Encompass Health - 2022 Guidance for Encompass Health and Enhabit June 7, 2022

The information contained in this presentation includes certain estimates, projections and other forward-looking information that reflect Encompass Health and Enhabit’s current outlooks, views and plans with respect to future events, including the timing and effects, such as the tax-free treatments, the incremental costs, Transition Services Agreement revenue and interest expense of the spin off and rebranding of the home health and hospice business and its impact on the business models, outlooks and guidance, growth targets, the COVID-19 pandemic and its effects, legislative and regulatory developments, strategy, capital expenditures, acquisition and other development activities, Enhabit’s share count, dividend strategies, repurchases of securities, effective tax rates, financial performance, financial assumptions, business model, balance sheet and cash flow plans, market share, and shareholder value-enhancing transactions. These estimates, projections and other forward-looking information are based on assumptions Encompass Health believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. Encompass Health and Enhabit undertake no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the attached Form 8-K dated June 7, 2022 to which this presentation is attached as Exhibit 99.2, the Form 10-K for the year ended December 31, 2021, the Form 10-Q for the quarter ended March 31, 2022, and in other documents Encompass Health previously filed with the SEC, many of which are beyond Encompass Health’s control, that may cause actual events or results to differ materially from the views, beliefs and estimates expressed herein. Note regarding presentation of non-GAAP financial measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, including Adjusted EBITDA, adjusted earnings per share, and adjusted free cash flow. Schedules are attached that reconcile the historical non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Forward-looking statements Encompass Health 2

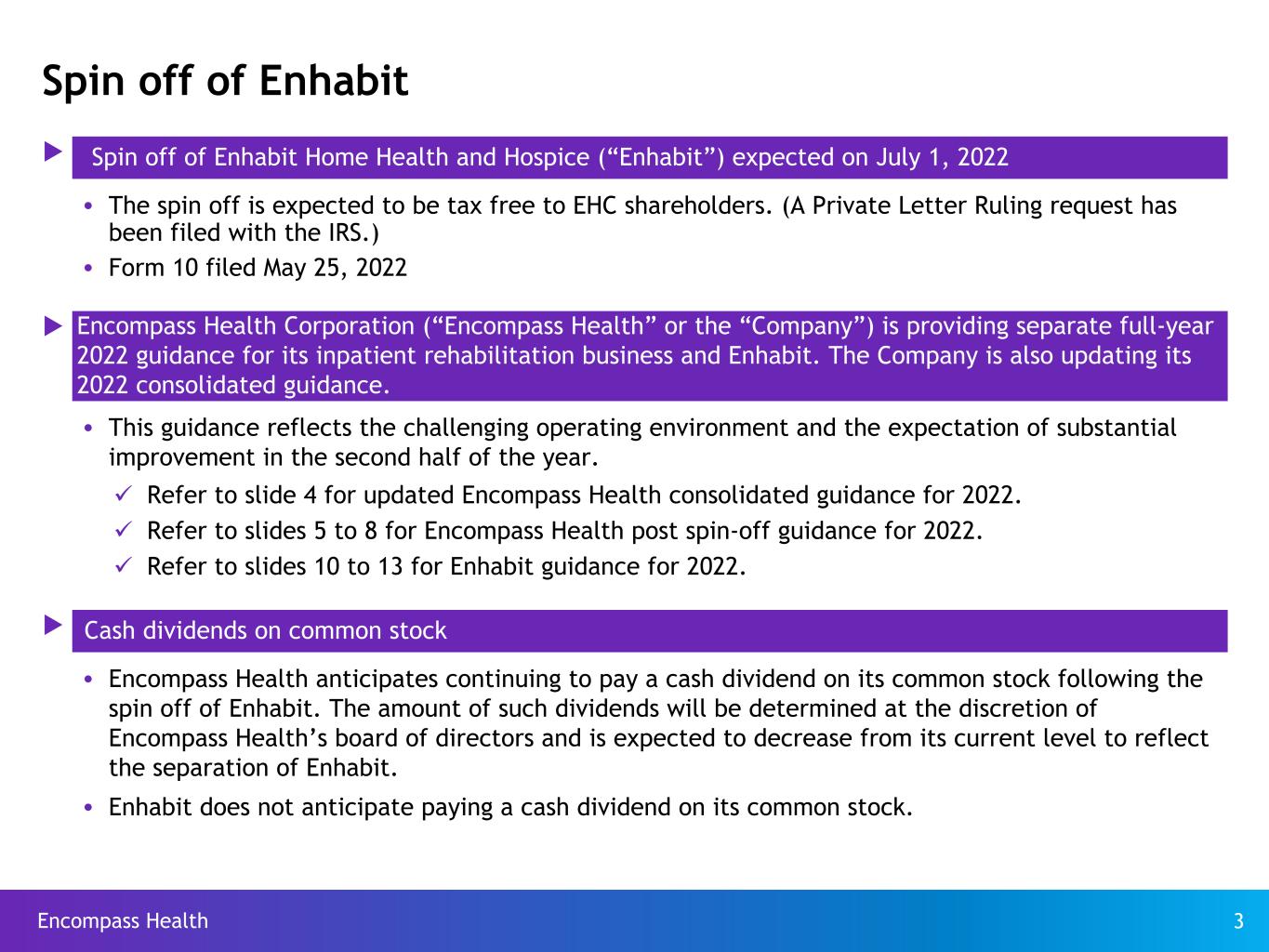

Encompass Health 3 Spin off of Enhabit u Spin off of Enhabit Home Health and Hospice (“Enhabit”) expected on July 1, 2022 Ÿ The spin off is expected to be tax free to EHC shareholders. (A Private Letter Ruling request has been filed with the IRS.) Ÿ Form 10 filed May 25, 2022 u Encompass Health Corporation (“Encompass Health” or the “Company”) is providing separate full-year 2022 guidance for its inpatient rehabilitation business and Enhabit. The Company is also updating its 2022 consolidated guidance. Ÿ This guidance reflects the challenging operating environment and the expectation of substantial improvement in the second half of the year. ü Refer to slide 4 for updated Encompass Health consolidated guidance for 2022. ü Refer to slides 5 to 8 for Encompass Health post spin-off guidance for 2022. ü Refer to slides 10 to 13 for Enhabit guidance for 2022. u Cash dividends on common stock Ÿ Encompass Health anticipates continuing to pay a cash dividend on its common stock following the spin off of Enhabit. The amount of such dividends will be determined at the discretion of Encompass Health’s board of directors and is expected to decrease from its current level to reflect the separation of Enhabit. Ÿ Enhabit does not anticipate paying a cash dividend on its common stock.

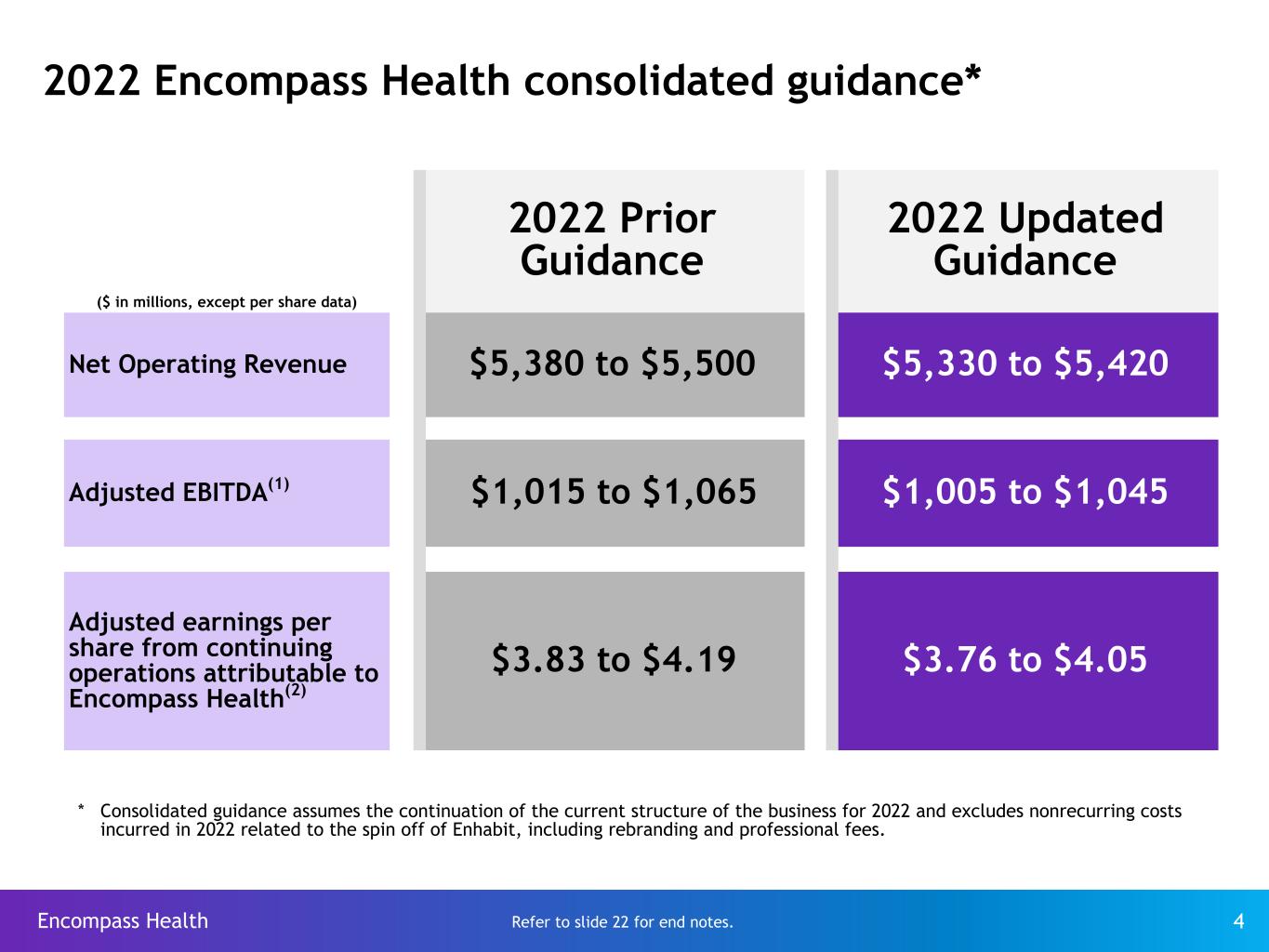

2022 Encompass Health consolidated guidance* 2022 Prior Guidance 2022 Updated Guidance ($ in millions, except per share data) Net Operating Revenue $5,380 to $5,500 $5,330 to $5,420 Adjusted EBITDA(1) $1,015 to $1,065 $1,005 to $1,045 Adjusted earnings per share from continuing operations attributable to Encompass Health(2) $3.83 to $4.19 $3.76 to $4.05 Encompass Health 4 * Consolidated guidance assumes the continuation of the current structure of the business for 2022 and excludes nonrecurring costs incurred in 2022 related to the spin off of Enhabit, including rebranding and professional fees. Refer to slide 22 for end notes.

