Third Quarter 2013 Earnings Call Supplemental Slides

The information contained in this presentation includes certain estimates, projections and other forward- looking information that reflect our current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, repurchases of securities, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance that any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2012, our Form 10-Q for the quarters ended March 31, 2013, June 30, 2013, and September 30, 2013, when filed, and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated October 28, 2013, to which the following supplemental slides are attached as Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements 2

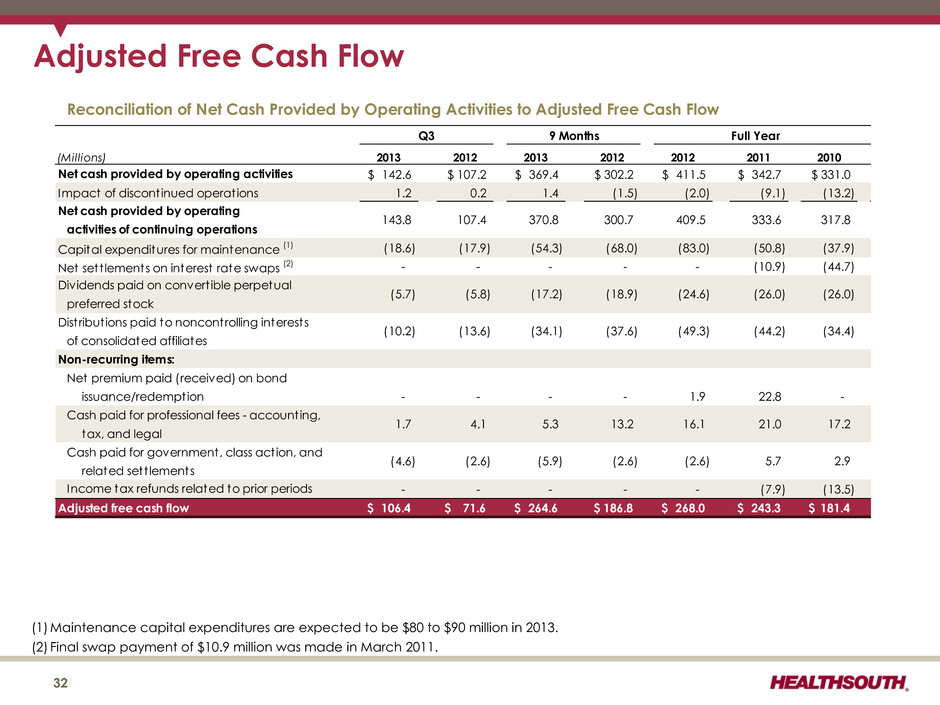

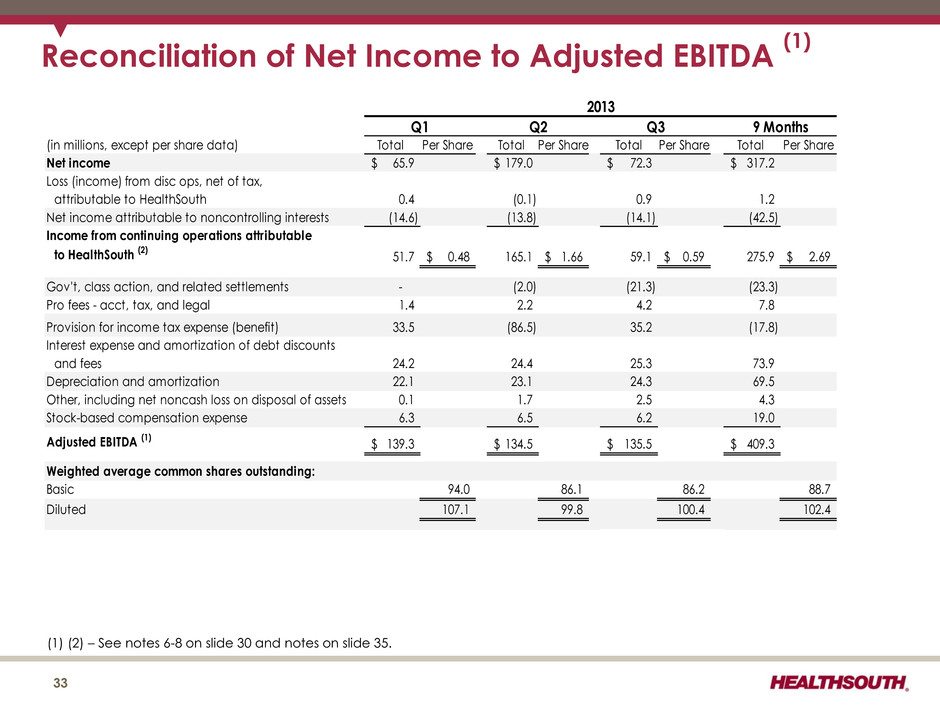

Table of Contents 3 4-7 8-9 10 11 12 13 14 15-16 2013 Revised Guidance - Adjusted EBITDA …………………………………………………………………………………………………………………………………………………………….17 2013 Revised Guidance - EPS ……………………………………………………………………………………………………………………………………….18 Income Tax Considerations…………………………………………………………………………………………………………………………………………19 Adjusted Free Cash Flow Considerations…………………………………………………………………………………………………………………………………………20 21 22 23 24 25 26 27 28 Outstanding Share Summary and Warrant Information……………………………………………………………………………….29-30 Adjusted EBITDA History……………………………………………………………………………………………………………………………………………….31 32 Reconciliations to GAAP…………………………………………………………………………………………………………………………………………………………33-36 Adjusted Free Cash Flow ……………………………………………………………………………………………………………………………………… Q3 2013 Summary……………………………………………………………………………………………………………………….. Revenues (Q3 2013 vs. Q3 2012)…………………………………………………………………………………………………………………………………………. Expenses (Q3 2013 vs. Q3 2012)……………………………………………………………………………………………… 11 Adjusted EBITDA……………………………………………………………………………………………………………………………………………………………….. Earnings per Share………………………………………………………………………………………………………………………………………… Highlights…………………………………………………………………………………………………………………………. Quality………………………………………………………………………………………………………………………………. Adjusted Free Cash Flow ……………………………………………………………………………………………………………………………………… Appendix………………………………………………………………………………………………………………………………………… Priorities for Reinvesting Free Cash Flow………………………………………………………………………………………………………………………………………… Revenues & Expenses (Sequential)………………………………………………………………………………………………………………………………………… Payment Sources (Percent of Revenues) ……………………………………………………………………………………………………………………………………… Operational and Labor Metrics………………………………………………………………………………………………………………………………………… Debt Schedule……………………………………………………………………………………………………………………………………………………………. Revenues & Expenses (9 months)…………………………………………………………………………………………….25 Business Outlook: 2013 to 2015…………………………………………………………………………………………………………………………………………

Q3 2013 Summary (Q3 2013 vs. Q3 2012) Revenue growth of 5.0% (negatively impacted by the effect of sequestration for Medicare patients) ― Inpatient revenue growth of 6.0% Discharge growth of 5.7% • Same-store discharge growth of 3.2% (negatively impacted by closure of 41 SNF beds at two hospitals in Q1 2013) • New-store growth was 2.5%; Ocala, FL (Q4 2012), Augusta, GA, Littleton, CO, Stuart, FL (Q2 2013) Revenue per discharge increased by 30 bps. • Positively impacted by pricing adjustments, higher patient acuity, and a higher percentage of Medicare patients • Negatively impacted by sequestration and a modest decline in average length of stay attributable to the timing of patient discharges around quarter end ― Outpatient and other revenue decline of 7.6% ($2.9 million) Bad debt as a percentage of revenue increased 10 bps to 1.4% primarily due to an increase in claim denials by fiscal intermediaries and a lengthening in the related adjudication process. 4

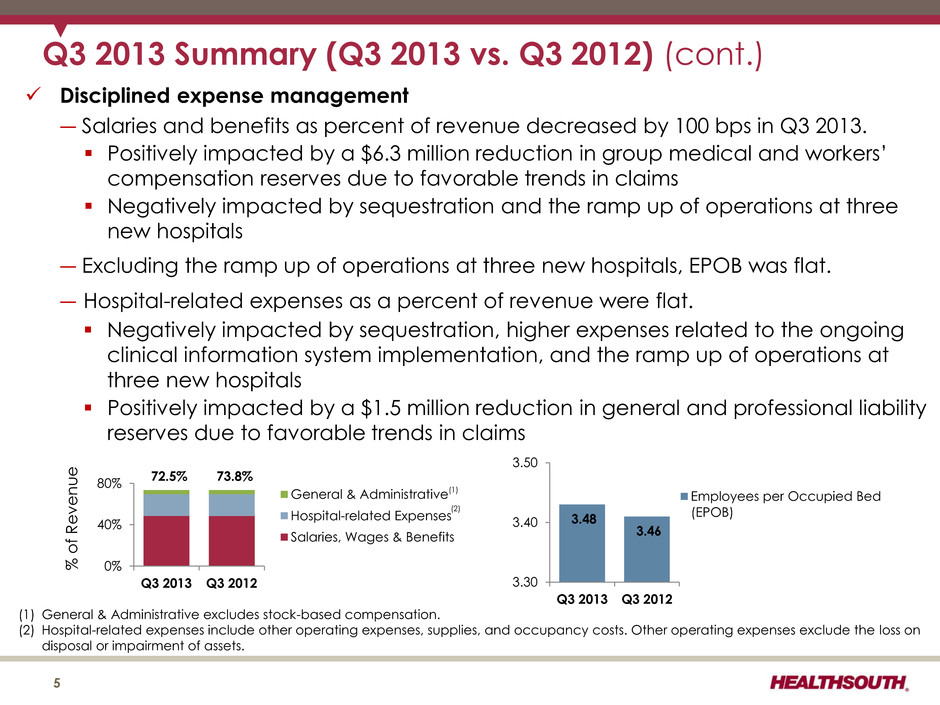

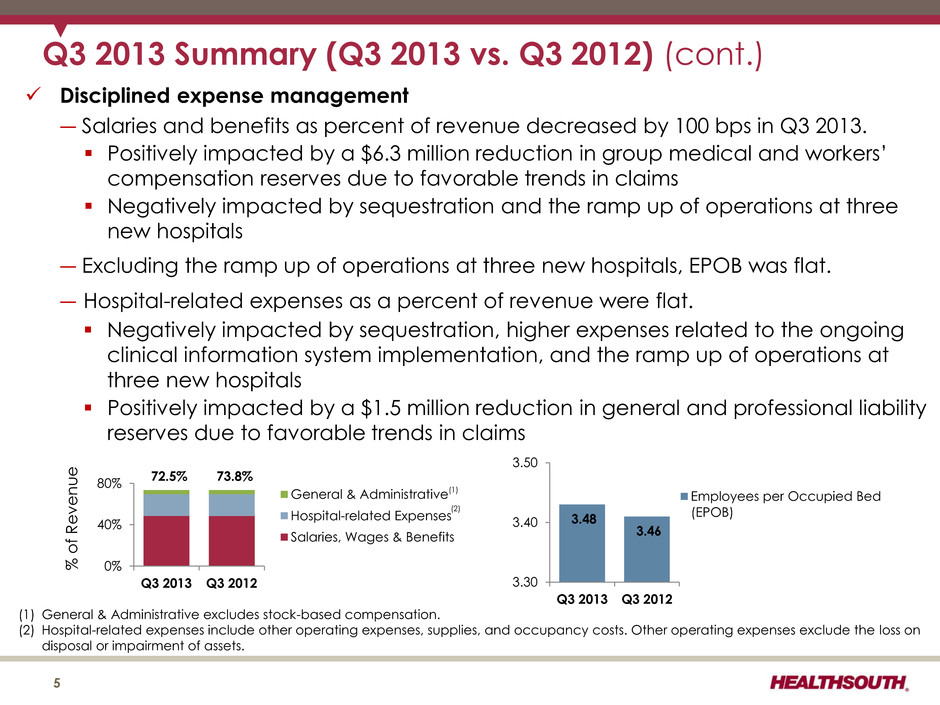

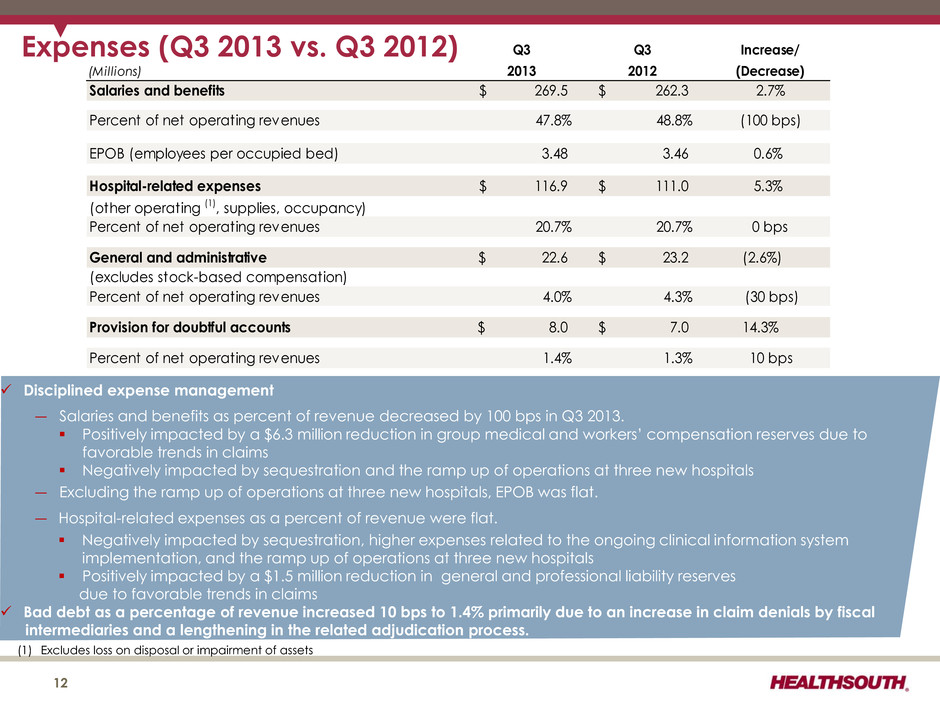

Disciplined expense management ― Salaries and benefits as percent of revenue decreased by 100 bps in Q3 2013. Positively impacted by a $6.3 million reduction in group medical and workers’ compensation reserves due to favorable trends in claims Negatively impacted by sequestration and the ramp up of operations at three new hospitals ― Excluding the ramp up of operations at three new hospitals, EPOB was flat. ― Hospital-related expenses as a percent of revenue were flat. Negatively impacted by sequestration, higher expenses related to the ongoing clinical information system implementation, and the ramp up of operations at three new hospitals Positively impacted by a $1.5 million reduction in general and professional liability reserves due to favorable trends in claims 0% 40% 80% Q3 2013 Q3 2012 General & Administrative Hospital-related Expenses Salaries, Wages & Benefits 72.5% 73.8% Q3 2013 Summary (Q3 2013 vs. Q3 2012) (cont.) 5 (1) General & Administrative excludes stock-based compensation. (2) Hospital-related expenses include other operating expenses, supplies, and occupancy costs. Other operating expenses exclude the loss on disposal or impairment of assets. 3.48 3.46 3.30 3.40 3.50 Q3 2013 Q3 2012 Employees per Occupied Bed (EPOB) % o f R e v enu e (1) (2)

