HealthSouth Acquires Encompass Home Health & Hospice 1

The information contained in this presentation includes certain estimates, projections and other forward- looking information that reflect our current outlook, views and plans with respect to future events, including the purchase price and the likelihood, timing and effects of the completion of this acquisition; anticipated tax benefits; the growth prospects of the acquired entity; the ability to leverage technologies and care delivery models; future balance sheet capacity; anticipated clinical, management, sales and compliance attributes of the acquired company’s operations; strategy; financial performance; and business model. These estimates, projections and other forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance that any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2013, the Form 10-Q for the quarters ended March 31, 2014, June 30, 2014, and September 30, 2014, the Form 8-K dated November 24, 2014, and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Our Form 8-K, dated November 24, 2014, to which the following supplemental slides are attached as Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements 2

Agenda 3 4 5 6 Encompass: Overv iew…………………………………………………………………………………..7 8 9 10 11 12 Encompass: Well-Positioned for Shift in Coordinated Care Delivery Models…………………………………………………………………………………… Transaction Summary…………………………………………………………………………………………………………. Transaction Summary…………………………………………………………………………………………………………………………… Strategic Rationale…………………………………………………………………………………………. Enhanced Growth Profile………………………………………………………………………………………… Encompass: Geographic Overlay with HealthSouth……………………………………………. Encompass: Operational Excellence………………………………………………………………. Encompass: Clinical Excellence……………………………………………………………………..

