Fourth Quarter 2018 Earnings Call Feb. 8, 2019 Supplemental Information

Forward-looking statements The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect Encompass Health’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, a potential settlement of the pending DOJ investigation, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, disintermediation, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the earnings release attached as Exhibit 99.1 to the Company’s Form 8-K dated February 7, 2019 (the “Q4 Earnings Release Form 8-K”), the Form 10-K for the year ended Dec. 31, 2018, when filed, and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note regarding presentation of non-GAAP financial measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. The Q4 Earnings Release Form 8-K, to which the following presentation is attached as Exhibit 99.2, provides further explanation and disclosure regarding Encompass Health’s use of non-GAAP financial measures and should be read in conjunction with this supplemental information. Encompass Health 2

Table of contents Q4 2018 Summary ................................................................................................... 4-5 Rebranding and name change ..................................................................................... 6 Clinical collaboration rate ......................................................................................... 7 Inpatient rehabilitation segment ................................................................................. 8-9 Home health & hospice segment.................................................................................. 10-11 Consolidated Adjusted EBITDA..................................................................................... 12 Earnings per share................................................................................................... 13-14 Adjusted free cash flow ............................................................................................ 15 Guidance.............................................................................................................. 16-17 Free cash flow assumptions and uses............................................................................. 18-19 Overview of rollover shares and SARs ............................................................................ 20 Appendix Map of locations ..................................................................................................... 22 Pre-payment claims denials - inpatient rehabilitation segment ............................................. 23 Expansion activity ................................................................................................... 24 Impact of new revenue recognition accounting standard ..................................................... 25 Business outlook ..................................................................................................... 26-28 Debt schedule and maturity profile .............................................................................. 29-30 New-store/same-store growth..................................................................................... 31-32 Payment sources (percent of revenues) ......................................................................... 33 Inpatient rehabilitation operational and labor metrics ....................................................... 34 Home health & hospice operational metrics .................................................................... 35 Share information ................................................................................................... 36 Segment operating results ......................................................................................... 37-38 Reconciliations to GAAP ............................................................................................ 39-47 End notes ............................................................................................................. 48-50 Encompass Health 3

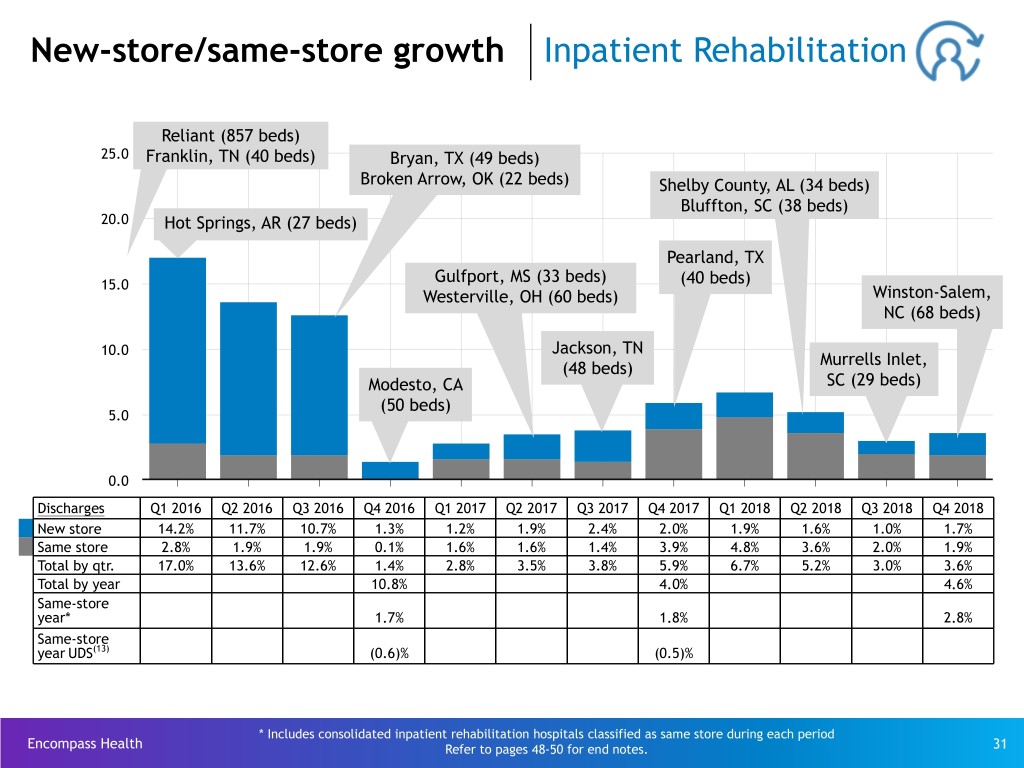

Q4 2018 summary Q4 Full Year ($millions) Q4 2018 Q4 2017 Growth 2018 2017 Growth Encompass Health Consolidated Net operating revenues* $ 1,096.0 $ 1,008.8 8.6% $ 4,277.3 $ 3,913.9 9.3% Adjusted EBITDA $ 221.8 $ 208.2 6.5% $ 901.0 $ 823.1 9.5% Inpatient Rehabilitation Segment Net operating revenues* $ 845.7 $ 802.4 5.4% $ 3,346.2 $ 3,141.3 6.5% Adjusted EBITDA $ 211.7 $ 207.1 2.2% $ 871.9 $ 821.2 6.2% Home Health and Hospice Segment Net operating revenues* $ 250.3 $ 206.4 21.3% $ 931.1 $ 772.6 20.5% Adjusted EBITDA $ 44.1 $ 34.4 28.2% $ 162.4 $ 125.9 29.0% Major takeaways: u Strong revenue growth in both segments Ÿ Inpatient rehabilitation growth driven by volume and pricing ü Discharge growth of 3.6%; same store = 1.9% § Same-store growth was negatively impacted by ~50 basis points due to the hurricane in the Panama City, Florida market. ü Net revenue per discharge increase of 2.2% Ÿ Home health and hospice growth driven by volume ü Admissions growth of 10.7%; same store = 5.4% § Same-store growth was negatively impacted by ~50 basis points due to the hurricane in the Panama City, Florida market. § New-store admission growth included the acquisition of Camellia Healthcare on May 1, 2018. ü Revenue per episode decrease of 0.1% u Consolidated Adjusted EBITDA increased 6.5% to $221.8 million. u Adjusted EPS of $0.80 per diluted share increased 14.3% - see pages 13 and 14. u Full-year 2018 adjusted free cash flow of $538.1 million - see page 15. * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health 4 Reconciliations to GAAP provided on pages 39-47.

Q4 2018 summary (cont.) u Expansion activity (see page 24) Ÿ Began operating a new 68-bed inpatient rehabilitation hospital in Winston-Salem, North Carolina, a joint venture with Novant Health, Inc. Ÿ Added four home health locations in Alabama, Massachusetts and South Carolina and two hospice locations in Alabama and Texas u Balance sheet Ÿ Leverage ratio of 2.8x at end of year u Shareholder distributions Ÿ Paid quarterly cash dividend of $0.27 per share in October 2018 Ÿ Declared a $0.27 per share quarterly cash dividend in October 2018 (paid in January 2019) u Accrual for loss contingencies(1) Ÿ Accrued loss contingencies of $52 million, or $0.52 per share, in the line item government, class action, and related settlements ü Based on recent discussions with the United States Department of Justice (“DOJ”), the Company established a reserve of $48 million in the fourth quarter of 2018 for the potential settlement of the investigation initially disclosed in March 2013.(1) Encompass Health Refer to pages 48-50 for end notes. 5

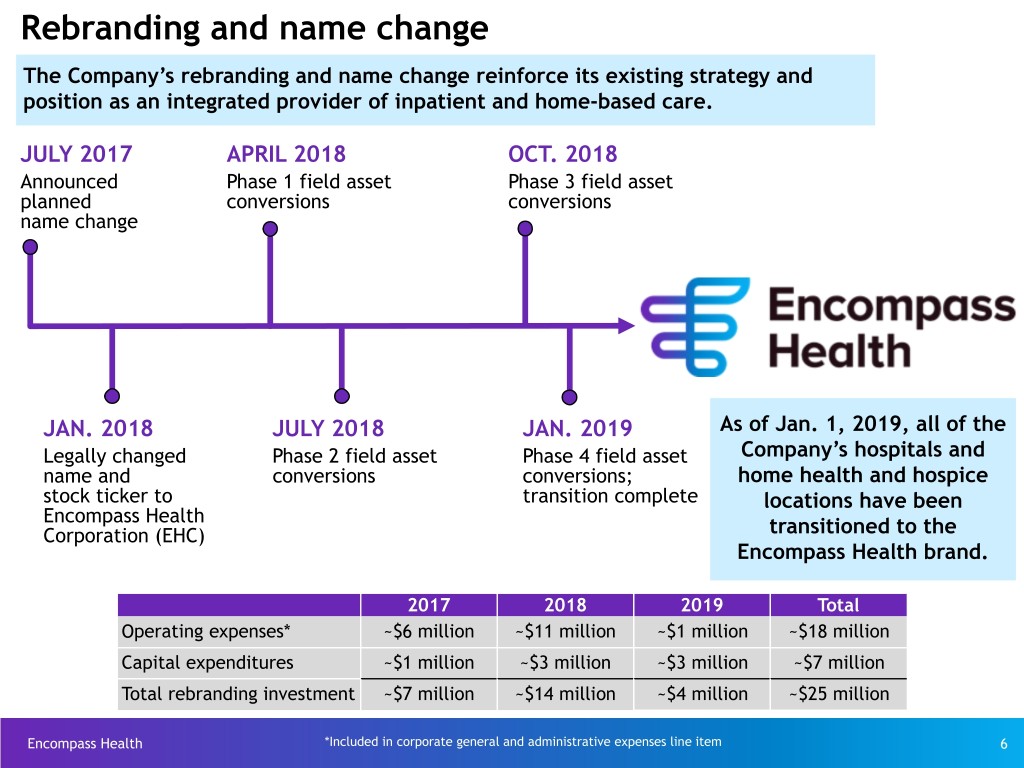

Rebranding and name change The Company’s rebranding and name change reinforce its existing strategy and position as an integrated provider of inpatient and home-based care. JULY 2017 APRIL 2018 OCT. 2018 Announced Phase 1 field asset Phase 3 field asset planned conversions conversions name change JAN. 2018 JULY 2018 JAN. 2019 As of Jan. 1, 2019, all of the Legally changed Phase 2 field asset Phase 4 field asset Company’s hospitals and name and conversions conversions; home health and hospice stock ticker to transition complete locations have been Encompass Health Corporation (EHC) transitioned to the Encompass Health brand. 2017 2018 2019 Total Operating expenses* ~$6 million ~$11 million ~$1 million ~$18 million Capital expenditures ~$1 million ~$3 million ~$3 million ~$7 million Total rebranding investment ~$7 million ~$14 million ~$4 million ~$25 million Encompass Health *Included in corporate general and administrative expenses line item 6

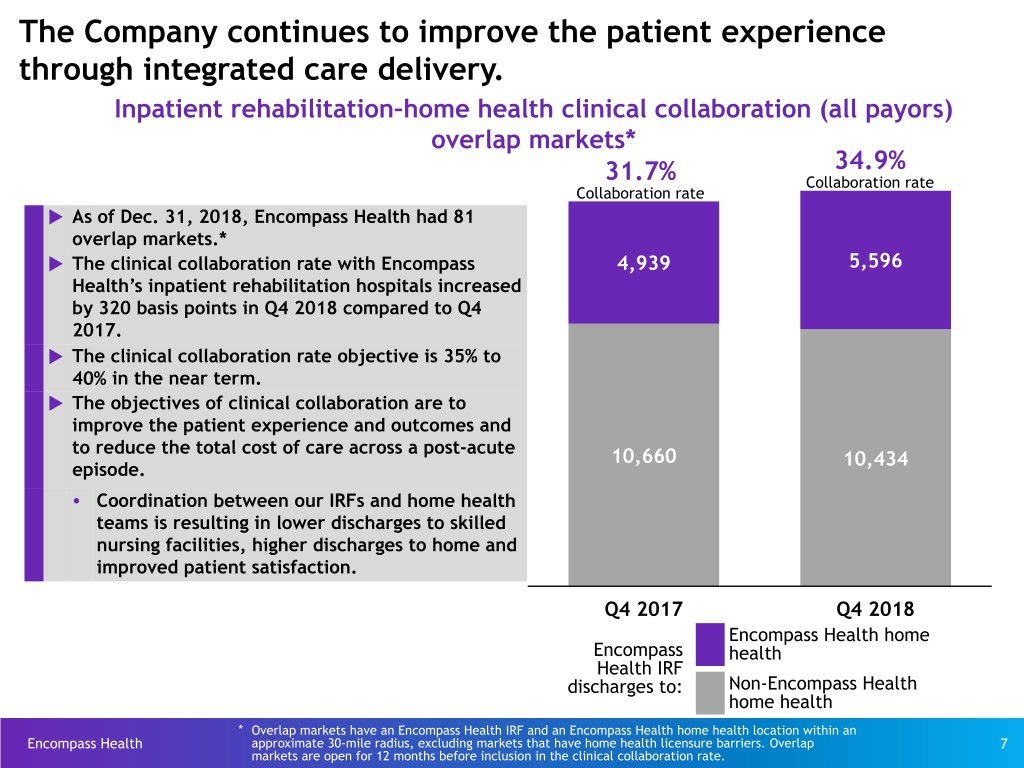

The Company continues to improve the patient experience through integrated care delivery. Inpatient rehabilitation–home health clinical collaboration (all payors) overlap markets* 34.9% 31.7% Collaboration rate Collaboration rate u As of Dec. 31, 2018, Encompass Health had 81 overlap markets.* u The clinical collaboration rate with Encompass 4,939 5,596 Health’s inpatient rehabilitation hospitals increased by 320 basis points in Q4 2018 compared to Q4 2017. u The clinical collaboration rate objective is 35% to 40% in the near term. u The objectives of clinical collaboration are to improve the patient experience and outcomes and to reduce the total cost of care across a post-acute 10,660 10,434 episode. Ÿ Coordination between our IRFs and home health teams is resulting in lower discharges to skilled nursing facilities, higher discharges to home and improved patient satisfaction. Q4 2017 Q4 2018 Encompass Health home Encompass health Health IRF discharges to: Non-Encompass Health home health * Overlap markets have an Encompass Health IRF and an Encompass Health home health location within an Encompass Health approximate 30-mile radius, excluding markets that have home health licensure barriers. Overlap 7 markets are open for 12 months before inclusion in the clinical collaboration rate.

Inpatient rehabilitation segment - revenue Q4 Q4 Favorable/ ($millions) 2018 2017 (Unfavorable) Net operating revenues:* Inpatient $ 822.8 $ 776.9 5.9% Outpatient and other 22.9 25.5 (10.2%) Total segment revenue $ 845.7 $ 802.4 5.4% (Actual Amounts) Discharges 45,498 43,910 3.6% Same-store discharge growth 1.9% Net patient revenue per discharge* $ 18,084 $ 17,693 2.2% u Revenue growth was driven by volume and pricing growth. Ÿ Same-store discharge growth of 1.9% was negatively impacted by ~50 basis points due to the ongoing effects of Hurricane Michael on operations in Panama City, Florida. Ÿ New-store discharge growth resulted from joint ventures in Murrells Inlet, SC (September 2018) and Winston-Salem, NC (October 2018) and wholly owned hospitals in Pearland, TX (October 2017), Shelby County, AL (April 2018), and Bluffton, SC (June 2018). Ÿ Growth in net patient revenue per discharge primarily resulted from an increase in reimbursement rates from all payors and improvements in discharge destination. u Outpatient and other revenue decreased due primarily to continued closures of hospital-based outpatient programs. u Revenue reserves (formerly bad debt expense) as a percent of revenue increased 50 basis points to 1.5% primarily due to new pre-payment claims denials (net of recoveries) and post-payment reserves for new Medicare Advantage contractual claim reviews with one managed care organization. Encompass Health * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. 8

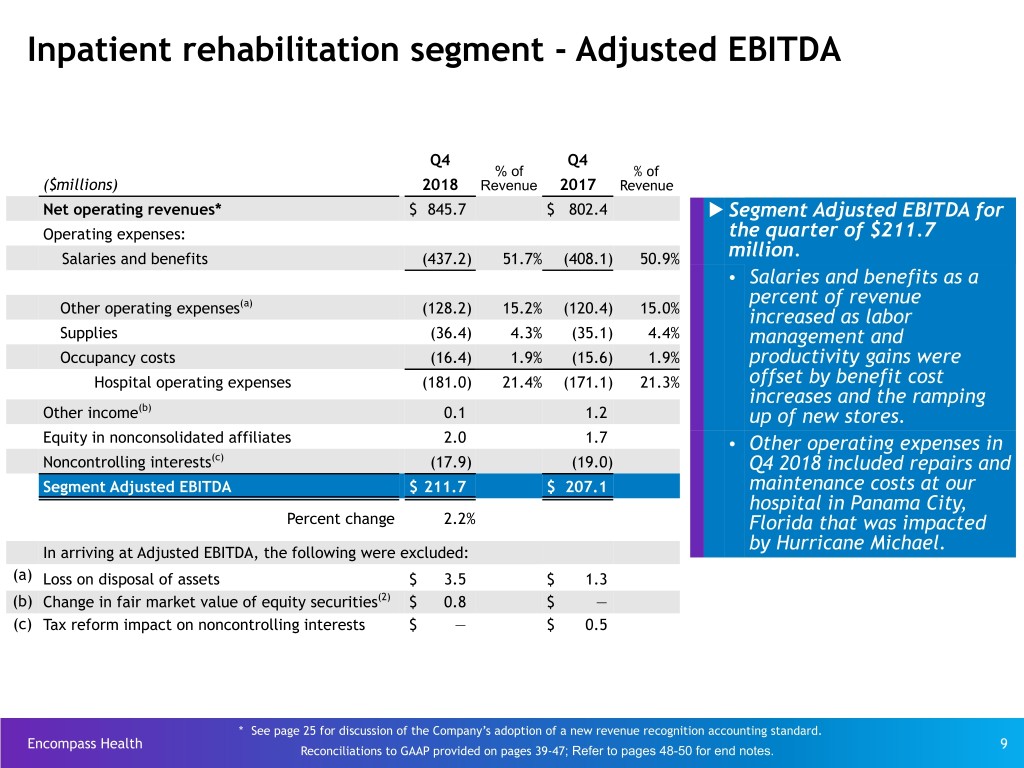

Inpatient rehabilitation segment - Adjusted EBITDA Q4 Q4 % of % of ($millions) 2018 Revenue 2017 Revenue Net operating revenues* $ 845.7 $ 802.4 u Segment Adjusted EBITDA for Operating expenses: the quarter of $211.7 Salaries and benefits (437.2) 51.7% (408.1) 50.9% million. • Salaries and benefits as a (a) percent of revenue Other operating expenses (128.2) 15.2% (120.4) 15.0% increased as labor Supplies (36.4) 4.3% (35.1) 4.4% management and Occupancy costs (16.4) 1.9% (15.6) 1.9% productivity gains were Hospital operating expenses (181.0) 21.4% (171.1) 21.3% offset by benefit cost increases and the ramping Other income(b) 0.1 1.2 up of new stores. Equity in nonconsolidated affiliates 2.0 1.7 • Other operating expenses in Noncontrolling interests(c) (17.9) (19.0) Q4 2018 included repairs and Segment Adjusted EBITDA $ 211.7 $ 207.1 maintenance costs at our hospital in Panama City, Percent change 2.2% Florida that was impacted In arriving at Adjusted EBITDA, the following were excluded: by Hurricane Michael. (a) Loss on disposal of assets $ 3.5 $ 1.3 (b) Change in fair market value of equity securities(2) $ 0.8 $ — (c) Tax reform impact on noncontrolling interests $ — $ 0.5 * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health 9 Reconciliations to GAAP provided on pages 39-47; Refer to pages 48-50 for end notes.

