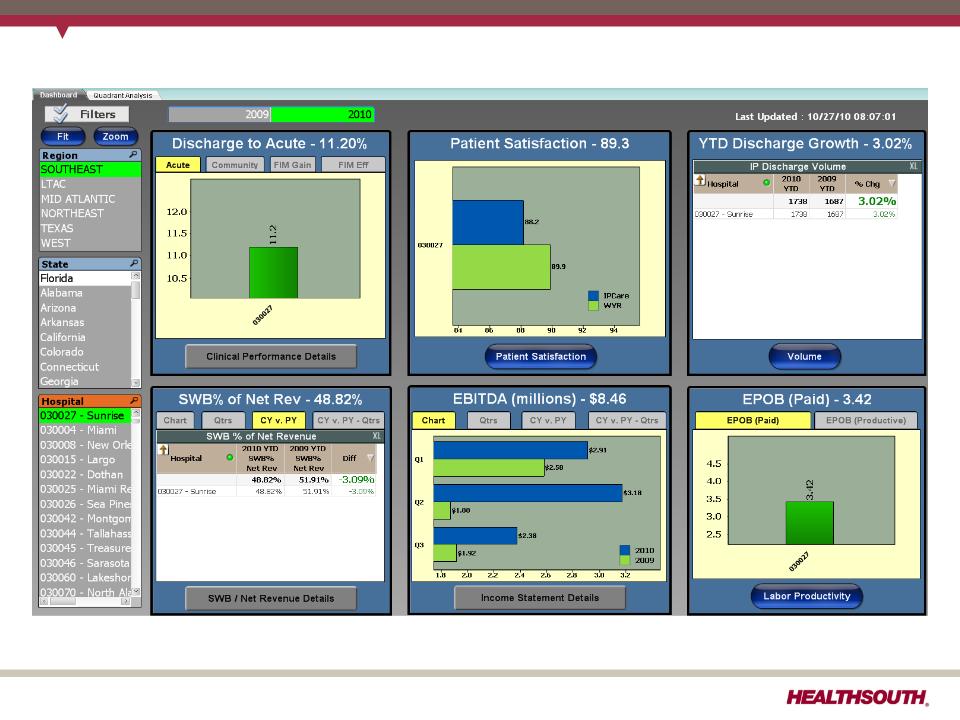

- EHC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Encompass Health (EHC) 8-KRegulation FD Disclosure

