Investor Reference Book Post Q1 2018 Earnings Release Last Updated May 15, 2018 HealthSouth is a leading provider of post-acute healthcare services, offering both facility-based and home-based post-acute services in 34 states and Puerto Rico through its network of inpatient rehabilitation hospitals, home health agencies, and hospice agencies.

Forward-Looking Statements The information contained in this Investor Reference Book includes certain estimates, projections and other forward- looking information that reflect Encompass Health’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, disintermediation, and shareholder value- enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this Investor Reference Book as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2017, the Form 10-Q for the quarter ended March 31, 2018, and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs, and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following Investor Reference Book includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the non-GAAP financial measures included in the following Investor Reference Book to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. The Company’s Form 8-K, dated May 15, 2018, to which the following Investor Reference Book is attached as Exhibit 99.1, provides further explanation and disclosure regarding Encompass Health’s use of non-GAAP financial measures and should be read in conjunction with this Investor Reference Book. Encompass Health 2

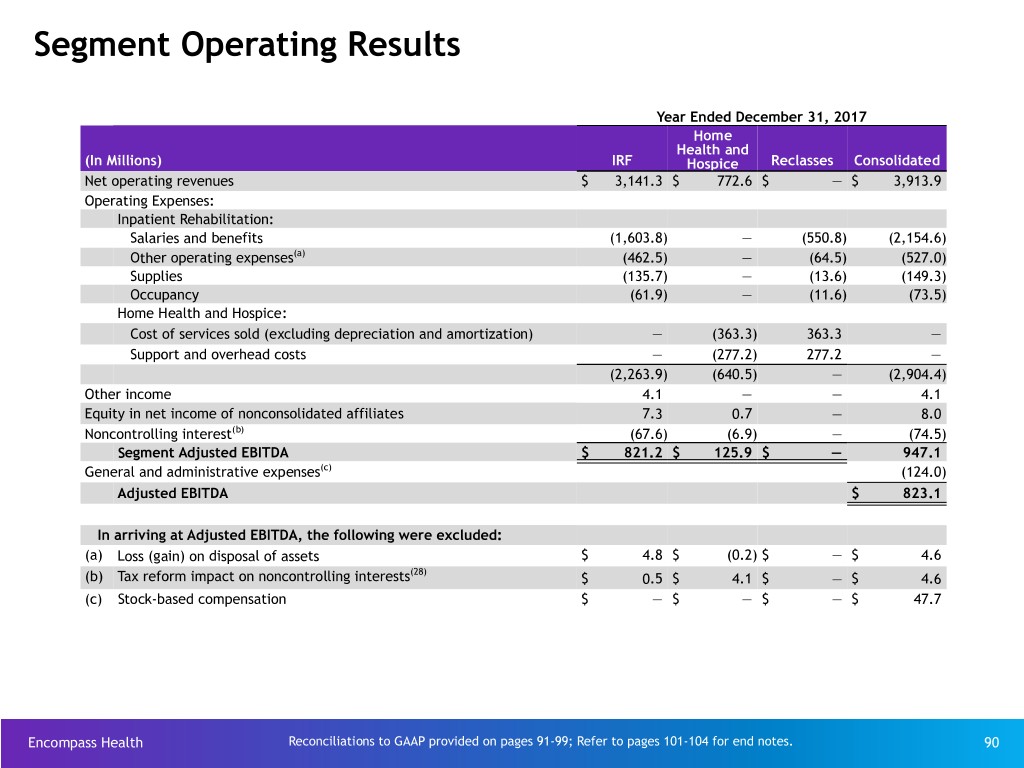

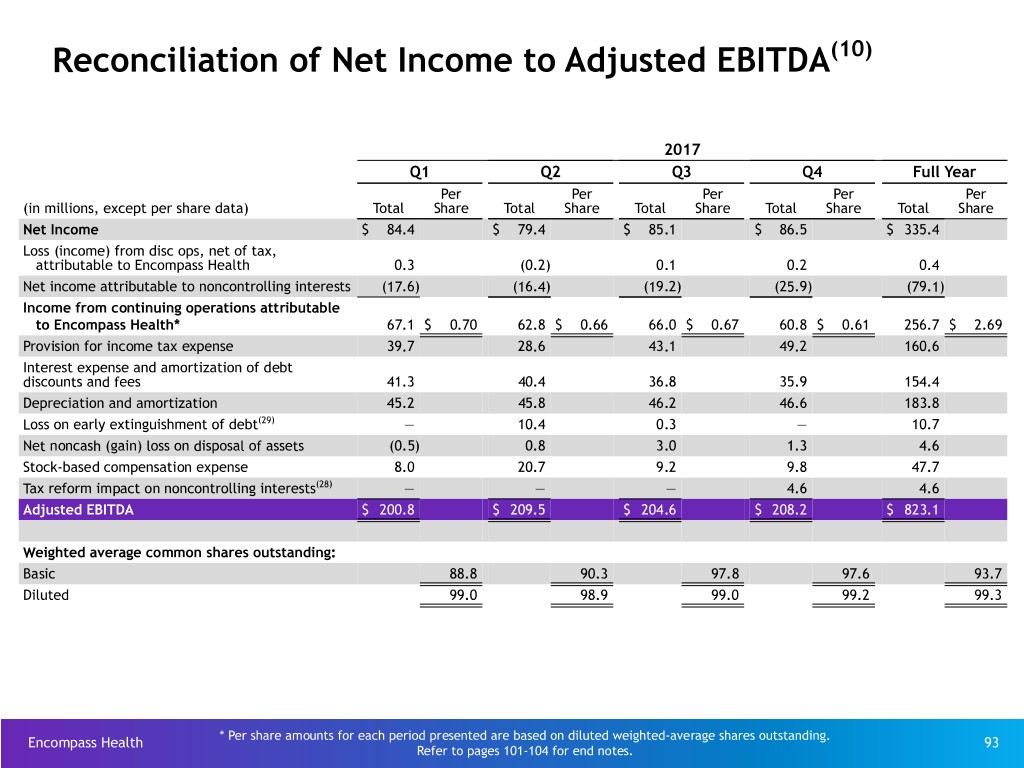

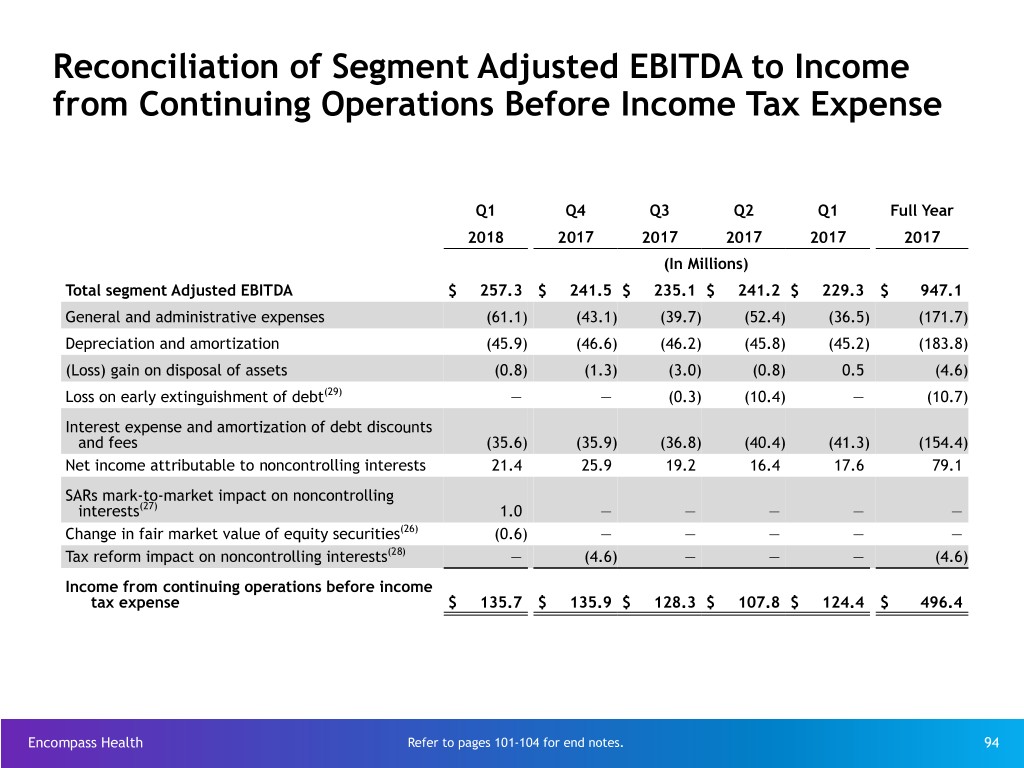

Table of Contents Company Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4-16 Investment Thesis and Strategy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17-24 Business Outlook, Including Guidance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25-39 Growth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40-51 Alternative Payment Models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52-56 Capital Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57-62 Information Technology. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63-66 Operational Metrics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67-72 Industry Structure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73-85 Segment Operating Results . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86-90 Reconciliations to GAAP and Share Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91-100 End Notes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101-104 Encompass Health 3

Company Overview Encompass Health is a leading provider of inpatient rehabilitation and home-based care committed to delivering high-quality, cost-effective, integrated care across the post-acute continuum. Encompass Health 4

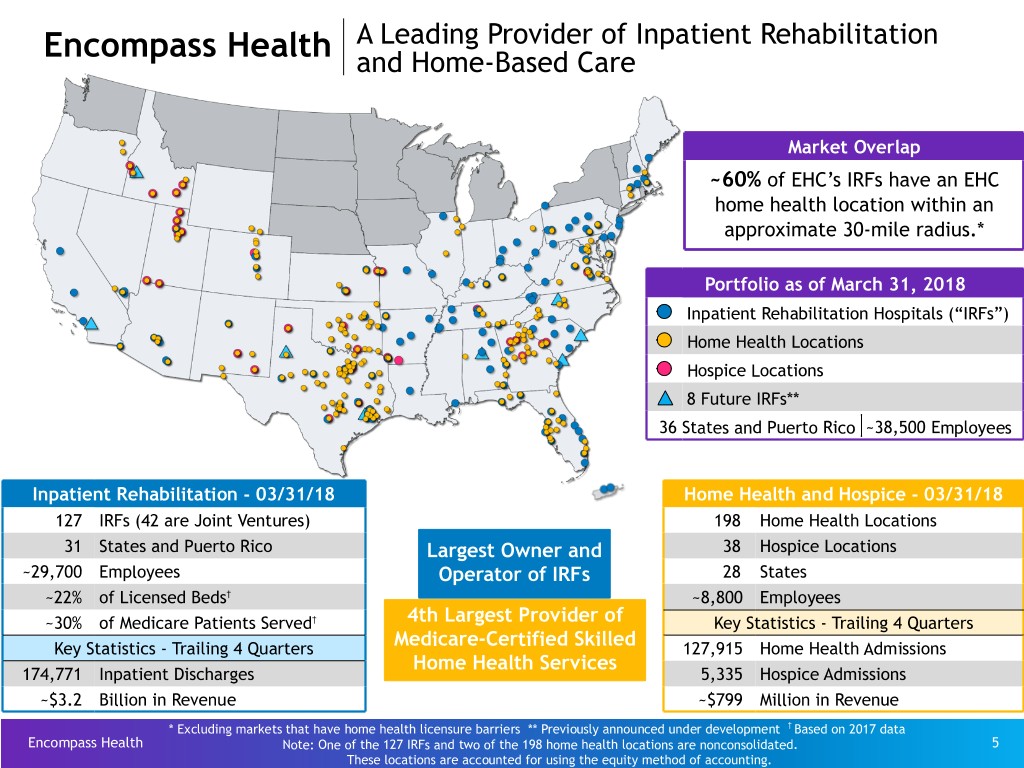

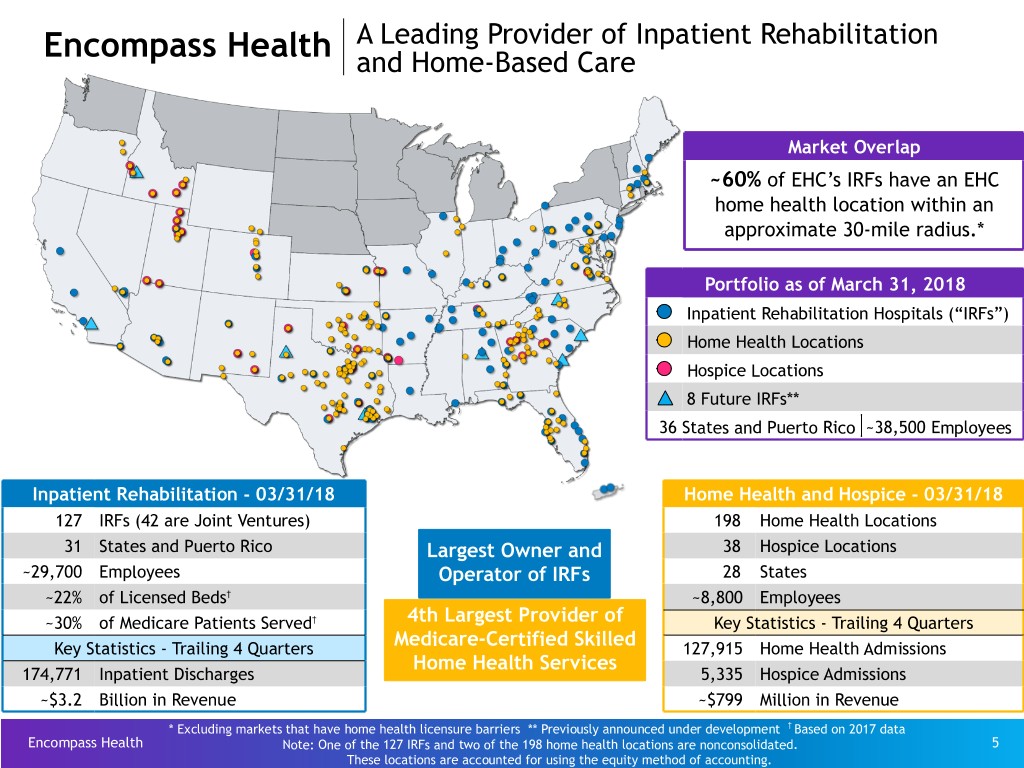

Encompass Health A Leading Provider of Inpatient Rehabilitation and Home-Based Care Market Overlap ~60% of EHC’s IRFs have an EHC home health location within an approximate 30-mile radius.* Portfolio as of March 31, 2018 Inpatient Rehabilitation Hospitals (“IRFs”) Home Health Locations Hospice Locations 8 Future IRFs** 36 States and Puerto Rico ~38,500 Employees Inpatient Rehabilitation - 03/31/18 Home Health and Hospice - 03/31/18 127 IRFs (42 are Joint Ventures) 198 Home Health Locations 31 States and Puerto Rico Largest Owner and 38 Hospice Locations ~29,700 Employees Operator of IRFs 28 States ~22% of Licensed Beds† ~8,800 Employees ~30% of Medicare Patients Served† 4th Largest Provider of Key Statistics - Trailing 4 Quarters Key Statistics - Trailing 4 Quarters Medicare-Certified Skilled 127,915 Home Health Admissions Home Health Services 174,771 Inpatient Discharges 5,335 Hospice Admissions ~$3.2 Billion in Revenue ~$799 Million in Revenue † * Excluding markets that have home health licensure barriers ** Previously announced under development Based on 2017 data Encompass Health Note: One of the 127 IRFs and two of the 198 home health locations are nonconsolidated. 5 These locations are accounted for using the equity method of accounting.

Company Overview Inpatient Rehabilitation Inpatient Rehabilitation 106 of the Company’s IRFs hold one or more disease-specific certifications from The Joint Commission’s Disease-Specific Hospitals Care Certification Program.(1) Major Services • Rehabilitation Physicians: manage and treat medical conditions and oversee rehabilitation program • Rehabilitation Nurses: provide personal care and oversee treatment plan for patients • Physical Therapists: address physical function, mobility, strength, balance, and safety • Occupational Therapists: promote independence through activities of daily living (“ADLs”) • Speech-Language Therapists: address speech/voice functions, swallowing, memory/cognition, and language/communication • Case Managers: coordinate care plan with physician, Care Transition Coordinators, caregivers and family • Post-Discharge Services: outpatient therapy and home health Encompass Health Refer to pages 101-104 for end notes. 6

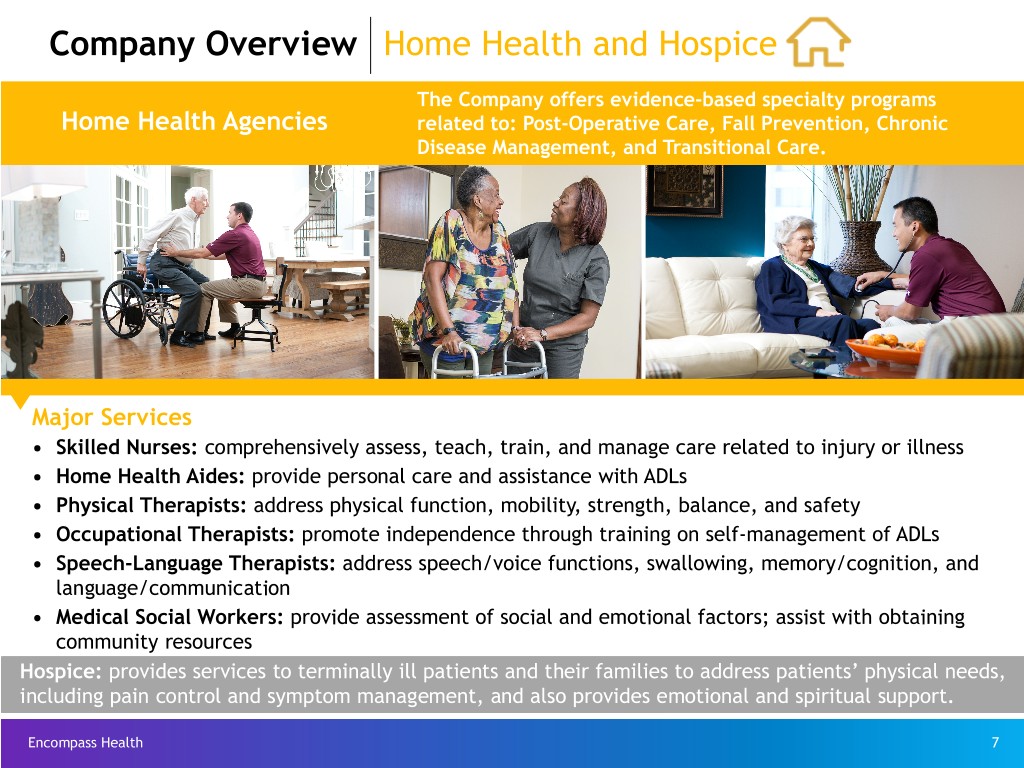

Company Overview Home Health and Hospice The Company offers evidence-based specialty programs Home Health Agencies related to: Post-Operative Care, Fall Prevention, Chronic Disease Management, and Transitional Care. Major Services • Skilled Nurses: comprehensively assess, teach, train, and manage care related to injury or illness • Home Health Aides: provide personal care and assistance with ADLs • Physical Therapists: address physical function, mobility, strength, balance, and safety • Occupational Therapists: promote independence through training on self-management of ADLs • Speech-Language Therapists: address speech/voice functions, swallowing, memory/cognition, and language/communication • Medical Social Workers: provide assessment of social and emotional factors; assist with obtaining community resources Hospice: provides services to terminally ill patients and their families to address patients’ physical needs, including pain control and symptom management, and also provides emotional and spiritual support. Encompass Health 7

IRF Patient Mix Home Health Patient Mix Referral Sources: Referral Sources: Acute Care Hospitals – 91% Acute Care Hospitals – 35% Physician Offices / Community – 7% Physician Offices / Community – 38% Skilled Nursing Facilities – 2% IRFs / LTCHs / SNFs – 27% Rehabilitation Impairment Category* Q1-18 2017 Demographics of all Medicare Home Health Users**: RIC 01 Stroke 18.0% 18.0% 100 RIC 02/03 Brain dysfunction 10.0% 10.1% 90 RIC 04/05 Spinal cord dysfunction 3.6% 4.0% 80 e 70 RIC 06 Neurological conditions 21.5% 21.6% g a t 60 RIC 07 Fracture of lower extremity 7.9% 7.9% n e c 50 RIC 08 Replacement of lower extremity joint 3.7% 4.1% r 85.1% e RIC 09 Other orthopedic 8.9% 9.3% P 40 RIC 10/11 Amputation 2.4% 2.6% 30 36.7% RIC 14 Cardiac 4.4% 4.3% 20 24.0% 31.9% RIC 17/18 Major multiple trauma 4.7% 5.3% 10 RIC 20 Other disabling impairments 11.6% 10.0% Age 85+ Lives Has 2 or Has 3 or alone more ADL more chronic — All other RICs 3.3% 2.8% limitations conditions Average Age of the Company’s IRF Patients: Average Age of the Company’s Home Health Patients: All Patients = 71 Medicare FFS = 76 All Patients = 76 Medicare FFS = 77 Admission to an IRF: Admission to home health: • Physicians and acute care hospital case managers are key • For Medicare, a patient must be confined to the home and need decision makers. skilled services. • All IRF patients must meet reasonable and necessary criteria • The patient must be under the care of a physician and receive and must be admitted by a physician. services under a home health plan of care established and • All IRF patients must be medically stable and have potential to periodically reviewed by a physician. tolerate three hours of therapy per day (minimum). • Medicare also requires a face-to-face encounter related to the • IRF patients receive 24-hour, 7 days a week nursing care. primary reason the patient requires home health services with a • Average length of stay = 12.7 days physician or an allowed non-physician practitioner. * Rehabilitation Impairment Categories (RICs) represent how the Company admitted the patient; BPCI (pages 54-55) Encompass Health uses Diagnostic-Related Groups (DRGs) which represent how the acute care hospital discharged the patient. 8 ** Source: Avalere Health and Alliance for Home Health Quality and Innovation Home Health Chart Book 2017

Leading Positions in Quality of Care IRF Quality Home Health Quality Discharge to Community 3.8 79.4% Percent of cases 78.7% 79.2% discharged to Quality of Care 75.7% 76.0% 76.0% the community, Star Ratings(3) including home 3.3 96% of our home health agencies or home with home health. are 3 Stars or higher; Higher is better. 51% are 4 Stars or higher 2016 2017 Q1-18 Discharge to Skilled Nursing Percent of Patient Satisfaction 13.1% 12.7% 12.7% 3.7 3.7 patients Star Ratings(3) 10.1% discharged to a 9.3% 9.4% 95% of our home health agencies skilled nursing are 3 Stars or higher; facility. Lower is better. 62% are 4 Stars or higher 2016 2017 Q1-18 Discharge to Acute Hospital 90 bps better Percent of 16.9% 30-Day patients 10.7% 10.7% 10.7% Readmission Rate 10.4% 10.4% 10.5% discharged to an Percent of patients acute care 16.0% hospital. readmitted to an acute care Lower is better. hospital. Lower is better. 2016 2017 Q1-18 UDSMR(2) Encompass Health National Average Encompass Health Encompass Health Refer to pages 101-104 for end notes. 9

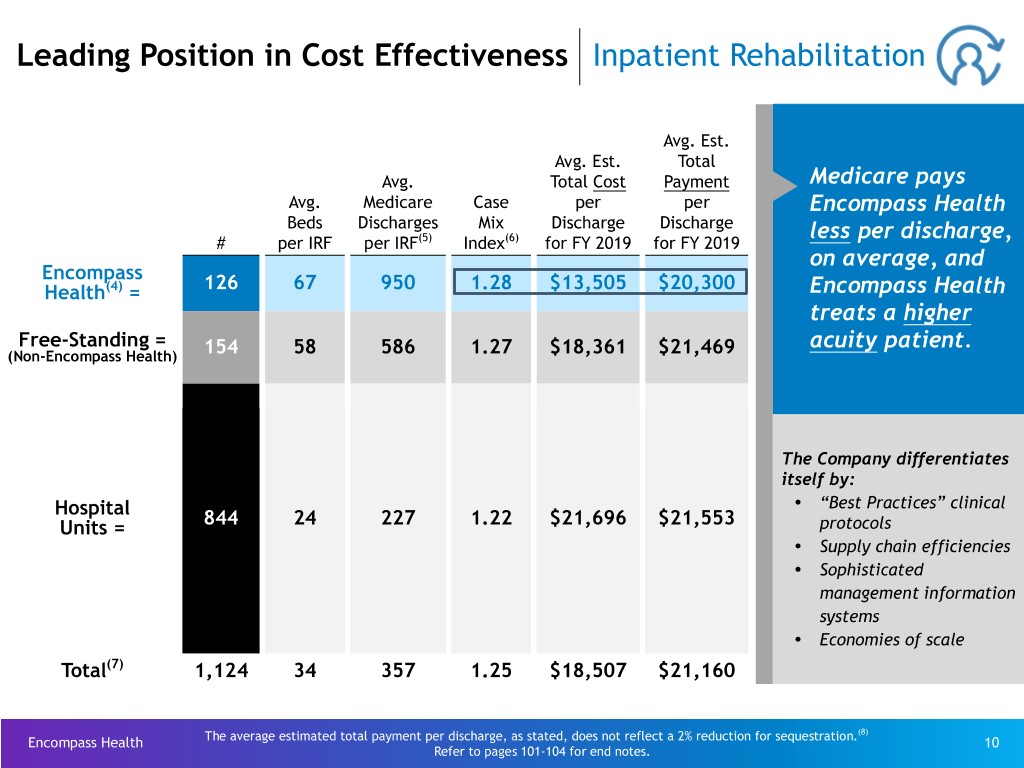

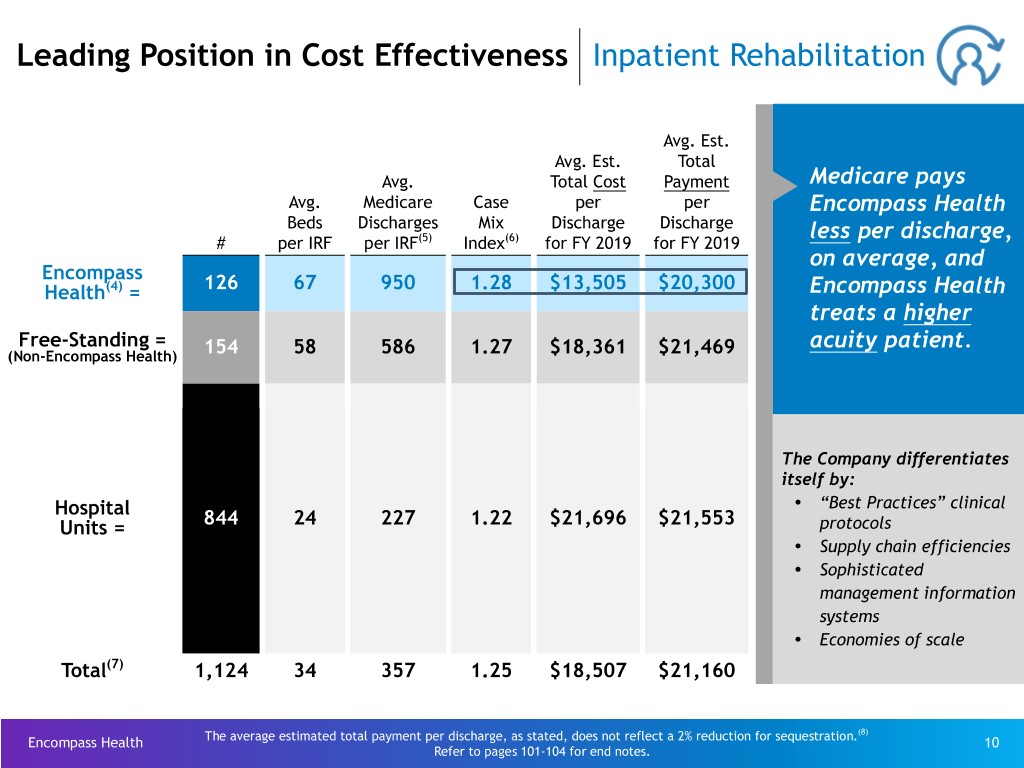

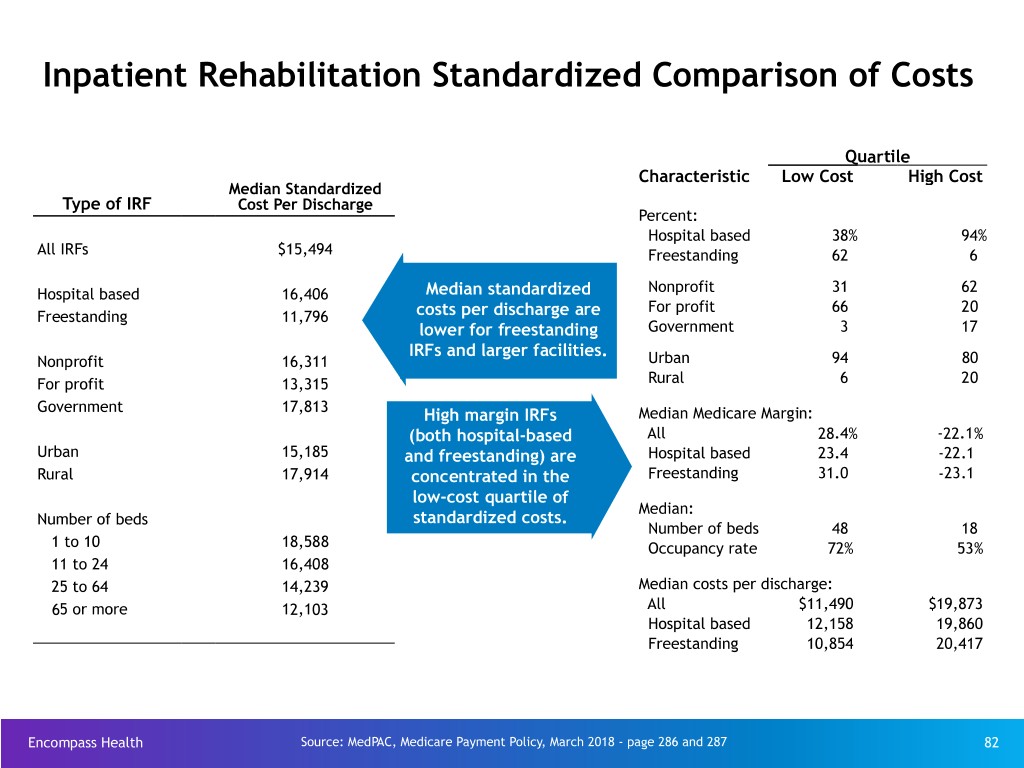

Leading Position in Cost Effectiveness Inpatient Rehabilitation Avg. Est. Avg. Est. Total Avg. Total Cost Payment Medicare pays Avg. Medicare Case per per Encompass Health Beds Discharges Mix Discharge Discharge less per discharge, # per IRF per IRF(5) Index(6) for FY 2019 for FY 2019 on average, and Encompass Health(4) = 126 67 950 1.28 $13,505 $20,300 Encompass Health treats a higher Free-Standing = acuity patient. (Non-Encompass Health) 154 58 586 1.27 $18,361 $21,469 The Company differentiates itself by: Ÿ Hospital “Best Practices” clinical Units = 844 24 227 1.22 $21,696 $21,553 protocols Ÿ Supply chain efficiencies Ÿ Sophisticated management information systems Ÿ Economies of scale Total(7) 1,124 34 357 1.25 $18,507 $21,160 (8) Encompass Health The average estimated total payment per discharge, as stated, does not reflect a 2% reduction for sequestration. 10 Refer to pages 101-104 for end notes.

