Third Quarter 2016 Earnings Call October 28, 2016 SUPPLEMENTAL INFORMATION

2 The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect HealthSouth’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, repurchases of securities, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2015, the form 10-Q for the quarters ended March 31, 2016, June 30, 2016, and September 30, 2016, when filed, and in other documents HealthSouth previously filed with the SEC, many of which are beyond its control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. HealthSouth’s Form 8-K, dated October 27, 2016, to which the following supplemental information is attached as Exhibit 99.2, provides further explanation and disclosure regarding HealthSouth’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Forward-Looking Statements

3 Table of Contents Q3 2016 Summary................................................................................................................................................. 4-5 Inpatient Rehabilitation Segment ........................................................................................................................... 6-7 Home Health & Hospice Segment, including Clinical Collaboration ...................................................................... 8-10 Earnings per Share ................................................................................................................................................ 11-12 Adjusted Free Cash Flow....................................................................................................................................... 13 Guidance................................................................................................................................................................ 14-15 Adjusted Free Cash Flow and Tax Assumptions.................................................................................................... 16 Appendix Map of Locations.................................................................................................................................................... 18 Pre-Payment Claims Denials - Inpatient Rehabilitation Segment.......................................................................... 19 Expansion Activity .................................................................................................................................................. 20 Business Outlook: Revenue Assumptions ............................................................................................................ 21 Free Cash Flow Priorities....................................................................................................................................... 22 Debt Schedule and Maturity Profile ....................................................................................................................... 23-24 New-Store/Same-Store IRF Growth ...................................................................................................................... 25 Alternative Payment Models .................................................................................................................................. 26-27 Payment Sources (Percent of Revenues).............................................................................................................. 28 Inpatient Rehabilitation Operational and Labor Metrics ......................................................................................... 29 Home Health & Hospice Operational Metrics ........................................................................................................ 30 Share Information .................................................................................................................................................. 31 Segment Operating Results................................................................................................................................... 32-34 Reconciliations to GAAP........................................................................................................................................ 35-43 End Notes .............................................................................................................................................................. 44-45

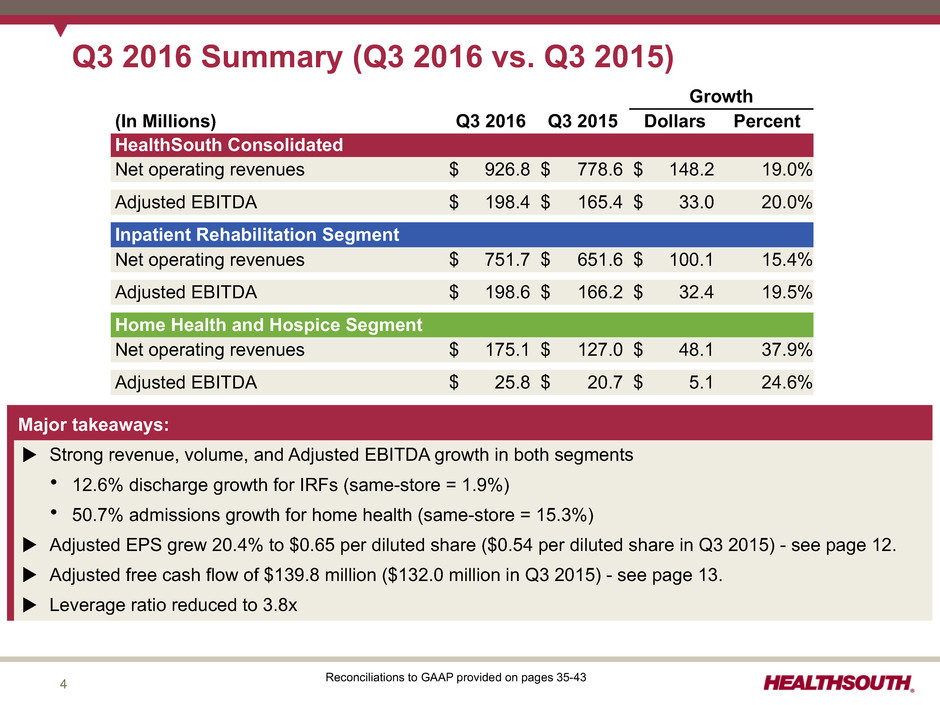

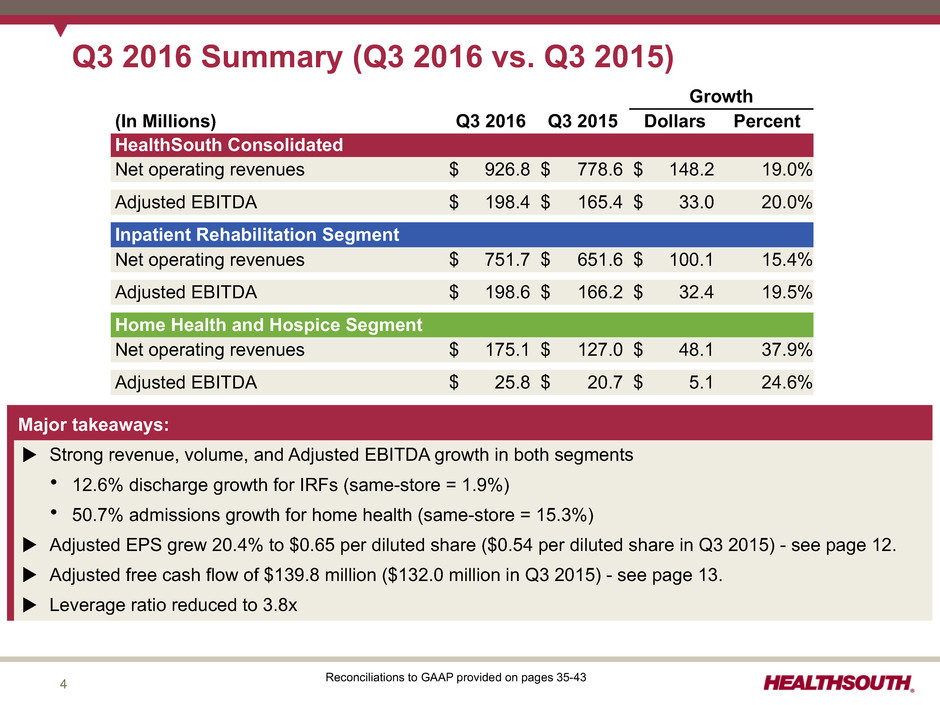

4 Q3 2016 Summary (Q3 2016 vs. Q3 2015) Growth (In Millions) Q3 2016 Q3 2015 Dollars Percent HealthSouth Consolidated Net operating revenues $ 926.8 $ 778.6 $ 148.2 19.0% Adjusted EBITDA $ 198.4 $ 165.4 $ 33.0 20.0% Inpatient Rehabilitation Segment Net operating revenues $ 751.7 $ 651.6 $ 100.1 15.4% Adjusted EBITDA $ 198.6 $ 166.2 $ 32.4 19.5% Home Health and Hospice Segment Net operating revenues $ 175.1 $ 127.0 $ 48.1 37.9% Adjusted EBITDA $ 25.8 $ 20.7 $ 5.1 24.6% Major takeaways: u Strong revenue, volume, and Adjusted EBITDA growth in both segments Ÿ 12.6% discharge growth for IRFs (same-store = 1.9%) Ÿ 50.7% admissions growth for home health (same-store = 15.3%) u Adjusted EPS grew 20.4% to $0.65 per diluted share ($0.54 per diluted share in Q3 2015) - see page 12. u Adjusted free cash flow of $139.8 million ($132.0 million in Q3 2015) - see page 13. u Leverage ratio reduced to 3.8x Reconciliations to GAAP provided on pages 35-43

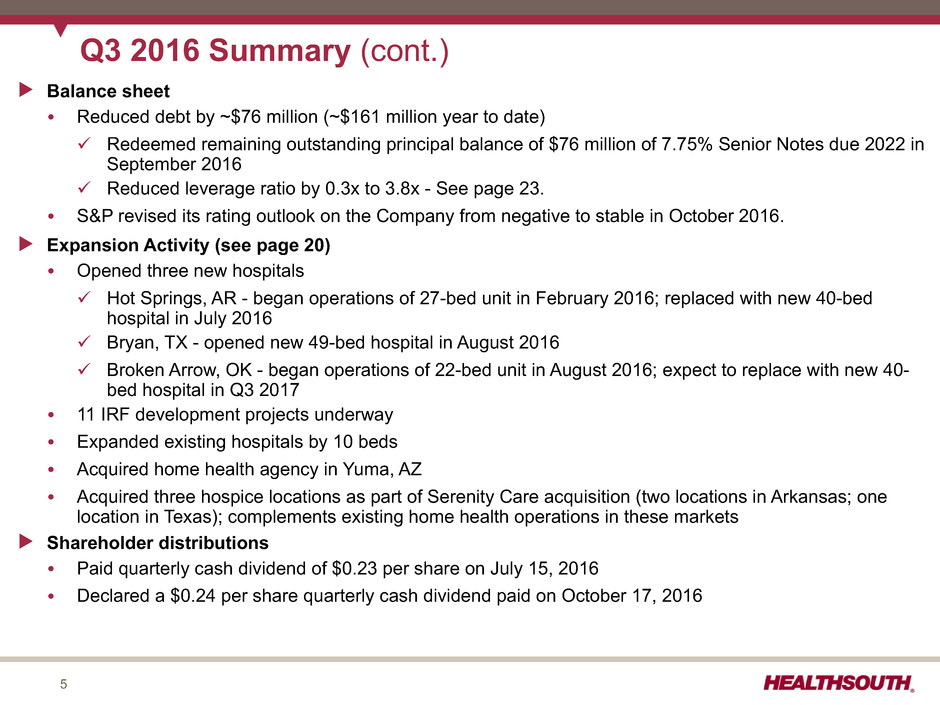

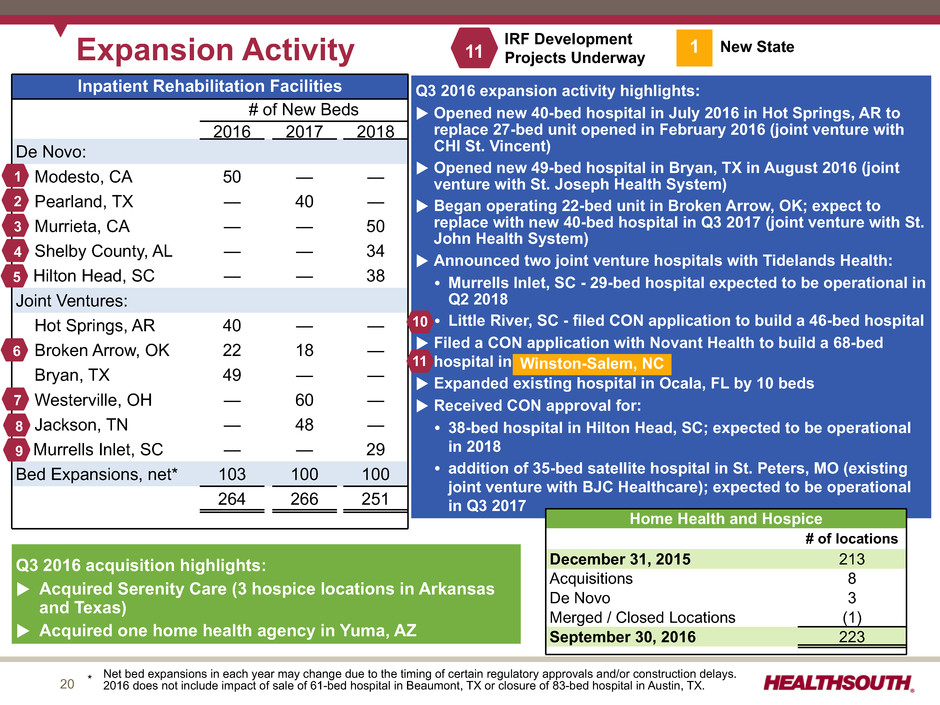

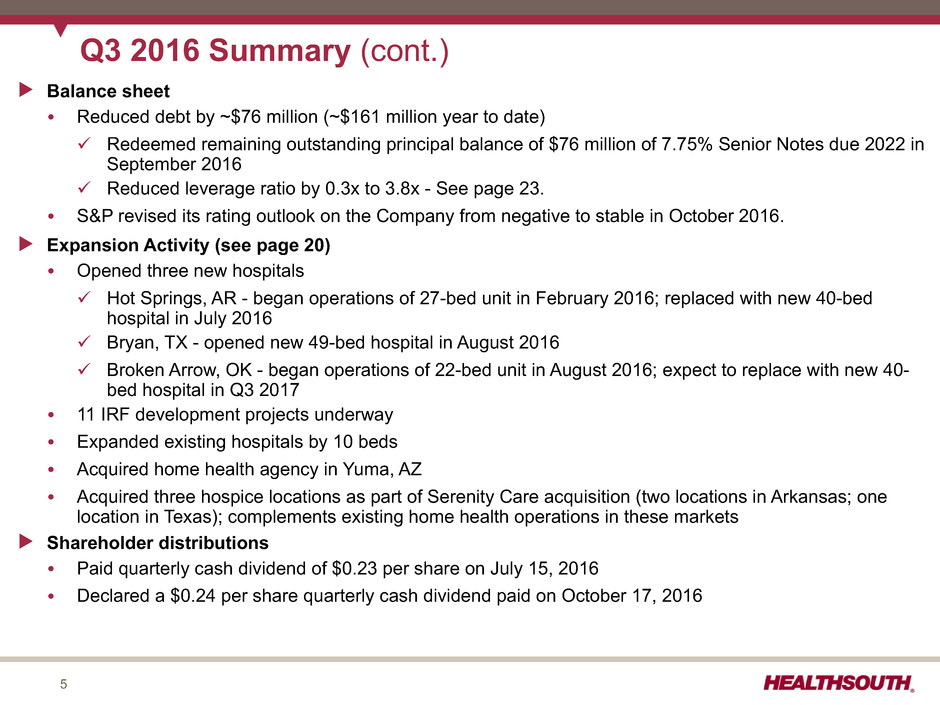

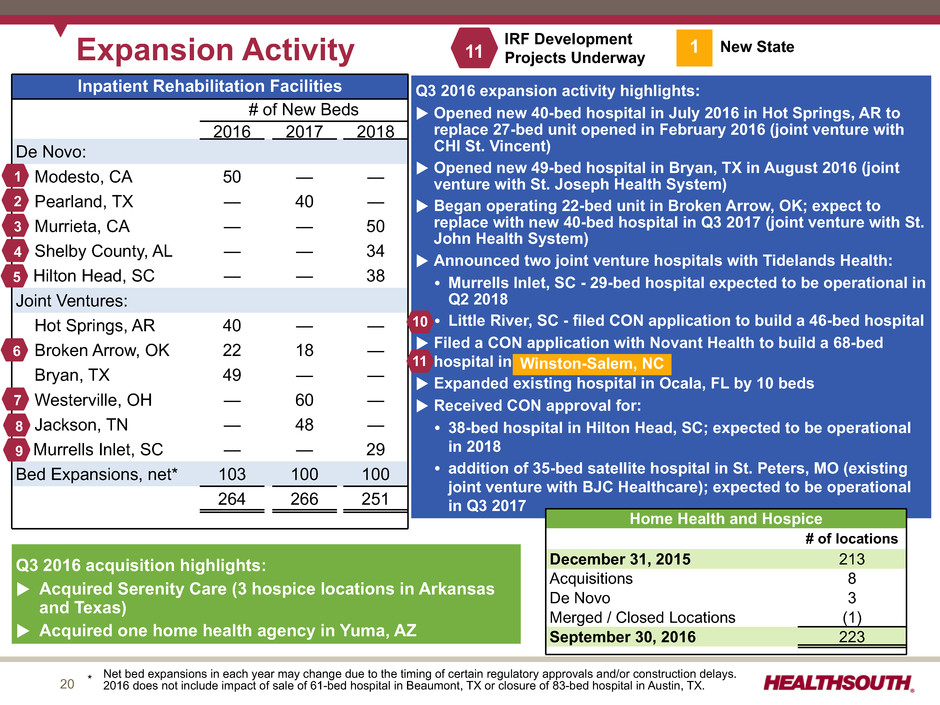

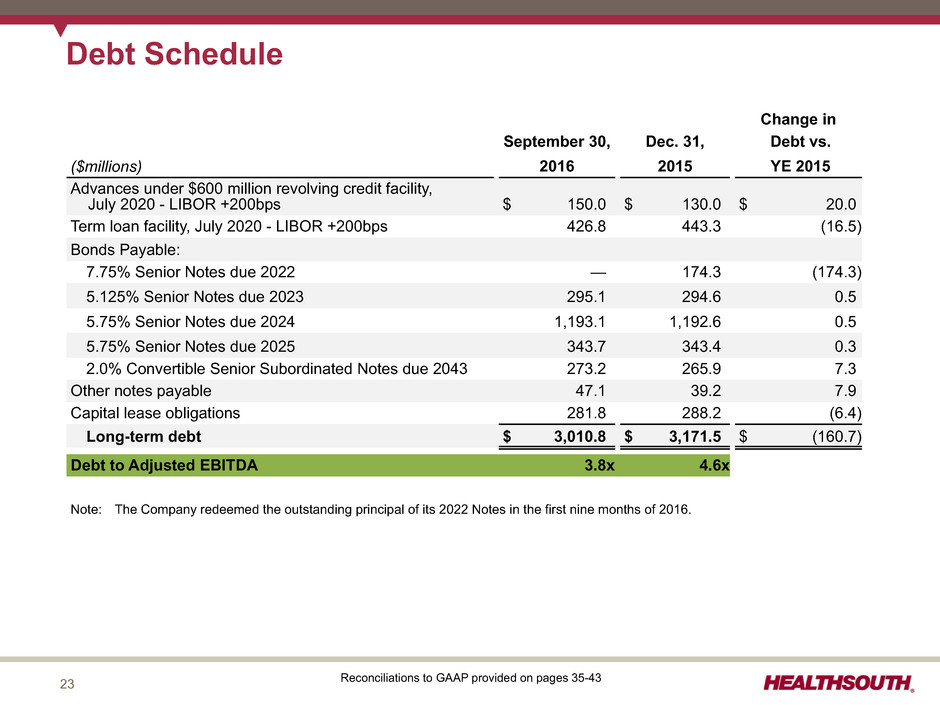

5 Q3 2016 Summary (cont.) u Balance sheet Ÿ Reduced debt by ~$76 million (~$161 million year to date) ü Redeemed remaining outstanding principal balance of $76 million of 7.75% Senior Notes due 2022 in September 2016 ü Reduced leverage ratio by 0.3x to 3.8x - See page 23. Ÿ S&P revised its rating outlook on the Company from negative to stable in October 2016. u Expansion Activity (see page 20) Ÿ Opened three new hospitals ü Hot Springs, AR - began operations of 27-bed unit in February 2016; replaced with new 40-bed hospital in July 2016 ü Bryan, TX - opened new 49-bed hospital in August 2016 ü Broken Arrow, OK - began operations of 22-bed unit in August 2016; expect to replace with new 40- bed hospital in Q3 2017 Ÿ 11 IRF development projects underway Ÿ Expanded existing hospitals by 10 beds Ÿ Acquired home health agency in Yuma, AZ Ÿ Acquired three hospice locations as part of Serenity Care acquisition (two locations in Arkansas; one location in Texas); complements existing home health operations in these markets u Shareholder distributions Ÿ Paid quarterly cash dividend of $0.23 per share on July 15, 2016 Ÿ Declared a $0.24 per share quarterly cash dividend paid on October 17, 2016

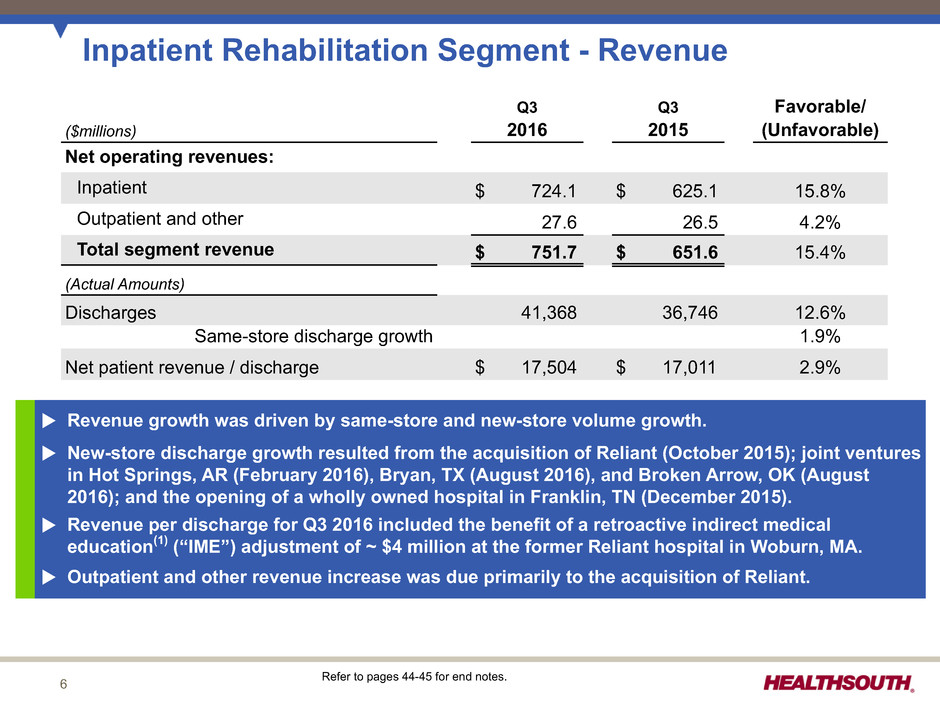

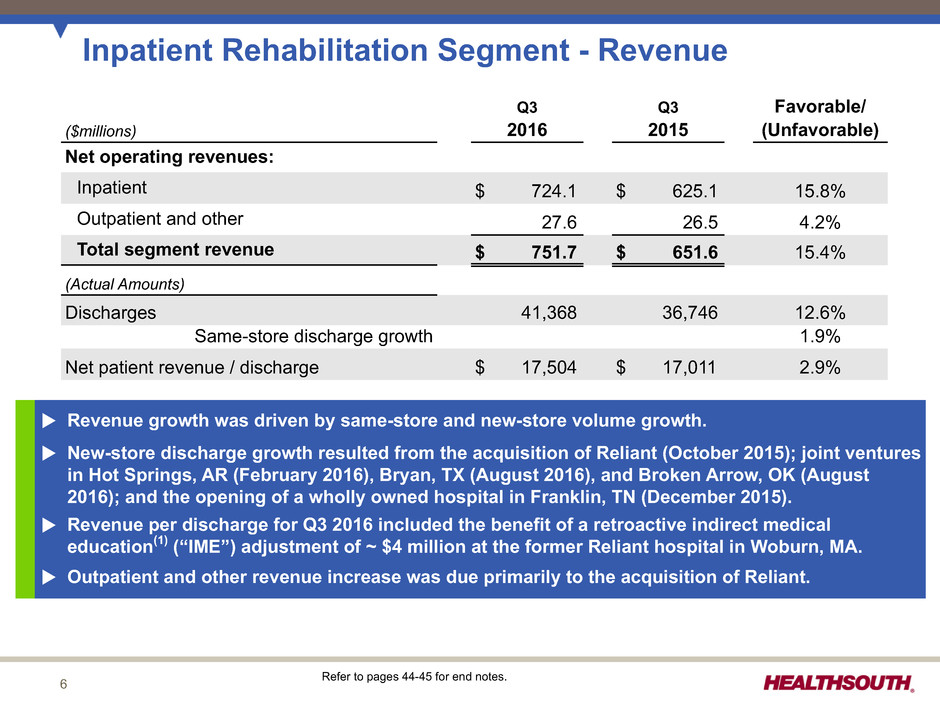

6 Inpatient Rehabilitation Segment - Revenue Q3 Q3 Favorable/ ($millions) 2016 2015 (Unfavorable) Net operating revenues: Inpatient $ 724.1 $ 625.1 15.8% Outpatient and other 27.6 26.5 4.2% Total segment revenue $ 751.7 $ 651.6 15.4% (Actual Amounts) Discharges 41,368 36,746 12.6% Same-store discharge growth 1.9% Net patient revenue / discharge $ 17,504 $ 17,011 2.9% u Revenue growth was driven by same-store and new-store volume growth. u New-store discharge growth resulted from the acquisition of Reliant (October 2015); joint ventures in Hot Springs, AR (February 2016), Bryan, TX (August 2016), and Broken Arrow, OK (August 2016); and the opening of a wholly owned hospital in Franklin, TN (December 2015). u Revenue per discharge for Q3 2016 included the benefit of a retroactive indirect medical education(1) (“IME”) adjustment of ~ $4 million at the former Reliant hospital in Woburn, MA. u Outpatient and other revenue increase was due primarily to the acquisition of Reliant. Refer to pages 44-45 for end notes.

