Third Quarter 2017 Earnings Call October 27, 2017 Supplemental Information

2 The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect HealthSouth’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2016, the form 10-Q for the quarters ended March 31, 2017, June 30, 2017, and September 30, 2017, when filed, and in other documents HealthSouth previously filed with the SEC, many of which are beyond HealthSouth’s control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. HealthSouth’s Form 8-K, dated October 26, 2017, to which the following supplemental information is attached as Exhibit 99.2, provides further explanation and disclosure regarding HealthSouth’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Forward-Looking Statements

3 Table of Contents Q3 2017 Summary................................................................................................................................................. 4-5 Rebranding and Name Change Initiative ............................................................................................................... 6 IRF-Home Health Clinical Collaboration ................................................................................................................ 7 Inpatient Rehabilitation Segment ........................................................................................................................... 8-9 Home Health & Hospice Segment ......................................................................................................................... 10-11 Consolidated Adjusted EBITDA ............................................................................................................................. 12 Earnings per Share ................................................................................................................................................ 13-14 Adjusted Free Cash Flow....................................................................................................................................... 15 Guidance................................................................................................................................................................ 16-17 Adjusted Free Cash Flow and Tax Assumptions.................................................................................................... 18 Free Cash Flow Priorities....................................................................................................................................... 19 Appendix Map of Locations.................................................................................................................................................... 21 Pre-Payment Claims Denials - Inpatient Rehabilitation Segment.......................................................................... 22 Expansion Activity .................................................................................................................................................. 23 Business Outlook ................................................................................................................................................... 24-26 Debt Schedule and Maturity Profile ....................................................................................................................... 27-28 New-Store/Same-Store IRF Growth ...................................................................................................................... 29 Payment Sources (Percent of Revenues).............................................................................................................. 30 Inpatient Rehabilitation Operational and Labor Metrics ......................................................................................... 31 Home Health & Hospice Operational Metrics ........................................................................................................ 32 Share Information .................................................................................................................................................. 33 Segment Operating Results................................................................................................................................... 34-36 Reconciliations to GAAP........................................................................................................................................ 37-45 End Notes .............................................................................................................................................................. 46-48

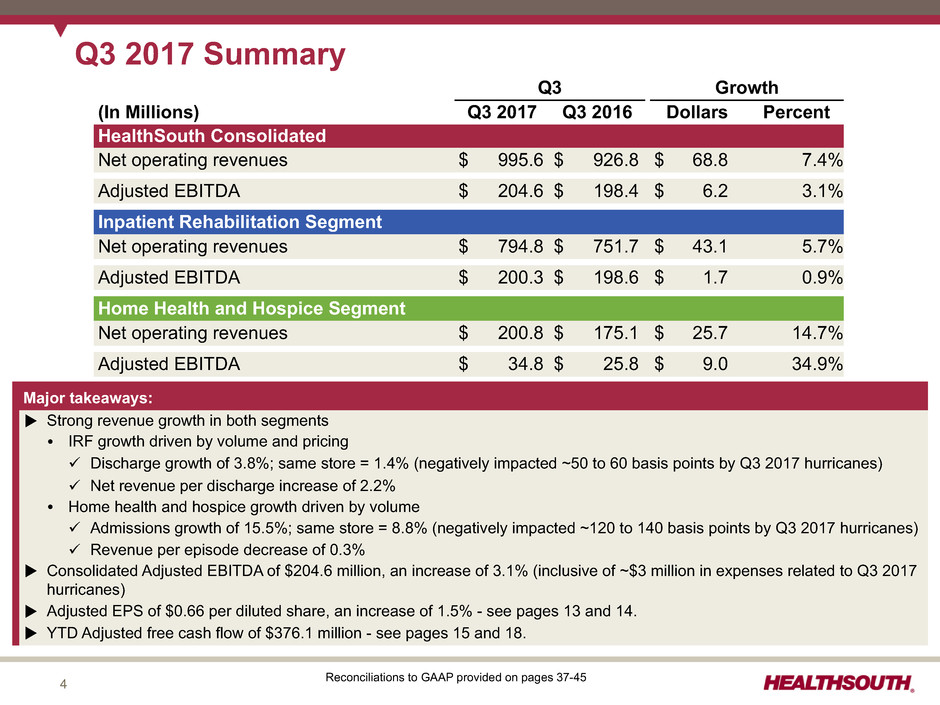

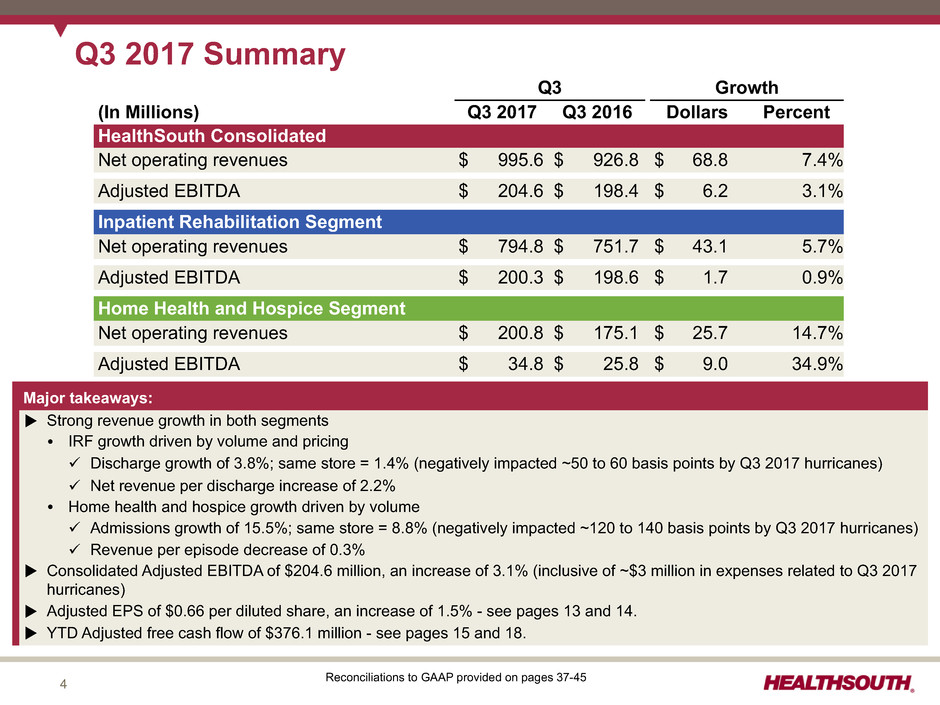

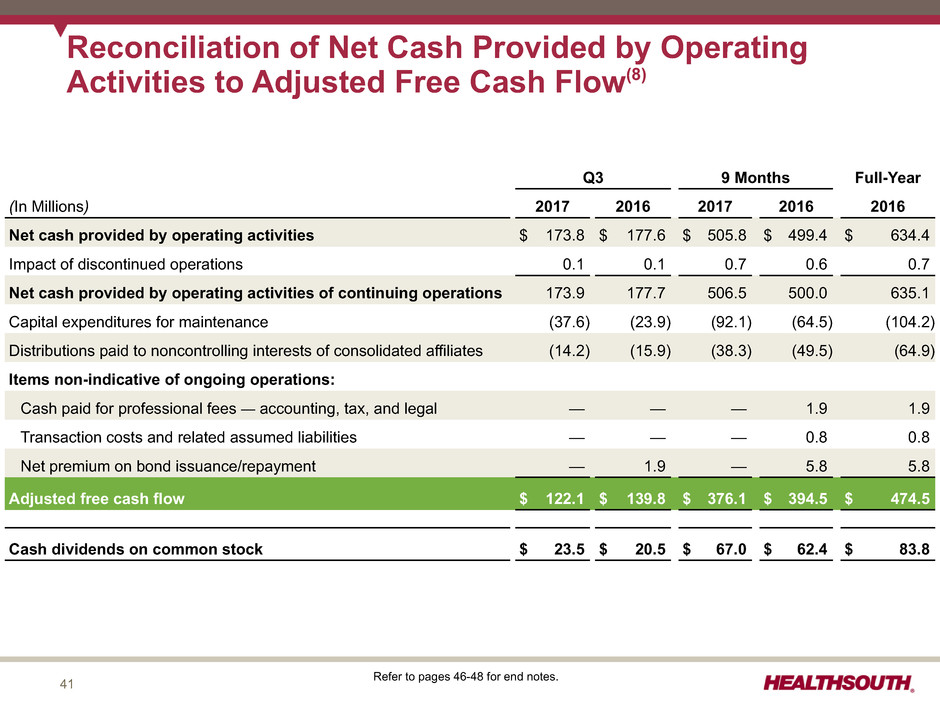

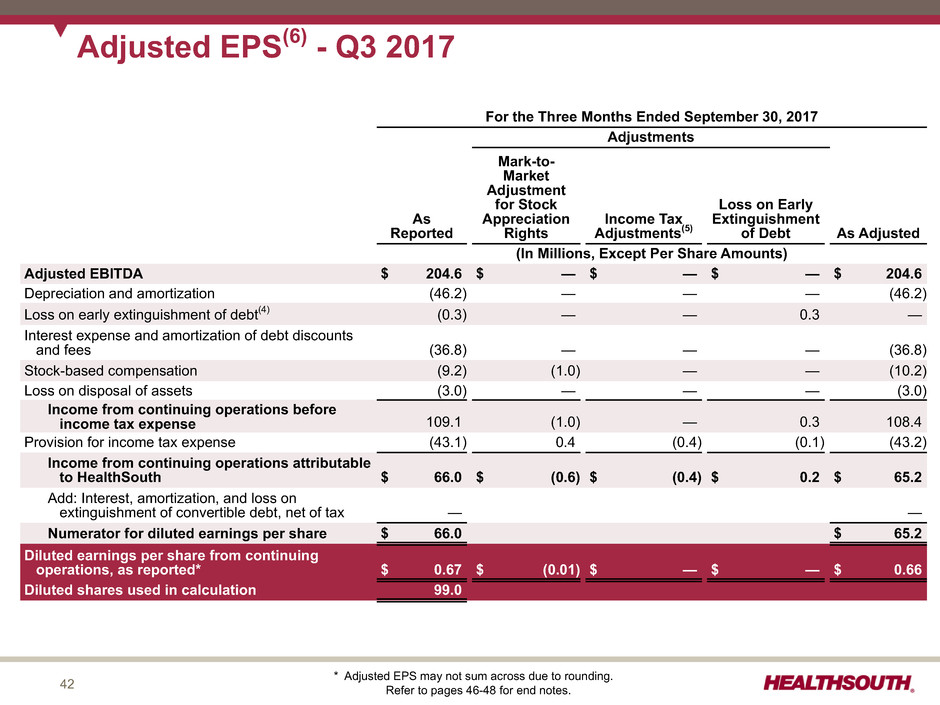

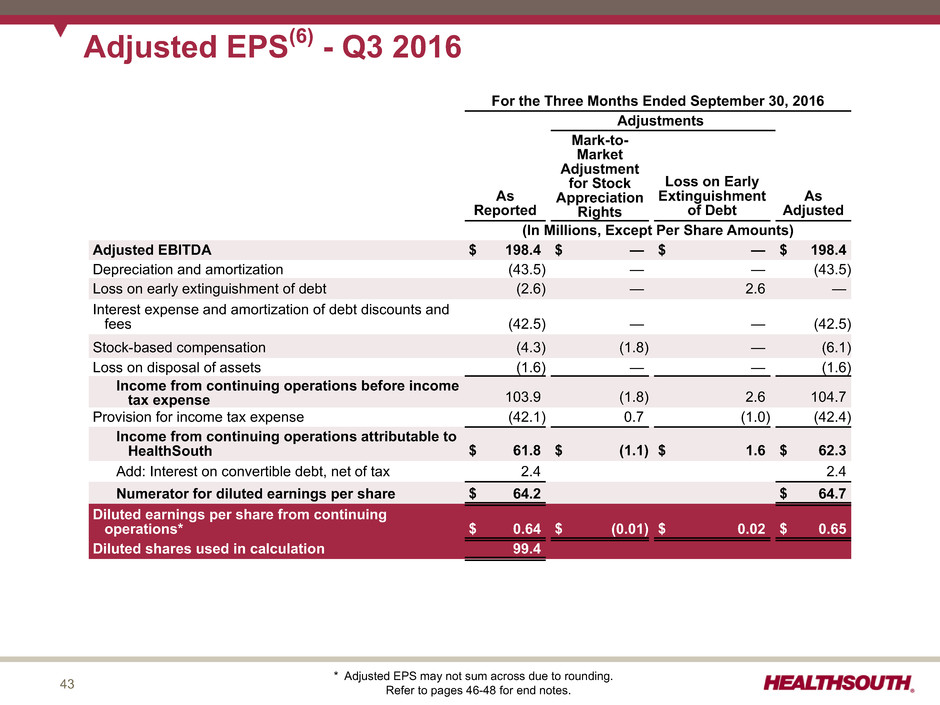

4 Q3 2017 Summary Q3 Growth (In Millions) Q3 2017 Q3 2016 Dollars Percent HealthSouth Consolidated Net operating revenues $ 995.6 $ 926.8 $ 68.8 7.4% Adjusted EBITDA $ 204.6 $ 198.4 $ 6.2 3.1% Inpatient Rehabilitation Segment Net operating revenues $ 794.8 $ 751.7 $ 43.1 5.7% Adjusted EBITDA $ 200.3 $ 198.6 $ 1.7 0.9% Home Health and Hospice Segment Net operating revenues $ 200.8 $ 175.1 $ 25.7 14.7% Adjusted EBITDA $ 34.8 $ 25.8 $ 9.0 34.9% Major takeaways: u Strong revenue growth in both segments Ÿ IRF growth driven by volume and pricing ü Discharge growth of 3.8%; same store = 1.4% (negatively impacted ~50 to 60 basis points by Q3 2017 hurricanes) ü Net revenue per discharge increase of 2.2% Ÿ Home health and hospice growth driven by volume ü Admissions growth of 15.5%; same store = 8.8% (negatively impacted ~120 to 140 basis points by Q3 2017 hurricanes) ü Revenue per episode decrease of 0.3% u Consolidated Adjusted EBITDA of $204.6 million, an increase of 3.1% (inclusive of ~$3 million in expenses related to Q3 2017 hurricanes) u Adjusted EPS of $0.66 per diluted share, an increase of 1.5% - see pages 13 and 14. u YTD Adjusted free cash flow of $376.1 million - see pages 15 and 18. Reconciliations to GAAP provided on pages 37-45

5 Q3 2017 Summary (cont.) u Expansion Activity (see page 23) Ÿ Began operating a new 48-bed inpatient rehabilitation hospital with West Tennessee Healthcare in Jackson, TN Ÿ Entered into an agreement with University Medical Center Health System to build a 40-bed inpatient rehabilitation hospital in Lubbock, TX (expect to begin construction in spring 2018) Ÿ Continued development of six previously announced IRF projects (two are joint ventures) Ÿ Expanded existing hospitals by 59 beds Ÿ Acquired six home health locations in Illinois, Indiana, Arizona, and Ohio u Announced Formation of Post-Acute Innovation Center in Collaboration with Cerner Ÿ Will develop clinical decision support tools designed to more effectively and efficiently manage patients across multiple care settings u Balance Sheet Ÿ Leverage ratio of 3.2x at end of third quarter Ÿ Amended credit agreement governing senior secured credit facility ü Increased size of revolver from $600 million to $700 million ü Decreased the balance of term loan facilities by ~$110 million to $300 million ü Reduced interest rate spread by 25 basis points ü Extended maturity by two years to 2022 u Shareholder Distributions Ÿ Repurchased 461,068 shares for $20.0 million in Q3 2017 ü Year-to-date 2017 repurchases of 919,646 shares for $38.1 million Ÿ Paid quarterly cash dividend of $0.24 per share in July 2017 Ÿ Declared a $0.25 per share quarterly cash dividend in July 2017 (paid in October 2017)

6 Rebranding and Name Change u Both business segments — inpatient rehabilitation and home health and hospice — will transition to the Encompass Health branding by the end of 2019. Ÿ Rebranding and name change reinforce the Company’s existing strategy and position as an integrated provider of inpatient and home-based care. Ÿ Effective as of January 1, 2018, HealthSouth Corporation will change its name to Encompass Health Corporation, with a corresponding ticker symbol change from “HLS” to “EHC.” Ÿ Total rebranding investment estimated to be ~$25 million to $30 million, to be incurred between 2017 and 2019. ü ~$7 million to $10 million expected to be incurred in 2017 Ÿ ~$6 million to $8 million expected to be operating expenses (included in corporate general and administrative expenses line item) Ÿ ~$1 million to $2 million expected to be capital expenditures

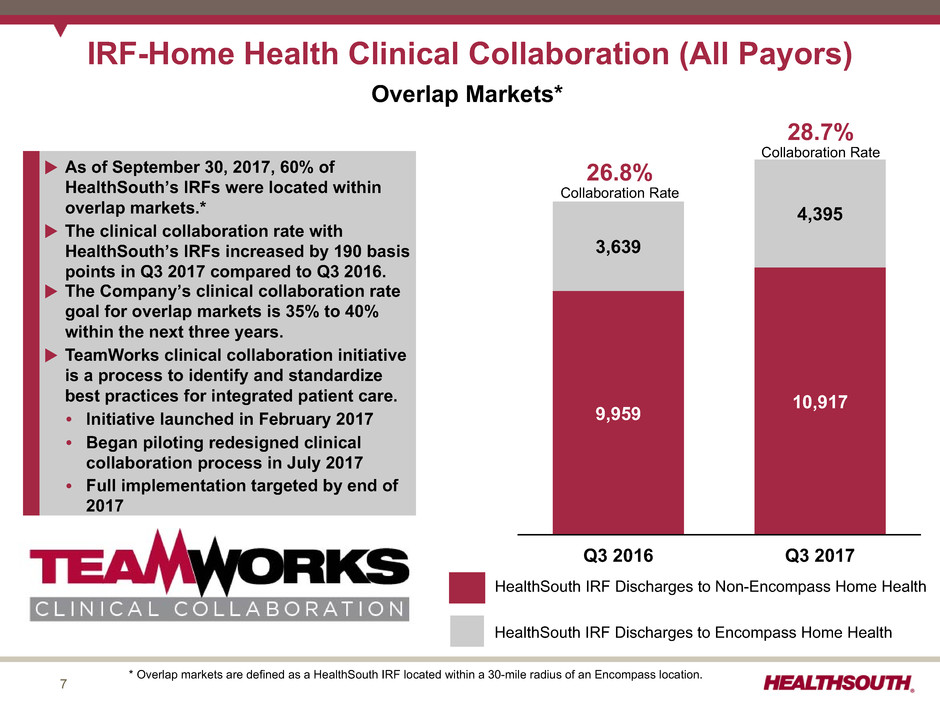

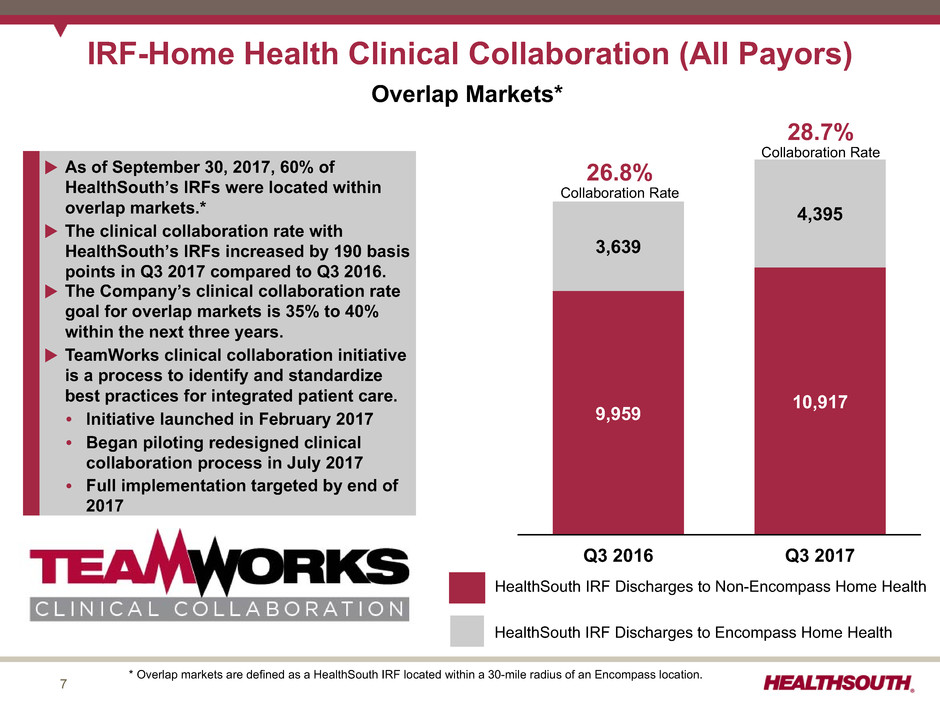

7 IRF-Home Health Clinical Collaboration (All Payors) Q3 2016 Q3 2017 9,959 10,917 3,639 4,395 26.8% Collaboration Rate 28.7% Collaboration Rate HealthSouth IRF Discharges to Non-Encompass Home Health HealthSouth IRF Discharges to Encompass Home Health u As of September 30, 2017, 60% of HealthSouth’s IRFs were located within overlap markets.* u The clinical collaboration rate with HealthSouth’s IRFs increased by 190 basis points in Q3 2017 compared to Q3 2016. u The Company’s clinical collaboration rate goal for overlap markets is 35% to 40% within the next three years. u TeamWorks clinical collaboration initiative is a process to identify and standardize best practices for integrated patient care. Ÿ Initiative launched in February 2017 Ÿ Began piloting redesigned clinical collaboration process in July 2017 Ÿ Full implementation targeted by end of 2017 Overlap Markets* * Overlap markets are defined as a HealthSouth IRF located within a 30-mile radius of an Encompass location.

