Enhabit Home Health & Hospice June 2022

Enhabit Home Health & Hospice 2 Disclaimer This presentation and the accompanying oral presentation (this “Presentation”) has been prepared by Enhabit, Inc. (the “Company”) solely for information purposes. This Presentation and its contents are confidential and may contain material non-public information about the Company, Encompass Health Corporation or their respective affiliates. By participating in this Presentation, you acknowledge and agree that (i) the information contained herein and the discussion between you and the Company are each strictly confidential and (ii) this Presentation is intended for the recipient of this information only and shall not, in whole or in part, be disclosed, reproduced, disseminated or quoted at any time or in any manner without the Company’s prior written consent (whether or not attributed directly to the Company as a source). This Presentation includes forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Presentation, including statements regarding the Company’s industry, position, goals, strategy, future operations, future financial position, plans, future revenues, estimated costs, prospects, margins, profitability, capital expenditures, liquidity, capital resources, plans and objectives of management are or may deemed to be, forward-looking statements. The words "anticipate,’’ ‘‘believe,’’ ‘‘continue,’’ "could,’’ ‘‘effort,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘forecast,’’ ‘‘goal,’’ ‘‘guidance,’’ ‘‘intend,’’ ‘‘may,’’ ‘‘objective,’’ ‘‘outlook,’’ ‘‘plan,’’ ‘‘potential,’’ ‘‘predict,’’ ‘‘projection,’’ ‘‘should,’’ ‘‘target,’’ ‘‘trajectory,’’ ‘‘will’’ or the negative of these terms or other comparable terms as they relate to the Company, are intended to identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. The Company has based these forward-looking statements largely on the Company’s current expectations and projections about future events and financial trends that it believes may affect the Company’s financial condition, results of operations, business strategy and financial needs, including current expectations and assumptions regarding, as of the date such statements are made, the Company’s future operating performance and financial condition, including the Company’s separation from Encompass Health Corporation, the expected timetable for the separation and distribution of the Company’s common stock to the shareholders of Encompass Health Corporation, and the Company’s future financial and operating performance, strategic and competitive advantages, leadership and future opportunities, as well as the economy and other future events or circumstances. The Company’s expectations and assumptions include, without limitation, internal forecasts and analyses of current and future market conditions and trends, management plans and strategies, operating efficiencies and economic conditions. You should not rely upon forward-looking statements as predictions of future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, level of activity, performance or achievements. In addition, neither the Company nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by the Company or any other person that the Company will achieve its objectives and plans in any specified time frame, or at all. These forward-looking statements speak only as of the date of this Presentation. Except as required by law, the Company assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. This Presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Non-GAAP financial measures are commonly used in our industry, have certain limitations and should not be construed as alternatives to financial measures determined in accordance with GAAP. The non-GAAP measures as defined by us may not be comparable to similar non-GAAP measures presented by other companies. Our presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that our future results will be unaffected by other unusual or non-recurring items. Please refer to the appendix for GAAP to non-GAAP reconciliation.

Enhabit Home Health & Hospice 3 Table of Contents • Introduction • Industry Overview • Competitive Strengths & Investment Highlights • Company Overview • Financial Overview • Appendix 1 2 5 4 3

Enhabit Home Health & Hospice 4 Introduction 1

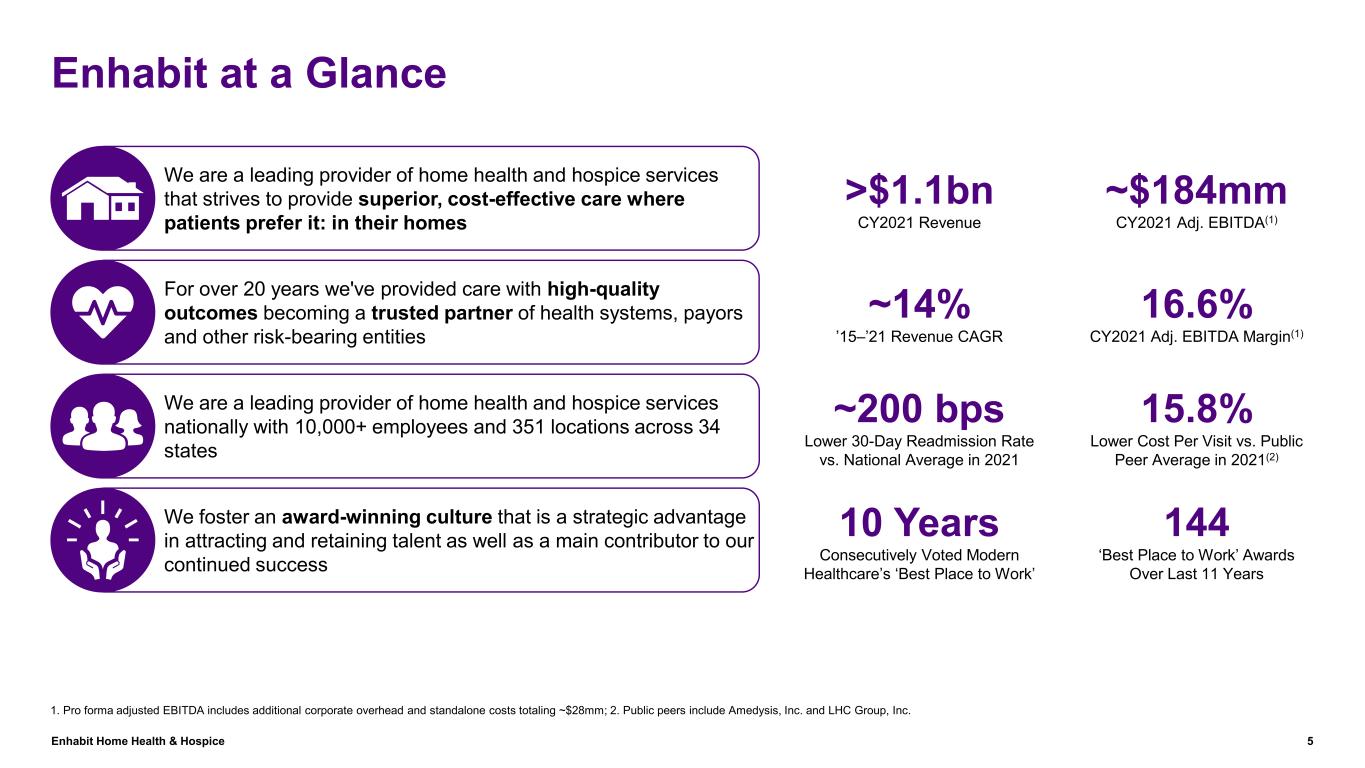

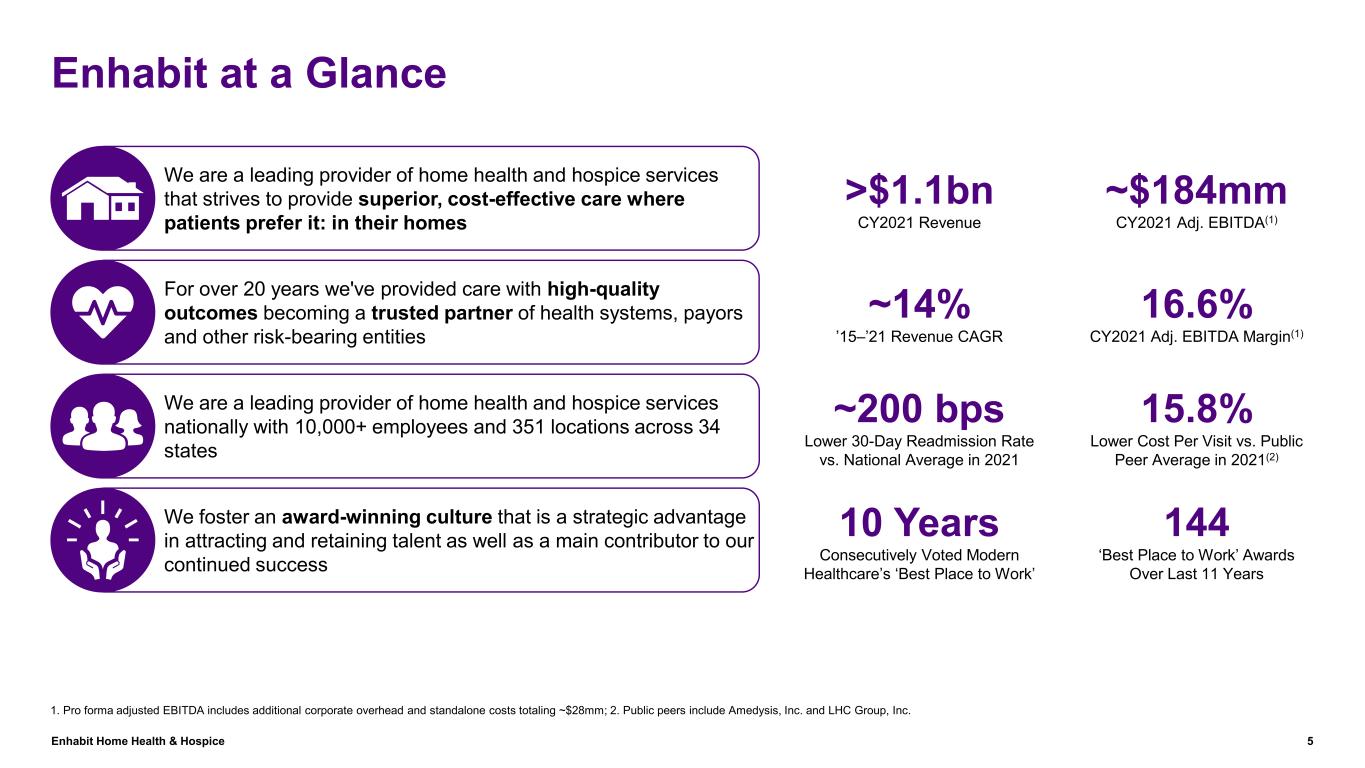

Enhabit Home Health & Hospice 5 Enhabit at a Glance 1. Pro forma adjusted EBITDA includes additional corporate overhead and standalone costs totaling ~$28mm; 2. Public peers include Amedysis, Inc. and LHC Group, Inc. We are a leading provider of home health and hospice services that strives to provide superior, cost-effective care where patients prefer it: in their homes For over 20 years we've provided care with high-quality outcomes becoming a trusted partner of health systems, payors and other risk-bearing entities We are a leading provider of home health and hospice services nationally with 10,000+ employees and 351 locations across 34 states We foster an award-winning culture that is a strategic advantage in attracting and retaining talent as well as a main contributor to our continued success ~200 bps Lower 30-Day Readmission Rate vs. National Average in 2021 10 Years Consecutively Voted Modern Healthcare’s ‘Best Place to Work’ >$1.1bn CY2021 Revenue ~14% ’15–’21 Revenue CAGR 15.8% Lower Cost Per Visit vs. Public Peer Average in 2021(2) 144 ‘Best Place to Work’ Awards Over Last 11 Years ~$184mm CY2021 Adj. EBITDA(1) 16.6% CY2021 Adj. EBITDA Margin(1)

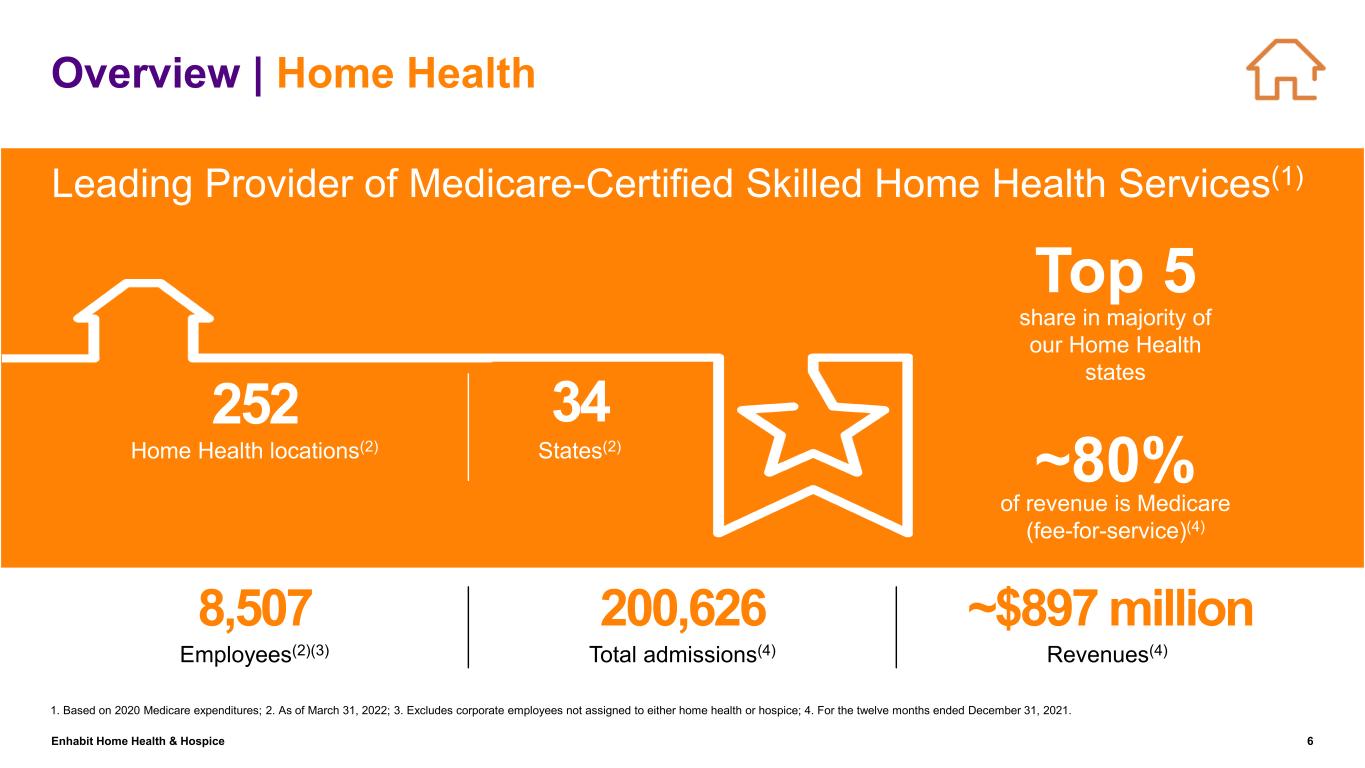

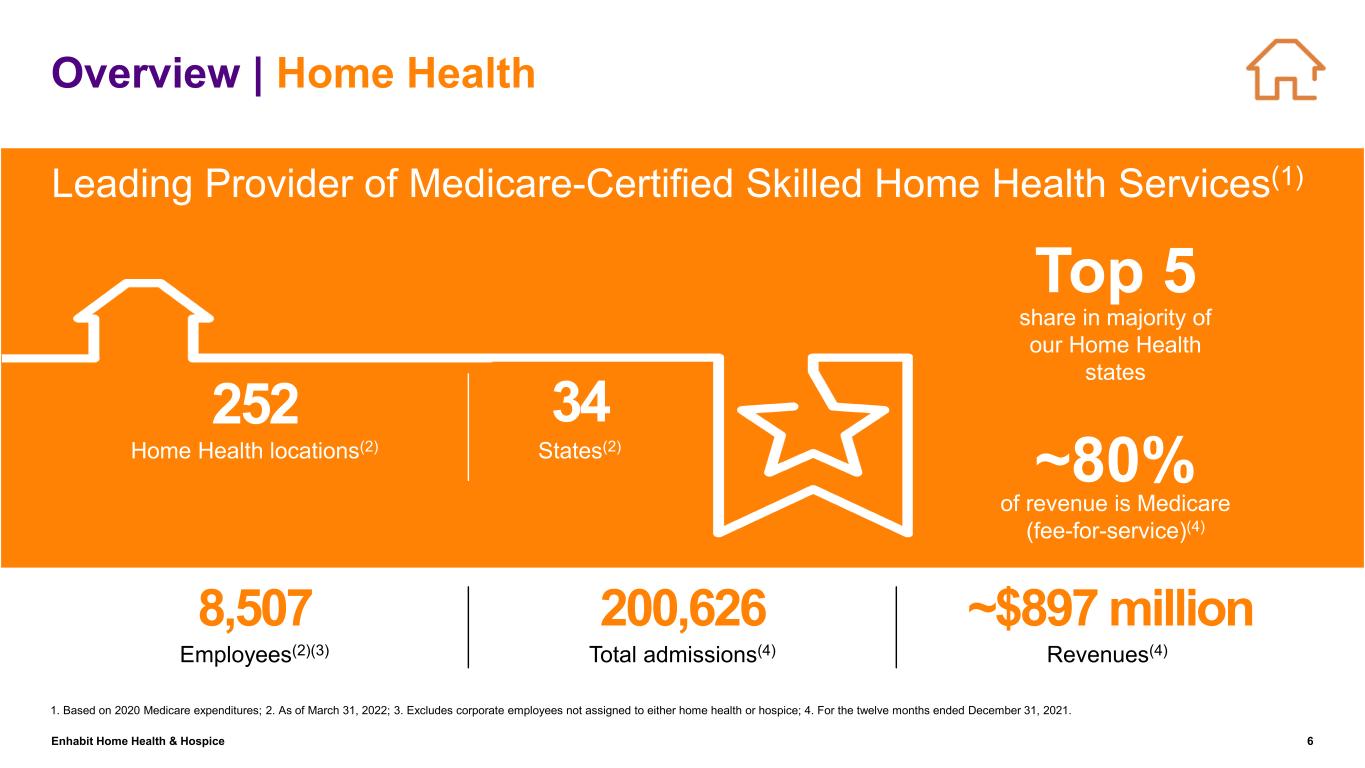

Enhabit Home Health & Hospice 6 Overview | Home Health Based on 2019 Medicare expenditures As of June 30, 2021 Excludes corporate employees not assigned to either home health or hospice Trailing 12 months through June 30, 2021 Leading Provider of Medicare-Certified Skilled Home Health Services(1) 252 Home Health locations(2) ~$897 million Revenues(4) 8,507 Employees(2)(3) share in majority of our Home Health states Top 5 ~80% of revenue is Medicare (fee-for-service)(4) 200,626 Total admissions(4) 1. Based on 2020 Medicare expenditures; 2. As of March 31, 2022; 3. Excludes corporate employees not assigned to either home health or hospice; 4. For the twelve months ended December 31, 2021. 34 States(2)

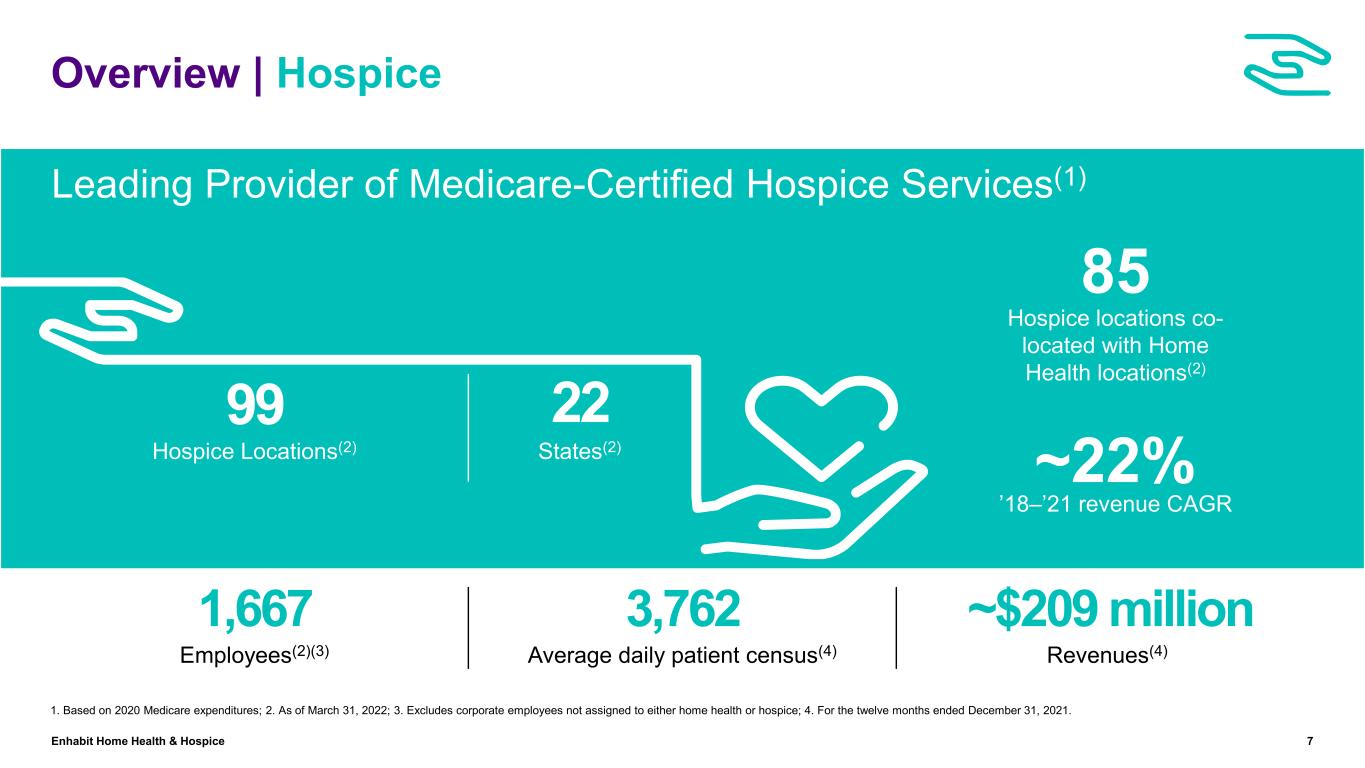

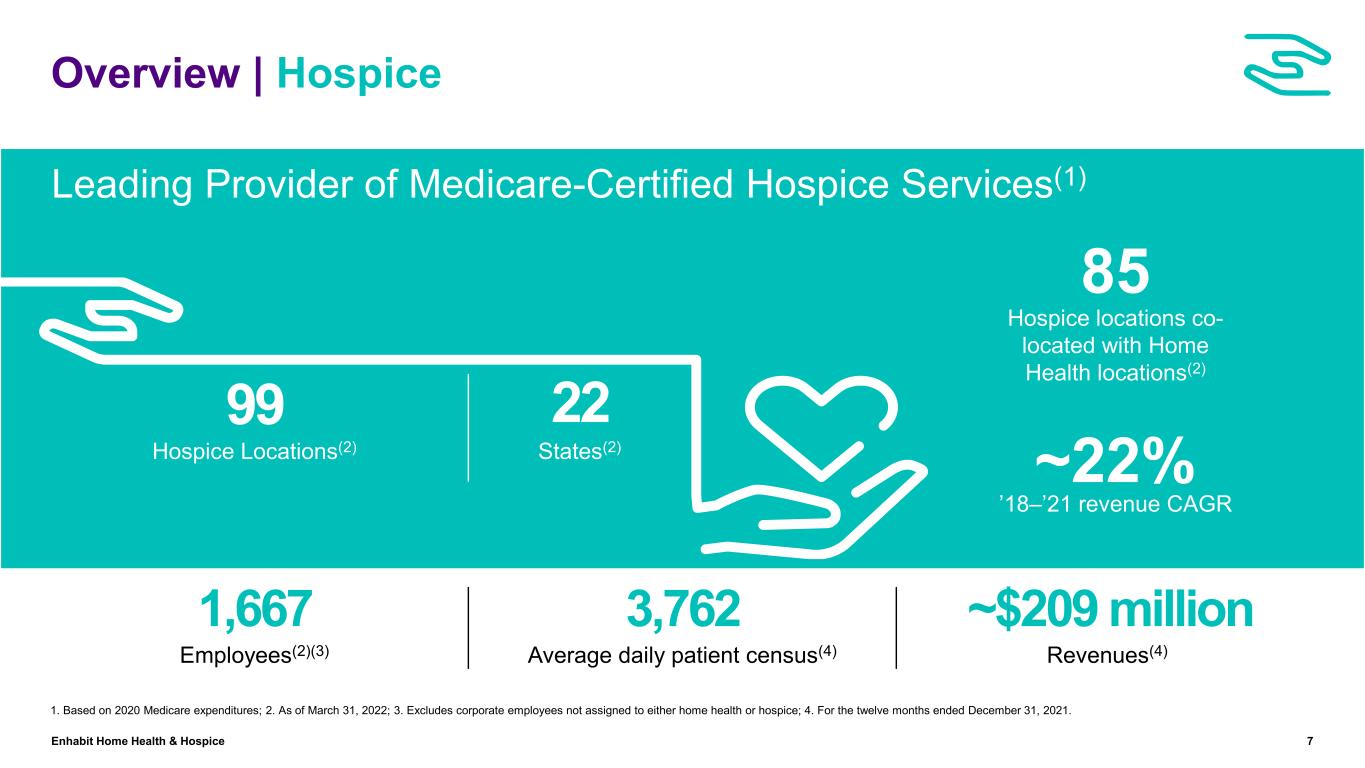

Enhabit Home Health & Hospice 7 Overview | Hospice 1. Based on 2020 Medicare expenditures; 2. As of March 31, 2022; 3. Excludes corporate employees not assigned to either home health or hospice; 4. For the twelve months ended December 31, 2021. Leading Provider of Medicare-Certified Hospice Services(1) ~$209 million Revenues(4) 1,667 Employees(2)(3) Hospice locations co- located with Home Health locations(2) 85 ~22% ’18–’21 revenue CAGR 3,762 Average daily patient census(4) 99 Hospice Locations(2) 22 States(2)