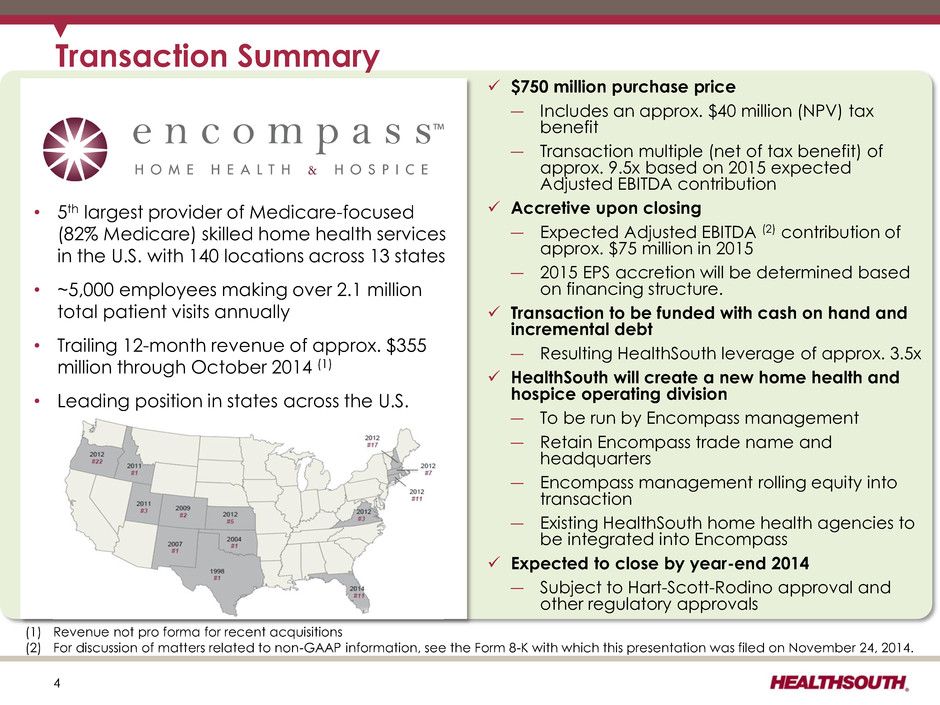

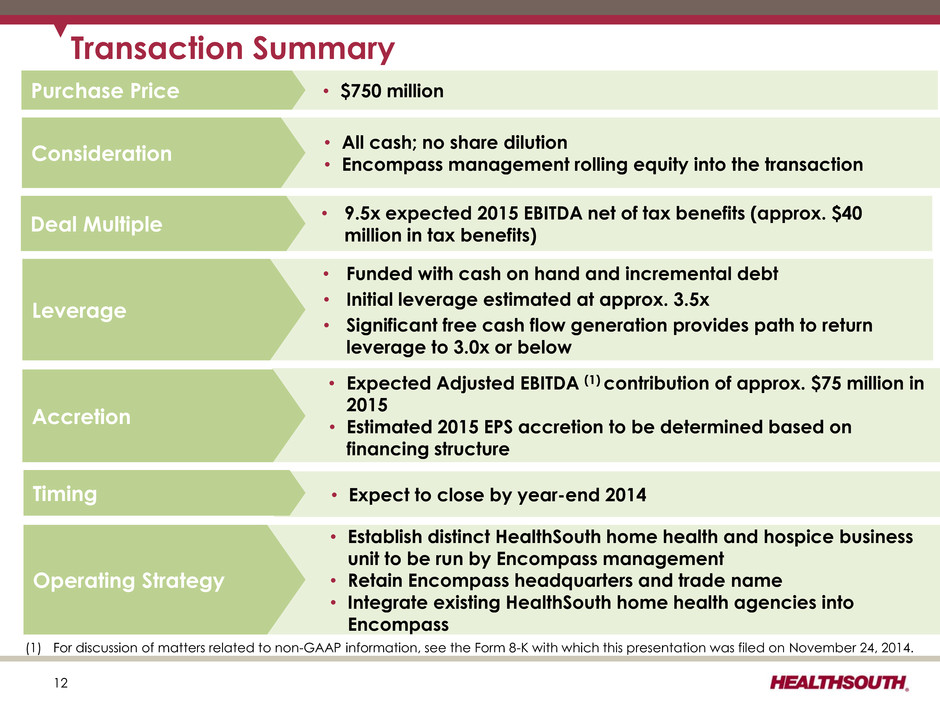

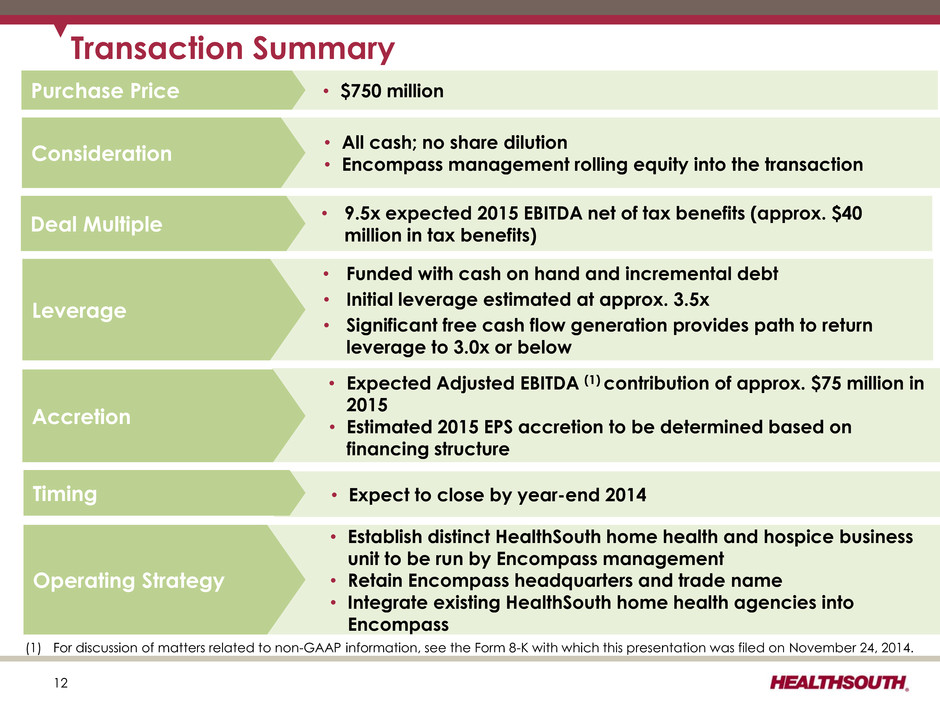

Transaction Summary $750 million purchase price ― Includes an approx. $40 million (NPV) tax benefit ― Transaction multiple (net of tax benefit) of approx. 9.5x based on 2015 expected Adjusted EBITDA contribution Accretive upon closing ― Expected Adjusted EBITDA (2) contribution of approx. $75 million in 2015 ― 2015 EPS accretion will be determined based on financing structure. Transaction to be funded with cash on hand and incremental debt ― Resulting HealthSouth leverage of approx. 3.5x HealthSouth will create a new home health and hospice operating division ― To be run by Encompass management ― Retain Encompass trade name and headquarters ― Encompass management rolling equity into transaction ― Existing HealthSouth home health agencies to be integrated into Encompass Expected to close by year-end 2014 ― Subject to Hart-Scott-Rodino approval and other regulatory approvals 4 (1) Revenue not pro forma for recent acquisitions (2) For discussion of matters related to non-GAAP information, see the Form 8-K with which this presentation was filed on November 24, 2014. • 5th largest provider of Medicare-focused (82% Medicare) skilled home health services in the U.S. with 140 locations across 13 states • ~5,000 employees making over 2.1 million total patient visits annually • Trailing 12-month revenue of approx. $355 million through October 2014 (1) • Leading position in states across the U.S.

