Encompass Health 1

Encompass Health Mark J. Ta r r Doug Coltharp Barb Jacobsmeyer President and Chief Executive Vice President and Executive Vice President, Executive Officer Chief Financial Officer President Inpatient Hospitals April Anthony Luke James Rusty Yeager Chief Executive Officer, President, Senior Vice President, Home Health and Hospice Home Health & Hospice Chief Information Officer Encompass Health 2

Encompass Health Investor Relations Team Crissy Carlisle Amy Rayborn Brittany Jager Chief Investor Relations Officer Administrative Coordinator Investor Relations Manager Encompass Health 3

Forward-looking statements The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect Encompass Health’s current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, cyber security, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, market share, development of new information tools and models, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions the Company believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2019 and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs, and estimates expressed herein. Note regarding presentation of non-GAAP financial measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, leverage ratios and adjusted free cash flow. The Company’s Form 8-K, dated March 4, 2020, to which the following presentation is attached as Exhibit 99.1, provides further explanation and disclosure regarding Encompass Health’s use of non-GAAP financial measures and should be read in conjunction with this presentation. Encompass Health 4

Company Overview, Strategy and Outlook Presented by Mark Tarr Encompass Health 5

Primary elements of our strategy Quality Workforce Enhance clinical Serve as an engaged and expertise and deliver productive workforce high-quality outcomes Financial resources Sustained growth Maintain a strong Expand our footprint to financial foundation reach more in need of our high-quality, connected care Advanced technology Post-acute innovation Implement technology to Lead the nation in patient- improve patient-centered focused, evidenced-based care and efficiency models that improve outcomes and efficiencies Encompass Health 6

Key takeaways Our integrated We use We are executing care model technology our growth produces the to leverage strategy high-quality, and enhance to meet the cost-effective care our clinical needs of an aging desired by and business population. providers, payors, processes. and patients. Encompass Health 7

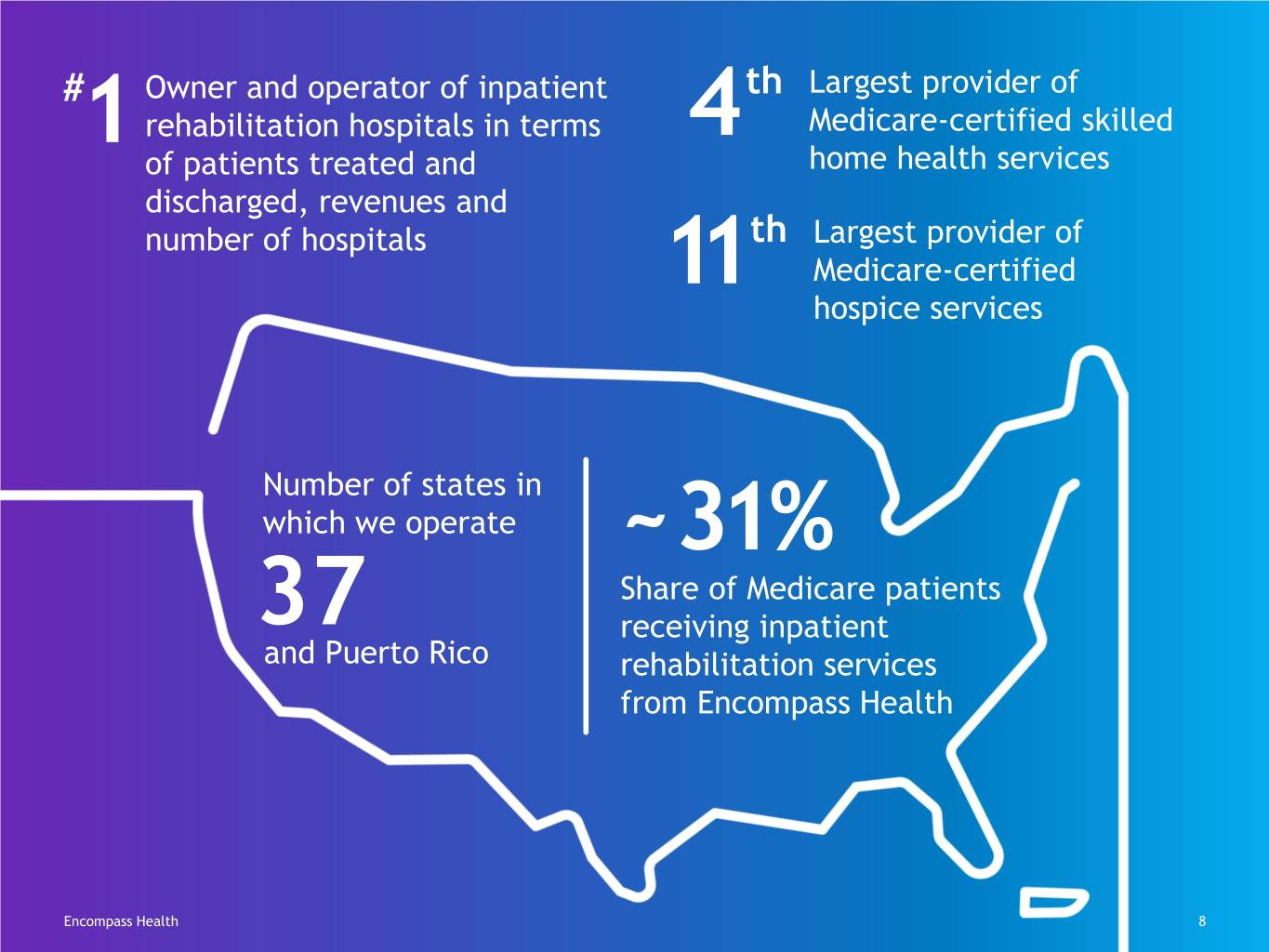

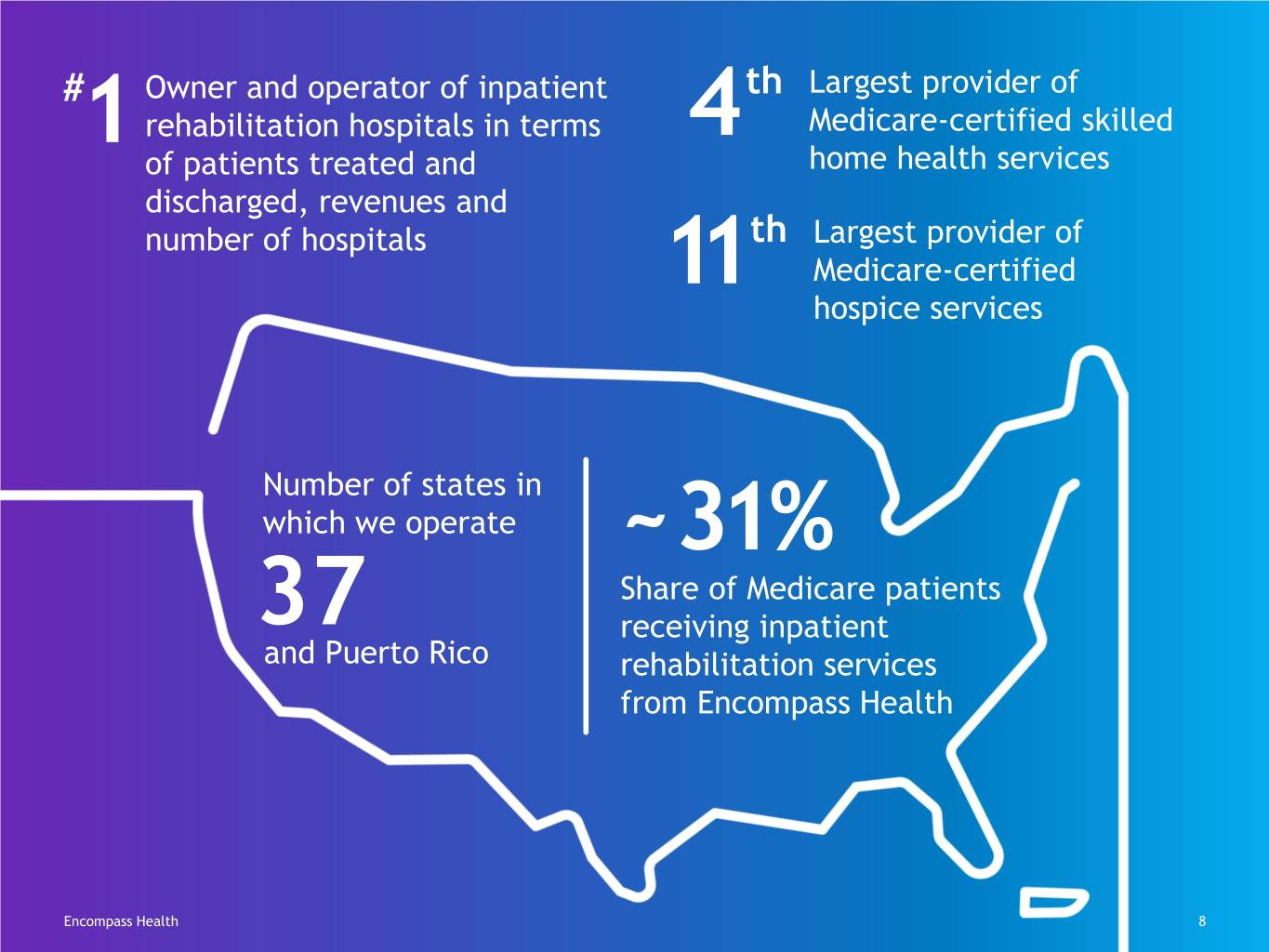

# Owner and operator of inpatient th Largest provider of rehabilitation hospitals in terms 4 Medicare-certified skilled 1 of patients treated and home health services discharged, revenues and number of hospitals th Largest provider of 11 Medicare-certified hospice services Number of states in which we operate ~31% Share of Medicare patients 37 receiving inpatient and Puerto Rico rehabilitation services from Encompass Health Encompass Health 8

Strength in our unique position Inpatient rehabilitation hospitals (“IRFs”) Home health locations Hospice locations 9 Future IRFs Unique combination of facility-based and home-based assets National scale across all service lines Encompass Health 9

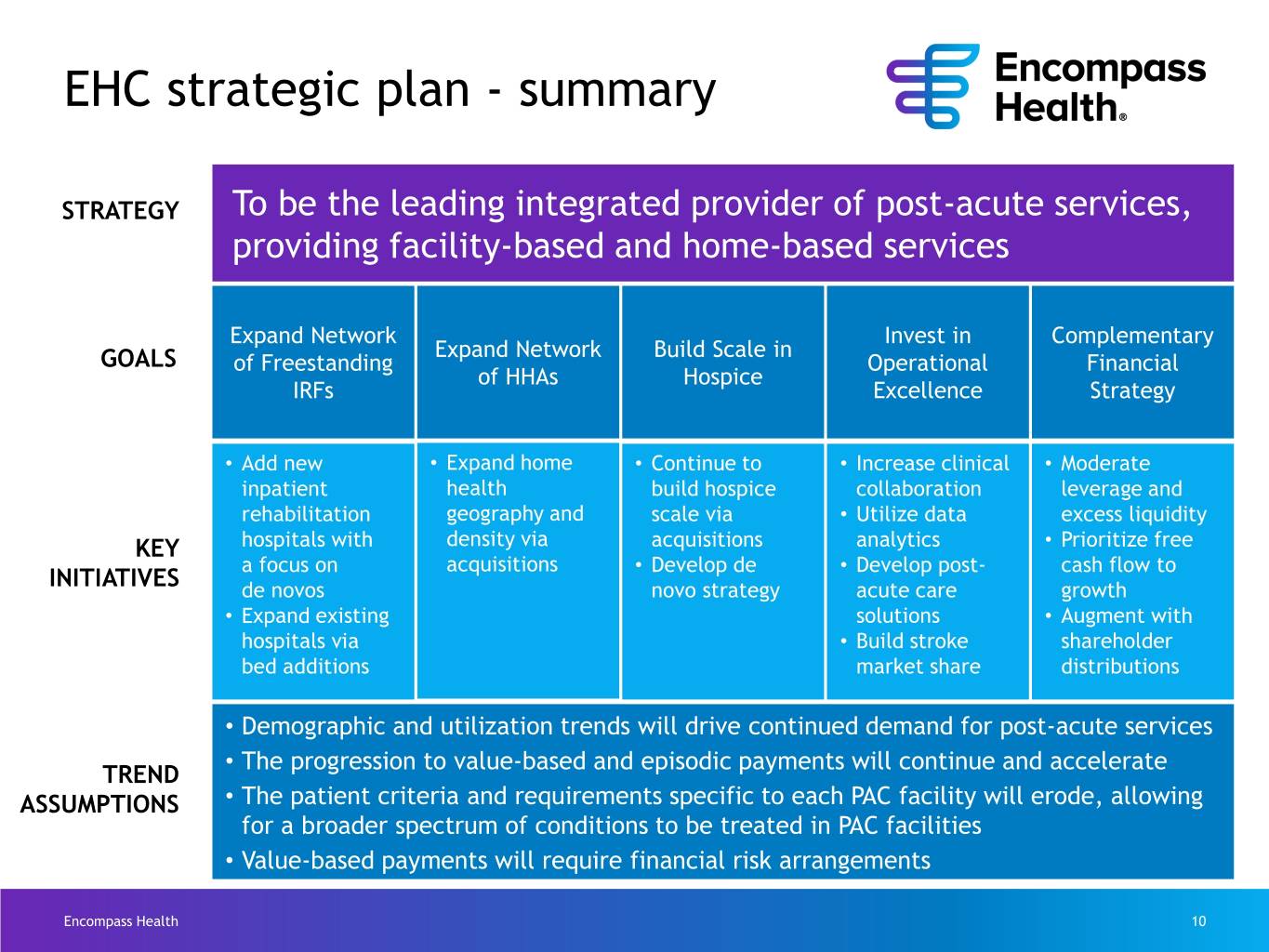

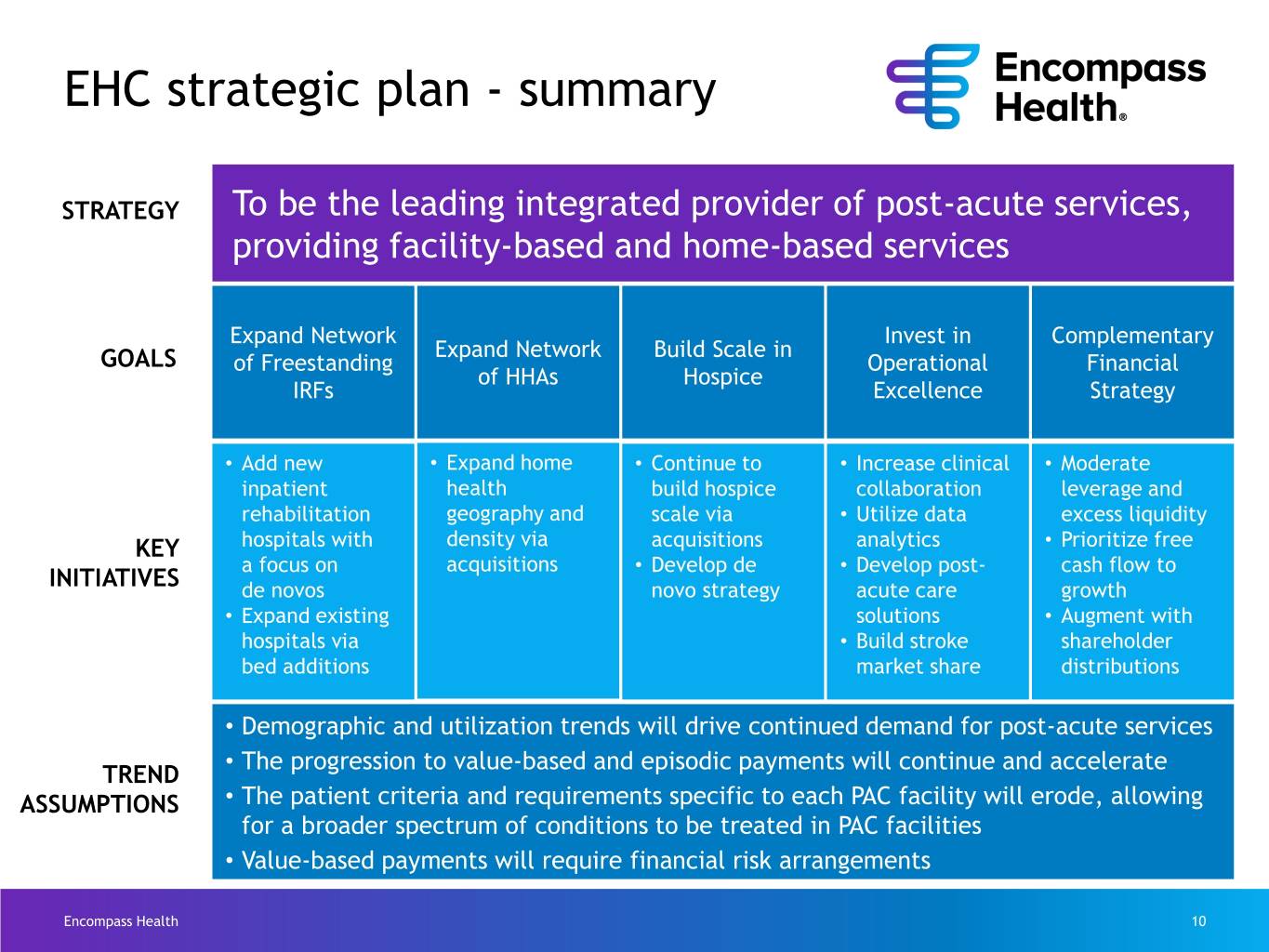

EHC strategic plan - summary STRATEGY To be the leading integrated provider of post-acute services, providing facility-based and home-based services Expand Network Invest in Complementary Expand Network Build Scale in GOALS of Freestanding Operational Financial of HHAs Hospice IRFs Excellence Strategy • Add new • Expand home • Continue to • Increase clinical • Moderate inpatient health build hospice collaboration leverage and rehabilitation geography and scale via • Utilize data excess liquidity KEY hospitals with density via acquisitions analytics • Prioritize free a focus on acquisitions • Develop de • Develop post- cash flow to INITIATIVES de novos novo strategy acute care growth • Expand existing solutions • Augment with hospitals via • Build stroke shareholder bed additions market share distributions • Demographic and utilization trends will drive continued demand for post-acute services The progression to value-based and episodic payments will continue and accelerate TREND • ASSUMPTIONS • The patient criteria and requirements specific to each PAC facility will erode, allowing for a broader spectrum of conditions to be treated in PAC facilities • Value-based payments will require financial risk arrangements Encompass Health 10

Our competitive strengths Unique combination of assets Quality of our clinical outcomes Cost effectiveness Extensive application of technology Financial strength Encompass Health 11

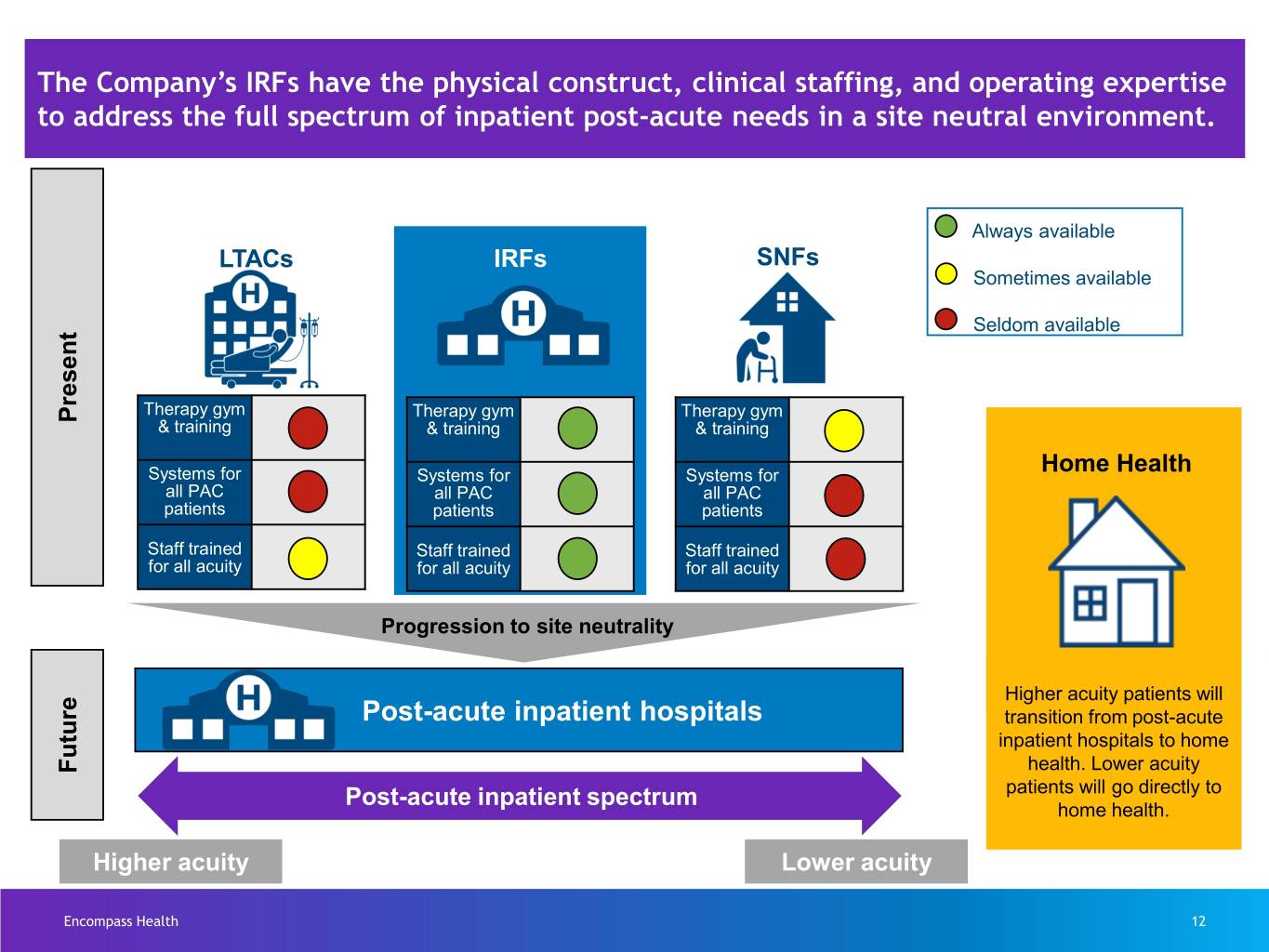

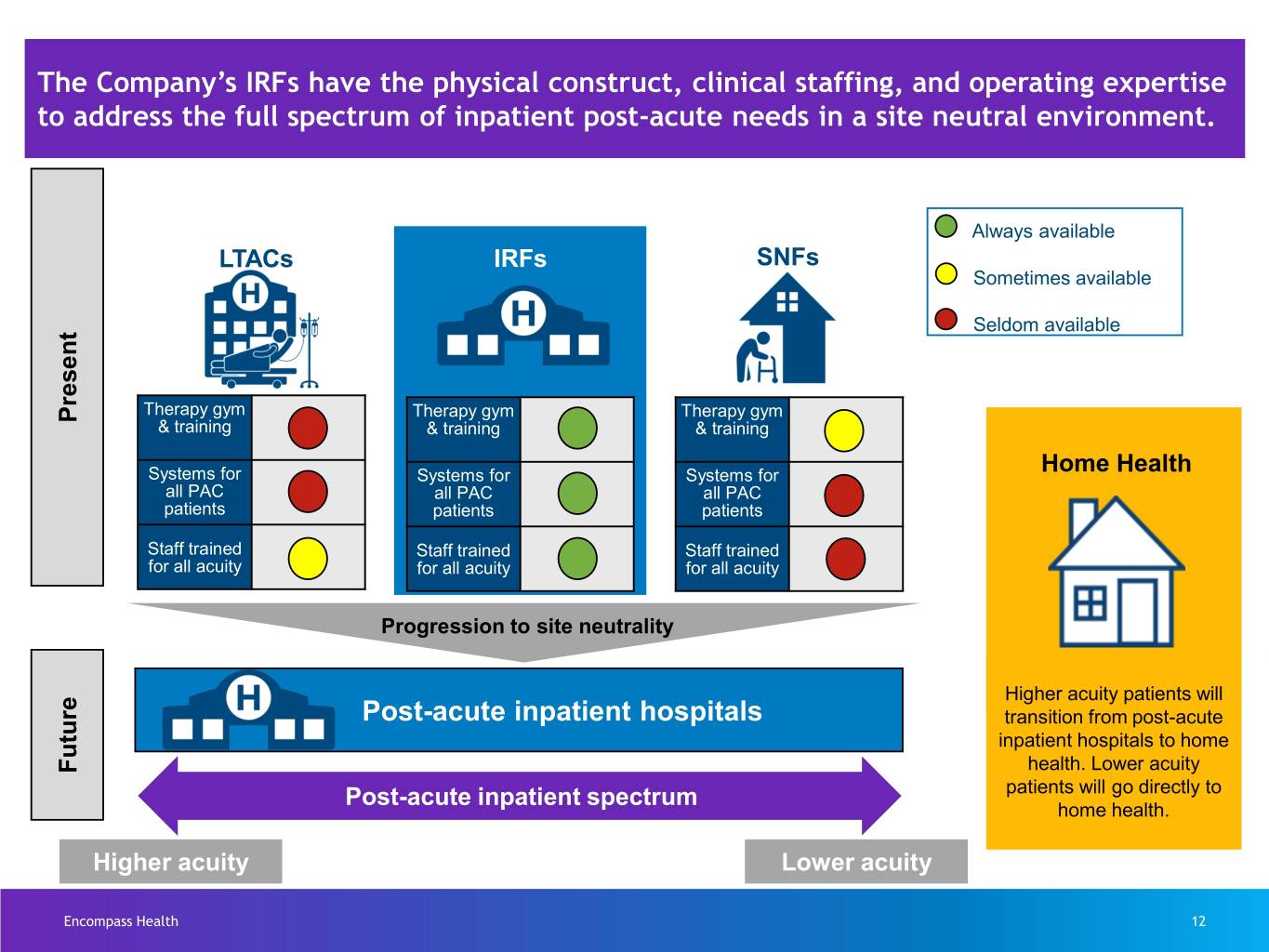

The Company’s IRFs have the physical construct, clinical staffing, and operating expertise to address the full spectrum of inpatient post-acute needs in a site neutral environment. Always available LTACs IRFs SNFs Sometimes available Seldom available Therapy gym Therapy gym Therapy gym Present & training & training & training Systems for Systems for Systems for Home Health all PAC all PAC all PAC patients patients patients Staff trained Staff trained Staff trained for all acuity for all acuity for all acuity Progression to site neutrality Higher acuity patients will Post-acute inpatient hospitals transition from post-acute inpatient hospitals to home Future health. Lower acuity patients will go directly to Post-acute inpatient spectrum home health. Higher acuity Lower acuity Encompass Health 12

Demographic tailwind CAGR (population growth by age) 2014 2018 2022 2026 Age to 2018 to 2022 to 2026 to 2030 65-69 2.8% 2.6% 1.6% (0.1)% 70-74 4.9% 3.7% 2.5% 2.1% 75-79 4.0% 5.0% 4.9% 2.0% 80+ 1.5% 2.4% 3.6% 5.2% Total 3.2% 3.3% 2.9% 2.2% The average age of our Medicare patients: Inpatient rehabilitation = 76 home health = 77 hospice = 83 Encompass Health 13

Sustained growth Encompass Health 14

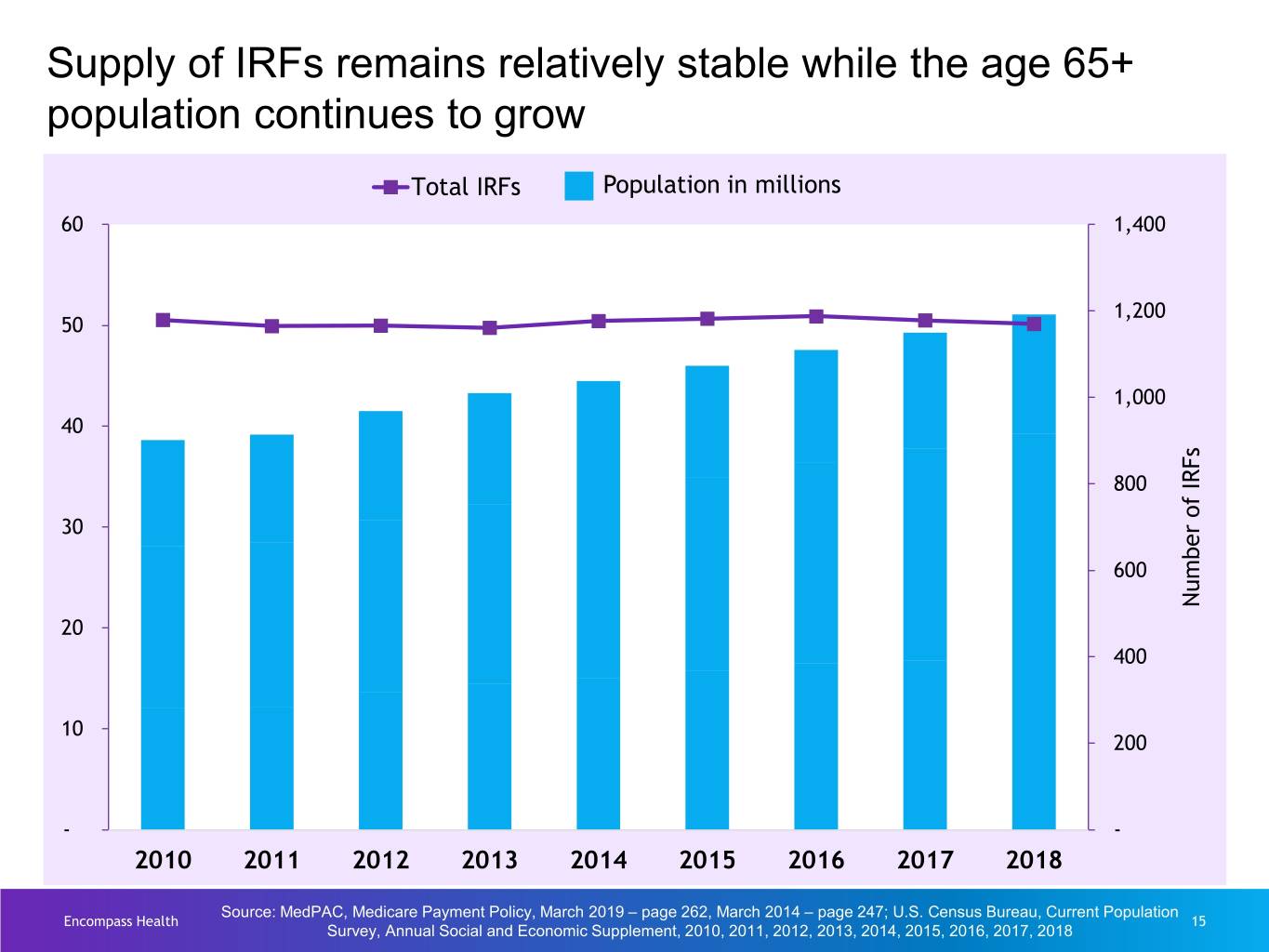

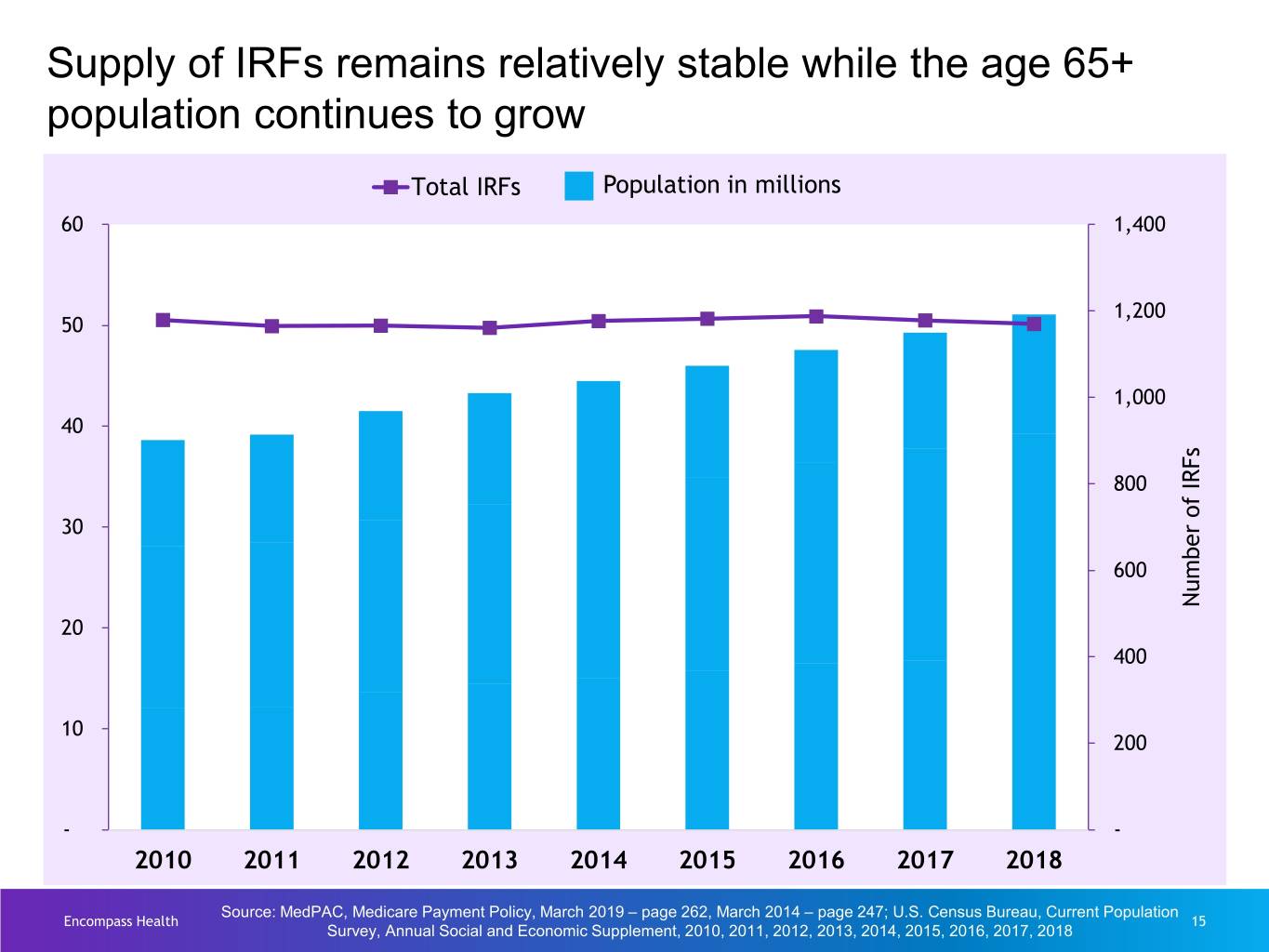

Supply of IRFs remains relatively stable while the age 65+ population continues to grow Total IRFs Population in millions 60 1,400 1,200 50 1,000 40 800 30 600 Number of of IRFs Number 20 400 10 200 - - 2010 2011 2012 2013 2014 2015 2016 2017 2018 Source: MedPAC, Medicare Payment Policy, March 2019 – page 262, March 2014 – page 247; U.S. Census Bureau, Current Population Encompass Health 15 Survey, Annual Social and Economic Supplement, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018

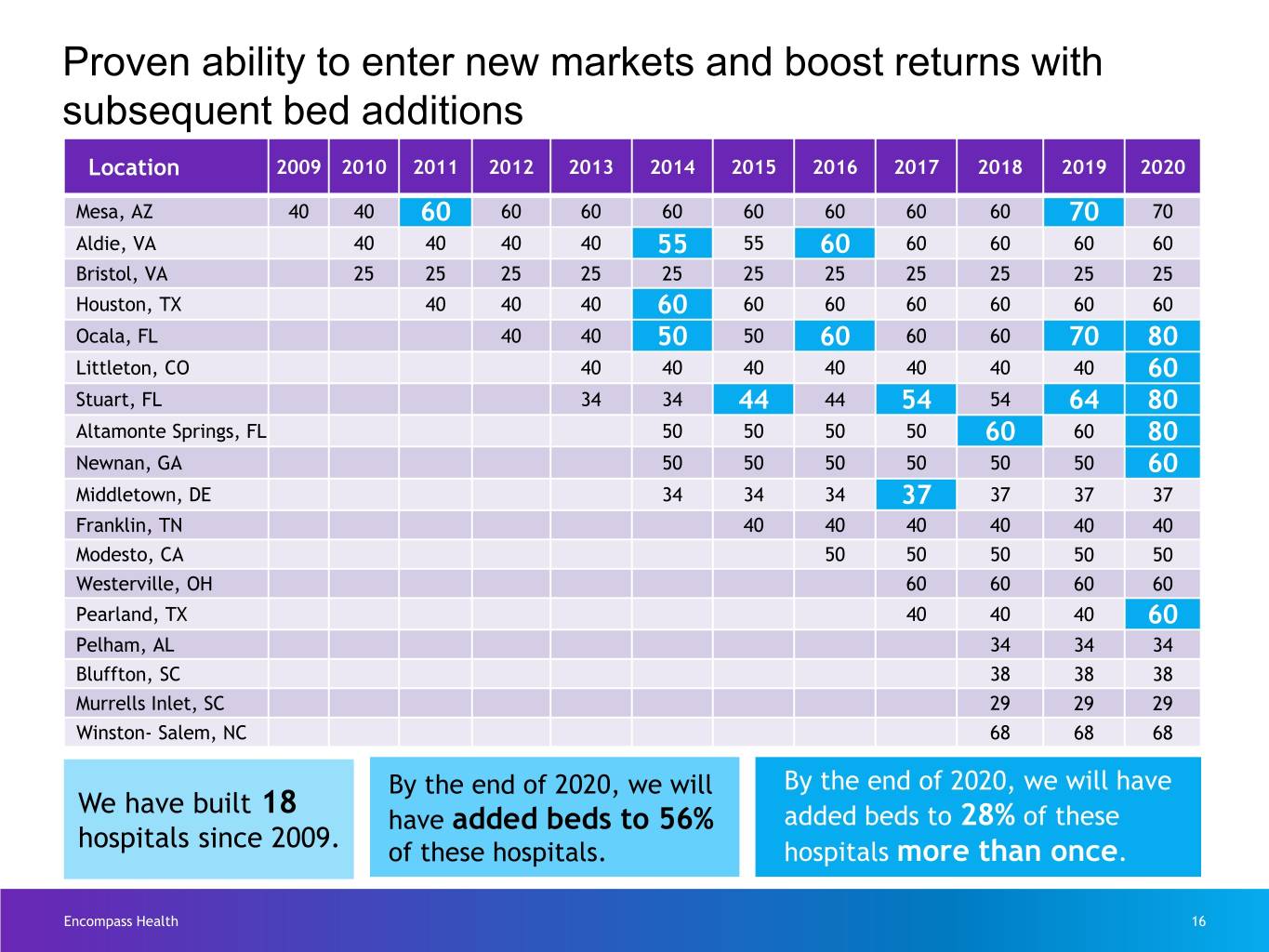

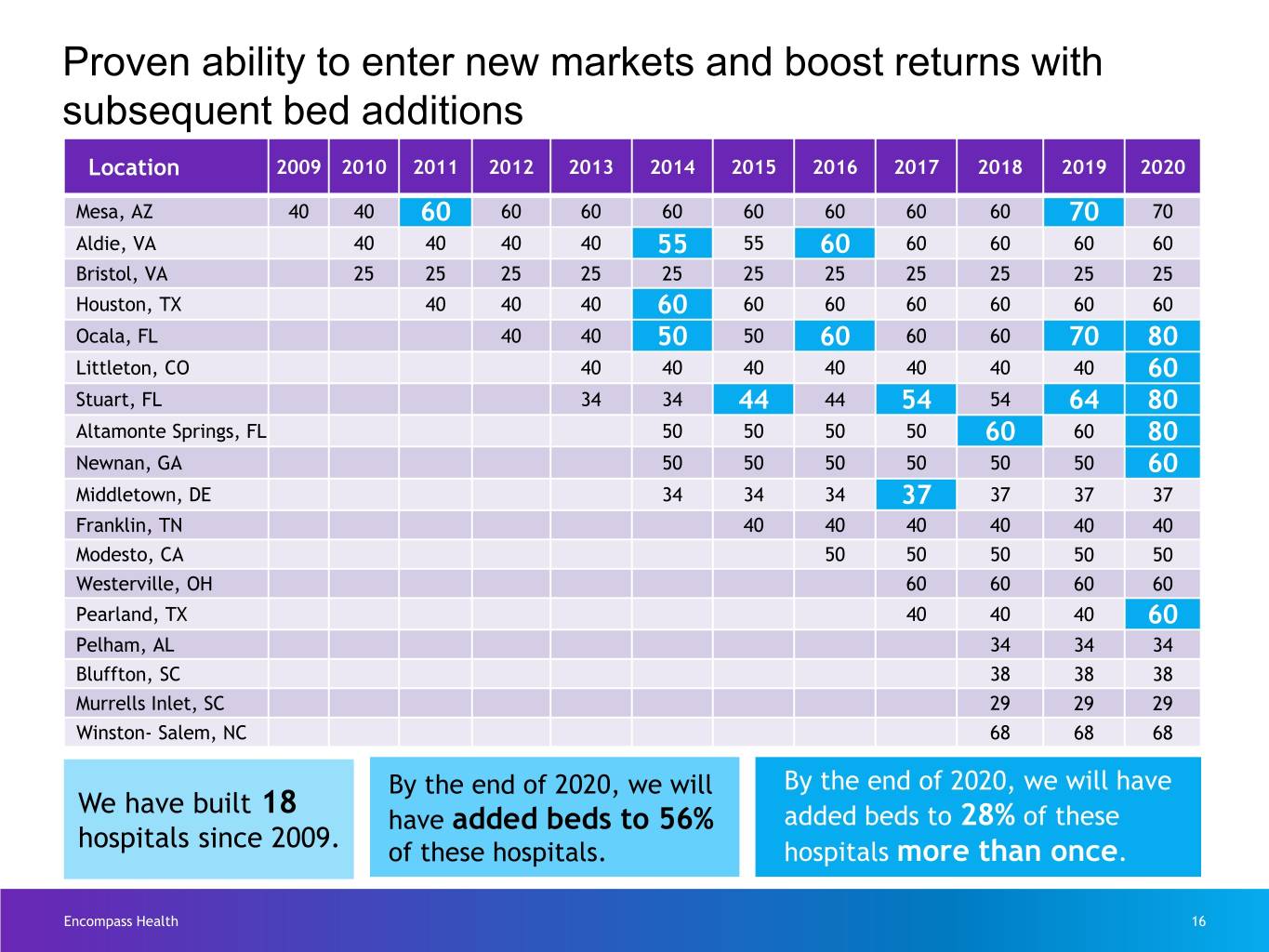

Proven ability to enter new markets and boost returns with subsequent bed additions Location 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Mesa, AZ 40 40 60 60 60 60 60 60 60 60 70 70 Aldie, VA 40 40 40 40 55 55 60 60 60 60 60 Bristol, VA 25 25 25 25 25 25 25 25 25 25 25 Houston, TX 40 40 40 60 60 60 60 60 60 60 Ocala, FL 40 40 50 50 60 60 60 70 80 Littleton, CO 40 40 40 40 40 40 40 60 Stuart, FL 34 34 44 44 54 54 64 80 Altamonte Springs, FL 50 50 50 50 60 60 80 Newnan, GA 50 50 50 50 50 50 60 Middletown, DE 34 34 34 37 37 37 37 Franklin, TN 40 40 40 40 40 40 Modesto, CA 50 50 50 50 50 Westerville, OH 60 60 60 60 Pearland, TX 40 40 40 60 Pelham, AL 34 34 34 Bluffton, SC 38 38 38 Murrells Inlet, SC 29 29 29 Winston- Salem, NC 68 68 68 By the end of 2020, we will By the end of 2020, we will have We have built 18 have added beds to 56% added beds to 28% of these hospitals since 2009. of these hospitals. hospitals more than once. Encompass Health 16

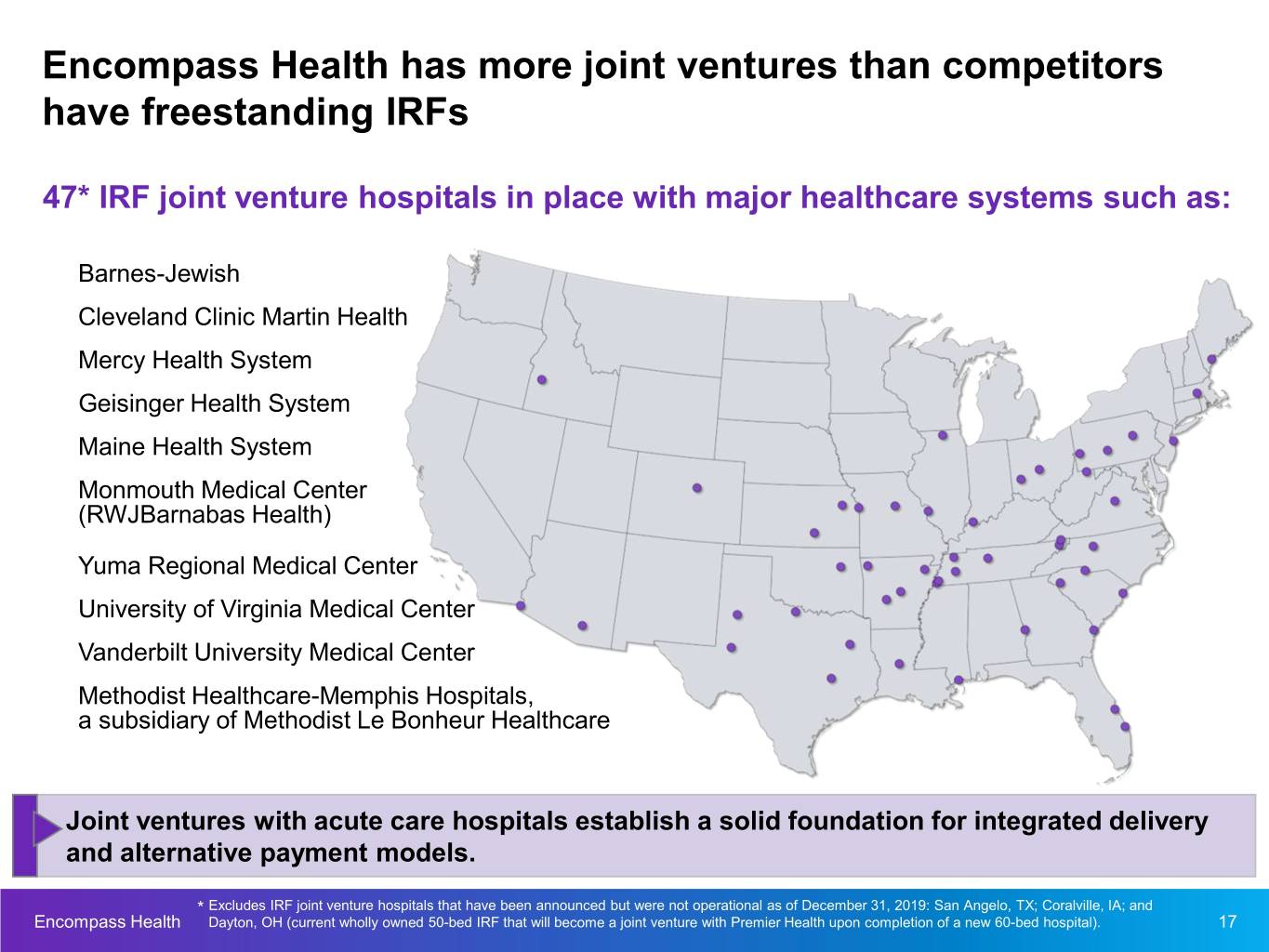

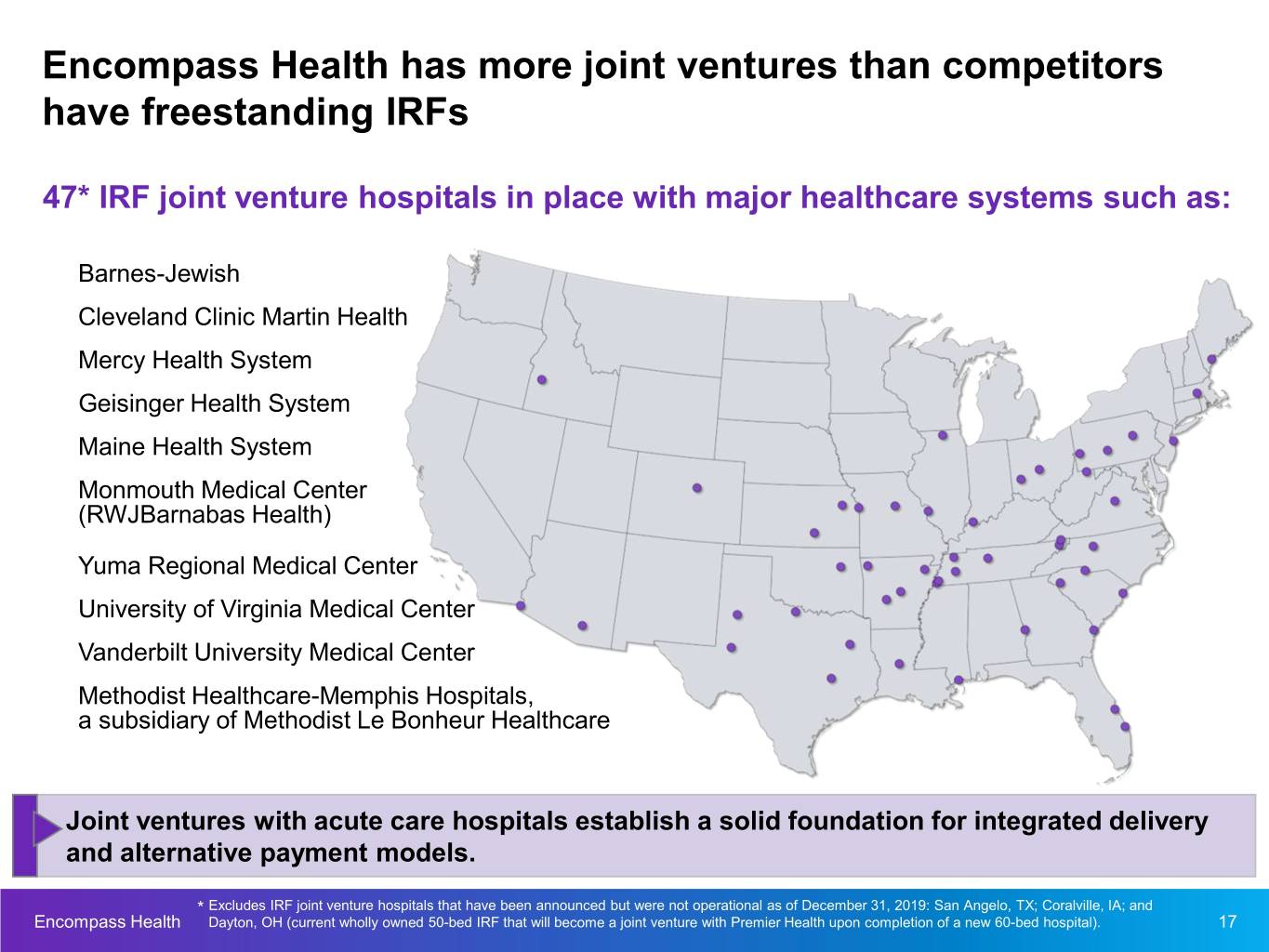

Encompass Health has more joint ventures than competitors have freestanding IRFs 47* IRF joint venture hospitals in place with major healthcare systems such as: Barnes-Jewish Cleveland Clinic Martin Health Mercy Health System Geisinger Health System Maine Health System Monmouth Medical Center (RWJBarnabas Health) Yuma Regional Medical Center University of Virginia Medical Center Vanderbilt University Medical Center Methodist Healthcare-Memphis Hospitals, a subsidiary of Methodist Le Bonheur Healthcare Joint ventures with acute care hospitals establish a solid foundation for integrated delivery and alternative payment models. * Excludes IRF joint venture hospitals that have been announced but were not operational as of December 31, 2019: San Angelo, TX; Coralville, IA; and Encompass Health Dayton, OH (current wholly owned 50-bed IRF that will become a joint venture with Premier Health upon completion of a new 60-bed hospital). 17

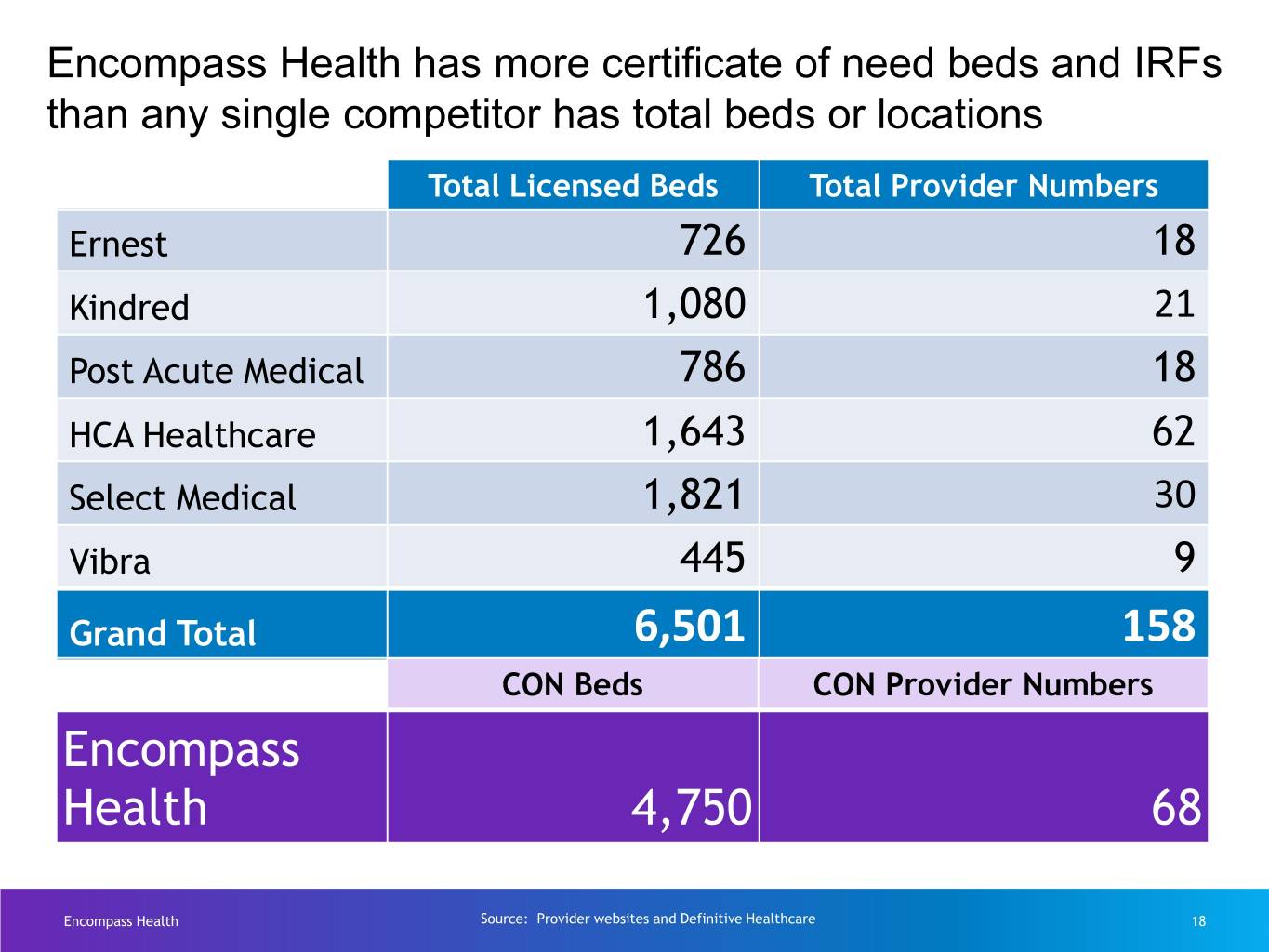

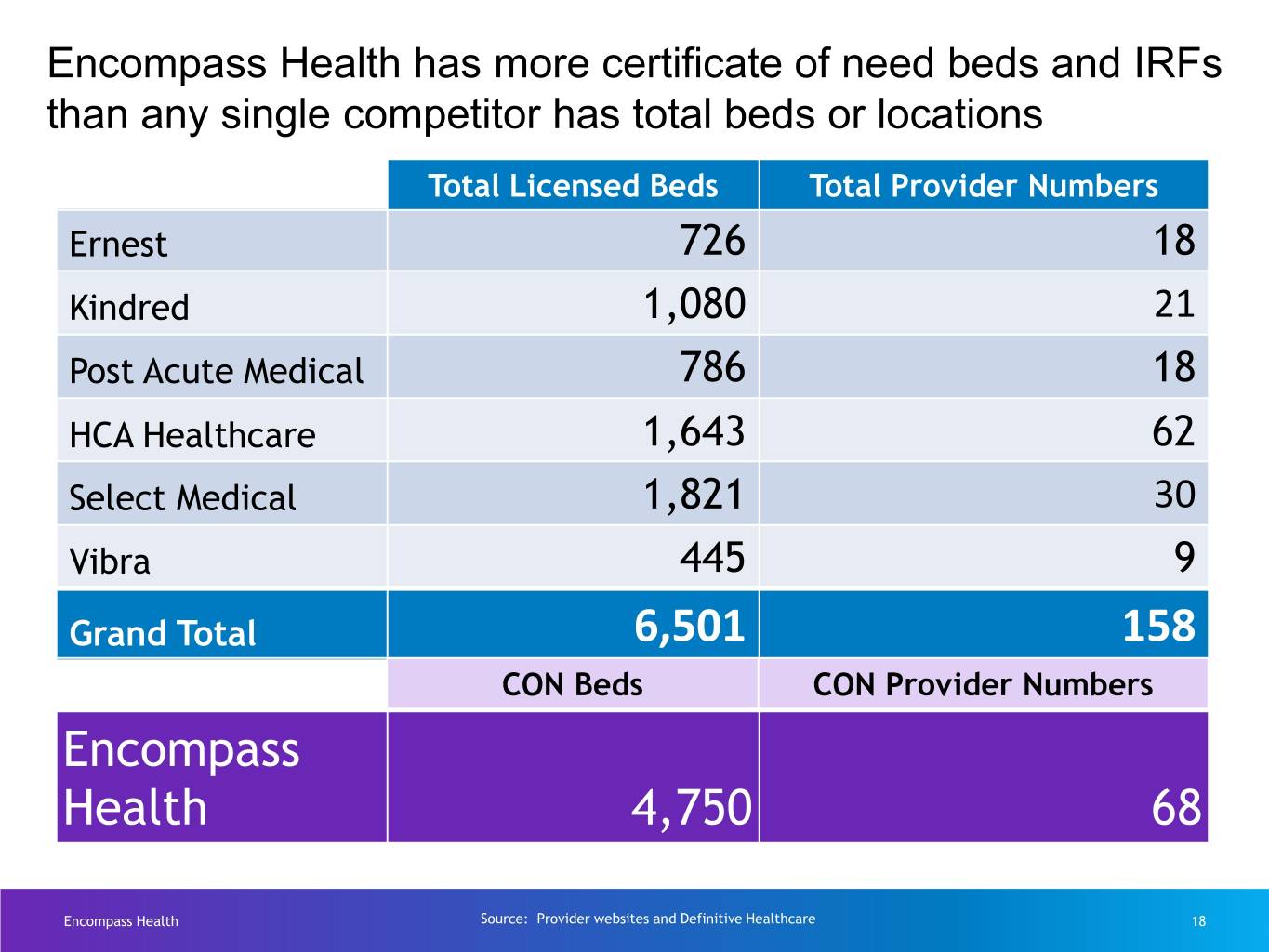

Encompass Health has more certificate of need beds and IRFs than any single competitor has total beds or locations Total Licensed Beds Total Provider Numbers Ernest 726 18 Kindred 1,080 21 Post Acute Medical 786 18 HCA Healthcare 1,643 62 Select Medical 1,821 30 Vibra 445 9 Grand Total 6,501 158 CON Beds CON Provider Numbers Encompass Health 4,750 68 Encompass Health Source: Provider websites and Definitive Healthcare 18