Enhabit Home Health & Hospice 8 Active History of Growth and Expansion Initiatives… Home Health & Hospice Locations Over Time Note: Acquired locations include incremental acquisitions to the headline transaction. Note: As of year-end except Q1 2022. 1. The 2019–2020 decline is due to the merging of certain Home Health and Hospice locations. # of Acquired Locations 59 13 14 38 48 1 22 2 # of De Novos 6 5 2 7 4 2 3 2 (1) Acquisitions 140 186 188 200 220 245 241 251 252 20 27 35 37 58 83 82 96 99 160 213 223 237 278 328 323 347 351 2014 2015 2016 2017 2018 2019 2020 2021 Q1 2022 Home Health Hospice

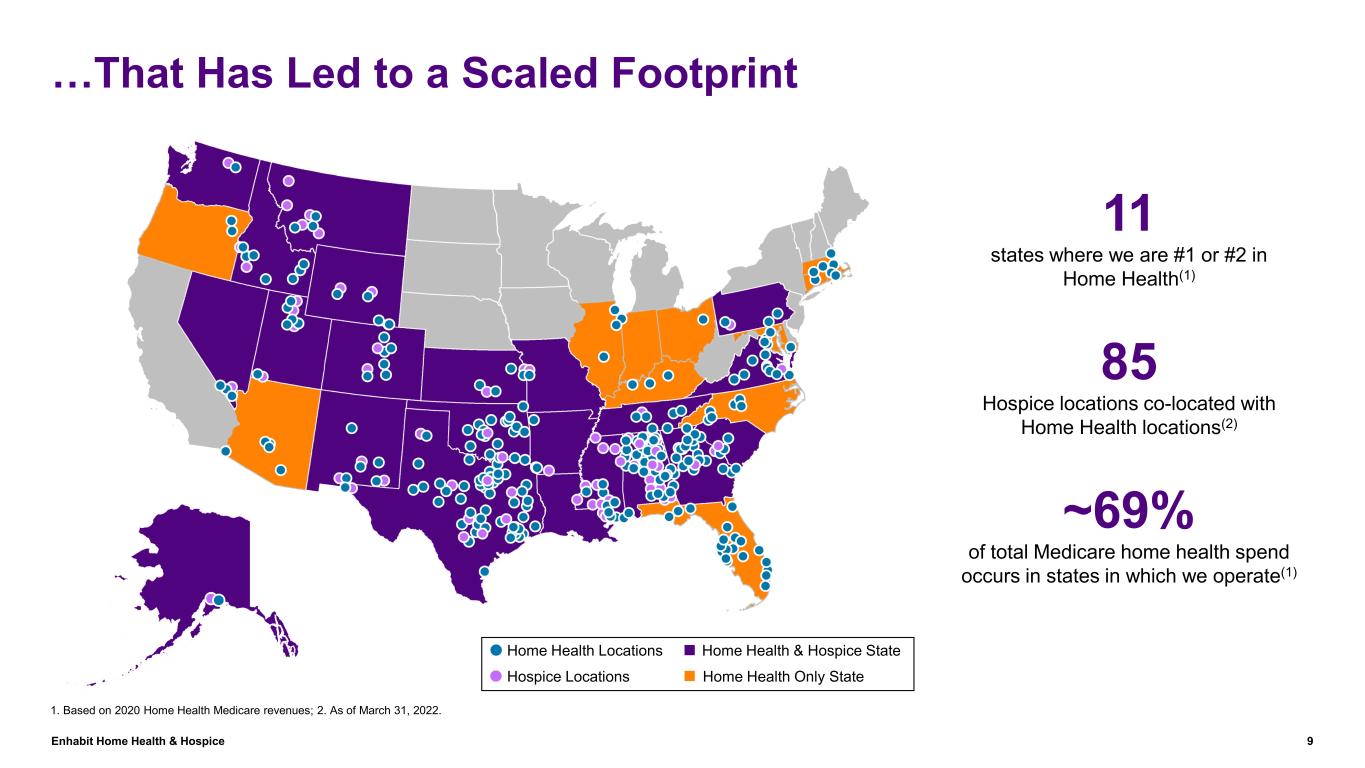

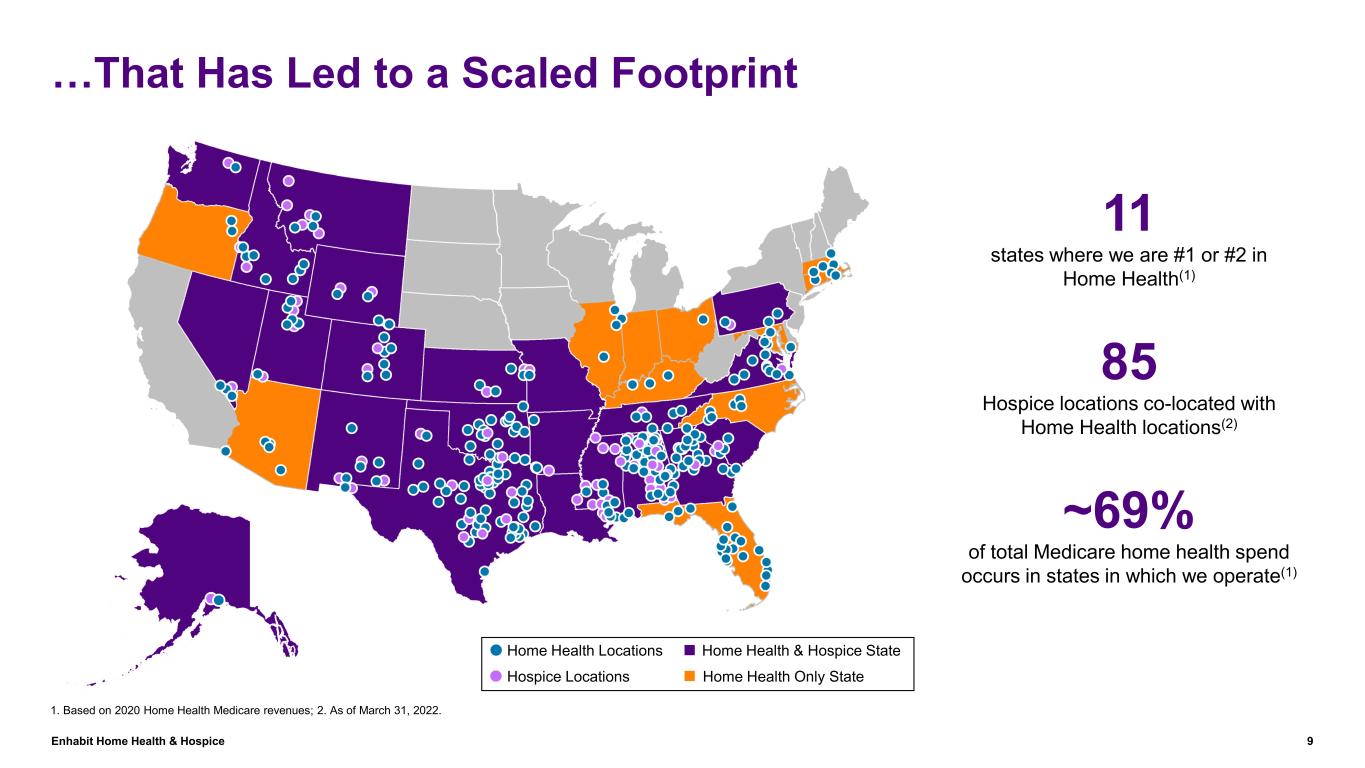

Enhabit Home Health & Hospice 9 …That Has Led to a Scaled Footprint 1. Based on 2020 Home Health Medicare revenues; 2. As of March 31, 2022. 11 states where we are #1 or #2 in Home Health(1) 85 Hospice locations co-located with Home Health locations(2) ~69% of total Medicare home health spend occurs in states in which we operate(1) Home Health Locations Hospice Locations Home Health & Hospice State Home Health Only State

Enhabit Home Health & Hospice 10 Industry Overview 2

Enhabit Home Health & Hospice 11 Industry Opportunity • In 2020, ~$124 billion(1) was spent on broader home health expenditures. This is expected to grow at a 6.3% CAGR until at least 2028 • Medicare skilled home health and hospice expenditures in 2020 were ~$17 billion and ~$22 billion, respectively • On a national basis: − 44% of Medicare beneficiaries chose a Medicare Advantage plan over traditional Medicare in November 2021 on a 12-month rolling basis − Total Medicare Advantage beneficiaries grew ~12% year over year Key Highlights 2028 home health expenditures ~$201bn(1) 2028 Medicare skilled home health expenditures 2028 Medicare hospice expenditures ~$32bn Medicare beneficiaries choosing MA in 2030 51%~$41bn Source: Centers for Medicare & Medicaid Services, Medicare Trustees’ Report Nov 2021. 1. 2020 National Health Expenditures reported by Centers for Medicare & Medicaid Services.

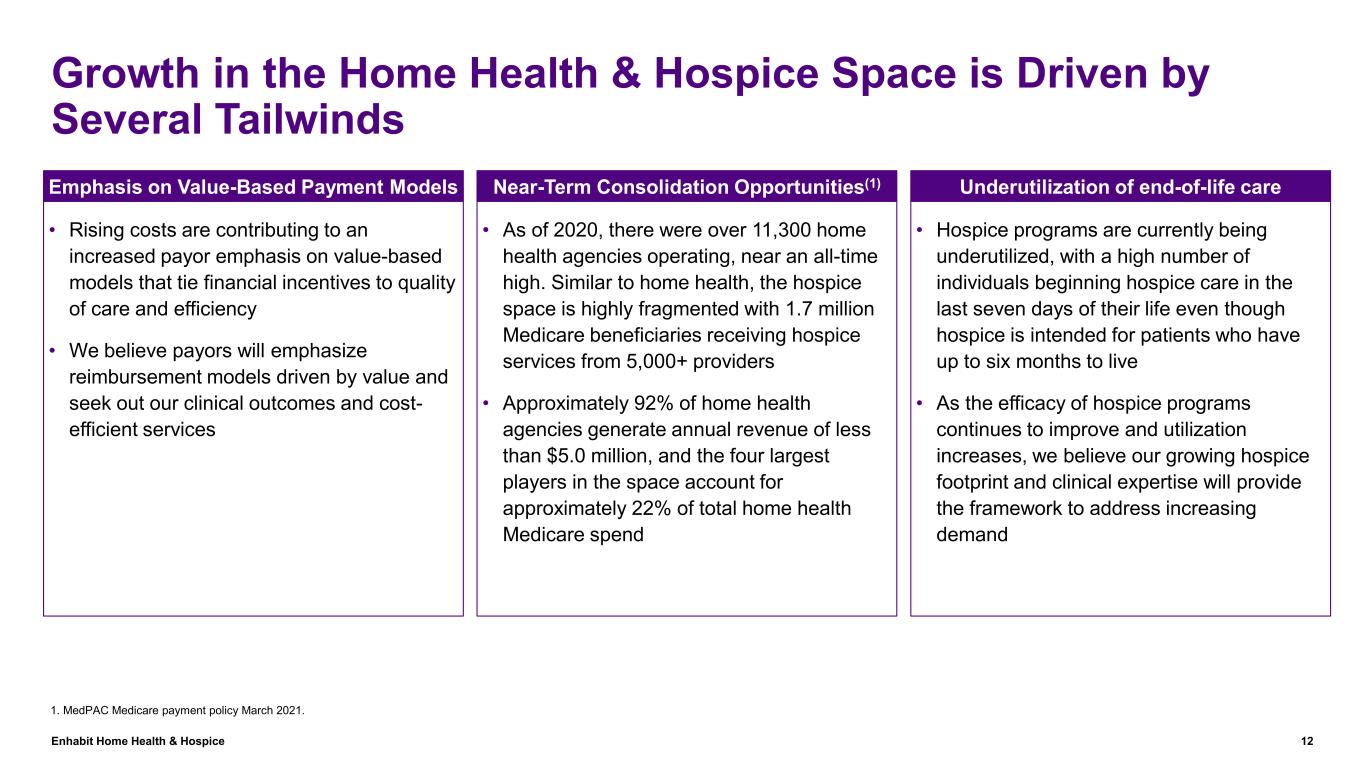

Enhabit Home Health & Hospice 12 Growth in the Home Health & Hospice Space is Driven by Several Tailwinds • As of 2020, there were over 11,300 home health agencies operating, near an all-time high. Similar to home health, the hospice space is highly fragmented with 1.7 million Medicare beneficiaries receiving hospice services from 5,000+ providers • Approximately 92% of home health agencies generate annual revenue of less than $5.0 million, and the four largest players in the space account for approximately 22% of total home health Medicare spend Near-Term Consolidation Opportunities(1) • Hospice programs are currently being underutilized, with a high number of individuals beginning hospice care in the last seven days of their life even though hospice is intended for patients who have up to six months to live • As the efficacy of hospice programs continues to improve and utilization increases, we believe our growing hospice footprint and clinical expertise will provide the framework to address increasing demand Underutilization of end-of-life care • Rising costs are contributing to an increased payor emphasis on value-based models that tie financial incentives to quality of care and efficiency • We believe payors will emphasize reimbursement models driven by value and seek out our clinical outcomes and cost- efficient services Emphasis on Value-Based Payment Models 1. MedPAC Medicare payment policy March 2021.

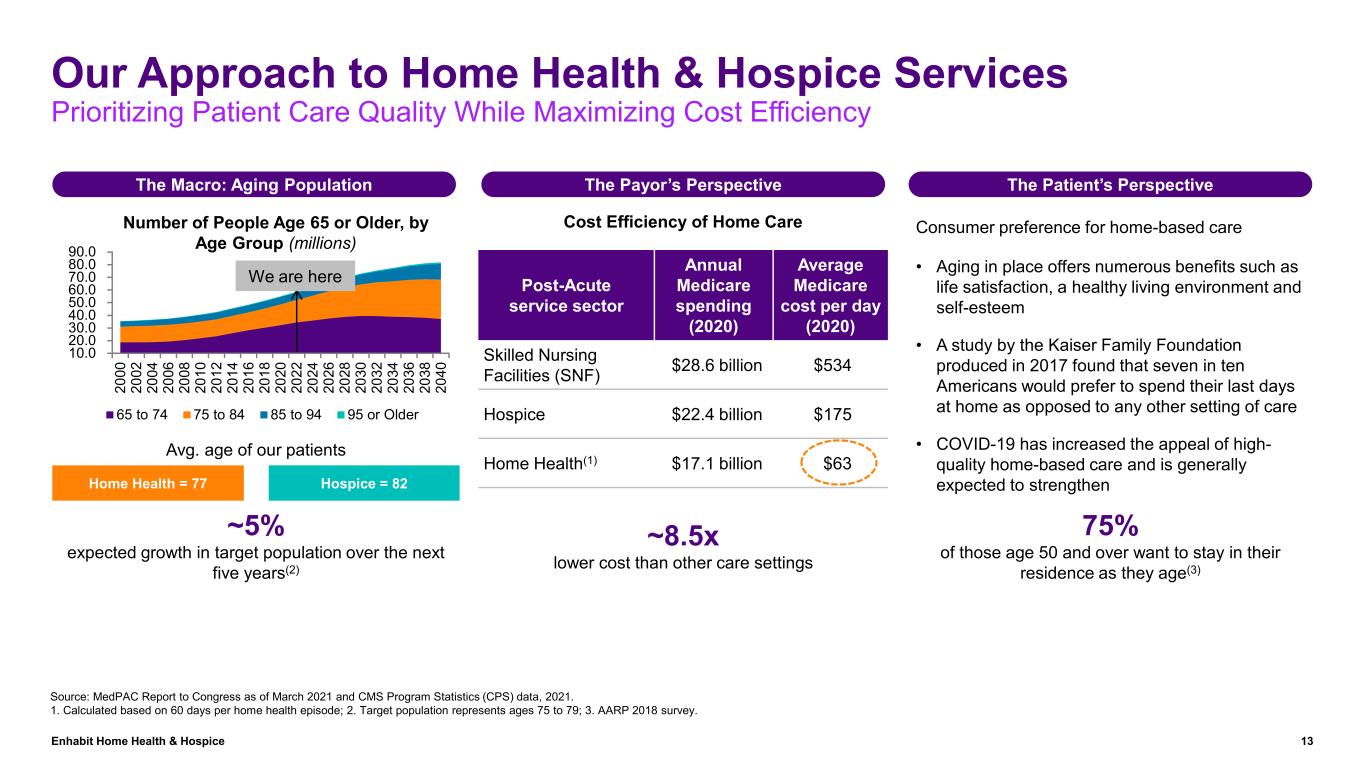

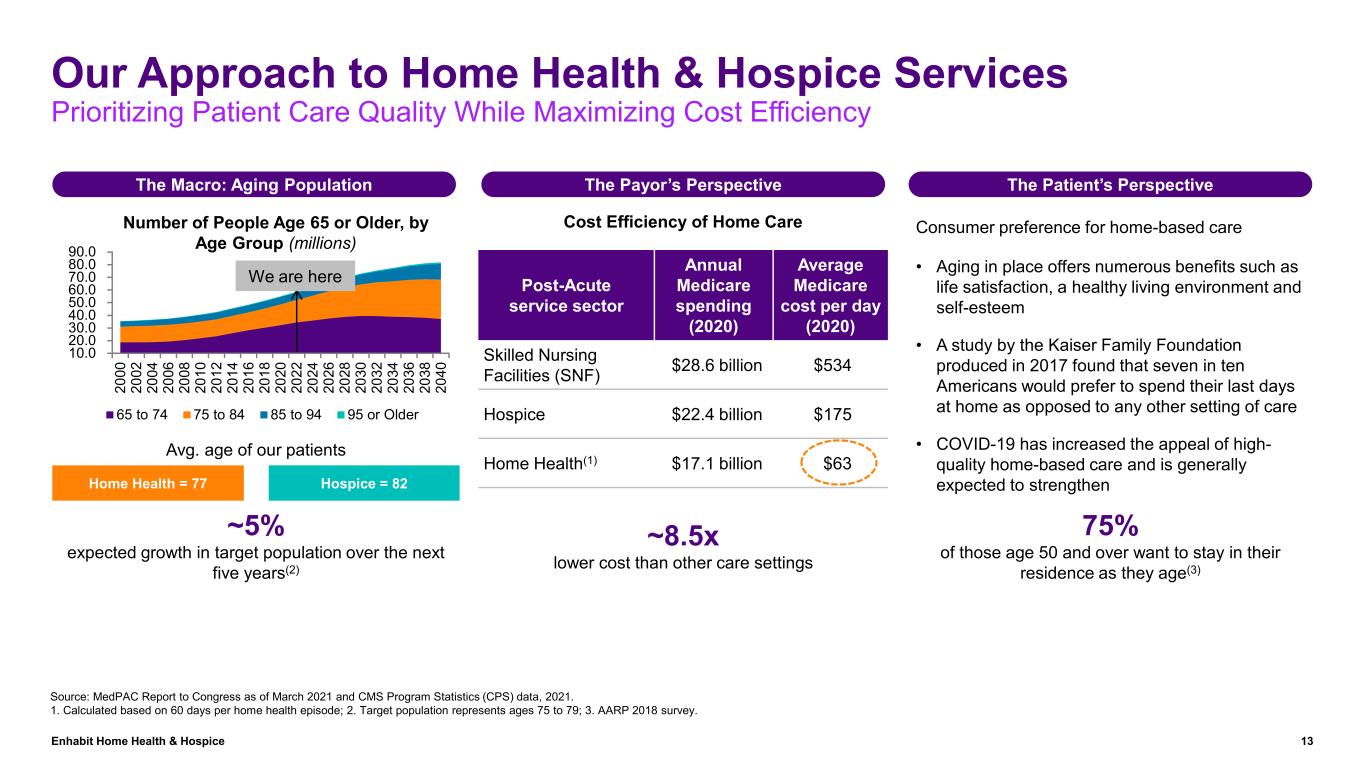

Enhabit Home Health & Hospice 13 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 90.0 20 00 20 02 20 04 20 06 20 08 20 10 20 12 20 14 20 16 20 18 20 20 20 22 20 24 20 26 20 28 20 30 20 32 20 34 20 36 20 38 20 40 65 to 74 75 to 84 85 to 94 95 or Older Our Approach to Home Health & Hospice Services Prioritizing Patient Care Quality While Maximizing Cost Efficiency We are here Cost Efficiency of Home Care Post-Acute service sector Annual Medicare spending (2020) Average Medicare cost per day (2020) Skilled Nursing Facilities (SNF) $28.6 billion $534 Hospice $22.4 billion $175 Home Health(1) $17.1 billion $63 ~8.5x lower cost than other care settings Number of People Age 65 or Older, by Age Group (millions) ~5% expected growth in target population over the next five years(2) Home Health = 77 Hospice = 82 Avg. age of our patients 75% of those age 50 and over want to stay in their residence as they age(3) Consumer preference for home-based care • Aging in place offers numerous benefits such as life satisfaction, a healthy living environment and self-esteem • A study by the Kaiser Family Foundation produced in 2017 found that seven in ten Americans would prefer to spend their last days at home as opposed to any other setting of care • COVID-19 has increased the appeal of high- quality home-based care and is generally expected to strengthen Source: MedPAC Report to Congress as of March 2021 and CMS Program Statistics (CPS) data, 2021. 1. Calculated based on 60 days per home health episode; 2. Target population represents ages 75 to 79; 3. AARP 2018 survey. The Macro: Aging Population The Payor’s Perspective The Patient’s Perspective

