Third Quarter 2015 Earnings Call October 29, 2015 Supplemental Slides

2 The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect our current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, repurchases of securities, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2014, the Form 10-Q for the quarters ended March 31, 2015, June 30, 2015, and September 30, 2015, when filed, and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated October 28, 2015, to which the following supplemental slides are attached as Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements

3 Table of Contents Q3 2015 Summary................................................................................................................................................. 4-5 Development ......................................................................................................................................................... 6 Acquisitions of Reliant and CareSouth.................................................................................................................. 7 The Company Post Reliant and CareSouth .......................................................................................................... 8 Inpatient Rehabilitation Segment........................................................................................................................... 9-14 Home Health & Hospice Segment ........................................................................................................................ 15-16 Earnings per Share................................................................................................................................................ 17 Adjusted Free Cash Flow ...................................................................................................................................... 18 2015 Guidance ...................................................................................................................................................... 19 Appendix................................................................................................................................................................ 20 Adjusted Free Cash Flow ...................................................................................................................................... 21-22 Priorities for Reinvesting Free Cash Flow ............................................................................................................. 23 Debt Schedule and Maturity Profile ...................................................................................................................... 24-25 New-Store/Same-Store IRF Growth ..................................................................................................................... 26 Payment Sources (Percent of Revenues) ............................................................................................................. 27 Inpatient Rehabilitation Operational and Labor Metrics ........................................................................................ 28 Home Health & Hospice Operational Metrics ....................................................................................................... 29 Share Information.................................................................................................................................................. 30 History Recast by Segment................................................................................................................................... 31-32 Reconciliations to GAAP ....................................................................................................................................... 33-36 End Notes ............................................................................................................................................................. 37-39

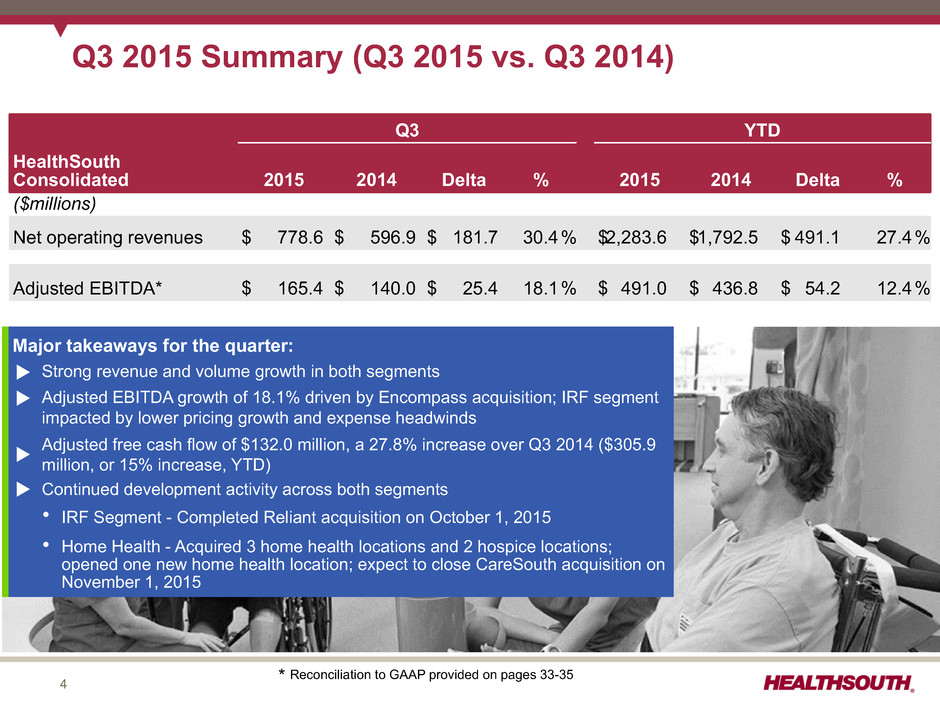

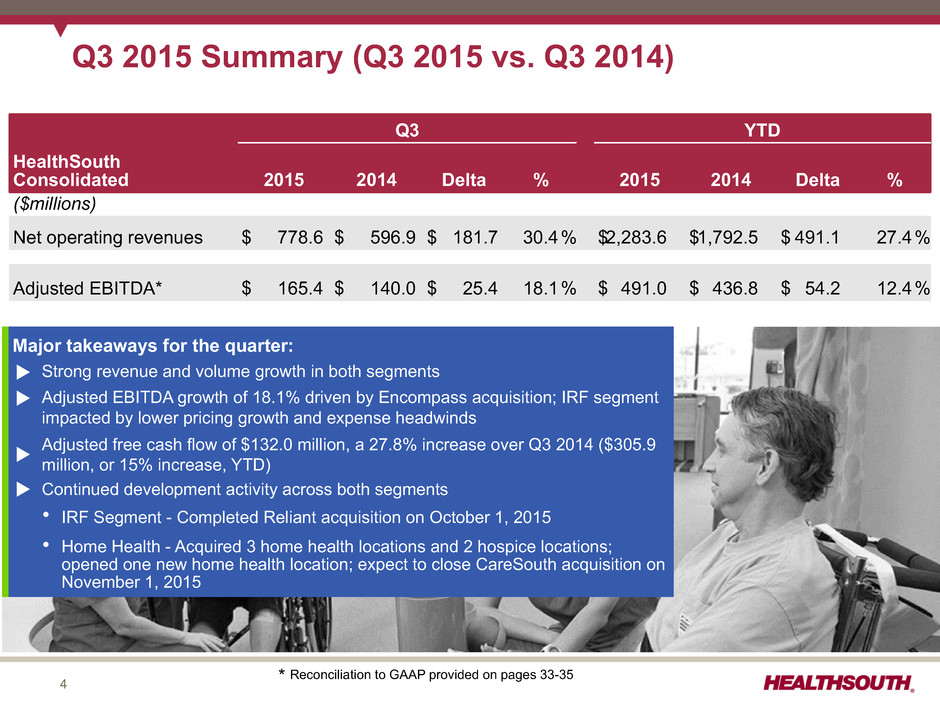

4 Q3 2015 Summary (Q3 2015 vs. Q3 2014) Q3 YTD HealthSouth Consolidated 2015 2014 Delta % 2015 2014 Delta % ($millions) Net operating revenues $ 778.6 $ 596.9 $ 181.7 30.4% $2,283.6 $1,792.5 $ 491.1 27.4% Adjusted EBITDA* $ 165.4 $ 140.0 $ 25.4 18.1% $ 491.0 $ 436.8 $ 54.2 12.4% Major takeaways for the quarter: u Strong revenue and volume growth in both segments u Adjusted EBITDA growth of 18.1% driven by Encompass acquisition; IRF segment impacted by lower pricing growth and expense headwinds u Adjusted free cash flow of $132.0 million, a 27.8% increase over Q3 2014 ($305.9million, or 15% increase, YTD) u Continued development activity across both segments Ÿ IRF Segment - Completed Reliant acquisition on October 1, 2015 Ÿ Home Health - Acquired 3 home health locations and 2 hospice locations; opened one new home health location; expect to close CareSouth acquisition on November 1, 2015 * Reconciliation to GAAP provided on pages 33-35

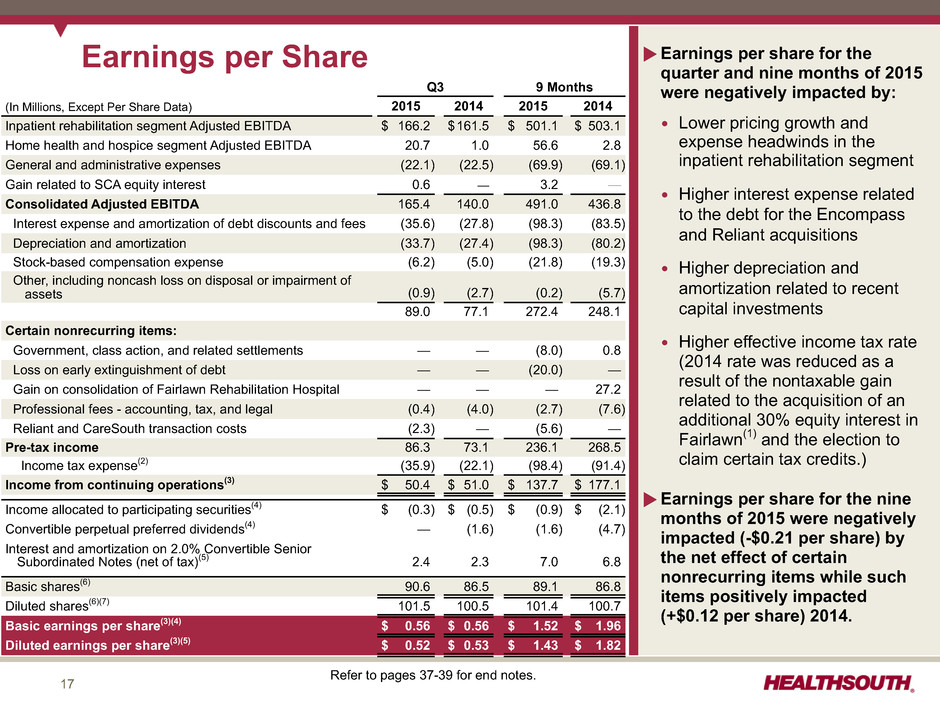

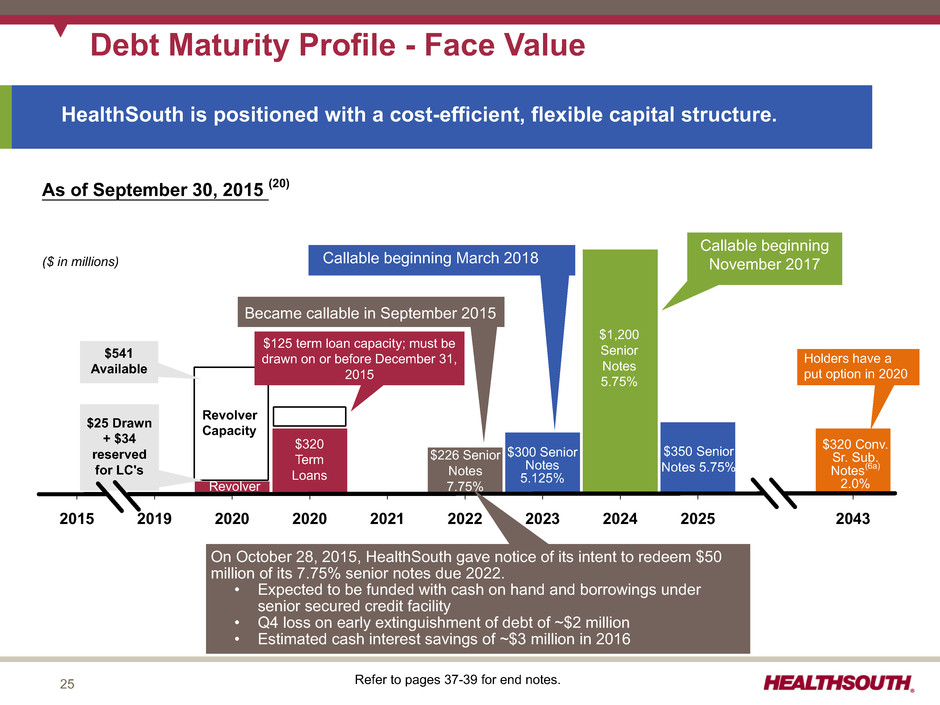

5 Q3 2015 Summary (cont.) u Balance sheet Ÿ Issued an additional $350 million of existing 5.75% senior notes due 2024 Ÿ Issued $350 million of 5.75% senior notes due 2025 Ÿ Used proceeds from both offerings to fund a portion of the Reliant acquisition Ÿ On October 28, 2015, gave notice of optional redemption of $50 million of 7.75% senior notes due 2022 (see page 25) u Diluted earnings per share of $0.52 were impacted by (see table on page 17): Ÿ Lower pricing growth and expense headwinds in the inpatient rehabilitation segment; Ÿ Higher interest expense related to the debt for the Encompass and Reliant acquisitions; Ÿ Higher depreciation and amortization related to recent capital investments; and Ÿ Higher effective income tax rate (2014 rate was reduced as a result of the nontaxable gain related to the acquisition of an additional 30% equity interest in Fairlawn(1) and the election to claim certain tax credits). u Shareholder distributions Ÿ Paid quarterly cash dividend of $0.21 per share on July 15, 2015 Ÿ Declared a $0.23 per share quarterly cash dividend paid on October 15, 2015 u Sale of Shares of Surgical Care Affiliates (SCA) Ÿ Sold remaining shares in Q3 2015 Ÿ Recorded gain of $0.6 million in Q3 2015 (total gain of $3.2 million in 9 months ended September 30, 2015) Refer to pages 37-39 for end notes.

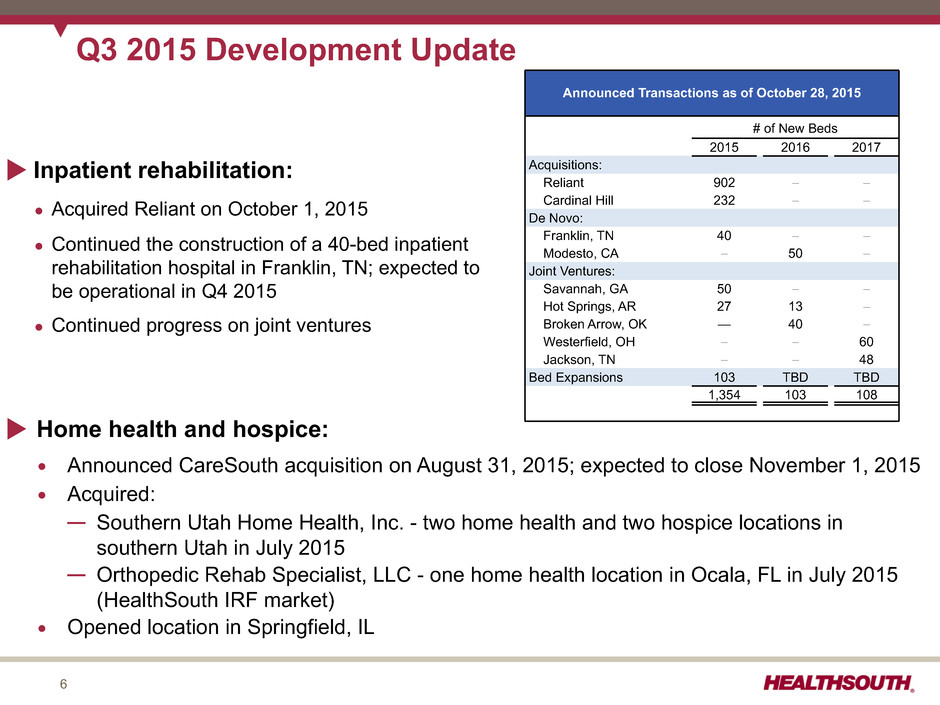

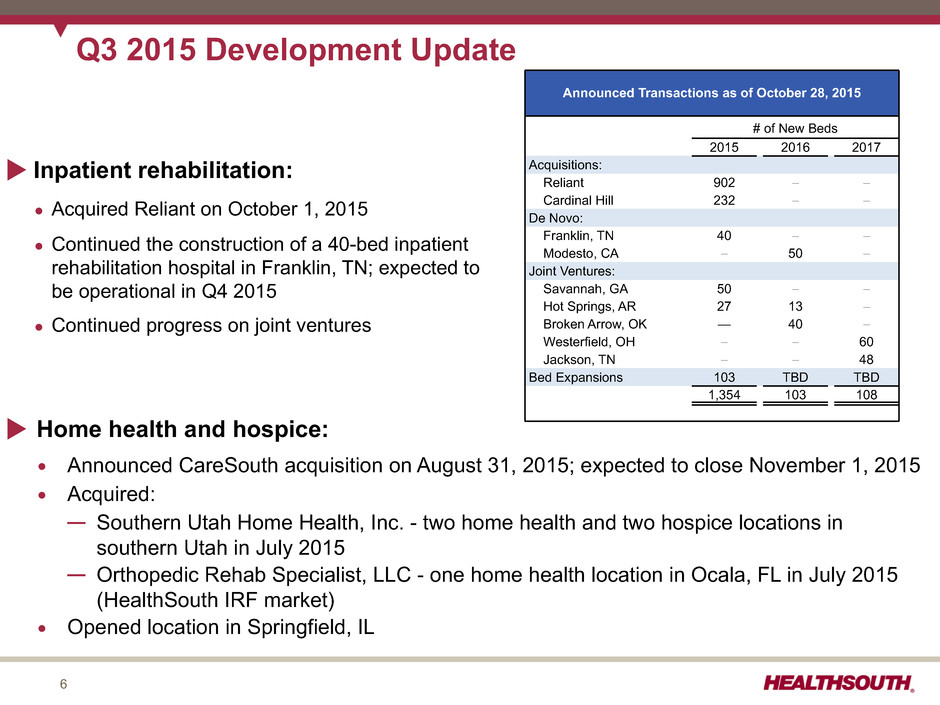

6 Q3 2015 Development Update u Inpatient rehabilitation: Ÿ Acquired Reliant on October 1, 2015 Ÿ Continued the construction of a 40-bed inpatient rehabilitation hospital in Franklin, TN; expected to be operational in Q4 2015 Ÿ Continued progress on joint ventures u Home health and hospice: Ÿ Announced CareSouth acquisition on August 31, 2015; expected to close November 1, 2015 Ÿ Acquired: — Southern Utah Home Health, Inc. - two home health and two hospice locations in southern Utah in July 2015 — Orthopedic Rehab Specialist, LLC - one home health location in Ocala, FL in July 2015 (HealthSouth IRF market) Ÿ Opened location in Springfield, IL Announced Transactions as of October 28, 2015 # of New Beds 2015 2016 2017 Acquisitions: Reliant 902 – – Cardinal Hill 232 – – De Novo: Franklin, TN 40 – – Modesto, CA – 50 – Joint Ventures: Savannah, GA 50 – – Hot Springs, AR 27 13 – Broken Arrow, OK — 40 – Westerfield, OH – – 60 Jackson, TN – – 48 Bed Expansions 103 TBD TBD 1,354 103 108

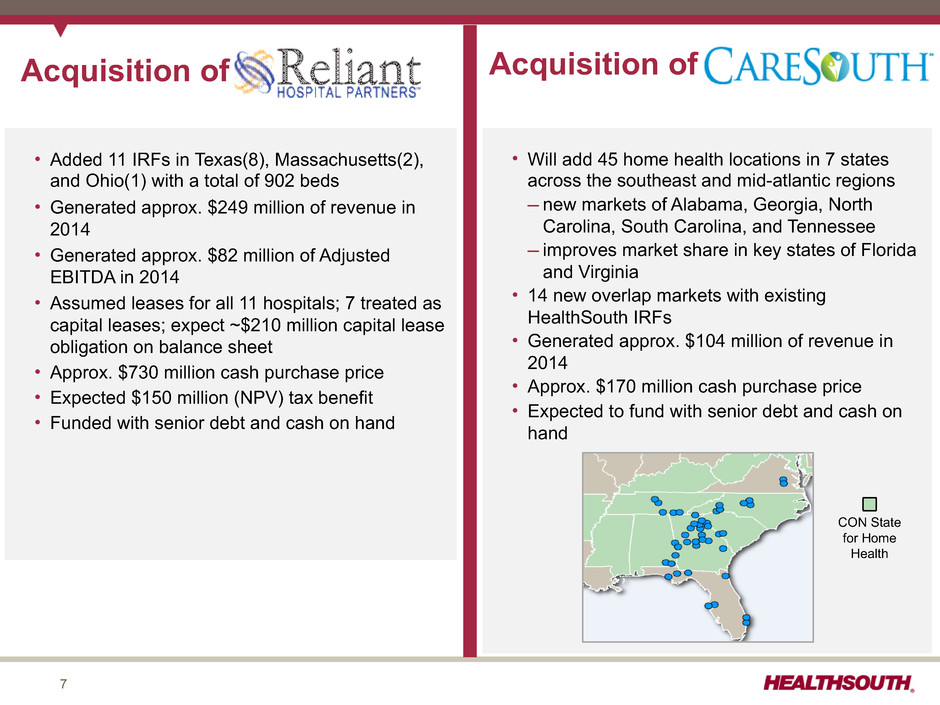

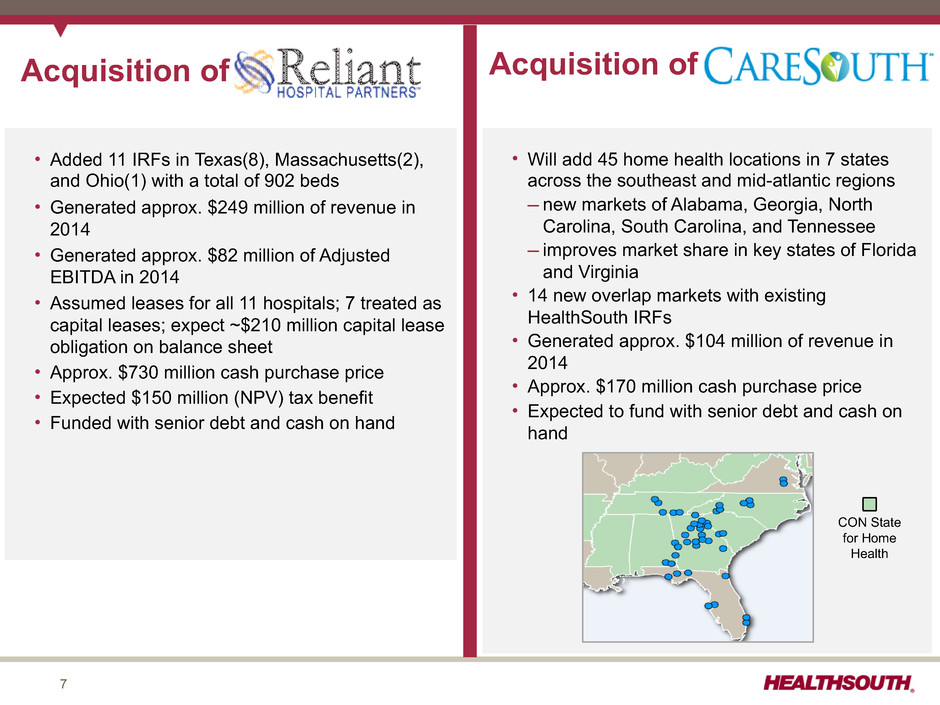

7 Acquisition of Ÿ Will add 45 home health locations in 7 states across the southeast and mid-atlantic regions —new markets of Alabama, Georgia, North Carolina, South Carolina, and Tennessee —improves market share in key states of Florida and Virginia Ÿ 14 new overlap markets with existing HealthSouth IRFs Ÿ Generated approx. $104 million of revenue in 2014 Ÿ Approx. $170 million cash purchase price Ÿ Expected to fund with senior debt and cash on hand Ÿ Added 11 IRFs in Texas(8), Massachusetts(2), and Ohio(1) with a total of 902 beds Ÿ Generated approx. $249 million of revenue in 2014 Ÿ Generated approx. $82 million of Adjusted EBITDA in 2014 Ÿ Assumed leases for all 11 hospitals; 7 treated as capital leases; expect ~$210 million capital lease obligation on balance sheet Ÿ Approx. $730 million cash purchase price Ÿ Expected $150 million (NPV) tax benefit Ÿ Funded with senior debt and cash on hand Acquisition of CON State for Home Health

