UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | | | | | | | | | | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under Rule 14a-12 |

Encompass Health Corporation |

| (Name of Registrant as Specified in Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | | No fee required |

| o | | Fee paid previously with preliminary materials |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 2, 2024

Dear fellow stockholder:

I am pleased to invite you to attend our 2024 Annual Meeting of Stockholders of Encompass Health Corporation, to be held on Thursday, May 2, 2024, at 11:00 a.m., central time, at our corporate headquarters at 9001 Liberty Parkway, Birmingham, Alabama 35242. Please visit our “Investors Relations” website at https://investor.encompasshealth.com for updates relating to attending the annual meeting.

We will consider the items of business described in the Proxy Statement accompanying this letter and respond to any questions you may have. The Proxy Statement contains important information about the matters to be voted on and the process for voting, along with information about Encompass Health, its management and its directors.

Every stockholder’s vote is important to us. Even if you plan to attend the annual meeting in person, please promptly vote by submitting your proxy by phone, by internet or by mail. The “Commonly Asked Questions” section of the Proxy Statement and the enclosed proxy card contain detailed instructions for submitting your proxy. If you plan to attend the annual meeting in person, you must provide proof of share ownership, such as an account statement, and a form of personal identification in order to be admitted to the meeting.

On behalf of the directors, management and employees of Encompass Health, thank you for your continued support of and ownership in our company.

Sincerely,

Donald L. Correll

Chairman of the Board of Directors

ENCOMPASS HEALTH CORPORATION

Notice of Annual Meeting of Stockholders

| | | | | |

| TIME | 11:00 a.m., central time, on Thursday, May 2, 2024 |

| |

| PLACE | ENCOMPASS HEALTH CORPORATION Corporate Headquarters 9001 Liberty Parkway Birmingham, Alabama 35242 Directions to the annual meeting are available by calling Investor Relations at 1-205-969-4600.

|

| |

| ITEMS OF BUSINESS | •To elect 10 directors to the board of directors to serve until our 2025 annual meeting of stockholders. Ø The board of directors recommends a vote FOR each nominee. •To ratify the appointment by Encompass Health’s Audit Committee of PricewaterhouseCoopers LLP as Encompass Health’s independent registered public accounting firm. Ø The board of directors recommends a vote FOR ratification. •To approve, on an advisory basis, the compensation of the named executive officers as disclosed in Encompass Health’s Definitive Proxy Statement for the 2024 annual meeting. Ø The board of directors recommends a vote FOR the approval of the compensation of our named executive officers. •To vote on a stockholder proposal requesting a report on the effectiveness of the Company’s diversity, equity, and inclusion efforts. Ø The board of directors recommends a vote AGAINST the stockholder proposal. •To transact such other business as may properly come before the annual meeting and any adjournment or postponement. |

| |

| RECORD DATE | You can vote if you are a holder of record of Encompass Health common stock on March 8, 2024. |

| |

| PROXY VOTING | Your vote is important. Please vote in one of these ways: •Via internet: Go to http://www.proxyvote.com and follow the instructions. You will need to enter the control number printed on your proxy card; •By telephone: Call toll-free 1-800-690-6903 and follow the instructions. You will need to enter the control number printed on your proxy card; •In writing: Complete, sign, date and promptly return your proxy card in the enclosed envelope; or •Submit a ballot in person at the annual meeting of stockholders. |

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be Held on May 2, 2024

Encompass Health’s Proxy Statement on Schedule 14A, form of proxy card, and 2023 Annual Report (including the 2023 Annual Report on Form 10-K) are available at http://www.proxyvote.com after entering the control number printed on your proxy card.

| | | | | | | | | | | |

| Birmingham, Alabama | | | Patrick Darby |

| April 2, 2024 | | | Secretary |

ENCOMPASS HEALTH CORPORATION

PROXY STATEMENT

TABLE OF CONTENTS

NOTE TO READERS

As used in this report, the terms “Encompass Health,” “we,” “us,” “our,” and the “Company” refer to Encompass Health Corporation and its consolidated subsidiaries, unless otherwise stated or indicated by context. We use the term “Encompass Health Corporation” to refer to Encompass Health Corporation alone wherever a distinction between Encompass Health Corporation and its subsidiaries is required or aids in the understanding of this filing.

This proxy statement and the accompanying form of proxy are first being sent to our stockholders on April 2, 2024.

ENCOMPASS HEALTH CORPORATION

PROXY STATEMENT

PROXY SUMMARY

This summary highlights selected information about the items to be voted on at our annual meeting and information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider in deciding how to vote, so you should read the entire proxy statement carefully before voting.

Proposals That Require Your Vote

| | | | | | | | | | | |

| Proposals | Board Recommendation | Votes Required for Approval | More Information |

| 1. Election of 10 directors to serve until our 2025 annual meeting | FOR each nominee | Votes for the director exceed the votes against the director | Page 8 |

| 2. Ratification of the appointment of our independent registered public accounting firm | FOR | Votes for the proposal exceed the votes against the proposal | Page 15 |

| 3. Approval, on an advisory basis, of our executive compensation | FOR | Votes for the proposal exceed the votes against the proposal | Page 17 |

| 4. Vote on a stockholder proposal requesting a report on the effectiveness of the Company’s diversity, equity, and inclusion efforts | AGAINST | Votes for represent the majority of our shares present and entitled to vote | Page 18 |

Say-on-Pay Highlights

We have received a say-on-pay approval vote of greater than 93% every year. We believe our stockholders have overwhelmingly endorsed our pay-for-performance track record, strong corporate governance, and compensation risk mitigation practices, including the following best practices related to executive compensation:

| | | | | |

| ü | Annual and long-term incentive plans have maximum award opportunities |

| ü | Annual and long-term incentive plans are designed with multiple measures of performance |

| ü | Annual incentive plan includes financial and sustainability metrics (human capital and quality of care) |

| ü | Long-term incentive plan has 3-year performance period and relative total shareholder return component |

| ü | Compensation “claw-back” policy applies to all officers, covers misconduct in some cases where a financial restatement has not occurred, and otherwise complies with NYSE claw-back requirements |

| ü | Equity ownership guidelines for executives require retention of 50% of net shares at the time of exercise/vesting until the ownership multiple is met. Non-employee directors must hold awards until departure |

| ü | Insider trading policy expressly prohibits hedging or pledging of our stock by executives and directors |

| ü | Change-of-control compensation arrangements include “double triggers” and do not gross-up for taxes |

Our pay-for-performance and other compensation best practices are discussed further beginning on page 38.