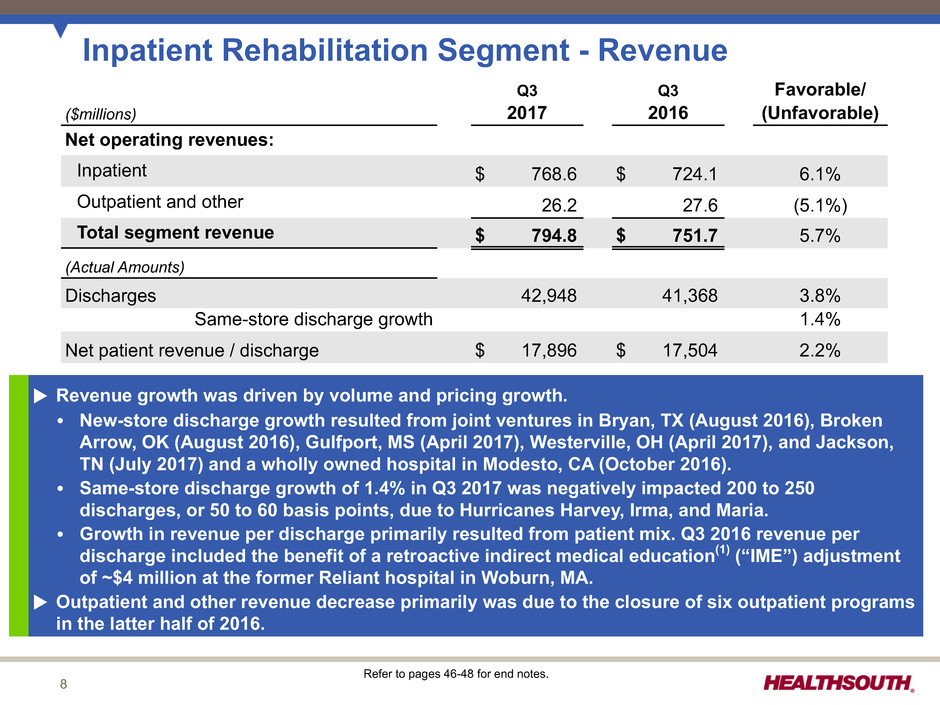

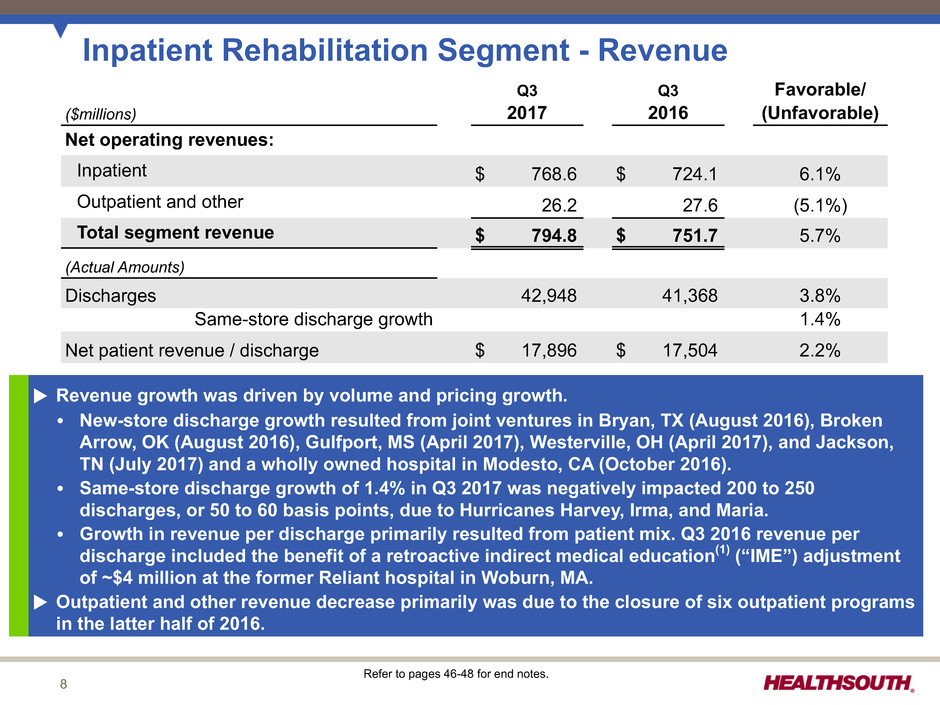

8 Inpatient Rehabilitation Segment - Revenue Q3 Q3 Favorable/ ($millions) 2017 2016 (Unfavorable) Net operating revenues: Inpatient $ 768.6 $ 724.1 6.1% Outpatient and other 26.2 27.6 (5.1%) Total segment revenue $ 794.8 $ 751.7 5.7% (Actual Amounts) Discharges 42,948 41,368 3.8% Same-store discharge growth 1.4% Net patient revenue / discharge $ 17,896 $ 17,504 2.2% u Revenue growth was driven by volume and pricing growth. Ÿ New-store discharge growth resulted from joint ventures in Bryan, TX (August 2016), Broken Arrow, OK (August 2016), Gulfport, MS (April 2017), Westerville, OH (April 2017), and Jackson, TN (July 2017) and a wholly owned hospital in Modesto, CA (October 2016). Ÿ Same-store discharge growth of 1.4% in Q3 2017 was negatively impacted 200 to 250 discharges, or 50 to 60 basis points, due to Hurricanes Harvey, Irma, and Maria. Ÿ Growth in revenue per discharge primarily resulted from patient mix. Q3 2016 revenue per discharge included the benefit of a retroactive indirect medical education(1) (“IME”) adjustment of ~$4 million at the former Reliant hospital in Woburn, MA. u Outpatient and other revenue decrease primarily was due to the closure of six outpatient programs in the latter half of 2016. Refer to pages 46-48 for end notes.

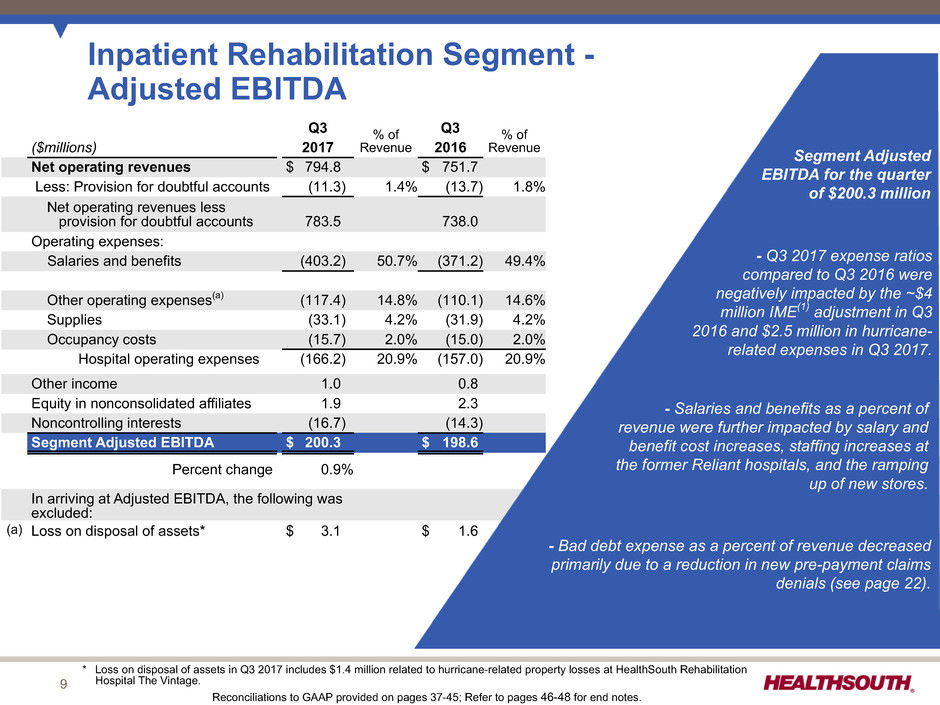

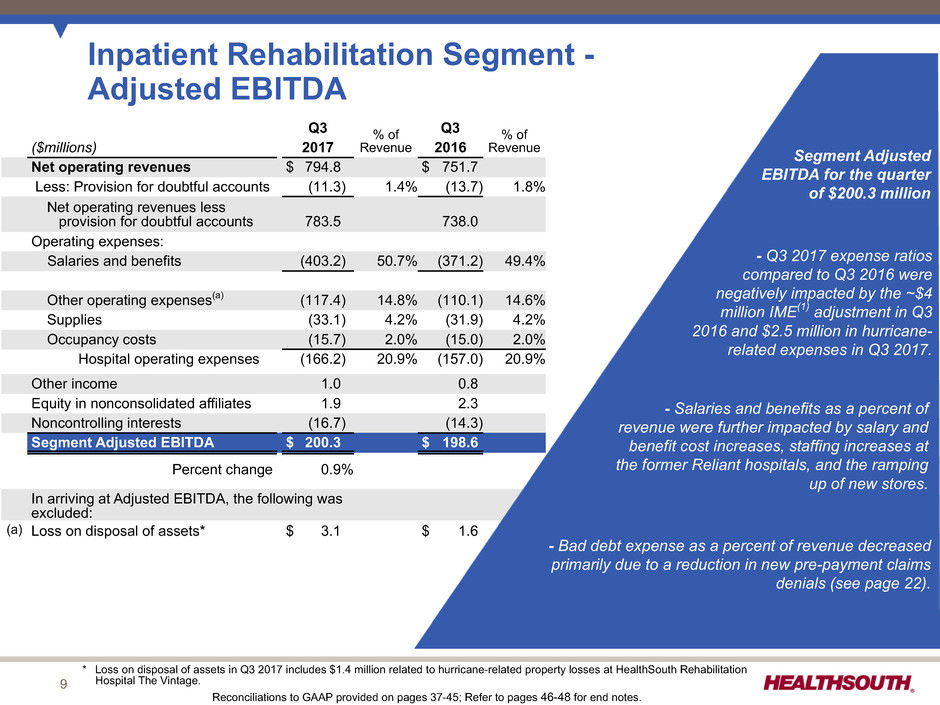

9 Inpatient Rehabilitation Segment - Adjusted EBITDA Q3 % of Revenue Q3 % of Revenue($millions) 2017 2016 Net operating revenues $ 794.8 $ 751.7 Less: Provision for doubtful accounts (11.3) 1.4% (13.7) 1.8% Net operating revenues less provision for doubtful accounts 783.5 738.0 Operating expenses: Salaries and benefits (403.2) 50.7% (371.2) 49.4% Other operating expenses(a) (117.4) 14.8% (110.1) 14.6% Supplies (33.1) 4.2% (31.9) 4.2% Occupancy costs (15.7) 2.0% (15.0) 2.0% Hospital operating expenses (166.2) 20.9% (157.0) 20.9% Other income 1.0 0.8 Equity in nonconsolidated affiliates 1.9 2.3 Noncontrolling interests (16.7) (14.3) Segment Adjusted EBITDA $ 200.3 $ 198.6 Percent change 0.9% In arriving at Adjusted EBITDA, the following was excluded: (a) Loss on disposal of assets* $ 3.1 $ 1.6 Segment Adjusted EBITDA for the quarter of $200.3 million - Salaries and benefits as a percent of revenue were further impacted by salary and benefit cost increases, staffing increases at the former Reliant hospitals, and the ramping up of new stores. - Bad debt expense as a percent of revenue decreased primarily due to a reduction in new pre-payment claims denials (see page 22). - Q3 2017 expense ratios compared to Q3 2016 were negatively impacted by the ~$4 million IME(1) adjustment in Q3 2016 and $2.5 million in hurricane- related expenses in Q3 2017. * Loss on disposal of assets in Q3 2017 includes $1.4 million related to hurricane-related property losses at HealthSouth Rehabilitation Hospital The Vintage. Reconciliations to GAAP provided on pages 37-45; Refer to pages 46-48 for end notes.

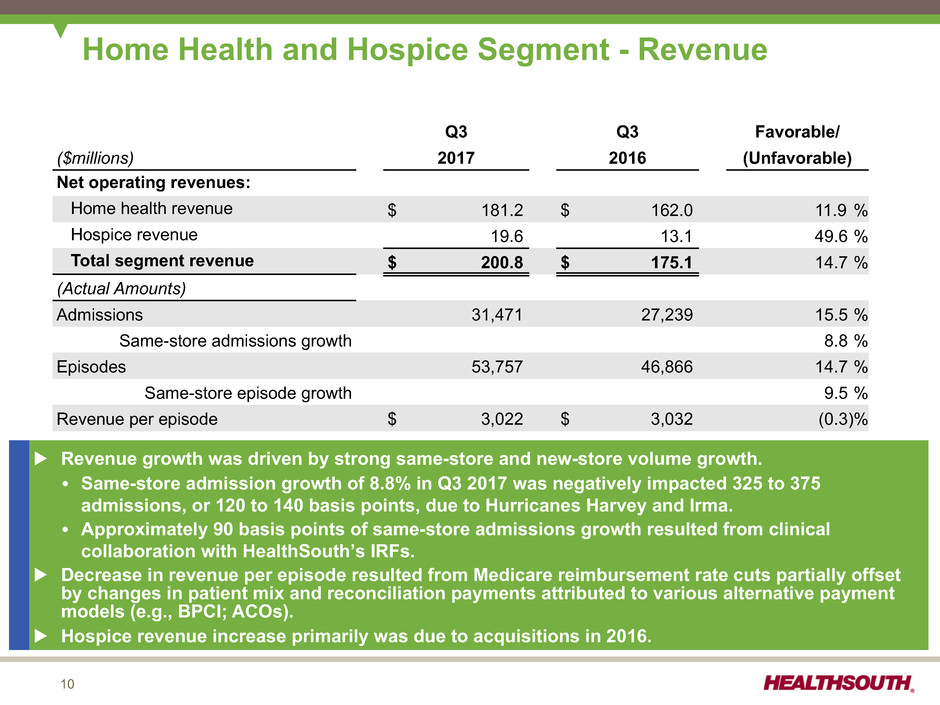

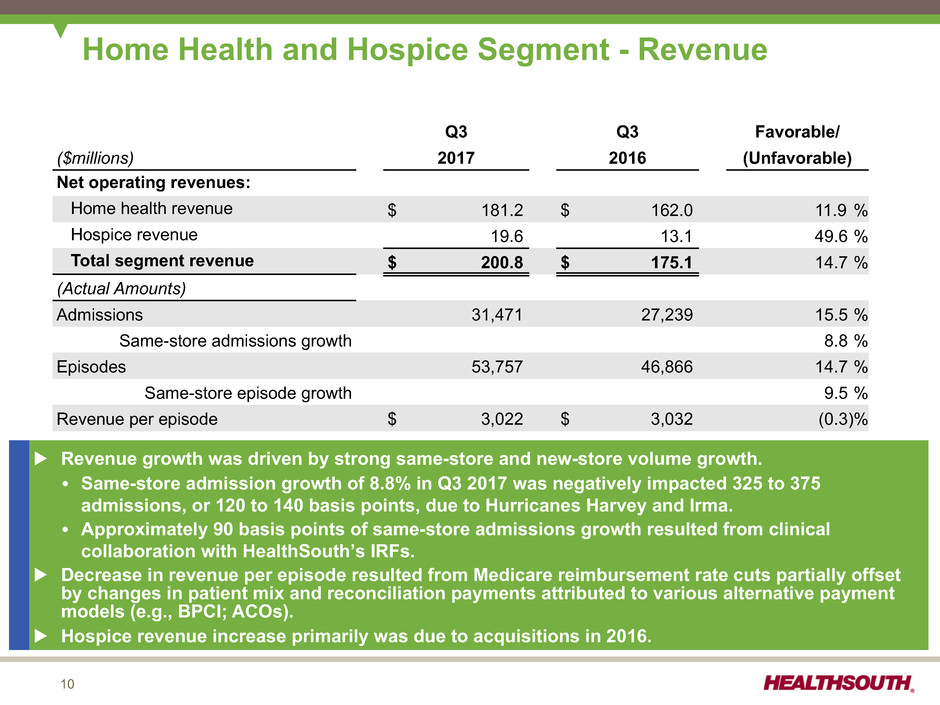

10 Home Health and Hospice Segment - Revenue Q3 Q3 Favorable/ ($millions) 2017 2016 (Unfavorable) Net operating revenues: Home health revenue $ 181.2 $ 162.0 11.9 % Hospice revenue 19.6 13.1 49.6 % Total segment revenue $ 200.8 $ 175.1 14.7 % (Actual Amounts) Admissions 31,471 27,239 15.5 % Same-store admissions growth 8.8 % Episodes 53,757 46,866 14.7 % Same-store episode growth 9.5 % Revenue per episode $ 3,022 $ 3,032 (0.3)% u Revenue growth was driven by strong same-store and new-store volume growth. Ÿ Same-store admission growth of 8.8% in Q3 2017 was negatively impacted 325 to 375 admissions, or 120 to 140 basis points, due to Hurricanes Harvey and Irma. Ÿ Approximately 90 basis points of same-store admissions growth resulted from clinical collaboration with HealthSouth’s IRFs. u Decrease in revenue per episode resulted from Medicare reimbursement rate cuts partially offset by changes in patient mix and reconciliation payments attributed to various alternative payment models (e.g., BPCI; ACOs). u Hospice revenue increase primarily was due to acquisitions in 2016.

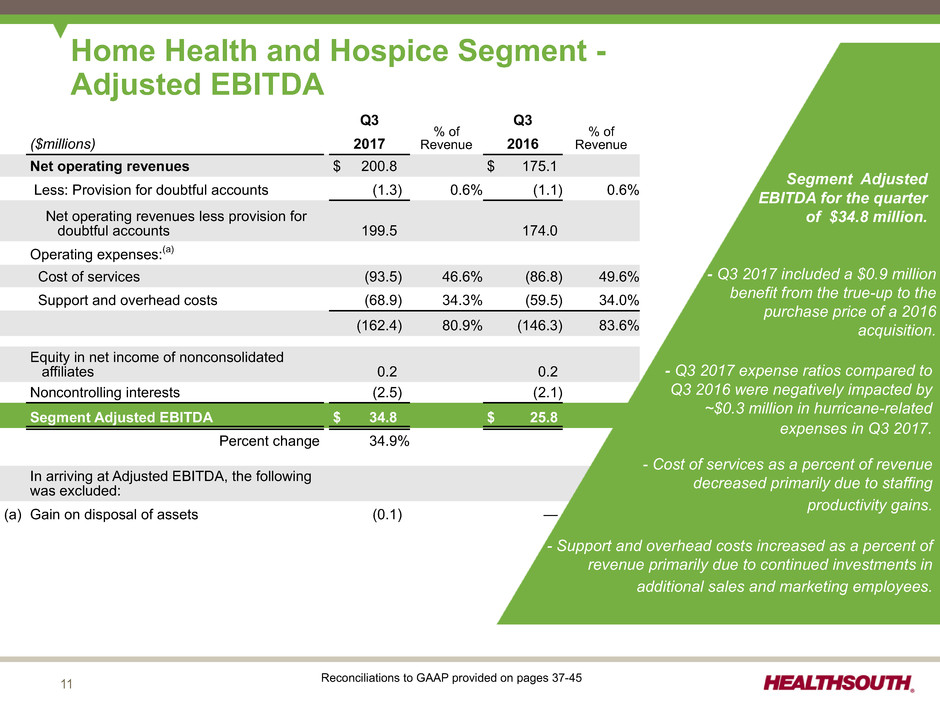

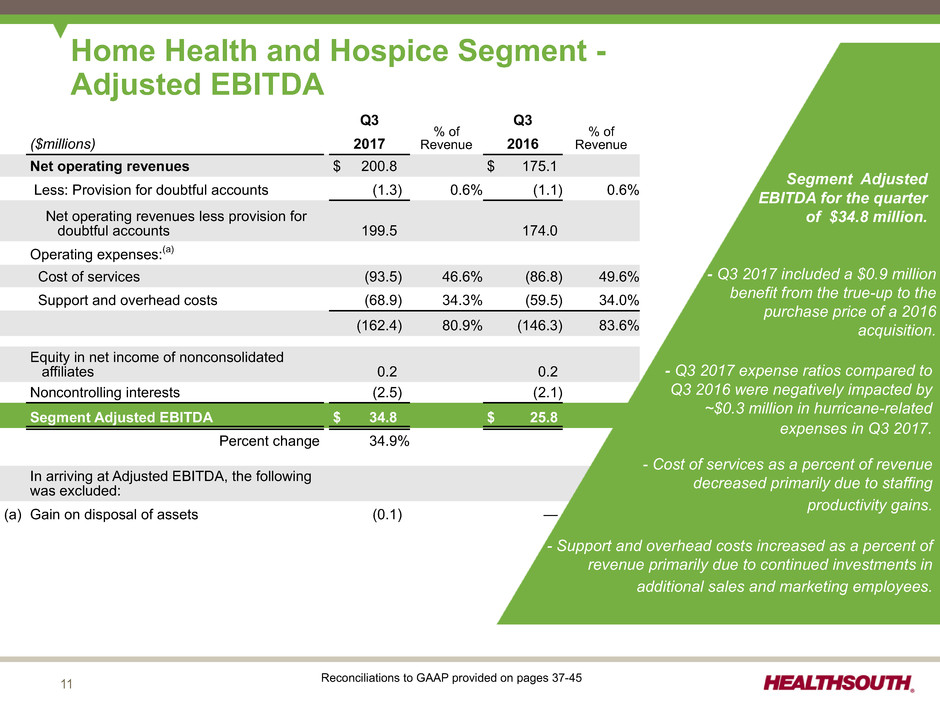

11 Q3 % of Revenue Q3 % of Revenue($millions) 2017 2016 Net operating revenues $ 200.8 $ 175.1 Less: Provision for doubtful accounts (1.3) 0.6% (1.1) 0.6% Net operating revenues less provision for doubtful accounts 199.5 174.0 Operating expenses:(a) Cost of services (93.5) 46.6% (86.8) 49.6% Support and overhead costs (68.9) 34.3% (59.5) 34.0% (162.4) 80.9% (146.3) 83.6% Equity in net income of nonconsolidated affiliates 0.2 0.2 Noncontrolling interests (2.5) (2.1) Segment Adjusted EBITDA $ 34.8 $ 25.8 Percent change 34.9% In arriving at Adjusted EBITDA, the following was excluded: (a) Gain on disposal of assets (0.1) — Home Health and Hospice Segment - Adjusted EBITDA Segment Adjusted EBITDA for the quarter of $34.8 million. - Cost of services as a percent of revenue decreased primarily due to staffing productivity gains. * Reconciliation to GAAP provided on pages 29-31 Reconciliations to GAAP provided on pages 37-45 - Support and overhead costs increased as a percent of revenue primarily due to continued investments in additional sales and marketing employees. - Q3 2017 expense ratios compared to Q3 2016 were negatively impacted by ~$0.3 million in hurricane-related expenses in Q3 2017. - Q3 2017 included a $0.9 million benefit from the true-up to the purchase price of a 2016 acquisition.