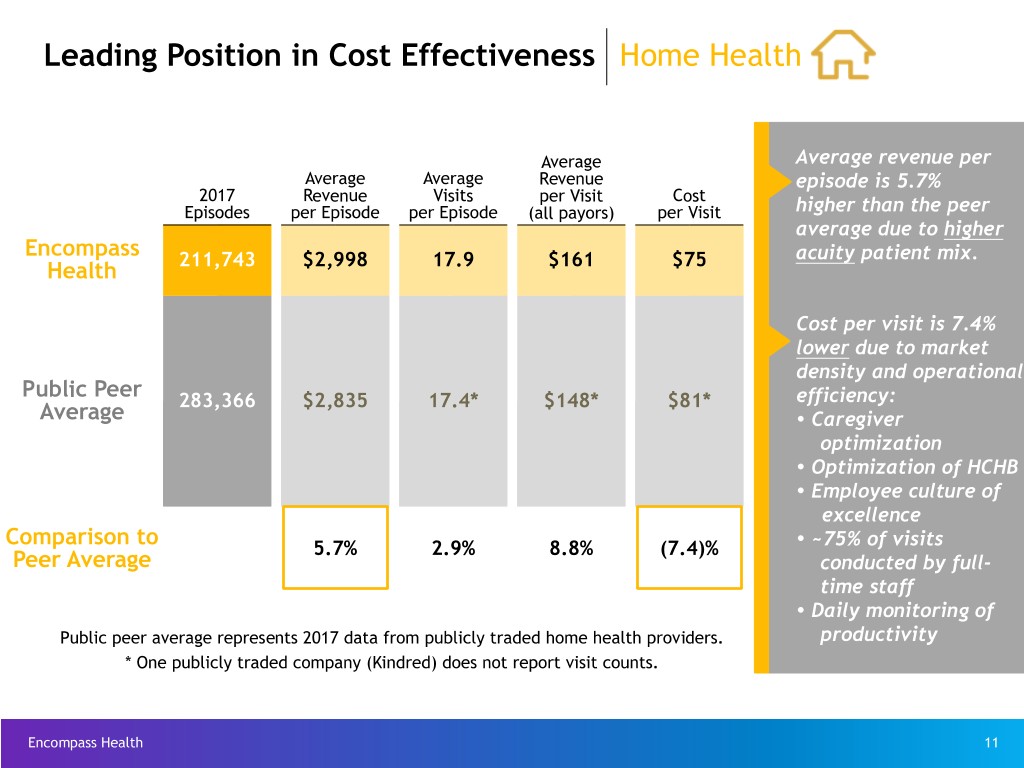

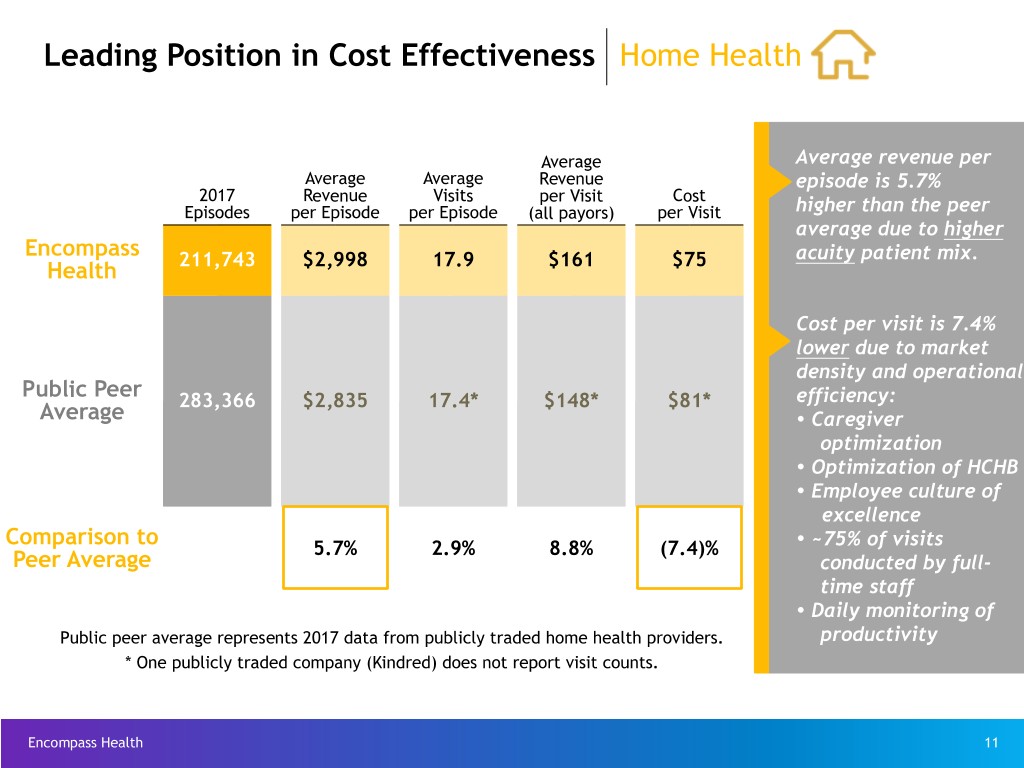

Leading Position in Cost Effectiveness Home Health Average Average revenue per Average Average Revenue episode is 5.7% 2017 Revenue Visits per Visit Cost Episodes per Episode per Episode (all payors) per Visit higher than the peer average due to higher Encompass acuity patient mix. Health 211,743 $2,998 17.9 $161 $75 Cost per visit is 7.4% lower due to market density and operational Public Peer 283,366 $2,835 17.4* $148* $81* efficiency: Average Ÿ Caregiver optimization Ÿ Optimization of HCHB Ÿ Employee culture of excellence Comparison to Ÿ 5.7% 2.9% 8.8% (7.4)% ~75% of visits Peer Average conducted by full- time staff Ÿ Daily monitoring of Public peer average represents 2017 data from publicly traded home health providers. productivity * One publicly traded company (Kindred) does not report visit counts. Encompass Health 11

New-Store/Same-Store Growth Inpatient Rehabilitation Reliant (857 beds) 25.0 Franklin, TN (40 beds) Bryan, TX (49 beds) Broken Arrow, OK (22 beds) Pearland, TX 20.0 Hot Springs, AR (27 beds) (40 beds) Gulfport, MS (33 beds) 15.0 Lexington, KY (158 beds) Westerville, OH (60 beds) Savannah, GA (50 beds) 10.0 Jackson, TN (48 beds) Modesto, CA (50 beds) 5.0 0.0 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Discharges Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Fairlawn(9) 1.1% New Store 4.4% 5.7% 15.6% 14.2% 11.7% 10.7% 1.3% 1.2% 1.9% 2.4% 2.0% 1.9% Same Store* 2.8% 3.9% 3.0% 2.8% 1.9% 1.9% 0.1% 1.6% 1.6% 1.4% 3.9% 4.8% Total by Qtr. 8.3% 9.6% 18.6% 17.0% 13.6% 12.6% 1.4% 2.8% 3.5% 3.8% 5.9% 6.7% Total by Year 10.9% 10.8% 4.0% Same-Store Year* 3.2% 1.7% 1.8% Same-Store Year UDS** 1.3% (0.6)% (0.5)% * Includes consolidated inpatient rehabilitation hospitals classified as same store during each period ** Data provided by UDSMR Encompass Health 12 Refer to pages 101-104 for end notes.

New-Store/Same-Store Growth Home Health Acquired CareSouth 70.0 (44 home health agencies in 7 states) in November 2015 60.0 50.0 40.0 30.0 20.0 10.0 0.0 Admissions QQ11 22016016 QQ22 22016016 QQ33 22016016 QQ44 22016016 QQ11 22017017 QQ22 22017017 QQ33 22017017 QQ44 22017017 QQ11 22018018 New Store 43.5% 41.6% 35.4% 8.1% 5.7% 6.4% 6.7% 3.5% 2.5% Same Store* 12.6% 11.1% 15.3% 14.0% 13.9% 13.3% 8.8% 10.1% 7.4% Total by Quarter 56.1% 52.7% 50.7% 22.1% 19.6% 19.7% 15.5% 13.6% 9.9% Total by Year 43.6% 17.0% Same-Store Year* 13.7% 11.4% u In 2016, the Company acquired or opened 10 home health locations. u In 2017, the Company acquired or opened 15 home health locations. u In Q1 2018, the Company opened 1 home health location. Encompass Health * Includes consolidated home health agencies classified as same store during each period 13

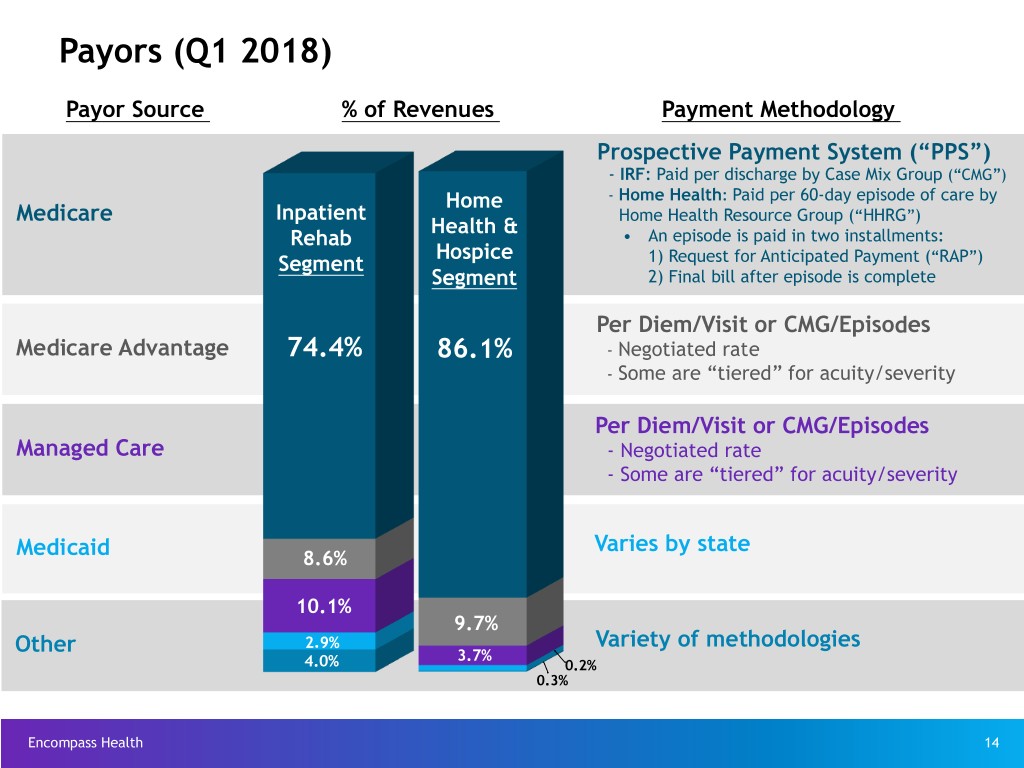

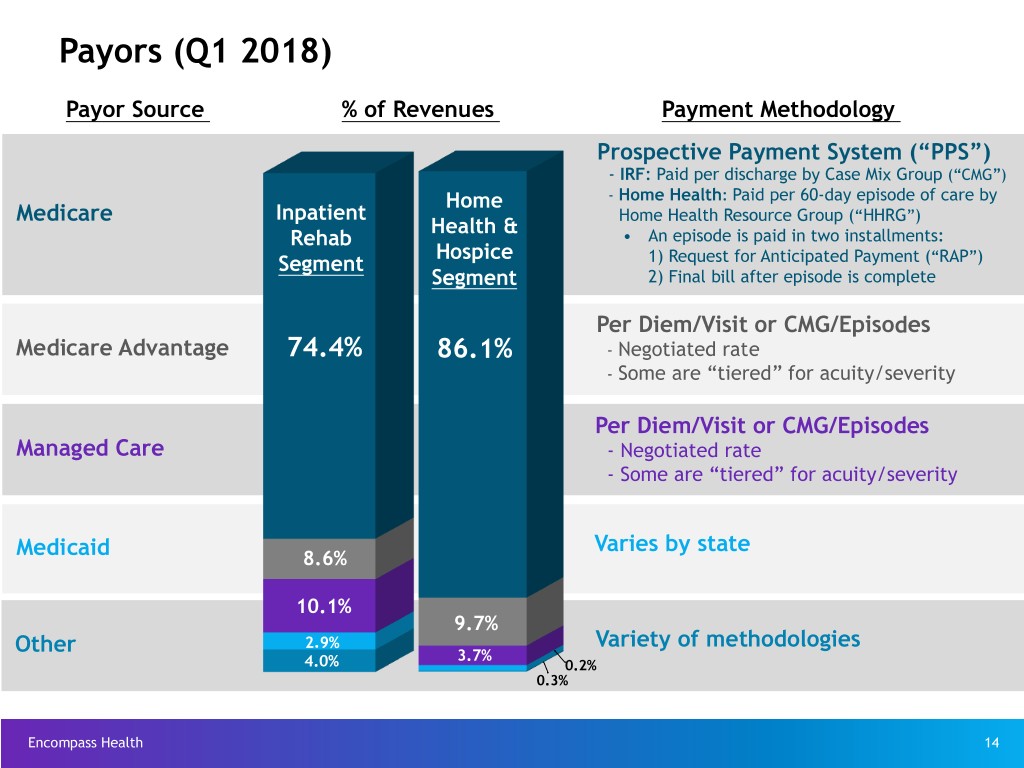

Payors (Q1 2018) Payor Source % of Revenues Payment Methodology Prospective Payment System (“PPS”) - IRF: Paid per discharge by Case Mix Group (“CMG”) Home - Home Health: Paid per 60-day episode of care by Medicare Inpatient Home Health Resource Group (“HHRG”) Health & Rehab • An episode is paid in two installments: Hospice Segment 1) Request for Anticipated Payment (“RAP”) Segment 2) Final bill after episode is complete Per Diem/Visit or CMG/Episodes Medicare Advantage 74.4% 86.1% - Negotiated rate - Some are “tiered” for acuity/severity Per Diem/Visit or CMG/Episodes Managed Care - Negotiated rate - Some are “tiered” for acuity/severity Varies by state Medicaid 8.6% 10.1% 9.7% 2.9% Variety of methodologies Other 3.7% 4.0% 0.2% 0.3% Encompass Health 14

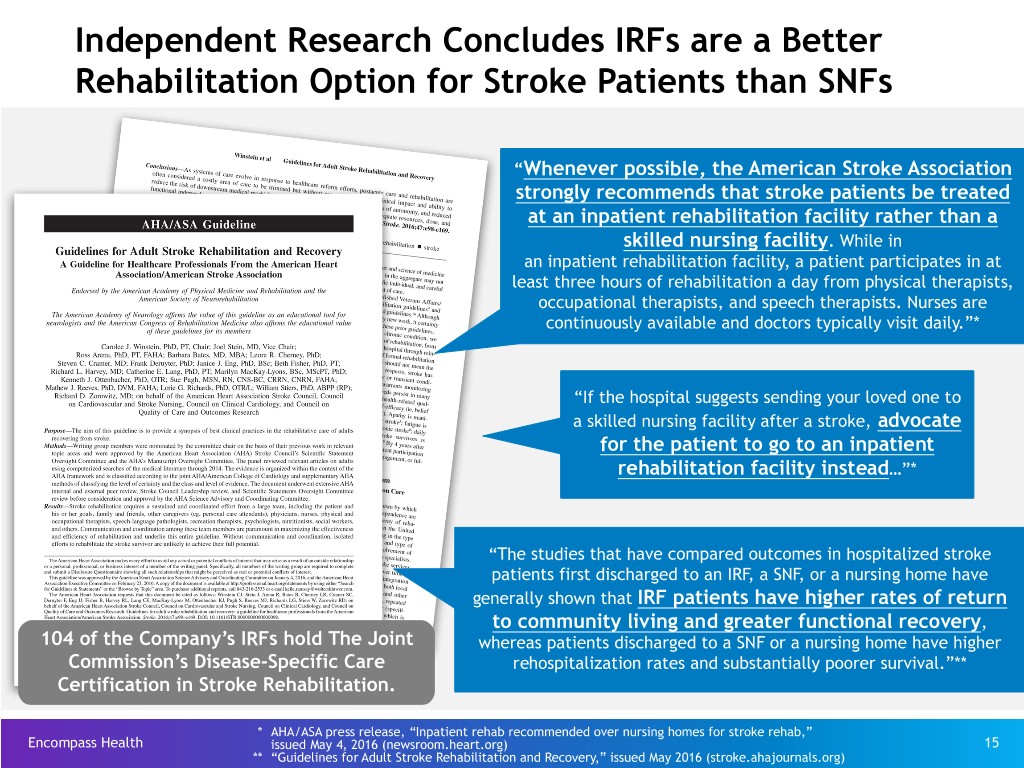

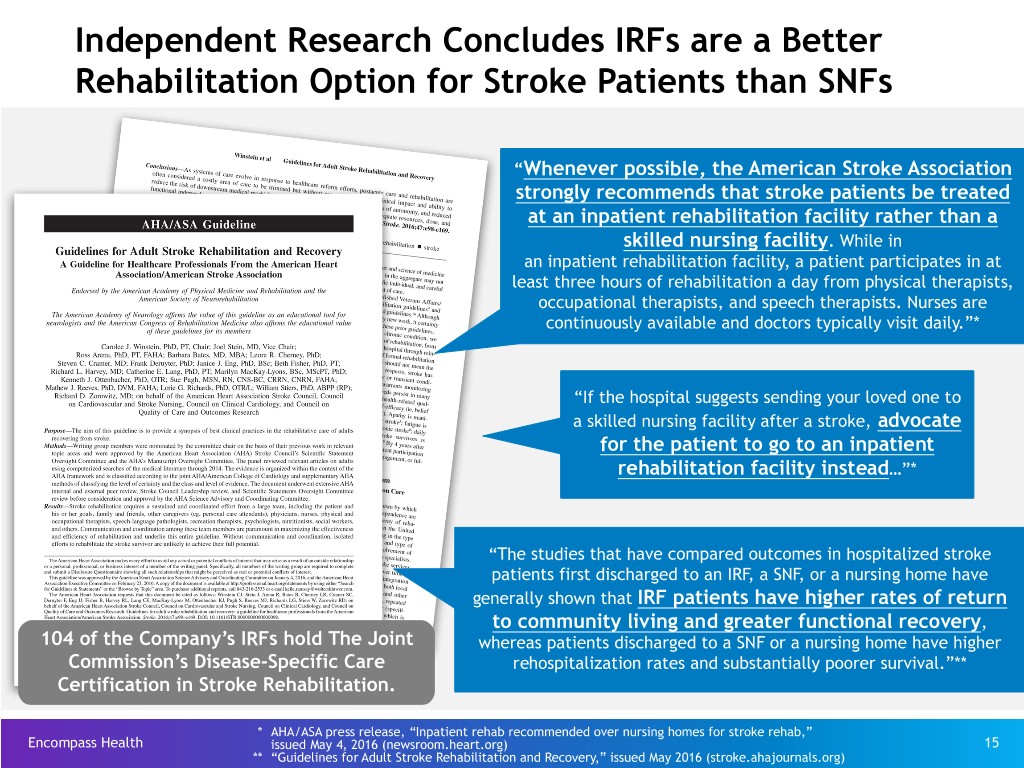

Independent Research Concludes IRFs are a Better Rehabilitation Option for Stroke Patients than SNFs “Whenever possible, the American Stroke Association strongly recommends that stroke patients be treated at an inpatient rehabilitation facility rather than a skilled nursing facility. While in an inpatient rehabilitation facility, a patient participates in at least three hours of rehabilitation a day from physical therapists, occupational therapists, and speech therapists. Nurses are continuously available and doctors typically visit daily.”* “If the hospital suggests sending your loved one to a skilled nursing facility after a stroke, advocate for the patient to go to an inpatient rehabilitation facility instead…”* “The studies that have compared outcomes in hospitalized stroke patients first discharged to an IRF, a SNF, or a nursing home have generally shown that IRF patients have higher rates of return to community living and greater functional recovery, 104 of the Company’s IRFs hold The Joint whereas patients discharged to a SNF or a nursing home have higher Commission’s Disease-Specific Care rehospitalization rates and substantially poorer survival.”** Certification in Stroke Rehabilitation. * AHA/ASA press release, “Inpatient rehab recommended over nursing homes for stroke rehab,” Encompass Health issued May 4, 2016 (newsroom.heart.org) 15 ** “Guidelines for Adult Stroke Rehabilitation and Recovery,” issued May 2016 (stroke.ahajournals.org)

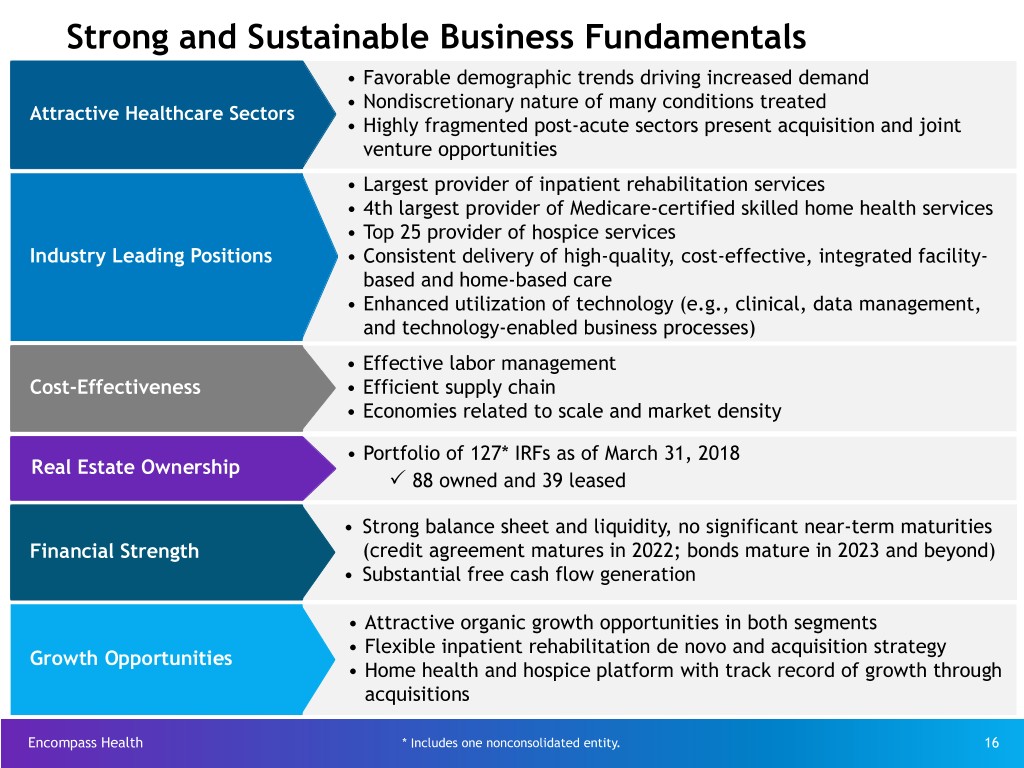

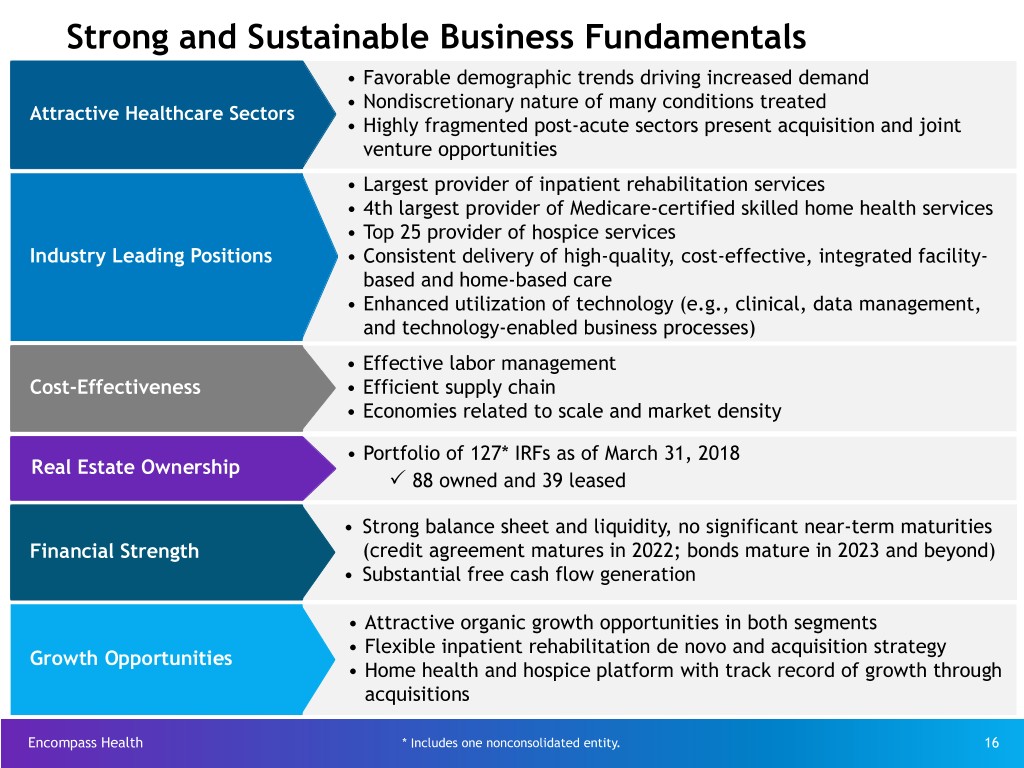

Strong and Sustainable Business Fundamentals • Favorable demographic trends driving increased demand • Nondiscretionary nature of many conditions treated Attractive Healthcare Sectors • Highly fragmented post-acute sectors present acquisition and joint venture opportunities • Largest provider of inpatient rehabilitation services • 4th largest provider of Medicare-certified skilled home health services • Top 25 provider of hospice services Industry Leading Positions • Consistent delivery of high-quality, cost-effective, integrated facility- based and home-based care • Enhanced utilization of technology (e.g., clinical, data management, and technology-enabled business processes) • Effective labor management Cost-Effectiveness • Efficient supply chain • Economies related to scale and market density • Portfolio of 127* IRFs as of March 31, 2018 Real Estate Ownership P 88 owned and 39 leased • Strong balance sheet and liquidity, no significant near-term maturities Financial Strength (credit agreement matures in 2022; bonds mature in 2023 and beyond) • Substantial free cash flow generation • Attractive organic growth opportunities in both segments • Flexible inpatient rehabilitation de novo and acquisition strategy Growth Opportunities • Home health and hospice platform with track record of growth through acquisitions Encompass Health * Includes one nonconsolidated entity. 16

Investment Thesis and Strategy Encompass Health’s ability to adapt to changes, build strategic relationships, and consistently provide high-quality, cost-effective care positions the Company for success in the evolving healthcare industry. Encompass Health 17

Investment Thesis Encompass Health is positioned to become the nation's leading provider of integrated post-acute services. The healthcare industry is evolving toward integrated delivery models and value-based care. Providers must be able to adapt to changes, build strategic relationships across the healthcare continuum, and consistently provide high-quality, cost-effective care to be successful. Demonstrated ability to adapt across economic cycles and in the face of numerous Change Agility and significant regulatory and legislative changes Joint ventures with acute-care partners comprise one-third of IRF portfolio. Formed Post-Acute Innovation Center in collaboration with Cerner Corporation to Strategic develop enhanced tools to manage patients across the continuum of care Relationships Partnered with the American Heart Association/American Stroke Association to jointly work to elevate national and local awareness that stroke is treatable and beatable through rehabilitation and community support Quality of Outcomes in both operating segments exceed national industry standards. Patient Outcomes Cost Treatment of more medically complex patients at lower average costs than other post-acute providers through superior clinical protocols, economies of scale, and Effectiveness technology-enabled business processes Both of the Company's segments benefit from favorable demographic trends and the Growth nondiscretionary nature of many conditions treated. Encompass Health 18

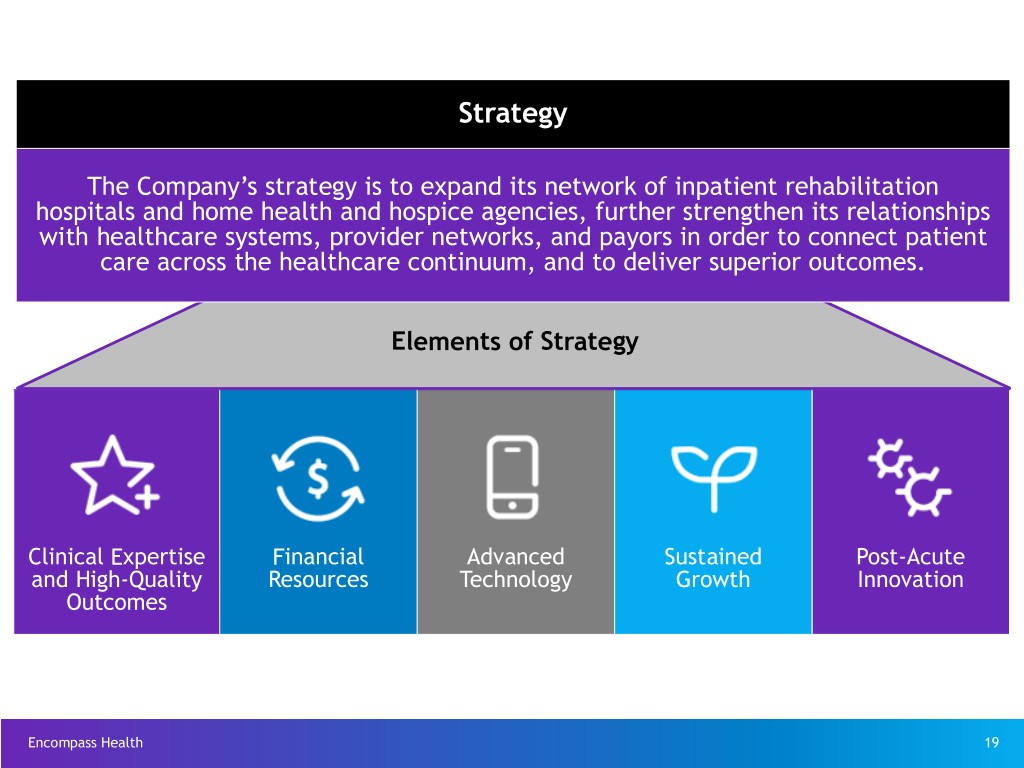

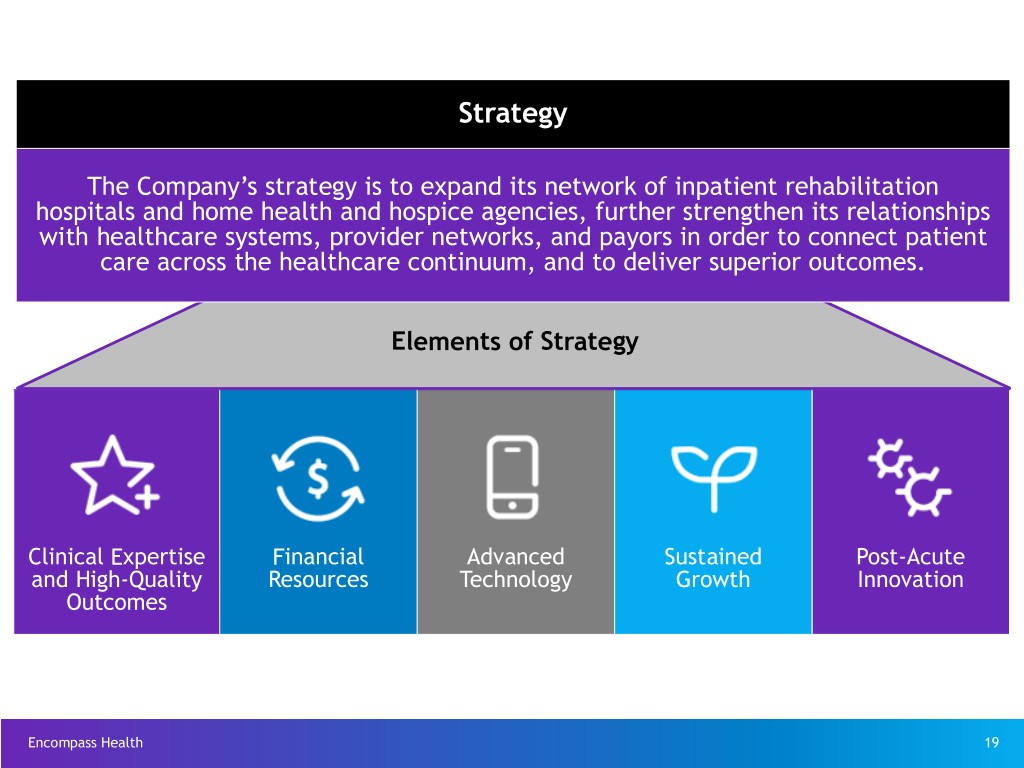

Strategy The Company’s strategy is to expand its network of inpatient rehabilitation hospitals and home health and hospice agencies, further strengthen its relationships with healthcare systems, provider networks, and payors in order to connect patient care across the healthcare continuum, and to deliver superior outcomes. Elements of Strategy Clinical Expertise Financial Advanced Sustained Post-Acute and High-Quality Resources Technology Growth Innovation Outcomes Encompass Health 19