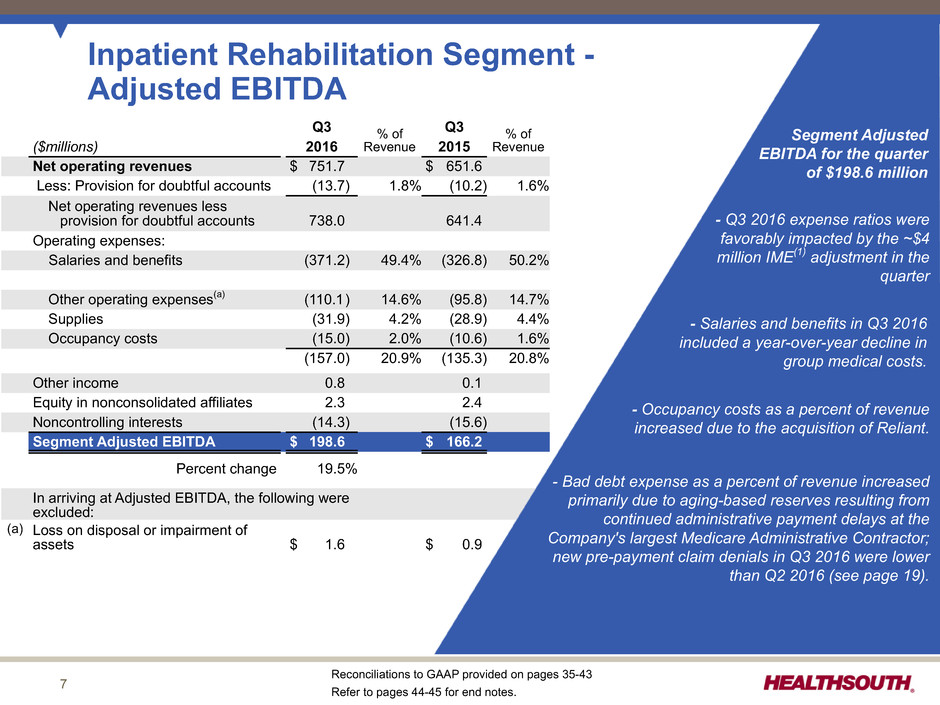

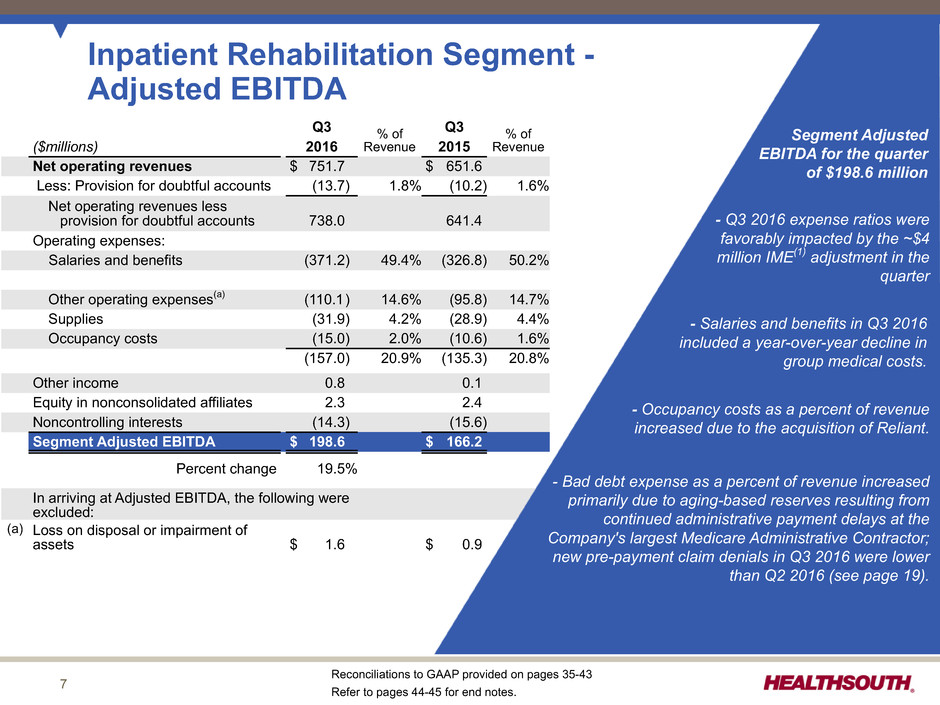

7 Inpatient Rehabilitation Segment - Adjusted EBITDA Q3 % of Revenue Q3 % of Revenue($millions) 2016 2015 Net operating revenues $ 751.7 $ 651.6 Less: Provision for doubtful accounts (13.7) 1.8% (10.2) 1.6% Net operating revenues less provision for doubtful accounts 738.0 641.4 Operating expenses: Salaries and benefits (371.2) 49.4% (326.8) 50.2% Other operating expenses(a) (110.1) 14.6% (95.8) 14.7% Supplies (31.9) 4.2% (28.9) 4.4% Occupancy costs (15.0) 2.0% (10.6) 1.6% (157.0) 20.9% (135.3) 20.8% Other income 0.8 0.1 Equity in nonconsolidated affiliates 2.3 2.4 Noncontrolling interests (14.3) (15.6) Segment Adjusted EBITDA $ 198.6 $ 166.2 Percent change 19.5% In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal or impairment of assets $ 1.6 $ 0.9 Segment Adjusted EBITDA for the quarter of $198.6 million - Salaries and benefits in Q3 2016 included a year-over-year decline in group medical costs. - Occupancy costs as a percent of revenue increased due to the acquisition of Reliant. - Bad debt expense as a percent of revenue increased primarily due to aging-based reserves resulting from continued administrative payment delays at the Company's largest Medicare Administrative Contractor; new pre-payment claim denials in Q3 2016 were lower than Q2 2016 (see page 19). Reconciliations to GAAP provided on pages 35-43 Refer to pages 44-45 for end notes. - Q3 2016 expense ratios were favorably impacted by the ~$4 million IME(1) adjustment in the quarter

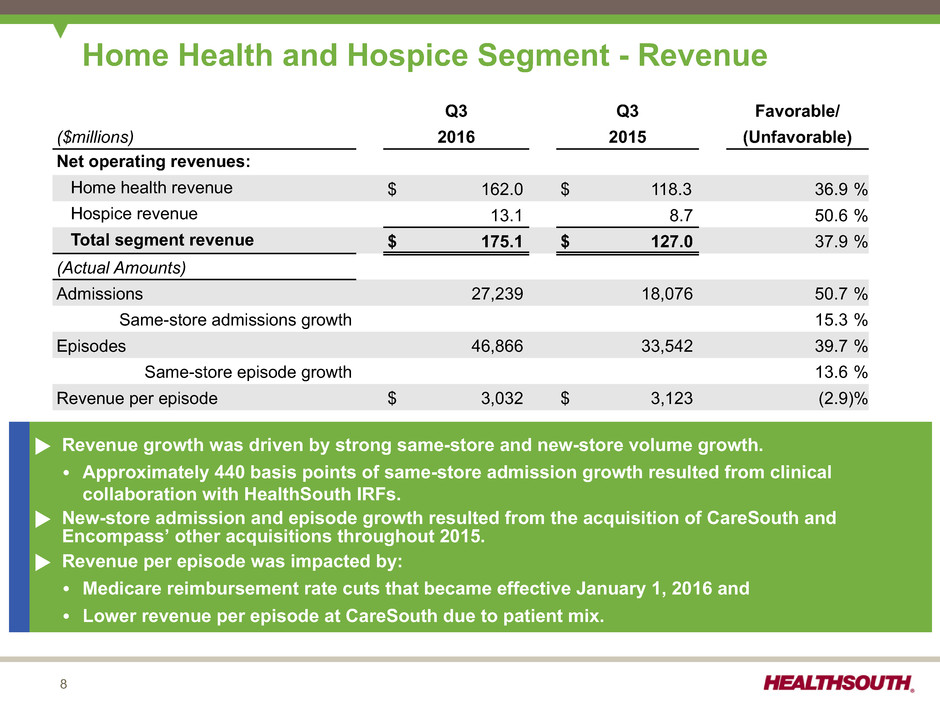

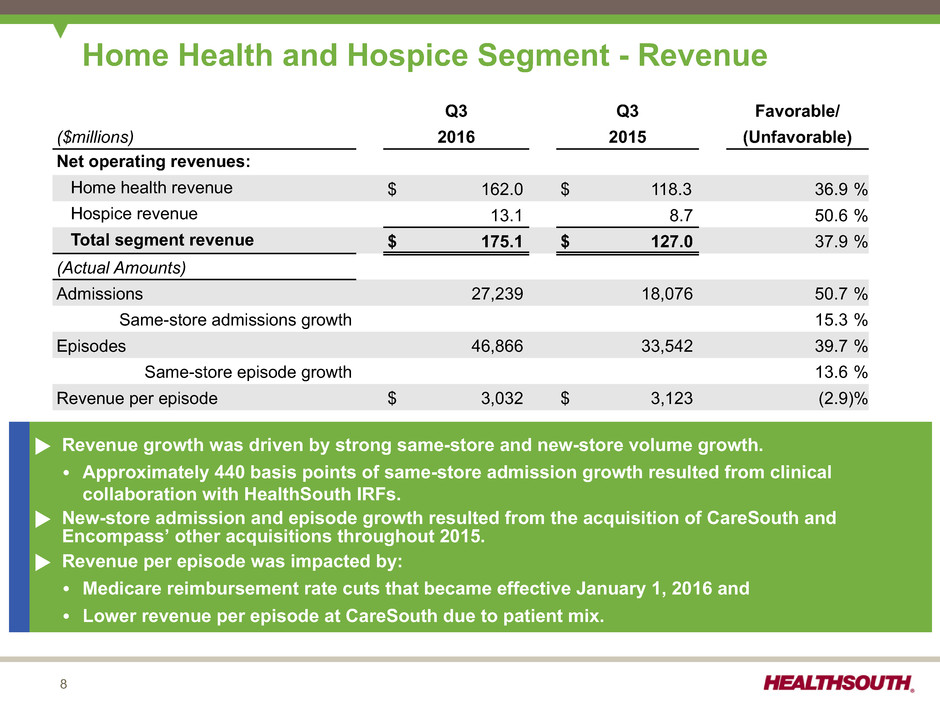

8 Home Health and Hospice Segment - Revenue Q3 Q3 Favorable/ ($millions) 2016 2015 (Unfavorable) Net operating revenues: Home health revenue $ 162.0 $ 118.3 36.9 % Hospice revenue 13.1 8.7 50.6 % Total segment revenue $ 175.1 $ 127.0 37.9 % (Actual Amounts) Admissions 27,239 18,076 50.7 % Same-store admissions growth 15.3 % Episodes 46,866 33,542 39.7 % Same-store episode growth 13.6 % Revenue per episode $ 3,032 $ 3,123 (2.9)% u Revenue growth was driven by strong same-store and new-store volume growth. Ÿ Approximately 440 basis points of same-store admission growth resulted from clinical collaboration with HealthSouth IRFs. u New-store admission and episode growth resulted from the acquisition of CareSouth and Encompass’ other acquisitions throughout 2015. u Revenue per episode was impacted by: Ÿ Medicare reimbursement rate cuts that became effective January 1, 2016 and Ÿ Lower revenue per episode at CareSouth due to patient mix.

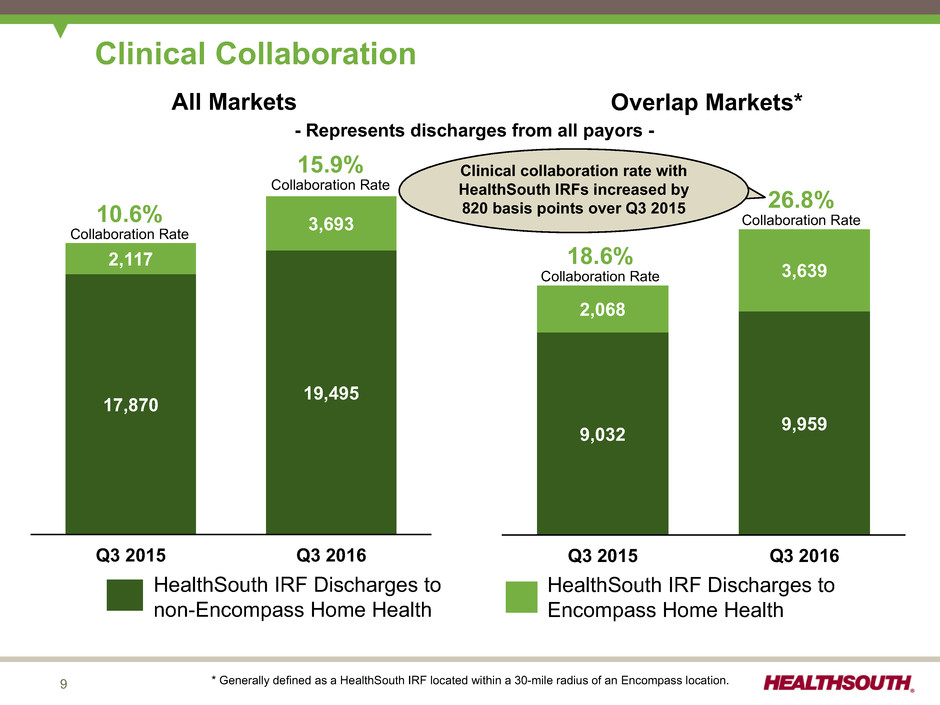

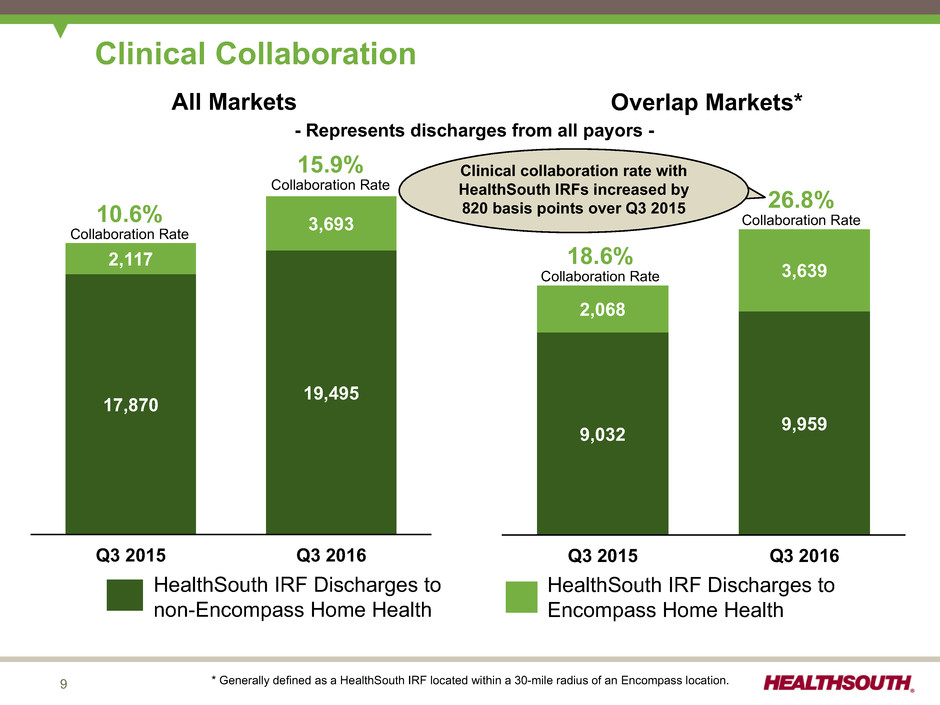

9 Clinical Collaboration All Markets Q3 2015 Q3 2016 17,870 19,495 2,117 3,69310.6%Collaboration Rate 15.9% Collaboration Rate Overlap Markets* Q3 2015 Q3 2016 9,032 9,959 2,068 3,639 18.6% Collaboration Rate 26.8% Collaboration Rate HealthSouth IRF Discharges to non-Encompass Home Health HealthSouth IRF Discharges to Encompass Home Health * Generally defined as a HealthSouth IRF located within a 30-mile radius of an Encompass location. - Represents discharges from all payors - Clinical collaboration rate with HealthSouth IRFs increased by 820 basis points over Q3 2015

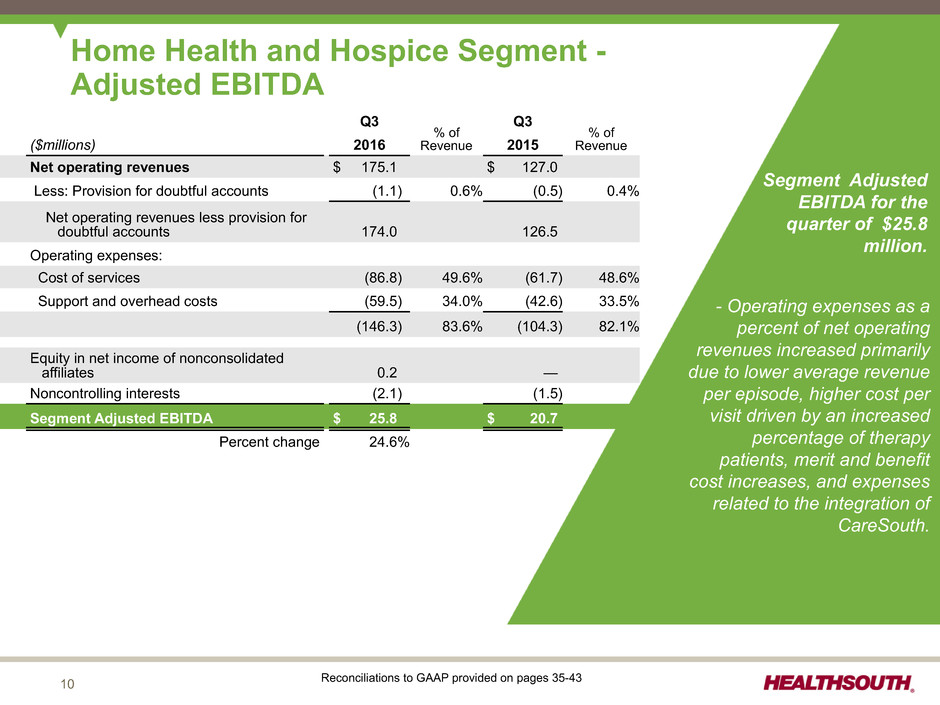

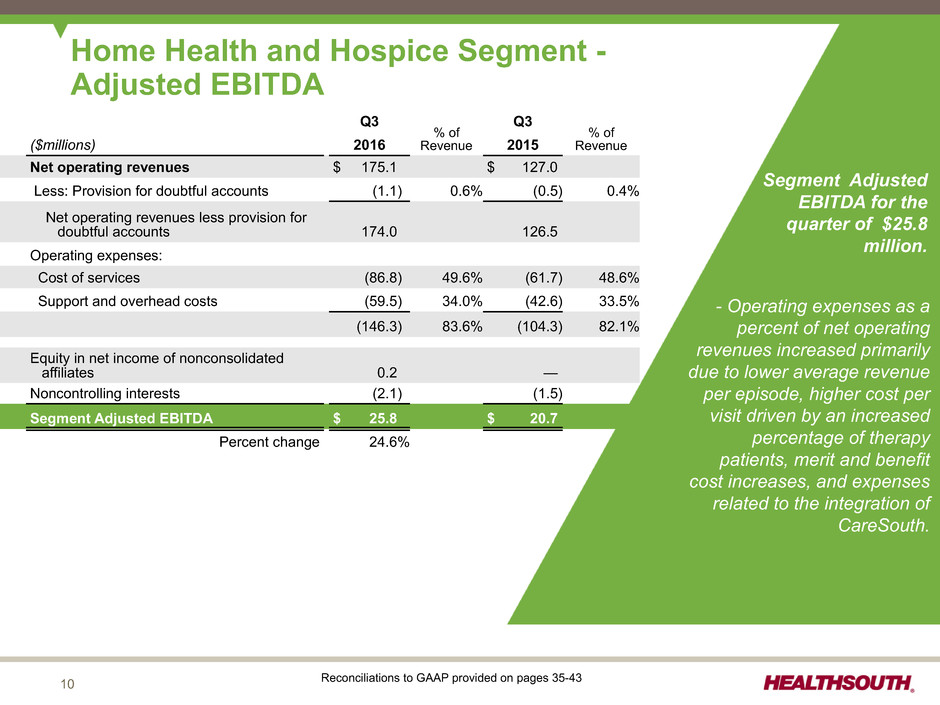

10 Q3 % of Revenue Q3 % of Revenue($millions) 2016 2015 Net operating revenues $ 175.1 $ 127.0 Less: Provision for doubtful accounts (1.1) 0.6% (0.5) 0.4% Net operating revenues less provision for doubtful accounts 174.0 126.5 Operating expenses: Cost of services (86.8) 49.6% (61.7) 48.6% Support and overhead costs (59.5) 34.0% (42.6) 33.5% (146.3) 83.6% (104.3) 82.1% Equity in net income of nonconsolidated affiliates 0.2 — Noncontrolling interests (2.1) (1.5) Segment Adjusted EBITDA $ 25.8 $ 20.7 Percent change 24.6% Home Health and Hospice Segment - Adjusted EBITDA Segment Adjusted EBITDA for the quarter of $25.8 million. - Operating expenses as a percent of net operating revenues increased primarily due to lower average revenue per episode, higher cost per visit driven by an increased percentage of therapy patients, merit and benefit cost increases, and expenses related to the integration of CareSouth. * Reconciliation to GAAP provided on pages 29-31 Reconciliations to GAAP provided on pages 35-43

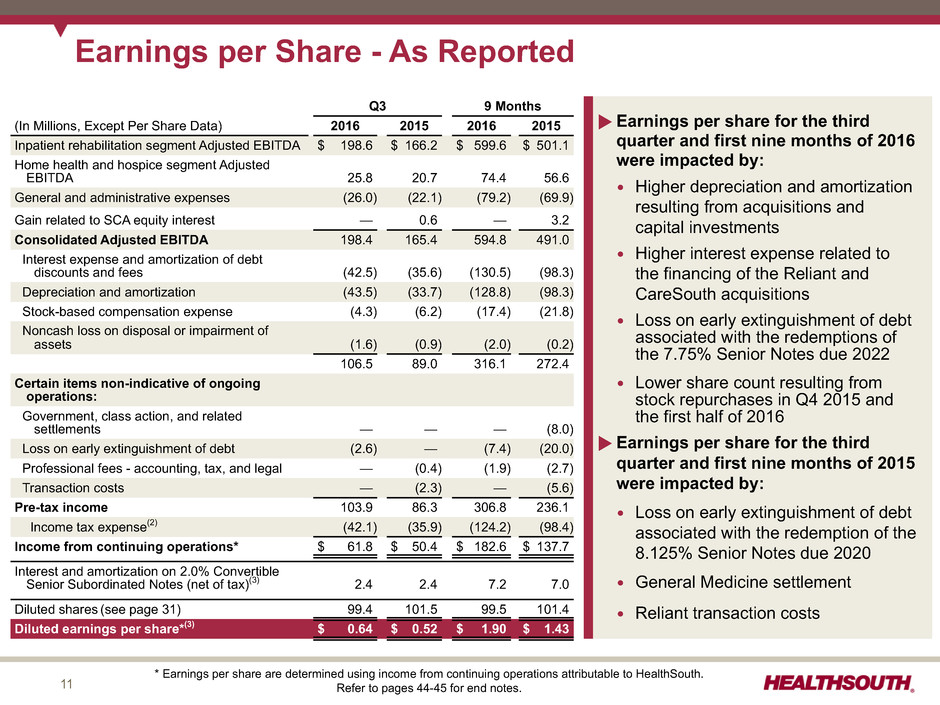

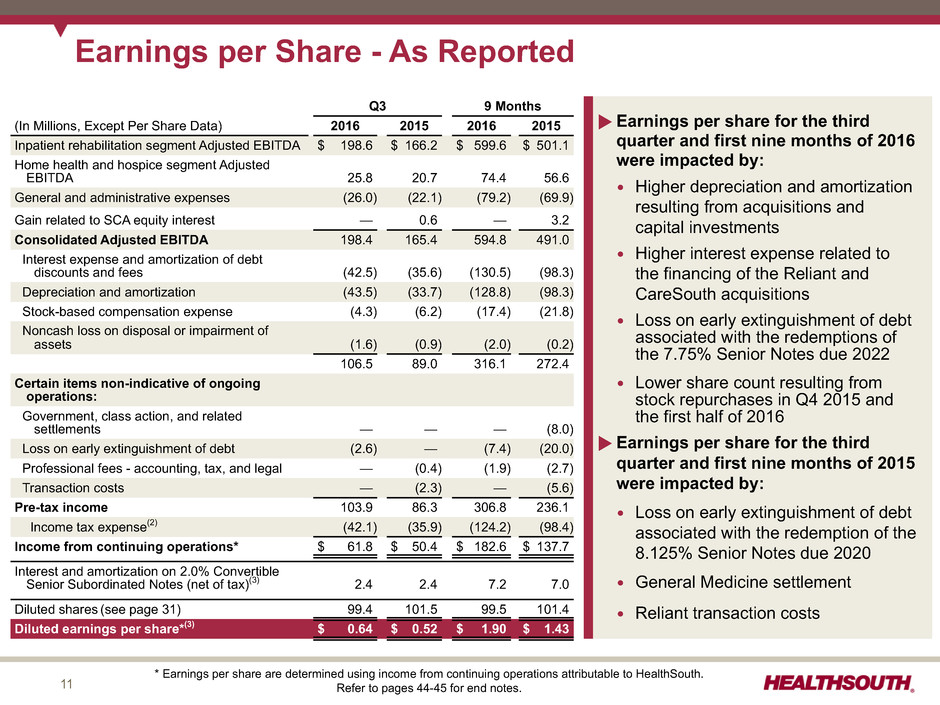

11 Earnings per Share - As Reported Q3 9 Months (In Millions, Except Per Share Data) 2016 2015 2016 2015 Inpatient rehabilitation segment Adjusted EBITDA $ 198.6 $ 166.2 $ 599.6 $ 501.1 Home health and hospice segment Adjusted EBITDA 25.8 20.7 74.4 56.6 General and administrative expenses (26.0) (22.1) (79.2) (69.9) Gain related to SCA equity interest — 0.6 — 3.2 Consolidated Adjusted EBITDA 198.4 165.4 594.8 491.0 Interest expense and amortization of debt discounts and fees (42.5) (35.6) (130.5) (98.3) Depreciation and amortization (43.5) (33.7) (128.8) (98.3) Stock-based compensation expense (4.3) (6.2) (17.4) (21.8) Noncash loss on disposal or impairment of assets (1.6) (0.9) (2.0) (0.2) 106.5 89.0 316.1 272.4 Certain items non-indicative of ongoing operations: Government, class action, and related settlements — — — (8.0) Loss on early extinguishment of debt (2.6) — (7.4) (20.0) Professional fees - accounting, tax, and legal — (0.4) (1.9) (2.7) Transaction costs — (2.3) — (5.6) Pre-tax income 103.9 86.3 306.8 236.1 Income tax expense(2) (42.1) (35.9) (124.2) (98.4) Income from continuing operations* $ 61.8 $ 50.4 $ 182.6 $ 137.7 Interest and amortization on 2.0% Convertible Senior Subordinated Notes (net of tax)(3) 2.4 2.4 7.2 7.0 Diluted shares (see page 31) 99.4 101.5 99.5 101.4 Diluted earnings per share*(3) $ 0.64 $ 0.52 $ 1.90 $ 1.43 u Earnings per share for the third quarter and first nine months of 2016 were impacted by: Ÿ Higher depreciation and amortization resulting from acquisitions and capital investments Ÿ Higher interest expense related to the financing of the Reliant and CareSouth acquisitions Ÿ Loss on early extinguishment of debt associated with the redemptions of the 7.75% Senior Notes due 2022 Ÿ Lower share count resulting from stock repurchases in Q4 2015 and the first half of 2016 u Earnings per share for the third quarter and first nine months of 2015 were impacted by: Ÿ Loss on early extinguishment of debt associated with the redemption of the 8.125% Senior Notes due 2020 Ÿ General Medicine settlement Ÿ Reliant transaction costs * Earnings per share are determined using income from continuing operations attributable to HealthSouth. Refer to pages 44-45 for end notes.