Strategic Rationale Attractive opportunity to enter the $33.5 billion Medicare home health and hospice markets which are adjacent to our core inpatient rehabilitation facilities (IRF) business Brings together two best-of-class post-acute providers with regard to patient outcomes and operating efficiency Compatible corporate cultures dedicated to patient care, employee satisfaction and shareholder value creation Highly complementary businesses serving the Medicare beneficiary population Favorable demographic trends driving increased demand for both inpatient rehabilitation and home health/hospice services Enhanced positioning to participate in integrated delivery and value-based payment models Shared commitment to technology enabled business processes Scalable management teams and supporting infrastructure facilitating accelerated growth Ability to leverage balance sheet capacity into a highly accretive transaction Sufficient free cash flow and capital availability to fund growth opportunities in both IRF and home health/hospice segments 5

Enhanced Growth Profile Organic growth fueled by operating improvements in previously acquired businesses ― Encompass has a strong record of meaningful growth following acquisition Significant opportunity to continue growth via acquisition ― Encompass has acquired 45 home health businesses since 2005 ― Highly fragmented home health market creates acquisition opportunities ― Over 12,000 home health agencies in the U.S. ― Approximately 95% of home health agencies have less than $5 million in annual revenue Ability to enhance patient choice and outcomes for HealthSouth IRF patients ― HealthSouth IRFs discharge approximately 72,000 patients per annum to home health • Currently only approximately 4% go to a HealthSouth home health agency • Currently only approximately 1% go to an Encompass home health agency ― Opportunity to offer HealthSouth IRF patients who are discharged to SNF a more cost-effective alternative Elevated opportunities to participate in integrated delivery and value-based payment models ― Ability to deliver facility-based and home-based care ― Industry leading quality outcomes and cost-effectiveness ― Leverage significant investment in technology • Homecare Homebase (HCHB) at Encompass • Cerner clinical information system (CIS) at HealthSouth 6