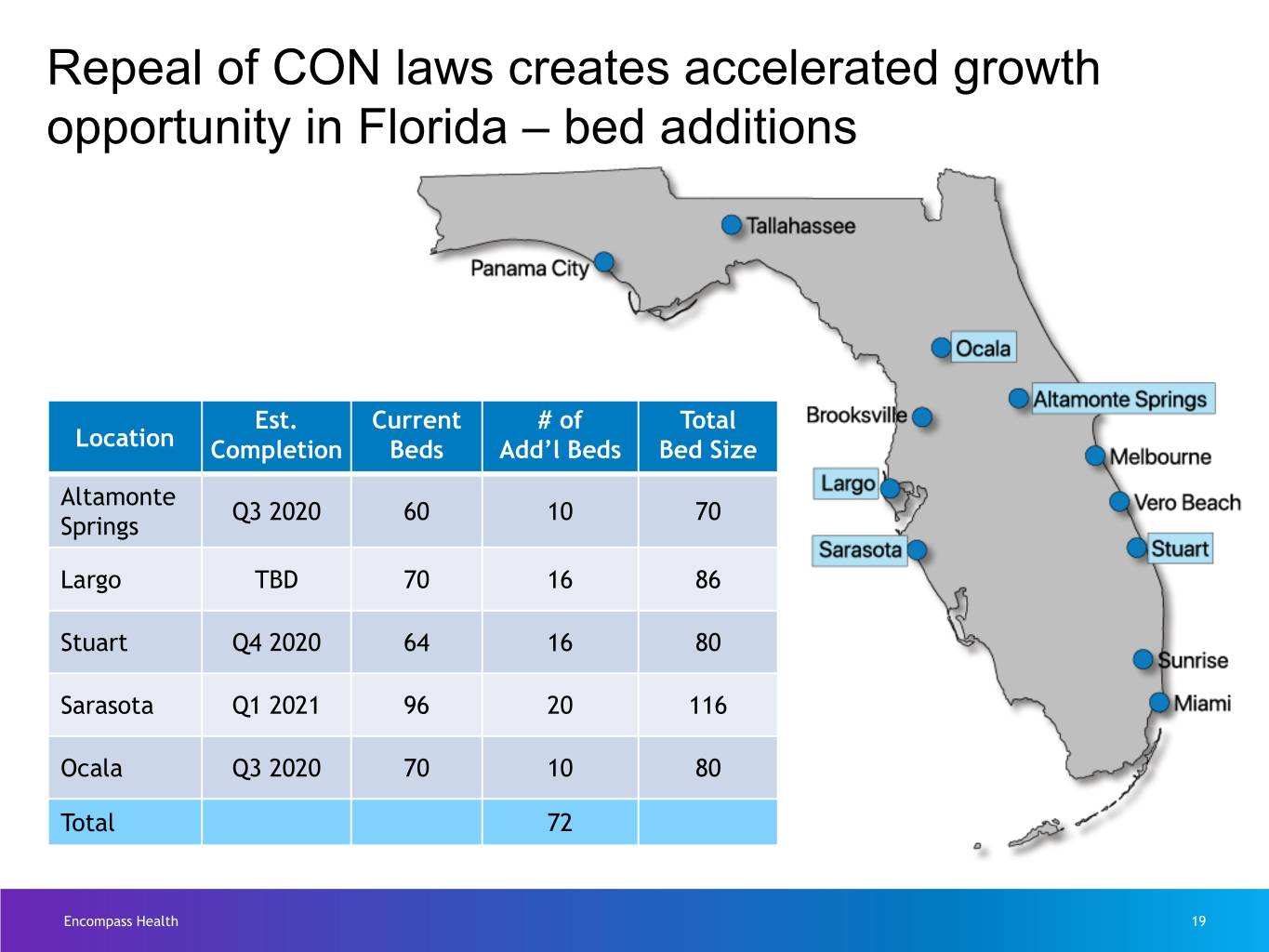

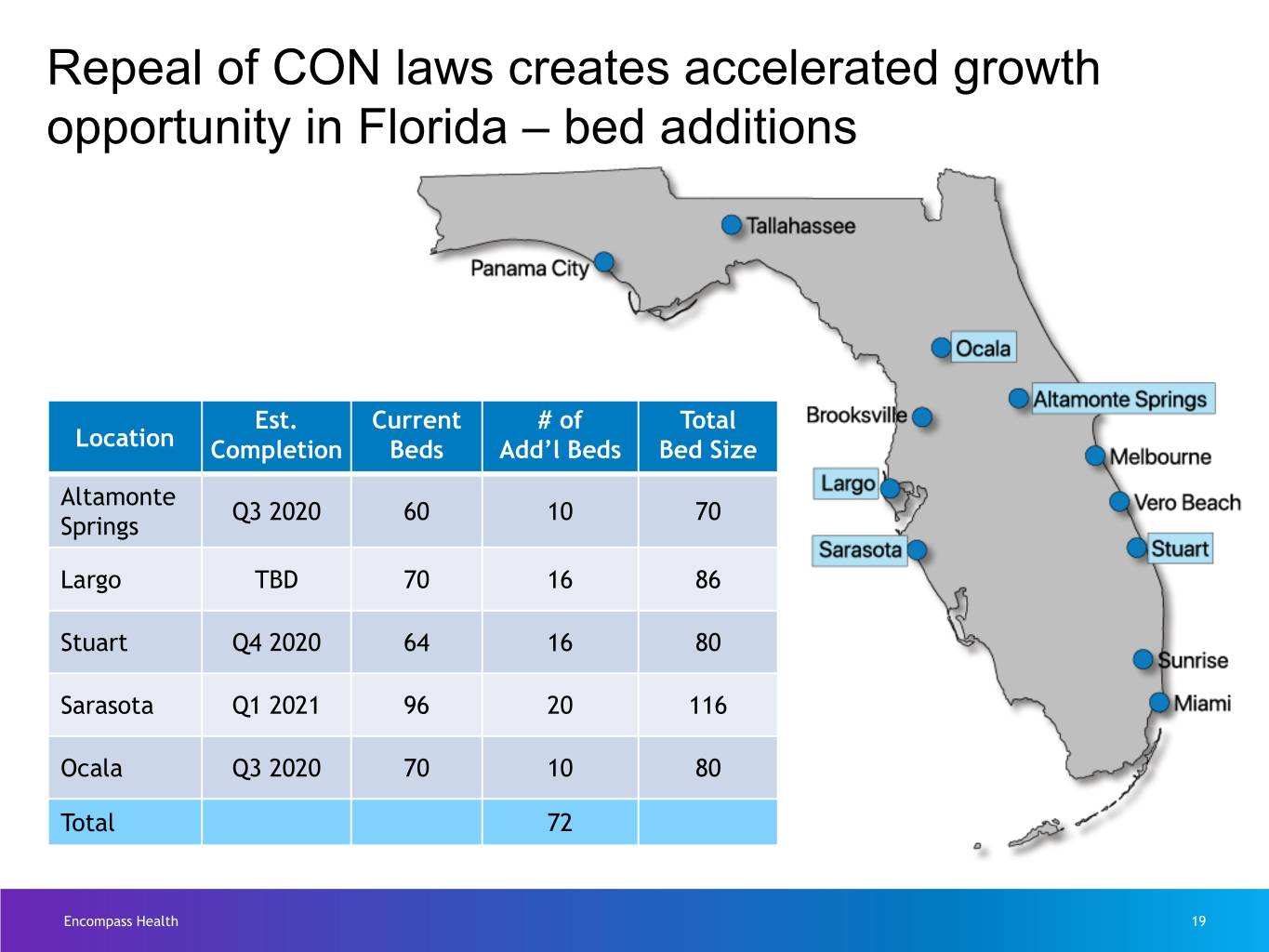

Repeal of CON laws creates accelerated growth opportunity in Florida – bed additions Est. Current # of Total Location Completion Beds Add’l Beds Bed Size Altamonte Q3 2020 60 10 70 Springs Largo TBD 70 16 86 Stuart Q4 2020 64 16 80 Sarasota Q1 2021 96 20 116 Ocala Q3 2020 70 10 80 Total 72 Encompass Health 19

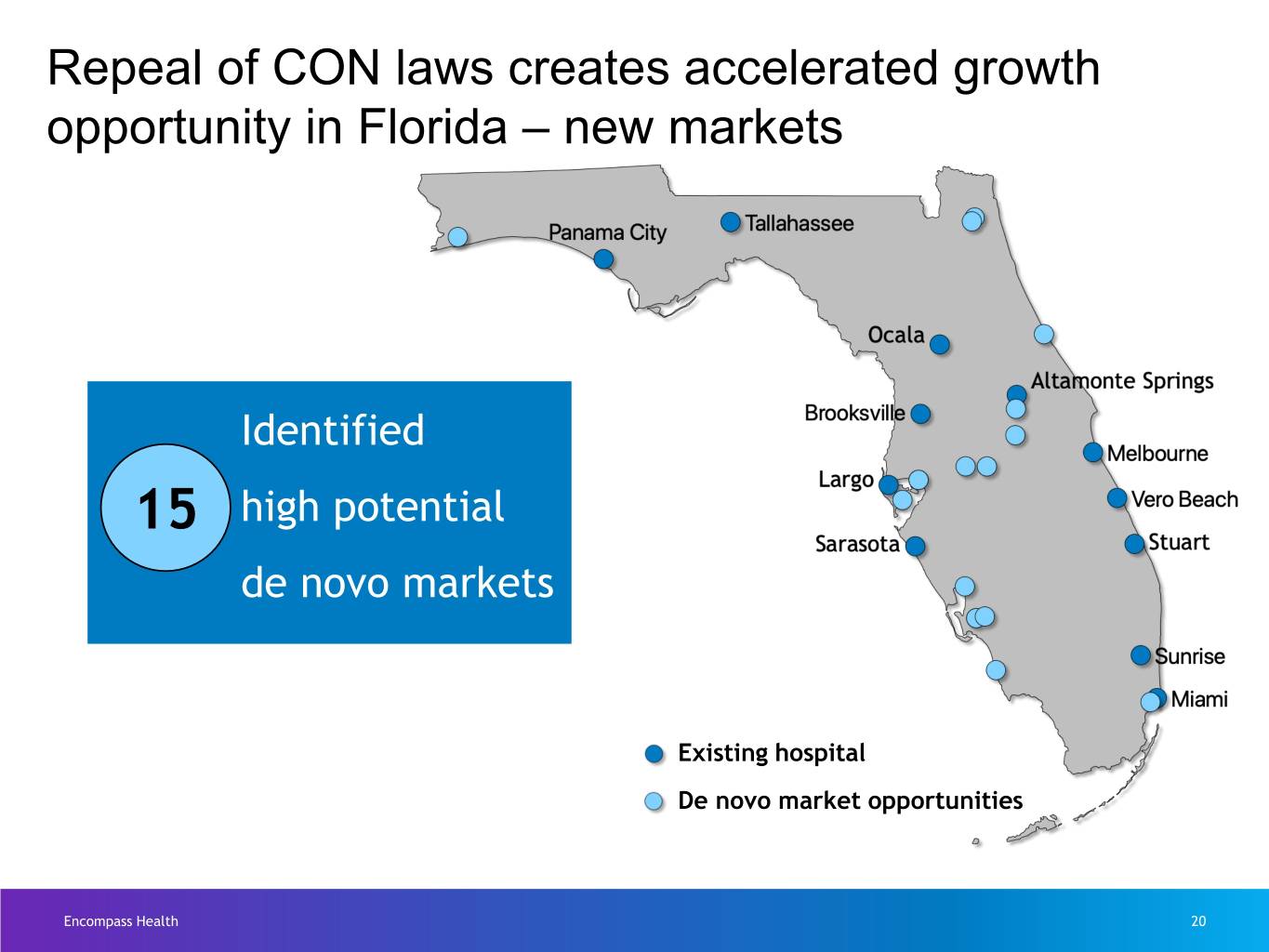

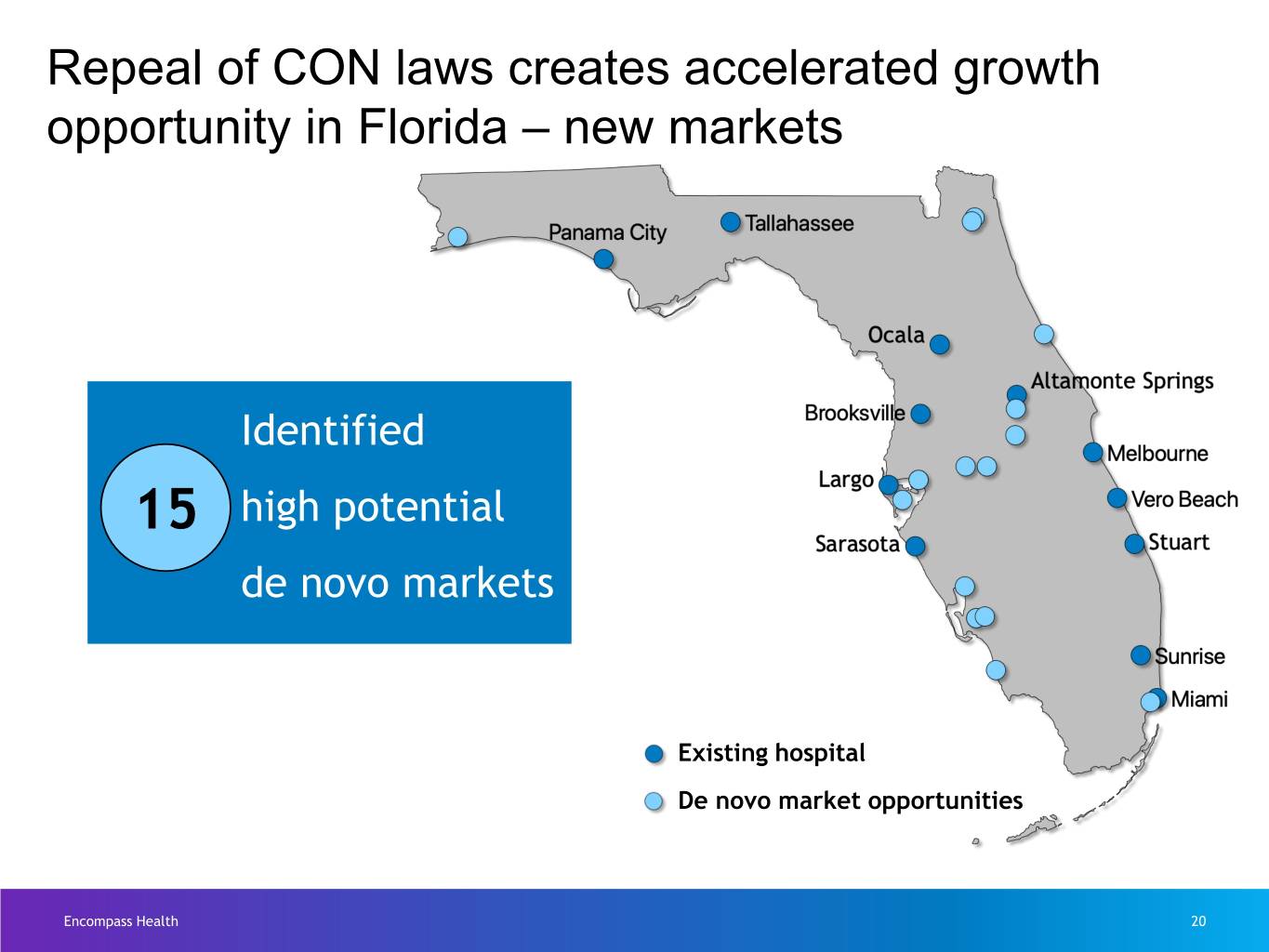

Repeal of CON laws creates accelerated growth opportunity in Florida – new markets Identified 15 high potential de novo markets Existing hospital De novo market opportunities Encompass Health 20

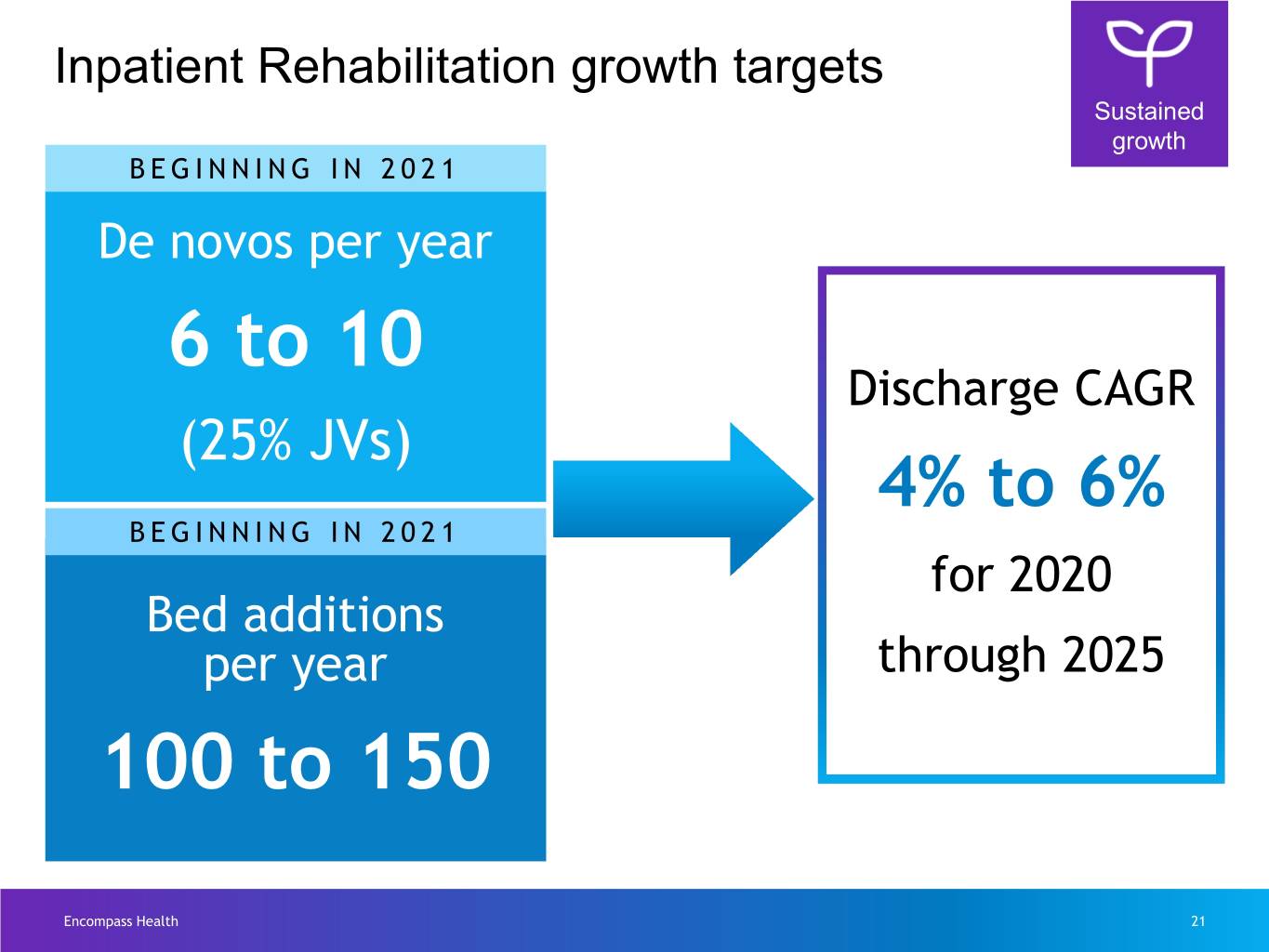

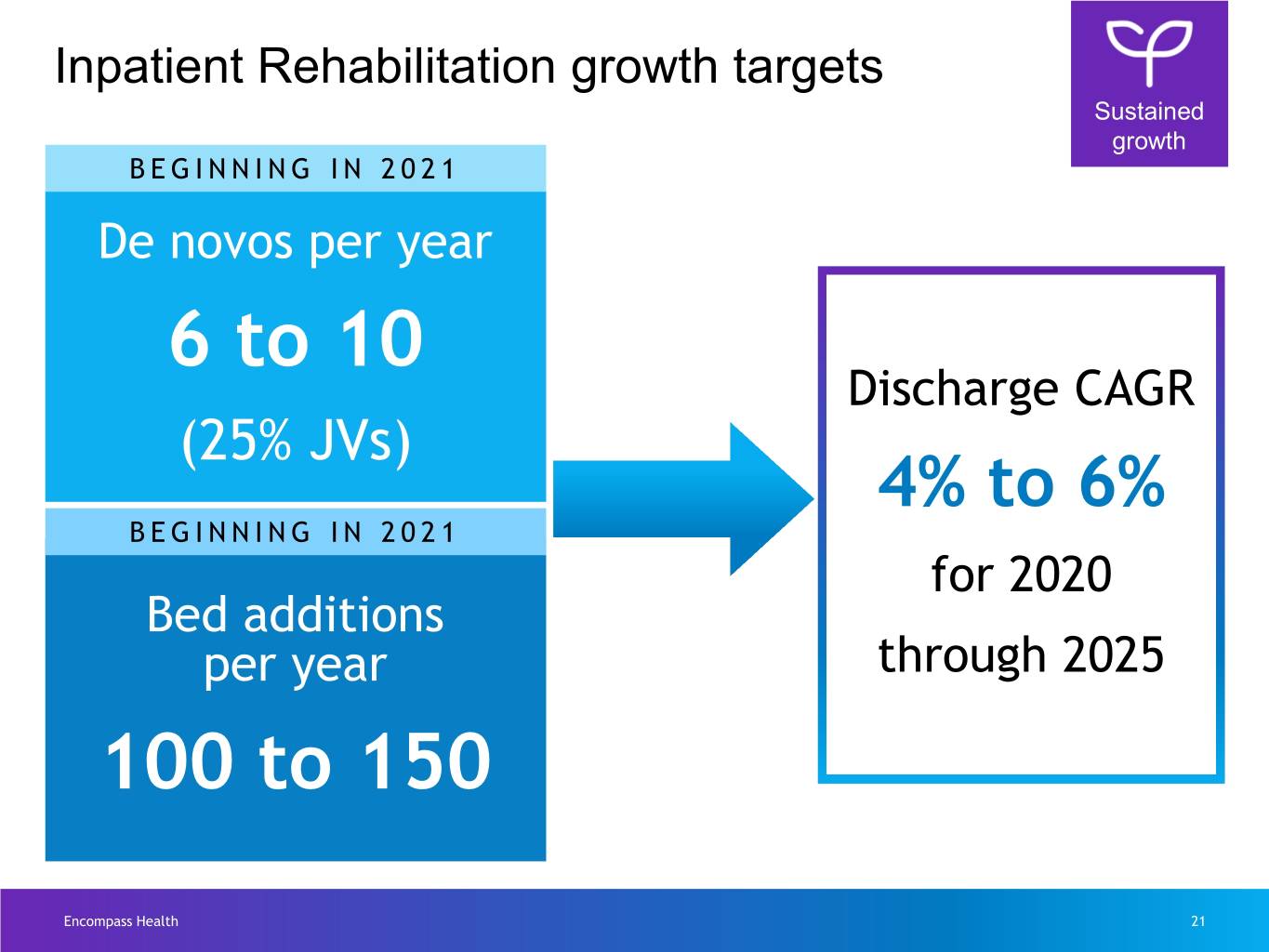

Inpatient Rehabilitation growth targets Sustained growth BEGINNING IN 2021 De novos per year 6 to 10 Discharge CAGR (25% JVs) 4% to 6% BEGINNING IN 2021 for 2020 Bed additions per year through 2025 100 to 150 Encompass Health 21

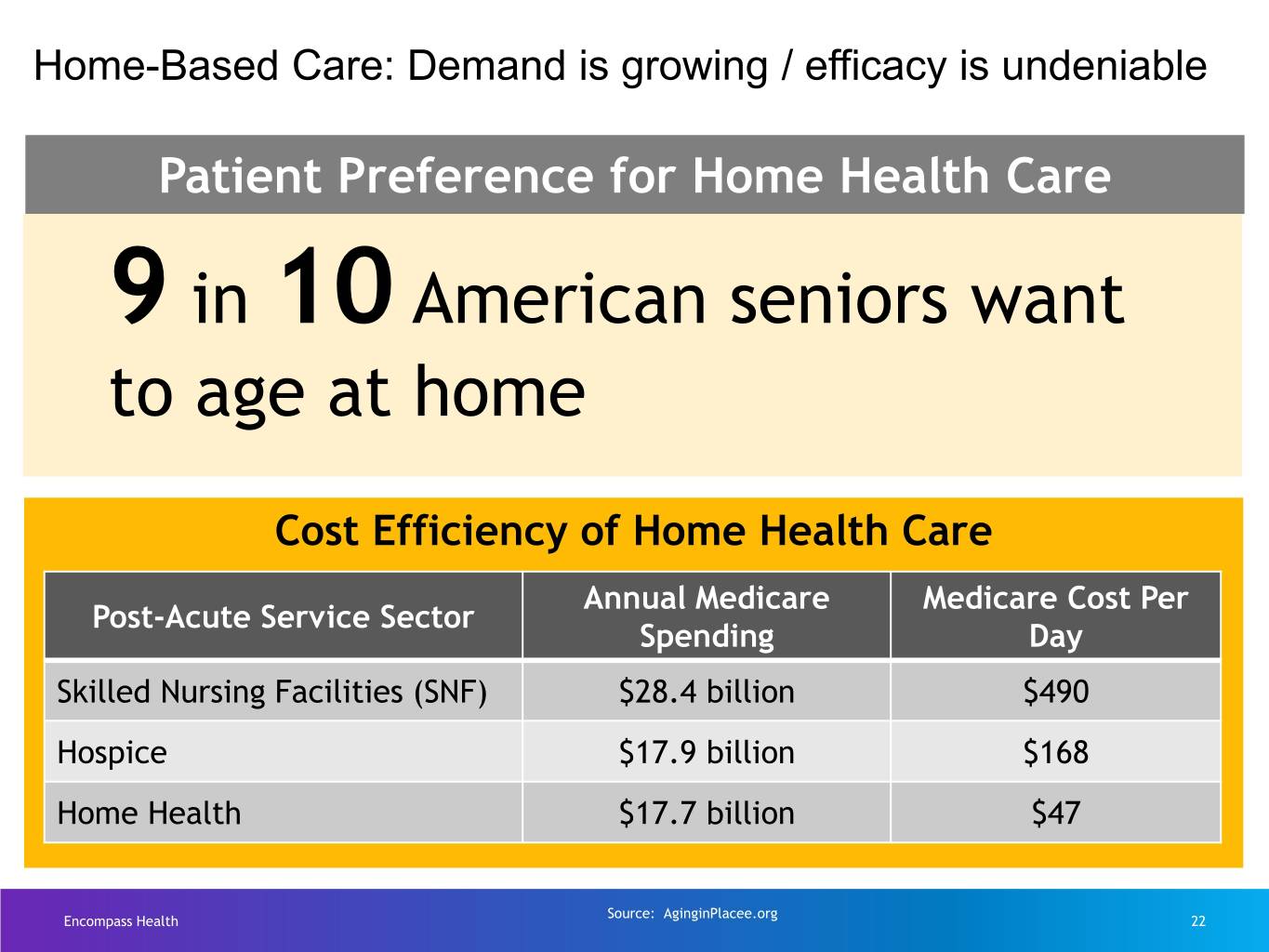

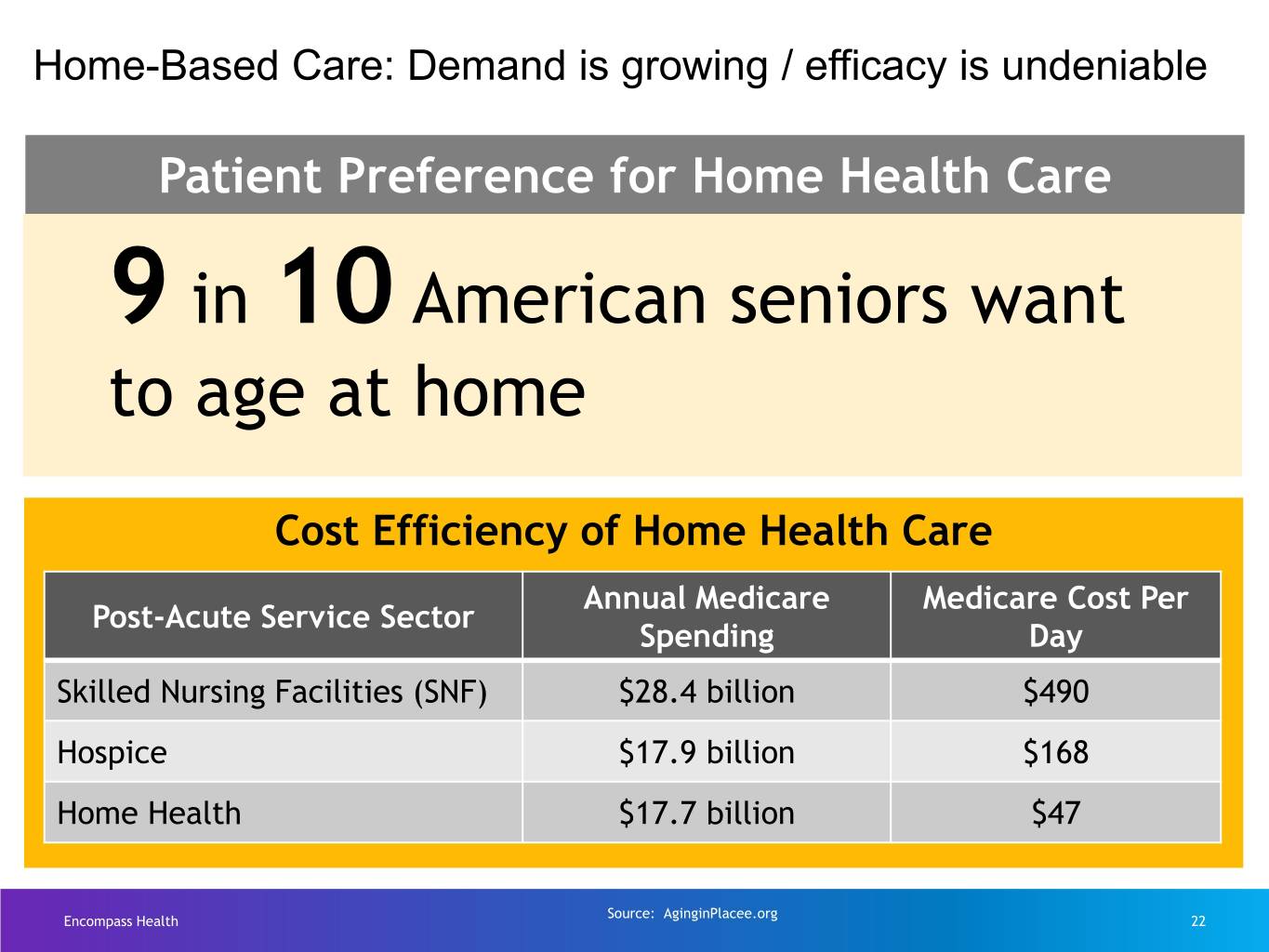

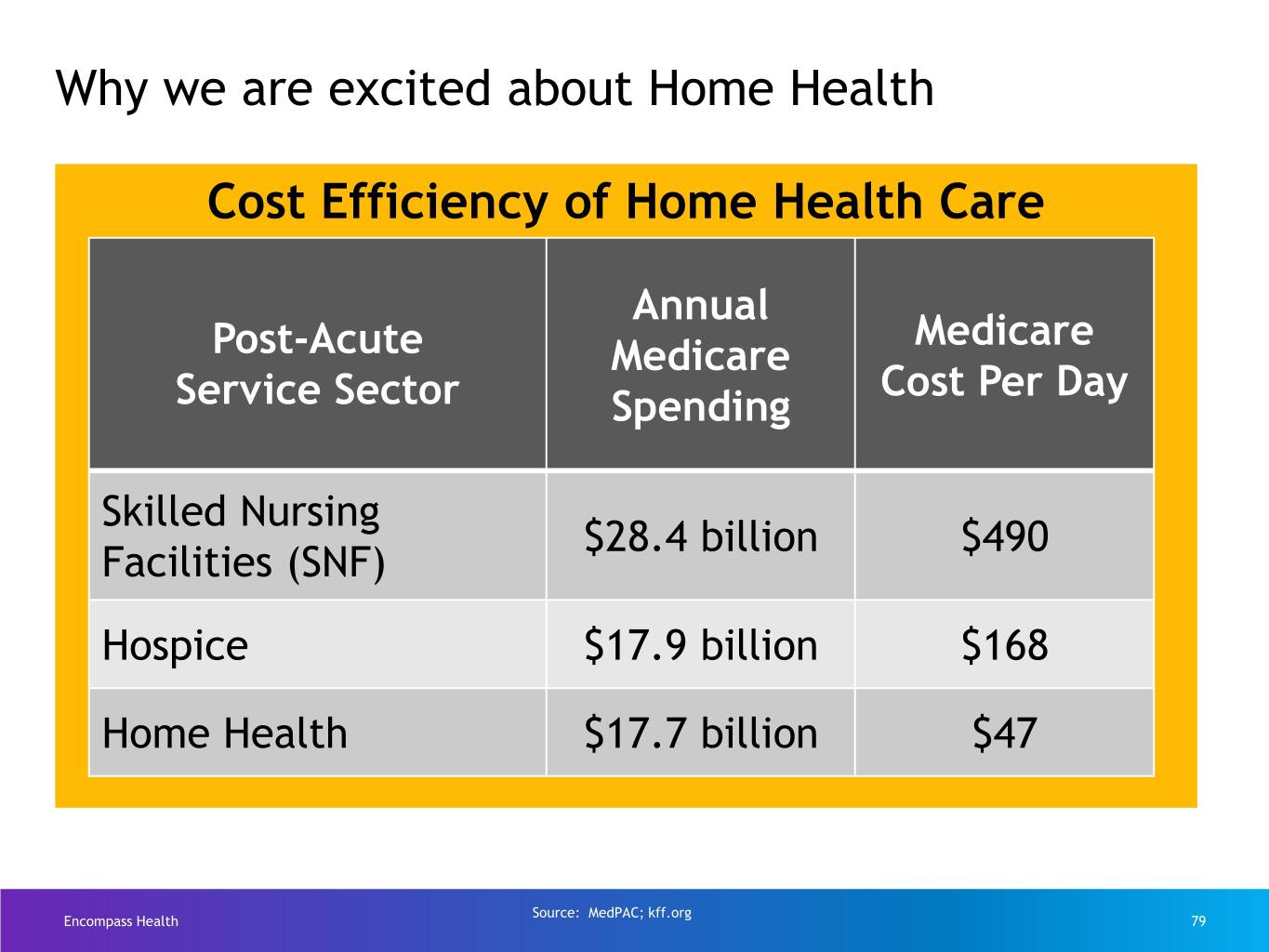

Home-Based Care: Demand is growing / efficacy is undeniable Patient Preference for Home Health Care 9 in 10 American seniors want to age at home Cost Efficiency of Home Health Care Annual Medicare Medicare Cost Per Post-Acute Service Sector Spending Day Skilled Nursing Facilities (SNF) $28.4 billion $490 Hospice $17.9 billion $168 Home Health $17.7 billion $47 Source: AginginPlacee.org Encompass Health 22

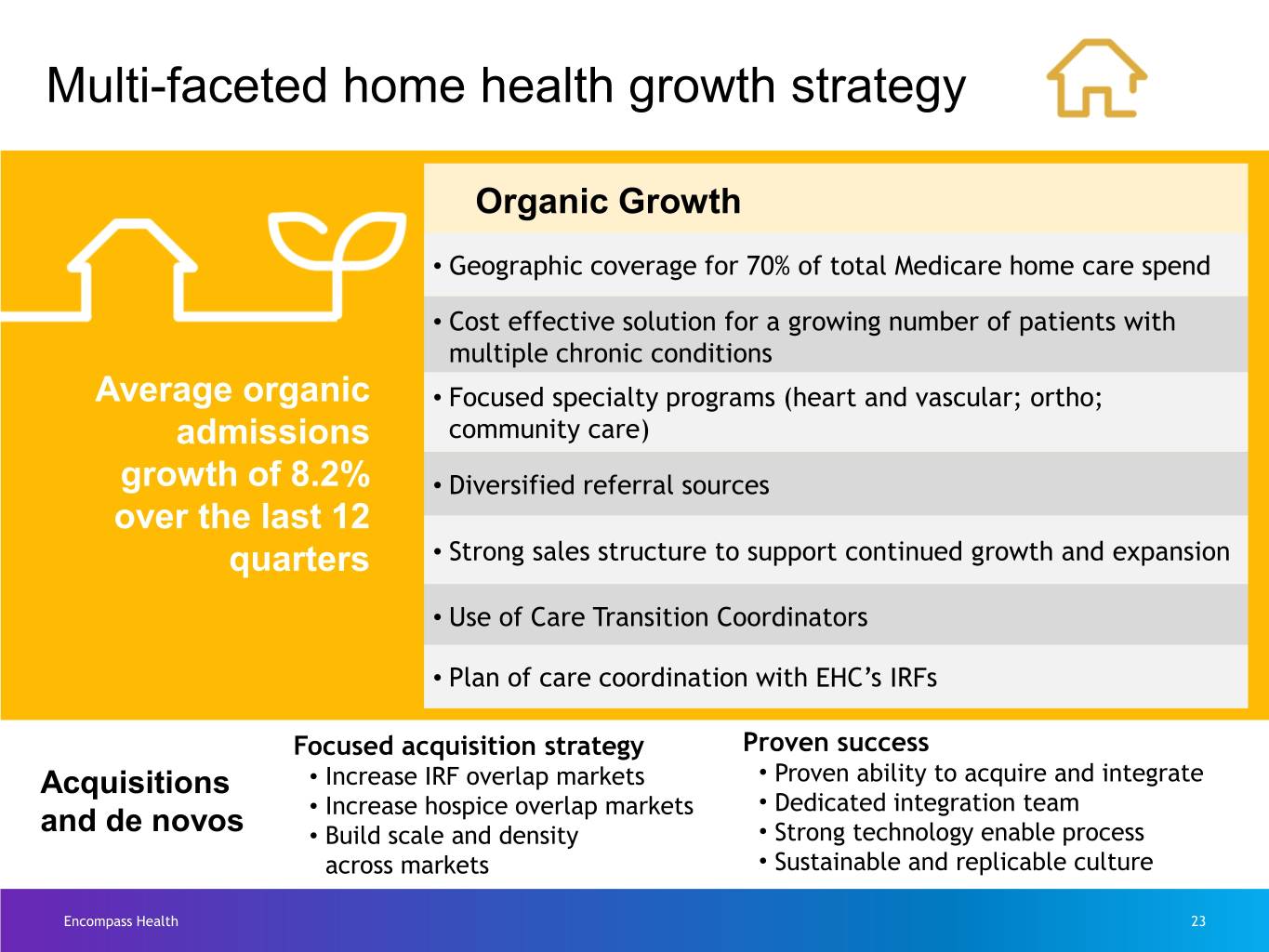

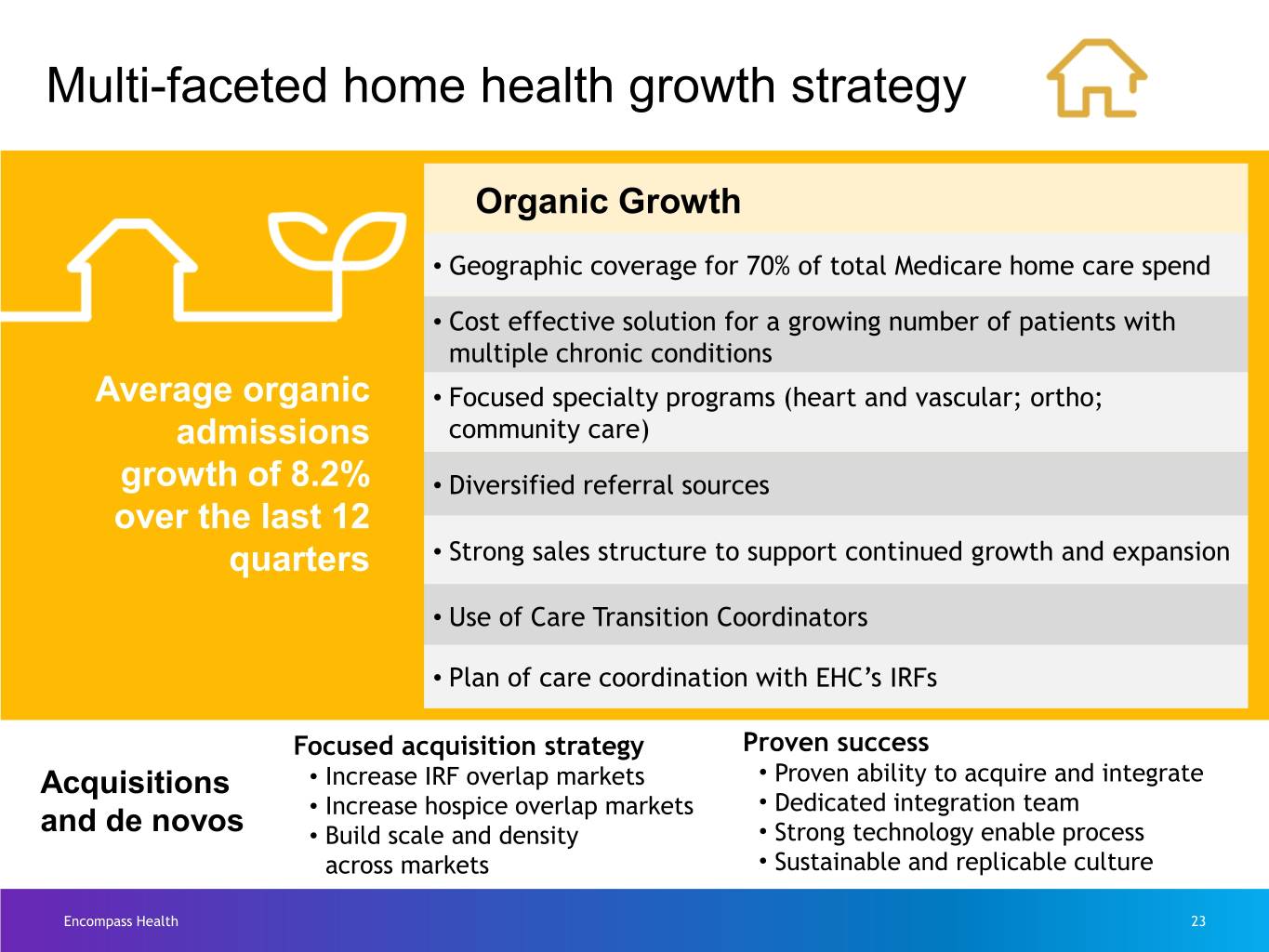

Multi-faceted home health growth strategy Organic Growth • Geographic coverage for 70% of total Medicare home care spend • Cost effective solution for a growing number of patients with multiple chronic conditions Average organic • Focused specialty programs (heart and vascular; ortho; admissions community care) growth of 8.2% • Diversified referral sources over the last 12 quarters • Strong sales structure to support continued growth and expansion • Use of Care Transition Coordinators • Plan of care coordination with EHC’s IRFs Focused acquisition strategy Proven success Acquisitions • Increase IRF overlap markets • Proven ability to acquire and integrate • Increase hospice overlap markets • Dedicated integration team and de novos • Build scale and density • Strong technology enable process across markets • Sustainable and replicable culture Encompass Health 23

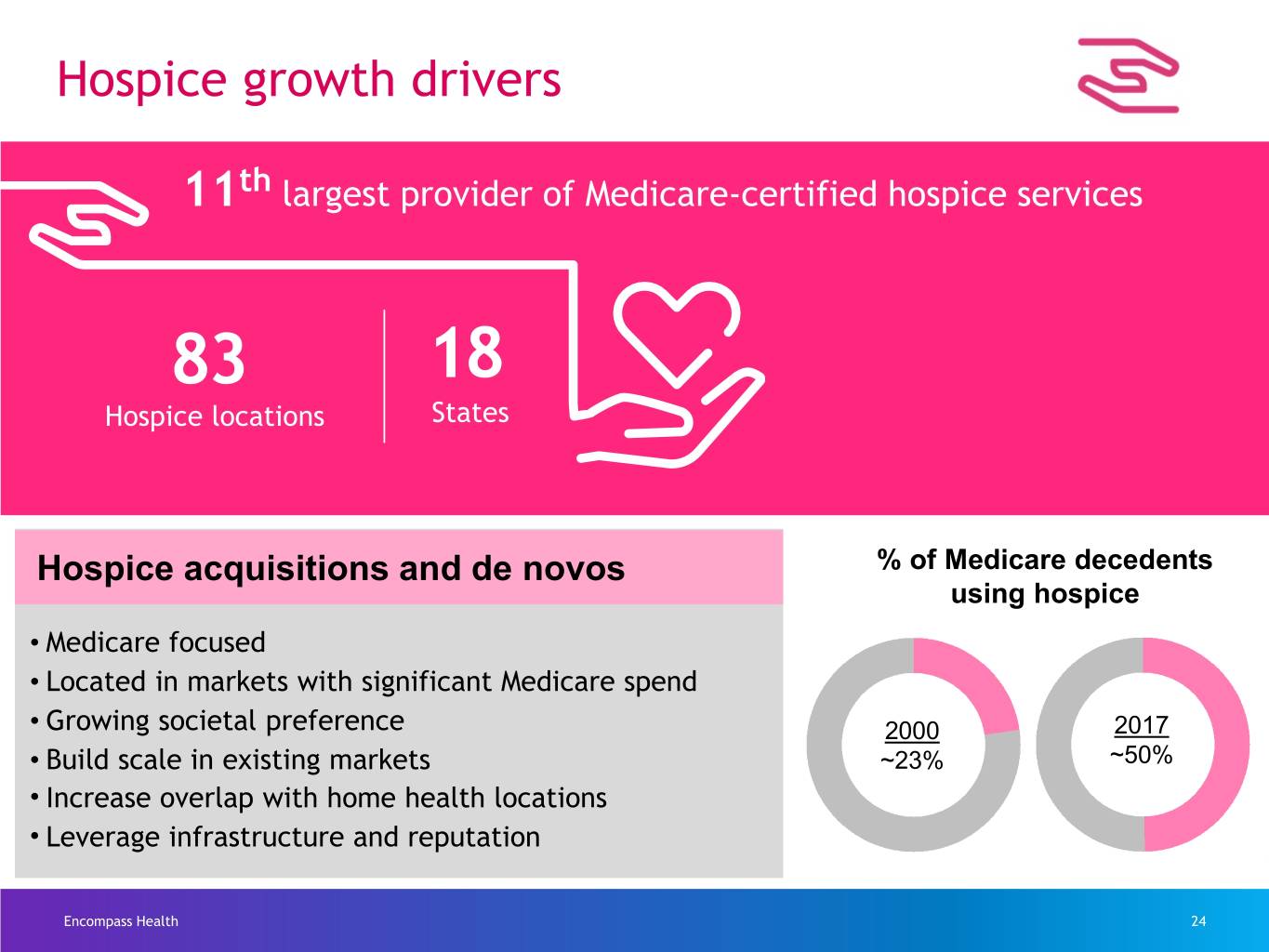

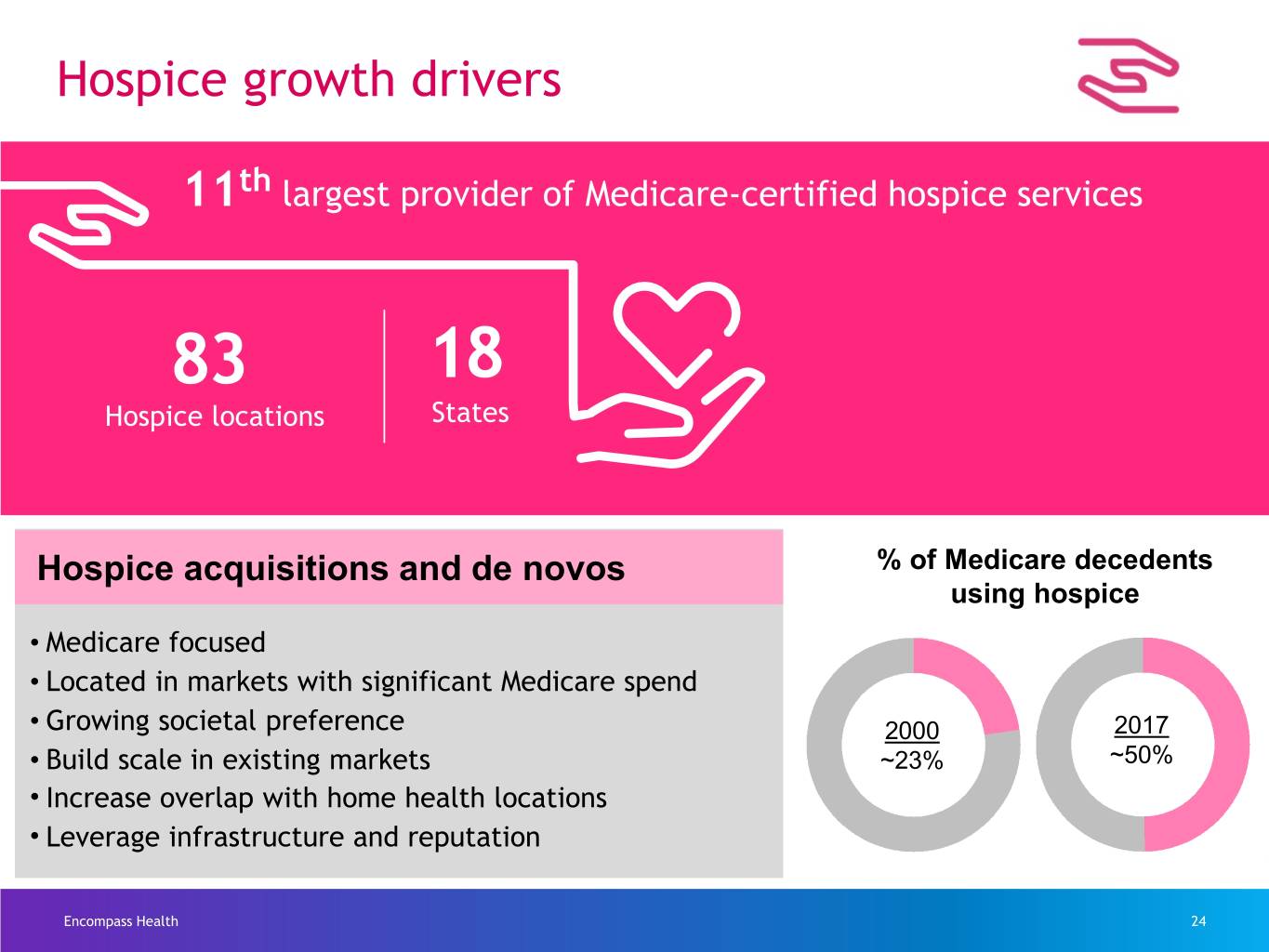

Hospice growth drivers 11th largest provider of Medicare-certified hospice services 83 18 Hospice locations States Hospice acquisitions and de novos % of Medicare decedents using hospice • Medicare focused • Located in markets with significant Medicare spend • Growing societal preference 2000 2017 • Build scale in existing markets ~23% ~50% • Increase overlap with home health locations • Leverage infrastructure and reputation Encompass Health 24

Home Health and Hospice growth targets Sustained growth Home Health Hospice Acquisitions admissions CAGR admissions CAGR $50 million to 10%+ 10% to 15% $100 million for 2020 through for 2020 through 2025 2025 per year Not inclusive of larger scale acquisitions Encompass Health 25

Clinical collaboration growth targets 100 overlap markets by 2025 45% all payor goal by 2025 Encompass Health 26

Consolidated CAGR targets Sustained growth Consolidated Consolidated Adjusted net operating adjusted free cash revenues EBITDA flow 7% to 9% 7% to 9% 8% to 10% 2020 through 2025 Encompass Health 27

Patient Journey Video Encompass Health 28

Inpatient Rehabilitation Presented by Barb Jacobsmeyer Encompass Health 29

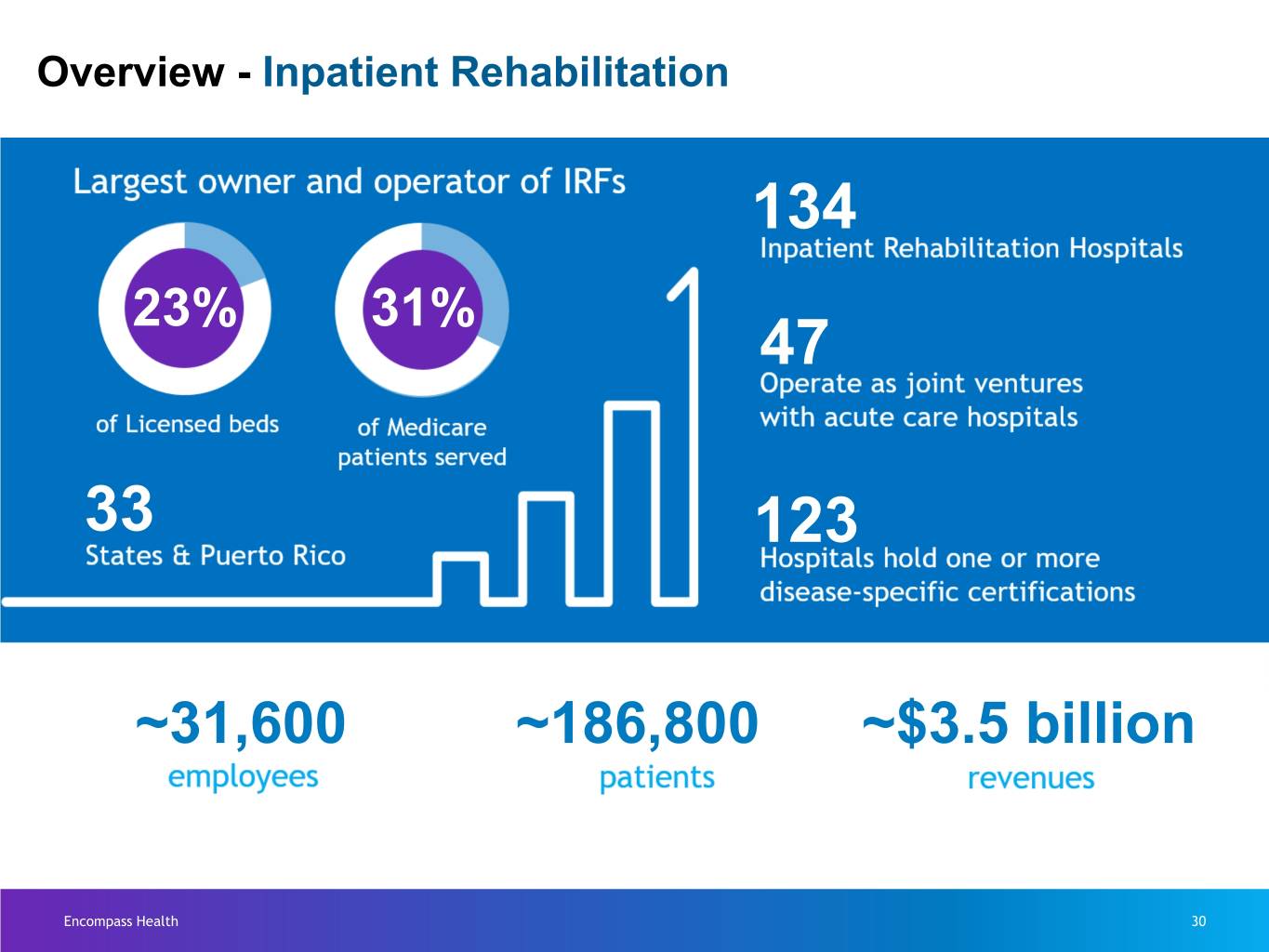

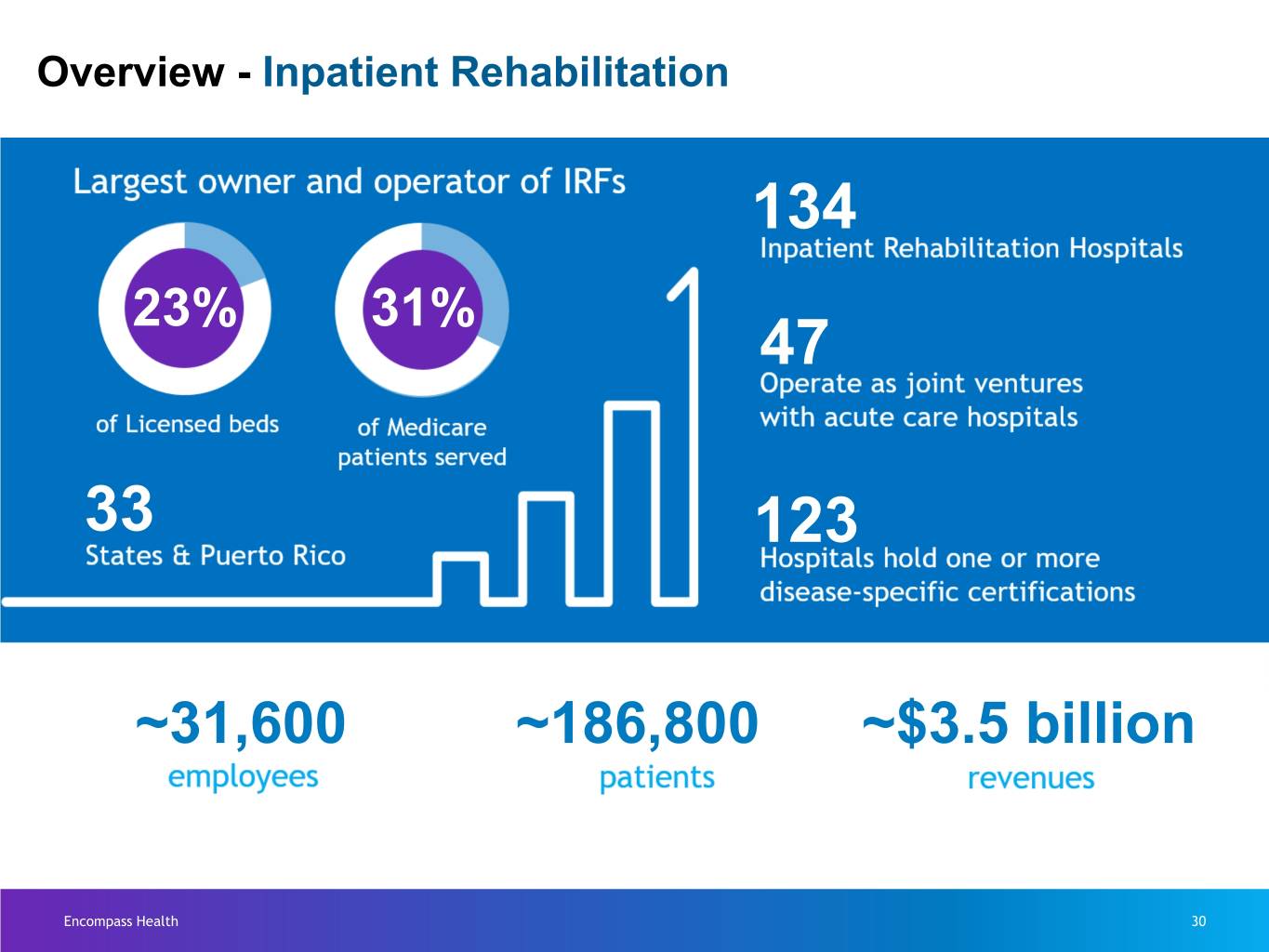

Overview - Inpatient Rehabilitation 134 23% 31% 47 33 123 ~31,600 ~186,800 ~$3.5 billion Encompass Health 30