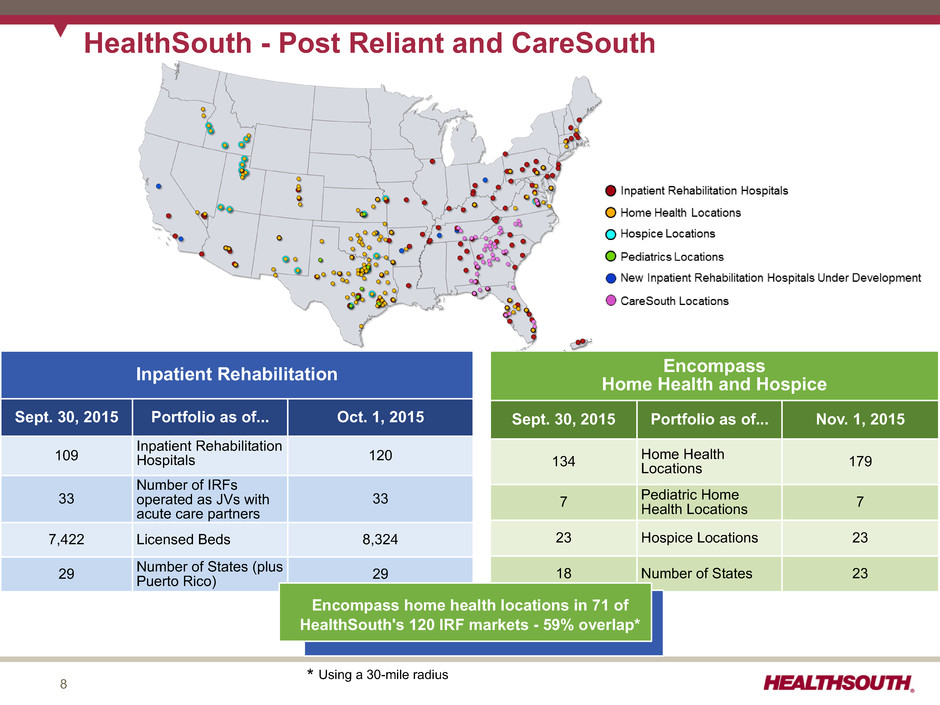

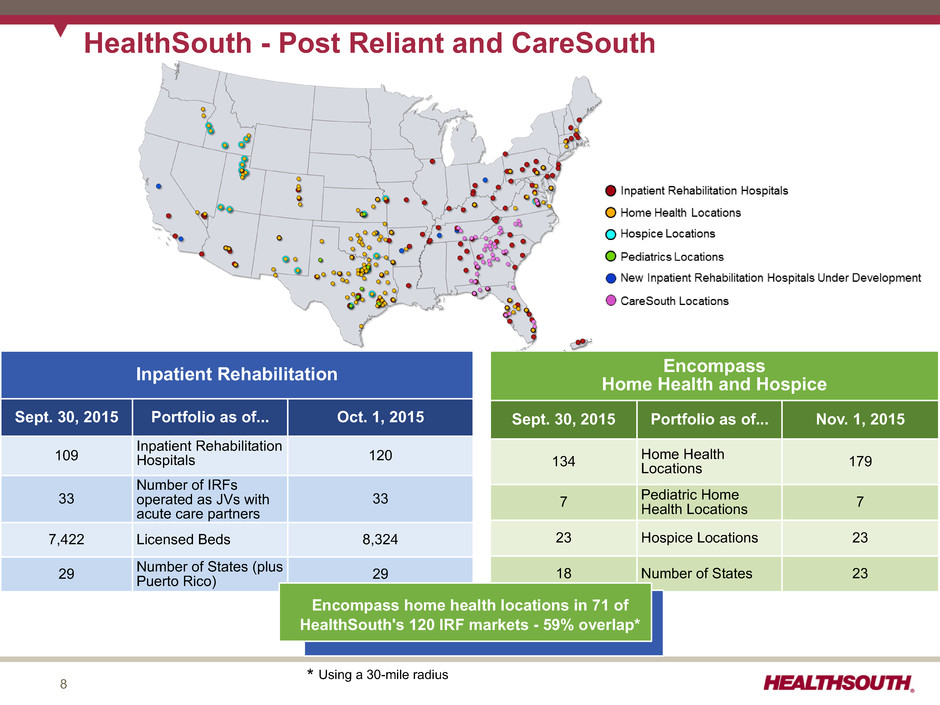

8 Inpatient Rehabilitation Sept. 30, 2015 Portfolio as of... Oct. 1, 2015 109 Inpatient RehabilitationHospitals 120 33 Number of IRFs operated as JVs with acute care partners 33 7,422 Licensed Beds 8,324 29 Number of States (plusPuerto Rico) 29 HealthSouth - Post Reliant and CareSouth Encompass Home Health and Hospice Sept. 30, 2015 Portfolio as of... Nov. 1, 2015 134 Home HealthLocations 179 7 Pediatric HomeHealth Locations 7 23 Hospice Locations 23 18 Number of States 23 Encompass home health locations in 71 of HealthSouth's 120 IRF markets - 59% overlap* * Using a 30-mile radius

9 Inpatient Rehabilitation Segment - Revenue Q3 Q3 Favorable/ ($millions) 2015 2014 (Unfavorable) Net operating revenues: Inpatient $ 625.1 $ 563.7 10.9% Outpatient and other 26.5 26.2 1.1% Total segment revenue $ 651.6 $ 589.9 10.5% (Actual Amounts) Discharges 36,746 33,541 9.6% New-store discharge growth 5.7% Same-store discharge growth 3.9% Net patient revenue / discharge $ 17,011 $ 16,806 1.2% u Revenue growth was driven primarily by strong discharge volume growth across all payors. u New-store discharge growth was driven by the addition of four new hospitals in Q4 2014 and the addition of Savannah (April) and Cardinal Hill (May) in 2015. u Revenue per discharge growth was impacted by: Ÿ lower average acuity of the patients treated Ÿ proportionally higher discharge growth in payor categories where the reimbursement is lower

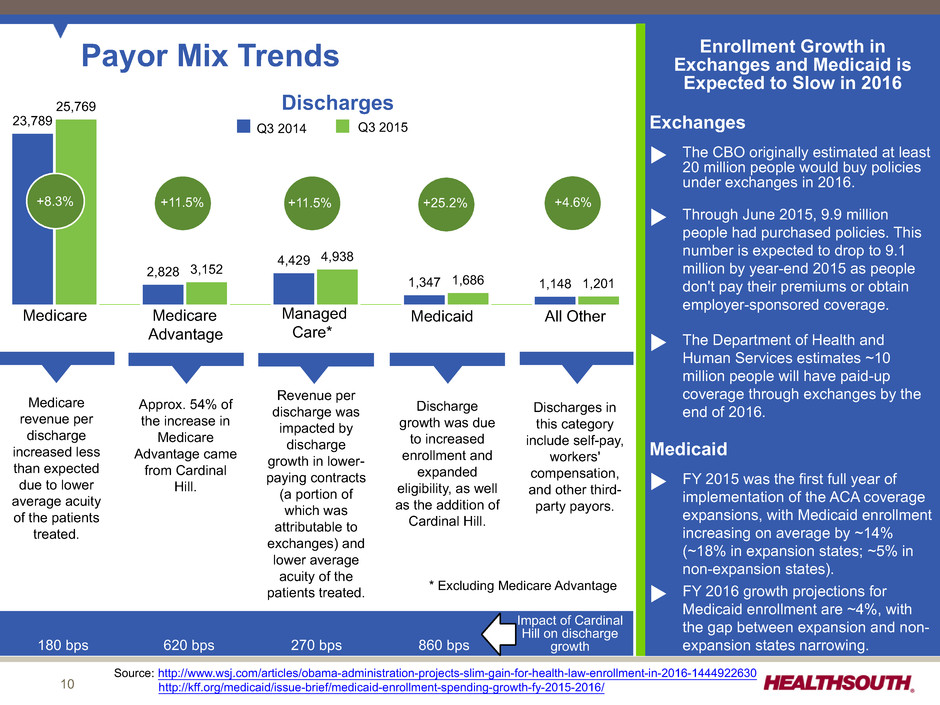

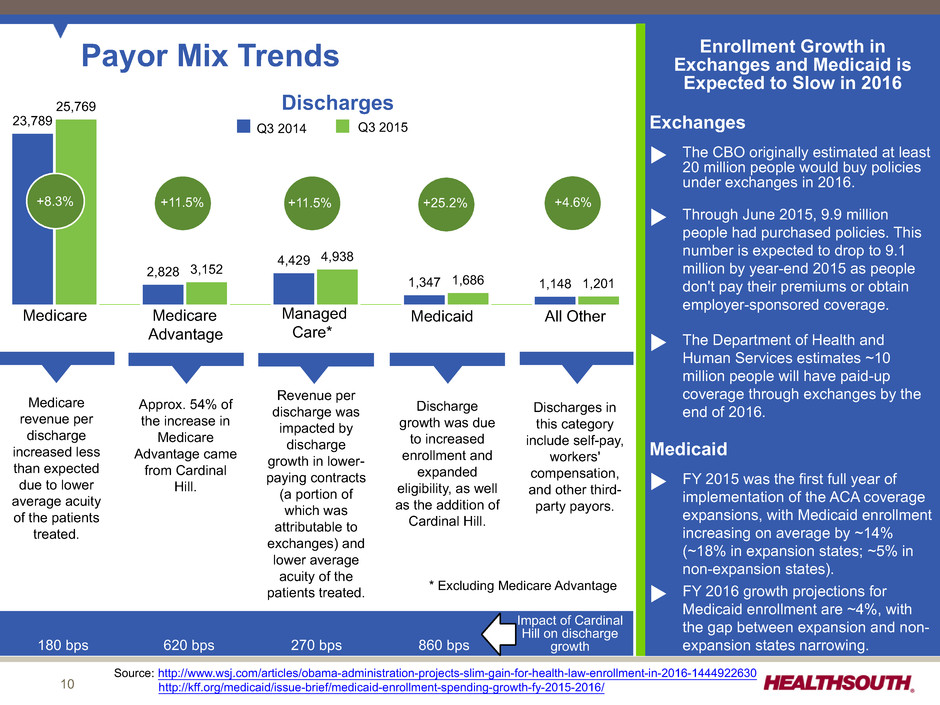

10 Payor Mix Trends 23,789 25,769 2,828 3,152 4,429 4,938 1,347 1,686 1,148 1,201 Q3 2014 Q3 2015 +8.3% +11.5% +11.5% +25.2% +4.6% Medicare Advantage Medicare Medicare revenue per discharge increased less than expected due to lower average acuity of the patients treated. Discharge growth was due to increased enrollment and expanded eligibility, as well as the addition of Cardinal Hill. Approx. 54% of the increase in Medicare Advantage came from Cardinal Hill. Revenue per discharge was impacted by discharge growth in lower- paying contracts (a portion of which was attributable to exchanges) and lower average acuity of the patients treated. Discharges Managed Care* Medicaid All Other * Excluding Medicare Advantage Increase in Revenue per Discharge Enrollment Growth in Exchanges and Medicaid is Expected to Slow in 2016 Exchanges u The CBO originally estimated at least20 million people would buy policies under exchanges in 2016. u Through June 2015, 9.9 million people had purchased policies. This number is expected to drop to 9.1 million by year-end 2015 as people don't pay their premiums or obtain employer-sponsored coverage. u The Department of Health and Human Services estimates ~10 million people will have paid-up coverage through exchanges by the end of 2016. Medicaid u FY 2015 was the first full year of implementation of the ACA coverage expansions, with Medicaid enrollment increasing on average by ~14% (~18% in expansion states; ~5% in non-expansion states). u FY 2016 growth projections for Medicaid enrollment are ~4%, with the gap between expansion and non- expansion states narrowing. Source: http://www.wsj.com/articles/obama-administration-projects-slim-gain-for-health-law-enrollment-in-2016-1444922630 http://kff.org/medicaid/issue-brief/medicaid-enrollment-spending-growth-fy-2015-2016/ Discharges in this category include self-pay, workers' compensation, and other third- party payors. 180 bps 620 bps 270 bps 860 bps Impact of Cardinal Hill on discharge growth

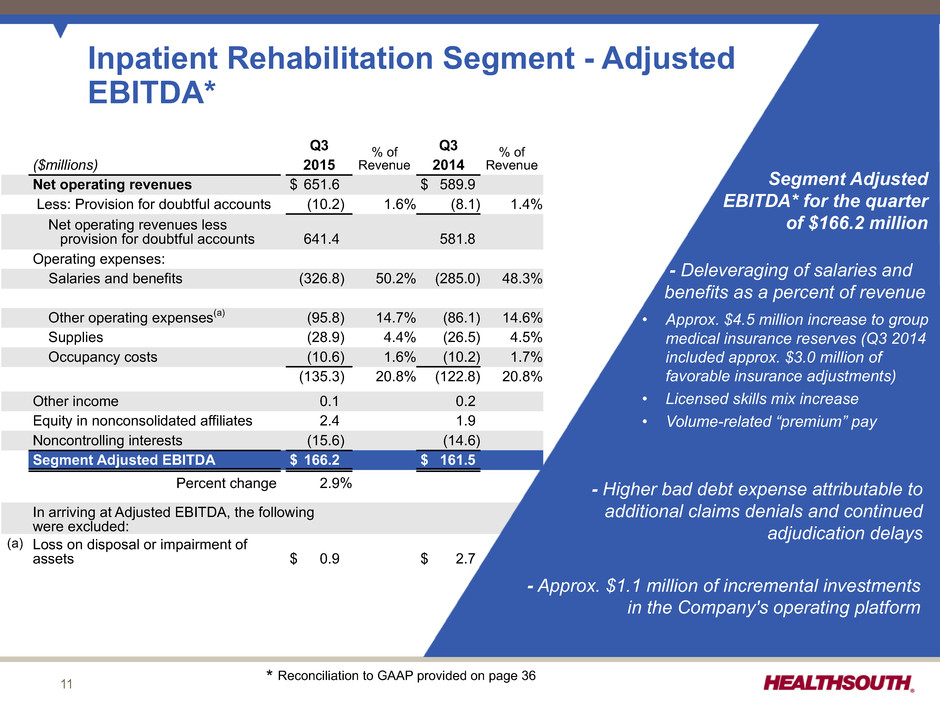

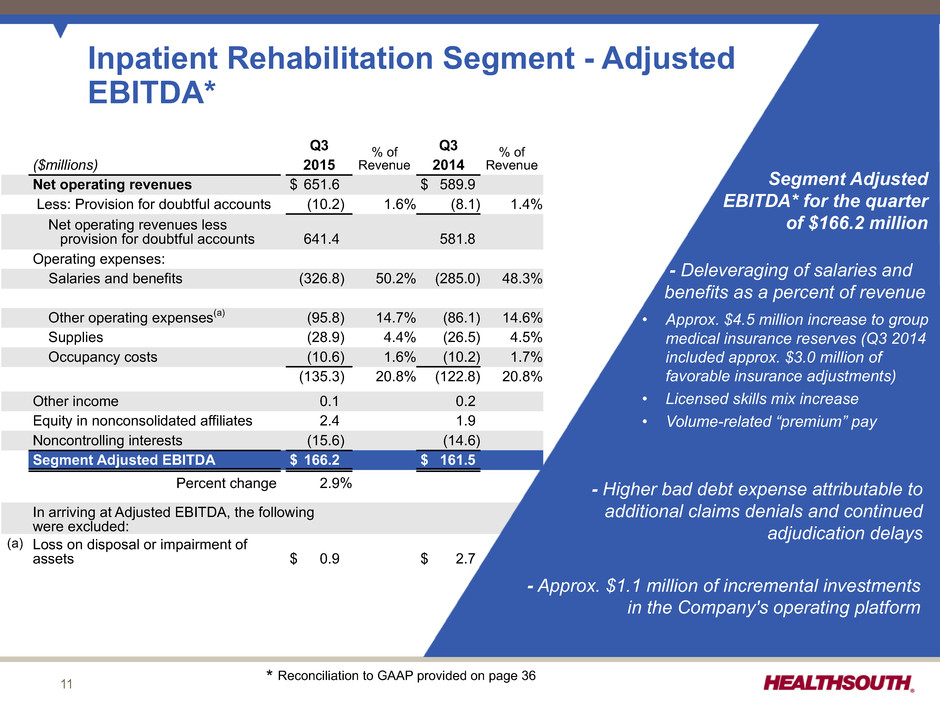

11 Inpatient Rehabilitation Segment - Adjusted EBITDA* Q3 % of Revenue Q3 % of Revenue($millions) 2015 2014 Net operating revenues $ 651.6 $ 589.9 Less: Provision for doubtful accounts (10.2) 1.6% (8.1) 1.4% Net operating revenues less provision for doubtful accounts 641.4 581.8 Operating expenses: Salaries and benefits (326.8) 50.2% (285.0) 48.3% Other operating expenses(a) (95.8) 14.7% (86.1) 14.6% Supplies (28.9) 4.4% (26.5) 4.5% Occupancy costs (10.6) 1.6% (10.2) 1.7% (135.3) 20.8% (122.8) 20.8% Other income 0.1 0.2 Equity in nonconsolidated affiliates 2.4 1.9 Noncontrolling interests (15.6) (14.6) Segment Adjusted EBITDA $ 166.2 $ 161.5 Percent change 2.9% In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal or impairment of assets $ 0.9 $ 2.7 Segment Adjusted EBITDA* for the quarter of $166.2 million - Higher bad debt expense attributable to additional claims denials and continued adjudication delays - Deleveraging of salaries and benefits as a percent of revenue • Approx. $4.5 million increase to group medical insurance reserves (Q3 2014 included approx. $3.0 million of favorable insurance adjustments) • Licensed skills mix increase • Volume-related “premium” pay * Reconciliation to GAAP provided on page 36 - Approx. $1.1 million of incremental investments in the Company's operating platform

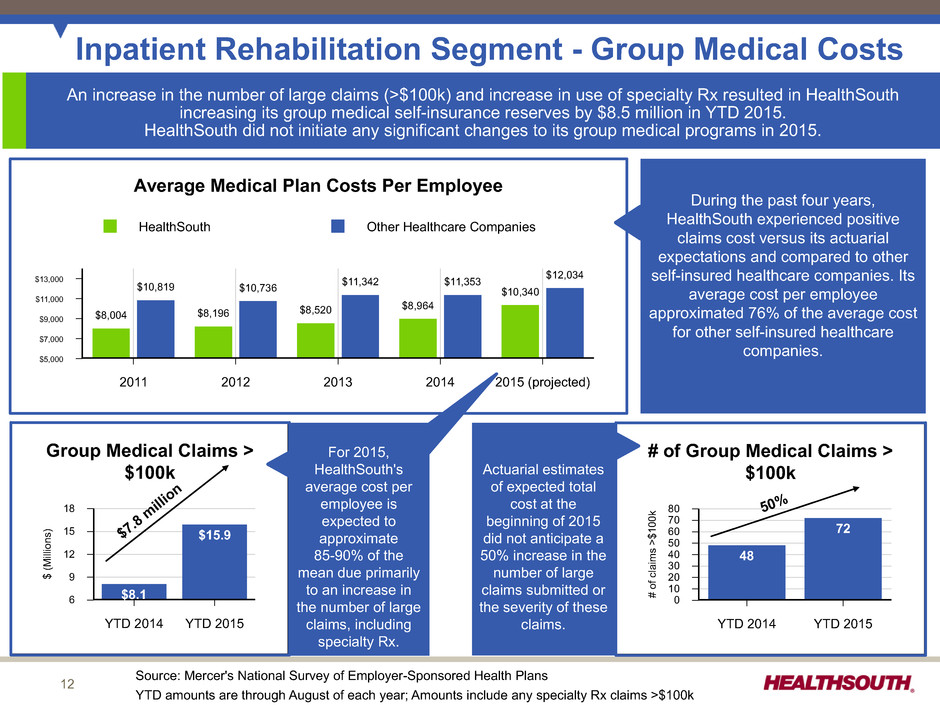

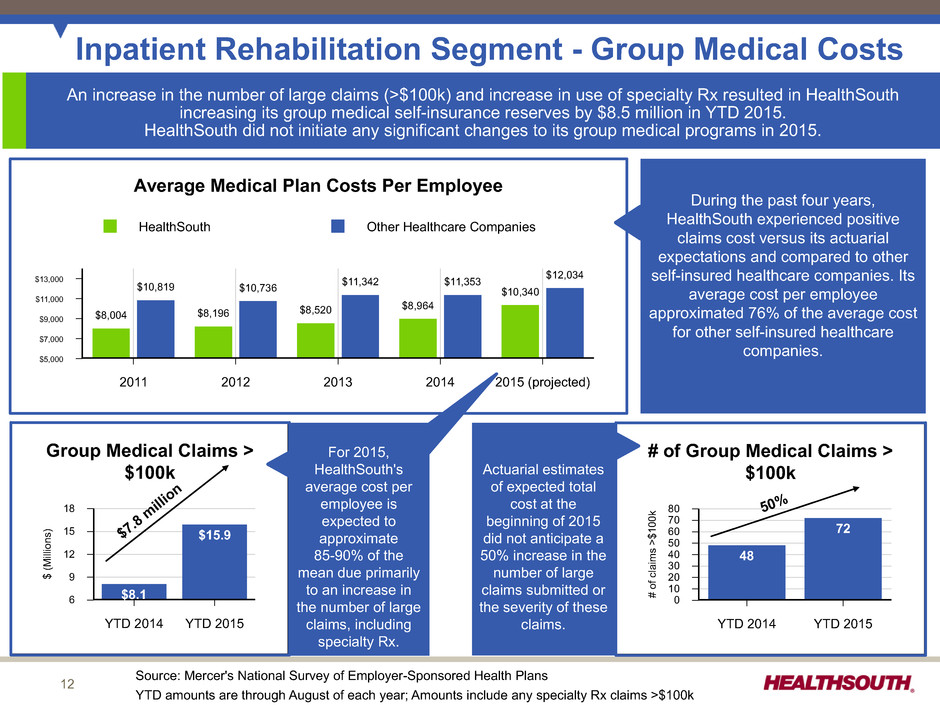

12 Group Medical Claims > $100k 18 15 12 9 6 $ (M illi on s) YTD 2014 YTD 2015 $8.1 $15.9 Inpatient Rehabilitation Segment - Group Medical Costs $7.8 millio n HealthSouth Other Healthcare Companies Average Medical Plan Costs Per Employee $13,000 $11,000 $9,000 $7,000 $5,000 2011 2012 2013 2014 2015 (projected) $8,004 $8,196 $8,520 $8,964 $10,340$10,819 $10,736 $11,342 $11,353 $12,034 An increase in the number of large claims (>$100k) and increase in use of specialty Rx resulted in HealthSouth increasing its group medical self-insurance reserves by $8.5 million in YTD 2015. HealthSouth did not initiate any significant changes to its group medical programs in 2015. During the past four years, HealthSouth experienced positive claims cost versus its actuarial expectations and compared to other self-insured healthcare companies. Its average cost per employee approximated 76% of the average cost for other self-insured healthcare companies. For 2015, HealthSouth's average cost per employee is expected to approximate 85-90% of the mean due primarily to an increase in the number of large claims, including specialty Rx. # of Group Medical Claims > $100k 80 70 60 50 40 30 20 10 0# of cl ai m s >$ 10 0k YTD 2014 YTD 2015 48 72 Actuarial estimates of expected total cost at the beginning of 2015 did not anticipate a 50% increase in the number of large claims submitted or the severity of these claims. 50% Source: Mercer's National Survey of Employer-Sponsored Health Plans YTD amounts are through August of each year; Amounts include any specialty Rx claims >$100k

