Exhibit 99-2

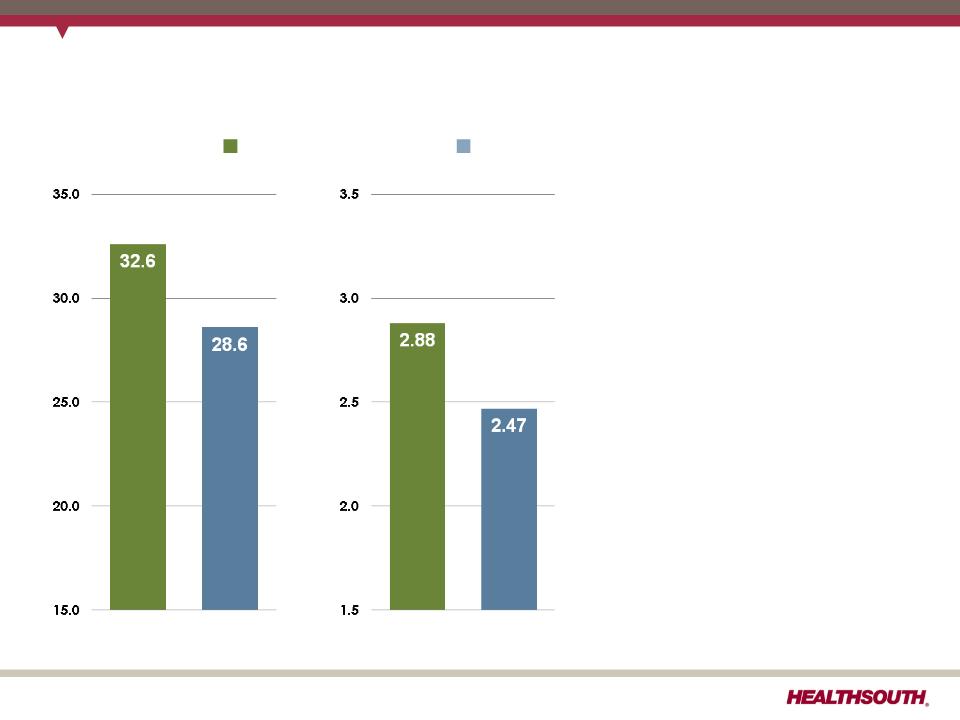

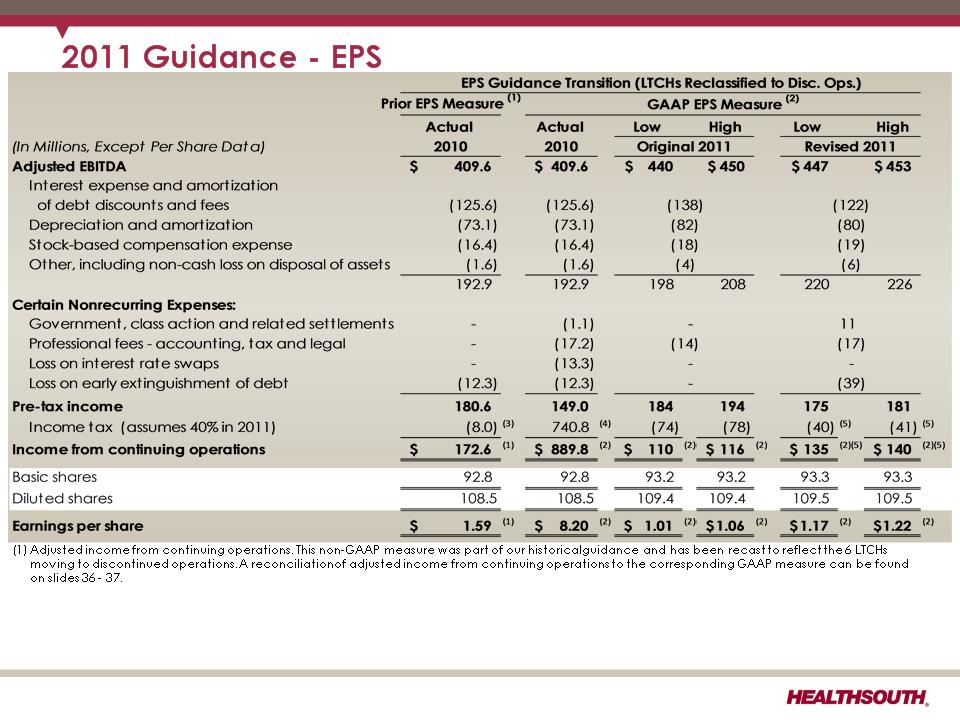

Earnings per Share from

Continuing Operations (1)