Governance Highlights

| | | | | |

| ü | Independent, non-executive chairman of the board |

| ü | 9 of 10 of our directors are independent |

| ü | All standing board committees are fully independent |

| ü | Heightened board independence requirement (75% of directors must be independent) |

| ü | Independent sessions are scheduled at every regular meeting of our board and its committees (no members of management are present at these independent sessions) |

| ü | Average tenure of director nominees is approximately 5.5 years (see page 8 for individual tenures) |

| ü | All directors attended at least 75% of the meetings of the board and the respective committees in 2023 |

| ü | Robust stock ownership requirements for directors and officers |

| ü | Majority voting in uncontested director elections, combined with contingent resignations of directors |

| ü | Declassified board with annual elections |

| ü | None of our directors serve on more than 2 outside public company boards |

| ü | Gender diversity (women comprise 40% of our director nominees, 26% of SVPs and above and 50% of hospital CEOs) |

| ü | Focus on board diversity in succession planning (20% of our director nominees are racially/ethnically diverse and 50% are female or racially/ethnically diverse) (see pages 29-30) |

| ü | No poison pill in place |

| ü | Annual board and committee performance evaluations and periodic involvement of outside advisors in such evaluations |

| ü | Active stockholder engagement program |

| ü | Regular reviews of succession plans for CEO and other senior executives |

| ü | Stockholders may amend our bylaws by simple majority vote |

| ü | Proxy reimbursement bylaw for stockholder proxy solicitation expenses (see pages 30-31) |

| ü | Stockholder-adopted exclusive forum bylaw for internal corporate claims |

| ü | Stockholders may act by written consent |

| ü | Stockholders representing 20% of outstanding shares may call a special meeting |

| ü | Term limit for directors of 15 years, subject to exceptions at the board’s discretion |

| ü | Mandatory retirement age for directors of 75, subject to exceptions at the board’s discretion |

| ü | Limitations on directorships for executive officers |

| ü | Enterprise risk management, including cybersecurity, oversight by full board and designated committees on regular schedule (see pages 23-24) |

| ü | ESG oversight by full board and designated committees on regular schedule (see pages 23-24) |

| ü | ESG/Sustainability targets in the executive compensation program (quality of care and employee turnover metrics)(see pages 43-44) |

| ü | Organizational focus on a strong culture that values diversity, equity, and inclusion and employee development and engagement (see the discussion in our 2023 Annual Report on Form 10-K) |

COMMONLY ASKED QUESTIONS

Why did I receive these proxy materials?

We are furnishing this proxy statement in connection with the solicitation by our board of directors of proxies to be voted at our 2024 annual meeting of stockholders and at any adjournment or postponement. At our annual meeting, stockholders will act upon the following proposals:

(1)to elect 10 directors to the board of directors to serve until our 2025 annual meeting of stockholders;

(2)to ratify the appointment by the Audit Committee of our board of directors of PricewaterhouseCoopers LLP as our independent registered public accounting firm;

(3)to approve, on an advisory basis, the compensation of the named executive officers, as disclosed in this proxy statement for the 2024 annual meeting;

(4)to vote on a stockholder proposal requesting a report on the effectiveness of the Company’s diversity, equity, and inclusion efforts; and

(5)to transact such other business as may properly come before the 2024 annual meeting of stockholders and any adjournment or postponement.

These proxy solicitation materials are being sent to our stockholders on or about April 2, 2024 and summarize the purposes of the meeting and the information you need to know to vote at the annual meeting.

What do I need to attend the meeting?

Attendance at the 2024 annual meeting of stockholders is limited to stockholders. Registration will begin at 10:30 a.m. central time, and each stockholder will be asked to present a valid form of photo identification. If you are a beneficial owner, to be admitted you will need proof of beneficial ownership in the form of a statement from the brokerage firm, bank or nominee or a legal proxy from that institution indicating you are a beneficial owner of our common stock or the sole legal proxy of a beneficial owner. All stockholders must check in at the registration desk at the meeting. Cameras, recording devices and other electronic devices will not be permitted at the meeting. Additional rules of conduct regarding the meeting will be provided at the meeting.

Who is entitled to vote at the meeting?

The board of directors has determined that those stockholders who are recorded in the books of our transfer agent as owning shares of our common stock as of the close of business on March 8, 2024, are entitled to receive notice of and to vote at the annual meeting of stockholders. As of February 14, 2024, there were 100,140,031 shares of our common stock issued and outstanding. Your shares may be (1) held directly in your name as the stockholder of record or (2) held for you as the beneficial owner through a stockbroker, bank or other nominee, or both. Our common stock is our only class of outstanding voting securities. Each share of common stock owned as of the close of business on March 8, 2024 is entitled to one vote on each matter properly brought before the annual meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most of our stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the meeting. If you requested a paper copy of the proxy materials, we have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker, bank, or nominee which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the meeting. However, because you are not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. Your broker, bank, or nominee

has enclosed or provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares. If you do not provide the stockholder of record with voting instructions, your shares may constitute broker non-votes. The effect of broker non-votes is more specifically described in “What vote is required to approve each item?” below.

How can I vote my shares at the annual meeting?

Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. Submitting your proxy by telephone, by internet or by mail will in no way limit your right to vote at the annual meeting if you later decide to attend in person.

Shares held beneficially in street name may be voted by you during the annual meeting only if you obtain a signed proxy from the record holder giving you the right to vote the shares. Owners of shares held in street name that expect to attend and vote at the meeting should contact their broker, bank or nominee as soon as possible to obtain the necessary proxy.

Even if you currently plan to attend the annual meeting, we recommend that you also submit your proxy as described below so your vote will be counted if you later decide not to attend the meeting.

How can I vote my shares without attending the meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker, bank, or nominee.

Please refer to the summary instructions below and those included on your proxy card or, for shares held in street name, the voting instruction form provided by your broker, bank, or nominee. The internet and telephone voting procedures established for our stockholders of record are designed to authenticate your identity, to allow you to give your voting instructions, and to confirm those instructions have been properly recorded. Internet and telephone voting for stockholders of record will be available 24 hours a day, and will close at 11:59 p.m. eastern time on May 1, 2024. The availability of internet and telephone voting for beneficial owners will depend on the voting processes of your broker, bank or other holder of record. Therefore, we recommend that you follow the voting instructions you receive.

•BY INTERNET – If you have internet access, you may submit your proxy from any location in the world by following the “internet” instructions on the proxy card . Please have one of those documents in hand when accessing the website as you will need the control number found there.

•BY TELEPHONE – If you live in the United States, Puerto Rico, or Canada, you may submit your proxy by following the “telephone” instructions on your proxy card. Please have one of those documents in hand when you call as you will need the control number found there.

•BY MAIL – If you requested a paper copy of the proxy materials, you may vote by mail by marking, signing, and dating your proxy card or, for shares held in street name, the voting instruction card included by your broker, bank, or nominee and mailing it in the accompanying enclosed, pre-addressed envelope. If you provide specific voting instructions, your shares will be voted as you instruct. If you do not have the pre-addressed envelope available, please mail your completed proxy card to: Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Mailed proxy cards must be received no later than May 1, 2024 in order to be counted.

If you cast your vote in any of the ways set forth above, your shares will be voted in accordance with your voting instructions unless you validly revoke your proxy. We do not currently anticipate that any other matters will be presented for action at the annual meeting. If any other matters are properly presented for action, the persons named as your proxies will vote your shares on these other matters in their discretion, under the discretionary authority you have granted to them in your proxy.

Can I access the proxy statement and annual report on the internet?

Yes. This proxy statement, the form of proxy card and our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”) are available at http://www.proxyvote.com after entering the control number printed on your proxy card. If you received a paper copy of the proxy materials, you have made a previous election to that effect. If you are a stockholder of record and would like to access future proxy materials electronically instead of receiving paper copies in the mail, there are several ways to do this. You can mark the appropriate box on your

proxy card or follow the instructions if you vote by telephone or the internet. If you have internet access, we hope you make this choice. Receiving future annual reports and proxy statements via the internet will be simpler for you, will save the Company money and is friendlier to the environment.

A copy of our 2023 Form 10-K and the proxy materials are also available without charge from the “Investors” section of our website at https://investor.encompasshealth.com. The 2023 Form 10-K and the proxy materials are also available in print to stockholders without charge and upon request, addressed to Encompass Health Corporation, 9001 Liberty Parkway, Birmingham, Alabama 35242, Attention: Corporate Secretary.

