Post Q4 2012 Earnings Release – Last updated February 27, 2013 I N V E S T O R R E F E R E N C E B O O K

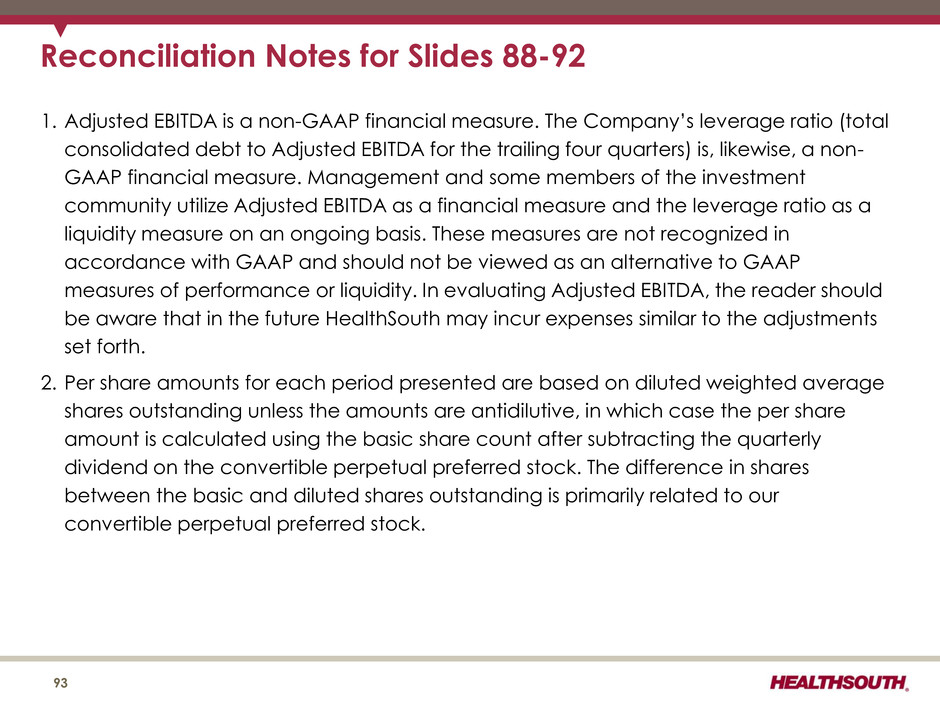

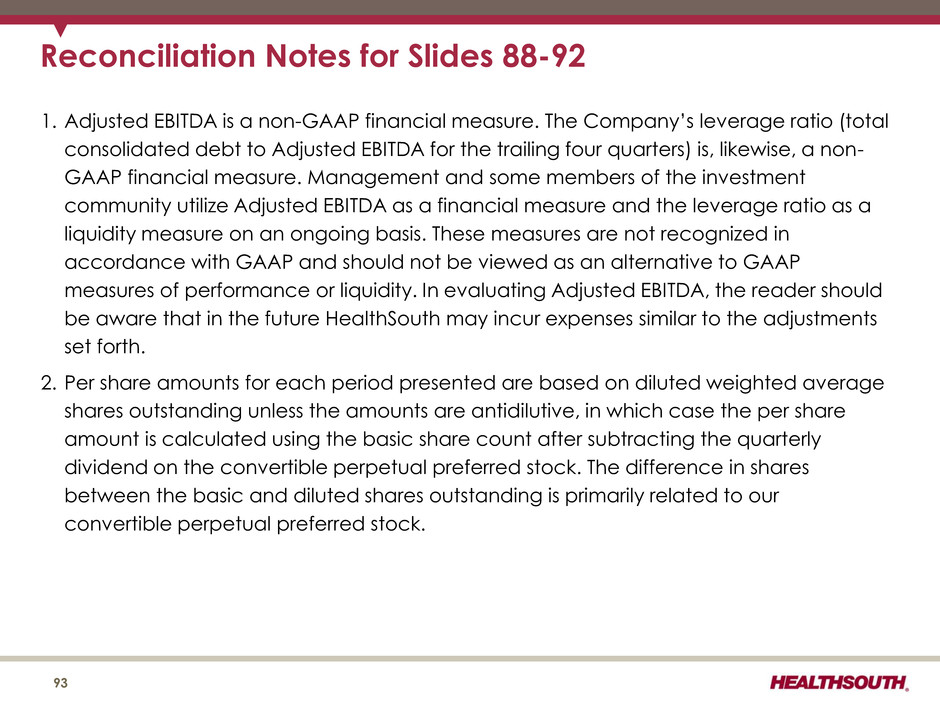

The information contained in this presentation includes certain estimates, projections and other forward- looking information that reflect our current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, repurchases of securities, including by means of a common stock tender offer, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance that any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2012 and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated February 27, 2013 to which the following supplemental slides are attached as Exhibit 99.1, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements 2

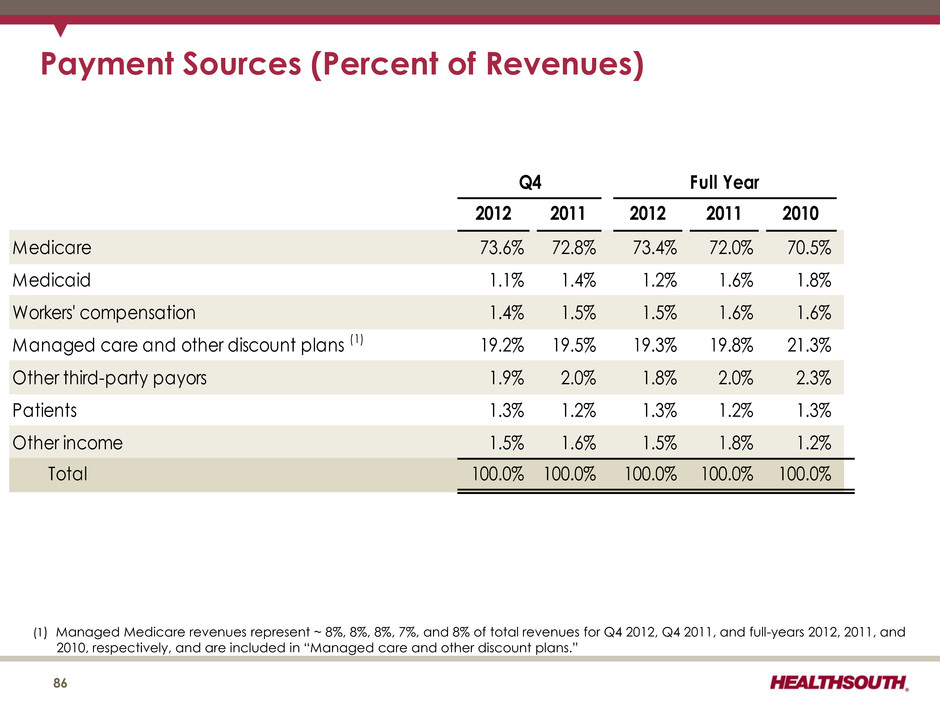

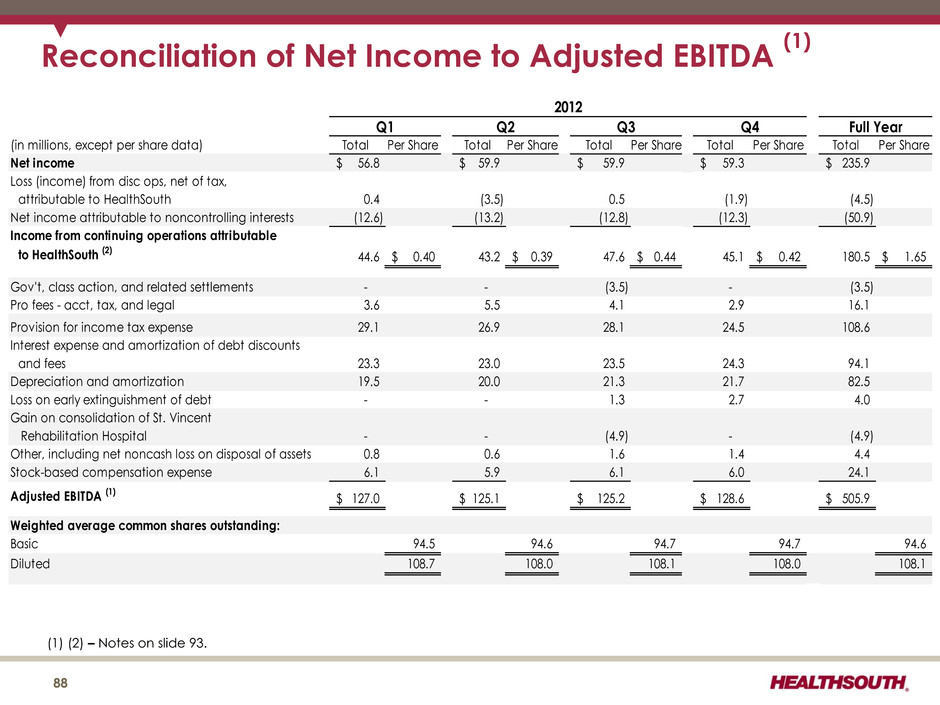

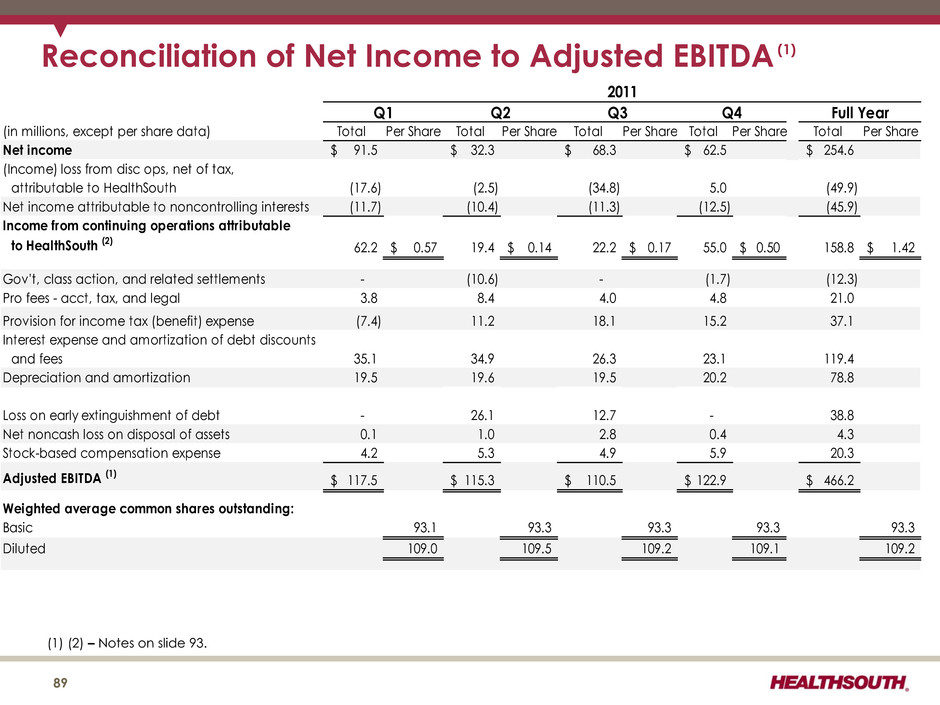

Table of Contents 4-16 17-31 32-41 42-45 46-50 51-54 55-59 60-70 71-82 83-86 Reconciliat ions to GAAP………………………………………………………………………………………………………………………………………………………..87-93 Growth……………………………………………………………………………………………………………………………………… Operational Init iat ives…………………………………………………………………………………………………………….. Guidance ………………………………………………………………………………………………………………………………………… Business Outlook: 2013 to 2015………………………………………………………………………………………………………………………………………… Operational Metrics……………………………………………………………………………………………………………………………………………………………. Our Company…………………………………………………………………………………………………………………………… Industry Structure………………………………………………………………………………………………………………………………………………………………. Historical Perspective…………………………………………………………………………………………………………………………………………. Free Cash Flow………………………………………………………………………………………………………………………………………. Refinancing and Delevering………………………………………………………………………………………………………………………………………… 3

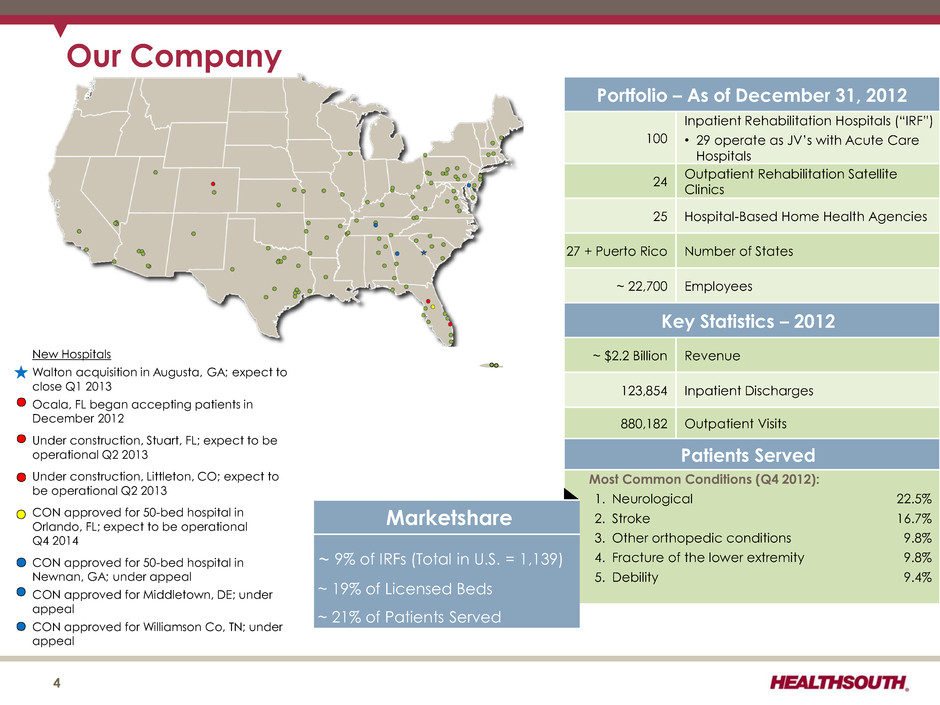

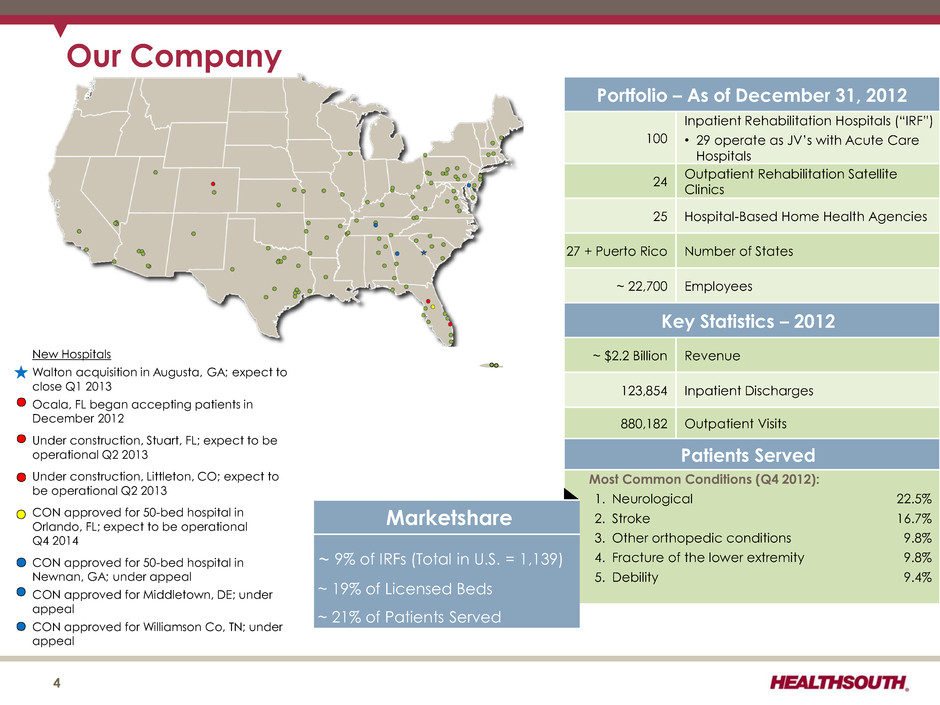

Portfolio – As of December 31, 2012 100 Inpatient Rehabilitation Hospitals (“IRF”) • 29 operate as JV’s with Acute Care Hospitals 24 Outpatient Rehabilitation Satellite Clinics 25 Hospital-Based Home Health Agencies 27 + Puerto Rico Number of States ~ 22,700 Employees Key Statistics – 2012 ~ $2.2 Billion Revenue 123,854 Inpatient Discharges 880,182 Outpatient Visits Patients Served Most Common Conditions (Q4 2012): 1. Neurological 22.5% 2. Stroke 16.7% 3. Other orthopedic conditions 9.8% 4. Fracture of the lower extremity 9.8% 5. Debility 9.4% 4 Marketshare ~ 9% of IRFs (Total in U.S. = 1,139) ~ 19% of Licensed Beds ~ 21% of Patients Served Our Company New Hospitals Walton acquisition in Augusta, GA; expect to close Q1 2013 Ocala, FL began accepting patients in December 2012 Under construction, Stuart, FL; expect to be operational Q2 2013 Under construction, Littleton, CO; expect to be operational Q2 2013 CON approved for 50-bed hospital in Orlando, FL; expect to be operational Q4 2014 CON approved for 50-bed hospital in Newnan, GA; under appeal CON approved for Middletown, DE; under appeal CON approved for Williamson Co, TN; under appeal

Our Hospitals Major Services • Rehabilitation Physicians: manage and treat medical needs of patients • Rehabilitation Nurses: oversee treatment programs of patients • Physical Therapists: address physical function, mobility, safety • Occupational Therapists: promote independence and re-integration • Speech-Language Therapists: treat communication and swallowing disorders • Case Managers: coordinate care plan with physician, caregivers and family • Post-discharge services: outpatient therapy and home health 5

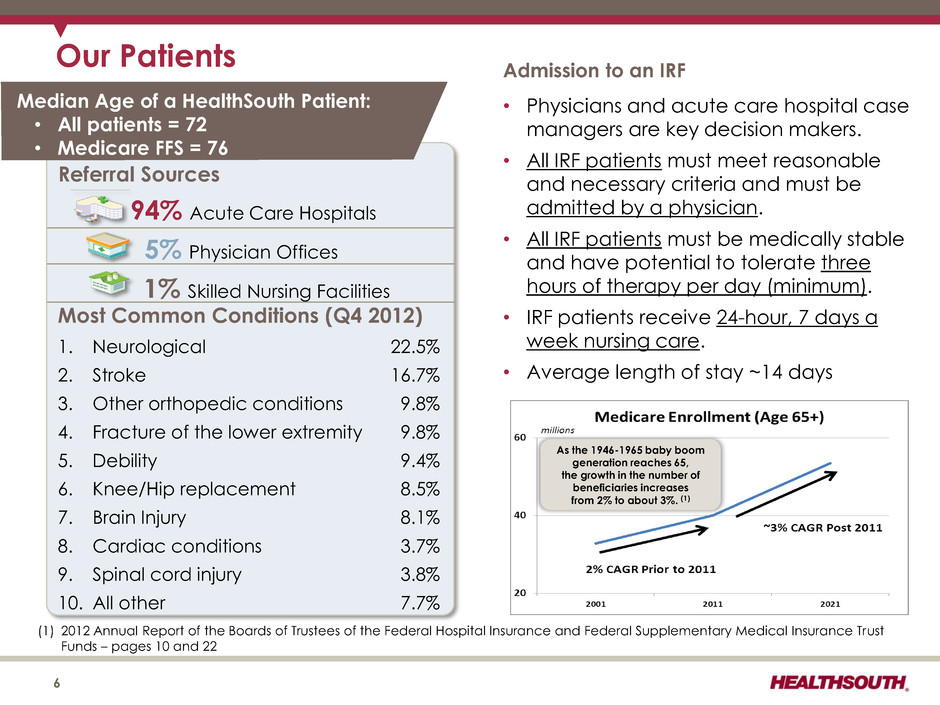

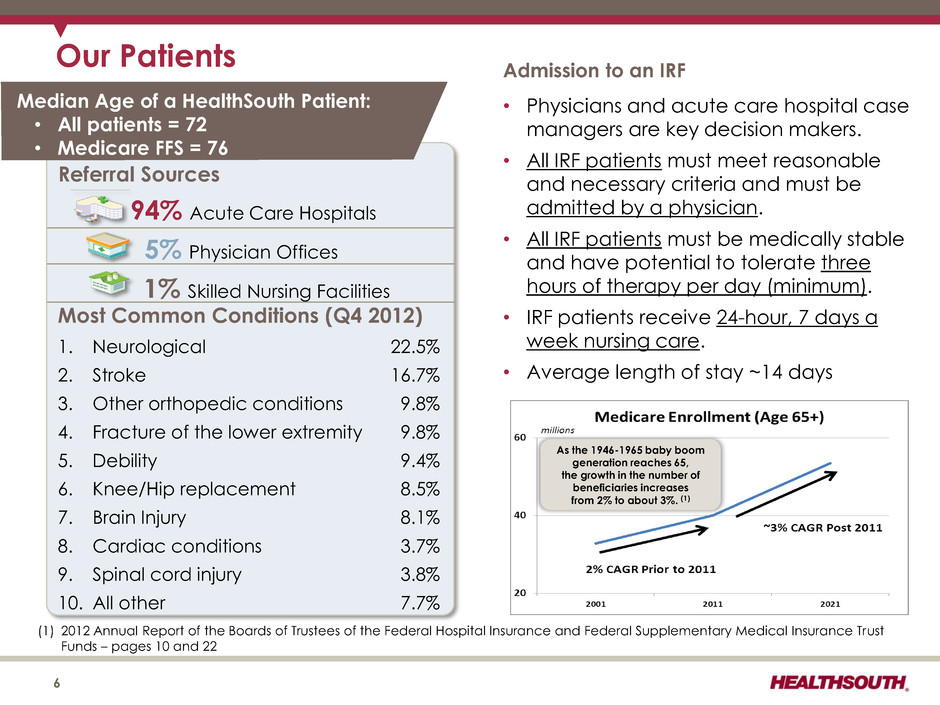

Our Patients 6 Most Common Conditions (Q4 2012) 1. Neurological 22.5% 2. Stroke 16.7% 3. Other orthopedic conditions 9.8% 4. Fracture of the lower extremity 9.8% 5. Debility 9.4% 6. Knee/Hip replacement 8.5% 7. Brain Injury 8.1% 8. Cardiac conditions 3.7% 9. Spinal cord injury 3.8% 10. All other 7.7% Referral Sources 94% Acute Care Hospitals 5% Physician Offices 1% Skilled Nursing Facilities Admission to an IRF • Physicians and acute care hospital case managers are key decision makers. • All IRF patients must meet reasonable and necessary criteria and must be admitted by a physician. • All IRF patients must be medically stable and have potential to tolerate three hours of therapy per day (minimum). • IRF patients receive 24-hour, 7 days a week nursing care. • Average length of stay ~14 days Median Age of a HealthSouth Patient: • All patients = 72 • Medicare FFS = 76 As the 1946-1965 baby boom generation reaches 65, the growth in the number of beneficiaries increases from 2% to about 3%. (1) (1) 2012 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds – pages 10 and 22

24 26 28 30 32 34 36 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 Our Quality FIM Gain is based on the change from admission to discharge of an 18 point assessment. HealthSouth UDS Average (1) 7 • Inpatient rehabilitation hospitals evaluate all patients at admission and upon discharge to determine their functional status. − FIM is the tool for measuring functional independence. • The difference between the FIM scores at admission and upon discharge is called the “FIM Gain.” − The greater the FIM Gain, the greater the patient’s level of independence, the better the patient outcome. (1) The UDS average is the risk adjusted average of a patient mix pulled from the UDS nation (including HealthSouth) that is similar to the HealthSouth actual patient mix. Cases are placed into CMGs by admitting impairment code, functional status at admission, and sometimes age. FIM is a registered trademark of Uniform Data System for Medical Rehabilitation, a division of UB Foundation Activities, Inc.

Avg. Beds per IRF Avg. Medicare Discharges per IRF (2) Avg. Est. Total Cost per Discharge for FY 2013 Avg. Est. Total Payment per Discharge for FY 2013 HLS (1) = 97 67 896 $12,371 $17,301 Free- standing (Non-HLS) = 135 52 597 $16,251 $18,603 Hospital Units = 907 23 231 $18,857 $18,249 Total 1,139 30 331 $16,805 $18,106 Total Inpatient Rehabilitation Facilities (IRFs): 1,139 Our Cost-Effectiveness • Medicare pays HealthSouth less per discharge, on average, and HealthSouth treats a higher acuity patient. 8 (1) The 97 for HLS does not include HealthSouth Rehabilitation Hospital of Cypress, TX, which opened in October 2011, HealthSouth Rehabilitation Hospital at Drake, which opened in December 2011, and HealthSouth Rehabilitation Hospital of Ocala, FL, which opened December 2012. (2) In 2011, HealthSouth averaged 1,233 total Medicare and non-Medicare discharges per hospital in its 96 consolidated hospitals. Source: FY 2013 CMS Rate Setting File (see next page) and Medicare Report to Congress, Medicare Payment Policy, March 2012 – pages 239 and 240 • HealthSouth differentiates itself by: “Best Practices” clinical protocols Supply chain efficiencies Sophisticated management information systems Economies of scale

CMS Fiscal Year 2013 IRF Rate Setting File Analysis Notes: (1) All data provided was filtered and compiled from the Centers for Medicare and Medicaid Services (CMS) Fiscal Year 2013 IRF rate setting file found at http://www.cms.gov/InpatientRehabFacPPS/07_DataFiles.asp#. The data presented was developed entirely by CMS and is based on its definitions which are different in form and substance from the criteria HealthSouth uses for external reporting purposes. Because CMS does not provide its detailed methodology, HealthSouth is not able to reconstruct the CMS projections or the calculation. (2) The CMS file contains data for each of the 1,139 inpatient rehabilitation facilities used to estimate the policy updates for the FY 2013 IRF-PPS Final Rule. Most of the data represents historical information from the CMS fiscal year 2011 period and does not reflect the same HealthSouth hospitals in operation today. The data presented was separated into three categories: Freestanding, Units, and HealthSouth. HealthSouth is a subset of Freestanding and the Total. 9

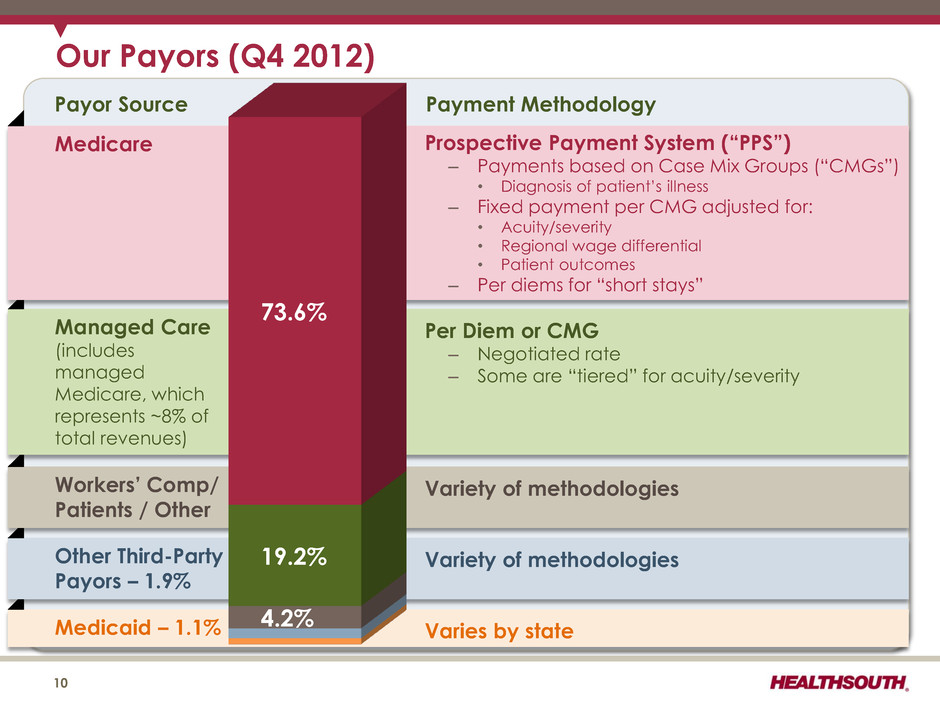

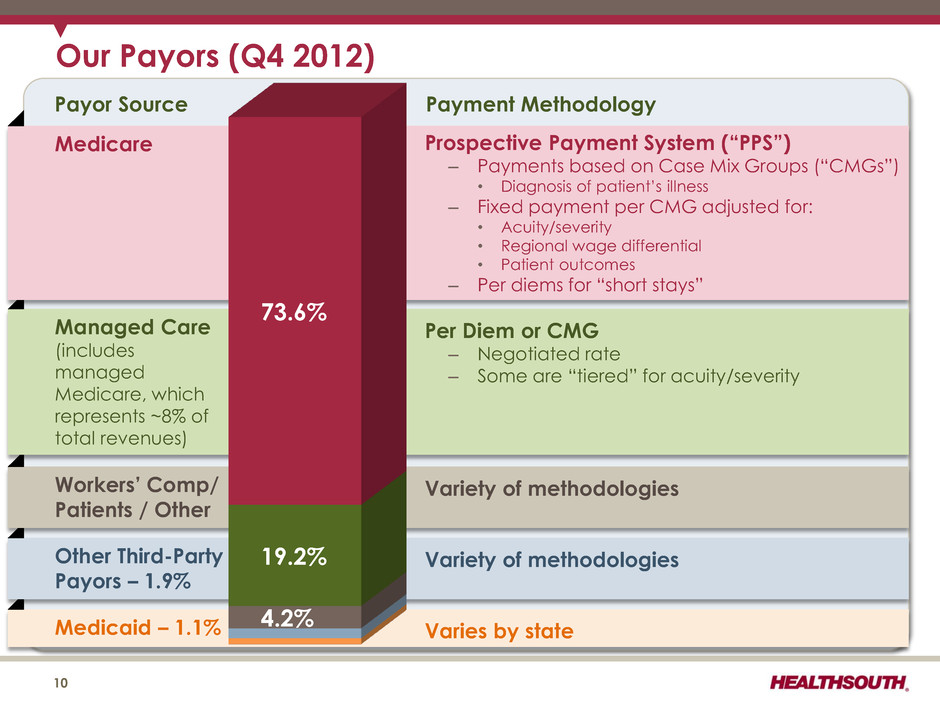

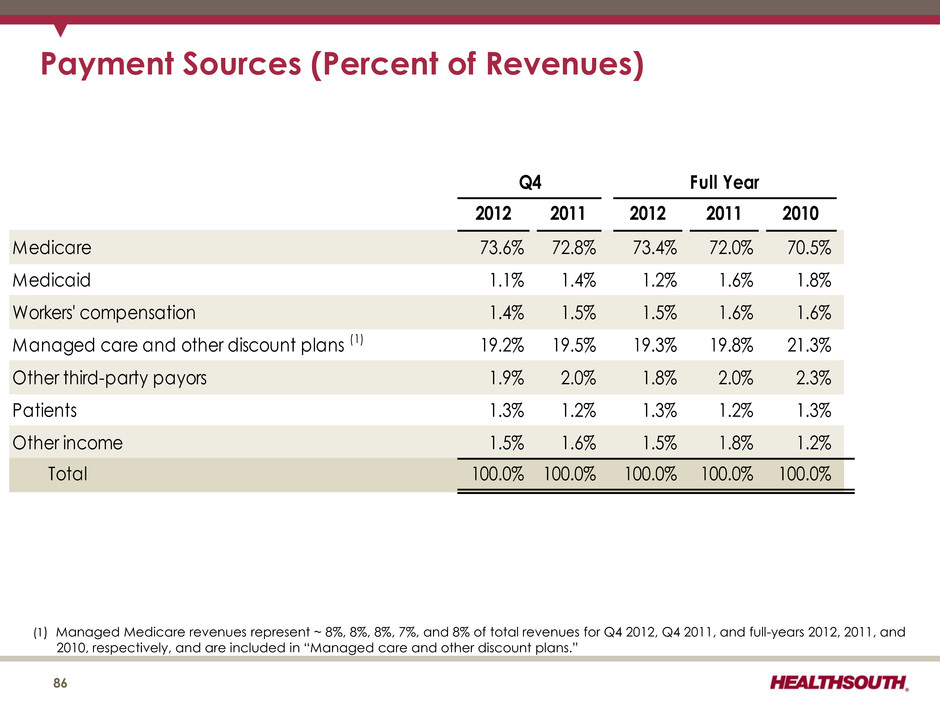

Medicaid – 1.1% Varies by state Other Third-Party Payors – 1.9% Variety of methodologies Workers’ Comp/ Patients / Other Variety of methodologies Managed Care (includes managed Medicare, which represents ~8% of total revenues) Medicare Payment Methodology Payor Source 10 Prospective Payment System (“PPS”) – Payments based on Case Mix Groups (“CMGs”) • Diagnosis of patient’s illness – Fixed payment per CMG adjusted for: • Acuity/severity • Regional wage differential • Patient outcomes – Per diems for “short stays” Per Diem or CMG – Negotiated rate – Some are “tiered” for acuity/severity 4.2% 19.2% 73.6% Our Payors (Q4 2012)

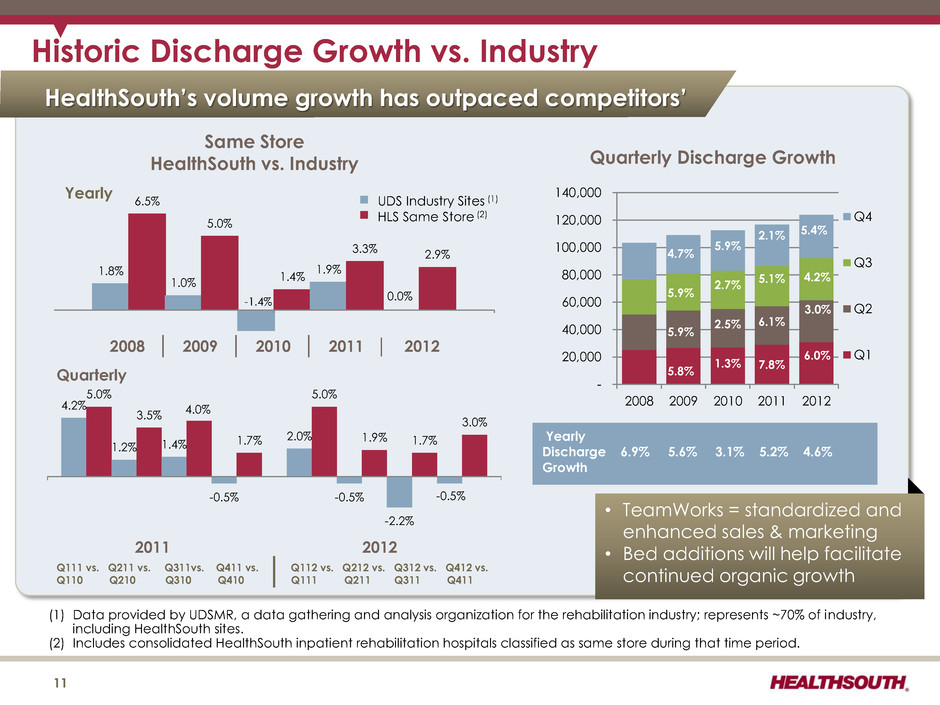

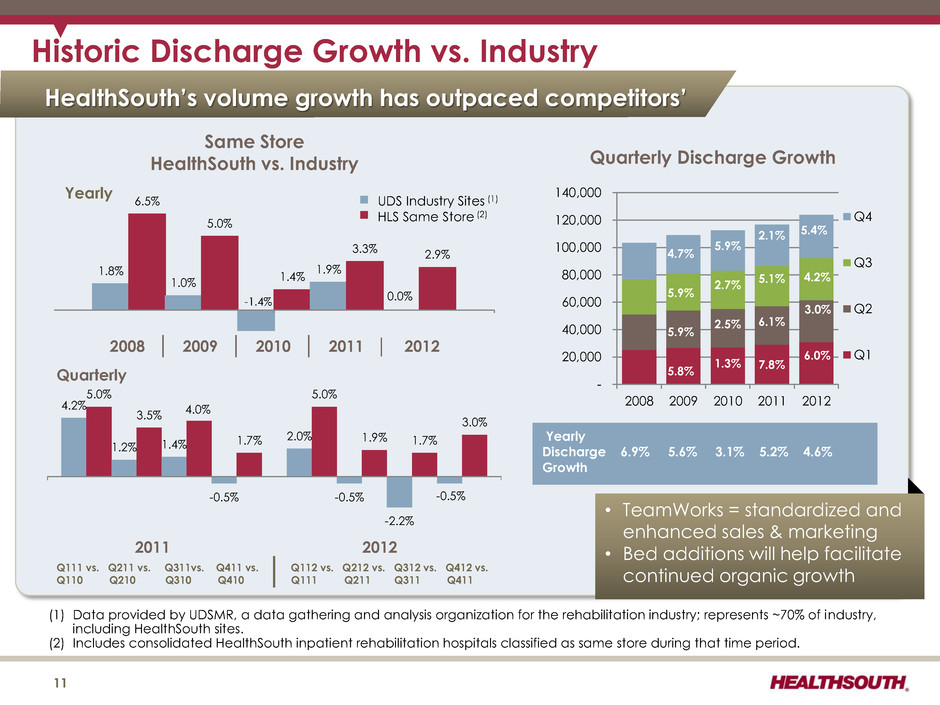

HealthSouth’s volume growth has outpaced competitors’ (1) Data provided by UDSMR, a data gathering and analysis organization for the rehabilitation industry; represents ~70% of industry, including HealthSouth sites. (2) Includes consolidated HealthSouth inpatient rehabilitation hospitals classified as same store during that time period. Historic Discharge Growth vs. Industry - 20,000 40,000 60,000 80,000 100,000 120,000 140,000 2008 2009 2010 2011 2012 Q4 Q3 Q2 Q1 5.4% 4.2% 3.0% 6.0% 4.7% 5.9% 5.9% 5.8% 5.9% 2.7% 2.5% 1.3% 11 4.2% 5.0% 1.2% 3.5% 1.4% 4.0% -0.5% 1.7% 2.0% 5.0% -0.5% 1.9% -2.2% 1.7% -0.5% 3.0% Quarterly • TeamWorks = standardized and enhanced sales & marketing • Bed additions will help facilitate continued organic growth 2.1% 5.1% 6.1% 7.8% Yearly Discharge 6.9% 5.6% 3.1% 5.2% 4.6% Growth Q111 vs. Q211 vs. Q311vs. Q411 vs. Q112 vs. Q212 vs. Q312 vs. Q412 vs. Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Quarterly Discharge Growth Same Store HealthSouth vs. Industry UDS Industry Sites (1) HLS Same Store (2) 1.8% 6.5% 1.0% 5.0% 1.4% 1.9% 3.3% 0.0% 2.9% Yearly 2011 2012 2008 │ 2009 │ 2010 │ 2011 │ 2012 -1.4%

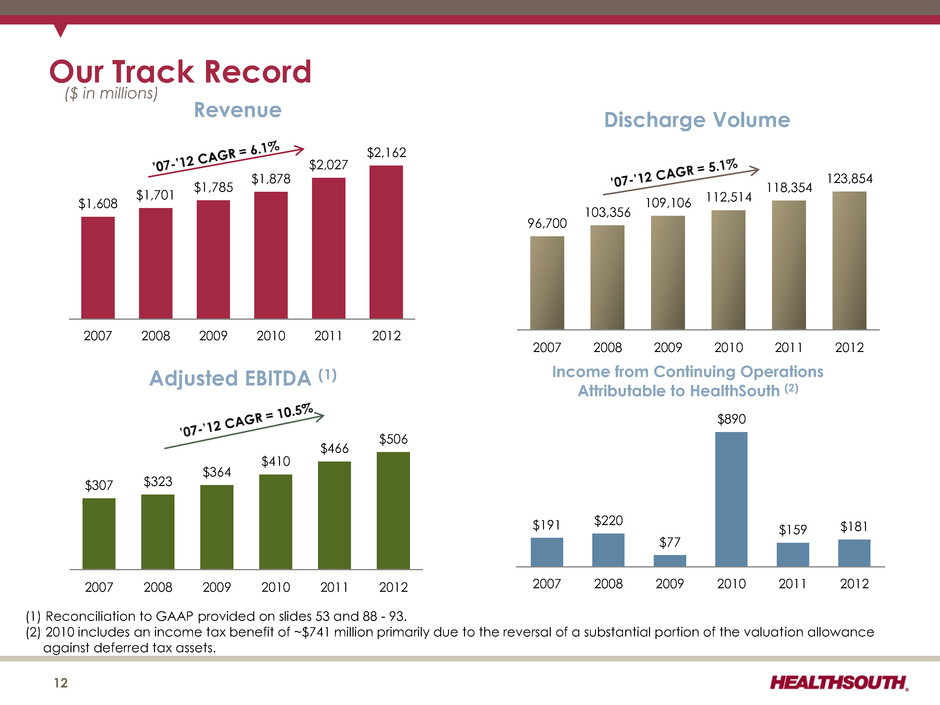

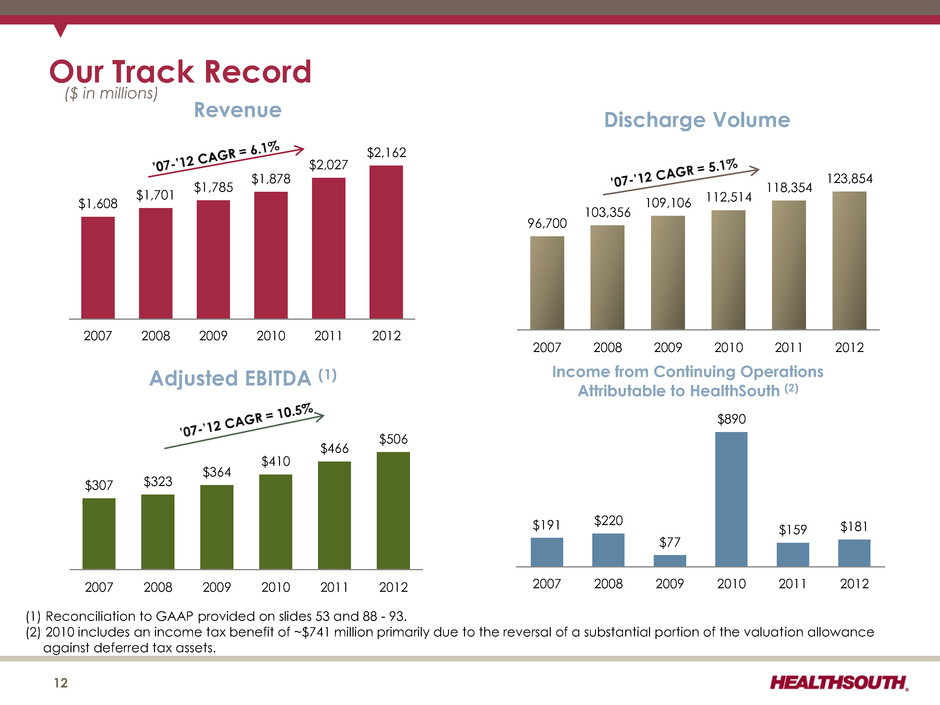

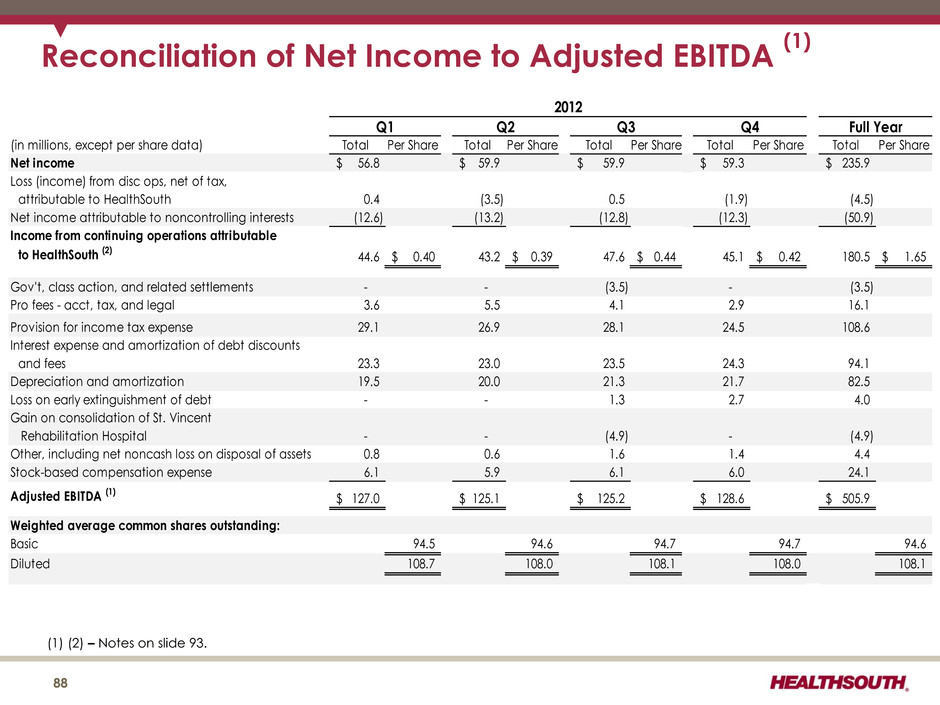

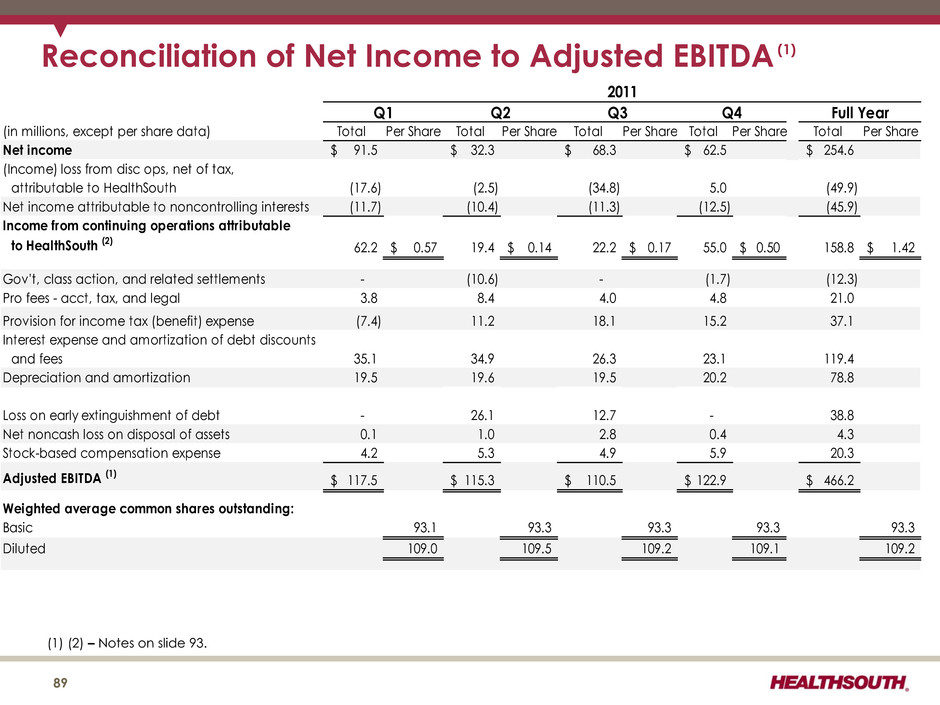

$1,608 $1,701 $1,785 $1,878 $2,027 $2,162 2007 2008 2009 2010 2011 2012 Revenue Our Track Record ($ in millions) (1) Reconciliation to GAAP provided on slides 53 and 88 - 93. (2) 2010 includes an income tax benefit of ~$741 million primarily due to the reversal of a substantial portion of the valuation allowance against deferred tax assets. $307 $323 $364 $410 $466 $506 2007 2008 2009 2010 2011 2012 Adjusted EBITDA (1) 96,700 103,356 109,106 112,514 118,354 123,854 2007 2008 2009 2010 2011 2012 Discharge Volume 12 $191 $220 $77 $890 $159 $181 2007 2008 2009 2010 2011 2012 Income from Continuing Operations Attributable to HealthSouth (2)

