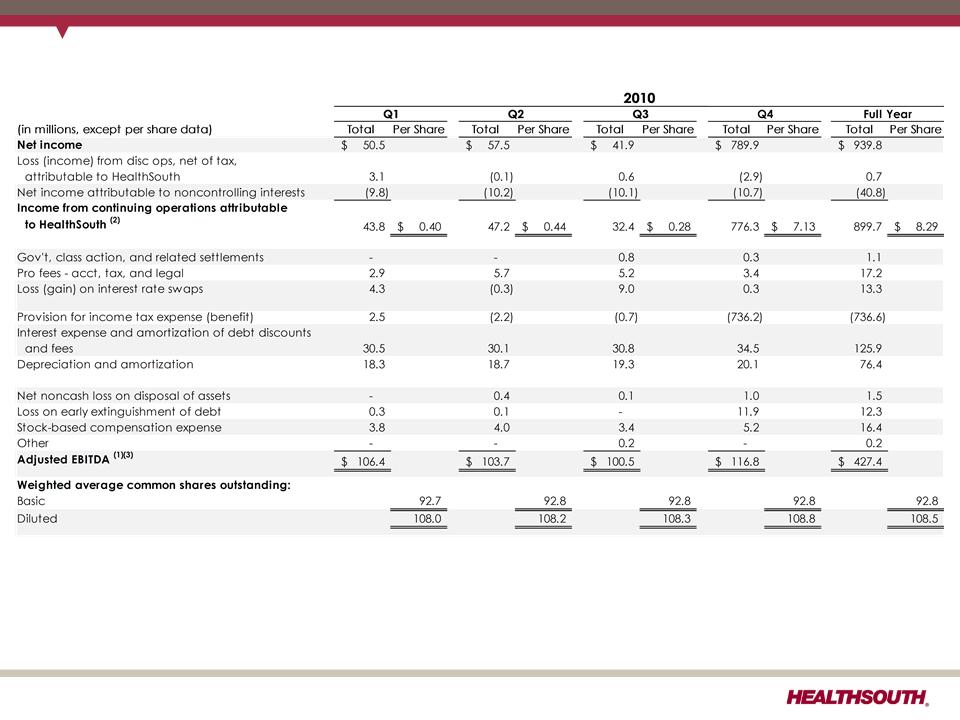

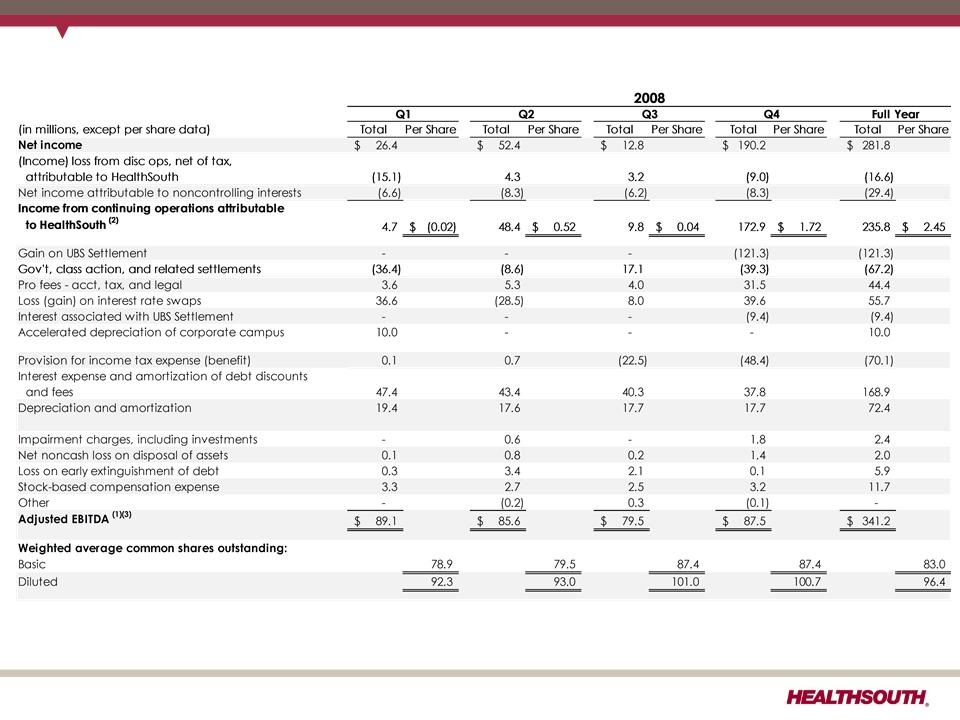

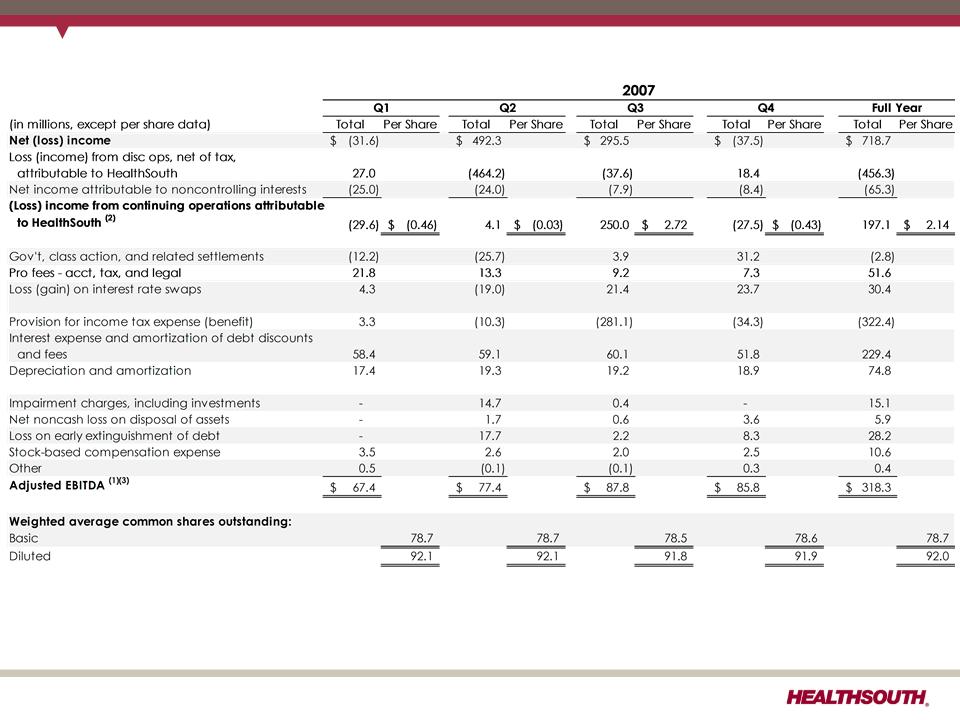

(1) Adjusted income from continuing operations. This non-GAAP measure was part of our historical guidance. A reconciliation of adjusted income from

continuing operations to the corresponding GAAP measure can be found on slides 91 and 92.

(2) Income from continuing operations attributable to HealthSouth

(3) Current period amounts in income tax provision; see slides 91 and 92

(4) Total income tax provision for full-year 2010, including the reversal of a substantial portion of the Company's valuation allowance against deferred tax assets.

(5) Includes a $0.27 per diluted share benefit related to the Company’s settlement with the IRS for tax years 2007 and 2008, and a reduction in unrecognized tax

benefits due to the lapse of the statute of limitations for certain federal and state claims.

37

Exhibit 99.1