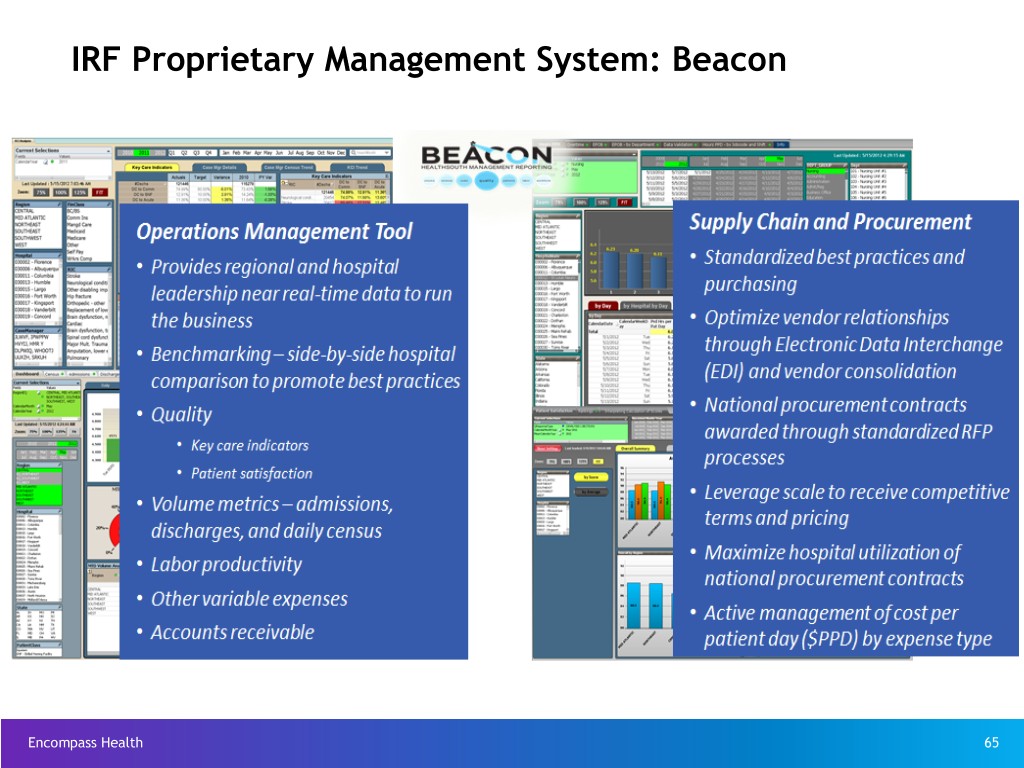

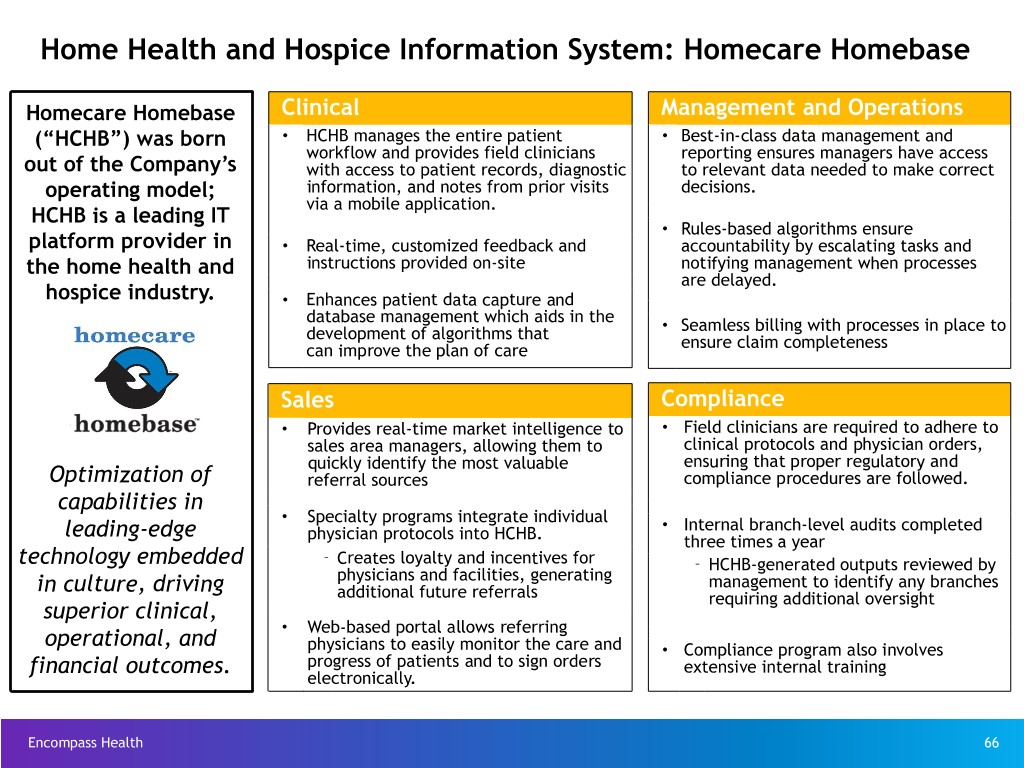

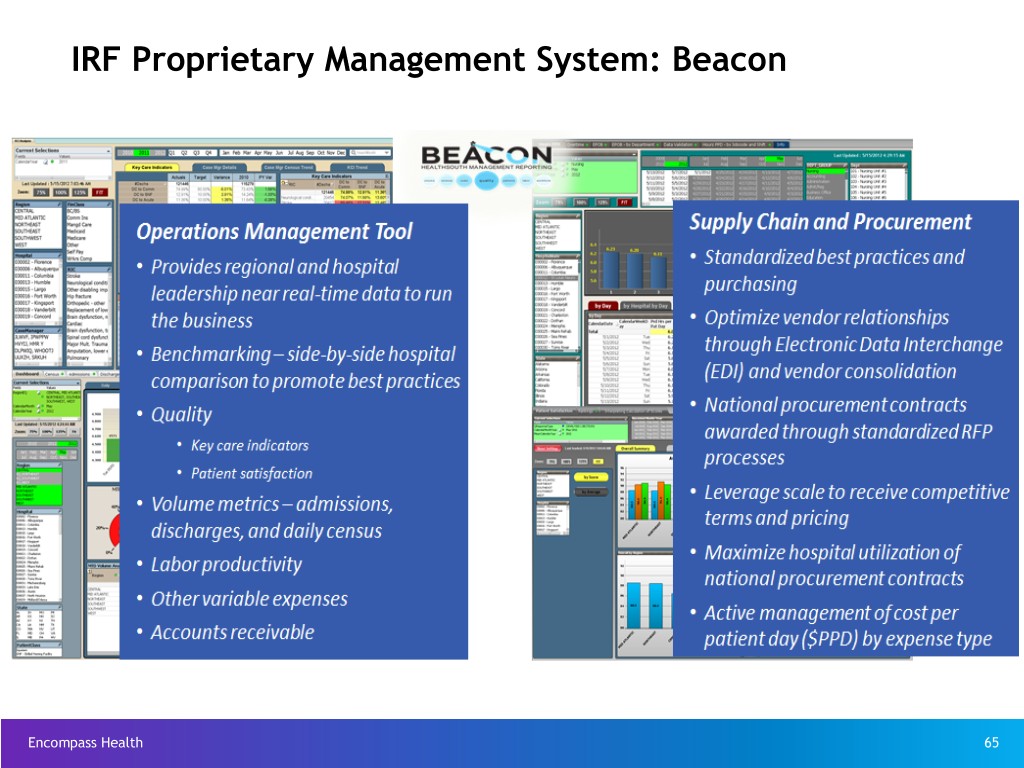

Elements of Strategy Institutional programs and advanced treatment protocols connect care and allow seamless transition of patients across the healthcare continuum Clinical Leverage technology to strengthen clinical data analytics Expertise and Integration of care transition coordinators High-Quality Outcomes 106 Encompass Health inpatient rehabilitation hospitals hold one or more disease- specific certifications, including 104 with stroke-specific certifications Outcomes in both operating segments exceed national industry standards (see page 9) Financial Strong, well-capitalized balance sheet Resources Free cash flow funds growth and shareholder distributions Proprietary rehabilitation-specific clinical information system (known as "ACE-IT") Advanced Technology Proprietary management reporting system (known as "Beacon") Optimization of Homecare Homebase Highly fragmented sectors present acquisition and joint venture growth opportunities Sustained Technology-facilitated and data-driven sales processes Growth Barriers to entry include capital investments, clinical expertise, regulatory compliance, and Certificate of Need (“CON”) requirements Predictive analytics used to enhance patient outcomes (e.g., ReACT; Sepsis Alert) Post-Acute Innovation Ongoing innovation with initiatives such as the Post-Acute Innovation Center Active participant in various alternative payment models Encompass Health 20

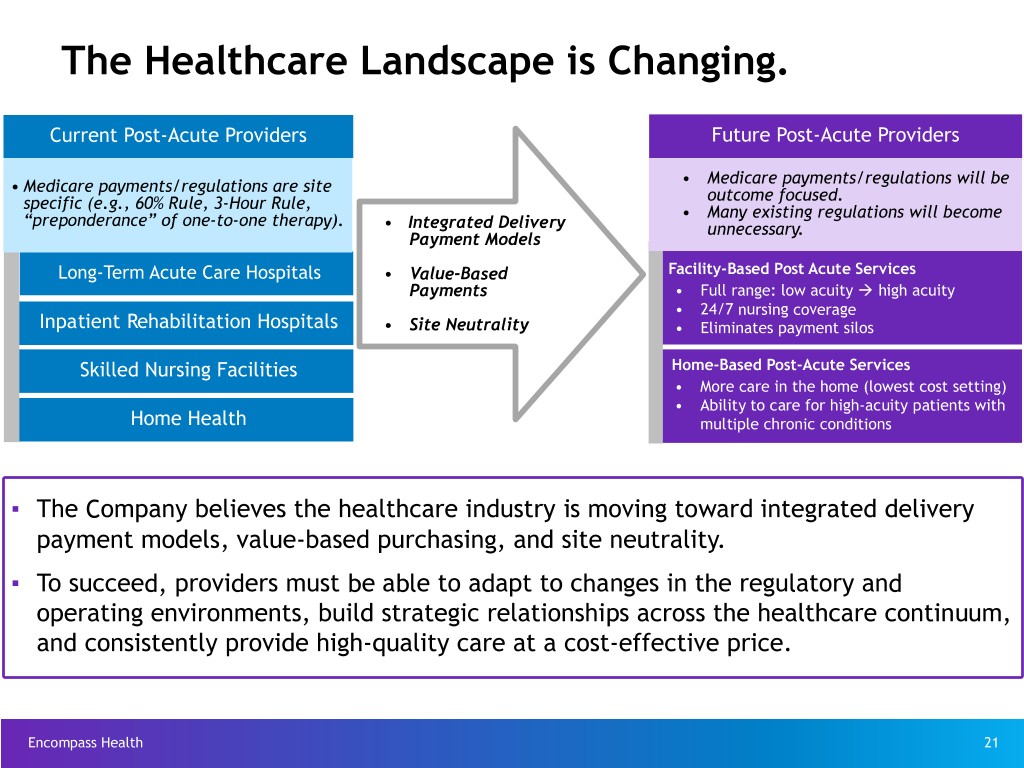

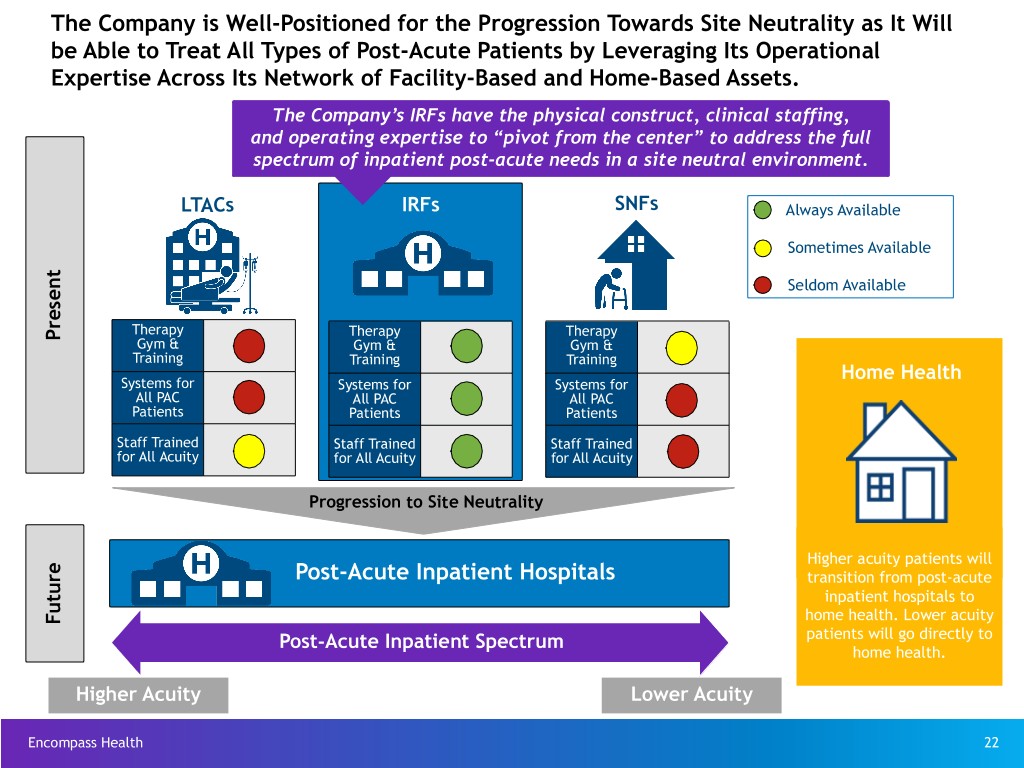

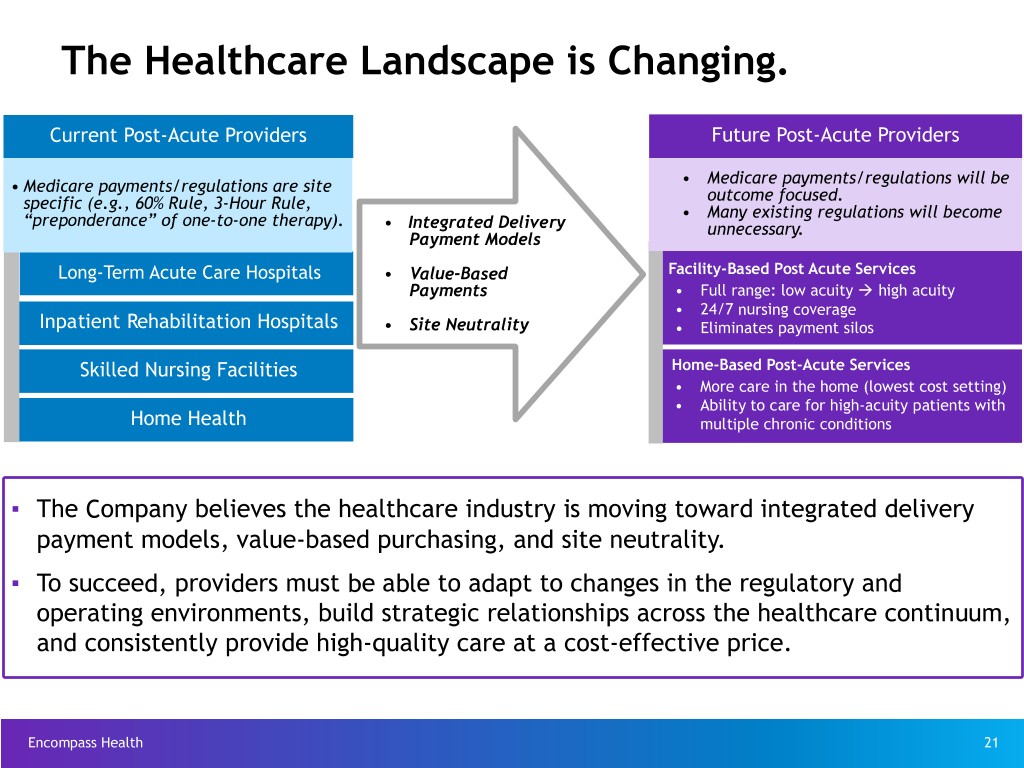

The Healthcare Landscape is Changing. Current Post-Acute Providers Future Post-Acute Providers • Medicare payments/regulations are site • Medicare payments/regulations will be specific (e.g., 60% Rule, 3-Hour Rule, outcome focused. “preponderance” of one-to-one therapy). • Many existing regulations will become • Integrated Delivery unnecessary. Payment Models Long-Term Acute Care Hospitals • Value-Based Facility-Based Post Acute Services Payments • Full range: low acuity à high acuity • 24/7 nursing coverage Inpatient Rehabilitation Hospitals • Site Neutrality • Eliminates payment silos Skilled Nursing Facilities Home-Based Post-Acute Services • More care in the home (lowest cost setting) • Ability to care for high-acuity patients with Home Health multiple chronic conditions ▪ The Company believes the healthcare industry is moving toward integrated delivery payment models, value-based purchasing, and site neutrality. ▪ To succeed, providers must be able to adapt to changes in the regulatory and operating environments, build strategic relationships across the healthcare continuum, and consistently provide high-quality care at a cost-effective price. Encompass Health 21

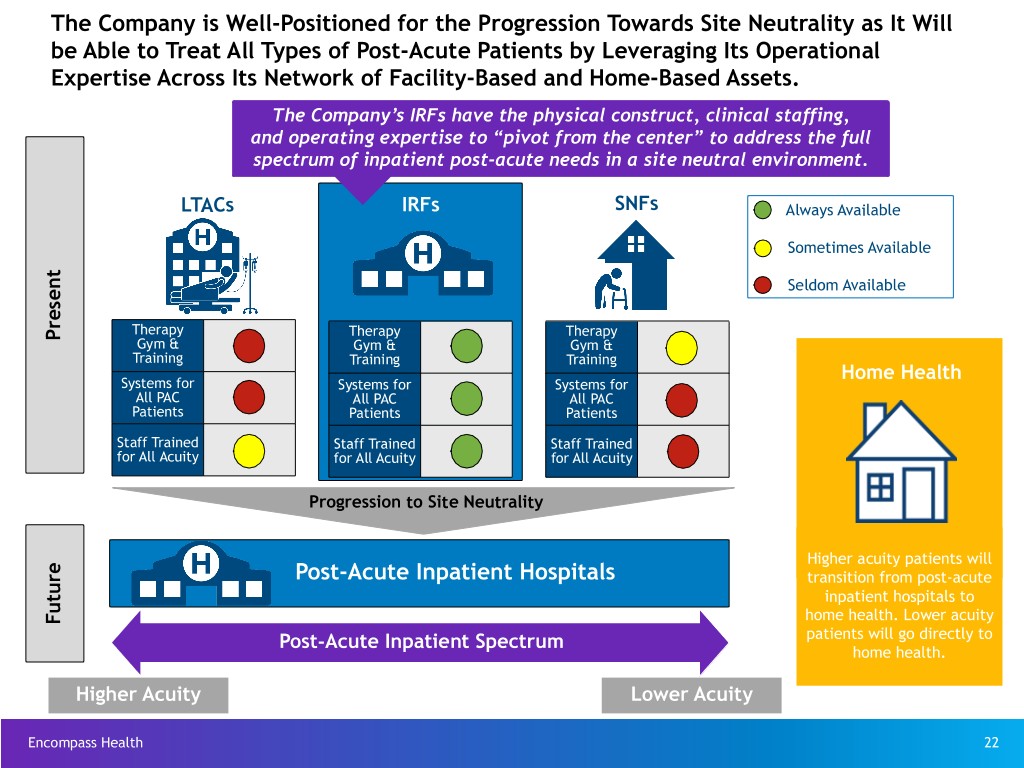

The Company is Well-Positioned for the Progression Towards Site Neutrality as It Will be Able to Treat All Types of Post-Acute Patients by Leveraging Its Operational Expertise Across Its Network of Facility-Based and Home-Based Assets. The Company’s IRFs have the physical construct, clinical staffing, and operating expertise to “pivot from the center” to address the full spectrum of inpatient post-acute needs in a site neutral environment. LTACs IRFs SNFs Always Available Sometimes Available Seldom Available Therapy Therapy Therapy Present Gym & Gym & Gym & Training Training Training Home Health Systems for Systems for Systems for All PAC All PAC All PAC Patients Patients Patients Staff Trained Staff Trained Staff Trained for All Acuity for All Acuity for All Acuity Progression to Site Neutrality Higher acuity patients will Post-Acute Inpatient Hospitals transition from post-acute inpatient hospitals to home health. Lower acuity Future Post-Acute Inpatient Spectrum patients will go directly to home health. Higher Acuity Lower Acuity Encompass Health 22

The Company Continues to Improve the Patient Experience Through Integrated Care Delivery Inpatient Rehabilitation–Home Health Clinical Collaboration (All Payors) Overlap Markets* 33.5% u As of March 31, 2018, ~60% of Encompass Collaboration Rate Health’s inpatient rehabilitation hospitals were 28.9% located within overlap markets.* Collaboration Rate u The clinical collaboration rate with Encompass 5,409 Health’s inpatient rehabilitation hospitals 4,308 increased by 460 basis points in Q1 2018 compared to Q1 2017. u The Company’s clinical collaboration rate objective for overlap markets is 35% to 40% within the next two years. u The primary objectives of clinical collaboration are to improve the patient experience and outcomes and to reduce the total cost of care 10,603 10,726 across a post-acute episode. Ÿ Coordination between EHC IRFs and EHC home health teams is resulting in lower discharges to SNFs and higher discharges to home in overlap markets. Ÿ Within overlap markets, patient satisfaction scores are increasing while acute care hospital Q1 2017 Q1 2018 readmission rates are decreasing. Encompass Health Home Health Encompass Health IRF Discharges to: Non-Encompass Health Home Health * Overlap markets have an Encompass Health IRF and an Encompass Health home health location within an Encompass Health approximate 30-mile radius, excluding markets that have home health licensure barriers. Home health 23 locations in overlap markets are open for 12 months before inclusion in the clinical collaboration rate.

Clinical Initiatives to Further Improve Quality Reduce Acute Care Transfers Pain Control / Reducing Infection Control Clinical Collaboration (tracked in the IRF QRP*) the Use of Opioids Problem: Problem: Problem: Poor coordination of the discharge Acute care transfers can Problem: Infections are a threat process between healthcare negatively influence patient Overprescription of to patient safety and add providers can result in challenges outcomes and result in opioids has contributed to a to growing healthcare with the transition of care, unnecessary healthcare nationwide opioid crisis. costs. unnecessary duplication of services, expenditures and penalties. and avoidable medical errors. Solution: Solution: Solution: Solution: Develop clinical protocols and Utilize extensive proprietary Standardize and improve A multidisciplinary approach coordinated discharge planning database of IRF patients to infection control practices to improve pain between IRFs and home health engage in predictive modeling across the company in management, including agencies; implemented TeamWorks to identify patients at risk for order to reduce the risk of nonpharmacologic treatment initiative to standardize best practices acute care transfer and infection to patients and of pain and vigilant opioid across all overlap markets; and implement intervention apply evidenced-based stewardship, will be integrate Care Transition Coordinators strategies as part decision making in EHC’s implemented across the to implement patient-centered of the plan of care. IRFs. company. transition plans that promote quality, safety and patient choice. Encompass Health * IRF Quality Reporting Program 24

Business Outlook, Including Guidance (as of May 15, 2018) Encompass Health 25

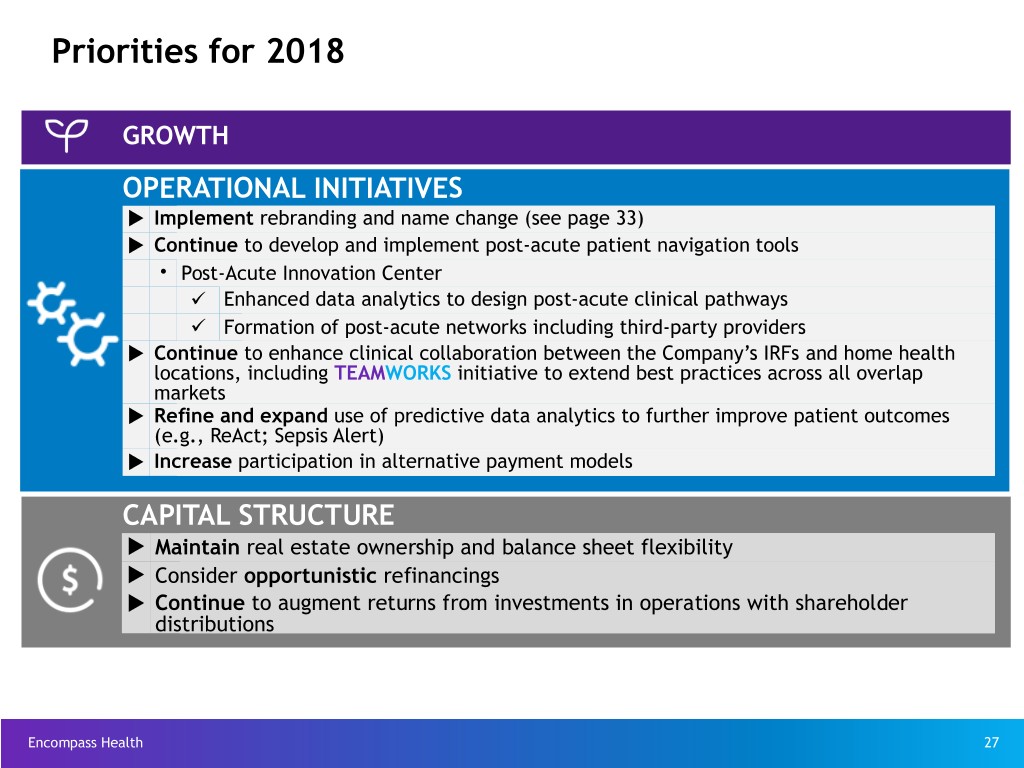

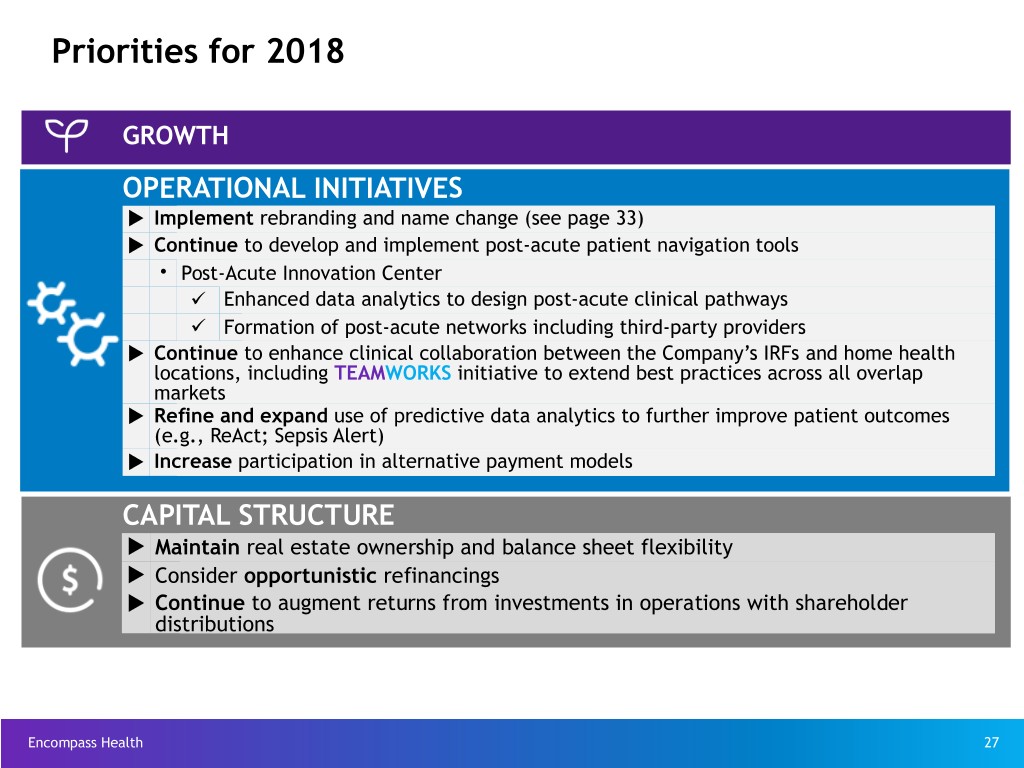

Priorities for 2018 GROWTH u Expand portfolio of inpatient rehabilitation hospitals Ÿ Demographic trends driving increased demand for inpatient rehabilitation services Ÿ IRFs are best positioned to expand service offering in the progression towards site neutrality (see page 22) Ÿ Joint venture or wholly owned opportunities based on market-specific dynamics Ÿ Increase capacity at existing IRFs via bed additons u Expand portfolio of home health and hospice agencies Ÿ Demographic trends driving increased demand for skilled home health services and in-home hospice services Ÿ Home health benefiting from skilled nursing facility (“SNF”) disintermediation Ÿ Continue emphasis on: ü Increasing overlap with the Company’s inpatient rehabilitation hospitals ü Increasing market density via acquisitions in existing and contiguous home health markets Ÿ Build scale in hospice service line OPERATIONAL INITIATIVES CAPITAL STRUCTURE Encompass Health 26

Priorities for 2018 GROWTH OPERATIONAL INITIATIVES u Implement rebranding and name change (see page 33) u Continue to develop and implement post-acute patient navigation tools • Post-Acute Innovation Center ü Enhanced data analytics to design post-acute clinical pathways ü Formation of post-acute networks including third-party providers u Continue to enhance clinical collaboration between the Company’s IRFs and home health locations, including TEAMWORKS initiative to extend best practices across all overlap markets u Refine and expand use of predictive data analytics to further improve patient outcomes (e.g., ReAct; Sepsis Alert) u Increase participation in alternative payment models CAPITAL STRUCTURE u Maintain real estate ownership and balance sheet flexibility u Consider opportunistic refinancings u Continue to augment returns from investments in operations with shareholder distributions Encompass Health 27

Guidance - as of May 15, 2018 Previous 2018 Full-Year Updated 2018 Full-Year Guidance Guidance (Provided Initially on April 26, 2018) Net Operating Revenues* Net Operating Revenues* $4,080 million to $4,190 million $4,110 million to $4,210 million Adjusted EBITDA(10) Adjusted EBITDA(10) $830 million to $850 million $845 million to $865 million Adjusted Earnings per Share Adjusted Earnings per Share from Continuing Operations from Continuing Operations Attributable to Encompass Attributable to Encompass Health(11) Health(11) $3.25 to $3.40 $3.30 to $3.45 * See page 29 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health 28 Refer to page 101-104 for end notes.

