INVESTOR REFERENCE BOOK Last updated March 6, 2017 HealthSouth is a leading provider of post-acute healthcare services, offering both facility-based and home-based post-acute services in 34 states and Puerto Rico through its network of inpatient rehabilitation hospitals, home health agencies, and hospice agencies.

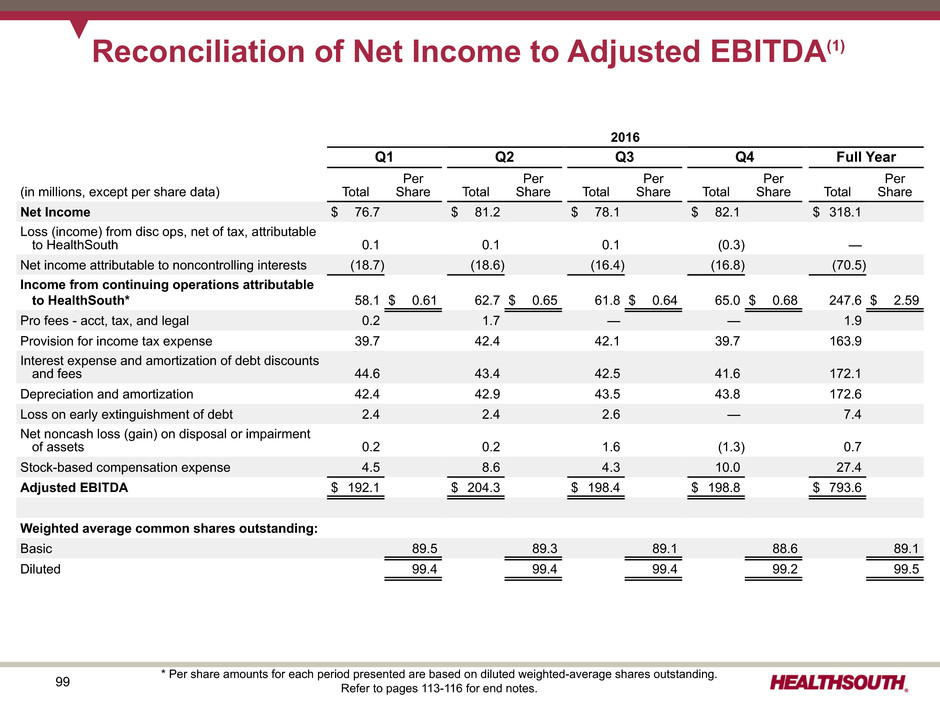

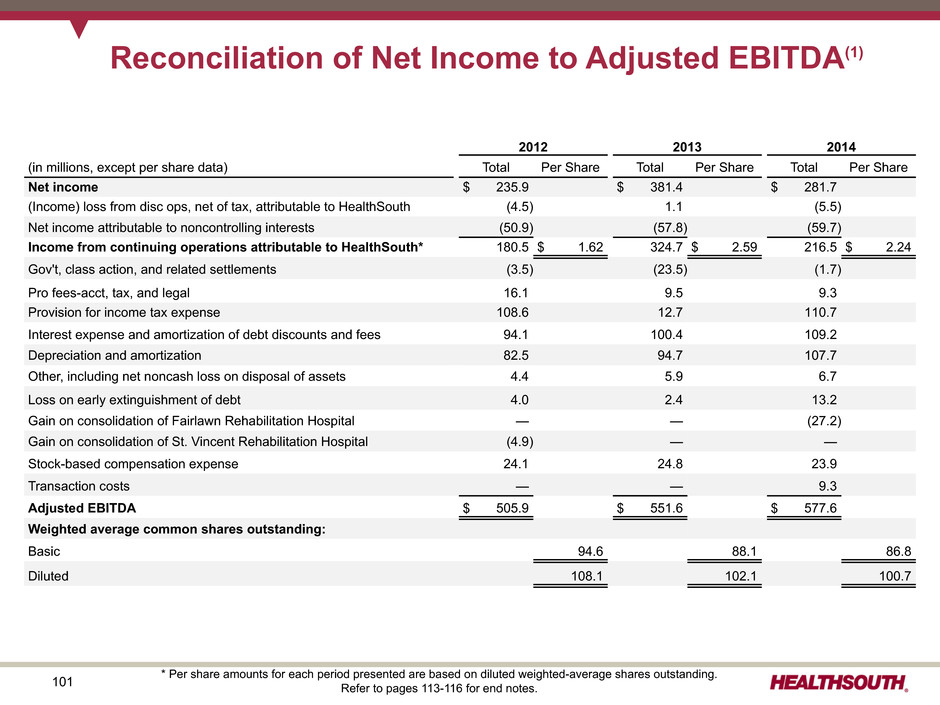

2 The information contained in this Investor Reference Book includes certain estimates, projections and other forward-looking information that reflect HealthSouth’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this Investor Reference Book as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2016 and in other documents HealthSouth previously filed with the SEC, many of which are beyond HealthSouth’s control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following Investor Reference Book includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the non- GAAP financial measures included in the following Investor Reference Book to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. HealthSouth’s Form 8-K, dated March 6, 2017, to which the following Investor Reference Book is attached as Exhibit 99.1, provides further explanation and disclosure regarding HealthSouth’s use of non-GAAP financial measures and should be read in conjunction with this Investor Reference Book. Forward-Looking Statements

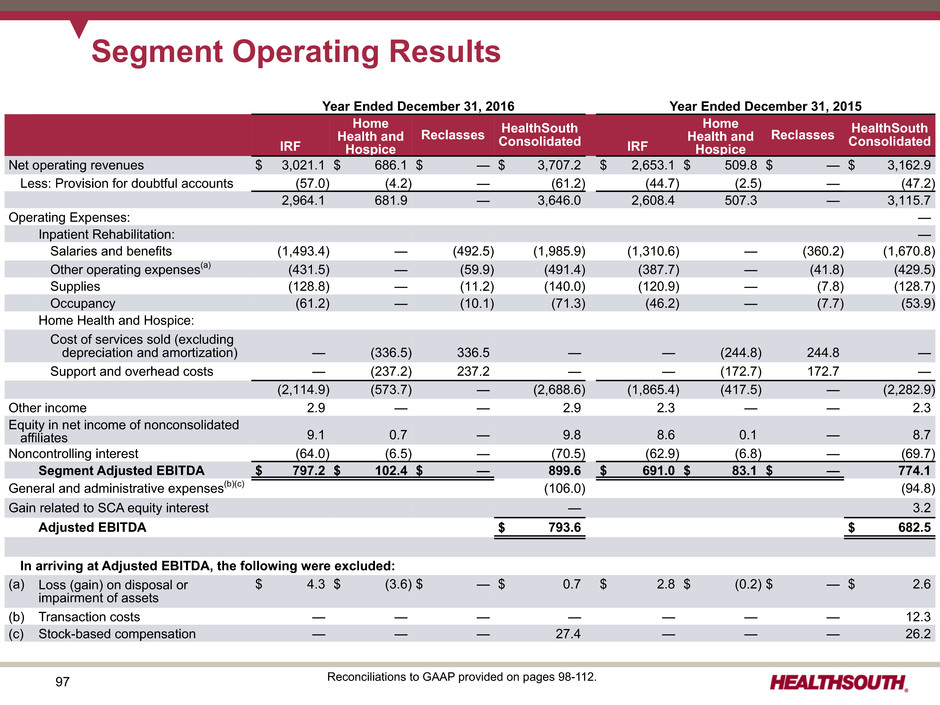

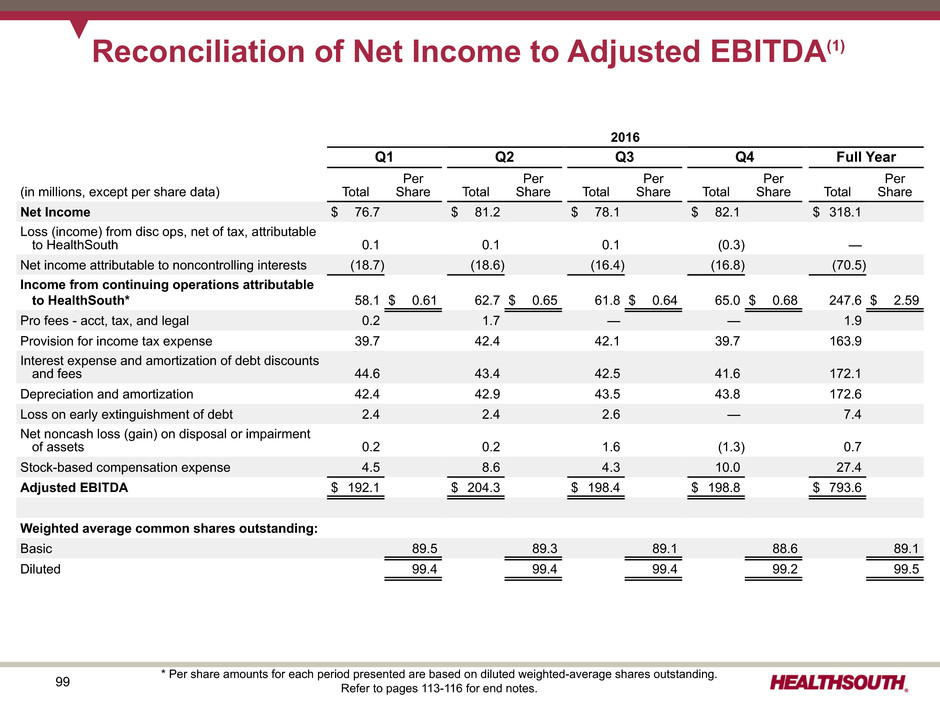

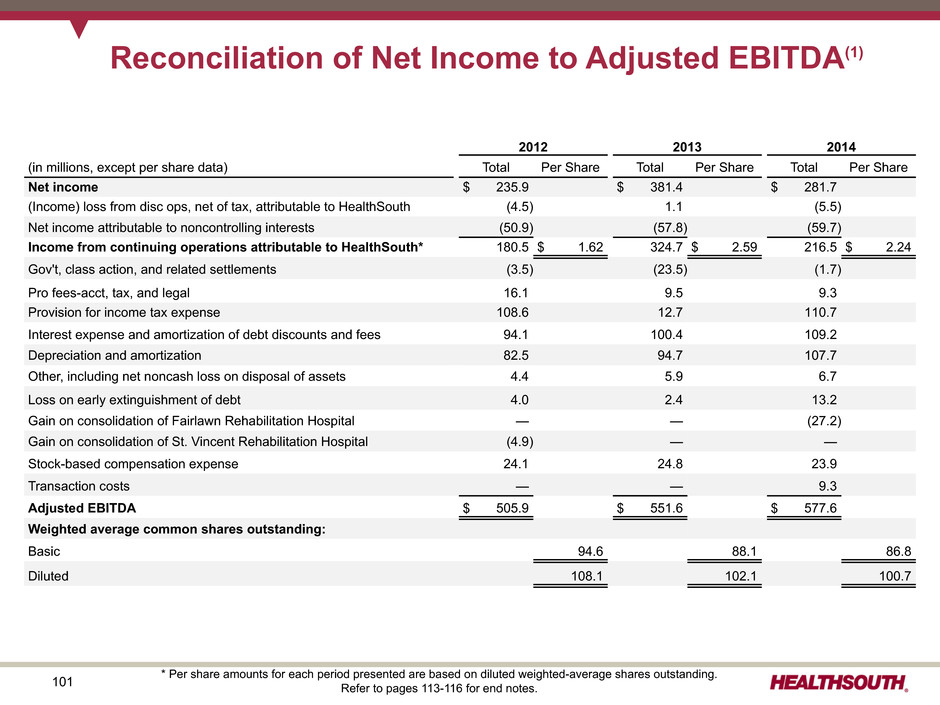

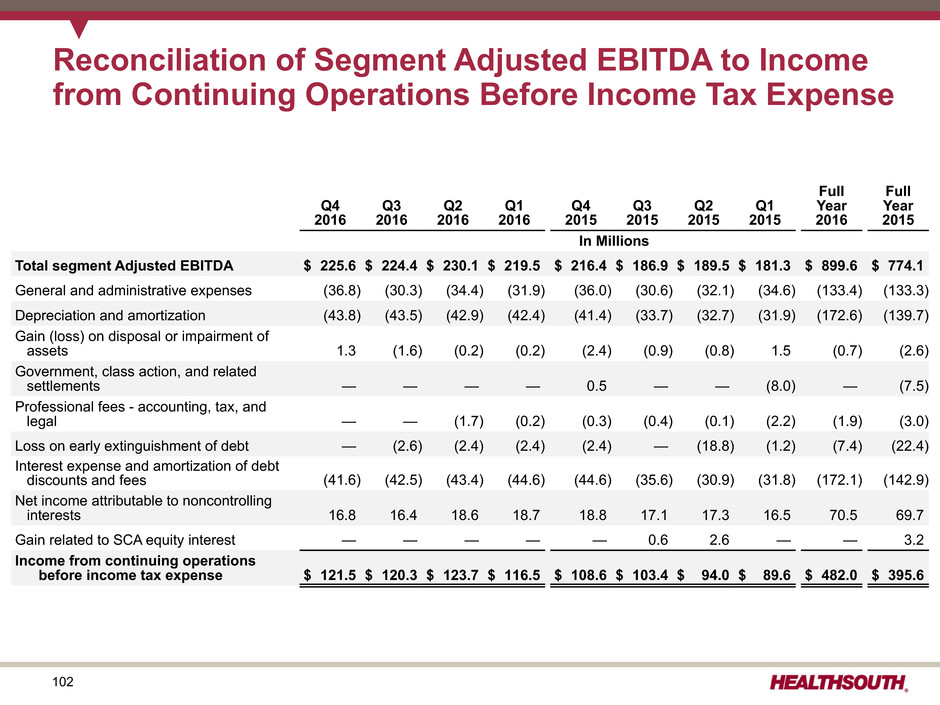

3 Table of Contents Guidance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-11 The Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12-26 Our Strategy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27-32 Business Outlook: 2017 to 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33-40 Growth. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41-52 Alternative Payment Models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53-63 Capital Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64-69 Information Technology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70-73 Operational Metrics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74-79 Industry Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80-92 Segment Operating Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93-97 Reconciliations to GAAP and Share Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98-112 End Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113-116

4 Guidance (as of March 6, 2017)

5 Priorities for 2017 GROWTH u Expand network of freestanding inpatient rehabilitation hospitals ("IRFs") Ÿ Demographic trends driving increasing demand for IRF services Ÿ IRFs are best positioned to expand service offering in the progression towards site neutrality Ÿ Continue emphasis on joint venture opportunities to enhance positioning in integrated delivery models u Expand network of home health agencies ($50 million to $100 million of acquisitions) Ÿ Demographic trends driving increasing demand for home health services Ÿ Home health will benefit from skilled nursing facility ("SNF") disintermediation Ÿ Continue emphasis on: Ÿ Increasing overlap with HealthSouth's IRFs Ÿ Increasing market density via acquisitions in existing and contiguous home health markets Ÿ Selectively acquiring hospice assets to overlap with home health locations OPERATIONAL INITIATIVES CAPITAL STRUCTURE

6 Priorities for 2017 GROWTH CAPITAL STRUCTURE OPERATIONAL INITIATIVES u Develop and implement initial risk sharing strategies Ÿ Implement collaborator and/or preferred provider agreements in select CJR markets (includes SHFFT) Ÿ Design and pilot commercial bundle with select Medicare Advantage plans u Enhance clinical collaboration between HealthSouth and Encompass Ÿ Structure and implement initiative to extrapolate best practices across all overlap markets Ÿ Utilize Care Transition Coordinators ("CTCs") to implement patient-centered transition plans that promote quality, safety and patient choice u Refine and expand clinical enhancements to further improve patient outcomes Ÿ Complete installation of EMR and continue in-service upgrades Ÿ Enhance utilization of clinical data analytics strategies Ÿ Refine and expand predictive model to identify patients at risk for acute care transfers u Increase stroke market share by further communicating the HealthSouth value proposition to acute care hospitals, physicians, and commercial payors Ÿ AHA and ASA guidelines recommend IRF over SNF Ÿ 99 of HealthSouth's hospitals hold stroke-specific certifications from The Joint Commission's Disease-Specific Care Certification Program. u Maintain strength and flexibility of balance sheet u Continue to augment returns from investments in operations with shareholder distributions

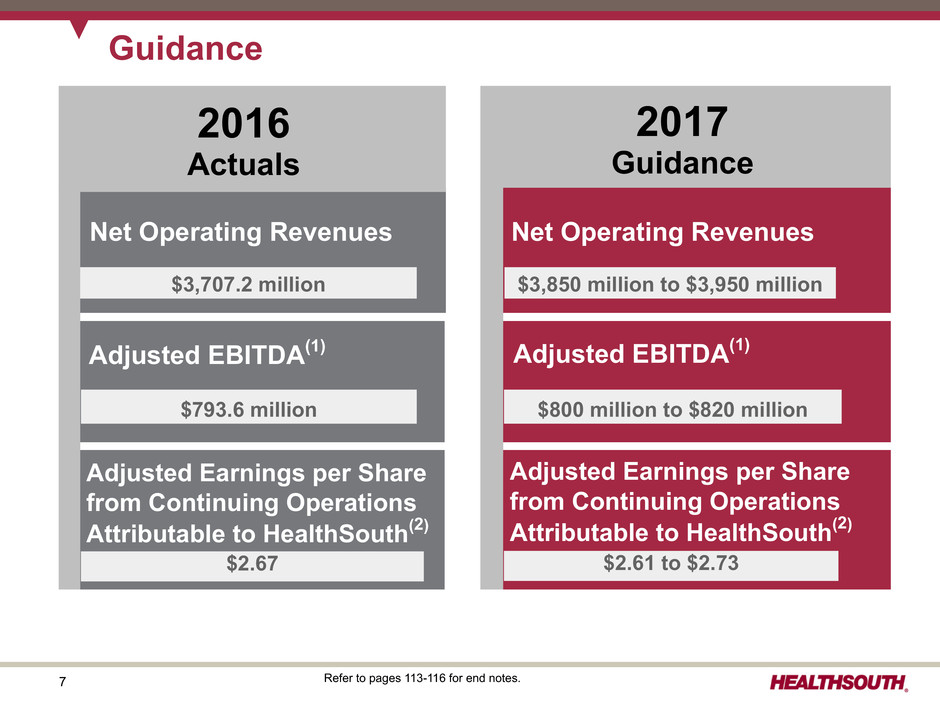

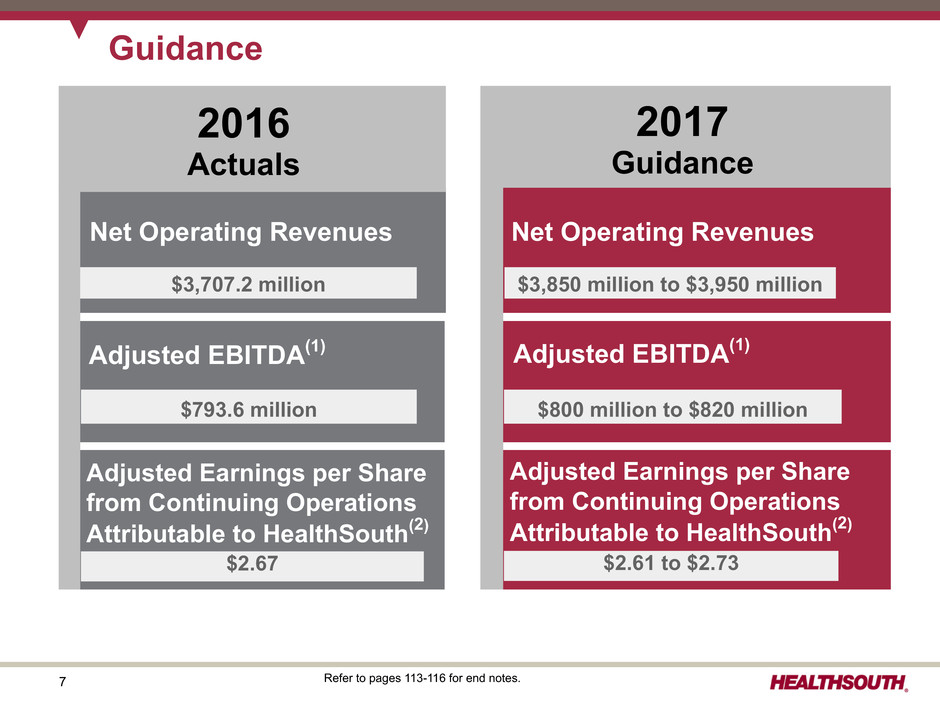

7 Refer to pages 113-116 for end notes. Guidance Adjusted EBITDA(1) Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth(2) Net Operating Revenues Net Operating Revenues $3,850 million to $3,950 million Adjusted EBITDA(1) $800 million to $820 million Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth(2) $2.61 to $2.73 $3,707.2 million $793.6 million $2.67 2017 Guidance 2016 Actuals

8 Refer to pages xxx-xxx for end notes. Adjusted EBITDA(1) Guidance Bridge Net Operating Revenues $3,xxx million to $3,xxx million Adjusted EBITDA(x) $8xx million to $8xx million Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth(x) $x.xx to $x.xx 2017 2016 Adjusted EBITDA Indirect Medical Education Adjustment in Q3 2016 Growth from Operations Impact of 2017 Home Health Rule Sale of Pediatric Home Health Business in Q4 2016 2017 Adjusted EBITDA Guidance Range u 2016 included the benefit of a retroactive indirect medical education (“IME”) adjustment of ~$4 million, which will not repeat in 2017, at the former Reliant hospital in Woburn, MA. u The ~3.6% net pricing reduction to Encompass of the HH-PPS final rule creates an ~$21 million headwind to Adjusted EBITDA in 2017.* u Sold pediatric home health assets in Q4 2016; Pediatrics generated ~$2 million of Adjusted EBITDA in 2016 u See page 9 for a list of guidance considerations. $794 $800 to $820 $33 to $53 ($4) ($2) ($21)(In Millions) 2016 2017 * Encompass' expectation for the CY2017 Medicare pricing reduction prior to the release of the HH-PPS rule was ~1.2%. Refer to pages 113-116 for end notes.