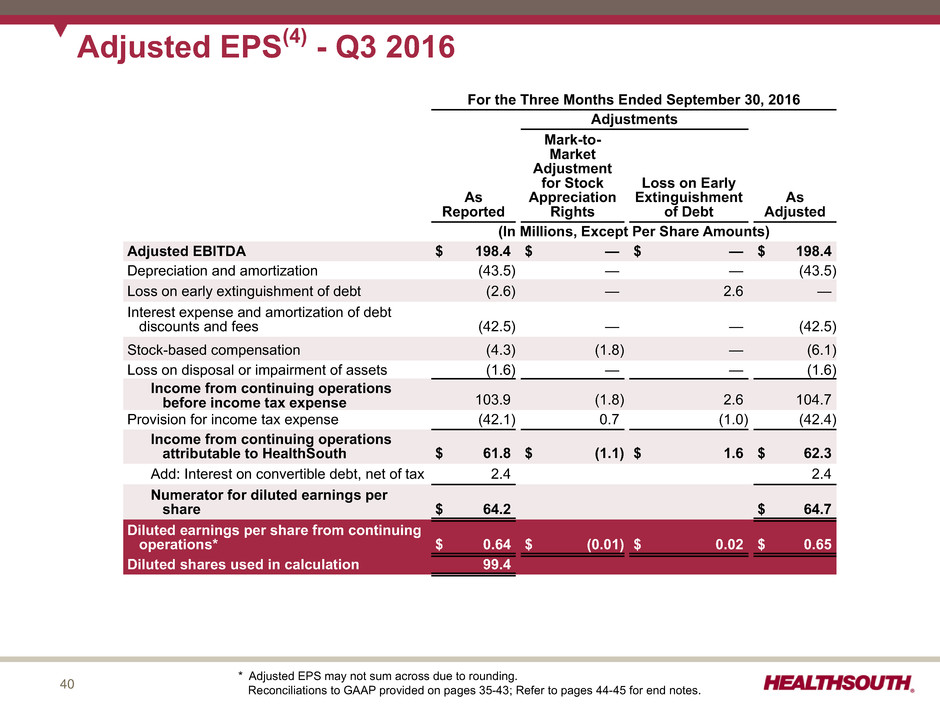

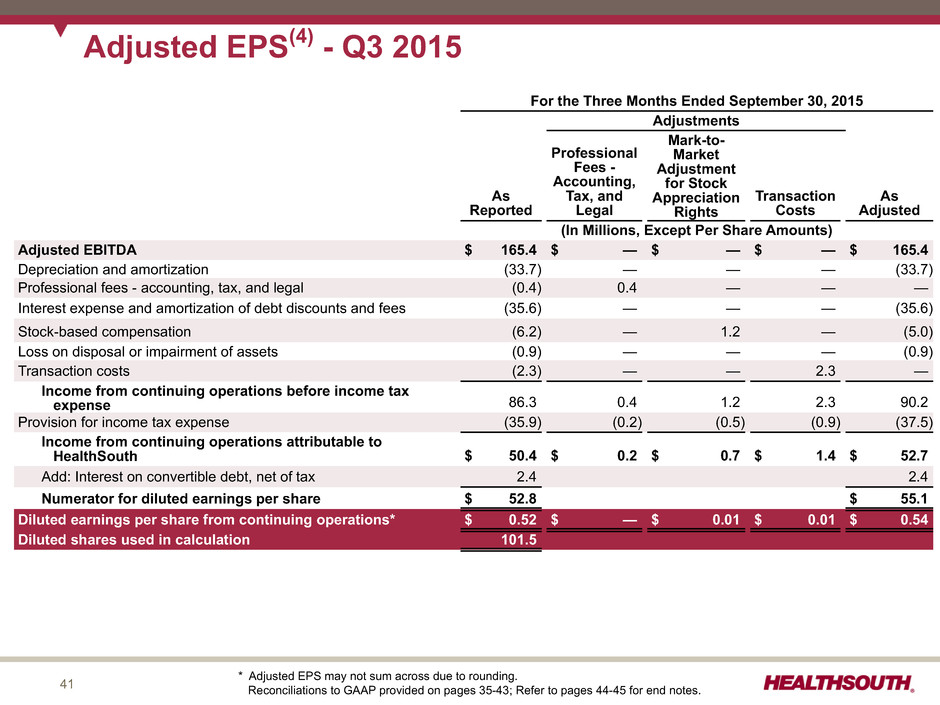

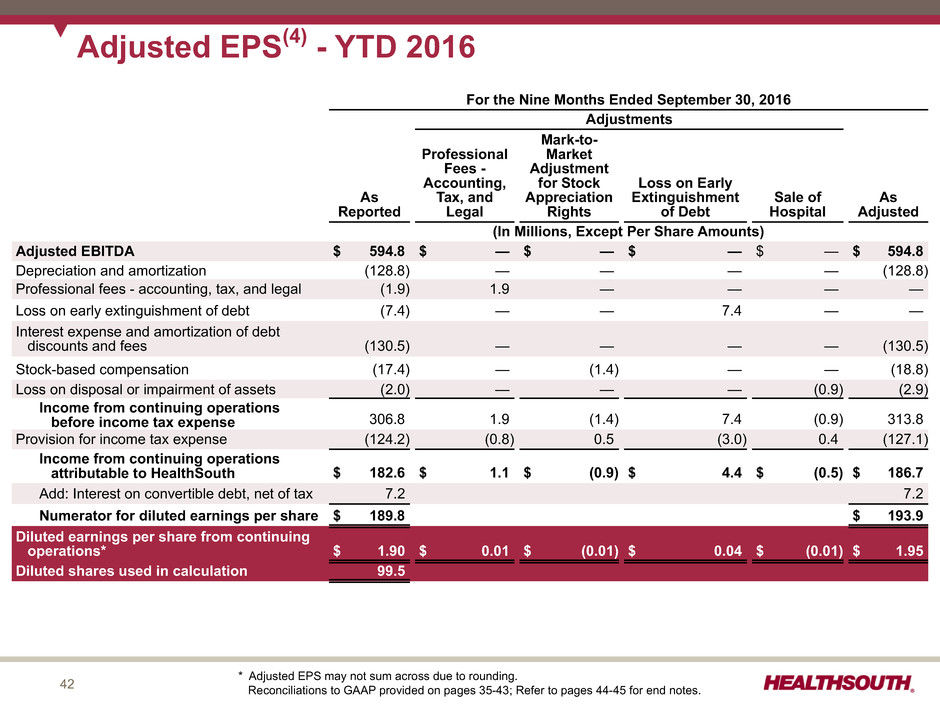

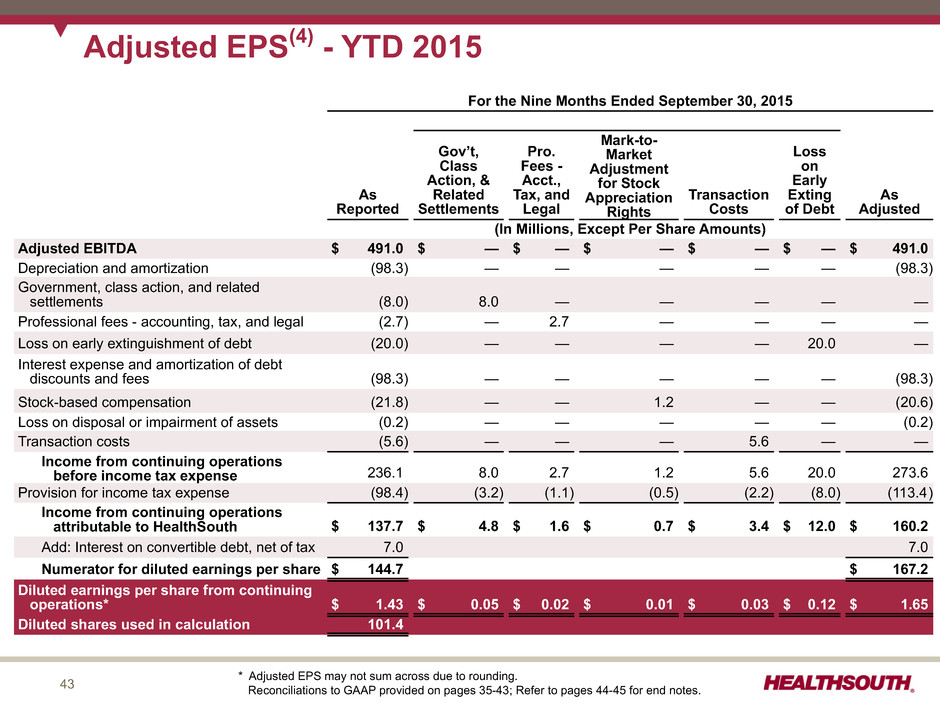

12 Q3 9 Months 2016 2015 2016 2015 Earnings per share, as reported $ 0.64 $ 0.52 $ 1.90 $ 1.43 Adjustments, net of tax: Government, class action, and related settlements — — — 0.05 Professional fees — accounting, tax, and legal — — 0.01 0.02 Mark-to-market adjustment for stock appreciation rights(5) (0.01) 0.01 (0.01) 0.01 Transaction costs — 0.01 — 0.03 Loss on early extinguishment of debt 0.02 — 0.04 0.12 Sale of hospital — — (0.01) — Adjusted earnings per share* $ 0.65 $ 0.54 $ 1.95 $ 1.65 Adjusted Earnings per Share(4) * Adjusted EPS may not sum due to rounding. See complete calculations of adjusted earnings per share on pages 40-43. Refer to pages 44-45 for end notes. Adjusted earnings per share removes the impact of items that are deemed to be non- indicative of the Company’s ongoing operations from the earnings per share calculation.

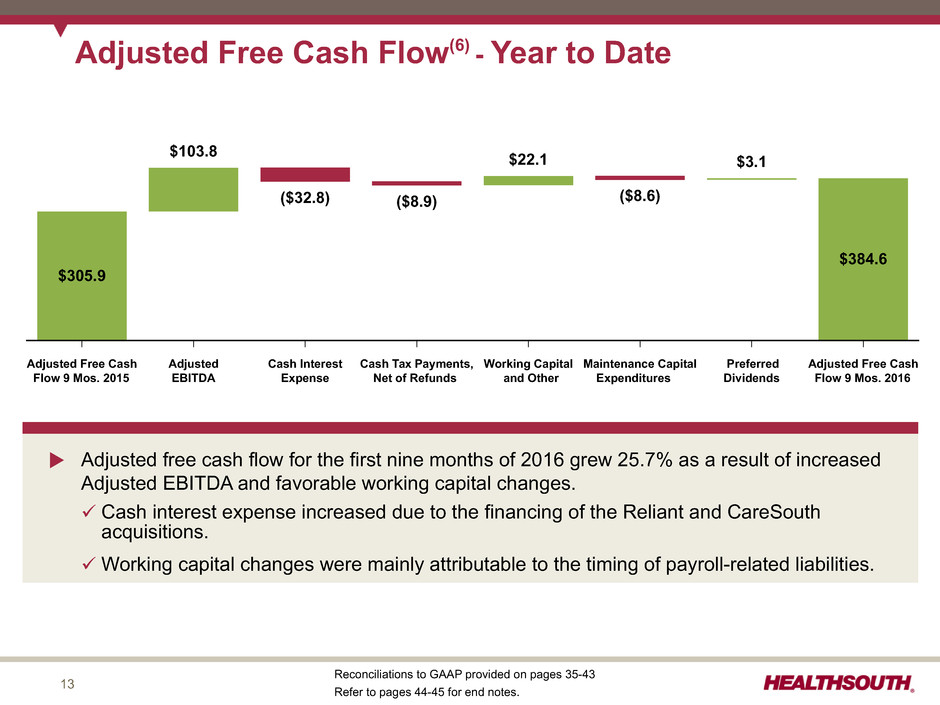

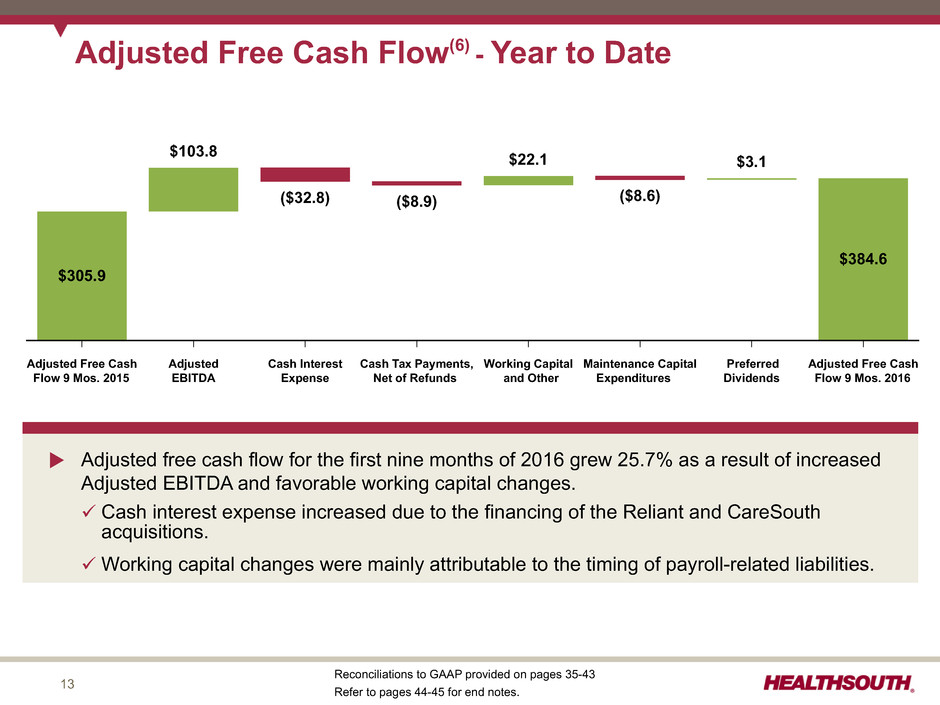

13 Adjusted Free Cash Flow 9 Mos. 2015 Adjusted EBITDA Cash Interest Expense Cash Tax Payments, Net of Refunds Working Capital and Other Maintenance Capital Expenditures Preferred Dividends Adjusted Free Cash Flow 9 Mos. 2016 $305.9 $103.8 ($32.8) ($8.9) $22.1 ($8.6) $3.1 $384.6 Adjusted Free Cash Flow(6) - Year to Date Reconciliations to GAAP provided on pages 35-43 Refer to pages 44-45 for end notes. u Adjusted free cash flow for the first nine months of 2016 grew 25.7% as a result of increased Adjusted EBITDA and favorable working capital changes. ü Cash interest expense increased due to the financing of the Reliant and CareSouth acquisitions. üWorking capital changes were mainly attributable to the timing of payroll-related liabilities.

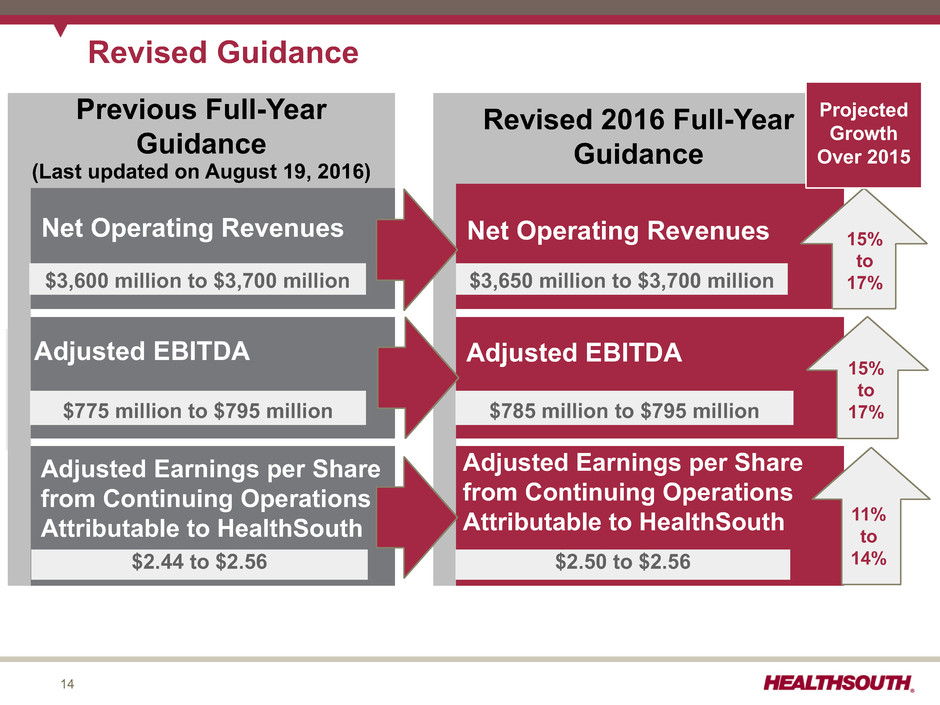

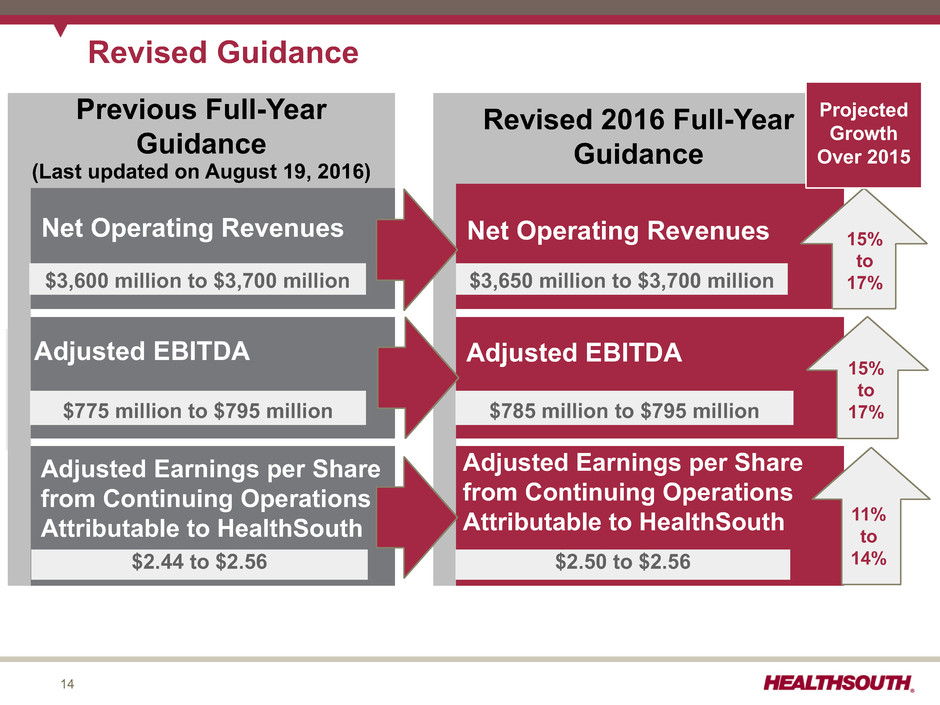

14 Adjusted EBITDA Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth Revised Guidance Net Operating Revenues Previous Full-Year Guidance (Last updated on August 19, 2016) Revised 2016 Full-Year Guidance Net Operating Revenues $3,650 million to $3,700 million Adjusted EBITDA $785 million to $795 million Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth $2.50 to $2.56 Projected Growth Over 2015 $3,600 million to $3,700 million $775 million to $795 million $2.44 to $2.56 15% to 17% 15% to 17% 11% to 14%

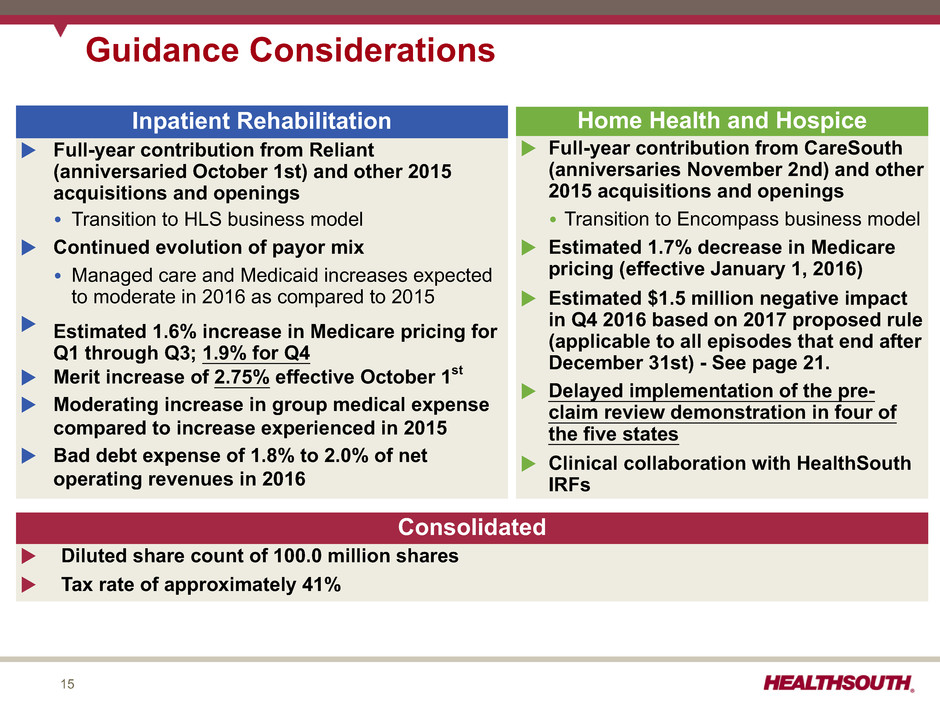

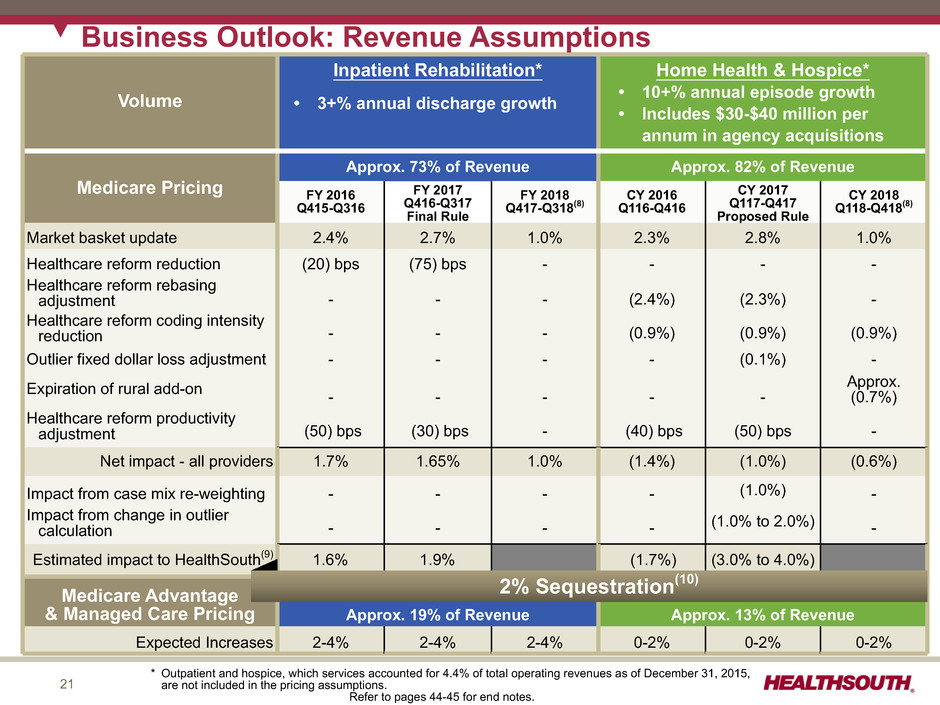

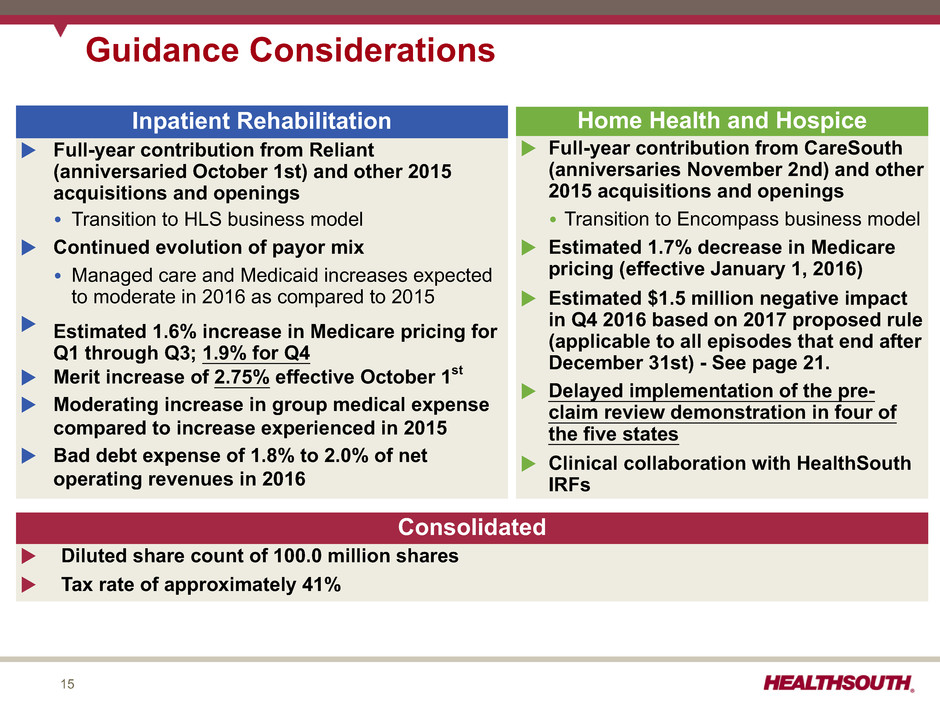

15 Inpatient Rehabilitation u Full-year contribution from Reliant (anniversaried October 1st) and other 2015 acquisitions and openings Ÿ Transition to HLS business model u Continued evolution of payor mix Ÿ Managed care and Medicaid increases expected to moderate in 2016 as compared to 2015 u Estimated 1.6% increase in Medicare pricing for Q1 through Q3; 1.9% for Q4 u Merit increase of 2.75% effective October 1st u Moderating increase in group medical expense compared to increase experienced in 2015 u Bad debt expense of 1.8% to 2.0% of net operating revenues in 2016 Guidance Considerations Home Health and Hospice u Full-year contribution from CareSouth (anniversaries November 2nd) and other 2015 acquisitions and openings Ÿ Transition to Encompass business model u Estimated 1.7% decrease in Medicare pricing (effective January 1, 2016) u Estimated $1.5 million negative impact in Q4 2016 based on 2017 proposed rule (applicable to all episodes that end after December 31st) - See page 21. u Delayed implementation of the pre- claim review demonstration in four of the five states u Clinical collaboration with HealthSouth IRFs Consolidated u Diluted share count of 100.0 million shares u Tax rate of approximately 41%

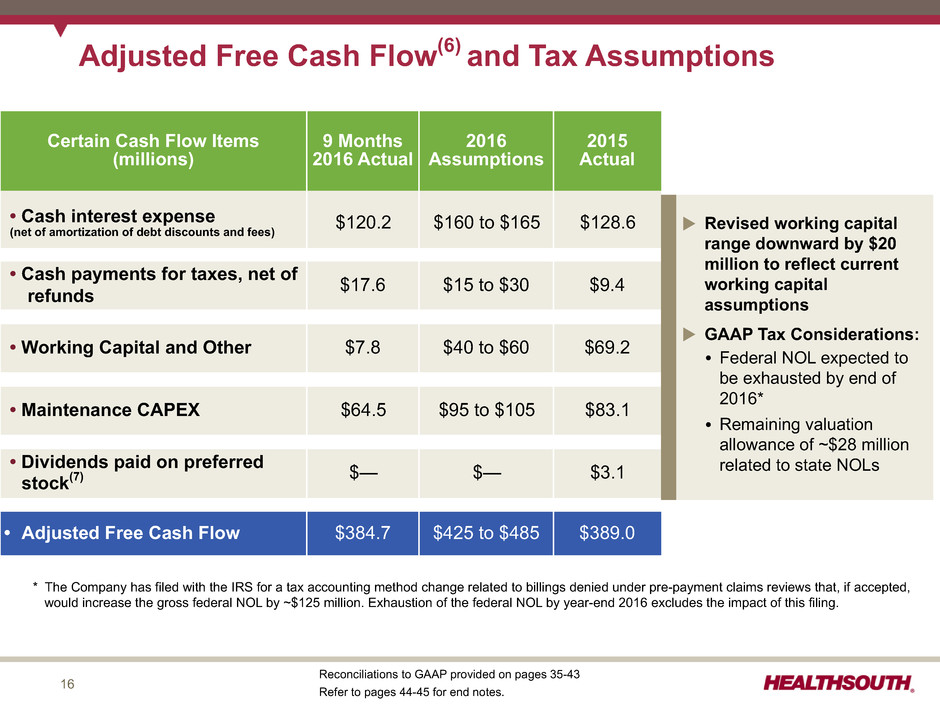

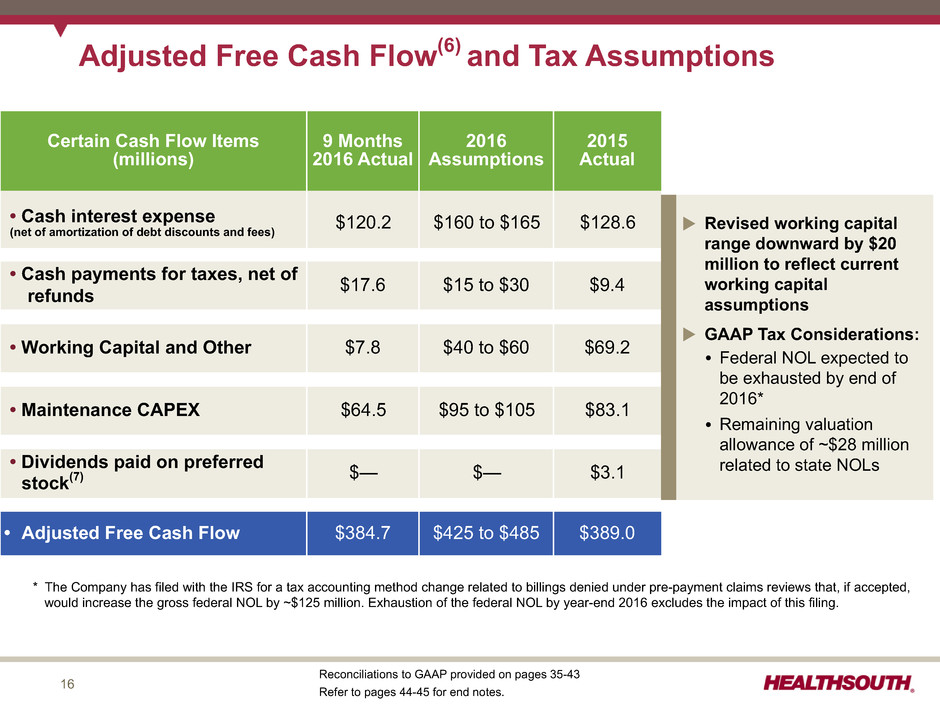

16 Adjusted Free Cash Flow(6) and Tax Assumptions Certain Cash Flow Items (millions) 9 Months 2016 Actual 2016 Assumptions 2015 Actual • Cash interest expense (net of amortization of debt discounts and fees) $120.2 $160 to $165 $128.6 • Cash payments for taxes, net of refunds $17.6 $15 to $30 $9.4 • Working Capital and Other $7.8 $40 to $60 $69.2 • Maintenance CAPEX $64.5 $95 to $105 $83.1 • Dividends paid on preferred stock(7) $— $— $3.1 • Adjusted Free Cash Flow $384.7 $425 to $485 $389.0 Reconciliations to GAAP provided on pages 35-43 Refer to pages 44-45 for end notes. u Revised working capital range downward by $20 million to reflect current working capital assumptions u GAAP Tax Considerations: Ÿ Federal NOL expected to be exhausted by end of 2016* Ÿ Remaining valuation allowance of ~$28 million related to state NOLs * The Company has filed with the IRS for a tax accounting method change related to billings denied under pre-payment claims reviews that, if accepted, would increase the gross federal NOL by ~$125 million. Exhaustion of the federal NOL by year-end 2016 excludes the impact of this filing.