12 Consolidated Adjusted EBITDA ($millions) Q3 2017 % of Consolidated Revenue Q3 2016 % of Consolidated Revenue Inpatient rehabilitation segment Adjusted EBITDA $ 200.3 $ 198.6 Home health and hospice segment Adjusted EBITDA 34.8 25.8 General and administrative expenses* (30.5) 3.1% (26.0) 2.8% Consolidated Adjusted EBITDA $ 204.6 $ 198.4 Percentage change 3.1% Consolidated Adjusted EBITDA for the quarter of $204.6 million. - General and administrative expenses increased as a percent of consolidated revenue primarily due to expenses associated with the Company’s rebranding and name change and the TeamWorks clinical collaboration initiative. General and Administrative Expenses Associated with Rebranding and TeamWorks ($millions) Q1 2017 Q2 2017 Q3 2017 YTD 2017 Rebranding and name change $ 0.5 $ 1.7 $ 1.5 $ 3.7 TeamWorks clinical collaboration(2) — 1.7 2.3 4.0 * General and administrative expenses in the above table exclude stock compensation of $9.2 million and $4.3 million for the third quarter of 2017 and 2016, respectively. . Reconciliations to GAAP provided on pages 37-45; Refer to pages 46-48 for end notes.

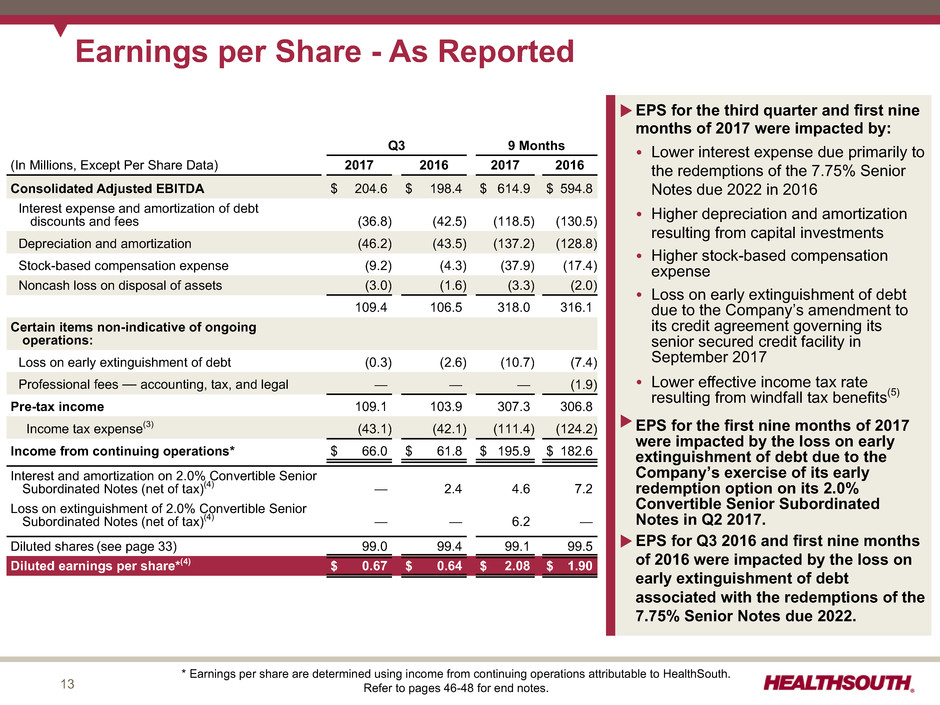

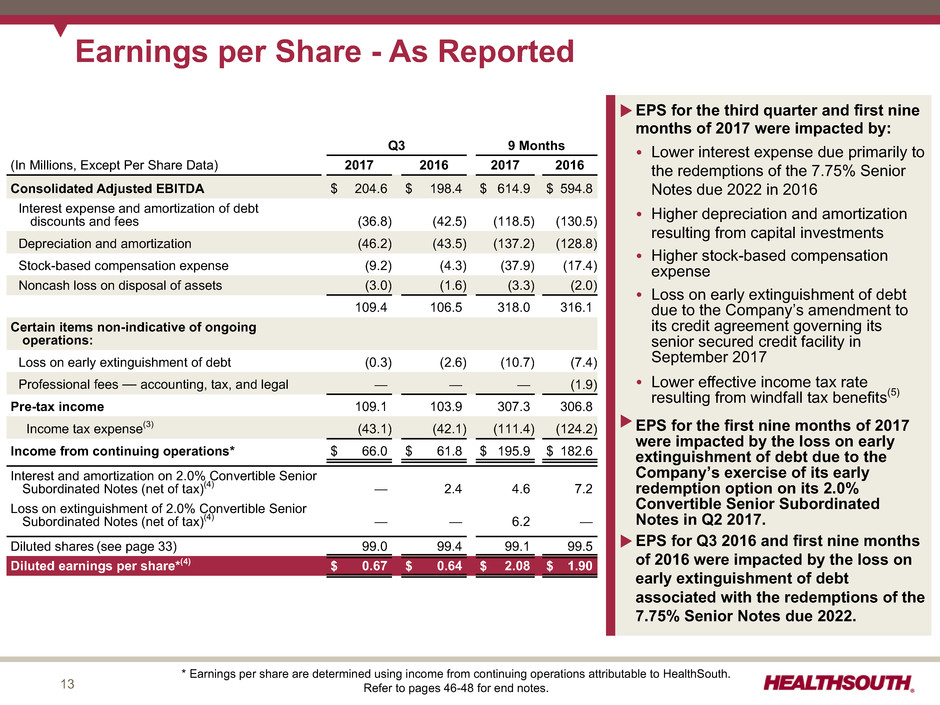

13 Earnings per Share - As Reported Q3 9 Months (In Millions, Except Per Share Data) 2017 2016 2017 2016 Consolidated Adjusted EBITDA $ 204.6 $ 198.4 $ 614.9 $ 594.8 Interest expense and amortization of debt discounts and fees (36.8) (42.5) (118.5) (130.5) Depreciation and amortization (46.2) (43.5) (137.2) (128.8) Stock-based compensation expense (9.2) (4.3) (37.9) (17.4) Noncash loss on disposal of assets (3.0) (1.6) (3.3) (2.0) 109.4 106.5 318.0 316.1 Certain items non-indicative of ongoing operations: Loss on early extinguishment of debt (0.3) (2.6) (10.7) (7.4) Professional fees — accounting, tax, and legal — — — (1.9) Pre-tax income 109.1 103.9 307.3 306.8 Income tax expense(3) (43.1) (42.1) (111.4) (124.2) Income from continuing operations* $ 66.0 $ 61.8 $ 195.9 $ 182.6 Interest and amortization on 2.0% Convertible Senior Subordinated Notes (net of tax)(4) — 2.4 4.6 7.2 Loss on extinguishment of 2.0% Convertible Senior Subordinated Notes (net of tax)(4) — — 6.2 — Diluted shares (see page 33) 99.0 99.4 99.1 99.5 Diluted earnings per share*(4) $ 0.67 $ 0.64 $ 2.08 $ 1.90 u EPS for the third quarter and first nine months of 2017 were impacted by: Ÿ Lower interest expense due primarily to the redemptions of the 7.75% Senior Notes due 2022 in 2016 Ÿ Higher depreciation and amortization resulting from capital investments Ÿ Higher stock-based compensation expense Ÿ Loss on early extinguishment of debt due to the Company’s amendment to its credit agreement governing its senior secured credit facility in September 2017 Ÿ Lower effective income tax rate resulting from windfall tax benefits(5) u EPS for the first nine months of 2017 were impacted by the loss on early extinguishment of debt due to the Company’s exercise of its early redemption option on its 2.0% Convertible Senior Subordinated Notes in Q2 2017. uEPS for Q3 2016 and first nine months of 2016 were impacted by the loss on early extinguishment of debt associated with the redemptions of the 7.75% Senior Notes due 2022. * Earnings per share are determined using income from continuing operations attributable to HealthSouth. Refer to pages 46-48 for end notes.

14 Q3 9 Months 2017 2016 2017 2016 Earnings per share, as reported $ 0.67 $ 0.64 $ 2.08 $ 1.90 Adjustments, net of tax: Professional fees — accounting, tax, and legal — — — 0.01 Mark-to-market adjustment for stock appreciation rights(7) (0.01) (0.01) 0.08 (0.01) Income tax adjustments(5) — — (0.10) — Loss on early extinguishment of debt(4) — 0.02 — 0.04 Sale of hospital — — — (0.01) Adjusted earnings per share* $ 0.66 $ 0.65 $ 2.07 $ 1.95 Adjusted Earnings per Share(6) * Adjusted EPS may not sum due to rounding. See complete calculations of adjusted earnings per share on pages 42-45 Refer to pages 46-48 for end notes. Adjusted earnings per share removes from the GAAP earnings per share calculation the impact of items the Company believes are non-indicative of its ongoing operating performance.

15 Adjusted Free Cash Flow 9 Mos. 2016 (8) Adjusted EBITDA Working Capital and Other Cash Interest Expense Cash Tax Payments, Net of Refunds Maintenance Capital Expenditures Adjusted Free Cash Flow 9 Mos. 2017 $394.5 $20.1 $24.1 $9.4 ($44.4) ($27.6) $376.1 2017 Adjusted Free Cash Flow(8) Reconciliations to GAAP provided on pages 37-45 Refer to pages 46-48 for end notes. u Adjusted free cash flow in year-to-date 2017 decreased primarily as a result of increased cash payments for taxes and increased maintenance capital expenditures. Ÿ Cash payments for taxes increased due to exhaustion of federal NOL in Q1 2017. Ÿ Increased maintenance capital expenditures resulted from refurbishments at certain larger hospitals, leasehold improvements and furnishings associated with the build-out of the Company’s new home office location, growth in the IRF segment, and an enhanced hospital maintenance program. Ÿ Working capital decreased primarily due to improved collection of accounts receivable.

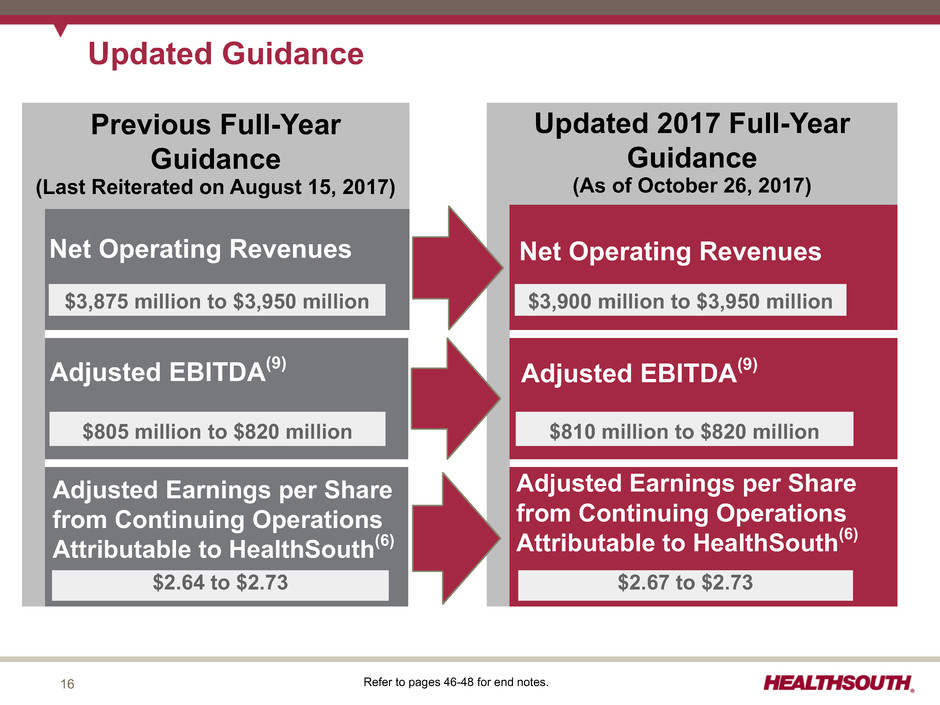

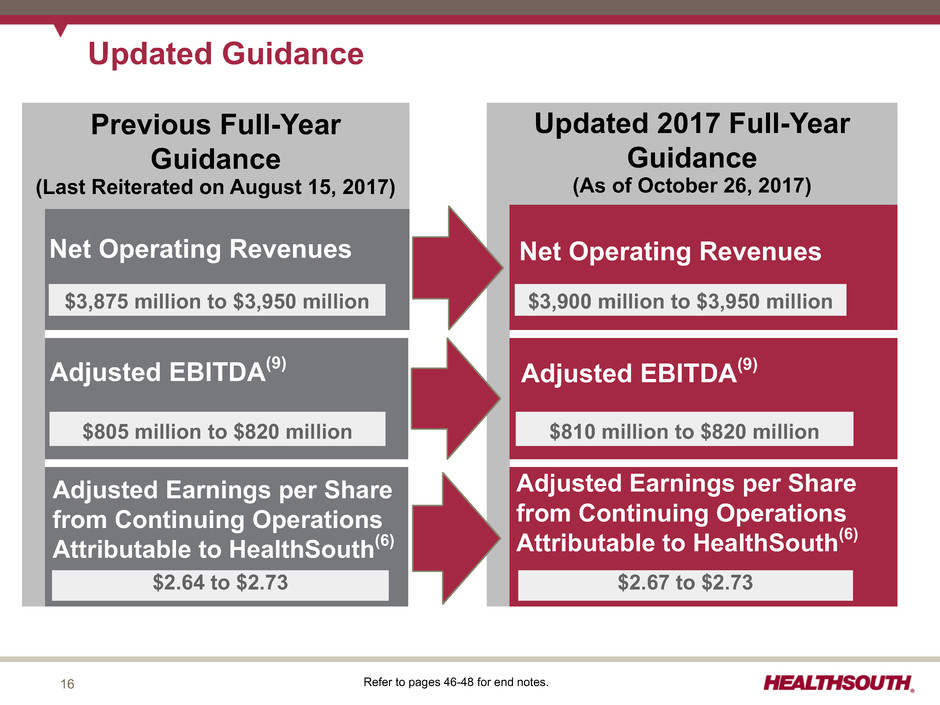

16 Refer to pages 46-48 for end notes. Updated Guidance Adjusted EBITDA(9) Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth(6) Net Operating Revenues Previous Full-Year Guidance (Last Reiterated on August 15, 2017) Updated 2017 Full-Year Guidance (As of October 26, 2017) Net Operating Revenues $3,900 million to $3,950 million Adjusted EBITDA(9) $810 million to $820 million Adjusted Earnings per Share from Continuing Operations Attributable to HealthSouth(6) $2.67 to $2.73 $3,875 million to $3,950 million $805 million to $820 million $2.64 to $2.73

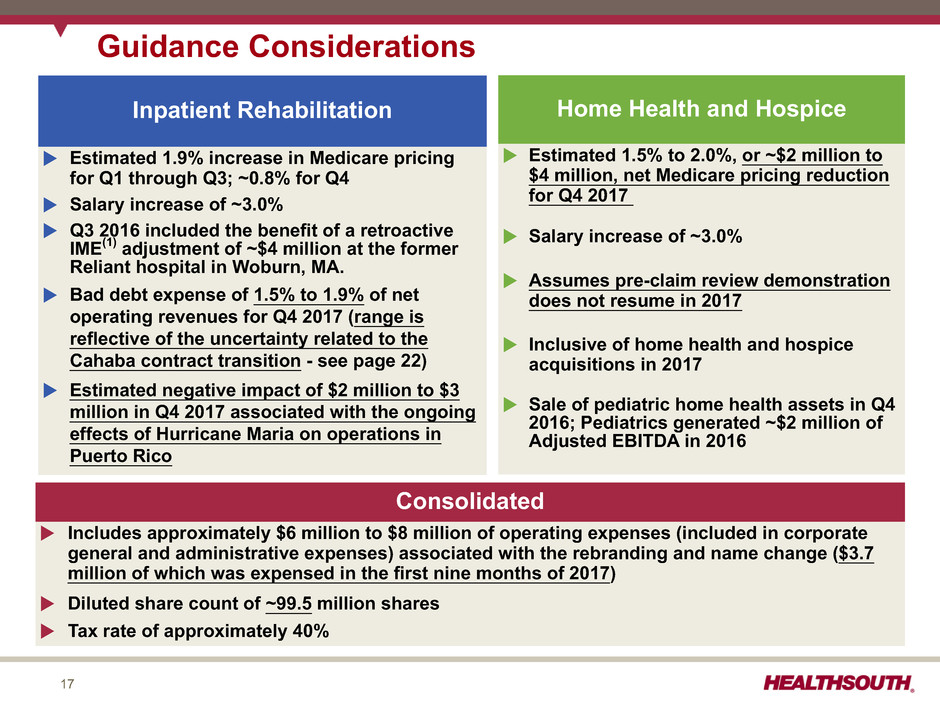

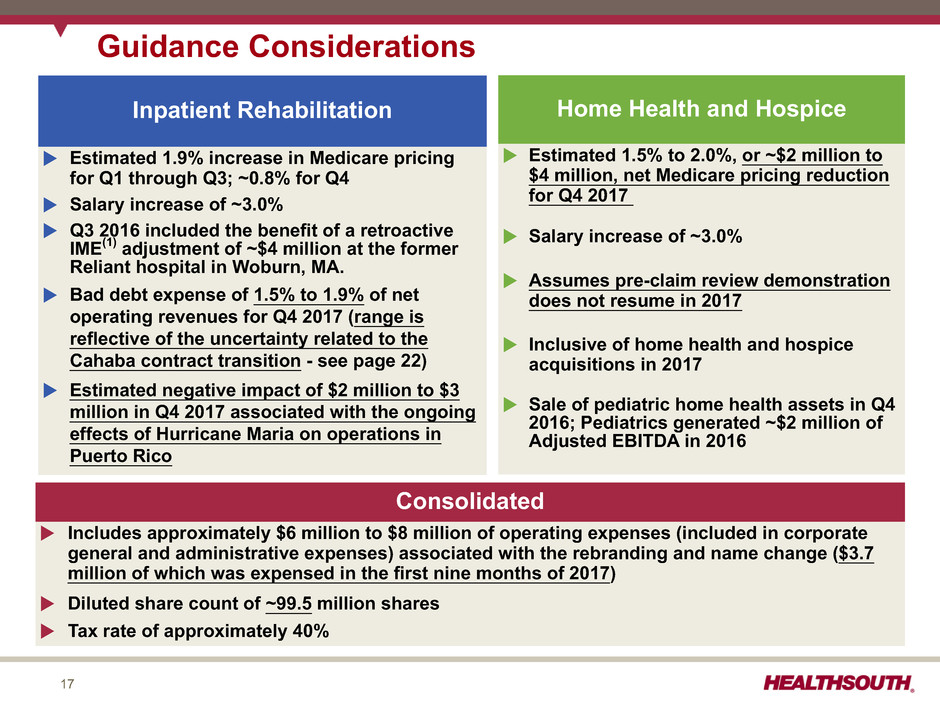

17 Guidance Considerations Inpatient Rehabilitation u Estimated 1.9% increase in Medicare pricing for Q1 through Q3; ~0.8% for Q4 u Salary increase of ~3.0% u Q3 2016 included the benefit of a retroactive IME(1) adjustment of ~$4 million at the former Reliant hospital in Woburn, MA. u Bad debt expense of 1.5% to 1.9% of net operating revenues for Q4 2017 (range is reflective of the uncertainty related to the Cahaba contract transition - see page 22) u Estimated negative impact of $2 million to $3 million in Q4 2017 associated with the ongoing effects of Hurricane Maria on operations in Puerto Rico Home Health and Hospice u Estimated 1.5% to 2.0%, or ~$2 million to $4 million, net Medicare pricing reduction for Q4 2017 u Salary increase of ~3.0% u Assumes pre-claim review demonstration does not resume in 2017 u Inclusive of home health and hospice acquisitions in 2017 u Sale of pediatric home health assets in Q4 2016; Pediatrics generated ~$2 million of Adjusted EBITDA in 2016 Consolidated u Includes approximately $6 million to $8 million of operating expenses (included in corporate general and administrative expenses) associated with the rebranding and name change ($3.7 million of which was expensed in the first nine months of 2017) u Diluted share count of ~99.5 million shares u Tax rate of approximately 40%