Impact of the New Revenue Recognition Accounting Standard u During the first quarter of 2018, Encompass Health adopted a new accounting standard (ASC 606 - Revenue from Contracts with Customers) which clarifies the standard for recognizing revenue. u The primary impact to the Company’s financial reporting was that amounts it previously presented as provision for doubtful accounts became a component of net operating revenue (both segments impacted similarly). • This had the effect of reducing net operating revenues but was neutral to Adjusted EBITDA and adjusted EPS. u The Company retrospectively adopted the new standard during Q1 2018, which means previously reported quarterly and full-year results for 2017 have been updated to reflect the requirements of the new standard. Impact of the New Revenue Standard - Historical Periods As Historically Reported As Currently Reported Under New Standard Q4-17 Q3-17 Q2-17 Q1-17 FY 2017 FY 2016 Q4-17 Q3-17 Q2-17 Q1-17 FY 2017 FY 2016 Net operating revenue (millions) $ 1,019.7 $ 995.6 $ 981.3 $ 974.8 $ 3,971.4 $ 3,707.2 $ 1,008.8 $ 981.6 $ 966.4 $ 957.1 $ 3,913.9 $ 3,642.6 Provision for doubtful accounts (millions) 9.7 12.6 13.7 16.4 52.4 61.2 — — — — — — Other operating expenses (millions) 139.5 137.6 130.5 129.1 536.7 492.1 138.3 136.2 129.3 127.8 531.6 488.7 Inpatient rehabilitation revenue/ discharge 17,871 17,896 17,823 18,131 17,929 17,577 17,693 17,654 17,557 17,812 17,679 17,265 IRF Segment - Prov. for doubtful accounts as a % of revenue 1.0% 1.4% 1.6% 1.8% 1.5% 1.9% N/A N/A N/A N/A N/A N/A Home health revenue/episode 2,989 3,022 2,989 2,991 2,998 3,031 2,976 3,008 2,975 2,978 2,984 3,017 Adjusted EBITDA (millions) 208.2 204.6 209.5 200.8 823.1 793.6 No Change Adjusted EPS 0.70 0.66 0.71 0.70 2.76 2.67 No Change Impact of the New Revenue Standard - Current Period Pro Forma Under Previous Accounting Standard As Currently Reported Under New Standard Q4-18 Q3-18 Q2-18 Q1-18 YTD 2018 Q4-18 Q3-18 Q2-18 Q1-18 YTD 2018 Net operating revenue (millions) $ — $ — $ — $ 1,056.7 $ 1,056.7 $ — $ — $ — $ 1,046.0 $ 1,046.0 Provision for doubtful accounts (millions) — — — 10.7 10.7 — — — — — Inpatient rehabilitation revenue/ discharge — — — 18,297 18,297 — — — 18,114 18,114 IRF Segment - Prov. for doubtful accounts as a % of revenue — — — 1.1% 1.1% — — — N/A N/A Home health revenue/episode — — — 2,937 2,937 — — — 2,934 2,934 Adjusted EBITDA (millions) No Change No Change Adjusted EPS No Change No Change Encompass Health 29

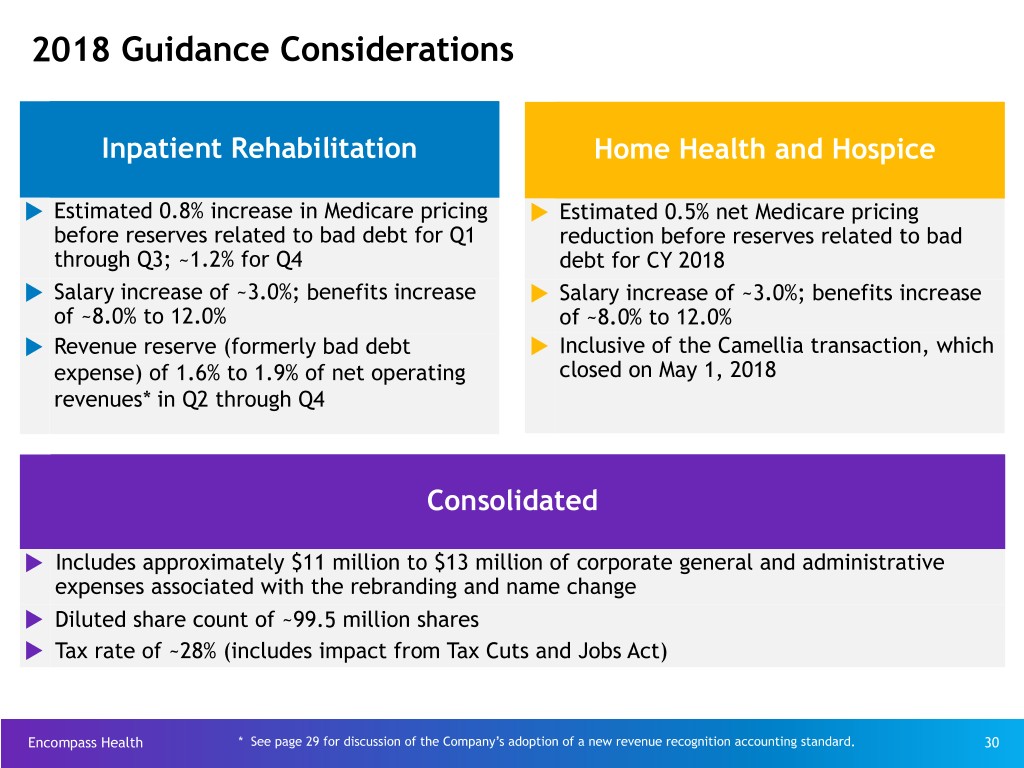

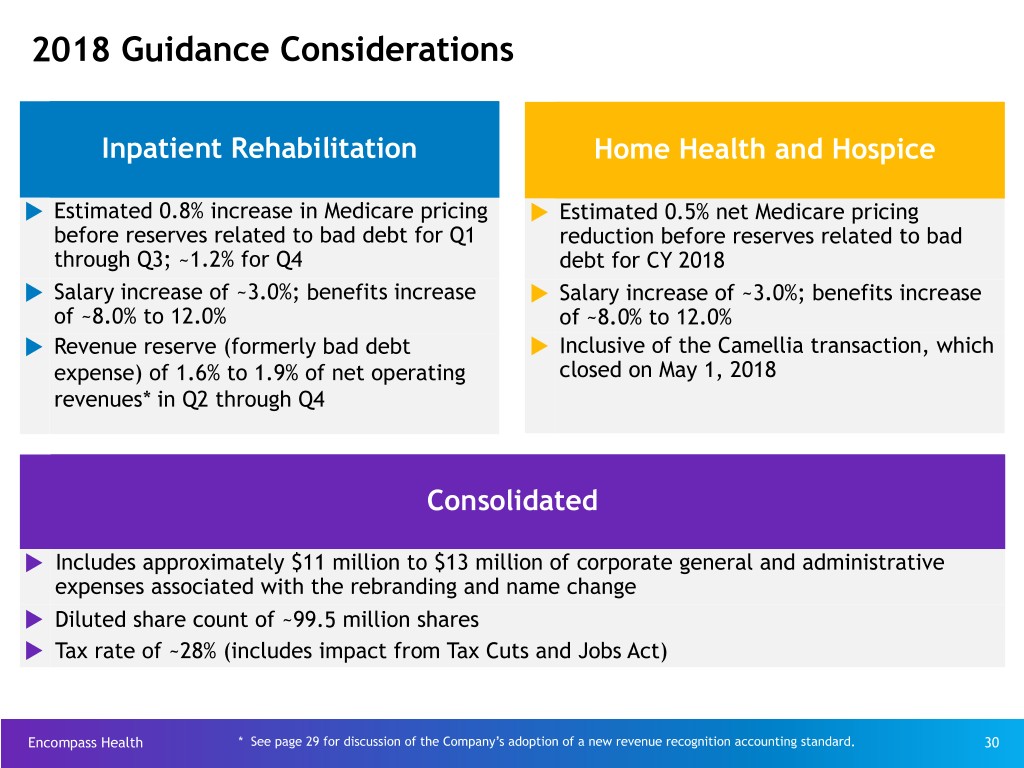

2018 Guidance Considerations Inpatient Rehabilitation Home Health and Hospice u Estimated 0.8% increase in Medicare pricing u Estimated 0.5% net Medicare pricing before reserves related to bad debt for Q1 reduction before reserves related to bad through Q3; ~1.2% for Q4 debt for CY 2018 u Salary increase of ~3.0%; benefits increase u Salary increase of ~3.0%; benefits increase of ~8.0% to 12.0% of ~8.0% to 12.0% u Revenue reserve (formerly bad debt u Inclusive of the Camellia transaction, which expense) of 1.6% to 1.9% of net operating closed on May 1, 2018 revenues* in Q2 through Q4 Consolidated u Includes approximately $11 million to $13 million of corporate general and administrative expenses associated with the rebranding and name change u Diluted share count of ~99.5 million shares u Tax rate of ~28% (includes impact from Tax Cuts and Jobs Act) Encompass Health * See page 29 for discussion of the Company’s adoption of a new revenue recognition accounting standard. 30

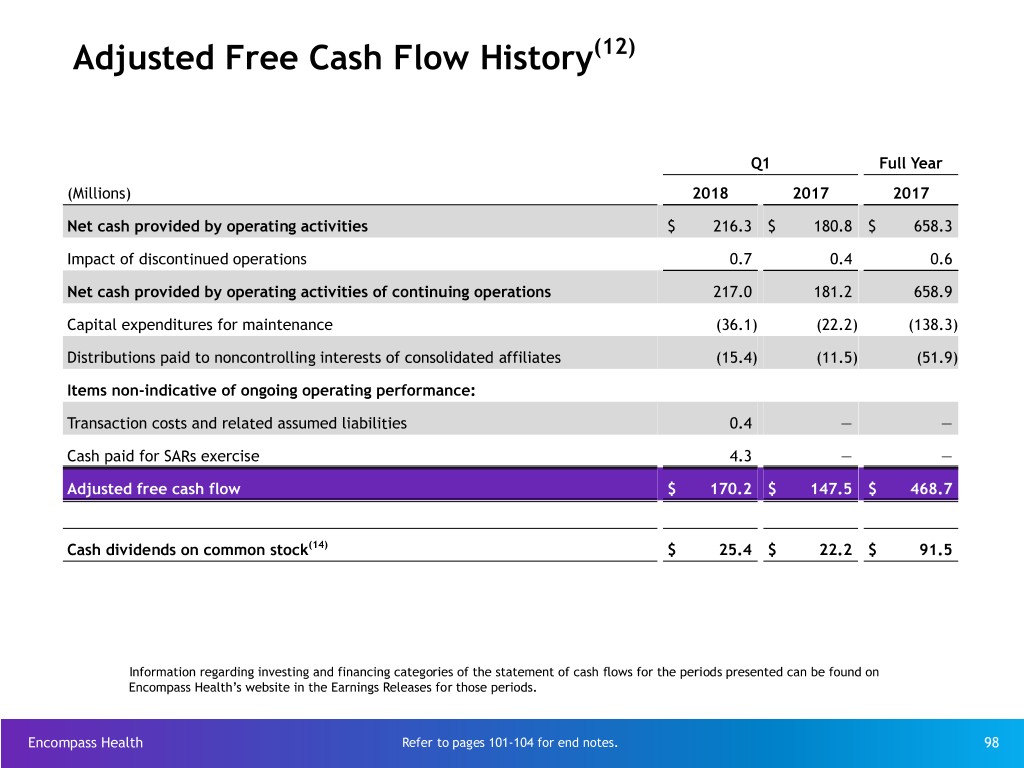

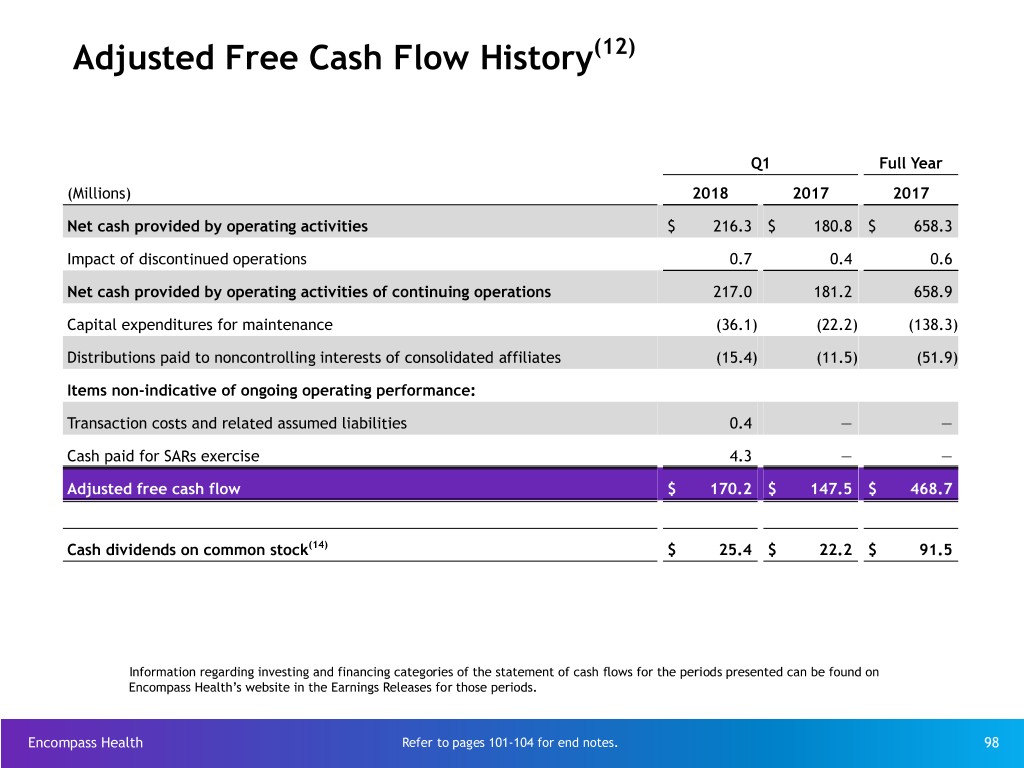

Adjusted Free Cash Flow(12) Assumptions 3 Months Certain Cash Flow Items 2018 2018 2017 (millions) Actual Assumptions Actual • Cash interest expense (net of amortization of debt $34.6 $140 to $150 $145.7 discounts and fees) u Increased cash payments for taxes in 2018 primarily due to exhaustion of federal NOL in Q1 2017 • Cash payments for taxes, net $1.5 $105 to $135 $94.5 of refunds u Working capital increase in 2018 due to expected resumption of Medicare pre-payment claims denials • Working capital and other $(19.1) $50 to $70 $(24.1) u Maintenance capital expenditures in 2018 reflect completion of new home office (began occupancy • Maintenance CAPEX $36.1 $130 to $150 $138.3 April 2, 2018) and completion of the ACE-IT installation (January 2018), offset by expenditures associated with rebranding. • Adjusted Free Cash Flow $170.2 $340 to $440 $468.7 Encompass Health Reconciliations to GAAP provided on pages 91-99. Refer to pages 101-104 for end notes. 31

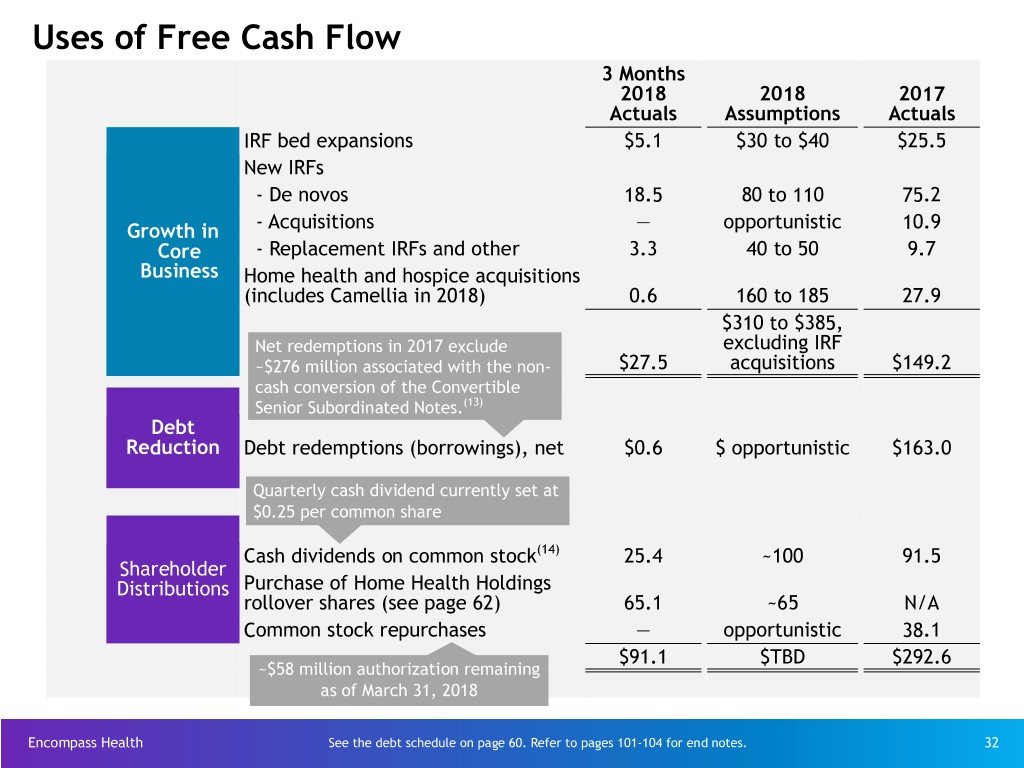

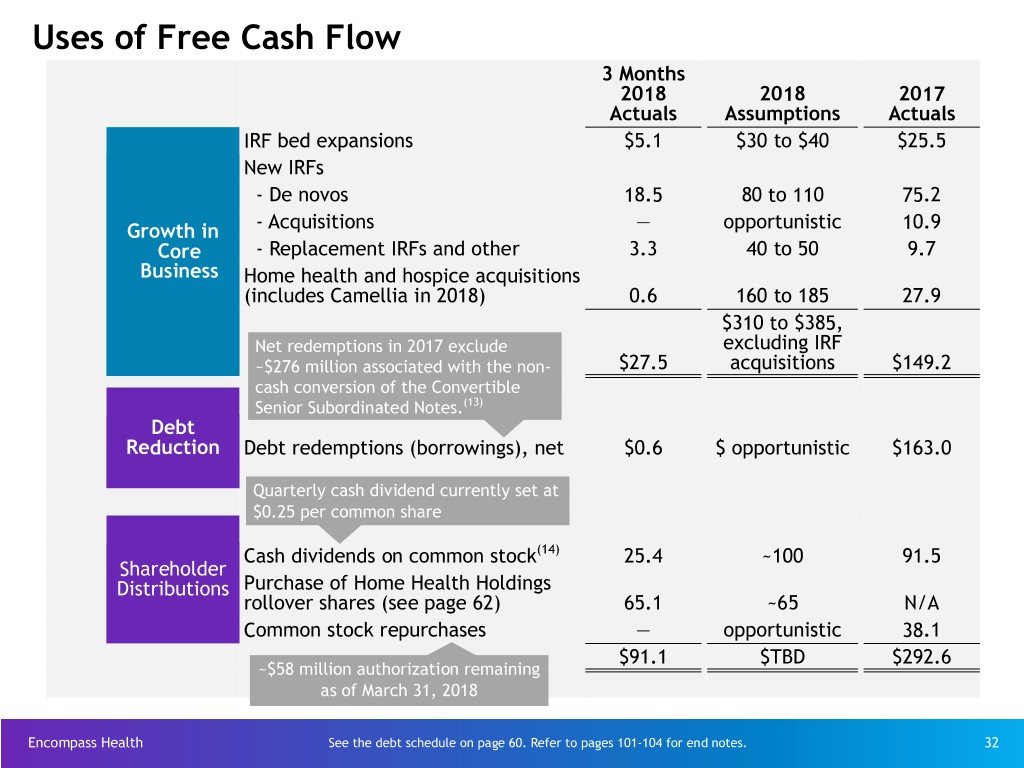

Uses of Free Cash Flow 3 Months 2018 2018 2017 Actuals Assumptions Actuals IRF bed expansions $5.1 $30 to $40 $25.5 New IRFs - De novos 18.5 80 to 110 75.2 Growth in - Acquisitions — opportunistic 10.9 Core - Replacement IRFs and other 3.3 40 to 50 9.7 Business Home health and hospice acquisitions (includes Camellia in 2018) 0.6 160 to 185 27.9 $310 to $385, Net redemptions in 2017 exclude excluding IRF ~$276 million associated with the non- $27.5 acquisitions $149.2 cash conversion of the Convertible Senior Subordinated Notes.(13) Debt Reduction Debt redemptions (borrowings), net $0.6 $ opportunistic $163.0 Quarterly cash dividend currently set at $0.25 per common share Cash dividends on common stock(14) 25.4 ~100 91.5 Shareholder Distributions Purchase of Home Health Holdings rollover shares (see page 62) 65.1 ~65 N/A Common stock repurchases — opportunistic 38.1 $91.1 $TBD $292.6 ~$58 million authorization remaining as of March 31, 2018 Encompass Health See the debt schedule on page 60. Refer to pages 101-104 for end notes. 32

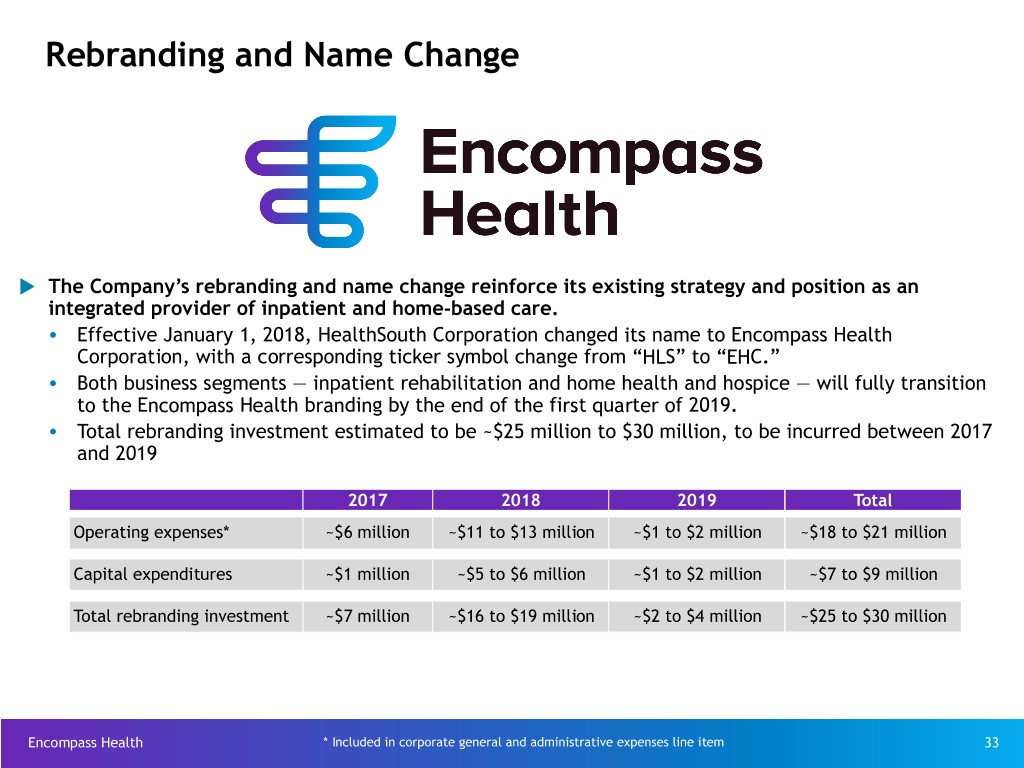

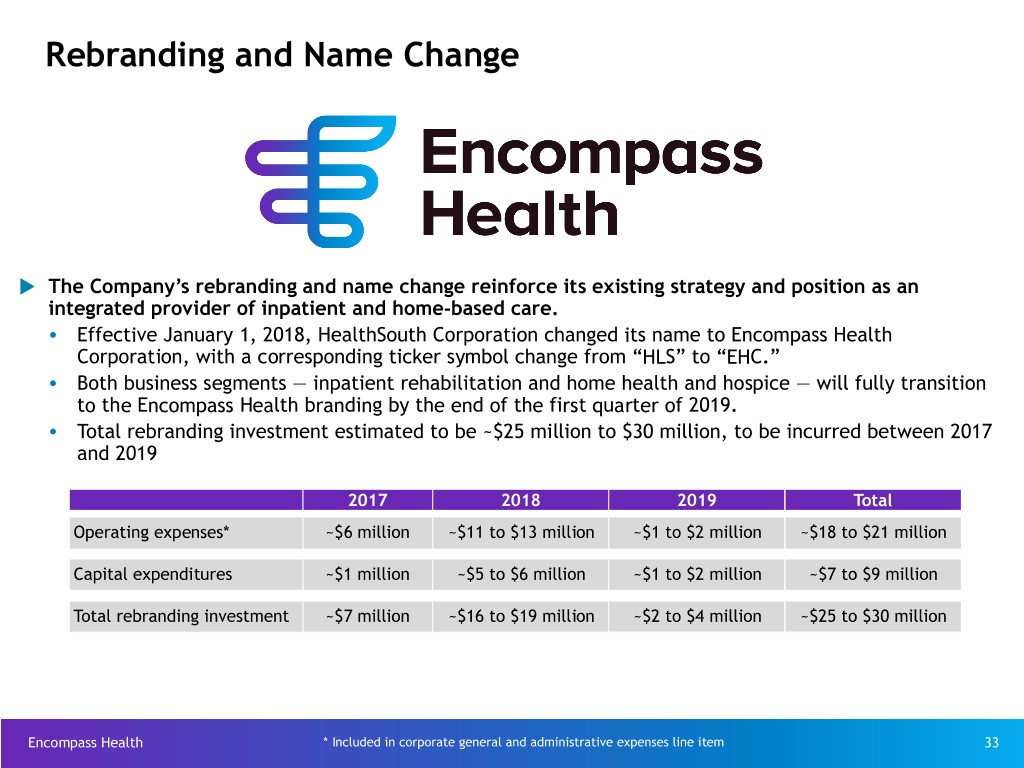

Rebranding and Name Change u The Company’s rebranding and name change reinforce its existing strategy and position as an integrated provider of inpatient and home-based care. Ÿ Effective January 1, 2018, HealthSouth Corporation changed its name to Encompass Health Corporation, with a corresponding ticker symbol change from “HLS” to “EHC.” Ÿ Both business segments — inpatient rehabilitation and home health and hospice — will fully transition to the Encompass Health branding by the end of the first quarter of 2019. Ÿ Total rebranding investment estimated to be ~$25 million to $30 million, to be incurred between 2017 and 2019 2017 2018 2019 Total Operating expenses* ~$6 million ~$11 to $13 million ~$1 to $2 million ~$18 to $21 million Capital expenditures ~$1 million ~$5 to $6 million ~$1 to $2 million ~$7 to $9 million Total rebranding investment ~$7 million ~$16 to $19 million ~$2 to $4 million ~$25 to $30 million Encompass Health * Included in corporate general and administrative expenses line item 33

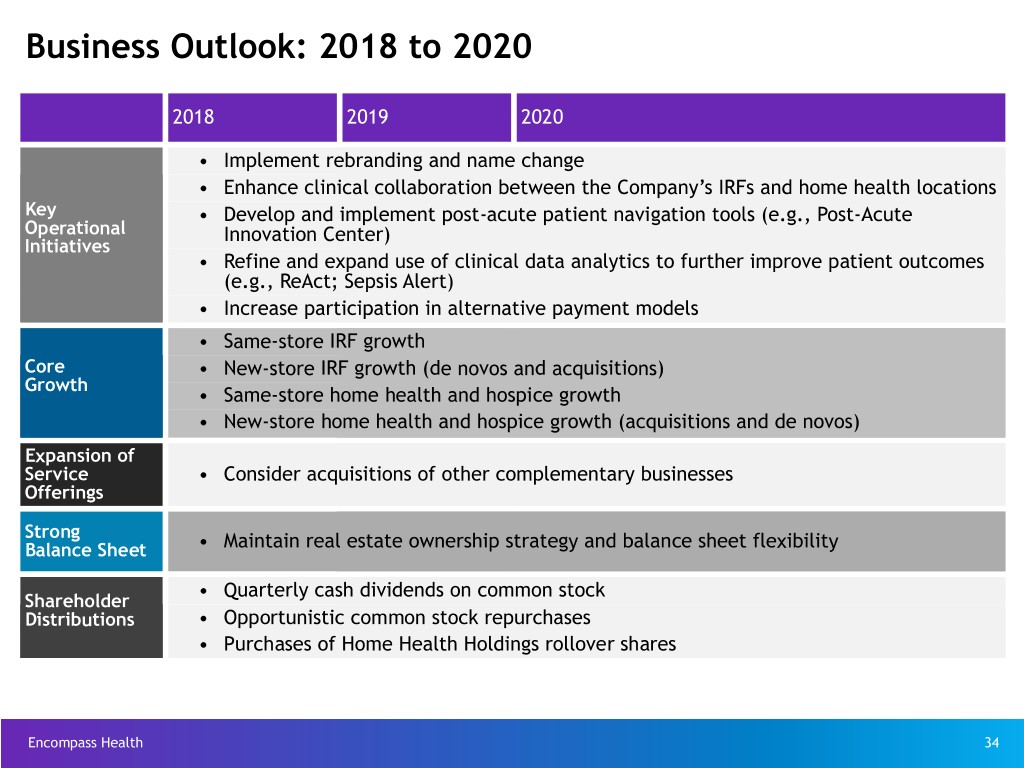

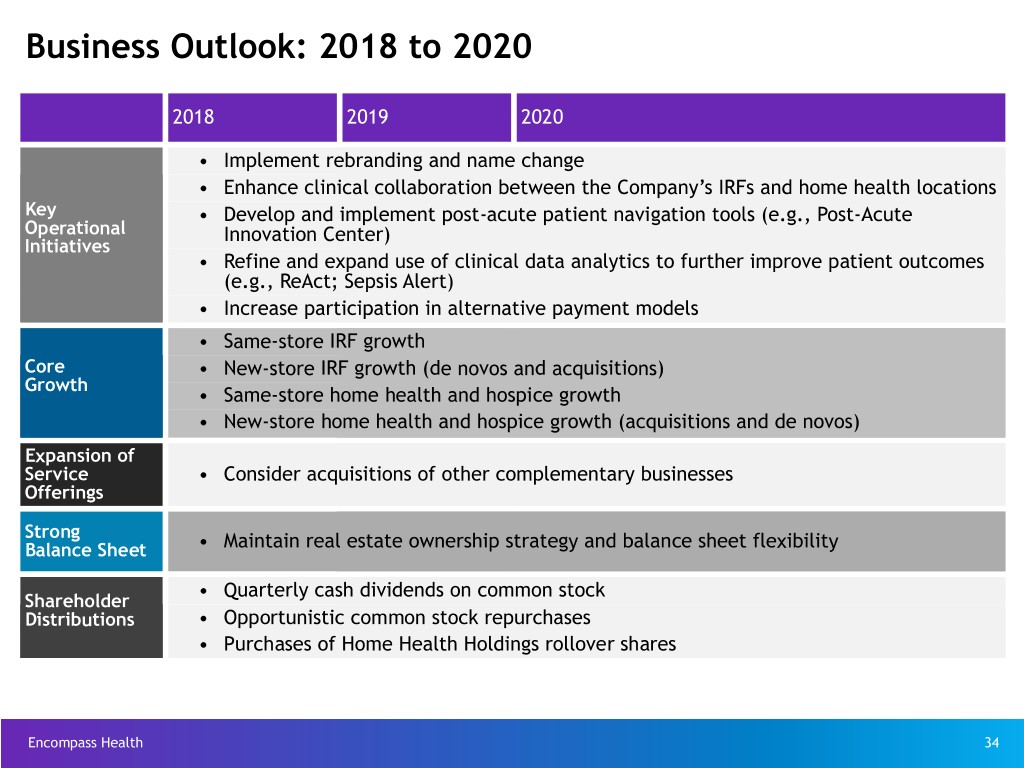

Business Outlook: 2018 to 2020 2018 2019 2020 • Implement rebranding and name change • Enhance clinical collaboration between the Company’s IRFs and home health locations Key • Develop and implement post-acute patient navigation tools (e.g., Post-Acute Operational Innovation Center) Initiatives • Refine and expand use of clinical data analytics to further improve patient outcomes (e.g., ReAct; Sepsis Alert) • Increase participation in alternative payment models • Same-store IRF growth Core • New-store IRF growth (de novos and acquisitions) Growth • Same-store home health and hospice growth • New-store home health and hospice growth (acquisitions and de novos) Expansion of Service • Consider acquisitions of other complementary businesses Offerings Strong Balance Sheet • Maintain real estate ownership strategy and balance sheet flexibility • Quarterly cash dividends on common stock Shareholder Distributions • Opportunistic common stock repurchases • Purchases of Home Health Holdings rollover shares Encompass Health 34

Business Outlook 2018 to 2020: Revenue Assumptions Volume Inpatient Rehabilitation* Home Health* (Includes New Stores) 3+% annual discharge growth 10+% annual admission growth Approx. 74% of Segment Revenue Approx. 86% of Segment Revenue Medicare Pricing FY 2018 FY 2019 FY 2020 CY 2018 CY 2019 CY 2020 (15) Q419-Q320 (15) Q119-Q419 (16) Q417-Q318 Q418-Q319 Estimate† Q118-Q418 Estimate† Q120-Q420 Market basket update 1.0% 2.9% 2.9% 1.0% 2.8% 1.5% Healthcare reform reduction - (0.75%) - - - - Coding intensity reduction - - - (0.9%) - - Legislative changes to the rural add-on program(16) - - - - ~(0.1%) ~(0.2%) Healthcare reform productivity adjustment - (0.8%) (0.6%) - (0.7%) - Net market basket update 1.0% 1.35% 2.3% 0.1% ~2.0% ~1.3% Change in wage index ~(0.1%) ~(0.1%) - - - - Change in CMG relative weights and average length of stay values ~(0.1%) ~(0.1%) - - - - Change in outlier threshold ~(0.0%) ~(0.0%) - - - - Impact from case mix re-weighting - - - ~(0.6%) - - Estimated impact to Encompass Health(17) ~0.8% ~1.2% ~(0.5%) Medicare Advantage Approx. 19% of Revenue Approx. 13% of Revenue and Managed Care Pricing Expected Increases 2-4% 2-4% 2-4% 0-2% 0-2% 0-2% * Outpatient and hospice, which services accounted for 4.6% of total operating revenues for full-year 2017, are not included in the pricing assumptions. † Estimates are based on current CMS and Congressional Budget Office projections Encompass Health which do not include potential changes from legislation or the CMS rule-making process. 35 Refer to pages 101-104 for end notes.