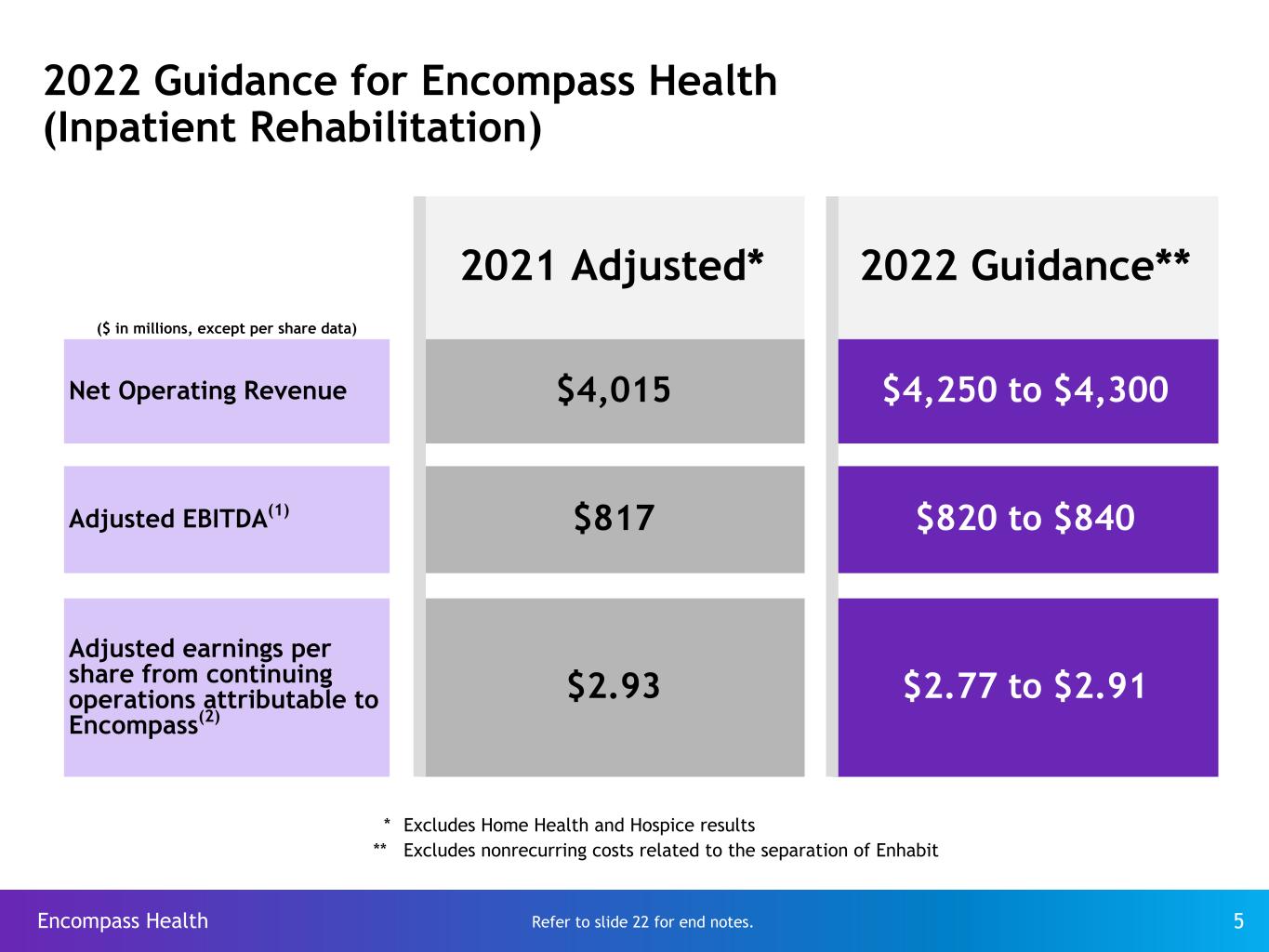

2022 Guidance for Encompass Health (Inpatient Rehabilitation) 2021 Adjusted* 2022 Guidance** ($ in millions, except per share data) Net Operating Revenue $4,015 $4,250 to $4,300 Adjusted EBITDA(1) $817 $820 to $840 Adjusted earnings per share from continuing operations attributable to Encompass(2) $2.93 $2.77 to $2.91 Encompass Health 5 * Excludes Home Health and Hospice results ** Excludes nonrecurring costs related to the separation of Enhabit Refer to slide 22 for end notes.

2022 Guidance considerations for Encompass Health u Encompass Health will operate a single reportable segment: inpatient rehabilitation. Ÿ An increase of 1.9% in Medicare pricing, prior to the resumption of sequestration Ÿ Revenue reserves related to bad debt of approximately 2.0% of net operating revenues Ÿ Salaries and benefits per FTE (inclusive of agency staffing costs, sign-on and shift bonuses) is expected to increase by approximately 5%. Staffing constraints and elevated costs are expected to continue in 2022 with improvement heavily skewed toward the second half of the year. Ÿ Pre-opening and new-store ramp-up costs of $10 million to $13 million Ÿ Reduction in general and administrative costs of $1 million to $3 million associated with the transition services agreement with Enhabit Ÿ Interest expense of $150 million to $160 million, assuming the receipt of approximately $570 million from Enhabit with the proceeds used to pay down Encompass Health debt Ÿ Tax rate of approximtely 26% Ÿ Diluted share count of approximately 100 million shares Ÿ Guidance excludes nonrecurring costs related to the separation of Enhabit. Ÿ Following the separation, the home health and hospice segment will be reflected as a discontinued operation and excluded from revenue, adjusted EBITDA and adjusted earnings per share on a retrospective basis for all periods presented. Encompass Health 6

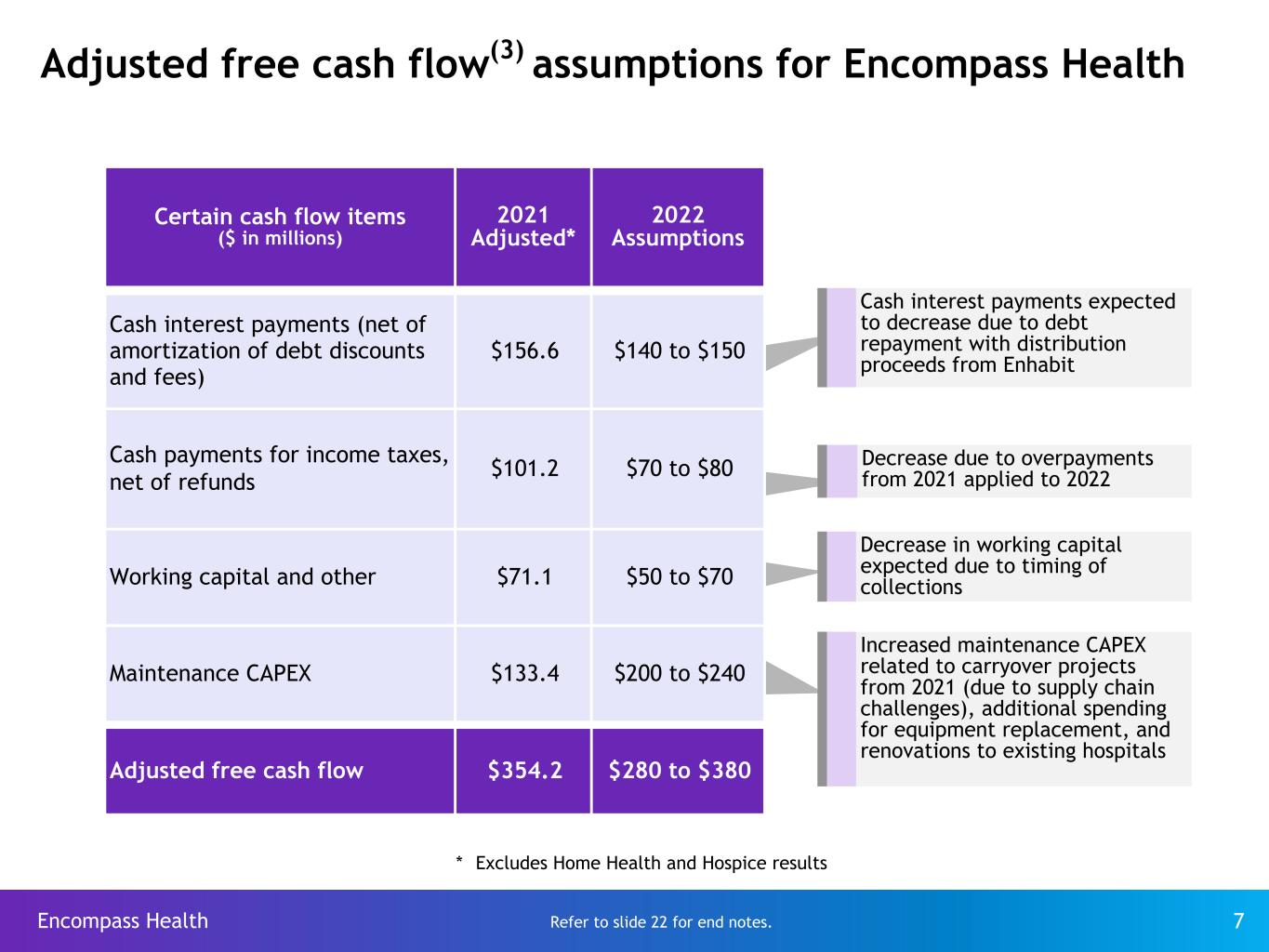

Adjusted free cash flow(3) assumptions for Encompass Health Certain cash flow items ($ in millions) 2021 Adjusted* 2022 Assumptions Cash interest payments (net of amortization of debt discounts and fees) $156.6 $140 to $150 Cash payments for income taxes, net of refunds $101.2 $70 to $80 Working capital and other $71.1 $50 to $70 Maintenance CAPEX $133.4 $200 to $240 Adjusted free cash flow $354.2 $280 to $380 Decrease due to overpayments from 2021 applied to 2022 Decrease in working capital expected due to timing of collections Increased maintenance CAPEX related to carryover projects from 2021 (due to supply chain challenges), additional spending for equipment replacement, and renovations to existing hospitals Encompass Health 7 Cash interest payments expected to decrease due to debt repayment with distribution proceeds from Enhabit * Excludes Home Health and Hospice results Refer to slide 22 for end notes.