Enhabit Home Health & Hospice 14 Competitive Strengths & Investment Highlights 3

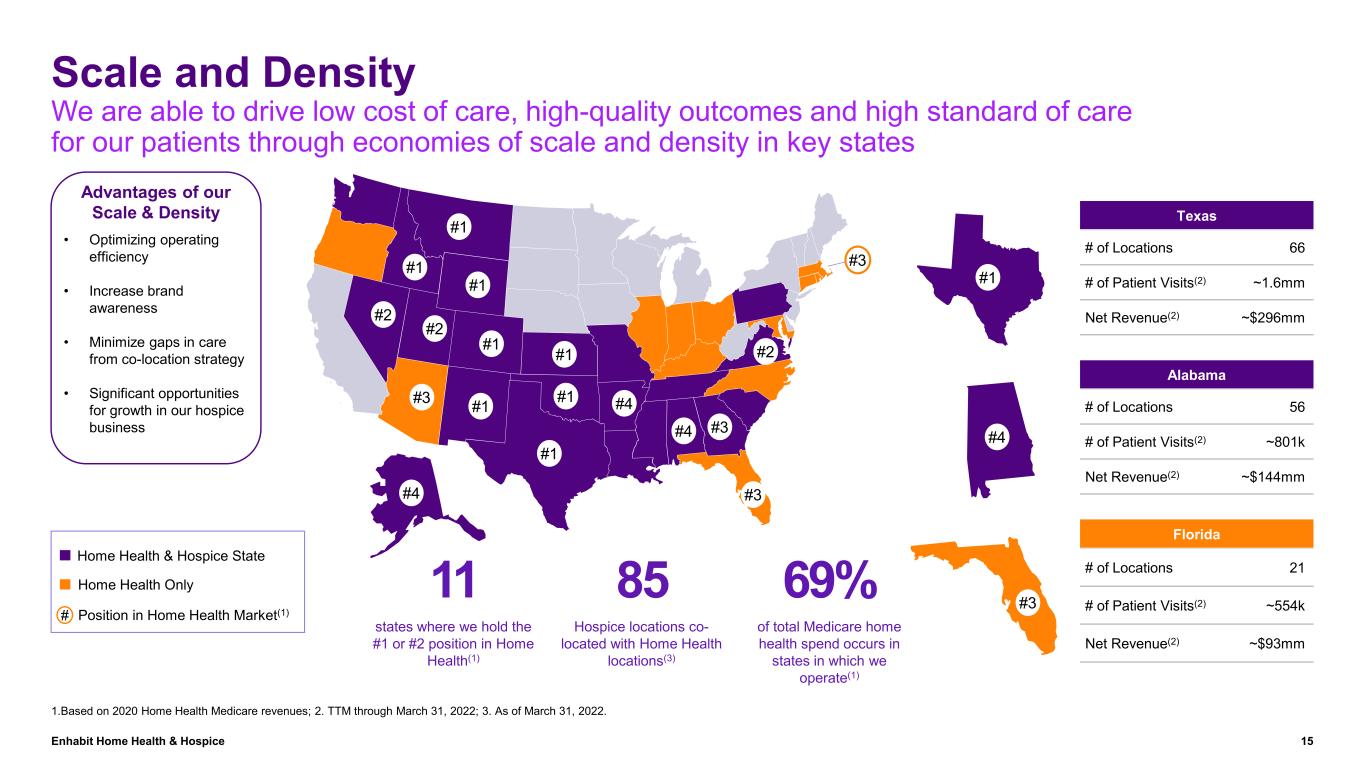

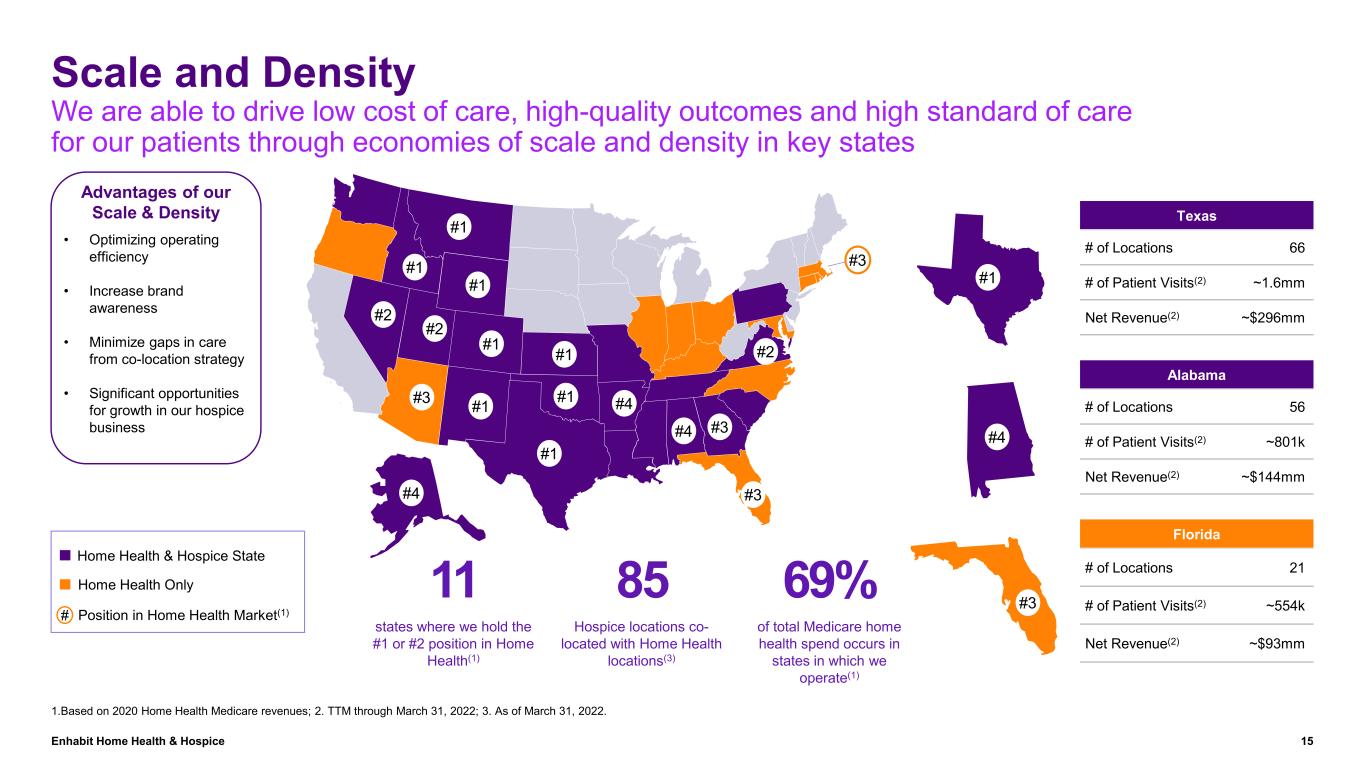

Enhabit Home Health & Hospice 15 Scale and Density We are able to drive low cost of care, high-quality outcomes and high standard of care for our patients through economies of scale and density in key states #3 #1 #1 #1 #1 #1 #1 #2 #1 #3 #2 #4 #4 #3 #2 #1 #3 11 states where we hold the #1 or #2 position in Home Health(1) 85 Hospice locations co- located with Home Health locations(3) 69% of total Medicare home health spend occurs in states in which we operate(1) Home Health & Hospice State Home Health Only # Position in Home Health Market(1) #1 #4 #3 Texas # of Locations 66 # of Patient Visits(2) ~1.6mm Net Revenue(2) ~$296mm Alabama # of Locations 56 # of Patient Visits(2) ~801k Net Revenue(2) ~$144mm Florida # of Locations 21 # of Patient Visits(2) ~554k Net Revenue(2) ~$93mm • Optimizing operating efficiency • Increase brand awareness • Minimize gaps in care from co-location strategy • Significant opportunities for growth in our hospice business Advantages of our Scale & Density 1.Based on 2020 Home Health Medicare revenues; 2. TTM through March 31, 2022; 3. As of March 31, 2022. #4

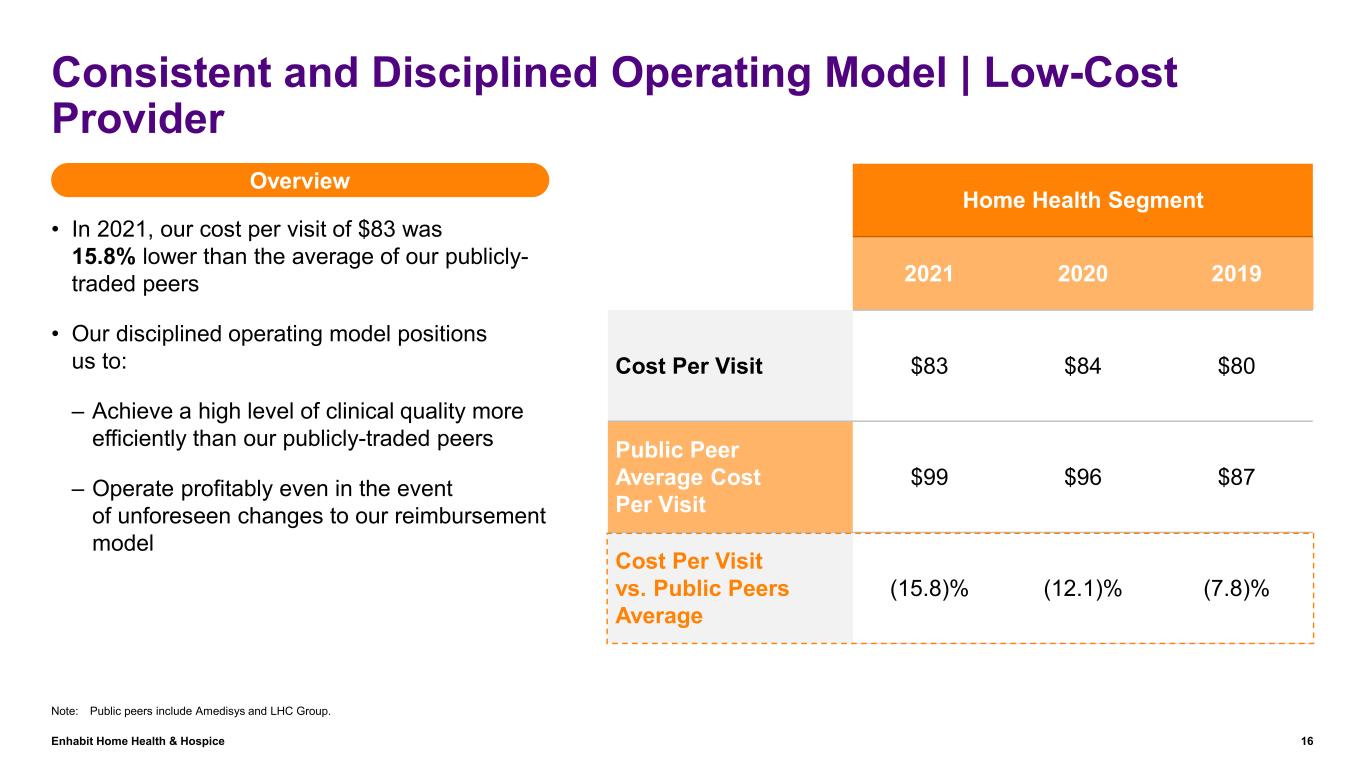

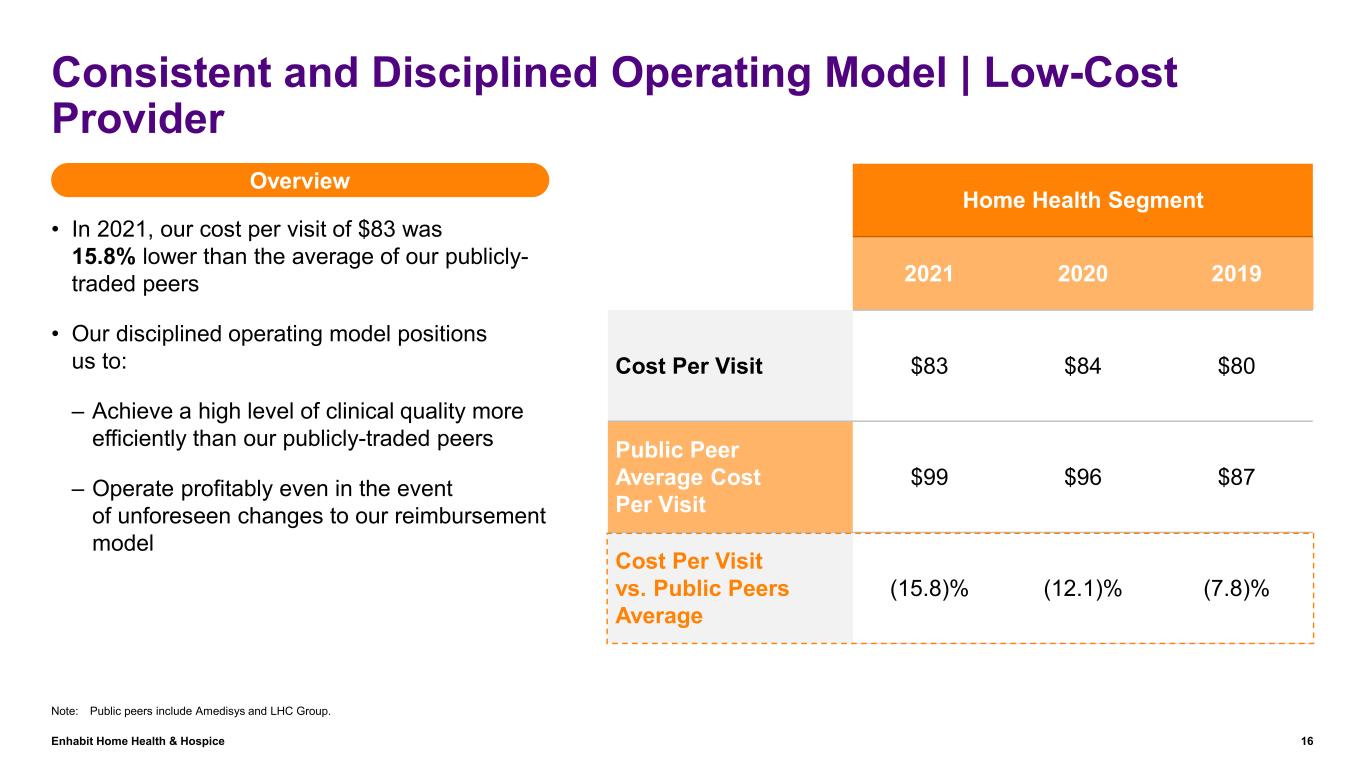

Enhabit Home Health & Hospice 16 Consistent and Disciplined Operating Model | Low-Cost Provider • In 2021, our cost per visit of $83 was 15.8% lower than the average of our publicly- traded peers • Our disciplined operating model positions us to: – Achieve a high level of clinical quality more efficiently than our publicly-traded peers – Operate profitably even in the event of unforeseen changes to our reimbursement model Home Health Segment 2021 2020 2019 Cost Per Visit $83 $84 $80 Public Peer Average Cost Per Visit $99 $96 $87 Cost Per Visit vs. Public Peers Average (15.8)% (12.1)% (7.8)% Overview Note: Public peers include Amedisys and LHC Group.

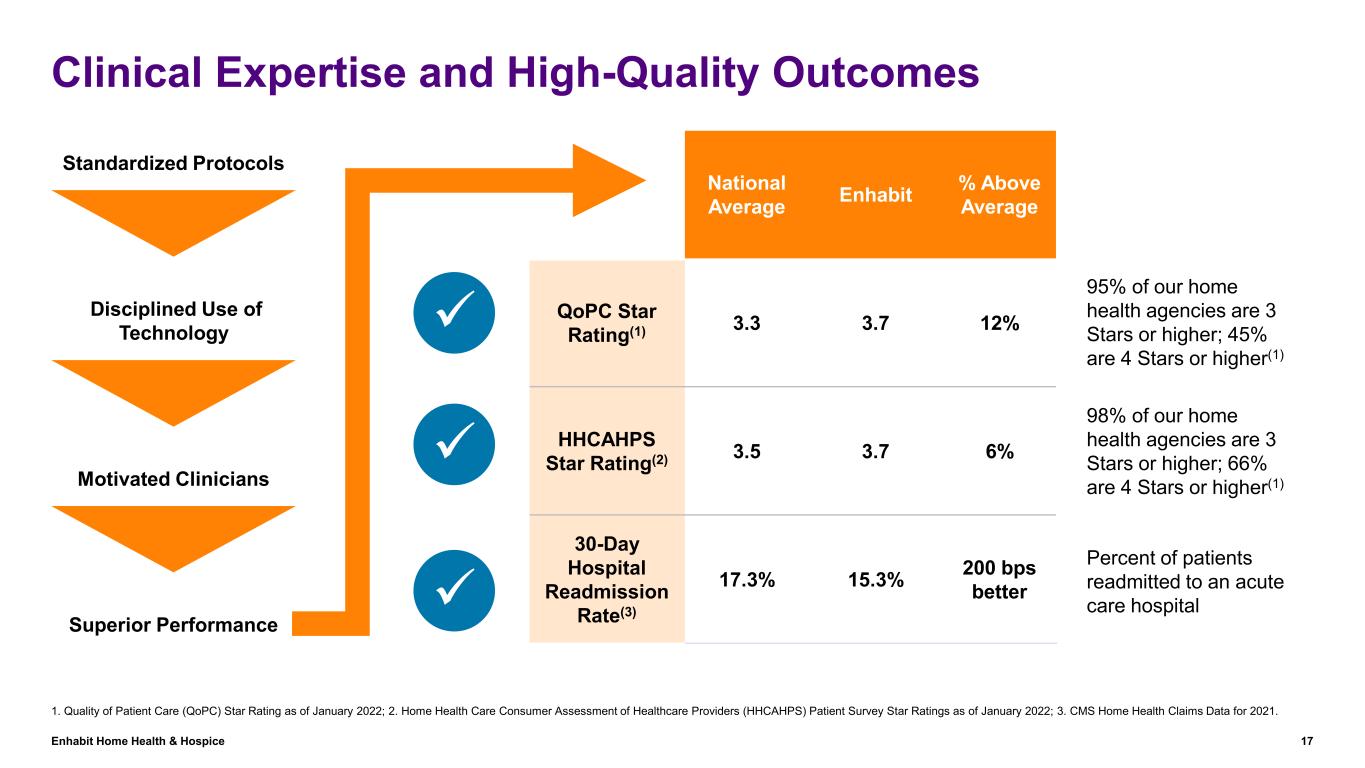

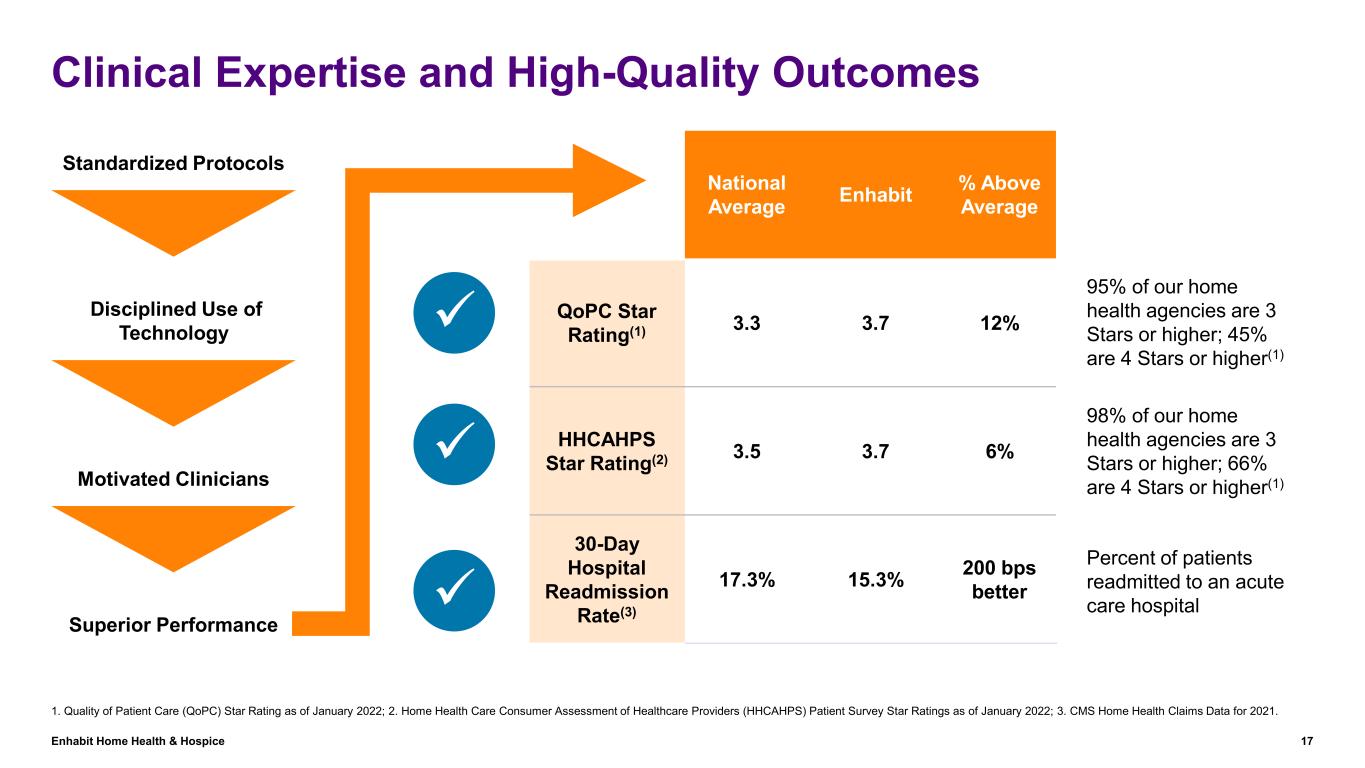

Enhabit Home Health & Hospice 17 Clinical Expertise and High-Quality Outcomes National Average Enhabit % Above Average QoPC Star Rating(1) 3.3 3.7 12% HHCAHPS Star Rating(2) 3.5 3.7 6% 30-Day Hospital Readmission Rate(3) 17.3% 15.3% 200 bps better Standardized Protocols Motivated Clinicians Disciplined Use of Technology Superior Performance 95% of our home health agencies are 3 Stars or higher; 45% are 4 Stars or higher(1) 98% of our home health agencies are 3 Stars or higher; 66% are 4 Stars or higher(1) Percent of patients readmitted to an acute care hospital 1. Quality of Patient Care (QoPC) Star Rating as of January 2022; 2. Home Health Care Consumer Assessment of Healthcare Providers (HHCAHPS) Patient Survey Star Ratings as of January 2022; 3. CMS Home Health Claims Data for 2021.