Filed: 15 Nov 11, 12:00am

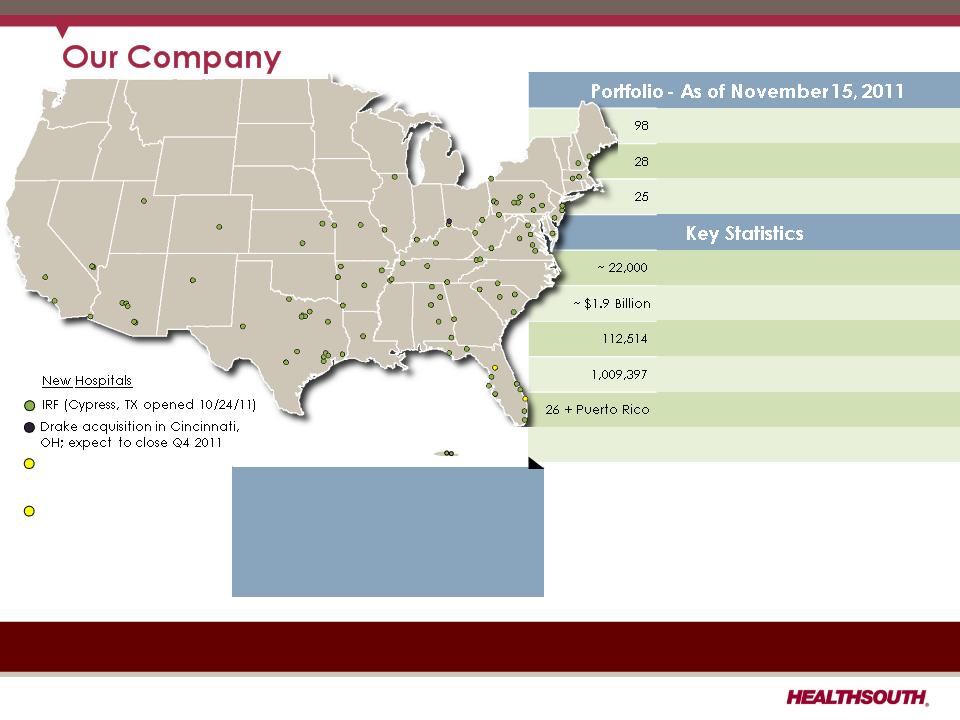

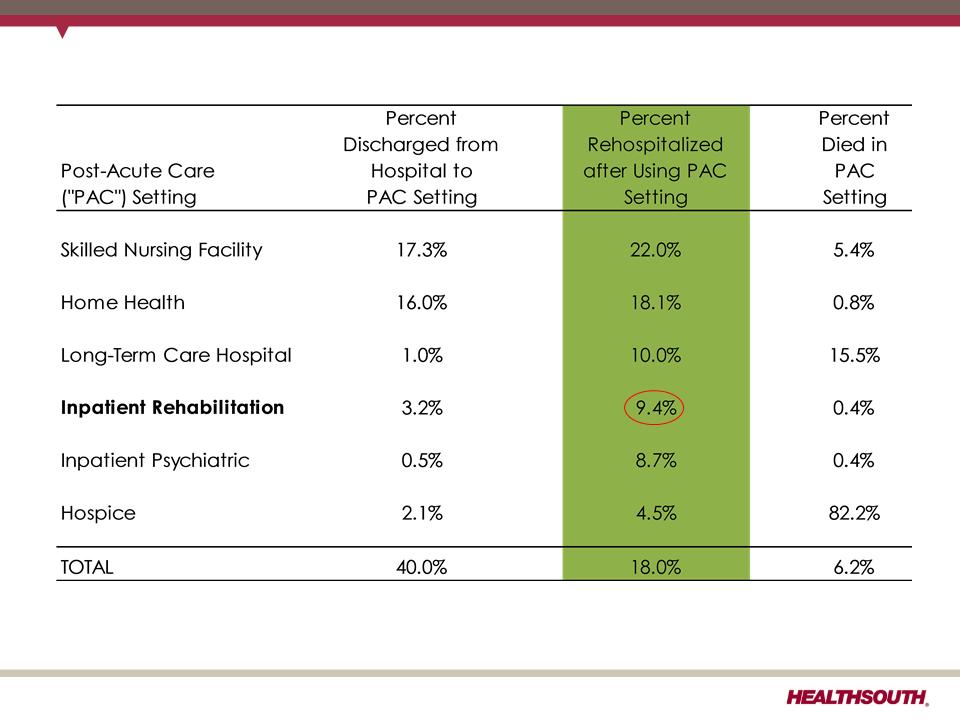

Inpatient Rehabilitation Hospitals (“IRF”) | |

Outpatient Rehabilitation Satellite Clinics | |