Are you planning on making the proxy materials only available by internet this year, unless paper copies are requested?

No. Although many public companies mail a notice to their shareholders so they can provide proxy materials through the internet, we have elected to use the “full set delivery” option and are providing paper copies of proxy materials to all of our shareholders, unless otherwise previously requested by the shareholder. Our proxy materials and 2023 Form 10-K comprising our Annual Report are also available via the internet. See “Can I access the proxy statement and report on the internet?” directly above. We may decide not to use the “full set delivery” option in the future; however, you will still have the right to request a free set of proxy materials by mail.

Can I change my vote after I submit my proxy?

Yes. Even after you have submitted your proxy, you may change your vote by:

•filing with our corporate secretary at 9001 Liberty Parkway, Birmingham, Alabama 35242, a signed, original written notice of revocation dated later than the proxy you submitted, provided such notice is received on or before May 1, 2024;

•submitting a duly executed proxy bearing a later date that is received on or before May 1, 2024;

•voting by telephone or internet on a later date; or

•attending the annual meeting and voting in person.

If you grant a proxy, you are not prevented from attending the annual meeting and voting in person. However, your attendance at the annual meeting will not by itself revoke a proxy you have previously granted; you must vote in person at the annual meeting to revoke your proxy.

If your shares are held by a broker, bank or other nominee, you may revoke your proxy by following the instructions provided by your broker, bank, or nominee. All valid proxies not revoked will be voted at the annual meeting.

What is “householding” and how does it affect me?

We are delivering the proxy materials addressed to all stockholders who share a single address unless they have notified us they wish to “opt out” of the program known as “householding.” Under the householding procedure, stockholders of record who have the same address and last name receive only one copy of the proxy materials. Householding is intended to reduce our printing and postage costs and material waste. WE WILL DELIVER A SEPARATE COPY OF THE ANNUAL REPORT OR PROXY STATEMENT PROMPTLY UPON WRITTEN OR ORAL REQUEST. You may request a separate copy by contacting our corporate secretary at 9001 Liberty Parkway, Birmingham, Alabama 35242, or by calling 1-205-967-7116.

If you are a stockholder of record and you choose not to have these disclosure documents sent to a single household address as described above, you must “opt-out” by writing to: Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes Way, Edgewood, New York 11717, or by calling 1-866-540-7095, and we will cease householding disclosure documents within 30 days. If we do not receive instructions to remove your account(s) from this service, your account(s) will continue to be householded. Conversely, if you are receiving multiple copies of these disclosure documents and wish to receive only one copy, you should contact your bank or broker for information regarding householding of disclosure documents and to request a change in delivery status.

Is there a list of stockholders entitled to vote at the meeting?

A complete list of stockholders entitled to vote at the meeting will be open for examination by our stockholders for any purpose germane to the meeting, during regular business hours at the meeting place, for ten days prior to the meeting.

What constitutes a quorum to transact business at the meeting?

Before any business may be transacted at the annual meeting, a quorum must be present. The presence at the annual meeting, in person or by proxy, of the holders of a majority of the shares of all of our capital stock outstanding and entitled to vote on the record date will constitute a quorum. At the close of business on February 14, 2024, 100,140,031 shares of our common stock were issued and outstanding. Proxies received but marked as withholds, abstentions, and broker non-votes will be included in the calculation of the number of shares considered to be present at the annual meeting for purposes of a quorum.

If a quorum is not present or if we decide that more time is necessary for the solicitation of proxies, we may adjourn the annual meeting. We may do this with or without a stockholder vote. If the stockholders vote to adjourn the annual meeting in accordance with our Bylaws, the named proxies will vote all shares of common stock for which they have voting authority in favor of adjournment.

What is the recommendation of the board of directors?

Our board of directors unanimously recommends a vote:

1.“FOR” the election of each of our 10 nominees to the board of directors;

2.“FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as Encompass Health’s independent registered public accounting firm;

3.“FOR” the approval of the compensation of our named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission; and

4.“AGAINST” the stockholder proposal requesting a report on the effectiveness of the Company’s diversity, equity, and inclusion efforts.

With respect to any other matter that properly comes before the annual meeting, the proxy holders will vote in accordance with their judgment on such matter.

What vote is required to approve each item?

The vote requirements for Proposals 1 and 2 are as follows:

•Each nominee for director named in Proposal 1 will be elected if the votes for the nominee exceed the number of votes against with respect to such nominee. Votes cast with respect to a nominee will exclude abstentions and broker non-votes.

•The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm will be approved if the votes cast for the proposal exceed those cast against the proposal. Broker non-votes will not be counted as votes cast for or against.

Please note that “say-on-pay,” Proposal 3, is only advisory in nature and has no binding effect on the Company or our board of directors. For Proposal 3, our board of directors will consider the proposal approved if the votes cast in favor of the proposal exceed the votes cast against it.

For Proposal 4, the affirmative vote of at least a majority of our shares present, in person or by proxy, and entitled to vote on the proposal will be required to approve if the stockholder proposal is validly presented at a meeting of stockholders. Under applicable Delaware law, in determining whether any stockholder proposal has received the requisite number of affirmative votes, abstentions will have the same effect as a vote against any stockholder proposal. Broker non-votes will be ignored.

A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. If you are a beneficial owner, your bank, broker or

other holder of record is permitted to vote your shares on the ratification of the independent registered public accounting firm even if the record holder does not receive voting instructions from you. Absent instructions from you, the record holder may not vote on any “nondiscretionary” matter including a director election, an equity compensation plan, a matter relating to executive compensation, certain corporate governance changes, or any stockholder proposal. In that case, without your voting instructions, a broker non-vote will occur. An “abstention” will occur at the annual meeting if your shares are deemed to be present at the annual meeting because you attend the annual meeting but you do not vote on any proposal or other matter which is required to be voted on at the annual meeting. You should consult your broker if you have questions about this.

There are no dissenters’ rights of appraisal in connection with any stockholder vote to be taken at the annual meeting.

What does it mean if I receive more than one proxy or voting instruction card?

It means your shares of common stock are registered differently or are in more than one account. Please return each proxy and voting instruction card you receive. Please submit your vote for each control number you have been assigned.

Where can I find the voting results of the meeting?

We will announce preliminary voting results at the meeting. We will publish the voting results in a Current Report on Form 8-K to be filed with the SEC no later than four business days following the end of the annual meeting. If preliminary results are reported initially, we will update the filing when final, certified results are available.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., acting as the inspector of election, will tabulate and certify the votes.

Who will pay for the cost of this proxy solicitation?

We are making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. If you choose to access the proxy materials or vote over the internet, however, you are responsible for internet access charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone, or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. We will request banks, brokers, nominees, custodians, and other fiduciaries who hold shares of our stock in street name, to forward these proxy solicitation materials to the beneficial owners of those shares and we will reimburse the reasonable out-of-pocket expenses they incur in doing so.

We have also retained Alliance Advisors, LLC to assist us in the solicitation of proxies. Alliance Advisors, LLC will solicit proxies on our behalf from individuals, brokers, bank nominees and other institutional holders in the same manner described above for a fee of $10,000, plus reasonable out of pocket expenses. We have also agreed to indemnify Alliance Advisors, LLC against certain claims.

Who should I contact if I have questions?