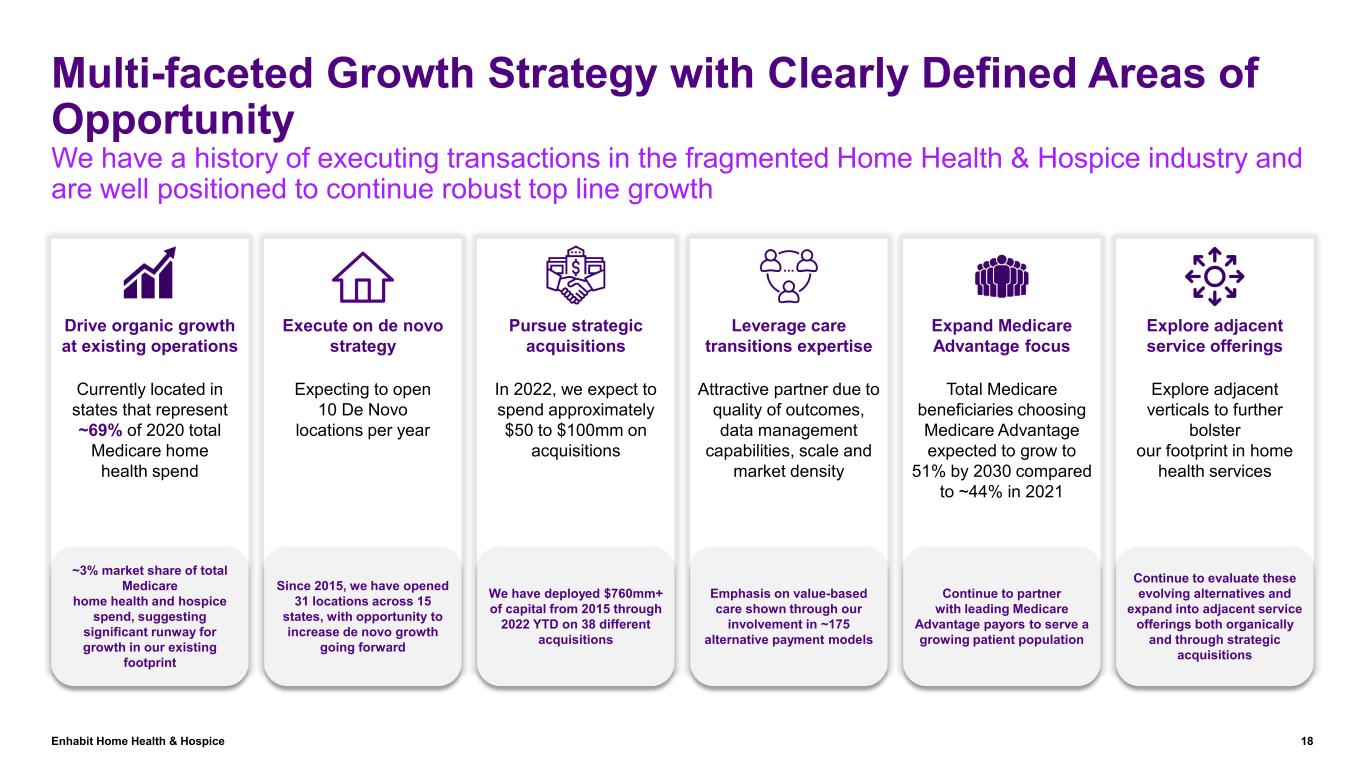

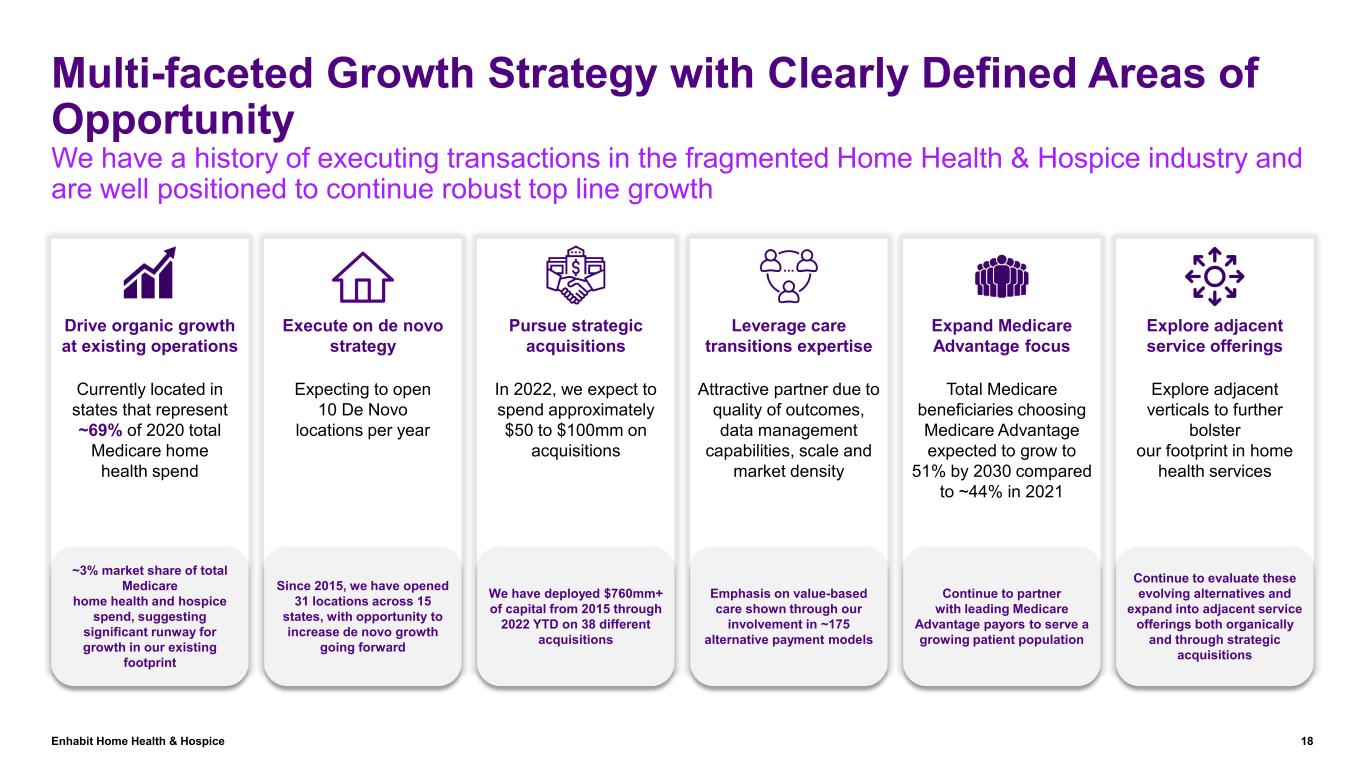

Enhabit Home Health & Hospice 18 Multi-faceted Growth Strategy with Clearly Defined Areas of Opportunity We have a history of executing transactions in the fragmented Home Health & Hospice industry and are well positioned to continue robust top line growth Drive organic growth at existing operations Execute on de novo strategy Pursue strategic acquisitions Leverage care transitions expertise Expand Medicare Advantage focus Explore adjacent service offerings Currently located in states that represent ~69% of 2020 total Medicare home health spend Expecting to open 10 De Novo locations per year In 2022, we expect to spend approximately $50 to $100mm on acquisitions Attractive partner due to quality of outcomes, data management capabilities, scale and market density Total Medicare beneficiaries choosing Medicare Advantage expected to grow to 51% by 2030 compared to ~44% in 2021 Explore adjacent verticals to further bolster our footprint in home health services ~3% market share of total Medicare home health and hospice spend, suggesting significant runway for growth in our existing footprint Since 2015, we have opened 31 locations across 15 states, with opportunity to increase de novo growth going forward We have deployed $760mm+ of capital from 2015 through 2022 YTD on 38 different acquisitions Emphasis on value-based care shown through our involvement in ~175 alternative payment models Continue to partner with leading Medicare Advantage payors to serve a growing patient population Continue to evaluate these evolving alternatives and expand into adjacent service offerings both organically and through strategic acquisitions

Enhabit Home Health & Hospice 19 Company Overview 4

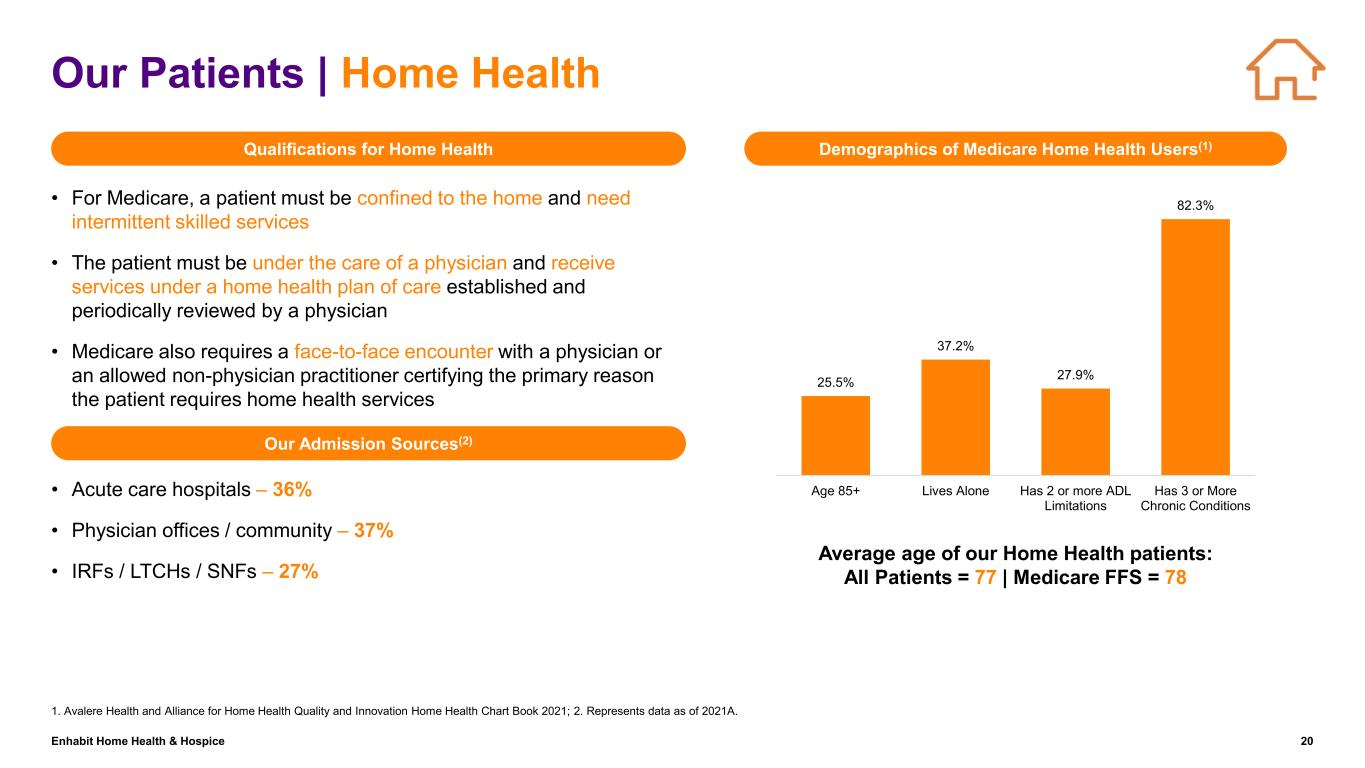

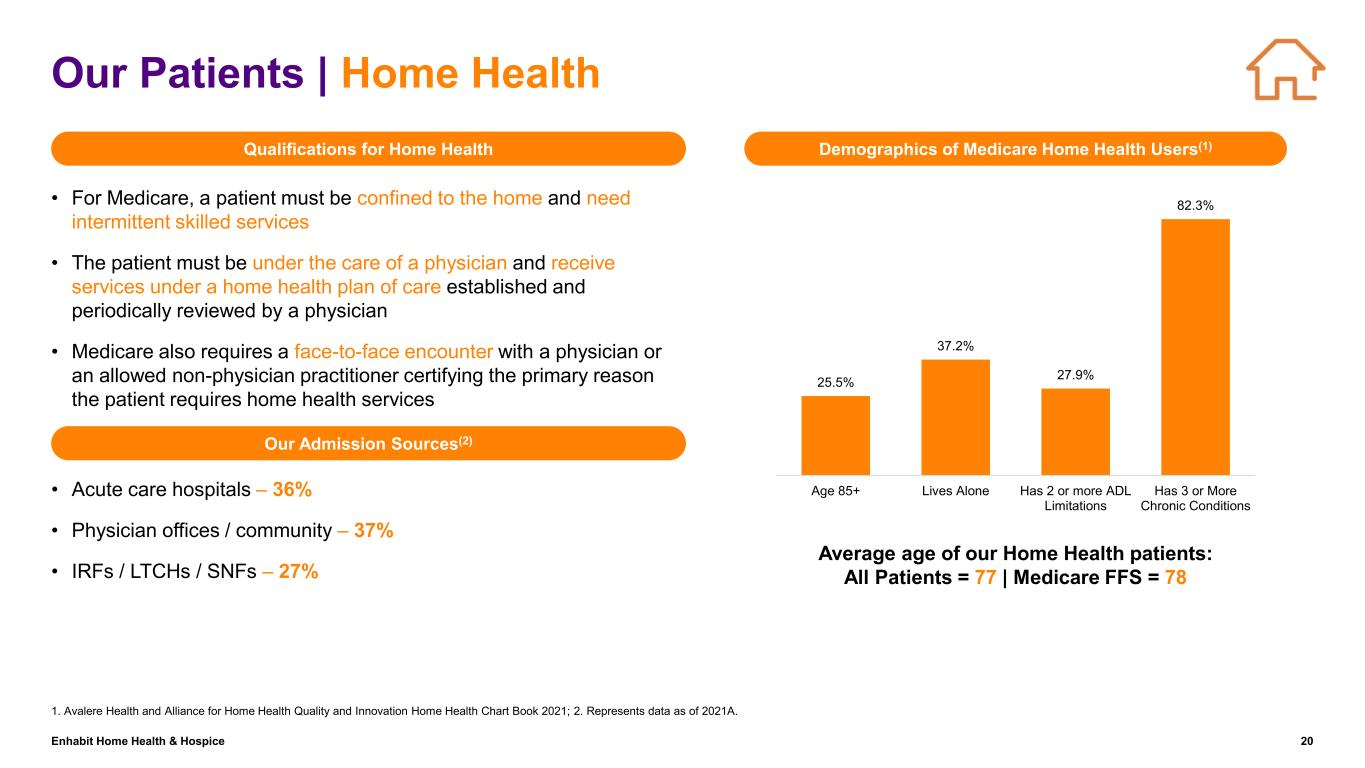

Enhabit Home Health & Hospice 20 Our Patients | Home Health 1. Avalere Health and Alliance for Home Health Quality and Innovation Home Health Chart Book 2021; 2. Represents data as of 2021A. • For Medicare, a patient must be confined to the home and need intermittent skilled services • The patient must be under the care of a physician and receive services under a home health plan of care established and periodically reviewed by a physician • Medicare also requires a face-to-face encounter with a physician or an allowed non-physician practitioner certifying the primary reason the patient requires home health services • Acute care hospitals – 36% • Physician offices / community – 37% • IRFs / LTCHs / SNFs – 27% Average age of our Home Health patients: All Patients = 77 | Medicare FFS = 78 Demographics of Medicare Home Health Users(1)Qualifications for Home Health Our Admission Sources(2) 25.5% 37.2% 27.9% 82.3% Age 85+ Lives Alone Has 2 or more ADL Limitations Has 3 or More Chronic Conditions

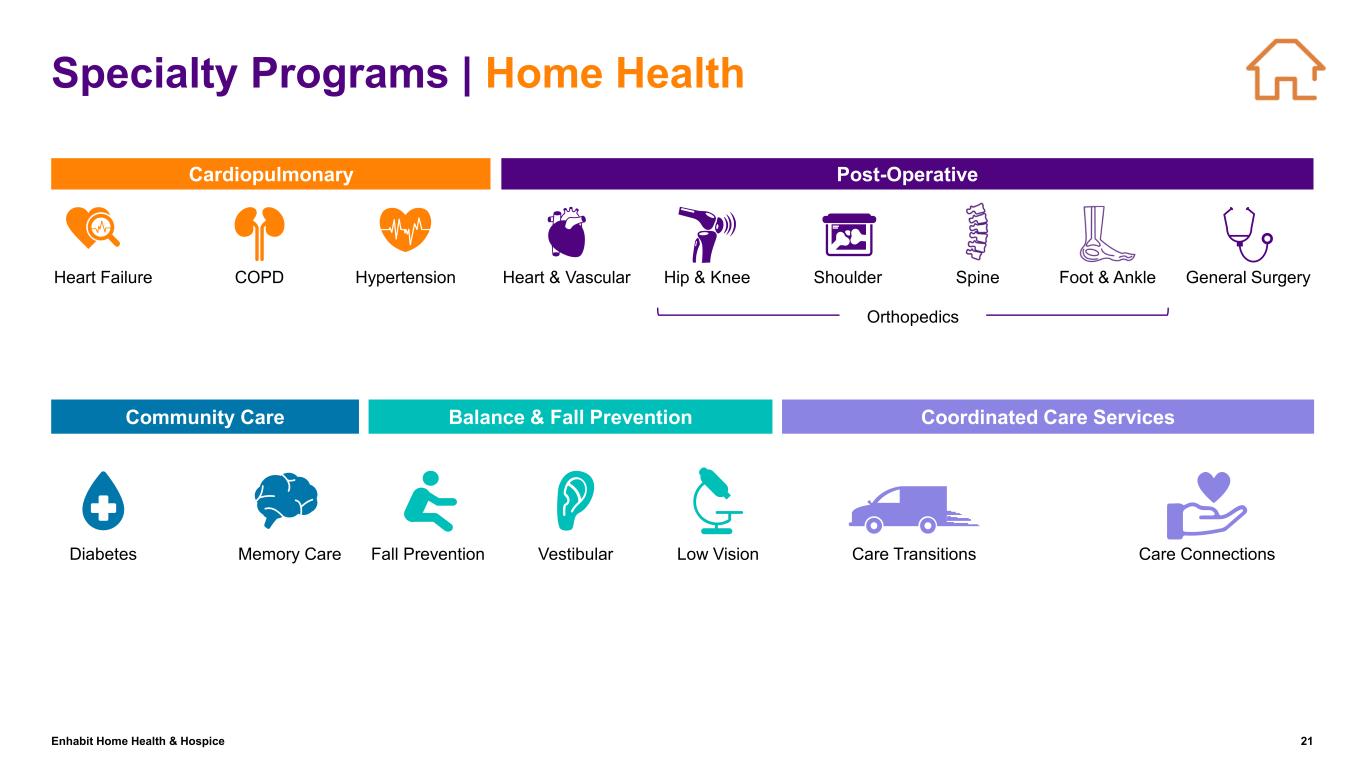

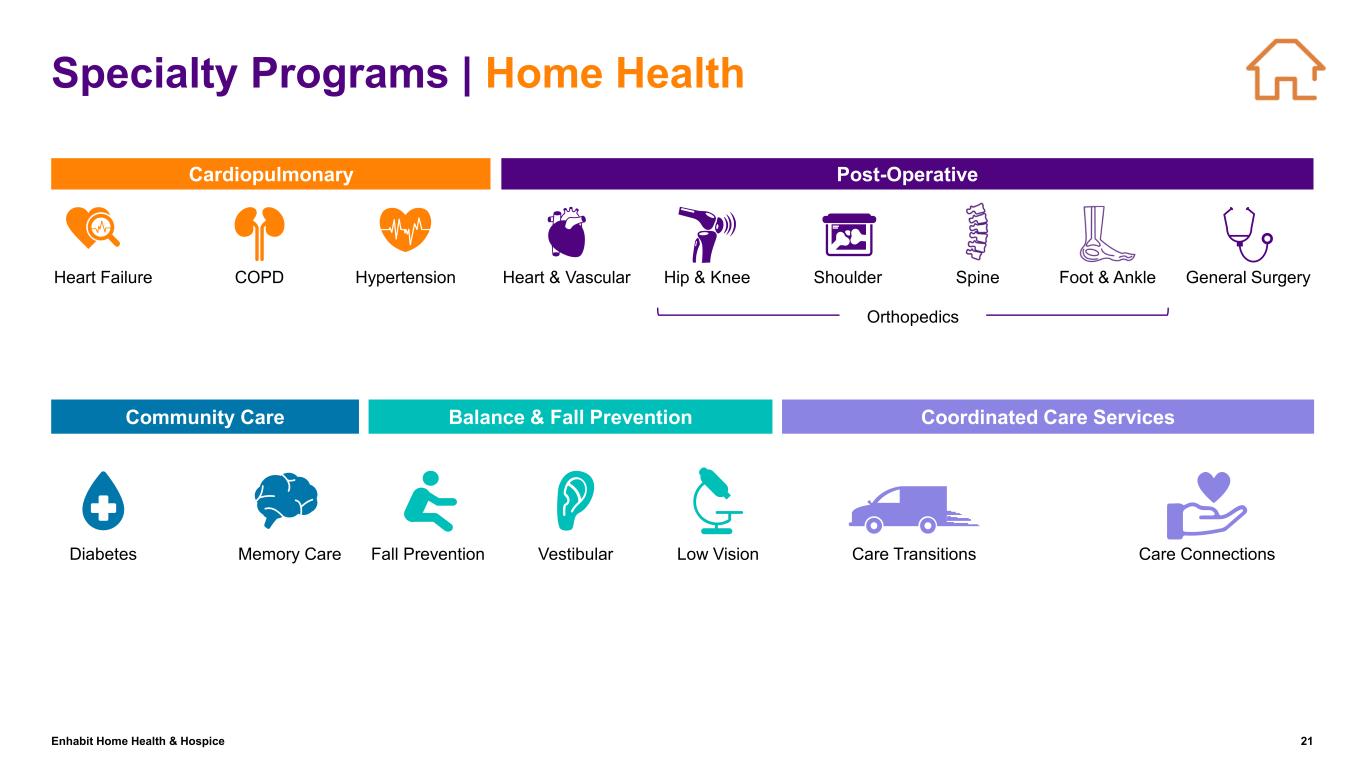

Enhabit Home Health & Hospice 21 Specialty Programs | Home Health Cardiopulmonary Post-Operative Community Care Balance & Fall Prevention Coordinated Care Services Heart Failure COPD Hypertension Heart & Vascular Hip & Knee Shoulder Spine Foot & Ankle General Surgery Orthopedics Diabetes Memory Care Fall Prevention Vestibular Low Vision Care Transitions Care Connections