Impacted by the following non-

recurring and tax-related items

that in aggregate decreased

earnings per share by $0.33 in Q2

2011 vs. Q2 2010:

• $26.1 million, or $0.28 per share,

loss (pre-tax) on early

extinguishment of debt related

to the Company’s repayment

of $335 million of 10.75% senior

notes on June 15, 2011

• $12.5 million, or $0.13 per

share, increase in income tax

expense mainly attributable to

the release of the valuation

allowance in Q4 2010

• $10.6 million, or $0.11 per share,

gain (pre-tax) in government,

class action, and related

settlements , and $2.7 million, or

$0.03 per share, expense (pre-

tax) for higher professional fees

primarily related to recoveries

13

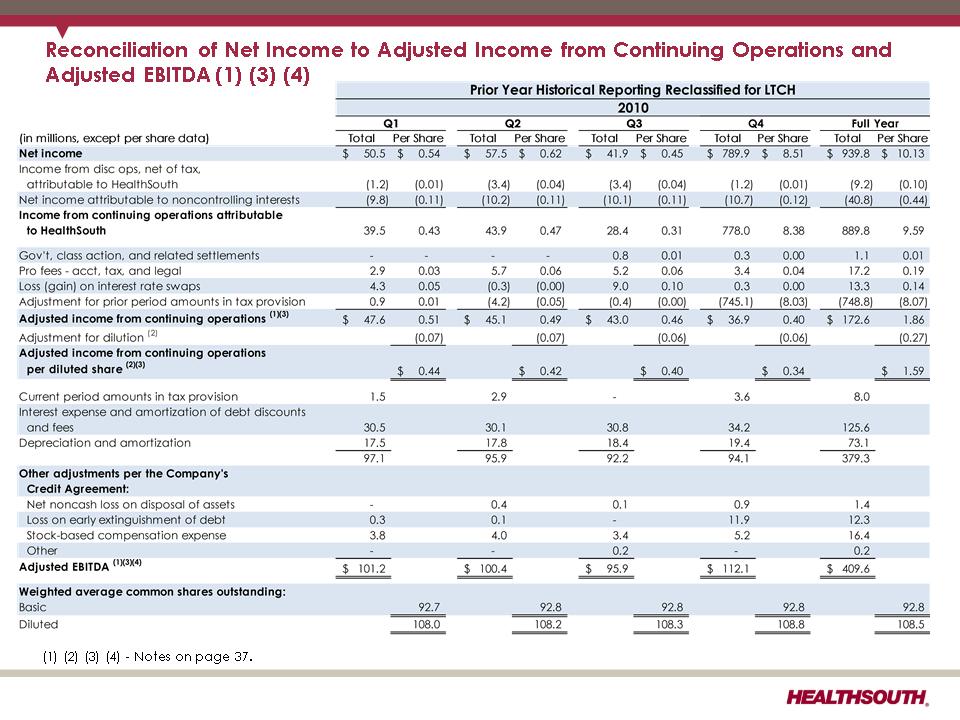

(1) Income from continuing operations attributable to HealthSouth

(2) Actual tax provision recorded for the period

(3) Cash income taxes for 3 and 6 months ended June 30, 2011 were $1.7 million and $4.2 million, respectively.

(4) During Q2 2010 and 6 months 2010, the Company maintained a valuation allowance against substantially all of its deferred tax assets. A substantial portion of the valuation

allowance was released in Q4 2010.

(5) Includes a $0.27 per diluted share benefit related to the Company’s settlement with the IRS for tax years 2007 and 2008 and a reduction in unrecognized tax benefits due to the

lapse of the statute of limitations for certain federal and state claims.

(6) Diluted earnings per share on a GAAP basis are the same as basic earnings per share due to the antidilutive impact in each period presented.