Fourth Quarter 2014 Earnings Call February 25, 2015 Supplemental Slides

2 The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect our current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, repurchases of securities, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance that any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2014, when filed, and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated February 24, 2015, to which the following supplemental slides are attached as Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements

3 Table of Contents Q4 2014 Summary ........................................................................................................................................... 4-8 Development .................................................................................................................................................... 9 Revenues (Q4 2014 vs. Q4 2013) ................................................................................................................... 10 Expenses (Q4 2014 vs. Q4 2013) .................................................................................................................... 11 Adjusted EBITDA ............................................................................................................................................. 12 Earnings per Share .......................................................................................................................................... 13 Adjusted Free Cash Flow ................................................................................................................................. 14-15 2015 Guidance - Adjusted EBITDA .................................................................................................................. 16 2015 Guidance - EPS....................................................................................................................................... 17 Adjusted Free Cash Flow and Tax Assumptions............................................................................................... 18 Priorities for Reinvesting Free Cash Flow ........................................................................................................ 19 Appendix........................................................................................................................................................... 20 Business Outlook: 2015 to 2017 ...................................................................................................................... 21-23 Our New-Store/Same-Store IRF Growth ......................................................................................................... 24 Debt Schedule and Maturity Profile ................................................................................................................. 25-26 Revenues & Expenses (Sequential) ................................................................................................................ 27 Revenues & Expenses (Full Year) ................................................................................................................... 28 Payment Sources (Percent of Revenues) ........................................................................................................ 29 Operational and Labor Metrics ......................................................................................................................... 30-31 Encompass Operational Metrics ...................................................................................................................... 32 Outstanding Share Summary, Warrant Information, and Conversion Price ..................................................... 33 Adjusted EBITDA History ................................................................................................................................. 34 Reconciliations to GAAP .................................................................................................................................. 35-38 End Notes ........................................................................................................................................................ 39-41

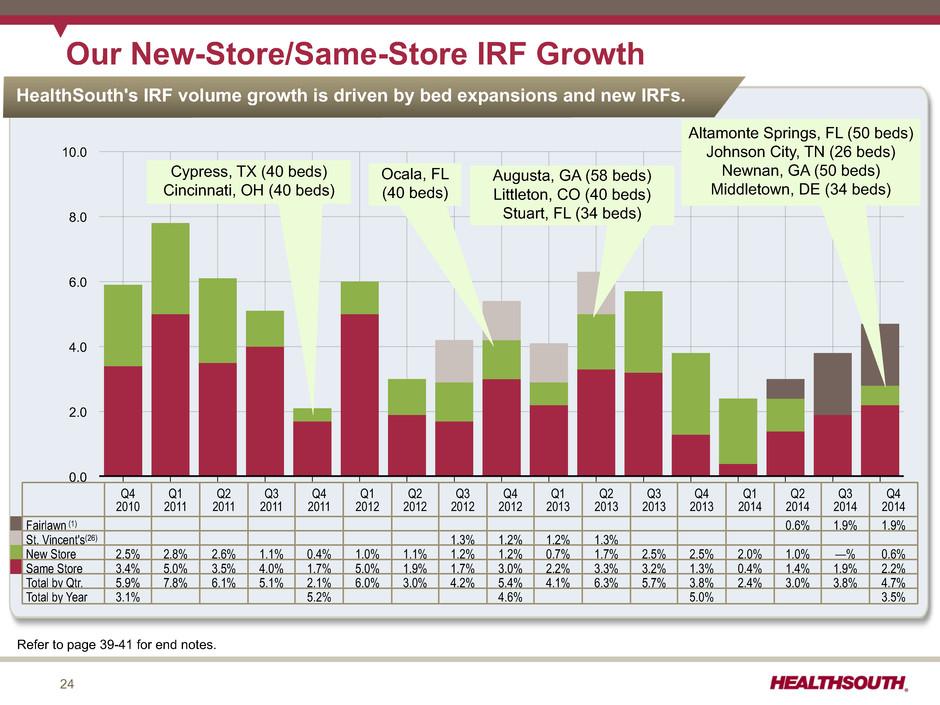

4 Q4 2014 Summary (Q4 2014 vs. Q4 2013) ü Revenue growth of 7.2% ― Inpatient revenue growth of 8.1% (210 bps attributable to Fairlawn(1); 150 bps attributable to RAC reserves in Q4 2013(2)) ▪ Discharge growth of 4.7% • Same-store discharge growth of 2.2% (negatively impacted by 30 bps for closure of 40 SNF beds in June 2014) • New-store discharge growth of 2.5% – Positively impacted by approx. 190 bps attributable to Fairlawn(1) – Negatively impacted by approx. 30 bps due to the delayed start-up at three new hospitals ▪ Revenue per discharge increased by 3.2% • Positively impacted by Medicare and managed care price adjustments and RAC reserves in Q4 2013(2) • Negatively impacted by the ramp-up at new hospitals ü Outpatient and other revenues decline of 6.1% ($2.1 million) ü Bad debt as a percent of revenue was 1.1% versus 0.6% in Q4 2013(2). Refer to pages 39-41 for end notes.

5 ü Salaries and benefits as a percent of revenue increased 150 bps mainly attributable to: ― Approx. $3 million lower reduction to self-insurance reserves for group medical and workers' compensation in Q4 2014 versus Q4 2013 ― Start-up costs for four new hospitals that opened in Q4 2014 ü Hospital-related expenses as a percent of revenue increased by 60 bps mainly attributable to: ― Approx. $4 million lower reduction to self-insurance reserves for general and professional liability in Q4 2014 versus Q4 2013 ― Start-up costs for four new hospitals that opened in Q4 2014 Q4 2014 Summary (Q4 2014 vs. Q4 2013) (cont.) Employees per Occupied Bed (EPOB) 4.5 3.0 1.5 0.0 Q4 2014 Q4 2013 3.52 3.48 Salaries, Wages & Benefits Hospital-related Expenses General & Administrative 80 40 0% of R ev en ue s Q4 2014 Q4 2013 73.9% 72.6% Refer to pages 39-41 for end notes. (3) (4)

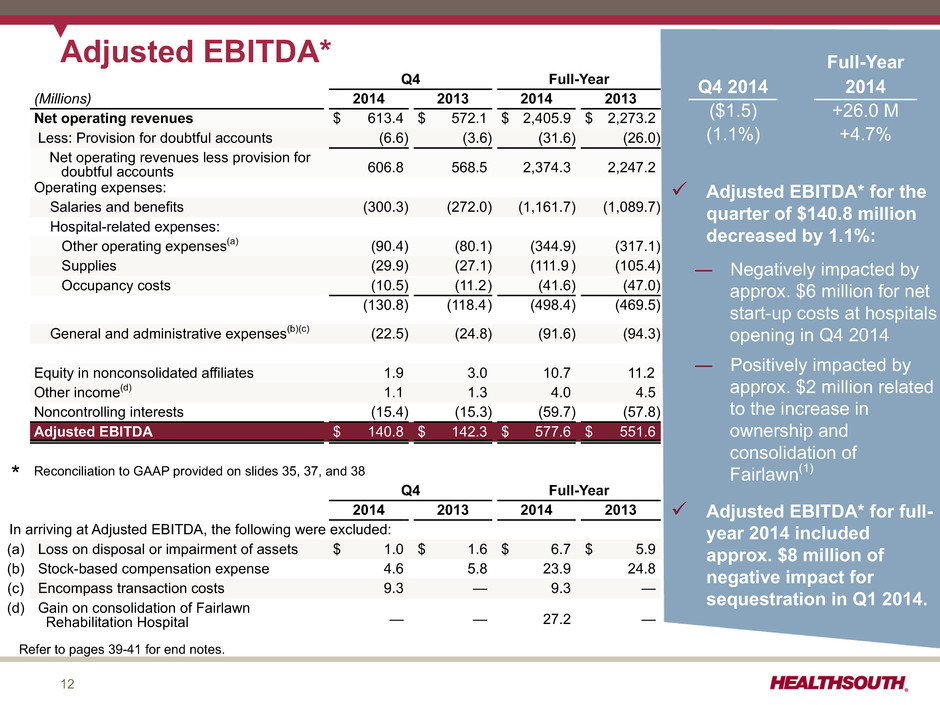

6 Q4 2014 Summary (Q4 2014 vs. Q4 2013) (cont.) ü Adjusted EBITDA* for the quarter of $140.8 million decreased by 1.1%: ― Negatively impacted by approx. $6 million for net start-up costs at hospitals opening in Q4 2014 ― Positively impacted by approx. $2 million related to the increase in ownership and consolidation of Fairlawn Rehabilitation Hospital(1) ü Diluted earnings(5) per share of $0.41 (see table on slide 13) negatively impacted by: ― $13.2 million, or $0.08 per share, loss on early extinguishment of debt ― $9.3 million, or $0.06 per share, for Encompass transaction costs *Reconciliation to GAAP provided on pages 35, 37, and 38 Refer to pages 39-41 for end notes.