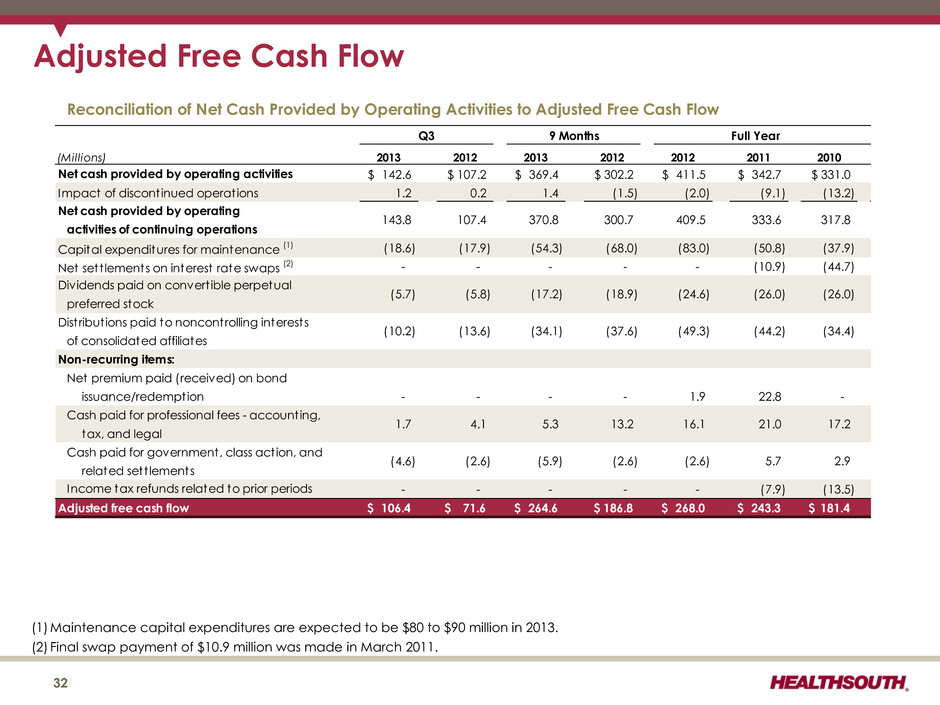

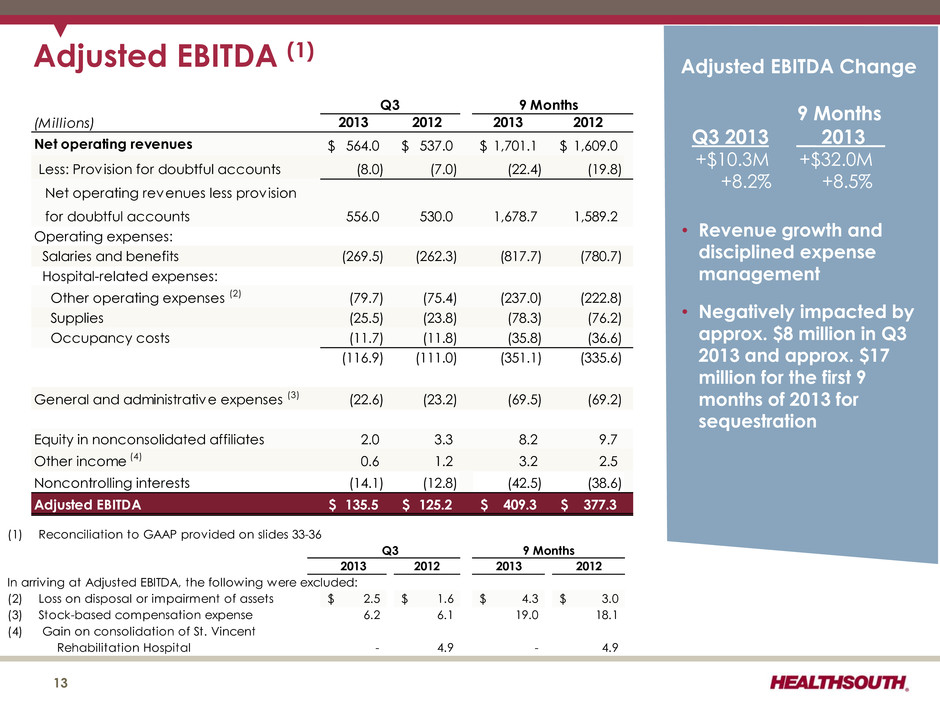

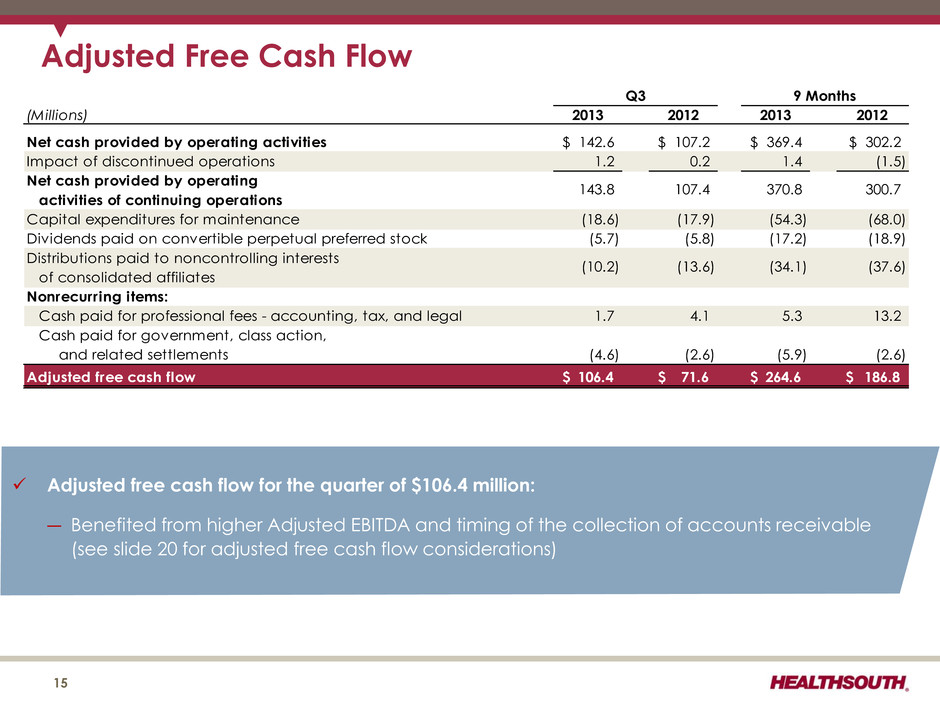

Q3 2013 Summary (Q3 2013 vs. Q3 2012) (cont.) Adjusted EBITDA (1) for the quarter of $135.5 million reflected growth of 8.2%. ― Negatively impacted by approx. $8 million for sequestration. Adjusted free cash flow (2) for the quarter of $106.4 million: ― Benefited from higher Adjusted EBITDA and timing of the collection of accounts receivable (see slide 20 for adjusted free cash flow considerations) Balance sheet enhancements ― Purchased the real estate previously subject to leases associated with four of our hospitals for approx. $70 million 6 (1) Reconciliation to GAAP provided on slides 33-36. (2) Reconciliation to GAAP provided on slide 32.

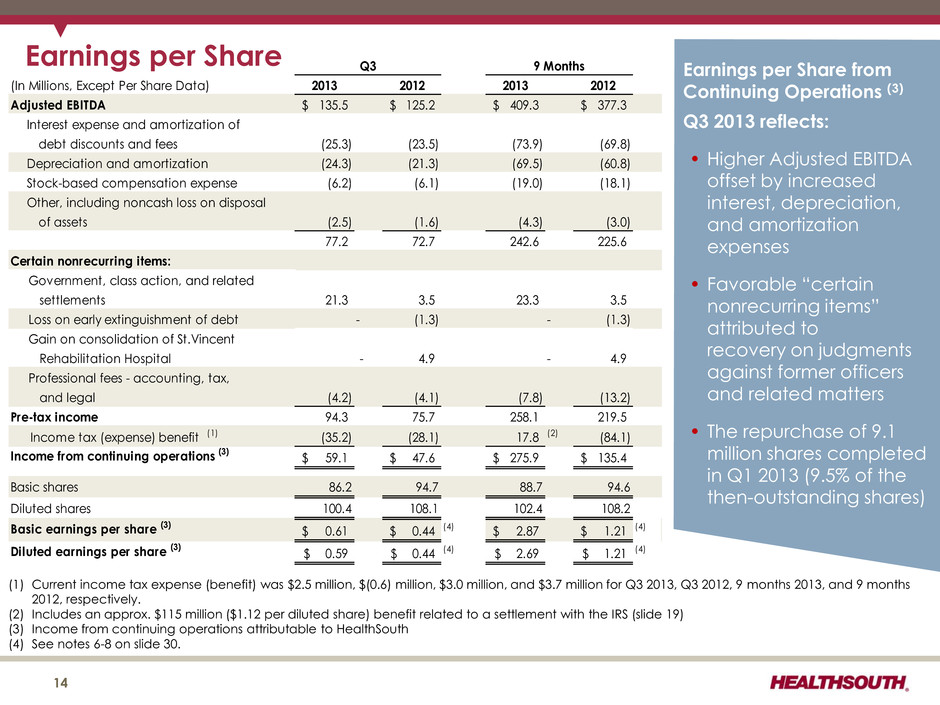

Q3 2013 Summary (Q3 2013 vs. Q3 2012) (cont.) Diluted earnings (1) per share of $0.59 reflected solid operating results and the benefit of certain other items (see table on slide 14). ― Q3 2013 diluted earnings per share of $0.59 benefited from two items having a net after-tax impact of $0.16 per share: $21.3 million gain in government, class action and related settlements (recovery on judgments against former officers and related matters) The repurchase of 9.1 million shares completed in Q1 2013 (9.5% of the then- outstanding shares) ― Q3 2012 diluted earnings per share of $0.44 benefited from two items having a net after-tax impact of $0.05 per share: $4.9 million gain on consolidation of St. Vincent Rehabilitation Hospital $3.5 million gain in government, class action, and related settlements (recovery on judgments against former officers) 7 (1) Income from continuing operations attributable to HealthSouth

Highlights Development: ― Continued construction on a replacement hospital for HealthSouth Rehabilitation Hospital of Western Massachusetts. This hospital will be owned and will replace an existing leased facility; expected to be operational Q4 2013. ― Broke ground in Q4 2013 for a 50-bed hospital in Altamonte Springs, FL; expected to be operational Q4 2014 ― Expect to break ground in Q4 2013 for a 50-bed inpatient rehabilitation hospital in Newnan, GA; expected to be operational Q4 2014 ― Expect to break ground in Q4 2013 for a 34-bed inpatient rehabilitation hospital in Middletown, DE; expected to be operational Q4 2014 ― Continued the design and permitting process to construct a 50-bed inpatient rehabilitation hospital in Modesto, CA; expected to be operational Q4 2015 8

Highlights (cont.) On October 25, 2013, the Company’s board of directors authorized the repurchase of up to $200 million of its common stock, subject to certain terms and conditions. The Company plans to give notice on October 29, 2013 of its intent to redeem $30.2 million and $27.9 million of its 7.25% Senior Notes due 2018 and its 7.75% Senior Notes due 2022, respectively. On October 25, 2013, the Company declared a quarterly cash dividend on its common stock payable on January 15, 2014 to holders of record on January 2, 2014. On October 15, 2013, the Company paid its first quarterly cash dividend on its common stock of $0.18 per share. New clinical information system now installed in 31 of the Company’s hospitals 95 HealthSouth hospitals have now received certification for one or more disease- specific certifications from The Joint Commission’s Disease Specific Care Certification Program. 9

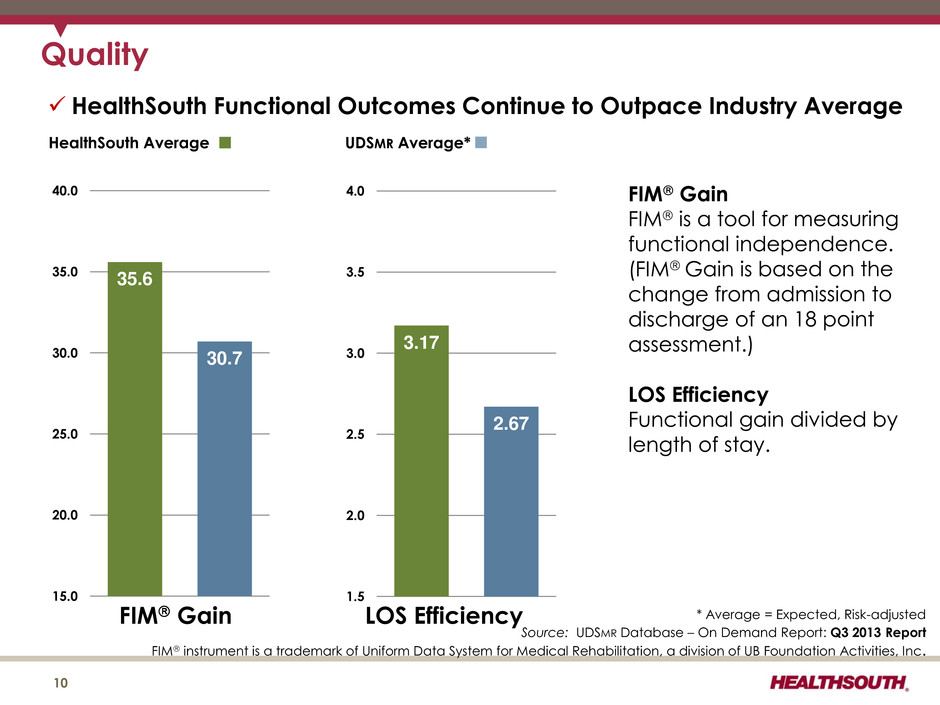

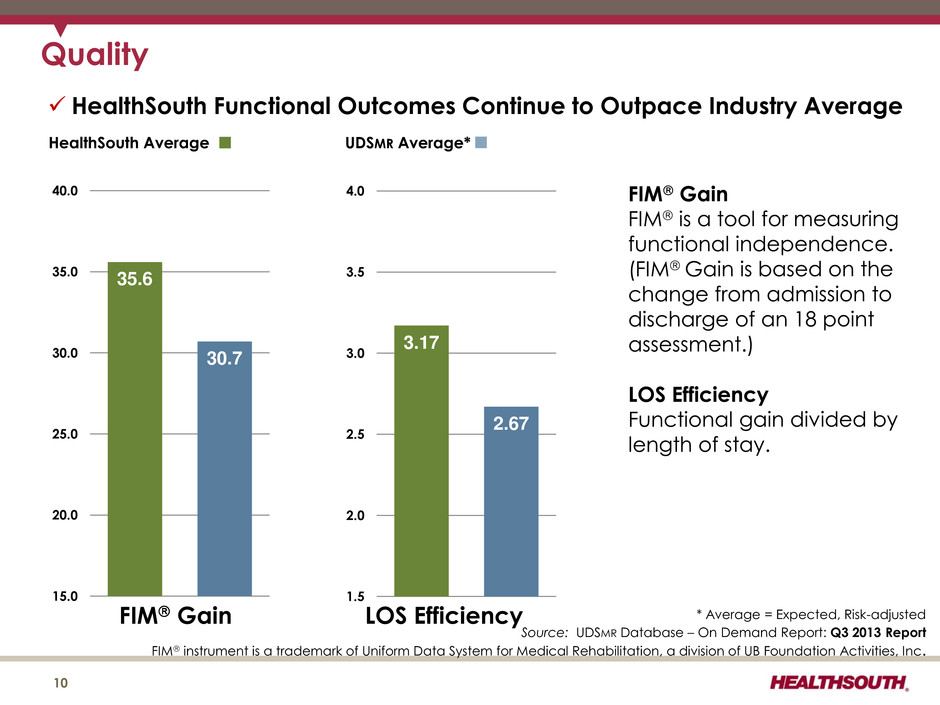

35.6 30.7 15.0 20.0 25.0 30.0 35.0 40.0 3.17 2.67 1.5 2.0 2.5 3.0 3.5 4.0 HealthSouth Functional Outcomes Continue to Outpace Industry Average HealthSouth Average UDSMR Average* FIM Gain LOS Efficiency * Average = Expected, Risk-adjusted Source: UDSMR Database – On Demand Report: Q3 2013 Report FIM instrument is a trademark of Uniform Data System for Medical Rehabilitation, a division of UB Foundation Activities, Inc. Quality 10

Q3 Q3 Increase/ (Millions) 2013 2012 (Decrease) Inpatient 528.8$ 498.9$ 6.0% Outpatient and other 35.2 38.1 (7.6%) Consolidated net operating 564.0$ 537.0$ 5.0% (Actual Amounts) Discharges 32,307 30,569 5.7% Net patient revenue / discharge 16,368$ 16,320$ 0.3% Revenues (Q3 2013 vs. Q3 2012) 11 Revenue growth of 5.0% (negatively impacted by the effect of sequestration for Medicare patients) ― Inpatient revenue growth of 6.0% Discharge growth of 5.7% • Same-store discharge growth of 3.2% (negatively impacted by closure of 41 SNF beds at two hospitals in Q1 2013) • New-store growth was 2.5%; Ocala, FL (Q4 2012), Augusta, GA, Littleton, CO, Stuart, FL (Q2 2013) Revenue per discharge increased by 30 bps. • Positively impacted by pricing adjustments, higher patient acuity, and a higher percentage of Medicare patients • Negatively impacted by sequestration and a modest decline in average length of stay attributable to the timing of patient discharges around quarter end ― Outpatient and other revenue decline of 7.6% ($2.9 million)