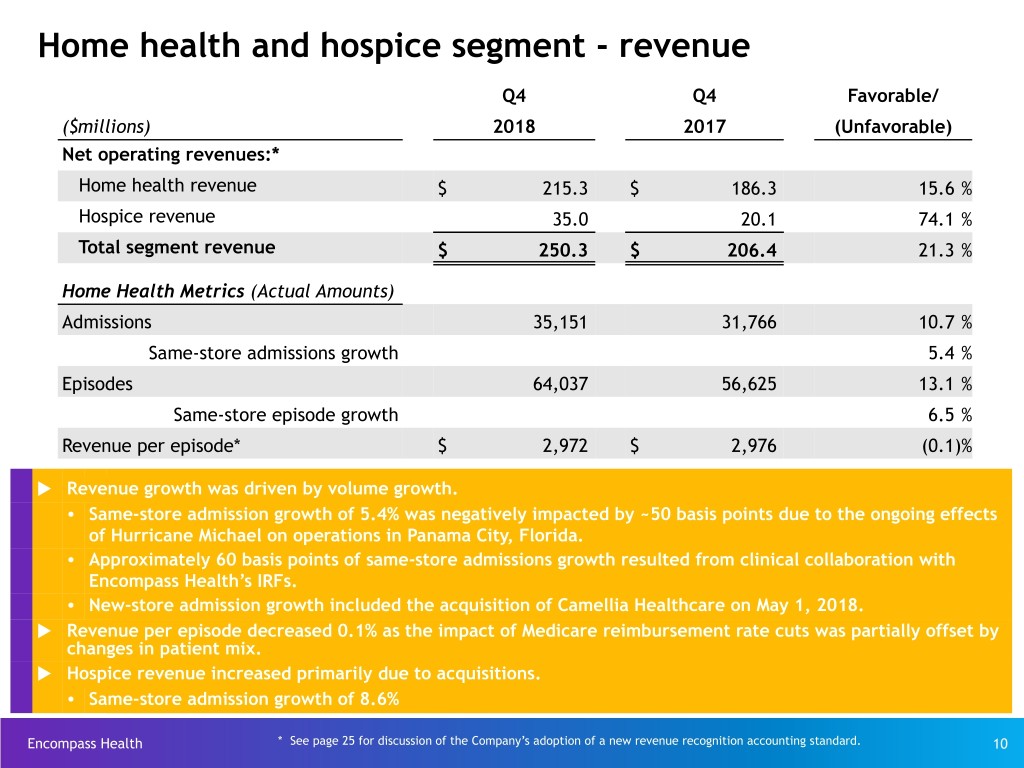

Home health and hospice segment - revenue Q4 Q4 Favorable/ ($millions) 2018 2017 (Unfavorable) Net operating revenues:* Home health revenue $ 215.3 $ 186.3 15.6 % Hospice revenue 35.0 20.1 74.1 % Total segment revenue $ 250.3 $ 206.4 21.3 % Home Health Metrics (Actual Amounts) Admissions 35,151 31,766 10.7 % Same-store admissions growth 5.4 % Episodes 64,037 56,625 13.1 % Same-store episode growth 6.5 % Revenue per episode* $ 2,972 $ 2,976 (0.1)% u Revenue growth was driven by volume growth. Ÿ Same-store admission growth of 5.4% was negatively impacted by ~50 basis points due to the ongoing effects of Hurricane Michael on operations in Panama City, Florida. Ÿ Approximately 60 basis points of same-store admissions growth resulted from clinical collaboration with Encompass Health’s IRFs. Ÿ New-store admission growth included the acquisition of Camellia Healthcare on May 1, 2018. u Revenue per episode decreased 0.1% as the impact of Medicare reimbursement rate cuts was partially offset by changes in patient mix. u Hospice revenue increased primarily due to acquisitions. Ÿ Same-store admission growth of 8.6% Encompass Health * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. 10

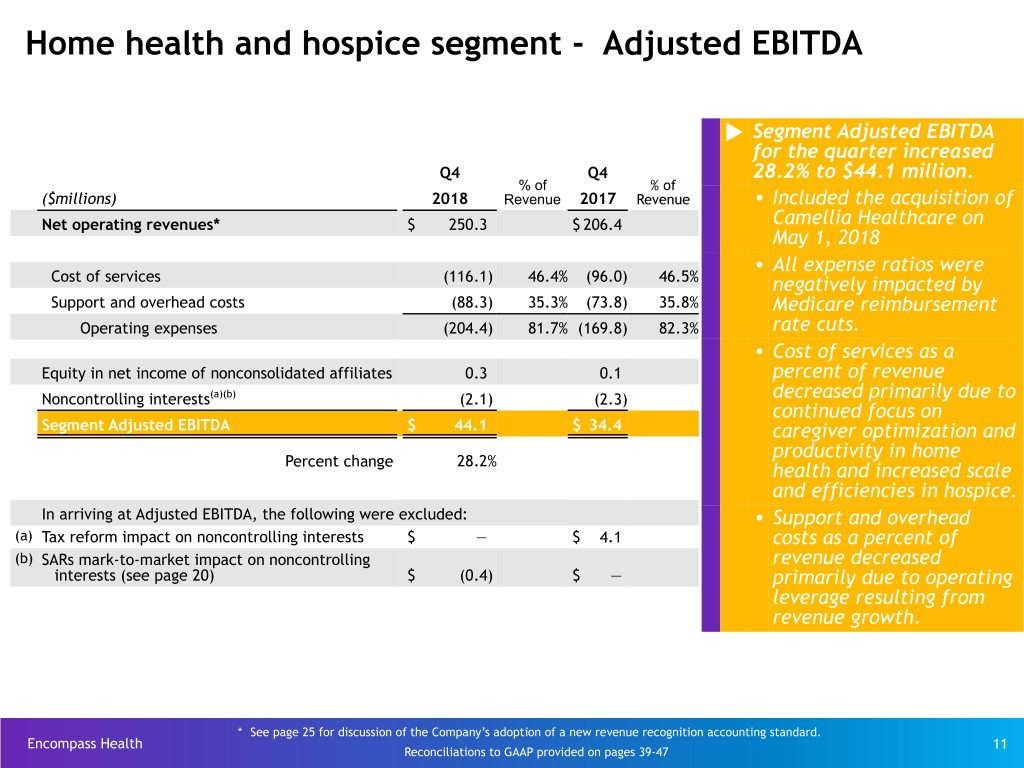

Home health and hospice segment - Adjusted EBITDA u Segment Adjusted EBITDA for the quarter increased Q4 Q4 28.2% to $44.1 million. % of % of ($millions) 2018 Revenue 2017 Revenue Ÿ Included the acquisition of Net operating revenues* $ 250.3 $ 206.4 Camellia Healthcare on May 1, 2018 Ÿ All expense ratios were Cost of services (116.1) 46.4% (96.0) 46.5% negatively impacted by Support and overhead costs (88.3) 35.3% (73.8) 35.8% Medicare reimbursement Operating expenses (204.4) 81.7% (169.8) 82.3% rate cuts. Ÿ Cost of services as a Equity in net income of nonconsolidated affiliates 0.3 0.1 percent of revenue Noncontrolling interests(a)(b) (2.1) (2.3) decreased primarily due to continued focus on Segment Adjusted EBITDA $ 44.1 $ 34.4 caregiver optimization and productivity in home Percent change 28.2% health and increased scale and efficiencies in hospice. In arriving at Adjusted EBITDA, the following were excluded: Ÿ Support and overhead (a) Tax reform impact on noncontrolling interests $ — $ 4.1 costs as a percent of (b) SARs mark-to-market impact on noncontrolling revenue decreased interests (see page 20) $ (0.4) $ — primarily due to operating leverage resulting from revenue growth. * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health 11 Reconciliations to GAAP provided on pages 39-47 * Reconciliation to GAAP provided on pages 29-31

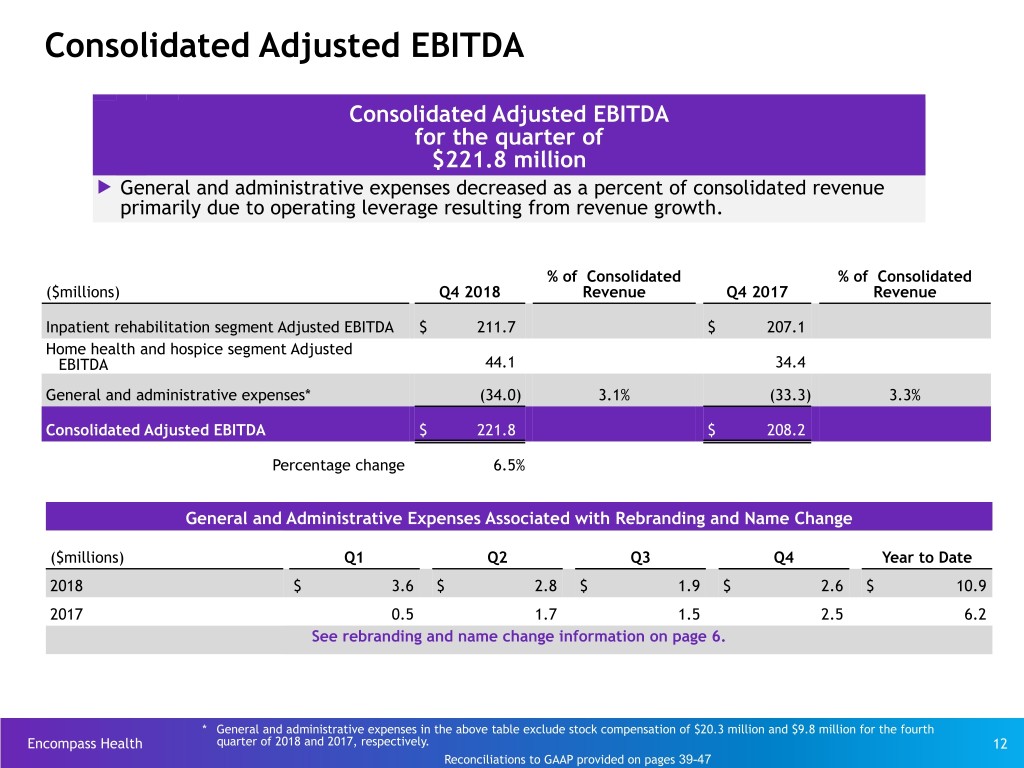

Consolidated Adjusted EBITDA Consolidated Adjusted EBITDA for the quarter of $221.8 million u General and administrative expenses decreased as a percent of consolidated revenue primarily due to operating leverage resulting from revenue growth. % of Consolidated % of Consolidated ($millions) Q4 2018 Revenue Q4 2017 Revenue Inpatient rehabilitation segment Adjusted EBITDA $ 211.7 $ 207.1 Home health and hospice segment Adjusted EBITDA 44.1 34.4 General and administrative expenses* (34.0) 3.1% (33.3) 3.3% Consolidated Adjusted EBITDA $ 221.8 $ 208.2 Percentage change 6.5% General and Administrative Expenses Associated with Rebranding and Name Change ($millions) Q1 Q2 Q3 Q4 Year to Date 2018 $ 3.6 $ 2.8 $ 1.9 $ 2.6 $ 10.9 2017 0.5 1.7 1.5 2.5 6.2 See rebranding and name change information on page 6. * General and administrative expenses in the above table exclude stock compensation of $20.3 million and $9.8 million for the fourth Encompass Health quarter of 2018 and 2017, respectively. 12 . Reconciliations to GAAP provided on pages 39-47

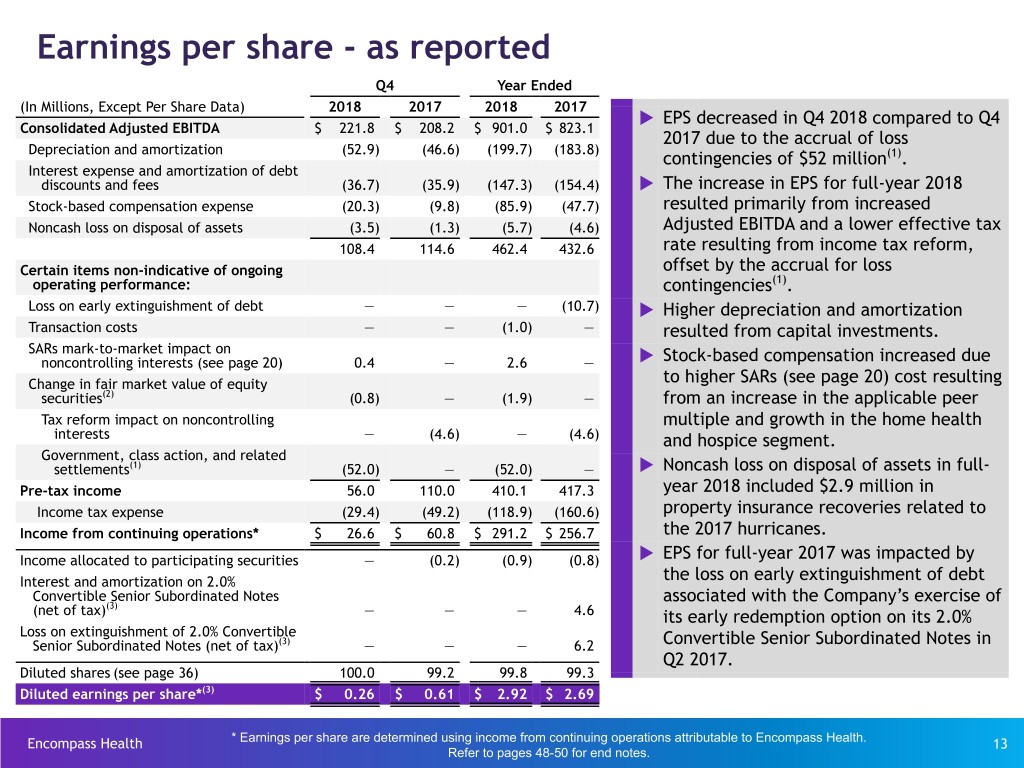

Earnings per share - as reported Q4 Year Ended (In Millions, Except Per Share Data) 2018 2017 2018 2017 u EPS decreased in Q4 2018 compared to Q4 Consolidated Adjusted EBITDA $ 221.8 $ 208.2 $ 901.0 $ 823.1 2017 due to the accrual of loss Depreciation and amortization (52.9) (46.6) (199.7) (183.8) contingencies of $52 million(1). Interest expense and amortization of debt discounts and fees (36.7) (35.9) (147.3) (154.4) u The increase in EPS for full-year 2018 Stock-based compensation expense (20.3) (9.8) (85.9) (47.7) resulted primarily from increased Noncash loss on disposal of assets (3.5) (1.3) (5.7) (4.6) Adjusted EBITDA and a lower effective tax 108.4 114.6 462.4 432.6 rate resulting from income tax reform, Certain items non-indicative of ongoing offset by the accrual for loss operating performance: contingencies(1). Loss on early extinguishment of debt — — — (10.7) u Higher depreciation and amortization Transaction costs — — (1.0) — resulted from capital investments. SARs mark-to-market impact on u noncontrolling interests (see page 20) 0.4 — 2.6 — Stock-based compensation increased due Change in fair market value of equity to higher SARs (see page 20) cost resulting securities(2) (0.8) — (1.9) — from an increase in the applicable peer Tax reform impact on noncontrolling multiple and growth in the home health interests — (4.6) — (4.6) and hospice segment. Government, class action, and related u settlements(1) (52.0) — (52.0) — Noncash loss on disposal of assets in full- Pre-tax income 56.0 110.0 410.1 417.3 year 2018 included $2.9 million in Income tax expense (29.4) (49.2) (118.9) (160.6) property insurance recoveries related to Income from continuing operations* $ 26.6 $ 60.8 $ 291.2 $ 256.7 the 2017 hurricanes. u Income allocated to participating securities — (0.2) (0.9) (0.8) EPS for full-year 2017 was impacted by Interest and amortization on 2.0% the loss on early extinguishment of debt Convertible Senior Subordinated Notes associated with the Company’s exercise of (3) (net of tax) — — — 4.6 its early redemption option on its 2.0% Loss on extinguishment of 2.0% Convertible Senior Subordinated Notes (net of tax)(3) — — — 6.2 Convertible Senior Subordinated Notes in Q2 2017. Diluted shares (see page 36) 100.0 99.2 99.8 99.3 Diluted earnings per share*(3) $ 0.26 $ 0.61 $ 2.92 $ 2.69 Encompass Health * Earnings per share are determined using income from continuing operations attributable to Encompass Health. 13 Refer to pages 48-50 for end notes.

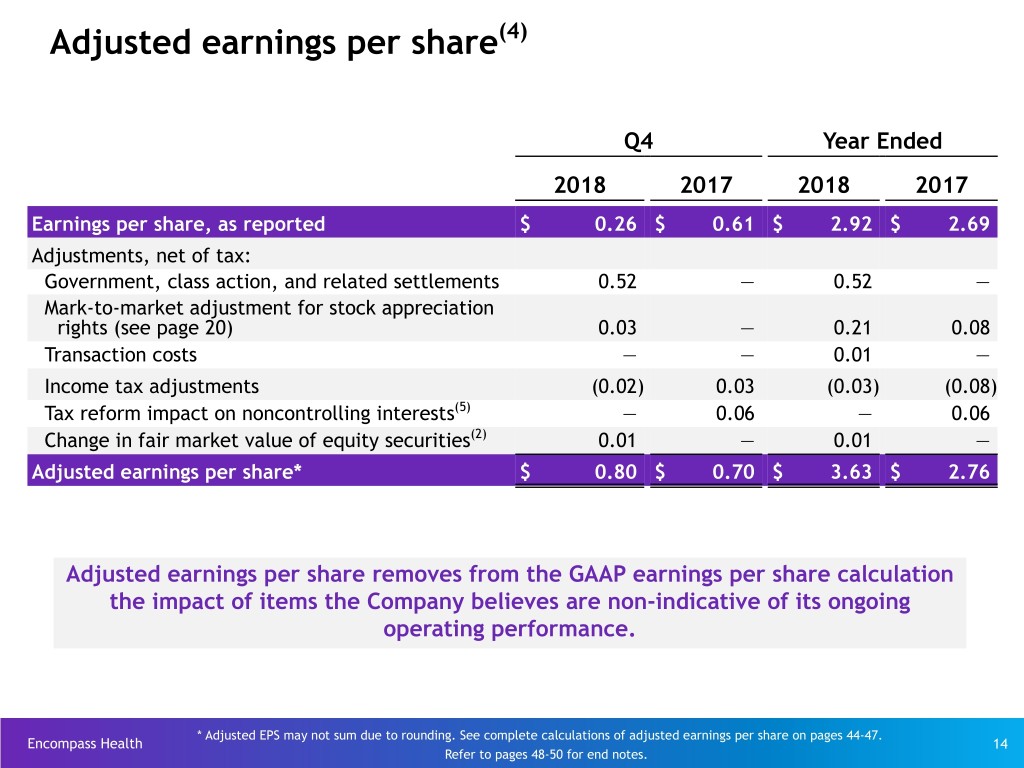

Adjusted earnings per share(4) Q4 Year Ended 2018 2017 2018 2017 Earnings per share, as reported $ 0.26 $ 0.61 $ 2.92 $ 2.69 Adjustments, net of tax: Government, class action, and related settlements 0.52 — 0.52 — Mark-to-market adjustment for stock appreciation rights (see page 20) 0.03 — 0.21 0.08 Transaction costs — — 0.01 — Income tax adjustments (0.02) 0.03 (0.03) (0.08) Tax reform impact on noncontrolling interests(5) — 0.06 — 0.06 Change in fair market value of equity securities(2) 0.01 — 0.01 — Adjusted earnings per share* $ 0.80 $ 0.70 $ 3.63 $ 2.76 Adjusted earnings per share removes from the GAAP earnings per share calculation the impact of items the Company believes are non-indicative of its ongoing operating performance. * Adjusted EPS may not sum due to rounding. See complete calculations of adjusted earnings per share on pages 44-47. Encompass Health 14 Refer to pages 48-50 for end notes.

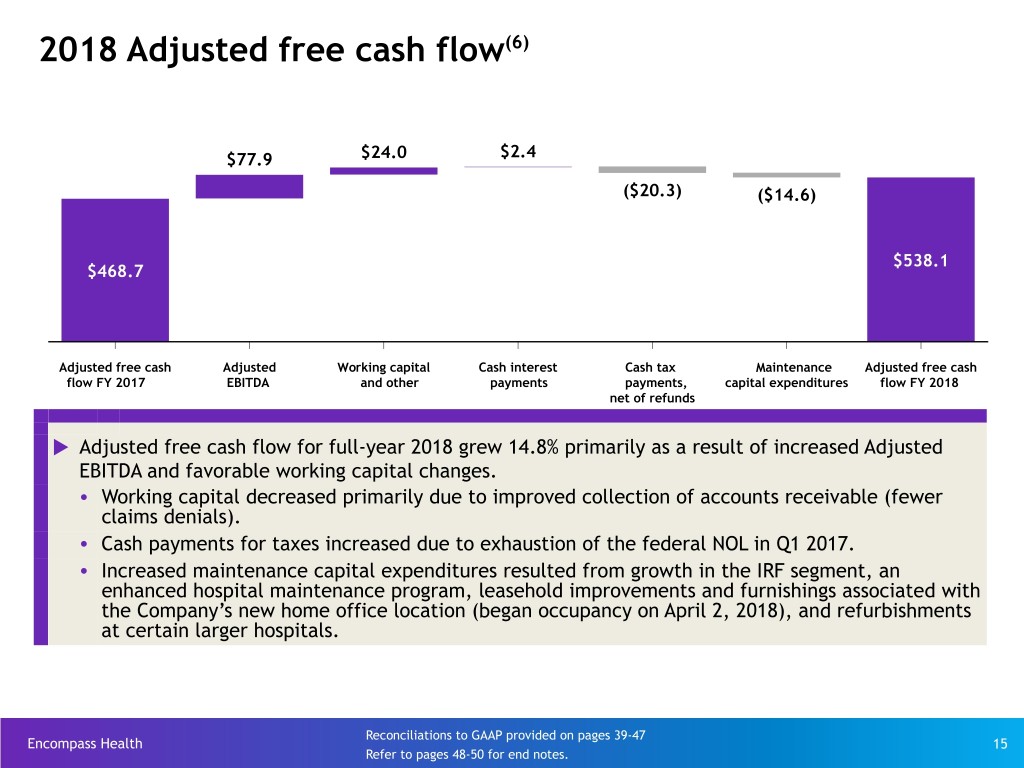

2018 Adjusted free cash flow(6) $77.9 $24.0 $2.4 ($20.3) ($14.6) $538.1 $468.7 Adjusted free cash Adjusted Working capital Cash interest Cash tax Maintenance Adjusted free cash flow FY 2017 EBITDA and other payments payments, capital expenditures flow FY 2018 net of refunds u Adjusted free cash flow for full-year 2018 grew 14.8% primarily as a result of increased Adjusted EBITDA and favorable working capital changes. Ÿ Working capital decreased primarily due to improved collection of accounts receivable (fewer claims denials). Ÿ Cash payments for taxes increased due to exhaustion of the federal NOL in Q1 2017. Ÿ Increased maintenance capital expenditures resulted from growth in the IRF segment, an enhanced hospital maintenance program, leasehold improvements and furnishings associated with the Company’s new home office location (began occupancy on April 2, 2018), and refurbishments at certain larger hospitals. Reconciliations to GAAP provided on pages 39-47 Encompass Health 15 Refer to pages 48-50 for end notes.