9 Guidance Considerations Inpatient Rehabilitation u Estimated 1.9% increase in Medicare pricing for Q1 through Q3; ~1.0% for Q4 (see page 35) u Salary increase of ~3.0% (see page 36) u 2016 included the benefit of a retroactive indirect medical education (“IME”) adjustment of ~$4 million at the former Reliant hospital in Woburn, MA. u Bad debt expense of 1.8% to 2.0% of net operating revenues Home Health and Hospice u Estimated 3.6%, or ~$21 million, net Medicare pricing reduction for CY 2017 (see page 35) u Salary increase of ~3.0% (see page 36) u Estimated incremental cost of $1.0 million to $1.5 million for the pre-claim review demonstration scheduled to begin in Florida on April 1, 2017 u Inclusive of home health and hospice acquisitions in 2017 (see page 11) u Sale of pediatric home health assets in Q4 2016; Pediatrics generated ~$2 million of Adjusted EBITDA in 2016 Consolidated u Diluted share count of ~100 million shares u Tax rate of approximately 40%

10 Reconciliations to GAAP provided on pages 98-112. Refer to pages 113-116 for end notes. Adjusted Free Cash Flow(3) and Tax Assumptions Certain Cash Flow Items (millions) 2015 Actuals 2016 Actuals 2017 Assumptions • Cash interest expense (net of amortization of debt discounts and fees) $128.6 $158.4 $150 to $160 • Cash payments for taxes, net of refunds $9.4 $31.9 $120 to $175 • Working Capital and Other $69.2 $36.2 $50 to $70 • Maintenance CAPEX $83.1 $104.2 $130 to $150 • Dividends paid on preferred stock(4) $3.1 $— $0 • Adjusted Free Cash Flow $389.0 $462.9 $245 to $370 * The Company has filed with the IRS for a tax accounting method change related to billings denied under pre-payment claims reviews that, if accepted, would replenish the gross federal NOL by ~$130 million. Exhaustion of the federal NOL by year-end 2016 excludes the impact of this filing. u Increased cash payments for taxes due to exhaustion of federal NOL as of December 31, 2016* u Increased maintenance capital expenditures due to growth in the Company, enhanced hospital maintenance program, and leasehold improvements and furnishings associated with the build-out of the Company’s new home office location (building will be leased)

11 Note: 2015 amount for debt borrowings included ~$208 million related to the Reliant hospitals' capital lease obligations.See the debt schedule on page 67. Refer to pages 113-116 for end notes. Free Cash Flow Priorities (In Millions) 2015 2016 2017 Actuals Actuals Assumptions IRF bed expansions $20.8 $19.1 $30 to $40 New IRF’s - De novos 47.8 72.6 85 to 105 - Acquisitions 786.2 — TBD - Replacement hospitals and other 5.8 11.1 10 to 20 New home health and hospice acquisitions 200.2 48.1 50 to 100 $1,060.8 $150.9 $175 to $265, excluding IRF acquisitions 2015 2016 2017 Actuals Actuals Assumptions Debt (borrowings) redemptions, net $(1,060.3) $155.1 $TBD Cash dividends on common stock(6) 77.2 83.8 ~$87 Common stock repurchases 45.3 65.6 TBD $(937.8) $304.5 $TBD Shareholder Distributions Growth in Core Business Debt Reduction Highest Priorit y The Company has ~$39 million of contractual debt repayment obligations in 2017.(5) ~$96 million authorization remaining as of December 31, 2016 Quarterly cash dividend currently set at $0.24 per common share

12 The Company

13 HealthSouth: A Leading Provider of Post-Acute Care 59% of HealthSouth's IRFs are located within a 30-mile radius of an Encompass location. Inpatient Rehabilitation Portfolio - As of December 31, 2016 123 Inpatient Rehabilitation Hospitals • 37 operate as joint ventures with acute care hospitals 30 Number of States (plus Puerto Rico) ~ 28,000 Employees Key Statistics - Full Year 2016 ~ $3.0 Billion Revenue 165,305 Inpatient Discharges 640,702 Outpatient Visits Note: One of the 123 IRFs and two of the 188 adult home health locations are nonconsolidated. These locations are accounted for using the equity method of accounting. Encompass Home Health and Hospice Portfolio – As of December 31, 2016 188 Home Health Locations 35 Hospice Locations 25 Number of States ~ 7,700 Employees Key Statistics - Full Year 2016 ~ $686 million Revenue 185,737 Home Health Episodes 3,337 Hospice Admissions IRF Market Share Largest owner & operator of IRFs 21% of Licensed Beds 28% of Medicare Patients Served Home Health and Hospice Market Share 4th largest provider of Medicare-certified skilled home health services

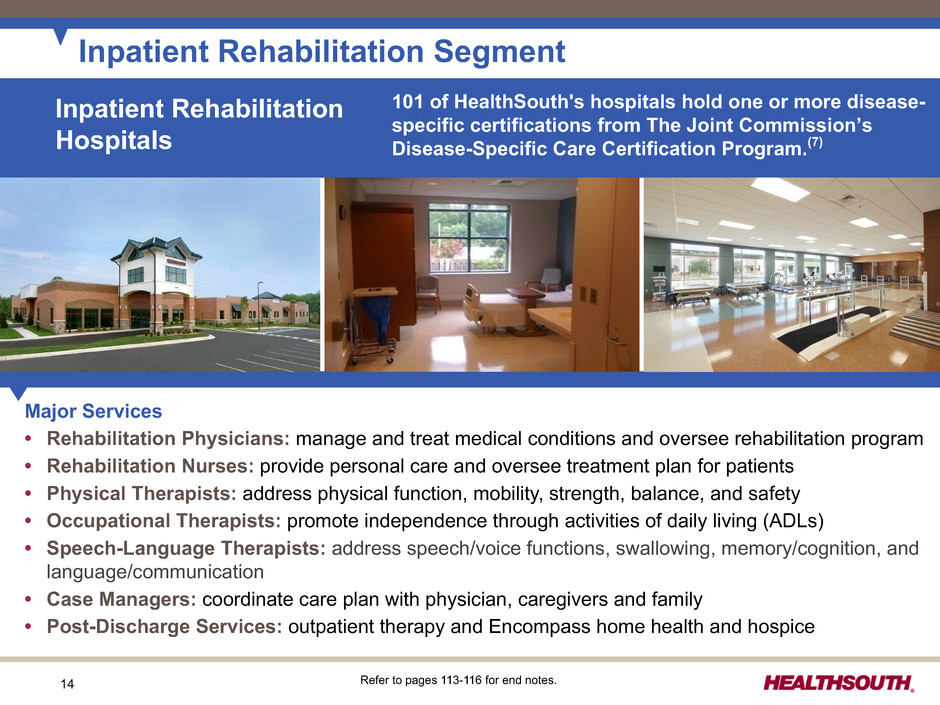

14 Inpatient Rehabilitation Segment Major Services • Rehabilitation Physicians: manage and treat medical conditions and oversee rehabilitation program • Rehabilitation Nurses: provide personal care and oversee treatment plan for patients • Physical Therapists: address physical function, mobility, strength, balance, and safety • Occupational Therapists: promote independence through activities of daily living (ADLs) • Speech-Language Therapists: address speech/voice functions, swallowing, memory/cognition, and language/communication • Case Managers: coordinate care plan with physician, caregivers and family • Post-Discharge Services: outpatient therapy and Encompass home health and hospice Inpatient Rehabilitation Hospitals Refer to pages 113-116 for end notes. 101 of HealthSouth's hospitals hold one or more disease- specific certifications from The Joint Commission’s Disease-Specific Care Certification Program.(7)

15 Major Services • Skilled Nurses: comprehensively assess, teach, train, and manage care related to injury or illness • Home Health Aides: provide personal care and assistance with ADLs • Physical Therapists: address physical function, mobility, strength, balance, and safety • Occupational Therapists: promote independence through training on self-management of ADLs • Speech-Language Therapists: address speech/voice functions, swallowing, memory/cognition, and language/communication • Medical Social Workers: provide assessment of social and emotional factors; assist with obtaining community resources Home Health and Hospice Segment (Encompass) Home Health Agencies Encompass offers a number of evidence-based specialty programs related to: Post-Operative Care, Fall Prevention, Chronic Disease Management, and Transitional Care. Hospice: provides services to terminally ill patients and their families to address patients' physical needs, including pain control and symptom management, and to provide emotional and spiritual support.

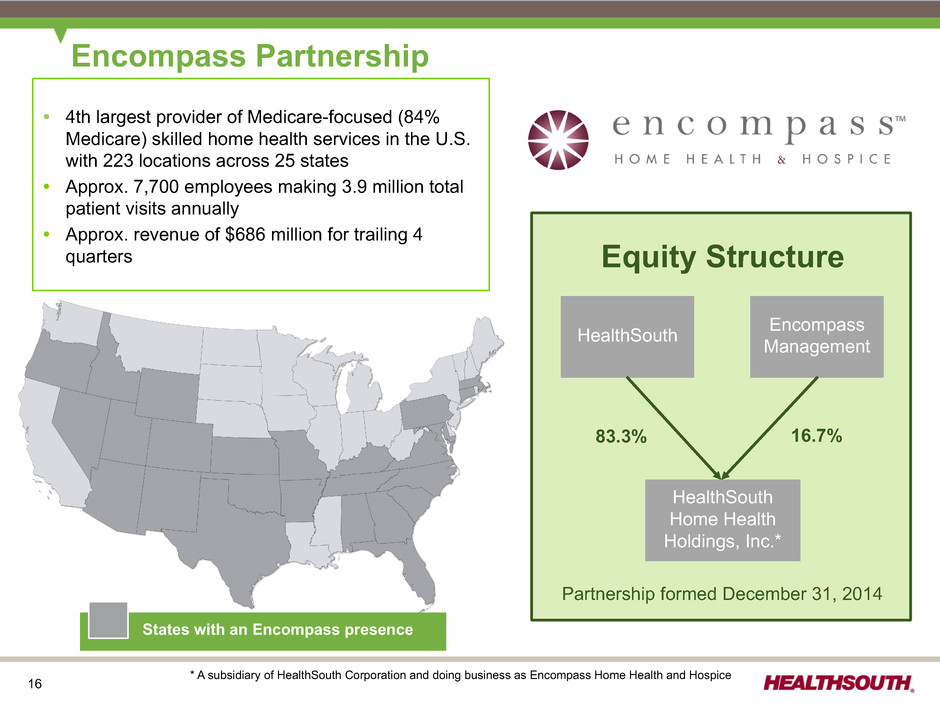

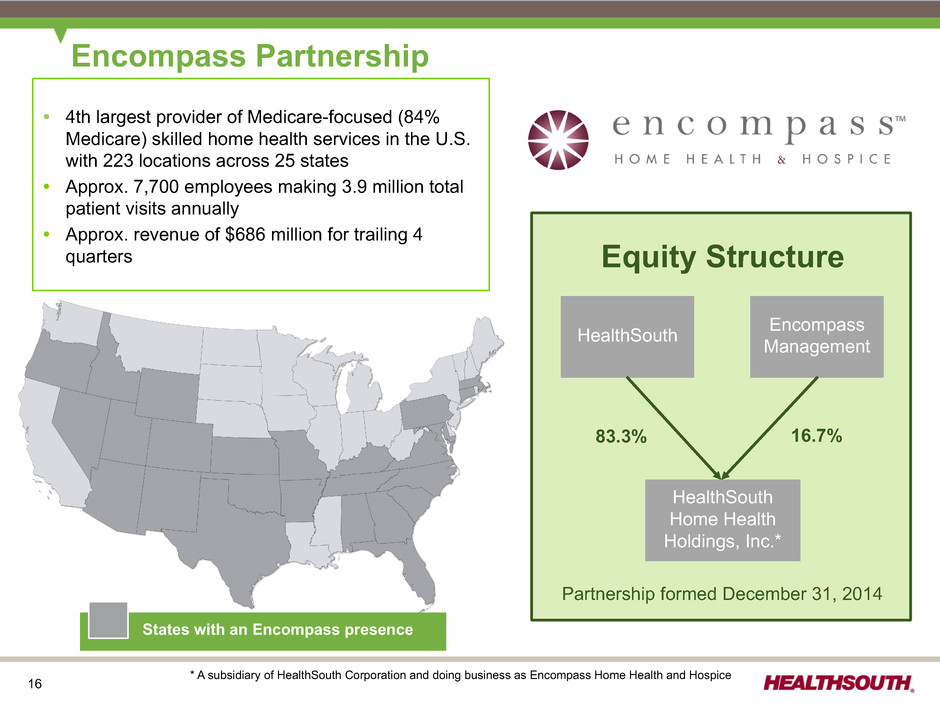

16 States with an Encompass presence Encompass Partnership • 4th largest provider of Medicare-focused (84% Medicare) skilled home health services in the U.S. with 223 locations across 25 states • Approx. 7,700 employees making 3.9 million total patient visits annually • Approx. revenue of $686 million for trailing 4 quarters * A subsidiary of HealthSouth Corporation and doing business as Encompass Home Health and Hospice Equity Structure HealthSouth EncompassManagement HealthSouth Home Health Holdings, Inc.* 16.7%83.3% Partnership formed December 31, 2014

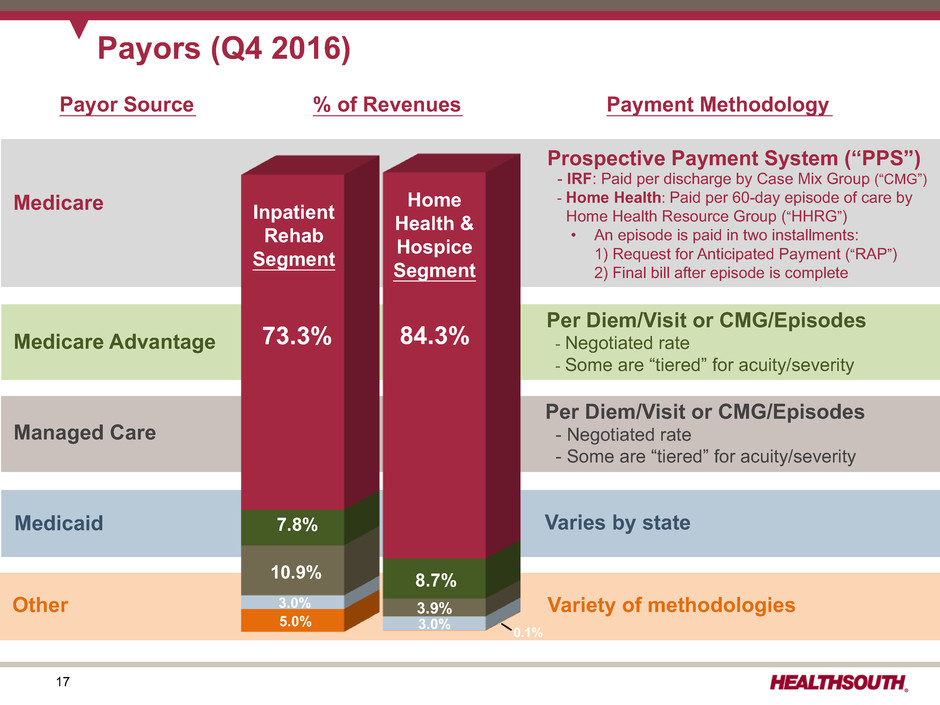

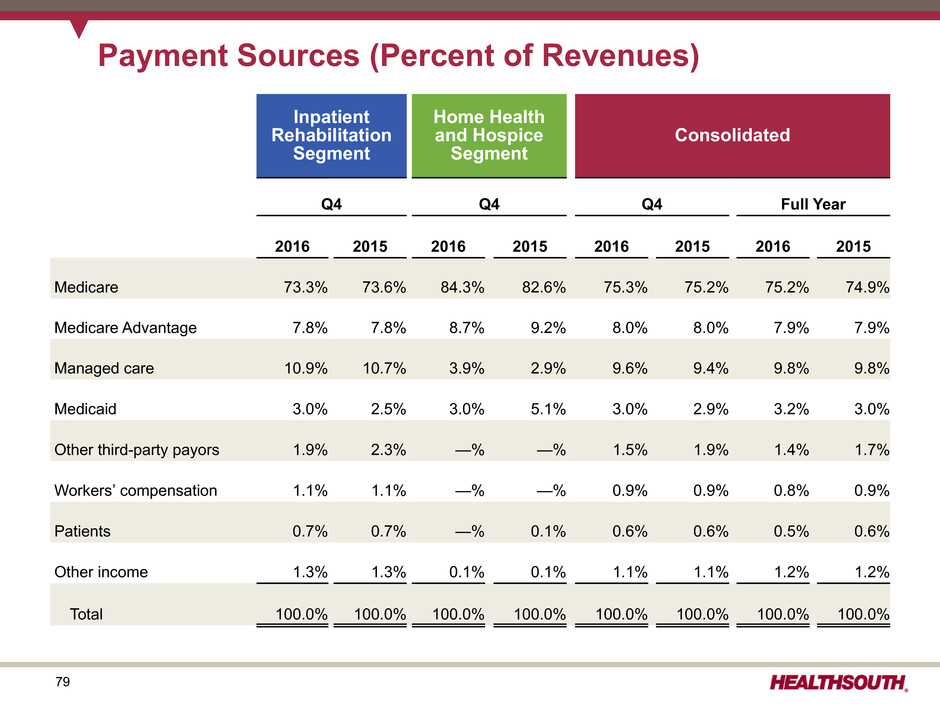

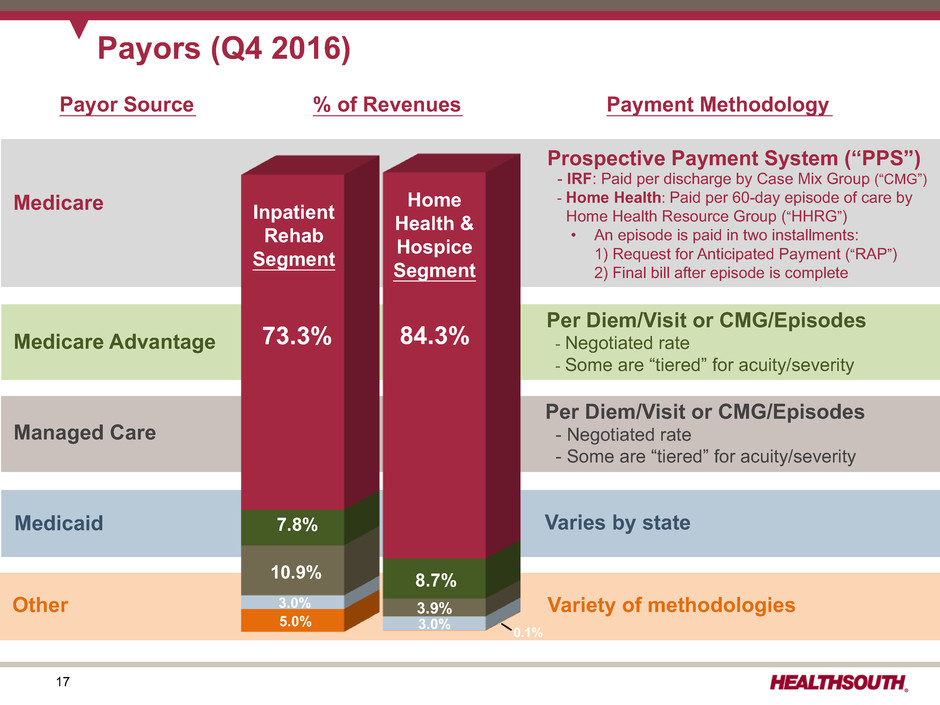

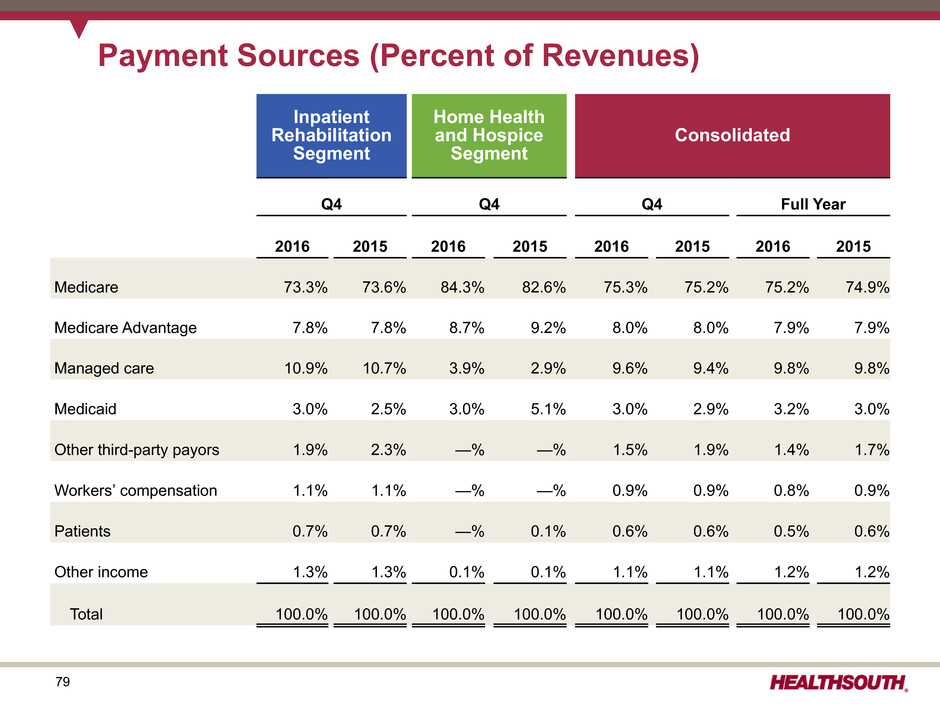

17 Managed Care Other Variety of methodologies Per Diem/Visit or CMG/Episodes - Negotiated rate - Some are “tiered” for acuity/severity Per Diem/Visit or CMG/Episodes - Negotiated rate - Some are “tiered” for acuity/severity Prospective Payment System (“PPS”) - IRF: Paid per discharge by Case Mix Group (“CMG”) - Home Health: Paid per 60-day episode of care by Home Health Resource Group (“HHRG”) • An episode is paid in two installments: 1) Request for Anticipated Payment (“RAP”) 2) Final bill after episode is complete Medicare Varies by state Medicare Advantage Medicaid Payors (Q4 2016) Payor Source Payment Methodology% of Revenues 84.3%73.3% 8.7% 7.8% 3.9% 10.9% 3.0% 3.0%5.0% 0.1% Inpatient Rehab Segment Home Health & Hospice Segment

18 Acute Care Hospitals -- 37% Physician Offices / Community -- 34% IRFs / LTCHs / SNFs -- 29% IRF Patient Mix Referral Sources: Rehabilitation Impairment Category* (Q4 2016): • Physicians and acute care hospital case managers are key decision makers. • All IRF patients must meet reasonable and necessary criteria and must be admitted by a physician. • All IRF patients must be medically stable and have potential to tolerate three hours of therapy per day (minimum). • IRF patients receive 24-hour, 7 days a week nursing care. • Average length of stay = 12.8 days Admission to an IRF: Average Age of a HealthSouth Patient: All Patients = 71 Medicare FFS = 76 RIC 01 Stroke 18.0% RIC 02/03 Brain dysfunction 9.8% RIC 04/05 Spinal cord dysfunction 3.9% RIC 06 Neurological conditions 20.3% RIC 07 Fracture of lower extremity 8.2% RIC 08 Replacement of lower extremity joint 4.8% RIC 09 Other orthopedic 9.8% RIC 10/11 Amputation 2.5% RIC 14 Cardiac 4.4% RIC 17/18 Major multiple trauma 5.6% RIC 20 Other disabling impairments 9.8% — All other RICs 2.9% Home Health Patient Mix Acute Care Hospitals -- 92% Physician Offices / Community -- 7% Skilled Nursing Facilities -- 1% Referral Sources: • For Medicare, a patient must be confined to the home and need skilled services. • The patient must be under the care of a physician and receive services under a home health plan of care established and periodically reviewed by a physician. • Medicare also requires a face-to-face encounter related to the primary reason the patient requires home health services with a physician or an allowed non-physician practitioner. Admission to home health: Average Age of an Encompass Patient: All Patients = 76 Medicare FFS = 77 100 90 80 70 60 50 40 30 20 10 Pe rc en ta ge 24.0% 36.7% 31.9% 85.1% Age 85+ Lives alone Has 2 or more ADL limitations Has 3 or more chronic conditions Demographics of all Medicare Home Health Users**: * Rehabilitation Impairment Categories (RICs) represent how HealthSouth admitted the patient; BPCI/CJR (pages 55-62) uses Diagnostic-Related Groups (DRGs) which represent how the acute care hospital discharged the patient. ** Source: Avalere Health and Alliance for Home Health Quality and Innovation Home Health Chart Book 2015

19 2014 2015 2016 10.6% 10.6% 10.4% 10.7% 10.6% 10.7% 2014 2015 2016 14.5% 13.9% 13.1% 11.4% 10.7% 10.1% 2014 2015 2016 74.4% 75.2% 75.7% 77.1% 78.0% 78.7% Home Health QualityIRF Quality Discharge to Community Discharge to Skilled Nursing Discharge to Acute Hospital Percent of cases discharged to the community, including home or home with home health. Higher is better. Percent of patients discharged to a skilled nursing facility. Lower is better. Percent of patients discharged to an acute care hospital. Lower is better. Refer to pages 113-116 for end notes. 3.8 3.2 Quality of Care Star Ratings(9) 99% of Encompass' home health agencies are 3 Stars or higher; 50% are 4 Stars or higher 3.6 3.6 Patient Satisfaction Star Ratings(9) 96% of Encompass' home health agencies are 3 Stars or higher; 60% are 4 Stars or higher Encompass National Average 16.1% 16.9% 30-Day Readmission Rate Percent of patients readmitted to an acute care hospital. Lower is better. 80 bps bette r UDSMR(8) HealthSouth Leading Positions in Quality of Care

20 Independent Research Concludes IRFs are a Better Rehabilitation Option for Stroke Patients than SNFs “If the hospital suggests sending your loved one to a skilled nursing facility after a stroke, advocate for the patient to go to an inpatient rehabilitation facility instead…”* “Whenever possible, the American Stroke Association strongly recommends that stroke patients be treated at an inpatient rehabilitation facility rather than a skilled nursing facility. While in an inpatient rehabilitation facility, a patient participates in at least three hours of rehabilitation a day from physical therapists, occupational therapists, and speech therapists. Nurses are continuously available and doctors typically visit daily.”* * ** AHA/ASA press release, "Inpatient rehab recommended over nursing homes for stroke rehab," issued May 4, 2016 (newsroom.heart.org) "Guidelines for Adult Stroke Rehabilitation and Recovery," issued May 2016 (stroke.ahajournals.org) “The studies that have compared outcomes in hospitalized stroke patients first discharged to an IRF, a SNF, or a nursing home have generally shown that IRF patients have higher rates of return to community living and greater functional recovery, whereas patients discharged to a SNF or a nursing home have higher rehospitalization rates and substantially poorer survival.”** 99 of HealthSouth's IRFs hold The Joint Commission's Disease-Specific Care Certification in Stroke Rehabilitation.