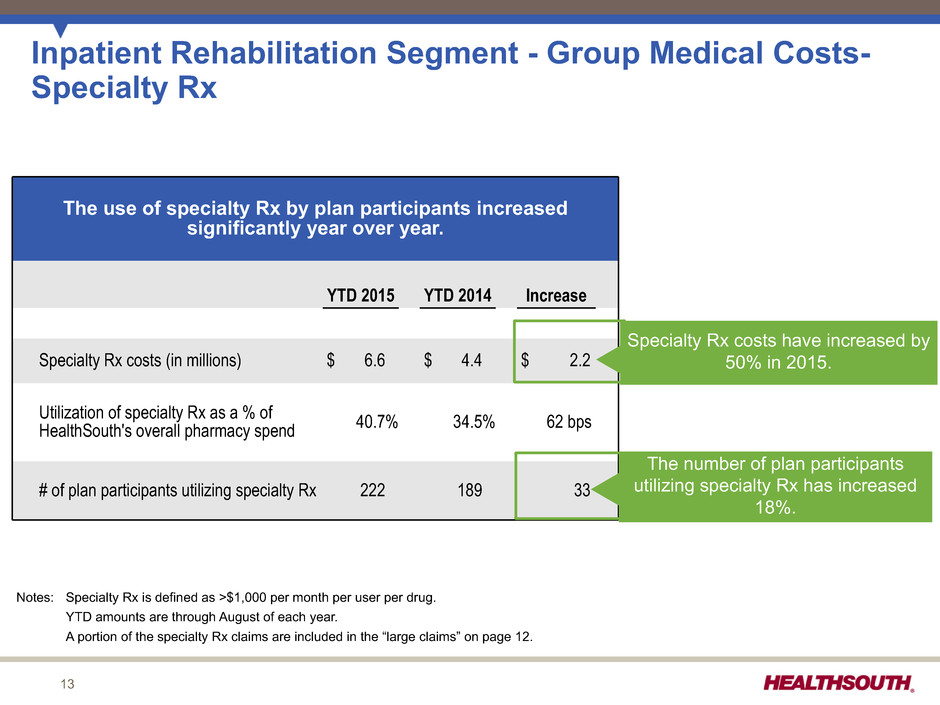

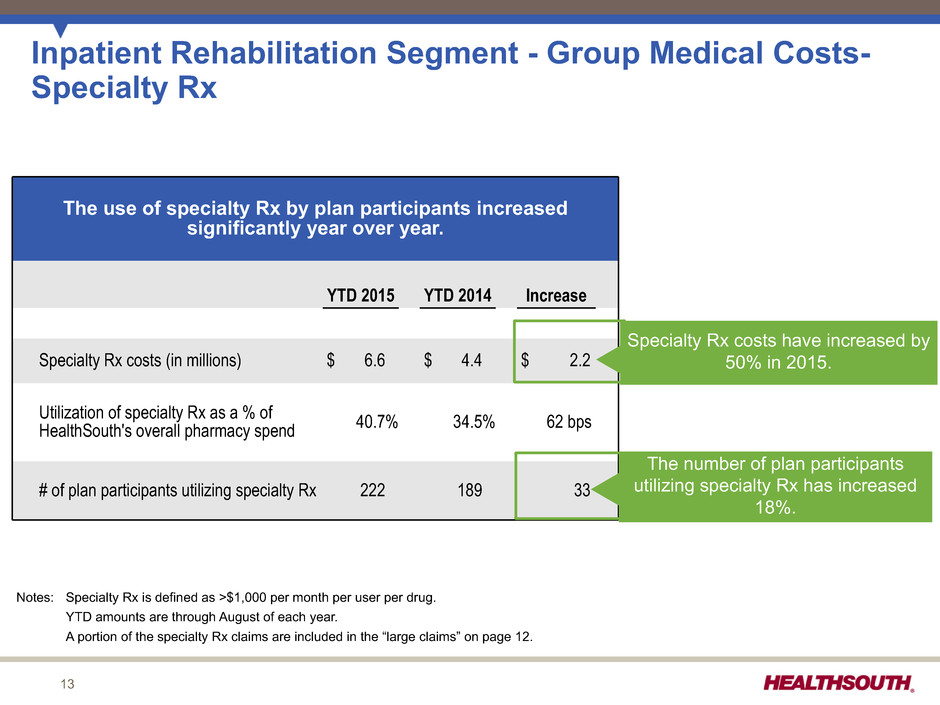

13 The use of specialty Rx by plan participants increased significantly year over year. YTD 2015 YTD 2014 Increase Specialty Rx costs (in millions) $ 6.6 $ 4.4 $ 2.2 Utilization of specialty Rx as a % of HealthSouth's overall pharmacy spend 40.7% 34.5% 62 bps # of plan participants utilizing specialty Rx 222 189 33 Inpatient Rehabilitation Segment - Group Medical Costs- Specialty Rx Specialty Rx costs have increased by 50% in 2015. The number of plan participants utilizing specialty Rx has increased 18%. Notes: Specialty Rx is defined as >$1,000 per month per user per drug. YTD amounts are through August of each year. A portion of the specialty Rx claims are included in the “large claims” on page 12.

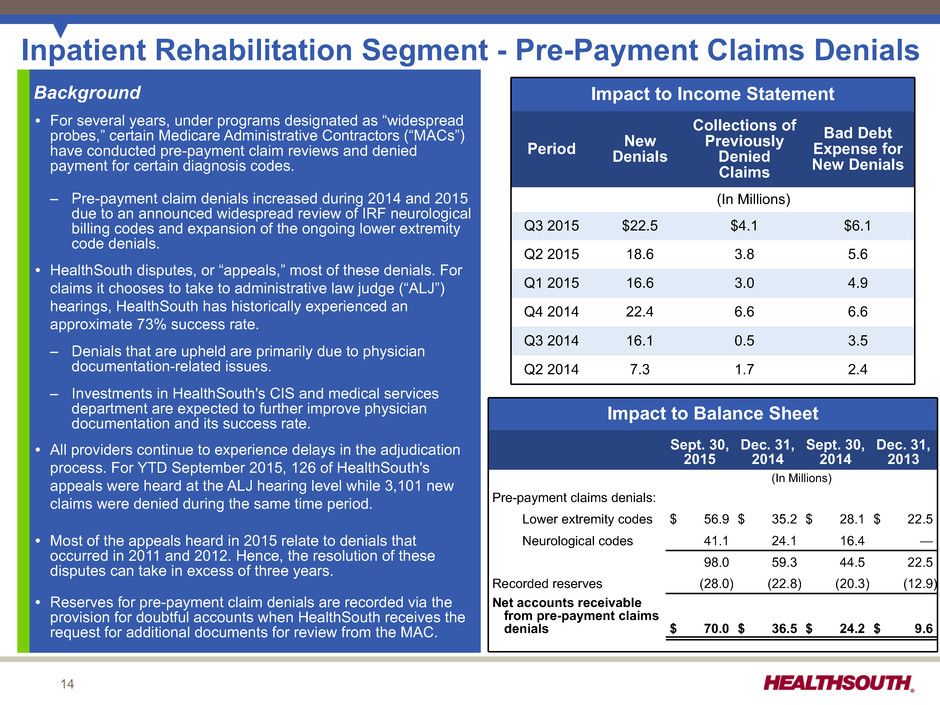

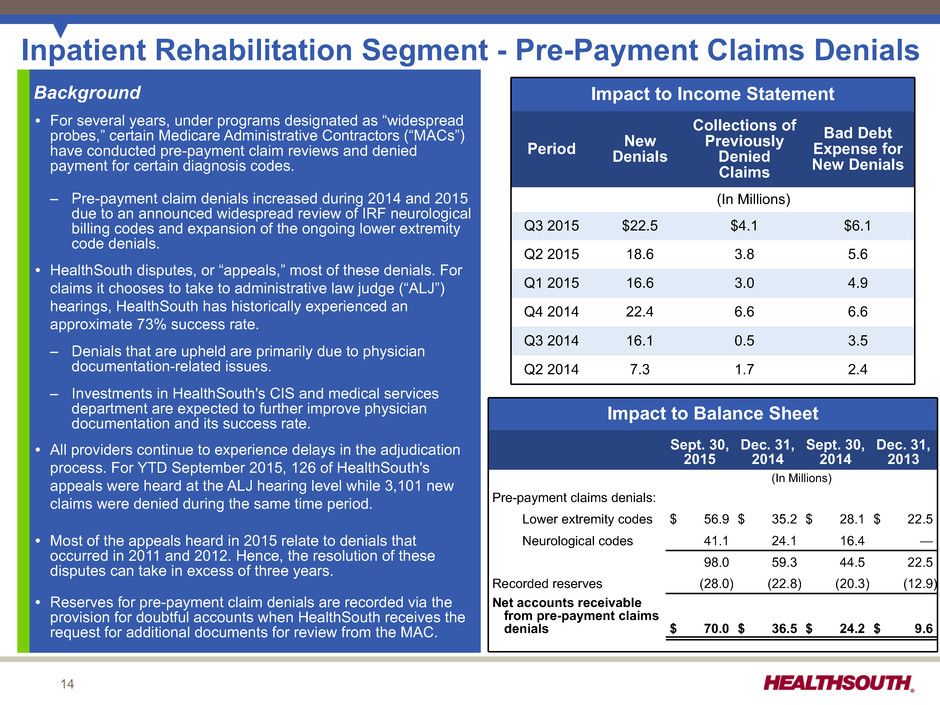

14 Inpatient Rehabilitation Segment - Pre-Payment Claims Denials Background Ÿ For several years, under programs designated as “widespread probes,” certain Medicare Administrative Contractors (“MACs”) have conducted pre-payment claim reviews and denied payment for certain diagnosis codes. – Pre-payment claim denials increased during 2014 and 2015 due to an announced widespread review of IRF neurological billing codes and expansion of the ongoing lower extremity code denials. Ÿ HealthSouth disputes, or “appeals,” most of these denials. For claims it chooses to take to administrative law judge (“ALJ”) hearings, HealthSouth has historically experienced an approximate 73% success rate. – Denials that are upheld are primarily due to physician documentation-related issues. – Investments in HealthSouth's CIS and medical services department are expected to further improve physician documentation and its success rate. Ÿ All providers continue to experience delays in the adjudication process. For YTD September 2015, 126 of HealthSouth's appeals were heard at the ALJ hearing level while 3,101 new claims were denied during the same time period. Ÿ Most of the appeals heard in 2015 relate to denials that occurred in 2011 and 2012. Hence, the resolution of these disputes can take in excess of three years. Ÿ Reserves for pre-payment claim denials are recorded via the provision for doubtful accounts when HealthSouth receives the request for additional documents for review from the MAC. Impact to Income Statement Period NewDenials Collections of Previously Denied Claims Bad Debt Expense for New Denials (In Millions) Q3 2015 $22.5 $4.1 $6.1 Q2 2015 18.6 3.8 5.6 Q1 2015 16.6 3.0 4.9 Q4 2014 22.4 6.6 6.6 Q3 2014 16.1 0.5 3.5 Q2 2014 7.3 1.7 2.4 Impact to Balance Sheet Sept. 30, 2015 Dec. 31, 2014 Sept. 30, 2014 Dec. 31, 2013 (In Millions) Pre-payment claims denials: Lower extremity codes $ 56.9 $ 35.2 $ 28.1 $ 22.5 Neurological codes 41.1 24.1 16.4 — 98.0 59.3 44.5 22.5 Recorded reserves (28.0) (22.8) (20.3) (12.9) Net accounts receivable from pre-payment claims denials $ 70.0 $ 36.5 $ 24.2 $ 9.6

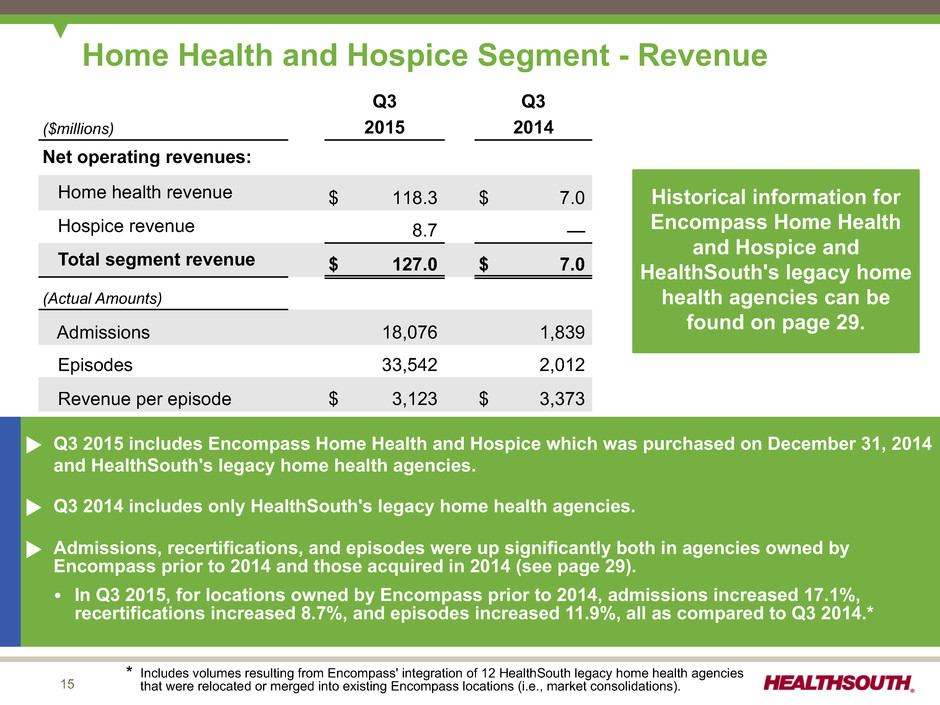

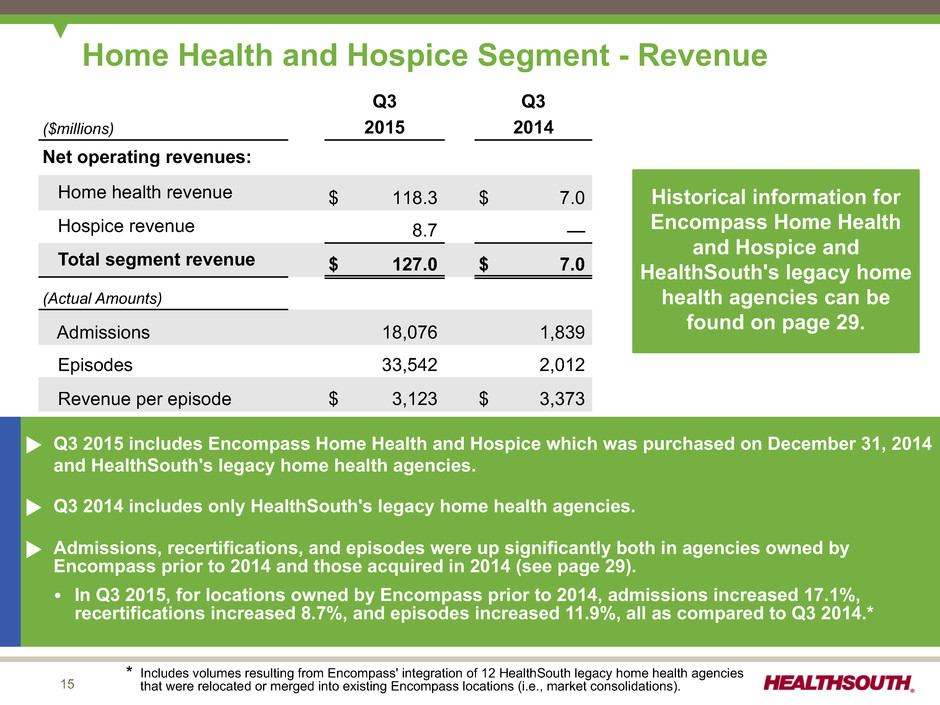

15 Home Health and Hospice Segment - Revenue Q3 Q3 ($millions) 2015 2014 Net operating revenues: Home health revenue $ 118.3 $ 7.0 Hospice revenue 8.7 — Total segment revenue $ 127.0 $ 7.0 (Actual Amounts) Admissions 18,076 1,839 Episodes 33,542 2,012 Revenue per episode $ 3,123 $ 3,373 u Q3 2015 includes Encompass Home Health and Hospice which was purchased on December 31, 2014 and HealthSouth's legacy home health agencies. u Q3 2014 includes only HealthSouth's legacy home health agencies. u Admissions, recertifications, and episodes were up significantly both in agencies owned by Encompass prior to 2014 and those acquired in 2014 (see page 29). Ÿ In Q3 2015, for locations owned by Encompass prior to 2014, admissions increased 17.1%, recertifications increased 8.7%, and episodes increased 11.9%, all as compared to Q3 2014.* Historical information for Encompass Home Health and Hospice and HealthSouth's legacy home health agencies can be found on page 29. * Includes volumes resulting from Encompass' integration of 12 HealthSouth legacy home health agencies that were relocated or merged into existing Encompass locations (i.e., market consolidations).

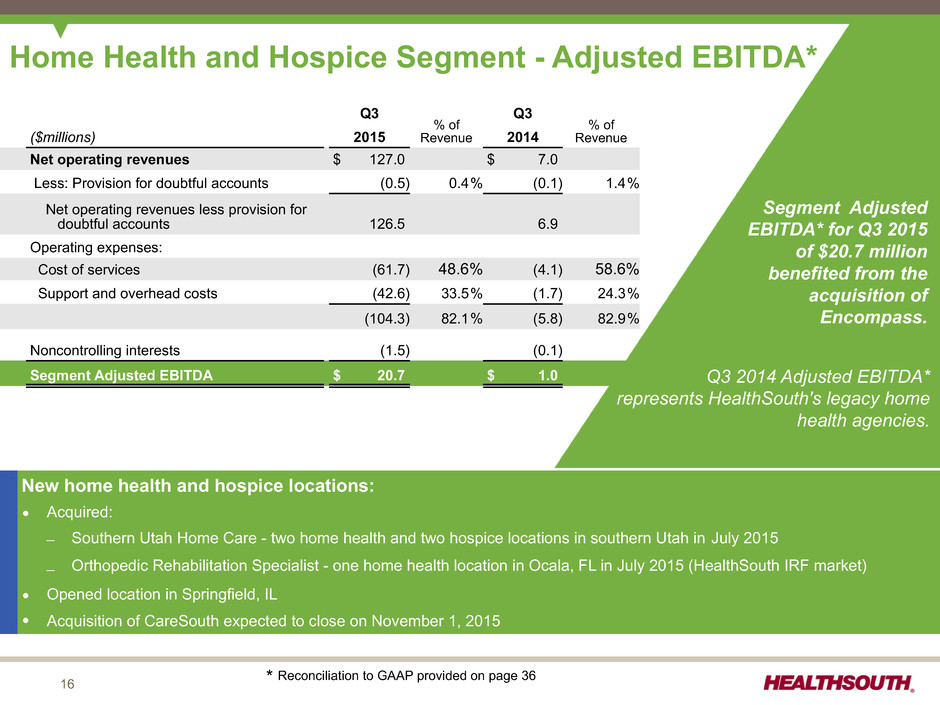

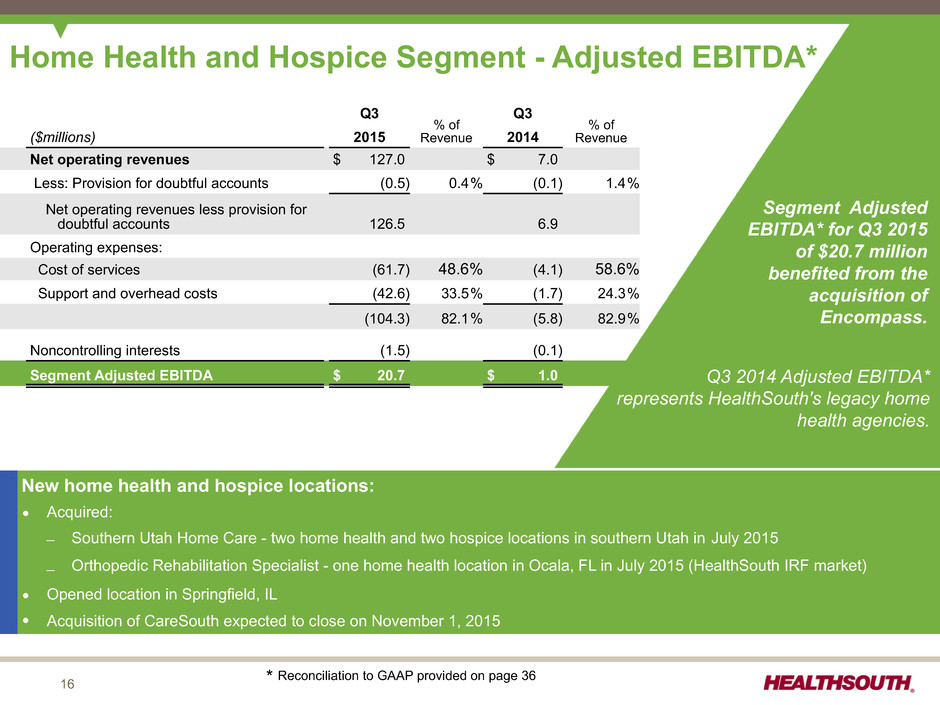

16 Q3 % of Revenue Q3 % of Revenue($millions) 2015 2014 Net operating revenues $ 127.0 $ 7.0 Less: Provision for doubtful accounts (0.5) 0.4% (0.1) 1.4% Net operating revenues less provision for doubtful accounts 126.5 6.9 Operating expenses: Cost of services (61.7) 48.6% (4.1) 58.6% Support and overhead costs (42.6) 33.5% (1.7) 24.3% (104.3) 82.1% (5.8) 82.9% Noncontrolling interests (1.5) (0.1) Segment Adjusted EBITDA $ 20.7 $ 1.0 Home Health and Hospice Segment - Adjusted EBITDA* Segment Adjusted EBITDA* for Q3 2015 of $20.7 million benefited from the acquisition of Encompass. Q3 2014 Adjusted EBITDA* represents HealthSouth's legacy home health agencies. New home health and hospice locations: Ÿ Acquired: – Southern Utah Home Care - two home health and two hospice locations in southern Utah in July 2015 – Orthopedic Rehabilitation Specialist - one home health location in Ocala, FL in July 2015 (HealthSouth IRF market) Ÿ Opened location in Springfield, IL Ÿ Acquisition of CareSouth expected to close on November 1, 2015 * Reconciliation to GAAP provided on pages 29-31 * Reconciliation to GAAP provided on page 36

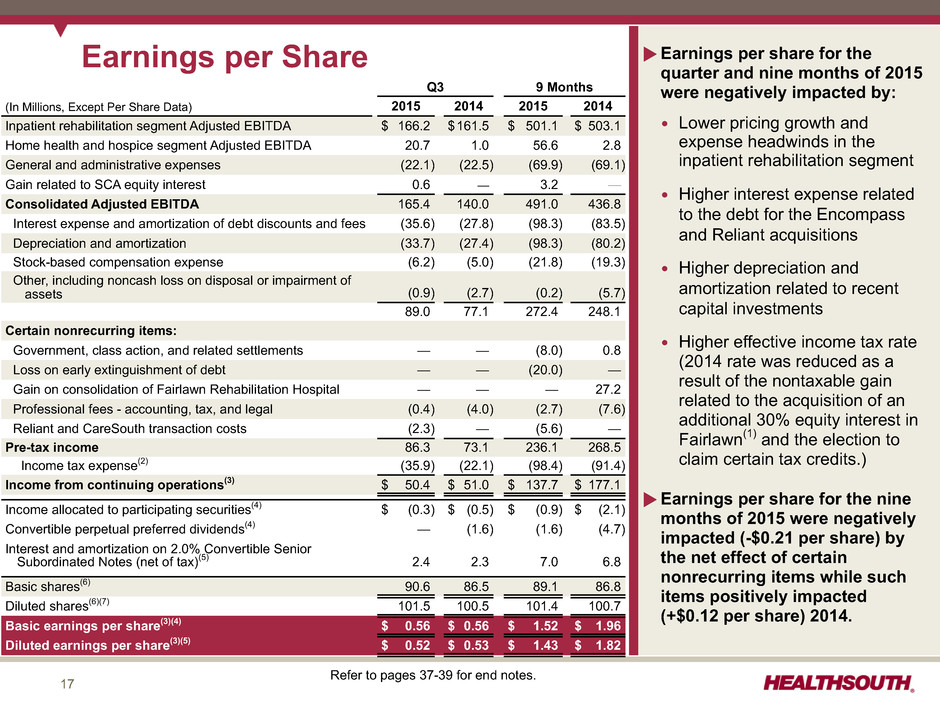

17 Earnings per Share Q3 9 Months (In Millions, Except Per Share Data) 2015 2014 2015 2014 Inpatient rehabilitation segment Adjusted EBITDA $ 166.2 $161.5 $ 501.1 $ 503.1 Home health and hospice segment Adjusted EBITDA 20.7 1.0 56.6 2.8 General and administrative expenses (22.1) (22.5) (69.9) (69.1) Gain related to SCA equity interest 0.6 — 3.2 — Consolidated Adjusted EBITDA 165.4 140.0 491.0 436.8 Interest expense and amortization of debt discounts and fees (35.6) (27.8) (98.3) (83.5) Depreciation and amortization (33.7) (27.4) (98.3) (80.2) Stock-based compensation expense (6.2) (5.0) (21.8) (19.3) Other, including noncash loss on disposal or impairment of assets (0.9) (2.7) (0.2) (5.7) 89.0 77.1 272.4 248.1 Certain nonrecurring items: Government, class action, and related settlements — — (8.0) 0.8 Loss on early extinguishment of debt — — (20.0) — Gain on consolidation of Fairlawn Rehabilitation Hospital — — — 27.2 Professional fees - accounting, tax, and legal (0.4) (4.0) (2.7) (7.6) Reliant and CareSouth transaction costs (2.3) — (5.6) — Pre-tax income 86.3 73.1 236.1 268.5 Income tax expense(2) (35.9) (22.1) (98.4) (91.4) Income from continuing operations(3) $ 50.4 $ 51.0 $ 137.7 $ 177.1 Income allocated to participating securities(4) $ (0.3) $ (0.5) $ (0.9) $ (2.1) Convertible perpetual preferred dividends(4) — (1.6) (1.6) (4.7) Interest and amortization on 2.0% Convertible Senior Subordinated Notes (net of tax)(5) 2.4 2.3 7.0 6.8 Basic shares(6) 90.6 86.5 89.1 86.8 Diluted shares(6)(7) 101.5 100.5 101.4 100.7 Basic earnings per share(3)(4) $ 0.56 $ 0.56 $ 1.52 $ 1.96 Diluted earnings per share(3)(5) $ 0.52 $ 0.53 $ 1.43 $ 1.82 uEarnings per share for the quarter and nine months of 2015 were negatively impacted by: Ÿ Lower pricing growth and expense headwinds in the inpatient rehabilitation segment Ÿ Higher interest expense related to the debt for the Encompass and Reliant acquisitions Ÿ Higher depreciation and amortization related to recent capital investments Ÿ Higher effective income tax rate (2014 rate was reduced as a result of the nontaxable gain related to the acquisition of an additional 30% equity interest in Fairlawn(1) and the election to claim certain tax credits.) uEarnings per share for the nine months of 2015 were negatively impacted (-$0.21 per share) by the net effect of certain nonrecurring items while such items positively impacted (+$0.12 per share) 2014. Refer to pages 37-39 for end notes.