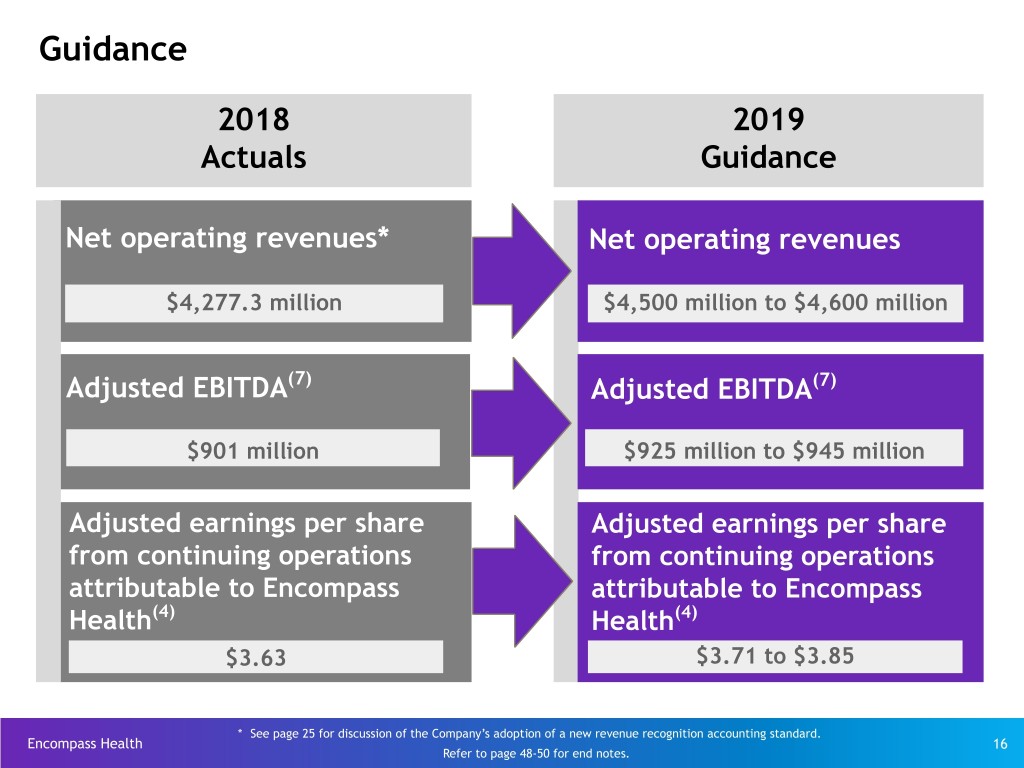

Guidance 2018 2019 Actuals Guidance Net operating revenues* Net operating revenues $4,277.3 million $4,500 million to $4,600 million Adjusted EBITDA(7) Adjusted EBITDA(7) $901 million $925 million to $945 million Adjusted earnings per share Adjusted earnings per share from continuing operations from continuing operations attributable to Encompass attributable to Encompass Health(4) Health(4) $3.63 $3.71 to $3.85 * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health 16 Refer to page 48-50 for end notes.

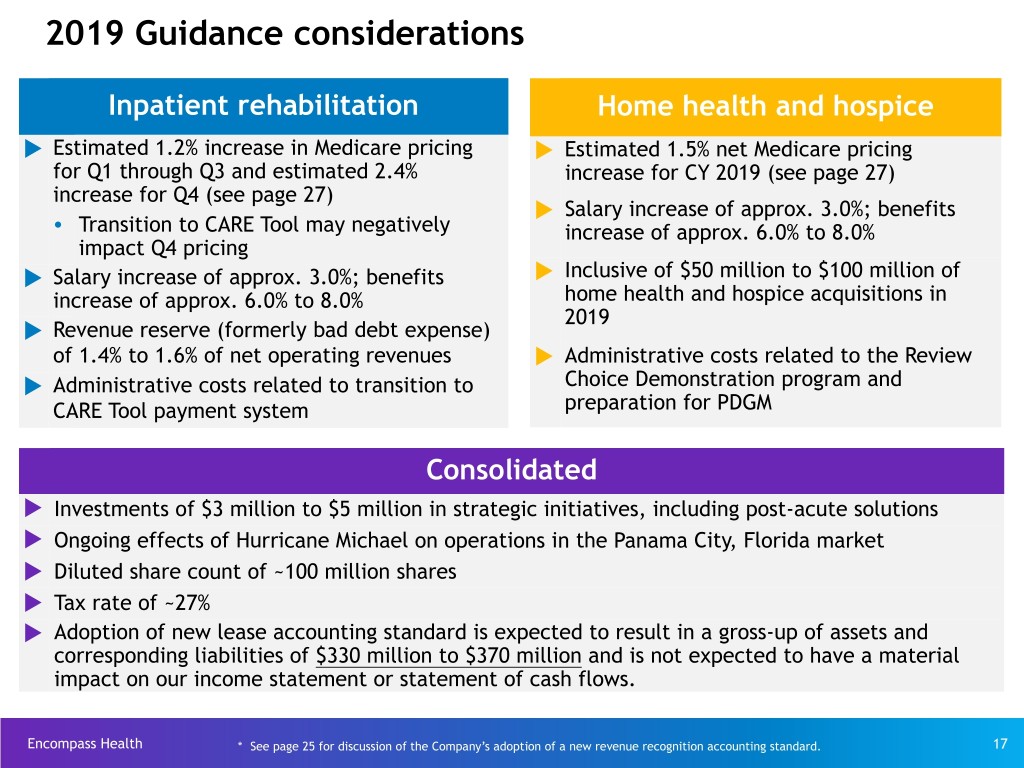

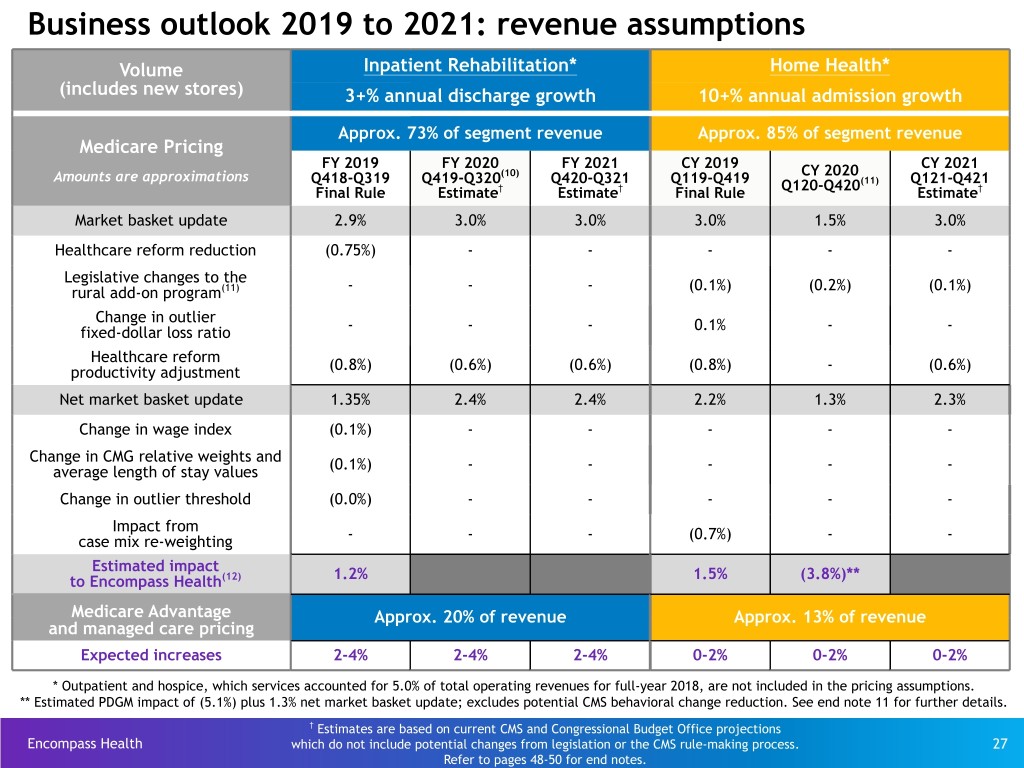

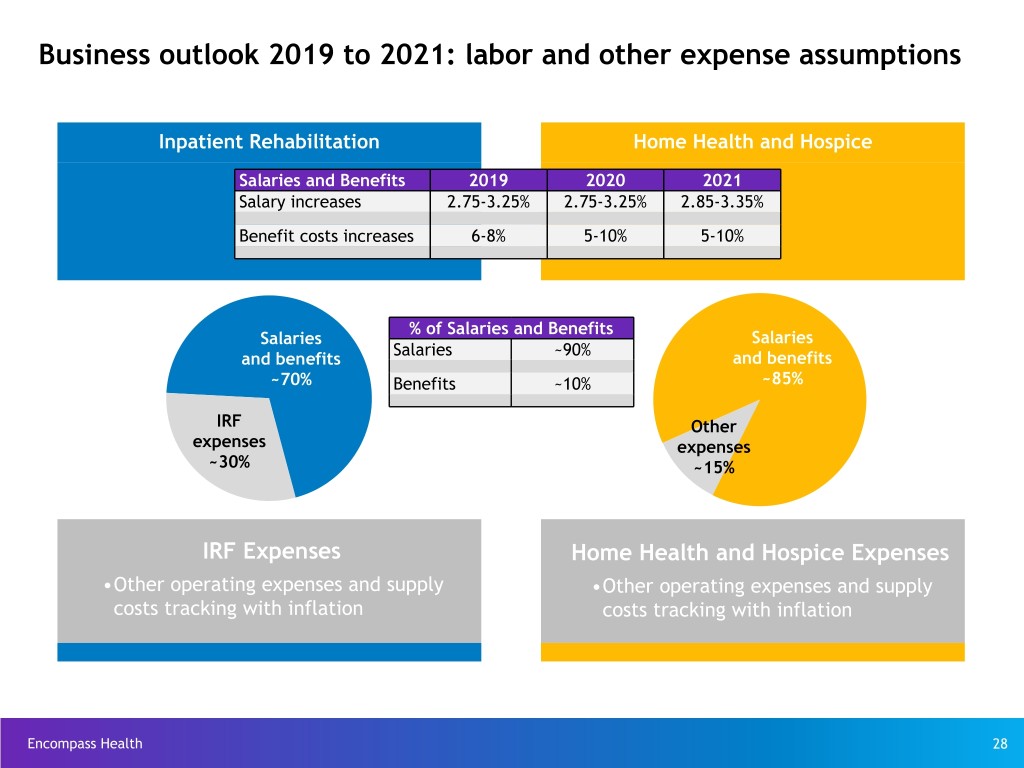

2019 Guidance considerations Inpatient rehabilitation Home health and hospice u Estimated 1.2% increase in Medicare pricing u Estimated 1.5% net Medicare pricing for Q1 through Q3 and estimated 2.4% increase for CY 2019 (see page 27) increase for Q4 (see page 27) u Ÿ Salary increase of approx. 3.0%; benefits Transition to CARE Tool may negatively increase of approx. 6.0% to 8.0% impact Q4 pricing u u Salary increase of approx. 3.0%; benefits Inclusive of $50 million to $100 million of increase of approx. 6.0% to 8.0% home health and hospice acquisitions in 2019 u Revenue reserve (formerly bad debt expense) of 1.4% to 1.6% of net operating revenues u Administrative costs related to the Review u Administrative costs related to transition to Choice Demonstration program and CARE Tool payment system preparation for PDGM Consolidated u Investments of $3 million to $5 million in strategic initiatives, including post-acute solutions u Ongoing effects of Hurricane Michael on operations in the Panama City, Florida market u Diluted share count of ~100 million shares u Tax rate of ~27% u Adoption of new lease accounting standard is expected to result in a gross-up of assets and corresponding liabilities of $330 million to $370 million and is not expected to have a material impact on our income statement or statement of cash flows. Encompass Health * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. 17

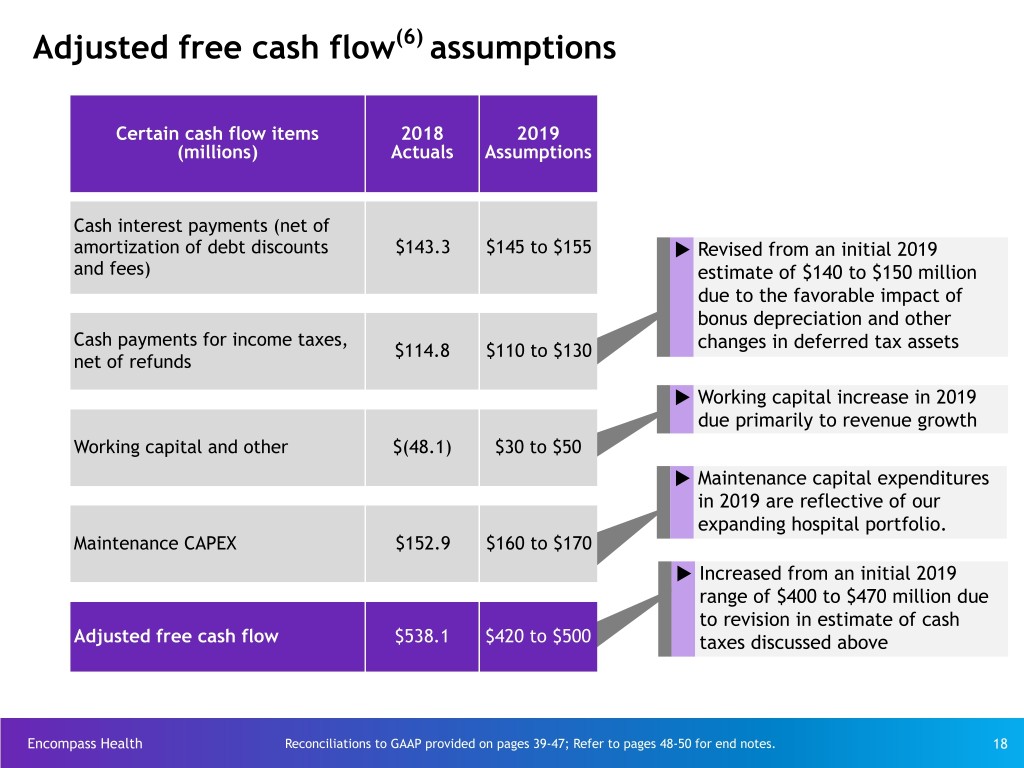

Adjusted free cash flow(6) assumptions Certain cash flow items 2018 2019 (millions) Actuals Assumptions Cash interest payments (net of amortization of debt discounts $143.3 $145 to $155 u Revised from an initial 2019 and fees) estimate of $140 to $150 million due to the favorable impact of bonus depreciation and other Cash payments for income taxes, $114.8 $110 to $130 changes in deferred tax assets net of refunds u Working capital increase in 2019 due primarily to revenue growth Working capital and other $(48.1) $30 to $50 u Maintenance capital expenditures in 2019 are reflective of our expanding hospital portfolio. Maintenance CAPEX $152.9 $160 to $170 u Increased from an initial 2019 range of $400 to $470 million due to revision in estimate of cash Adjusted free cash flow $538.1 $420 to $500 taxes discussed above Encompass Health Reconciliations to GAAP provided on pages 39-47; Refer to pages 48-50 for end notes. 18

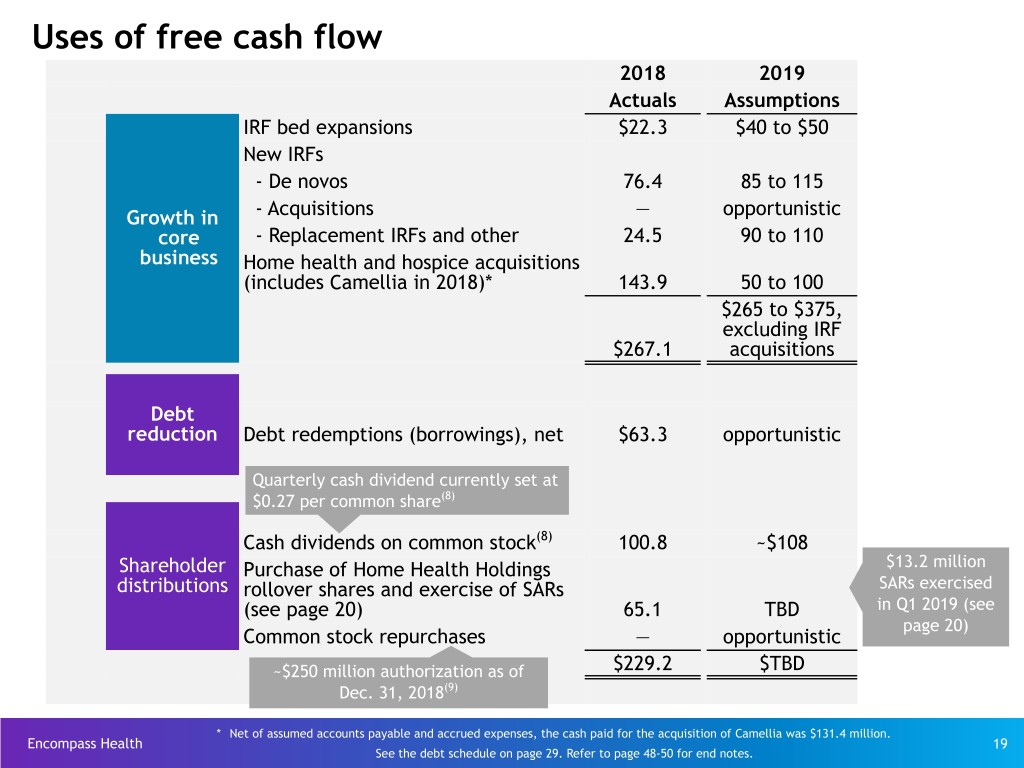

Uses of free cash flow 2018 2019 Actuals Assumptions IRF bed expansions $22.3 $40 to $50 New IRFs - De novos 76.4 85 to 115 Growth in - Acquisitions — opportunistic core - Replacement IRFs and other 24.5 90 to 110 business Home health and hospice acquisitions (includes Camellia in 2018)* 143.9 50 to 100 $265 to $375, excluding IRF $267.1 acquisitions Debt reduction Debt redemptions (borrowings), net $63.3 opportunistic Quarterly cash dividend currently set at $0.27 per common share(8) Cash dividends on common stock(8) 100.8 ~$108 Shareholder Purchase of Home Health Holdings $13.2 million distributions rollover shares and exercise of SARs SARs exercised (see page 20) 65.1 TBD in Q1 2019 (see page 20) Common stock repurchases — opportunistic ~$250 million authorization as of $229.2 $TBD Dec. 31, 2018(9) * Net of assumed accounts payable and accrued expenses, the cash paid for the acquisition of Camellia was $131.4 million. Encompass Health 19 See the debt schedule on page 29. Refer to page 48-50 for end notes.