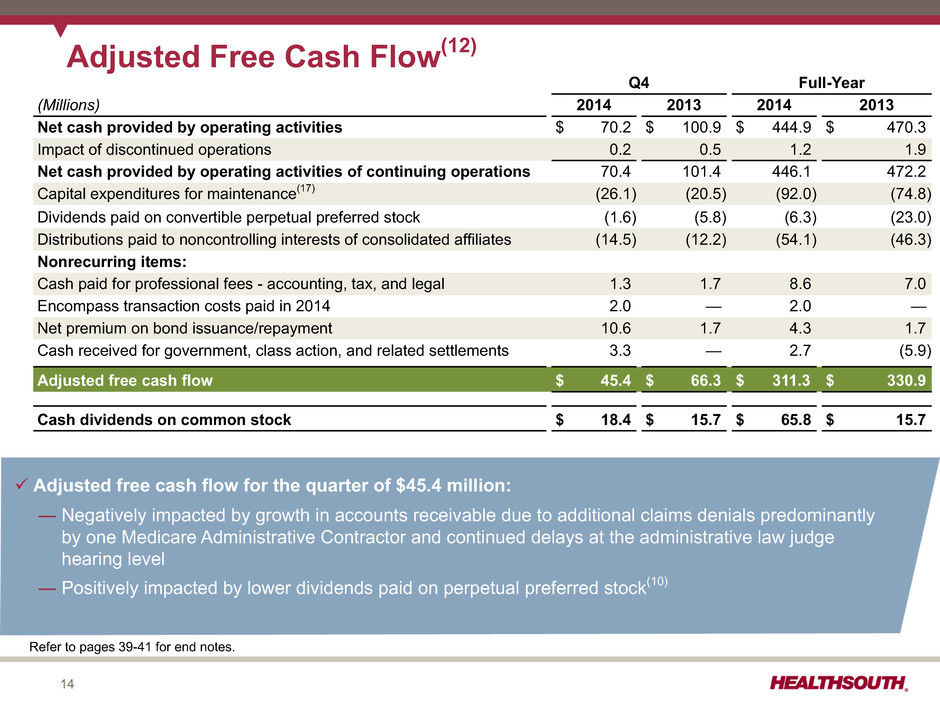

7 Q4 2014 Summary (cont.) ü Adjusted free cash flow* for the quarter of $45.4 million: ― Negatively impacted by growth in accounts receivable due to additional claims denials predominantly by one Medicare Administrative Contractor and continued delays at the administrative law judge hearing level ― Positively impacted by lower dividends paid on perpetual preferred stock(10) ü Balance sheet enhancements: ― In October, the Company redeemed all $271 million of its 7.25% senior notes due 2018. ― In December, the Company redeemed approx. $25 million of its 7.75% senior notes due 2022 (exercise of its 10% call rights). ― In December, the Company amended its credit agreement to add a $300 million term loan. ü Shareholder distributions: ― Paid quarterly cash dividend of $0.21 per share on October 15, 2014 ― Declared a $0.21 per share quarterly dividend paid on January 15, 2015 * Reconciliation to GAAP provided on page 14 Refer to pages 39-41 for end notes.

8 Q4 2014 Summary (cont.) ü Acquired Encompass Home Health and Hospice (closed December 31, 2014) — $750 million purchase price; $695.5 million in cash and $64.5 million in Encompass management equity roll — Transaction funded via credit facility • In January 2015, the Company issued $400 million of additional 5.75% senior notes due 2024 and used the proceeds to repay a portion of the term loan and revolver.(28) • Pro forma leverage of approx. 3.3x(6) — New HealthSouth home health and hospice operating segment • Retaining Encompass management and trade name • Will integrate existing 25 HealthSouth home health agencies into Encompass(27) — Accretive upon closing • Expected Adjusted EBITDA contribution of approx. $72 million in 2015 (after noncontrolling interest; Encompass management equity roll was greater than originally forecast, resulting in an increased estimate for noncontrolling interest). • Expected EPS accretion of approx. $0.15 in 2015 Refer to pages 39-41 for end notes.

9 Development ü Opened four new hospitals (three de novos; one acquisition): ― Altamonte Springs, FL (50 beds); opened October 2014 ― Johnson City, TN (26 beds); acquired Quillen Rehabilitation Hospital November 2014 ― Newnan, GA (50 beds); opened December 2014 ― Middletown, DE (34 beds); opened December 2014 ü New development: ― Entered into an agreement to acquire Cardinal Hill Rehabilitation Hospital in Lexington, KY (158 licensed inpatient rehabilitation beds and 74 licensed skilled nursing beds); expect to close in the first half of 2015 ― Continued progress on a new joint venture 50-bed inpatient rehabilitation hospital in Savannah, GA with Memorial University Medical Center; expect to be operational in first half 2015 ― Began construction of a 40-bed inpatient rehabilitation hospital in Franklin, TN; expect to be operational in Q4 2015 ― Continued the design and permitting process to construct a 50-bed inpatient rehabilitation hospital in Modesto, CA; expect to be operational in Q2 2016 ― Acquired land and began the design and permitting process on a 50-bed inpatient rehabilitation hospital in Murrieta, CA; expect to be operational in Q4 2017

10 Revenues (Q4 2014 vs. Q4 2013) Q4 Q4 Increase/ (Millions) 2014 2013 (Decrease) Inpatient $ 580.9 $ 537.5 8.1% Outpatient and other 32.5 34.6 (6.1%) Consolidated net operating $ 613.4 $ 572.1 7.2% (Actual Amounts) Discharges 34,465 32,906 4.7% Net patient revenue / discharge $ 16,855 $ 16,334 3.2% ü Revenue growth of 7.2% ― Inpatient revenue growth of 8.1% (210 bps attributable to Fairlawn(1); 150 bps attributable to RAC reserves in Q4 2013(2)) ▪ Discharge growth of 4.7% • Same-store discharge growth of 2.2% (negatively impacted by 30 bps for closure of 40 SNF beds in June 2014) • New-store discharge growth of 2.5% – Positively impacted by approx. 190 bps attributable to Fairlawn(1) – Negatively impacted by approx. 30 bps due to the delayed start-up at three new hospitals ▪ Revenue per discharge increased by 3.2% • Positively impacted by Medicare and managed care price adjustments and RAC reserves in Q4 2013(2) • Negatively impacted by the ramp-up at new hospitals ü Outpatient and other revenues decline of 6.1% ($2.1 million) ü Bad debt as a percent of revenue was 1.1% versus 0.6% in Q4 2013(2). Refer to pages 39-41 for end notes.

11 Expenses (Q4 2014 vs. Q4 2013) Q4 Q4 Increase/ (Millions) 2014 2013 (Decrease) Salaries and benefits $ 300.3 $ 272.0 10.4% Percent of net operating revenues 49.0% 47.5% 150 bps EPOB (employees per occupied bed) 3.52 3.48 1.1% Hospital-related expenses(3) $ 130.8 $ 118.4 10.5% (other operating, supplies, occupancy) Percent of net operating revenues 21.3% 20.7% 60 bps General and administrative(4) $ 22.5 $ 24.8 (9.3%) (excludes stock-based compensation) Percent of net operating revenues 3.7% 4.3% (60 bps) Provision for doubtful accounts $ 6.6 $ 3.6 83.3% Percent of net operating revenues 1.1% 0.6% 50 bps ü Salaries and benefits as a percent of revenue increased 150 bps mainly attributable to: ― Approx. $3 million lower reduction to self-insurance reserves for group medical and workers' compensation in Q4 2014 versus Q4 2013 ― Start-up costs for four new hospitals that opened in Q4 2014 ü Hospital-related expenses as a percent of revenue increased by 60 bps mainly attributable to: ― Approx. $4 million lower reduction to self-insurance reserves for general and professional liability in Q4 2014 versus Q4 2013 ― Start-up costs for four new hospitals that opened in Q4 2014 Refer to pages 39-41 for end notes.