Who are these patients, and why did they come our way? Encompass Health 31

Hospital level care Encompass Health 32

Physician Engagement Encompass Health 33

Full Care Team Encompass Health 34

On-Site Pharmacy Encompass Health 35

Specialized and Intensive Therapy Encompass Health 36

Minimum of 3 hours of therapy 5 days a week Encompass Health 37

We invest significantly in rehabilitation technologies to further improve patient outcomes ReoGO Burt VitalStim Bioness H200 DynaVision Biodex FreeStep Biodex Balance System Bioness Integrated Therapy System (BITS) Encompass Health 38

Activities of Daily Living Suite Encompass Health 39

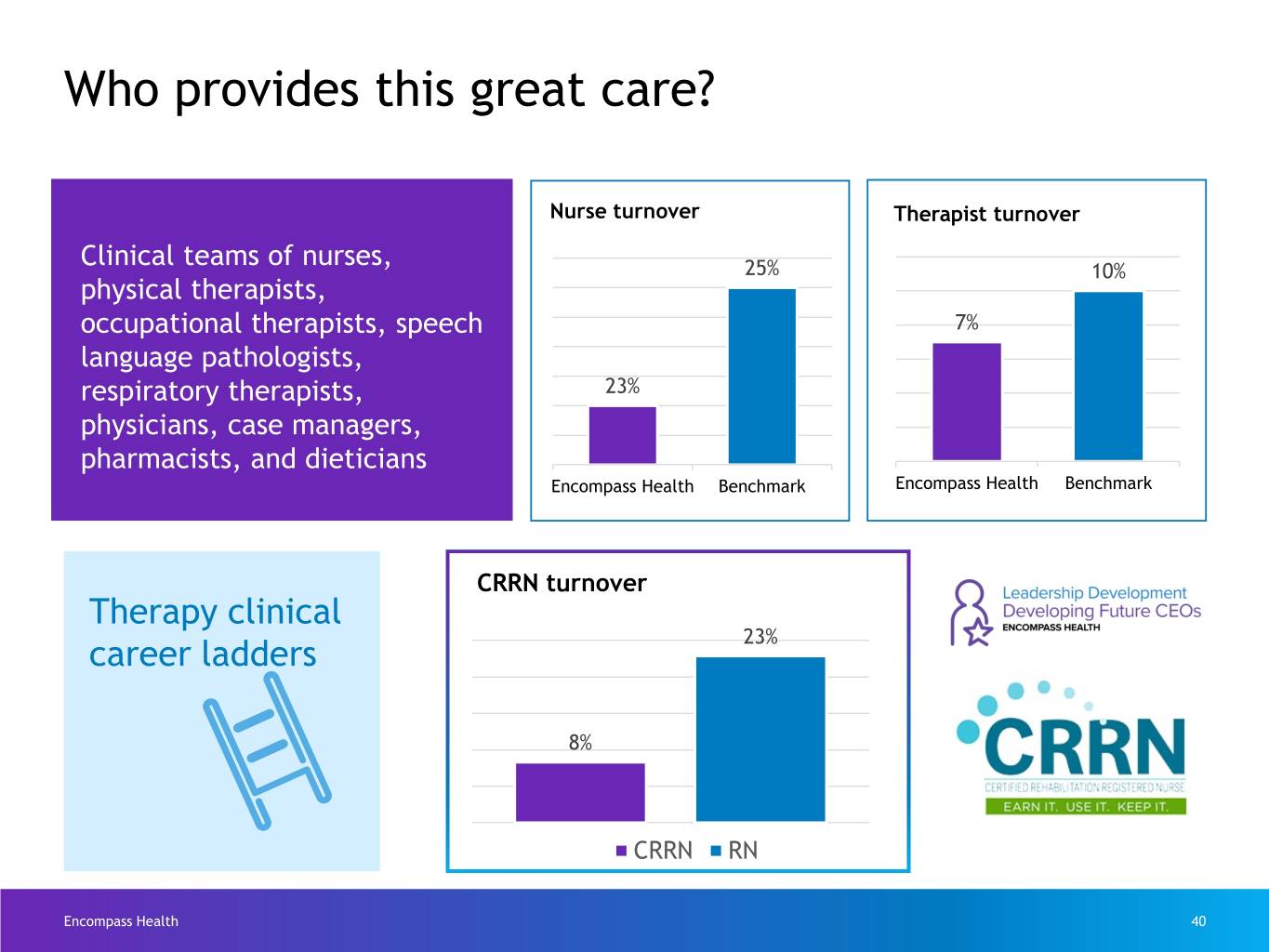

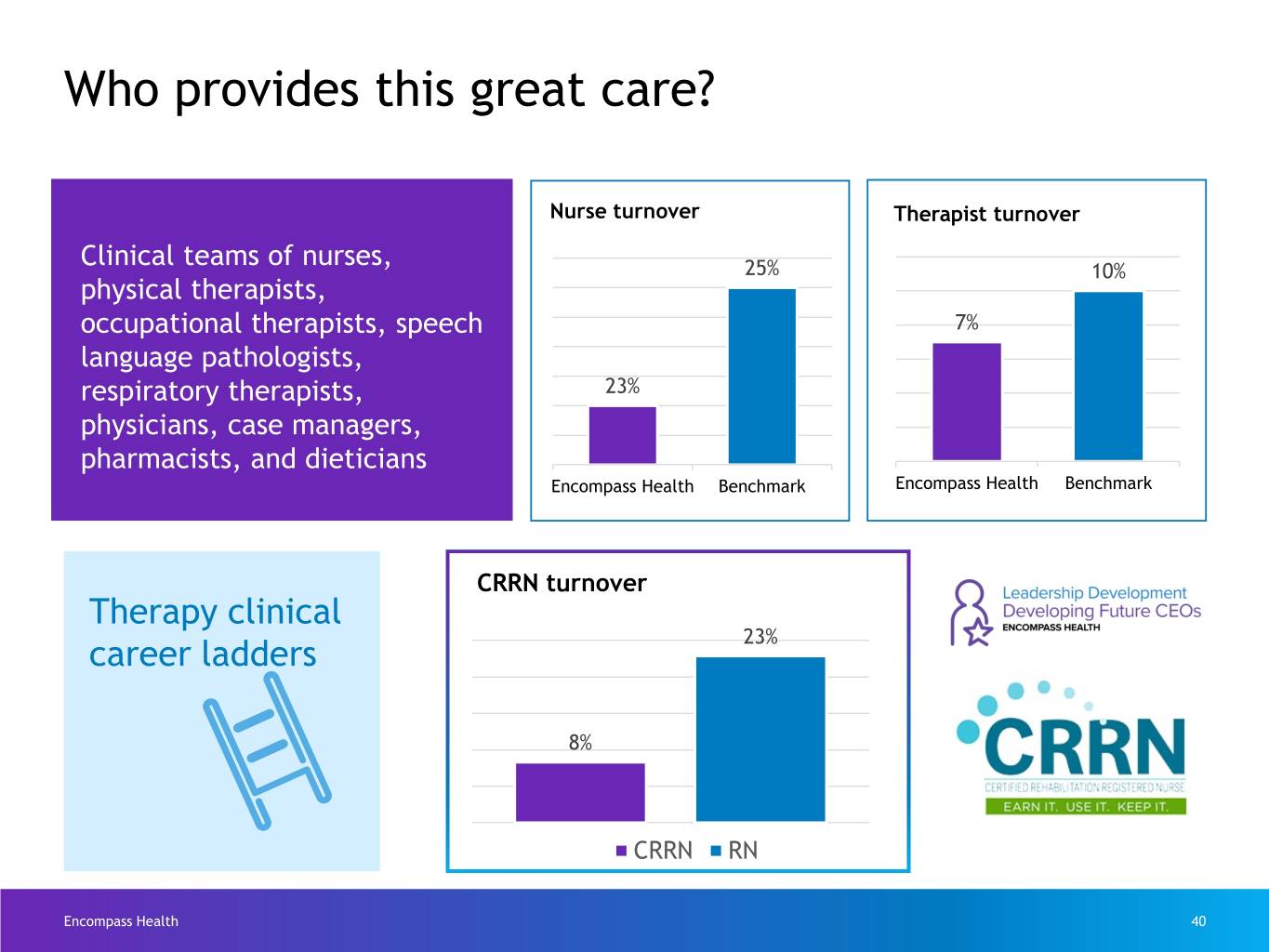

Who provides this great care? Nurse turnover Therapist turnover Clinical teams of nurses, 25% 10% physical therapists, occupational therapists, speech 7% language pathologists, respiratory therapists, 23% physicians, case managers, pharmacists, and dieticians Encompass Health Benchmark Encompass Health Benchmark CRRN turnover Therapy clinical 23% career ladders 8% CRRN RN Encompass Health 40

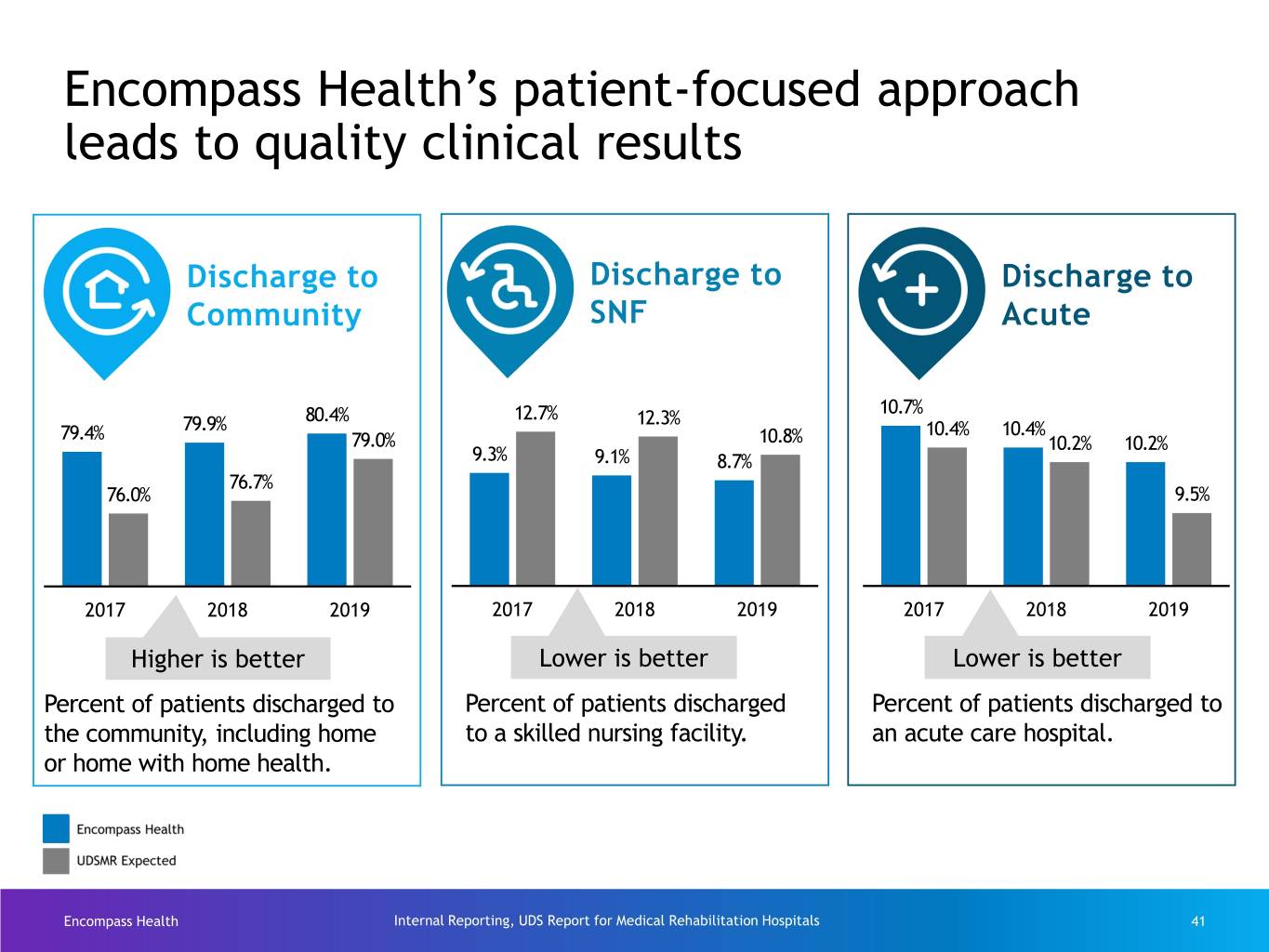

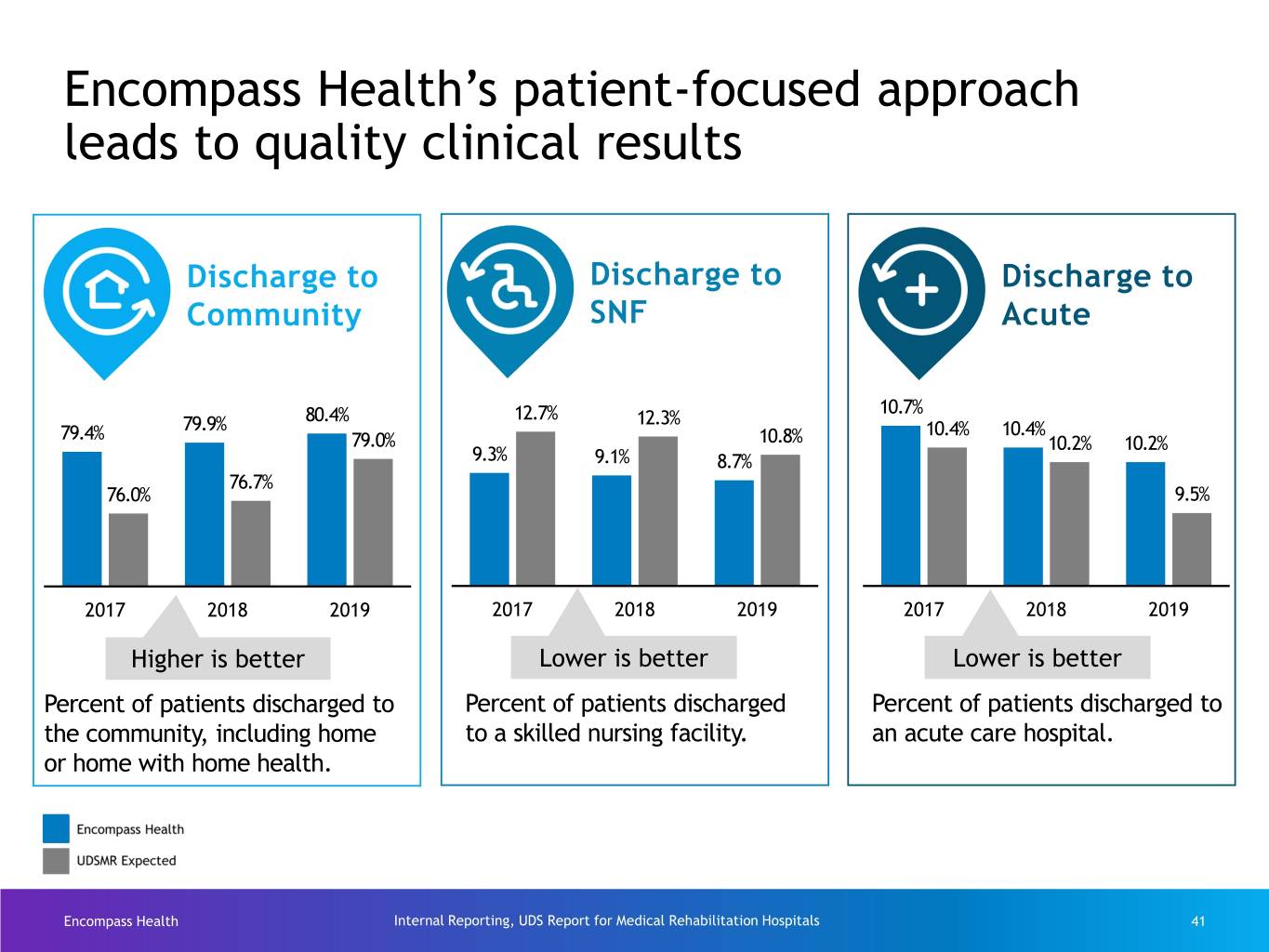

Encompass Health’s patient-focused approach leads to quality clinical results Discharge to Discharge to Discharge to Community SNF Acute 10.7% 80.4% 12.7% 12.3% 79.4% 79.9% 10.4% 10.4% 79.0% 10.8% 10.2% 10.2% 9.3% 9.1% 8.7% 76.7% 76.0% 9.5% 2017 2018 2019 2017 2018 2019 2017 2018 2019 Higher is better Lower is better Lower is better Percent of patients discharged to Percent of patients discharged Percent of patients discharged to the community, including home to a skilled nursing facility. an acute care hospital. or home with home health. Encompass Health Internal Reporting, UDS Report for Medical Rehabilitation Hospitals 41

Technology Supports Our Staff Encompass Health 42

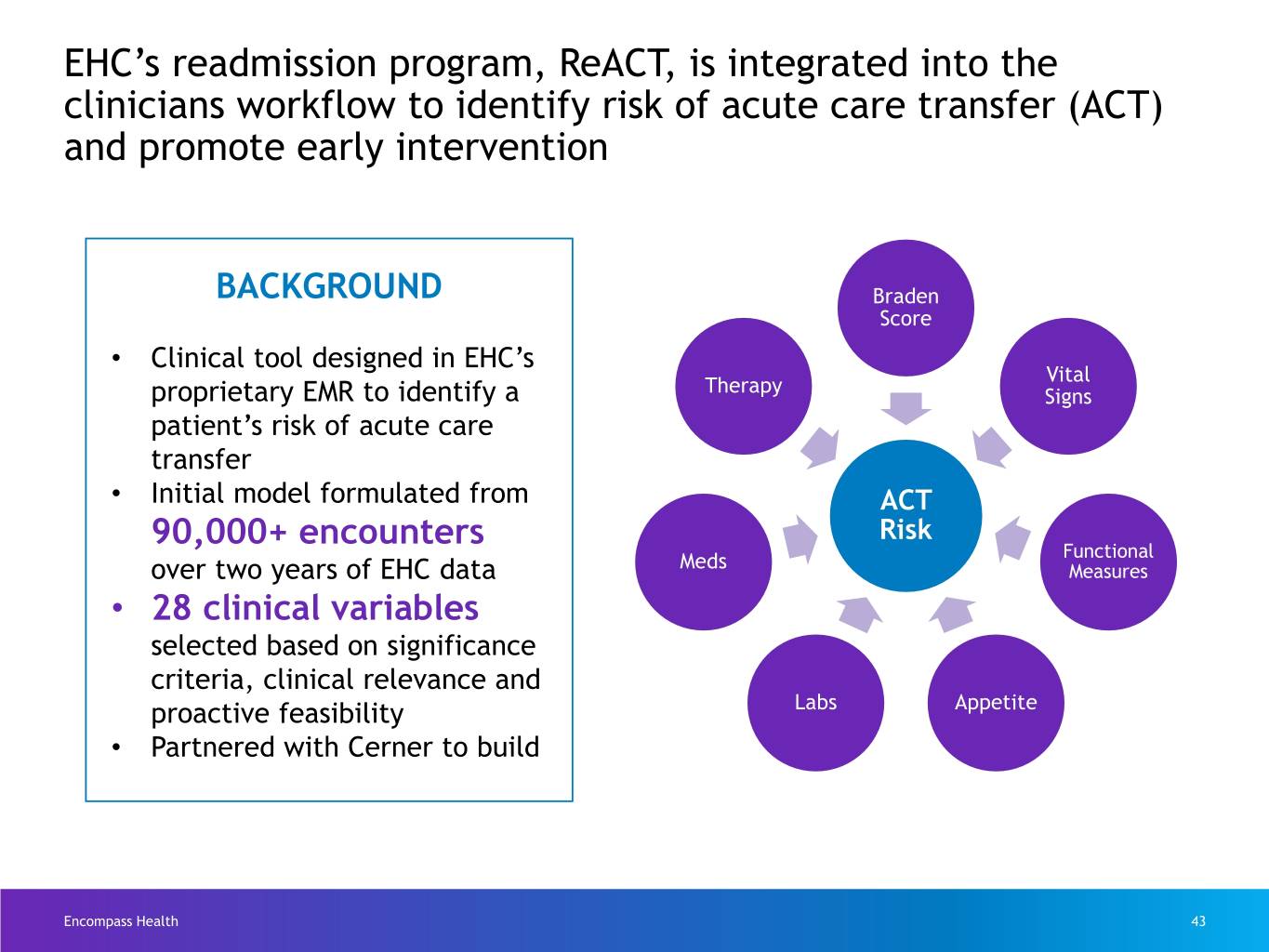

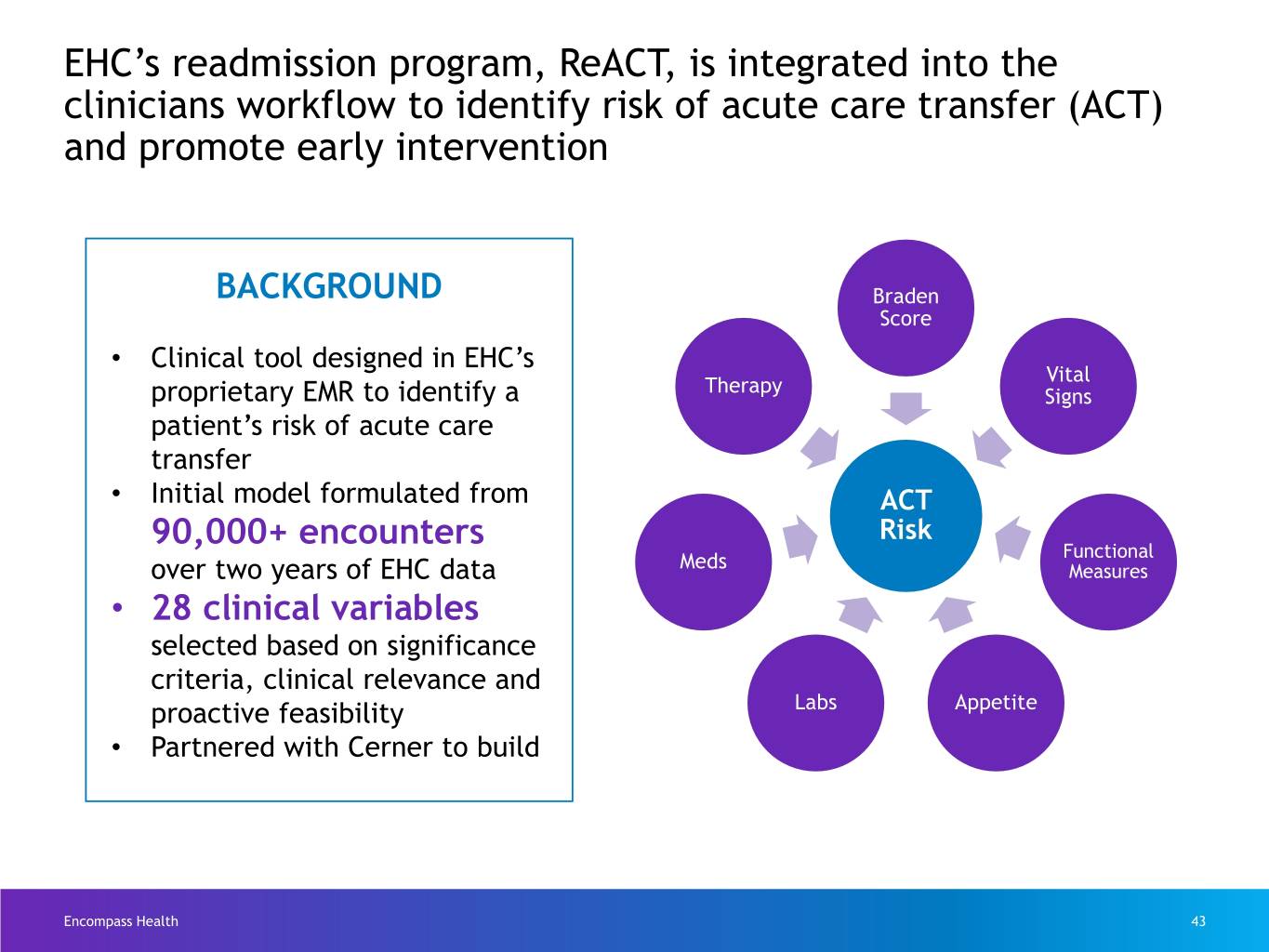

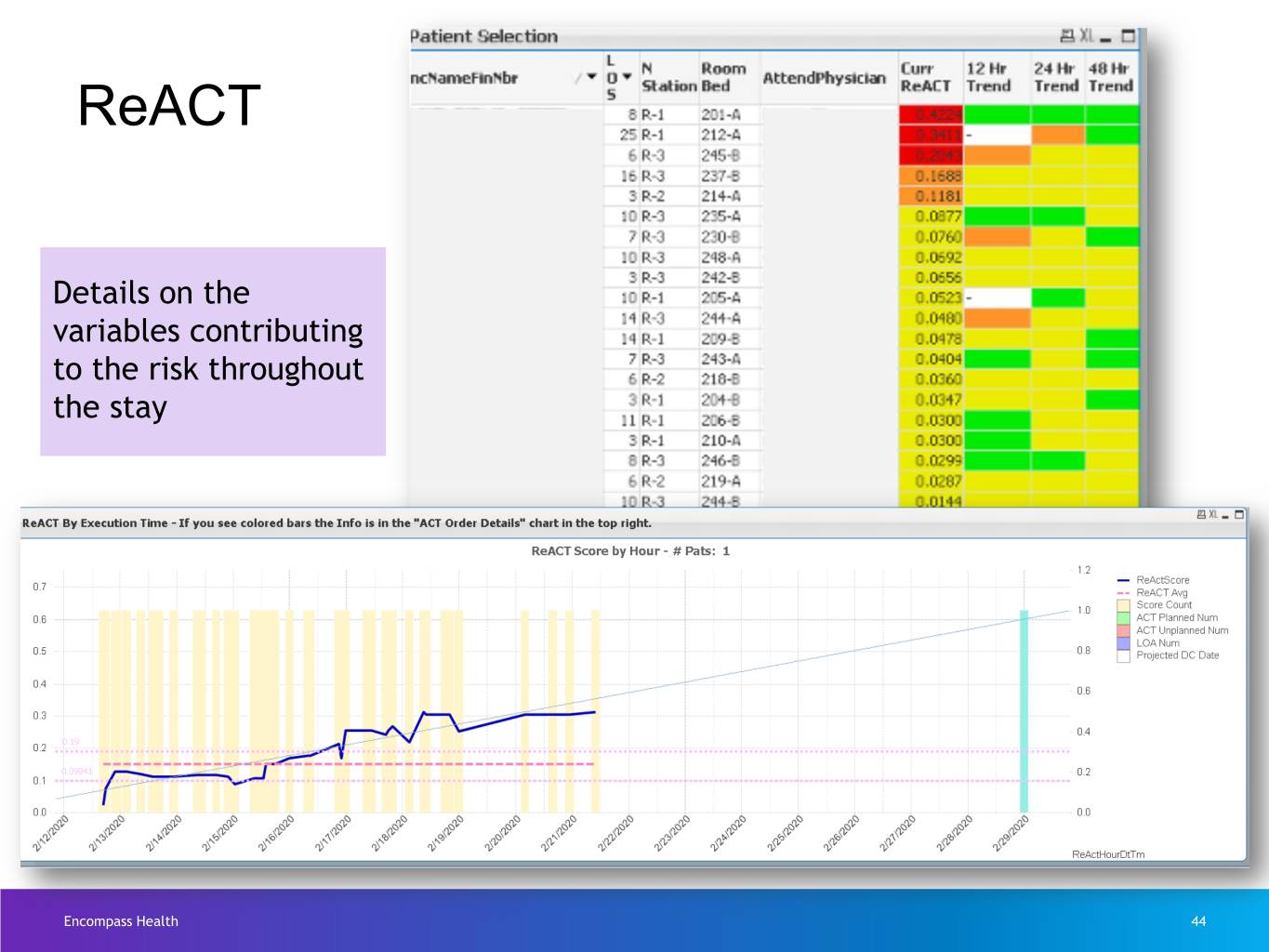

EHC’s readmission program, ReACT, is integrated into the clinicians workflow to identify risk of acute care transfer (ACT) and promote early intervention BACKGROUND Braden Score • Clinical tool designed in EHC’s Vital Therapy proprietary EMR to identify a Signs patient’s risk of acute care transfer • Initial model formulated from ACT 90,000+ encounters Risk Meds Functional over two years of EHC data Measures • 28 clinical variables selected based on significance criteria, clinical relevance and proactive feasibility Labs Appetite • Partnered with Cerner to build Encompass Health 43

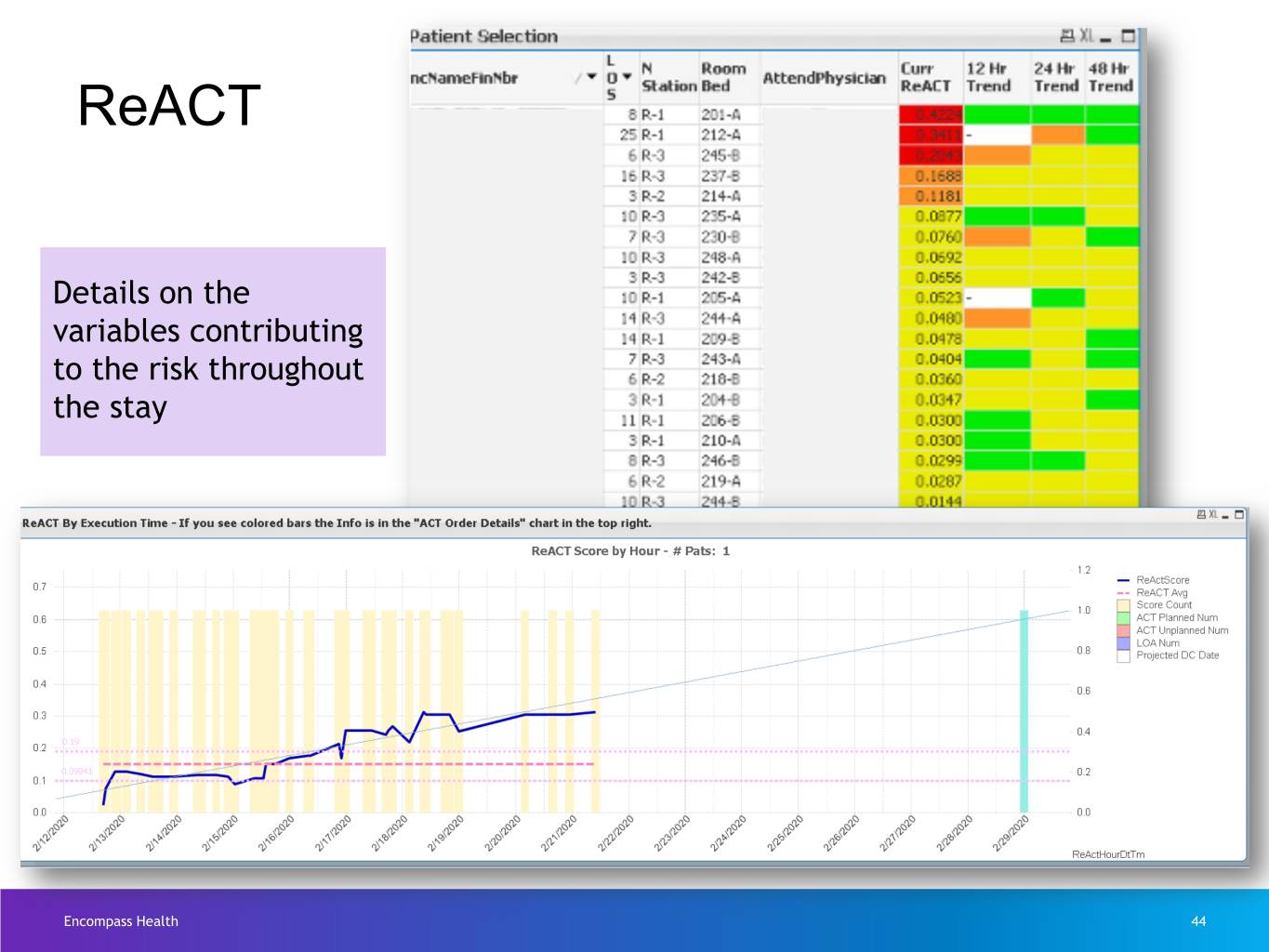

ReACT Details on the variables contributing to the risk throughout the stay Encompass Health 44

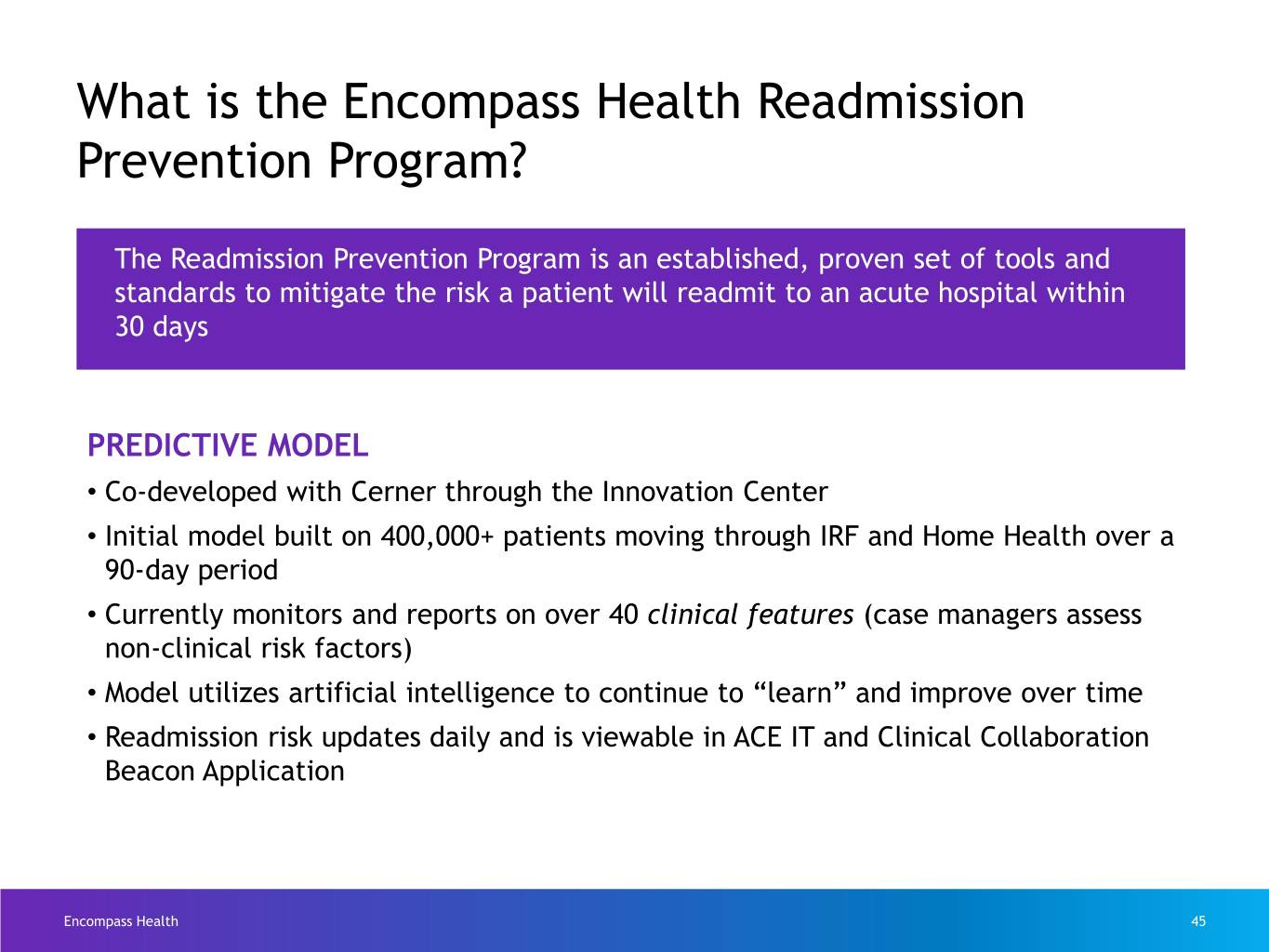

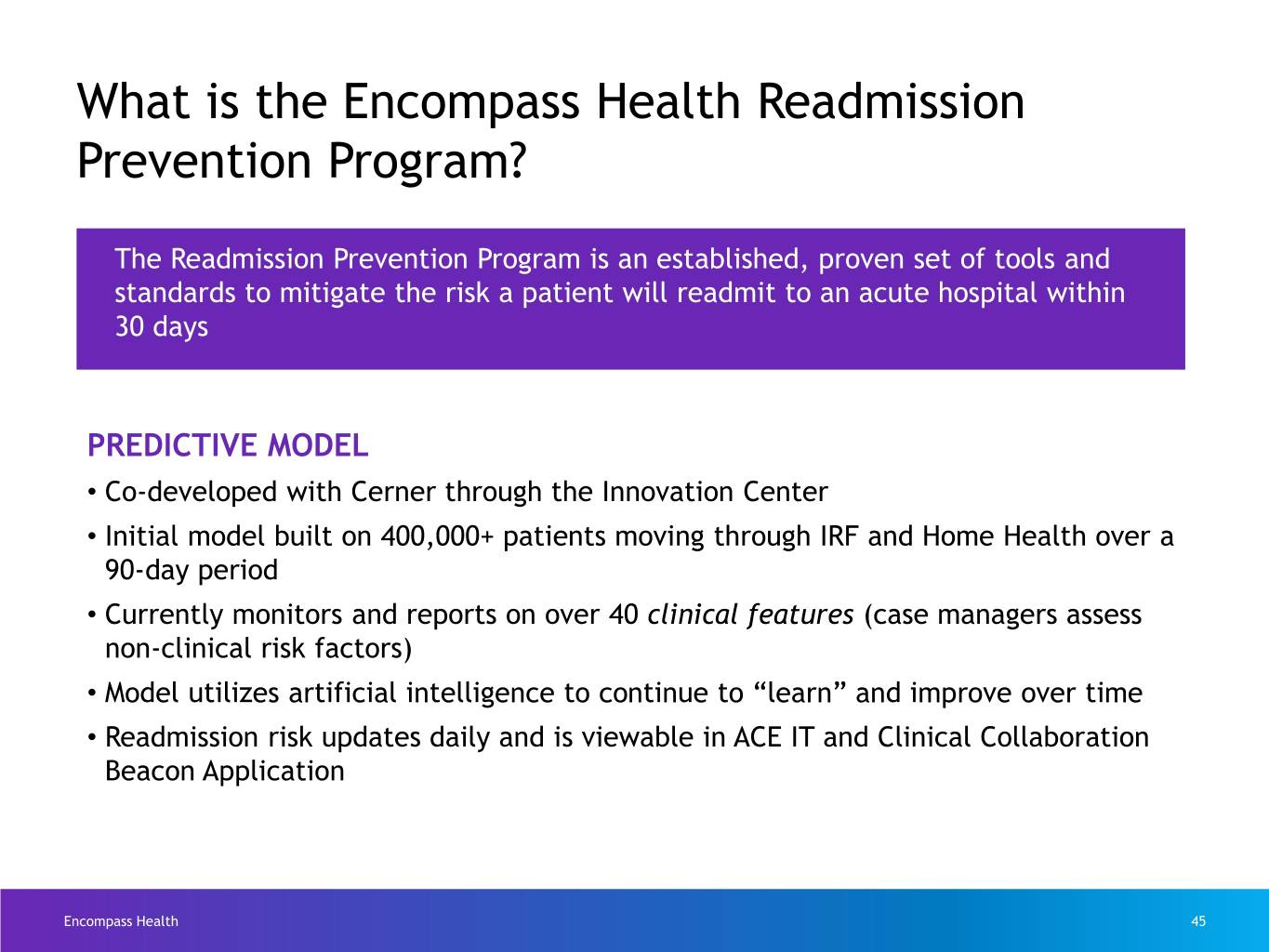

What is the Encompass Health Readmission Prevention Program? The Readmission Prevention Program is an established, proven set of tools and standards to mitigate the risk a patient will readmit to an acute hospital within 30 days PREDICTIVE MODEL • Co-developed with Cerner through the Innovation Center • Initial model built on 400,000+ patients moving through IRF and Home Health over a 90-day period • Currently monitors and reports on over 40 clinical features (case managers assess non-clinical risk factors) • Model utilizes artificial intelligence to continue to “learn” and improve over time • Readmission risk updates daily and is viewable in ACE IT and Clinical Collaboration Beacon Application Encompass Health 45

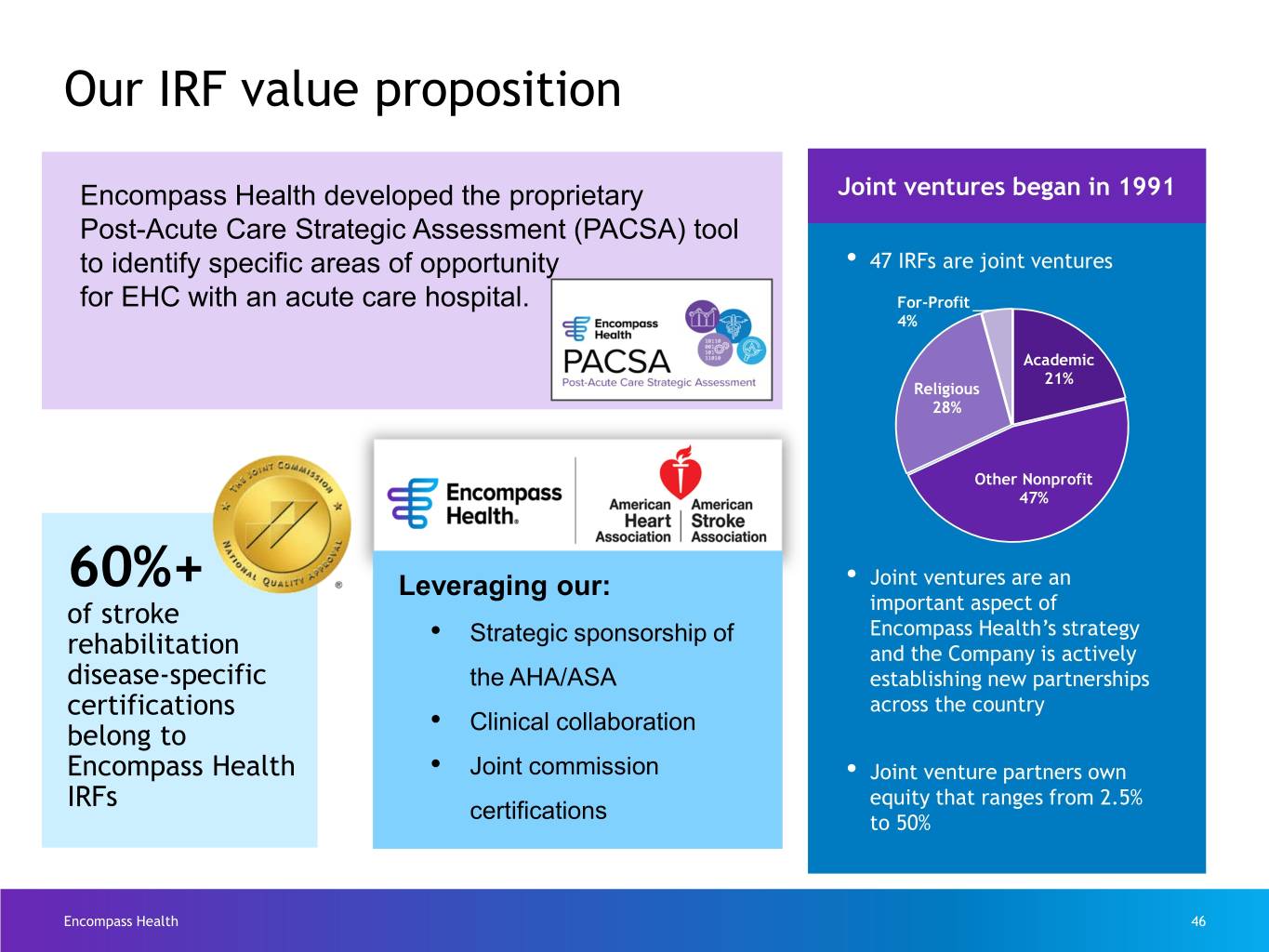

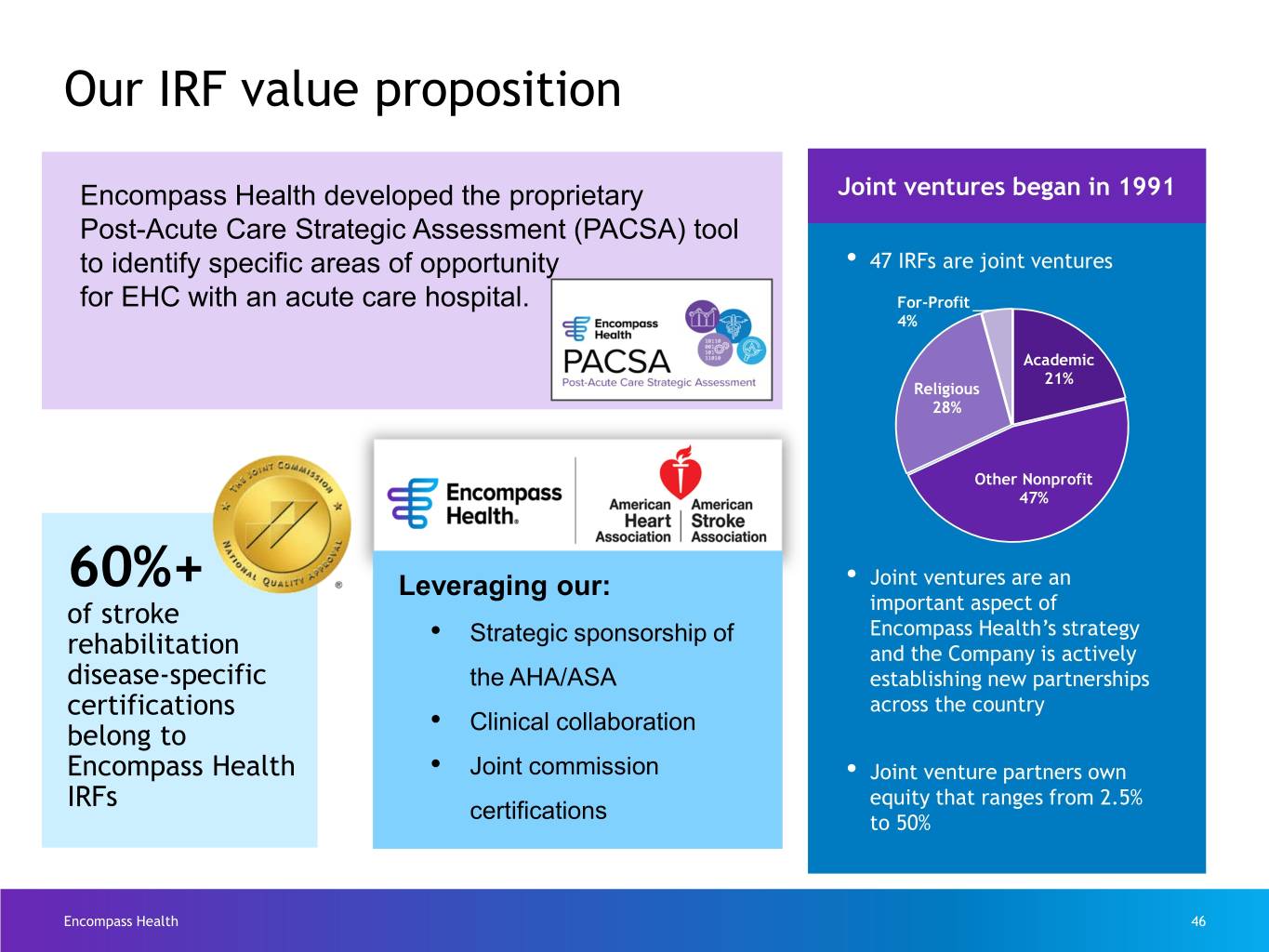

Our IRF value proposition Encompass Health developed the proprietary JointJoint ventures ventures began began in in 1991 1991 Post-Acute Care Strategic Assessment (PACSA) tool to identify specific areas of opportunity • 47 IRFs are joint ventures for EHC with an acute care hospital. For-Profit 4% Academic 21% Religious 28% Other Nonprofit 47% 60%+ Leveraging our: • Joint ventures are an of stroke important aspect of • Strategic sponsorship of Encompass Health’s strategy rehabilitation and the Company is actively disease-specific the AHA/ASA establishing new partnerships certifications across the country belong to • Clinical collaboration Encompass Health • Joint commission • Joint venture partners own IRFs equity that ranges from 2.5% certifications to 50% Encompass Health 46

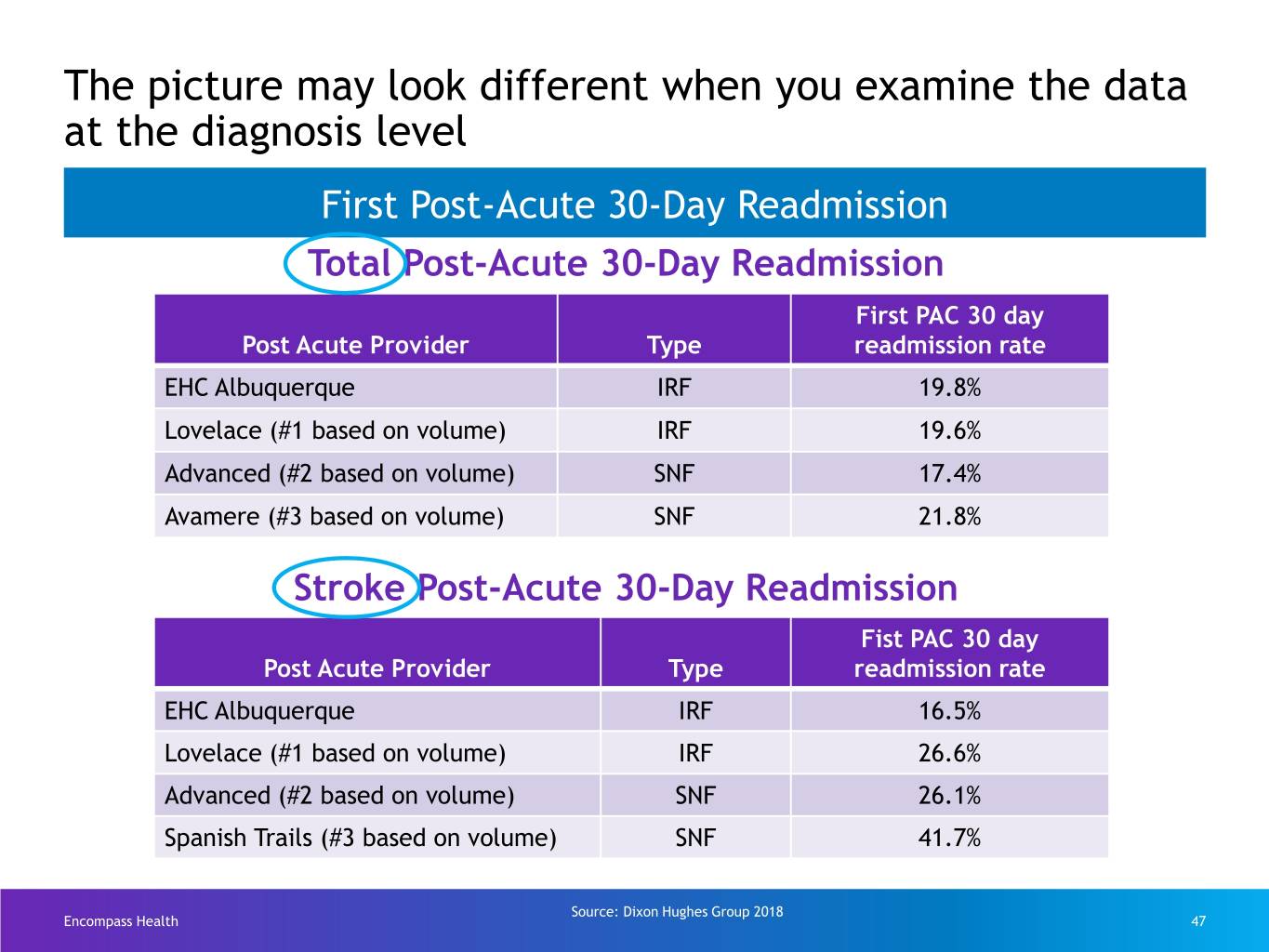

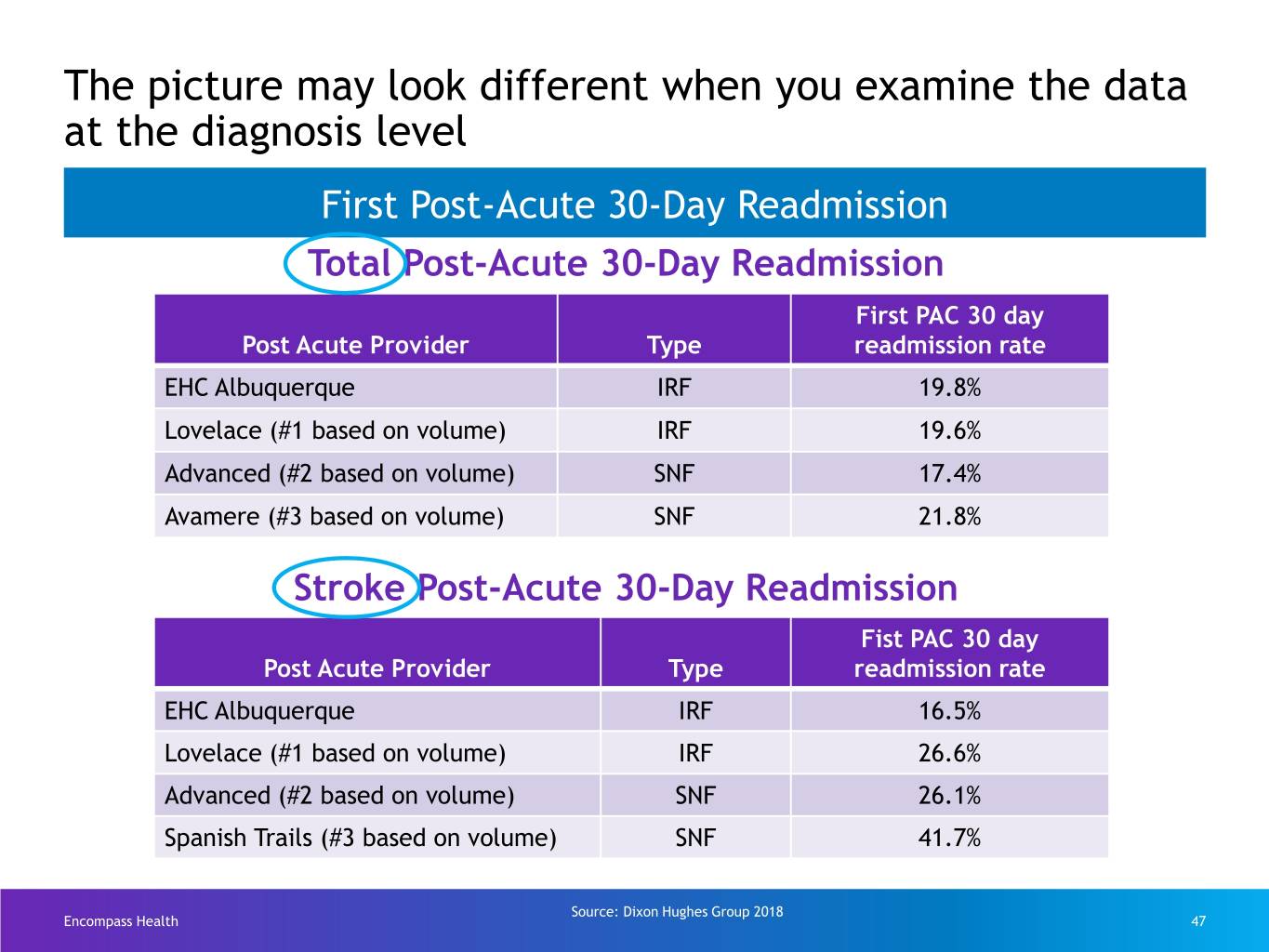

The picture may look different when you examine the data at the diagnosis level First Post-Acute 30-Day Readmission Total Post-Acute 30-Day Readmission First PAC 30 day Post Acute Provider Type readmission rate EHC Albuquerque IRF 19.8% Lovelace (#1 based on volume) IRF 19.6% Advanced (#2 based on volume) SNF 17.4% Avamere (#3 based on volume) SNF 21.8% Stroke Post-Acute 30-Day Readmission Fist PAC 30 day Post Acute Provider Type readmission rate EHC Albuquerque IRF 16.5% Lovelace (#1 based on volume) IRF 26.6% Advanced (#2 based on volume) SNF 26.1% Spanish Trails (#3 based on volume) SNF 41.7% Source: Dixon Hughes Group 2018 Encompass Health 47