Appendix

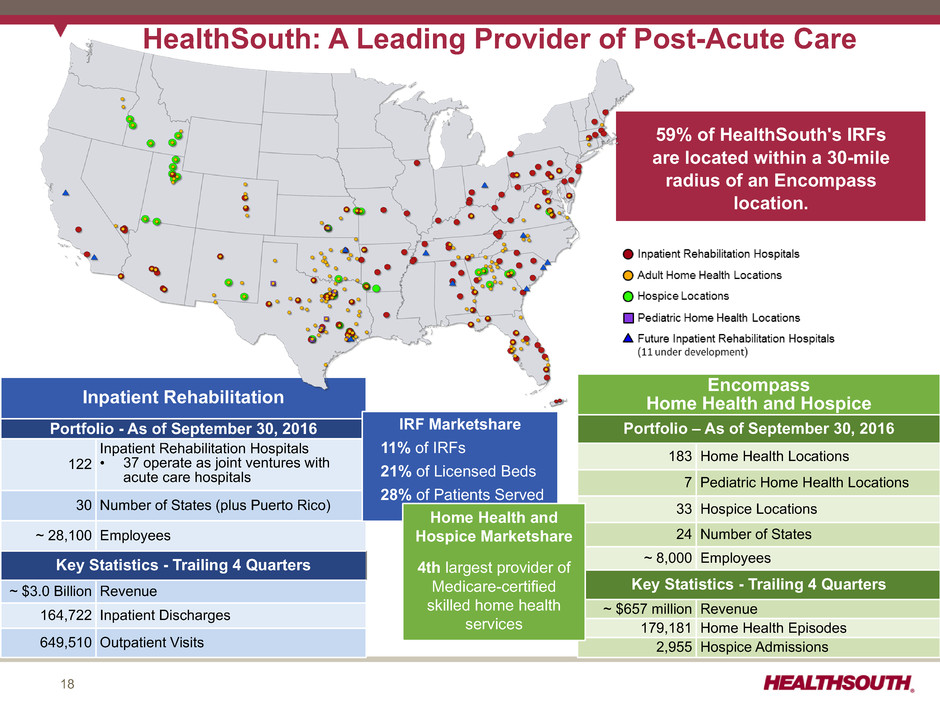

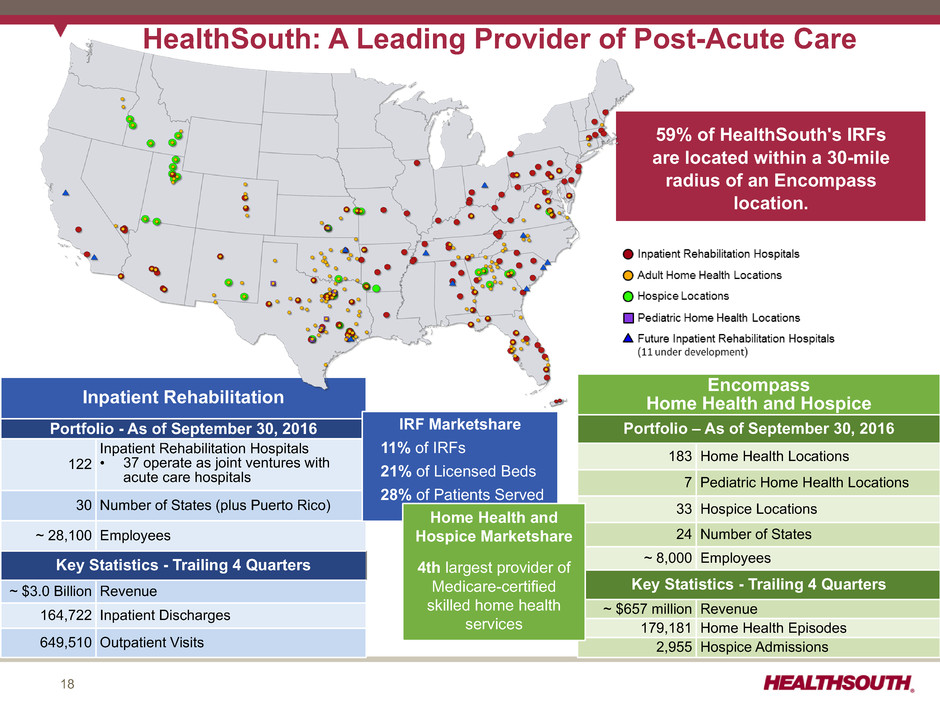

18 HealthSouth: A Leading Provider of Post-Acute Care 59% of HealthSouth's IRFs are located within a 30-mile radius of an Encompass location. Inpatient Rehabilitation Portfolio - As of September 30, 2016 122 Inpatient Rehabilitation Hospitals • 37 operate as joint ventures with acute care hospitals 30 Number of States (plus Puerto Rico) ~ 28,100 Employees Key Statistics - Trailing 4 Quarters ~ $3.0 Billion Revenue 164,722 Inpatient Discharges 649,510 Outpatient Visits IRF Marketshare 11% of IRFs 21% of Licensed Beds 28% of Patients Served Encompass Home Health and Hospice Portfolio – As of September 30, 2016 183 Home Health Locations 7 Pediatric Home Health Locations 33 Hospice Locations 24 Number of States ~ 8,000 Employees Key Statistics - Trailing 4 Quarters ~ $657 million Revenue 179,181 Home Health Episodes 2,955 Hospice Admissions Home Health and Hospice Marketshare 4th largest provider of Medicare-certified skilled home health services

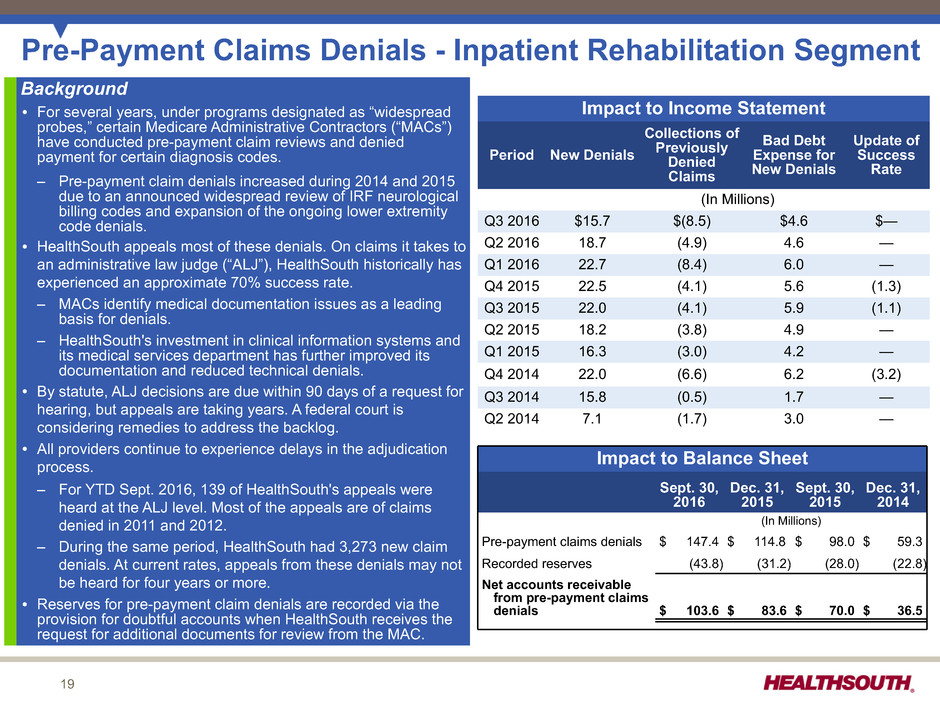

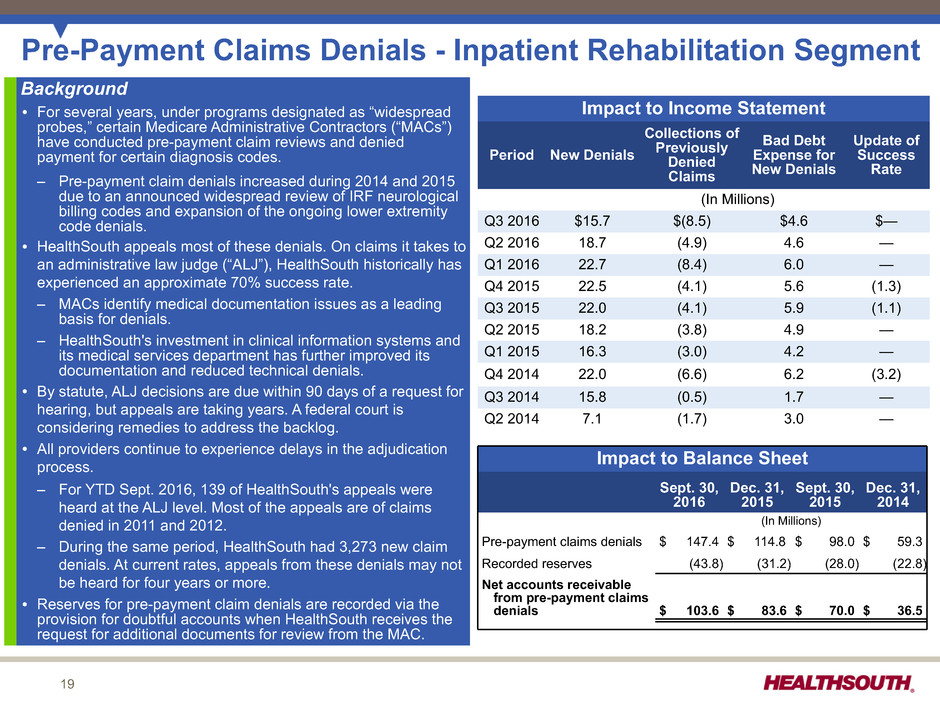

19 Pre-Payment Claims Denials - Inpatient Rehabilitation Segment Background Ÿ For several years, under programs designated as “widespread probes,” certain Medicare Administrative Contractors (“MACs”) have conducted pre-payment claim reviews and denied payment for certain diagnosis codes. – Pre-payment claim denials increased during 2014 and 2015 due to an announced widespread review of IRF neurological billing codes and expansion of the ongoing lower extremity code denials. Ÿ HealthSouth appeals most of these denials. On claims it takes to an administrative law judge (“ALJ”), HealthSouth historically has experienced an approximate 70% success rate. – MACs identify medical documentation issues as a leading basis for denials. – HealthSouth's investment in clinical information systems and its medical services department has further improved its documentation and reduced technical denials. Ÿ By statute, ALJ decisions are due within 90 days of a request for hearing, but appeals are taking years. A federal court is considering remedies to address the backlog. Ÿ All providers continue to experience delays in the adjudication process. – For YTD Sept. 2016, 139 of HealthSouth's appeals were heard at the ALJ level. Most of the appeals are of claims denied in 2011 and 2012. – During the same period, HealthSouth had 3,273 new claim denials. At current rates, appeals from these denials may not be heard for four years or more. Ÿ Reserves for pre-payment claim denials are recorded via the provision for doubtful accounts when HealthSouth receives the request for additional documents for review from the MAC. Impact to Income Statement Period New Denials Collections of Previously Denied Claims Bad Debt Expense for New Denials Update of Success Rate (In Millions) Q3 2016 $15.7 $(8.5) $4.6 $— Q2 2016 18.7 (4.9) 4.6 — Q1 2016 22.7 (8.4) 6.0 — Q4 2015 22.5 (4.1) 5.6 (1.3) Q3 2015 22.0 (4.1) 5.9 (1.1) Q2 2015 18.2 (3.8) 4.9 — Q1 2015 16.3 (3.0) 4.2 — Q4 2014 22.0 (6.6) 6.2 (3.2) Q3 2014 15.8 (0.5) 1.7 — Q2 2014 7.1 (1.7) 3.0 — Impact to Balance Sheet Sept. 30, 2016 Dec. 31, 2015 Sept. 30, 2015 Dec. 31, 2014 (In Millions) Pre-payment claims denials $ 147.4 $ 114.8 $ 98.0 $ 59.3 Recorded reserves (43.8) (31.2) (28.0) (22.8) Net accounts receivable from pre-payment claims denials $ 103.6 $ 83.6 $ 70.0 $ 36.5

20 Expansion Activity Inpatient Rehabilitation Facilities # of New Beds 2016 2017 2018 De Novo: Modesto, CA 50 — — Pearland, TX — 40 — Murrieta, CA — — 50 Shelby County, AL — — 34 Hilton Head, SC — — 38 Joint Ventures: Hot Springs, AR 40 — — Broken Arrow, OK 22 18 — Bryan, TX 49 — — Westerville, OH — 60 — Jackson, TN — 48 — Murrells Inlet, SC — — 29 Bed Expansions, net* 103 100 100 264 266 251 * Net bed expansions in each year may change due to the timing of certain regulatory approvals and/or construction delays.2016 does not include impact of sale of 61-bed hospital in Beaumont, TX or closure of 83-bed hospital in Austin, TX. Q3 2016 acquisition highlights: u Acquired Serenity Care (3 hospice locations in Arkansas and Texas) u Acquired one home health agency in Yuma, AZ Q3 2016 expansion activity highlights: u Opened new 40-bed hospital in July 2016 in Hot Springs, AR to replace 27-bed unit opened in February 2016 (joint venture with CHI St. Vincent) u Opened new 49-bed hospital in Bryan, TX in August 2016 (joint venture with St. Joseph Health System) u Began operating 22-bed unit in Broken Arrow, OK; expect to replace with new 40-bed hospital in Q3 2017 (joint venture with St. John Health System) u Announced two joint venture hospitals with Tidelands Health: Ÿ Murrells Inlet, SC - 29-bed hospital expected to be operational in Q2 2018 Ÿ Little River, SC - filed CON application to build a 46-bed hospital u Filed a CON application with Novant Health to build a 68-bed hospital in Winston-Salem, NC u Expanded existing hospital in Ocala, FL by 10 beds u Received CON approval for: Ÿ 38-bed hospital in Hilton Head, SC; expected to be operational in 2018 Ÿ addition of 35-bed satellite hospital in St. Peters, MO (existing joint venture with BJC Healthcare); expected to be operational in Q3 2017 2 1 3 4 5 6 7 11 IRF Development Projects Underway 1 New State 8 9 10 11 inston-Salem, N Home Health and Hospice # of locations December 31, 2015 213 Acquisitions 8 De Novo 3 Merged / Closed Locations (1) September 30, 2016 223

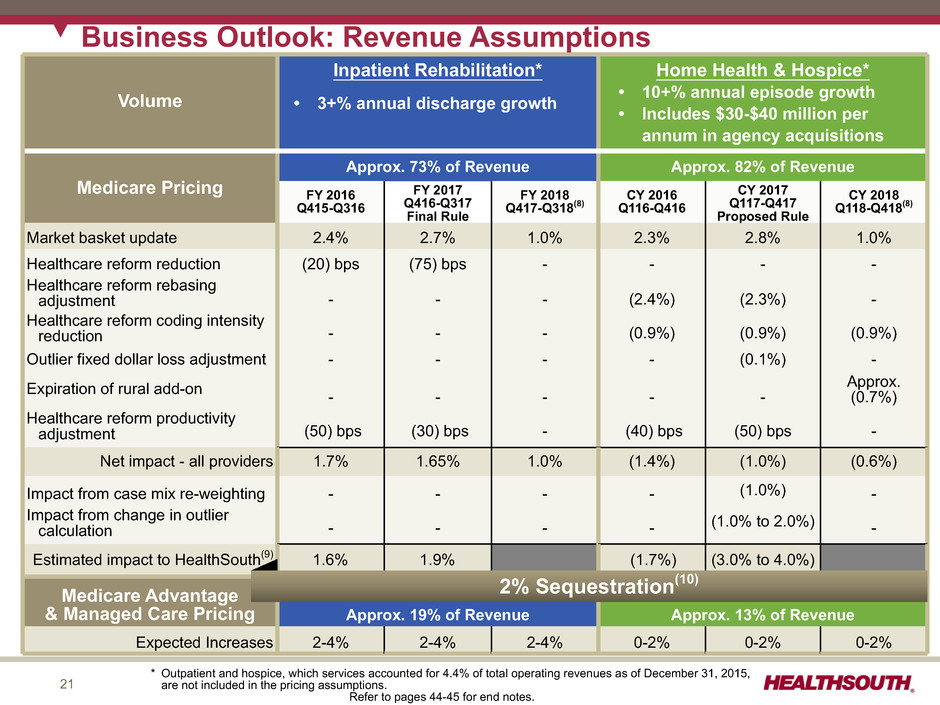

21 * Outpatient and hospice, which services accounted for 4.4% of total operating revenues as of December 31, 2015, are not included in the pricing assumptions. Refer to pages 44-45 for end notes. • 10% to15% annual episode growth • Includes $35-$40 million per annum in agency acquisitions Volume Inpatient Rehabilitation* Home Health & Hospice* Medicare Pricing Approx. 73% of Revenue Approx. 82% of Revenue FY 2016 Q415-Q316 FY 2017 Q416-Q317 Final Rule FY 2018 Q417-Q318(8) CY 2016 Q116-Q416 CY 2017 Q117-Q417 Proposed Rule CY 2018 Q118-Q418(8) Market basket update 2.4% 2.7% 1.0% 2.3% 2.8% 1.0% Healthcare reform reduction (20) bps (75) bps - - - - Healthcare reform rebasing adjustment - - - (2.4%) (2.3%) - Healthcare reform coding intensity reduction - - - (0.9%) (0.9%) (0.9%) Outlier fixed dollar loss adjustment - - - - (0.1%) - Expiration of rural add-on - - - - - Approx. (0.7%) Healthcare reform productivity adjustment (50) bps (30) bps - (40) bps (50) bps - Net impact - all providers 1.7% 1.65% 1.0% (1.4%) (1.0%) (0.6%) Impact from case mix re-weighting - - - - (1.0%) - Impact from change in outlier calculation - - - - (1.0% to 2.0%) - Estimated impact to HealthSouth(9) 1.6% 1.9% (1.7%) (3.0% to 4.0%) Medicare Advantage & Managed Care Pricing Approx. 19% of Revenue Approx. 13% of Revenue Expected Increases 2-4% 2-4% 2-4% 0-2% 0-2% 0-2% Business Outlook: Revenue Assumptions 2% Sequestration(10) • 3+% annual discharge growth • 10+% annual episode growth• Includes $30-$40 million per annum in agency acquisitions

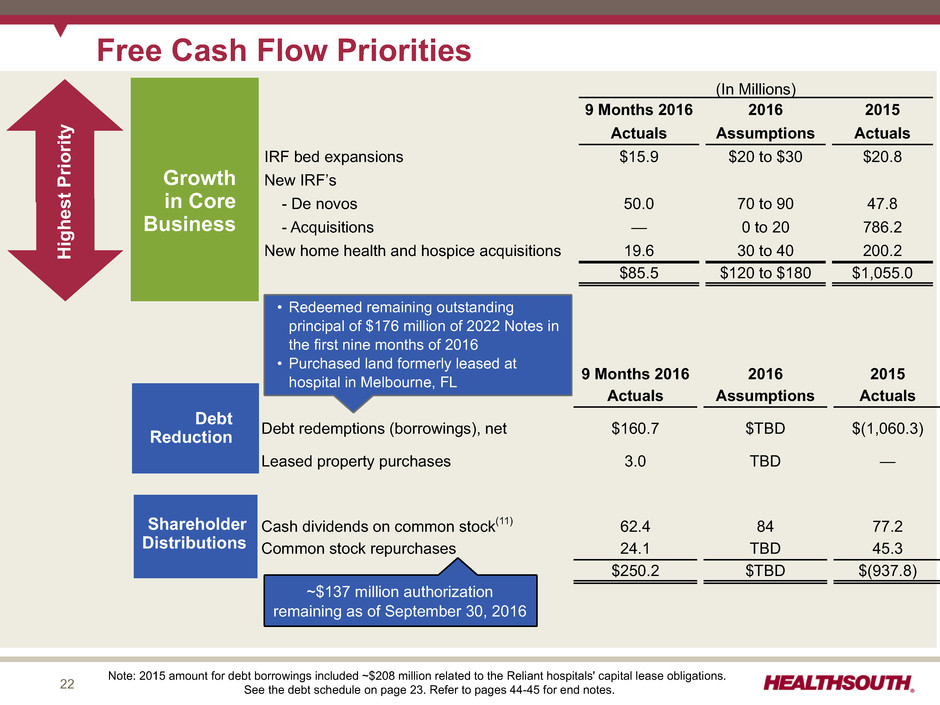

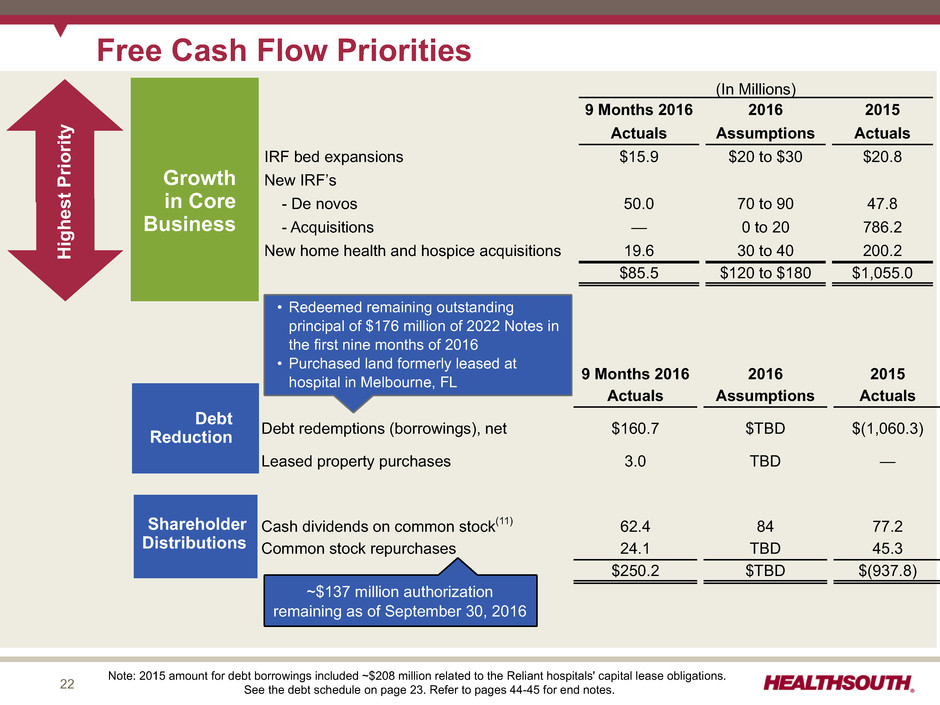

22 Free Cash Flow Priorities (In Millions) 9 Months 2016 2016 2015 Actuals Assumptions Actuals IRF bed expansions $15.9 $20 to $30 $20.8 New IRF’s - De novos 50.0 70 to 90 47.8 - Acquisitions — 0 to 20 786.2 New home health and hospice acquisitions 19.6 30 to 40 200.2 $85.5 $120 to $180 $1,055.0 9 Months 2016 2016 2015 Actuals Assumptions Actuals Debt redemptions (borrowings), net $160.7 $TBD $(1,060.3) Leased property purchases 3.0 TBD — Cash dividends on common stock(11) 62.4 84 77.2 Common stock repurchases 24.1 TBD 45.3 $250.2 $TBD $(937.8) Shareholder Distributions Growth in Core Business Debt Reduction Highest Priorit y • Redeemed remaining outstanding principal of $176 million of 2022 Notes in the first nine months of 2016 • Purchased land formerly leased at hospital in Melbourne, FL ~$137 million authorization remaining as of September 30, 2016 Note: 2015 amount for debt borrowings included ~$208 million related to the Reliant hospitals' capital lease obligations. See the debt schedule on page 23. Refer to pages 44-45 for end notes.

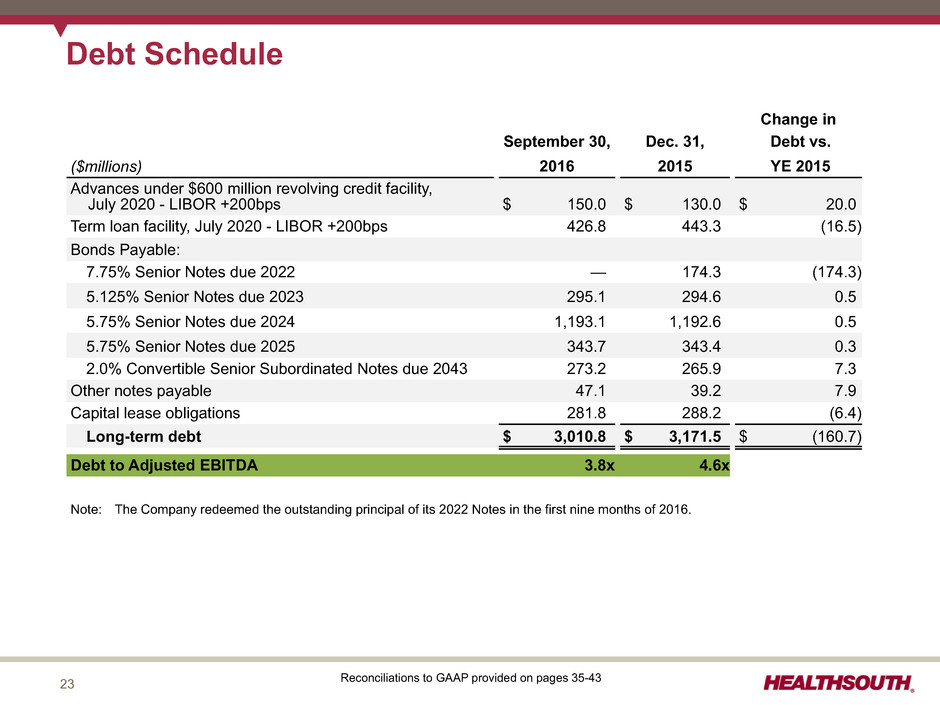

23 Debt Schedule Change in September 30, Dec. 31, Debt vs. ($millions) 2016 2015 YE 2015 Advances under $600 million revolving credit facility, July 2020 - LIBOR +200bps $ 150.0 $ 130.0 $ 20.0 Term loan facility, July 2020 - LIBOR +200bps 426.8 443.3 (16.5) Bonds Payable: 7.75% Senior Notes due 2022 — 174.3 (174.3) 5.125% Senior Notes due 2023 295.1 294.6 0.5 5.75% Senior Notes due 2024 1,193.1 1,192.6 0.5 5.75% Senior Notes due 2025 343.7 343.4 0.3 2.0% Convertible Senior Subordinated Notes due 2043 273.2 265.9 7.3 Other notes payable 47.1 39.2 7.9 Capital lease obligations 281.8 288.2 (6.4) Long-term debt $ 3,010.8 $ 3,171.5 $ (160.7) Debt to Adjusted EBITDA 3.8x 4.6x Reconciliations to GAAP provided on pages 35-43 Note: The Company redeemed the outstanding principal of its 2022 Notes in the first nine months of 2016.