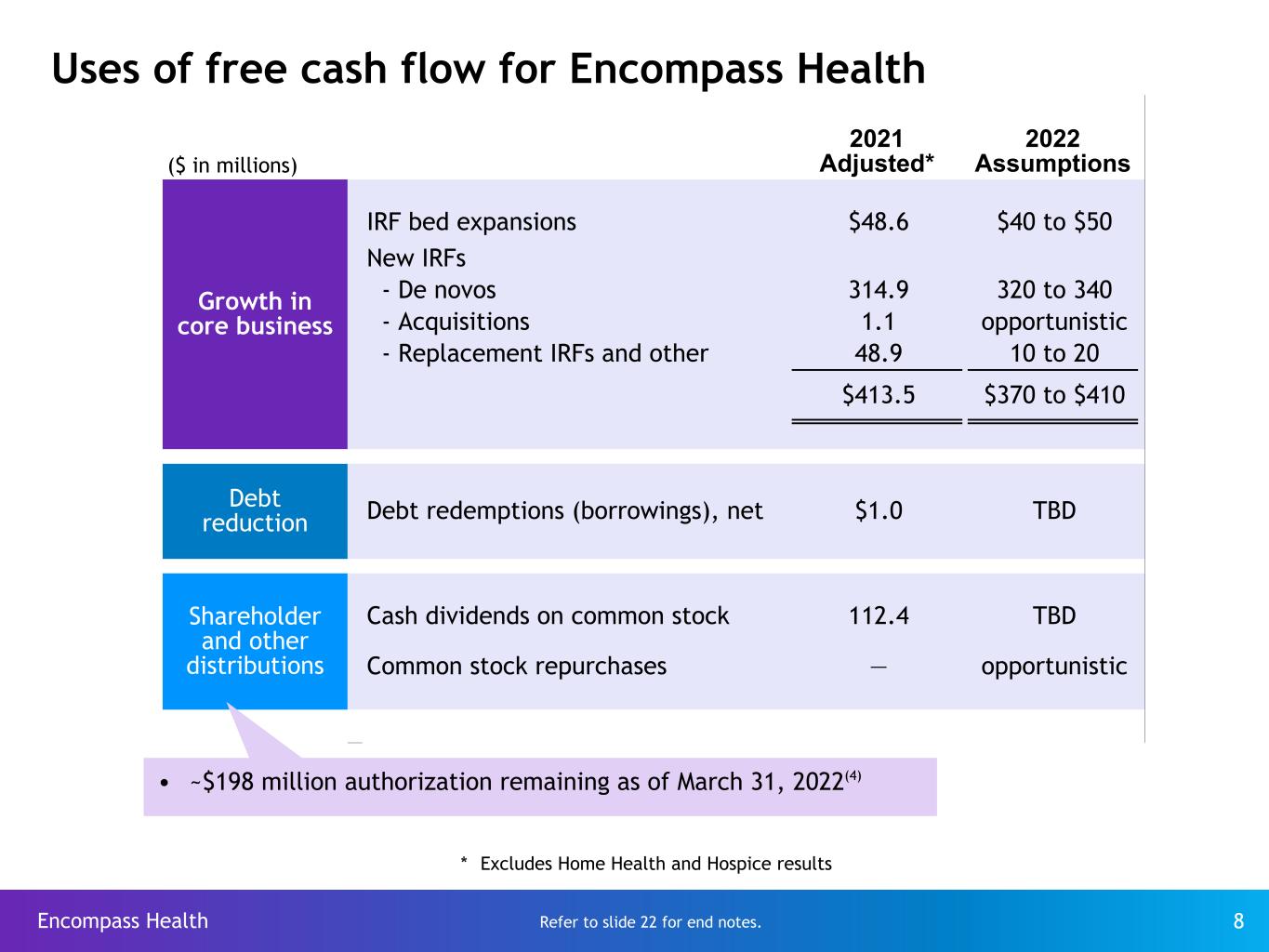

Uses of free cash flow for Encompass Health Encompass Health 8 ($ in millions) 2021 Adjusted* 2022 Assumptions Growth in core business IRF bed expansions $48.6 $40 to $50 New IRFs - De novos 314.9 320 to 340 - Acquisitions 1.1 opportunistic - Replacement IRFs and other 48.9 10 to 20 $413.5 $370 to $410 Debt reduction Debt redemptions (borrowings), net $1.0 TBD Shareholder and other distributions Cash dividends on common stock 112.4 TBD Common stock repurchases — opportunistic Ÿ ~$198 million authorization remaining as of March 31, 2022(4) * Excludes Home Health and Hospice results Refer to slide 22 for end notes.

2022-2026 Growth targets for Encompass Health Strong and sustainable business fundamentals Ÿ Strong demographic tailwinds Ÿ Multi-faceted growth strategy Ÿ Highly fragmented sector presents acquisition and joint venture opportunities Ÿ Consistent delivery of high-quality, cost-effective care Ÿ Economies related to scale and market density Ÿ Substantial cash flow generation Encompass Health 9 6 to 10 De novos per year 100 to 150 bed additions per year 6% to 8% Discharge CAGR

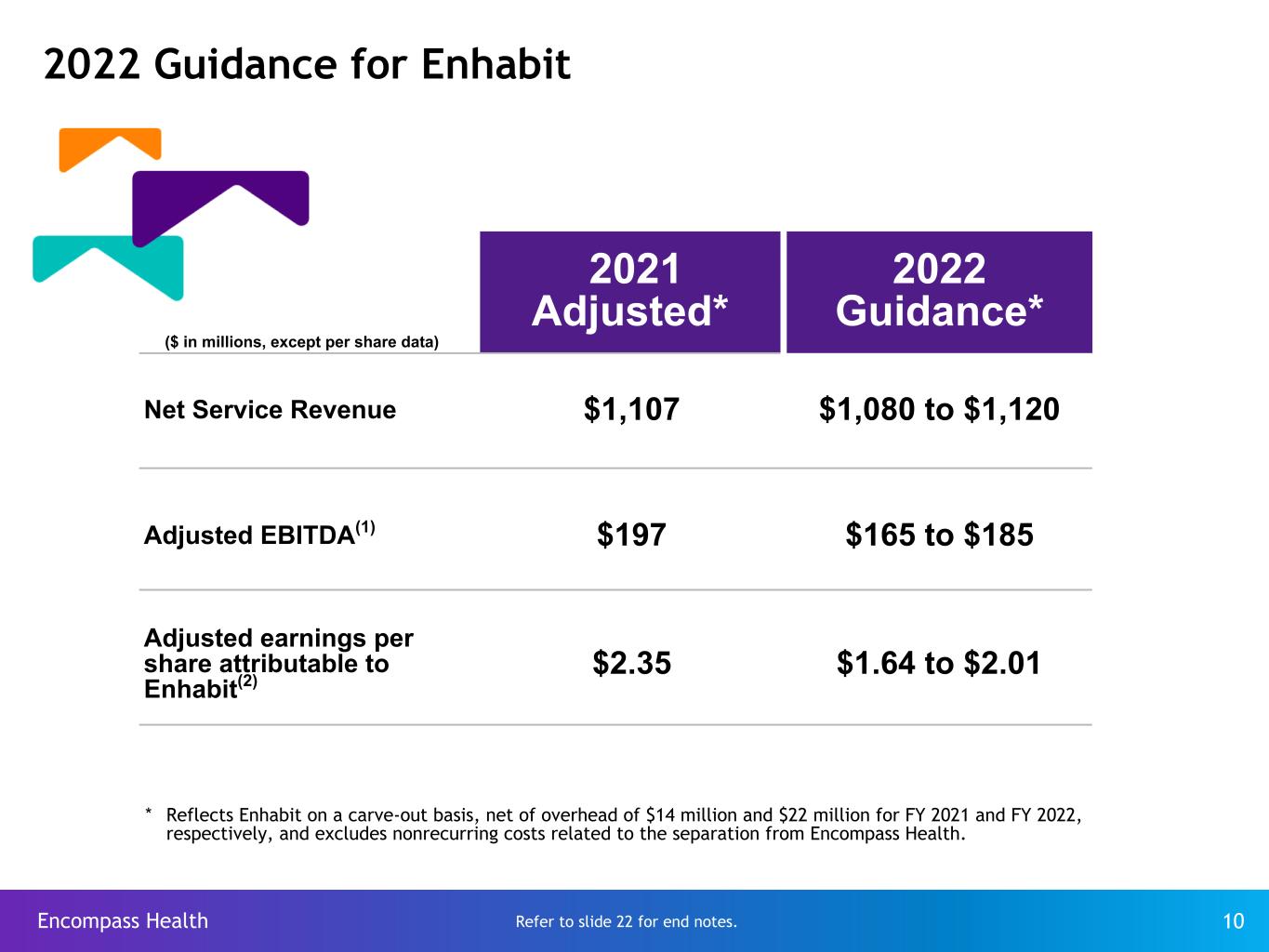

2022 Guidance for Enhabit 2021 Adjusted* 2022 Guidance* ($ in millions, except per share data) Net Service Revenue $1,107 $1,080 to $1,120 Adjusted EBITDA(1) $197 $165 to $185 Adjusted earnings per share attributable to Enhabit(2) $2.35 $1.64 to $2.01 Encompass Health 10 * Reflects Enhabit on a carve-out basis, net of overhead of $14 million and $22 million for FY 2021 and FY 2022, respectively, and excludes nonrecurring costs related to the separation from Encompass Health. Refer to slide 22 for end notes.