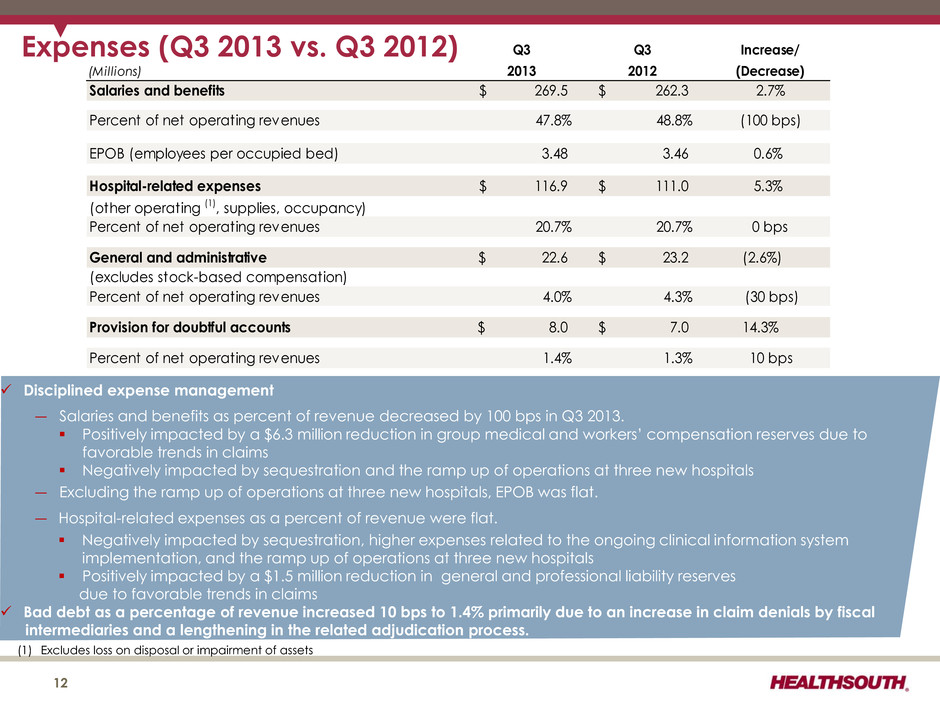

Expenses (Q3 2013 vs. Q3 2012) 12 Q3 Q3 Increase/ (Millions) 2013 2012 (Decrease) Salaries and benefits 269.5$ 262.3$ 2.7% Percent of net operating revenues 47.8% 48.8% (100 bps) EPOB (employees per occupied bed) 3.48 3.46 0.6% Hospital-related expenses 116.9$ 111.0$ 5.3% (other operating (1), supplies, occupancy) Percent of net operating revenues 20.7% 20.7% 0 bps General and administrative 22.6$ 23.2$ (2.6%) (excludes stock-based compensation) Percent of net operating revenues 4.0% 4.3% (30 bps) Provision for doubtful accounts 8.0$ 7.0$ 14.3% Percent of net operating revenues 1.4% 1.3% 10 bps Disciplined expense management ― Salaries and benefits as percent of revenue decreased by 100 bps in Q3 2013. Positively impacted by a $6.3 million reduction in group medical and workers’ compensation reserves due to favorable trends in claims Negatively impacted by sequestration and the ramp up of operations at three new hospitals ― Excluding the ramp up of operations at three new hospitals, EPOB was flat. ― Hospital-related expenses as a percent of revenue were flat. Negatively impacted by sequestration, higher expenses related to the ongoing clinical information system implementation, and the ramp up of operations at three new hospitals Positively impacted by a $1.5 million reduction in general and professional liability reserves due to favorable trends in claims Bad debt as a percentage of revenue increased 10 bps to 1.4% primarily due to an increase in claim denials by fiscal intermediaries and a lengthening in the related adjudication process. (1) Excludes loss on disposal or impairment of assets

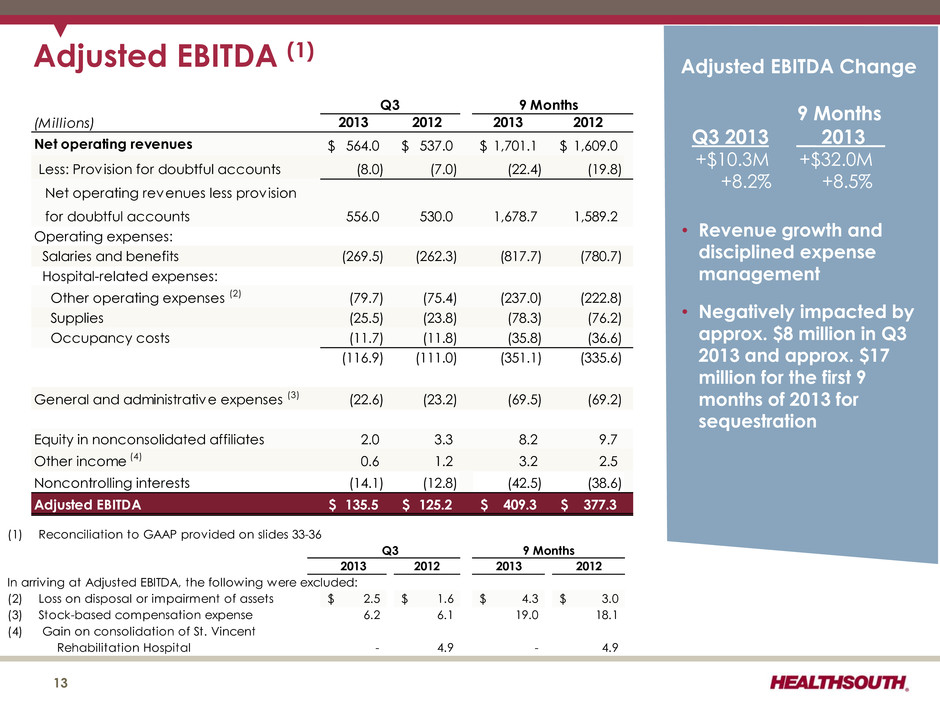

Adjusted EBITDA Change 9 Months Q3 2013 __ 2013__ +$10.3M +$32.0M +8.2% +8.5% • Revenue growth and disciplined expense management • Negatively impacted by approx. $8 million in Q3 2013 and approx. $17 million for the first 9 months of 2013 for sequestration Adjusted EBITDA (1) 13 (Millions) 2013 2012 2013 2012 Net operating revenues 564.0$ 537.0$ 1,701.1$ 1,609.0$ Less: Provision for doubtful accounts (8.0) (7.0) (22.4) (19.8) Net operating revenues less provision for doubtful accounts 556.0 530.0 1,678.7 1,589.2 Operating expenses: Salaries and benefits (269.5) (262.3) (817.7) (780.7) Hospital-related expenses: Other operating expenses (2) (79.7) (75.4) (237.0) (222.8) Supplies (25.5) (23.8) (78.3) (76.2) Occupancy costs (11.7) (11.8) (35.8) (36.6) (116.9) (111.0) (351.1) (335.6) General and administrative expenses (3) (22.6) (23.2) (69.5) (69.2) Equity in nonconsolidated affiliates 2.0 3.3 8.2 9.7 Other income (4) 0.6 1.2 3.2 2.5 Noncontrolling interests (14.1) (12.8) (42.5) (38.6) Adjusted EBITDA 135.5$ 125.2$ 409.3$ 377.3$ (1) Reconciliation to GAAP provided on slides 33-36 2013 2012 2013 2012 In arriving at Adjusted EBITDA, the following were excluded: (2) Loss on disposal or impairment of assets 2.5$ 1.6$ 4.3$ 3.0$ (3) Stock-based compensation expense 6.2 6.1 19.0 18.1 (4) Gain on consolidation of St. Vincent Rehabilitation Hospital - 4.9 - 4.9 Q3 Q3 9 Months 9 Months

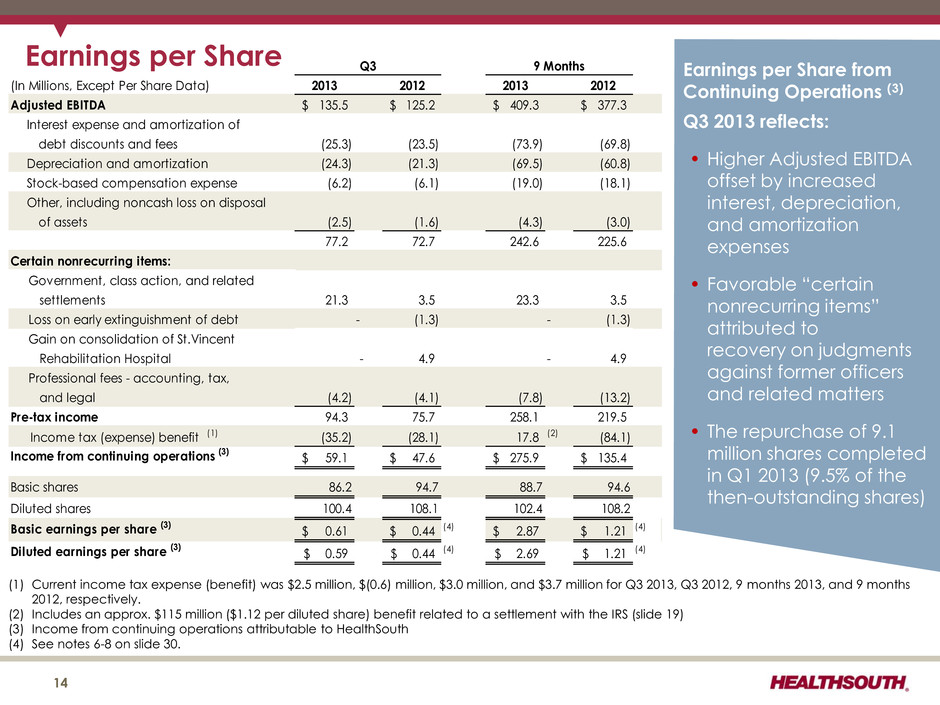

Earnings per Share from Continuing Operations (3) Q3 2013 reflects: • Higher Adjusted EBITDA offset by increased interest, depreciation, and amortization expenses • Favorable “certain nonrecurring items” attributed to recovery on judgments against former officers and related matters • The repurchase of 9.1 million shares completed in Q1 2013 (9.5% of the then-outstanding shares) Earnings per Share 14 (1) Current income tax expense (benefit) was $2.5 million, $(0.6) million, $3.0 million, and $3.7 million for Q3 2013, Q3 2012, 9 months 2013, and 9 months 2012, respectively. (2) Includes an approx. $115 million ($1.12 per diluted share) benefit related to a settlement with the IRS (slide 19) (3) Income from continuing operations attributable to HealthSouth (4) See notes 6-8 on slide 30. (In Millions, Except Per Share Data) 2013 2012 2013 2012 Adjusted EBITDA 135.5$ 125.2$ 409.3$ 377.3$ Interest expense and amortization of debt discounts and fees (25.3) (23.5) (73.9) (69.8) Depreciation and amortization (24.3) (21.3) (69.5) (60.8) Stock-based compensation expense (6.2) (6.1) (19.0) (18.1) Other, including noncash loss on disposal of assets (2.5) (1.6) (4.3) (3.0) 77.2 72.7 242.6 225.6 Certain nonrecurring items: Government, class action, and related settlements 21.3 3.5 23.3 3.5 Loss on early extinguishment of debt - (1.3) - (1.3) Gain on consolidation of St.Vincent Rehabilitation Hospital - 4.9 - 4.9 Professional fees - accounting, tax, and legal (4.2) (4.1) (7.8) (13.2) Pre-tax income 94.3 75.7 258.1 219.5 Income tax (expense) benefit (1) (35.2) (28.1) 17.8 (2) (84.1) Income from continuing operations (3) 59.1$ 47.6$ 275.9$ 135.4$ Basic shares 86.2 94.7 88.7 94.6 Diluted shares 100.4 108.1 102.4 108.2 Basic earnings per share (3) 0.61$ 0.44$ (4) 2.87$ 1.21$ (4) Diluted earnings p r share (3) 0.59$ 0.44$ (4) 2.69$ 1.21$ (4) Q3 9 Months

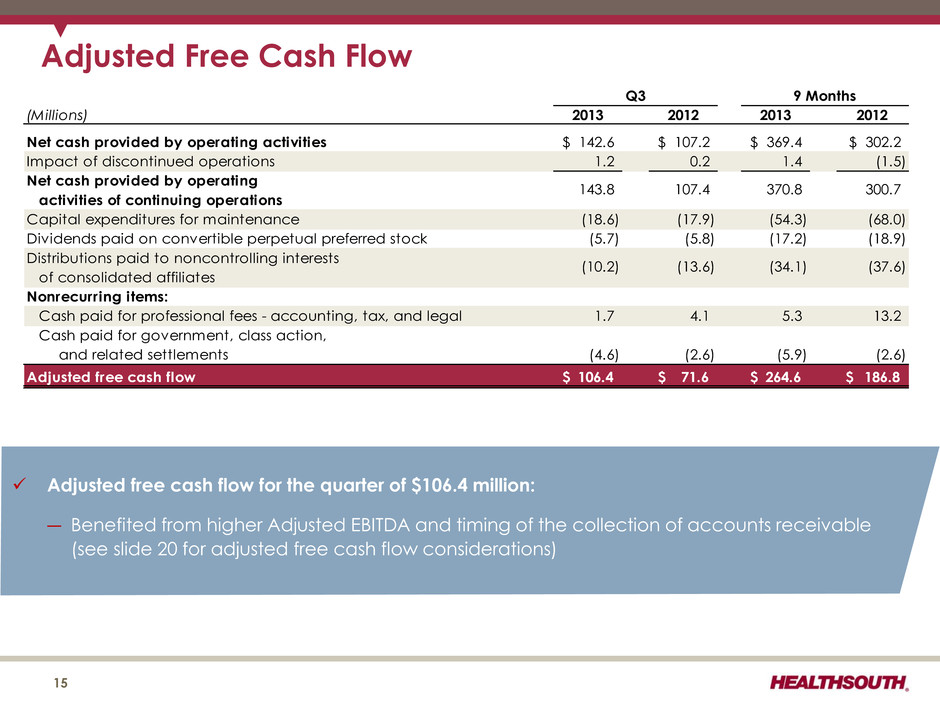

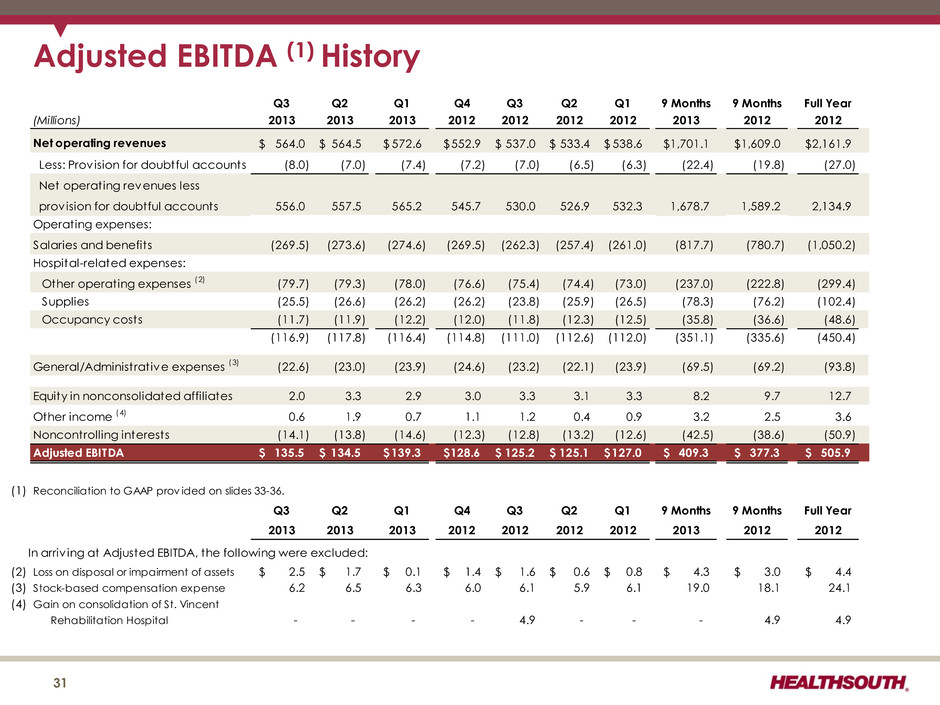

Adjusted Free Cash Flow 15 (Millions) 2013 2012 2013 2012 142.6$ 107.2$ 369.4$ 302.2$ 1.2 0.2 1.4 (1.5) Capital expenditures for maintenance (18.6) (17.9) (54.3) (68.0) Dividends paid on convertible perpetual preferred stock (5.7) (5.8) (17.2) (18.9) Distributions paid to noncontrolling interests of consolidated affiliates Nonrecurring items: Cash paid for professional fees - accounting, tax, and legal 1.7 4.1 5.3 13.2 Cash paid for government, class action, and related settlements (4.6) (2.6) (5.9) (2.6) Adjusted free cash flow 106.4$ 71.6$ 264.6$ 186.8$ Net cash provided by operating activities Net cash provided by operating activities of continuing operations Impact of discontinued operations (34.1) (10.2) (13.6) 370.8 9 Months 300.7 (37.6) Q3 143.8 107.4 Adjusted free cash flow for the quarter of $106.4 million: ― Benefited from higher Adjusted EBITDA and timing of the collection of accounts receivable (see slide 20 for adjusted free cash flow considerations)