24 2015 2019 2020 2020 2021 2022 2023 2024 2025 2043 $350 Senior Notes 5.75% $1,200 Senior Notes 5.75% $320 Conv. Sr. Sub. Notes 2.0% $300 Senior Notes 5.125% $150 Drawn + $33 reserved for LC’s Holders have a put option in 2020 As of September 30, 2016* Debt Maturity Profile - Face Value ($ in millions) $417 Available Callable beginning November 2017 HealthSouth is positioned with a cost-efficient, flexible capital structure. Callable beginning March 2018 Revolver Revolver Capacity $428 Term Loans Callable beginning September 2020 * This chart does not include ~$282 million of capital lease obligations or ~$47 million of other notes payable. See the debt schedule on page 23. No significant debt maturities prior to 2020

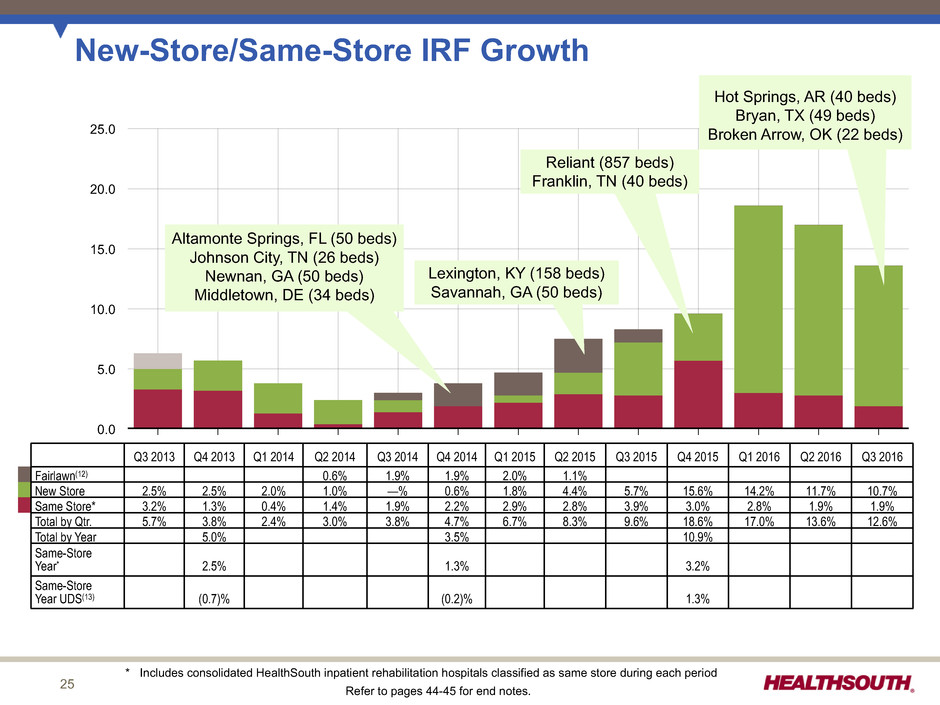

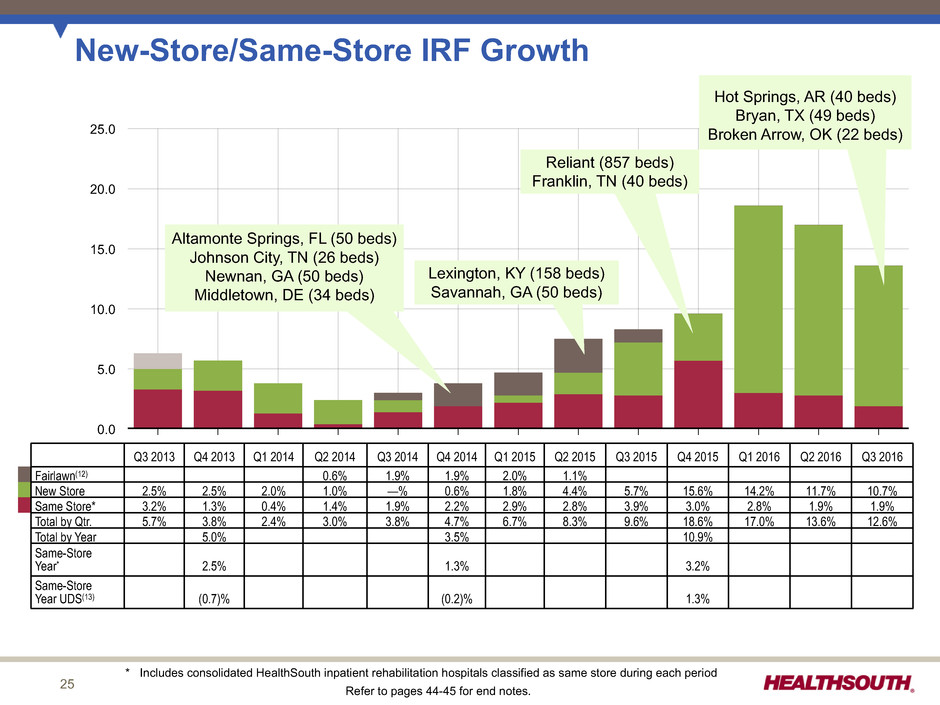

25 25.0 20.0 15.0 10.0 5.0 0.0 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 New-Store/Same-Store IRF Growth Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Fairlawn(12) 0.6% 1.9% 1.9% 2.0% 1.1% New Store 2.5% 2.5% 2.0% 1.0% —% 0.6% 1.8% 4.4% 5.7% 15.6% 14.2% 11.7% 10.7% Same Store* 3.2% 1.3% 0.4% 1.4% 1.9% 2.2% 2.9% 2.8% 3.9% 3.0% 2.8% 1.9% 1.9% Total by Qtr. 5.7% 3.8% 2.4% 3.0% 3.8% 4.7% 6.7% 8.3% 9.6% 18.6% 17.0% 13.6% 12.6% Total by Year 5.0% 3.5% 10.9% Same-Store Year* 2.5% 1.3% 3.2% Same-Store Year UDS(13) (0.7)% (0.2)% 1.3% Altamonte Springs, FL (50 beds) Johnson City, TN (26 beds) Newnan, GA (50 beds) Middletown, DE (34 beds) Reliant (857 beds) Franklin, TN (40 beds) Lexington, KY (158 beds) Savannah, GA (50 beds) Hot Springs, AR (40 beds) Bryan, TX (49 beds) Broken Arrow, OK (22 beds) * Includes consolidated HealthSouth inpatient rehabilitation hospitals classified as same store during each period Refer to pages 44-45 for end notes.

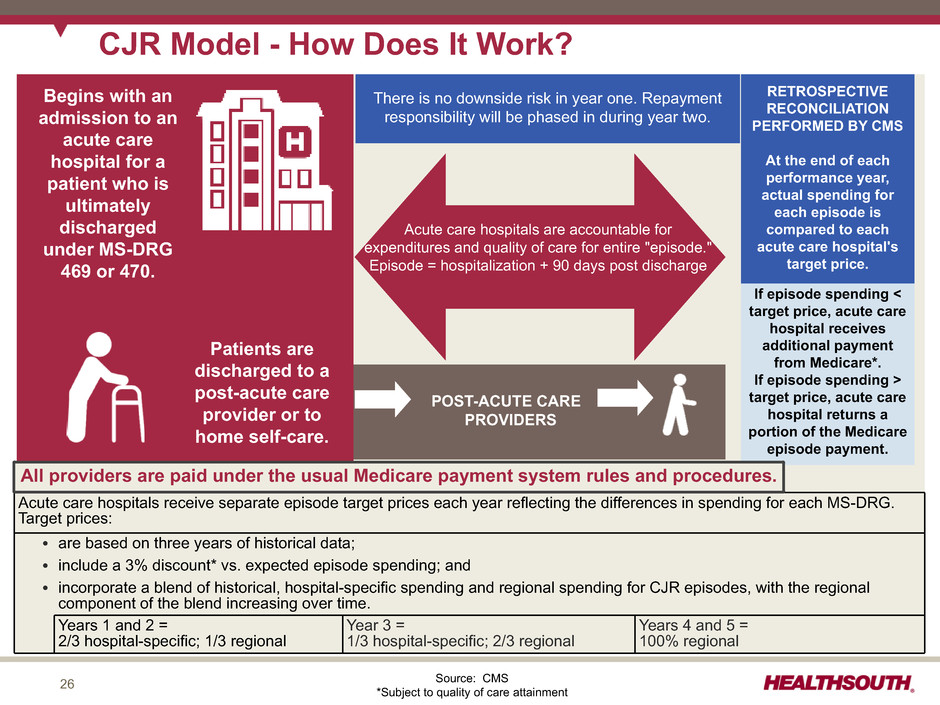

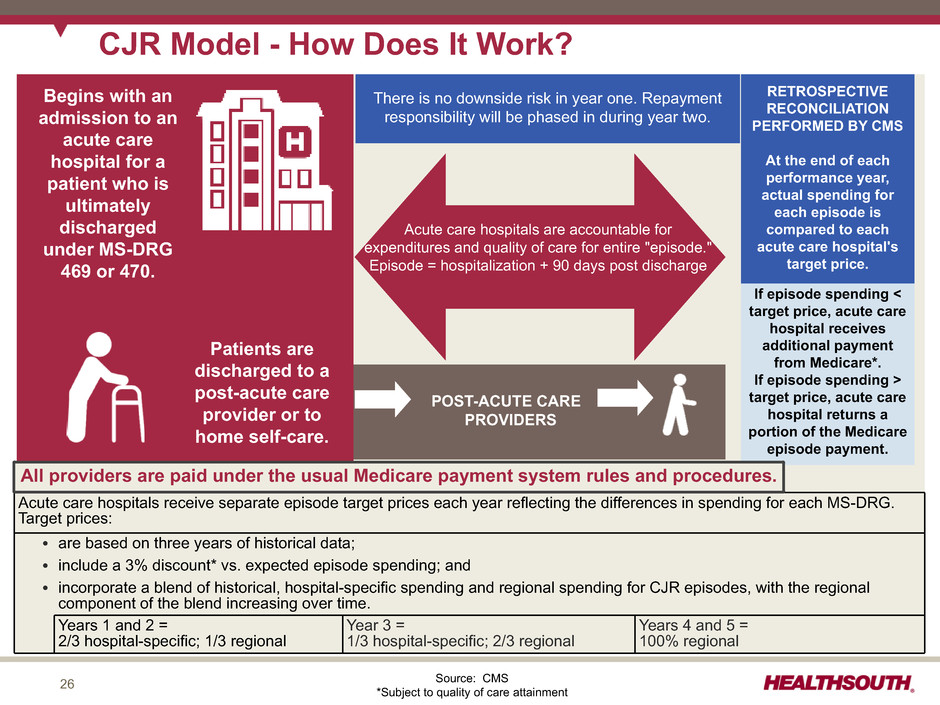

26 If episode spending < target price, acute care hospital receives additional payment from Medicare*. If episode spending > target price, acute care hospital returns a portion of the Medicare episode payment. CJR Model - How Does It Work? POST-ACUTE CARE PROVIDERS Acute care hospitals are accountable for expenditures and quality of care for entire "episode." Episode = hospitalization + 90 days post discharge Begins with an admission to an acute care hospital for a patient who is ultimately discharged under MS-DRG 469 or 470. Acute care hospitals receive separate episode target prices each year reflecting the differences in spending for each MS-DRG. Target prices: Ÿ are based on three years of historical data; Ÿ include a 3% discount* vs. expected episode spending; and Ÿ incorporate a blend of historical, hospital-specific spending and regional spending for CJR episodes, with the regional component of the blend increasing over time. Years 1 and 2 = 2/3 hospital-specific; 1/3 regional Year 3 = 1/3 hospital-specific; 2/3 regional Years 4 and 5 = 100% regional RETROSPECTIVE RECONCILIATION PERFORMED BY CMS At the end of each performance year, actual spending for each episode is compared to each acute care hospital's target price. There is no downside risk in year one. Repayment responsibility will be phased in during year two. All providers are paid under the usual Medicare payment system rules and procedures. Patients are discharged to a post-acute care provider or to home self-care. Source: CMS *Subject to quality of care attainment

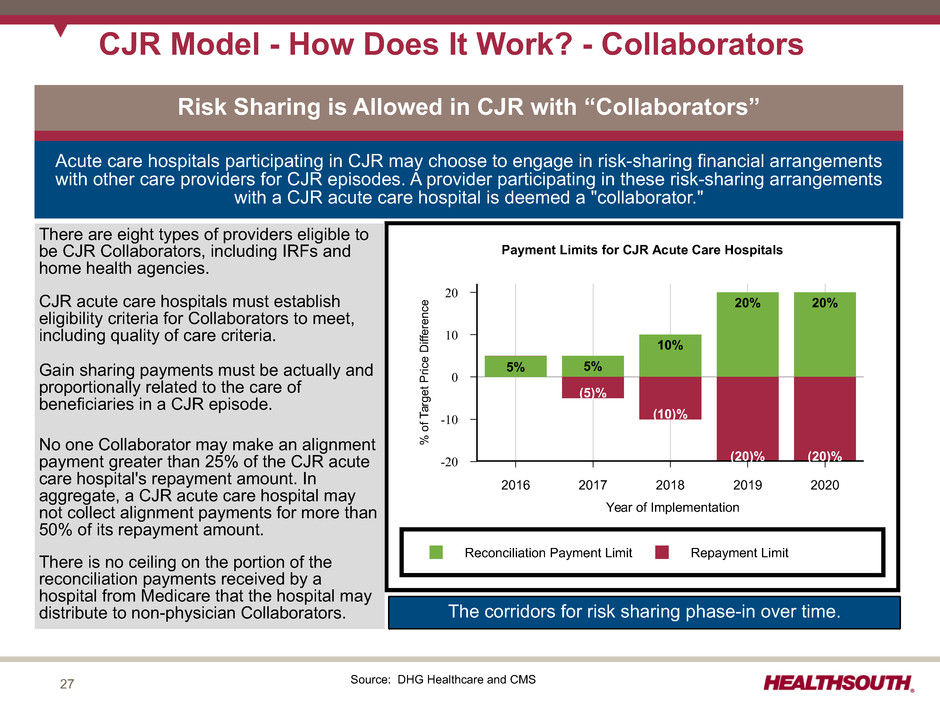

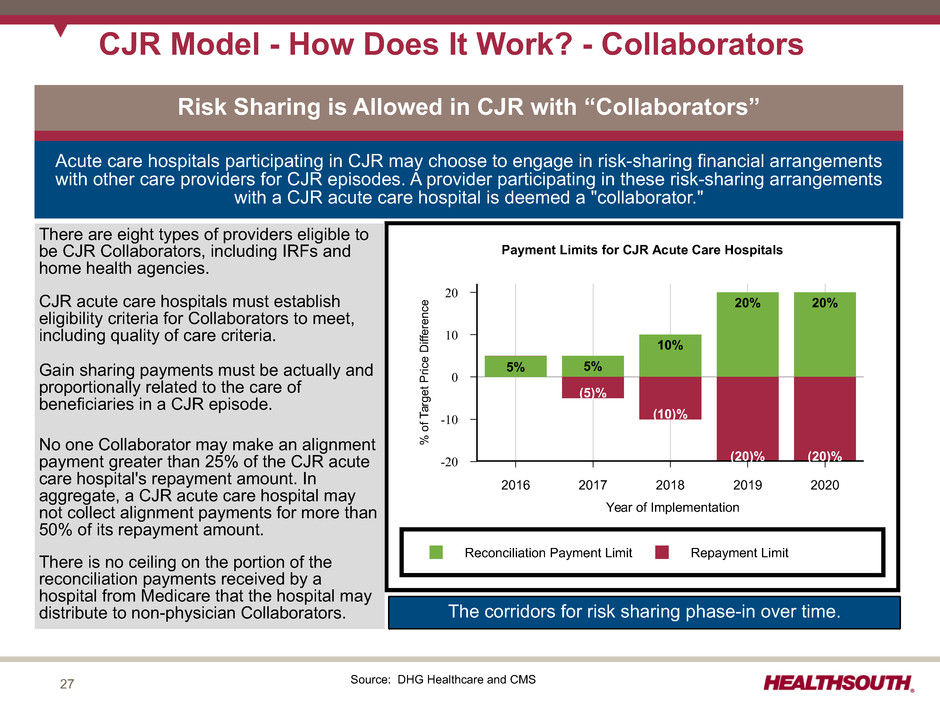

27 CJR Model - How Does It Work? - Collaborators Reconciliation Payment Limit Repayment Limit Payment Limits for CJR Acute Care Hospitals 20 10 0 -10 -20 % of Ta rg et Pr ic e D iff er en ce 2016 2017 2018 2019 2020 Year of Implementation 5% 5% 10% 20% 20% (5)% (10)% (20)% (20)% Risk Sharing is Allowed in CJR with “Collaborators” Acute care hospitals participating in CJR may choose to engage in risk-sharing financial arrangements with other care providers for CJR episodes. A provider participating in these risk-sharing arrangements with a CJR acute care hospital is deemed a "collaborator." There are eight types of providers eligible to be CJR Collaborators, including IRFs and home health agencies. CJR acute care hospitals must establish eligibility criteria for Collaborators to meet, including quality of care criteria. Gain sharing payments must be actually and proportionally related to the care of beneficiaries in a CJR episode. No one Collaborator may make an alignment payment greater than 25% of the CJR acute care hospital's repayment amount. In aggregate, a CJR acute care hospital may not collect alignment payments for more than 50% of its repayment amount. There is no ceiling on the portion of the reconciliation payments received by a hospital from Medicare that the hospital may distribute to non-physician Collaborators. Source: DHG Healthcare and CMS The corridors for risk sharing phase-in over time.

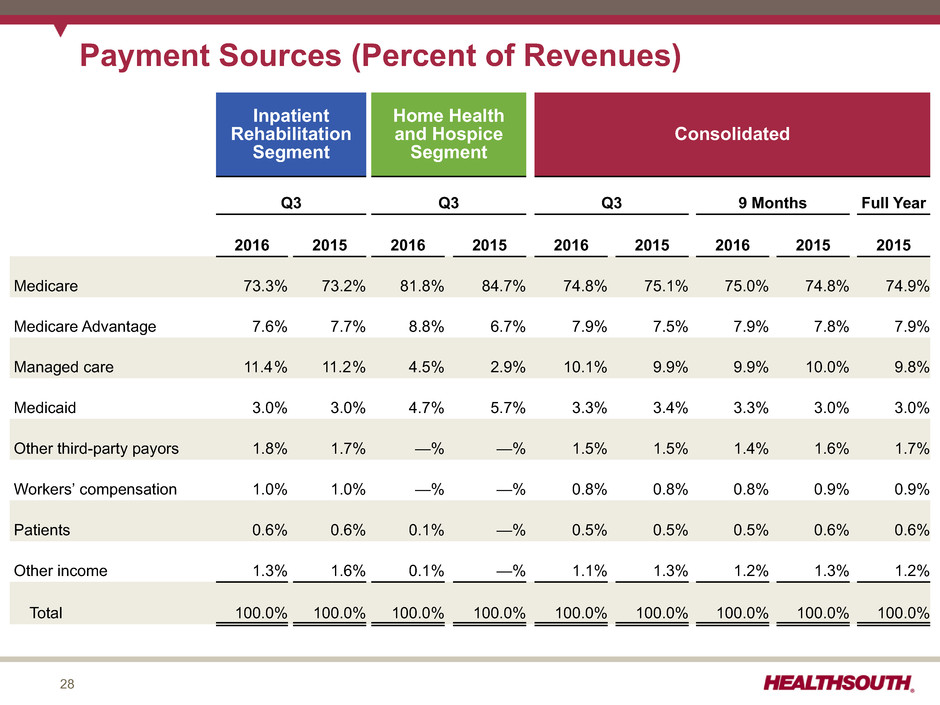

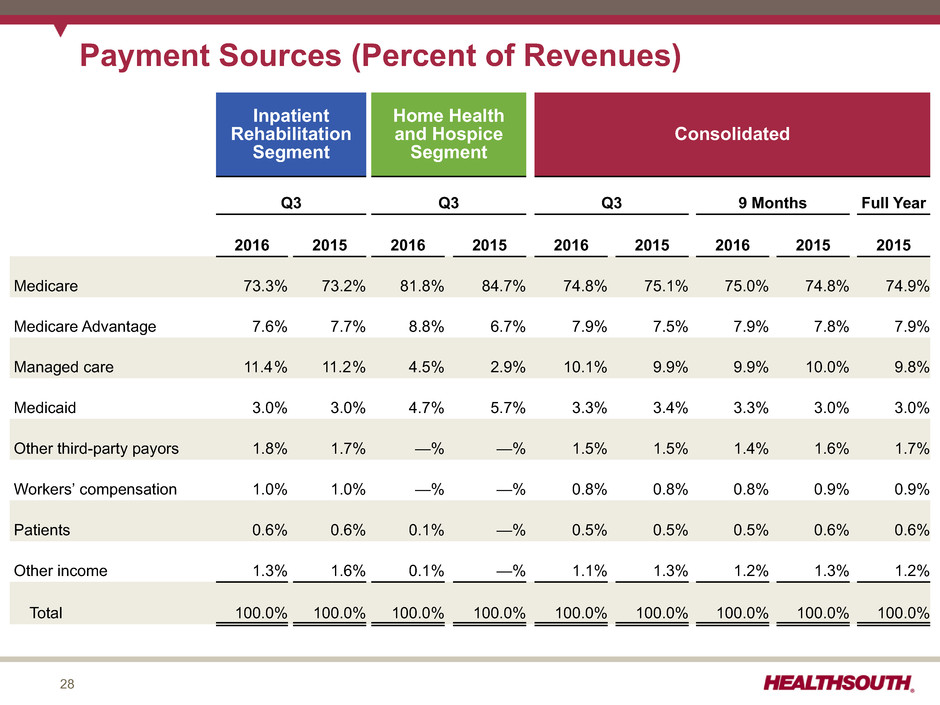

28 Payment Sources (Percent of Revenues) Inpatient Rehabilitation Segment Home Health and Hospice Segment Consolidated Q3 Q3 Q3 9 Months Full Year 2016 2015 2016 2015 2016 2015 2016 2015 2015 Medicare 73.3% 73.2% 81.8% 84.7% 74.8% 75.1% 75.0% 74.8% 74.9% Medicare Advantage 7.6% 7.7% 8.8% 6.7% 7.9% 7.5% 7.9% 7.8% 7.9% Managed care 11.4% 11.2% 4.5% 2.9% 10.1% 9.9% 9.9% 10.0% 9.8% Medicaid 3.0% 3.0% 4.7% 5.7% 3.3% 3.4% 3.3% 3.0% 3.0% Other third-party payors 1.8% 1.7% —% —% 1.5% 1.5% 1.4% 1.6% 1.7% Workers’ compensation 1.0% 1.0% —% —% 0.8% 0.8% 0.8% 0.9% 0.9% Patients 0.6% 0.6% 0.1% —% 0.5% 0.5% 0.5% 0.6% 0.6% Other income 1.3% 1.6% 0.1% —% 1.1% 1.3% 1.2% 1.3% 1.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

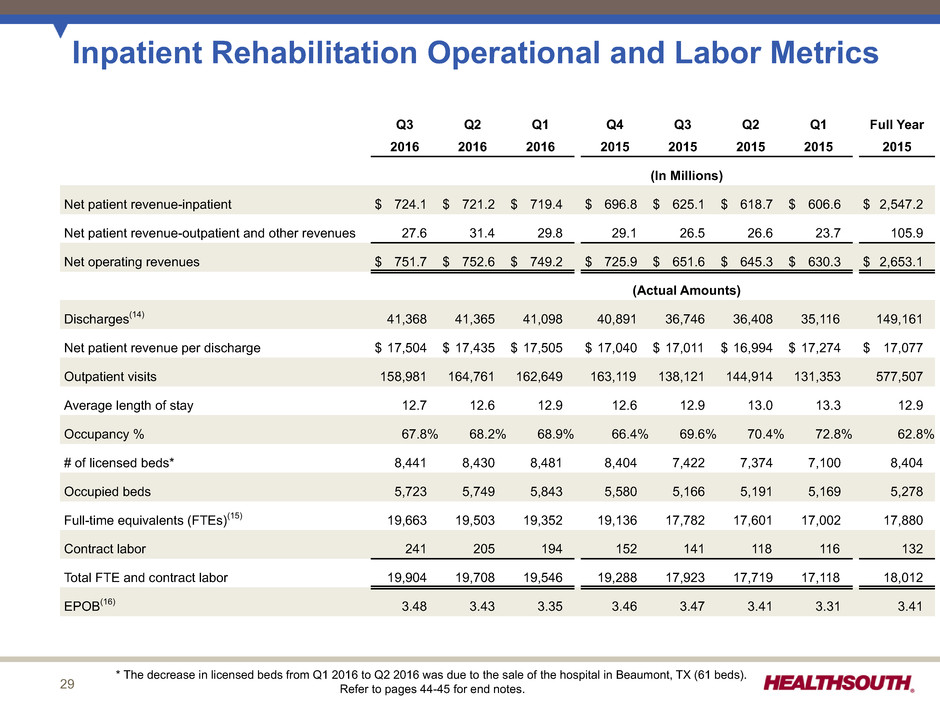

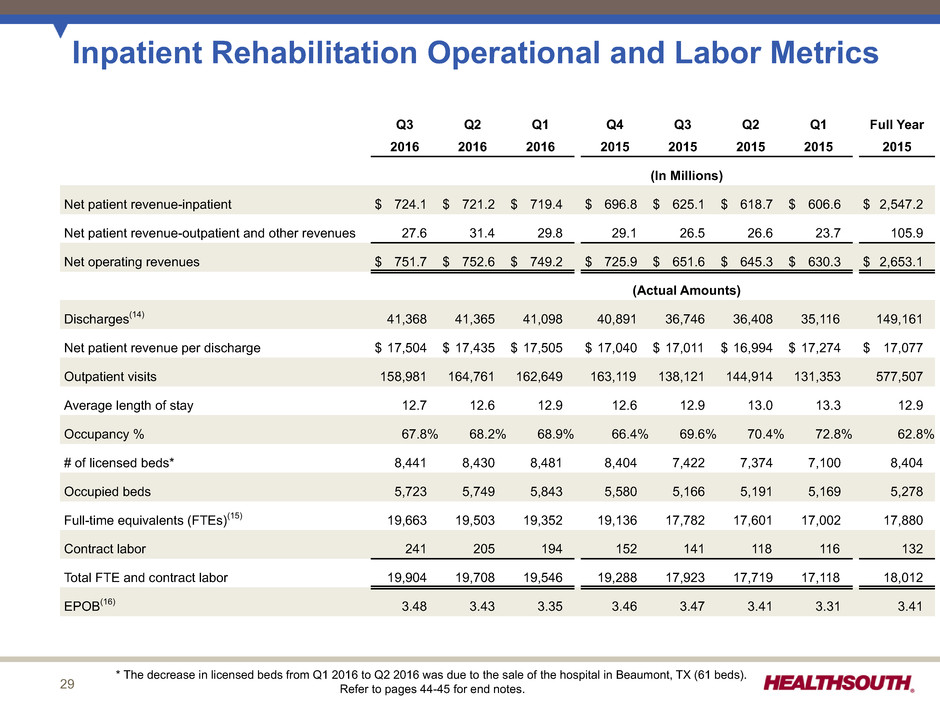

29 Inpatient Rehabilitation Operational and Labor Metrics Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year 2016 2016 2016 2015 2015 2015 2015 2015 (In Millions) Net patient revenue-inpatient $ 724.1 $ 721.2 $ 719.4 $ 696.8 $ 625.1 $ 618.7 $ 606.6 $ 2,547.2 Net patient revenue-outpatient and other revenues 27.6 31.4 29.8 29.1 26.5 26.6 23.7 105.9 Net operating revenues $ 751.7 $ 752.6 $ 749.2 $ 725.9 $ 651.6 $ 645.3 $ 630.3 $ 2,653.1 (Actual Amounts) Discharges(14) 41,368 41,365 41,098 40,891 36,746 36,408 35,116 149,161 Net patient revenue per discharge $ 17,504 $ 17,435 $ 17,505 $ 17,040 $ 17,011 $ 16,994 $ 17,274 $ 17,077 Outpatient visits 158,981 164,761 162,649 163,119 138,121 144,914 131,353 577,507 Average length of stay 12.7 12.6 12.9 12.6 12.9 13.0 13.3 12.9 Occupancy % 67.8% 68.2% 68.9% 66.4% 69.6% 70.4% 72.8% 62.8% # of licensed beds* 8,441 8,430 8,481 8,404 7,422 7,374 7,100 8,404 Occupied beds 5,723 5,749 5,843 5,580 5,166 5,191 5,169 5,278 Full-time equivalents (FTEs)(15) 19,663 19,503 19,352 19,136 17,782 17,601 17,002 17,880 Contract labor 241 205 194 152 141 118 116 132 Total FTE and contract labor 19,904 19,708 19,546 19,288 17,923 17,719 17,118 18,012 EPOB(16) 3.48 3.43 3.35 3.46 3.47 3.41 3.31 3.41 * The decrease in licensed beds from Q1 2016 to Q2 2016 was due to the sale of the hospital in Beaumont, TX (61 beds). Refer to pages 44-45 for end notes.