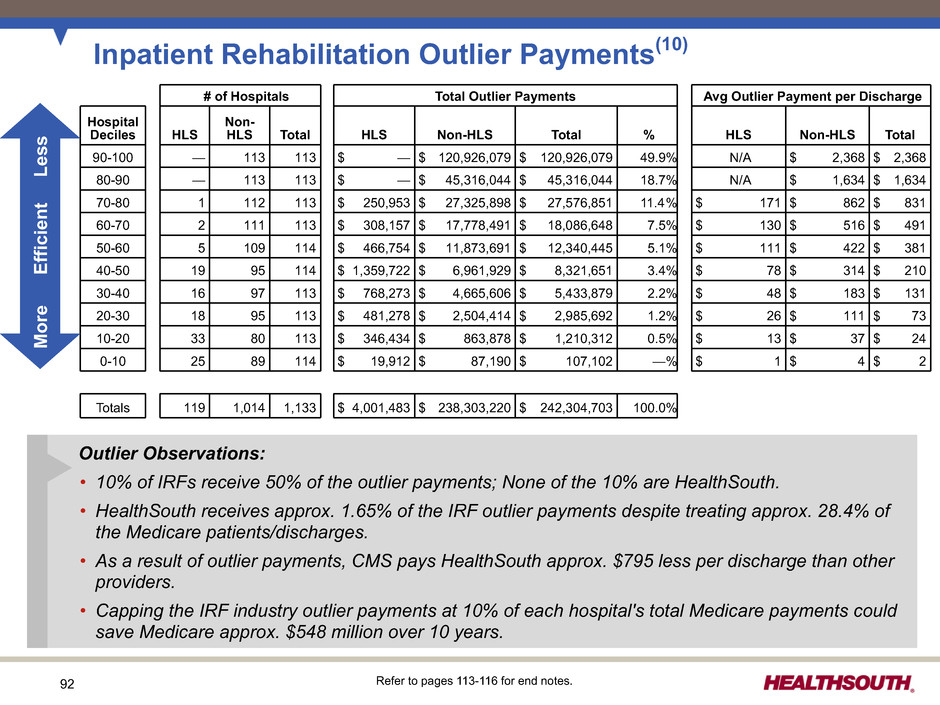

21 Leading Position in Cost Effectiveness(10) - IRFs Medicare pays HealthSouth less per discharge, on average, and HealthSouth treats a higher acuity patient. Avg. Beds per IRF Avg. Medicare Discharges per IRF(12) Case Mix Index(13) Avg. Est. Total Cost per Discharge for FY 2017 Avg. Est. Total Payment per Discharge for FY 2017 HLS(11) = 119 68 956 1.25 $12,645 $19,371 Free- Standing (Non-HLS) = 144 57 582 1.23 $16,653 $20,248 Hospital Units = 870 24 234 1.18 $19,879 $20,551 Total 1,133 33 354 1.21 $17,152 $20,153 The average estimated total payment per discharge, as stated, does not reflect a 2% reduction for sequestration.(14) Refer to pages 113-116 for end notes. HealthSouth differentiates itself by: Ÿ “Best Practices” clinical protocols Ÿ Supply chain efficiencies Ÿ Sophisticated management information systems Ÿ Economies of scale

22 2015 AverageRevenue Visits Effective Revenue Cost Episodes per Episode per Episode per Visit per Visit Encompass 137,568 $3,072 19 $162 $72 Public Peer Average 259,215 $2,732 17* $161 $84* Encompass Compared to Peer Average 12.4% 11.8% 0.6% (14.3)% Leading Position in Cost Effectiveness - Home Health Public peer average represents 2015 data from publicly traded home health providers. * One publicly traded company (Kindred) does not report visit counts. Encompass' average revenue per episode is 12.4% higher due to higher acuity patient mix. Encompass' cost per visit is 14.3% lower due to market density & operational efficiency: Ÿ Caregiver optimization Ÿ Full utilization of Homecare Homebase (HCHB) Ÿ Employee culture of excellence Ÿ ~76% of visits conducted by full-time staff Ÿ Daily monitoring of productivity

23 IRF New-Store/Same-Store Growth * Includes consolidated HealthSouth inpatient rehabilitation hospitals classified as same store during each period Refer to pages 113-116 for end notes. 25.0 20.0 15.0 10.0 5.0 0.0 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Fairlawn(15) 0.6% 1.9% 1.9% 2.0% 1.1% New Store 2.0% 1.0% —% 0.6% 1.8% 4.4% 5.7% 15.6% 14.2% 11.7% 10.7% 1.3% Same Store* 0.4% 1.4% 1.9% 2.2% 2.9% 2.8% 3.9% 3.0% 2.8% 1.9% 1.9% 0.1% Total by Qtr. 2.4% 3.0% 3.8% 4.7% 6.7% 8.3% 9.6% 18.6% 17.0% 13.6% 12.6% 1.4% Total by Year 3.5% 10.9% 10.8% Same-Store Year* 1.3% 3.2% 1.7% Same-Store Year UDS(16) (0.2)% 1.3% (0.6)% Altamonte Springs, FL (50 beds) Johnson City, TN (26 beds) Newnan, GA (50 beds) Middletown, DE (34 beds) Reliant (857 beds) Franklin, TN (40 beds) Lexington, KY (158 beds) Savannah, GA (50 beds) Hot Springs, AR (40 beds) Bryan, TX (49 beds) Broken Arrow, OK (22 beds) Modesto, CA (50 beds)

24 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Home Health New-Store/Same-Store Growth Admissions Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 New Store 11.9% 13.6% 15.7% 37.4% 43.5% 41.6% 35.4% 8.1% Same Store* N/A N/A N/A N/A 12.6% 11.1% 15.3% 14.0% Encompass owned locations** 10.9% 8.7% 10.3% 15.0% N/A N/A N/A N/A Total by Qtr. 22.8% 22.3% 26.0% 52.4% 56.1% 52.7% 50.7% 22.1% Total by Year 31.4% 43.6% Same-Store Year* N/A 13.7% Encompass owned locations Year** 11.2% N/A * Includes consolidated Encompass home health agencies classified as same store during each period ** Includes admissions for locations Encompass owned prior to HealthSouth acquisition on December 31, 2014, and HealthSouth's legacy agencies Acquired CareSouth (44 home health agencies in 7 states) Note: In addition to completing the CareSouth acquisition, in 2015, Encompass opened four home health locations and acquired ten home health locations. In 2016, Encompass opened three home health locations and acquired seven home health locations.

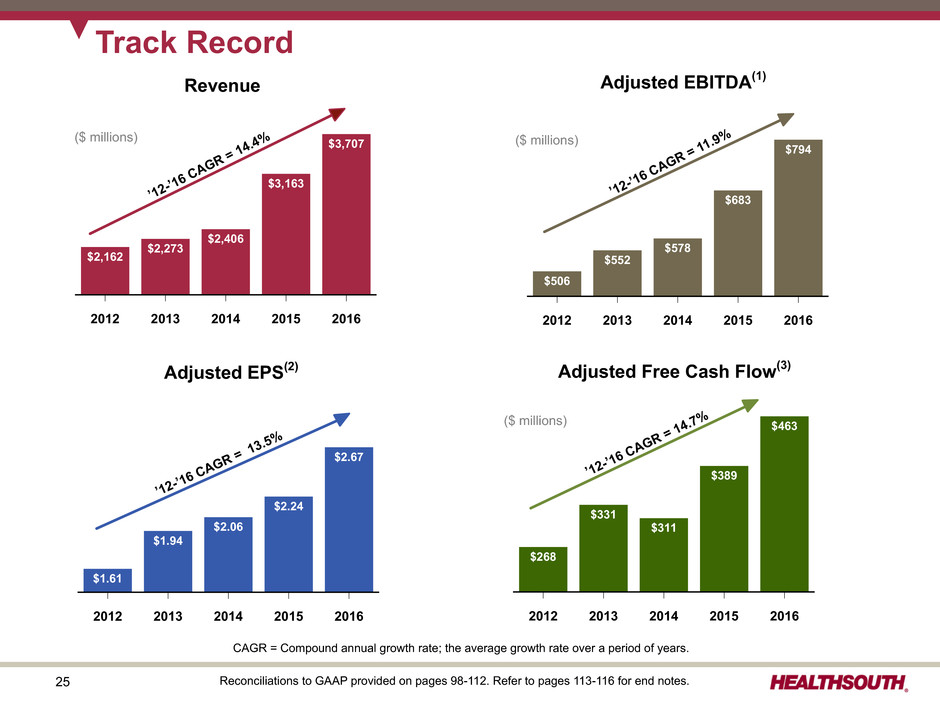

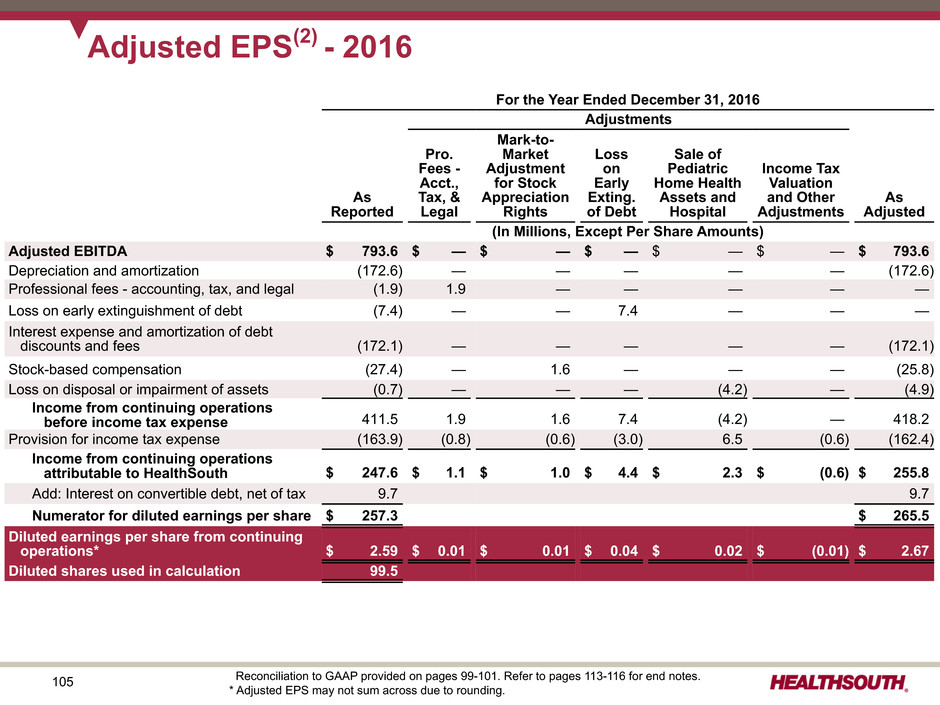

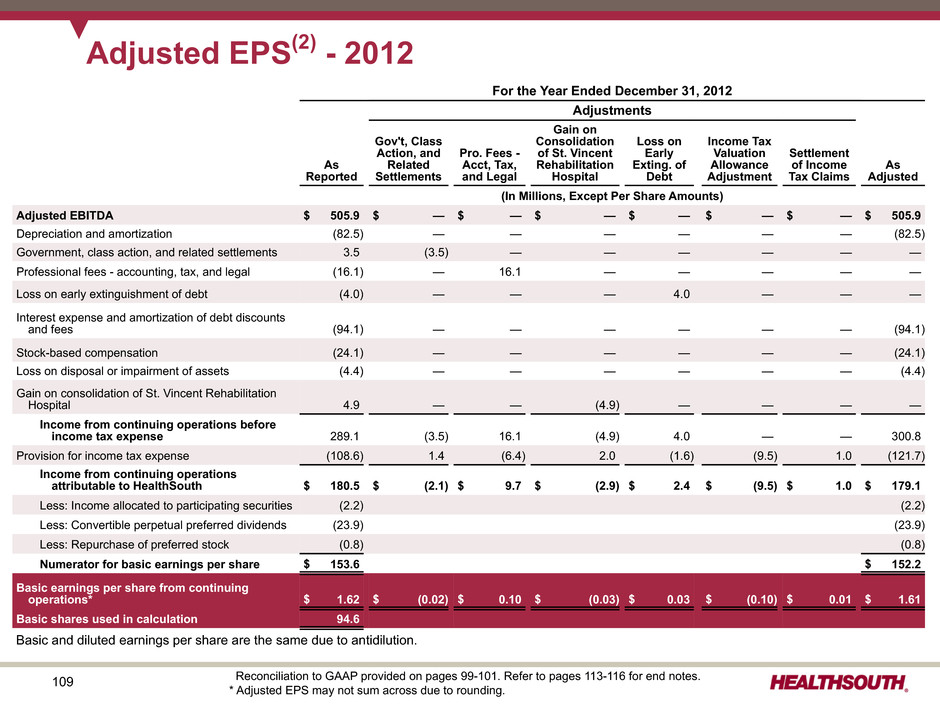

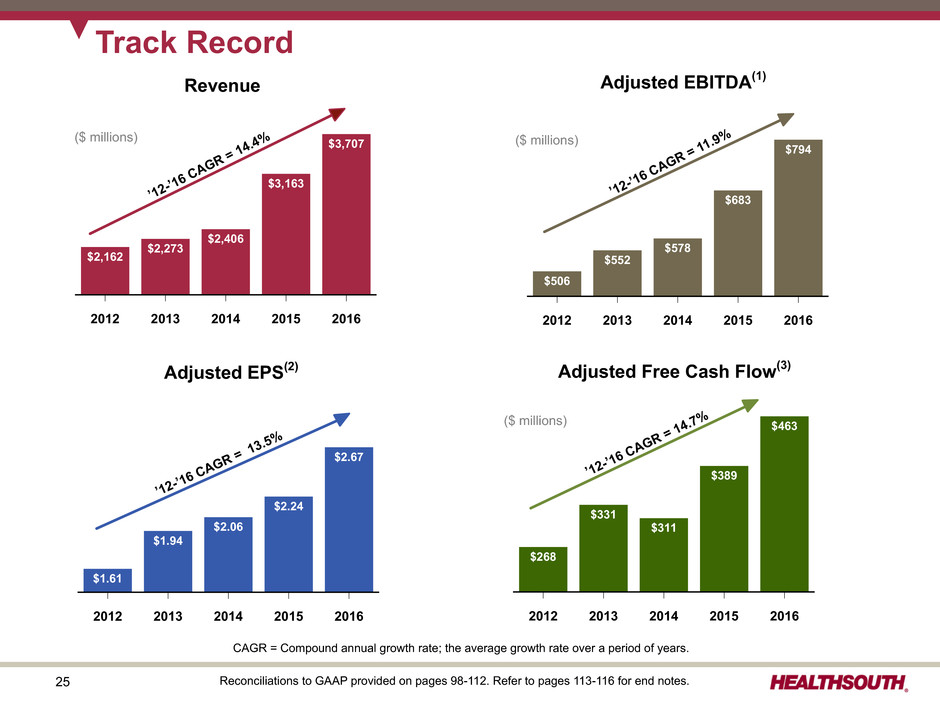

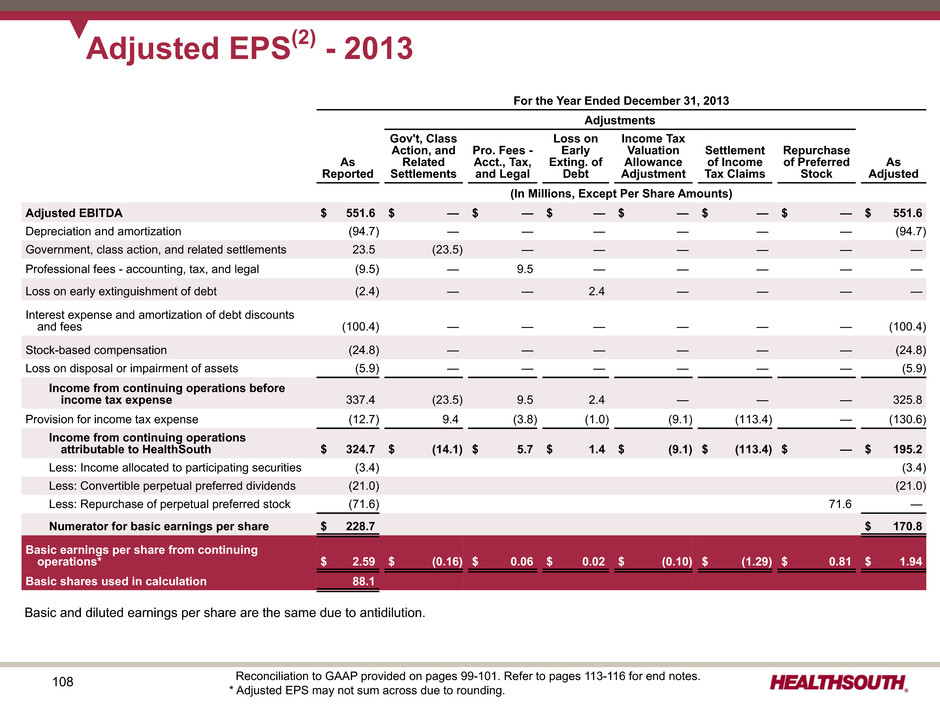

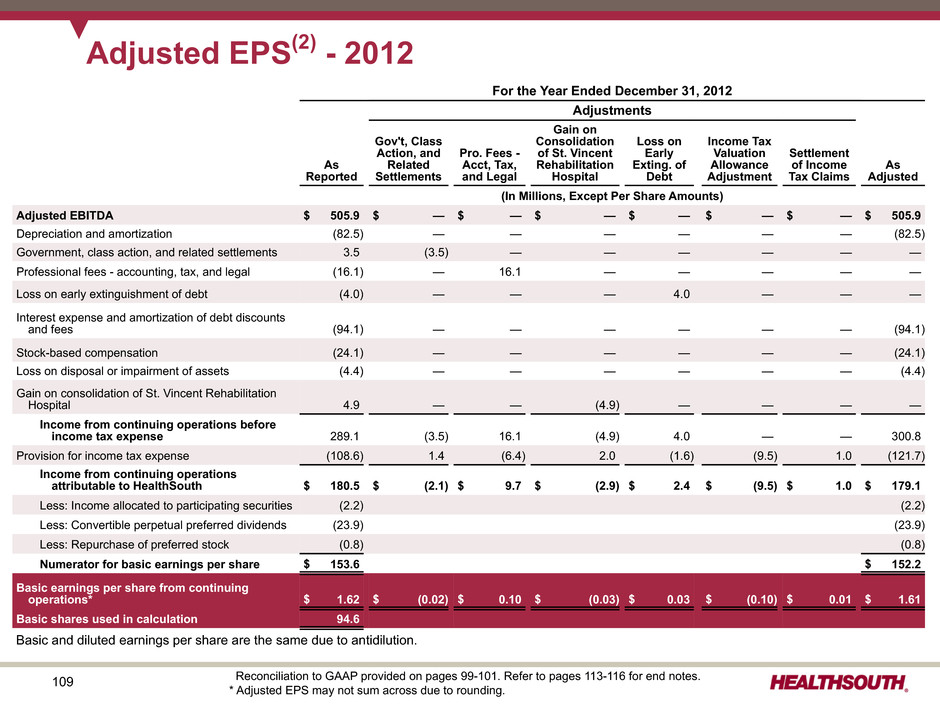

25 Adjusted EPS(2) Track Record 2012 2013 2014 2015 2016 $2,162 $2,273 $2,406 $3,163 $3,707($ millions) 2012 2013 2014 2015 2016 $506 $552 $578 $683 $794 ’12-’16 CAGR = 11.9 %($ millions) ’12-’16 CAGR = 14.4 % Adjusted EBITDA(1) 2012 2013 2014 2015 2016 $1.61 $1.94 $2.06 $2.24 $2.67 ’12-’16 CAGR = 13.5 % 2012 2013 2014 2015 2016 $268 $331 $311 $389 $463 Adjusted Free Cash Flow(3) ($ millions) ’12-’16 CAGR = 14.7 % Revenue Reconciliations to GAAP provided on pages 98-112. Refer to pages 113-116 for end notes. CAGR = Compound annual growth rate; the average growth rate over a period of years.

26 • Largest provider of inpatient rehabilitation services • 4th largest provider of Medicare-certified skilled home health services • Consistent delivery of high-quality, cost-effective care • Enhanced utilization of technology (e.g., clinical, data management, and technology-enabled business processes) HLS: Strong and Sustainable Business Fundamentals • Effective labor management • Continued improvements in supply chain • Economies related to scale and market density Cost-Effectiveness • Strong balance sheet and liquidity, no significant near-term maturities (credit agreement matures in 2020; bonds mature in 2023 and beyond) • Substantial free cash flow generation • Attractive organic growth opportunities in both segments • Flexible inpatient rehabilitation de novo and acquisition strategy • Home health and hospice platform with track record of growth through acquisitions in highly fragmented industry segments • Portfolio of 123* IRFs as of December 31, 2016 P 85 owned and 38 leased Real Estate Portfolio Attractive Healthcare Sectors Growth Opportunities Cost-Effectiveness • Favorable demographic trends • Nondiscretionary nature of many conditions treated • Highly fragmented post-acute industries present significant acquisition and joint venture opportunities Industry Leading Position Financial Strength * Includes one nonconsolidated entity.