Hospital-Based Home Health Agencies | |

Employees | |

Revenue in 2010 | |

Inpatient Discharges in 2010 | |

Outpatient Visits in 2010 | |

Number of States | |

NYSE (HLS) | Exchange (Symbol) |

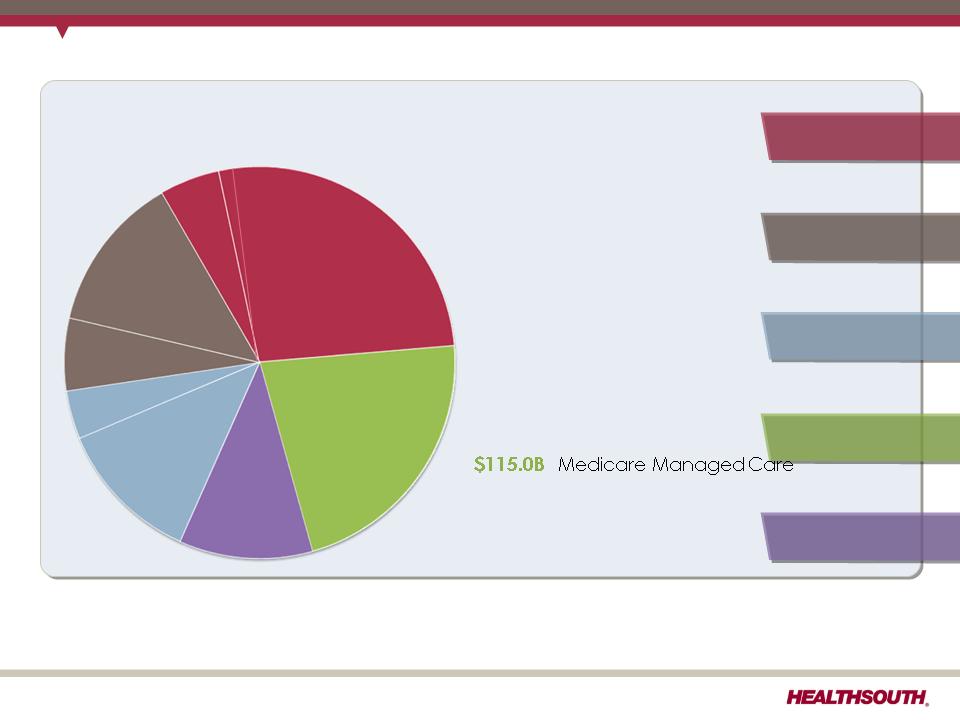