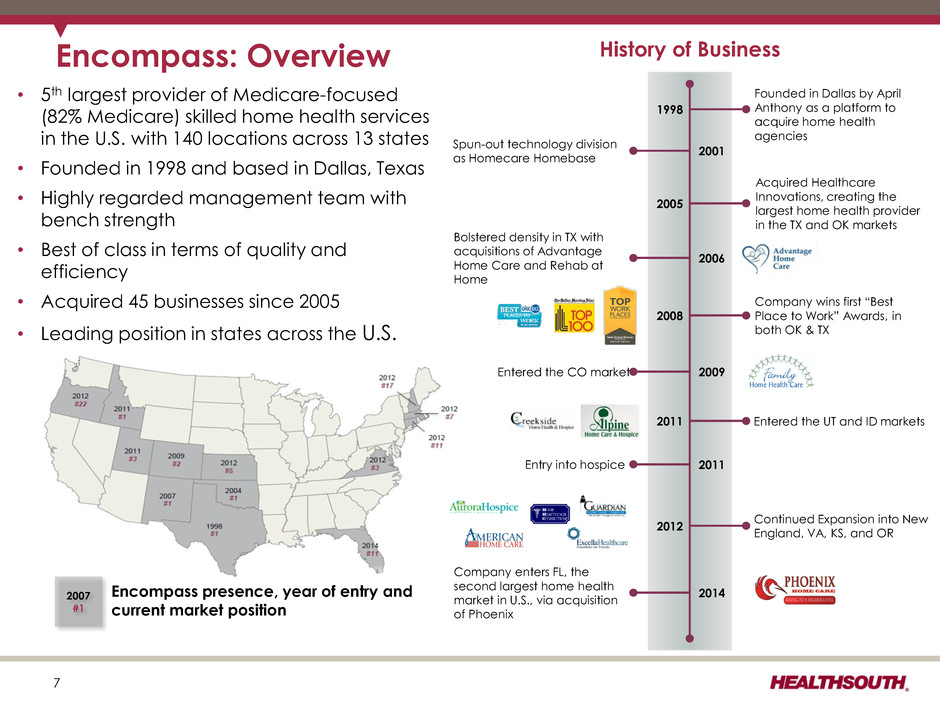

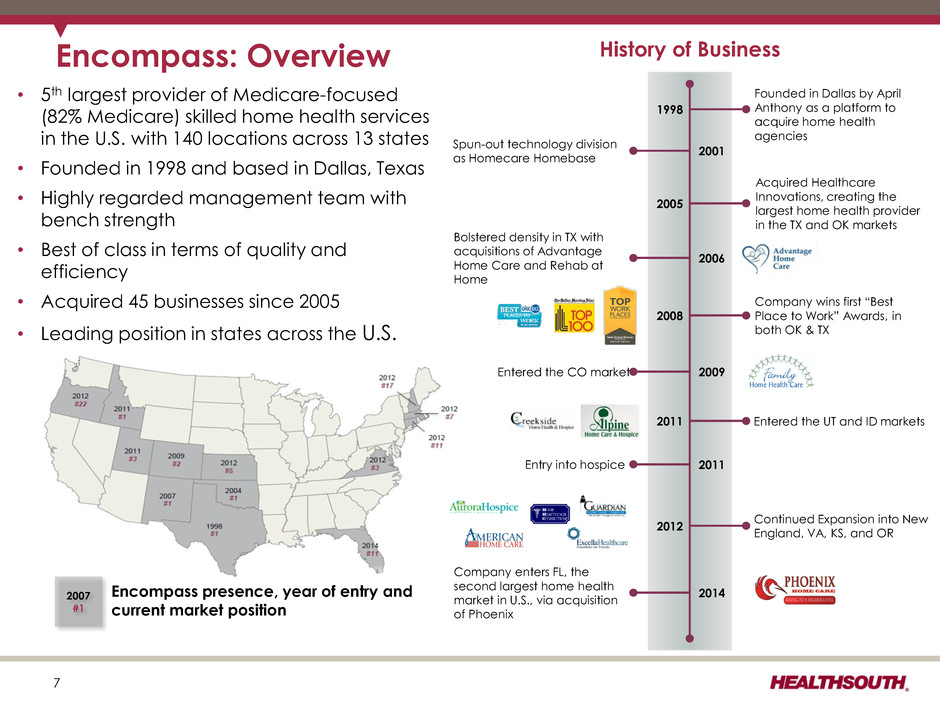

Encompass: Overview 7 • 5th largest provider of Medicare-focused (82% Medicare) skilled home health services in the U.S. with 140 locations across 13 states • Founded in 1998 and based in Dallas, Texas • Highly regarded management team with bench strength • Best of class in terms of quality and efficiency • Acquired 45 businesses since 2005 • Leading position in states across the U.S. History of Business 2007 #1 Encompass presence, year of entry and current market position Founded in Dallas by April Anthony as a platform to acquire home health agencies 1998 2001 Spun-out technology division as Homecare Homebase Acquired Healthcare Innovations, creating the largest home health provider in the TX and OK markets 2005 2006 Bolstered density in TX with acquisitions of Advantage Home Care and Rehab at Home Company wins first “Best Place to Work” Awards, in both OK & TX 2008 2009 Entered the CO market Entered the UT and ID markets 2011 2011 Entry into hospice Continued Expansion into New England, VA, KS, and OR 2012 2014 Company enters FL, the second largest home health market in U.S., via acquisition of Phoenix