27 Our Strategy

28 Both Segments Benefit from a Demographic Tailwind: Expanding Medicare Beneficiary Population Key Observations: • The growth rate of Medicare beneficiaries increased in 2011 to an approx. 3% CAGR as “baby boomers” started turning 65. • In 2030, the Medicare population is projected to increase to 81 million beneficiaries from 55 million beneficiaries today. Source: www.census.gov/population/projections/files/summary/NP2014-T9.xls; Center for Medicare & Medicaid Services, Medicare Trustees Report - June 2016 - pages 186, 191 Average Age of HealthSouth Patients IRF Home Health < 65 years 29% 11% 65 to 69 years 13% 11% 70 to 74 years 13% 13% 75 to 79 years 14% 15% 80 to 84 years 14% 17% 85 to 89 years 11% 17% > 90 years 6% 16%

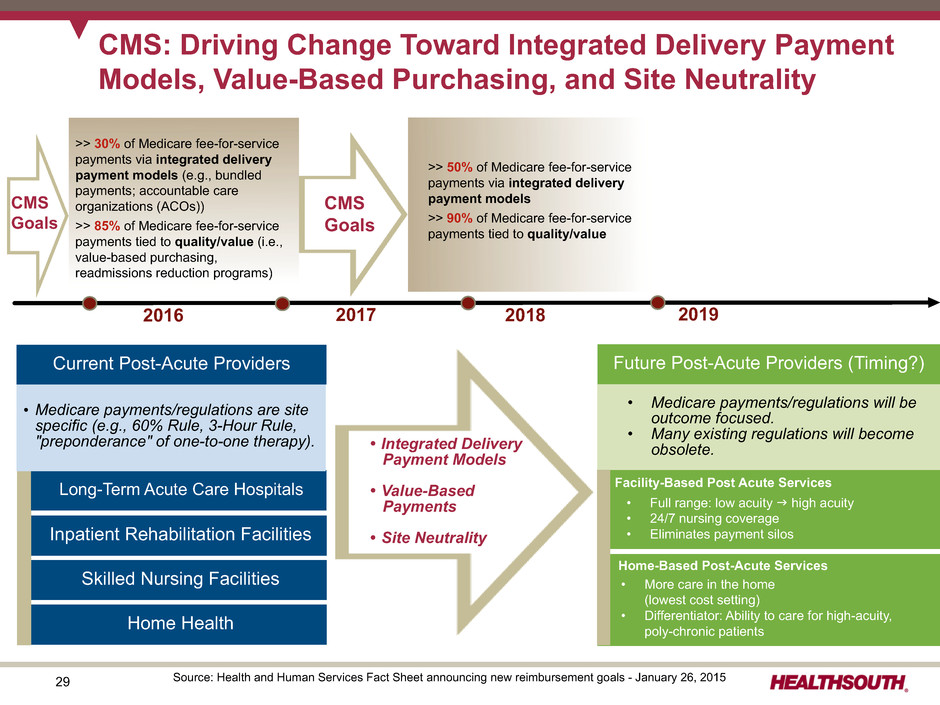

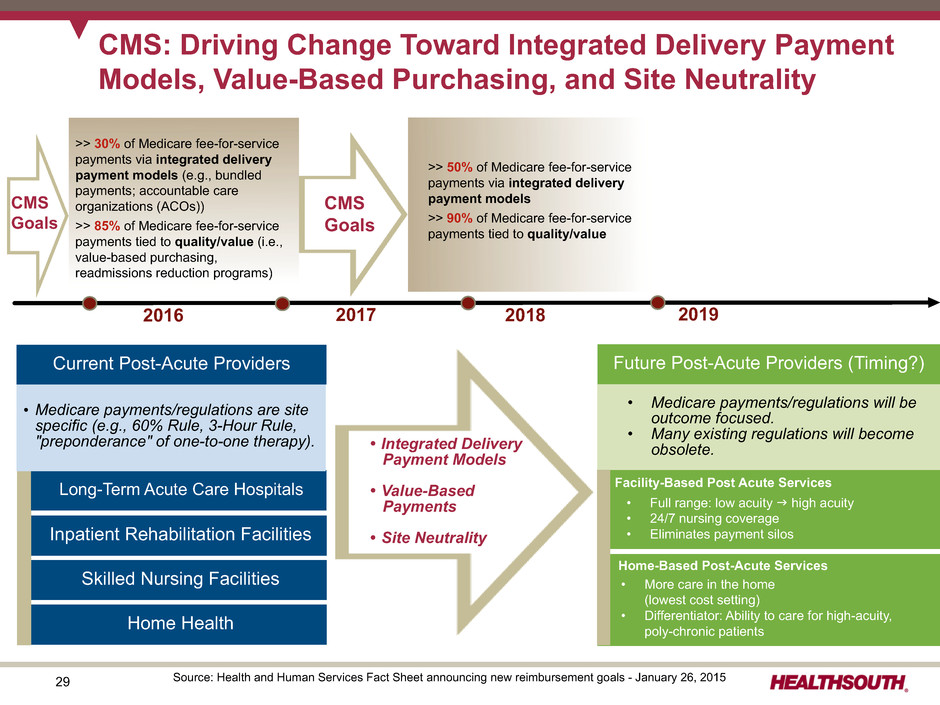

29 CMS: Driving Change Toward Integrated Delivery Payment Models, Value-Based Purchasing, and Site Neutrality Future Post-Acute Providers (Timing?) Inpatient Rehabilitation Facilities • Full range: low acuity g high acuity • 24/7 nursing coverage • Eliminates payment silos Home-Based Post-Acute Services • More care in the home (lowest cost setting) • Differentiator: Ability to care for high-acuity, poly-chronic patients >> 50% of Medicare fee-for-service payments via integrated delivery payment models >> 90% of Medicare fee-for-service payments tied to quality/value Ÿ Integrated Delivery Payment Models Ÿ Value-Based Payments • Site Neutrality Current Post-Acute Providers • Medicare payments/regulations will be outcome focused. • Many existing regulations will become obsolete. Facility-Based Post Acute Services >> 30% of Medicare fee-for-service payments via integrated delivery payment models (e.g., bundled payments; accountable care organizations (ACOs)) >> 85% of Medicare fee-for-service payments tied to quality/value (i.e., value-based purchasing, readmissions reduction programs) 20172016 Source: Health and Human Services Fact Sheet announcing new reimbursement goals - January 26, 2015 CMS Goals 2018 2019 CMS Goals Skilled Nursing Facilities Home Health Long-Term Acute Care Hospitals • Medicare payments/regulations are site specific (e.g., 60% Rule, 3-Hour Rule, "preponderance" of one-to-one therapy).

30 Always Available Sometimes Available Seldom Available Therapy Gym & Training Systems for All PAC Patients Staff Trained for All Acuity Therapy Gym & Training Systems for All PAC Patients Staff Trained for All Acuity Therapy Gym & Training Systems for All PAC Patients Staff Trained for All Acuity LTACs HealthSouth IRFs SNFs Encompass Home Health HealthSouth’s rehabilitation hospitals have the physical construct, clinical staffing, and operating expertise to “pivot from the center” to address the full spectrum of inpatient post-acute needs in a site neutral environment. HealthSouth is Well-Positioned for the Progression Towards Site Neutrality as It Will be Able to Treat All Types of Post-Acute Patients by Leveraging Its Operational Expertise Across Its Network of Facility-Based and Home-Based Assets. Higher acuity patients will transition from HealthSouth post-acute inpatient facilities to Encompass Home Health. Lower acuity patients will go directly to Encompass Home Health. Post-Acute Inpatient Spectrum Higher Acuity Lower Acuity Progression to Site Neutrality HealthSouth's Post-Acute Inpatient Facilities Presen t Futur e

31 IRF-Home Health Clinical Collaboration (All Payors) Q4 2015 Q4 2016 10,360 10,074 2,735 3,963 20.9% Collaboration Rate 28.2% Collaboration Rate HealthSouth IRF Discharges to Non- Encompass Home Health HealthSouth IRF Discharges to Encompass Home Health Clinical collaboration rate with HealthSouth IRFs increased by 730 basis points over Q4 2015 u Overlap markets are defined as a HealthSouth IRF located within a 30- mile radius of an Encompass location u Currently, 59% of HealthSouth’s IRFs are located within overlap markets. u The Company’s clinical collaboration rate goal for overlap markets is 35% to 40% within the next three years. Overlap Markets

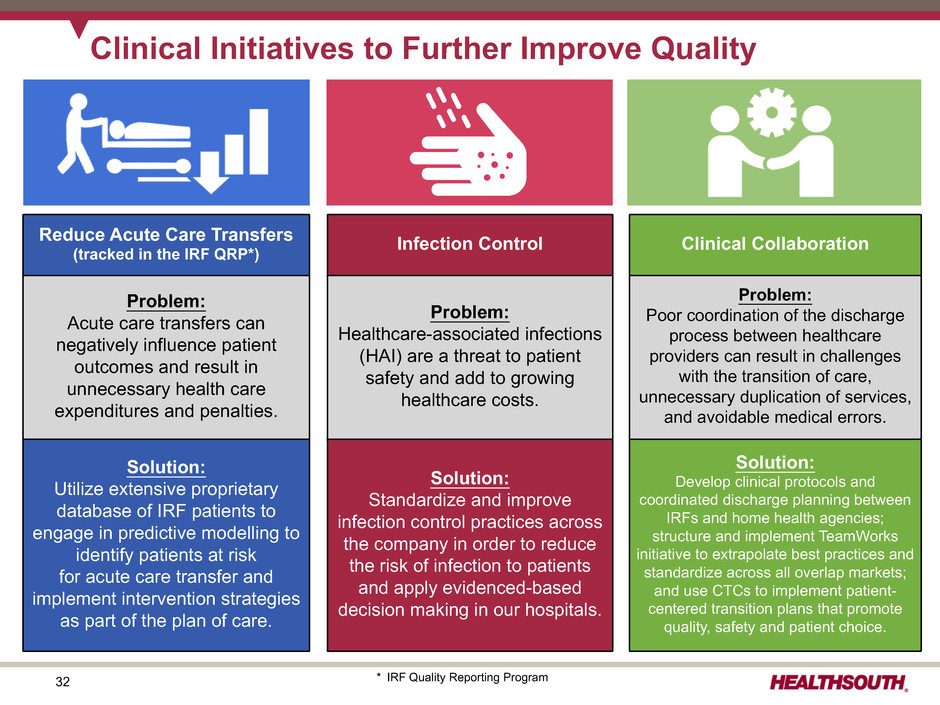

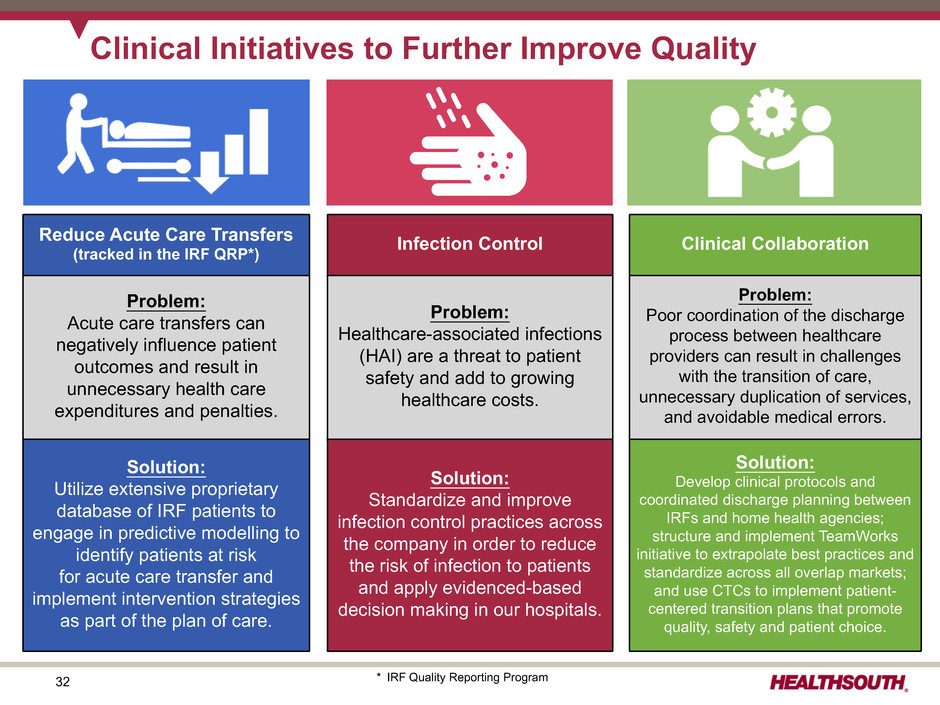

32 Solution: Utilize extensive proprietary database of IRF patients to engage in predictive modelling to identify patients at risk for acute care transfer and implement intervention strategies as part of the plan of care. Solution: Standardize and improve infection control practices across the company in order to reduce the risk of infection to patients and apply evidenced-based decision making in our hospitals. Solution: Develop clinical protocols and coordinated discharge planning between IRFs and home health agencies; structure and implement TeamWorks initiative to extrapolate best practices and standardize across all overlap markets; and use CTCs to implement patient- centered transition plans that promote quality, safety and patient choice. Problem: Acute care transfers can negatively influence patient outcomes and result in unnecessary health care expenditures and penalties. Problem: Healthcare-associated infections (HAI) are a threat to patient safety and add to growing healthcare costs. Problem: Poor coordination of the discharge process between healthcare providers can result in challenges with the transition of care, unnecessary duplication of services, and avoidable medical errors. Clinical Initiatives to Further Improve Quality Reduce Acute Care Transfers (tracked in the IRF QRP*) Infection Control Clinical Collaboration * IRF Quality Reporting Program

33 Business Outlook 2017 to 2019 (as of March 6, 2017)

34 • Same-store IRF growth • New-store IRF growth (de novos and acquisitions) • Same-store home health and hospice growth • New-store home health and hospice growth (acquisitions) Core Growth Strong Balance Sheet Key Operational Initiatives Shareholder Distributions Opportunistic Growth Business Outlook 2017 to 2019* 2017 2018 2019 Business Model • Adjusted EBITDA CAGR: 5% - 9%** • Strong free cash flow generation • Quarterly cash dividends • Opportunistic repurchases - (~$96 million authorization remaining as of December 31, 2016) • Develop and implement risk sharing strategies • Enhance clinical collaboration between HealthSouth and Encompass • Refine and expand clinical data analytics utilization to further improve patient outcomes • Leverage clinical expertise to increase stroke admissions • Complete installation of EMR and enhance utilization via continuous in-service upgrades • Target leverage of 3.5x to 3.8x by year-end, subject to opportunities for creating shareholder value Strategy Componen t • Consider acquisitions of other complementary businesses • Target leverage of 3.5x or less, subject to opportunities for creating shareholder value * If legislation affecting Medicare is passed, HealthSouth will evaluate its effect on its business model. ** This is a multi-year CAGR; annual results may fall outside the range.

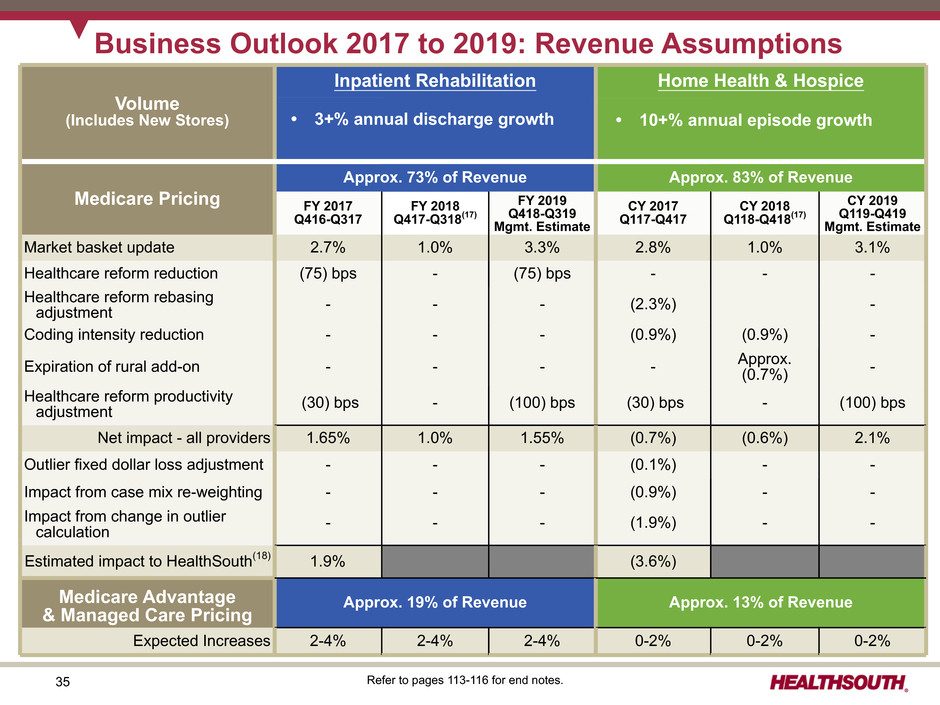

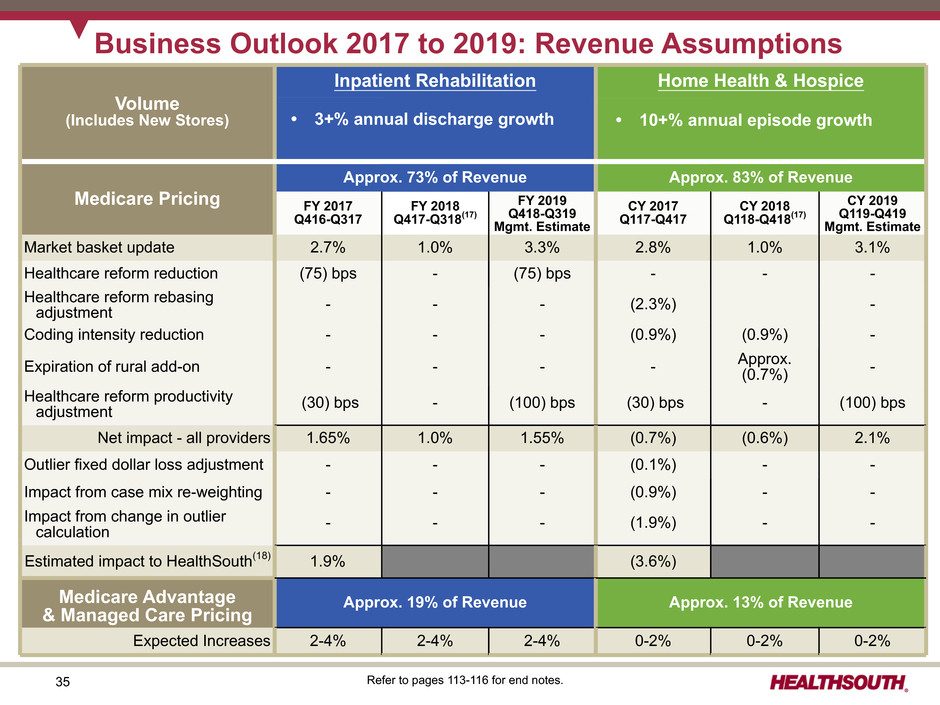

35 • 10% to15% annual episode growth • Includes $35-$40 million per annum in agency acquisitions Volume (Includes New Stores) Inpatient Rehabilitation Home Health & Hospice Medicare Pricing Approx. 73% of Revenue Approx. 83% of Revenue FY 2017 Q416-Q317 FY 2018 Q417-Q318(17) FY 2019 Q418-Q319 Mgmt. Estimate CY 2017 Q117-Q417 CY 2018 Q118-Q418(17) CY 2019 Q119-Q419 Mgmt. Estimate Market basket update 2.7% 1.0% 3.3% 2.8% 1.0% 3.1% Healthcare reform reduction (75) bps - (75) bps - - - Healthcare reform rebasing adjustment - - - (2.3%) - Coding intensity reduction - - - (0.9%) (0.9%) - Expiration of rural add-on - - - - Approx.(0.7%) - Healthcare reform productivity adjustment (30) bps - (100) bps (30) bps - (100) bps Net impact - all providers 1.65% 1.0% 1.55% (0.7%) (0.6%) 2.1% Outlier fixed dollar loss adjustment - - - (0.1%) - - Impact from case mix re-weighting - - - (0.9%) - - Impact from change in outlier calculation - - - (1.9%) - - Estimated impact to HealthSouth(18) 1.9% (3.6%) Medicare Advantage & Managed Care Pricing Approx. 19% of Revenue Approx. 13% of Revenue Expected Increases 2-4% 2-4% 2-4% 0-2% 0-2% 0-2% Business Outlook 2017 to 2019: Revenue Assumptions • 3+% annual discharge growth • 10+% annual episode growth Refer to pages 113-116 for end notes.