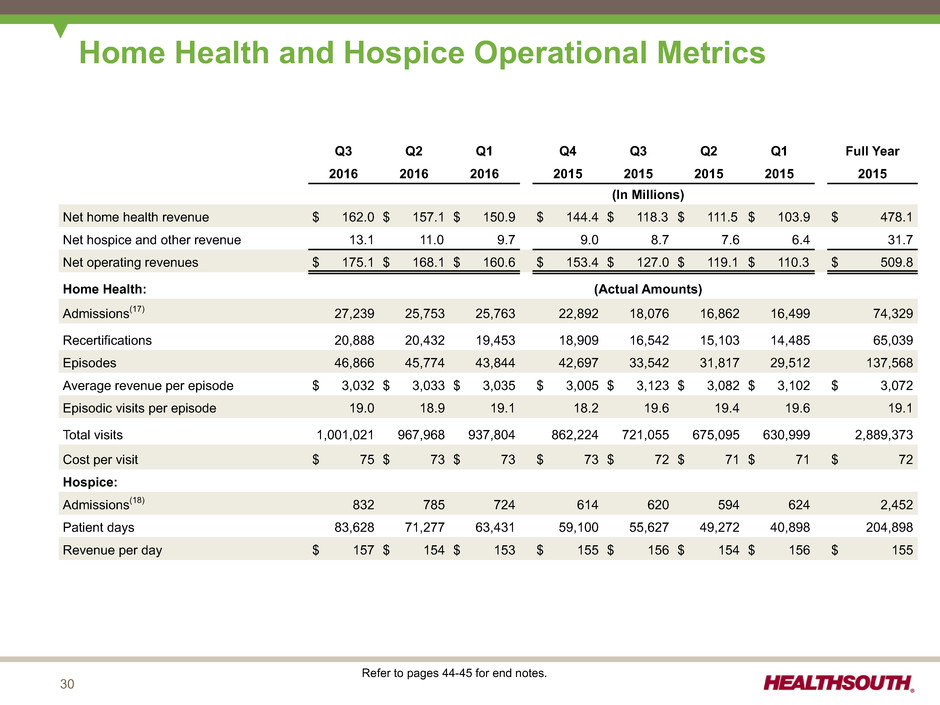

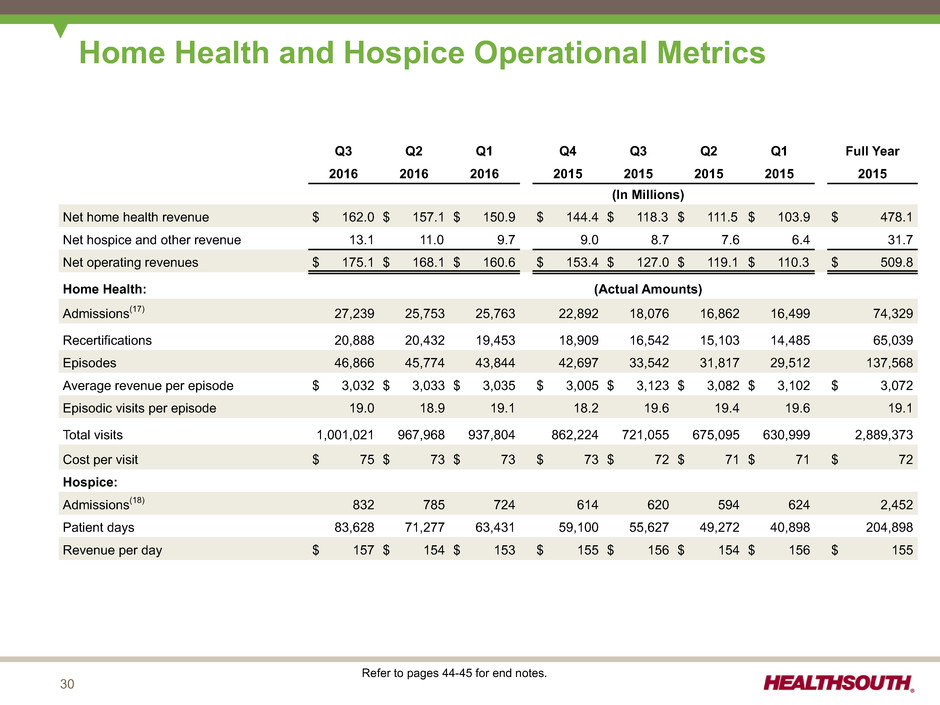

30 Home Health and Hospice Operational Metrics Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year 2016 2016 2016 2015 2015 2015 2015 2015 (In Millions) Net home health revenue $ 162.0 $ 157.1 $ 150.9 $ 144.4 $ 118.3 $ 111.5 $ 103.9 $ 478.1 Net hospice and other revenue 13.1 11.0 9.7 9.0 8.7 7.6 6.4 31.7 Net operating revenues $ 175.1 $ 168.1 $ 160.6 $ 153.4 $ 127.0 $ 119.1 $ 110.3 $ 509.8 Home Health: (Actual Amounts) Admissions(17) 27,239 25,753 25,763 22,892 18,076 16,862 16,499 74,329 Recertifications 20,888 20,432 19,453 18,909 16,542 15,103 14,485 65,039 Episodes 46,866 45,774 43,844 42,697 33,542 31,817 29,512 137,568 Average revenue per episode $ 3,032 $ 3,033 $ 3,035 $ 3,005 $ 3,123 $ 3,082 $ 3,102 $ 3,072 Episodic visits per episode 19.0 18.9 19.1 18.2 19.6 19.4 19.6 19.1 Total visits 1,001,021 967,968 937,804 862,224 721,055 675,095 630,999 2,889,373 Cost per visit $ 75 $ 73 $ 73 $ 73 $ 72 $ 71 $ 71 $ 72 Hospice: Admissions(18) 832 785 724 614 620 594 624 2,452 Patient days 83,628 71,277 63,431 59,100 55,627 49,272 40,898 204,898 Revenue per day $ 157 $ 154 $ 153 $ 155 $ 156 $ 154 $ 156 $ 155 Refer to pages 44-45 for end notes.

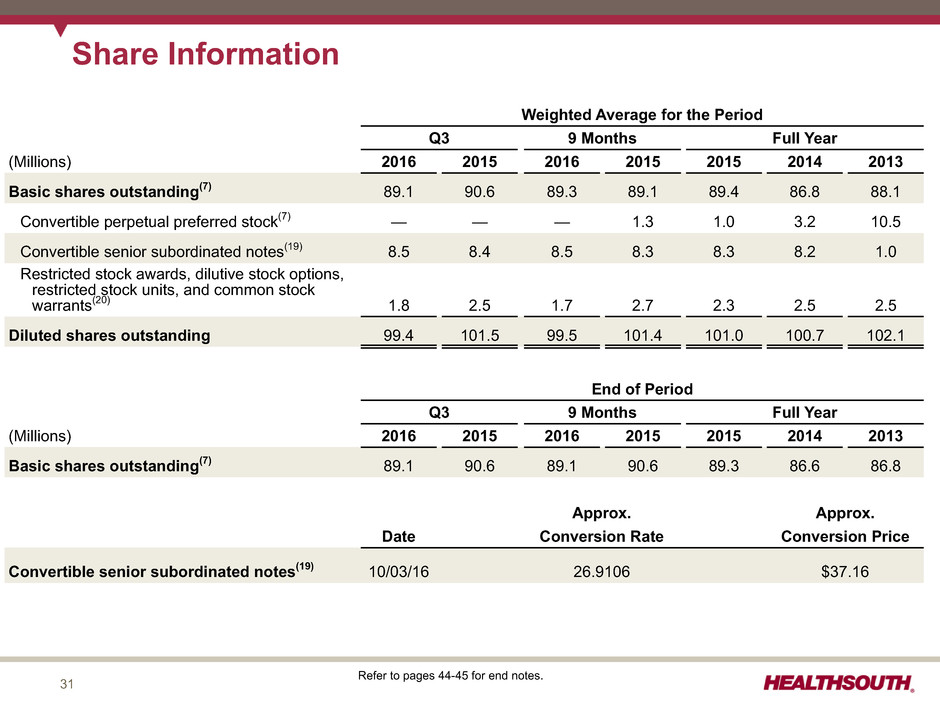

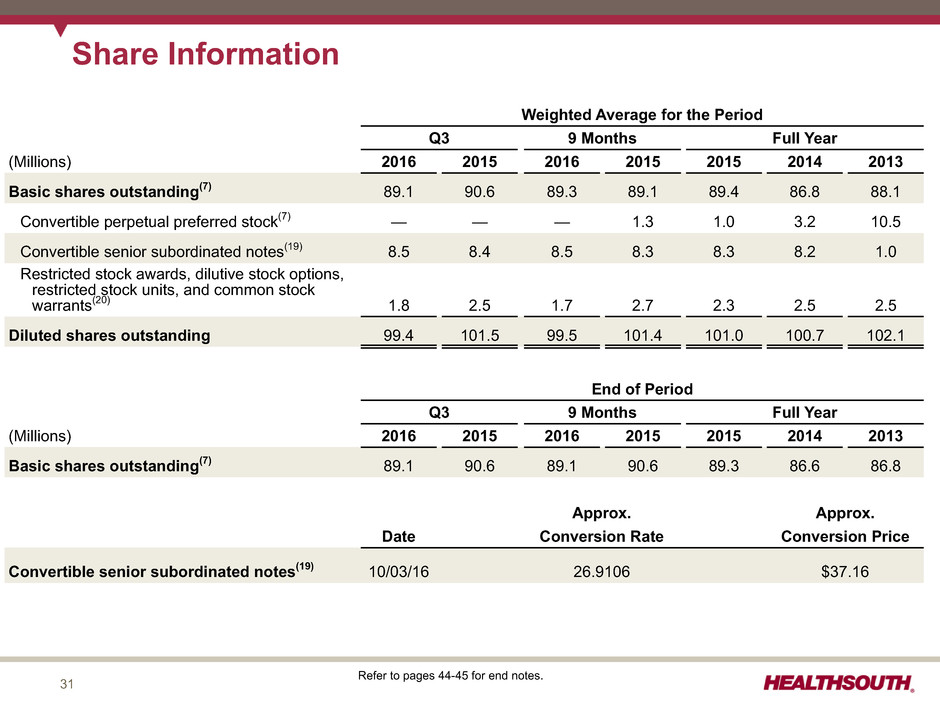

31 Share Information Weighted Average for the Period Q3 9 Months Full Year (Millions) 2016 2015 2016 2015 2015 2014 2013 Basic shares outstanding(7) 89.1 90.6 89.3 89.1 89.4 86.8 88.1 Convertible perpetual preferred stock(7) — — — 1.3 1.0 3.2 10.5 Convertible senior subordinated notes(19) 8.5 8.4 8.5 8.3 8.3 8.2 1.0 Restricted stock awards, dilutive stock options, restricted stock units, and common stock warrants(20) 1.8 2.5 1.7 2.7 2.3 2.5 2.5 Diluted shares outstanding 99.4 101.5 99.5 101.4 101.0 100.7 102.1 End of Period Q3 9 Months Full Year (Millions) 2016 2015 2016 2015 2015 2014 2013 Basic shares outstanding(7) 89.1 90.6 89.1 90.6 89.3 86.6 86.8 Approx. Approx. Date Conversion Rate Conversion Price Convertible senior subordinated notes(19) 10/03/16 26.9106 $37.16 Refer to pages 44-45 for end notes.

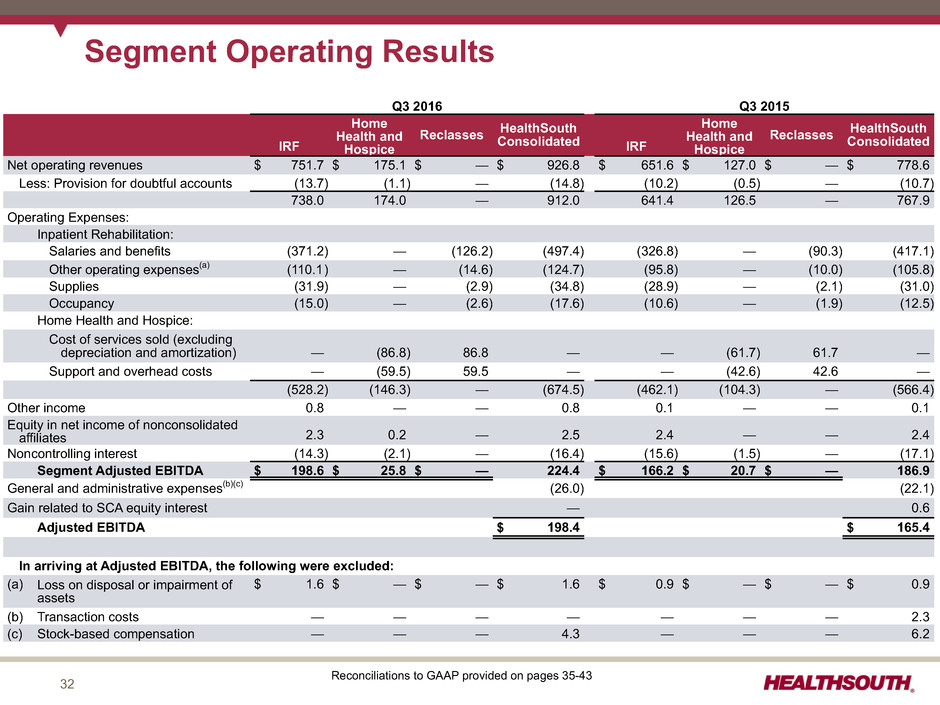

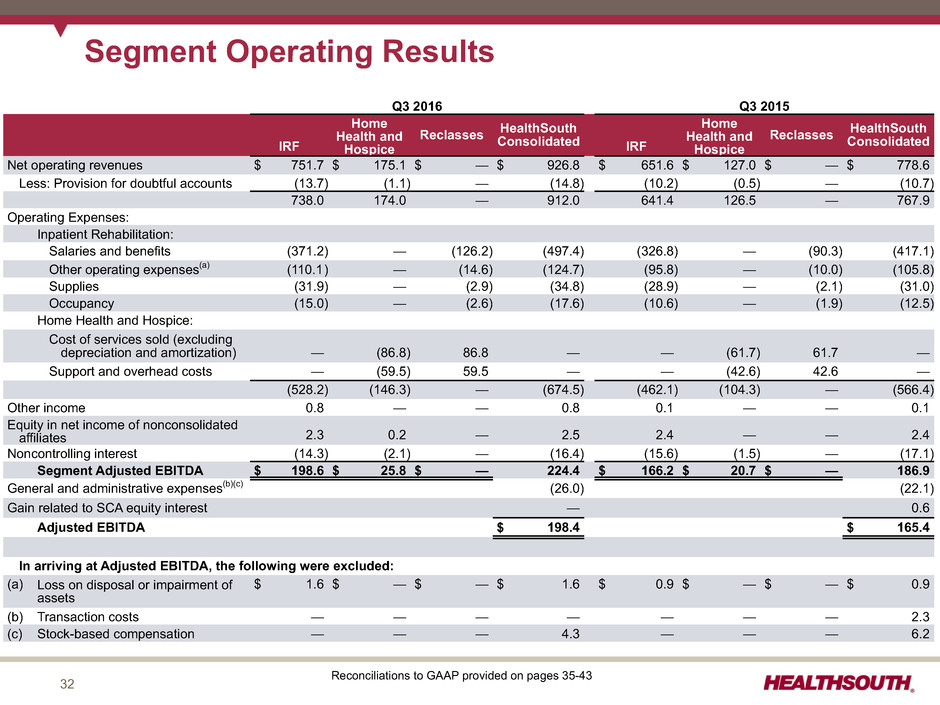

32 Segment Operating Results Q3 2016 Q3 2015 IRF Home Health and Hospice Reclasses HealthSouthConsolidated IRF Home Health and Hospice Reclasses HealthSouthConsolidated Net operating revenues $ 751.7 $ 175.1 $ — $ 926.8 $ 651.6 $ 127.0 $ — $ 778.6 Less: Provision for doubtful accounts (13.7) (1.1) — (14.8) (10.2) (0.5) — (10.7) 738.0 174.0 — 912.0 641.4 126.5 — 767.9 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (371.2) — (126.2) (497.4) (326.8) — (90.3) (417.1) Other operating expenses(a) (110.1) — (14.6) (124.7) (95.8) — (10.0) (105.8) Supplies (31.9) — (2.9) (34.8) (28.9) — (2.1) (31.0) Occupancy (15.0) — (2.6) (17.6) (10.6) — (1.9) (12.5) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (86.8) 86.8 — — (61.7) 61.7 — Support and overhead costs — (59.5) 59.5 — — (42.6) 42.6 — (528.2) (146.3) — (674.5) (462.1) (104.3) — (566.4) Other income 0.8 — — 0.8 0.1 — — 0.1 Equity in net income of nonconsolidated affiliates 2.3 0.2 — 2.5 2.4 — — 2.4 Noncontrolling interest (14.3) (2.1) — (16.4) (15.6) (1.5) — (17.1) Segment Adjusted EBITDA $ 198.6 $ 25.8 $ — 224.4 $ 166.2 $ 20.7 $ — 186.9 General and administrative expenses(b)(c) (26.0) (22.1) Gain related to SCA equity interest — 0.6 Adjusted EBITDA $ 198.4 $ 165.4 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal or impairment of assets $ 1.6 $ — $ — $ 1.6 $ 0.9 $ — $ — $ 0.9 (b) Transaction costs — — — — — — — 2.3 (c) Stock-based compensation — — — 4.3 — — — 6.2 Reconciliations to GAAP provided on pages 35-43

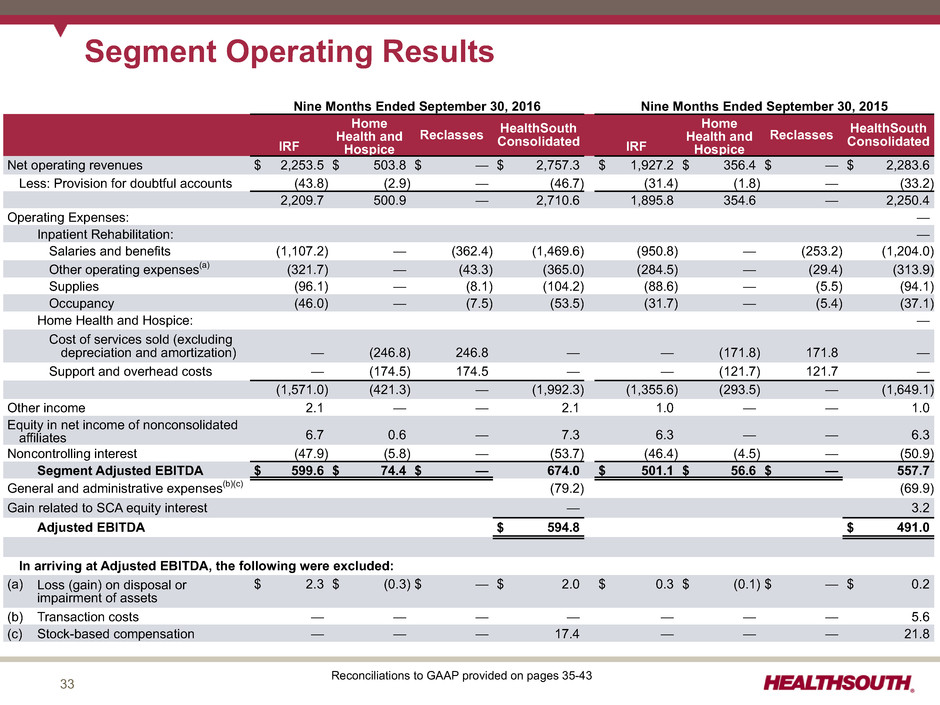

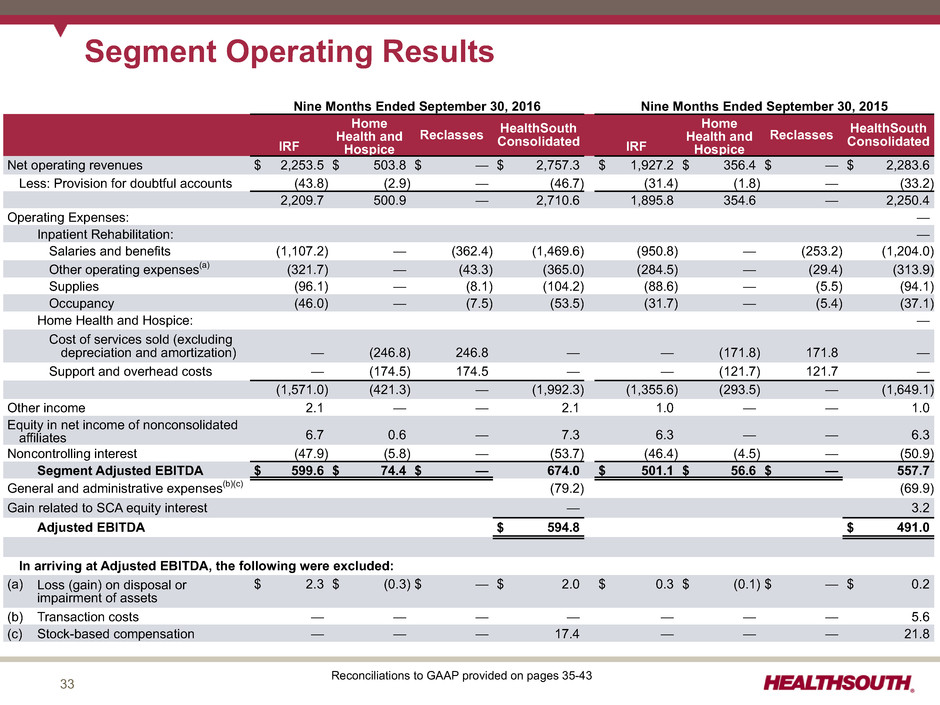

33 Segment Operating Results Nine Months Ended September 30, 2016 Nine Months Ended September 30, 2015 IRF Home Health and Hospice Reclasses HealthSouthConsolidated IRF Home Health and Hospice Reclasses HealthSouthConsolidated Net operating revenues $ 2,253.5 $ 503.8 $ — $ 2,757.3 $ 1,927.2 $ 356.4 $ — $ 2,283.6 Less: Provision for doubtful accounts (43.8) (2.9) — (46.7) (31.4) (1.8) — (33.2) 2,209.7 500.9 — 2,710.6 1,895.8 354.6 — 2,250.4 Operating Expenses: — Inpatient Rehabilitation: — Salaries and benefits (1,107.2) — (362.4) (1,469.6) (950.8) — (253.2) (1,204.0) Other operating expenses(a) (321.7) — (43.3) (365.0) (284.5) — (29.4) (313.9) Supplies (96.1) — (8.1) (104.2) (88.6) — (5.5) (94.1) Occupancy (46.0) — (7.5) (53.5) (31.7) — (5.4) (37.1) Home Health and Hospice: — Cost of services sold (excluding depreciation and amortization) — (246.8) 246.8 — — (171.8) 171.8 — Support and overhead costs — (174.5) 174.5 — — (121.7) 121.7 — (1,571.0) (421.3) — (1,992.3) (1,355.6) (293.5) — (1,649.1) Other income 2.1 — — 2.1 1.0 — — 1.0 Equity in net income of nonconsolidated affiliates 6.7 0.6 — 7.3 6.3 — — 6.3 Noncontrolling interest (47.9) (5.8) — (53.7) (46.4) (4.5) — (50.9) Segment Adjusted EBITDA $ 599.6 $ 74.4 $ — 674.0 $ 501.1 $ 56.6 $ — 557.7 General and administrative expenses(b)(c) (79.2) (69.9) Gain related to SCA equity interest — 3.2 Adjusted EBITDA $ 594.8 $ 491.0 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal or impairment of assets $ 2.3 $ (0.3) $ — $ 2.0 $ 0.3 $ (0.1) $ — $ 0.2 (b) Transaction costs — — — — — — — 5.6 (c) Stock-based compensation — — — 17.4 — — — 21.8 Reconciliations to GAAP provided on pages 35-43

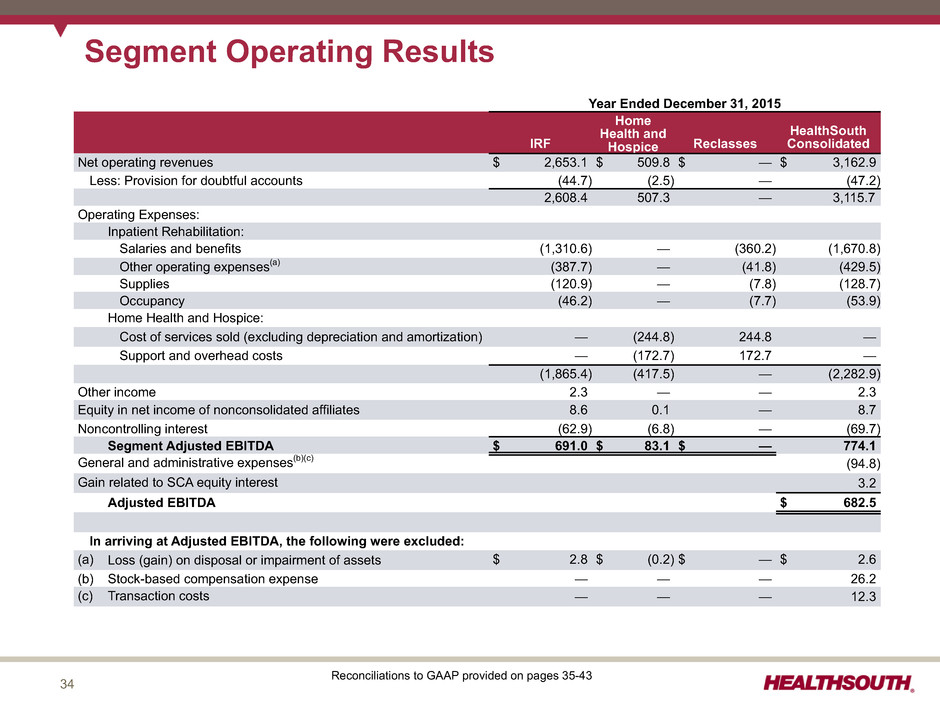

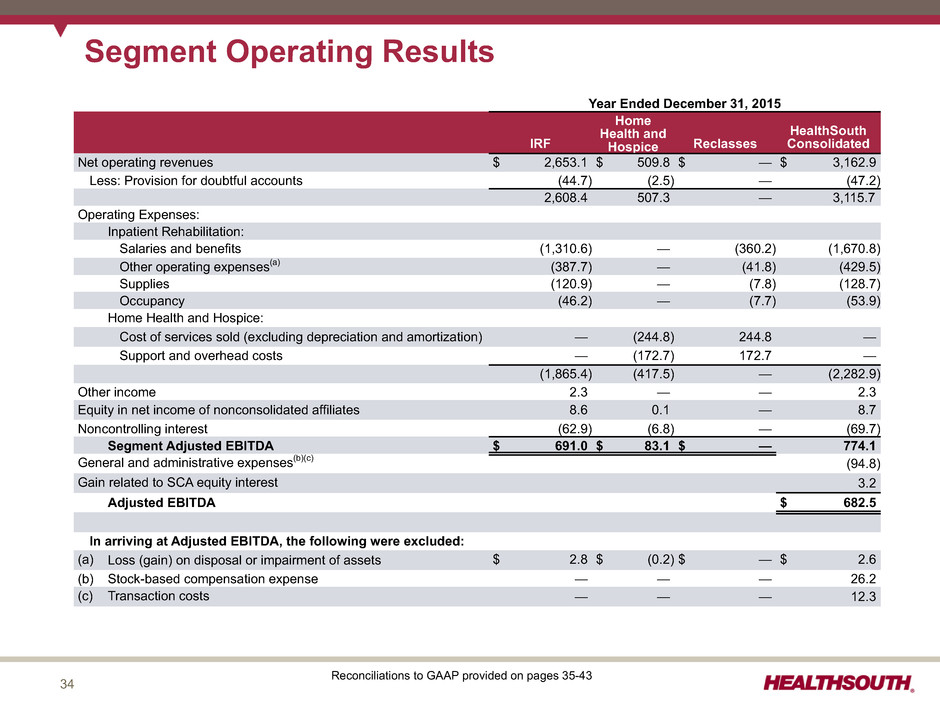

34 Segment Operating Results Year Ended December 31, 2015 IRF Home Health and Hospice Reclasses HealthSouth Consolidated Net operating revenues $ 2,653.1 $ 509.8 $ — $ 3,162.9 Less: Provision for doubtful accounts (44.7) (2.5) — (47.2) 2,608.4 507.3 — 3,115.7 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (1,310.6) — (360.2) (1,670.8) Other operating expenses(a) (387.7) — (41.8) (429.5) Supplies (120.9) — (7.8) (128.7) Occupancy (46.2) — (7.7) (53.9) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (244.8) 244.8 — Support and overhead costs — (172.7) 172.7 — (1,865.4) (417.5) — (2,282.9) Other income 2.3 — — 2.3 Equity in net income of nonconsolidated affiliates 8.6 0.1 — 8.7 Noncontrolling interest (62.9) (6.8) — (69.7) Segment Adjusted EBITDA $ 691.0 $ 83.1 $ — 774.1 General and administrative expenses(b)(c) (94.8) Gain related to SCA equity interest 3.2 Adjusted EBITDA $ 682.5 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal or impairment of assets $ 2.8 $ (0.2) $ — $ 2.6 (b) Stock-based compensation expense — — — 26.2 (c) Transaction costs — — — 12.3 Reconciliations to GAAP provided on pages 35-43