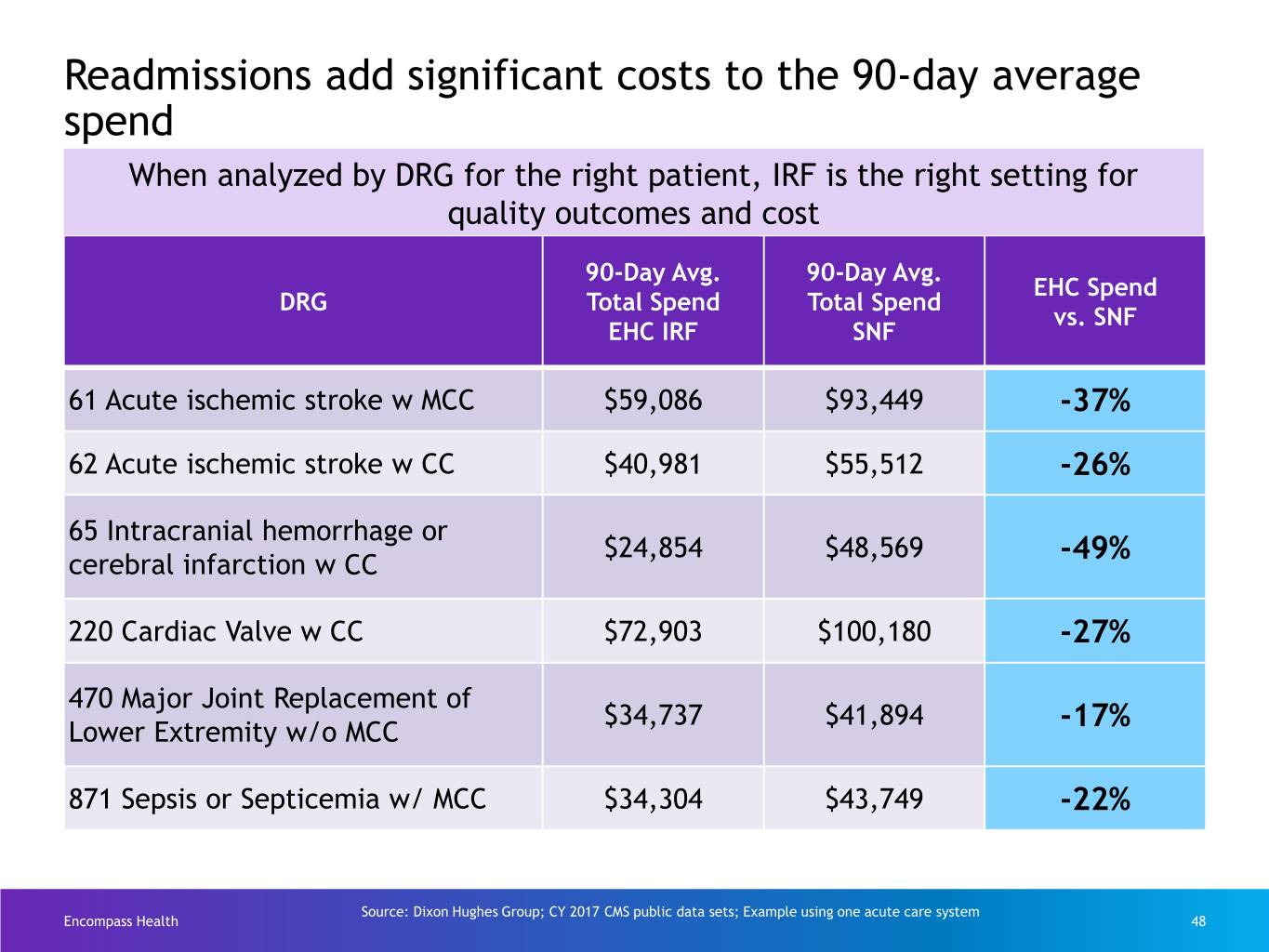

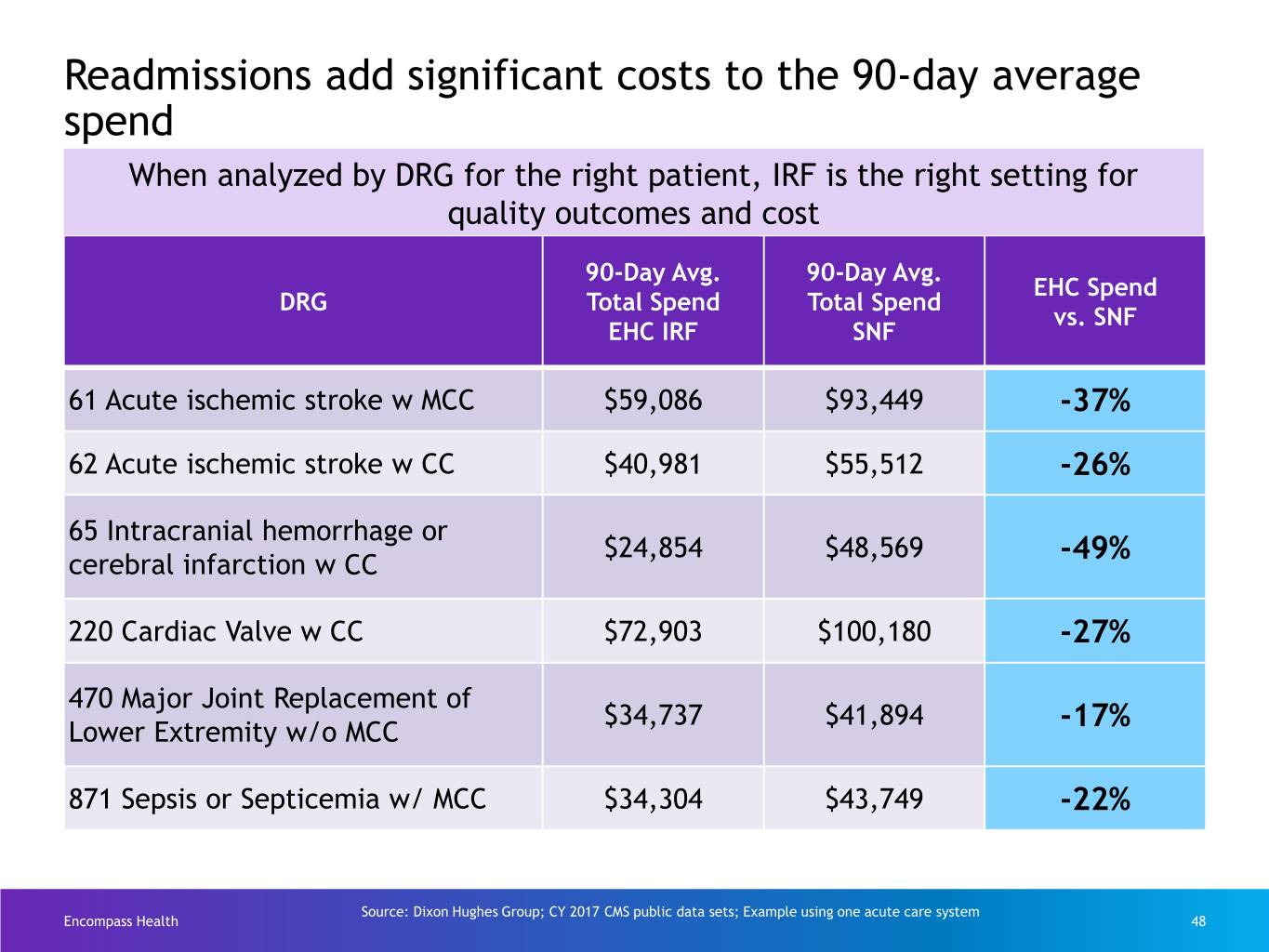

Readmissions add significant costs to the 90-day average spend When analyzed by DRG for the right patient, IRF is the right setting for quality outcomes and cost 90-Day Avg. 90-Day Avg. EHC Spend DRG Total Spend Total Spend vs. SNF EHC IRF SNF 61 Acute ischemic stroke w MCC $59,086 $93,449 -37% 62 Acute ischemic stroke w CC $40,981 $55,512 -26% 65 Intracranial hemorrhage or $24,854 $48,569 -49% cerebral infarction w CC 220 Cardiac Valve w CC $72,903 $100,180 -27% 470 Major Joint Replacement of $34,737 $41,894 -17% Lower Extremity w/o MCC 871 Sepsis or Septicemia w/ MCC $34,304 $43,749 -22% Source: Dixon Hughes Group; CY 2017 CMS public data sets; Example using one acute care system Encompass Health 48

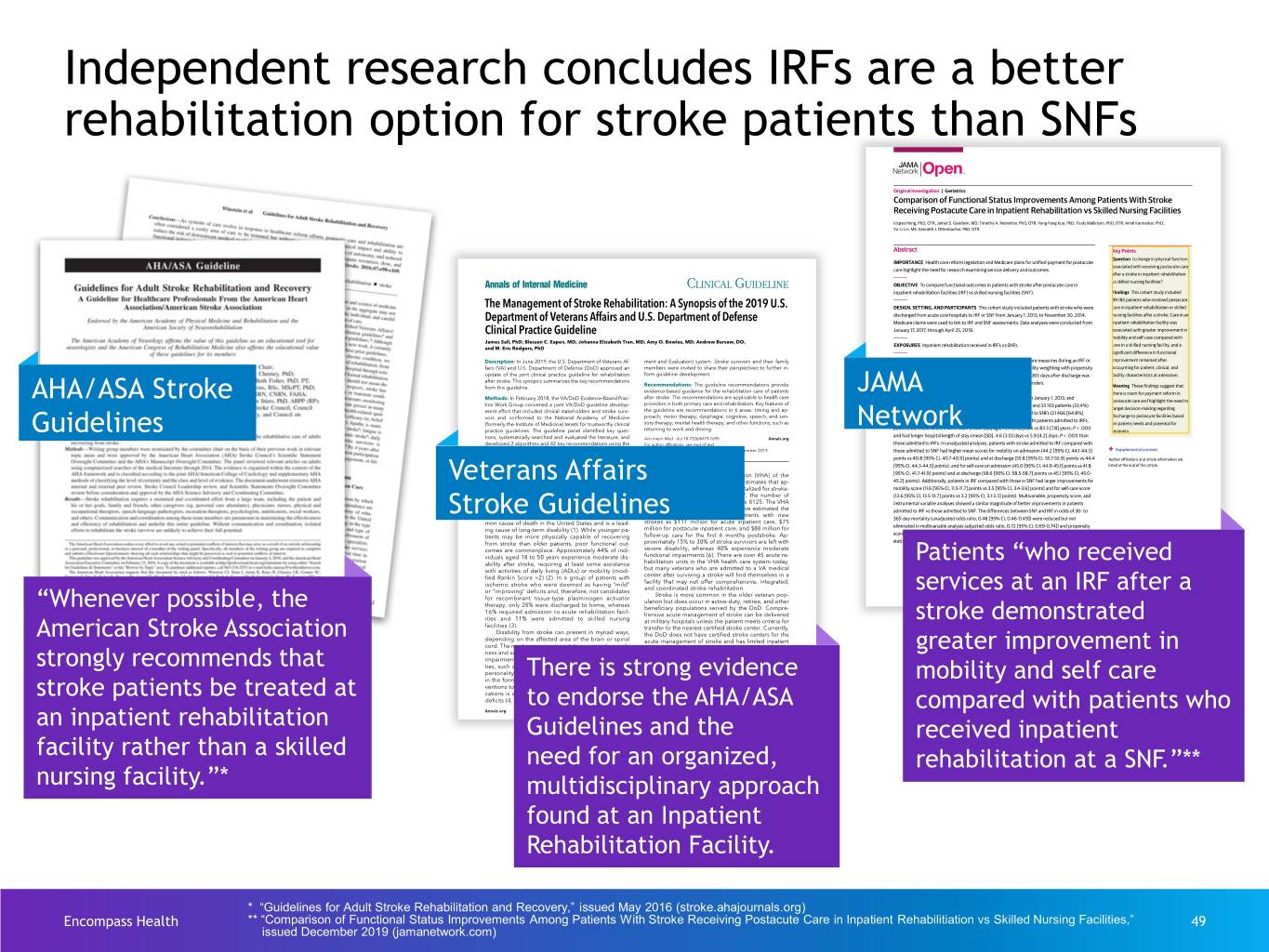

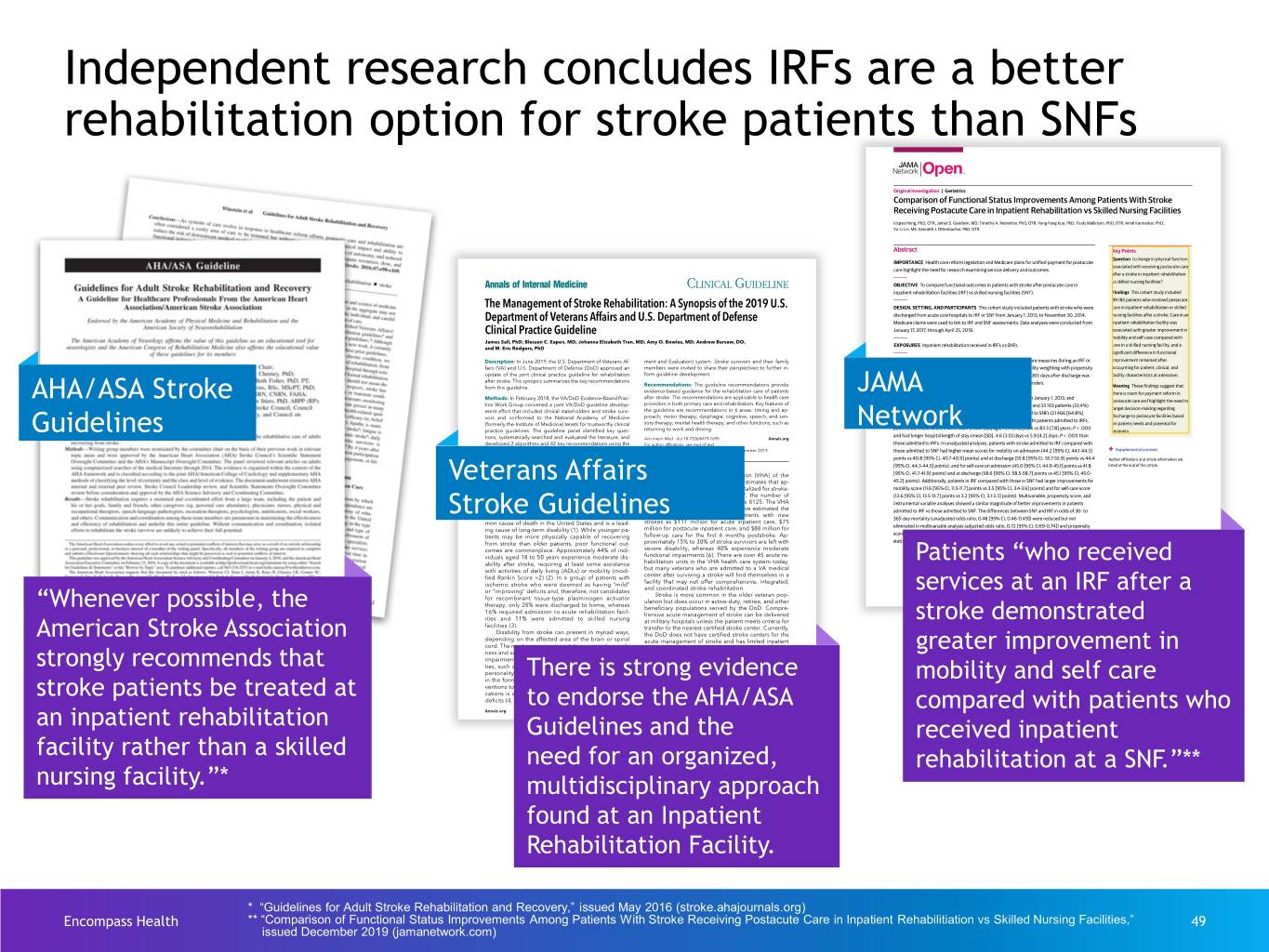

Independent research concludes IRFs are a better rehabilitation option for stroke patients than SNFs AHA/ASA Stroke JAMA Guidelines Network Veterans Affairs Stroke Guidelines Patients “who received services at an IRF after a “Whenever possible, the stroke demonstrated American Stroke Association greater improvement in strongly recommends that There is strong evidence mobility and self care stroke patients be treated at to endorse the AHA/ASA compared with patients who an inpatient rehabilitation Guidelines and the received inpatient facility rather than a skilled need for an organized, rehabilitation at a SNF.”** nursing facility.”* multidisciplinary approach found at an Inpatient Rehabilitation Facility. * “Guidelines for Adult Stroke Rehabilitation and Recovery,” issued May 2016 (stroke.ahajournals.org) Encompass Health ** “Comparison of Functional Status Improvements Among Patients With Stroke Receiving Postacute Care in Inpatient Rehabilitiation vs Skilled Nursing Facilities,” 49 issued December 2019 (jamanetwork.com)

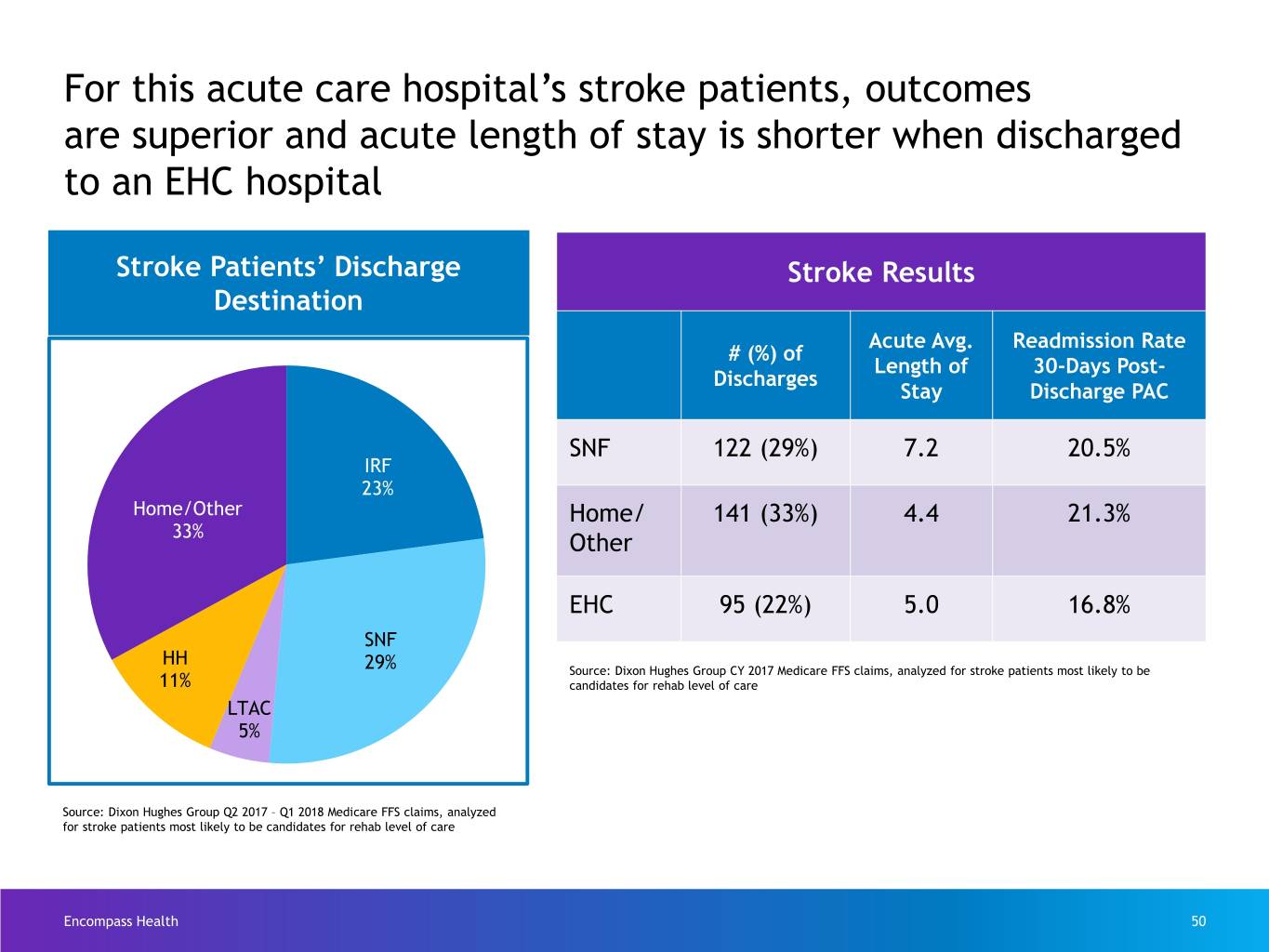

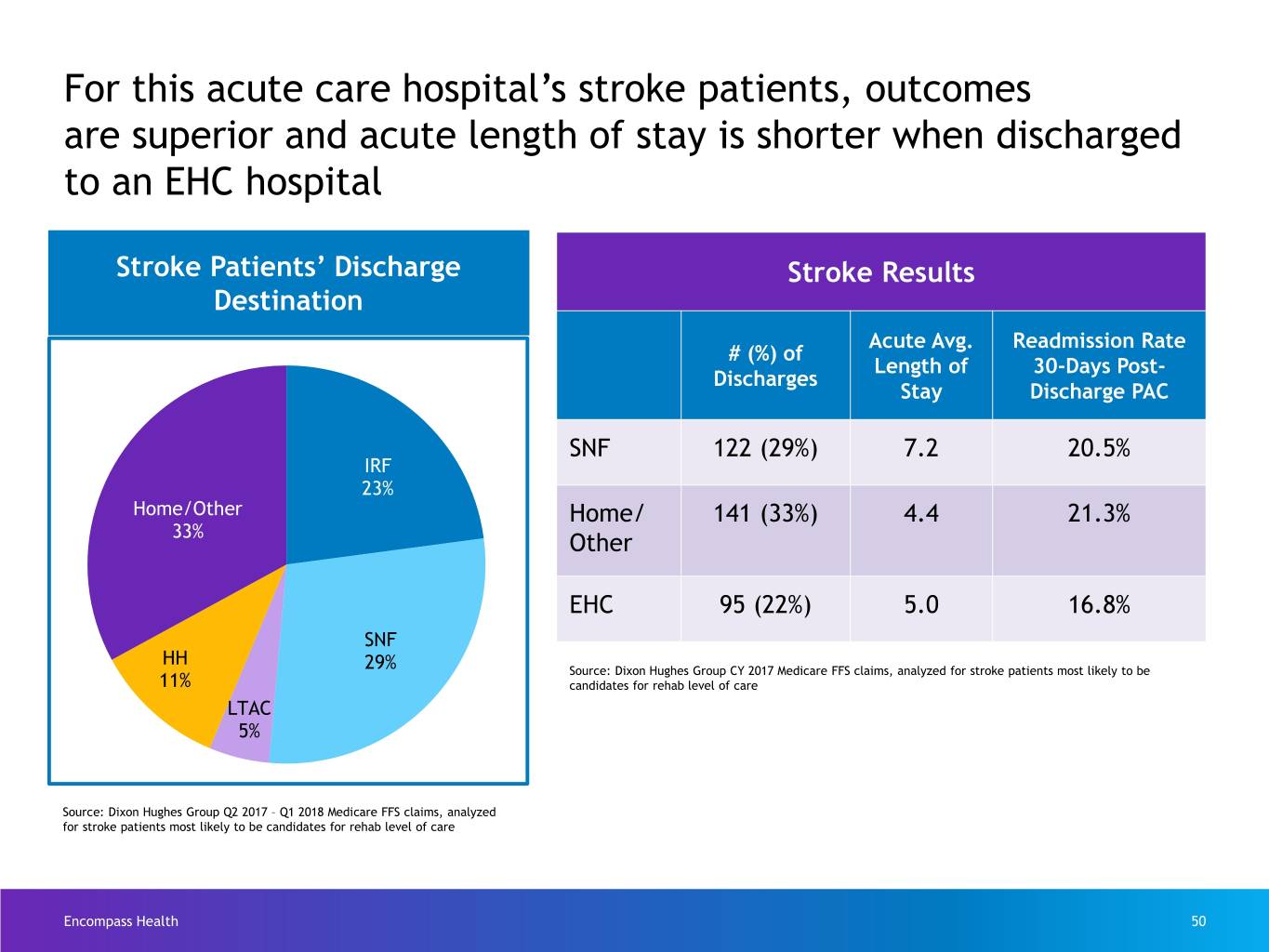

For this acute care hospital’s stroke patients, outcomes are superior and acute length of stay is shorter when discharged to an EHC hospital Stroke Patients’ Discharge Stroke Results Destination Acute Avg. Readmission Rate # (%) of Length of 30-Days Post- Discharges Stay Discharge PAC SNF 122 (29%) 7.2 20.5% IRF 23% Home/Other Home/ 141 (33%) 4.4 21.3% 33% Other EHC 95 (22%) 5.0 16.8% SNF HH 29% Source: Dixon Hughes Group CY 2017 Medicare FFS claims, analyzed for stroke patients most likely to be 11% candidates for rehab level of care LTAC 5% Source: Dixon Hughes Group Q2 2017 – Q1 2018 Medicare FFS claims, analyzed for stroke patients most likely to be candidates for rehab level of care Encompass Health 50

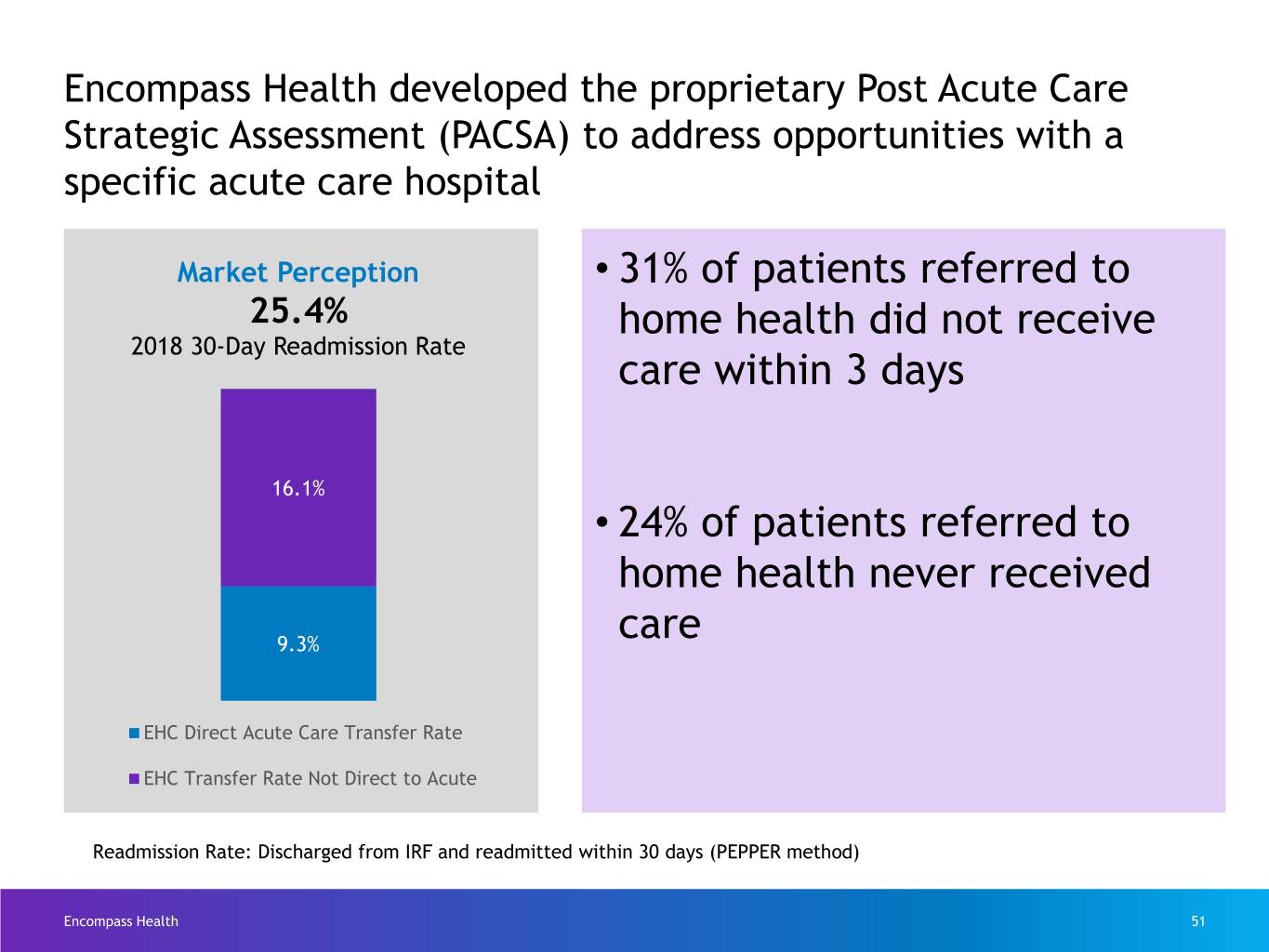

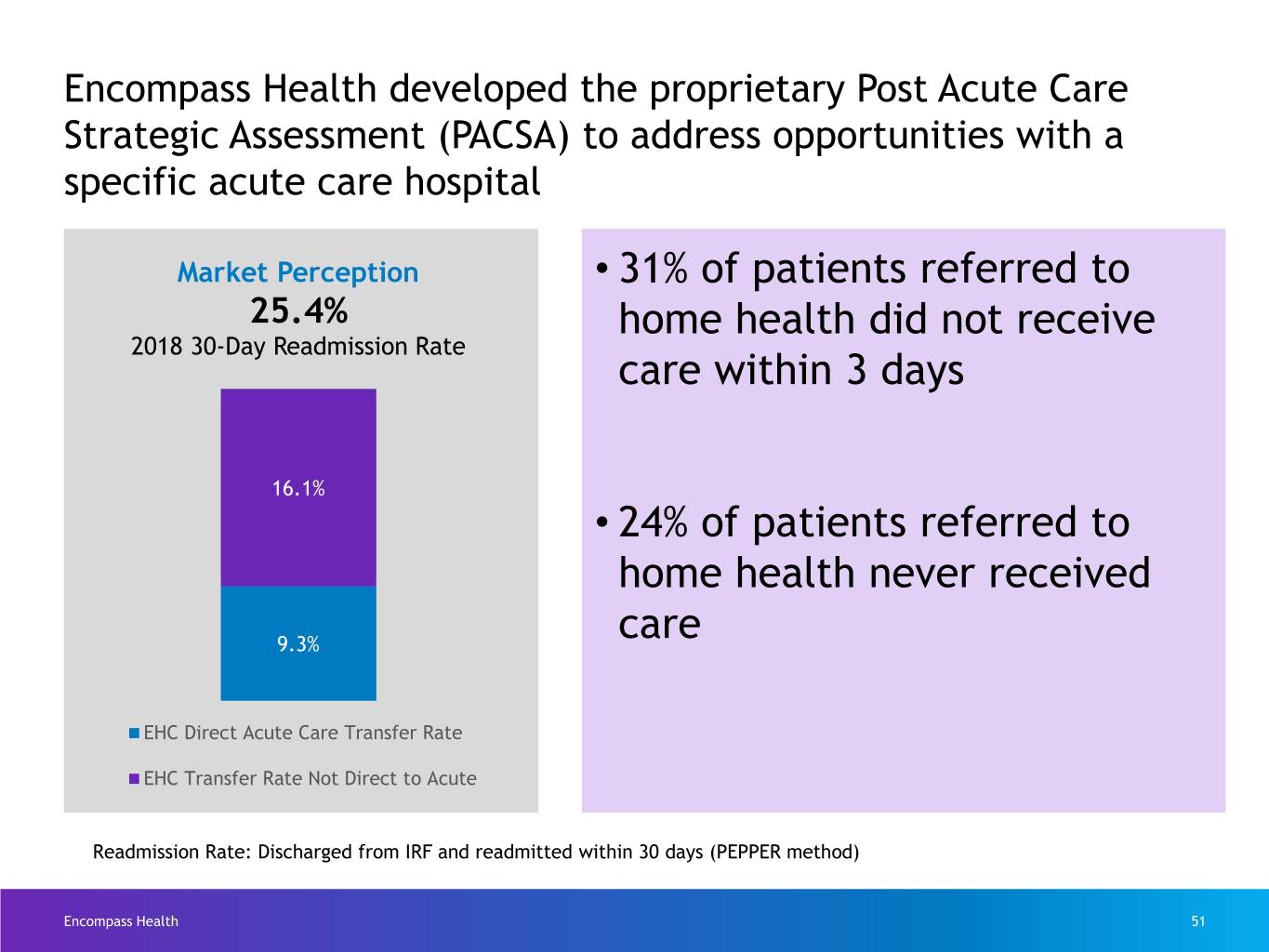

Encompass Health developed the proprietary Post Acute Care Strategic Assessment (PACSA) to address opportunities with a specific acute care hospital Market Perception • 31% of patients referred to 25.4% home health did not receive 2018 30-Day Readmission Rate care within 3 days 16.1% • 24% of patients referred to home health never received 9.3% care EHC Direct Acute Care Transfer Rate EHC Transfer Rate Not Direct to Acute Readmission Rate: Discharged from IRF and readmitted within 30 days (PEPPER method) Encompass Health 51

AHA/ASA strategic sponsorship – by the numbers 51,777 Life After Stroke guides distributed by 11.2M+4 Encompass Health Reach on AHA/ASA- hospitals owned channels (e.g. 11,000 blog, 42 hospitals Number of guests e-newsletters, reached through included in the 20 AHA home page) Life After 20 Go Red for 9,460 Go Red sponsored Stroke guide downloads Women Luncheons luncheons from the AHA/ASA website Encompass Health Data thru December 2019 52

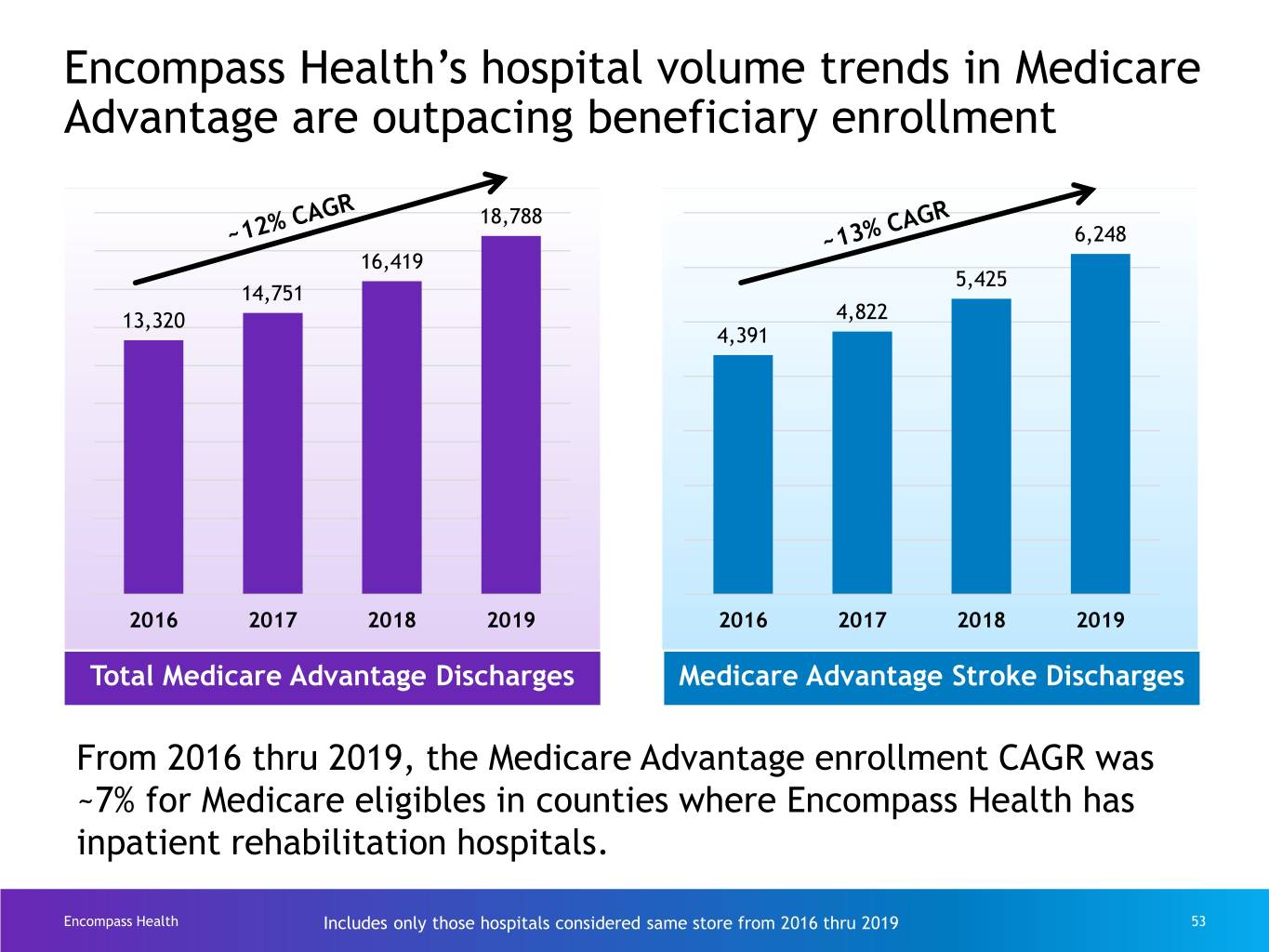

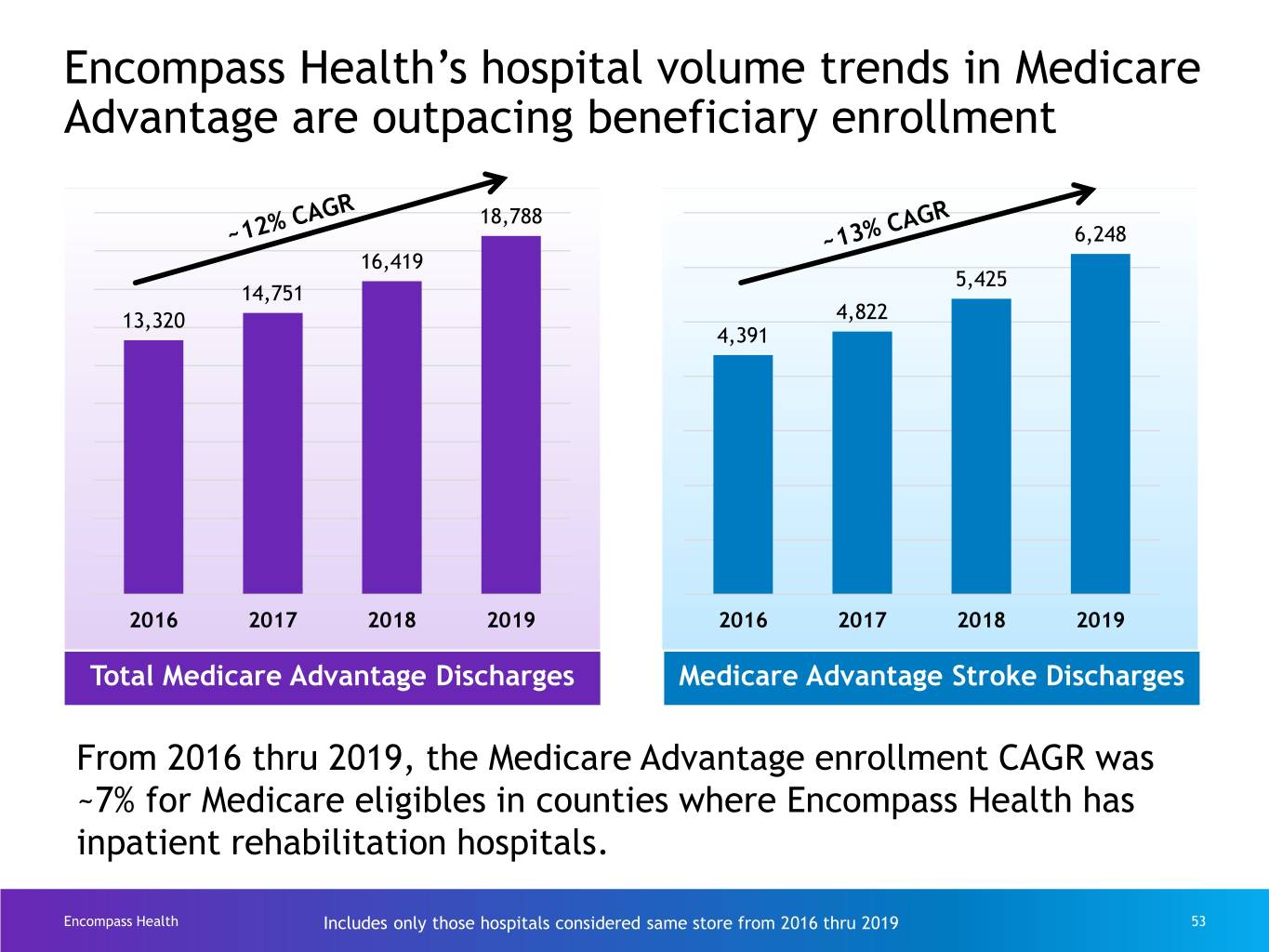

Encompass Health’s hospital volume trends in Medicare Advantage are outpacing beneficiary enrollment 18,788 6,248 16,419 5,425 14,751 13,320 4,822 4,391 2016 2017 2018 2019 2016 2017 2018 2019 Total Medicare Advantage Discharges Medicare Advantage Stroke Discharges From 2016 thru 2019, the Medicare Advantage enrollment CAGR was ~7% for Medicare eligibles in counties where Encompass Health has inpatient rehabilitation hospitals. Encompass Health Includes only those hospitals considered same store from 2016 thru 2019 53

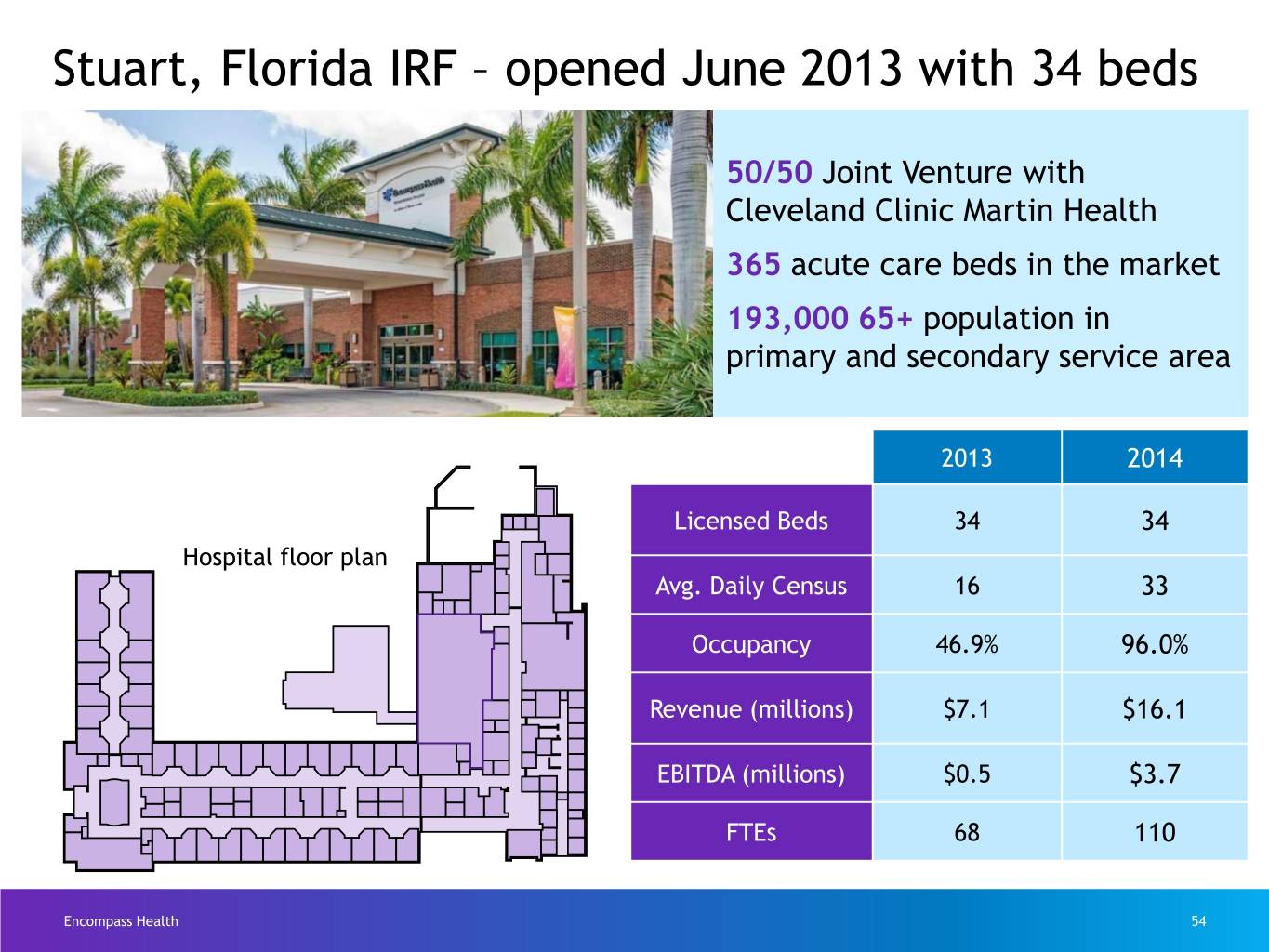

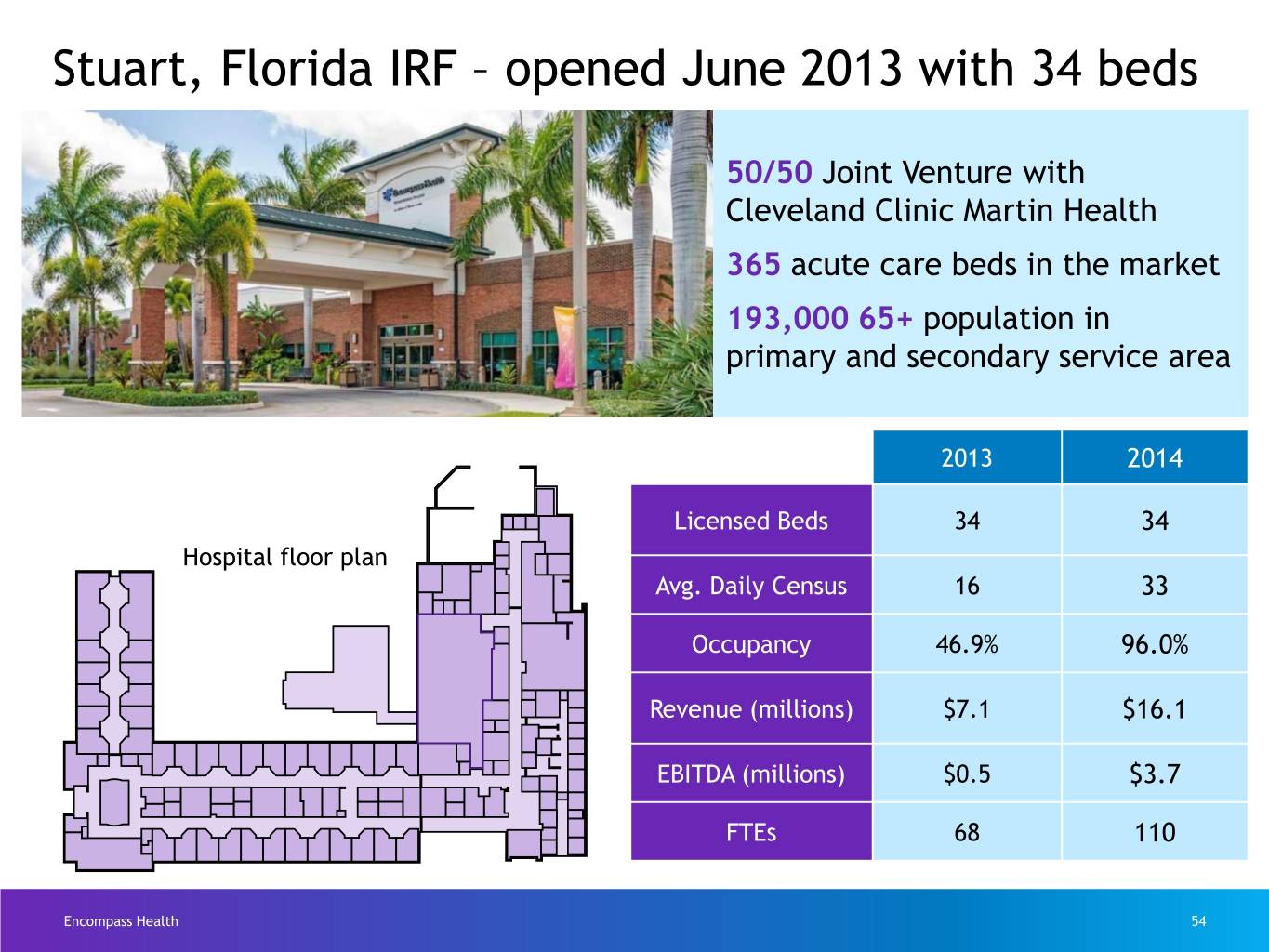

Stuart, Florida IRF – opened June 2013 with 34 beds 50/50 Joint Venture with Cleveland Clinic Martin Health 365 acute care beds in the market 193,000 65+ population in primary and secondary service area 2013 2014 Licensed Beds 34 34 Hospital floor plan Avg. Daily Census 16 33 Occupancy 46.9% 96.0% Revenue (millions) $7.1 $16.1 EBITDA (millions) $0.5 $3.7 FTEs 68 110 Encompass Health 54

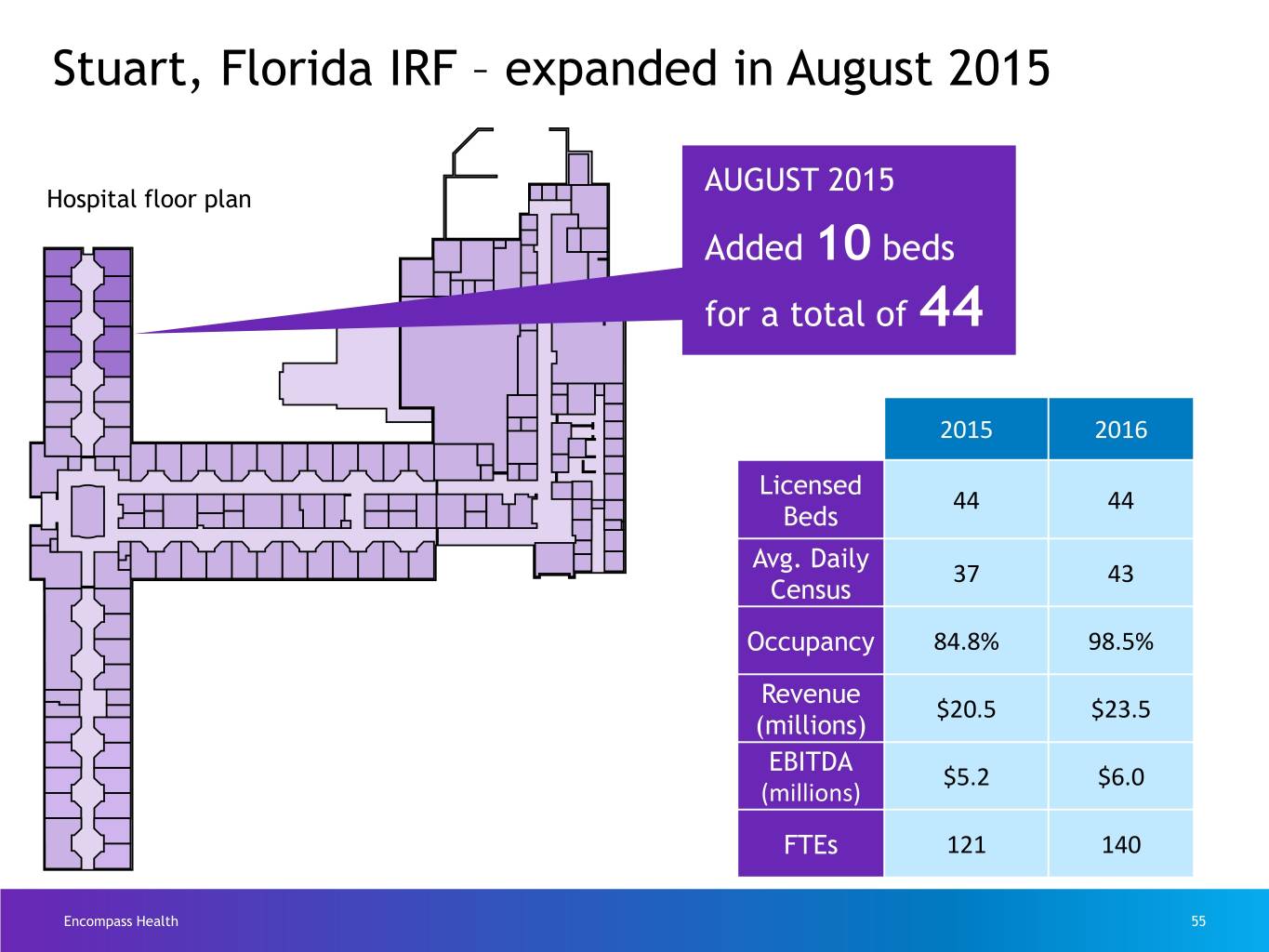

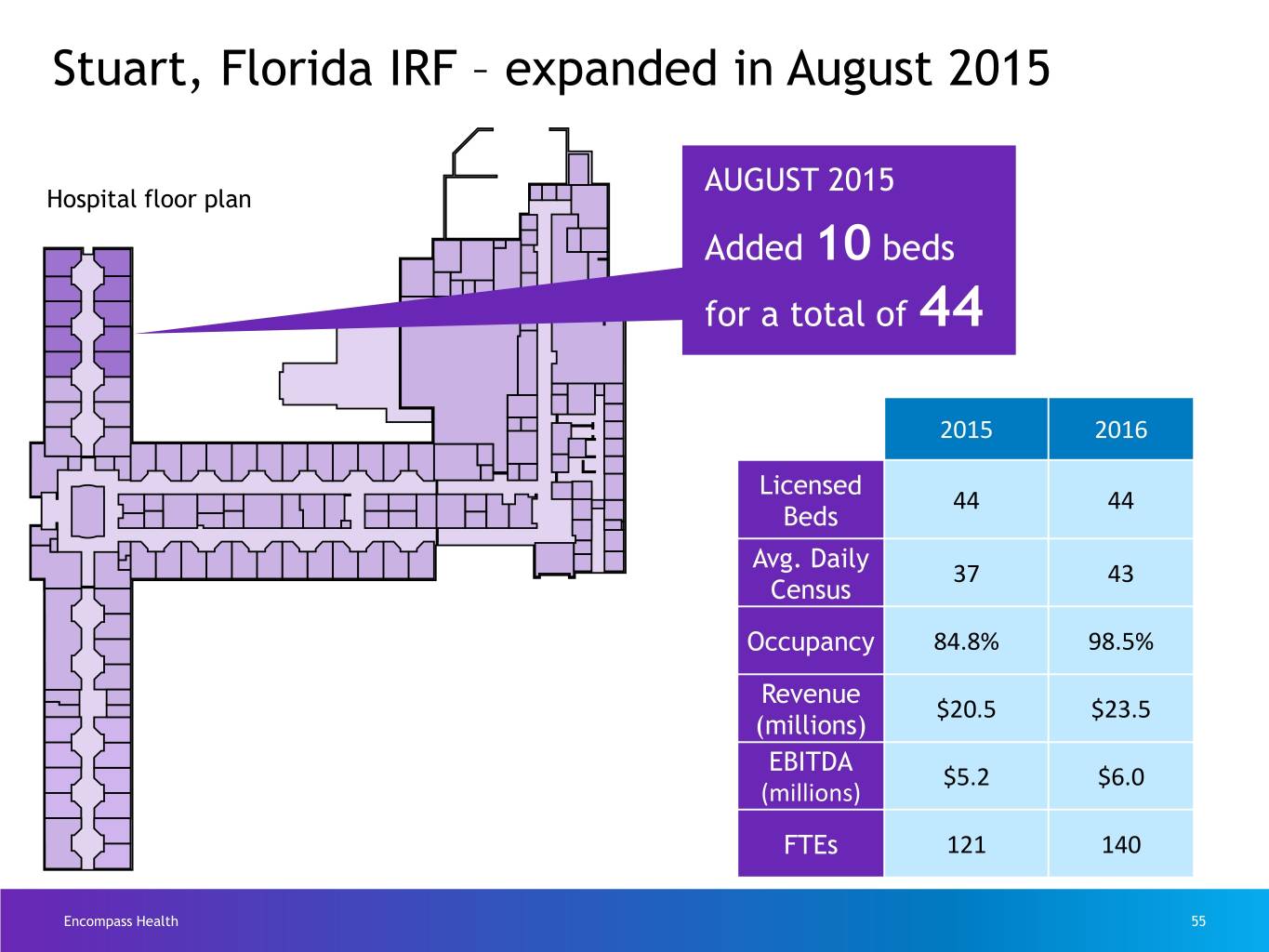

Stuart, Florida IRF – expanded in August 2015 AUGUST 2015 Hospital floor plan Added 10 beds for a total of 44 2015 2016 Licensed 44 44 Beds Avg. Daily 37 43 Census Occupancy 84.8% 98.5% MAY 2017 Revenue $20.5 $23.5 Added 10 beds (millions) EBITDA $5.2 $6.0 for a total of 54 (millions) FTEs 121 140 Encompass Health 55