36 Inpatient Rehabilitation Home Health and Hospice Business Outlook 2017 to 2019: Labor and Other Expense Assumptions Salaries & Benefits ~70% Hospital Expenses ~30% Salaries and Benefits 2017 2018 2019 Salary increases 2.75-3.25% 2.75-3.25% 2.75-3.25% Benefit costs increases 5-10% 5-10% 5-10% Hospital Expenses • Other operating expenses and supply costs tracking with inflation Salaries & Benefits ~85% Other Expenses ~15% Home Health Expenses • Other operating expenses and supply costs tracking with inflation Percent of Salaries & Benefits Salaries ~ 90% Benefits ~10%

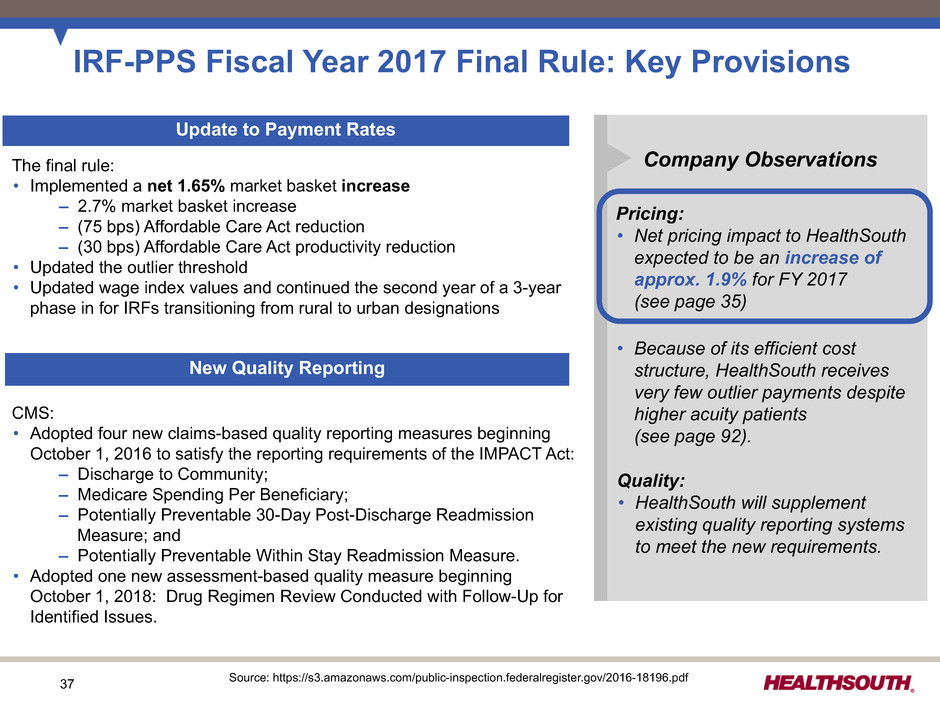

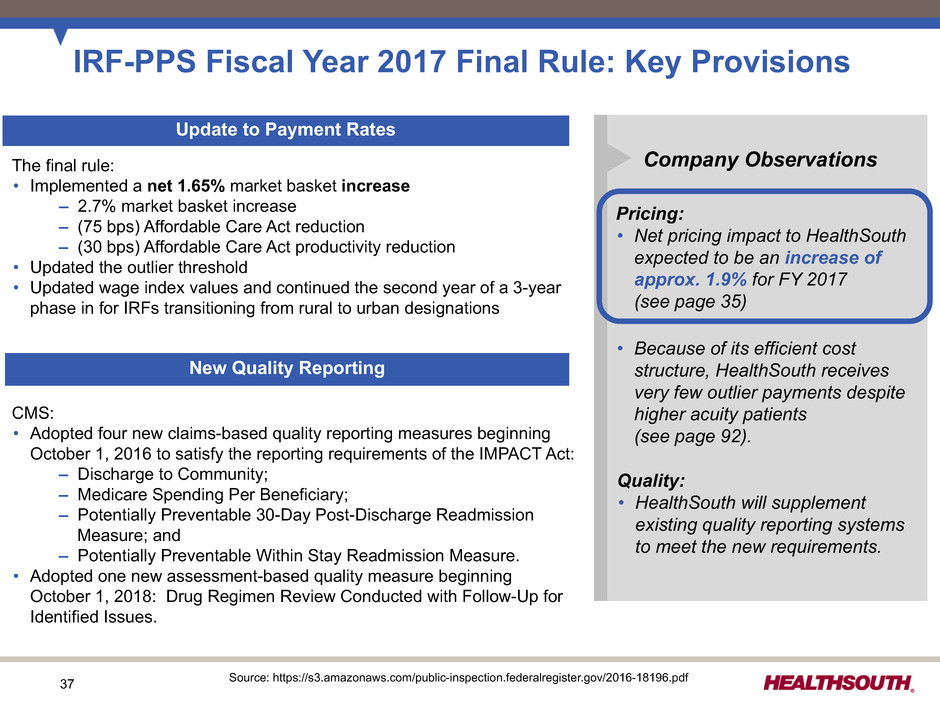

37 CMS: • Adopted four new claims-based quality reporting measures beginning October 1, 2016 to satisfy the reporting requirements of the IMPACT Act: – Discharge to Community; – Medicare Spending Per Beneficiary; – Potentially Preventable 30-Day Post-Discharge Readmission Measure; and – Potentially Preventable Within Stay Readmission Measure. • Adopted one new assessment-based quality measure beginning October 1, 2018: Drug Regimen Review Conducted with Follow-Up for Identified Issues. IRF-PPS Fiscal Year 2017 Final Rule: Key Provisions New Quality Reporting Update to Payment Rates Company Observations Pricing: • Net pricing impact to HealthSouth expected to be an increase of approx. 1.9% for FY 2017 (see page 35) • Because of its efficient cost structure, HealthSouth receives very few outlier payments despite higher acuity patients (see page 92). Quality: • HealthSouth will supplement existing quality reporting systems to meet the new requirements. The final rule: • Implemented a net 1.65% market basket increase – 2.7% market basket increase – (75 bps) Affordable Care Act reduction – (30 bps) Affordable Care Act productivity reduction • Updated the outlier threshold • Updated wage index values and continued the second year of a 3-year phase in for IRFs transitioning from rural to urban designations Source: https://s3.amazonaws.com/public-inspection.federalregister.gov/2016-18196.pdf

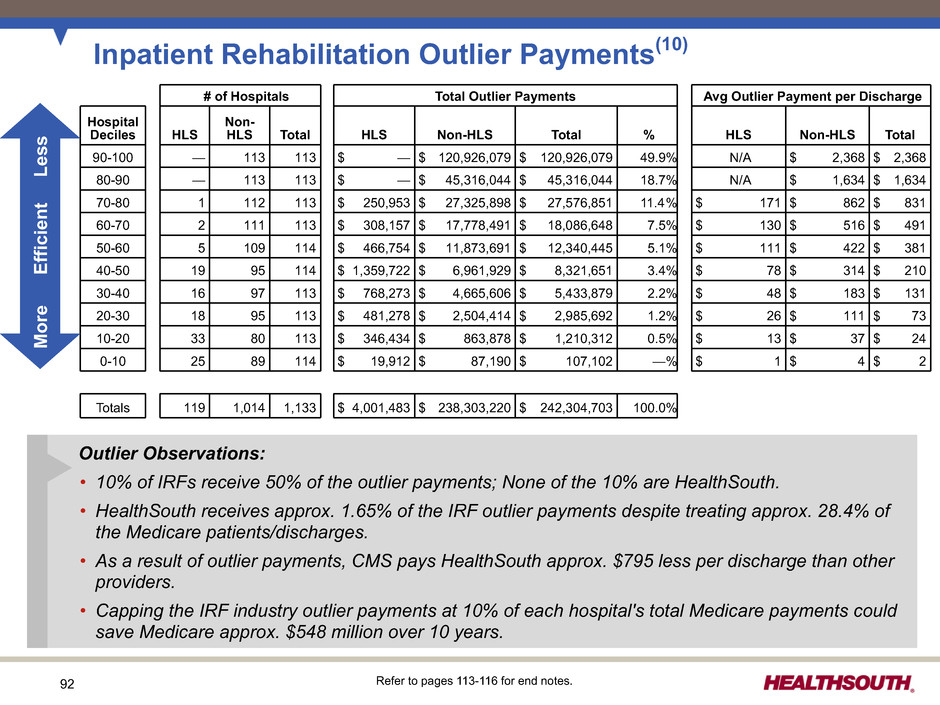

38 Pricing: • Net pricing impact to Encompass expected to be a reduction of approx. 3.6% for CY 2017 (see page 35) • The final rule requires the recalibration of case-mix weights and the conversion of outlier payments to a per-unit methodology to be budget neutral for the industry. However, these changes will have a disproportionate impact on Encompass based on its patient mix. Quality: • Encompass will supplement existing processes and systems to meet the new requirements. HH-PPS Calendar Year 2017 Final Rule: Key Provisions New Quality Reporting Update to Payment Rates Company ObservationsThe final rule: • Implemented a net 2.5% market basket increase – 2.8% market basket increase – (30 bps) Affordable Care Act productivity reduction • Implemented the final year of the four-year phase-in of the ACA mandated rebasing adjustment. The net rebasing reduction is approximately (2.3%). • Implemented the second year of a three-year nominal case-mix coding intensity reduction adjustment of (0.9%) • Updated the outlier fixed-dollar loss ratio from 0.45 to 0.55 • Recalibrated the case-mix weights to reflect current home health resource use and changes in utilization patterns • Converted outlier payments from a "per-visit" to a "per-unit" methodology, with “per-visit” rates converted into 15 minute “per-unit” rates CMS: • Adopted, for the CY 2018 payment determination, four measures to meet the requirements of the IMPACT Act: – Medicare Spending per Beneficiary (Claims Based); – Discharge to Community (Claims Based); – Potentially Preventable 30-Day Post-Discharge Readmission Measure (Claims Based); and – Drug Regimen Review Conducted with Follow-Up for Identified Issues (Patient Assessment Based) • Removed 28 quality measures, beginning with CY 2017, and 6 process measures, beginning with CY 2018, due to CMS determining these measures have been “topped-out” Source: https://s3.amazonaws.com/public-inspection.federalregister.gov/2016-26290.pdf

39 Home Health Pre-Claim Review Demonstration State Start Date EncompassAgencies Illinois August 3, 2016 — Florida* April 1, 2017 17 Texas To be determined 52 Michigan To be determined — Massachusetts To be determined 2 Encompass is well-prepared. * Encompass estimates the incremental cost of implementation will be $1.0 million to $1.5 million in 2017. Source: CMS Pre-Claim Review Demonstration Overview - July 2016 • Clinical team reviewed all documentation requirements and workflow • Added features in HCHB to minimize the administrative burden and make electronic submission of data easier • Worked with physicians to ensure consistency between their supporting documentation and Encompass supporting documentation Q. What is a pre-claim review? A. Pre-claim review is a process through which a home health agency must submit documentation to support medical necessity for each episode to the Medicare Administrative Contractor prior to billing the final claim. Q. What is the goal of the demonstration? A. CMS is testing methods for identifying, investigating, and prosecuting Medicare fraud occurring in the home health industry by trying to ensure applicable coverage and coding rules are met before the final claim is submitted. Q. How long is the demonstration? A. Three years Q. Who is involved? A. All home health agencies who are located in and render services to Medicare fee-for-service beneficiaries in Illinois, Florida, Texas, Michigan and Massachusetts.

40 IMPACT Act of 2014 - Enacted October 6, 2014 Company observations and considerations with respect to the IMPACT Act: ▪ It was developed on a bi-partisan basis by the House Ways and Means and Senate Finance Committees and incorporated feedback from healthcare providers and provider organizations that responded to the Committees’ solicitation of post-acute payment reform ideas and proposals. ▪ It directs the United States Department of Health and Human Services (“HHS”), in consultation with healthcare stakeholders, to implement standardized data collection processes for post-acute quality and resource use measures. ▪ Although the IMPACT Act does not specifically call for the implementation of a new post-acute payment system, the Company believes this act will lay the foundation for possible future post-acute payment policies that would be based on patients’ medical conditions and other clinical factors rather than the setting where the care is provided. ▪ It will create additional data reporting requirements for the Company’s hospitals(19) and home health agencies. The precise details of these new reporting requirements, including timing and content, will be developed and implemented by the Centers for Medicare and Medicaid Services through the regulatory process that the Company expects will take place over the next several years. ▪ While the Company cannot quantify the potential financial effect of the IMPACT Act on HealthSouth, the Company believes any post-acute payment system that is data driven and focuses on the needs and underlying medical conditions of post-acute patients will be positive for providers who offer high-quality, cost- effective care. HealthSouth believes it is doing just that and expects this act will be positive for the Company. ▪ However, it will likely take years for the quality data to be gathered, standardized patient assessment data to be assembled and disseminated, and potential payment policies to be developed, tested and promulgated. As the nation’s largest owner and operator of inpatient rehabilitation hospitals, HealthSouth looks forward to working with HHS, the Medicare Payment Advisory Commission and other healthcare stakeholders on these initiatives. Source: https://www.govtrack.us/congress/bills/113/hr4994/text Refer to pages 113-116 for end notes.

41 Growth

42 1,600 1,400 1,200 1,000 800 600 400 200 0 130 125 120 115 110 105 100 95 90 85 80 75 70 2012 2013 2014 2015 2016 Projected 2017 % Increase in licensed beds 3% 4% 18% 1% 4% Total number of licensed beds 6,656 6,825 7,095 8,404 8,504* 8,853 Total number of IRFs 100 103 107 121 123* 127 Multi-faceted IRF Growth Strategy De Novos Acquisitions Bed Expansions Total IRFsNew Beds 2016 bed count increase Ÿ Modesto, CA (50 beds) Ÿ Hot Springs, AR (40 beds) Ÿ Bryan, TX (49 beds) Ÿ Broken Arrow, OK (22 beds)** Ÿ Bed expansions (83 beds) ** Broken Arrow, OK was a 22-bed acquisition completed in Q3 2016 and began operations at its existing location. A new 40-bed hospital is being constructed (+18 beds) and operations will move to the new location once the hospital is completed (expected Q3 2017). 2017 projected bed count increase Ÿ Broken Arrow, OK (18 beds)** Ÿ Pearland, TX (40 beds) Ÿ Westerville, OH (60 beds) Ÿ Jackson, TN (48 beds) Ÿ Gulfport, MS (33 beds) Ÿ Bed expansions (~150 beds)* 2016 total number of licensed beds and total number of IRFs includes the disposal of 61 beds at Beaumont, TX (sold June 2016) and 83 beds at Austin, TX (closed August 2016 ). Wholly Owned and Joint Venture s

43 Disciplined Approach to New Store Growth – $7.4 Billion Medicare IRF Market – Considerations: – Demographics – Forecasted growth in the number of patients requiring rehab- level of care – Presence of other IRFs; SNFs – Bed need – Geographic proximity to other HLS IRFs and Encompass agencies – Ability of Encompass to enter the market – Willingness of seller(s) – Potential joint venture partners – HLS confidence in ability to close Source: MedPAC December 2016 Public Meeting presentation CA = confidentiality agreement IRF Growth Pipeline Typical Development Pipeline Factors: • CON process/timeline • Fair market valuation of contributed assets (joint ventures only) • Partnership complexities HLS Value Proposition CAPEX to build free-standing IRF, freeing up space for medical/surgical beds in an acute care facility for a JV partner Enhance the position of the acute care hospital to meet quality requirements and effectively participate in alternative payment models Increased acute care hospital flow-through by taking appropriate higher acuity patients faster than other post- acute settings Proprietary rehabilitation-specific clinical information system ("ACE-IT") integrated with acute care hospitals' clinical information systems to facilitate patient transfers, reduce readmissions, and enhance outcomes Proprietary real-time performance management systems (care management, labor productivity, quality reporting, therapy analysis and expense management) to ensure appropriate clinical oversight and improve profitability Proven track record of efficient management of regulatory process (CON, licensure, occupancy, etc.) Experienced transaction/integration team National leader in post-acute policy activities Partnership with Encompass facilitates clinical collaboration No. of Projects Exploratory / CA Executed 30 - 40 Actively Working 10 - 12 Near-term Actionable 4 - 6

44 • • HealthSouth's IRF joint ventures began in 1991 with Vanderbilt University Medical Center. • HealthSouth's joint venture hospital partners own equity that ranges from 2.5% to 50%. • 36 of 37 hospitals are consolidated joint ventures, with one accounted for under the equity method. IRF Acute Care Joint Venture Partnerships 37* joint venture hospitals in place with major healthcare systems such as: Joint ventures with acute care hospitals establish a solid foundation for clinical collaboration and alternative payment models. • Barnes-Jewish • Monmouth Medical Center (Barnabas Health) • University of Virginia Medical Center • Yuma Regional Medical Center • Vanderbilt University Medical Center • Mercy Health System • Geisinger Health System • Maine Medical Center • Martin Health System • Methodist Healthcare-Memphis Hospitals, a subsidiary of Methodist Le Bonheur Healthcare * Excludes joint venture hospitals that have been announced but were not operational as of December 31, 2016: Jackson, TN; Westerville, OH; Winston-Salem, NC; Murrells Inlet, SC; Little River, SC; and Gulfport, MS.

45 New IRFs: Illustrative De Novo Timeline Day 1 With CON Permitting & Design Planning & Zoning Groundbreaking Permitting & Design Planning & Zoning Groundbreaking Day 1 Without CON 6 months to 3 years 20 months CON Process Construction Construction Opening Month 20 Opening In California, the design and permitting process can take more than 12 months.

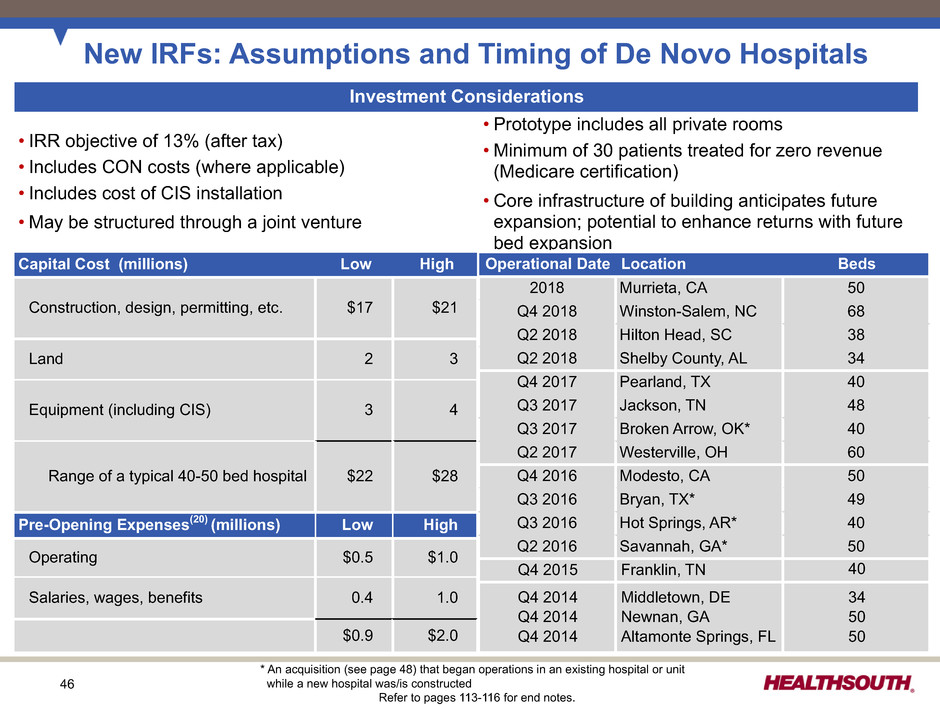

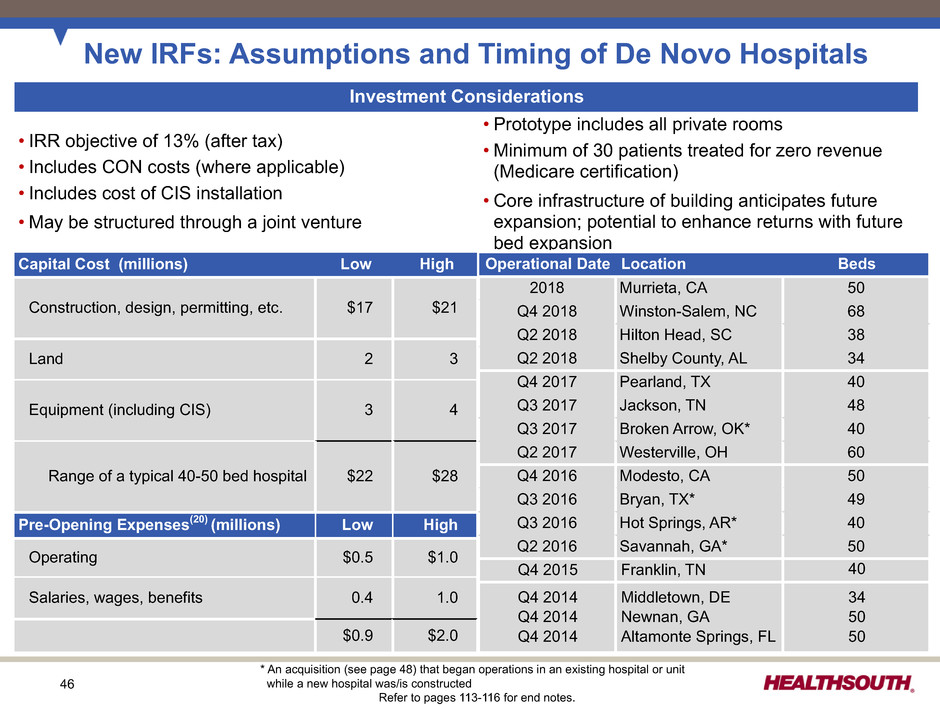

46 Investment Considerations • IRR objective of 13% (after tax) • Includes CON costs (where applicable) • Includes cost of CIS installation • May be structured through a joint venture • Prototype includes all private rooms • Minimum of 30 patients treated for zero revenue (Medicare certification) • Core infrastructure of building anticipates future expansion; potential to enhance returns with future bed expansion Capital Cost (millions) Low High Operational Date Location Beds Construction, design, permitting, etc. $17 $21 2018 Murrieta, CA 50 2017 Bryan, TX 30 2017 Jackson, TN(34) 48 Land 2 3 Q1 2017 Westerville, OH 60Q4 2016 Broken Arrow, OK(34) 40 Equipment (including CIS) 3 4 Q2 2016 Hot Springs, AR(34) 40 Q2 2016 Savannah, GA(34) 50 Q2 2016 Modesto, CA 50 Range of a typical 40-50 bed hospital $22 $28 Q4 2015 Franklin, TN 40 Q4 2014 Q4 2014 Q4 2014 Middletown, DE Newnan, GA Altamonte Springs, FL 34 50 50 Pre-Opening Expenses(20) (millions) Low High Q2 2013 Q2 2013 Littleton, CO Stuart, FL 40 34 Operating $0.5 $1.0 Q4 2012 Ocala, FL 40 Salaries, wages, benefits 0.4 1.0 Q4 2011 Cypress, TX 40 $0.9 $2.0 New IRFs: Assumptions and Timing of De Novo Hospitals Operational Date Location Beds 2018 Murrieta, CA 50 Q4 2018 Winston-Salem, NC 68 Q2 2018 Hilton Head, SC 38 Q2 2018 Shelby County, AL 34 Q4 2017 Pearland, TX 40 Q3 2017 Jackson, TN 48 Q3 2017 Broken Arrow, OK* 40 Q2 2017 Westerville, OH 60 Q4 2016 Modesto, CA 50 Q3 2016 Bryan, TX* 49 Q3 2016 Hot Springs, AR* 40 Q2 2016 Savannah, GA* 50 Q4 2015 Franklin, TN 40 Q4 2014 Q4 2014 Q4 2014 Middletown, DE Newnan, GA Altamonte Springs, FL 34 50 50 * An acquisition (see page 48) that began operations in an existing hospital or unit while a new hospital was/is constructed Refer to pages 113-116 for end notes.

47 Ocala (12/2012) Littleton (05/2013) Stuart (06/2013) Altamonte Springs (10/2014) Newnan (12/2014) Middletown (12/2014) Franklin (12/2015) Modesto (10/2016) HLS average 2016 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1 2 3 4 5 6 7 8 9 10 11 12 Months IRF De Novo Occupancy and EBITDA* Trends Occupancy Sustained Positive EBITDA * Hospital EBITDA = earnings before interest, taxes, depreciation, and amortization directly attributable to the related hospital. occupancy

48 New IRFs: Assumptions for Individual Hospital Acquisitions Unit/Equity Acquisitions Location Beds DateAcquired Worcester, MA(15) 110 Q2 2014 San Antonio, TX 34 Q3 2012 Ft. Smith, AR 30 Q3 2010 Little Rock, AR 23 Q1 2010 Altoona, PA 18 Q4 2009 Arlington, TX 30 Q3 2008 IRF Acquisitions Location Date Acquired Beds AcquiredCensus One Year Later Census Broken Arrow, OK* Q3 2016 22 15 TBD Bryan, TX* Q3 2016 19 18 TBD Hot Springs, AR* Q1 2016 20 5 TBD Lexington, KY Q2 2015 232 140 125 Savannah, GA* Q2 2015 50 31 33 Johnson City, TN Q4 2014 26 6 21 Augusta, GA Q2 2013 58 31 39 Investment Considerations Value Added • IRR objective of 13% (after tax) • May be structured through a joint venture • Includes cost of CIS installation • TeamWorks approach to sales/marketing • Labor management tools and best practices • Clinical expertise and protocols • Clinical technology and programming (CIS installation) • Supply chain efficiencies • Medical leadership and clinical advisory boards • Partnership with Encompass (where applicable) * An acquisition that began operations in an existing hospital or unit while a new hospital was/is constructed (see page 46) Refer to pages 113-116 for end notes.