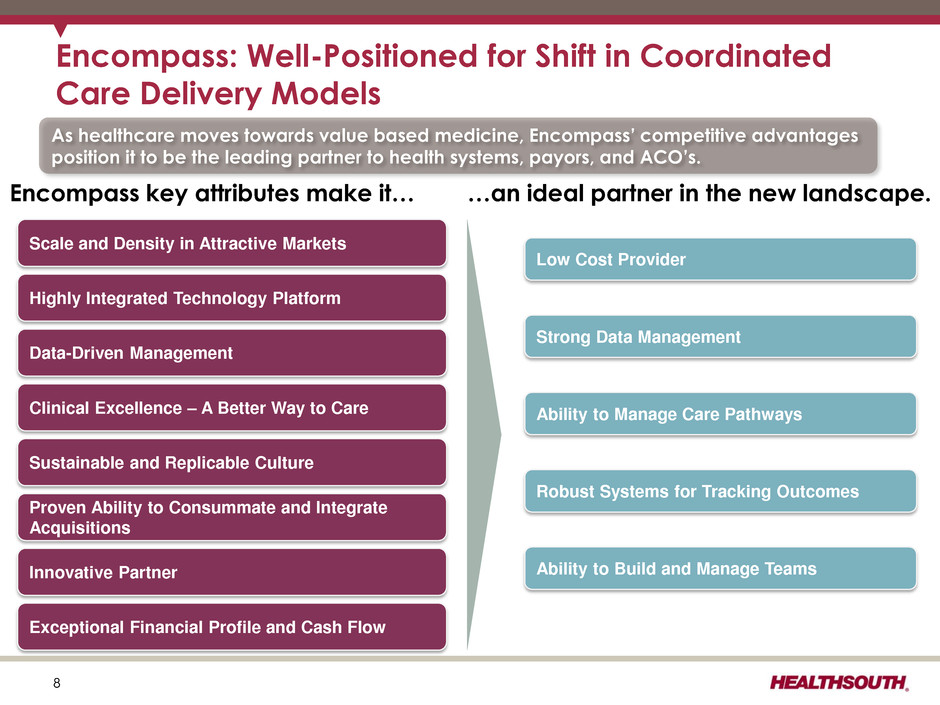

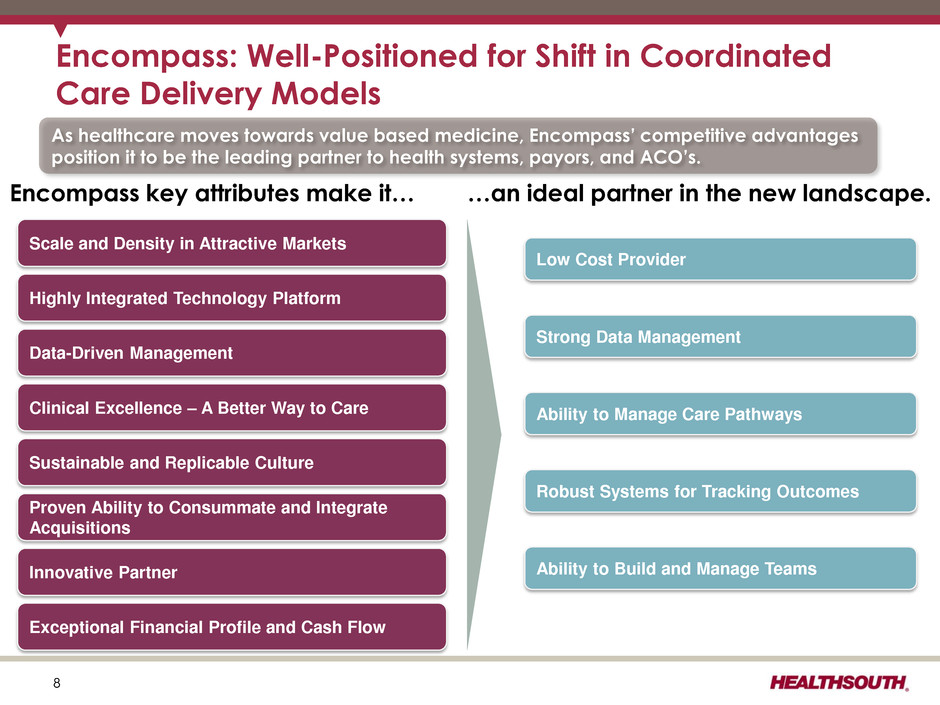

Encompass: Well-Positioned for Shift in Coordinated Care Delivery Models Clinical Excellence – A Better Way to Care Scale and Density in Attractive Markets Highly Integrated Technology Platform Data-Driven Management Proven Ability to Consummate and Integrate Acquisitions Innovative Partner Exceptional Financial Profile and Cash Flow Robust Systems for Tracking Outcomes Low Cost Provider Strong Data Management Ability to Manage Care Pathways Sustainable and Replicable Culture Ability to Build and Manage Teams Encompass key attributes make it… …an ideal partner in the new landscape. As healthcare moves towards value based medicine, Encompass’ competitive advantages position it to be the leading partner to health systems, payors, and ACO’s. 8