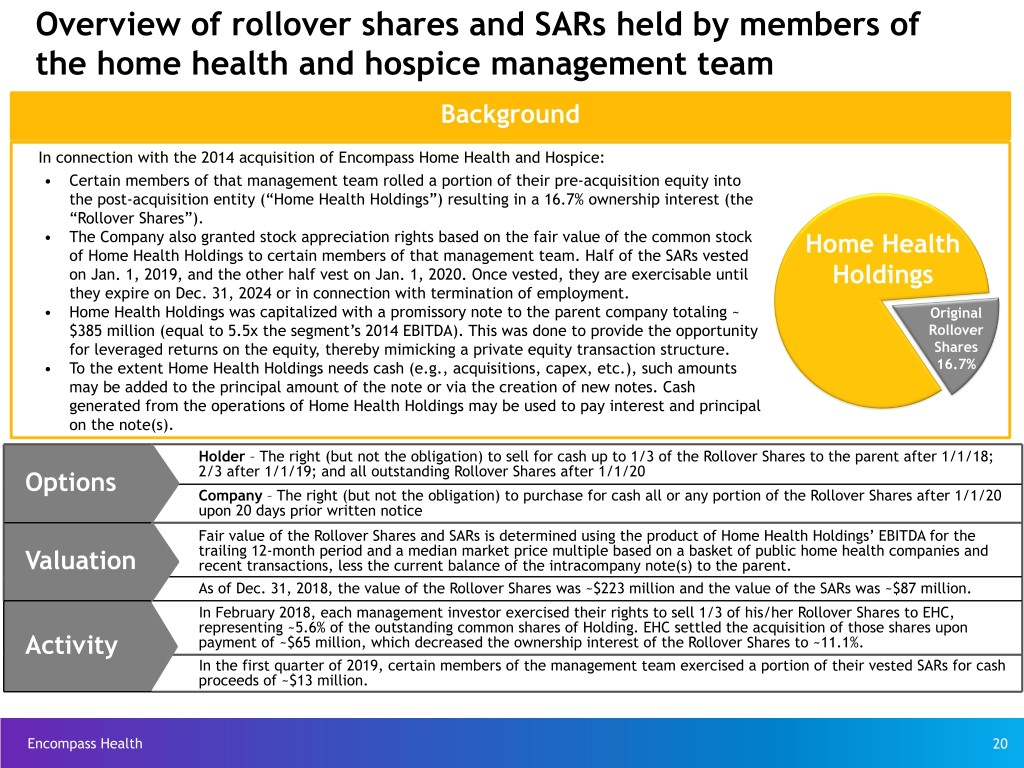

Overview of rollover shares and SARs held by members of the home health and hospice management team Background In connection with the 2014 acquisition of Encompass Home Health and Hospice: • Certain members of that management team rolled a portion of their pre-acquisition equity into the post-acquisition entity (“Home Health Holdings”) resulting in a 16.7% ownership interest (the “Rollover Shares”). • The Company also granted stock appreciation rights based on the fair value of the common stock of Home Health Holdings to certain members of that management team. Half of the SARs vested Home Health on Jan. 1, 2019, and the other half vest on Jan. 1, 2020. Once vested, they are exercisable until Holdings they expire on Dec. 31, 2024 or in connection with termination of employment. • Home Health Holdings was capitalized with a promissory note to the parent company totaling ~ Original $385 million (equal to 5.5x the segment’s 2014 EBITDA). This was done to provide the opportunity Rollover for leveraged returns on the equity, thereby mimicking a private equity transaction structure. Shares • To the extent Home Health Holdings needs cash (e.g., acquisitions, capex, etc.), such amounts 16.7% may be added to the principal amount of the note or via the creation of new notes. Cash generated from the operations of Home Health Holdings may be used to pay interest and principal on the note(s). Holder – The right (but not the obligation) to sell for cash up to 1/3 of the Rollover Shares to the parent after 1/1/18; 2/3 after 1/1/19; and all outstanding Rollover Shares after 1/1/20 Options Company – The right (but not the obligation) to purchase for cash all or any portion of the Rollover Shares after 1/1/20 upon 20 days prior written notice Fair value of the Rollover Shares and SARs is determined using the product of Home Health Holdings’ EBITDA for the trailing 12-month period and a median market price multiple based on a basket of public home health companies and Valuation recent transactions, less the current balance of the intracompany note(s) to the parent. As of Dec. 31, 2018, the value of the Rollover Shares was ~$223 million and the value of the SARs was ~$87 million. In February 2018, each management investor exercised their rights to sell 1/3 of his/her Rollover Shares to EHC, representing ~5.6% of the outstanding common shares of Holding. EHC settled the acquisition of those shares upon Activity payment of ~$65 million, which decreased the ownership interest of the Rollover Shares to ~11.1%. In the first quarter of 2019, certain members of the management team exercised a portion of their vested SARs for cash proceeds of ~$13 million. Encompass Health 20

Appendix

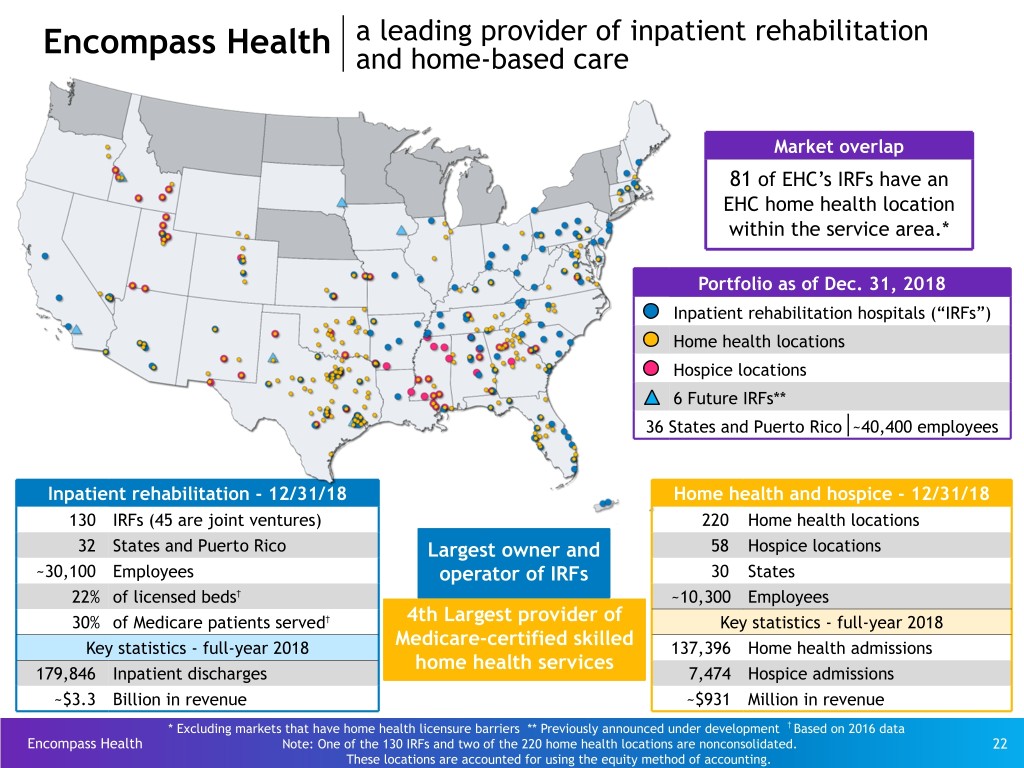

Encompass Health a leading provider of inpatient rehabilitation and home-based care Market overlap 81 of EHC’s IRFs have an EHC home health location within the service area.* Portfolio as of Dec. 31, 2018 Inpatient rehabilitation hospitals (“IRFs”) Home health locations Hospice locations 6 Future IRFs** 36 States and Puerto Rico ~40,400 employees Inpatient rehabilitation - 12/31/18 Home health and hospice - 12/31/18 130 IRFs (45 are joint ventures) 220 Home health locations 32 States and Puerto Rico Largest owner and 58 Hospice locations ~30,100 Employees operator of IRFs 30 States 22% of licensed beds† ~10,300 Employees 30% of Medicare patients served† 4th Largest provider of Key statistics - full-year 2018 Key statistics - full-year 2018 Medicare-certified skilled 137,396 Home health admissions home health services 179,846 Inpatient discharges 7,474 Hospice admissions ~$3.3 Billion in revenue ~$931 Million in revenue † * Excluding markets that have home health licensure barriers ** Previously announced under development Based on 2016 data Encompass Health Note: One of the 130 IRFs and two of the 220 home health locations are nonconsolidated. 22 These locations are accounted for using the equity method of accounting.

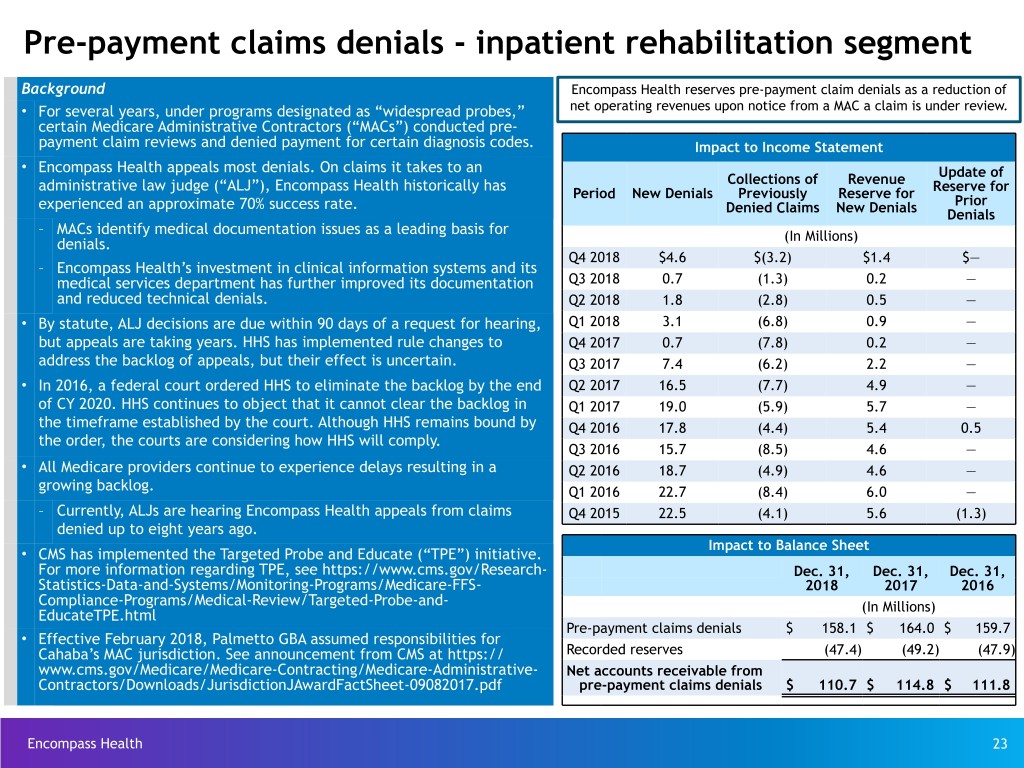

Pre-payment claims denials - inpatient rehabilitation segment Background Encompass Health reserves pre-payment claim denials as a reduction of • For several years, under programs designated as “widespread probes,” net operating revenues upon notice from a MAC a claim is under review. certain Medicare Administrative Contractors (“MACs”) conducted pre- payment claim reviews and denied payment for certain diagnosis codes. Impact to Income Statement • Encompass Health appeals most denials. On claims it takes to an Update of administrative law judge (“ALJ”), Encompass Health historically has Collections of Revenue Period New Denials Previously Reserve for Reserve for experienced an approximate 70% success rate. Prior Denied Claims New Denials Denials – MACs identify medical documentation issues as a leading basis for (In Millions) denials. Q4 2018 $4.6 $(3.2) $1.4 $— – Encompass Health’s investment in clinical information systems and its medical services department has further improved its documentation Q3 2018 0.7 (1.3) 0.2 — and reduced technical denials. Q2 2018 1.8 (2.8) 0.5 — • By statute, ALJ decisions are due within 90 days of a request for hearing, Q1 2018 3.1 (6.8) 0.9 — but appeals are taking years. HHS has implemented rule changes to Q4 2017 0.7 (7.8) 0.2 — address the backlog of appeals, but their effect is uncertain. Q3 2017 7.4 (6.2) 2.2 — • In 2016, a federal court ordered HHS to eliminate the backlog by the end Q2 2017 16.5 (7.7) 4.9 — of CY 2020. HHS continues to object that it cannot clear the backlog in Q1 2017 19.0 (5.9) 5.7 — the timeframe established by the court. Although HHS remains bound by Q4 2016 17.8 (4.4) 5.4 0.5 the order, the courts are considering how HHS will comply. Q3 2016 15.7 (8.5) 4.6 — • All Medicare providers continue to experience delays resulting in a Q2 2016 18.7 (4.9) 4.6 — growing backlog. Q1 2016 22.7 (8.4) 6.0 — – Currently, ALJs are hearing Encompass Health appeals from claims Q4 2015 22.5 (4.1) 5.6 (1.3) denied up to eight years ago. Impact to Balance Sheet • CMS has implemented the Targeted Probe and Educate (“TPE”) initiative. For more information regarding TPE, see https://www.cms.gov/Research- Dec. 31, Dec. 31, Dec. 31, Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS- 2018 2017 2016 Compliance-Programs/Medical-Review/Targeted-Probe-and- (In Millions) EducateTPE.html Pre-payment claims denials $ 158.1 $ 164.0 $ 159.7 • Effective February 2018, Palmetto GBA assumed responsibilities for Cahaba’s MAC jurisdiction. See announcement from CMS at https:// Recorded reserves (47.4) (49.2) (47.9) www.cms.gov/Medicare/Medicare-Contracting/Medicare-Administrative- Net accounts receivable from Contractors/Downloads/JurisdictionJAwardFactSheet-09082017.pdf pre-payment claims denials $ 110.7 $ 114.8 $ 111.8 Encompass Health 23

Expansion activity Inpatient Rehabilitation Facilities Previously announced 6 IRF development 4 New states # of New Beds projects underway 2018 2019 2020 De novo: Shelby County, AL 34 — — Bluffton, SC 38 — — 1 Murrieta, CA — 50 — 2 Katy, TX — 40 3 SiouxSioux Falls, Falls, SD SD — — 40 4 Coralville,Coralville, IA IA — — 40 Joint ventures: Murrells Inlet, SC 29 — — Q4 2018 expansion activity highlights: Winston-Salem,Winston-Salem, NC* NC 68 — — u Began operating a new 68-bed inpatient rehabilitation 5 Lubbock, TX — 40 — hospital in Winston-Salem, North Carolina in joint venture with Novant Health 6 Boise,Boise, ID ID — 40 — Bed expansions, net* 26 ~150 ~100 195 ~320 ~180 Home Health and Hospice # of Locations Dec. 31, 2017 237 Q4 2018 expansion activity highlights: Acquisitions 38 u Added four home health locations in Alabama, Opening of new locations 7 Massachusetts and South Carolina Merging of locations (4) u Added two hospice locations in Alabama and Texas Dec. 31, 2018 278 Encompass Health * Net bed expansions in each year may change due to the timing of certain regulatory approvals and/or construction delays. 24

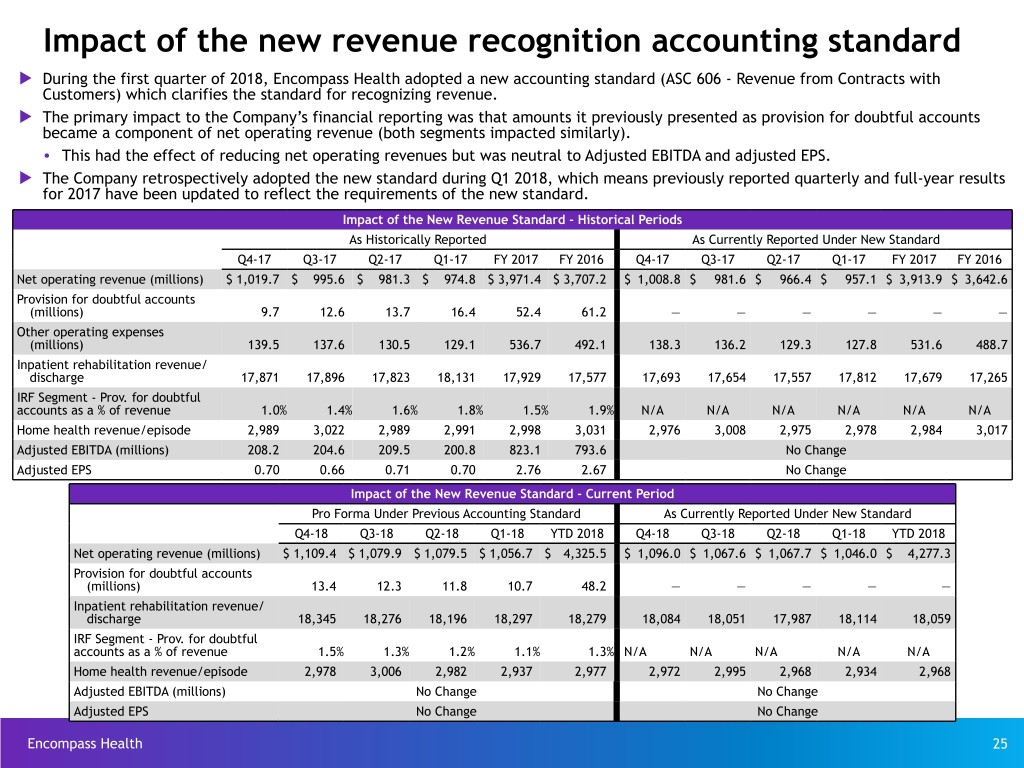

Impact of the new revenue recognition accounting standard u During the first quarter of 2018, Encompass Health adopted a new accounting standard (ASC 606 - Revenue from Contracts with Customers) which clarifies the standard for recognizing revenue. u The primary impact to the Company’s financial reporting was that amounts it previously presented as provision for doubtful accounts became a component of net operating revenue (both segments impacted similarly). • This had the effect of reducing net operating revenues but was neutral to Adjusted EBITDA and adjusted EPS. u The Company retrospectively adopted the new standard during Q1 2018, which means previously reported quarterly and full-year results for 2017 have been updated to reflect the requirements of the new standard. Impact of the New Revenue Standard - Historical Periods As Historically Reported As Currently Reported Under New Standard Q4-17 Q3-17 Q2-17 Q1-17 FY 2017 FY 2016 Q4-17 Q3-17 Q2-17 Q1-17 FY 2017 FY 2016 Net operating revenue (millions) $ 1,019.7 $ 995.6 $ 981.3 $ 974.8 $ 3,971.4 $ 3,707.2 $ 1,008.8 $ 981.6 $ 966.4 $ 957.1 $ 3,913.9 $ 3,642.6 Provision for doubtful accounts (millions) 9.7 12.6 13.7 16.4 52.4 61.2 — — — — — — Other operating expenses (millions) 139.5 137.6 130.5 129.1 536.7 492.1 138.3 136.2 129.3 127.8 531.6 488.7 Inpatient rehabilitation revenue/ discharge 17,871 17,896 17,823 18,131 17,929 17,577 17,693 17,654 17,557 17,812 17,679 17,265 IRF Segment - Prov. for doubtful accounts as a % of revenue 1.0% 1.4% 1.6% 1.8% 1.5% 1.9% N/A N/A N/A N/A N/A N/A Home health revenue/episode 2,989 3,022 2,989 2,991 2,998 3,031 2,976 3,008 2,975 2,978 2,984 3,017 Adjusted EBITDA (millions) 208.2 204.6 209.5 200.8 823.1 793.6 No Change Adjusted EPS 0.70 0.66 0.71 0.70 2.76 2.67 No Change Impact of the New Revenue Standard - Current Period Pro Forma Under Previous Accounting Standard As Currently Reported Under New Standard Q4-18 Q3-18 Q2-18 Q1-18 YTD 2018 Q4-18 Q3-18 Q2-18 Q1-18 YTD 2018 Net operating revenue (millions) $ 1,109.4 $ 1,079.9 $ 1,079.5 $ 1,056.7 $ 4,325.5 $ 1,096.0 $ 1,067.6 $ 1,067.7 $ 1,046.0 $ 4,277.3 Provision for doubtful accounts (millions) 13.4 12.3 11.8 10.7 48.2 — — — — — Inpatient rehabilitation revenue/ discharge 18,345 18,276 18,196 18,297 18,279 18,084 18,051 17,987 18,114 18,059 IRF Segment - Prov. for doubtful accounts as a % of revenue 1.5% 1.3% 1.2% 1.1% 1.3% N/A N/A N/A N/A N/A Home health revenue/episode 2,978 3,006 2,982 2,937 2,977 2,972 2,995 2,968 2,934 2,968 Adjusted EBITDA (millions) No Change No Change Adjusted EPS No Change No Change Encompass Health 25