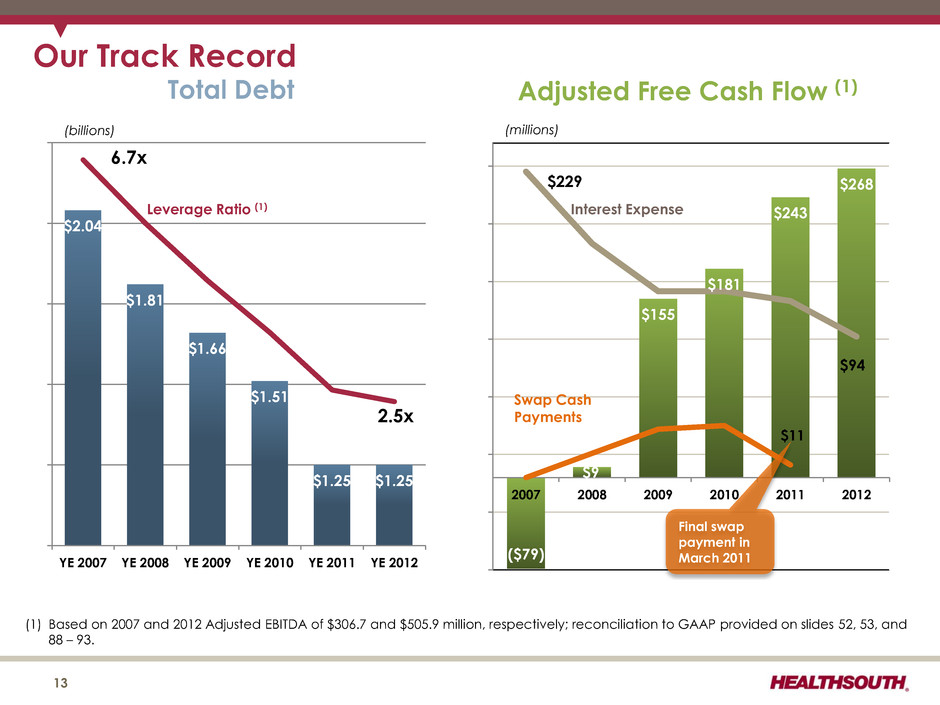

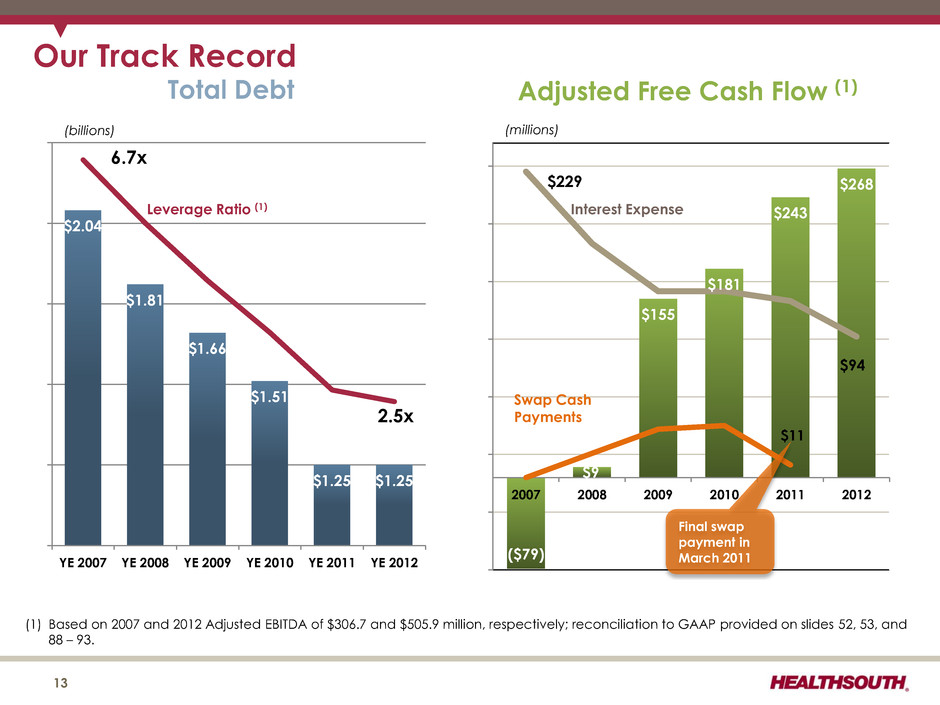

$2.04 $1.81 $1.66 $1.51 $1.25 $1.25 0 1 2 3 4 5 6 7 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 YE 2007 YE 2008 YE 2009 YE 2010 YE 2011 YE 2012 Total Debt 6.7x 2.5x Our Track Record 13 Leverage Ratio (1) (billions) ($79) $9 $155 $181 $243 $268 $11 ($70) ($20) $30 $80 $130 $180 $230 2007 2008 2009 2010 2011 2012 Adjusted Free Cash Flow (1) (millions) Swap Cash Payments Final swap payment in March 2011 (1) Based on 2007 and 2012 Adjusted EBITDA of $306.7 and $505.9 million, respectively; reconciliation to GAAP provided on slides 52, 53, and 88 – 93. Interest Expense $229 $94

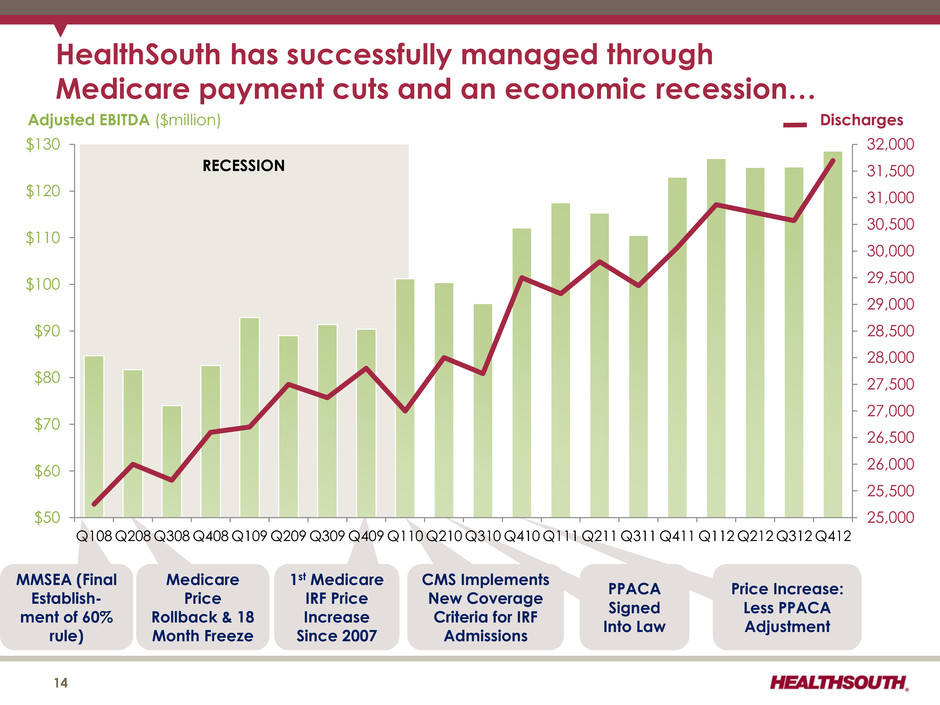

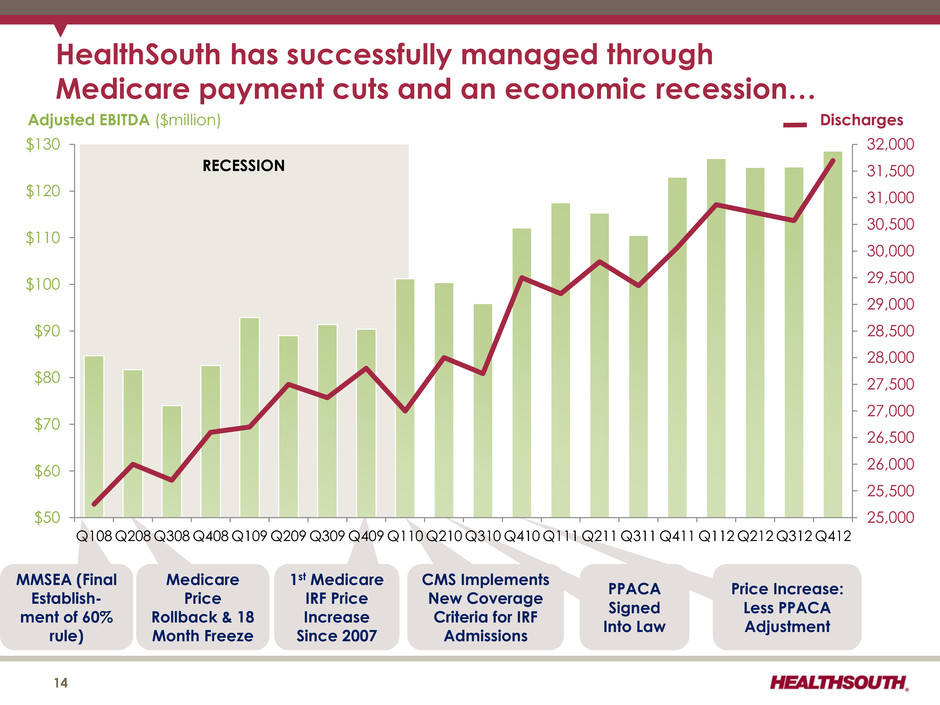

PPACA Signed Into Law MMSEA (Final Establish- ment of 60% rule) Medicare Price Rollback & 18 Month Freeze 1st Medicare IRF Price Increase Since 2007 CMS Implements New Coverage Criteria for IRF Admissions Price Increase: Less PPACA Adjustment RECESSION 25,000 25,500 26,000 26,500 27,000 27,500 28,000 28,500 29,000 29,500 30,000 30,500 31,000 31,500 32,000 $50 $60 $70 $80 $90 $100 $110 $120 $130 Q108 Q208 Q308 Q408 Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412 HealthSouth has successfully managed through Medicare payment cuts and an economic recession… 14 Adjusted EBITDA ($million) Discharges

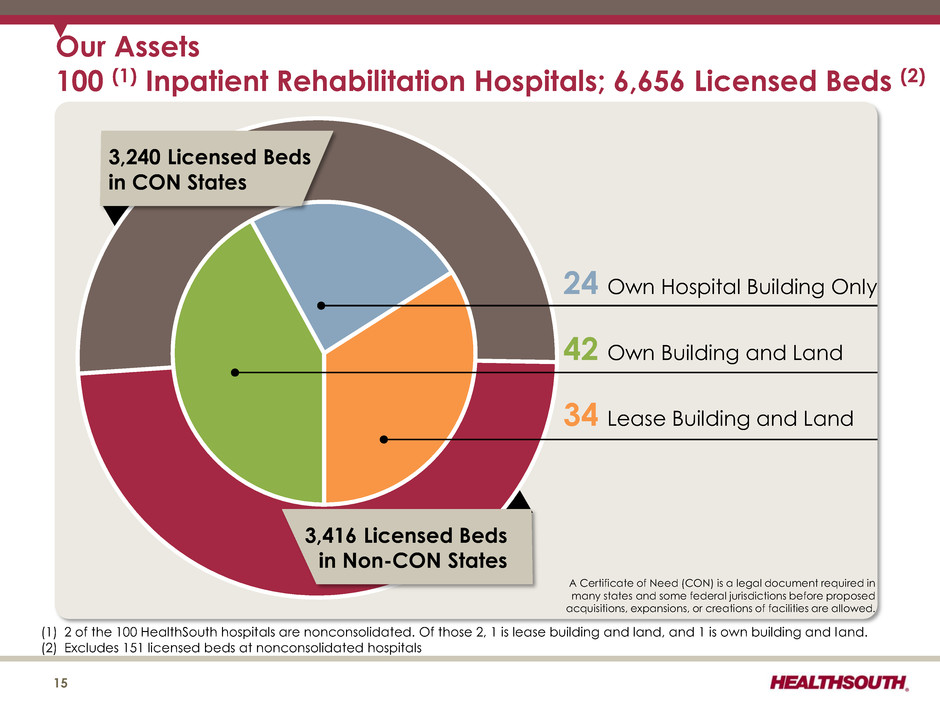

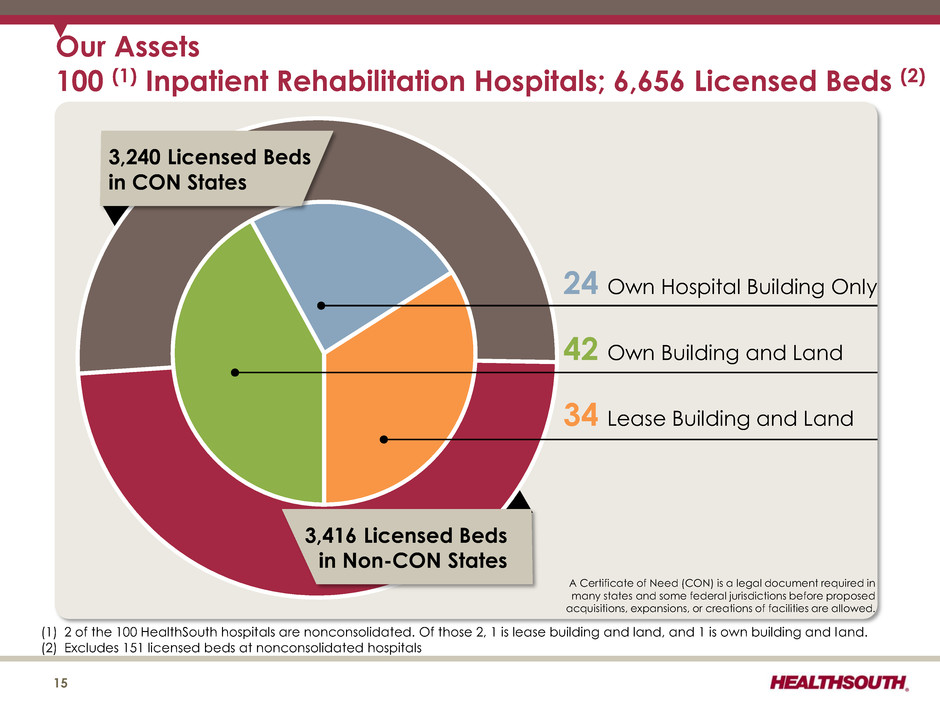

15 3,240 Licensed Beds in CON States Our Assets 100 (1) Inpatient Rehabilitation Hospitals; 6,656 Licensed Beds (2) 3,416 Licensed Beds in Non-CON States 24 Own Hospital Building Only 42 Own Building and Land 34 Lease Building and Land A Certificate of Need (CON) is a legal document required in many states and some federal jurisdictions before proposed acquisitions, expansions, or creations of facilities are allowed. (1) 2 of the 100 HealthSouth hospitals are nonconsolidated. Of those 2, 1 is lease building and land, and 1 is own building and land. (2) Excludes 151 licensed beds at nonconsolidated hospitals

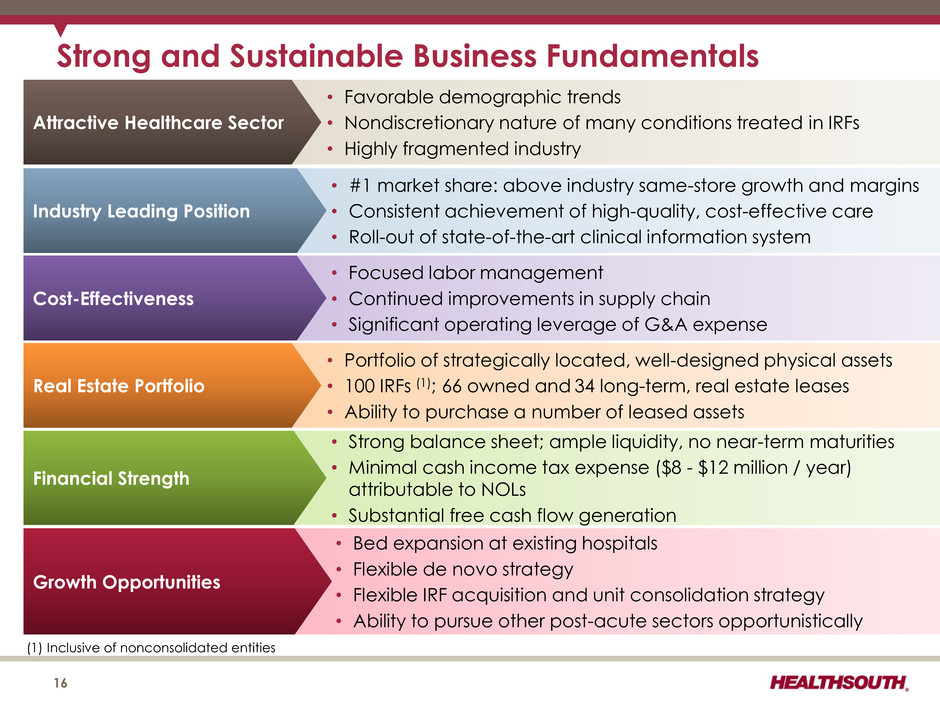

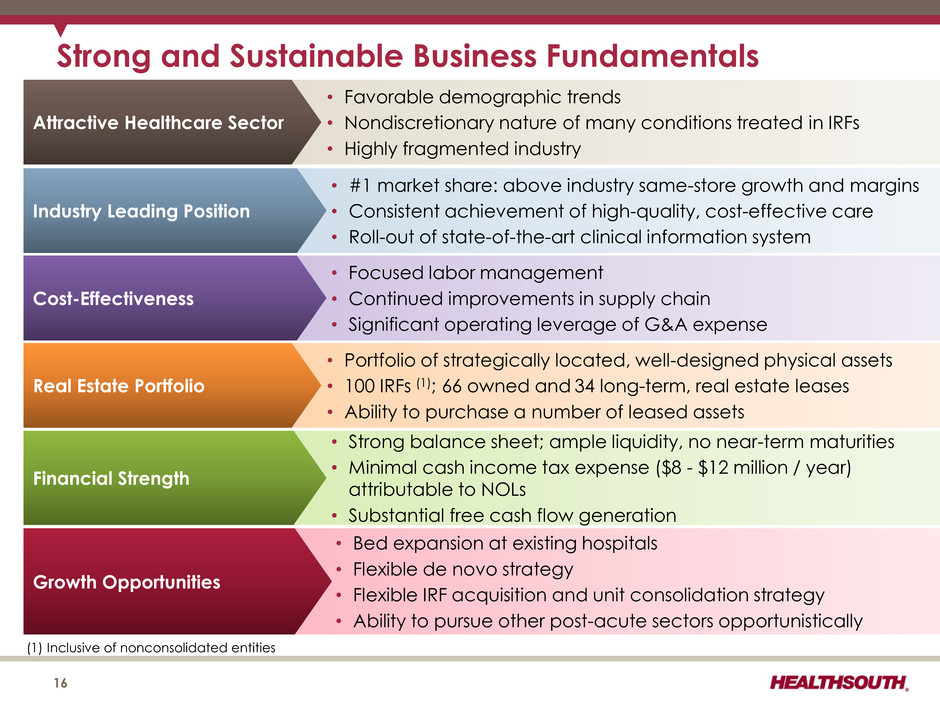

Strong and Sustainable Business Fundamentals • Bed expansion at existing hospitals • Flexible de novo strategy • Flexible IRF acquisition and unit consolidation strategy • Ability to pursue other post-acute sectors opportunistically Growth Opportunities • Strong balance sheet; ample liquidity, no near-term maturities • Minimal cash income tax expense ($8 - $12 million / year) attributable to NOLs • Substantial free cash flow generation Financial Strength • #1 market share: above industry same-store growth and margins • Consistent achievement of high-quality, cost-effective care • Roll-out of state-of-the-art clinical information system Industry Leading Position • Favorable demographic trends • Nondiscretionary nature of many conditions treated in IRFs • Highly fragmented industry Attractive Healthcare Sector 16 • Focused labor management • Continued improvements in supply chain • Significant operating leverage of G&A expense Cost-Effectiveness • Portfolio of strategically located, well-designed physical assets • 100 IRFs (1); 66 owned and 34 long-term, real estate leases • Ability to purchase a number of leased assets Real Estate Portfolio (1) Inclusive of nonconsolidated entities

Industry Structure 17

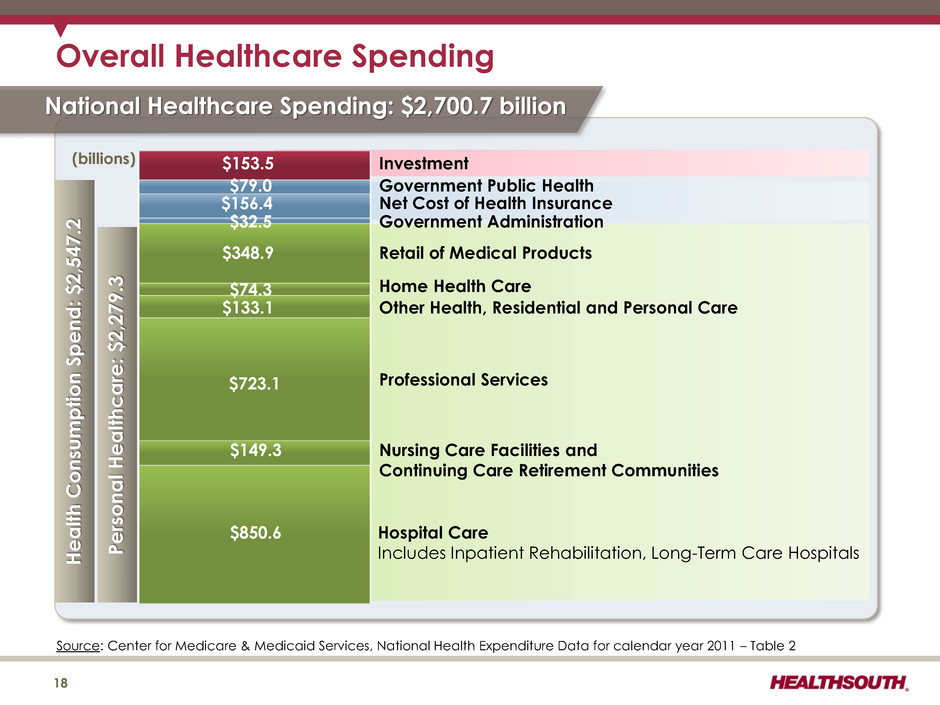

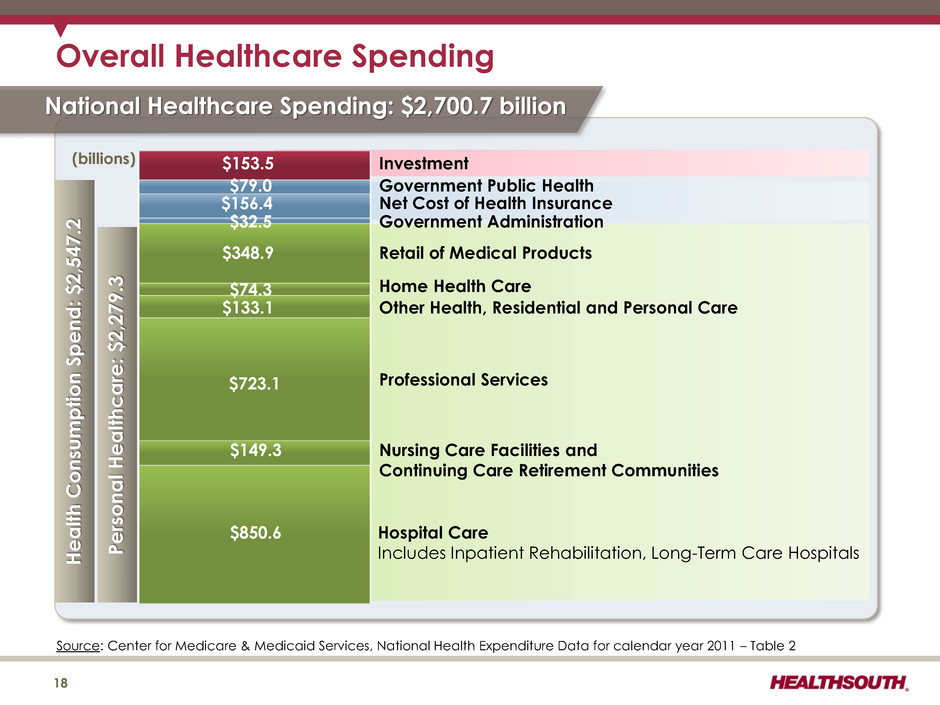

Person a l He a lt hc a re: $2,279. 3 Source: Center for Medicare & Medicaid Services, National Health Expenditure Data for calendar year 2011 – Table 2 Overall Healthcare Spending Hospital Care Includes Inpatient Rehabilitation, Long-Term Care Hospitals $850.6 $149.3 $723.1 $133.1 $74.3 $348.9 Nursing Care Facilities and Continuing Care Retirement Communities He a lt h C onsu m p tion S p en d : $2,547.2 Professional Services Other Health, Residential and Personal Care Home Health Care Retail of Medical Products $32.5 Government Administration $156.4 Net Cost of Health Insurance $79.0 Government Public Health $153.5 Investment National Healthcare Spending: $2,700.7 billion 18 (billions)

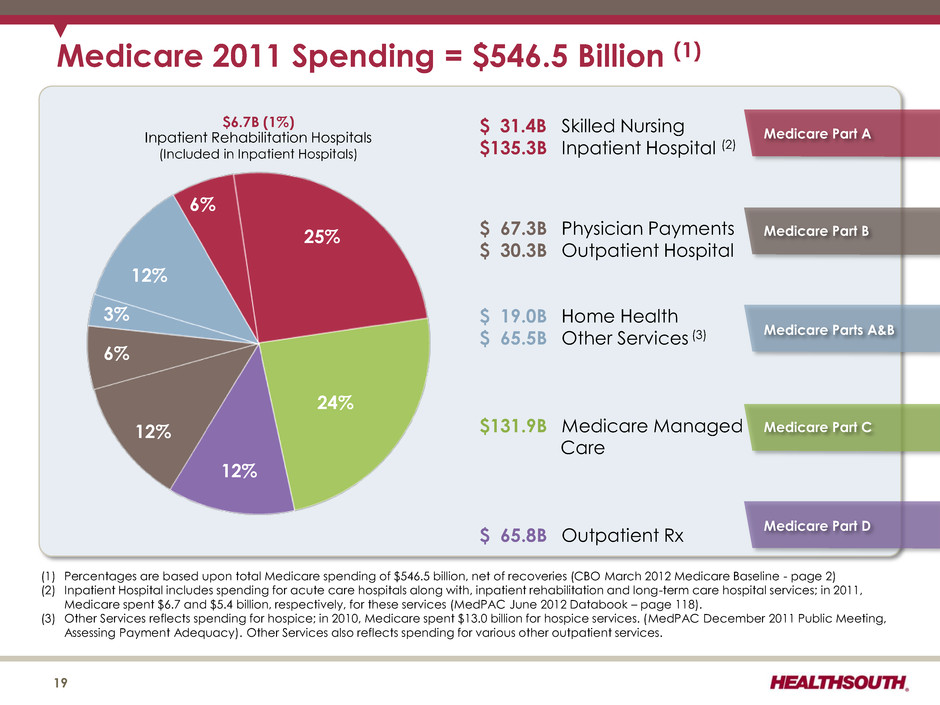

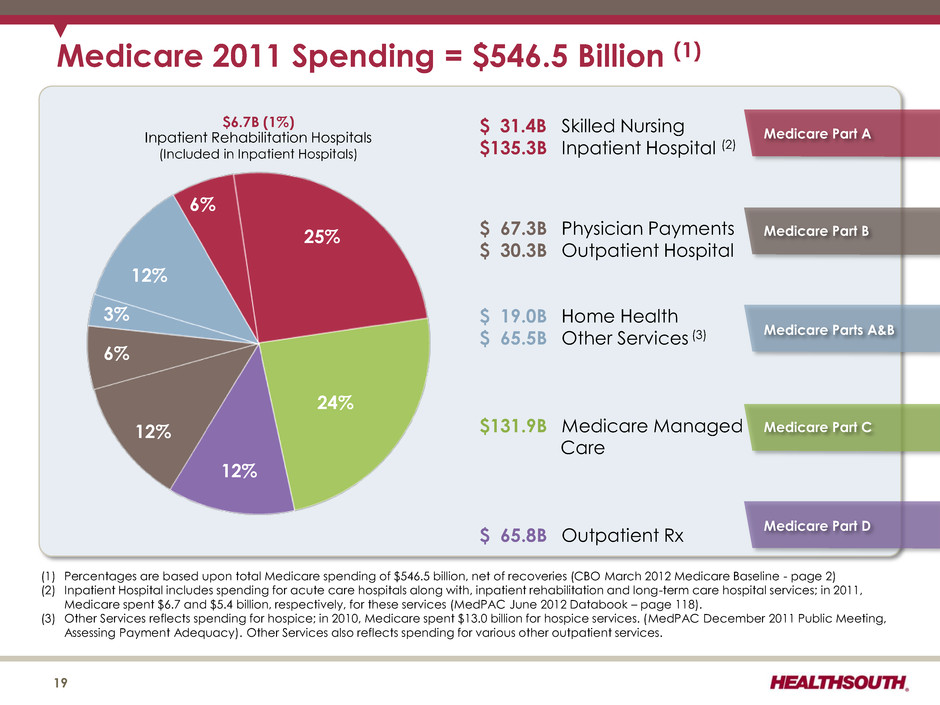

Medicare 2011 Spending = $546.5 Billion (1) (1) Percentages are based upon total Medicare spending of $546.5 billion, net of recoveries (CBO March 2012 Medicare Baseline - page 2) (2) Inpatient Hospital includes spending for acute care hospitals along with, inpatient rehabilitation and long-term care hospital services; in 2011, Medicare spent $6.7 and $5.4 billion, respectively, for these services (MedPAC June 2012 Databook – page 118). (3) Other Services reflects spending for hospice; in 2010, Medicare spent $13.0 billion for hospice services. (MedPAC December 2011 Public Meeting, Assessing Payment Adequacy). Other Services also reflects spending for various other outpatient services. $ 31.4B Skilled Nursing $ 135.3B Inpatient Hospital (2) $ 67.3B Physician Payments $ 30.3B Outpatient Hospital $ 19.0B Home Health $ 65.5B Other Services (3) $ 131.9B Medicare Managed Care $ 65.8B Outpatient Rx 6% 25% 24% 12% 12% 6% 3% 12% $6.7B (1%) Inpatient Rehabilitation Hospitals (Included in Inpatient Hospitals) Medicare Part B Medicare Part C Medicare Parts A&B Medicare Part D Medicare Part A 19

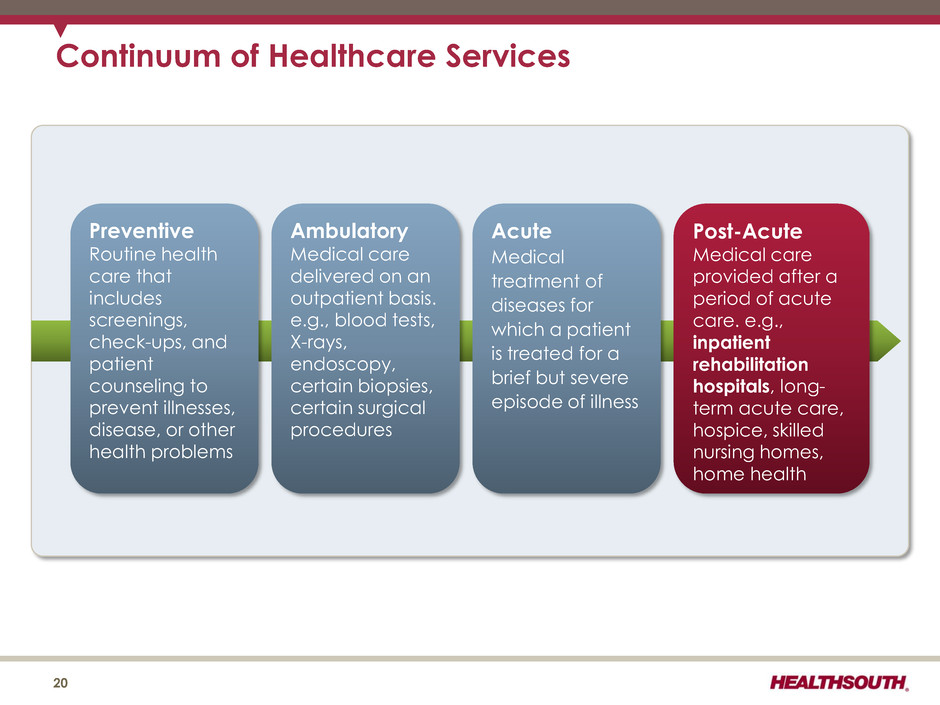

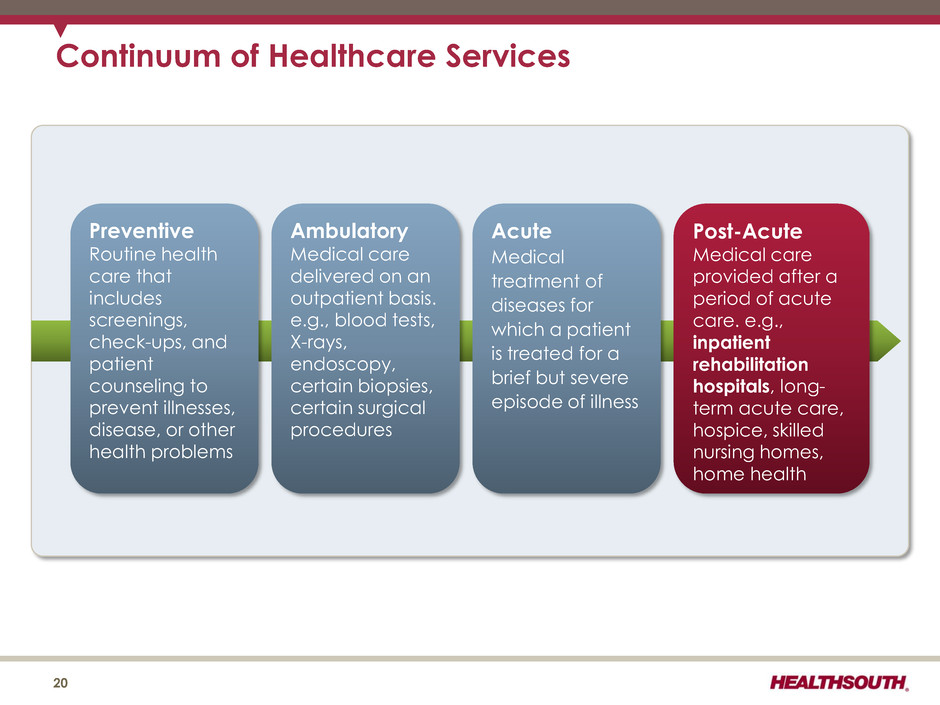

Preventive Routine health care that includes screenings, check-ups, and patient counseling to prevent illnesses, disease, or other health problems Acute Medical treatment of diseases for which a patient is treated for a brief but severe episode of illness Ambulatory Medical care delivered on an outpatient basis. e.g., blood tests, X-rays, endoscopy, certain biopsies, certain surgical procedures Post-Acute Medical care provided after a period of acute care. e.g., inpatient rehabilitation hospitals, long- term acute care, hospice, skilled nursing homes, home health Continuum of Healthcare Services 20

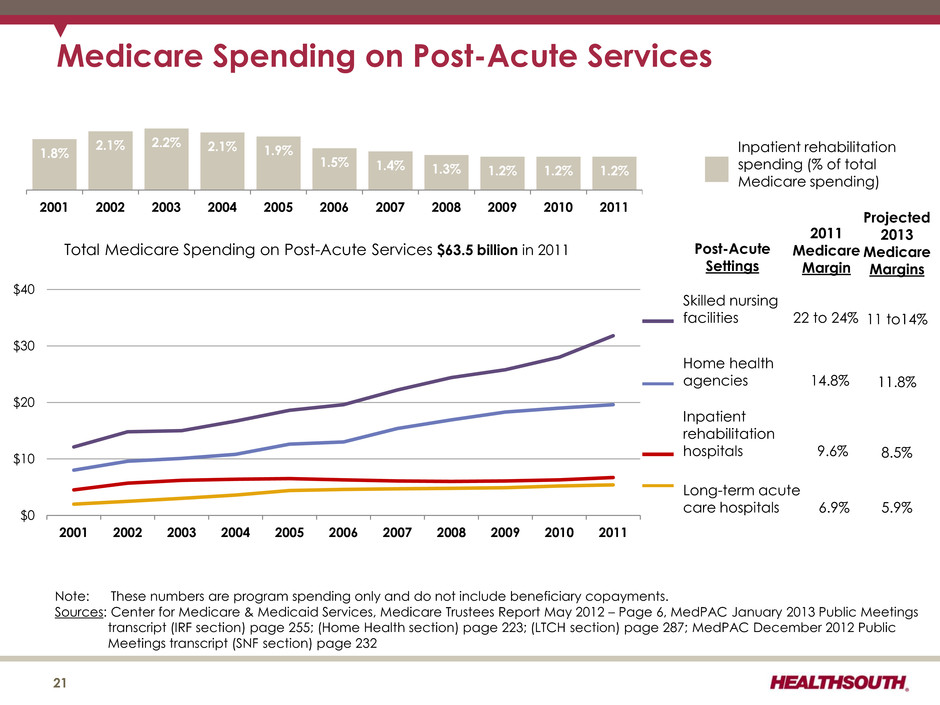

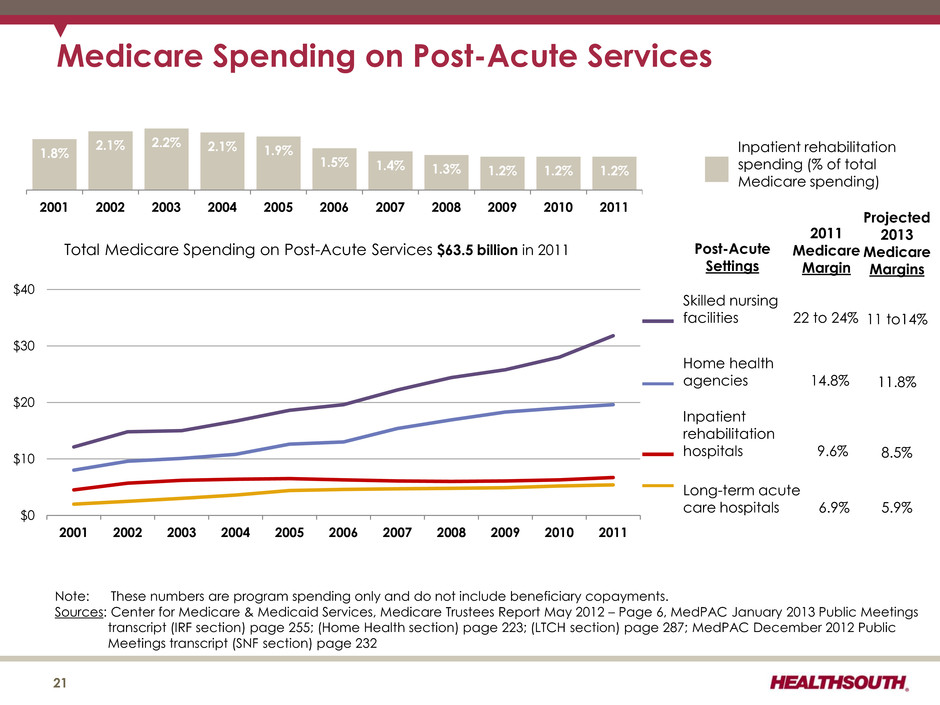

$0 $10 $20 $30 $40 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Total Medicare Spending on Post-Acute Services $63.5 billion in 2011 Note: These numbers are program spending only and do not include beneficiary copayments. Sources: Center for Medicare & Medicaid Services, Medicare Trustees Report May 2012 – Page 6, MedPAC January 2013 Public Meetings transcript (IRF section) page 255; (Home Health section) page 223; (LTCH section) page 287; MedPAC December 2012 Public Meetings transcript (SNF section) page 232 Medicare Spending on Post-Acute Services Skilled nursing facilities 22 to 24% Home health agencies 14.8% Inpatient rehabilitation hospitals 9.6% Long-term acute care hospitals 6.9% 21 2011 Medicare Margin Post-Acute Settings Inpatient rehabilitation spending (% of total Medicare spending) 1.8% 2.1% 2.2% 2.1% 1.9% 1.5% 1.4% 1.3% 1.2% 1.2% 1.2% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Projected 2013 Medicare Margins 11 to14% 11.8% 8.5% 5.9%

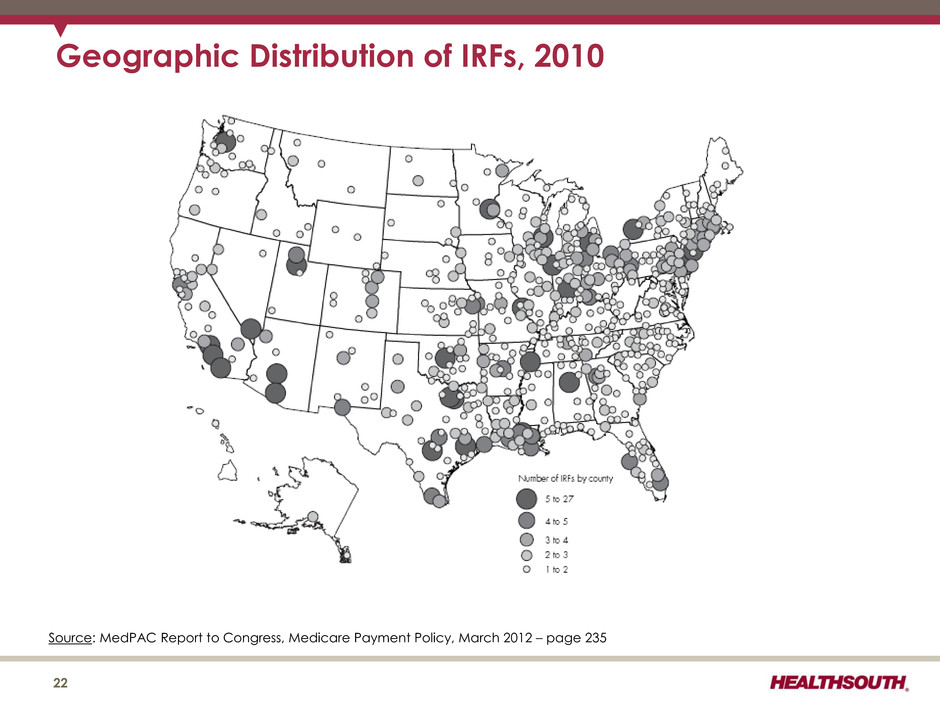

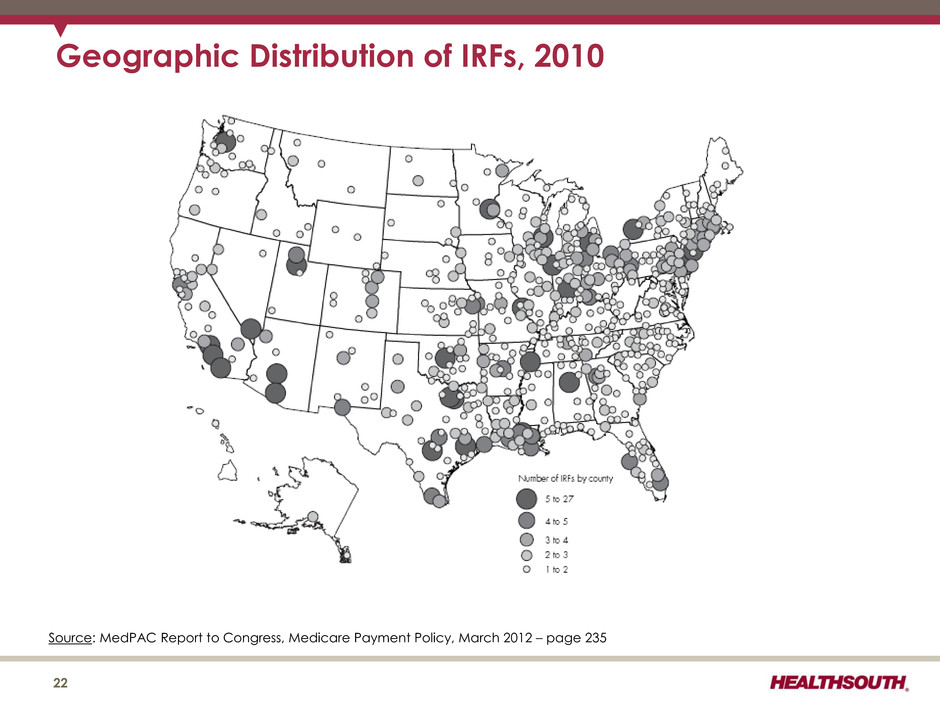

Geographic Distribution of IRFs, 2010 22 Source: MedPAC Report to Congress, Medicare Payment Policy, March 2012 – page 235

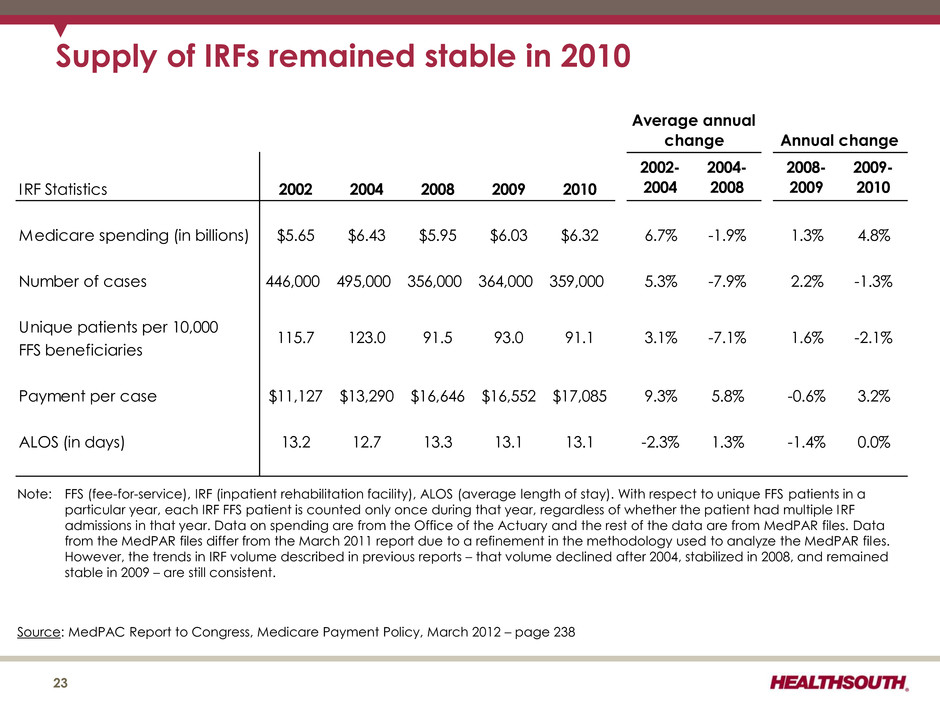

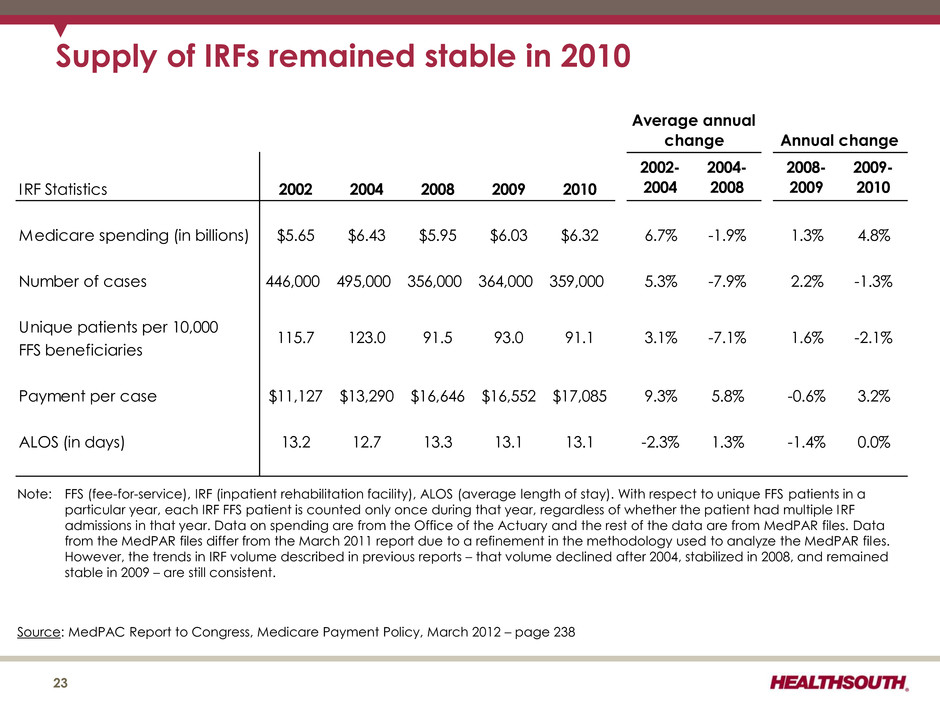

Supply of IRFs remained stable in 2010 23 Source: MedPAC Report to Congress, Medicare Payment Policy, March 2012 – page 238 IRF Statistics 2002 2004 2008 2009 2010 2002- 2004 2004- 2008 2008- 2009 2009- 2010 Medicare spending (in billions) $5.65 $6.43 $5.95 $6.03 $6.32 6.7% -1.9% 1.3% 4.8% Number of cases 446,000 495,000 356,000 364,000 359,000 5.3% -7.9% 2.2% -1.3% Unique patients per 10,000 FFS beneficiaries Payment per case $11,127 $13,290 $16,646 $16,552 $17,085 9.3% 5.8% -0.6% 3.2% ALOS (in days) 13.2 12.7 13.3 13.1 13.1 -2.3% 1.3% -1.4% 0.0% -2.1% Average annual change Annual change 115.7 123.0 91.5 93.0 91.1 3.1% -7.1% 1.6% Note: FFS (fee-for-service), IRF (inpatient rehabilitation facility), ALOS (average length of stay). With respect to unique FFS patients in a particular year, each IRF FFS patient is counted only once during that year, regardless of whether the patient had multiple IRF admissions in that year. Data on spending are from the Office of the Actuary and the rest of the data are from MedPAR files. Data from the MedPAR files differ from the March 2011 report due to a refinement in the methodology used to analyze the MedPAR files. However, the trends in IRF volume described in previous reports – that volume declined after 2004, stabilized in 2008, and remained stable in 2009 – are still consistent.