Business Outlook 2018 to 2020: Labor and Other Expense Assumptions Inpatient Rehabilitation Home Health and Hospice Salaries and Benefits 2018 2019 2020 Salary increases 2.75-3.25% 2.75-3.25% 2.75-3.25% Benefit costs increases 8-12%* 5-10% 5-10% % of Salaries and Benefits Salaries Salaries Salaries ~90% and Benefits and Benefits ~70% Benefits ~10% ~85% IRF Other Expenses Expenses ~30% ~15% IRF Expenses Home Health and Hospice Expenses •Other operating expenses and supply •Other operating expenses and supply costs tracking with inflation costs tracking with inflation Encompass Health * Expected benefit costs increase in 2018 is reflective of lower group medical expenses incurred in 2017. 36

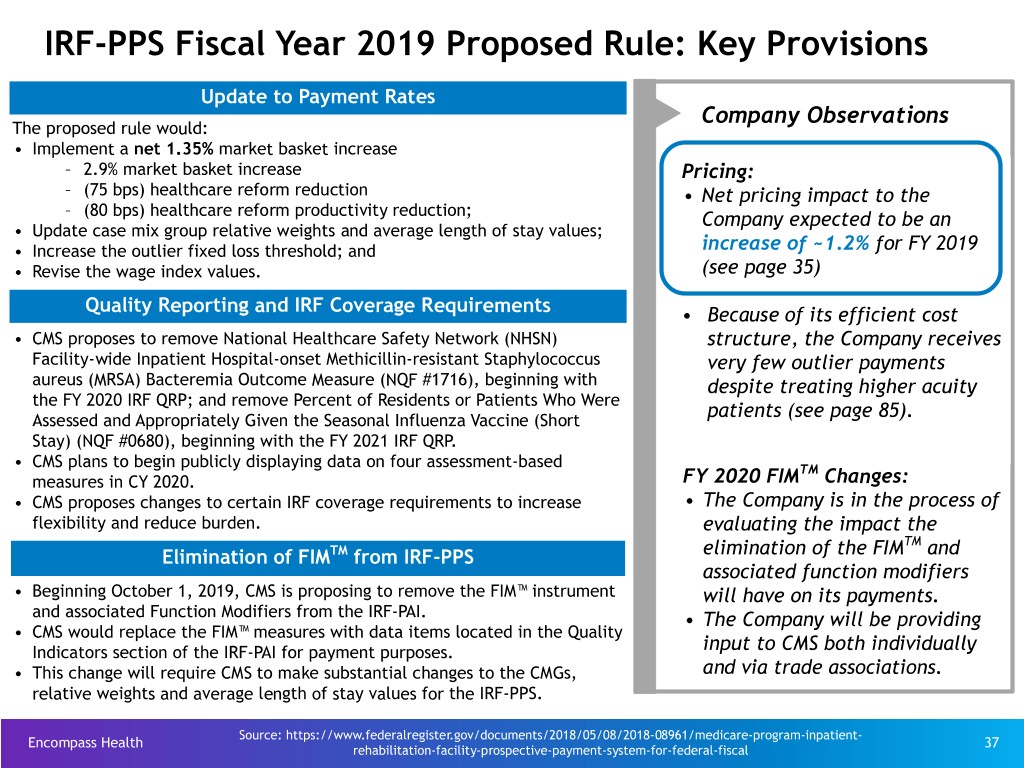

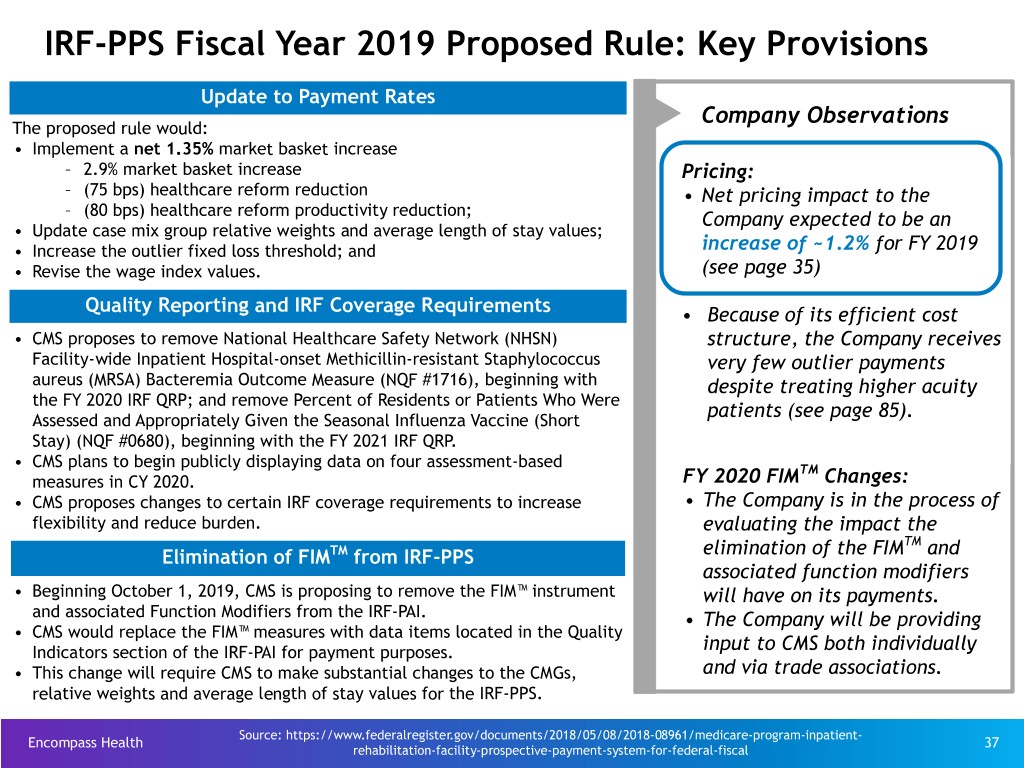

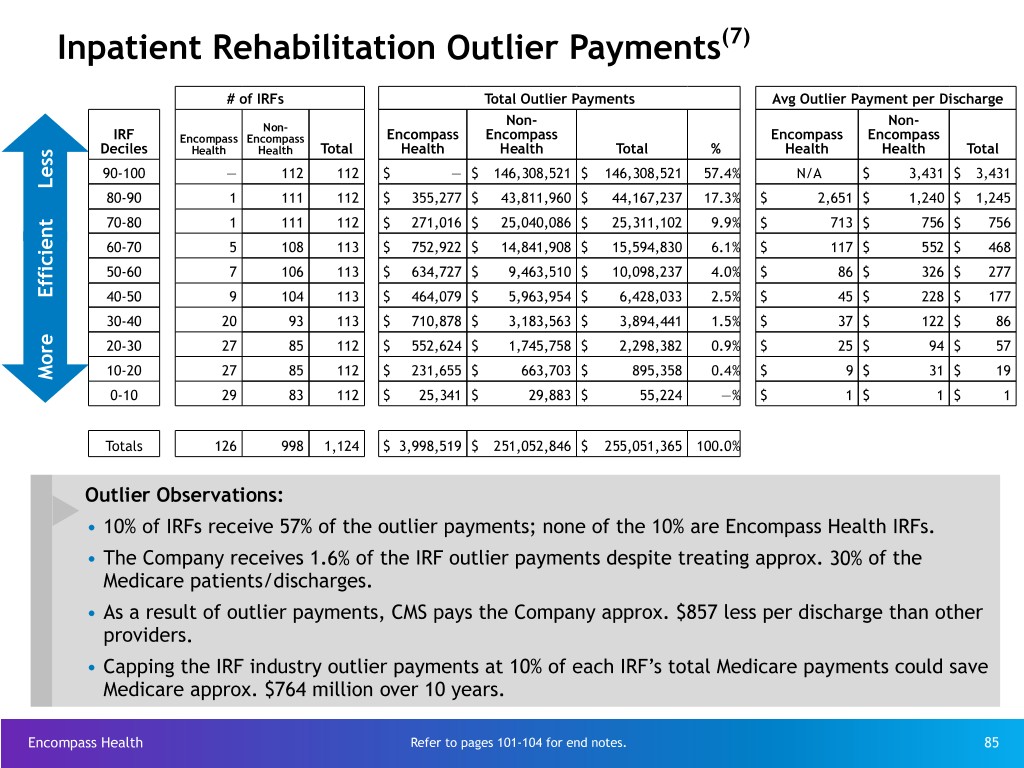

IRF-PPS Fiscal Year 2019 Proposed Rule: Key Provisions Update to Payment Rates Company Observations The proposed rule would: • Implement a net 1.35% market basket increase – 2.9% market basket increase Pricing: – (75 bps) healthcare reform reduction • Net pricing impact to the – (80 bps) healthcare reform productivity reduction; Company expected to be an • Update case mix group relative weights and average length of stay values; • Increase the outlier fixed loss threshold; and increase of ~1.2% for FY 2019 • Revise the wage index values. (see page 35) Quality Reporting and IRF Coverage Requirements • Because of its efficient cost • CMS proposes to remove National Healthcare Safety Network (NHSN) structure, the Company receives Facility-wide Inpatient Hospital-onset Methicillin-resistant Staphylococcus very few outlier payments aureus (MRSA) Bacteremia Outcome Measure (NQF #1716), beginning with despite treating higher acuity the FY 2020 IRF QRP; and remove Percent of Residents or Patients Who Were patients (see page 85). Assessed and Appropriately Given the Seasonal Influenza Vaccine (Short Stay) (NQF #0680), beginning with the FY 2021 IRF QRP. • CMS plans to begin publicly displaying data on four assessment-based TM measures in CY 2020. FY 2020 FIM Changes: • CMS proposes changes to certain IRF coverage requirements to increase • The Company is in the process of flexibility and reduce burden. evaluating the impact the TM Elimination of FIMTM from IRF-PPS elimination of the FIM and associated function modifiers • Beginning October 1, 2019, CMS is proposing to remove the FIM™ instrument will have on its payments. and associated Function Modifiers from the IRF-PAI. • The Company will be providing • CMS would replace the FIM™ measures with data items located in the Quality Indicators section of the IRF-PAI for payment purposes. input to CMS both individually • This change will require CMS to make substantial changes to the CMGs, and via trade associations. relative weights and average length of stay values for the IRF-PPS. Source: https://www.federalregister.gov/documents/2018/05/08/2018-08961/medicare-program-inpatient- Encompass Health 37 rehabilitation-facility-prospective-payment-system-for-federal-fiscal

HH-PPS Calendar Year 2018 Final Rule: Key Provisions Final Rule Update to 2018 Payment Rates Company Observations The final rule: • Implemented a net 1.0% market basket increase as established by the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015 and Pricing: • Implemented year three of a three-year nominal case-mix coding • Net pricing impact to the intensity reduction adjustment of (0.9%). Company expected to be a The final rule would have implemented the expiration of the rural add-on decrease of ~0.5% for CY 2018 (0.5%), but Congress elected to extend the adjustment through 2022(16), (see page 35) albeit declining in amount along the way. New Quality Reporting Measures Quality: CMS adopted, for the CY 2020 payment determination, three measures to meet the requirements of the IMPACT Act: • The Company will supplement • Changes in skin integrity post-acute care pressure ulcer/injury; existing processes and systems to • Application of % of residents experiencing one or more falls with major meet the new requirements. injury; and • Application of % of long-term care hospital patients with an admit and discharge functional assessment and care plan that addresses function. (16) These finalized measures will be calculated from OASIS data. Payment System : • The Company will continue to Proposed Home Health Groupings Model Not Finalized(16) engage with CMS, Congress, and other stakeholders to ensure any CMS did not finalize its proposal to implement significant changes to the change to the underlying payment home health payment system beginning on January 1, 2019. These changes system maintains access to needed were known as the Home Health Groupings Model (“HHGM”). home health services. Sources: https://www.federalregister.gov/documents/2017/11/07/2017-23935/medicare-and-medicaid- Encompass Health programs-cy-2018-home-health-prospective-payment-system-rate-update-and-cy 38 Refer to pages 101-104 for end notes.

IMPACT Act of 2014 - Enacted October 6, 2014 Company observations and considerations with respect to the IMPACT Act: ▪ It was developed on a bi-partisan basis by the House Ways and Means and Senate Finance Committees and incorporated feedback from healthcare providers and provider organizations that responded to the Committees’ solicitation of post-acute payment reform ideas and proposals. ▪ It directs the United States Department of Health and Human Services (“HHS”), in consultation with healthcare stakeholders, to implement standardized data collection processes for post-acute quality and resource use measures. ▪ Although the IMPACT Act does not specifically call for the implementation of a new post-acute payment system, the Company believes this act will lay the foundation for possible future post-acute payment policies that would be based on patients’ medical conditions and other clinical factors rather than the setting where the care is provided. ▪ It will create additional data reporting requirements for the Company’s IRFs(18) and home health agencies. The precise details of these new reporting requirements, including timing and content, will be developed and implemented by the Centers for Medicare and Medicaid Services through the regulatory process the Company expects will take place over the next several years. ▪ While the Company cannot quantify the potential financial effect of the IMPACT Act on Encompass Health, the Company believes any post-acute payment system that is data driven and focuses on the needs and underlying medical conditions of post-acute patients will be positive for providers who offer high-quality, cost-effective care. Encompass Health believes it is doing just that and expects this act will be positive for the Company. ▪ However, it will likely take years for the quality data to be gathered, standardized patient assessment data to be assembled and disseminated, and potential payment policies to be developed, tested and promulgated. As the nation’s largest owner and operator of inpatient rehabilitation hospitals, the Company looks forward to working with HHS, the Medicare Payment Advisory Commission and other healthcare stakeholders on these initiatives. Source: https://www.govtrack.us/congress/bills/113/hr4994/text Encompass Health Refer to pages 101-104 for end notes. 39

Growth Encompass Health is a leader in serving the post-acute patient population and has multiple avenues available for sustained growth in both segments. Favorable demographic trends are driving increased demand. Encompass Health 40

The Company Has Multiple Avenues Available for Sustained Growth in Both Segments u The Company continues to have excellent organic growth opportunities in inpatient rehabilitation, home health, and hospice. — Track record of consistent market share gains — IRF organic growth supplemented by bed additions — Maturation of acquired home health locations u Target four to six new inpatient rehabilitation hospitals per year to complement organic growth — De novos and acquisitions will allow entry into, and growth in, new markets. — Proven track record of success u Target $50 to $100* million per year toward home health and hospice acquisitions to complement organic growth — Home health acquisitions and new-store growth prioritized in Encompass Health IRF markets without current overlap — Build additional scale in hospice via acquisitions and de novos * On May 1, 2018, the Company completed the acquisition of Camellia Healthcare for ~$135 million. As a result, the Company expects to spend approximately $160 million to $185 million on home health and hospice acquisitions in 2018. Encompass Health 41

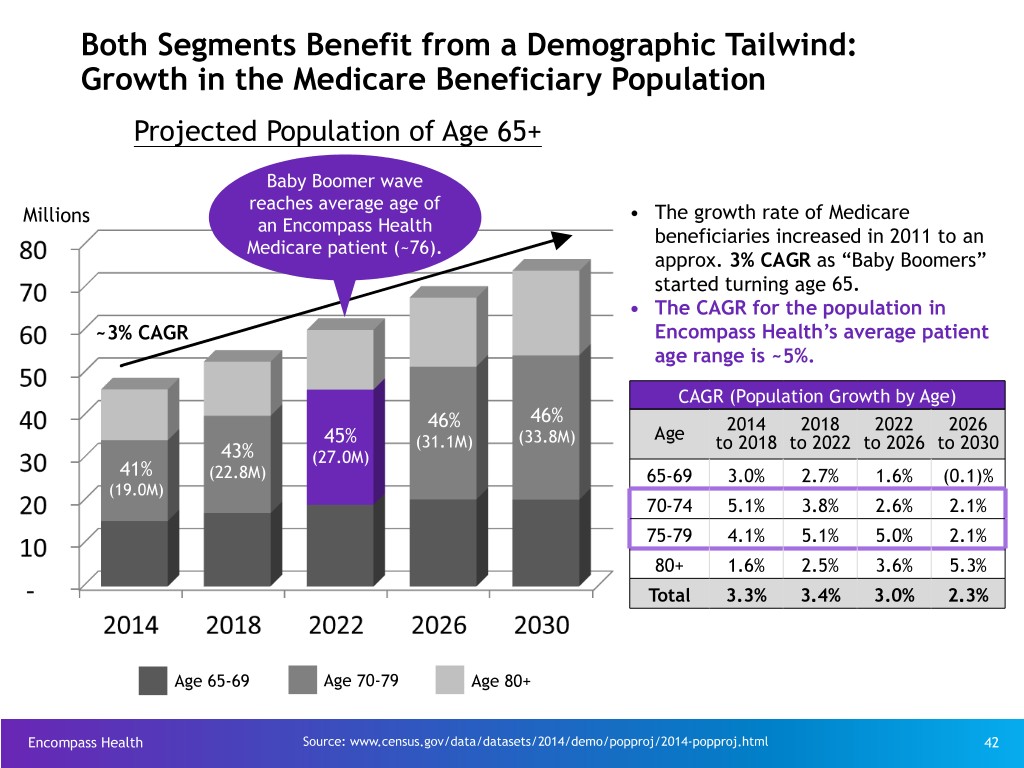

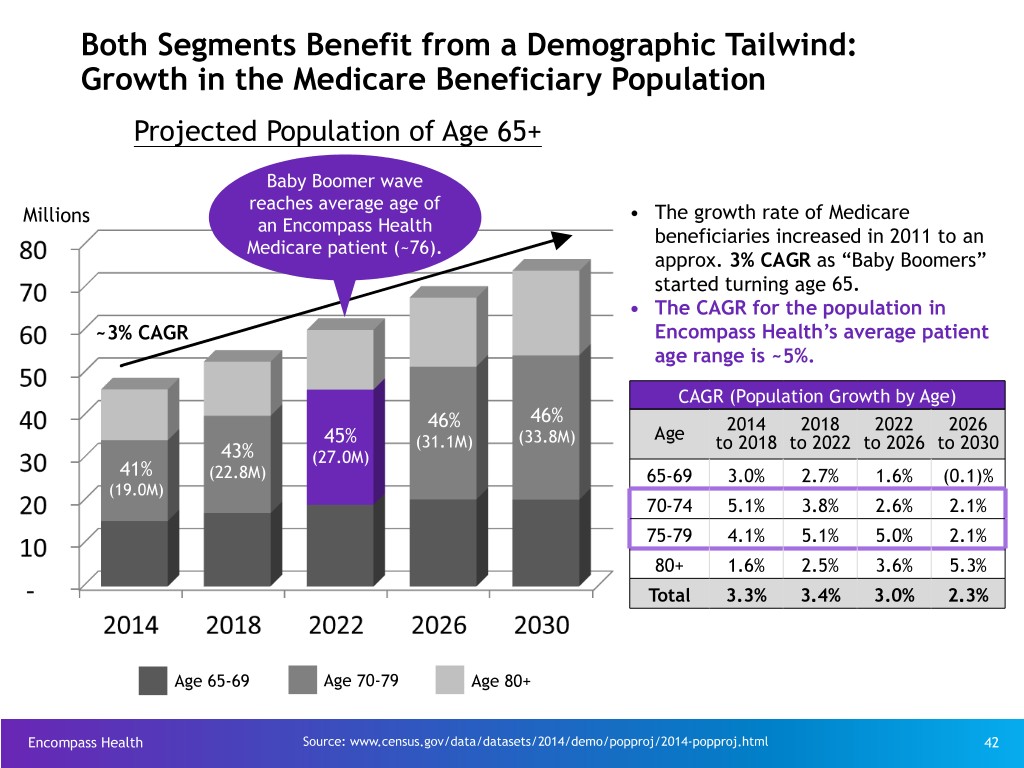

Both Segments Benefit from a Demographic Tailwind: Growth in the Medicare Beneficiary Population Projected Population of Age 65+ Baby Boomer wave reaches average age of Millions • The growth rate of Medicare an Encompass Health beneficiaries increased in 2011 to an Medicare patient (~76). approx. 3% CAGR as “Baby Boomers” started turning age 65. • The CAGR for the population in ~3% CAGR Encompass Health’s average patient age range is ~5%. CAGR (Population Growth by Age) 46% 46% 2014 2018 2022 2026 45% (31.1M) (33.8M) Age to 2018 to 2022 to 2026 to 2030 43% (27.0M) 41% (22.8M) 65-69 3.0% 2.7% 1.6% (0.1)% (19.0M) 70-74 5.1% 3.8% 2.6% 2.1% 75-79 4.1% 5.1% 5.0% 2.1% 80+ 1.6% 2.5% 3.6% 5.3% Total 3.3% 3.4% 3.0% 2.3% Age 65-69 Age 70-79 Age 80+ Encompass Health Source: www.census.gov/data/datasets/2014/demo/popproj/2014-popproj.html 42

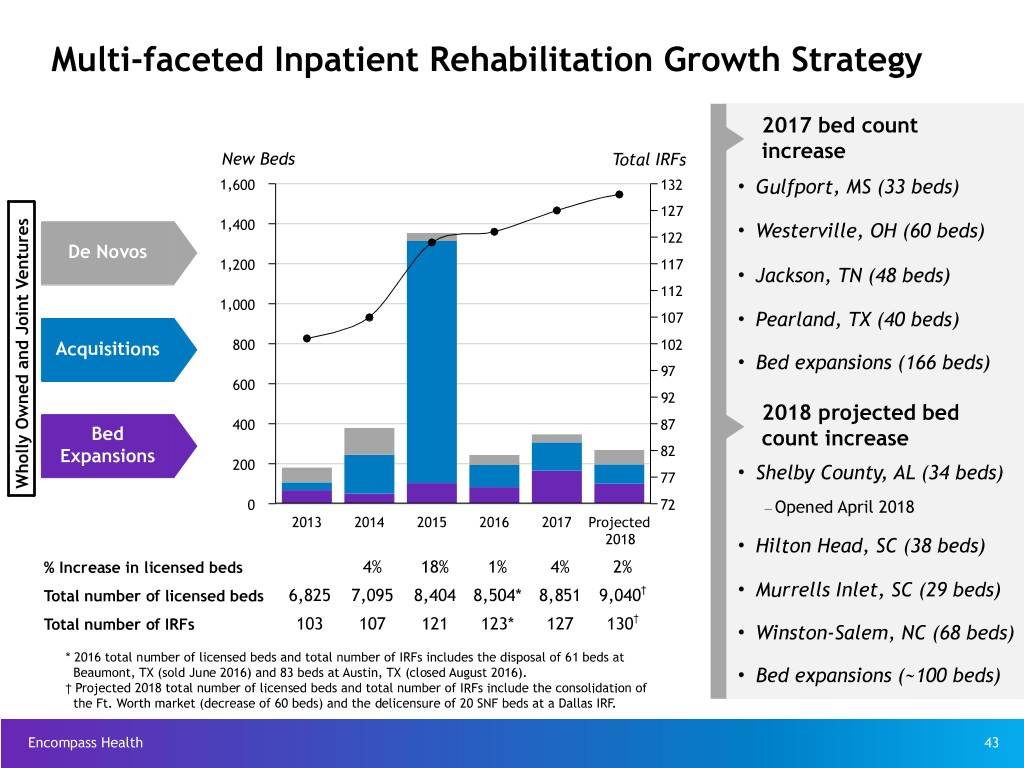

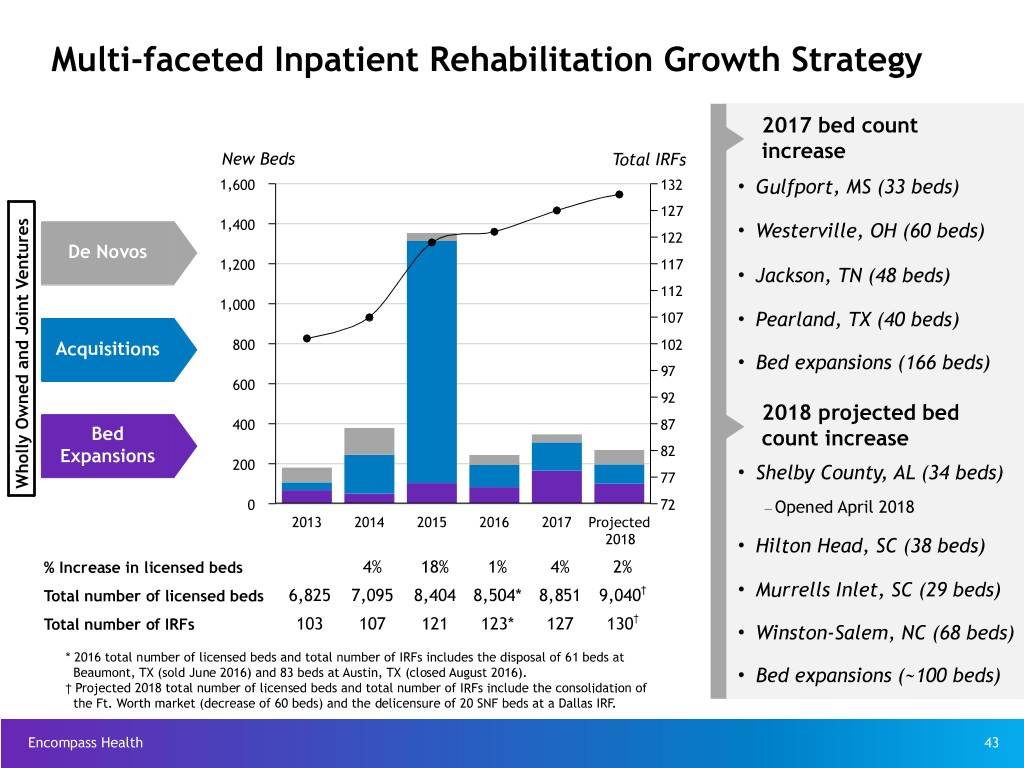

Multi-faceted Inpatient Rehabilitation Growth Strategy 2017 bed count New Beds Total IRFs increase 1,600 132 • Gulfport, MS (33 beds) 127 1,400 122 • Westerville, OH (60 beds) De Novos 1,200 117 • Jackson, TN (48 beds) 112 1,000 107 • Pearland, TX (40 beds) Acquisitions 800 102 97 • Bed expansions (166 beds) 600 92 2018 projected bed 400 87 Bed count increase 82 Expansions 200 77 • Shelby County, AL (34 beds) Wholly Owned and Joint Ventures 0 72 – Opened April 2018 2013 2014 2015 2016 2017 Projected 2018 • Hilton Head, SC (38 beds) % Increase in licensed beds 4% 18% 1% 4% 2% Total number of licensed beds 6,825 7,095 8,404 8,504* 8,851 9,040† • Murrells Inlet, SC (29 beds) † Total number of IRFs 103 107 121 123* 127 130 • Winston-Salem, NC (68 beds) * 2016 total number of licensed beds and total number of IRFs includes the disposal of 61 beds at Beaumont, TX (sold June 2016) and 83 beds at Austin, TX (closed August 2016). • Bed expansions (~100 beds) † Projected 2018 total number of licensed beds and total number of IRFs include the consolidation of the Ft. Worth market (decrease of 60 beds) and the delicensure of 20 SNF beds at a Dallas IRF. Encompass Health 43

Inpatient Rehabilitation Growth Pipeline Disciplined Approach to New Store Growth The Company’s Value Proposition – $7.7 Billion Medicare IRF Market – CAPEX to build free-standing IRF, freeing up space for Considerations: ü medical/surgical beds in an acute care facility for a JV partner – Market demographics Enhance the position of the acute care hospital to meet ü quality requirements and effectively participate in alternative payment models – Presence of other IRFs Increased acute care hospital flow-through by taking ü appropriate higher acuity patients faster than other post- – Geographic proximity to other Company acute settings ü Clinical collaboration between the Company’s IRFs and home IRFs and home health locations health locations Proprietary rehabilitation-specific clinical information system – Potential joint venture partners ü (“ACE-IT”) integrated with acute care hospitals’ clinical information systems to facilitate patient transfers, reduce readmissions, and enhance outcomes Typical Development Pipeline Proprietary real-time performance management systems (care ü management, labor productivity, quality reporting, therapy Exploratory / Actively Near-term analysis and expense management) to ensure appropriate clinical oversight and improve profitability CA Executed Working Actionable ü Proven track record of efficient management of regulatory process (CON, licensure, occupancy, etc.) No. of Projects 30 - 40 10 - 12 4 - 6 ü Experienced transaction/integration team Factors: ü National leader in post-acute policy activities • Certificate of Need process/timeline ü TeamWorks approach to sales and marketing • Fair market valuation of contributed assets (joint ü ventures only) Supply chain efficiencies ü • Partnership complexities Medical leadership and clinical advisory boards Source: MedPAC, Medicare Payment Policy, March 2018 - page 267 Encompass Health CA = confidentiality agreement 44

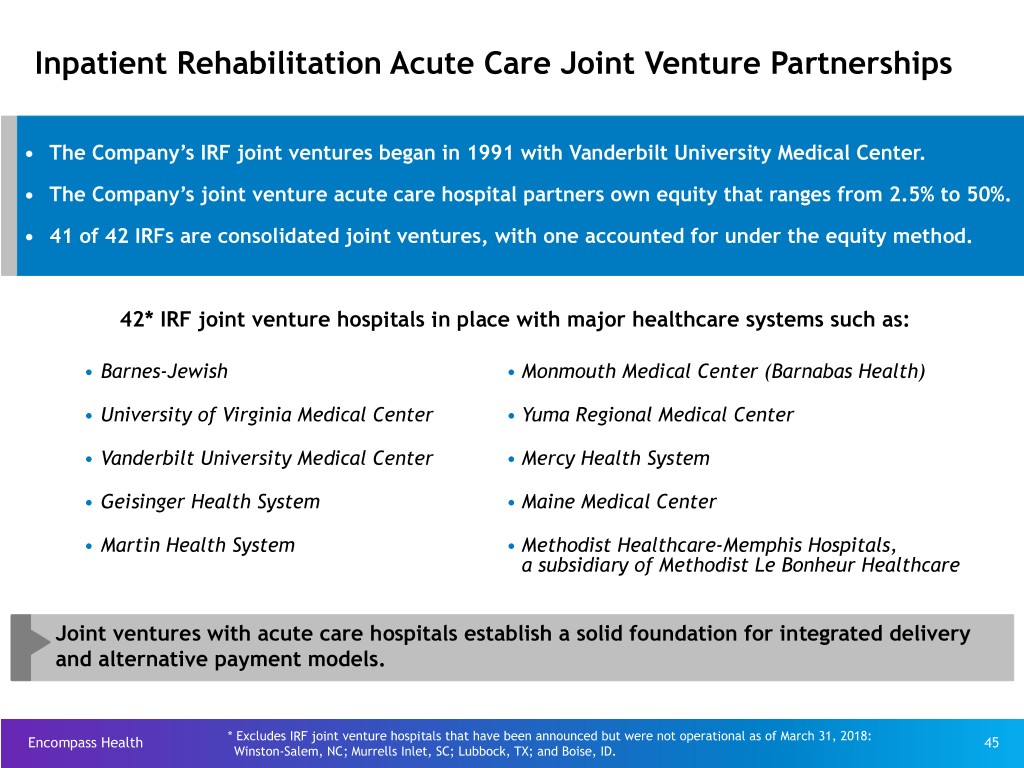

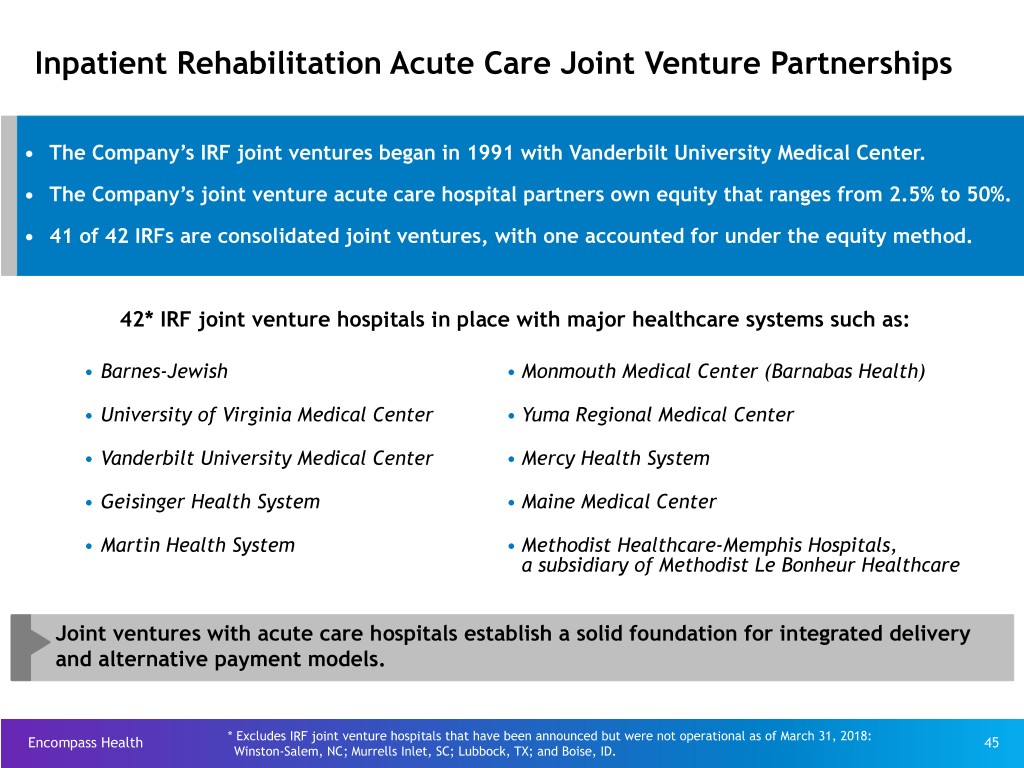

Inpatient Rehabilitation Acute Care Joint Venture Partnerships • The Company’s IRF joint ventures began in 1991 with Vanderbilt University Medical Center. • The Company’s joint venture acute care hospital partners own equity that ranges from 2.5% to 50%. • 41 of 42 IRFs are consolidated joint ventures, with one accounted for under the equity method. 42* IRF joint venture hospitals in place with major healthcare systems such as: • Barnes-Jewish • Monmouth Medical Center (Barnabas Health) • University of Virginia Medical Center • Yuma Regional Medical Center • Vanderbilt University Medical Center • Mercy Health System • Geisinger Health System • Maine Medical Center • Martin Health System • Methodist Healthcare-Memphis Hospitals, a subsidiary of Methodist Le Bonheur Healthcare Joint ventures with acute care hospitals establish a solid foundation for integrated delivery and alternative payment models. Encompass Health * Excludes IRF joint venture hospitals that have been announced but were not operational as of March 31, 2018: 45 Winston-Salem, NC; Murrells Inlet, SC; Lubbock, TX; and Boise, ID.