If you hold our common stock through a brokerage account and you have any questions or need assistance in voting your shares, you should contact the broker or bank where you hold the account. If you are a registered holder of our common stock and you have any questions or need assistance in voting your shares, please call our Investor Relations department at 1-205-969-4600. As an additional resource, the SEC website has a variety of information about the proxy voting process at www.sec.gov/spotlight/proxymatters.

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT WILL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE OF THIS PROXY STATEMENT.

ITEMS OF BUSINESS REQUIRING YOUR VOTE

Proposal 1 – Election of Directors

Director Nominees

The board of directors of Encompass Health currently consists of 12 members. At the end of this year’s term, two directors, Messrs. Correll and Chidsey, will be retiring from the Encompass Health board and will not stand for re-election. In conjunction with the retirement of these directors, our board has approved a reduction in the size of the board from 12 to 10 members effective as of the end of this year’s annual meeting of stockholders. Based on the recommendation of the Nominating/Corporate Governance Committee, our board proposes that each of the 10 nominees listed below be elected as directors at this annual meeting and serve until our 2025 annual meeting of stockholders. Following this annual meeting, the elected members of the board will elect a new independent chairman of the board in accordance with the requirement of the Corporate Governance Guidelines.

Each director nominee named in this Proposal 1 will be elected if the votes for that nominee exceed the number of votes cast against that nominee. Votes cast with respect to a nominee will exclude abstentions and broker non-votes. If a nominee becomes unable or unwilling to accept the nomination or election, the persons designated as proxies will be entitled to vote for any other person designated as a substitute nominee by our board of directors. We have no reason to believe that any of the following nominees will be unable to serve. Below we have provided information relating to each of the director nominees proposed for election by our board, including a brief description of why he or she was nominated.

| | | | | | | | | | | | | | | | | | | | |

| Name of Nominee | | Age | | Current Roles | | Date Became

Director |

| Greg D. Carmichael* | | 62 | | Member of Compensation and Human Capital Committee (Chair) and Nominating/Corporate Governance Committee | | 1/1/2020 |

| Edward M. Christie III* | | 53 | | Member of Audit Committee | | 11/27/2023 |

| Joan E. Herman* | | 70 | | Member of Audit Committee and Compliance and Quality of Care Committee (Chair) | | 1/25/2013 |

| Leslye G. Katz* | | 69 | | Member of Finance Committee and Nominating/Corporate Governance Committee (Chair) | | 1/25/2013 |

| Patricia A. Maryland* | | 70 | | Member of Compensation and Human Capital Committee and Compliance and Quality of Care Committee | | 1/1/2020 |

| Kevin J. O’Connor* | | 56 | | Member of Compliance and Quality of Care Committee and Nominating/Corporate Governance Committee | | 3/30/2022 |

| Christopher R. Reidy* | | 67 | | Member of Audit Committee (Chair) and Finance Committee | | 10/1/2021 |

| Nancy M. Schlichting* | | 69 | | Member of Compensation and Human Capital Committee and Compliance and Quality of Care Committee | | 12/11/2017 |

| Mark J. Tarr | | 62 | | President and Chief Executive Officer | | 12/29/2016 |

| Terrance Williams* | | 55 | | Member of Audit Committee and Finance Committee (Chair) | | 1/1/2020 |

| | | | | | |

* Denotes independent director. | | | | |

There are no arrangements or understandings known to us between any of the nominees listed above and any other person pursuant to which that person was or is to be selected as a director or nominee, other than any arrangements or understandings with persons acting solely as directors or officers of Encompass Health.

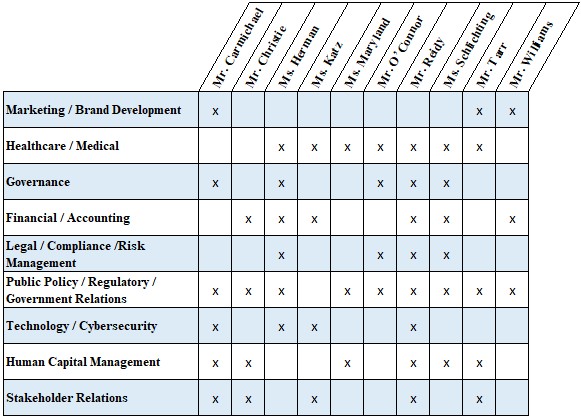

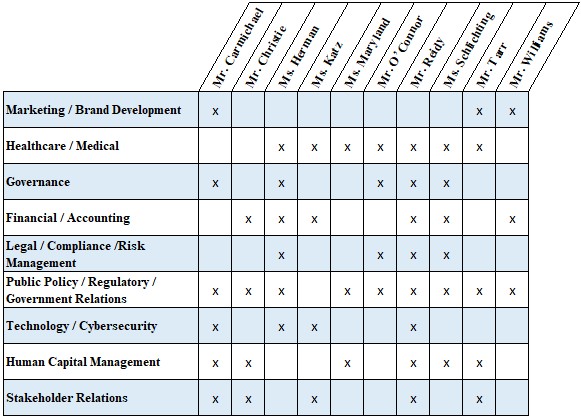

All of the director nominees have public company, senior leadership and strategic planning experience and financial literacy. The following matrix is intended to summarize the other primary experience, skills, and qualifications of the nominees. Each nominee’s individual experiences and qualifications are described in more detail in the biographies below.

| | | | | |

| Greg D. Carmichael Mr. Carmichael has served as executive chair of the board of directors of City National Bank, a subsidiary of Royal Bank of Canada, since October 2, 2023. Mr. Carmichael retired as the executive chairman of Fifth Third Bancorp in April 2023. In July 2022, he retired as president and chief executive officer of Fifth Third. He originally joined Fifth Third in 2003 and served in various other executive roles, including chief operating officer and chief information officer. From 2000 to 2003, Mr. Carmichael was vice president and chief information officer for Emerson Electric, a worldwide provider of technology and energy solutions. From 1996 to 2000, he served in the same roles for a subsidiary of Emerson, and from 1986 to 1996, he served in several information technology and leadership roles at General Electric. On March 12, 2023, the Federal Deposit Insurance Corporation (the “FDIC”) appointed Mr. Carmichael as chief executive officer of Signature Bridge Bank, N.A., the successor to Signature Bank, which went into FDIC receivership that same date. Mr. Carmichael has extensive experience in matters of information technology, finance, corporate strategy and senior leadership relevant to large public companies. His extensive experience with IT matters includes cybersecurity oversight as a result of his leadership roles in multiple IT departments. |

| | | | | |

| Edward M. Christie III Mr. Christie has served as president and chief executive officer of Spirit Airlines, Inc. since January 2019. In his tenure with Spirit, which began in April 2012, Mr. Christie has held a number of leadership roles and responsibilities, including as Chief Financial Officer. Prior to joining Spirit, he served as Vice President and Chief Financial Officer of Pinnacle Airlines Corp. from July 2011 to March 2012. Prior to that, Mr. Christie was a partner in the management consulting firm of Vista Strategic Group LLC from May 2010 to July 2011. From 2002 to 2010, Mr. Christie served in various positions, including Chief Financial Officer, at Frontier Airlines. Mr. Christie has served on the board of directors of Spirit since January 2018. Mr. Christie has significant experience in finance, strategic and public company leadership, operations, and governmental relations and regulation. |