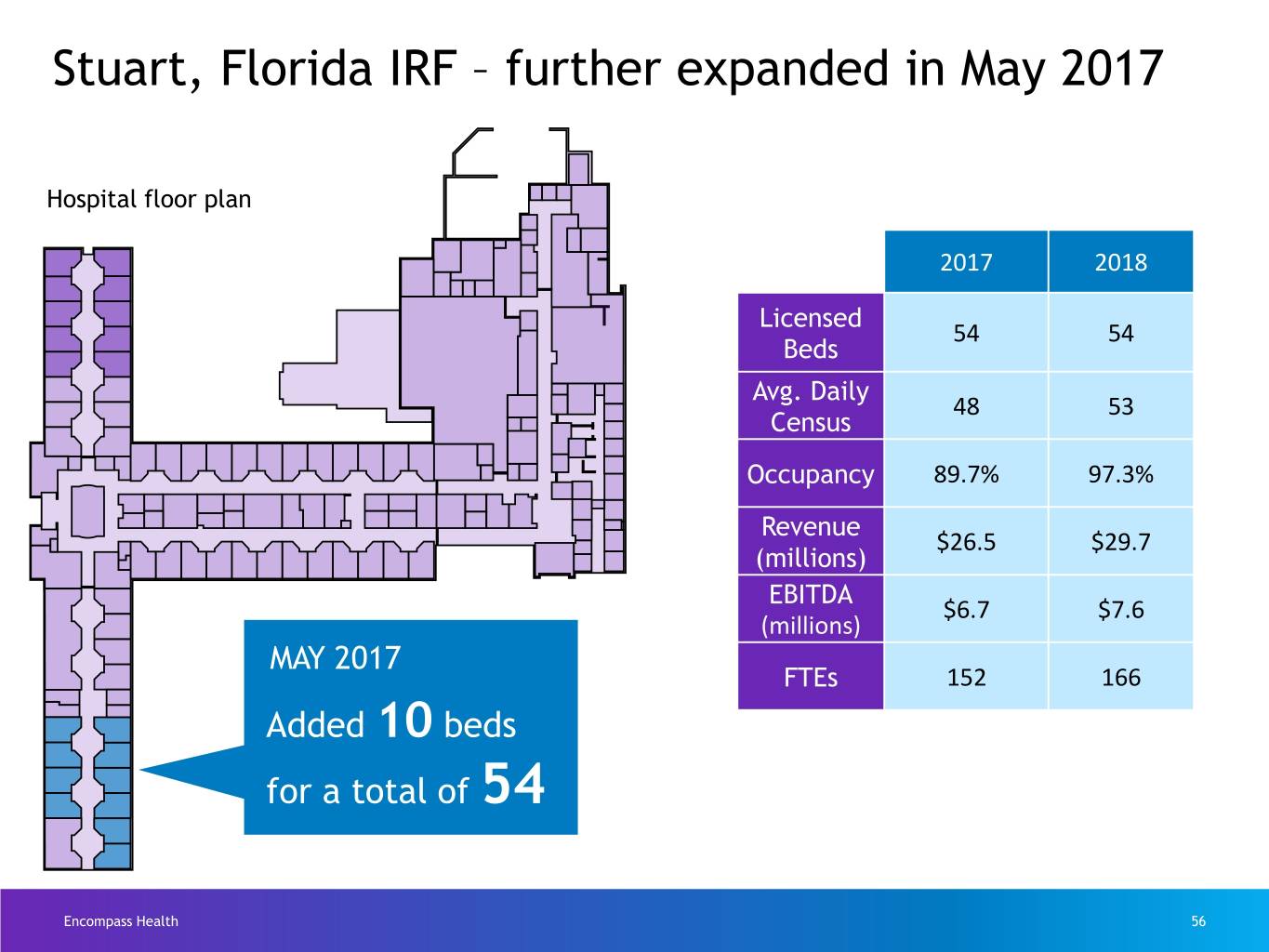

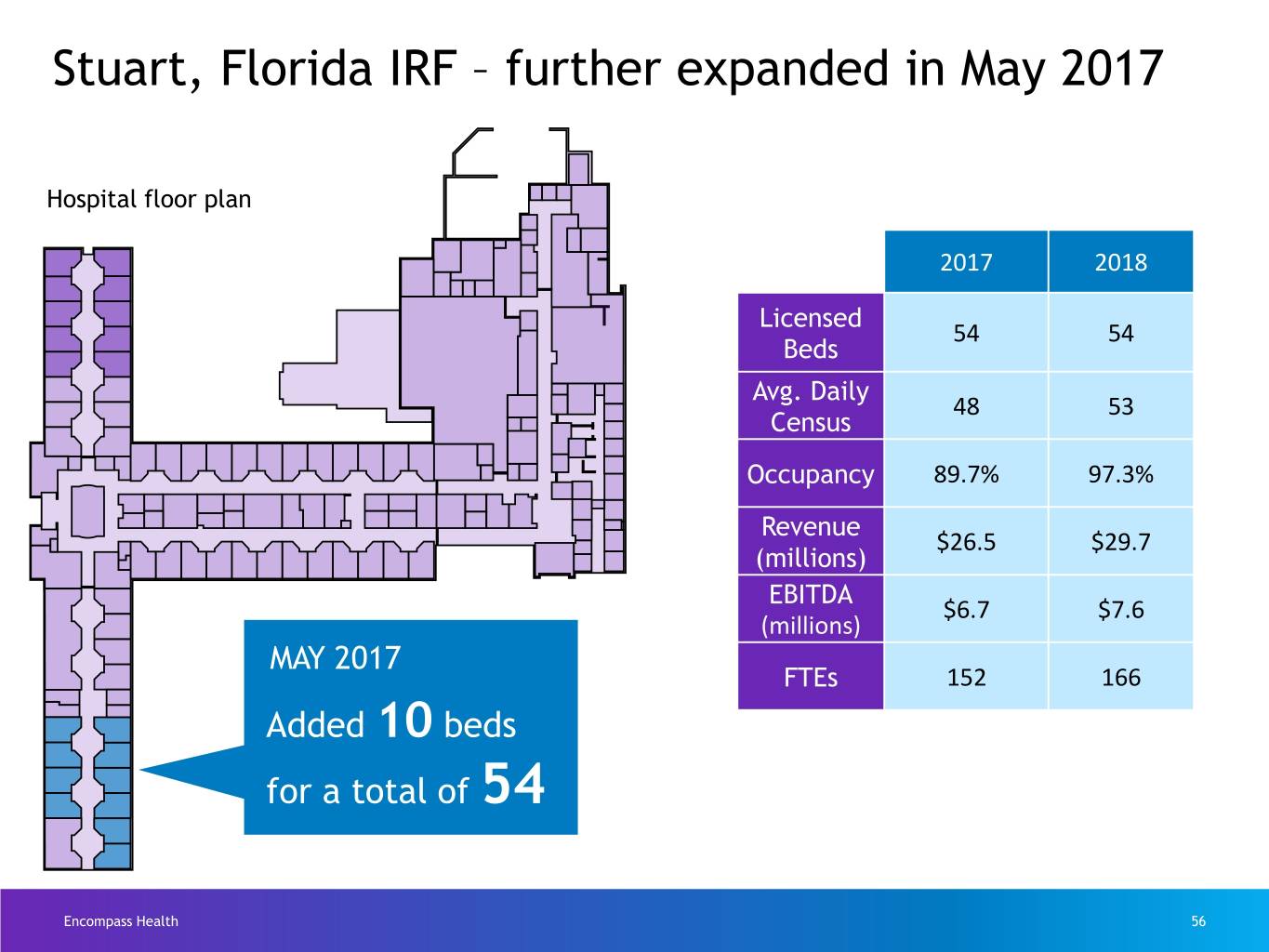

Stuart, Florida IRF – further expanded in May 2017 AUGUST 2015 Hospital floor plan 2017 2018 Licensed 54 54 Beds Avg. Daily 48 53 Census Occupancy 89.7% 97.3% Revenue $26.5 $29.7 (millions) EBITDA $6.7 $7.6 (millions) MAY 2017 FTEs 152 166 Added 10 beds for a total of 54 Encompass Health 56

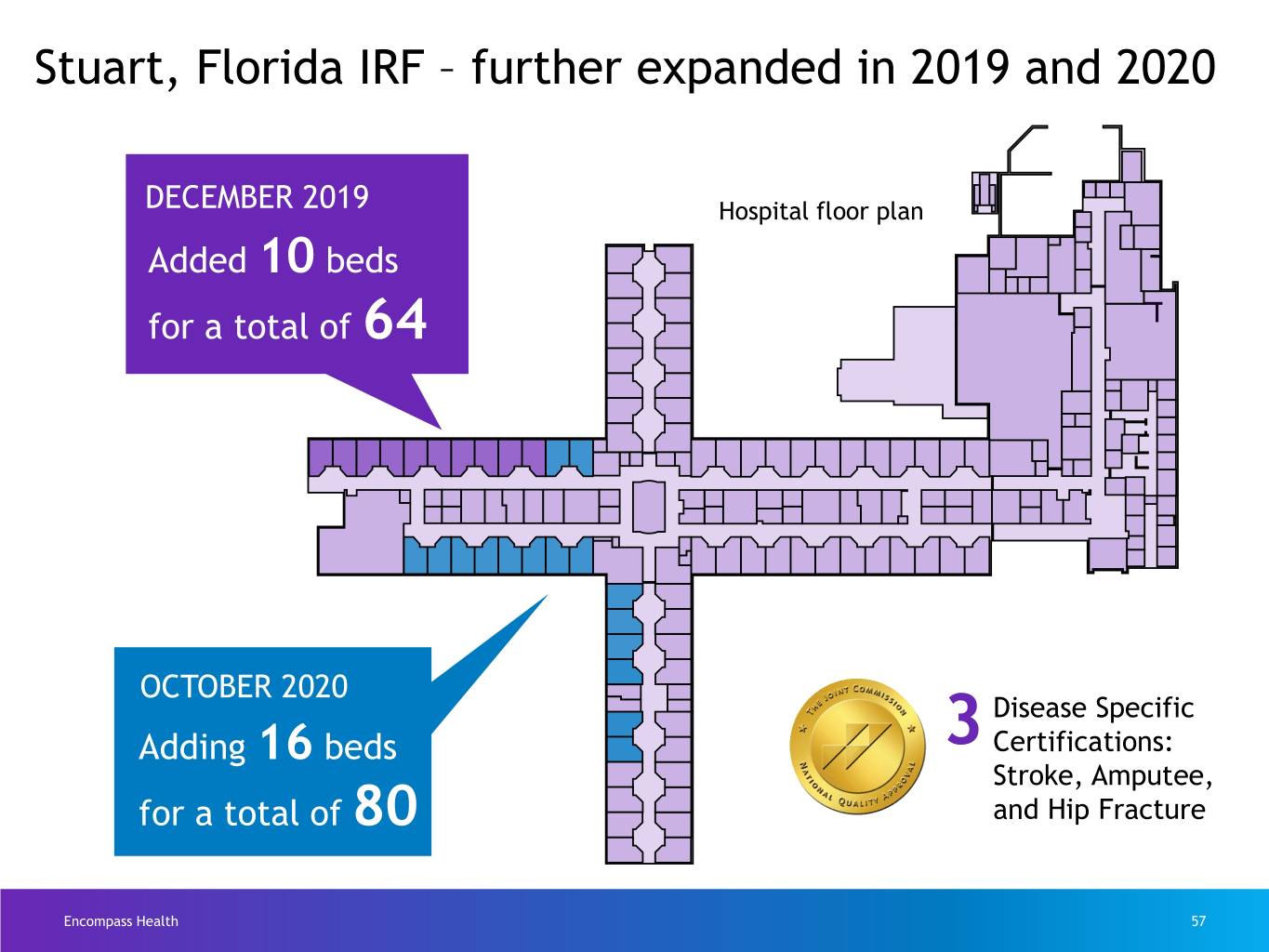

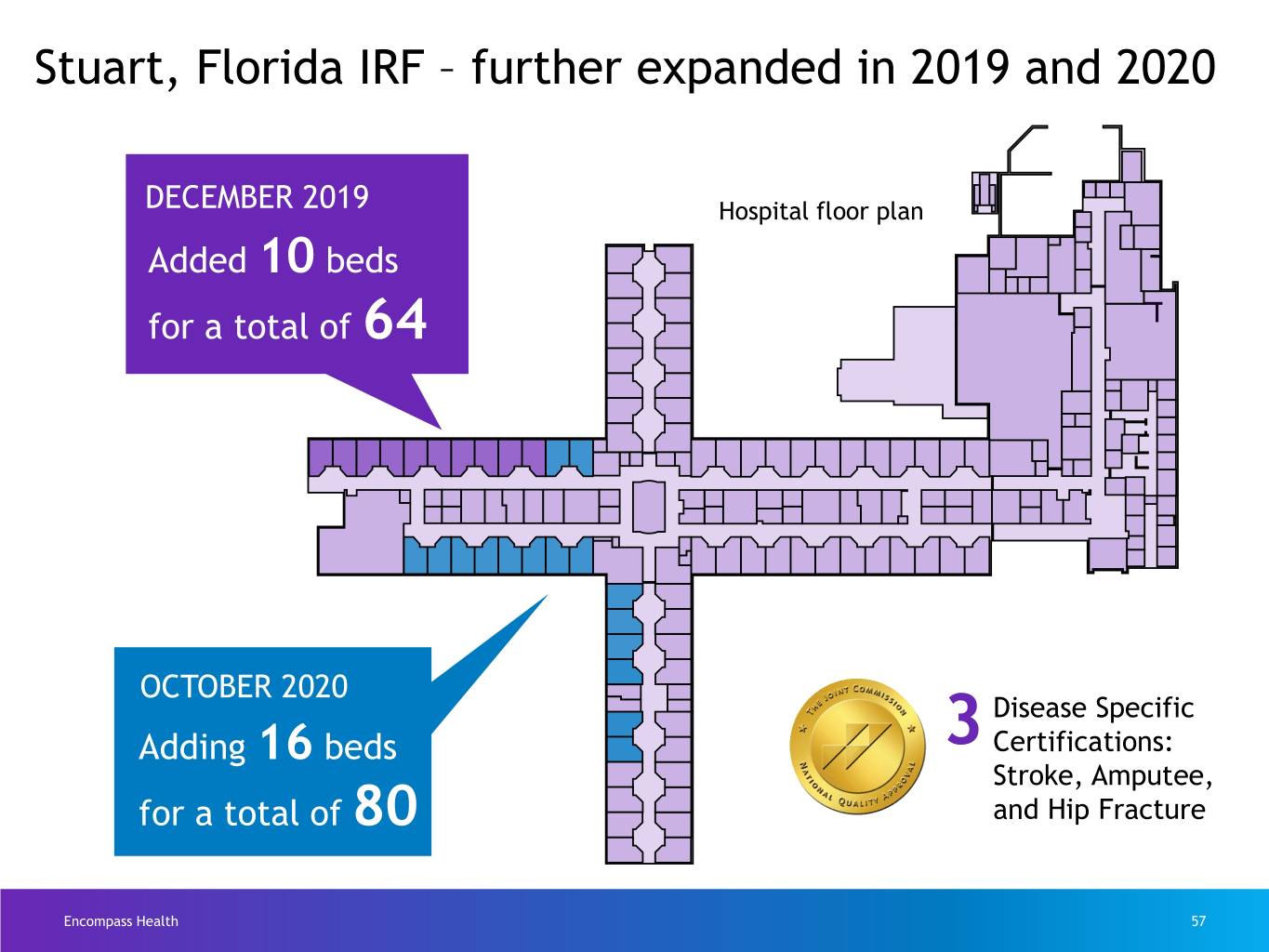

Stuart, Florida IRF – further expanded in 2019 and 2020 DECEMBER 2019 Hospital floor plan Added 10 beds for a total of 64 OCTOBER 2020 Disease Specific Adding 16 beds 3 Certifications: Stroke, Amputee, for a total of 80 and Hip Fracture Encompass Health 57

Leading position in cost effectiveness Avg. est. Avg. est. total Avg. total cost payment Avg. Medicare Case per per beds discharges mix discharge discharge # per IRF per IRF index for FY 2019 for FY 2019 Encompass 126 67 951 1.28 $13,622 $20,315 Health= Medicare pays Free-standing = (Non-Encompass 154 58 589 1.27 $18,107 $21,400 Encompass Health Health) less per discharge, on average, and Encompass Health treats a higher Hospital 846 24 228 1.22 $21,483 $21,569 units = acuity patient. Total 1,126 34 358 1.25 $18,388 $21,159 Encompass Health The average estimated total payment per discharge, as stated, does not reflect a 2% reduction for sequestration. 58

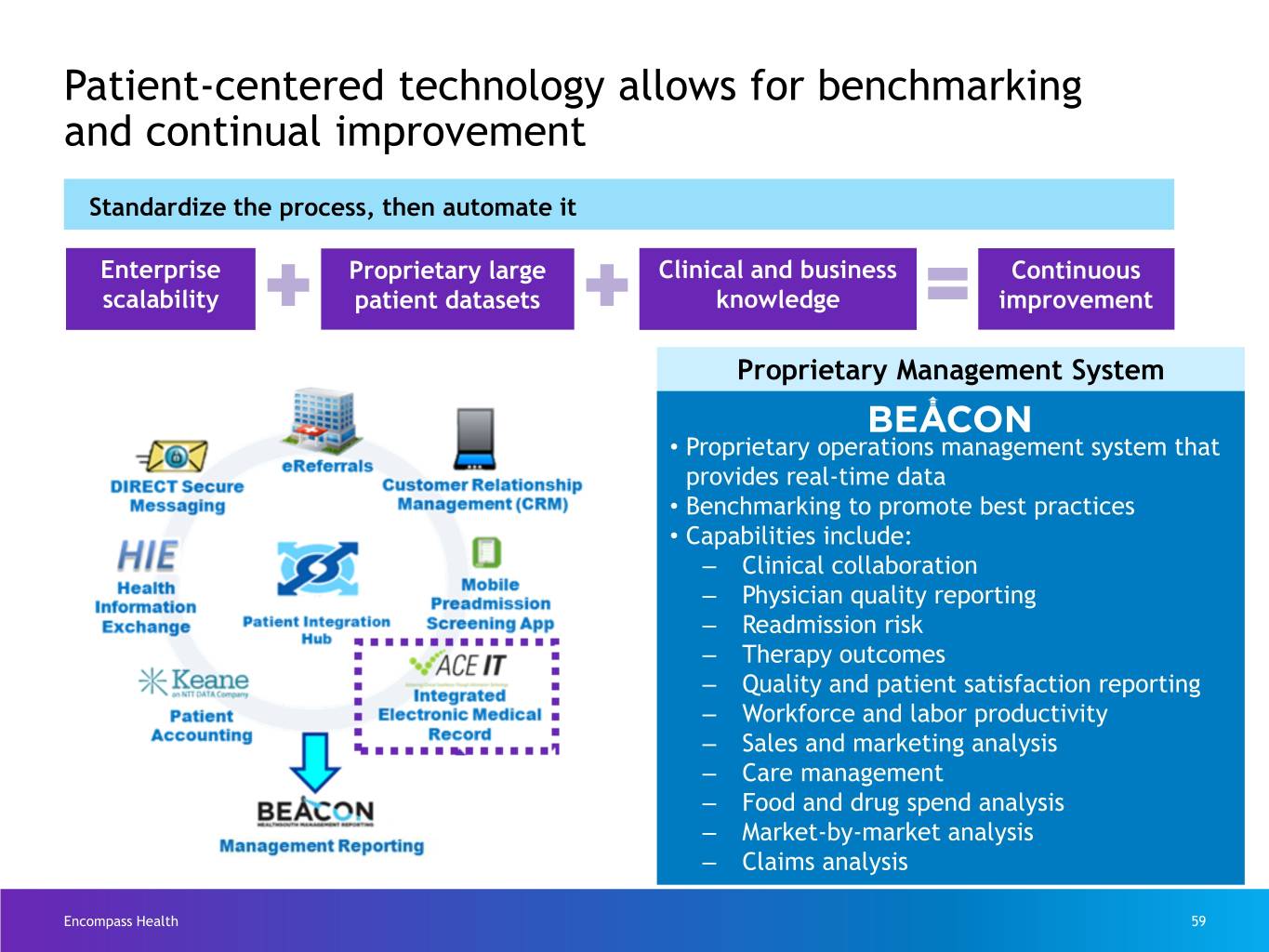

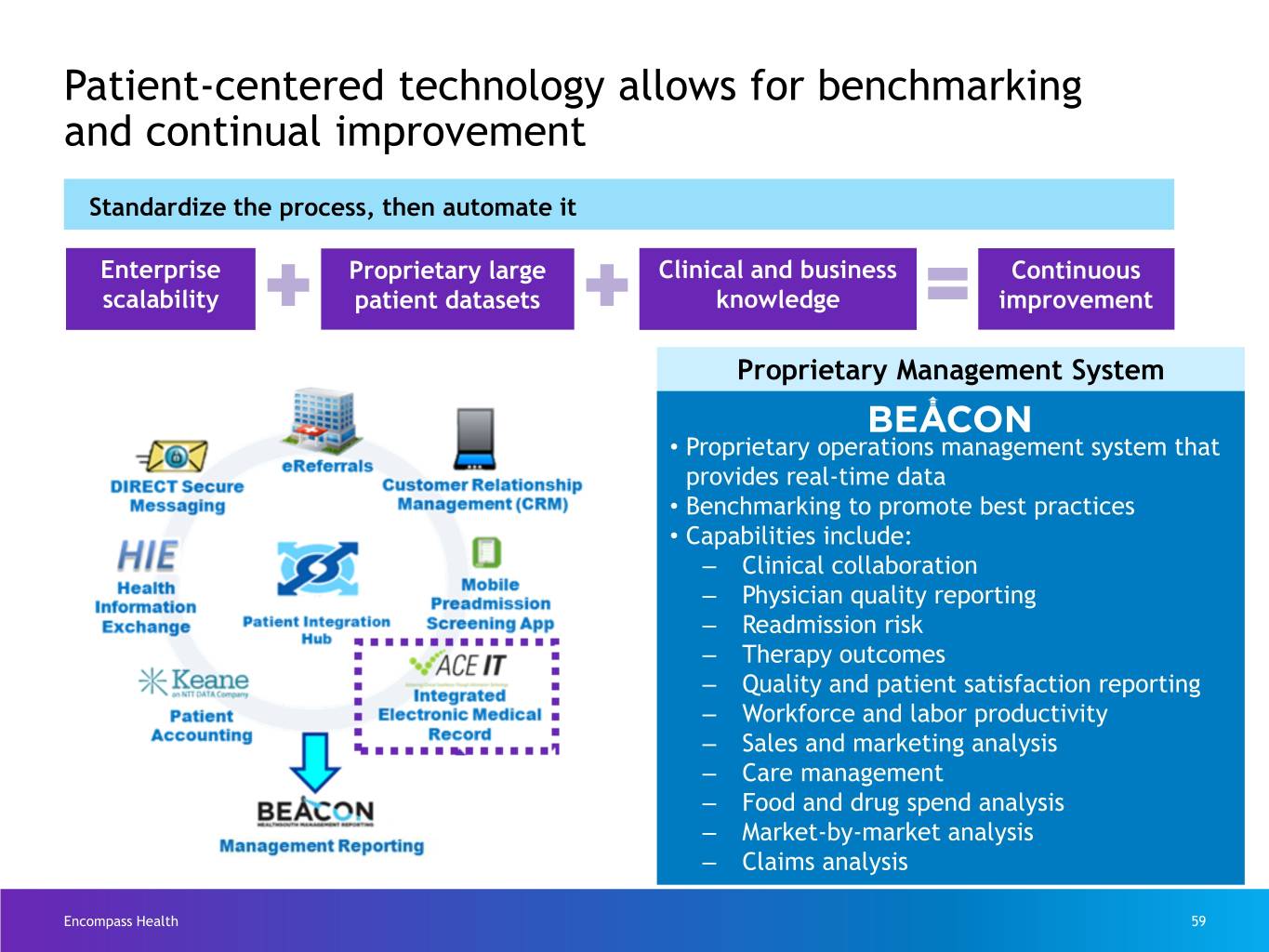

Patient-centered technology allows for benchmarking and continual improvement Standardize the process, then automate it Enterprise Proprietary large Clinical and business Continuous scalability patient datasets knowledge improvement Proprietary Management System • Proprietary operations management system that provides real-time data • Benchmarking to promote best practices • Capabilities include: ‒ Clinical collaboration ‒ Physician quality reporting ‒ Readmission risk ‒ Therapy outcomes ‒ Quality and patient satisfaction reporting ‒ Workforce and labor productivity ‒ Sales and marketing analysis ‒ Care management ‒ Food and drug spend analysis ‒ Market-by-market analysis ‒ Claims analysis Encompass Health 59

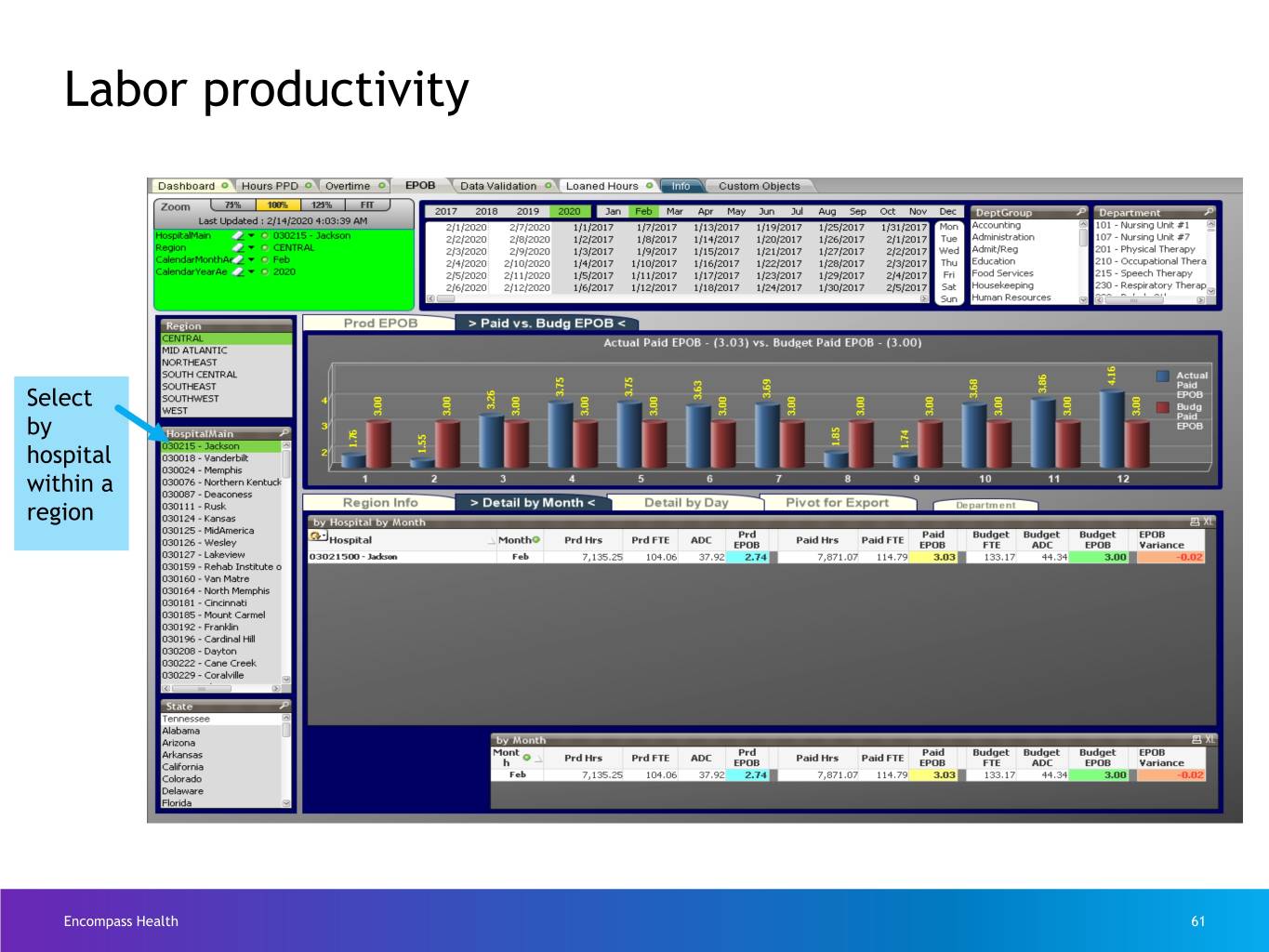

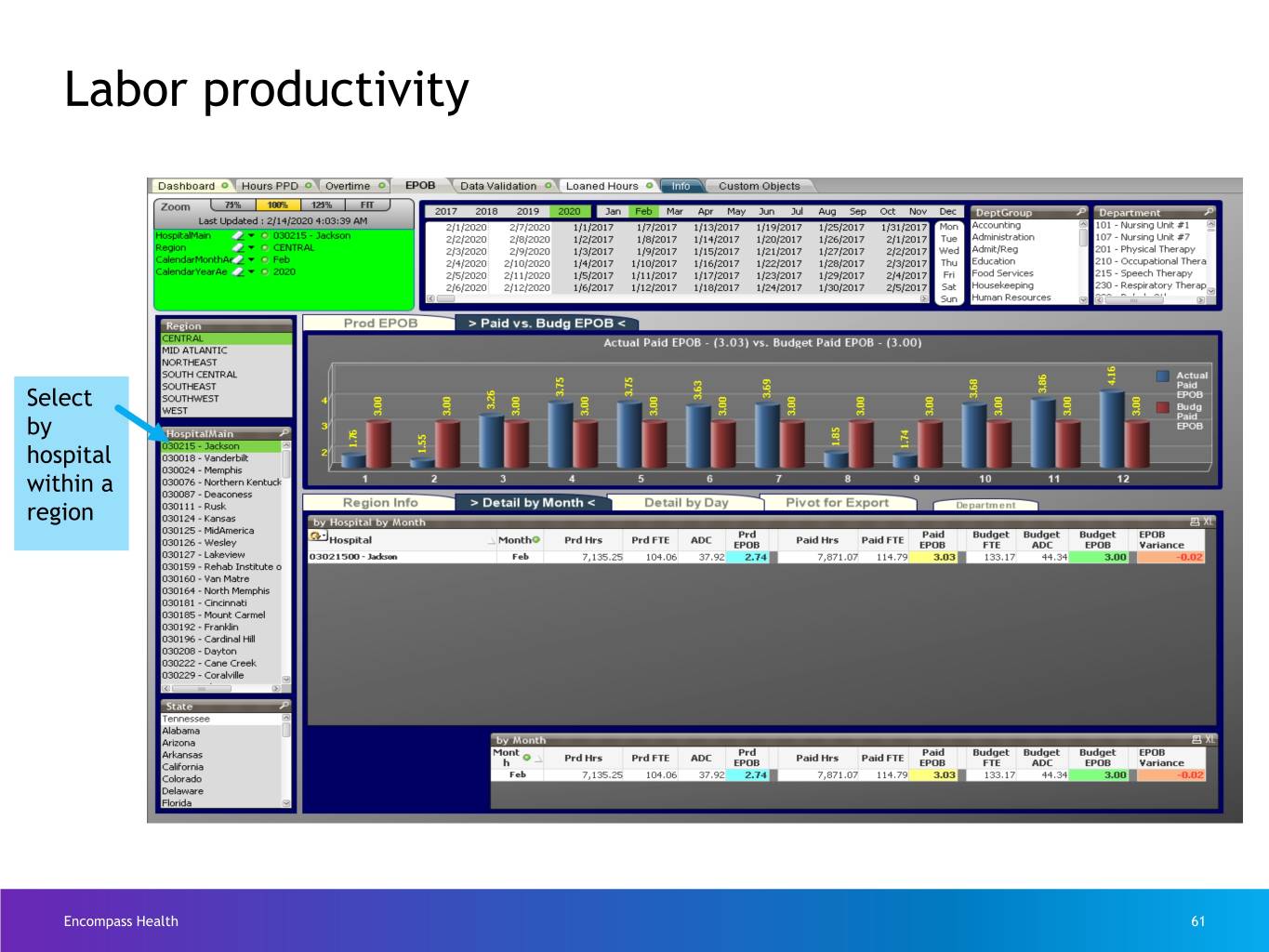

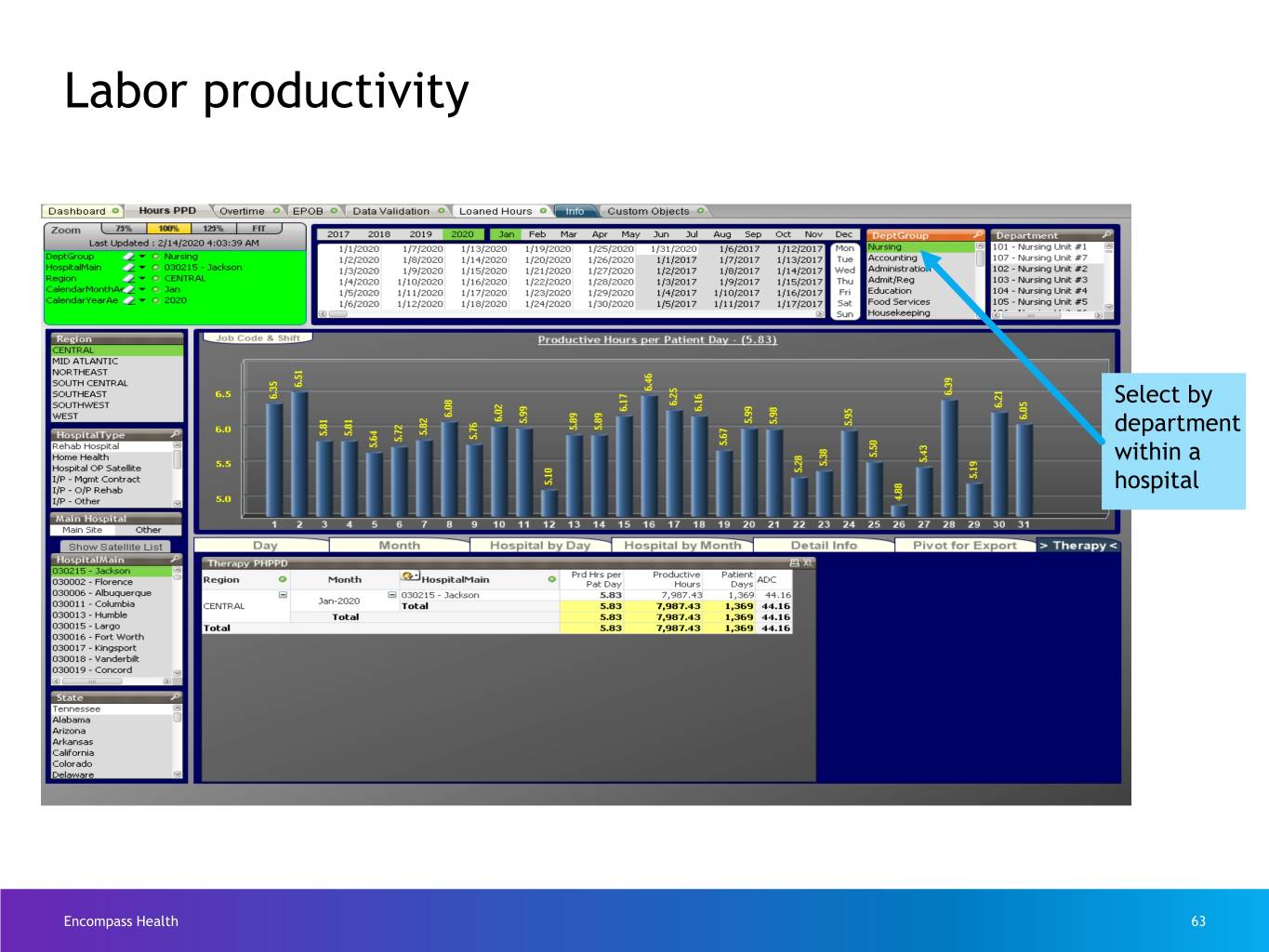

Labor productivity Select date range Select by region Combines time & attendance system with patient accounting system to show labor metrics Encompass Health 60

Labor productivity Select by hospital within a region Encompass Health 61

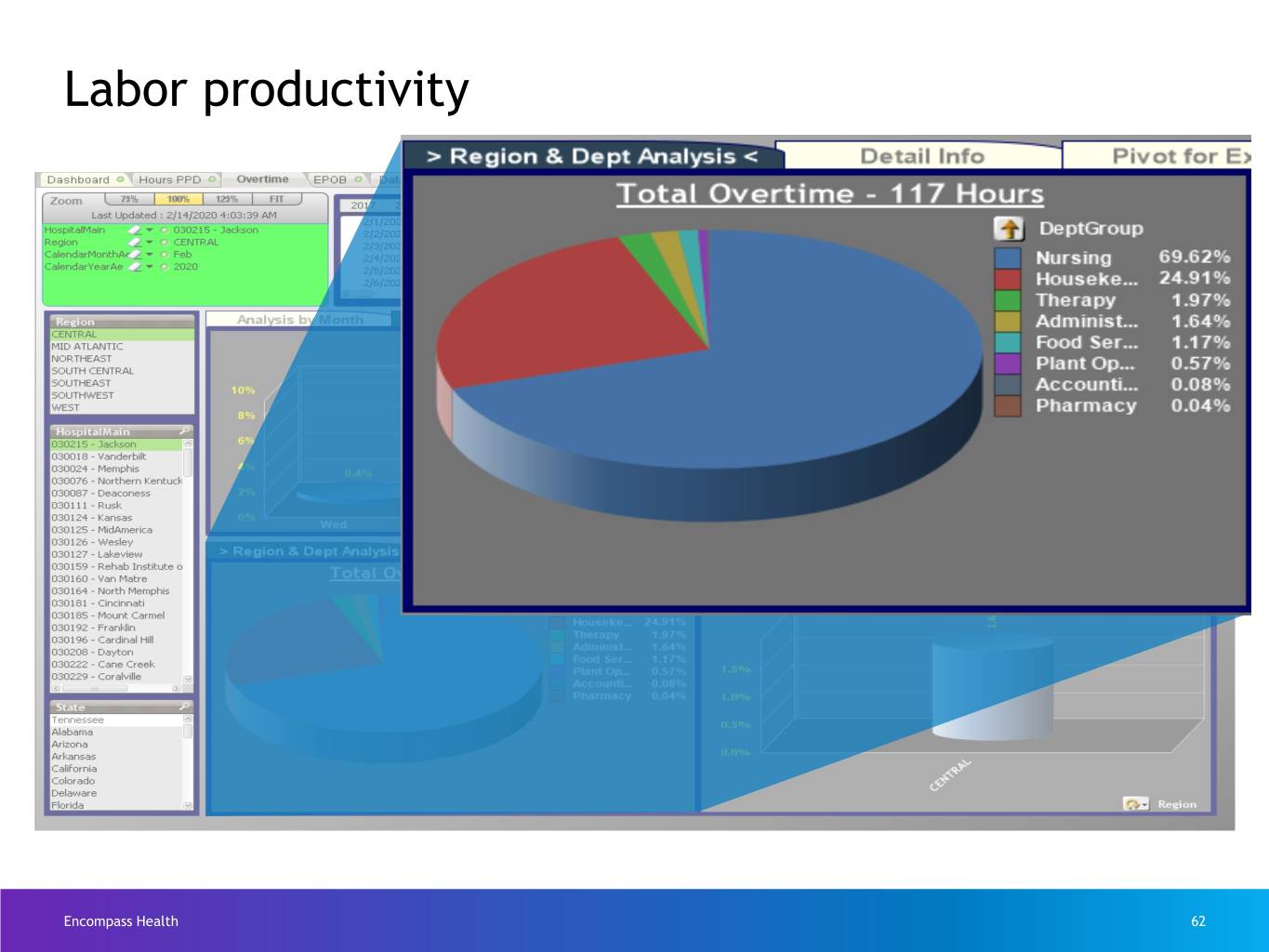

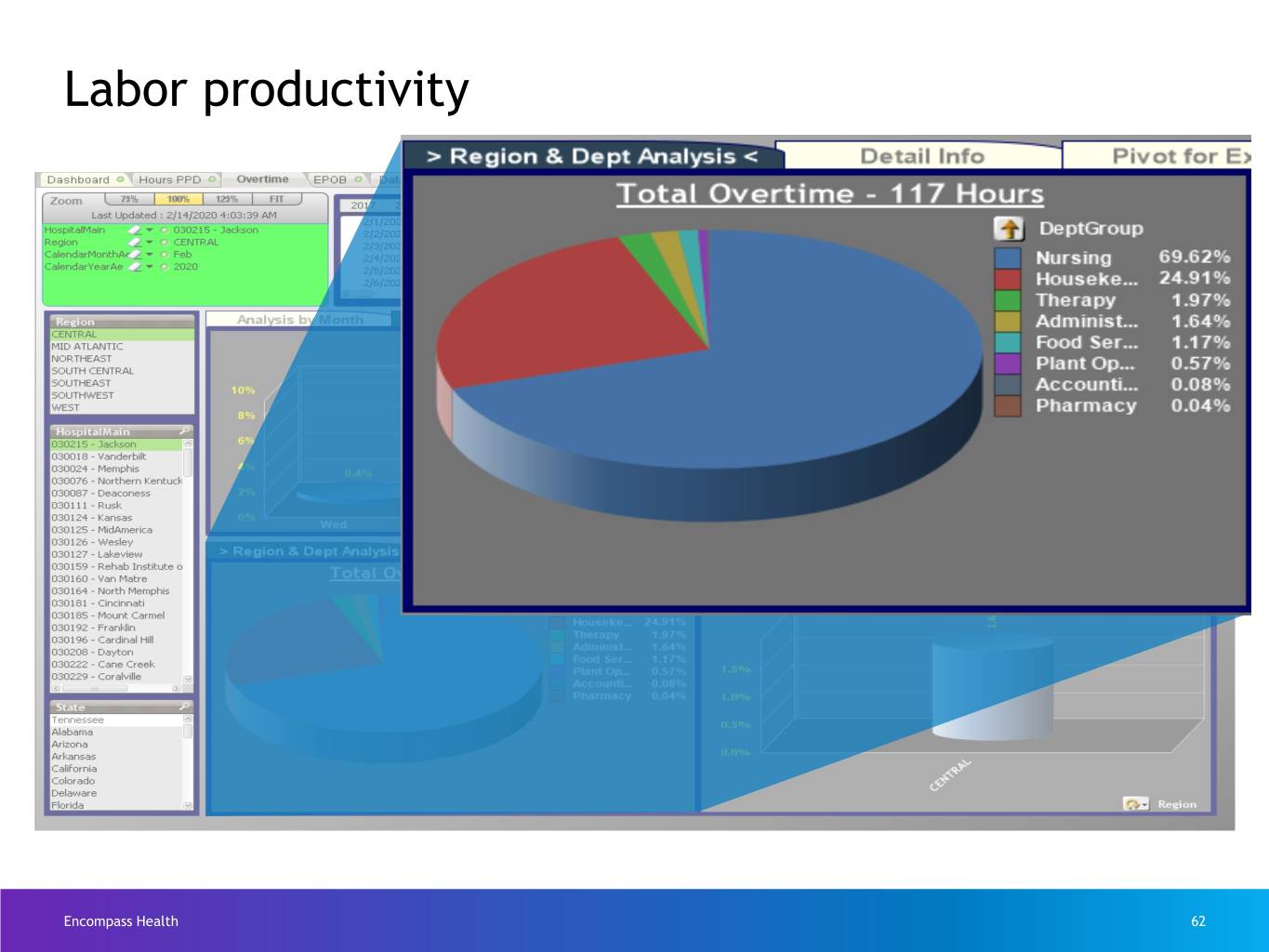

Labor productivity Encompass Health 62

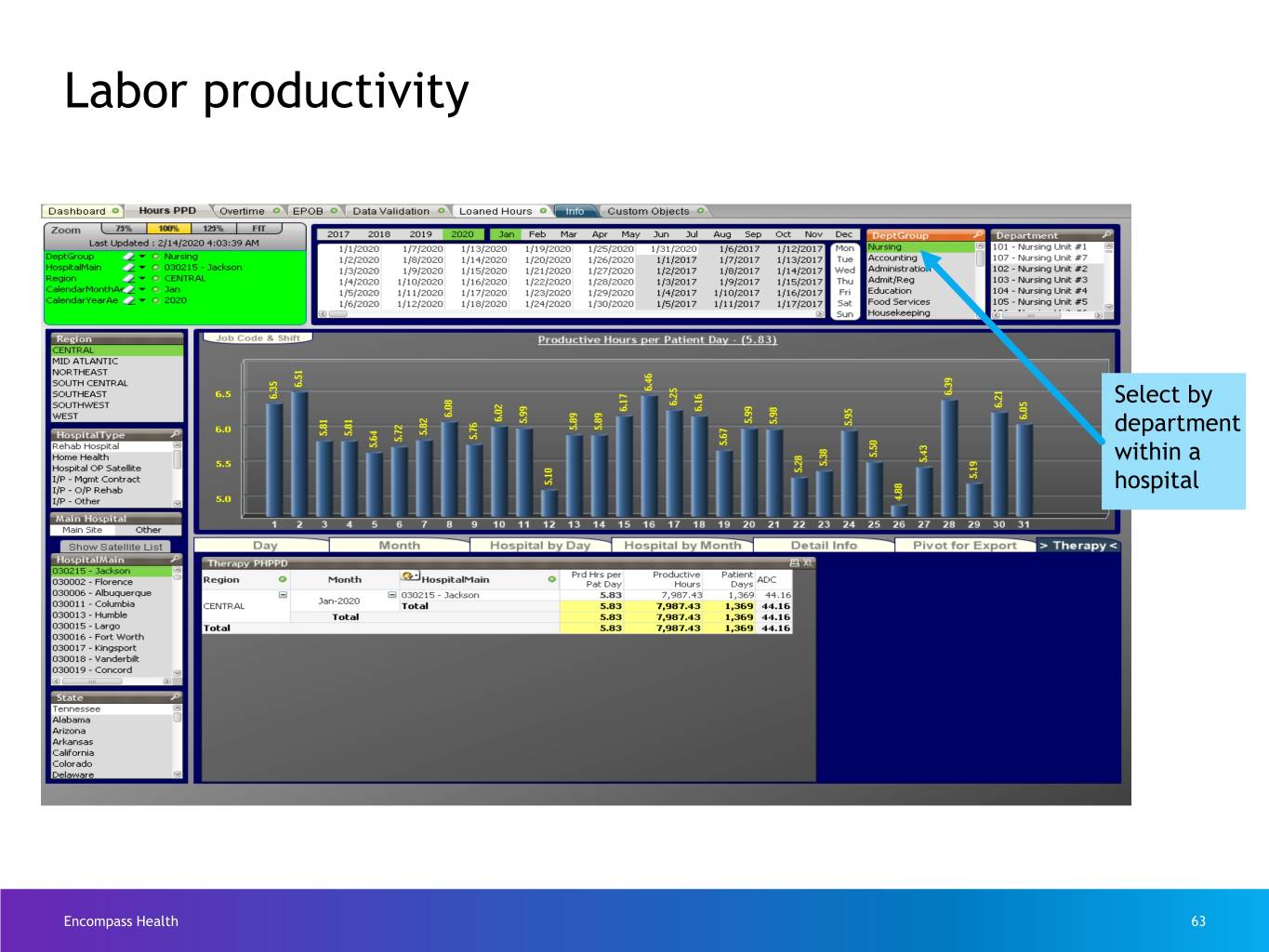

Labor productivity Select by department within a hospital Encompass Health 63

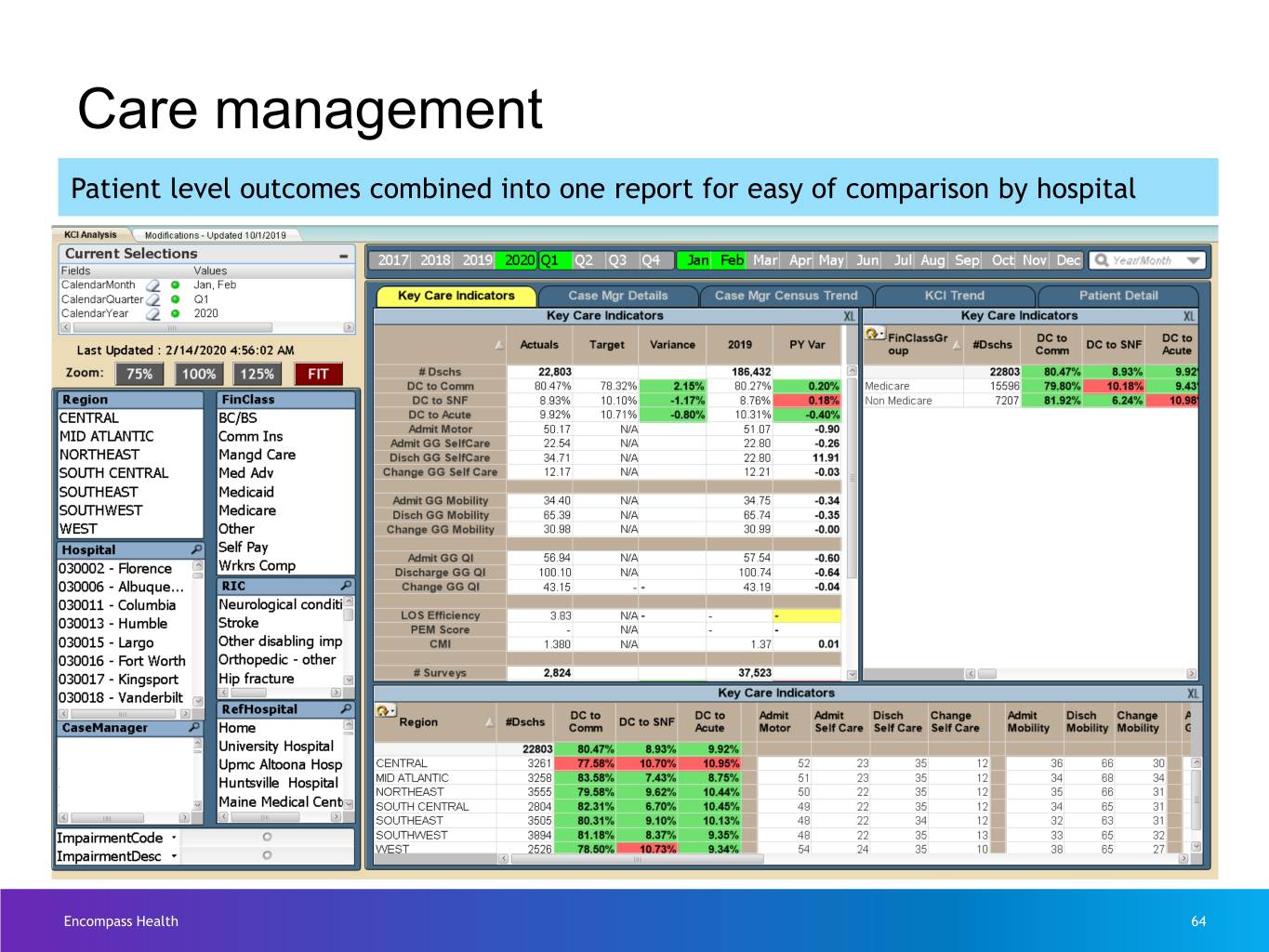

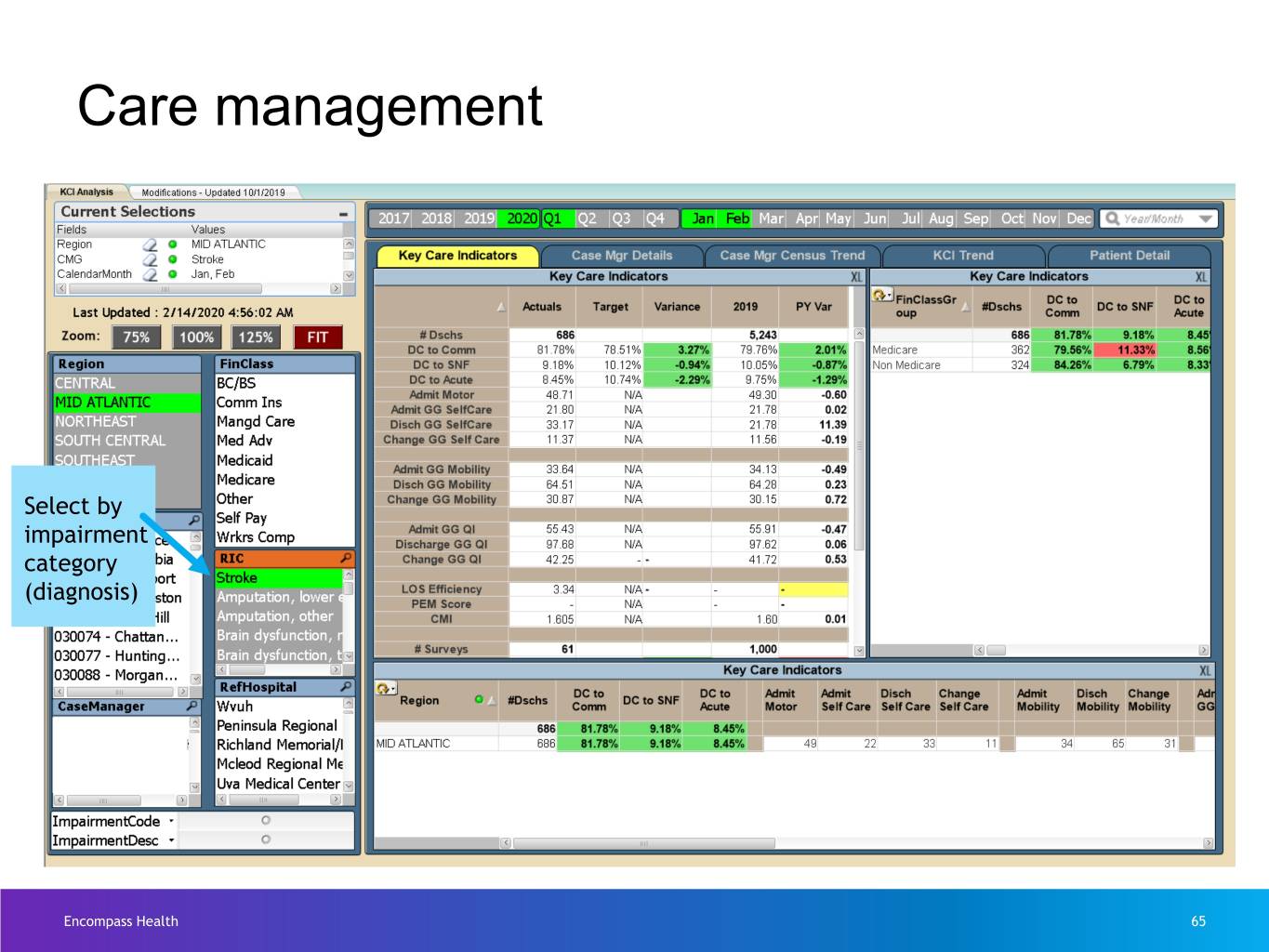

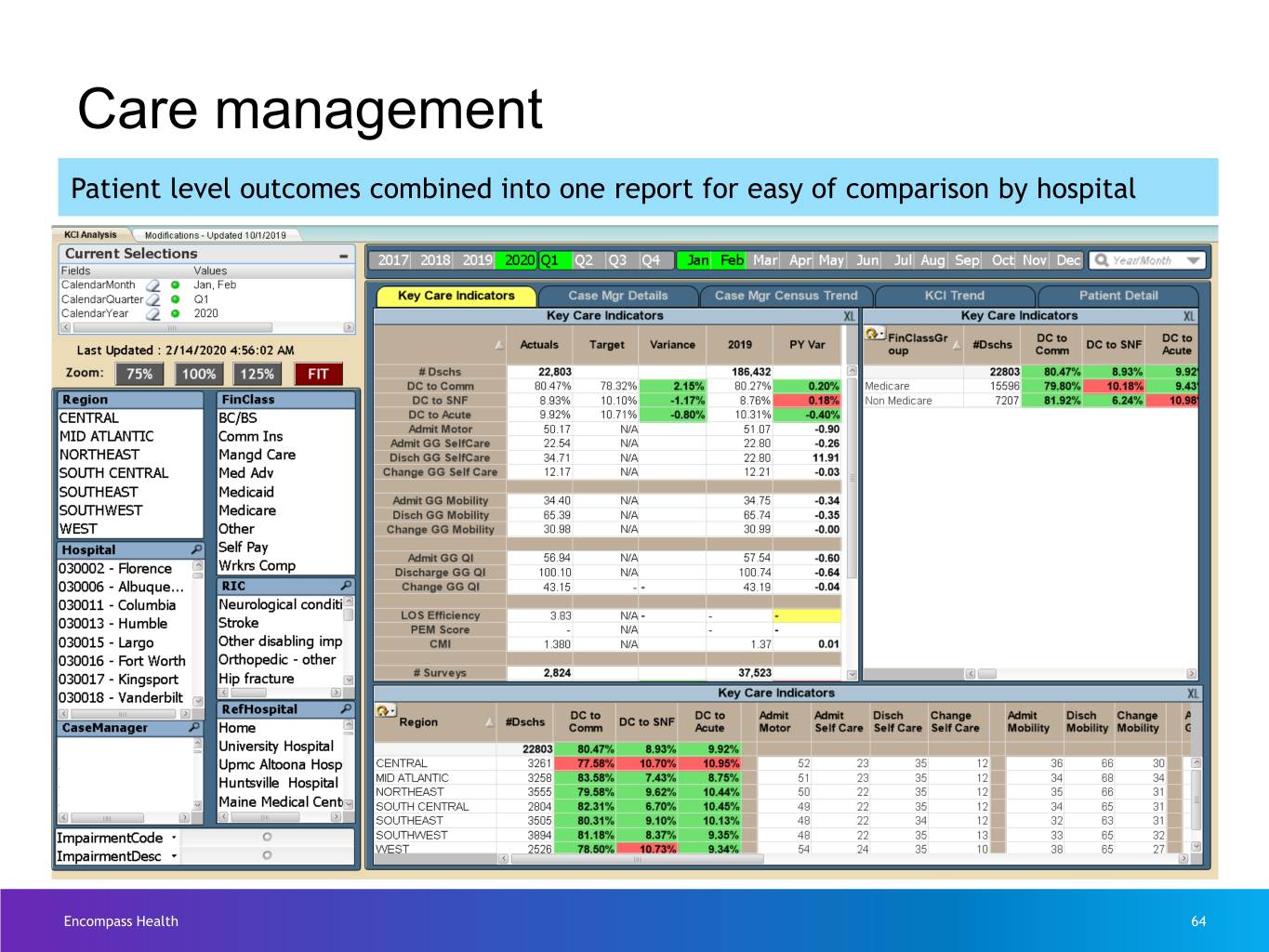

Care management Patient level outcomes combined into one report for easy of comparison by hospital Encompass Health 64