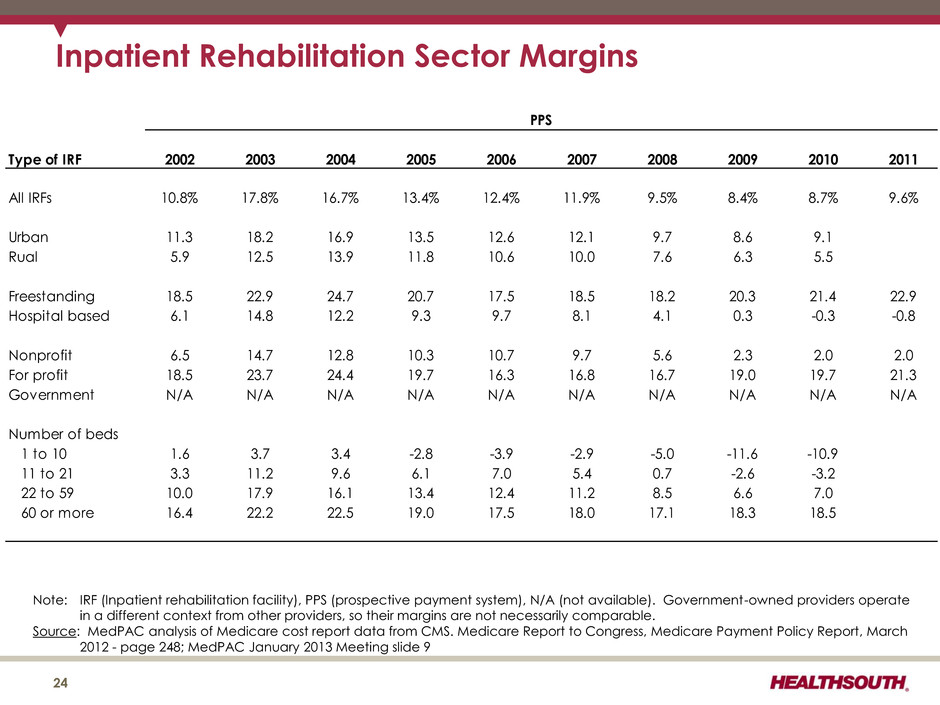

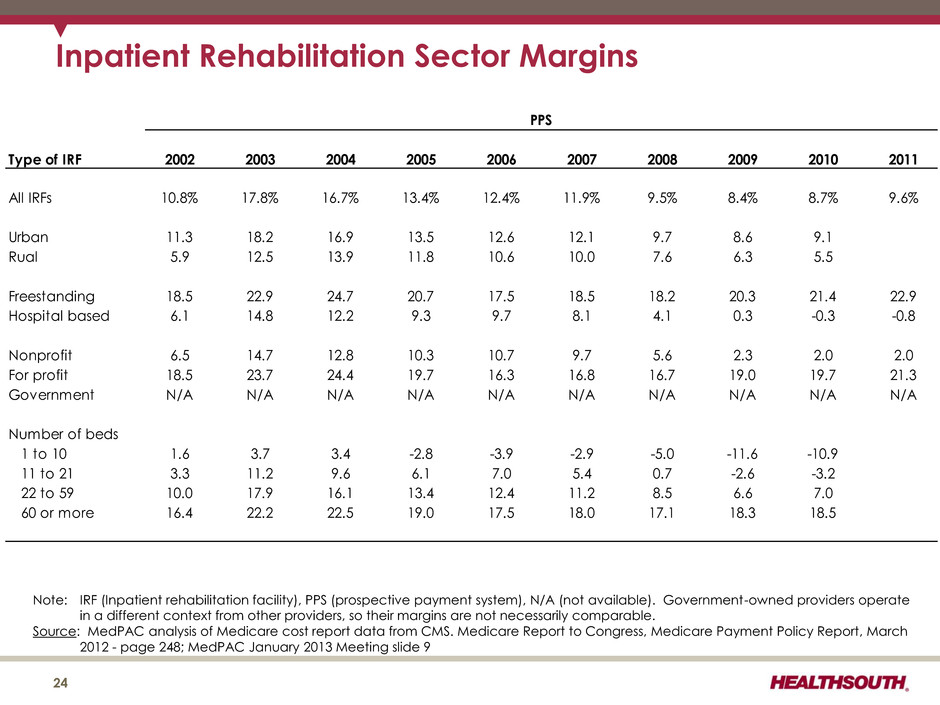

24 Inpatient Rehabilitation Sector Margins Type of IRF 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 All IRFs 10.8% 17.8% 16.7% 13.4% 12.4% 11.9% 9.5% 8.4% 8.7% 9.6% Urban 11.3 18.2 16.9 13.5 12.6 12.1 9.7 8.6 9.1 Rual 5.9 12.5 13.9 11.8 10.6 10.0 7.6 6.3 5.5 Freestanding 18.5 22.9 24.7 20.7 17.5 18.5 18.2 20.3 21.4 22.9 Hospital based 6.1 14.8 12.2 9.3 9.7 8.1 4.1 0.3 -0.3 -0.8 Nonprofit 6.5 14.7 12.8 10.3 10.7 9.7 5.6 2.3 2.0 2.0 For profit 18.5 23.7 24.4 19.7 16.3 16.8 16.7 19.0 19.7 21.3 Government N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A Number of beds 1 to 10 1.6 3.7 3.4 -2.8 -3.9 -2.9 -5.0 -11.6 -10.9 11 to 21 3.3 11.2 9.6 6.1 7.0 5.4 0.7 -2.6 -3.2 22 to 59 10.0 17.9 16.1 13.4 12.4 11.2 8.5 6.6 7.0 60 or more 16.4 22.2 22.5 19.0 17.5 18.0 17.1 18.3 18.5 PPS Note: IRF (Inpatient rehabilitation facility), PPS (prospective payment system), N/A (not available). Government-owned providers operate in a different context from other providers, so their margins are not necessarily comparable. Source: MedPAC analysis of Medicare cost report data from CMS. Medicare Report to Congress, Medicare Payment Policy Report, March 2012 - page 248; MedPAC January 2013 Meeting slide 9

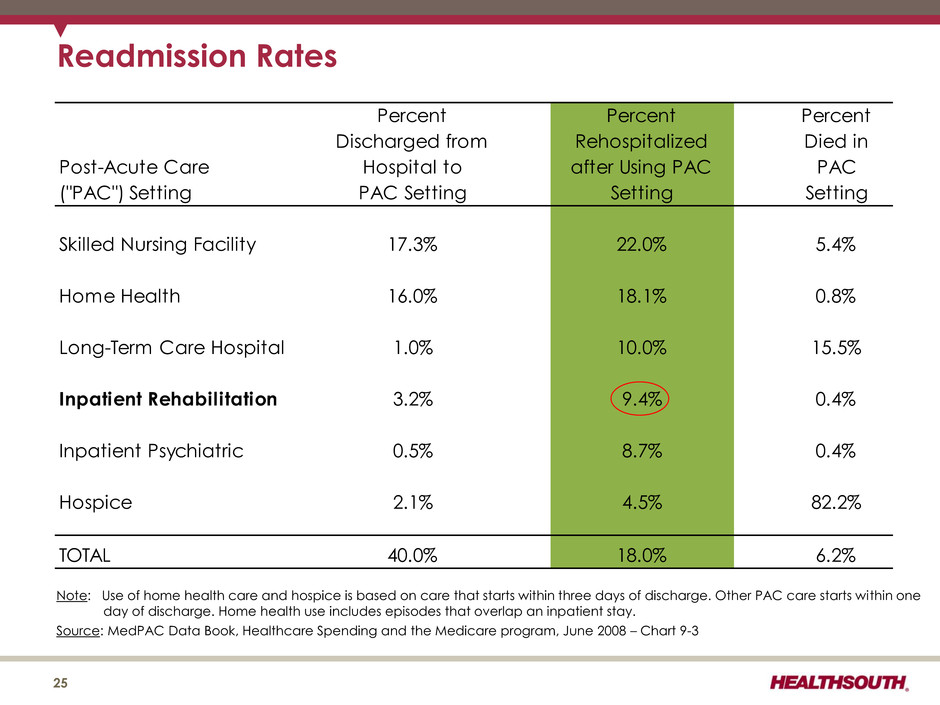

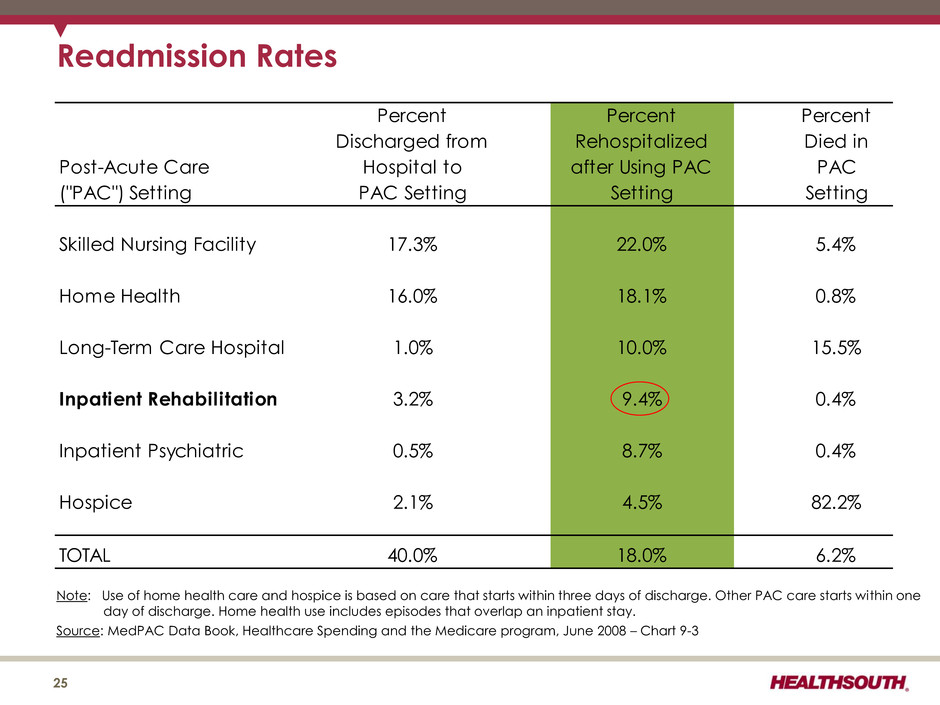

Post-Acute Care ("PAC") Setting Percent Discharged from Hospital to PAC Setting Percent Rehospitalized after Using PAC Setting Percent Died in PAC Setting Skilled Nursing Facility 17.3% 22.0% 5.4% Home Health 16.0% 18.1% 0.8% Long-Term Care Hospital 1.0% 10.0% 15.5% Inpatient Rehabilitation 3.2% 9.4% 0.4% Inpatient Psychiatric 0.5% 8.7% 0.4% Hospice 2.1% 4.5% 82.2% TOTAL 40.0% 18.0% 6.2% Readmission Rates Note: Use of home health care and hospice is based on care that starts within three days of discharge. Other PAC care starts within one day of discharge. Home health use includes episodes that overlap an inpatient stay. Source: MedPAC Data Book, Healthcare Spending and the Medicare program, June 2008 – Chart 9-3 25

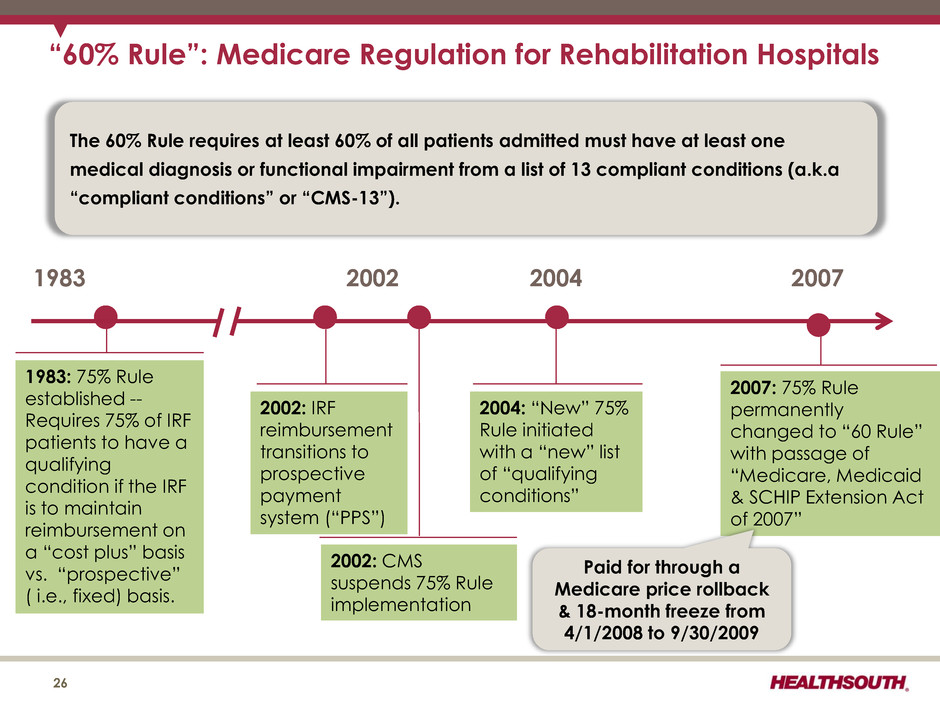

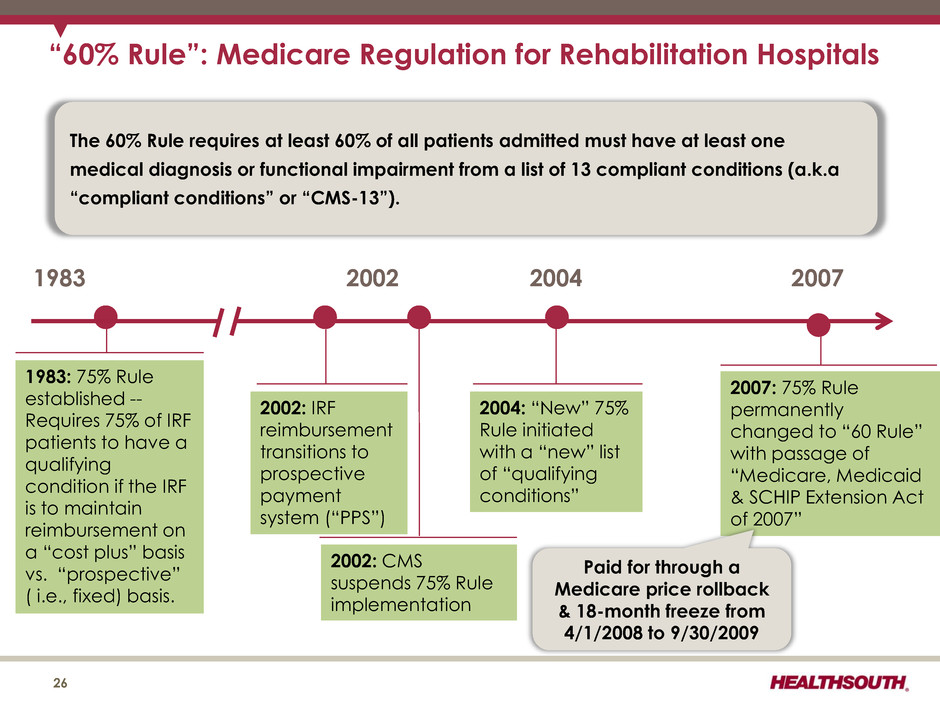

“60% Rule”: Medicare Regulation for Rehabilitation Hospitals 26 1983 1983: 75% Rule established -- Requires 75% of IRF patients to have a qualifying condition if the IRF is to maintain reimbursement on a “cost plus” basis vs. “prospective” ( i.e., fixed) basis. The 60% Rule requires at least 60% of all patients admitted must have at least one medical diagnosis or functional impairment from a list of 13 compliant conditions (a.k.a “compliant conditions” or “CMS-13”). 2002 2004 2007 2002: IRF reimbursement transitions to prospective payment system (“PPS”) 2002: CMS suspends 75% Rule implementation 2004: “New” 75% Rule initiated with a “new” list of “qualifying conditions” 2007: 75% Rule permanently changed to “60 Rule” with passage of “Medicare, Medicaid & SCHIP Extension Act of 2007” Paid for through a Medicare price rollback & 18-month freeze from 4/1/2008 to 9/30/2009

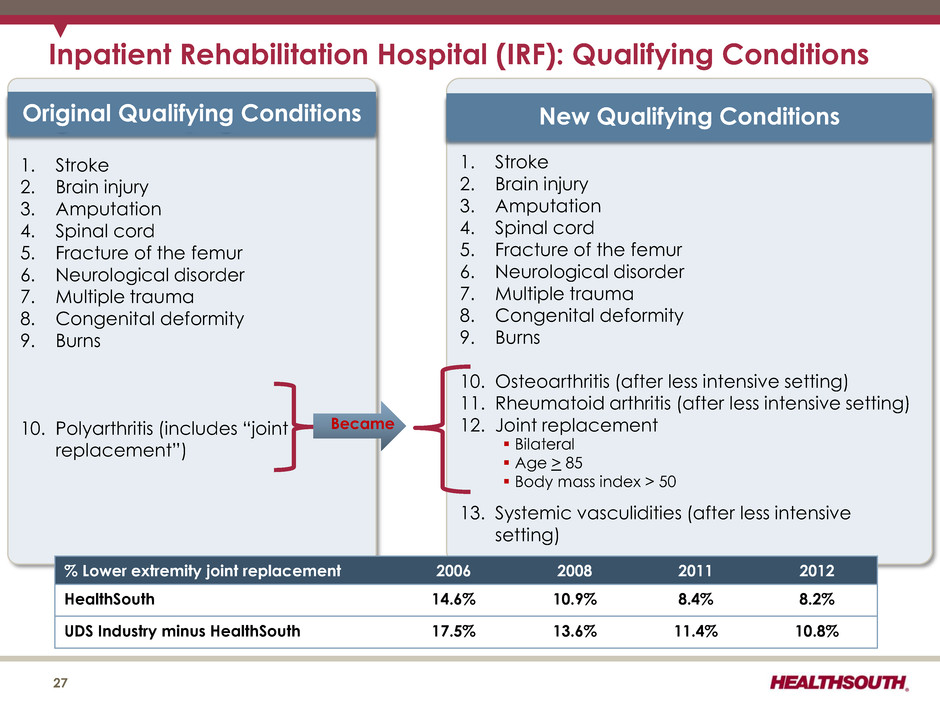

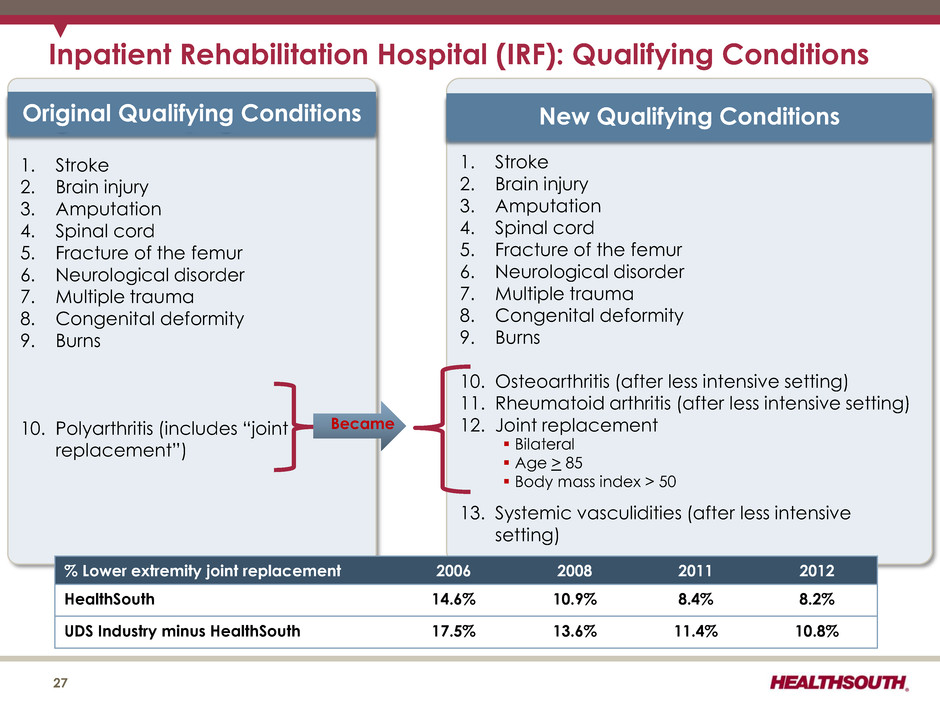

Inpatient Rehabilitation Hospital (IRF): Qualifying Conditions 27 1. Stroke 2. Brain injury 3. Amputation 4. Spinal cord 5. Fracture of the femur 6. Neurological disorder 7. Multiple trauma 8. Congenital deformity 9. Burns 10. Polyarthritis (includes “joint replacement”) Original Qualifying Conditions 1. Stroke 2. Brain injury 3. Amputation 4. Spinal cord 5. Fracture of the femur 6. Neurological disorder 7. Multiple trauma 8. Congenital deformity 9. Burns 10. Osteoarthritis (after less intensive setting) 11. Rheumatoid arthritis (after less intensive setting) 12. Joint replacement 13. Systemic vasculidities (after less intensive setting) New Qualifying Conditions Became Bilateral Age > 85 Body mass index > 50 % Lower extremity joint replacement 2006 2008 2011 2012 HealthSouth 14.6% 10.9% 8.4% 8.2% UDS Industry minus HealthSouth 17.5% 13.6% 11.4% 10.8%

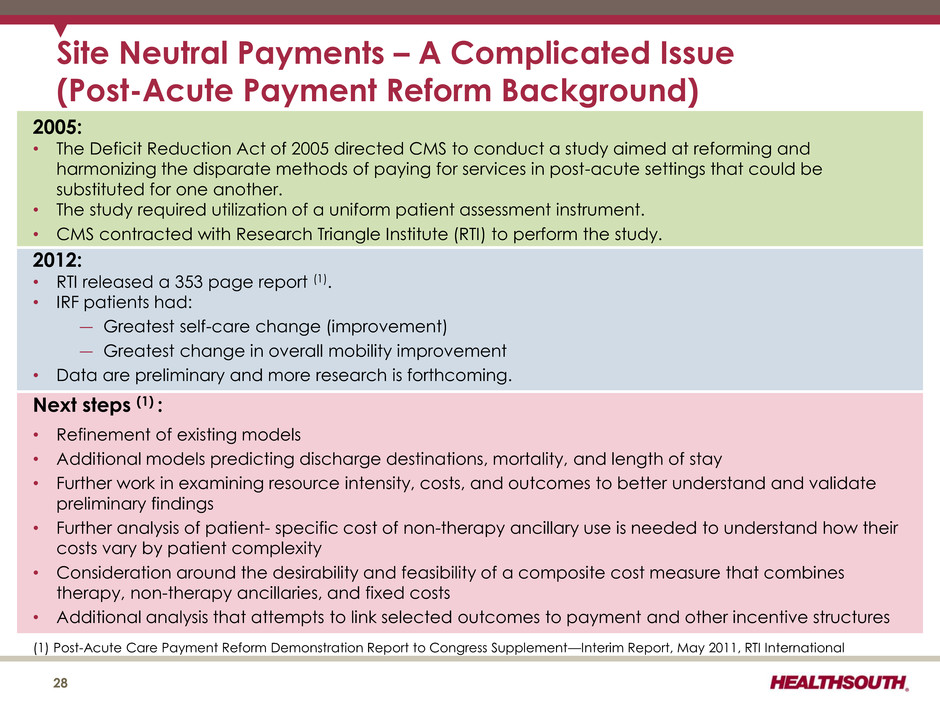

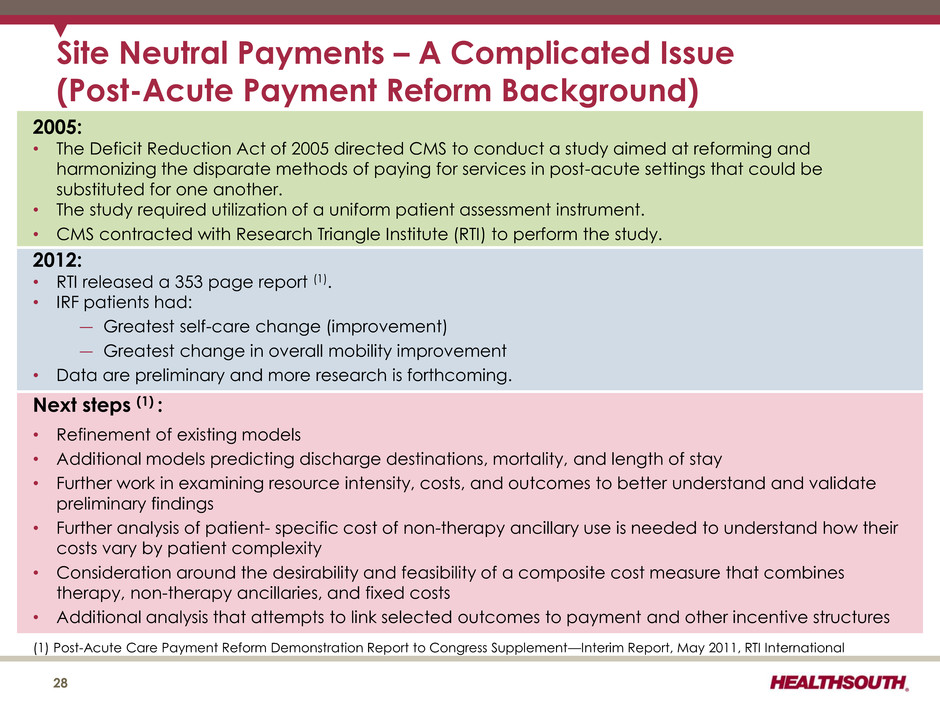

Site Neutral Payments – A Complicated Issue (Post-Acute Payment Reform Background) 28 (1) Post-Acute Care Payment Reform Demonstration Report to Congress Supplement—Interim Report, May 2011, RTI International 2005: • The Deficit Reduction Act of 2005 directed CMS to conduct a study aimed at reforming and harmonizing the disparate methods of paying for services in post-acute settings that could be substituted for one another. • The study required utilization of a uniform patient assessment instrument. • CMS contracted with Research Triangle Institute (RTI) to perform the study. 2012: • RTI released a 353 page report (1). • IRF patients had: ― Greatest self-care change (improvement) ― Greatest change in overall mobility improvement • Data are preliminary and more research is forthcoming. Next steps (1) : • Refinement of existing models • Additional models predicting discharge destinations, mortality, and length of stay • Further work in examining resource intensity, costs, and outcomes to better understand and validate preliminary findings • Further analysis of patient- specific cost of non-therapy ancillary use is needed to understand how their costs vary by patient complexity • Consideration around the desirability and feasibility of a composite cost measure that combines therapy, non-therapy ancillaries, and fixed costs • Additional analysis that attempts to link selected outcomes to payment and other incentive structures

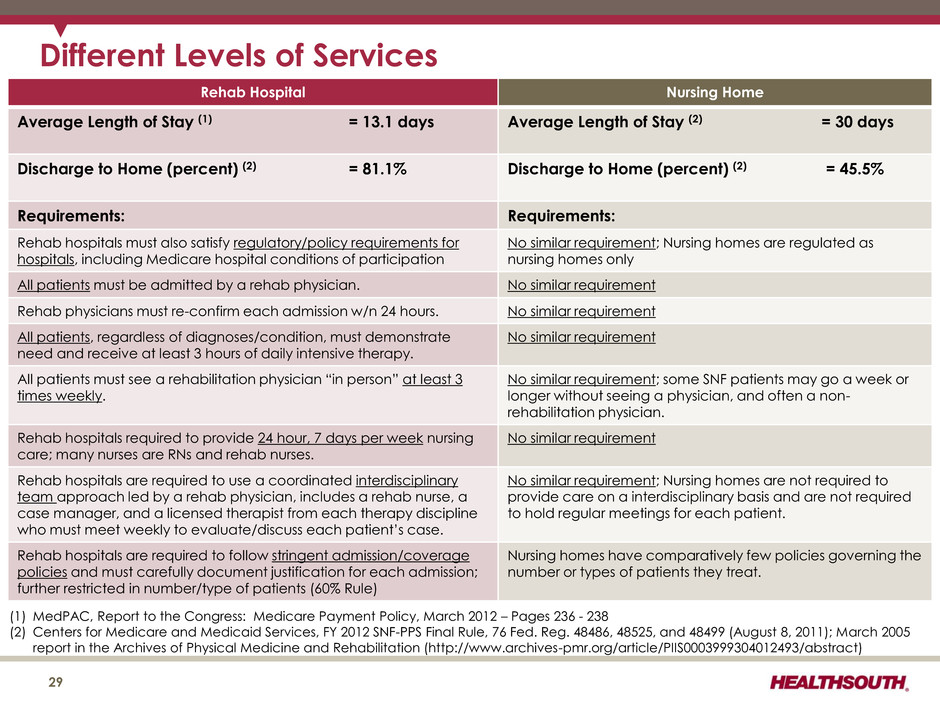

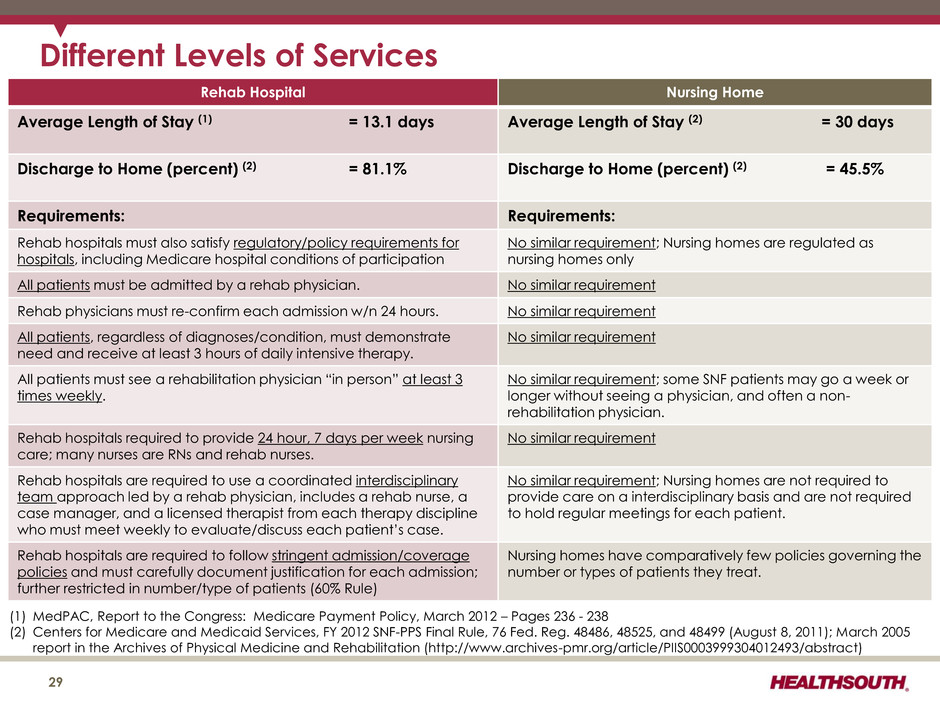

Different Levels of Services Rehab Hospital Nursing Home Average Length of Stay (1) = 13.1 days Average Length of Stay (2) = 30 days Discharge to Home (percent) (2) = 81.1% Discharge to Home (percent) (2) = 45.5% Requirements: Requirements: Rehab hospitals must also satisfy regulatory/policy requirements for hospitals, including Medicare hospital conditions of participation No similar requirement; Nursing homes are regulated as nursing homes only All patients must be admitted by a rehab physician. No similar requirement Rehab physicians must re-confirm each admission w/n 24 hours. No similar requirement All patients, regardless of diagnoses/condition, must demonstrate need and receive at least 3 hours of daily intensive therapy. No similar requirement All patients must see a rehabilitation physician “in person” at least 3 times weekly. No similar requirement; some SNF patients may go a week or longer without seeing a physician, and often a non- rehabilitation physician. Rehab hospitals required to provide 24 hour, 7 days per week nursing care; many nurses are RNs and rehab nurses. No similar requirement Rehab hospitals are required to use a coordinated interdisciplinary team approach led by a rehab physician, includes a rehab nurse, a case manager, and a licensed therapist from each therapy discipline who must meet weekly to evaluate/discuss each patient’s case. No similar requirement; Nursing homes are not required to provide care on a interdisciplinary basis and are not required to hold regular meetings for each patient. Rehab hospitals are required to follow stringent admission/coverage policies and must carefully document justification for each admission; further restricted in number/type of patients (60% Rule) Nursing homes have comparatively few policies governing the number or types of patients they treat. (1) MedPAC, Report to the Congress: Medicare Payment Policy, March 2012 – Pages 236 - 238 (2) Centers for Medicare and Medicaid Services, FY 2012 SNF-PPS Final Rule, 76 Fed. Reg. 48486, 48525, and 48499 (August 8, 2011); March 2005 report in the Archives of Physical Medicine and Rehabilitation (http://www.archives-pmr.org/article/PIIS0003999304012493/abstract) 29

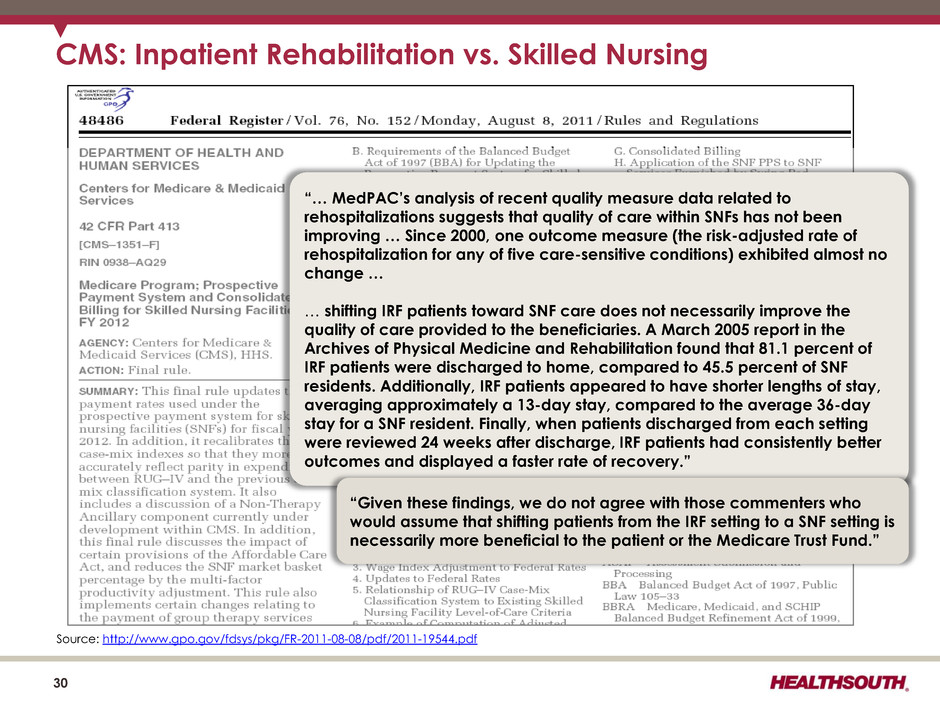

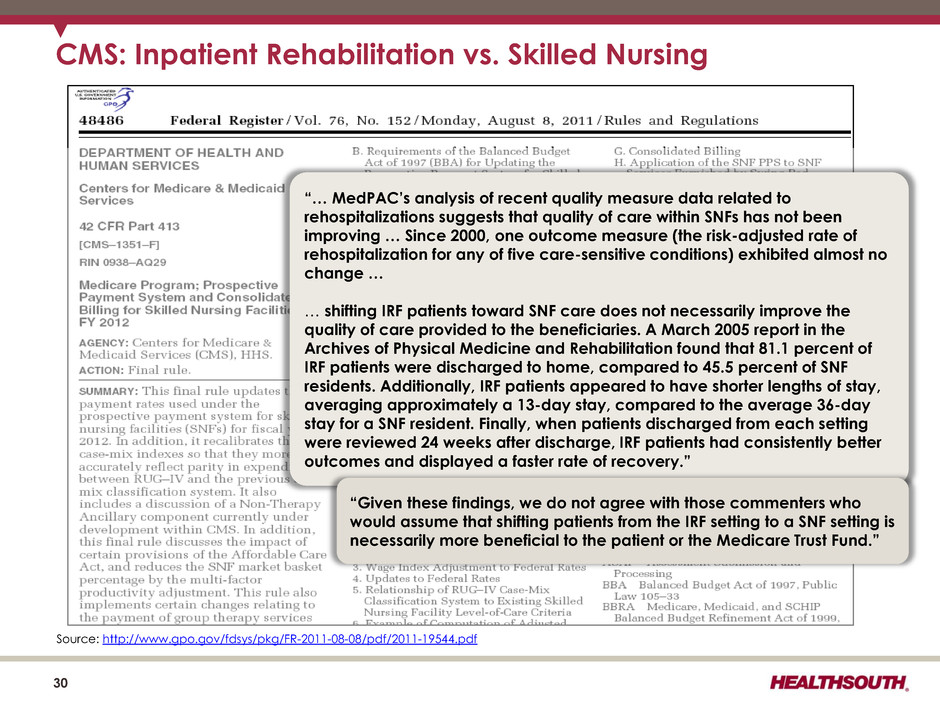

30 CMS: Inpatient Rehabilitation vs. Skilled Nursing “… MedPAC’s analysis of recent quality measure data related to rehospitalizations suggests that quality of care within SNFs has not been improving … Since 2000, one outcome measure (the risk-adjusted rate of rehospitalization for any of five care-sensitive conditions) exhibited almost no change … … shifting IRF patients toward SNF care does not necessarily improve the quality of care provided to the beneficiaries. A March 2005 report in the Archives of Physical Medicine and Rehabilitation found that 81.1 percent of IRF patients were discharged to home, compared to 45.5 percent of SNF residents. Additionally, IRF patients appeared to have shorter lengths of stay, averaging approximately a 13-day stay, compared to the average 36-day stay for a SNF resident. Finally, when patients discharged from each setting were reviewed 24 weeks after discharge, IRF patients had consistently better outcomes and displayed a faster rate of recovery.” “Given these findings, we do not agree with those commenters who would assume that shifting patients from the IRF setting to a SNF setting is necessarily more beneficial to the patient or the Medicare Trust Fund.” Source: http://www.gpo.gov/fdsys/pkg/FR-2011-08-08/pdf/2011-19544.pdf