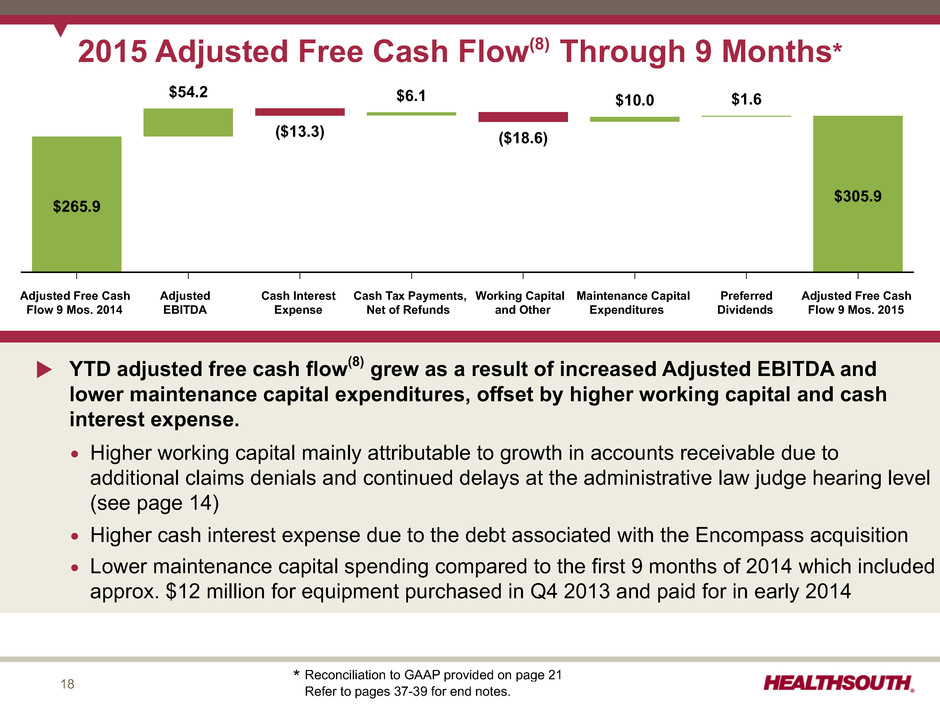

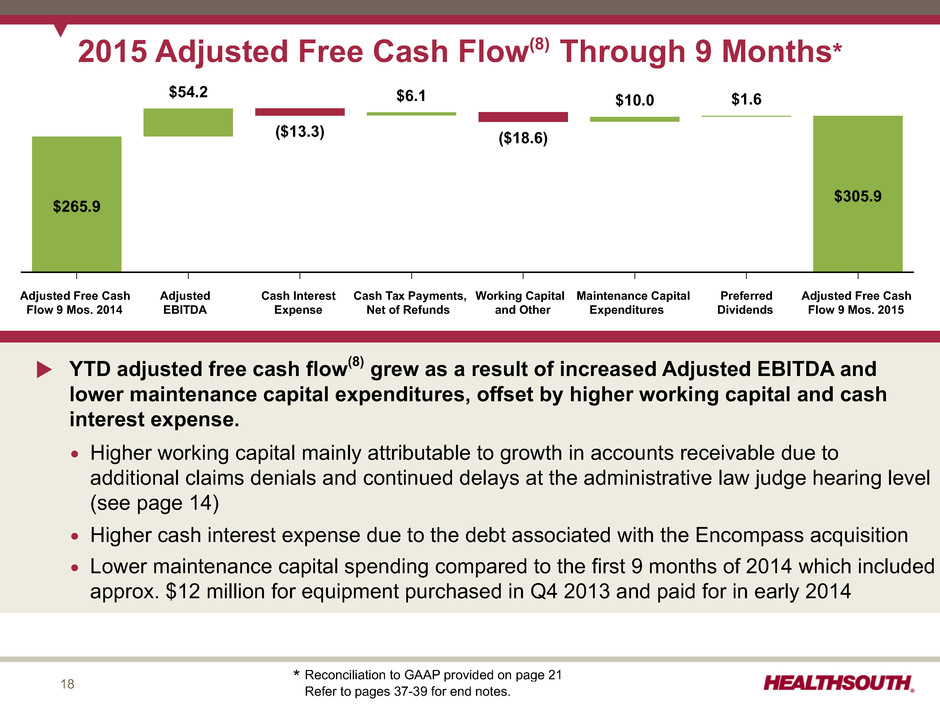

18 Adjusted Free Cash Flow 9 Mos. 2014 Adjusted EBITDA Cash Interest Expense Cash Tax Payments, Net of Refunds Working Capital and Other Maintenance Capital Expenditures Preferred Dividends Adjusted Free Cash Flow 9 Mos. 2015 $265.9 $54.2 ($13.3) $6.1 ($18.6) $10.0 $1.6 $305.9 2015 Adjusted Free Cash Flow(8) Through 9 Months* * Reconciliation to GAAP provided on page 21 Refer to pages 37-39 for end notes. u YTD adjusted free cash flow(8) grew as a result of increased Adjusted EBITDA and lower maintenance capital expenditures, offset by higher working capital and cash interest expense. Ÿ Higher working capital mainly attributable to growth in accounts receivable due to additional claims denials and continued delays at the administrative law judge hearing level (see page 14) Ÿ Higher cash interest expense due to the debt associated with the Encompass acquisition Ÿ Lower maintenance capital spending compared to the first 9 months of 2014 which included approx. $12 million for equipment purchased in Q4 2013 and paid for in early 2014

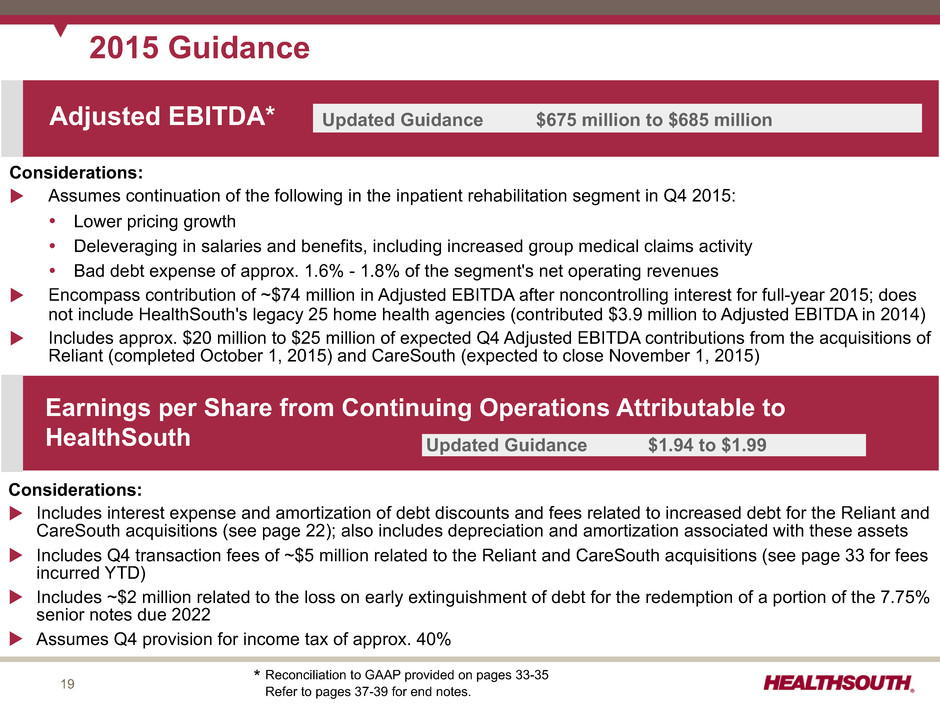

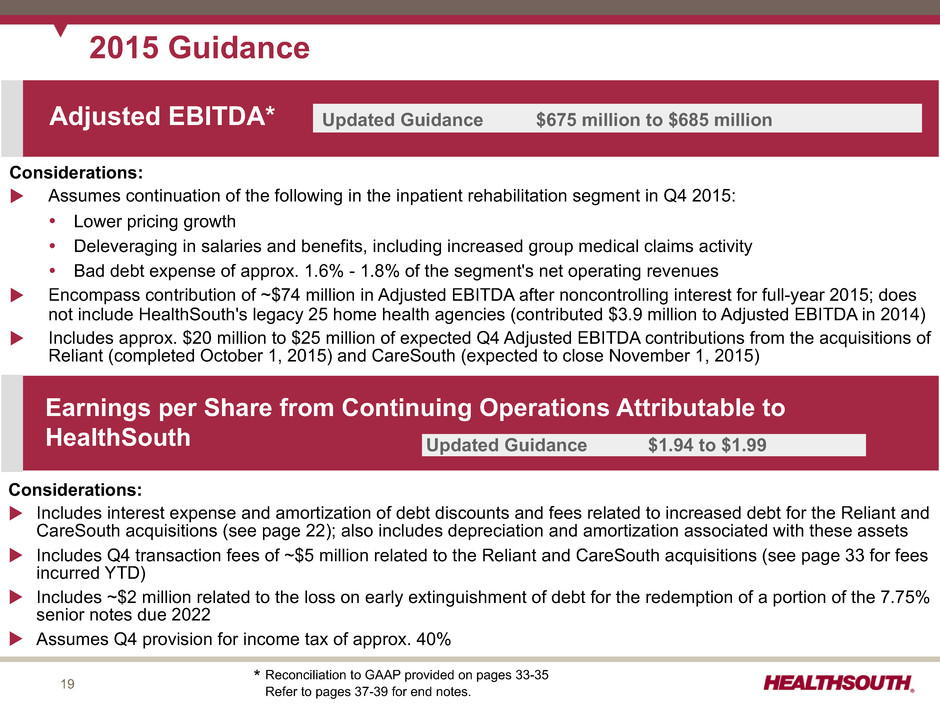

19 2015 Guidance Considerations: u Assumes continuation of the following in the inpatient rehabilitation segment in Q4 2015: Ÿ Lower pricing growth Ÿ Deleveraging in salaries and benefits, including increased group medical claims activity Ÿ Bad debt expense of approx. 1.6% - 1.8% of the segment's net operating revenues u Encompass contribution of ~$74 million in Adjusted EBITDA after noncontrolling interest for full-year 2015; does not include HealthSouth's legacy 25 home health agencies (contributed $3.9 million to Adjusted EBITDA in 2014) u Includes approx. $20 million to $25 million of expected Q4 Adjusted EBITDA contributions from the acquisitions of Reliant (completed October 1, 2015) and CareSouth (expected to close November 1, 2015) * Reconciliation to GAAP provided on pages 33-35 Refer to pages 37-39 for end notes. Considerations: u Includes interest expense and amortization of debt discounts and fees related to increased debt for the Reliant and CareSouth acquisitions (see page 22); also includes depreciation and amortization associated with these assets u Includes Q4 transaction fees of ~$5 million related to the Reliant and CareSouth acquisitions (see page 33 for fees incurred YTD) u Includes ~$2 million related to the loss on early extinguishment of debt for the redemption of a portion of the 7.75% senior notes due 2022 u Assumes Q4 provision for income tax of approx. 40% Updated Guidance $675 million to $685 million Updated Guidance $1.94 to $1.99 Adjusted EBITDA* Earnings per Share from Continuing Operations Attributable to HealthSouth

Appendix

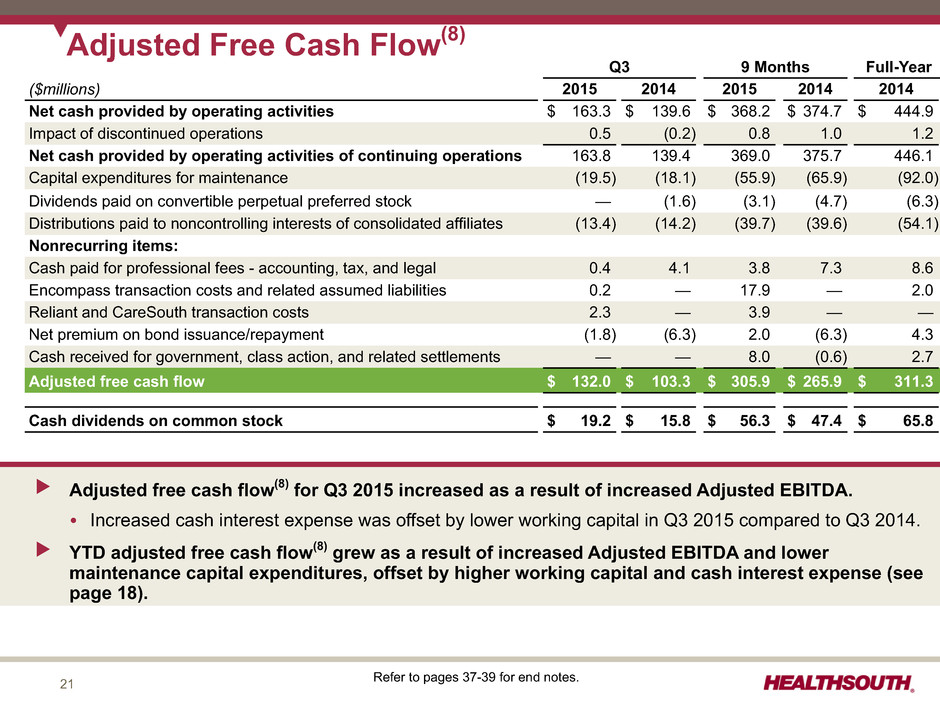

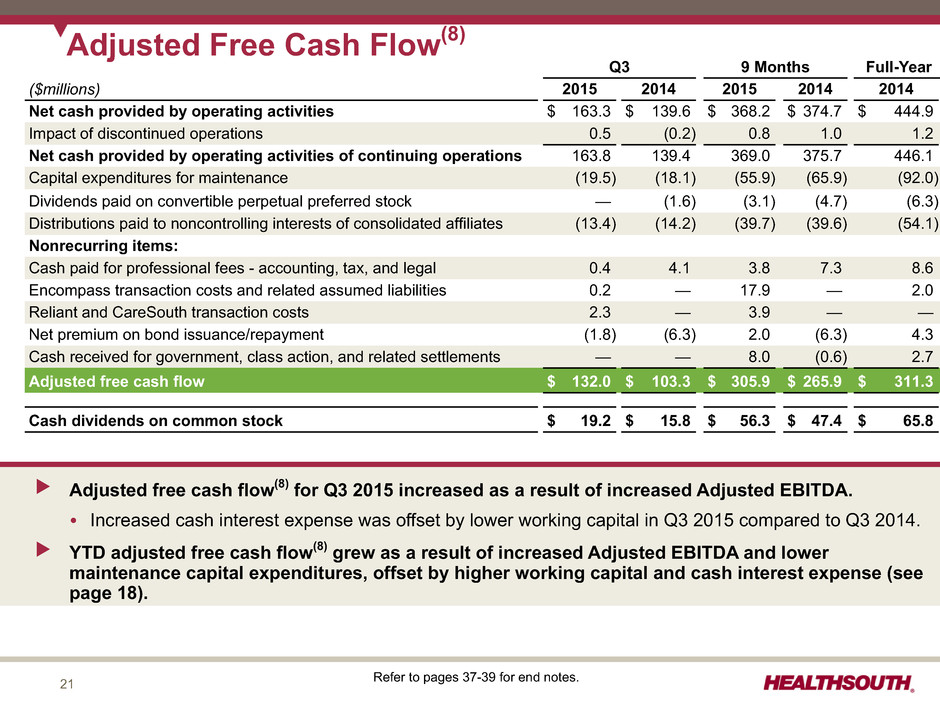

21 Adjusted Free Cash Flow(8) Q3 9 Months Full-Year ($millions) 2015 2014 2015 2014 2014 Net cash provided by operating activities $ 163.3 $ 139.6 $ 368.2 $ 374.7 $ 444.9 Impact of discontinued operations 0.5 (0.2) 0.8 1.0 1.2 Net cash provided by operating activities of continuing operations 163.8 139.4 369.0 375.7 446.1 Capital expenditures for maintenance (19.5) (18.1) (55.9) (65.9) (92.0) Dividends paid on convertible perpetual preferred stock — (1.6) (3.1) (4.7) (6.3) Distributions paid to noncontrolling interests of consolidated affiliates (13.4) (14.2) (39.7) (39.6) (54.1) Nonrecurring items: Cash paid for professional fees - accounting, tax, and legal 0.4 4.1 3.8 7.3 8.6 Encompass transaction costs and related assumed liabilities 0.2 — 17.9 — 2.0 Reliant and CareSouth transaction costs 2.3 — 3.9 — — Net premium on bond issuance/repayment (1.8) (6.3) 2.0 (6.3) 4.3 Cash received for government, class action, and related settlements — — 8.0 (0.6) 2.7 Adjusted free cash flow $ 132.0 $ 103.3 $ 305.9 $ 265.9 $ 311.3 Cash dividends on common stock $ 19.2 $ 15.8 $ 56.3 $ 47.4 $ 65.8 Refer to pages 37-39 for end notes. u Adjusted free cash flow(8) for Q3 2015 increased as a result of increased Adjusted EBITDA. Ÿ Increased cash interest expense was offset by lower working capital in Q3 2015 compared to Q3 2014. u YTD adjusted free cash flow(8) grew as a result of increased Adjusted EBITDA and lower maintenance capital expenditures, offset by higher working capital and cash interest expense (see page 18).

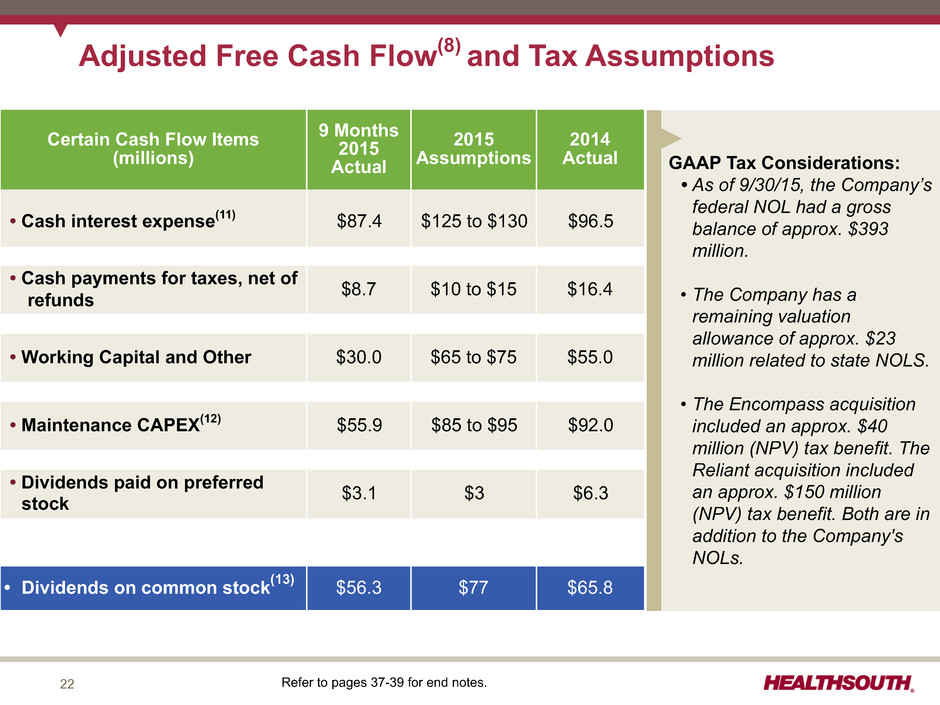

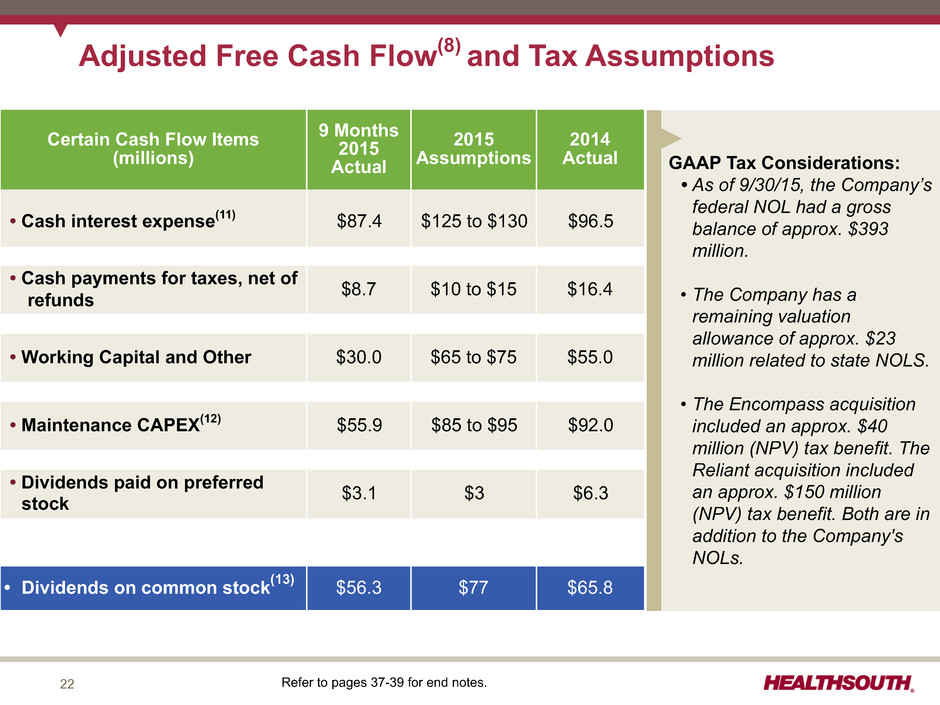

22 Adjusted Free Cash Flow(8) and Tax Assumptions Certain Cash Flow Items (millions) 9 Months 2015 Actual 2015 Assumptions 2014 Actual • Cash interest expense(11) $87.4 $125 to $130 $96.5 • Cash payments for taxes, net of refunds $8.7 $10 to $15 $16.4 • Working Capital and Other $30.0 $65 to $75 $55.0 • Maintenance CAPEX(12) $55.9 $85 to $95 $92.0 • Dividends paid on preferred stock $3.1 $3 $6.3 • Dividends on common stock(13) $56.3 $77 $65.8 Refer to pages 37-39 for end notes. GAAP Tax Considerations: • As of 9/30/15, the Company’s federal NOL had a gross balance of approx. $393 million. • The Company has a remaining valuation allowance of approx. $23 million related to state NOLS. • The Encompass acquisition included an approx. $40 million (NPV) tax benefit. The Reliant acquisition included an approx. $150 million (NPV) tax benefit. Both are in addition to the Company's NOLs.