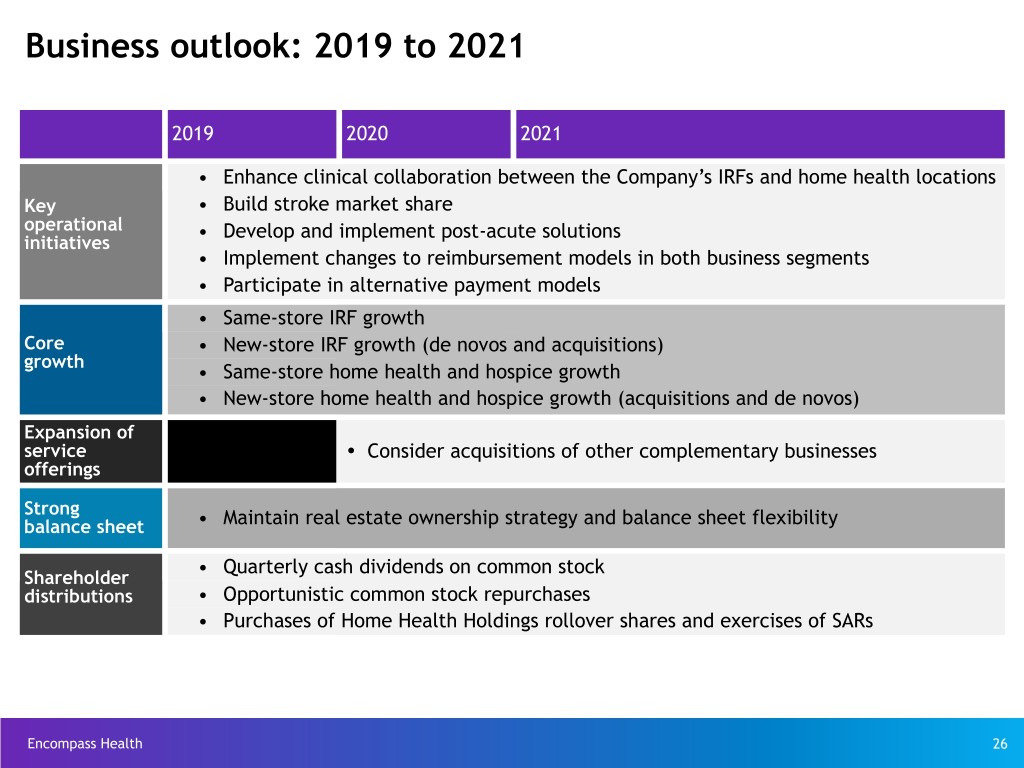

Business outlook: 2019 to 2021 2019 2020 2021 • Enhance clinical collaboration between the Company’s IRFs and home health locations Key • Build stroke market share operational • Develop and implement post-acute solutions initiatives • Implement changes to reimbursement models in both business segments • Participate in alternative payment models • Same-store IRF growth Core • New-store IRF growth (de novos and acquisitions) growth • Same-store home health and hospice growth • New-store home health and hospice growth (acquisitions and de novos) Expansion of service Ÿ Consider acquisitions of other complementary businesses offerings Strong balance sheet • Maintain real estate ownership strategy and balance sheet flexibility • Quarterly cash dividends on common stock Shareholder distributions • Opportunistic common stock repurchases • Purchases of Home Health Holdings rollover shares and exercises of SARs Encompass Health 26

Business outlook 2019 to 2021: revenue assumptions Volume Inpatient Rehabilitation* Home Health* (includes new stores) 3+% annual discharge growth 10+% annual admission growth Approx. 73% of segment revenue Approx. 85% of segment revenue Medicare Pricing FY 2019 FY 2020 FY 2021 CY 2019 CY 2021 (10) CY 2020 Amounts are approximations Q418-Q319 Q419-Q320 Q420-Q321 Q119-Q419 (11) Q121-Q421 Final Rule Estimate† Estimate† Final Rule Q120-Q420 Estimate† Market basket update 2.9% 3.0% 3.0% 3.0% 1.5% 3.0% Healthcare reform reduction (0.75%) - - - - - Legislative changes to the rural add-on program(11) - - - (0.1%) (0.2%) (0.1%) Change in outlier fixed-dollar loss ratio - - - 0.1% - - Healthcare reform productivity adjustment (0.8%) (0.6%) (0.6%) (0.8%) - (0.6%) Net market basket update 1.35% 2.4% 2.4% 2.2% 1.3% 2.3% Change in wage index (0.1%) - - - - - Change in CMG relative weights and average length of stay values (0.1%) - - - - - Change in outlier threshold (0.0%) - - - - - Impact from case mix re-weighting - - - (0.7%) - - Estimated impact to Encompass Health(12) 1.2% 1.5% (3.8%)** Medicare Advantage Approx. 20% of revenue Approx. 13% of revenue and managed care pricing Expected increases 2-4% 2-4% 2-4% 0-2% 0-2% 0-2% * Outpatient and hospice, which services accounted for 5.0% of total operating revenues for full-year 2018, are not included in the pricing assumptions. ** Estimated PDGM impact of (5.1%) plus 1.3% net market basket update; excludes potential CMS behavioral change reduction. See end note 11 for further details. † Estimates are based on current CMS and Congressional Budget Office projections Encompass Health which do not include potential changes from legislation or the CMS rule-making process. 27 Refer to pages 48-50 for end notes.

Business outlook 2019 to 2021: labor and other expense assumptions Inpatient Rehabilitation Home Health and Hospice Salaries and Benefits 2019 2020 2021 Salary increases 2.75-3.25% 2.75-3.25% 2.85-3.35% Benefit costs increases 6-8% 5-10% 5-10% % of Salaries and Benefits Salaries Salaries Salaries ~90% and benefits and benefits ~70% Benefits ~10% ~85% IRF Other expenses expenses ~30% ~15% IRF Expenses Home Health and Hospice Expenses •Other operating expenses and supply •Other operating expenses and supply costs tracking with inflation costs tracking with inflation Encompass Health 28

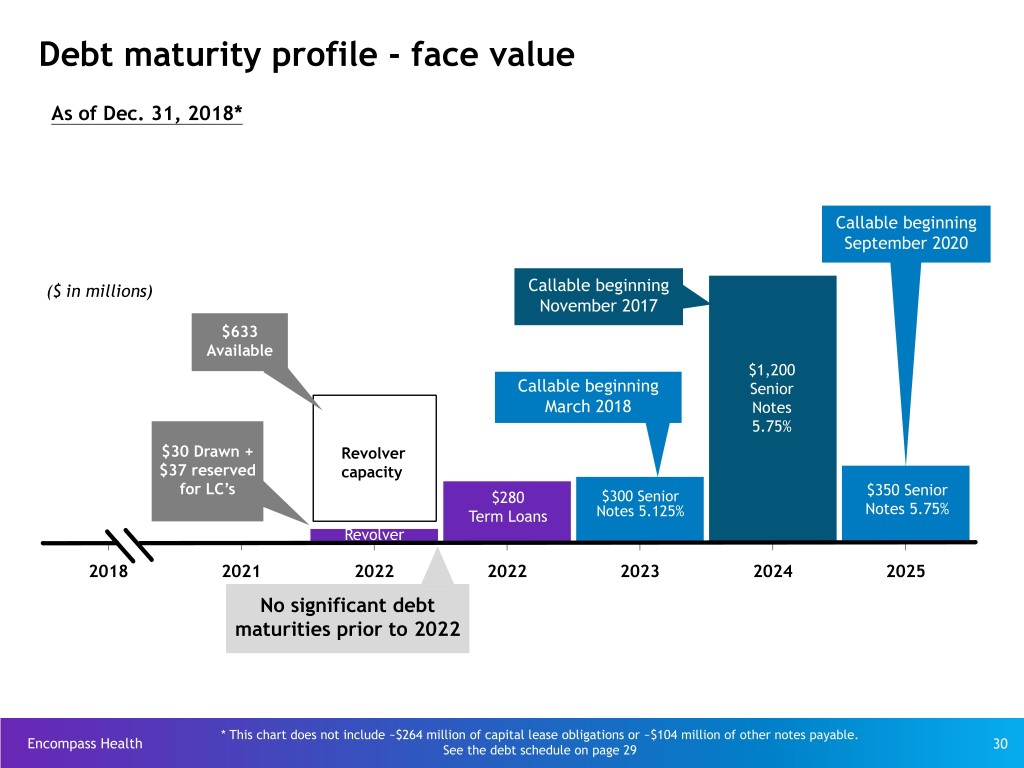

Debt schedule Change in December 31, December 31, Debt vs. ($millions) 2018 2017 YE 2017 Advances under $700 million revolving credit facility, September 2022 - LIBOR +150bps $ 30.0 $ 95.0 $ (65.0) Term loan facility, September 2022 - LIBOR +150bps 280.1 294.7 (14.6) Bonds Payable: 5.125% Senior Notes due 2023 296.6 295.9 0.7 5.75% Senior Notes due 2024 1,194.7 1,193.9 0.8 5.75% Senior Notes due 2025 345.0 344.4 0.6 Other notes payable 104.2 82.3 21.9 Capital lease obligations 263.8 271.5 (7.7) Long-term debt $ 2,514.4 $ 2,577.7 $ (63.3) Debt to Adjusted EBITDA 2.8x 3.1x Encompass Health Reconciliations to GAAP provided on pages 39-47 29

Debt maturity profile - face value As of Dec. 31, 2018* Callable beginning September 2020 ($ in millions) Callable beginning November 2017 $633 Available $1,200 Callable beginning Senior March 2018 Notes 5.75% $30 Drawn + Revolver $37 reserved capacity for LC’s $280 $300 Senior $350 Senior Term Loans Notes 5.125% Notes 5.75% Revolver 2018 2021 2022 2022 2023 2024 2025 No significant debt maturities prior to 2022 * This chart does not include ~$264 million of capital lease obligations or ~$104 million of other notes payable. Encompass Health See the debt schedule on page 29 30

New-store/same-store growth Inpatient Rehabilitation Reliant (857 beds) 25.0 Franklin, TN (40 beds) Bryan, TX (49 beds) Broken Arrow, OK (22 beds) Shelby County, AL (34 beds) Bluffton, SC (38 beds) 20.0 Hot Springs, AR (27 beds) Pearland, TX 15.0 Gulfport, MS (33 beds) (40 beds) Westerville, OH (60 beds) Winston-Salem, NC (68 beds) 10.0 Jackson, TN Murrells Inlet, (48 beds) Modesto, CA SC (29 beds) (50 beds) 5.0 0.0 Discharges Q1Q1 20162016 Q2Q2 20162016 Q3Q3 20162016 Q4Q4 20162016 Q1Q1 20172017 Q2Q2 20172017 Q3Q3 20172017 Q4Q4 20172017 QQ11 22018018 QQ22 22018018 QQ33 22018018 QQ44 22018018 New store 14.2% 11.7% 10.7% 1.3% 1.2% 1.9% 2.4% 2.0% 1.9% 1.6% 1.0% 1.7% Same store 2.8% 1.9% 1.9% 0.1% 1.6% 1.6% 1.4% 3.9% 4.8% 3.6% 2.0% 1.9% Total by qtr. 17.0% 13.6% 12.6% 1.4% 2.8% 3.5% 3.8% 5.9% 6.7% 5.2% 3.0% 3.6% Total by year 10.8% 4.0% 4.6% Same-store year* 1.7% 1.8% 2.8% Same-store year UDS(13) (0.6)% (0.5)% * Includes consolidated inpatient rehabilitation hospitals classified as same store during each period Encompass Health Refer to pages 48-50 for end notes. 31

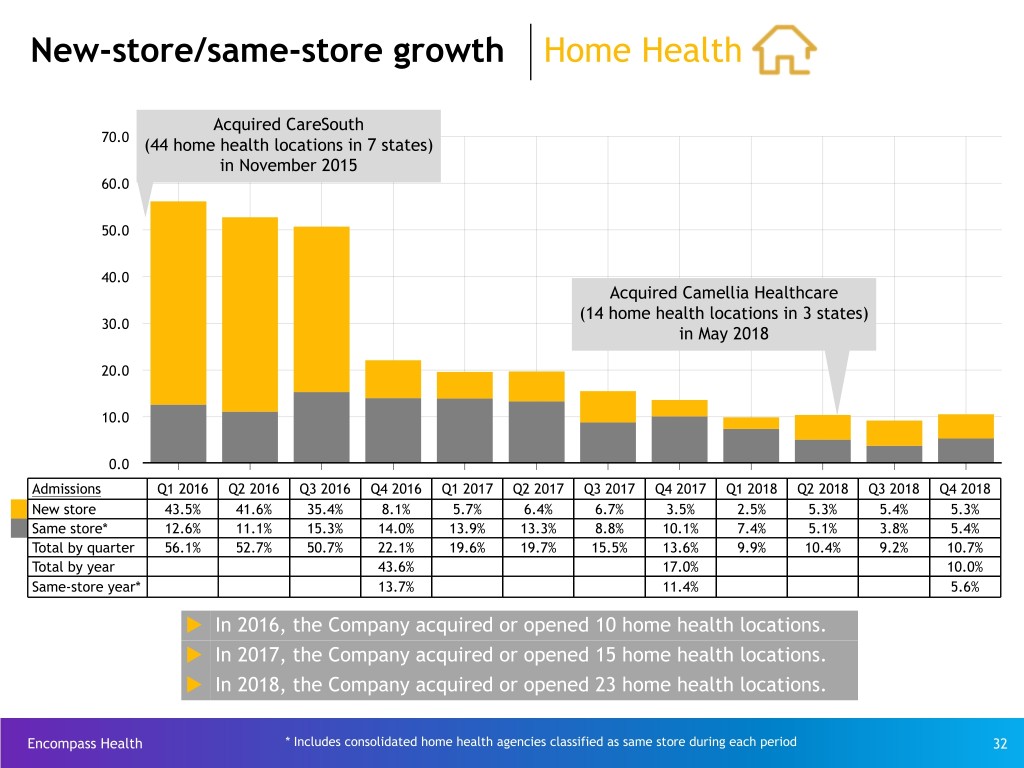

New-store/same-store growth Home Health Acquired CareSouth 70.0 (44 home health locations in 7 states) in November 2015 60.0 50.0 40.0 Acquired Camellia Healthcare (14 home health locations in 3 states) 30.0 in May 2018 20.0 10.0 0.0 Admissions QQ11 2 2016016 QQ22 22016016 QQ33 22016016 QQ44 22016016 QQ11 22017017 QQ22 22017017 QQ33 22017017 QQ44 22017017 QQ11 22018018 QQ22 22018018 Q3Q3 20182018 Q4Q4 20182018 New store 43.5% 41.6% 35.4% 8.1% 5.7% 6.4% 6.7% 3.5% 2.5% 5.3% 5.4% 5.3% Same store* 12.6% 11.1% 15.3% 14.0% 13.9% 13.3% 8.8% 10.1% 7.4% 5.1% 3.8% 5.4% Total by quarter 56.1% 52.7% 50.7% 22.1% 19.6% 19.7% 15.5% 13.6% 9.9% 10.4% 9.2% 10.7% Total by year 43.6% 17.0% 10.0% Same-store year* 13.7% 11.4% 5.6% u In 2016, the Company acquired or opened 10 home health locations. u In 2017, the Company acquired or opened 15 home health locations. u In 2018, the Company acquired or opened 23 home health locations. Encompass Health * Includes consolidated home health agencies classified as same store during each period 32

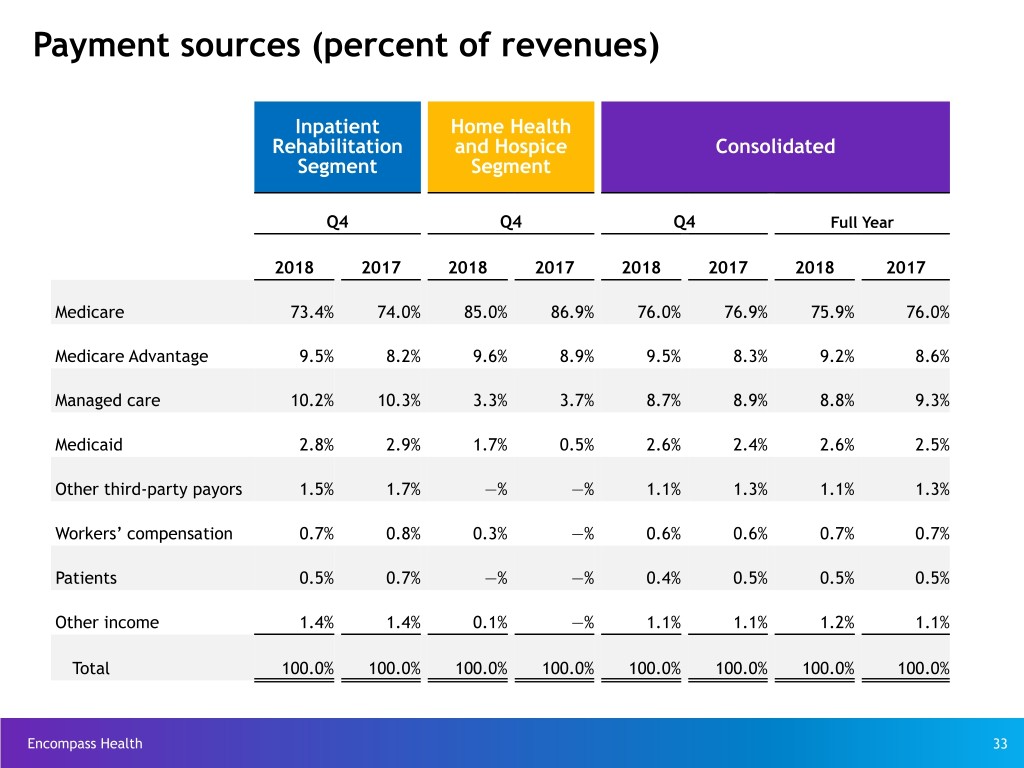

Payment sources (percent of revenues) Inpatient Home Health Rehabilitation and Hospice Consolidated Segment Segment Q4 Q4 Q4 Full Year 2018 2017 2018 2017 2018 2017 2018 2017 Medicare 73.4% 74.0% 85.0% 86.9% 76.0% 76.9% 75.9% 76.0% Medicare Advantage 9.5% 8.2% 9.6% 8.9% 9.5% 8.3% 9.2% 8.6% Managed care 10.2% 10.3% 3.3% 3.7% 8.7% 8.9% 8.8% 9.3% Medicaid 2.8% 2.9% 1.7% 0.5% 2.6% 2.4% 2.6% 2.5% Other third-party payors 1.5% 1.7% —% —% 1.1% 1.3% 1.1% 1.3% Workers’ compensation 0.7% 0.8% 0.3% —% 0.6% 0.6% 0.7% 0.7% Patients 0.5% 0.7% —% —% 0.4% 0.5% 0.5% 0.5% Other income 1.4% 1.4% 0.1% —% 1.1% 1.1% 1.2% 1.1% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% Encompass Health 33

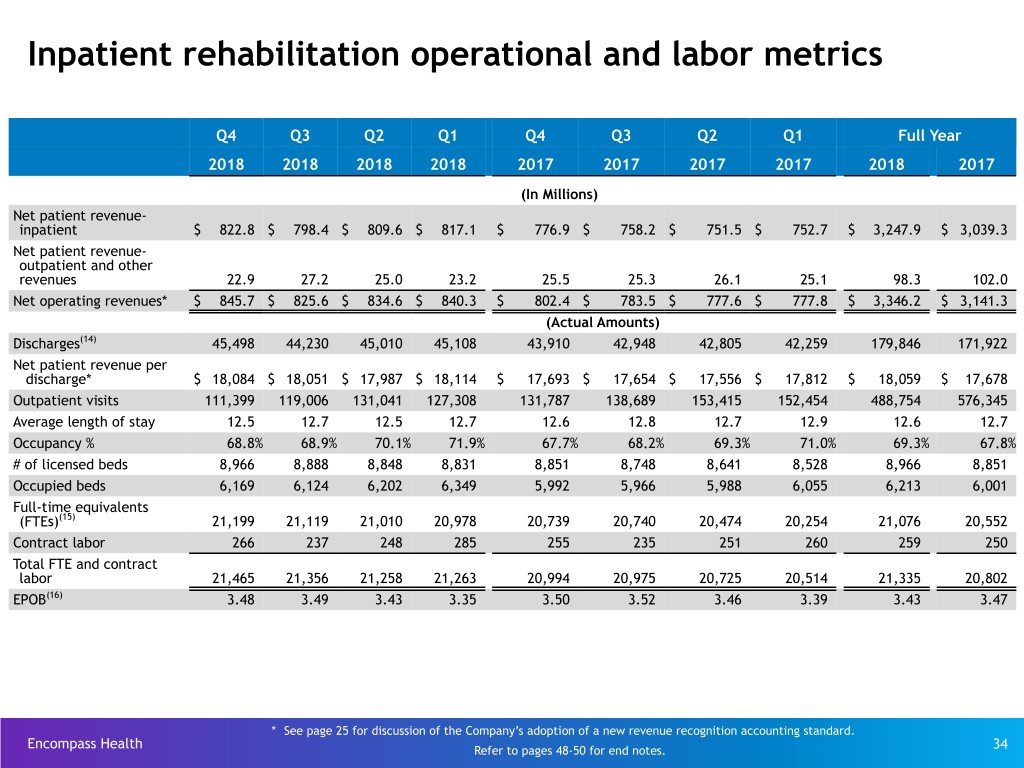

Inpatient rehabilitation operational and labor metrics Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year 2018 2018 2018 2018 2017 2017 2017 2017 2018 2017 (In Millions) Net patient revenue- inpatient $ 822.8 $ 798.4 $ 809.6 $ 817.1 $ 776.9 $ 758.2 $ 751.5 $ 752.7 $ 3,247.9 $ 3,039.3 Net patient revenue- outpatient and other revenues 22.9 27.2 25.0 23.2 25.5 25.3 26.1 25.1 98.3 102.0 Net operating revenues* $ 845.7 $ 825.6 $ 834.6 $ 840.3 $ 802.4 $ 783.5 $ 777.6 $ 777.8 $ 3,346.2 $ 3,141.3 (Actual Amounts) Discharges(14) 45,498 44,230 45,010 45,108 43,910 42,948 42,805 42,259 179,846 171,922 Net patient revenue per discharge* $ 18,084 $ 18,051 $ 17,987 $ 18,114 $ 17,693 $ 17,654 $ 17,556 $ 17,812 $ 18,059 $ 17,678 Outpatient visits 111,399 119,006 131,041 127,308 131,787 138,689 153,415 152,454 488,754 576,345 Average length of stay 12.5 12.7 12.5 12.7 12.6 12.8 12.7 12.9 12.6 12.7 Occupancy % 68.8% 68.9% 70.1% 71.9% 67.7% 68.2% 69.3% 71.0% 69.3% 67.8% # of licensed beds 8,966 8,888 8,848 8,831 8,851 8,748 8,641 8,528 8,966 8,851 Occupied beds 6,169 6,124 6,202 6,349 5,992 5,966 5,988 6,055 6,213 6,001 Full-time equivalents (FTEs)(15) 21,199 21,119 21,010 20,978 20,739 20,740 20,474 20,254 21,076 20,552 Contract labor 266 237 248 285 255 235 251 260 259 250 Total FTE and contract labor 21,465 21,356 21,258 21,263 20,994 20,975 20,725 20,514 21,335 20,802 EPOB(16) 3.48 3.49 3.43 3.35 3.50 3.52 3.46 3.39 3.43 3.47 * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health Refer to pages 48-50 for end notes. 34