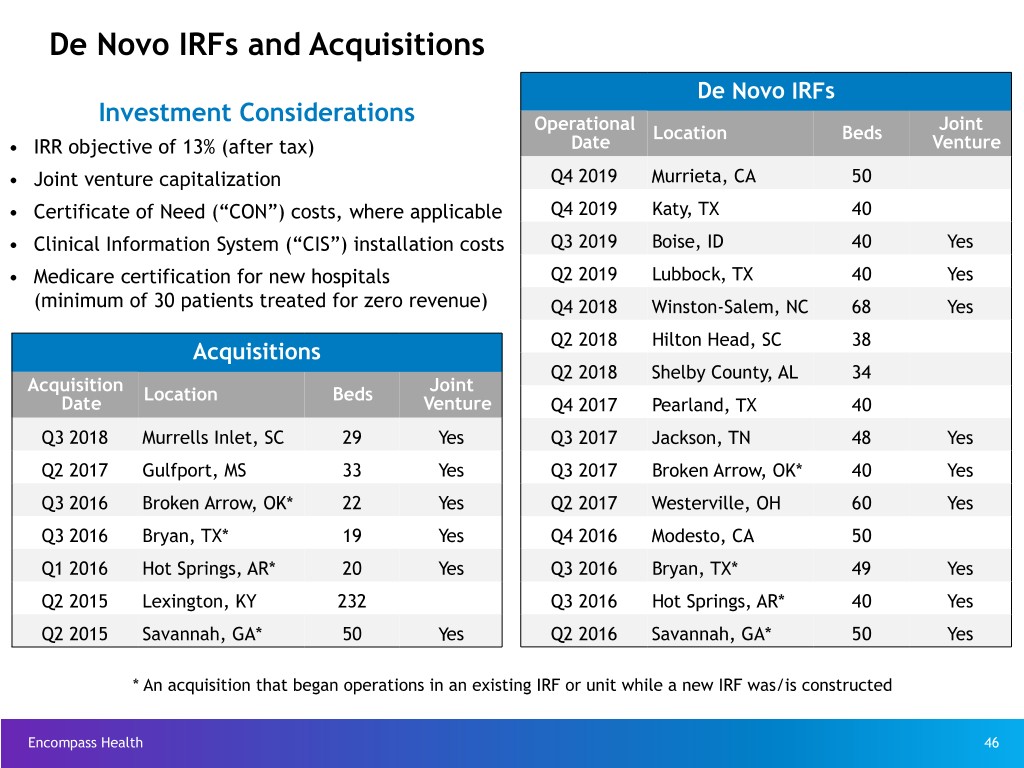

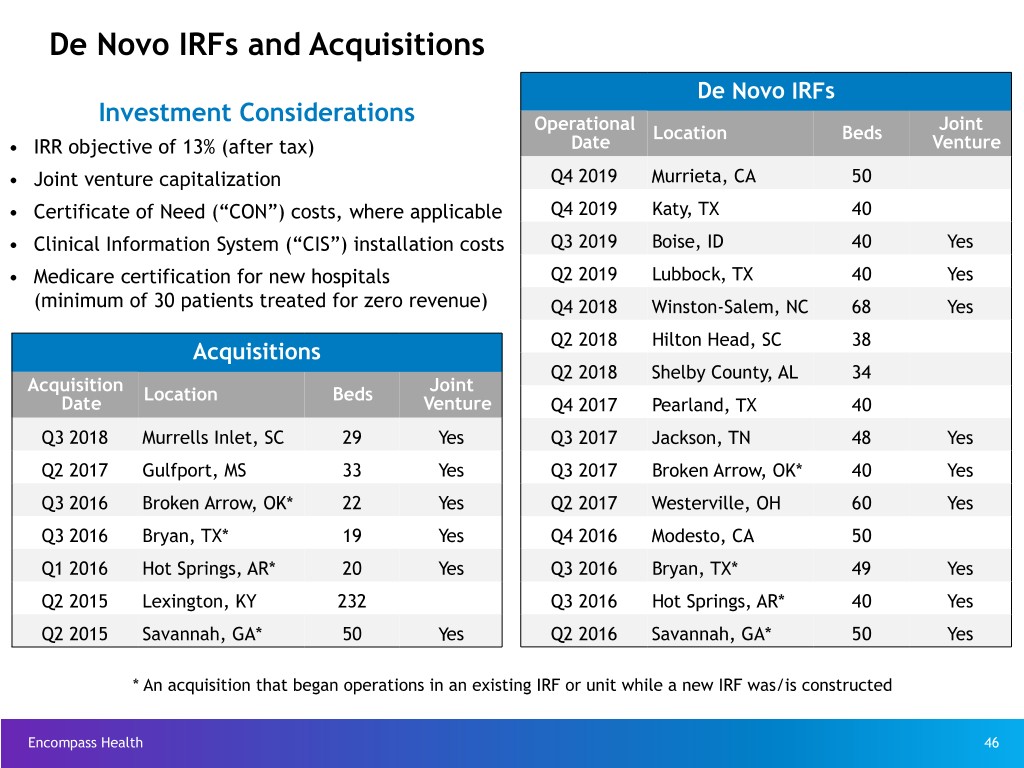

De Novo IRFs and Acquisitions De Novo IRFs Investment Considerations Operational Location Beds Joint • IRR objective of 13% (after tax) Date Venture • Joint venture capitalization Q4 2019 Murrieta, CA 50 • Certificate of Need (“CON”) costs, where applicable Q4 2019 Katy, TX 40 • Clinical Information System (“CIS”) installation costs Q3 2019 Boise, ID 40 Yes • Medicare certification for new hospitals Q2 2019 Lubbock, TX 40 Yes (minimum of 30 patients treated for zero revenue) Q4 2018 Winston-Salem, NC 68 Yes Q2 2018 Hilton Head, SC 38 Acquisitions Q2 2018 Shelby County, AL 34 Acquisition Location Beds Joint Date Venture Q4 2017 Pearland, TX 40 Q3 2018 Murrells Inlet, SC 29 Yes Q3 2017 Jackson, TN 48 Yes Q2 2017 Gulfport, MS 33 Yes Q3 2017 Broken Arrow, OK* 40 Yes Q3 2016 Broken Arrow, OK* 22 Yes Q2 2017 Westerville, OH 60 Yes Q3 2016 Bryan, TX* 19 Yes Q4 2016 Modesto, CA 50 Q1 2016 Hot Springs, AR* 20 Yes Q3 2016 Bryan, TX* 49 Yes Q2 2015 Lexington, KY 232 Q3 2016 Hot Springs, AR* 40 Yes Q2 2015 Savannah, GA* 50 Yes Q2 2016 Savannah, GA* 50 Yes * An acquisition that began operations in an existing IRF or unit while a new IRF was/is constructed Encompass Health 46

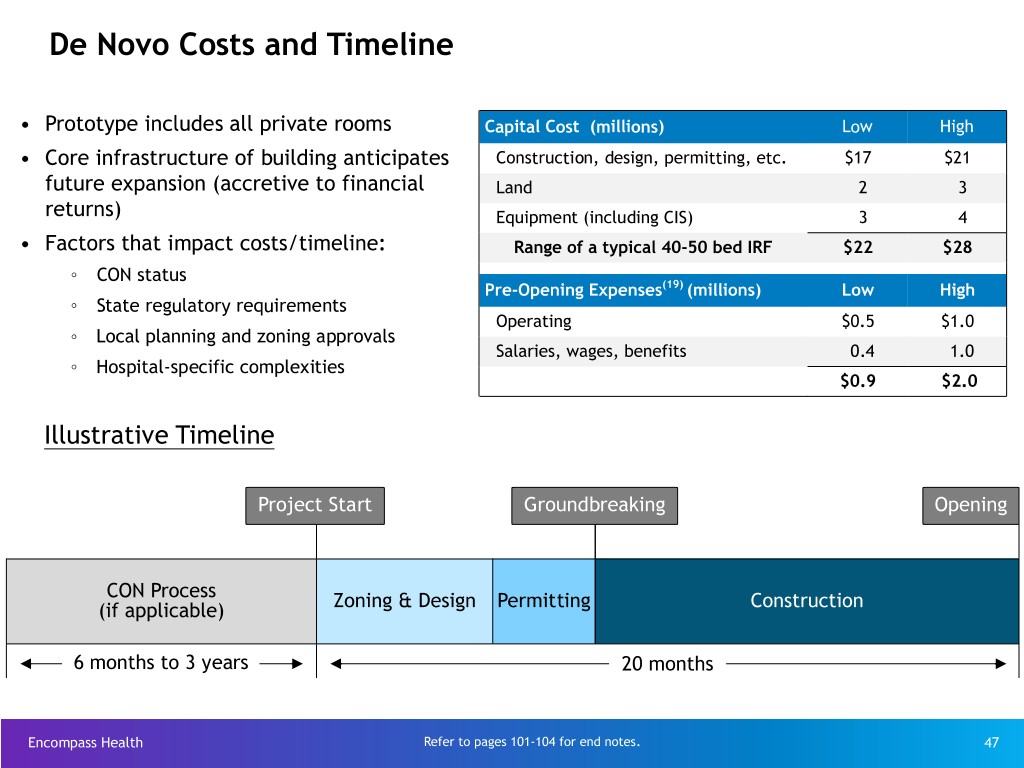

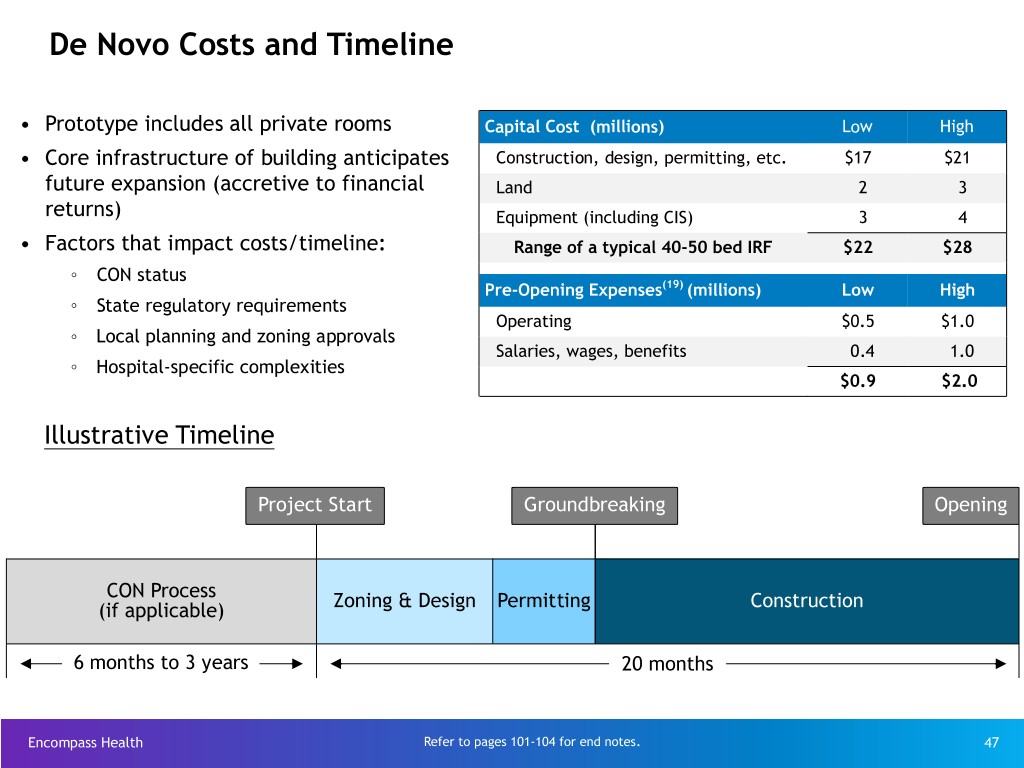

De Novo Costs and Timeline • Prototype includes all private rooms Capital Cost (millions) Low High • Core infrastructure of building anticipates Construction, design, permitting, etc. $17 $21 future expansion (accretive to financial Land 2 3 returns) Equipment (including CIS) 3 4 • Factors that impact costs/timeline: Range of a typical 40-50 bed IRF $22 $28 ◦ CON status Pre-Opening Expenses(19) (millions) Low High ◦ State regulatory requirements Operating $0.5 $1.0 ◦ Local planning and zoning approvals Salaries, wages, benefits 0.4 1.0 ◦ Hospital-specific complexities $0.9 $2.0 Illustrative Timeline Project Start Groundbreaking Opening CON Process (if applicable) Zoning & Design Permitting Construction 6 months to 3 years 20 months Encompass Health Refer to pages 101-104 for end notes. 47

IRF De Novo Occupancy and EBITDA* Trends Occupancy Sustained Positive EBITDA 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1 2 3 4 5 6 7 8 9 10 11 12 Months Stuart (06/2013) Altamonte Newnan (12/2014) Middletown (12/2014) Springs (10/2014) Franklin (12/2015) Modesto (10/2016) Westerville (04/2017) Pearland (10/2017) The Company’s average 2017 occupancy Encompass Health * IRF EBITDA = earnings before interest, taxes, depreciation, and amortization 48 directly attributable to the related hospital.

Multi-faceted Home Health and Hospice Growth Strategy • Strong demand due to cost effectiveness of home-based care and implementation of alternative payment models Organic Growth • Strong organic growth from existing agencies • Located in markets with attractive demographics * Currently located in states that represent ~67% of total Medicare home health and hospice spend • Highly fragmented market Home Health • Prioritization of new IRF overlap markets Acquisitions • Proven ability to consummate and integrate acquisitions and De Novos • Sustainable and replicable culture • Implementation of best practices and technology • Attractive partner due to quality of outcomes, data management, scale and market density, and willingness/ability to treat high acuity and/or Clinical chronic patients Collaboration • Plan of care coordination with the Company’s IRFs • Care Transition Coordinators serve as representatives in transitional care activities and strategic relationships with other healthcare providers Hospice • Prioritization of existing home health markets Acquisitions • Opportunity to build scale and leverage components of existing and De Novos infrastructure Encompass Health 49

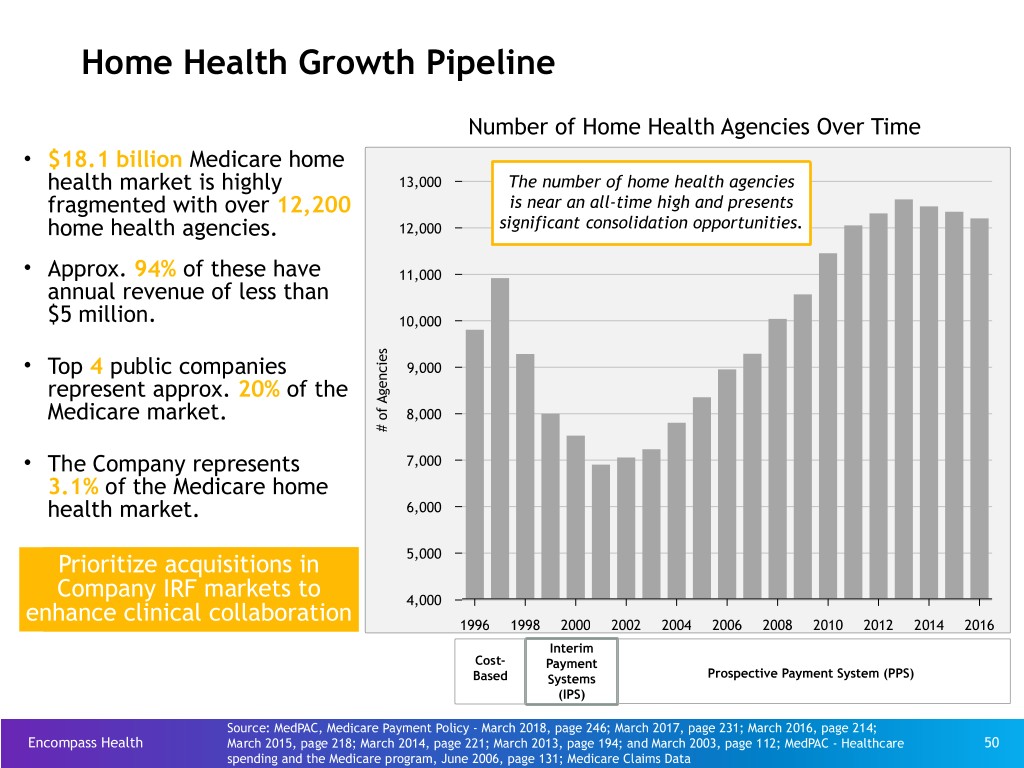

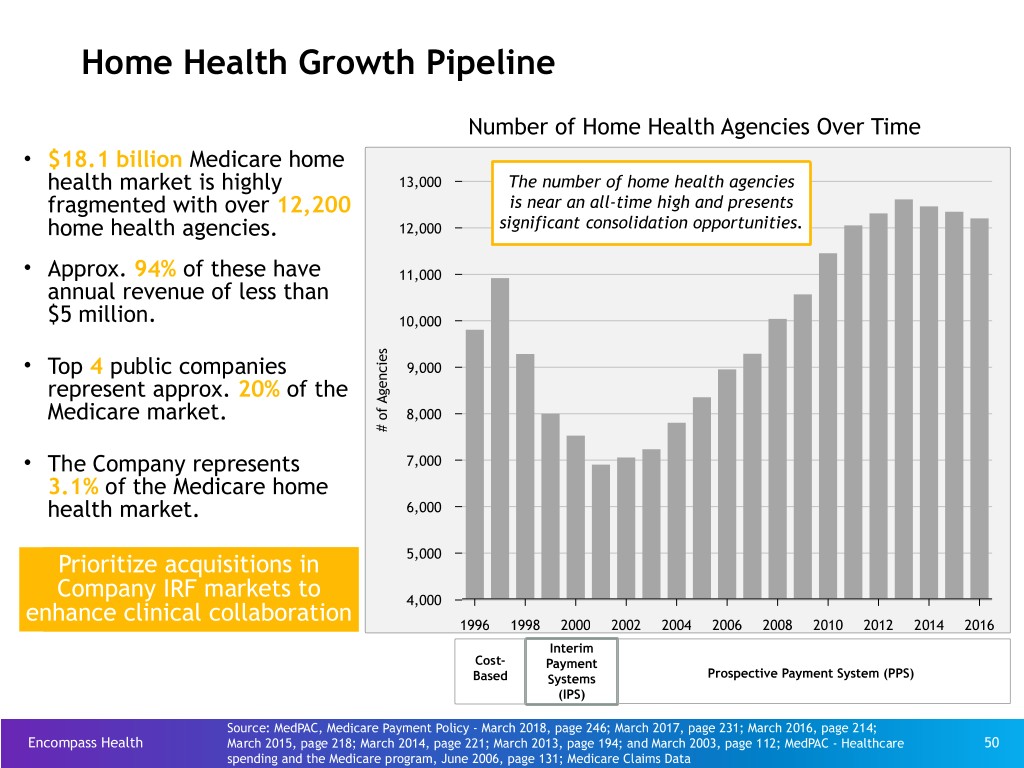

Home Health Growth Pipeline Number of Home Health Agencies Over Time • $18.1 billion Medicare home health market is highly 13,000 The number of home health agencies fragmented with over 12,200 is near an all-time high and presents home health agencies. 12,000 significant consolidation opportunities. • Approx. 94% of these have 11,000 annual revenue of less than $5 million. 10,000 s e i • Top 4 public companies c 9,000 n e represent approx. 20% of the g A f Medicare market. o 8,000 # • The Company represents 7,000 3.1% of the Medicare home health market. 6,000 Prioritize acquisitions in 5,000 Company IRF markets to 4,000 enhance clinical collaboration 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 Interim Cost- Payment Based Systems Prospective Payment System (PPS) (IPS) Source: MedPAC, Medicare Payment Policy - March 2018, page 246; March 2017, page 231; March 2016, page 214; Encompass Health March 2015, page 218; March 2014, page 221; March 2013, page 194; and March 2003, page 112; MedPAC - Healthcare 50 spending and the Medicare program, June 2006, page 131; Medicare Claims Data

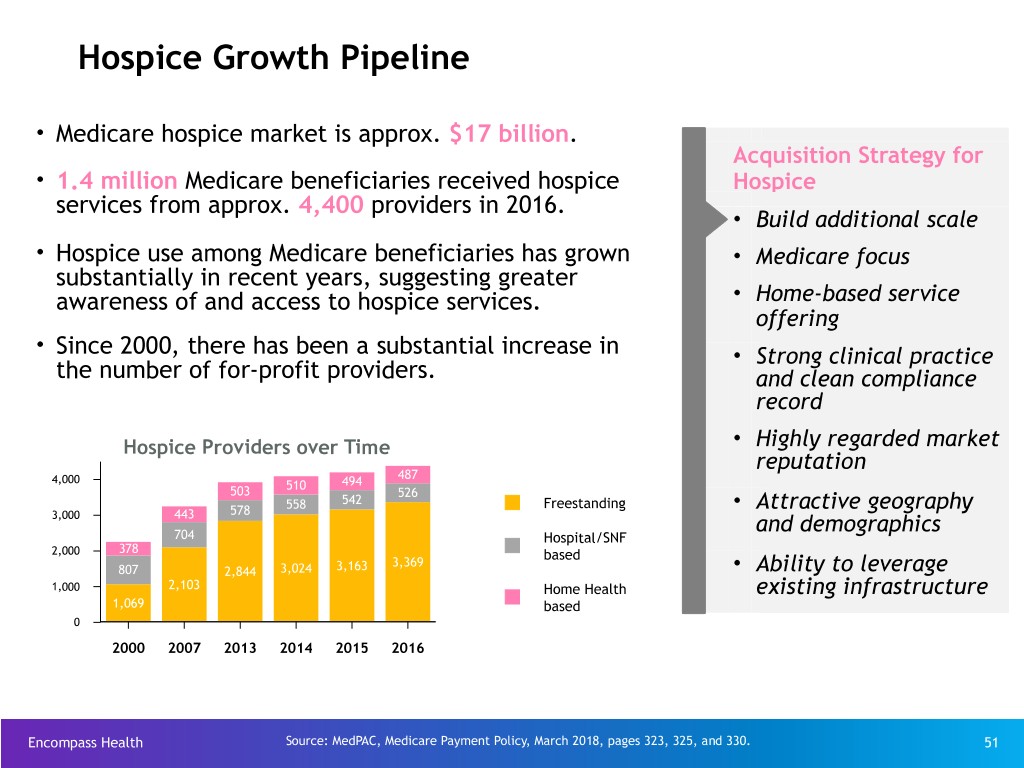

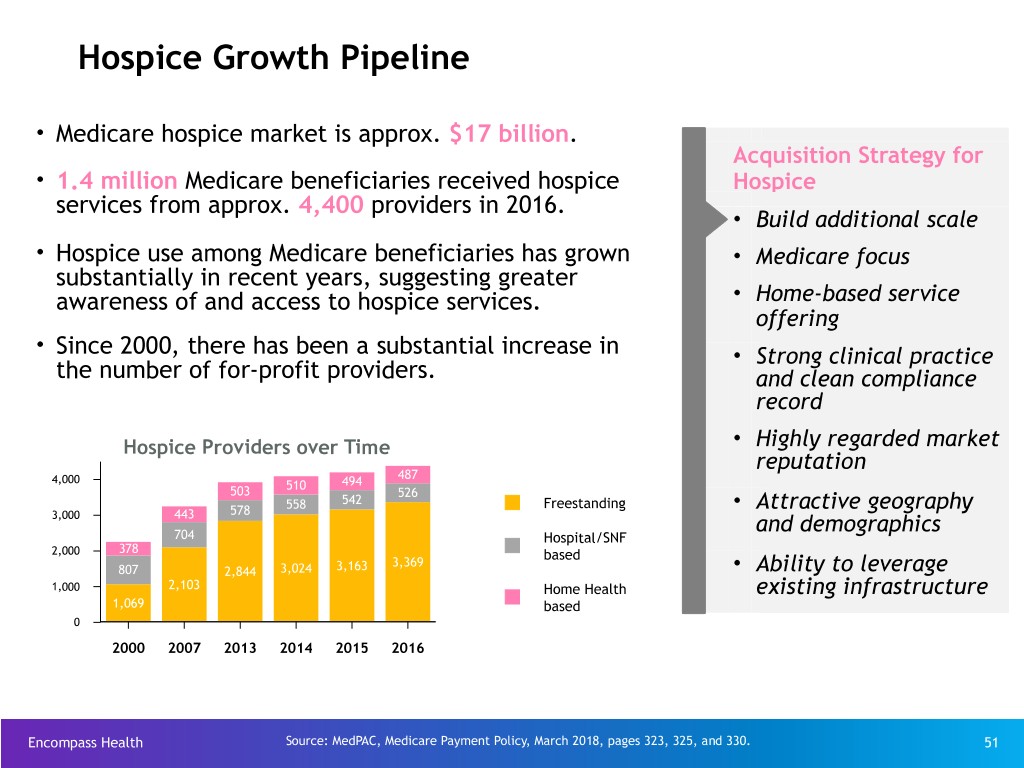

Hospice Growth Pipeline • Medicare hospice market is approx. $17 billion. Acquisition Strategy for • 1.4 million Medicare beneficiaries received hospice Hospice services from approx. 4,400 providers in 2016. • Build additional scale • Hospice use among Medicare beneficiaries has grown • Medicare focus substantially in recent years, suggesting greater awareness of and access to hospice services. • Home-based service offering • Since 2000, there has been a substantial increase in • Strong clinical practice the number of for-profit providers. and clean compliance record Hospice Providers over Time • Highly regarded market reputation 487 4,000 510 494 503 526 542 578 558 Freestanding • Attractive geography 3,000 443 and demographics 704 Hospital/SNF 2,000 378 based 3,369 807 2,844 3,024 3,163 • Ability to leverage 1,000 2,103 Home Health existing infrastructure 1,069 based 0 2000 2007 2013 2014 2015 2016 Encompass Health Source: MedPAC, Medicare Payment Policy, March 2018, pages 323, 325, and 330. 51

Alternative Payment Models Encompass Health 52

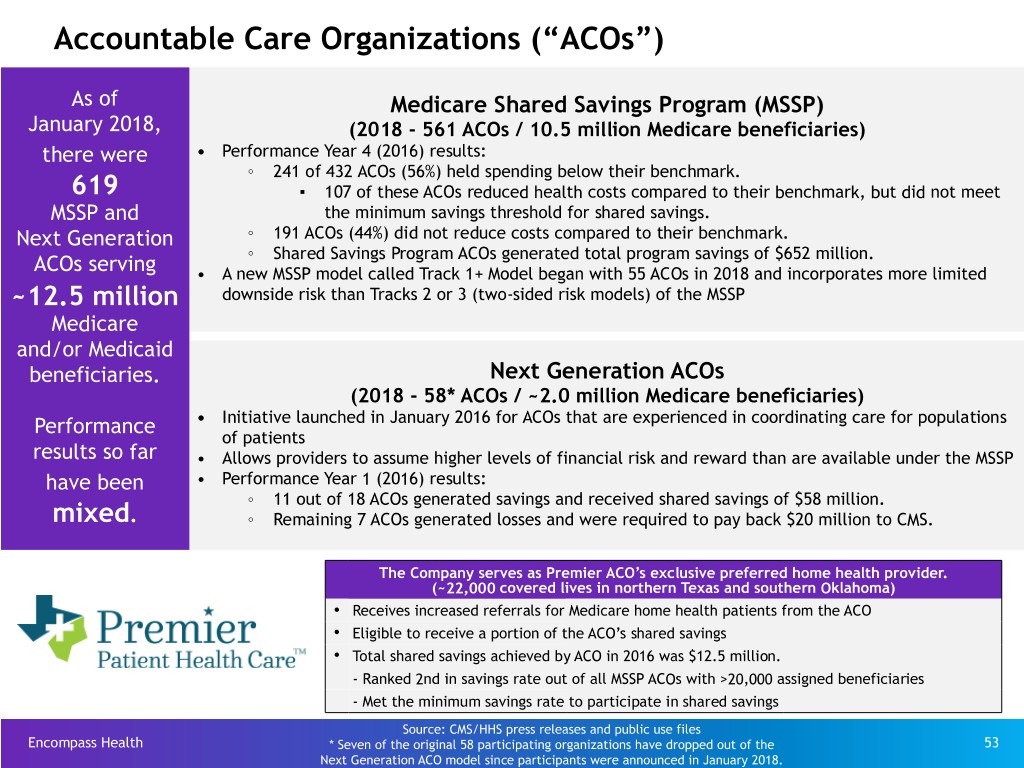

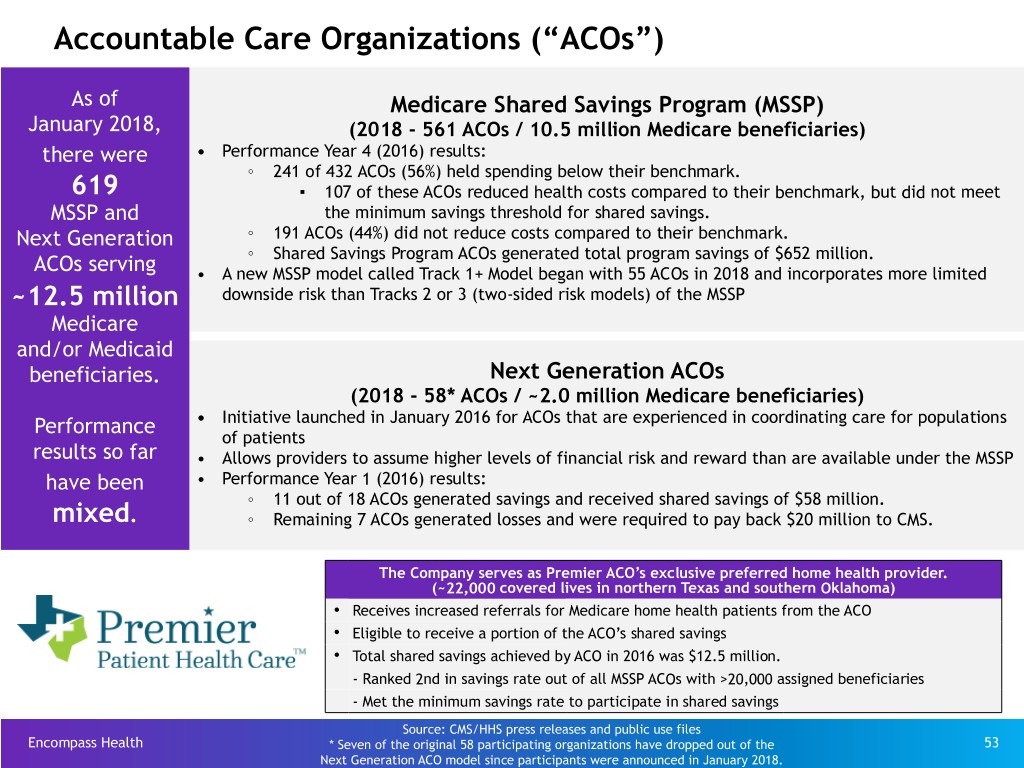

Accountable Care Organizations (“ACOs”) As of Medicare Shared Savings Program (MSSP) January 2018, (2018 - 561 ACOs / 10.5 million Medicare beneficiaries) there were • Performance Year 4 (2016) results: ◦ 241 of 432 ACOs (56%) held spending below their benchmark. 619 ▪ 107 of these ACOs reduced health costs compared to their benchmark, but did not meet MSSP and the minimum savings threshold for shared savings. Next Generation ◦ 191 ACOs (44%) did not reduce costs compared to their benchmark. ◦ Shared Savings Program ACOs generated total program savings of $652 million. ACOs serving • A new MSSP model called Track 1+ Model began with 55 ACOs in 2018 and incorporates more limited ~12.5 million downside risk than Tracks 2 or 3 (two-sided risk models) of the MSSP Medicare and/or Medicaid beneficiaries. Next Generation ACOs (2018 - 58* ACOs / ~2.0 million Medicare beneficiaries) Performance • Initiative launched in January 2016 for ACOs that are experienced in coordinating care for populations of patients results so far • Allows providers to assume higher levels of financial risk and reward than are available under the MSSP have been • Performance Year 1 (2016) results: ◦ 11 out of 18 ACOs generated savings and received shared savings of $58 million. mixed. ◦ Remaining 7 ACOs generated losses and were required to pay back $20 million to CMS. The Company serves as Premier ACO’s exclusive preferred home health provider. (~22,000 covered lives in northern Texas and southern Oklahoma) Ÿ Receives increased referrals for Medicare home health patients from the ACO Ÿ Eligible to receive a portion of the ACO’s shared savings Ÿ Total shared savings achieved by ACO in 2016 was $12.5 million. - Ranked 2nd in savings rate out of all MSSP ACOs with >20,000 assigned beneficiaries - Met the minimum savings rate to participate in shared savings Source: CMS/HHS press releases and public use files Encompass Health * Seven of the original 58 participating organizations have dropped out of the 53 Next Generation ACO model since participants were announced in January 2018.