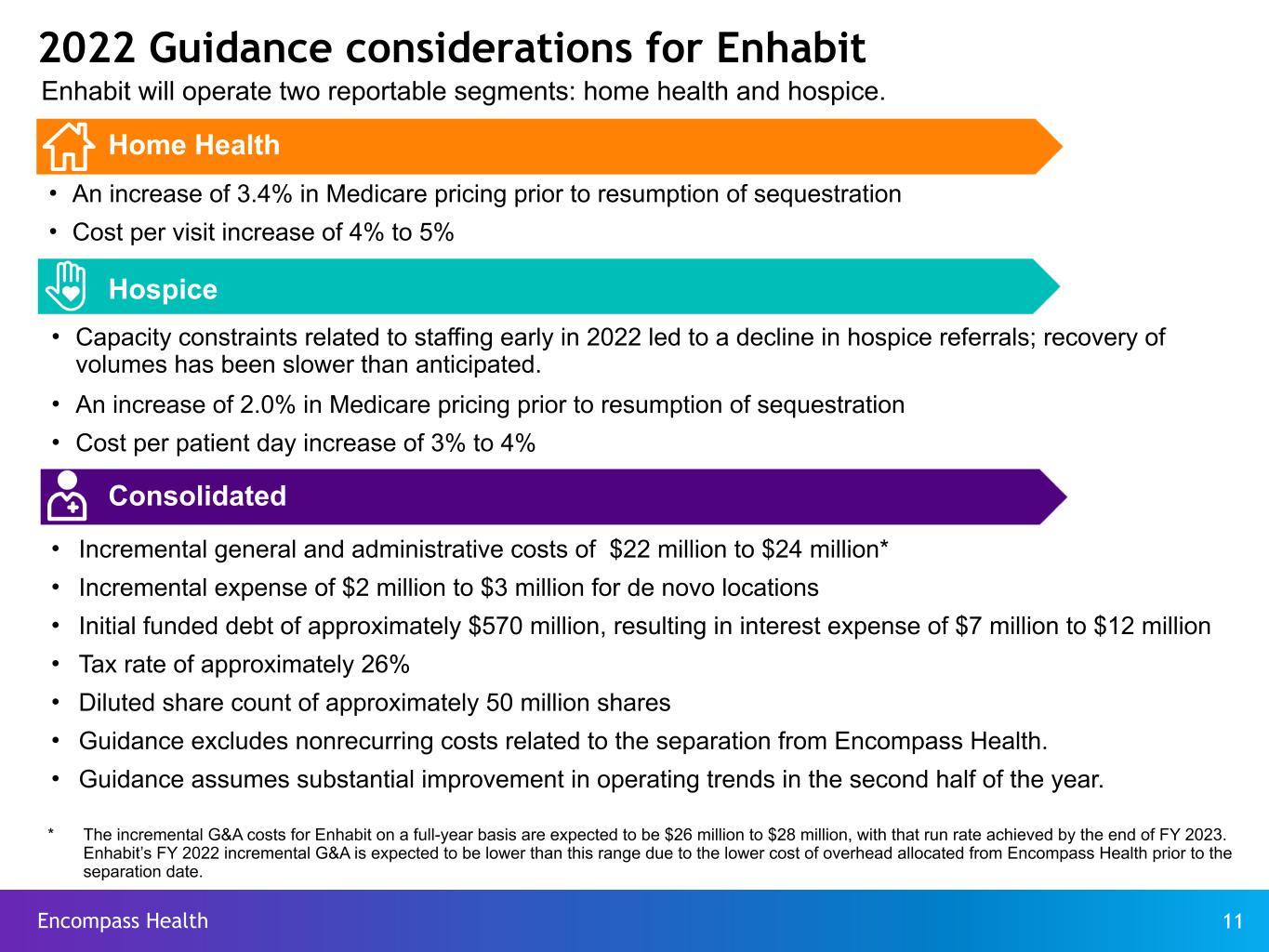

2022 Guidance considerations for Enhabit Ÿ An increase of 3.4% in Medicare pricing prior to resumption of sequestration Ÿ Cost per visit increase of 4% to 5% Ÿ Capacity constraints related to staffing early in 2022 led to a decline in hospice referrals; recovery of volumes has been slower than anticipated. Ÿ An increase of 2.0% in Medicare pricing prior to resumption of sequestration Ÿ Cost per patient day increase of 3% to 4% Ÿ Incremental general and administrative costs of $22 million to $24 million* Ÿ Incremental expense of $2 million to $3 million for de novo locations Ÿ Initial funded debt of approximately $570 million, resulting in interest expense of $7 million to $12 million Ÿ Tax rate of approximately 26% Ÿ Diluted share count of approximately 50 million shares Ÿ Guidance excludes nonrecurring costs related to the separation from Encompass Health. Ÿ Guidance assumes substantial improvement in operating trends in the second half of the year. Encompass Health 11 Consolidated Hospice Home Health Enhabit will operate two reportable segments: home health and hospice. * The incremental G&A costs for Enhabit on a full-year basis are expected to be $26 million to $28 million, with that run rate achieved by the end of FY 2023. Enhabit’s FY 2022 incremental G&A is expected to be lower than this range due to the lower cost of overhead allocated from Encompass Health prior to the separation date.

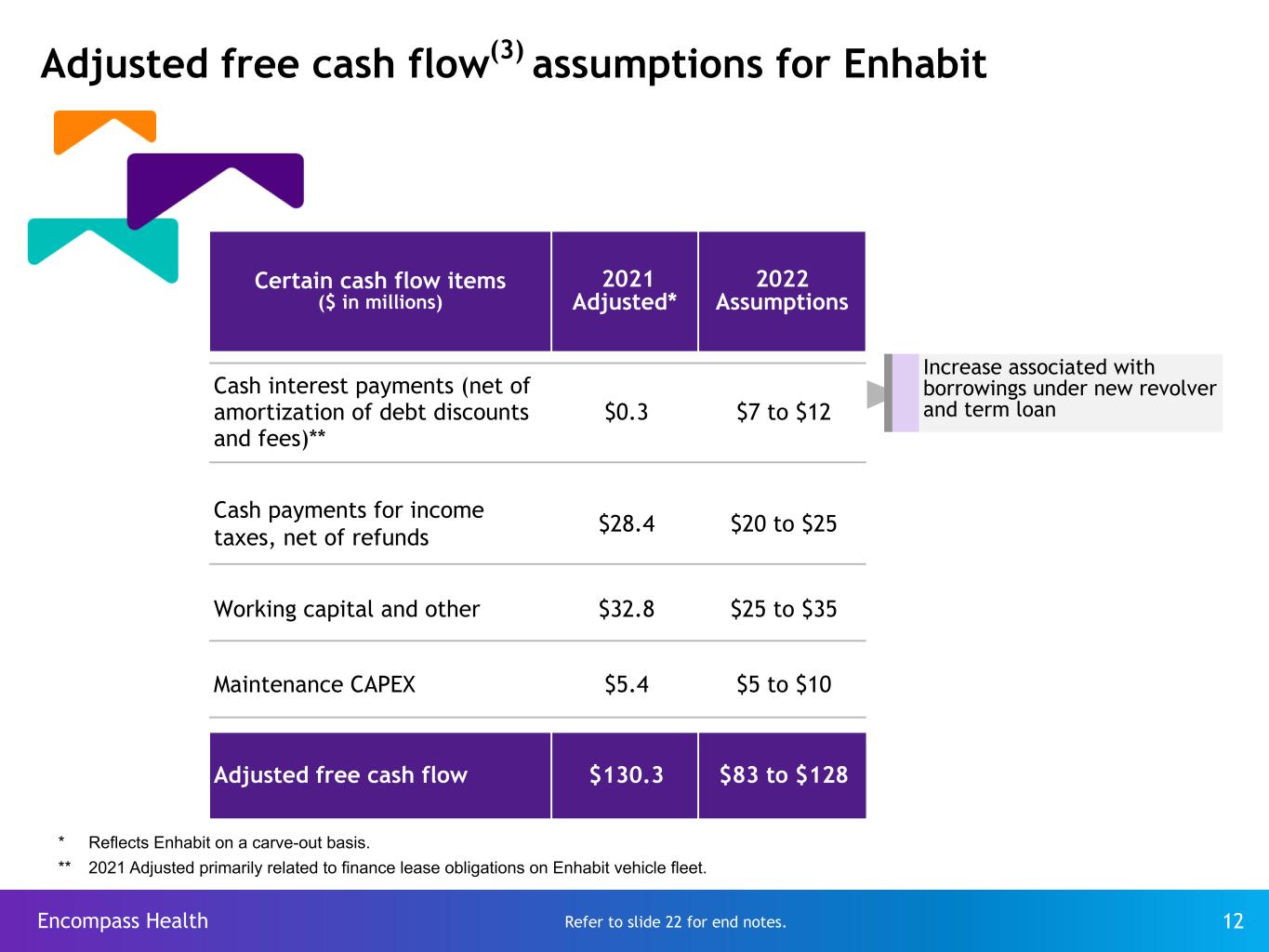

Adjusted free cash flow(3) assumptions for Enhabit Certain cash flow items ($ in millions) 2021 Adjusted* 2022 Assumptions Cash interest payments (net of amortization of debt discounts and fees)** $0.3 $7 to $12 Cash payments for income taxes, net of refunds $28.4 $20 to $25 Working capital and other $32.8 $25 to $35 Maintenance CAPEX $5.4 $5 to $10 Adjusted free cash flow $130.3 $83 to $128 Increase associated with borrowings under new revolver and term loan Encompass Health 12 * Reflects Enhabit on a carve-out basis. ** 2021 Adjusted primarily related to finance lease obligations on Enhabit vehicle fleet. Refer to slide 22 for end notes.