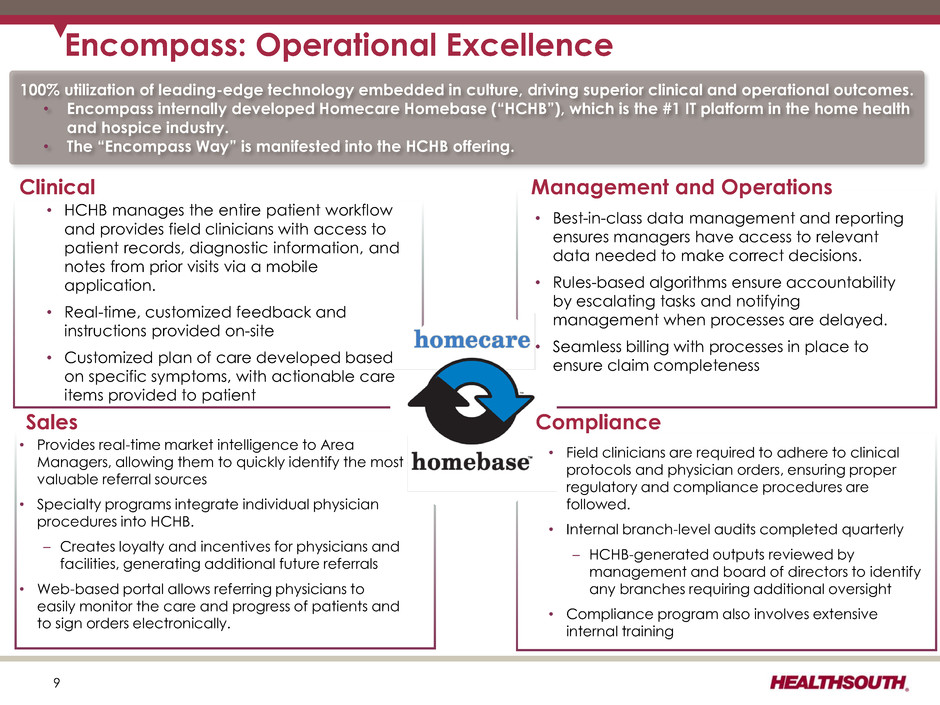

Encompass: Operational Excellence • HCHB manages the entire patient workflow and provides field clinicians with access to patient records, diagnostic information, and notes from prior visits via a mobile application. • Real-time, customized feedback and instructions provided on-site • Customized plan of care developed based on specific symptoms, with actionable care items provided to patient • Provides real-time market intelligence to Area Managers, allowing them to quickly identify the most valuable referral sources • Specialty programs integrate individual physician procedures into HCHB. – Creates loyalty and incentives for physicians and facilities, generating additional future referrals • Web-based portal allows referring physicians to easily monitor the care and progress of patients and to sign orders electronically. • Field clinicians are required to adhere to clinical protocols and physician orders, ensuring proper regulatory and compliance procedures are followed. • Internal branch-level audits completed quarterly – HCHB-generated outputs reviewed by management and board of directors to identify any branches requiring additional oversight • Compliance program also involves extensive internal training • Best-in-class data management and reporting ensures managers have access to relevant data needed to make correct decisions. • Rules-based algorithms ensure accountability by escalating tasks and notifying management when processes are delayed. • Seamless billing with processes in place to ensure claim completeness 100% utilization of leading-edge technology embedded in culture, driving superior clinical and operational outcomes. • Encompass internally developed Homecare Homebase (“HCHB”), which is the #1 IT platform in the home health and hospice industry. • The “Encompass Way” is manifested into the HCHB offering. Clinical Management and Operations Sales Compliance 9