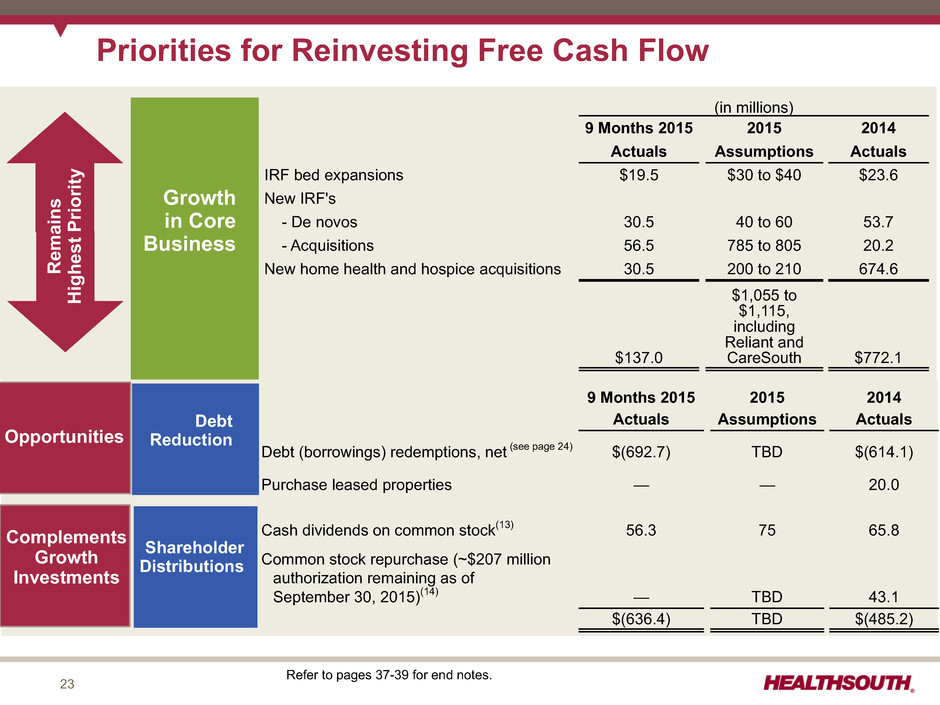

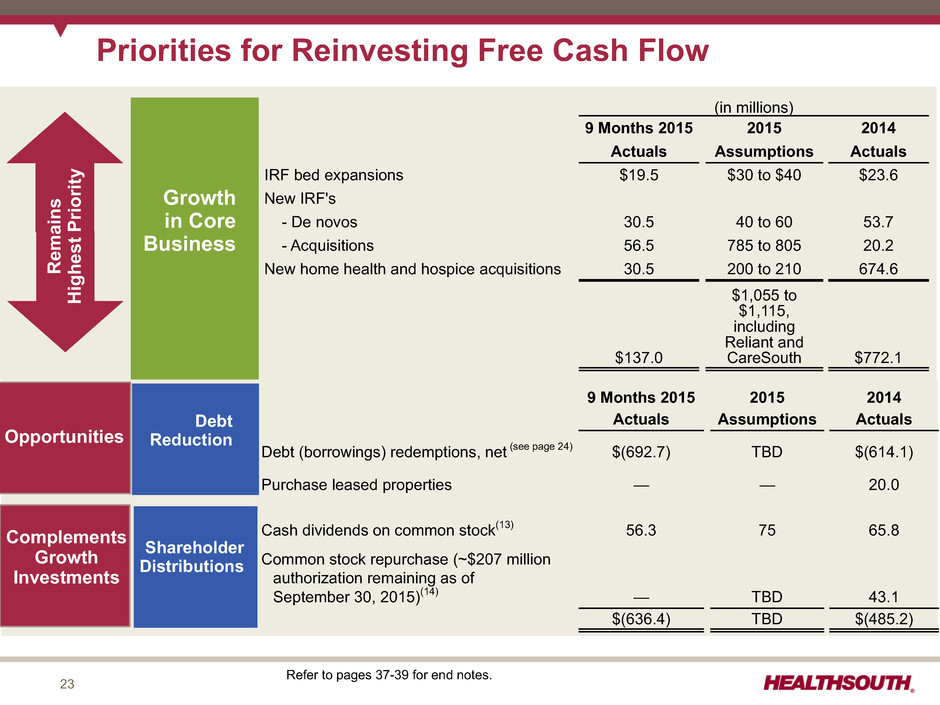

23 Priorities for Reinvesting Free Cash Flow Opportunities (in millions) 9 Months 2015 2015 2014 Actuals Assumptions Actuals IRF bed expansions $19.5 $30 to $40 $23.6 New IRF's - De novos 30.5 40 to 60 53.7 - Acquisitions 56.5 785 to 805 20.2 New home health and hospice acquisitions 30.5 200 to 210 674.6 $137.0 $1,055 to $1,115, including Reliant and CareSouth $772.1 9 Months 2015 2015 2014 Actuals Assumptions Actuals Debt (borrowings) redemptions, net (see page 24) $(692.7) TBD $(614.1) Purchase leased properties — — 20.0 Cash dividends on common stock(13) 56.3 75 65.8 Common stock repurchase (~$207 million authorization remaining as of September 30, 2015)(14) — TBD 43.1 $(636.4) TBD $(485.2) Complements Growth Investments Shareholder Distributions Growth in Core Business Debt Reduction Remain s Highest Priorit y Refer to pages 37-39 for end notes.

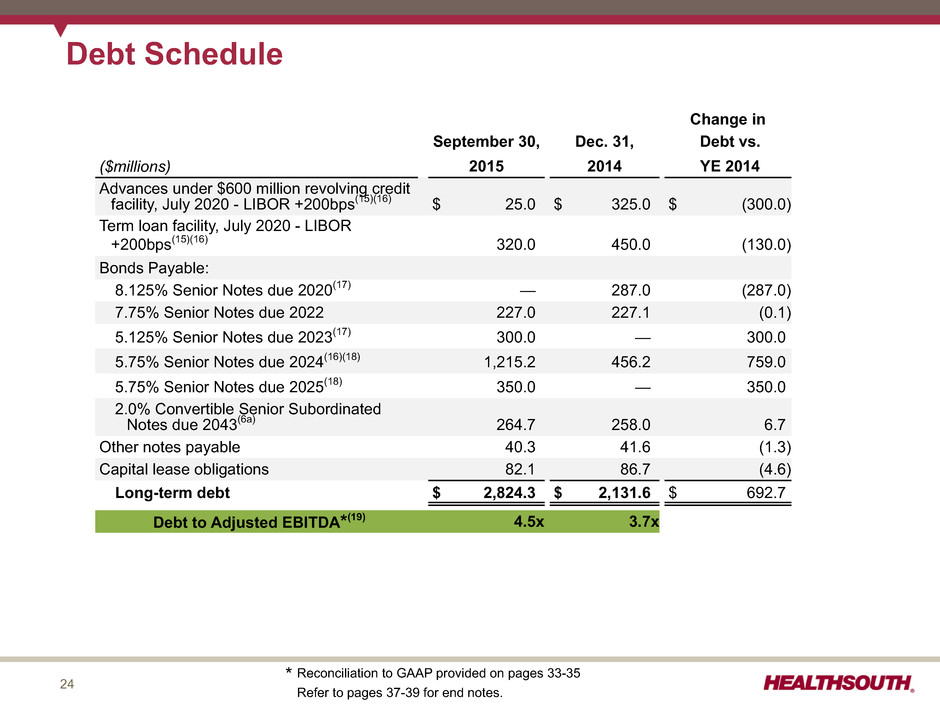

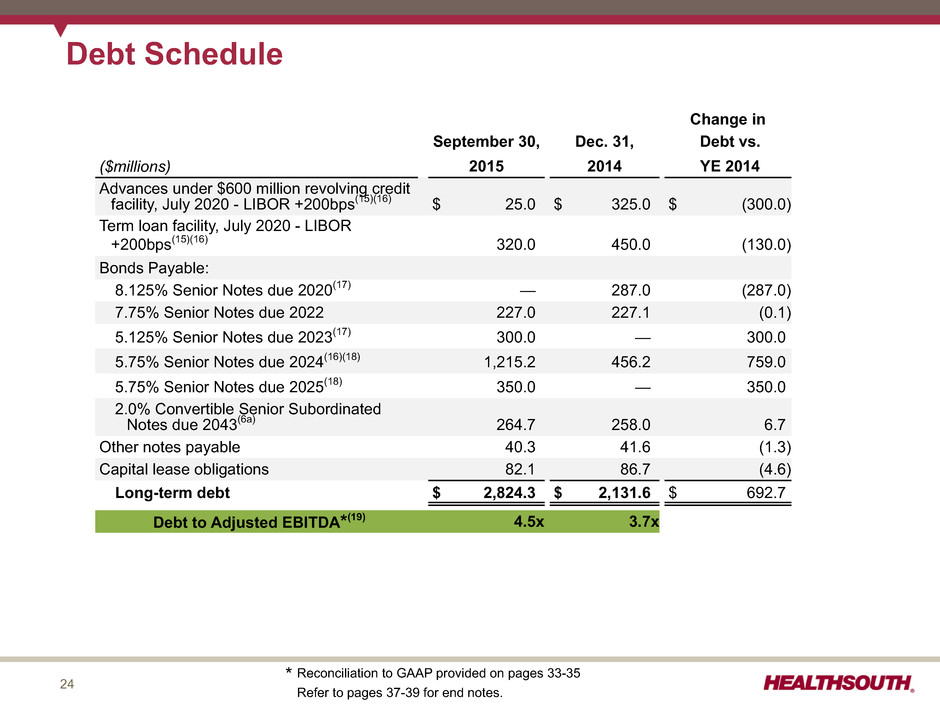

24 Debt Schedule Change in September 30, Dec. 31, Debt vs. ($millions) 2015 2014 YE 2014 Advances under $600 million revolving credit facility, July 2020 - LIBOR +200bps(15)(16) $ 25.0 $ 325.0 $ (300.0) Term loan facility, July 2020 - LIBOR +200bps(15)(16) 320.0 450.0 (130.0) Bonds Payable: 8.125% Senior Notes due 2020(17) — 287.0 (287.0) 7.75% Senior Notes due 2022 227.0 227.1 (0.1) 5.125% Senior Notes due 2023(17) 300.0 — 300.0 5.75% Senior Notes due 2024(16)(18) 1,215.2 456.2 759.0 5.75% Senior Notes due 2025(18) 350.0 — 350.0 2.0% Convertible Senior Subordinated Notes due 2043(6a) 264.7 258.0 6.7 Other notes payable 40.3 41.6 (1.3) Capital lease obligations 82.1 86.7 (4.6) Long-term debt $ 2,824.3 $ 2,131.6 $ 692.7 Debt to Adjusted EBITDA*(19) 4.5x 3.7x * Reconciliation to GAAP provided on pages 33-35 Refer to pages 37-39 for end notes.

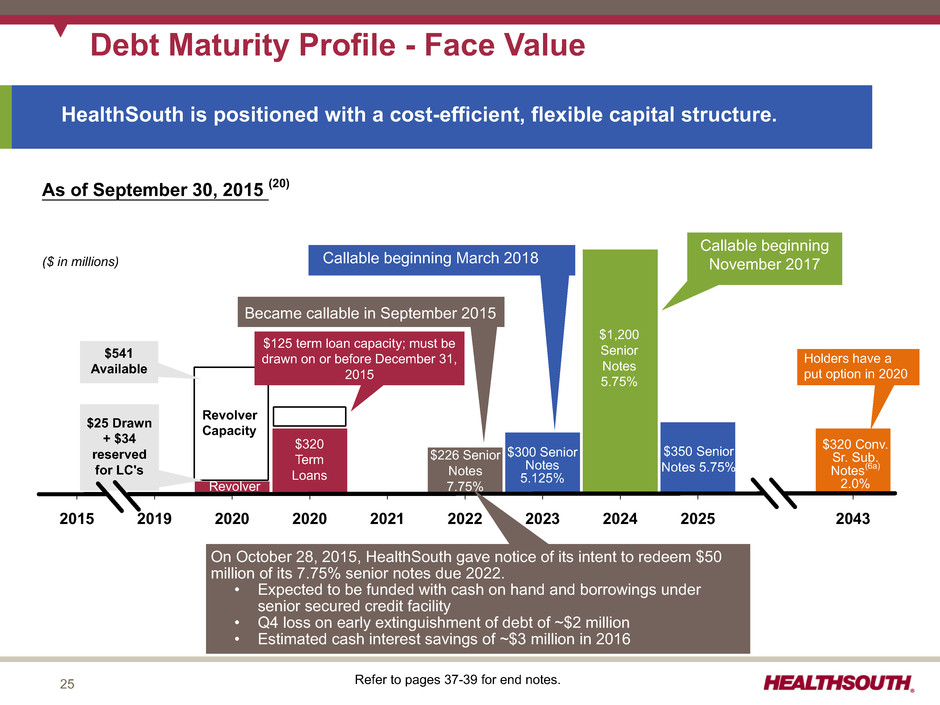

25 2015 2019 2020 2020 2021 2022 2023 2024 2025 2043 $350 Senior Notes 5.75% $1,200 Senior Notes 5.75% $320 Conv. Sr. Sub. Notes(6a) 2.0% $300 Senior Notes 5.125% $25 Drawn + $34 reserved for LC's Holders have a put option in 2020 As of September 30, 2015 (20) Debt Maturity Profile - Face Value ($ in millions) $541 Available $226 Senior Notes 7.75% Refer to pages 37-39 for end notes. Callable beginning November 2017 HealthSouth is positioned with a cost-efficient, flexible capital structure. Callable beginning March 2018 Revolver Revolver Capacity $125 term loan capacity; must be drawn on or before December 31, 2015 $320 Term Loans Became callable in September 2015 On October 28, 2015, HealthSouth gave notice of its intent to redeem $50 million of its 7.75% senior notes due 2022. • Expected to be funded with cash on hand and borrowings under senior secured credit facility • Q4 loss on early extinguishment of debt of ~$2 million • Estimated cash interest savings of ~$3 million in 2016

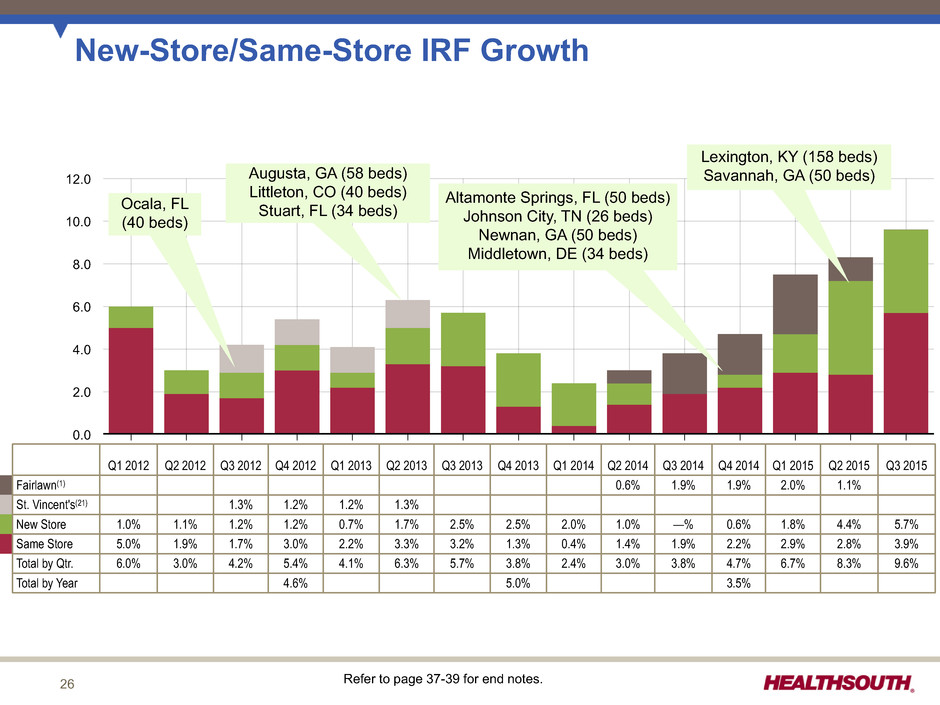

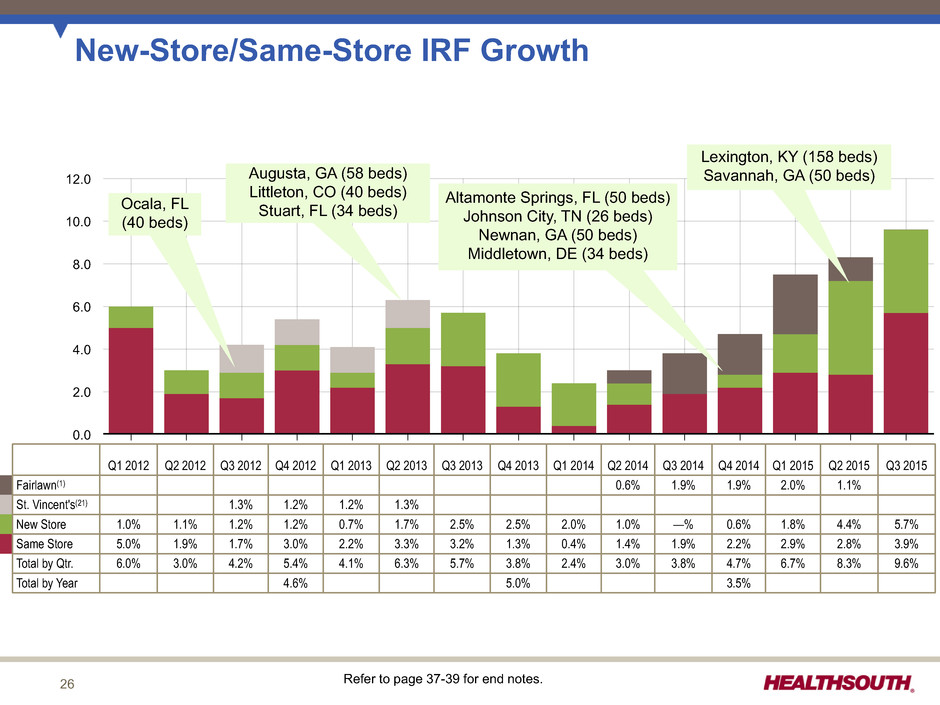

26 12.0 10.0 8.0 6.0 4.0 2.0 0.0 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 New-Store/Same-Store IRF Growth Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Fairlawn(1) 0.6% 1.9% 1.9% 2.0% 1.1% St. Vincent's(21) 1.3% 1.2% 1.2% 1.3% New Store 1.0% 1.1% 1.2% 1.2% 0.7% 1.7% 2.5% 2.5% 2.0% 1.0% —% 0.6% 1.8% 4.4% 5.7% Same Store 5.0% 1.9% 1.7% 3.0% 2.2% 3.3% 3.2% 1.3% 0.4% 1.4% 1.9% 2.2% 2.9% 2.8% 3.9% Total by Qtr. 6.0% 3.0% 4.2% 5.4% 4.1% 6.3% 5.7% 3.8% 2.4% 3.0% 3.8% 4.7% 6.7% 8.3% 9.6% Total by Year 4.6% 5.0% 3.5% Altamonte Springs, FL (50 beds) Johnson City, TN (26 beds) Newnan, GA (50 beds) Middletown, DE (34 beds) Ocala, FL (40 beds) Augusta, GA (58 beds) Littleton, CO (40 beds) Stuart, FL (34 beds) Refer to page 37-39 for end notes. Lexington, KY (158 beds) Savannah, GA (50 beds)

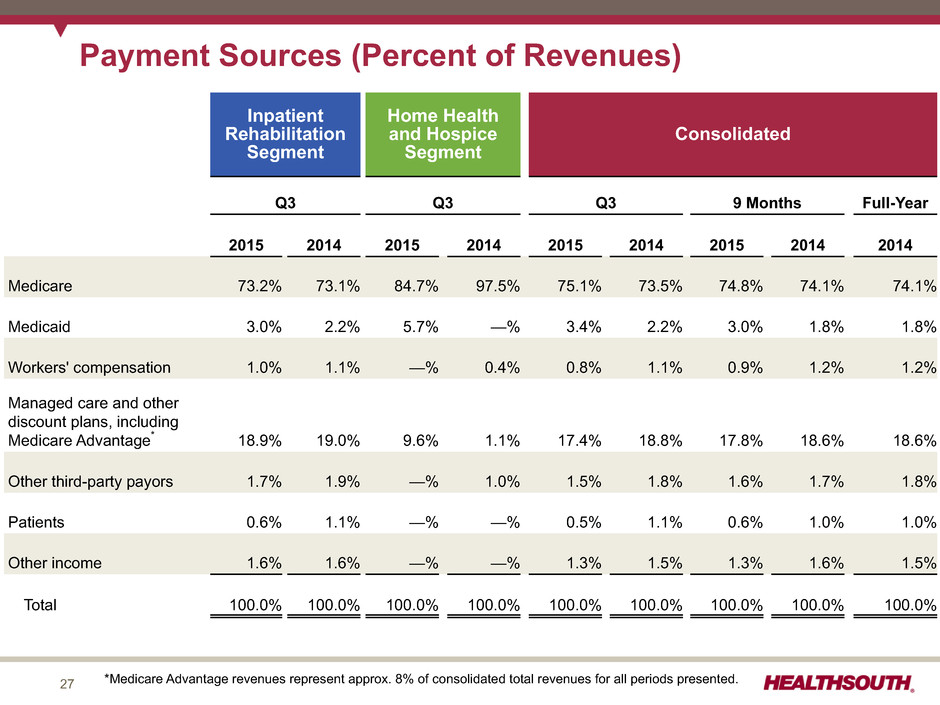

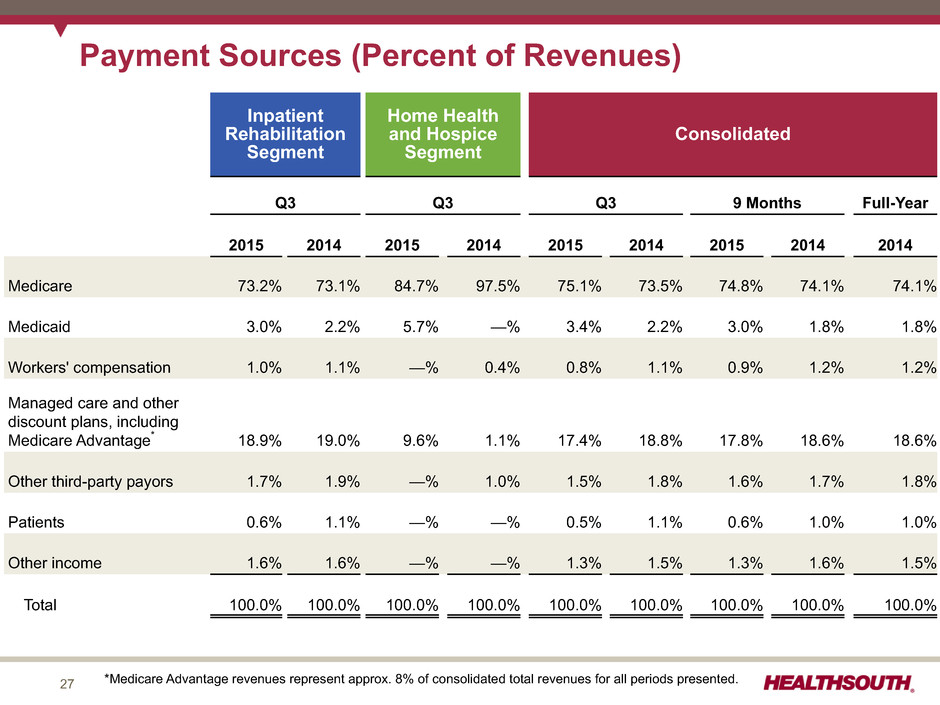

27 Payment Sources (Percent of Revenues) Inpatient Rehabilitation Segment Home Health and Hospice Segment Consolidated Q3 Q3 Q3 9 Months Full-Year 2015 2014 2015 2014 2015 2014 2015 2014 2014 Medicare 73.2% 73.1% 84.7% 97.5% 75.1% 73.5% 74.8% 74.1% 74.1% Medicaid 3.0% 2.2% 5.7% —% 3.4% 2.2% 3.0% 1.8% 1.8% Workers' compensation 1.0% 1.1% —% 0.4% 0.8% 1.1% 0.9% 1.2% 1.2% Managed care and other discount plans, including Medicare Advantage* 18.9% 19.0% 9.6% 1.1% 17.4% 18.8% 17.8% 18.6% 18.6% Other third-party payors 1.7% 1.9% —% 1.0% 1.5% 1.8% 1.6% 1.7% 1.8% Patients 0.6% 1.1% —% —% 0.5% 1.1% 0.6% 1.0% 1.0% Other income 1.6% 1.6% —% —% 1.3% 1.5% 1.3% 1.6% 1.5% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% *Medicare Advantage revenues represent approx. 8% of consolidated total revenues for all periods presented.