12 Adjusted EBITDA* Q4 Full-Year (Millions) 2014 2013 2014 2013 Net operating revenues $ 613.4 $ 572.1 $ 2,405.9 $ 2,273.2 Less: Provision for doubtful accounts (6.6) (3.6) (31.6) (26.0) Net operating revenues less provision for doubtful accounts 606.8 568.5 2,374.3 2,247.2 Operating expenses: Salaries and benefits (300.3) (272.0) (1,161.7) (1,089.7) Hospital-related expenses: Other operating expenses(a) (90.4) (80.1) (344.9) (317.1) Supplies (29.9) (27.1) (111.9 ) (105.4) Occupancy costs (10.5) (11.2) (41.6) (47.0) (130.8) (118.4) (498.4) (469.5) General and administrative expenses(b)(c) (22.5) (24.8) (91.6) (94.3) Equity in nonconsolidated affiliates 1.9 3.0 10.7 11.2 Other income(d) 1.1 1.3 4.0 4.5 Noncontrolling interests (15.4) (15.3) (59.7) (57.8) Adjusted EBITDA $ 140.8 $ 142.3 $ 577.6 $ 551.6 * Reconciliation to GAAP provided on slides 35, 37, and 38 Q4 Full-Year 2014 2013 2014 2013 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal or impairment of assets $ 1.0 $ 1.6 $ 6.7 $ 5.9 (b) Stock-based compensation expense 4.6 5.8 23.9 24.8 (c) Encompass transaction costs 9.3 — 9.3 — (d) Gain on consolidation of Fairlawn Rehabilitation Hospital — — 27.2 — Full-Year Q4 2014 2014 ($1.5) +26.0 M (1.1%) +4.7% ü Adjusted EBITDA* for the quarter of $140.8 million decreased by 1.1%: ― Negatively impacted by approx. $6 million for net start-up costs at hospitals opening in Q4 2014 ― Positively impacted by approx. $2 million related to the increase in ownership and consolidation of Fairlawn(1) ü Adjusted EBITDA* for full- year 2014 included approx. $8 million of negative impact for sequestration in Q1 2014. Refer to pages 39-41 for end notes.

13 Earnings per Share Q4 2014 reflects: ü Diluted earnings(5) per share of $0.41 negatively impacted by: ― $13.2 million, or $0.08 per share, loss on early extinguishment of debt ― $9.3 million, or $0.06 per share, for Encompass transaction costs Full-year 2013 reflects: ― An approx. $115 million, or $1.31 per basic share, benefit related to a settlement with the IRS(9) ― $71.6 million, or $0.81 per share, repurchase premium on the preferred stock in the exchange transaction(10) Refer to pages 39-41 for end notes. Q4 Full-Year (In Millions, Except Per Share Data) 2014 2013 2014 2013 Adjusted EBITDA $ 140.8 $ 142.3 $ 577.6 $ 551.6 Interest expense and amortization of debt discounts and fees (25.7) (26.5) (109.2) (100.4) Depreciation and amortization (27.5) (25.2) (107.7) (94.7) Stock-based compensation expense (4.6) (5.8) (23.9) (24.8) Other, including noncash loss on disposal or impairment of assets (1.0) (1.6) (6.7) (5.9) 82.0 83.2 330.1 325.8 Certain nonrecurring items: Government, class action, and related settlements 0.9 0.2 1.7 23.5 Loss on early extinguishment of debt (13.2) (2.4) (13.2) (2.4) Gain on consolidation of Fairlawn Rehabilitation Hospital — — 27.2 — Professional fees - accounting, tax, and legal (1.7) (1.7) (9.3) (9.5) Encompass transaction costs (9.3) — (9.3) — Pre-tax income 58.7 79.3 327.2 337.4 Income tax expense(7) (19.3) (8) (30.5) (110.7) (8) (12.7) (9) Income from continuing operations(5) $ 39.4 $ 48.8 $ 216.5 $ 324.7 Income allocated to participating securities (0.3) — (2.3) (3.4) Convertible perpetual preferred dividends (1.6) (3.8) (6.3) (21.0) Repurchase of convertible perpetual preferred stock(10) — (71.6) — (71.6) Interest and amortization on 2.0% Convertible Senior Subordinated Notes (net of tax)(11) 2.2 1.0 9.0 1.0 Basic shares 86.6 86.4 86.8 88.1 Diluted shares 100.8 100.8 100.7 102.1 Basic earnings per share (5) $ 0.43 $ (0.31) $ 2.40 $ 2.59 Diluted earnings per share(5) (11) $ 0.41 $ (0.31) (14) $ 2.24 $ 2.59 (14)

14 Adjusted Free Cash Flow(12) Q4 Full-Year (Millions) 2014 2013 2014 2013 Net cash provided by operating activities $ 70.2 $ 100.9 $ 444.9 $ 470.3 Impact of discontinued operations 0.2 0.5 1.2 1.9 Net cash provided by operating activities of continuing operations 70.4 101.4 446.1 472.2 Capital expenditures for maintenance(17) (26.1) (20.5) (92.0) (74.8) Dividends paid on convertible perpetual preferred stock (1.6) (5.8) (6.3) (23.0) Distributions paid to noncontrolling interests of consolidated affiliates (14.5) (12.2) (54.1) (46.3) Nonrecurring items: Cash paid for professional fees - accounting, tax, and legal 1.3 1.7 8.6 7.0 Encompass transaction costs paid in 2014 2.0 — 2.0 — Net premium on bond issuance/repayment 10.6 1.7 4.3 1.7 Cash received for government, class action, and related settlements 3.3 — 2.7 (5.9) Adjusted free cash flow $ 45.4 $ 66.3 $ 311.3 $ 330.9 Cash dividends on common stock $ 18.4 $ 15.7 $ 65.8 $ 15.7 ü Adjusted free cash flow for the quarter of $45.4 million: ― Negatively impacted by growth in accounts receivable due to additional claims denials predominantly by one Medicare Administrative Contractor and continued delays at the administrative law judge hearing level ― Positively impacted by lower dividends paid on perpetual preferred stock(10) Refer to pages 39-41 for end notes.

15 Adjusted Free Cash Flow* Operating Cash Flows Investing and Financing Cash Flows 12 Months Change (Millions) 2014 2013 $ % Adjusted free cash flow(12) $311.3 $330.9 (19.6) (5.9)% Adjusted Free Cash Flow 12 Mos. 2013 Adjusted EBITDA Cash Interest Expense Cash Tax Payments, Net of Refunds Working Capital and Other Maintenance Capital Expenditures Preferred Dividends Adjusted Free Cash Flow 12 Mos. 2014 $330.9 $26.0 ($1.1) ($8.7) ($35.3) ($17.2) $16.7 $311.3 Operating Cash Flows Investing and Financing Cash Flows ü Adjusted free cash flow* for the year of $311.3 million: ― Benefited from increased Adjusted EBITDA and lower dividends paid on perpetual preferred stock(10) ― Working capital negatively impacted by growth in accounts receivable due to additional claims denials predominantly by one Medicare Administrative Contractor and continued delays at the administrative law judge hearing level — Maintenance capital expenditures negatively impacted by approx. $12 million for equipment purchases that were invoiced in Q4 2013 and paid in early 2014 *Reconciliation to GAAP provided on page 14 Refer to pages 39-41 for end notes.