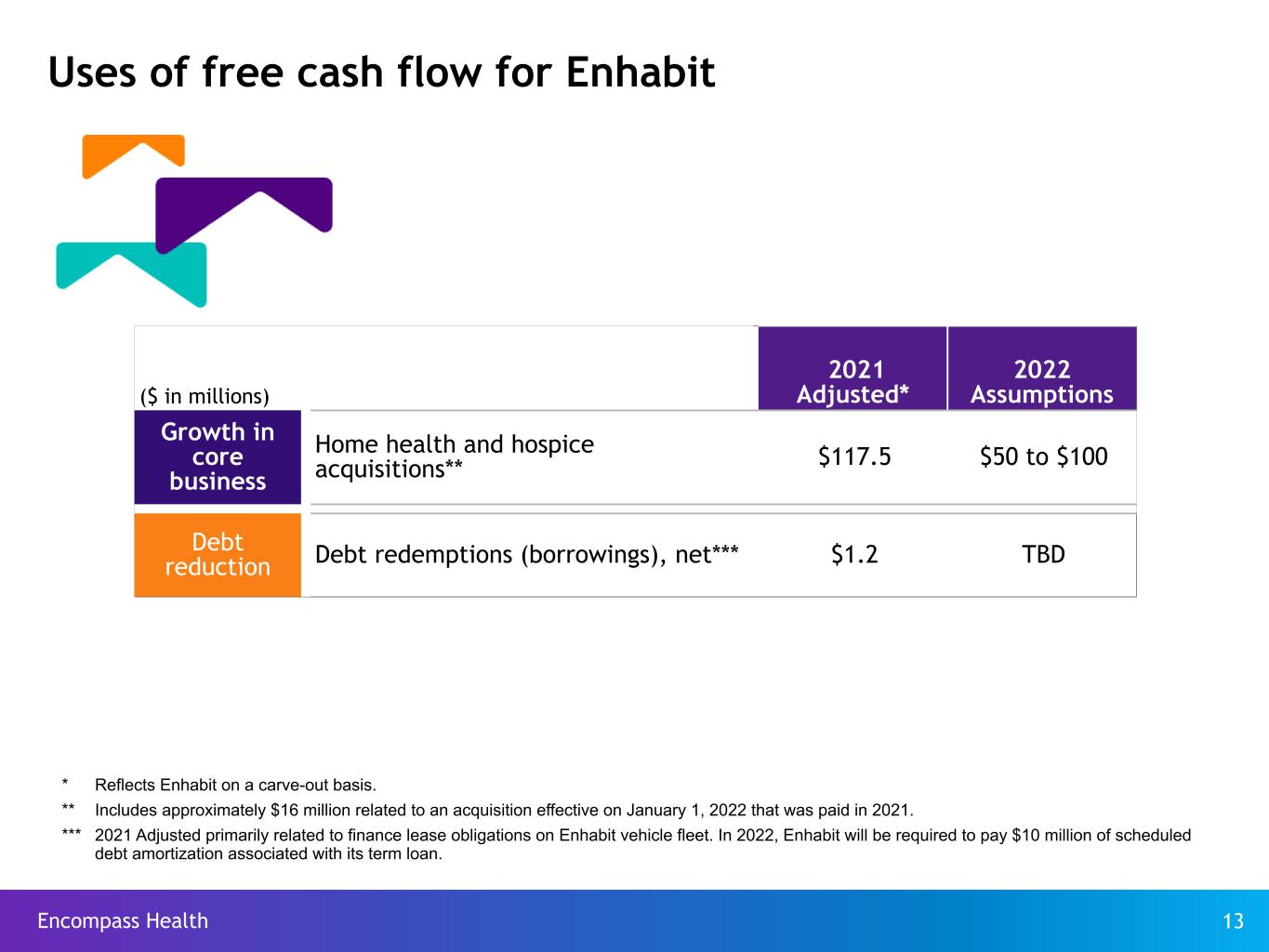

Uses of free cash flow for Enhabit ($ in millions) 2021 Adjusted* 2022 Assumptions Growth in core business Home health and hospice acquisitions** $117.5 $50 to $100 Debt reduction Debt redemptions (borrowings), net*** $1.2 TBD Encompass Health 13 * Reflects Enhabit on a carve-out basis. ** Includes approximately $16 million related to an acquisition effective on January 1, 2022 that was paid in 2021. *** 2021 Adjusted primarily related to finance lease obligations on Enhabit vehicle fleet. In 2022, Enhabit will be required to pay $10 million of scheduled debt amortization associated with its term loan.

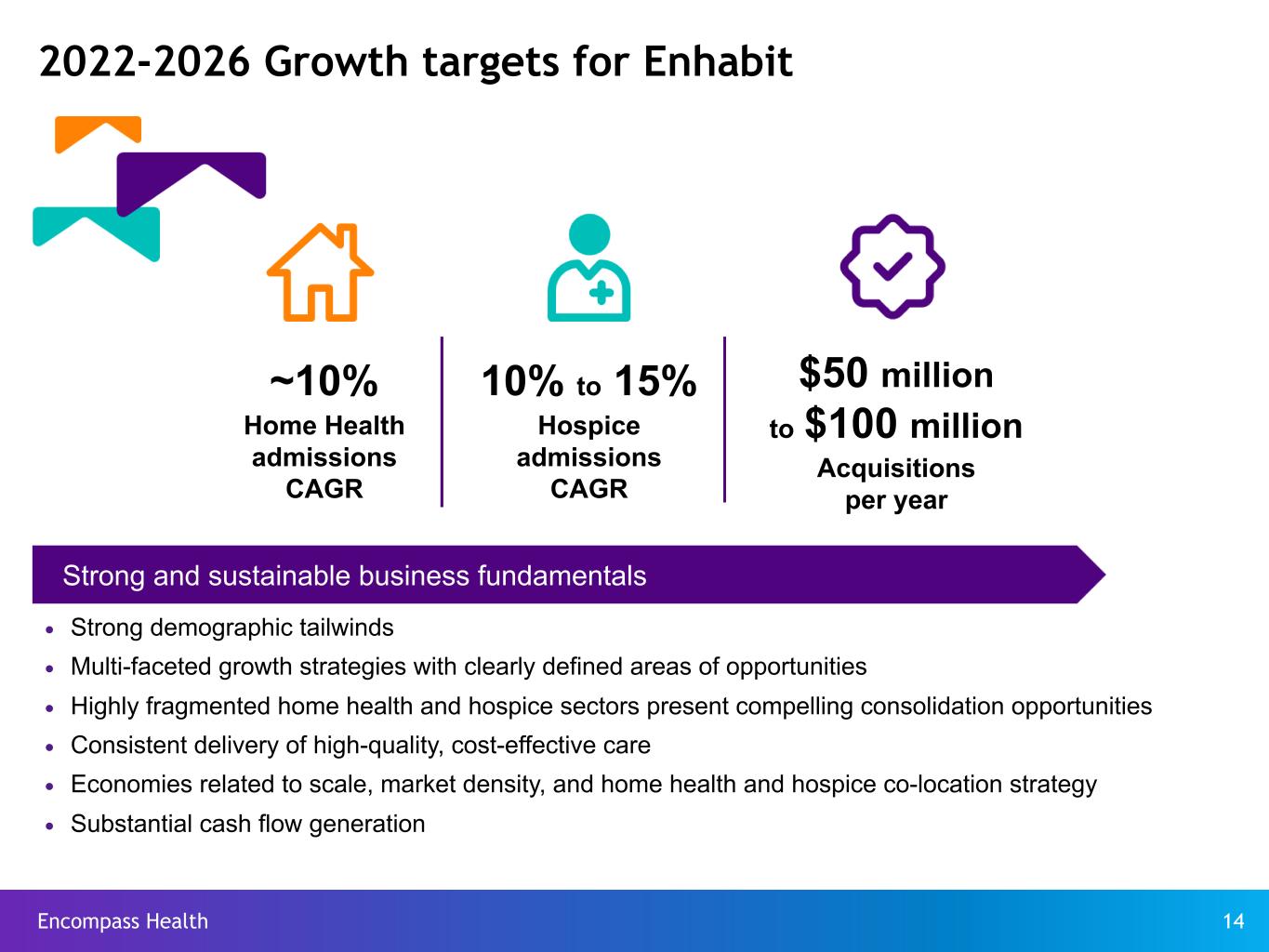

2022-2026 Growth targets for Enhabit ~10% Home Health admissions CAGR 10% to 15% Hospice admissions CAGR $50 million to $100 million Acquisitions per year Ÿ Strong demographic tailwinds Ÿ Multi-faceted growth strategies with clearly defined areas of opportunities Ÿ Highly fragmented home health and hospice sectors present compelling consolidation opportunities Ÿ Consistent delivery of high-quality, cost-effective care Ÿ Economies related to scale, market density, and home health and hospice co-location strategy Ÿ Substantial cash flow generation Encompass Health 14 Strong and sustainable business fundamentals