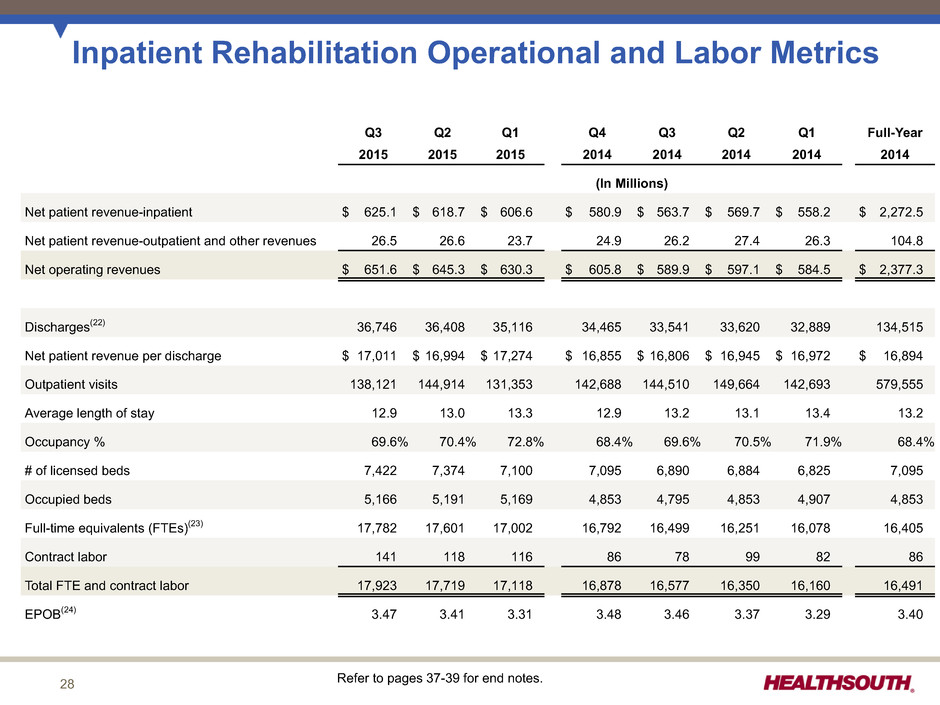

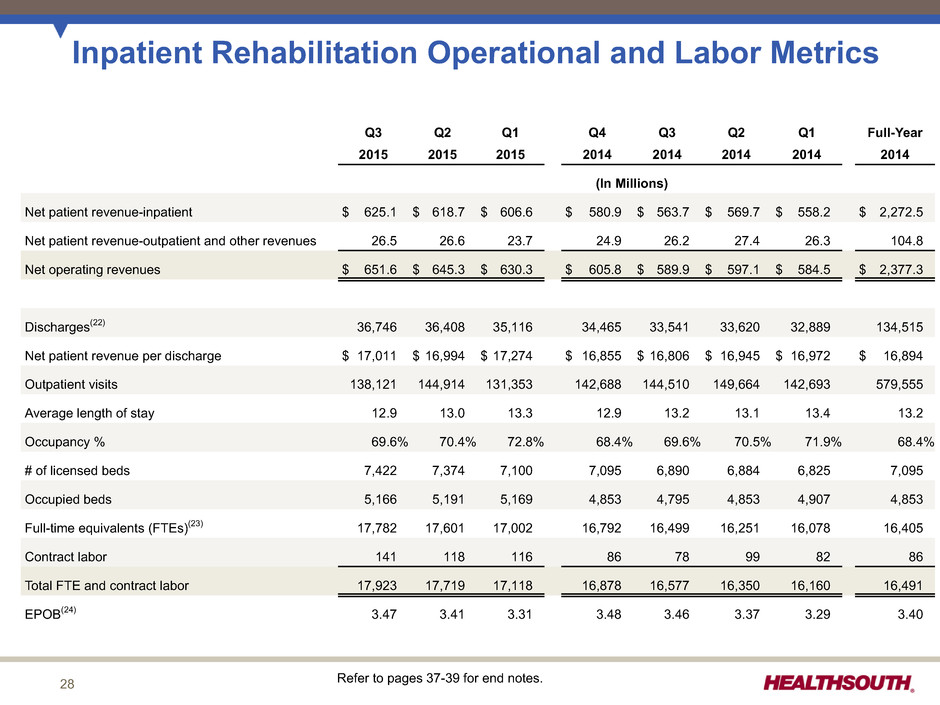

28 Inpatient Rehabilitation Operational and Labor Metrics Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year 2015 2015 2015 2014 2014 2014 2014 2014 (In Millions) Net patient revenue-inpatient $ 625.1 $ 618.7 $ 606.6 $ 580.9 $ 563.7 $ 569.7 $ 558.2 $ 2,272.5 Net patient revenue-outpatient and other revenues 26.5 26.6 23.7 24.9 26.2 27.4 26.3 104.8 Net operating revenues $ 651.6 $ 645.3 $ 630.3 $ 605.8 $ 589.9 $ 597.1 $ 584.5 $ 2,377.3 Discharges(22) 36,746 36,408 35,116 34,465 33,541 33,620 32,889 134,515 Net patient revenue per discharge $ 17,011 $ 16,994 $ 17,274 $ 16,855 $ 16,806 $ 16,945 $ 16,972 $ 16,894 Outpatient visits 138,121 144,914 131,353 142,688 144,510 149,664 142,693 579,555 Average length of stay 12.9 13.0 13.3 12.9 13.2 13.1 13.4 13.2 Occupancy % 69.6% 70.4% 72.8% 68.4% 69.6% 70.5% 71.9% 68.4% # of licensed beds 7,422 7,374 7,100 7,095 6,890 6,884 6,825 7,095 Occupied beds 5,166 5,191 5,169 4,853 4,795 4,853 4,907 4,853 Full-time equivalents (FTEs)(23) 17,782 17,601 17,002 16,792 16,499 16,251 16,078 16,405 Contract labor 141 118 116 86 78 99 82 86 Total FTE and contract labor 17,923 17,719 17,118 16,878 16,577 16,350 16,160 16,491 EPOB(24) 3.47 3.41 3.31 3.48 3.46 3.37 3.29 3.40 Refer to pages 37-39 for end notes.

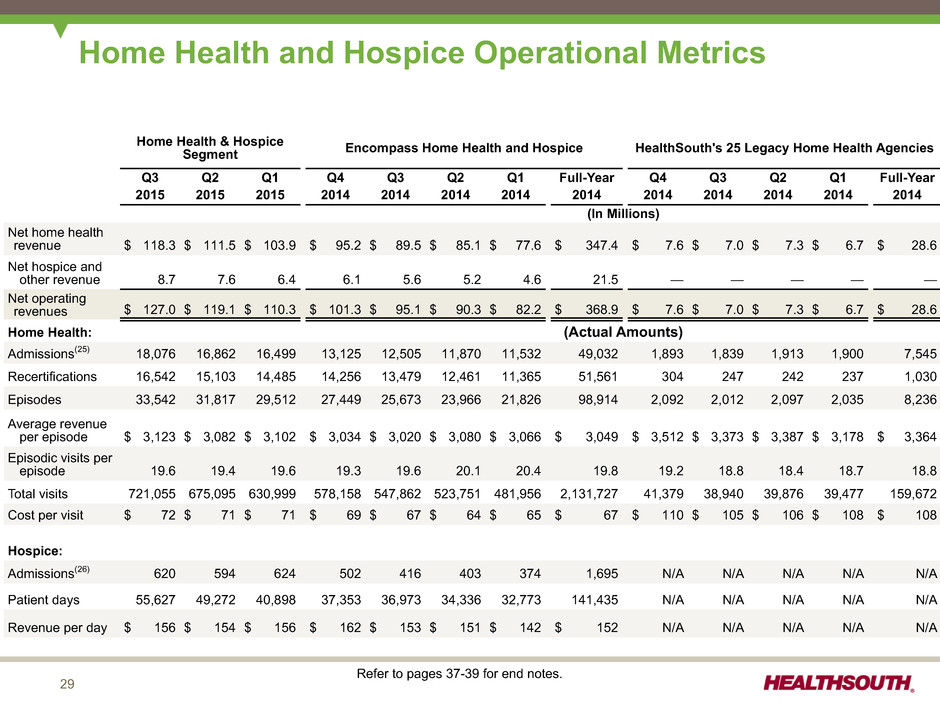

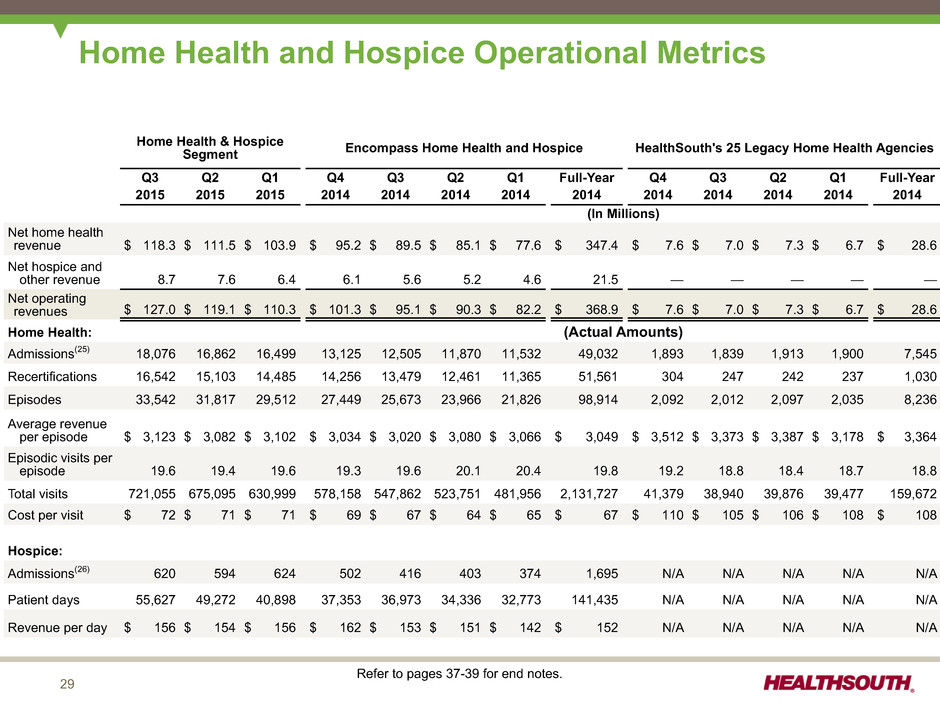

29 Home Health and Hospice Operational Metrics Home Health & Hospice Segment Encompass Home Health and Hospice HealthSouth's 25 Legacy Home Health Agencies Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full-Year Q4 Q3 Q2 Q1 Full-Year 2015 2015 2015 2014 2014 2014 2014 2014 2014 2014 2014 2014 2014 (In Millions) Net home health revenue $ 118.3 $ 111.5 $ 103.9 $ 95.2 $ 89.5 $ 85.1 $ 77.6 $ 347.4 $ 7.6 $ 7.0 $ 7.3 $ 6.7 $ 28.6 Net hospice and other revenue 8.7 7.6 6.4 6.1 5.6 5.2 4.6 21.5 — — — — — Net operating revenues $ 127.0 $ 119.1 $ 110.3 $ 101.3 $ 95.1 $ 90.3 $ 82.2 $ 368.9 $ 7.6 $ 7.0 $ 7.3 $ 6.7 $ 28.6 Home Health: (Actual Amounts) Admissions(25) 18,076 16,862 16,499 13,125 12,505 11,870 11,532 49,032 1,893 1,839 1,913 1,900 7,545 Recertifications 16,542 15,103 14,485 14,256 13,479 12,461 11,365 51,561 304 247 242 237 1,030 Episodes 33,542 31,817 29,512 27,449 25,673 23,966 21,826 98,914 2,092 2,012 2,097 2,035 8,236 Average revenue per episode $ 3,123 $ 3,082 $ 3,102 $ 3,034 $ 3,020 $ 3,080 $ 3,066 $ 3,049 $ 3,512 $ 3,373 $ 3,387 $ 3,178 $ 3,364 Episodic visits per episode 19.6 19.4 19.6 19.3 19.6 20.1 20.4 19.8 19.2 18.8 18.4 18.7 18.8 Total visits 721,055 675,095 630,999 578,158 547,862 523,751 481,956 2,131,727 41,379 38,940 39,876 39,477 159,672 Cost per visit $ 72 $ 71 $ 71 $ 69 $ 67 $ 64 $ 65 $ 67 $ 110 $ 105 $ 106 $ 108 $ 108 Hospice: Admissions(26) 620 594 624 502 416 403 374 1,695 N/A N/A N/A N/A N/A Patient days 55,627 49,272 40,898 37,353 36,973 34,336 32,773 141,435 N/A N/A N/A N/A N/A Revenue per day $ 156 $ 154 $ 156 $ 162 $ 153 $ 151 $ 142 $ 152 N/A N/A N/A N/A N/A Refer to pages 37-39 for end notes.

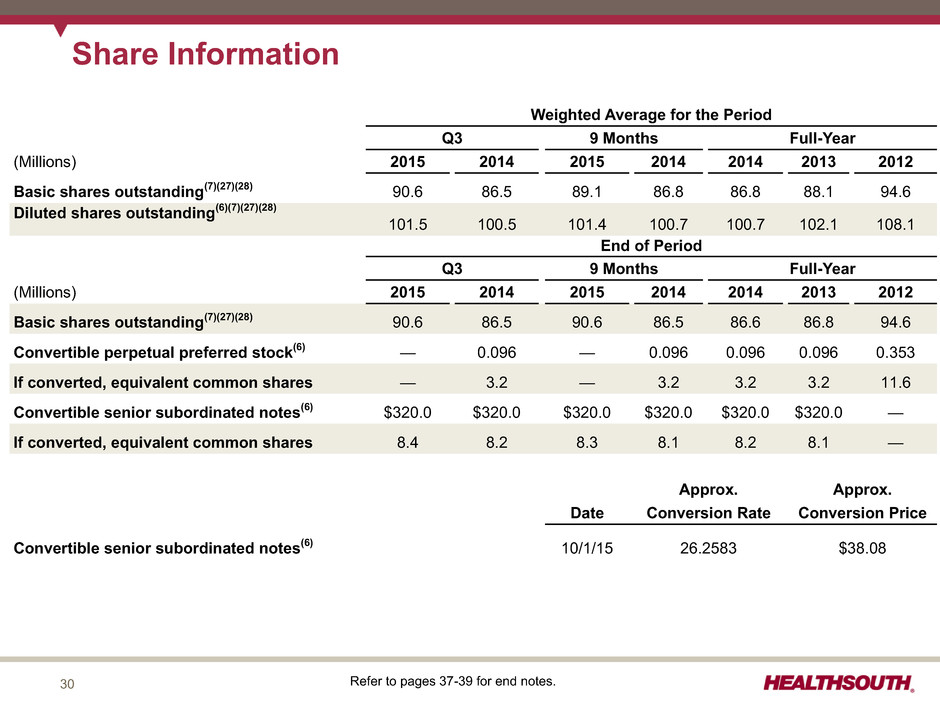

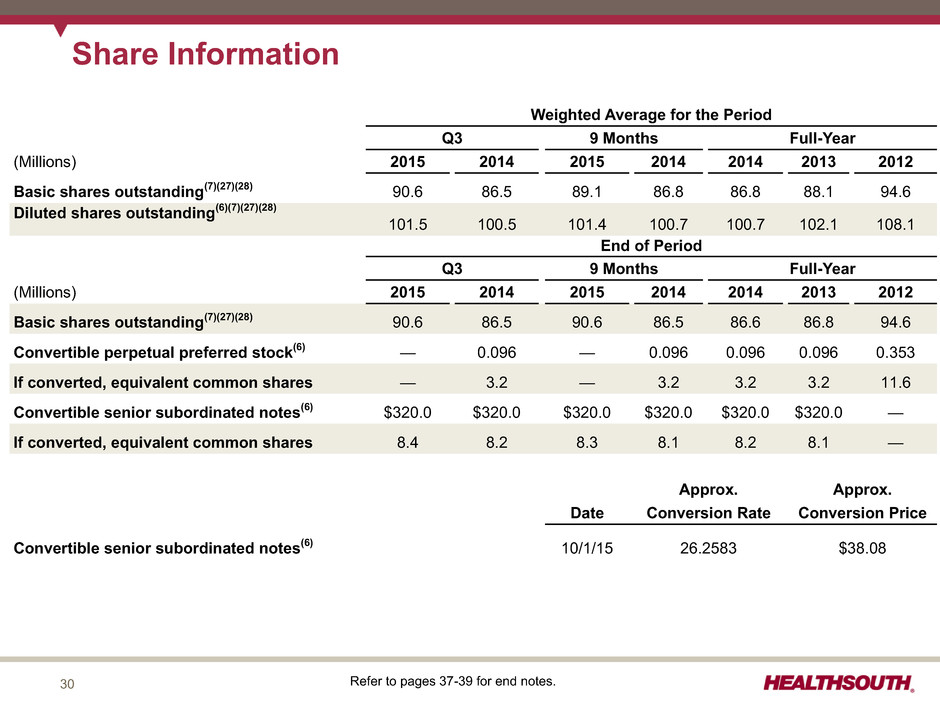

30 Share Information Weighted Average for the Period Q3 9 Months Full-Year (Millions) 2015 2014 2015 2014 2014 2013 2012 Basic shares outstanding(7)(27)(28) 90.6 86.5 89.1 86.8 86.8 88.1 94.6 Diluted shares outstanding(6)(7)(27)(28) 101.5 100.5 101.4 100.7 100.7 102.1 108.1 End of Period Q3 9 Months Full-Year (Millions) 2015 2014 2015 2014 2014 2013 2012 Basic shares outstanding(7)(27)(28) 90.6 86.5 90.6 86.5 86.6 86.8 94.6 Convertible perpetual preferred stock(6) — 0.096 — 0.096 0.096 0.096 0.353 If converted, equivalent common shares — 3.2 — 3.2 3.2 3.2 11.6 Convertible senior subordinated notes(6) $320.0 $320.0 $320.0 $320.0 $320.0 $320.0 — If converted, equivalent common shares 8.4 8.2 8.3 8.1 8.2 8.1 — Approx. Approx. Date Conversion Rate Conversion Price Convertible senior subordinated notes(6) 10/1/15 26.2583 $38.08 Refer to pages 37-39 for end notes.

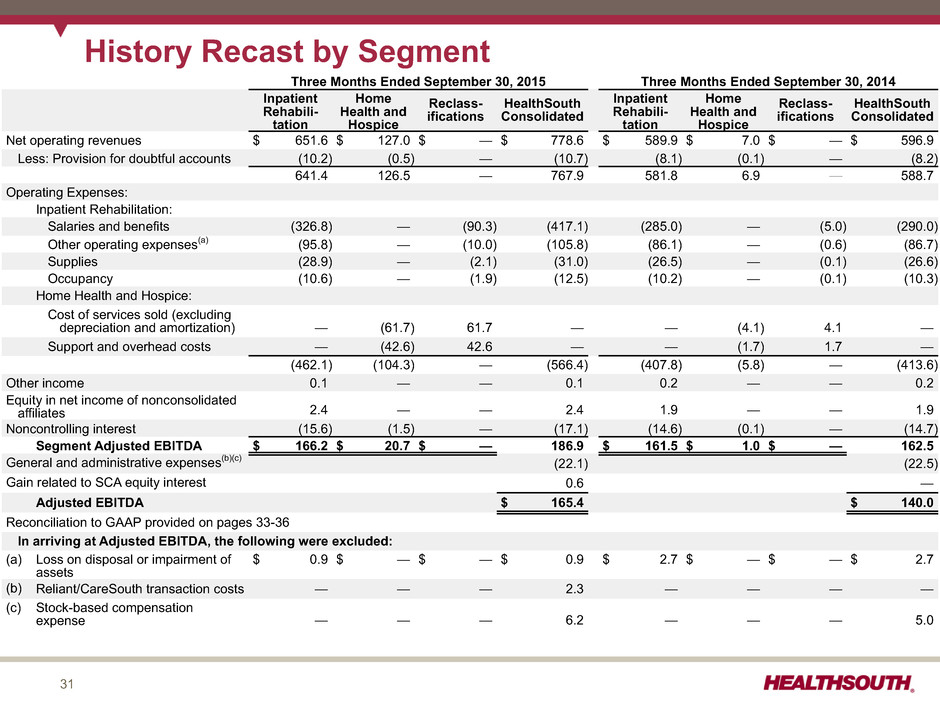

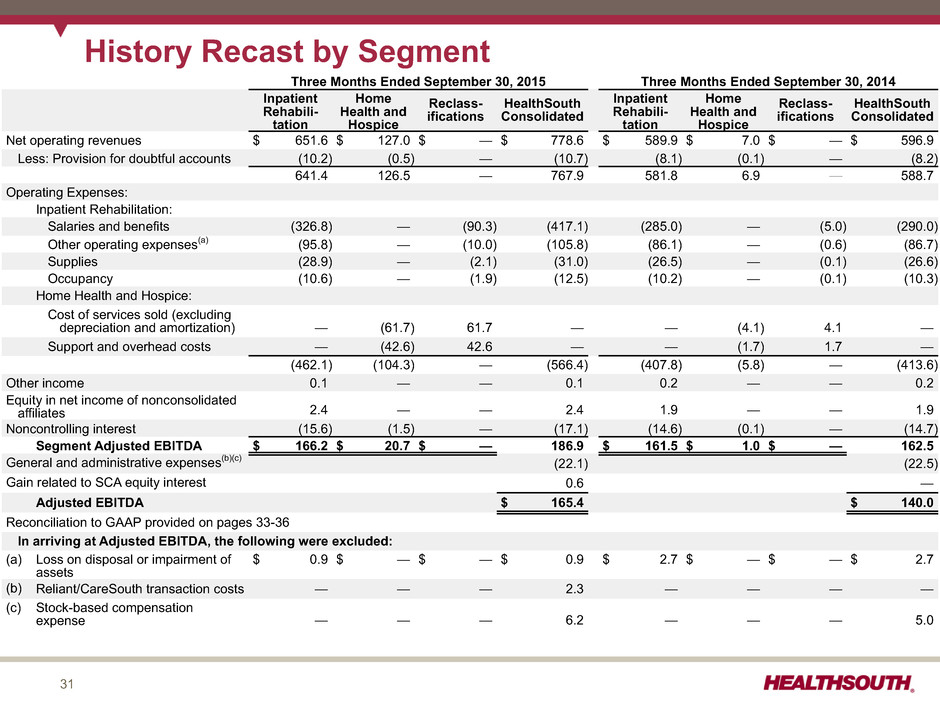

31 History Recast by Segment Three Months Ended September 30, 2015 Three Months Ended September 30, 2014 Inpatient Rehabili- tation Home Health and Hospice Reclass- ifications HealthSouth Consolidated Inpatient Rehabili- tation Home Health and Hospice Reclass- ifications HealthSouth Consolidated Net operating revenues $ 651.6 $ 127.0 $ — $ 778.6 $ 589.9 $ 7.0 $ — $ 596.9 Less: Provision for doubtful accounts (10.2) (0.5) — (10.7) (8.1) (0.1) — (8.2) 641.4 126.5 — 767.9 581.8 6.9 — 588.7 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (326.8) — (90.3) (417.1) (285.0) — (5.0) (290.0) Other operating expenses(a) (95.8) — (10.0) (105.8) (86.1) — (0.6) (86.7) Supplies (28.9) — (2.1) (31.0) (26.5) — (0.1) (26.6) Occupancy (10.6) — (1.9) (12.5) (10.2) — (0.1) (10.3) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (61.7) 61.7 — — (4.1) 4.1 — Support and overhead costs — (42.6) 42.6 — — (1.7) 1.7 — (462.1) (104.3) — (566.4) (407.8) (5.8) — (413.6) Other income 0.1 — — 0.1 0.2 — — 0.2 Equity in net income of nonconsolidated affiliates 2.4 — — 2.4 1.9 — — 1.9 Noncontrolling interest (15.6) (1.5) — (17.1) (14.6) (0.1) — (14.7) Segment Adjusted EBITDA $ 166.2 $ 20.7 $ — 186.9 $ 161.5 $ 1.0 $ — 162.5 General and administrative expenses(b)(c) (22.1) (22.5) Gain related to SCA equity interest 0.6 — Adjusted EBITDA $ 165.4 $ 140.0 Reconciliation to GAAP provided on pages 33-36 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal or impairment of assets $ 0.9 $ — $ — $ 0.9 $ 2.7 $ — $ — $ 2.7 (b) Reliant/CareSouth transaction costs — — — 2.3 — — — — (c) Stock-based compensation expense — — — 6.2 — — — 5.0