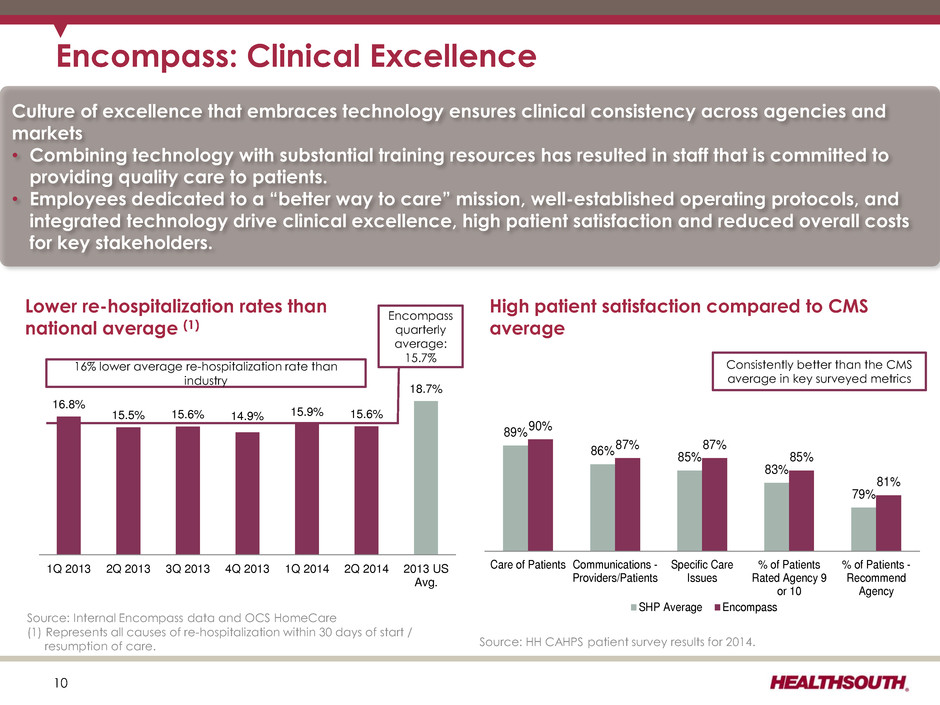

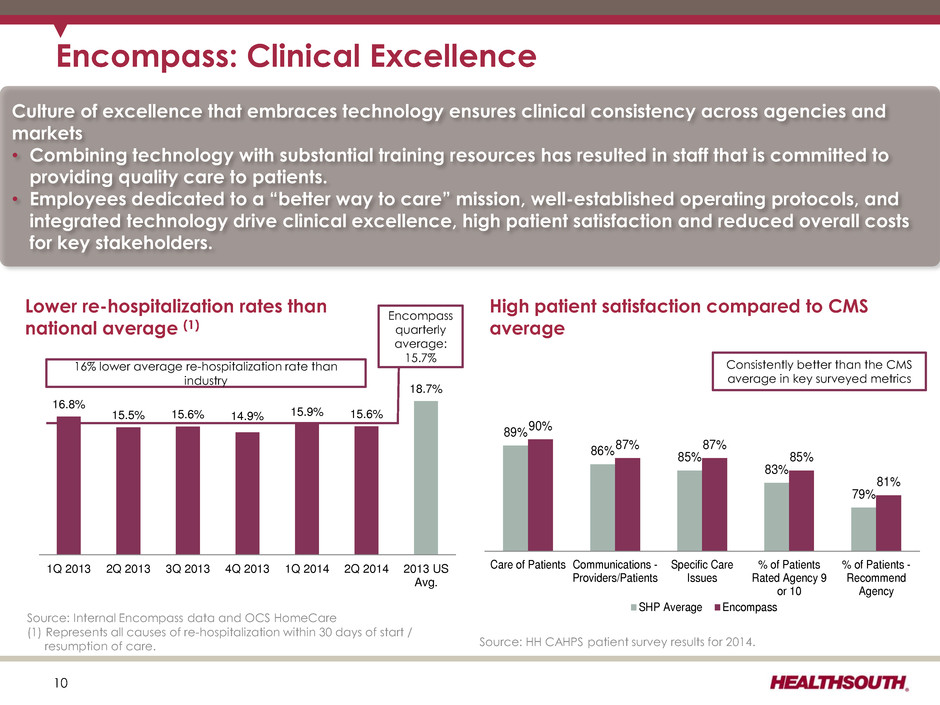

Encompass: Clinical Excellence 10 Consistently better than the CMS average in key surveyed metrics 16% lower average re-hospitalization rate than industry Encompass quarterly average: 15.7% 16.8% 15.5% 15.6% 14.9% 15.9% 15.6% 18.7% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 2Q 2014 2013 US Avg. Source: Internal Encompass data and OCS HomeCare (1) Represents all causes of re-hospitalization within 30 days of start / resumption of care. Source: HH CAHPS patient survey results for 2014. Lower re-hospitalization rates than national average (1) High patient satisfaction compared to CMS average 89% 86% 85% 83% 79% 90% 87% 87% 85% 81% Care of Patients Communications - Providers/Patients Specific Care Issues % of Patients Rated Agency 9 or 10 % of Patients - Recommend Agency SHP Average Encompass Culture of excellence that embraces technology ensures clinical consistency across agencies and markets • Combining technology with substantial training resources has resulted in staff that is committed to providing quality care to patients. • Employees dedicated to a “better way to care” mission, well-established operating protocols, and integrated technology drive clinical excellence, high patient satisfaction and reduced overall costs for key stakeholders.