Appendix Encompass Health 15

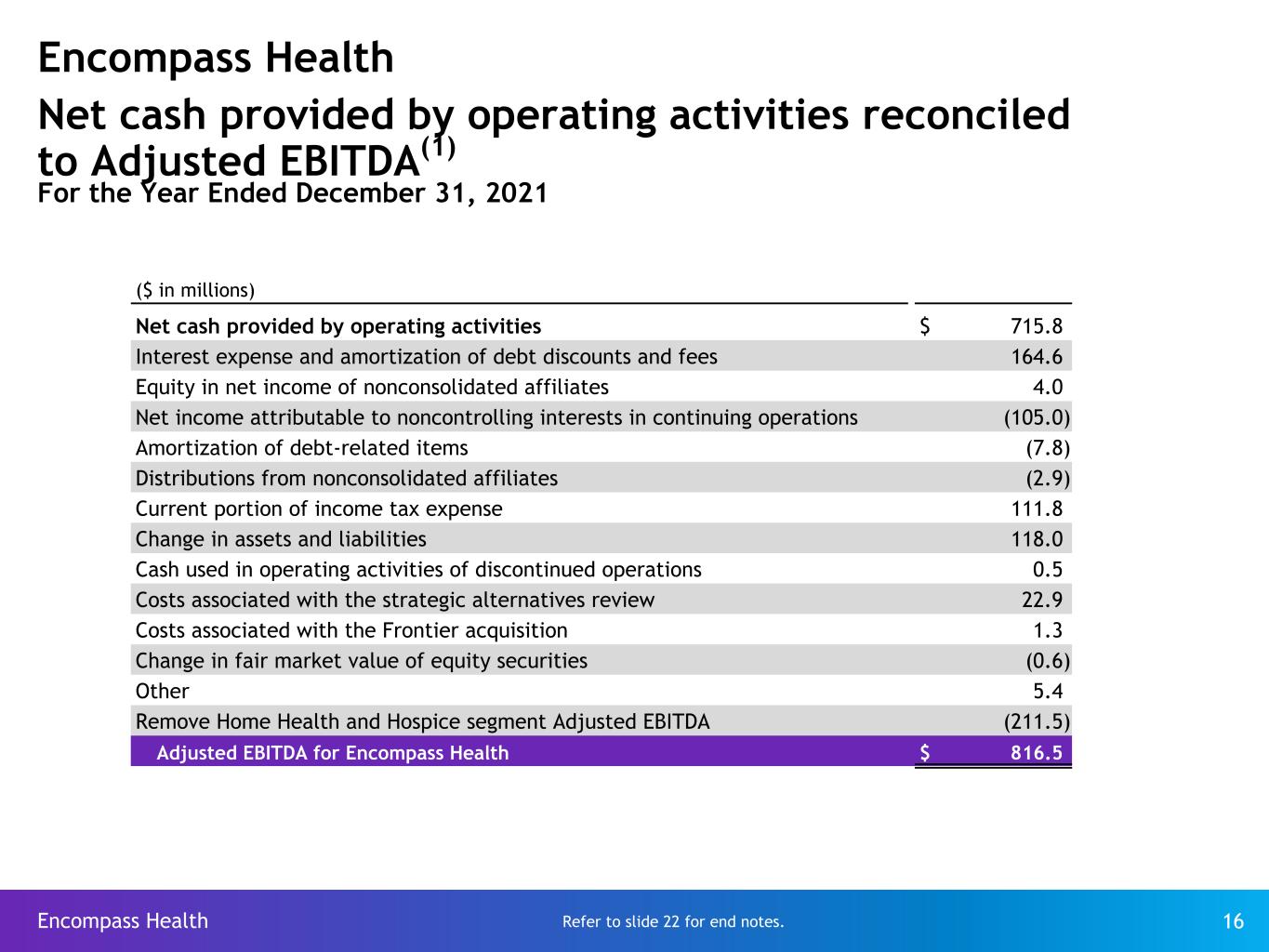

Encompass Health Net cash provided by operating activities reconciled to Adjusted EBITDA(1) For the Year Ended December 31, 2021 ($ in millions) Net cash provided by operating activities $ 715.8 Interest expense and amortization of debt discounts and fees 164.6 Equity in net income of nonconsolidated affiliates 4.0 Net income attributable to noncontrolling interests in continuing operations (105.0) Amortization of debt-related items (7.8) Distributions from nonconsolidated affiliates (2.9) Current portion of income tax expense 111.8 Change in assets and liabilities 118.0 Cash used in operating activities of discontinued operations 0.5 Costs associated with the strategic alternatives review 22.9 Costs associated with the Frontier acquisition 1.3 Change in fair market value of equity securities (0.6) Other 5.4 Remove Home Health and Hospice segment Adjusted EBITDA (211.5) Adjusted EBITDA for Encompass Health $ 816.5 Encompass Health 16Refer to slide 22 for end notes.

Encompass Health Reconciliation of net cash provided by operating activities to adjusted free cash flow(3) For the Year Ended December 31, 2021 ($ in millions) Net cash provided by operating activities $ 715.8 Impact of discontinued operations 0.5 Net cash provided by operating activities of continuing operations 716.3 Capital expenditures for maintenance (138.8) Distributions paid to noncontrolling interests of consolidated affiliates (102.9) Items not indicative of ongoing operating performance: Transaction costs and related assumed liabilities 24.2 Remove Home Health and Hospice segment results (144.6) Adjusted free cash flow for Encompass Health $ 354.2 Cash dividends on common stock $ 112.4 Encompass Health 17Refer to slide 22 for end notes.

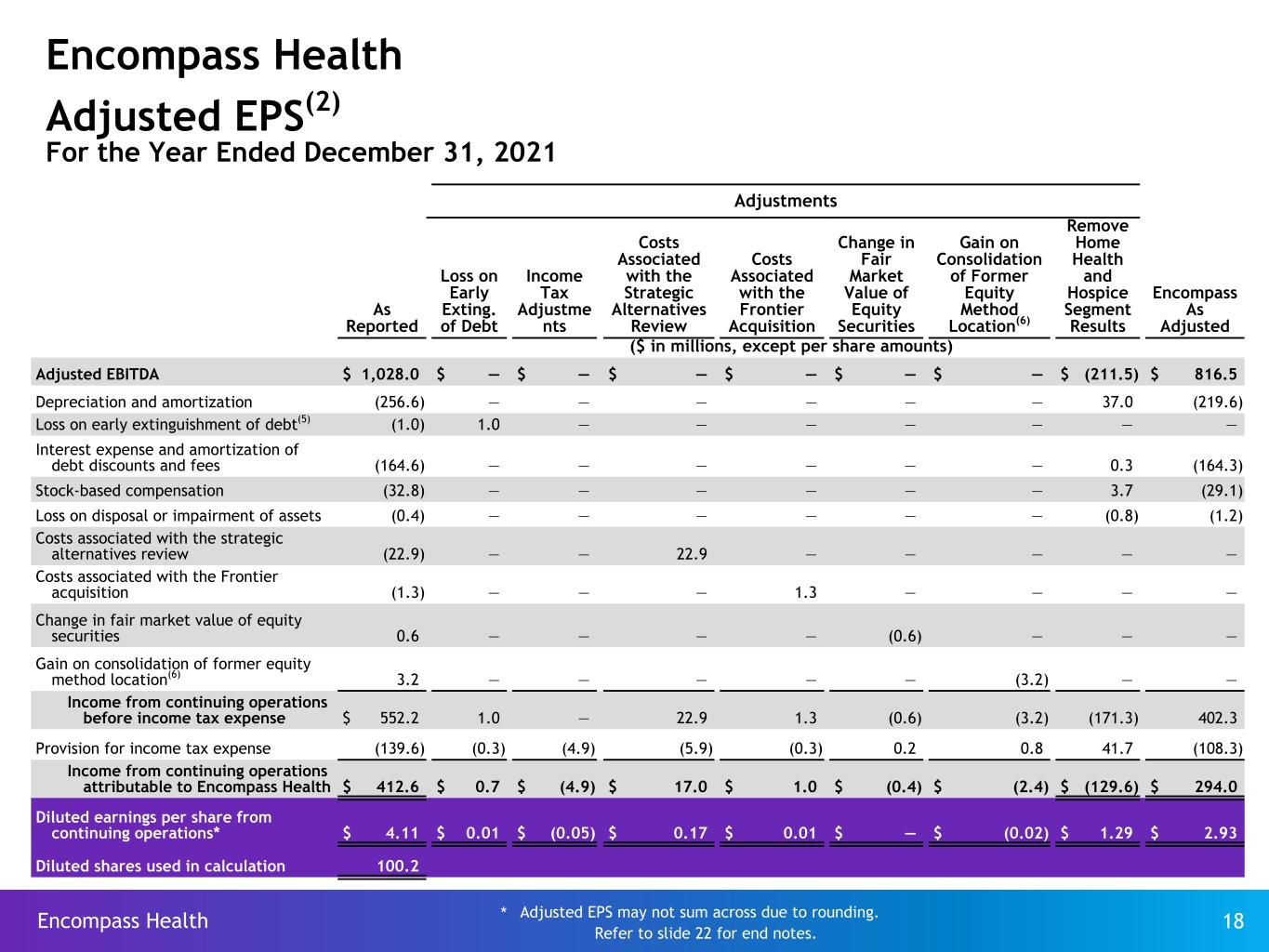

Adjustments As Reported Loss on Early Exting. of Debt Income Tax Adjustme nts Costs Associated with the Strategic Alternatives Review Costs Associated with the Frontier Acquisition Change in Fair Market Value of Equity Securities Gain on Consolidation of Former Equity Method Location(6) Remove Home Health and Hospice Segment Results Encompass As Adjusted ($ in millions, except per share amounts) Adjusted EBITDA $ 1,028.0 $ — $ — $ — $ — $ — $ — $ (211.5) $ 816.5 Depreciation and amortization (256.6) — — — — — — 37.0 (219.6) Loss on early extinguishment of debt(5) (1.0) 1.0 — — — — — — — Interest expense and amortization of debt discounts and fees (164.6) — — — — — — 0.3 (164.3) Stock-based compensation (32.8) — — — — — — 3.7 (29.1) Loss on disposal or impairment of assets (0.4) — — — — — — (0.8) (1.2) Costs associated with the strategic alternatives review (22.9) — — 22.9 — — — — — Costs associated with the Frontier acquisition (1.3) — — — 1.3 — — — — Change in fair market value of equity securities 0.6 — — — — (0.6) — — — Gain on consolidation of former equity method location(6) 3.2 — — — — — (3.2) — — Income from continuing operations before income tax expense $ 552.2 1.0 — 22.9 1.3 (0.6) (3.2) (171.3) 402.3 Provision for income tax expense (139.6) (0.3) (4.9) (5.9) (0.3) 0.2 0.8 41.7 (108.3) Income from continuing operations attributable to Encompass Health $ 412.6 $ 0.7 $ (4.9) $ 17.0 $ 1.0 $ (0.4) $ (2.4) $ (129.6) $ 294.0 Diluted earnings per share from continuing operations* $ 4.11 $ 0.01 $ (0.05) $ 0.17 $ 0.01 $ — $ (0.02) $ 1.29 $ 2.93 Diluted shares used in calculation 100.2 Encompass Health Adjusted EPS(2) For the Year Ended December 31, 2021 * Adjusted EPS may not sum across due to rounding. Refer to slide 22 for end notes. Encompass Health 18