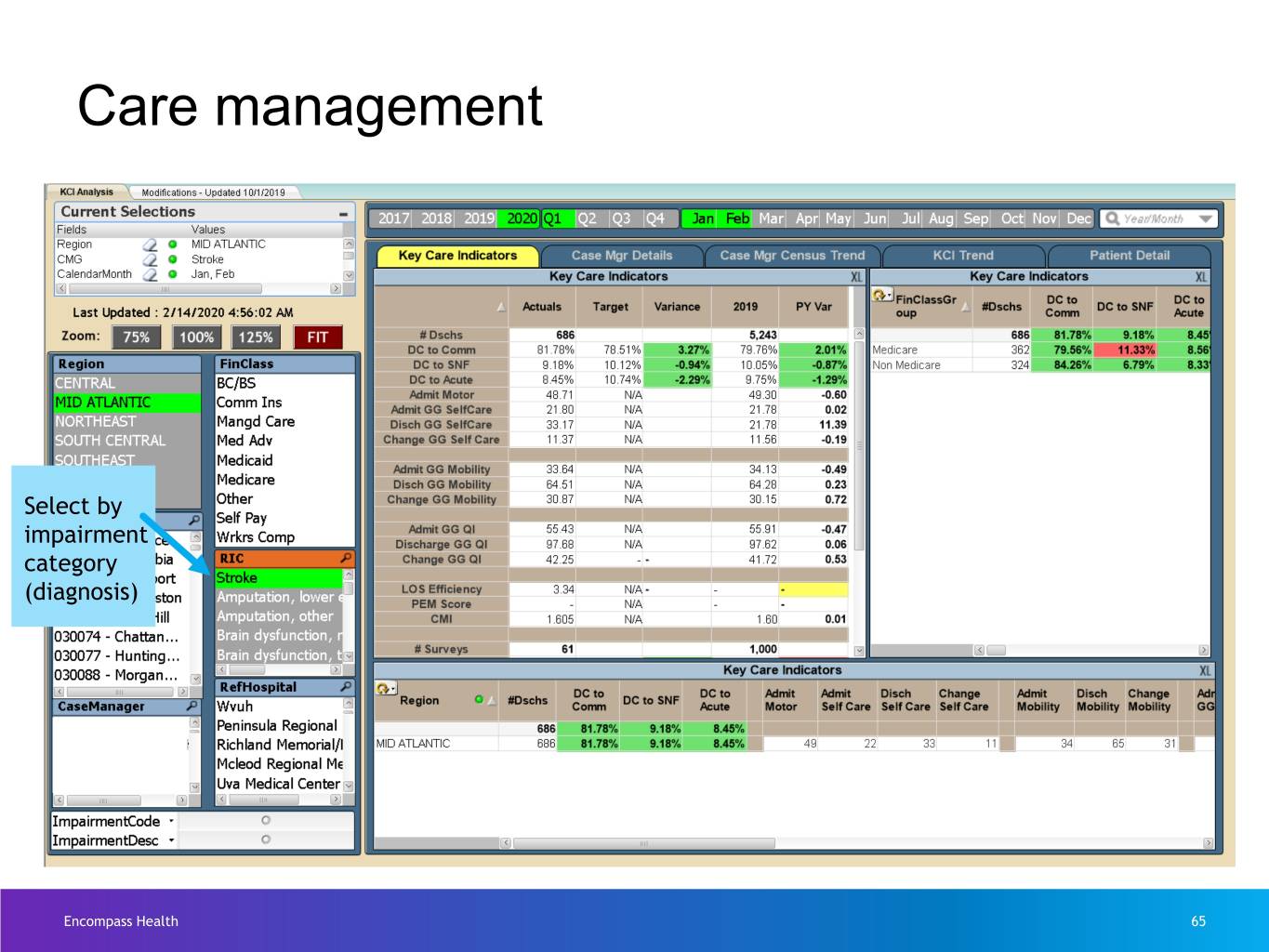

Care management Select by impairment category (diagnosis) Encompass Health 65

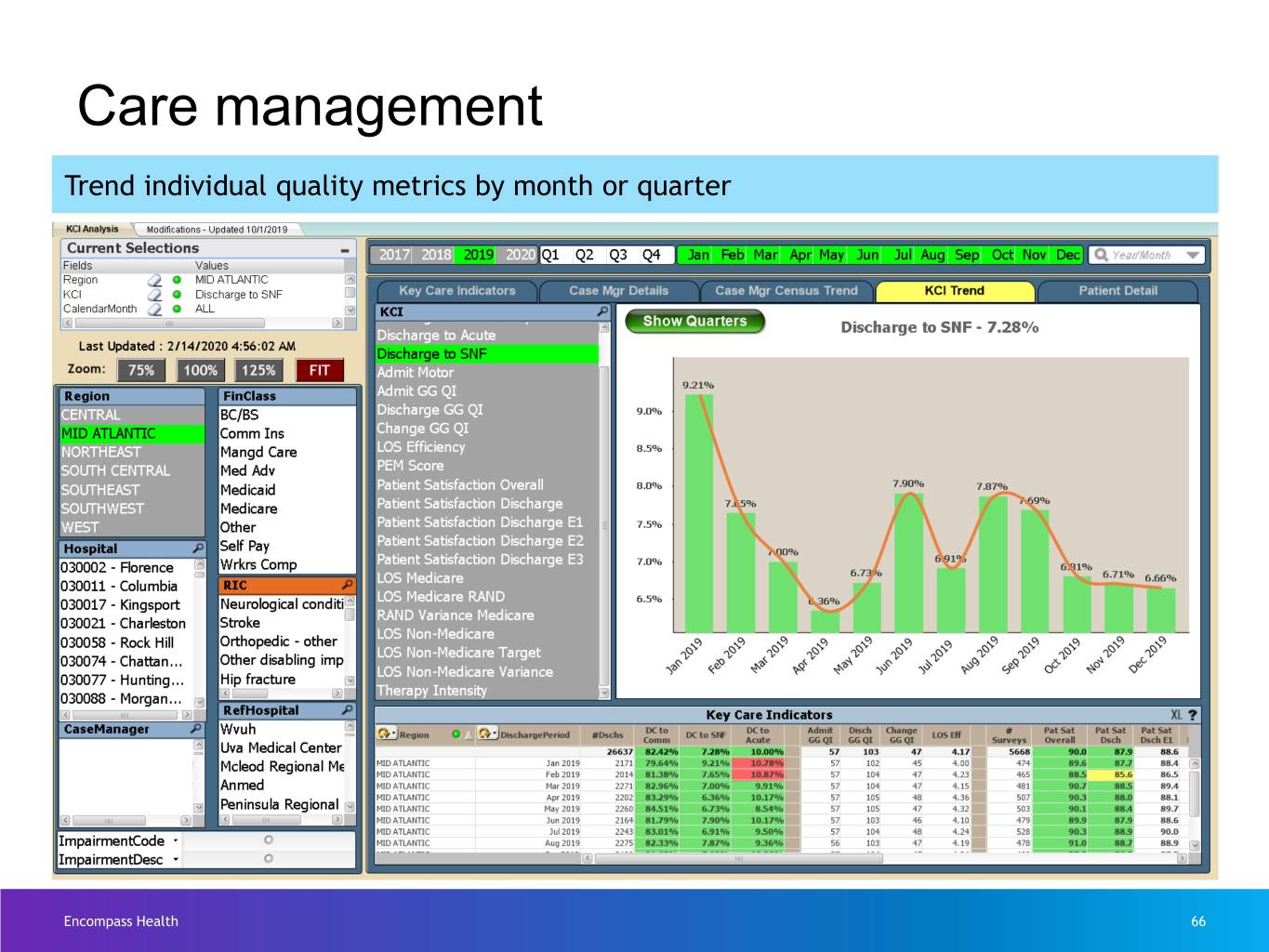

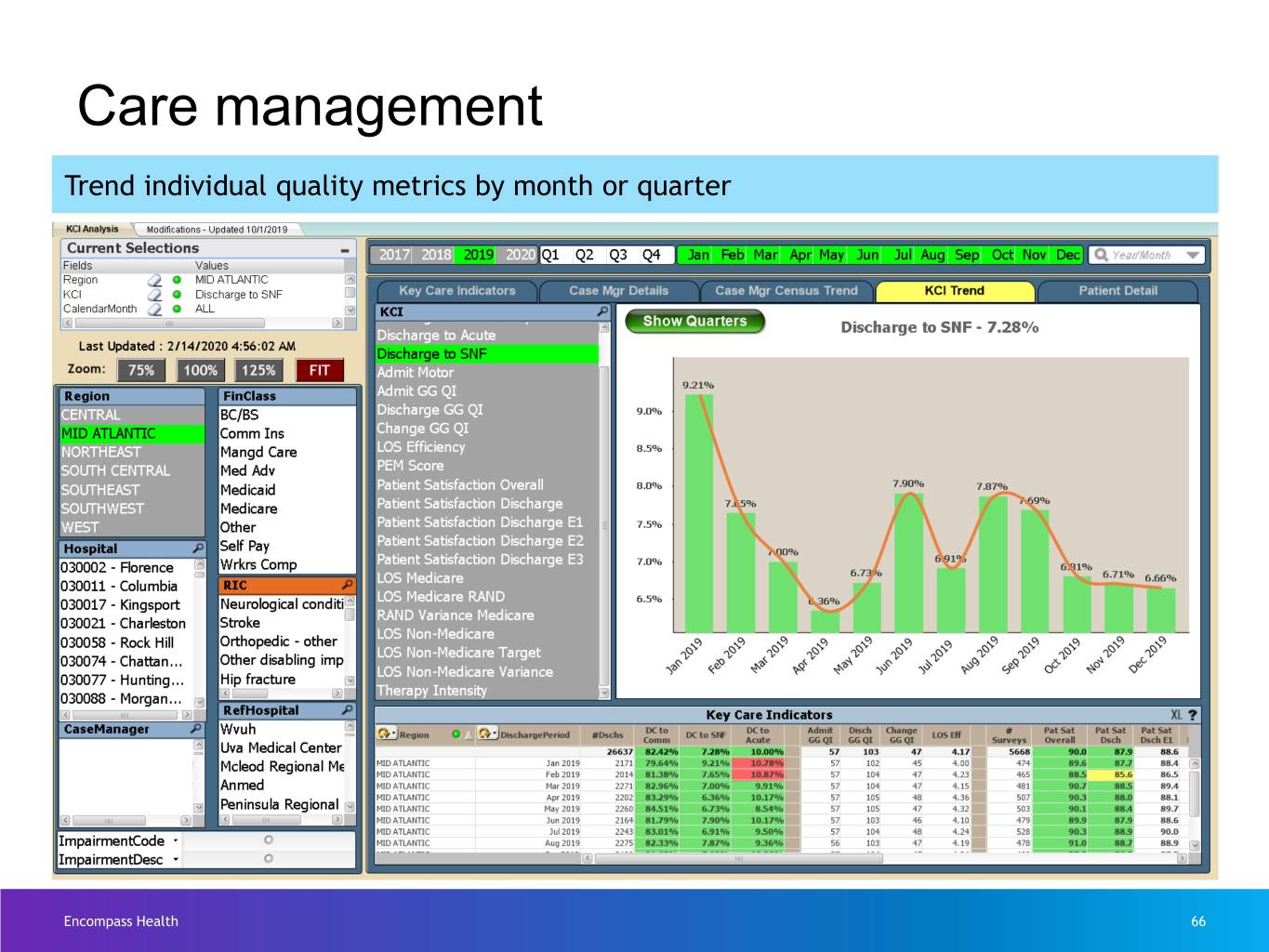

Care management Trend individual quality metrics by month or quarter Encompass Health 66

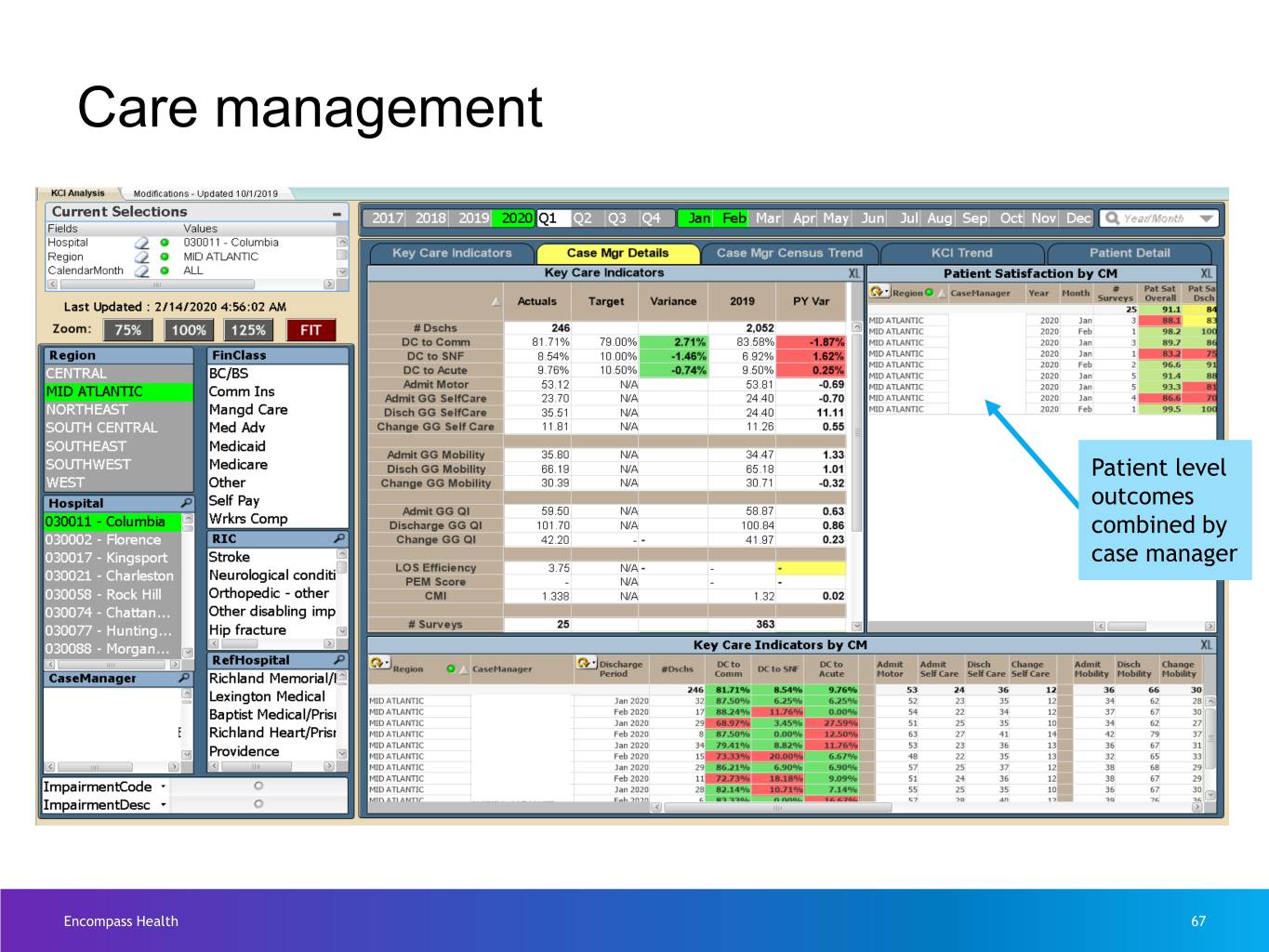

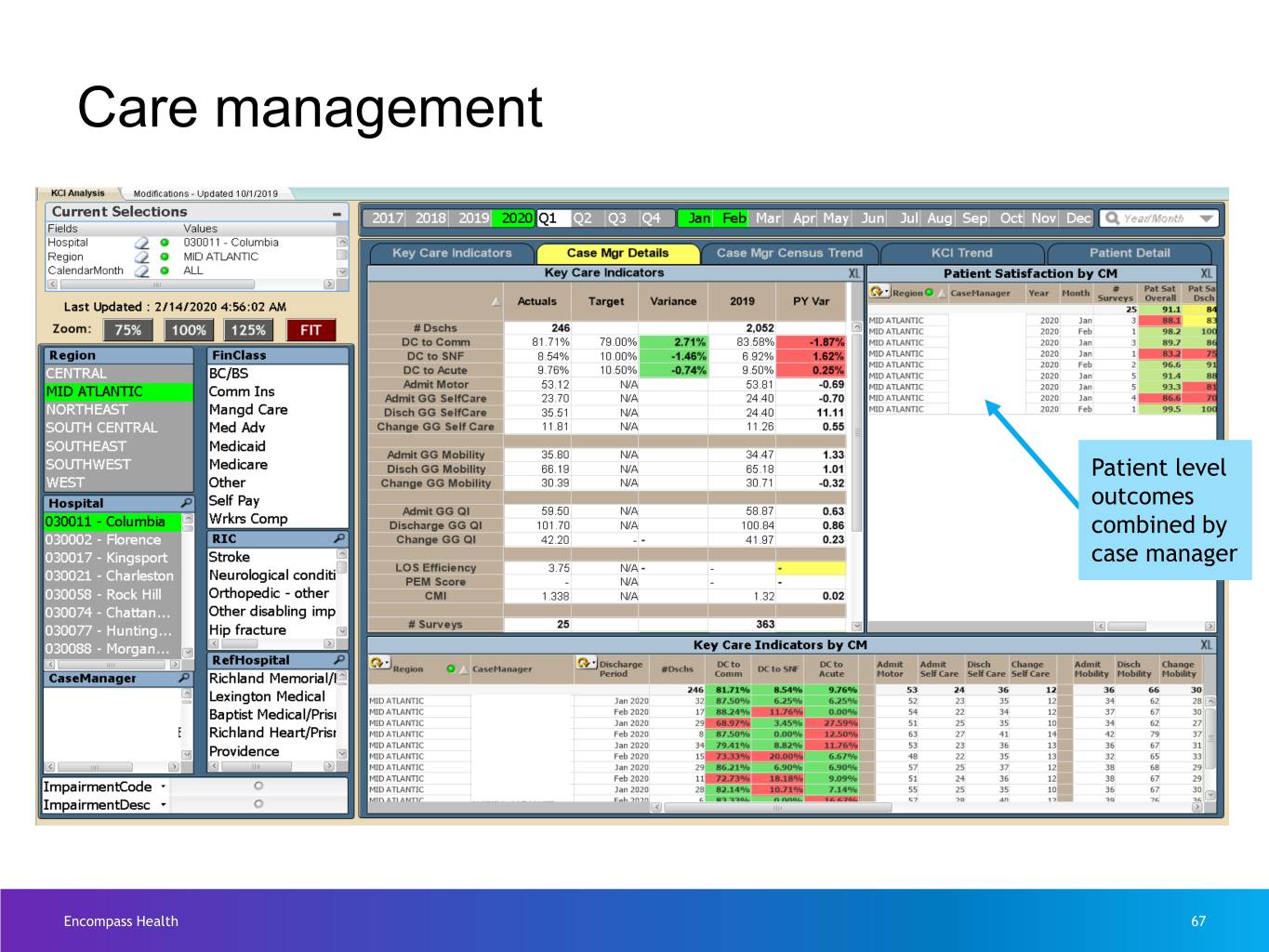

Care management Patient level outcomes combined by case manager Encompass Health 67

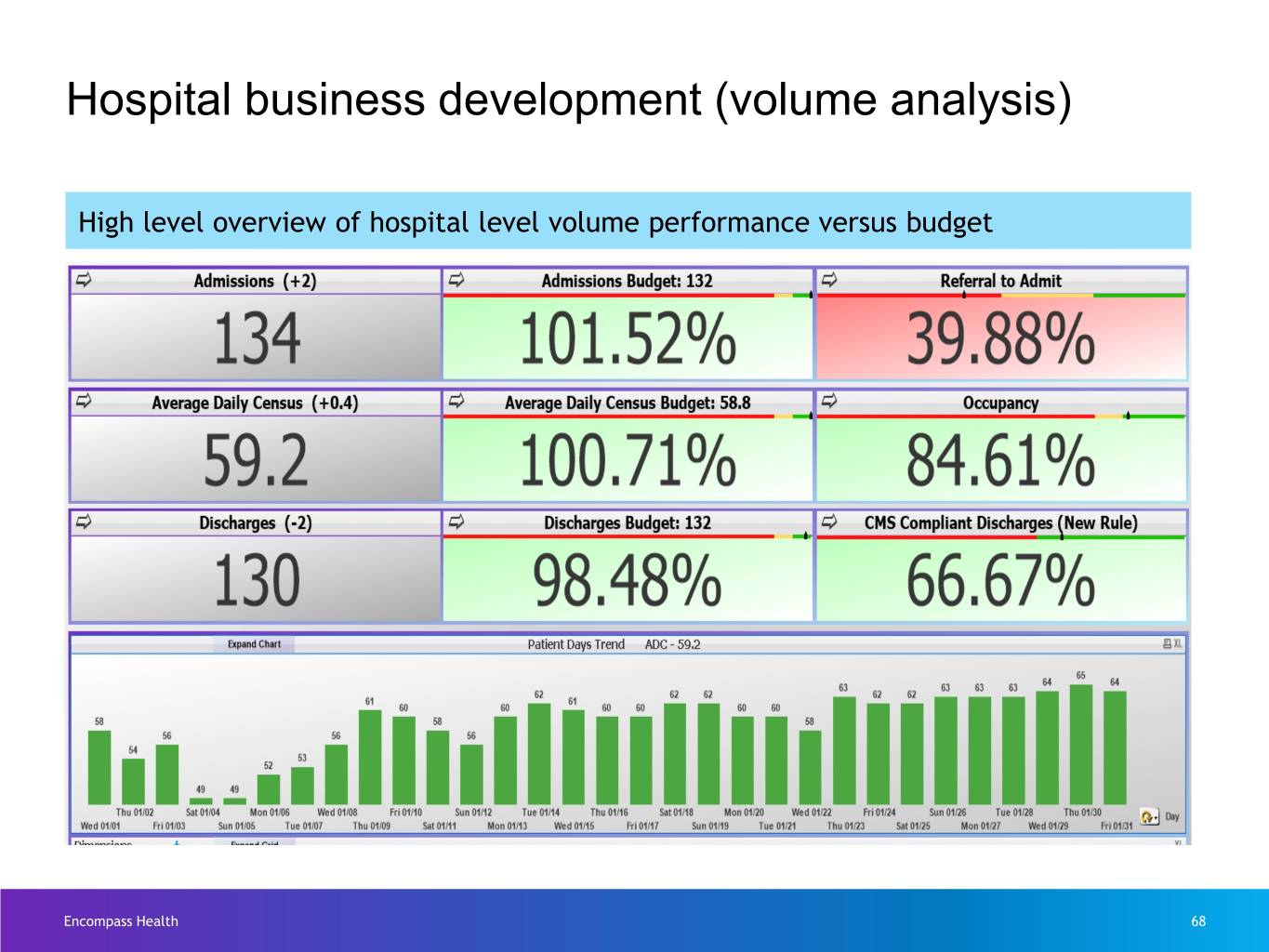

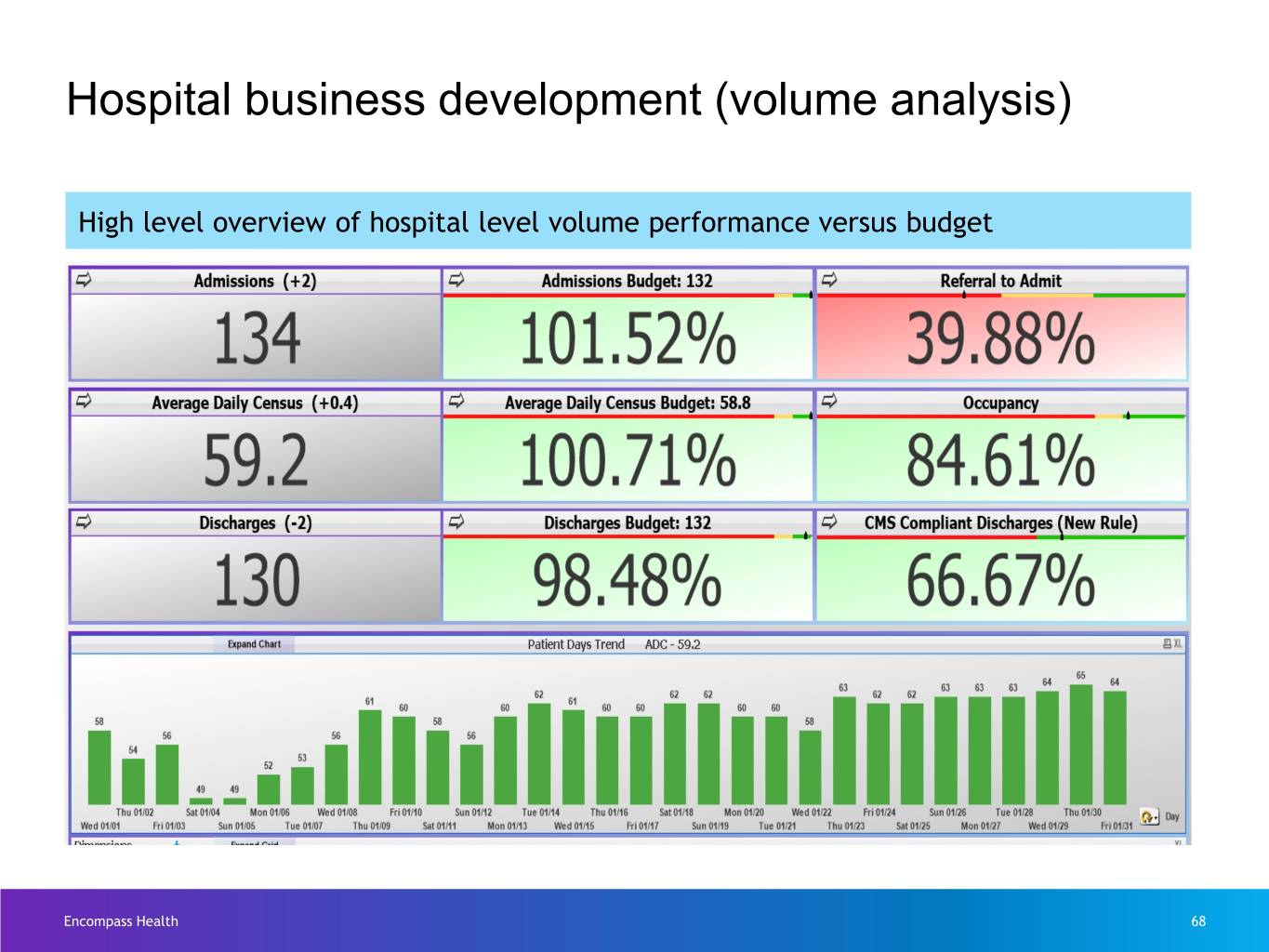

Hospital business development (volume analysis) High level overview of hospital level volume performance versus budget Encompass Health 68

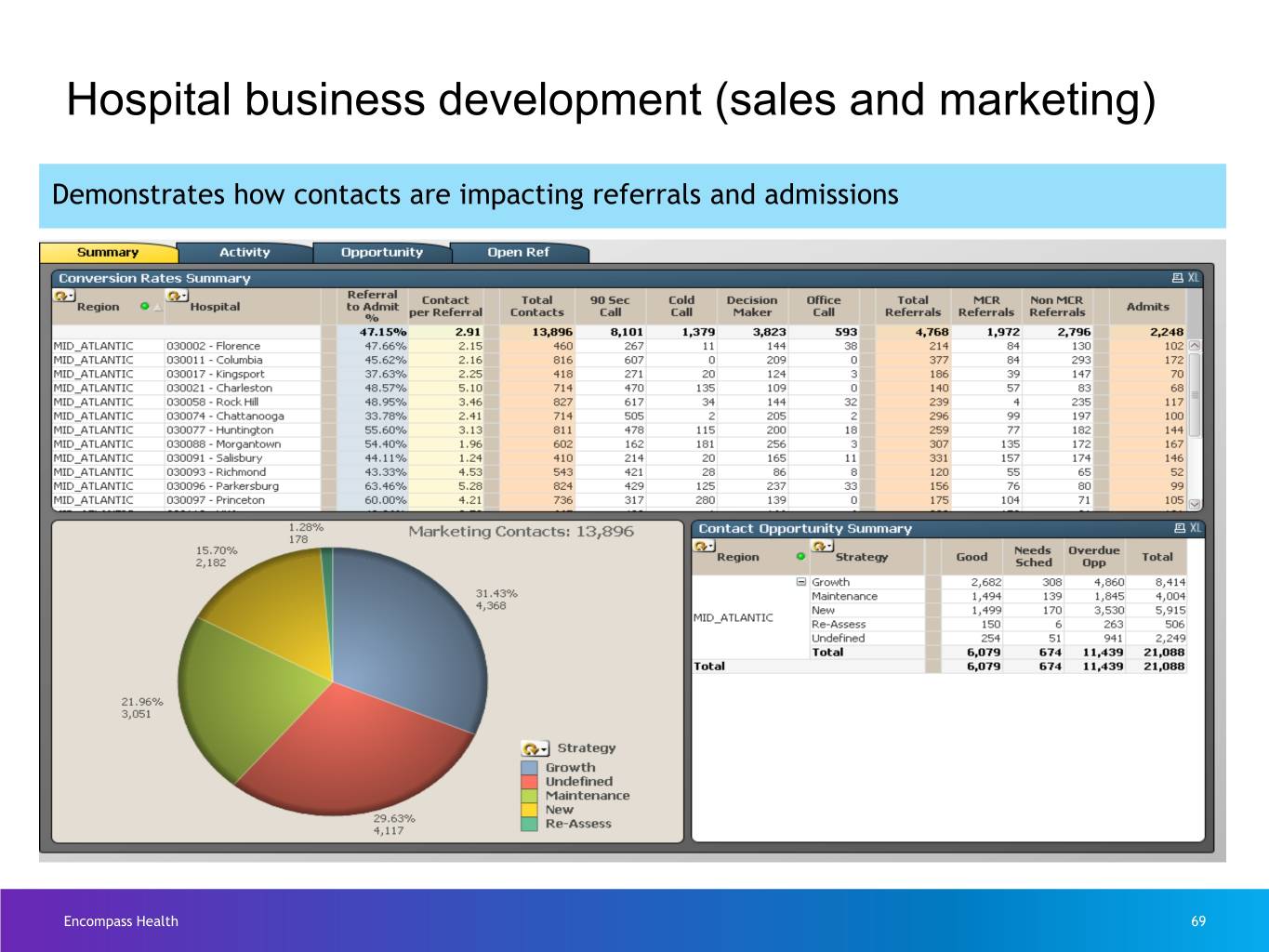

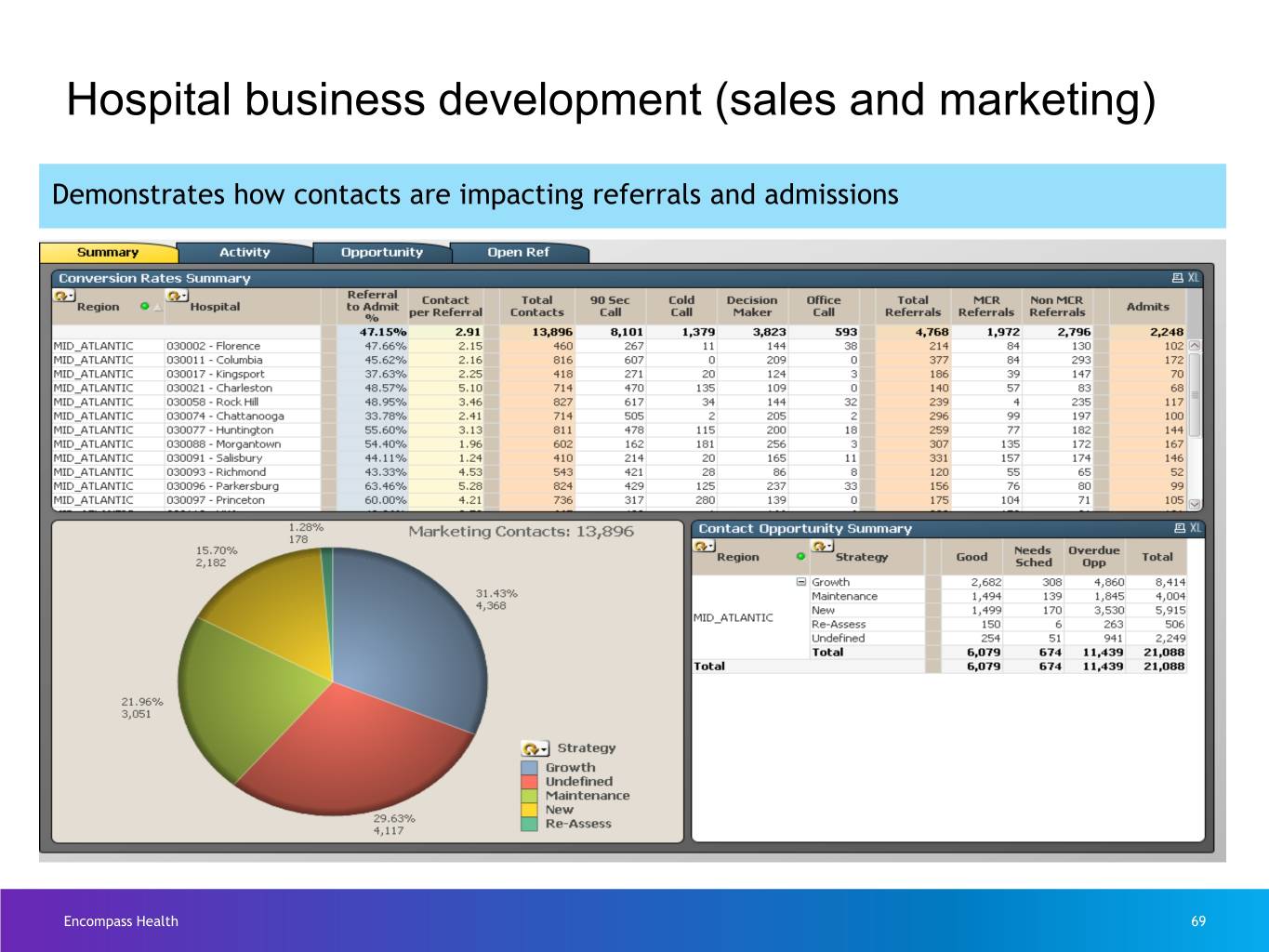

Hospital business development (sales and marketing) Demonstrates how contacts are impacting referrals and admissions Encompass Health 69

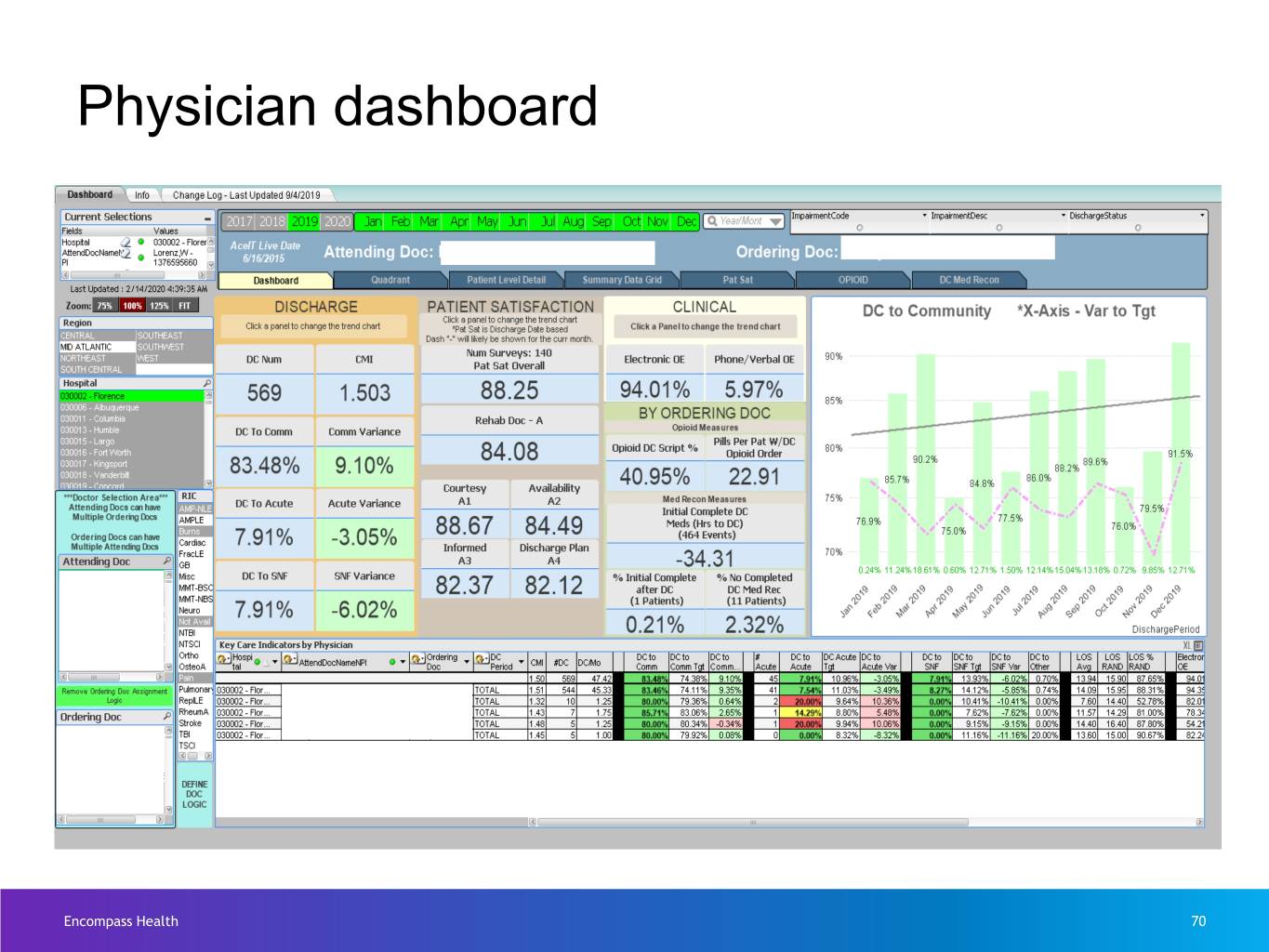

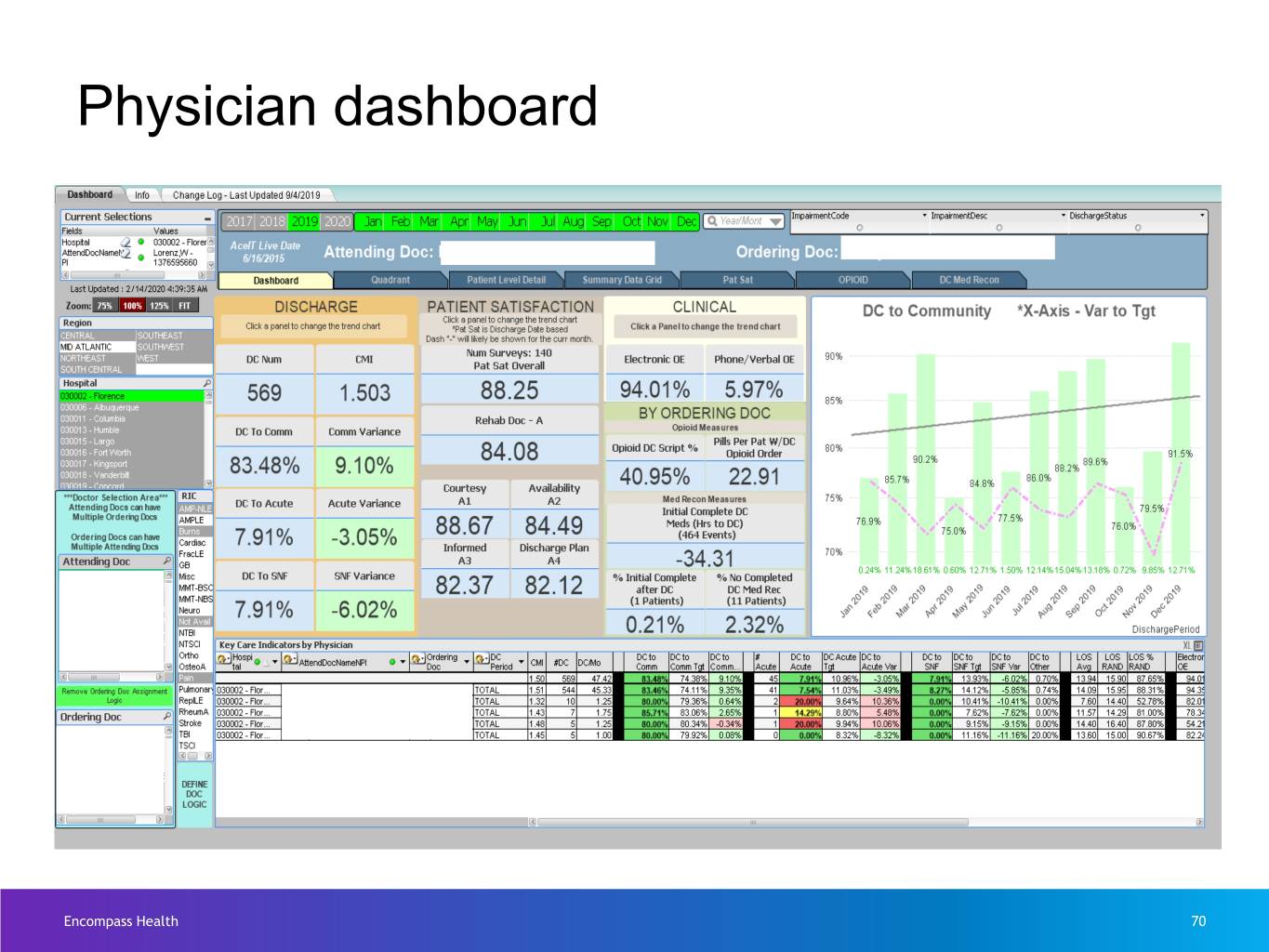

Physician dashboard Encompass Health 70

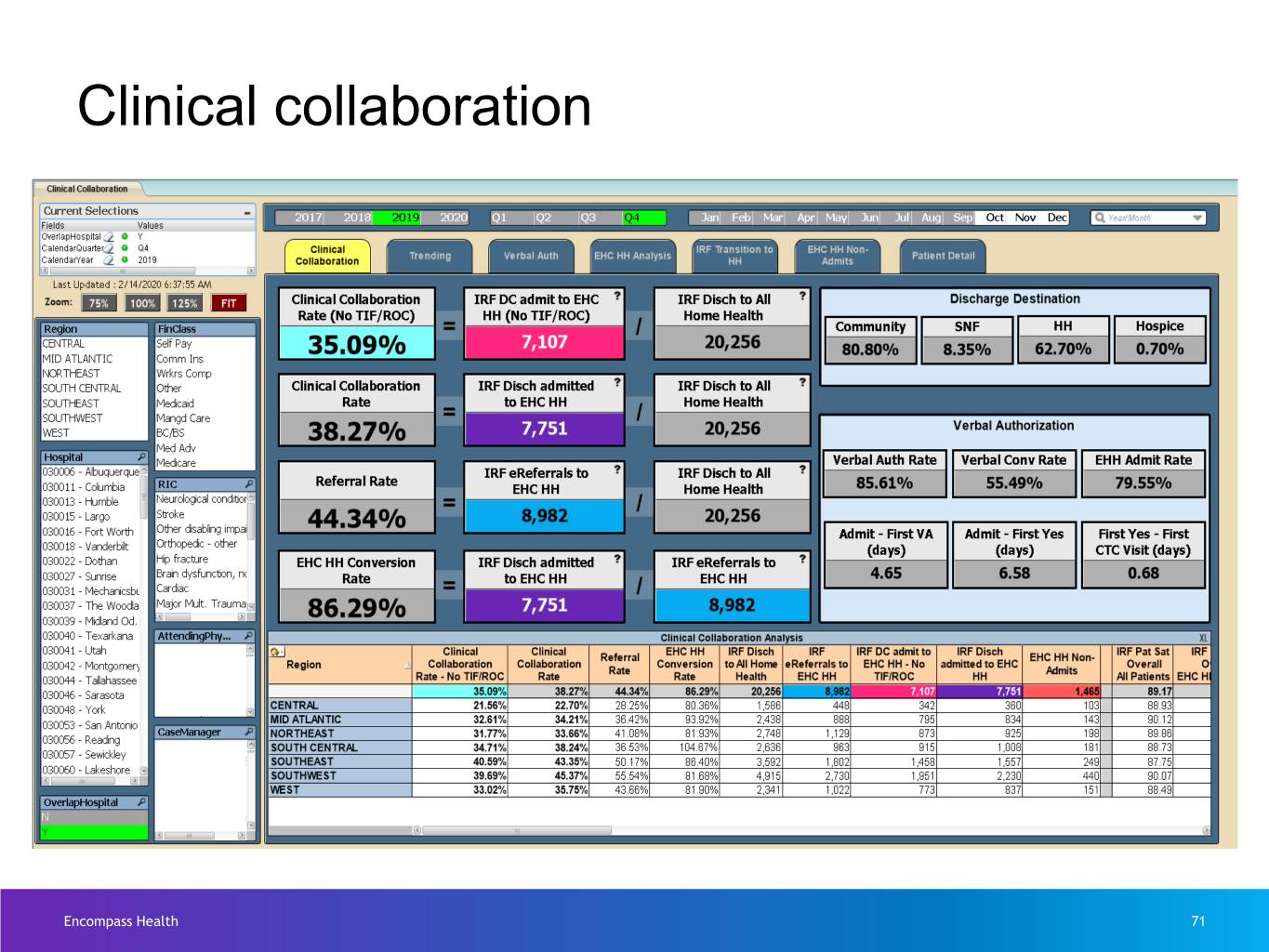

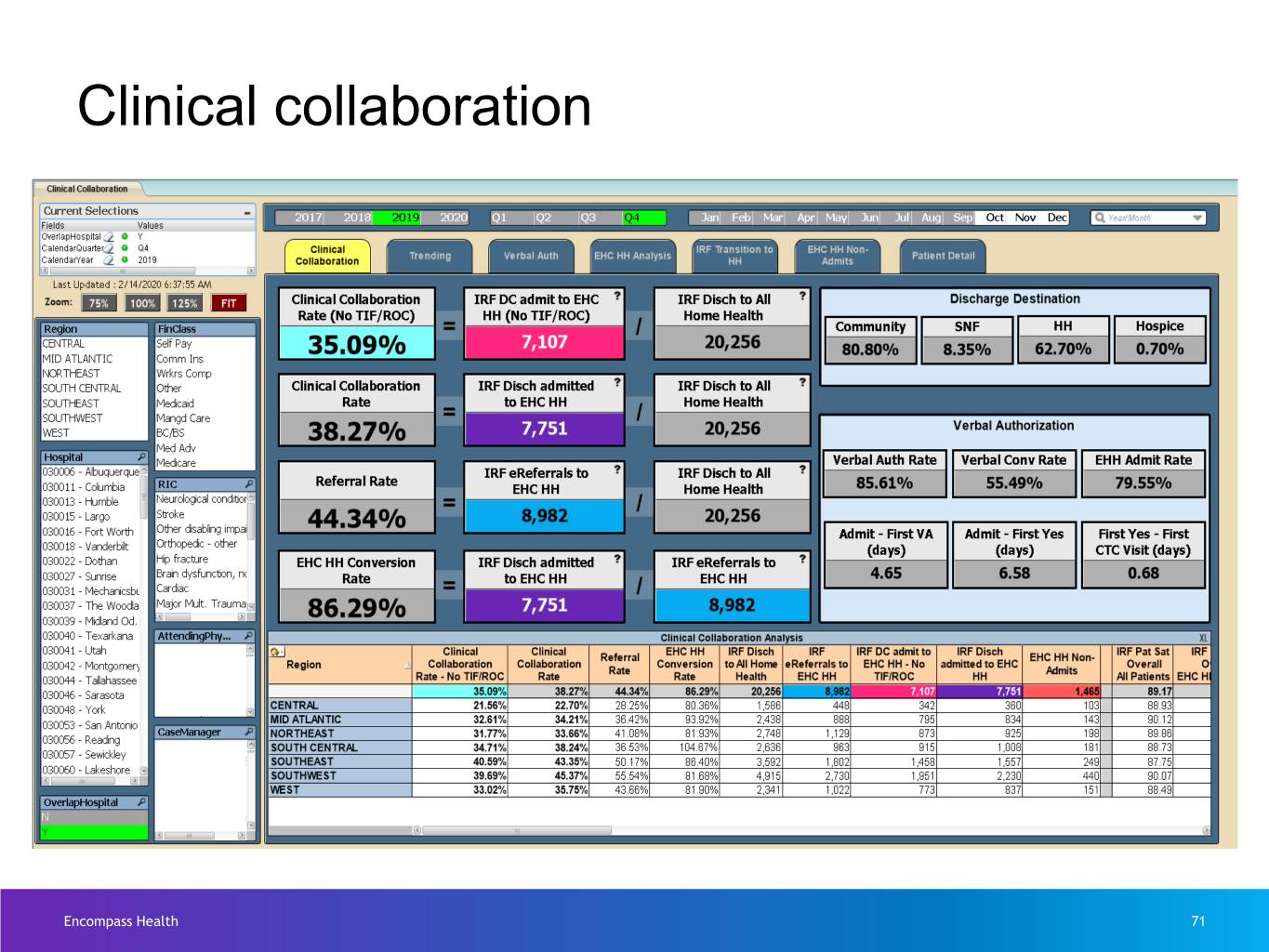

Clinical collaboration Encompass Health 71

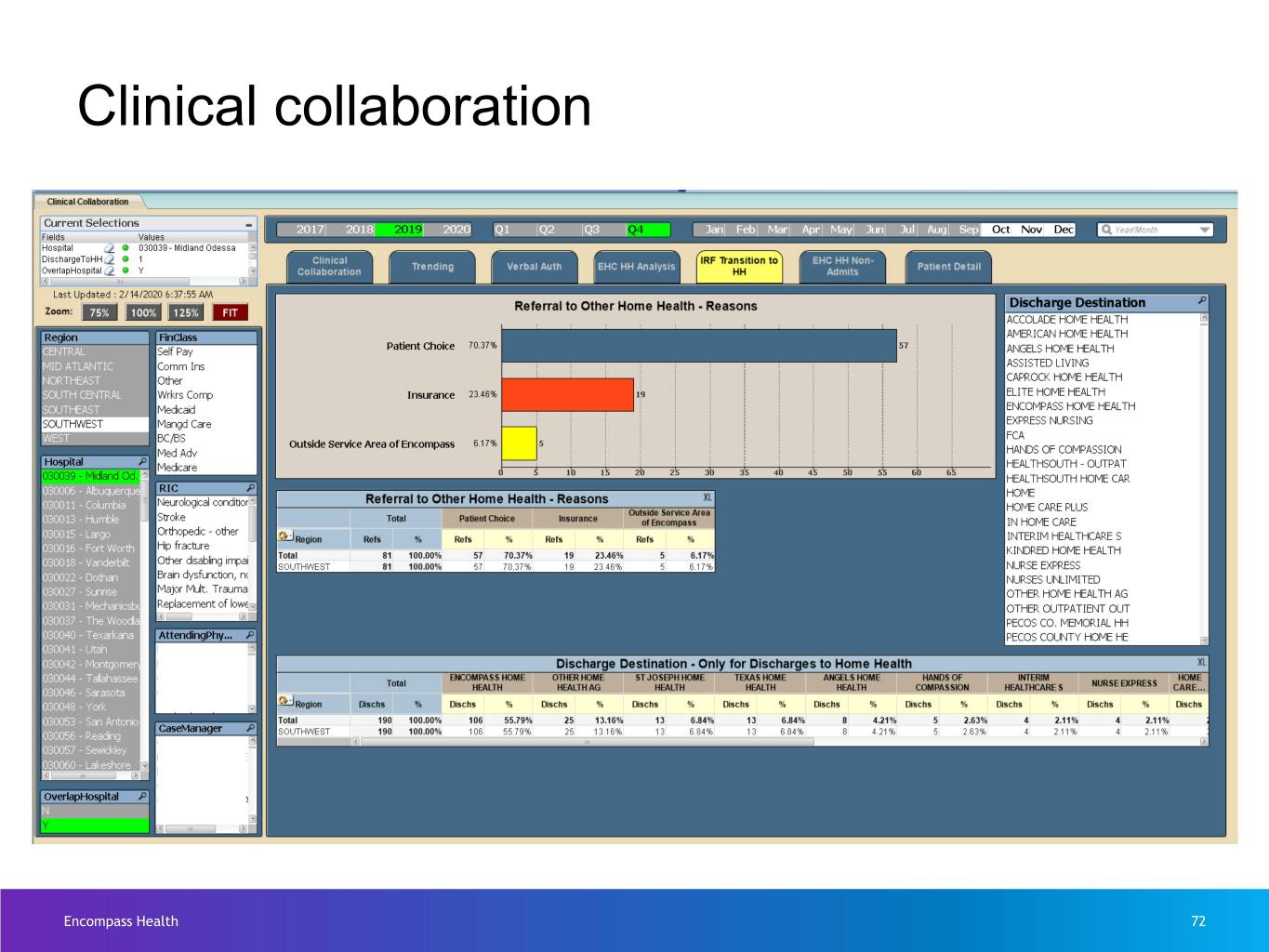

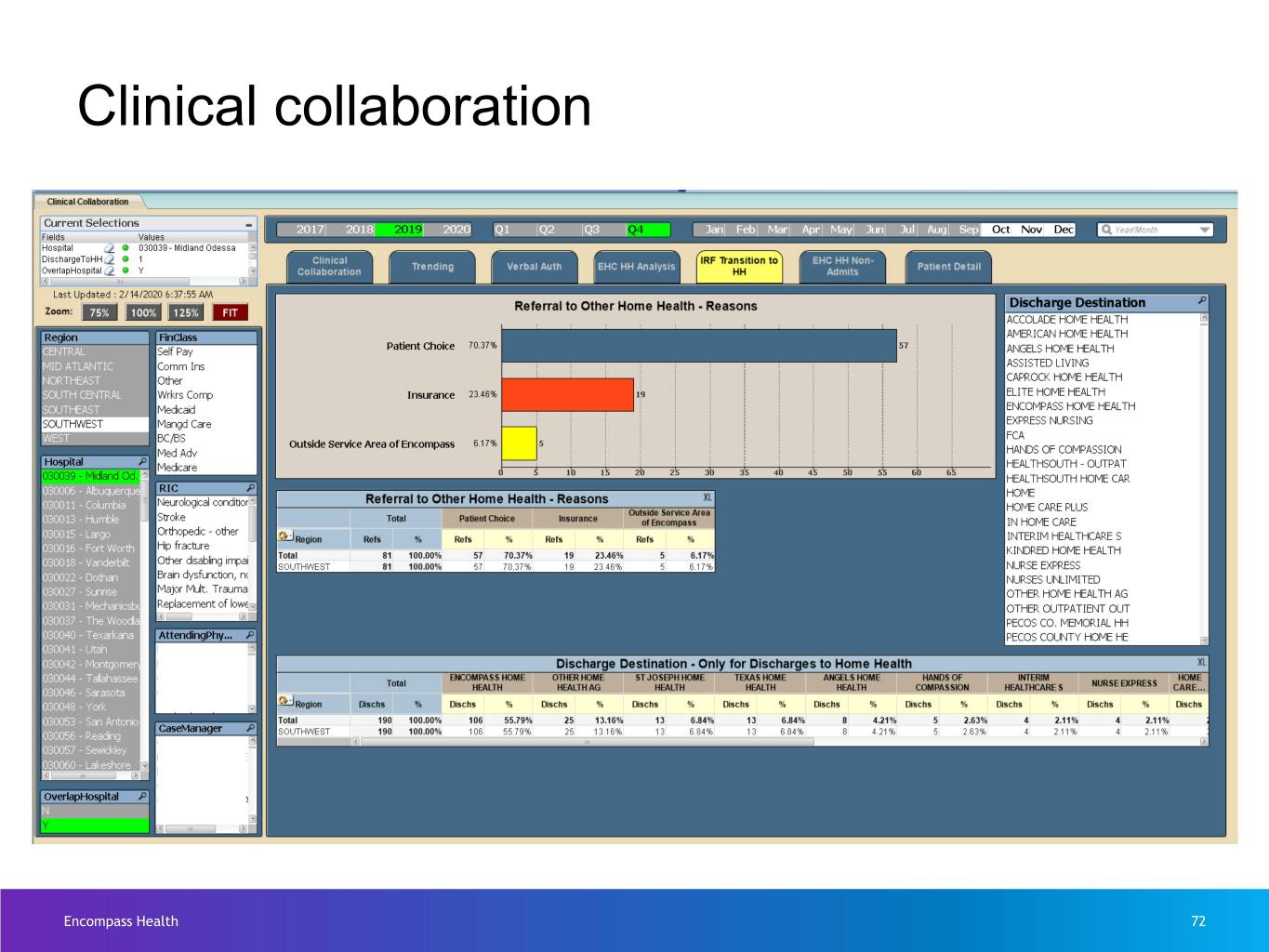

Clinical collaboration Encompass Health 72

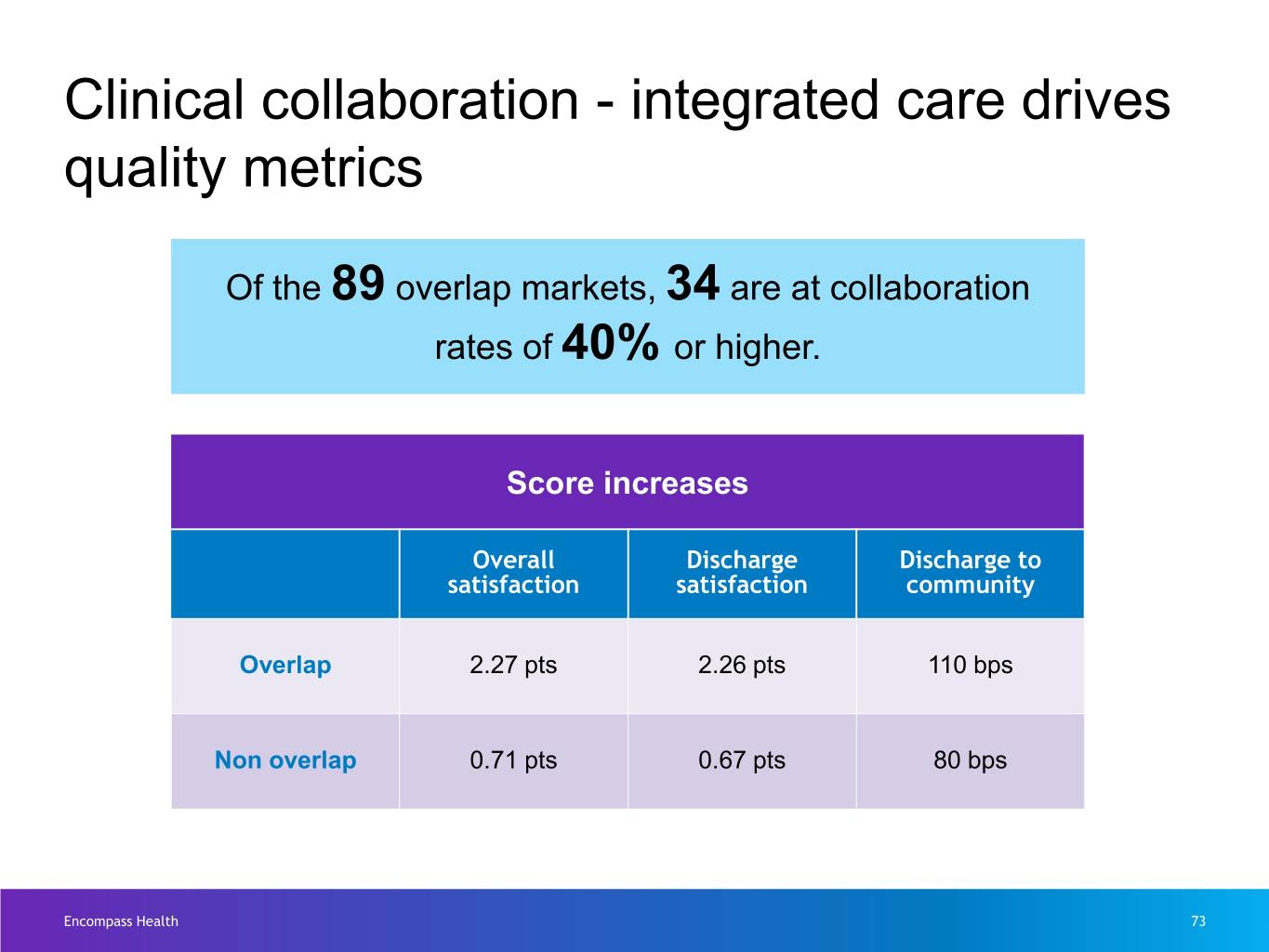

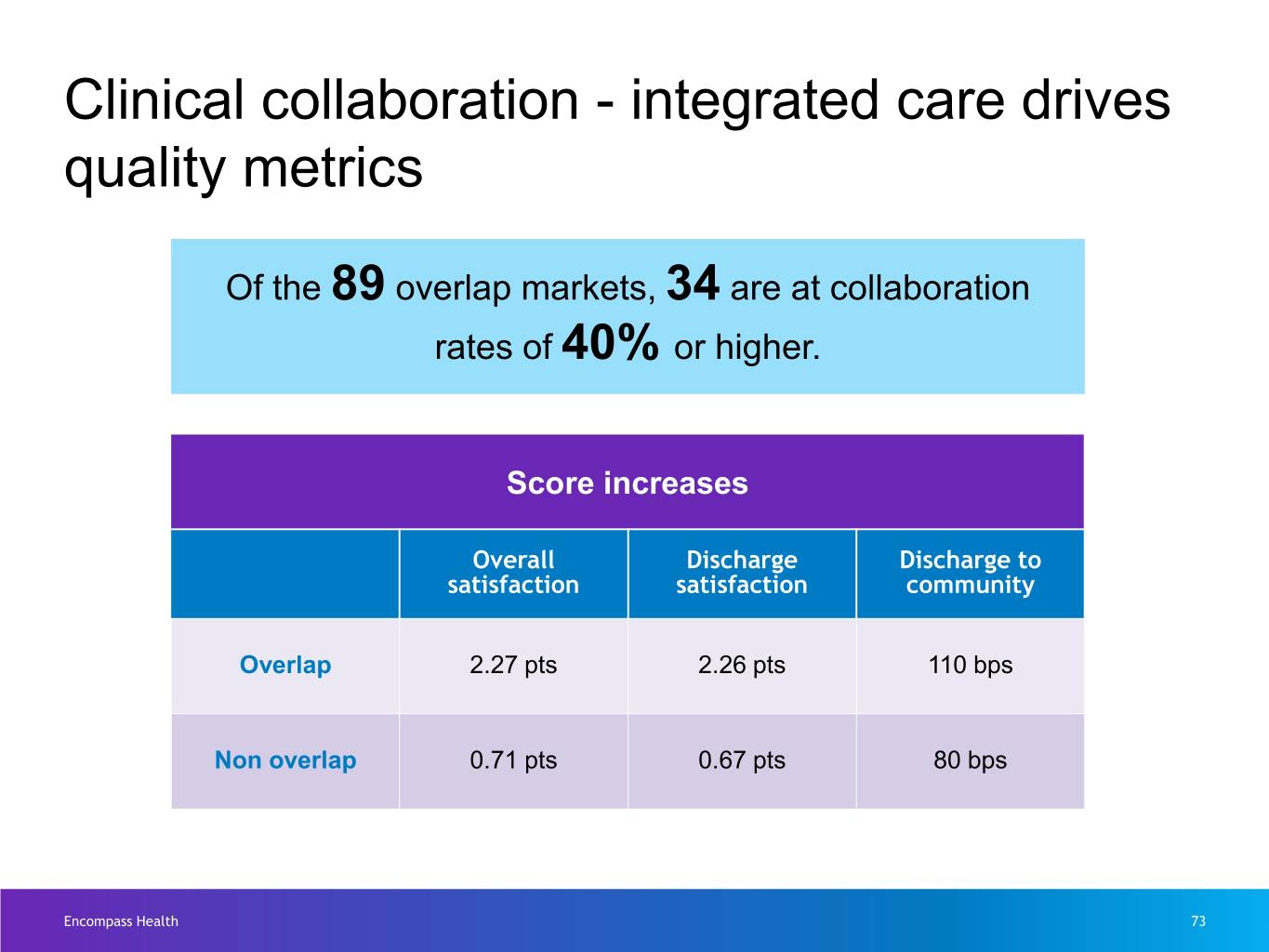

Clinical collaboration - integrated care drives quality metrics Of the 89 overlap markets, 34 are at collaboration rates of 40% or higher. Score increases Overall Discharge Discharge to satisfaction satisfaction community Overlap 2.27 pts 2.26 pts 110 bps Non overlap 0.71 pts 0.67 pts 80 bps Encompass Health 73