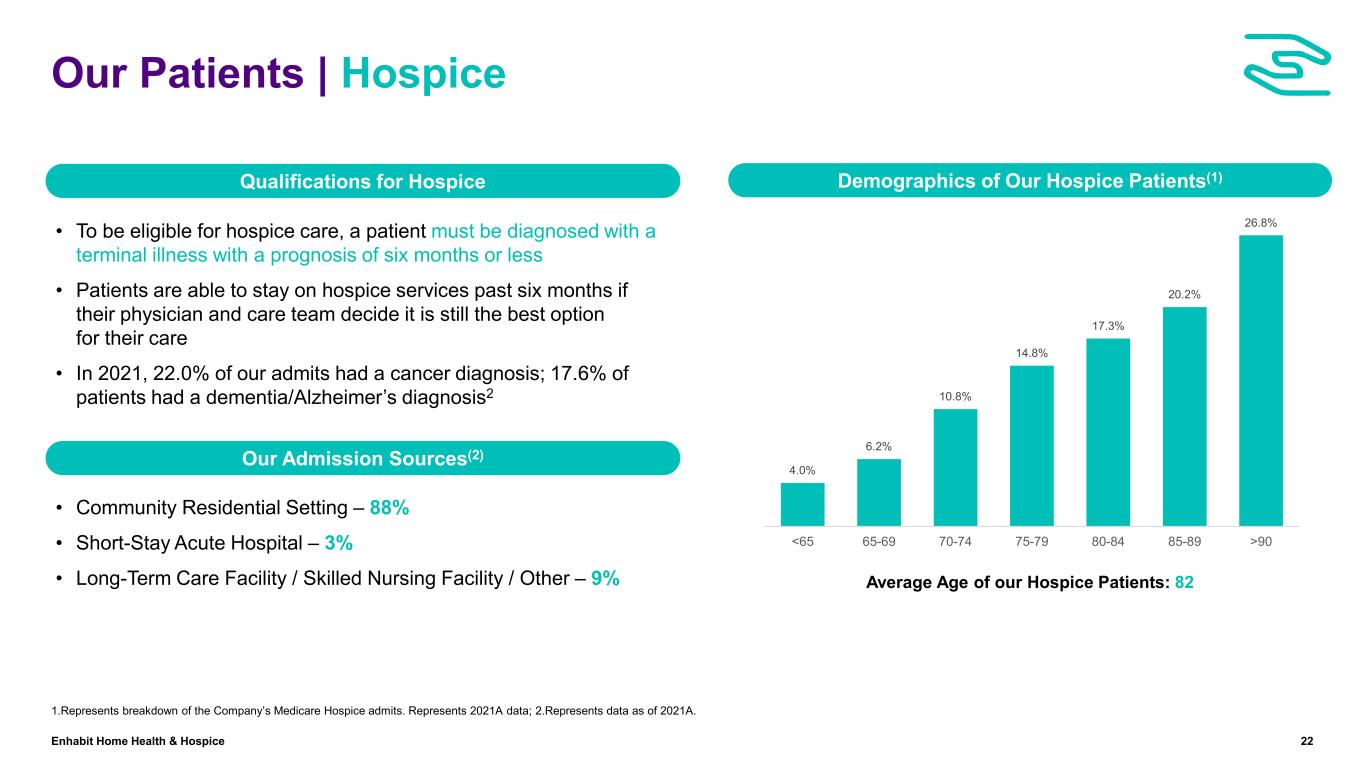

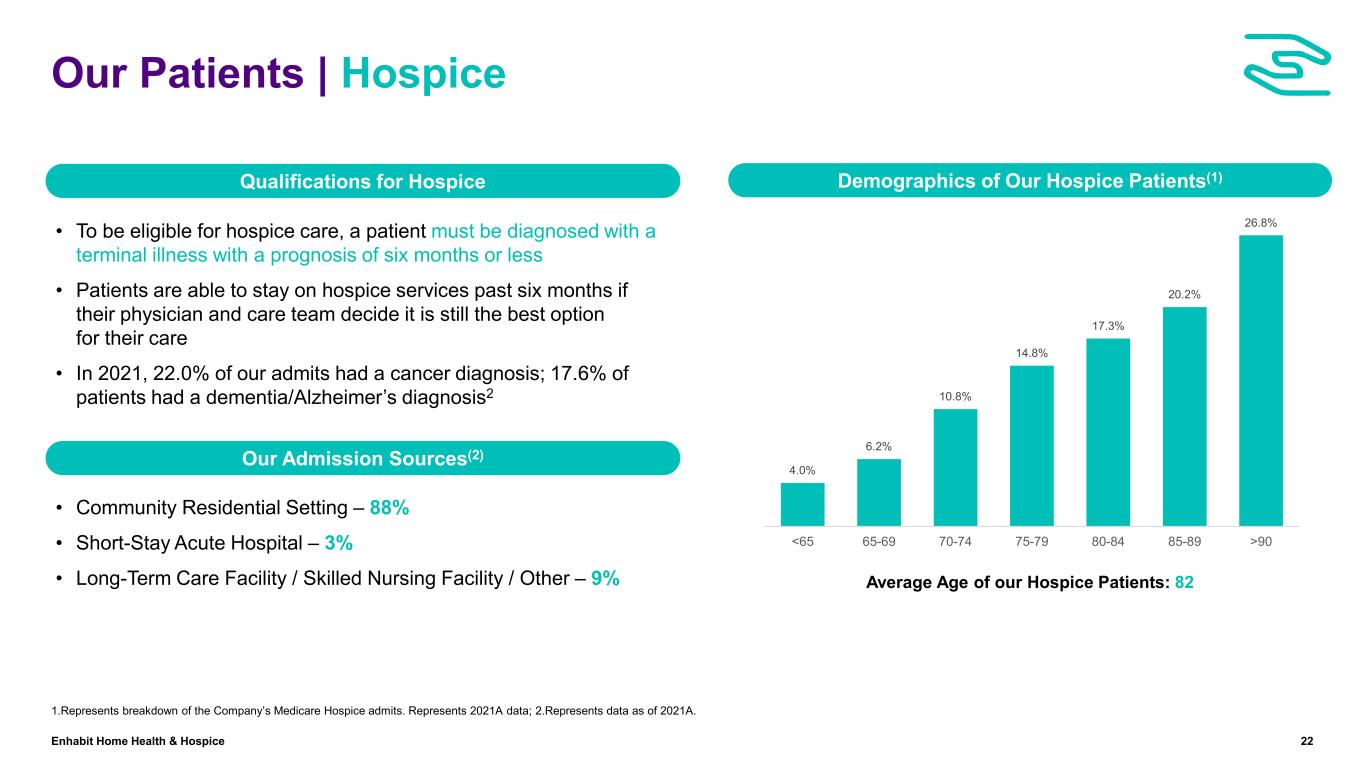

Enhabit Home Health & Hospice 22 Our Patients | Hospice • To be eligible for hospice care, a patient must be diagnosed with a terminal illness with a prognosis of six months or less • Patients are able to stay on hospice services past six months if their physician and care team decide it is still the best option for their care • In 2021, 22.0% of our admits had a cancer diagnosis; 17.6% of patients had a dementia/Alzheimer’s diagnosis2 1.Represents breakdown of the Company’s Medicare Hospice admits. Represents 2021A data; 2.Represents data as of 2021A. • Community Residential Setting – 88% • Short-Stay Acute Hospital – 3% • Long-Term Care Facility / Skilled Nursing Facility / Other – 9% Average Age of our Hospice Patients: 82 Qualifications for Hospice Our Admission Sources(2) Demographics of Our Hospice Patients(1) 4.0% 6.2% 10.8% 14.8% 17.3% 20.2% 26.8% <65 65-69 70-74 75-79 80-84 85-89 >90

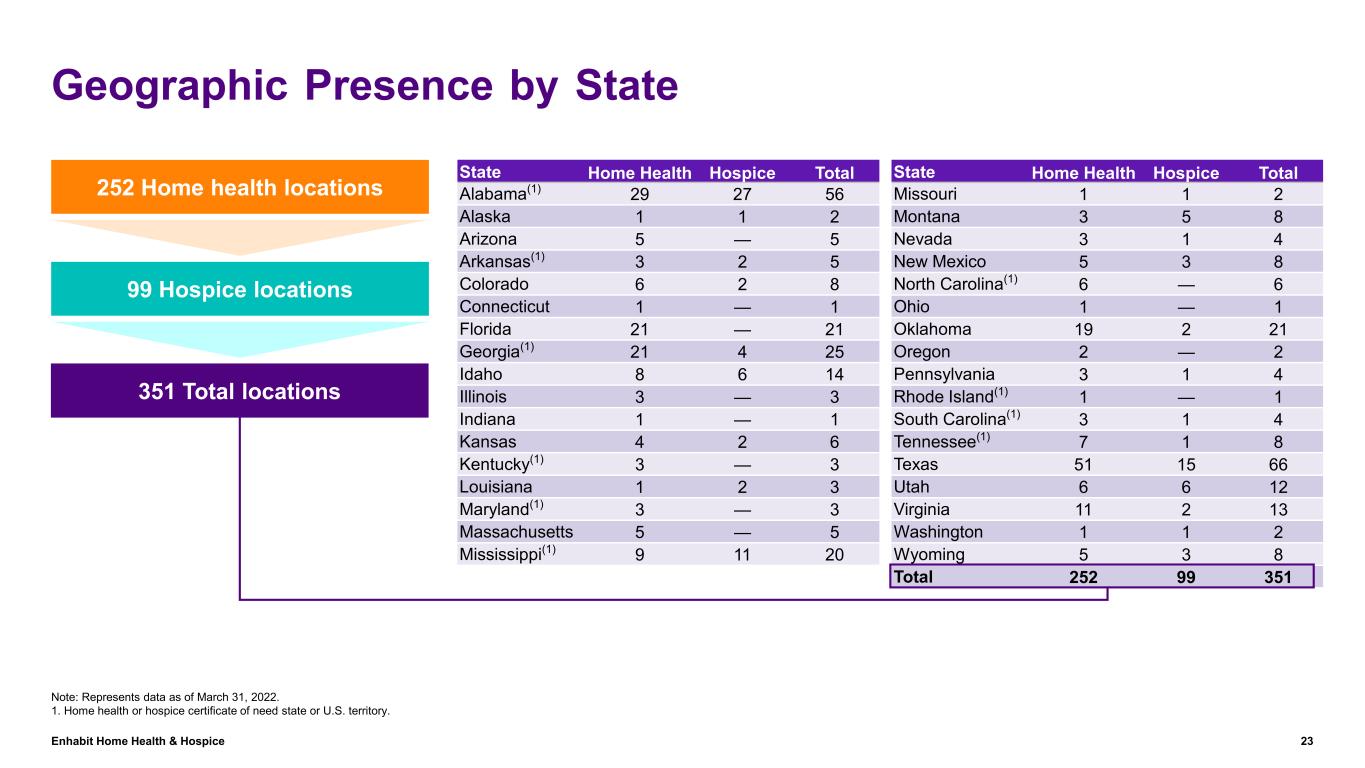

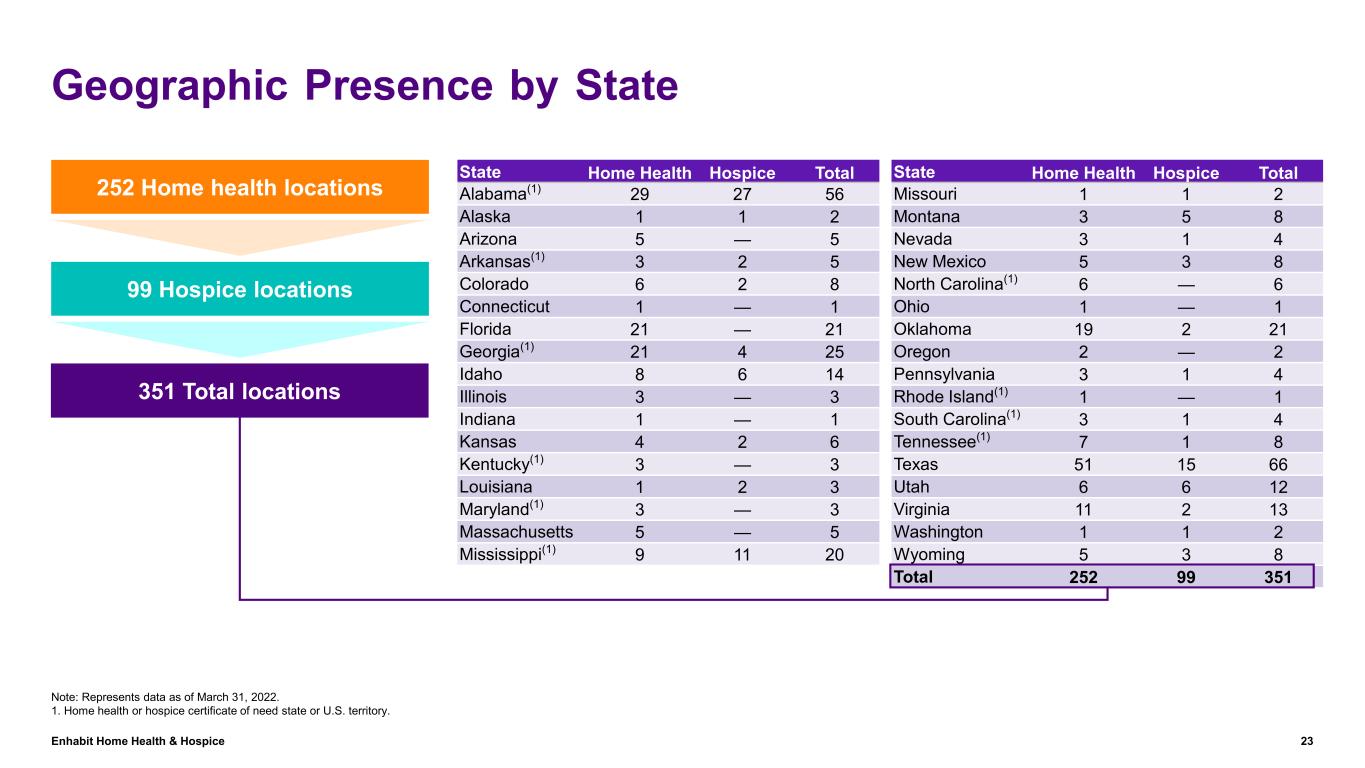

Enhabit Home Health & Hospice 23 Geographic Presence by State Note: Represents data as of March 31, 2022. 1. Home health or hospice certificate of need state or U.S. territory. State Home Health Hospice Total Missouri 1 1 2 Montana 3 5 8 Nevada 3 1 4 New Mexico 5 3 8 North Carolina(1) 6 — 6 Ohio 1 — 1 Oklahoma 19 2 21 Oregon 2 — 2 Pennsylvania 3 1 4 Rhode Island(1) 1 — 1 South Carolina(1) 3 1 4 Tennessee(1) 7 1 8 Texas 51 15 66 Utah 6 6 12 Virginia 11 2 13 Washington 1 1 2 Wyoming 5 3 8 Total 252 99 351 252 Home health locations 99 Hospice locations 351 Total locations State Home Health Hospice Total Alabama(1) 29 27 56 Alaska 1 1 2 Arizona 5 — 5 Arkansas(1) 3 2 5 Colorado 6 2 8 Connecticut 1 — 1 Florida 21 — 21 Georgia(1) 21 4 25 Idaho 8 6 14 Illinois 3 — 3 Indiana 1 — 1 Kansas 4 2 6 Kentucky(1) 3 — 3 Louisiana 1 2 3 Maryland(1) 3 — 3 Massachusetts 5 — 5 Mississippi(1) 9 11 20

Enhabit Home Health & Hospice 24 Comprehensive Compliance Program Program Overview • Our comprehensive compliance program helps ensure we meet regulatory and legal requirements applicable to our business • Process is supported by technology systems and highly coordinated workflows between all involved parties • Centralized quality assessment functions completed outside individual branches to ensure full credibility • Program is overseen by Compliance / Quality of Care Committee of our Board of Directors • Chief Compliance Officer provides regular reports to the committee 1 2 3 4 5

Enhabit Home Health & Hospice 25 Experienced Management Team Barb Jacobsmeyer, Chief Executive Officer Crissy Carlisle, Chief Financial Officer • Named CEO in June 2021 • Previously served as the Encompass Health’s Executive Vice President of Operations since 2016 • Joined Encompass Health in 2007 and has served in various executive roles including President of Encompass Health’s central region and CEO of the Rehabilitation Hospital of St. Louis • Prior to joining Encompass Health, Barb served as COO of Des Peres Hospital • Named CFO in August 2021 • Previously served as Encompass Health’s Chief Investor Relations Officer since 2015 • Joined Encompass Health in 2005 as Director of SEC Reporting • Previously served as a Director within the corporate recovery division of FTI Consulting and a Manager within PricewaterhouseCoopers LLP’s audit practice Management Team Chad Knight General Counsel Dan Peoples EVP, Sales and Marketing Jeanne Kalvaitis EVP, Hospice Operations Julie Jolley EVP, Home Health Operations Bud Langham EVP, Clinical Excellence & Strategy Tanya Marion Chief Human Resources Officer

Enhabit Home Health & Hospice 26 Financial Overview 5

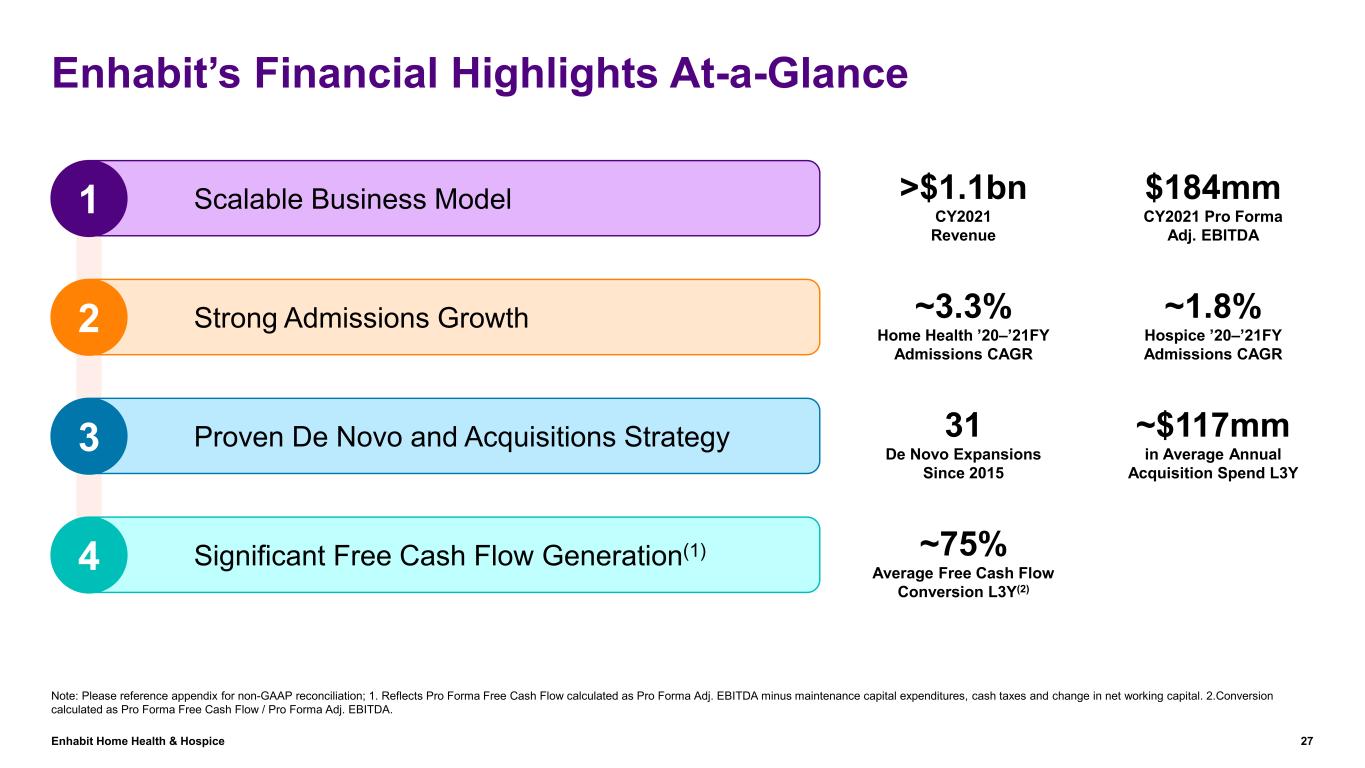

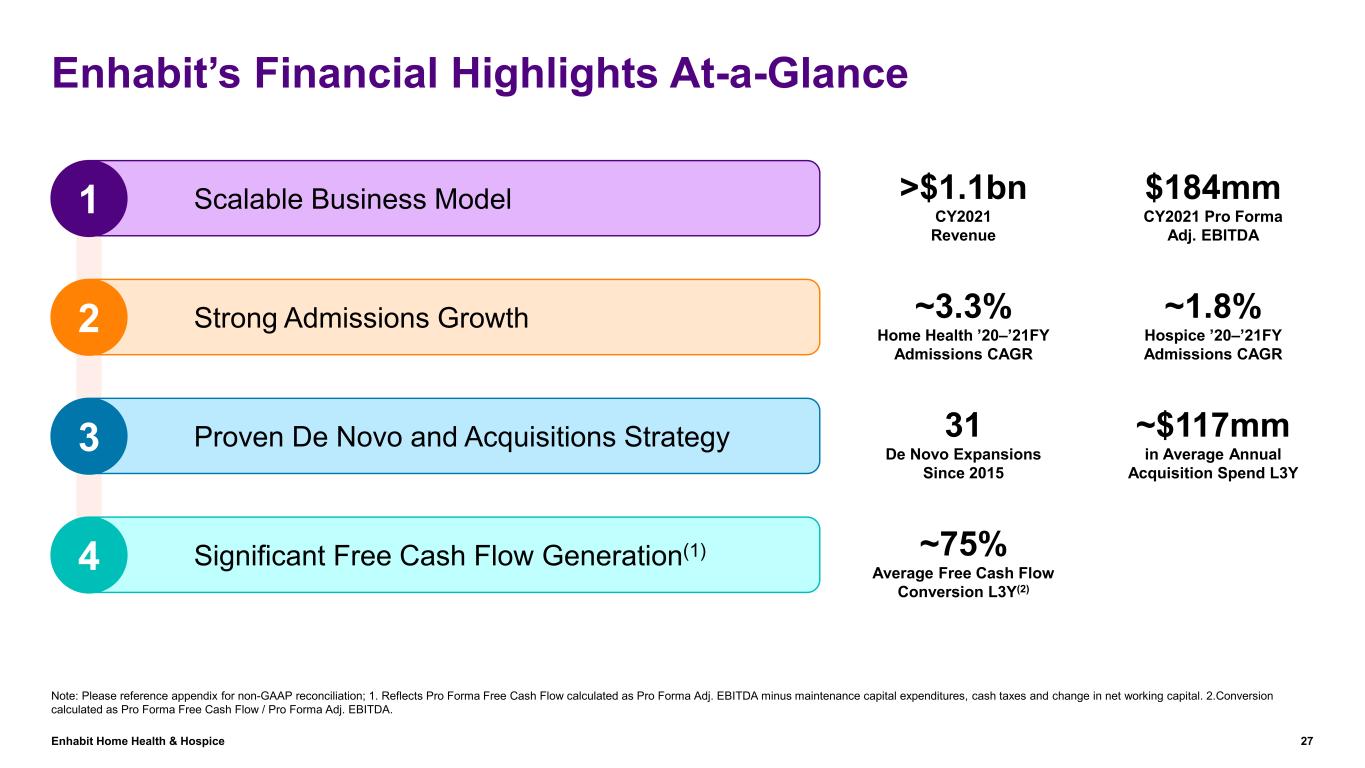

Enhabit Home Health & Hospice 27 Enhabit’s Financial Highlights At-a-Glance Significant Free Cash Flow Generation(1) Proven De Novo and Acquisitions Strategy Strong Admissions Growth Scalable Business Model ~1.8% Hospice ’20–’21FY Admissions CAGR 31 De Novo Expansions Since 2015 ~75% Average Free Cash Flow Conversion L3Y(2) >$1.1bn CY2021 Revenue 1 2 3 4 $184mm CY2021 Pro Forma Adj. EBITDA ~3.3% Home Health ’20–’21FY Admissions CAGR ~$117mm in Average Annual Acquisition Spend L3Y Note: Please reference appendix for non-GAAP reconciliation; 1. Reflects Pro Forma Free Cash Flow calculated as Pro Forma Adj. EBITDA minus maintenance capital expenditures, cash taxes and change in net working capital. 2.Conversion calculated as Pro Forma Free Cash Flow / Pro Forma Adj. EBITDA.