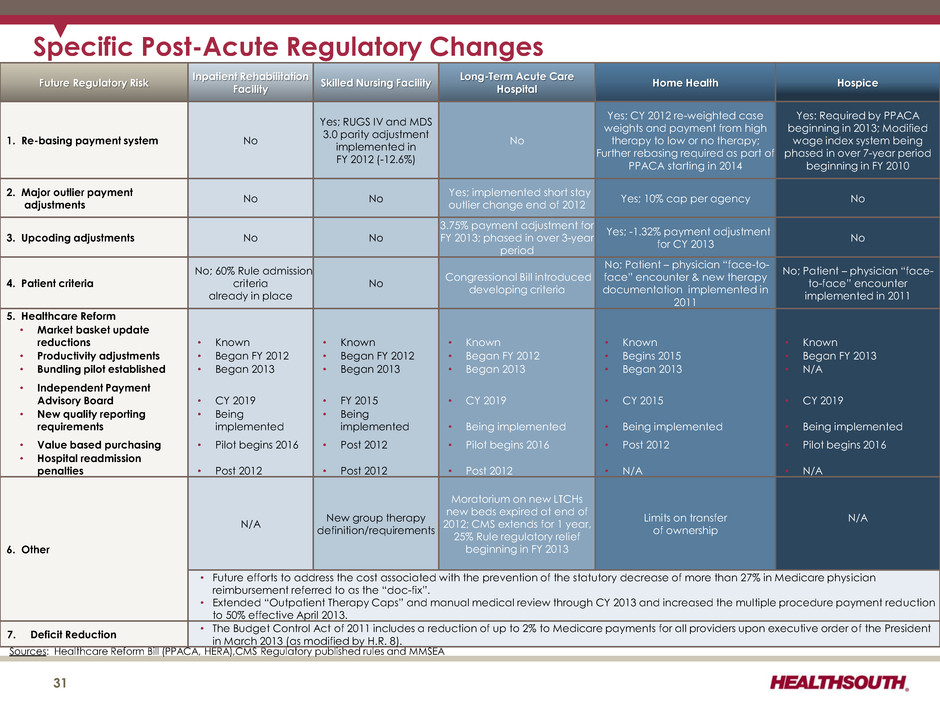

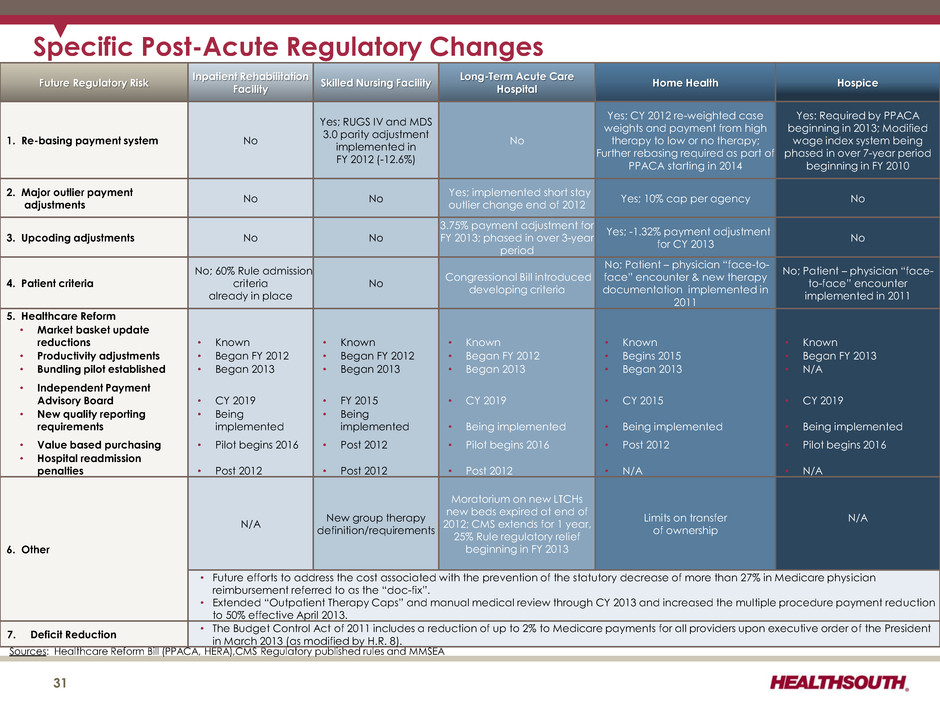

Future Regulatory Risk Inpatient Rehabilitation Facility Skilled Nursing Facility Long-Term Acute Care Hospital Home Health Hospice 1. Re-basing payment system No Yes; RUGS IV and MDS 3.0 parity adjustment implemented in FY 2012 (-12.6%) No Yes; CY 2012 re-weighted case weights and payment from high therapy to low or no therapy; Further rebasing required as part of PPACA starting in 2014 Yes: Required by PPACA beginning in 2013; Modified wage index system being phased in over 7-year period beginning in FY 2010 2. Major outlier payment adjustments No No Yes; implemented short stay outlier change end of 2012 Yes; 10% cap per agency No 3. Upcoding adjustments No No 3.75% payment adjustment for FY 2013; phased in over 3-year period Yes; -1.32% payment adjustment for CY 2013 No 4. Patient criteria No; 60% Rule admission criteria already in place No Congressional Bill introduced developing criteria No; Patient – physician “face-to- face” encounter & new therapy documentation implemented in 2011 No; Patient – physician “face- to-face” encounter implemented in 2011 5. Healthcare Reform • Market basket update reductions • Known • Known • Known • Known • Known • Productivity adjustments • Began FY 2012 • Began FY 2012 • Began FY 2012 • Begins 2015 • Began FY 2013 • Bundling pilot established • Began 2013 • Began 2013 • Began 2013 • Began 2013 • N/A • Independent Payment Advisory Board • CY 2019 • FY 2015 • CY 2019 • CY 2015 • CY 2019 • New quality reporting requirements • Being implemented • Being implemented • Being implemented • Being implemented • Being implemented • Value based purchasing • Pilot begins 2016 • Post 2012 • Pilot begins 2016 • Post 2012 • Pilot begins 2016 • Hospital readmission penalties • Post 2012 • Post 2012 • Post 2012 • N/A • N/A 6. Other N/A New group therapy definition/requirements Moratorium on new LTCHs new beds expired at end of 2012; CMS extends for 1 year, 25% Rule regulatory relief beginning in FY 2013 Limits on transfer of ownership N/A • Future efforts to address the cost associated with the prevention of the statutory decrease of more than 27% in Medicare physician reimbursement referred to as the “doc-fix”. • Extended “Outpatient Therapy Caps” and manual medical review through CY 2013 and increased the multiple procedure payment reduction to 50% effective April 2013. 7. Deficit Reduction • The Budget Control Act of 2011 includes a reduction of up to 2% to Medicare payments for all providers upon executive order of the President in March 2013 (as modified by H.R. 8). Specific Post-Acute Regulatory Changes Sources: Healthcare Reform Bill (PPACA, HERA),CMS Regulatory published rules and MMSEA 31

Historical Perspective 32

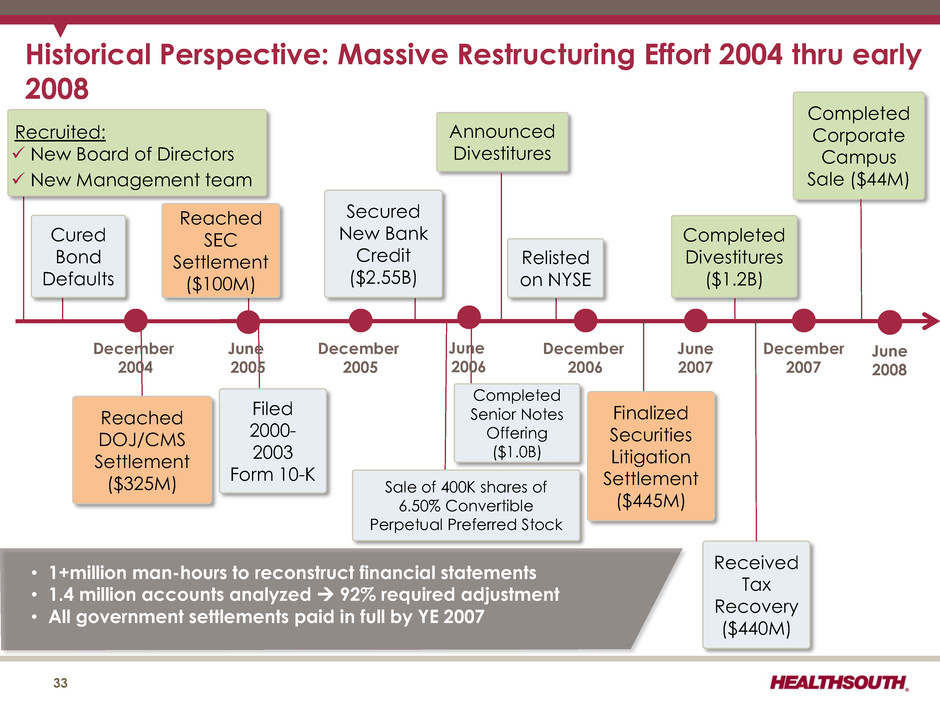

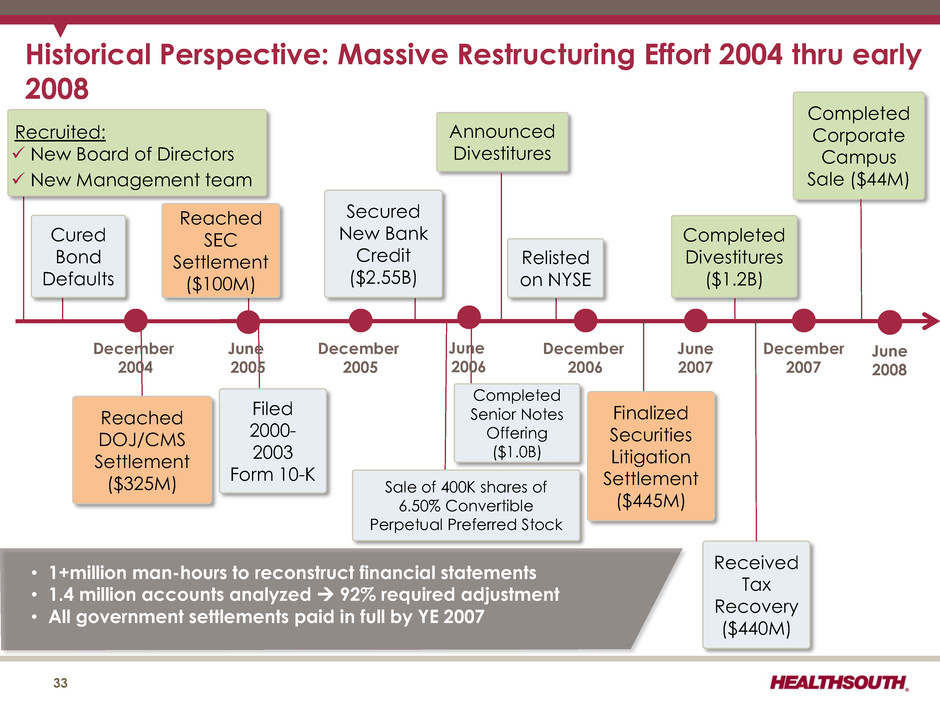

Historical Perspective: Massive Restructuring Effort 2004 thru early 2008 December 2004 June 2005 December 2005 June 2006 December 2006 June 2007 December 2007 Reached DOJ/CMS Settlement ($325M) Filed 2000- 2003 Form 10-K Completed Senior Notes Offering ($1.0B) Announced Divestitures Finalized Securities Litigation Settlement ($445M) Received Tax Recovery ($440M) Completed Corporate Campus Sale ($44M) Cured Bond Defaults Secured New Bank Credit ($2.55B) Reached SEC Settlement ($100M) Relisted on NYSE Completed Divestitures ($1.2B) • 1+million man-hours to reconstruct financial statements • 1.4 million accounts analyzed 92% required adjustment • All government settlements paid in full by YE 2007 33 Recruited: New Board of Directors New Management team Sale of 400K shares of 6.50% Convertible Perpetual Preferred Stock June 2008

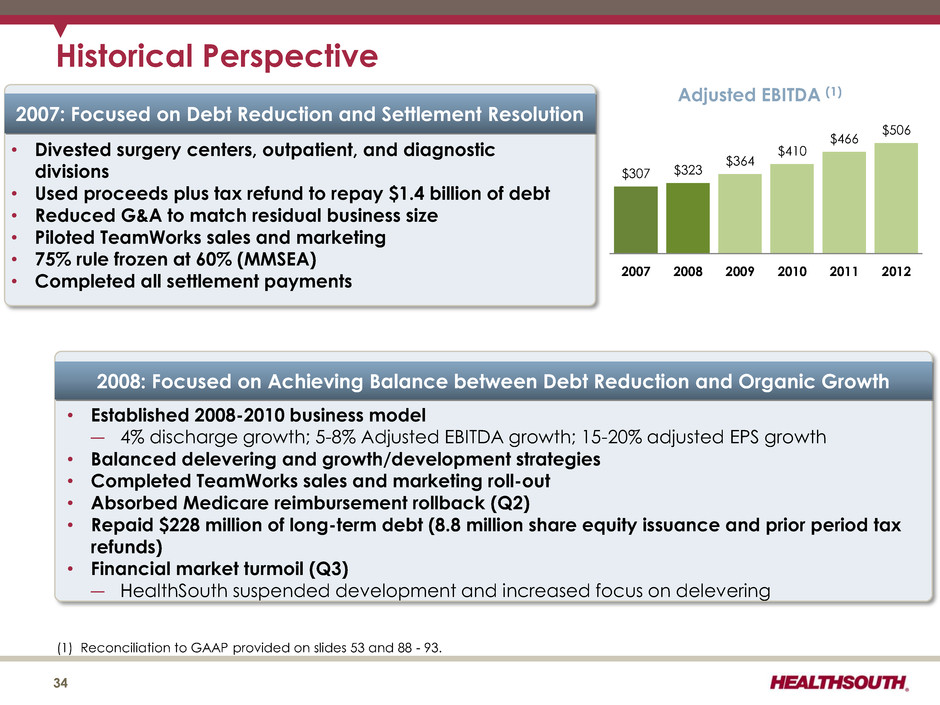

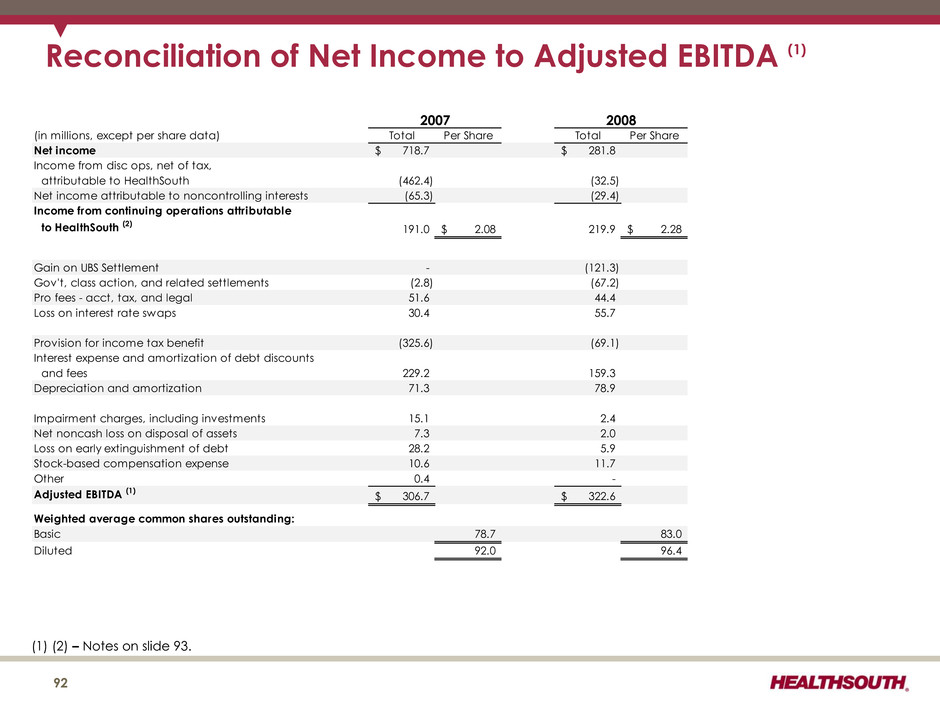

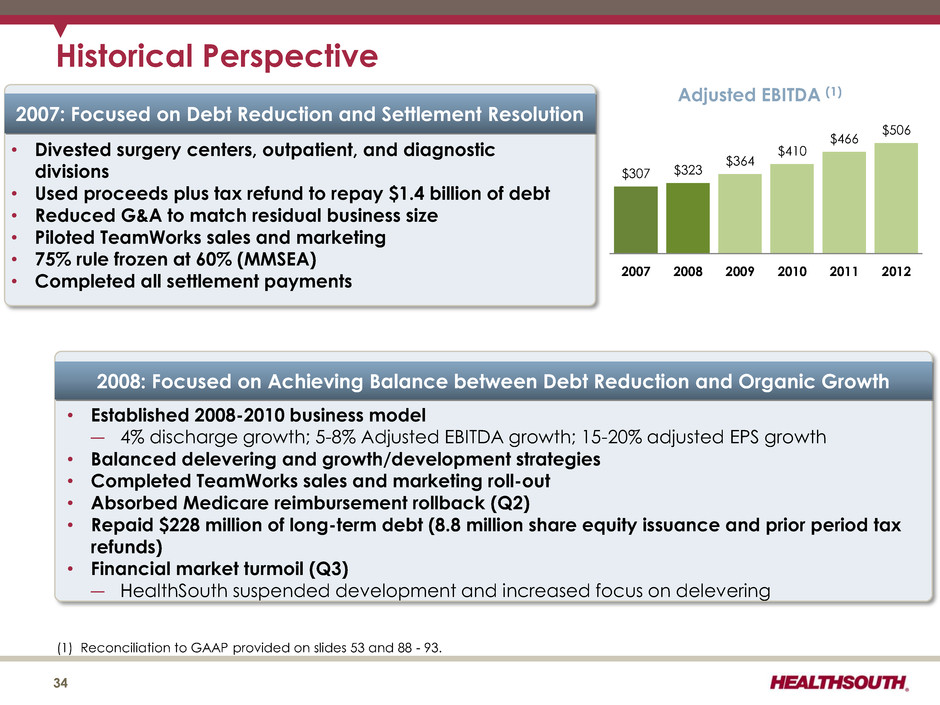

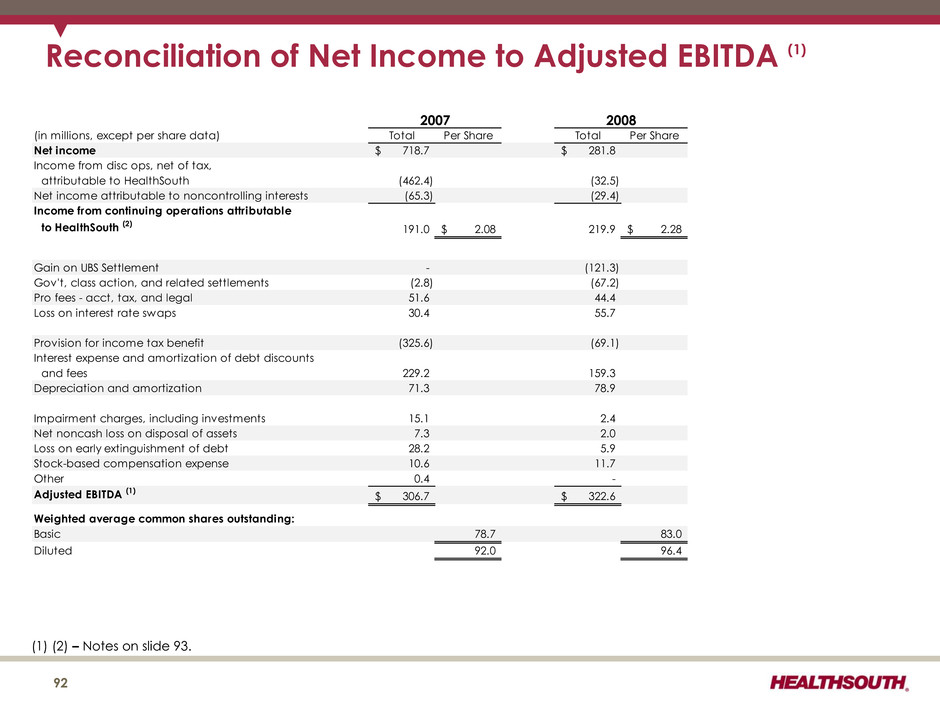

Historical Perspective 34 $307 $323 $364 $410 $466 $506 2007 2008 2009 2010 2011 2012 Adjusted EBITDA (1) (1) Reconciliation to GAAP provided on slides 53 and 88 - 93. 2007: Focused on Debt Reduction and Settlement Resolution • Divested surgery centers, outpatient, and diagnostic divisions • Used proceeds plus tax refund to repay $1.4 billion of debt • Reduced G&A to match residual business size • Piloted TeamWorks sales and marketing • 75% rule frozen at 60% (MMSEA) • Completed all settlement payments 2008: Focused on Achieving Balance between Debt Reduction and Organic Growth • Established 2008-2010 business model ― 4% discharge growth; 5-8% Adjusted EBITDA growth; 15-20% adjusted EPS growth • Balanced delevering and growth/development strategies • Completed TeamWorks sales and marketing roll-out • Absorbed Medicare reimbursement rollback (Q2) • Repaid $228 million of long-term debt (8.8 million share equity issuance and prior period tax refunds) • Financial market turmoil (Q3) ― HealthSouth suspended development and increased focus on delevering

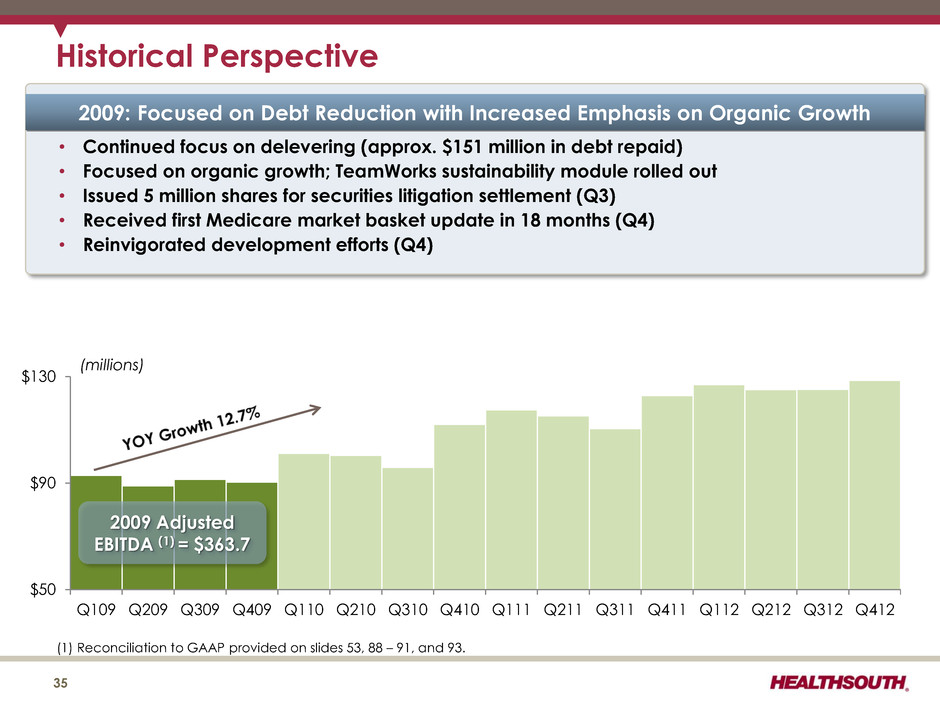

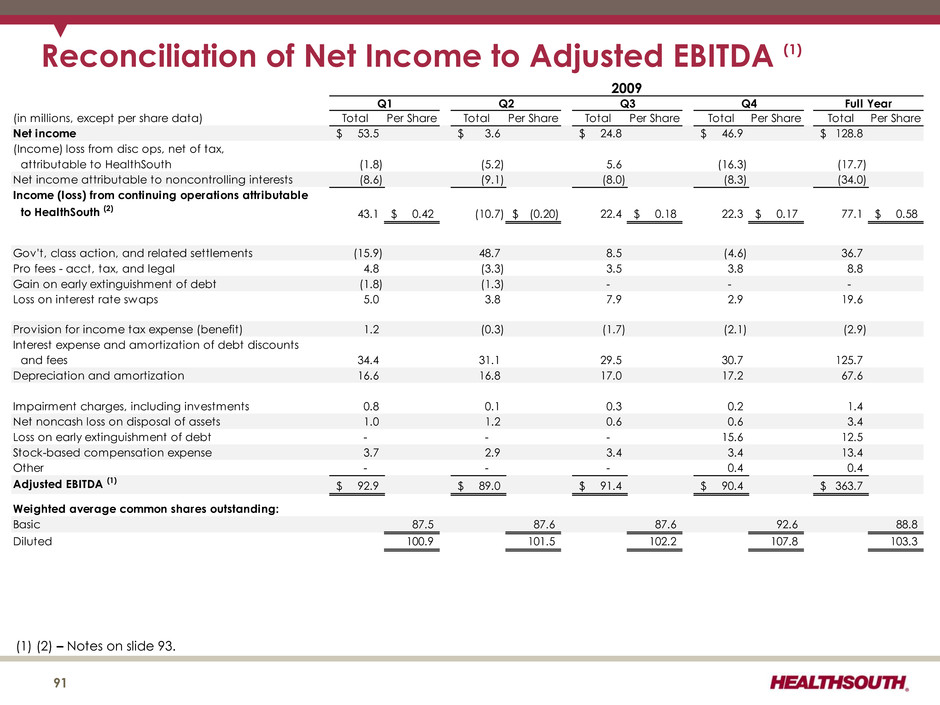

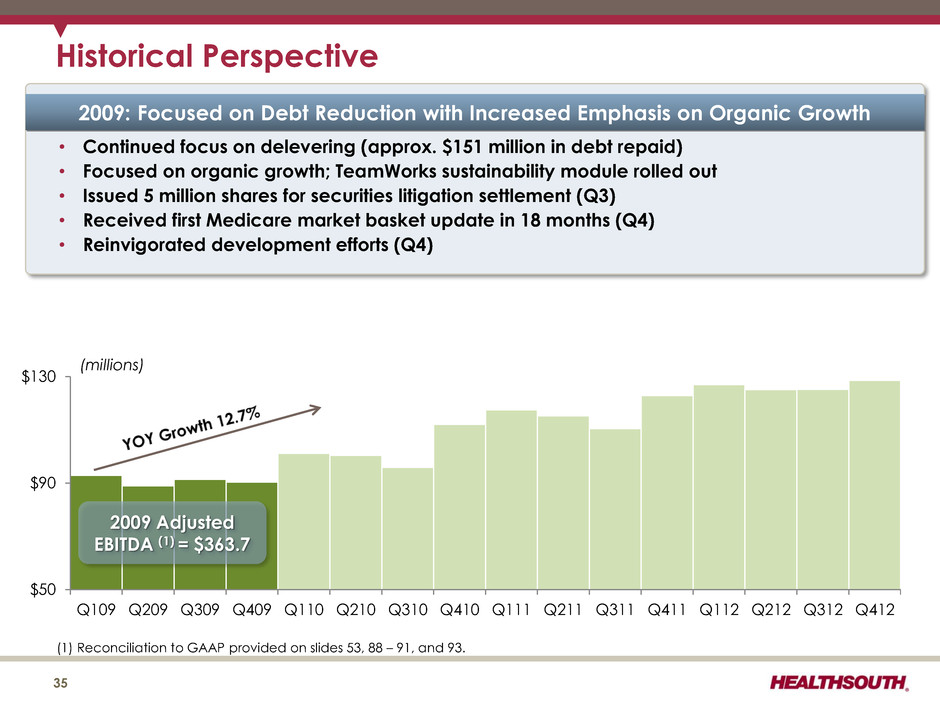

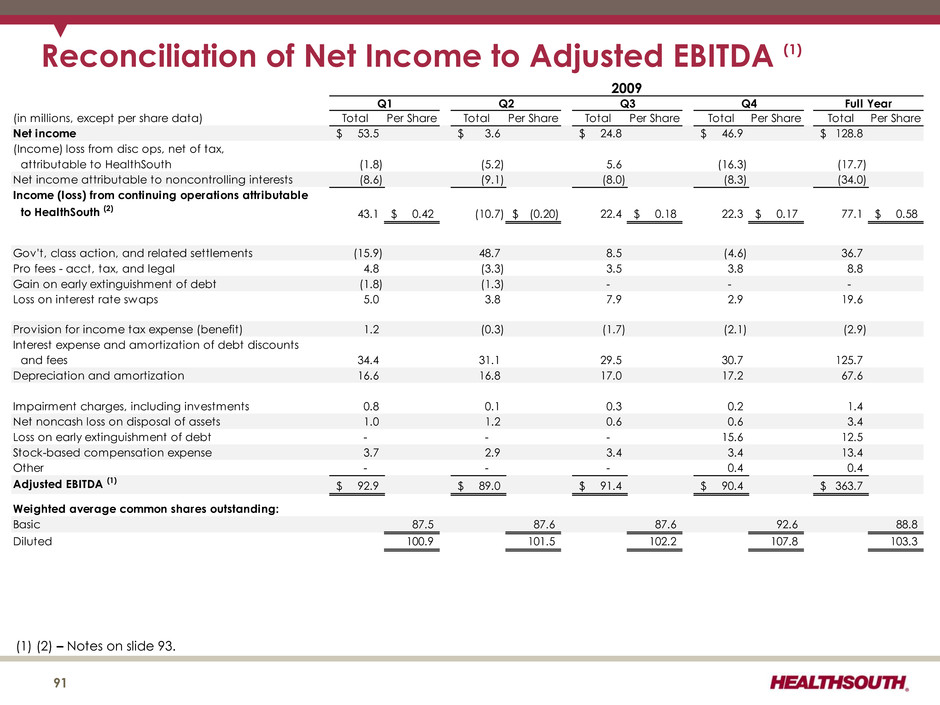

$50 $90 $130 Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412 Historical Perspective 35 2009 Adjusted EBITDA (1) = $363.7 (1) Reconciliation to GAAP provided on slides 53, 88 – 91, and 93. (millions) 2009: Focused on Debt Reduction with Increased Emphasis on Organic Growth • Continued focus on delevering (approx. $151 million in debt repaid) • Focused on organic growth; TeamWorks sustainability module rolled out • Issued 5 million shares for securities litigation settlement (Q3) • Received first Medicare market basket update in 18 months (Q4) • Reinvigorated development efforts (Q4)

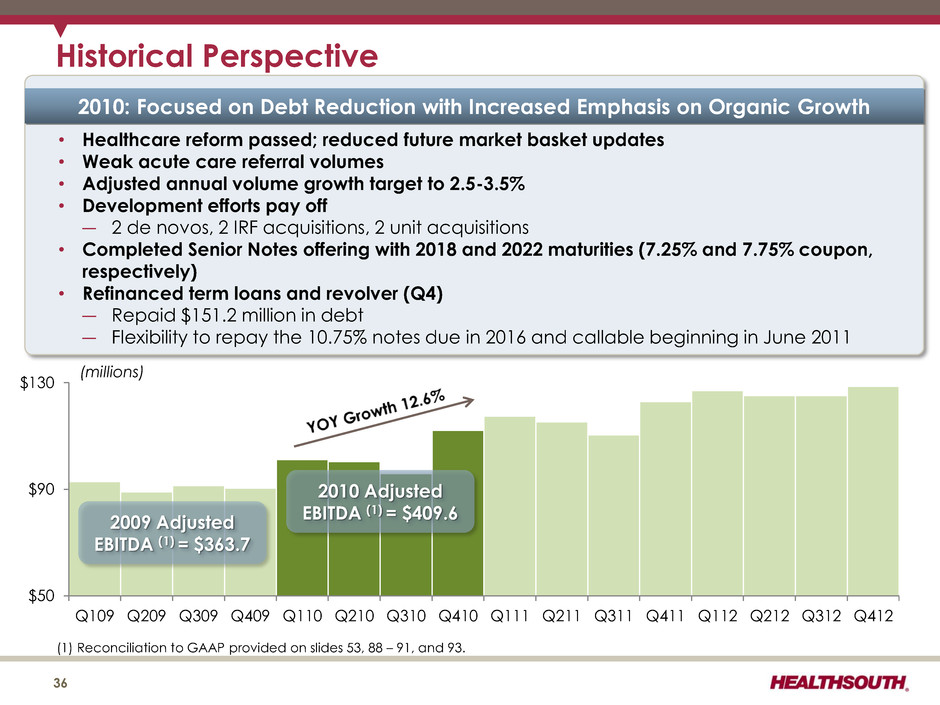

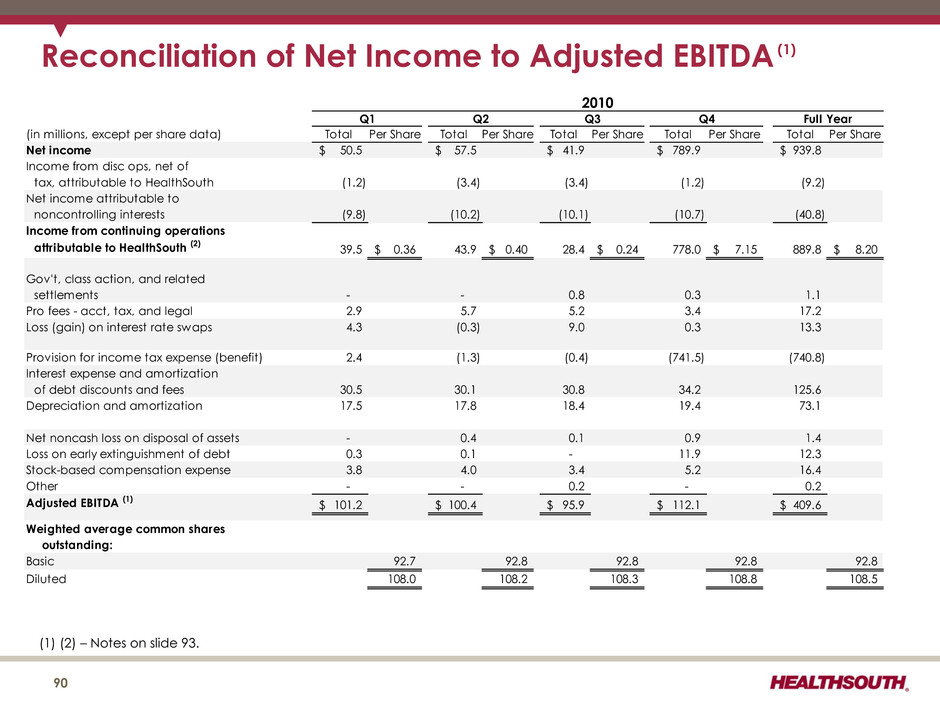

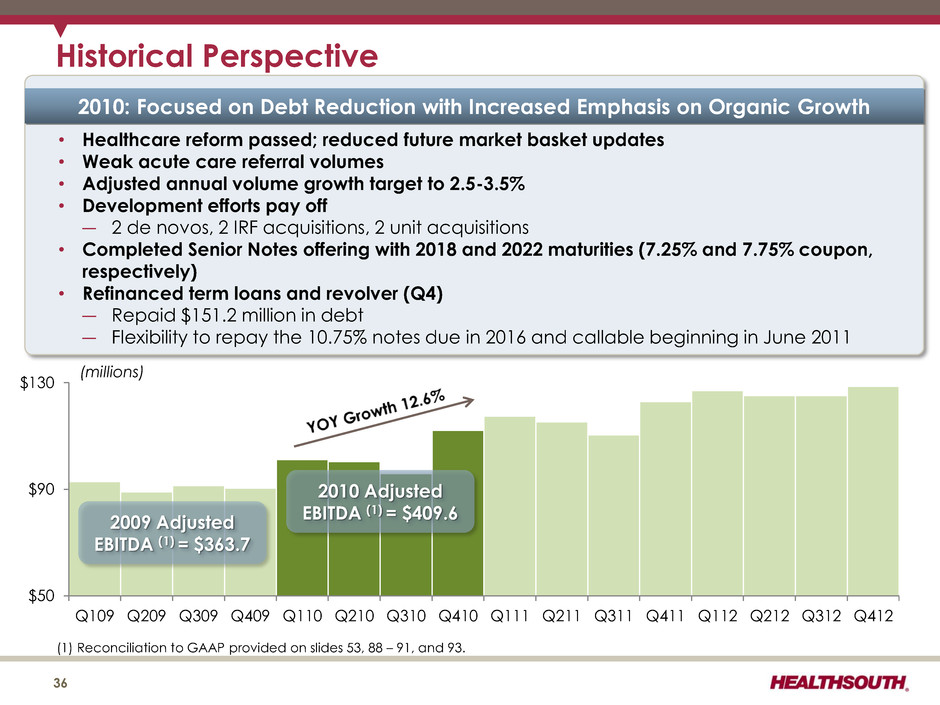

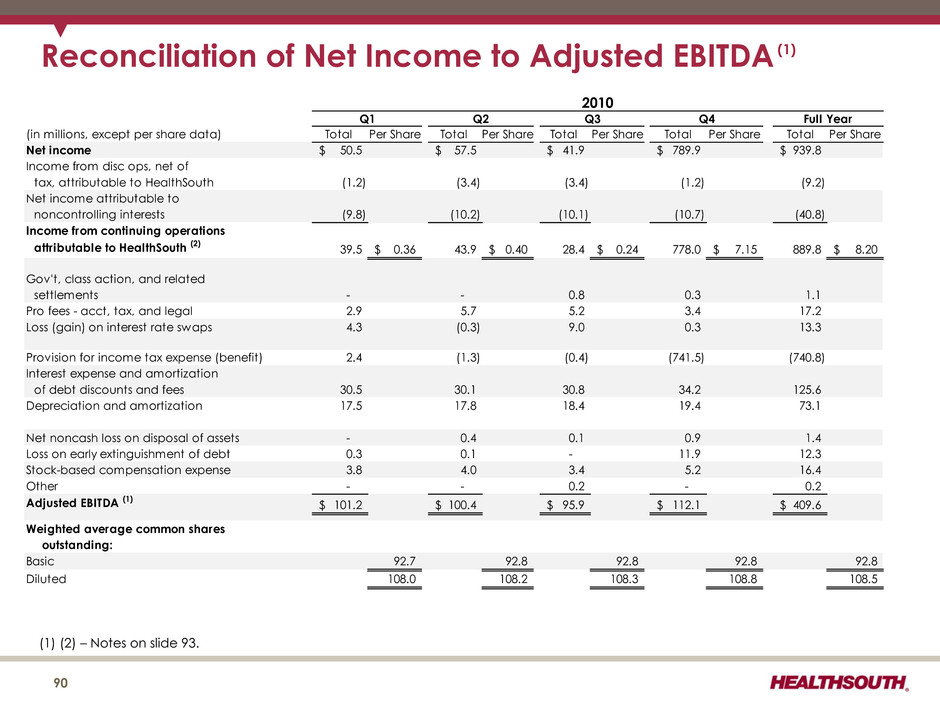

$50 $90 $130 Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412 Historical Perspective 36 2010 Adjusted EBITDA (1) = $409.6 (1) Reconciliation to GAAP provided on slides 53, 88 – 91, and 93. (millions) 2009 Adjusted EBITDA (1) = $363.7 2010: Focused on Debt Reduction with Increased Emphasis on Organic Growth • Healthcare reform passed; reduced future market basket updates • Weak acute care referral volumes • Adjusted annual volume growth target to 2.5-3.5% • Development efforts pay off ― 2 de novos, 2 IRF acquisitions, 2 unit acquisitions • Completed Senior Notes offering with 2018 and 2022 maturities (7.25% and 7.75% coupon, respectively) • Refinanced term loans and revolver (Q4) ― Repaid $151.2 million in debt ― Flexibility to repay the 10.75% notes due in 2016 and callable beginning in June 2011

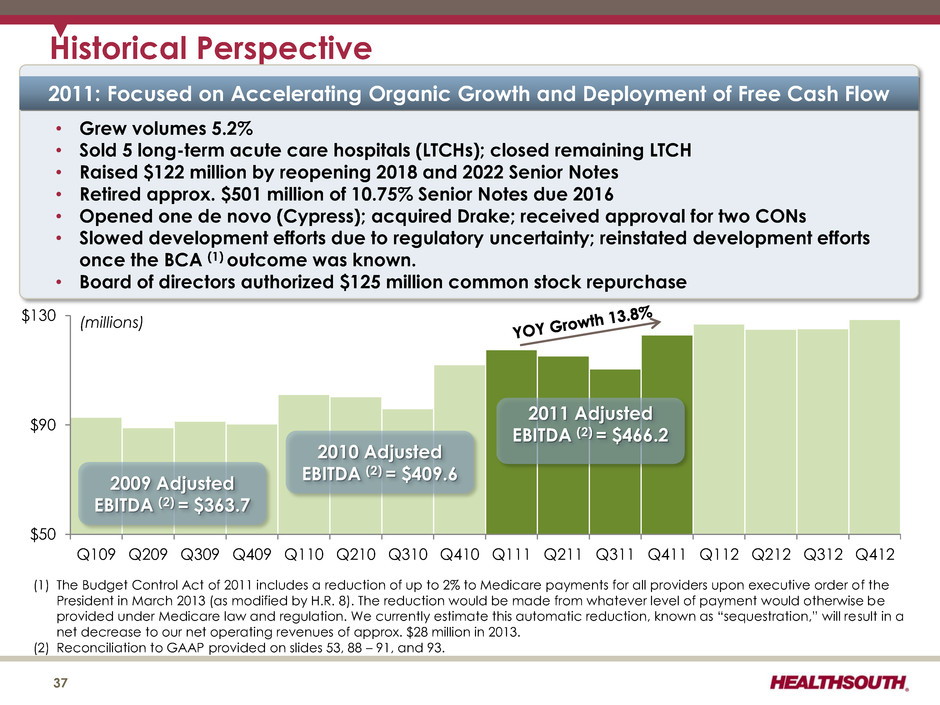

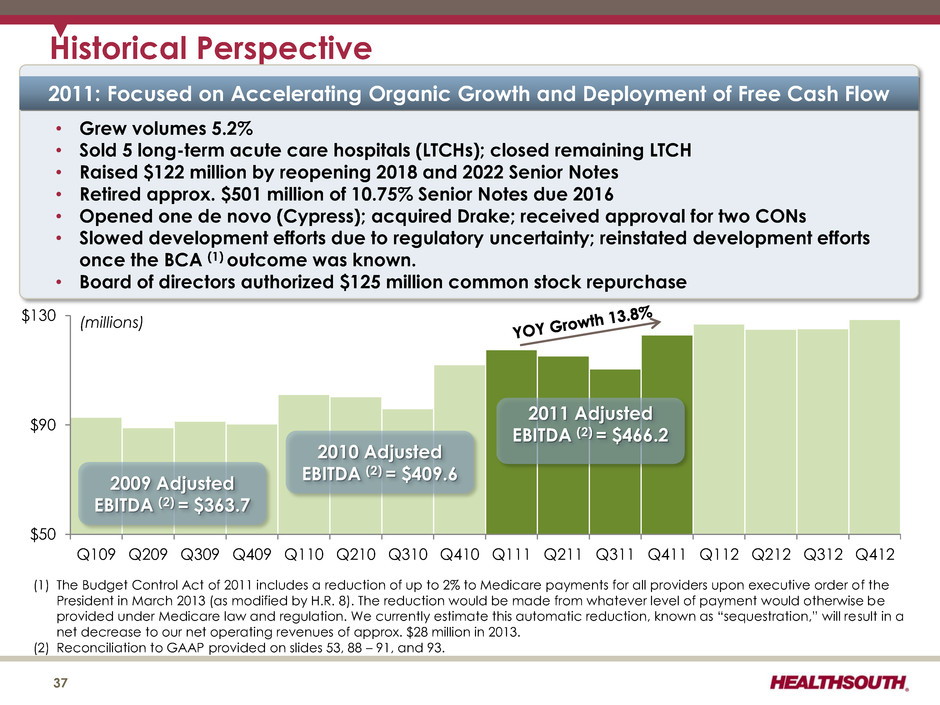

$50 $90 $130 Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412 2011 Adjusted EBITDA (2) = $466.2 Historical Perspective 37 2010 Adjusted EBITDA (2) = $409.6 (1) The Budget Control Act of 2011 includes a reduction of up to 2% to Medicare payments for all providers upon executive order of the President in March 2013 (as modified by H.R. 8). The reduction would be made from whatever level of payment would otherwise be provided under Medicare law and regulation. We currently estimate this automatic reduction, known as “sequestration,” will result in a net decrease to our net operating revenues of approx. $28 million in 2013. (2) Reconciliation to GAAP provided on slides 53, 88 – 91, and 93. (millions) 2009 Adjusted EBITDA (2) = $363.7 2011: Focused on Accelerating Organic Growth and Deployment of Free Cash Flow • Grew volumes 5.2% • Sold 5 long-term acute care hospitals (LTCHs); closed remaining LTCH • Raised $122 million by reopening 2018 and 2022 Senior Notes • Retired approx. $501 million of 10.75% Senior Notes due 2016 • Opened one de novo (Cypress); acquired Drake; received approval for two CONs • Slowed development efforts due to regulatory uncertainty; reinstated development efforts once the BCA (1) outcome was known. • Board of directors authorized $125 million common stock repurchase

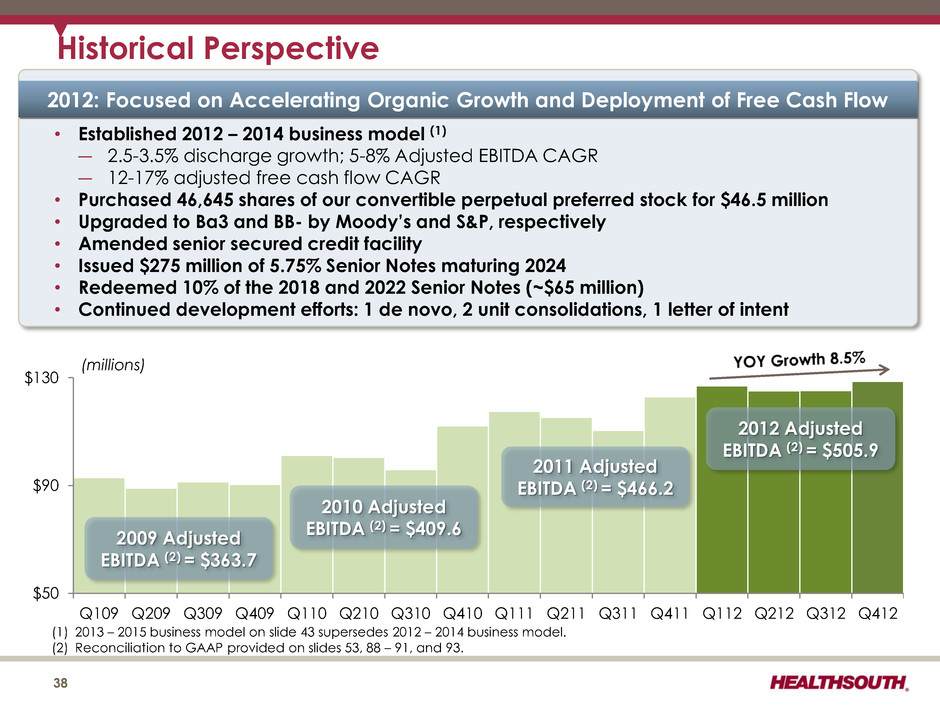

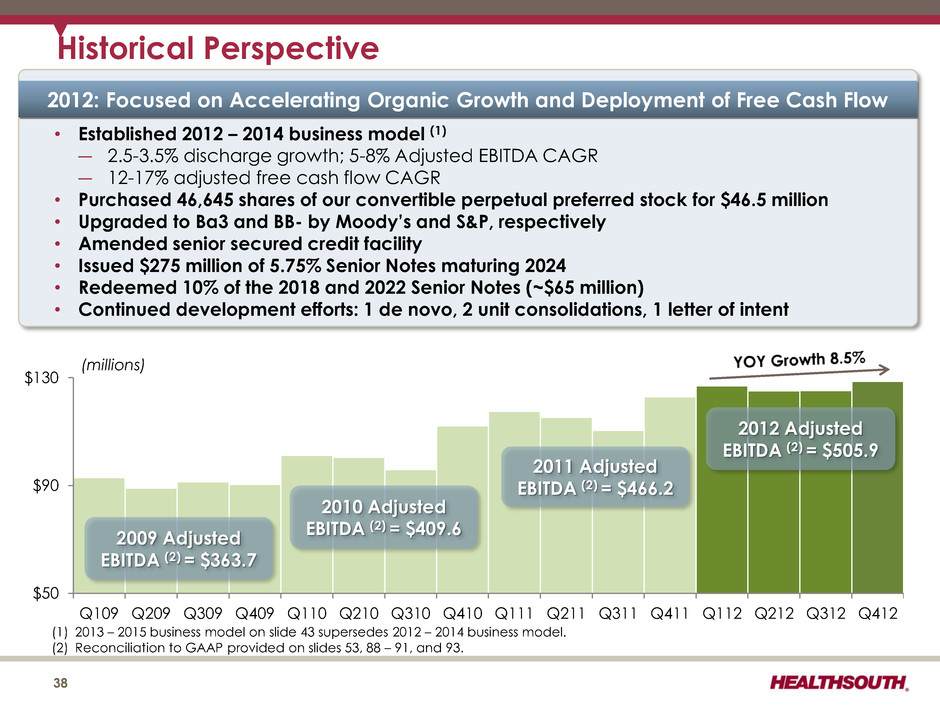

$50 $90 $130 Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412 2011 Adjusted EBITDA (2) = $466.2 Historical Perspective 38 2010 Adjusted EBITDA (2) = $409.6 (1) 2013 – 2015 business model on slide 43 supersedes 2012 – 2014 business model. (2) Reconciliation to GAAP provided on slides 53, 88 – 91, and 93. (millions) 2009 Adjusted EBITDA (2) = $363.7 2012 Adjusted EBITDA (2) = $505.9 2012: Focused on Accelerating Organic Growth and Deployment of Free Cash Flow • Established 2012 – 2014 business model (1) ― 2.5-3.5% discharge growth; 5-8% Adjusted EBITDA CAGR ― 12-17% adjusted free cash flow CAGR • Purchased 46,645 shares of our convertible perpetual preferred stock for $46.5 million • Upgraded to Ba3 and BB- by Moody’s and S&P, respectively • Amended senior secured credit facility • Issued $275 million of 5.75% Senior Notes maturing 2024 • Redeemed 10% of the 2018 and 2022 Senior Notes (~$65 million) • Continued development efforts: 1 de novo, 2 unit consolidations, 1 letter of intent