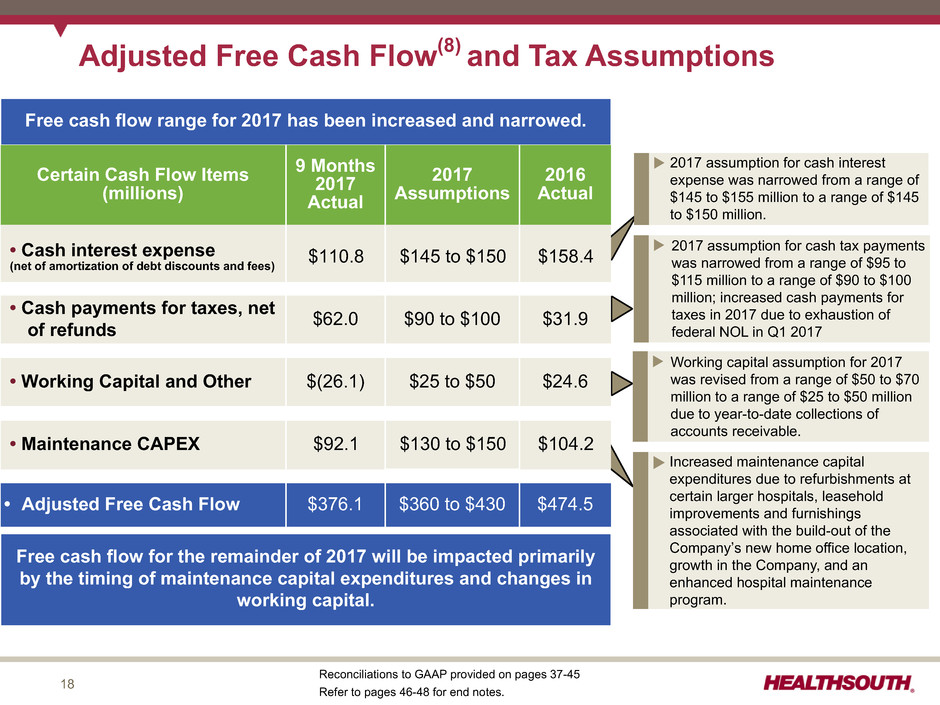

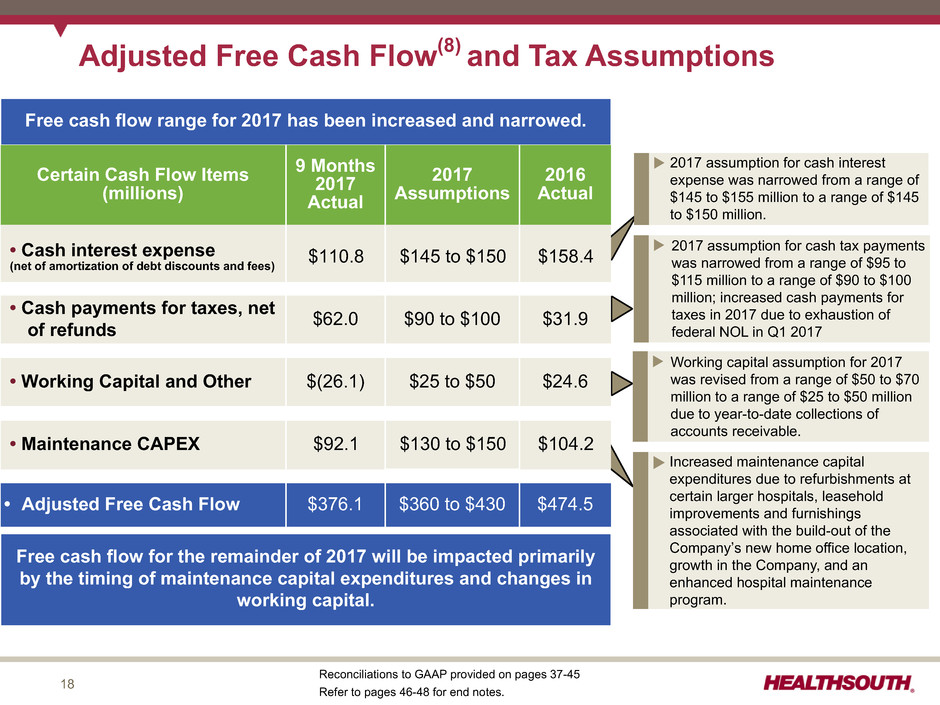

18 Adjusted Free Cash Flow(8) and Tax Assumptions Certain Cash Flow Items (millions) 9 Months 2017 Actual 2017 Assumptions 2016 Actual • Cash interest expense (net of amortization of debt discounts and fees) $110.8 $145 to $150 $158.4 • Cash payments for taxes, net of refunds $62.0 $90 to $100 $31.9 • Working Capital and Other $(26.1) $25 to $50 $24.6 • Maintenance CAPEX $92.1 $130 to $150 $104.2 • Adjusted Free Cash Flow $376.1 $360 to $430 $474.5 Reconciliations to GAAP provided on pages 37-45 Refer to pages 46-48 for end notes. u Increased maintenance capital expenditures due to refurbishments at certain larger hospitals, leasehold improvements and furnishings associated with the build-out of the Company’s new home office location, growth in the Company, and an enhanced hospital maintenance program. u 2017 assumption for cash tax payments was narrowed from a range of $95 to $115 million to a range of $90 to $100 million; increased cash payments for taxes in 2017 due to exhaustion of federal NOL in Q1 2017 u Working capital assumption for 2017 was revised from a range of $50 to $70 million to a range of $25 to $50 million due to year-to-date collections of accounts receivable. Free cash flow for the remainder of 2017 will be impacted primarily by the timing of maintenance capital expenditures and changes in working capital. u 2017 assumption for cash interest expense was narrowed from a range of $145 to $155 million to a range of $145 to $150 million. Free cash flow range for 2017 has been increased and narrowed.

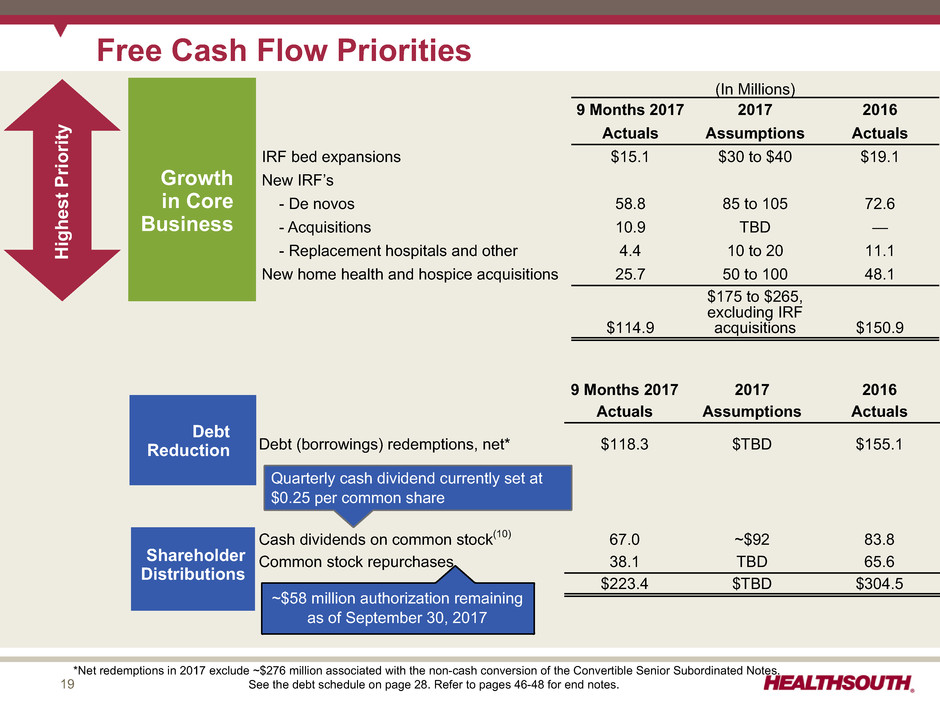

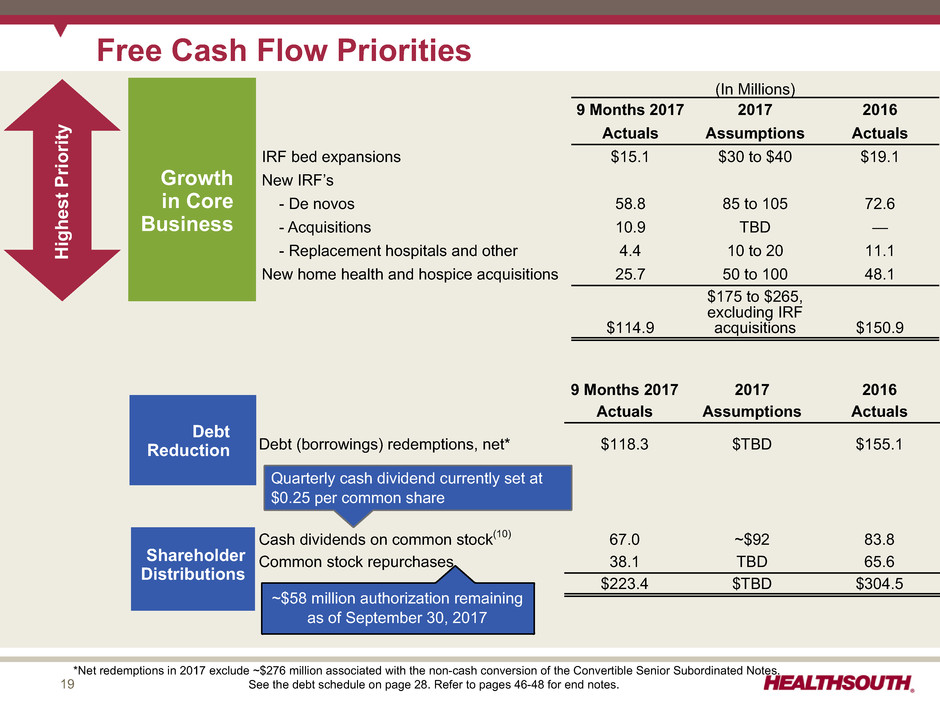

19 *Net redemptions in 2017 exclude ~$276 million associated with the non-cash conversion of the Convertible Senior Subordinated Notes. See the debt schedule on page 28. Refer to pages 46-48 for end notes. Free Cash Flow Priorities (In Millions) 9 Months 2017 2017 2016 Actuals Assumptions Actuals IRF bed expansions $15.1 $30 to $40 $19.1 New IRF’s - De novos 58.8 85 to 105 72.6 - Acquisitions 10.9 TBD — - Replacement hospitals and other 4.4 10 to 20 11.1 New home health and hospice acquisitions 25.7 50 to 100 48.1 $114.9 $175 to $265, excluding IRF acquisitions $150.9 9 Months 2017 2017 2016 Actuals Assumptions Actuals Debt (borrowings) redemptions, net* $118.3 $TBD $155.1 Cash dividends on common stock(10) 67.0 ~$92 83.8 Common stock repurchases 38.1 TBD 65.6 $223.4 $TBD $304.5 Shareholder Distributions Growth in Core Business Debt Reduction Highest Priorit y ~$58 million authorization remaining as of September 30, 2017 Quarterly cash dividend currently set at $0.25 per common share

Appendix

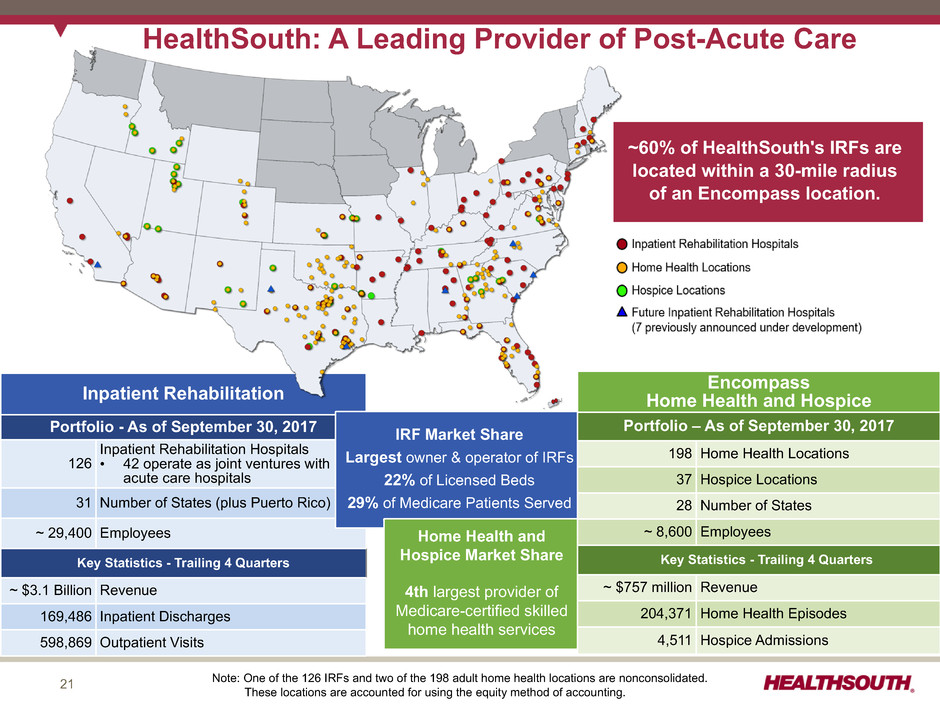

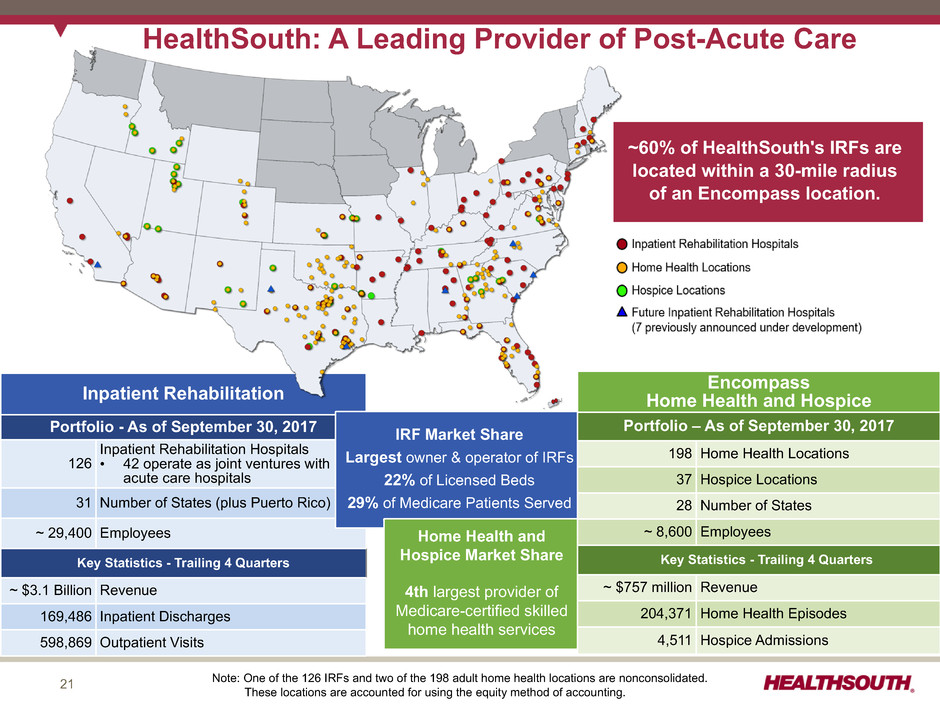

21 HealthSouth: A Leading Provider of Post-Acute Care ~60% of HealthSouth's IRFs are located within a 30-mile radius of an Encompass location. Inpatient Rehabilitation Portfolio - As of September 30, 2017 126 Inpatient Rehabilitation Hospitals • 42 operate as joint ventures with acute care hospitals 31 Number of States (plus Puerto Rico) ~ 29,400 Employees Key Statistics - Trailing 4 Quarters ~ $3.1 Billion Revenue 169,486 Inpatient Discharges 598,869 Outpatient Visits Note: One of the 126 IRFs and two of the 198 adult home health locations are nonconsolidated. These locations are accounted for using the equity method of accounting. IRF Market Share Largest owner & operator of IRFs 22% of Licensed Beds 29% of Medicare Patients Served Home Health and Hospice Market Share 4th largest provider of Medicare-certified skilled home health services Encompass Home Health and Hospice Portfolio – As of September 30, 2017 198 Home Health Locations 37 Hospice Locations 28 Number of States ~ 8,600 Employees Key Statistics - Trailing 4 Quarters ~ $757 million Revenue 204,371 Home Health Episodes 4,511 Hospice Admissions

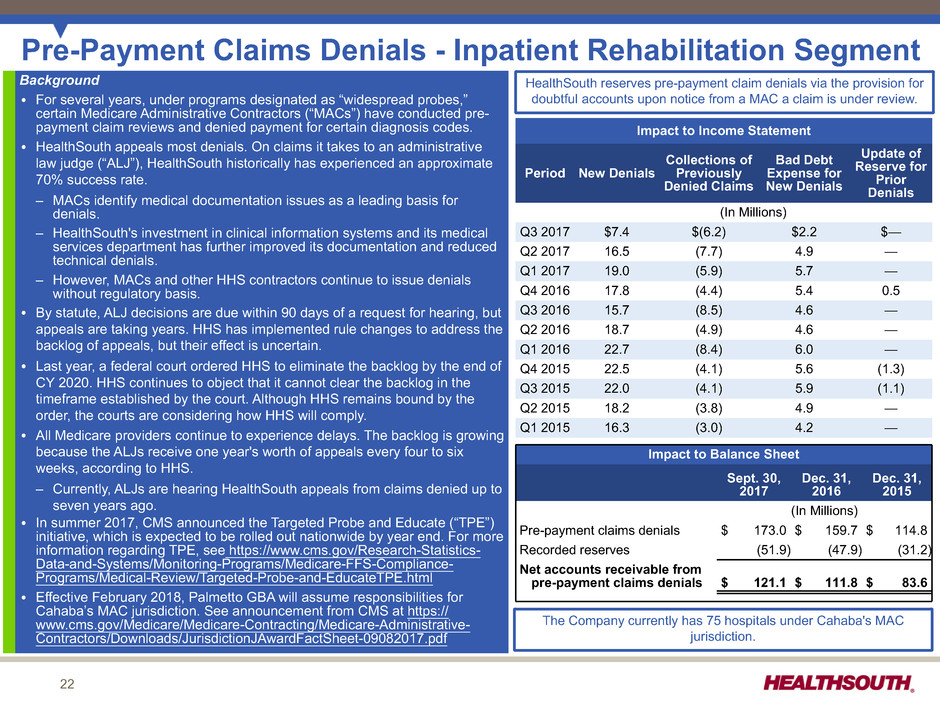

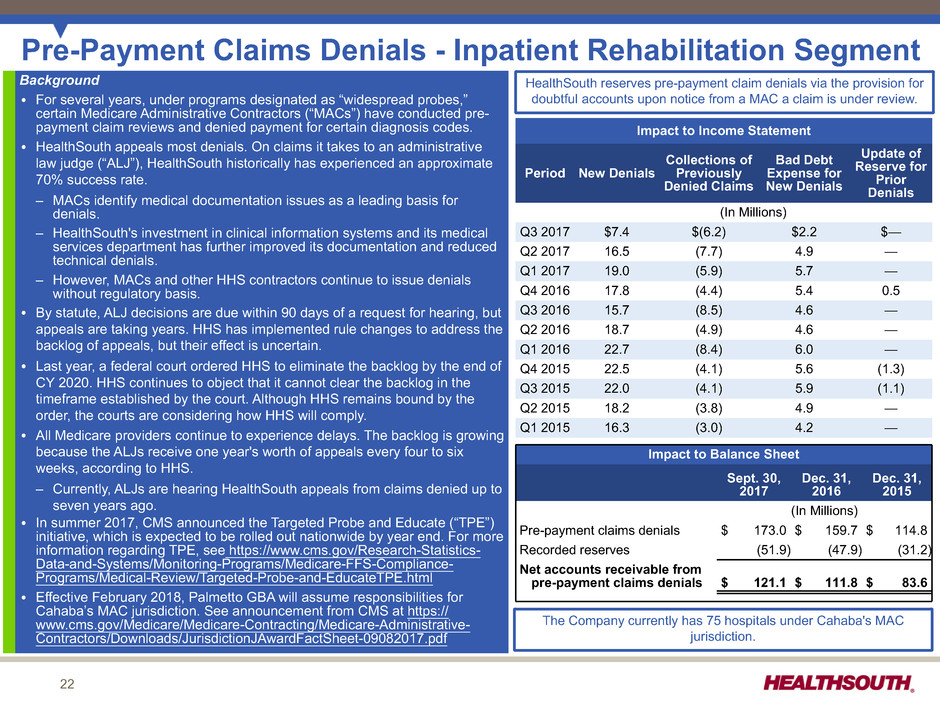

22 Pre-Payment Claims Denials - Inpatient Rehabilitation Segment Impact to Income Statement Period New Denials Collections of Previously Denied Claims Bad Debt Expense for New Denials Update of Reserve for Prior Denials (In Millions) Q3 2017 $7.4 $(6.2) $2.2 $— Q2 2017 16.5 (7.7) 4.9 — Q1 2017 19.0 (5.9) 5.7 — Q4 2016 17.8 (4.4) 5.4 0.5 Q3 2016 15.7 (8.5) 4.6 — Q2 2016 18.7 (4.9) 4.6 — Q1 2016 22.7 (8.4) 6.0 — Q4 2015 22.5 (4.1) 5.6 (1.3) Q3 2015 22.0 (4.1) 5.9 (1.1) Q2 2015 18.2 (3.8) 4.9 — Q1 2015 16.3 (3.0) 4.2 — Impact to Balance Sheet Sept. 30, 2017 Dec. 31, 2016 Dec. 31, 2015 (In Millions) Pre-payment claims denials $ 173.0 $ 159.7 $ 114.8 Recorded reserves (51.9) (47.9) (31.2) Net accounts receivable from pre-payment claims denials $ 121.1 $ 111.8 $ 83.6 Background Ÿ For several years, under programs designated as “widespread probes,” certain Medicare Administrative Contractors (“MACs”) have conducted pre- payment claim reviews and denied payment for certain diagnosis codes. Ÿ HealthSouth appeals most denials. On claims it takes to an administrative law judge (“ALJ”), HealthSouth historically has experienced an approximate 70% success rate. – MACs identify medical documentation issues as a leading basis for denials. – HealthSouth's investment in clinical information systems and its medical services department has further improved its documentation and reduced technical denials. – However, MACs and other HHS contractors continue to issue denials without regulatory basis. Ÿ By statute, ALJ decisions are due within 90 days of a request for hearing, but appeals are taking years. HHS has implemented rule changes to address the backlog of appeals, but their effect is uncertain. Ÿ Last year, a federal court ordered HHS to eliminate the backlog by the end of CY 2020. HHS continues to object that it cannot clear the backlog in the timeframe established by the court. Although HHS remains bound by the order, the courts are considering how HHS will comply. Ÿ All Medicare providers continue to experience delays. The backlog is growing because the ALJs receive one year's worth of appeals every four to six weeks, according to HHS. – Currently, ALJs are hearing HealthSouth appeals from claims denied up to seven years ago. Ÿ In summer 2017, CMS announced the Targeted Probe and Educate (“TPE”) initiative, which is expected to be rolled out nationwide by year end. For more information regarding TPE, see https://www.cms.gov/Research-Statistics- Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance- Programs/Medical-Review/Targeted-Probe-and-EducateTPE.html Ÿ Effective February 2018, Palmetto GBA will assume responsibilities for Cahaba’s MAC jurisdiction. See announcement from CMS at https:// www.cms.gov/Medicare/Medicare-Contracting/Medicare-Administrative- Contractors/Downloads/JurisdictionJAwardFactSheet-09082017.pdf HealthSouth reserves pre-payment claim denials via the provision for doubtful accounts upon notice from a MAC a claim is under review. The Company currently has 75 hospitals under Cahaba's MAC jurisdiction.