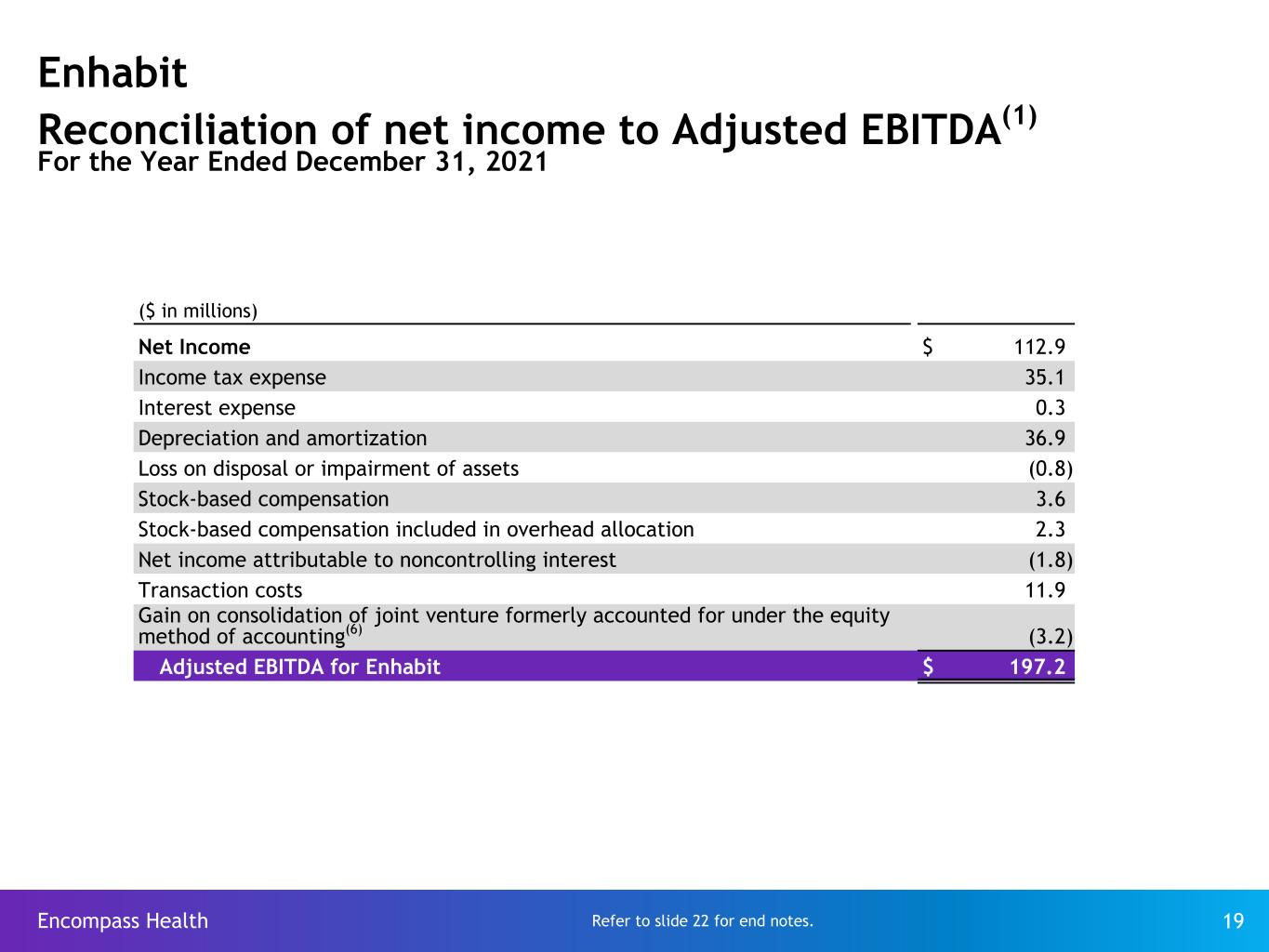

Enhabit Reconciliation of net income to Adjusted EBITDA(1) For the Year Ended December 31, 2021 Refer to slide 22 for end notes.Encompass Health 19 ($ in millions) Net Income $ 112.9 Income tax expense 35.1 Interest expense 0.3 Depreciation and amortization 36.9 Loss on disposal or impairment of assets (0.8) Stock-based compensation 3.6 Stock-based compensation included in overhead allocation 2.3 Net income attributable to noncontrolling interest (1.8) Transaction costs 11.9 Gain on consolidation of joint venture formerly accounted for under the equity method of accounting(6) (3.2) Adjusted EBITDA for Enhabit $ 197.2

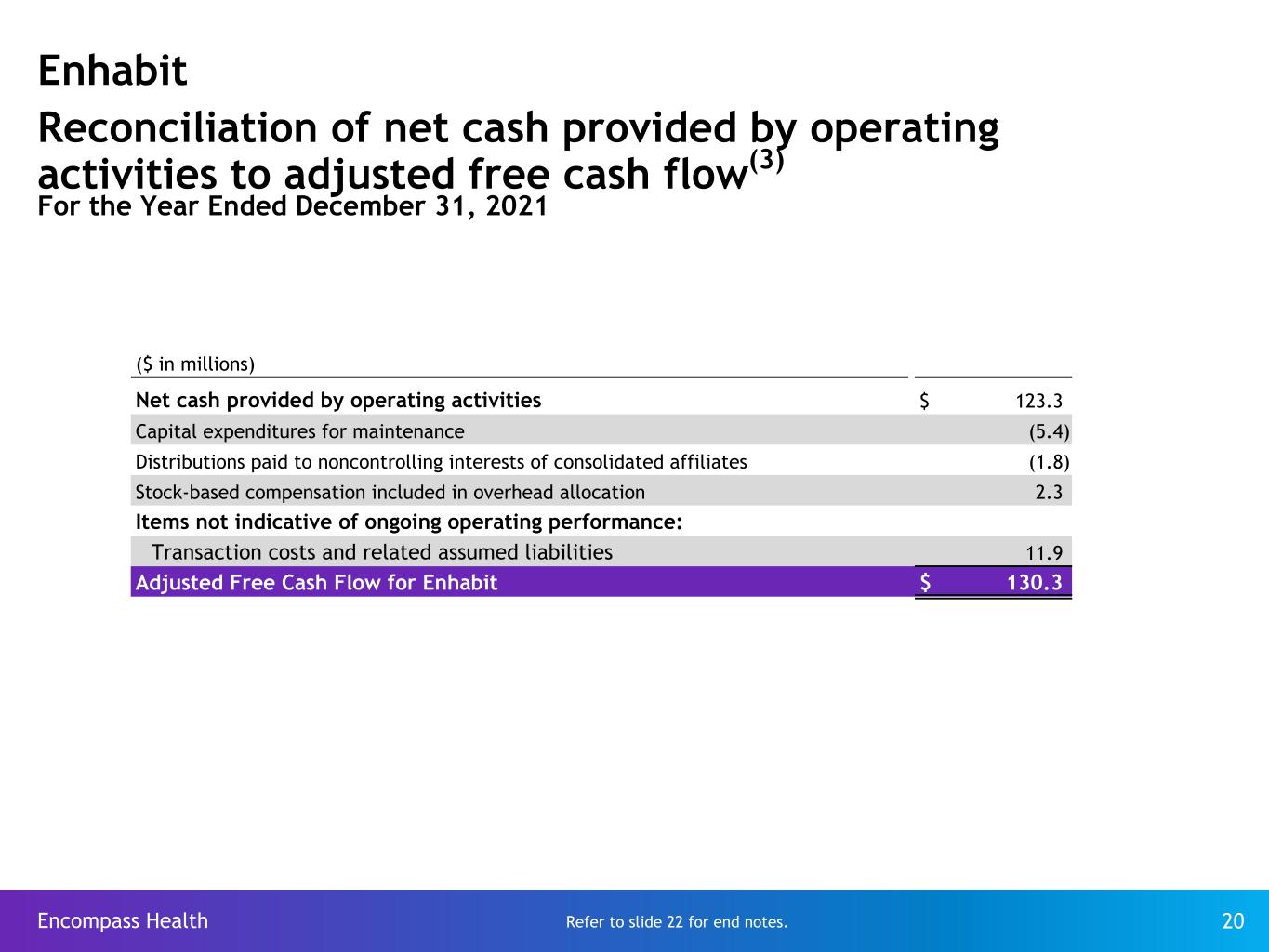

Enhabit Reconciliation of net cash provided by operating activities to adjusted free cash flow(3) For the Year Ended December 31, 2021 Encompass Health 20 ($ in millions) Net cash provided by operating activities $ 123.3 Capital expenditures for maintenance (5.4) Distributions paid to noncontrolling interests of consolidated affiliates (1.8) Stock-based compensation included in overhead allocation 2.3 Items not indicative of ongoing operating performance: Transaction costs and related assumed liabilities 11.9 Adjusted Free Cash Flow for Enhabit $ 130.3 Refer to slide 22 for end notes.