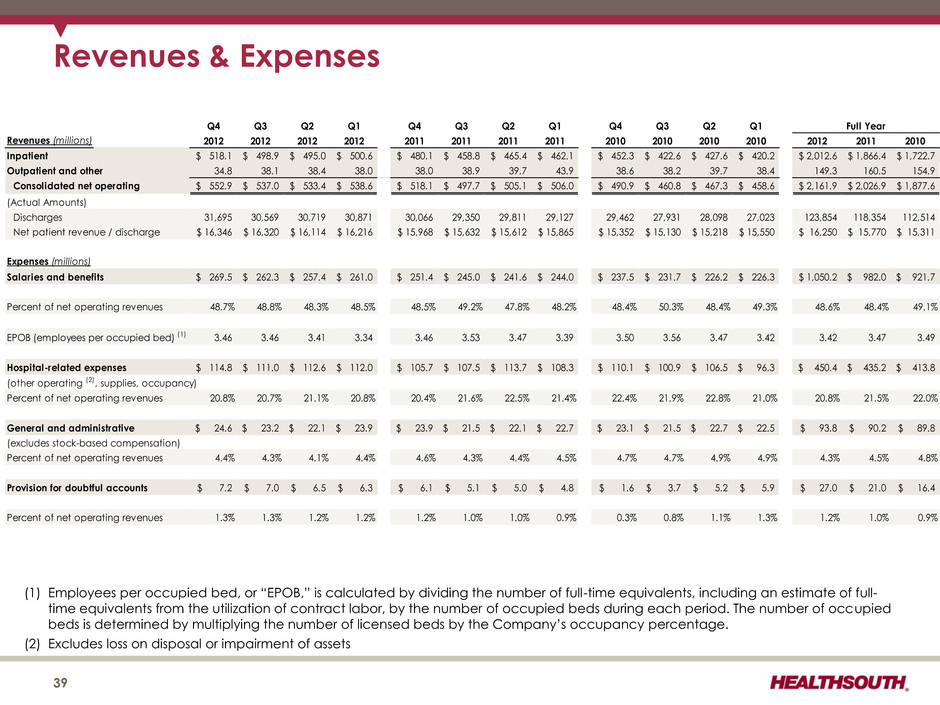

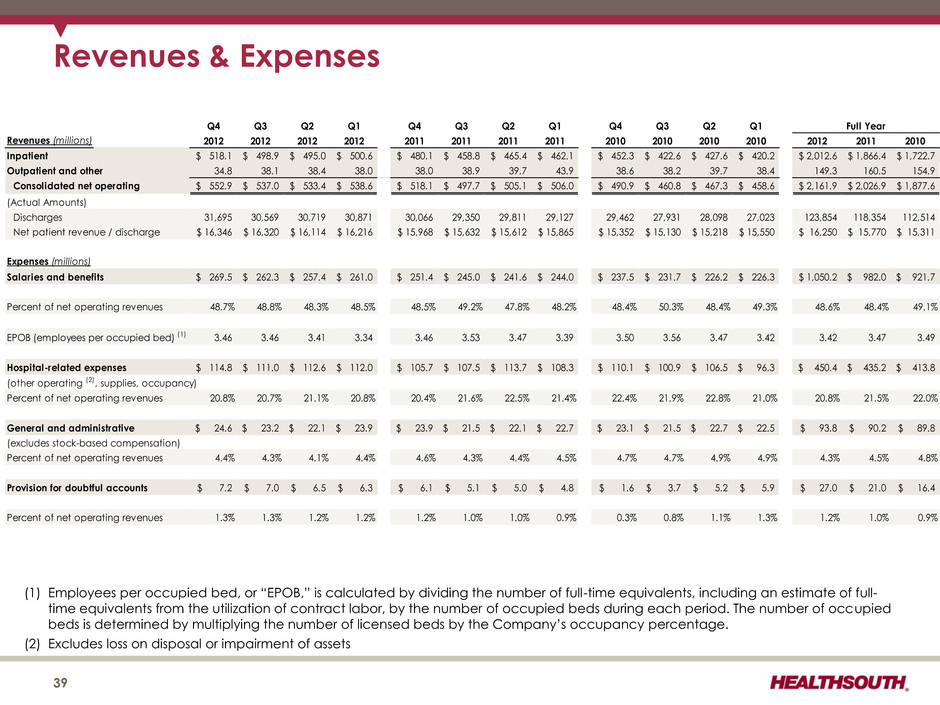

Revenues & Expenses 39 (1) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full- time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. (2) Excludes loss on disposal or impairment of assets Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Revenues (millions) 2012 2012 2012 2012 2011 2011 2011 2011 2010 2010 2010 2010 2012 2011 2010 Inpatient 518.1$ 498.9$ 495.0$ 500.6$ 480.1$ 458.8$ 465.4$ 462.1$ 452.3$ 422.6$ 427.6$ 420.2$ 2,012.6$ 1,866.4$ 1,722.7$ Outpatient and other 34.8 38.1 38.4 38.0 38.0 38.9 39.7 43.9 38.6 38.2 39.7 38.4 149.3 160.5 154.9 Consolidated net operating 552.9$ 537.0$ 533.4$ 538.6$ 518.1$ 497.7$ 505.1$ 506.0$ 490.9$ 460.8$ 467.3$ 458.6$ 2,161.9$ 2,026.9$ 1,877.6$ (Actual Amounts) Discharges 31,695 30,569 30,719 30,871 30,066 29,350 29,811 29,127 29,462 27,931 28,098 27,023 123,854 118,354 112,514 Net patient revenue / discharge 16,346$ 16,320$ 16,114$ 16,216$ 15,968$ 15,632$ 15,612$ 15,865$ 15,352$ 15,130$ 15,218$ 15,550$ 16,250$ 15,770$ 15,311$ Expenses (millions) Salaries and benefits 269.5$ 262.3$ 257.4$ 261.0$ 251.4$ 245.0$ 241.6$ 244.0$ 237.5$ 231.7$ 226.2$ 226.3$ 1,050.2$ 982.0$ 921.7$ Percent of net operating revenues 48.7% 48.8% 48.3% 48.5% 48.5% 49.2% 47.8% 48.2% 48.4% 50.3% 48.4% 49.3% 48.6% 48.4% 49.1% EPOB (employees per occupied bed) (1) 3.46 3.46 3.41 3.34 3.46 3.53 3.47 3.39 3.50 3.56 3.47 3.42 3.42 3.47 3.49 Hospital-related expenses 114.8$ 111.0$ 112.6$ 112.0$ 105.7$ 107.5$ 113.7$ 108.3$ 110.1$ 100.9$ 106.5$ 96.3$ 450.4$ 435.2$ 413.8$ (other operating (2), supplies, occupancy) Percent of net operating revenues 20.8% 20.7% 21.1% 20.8% 20.4% 21.6% 22.5% 21.4% 22.4% 21.9% 22.8% 21.0% 20.8% 21.5% 22.0% General and administrative 24.6$ 23.2$ 22.1$ 23.9$ 23.9$ 21.5$ 22.1$ 22.7$ 23.1$ 21.5$ 22.7$ 22.5$ 93.8$ 90.2$ 89.8$ (excludes stock-based compensation) Percent of net operating revenues 4.4% 4.3% 4.1% 4.4% 4.6% 4.3% 4.4% 4.5% 4.7% 4.7% 4.9% 4.9% 4.3% 4.5% 4.8% Provision for doubtful accounts 7.2$ 7.0$ 6.5$ 6.3$ 6.1$ 5.1$ 5.0$ 4.8$ 1.6$ 3.7$ 5.2$ 5.9$ 27.0$ 21.0$ 16.4$ Percent of net operating revenues 1.3% 1.3% 1.2% 1.2% 1.2% 1.0% 1.0% 0.9% 0.3% 0.8% 1.1% 1.3% 1.2% 1.0% 0.9% Full Year

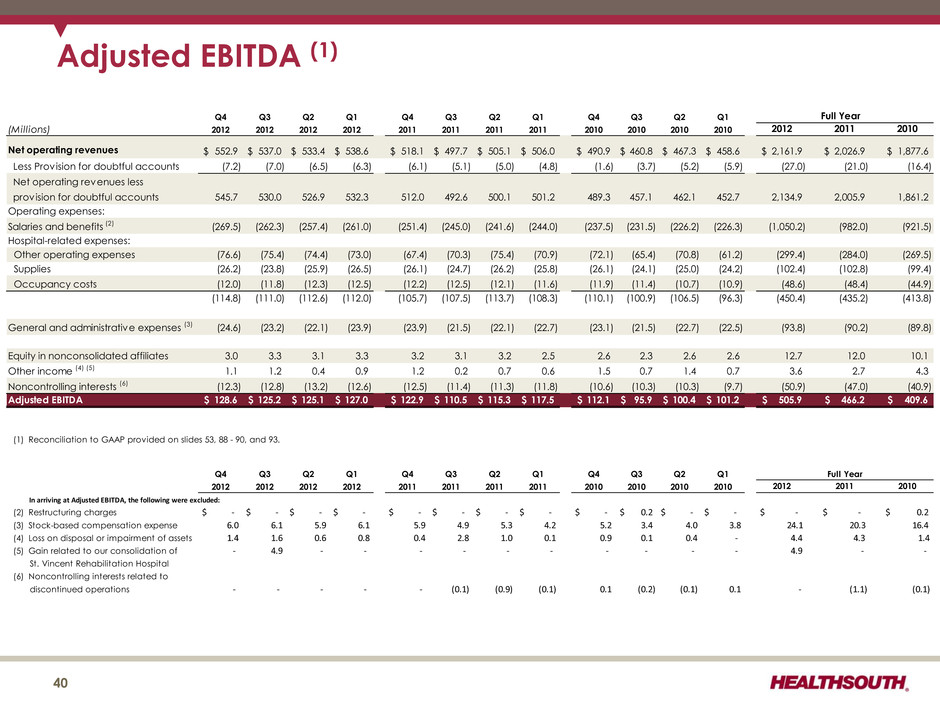

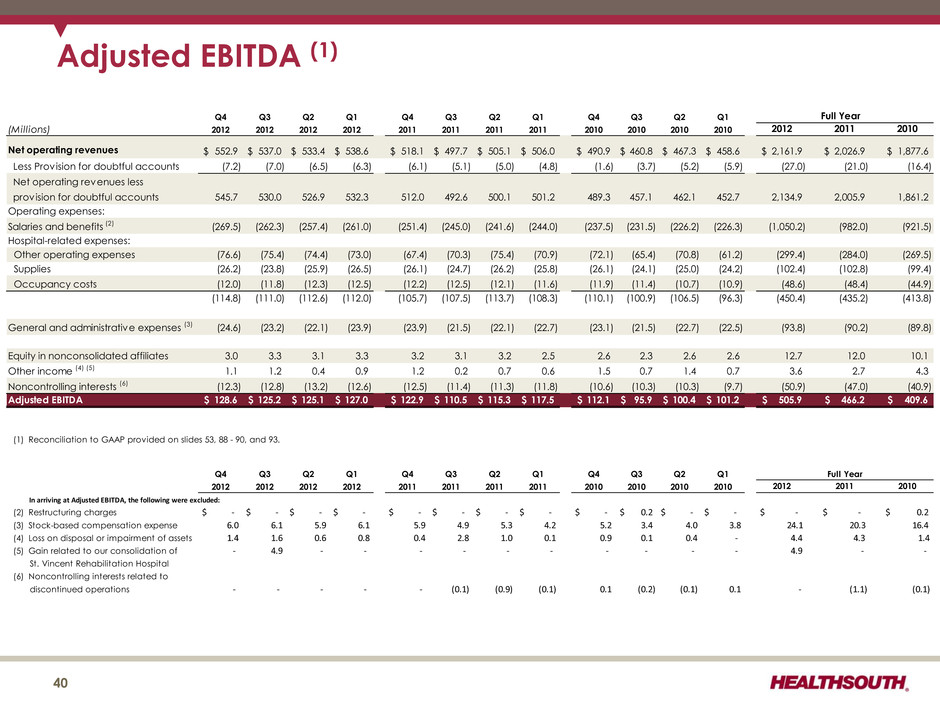

Adjusted EBITDA (1) 40 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year (Millions) 2012 2012 2012 2012 2011 2011 2011 2011 2010 2010 2010 2010 2012 2011 2010 Net operating revenues 552.9$ 537.0$ 533.4$ 538.6$ 518.1$ 497.7$ 505.1$ 506.0$ 490.9$ 460.8$ 467.3$ 458.6$ 2,161.9$ 2,026.9$ 1,877.6$ Less Provision for doubtful accounts (7.2) (7.0) (6.5) (6.3) (6.1) (5.1) (5.0) (4.8) (1.6) (3.7) (5.2) (5.9) (27.0) (21.0) (16.4) Net operating revenues less provision for doubtful accounts 545.7 530.0 526.9 532.3 512.0 492.6 500.1 501.2 489.3 457.1 462.1 452.7 2,134.9 2,005.9 1,861.2 Operating expenses: Salaries and benefits (2) (269.5) (262.3) (257.4) (261.0) (251.4) (245.0) (241.6) (244.0) (237.5) (231.5) (226.2) (226.3) (1,050.2) (982.0) (921.5) Hospital-related expenses: Other operating expenses (76.6) (75.4) (74.4) (73.0) (67.4) (70.3) (75.4) (70.9) (72.1) (65.4) (70.8) (61.2) (299.4) (284.0) (269.5) Supplies (26.2) (23.8) (25.9) (26.5) (26.1) (24.7) (26.2) (25.8) (26.1) (24.1) (25.0) (24.2) (102.4) (102.8) (99.4) Occupancy costs (12.0) (11.8) (12.3) (12.5) (12.2) (12.5) (12.1) (11.6) (11.9) (11.4) (10.7) (10.9) (48.6) (48.4) (44.9) (114.8) (111.0) (112.6) (112.0) (105.7) (107.5) (113.7) (108.3) (110.1) (100.9) (106.5) (96.3) (450.4) (435.2) (413.8) General and administrative expenses (3) (24.6) (23.2) (22.1) (23.9) (23.9) (21.5) (22.1) (22.7) (23.1) (21.5) (22.7) (22.5) (93.8) (90.2) (89.8) Equity in nonconsolidated affiliates 3.0 3.3 3.1 3.3 3.2 3.1 3.2 2.5 2.6 2.3 2.6 2.6 12.7 12.0 10.1 Other income (4) (5) 1.1 1.2 0.4 0.9 1.2 0.2 0.7 0.6 1.5 0.7 1.4 0.7 3.6 2.7 4.3 Noncontrolling interests (6) (12.3) (12.8) (13.2) (12.6) (12.5) (11.4) (11.3) (11.8) (10.6) (10.3) (10.3) (9.7) (50.9) (47.0) (40.9) Adjusted EBITDA 128.6$ 125.2$ 125.1$ 127.0$ 122.9$ 110.5$ 115.3$ 117.5$ 112.1$ 95.9$ 100.4$ 101.2$ 505.9$ 466.2$ 409.6$ (1) Reconciliation to GAAP provided on slides 53, 88 - 90, and 93. Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 2012 2012 2012 2012 2011 2011 2011 2011 2010 2010 2010 2010 2012 2011 2010 In arriving at Adjusted EBITDA, the following were excluded: (2) Restructuring charges $ - $ - $ - $ - $ - $ - $ - $ - $ - 0.2$ $ - $ - $ - $ - $ 0.2 (3) Stock-based compensation expense 6.0 6.1 5.9 6.1 5.9 4.9 5.3 4.2 5.2 3.4 4.0 3.8 24.1 20.3 16.4 (4) Loss on disposal or impairment of assets 1.4 1.6 0.6 0.8 0.4 2.8 1.0 0.1 0.9 0.1 0.4 - 4.4 4.3 1.4 (5) Gain related to our consolidation of - 4.9 - - - - - - - - - - 4.9 - - St. Vincent Rehabilitation Hospital (6) Noncontrolling interests related to discontinued operations - - - - - (0.1) (0.9) (0.1) 0.1 (0.2) (0.1) 0.1 - (1.1) (0.1) Full Year

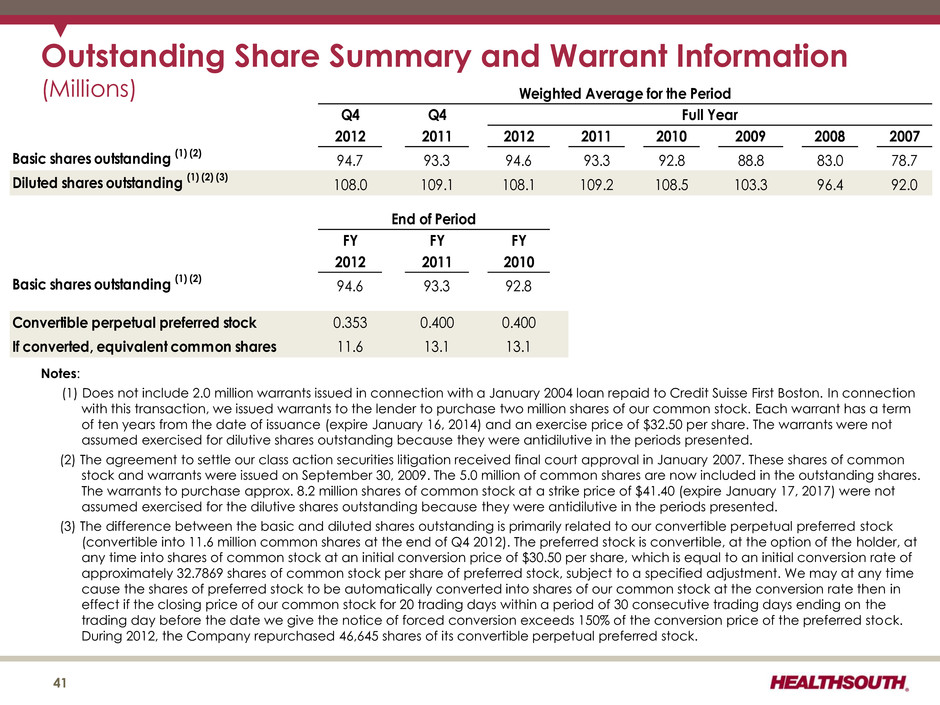

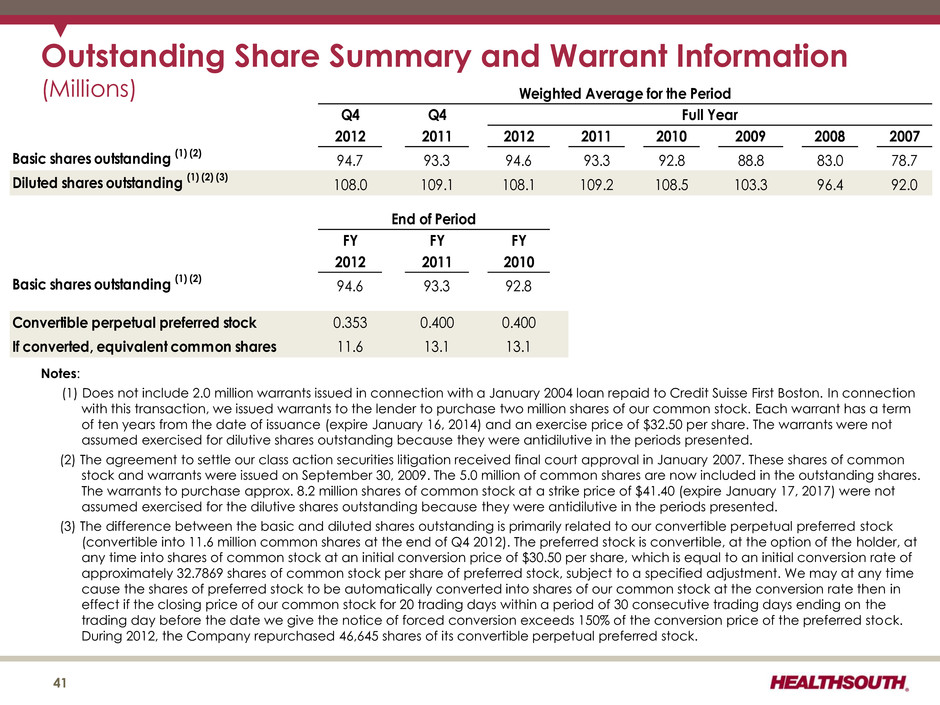

Outstanding Share Summary and Warrant Information (Millions) Q4 Q4 2012 2011 2012 2011 2010 2009 2008 2007 Basic shares outstanding (1) (2) 94.7 93.3 94.6 93.3 92.8 88.8 83.0 78.7 Diluted shares outstanding (1) (2) (3) 108.0 109.1 108.1 109.2 108.5 103.3 96.4 92.0 FY FY FY 2012 2011 2010 Basic shares outstanding (1) (2) 94.6 93.3 92.8 Convertible perpetual preferred stock 0.353 0.400 0.400 If converted, equivalent common shares 11.6 13.1 13.1 End of Period Weighted Average for the Period Full Year 41 Notes: (1) Does not include 2.0 million warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In connection with this transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term of ten years from the date of issuance (expire January 16, 2014) and an exercise price of $32.50 per share. The warrants were not assumed exercised for dilutive shares outstanding because they were antidilutive in the periods presented. (2) The agreement to settle our class action securities litigation received final court approval in January 2007. These shares of common stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are now included in the outstanding shares. The warrants to purchase approx. 8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) were not assumed exercised for the dilutive shares outstanding because they were antidilutive in the periods presented. (3) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock (convertible into 11.6 million common shares at the end of Q4 2012). The preferred stock is convertible, at the option of the holder, at any time into shares of common stock at an initial conversion price of $30.50 per share, which is equal to an initial conversion rate of approximately 32.7869 shares of common stock per share of preferred stock, subject to a specified adjustment. We may at any time cause the shares of preferred stock to be automatically converted into shares of our common stock at the conversion rate then in effect if the closing price of our common stock for 20 trading days within a period of 30 consecutive trading days ending on the trading day before the date we give the notice of forced conversion exceeds 150% of the conversion price of the preferred stock. During 2012, the Company repurchased 46,645 shares of its convertible perpetual preferred stock.

Business Outlook 2013 to 2015 (as of February 27, 2013) 42

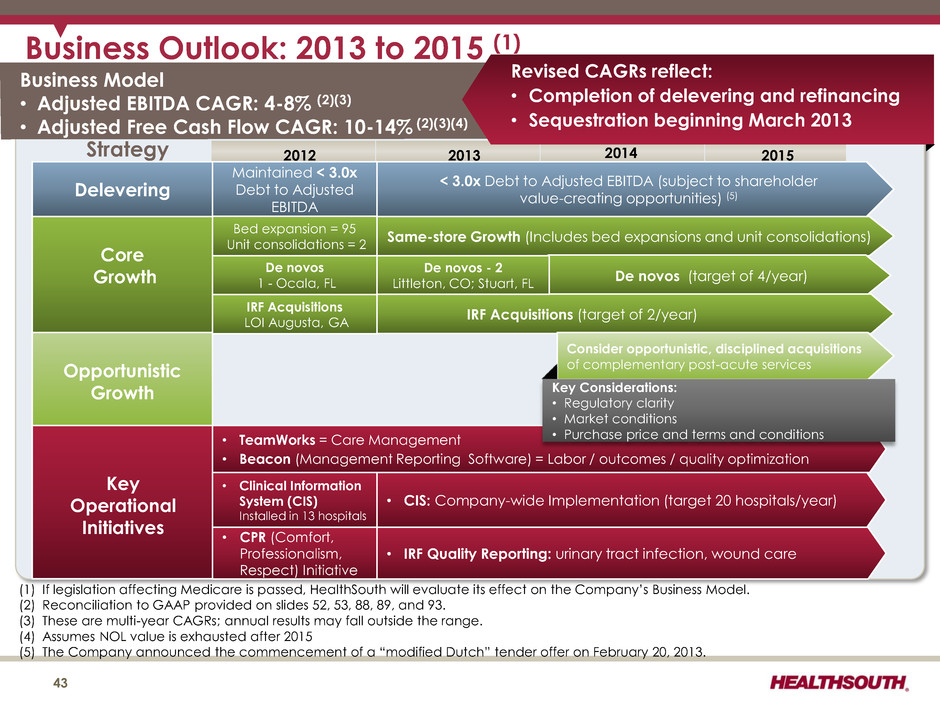

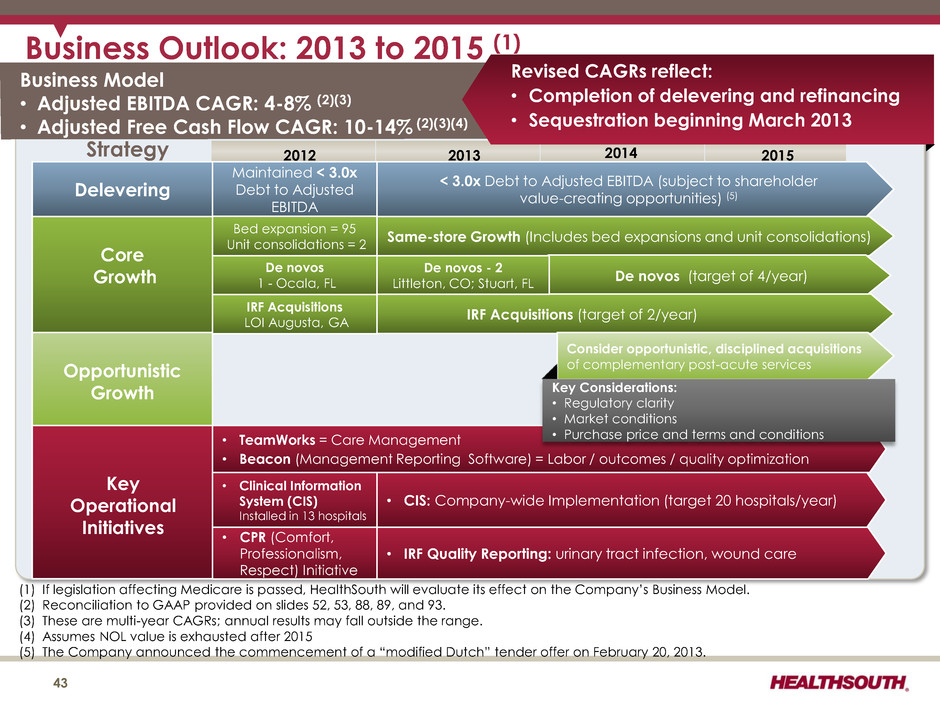

Business Outlook: 2013 to 2015 (1) Business Model • Adjusted EBITDA CAGR: 4-8% (2)(3) • Adjusted Free Cash Flow CAGR: 10-14% (2)(3)(4) Strategy 2012 2013 2014 2015 Delevering Maintained < 3.0x Debt to Adjusted EBITDA < 3.0x Debt to Adjusted EBITDA (subject to shareholder value-creating opportunities) (5) Core Growth Same-store Growth (Includes bed expansions and unit consolidations) De novos (target of 4/year) IRF Acquisitions (target of 2/year) Consider opportunistic, disciplined acquisitions of complementary post-acute services (1) If legislation affecting Medicare is passed, HealthSouth will evaluate its effect on the Company’s Business Model. (2) Reconciliation to GAAP provided on slides 52, 53, 88, 89, and 93. (3) These are multi-year CAGRs; annual results may fall outside the range. (4) Assumes NOL value is exhausted after 2015 (5) The Company announced the commencement of a “modified Dutch” tender offer on February 20, 2013. 43 De novos 1 - Ocala, FL • Clinical Information System (CIS) Installed in 13 hospitals Key Operational Initiatives • TeamWorks = Care Management • Beacon (Management Reporting Software) = Labor / outcomes / quality optimization • CIS: Company-wide Implementation (target 20 hospitals/year) Key Considerations: • Regulatory clarity • Market conditions • Purchase price and terms and conditions IRF Acquisitions LOI Augusta, GA De novos - 2 Littleton, CO; Stuart, FL Opportunistic Growth Revised CAGRs reflect: • Completion of delevering and refinancing • Sequestration beginning March 2013 Bed expansion = 95 Unit consolidations = 2 • CPR (Comfort, Professionalism, Respect) Initiative • IRF Quality Reporting: urinary tract infection, wound care

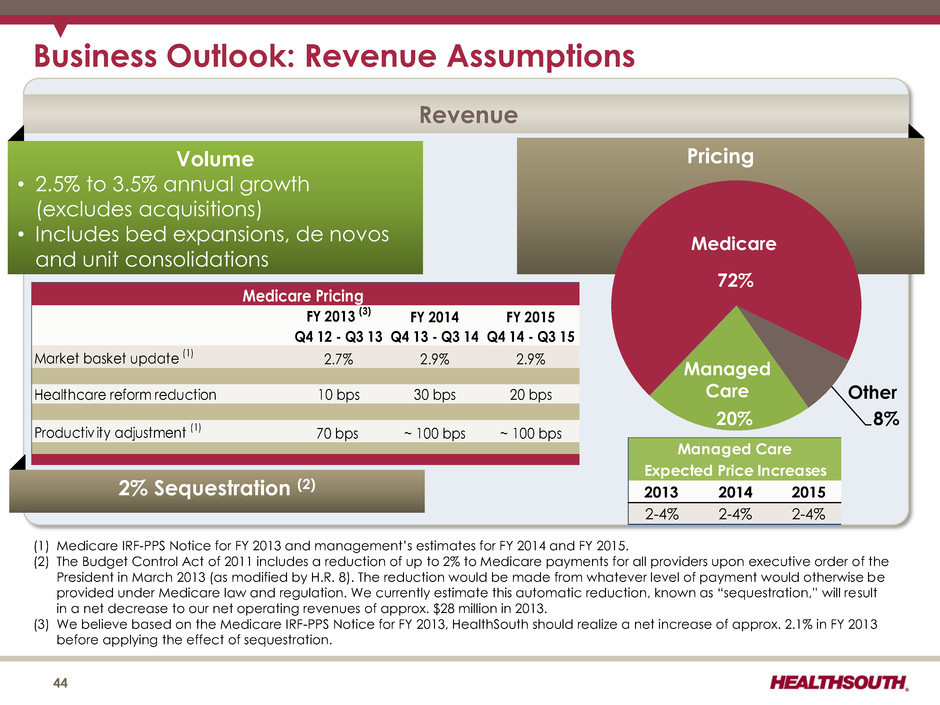

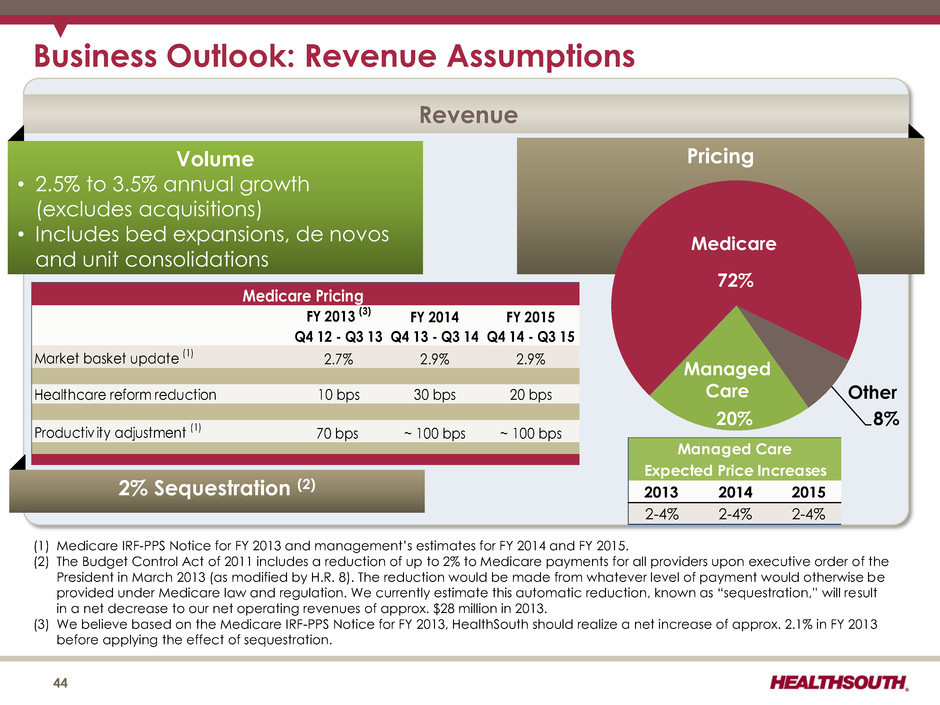

Business Outlook: Revenue Assumptions Revenue Volume • 2.5% to 3.5% annual growth (excludes acquisitions) • Includes bed expansions, de novos and unit consolidations Pricing 72% 8% 20% FY 2013 (3) FY 2014 FY 2015 Q4 12 - Q3 13 Q4 13 - Q3 14 Q4 14 - Q3 15 Market basket update (1) 2.7% 2.9% 2.9% Healthcare reform reduction 10 bps 30 bps 20 bps Productiv ity adjustment (1) 70 bps ~ 100 bps ~ 100 bps Medicare Pricing 2013 2014 2015 2-4% 2-4% 2-4% Expected Price Increases Managed Care Medicare Managed Care Other (1) Medicare IRF-PPS Notice for FY 2013 and management’s estimates for FY 2014 and FY 2015. (2) The Budget Control Act of 2011 includes a reduction of up to 2% to Medicare payments for all providers upon executive order of the President in March 2013 (as modified by H.R. 8). The reduction would be made from whatever level of payment would otherwise be provided under Medicare law and regulation. We currently estimate this automatic reduction, known as “sequestration,” will result in a net decrease to our net operating revenues of approx. $28 million in 2013. (3) We believe based on the Medicare IRF-PPS Notice for FY 2013, HealthSouth should realize a net increase of approx. 2.1% in FY 2013 before applying the effect of sequestration. 44 2% Sequestration (2)

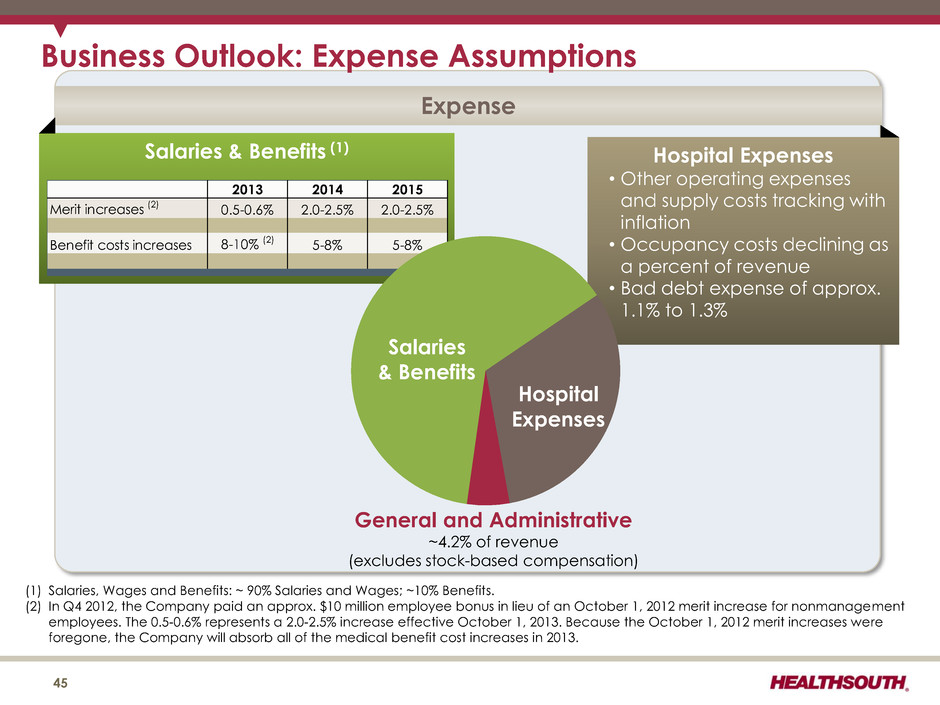

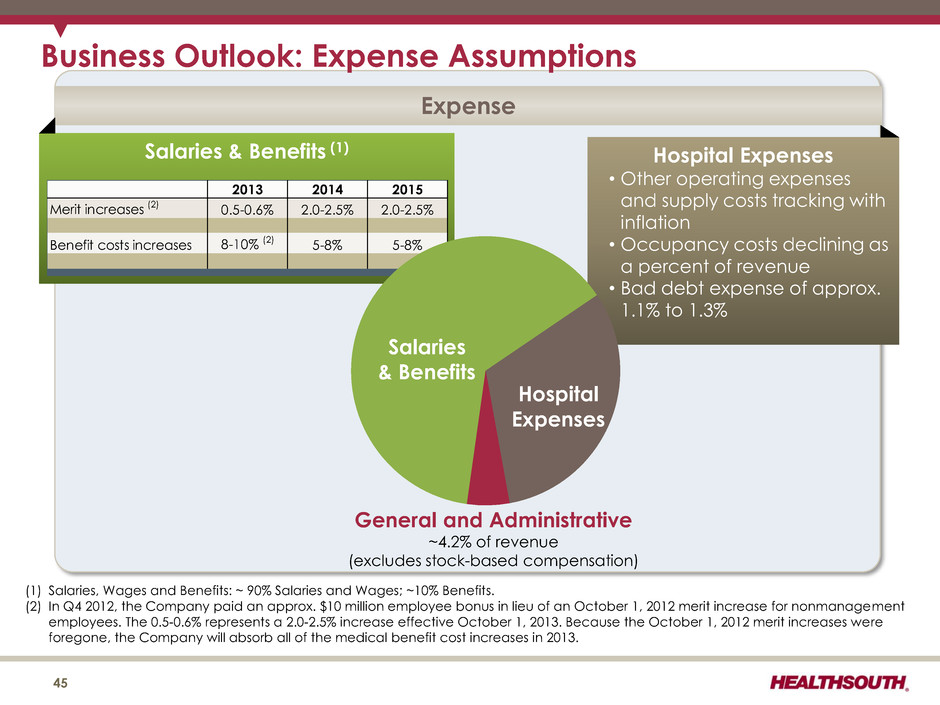

Business Outlook: Expense Assumptions Expense Salaries & Benefits (1) Hospital Expenses • Other operating expenses and supply costs tracking with inflation • Occupancy costs declining as a percent of revenue • Bad debt expense of approx. 1.1% to 1.3% 2013 2014 2015 Merit increases (2) 0.5-0.6% 2.0-2.5% 2.0-2.5% Benefit costs in reases 8-10% (2) 5-8% 5-8% General and Administrative ~4.2% of revenue (excludes stock-based compensation) Salaries & Benefits Hospital Expenses (1) Salaries, Wages and Benefits: ~ 90% Salaries and Wages; ~10% Benefits. (2) In Q4 2012, the Company paid an approx. $10 million employee bonus in lieu of an October 1, 2012 merit increase for nonmanagement employees. The 0.5-0.6% represents a 2.0-2.5% increase effective October 1, 2013. Because the October 1, 2012 merit increases were foregone, the Company will absorb all of the medical benefit cost increases in 2013. 45

Guidance (as of February 27, 2013) 46

2013 Guidance - Adjusted EBITDA(1) 47 2013 Adjusted EBITDA = $506 million to $516 million 2012 1) One-time bonus, net of an assumed 2.25% merit increase beginning October 1, 2012 2) Approx. $6 million reduction in group medical and workers’ compensation reserves due to favorable trends in claims 3) Favorable adjustment of approx. $4 million to general and professional liability reserves 2013 4) Adjusted EBITDA reduction of approx. $25 million (net of noncontrolling interests) for sequestration starting in mid-March 2013 5) Higher noncontrolling interests expense of $5 million due to changes at two joint ventures (Jonesboro, Memphis) 6) Increased operating expense of approx. $4 million for the continued implementation of the CIS (1) Reconciliation to GAAP provided on slides 53, 88, 89, and 93. 2012 2013 $505.9 $506 to $516 $4.5 ($6) ($4) ($25) ($5) ($4) $39.6 to $49.6 2012 Adjusted EBITDA 1 2 3 4 5 6 2013 Adjusted EBITDA Growth 2013 Adjusted EBITDA Guidance (millions) Discharge growth between 3.0% and 4.0% (includes acquisition of Walton) Revenue growth before sequestration of 4.9% to 6.2% and revenue per discharge growth of 2.3% to 2.6% Net impact of foregone merit increase

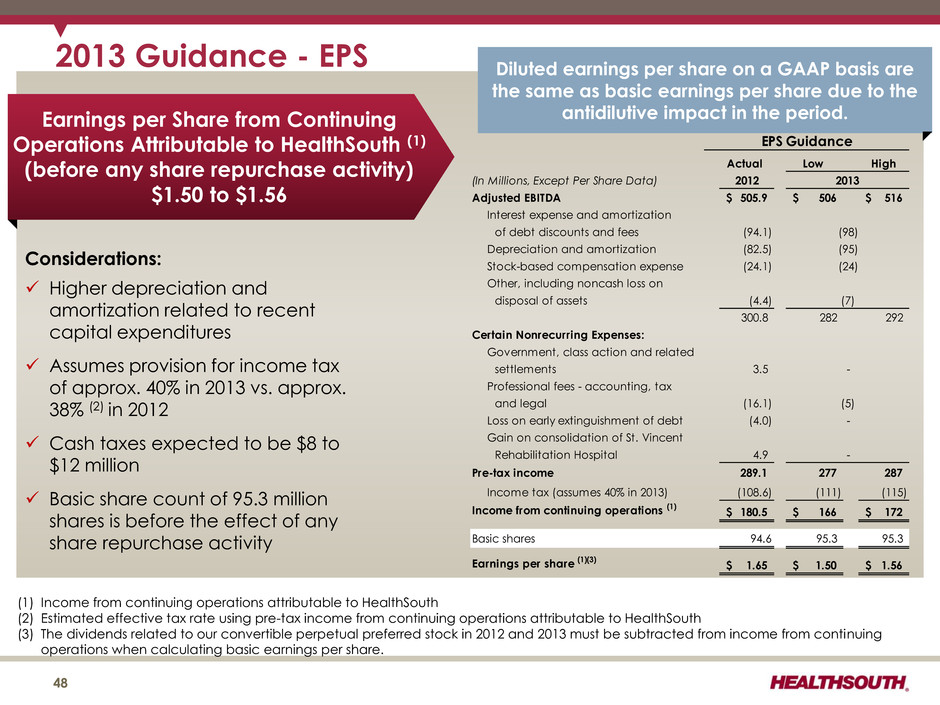

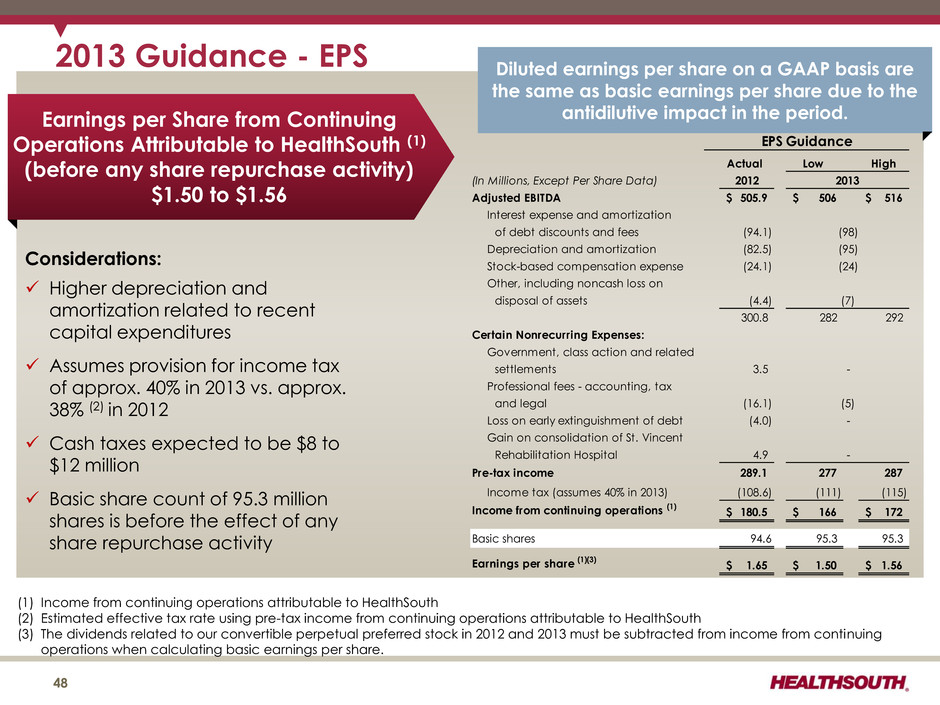

2013 Guidance - EPS Earnings per Share from Continuing Operations Attributable to HealthSouth (1) (before any share repurchase activity) $1.50 to $1.56 Considerations: Higher depreciation and amortization related to recent capital expenditures Assumes provision for income tax of approx. 40% in 2013 vs. approx. 38% (2) in 2012 Cash taxes expected to be $8 to $12 million Basic share count of 95.3 million shares is before the effect of any share repurchase activity Diluted earnings per share on a GAAP basis are the same as basic earnings per share due to the antidilutive impact in the period. (1) Income from continuing operations attributable to HealthSouth (2) Estimated effective tax rate using pre-tax income from continuing operations attributable to HealthSouth (3) The dividends related to our convertible perpetual preferred stock in 2012 and 2013 must be subtracted from income from continuing operations when calculating basic earnings per share. 48 Actual Low High (In Millions, Except Per Share Data) 2012 Adjusted EBITDA 505.9$ 506$ 516$ Interest expense and amortization of debt discounts and fees (94.1) Depreciation and amortization (82.5) Stock-based compensation expense (24.1) Other, including noncash loss on disposal of assets (4.4) 300.8 282 292 Certain Nonrecurring Expenses: Government, class action and related settlements 3.5 Professional fees - accounting, tax and legal (16.1) Loss on early extinguishment of debt (4.0) Gain on consolidation of St. Vincent Rehabilitation Hospital 4.9 Pre-tax income 289.1 277 287 Income tax (assumes 40% in 2013) (108.6) (111) (115) Income from continuing operations (1) 180.5$ 166$ 172$ Basic shares 94.6 95.3 95.3 Earnings per share (1)(3) 1.65$ 1.50$ 1.56$ EPS Guidance 2013 (98) (95) (24) - - - (5) (7)