23 Expansion Activity Inpatient Rehabilitation Facilities # of New Beds 2017 2018 2019 De Novo: Pearland, TX 40 — — Shelby County, AL — 34 — Hilton Head, SC — 38 — Murrieta, CA — — 50 Joint Ventures: Gulfport, MS (April) 33 — — Westerville, OH (April) 60 — — Jackson, TN* (July) 48 — — Murrells Inlet, SC — 29 — Winston-Salem, NC — 68 — Lubbock, TX — — 40 Bed Expansions, net** 167 ~100 ~100 348 ~269 ~190 * ** Existing wholly owned, 40-bed IRF in Martin, TN became JV in conjunction with this opening Net bed expansions in each year may change due to the timing of certain regulatory approvals and/or construction delays. Q3 2017 acquisition highlights: u Acquired six home health locations in Illinois, Indiana, Arizona, and Ohio u Merged one home health location in Virginia with another existing location Q3 2017 expansion activity highlights: uBegan operating a new 48-bed inpatient rehabilitation hospital with West Tennessee Healthcare in Jackson, TN uEntered into an agreement with University Medical Center Health System to build a 40-bed inpatient rehabilitation hospital in Lubbock, TX uDelayed opening of new 40-bed hospital in Pearland, TX from October 1 to mid-Q4 2017 due to damage caused by Hurricane Harvey uExpanded existing hospitals by 59 beds 2 3 4 5 7 Previously Announced IRF Development Projects Underway 2 New States Home Health and Hospice # of locations December 31, 2016 223 Acquisitions 12 Opening of new locations 3 Merging of locations (3) September 30, 2017 235 1 6 Winston-Salem, NC Gulfport, MS 7

24 • Same-store IRF growth • New-store IRF growth (de novos and acquisitions) • Same-store home health and hospice growth • New-store home health and hospice growth (acquisitions) Core Growth Strong Balance Sheet Key Operational Initiatives Shareholder Distributions Opportunistic Growth Business Outlook 2017 to 2019* 2017 2018 2019 Business Model • Adjusted EBITDA CAGR: 5% - 9%** • Strong free cash flow generation • Quarterly cash dividends • Opportunistic repurchases - (~$58 million authorization remaining as of September 30, 2017) • Implement rebranding and name change • Enhance clinical collaboration between IRFs and home health locations (TeamWorks) • Refine and expand clinical data analytics utilization to further improve patient outcomes (e.g., ReACT; Sepsis Alert) • Leverage clinical expertise to increase stroke admissions • Complete installation of EMR and enhance utilization via continuous in-service upgrades • Develop advanced analytics and predictive models for post-acute management (Post-Acute Innovation Center) • Increase participation in alternative payment models • Leverage of 3.5x or less, subject to opportunities for creating shareholder value Strategy Componen t • Consider acquisitions of other complementary businesses * If legislation affecting Medicare is passed, or if significant changes are made to the home health payment system as suggested in the 2018 proposed home health rule, HealthSouth will evaluate its effect on its business model. ** This is a multi-year CAGR; annual results may fall outside the range.

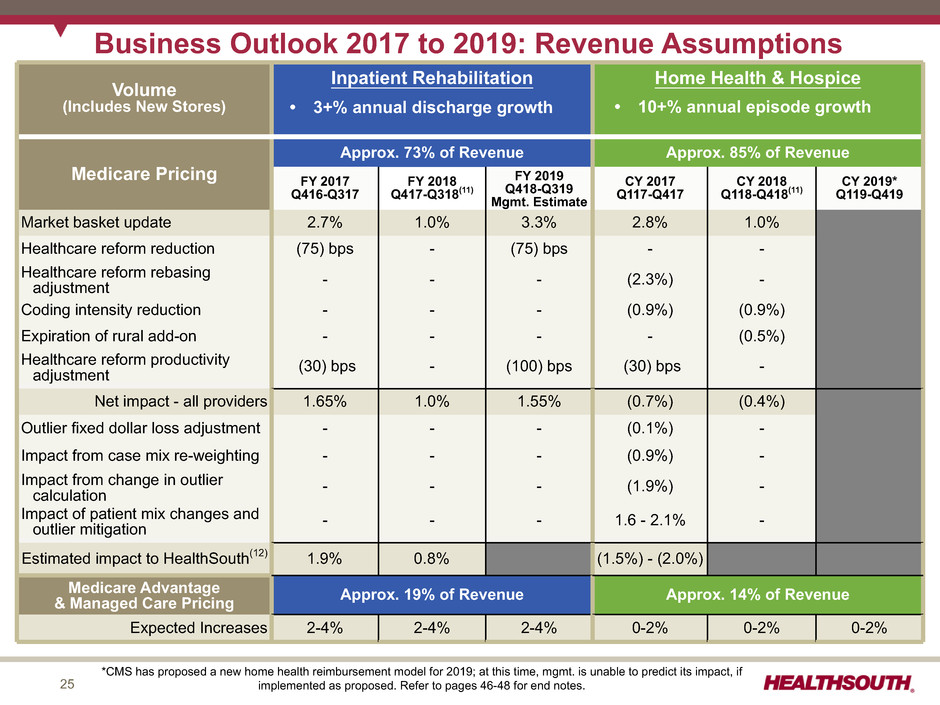

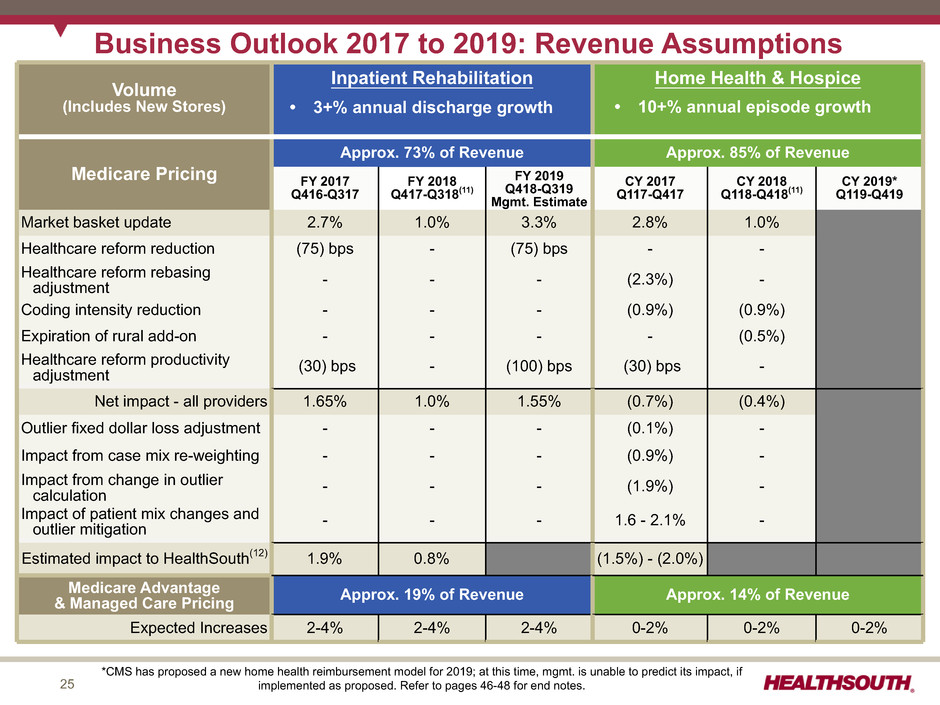

25 • 10% to15% annual episode growth • Includes $35-$40 million per annum in agency acquisitions Volume (Includes New Stores) Inpatient Rehabilitation Home Health & Hospice Medicare Pricing Approx. 73% of Revenue Approx. 85% of Revenue FY 2017 Q416-Q317 FY 2018 Q417-Q318(11) FY 2019 Q418-Q319 Mgmt. Estimate CY 2017 Q117-Q417 CY 2018 Q118-Q418(11) CY 2019* Q119-Q419 Market basket update 2.7% 1.0% 3.3% 2.8% 1.0% Healthcare reform reduction (75) bps - (75) bps - - Healthcare reform rebasing adjustment - - - (2.3%) - Coding intensity reduction - - - (0.9%) (0.9%) Expiration of rural add-on - - - - (0.5%) Healthcare reform productivity adjustment (30) bps - (100) bps (30) bps - Net impact - all providers 1.65% 1.0% 1.55% (0.7%) (0.4%) Outlier fixed dollar loss adjustment - - - (0.1%) - Impact from case mix re-weighting - - - (0.9%) - Impact from change in outlier calculation - - - (1.9%) - Impact of patient mix changes and outlier mitigation - - - 1.6 - 2.1% - Estimated impact to HealthSouth(12) 1.9% 0.8% (1.5%) - (2.0%) Medicare Advantage & Managed Care Pricing Approx. 19% of Revenue Approx. 14% of Revenue Expected Increases 2-4% 2-4% 2-4% 0-2% 0-2% 0-2% Business Outlook 2017 to 2019: Revenue Assumptions • 3+% annual discharge growth • 10+% annual episode growth *CMS has proposed a new home health reimbursement model for 2019; at this time, mgmt. is unable to predict its impact, if implemented as proposed. Refer to pages 46-48 for end notes.

26 Inpatient Rehabilitation Home Health and Hospice Business Outlook 2017 to 2019: Labor and Other Expense Assumptions Salaries & Benefits ~70% Hospital Expenses ~30% Salaries and Benefits 2017 2018 2019 Salary increases 2.75-3.25% 2.75-3.25% 2.75-3.25% Benefit costs increases 5-10% 5-10% 5-10% Hospital Expenses • Other operating expenses and supply costs tracking with inflation Salaries & Benefits ~85% Other Expenses ~15% Home Health Expenses • Other operating expenses and supply costs tracking with inflation Percent of Salaries & Benefits Salaries ~ 90% Benefits ~10%

27 2017 2021 2022 2022 2023 2024 2025 $350 Senior Notes 5.75% $1,200 Senior Notes 5.75% $300 Senior Notes 5.125% $138 Drawn + $35 reserved for LC’s As of September 30, 2017* Debt Maturity Profile - Face Value ($ in millions) $527 Available Callable beginning November 2017 HealthSouth is positioned with a cost-efficient, flexible capital structure. Revolver Revolver Capacity $298 Term Loans Callable beginning September 2020 * This chart does not include ~$272 million of capital lease obligations or ~$80 million of other notes payable. See the debt schedule on page 28. No significant debt maturities prior to 2022 Callable beginning March 2018

28 Debt Schedule Change in September 30, Dec. 31, Debt vs. ($millions) 2017 2016 YE 2016 Advances under $700 million revolving credit facility, September 2022 - LIBOR +150bps $ 138.0 $ 152.0 $ (14.0) Term loan facility, September 2022 - LIBOR +150bps 298.3 421.2 (122.9) Bonds Payable: 5.125% Senior Notes due 2023 295.7 295.3 0.4 5.75% Senior Notes due 2024 1,193.7 1,193.2 0.5 5.75% Senior Notes due 2025 344.3 343.9 0.4 2.0% Convertible Senior Subordinated Notes due 2043 — 275.7 (275.7) Other notes payable 80.1 55.8 24.3 Capital lease obligations 272.3 279.3 (7.0) Long-term debt $ 2,622.4 $ 3,016.4 $ (394.0) Debt to Adjusted EBITDA 3.2x 3.8x Reconciliations to GAAP provided on pages 37-45

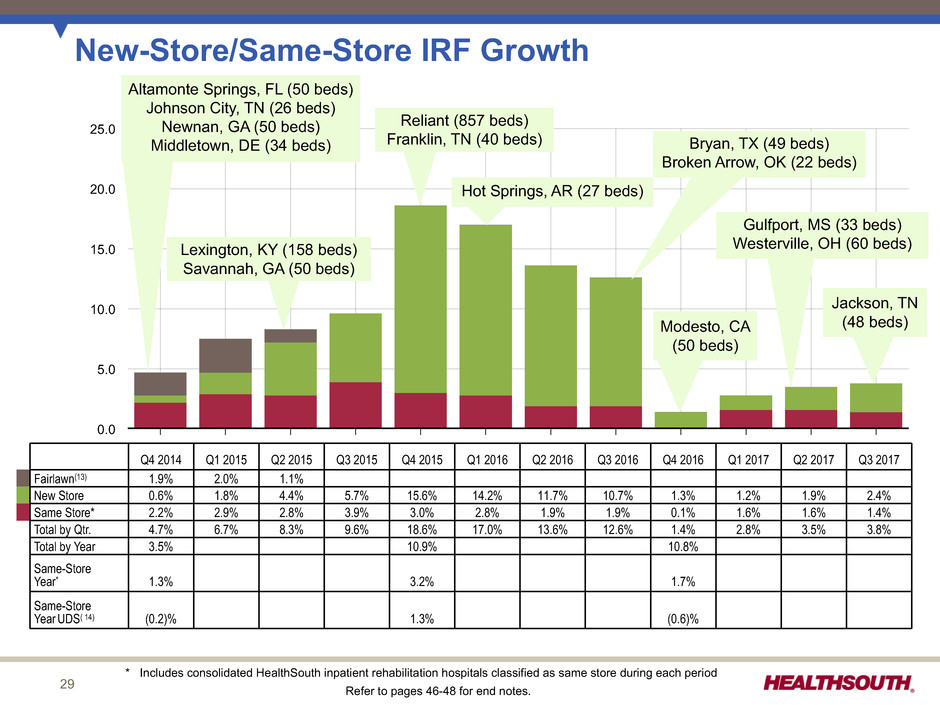

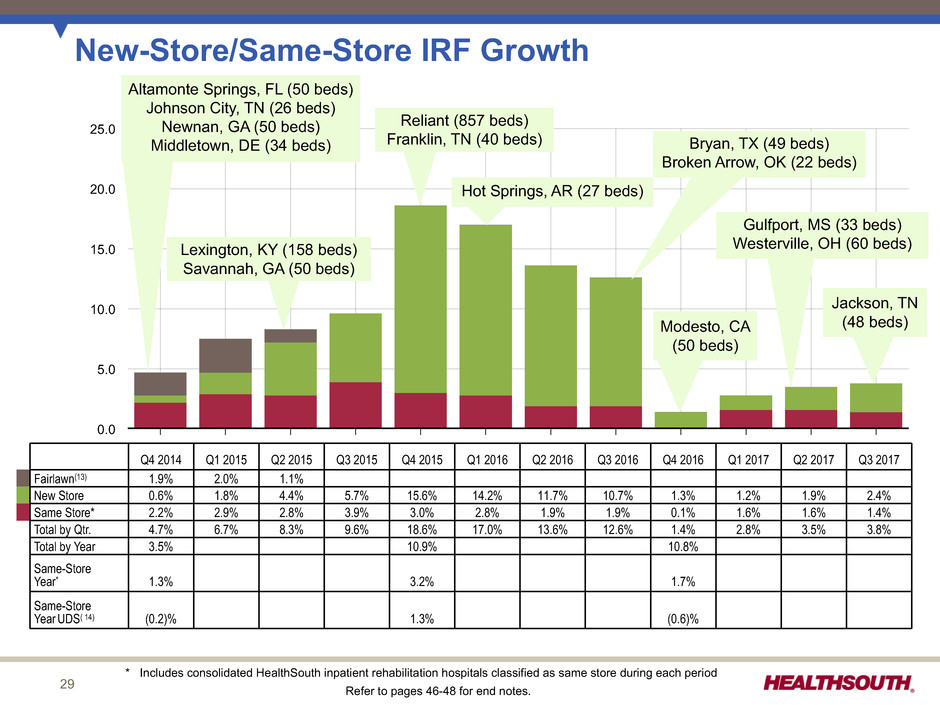

29 25.0 20.0 15.0 10.0 5.0 0.0 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 New-Store/Same-Store IRF Growth Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Fairlawn(13) 1.9% 2.0% 1.1% New Store 0.6% 1.8% 4.4% 5.7% 15.6% 14.2% 11.7% 10.7% 1.3% 1.2% 1.9% 2.4% Same Store* 2.2% 2.9% 2.8% 3.9% 3.0% 2.8% 1.9% 1.9% 0.1% 1.6% 1.6% 1.4% Total by Qtr. 4.7% 6.7% 8.3% 9.6% 18.6% 17.0% 13.6% 12.6% 1.4% 2.8% 3.5% 3.8% Total by Year 3.5% 10.9% 10.8% Same-Store Year* 1.3% 3.2% 1.7% Same-Store Year UDS( 14) (0.2)% 1.3% (0.6)% Altamonte Springs, FL (50 beds) Johnson City, TN (26 beds) Newnan, GA (50 beds) Middletown, DE (34 beds) Reliant (857 beds) Franklin, TN (40 beds) Lexington, KY (158 beds) Savannah, GA (50 beds) Bryan, TX (49 beds) Broken Arrow, OK (22 beds) * Includes consolidated HealthSouth inpatient rehabilitation hospitals classified as same store during each period Refer to pages 46-48 for end notes. Modesto, CA (50 beds) Hot Springs, AR (27 beds) Gulfport, MS (33 beds) Westerville, OH (60 beds) Jackson, TN (48 beds)

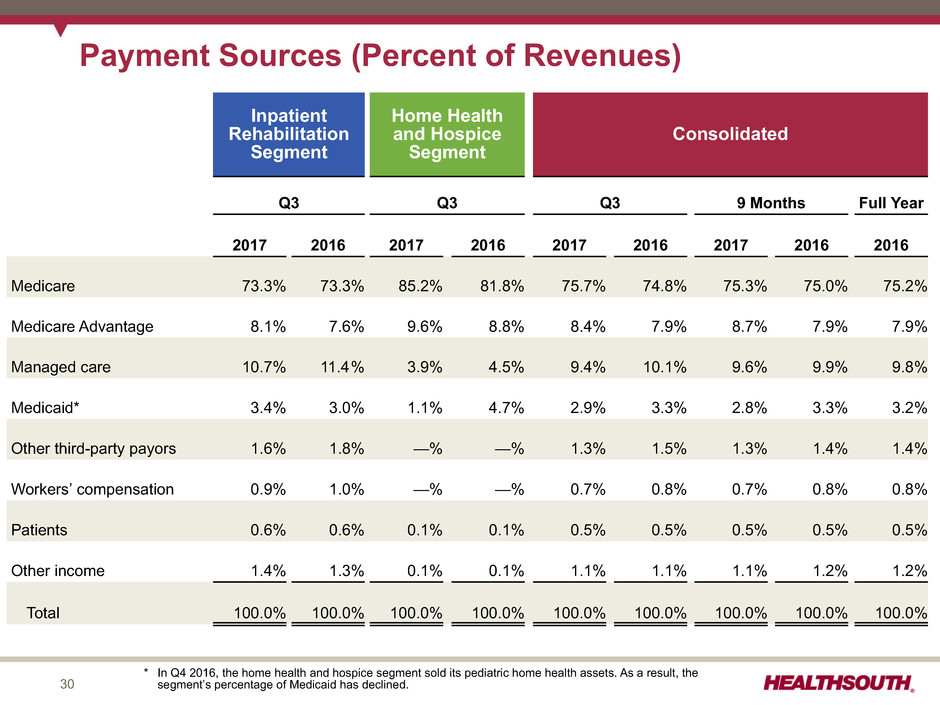

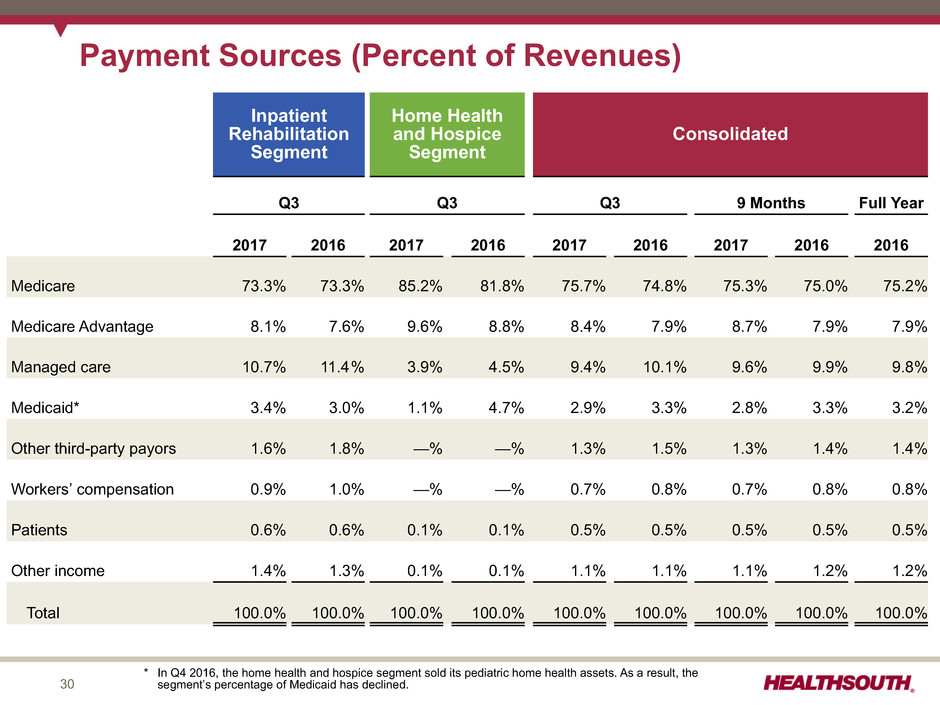

30 Payment Sources (Percent of Revenues) Inpatient Rehabilitation Segment Home Health and Hospice Segment Consolidated Q3 Q3 Q3 9 Months Full Year 2017 2016 2017 2016 2017 2016 2017 2016 2016 Medicare 73.3% 73.3% 85.2% 81.8% 75.7% 74.8% 75.3% 75.0% 75.2% Medicare Advantage 8.1% 7.6% 9.6% 8.8% 8.4% 7.9% 8.7% 7.9% 7.9% Managed care 10.7% 11.4% 3.9% 4.5% 9.4% 10.1% 9.6% 9.9% 9.8% Medicaid* 3.4% 3.0% 1.1% 4.7% 2.9% 3.3% 2.8% 3.3% 3.2% Other third-party payors 1.6% 1.8% —% —% 1.3% 1.5% 1.3% 1.4% 1.4% Workers’ compensation 0.9% 1.0% —% —% 0.7% 0.8% 0.7% 0.8% 0.8% Patients 0.6% 0.6% 0.1% 0.1% 0.5% 0.5% 0.5% 0.5% 0.5% Other income 1.4% 1.3% 0.1% 0.1% 1.1% 1.1% 1.1% 1.2% 1.2% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% * In Q4 2016, the home health and hospice segment sold its pediatric home health assets. As a result, the segment’s percentage of Medicaid has declined.