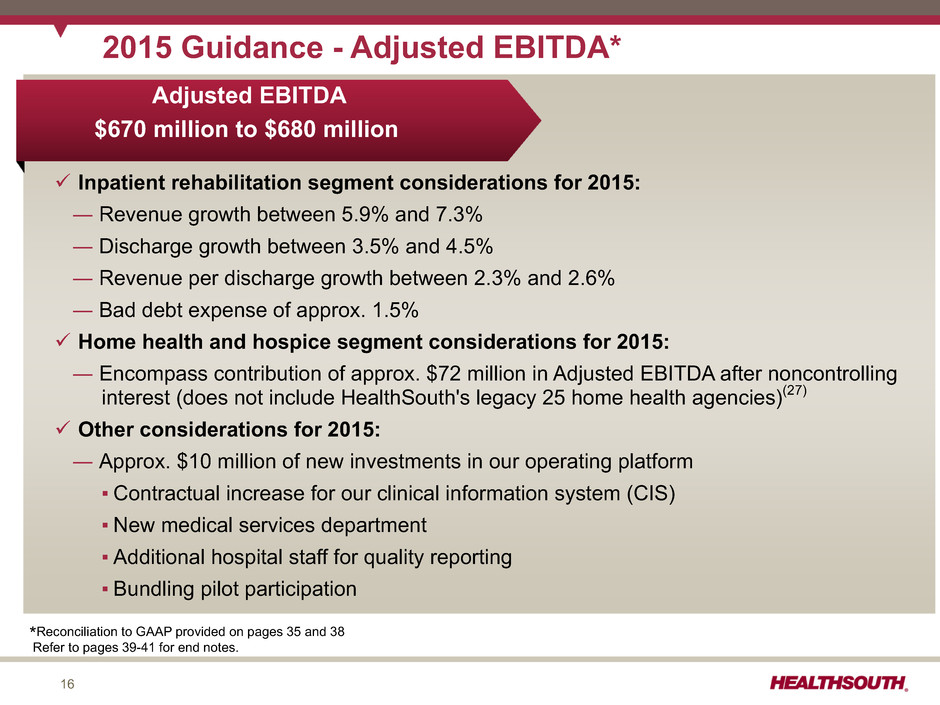

16 2015 Guidance - Adjusted EBITDA* ü Inpatient rehabilitation segment considerations for 2015: ― Revenue growth between 5.9% and 7.3% ― Discharge growth between 3.5% and 4.5% ― Revenue per discharge growth between 2.3% and 2.6% ― Bad debt expense of approx. 1.5% ü Home health and hospice segment considerations for 2015: ― Encompass contribution of approx. $72 million in Adjusted EBITDA after noncontrolling interest (does not include HealthSouth's legacy 25 home health agencies)(27) ü Other considerations for 2015: ― Approx. $10 million of new investments in our operating platform ▪ Contractual increase for our clinical information system (CIS) ▪ New medical services department ▪ Additional hospital staff for quality reporting ▪ Bundling pilot participation Adjusted EBITDA $670 million to $680 million *Reconciliation to GAAP provided on pages 35 and 38 Refer to pages 39-41 for end notes.

17 2015 Guidance - EPS Considerations: ü Higher depreciation and amortization related to recent capital investments ü Higher interest expense and amortization of debt discounts and fees related to the increased debt for the Encompass acquisition ü Assumes provision for income tax of approx. 40% (cash taxes expected to be $15 - $20 million for full-year 2015) ü Share count is before the effect of any potential share repurchase activity. ü Diluted share count includes 3.2 million shares for the convertible preferred security under which the Company has a forced conversion option at a common stock price of $44.55(10). EPS Guidance Actual Low High (In Millions, Except Per Share Data) 2014 2015 Adjusted EBITDA $ 577.6 $ 670 $ 680 Interest expense and amortization of debt discounts and fees (109.2) (129) Depreciation and amortization (107.7) (134) Stock-based compensation expense (23.9) (28) Other, including noncash loss on disposal and impairment of assets (6.7) (7) 330.1 372 382 Certain Nonrecurring Expenses: Government, class action, and related settlements 1.7 — Professional fees - accounting, tax, and legal (9.3) (9) Loss on early extinguishment of debt (13.2) (2) Gain related to consolidation of Fairlawn Rehabilitation Hospital(1) 27.2 — Encompass transaction costs (9.3) — Pre-tax income 327.2 361 371 Income tax (110.7) (144) (148) Income from continuing operations(5) $ 216.5 $ 217 $ 223 Income allocated to participating securities(13) $ (2.3) $ (2) $ (2) Convertible perpetual preferred dividends(13) (6.3) (6) (6) After-tax convertible debt interest expense(11) 9.0 9 9 Basic shares(13) 86.8 87.1 87.1 Diluted shares(11) 100.7 101.1 101.1 Earnings per share $ 2.24 $ 2.24 $ 2.29 Earnings per Share from Continuing Operations Attributable to HealthSouth(5) $ 2.24 to $ 2.29 Refer to pages 39-41 for end notes.

18 Adjusted Free Cash Flow* and Tax Assumptions Certain Cash Flow Items(12) (millions) 2015 Assumptions 2014 Actual 2013 Actual • Cash interest expense(15) $110 to $115 $96.5 $95.4 • Cash payments for taxes, net of refunds $15 to $20 $16.4 $7.7 • Working Capital and Other(16) $40 to $50 $55.0 $19.6 • Maintenance CAPEX(17) $90 to $100 $92.0 $74.8 • Dividends paid on preferred stock $6 $6.3 $23.0 • Dividends on common stock(12) $74 $65.8 $15.7 GAAP Tax Considerations: • As of 12/31/14, the Company’s federal NOL had a gross balance of approx. $630 million. • The Company has a remaining valuation allowance of approx. $23 million related to state NOLs. • The Encompass acquisition includes an approx. $40 million (NPV) tax benefit (in addition to the Company's NOLs). * Reconciliation to GAAP provided on page 14 Refer to pages 39-41 for end notes

19 Priorities for Reinvesting Free Cash Flow Opportunity «« Remain s Highest Priorit y 2015 2014 2013 Assumptions Actuals Actuals IRF bed expansions $30 to $40 $23.6 $24.9 New IRF's - De novos 40 to 60 53.7 26.6 - Acquisitions TBD 20.2 28.9 New home health and hospice acquisitions 30 to 40 674.6(18) — $100 to $140, excluding IRF acquisitions $772.1 $80.4 2015 2014 2013 Assumptions Actuals Actuals Debt (borrowings) redemptions, net(10)(18)(28) TBD $(614.1) $(264.0) Purchase leased properties TBD 20.0 90.3 Convertible preferred stock repurchase(10) TBD — 249.0 Cash dividends on common stock(19) 74 65.8 15.7 Common stock repurchase (~$207 million authorization remaining as of December 31, 2014)(20) TBD 43.1 234.1 TBD $(485.2) $325.1 Complements Growth Investments Shareholder Distributions Growth in Core Business Debt Reduction Refer to pages 39-41 for end notes.

Appendix

21 Key Operational Initiatives Shareholder Distributions Core Growth Complementary Growth 2015 2016 2017 • Quarterly cash dividends • Opportunistic repurchases ($207 million authorization remaining as of December 31, 2014) • Target Leverage < 3.0x (subject to shareholder value-creating opportunities) Strong Balance Sheet • Same-store IRF Growth • New-Store IRF growth (Target 4-6/Year) • Same-store Home Health and Hospice Growth • New-store Home Health and Hospice Growth • Consider acquisitions of other complementary post-acute businesses • Enhance clinical outcomes and patient experience • Implementing CIS: installed in 58 IRF's at YE 2014; Expect all IRF's to be on system by YE 2017 • Participate in new delivery and payment models (ACO's; bundling) Strategy Componen t Business Outlook: 2015 to 2017(21) • Adjusted EBITDA* CAGR: 5% - 9% (2014 base-year Adjusted EBITDA includes an estimate for Encompass)(22) • Continued strong free cash flow generation Business Model : *Reconciliation to GAAP provided on slides 35 and 38 Refer to pages 39-41 for end notes.

22 Volume Inpatient Rehabilitation Home Health & Hospice Medicare Pricing Inpatient Rehabilitation Approx. 74% of Revenue Home Health & Hospice Approx. 83% of Revenue FY 2015 (23) Q414-Q315 FY 2016 Q415-Q316 FY 2017 Q416-Q317 FY 2015 (24) Q115-Q415 FY 2016 Q116-Q416 FY 2017 Q117-Q117 Market basket update 2.9% 2.9% 2.9% 2.6% 2.6% 2.6% Healthcare reform reduction (20) bps (20) bps (75) bps - - - Healthcare reform rebasing adjustment - - - (2.4%)(41) (2.8%) (2.8%) Healthcare reform productivity adjustment (50) bps Approx. (100) bps Approx. (100) bps (50) bps Approx. (100) bps Approx. (100) bps Net impact 2.2% 1.7% 1.15% (0.3%) (1.2%) (1.2%) Managed Care Pricing Inpatient Rehabilitation Approx. 19% of Revenue Home Health & Hospice Approx. 10% of Revenue 2015 2016 2017 2015 2016 2017 Expected increases 2-4% 2-4% 2-4% 2-4% 2-4% 2-4% Business Outlook: Revenue Assumptions 2% Sequestration(25) • 2.5% to 3.5% annual discharge growth (excludes acquisitions) • Includes bed expansions, de novos and unit consolidations • 10% to 15% annual episode growth • Includes $35-$40 million per annum in agency acquisitions Refer to pages 39-41 for end notes.