Income Tax Considerations GAAP Considerations: •As of 12/31/12, the Company’s federal NOL had a balance of approx. $1.0 billion. • The Company has a remaining valuation allowance of approx. $40 million, primarily related to state NOLs. Cash Tax Payments: • The Company expects to pay approx. $8 million to $12 million per year of income tax. •HealthSouth is not currently subject to an annual use limitation (“AUL”) under Internal Revenue Code Section 382 (“Section 382”). An “ownership change,” as defined by Section 382, could subject the Company to an AUL, which would approximate the value of the Company at the time of the “ownership change” multiplied by the long- term tax exempt rate. 49

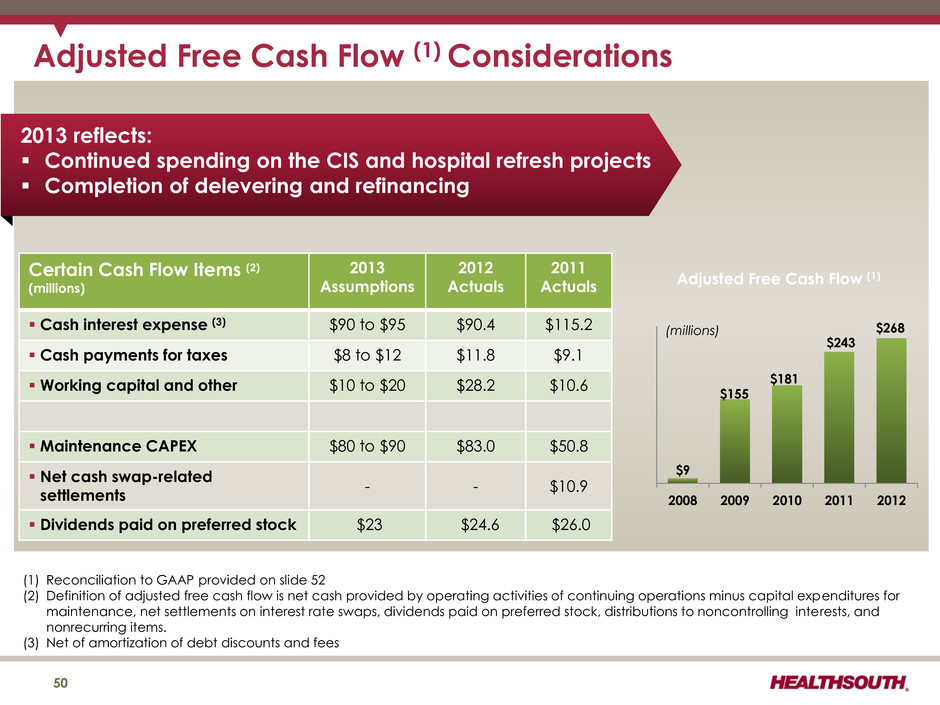

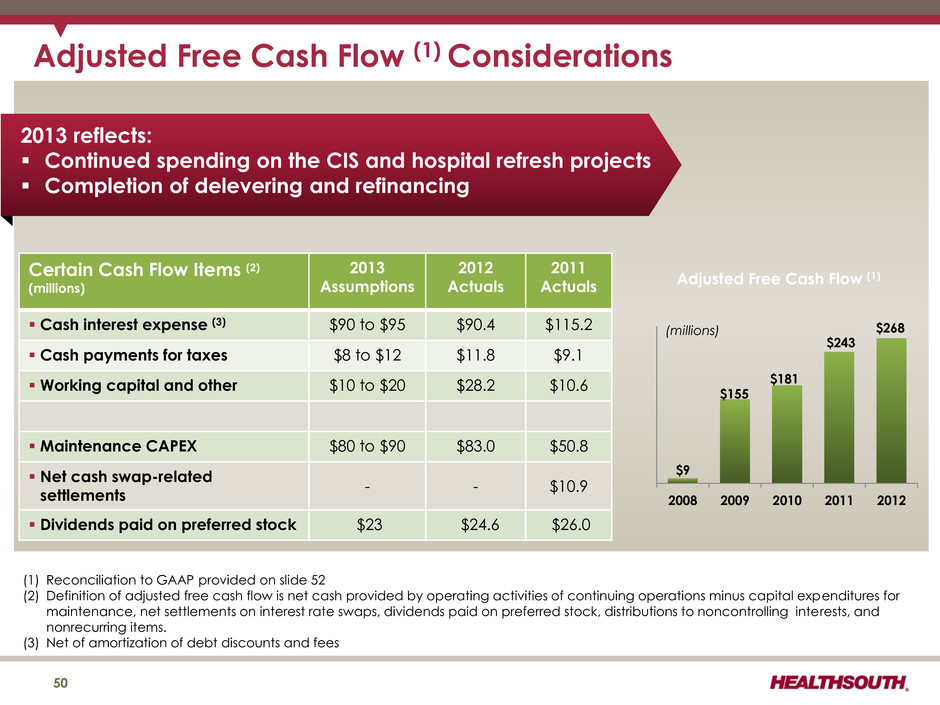

Adjusted Free Cash Flow (1) Considerations (1) Reconciliation to GAAP provided on slide 52 (2) Definition of adjusted free cash flow is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, net settlements on interest rate swaps, dividends paid on preferred stock, distributions to noncontrolling interests, and nonrecurring items. (3) Net of amortization of debt discounts and fees 50 Certain Cash Flow Items (2) (millions) 2013 Assumptions 2012 Actuals 2011 Actuals Cash interest expense (3) $90 to $95 $90.4 $115.2 Cash payments for taxes $8 to $12 $11.8 $9.1 Working capital and other $10 to $20 $28.2 $10.6 Maintenance CAPEX $80 to $90 $83.0 $50.8 Net cash swap-related settlements - - $10.9 Dividends paid on preferred stock $23 $24.6 $26.0 2013 reflects: Continued spending on the CIS and hospital refresh projects Completion of delevering and refinancing $9 $155 $181 $243 $268 2008 2009 2010 2011 2012 Adjusted Free Cash Flow (1) (millions)

Free Cash Flow 51

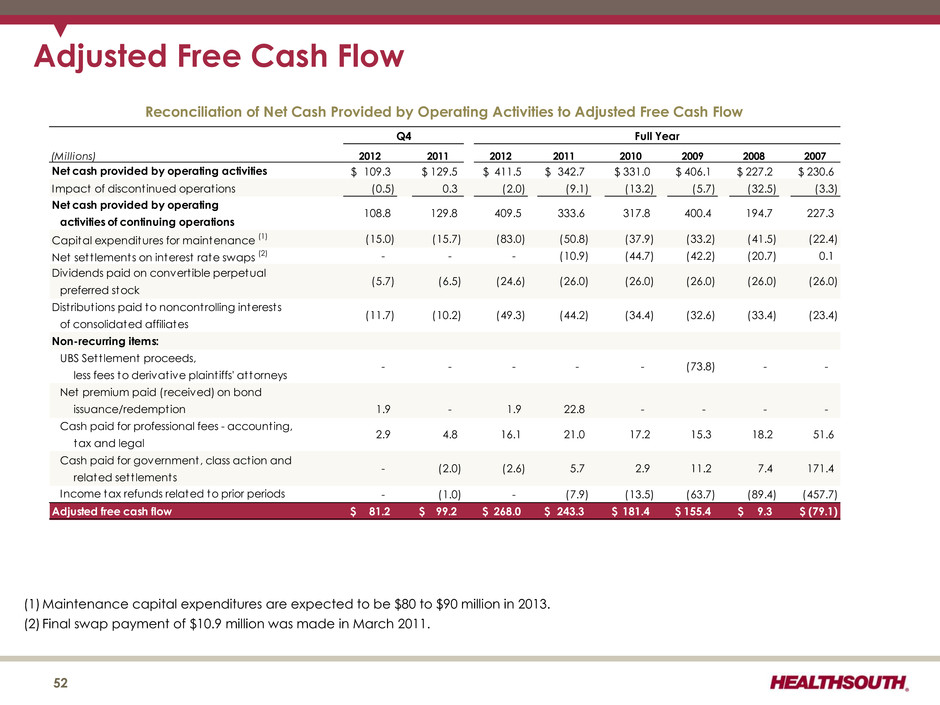

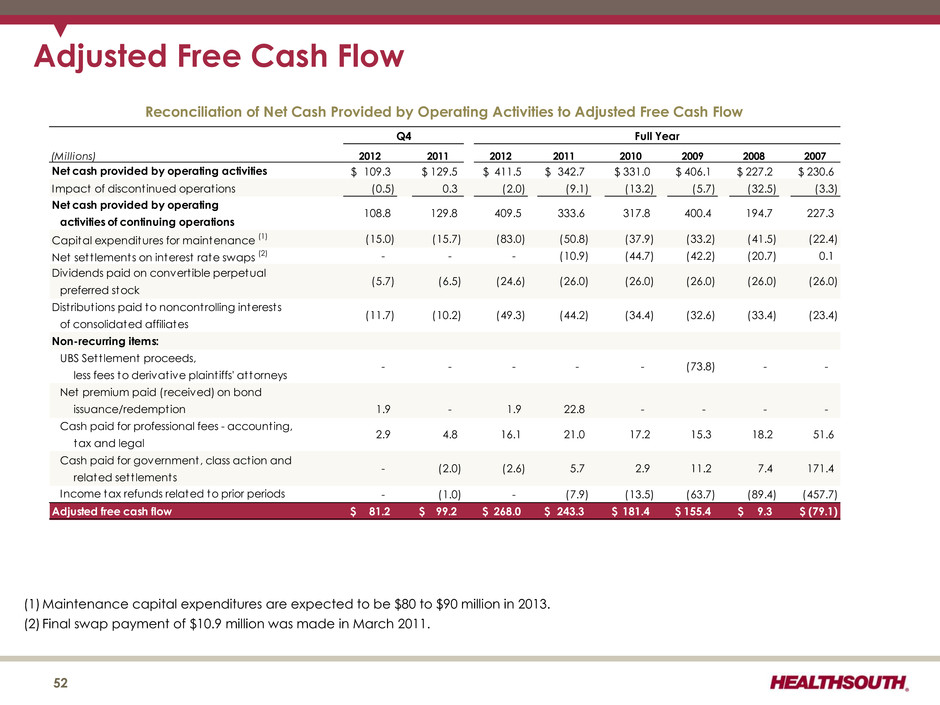

Adjusted Free Cash Flow (Millions) 2012 2011 2012 2011 2010 2009 2008 2007 109.3$ 129.5$ 411.5$ 342.7$ 331.0$ 406.1$ 227.2$ 230.6$ (0.5) 0.3 (2.0) (9.1) (13.2) (5.7) (32.5) (3.3) Capital expenditures for maintenance (1) (15.0) (15.7) (83.0) (50.8) (37.9) (33.2) (41.5) (22.4) Net sett lements on interest rate swaps (2) - - - (10.9) (44.7) (42.2) (20.7) 0.1 Dividends paid on convert ible perpetual preferred stock Distribut ions paid to noncontrolling interests of consolidated affiliates Non-recurring items: UBS Sett lement proceeds, less fees to derivative plaint iffs' attorneys Net premium paid (received) on bond issuance/redemption 1.9 - 1.9 22.8 - - - - Cash paid for professional fees - accounting, tax and legal Cash paid for government, class action and related sett lements - (1.0) - (7.9) (13.5) (63.7) (89.4) (457.7) Adjusted free cash flow 81.2$ 99.2$ 268.0$ 243.3$ 181.4$ 155.4$ 9.3$ (79.1)$ - (2.0) 194.7 (26.0) (33.4) - 18.2 7.4 15.3 (32.6) Q4 108.8 129.8 - - 2.9 4.8 171.4 21.0 activities of continuing operations Net cash provided by operating Impact of discontinued operations - (73.8) Net cash provided by operating activities - Income tax refunds related to prior periods (5.7) (6.5) (11.7) (10.2) 51.6 5.7 2.9 11.2 17.2 Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow - 16.1 227.3 (26.0) (23.4) 333.6 (26.0) 400.4 (34.4) Full Year (2.6) 409.5 - (44.2) (24.6) (49.3) 317.8 (26.0) (26.0) (1) Maintenance capital expenditures are expected to be $80 to $90 million in 2013. (2) Final swap payment of $10.9 million was made in March 2011. 52

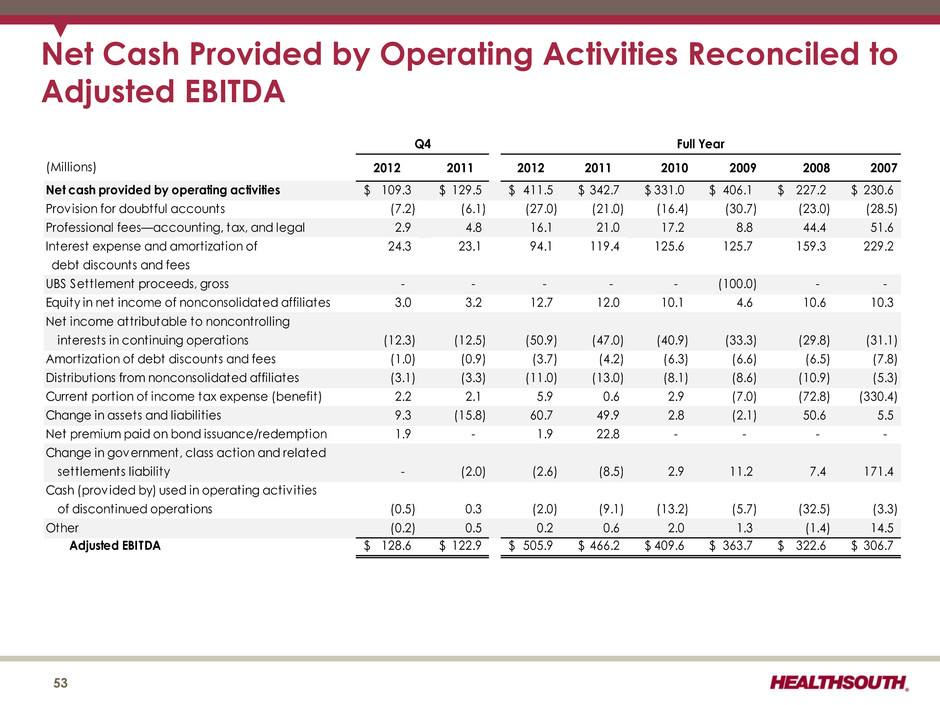

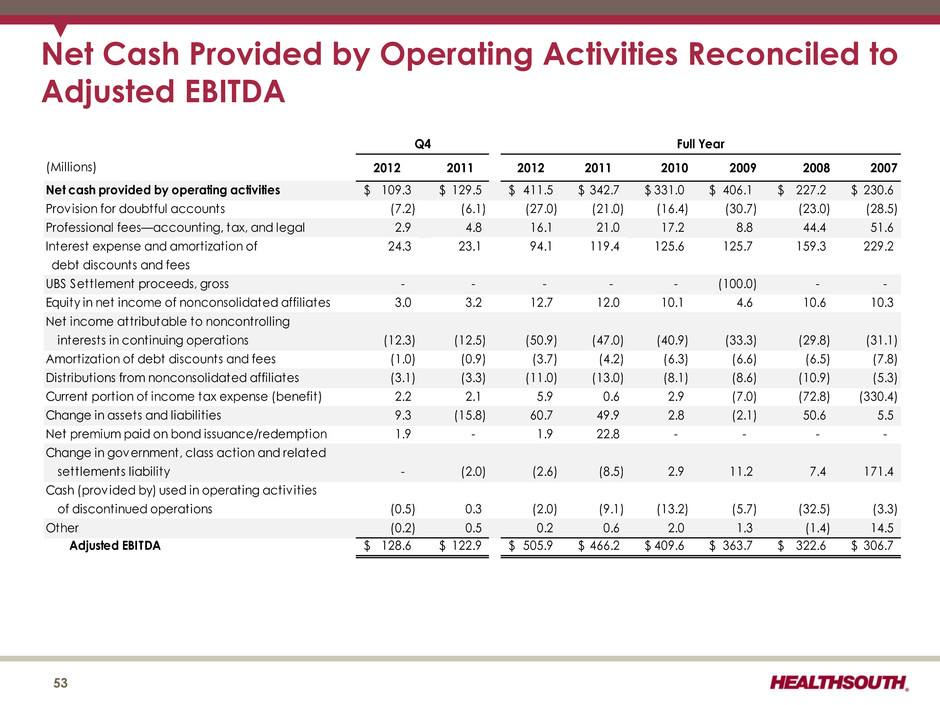

(Millions) 2012 2011 2012 2011 2010 2009 2008 2007 Net cash provided by operating activities 109.3$ 129.5$ 411.5$ 342.7$ 331.0$ 406.1$ 227.2$ 230.6$ Provision for doubtful accounts (7.2) (6.1) (27.0) (21.0) (16.4) (30.7) (23.0) (28.5) Professional fees—accounting, tax, and legal 2.9 4.8 16.1 21.0 17.2 8.8 44.4 51.6 Interest expense and amortization of 24.3 23.1 94.1 119.4 125.6 125.7 159.3 229.2 debt discounts and fees UBS Settlement proceeds, gross - - - - - (100.0) - - Equity in net income of nonconsolidated affiliates 3.0 3.2 12.7 12.0 10.1 4.6 10.6 10.3 Net income attributable to noncontrolling interests in continuing operations (12.3) (12.5) (50.9) (47.0) (40.9) (33.3) (29.8) (31.1) Amortization of debt discounts and fees (1.0) (0.9) (3.7) (4.2) (6.3) (6.6) (6.5) (7.8) Distributions from nonconsolidated affiliates (3.1) (3.3) (11.0) (13.0) (8.1) (8.6) (10.9) (5.3) Current portion of income tax expense (benefit) 2.2 2.1 5.9 0.6 2.9 (7.0) (72.8) (330.4) Change in assets and liabilit ies 9.3 (15.8) 60.7 49.9 2.8 (2.1) 50.6 5.5 Net premium paid on bond issuance/redemption 1.9 - 1.9 22.8 - - - - Change in government, class action and related settlements liability - (2.0) (2.6) (8.5) 2.9 11.2 7.4 171.4 Cash (provided by) used in operating activ ities of discontinued operations (0.5) 0.3 (2.0) (9.1) (13.2) (5.7) (32.5) (3.3) Other (0.2) 0.5 0.2 0.6 2.0 1.3 (1.4) 14.5 Adjusted EBITDA 128.6$ 122.9$ 505.9$ 466.2$ 409.6$ 363.7$ 322.6$ 306.7$ Q4 Full Year Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA 53

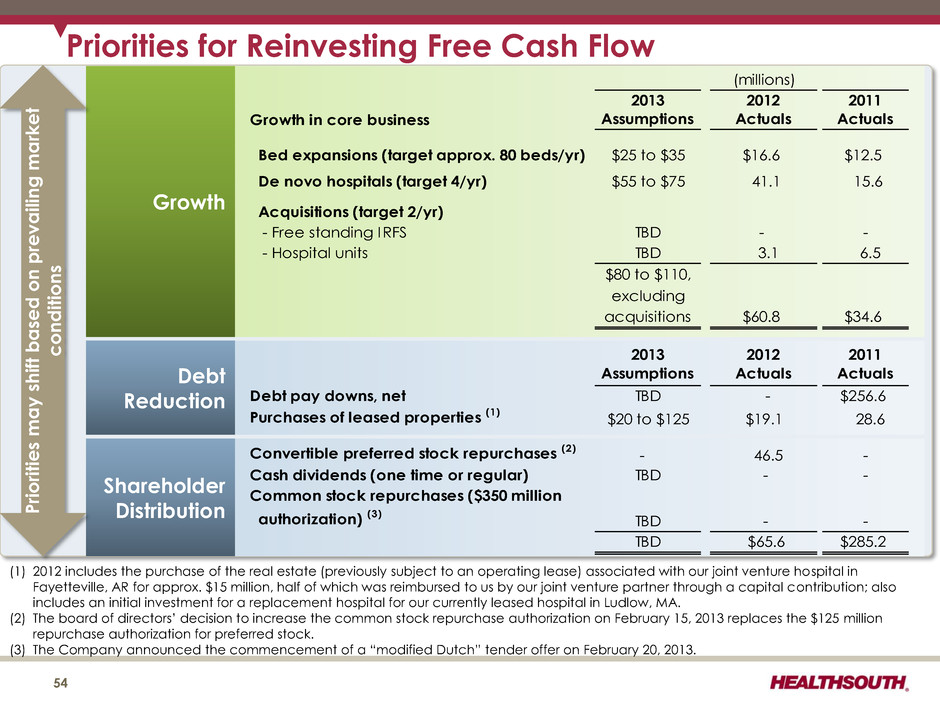

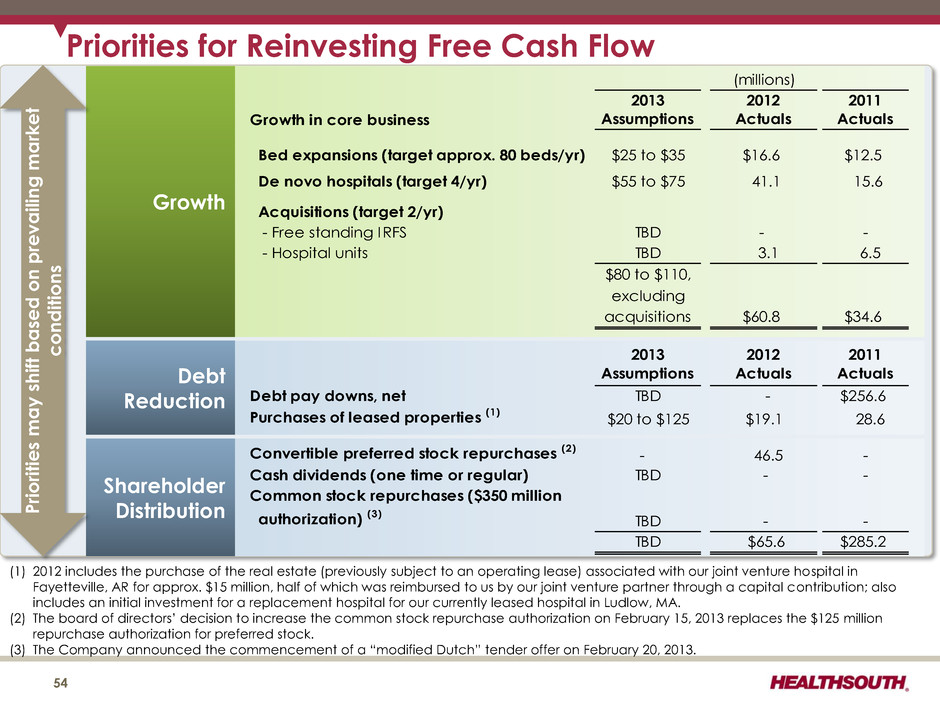

Priorities for Reinvesting Free Cash Flow 54 Growth Debt Reduction Shareholder Distribution (1) 2012 includes the purchase of the real estate (previously subject to an operating lease) associated with our joint venture hospital in Fayetteville, AR for approx. $15 million, half of which was reimbursed to us by our joint venture partner through a capital contribution; also includes an initial investment for a replacement hospital for our currently leased hospital in Ludlow, MA. (2) The board of directors’ decision to increase the common stock repurchase authorization on February 15, 2013 replaces the $125 million repurchase authorization for preferred stock. (3) The Company announced the commencement of a “modified Dutch” tender offer on February 20, 2013. (millions) Growth in core business 2013 Assumptions 2012 Actuals 2011 Actuals Bed expansions (target approx. 80 beds/yr) $25 to $35 $16.6 $12.5 De novo hospitals (target 4/yr) $55 to $75 41.1 15.6 Acquisitions (target 2/yr) - Free standing IRFS TBD - - - Hospital units TBD 3.1 6.5 $80 to $110, excluding acquisitions $60.8 $34.6 2013 Assumptions 2012 Actuals 2011 Actuals Debt pay downs, net TBD - $256.6 Purchases of leased properties (1) $20 to $125 $19.1 28.6 Convertible preferred stock repurchases (2) - 46.5 - Cash dividends (one time or regular) TBD - - Common stock repurchases ($350 million authorization) (3) TBD - - TBD $65.6 $285.2 P rio ritie s may s hift b a sed on p re v ai lin g ma rket condi tion s

Refinancing and Delevering 55

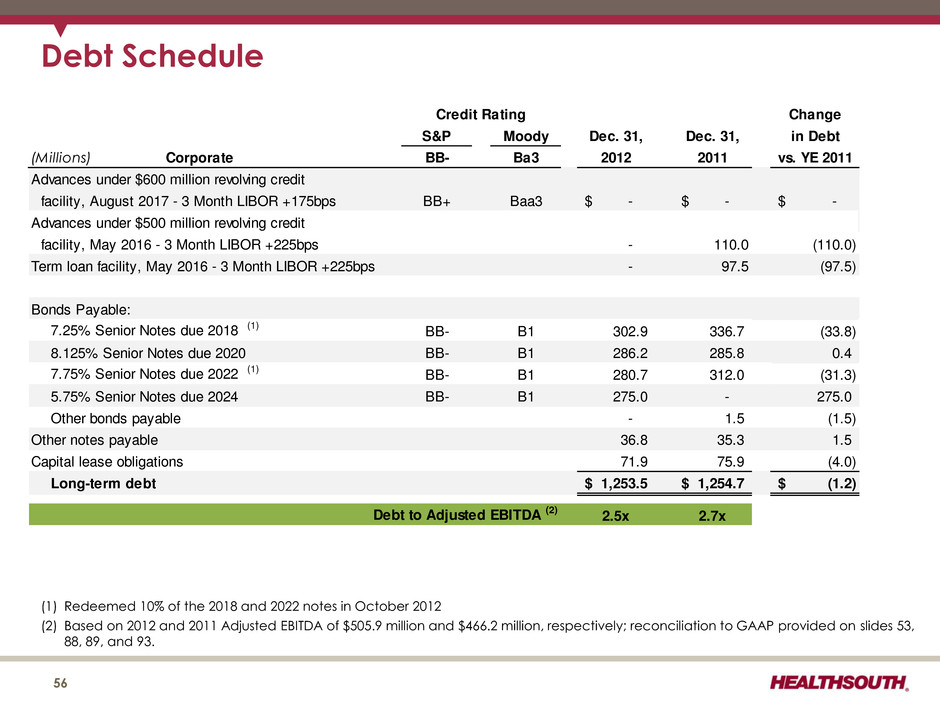

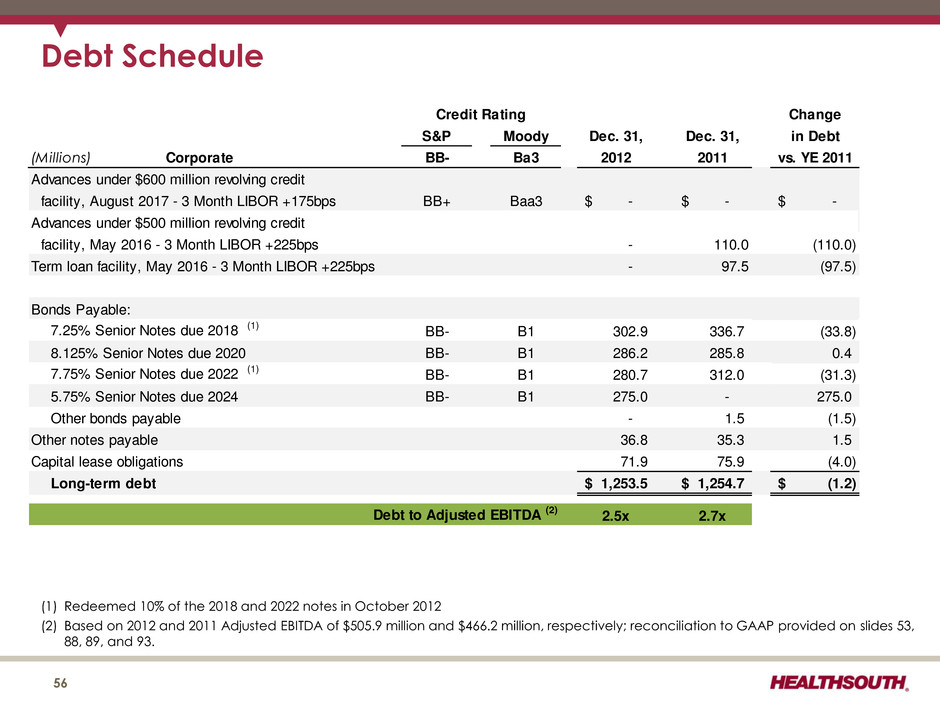

Debt Schedule (1) Redeemed 10% of the 2018 and 2022 notes in October 2012 (2) Based on 2012 and 2011 Adjusted EBITDA of $505.9 million and $466.2 million, respectively; reconciliation to GAAP provided on slides 53, 88, 89, and 93. 56 Change S&P Moody Dec. 31, Dec. 31, in Debt (Millions) Corporate BB- Ba3 2012 2011 vs. YE 2011 Advances under $600 million revolving credit facility, August 2017 - 3 Month LIBOR +175bps BB+ Baa3 -$ -$ -$ Advances under $500 million revolving credit facility, May 2016 - 3 Month LIBOR +225bps - 110.0 (110.0) Term loan facility, May 2016 - 3 Month LIBOR +225bps - 97.5 (97.5) Bonds Payable: 7.25% Senior Notes due 2018 (1) BB- B1 302.9 336.7 (33.8) 8.125% Senior Notes due 2020 BB- B1 286.2 285.8 0.4 7.75% Senior Notes due 2022 (1) BB- B1 280.7 312.0 (31.3) 5.75% Senior Notes due 2024 BB- B1 275.0 - 275.0 Other bonds payable - 1.5 (1.5) Other notes payable 36.8 35.3 1.5 Capital lease obligations 71.9 75.9 (4.0) Long-term debt 1,253.5$ 1,254.7$ (1.2)$ Debt to Adjusted EBITDA (2) 2.5x 2.7x Credit Rating

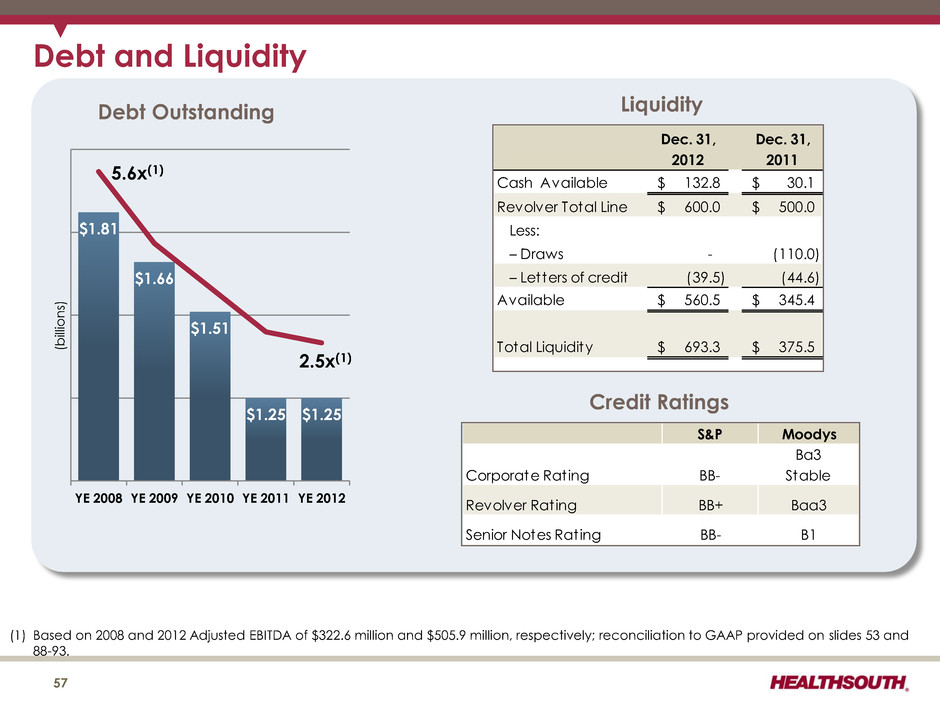

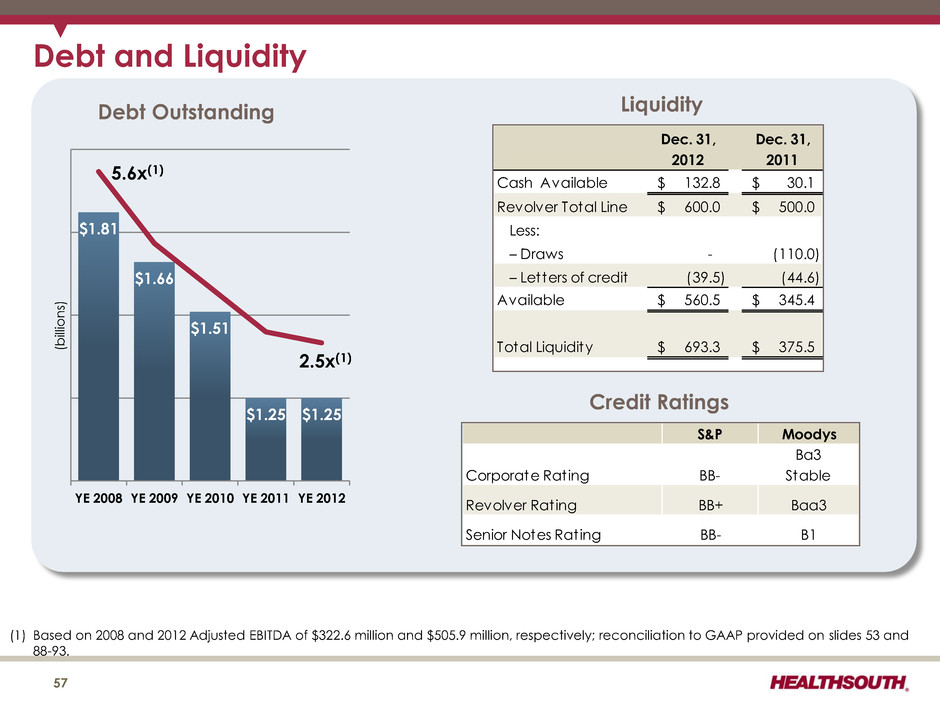

($ Billions) Year-End 2010 Goal: 3.75x to 4.00x (1) Based on 2008 and 2012 Adjusted EBITDA of $322.6 million and $505.9 million, respectively; reconciliation to GAAP provided on slides 53 and 88-93. Debt and Liquidity Dec. 31, Dec. 31, 2012 2011 Cash Available 132.8$ 30.1$ Revolver Total Line 600.0$ 500.0$ Less: – Draws - (110.0) – Letters of credit (39.5) (44.6) 560.5$ 345.4$ Total Liquidity 693.3$ 375.5$ Available Liquidity 57 $1.81 $1.66 $1.51 $1.25 $1.25 YE 2008 YE 2009 YE 2010 YE 2011 YE 2012 5.6x(1) 2.5x(1) Debt Outstanding Credit Ratings S&P Moodys Corporate Rating BB- Ba3 Stable Revolver Rating BB+ Baa3 Senior Notes Rating BB- B1 (b ill io n s)

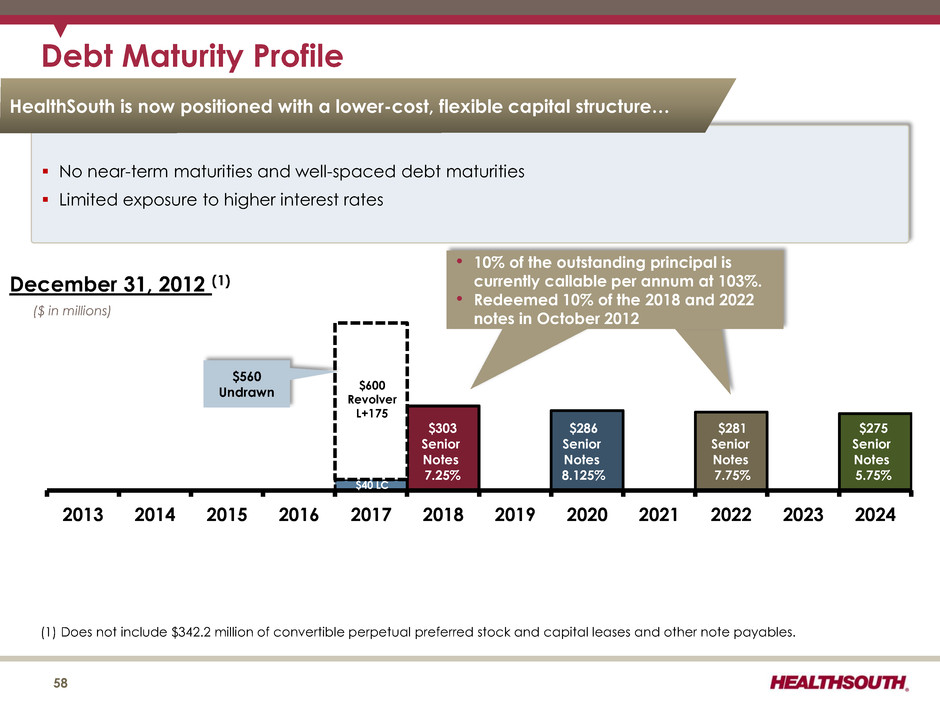

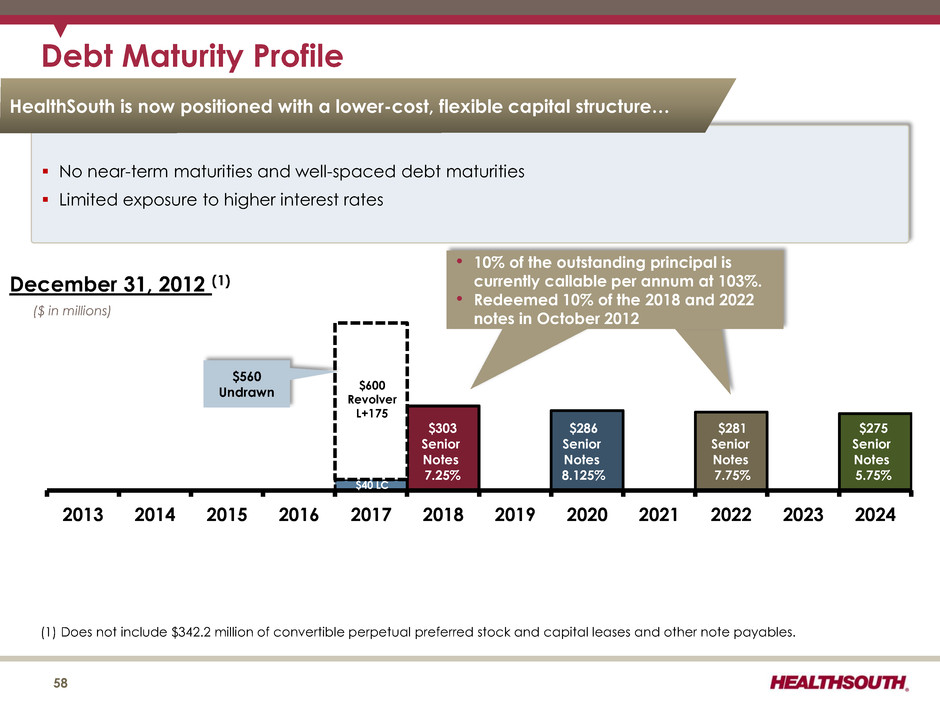

Debt Maturity Profile 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 $303 Senior Notes 7.25% $286 Senior Notes 8.125% $281 Senior Notes 7.75% ($ in millions) $40 LC $600 Revolver L+175 December 31, 2012 (1) $560 Undrawn • 10% of the outstanding principal is currently callable per annum at 103%. • Redeemed 10% of the 2018 and 2022 notes in October 2012 (1) Does not include $342.2 million of convertible perpetual preferred stock and capital leases and other note payables. No near-term maturities and well-spaced debt maturities Limited exposure to higher interest rates $275 Senior Notes 5.75% HealthSouth is now positioned with a lower-cost, flexible capital structure… 58

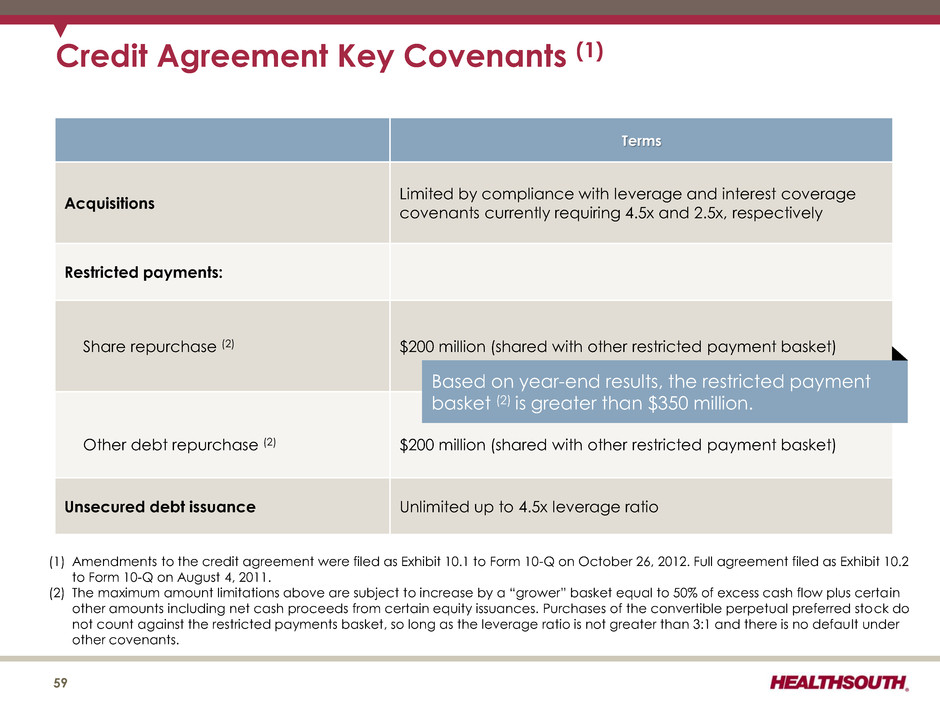

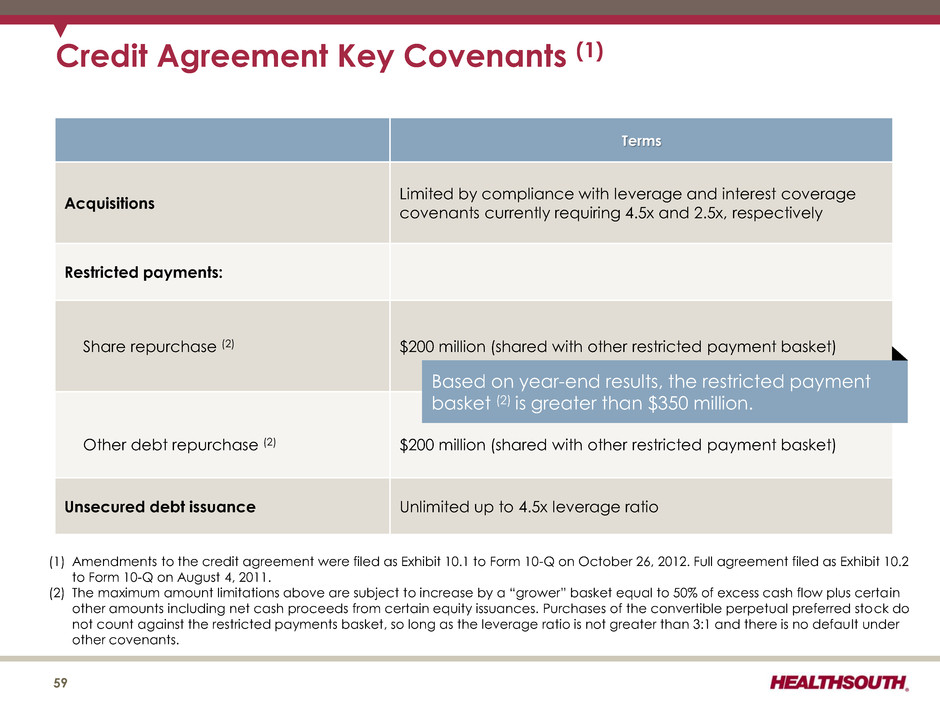

Credit Agreement Key Covenants (1) Terms Acquisitions Limited by compliance with leverage and interest coverage covenants currently requiring 4.5x and 2.5x, respectively Restricted payments: Share repurchase (2) $200 million (shared with other restricted payment basket) Other debt repurchase (2) $200 million (shared with other restricted payment basket) Unsecured debt issuance Unlimited up to 4.5x leverage ratio 59 (1) Amendments to the credit agreement were filed as Exhibit 10.1 to Form 10-Q on October 26, 2012. Full agreement filed as Exhibit 10.2 to Form 10-Q on August 4, 2011. (2) The maximum amount limitations above are subject to increase by a “grower” basket equal to 50% of excess cash flow plus certa in other amounts including net cash proceeds from certain equity issuances. Purchases of the convertible perpetual preferred stock do not count against the restricted payments basket, so long as the leverage ratio is not greater than 3:1 and there is no default under other covenants. Based on year-end results, the restricted payment basket (2) is greater than $350 million.