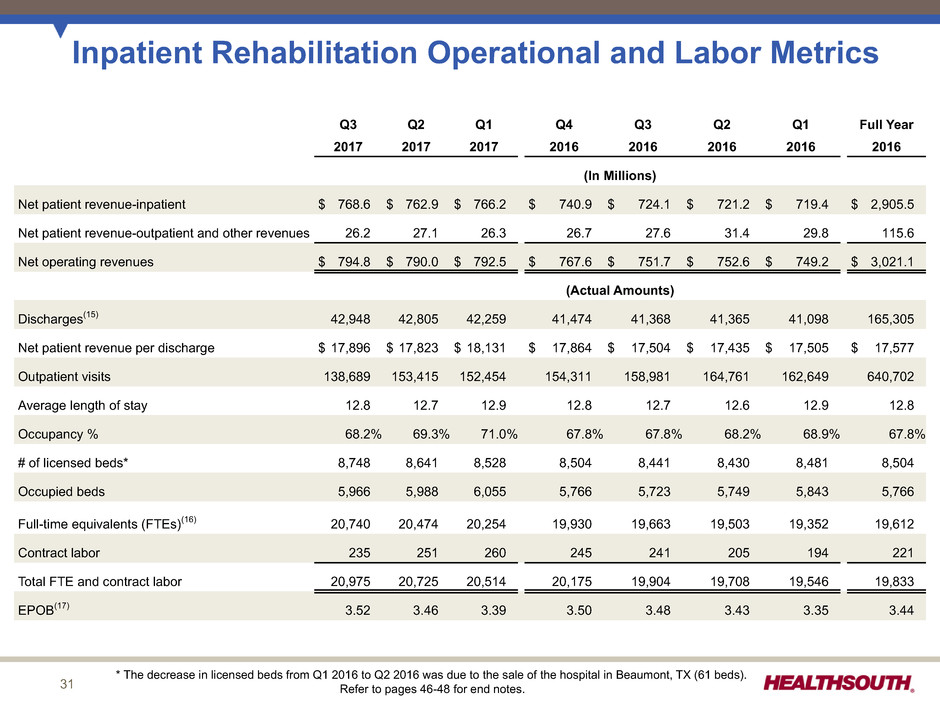

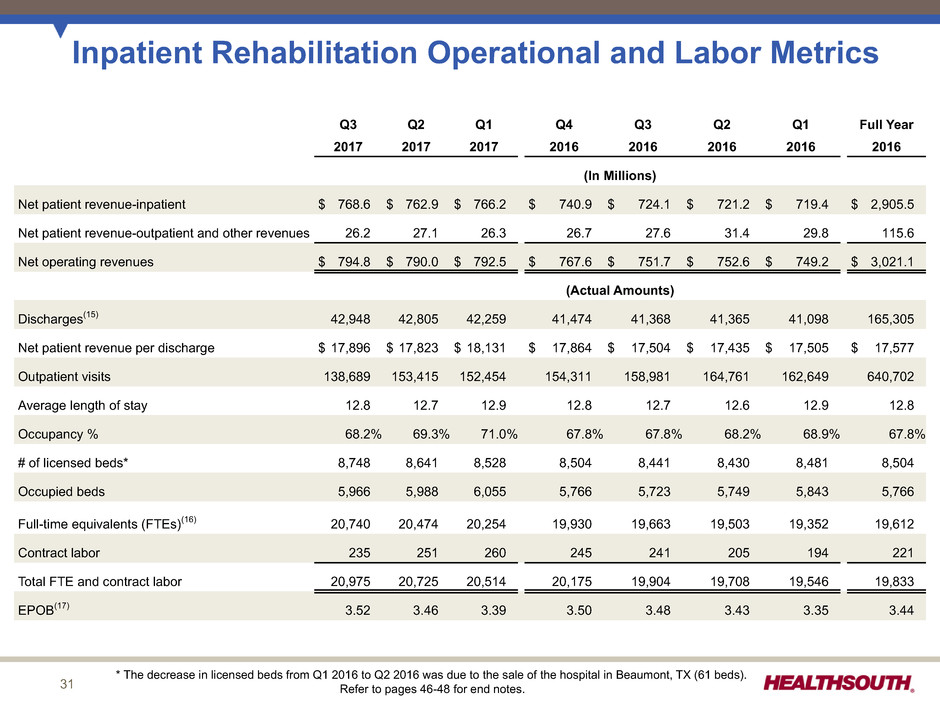

31 Inpatient Rehabilitation Operational and Labor Metrics Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year 2017 2017 2017 2016 2016 2016 2016 2016 (In Millions) Net patient revenue-inpatient $ 768.6 $ 762.9 $ 766.2 $ 740.9 $ 724.1 $ 721.2 $ 719.4 $ 2,905.5 Net patient revenue-outpatient and other revenues 26.2 27.1 26.3 26.7 27.6 31.4 29.8 115.6 Net operating revenues $ 794.8 $ 790.0 $ 792.5 $ 767.6 $ 751.7 $ 752.6 $ 749.2 $ 3,021.1 (Actual Amounts) Discharges(15) 42,948 42,805 42,259 41,474 41,368 41,365 41,098 165,305 Net patient revenue per discharge $ 17,896 $ 17,823 $ 18,131 $ 17,864 $ 17,504 $ 17,435 $ 17,505 $ 17,577 Outpatient visits 138,689 153,415 152,454 154,311 158,981 164,761 162,649 640,702 Average length of stay 12.8 12.7 12.9 12.8 12.7 12.6 12.9 12.8 Occupancy % 68.2% 69.3% 71.0% 67.8% 67.8% 68.2% 68.9% 67.8% # of licensed beds* 8,748 8,641 8,528 8,504 8,441 8,430 8,481 8,504 Occupied beds 5,966 5,988 6,055 5,766 5,723 5,749 5,843 5,766 Full-time equivalents (FTEs)(16) 20,740 20,474 20,254 19,930 19,663 19,503 19,352 19,612 Contract labor 235 251 260 245 241 205 194 221 Total FTE and contract labor 20,975 20,725 20,514 20,175 19,904 19,708 19,546 19,833 EPOB(17) 3.52 3.46 3.39 3.50 3.48 3.43 3.35 3.44 * The decrease in licensed beds from Q1 2016 to Q2 2016 was due to the sale of the hospital in Beaumont, TX (61 beds). Refer to pages 46-48 for end notes.

32 Home Health and Hospice Operational Metrics Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year 2017 2017 2017 2016 2016 2016 2016 2016 (In Millions) Net home health revenue $ 181.2 $ 172.9 $ 165.3 $ 165.2 $ 162.0 $ 157.1 $ 150.9 $ 635.2 Net hospice and other revenue 19.6 18.4 17.0 17.1 13.1 11.0 9.7 50.9 Net operating revenues $ 200.8 $ 191.3 $ 182.3 $ 182.3 $ 175.1 $ 168.1 $ 160.6 $ 686.1 Home Health: (Actual Amounts) Admissions(18) 31,471 30,823 30,810 27,957 27,239 25,753 25,763 106,712 Recertifications 24,396 22,568 20,546 21,422 20,888 20,432 19,453 82,195 Episodes 53,757 52,101 49,260 49,253 46,866 45,774 43,844 185,737 Average revenue per episode $ 3,022 $ 2,989 $ 2,991 $ 3,023 $ 3,032 $ 3,033 $ 3,035 $ 3,031 Episodic visits per episode 17.7 18.1 18.7 18.4 19.0 18.9 19.1 18.8 Total visits 1,101,109 1,095,225 1,070,356 1,033,502 1,001,021 967,968 937,804 3,940,295 Cost per visit $ 76 $ 73 $ 75 $ 76 $ 75 $ 73 $ 73 $ 74 Hospice: Admissions(19) 1,273 1,114 1,128 996 832 785 724 3,337 Patient days 123,491 113,028 108,717 104,183 83,628 71,277 63,431 322,519 Revenue per day $ 159 $ 162 $ 157 $ 164 $ 157 $ 154 $ 153 $ 158 Refer to pages 46-48 for end notes.

33 Share Information Weighted Average for the Period Q3 9 Months Full Year (Millions) 2017 2016 2017 2016 2016 2015 2014 Basic shares outstanding(20)(21) 97.8 89.1 92.3 89.3 89.1 89.4 86.8 Convertible perpetual preferred stock(20) — — — — — 1.0 3.2 Convertible senior subordinated notes(21) — 8.5 5.4 8.5 8.5 8.3 8.2 Restricted stock awards, dilutive stock options, restricted stock units, and common stock warrants(22) 1.2 1.8 1.4 1.7 1.9 2.3 2.5 Diluted shares outstanding 99.0 99.4 99.1 99.5 99.5 101.0 100.7 End of Period Q3 9 Months Full Year (Millions) 2017 2016 2017 2016 2016 2015 2014 Basic shares outstanding(20)(21) 97.6 89.1 97.6 89.1 88.3 89.3 86.6 Refer to pages 46-48 for end notes.

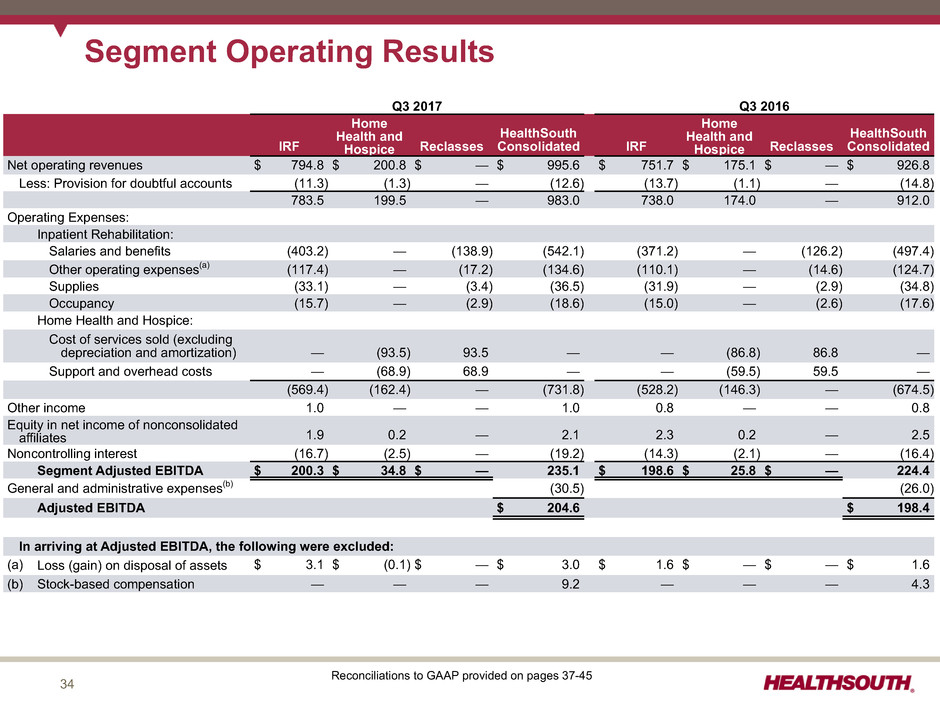

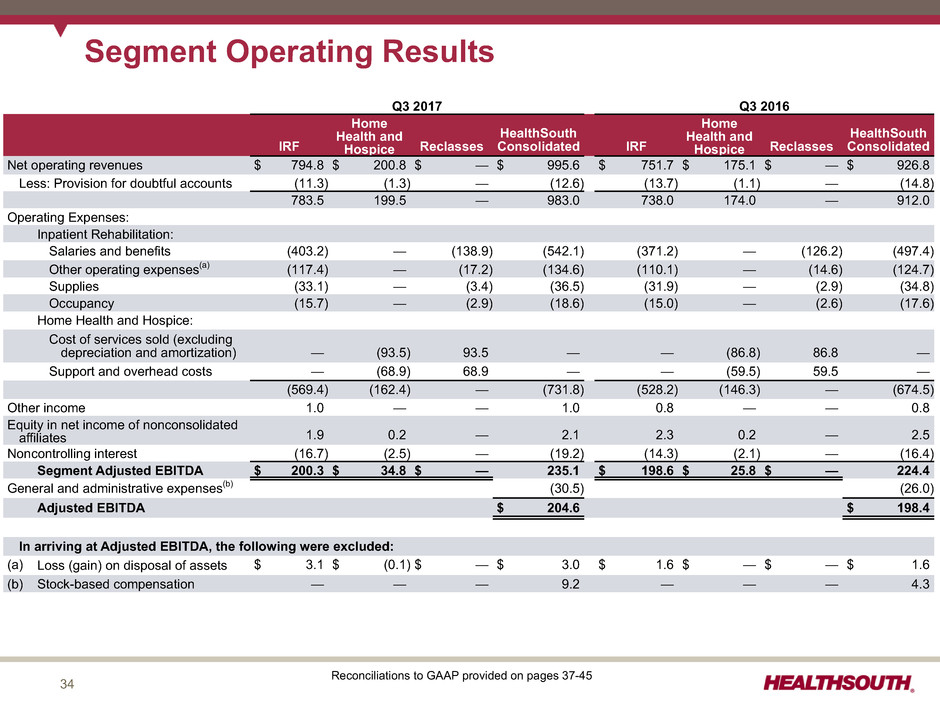

34 Segment Operating Results Q3 2017 Q3 2016 IRF Home Health and Hospice Reclasses HealthSouth Consolidated IRF Home Health and Hospice Reclasses HealthSouth Consolidated Net operating revenues $ 794.8 $ 200.8 $ — $ 995.6 $ 751.7 $ 175.1 $ — $ 926.8 Less: Provision for doubtful accounts (11.3) (1.3) — (12.6) (13.7) (1.1) — (14.8) 783.5 199.5 — 983.0 738.0 174.0 — 912.0 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (403.2) — (138.9) (542.1) (371.2) — (126.2) (497.4) Other operating expenses(a) (117.4) — (17.2) (134.6) (110.1) — (14.6) (124.7) Supplies (33.1) — (3.4) (36.5) (31.9) — (2.9) (34.8) Occupancy (15.7) — (2.9) (18.6) (15.0) — (2.6) (17.6) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (93.5) 93.5 — — (86.8) 86.8 — Support and overhead costs — (68.9) 68.9 — — (59.5) 59.5 — (569.4) (162.4) — (731.8) (528.2) (146.3) — (674.5) Other income 1.0 — — 1.0 0.8 — — 0.8 Equity in net income of nonconsolidated affiliates 1.9 0.2 — 2.1 2.3 0.2 — 2.5 Noncontrolling interest (16.7) (2.5) — (19.2) (14.3) (2.1) — (16.4) Segment Adjusted EBITDA $ 200.3 $ 34.8 $ — 235.1 $ 198.6 $ 25.8 $ — 224.4 General and administrative expenses(b) (30.5) (26.0) Adjusted EBITDA $ 204.6 $ 198.4 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal of assets $ 3.1 $ (0.1) $ — $ 3.0 $ 1.6 $ — $ — $ 1.6 (b) Stock-based compensation — — — 9.2 — — — 4.3 Reconciliations to GAAP provided on pages 37-45

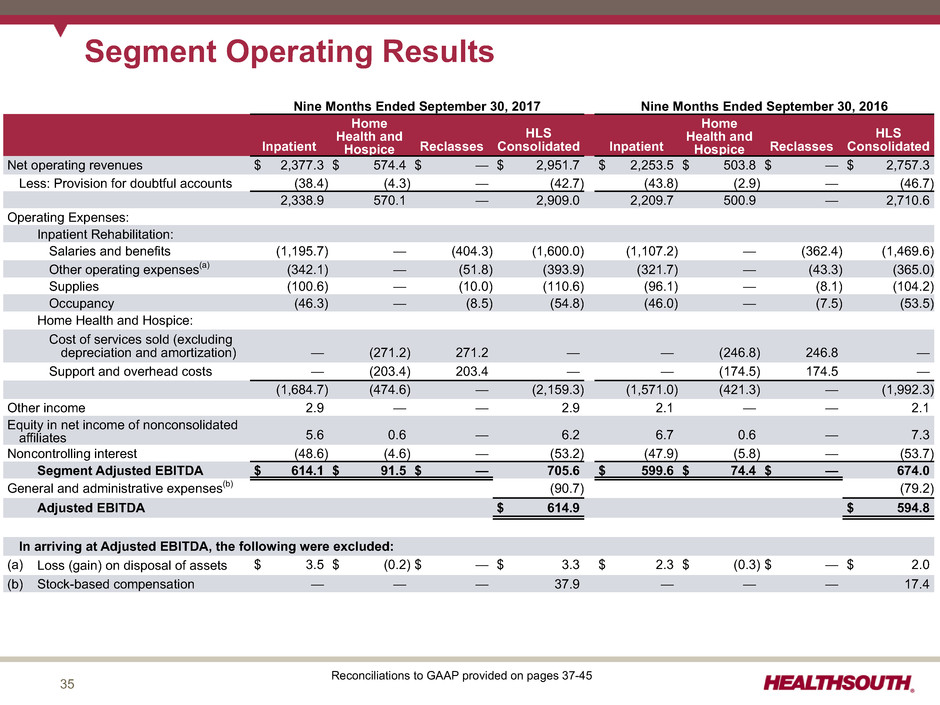

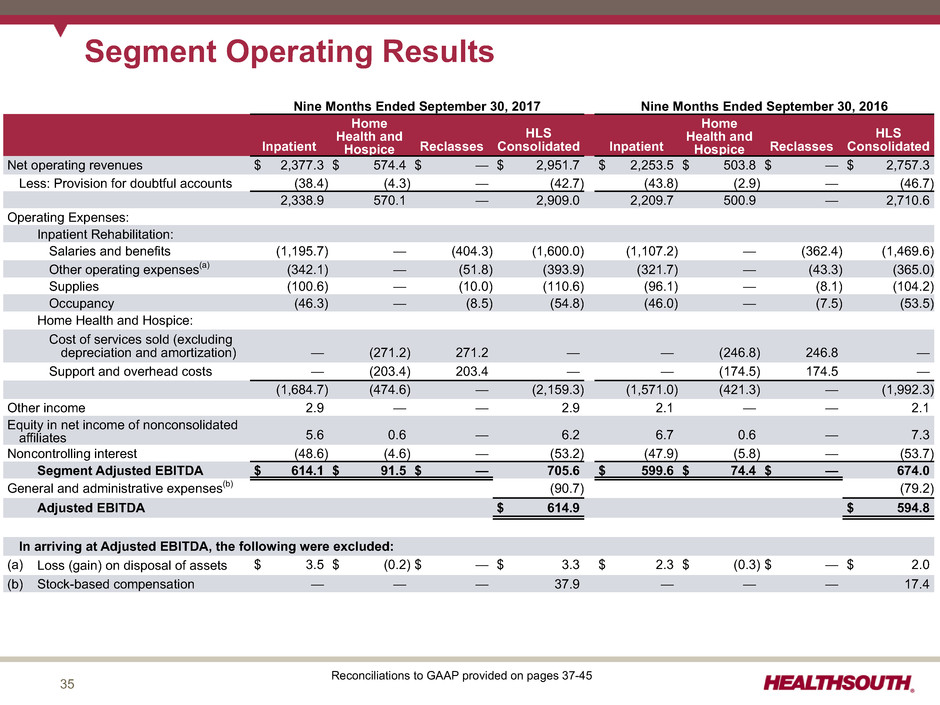

35 Segment Operating Results Nine Months Ended September 30, 2017 Nine Months Ended September 30, 2016 Inpatient Home Health and Hospice Reclasses HLS Consolidated Inpatient Home Health and Hospice Reclasses HLS Consolidated Net operating revenues $ 2,377.3 $ 574.4 $ — $ 2,951.7 $ 2,253.5 $ 503.8 $ — $ 2,757.3 Less: Provision for doubtful accounts (38.4) (4.3) — (42.7) (43.8) (2.9) — (46.7) 2,338.9 570.1 — 2,909.0 2,209.7 500.9 — 2,710.6 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (1,195.7) — (404.3) (1,600.0) (1,107.2) — (362.4) (1,469.6) Other operating expenses(a) (342.1) — (51.8) (393.9) (321.7) — (43.3) (365.0) Supplies (100.6) — (10.0) (110.6) (96.1) — (8.1) (104.2) Occupancy (46.3) — (8.5) (54.8) (46.0) — (7.5) (53.5) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (271.2) 271.2 — — (246.8) 246.8 — Support and overhead costs — (203.4) 203.4 — — (174.5) 174.5 — (1,684.7) (474.6) — (2,159.3) (1,571.0) (421.3) — (1,992.3) Other income 2.9 — — 2.9 2.1 — — 2.1 Equity in net income of nonconsolidated affiliates 5.6 0.6 — 6.2 6.7 0.6 — 7.3 Noncontrolling interest (48.6) (4.6) — (53.2) (47.9) (5.8) — (53.7) Segment Adjusted EBITDA $ 614.1 $ 91.5 $ — 705.6 $ 599.6 $ 74.4 $ — 674.0 General and administrative expenses(b) (90.7) (79.2) Adjusted EBITDA $ 614.9 $ 594.8 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal of assets $ 3.5 $ (0.2) $ — $ 3.3 $ 2.3 $ (0.3) $ — $ 2.0 (b) Stock-based compensation — — — 37.9 — — — 17.4 Reconciliations to GAAP provided on pages 37-45