Enhabit Home Health & Hospice 28 Basis of Presentation | Historical Financials Historical Financials • Financial information for historical periods through December 31, 2021 presented consistent with Home Health & Hospice’s audited carve out financial statements, adjusted to reflect the following: − Elimination of corporate allocations from EHC to Home Health & Hospice pertaining to certain EHC corporate overhead expenses − Inclusion of estimated incremental standalone costs necessary to support Home Health & Hospice as a public standalone company and replace EHC corporate support − Based on comprehensive review of required functional support • Financial information is presented by Home Health & Hospice service lines: Home Health and Hospice • Corporate includes corporate G&A incurred within Home Health & Hospice (and not allocated to Home Health or Hospice segments) as well as incremental standalone costs referenced above

Enhabit Home Health & Hospice 29 Financial Overview ($ in millions) Net Service Revenue Gross Margin Pro Forma Adjusted EBITDA Pro Forma Free Cash Flow(1) % Growth – (1.3)% 2.6% % Margin % Margin % Conversion(2) Note: Please reference appendix for non-GAAP reconciliation. 1. Pro Forma Free Cash Flow calculated as Pro Forma Adj. EBITDA minus maintenance capital expenditures, cash taxes and change in net working capital. It has not been burdened with interest. 2. Conversion calculated as Pro Forma Free Cash Flow / Pro Forma Adj. EBITDA. 76.8 % 83.8 % 64.1 % 51.7% 50.1% 53.6% 16.2% 12.6% 16.6% $918 $878 $897 $174 $201 $209 $1,092 $1,078 $1,107 2019 2020 2021 Home Health Hospice $473 $434 $474 $92 $107 $119 $565 $541 $593 2019 2020 2021 Home Health Hospice $177 $136 $184 2019 2020 2021 $136 $114 $118 2019 2020 2021

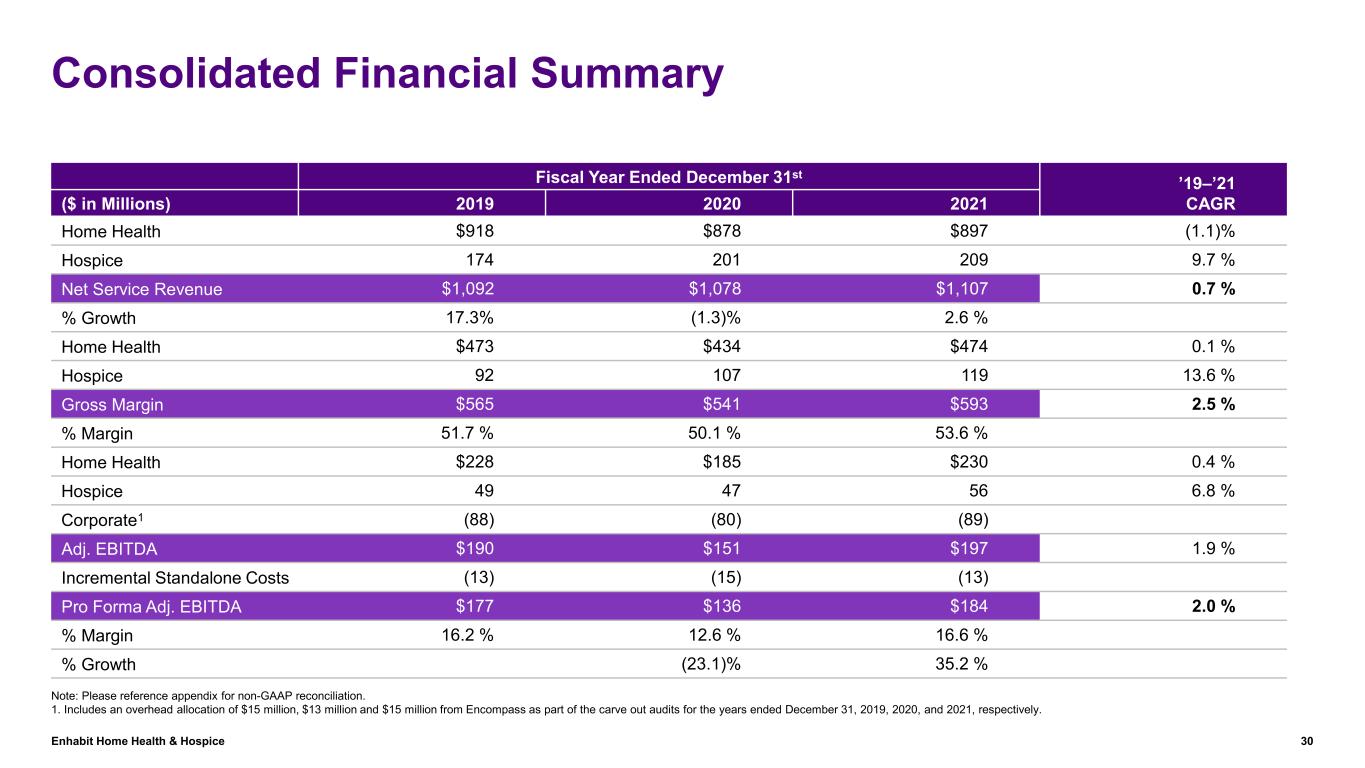

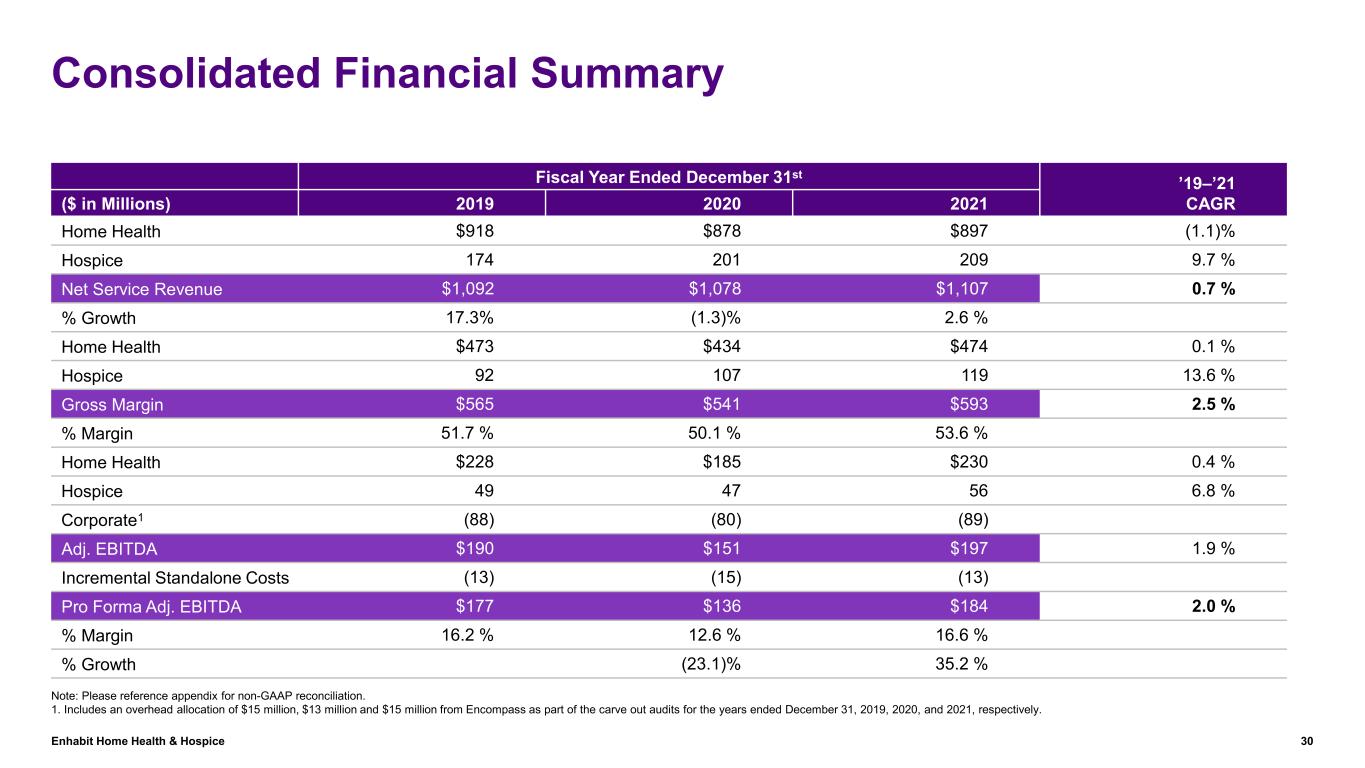

Enhabit Home Health & Hospice 30 Consolidated Financial Summary Fiscal Year Ended December 31st ’19–’21 CAGR($ in Millions) 2019 2020 2021 Home Health $918 $878 $897 (1.1)% Hospice 174 201 209 9.7 % Net Service Revenue $1,092 $1,078 $1,107 0.7 % % Growth 17.3% (1.3)% 2.6 % Home Health $473 $434 $474 0.1 % Hospice 92 107 119 13.6 % Gross Margin $565 $541 $593 2.5 % % Margin 51.7 % 50.1 % 53.6 % Home Health $228 $185 $230 0.4 % Hospice 49 47 56 6.8 % Corporate1 (88) (80) (89) Adj. EBITDA $190 $151 $197 1.9 % Incremental Standalone Costs (13) (15) (13) Pro Forma Adj. EBITDA $177 $136 $184 2.0 % % Margin 16.2 % 12.6 % 16.6 % % Growth (23.1)% 35.2 % Note: Please reference appendix for non-GAAP reconciliation. 1. Includes an overhead allocation of $15 million, $13 million and $15 million from Encompass as part of the carve out audits for the years ended December 31, 2019, 2020, and 2021, respectively.

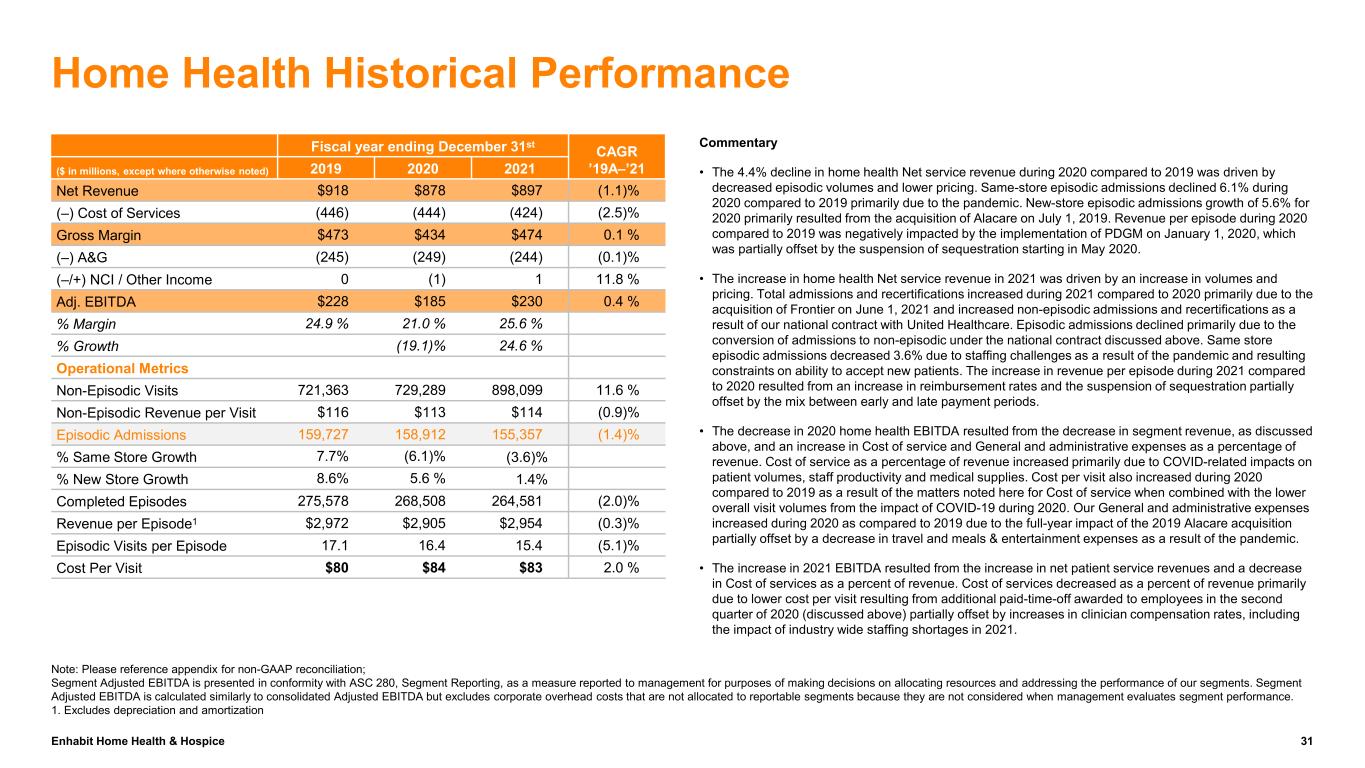

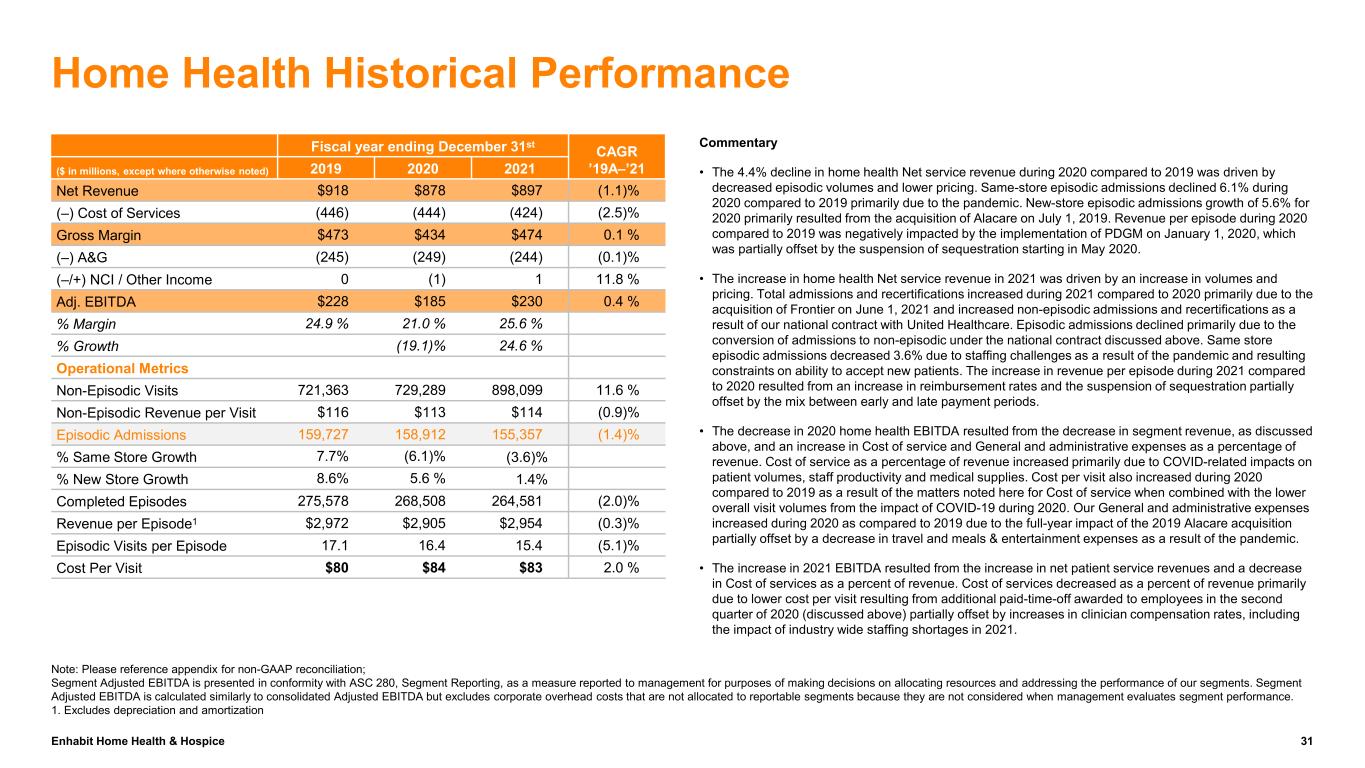

Enhabit Home Health & Hospice 31 Home Health Historical Performance Fiscal year ending December 31st CAGR ’19A–’21($ in millions, except where otherwise noted) 2019 2020 2021 Net Revenue $918 $878 $897 (1.1)% (–) Cost of Services (446) (444) (424) (2.5)% Gross Margin $473 $434 $474 0.1 % (–) A&G (245) (249) (244) (0.1)% (–/+) NCI / Other Income 0 (1) 1 11.8 % Adj. EBITDA $228 $185 $230 0.4 % % Margin 24.9 % 21.0 % 25.6 % % Growth (19.1)% 24.6 % Operational Metrics Non-Episodic Visits 721,363 729,289 898,099 11.6 % Non-Episodic Revenue per Visit $116 $113 $114 (0.9)% Episodic Admissions 159,727 158,912 155,357 (1.4)% % Same Store Growth 7.7% (6.1)% (3.6)% % New Store Growth 8.6% 5.6 % 1.4% Completed Episodes 275,578 268,508 264,581 (2.0)% Revenue per Episode1 $2,972 $2,905 $2,954 (0.3)% Episodic Visits per Episode 17.1 16.4 15.4 (5.1)% Cost Per Visit $80 $84 $83 2.0 % Note: Please reference appendix for non-GAAP reconciliation; Segment Adjusted EBITDA is presented in conformity with ASC 280, Segment Reporting, as a measure reported to management for purposes of making decisions on allocating resources and addressing the performance of our segments. Segment Adjusted EBITDA is calculated similarly to consolidated Adjusted EBITDA but excludes corporate overhead costs that are not allocated to reportable segments because they are not considered when management evaluates segment performance. 1. Excludes depreciation and amortization Commentary • The 4.4% decline in home health Net service revenue during 2020 compared to 2019 was driven by decreased episodic volumes and lower pricing. Same-store episodic admissions declined 6.1% during 2020 compared to 2019 primarily due to the pandemic. New-store episodic admissions growth of 5.6% for 2020 primarily resulted from the acquisition of Alacare on July 1, 2019. Revenue per episode during 2020 compared to 2019 was negatively impacted by the implementation of PDGM on January 1, 2020, which was partially offset by the suspension of sequestration starting in May 2020. • The increase in home health Net service revenue in 2021 was driven by an increase in volumes and pricing. Total admissions and recertifications increased during 2021 compared to 2020 primarily due to the acquisition of Frontier on June 1, 2021 and increased non-episodic admissions and recertifications as a result of our national contract with United Healthcare. Episodic admissions declined primarily due to the conversion of admissions to non-episodic under the national contract discussed above. Same store episodic admissions decreased 3.6% due to staffing challenges as a result of the pandemic and resulting constraints on ability to accept new patients. The increase in revenue per episode during 2021 compared to 2020 resulted from an increase in reimbursement rates and the suspension of sequestration partially offset by the mix between early and late payment periods. • The decrease in 2020 home health EBITDA resulted from the decrease in segment revenue, as discussed above, and an increase in Cost of service and General and administrative expenses as a percentage of revenue. Cost of service as a percentage of revenue increased primarily due to COVID-related impacts on patient volumes, staff productivity and medical supplies. Cost per visit also increased during 2020 compared to 2019 as a result of the matters noted here for Cost of service when combined with the lower overall visit volumes from the impact of COVID-19 during 2020. Our General and administrative expenses increased during 2020 as compared to 2019 due to the full-year impact of the 2019 Alacare acquisition partially offset by a decrease in travel and meals & entertainment expenses as a result of the pandemic. • The increase in 2021 EBITDA resulted from the increase in net patient service revenues and a decrease in Cost of services as a percent of revenue. Cost of services decreased as a percent of revenue primarily due to lower cost per visit resulting from additional paid-time-off awarded to employees in the second quarter of 2020 (discussed above) partially offset by increases in clinician compensation rates, including the impact of industry wide staffing shortages in 2021.

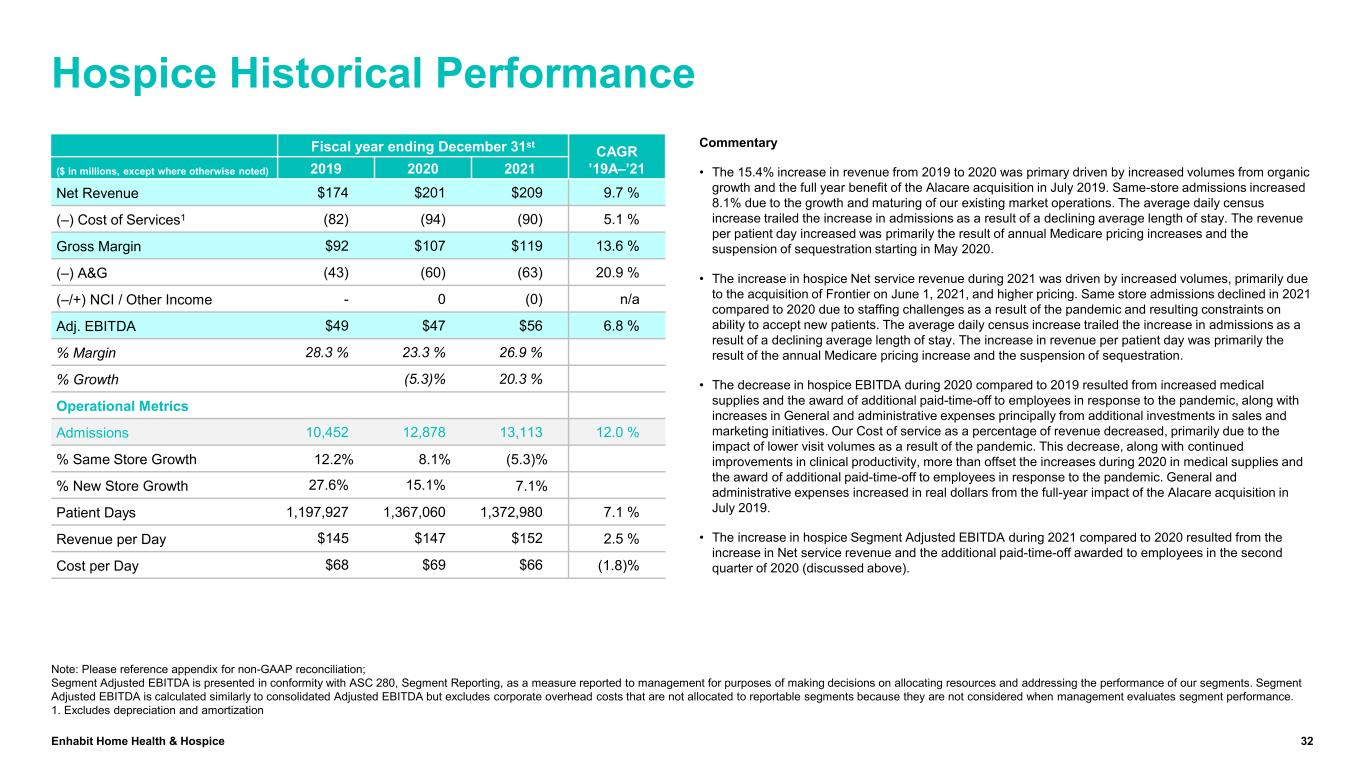

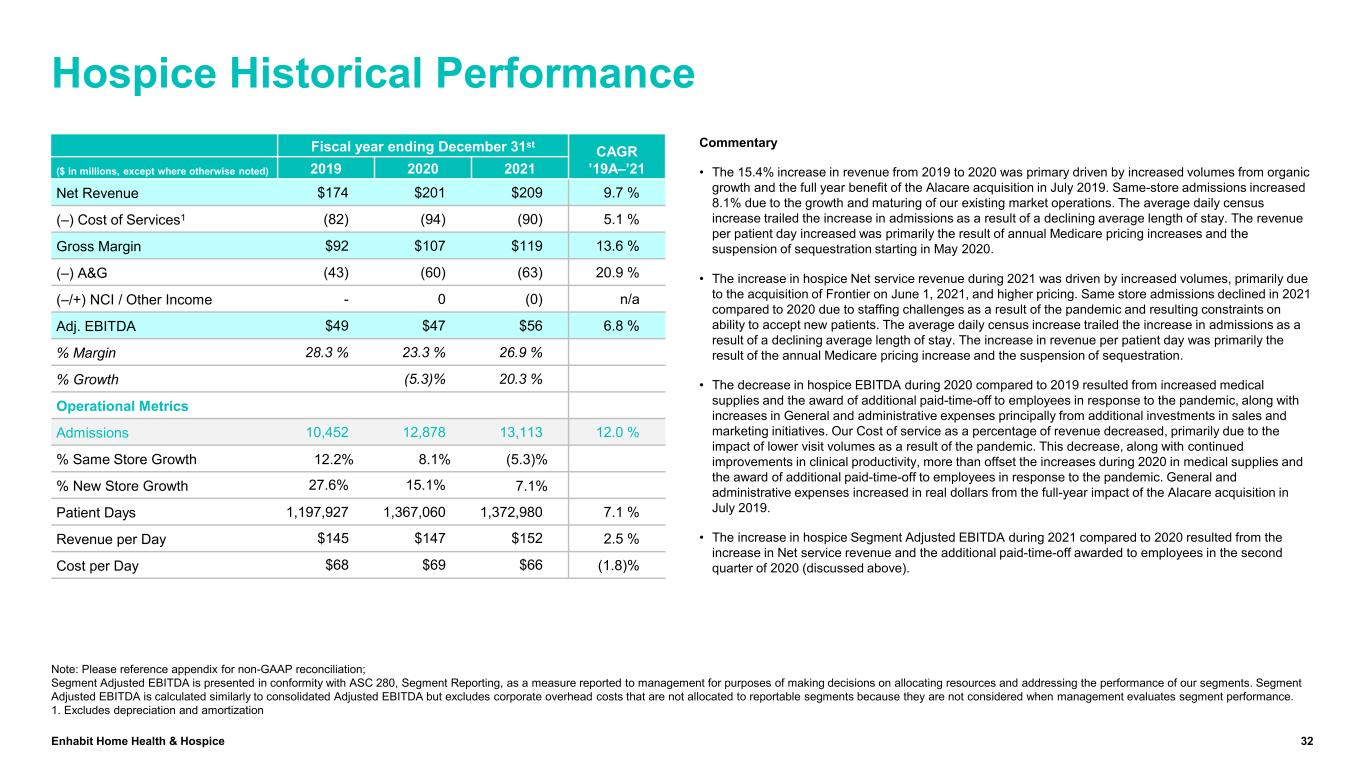

Enhabit Home Health & Hospice 32 Hospice Historical Performance Fiscal year ending December 31st CAGR ’19A–’21($ in millions, except where otherwise noted) 2019 2020 2021 Net Revenue $174 $201 $209 9.7 % (–) Cost of Services1 (82) (94) (90) 5.1 % Gross Margin $92 $107 $119 13.6 % (–) A&G (43) (60) (63) 20.9 % (–/+) NCI / Other Income - 0 (0) n/a Adj. EBITDA $49 $47 $56 6.8 % % Margin 28.3 % 23.3 % 26.9 % % Growth (5.3)% 20.3 % Operational Metrics Admissions 10,452 12,878 13,113 12.0 % % Same Store Growth 12.2% 8.1% (5.3)% % New Store Growth 27.6% 15.1% 7.1% Patient Days 1,197,927 1,367,060 1,372,980 7.1 % Revenue per Day $145 $147 $152 2.5 % Cost per Day $68 $69 $66 (1.8)% Note: Please reference appendix for non-GAAP reconciliation; Segment Adjusted EBITDA is presented in conformity with ASC 280, Segment Reporting, as a measure reported to management for purposes of making decisions on allocating resources and addressing the performance of our segments. Segment Adjusted EBITDA is calculated similarly to consolidated Adjusted EBITDA but excludes corporate overhead costs that are not allocated to reportable segments because they are not considered when management evaluates segment performance. 1. Excludes depreciation and amortization Commentary • The 15.4% increase in revenue from 2019 to 2020 was primary driven by increased volumes from organic growth and the full year benefit of the Alacare acquisition in July 2019. Same-store admissions increased 8.1% due to the growth and maturing of our existing market operations. The average daily census increase trailed the increase in admissions as a result of a declining average length of stay. The revenue per patient day increased was primarily the result of annual Medicare pricing increases and the suspension of sequestration starting in May 2020. • The increase in hospice Net service revenue during 2021 was driven by increased volumes, primarily due to the acquisition of Frontier on June 1, 2021, and higher pricing. Same store admissions declined in 2021 compared to 2020 due to staffing challenges as a result of the pandemic and resulting constraints on ability to accept new patients. The average daily census increase trailed the increase in admissions as a result of a declining average length of stay. The increase in revenue per patient day was primarily the result of the annual Medicare pricing increase and the suspension of sequestration. • The decrease in hospice EBITDA during 2020 compared to 2019 resulted from increased medical supplies and the award of additional paid-time-off to employees in response to the pandemic, along with increases in General and administrative expenses principally from additional investments in sales and marketing initiatives. Our Cost of service as a percentage of revenue decreased, primarily due to the impact of lower visit volumes as a result of the pandemic. This decrease, along with continued improvements in clinical productivity, more than offset the increases during 2020 in medical supplies and the award of additional paid-time-off to employees in response to the pandemic. General and administrative expenses increased in real dollars from the full-year impact of the Alacare acquisition in July 2019. • The increase in hospice Segment Adjusted EBITDA during 2021 compared to 2020 resulted from the increase in Net service revenue and the additional paid-time-off awarded to employees in the second quarter of 2020 (discussed above).