Growth 60

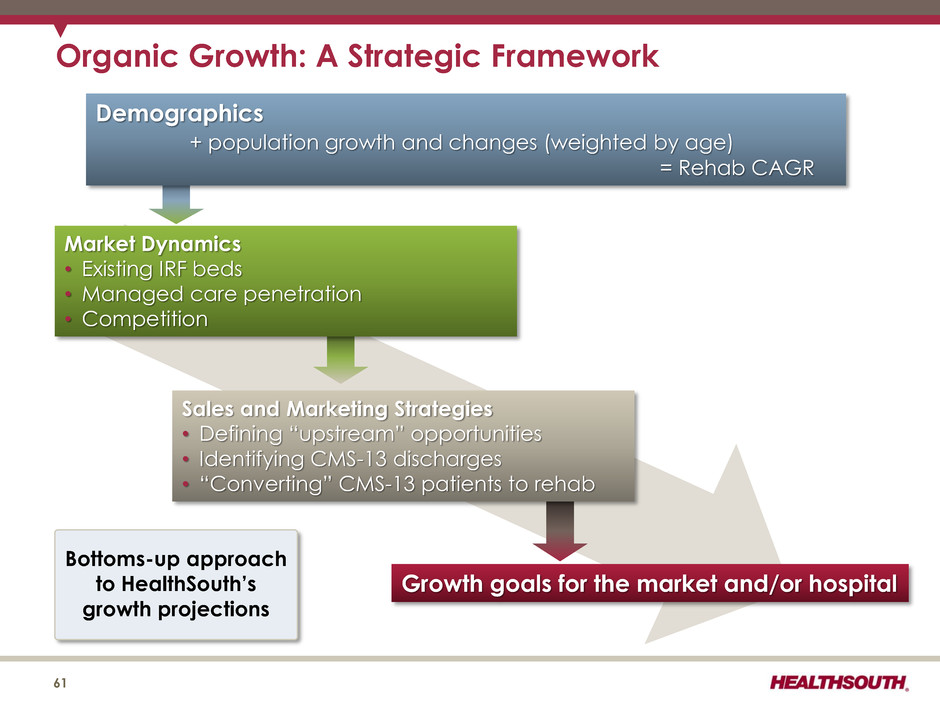

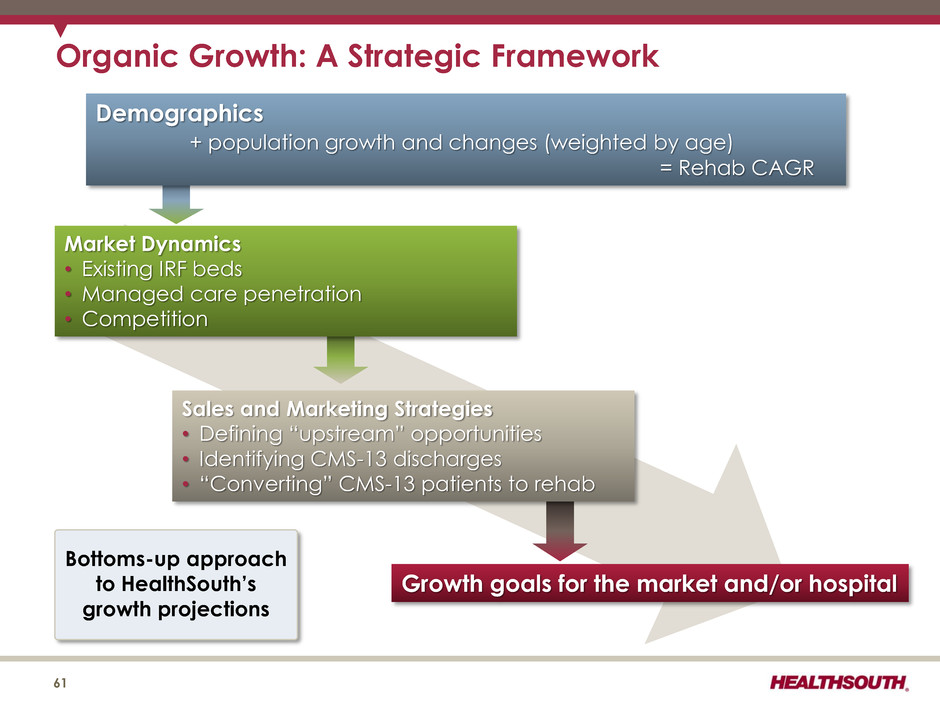

Demographics + population growth and changes (weighted by age) = Rehab CAGR Growth goals for the market and/or hospital Sales and Marketing Strategies • Defining “upstream” opportunities • Identifying CMS-13 discharges • “Converting” CMS-13 patients to rehab Market Dynamics • Existing IRF beds • Managed care penetration • Competition Organic Growth: A Strategic Framework Bottoms-up approach to HealthSouth’s growth projections 61

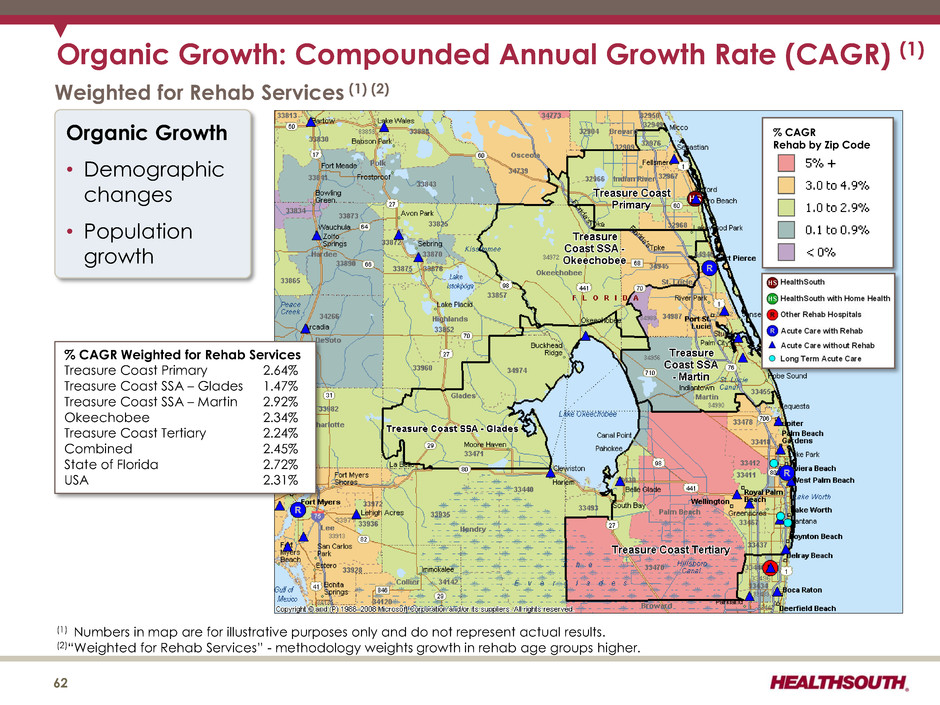

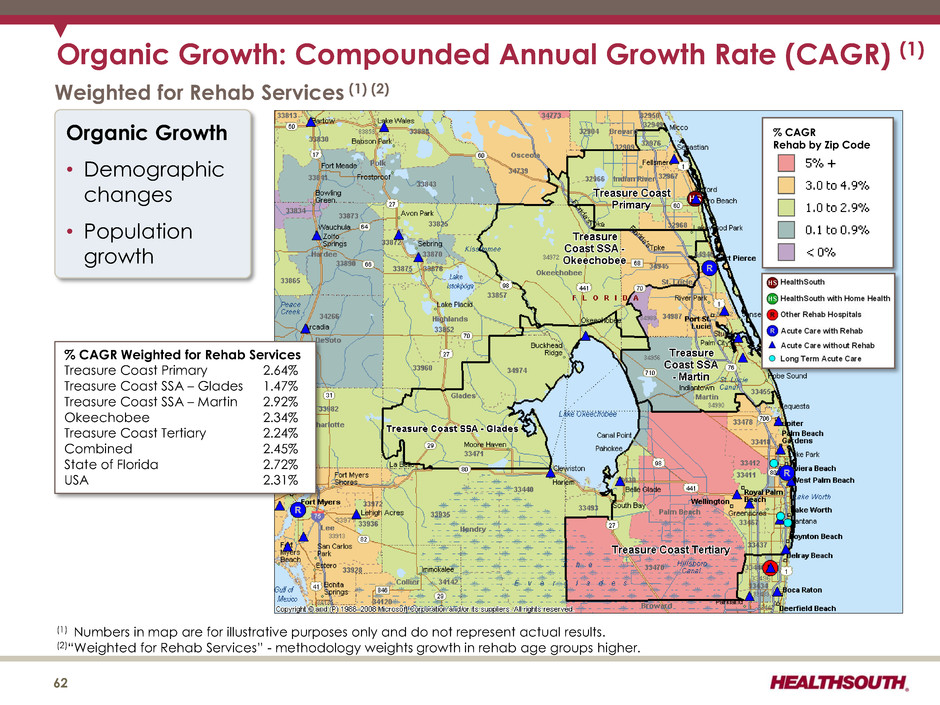

Organic Growth: Compounded Annual Growth Rate (CAGR) (1) (1) Numbers in map are for illustrative purposes only and do not represent actual results. (2)“Weighted for Rehab Services” - methodology weights growth in rehab age groups higher. % CAGR Rehab by Zip Code Weighted for Rehab Services (1) (2) Organic Growth • Demographic changes • Population growth % CAGR Weighted for Rehab Services Treasure Coast Primary 2.64% Treasure Coast SSA – Glades 1.47% Treasure Coast SSA – Martin 2.92% Okeechobee 2.34% Treasure Coast Tertiary 2.24% Combined 2.45% State of Florida 2.72% USA 2.31% 62

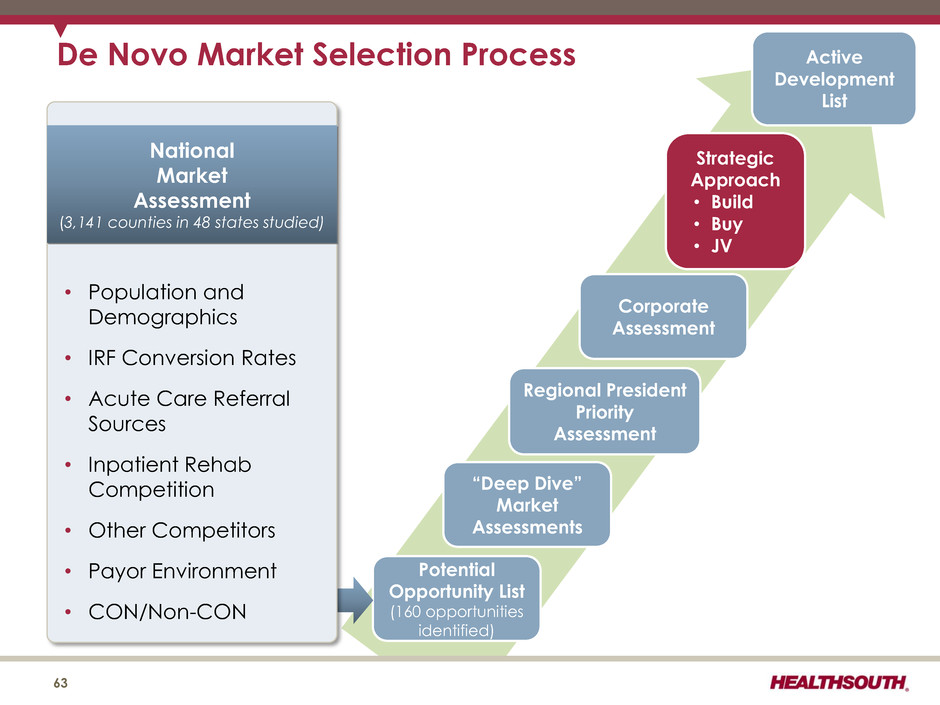

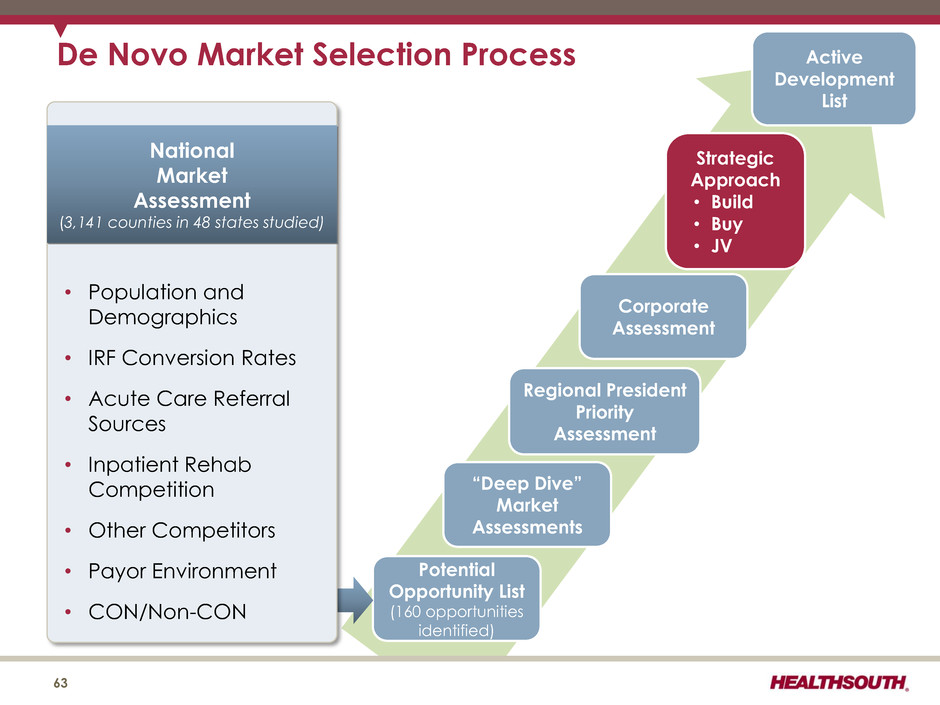

De Novo Market Selection Process 63 Active Development List Corporate Assessment Strategic Approach • Build • Buy • JV Regional President Priority Assessment “Deep Dive” Market Assessments Potential Opportunity List (160 opportunities identified) National Market Assessment (3,141 counties in 48 states studied) • Population and Demographics • IRF Conversion Rates • Acute Care Referral Sources • Inpatient Rehab Competition • Other Competitors • Payor Environment • CON/Non-CON

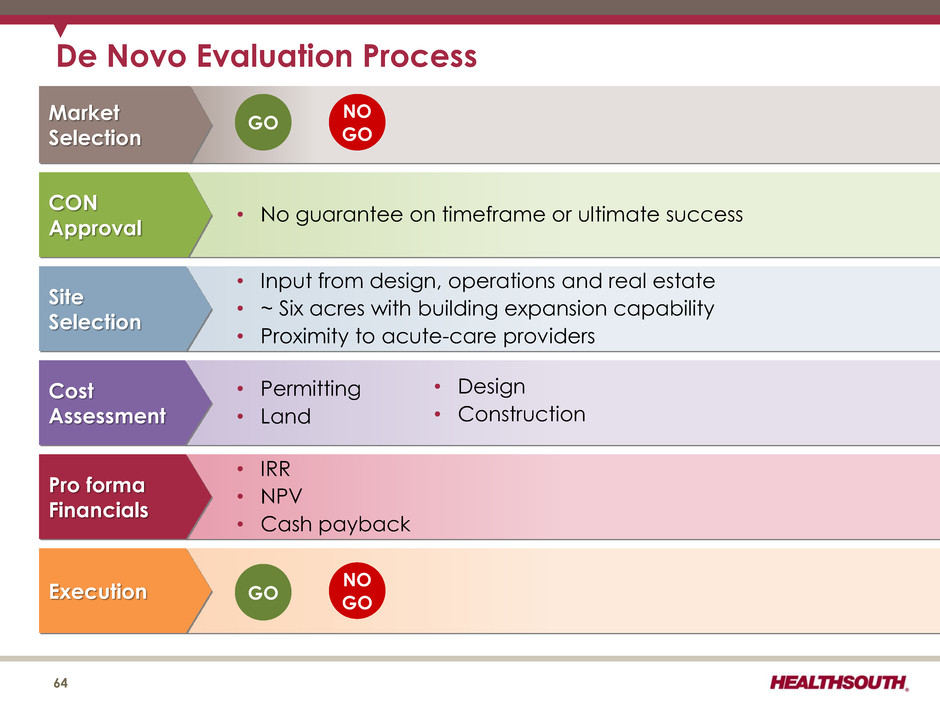

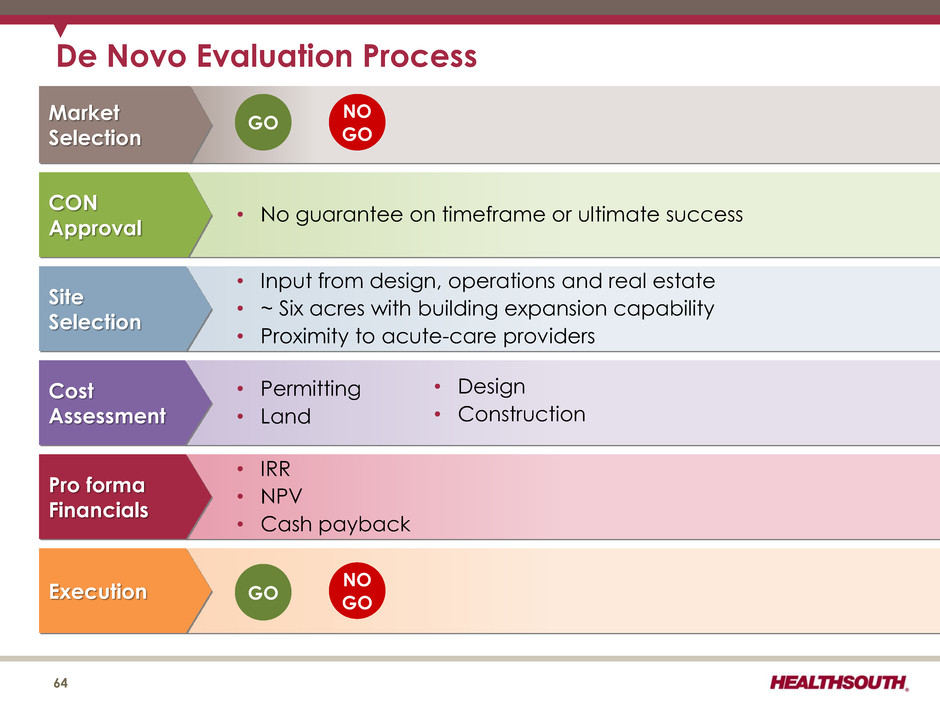

• No guarantee on timeframe or ultimate success • Input from design, operations and real estate • ~ Six acres with building expansion capability • Proximity to acute-care providers • Permitting • Land • IRR • NPV • Cash payback ..... CON Approval Site Selection Cost Assessment Pro forma Financials Execution • Design • Construction NO GO GO De Novo Evaluation Process 64 Market Selection GO NO GO

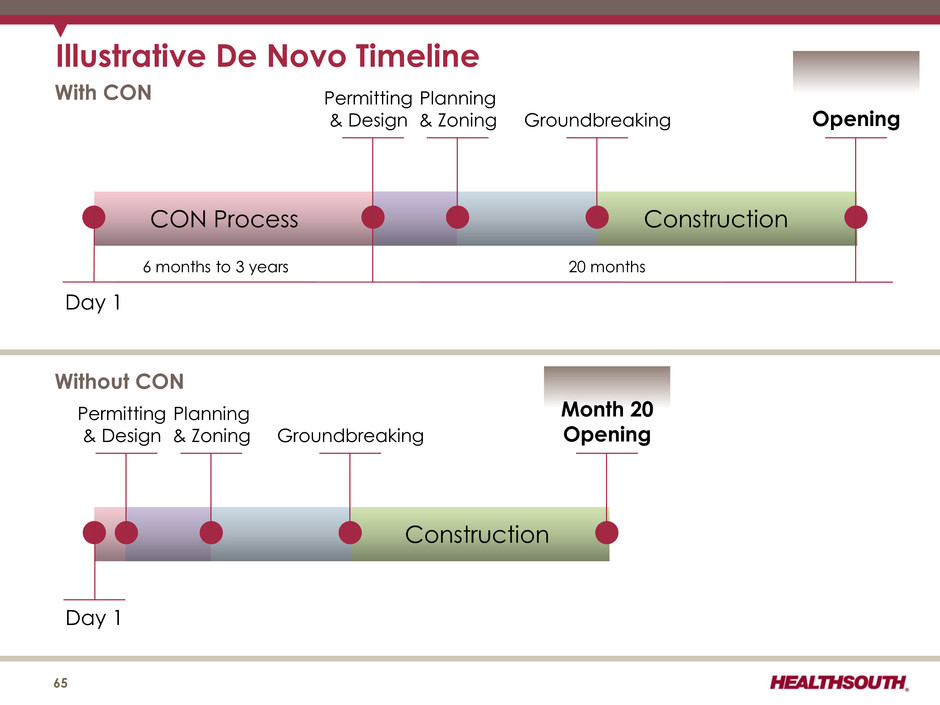

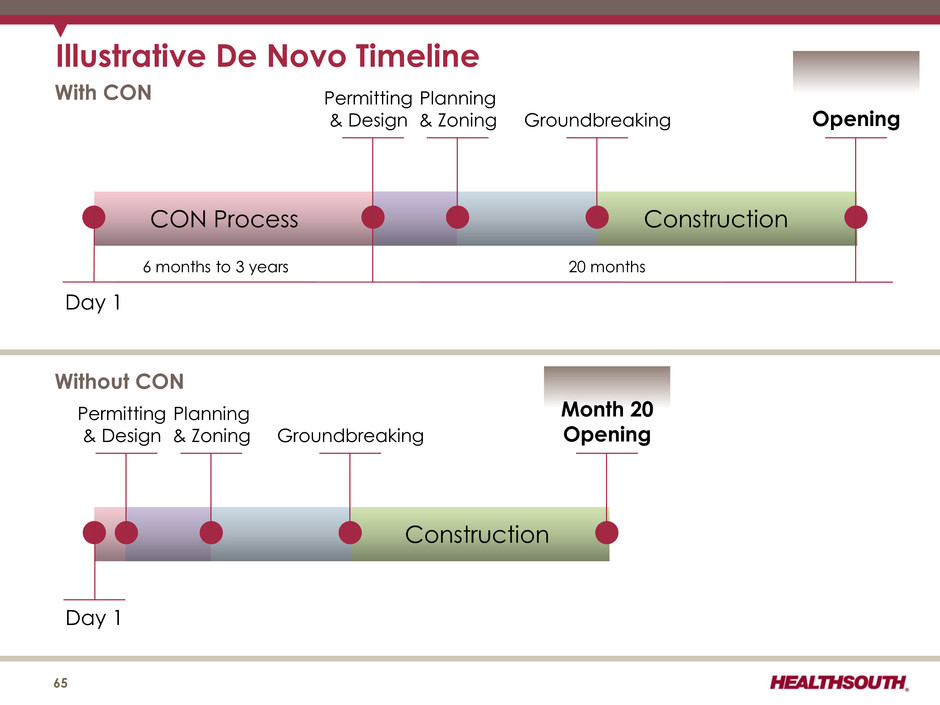

Illustrative De Novo Timeline 65 Day 1 CON Process Construction With CON Permitting & Design Planning & Zoning Groundbreaking Opening Construction Permitting & Design Planning & Zoning Groundbreaking Month 20 Opening Day 1 Without CON 6 months to 3 years 20 months

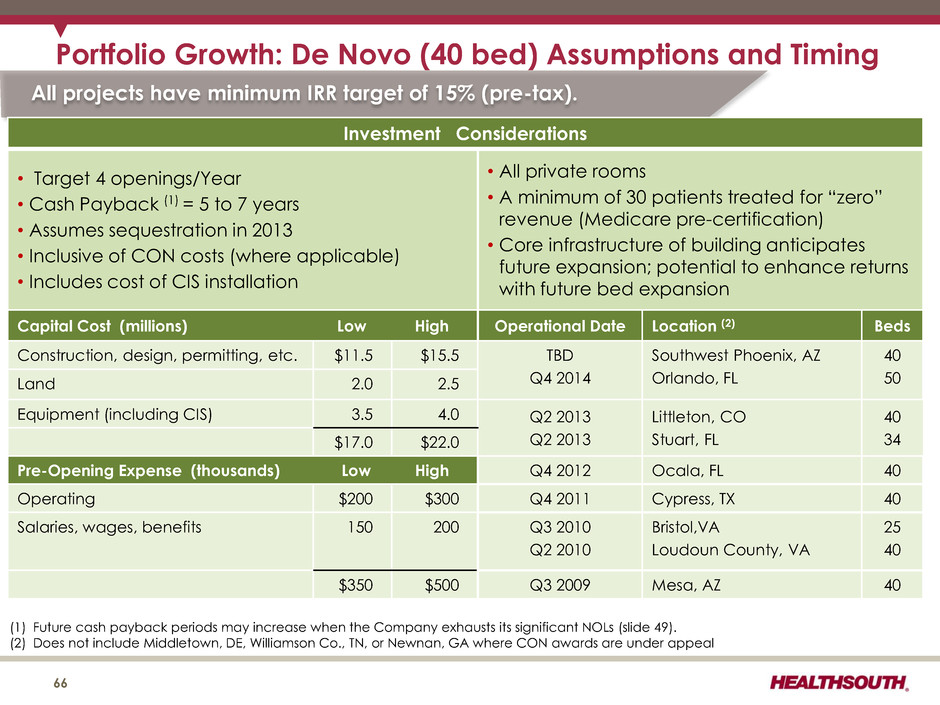

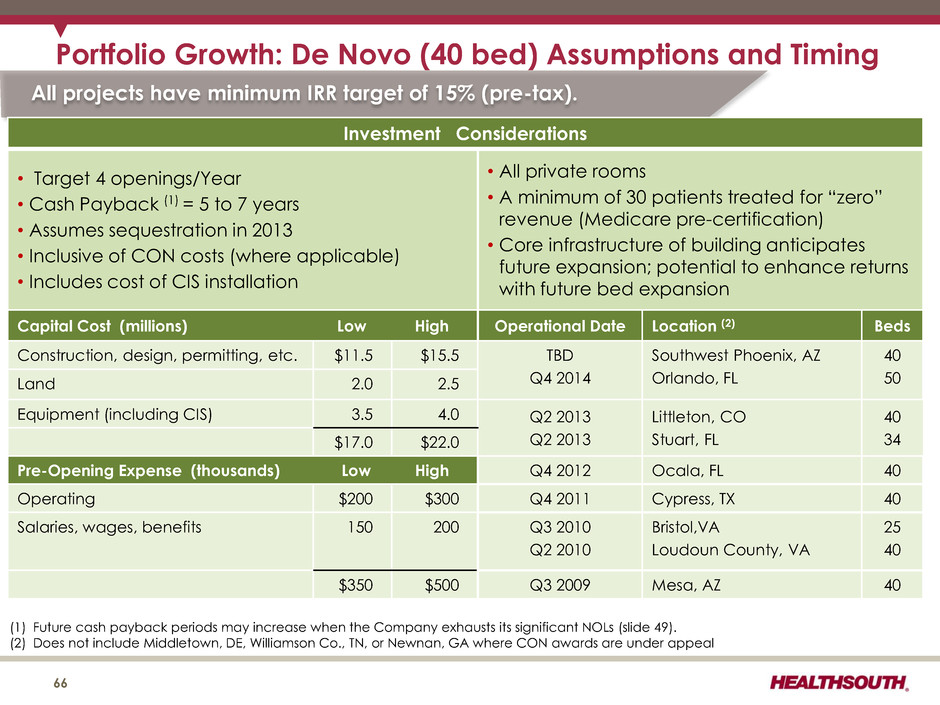

Portfolio Growth: De Novo (40 bed) Assumptions and Timing 66 (1) Future cash payback periods may increase when the Company exhausts its significant NOLs (slide 49). (2) Does not include Middletown, DE, Williamson Co., TN, or Newnan, GA where CON awards are under appeal All projects have minimum IRR target of 15% (pre-tax). Investment Considerations • Target 4 openings/Year • Cash Payback (1) = 5 to 7 years • Assumes sequestration in 2013 • Inclusive of CON costs (where applicable) • Includes cost of CIS installation • All private rooms • A minimum of 30 patients treated for “zero” revenue (Medicare pre-certification) • Core infrastructure of building anticipates future expansion; potential to enhance returns with future bed expansion Capital Cost (millions) Low High Operational Date Location (2) Beds Construction, design, permitting, etc. $11.5 $15.5 TBD Q4 2014 Southwest Phoenix, AZ Orlando, FL 40 50 Land 2.0 2.5 Equipment (including CIS) 3.5 4.0 Q2 2013 Q2 2013 Littleton, CO Stuart, FL 40 34 $17.0 $22.0 Pre-Opening Expense (thousands) Low High Q4 2012 Ocala, FL 40 Operating $200 $300 Q4 2011 Cypress, TX 40 Salaries, wages, benefits 150 200 Q3 2010 Q2 2010 Bristol,VA Loudoun County, VA 25 40 $350 $500 Q3 2009 Mesa, AZ 40

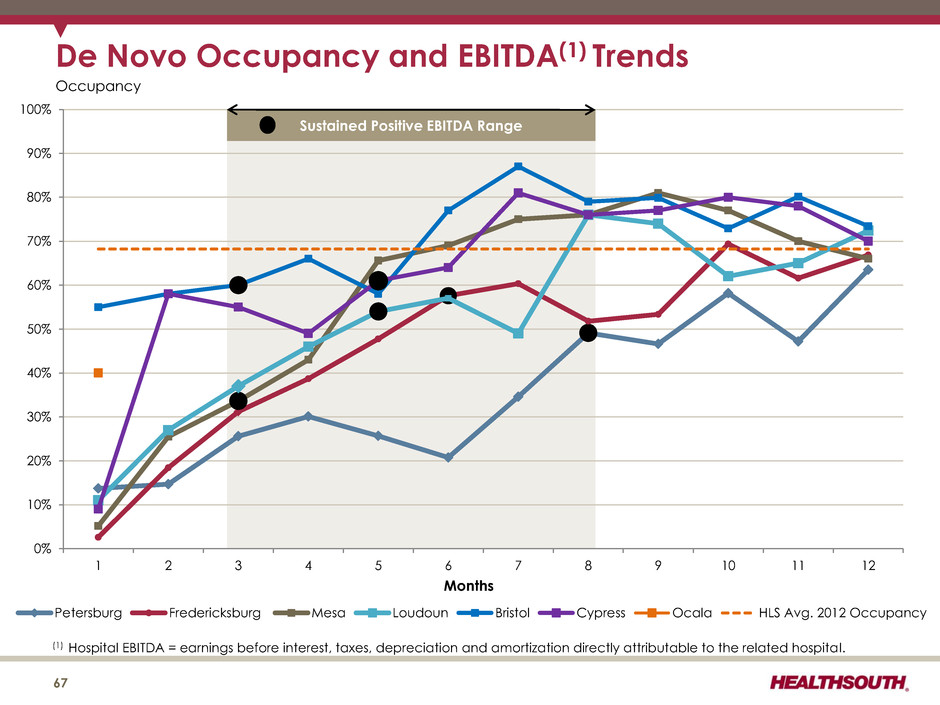

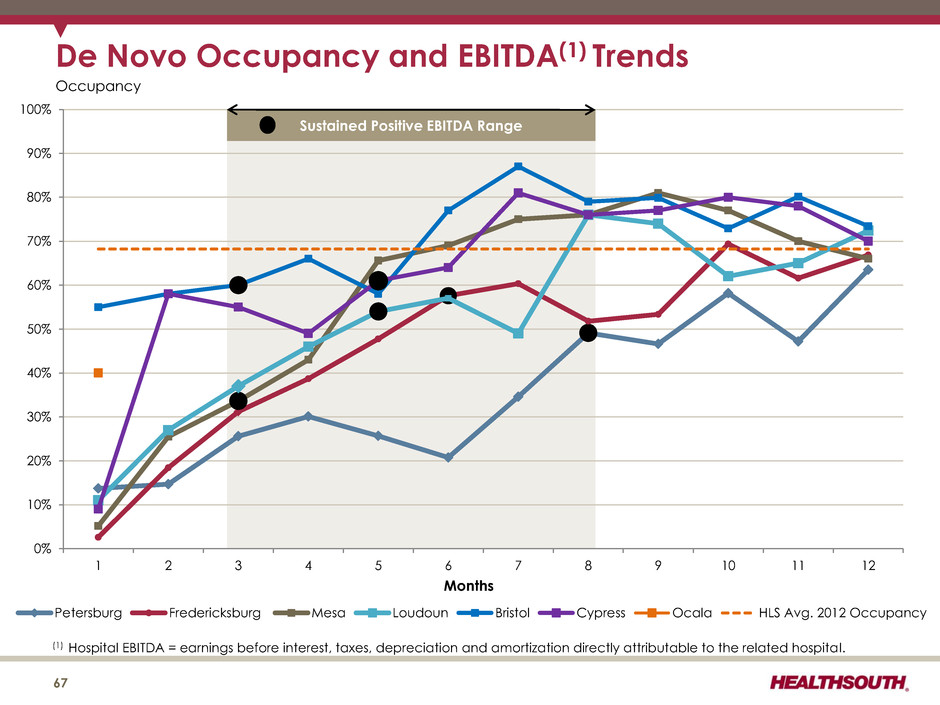

(1) Hospital EBITDA = earnings before interest, taxes, depreciation and amortization directly attributable to the related hospital. De Novo Occupancy and EBITDA(1) Trends 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1 2 3 4 5 6 7 8 9 10 11 12 Petersburg Fredericksburg Mesa Loudoun Bristol Cypress Ocala HLS Avg. 2012 Occupancy Months 67 Occupancy Sustained Positive EBITDA Range

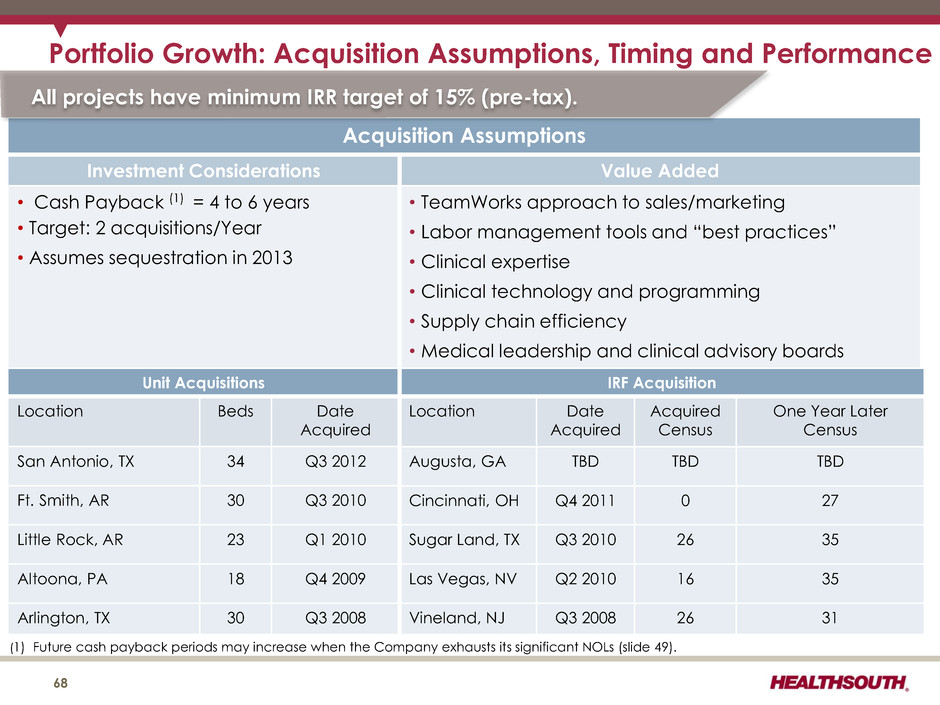

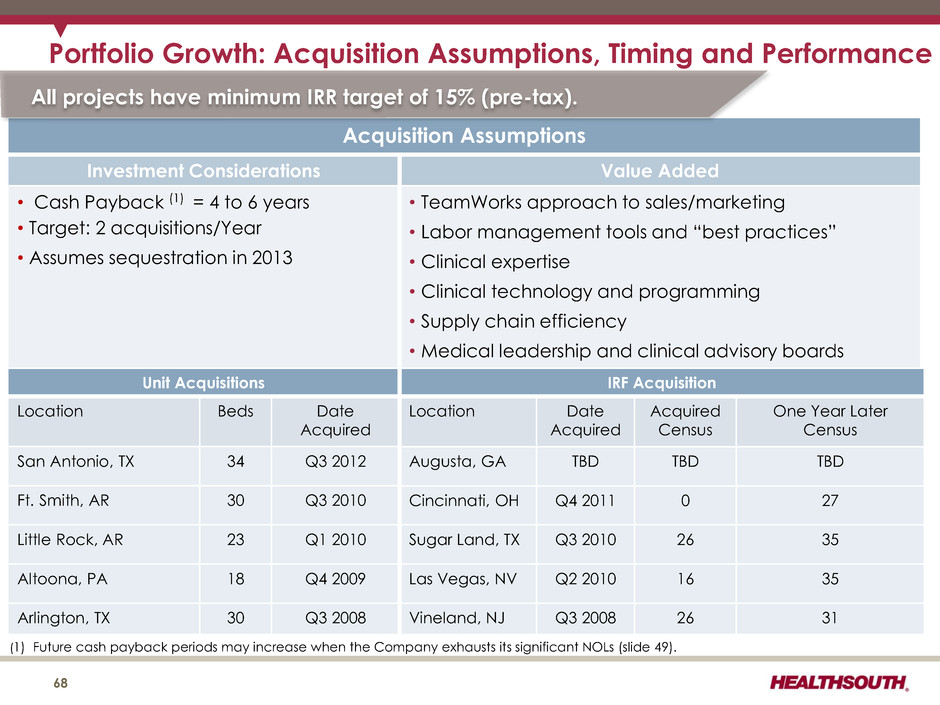

Portfolio Growth: Acquisition Assumptions, Timing and Performance 68 (1) Future cash payback periods may increase when the Company exhausts its significant NOLs (slide 49). Acquisition Assumptions Investment Considerations Value Added • Cash Payback (1) = 4 to 6 years • Target: 2 acquisitions/Year • Assumes sequestration in 2013 • TeamWorks approach to sales/marketing • Labor management tools and “best practices” • Clinical expertise • Clinical technology and programming • Supply chain efficiency • Medical leadership and clinical advisory boards All projects have minimum IRR target of 15% (pre-tax). Unit Acquisitions Location Beds Date Acquired San Antonio, TX 34 Q3 2012 Ft. Smith, AR 30 Q3 2010 Little Rock, AR 23 Q1 2010 Altoona, PA 18 Q4 2009 Arlington, TX 30 Q3 2008 IRF Acquisition Location Date Acquired Acquired Census One Year Later Census Augusta, GA TBD TBD TBD Cincinnati, OH Q4 2011 0 27 Sugar Land, TX Q3 2010 26 35 Las Vegas, NV Q2 2010 16 35 Vineland, NJ Q3 2008 26 31

69 Acute Care Hospital Discharge Long-Term Acute Care Hospital (1) Hospice Inpatient Rehabilitation Facility (1) Skilled Nursing Facility Home Health (1) (Highest Acuity) (Lowest Acuity) Future Growth: Complementary Post-Acute Care Services Medicare Spending (billions) $5.4 $13.0 $6.7 $31.8 $19.6 # of Discharges 134,683 1,159,000 359,000 2,418,442 3,400,000 Length of Stay 26.6 days 86 days 13.1 days <100 days N/A # of Providers 436 3,696 1,165 15,161 12,026 Facility Ownership Mix For-Profit (83%) Non-Profit (16%) Gov't (1%) For-Profit (55%) Non-Profit (31%) Other (14%) For-Profit (25%) Non-Profit (62%) Gov't (13%) For-Profit (70%) Non-Profit (25%) Gov't (5%) For-Profit (87%) Non-Profit (13%) Hospital vs. Free-standing Free-standing (70%) Hospital Based (30%) Free-standing (70%) Hospital Based (14%) Home Based (16%) Free-standing (20%) Hospital Based (80%) Free-standing (94%) Hospital Based (6%) N/A Rural vs. Urban Urban (95%) Rural (5%) Urban (70%) Rural (30%) Urban (83%) Rural (17%) Urban (70%) Rural (30%) Urban (86%) Rural (14%) (1) For information on HealthSouth’s hospital portfolio, see slide 4. Sources: Medpac Data Book, June 2012 – pages 117-119, 126, 127, 129, 133, 135, 192, and 194, Medpac Payment Policy, March 2012 – pages 175, 198, 239, 290, 302

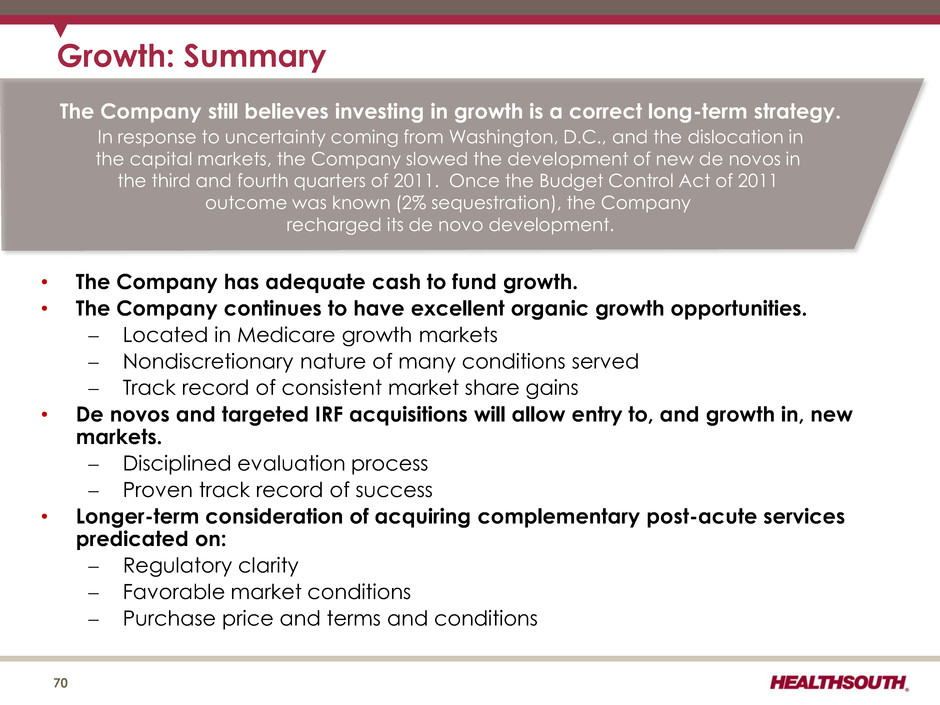

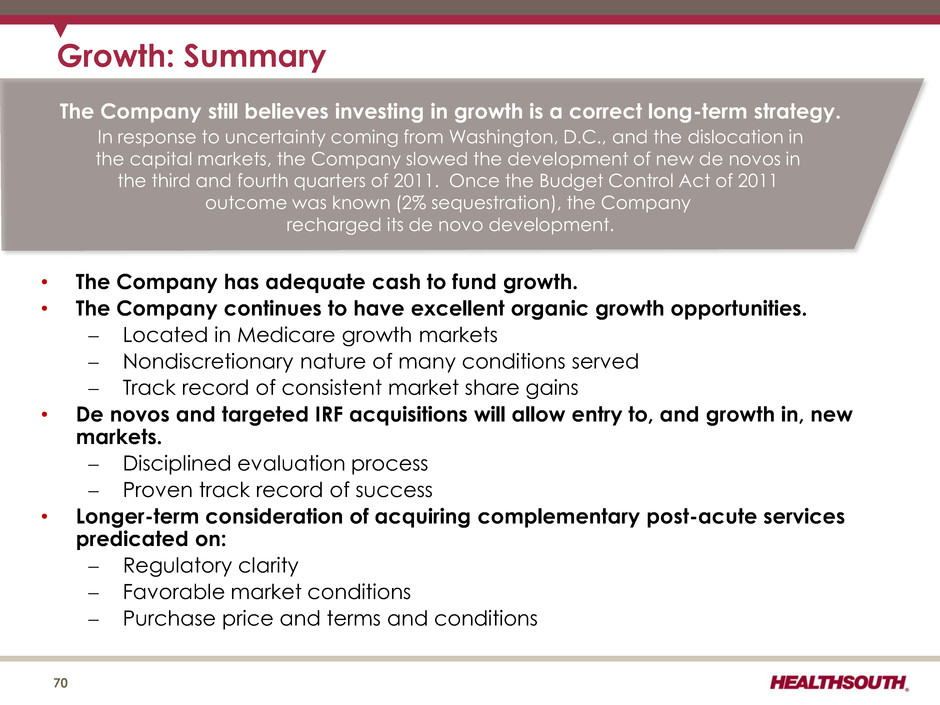

• The Company has adequate cash to fund growth. • The Company continues to have excellent organic growth opportunities. Located in Medicare growth markets Nondiscretionary nature of many conditions served Track record of consistent market share gains • De novos and targeted IRF acquisitions will allow entry to, and growth in, new markets. Disciplined evaluation process Proven track record of success • Longer-term consideration of acquiring complementary post-acute services predicated on: Regulatory clarity Favorable market conditions Purchase price and terms and conditions Growth: Summary 70 The Company still believes investing in growth is a correct long-term strategy. In response to uncertainty coming from Washington, D.C., and the dislocation in the capital markets, the Company slowed the development of new de novos in the third and fourth quarters of 2011. Once the Budget Control Act of 2011 outcome was known (2% sequestration), the Company recharged its de novo development.