49 • Complementary business to core home health services • Prioritization of Encompass home health markets * No Encompass hospice offering in the majority of Encompass' current home health locations • Ability to leverage existing Encompass infrastructure • Strong demand due to cost effectiveness of home-based care and implementation of bundled payments • Strong organic growth from existing agencies • Located in markets with attractive demographics * Encompass currently located in states that represent approx. 57% of total Medicare home health and hospice spend Organic Growth • Attractive partner due to quality of outcomes, data management, scale and market density, and willingness/ability to treat high acuity and/or chronic patients • Plan of care coordination with HealthSouth IRFs • Care Transition Coordinators (CTCs) serve as representatives in transitional care activities and strategic relationships with other healthcare providers • Highly fragmented market • Prioritization of HealthSouth IRF markets • Proven ability to consummate and integrate acquisitions • Sustainable and replicable culture • Implementation of Encompass' best practices and technology Home Health Acquisitions Hospice Acquisitions Clinical Collaboration Multi-faceted Home Health & Hospice Growth Strategy

50 13,000 12,000 11,000 10,000 9,000 8,000 7,000 6,000 5,000 4,000 # of Ag en ci es 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Home Health Growth Pipeline Ÿ $18.1 billion Medicare home health market is highly fragmented with over 12,300 home health agencies. Ÿ Approx. 93% of these have annual revenue of less than $5 million. Ÿ Top 5 public companies represent approx. 19% of the Medicare market. Ÿ Encompass represents 2.6% of the Medicare home health market. Prioritize acquisitions in HLS IRF markets to enhance clinical collaboration Number of Home Health Agencies Over Time Cost- Based Interim Payment Systems (IPS) Prospective Payment System (PPS) The number of home health agencies is near an all-time high and presents significant consolidation opportunities. Source: MedPAC December 2016 Public Meeting presentation; MedPAC - Report to Congress: Medicare Payment Policy - March 2016, page 214, March 2015, page 218, March 2014, page 221, March 2013, page 194, and March 2003, page 112; MedPAC - Healthcare spending and the Medicare program, June 2006, page 131; Health Market Science

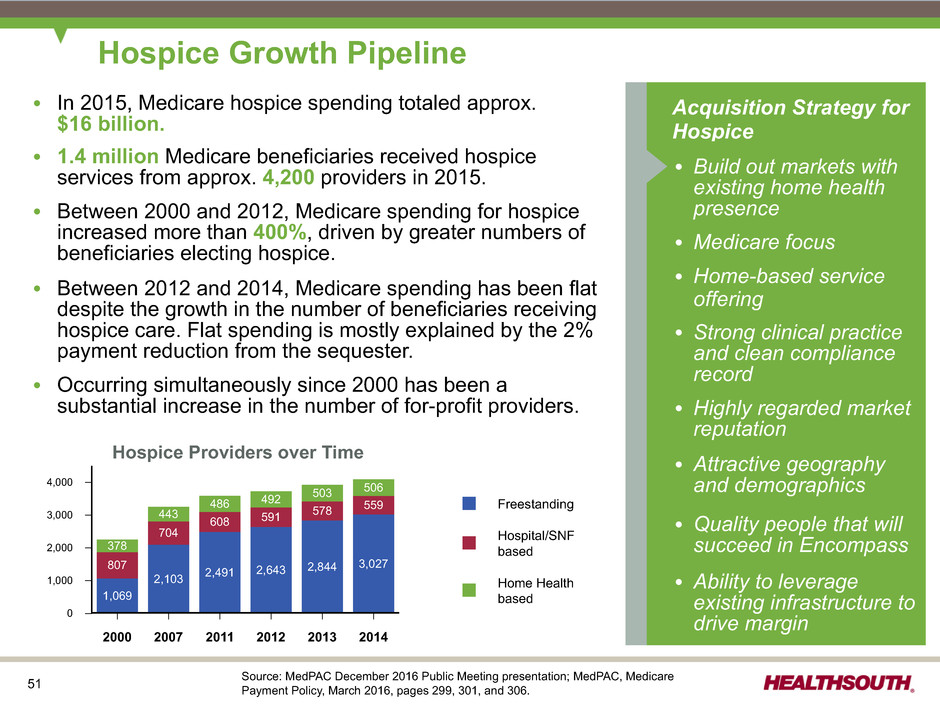

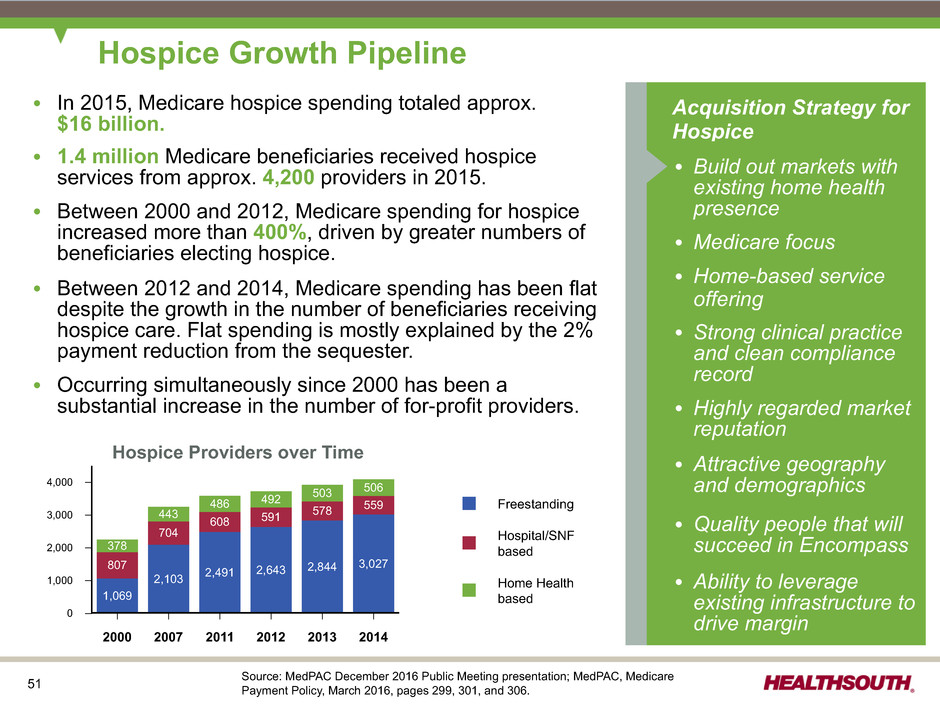

51 Freestanding Hospital/SNF based Home Health based 4,000 3,000 2,000 1,000 0 2000 2007 2011 2012 2013 2014 1,069 2,103 2,491 2,643 2,844 3,027807 704 608 591 578 559 378 443 486 492 503 506 Hospice Growth Pipeline Ÿ In 2015, Medicare hospice spending totaled approx. $16 billion. Ÿ 1.4 million Medicare beneficiaries received hospice services from approx. 4,200 providers in 2015. Ÿ Between 2000 and 2012, Medicare spending for hospice increased more than 400%, driven by greater numbers of beneficiaries electing hospice. Ÿ Between 2012 and 2014, Medicare spending has been flat despite the growth in the number of beneficiaries receiving hospice care. Flat spending is mostly explained by the 2% payment reduction from the sequester. Ÿ Occurring simultaneously since 2000 has been a substantial increase in the number of for-profit providers. Acquisition Strategy for Hospice Ÿ Build out markets with existing home health presence Ÿ Medicare focus Ÿ Home-based service offering Ÿ Strong clinical practice and clean compliance record Ÿ Highly regarded market reputation Ÿ Attractive geography and demographics Ÿ Quality people that will succeed in Encompass Ÿ Ability to leverage existing infrastructure to drive margin Hospice Providers over Time Source: MedPAC December 2016 Public Meeting presentation; MedPAC, Medicare Payment Policy, March 2016, pages 299, 301, and 306.

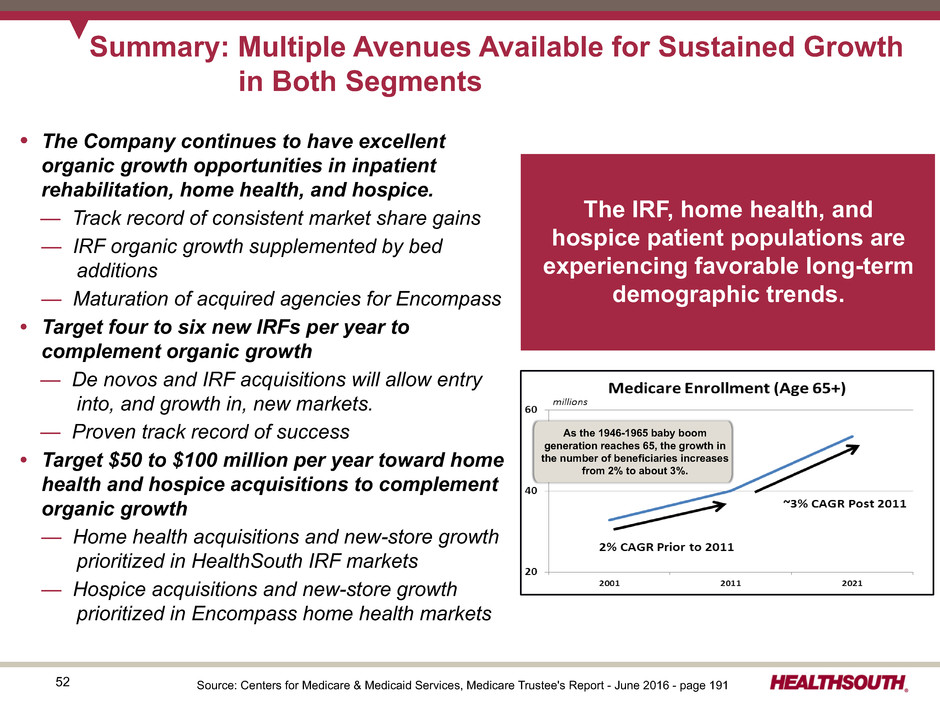

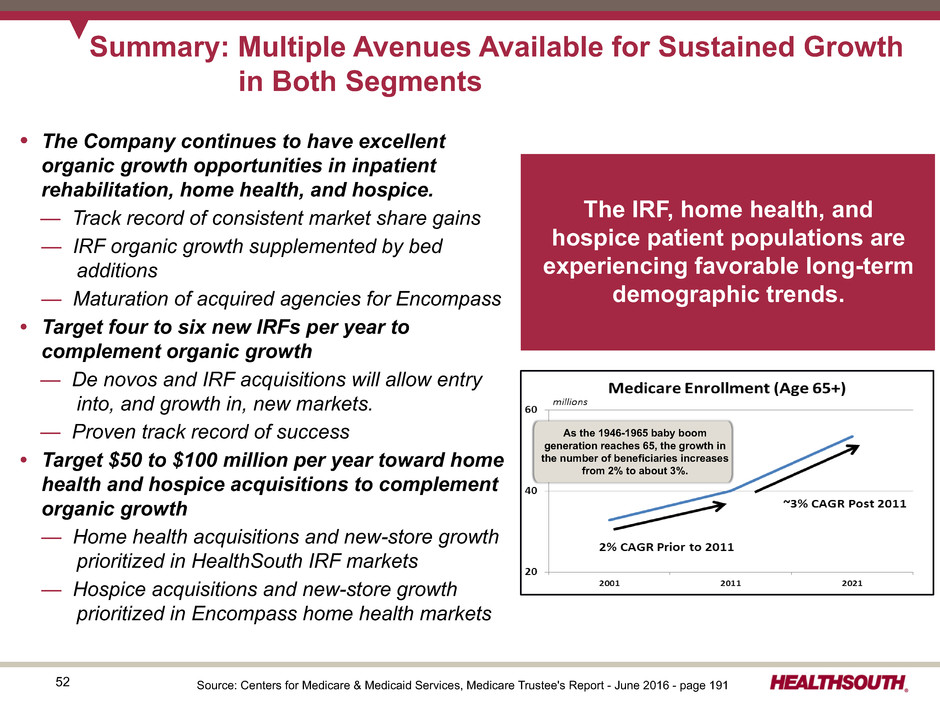

52 Summary: Multiple Avenues Available for Sustained Growth in Both Segments • The Company continues to have excellent organic growth opportunities in inpatient rehabilitation, home health, and hospice. — Track record of consistent market share gains — IRF organic growth supplemented by bed additions — Maturation of acquired agencies for Encompass • Target four to six new IRFs per year to complement organic growth — De novos and IRF acquisitions will allow entry into, and growth in, new markets. — Proven track record of success • Target $50 to $100 million per year toward home health and hospice acquisitions to complement organic growth — Home health acquisitions and new-store growth prioritized in HealthSouth IRF markets — Hospice acquisitions and new-store growth prioritized in Encompass home health markets As the 1946-1965 baby boom generation reaches 65, the growth in the number of beneficiaries increases from 2% to about 3%. Source: Centers for Medicare & Medicaid Services, Medicare Trustee's Report - June 2016 - page 191 The IRF, home health, and hospice patient populations are experiencing favorable long-term demographic trends.

53 Alternative Payment Models

54 Accountable Care Organizations (ACOs) Pioneer ACOs (2016 – 9 ACOs / ~275,000 Medicare beneficiaries) • 32 Pioneer ACOs launched since program’s inception; 9 remained in the program prior to the model concluding on December 31, 2016 (some had voluntarily transferred to the Next Generation ACO program - see below). • Only half of the participants or less earned shared savings in 2012, 2013, 2014, and 2015. • Shared savings CMS paid to Pioneer ACOs totaled $77 million in 2012, $68 million in 2013, $82 million in 2014, and $34 million in 2015 (an average of $5.7 million per ACO). • Estimates suggest ACO start-up and annual administrative costs significantly reduce or exceed the shared savings generated from ACOs. Medicare Shared Savings Program (MSSP) (480 ACOs / 9.0 million Medicare beneficiaries) • Year 3 performance for 392 MSSP ACOs: ◦ 119 ACOs (30%) held spending below their benchmark. ◦ 83 ACOs (21%) reduced health costs compared to their benchmark, but did not meet the minimum savings threshold for shared savings. ◦ 190 ACOs (49%) did not reduce costs compared to their benchmark. ◦ Shared Savings Program ACOs generated total program savings of $429 million. Source: CMS/HHS press releases; Government Accountability Office (GAO) Report to the House Ways and Means – April 2015; AHA/McManis report - April 2011 Encompass serves as Premier ACO's (~22,000 covered lives in north Texas and southern Oklahoma) exclusive preferred home health provider. Ÿ Receives increased referrals for Medicare home health patients from the ACO Ÿ Eligible to receive a portion of the ACO's shared savings Ÿ Total shared savings achieved by ACO in 2015 was $5.8 million. - Ranked 8th out of all MSSP ACOs that started on or after January 1, 2014. - Did not meet minimum savings rate for Encompass to qualify for shared savings As of January 2017, there were 562 Medicare ACOs serving 12.3 million Medicare and/or Medicaid beneficiaries. Performance results so far have been mixed. Medicare ACO Track 1+ Model – will start in 2018 • Will test a payment design that incorporates more limited downside risk than Tracks 2 or 3 of the Shared Savings Program Next Generation ACOs • Initiative for ACOs that are experienced in coordinating care for populations of patients; 45 ACO participants • Allows providers to assume higher levels of financial risk and reward than are available under Pioneer ACOs and MSSP

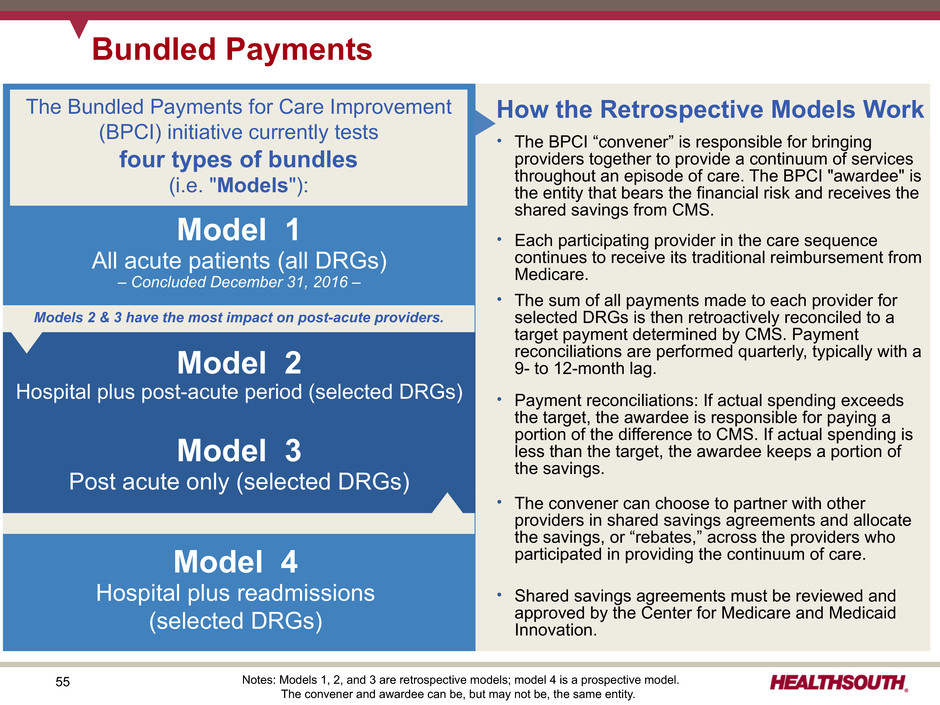

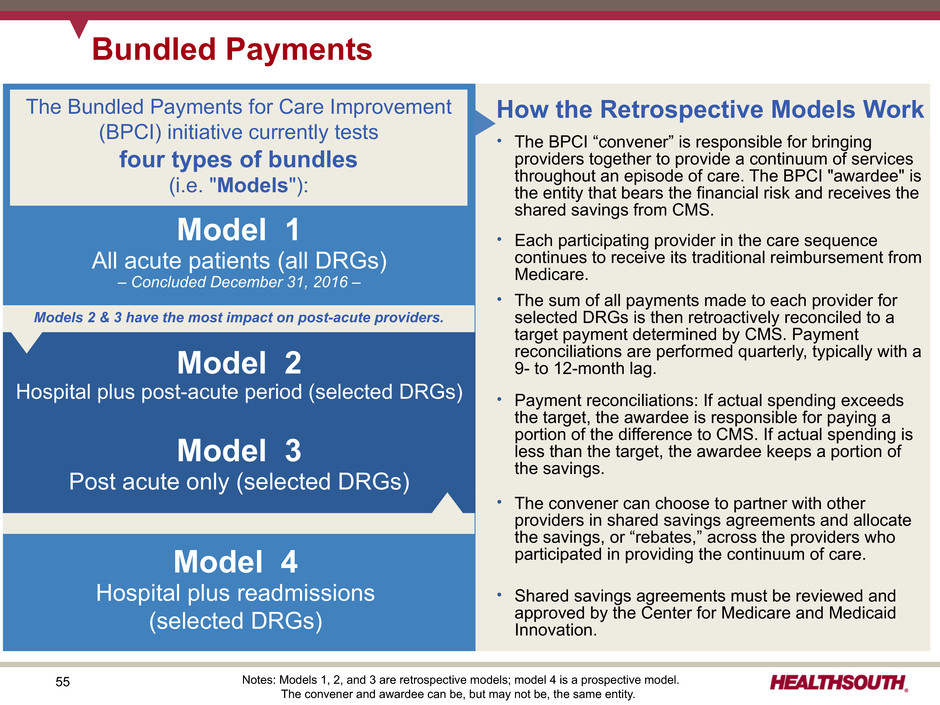

55 Bundled Payments How the Retrospective Models Work Ÿ The BPCI “convener” is responsible for bringing providers together to provide a continuum of services throughout an episode of care. The BPCI "awardee" is the entity that bears the financial risk and receives the shared savings from CMS. Ÿ Each participating provider in the care sequence continues to receive its traditional reimbursement from Medicare. Ÿ The sum of all payments made to each provider for selected DRGs is then retroactively reconciled to a target payment determined by CMS. Payment reconciliations are performed quarterly, typically with a 9- to 12-month lag. Ÿ Payment reconciliations: If actual spending exceeds the target, the awardee is responsible for paying a portion of the difference to CMS. If actual spending is less than the target, the awardee keeps a portion of the savings. Ÿ The convener can choose to partner with other providers in shared savings agreements and allocate the savings, or “rebates,” across the providers who participated in providing the continuum of care. Ÿ Shared savings agreements must be reviewed and approved by the Center for Medicare and Medicaid Innovation. Model 1 All acute patients (all DRGs) – Concluded December 31, 2016 – The Bundled Payments for Care Improvement (BPCI) initiative currently tests four types of bundles (i.e. "Models"): Models 2 & 3 have the most impact on post-acute providers. Model 2 Hospital plus post-acute period (selected DRGs) Model 3 Post acute only (selected DRGs) Model 4 Hospital plus readmissions (selected DRGs) Notes: Models 1, 2, and 3 are retrospective models; model 4 is a prospective model. The convener and awardee can be, but may not be, the same entity.