23 Inpatient Rehabilitation Home Health and Hospice Business Outlook: Labor and Other Expense Assumptions Salaries & Benefits ~70% Hospital Expenses ~30% Salaries and Benefits 2015 2016 2017 Merit increases 2.25-2.75% 2.5-3.0% 2.5-3.0% Benefit costs 5-8% 5-8% 5-8% Hospital Expenses • Other operating expenses and supply costs tracking with inflation Salaries & Benefits ~86% Other Expenses ~14% Home Health Expenses • Other operating expenses and supply costs tracking with inflation Percent of Salaries & Benefits Salaries ~ 88% Benefit ~12%

24 10.0 8.0 6.0 4.0 2.0 0.0 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Our New-Store/Same-Store IRF Growth HealthSouth's IRF volume growth is driven by bed expansions and new IRFs. Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Fairlawn (1) 0.6% 1.9% 1.9% St. Vincent's(26) 1.3% 1.2% 1.2% 1.3% New Store 2.5% 2.8% 2.6% 1.1% 0.4% 1.0% 1.1% 1.2% 1.2% 0.7% 1.7% 2.5% 2.5% 2.0% 1.0% —% 0.6% Same Store 3.4% 5.0% 3.5% 4.0% 1.7% 5.0% 1.9% 1.7% 3.0% 2.2% 3.3% 3.2% 1.3% 0.4% 1.4% 1.9% 2.2% Total by Qtr. 5.9% 7.8% 6.1% 5.1% 2.1% 6.0% 3.0% 4.2% 5.4% 4.1% 6.3% 5.7% 3.8% 2.4% 3.0% 3.8% 4.7% Total by Year 3.1% 5.2% 4.6% 5.0% 3.5% Altamonte Springs, FL (50 beds) Johnson City, TN (26 beds) Newnan, GA (50 beds) Middletown, DE (34 beds) Cypress, TX (40 beds) Cincinnati, OH (40 beds) Ocala, FL (40 beds) Augusta, GA (58 beds) Littleton, CO (40 beds) Stuart, FL (34 beds) Refer to page 39-41 for end notes.

25 Debt Schedule Credit Rating Pro Forma Post Pro Forma Change in S&P Moody Issuance and Dec. 31, Dec. 31, Debt vs. (Millions) Corporate BB- Ba3 Term Loan Paydown(28) 2014(28) 2013 YE 2013 Advances under $600 million revolving credit facility, September 2019 - LIBOR +175bps(28) BB+ Baa3 $ 175.0 $ 325.0 $ 45.0 $ 130.0 Term loan facility, September 2019 - LIBOR +175bps(28) BB+ Baa3 200.0 450.0 — 200.0 Bonds Payable: 7.25% Senior Notes due 2018(28) BB- Ba3 — — 272.4 (272.4) 8.125% Senior Notes due 2020 BB- Ba3 287.0 287.0 286.6 0.4 7.75% Senior Notes due 2022(28) BB- Ba3 227.1 227.1 252.5 (25.4) 5.75% Senior Notes due 2024(28) BB- Ba3 864.2 456.2 275.0 589.2 2.00% Convertible Senior Subordinated Notes due 2043(10a) 258.0 258.0 249.5 8.5 Other notes payable 41.6 41.6 47.6 (6.0) Capital lease obligations 86.7 86.7 88.9 (2.2) Long-term debt $ 2,139.6 $ 2,131.6 $1,517.5 $ 622.1 Debt to Adjusted EBITDA*(30) 3.7x 3.7x 2.8x *Reconciliation to GAAP provided on slides 35, 37, and 38 Refer to pages 39-41 for end notes.

26 2015 2018 2019 2019 2020 2021 2022 2023 2024 2043 $290 Senior Notes 8.125% $850 Senior Notes 5.75% $320 Conv. Sr. Sub. Notes(10a) 2.0% $226 Senior Notes 7.75% $175 Drawn + $32 LC Holders have a put option in 2020 Proforma Dec. 31, 2014 for Issuance and Credit Facility Repayments(28)(29) Debt Maturity Profile - Face Value Call schedule: • February 15, 2015 (price 104.063) • February 15, 2016 (price 102.708) • February 15, 2017 (price 101.354) • February 15, 2018 and thereafter (price 100.000) HealthSouth is positioned with a cost-efficient, flexible capital structure. ($ in millions) $393 Undrawn $200 Term Loan(28) Refer to pages 39-41 for end notes. In January 2015, the Company issued $400 million of additional 5.75% senior notes due 2024 and used the proceeds to repay a portion of the term loan and revolver.(28) Callable beginning September 2015 Callable beginning November 2017 $2.5 million quarterly term loan payments begin March 2015.

27 Revenues & Expenses (Sequential) Q4 Q3 Increase/ Revenues (millions) 2014 2014 (Decrease) Inpatient $ 580.9 $ 563.7 3.1% Outpatient and other 32.5 33.2 (2.1%) Consolidated net operating $ 613.4 $ 596.9 2.8% (Actual Amounts) Discharges 34,465 33,541 2.8% Net patient revenue / discharge $ 16,855 $ 16,806 0.3% Expenses (millions) Salaries and benefits $ 300.3 $ 290.0 3.6% Percent of net operating revenues 49.0% 48.6% 40 bps EPOB (employees per occupied bed) 3.52 3.50 0.6% Hospital-related expenses(3) $ 130.8 $ 123.6 5.8% (other operating, supplies, occupancy) Percent of net operating revenues 21.3% 20.7% 60 bps General and administrative(4) $ 22.5 $ 22.5 —% (excludes stock-based compensation) Percent of net operating revenues 3.7% 3.8% (10 bps) Provision for doubtful acounts $ 6.6 $ 8.2 (19.5%) Percent of net operating revenues 1.1% 1.4% (30 bps) Refer to pages 39-41 for end notes.

28 Revenues & Expenses (Full Year) 12-Months 12-Months Increase/ Revenues (millions) 2014 2013 (Decrease Inpatient $ 2,272.5 $ 2,130.8 6.7% Outpatient and other 133.4 142.4 (6.3%) Consolidated net operating $ 2,405.9 $ 2,273.2 5.8% (Actual Amounts) Discharges 134,515 129,988 3.5% Net patient revenue / discharge $ 16,894 $ 16,392 3.1% Expenses (millions) Salaries and benefits $ 1,161.7 $ 1,089.7 6.6% Percent of net operating revenues 48.3% 47.9% 40 bps EPOB (employees per occupied bed) 3.44 3.44 —% Hospital-related expenses(3) $ 498.4 $ 469.5 6.2% (other operating, supplies, occupancy) Percent of net operating revenues 20.7% 20.7% — bps General and administrative(4) $ 91.6 $ 94.3 (2.9%) (excludes stock-based compensation) Percent of net operating revenues 3.8% 4.1% (30 bps) Provision for doubtful acounts $ 31.6 $ 26.0 21.5% Percent of net operating revenues 1.3% 1.1% 20 bps Refer to pages 39-41 for end notes.

29 Payment Sources (Percent of Revenues) Q4 Full-Year 2014 2013 2014 2013 Medicare 73.9% 74.7% 74.1% 74.5% Medicaid 2.0% 1.2% 1.8% 1.2% Workers' compensation 1.1% 1.2% 1.2% 1.2% Managed care and other discount plans, including Medicare Advantage(31) 18.8% 18.3% 18.6% 18.5% Other third-party payors 1.9% 1.8% 1.8% 1.8% Patients 0.9% 1.1% 1.0% 1.1% Other income 1.4% 1.7% 1.5% 1.7% Total 100.0% 100.0% 100.0% 100.0% Refer to pages 39-41 for end notes.

30 Operational and Labor Metrics Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year 2014 2014 2014 2014 2013 2013 2013 2013 2014 2013 (In Millions) Net patient revenue- inpatient $ 580.9 $ 563.7 $ 569.7 $ 558.2 $ 537.5 $ 528.8 $ 527.4 $ 537.1 $ 2,272.5 $ 2,130.8 Net patient revenue- outpatient and other revenues 32.5 33.2 34.7 33.0 34.6 35.2 37.1 35.5 133.4 142.4 Net operating revenues $ 613.4 $ 596.9 $ 604.4 $ 591.2 $ 572.1 $ 564.0 $ 564.5 $ 572.6 $ 2,405.9 $ 2,273.2 (Actual Amounts) Discharges(32) 34,465 33,541 33,620 32,889 32,906 32,307 32,645 32,130 134,515 129,988 Outpatient visits 184,067 183,450 189,540 182,170 192,474 202,479 211,207 200,471 739,227 806,631 Average length of stay 12.9 13.2 13.1 13.4 13.1 13.3 13.2 13.5 13.2 13.3 Occupancy % 68.4% 69.6% 70.5% 71.9% 68.6% 69.0% 69.9% 72.4% 68.4% 69.3% # of licensed beds 7,095 6,890 6,884 6,825 6,825 6,789 6,777 6,646 7,095 6,825 Occupied beds 4,853 4,795 4,853 4,907 4,682 4,684 4,737 4,812 4,853 4,730 Full-time equivalents (FTEs)(33) 17,020 16,719 16,473 16,301 16,243 16,295 16,257 15,894 16,628 16,172 Contract labor 86 77 99 83 72 76 72 85 86 76 Total FTE and contract labor 17,106 16,796 16,572 16,384 16,315 16,371 16,329 15,979 16,714 16,248 EPOB(34) 3.52 3.50 3.41 3.34 3.48 3.50 3.45 3.32 3.44 3.44 Refer to pages 39-41 for end notes.