Operational Initiatives 71

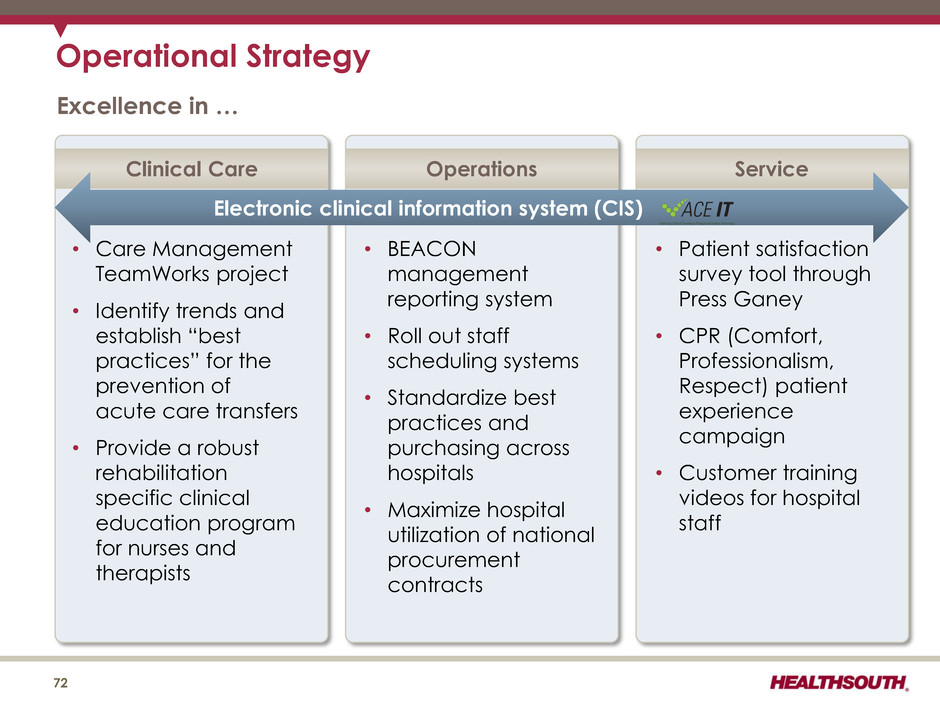

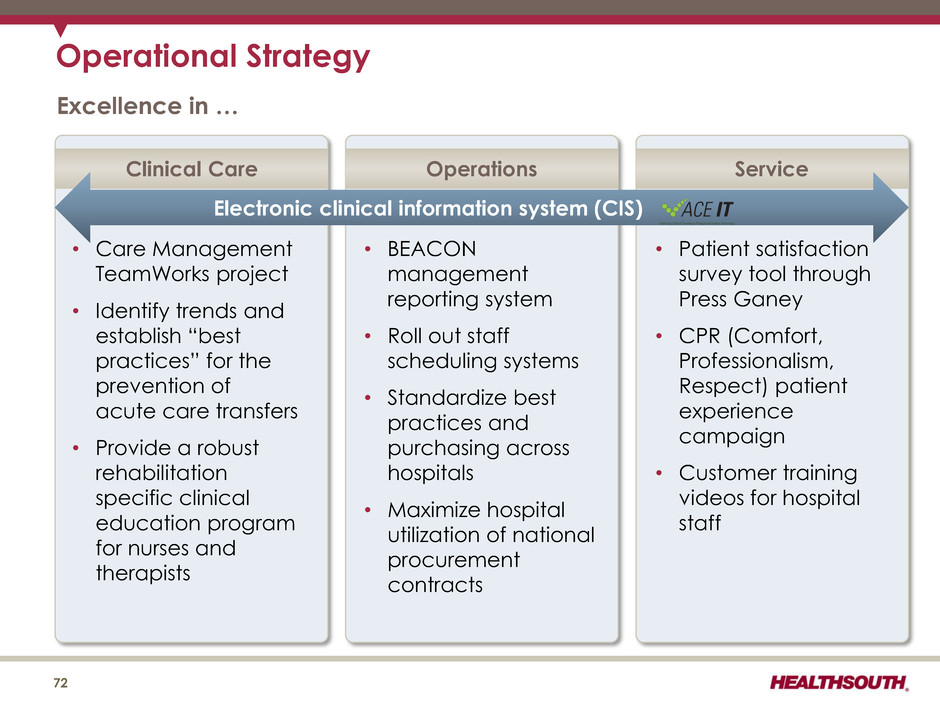

Operational Strategy Excellence in … 72 • Care Management TeamWorks project • Identify trends and establish “best practices” for the prevention of acute care transfers • Provide a robust rehabilitation specific clinical education program for nurses and therapists • BEACON management reporting system • Roll out staff scheduling systems • Standardize best practices and purchasing across hospitals • Maximize hospital utilization of national procurement contracts • Patient satisfaction survey tool through Press Ganey • CPR (Comfort, Professionalism, Respect) patient experience campaign • Customer training videos for hospital staff Clinical Care Operations Service Electronic clinical information system (CIS)

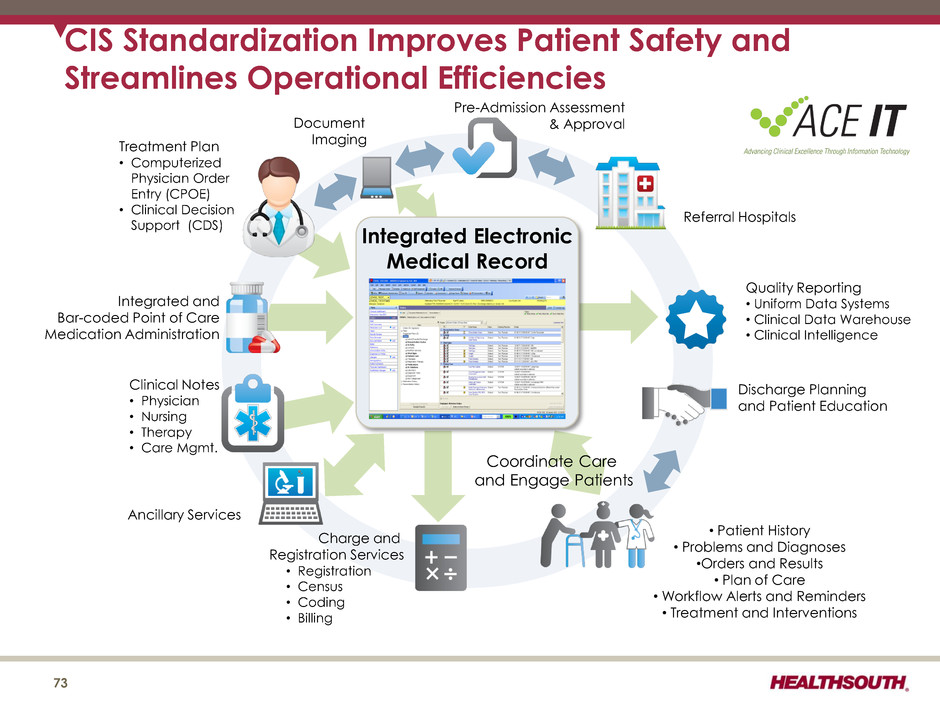

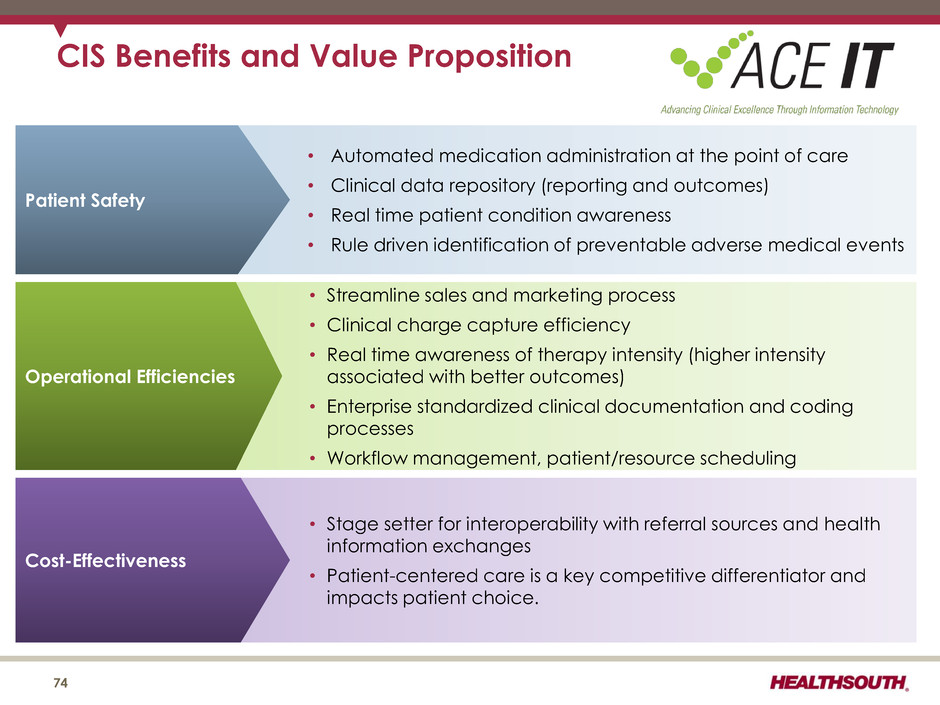

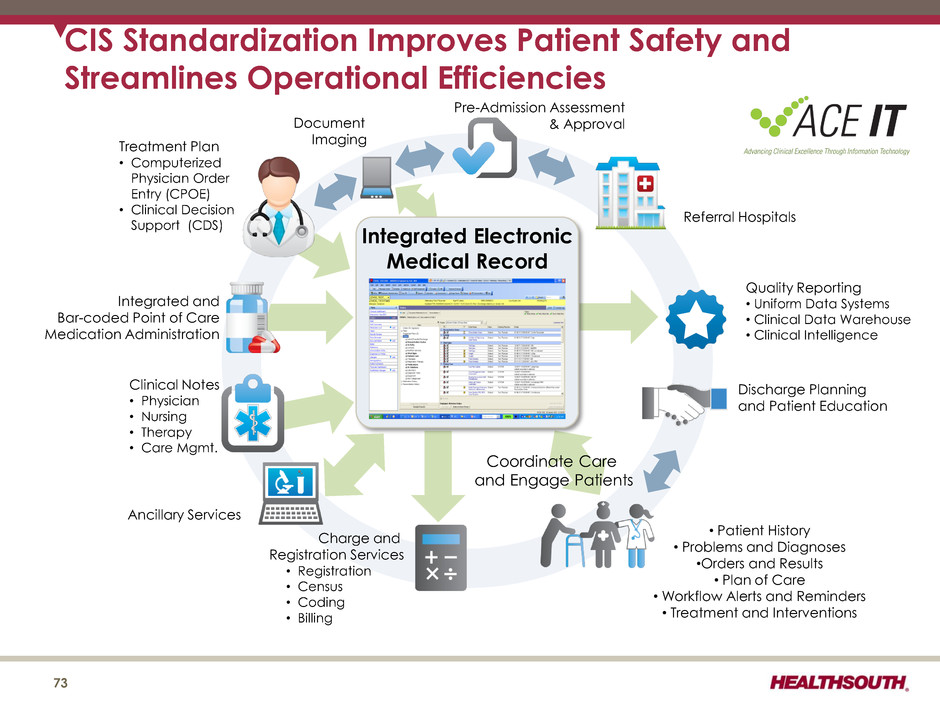

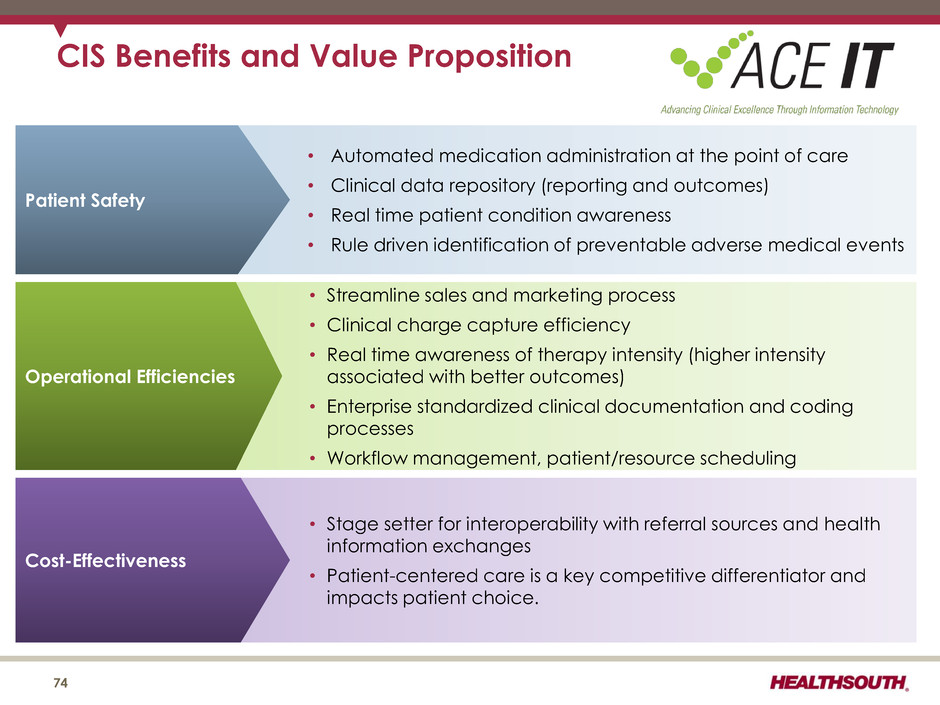

CIS Standardization Improves Patient Safety and Streamlines Operational Efficiencies Pre-Admission Assessment & Approval Discharge Planning and Patient Education • Patient History • Problems and Diagnoses •Orders and Results • Plan of Care • Workflow Alerts and Reminders • Treatment and Interventions Document Imaging Charge and Registration Services • Registration • Census • Coding • Billing Quality Reporting • Uniform Data Systems • Clinical Data Warehouse • Clinical Intelligence Integrated Electronic Medical Record Referral Hospitals Coordinate Care and Engage Patients Ancillary Services Clinical Notes • Physician • Nursing • Therapy • Care Mgmt. Integrated and Bar-coded Point of Care Medication Administration Treatment Plan • Computerized Physician Order Entry (CPOE) • Clinical Decision Support (CDS) CIS Benefits and Value Proposition • Streamline sales and marketing process • Clinical charge capture efficiency • Real time awareness of therapy intensity (higher intensity associated with better outcomes) • Enterprise standardized clinical documentation and coding processes • Workflow management, patient/resource scheduling Operational Efficiencies • Automated medication administration at the point of care • Clinical data repository (reporting and outcomes) • Real time patient condition awareness • Rule driven identification of preventable adverse medical events Patient Safety 76 • Stage setter for interoperability with referral source and health information exchanges • Patient-centered care is a key competitive differentiator and impacts patient choice Cost-Effectiveness 73

CIS Benefits and Value Proposition • Streamline sales and marketing process • Clinical charge capture efficiency • Real time awareness of therapy intensity (higher intensity associated with better outcomes) • Enterprise standardized clinical documentation and coding processes • Workflow management, patient/resource scheduling Operational Efficiencies • Automated medication administration at the point of care • Clinical data repository (reporting and outcomes) • Real time patient condition awareness • Rule driven identification of preventable adverse medical events Patient Safety 74 • Stage setter for interoperability with referral sources and health information exchanges • Patient-centered care is a key competitive differentiator and impacts patient choice. Cost-Effectiveness

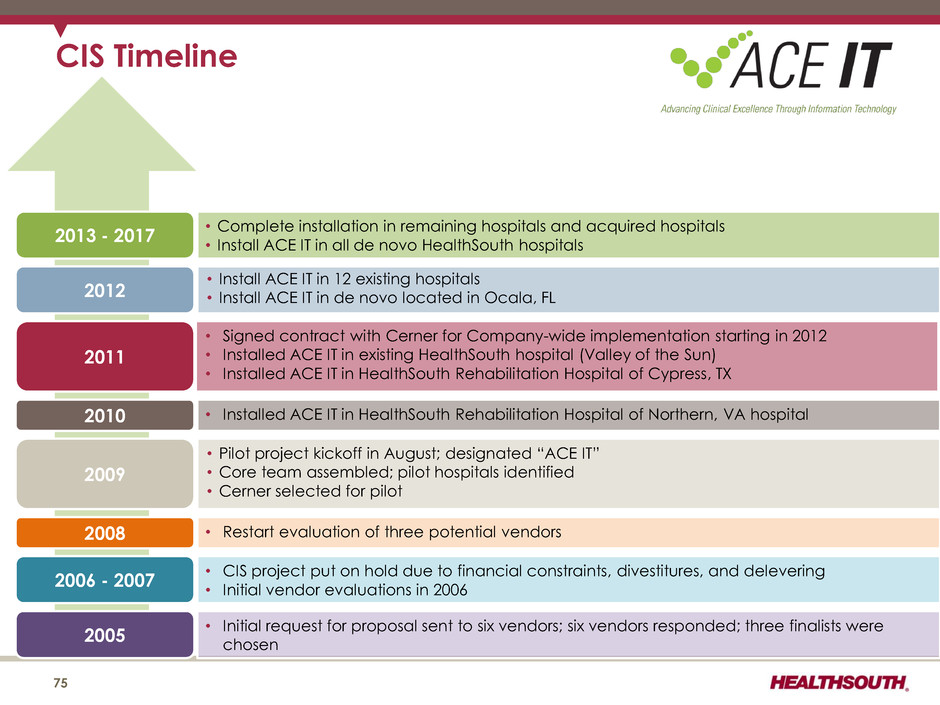

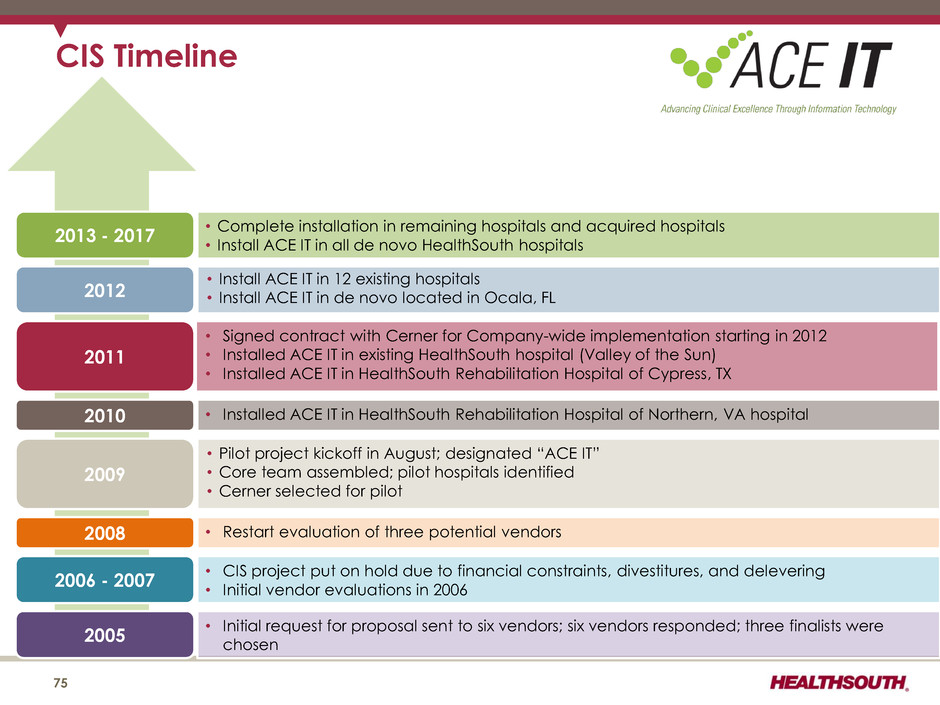

• Installed ACE IT in HealthSouth Rehabilitation Hospital of Northern, VA hospital • Pilot project kickoff in August; designated “ACE IT” • Core team assembled; pilot hospitals identified • Cerner selected for pilot • Signed contract with Cerner for Company-wide implementation starting in 2012 • Installed ACE IT in existing HealthSouth hospital (Valley of the Sun) • Installed ACE IT in HealthSouth Rehabilitation Hospital of Cypress, TX • Install ACE IT in 12 existing hospitals • Install ACE IT in de novo located in Ocala, FL • Complete installation in remaining hospitals and acquired hospitals • Install ACE IT in all de novo HealthSouth hospitals CIS Timeline 75 2010 2011 2012 2013 - 2017 2009 2008 2006 - 2007 2005 • Restart evaluation of three potential vendors • CIS project put on hold due to financial constraints, divestitures, and delevering • Initial vendor evaluations in 2006 • Initial request for proposal sent to six vendors; six vendors responded; three finalists were chosen

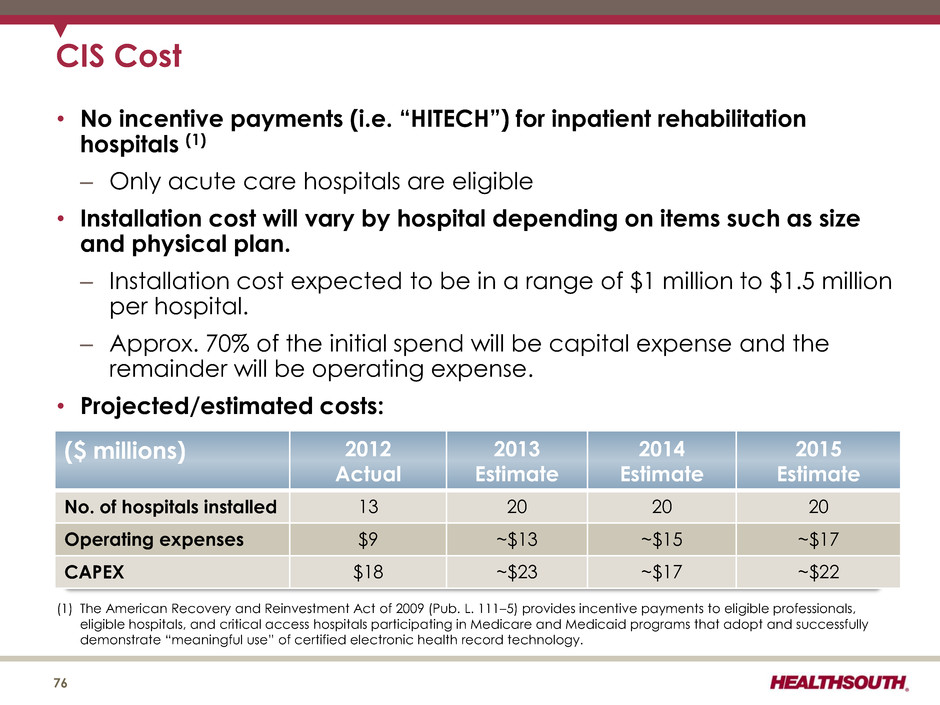

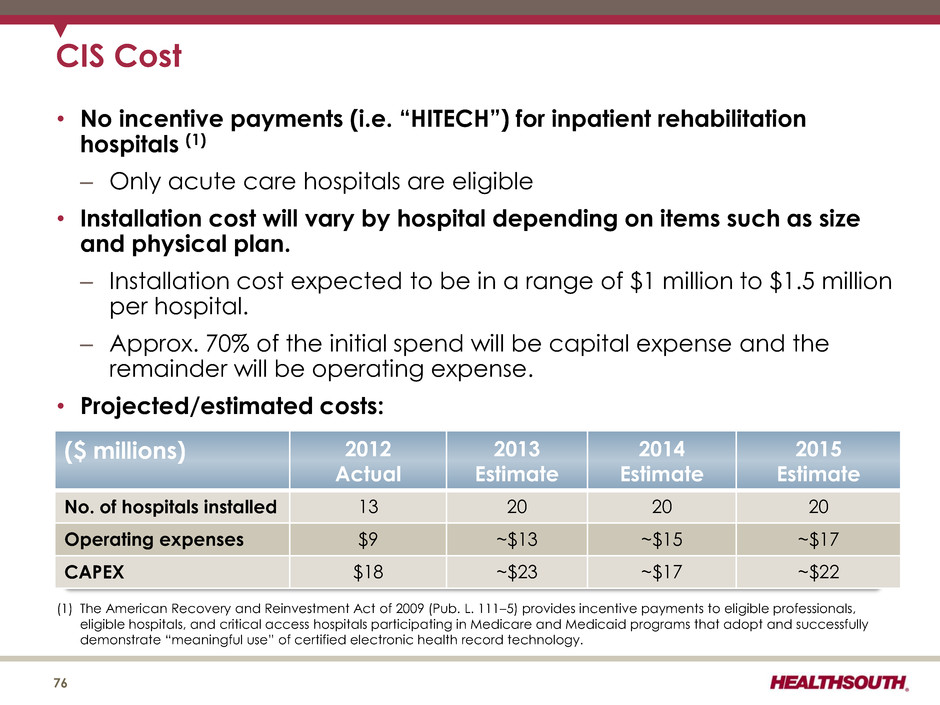

CIS Cost 76 • No incentive payments (i.e. “HITECH”) for inpatient rehabilitation hospitals (1) – Only acute care hospitals are eligible • Installation cost will vary by hospital depending on items such as size and physical plan. – Installation cost expected to be in a range of $1 million to $1.5 million per hospital. – Approx. 70% of the initial spend will be capital expense and the remainder will be operating expense. • Projected/estimated costs: (1) The American Recovery and Reinvestment Act of 2009 (Pub. L. 111–5) provides incentive payments to eligible professionals, eligible hospitals, and critical access hospitals participating in Medicare and Medicaid programs that adopt and successfully demonstrate “meaningful use” of certified electronic health record technology. ($ millions) 2012 Actual 2013 Estimate 2014 Estimate 2015 Estimate No. of hospitals installed 13 20 20 20 Operating expenses $9 ~$13 ~$15 ~$17 CAPEX $18 ~$23 ~$17 ~$22

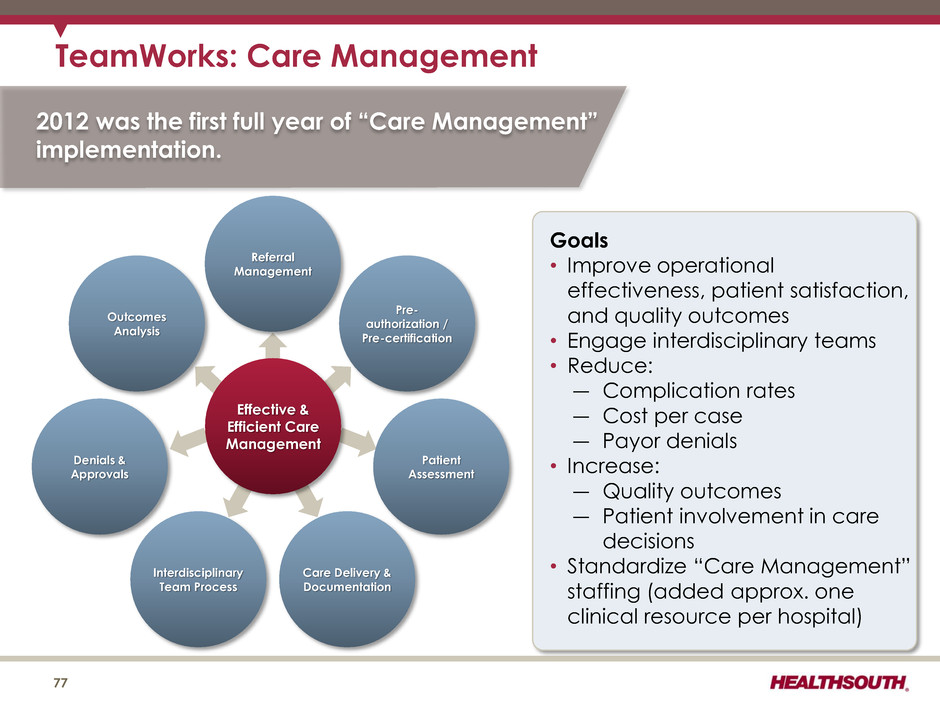

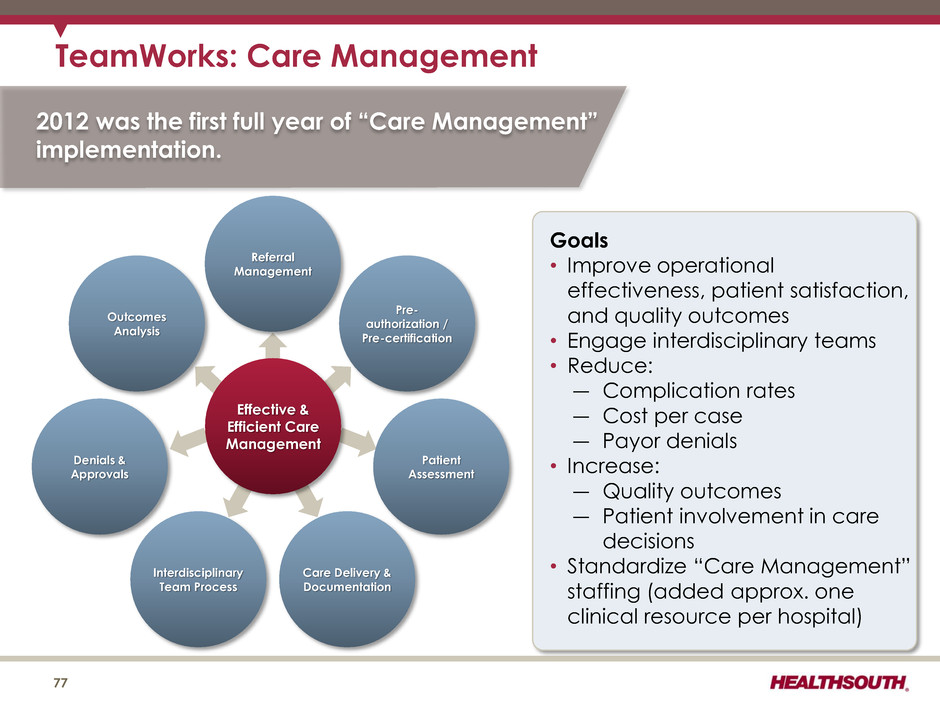

TeamWorks: Care Management 77 Goals • Improve operational effectiveness, patient satisfaction, and quality outcomes • Engage interdisciplinary teams • Reduce: ― Complication rates ― Cost per case ― Payor denials • Increase: ― Quality outcomes ― Patient involvement in care decisions • Standardize “Care Management” staffing (added approx. one clinical resource per hospital) 2012 was the first full year of “Care Management” implementation. Referral Management Pre- authorization / Pre-certification Patient Assessment Care Delivery & Documentation Interdisciplinary Team Process Denials & Approvals Outcomes Analysis Effective & Efficient Care Management

CPR: Comfort, Professionalism, Respect • All employees trained in the CPR campaign. • Hospital-based trained facilitators will work directly with employees. • A series of short videos is used to depict common scenarios of patient/staff situations. • Facilitator training is highly interactive, encouraging discussions among staff. CPR is an in-house course designed to train all employees to realize that even minor encounters between staff and patients can have a memorable impact on the patient’s entire experience. Ultimate goal is to improve employee- to-patient interactions, leading to: • Improved patient satisfaction scores • Reduced patient complaints • More satisfied employees 78

79

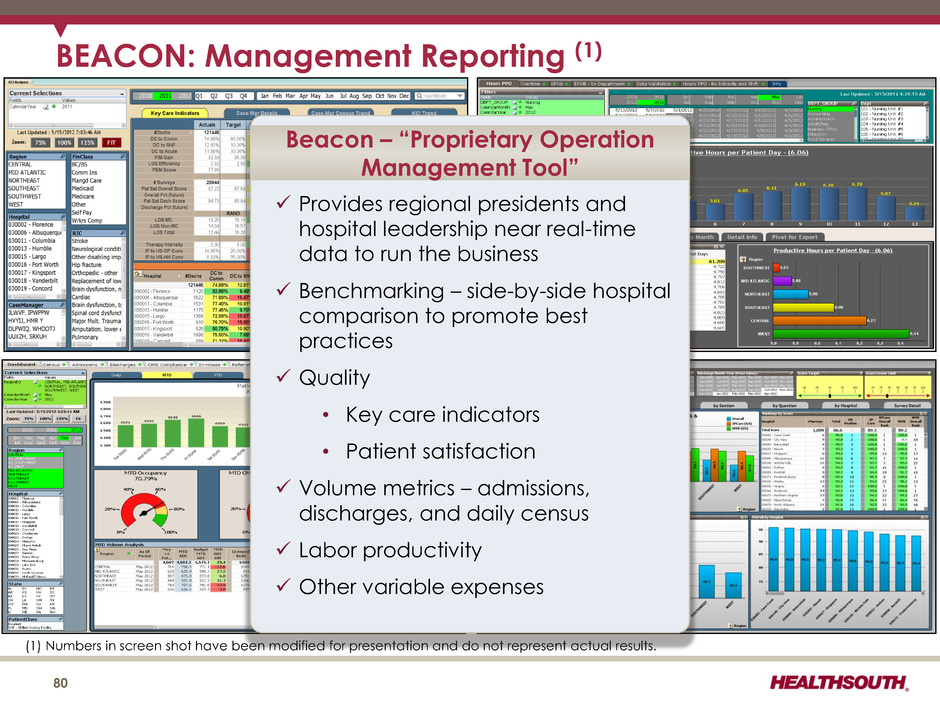

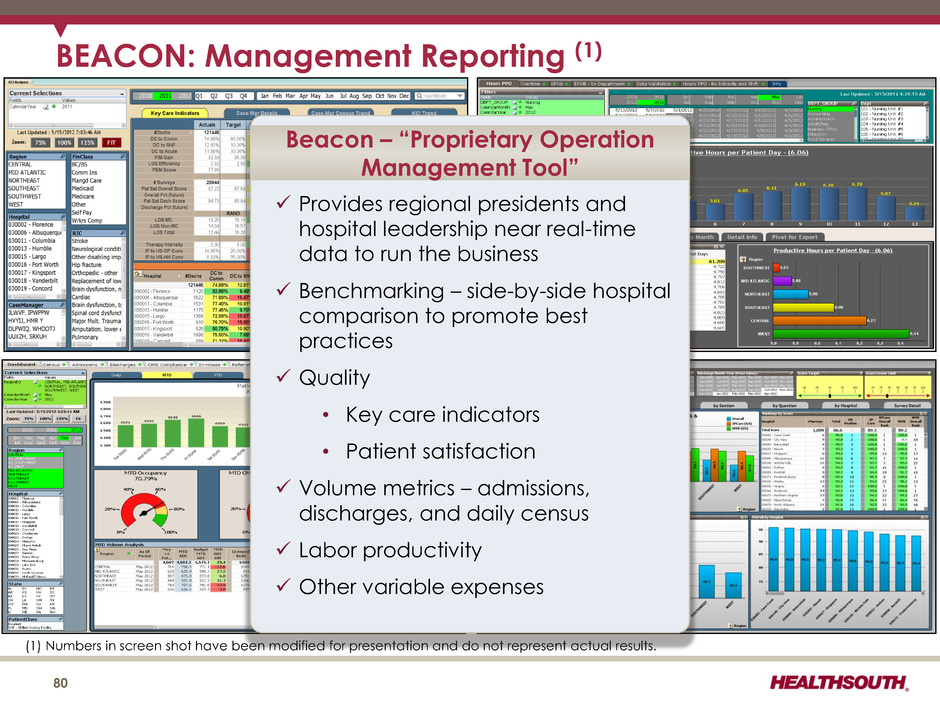

80 BEACON: Management Reporting (1) (1) Numbers in screen shot have been modified for presentation and do not represent actual results. Provides regional presidents and hospital leadership near real-time data to run the business Benchmarking – side-by-side hospital comparison to promote best practices Quality • Key care indicators • Patient satisfaction Volume metrics – admissions, discharges, and daily census Labor productivity Other variable expenses Beacon – “Proprietary Operation Management Tool”

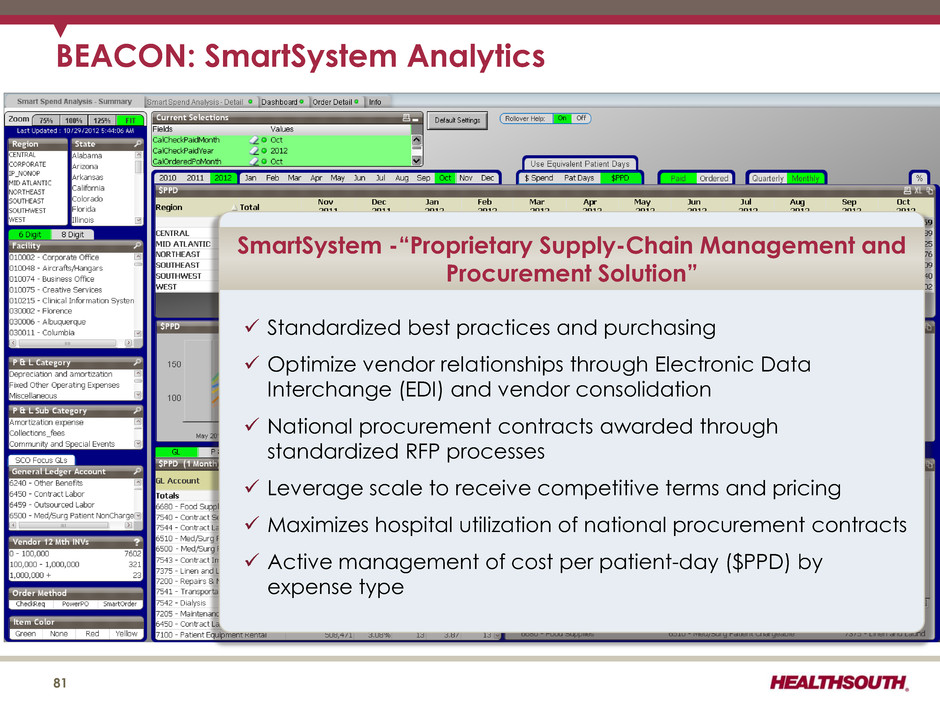

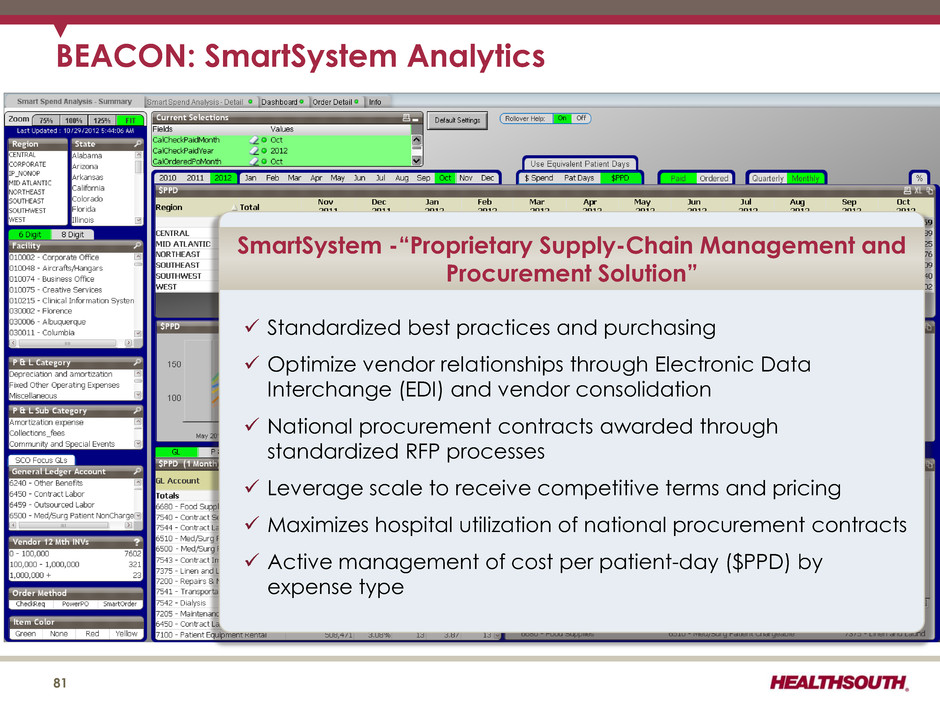

81 BEACON: SmartSystem Analytics Standardized best practices and purchasing Optimize vendor relationships through Electronic Data Interchange (EDI) and vendor consolidation National procurement contracts awarded through standardized RFP processes Leverage scale to receive competitive terms and pricing Maximizes hospital utilization of national procurement contracts Active management of cost per patient-day ($PPD) by expense type SmartSystem -“Proprietary Supply-Chain Management and Procurement Solution”

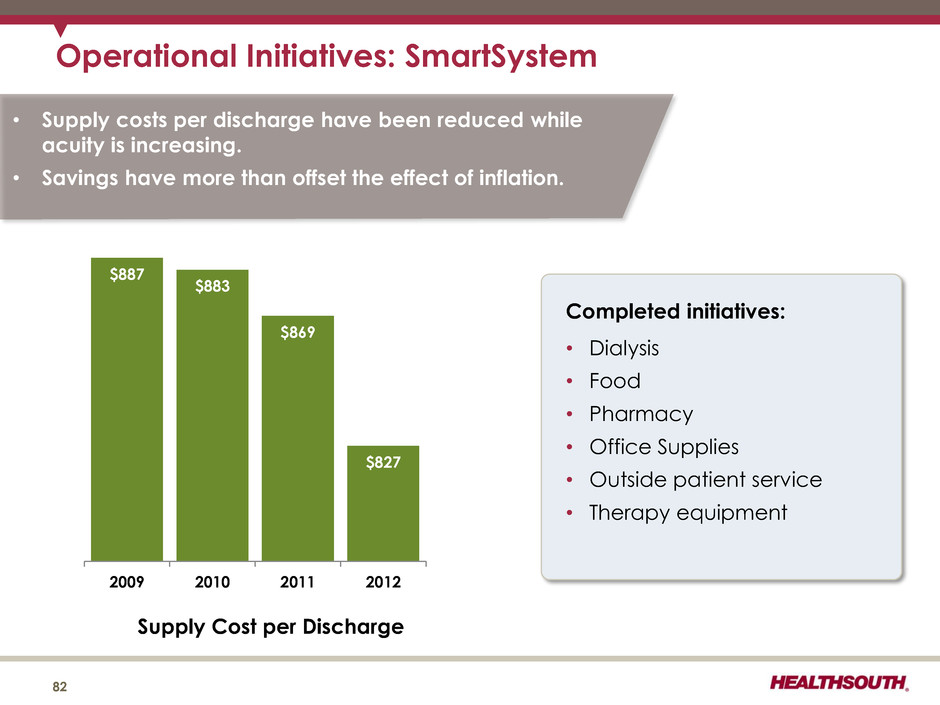

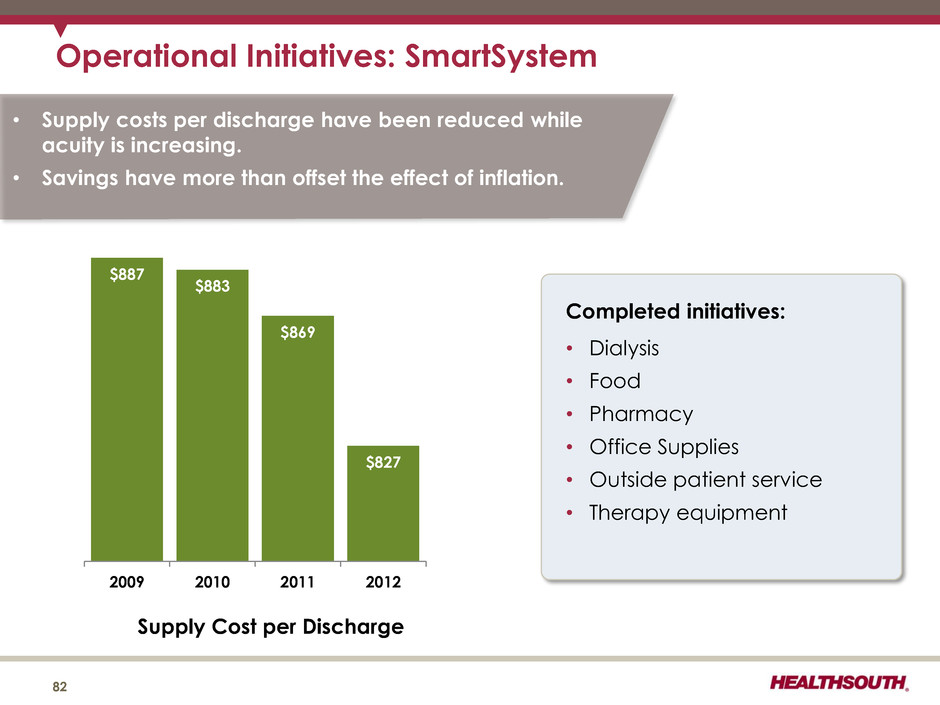

Operational Initiatives: SmartSystem 82 $887 $883 $869 $827 2009 2010 2011 2012 Supply Cost per Discharge 82 Completed initiatives: • Dialysis • Food • Pharmacy • Office Supplies • Outside patient service • Therapy equipment • Supply costs per discharge have been reduced while acuity is increasing. • Savings have more than offset the effect of inflation.

Operational Metrics 83

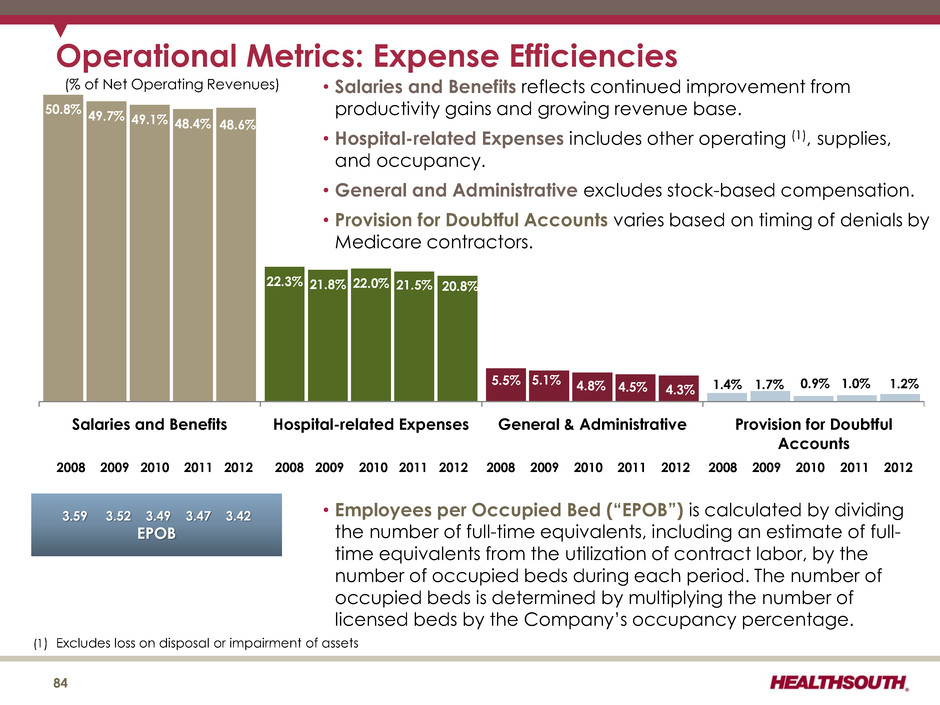

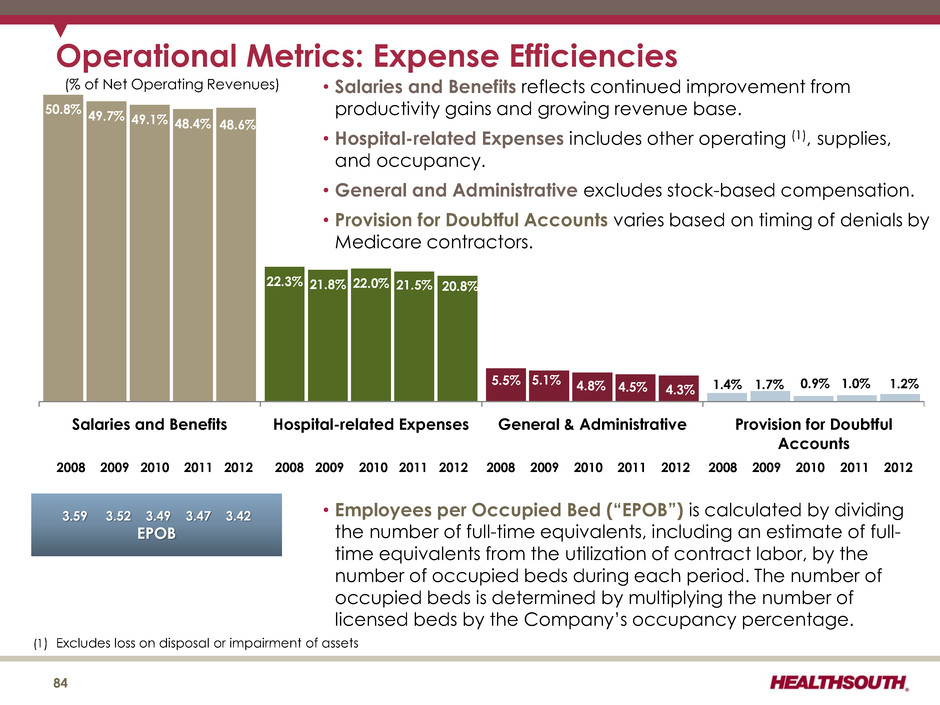

• Salaries and Benefits reflects continued improvement from productivity gains and growing revenue base. • Hospital-related Expenses includes other operating (1), supplies, and occupancy. • General and Administrative excludes stock-based compensation. • Provision for Doubtful Accounts varies based on timing of denials by Medicare contractors. • Employees per Occupied Bed (“EPOB”) is calculated by dividing the number of full-time equivalents, including an estimate of full- time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. 50.8% 22.3% 5.5% 1.4% 49.7% 21.8% 5.1% 1.7% 49.1% 22.0% 4.8% 0.9% 48.4% 21.5% 4.5% 1.0% 48.6% 20.8% 4.3% 1.2% Salaries and Benefits Hospital-related Expenses General & Administrative Provision for Doubtful Accounts Operational Metrics: Expense Efficiencies (% of Net Operating Revenues) 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 3.59 3.52 3.49 3.47 3.42 EPOB 84 (1) Excludes loss on disposal or impairment of assets