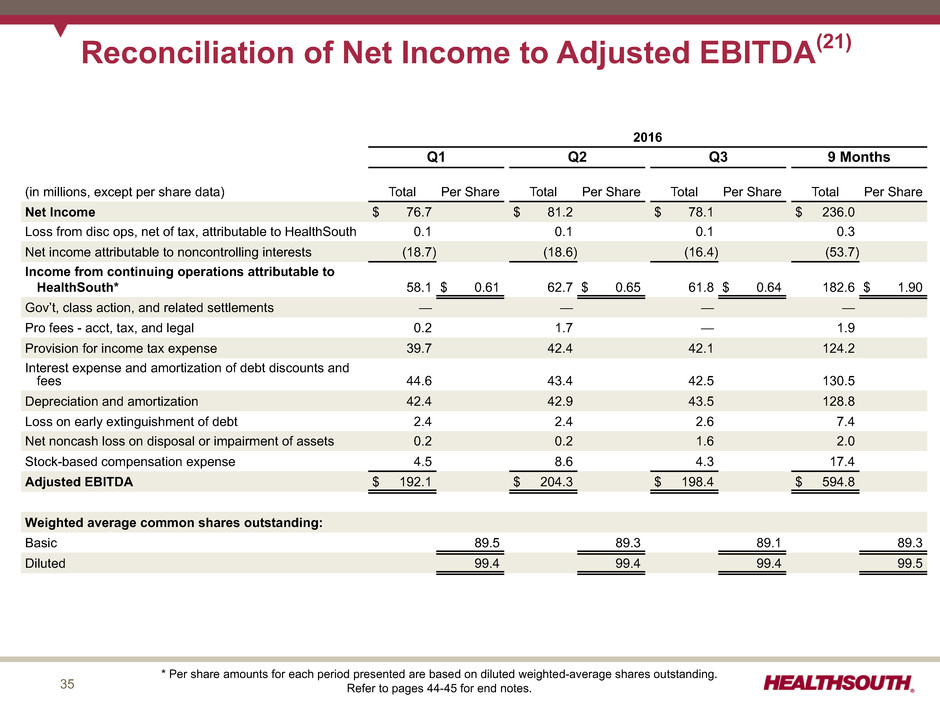

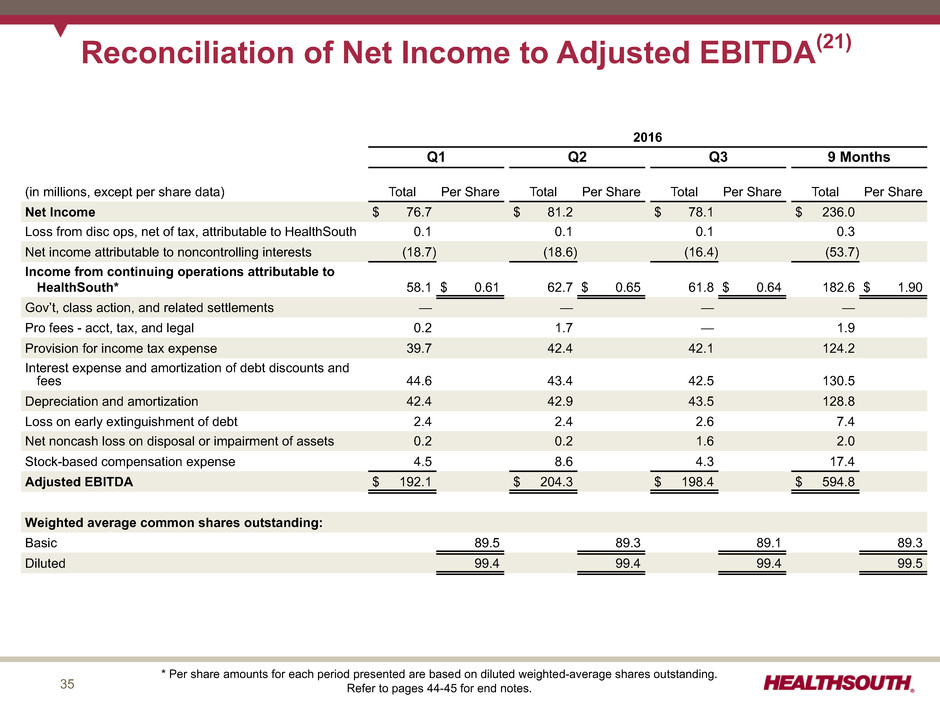

35 Reconciliation of Net Income to Adjusted EBITDA(21) 2016 Q1 Q2 Q3 9 Months (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 76.7 $ 81.2 $ 78.1 $ 236.0 Loss from disc ops, net of tax, attributable to HealthSouth 0.1 0.1 0.1 0.3 Net income attributable to noncontrolling interests (18.7) (18.6) (16.4) (53.7) Income from continuing operations attributable to HealthSouth* 58.1 $ 0.61 62.7 $ 0.65 61.8 $ 0.64 182.6 $ 1.90 Gov’t, class action, and related settlements — — — — Pro fees - acct, tax, and legal 0.2 1.7 — 1.9 Provision for income tax expense 39.7 42.4 42.1 124.2 Interest expense and amortization of debt discounts and fees 44.6 43.4 42.5 130.5 Depreciation and amortization 42.4 42.9 43.5 128.8 Loss on early extinguishment of debt 2.4 2.4 2.6 7.4 Net noncash loss on disposal or impairment of assets 0.2 0.2 1.6 2.0 Stock-based compensation expense 4.5 8.6 4.3 17.4 Adjusted EBITDA $ 192.1 $ 204.3 $ 198.4 $ 594.8 Weighted average common shares outstanding: Basic 89.5 89.3 89.1 89.3 Diluted 99.4 99.4 99.4 99.5 * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. Refer to pages 44-45 for end notes.

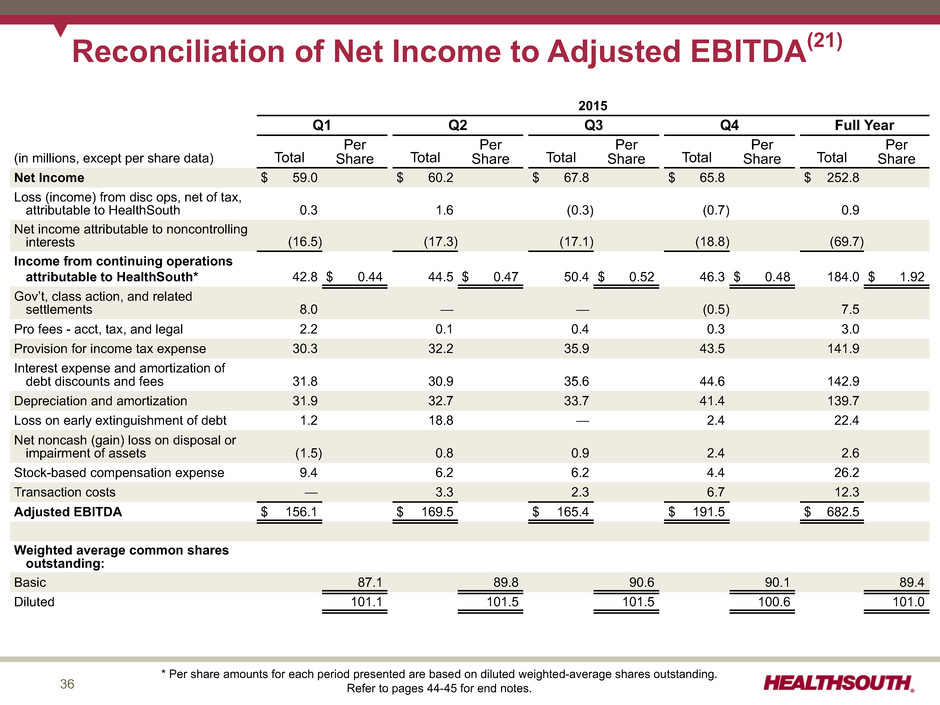

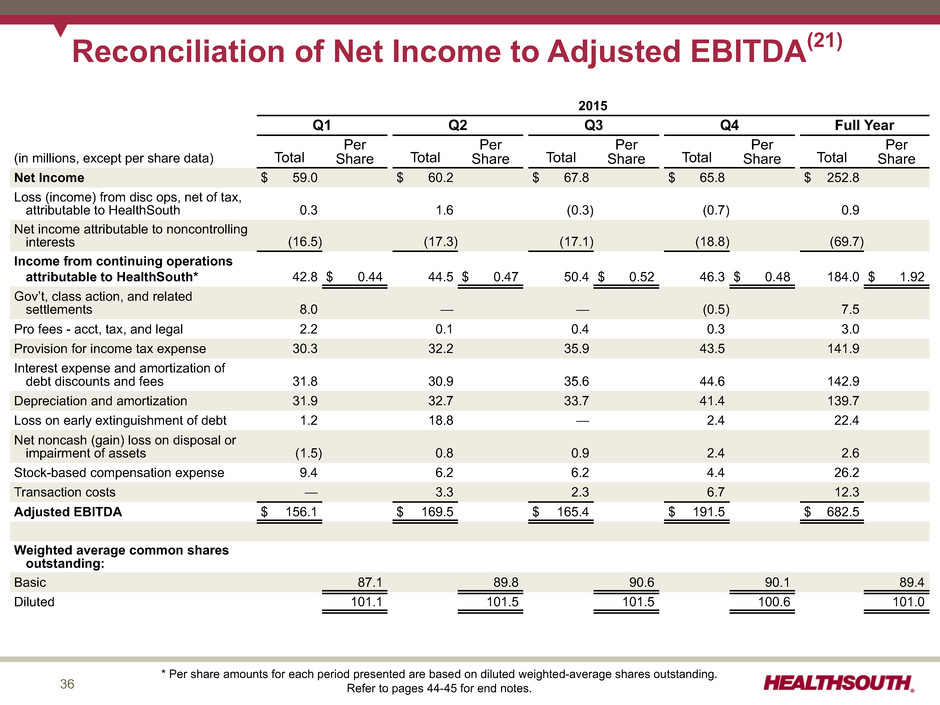

36 Reconciliation of Net Income to Adjusted EBITDA(21) 2015 Q1 Q2 Q3 Q4 Full Year (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 59.0 $ 60.2 $ 67.8 $ 65.8 $ 252.8 Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.3 1.6 (0.3) (0.7) 0.9 Net income attributable to noncontrolling interests (16.5) (17.3) (17.1) (18.8) (69.7) Income from continuing operations attributable to HealthSouth* 42.8 $ 0.44 44.5 $ 0.47 50.4 $ 0.52 46.3 $ 0.48 184.0 $ 1.92 Gov’t, class action, and related settlements 8.0 — — (0.5) 7.5 Pro fees - acct, tax, and legal 2.2 0.1 0.4 0.3 3.0 Provision for income tax expense 30.3 32.2 35.9 43.5 141.9 Interest expense and amortization of debt discounts and fees 31.8 30.9 35.6 44.6 142.9 Depreciation and amortization 31.9 32.7 33.7 41.4 139.7 Loss on early extinguishment of debt 1.2 18.8 — 2.4 22.4 Net noncash (gain) loss on disposal or impairment of assets (1.5) 0.8 0.9 2.4 2.6 Stock-based compensation expense 9.4 6.2 6.2 4.4 26.2 Transaction costs — 3.3 2.3 6.7 12.3 Adjusted EBITDA $ 156.1 $ 169.5 $ 165.4 $ 191.5 $ 682.5 Weighted average common shares outstanding: Basic 87.1 89.8 90.6 90.1 89.4 Diluted 101.1 101.5 101.5 100.6 101.0 * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. Refer to pages 44-45 for end notes.

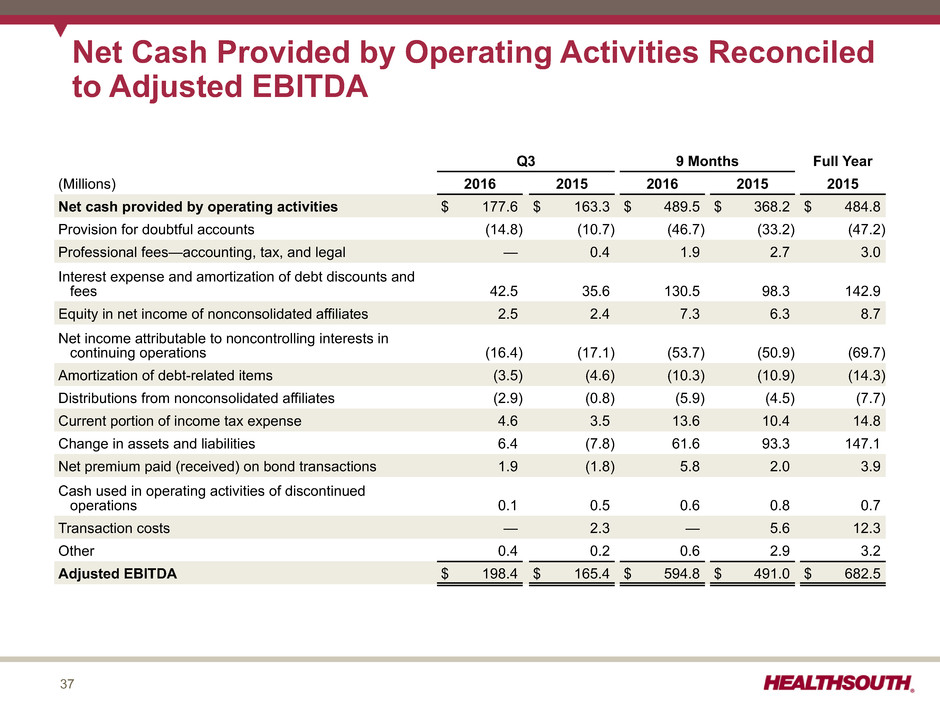

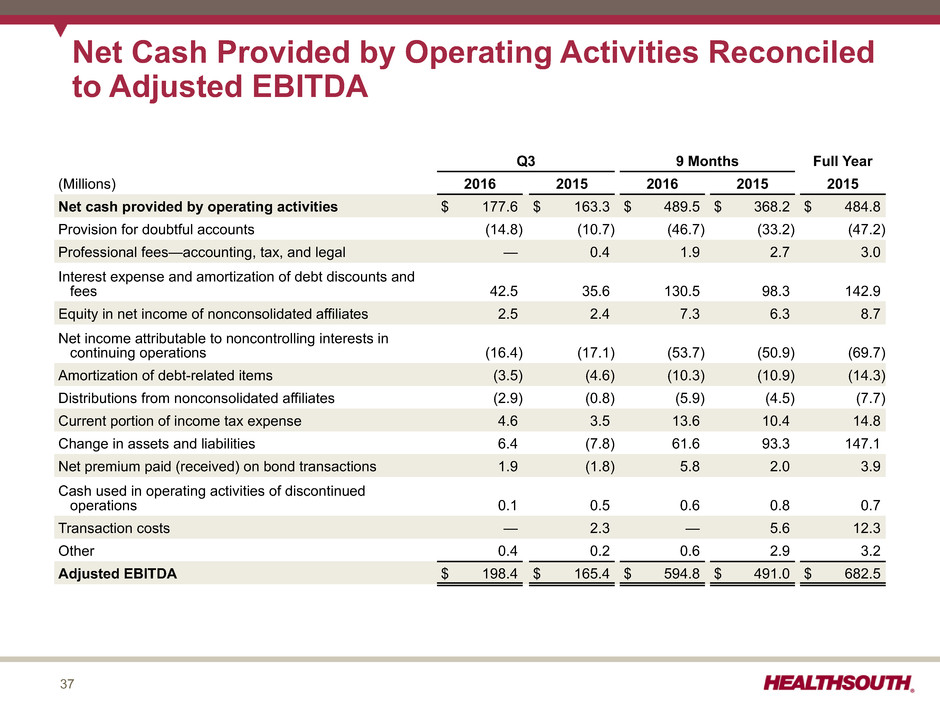

37 Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA Q3 9 Months Full Year (Millions) 2016 2015 2016 2015 2015 Net cash provided by operating activities $ 177.6 $ 163.3 $ 489.5 $ 368.2 $ 484.8 Provision for doubtful accounts (14.8) (10.7) (46.7) (33.2) (47.2) Professional fees—accounting, tax, and legal — 0.4 1.9 2.7 3.0 Interest expense and amortization of debt discounts and fees 42.5 35.6 130.5 98.3 142.9 Equity in net income of nonconsolidated affiliates 2.5 2.4 7.3 6.3 8.7 Net income attributable to noncontrolling interests in continuing operations (16.4) (17.1) (53.7) (50.9) (69.7) Amortization of debt-related items (3.5) (4.6) (10.3) (10.9) (14.3) Distributions from nonconsolidated affiliates (2.9) (0.8) (5.9) (4.5) (7.7) Current portion of income tax expense 4.6 3.5 13.6 10.4 14.8 Change in assets and liabilities 6.4 (7.8) 61.6 93.3 147.1 Net premium paid (received) on bond transactions 1.9 (1.8) 5.8 2.0 3.9 Cash used in operating activities of discontinued operations 0.1 0.5 0.6 0.8 0.7 Transaction costs — 2.3 — 5.6 12.3 Other 0.4 0.2 0.6 2.9 3.2 Adjusted EBITDA $ 198.4 $ 165.4 $ 594.8 $ 491.0 $ 682.5

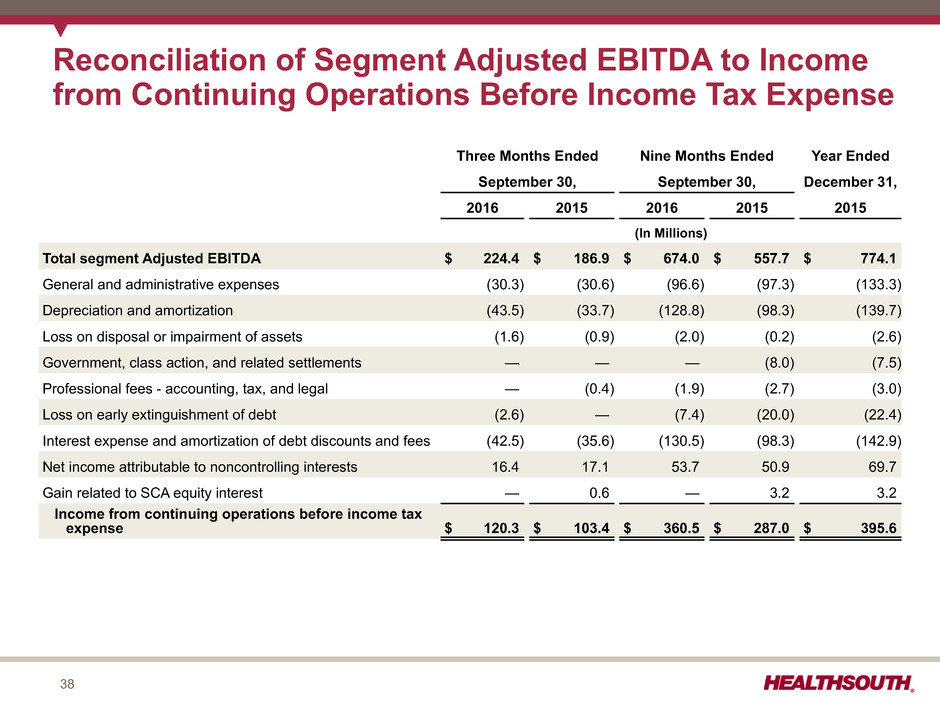

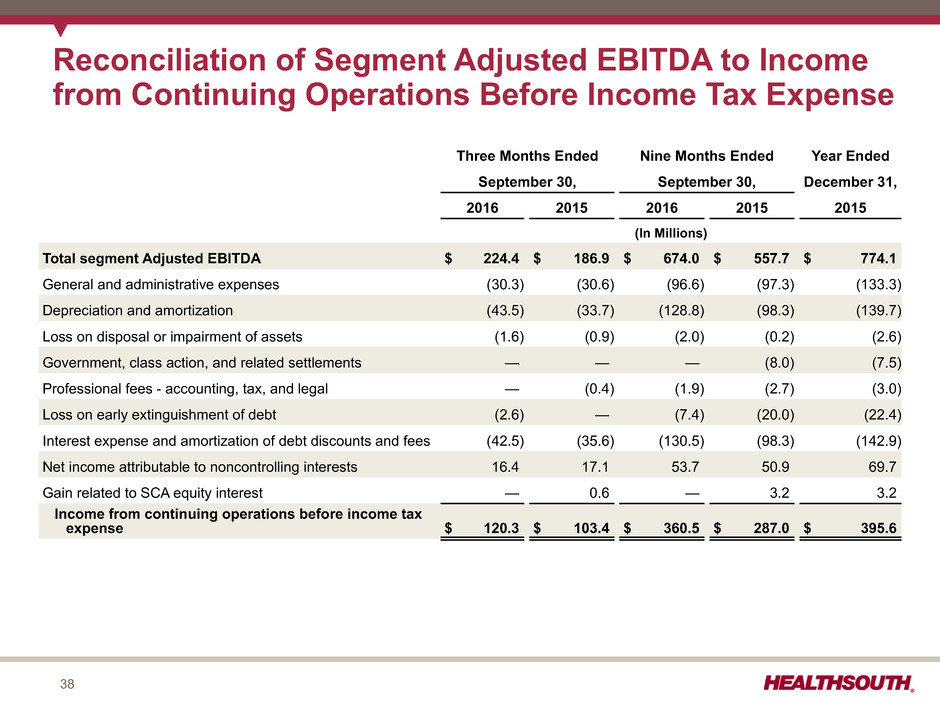

38 Reconciliation of Segment Adjusted EBITDA to Income from Continuing Operations Before Income Tax Expense Three Months Ended Nine Months Ended Year Ended September 30, September 30, December 31, 2016 2015 2016 2015 2015 (In Millions) Total segment Adjusted EBITDA $ 224.4 $ 186.9 $ 674.0 $ 557.7 $ 774.1 General and administrative expenses (30.3) (30.6) (96.6) (97.3) (133.3) Depreciation and amortization (43.5) (33.7) (128.8) (98.3) (139.7) Loss on disposal or impairment of assets (1.6) (0.9) (2.0) (0.2) (2.6) Government, class action, and related settlements — — — (8.0) (7.5) Professional fees - accounting, tax, and legal — (0.4) (1.9) (2.7) (3.0) Loss on early extinguishment of debt (2.6) — (7.4) (20.0) (22.4) Interest expense and amortization of debt discounts and fees (42.5) (35.6) (130.5) (98.3) (142.9) Net income attributable to noncontrolling interests 16.4 17.1 53.7 50.9 69.7 Gain related to SCA equity interest — 0.6 — 3.2 3.2 Income from continuing operations before income tax expense $ 120.3 $ 103.4 $ 360.5 $ 287.0 $ 395.6

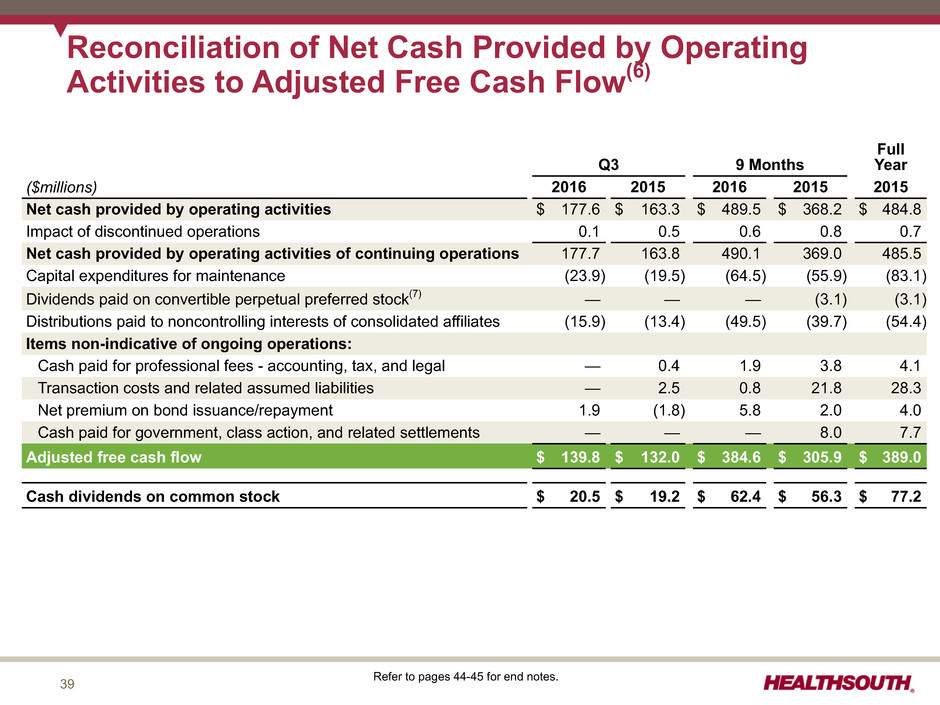

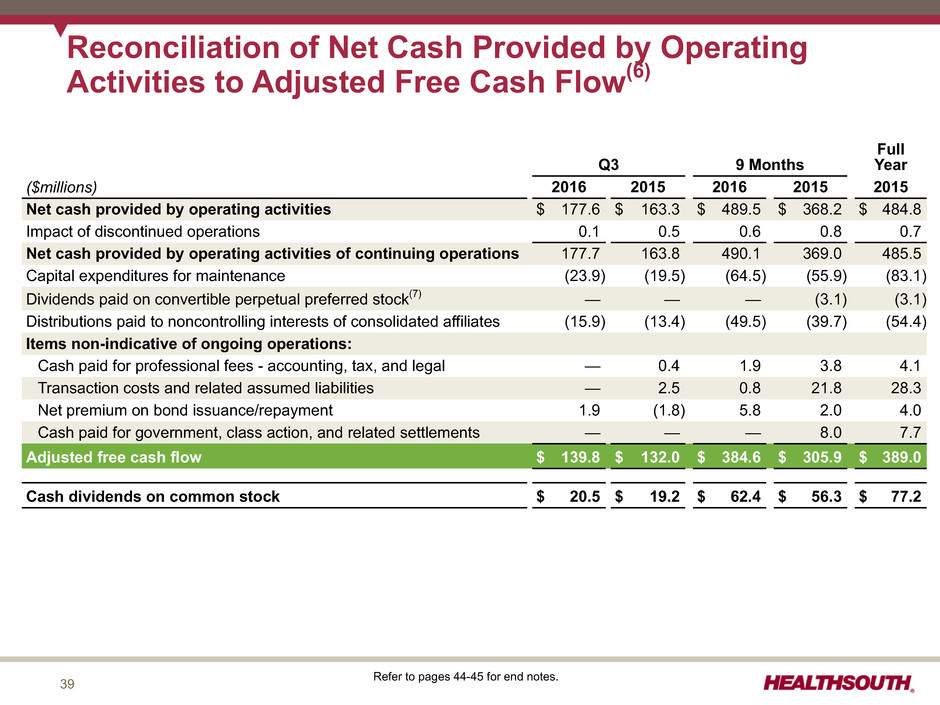

39 Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow(6) Q3 9 Months Full Year ($millions) 2016 2015 2016 2015 2015 Net cash provided by operating activities $ 177.6 $ 163.3 $ 489.5 $ 368.2 $ 484.8 Impact of discontinued operations 0.1 0.5 0.6 0.8 0.7 Net cash provided by operating activities of continuing operations 177.7 163.8 490.1 369.0 485.5 Capital expenditures for maintenance (23.9) (19.5) (64.5) (55.9) (83.1) Dividends paid on convertible perpetual preferred stock(7) — — — (3.1) (3.1) Distributions paid to noncontrolling interests of consolidated affiliates (15.9) (13.4) (49.5) (39.7) (54.4) Items non-indicative of ongoing operations: Cash paid for professional fees - accounting, tax, and legal — 0.4 1.9 3.8 4.1 Transaction costs and related assumed liabilities — 2.5 0.8 21.8 28.3 Net premium on bond issuance/repayment 1.9 (1.8) 5.8 2.0 4.0 Cash paid for government, class action, and related settlements — — — 8.0 7.7 Adjusted free cash flow $ 139.8 $ 132.0 $ 384.6 $ 305.9 $ 389.0 Cash dividends on common stock $ 20.5 $ 19.2 $ 62.4 $ 56.3 $ 77.2 Refer to pages 44-45 for end notes.