Home health and hospice operational metrics Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1 Full Year 2018 2018 2018 2018 2017 2017 2017 2017 2018 2017 (In Millions) Net home health revenue $ 215.3 $ 209.2 $ 204.8 $ 185.3 $ 186.3 $ 180.3 $ 171.9 $ 163.9 $ 814.6 $ 702.4 Net hospice revenue 35.0 32.8 28.3 20.4 20.1 17.8 16.9 15.4 116.5 70.2 Net operating revenues* $ 250.3 $ 242.0 $ 233.1 $ 205.7 $ 206.4 $ 198.1 $ 188.8 $ 179.3 $ 931.1 $ 772.6 Home Health: (Actual Amounts) Admissions(17) 35,151 34,364 34,026 33,855 31,766 31,471 30,823 30,810 137,396 124,870 Recertifications 29,530 28,733 28,089 25,229 25,479 24,396 22,568 20,546 111,581 92,989 Episodes 64,037 61,765 61,238 56,658 56,625 53,757 52,101 49,260 243,698 211,743 Average revenue per episode* $ 2,972 $ 2,995 $ 2,968 $ 2,934 $ 2,976 $ 3,008 $ 2,975 $ 2,978 $ 2,968 $ 2,984 Episodic visits per episode 17.4 17.6 17.5 17.9 17.3 17.7 18.1 18.7 17.6 17.9 Total visits 1,285,150 1,259,055 1,240,490 1,174,950 1,124,268 1,101,109 1,095,225 1,070,356 4,959,645 4,390,958 Cost per visit $ 76 $ 77 $ 76 $ 75 $ 77 $ 76 $ 73 $ 75 $ 76 $ 75 Hospice: Admissions(18) 2,030 2,054 1,797 1,593 1,355 1,273 1,114 1,128 7,474 4,870 Patient days 231,515 223,834 192,404 143,231 134,113 123,491 113,028 108,717 790,984 479,350 Revenue per day* $ 151 $ 147 $ 148 $ 142 $ 150 $ 145 $ 149 $ 141 $ 147 $ 146 * See page 25 for discussion of the Company’s adoption of a new revenue recognition accounting standard. Encompass Health Refer to pages 48-50 for end notes. 35

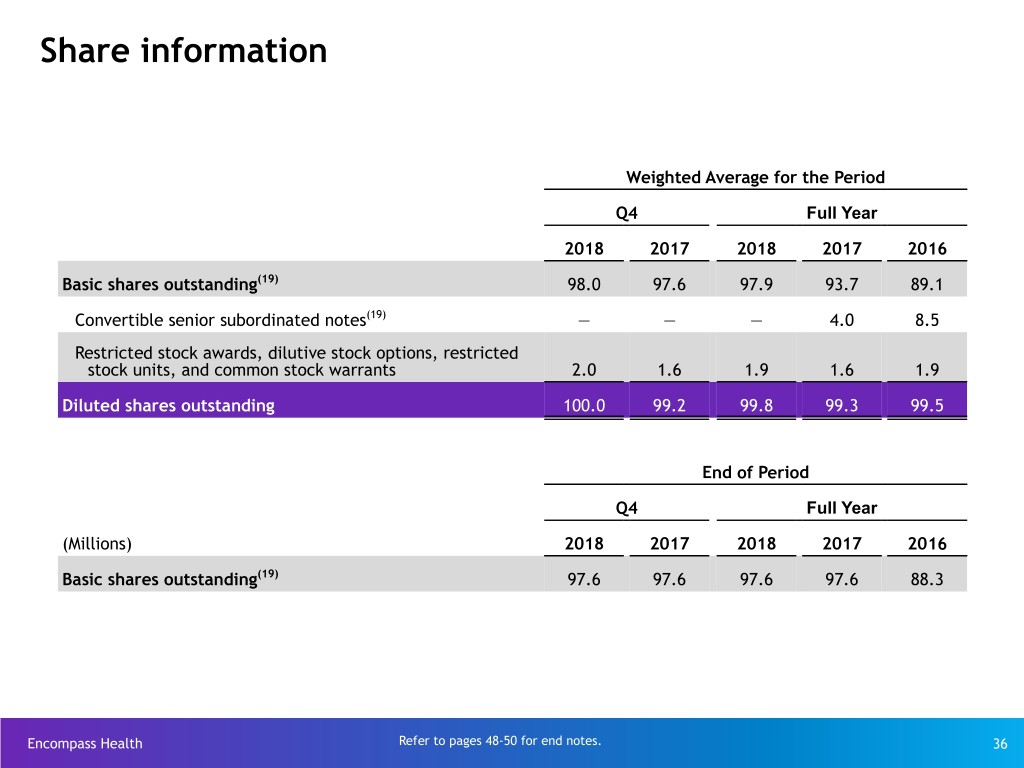

Share information Weighted Average for the Period Q4 Full Year 2018 2017 2018 2017 2016 Basic shares outstanding(19) 98.0 97.6 97.9 93.7 89.1 Convertible senior subordinated notes(19) — — — 4.0 8.5 Restricted stock awards, dilutive stock options, restricted stock units, and common stock warrants 2.0 1.6 1.9 1.6 1.9 Diluted shares outstanding 100.0 99.2 99.8 99.3 99.5 End of Period Q4 Full Year (Millions) 2018 2017 2018 2017 2016 Basic shares outstanding(19) 97.6 97.6 97.6 97.6 88.3 Encompass Health Refer to pages 48-50 for end notes. 36

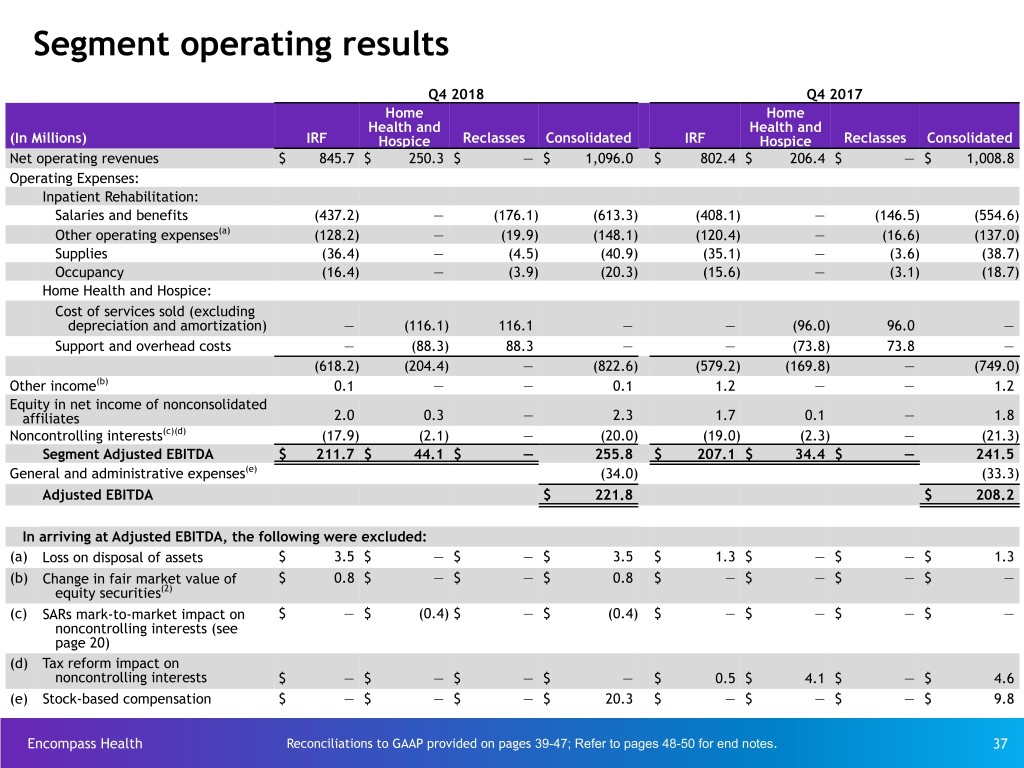

Segment operating results Q4 2018 Q4 2017 Home Home Health and Health and (In Millions) IRF Hospice Reclasses Consolidated IRF Hospice Reclasses Consolidated Net operating revenues $ 845.7 $ 250.3 $ — $ 1,096.0 $ 802.4 $ 206.4 $ — $ 1,008.8 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (437.2) — (176.1) (613.3) (408.1) — (146.5) (554.6) Other operating expenses(a) (128.2) — (19.9) (148.1) (120.4) — (16.6) (137.0) Supplies (36.4) — (4.5) (40.9) (35.1) — (3.6) (38.7) Occupancy (16.4) — (3.9) (20.3) (15.6) — (3.1) (18.7) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (116.1) 116.1 — — (96.0) 96.0 — Support and overhead costs — (88.3) 88.3 — — (73.8) 73.8 — (618.2) (204.4) — (822.6) (579.2) (169.8) — (749.0) Other income(b) 0.1 — — 0.1 1.2 — — 1.2 Equity in net income of nonconsolidated affiliates 2.0 0.3 — 2.3 1.7 0.1 — 1.8 Noncontrolling interests(c)(d) (17.9) (2.1) — (20.0) (19.0) (2.3) — (21.3) Segment Adjusted EBITDA $ 211.7 $ 44.1 $ — 255.8 $ 207.1 $ 34.4 $ — 241.5 General and administrative expenses(e) (34.0) (33.3) Adjusted EBITDA $ 221.8 $ 208.2 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss on disposal of assets $ 3.5 $ — $ — $ 3.5 $ 1.3 $ — $ — $ 1.3 (b) Change in fair market value of $ 0.8 $ — $ — $ 0.8 $ — $ — $ — $ — equity securities(2) (c) SARs mark-to-market impact on $ — $ (0.4) $ — $ (0.4) $ — $ — $ — $ — noncontrolling interests (see page 20) (d) Tax reform impact on noncontrolling interests $ — $ — $ — $ — $ 0.5 $ 4.1 $ — $ 4.6 (e) Stock-based compensation $ — $ — $ — $ 20.3 $ — $ — $ — $ 9.8 Encompass Health Reconciliations to GAAP provided on pages 39-47; Refer to pages 48-50 for end notes. 37

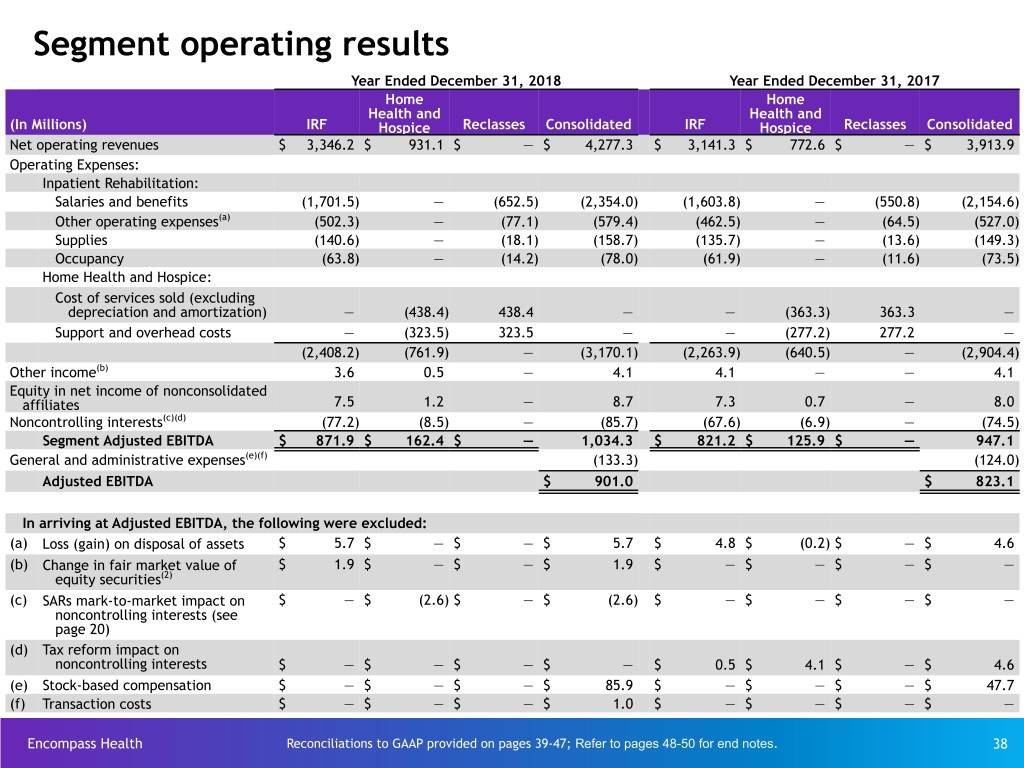

Segment operating results Year Ended December 31, 2018 Year Ended December 31, 2017 Home Home Health and Health and (In Millions) IRF Hospice Reclasses Consolidated IRF Hospice Reclasses Consolidated Net operating revenues $ 3,346.2 $ 931.1 $ — $ 4,277.3 $ 3,141.3 $ 772.6 $ — $ 3,913.9 Operating Expenses: Inpatient Rehabilitation: Salaries and benefits (1,701.5) — (652.5) (2,354.0) (1,603.8) — (550.8) (2,154.6) Other operating expenses(a) (502.3) — (77.1) (579.4) (462.5) — (64.5) (527.0) Supplies (140.6) — (18.1) (158.7) (135.7) — (13.6) (149.3) Occupancy (63.8) — (14.2) (78.0) (61.9) — (11.6) (73.5) Home Health and Hospice: Cost of services sold (excluding depreciation and amortization) — (438.4) 438.4 — — (363.3) 363.3 — Support and overhead costs — (323.5) 323.5 — — (277.2) 277.2 — (2,408.2) (761.9) — (3,170.1) (2,263.9) (640.5) — (2,904.4) Other income(b) 3.6 0.5 — 4.1 4.1 — — 4.1 Equity in net income of nonconsolidated affiliates 7.5 1.2 — 8.7 7.3 0.7 — 8.0 Noncontrolling interests(c)(d) (77.2) (8.5) — (85.7) (67.6) (6.9) — (74.5) Segment Adjusted EBITDA $ 871.9 $ 162.4 $ — 1,034.3 $ 821.2 $ 125.9 $ — 947.1 General and administrative expenses(e)(f) (133.3) (124.0) Adjusted EBITDA $ 901.0 $ 823.1 In arriving at Adjusted EBITDA, the following were excluded: (a) Loss (gain) on disposal of assets $ 5.7 $ — $ — $ 5.7 $ 4.8 $ (0.2) $ — $ 4.6 (b) Change in fair market value of $ 1.9 $ — $ — $ 1.9 $ — $ — $ — $ — equity securities(2) (c) SARs mark-to-market impact on $ — $ (2.6) $ — $ (2.6) $ — $ — $ — $ — noncontrolling interests (see page 20) (d) Tax reform impact on noncontrolling interests $ — $ — $ — $ — $ 0.5 $ 4.1 $ — $ 4.6 (e) Stock-based compensation $ — $ — $ — $ 85.9 $ — $ — $ — $ 47.7 (f) Transaction costs $ — $ — $ — $ 1.0 $ — $ — $ — $ — Encompass Health Reconciliations to GAAP provided on pages 39-47; Refer to pages 48-50 for end notes. 38

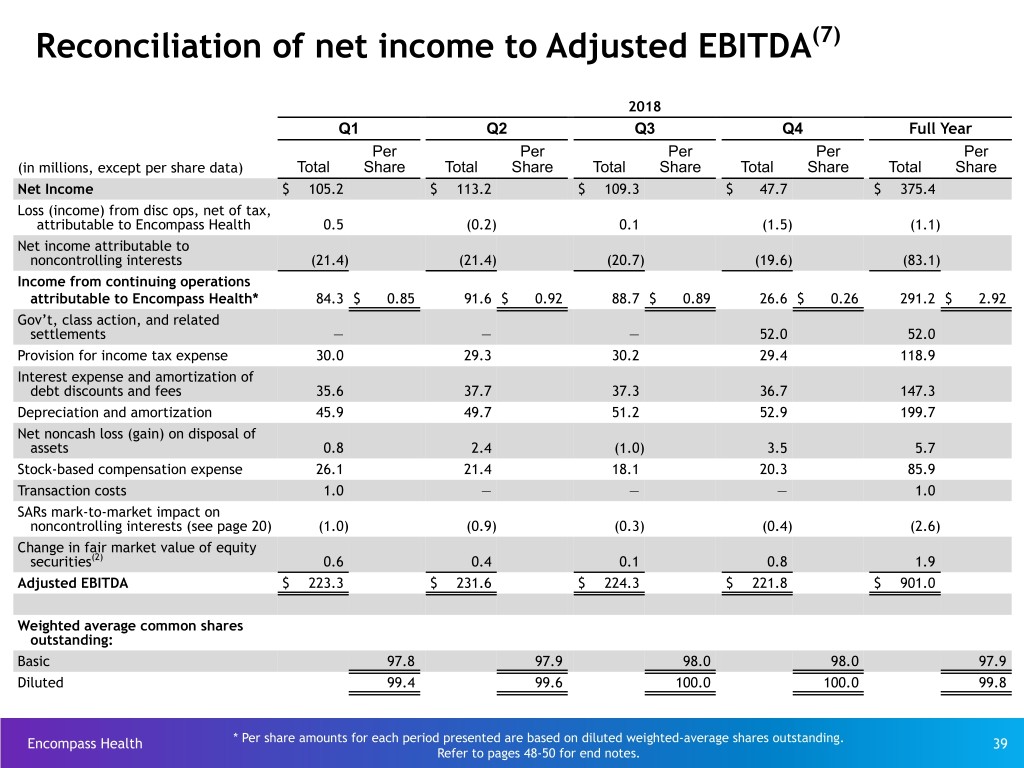

Reconciliation of net income to Adjusted EBITDA(7) 2018 Q1 Q2 Q3 Q4 Full Year Per Per Per Per Per (in millions, except per share data) Total Share Total Share Total Share Total Share Total Share Net Income $ 105.2 $ 113.2 $ 109.3 $ 47.7 $ 375.4 Loss (income) from disc ops, net of tax, attributable to Encompass Health 0.5 (0.2) 0.1 (1.5) (1.1) Net income attributable to noncontrolling interests (21.4) (21.4) (20.7) (19.6) (83.1) Income from continuing operations attributable to Encompass Health* 84.3 $ 0.85 91.6 $ 0.92 88.7 $ 0.89 26.6 $ 0.26 291.2 $ 2.92 Gov’t, class action, and related settlements — — — 52.0 52.0 Provision for income tax expense 30.0 29.3 30.2 29.4 118.9 Interest expense and amortization of debt discounts and fees 35.6 37.7 37.3 36.7 147.3 Depreciation and amortization 45.9 49.7 51.2 52.9 199.7 Net noncash loss (gain) on disposal of assets 0.8 2.4 (1.0) 3.5 5.7 Stock-based compensation expense 26.1 21.4 18.1 20.3 85.9 Transaction costs 1.0 — — — 1.0 SARs mark-to-market impact on noncontrolling interests (see page 20) (1.0) (0.9) (0.3) (0.4) (2.6) Change in fair market value of equity securities(2) 0.6 0.4 0.1 0.8 1.9 Adjusted EBITDA $ 223.3 $ 231.6 $ 224.3 $ 221.8 $ 901.0 Weighted average common shares outstanding: Basic 97.8 97.9 98.0 98.0 97.9 Diluted 99.4 99.6 100.0 100.0 99.8 Encompass Health * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. 39 Refer to pages 48-50 for end notes.