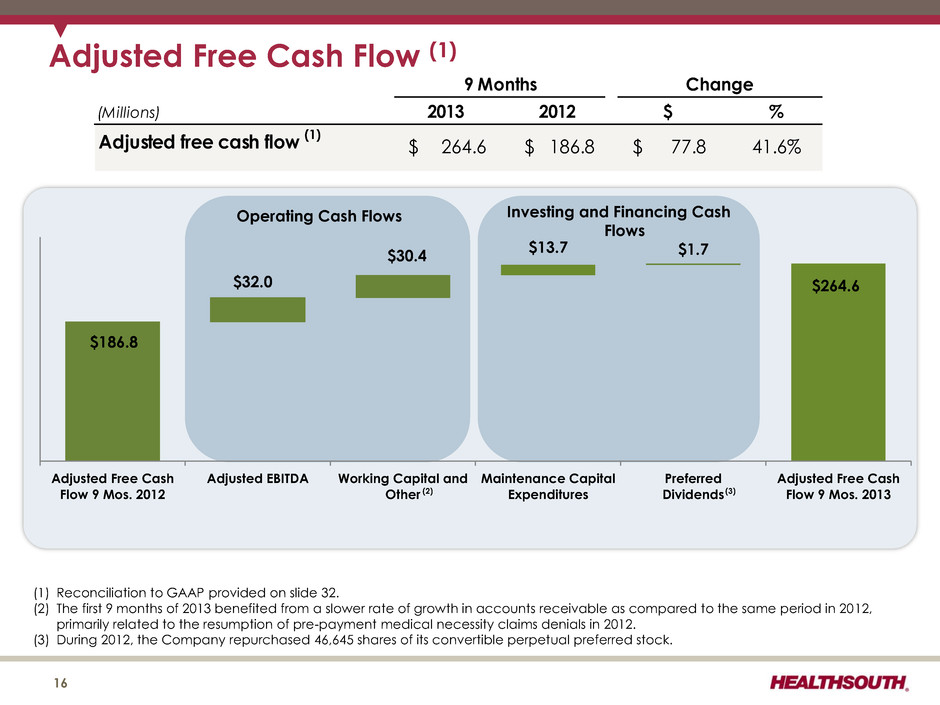

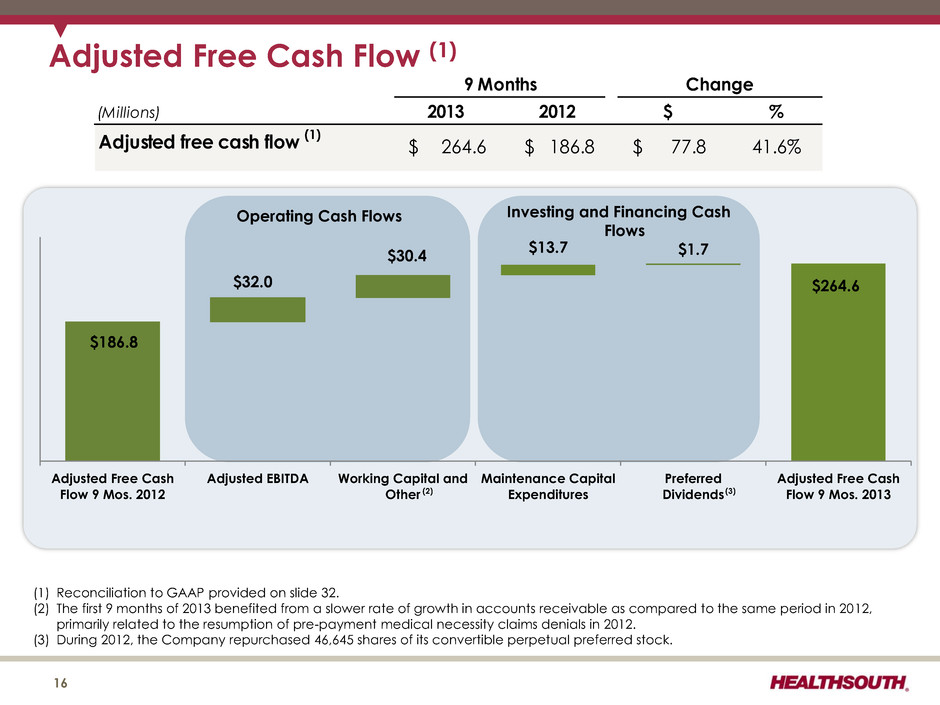

$186.8 $264.6 $32.0 $30.4 $13.7 $1.7 Adjusted Free Cash Flow 9 Mos. 2012 Adjusted EBITDA Working Capital and Other Maintenance Capital Expenditures Preferred Dividends Adjusted Free Cash Flow 9 Mos. 2013 (3) (2) Adjusted Free Cash Flow (1) (Millions) 2013 2012 $ % Adjusted free cash flow (1) 9 Months Change 264.6$ 186.8$ 77.8$ 41.6% (1) Reconciliation to GAAP provided on slide 32. (2) The first 9 months of 2013 benefited from a slower rate of growth in accounts receivable as compared to the same period in 2012, primarily related to the resumption of pre-payment medical necessity claims denials in 2012. (3) During 2012, the Company repurchased 46,645 shares of its convertible perpetual preferred stock. 16 Operating Cash Flows Investing and Financing Cash Flows

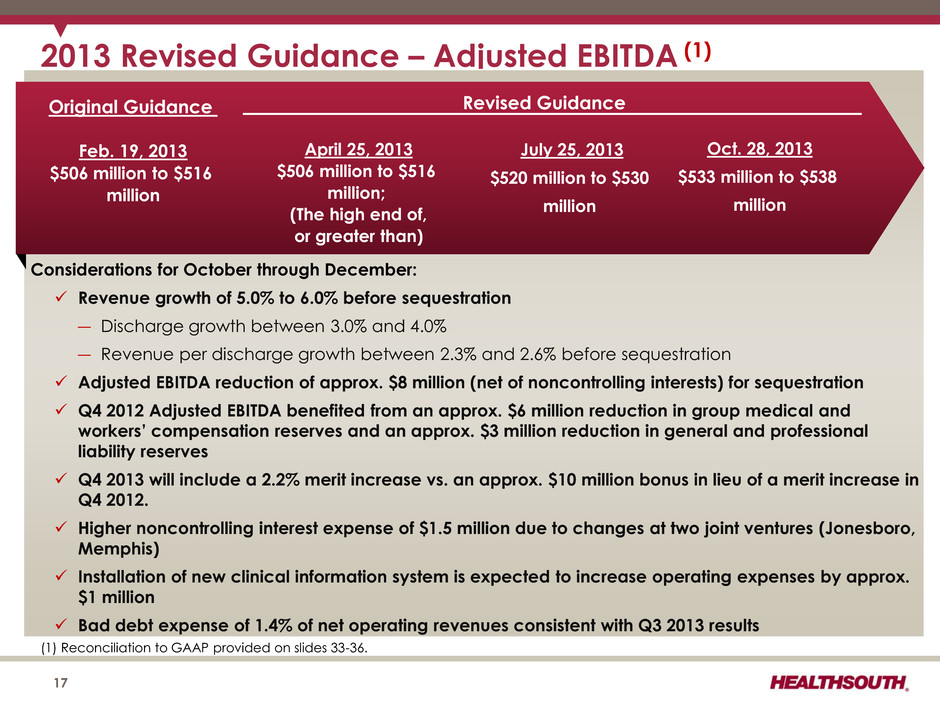

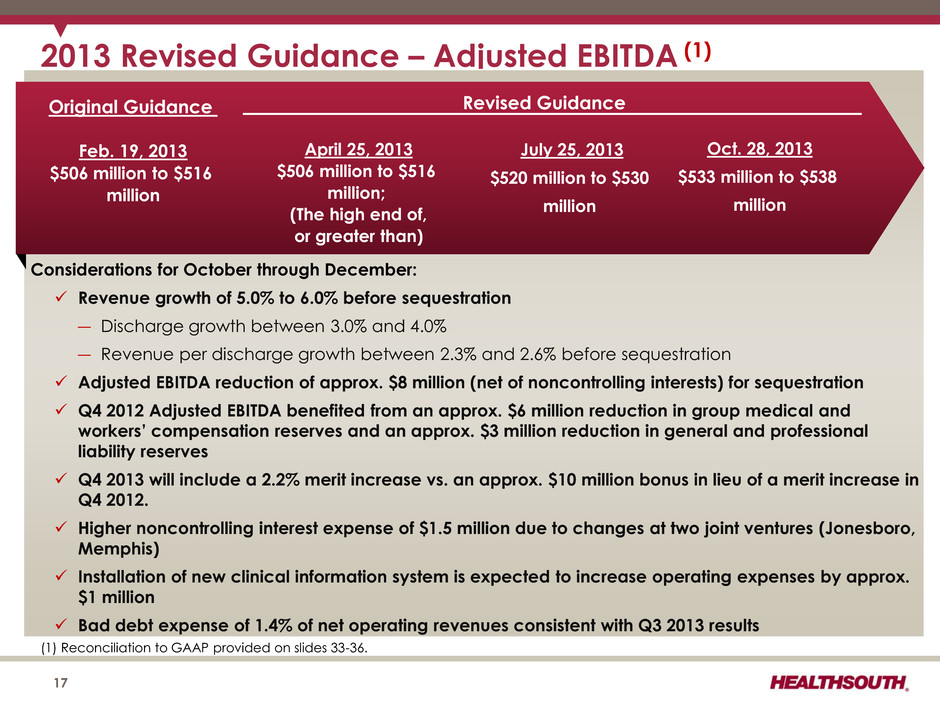

2013 Revised Guidance – Adjusted EBITDA (1) (1) Reconciliation to GAAP provided on slides 33-36. Considerations for October through December: Revenue growth of 5.0% to 6.0% before sequestration ― Discharge growth between 3.0% and 4.0% ― Revenue per discharge growth between 2.3% and 2.6% before sequestration Adjusted EBITDA reduction of approx. $8 million (net of noncontrolling interests) for sequestration Q4 2012 Adjusted EBITDA benefited from an approx. $6 million reduction in group medical and workers’ compensation reserves and an approx. $3 million reduction in general and professional liability reserves Q4 2013 will include a 2.2% merit increase vs. an approx. $10 million bonus in lieu of a merit increase in Q4 2012. Higher noncontrolling interest expense of $1.5 million due to changes at two joint ventures (Jonesboro, Memphis) Installation of new clinical information system is expected to increase operating expenses by approx. $1 million Bad debt expense of 1.4% of net operating revenues consistent with Q3 2013 results 17 Revised Guidance April 25, 2013 $506 million to $516 million; (The high end of, or greater than) Original Guidance Feb. 19, 2013 $506 million to $516 million July 25, 2013 $520 million to $530 million Oct. 28, 2013 $533 million to $538 million

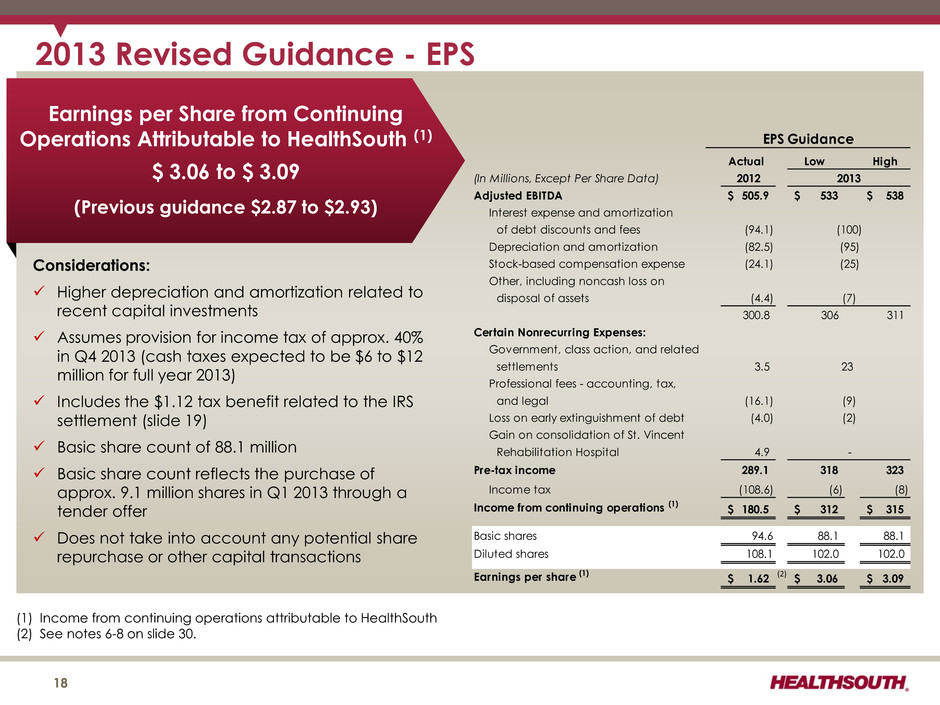

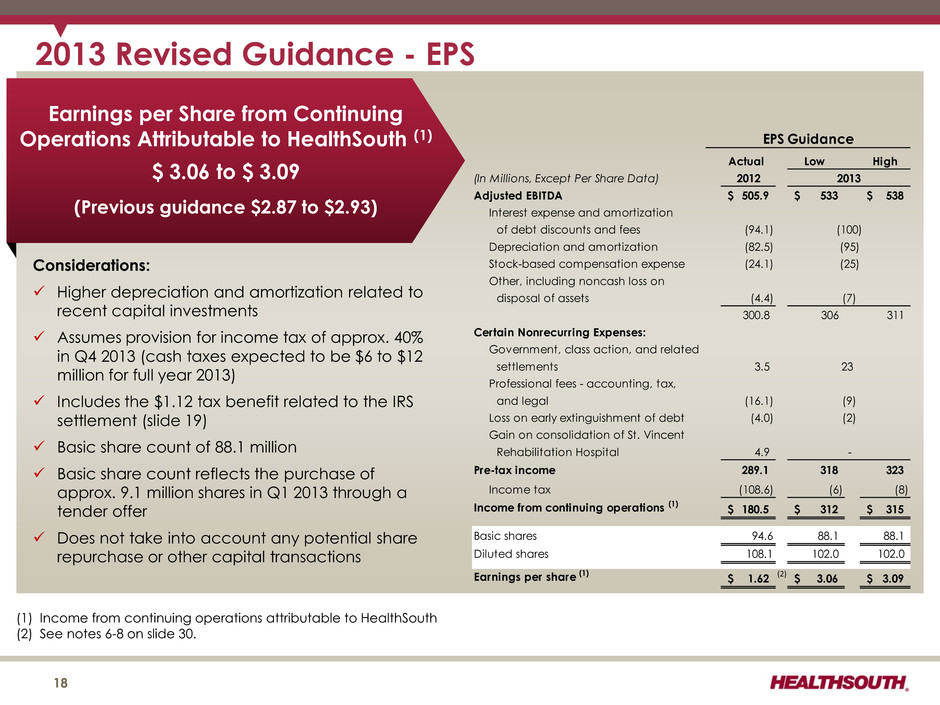

2013 Revised Guidance - EPS Earnings per Share from Continuing Operations Attributable to HealthSouth (1) $ 3.06 to $ 3.09 (Previous guidance $2.87 to $2.93) Considerations: Higher depreciation and amortization related to recent capital investments Assumes provision for income tax of approx. 40% in Q4 2013 (cash taxes expected to be $6 to $12 million for full year 2013) Includes the $1.12 tax benefit related to the IRS settlement (slide 19) Basic share count of 88.1 million Basic share count reflects the purchase of approx. 9.1 million shares in Q1 2013 through a tender offer Does not take into account any potential share repurchase or other capital transactions (1) Income from continuing operations attributable to HealthSouth (2) See notes 6-8 on slide 30. 18 Actual Low High (In Millions, Except Per Share Data) 2012 Adjusted EBITDA 505.9$ 533$ 538$ Interest expense and amortization of debt discounts and fees (94.1) Depreciation and amortization (82.5) Stock-based compensation expense (24.1) Other, including noncash loss on disposal of assets (4.4) 300.8 306 311 Certain Nonrecurring Expenses: Government, class action, and related settlements 3.5 Professional fees - accounting, tax, and legal (16.1) Loss on early extinguishment of debt (4.0) Gain on consolidation of St. Vincent Rehabilitation Hospital 4.9 Pre-tax income 289.1 318 323 Income tax (108.6) (6) (8) Income from continuing operations (1) 180.5$ 312$ 315$ Basic shares 94.6 88.1 88.1 Diluted shares 108.1 102.0 102.0 Earnings per share (1) 1.62$ (2) 3.06$ 3.09$ - (2) 23 (9) (7) EPS Guidance 2013 (100) (95) (25)