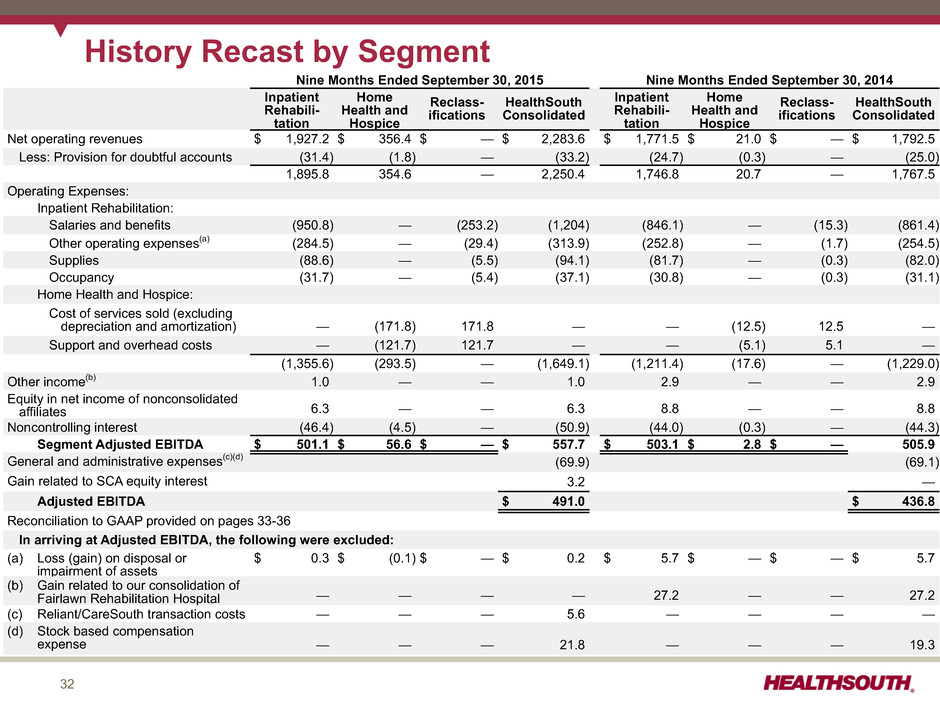

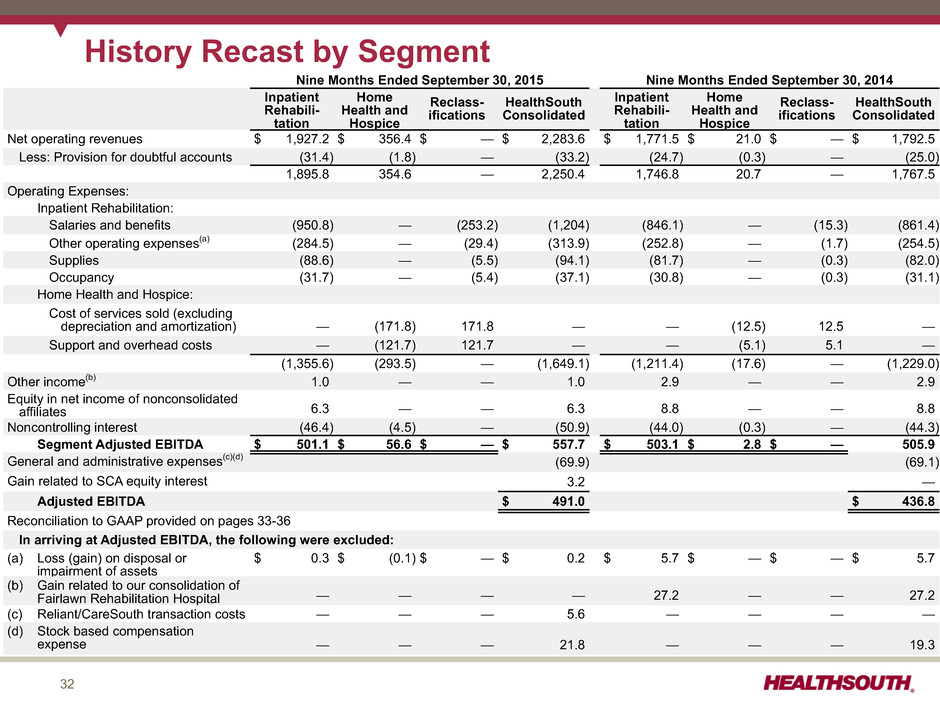

32 History Recast by Segment Nine Months Ended September 30, 2015 Nine Months Ended September 30, 2014 Inpatient Rehabili- tation Home Health and Hospice Reclass- ifications HealthSouth Consolidated Inpatient Rehabili- tation Home Health and Hospice Reclass- ifications HealthSouth Consolidated Net operating revenues $ 1,927.2 $ 356.4 $ — $ 2,283.6 $ 1,771.5 $ 21.0 $ — $ 1,792.5 Less: Provision for doubtful accounts (31.4) (1.8) — (33.2) (24.7) (0.3) — (25.0) 1,895.8 354.6 — 2,250.4 1,746.8 20.7 — 1,767.5 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (950.8) — (253.2) (1,204) (846.1) — (15.3) (861.4) Other operating expenses(a) (284.5) — (29.4) (313.9) (252.8) — (1.7) (254.5) Supplies (88.6) — (5.5) (94.1) (81.7) — (0.3) (82.0) Occupancy (31.7) — (5.4) (37.1) (30.8) — (0.3) (31.1) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (171.8) 171.8 — — (12.5) 12.5 — Support and overhead costs — (121.7) 121.7 — — (5.1) 5.1 — (1,355.6) (293.5) — (1,649.1) (1,211.4) (17.6) — (1,229.0) Other income(b) 1.0 — — 1.0 2.9 — — 2.9 Equity in net income of nonconsolidated affiliates 6.3 — — 6.3 8.8 — — 8.8 Noncontrolling interest (46.4) (4.5) — (50.9) (44.0) (0.3) — (44.3) Segment Adjusted EBITDA $ 501.1 $ 56.6 $ — $ 557.7 $ 503.1 $ 2.8 $ — 505.9 General and administrative expenses(c)(d) (69.9) (69.1) Gain related to SCA equity interest 3.2 — Adjusted EBITDA $ 491.0 $ 436.8 Reconciliation to GAAP provided on pages 33-36 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal or impairment of assets $ 0.3 $ (0.1) $ — $ 0.2 $ 5.7 $ — $ — $ 5.7 (b) Gain related to our consolidation of Fairlawn Rehabilitation Hospital — — — — 27.2 — — 27.2 (c) Reliant/CareSouth transaction costs — — — 5.6 — — — — (d) Stock based compensation expense — — — 21.8 — — — 19.3

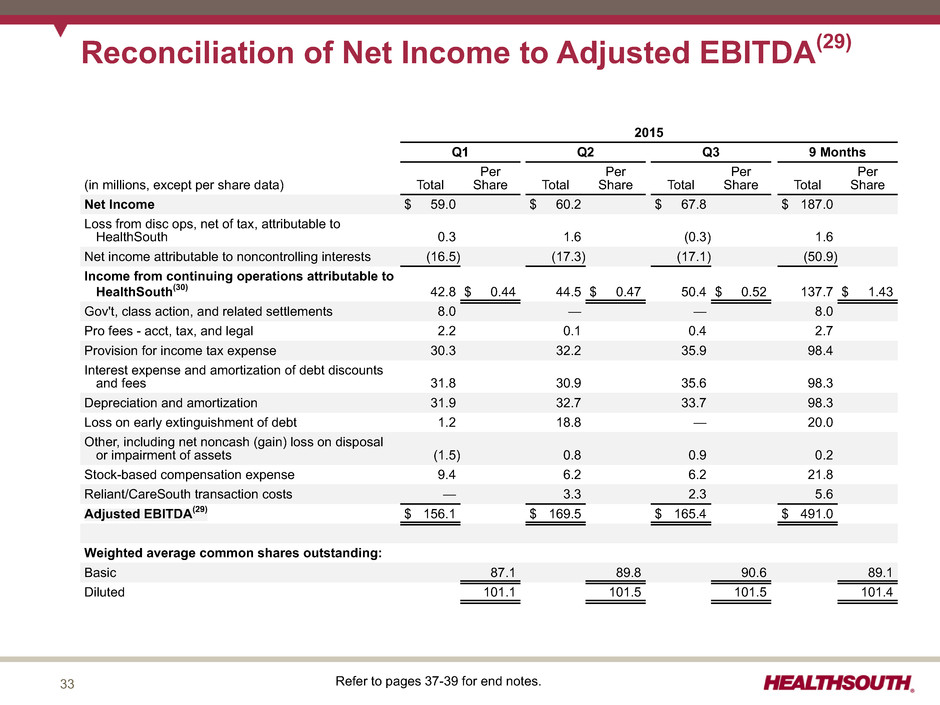

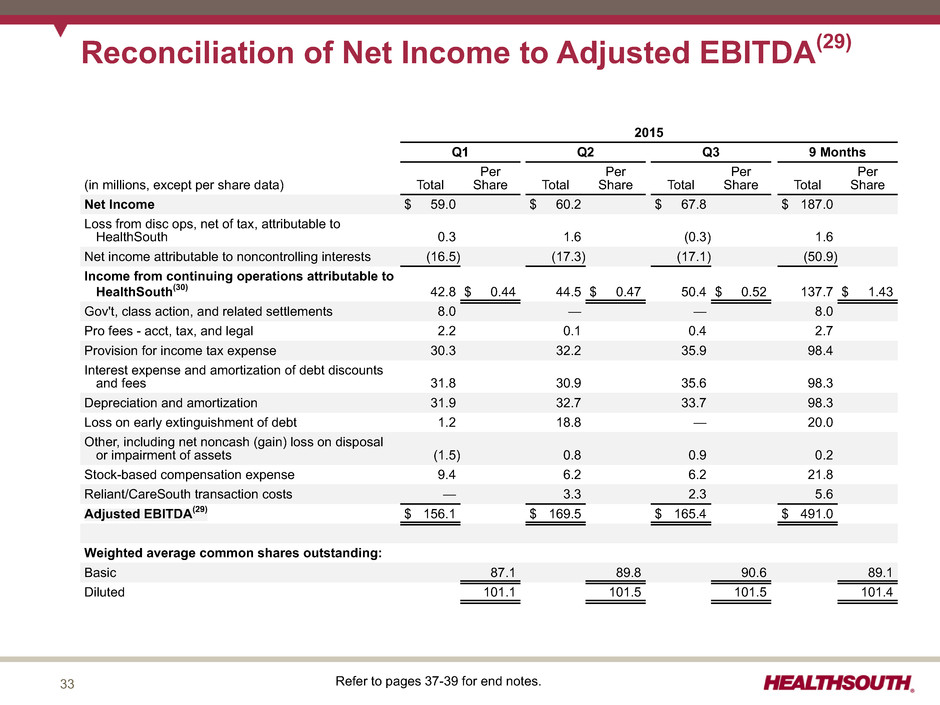

33 Reconciliation of Net Income to Adjusted EBITDA(29) 2015 Q1 Q2 Q3 9 Months (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 59.0 $ 60.2 $ 67.8 $ 187.0 Loss from disc ops, net of tax, attributable to HealthSouth 0.3 1.6 (0.3) 1.6 Net income attributable to noncontrolling interests (16.5) (17.3) (17.1) (50.9) Income from continuing operations attributable to HealthSouth(30) 42.8 $ 0.44 44.5 $ 0.47 50.4 $ 0.52 137.7 $ 1.43 Gov't, class action, and related settlements 8.0 — — 8.0 Pro fees - acct, tax, and legal 2.2 0.1 0.4 2.7 Provision for income tax expense 30.3 32.2 35.9 98.4 Interest expense and amortization of debt discounts and fees 31.8 30.9 35.6 98.3 Depreciation and amortization 31.9 32.7 33.7 98.3 Loss on early extinguishment of debt 1.2 18.8 — 20.0 Other, including net noncash (gain) loss on disposal or impairment of assets (1.5) 0.8 0.9 0.2 Stock-based compensation expense 9.4 6.2 6.2 21.8 Reliant/CareSouth transaction costs — 3.3 2.3 5.6 Adjusted EBITDA(29) $ 156.1 $ 169.5 $ 165.4 $ 491.0 Weighted average common shares outstanding: Basic 87.1 89.8 90.6 89.1 Diluted 101.1 101.5 101.5 101.4 Refer to pages 37-39 for end notes.

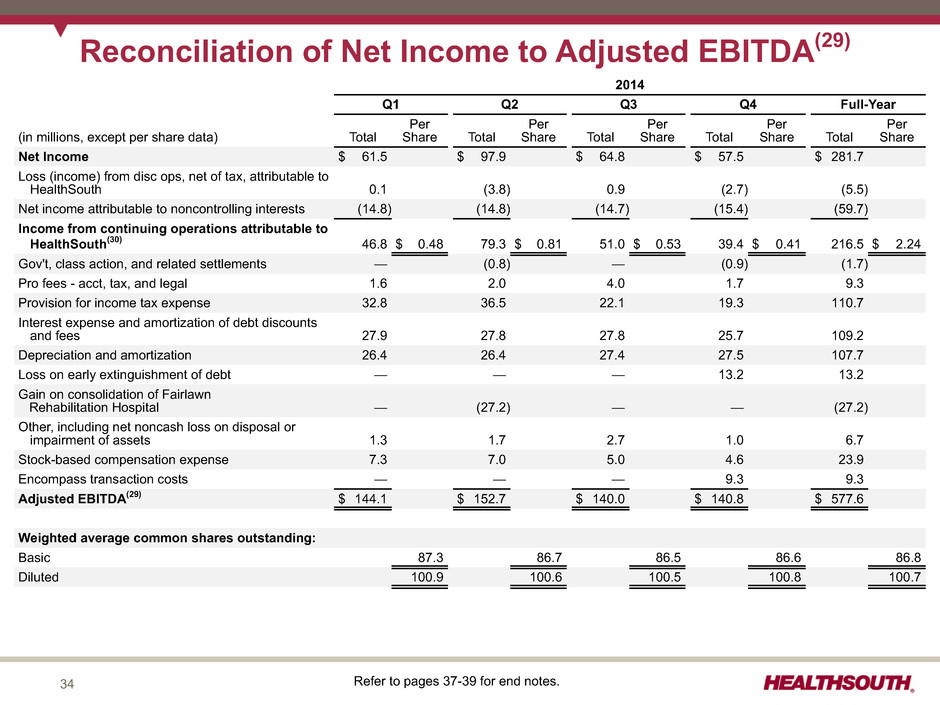

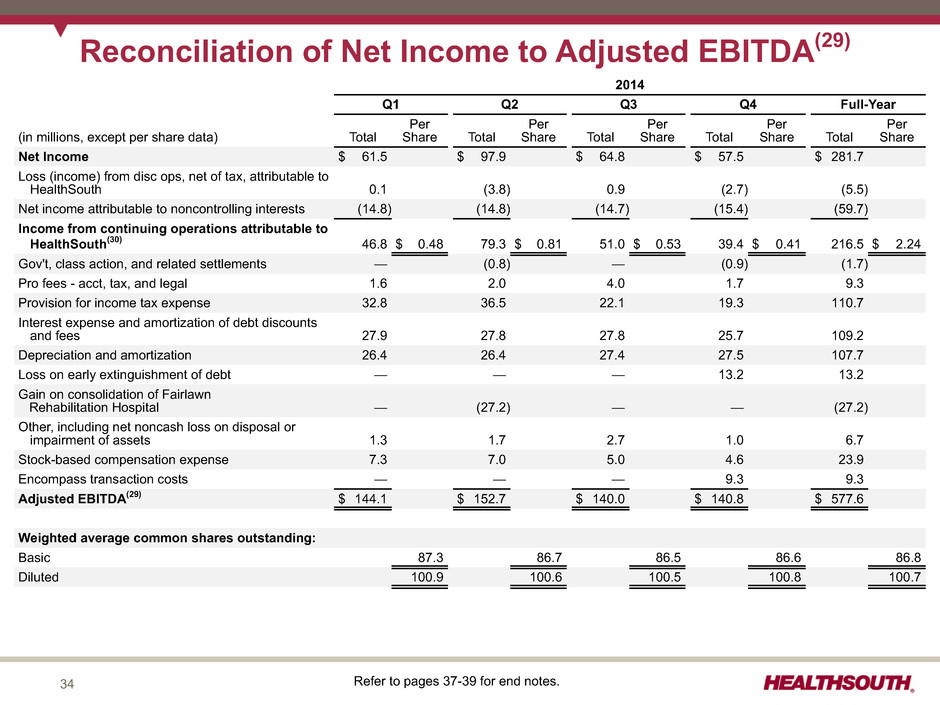

34 Reconciliation of Net Income to Adjusted EBITDA(29) 2014 Q1 Q2 Q3 Q4 Full-Year (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 61.5 $ 97.9 $ 64.8 $ 57.5 $ 281.7 Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.1 (3.8) 0.9 (2.7) (5.5) Net income attributable to noncontrolling interests (14.8) (14.8) (14.7) (15.4) (59.7) Income from continuing operations attributable to HealthSouth(30) 46.8 $ 0.48 79.3 $ 0.81 51.0 $ 0.53 39.4 $ 0.41 216.5 $ 2.24 Gov't, class action, and related settlements — (0.8) — (0.9) (1.7) Pro fees - acct, tax, and legal 1.6 2.0 4.0 1.7 9.3 Provision for income tax expense 32.8 36.5 22.1 19.3 110.7 Interest expense and amortization of debt discounts and fees 27.9 27.8 27.8 25.7 109.2 Depreciation and amortization 26.4 26.4 27.4 27.5 107.7 Loss on early extinguishment of debt — — — 13.2 13.2 Gain on consolidation of Fairlawn Rehabilitation Hospital — (27.2) — — (27.2) Other, including net noncash loss on disposal or impairment of assets 1.3 1.7 2.7 1.0 6.7 Stock-based compensation expense 7.3 7.0 5.0 4.6 23.9 Encompass transaction costs — — — 9.3 9.3 Adjusted EBITDA(29) $ 144.1 $ 152.7 $ 140.0 $ 140.8 $ 577.6 Weighted average common shares outstanding: Basic 87.3 86.7 86.5 86.6 86.8 Diluted 100.9 100.6 100.5 100.8 100.7 Refer to pages 37-39 for end notes.

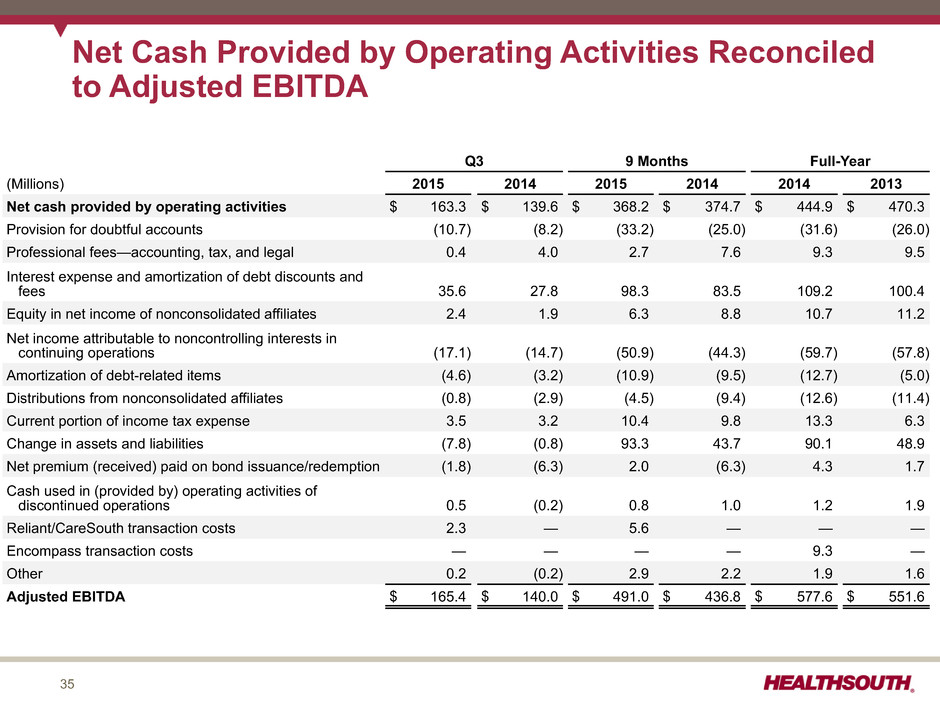

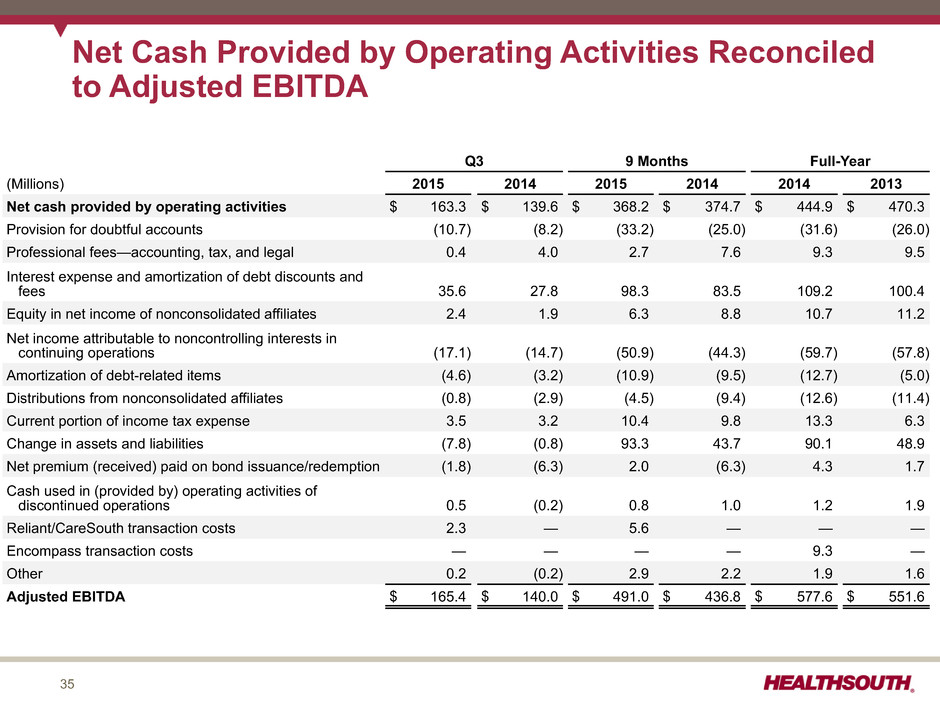

35 Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA Q3 9 Months Full-Year (Millions) 2015 2014 2015 2014 2014 2013 Net cash provided by operating activities $ 163.3 $ 139.6 $ 368.2 $ 374.7 $ 444.9 $ 470.3 Provision for doubtful accounts (10.7) (8.2) (33.2) (25.0) (31.6) (26.0) Professional fees—accounting, tax, and legal 0.4 4.0 2.7 7.6 9.3 9.5 Interest expense and amortization of debt discounts and fees 35.6 27.8 98.3 83.5 109.2 100.4 Equity in net income of nonconsolidated affiliates 2.4 1.9 6.3 8.8 10.7 11.2 Net income attributable to noncontrolling interests in continuing operations (17.1) (14.7) (50.9) (44.3) (59.7) (57.8) Amortization of debt-related items (4.6) (3.2) (10.9) (9.5) (12.7) (5.0) Distributions from nonconsolidated affiliates (0.8) (2.9) (4.5) (9.4) (12.6) (11.4) Current portion of income tax expense 3.5 3.2 10.4 9.8 13.3 6.3 Change in assets and liabilities (7.8) (0.8) 93.3 43.7 90.1 48.9 Net premium (received) paid on bond issuance/redemption (1.8) (6.3) 2.0 (6.3) 4.3 1.7 Cash used in (provided by) operating activities of discontinued operations 0.5 (0.2) 0.8 1.0 1.2 1.9 Reliant/CareSouth transaction costs 2.3 — 5.6 — — — Encompass transaction costs — — — — 9.3 — Other 0.2 (0.2) 2.9 2.2 1.9 1.6 Adjusted EBITDA $ 165.4 $ 140.0 $ 491.0 $ 436.8 $ 577.6 $ 551.6