| | | | | |

| Joan E. Herman Ms. Herman has served as the president and chief executive officer of Herman & Associates, LLC, a healthcare and management consulting firm, since 2008. Herman & Associates provides services to healthcare providers, pharmacy benefit managers, managed care organizations, and private equity firms. From 1998 to 2008, she served in a number of senior management positions, including president and chief executive officer for two corporate divisions, at Elevance, Inc. (f/k/a Anthem, Inc. and WellPoint, Inc.), a leading managed healthcare company that offers network-based managed care plans. Prior to joining Elevance, she served in a number of senior positions at Phoenix Life Insurance Company for 16 years, lastly as senior vice president of strategic development. She currently serves as a director and a member of the audit, compensation, and compliance committees of Ionis Pharmaceuticals, Inc., an RNA-targeted drug discovery and development firm. She also serves on the board of Fifth Avenue Private Equity 17 Fund. Ms. Herman has extensive experience leading large complex businesses, including in the healthcare and insurance industries. With Elevance, she gained experience dealing with government reimbursement issues as well as state and federal healthcare and insurance regulators. Additionally, she has completed the National Association of Corporate Directors’ Cyber-Risk Oversight Program, which is designed to enhance cybersecurity literacy and strengthen cyber-risk oversight practices, and holds a CERT Certificate in Cybersecurity Oversight. Her senior involvement and board service with various community and charity organizations evidences her leadership skills and character. |

| | | | | |

| Leslye G. Katz From January 2007 to December 2010, Ms. Katz served as senior vice president and chief financial officer of IMS Health, Inc., a provider of information, services, and technology for clients in the pharmaceutical and healthcare industries. Prior to that, she served as vice president and controller for five years. From July 1998 to July 2001, Ms. Katz served as senior vice president and chief financial officer of American Lawyer Media, Inc., a privately held legal media and publishing company. Prior to joining American Lawyer Media, Ms. Katz held a number of financial management positions with The Dun & Bradstreet Corporation, followed by two years as vice president and treasurer of Cognizant Corporation, a spin off from D&B. She currently serves as vice-chair of the board of directors of My Sisters’ Place, a not-for-profit provider of shelter, advocacy, and support services to victims of domestic violence. Ms. Katz has extensive experience in financial management at companies serving the healthcare and pharmaceutical industries, as well as expertise in mergers and acquisitions, treasury, financial planning and analysis, SEC reporting, investor relations, real estate, and procurement. She has further demonstrated her leadership and character in her board service with community charities. |

| | | | | |

| Patricia A. Maryland Ms. Maryland has 40 years of healthcare administration experience. In 2019, she retired as an executive vice president for Ascension and president and chief executive officer at Ascension Healthcare, a leading non-profit health system operating more than 2,600 sites of care including 150 hospitals and more than 50 senior living facilities in 20 states and the District of Columbia. Prior to that, Ms. Maryland held other executive and management positions in the Ascension organization for 13 years, including president and chief executive of the St. John Providence Health System and president of the Indianapolis Hospital, St. Vincent’s Health System. Prior to joining Ascension, Ms. Maryland worked in administrative roles with Detroit Medical Center, North Oakland Medical Centers, Cleveland Clinic Foundation and Mercy Hospital. Ms. Maryland also serves as a director on the board of Surgery Partners, Inc., an operator of surgical facilities and provider of ancillary services, and Privia Health Group, Inc., a national physician platform for the healthcare delivery experience. Ms. Maryland has extensive senior management and strategy planning experience with large healthcare provider organizations as described above and as a result brings a wealth of knowledge and understanding of the healthcare industry. She has demonstrated leadership and character through involvement, including board roles, over many years in numerous community and healthcare related non-profit organizations. |

| | | | | |

| Kevin J. O’Connor Mr. O’Connor is the Senior Vice President, Chief Legal Officer of Carrier Global Corporation, a leading global provider of healthy, safe and sustainable building and cold chain solutions, where he oversees the company’s legal, governance, compliance and government affairs worldwide. Prior to joining Carrier in 2020, he was Chief Legal Officer of Point72 Asset Management from 2015 through early 2020. Prior to that, he served as Vice President, Global Ethics and Compliance for United Technologies Corporation from 2012 to 2015. Prior to his corporate leadership roles, Mr. O’Connor practiced law for 20 years in both private and public practice, including serving in various roles at the United States Department of Justice, including Associate Attorney General and United States Attorney for the District of Connecticut, and at the United States Securities and Exchange Commission, Division of Enforcement. He previously served on the strategic advisory council of Vencore, Inc., a private defense contractor serving intelligence, defense, and other agencies, and currently serves on the board of trustees for the University of Connecticut. Mr. O’Connor has extensive senior leadership, legal, compliance, and regulatory/risk management experience as described above. He also has healthcare provider experience having served as the chair of the board of directors of Trinity Health of New England, a large integrated health system. |

| | | | | |

| Christopher R. Reidy On March 31, 2022, Mr. Reidy retired as Executive Vice President, Strategic Advisor of Becton, Dickinson and Company (“BD”), one of the largest global medical technology companies in the world. Prior to that role, he served as BD’s executive vice president, chief financial officer and chief administrative officer where he managed strategic transactions and oversaw many functions, including finance, information technology and security, business development, and enterprise risk management. Prior to joining BD in 2013, he served in many senior finance and accounting roles, including corporate vice president and chief financial officer for ADP Corporation; vice president, controller & chief accounting officer and division CFO roles at AT&T Corporation; and audit partner at Deloitte & Touche. He currently serves on the board of directors of Embecta Corp., one of the largest pure-play diabetes management companies in the world, where he serves as chair of the technology committee. He also sits on the board of Atlantic Health System and is a member of the executive committee and chair of the finance and investment committee. Mr. Reidy has extensive senior management and administrative experience with a vendor for a wide range healthcare providers as described above and as a result brings a wealth of knowledge and understanding of the healthcare industry. He also has significant experience in finance, accounting, strategic planning, risk management, and information technology and security. He qualifies as an “audit committee financial expert” within the meaning of SEC regulations. He also has extensive cybersecurity oversight experience as a result of his roles at both BD and ADP where the chief information security officers reported directly to him and he was heavily involved in the respective cybersecurity programs. At BD, the information technology department reported to him.

|

| | | | | |

| Nancy M. Schlichting In December 2016, Ms. Schlichting retired as the president and chief executive officer at Henry Ford Health System, Inc., a position she held from June 2003. Prior to that, Ms. Schlichting served as HFHS’s executive vice president and chief operating officer from 1998 to 2003. She also served as president and chief executive officer of HFHS’s Henry Ford Hospital from 2001 to 2003. During her time at HFHS, the company garnered significant national recognition, including the Malcolm Baldrige National Quality Award and the John M. Eisenberg Patient Safety and Quality Award. Prior to joining HFHS in 1998, Ms. Schlichting served as the president of the Eastern Region of Catholic Health Initiatives, president and chief executive officer of Riverside Methodist Hospitals and executive vice president and chief operating officer of Akron City Hospital and Summa Health System. Ms. Schlichting currently serves as a director of Walgreens Boots Alliance, Inc., where she serves on the audit committee and chairs the compensation and leadership performance committee, and Baxter International Inc., where she serves on the quality, compliance and technology committee and chairs the compensation and and leadership performance committee, and Baxter International Inc., where she serves on the quality, compliance and technology committee and chairs the compensation and human capital committee. She recently served on the boards of Hill-Rom Holdings, Inc. and Pear Therapeutics, Inc.