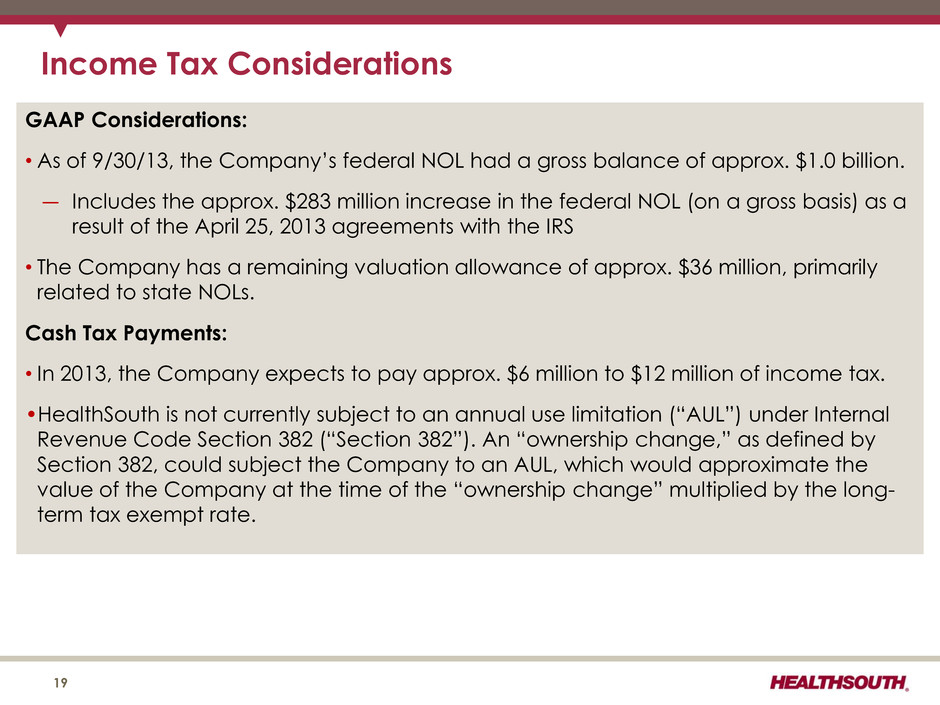

Income Tax Considerations GAAP Considerations: •As of 9/30/13, the Company’s federal NOL had a gross balance of approx. $1.0 billion. ― Includes the approx. $283 million increase in the federal NOL (on a gross basis) as a result of the April 25, 2013 agreements with the IRS • The Company has a remaining valuation allowance of approx. $36 million, primarily related to state NOLs. Cash Tax Payments: • In 2013, the Company expects to pay approx. $6 million to $12 million of income tax. •HealthSouth is not currently subject to an annual use limitation (“AUL”) under Internal Revenue Code Section 382 (“Section 382”). An “ownership change,” as defined by Section 382, could subject the Company to an AUL, which would approximate the value of the Company at the time of the “ownership change” multiplied by the long- term tax exempt rate. 19

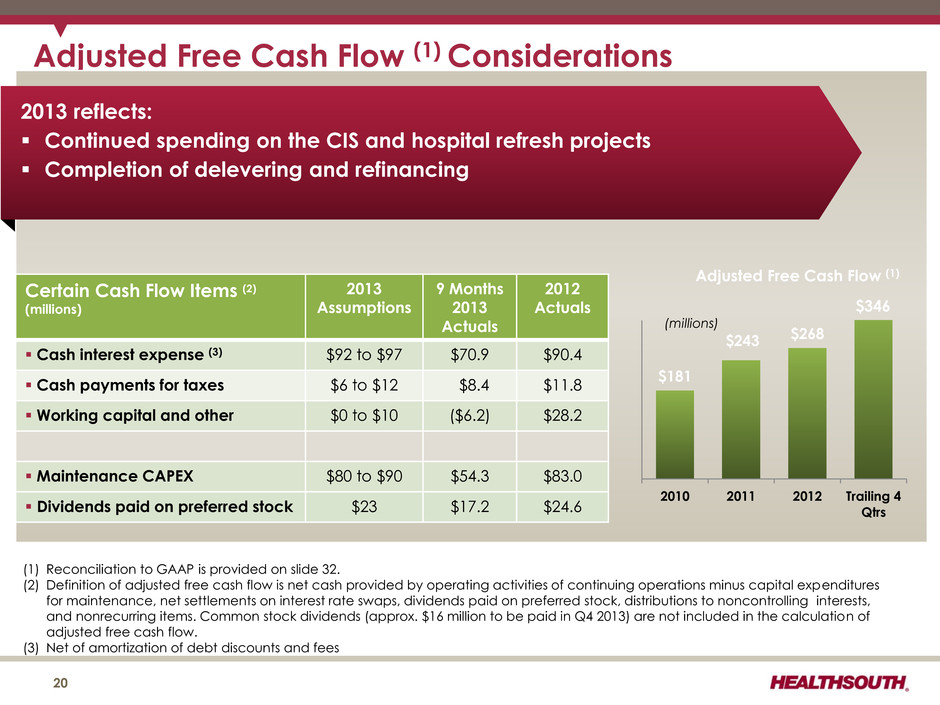

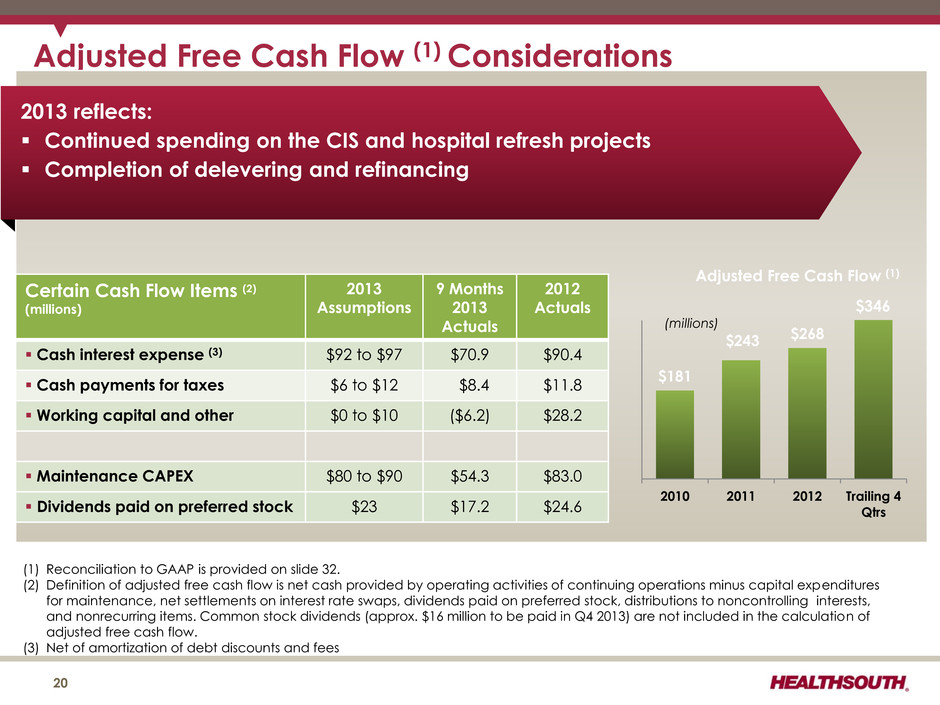

Adjusted Free Cash Flow (1) Considerations (1) Reconciliation to GAAP is provided on slide 32. (2) Definition of adjusted free cash flow is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, net settlements on interest rate swaps, dividends paid on preferred stock, distributions to noncontrolling interests, and nonrecurring items. Common stock dividends (approx. $16 million to be paid in Q4 2013) are not included in the calculation of adjusted free cash flow. (3) Net of amortization of debt discounts and fees 20 Certain Cash Flow Items (2) (millions) 2013 Assumptions 9 Months 2013 Actuals 2012 Actuals Cash interest expense (3) $92 to $97 $70.9 $90.4 Cash payments for taxes $6 to $12 $8.4 $11.8 Working capital and other $0 to $10 ($6.2) $28.2 Maintenance CAPEX $80 to $90 $54.3 $83.0 Dividends paid on preferred stock $23 $17.2 $24.6 2013 reflects: Continued spending on the CIS and hospital refresh projects Completion of delevering and refinancing $181 $243 $268 2010 2011 2012 Trailing 4 Qtrs Adjusted Free Cash Flow (1) (millions) $346

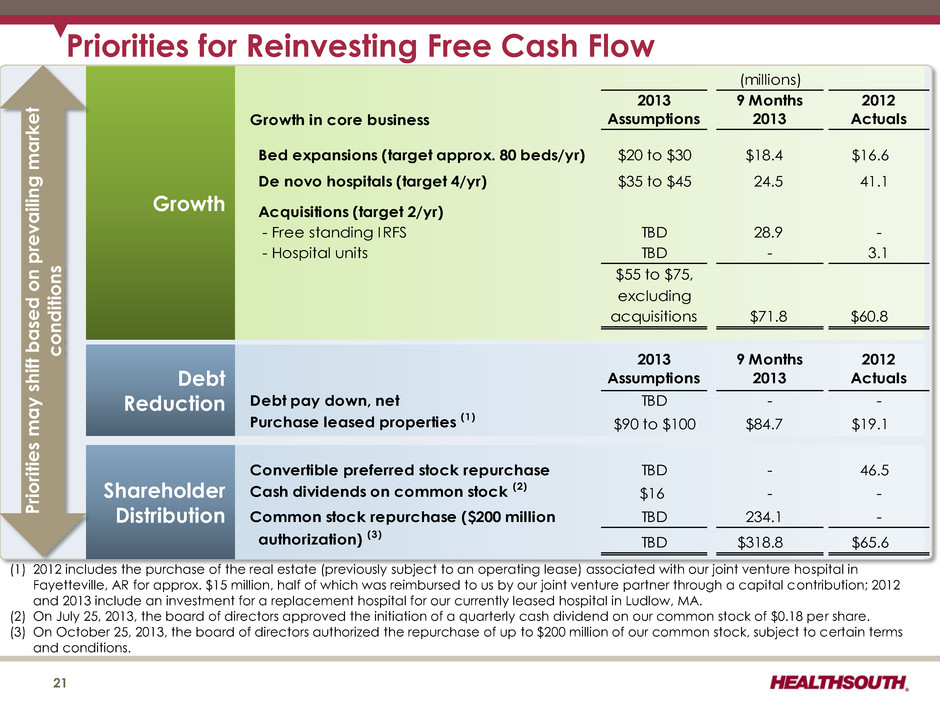

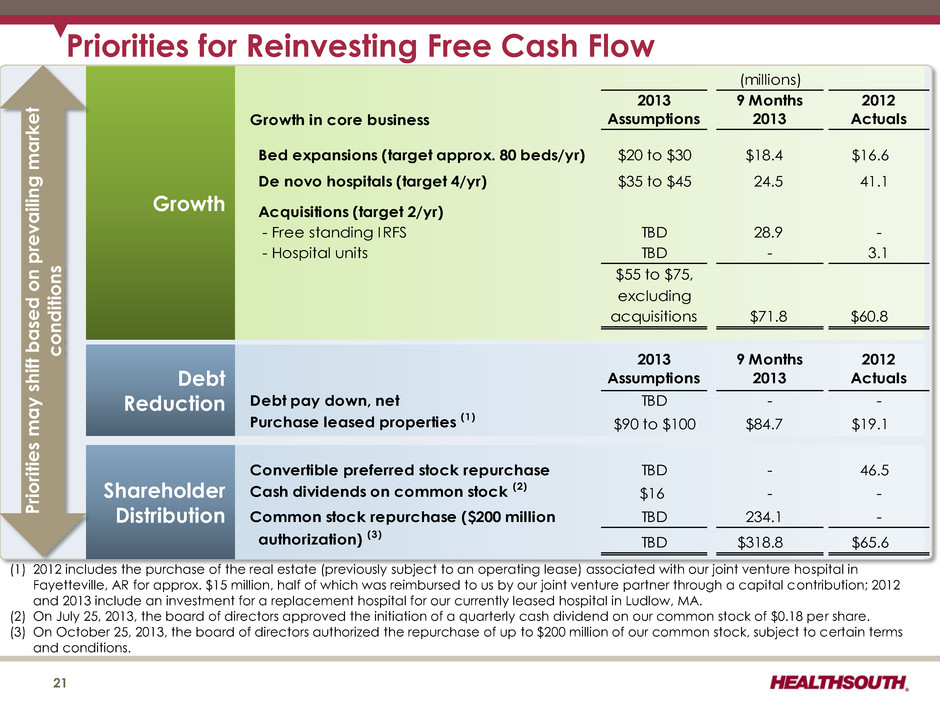

Priorities for Reinvesting Free Cash Flow 21 Growth Debt Reduction Shareholder Distribution (1) 2012 includes the purchase of the real estate (previously subject to an operating lease) associated with our joint venture hospital in Fayetteville, AR for approx. $15 million, half of which was reimbursed to us by our joint venture partner through a capital contribution; 2012 and 2013 include an investment for a replacement hospital for our currently leased hospital in Ludlow, MA. (2) On July 25, 2013, the board of directors approved the initiation of a quarterly cash dividend on our common stock of $0.18 per share. (3) On October 25, 2013, the board of directors authorized the repurchase of up to $200 million of our common stock, subject to certain terms and conditions. (millions) Growth in core business 2013 Assumptions 9 Months 2013 2012 Actuals Bed expansions (target approx. 80 beds/yr) $20 to $30 $18.4 $16.6 De novo hospitals (target 4/yr) $35 to $45 24.5 41.1 Acquisitions (target 2/yr) - Free standing IRFS TBD 28.9 - - Hospital units TBD - 3.1 $55 to $75, excluding acquisitions $71.8 $60.8 2013 Assumptions 9 Months 2013 2012 Actuals Debt pay down, net TBD - - Purchase leased properties (1) $90 to $100 $84.7 $19.1 Convertible preferred stock repurchase TBD - 46.5 Cash dividends on common stock (2) $16 - - Common stock repurchase ($200 million TBD 234.1 - authorization) (3) TBD $318.8 $65.6 P riori ties ma y s hift ba sed on p re v ailing mark e t c o ndition s

Appendix

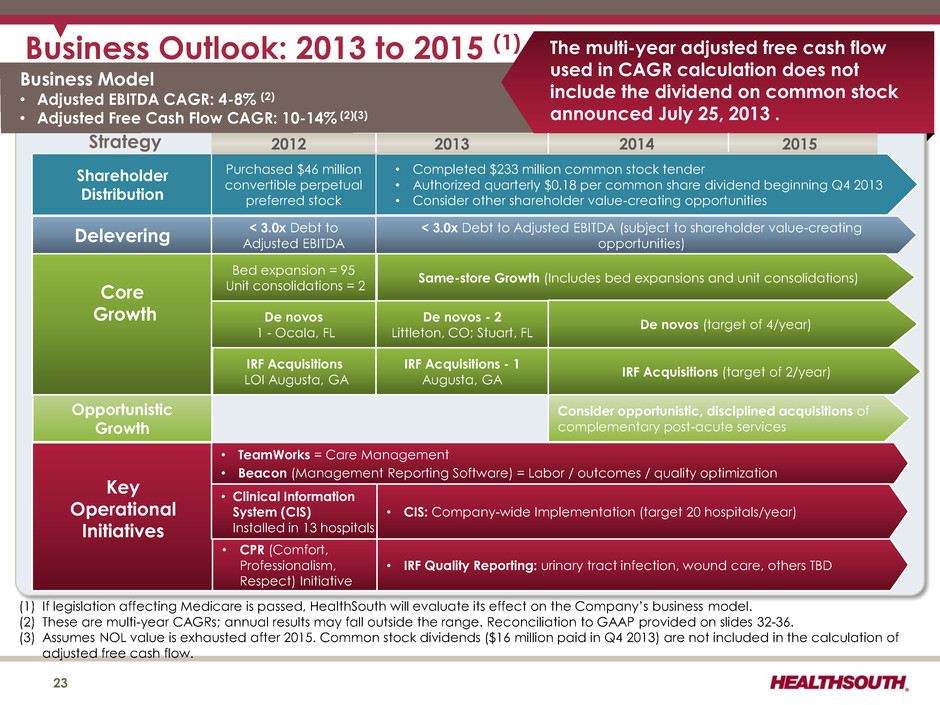

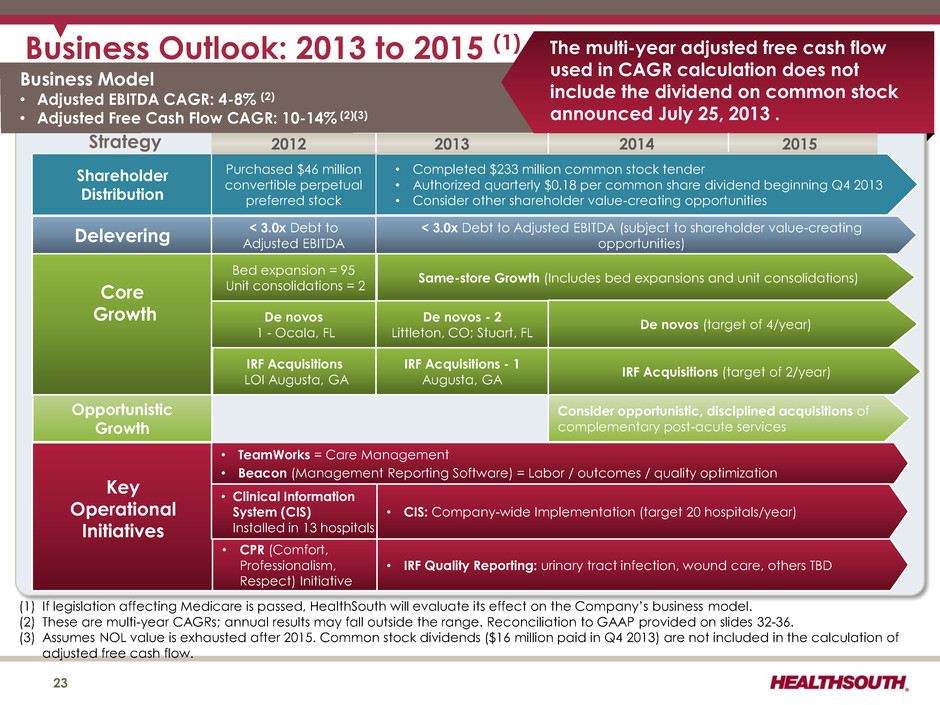

Business Outlook: 2013 to 2015 (1) Business Model • Adjusted EBITDA CAGR: 4-8% (2) • Adjusted Free Cash Flow CAGR: 10-14% (2)(3) Strategy Delevering < 3.0x Debt to Adjusted EBITDA < 3.0x Debt to Adjusted EBITDA (subject to shareholder value-creating opportunities) Core Growth Same-store Growth (Includes bed expansions and unit consolidations) De novos (target of 4/year) IRF Acquisitions (target of 2/year) Consider opportunistic, disciplined acquisitions of complementary post-acute services (1) If legislation affecting Medicare is passed, HealthSouth will evaluate its effect on the Company’s business model. (2) These are multi-year CAGRs; annual results may fall outside the range. Reconciliation to GAAP provided on slides 32-36. (3) Assumes NOL value is exhausted after 2015. Common stock dividends ($16 million paid in Q4 2013) are not included in the calculation of adjusted free cash flow. 23 De novos 1 - Ocala, FL • Clinical Information System (CIS) Installed in 13 hospitals Key Operational Initiatives • TeamWorks = Care Management • Beacon (Management Reporting Software) = Labor / outcomes / quality optimization • CIS: Company-wide Implementation (target 20 hospitals/year) IRF Acquisitions LOI Augusta, GA De novos - 2 Littleton, CO; Stuart, FL Opportunistic Growth The multi-year adjusted free cash flow used in CAGR calculation does not include the dividend on common stock announced July 25, 2013 . Bed expansion = 95 Unit consolidations = 2 • CPR (Comfort, Professionalism, Respect) Initiative • IRF Quality Reporting: urinary tract infection, wound care, others TBD IRF Acquisitions - 1 Augusta, GA Shareholder Distribution • Completed $233 million common stock tender • Authorized quarterly $0.18 per common share dividend beginning Q4 2013 • Consider other shareholder value-creating opportunities Purchased $46 million convertible perpetual preferred stock 2012 2013 2014 2015