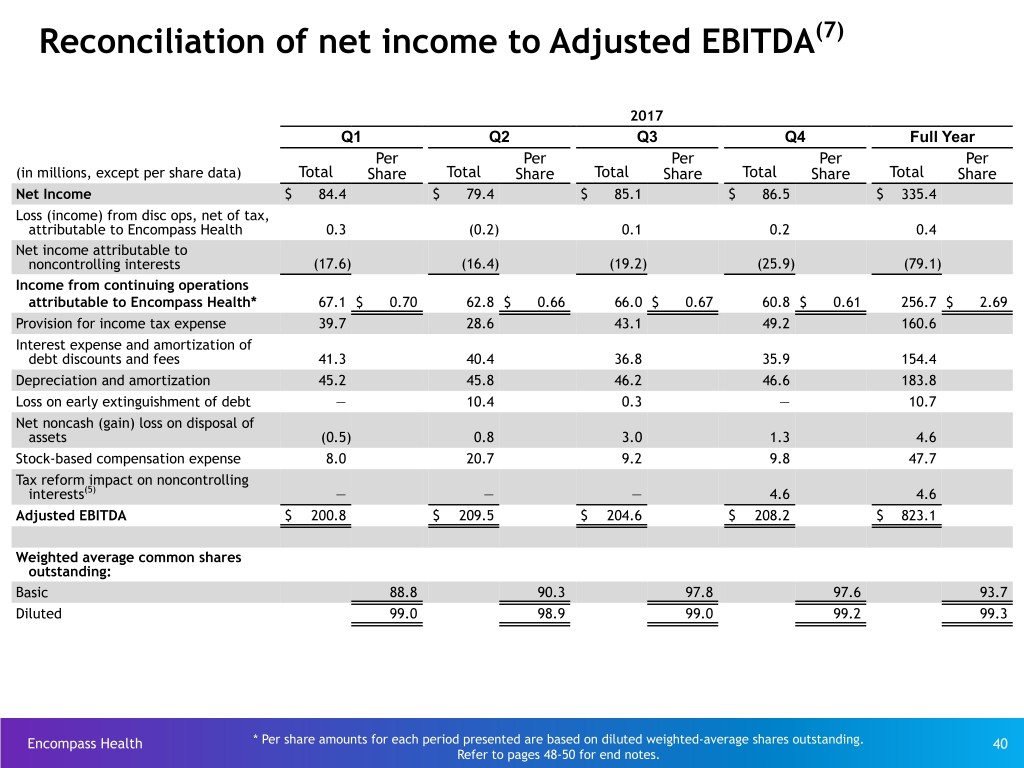

Reconciliation of net income to Adjusted EBITDA(7) 2017 Q1 Q2 Q3 Q4 Full Year Per Per Per Per Per (in millions, except per share data) Total Share Total Share Total Share Total Share Total Share Net Income $ 84.4 $ 79.4 $ 85.1 $ 86.5 $ 335.4 Loss (income) from disc ops, net of tax, attributable to Encompass Health 0.3 (0.2) 0.1 0.2 0.4 Net income attributable to noncontrolling interests (17.6) (16.4) (19.2) (25.9) (79.1) Income from continuing operations attributable to Encompass Health* 67.1 $ 0.70 62.8 $ 0.66 66.0 $ 0.67 60.8 $ 0.61 256.7 $ 2.69 Provision for income tax expense 39.7 28.6 43.1 49.2 160.6 Interest expense and amortization of debt discounts and fees 41.3 40.4 36.8 35.9 154.4 Depreciation and amortization 45.2 45.8 46.2 46.6 183.8 Loss on early extinguishment of debt — 10.4 0.3 — 10.7 Net noncash (gain) loss on disposal of assets (0.5) 0.8 3.0 1.3 4.6 Stock-based compensation expense 8.0 20.7 9.2 9.8 47.7 Tax reform impact on noncontrolling interests(5) — — — 4.6 4.6 Adjusted EBITDA $ 200.8 $ 209.5 $ 204.6 $ 208.2 $ 823.1 Weighted average common shares outstanding: Basic 88.8 90.3 97.8 97.6 93.7 Diluted 99.0 98.9 99.0 99.2 99.3 Encompass Health * Per share amounts for each period presented are based on diluted weighted-average shares outstanding. 40 Refer to pages 48-50 for end notes.

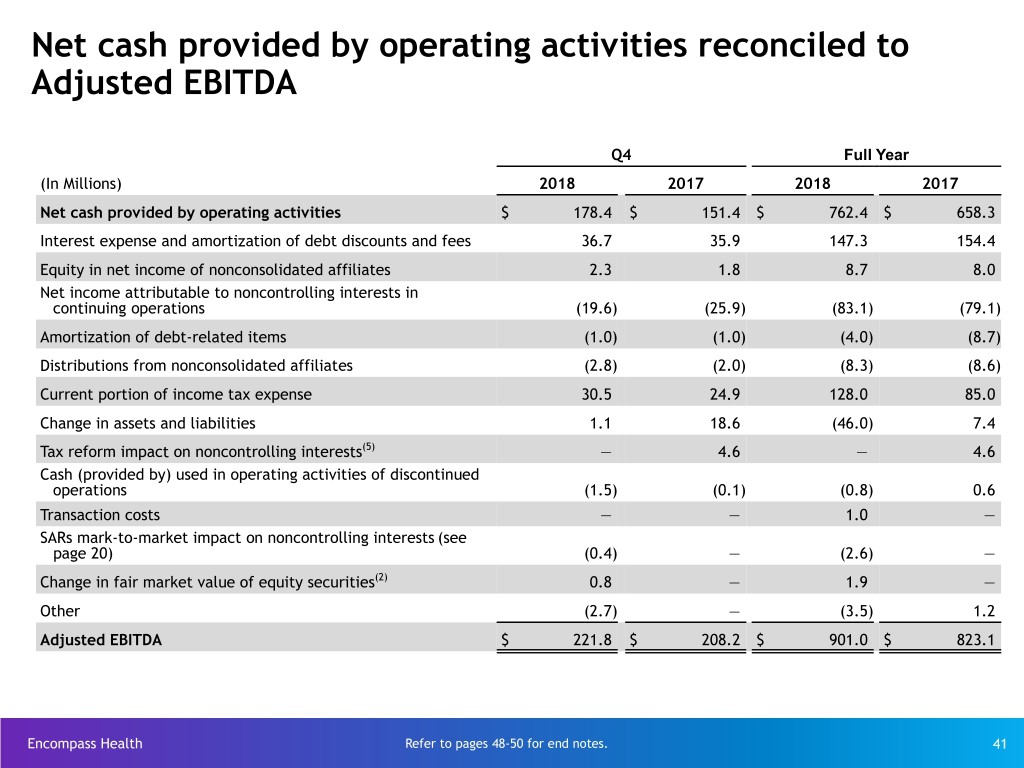

Net cash provided by operating activities reconciled to Adjusted EBITDA Q4 Full Year (In Millions) 2018 2017 2018 2017 Net cash provided by operating activities $ 178.4 $ 151.4 $ 762.4 $ 658.3 Interest expense and amortization of debt discounts and fees 36.7 35.9 147.3 154.4 Equity in net income of nonconsolidated affiliates 2.3 1.8 8.7 8.0 Net income attributable to noncontrolling interests in continuing operations (19.6) (25.9) (83.1) (79.1) Amortization of debt-related items (1.0) (1.0) (4.0) (8.7) Distributions from nonconsolidated affiliates (2.8) (2.0) (8.3) (8.6) Current portion of income tax expense 30.5 24.9 128.0 85.0 Change in assets and liabilities 1.1 18.6 (46.0) 7.4 Tax reform impact on noncontrolling interests(5) — 4.6 — 4.6 Cash (provided by) used in operating activities of discontinued operations (1.5) (0.1) (0.8) 0.6 Transaction costs — — 1.0 — SARs mark-to-market impact on noncontrolling interests (see page 20) (0.4) — (2.6) — Change in fair market value of equity securities(2) 0.8 — 1.9 — Other (2.7) — (3.5) 1.2 Adjusted EBITDA $ 221.8 $ 208.2 $ 901.0 $ 823.1 Encompass Health Refer to pages 48-50 for end notes. 41

Reconciliation of segment Adjusted EBITDA to income from continuing operations before income tax expense Three Months Ended Year Ended December 31, December 31, 2018 2017 2018 2017 (In Millions) Total segment Adjusted EBITDA $ 255.8 $ 241.5 $ 1,034.3 $ 947.1 General and administrative expenses (54.3) (43.1) (220.2) (171.7) Depreciation and amortization (52.9) (46.6) (199.7) (183.8) Loss on disposal of assets (3.5) (1.3) (5.7) (4.6) Government, class action, and related settlements (52.0) — (52.0) — Loss on early extinguishment of debt — — — (10.7) Interest expense and amortization of debt discounts and fees (36.7) (35.9) (147.3) (154.4) Net income attributable to noncontrolling interests 19.6 25.9 83.1 79.1 SARs mark-to-market impact on noncontrolling interests (see page 20) 0.4 — 2.6 — Change in fair market value of equity securities(2) (0.8) — (1.9) — Tax reform impact on noncontrolling interests(5) — (4.6) — (4.6) Income from continuing operations before income tax expense $ 75.6 $ 135.9 $ 493.2 $ 496.4 Encompass Health Refer to pages 48-50 for end notes. 42

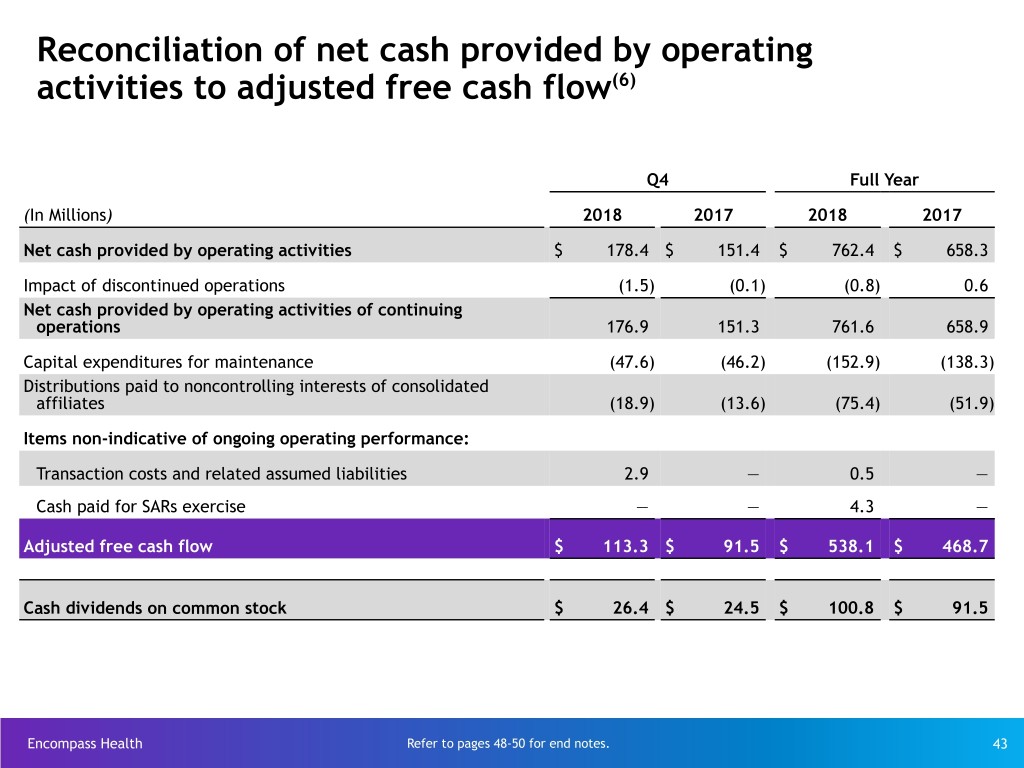

Reconciliation of net cash provided by operating activities to adjusted free cash flow(6) Q4 Full Year (In Millions) 2018 2017 2018 2017 Net cash provided by operating activities $ 178.4 $ 151.4 $ 762.4 $ 658.3 Impact of discontinued operations (1.5) (0.1) (0.8) 0.6 Net cash provided by operating activities of continuing operations 176.9 151.3 761.6 658.9 Capital expenditures for maintenance (47.6) (46.2) (152.9) (138.3) Distributions paid to noncontrolling interests of consolidated affiliates (18.9) (13.6) (75.4) (51.9) Items non-indicative of ongoing operating performance: Transaction costs and related assumed liabilities 2.9 — 0.5 — Cash paid for SARs exercise — — 4.3 — Adjusted free cash flow $ 113.3 $ 91.5 $ 538.1 $ 468.7 Cash dividends on common stock $ 26.4 $ 24.5 $ 100.8 $ 91.5 Encompass Health Refer to pages 48-50 for end notes. 43

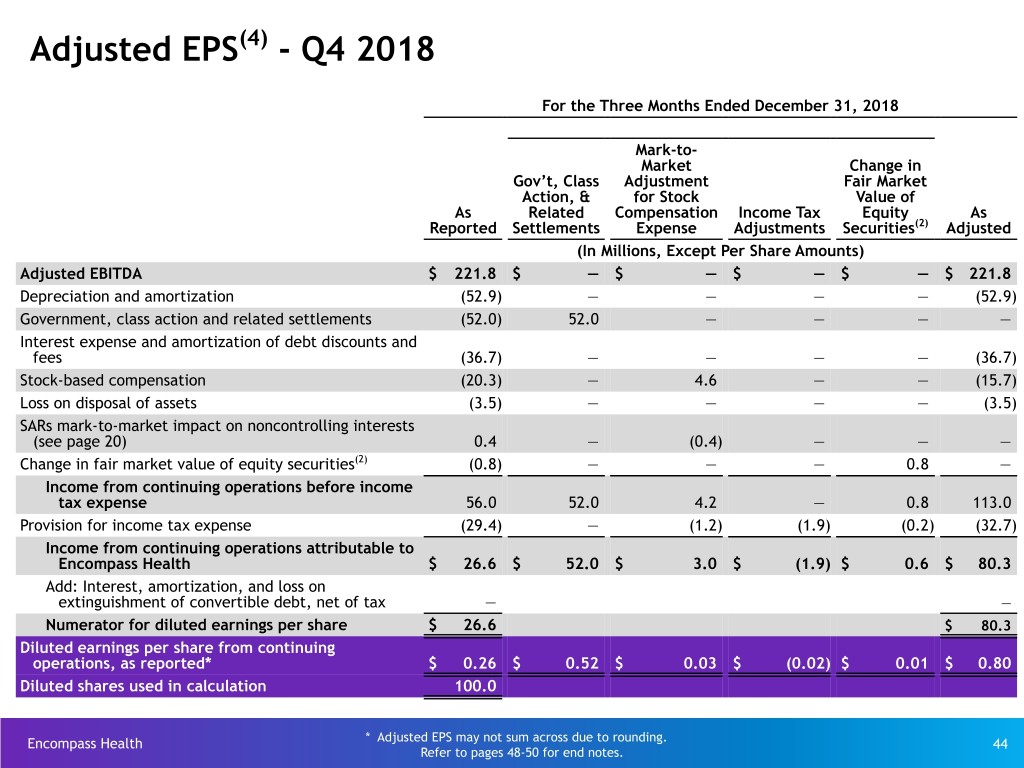

Adjusted EPS(4) - Q4 2018 For the Three Months Ended December 31, 2018 Mark-to- Market Change in Gov’t, Class Adjustment Fair Market Action, & for Stock Value of As Related Compensation Income Tax Equity As Reported Settlements Expense Adjustments Securities(2) Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 221.8 $ — $ — $ — $ — $ 221.8 Depreciation and amortization (52.9) — — — — (52.9) Government, class action and related settlements (52.0) 52.0 — — — — Interest expense and amortization of debt discounts and fees (36.7) — — — — (36.7) Stock-based compensation (20.3) — 4.6 — — (15.7) Loss on disposal of assets (3.5) — — — — (3.5) SARs mark-to-market impact on noncontrolling interests (see page 20) 0.4 — (0.4) — — — Change in fair market value of equity securities(2) (0.8) — — — 0.8 — Income from continuing operations before income tax expense 56.0 52.0 4.2 — 0.8 113.0 Provision for income tax expense (29.4) — (1.2) (1.9) (0.2) (32.7) Income from continuing operations attributable to Encompass Health $ 26.6 $ 52.0 $ 3.0 $ (1.9) $ 0.6 $ 80.3 Add: Interest, amortization, and loss on extinguishment of convertible debt, net of tax — — Numerator for diluted earnings per share $ 26.6 $ 80.3 Diluted earnings per share from continuing operations, as reported* $ 0.26 $ 0.52 $ 0.03 $ (0.02) $ 0.01 $ 0.80 Diluted shares used in calculation 100.0 Encompass Health * Adjusted EPS may not sum across due to rounding. 44 Refer to pages 48-50 for end notes.

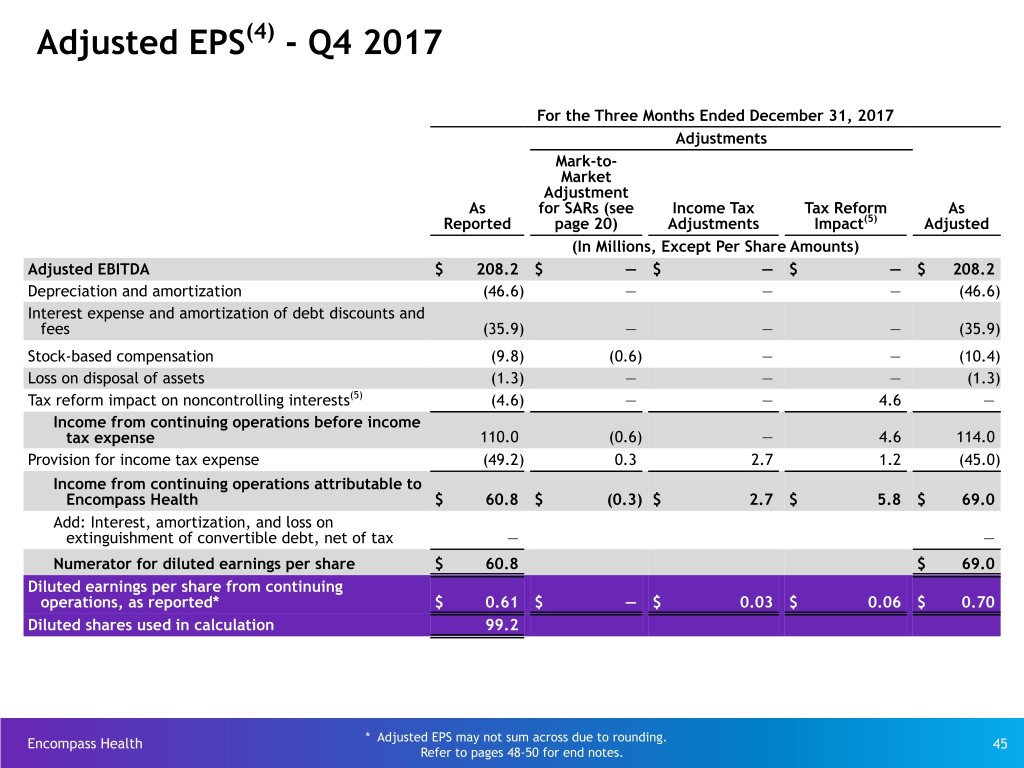

Adjusted EPS(4) - Q4 2017 For the Three Months Ended December 31, 2017 Adjustments Mark-to- Market Adjustment As for SARs (see Income Tax Tax Reform As Reported page 20) Adjustments Impact(5) Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 208.2 $ — $ — $ — $ 208.2 Depreciation and amortization (46.6) — — — (46.6) Interest expense and amortization of debt discounts and fees (35.9) — — — (35.9) Stock-based compensation (9.8) (0.6) — — (10.4) Loss on disposal of assets (1.3) — — — (1.3) Tax reform impact on noncontrolling interests(5) (4.6) — — 4.6 — Income from continuing operations before income tax expense 110.0 (0.6) — 4.6 114.0 Provision for income tax expense (49.2) 0.3 2.7 1.2 (45.0) Income from continuing operations attributable to Encompass Health $ 60.8 $ (0.3) $ 2.7 $ 5.8 $ 69.0 Add: Interest, amortization, and loss on extinguishment of convertible debt, net of tax — — Numerator for diluted earnings per share $ 60.8 $ 69.0 Diluted earnings per share from continuing operations, as reported* $ 0.61 $ — $ 0.03 $ 0.06 $ 0.70 Diluted shares used in calculation 99.2 Encompass Health * Adjusted EPS may not sum across due to rounding. 45 Refer to pages 48-50 for end notes.