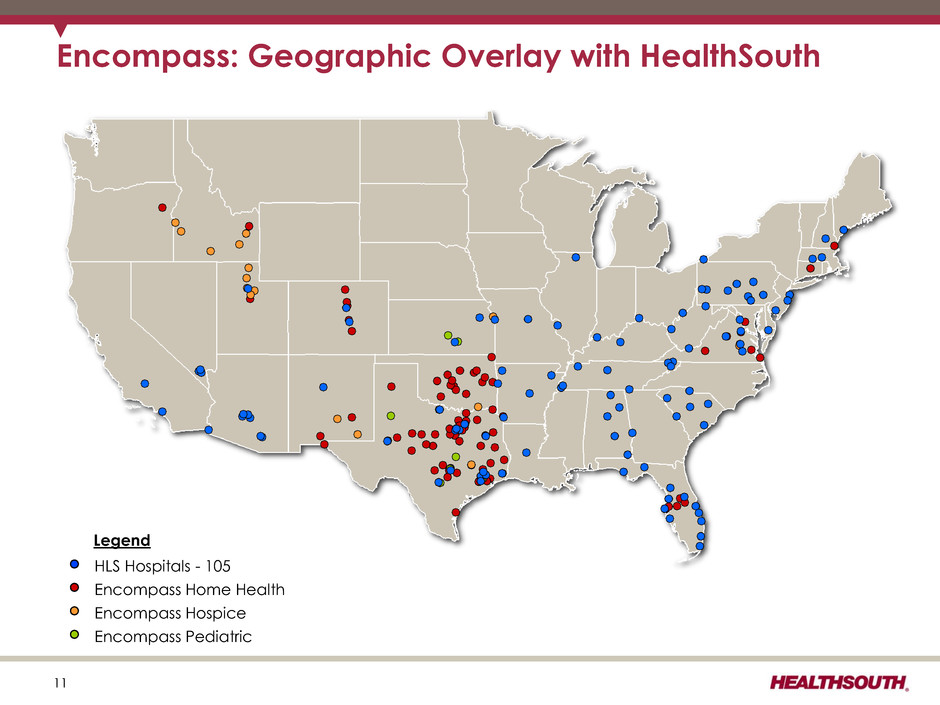

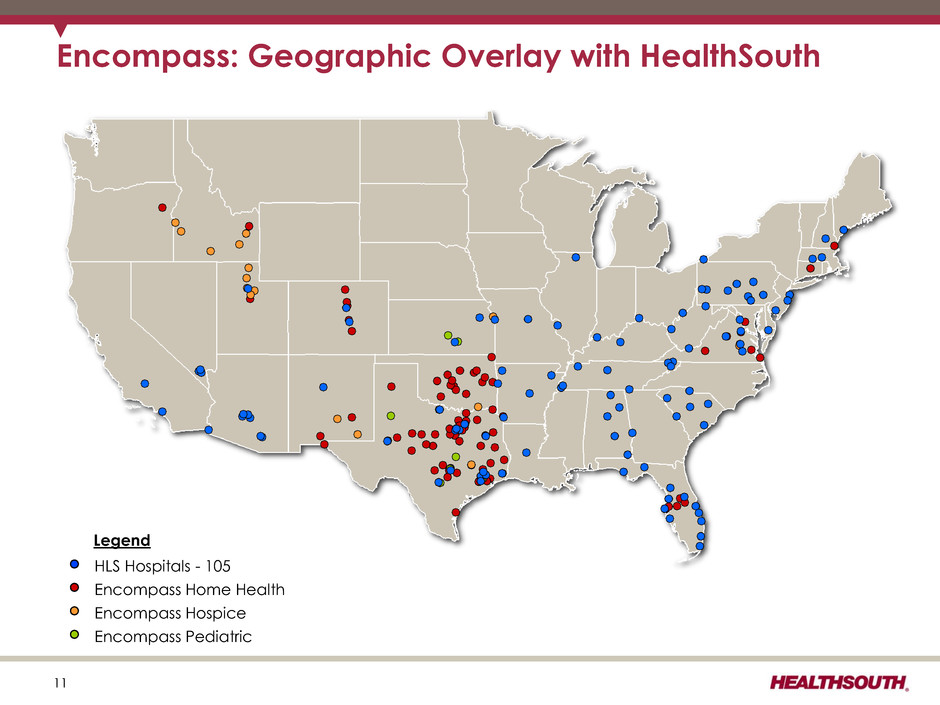

Encompass: Geographic Overlay with HealthSouth Encompass Home Health Legend Encompass Hospice Encompass Pediatric HLS Hospitals - 105 11

Transaction Summary • Expected Adjusted EBITDA (1) contribution of approx. $75 million in 2015 • Estimated 2015 EPS accretion to be determined based on financing structure Accretion • All cash; no share dilution • Encompass management rolling equity into the transaction Consideration • Funded with cash on hand and incremental debt • Initial leverage estimated at approx. 3.5x • Significant free cash flow generation provides path to return leverage to 3.0x or below Leverage 12 • $750 million Purchase Price • 9.5x expected 2015 EBITDA net of tax benefits (approx. $40 million in tax benefits) Deal Multiple (1) For discussion of matters related to non-GAAP information, see the Form 8-K with which this presentation was filed on November 24, 2014. • Expect to close by year-end 2014 Timing • Establish distinct HealthSouth home health and hospice business unit to be run by Encompass management • Retain Encompass headquarters and trade name • Integrate existing HealthSouth home health agencies into Encompass Operating Strategy

13