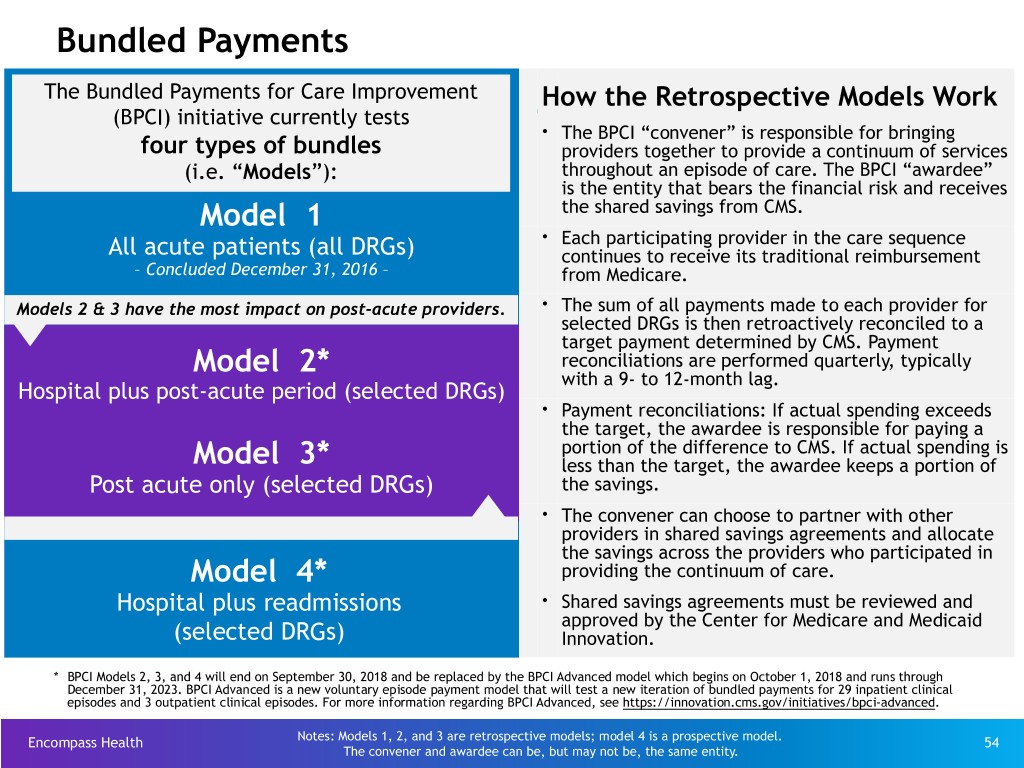

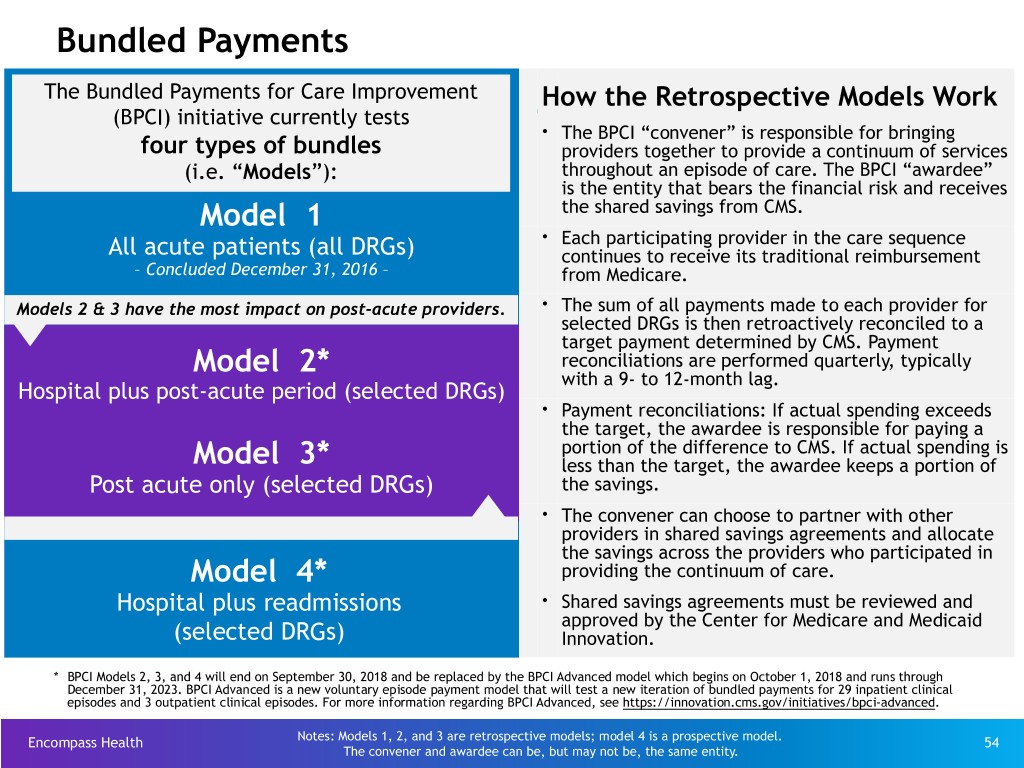

Bundled Payments The Bundled Payments for Care Improvement How the Retrospective Models Work (BPCI) initiative currently tests Ÿ The BPCI “convener” is responsible for bringing four types of bundles providers together to provide a continuum of services (i.e. “Models”): throughout an episode of care. The BPCI “awardee” is the entity that bears the financial risk and receives Model 1 the shared savings from CMS. Ÿ Each participating provider in the care sequence All acute patients (all DRGs) continues to receive its traditional reimbursement – Concluded December 31, 2016 – from Medicare. Ÿ Models 2 & 3 have the most impact on post-acute providers. The sum of all payments made to each provider for selected DRGs is then retroactively reconciled to a target payment determined by CMS. Payment Model 2* reconciliations are performed quarterly, typically with a 9- to 12-month lag. Hospital plus post-acute period (selected DRGs) Ÿ Payment reconciliations: If actual spending exceeds the target, the awardee is responsible for paying a portion of the difference to CMS. If actual spending is Model 3* less than the target, the awardee keeps a portion of Post acute only (selected DRGs) the savings. Ÿ The convener can choose to partner with other providers in shared savings agreements and allocate the savings across the providers who participated in Model 4* providing the continuum of care. Hospital plus readmissions Ÿ Shared savings agreements must be reviewed and approved by the Center for Medicare and Medicaid (selected DRGs) Innovation. * BPCI Models 2, 3, and 4 will end on September 30, 2018 and be replaced by the BPCI Advanced model which begins on October 1, 2018 and runs through December 31, 2023. BPCI Advanced is a new voluntary episode payment model that will test a new iteration of bundled payments for 29 inpatient clinical episodes and 3 outpatient clinical episodes. For more information regarding BPCI Advanced, see https://innovation.cms.gov/initiatives/bpci-advanced. Encompass Health Notes: Models 1, 2, and 3 are retrospective models; model 4 is a prospective model. 54 The convener and awardee can be, but may not be, the same entity.

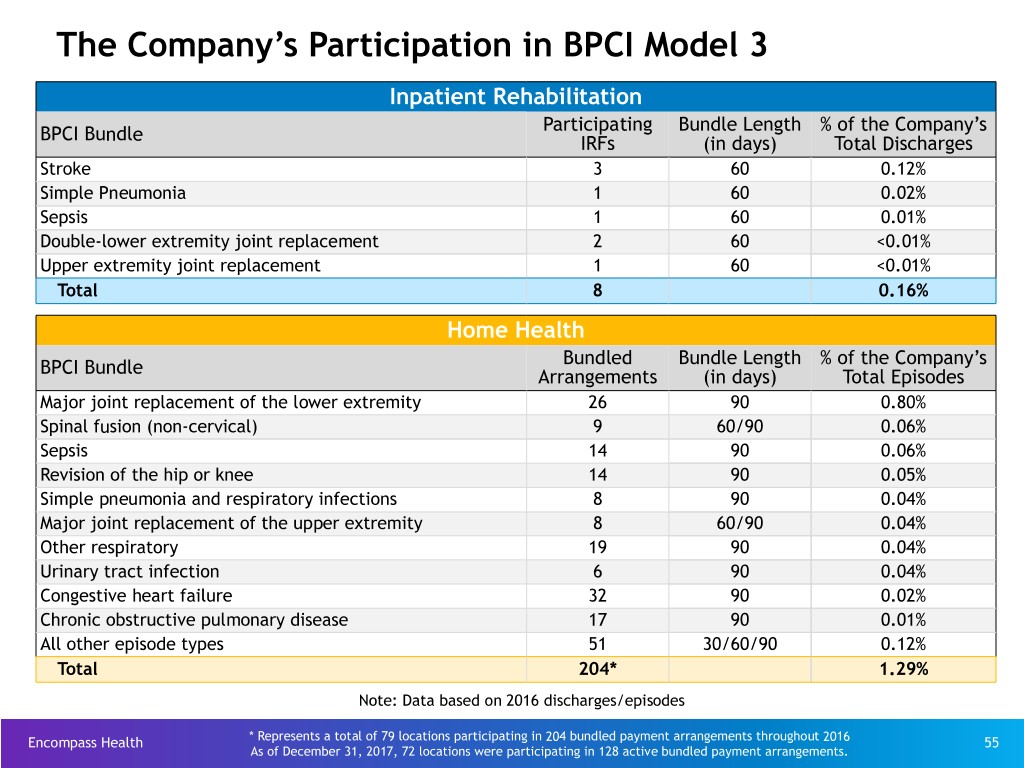

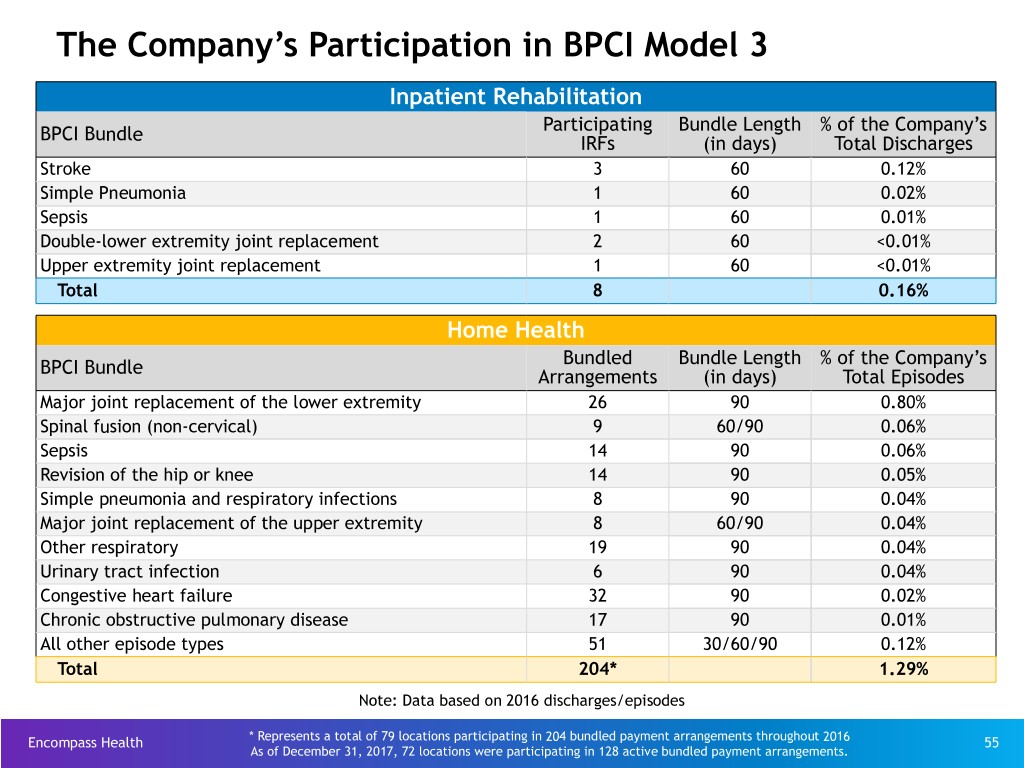

The Company’s Participation in BPCI Model 3 Inpatient Rehabilitation Participating Bundle Length % of the Company’s BPCI Bundle IRFs (in days) Total Discharges Stroke 3 60 0.12% Simple Pneumonia 1 60 0.02% Sepsis 1 60 0.01% Double-lower extremity joint replacement 2 60 <0.01% Upper extremity joint replacement 1 60 <0.01% Total 8 0.16% Home Health Bundled Bundle Length % of the Company’s BPCI Bundle Arrangements (in days) Total Episodes Major joint replacement of the lower extremity 26 90 0.80% Spinal fusion (non-cervical) 9 60/90 0.06% Sepsis 14 90 0.06% Revision of the hip or knee 14 90 0.05% Simple pneumonia and respiratory infections 8 90 0.04% Major joint replacement of the upper extremity 8 60/90 0.04% Other respiratory 19 90 0.04% Urinary tract infection 6 90 0.04% Congestive heart failure 32 90 0.02% Chronic obstructive pulmonary disease 17 90 0.01% All other episode types 51 30/60/90 0.12% Total 204* 1.29% Note: Data based on 2016 discharges/episodes Encompass Health * Represents a total of 79 locations participating in 204 bundled payment arrangements throughout 2016 55 As of December 31, 2017, 72 locations were participating in 128 active bundled payment arrangements.

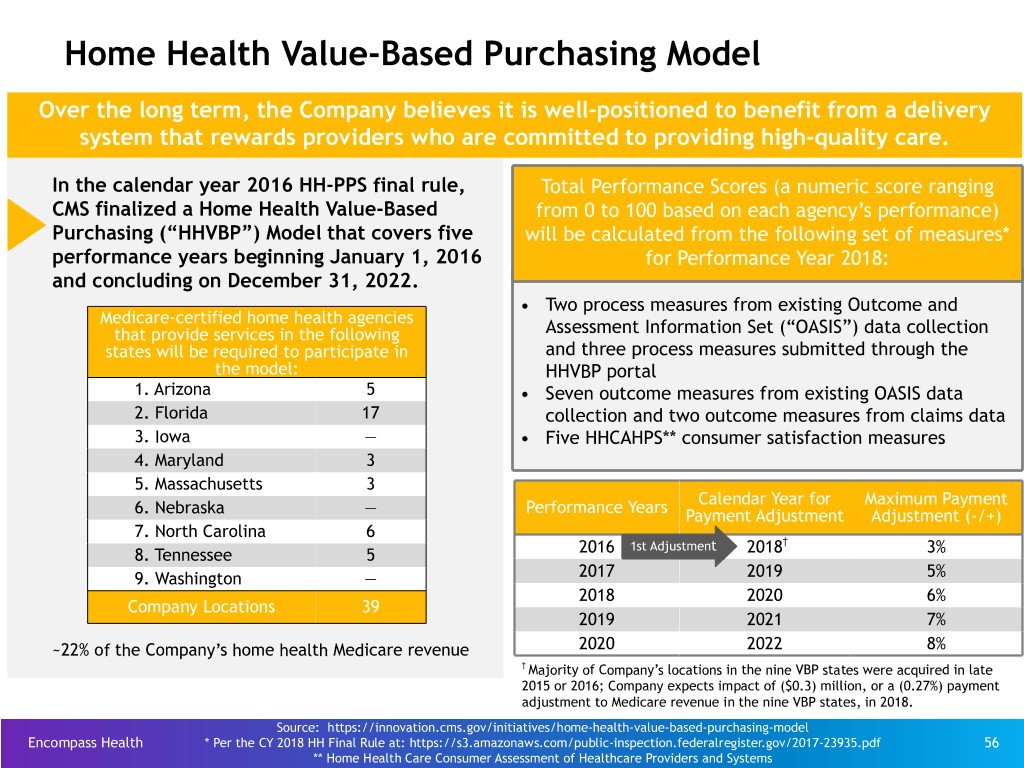

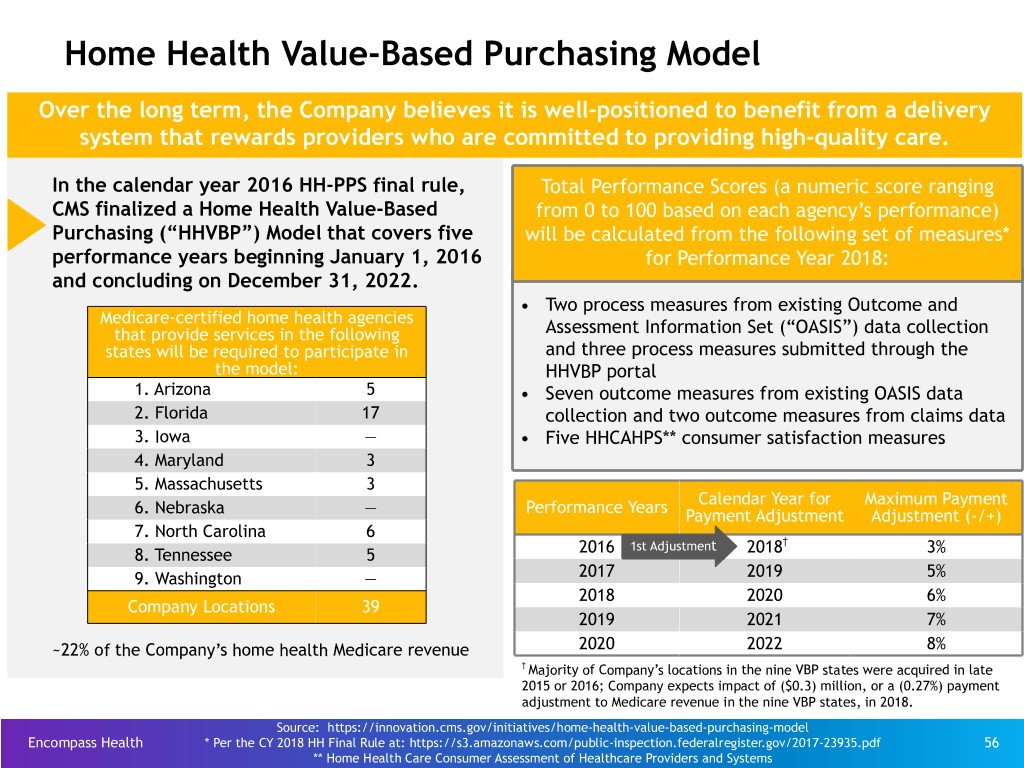

Home Health Value-Based Purchasing Model Over the long term, the Company believes it is well-positioned to benefit from a delivery system that rewards providers who are committed to providing high-quality care. In the calendar year 2016 HH-PPS final rule, Total Performance Scores (a numeric score ranging CMS finalized a Home Health Value-Based from 0 to 100 based on each agency’s performance) Purchasing (“HHVBP”) Model that covers five will be calculated from the following set of measures* performance years beginning January 1, 2016 for Performance Year 2018: and concluding on December 31, 2022. • Two process measures from existing Outcome and Medicare-certified home health agencies that provide services in the following Assessment Information Set (“OASIS”) data collection states will be required to participate in and three process measures submitted through the the model: HHVBP portal 1. Arizona 5 • Seven outcome measures from existing OASIS data 2. Florida 17 collection and two outcome measures from claims data 3. Iowa — • Five HHCAHPS** consumer satisfaction measures 4. Maryland 3 5. Massachusetts 3 Calendar Year for Maximum Payment 6. Nebraska — Performance Years Payment Adjustment Adjustment (-/+) 7. North Carolina 6 1st Adjustment † 8. Tennessee 5 2016 2018 3% 9. Washington — 2017 2019 5% 2018 2020 6% Company Locations 39 2019 2021 7% ~22% of the Company’s home health Medicare revenue 2020 2022 8% † Majority of Company’s locations in the nine VBP states were acquired in late 2015 or 2016; Company expects impact of ($0.3) million, or a (0.27%) payment adjustment to Medicare revenue in the nine VBP states, in 2018. Source: https://innovation.cms.gov/initiatives/home-health-value-based-purchasing-model Encompass Health * Per the CY 2018 HH Final Rule at: https://s3.amazonaws.com/public-inspection.federalregister.gov/2017-23935.pdf 56 ** Home Health Care Consumer Assessment of Healthcare Providers and Systems

Capital Structure Encompass Health is positioned with a cost-efficient, flexible capital structure. Encompass Health 57

Debt Maturity Profile - Face Value As of March 31, 2018* Callable beginning September 2020 ($ in millions) Callable beginning November 2017 $568 Available $1,200 Callable beginning Senior March 2018 Notes 5.75% $95 Drawn + Revolver $37 reserved Capacity for LC’s $291 $300 Senior $350 Senior Term Loans Notes 5.125% Notes 5.75% Revolver 2018 2021 2022 2022 2023 2024 2025 No significant debt maturities prior to 2022 * This chart does not include ~$268 million of capital lease obligations or ~$88 million of other notes payable. Encompass Health 58 See the debt schedule on page 60.

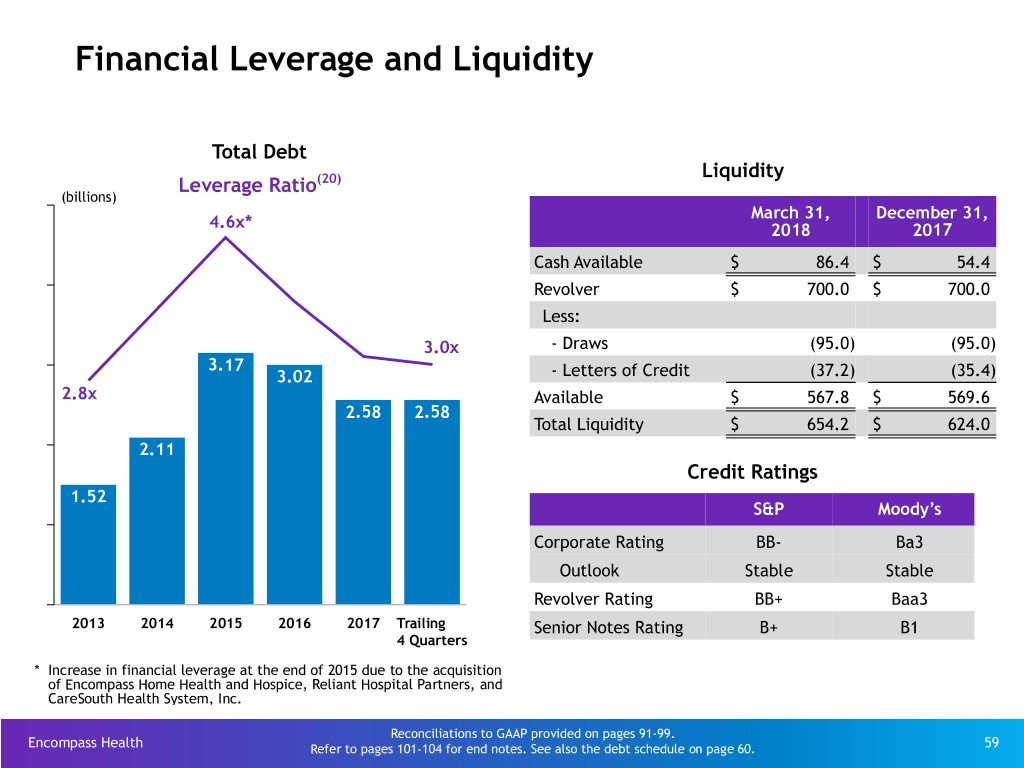

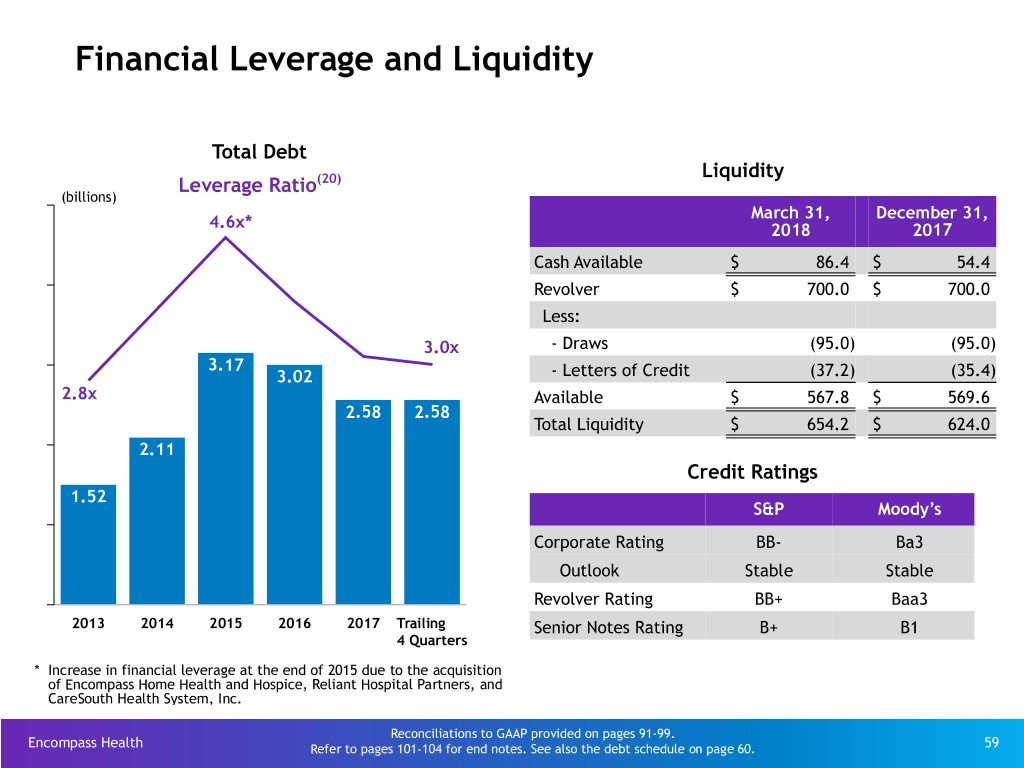

Financial Leverage and Liquidity Total Debt Liquidity Leverage Ratio(20) (billions) March 31, December 31, 4.6x* 2018 2017 Cash Available $ 86.4 $ 54.4 Revolver $ 700.0 $ 700.0 Less: 3.0x - Draws (95.0) (95.0) 3.17 3.02 - Letters of Credit (37.2) (35.4) 2.8x Available $ 567.8 $ 569.6 2.58 2.58 Total Liquidity $ 654.2 $ 624.0 2.11 Credit Ratings 1.52 S&P Moody’s Corporate Rating BB- Ba3 Outlook Stable Stable Revolver Rating BB+ Baa3 2013 2014 2015 2016 2017 Trailing Senior Notes Rating B+ B1 4 Quarters * Increase in financial leverage at the end of 2015 due to the acquisition of Encompass Home Health and Hospice, Reliant Hospital Partners, and CareSouth Health System, Inc. Reconciliations to GAAP provided on pages 91-99. Encompass Health Refer to pages 101-104 for end notes. See also the debt schedule on page 60. 59 (1)

Debt Schedule Change in March 31, December 31, Debt vs. ($millions) 2018 2017 YE 2017 Advances under $700 million revolving credit facility, September 2022 - LIBOR +150bps $ 95.0 $ 95.0 $ — Term loan facility, September 2022 - LIBOR +150bps 291.0 294.7 (3.7) Bonds Payable: 5.125% Senior Notes due 2023 296.1 295.9 0.2 5.75% Senior Notes due 2024 1,194.1 1,193.9 0.2 5.75% Senior Notes due 2025 344.6 344.4 0.2 Other notes payable 87.9 82.3 5.6 Capital lease obligations 268.4 271.5 (3.1) Long-term debt $ 2,577.1 $ 2,577.7 $ (0.6) Debt to Adjusted EBITDA 3.0x 3.1x Encompass Health Reconciliations to GAAP provided on pages 91-99. 60