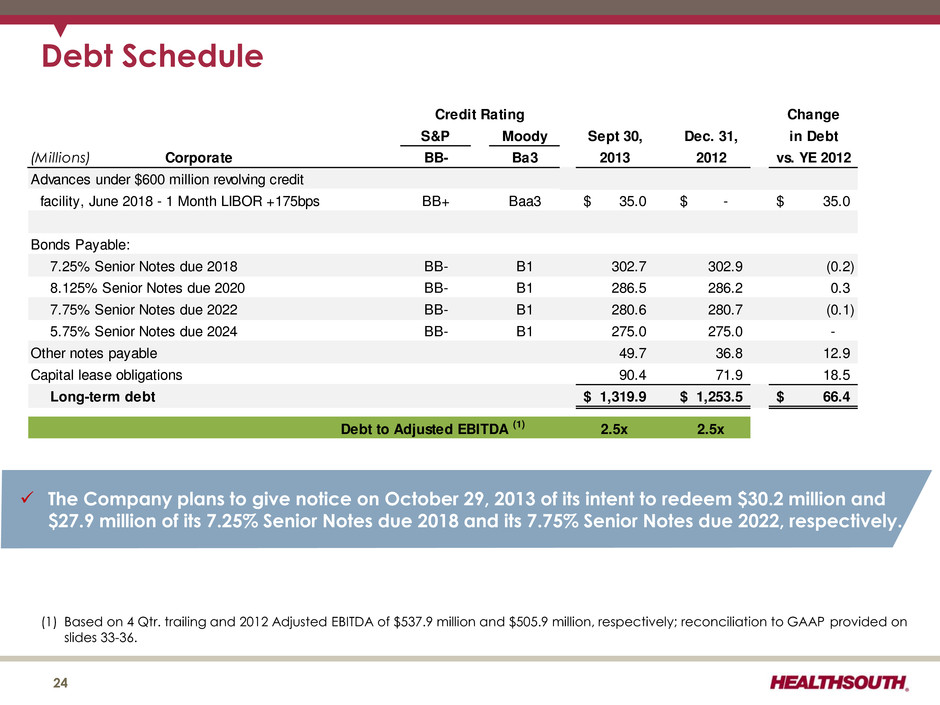

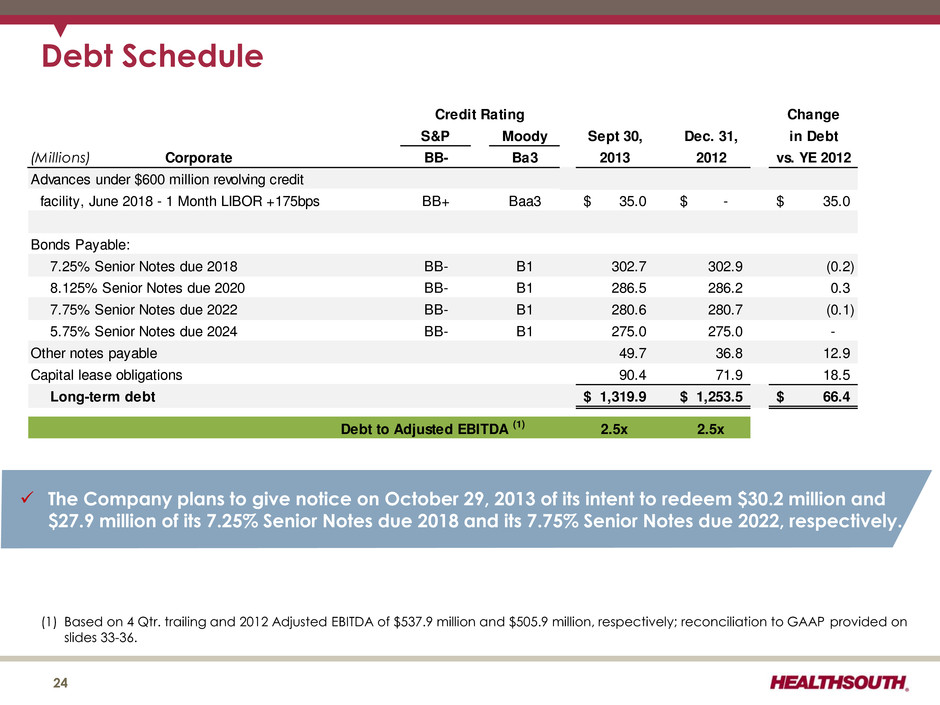

Debt Schedule (1) Based on 4 Qtr. trailing and 2012 Adjusted EBITDA of $537.9 million and $505.9 million, respectively; reconciliation to GAAP provided on slides 33-36. 24 Change S&P Moody Sept 30, Dec. 31, in Debt (Millions) Corporate BB- Ba3 2013 2012 vs. YE 2012 Advances under $600 million revolving credit facility, June 2018 - 1 Month LIBOR +175bps BB+ Baa3 35.0$ -$ 35.0$ Bonds Payable: 7.25% Senior Notes due 2018 BB- B1 302.7 302.9 (0.2) 8.125% Senior Notes due 2020 BB- B1 286.5 286.2 0.3 7.75% Senior Notes due 2022 BB- B1 280.6 280.7 (0.1) 5.75% Senior Notes due 2024 BB- B1 275.0 275.0 - Other notes payable 49.7 36.8 12.9 Capital lease obligations 90.4 71.9 18.5 Long-term debt 1,319.9$ 1,253.5$ 66.4$ 2.5x 2.5x Credit Rating Debt to Adjusted EBITDA (1) The Company plans to give notice on October 29, 2013 of its intent to redeem $30.2 million and $27.9 million of its 7.25% Senior Notes due 2018 and its 7.75% Senior Notes due 2022, respectively.

Revenues & Expenses (Sequential) Q3 Q2 Increase/ Revenues (millions) 2013 2013 (Decrease) Inpatient 528.8$ 527.4$ 0.3% Outpatient and other 35.2 37.1 (5.1%) Consolidated net operating 564.0$ 564.5$ (0.1%) (Actual Amounts) Discharges 32,307 32,645 (1.0%) Net patient revenue / discharge 16,368$ 16,156$ 1.3% Expenses (millions) Salaries and benefits 269.5$ 273.6$ (1.5%) Percent of net operating revenues 47.8% 48.5% (70 bps) EPOB (employees per occupied bed) 3.48 3.43 1.5% Hospital-related expenses 116.9$ 117.8$ (0.8%) (other operating (1), supplies, occupancy, bad debts) Percent of net operating revenues 20.7% 20.9% (20 bps) General and administrative 22.6$ 23.0$ (1.7%) (excludes stock-based compensation) Percent of net operating revenues 4.0% 4.1% (10 bps) Provision for doubtful acounts 8.0$ 7.0$ 14.3% Percent of net operating revenues 1.4% 1.2% 20 bps 25 (1) Excludes loss on disposal or impairment of assets

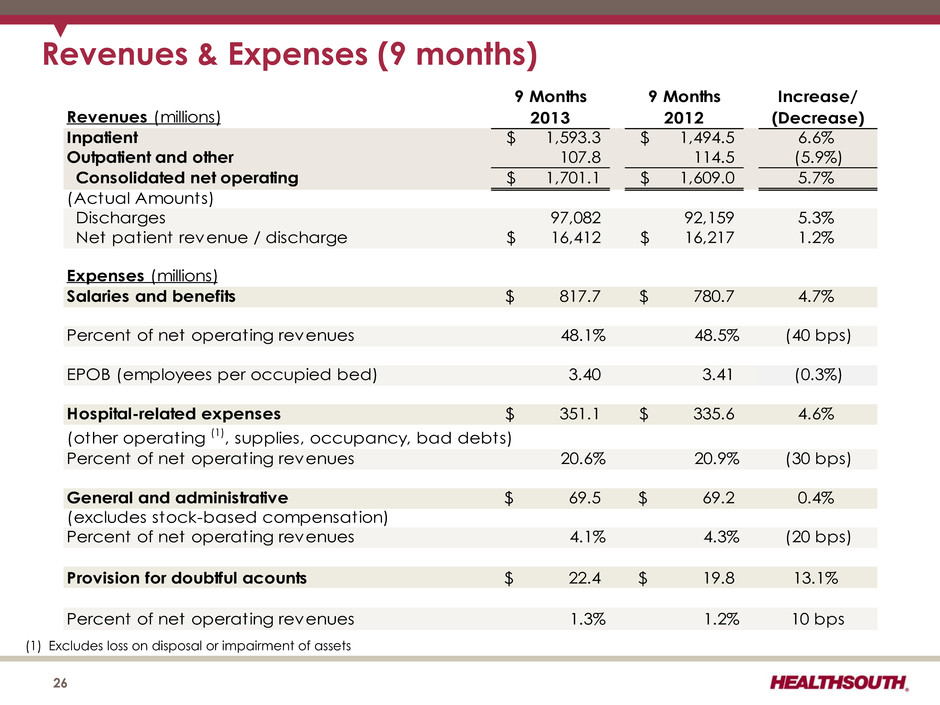

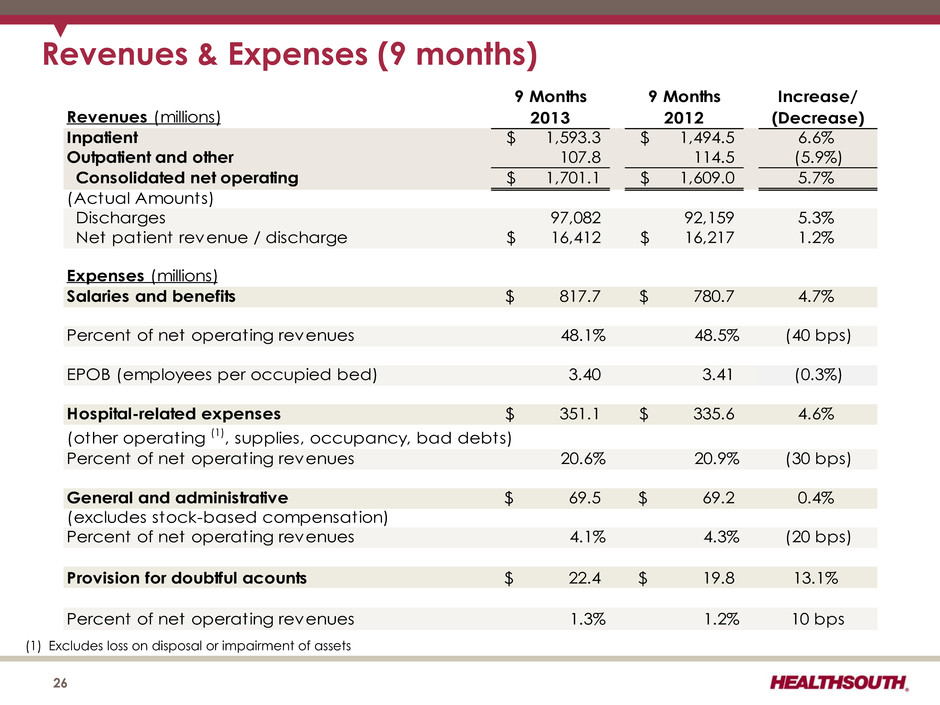

Revenues & Expenses (9 months) 9 Months 9 Months Increase/ Revenues (millions) 2013 2012 (Decrease) Inpatient 1,593.3$ 1,494.5$ 6.6% Outpatient and other 107.8 114.5 (5.9%) Consolidated net operating 1,701.1$ 1,609.0$ 5.7% (Actual Amounts) Discharges 97,082 92,159 5.3% Net patient revenue / discharge 16,412$ 16,217$ 1.2% Expenses (millions) Salaries and benefits 817.7$ 780.7$ 4.7% Percent of net operating revenues 48.1% 48.5% (40 bps) EPOB (employees per occupied bed) 3.40 3.41 (0.3%) Hospital-related expenses 351.1$ 335.6$ 4.6% (other operating (1), supplies, occupancy, bad debts) Percent of net operating revenues 20.6% 20.9% (30 bps) General and administrative 69.5$ 69.2$ 0.4% (excludes stock-based compensation) Percent of net operating revenues 4.1% 4.3% (20 bps) Provision for doubtful acounts 22.4$ 19.8$ 13.1% Percent of net operating revenues 1.3% 1.2% 10 bps 26 (1) Excludes loss on disposal or impairment of assets

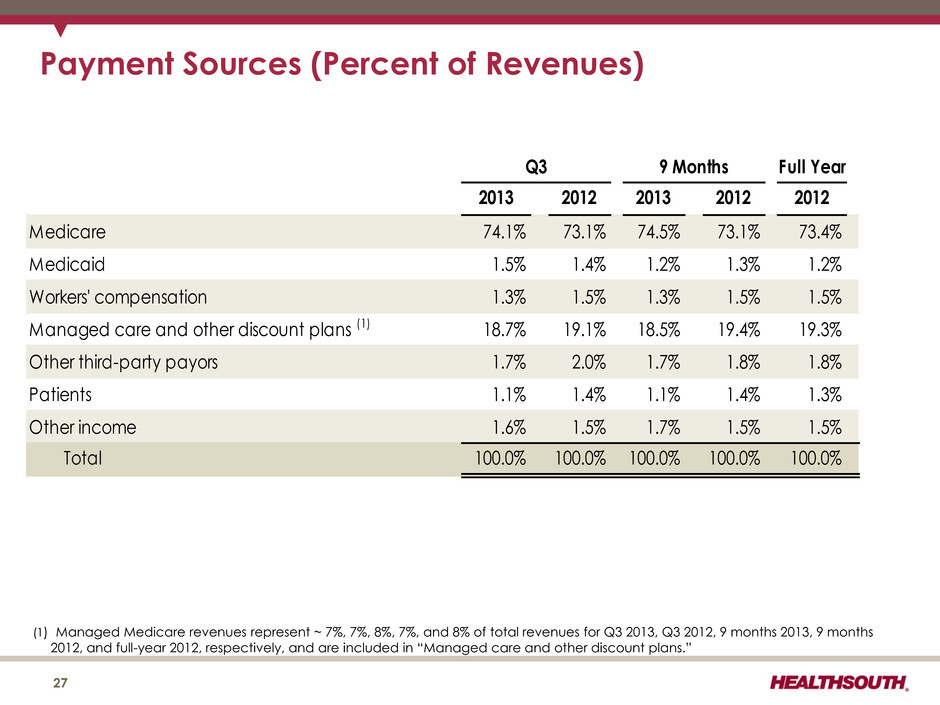

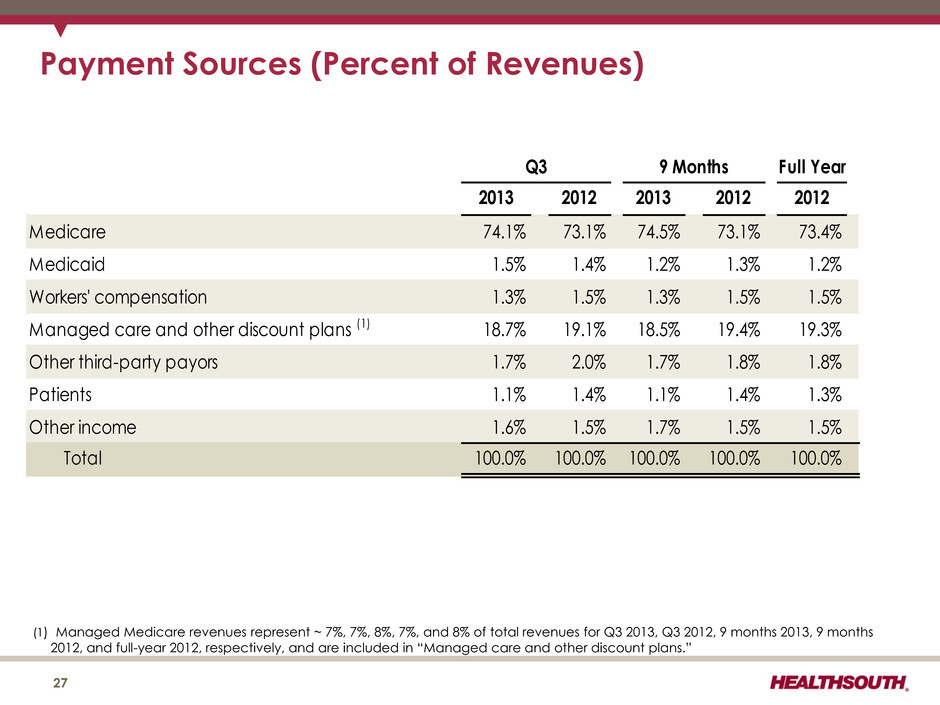

Payment Sources (Percent of Revenues) Full Year 2013 2012 2013 2012 2012 Medicare 74.1% 73.1% 74.5% 73.1% 73.4% Medicaid 1.5% 1.4% 1.2% 1.3% 1.2% Workers' compensation 1.3% 1.5% 1.3% 1.5% 1.5% Managed care and other discount plans (1) 18.7% 19.1% 18.5% 19.4% 19.3% Other third-party payors 1.7% 2.0% 1.7% 1.8% 1.8% Patients 1.1% 1.4% 1.1% 1.4% 1.3% Other income 1.6% 1.5% 1.7% 1.5% 1.5% Total 100.0% 100.0% 100.0% 100.0% 100.0% Q3 9 Months (1) Managed Medicare revenues represent ~ 7%, 7%, 8%, 7%, and 8% of total revenues for Q3 2013, Q3 2012, 9 months 2013, 9 months 2012, and full-year 2012, respectively, and are included in “Managed care and other discount plans.” 27