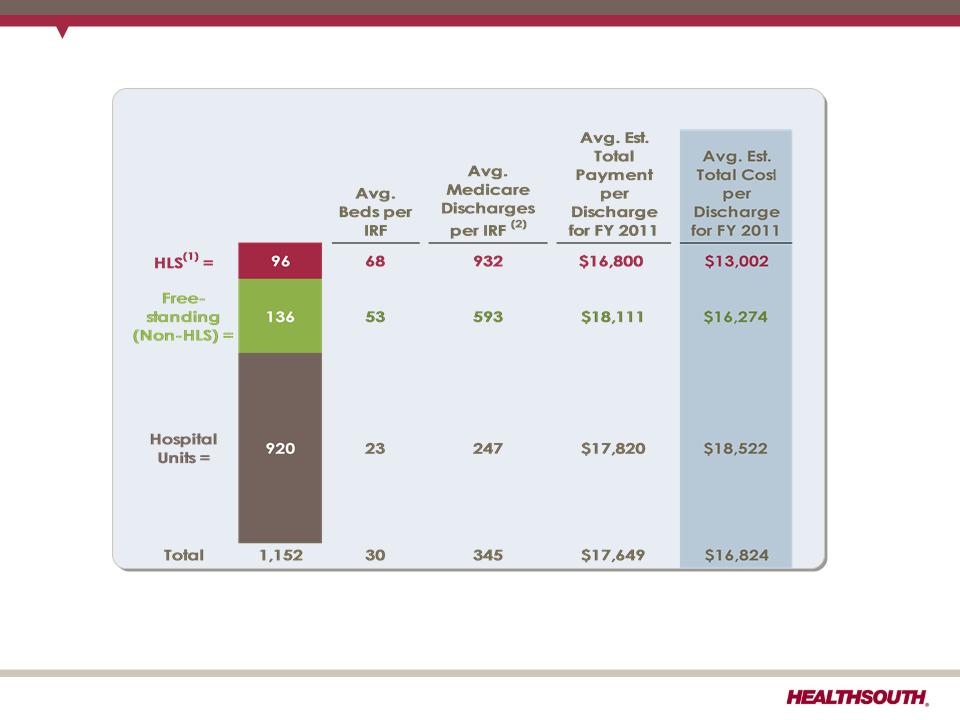

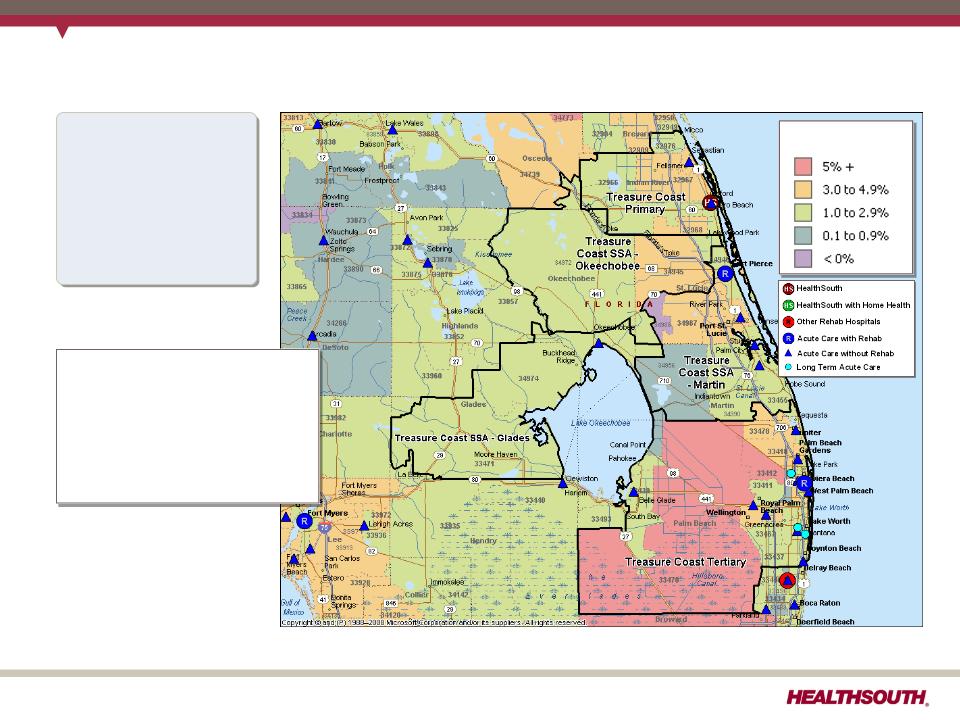

Marketshare |

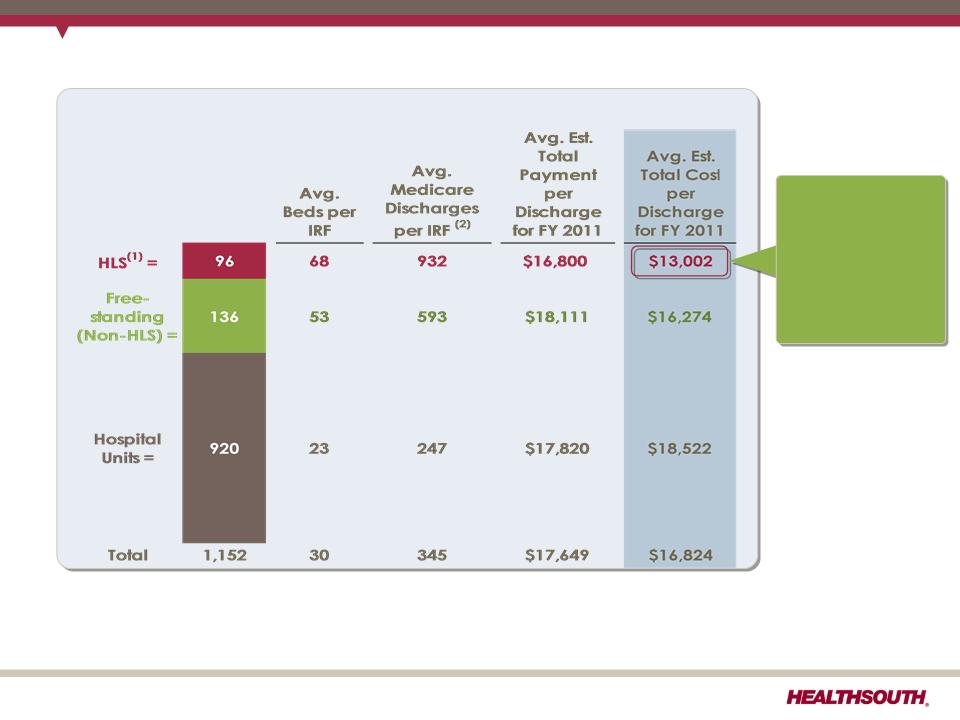

~ 8% of IRFs (Total in U.S. = 1,152) ~ 19% of Licensed Beds ~ 23% of Patients Served |