Enhabit Home Health & Hospice 33 Capital Expenditures Overview ($ in millions) Capital Expenditures % of Consolidated Revenue Pro Forma Adjusted Free Cash Flow1 % Conversion 76.8 % 83.8 % 64.1 %22.3% 0.4% 11.1% Note: Please reference appendix for non-GAAP reconciliation. 1. Pro Forma Free Cash Flow calculated as Pro Forma Adj. EBITDA minus maintenance capital expenditures, cash taxes and change in net working capital. It has not been burdened with interest. 2. Conversion calculated as Pro Forma Free Cash Flow / Pro Forma Adj. EBITDA. $232 $1 $118 $12 $4 $5 $244 $5 $123 2019 2020 2021 Acquisition capital expenditures Maintenance capital expenditures $136 $114 $118 2019 2020 2021

Enhabit Home Health & Hospice 34 Pro Forma Capitalization ($ in millions) 1Does not net debt issuance costs of $3.5 million 22021 Pro Forma Adjusted EBITDA reflects 2021 Adjusted EBITDA of $197.2 million (including allocated corporate overhead costs of $14.3 million) and standalone costs of $13.2 million At Close Cash and Cash Equivalents $ 5 $350M Revolver due 2027 170 Term Loan A due 2027 400 Total Secured Debt $ 570 Finance Lease Obligations 7 Other Notes Payable 2 Total Debt1 $ 579 Net Debt $ 573 12/31/2021 Pro Forma Adjusted EBITDA2 $ 184 Gross Leverage 3.1 x Net Leverage 3.1 x

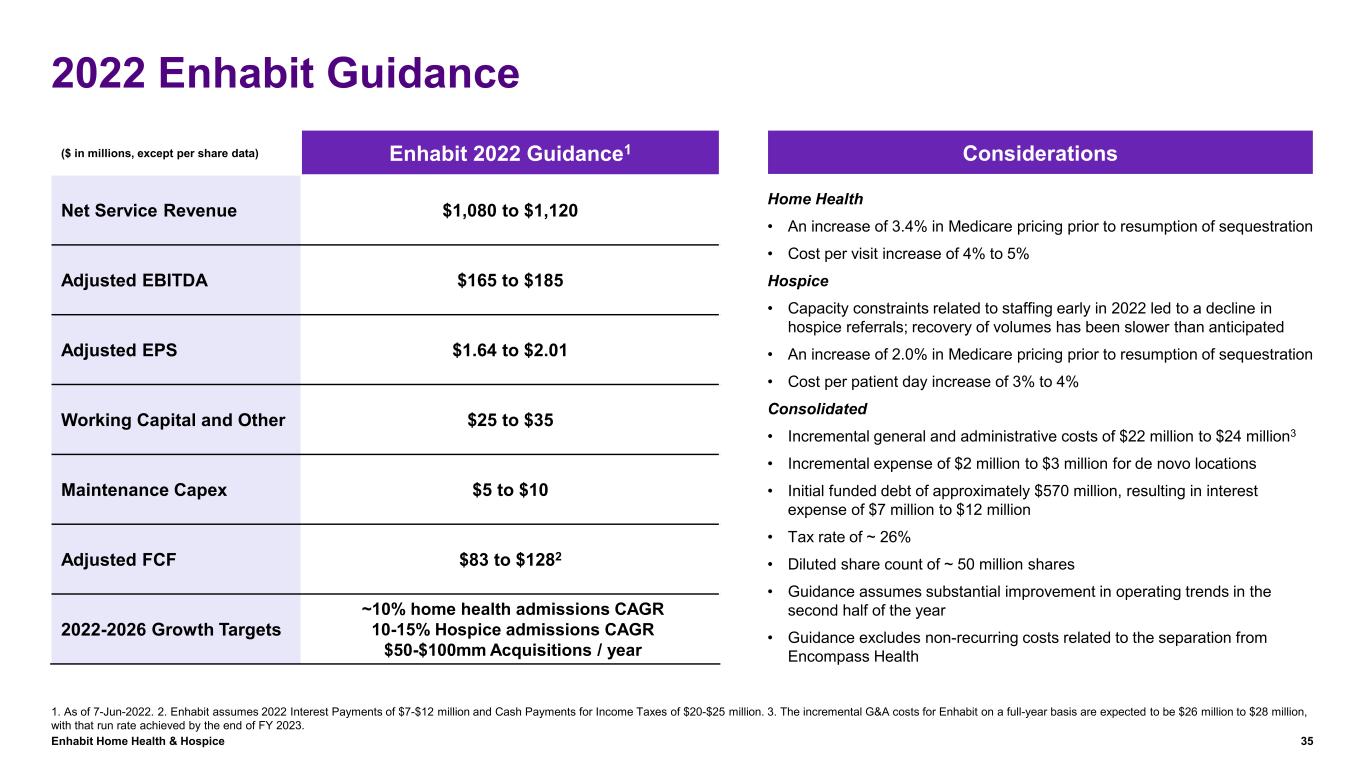

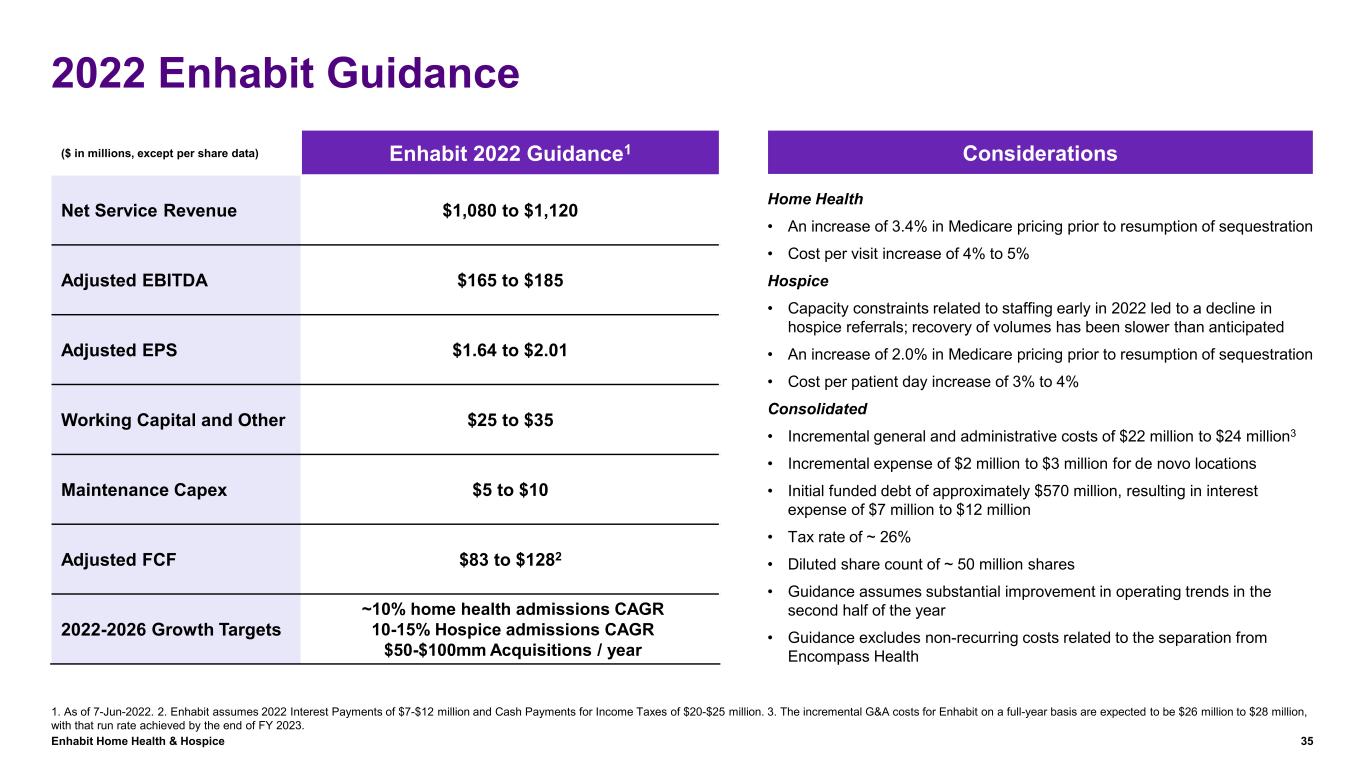

Enhabit Home Health & Hospice 35 2022 Enhabit Guidance ($ in millions, except per share data) Enhabit 2022 Guidance1 Net Service Revenue $1,080 to $1,120 Adjusted EBITDA $165 to $185 Adjusted EPS $1.64 to $2.01 Working Capital and Other $25 to $35 Maintenance Capex $5 to $10 Adjusted FCF $83 to $1282 2022-2026 Growth Targets ~10% home health admissions CAGR 10-15% Hospice admissions CAGR $50-$100mm Acquisitions / year 1. As of 7-Jun-2022. 2. Enhabit assumes 2022 Interest Payments of $7-$12 million and Cash Payments for Income Taxes of $20-$25 million. 3. The incremental G&A costs for Enhabit on a full-year basis are expected to be $26 million to $28 million, with that run rate achieved by the end of FY 2023. Home Health • An increase of 3.4% in Medicare pricing prior to resumption of sequestration • Cost per visit increase of 4% to 5% Hospice • Capacity constraints related to staffing early in 2022 led to a decline in hospice referrals; recovery of volumes has been slower than anticipated • An increase of 2.0% in Medicare pricing prior to resumption of sequestration • Cost per patient day increase of 3% to 4% Consolidated • Incremental general and administrative costs of $22 million to $24 million3 • Incremental expense of $2 million to $3 million for de novo locations • Initial funded debt of approximately $570 million, resulting in interest expense of $7 million to $12 million • Tax rate of ~ 26% • Diluted share count of ~ 50 million shares • Guidance assumes substantial improvement in operating trends in the second half of the year • Guidance excludes non-recurring costs related to the separation from Encompass Health Considerations

Enhabit Home Health & Hospice 36 Appendix

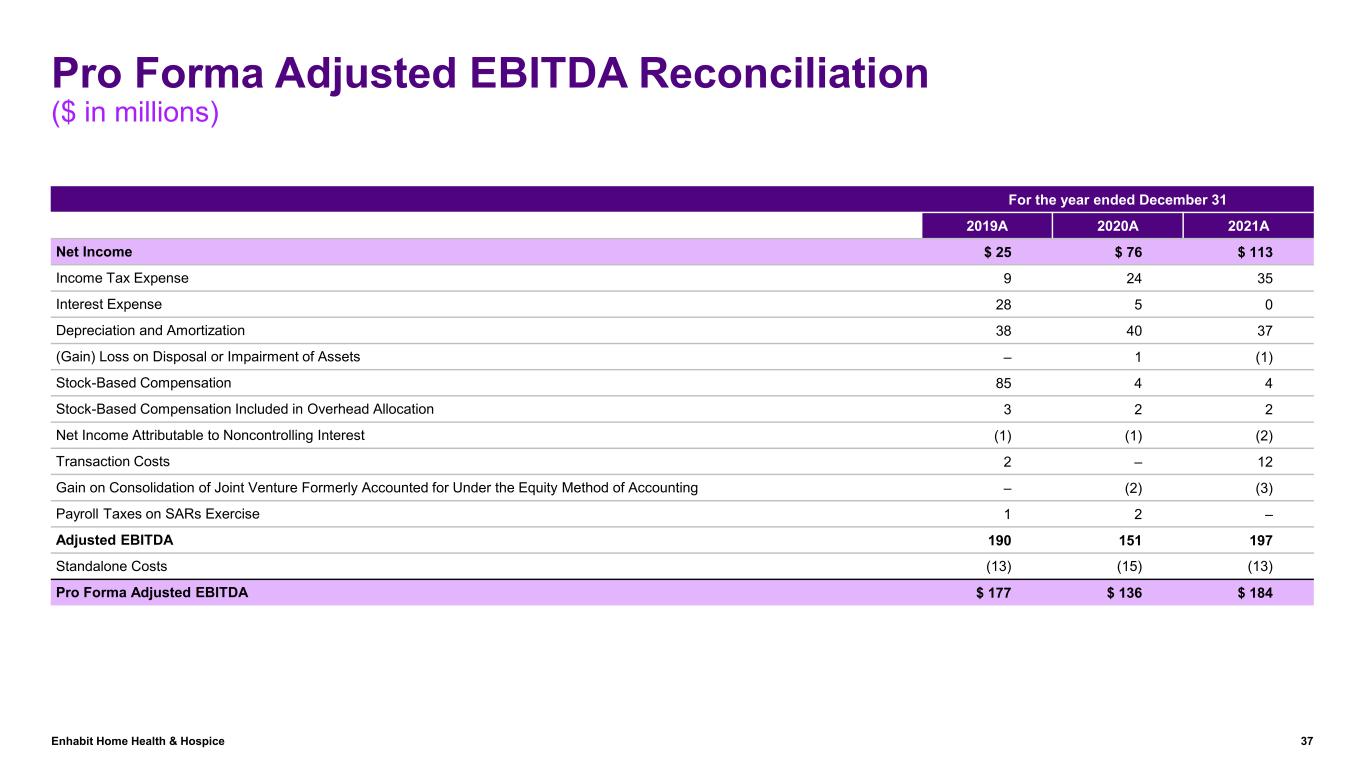

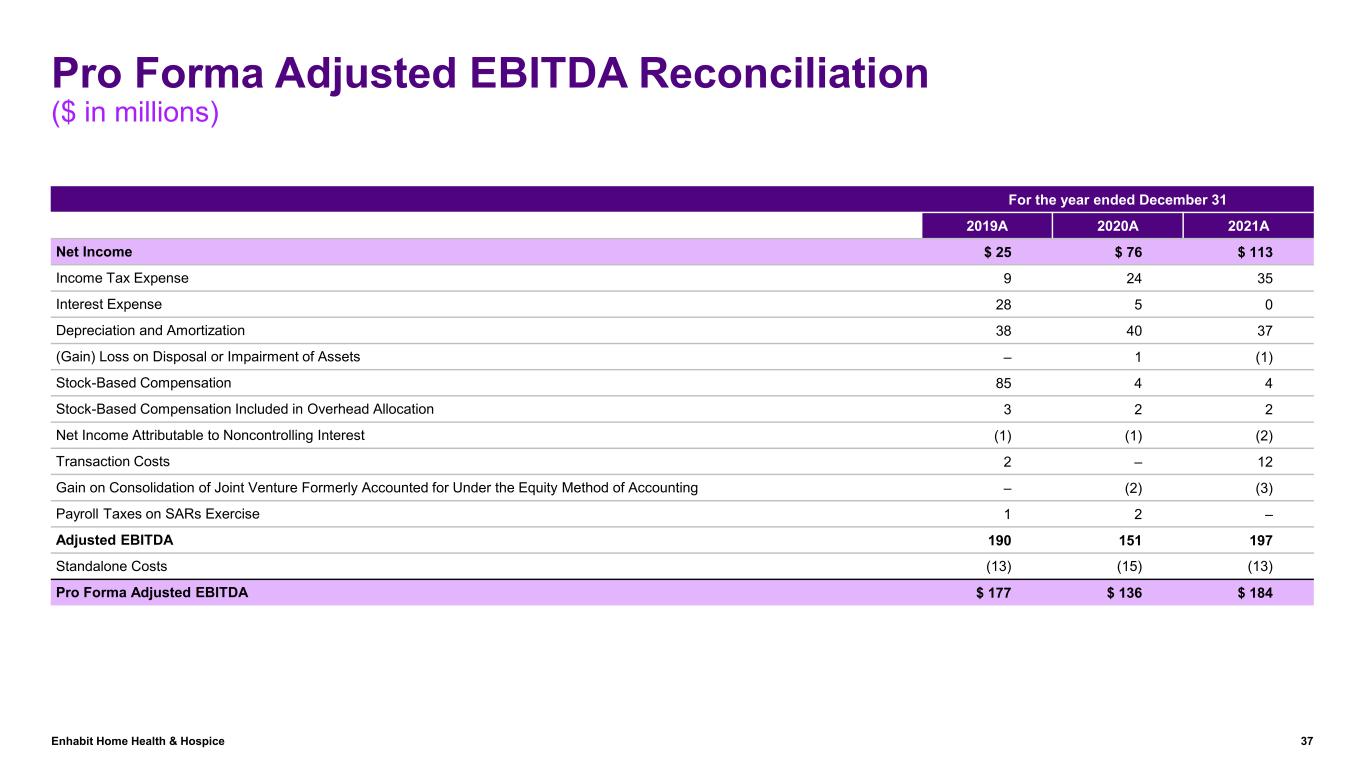

Enhabit Home Health & Hospice 37 Pro Forma Adjusted EBITDA Reconciliation ($ in millions) For the year ended December 31 2019A 2020A 2021A Net Income $ 25 $ 76 $ 113 Income Tax Expense 9 24 35 Interest Expense 28 5 0 Depreciation and Amortization 38 40 37 (Gain) Loss on Disposal or Impairment of Assets – 1 (1) Stock-Based Compensation 85 4 4 Stock-Based Compensation Included in Overhead Allocation 3 2 2 Net Income Attributable to Noncontrolling Interest (1) (1) (2) Transaction Costs 2 – 12 Gain on Consolidation of Joint Venture Formerly Accounted for Under the Equity Method of Accounting – (2) (3) Payroll Taxes on SARs Exercise 1 2 – Adjusted EBITDA 190 151 197 Standalone Costs (13) (15) (13) Pro Forma Adjusted EBITDA $ 177 $ 136 $ 184