56 BPCI Model 2, CJR, and EPM Opportunities HLS Referral Source Bundle Type % of HLS MedicareDischarges % of Total HLS Discharges 115 acute care hospitals participating in Model 2 / Phase 2 in 80 HLS IRF markets(21) Bundles selected for Model 2 participation are chosen from a list of 48 BPCI-eligible bundles. 2.8% 2.0% Approx. 850 acute care hospitals in 67 geographic areas included in the Comprehensive Care for Joint Replacement Model ("CJR") and Episode Payment Model ("EPM") Lower extremity joint replacement ("LEJR") and surgical hip and femur fracture treatment ("SHFFT") 3.3% 2.3% Approx. 1,100 acute care hospitals in 98 geographic areas included in Cardiac EPM Acute myocardial infarction ("AMI") and coronary artery bypass graft ("CABG") model 0.7% 0.5% Bundling Participation and Opportunities - Inpatient Rehabilitation HealthSouth IRF Participation in BPCI Model 3 BPCI Bundle / Number of IRFs Bundle Length % of HLS Medicare Discharges % of Total HLS Discharges Stroke (3 IRFs) 60 days 0.22% 0.16% Simple Pneumonia (1 IRF) 60 days 0.01% 0.01% Sepsis (1 IRF) 60 days 0.03% 0.02% Double-lower extremity joint replacement (2 IRFs) 60 days 0.03% 0.02% Upper extremity joint replacement (1 IRF) 60 days 0.0% 0.0% Data on this page is based on 2015 discharges. Refer to pages 113-116 for end notes. 30 to 40% of these patients have complicating comorbidities ~35% of these discharges are LEJR episodes and ~40% of these LEJR patients have complicating comorbidities HealthSouth has 36 IRFs located in CJR markets; 20 overlap with Encompass 40 to 50% of these patients have complicating comorbidities HealthSouth has 40 IRFs located in cardiac markets; 26 overlap with Encompass

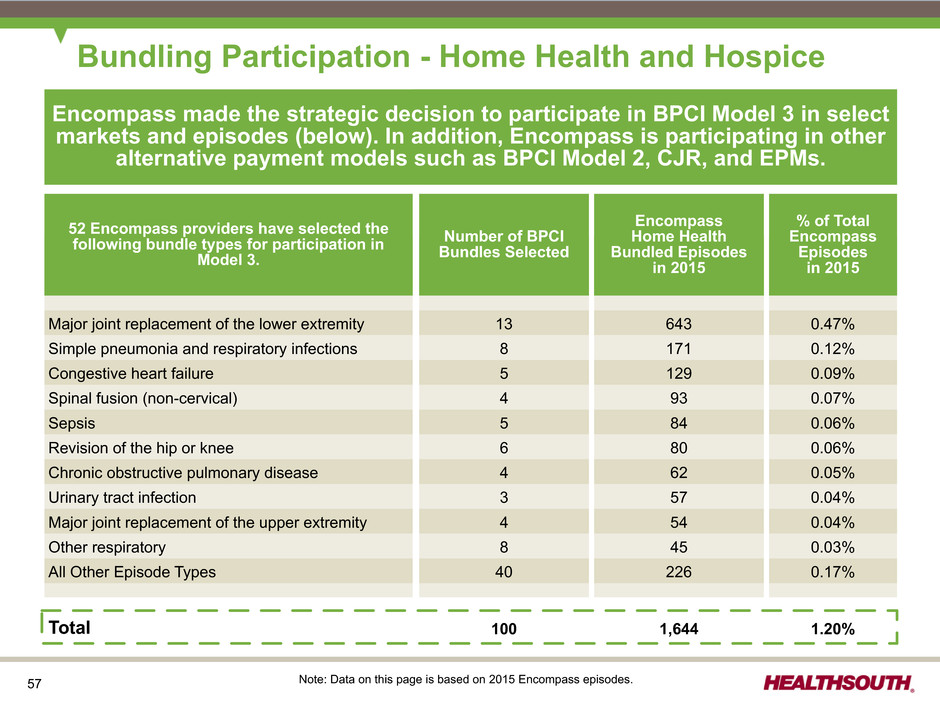

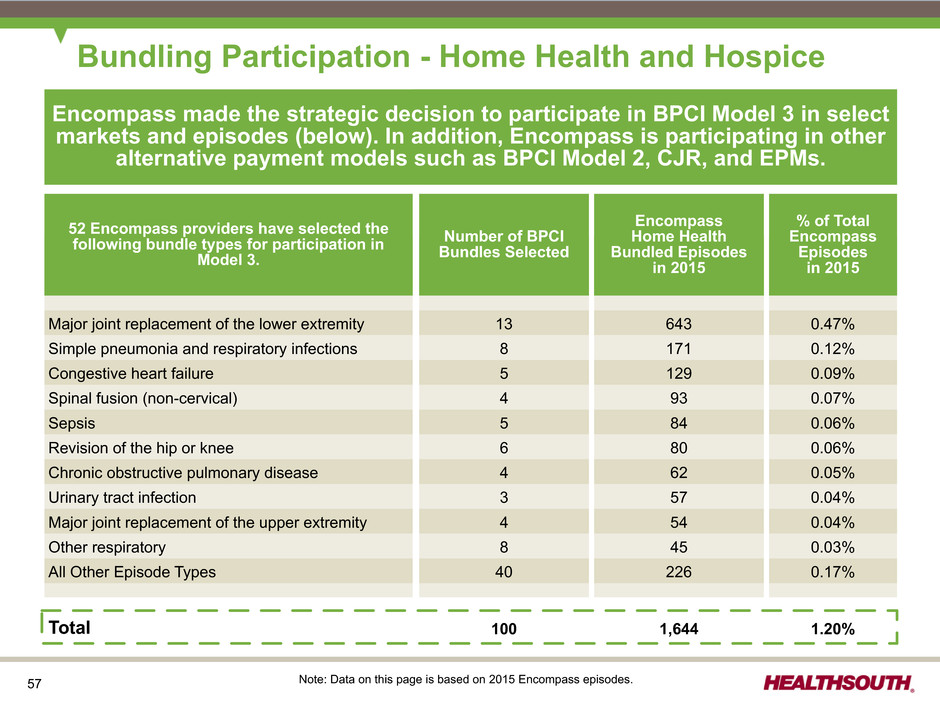

57 Bundling Participation - Home Health and Hospice Encompass made the strategic decision to participate in BPCI Model 3 in select markets and episodes (below). In addition, Encompass is participating in other alternative payment models such as BPCI Model 2, CJR, and EPMs. 52 Encompass providers have selected the following bundle types for participation in Model 3. Number of BPCI Bundles Selected Encompass Home Health Bundled Episodes in 2015 % of Total Encompass Episodes in 2015 Major joint replacement of the lower extremity 13 643 0.47% Simple pneumonia and respiratory infections 8 171 0.12% Congestive heart failure 5 129 0.09% Spinal fusion (non-cervical) 4 93 0.07% Sepsis 5 84 0.06% Revision of the hip or knee 6 80 0.06% Chronic obstructive pulmonary disease 4 62 0.05% Urinary tract infection 3 57 0.04% Major joint replacement of the upper extremity 4 54 0.04% Other respiratory 8 45 0.03% All Other Episode Types 40 226 0.17% Total 100 1,644 1.20% Note: Data on this page is based on 2015 Encompass episodes.

58 Alternative Payment Models: Comprehensive Care for Joint Replacement Model and Episode Payment Model – Surgical Hip/Femur Fracture Treatment * These comorbidities are specific to acute care hospitals and are defined differently than IRFs' comorbidities. Source: https://innovation.cms.gov/initiatives/cjr The Comprehensive Care for Joint Replacement Model (“CJR”) and Episode Payment Model - Surgical Hip/Femur Fracture Treatment (“SHFFT”) are payment models for episodes of care related to knee and hip replacements and fractures under Medicare. The CJR model is a five-year model that began April 1, 2016 in 67 geographic areas. The SHFFT model is a five year model that will begin July 1, 2017 in the same geographic areas. Acute care hospital patients are categorized by Medicare Severity Diagnosis Related Groups (“MS-DRGs”); the CJR model covers two MS-DRGs (469, 470) and the SHFFT model covers three MS-DRGs (480, 481, 482): MS-DRG 469 Major joint replacement or reattachment of lower extremity with major complications or comorbidities* MS-DRG 470 Major joint replacement or reattachment of lower extremity without major complications or comorbidities* MS-DRG 480 Hip and femur procedures except major joint with major complications or comorbidities* MS-DRG 481 Hip and femur procedures except major joint with complications or comorbidities* MS-DRG 482 Hip and femur procedures except major joint without complications or comorbidities* IRF patients are categorized by Rehabilitation Impairment Categories (“RICs”); CJR model patients are a subset of two RICs: RIC 07 Lower extremity fractures (~77% are MS-DRGs 469, 470, 480, 481 and 482) RIC 08 Lower extremity joint replacements (~76% are MS-DRGs 469, 470, 480, 481 and 482) Since the implementation of the 60% Rule in 2007, the relative number of RIC 07 and RIC 08 patients treated in HealthSouth IRFs has declined significantly. RIC % of HealthSouth Medicare Discharges 2005 2007 2009 2011 2013 2015 2016 Total RIC 07 (Fractures) 13.1% 14.8% 13.6% 11.6% 10.2% 9.8% 6.5% Total RIC 08 (Replacements) 17.9% 11.8% 9.0% 7.6% 6.7% 5.5% 3.2%

59 If episode spending < target price, acute care hospital receives additional payment from Medicare. If episode spending > target price, acute care hospital returns a portion of the Medicare episode payment. CJR and SHFFT Models - How Do They Work? POST-ACUTE CARE PROVIDERS Acute care hospitals are accountable for expenditures and quality of care for entire "episode." Episode = hospitalization + 90 days post discharge Begins with an admission to an acute care hospital for a patient who is ultimately discharged under MS-DRG 469, 470, 480, 481, and 482. Acute care hospitals receive separate episode target prices each year reflecting the differences in spending for each MS-DRG. Target prices: ü are based on three years of historical data; ü include mandatory percentage discounts of up to 3% vs. benchmark episode spending; and ü incorporate a blend of historical, hospital-specific spending and regional spending for episodes, with the regional component of the blend increasing over time. Years 1 and 2 = 2/3 hospital-specific; 1/3 regional Year 3 = 1/3 hospital-specific; 2/3 regional Years 4 and 5 = 100% regional RETROSPECTIVE RECONCILIATION PERFORMED BY CMS At the end of each performance year, actual spending for each episode is compared to each acute care hospital's target price. There is no downside risk in year one. Repayment responsibility will be phased in during year two. All providers are paid under the usual Medicare payment system rules and procedures. Patients are discharged to a post-acute care provider or to home self-care. Source: CMS

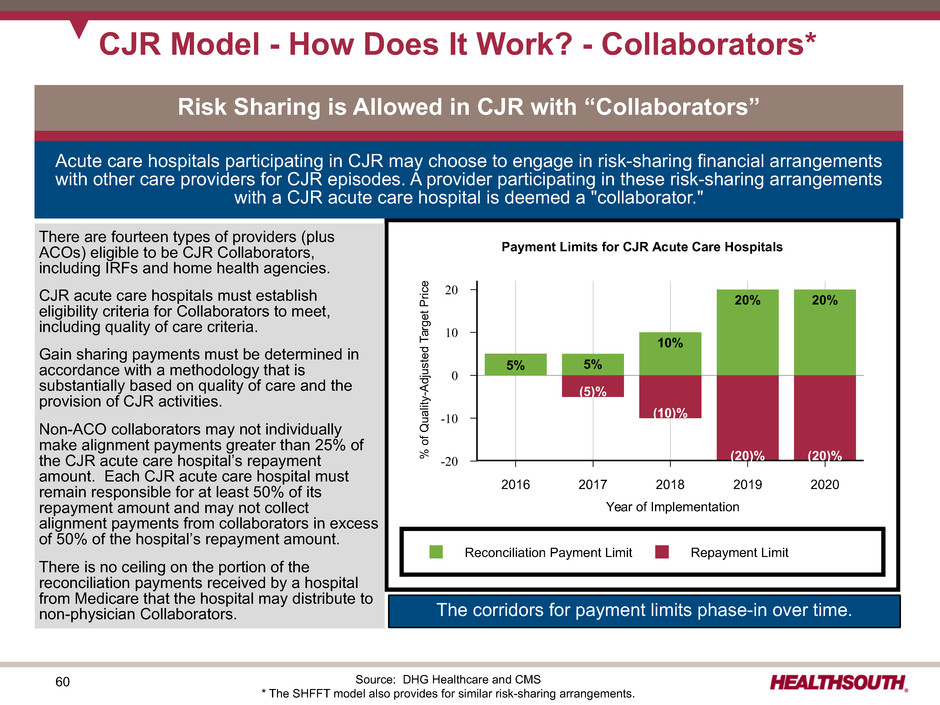

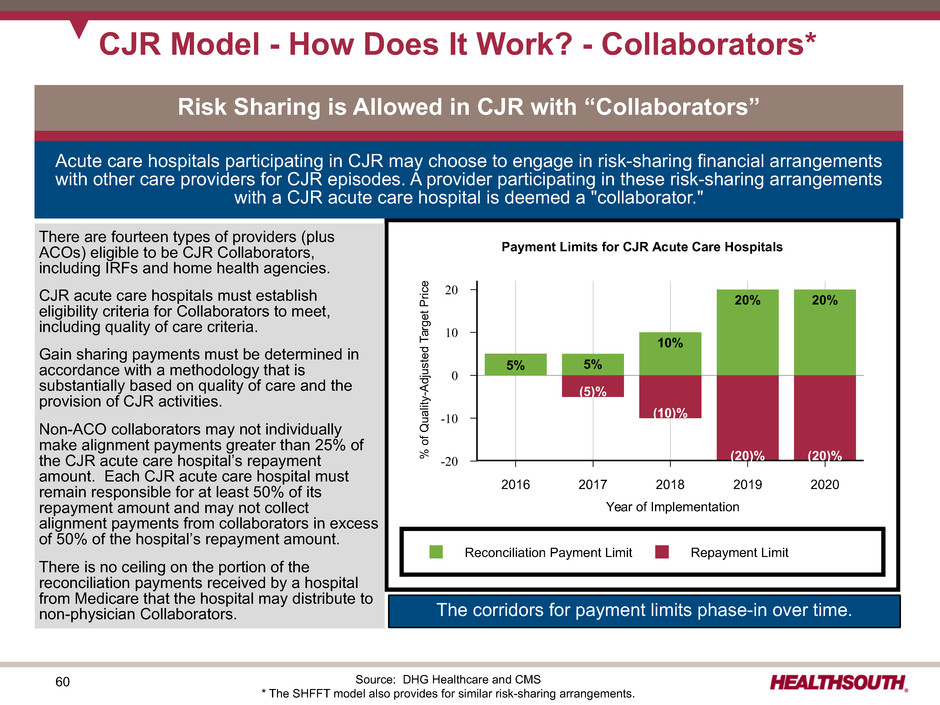

60 CJR Model - How Does It Work? - Collaborators* Reconciliation Payment Limit Repayment Limit Payment Limits for CJR Acute Care Hospitals 20 10 0 -10 -20% of Q ua lit y- Ad ju st ed Ta rg et Pr ic e 2016 2017 2018 2019 2020 Year of Implementation 5% 5% 10% 20% 20% (5)% (10)% (20)% (20)% Risk Sharing is Allowed in CJR with “Collaborators” Acute care hospitals participating in CJR may choose to engage in risk-sharing financial arrangements with other care providers for CJR episodes. A provider participating in these risk-sharing arrangements with a CJR acute care hospital is deemed a "collaborator." There are fourteen types of providers (plus ACOs) eligible to be CJR Collaborators, including IRFs and home health agencies. CJR acute care hospitals must establish eligibility criteria for Collaborators to meet, including quality of care criteria. Gain sharing payments must be determined in accordance with a methodology that is substantially based on quality of care and the provision of CJR activities. Non-ACO collaborators may not individually make alignment payments greater than 25% of the CJR acute care hospital’s repayment amount. Each CJR acute care hospital must remain responsible for at least 50% of its repayment amount and may not collect alignment payments from collaborators in excess of 50% of the hospital’s repayment amount. There is no ceiling on the portion of the reconciliation payments received by a hospital from Medicare that the hospital may distribute to non-physician Collaborators. Source: DHG Healthcare and CMS * The SHFFT model also provides for similar risk-sharing arrangements. The corridors for payment limits phase-in over time.

61 CJR and SHFFT Models - What's the Potential Impact to HealthSouth? Participation by acute care hospitals subject to limitation, notably if the hospital is participating in certain other alternative payment programs, such certain models of the Bundled Payment for Care Improvement (BPCI) initiative * Complicating comorbidities include conditions such as diabetes, morbid obesity, and congestive heart failure. ~30% of HealthSouth's fractures and ~40% of HealthSouth's replacements have complicating comorbidities* that require the intensity of care delivered in an IRF. HealthSouth CJR and SHFFT MS-DRG Discharges in Applicable Markets Fractures ~1,980 discharges Replacements ~1,080 discharges Σ = ~3,060 Discharges, or ~3.3% of Total HLS Medicare Discharges (~2.3% of Total HLS Discharges) 90-Day Episode Spend Fractures HLS cost ≤ SNF cost HLS cost > SNF cost ~1,370 discharges ~610 discharges Replacements HLS cost ≤ SNF cost HLS cost > SNF cost ~130 discharges ~950 discharges Fractures (average revenue per discharge of ~$19,300) Replacements (average revenue per discharge of ~$14,400) Total CJR and SHFFT MS-DRG discharges in applicable markets ~1,980 ~1,080 CJR and SHFFT MS- DRG discharges with HLS cost ≤ SNF cost (~1,370) (~130) Discharges with complicating comorbidities (~180) (~380) Residual CJR and SHFFT MS-DRG discharges ~430 ~570 Source: 2015 Medicare claims data

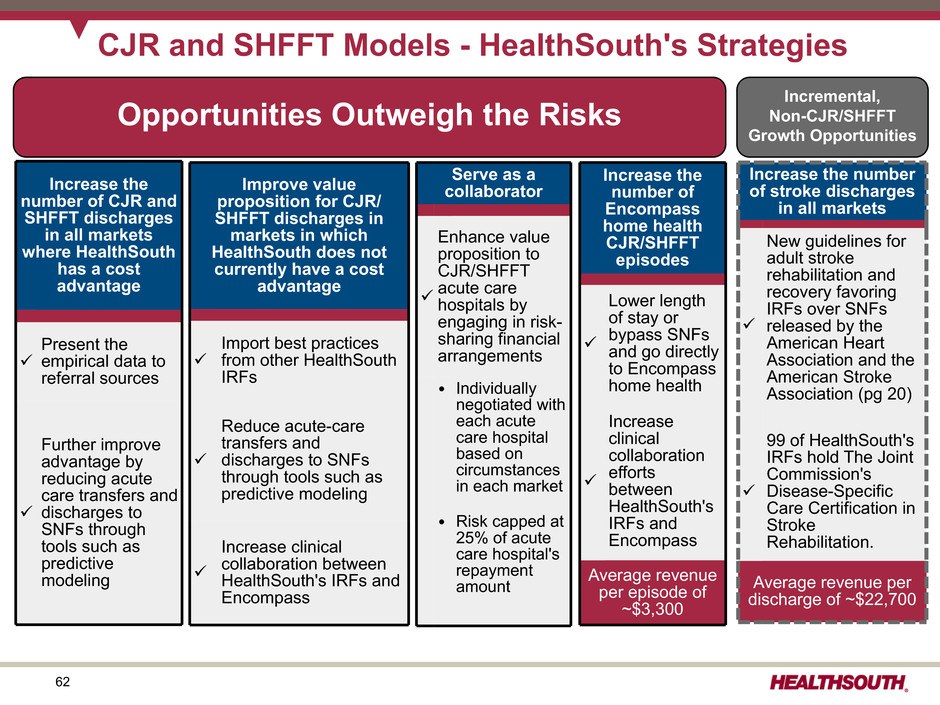

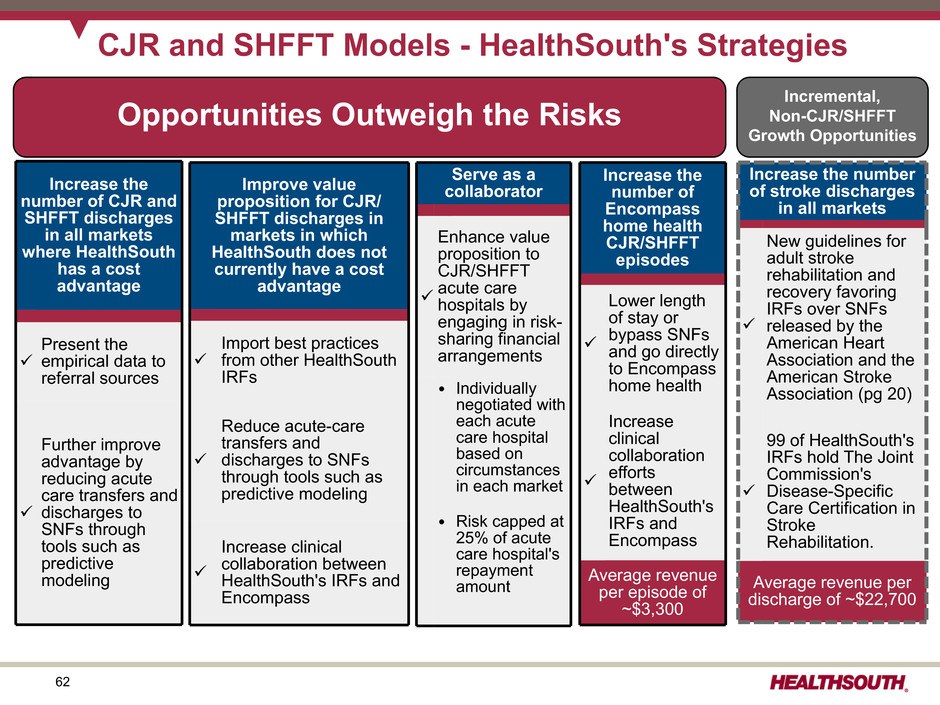

62 CJR and SHFFT Models - HealthSouth's Strategies Opportunities Outweigh the Risks Increase the number of CJR and SHFFT discharges in all markets where HealthSouth has a cost advantage ü Present the empirical data to referral sources ü Further improve advantage by reducing acute care transfers and discharges to SNFs through tools such as predictive modeling Increase the number of stroke discharges in all markets ü New guidelines for adult stroke rehabilitation and recovery favoring IRFs over SNFs released by the American Heart Association and the American Stroke Association (pg 20) a ü 99 of HealthSouth's IRFs hold The Joint Commission's Disease-Specific Care Certification in Stroke Rehabilitation. Average revenue per discharge of ~$22,700 Improve value proposition for CJR/ SHFFT discharges in markets in which HealthSouth does not currently have a cost advantage ü Import best practices from other HealthSouth IRFs ü Reduce acute-care transfers and discharges to SNFs through tools such as predictive modeling ü Increase clinical collaboration between HealthSouth's IRFs and Encompass Serve as a collaborator ü Enhance value proposition to CJR/SHFFT acute care hospitals by engaging in risk- sharing financial arrangements Ÿ Individually negotiated with each acute care hospital based on circumstances in each market Ÿ Risk capped at 25% of acute care hospital's repayment amount Incremental, Non-CJR/SHFFT Growth Opportunities Increase the number of Encompass home health CJR/SHFFT episodes ü Lower length of stay or bypass SNFs and go directly to Encompass home health ü Increase clinical collaboration efforts between HealthSouth's IRFs and Encompass Average revenue per episode of ~$3,300