Ms. Schlichting has extensive senior management and administrative experience with large healthcare provider organizations as described above and as a result brings a wealth of knowledge and understanding of the healthcare industry. She has demonstrated leadership and character through involvement, including board roles, over many years in numerous community and healthcare related non-profit organizations. |

| | | | | |

| Mark J. Tarr Mr. Tarr became our President and Chief Executive Officer on December 29, 2016. Previously, he served as executive vice president of our operations since October 1, 2007, to which the chief operating officer designation was added on February 24, 2011. Mr. Tarr joined us in 1993 and has held various management positions with us, including serving as president of our inpatient division from 2004 to 2007, as senior vice president with responsibility for all inpatient operations in Texas, Louisiana, Arkansas, Oklahoma, and Kansas from 1997 to 2004, as director of operations of our 80-bed rehabilitation hospital in Nashville, Tennessee from 1994 to 1997, and as chief executive officer/administrator of our 70-bed rehabilitation hospital in Vero Beach, Florida from 1992 to 1994. Mr. Tarr serves on the board of directors of Protective Life Corp. Mr. Tarr, as our president and chief executive officer, directs the strategic, financial and operational management of the Company and, in this capacity, provides unique insights into its detailed operations. He also has the benefit of more than 30 years of experience in the operation and management of inpatient rehabilitation hospitals. |

| | | | | |

| Terrance Williams On June 26, 2023, Mr. Williams became President and Chief Executive Officer-elect at TruStage Financial Group, Inc., a large provider of insurance, investments, and financial technology solutions. Prior to that, he served as the executive vice president and president of protection products and services at Allstate Corporation, where he had accountability for a portfolio of businesses outside of the core insurance market with nearly $5 billion in revenues and over 3,800 employees globally. Before joining Allstate in January 2020, he served as executive vice president and chief marketing officer for Nationwide Mutual Insurance Company, as well as the president of the Nationwide’s emerging businesses group, which included legacy niche and emerging businesses, innovation teams, and a venture capital fund. During 24 years with Nationwide, he advanced through leadership roles touching almost every aspect of the business, including underwriting, claims, operations, sales and various profit and loss management roles. Mr. Williams has a deep and broad base of marketing, insurance (payor), and regulated-industry experience. He also brings extensive experience in managing every aspect of business from sales, marketing, and operations to enterprise strategy across a large geographic platform. He qualifies as an “audit committee financial expert” within the meaning of SEC regulations. |

Board Recommendation

The board of directors unanimously recommends that you vote “FOR” the election of all 10 director nominees.

Proposal 2 – Ratification of Appointment of Independent Registered Public Accounting Firm

Appointment of PricewaterhouseCoopers LLP

In accordance with its charter, the Audit Committee of our board of directors selected the firm of PricewaterhouseCoopers LLP to be our independent registered public accounting firm for the 2024 audit period, and with the endorsement of the board of directors, recommends to our stockholders that they ratify that appointment. The Audit Committee will reconsider the appointment of PricewaterhouseCoopers LLP for the next audit period if such appointment is not ratified. Representatives of PricewaterhouseCoopers LLP are expected to attend the annual meeting and will have the opportunity to make a statement if they desire, and are expected to be available to respond to appropriate questions.

The Audit Committee recognizes the importance of maintaining the independence of our independent registered public accounting firm, both in fact and appearance. Consistent with its charter, the Audit Committee has evaluated PricewaterhouseCoopers LLP’s qualifications, performance, and independence, including that of the lead audit partner. The Audit Committee reviews and approves, in advance, the audit scope, the types of non-audit services, if any, and the estimated fees for each category for the coming year. For each category of proposed service, PricewaterhouseCoopers LLP is required to confirm that the provision of such services does not impair their independence. Before selecting PricewaterhouseCoopers LLP, the Audit Committee carefully considered that firm’s qualifications as an independent registered public accounting firm for the Company. This included a review of its performance in prior years, as well as its reputation for integrity and competence in the fields of accounting and auditing. The Audit Committee has expressed its satisfaction with PricewaterhouseCoopers LLP in all of these respects. The Audit Committee’s review included inquiry concerning any litigation involving PricewaterhouseCoopers LLP and any proceedings by the SEC against the firm. The Audit Committee concluded that the ability of PricewaterhouseCoopers LLP to perform services for us is in no way adversely affected by any such investigation or litigation.

Pre-Approval of Principal Accountant Services

The Audit Committee is responsible for the appointment, oversight, and evaluation of our independent registered public accounting firm. In accordance with our Audit Committee’s charter, our Audit Committee must approve, in advance of the service, all audit and permissible non-audit services provided by our independent registered public accounting firm. Our independent registered public accounting firm may not be retained to perform the non-audit services specified in Section 10A(g) of the Securities Exchange Act of 1934, as amended. The Audit Committee has concluded that provision of the non-audit services described in that section is not compatible with maintaining the independence of PricewaterhouseCoopers LLP.

The Audit Committee has established a policy regarding pre-approval of audit and permissible non-audit services provided by our independent registered public accounting firm, as well as all engagement fees and terms for our independent registered public accounting firm. Under the policy, the Audit Committee must approve the services to be rendered and fees to be charged by our independent registered public accounting firm. Typically, the Audit Committee approves services up to a specific amount of fees. The Audit Committee must then approve, in advance, any services or fees exceeding those pre-approved levels, provided that the chair may approve any excess fees up to 5% of previously approved amounts. To the extent permitted by applicable regulations and the rules of the New York Stock Exchange, the Audit Committee may delegate general pre-approval authority to a subcommittee of one or more of its members.

Principal Accountant Fees and Services

With respect to the audits for the years ended December 31, 2023 and 2022, the Audit Committee approved the audit services to be performed by PricewaterhouseCoopers LLP, as well as certain categories and types of audit-related and permitted non-audit services. In 2023 and 2022, the Audit Committee approved all audit, audit-related, and other fees in accordance with SEC pre-approval rules. The following table shows the aggregate fees paid or accrued for professional services rendered by PricewaterhouseCoopers LLP for the years ended December 31, 2023 and 2022, with respect to various services provided to us and our subsidiaries.

| | | | | | | | | | | | | | |

| | | For the Year Ended December 31, |

| | | 2023 | | 2022 |

| | (In Millions) |

Audit fees(1) | | $ | 3.27 | | | $ | 4.16 | |

Audit-related fees(2) | | 0.01 | | | 0.54 | |

| Total audit and audit-related fees | | 3.28 | | | 4.70 | |

Tax fees(3) | | 0.02 | | | 0.02 | |

All other fees(4) | | 0.14 | | | 0.02 | |

| Total fees | | $ | 3.44 | | | $ | 4.74 | |

_____________________________

(1)Audit fees – Represents aggregate fees paid or accrued for professional services rendered for the audit of our consolidated financial statements and internal control over financial reporting for each year presented and the carve-out audit of our home health & hospice business in connection with its separation as an independent publicly traded company; fees for professional services rendered for the review of financial statements included in our Form 10-Q filings, and fees for professional services normally provided by our independent registered public accounting firm in connection with statutory and regulatory engagements required by various partnership agreements or state and local laws in the jurisdictions in which we operate or manage hospitals.

(2)Audit-related fees – Represents aggregate fees paid or accrued for assurance and related services that are reasonably related to the performance of audit services and traditionally are performed by our independent auditor, including fees related to work associated with registration of securities for our home health & hospice business in connection with its separation as an independent publicly traded company.