31 Fairlawn Rehabilitation Hospital as Consolidated Entity Fairlawn Rehabilitation Hospital as Equity Method Entity Fairlawn Rehabilitation Hospital as Consolidated Entity Fairlawn Rehabilitation Hospital as Equity Method Entity Q4 2014 As Reported Q4 2014 Without Accounting or Ownership Change Difference Full-Year 2014 As Reported Full-Year 2014 Without Accounting or Ownership Change Difference (In Millions) Net patient revenue-inpatient $ 580.9 $ 569.7 $ 11.2 $ 2,272.5 $ 2,246.3 $ 26.2 Net patient revenue-outpatient and other revenues 32.5 32.8 (0.3) 133.4 134.1 (0.7) Net operating revenues $ 613.4 $ 602.5 $ 10.9 $ 2,405.9 $ 2,380.4 $ 25.5 Actual Amounts Discharges(32) 34,465 33,825 640 134,515 133,035 1,480 Outpatient visits 184,067 181,544 2,523 739,227 733,257 5,970 Average length of stay (days) 12.9 13.0 (0.1) 13.2 13.2 — Occupancy % 68.4% 68.2% 0.2% 68.4% 68.7% (0.3%) # of licensed beds 7,095 6,985 110 7,095 6,985 110 Occupied beds 4,853 4,764 89 4,853 4,799 54 Full-time equivalents (FTEs)(33) 17,020 16,736 284 16,628 16,462 166 Contract labor 86 86 — 86 86 — Total FTE and contract labor 17,106 16,822 284 16,714 16,548 166 EPOB(34) 3.52 3.53 (0.01) 3.44 3.45 (0.01) Operational and Labor Metrics Impact of Fairlawn Rehabilitation Hospital Consolidation(1) Refer to pages 39-41 for end notes.

32 Medicare: 83% Medicaid: 7% Medicare Advantage, commercial, and other: 10% 2013 2014 39,350 49,032 Encompass Operational Metrics 2013 2014 $302 $369 Revenue Payor Mix(40) Home Health Home Health Hospice Admissions Total Episodes Daily Census 2013 2014 80,594 98,461 Visits per Episode 20.5 19.9 2013 2014 268 387 Refer to page 39-41 for end notes. ($million)

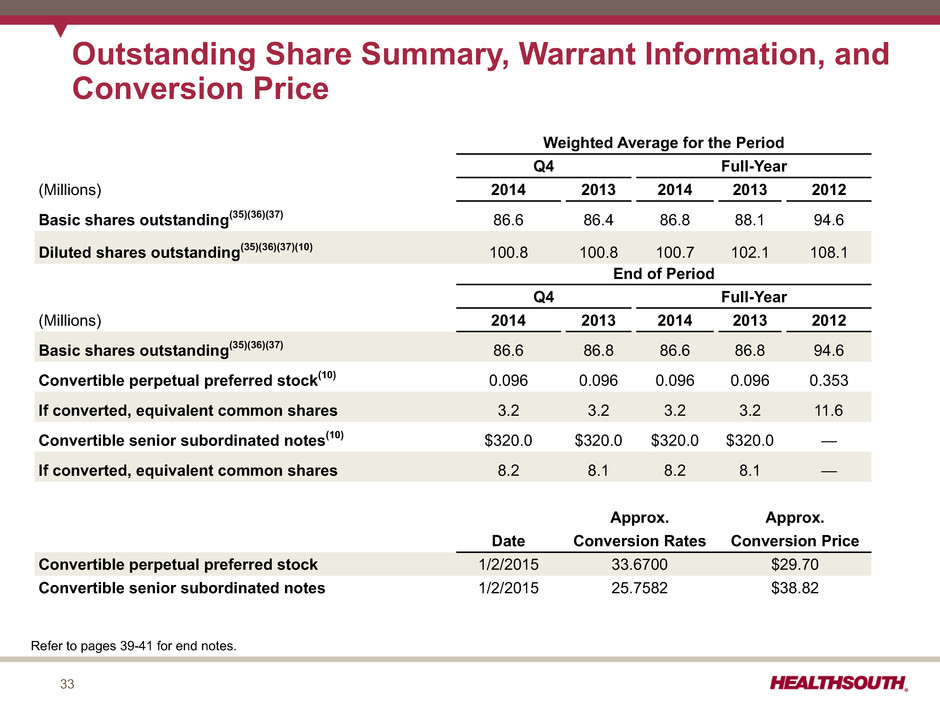

33 Outstanding Share Summary, Warrant Information, and Conversion Price Weighted Average for the Period Q4 Full-Year (Millions) 2014 2013 2014 2013 2012 Basic shares outstanding(35)(36)(37) 86.6 86.4 86.8 88.1 94.6 Diluted shares outstanding(35)(36)(37)(10) 100.8 100.8 100.7 102.1 108.1 End of Period Q4 Full-Year (Millions) 2014 2013 2014 2013 2012 Basic shares outstanding(35)(36)(37) 86.6 86.8 86.6 86.8 94.6 Convertible perpetual preferred stock(10) 0.096 0.096 0.096 0.096 0.353 If converted, equivalent common shares 3.2 3.2 3.2 3.2 11.6 Convertible senior subordinated notes(10) $320.0 $320.0 $320.0 $320.0 — If converted, equivalent common shares 8.2 8.1 8.2 8.1 — Approx. Approx. Date Conversion Rates Conversion Price Convertible perpetual preferred stock 1/2/2015 33.6700 $29.70 Convertible senior subordinated notes 1/2/2015 25.7582 $38.82 Refer to pages 39-41 for end notes.

34 Adjusted EBITDA History* Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year (Millions) 2014 2014 2014 2014 2013 2013 2013 2013 2014 2013 Net operating revenues $ 613.4 $ 596.9 $ 604.4 $ 591.2 $ 572.1 $ 564.0 $ 564.5 $ 572.6 $ 2,405.9 $ 2,273.2 Less: Provision for doubtful accounts (6.6) (8.2) (9.3) (7.5) (3.6) (8.0) (7.0) (7.4) (31.6) (26.0) Net operating revenues less provision for doubtful accounts 606.8 588.7 595.1 583.7 568.5 556.0 557.5 565.2 2,374.3 2,247.2 Operating expenses: Salaries and benefits (300.3) (290.0) (285.3) (286.1) (272.0) (269.5) (273.6) (274.6) (1,161.7) (1,089.7) Hospital-related expenses: Other operating expenses(a) (90.4) (86.7) (84.6) (83.2) (80.1) (79.7) (79.3) (78.0) (344.9) (317.1) Supplies (29.9) (26.6) (27.8) (27.6) (27.1) (25.5) (26.6) (26.2) (111.9 ) (105.4) Occupancy costs (10.5) (10.3) (10.3) (10.5) (11.2) (11.7) (11.9) (12.2) (41.6) (47.0) (130.8) (123.6) (122.7) (121.3) (118.4) (116.9) (117.8) (116.4) (498.4) (469.5) General/Administrative expenses(b)(c) (22.5) (22.5) (23.2) (23.4) (24.8) (22.6) (23.0) (23.9) (91.6) (94.3) Equity in nonconsolidated affiliates 1.9 1.9 2.6 4.3 3.0 2.0 3.3 2.9 10.7 11.2 Other income(d) 1.1 0.2 1.0 1.7 1.3 0.6 1.9 0.7 4.0 4.5 Noncontrolling interests (15.4) (14.7) (14.8) (14.8) (15.3) (14.1) (13.8) (14.6) (59.7) (57.8) Adjusted EBITDA $ 140.8 $ 140.0 $ 152.7 $ 144.1 $ 142.3 $ 135.5 $ 134.5 $ 139.3 $ 577.6 $ 551.6 * Reconciliation to GAAP provided on slides 35, 37, and 38 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year Full-Year 2014 2014 2014 2014 2013 2013 2013 2013 2014 2013 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal or impairment of assets $ 1.0 $ 2.7 $ 1.7 $ 1.3 $ 1.6 $ 2.5 $ 1.7 $ 0.1 $ 6.7 $ 5.9 (b) Stock-based compensation expense 4.6 5.0 7.0 7.3 5.8 6.2 6.5 6.3 23.9 24.8 (c) Encompass transaction costs 9.3 — — — — — — — 9.3 — (d) Gain on consolidation of Fairlawn Rehabilitation Hospital — — 27.2 — — — — — 27.2 —