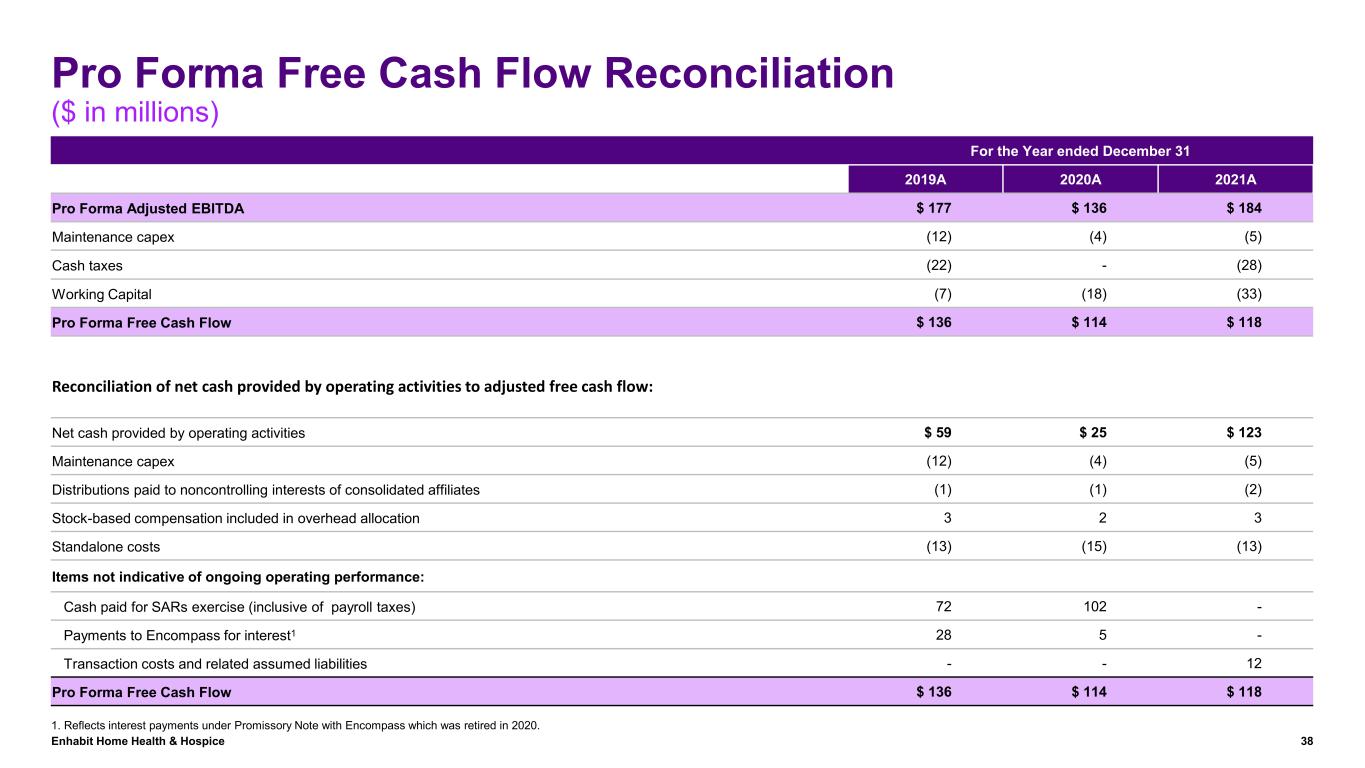

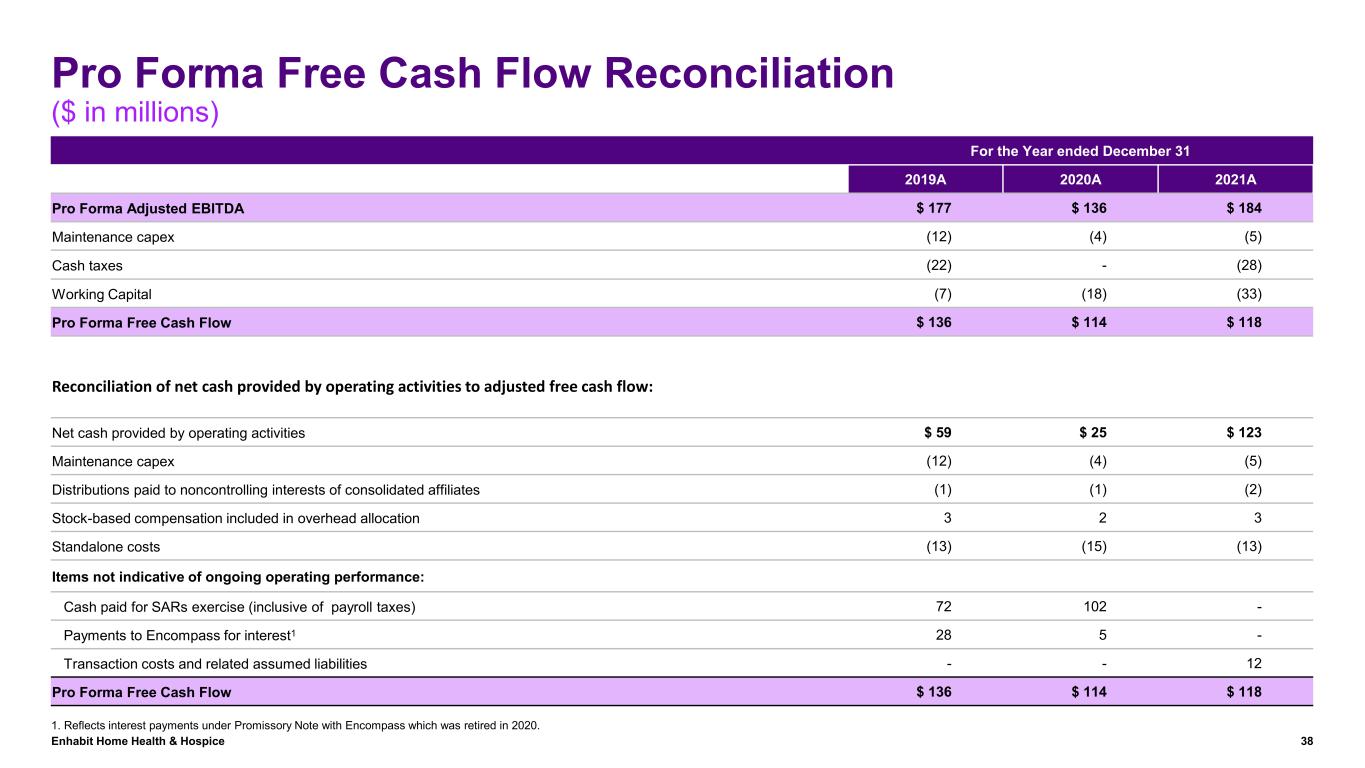

Enhabit Home Health & Hospice 38 Pro Forma Free Cash Flow Reconciliation ($ in millions) For the Year ended December 31 2019A 2020A 2021A Pro Forma Adjusted EBITDA $ 177 $ 136 $ 184 Maintenance capex (12) (4) (5) Cash taxes (22) - (28) Working Capital (7) (18) (33) Pro Forma Free Cash Flow $ 136 $ 114 $ 118 Reconciliation of net cash provided by operating activities to adjusted free cash flow: Net cash provided by operating activities $ 59 $ 25 $ 123 Maintenance capex (12) (4) (5) Distributions paid to noncontrolling interests of consolidated affiliates (1) (1) (2) Stock-based compensation included in overhead allocation 3 2 3 Standalone costs (13) (15) (13) Items not indicative of ongoing operating performance: Cash paid for SARs exercise (inclusive of payroll taxes) 72 102 - Payments to Encompass for interest1 28 5 - Transaction costs and related assumed liabilities - - 12 Pro Forma Free Cash Flow $ 136 $ 114 $ 118 1. Reflects interest payments under Promissory Note with Encompass which was retired in 2020.

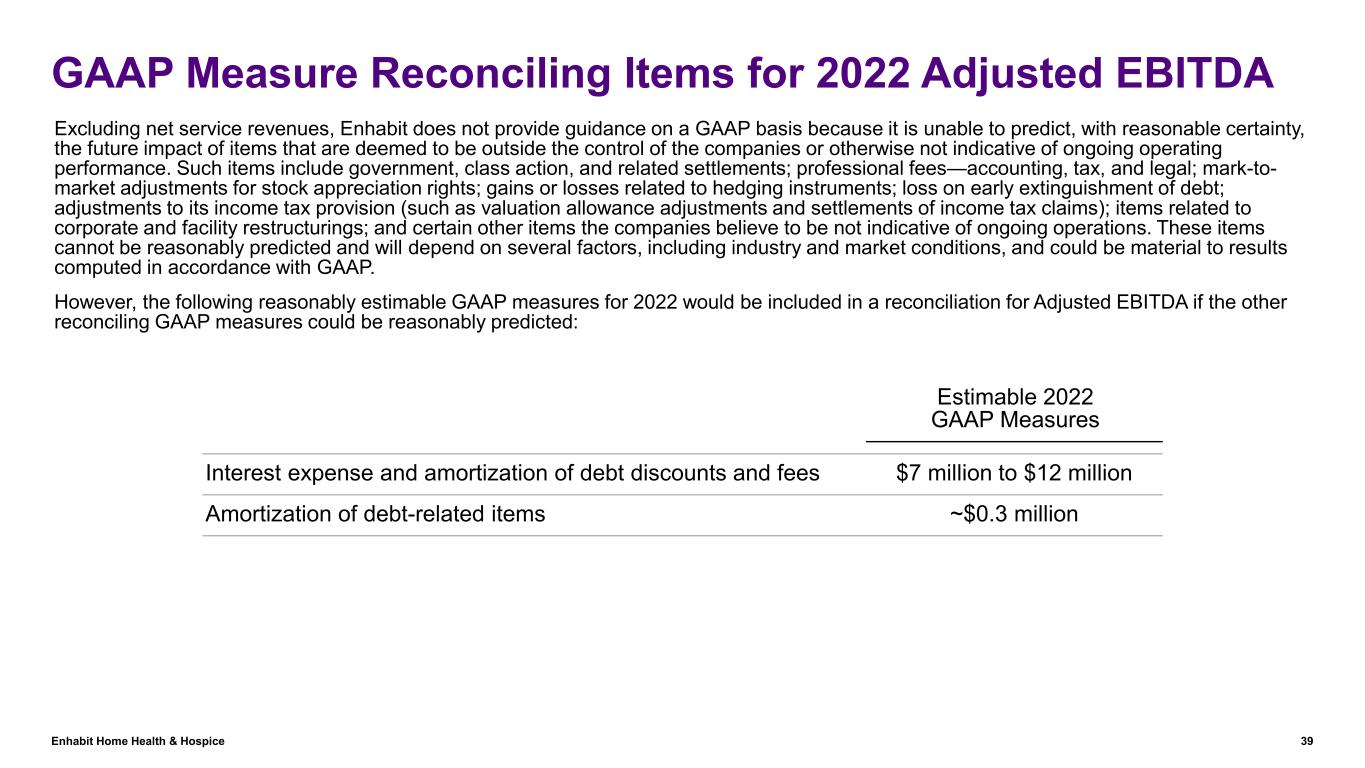

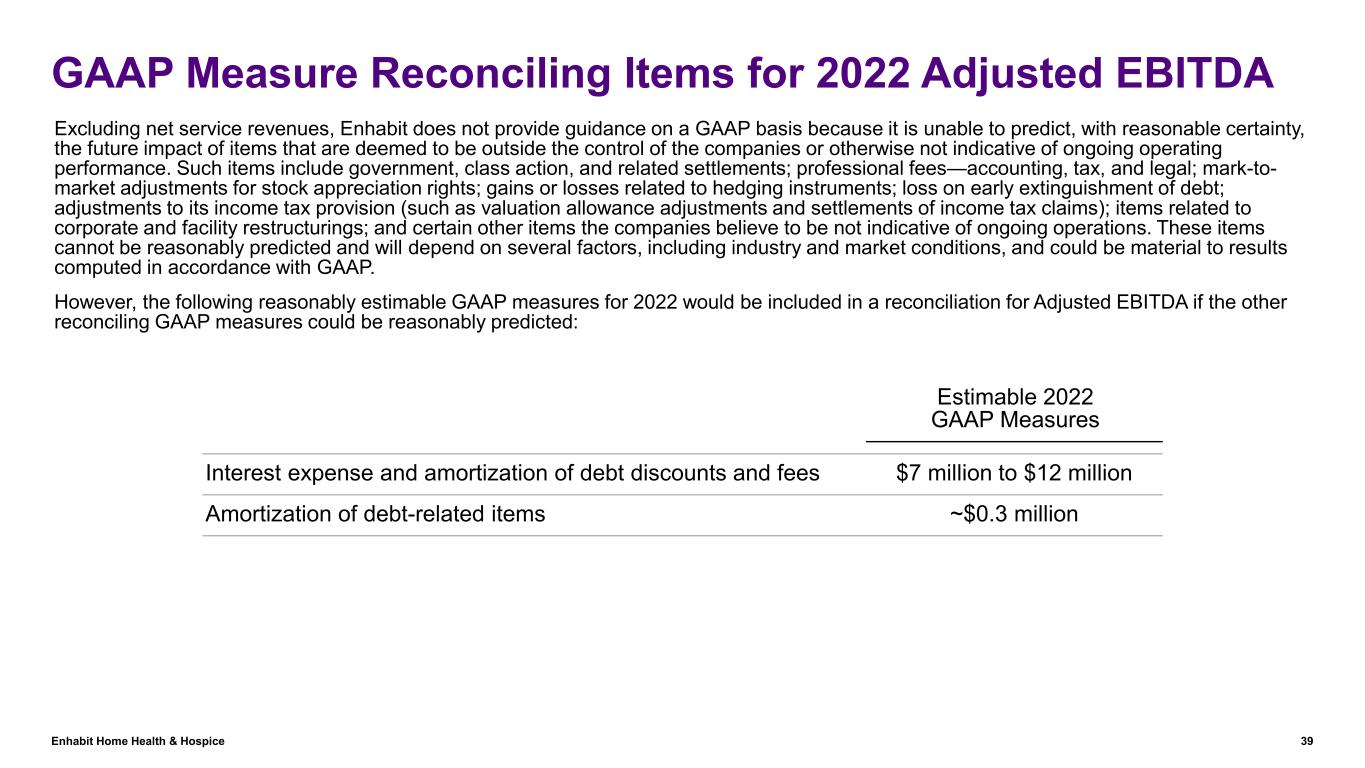

Enhabit Home Health & Hospice 39 GAAP Measure Reconciling Items for 2022 Adjusted EBITDA Estimable 2022 GAAP Measures Interest expense and amortization of debt discounts and fees $7 million to $12 million Amortization of debt-related items ~$0.3 million Excluding net service revenues, Enhabit does not provide guidance on a GAAP basis because it is unable to predict, with reasonable certainty, the future impact of items that are deemed to be outside the control of the companies or otherwise not indicative of ongoing operating performance. Such items include government, class action, and related settlements; professional fees—accounting, tax, and legal; mark-to- market adjustments for stock appreciation rights; gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); items related to corporate and facility restructurings; and certain other items the companies believe to be not indicative of ongoing operations. These items cannot be reasonably predicted and will depend on several factors, including industry and market conditions, and could be material to results computed in accordance with GAAP. However, the following reasonably estimable GAAP measures for 2022 would be included in a reconciliation for Adjusted EBITDA if the other reconciling GAAP measures could be reasonably predicted:

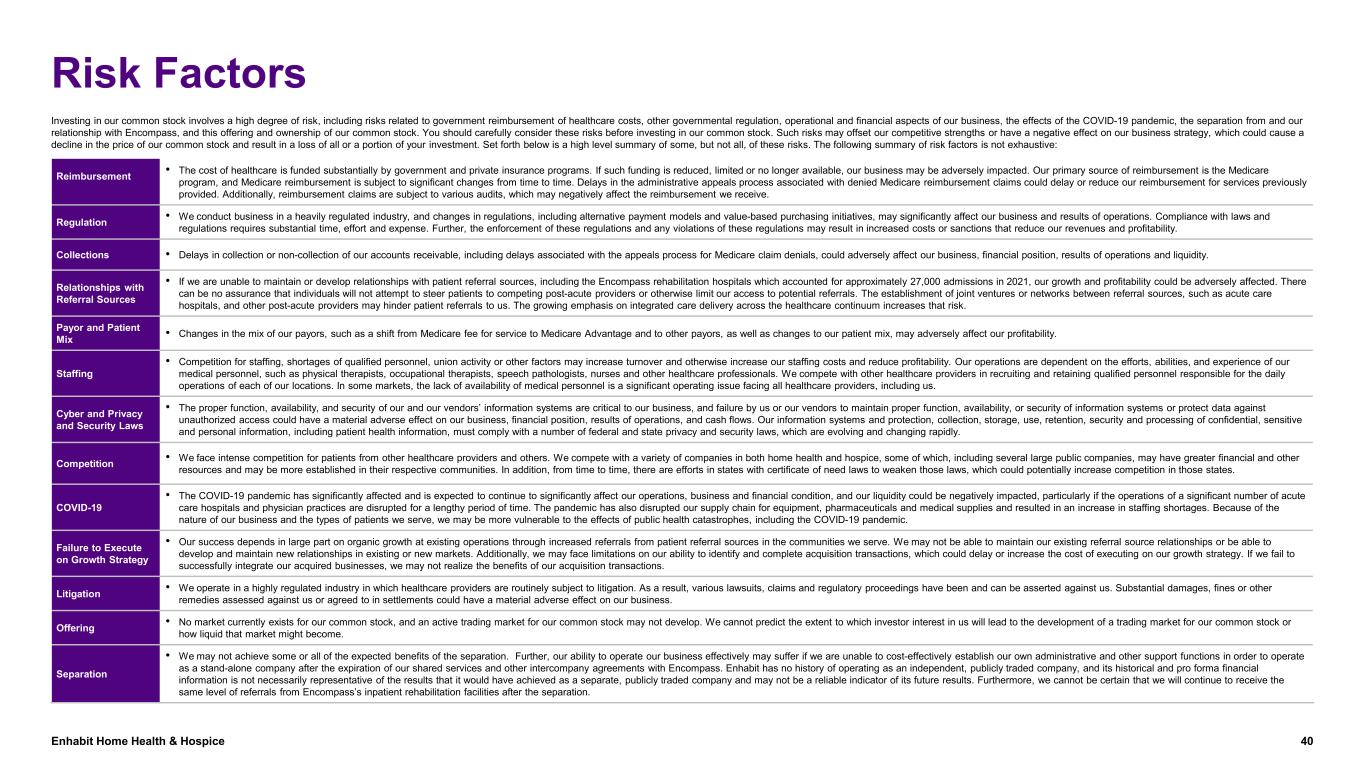

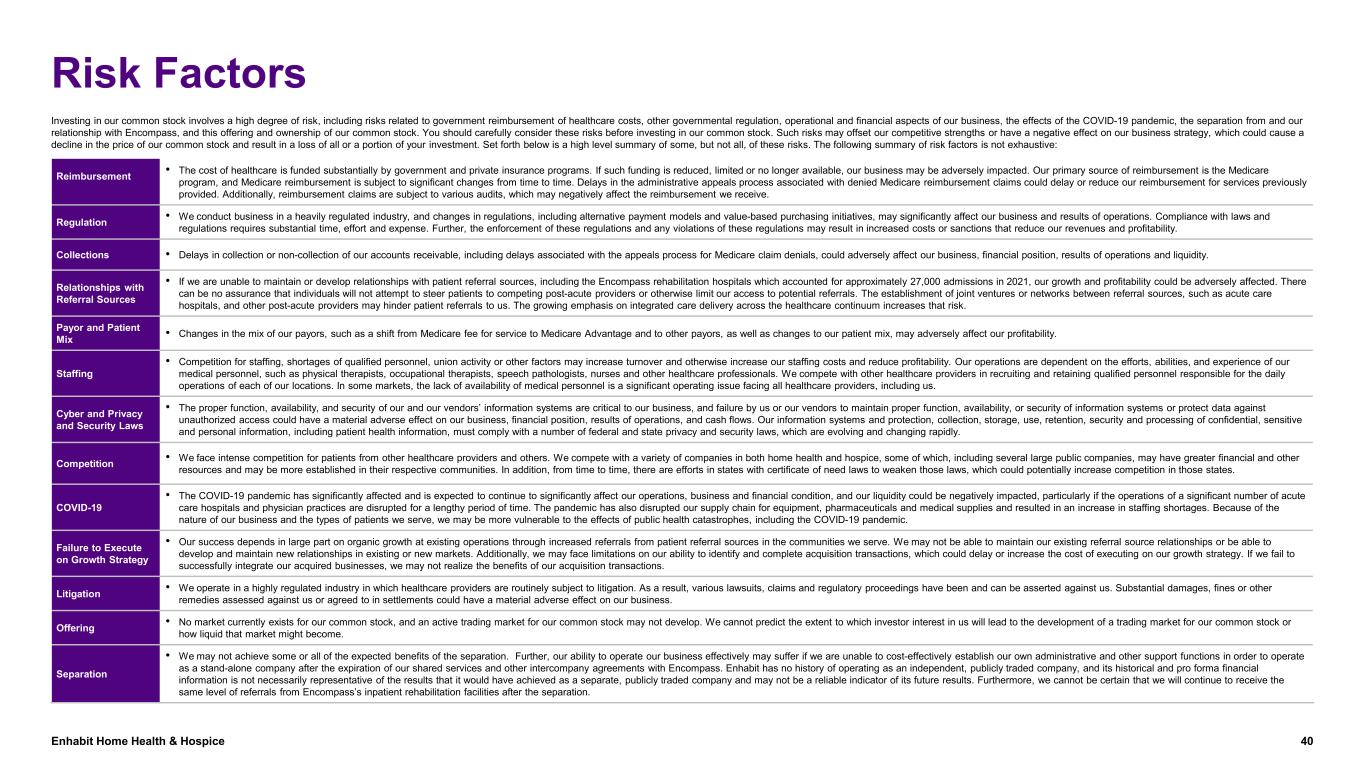

Enhabit Home Health & Hospice 40 Risk Factors Investing in our common stock involves a high degree of risk, including risks related to government reimbursement of healthcare costs, other governmental regulation, operational and financial aspects of our business, the effects of the COVID-19 pandemic, the separation from and our relationship with Encompass, and this offering and ownership of our common stock. You should carefully consider these risks before investing in our common stock. Such risks may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of our common stock and result in a loss of all or a portion of your investment. Set forth below is a high level summary of some, but not all, of these risks. The following summary of risk factors is not exhaustive: Reimbursement • The cost of healthcare is funded substantially by government and private insurance programs. If such funding is reduced, limited or no longer available, our business may be adversely impacted. Our primary source of reimbursement is the Medicare program, and Medicare reimbursement is subject to significant changes from time to time. Delays in the administrative appeals process associated with denied Medicare reimbursement claims could delay or reduce our reimbursement for services previously provided. Additionally, reimbursement claims are subject to various audits, which may negatively affect the reimbursement we receive. Regulation • We conduct business in a heavily regulated industry, and changes in regulations, including alternative payment models and value-based purchasing initiatives, may significantly affect our business and results of operations. Compliance with laws and regulations requires substantial time, effort and expense. Further, the enforcement of these regulations and any violations of these regulations may result in increased costs or sanctions that reduce our revenues and profitability. Collections • Delays in collection or non-collection of our accounts receivable, including delays associated with the appeals process for Medicare claim denials, could adversely affect our business, financial position, results of operations and liquidity. Relationships with Referral Sources • If we are unable to maintain or develop relationships with patient referral sources, including the Encompass rehabilitation hospitals which accounted for approximately 27,000 admissions in 2021, our growth and profitability could be adversely affected. There can be no assurance that individuals will not attempt to steer patients to competing post-acute providers or otherwise limit our access to potential referrals. The establishment of joint ventures or networks between referral sources, such as acute care hospitals, and other post-acute providers may hinder patient referrals to us. The growing emphasis on integrated care delivery across the healthcare continuum increases that risk. Payor and Patient Mix • Changes in the mix of our payors, such as a shift from Medicare fee for service to Medicare Advantage and to other payors, as well as changes to our patient mix, may adversely affect our profitability. Staffing • Competition for staffing, shortages of qualified personnel, union activity or other factors may increase turnover and otherwise increase our staffing costs and reduce profitability. Our operations are dependent on the efforts, abilities, and experience of our medical personnel, such as physical therapists, occupational therapists, speech pathologists, nurses and other healthcare professionals. We compete with other healthcare providers in recruiting and retaining qualified personnel responsible for the daily operations of each of our locations. In some markets, the lack of availability of medical personnel is a significant operating issue facing all healthcare providers, including us. Cyber and Privacy and Security Laws • The proper function, availability, and security of our and our vendors’ information systems are critical to our business, and failure by us or our vendors to maintain proper function, availability, or security of information systems or protect data against unauthorized access could have a material adverse effect on our business, financial position, results of operations, and cash flows. Our information systems and protection, collection, storage, use, retention, security and processing of confidential, sensitive and personal information, including patient health information, must comply with a number of federal and state privacy and security laws, which are evolving and changing rapidly. Competition • We face intense competition for patients from other healthcare providers and others. We compete with a variety of companies in both home health and hospice, some of which, including several large public companies, may have greater financial and other resources and may be more established in their respective communities. In addition, from time to time, there are efforts in states with certificate of need laws to weaken those laws, which could potentially increase competition in those states. COVID-19 • The COVID-19 pandemic has significantly affected and is expected to continue to significantly affect our operations, business and financial condition, and our liquidity could be negatively impacted, particularly if the operations of a significant number of acute care hospitals and physician practices are disrupted for a lengthy period of time. The pandemic has also disrupted our supply chain for equipment, pharmaceuticals and medical supplies and resulted in an increase in staffing shortages. Because of the nature of our business and the types of patients we serve, we may be more vulnerable to the effects of public health catastrophes, including the COVID-19 pandemic. Failure to Execute on Growth Strategy • Our success depends in large part on organic growth at existing operations through increased referrals from patient referral sources in the communities we serve. We may not be able to maintain our existing referral source relationships or be able to develop and maintain new relationships in existing or new markets. Additionally, we may face limitations on our ability to identify and complete acquisition transactions, which could delay or increase the cost of executing on our growth strategy. If we fail to successfully integrate our acquired businesses, we may not realize the benefits of our acquisition transactions. Litigation • We operate in a highly regulated industry in which healthcare providers are routinely subject to litigation. As a result, various lawsuits, claims and regulatory proceedings have been and can be asserted against us. Substantial damages, fines or other remedies assessed against us or agreed to in settlements could have a material adverse effect on our business. Offering • No market currently exists for our common stock, and an active trading market for our common stock may not develop. We cannot predict the extent to which investor interest in us will lead to the development of a trading market for our common stock or how liquid that market might become. Separation • We may not achieve some or all of the expected benefits of the separation. Further, our ability to operate our business effectively may suffer if we are unable to cost-effectively establish our own administrative and other support functions in order to operate as a stand-alone company after the expiration of our shared services and other intercompany agreements with Encompass. Enhabit has no history of operating as an independent, publicly traded company, and its historical and pro forma financial information is not necessarily representative of the results that it would have achieved as a separate, publicly traded company and may not be a reliable indicator of its future results. Furthermore, we cannot be certain that we will continue to receive the same level of referrals from Encompass’s inpatient rehabilitation facilities after the separation.