(3)Tax fees – Represents fees for all professional tax services provided by our independent auditor’s tax professionals, such as preparation of Puerto Rico tax returns and other tax compliance matters, but not including any services related to the audit of our financial statements.

(4)All other fees – Represents fees paid or due to our independent auditor for (i) costs incurred related to the Company’s suit against various third parties in Delaware, (ii) an automated disclosure checklist, and (iii) other subscription fees.

Board Recommendation

The board of directors and the Audit Committee unanimously recommend that you vote “FOR” ratifying the appointment of PricewaterhouseCoopers LLP as Encompass Health’s independent registered public accounting firm for the 2024 audit period.

Proposal 3 – Advisory Vote on Executive Compensation

We seek your advisory vote on our executive compensation programs and ask that you support the compensation of our named executive officers as disclosed under the heading “Executive Compensation,” including the “Executive Summary” section, beginning on page 36 and the accompanying tables and related narrative disclosure. This proposal, commonly referred to as a “say-on-pay” proposal, gives stockholders the opportunity to express their views on the named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the named executive officers and the philosophy, policies, and practices described in this proxy statement.

As described under the heading “Compensation Discussion and Analysis,” the Company provides annual and long-term compensation programs, as well as other benefit plans, to attract, motivate, and retain the named executive officers, each of whom is critical to the Company’s success, and to create a remuneration and incentive program that aligns the interests of the named executive officers with those of stockholders. The board of directors believes the program strikes the appropriate balance between utilizing responsible, measured pay practices and effectively incentivizing the named executive officers to dedicate themselves fully to value creation for our stockholders. At the 2023 annual meeting, 94.0% of stockholders voting on the say-on-pay proposal approved of our executive compensation programs.

You are encouraged to read the information detailed under the heading “Executive Compensation” beginning on page 36 for additional details about the Company’s executive compensation programs.

The board of directors strongly endorses the Company’s executive compensation programs and recommends that the stockholders vote in favor of the following resolution:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Encompass Health Corporation Definitive Proxy Statement for the 2024 annual meeting of stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and disclosure.”

This say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation and Human Capital Committee or the board of directors. Our board of directors and its Compensation and Human Capital Committee value the opinions of our stockholders and to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, we will consider stockholders’ concerns and the Compensation and Human Capital Committee will evaluate whether any actions are necessary to address those concerns. The board has elected to hold the say-on-pay advisory vote annually until further notice, so the next advisory vote is expected to be in connection with the 2025 annual meeting of stockholders.

Board Recommendation

The board of directors unanimously recommends a vote “FOR” the approval of the compensation of our named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission.

Proposal 4 – Stockholder Proposal Requesting a Report on the Effectiveness of the Company’s Diversity, Equity, and Inclusion Efforts

We have been informed that As You Sow, on behalf of Marguerite Casey Foundation,1 a beneficial owner of 1,619 shares of our common stock, intends to present the proposal set forth below at our Annual Meeting of Stockholders. In accordance with SEC rules, we are including this stockholder proposal, along with the supporting statement of the proponent. The Company is not responsible for any inaccuracies in this stockholder proposal and supporting statement.

Our board of directors recommends that you vote AGAINST this proposal for the reasons set forth in the Company’s Statements in Opposition, which follows this proposal.

RESOLVED: Shareholders request that Encompass Health Corp. (“Encompass Health”) report to shareholders on the effectiveness of the Company's diversity, equity, and inclusion efforts. The report should be done at reasonable expense, exclude proprietary information, and provide transparency on outcomes, using quantitative metrics for workforce diversity, hiring, promotion, and retention of employees, including data by gender, race, and ethnicity.

SUPPORTING STATEMENT: Quantitative data is sought so that investors can assess and compare the effectiveness of companies’ diversity, equity, and inclusion programs.

It is advised that this content be provided through Encompass Health’s existing sustainability reporting infrastructure. An independent report specific to this topic is not requested.

WHEREAS: More than half of the S&P 500 and over one-third of the Russell 1000 have released, or have committed to release, their consolidated EEO-1 forms, a best practice in diversity data reporting. Companies that release, or have committed to release, more inclusion data than Encompass Health include Baxter International, Biogen, CVS Health, Gilead Sciences, Pfizer, and UnitedHealth Group.

As You Sow and Whistle Stop Capital released research in November 2023 that reviewed the EEO-1 reports of 1,641 companies against financial performance metrics from 2016-2021.2 Within the healthcare sector, statistically significant positive correlations were found between increased manager diversity and free cash flow per share, income after tax, and ten-year revenue compound annual growth rate.

As of the date of the filing of this proposal, Encompass Health had not yet released its consolidated EEO-1 form, nor had it shared sufficient hiring, retention, or promotion data to allow investors to determine the effectiveness of its diversity and inclusion programs.

As detailed below, inclusion indicators are also important in assessing Encompass Health’s workplace equity efforts and if the Company will be able to successfully build, utilize, and maintain a diverse management team.

Hiring: Studies conducted by economists at the University of Chicago and UC Berkeley found that “discriminating companies tend to be less profitable,” stating “it is costly for firms to discriminate against productive workers.”3

Promotion: Without equitable promotional practices, companies will be unable to build the necessary employee pipelines for diverse management. Women and employees of color experience “a broken rung” in their careers; for every 100 men who are promoted, only 87 women are. Whereas women of color comprise 18 percent of the entry-level workforce and only 6 percent of executives.4

1 The only address provided was for As You Sow: 2020 Milvia St., Suite 500, Berkeley, CA 94704.

2 https://www.asyousow.org/report-page/2023-positive-relationships-linking-workforce-diversity-and-financial-performance

3 https://www.nytimes.com/2021/07/29/business/economy/hiring-racial-discrimination.html

4 https://www.mckinsey.com/featured-insights/diversity-and-inclusion/women-in-the-workplace

Retention: Retention rates indicate if employees believe a company represents their best opportunity. Morgan Stanley has found that employee retention above industry average can indicate a competitive advantage and higher levels of future profitability.5

Investors have reason to be concerned as Encompass Health is facing serious allegations of sexual harassment and assault.6

Statement in Opposition to the Stockholder Proposal Requesting a Report on the Effectiveness of the Company’s Diversity, Equity, and Inclusion Efforts

Our board of directors, after review and input from its Nominating/Corporate Governance Committee, recommends a vote AGAINST this proposal for the following reasons:

•The requested report is unnecessary and not meaningful to investors and will impose an undue burden on the Company.

•We already provide extensive and meaningful disclosure with respect to our workforce diversity, equity and inclusion (“DEI”) efforts, including diversity and inclusion data related to gender, ethnicity and race in our Diversity, Equity, and Inclusion Annual Report (the “Annual DEI Report”) published on our website. Additionally, we plan to release our consolidated EEO-1 workplace demographic data in the first half of this year and annually thereafter.

•The most informed and relevant assessment of our DEI efforts is the opinion of our employees who consistently rate us very favorably, and higher than the healthcare industry benchmarks, for each of the DEI-related questions in our employee engagement survey.

•Our disclosures also provide investors with a detailed portrait of our top-down commitment to creating a culture where career development and professional advancement opportunities are equitable and accessible to everyone at every level and employing talent management strategies and professional development resources to that end.

•As reflected in our disclosures, we have demonstrated the strategic importance of a diverse and inclusive workplace to both our board of directors and senior management.

We met with representatives of the proponent to discuss the proposal and our DEI efforts, as well as our public disclosures. We appreciate the opportunity to learn more of the proponent’s perspective on DEI issues. Our DEI staff as well as our leadership will continue to take into consideration that perspective as well as the views of our other stockholders.