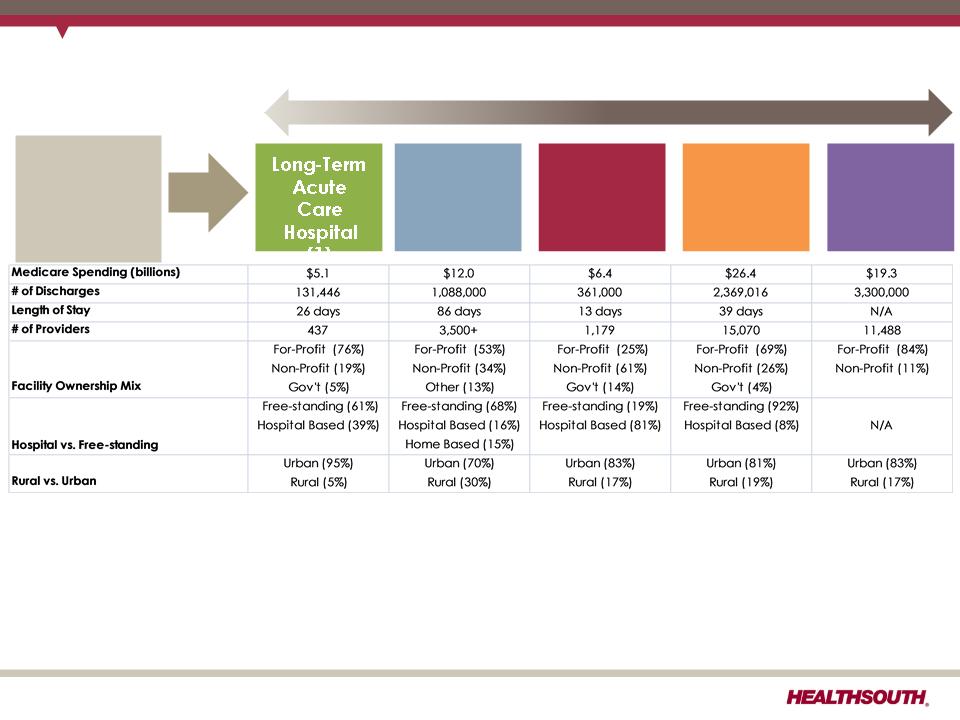

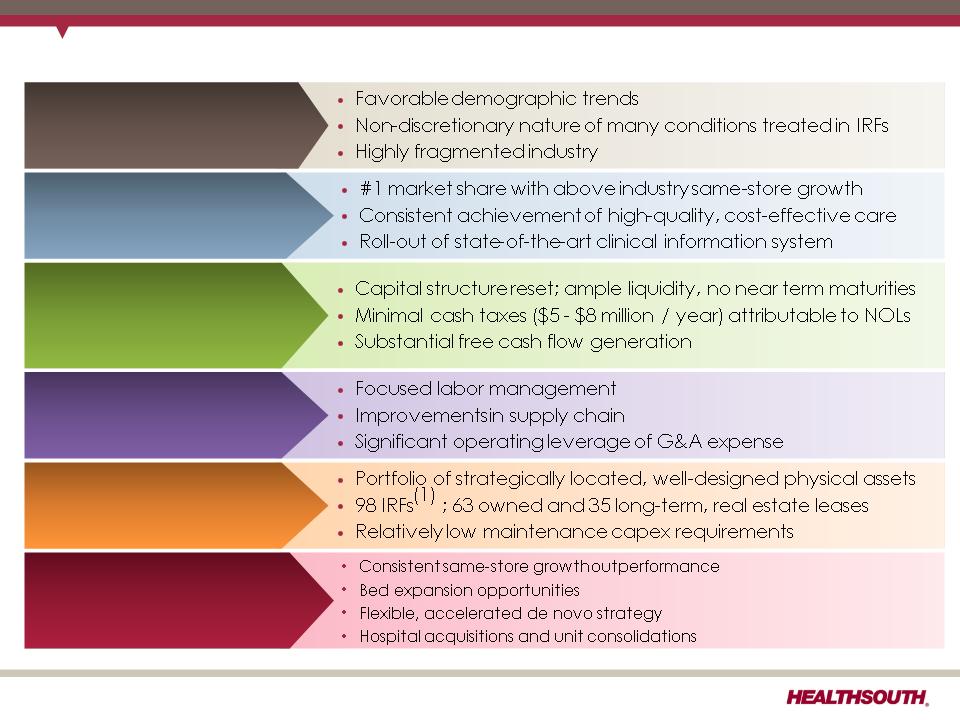

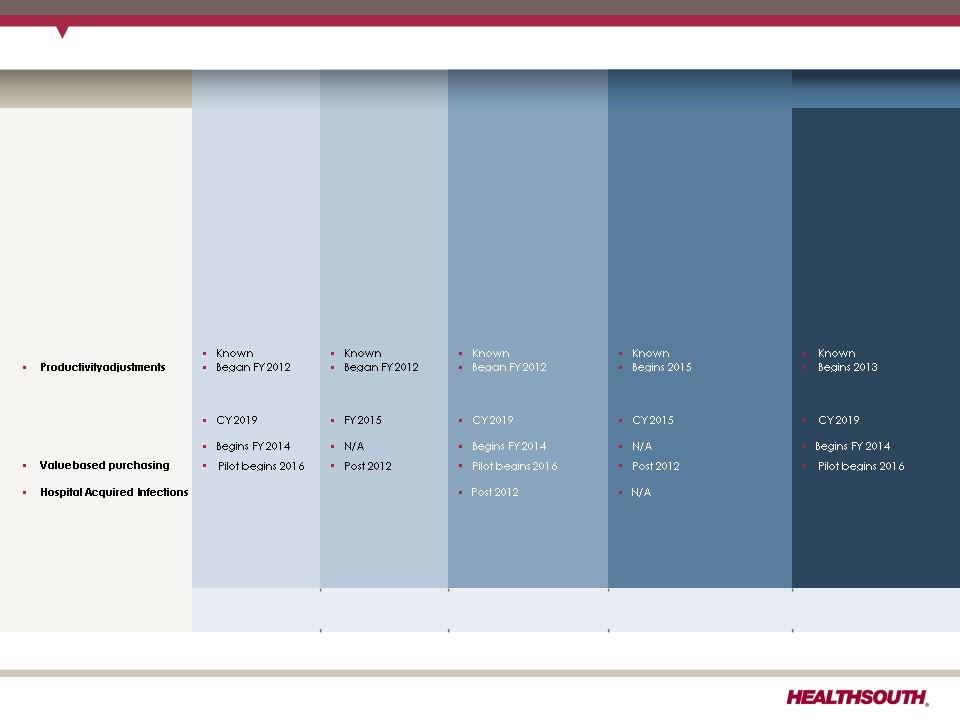

Future Regulatory Risk | Inpatient Rehabilitation Facility | Skilled Nursing Facility | Long-Term Acute Care Hospital | Home Health | Hospice |

1. Re-basing payment system | No | Yes; RUGS IV and MDS 3.0 parity adjustment for FY 2012 (-12.6%) | No | Yes; CY re-weighting re-distributes payment from high therapy to low or no therapy; Rebasing required as part of PPACA starting in 2014 | Yes: Required by PPACA beginning in 2013; Modified wage index system being phased in over 7-year period beginning in FY 2010 |

2. Major outlier payment adjustments | No | No | Yes; will occur when MMSEA relief expires (short stay outliers) | Yes; 10% cap per agency; 2.5% taken out of outlier pool in 2011 | No |

3. Upcoding adjustments | No | No | Yes; occurred in FY 2011 | Yes; occurring in CY 2011 (-3.79%), CY 2012(-3.79%), and CY 2013 (-1.32%) | No |

4. Patient criteria | No; 60% Rule admission criteria already in place | No | Congressional Bill introduced developing criteria | Patient - physician “face-to-face” encounter & new therapy documentation required beginning in 2011 | Patient - physician “face-to- face” encounter required beginning in 2011 |

5. Healthcare Reform | |||||

• Market basket update reductions | |||||

• Bundling pilot established | • By 2013 | • By 2013 | • By 2013 | • By 2013 | • N/A |

• Independent Payment Advisory Board | |||||

• New quality reporting requirements | |||||

• Post 2012 | • Post 2012 | •N/A | |||

6. Other | N/A | New group therapy definition/requirements | 25% Rule regulatory relief expires in 2012/2013; prohibition on new LTCHs through 2012; Medicare Advantage patients counted in the 25 day length of stay criteria Jan. 2012 | Limits on transfer of ownership | MedPAC recommending overhaul of payment system methodology in FY 2013 |