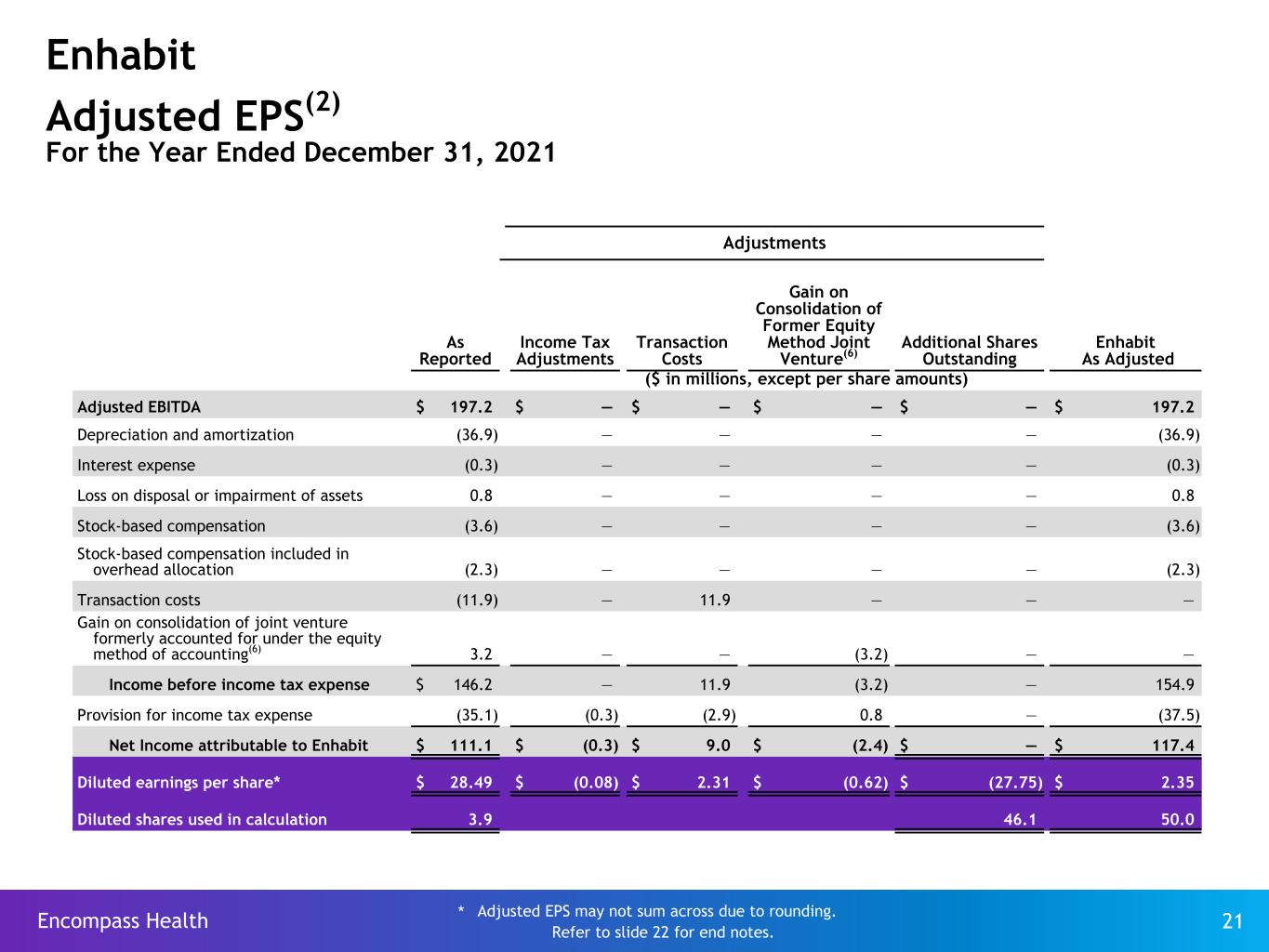

Enhabit Adjusted EPS(2) For the Year Ended December 31, 2021 Encompass Health 21 Adjustments As Reported Income Tax Adjustments Transaction Costs Gain on Consolidation of Former Equity Method Joint Venture(6) Additional Shares Outstanding Enhabit As Adjusted ($ in millions, except per share amounts) Adjusted EBITDA $ 197.2 $ — $ — $ — $ — $ 197.2 Depreciation and amortization (36.9) — — — — (36.9) Interest expense (0.3) — — — — (0.3) Loss on disposal or impairment of assets 0.8 — — — — 0.8 Stock-based compensation (3.6) — — — — (3.6) Stock-based compensation included in overhead allocation (2.3) — — — — (2.3) Transaction costs (11.9) — 11.9 — — — Gain on consolidation of joint venture formerly accounted for under the equity method of accounting(6) 3.2 — — (3.2) — — Income before income tax expense $ 146.2 — 11.9 (3.2) — 154.9 Provision for income tax expense (35.1) (0.3) (2.9) 0.8 — (37.5) Net Income attributable to Enhabit $ 111.1 $ (0.3) $ 9.0 $ (2.4) $ — $ 117.4 Diluted earnings per share* $ 28.49 $ (0.08) $ 2.31 $ (0.62) $ (27.75) $ 2.35 Diluted shares used in calculation 3.9 46.1 50.0 * Adjusted EPS may not sum across due to rounding. Refer to slide 22 for end notes.

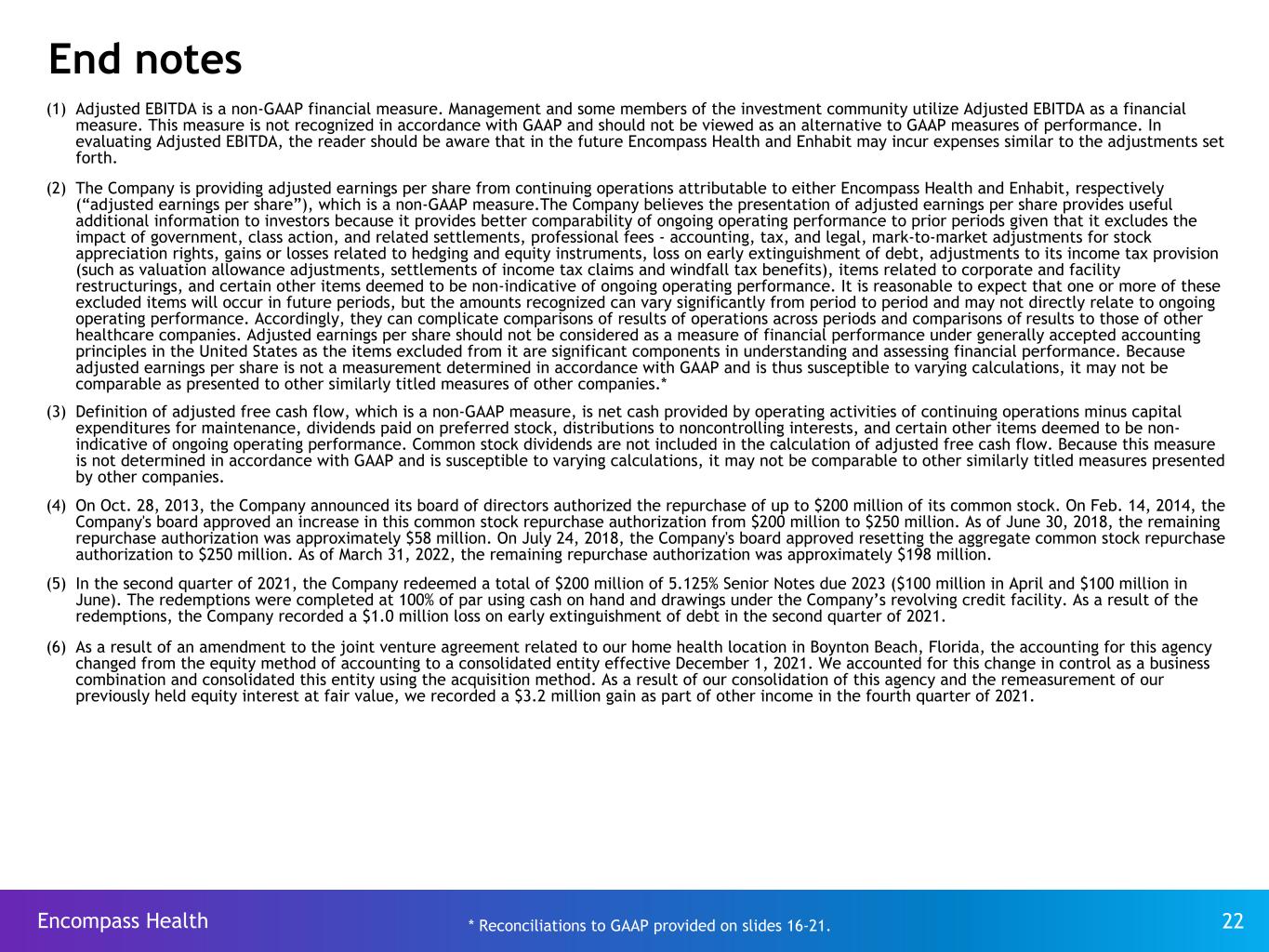

End notes (1) Adjusted EBITDA is a non-GAAP financial measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure. This measure is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. In evaluating Adjusted EBITDA, the reader should be aware that in the future Encompass Health and Enhabit may incur expenses similar to the adjustments set forth. (2) The Company is providing adjusted earnings per share from continuing operations attributable to either Encompass Health and Enhabit, respectively (“adjusted earnings per share”), which is a non-GAAP measure.The Company believes the presentation of adjusted earnings per share provides useful additional information to investors because it provides better comparability of ongoing operating performance to prior periods given that it excludes the impact of government, class action, and related settlements, professional fees - accounting, tax, and legal, mark-to-market adjustments for stock appreciation rights, gains or losses related to hedging and equity instruments, loss on early extinguishment of debt, adjustments to its income tax provision (such as valuation allowance adjustments, settlements of income tax claims and windfall tax benefits), items related to corporate and facility restructurings, and certain other items deemed to be non-indicative of ongoing operating performance. It is reasonable to expect that one or more of these excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period and may not directly relate to ongoing operating performance. Accordingly, they can complicate comparisons of results of operations across periods and comparisons of results to those of other healthcare companies. Adjusted earnings per share should not be considered as a measure of financial performance under generally accepted accounting principles in the United States as the items excluded from it are significant components in understanding and assessing financial performance. Because adjusted earnings per share is not a measurement determined in accordance with GAAP and is thus susceptible to varying calculations, it may not be comparable as presented to other similarly titled measures of other companies.* (3) Definition of adjusted free cash flow, which is a non-GAAP measure, is net cash provided by operating activities of continuing operations minus capital expenditures for maintenance, dividends paid on preferred stock, distributions to noncontrolling interests, and certain other items deemed to be non- indicative of ongoing operating performance. Common stock dividends are not included in the calculation of adjusted free cash flow. Because this measure is not determined in accordance with GAAP and is susceptible to varying calculations, it may not be comparable to other similarly titled measures presented by other companies. (4) On Oct. 28, 2013, the Company announced its board of directors authorized the repurchase of up to $200 million of its common stock. On Feb. 14, 2014, the Company's board approved an increase in this common stock repurchase authorization from $200 million to $250 million. As of June 30, 2018, the remaining repurchase authorization was approximately $58 million. On July 24, 2018, the Company's board approved resetting the aggregate common stock repurchase authorization to $250 million. As of March 31, 2022, the remaining repurchase authorization was approximately $198 million. (5) In the second quarter of 2021, the Company redeemed a total of $200 million of 5.125% Senior Notes due 2023 ($100 million in April and $100 million in June). The redemptions were completed at 100% of par using cash on hand and drawings under the Company’s revolving credit facility. As a result of the redemptions, the Company recorded a $1.0 million loss on early extinguishment of debt in the second quarter of 2021. (6) As a result of an amendment to the joint venture agreement related to our home health location in Boynton Beach, Florida, the accounting for this agency changed from the equity method of accounting to a consolidated entity effective December 1, 2021. We accounted for this change in control as a business combination and consolidated this entity using the acquisition method. As a result of our consolidation of this agency and the remeasurement of our previously held equity interest at fair value, we recorded a $3.2 million gain as part of other income in the fourth quarter of 2021. * Reconciliations to GAAP provided on slides 16-21.Encompass Health 22