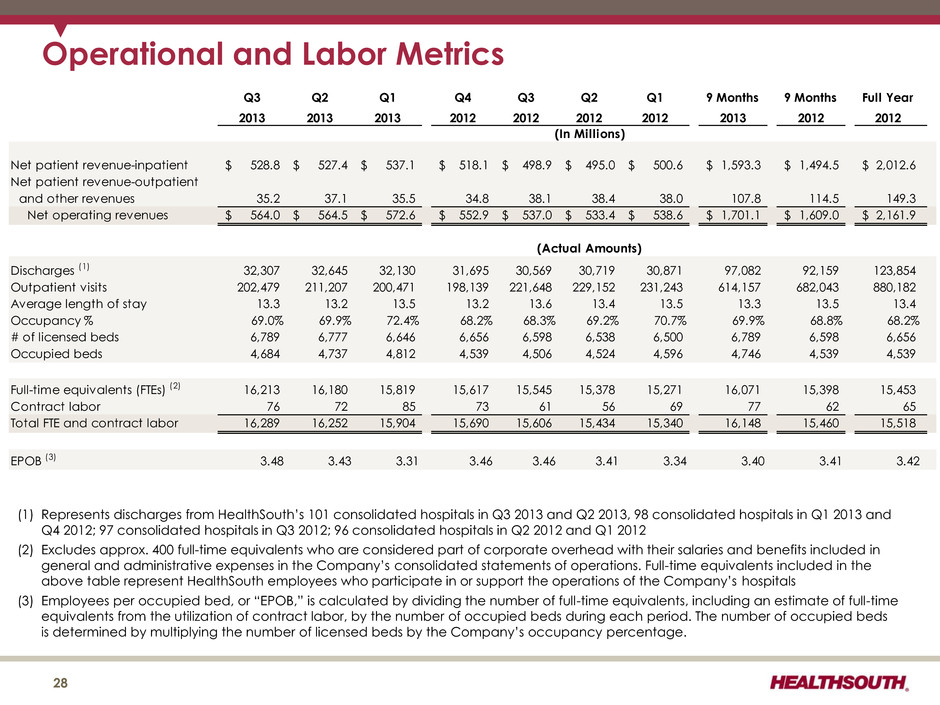

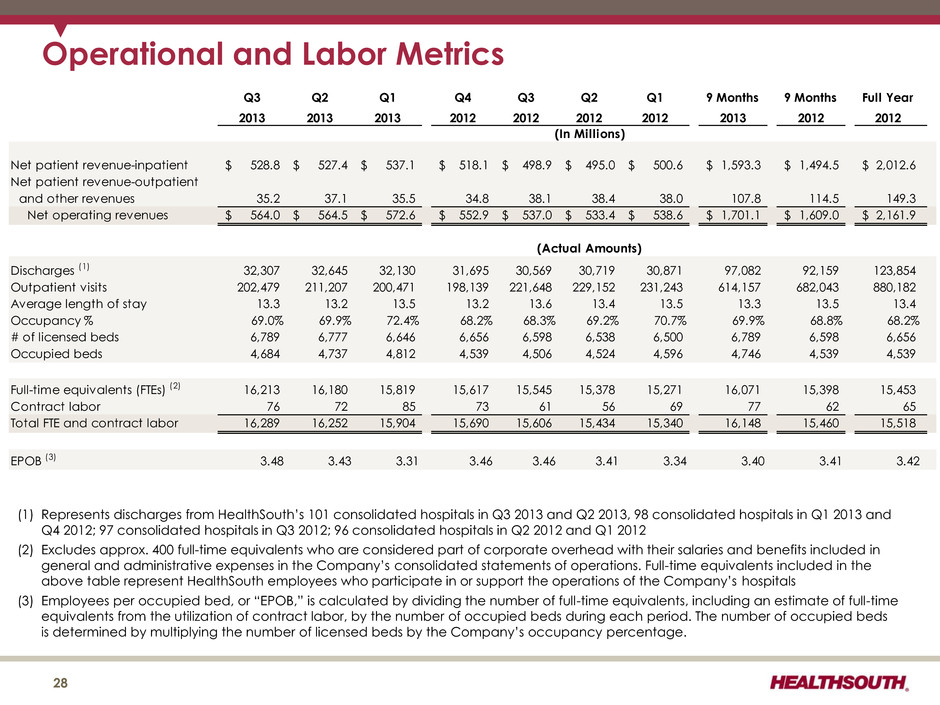

Operational and Labor Metrics (1) Represents discharges from HealthSouth’s 101 consolidated hospitals in Q3 2013 and Q2 2013, 98 consolidated hospitals in Q1 2013 and Q4 2012; 97 consolidated hospitals in Q3 2012; 96 consolidated hospitals in Q2 2012 and Q1 2012 (2) Excludes approx. 400 full-time equivalents who are considered part of corporate overhead with their salaries and benefits included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the above table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals (3) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. Q3 Q2 Q1 Q4 Q3 Q2 Q1 9 Months 9 Months Full Year 2013 2013 2013 2012 2012 2012 2012 2013 2012 2012 (In Millions) Net patient revenue-inpatient 528.8$ 527.4$ 537.1$ 518.1$ 498.9$ 495.0$ 500.6$ 1,593.3$ 1,494.5$ 2,012.6$ Net patient revenue-outpatient and other revenues 35.2 37.1 35.5 34.8 38.1 38.4 38.0 107.8 114.5 149.3 Net operating revenues 564.0$ 564.5$ 572.6$ 552.9$ 537.0$ 533.4$ 538.6$ 1,701.1$ 1,609.0$ 2,161.9$ (Actual Amounts) Discharges (1) 32,307 32,645 32,130 31,695 30,569 30,719 30,871 97,082 92,159 123,854 Outpatient visits 202,479 211,207 200,471 198,139 221,648 229,152 231,243 614,157 682,043 880,182 Average length of stay 13.3 13.2 13.5 13.2 13.6 13.4 13.5 13.3 13.5 13.4 Occupancy % 69.0% 69.9% 72.4% 68.2% 68.3% 69.2% 70.7% 69.9% 68.8% 68.2% # of licensed beds 6,789 6,777 6,646 6,656 6,598 6,538 6,500 6,789 6,598 6,656 Occupied beds 4,684 4,737 4,812 4,539 4,506 4,524 4,596 4,746 4,539 4,539 Full-time equivalents (FTEs) (2) 16,213 16,180 15,819 15,617 15,545 15,378 15,271 16,071 15,398 15,453 Contract labor 76 72 85 73 61 56 69 77 62 65 Total FTE and contract labor 16,289 16,252 15,904 15,690 15,606 15,434 15,340 16,148 15,460 15,518 EPOB (3) 3.48 3.43 3.31 3.46 3.46 3.41 3.34 3.40 3.41 3.42 28

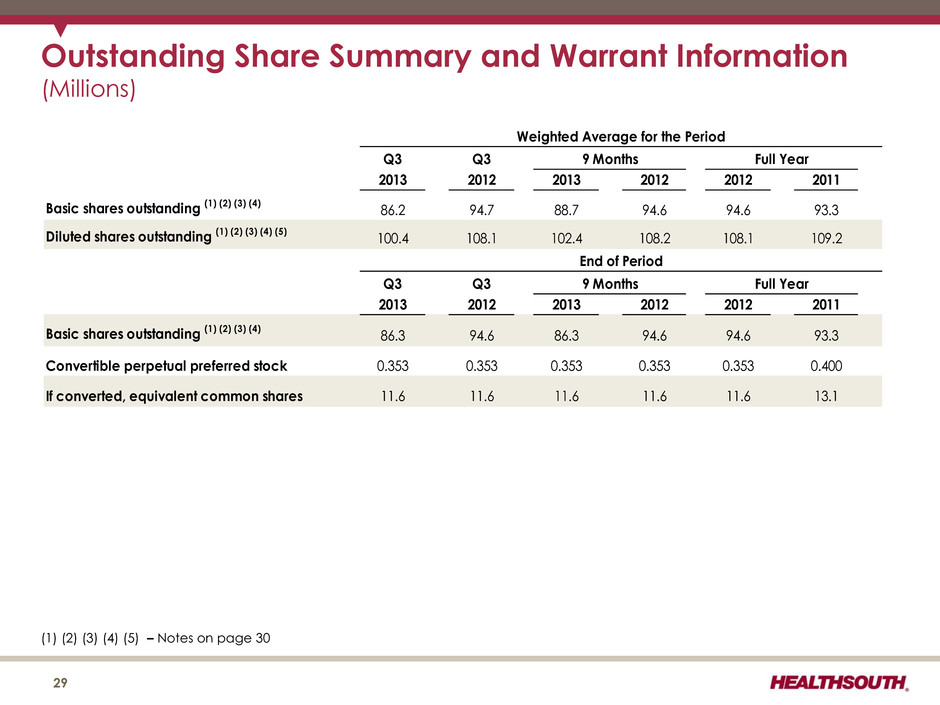

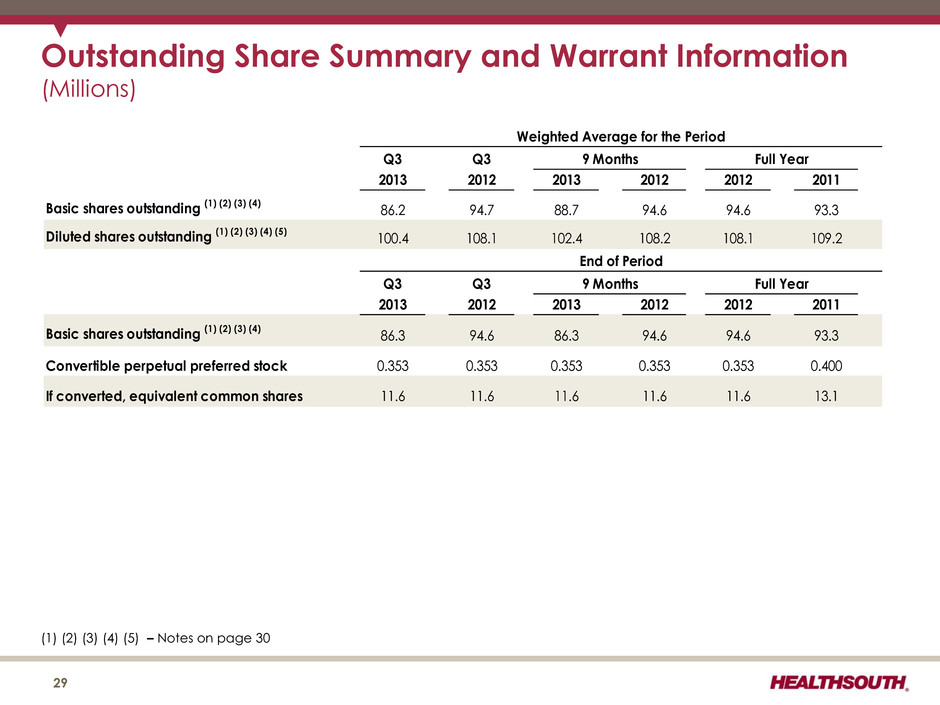

Outstanding Share Summary and Warrant Information (Millions) Q3 Q3 2013 2012 2013 2012 2012 2011 Basic shares outstanding (1) (2) (3) (4) 86.2 94.7 88.7 94.6 94.6 93.3 Diluted shares outstanding (1) (2) (3) (4) (5) 100.4 108.1 102.4 108.2 108.1 109.2 Q3 Q3 2013 2012 2013 2012 2012 2011 Basic shares outstanding (1) (2) (3) (4) 86.3 94.6 86.3 94.6 94.6 93.3 Convertible perpetual preferred stock 0.353 0.353 0.353 0.353 0.353 0.400 If converted, equivalent common shares 11.6 11.6 11.6 11.6 11.6 13.1 Weighted Average for the Period End of Period Full Year Full Year 9 Months 9 Months 29 (1) (2) (3) (4) (5) – Notes on page 30

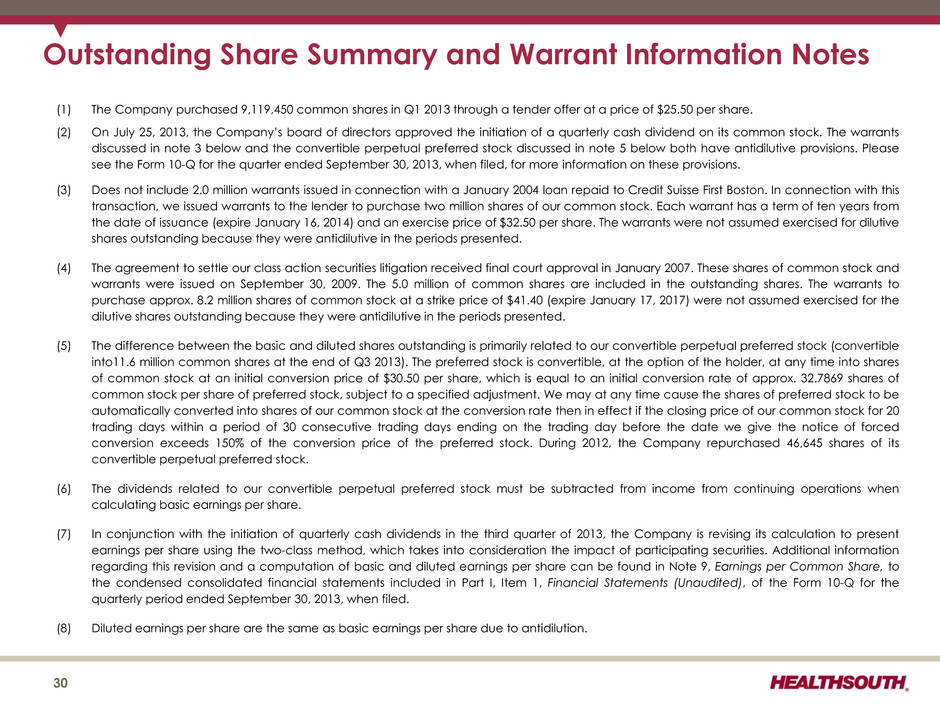

Outstanding Share Summary and Warrant Information Notes 30 (1) The Company purchased 9,119,450 common shares in Q1 2013 through a tender offer at a price of $25.50 per share. (2) On July 25, 2013, the Company’s board of directors approved the initiation of a quarterly cash dividend on its common stock. The warrants discussed in note 3 below and the convertible perpetual preferred stock discussed in note 5 below both have antidilutive provisions. Please see the Form 10-Q for the quarter ended September 30, 2013, when filed, for more information on these provisions. (3) Does not include 2.0 million warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In connection with this transaction, we issued warrants to the lender to purchase two million shares of our common stock. Each warrant has a term of ten years from the date of issuance (expire January 16, 2014) and an exercise price of $32.50 per share. The warrants were not assumed exercised for dilutive shares outstanding because they were antidilutive in the periods presented. (4) The agreement to settle our class action securities litigation received final court approval in January 2007. These shares of common stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are included in the outstanding shares. The warrants to purchase approx. 8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) were not assumed exercised for the dilutive shares outstanding because they were antidilutive in the periods presented. (5) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock (convertible into11.6 million common shares at the end of Q3 2013). The preferred stock is convertible, at the option of the holder, at any time into shares of common stock at an initial conversion price of $30.50 per share, which is equal to an initial conversion rate of approx. 32.7869 shares of common stock per share of preferred stock, subject to a specified adjustment. We may at any time cause the shares of preferred stock to be automatically converted into shares of our common stock at the conversion rate then in effect if the closing price of our common stock for 20 trading days within a period of 30 consecutive trading days ending on the trading day before the date we give the notice of forced conversion exceeds 150% of the conversion price of the preferred stock. During 2012, the Company repurchased 46,645 shares of its convertible perpetual preferred stock. (6) The dividends related to our convertible perpetual preferred stock must be subtracted from income from continuing operations when calculating basic earnings per share. (7) In conjunction with the initiation of quarterly cash dividends in the third quarter of 2013, the Company is revising its calculation to present earnings per share using the two-class method, which takes into consideration the impact of participating securities. Additional information regarding this revision and a computation of basic and diluted earnings per share can be found in Note 9, Earnings per Common Share, to the condensed consolidated financial statements included in Part I, Item 1, Financial Statements (Unaudited), of the Form 10-Q for the quarterly period ended September 30, 2013, when filed. (8) Diluted earnings per share are the same as basic earnings per share due to antidilution.