36 Segment Operating Results Year Ended December 31, 2016 IRF Home Health and Hospice Reclasses HealthSouth Consolidated Net operating revenues $ 3,021.1 $ 686.1 $ — $ 3,707.2 Less: Provision for doubtful accounts (57.0) (4.2) — (61.2) 2,964.1 681.9 — 3,646.0 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (1,493.4) — (492.5) (1,985.9) Other operating expenses(a) (431.5) — (59.9) (491.4) Supplies (128.8) — (11.2) (140.0) Occupancy (61.2) — (10.1) (71.3) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (336.5) 336.5 — Support and overhead costs — (237.2) 237.2 — (2,114.9) (573.7) — (2,688.6) Other income 2.9 — — 2.9 Equity in net income of nonconsolidated affiliates 9.1 0.7 — 9.8 Noncontrolling interest (64.0) (6.5) — (70.5) Segment Adjusted EBITDA $ 797.2 $ 102.4 $ — 899.6 General and administrative expenses(b) (106.0) Adjusted EBITDA $ 793.6 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal of assets $ 4.3 $ (3.6) $ — $ 0.7 (b) Stock-based compensation expense — — — 27.4 Reconciliations to GAAP provided on pages 37-45

37 Reconciliation of Net Income to Adjusted EBITDA(9) 2017 Q1 Q2 Q3 9 Months (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 84.4 $ 79.4 $ 85.1 $ 248.9 Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.3 (0.2) 0.1 0.2 Net income attributable to noncontrolling interests (17.6) (16.4) (19.2) (53.2) Income from continuing operations attributable to HealthSouth* 67.1 $ 0.70 62.8 $ 0.66 66.0 $ 0.67 195.9 $ 2.08 Provision for income tax expense 39.7 28.6 43.1 111.4 Interest expense and amortization of debt discounts and fees 41.3 40.4 36.8 118.5 Depreciation and amortization 45.2 45.8 46.2 137.2 Loss on early extinguishment of debt — 10.4 0.3 10.7 Net noncash (gain) loss on disposal of assets (0.5) 0.8 3.0 3.3 Stock-based compensation expense 8.0 20.7 9.2 37.9 Adjusted EBITDA $ 200.8 $ 209.5 $ 204.6 $ 614.9 Weighted average common shares outstanding: Basic 88.8 90.3 97.8 92.3 Diluted 99.0 98.9 99.0 99.1 * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. Refer to pages 46-48 for end notes.

38 Reconciliation of Net Income to Adjusted EBITDA(9) 2016 Q1 Q2 Q3 Q4 Full Year (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net Income $ 76.7 $ 81.2 $ 78.1 $ 82.1 $ 318.1 Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.1 0.1 0.1 (0.3) — Net income attributable to noncontrolling interests (18.7) (18.6) (16.4) (16.8) (70.5) Income from continuing operations attributable to HealthSouth* 58.1 $ 0.61 62.7 $ 0.65 61.8 $ 0.64 65.0 $ 0.68 247.6 $ 2.59 Professional fees — acct, tax, and legal 0.2 1.7 — — 1.9 Provision for income tax expense 39.7 42.4 42.1 39.7 163.9 Interest expense and amortization of debt discounts and fees 44.6 43.4 42.5 41.6 172.1 Depreciation and amortization 42.4 42.9 43.5 43.8 172.6 Loss on early extinguishment of debt 2.4 2.4 2.6 — 7.4 Net noncash loss (gain) on disposal of assets 0.2 0.2 1.6 (1.3) 0.7 Stock-based compensation expense 4.5 8.6 4.3 10.0 27.4 Adjusted EBITDA $ 192.1 $ 204.3 $ 198.4 $ 198.8 $ 793.6 Weighted average common shares outstanding: Basic 89.5 89.3 89.1 88.6 89.1 Diluted 99.4 99.4 99.4 99.2 99.5 * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. Refer to pages 46-48 for end notes.

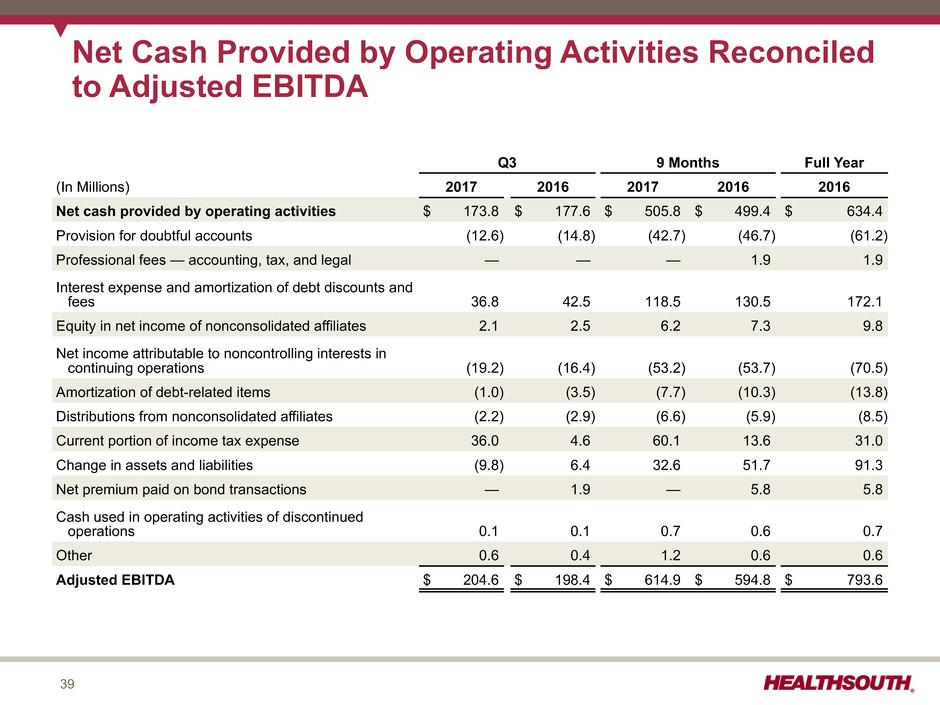

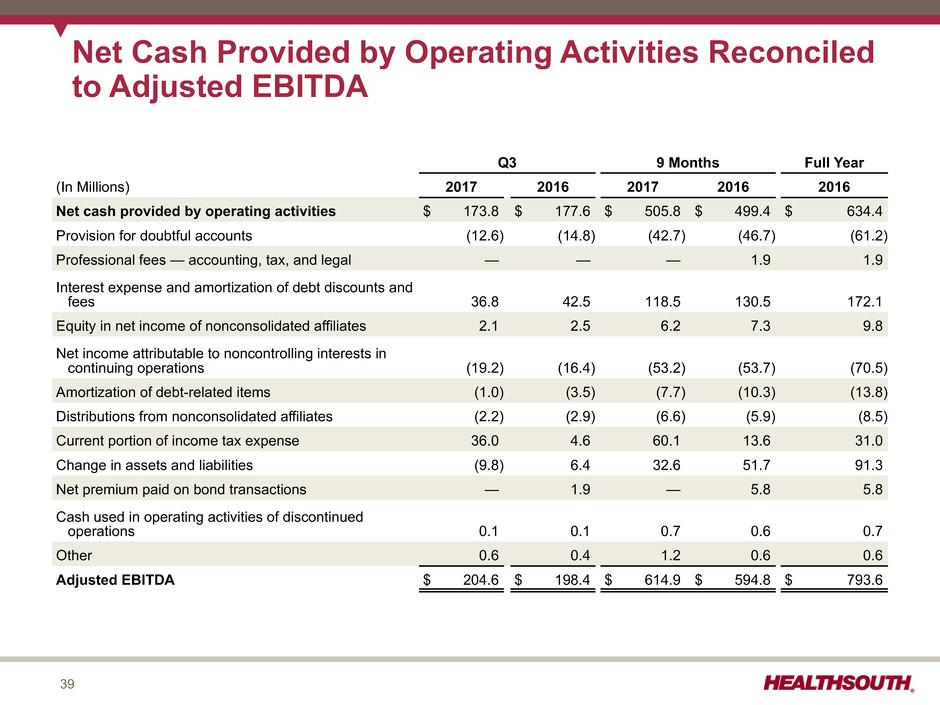

39 Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA Q3 9 Months Full Year (In Millions) 2017 2016 2017 2016 2016 Net cash provided by operating activities $ 173.8 $ 177.6 $ 505.8 $ 499.4 $ 634.4 Provision for doubtful accounts (12.6) (14.8) (42.7) (46.7) (61.2) Professional fees — accounting, tax, and legal — — — 1.9 1.9 Interest expense and amortization of debt discounts and fees 36.8 42.5 118.5 130.5 172.1 Equity in net income of nonconsolidated affiliates 2.1 2.5 6.2 7.3 9.8 Net income attributable to noncontrolling interests in continuing operations (19.2) (16.4) (53.2) (53.7) (70.5) Amortization of debt-related items (1.0) (3.5) (7.7) (10.3) (13.8) Distributions from nonconsolidated affiliates (2.2) (2.9) (6.6) (5.9) (8.5) Current portion of income tax expense 36.0 4.6 60.1 13.6 31.0 Change in assets and liabilities (9.8) 6.4 32.6 51.7 91.3 Net premium paid on bond transactions — 1.9 — 5.8 5.8 Cash used in operating activities of discontinued operations 0.1 0.1 0.7 0.6 0.7 Other 0.6 0.4 1.2 0.6 0.6 Adjusted EBITDA $ 204.6 $ 198.4 $ 614.9 $ 594.8 $ 793.6

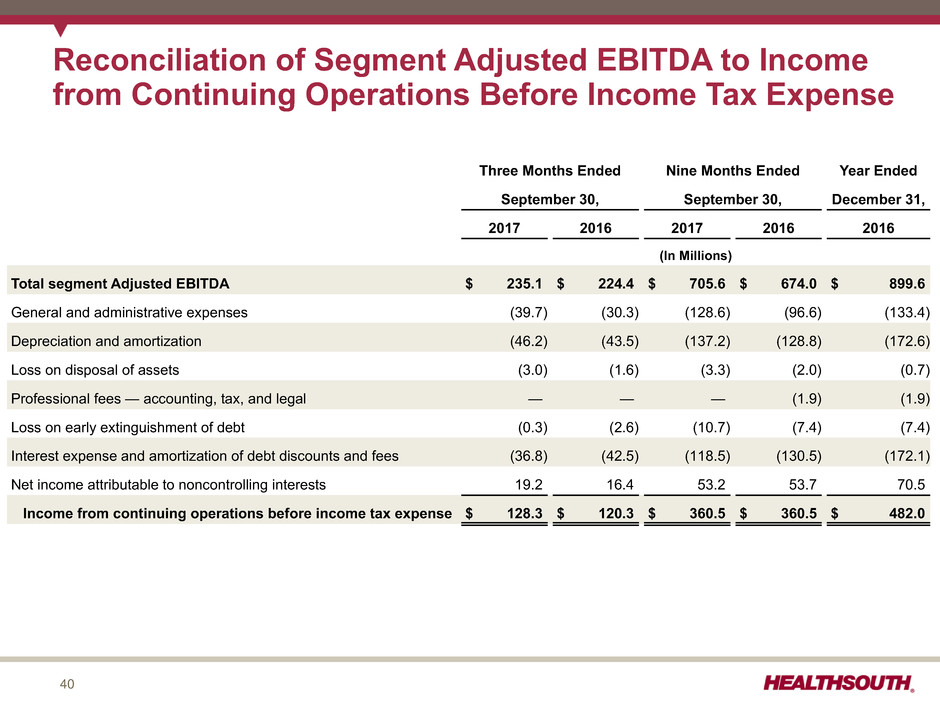

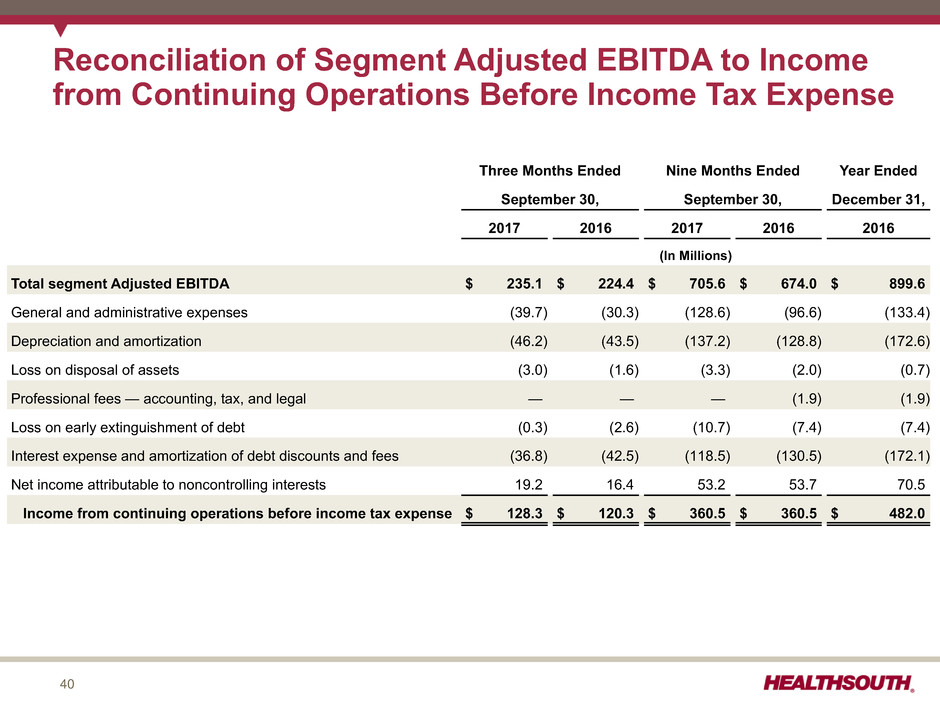

40 Reconciliation of Segment Adjusted EBITDA to Income from Continuing Operations Before Income Tax Expense Three Months Ended Nine Months Ended Year Ended September 30, September 30, December 31, 2017 2016 2017 2016 2016 (In Millions) Total segment Adjusted EBITDA $ 235.1 $ 224.4 $ 705.6 $ 674.0 $ 899.6 General and administrative expenses (39.7) (30.3) (128.6) (96.6) (133.4) Depreciation and amortization (46.2) (43.5) (137.2) (128.8) (172.6) Loss on disposal of assets (3.0) (1.6) (3.3) (2.0) (0.7) Professional fees — accounting, tax, and legal — — — (1.9) (1.9) Loss on early extinguishment of debt (0.3) (2.6) (10.7) (7.4) (7.4) Interest expense and amortization of debt discounts and fees (36.8) (42.5) (118.5) (130.5) (172.1) Net income attributable to noncontrolling interests 19.2 16.4 53.2 53.7 70.5 Income from continuing operations before income tax expense $ 128.3 $ 120.3 $ 360.5 $ 360.5 $ 482.0

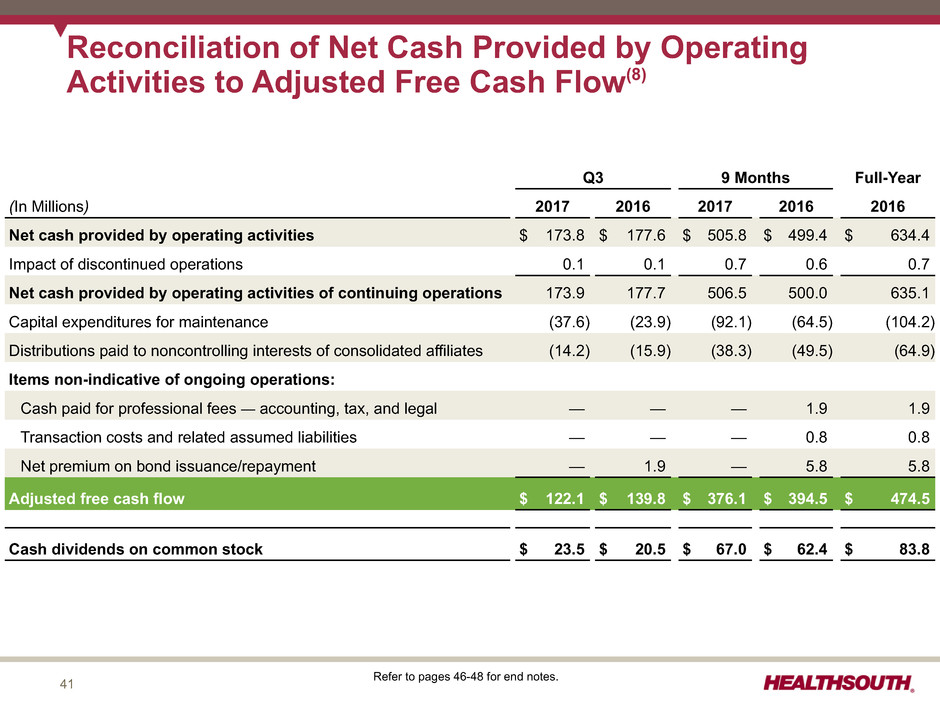

41 Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow(8) Q3 9 Months Full-Year (In Millions) 2017 2016 2017 2016 2016 Net cash provided by operating activities $ 173.8 $ 177.6 $ 505.8 $ 499.4 $ 634.4 Impact of discontinued operations 0.1 0.1 0.7 0.6 0.7 Net cash provided by operating activities of continuing operations 173.9 177.7 506.5 500.0 635.1 Capital expenditures for maintenance (37.6) (23.9) (92.1) (64.5) (104.2) Distributions paid to noncontrolling interests of consolidated affiliates (14.2) (15.9) (38.3) (49.5) (64.9) Items non-indicative of ongoing operations: Cash paid for professional fees — accounting, tax, and legal — — — 1.9 1.9 Transaction costs and related assumed liabilities — — — 0.8 0.8 Net premium on bond issuance/repayment — 1.9 — 5.8 5.8 Adjusted free cash flow $ 122.1 $ 139.8 $ 376.1 $ 394.5 $ 474.5 Cash dividends on common stock $ 23.5 $ 20.5 $ 67.0 $ 62.4 $ 83.8 Refer to pages 46-48 for end notes.

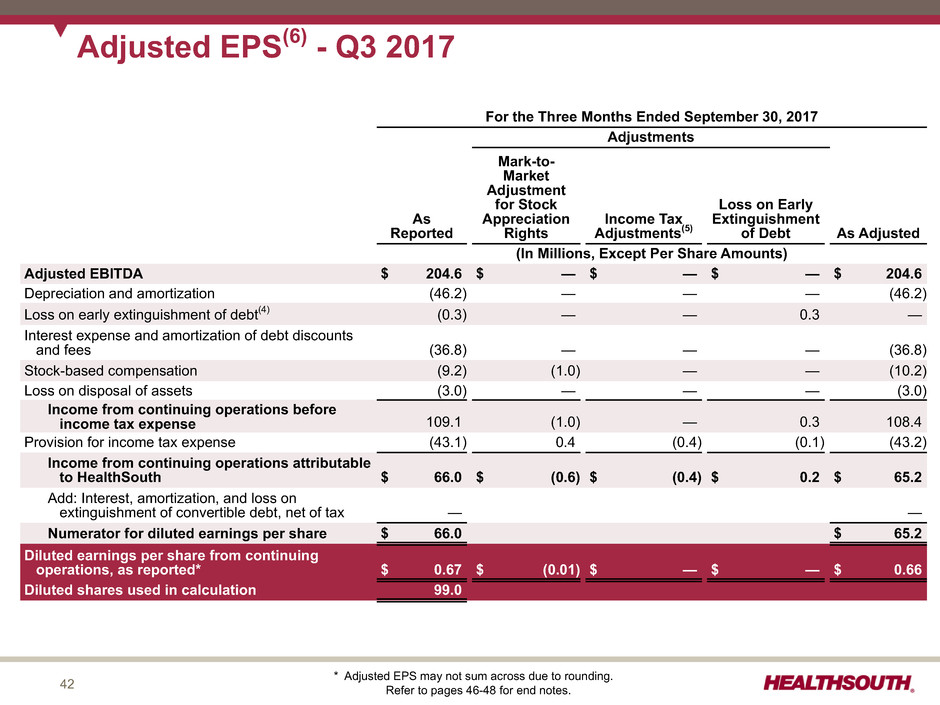

42 For the Three Months Ended September 30, 2017 Adjustments As Reported Mark-to- Market Adjustment for Stock Appreciation Rights Income Tax Adjustments(5) Loss on Early Extinguishment of Debt As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 204.6 $ — $ — $ — $ 204.6 Depreciation and amortization (46.2) — — — (46.2) Loss on early extinguishment of debt(4) (0.3) — — 0.3 — Interest expense and amortization of debt discounts and fees (36.8) — — — (36.8) Stock-based compensation (9.2) (1.0) — — (10.2) Loss on disposal of assets (3.0) — — — (3.0) Income from continuing operations before income tax expense 109.1 (1.0) — 0.3 108.4 Provision for income tax expense (43.1) 0.4 (0.4) (0.1) (43.2) Income from continuing operations attributable to HealthSouth $ 66.0 $ (0.6) $ (0.4) $ 0.2 $ 65.2 Add: Interest, amortization, and loss on extinguishment of convertible debt, net of tax — — Numerator for diluted earnings per share $ 66.0 $ 65.2 Diluted earnings per share from continuing operations, as reported* $ 0.67 $ (0.01) $ — $ — $ 0.66 Diluted shares used in calculation 99.0 Adjusted EPS(6) - Q3 2017 * Adjusted EPS may not sum across due to rounding. Refer to pages 46-48 for end notes.