35 Reconciliation of Net Income to Adjusted EBITDA(38) 2014 Q1 Q2 Q3 Q4 Full-Year (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 61.5 $ 97.9 $ 64.8 $ 57.5 $ 281.7 Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.1 (3.8) 0.9 (2.7) (5.5) Net income attributable to noncontrolling interests (14.8) (14.8) (14.7) (15.4) (59.7) Income from continuing operations attributable to HealthSouth(39) 46.8 $ 0.48 79.3 $ 0.81 51.0 $ 0.53 39.4 $ 0.41 216.5 $ 2.24 Gov't, class action, and related settlements — (0.8) — (0.9) (1.7) Pro fees - acct, tax, and legal 1.6 2.0 4.0 1.7 9.3 Provision for income tax expense 32.8 36.5 22.1 19.3 110.7 Interest expense and amortization of debt discounts and fees 27.9 27.8 27.8 25.7 109.2 Depreciation and amortization 26.4 26.4 27.4 27.5 107.7 Loss on early extinguishment of debt — — — 13.2 13.2 Gain on consolidation of Fairlawn Rehabilitation Hospital — (27.2) — — (27.2) Other, including net noncash loss on disposal or impairment of assets 1.3 1.7 2.7 1.0 6.7 Stock-based compensation expense 7.3 7.0 5.0 4.6 23.9 Encompass transaction costs — — — 9.3 9.3 Adjusted EBITDA(38) $ 144.1 $ 152.7 $ 140.0 $ 140.8 $ 577.6 Weighted average common shares outstanding: Basic 87.3 86.7 86.5 86.6 86.8 Diluted 100.9 100.6 100.5 100.8 100.7 Refer to pages 39-41 for end notes.

36 Fairlawn Rehabilitation Hospital as Consolidated Entity Fairlawn Rehabilitation Hospital as Equity Method Entity Fairlawn Rehabilitation Hospital as Consolidated Entity Fairlawn Rehabilitation Hospital as Equity Method Entity Q4 2014 As Reported Q4 2014 Without Accounting or Ownership Change Difference Full-Year 2014 As Reported Full-Year 2014 Without Accounting or Ownership Change Difference Total PerShare Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net income $ 57.5 $ 54.2 $ 3.3 $ 281.7 $ 249.1 $ 32.6 Income from discops, net of tax, attributable to HealthSouth (2.7) (2.7) — (5.5) (5.5) — Net income attributable to noncontrolling interests (15.4) (15.0) (0.4) (59.7) (58.8) (0.9) Income from continuing operations attributable to HealthSouth(39) 39.4 $ 0.41 36.5 $ 0.38 2.9 $ 0.03 216.5 $ 2.24 184.8 $ 1.92 31.7 $ 0.32 Gov't, class action, and related settlements (0.9) (0.9) — (1.7) (1.7) — Pro fees-acct, tax, and legal 1.7 1.7 — 9.3 9.3 — Provision for income tax expense 19.3 20.6 (1.3) 110.7 111.0 (0.3) Interest expense and amortization of debt discounts and fees 25.7 25.7 — 109.2 109.2 — Depreciation and amortization 27.5 26.9 0.6 107.7 13.2 94.5 Loss on early extinguishment of debt 13.2 13.2 — 13.2 106.1 (92.9) Gain on consolidation of Fairlawn Rehabilitation Hospital — — — (27.2) — (27.2) Other, including net noncash loss on disposal or impairment of assets 1.0 1.0 — 6.7 6.8 (0.1) Stock-based compensation expense 4.6 4.6 — 23.9 23.9 — Encompass transaction costs 9.3 9.3 — 9.3 9.3 — Adjusted EBITDA(38) $ 140.8 $ 138.6 $ 2.2 $ 577.6 $ 571.9 $ 5.7 Weighted average common shares outstanding: Basic 86.6 86.6 — 86.8 86.8 — Diluted 100.8 100.8 — 100.7 100.7 — Reconciliation of Net Income to Adjusted EBITDA(38)- Impact of Consolidation of Fairlawn Rehabilitation Hospital(1) Refer to pages 39-41 for end notes.

37 Reconciliation of Net Income to Adjusted EBITDA(38) 2013 Q1 Q2 Q3 Q4 Full-Year (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net income $ 65.9 $ 179.0 $ 72.3 $ 64.2 $ 381.4 Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.4 (0.1) 0.9 (0.1) 1.1 Net income attributable to noncontrolling interests (14.6) (13.8) (14.1) (15.3) (57.8) Income from continuing operations attributable to HealthSouth(39) 51.7 $ 0.48 165.1 $ 1.66 59.1 $ 0.59 48.8 $ (0.31) 324.7 $ 2.59 Gov't, class action, and related settlements — (2.0) (21.3) (0.2) (23.5) Pro fees - acct, tax, and legal 1.4 2.2 4.2 1.7 9.5 Provision for income tax expense (benefit) 33.5 (86.5) 35.2 30.5 12.7 Interest expense and amortization of debt discounts and fees 24.2 24.4 25.3 26.5 100.4 Depreciation and amortization 22.1 23.1 24.3 25.2 94.7 Loss on early extinguishment of debt — — — 2.4 2.4 Other, including net noncash loss on disposal of assets 0.1 1.7 2.5 1.6 5.9 Stock-based compensation expense 6.3 6.5 6.2 5.8 24.8 Adjusted EBITDA(38) $ 139.3 $ 134.5 $ 135.5 $ 142.3 $ 551.6 Weighted average common shares outstanding: Basic 94.0 86.1 86.2 86.4 88.1 Diluted 107.1 99.8 100.4 100.8 102.1 Refer to pages 39-41 for end notes.

38 Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA Q4 Full-Year (Millions) 2014 2013 2014 2013 Net cash provided by operating activities $ 70.2 $ 100.9 $ 444.9 $ 470.3 Provision for doubtful accounts (6.6) (3.6) (31.6) (26.0) Professional fees—accounting, tax, and legal 1.7 1.7 9.3 9.5 Interest expense and amortization of debt discounts and fees 25.7 26.5 109.2 100.4 Equity in net income of nonconsolidated affiliates 1.9 3.0 10.7 11.2 Net income attributable to noncontrolling interests in continuing operations (15.4) (15.3) (59.7) (57.8) Amortization of debt-related items (3.2) (2.0) (12.7) (5.0) Distributions from nonconsolidated affiliates (3.2) (1.8) (12.6) (11.4) Current portion of income tax expense 3.5 3.3 13.3 6.3 Change in assets and liabilities 46.4 27.1 90.1 48.9 Net premium paid on bond issuance/redemption 10.6 1.7 4.3 1.7 Cash used in operating activities of discontinued operations 0.2 0.5 1.2 1.9 Encompass transaction costs 9.3 — 9.3 — Other (0.3) 0.3 1.9 1.6 Adjusted EBITDA $ 140.8 $ 142.3 $ 577.6 $ 551.6