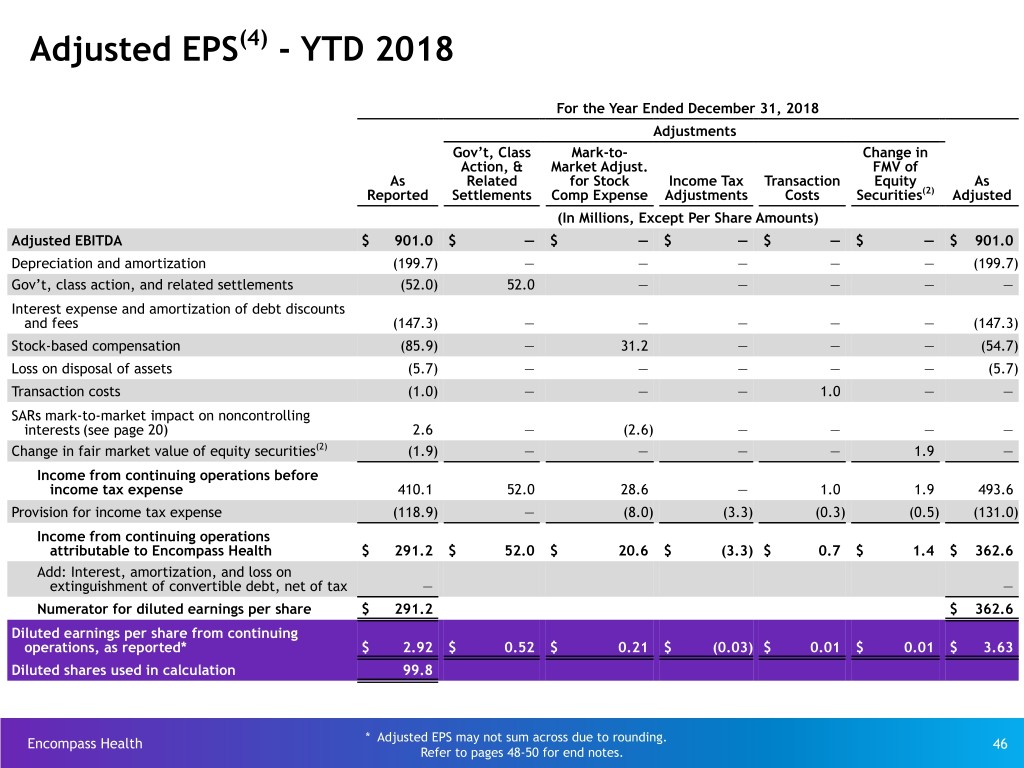

Adjusted EPS(4) - YTD 2018 For the Year Ended December 31, 2018 Adjustments Gov’t, Class Mark-to- Change in Action, & Market Adjust. FMV of As Related for Stock Income Tax Transaction Equity As Reported Settlements Comp Expense Adjustments Costs Securities(2) Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 901.0 $ — $ — $ — $ — $ — $ 901.0 Depreciation and amortization (199.7) — — — — — (199.7) Gov’t, class action, and related settlements (52.0) 52.0 — — — — — Interest expense and amortization of debt discounts and fees (147.3) — — — — — (147.3) Stock-based compensation (85.9) — 31.2 — — — (54.7) Loss on disposal of assets (5.7) — — — — — (5.7) Transaction costs (1.0) — — — 1.0 — — SARs mark-to-market impact on noncontrolling interests (see page 20) 2.6 — (2.6) — — — — Change in fair market value of equity securities(2) (1.9) — — — — 1.9 — Income from continuing operations before income tax expense 410.1 52.0 28.6 — 1.0 1.9 493.6 Provision for income tax expense (118.9) — (8.0) (3.3) (0.3) (0.5) (131.0) Income from continuing operations attributable to Encompass Health $ 291.2 $ 52.0 $ 20.6 $ (3.3) $ 0.7 $ 1.4 $ 362.6 Add: Interest, amortization, and loss on extinguishment of convertible debt, net of tax — — Numerator for diluted earnings per share $ 291.2 $ 362.6 Diluted earnings per share from continuing operations, as reported* $ 2.92 $ 0.52 $ 0.21 $ (0.03) $ 0.01 $ 0.01 $ 3.63 Diluted shares used in calculation 99.8 Encompass Health * Adjusted EPS may not sum across due to rounding. 46 Refer to pages 48-50 for end notes.

Adjusted EPS(4) - YTD 2017 Year Ended December 31, 2017 Adjustments Mark-to- Market Adjustment Tax Loss on Early As for SARs (see Reform Extinguishment Income Tax As Reported page 20) Impact(5) of Debt Adjustments Adjusted (In Millions, Except Per Share Amounts) Adjusted EBITDA $ 823.1 $ — $ — $ — $ — $ 823.1 Depreciation and amortization (183.8) — — — — (183.8) Loss on early extinguishment of debt(3) (10.7) — — 0.3 — (10.4) Interest expense and amortization of debt discounts and fees (154.4) — — — — (154.4) Stock-based compensation (47.7) 13.3 — — — (34.4) Loss on disposal of assets (4.6) — — — — (4.6) Tax reform impact on noncontrolling interests(5) (4.6) — 4.6 — — — Income from continuing operations before income tax expense 417.3 13.3 4.6 0.3 — 435.5 Provision for income tax expense (160.6) (5.3) 1.2 (0.1) (7.7) (172.5) Income from continuing operations attributable to Encompass Health $ 256.7 $ 8.0 $ 5.8 $ 0.2 $ (7.7) $ 263.0 Add: Interest, amortization, and loss on extinguishment of convertible debt, net of tax 10.8 10.8 Numerator for diluted earnings per share $ 267.5 $ 273.8 Diluted earnings per share from continuing operations, as reported* $ 2.69 $ 0.08 $ 0.06 $ — $ (0.08) $ 2.76 Diluted shares used in calculation 99.3 Encompass Health * Adjusted EPS may not sum across due to rounding. 47 Refer to pages 48-50 for end notes.

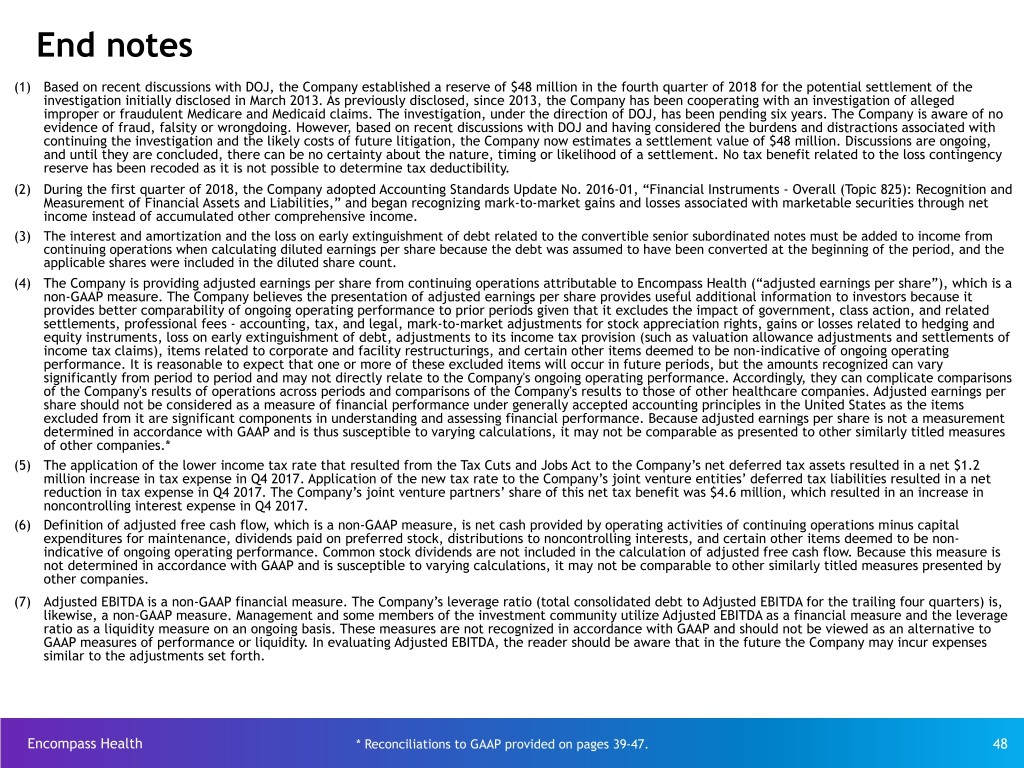

End notes (1) Based on recent discussions with DOJ, the Company established a reserve of $48 million in the fourth quarter of 2018 for the potential settlement of the investigation initially disclosed in March 2013. As previously disclosed, since 2013, the Company has been cooperating with an investigation of alleged improper or fraudulent Medicare and Medicaid claims. The investigation, under the direction of DOJ, has been pending six years. The Company is aware of no evidence of fraud, falsity or wrongdoing. However, based on recent discussions with DOJ and having considered the burdens and distractions associated with continuing the investigation and the likely costs of future litigation, the Company now estimates a settlement value of $48 million. Discussions are ongoing, and until they are concluded, there can be no certainty about the nature, timing or likelihood of a settlement. No tax benefit related to the loss contingency reserve has been recoded as it is not possible to determine tax deductibility. (2) During the first quarter of 2018, the Company adopted Accounting Standards Update No. 2016-01, “Financial Instruments - Overall (Topic 825): Recognition and Measurement of Financial Assets and Liabilities,” and began recognizing mark-to-market gains and losses associated with marketable securities through net income instead of accumulated other comprehensive income. (3) The interest and amortization and the loss on early extinguishment of debt related to the convertible senior subordinated notes must be added to income from continuing operations when calculating diluted earnings per share because the debt was assumed to have been converted at the beginning of the period, and the applicable shares were included in the diluted share count. (4) The Company is providing adjusted earnings per share from continuing operations attributable to Encompass Health (“adjusted earnings per share”), which is a non-GAAP measure. The Company believes the presentation of adjusted earnings per share provides useful additional information to investors because it provides better comparability of ongoing operating performance to prior periods given that it excludes the impact of government, class action, and related settlements, professional fees - accounting, tax, and legal, mark-to-market adjustments for stock appreciation rights, gains or losses related to hedging and equity instruments, loss on early extinguishment of debt, adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims), items related to corporate and facility restructurings, and certain other items deemed to be non-indicative of ongoing operating performance. It is reasonable to expect that one or more of these excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period and may not directly relate to the Company's ongoing operating performance. Accordingly, they can complicate comparisons of the Company's results of operations across periods and comparisons of the Company's results to those of other healthcare companies. Adjusted earnings per share should not be considered as a measure of financial performance under generally accepted accounting principles in the United States as the items excluded from it are significant components in understanding and assessing financial performance. Because adjusted earnings per share is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, it may not be comparable as presented to other similarly titled measures of other companies.* (5) The application of the lower income tax rate that resulted from the Tax Cuts and Jobs Act to the Company’s net deferred tax assets resulted in a net $1.2 million increase in tax expense in Q4 2017. Application of the new tax rate to the Company’s joint venture entities’ deferred tax liabilities resulted in a net reduction in tax expense in Q4 2017. The Company’s joint venture partners’ share of this net tax benefit was $4.6 million, which resulted in an increase in noncontrolling interest expense in Q4 2017. (6) Definition of adjusted free cash flow, which is a non-GAAP measure, is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, dividends paid on preferred stock, distributions to noncontrolling interests, and certain other items deemed to be non- indicative of ongoing operating performance. Common stock dividends are not included in the calculation of adjusted free cash flow. Because this measure is not determined in accordance with GAAP and is susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. (7) Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non-GAAP measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future the Company may incur expenses similar to the adjustments set forth. Encompass Health * Reconciliations to GAAP provided on pages 39-47. 48

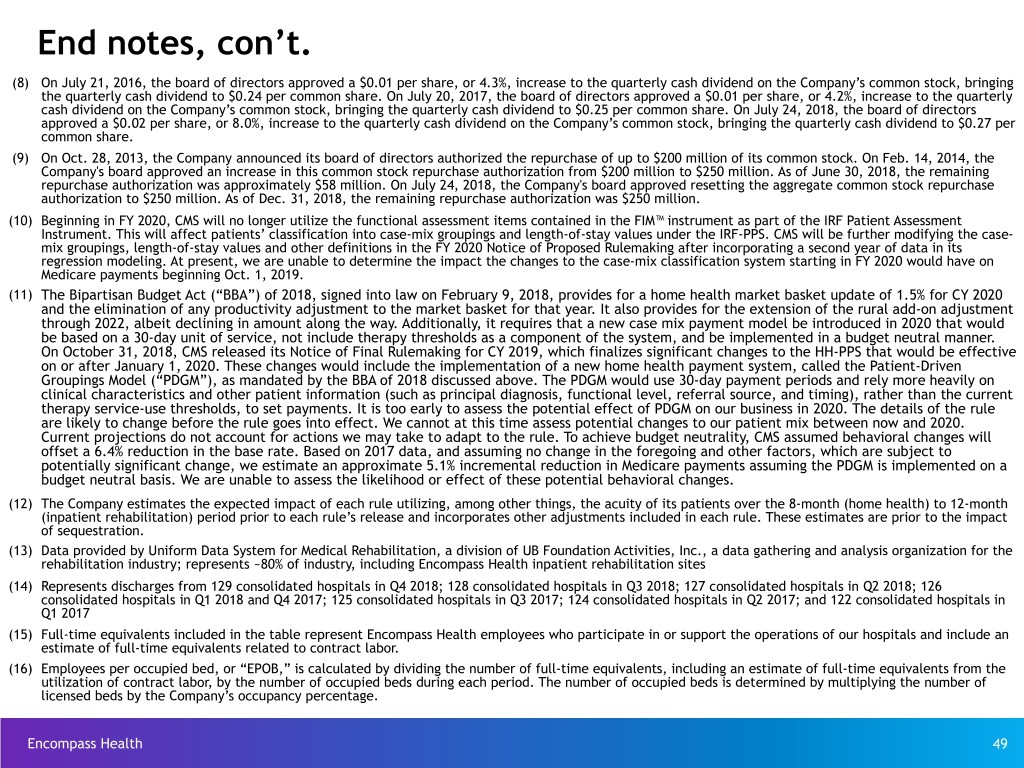

End notes, con’t. (8) On July 21, 2016, the board of directors approved a $0.01 per share, or 4.3%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.24 per common share. On July 20, 2017, the board of directors approved a $0.01 per share, or 4.2%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.25 per common share. On July 24, 2018, the board of directors approved a $0.02 per share, or 8.0%, increase to the quarterly cash dividend on the Company’s common stock, bringing the quarterly cash dividend to $0.27 per common share. (9) On Oct. 28, 2013, the Company announced its board of directors authorized the repurchase of up to $200 million of its common stock. On Feb. 14, 2014, the Company's board approved an increase in this common stock repurchase authorization from $200 million to $250 million. As of June 30, 2018, the remaining repurchase authorization was approximately $58 million. On July 24, 2018, the Company's board approved resetting the aggregate common stock repurchase authorization to $250 million. As of Dec. 31, 2018, the remaining repurchase authorization was $250 million. (10) Beginning in FY 2020, CMS will no longer utilize the functional assessment items contained in the FIM™ instrument as part of the IRF Patient Assessment Instrument. This will affect patients’ classification into case-mix groupings and length-of-stay values under the IRF-PPS. CMS will be further modifying the case- mix groupings, length-of-stay values and other definitions in the FY 2020 Notice of Proposed Rulemaking after incorporating a second year of data in its regression modeling. At present, we are unable to determine the impact the changes to the case-mix classification system starting in FY 2020 would have on Medicare payments beginning Oct. 1, 2019. (11) The Bipartisan Budget Act (“BBA”) of 2018, signed into law on February 9, 2018, provides for a home health market basket update of 1.5% for CY 2020 and the elimination of any productivity adjustment to the market basket for that year. It also provides for the extension of the rural add-on adjustment through 2022, albeit declining in amount along the way. Additionally, it requires that a new case mix payment model be introduced in 2020 that would be based on a 30-day unit of service, not include therapy thresholds as a component of the system, and be implemented in a budget neutral manner. On October 31, 2018, CMS released its Notice of Final Rulemaking for CY 2019, which finalizes significant changes to the HH-PPS that would be effective on or after January 1, 2020. These changes would include the implementation of a new home health payment system, called the Patient-Driven Groupings Model (“PDGM”), as mandated by the BBA of 2018 discussed above. The PDGM would use 30-day payment periods and rely more heavily on clinical characteristics and other patient information (such as principal diagnosis, functional level, referral source, and timing), rather than the current therapy service-use thresholds, to set payments. It is too early to assess the potential effect of PDGM on our business in 2020. The details of the rule are likely to change before the rule goes into effect. We cannot at this time assess potential changes to our patient mix between now and 2020. Current projections do not account for actions we may take to adapt to the rule. To achieve budget neutrality, CMS assumed behavioral changes will offset a 6.4% reduction in the base rate. Based on 2017 data, and assuming no change in the foregoing and other factors, which are subject to potentially significant change, we estimate an approximate 5.1% incremental reduction in Medicare payments assuming the PDGM is implemented on a budget neutral basis. We are unable to assess the likelihood or effect of these potential behavioral changes. (12) The Company estimates the expected impact of each rule utilizing, among other things, the acuity of its patients over the 8-month (home health) to 12-month (inpatient rehabilitation) period prior to each rule’s release and incorporates other adjustments included in each rule. These estimates are prior to the impact of sequestration. (13) Data provided by Uniform Data System for Medical Rehabilitation, a division of UB Foundation Activities, Inc., a data gathering and analysis organization for the rehabilitation industry; represents ~80% of industry, including Encompass Health inpatient rehabilitation sites (14) Represents discharges from 129 consolidated hospitals in Q4 2018; 128 consolidated hospitals in Q3 2018; 127 consolidated hospitals in Q2 2018; 126 consolidated hospitals in Q1 2018 and Q4 2017; 125 consolidated hospitals in Q3 2017; 124 consolidated hospitals in Q2 2017; and 122 consolidated hospitals in Q1 2017 (15) Full-time equivalents included in the table represent Encompass Health employees who participate in or support the operations of our hospitals and include an estimate of full-time equivalents related to contract labor. (16) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is determined by multiplying the number of licensed beds by the Company’s occupancy percentage. Encompass Health 49

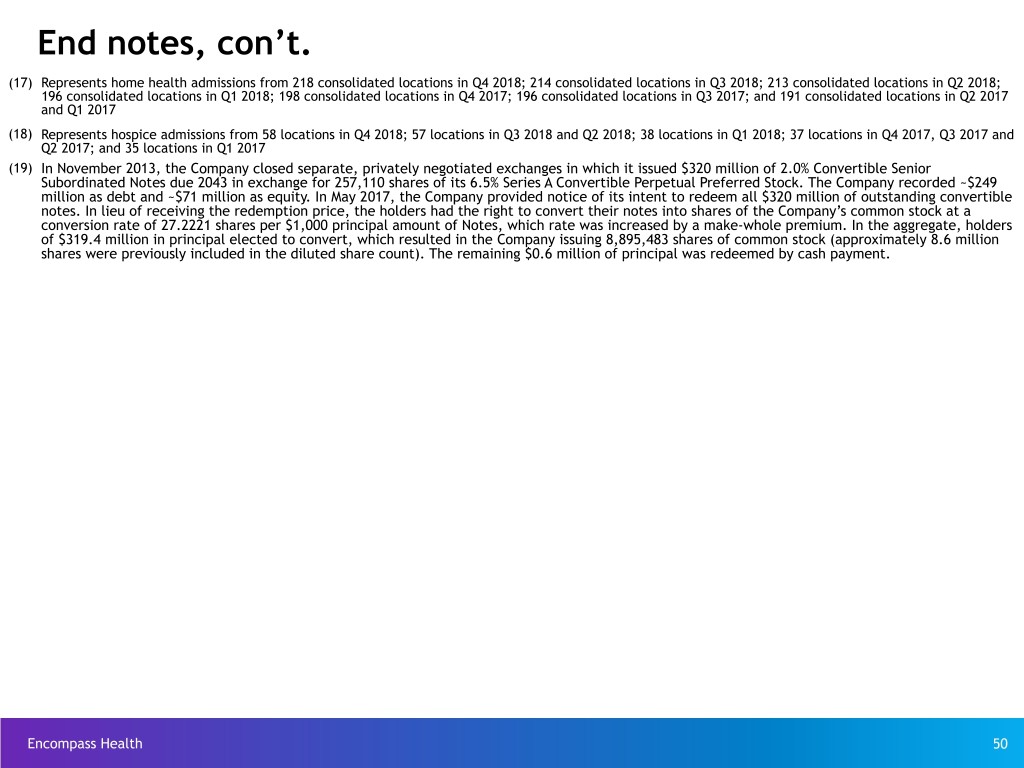

End notes, con’t. (17) Represents home health admissions from 218 consolidated locations in Q4 2018; 214 consolidated locations in Q3 2018; 213 consolidated locations in Q2 2018; 196 consolidated locations in Q1 2018; 198 consolidated locations in Q4 2017; 196 consolidated locations in Q3 2017; and 191 consolidated locations in Q2 2017 and Q1 2017 (18) Represents hospice admissions from 58 locations in Q4 2018; 57 locations in Q3 2018 and Q2 2018; 38 locations in Q1 2018; 37 locations in Q4 2017, Q3 2017 and Q2 2017; and 35 locations in Q1 2017 (19) In November 2013, the Company closed separate, privately negotiated exchanges in which it issued $320 million of 2.0% Convertible Senior Subordinated Notes due 2043 in exchange for 257,110 shares of its 6.5% Series A Convertible Perpetual Preferred Stock. The Company recorded ~$249 million as debt and ~$71 million as equity. In May 2017, the Company provided notice of its intent to redeem all $320 million of outstanding convertible notes. In lieu of receiving the redemption price, the holders had the right to convert their notes into shares of the Company’s common stock at a conversion rate of 27.2221 shares per $1,000 principal amount of Notes, which rate was increased by a make-whole premium. In the aggregate, holders of $319.4 million in principal elected to convert, which resulted in the Company issuing 8,895,483 shares of common stock (approximately 8.6 million shares were previously included in the diluted share count). The remaining $0.6 million of principal was redeemed by cash payment. Encompass Health 50