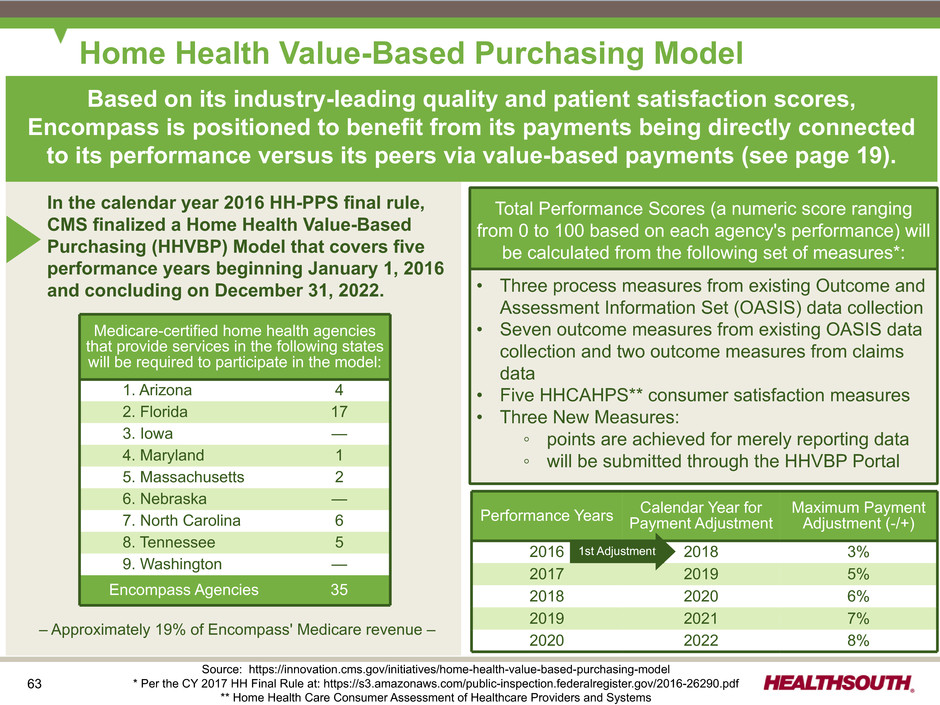

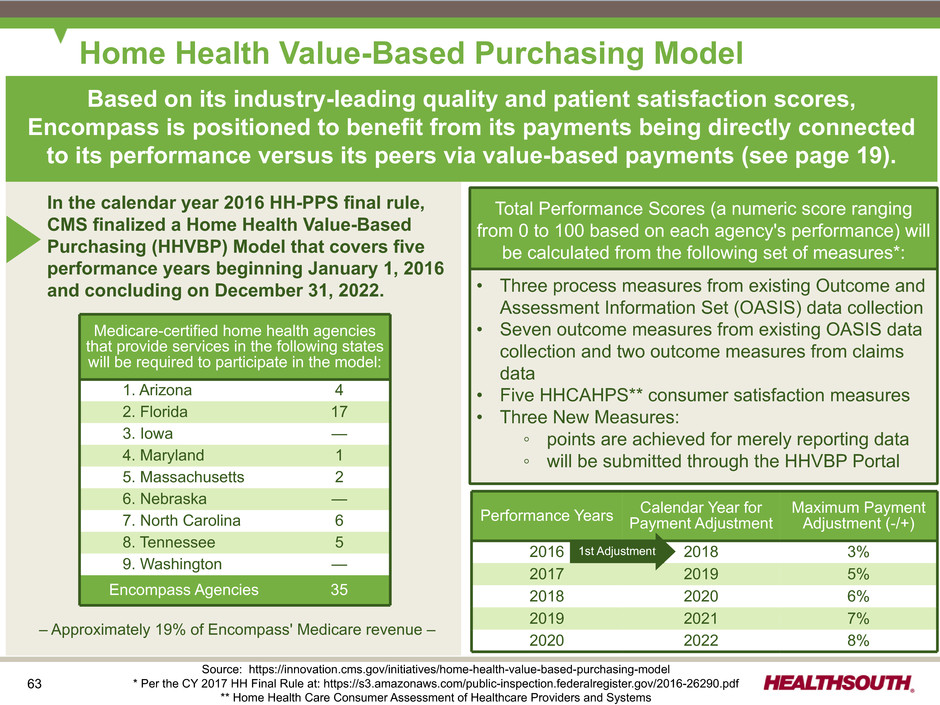

63 Medicare-certified home health agencies that provide services in the following states will be required to participate in the model: 1. Arizona 4 2. Florida 17 3. Iowa — 4. Maryland 1 5. Massachusetts 2 6. Nebraska — 7. North Carolina 6 8. Tennessee 5 9. Washington — Encompass Agencies 35 In the calendar year 2016 HH-PPS final rule, CMS finalized a Home Health Value-Based Purchasing (HHVBP) Model that covers five performance years beginning January 1, 2016 and concluding on December 31, 2022. Home Health Value-Based Purchasing Model Based on its industry-leading quality and patient satisfaction scores, Encompass is positioned to benefit from its payments being directly connected to its performance versus its peers via value-based payments (see page 19). • Three process measures from existing Outcome and Assessment Information Set (OASIS) data collection • Seven outcome measures from existing OASIS data collection and two outcome measures from claims data • Five HHCAHPS** consumer satisfaction measures • Three New Measures: ◦ points are achieved for merely reporting data ◦ will be submitted through the HHVBP Portal Total Performance Scores (a numeric score ranging from 0 to 100 based on each agency's performance) will be calculated from the following set of measures*: Performance Years Calendar Year forPayment Adjustment Maximum Payment Adjustment (-/+) 2016 2018 3% 2017 2019 5% 2018 2020 6% 2019 2021 7% 2020 2022 8% Source: https://innovation.cms.gov/initiatives/home-health-value-based-purchasing-model * Per the CY 2017 HH Final Rule at: https://s3.amazonaws.com/public-inspection.federalregister.gov/2016-26290.pdf ** Home Health Care Consumer Assessment of Healthcare Providers and Systems – Approximately 19% of Encompass' Medicare revenue – 1st Adjustment

64 Capital Structure

65 Debt Maturity Profile - Face Value * This chart does not include ~$279 million of capital lease obligations or ~$56 million of other notes payable. See the debt schedule on page 67. 2016 2019 2020 2020 2021 2022 2023 2024 2025 2043 $350 Senior Notes 5.75% $1,200 Senior Notes 5.75% $320 Conv. Sr. Sub. Notes 2.0% $300 Senior Notes 5.125% $152 Drawn + $33 reserved for LC’s Holders have a put option in 2020 As of December 31, 2016* ($ in millions) $415 Available Callable beginning November 2017 HealthSouth is positioned with a cost-efficient, flexible capital structure. Callable beginning March 2018 Revolver Revolver Capacity $421 Term Loans Callable beginning September 2020 No significant debt maturities prior to 2020

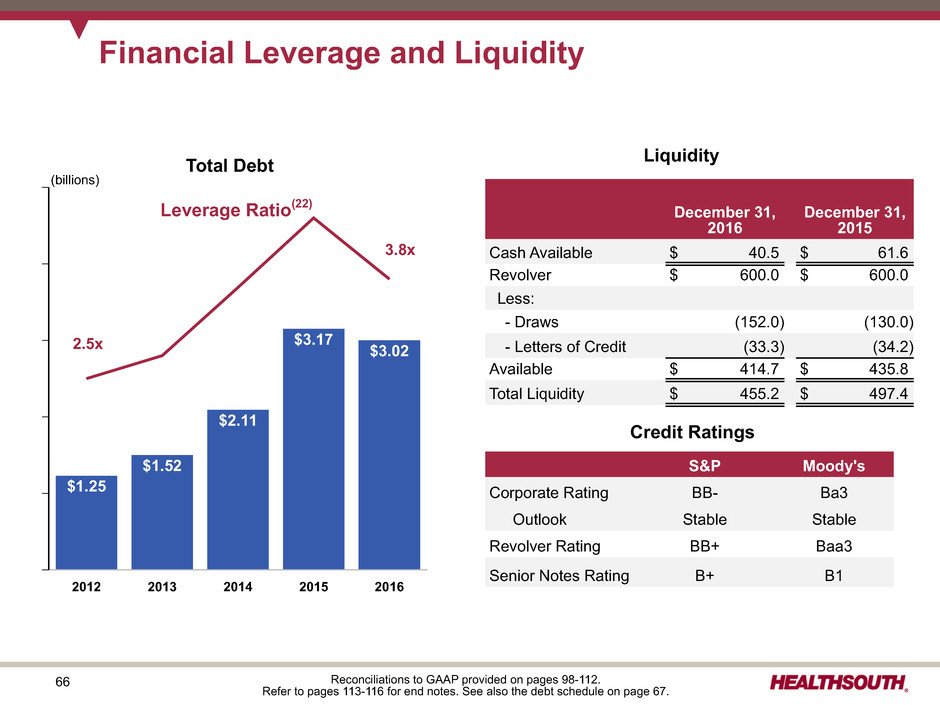

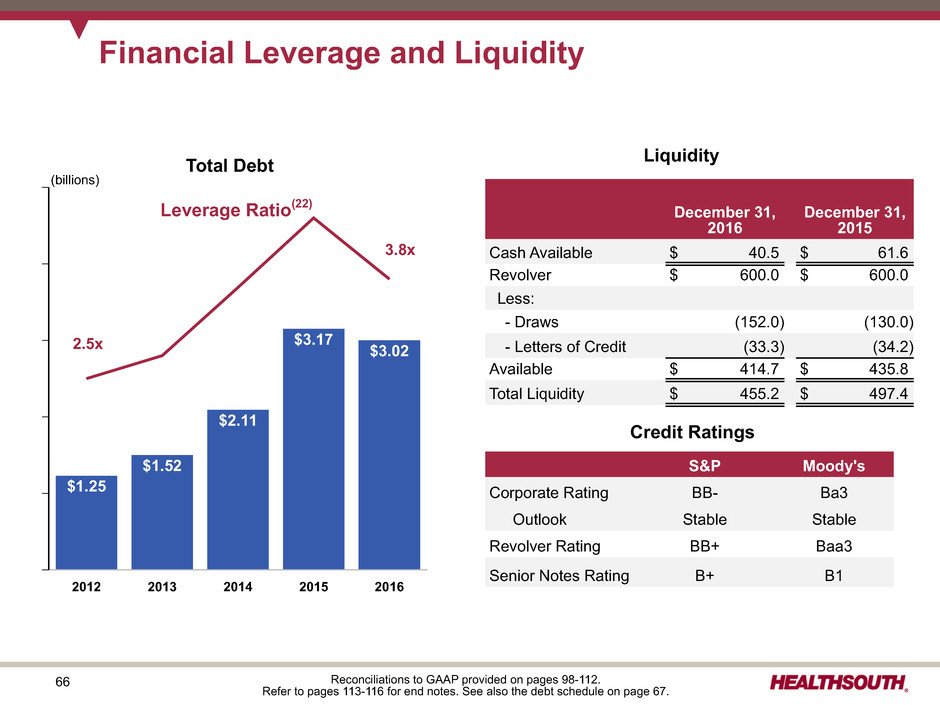

66 S&P Moody's Corporate Rating BB- Ba3 Outlook Stable Stable Revolver Rating BB+ Baa3 Senior Notes Rating B+ B1 Financial Leverage and Liquidity (1) Liquidity Credit Ratings 2012 2013 2014 2015 2016 $1.25 $1.52 $2.11 $3.17 $3.02 (billions) Leverage Ratio(22) Total Debt 3.8x December 31, 2016 December 31, 2015 Cash Available $ 40.5 $ 61.6 Revolver $ 600.0 $ 600.0 Less: - Draws (152.0) (130.0) - Letters of Credit (33.3) (34.2) Available $ 414.7 $ 435.8 Total Liquidity $ 455.2 $ 497.4 Reconciliations to GAAP provided on pages 98-112. Refer to pages 113-116 for end notes. See also the debt schedule on page 67. 2.5x

67 Debt Schedule Reconciliations to GAAP provided on pages 98-112. Change in Dec. 31, Dec. 31, Debt vs. ($millions) 2016 2015 YE 2015 Advances under $600 million revolving credit facility, July 2020 - LIBOR +200bps $ 152.0 $ 130.0 $ 22.0 Term loan facility, July 2020 - LIBOR +200bps 421.2 443.3 (22.1) Bonds Payable: 7.75% Senior Notes due 2022 — 174.3 (174.3) 5.125% Senior Notes due 2023 295.3 294.6 0.7 5.75% Senior Notes due 2024 1,193.2 1,192.6 0.6 5.75% Senior Notes due 2025 343.9 343.4 0.5 2.0% Convertible Senior Subordinated Notes due 2043 275.7 265.9 9.8 Other notes payable 55.8 39.2 16.6 Capital lease obligations 279.3 288.2 (8.9) Long-term debt $ 3,016.4 $ 3,171.5 $ (155.1) Debt to Adjusted EBITDA(1) 3.8x 4.6x

68 2.0% Convertible Senior Subordinated Notes Due 2043 Background • In November 2013, the Company issued $320 million of 2.0% Convertible Senior Subordinated Notes due 2043 in exchange for 257,110 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. • The Company viewed the Convertible Perpetual Preferred Stock as having a high cost of capital with limited alternatives for redemption. • Investors were willing to trade the 6.5% dividend on the Convertible Perpetual Preferred Stock for the 2.0% coupon on the Convertible Senior Subordinated Notes in large part due to the liquidity offered via the investor put option (a protection against downside credit risk). Terms • Issued - $320 million (recorded as approx. $249 million of debt and $71 million of equity) • Coupon - 2.0% • Underlying shares - approx. 8.5 million common shares (8.3 million included in 2015 weighted average diluted share count) • Current conversion price - $37.16 • Current conversion rate - 26.9106 • Convertible, by the holder, at any time into shares of the Company's common stock ü At the Company's option, settlement can be made in cash, shares, or any combination thereof. Options Holders' Option • Put option effective December 1, 2020 at 100% of principal amount, plus accrued and unpaid interest which must be settled in cash Company's Option • Right to redeem, prior to December 2018, at 100% of the principal amount (plus a make-whole premium) if volume weighted average price of Company's common stock is at least 120% (currently $44.59) of the conversion price of the convertible notes for at least 20 trading days during any 30 consecutive trading day period • Holders may elect to convert their notes in lieu of redemption and receive any make- whole premium due • After December 2018, fully redeemable, at par, for cash

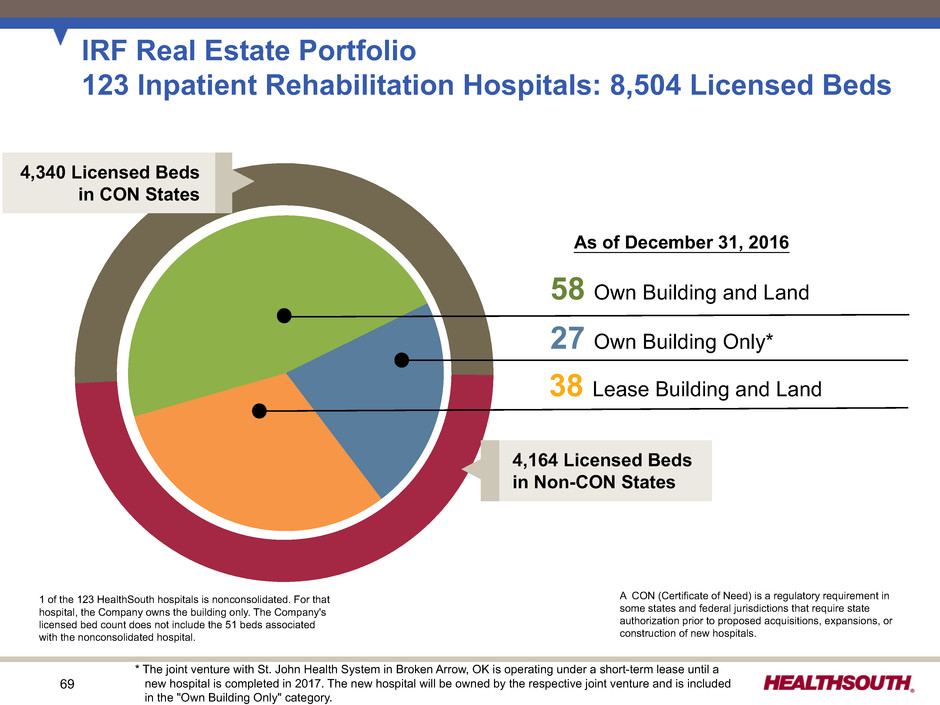

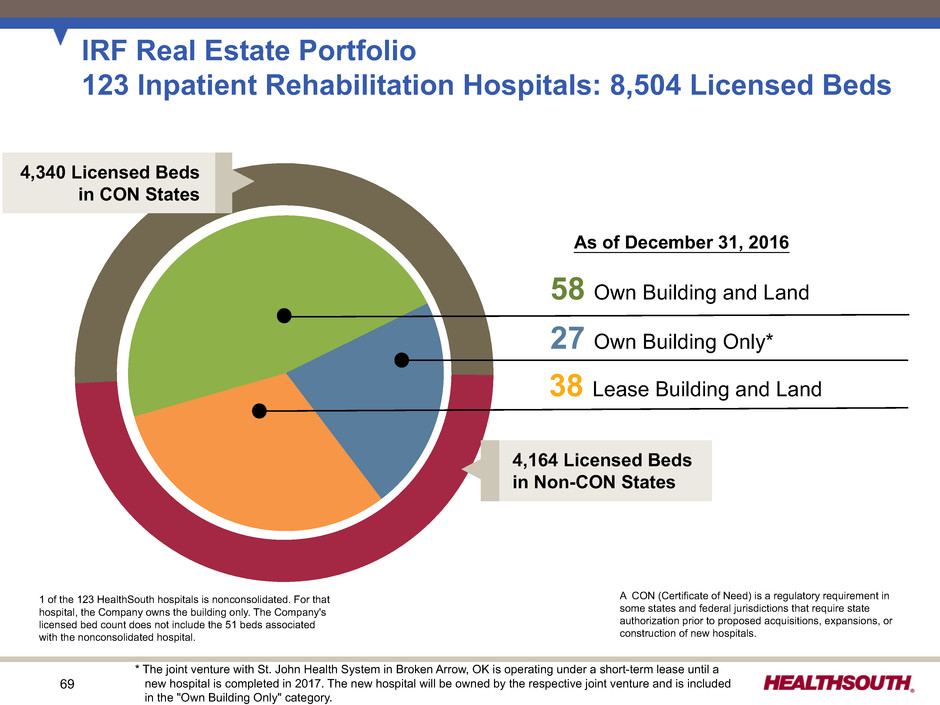

69 38 Lease Building and Land A CON (Certificate of Need) is a regulatory requirement in some states and federal jurisdictions that require state authorization prior to proposed acquisitions, expansions, or construction of new hospitals. 58 Own Building and Land 27 Own Building Only* IRF Real Estate Portfolio 123 Inpatient Rehabilitation Hospitals: 8,504 Licensed Beds 4,340 Licensed Beds in CON States 4,164 Licensed Beds in Non-CON States 1 of the 123 HealthSouth hospitals is nonconsolidated. For that hospital, the Company owns the building only. The Company's licensed bed count does not include the 51 beds associated with the nonconsolidated hospital. As of December 31, 2016 * The joint venture with St. John Health System in Broken Arrow, OK is operating under a short-term lease until a new hospital is completed in 2017. The new hospital will be owned by the respective joint venture and is included in the "Own Building Only" category.

70 Information Technology

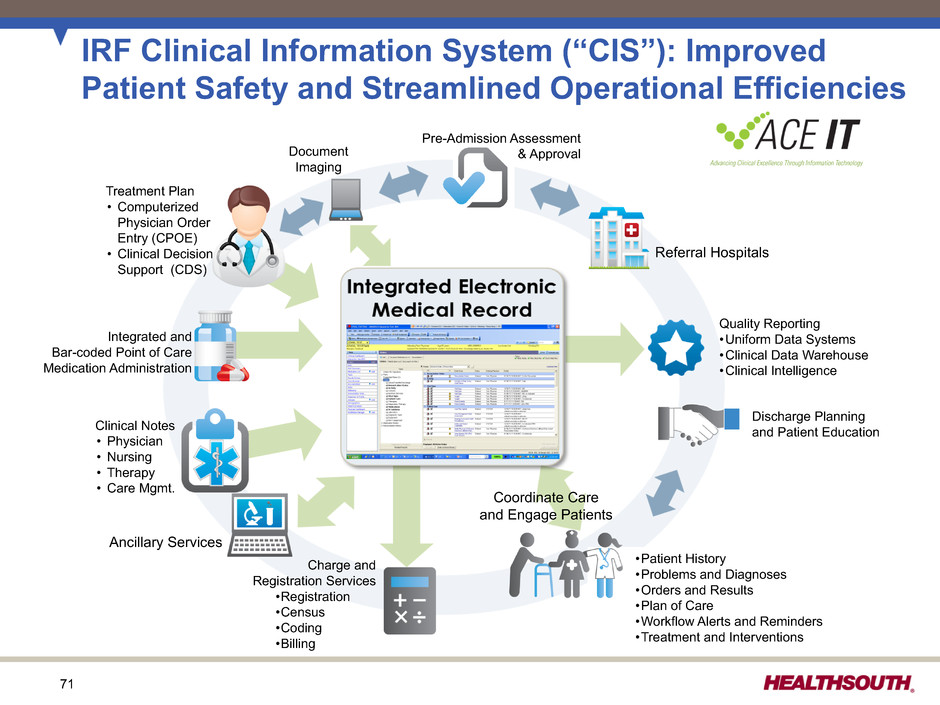

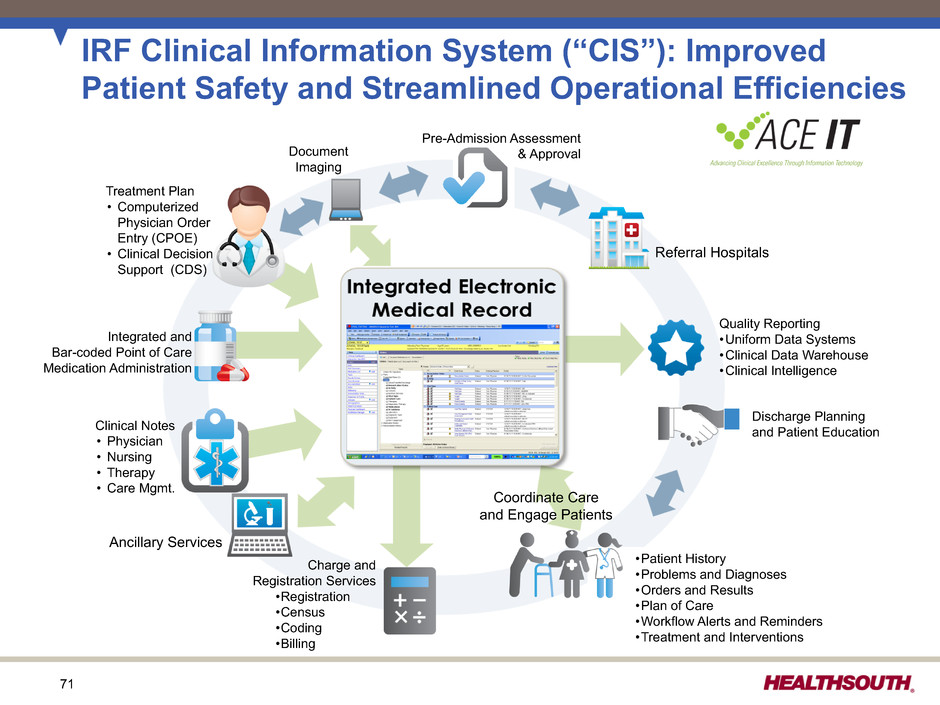

71 IRF Clinical Information System (“CIS”): Improved Patient Safety and Streamlined Operational Efficiencies Pre-Admission Assessment & Approval Discharge Planning and Patient Education •Patient History •Problems and Diagnoses •Orders and Results •Plan of Care •Workflow Alerts and Reminders •Treatment and Interventions Document Imaging Charge and Registration Services •Registration •Census •Coding •Billing Quality Reporting •Uniform Data Systems •Clinical Data Warehouse •Clinical Intelligence Referral Hospitals Ancillary Services Clinical Notes • Physician • Nursing • Therapy • Care Mgmt. Integrated and Bar-coded Point of Care Medication Administration Treatment Plan • Computerized Physician Order Entry (CPOE) • Clinical Decision Support (CDS) Coordinate Care and Engage Patients

72 IRF Proprietary Management System: Beacon