7. Deficit Reduction (1) |

GAAP Considerations: •As of 9/30/11, the Company had an ending balance of approx. $1.3 billion in federal NOLs and a remaining valuation allowance of approx. $105 million, primarily related to state NOLs. •Expect effective tax rate of approx. 40% going forward Future Cash Tax Payments: •The Company expects to pay approx. $5 million to $8 million per year of income tax. •The Company does not expect to pay significant federal income taxes for up to 7 years. •HealthSouth is not currently subject to an annual use limitation (“AUL”) under Internal Revenue Code Section 382 (“Section 382”). A “change of ownership,” as defined by Section 382, would subject us to an AUL, which is equal to the market capitalization of the Company at the time of the “change of ownership” multiplied by the long-term tax exempt rate. |

Terms | |

Acquisitions | Limited by compliance with leverage and interest coverage covenants currently requiring 4.75x and 2.5x, respectively |

Restricted payments: | |

10.75% repurchase | Unlimited up to 4.5x leverage ratio (revolver draws available for repurchase) |

Share repurchase (2) | $200 million (shared with other restricted payment basket) |

Other debt repurchase (2) | $200 million (shared with other restricted payment basket) |

Unsecured debt issuance | Unlimited up to 4.5x leverage ratio |

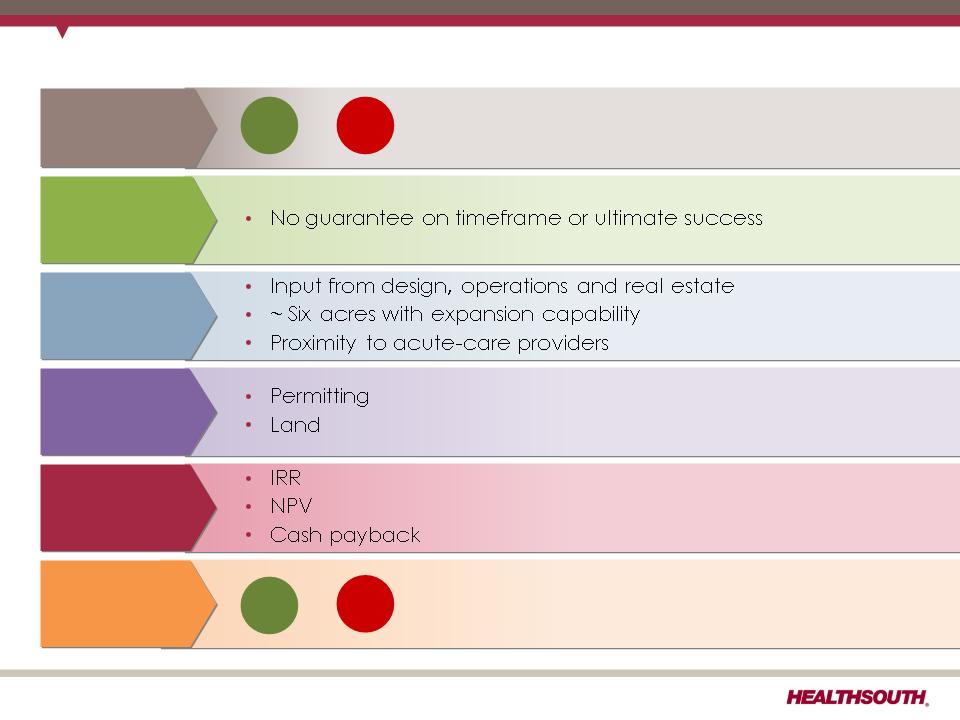

Capital Cost | $ Range | |

(millions) | Low | High |

Construction, design, permitting, etc. | $11.0 | $14.5 |

Land | 1.5 | 3.5 |

Equipment | 2.5 | 3.0 |

$15.0 | $21.0 | |

Pre-opening Expenses | ||

(thousands) | Low | High |

Operating | $200 | $300 |

Salaries, wages and benefits | 150 | 200 |

$350 | $500 | |

Date Acquired | Acquired Census | Q3 2011 Census | |

Vineland | Q3 2008 | 26 | 34 |

Desert Canyon | Q2 2010 | 16 | 34 |

Sugar Land | Q3 2010 | 26 | 34 |

Ft. Smith | Q3 2010 | 15 | 39 |