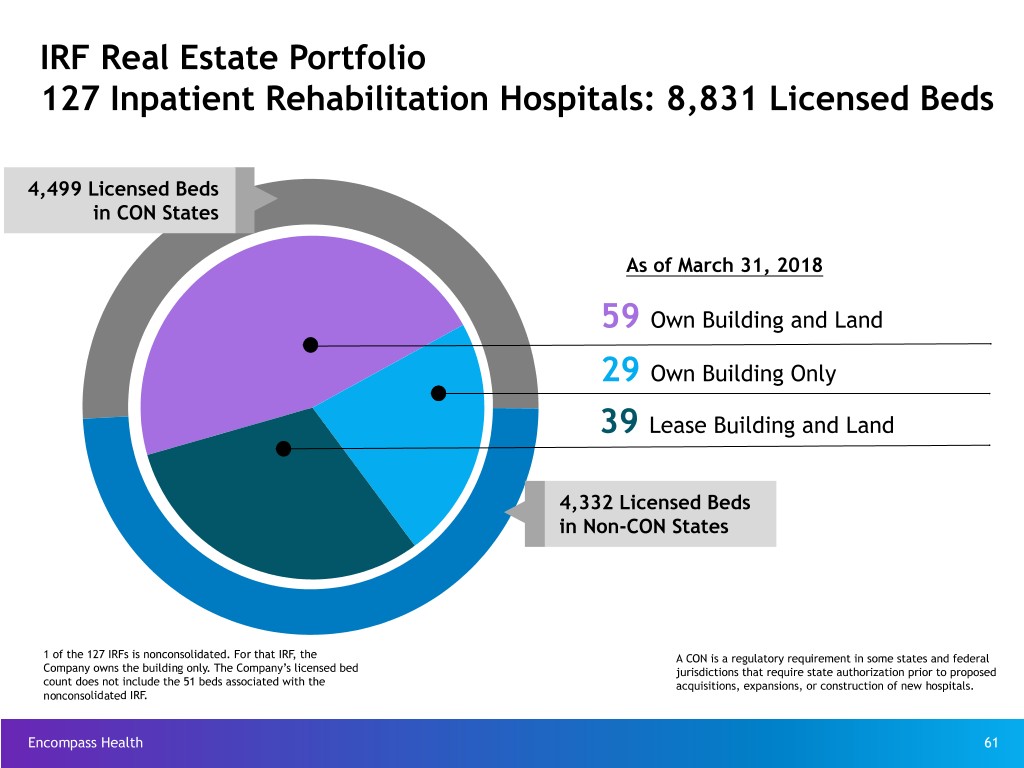

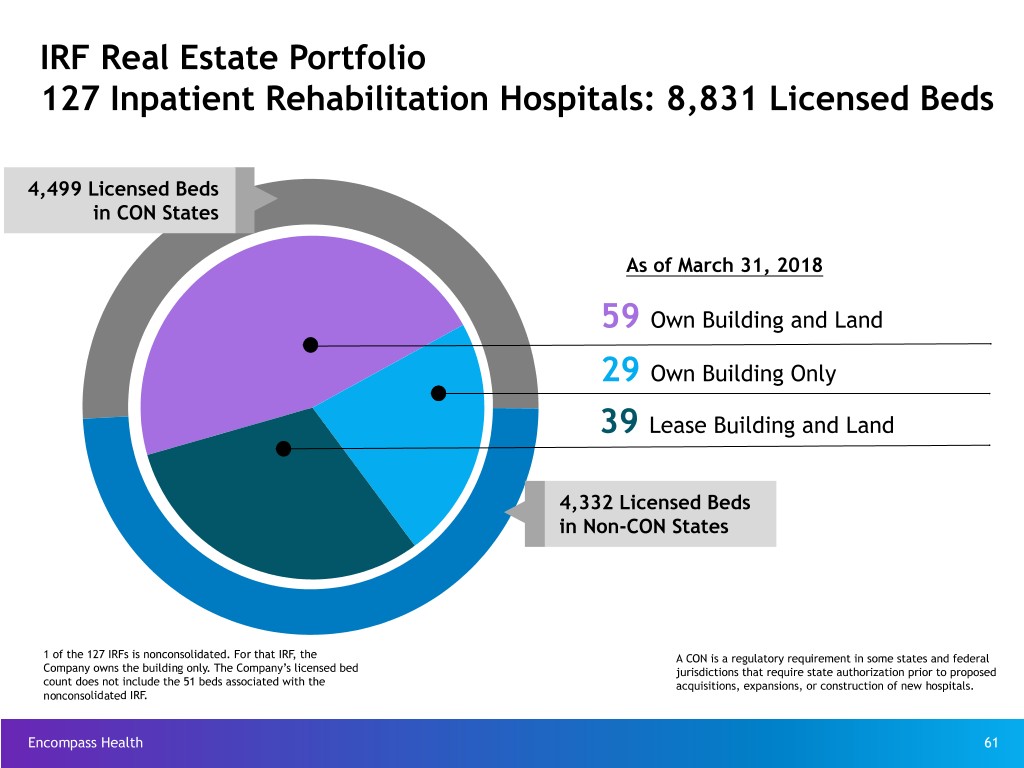

IRF Real Estate Portfolio 127 Inpatient Rehabilitation Hospitals: 8,831 Licensed Beds 4,499 Licensed Beds in CON States As of March 31, 2018 59 Own Building and Land 29 Own Building Only 39 Lease Building and Land 4,332 Licensed Beds in Non-CON States 1 of the 127 IRFs is nonconsolidated. For that IRF, the A CON is a regulatory requirement in some states and federal Company owns the building only. The Company’s licensed bed jurisdictions that require state authorization prior to proposed count does not include the 51 beds associated with the acquisitions, expansions, or construction of new hospitals. nonconsolidated IRF. Encompass Health 61

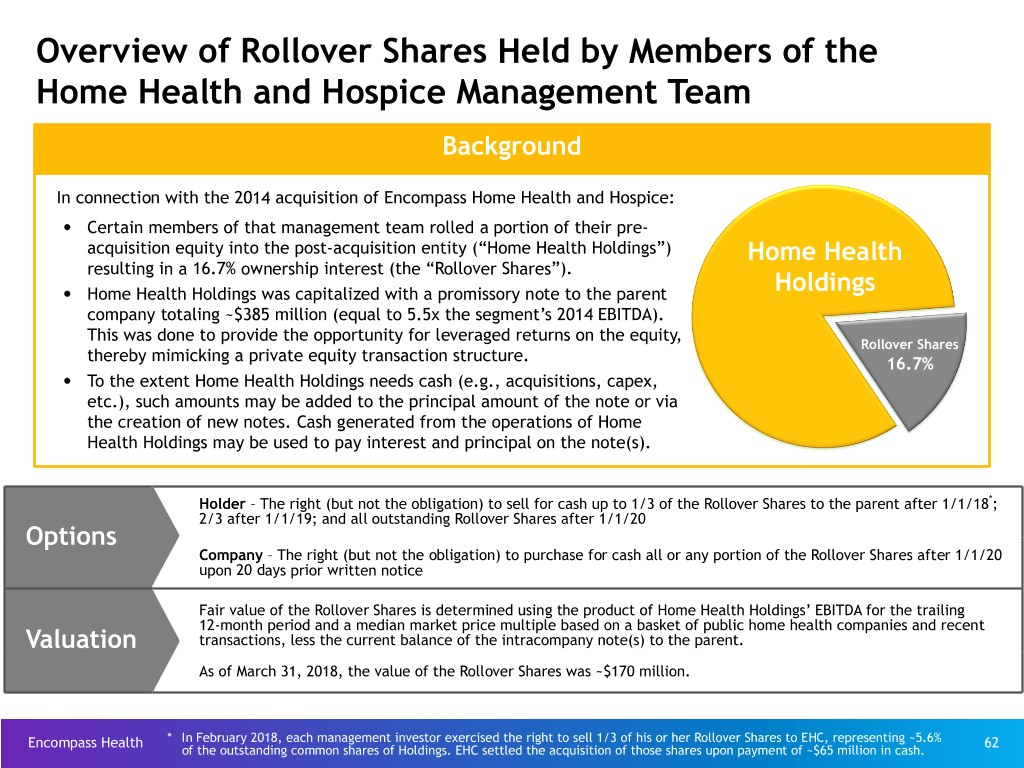

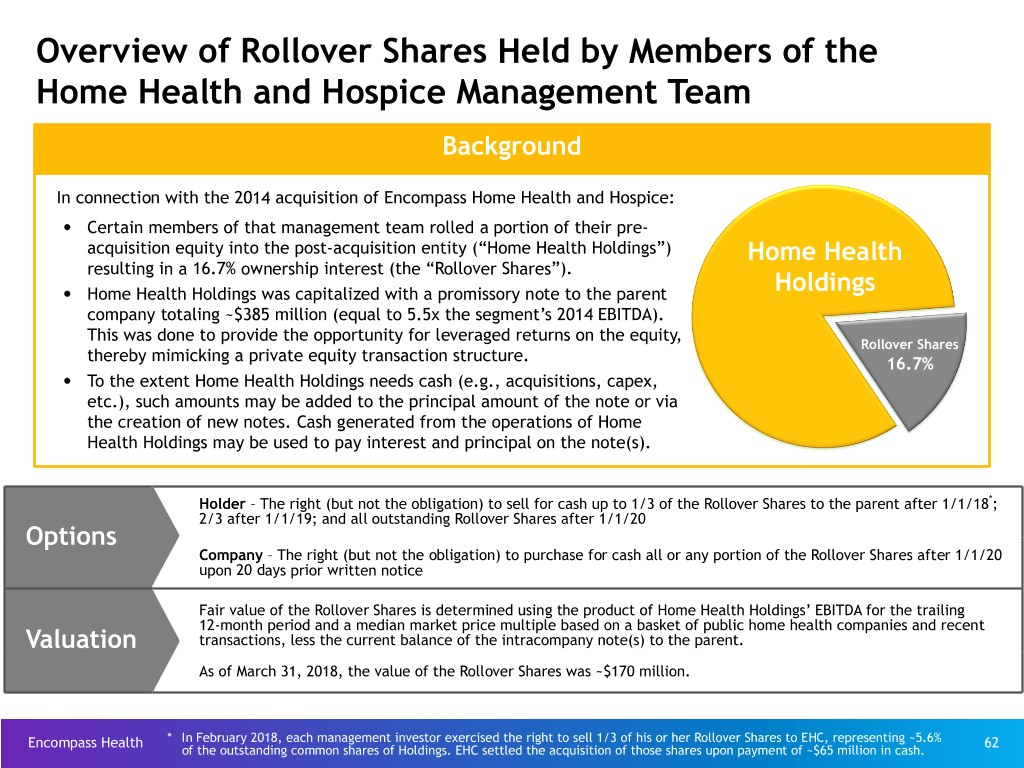

Overview of Rollover Shares Held by Members of the Home Health and Hospice Management Team Background In connection with the 2014 acquisition of Encompass Home Health and Hospice: • Certain members of that management team rolled a portion of their pre- acquisition equity into the post-acquisition entity (“Home Health Holdings”) Home Health resulting in a 16.7% ownership interest (the “Rollover Shares”). • Home Health Holdings was capitalized with a promissory note to the parent Holdings company totaling ~$385 million (equal to 5.5x the segment’s 2014 EBITDA). This was done to provide the opportunity for leveraged returns on the equity, Rollover Shares thereby mimicking a private equity transaction structure. 16.7% • To the extent Home Health Holdings needs cash (e.g., acquisitions, capex, etc.), such amounts may be added to the principal amount of the note or via the creation of new notes. Cash generated from the operations of Home Health Holdings may be used to pay interest and principal on the note(s). Holder – The right (but not the obligation) to sell for cash up to 1/3 of the Rollover Shares to the parent after 1/1/18*; 2/3 after 1/1/19; and all outstanding Rollover Shares after 1/1/20 Options Company – The right (but not the obligation) to purchase for cash all or any portion of the Rollover Shares after 1/1/20 upon 20 days prior written notice Fair value of the Rollover Shares is determined using the product of Home Health Holdings’ EBITDA for the trailing 12-month period and a median market price multiple based on a basket of public home health companies and recent Valuation transactions, less the current balance of the intracompany note(s) to the parent. As of March 31, 2018, the value of the Rollover Shares was ~$170 million. Encompass Health * In February 2018, each management investor exercised the right to sell 1/3 of his or her Rollover Shares to EHC, representing ~5.6% 62 of the outstanding common shares of Holdings. EHC settled the acquisition of those shares upon payment of ~$65 million in cash.

Information Technology Encompass Health utilizes information technology to improve patient care and generate operating efficiencies. Encompass Health 63

IRF Clinical Information System (“CIS”): Improved Patient Safety and Streamlined Operational Efficiencies Pre-Admission Assessment Document & Approval Imaging Treatment Plan • Computerized Physician Order Entry ("CPOE") • Clinical Decision Referral Hospitals Support ("CDS") Quality Reporting Integrated and •Uniform Data Systems Bar-coded Point of Care •Clinical Data Warehouse Medication Administration •Clinical Intelligence Discharge Planning Clinical Notes and Patient Education • Physician • Nursing • Therapy • Care Mgmt. Coordinate Care and Engage Patients Ancillary Services Charge and •Patient History Registration Services •Problems and Diagnoses •Registration •Orders and Results •Census •Plan of Care •Coding •Workflow Alerts and Reminders •Billing •Treatment and Interventions Encompass Health 64

IRF Proprietary Management System: Beacon Encompass Health 65

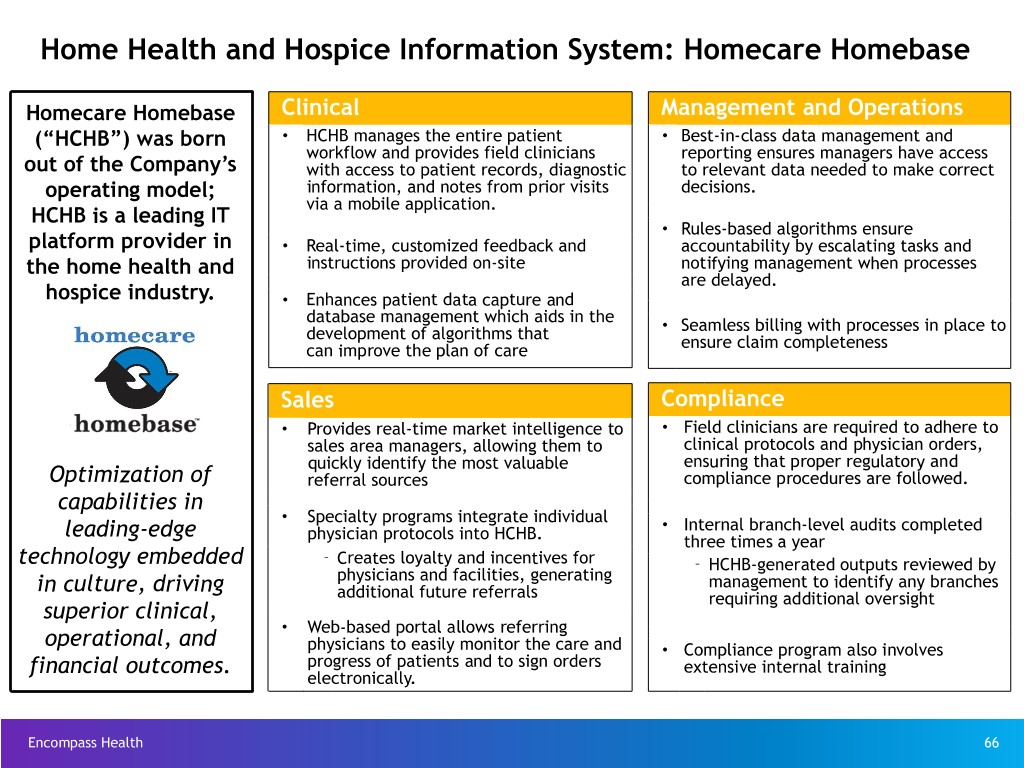

Home Health and Hospice Information System: Homecare Homebase Homecare Homebase Clinical Management and Operations (“HCHB”) was born • HCHB manages the entire patient • Best-in-class data management and workflow and provides field clinicians reporting ensures managers have access out of the Company’s with access to patient records, diagnostic to relevant data needed to make correct operating model; information, and notes from prior visits decisions. via a mobile application. HCHB is a leading IT • Rules-based algorithms ensure platform provider in • Real-time, customized feedback and accountability by escalating tasks and the home health and instructions provided on-site notifying management when processes are delayed. hospice industry. • Enhances patient data capture and database management which aids in the • development of algorithms that Seamless billing with processes in place to can improve the plan of care ensure claim completeness Sales Compliance • Provides real-time market intelligence to • Field clinicians are required to adhere to sales area managers, allowing them to clinical protocols and physician orders, quickly identify the most valuable ensuring that proper regulatory and Optimization of referral sources compliance procedures are followed. capabilities in • Specialty programs integrate individual leading-edge • Internal branch-level audits completed physician protocols into HCHB. three times a year technology embedded – Creates loyalty and incentives for – HCHB-generated outputs reviewed by in culture, driving physicians and facilities, generating management to identify any branches additional future referrals requiring additional oversight superior clinical, • Web-based portal allows referring operational, and physicians to easily monitor the care and • Compliance program also involves financial outcomes. progress of patients and to sign orders extensive internal training electronically. Encompass Health 66

Operational Metrics Encompass Health 67

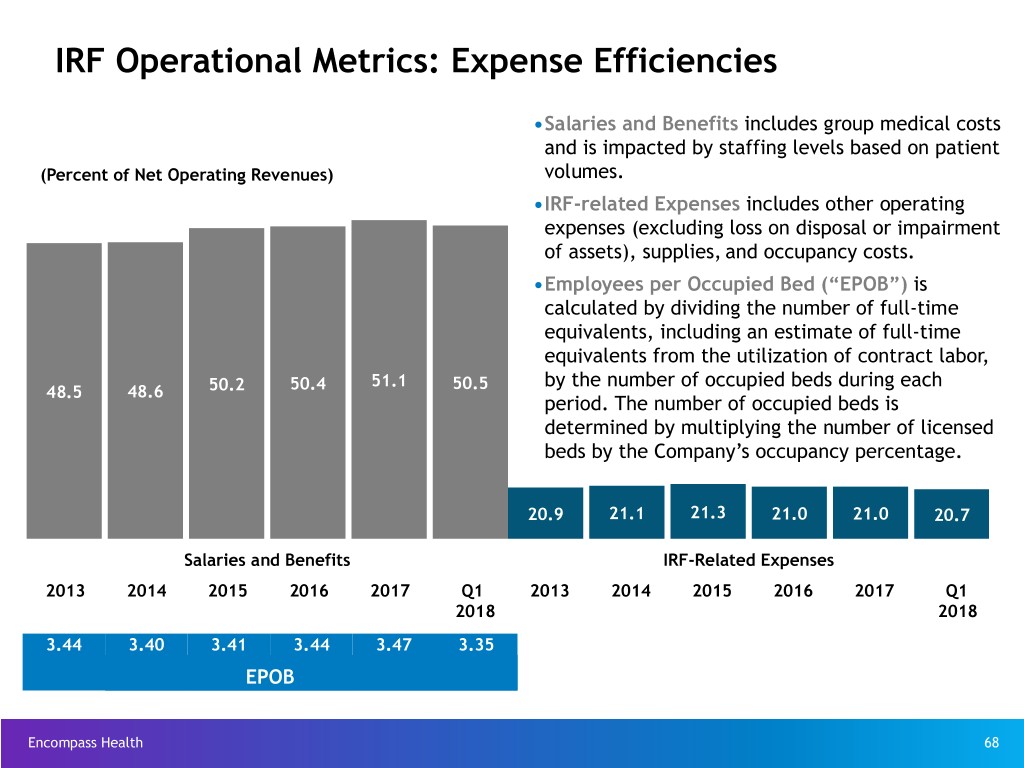

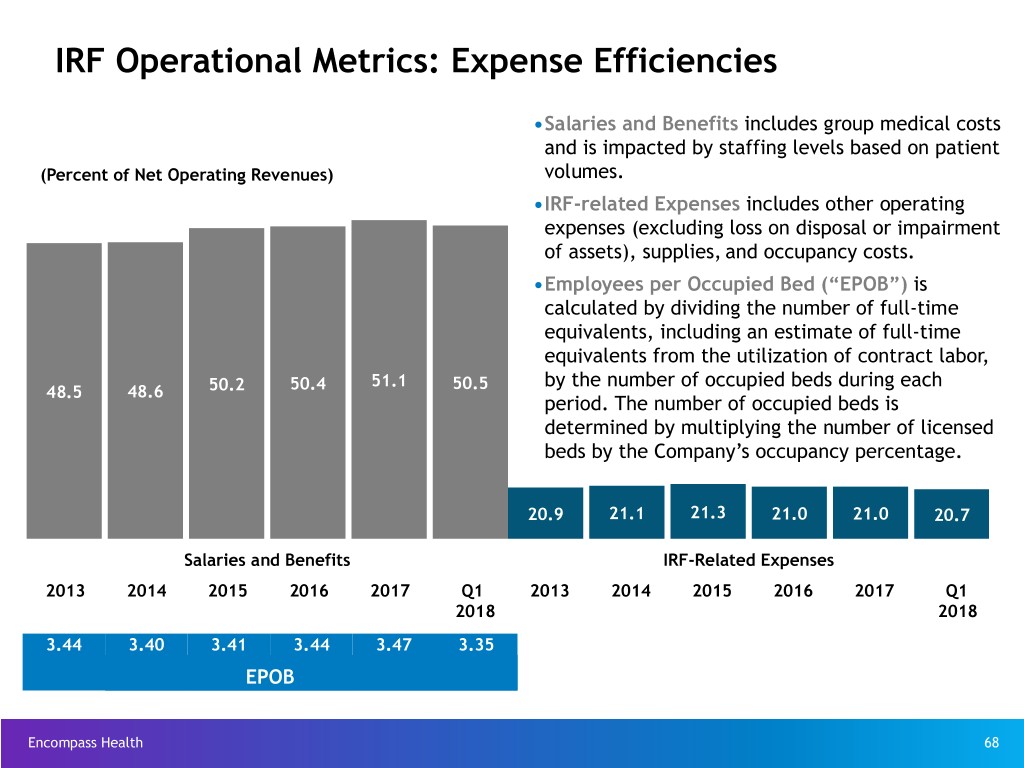

IRF Operational Metrics: Expense Efficiencies •Salaries and Benefits includes group medical costs and is impacted by staffing levels based on patient (Percent of Net Operating Revenues) volumes. •IRF-related Expenses includes other operating expenses (excluding loss on disposal or impairment of assets), supplies, and occupancy costs. •Employees per Occupied Bed (“EPOB”) is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, 51.1 50.5 by the number of occupied beds during each 48.5 48.6 50.2 50.4 period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. 20.9 21.1 21.3 21.0 21.0 20.7 Salaries and Benefits IRF-Related Expenses 2013 2014 2015 2016 2017 Q1 2013 2014 2015 2016 2017 Q1 2018 2018 3.44 3.40 3.41 3.44 3.47 3.35 EPOB Encompass Health 68

Pre-Payment Claims Denials - Inpatient Rehabilitation Segment Background Encompass Health reserves pre-payment claim denials as a reduction of • For several years, under programs designated as “widespread probes,” net operating revenues upon notice from a MAC a claim is under review. certain Medicare Administrative Contractors (“MACs”) conducted pre- payment claim reviews and denied payment for certain diagnosis codes. Impact to Income Statement • Encompass Health appeals most denials. On claims it takes to an Update of administrative law judge (“ALJ”), Encompass Health historically has Collections of Revenue Period New Denials Previously Reserve for Reserve for experienced an approximate 70% success rate. Prior Denied Claims New Denials Denials – MACs identify medical documentation issues as a leading basis for (In Millions) denials. Q1 2018 $3.1 $(6.8) $0.9 $— – Encompass Health’s investment in clinical information systems and its medical services department has further improved its documentation Q4 2017 0.7 (7.8) 0.2 — and reduced technical denials. Q3 2017 7.4 (6.2) 2.2 — • By statute, ALJ decisions are due within 90 days of a request for hearing, Q2 2017 16.5 (7.7) 4.9 — but appeals are taking years. HHS has implemented rule changes to Q1 2017 19.0 (5.9) 5.7 — address the backlog of appeals, but their effect is uncertain. Q4 2016 17.8 (4.4) 5.4 0.5 • In 2016, a federal court ordered HHS to eliminate the backlog by the end Q3 2016 15.7 (8.5) 4.6 — of CY 2020. HHS continues to object that it cannot clear the backlog in Q2 2016 18.7 (4.9) 4.6 — the timeframe established by the court. Although HHS remains bound by Q1 2016 22.7 (8.4) 6.0 — the order, the courts are considering how HHS will comply. Q4 2015 22.5 (4.1) 5.6 (1.3) • All Medicare providers continue to experience delays resulting in a Q3 2015 22.0 (4.1) 5.9 (1.1) growing backlog. Q2 2015 18.2 (3.8) 4.9 — – Currently, ALJs are hearing Encompass Health appeals from claims Q1 2015 16.3 (3.0) 4.2 — denied up to eight years ago. Impact to Balance Sheet • CMS has implemented the Targeted Probe and Educate (“TPE”) initiative. For more information regarding TPE, see https://www.cms.gov/Research- March 31, Dec. 31, Dec. 31, Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS- 2018 2017 2016 Compliance-Programs/Medical-Review/Targeted-Probe-and- (In Millions) EducateTPE.html Pre-payment claims denials $ 159.4 $ 164.0 $ 159.7 • Effective February 2018, Palmetto GBA assumed responsibilities for Cahaba’s MAC jurisdiction. See announcement from CMS at https:// Recorded reserves (47.8) (49.2) (47.9) www.cms.gov/Medicare/Medicare-Contracting/Medicare-Administrative- Net accounts receivable from Contractors/Downloads/JurisdictionJAwardFactSheet-09082017.pdf pre-payment claims denials $ 111.6 $ 114.8 $ 111.8 Encompass Health 69

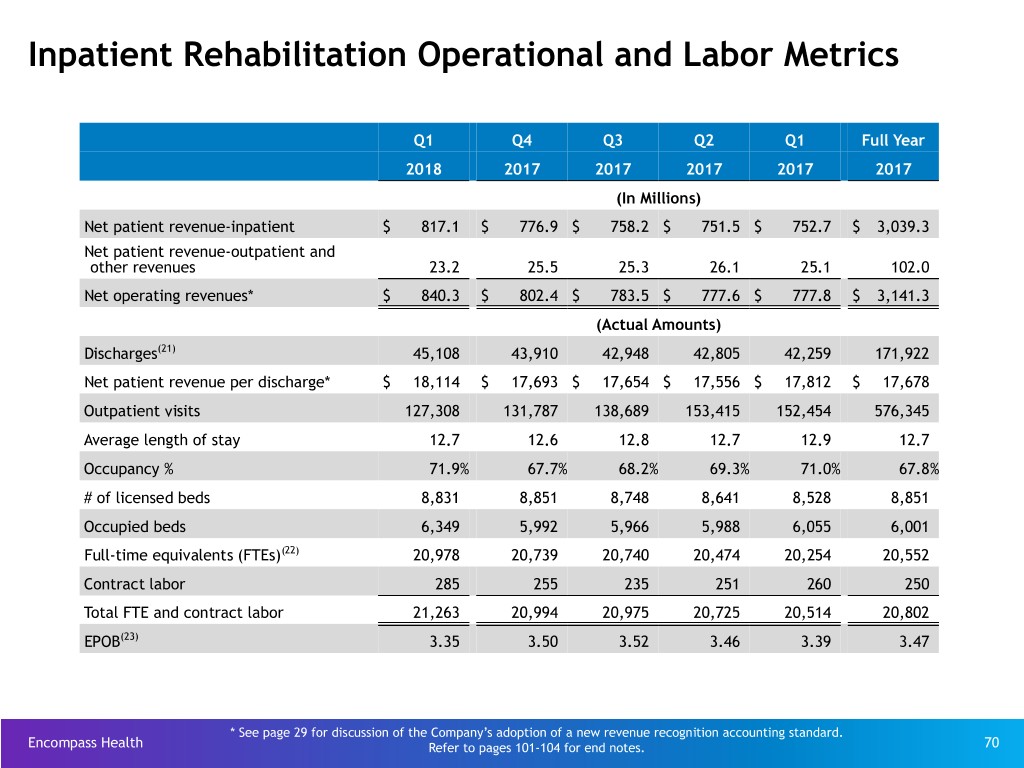

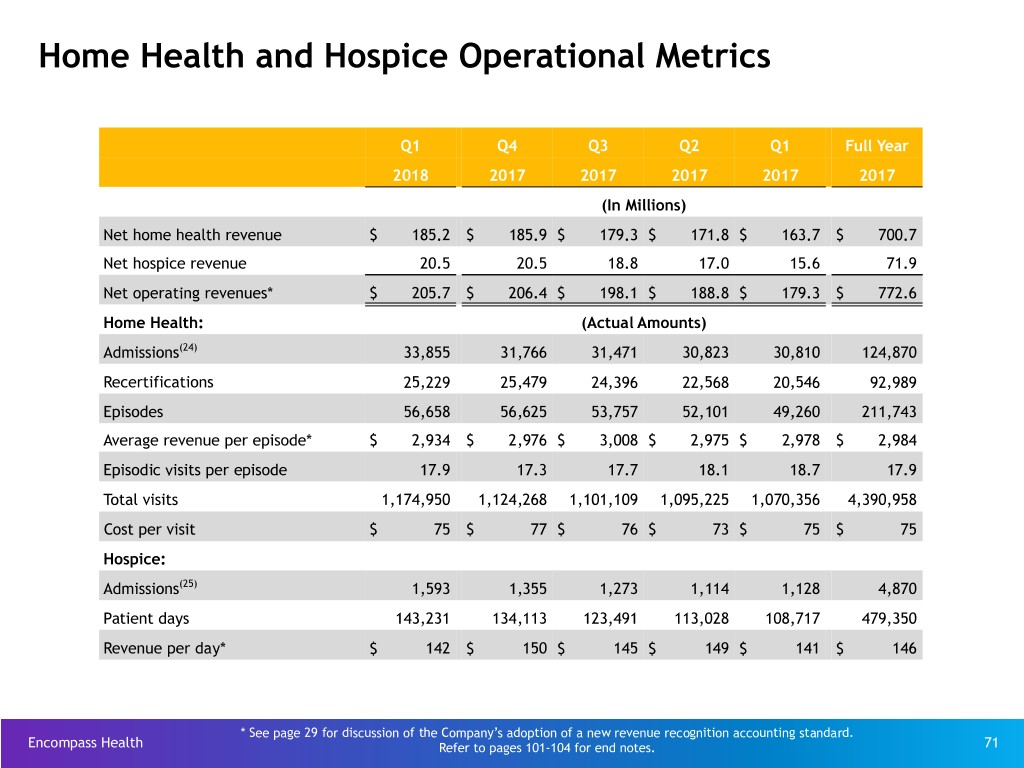

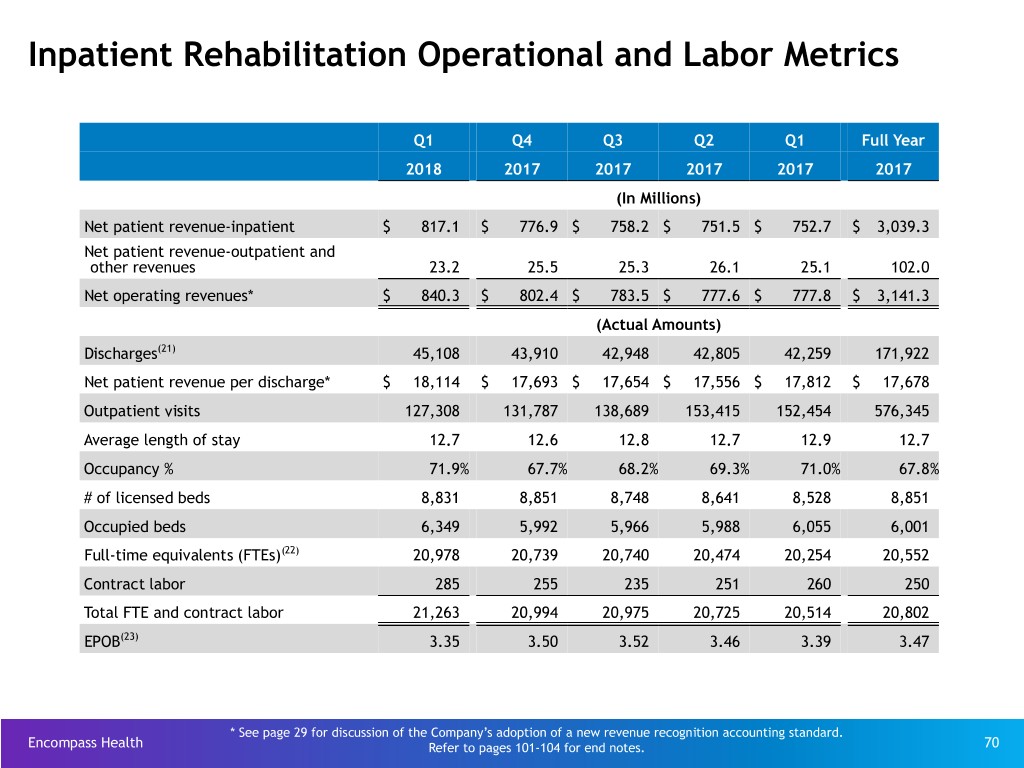

Inpatient Rehabilitation Operational and Labor Metrics Q1 Q4 Q3 Q2 Q1 Full Year 2018 2017 2017 2017 2017 2017 (In Millions) Net patient revenue-inpatient $ 817.1 $ 776.9 $ 758.2 $ 751.5 $ 752.7 $ 3,039.3 Net patient revenue-outpatient and other revenues 23.2 25.5 25.3 26.1 25.1 102.0 Net operating revenues* $ 840.3 $ 802.4 $ 783.5 $ 777.6 $ 777.8 $ 3,141.3 (Actual Amounts) Discharges(21) 45,108 43,910 42,948 42,805 42,259 171,922 Net patient revenue per discharge* $ 18,114 $ 17,693 $ 17,654 $ 17,556 $ 17,812 $ 17,678 Outpatient visits 127,308 131,787 138,689 153,415 152,454 576,345 Average length of stay 12.7 12.6 12.8 12.7 12.9 12.7 Occupancy % 71.9% 67.7% 68.2% 69.3% 71.0% 67.8% # of licensed beds 8,831 8,851 8,748 8,641 8,528 8,851 Occupied beds 6,349 5,992 5,966 5,988 6,055 6,001 Full-time equivalents (FTEs)(22) 20,978 20,739 20,740 20,474 20,254 20,552 Contract labor 285 255 235 251 260 250 Total FTE and contract labor 21,263 20,994 20,975 20,725 20,514 20,802 EPOB(23) 3.35 3.50 3.52 3.46 3.39 3.47 * See page 29 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health Refer to pages 101-104 for end notes. 70