Clinical Collaboration Encompass Health 74

Home Health Presented by April Anthony and Luke James Encompass Health 75

Overview – Home Health 4th largest provider of Medicare-certified skilled home health services 89 overlap markets with Encompass Health Rehabilitation 245 31 Hospitals Home Health locations States 82% of revenue is Medicare ~9,900 ~159,700 ~$900 million employees home health revenues admissions Encompass Health 76

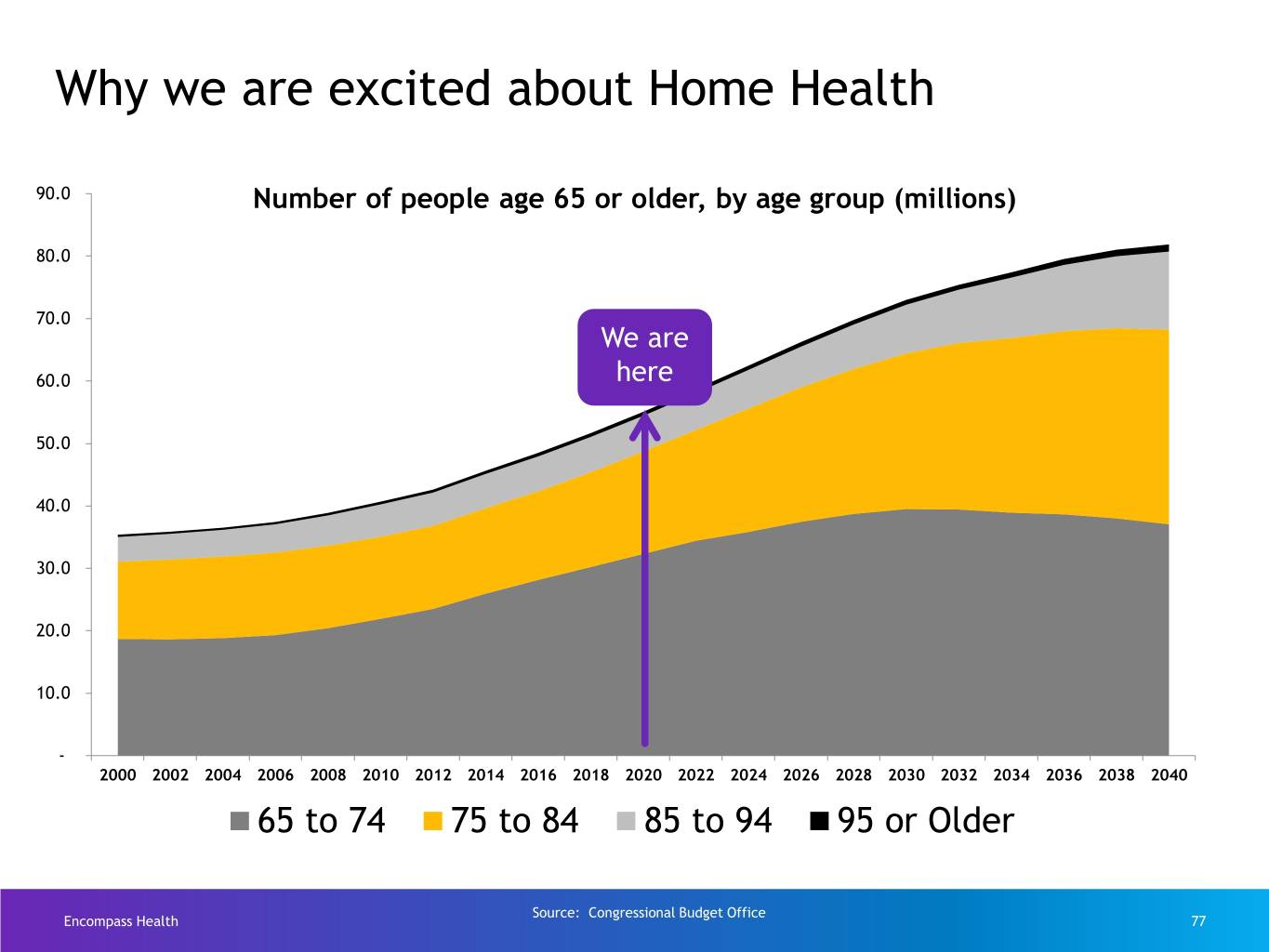

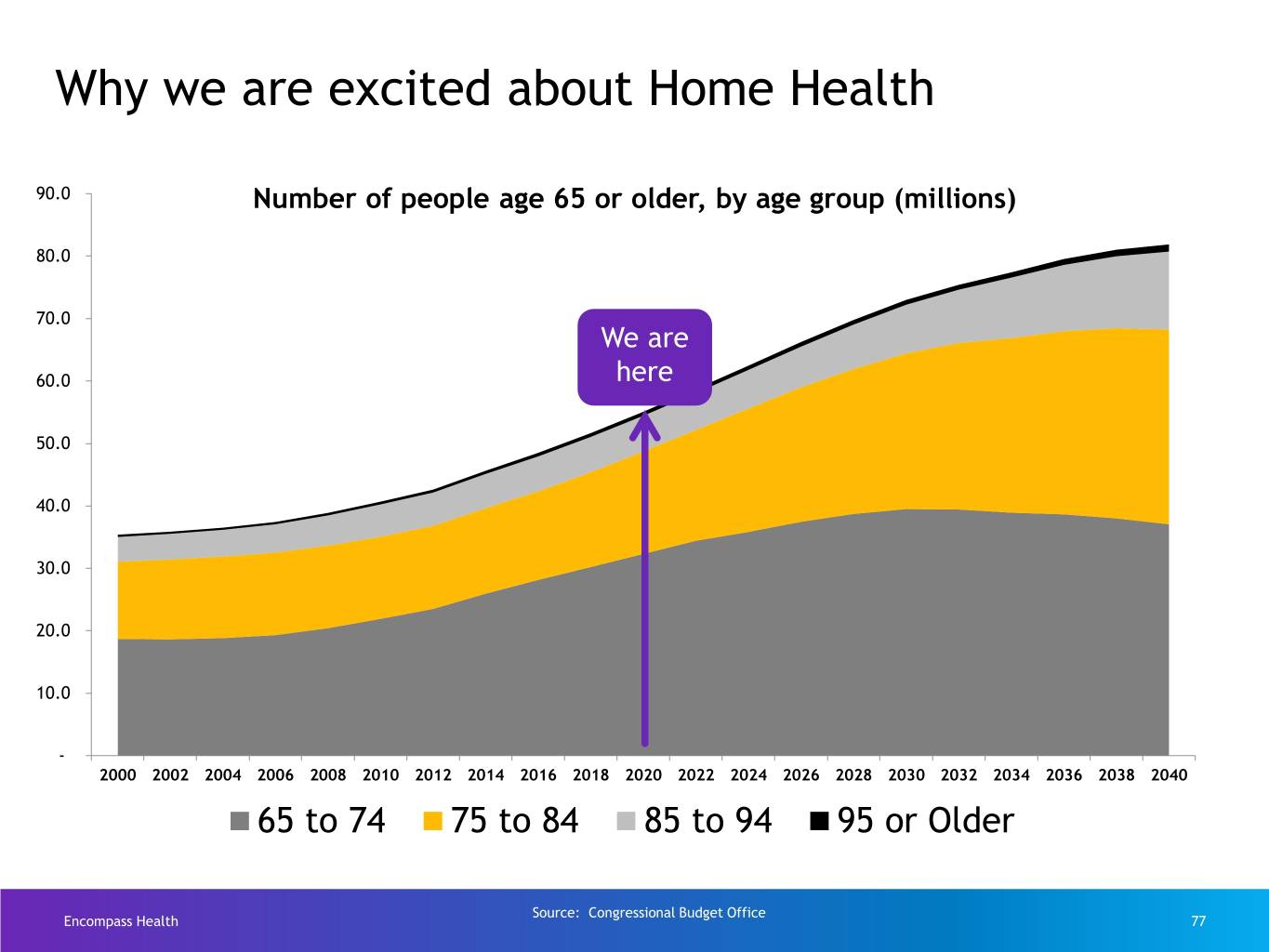

Why we are excited about Home Health 90.0 Number of people age 65 or older, by age group (millions) 80.0 70.0 We are 60.0 here 50.0 40.0 30.0 20.0 10.0 - 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 65 to 74 75 to 84 85 to 94 95 or Older Source: Congressional Budget Office Encompass Health 77

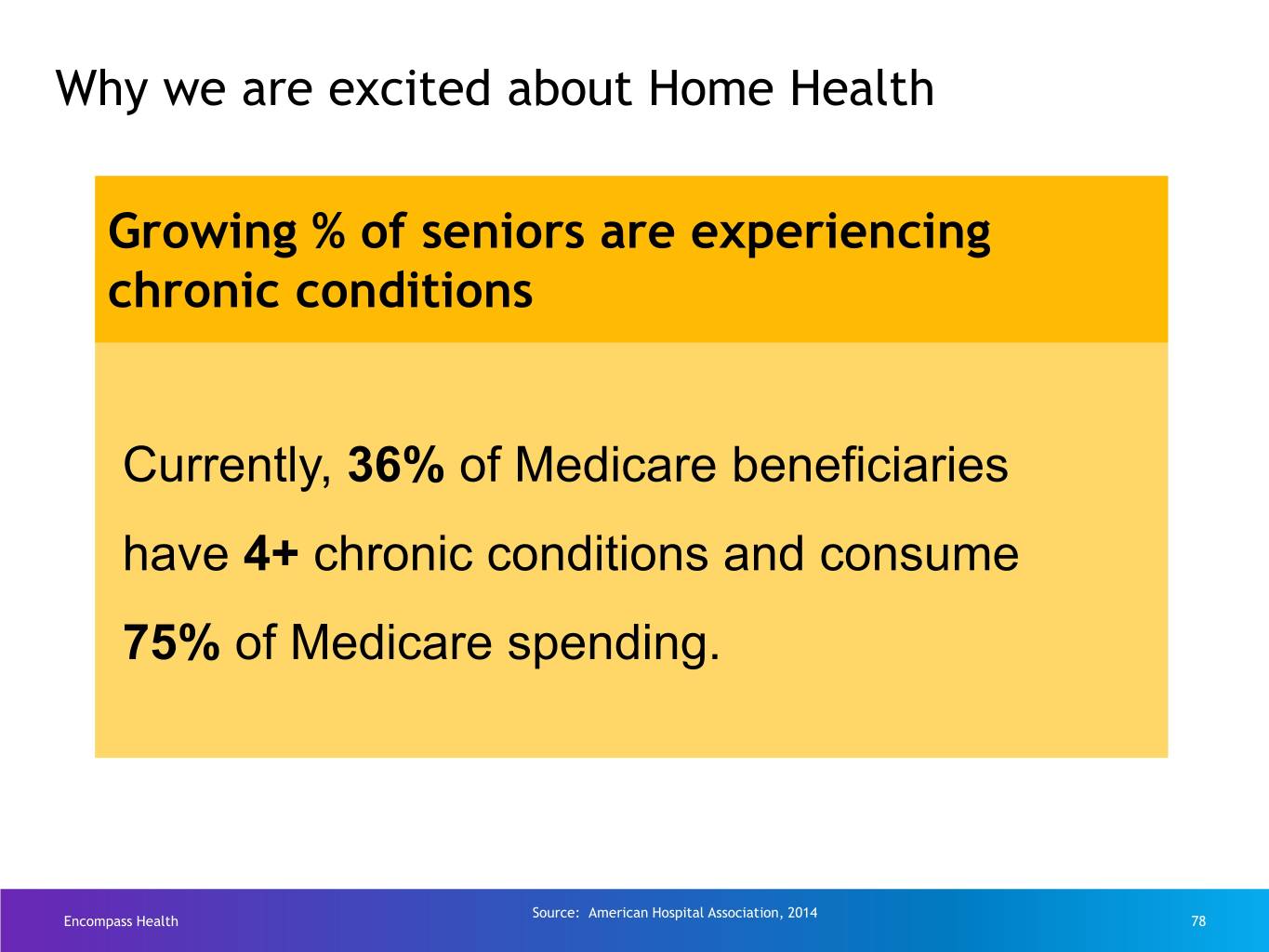

Why we are excited about Home Health Growing % of seniors are experiencing chronic conditions Currently, 36% of Medicare beneficiaries have 4+ chronic conditions and consume 75% of Medicare spending. Source: American Hospital Association, 2014 Encompass Health 78

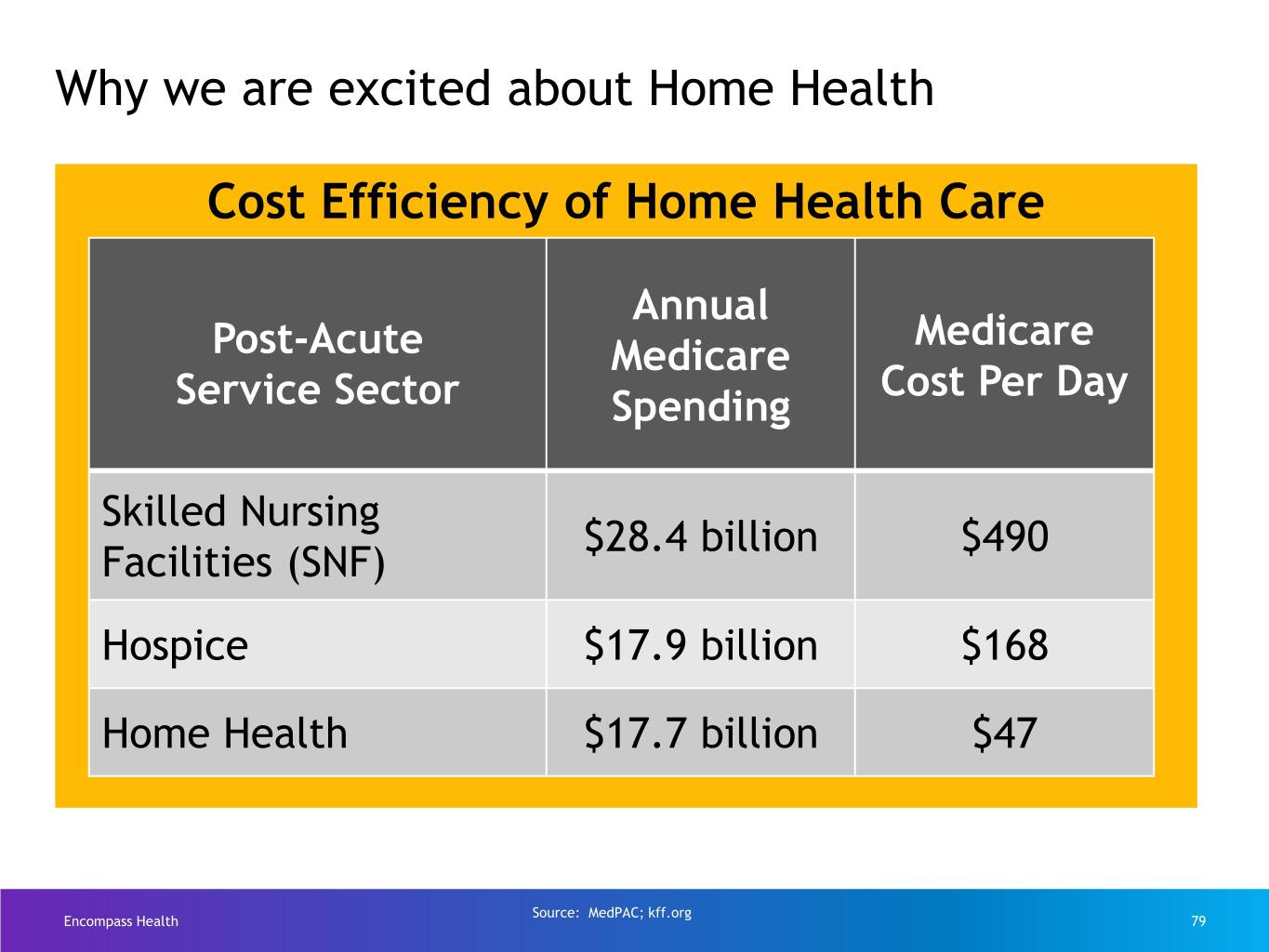

Why we are excited about Home Health Cost Efficiency of Home Health Care Annual Medicare Post-Acute Medicare Cost Per Day Service Sector Spending Skilled Nursing $28.4 billion $490 Facilities (SNF) Hospice $17.9 billion $168 Home Health $17.7 billion $47 Source: MedPAC; kff.org Encompass Health 79

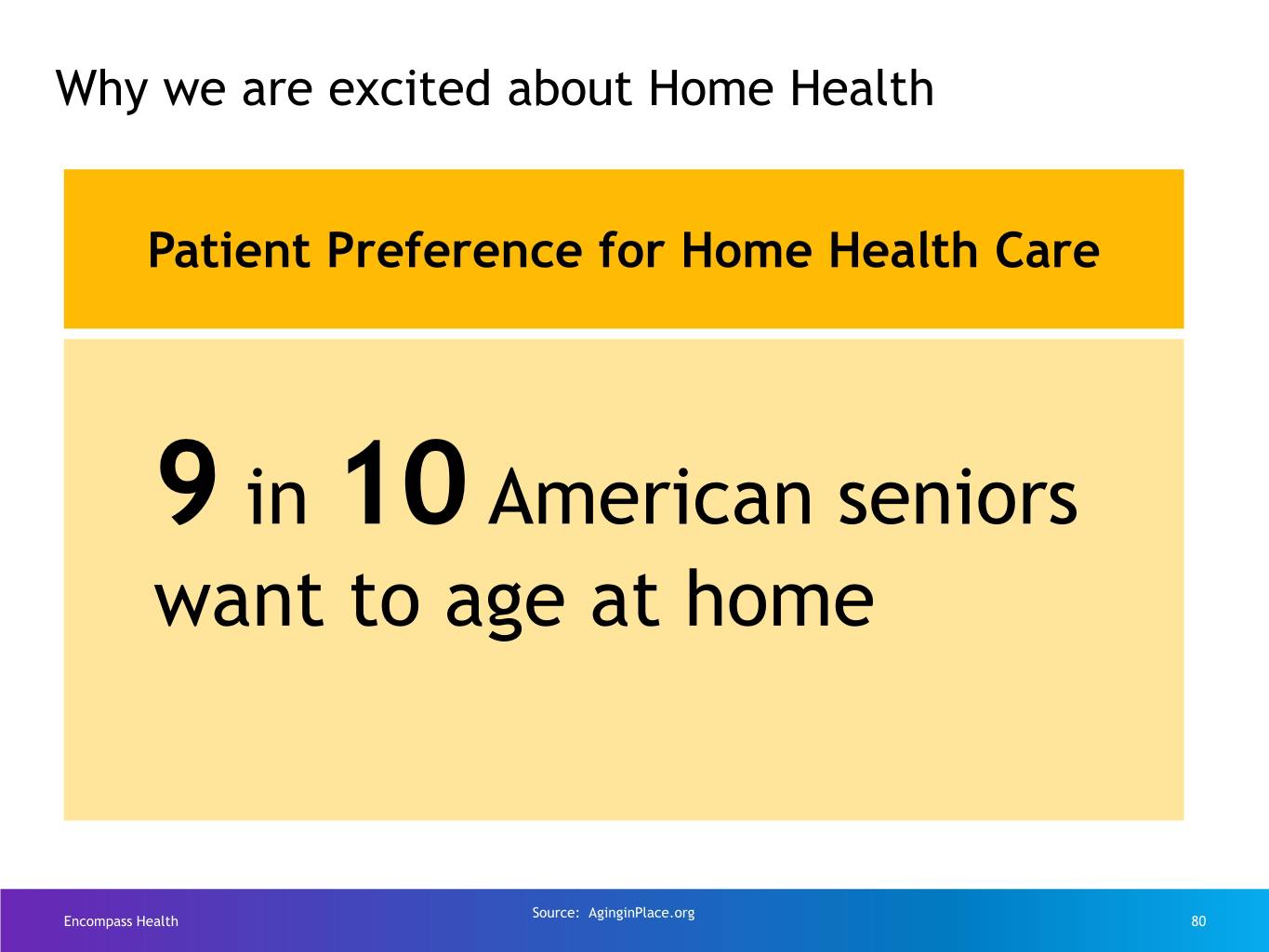

Why we are excited about Home Health Patient Preference for Home Health Care 9 in 10 American seniors want to age at home Source: AginginPlace.org Encompass Health 80

How we grow Clinical Care Specialty Traditional Collaboration Transitions Programs Referrals 14% of admits 34% of admits 32% of admits 20% of admits • Clinical collaboration • Care Transitions • Heart & Vascular • Internal Medicine rate for Medicare is Coordinators • Joint & Ortho • Family practice 43% • High-quality • Community Care • Gerontology outcomes, low re- hospitalization rates Encompass Health 81

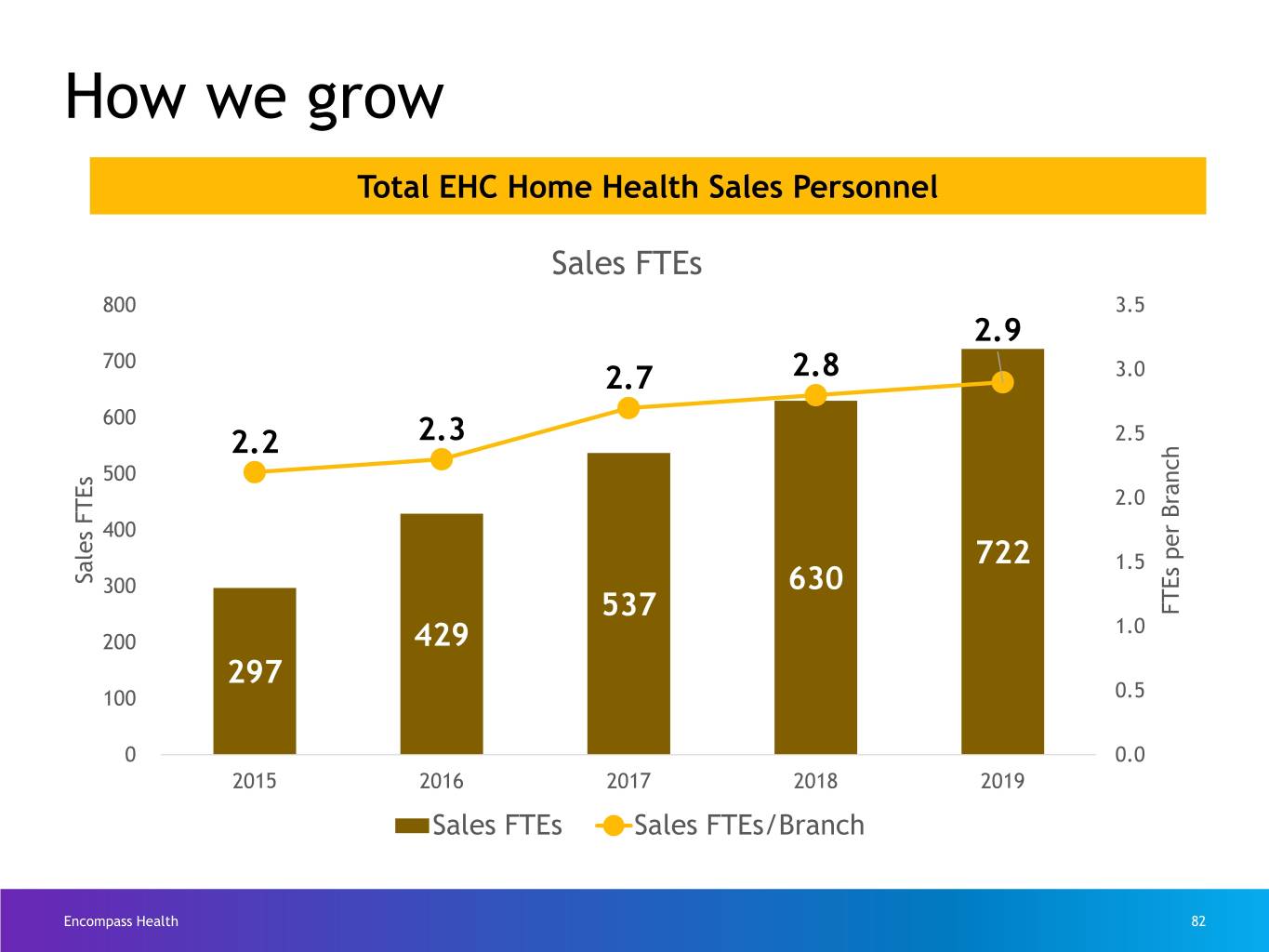

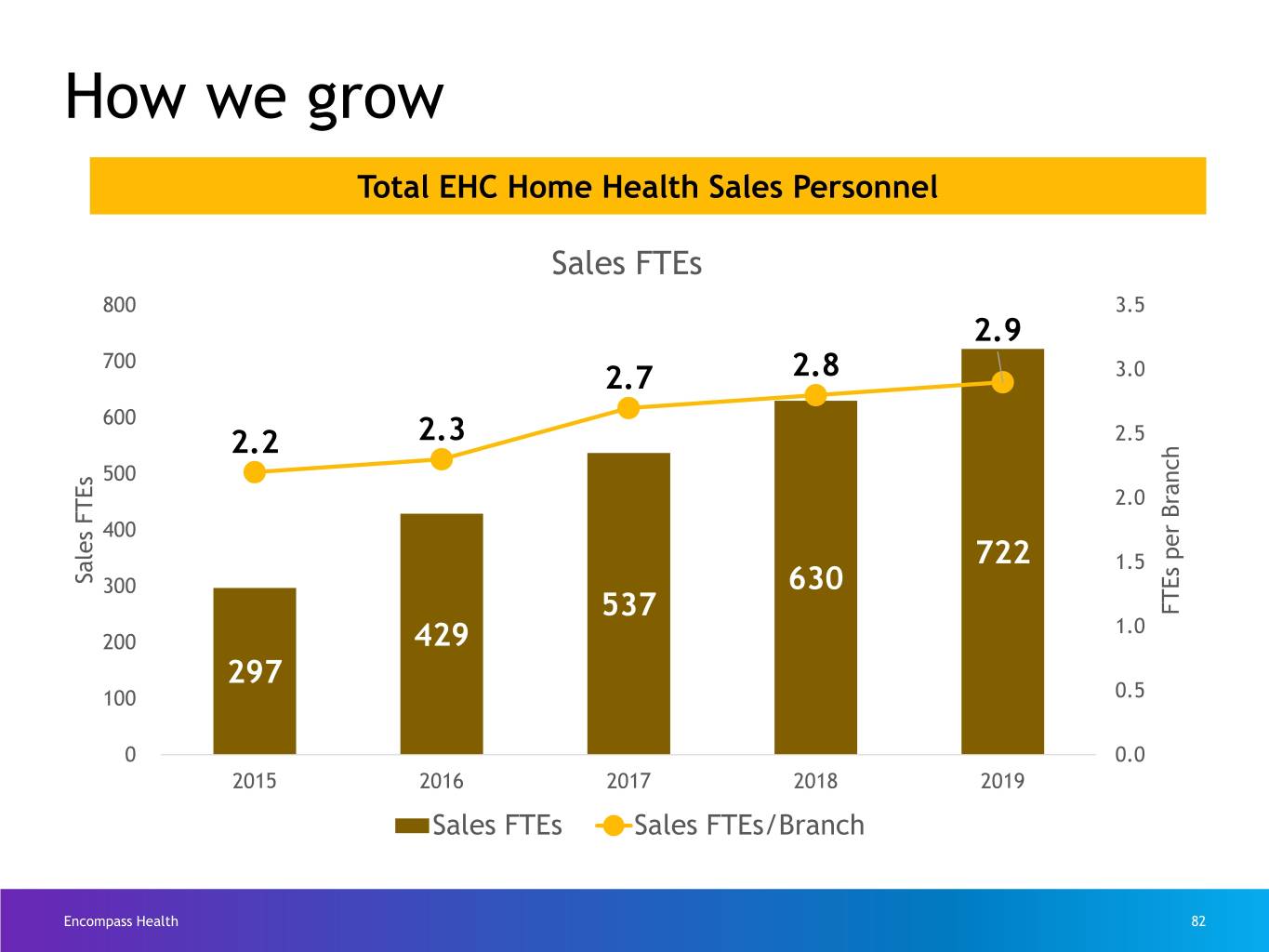

How we grow Total EHC Home Health Sales Personnel Sales FTEs 800 3.5 2.9 700 2.7 2.8 3.0 600 2.2 2.3 2.5 500 2.0 400 722 1.5 Sales FTEs 300 630 537 FTEs per Branch 1.0 200 429 297 100 0.5 0 0.0 2015 2016 2017 2018 2019 Sales FTEs Sales FTEs/Branch Encompass Health 82

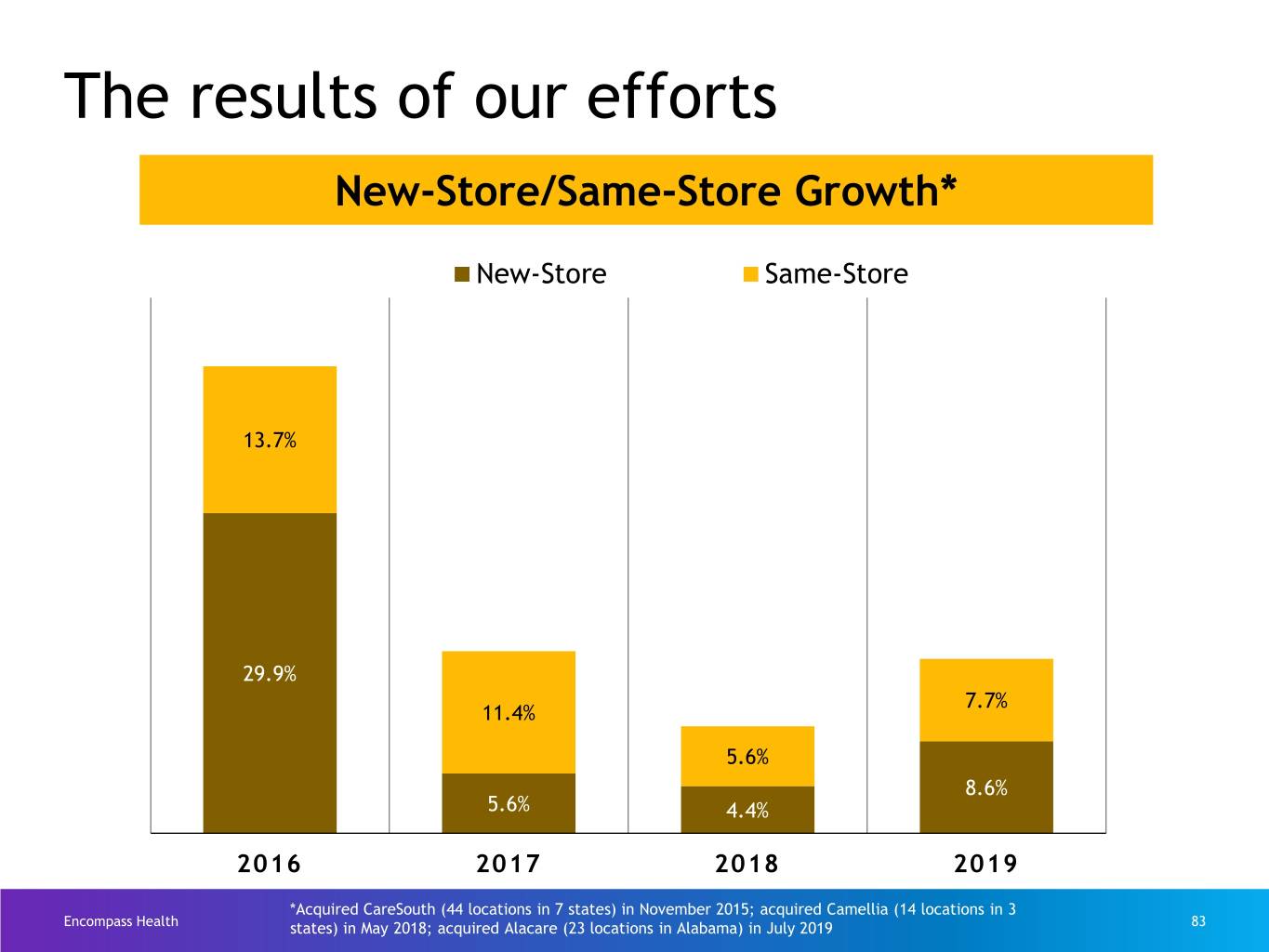

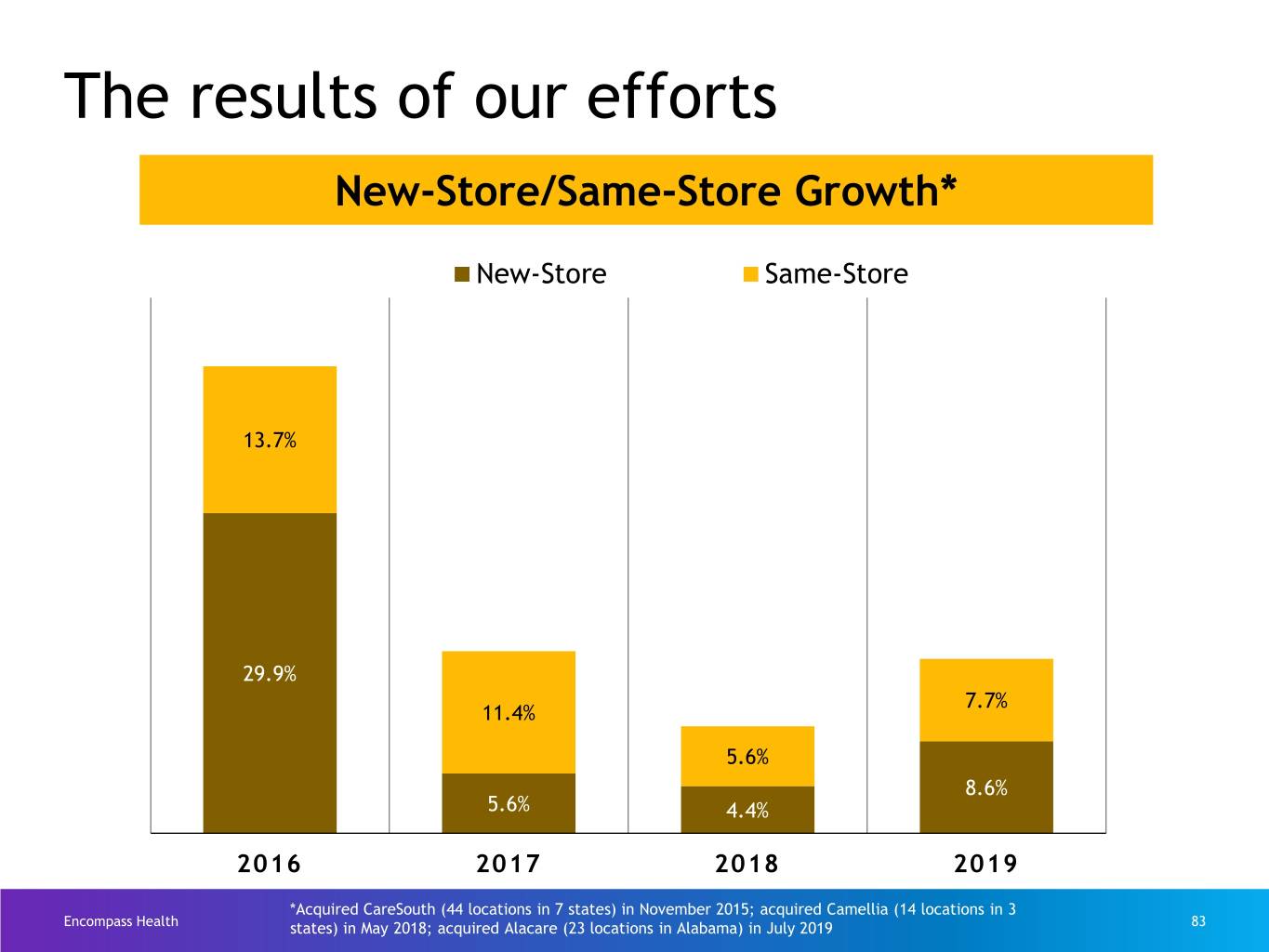

The results of our efforts New-Store/Same-Store Growth* New-Store Same-Store 13.7% 29.9% 7.7% 11.4% 5.6% 8.6% 5.6% 4.4% 2016 2017 2018 2019 *Acquired CareSouth (44 locations in 7 states) in November 2015; acquired Camellia (14 locations in 3 Encompass Health states) in May 2018; acquired Alacare (23 locations in Alabama) in July 2019 83

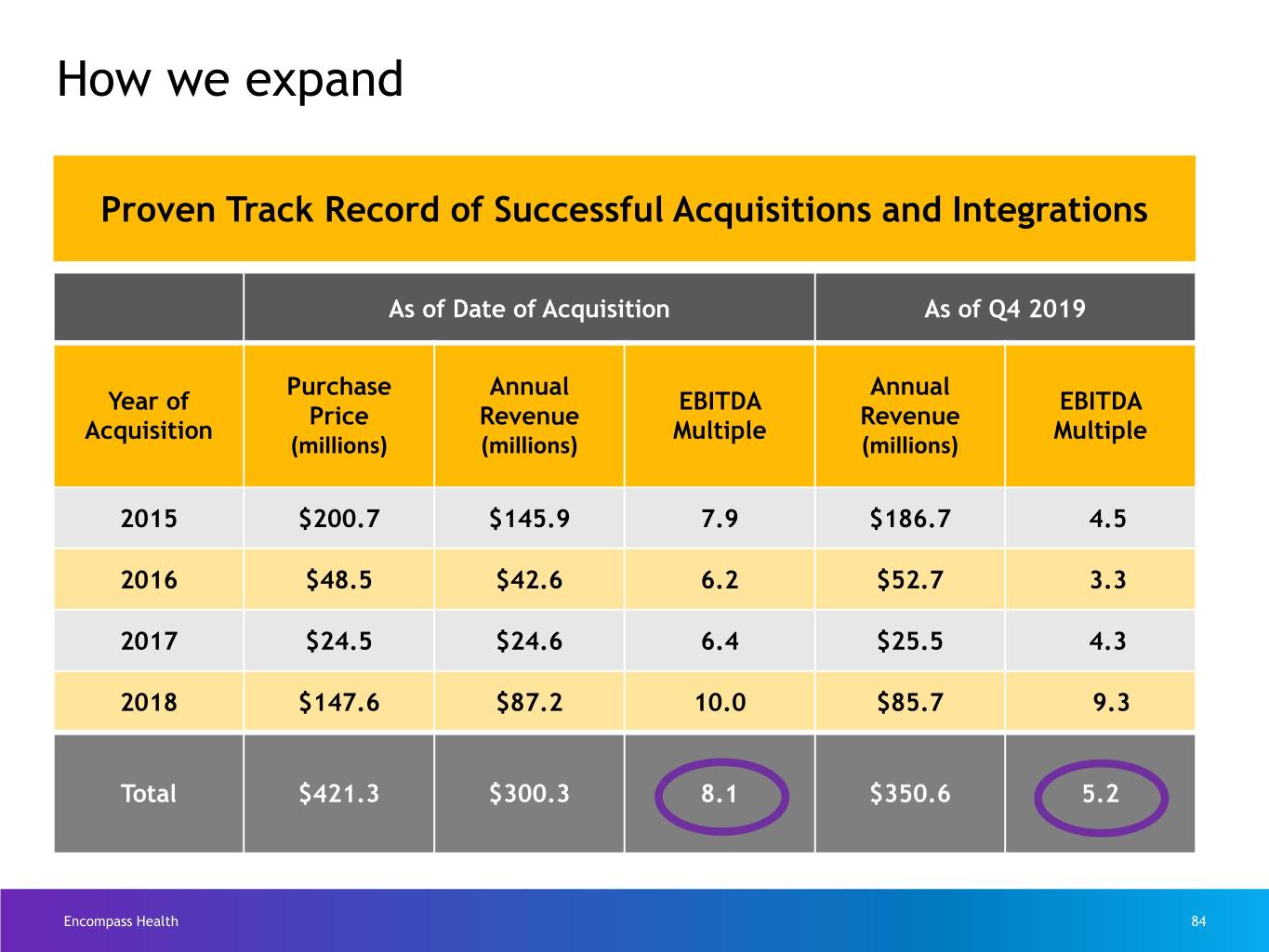

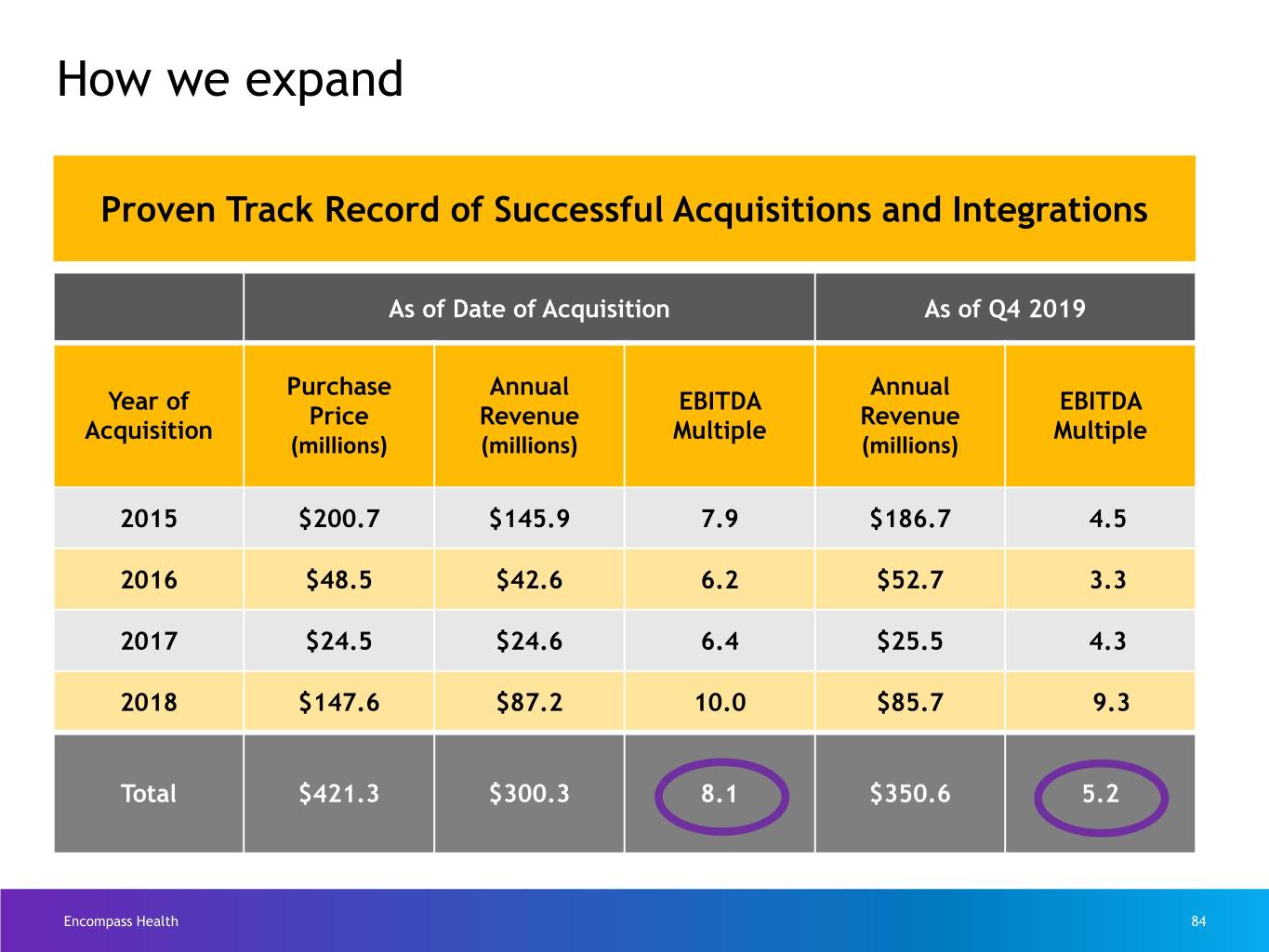

ClinicalHow we expandCollaboration Proven Track Record of Successful Acquisitions and Integrations As of Date of Acquisition As of Q4 2019 Purchase Annual Annual Year of EBITDA EBITDA Price Revenue Revenue Acquisition Multiple Multiple (millions) (millions) (millions) 2015 $200.7 $145.9 7.9 $186.7 4.5 2016 $48.5 $42.6 6.2 $52.7 3.3 2017 $24.5 $24.6 6.4 $25.5 4.3 2018 $147.6 $87.2 10.0 $85.7 9.3 Total $421.3 $300.3 8.1 $350.6 5.2 Encompass Health 84

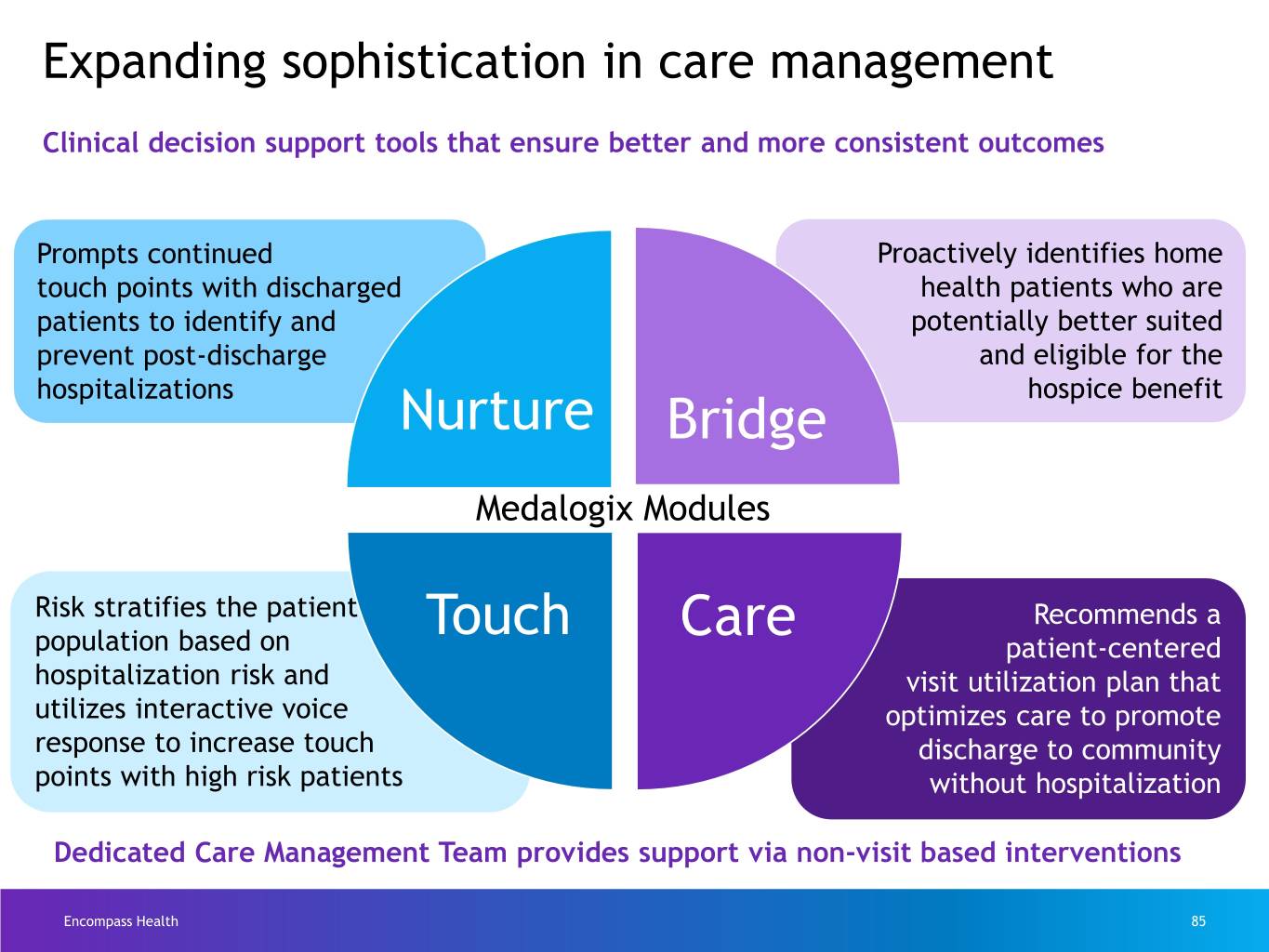

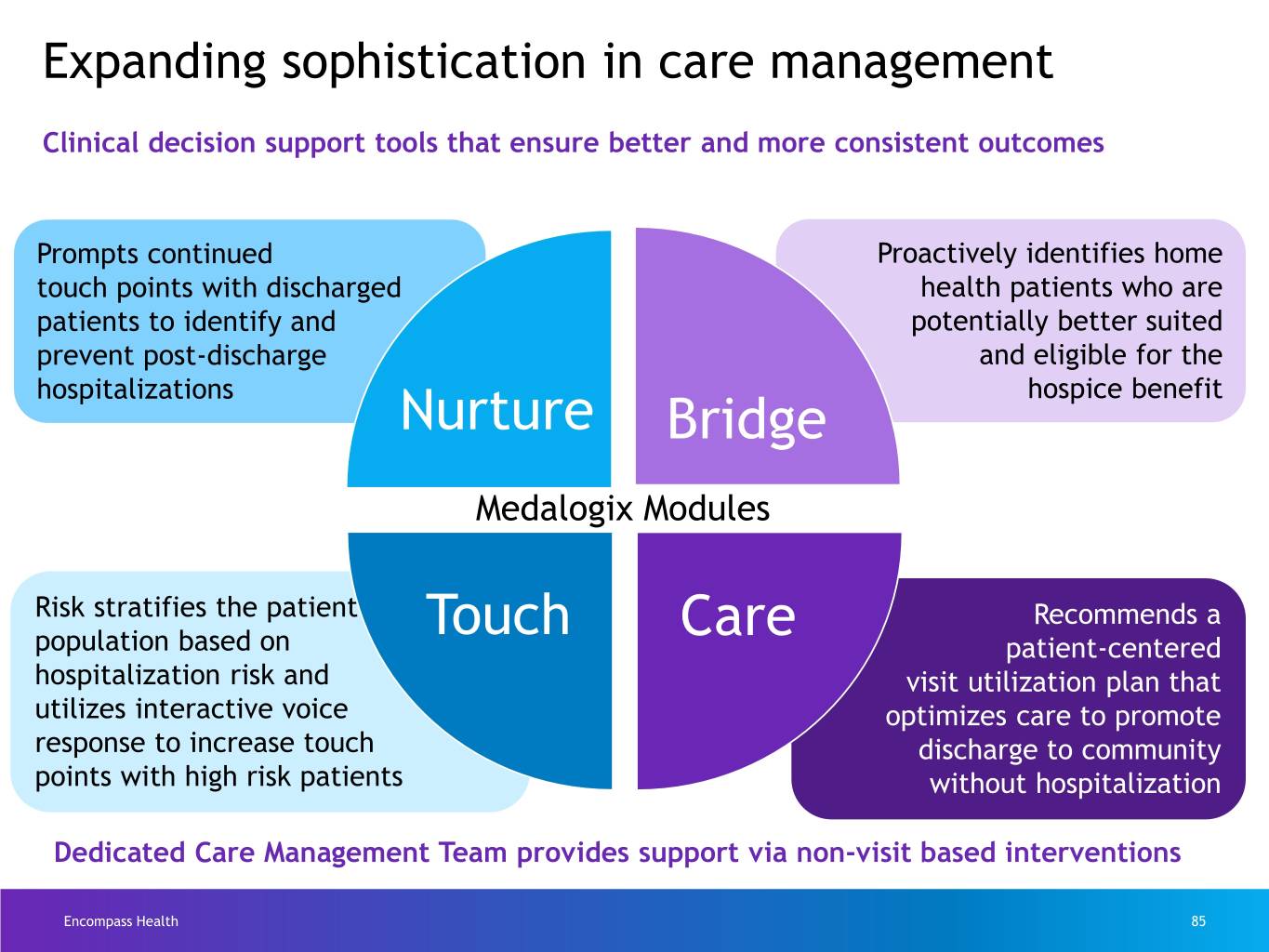

Expanding sophistication in care management Clinical decision support tools that ensure better and more consistent outcomes Prompts continued Proactively identifies home touch points with discharged health patients who are patients to identify and potentially better suited prevent post-discharge and eligible for the hospitalizations hospice benefit Nurture Bridge Medalogix Modules Risk stratifies the patient Touch Care Recommends a population based on patient-centered hospitalization risk and visit utilization plan that utilizes interactive voice optimizes care to promote response to increase touch discharge to community points with high risk patients without hospitalization Dedicated Care Management Team provides support via non-visit based interventions Encompass Health 85