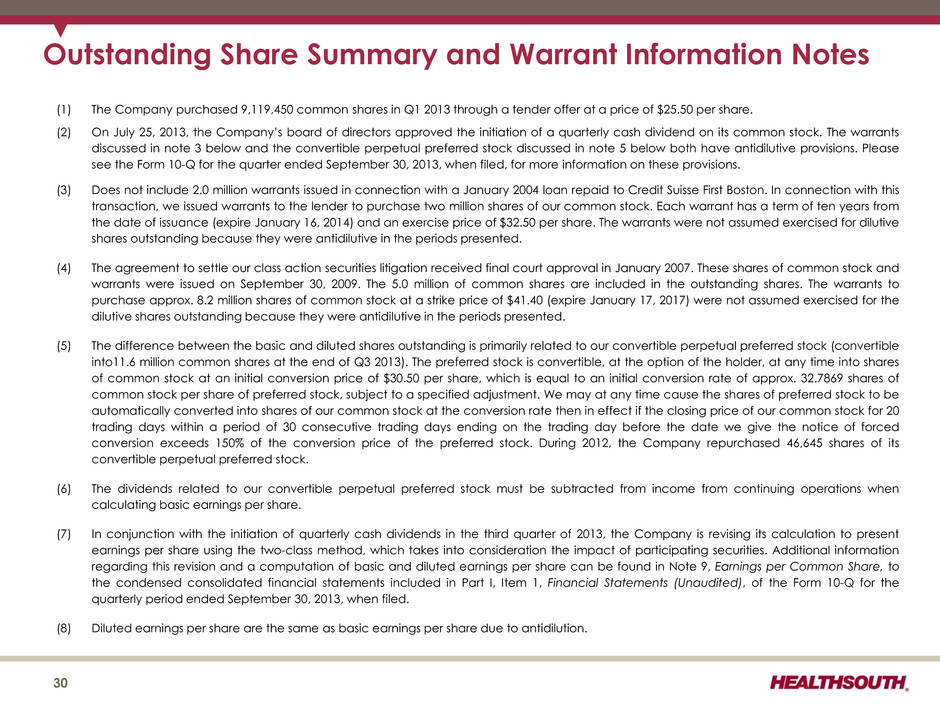

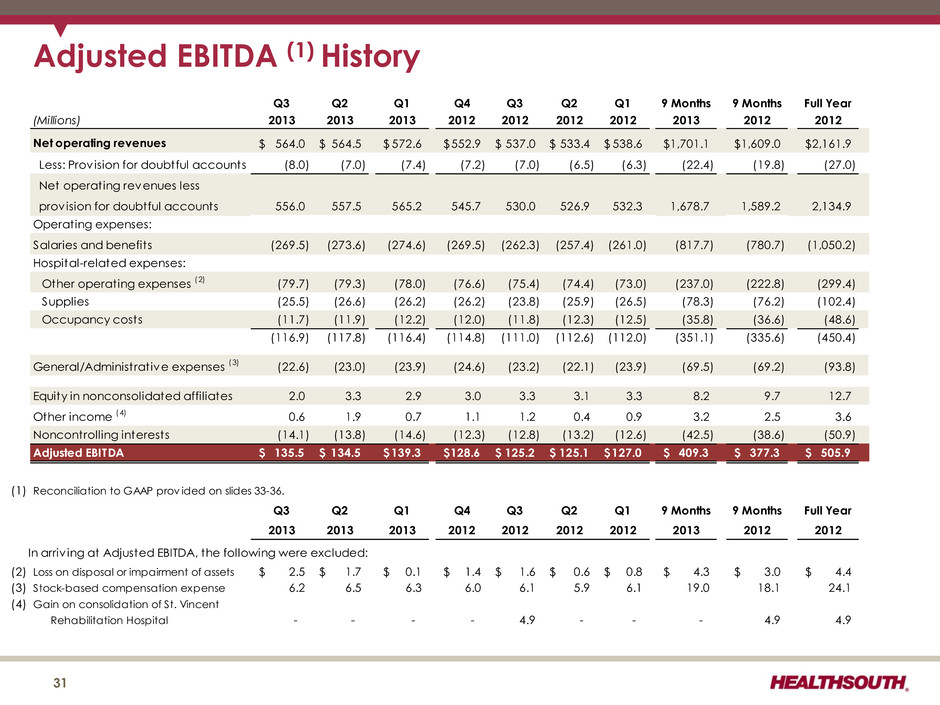

Adjusted EBITDA (1) History 31 Q3 Q2 Q1 Q4 Q3 Q2 Q1 9 Months 9 Months Full Year (Millions) 2013 2013 2013 2012 2012 2012 2012 2013 2012 2012 Net operating revenues 564.0$ 564.5$ 572.6$ 552.9$ 537.0$ 533.4$ 538.6$ 1,701.1$ 1,609.0$ 2,161.9$ Less: Provision for doubtful accounts (8.0) (7.0) (7.4) (7.2) (7.0) (6.5) (6.3) (22.4) (19.8) (27.0) Net operating revenues less provision for doubtful accounts 556.0 557.5 565.2 545.7 530.0 526.9 532.3 1,678.7 1,589.2 2,134.9 Operating expenses: Salaries and benefits (269.5) (273.6) (274.6) (269.5) (262.3) (257.4) (261.0) (817.7) (780.7) (1,050.2) Hospital-related expenses: Other operating expenses (2) (79.7) (79.3) (78.0) (76.6) (75.4) (74.4) (73.0) (237.0) (222.8) (299.4) Supplies (25.5) (26.6) (26.2) (26.2) (23.8) (25.9) (26.5) (78.3) (76.2) (102.4) Occupancy costs (11.7) (11.9) (12.2) (12.0) (11.8) (12.3) (12.5) (35.8) (36.6) (48.6) (116.9) (117.8) (116.4) (114.8) (111.0) (112.6) (112.0) (351.1) (335.6) (450.4) General/Administrative expenses (3) (22.6) (23.0) (23.9) (24.6) (23.2) (22.1) (23.9) (69.5) (69.2) (93.8) Equity in nonconsolidated affiliates 2.0 3.3 2.9 3.0 3.3 3.1 3.3 8.2 9.7 12.7 Other income (4) 0.6 1.9 0.7 1.1 1.2 0.4 0.9 3.2 2.5 3.6 Noncontrolling interests (14.1) (13.8) (14.6) (12.3) (12.8) (13.2) (12.6) (42.5) (38.6) (50.9) Adjusted EBITDA 135.5$ 134.5$ 139.3$ 128.6$ 125.2$ 125.1$ 127.0$ 409.3$ 377.3$ 505.9$ (1) Reconciliation to GAAP prov ided on slides 33-36. Q3 Q2 Q1 Q4 Q3 Q2 Q1 9 Months 9 Months Full Year 2013 2013 2013 2012 2012 2012 2012 2013 2012 2012 In arriv ing at Adjusted EBITDA, the following were excluded: (2) Loss on disposal or impairment of assets 2.5$ 1.7$ 0.1$ 1.4$ 1.6$ 0.6$ 0.8$ 4.3$ 3.0$ 4.4$ (3) Stock-based compensation expense 6.2 6.5 6.3 6.0 6.1 5.9 6.1 19.0 18.1 24.1 (4) Gain on consolidation of St. Vincent Rehabilitation Hospital - - - - 4.9 - - - 4.9 4.9

Adjusted Free Cash Flow Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow (Millions) 2013 2012 2013 2012 2012 2011 2010 142.6$ 107.2$ 369.4$ 302.2$ 411.5$ 342.7$ 331.0$ 1.2 0.2 1.4 (1.5) (2.0) (9.1) (13.2) Capital expenditures for maintenance (1) (18.6) (17.9) (54.3) (68.0) (83.0) (50.8) (37.9) Net sett lements on interest rate swaps (2) - - - - - (10.9) (44.7) Dividends paid on convert ible perpetual preferred stock Distribut ions paid to noncontrolling interests of consolidated affiliates Non-recurring items: Net premium paid (received) on bond issuance/redemption - - - - 1.9 22.8 - Cash paid for professional fees - accounting, tax, and legal Cash paid for government, class action, and related sett lements - - - - - (7.9) (13.5) Adjusted free cash flow 106.4$ 71.6$ 264.6$ 186.8$ 268.0$ 243.3$ 181.4$ Full Year 5.3 13.2 (5.9) (2.6) 9 Months (34.1) (37.6) 370.8 300.7 (4.6) (2.6) Q3 143.8 107.4 (5.7) (5.8) (10.2) (13.6) Income tax refunds related to prior periods (24.6) (49.3) (44.2) (26.0) 1.7 4.1 (34.4) (17.2) (18.9) 2.9 17.2 21.0 333.6 (26.0) 317.8 16.1 (2.6) activities of continuing operations Net cash provided by operating Impact of discontinued operations Net cash provided by operating activities 409.5 5.7 (1) Maintenance capital expenditures are expected to be $80 to $90 million in 2013. (2) Final swap payment of $10.9 million was made in March 2011. 32

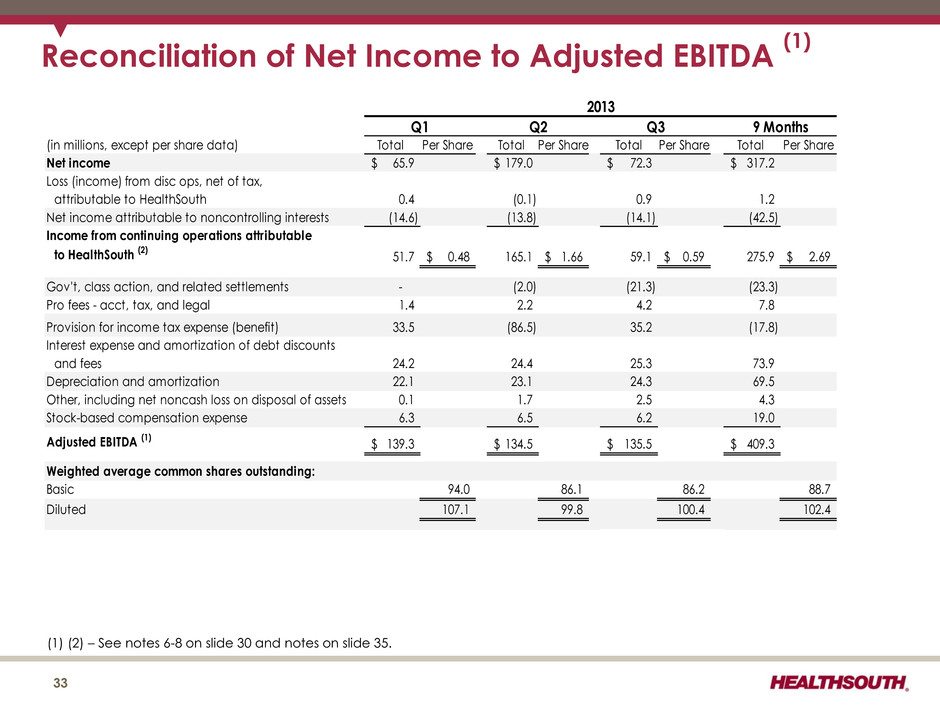

Reconciliation of Net Income to Adjusted EBITDA (1) (1) (2) – See notes 6-8 on slide 30 and notes on slide 35. (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Net income 65.9$ 179.0$ 72.3$ 317.2$ Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.4 (0.1) 0.9 1.2 Net income attributable to noncontrolling interests (14.6) (13.8) (14.1) (42.5) Income from continuing operations attributable to HealthSouth (2) 51.7 0.48$ 165.1 1.66$ 59.1 0.59$ 275.9 2.69$ Gov't, class action, and related settlements - (2.0) (21.3) (23.3) Pro fees - acct, tax, and legal 1.4 2.2 4.2 7.8 Provision for income tax expense (benefit) 33.5 (86.5) 35.2 (17.8) Interest expense and amortization of debt discounts and fees 24.2 24.4 25.3 73.9 Depreciation and amortization 22.1 23.1 24.3 69.5 Other, including net noncash loss on disposal of assets 0.1 1.7 2.5 4.3 Stock-based compensation expense 6.3 6.5 6.2 19.0 Adjusted EBITDA (1) 139.3$ 134.5$ 135.5$ 409.3$ Weighted average common shares outstanding: Basic 94.0 86.1 86.2 88.7 Diluted 107.1 99.8 100.4 102.4 2013 9 MonthsQ1 Q2 Q3 33

Reconciliation of Net Income to Adjusted EBITDA (1) (1) (2) – See notes 6-8 on slide 30 and notes on slide 35 (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net income 56.8$ 59.9$ 59.9$ 59.3$ 235.9$ Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.4 (3.5) 0.5 (1.9) (4.5) Net income attributable to noncontrolling interests (12.6) (13.2) (12.8) (12.3) (50.9) Income from continuing operations attributable to HealthSouth (2) 44.6 0.39$ 43.2 0.38$ 47.6 0.44$ 45.1 0.41$ 180.5 1.62$ Gov't, class action, and related settlements - - (3.5) - (3.5) Pro fees - acct, tax, and legal 3.6 5.5 4.1 2.9 16.1 Provision for income tax expense 29.1 26.9 28.1 24.5 108.6 Interest expense and amortization of debt discounts and fees 23.3 23.0 23.5 24.3 94.1 Depreciation and amortization 19.5 20.0 21.3 21.7 82.5 Loss on early extinguishment of debt - - 1.3 2.7 4.0 Gain on consolidation of St. Vincent Rehabilitation Hospital - - (4.9) - (4.9) Other, including net noncash loss on disposal of assets 0.8 0.6 1.6 1.4 4.4 Stock-based compensation expense 6.1 5.9 6.1 6.0 24.1 Adjusted EBITDA (1) 127.0$ 125.1$ 125.2$ 128.6$ 505.9$ Weighted average common shares outstanding: Basic 94.5 94.6 94.7 94.7 94.6 Diluted 108.7 108.0 108.1 108.0 108.1 2012 Full YearQ1 Q2 Q4Q3 34

Reconciliation Notes for Slides 33-34 1. Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non- GAAP financial measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments set forth. 2. Per share amounts for each period presented are based on diluted weighted average shares outstanding unless the amounts are antidilutive, in which case the per share amount is calculated using the basic share count after subtracting the quarterly dividend on the convertible perpetual preferred stock and income allocated to participating securities. The difference in shares between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock. 35

Full Year (Millions) 2013 2012 2013 2012 2012 Net cash provided by operating activities 142.6$ 107.2$ 369.4$ 302.2$ 411.5$ Provision for doubtful accounts (8.0) (7.0) (22.4) (19.8) (27.0) Professional fees—accounting, tax, and legal 4.2 4.1 7.8 13.2 16.1 Interest expense and amortization of debt discounts and fees 25.3 23.5 73.9 69.8 94.1 Equity in net income of nonconsolidated affiliates 2.0 3.3 8.2 9.7 12.7 Net income attributable to noncontrolling interests in continuing operations (14.1) (12.8) (42.5) (38.6) (50.9) Amortization of debt discounts and fees (1.0) (0.9) (3.0) (2.7) (3.7) Distributions from nonconsolidated affiliates (4.6) (2.4) (9.6) (7.9) (11.0) Current portion of income tax expense (benefit) 2.5 (0.6) 3.0 3.7 5.9 Change in assets and liabilit ies (14.4) 10.4 21.8 48.8 58.1 Net premium paid on bond issuance/redemption - - - - 1.9 Cash used in (provided by) operating activ ities of discontinued operations 1.2 0.2 1.4 (1.5) (2.0) Other (0.2) 0.2 1.3 0.4 0.2 Adjusted EBITDA 135.5$ 125.2$ 409.3$ 377.3$ 505.9$ Q3 9 Months Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA 36