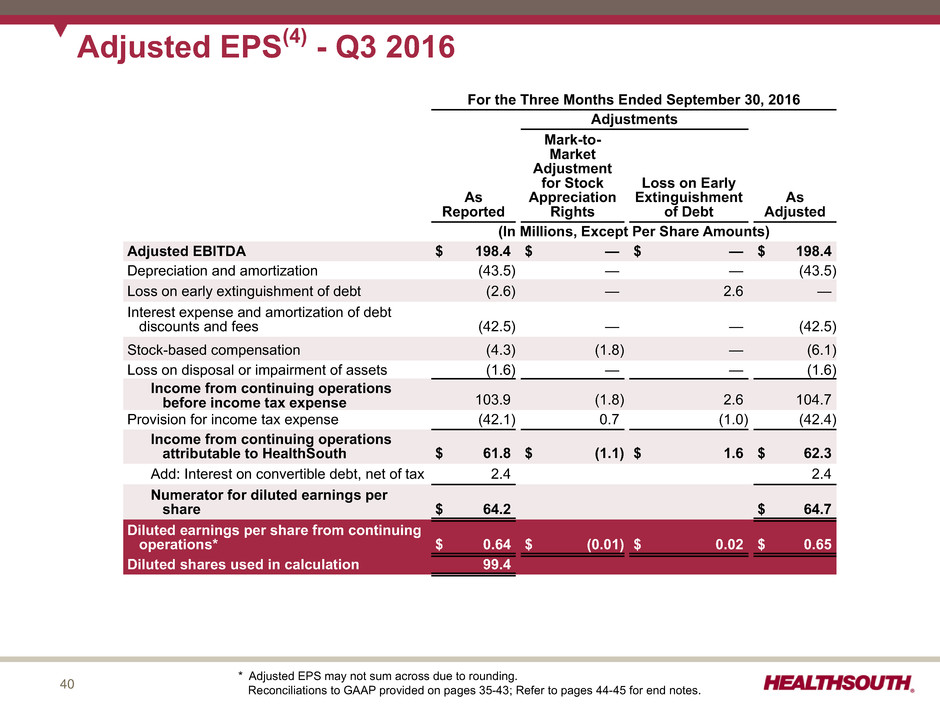

40 For the Three Months Ended September 30, 2016 Adjustments As Reported Mark-to- Market Adjustment for Stock Appreciation Rights Loss on Early Extinguishment of Debt As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 198.4 $ — $ — $ 198.4 Depreciation and amortization (43.5) — — (43.5) Loss on early extinguishment of debt (2.6) — 2.6 — Interest expense and amortization of debt discounts and fees (42.5) — — (42.5) Stock-based compensation (4.3) (1.8) — (6.1) Loss on disposal or impairment of assets (1.6) — — (1.6) Income from continuing operations before income tax expense 103.9 (1.8) 2.6 104.7 Provision for income tax expense (42.1) 0.7 (1.0) (42.4) Income from continuing operations attributable to HealthSouth $ 61.8 $ (1.1) $ 1.6 $ 62.3 Add: Interest on convertible debt, net of tax 2.4 2.4 Numerator for diluted earnings per share $ 64.2 $ 64.7 Diluted earnings per share from continuing operations* $ 0.64 $ (0.01) $ 0.02 $ 0.65 Diluted shares used in calculation 99.4 Adjusted EPS(4) - Q3 2016 * Adjusted EPS may not sum across due to rounding. Reconciliations to GAAP provided on pages 35-43; Refer to pages 44-45 for end notes.

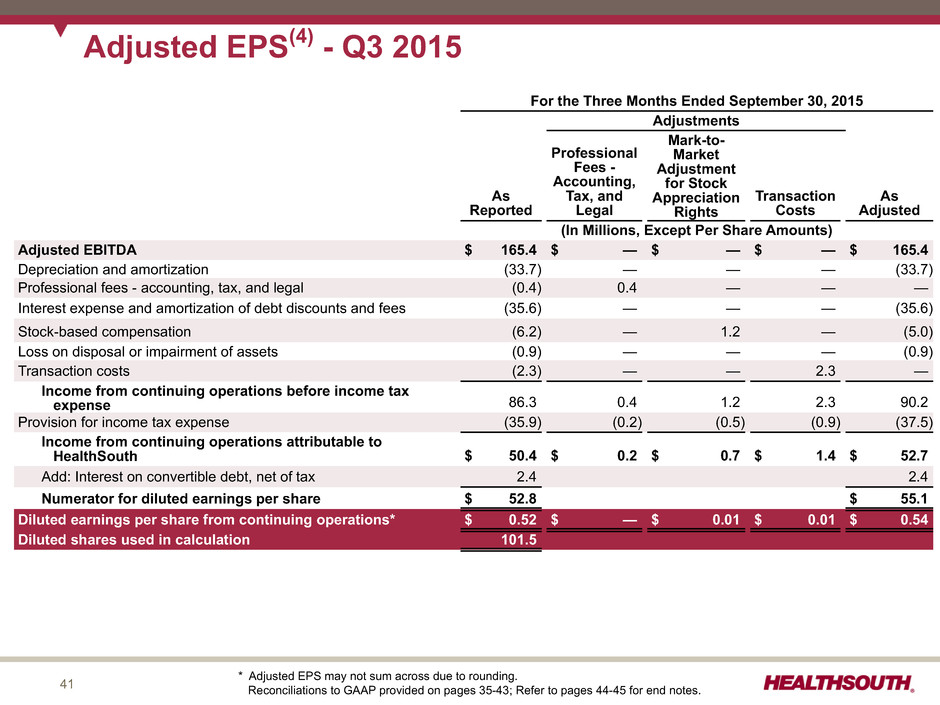

41 For the Three Months Ended September 30, 2015 Adjustments As Reported Professional Fees - Accounting, Tax, and Legal Mark-to- Market Adjustment for Stock Appreciation Rights Transaction Costs As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 165.4 $ — $ — $ — $ 165.4 Depreciation and amortization (33.7) — — — (33.7) Professional fees - accounting, tax, and legal (0.4) 0.4 — — — Interest expense and amortization of debt discounts and fees (35.6) — — — (35.6) Stock-based compensation (6.2) — 1.2 — (5.0) Loss on disposal or impairment of assets (0.9) — — — (0.9) Transaction costs (2.3) — — 2.3 — Income from continuing operations before income tax expense 86.3 0.4 1.2 2.3 90.2 Provision for income tax expense (35.9) (0.2) (0.5) (0.9) (37.5) Income from continuing operations attributable to HealthSouth $ 50.4 $ 0.2 $ 0.7 $ 1.4 $ 52.7 Add: Interest on convertible debt, net of tax 2.4 2.4 Numerator for diluted earnings per share $ 52.8 $ 55.1 Diluted earnings per share from continuing operations* $ 0.52 $ — $ 0.01 $ 0.01 $ 0.54 Diluted shares used in calculation 101.5 Adjusted EPS(4) - Q3 2015 * Adjusted EPS may not sum across due to rounding. Reconciliations to GAAP provided on pages 35-43; Refer to pages 44-45 for end notes.

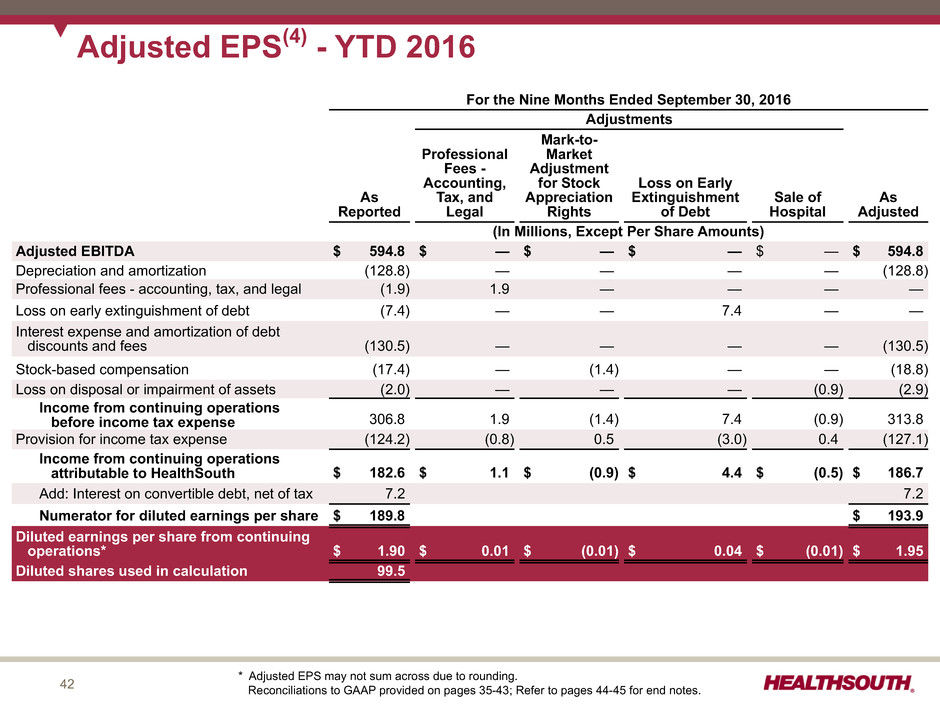

42 For the Nine Months Ended September 30, 2016 Adjustments As Reported Professional Fees - Accounting, Tax, and Legal Mark-to- Market Adjustment for Stock Appreciation Rights Loss on Early Extinguishment of Debt Sale of Hospital As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 594.8 $ — $ — $ — $ — $ 594.8 Depreciation and amortization (128.8) — — — — (128.8) Professional fees - accounting, tax, and legal (1.9) 1.9 — — — — Loss on early extinguishment of debt (7.4) — — 7.4 — — Interest expense and amortization of debt discounts and fees (130.5) — — — — (130.5) Stock-based compensation (17.4) — (1.4) — — (18.8) Loss on disposal or impairment of assets (2.0) — — — (0.9) (2.9) Income from continuing operations before income tax expense 306.8 1.9 (1.4) 7.4 (0.9) 313.8 Provision for income tax expense (124.2) (0.8) 0.5 (3.0) 0.4 (127.1) Income from continuing operations attributable to HealthSouth $ 182.6 $ 1.1 $ (0.9) $ 4.4 $ (0.5) $ 186.7 Add: Interest on convertible debt, net of tax 7.2 7.2 Numerator for diluted earnings per share $ 189.8 $ 193.9 Diluted earnings per share from continuing operations* $ 1.90 $ 0.01 $ (0.01) $ 0.04 $ (0.01) $ 1.95 Diluted shares used in calculation 99.5 Adjusted EPS(4) - YTD 2016 * Adjusted EPS may not sum across due to rounding. Reconciliations to GAAP provided on pages 35-43; Refer to pages 44-45 for end notes.

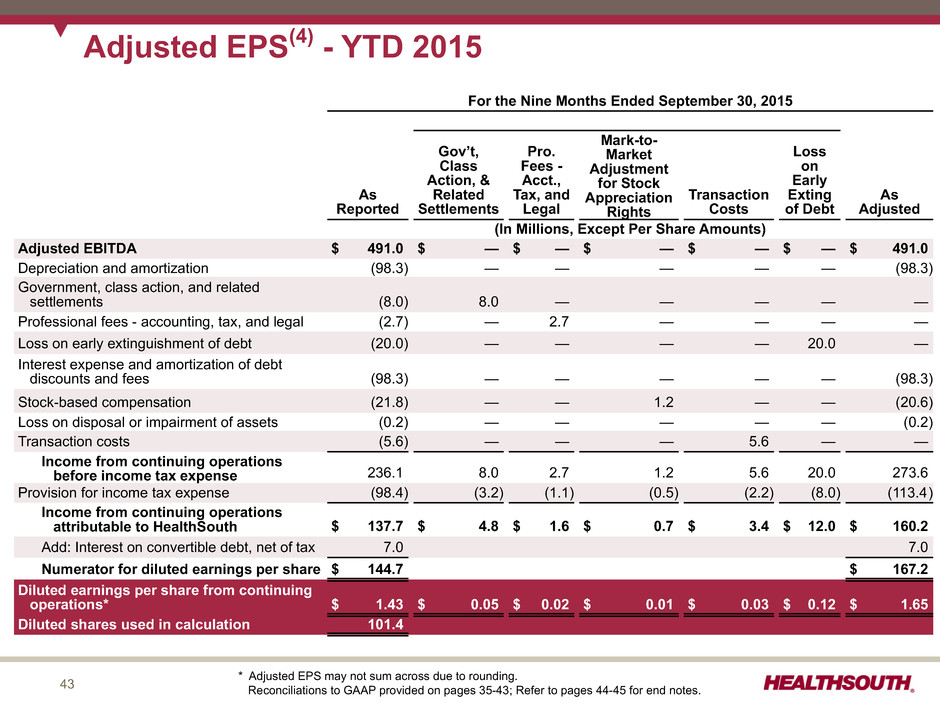

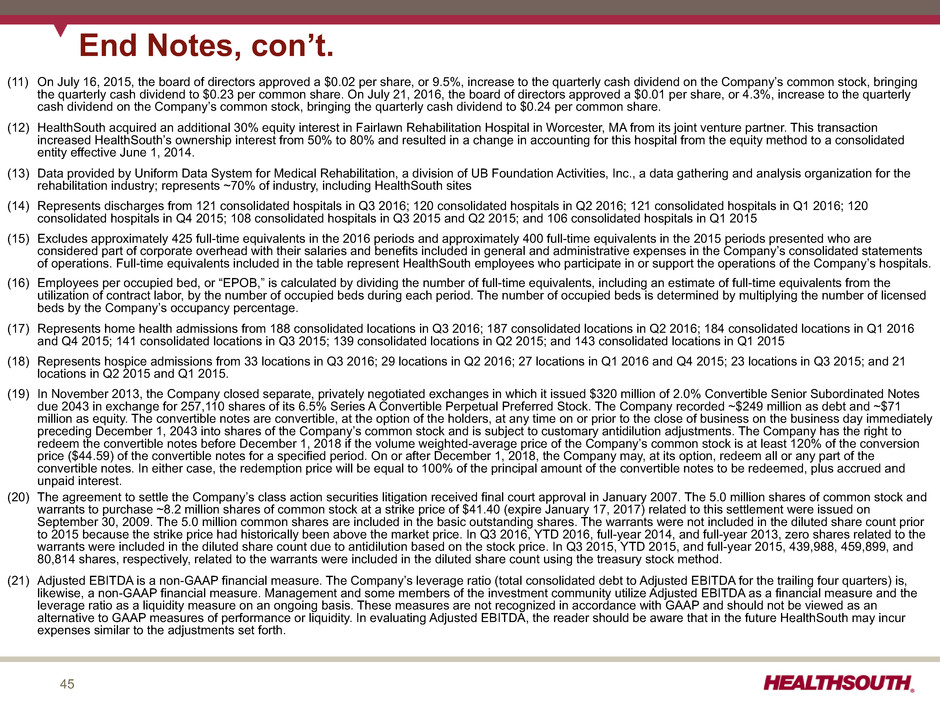

43 For the Nine Months Ended September 30, 2015 As Reported Gov’t, Class Action, & Related Settlements Pro. Fees - Acct., Tax, and Legal Mark-to- Market Adjustment for Stock Appreciation Rights Transaction Costs Loss on Early Exting of Debt As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 491.0 $ — $ — $ — $ — $ — $ 491.0 Depreciation and amortization (98.3) — — — — — (98.3) Government, class action, and related settlements (8.0) 8.0 — — — — — Professional fees - accounting, tax, and legal (2.7) — 2.7 — — — — Loss on early extinguishment of debt (20.0) — — — — 20.0 — Interest expense and amortization of debt discounts and fees (98.3) — — — — — (98.3) Stock-based compensation (21.8) — — 1.2 — — (20.6) Loss on disposal or impairment of assets (0.2) — — — — — (0.2) Transaction costs (5.6) — — — 5.6 — — Income from continuing operations before income tax expense 236.1 8.0 2.7 1.2 5.6 20.0 273.6 Provision for income tax expense (98.4) (3.2) (1.1) (0.5) (2.2) (8.0) (113.4) Income from continuing operations attributable to HealthSouth $ 137.7 $ 4.8 $ 1.6 $ 0.7 $ 3.4 $ 12.0 $ 160.2 Add: Interest on convertible debt, net of tax 7.0 7.0 Numerator for diluted earnings per share $ 144.7 $ 167.2 Diluted earnings per share from continuing operations* $ 1.43 $ 0.05 $ 0.02 $ 0.01 $ 0.03 $ 0.12 $ 1.65 Diluted shares used in calculation 101.4 Adjusted EPS(4) - YTD 2015 * Adjusted EPS may not sum across due to rounding. Reconciliations to GAAP provided on pages 35-43; Refer to pages 44-45 for end notes.

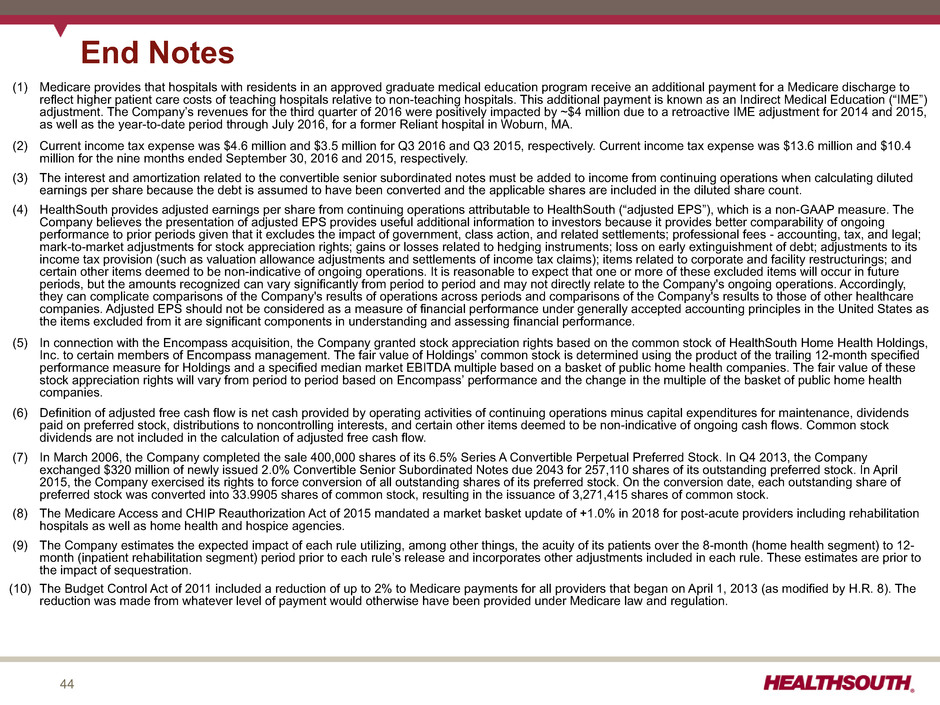

44 End Notes (1) Medicare provides that hospitals with residents in an approved graduate medical education program receive an additional payment for a Medicare discharge to reflect higher patient care costs of teaching hospitals relative to non-teaching hospitals. This additional payment is known as an Indirect Medical Education (“IME”) adjustment. The Company’s revenues for the third quarter of 2016 were positively impacted by ~$4 million due to a retroactive IME adjustment for 2014 and 2015, as well as the year-to-date period through July 2016, for a former Reliant hospital in Woburn, MA. (2) Current income tax expense was $4.6 million and $3.5 million for Q3 2016 and Q3 2015, respectively. Current income tax expense was $13.6 million and $10.4 million for the nine months ended September 30, 2016 and 2015, respectively. (3) The interest and amortization related to the convertible senior subordinated notes must be added to income from continuing operations when calculating diluted earnings per share because the debt is assumed to have been converted and the applicable shares are included in the diluted share count. (4) HealthSouth provides adjusted earnings per share from continuing operations attributable to HealthSouth (“adjusted EPS”), which is a non-GAAP measure. The Company believes the presentation of adjusted EPS provides useful additional information to investors because it provides better comparability of ongoing performance to prior periods given that it excludes the impact of government, class action, and related settlements; professional fees - accounting, tax, and legal; mark-to-market adjustments for stock appreciation rights; gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items related to corporate and facility restructurings; and certain other items deemed to be non-indicative of ongoing operations. It is reasonable to expect that one or more of these excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period and may not directly relate to the Company's ongoing operations. Accordingly, they can complicate comparisons of the Company's results of operations across periods and comparisons of the Company's results to those of other healthcare companies. Adjusted EPS should not be considered as a measure of financial performance under generally accepted accounting principles in the United States as the items excluded from it are significant components in understanding and assessing financial performance. (5) In connection with the Encompass acquisition, the Company granted stock appreciation rights based on the common stock of HealthSouth Home Health Holdings, Inc. to certain members of Encompass management. The fair value of Holdings’ common stock is determined using the product of the trailing 12-month specified performance measure for Holdings and a specified median market EBITDA multiple based on a basket of public home health companies. The fair value of these stock appreciation rights will vary from period to period based on Encompass’ performance and the change in the multiple of the basket of public home health companies. (6) Definition of adjusted free cash flow is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, dividends paid on preferred stock, distributions to noncontrolling interests, and certain other items deemed to be non-indicative of ongoing cash flows. Common stock dividends are not included in the calculation of adjusted free cash flow. (7) In March 2006, the Company completed the sale 400,000 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. In Q4 2013, the Company exchanged $320 million of newly issued 2.0% Convertible Senior Subordinated Notes due 2043 for 257,110 shares of its outstanding preferred stock. In April 2015, the Company exercised its rights to force conversion of all outstanding shares of its preferred stock. On the conversion date, each outstanding share of preferred stock was converted into 33.9905 shares of common stock, resulting in the issuance of 3,271,415 shares of common stock. (8) The Medicare Access and CHIP Reauthorization Act of 2015 mandated a market basket update of +1.0% in 2018 for post-acute providers including rehabilitation hospitals as well as home health and hospice agencies. (9) The Company estimates the expected impact of each rule utilizing, among other things, the acuity of its patients over the 8-month (home health segment) to 12- month (inpatient rehabilitation segment) period prior to each rule’s release and incorporates other adjustments included in each rule. These estimates are prior to the impact of sequestration. (10) The Budget Control Act of 2011 included a reduction of up to 2% to Medicare payments for all providers that began on April 1, 2013 (as modified by H.R. 8). The reduction was made from whatever level of payment would otherwise have been provided under Medicare law and regulation.

45 End Notes, con’t. (11) On July 16, 2015, the board of directors approved a $0.02 per share, or 9.5%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.23 per common share. On July 21, 2016, the board of directors approved a $0.01 per share, or 4.3%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.24 per common share. (12) HealthSouth acquired an additional 30% equity interest in Fairlawn Rehabilitation Hospital in Worcester, MA from its joint venture partner. This transaction increased HealthSouth’s ownership interest from 50% to 80% and resulted in a change in accounting for this hospital from the equity method to a consolidated entity effective June 1, 2014. (13) Data provided by Uniform Data System for Medical Rehabilitation, a division of UB Foundation Activities, Inc., a data gathering and analysis organization for the rehabilitation industry; represents ~70% of industry, including HealthSouth sites (14) Represents discharges from 121 consolidated hospitals in Q3 2016; 120 consolidated hospitals in Q2 2016; 121 consolidated hospitals in Q1 2016; 120 consolidated hospitals in Q4 2015; 108 consolidated hospitals in Q3 2015 and Q2 2015; and 106 consolidated hospitals in Q1 2015 (15) Excludes approximately 425 full-time equivalents in the 2016 periods and approximately 400 full-time equivalents in the 2015 periods presented who are considered part of corporate overhead with their salaries and benefits included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals. (16) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. (17) Represents home health admissions from 188 consolidated locations in Q3 2016; 187 consolidated locations in Q2 2016; 184 consolidated locations in Q1 2016 and Q4 2015; 141 consolidated locations in Q3 2015; 139 consolidated locations in Q2 2015; and 143 consolidated locations in Q1 2015 (18) Represents hospice admissions from 33 locations in Q3 2016; 29 locations in Q2 2016; 27 locations in Q1 2016 and Q4 2015; 23 locations in Q3 2015; and 21 locations in Q2 2015 and Q1 2015. (19) In November 2013, the Company closed separate, privately negotiated exchanges in which it issued $320 million of 2.0% Convertible Senior Subordinated Notes due 2043 in exchange for 257,110 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. The Company recorded ~$249 million as debt and ~$71 million as equity. The convertible notes are convertible, at the option of the holders, at any time on or prior to the close of business on the business day immediately preceding December 1, 2043 into shares of the Company’s common stock and is subject to customary antidilution adjustments. The Company has the right to redeem the convertible notes before December 1, 2018 if the volume weighted-average price of the Company’s common stock is at least 120% of the conversion price ($44.59) of the convertible notes for a specified period. On or after December 1, 2018, the Company may, at its option, redeem all or any part of the convertible notes. In either case, the redemption price will be equal to 100% of the principal amount of the convertible notes to be redeemed, plus accrued and unpaid interest. (20) The agreement to settle the Company’s class action securities litigation received final court approval in January 2007. The 5.0 million shares of common stock and warrants to purchase ~8.2 million shares of common stock at a strike price of $41.40 (expire January 17, 2017) related to this settlement were issued on September 30, 2009. The 5.0 million common shares are included in the basic outstanding shares. The warrants were not included in the diluted share count prior to 2015 because the strike price had historically been above the market price. In Q3 2016, YTD 2016, full-year 2014, and full-year 2013, zero shares related to the warrants were included in the diluted share count due to antidilution based on the stock price. In Q3 2015, YTD 2015, and full-year 2015, 439,988, 459,899, and 80,814 shares, respectively, related to the warrants were included in the diluted share count using the treasury stock method. (21) Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP financial measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments set forth.