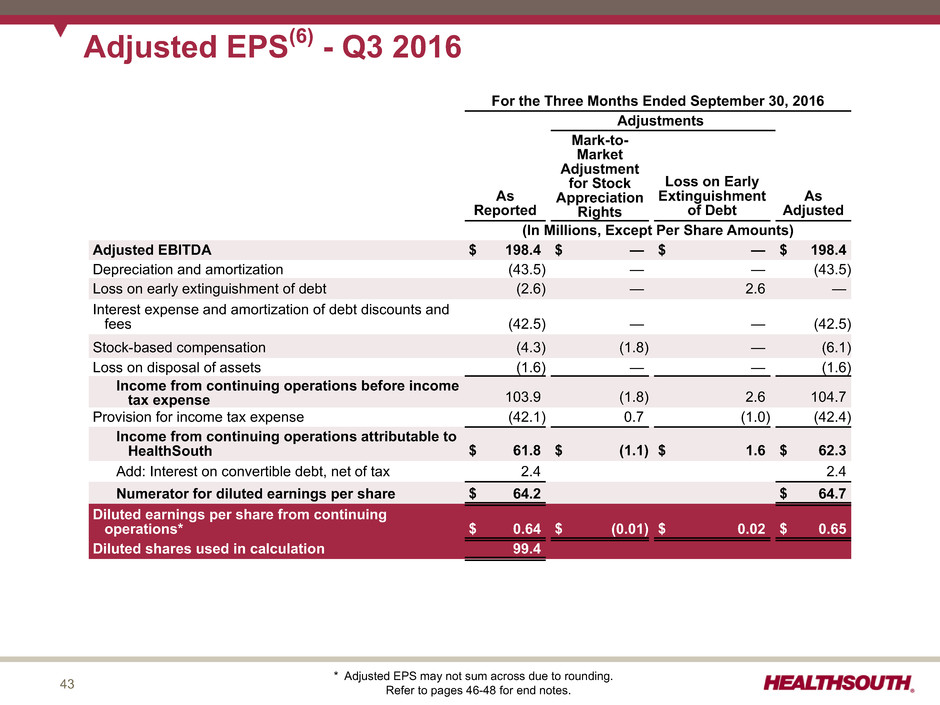

43 For the Three Months Ended September 30, 2016 Adjustments As Reported Mark-to- Market Adjustment for Stock Appreciation Rights Loss on Early Extinguishment of Debt As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 198.4 $ — $ — $ 198.4 Depreciation and amortization (43.5) — — (43.5) Loss on early extinguishment of debt (2.6) — 2.6 — Interest expense and amortization of debt discounts and fees (42.5) — — (42.5) Stock-based compensation (4.3) (1.8) — (6.1) Loss on disposal of assets (1.6) — — (1.6) Income from continuing operations before income tax expense 103.9 (1.8) 2.6 104.7 Provision for income tax expense (42.1) 0.7 (1.0) (42.4) Income from continuing operations attributable to HealthSouth $ 61.8 $ (1.1) $ 1.6 $ 62.3 Add: Interest on convertible debt, net of tax 2.4 2.4 Numerator for diluted earnings per share $ 64.2 $ 64.7 Diluted earnings per share from continuing operations* $ 0.64 $ (0.01) $ 0.02 $ 0.65 Diluted shares used in calculation 99.4 Adjusted EPS(6) - Q3 2016 * Adjusted EPS may not sum across due to rounding. Refer to pages 46-48 for end notes.

44 Adjusted EPS(6) - YTD 2017 For the Nine Months Ended September 30, 2017 Adjustments As Reported Mark-to- Market Adjustment for Stock Appreciation Rights Loss on Early Extinguishment of Debt Income Tax Adjustments(5) As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 614.9 $ — $ — $ — $ 614.9 Depreciation and amortization (137.2) — — — (137.2) Loss on early extinguishment of debt(4) (10.7) — 0.3 — (10.4) Interest expense and amortization of debt discounts and fees (118.5) — — — (118.5) Stock-based compensation (37.9) 13.9 — — (24.0) Loss on disposal of assets (3.3) — — — (3.3) Income from continuing operations before income tax expense 307.3 13.9 0.3 — 321.5 Provision for income tax expense (111.4) (5.6) (0.1) (10.4) (127.5) Income from continuing operations attributable to HealthSouth $ 195.9 $ 8.3 $ 0.2 $ (10.4) $ 194.0 Add: Interest, amortization, and loss on extinguishment of convertible debt, net of tax 10.8 10.8 Numerator for diluted earnings per share $ 206.7 $ 204.8 Diluted earnings per share from continuing operations, as reported* $ 2.08 $ 0.08 $ — $ (0.10) $ 2.07 Diluted shares used in calculation 99.1 * Adjusted EPS may not sum across due to rounding. Refer to pages 46-48 for end notes.

45 Adjusted EPS(6) - YTD 2016 For the Nine Months Ended September 30, 2016 Adjustments As Reported Professional Fees — Accounting, Tax, & Legal Mark-to- Market Adjustment for Stock Appreciation Rights Loss on Early Extinguishment of Debt Sale of Hospital As Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 594.8 $ — $ — $ — $ — $ 594.8 Depreciation and amortization (128.8) — — — — (128.8) Professional fees — accounting, tax, and legal (1.9) 1.9 — — — — Loss on early extinguishment of debt (7.4) — — 7.4 — — Interest expense and amortization of debt discounts and fees (130.5) — — — — (130.5) Stock-based compensation (17.4) — (1.4) — — (18.8) Loss on disposal of assets (2.0) — — — (0.9) (2.9) Income from continuing operations before income tax expense 306.8 1.9 (1.4) 7.4 (0.9) 313.8 Provision for income tax expense (124.2) (0.8) 0.5 (3.0) 0.4 (127.1) Income from continuing operations attributable to HealthSouth $ 182.6 $ 1.1 $ (0.9) $ 4.4 $ (0.5) $ 186.7 Add: Interest on convertible debt, net of tax 7.2 7.2 Numerator for diluted earnings per share $ 189.8 $ 193.9 Diluted earnings per share from continuing operations* $ 1.90 $ 0.01 $ (0.01) $ 0.04 $ (0.01) $ 1.95 Diluted shares used in calculation 99.5 * Adjusted EPS may not sum across due to rounding. Refer to pages 46-48 for end notes.

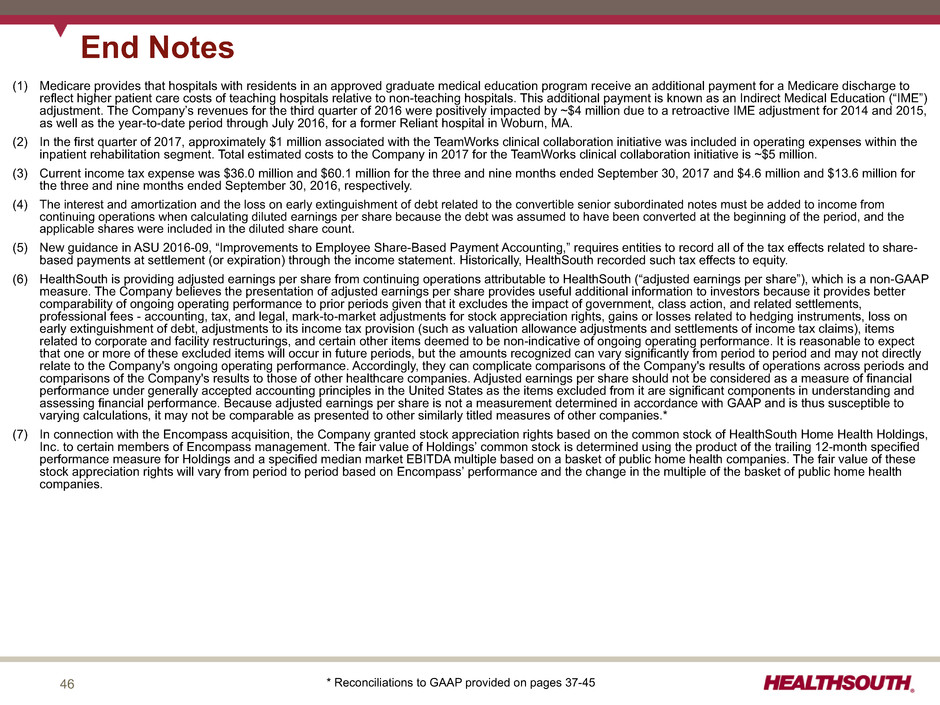

46 End Notes (1) Medicare provides that hospitals with residents in an approved graduate medical education program receive an additional payment for a Medicare discharge to reflect higher patient care costs of teaching hospitals relative to non-teaching hospitals. This additional payment is known as an Indirect Medical Education (“IME”) adjustment. The Company’s revenues for the third quarter of 2016 were positively impacted by ~$4 million due to a retroactive IME adjustment for 2014 and 2015, as well as the year-to-date period through July 2016, for a former Reliant hospital in Woburn, MA. (2) In the first quarter of 2017, approximately $1 million associated with the TeamWorks clinical collaboration initiative was included in operating expenses within the inpatient rehabilitation segment. Total estimated costs to the Company in 2017 for the TeamWorks clinical collaboration initiative is ~$5 million. (3) Current income tax expense was $36.0 million and $60.1 million for the three and nine months ended September 30, 2017 and $4.6 million and $13.6 million for the three and nine months ended September 30, 2016, respectively. (4) The interest and amortization and the loss on early extinguishment of debt related to the convertible senior subordinated notes must be added to income from continuing operations when calculating diluted earnings per share because the debt was assumed to have been converted at the beginning of the period, and the applicable shares were included in the diluted share count. (5) New guidance in ASU 2016-09, “Improvements to Employee Share-Based Payment Accounting,” requires entities to record all of the tax effects related to share- based payments at settlement (or expiration) through the income statement. Historically, HealthSouth recorded such tax effects to equity. (6) HealthSouth is providing adjusted earnings per share from continuing operations attributable to HealthSouth (“adjusted earnings per share”), which is a non-GAAP measure. The Company believes the presentation of adjusted earnings per share provides useful additional information to investors because it provides better comparability of ongoing operating performance to prior periods given that it excludes the impact of government, class action, and related settlements, professional fees - accounting, tax, and legal, mark-to-market adjustments for stock appreciation rights, gains or losses related to hedging instruments, loss on early extinguishment of debt, adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims), items related to corporate and facility restructurings, and certain other items deemed to be non-indicative of ongoing operating performance. It is reasonable to expect that one or more of these excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period and may not directly relate to the Company's ongoing operating performance. Accordingly, they can complicate comparisons of the Company's results of operations across periods and comparisons of the Company's results to those of other healthcare companies. Adjusted earnings per share should not be considered as a measure of financial performance under generally accepted accounting principles in the United States as the items excluded from it are significant components in understanding and assessing financial performance. Because adjusted earnings per share is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, it may not be comparable as presented to other similarly titled measures of other companies.* (7) In connection with the Encompass acquisition, the Company granted stock appreciation rights based on the common stock of HealthSouth Home Health Holdings, Inc. to certain members of Encompass management. The fair value of Holdings’ common stock is determined using the product of the trailing 12-month specified performance measure for Holdings and a specified median market EBITDA multiple based on a basket of public home health companies. The fair value of these stock appreciation rights will vary from period to period based on Encompass’ performance and the change in the multiple of the basket of public home health companies. * Reconciliations to GAAP provided on pages 37-45

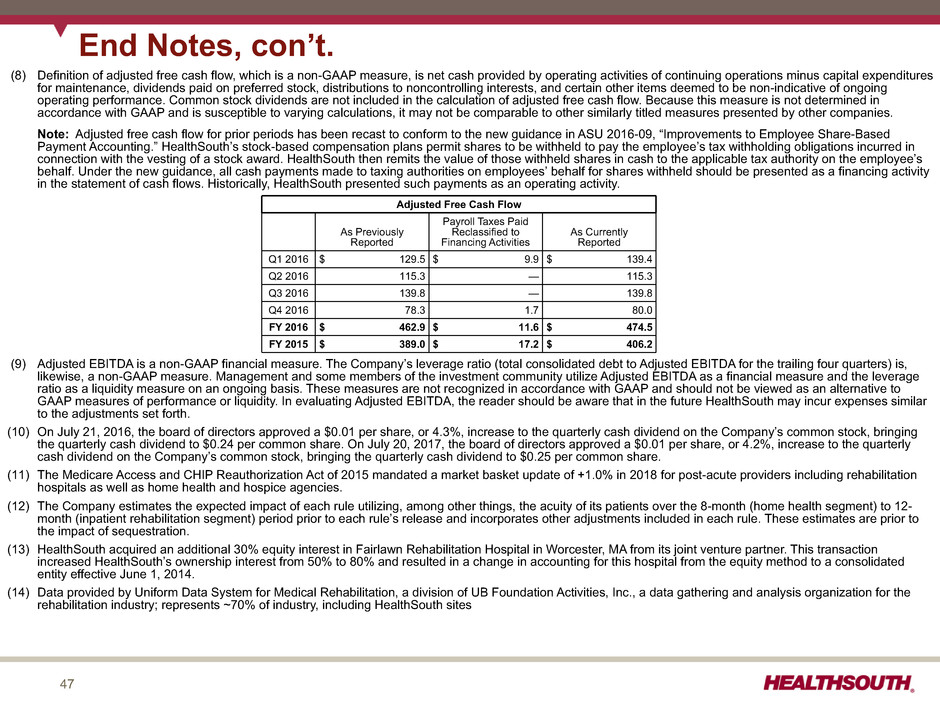

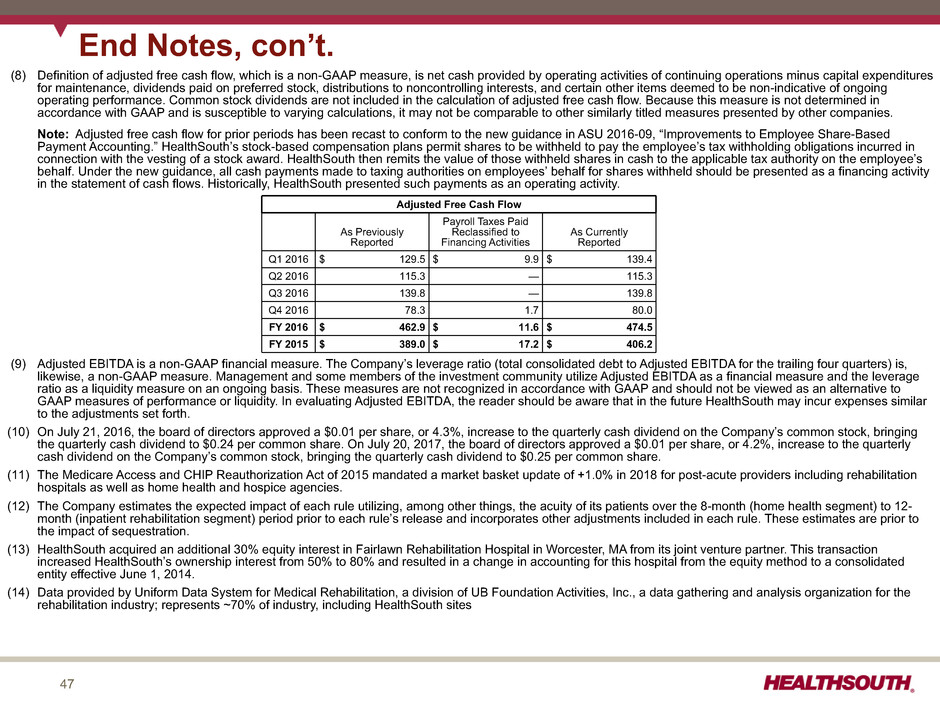

47 End Notes, con’t. (8) Definition of adjusted free cash flow, which is a non-GAAP measure, is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, dividends paid on preferred stock, distributions to noncontrolling interests, and certain other items deemed to be non-indicative of ongoing operating performance. Common stock dividends are not included in the calculation of adjusted free cash flow. Because this measure is not determined in accordance with GAAP and is susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. Note: Adjusted free cash flow for prior periods has been recast to conform to the new guidance in ASU 2016-09, “Improvements to Employee Share-Based Payment Accounting.” HealthSouth’s stock-based compensation plans permit shares to be withheld to pay the employee’s tax withholding obligations incurred in connection with the vesting of a stock award. HealthSouth then remits the value of those withheld shares in cash to the applicable tax authority on the employee’s behalf. Under the new guidance, all cash payments made to taxing authorities on employees’ behalf for shares withheld should be presented as a financing activity in the statement of cash flows. Historically, HealthSouth presented such payments as an operating activity. (9) Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments set forth. (10) On July 21, 2016, the board of directors approved a $0.01 per share, or 4.3%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.24 per common share. On July 20, 2017, the board of directors approved a $0.01 per share, or 4.2%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.25 per common share. (11) The Medicare Access and CHIP Reauthorization Act of 2015 mandated a market basket update of +1.0% in 2018 for post-acute providers including rehabilitation hospitals as well as home health and hospice agencies. (12) The Company estimates the expected impact of each rule utilizing, among other things, the acuity of its patients over the 8-month (home health segment) to 12- month (inpatient rehabilitation segment) period prior to each rule’s release and incorporates other adjustments included in each rule. These estimates are prior to the impact of sequestration. (13) HealthSouth acquired an additional 30% equity interest in Fairlawn Rehabilitation Hospital in Worcester, MA from its joint venture partner. This transaction increased HealthSouth’s ownership interest from 50% to 80% and resulted in a change in accounting for this hospital from the equity method to a consolidated entity effective June 1, 2014. (14) Data provided by Uniform Data System for Medical Rehabilitation, a division of UB Foundation Activities, Inc., a data gathering and analysis organization for the rehabilitation industry; represents ~70% of industry, including HealthSouth sites Adjusted Free Cash Flow As Previously Reported Payroll Taxes Paid Reclassified to Financing Activities As Currently Reported Q1 2016 $ 129.5 $ 9.9 $ 139.4 Q2 2016 115.3 — 115.3 Q3 2016 139.8 — 139.8 Q4 2016 78.3 1.7 80.0 FY 2016 $ 462.9 $ 11.6 $ 474.5 FY 2015 $ 389.0 $ 17.2 $ 406.2

48 End Notes, con’t. (15) Represents discharges from 125 consolidated hospitals in Q3 2017; 124 consolidated hospitals in Q2 2017; 122 consolidated hospitals in Q1 2017 and Q4 2016; 121 consolidated hospitals in Q3 2016; 120 consolidated hospitals in Q2 2016; and 121 consolidated hospitals in Q1 2016 (16) Excludes approximately 440 full-time equivalents in the 2017 periods and approximately 420 full-time equivalents in the 2016 periods presented who are considered part of corporate overhead with their salaries and benefits included in general and administrative expenses in the Company’s consolidated statements of operations. Full-time equivalents included in the table represent HealthSouth employees who participate in or support the operations of the Company’s hospitals. (17) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. (18) Represents home health admissions from 196 consolidated locations in Q3 2017; 191 consolidated locations in Q2 2017 and Q1 2017; 186 consolidated locations in Q4 2016; 188 consolidated locations in Q3 2016; 187 consolidated locations in Q2 2016; and 184 consolidated locations in Q1 2016 (19) Represents hospice admissions from 37 locations in Q3 2017 and Q2 2017; 35 locations in Q1 2017 and Q4 2016; 33 locations in Q3 2016; 29 locations in Q2 2016; and 27 locations in Q1 2016 (20) In March 2006, the Company completed the sale of 400,000 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. In Q4 2013, the Company exchanged $320 million of newly issued 2.0% Convertible Senior Subordinated Notes due 2043 for 257,110 shares of its outstanding preferred stock. In April 2015, the Company exercised its rights to force conversion of all outstanding shares of its preferred stock. On the conversion date, each outstanding share of preferred stock was converted into 33.9905 shares of common stock, resulting in the issuance of 3,271,415 shares of common stock. (21) In November 2013, the Company closed separate, privately negotiated exchanges in which it issued $320 million of 2.0% Convertible Senior Subordinated Notes due 2043 in exchange for 257,110 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. The Company recorded ~$249 million as debt and ~$71 million as equity. In May 2017, the Company provided notice of its intent to redeem all $320 million of outstanding convertible notes. In lieu of receiving the redemption price, the holders had the right to convert their notes into shares of the Company’s common stock at a conversion rate of 27.2221 shares per $1,000 principal amount of Notes, which rate was increased by a make-whole premium. In the aggregate, holders of $319.4 million in principal elected to convert, which resulted in the Company issuing 8,895,483 shares of common stock (approximately 8.6 million shares were previously included in the diluted share count). The remaining $0.6 million of principal was redeemed by cash payment. (22) The agreement to settle the Company’s class action securities litigation received final court approval in January 2007. The 5.0 million shares of common stock and warrants to purchase ~8.2 million shares of common stock at a strike price of $41.40 (expired January 17, 2017) related to this settlement were issued on September 30, 2009. The 5.0 million common shares are included in the basic outstanding shares. The warrants were not included in the diluted share count prior to 2015 because the strike price had historically been above the market price. In full-year 2016 and full-year 2014, zero shares related to the warrants were included in the diluted share count due to antidilution based on the stock price. In full-year 2015, 80,814 shares related to the warrants were included in the diluted share count using the treasury stock method.