39 End Notes (1) HealthSouth acquired an additional 30% equity interest in Fairlawn Rehabilitation Hospital in Worcester, MA from its joint venture partner. This transaction increased HealthSouth's ownership interest from 50% to 80% and resulted in a change in accounting for this hospital from the equity method to a consolidated entity effective June 1, 2014. (2) In connection with CMS approved and announced RAC audits related to IRFs, we received requests in 2013 to review certain patient files for discharges occurring from 2010 through 2013, for which we have previously received payment. Based on our assessment of claims review results and our historical experience with the adjudication process, we established an approx. $8 million reserve via contractual allowances which reduced net operating revenues in Q4 2013. Concurrently, we reversed approx. $4 million in bad debt reserves established during 2013 related to th RAC audits. (3) Hospital-related expenses include other operating expenses, supplies, and occupancy costs. Other operating expenses exclude the loss on disposal or impairment of assets. (4) General & Administrative excludes stock-based compensation and the Encompass transaction costs. (5) Earnings per share are determined using income from continuing operations attributable to HealthSouth. (6) The pro forma leverage ratio is based on year-end 2014 debt and includes an estimate of Encompass' Adjusted EBITDA for 2014 of approx. $61 million, which represents 83.3% ownership. (7) Current income tax expense was $3.5 million, $3.3 million, $13.3 million, and $6.3 million for Q4 2014, Q4 2013, full-year 2014, and full-year 2013, respectively. (8) The Company's effective income tax rate in 2014 was reduced as a result of the nontaxable gain related to its acquisition of an additional 30% equity interest in Fairlawn. (9) Income tax expense in 2013 included an approx. $115 million, or $1.31 per basic share, benefit related to a settlement with the IRS. (10) The difference between the basic and diluted shares outstanding is primarily related to the convertible senior subordinated notes and our convertible perpetual preferred stock (convertible into 8.2 million and 3.2 million common shares, respectively, as of December 31, 2014). a. On November 18, 2013, the Company closed separate, privately negotiated exchanges in which it issued $320 million of 2.0% Convertible Senior Subordinated Notes due 2043 in exchange for 257,110 shares of the Company’s 6.5% Series A Convertible Perpetual Preferred Stock. The Company recorded approx. $249 million as debt and approx. $71 million as equity. The convertible notes are convertible, at the option of the holders, at any time on or prior to the close of business on the business day immediately preceding December 1, 2043 into shares of the Company’s common stock at a conversion rate of approx. 25.7582 shares per $1,000 in principal amount, which is equal to a conversion price of approximately $38.82 per share, subject to customary antidilution adjustments. The Company has the right to redeem the convertible notes before December 1, 2018 if the volume weighted average price of the Company’s common stock is at least 120% ($46.58) of the conversion price of the convertible notes for a specified period. On or after December 1, 2018, the Company may, at its option, redeem all or any part of the convertible notes. In either case, the redemption price will be equal to 100% of the principal amount of the convertible notes to be redeemed, plus accrued and unpaid interest. As a result of the transaction, the dividend on the convertible perpetual preferred stock was reduced from approx. $5.7 million per quarter to approx. $1.6 million per quarter. b. The 96,245 shares of preferred stock outstanding after the exchange transaction are convertible, at the option of the holder, at any time into shares of common stock at a conversion price of $29.70 per share, which is equal to a conversion rate of approx. 33.6700 shares of common stock per share of preferred stock, subject to a specified adjustment. We may at any time cause the shares of preferred stock to be automatically converted into shares of our common stock at the conversion rate then in effect if the closing price of our common stock for 20 trading days within a period of 30 consecutive trading days ending on the trading day before the date we give the notice of forced conversion exceeds 150% ($44.55) of the conversion price of the preferred stock.

40 (11) The interest and amortization related to the convertible senior subordinated notes must be added to income from continuing operations when calculating diluted earnings per share. (12) Definition of adjusted free cash flow is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, dividends paid on preferred stock, distributions to noncontrolling interests, and nonrecurring items. Common stock dividends are not included in the calculation of adjusted free cash flow. (13) The income allocated to participating securities, the convertible perpetual preferred dividends, and the repurchase premium (2013 only) on preferred stock need to be subtracted from income from continuing operations to calculate basic earnings per share. (14) Diluted earnings per share are the same as basic earnings per share due to antidilution. (15) Cash interest expense is net of amortization of debt discounts and fees. (16) 2014 working capital was negatively impacted by growth in accounts receivable due to additional claims denials predominantly by one Medicare Administrative Contractor and continued delays at the administrative law judge hearing level. (17) Capital expenditures for maintenance in 2013 benefited by approx. $12 million for equipment purchases that were invoiced in Q4 2013 and paid in early 2014. (18) The Encompass acquisition was funded using a combination of draws under the revolving credit facility and expanded term loan facility. (19) On July 25, 2013, the board of directors approved the initiation of a quarterly cash dividend on our common stock of $0.18 per share. On July 17, 2014, the board of directors approved a $0.03 per share, or 16.7%, increase to the quarterly cash dividend on our common stock, bringing the quarterly cash dividend to $0.21 per common share. (20) On February 14, 2014, the board of directors approved an increase in our existing common stock repurchase authorization from $200 million to $250 million. The $234 million reflects the tender offer completed in Q1 2013 for approx. 9.5% of the common shares. (21) If legislation affecting Medicare is passed, HealthSouth will evaluate its effect on the Company’s business model. (22) To arrive at the 5% - 9% CAGR, 2014 (the base year) includes an estimate of Adjusted EBITDA for Encompass. This is a multi-year CAGR; annual results may fall outside the range. (23) HealthSouth believes, based on the Medicare IRF-PPS Final Rule for FY 2015, it should realize a net increase of approx. 2.3% in FY 2015 before sequestration. (24) Encompass believes, based on the Medicare Home Health Prospective Payment System Final Rule for CY 2015, it should realize an approx. 1.3% net reduction in revenue per episode for calendar year 2015. (25) The Budget Control Act of 2011 included a reduction of up to 2% to Medicare payments for all providers that began on April 1, 2013 (as modified by H.R. 8). The reduction was made from whatever level of payment would otherwise have been provided under Medicare law and regulation. This automatic reduction, known as “sequestration,” resulted in a net year-over-year decrease to our net operating revenues of approx. $9 million in 2014 (anniversaried April 1, 2014). (26) In Q3 2012, HealthSouth amended the joint venture agreement related to St. Vincent Rehabilitation Hospital in Sherwood, AR which resulted in a change in accounting for this hospital from the equity method of accounting to a consolidated entity. The hospital moved to same store in Q3 2013. (27) Beginning in Q1 2015, HealthSouth's legacy 25 home health agencies will be included in the home health and hospice segment. The 2014 results for these agencies will be recast and reported in the 2014 results for the home health and hospice segment. End Notes, con't.

41 End Notes, con't. (28) In September 2014, the Company issued an additional $175 million of its 5.75% senior notes due 2024. In September and December 2014, the Company amended its credit agreement to, among other things, add $450 million of term loan facility capacity and extend the revolver maturity to September 2019. In October 2014, the Company redeemed all of its 7.25% senior notes due 2018 (approx. $271 million) using the proceeds from the September offering of 5.75% senior notes due 2024, a $75 million draw under its term loan facilities, and cash on hand. In December 2014, the Company redeemed approx. $25 million (exercise of 10% call rights) of its 7.75% senior notes due 2022 using cash on hand. In December 2014, the Company drew $375 million under its term loan facitities and $325 million under its revolving credit facility to fund the acquisition of Encompass. In January 2015, the Company issued an additional $400 million of its 5.75% senior notes due 2024 and used $250 million of the net proceeds to repay borrowings under its term loan facilities, with the remainder used to repay borrowings under its revolving credit facility. (29) Pro forma debt amounts do not include approx. $93 million of convertible perpetual preferred stock, approx. $87 million of capital leases, and approx. $42 million of other notes payable. (30) The leverage ratio is based on Adjusted EBITDA for 2014 and 2013 of $577.6 million and $551.6 million, respectively. Pro forma leverage with Encompass Adjusted EBITDA included would be approx. 3.3x. (31) Medicare Advantage revenues represent approx. 8% of total revenues for all periods presented. (32) Represents discharges from HealthSouth’s 106 consolidated hospitals in Q4 2014; 102 consolidated hospitals in Q3 2014 and Q2 2014; 101 consolidated hospitals in Q1 2014, Q4 2013, Q3 2013 and Q2 2013; 98 consolidated hospitals in Q1 2013. (33) Excludes approximately 400 full-time equivalents who are considered part of corporate overhead with their salaries and benefits included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals. (34) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. (35) The Company purchased 9,119,450 common shares in Q1 2013 through a tender offer at a price of $25.50 per share. (36) 10 million warrants (pre-October 2006 reverse split) were issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. The warrants expired on January 16, 2014. The holders of these warrants chose both cash and cashless exercises into shares of our common stock. Prior to warrant expiration, 755,323 shares of our common stock were issued upon exercise between September 30, 2013 and January 16, 2014. (37) The agreement to settle our class action securities litigation received final court approval in January 2007. These shares of common stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are included in the outstanding shares. The warrants to purchase approx. 8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) were not assumed exercised for the dilutive shares outstanding because they were antidilutive in the periods presented. (38) Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments set forth. (39) Per share amounts for each period presented are based on diluted weighted average shares outstanding unless the amounts are antidilutive, in which case the per share amount is calculated using the basic share count after subtracting the quarterly dividend on the convertible perpetual preferred stock, income allocated to participating securities, and the repurchase premium on shares of preferred stock. The difference in shares between the basic and diluted shares outstanding is primarily related to the convertible senior subordinated notes and our convertible perpetual preferred stock. (40) Payor mix reflects 2014 revenue. (41) The net 2.4% rebasing adjustment is net of the case mix index budget neutrality factor and an increase in estimated outlier payments.