Medalogix Care Patient Name Physician Name Encompass Health 86

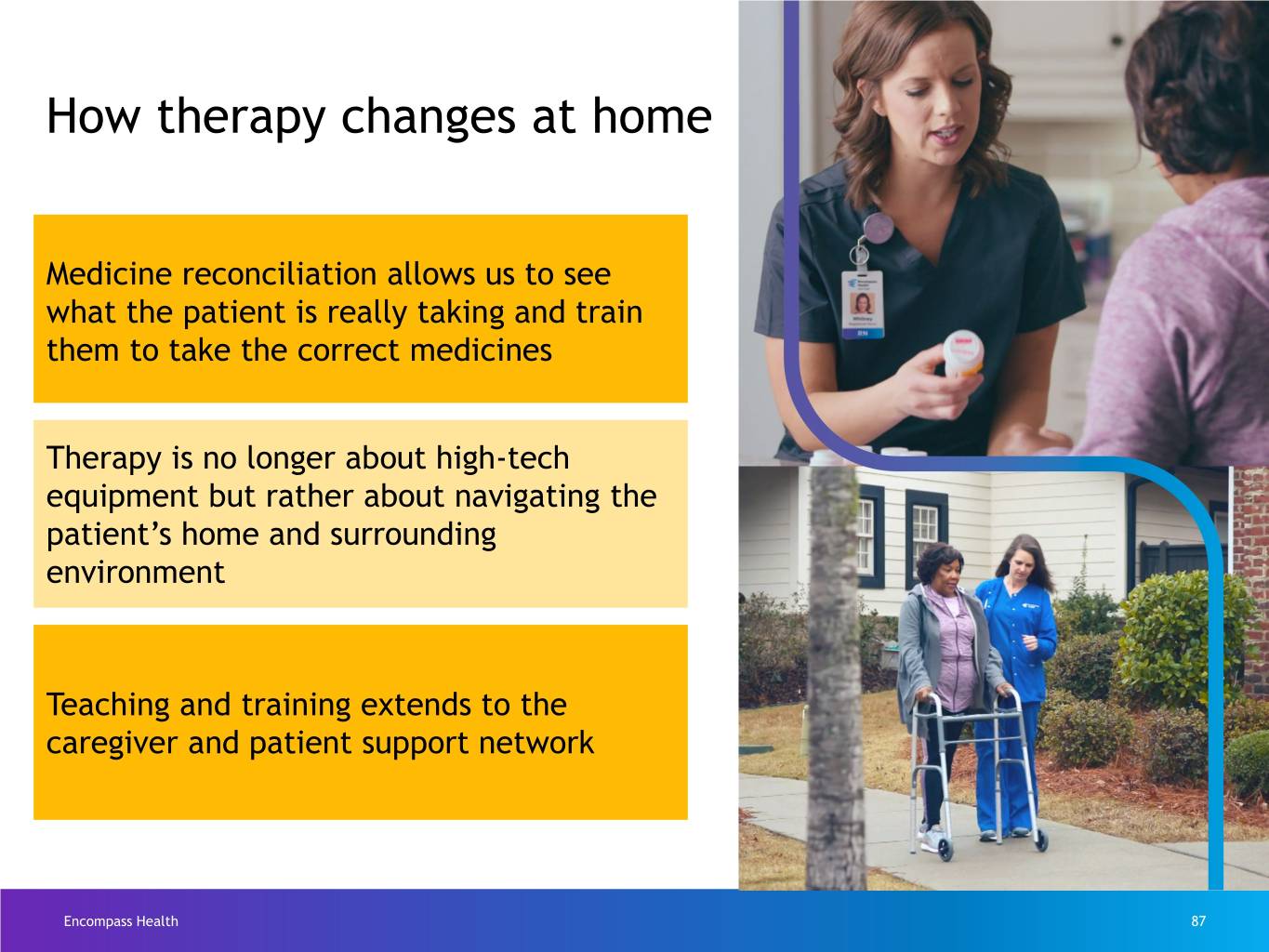

How therapy changes at home Medicine reconciliation allows us to see what the patient is really taking and train them to take the correct medicines Therapy is no longer about high-tech equipment but rather about navigating the patient’s home and surrounding environment Teaching and training extends to the caregiver and patient support network Encompass Health 87

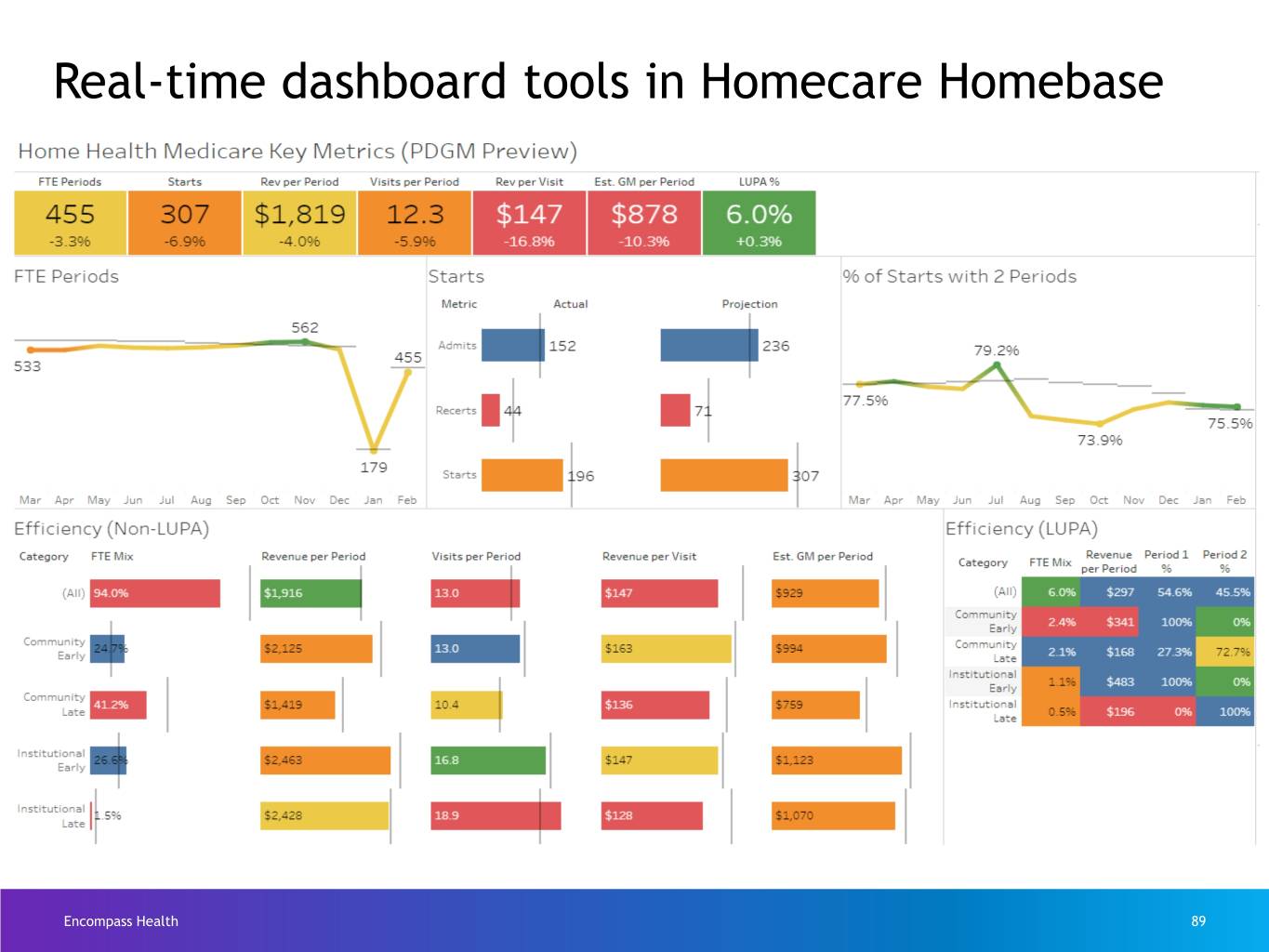

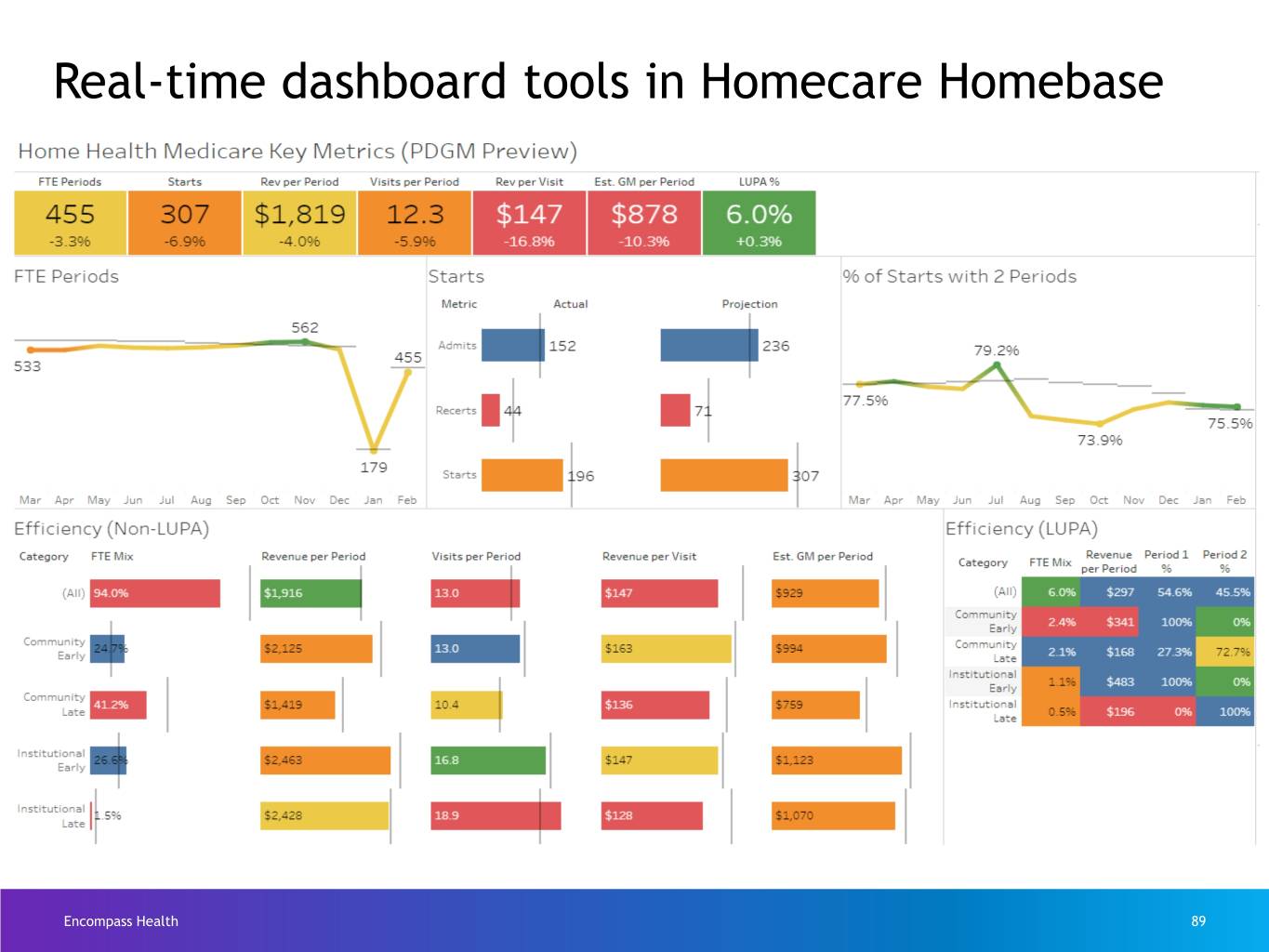

Technology-enabled outcomes Homecare Homebase is an exceptional tool. We make it more effective by our disciplined use and response to the guidance and information it provides. Produces Promotes Ensures Enhances operational clinical compliant financial efficiency consistency processes opportunity Encompass Health 88

Real-time dashboard tools in Homecare Homebase Encompass Health 89

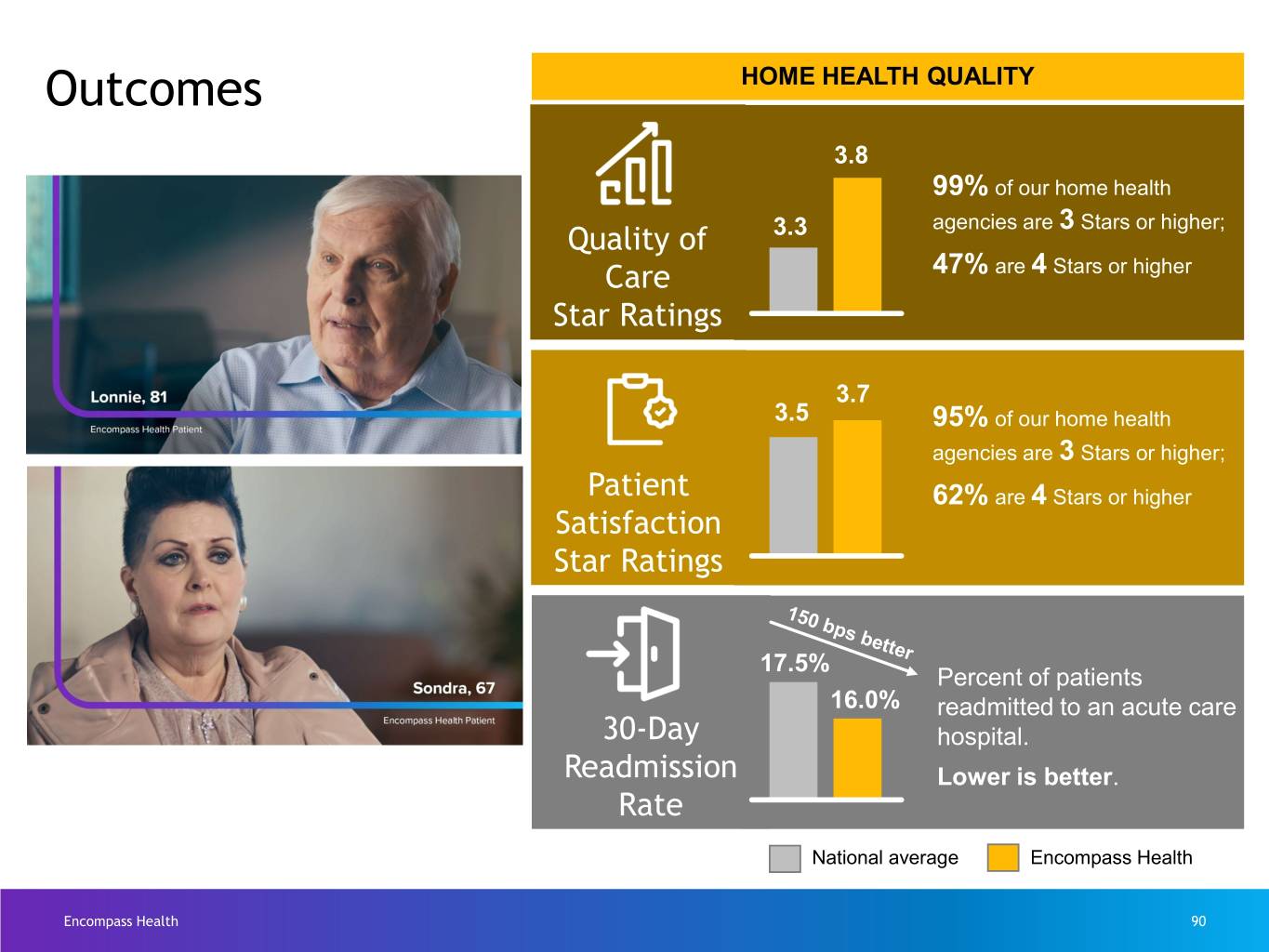

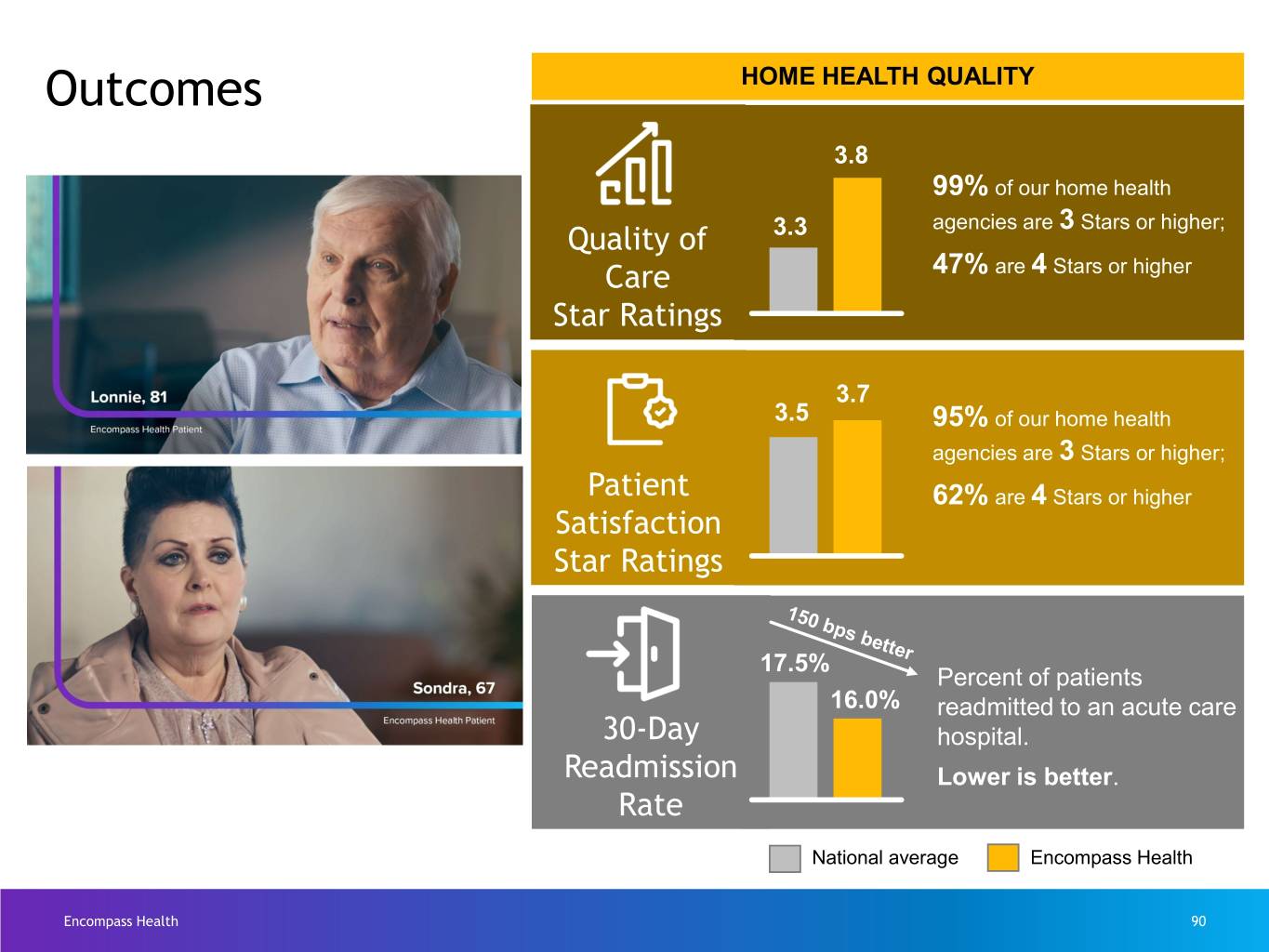

Outcomes HOME HEALTH QUALITY 3.8 99% of our home health agencies are 3 Stars or higher; Quality of 3.3 Care 47% are 4 Stars or higher Star Ratings 3.7 3.5 95% of our home health agencies are 3 Stars or higher; Patient 62% are 4 Stars or higher Satisfaction Star Ratings 17.5% Percent of patients 16.0% readmitted to an acute care 30-Day hospital. Readmission Lower is better. Rate National average Encompass Health Encompass Health 90

Best place to work culture 2016 2017 2018 2019 2020 Encompass Health 91

2020+: Evolving payment models and payor relationships PDGM requires the combination of accurate coding and assessment, efficient care planning and effective care delivery RCD will require thorough upfront processes including timely face-to-face and timely document signatures Expansion in non-Medicare payor relationships Evolving payment models will benefit providers like EHC and we are already leading the way Encompass Health 92

Keys to success in Patient-Driven Groupings Model (PDGM) Focus Area Need Result Referral Documentation Complete referral ‘Whole picture’ information from every information for better referral source coding & care planning Coding & Assessment Precise information Enhanced ability to care collected in the home plan and bill for correct reimbursement Care Planning Proven evidence-based Individualized care plans tools in the hands of for every patient, every clinicians episode Care Delivery Equipped, passionate Best-in-class clinical and Care Delivery caregivers patient satisfaction outcomes Encompass Health 93

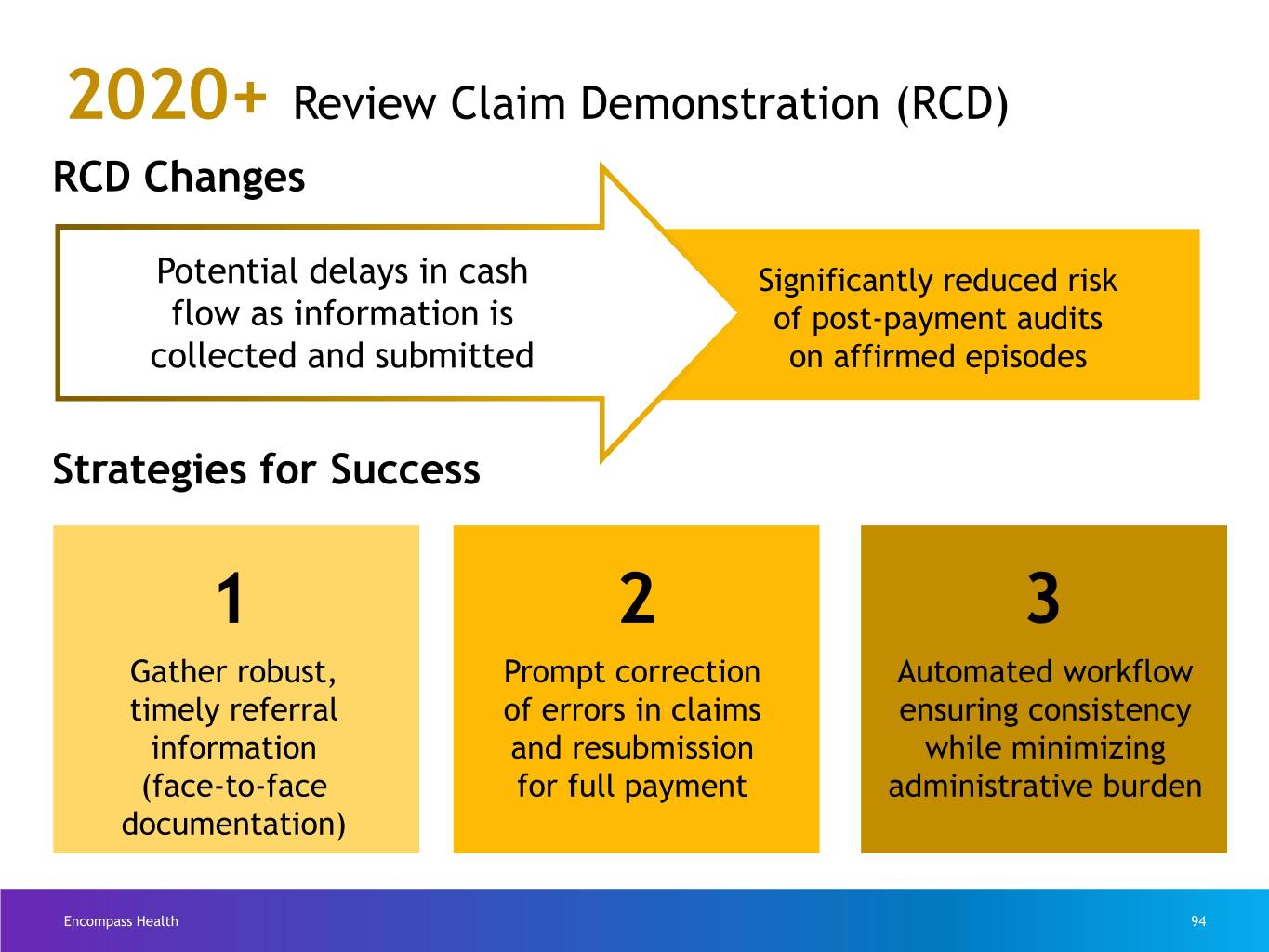

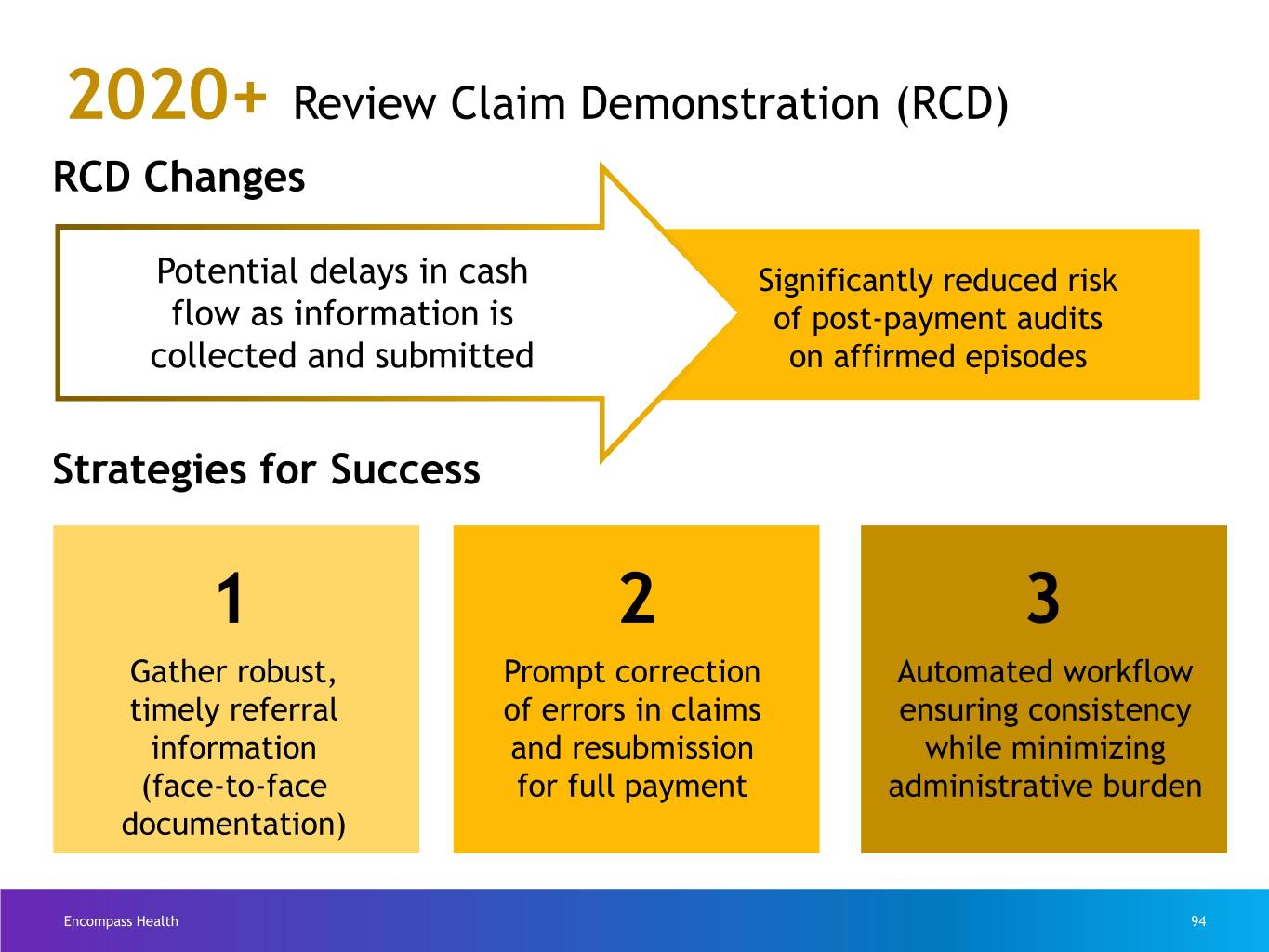

2020+ Review Claim Demonstration (RCD) RCD Changes Potential delays in cash Significantly reduced risk flow as information is of post-payment audits collected and submitted on affirmed episodes Strategies for Success 1 2 3 Gather robust, Prompt correction Automated workflow timely referral of errors in claims ensuring consistency information and resubmission while minimizing (face-to-face for full payment administrative burden documentation) Encompass Health 94

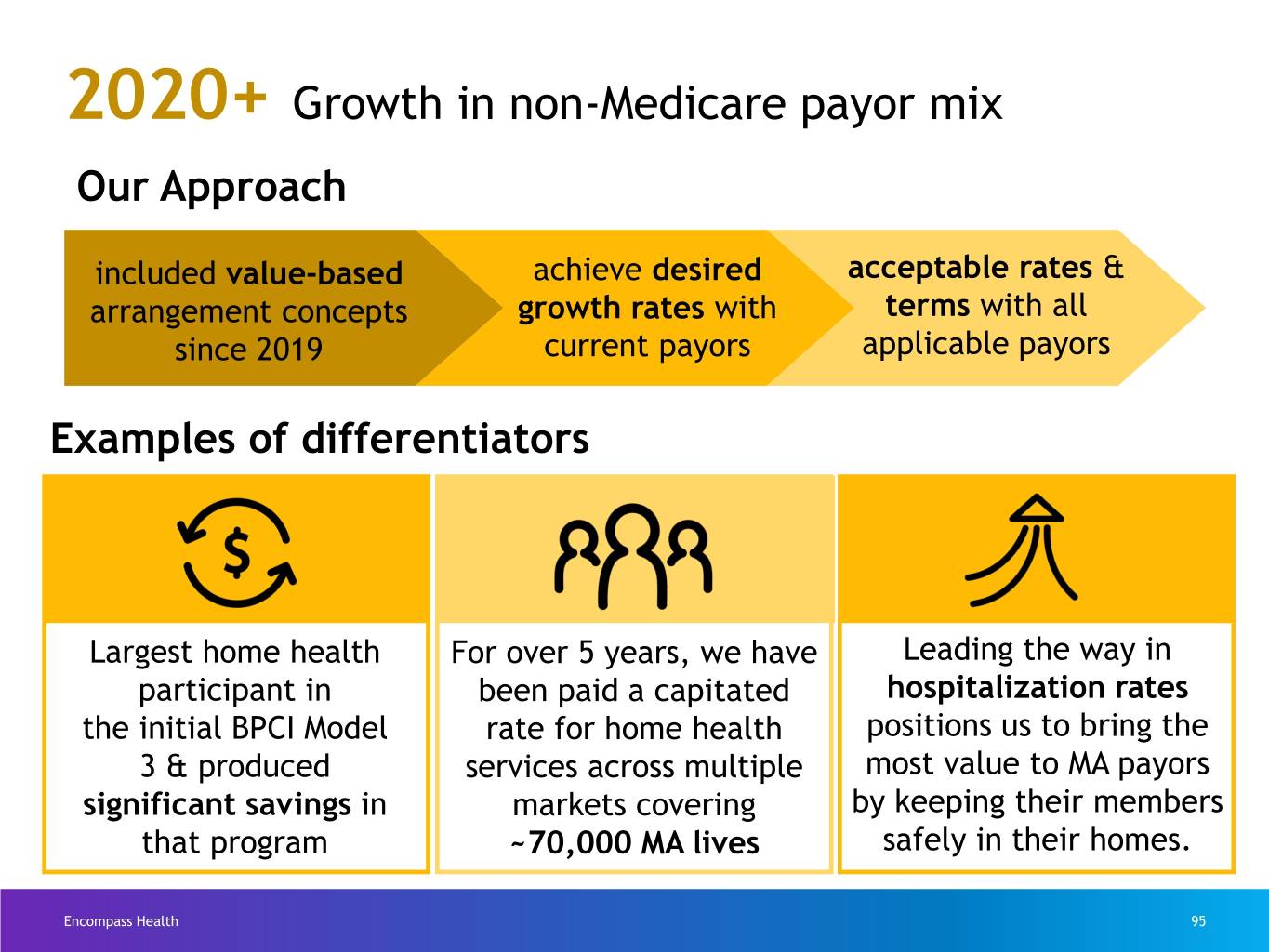

2020+ Growth in non-Medicare payor mix Our Approach included value-based achieve desired acceptable rates & arrangement concepts growth rates with terms with all since 2019 current payors applicable payors Examples of differentiators Largest home health For over 5 years, we have Leading the way in participant in been paid a capitated hospitalization rates the initial BPCI Model rate for home health positions us to bring the 3 & produced services across multiple most value to MA payors significant savings in markets covering by keeping their members that program ~70,000 MA lives safely in their homes. Encompass Health 95

Hospice Presented by April Anthony Encompass Health 96

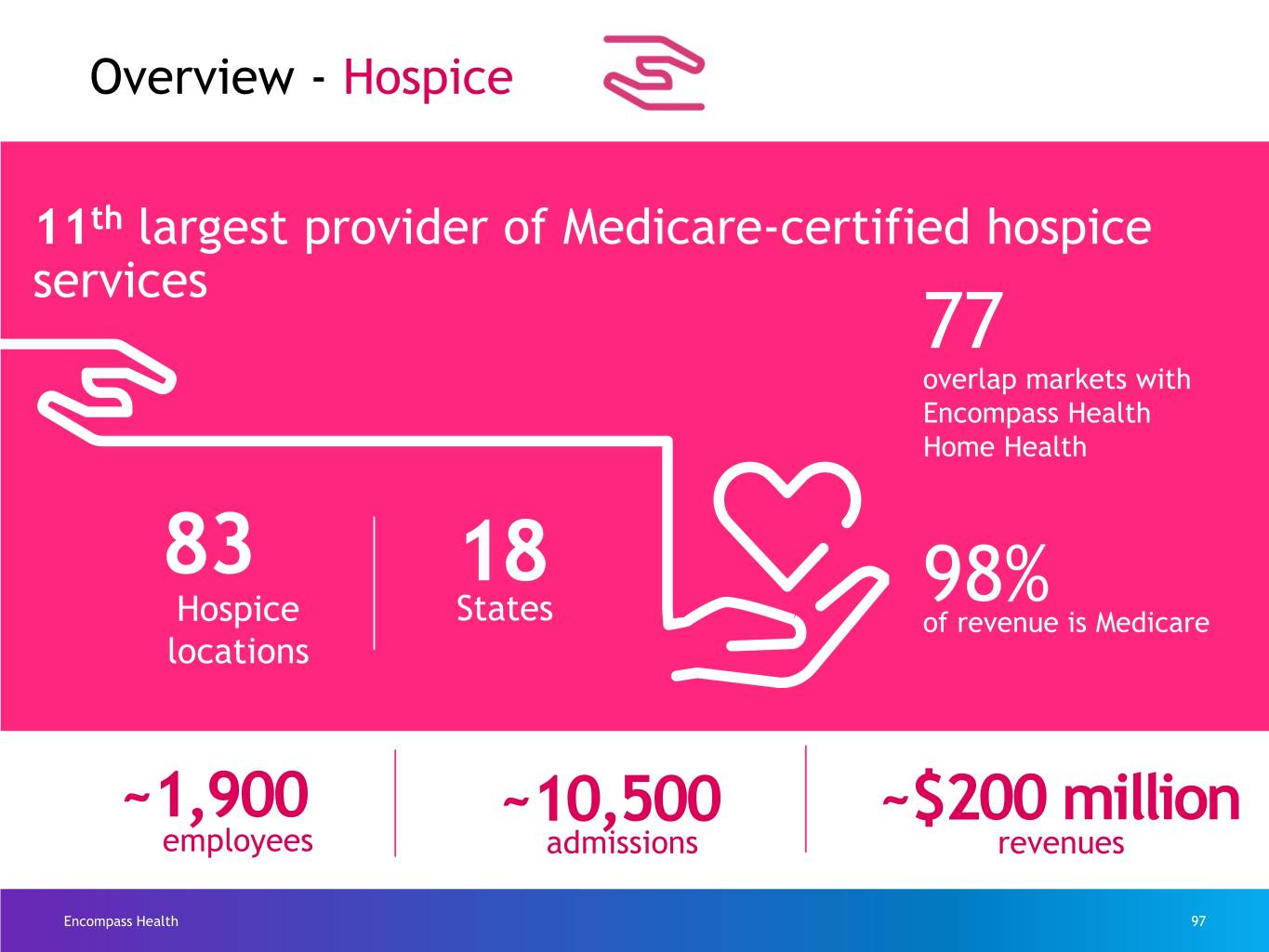

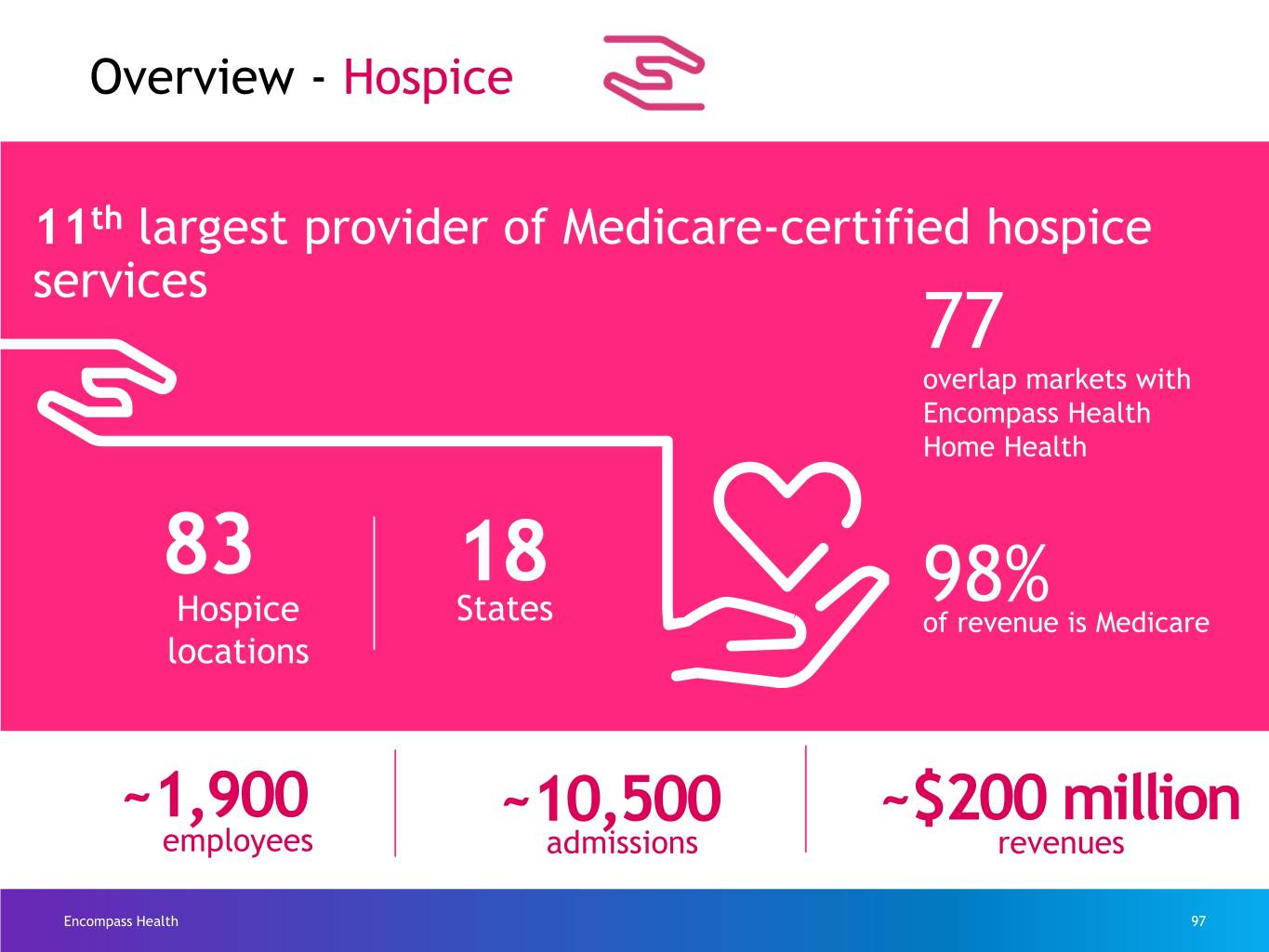

Overview - Hospice 11th largest provider of Medicare-certified hospice services 77 overlap markets with Encompass Health Home Health 83 18 98% Hospice States of revenue is Medicare locations ~1,900 ~10,500 ~$200 million employees admissions revenues Encompass Health 97

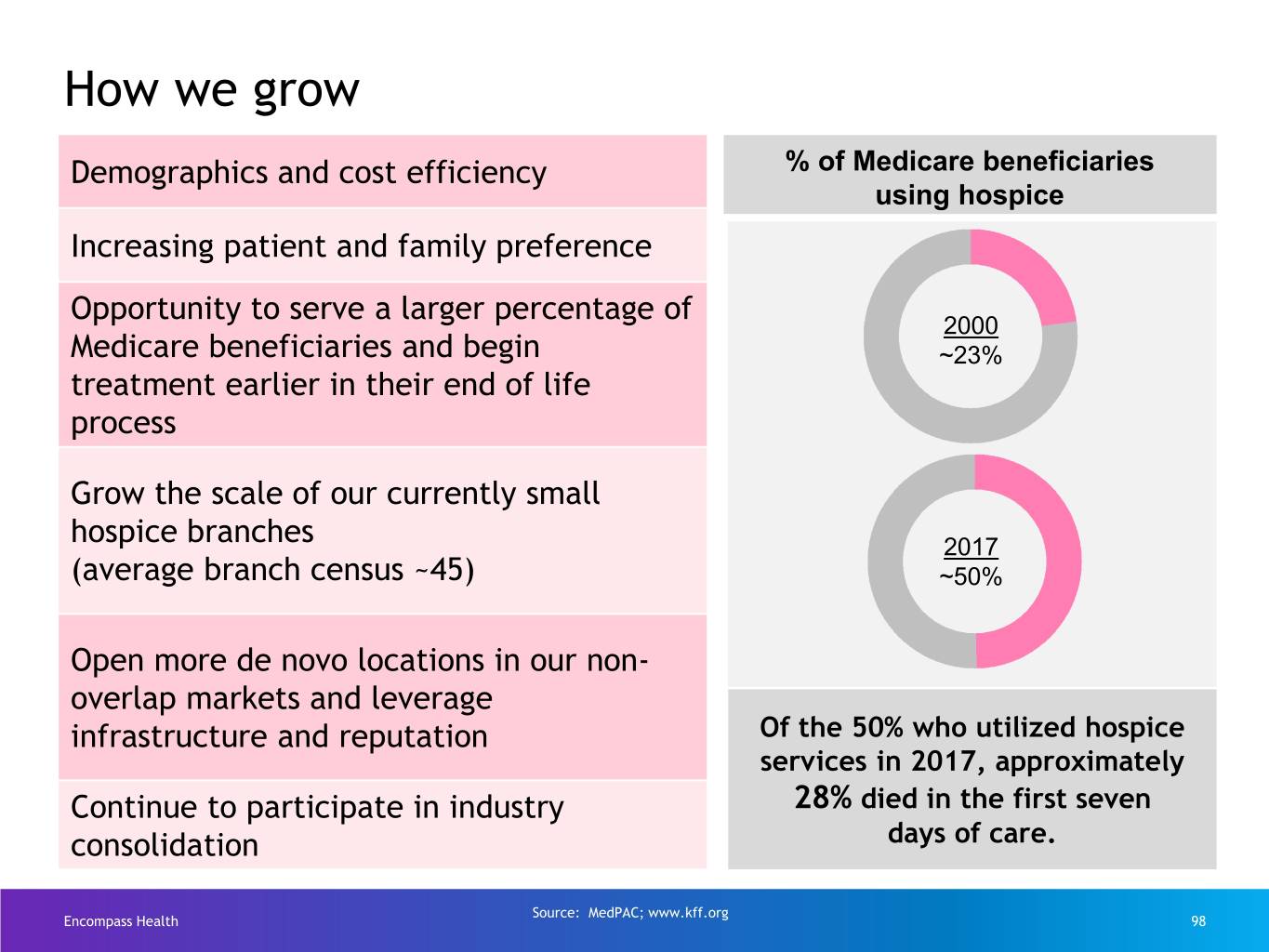

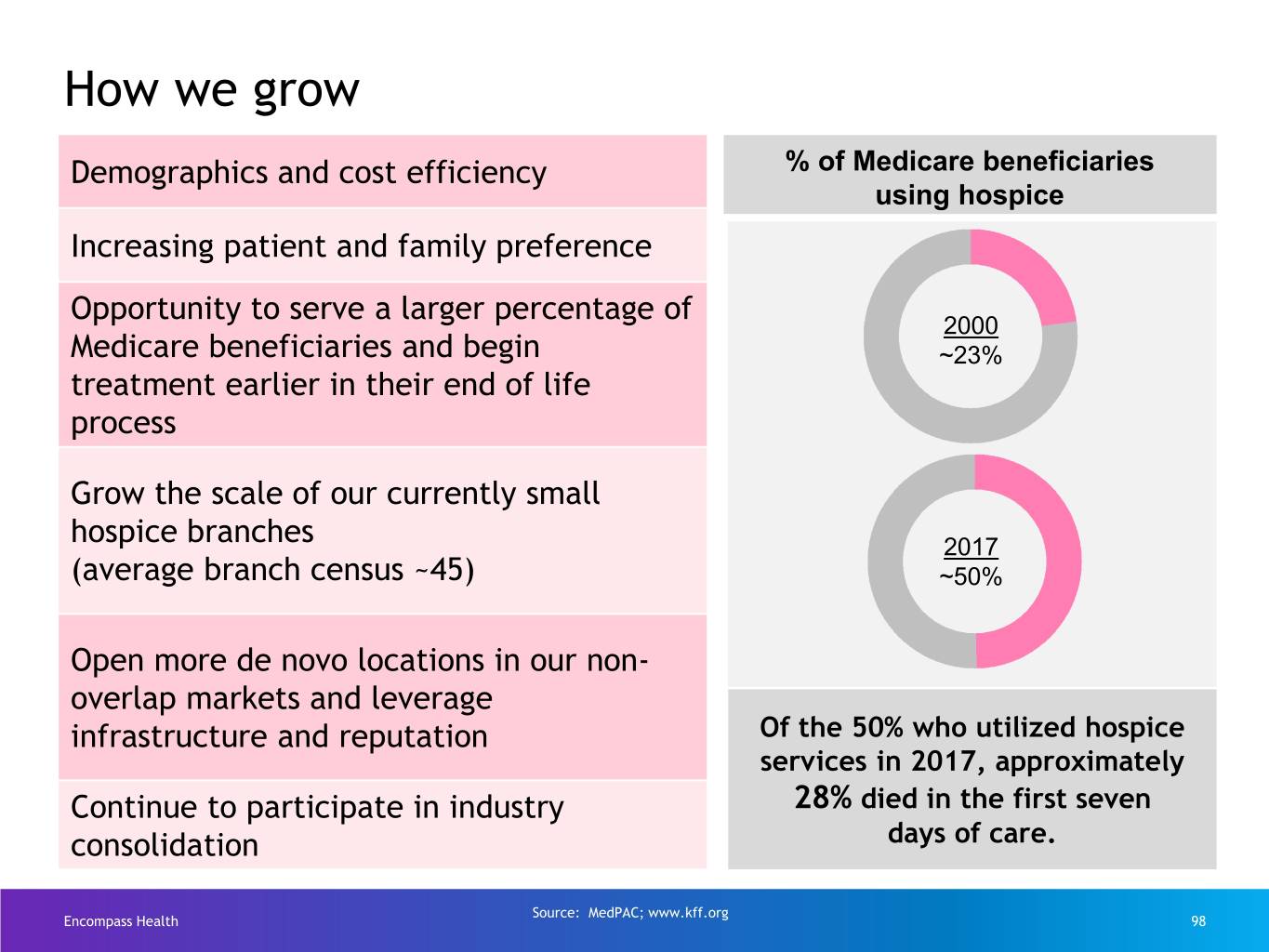

How we grow Demographics and cost efficiency % of Medicare beneficiaries using hospice Increasing patient and family preference Opportunity to serve a larger percentage of 2000 Medicare beneficiaries and begin ~23% treatment earlier in their end of life process Grow the scale of our currently small hospice branches 2017 (average branch census ~45) ~50% Open more de novo locations in our non- overlap markets and leverage infrastructure and reputation Of the 50% who utilized hospice services in 2017, approximately Continue to participate in industry 28% died in the first seven consolidation days of care. Source: MedPAC; www.kff.org Encompass Health 98

Financial Strategy Presented by Doug Coltharp Encompass Health 99

Growth requires investment. Investment requires funding. Encompass Health 100

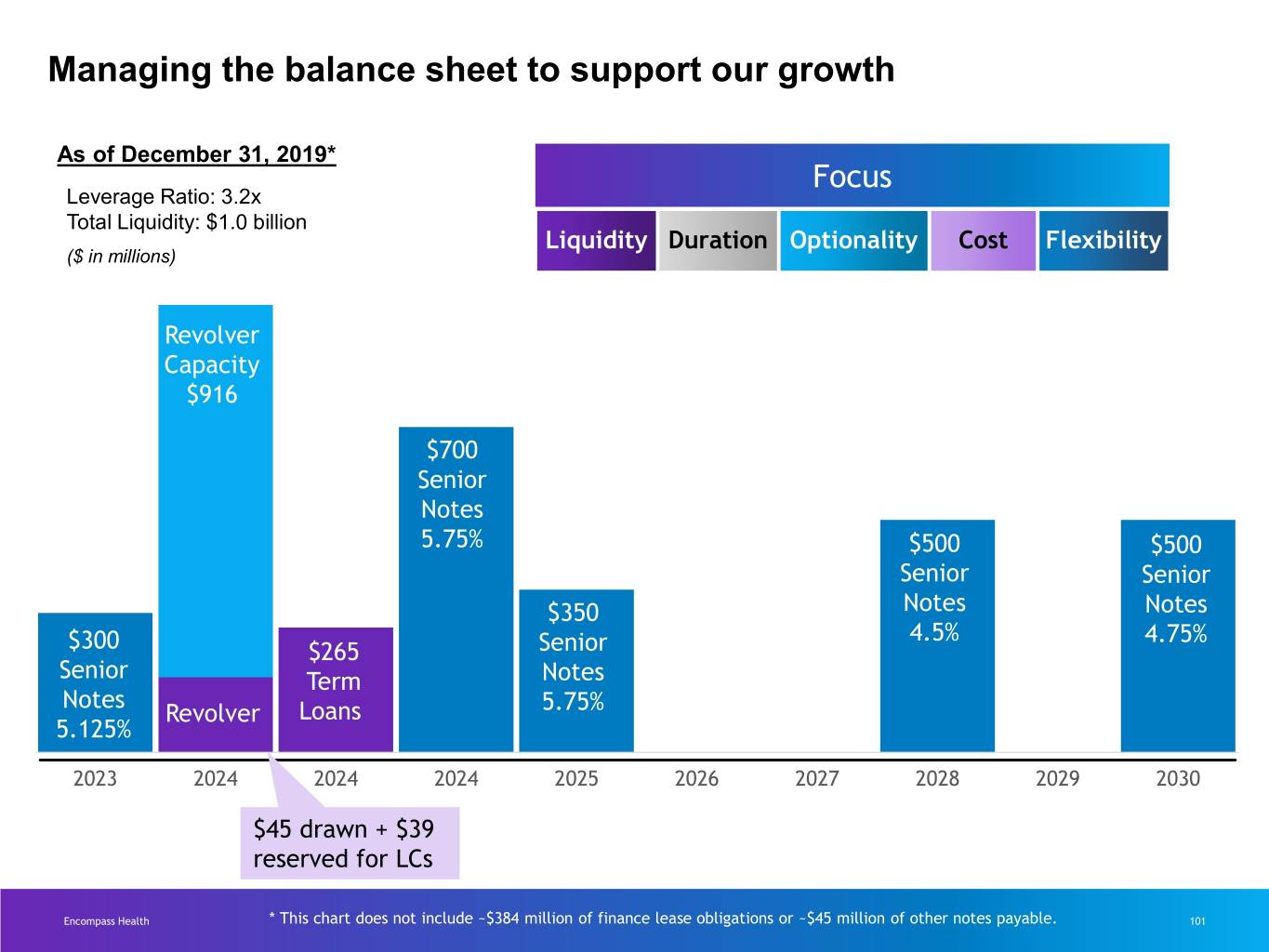

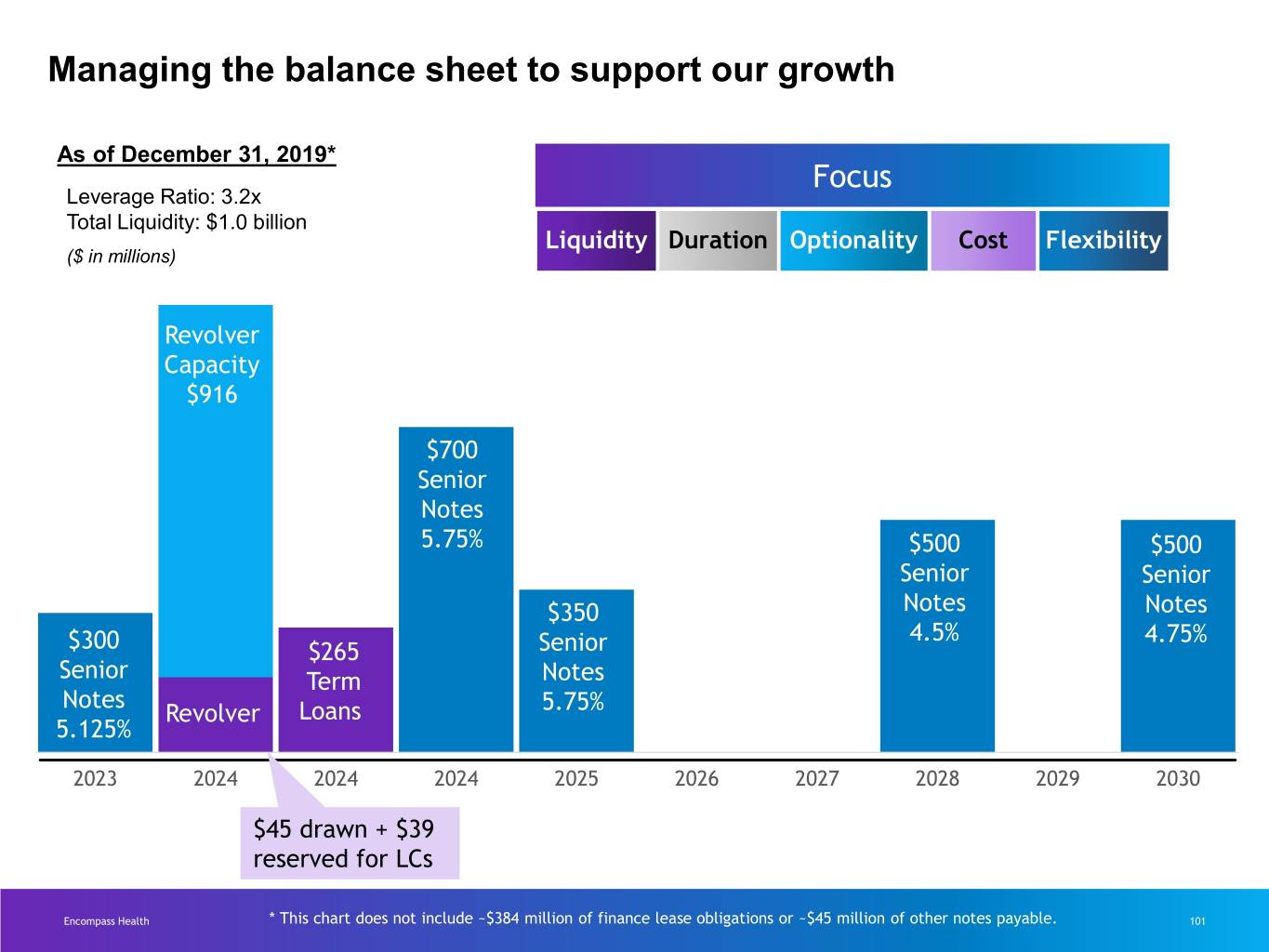

Managing the balance sheet to support our growth As of December 31, 2019* Focus Leverage Ratio: 3.2x Total Liquidity: $1.0 billion Liquidity Duration Optionality Cost Flexibility ($ in millions) Revolver Capacity $916 $700 Senior Notes 5.75% $500 $500 Senior Senior $350 Notes Notes 4.5% 4.75% $300 $265 Senior Senior Te rm Notes Notes Revolver Loans 5.75% 5.125% 2023 2024 2024 2024 2025 2026 2027 2028 2029 2030 $45 drawn + $39 reserved for LCs Encompass Health * This chart does not include ~$384 million of finance lease obligations or ~$45 million of other notes payable. 101

Managing the balance sheet to support our growth Financial Comparison of YE 2018 to YE 2019 resources Liquidity • Increased revolving credit facility from $700M to ~$1.0B • Bank credit facilities extended 2+ years Duration • Average remaining maturity of senior notes extended from ~6 years to ~7 years • Exercised call on 2024 senior notes to reduce refinancing Optionality risk • Both tranches of new senior notes priced below 5.00% Cost • Favorable rate arbitrage on call of 2024 notes Flexibility • Enhanced flexibility of bank credit facility covenants Encompass Health 102

Summary Presented by Mark Tarr Encompass Health 103

Key takeaways Our integrated We use We are executing care model technology our growth produces the to leverage strategy high-quality, and enhance to meet the cost-effective care our clinical needs of an aging desired by and business population. providers, payors, processes. and patients. Encompass Health 104

Q&A Moderated by Crissy Carlisle Encompass Health 105

Closing Remarks Presented by Crissy Carlisle Encompass Health 106

Video Encompass Health 107

Committed to delivering integrated high-quality, cost-effective care across the healthcare continuum Encompass Health 108