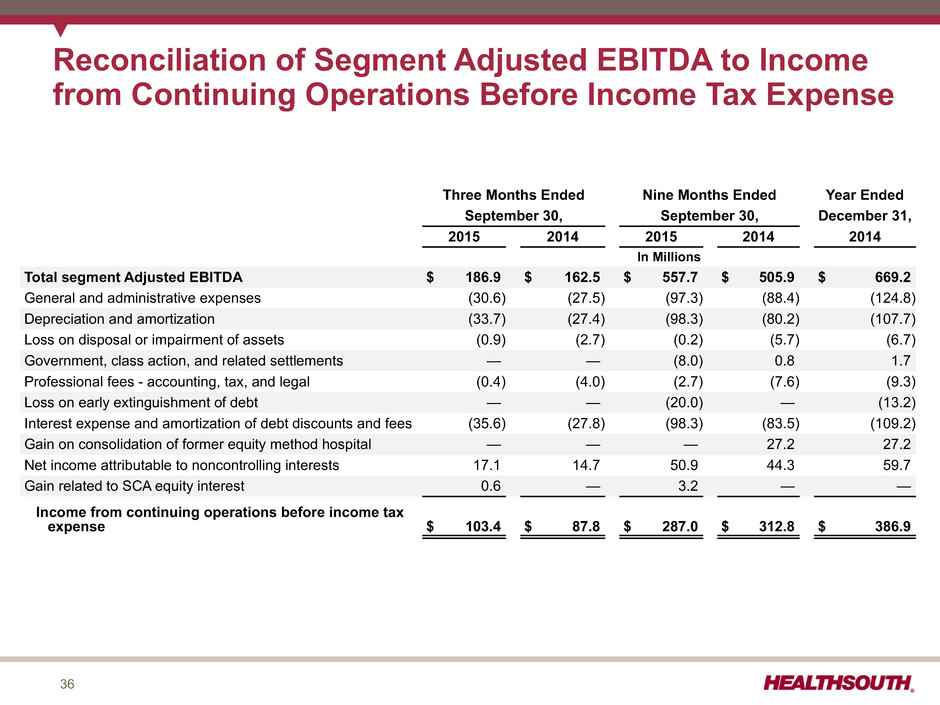

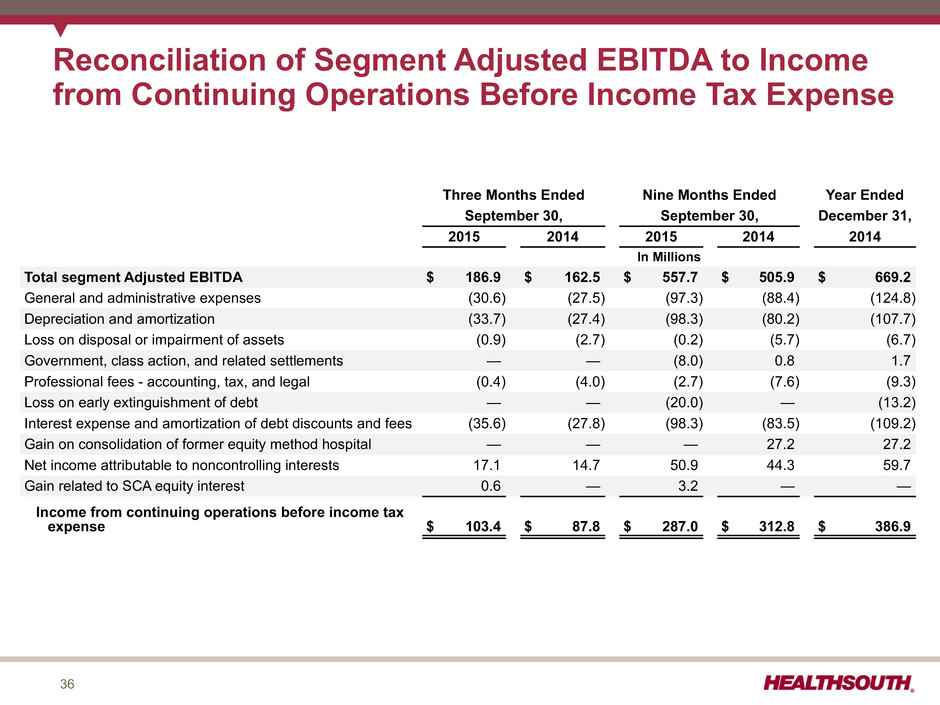

36 Reconciliation of Segment Adjusted EBITDA to Income from Continuing Operations Before Income Tax Expense Three Months Ended Nine Months Ended Year Ended September 30, September 30, December 31, 2015 2014 2015 2014 2014 In Millions Total segment Adjusted EBITDA $ 186.9 $ 162.5 $ 557.7 $ 505.9 $ 669.2 General and administrative expenses (30.6) (27.5) (97.3) (88.4) (124.8) Depreciation and amortization (33.7) (27.4) (98.3) (80.2) (107.7) Loss on disposal or impairment of assets (0.9) (2.7) (0.2) (5.7) (6.7) Government, class action, and related settlements — — (8.0) 0.8 1.7 Professional fees - accounting, tax, and legal (0.4) (4.0) (2.7) (7.6) (9.3) Loss on early extinguishment of debt — — (20.0) — (13.2) Interest expense and amortization of debt discounts and fees (35.6) (27.8) (98.3) (83.5) (109.2) Gain on consolidation of former equity method hospital — — — 27.2 27.2 Net income attributable to noncontrolling interests 17.1 14.7 50.9 44.3 59.7 Gain related to SCA equity interest 0.6 — 3.2 — — Income from continuing operations before income tax expense $ 103.4 $ 87.8 $ 287.0 $ 312.8 $ 386.9

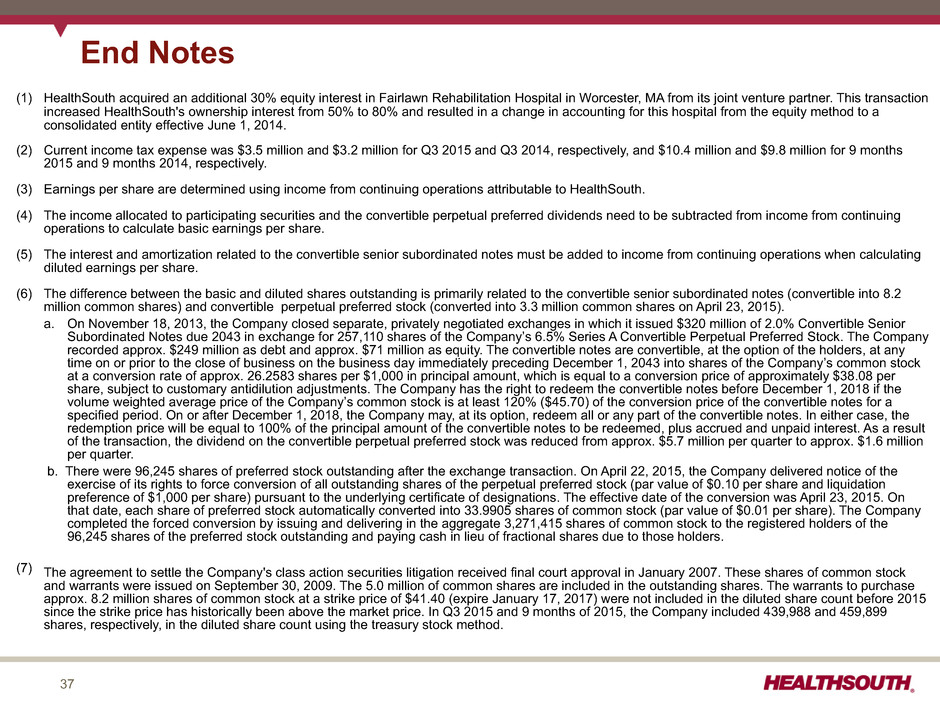

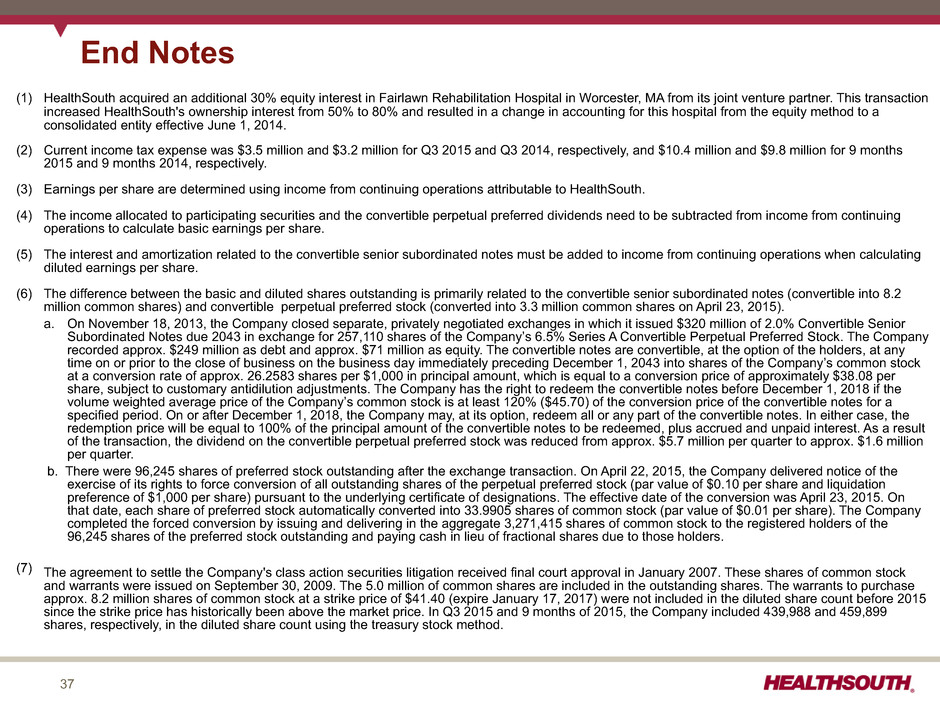

37 End Notes (1) HealthSouth acquired an additional 30% equity interest in Fairlawn Rehabilitation Hospital in Worcester, MA from its joint venture partner. This transaction increased HealthSouth's ownership interest from 50% to 80% and resulted in a change in accounting for this hospital from the equity method to a consolidated entity effective June 1, 2014. (2) Current income tax expense was $3.5 million and $3.2 million for Q3 2015 and Q3 2014, respectively, and $10.4 million and $9.8 million for 9 months 2015 and 9 months 2014, respectively. (3) Earnings per share are determined using income from continuing operations attributable to HealthSouth. (4) The income allocated to participating securities and the convertible perpetual preferred dividends need to be subtracted from income from continuing operations to calculate basic earnings per share. (5) The interest and amortization related to the convertible senior subordinated notes must be added to income from continuing operations when calculating diluted earnings per share. (6) The difference between the basic and diluted shares outstanding is primarily related to the convertible senior subordinated notes (convertible into 8.2 million common shares) and convertible perpetual preferred stock (converted into 3.3 million common shares on April 23, 2015). a. On November 18, 2013, the Company closed separate, privately negotiated exchanges in which it issued $320 million of 2.0% Convertible Senior Subordinated Notes due 2043 in exchange for 257,110 shares of the Company’s 6.5% Series A Convertible Perpetual Preferred Stock. The Company recorded approx. $249 million as debt and approx. $71 million as equity. The convertible notes are convertible, at the option of the holders, at any time on or prior to the close of business on the business day immediately preceding December 1, 2043 into shares of the Company’s common stock at a conversion rate of approx. 26.2583 shares per $1,000 in principal amount, which is equal to a conversion price of approximately $38.08 per share, subject to customary antidilution adjustments. The Company has the right to redeem the convertible notes before December 1, 2018 if the volume weighted average price of the Company’s common stock is at least 120% ($45.70) of the conversion price of the convertible notes for a specified period. On or after December 1, 2018, the Company may, at its option, redeem all or any part of the convertible notes. In either case, the redemption price will be equal to 100% of the principal amount of the convertible notes to be redeemed, plus accrued and unpaid interest. As a result of the transaction, the dividend on the convertible perpetual preferred stock was reduced from approx. $5.7 million per quarter to approx. $1.6 million per quarter. b. There were 96,245 shares of preferred stock outstanding after the exchange transaction. On April 22, 2015, the Company delivered notice of the exercise of its rights to force conversion of all outstanding shares of the perpetual preferred stock (par value of $0.10 per share and liquidation preference of $1,000 per share) pursuant to the underlying certificate of designations. The effective date of the conversion was April 23, 2015. On that date, each share of preferred stock automatically converted into 33.9905 shares of common stock (par value of $0.01 per share). The Company completed the forced conversion by issuing and delivering in the aggregate 3,271,415 shares of common stock to the registered holders of the 96,245 shares of the preferred stock outstanding and paying cash in lieu of fractional shares due to those holders. (7) The agreement to settle the Company's class action securities litigation received final court approval in January 2007. These shares of common stock and warrants were issued on September 30, 2009. The 5.0 million of common shares are included in the outstanding shares. The warrants to purchase approx. 8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) were not included in the diluted share count before 2015 since the strike price has historically been above the market price. In Q3 2015 and 9 months of 2015, the Company included 439,988 and 459,899 shares, respectively, in the diluted share count using the treasury stock method.

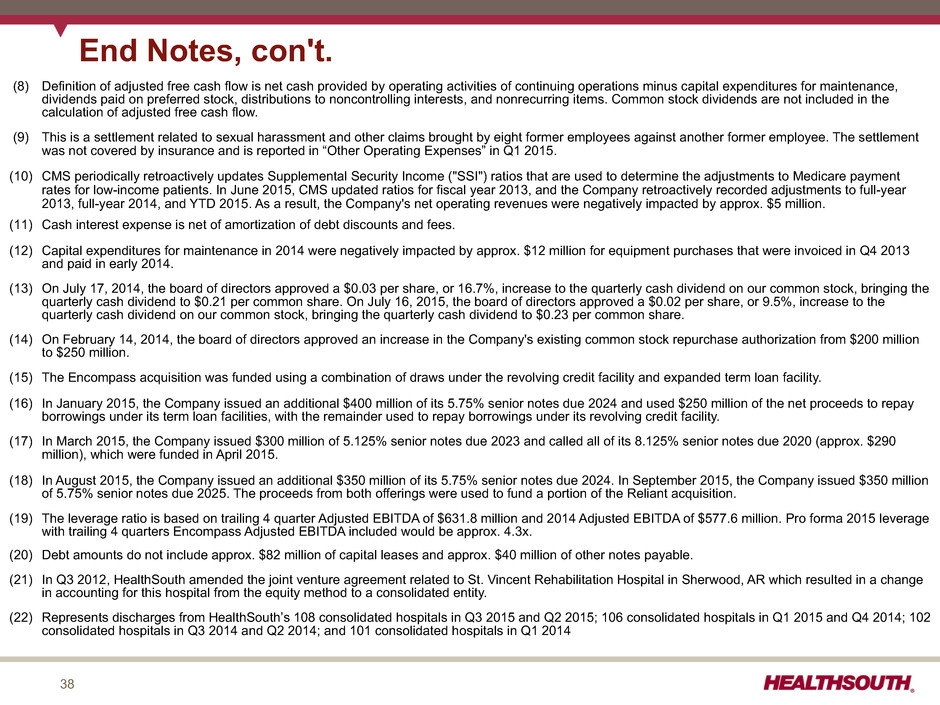

38 (8) Definition of adjusted free cash flow is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, dividends paid on preferred stock, distributions to noncontrolling interests, and nonrecurring items. Common stock dividends are not included in the calculation of adjusted free cash flow. (9) This is a settlement related to sexual harassment and other claims brought by eight former employees against another former employee. The settlement was not covered by insurance and is reported in “Other Operating Expenses” in Q1 2015. (10) CMS periodically retroactively updates Supplemental Security Income ("SSI") ratios that are used to determine the adjustments to Medicare payment rates for low-income patients. In June 2015, CMS updated ratios for fiscal year 2013, and the Company retroactively recorded adjustments to full-year 2013, full-year 2014, and YTD 2015. As a result, the Company's net operating revenues were negatively impacted by approx. $5 million. (11) Cash interest expense is net of amortization of debt discounts and fees. (12) Capital expenditures for maintenance in 2014 were negatively impacted by approx. $12 million for equipment purchases that were invoiced in Q4 2013 and paid in early 2014. (13) On July 17, 2014, the board of directors approved a $0.03 per share, or 16.7%, increase to the quarterly cash dividend on our common stock, bringing the quarterly cash dividend to $0.21 per common share. On July 16, 2015, the board of directors approved a $0.02 per share, or 9.5%, increase to the quarterly cash dividend on our common stock, bringing the quarterly cash dividend to $0.23 per common share. (14) On February 14, 2014, the board of directors approved an increase in the Company's existing common stock repurchase authorization from $200 million to $250 million. (15) The Encompass acquisition was funded using a combination of draws under the revolving credit facility and expanded term loan facility. (16) In January 2015, the Company issued an additional $400 million of its 5.75% senior notes due 2024 and used $250 million of the net proceeds to repay borrowings under its term loan facilities, with the remainder used to repay borrowings under its revolving credit facility. (17) In March 2015, the Company issued $300 million of 5.125% senior notes due 2023 and called all of its 8.125% senior notes due 2020 (approx. $290 million), which were funded in April 2015. (18) In August 2015, the Company issued an additional $350 million of its 5.75% senior notes due 2024. In September 2015, the Company issued $350 million of 5.75% senior notes due 2025. The proceeds from both offerings were used to fund a portion of the Reliant acquisition. (19) The leverage ratio is based on trailing 4 quarter Adjusted EBITDA of $631.8 million and 2014 Adjusted EBITDA of $577.6 million. Pro forma 2015 leverage with trailing 4 quarters Encompass Adjusted EBITDA included would be approx. 4.3x. (20) Debt amounts do not include approx. $82 million of capital leases and approx. $40 million of other notes payable. (21) In Q3 2012, HealthSouth amended the joint venture agreement related to St. Vincent Rehabilitation Hospital in Sherwood, AR which resulted in a change in accounting for this hospital from the equity method to a consolidated entity. (22) Represents discharges from HealthSouth’s 108 consolidated hospitals in Q3 2015 and Q2 2015; 106 consolidated hospitals in Q1 2015 and Q4 2014; 102 consolidated hospitals in Q3 2014 and Q2 2014; and 101 consolidated hospitals in Q1 2014 End Notes, con't.

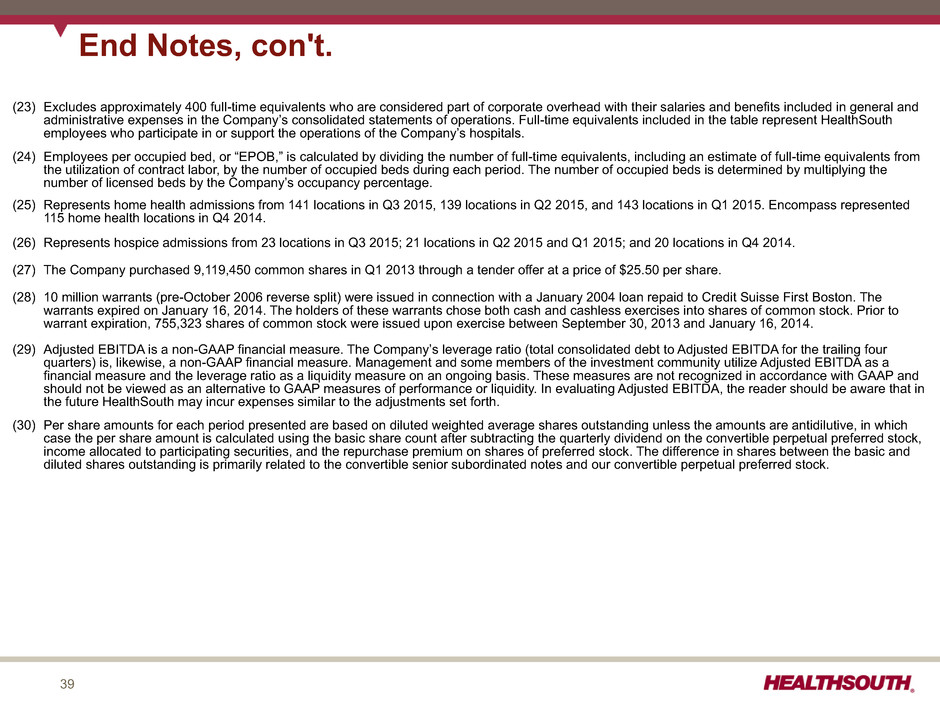

39 End Notes, con't. (23) Excludes approximately 400 full-time equivalents who are considered part of corporate overhead with their salaries and benefits included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals. (24) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. (25) Represents home health admissions from 141 locations in Q3 2015, 139 locations in Q2 2015, and 143 locations in Q1 2015. Encompass represented 115 home health locations in Q4 2014. (26) Represents hospice admissions from 23 locations in Q3 2015; 21 locations in Q2 2015 and Q1 2015; and 20 locations in Q4 2014. (27) The Company purchased 9,119,450 common shares in Q1 2013 through a tender offer at a price of $25.50 per share. (28) 10 million warrants (pre-October 2006 reverse split) were issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. The warrants expired on January 16, 2014. The holders of these warrants chose both cash and cashless exercises into shares of common stock. Prior to warrant expiration, 755,323 shares of common stock were issued upon exercise between September 30, 2013 and January 16, 2014. (29) Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments set forth. (30) Per share amounts for each period presented are based on diluted weighted average shares outstanding unless the amounts are antidilutive, in which case the per share amount is calculated using the basic share count after subtracting the quarterly dividend on the convertible perpetual preferred stock, income allocated to participating securities, and the repurchase premium on shares of preferred stock. The difference in shares between the basic and diluted shares outstanding is primarily related to the convertible senior subordinated notes and our convertible perpetual preferred stock.