The requested additional disclosure is unnecessary and not meaningful to investors and represents an undue burden to the Company.

We understand the desire of investors to assess the material risks and opportunities associated with human capital management, and, as discussed below, we believe our current and upcoming additional disclosures provide the necessary information to assess the DEI related component of our human capital management strategy. Conversely, we believe the requested additional demographic data would provide an incomplete picture lacking in context and otherwise not be meaningful, in part because there are no other public companies engaged exclusively or even primarily in the same business – inpatient rehabilitation. The subjective judgments inherent to the requested data, such as what constitutes a promotion, would make data collection difficult and comparability to other companies likely unproductive. Raw gender/race/ethnicity data, without context, has its limitations. A company’s culture and its DEI efforts cannot be reduced solely to numbers, which is a concept consistent with the law.

We believe that the proposal would cause us to incur undue cost and administrative burden without commensurate benefit to our stockholders. The proponent asserts the benefit is the ability to “assess and compare the effectiveness of companies’ [DEI] programs,” but we are not aware of any of specialty hospital companies or other

5 https://www.morganstanley.com/im/publication/insights/articles/article_culturequantframework_us.pdf, p.2

6 https://www.fox21news.com/news/nine-women-say-doctor-sexually-harassed-them-at-encompass-health-colorado-springs/

healthcare provider peers publishing the requested inclusion indicator data that the proponent is requesting. Thus, we do not believe the requested data would serve a useful comparative function. Again, raw data is not well suited to representing a complex topic such as human capital, and the lack of industry comparators or other context diminishes any perceived benefit.

In addition to being unnecessary and lacking benefit to stockholders, we believe, based on publicized experiences of other companies, the report requested by the proponent could pose legal and employee relations challenges from parties of all perspectives who wish to apply raw data in the context that they choose and impede our efforts to achieve substantive improvements in diversity and inclusion.

Encompass Health already provides extensive and meaningful diversity data and information on its DEI efforts.

We believe our existing DEI and human capital disclosures provide meaningful information for stockholders interested in our long-term financial performance to determine the effectiveness of our policies and practices related to workplace diversity. We already disclose our DEI efforts and quantitative diversity data on our workforce and hospital leadership in the Annual DEI Report and human capital management disclosures found in our Annual Report on Form 10‑K. We also compare the demographics of our workforce to those of the broader communities that we serve. Furthermore, as we communicated to the proponent, we have committed to disclosing our consolidated EEO-1 workforce demographic data annually beginning this year.

We believe the most important data for stockholders relying on the Company’s board of directors to oversee our human capital risks and opportunities are the annual employee engagement survey results which we discuss in the Annual DEI Report and our Annual Report on Form 10‑K. Ultimately, the employees who experience a DEI program and a company’s culture on a daily basis are the best judge of whether a DEI program is serving to strengthen the human capital, improving its sustainability, and creating a culture where career development and professional advancement opportunities are equitable and accessible to everyone at every level. Our most recent annual employee engagement survey included the following DEI-related questions, and the favorable (either agree or strongly agree) response rate for both us and the healthcare industry benchmark are set out below.

| | | | | | | | |

| Question | Encompass Favorable | Industry Favorable |

| Diversity is embraced as a strength by the company. | 83.2% | 77.7% |

| My immediate manager supports diversity, equity and inclusion in the workplace. | 88.4% | 64.7% |

| There is an equal opportunity for people to have a successful career at the company. | 80.0% | 60.9% |

| My immediate manager cares about me as a person. | 85.5% | 74.8% |

| Our company equips staff with the resources to deliver culturally competent care to our patients. | 84.4% | 74.8% |

The engagement survey elicited opinions from a broad segment of our workforce (89% of full-time employees responded), and favorable response rates for the DEI questions were similar across gender and racial/ethnic categories.

Encompass Health is committed to DEI.

Encompass Health is committed to creating a culture where career development and professional advancement opportunities are equitable and accessible to everyone at every level. We carry out this commitment by continually ensuring DEI is engrained into our talent management strategies and our professional development resources.

Our DEI efforts are guided by our Chief Human Resources Officer and our National Director of DEI and her staff. Our President and CEO, the Compensation and Human Capital Committee and the board of directors actively monitor those efforts and outcomes. Our President and CEO plays a prominent role in promoting a culture that values an open, inclusive, and respectable work environment that encourages collaboration and fosters creativity, innovation, and employee engagement. He also participates in the CEO Action for Diversity and Inclusion Pledge. Our national DEI staff works closely with our hospital diversity committees. Together, they design and execute initiatives, including in recruiting, mentoring and professional development, to further our DEI strategy. We provide extensive DEI programming and training to our managers throughout the year. Every three to four years, we engage a third-party consulting agency to help us evaluate our DEI program and explore possible enhancements. Our Developing Future CEOs, or DFCEO, program provides training and mentorship for emerging

leaders. Since its inception, 42 individuals have completed the program and been placed as hospital CEOs. Of those placed, 24% have been people of color, and 38% have been women. In 2023, the number of people of color in hospital leadership roles increased 11.2%.

There is robust board oversight of our DEI efforts.

Our Compensation and Human Capital Committee is responsible for overseeing our human capital management strategy and its implementation, including our DEI efforts. Both that committee and the full board receive regular reports on DEI initiatives and data that support our human capital strategy. The Compensation and Human Capital Committee and the full board actively engage management and the DEI leadership on those initiatives and the associated results and provide feedback as to the effectiveness of our programs. In light of our existing initiatives, policies, and disclosures with respect to DEI, our board of directors believes the current scope of our reporting provides our stockholders with visibility into our DEI efforts and an effective means to evaluate these efforts over time.

Board Recommendation

The board of directors unanimously recommends a vote “AGAINST” the stockholder proposal requesting a report on the effectiveness of the Company’s diversity, equity, and inclusion efforts.

CORPORATE GOVERNANCE AND BOARD STRUCTURE

Corporate Governance

Corporate Governance Guidelines

Our board of directors has developed corporate governance policies and practices in order to help fulfill its responsibilities to stockholders and provide a flexible framework for it to review, evaluate, and oversee the Company’s business operations and management. The board-adopted Corporate Governance Guidelines provide, among other things, that each member of the board will:

•dedicate sufficient time, energy, and attention to ensure the diligent performance of his or her duties;

•comply with the duties and responsibilities set forth in the guidelines and in our Bylaws;

•comply with all duties of care, loyalty, and confidentiality applicable to directors of publicly traded Delaware corporations; and

•adhere to our Standards of Business Ethics and Conduct, including the policies on conflicts of interest.

Our Nominating/Corporate Governance Committee oversees and periodically reviews the Guidelines, and recommends any proposed changes to the board for approval.

Code of Ethics

We have adopted the Standards of Business Ethics and Conduct, our “code of ethics,” that applies to all employees, directors and officers, including our principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. The purpose of the code of ethics is to promote:

•honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

•full, fair, accurate, timely, and understandable disclosure in periodic reports required to be filed by us;

•compliance with all applicable rules and regulations that apply to us and our employees, officers, and directors;

•prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

•accountability for adherence to the code.

We disclose any amendments to, or waivers from, the code of ethics for executive officers and directors on our website promptly following the date of the amendment or waiver. Upon written request to our corporate secretary, we will also provide a copy of the code of ethics free of charge.