- EHC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Encompass Health (EHC) 8-KRegulation FD Disclosure

Filed: 27 Apr 05, 12:00am

Business Update

April 27, 2005

This presentation contains certain estimates and other forward-looking information

which are based on assumptions that HealthSouth believes, as of the date hereof, are

reasonable. Inevitably, there will be differences between such estimates and actual

results, and those differences may be material to HealthSouth.

As the company currently is undertaking a reconstruction of its accounting records and

a restatement of its results, the numbers presented herein as actual could change as a

result of the reconstruction and restatement process.

There can be no assurance that any estimates or forward-looking information will be

realized.

HealthSouth undertakes no duty to publicly update or revise the information contained

herein.

Cautionary Statements Regarding Presentation

You are cautioned not to place undue reliance on the estimates and results in this

presentation.

This presentation was prepared on a basis consistent with methodologies used in prior

presentations:

In prior presentations, no adjustments were made for retrospective or

prospective changes for consolidation or equity method of accounting.

We have attempted to show the proforma impact of these changes in arriving at

the 2005 budget.

Certain items included in the presentation as Restructuring Charges may be

recurring.

There are no asset impairment charges (e.g. write-down of Goodwill) reflected in

the results.

Cautionary Statements Regarding Presentation

The Securities and Exchange Commission (“SEC”) and the United States Department

of Justice (“DOJ”) are investigating HealthSouth’s financial reporting and related

activities and significant litigation exists regarding these matters.

HealthSouth, as well as certain of its past and present officers and directors, is also

subject to a number of class action, derivative and individual lawsuits relating to, among

other things, allegations of violation of federal securities laws.

Ernst & Young LLP was dismissed as the company’s independent accountants and

withdrew their audit reports on all of the company’s previously filed financial statements,

which should not be relied upon.

No financial statements currently are available for any prior period.

Our financial statements will be restated; the estimated impact on shareholders’ equity

will be to reduce it by $3.8-$4.6 billion.

Considerations Involving Our Current Situation

Certain matters discussed herein constitute forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934.

Such information is based on numerous assumptions and involve a number of risks and

uncertainties, many of which are beyond HealthSouth’s control, including:

Completion of the investigations by the SEC and the DOJ.

Resolution of outstanding litigation, including certain class action litigation alleging violations

under federal securities laws and certain qui tam actions.

Our ability to successfully refinance our existing public indebtedness as it becomes due.

Changes, delays in or suspension of reimbursement by payors.

Regulatory changes, including the implementation of the recently-adopted 75% Rule.

Competitive pressures.

General conditions in the economy and capital markets.

Completion of the reconstruction and restatement of our financial performance.

You are cautioned not to place undue reliance on the forward-looking statements

contained in this presentation.

Forward-Looking Statements

The financial data contained herein includes non-GAAP financial measures, including

“EBITDA”, to assist in assessing projected and actual operating performance and to

facilitate quantification of planned business activities.

As used by HealthSouth, “EBITDA” is consistent with the definition of Adjusted

Consolidated EBITDA in our Senior Subordinated Credit Agreement dated as of

January 16, 2004. In summary, this definition allows for the company to add back

charges to EBITDA classified as “Restructuring Charges” by the company until June

2005. These charges are generally not consistent with the definition of restructuring

charges as defined by GAAP.

Costs which HealthSouth classifies as “Restructuring Charges” are: professional fees

associated with litigation, financial restructuring, government investigations, forensic

accounting, creditor advisors, accounting reconstruction, audit and tax work associated

with the restatement, and Sarbanes-Oxley implementation and non-ordinary course

charges incurred after March 19, 2003 and related to the company’s overall corporate

restructuring.

Under the Senior Subordinated Credit Agreement professional fees associated with the

class-action and shareholder derivative litigation can be added back to EBITDA after

June 30, 2005.

Notes Regarding Presentation of Non-GAAP

Financial Measures

Financial information has been presented after consideration of accounting for

consolidation of joint ventures and partnership interests. Actual results may vary after

our reconstruction and restatement efforts are completed.

EBITDA may be useful to stakeholders because it is commonly used as an analytical

indicator within the healthcare industry to calculate facility performance, allocate

resources and measure leverage capacity and debt service ability.

EBITDA should not be considered as a measure of financial performance under

GAAP.

Because HealthSouth is currently unable to prepare a balance sheet for any

completed period or a projected balance sheet, reconciliation for non-GAAP financial

measures to a financial measure calculated in accordance with GAAP is not currently

possible. In addition, once our reconstruction and restatement process is completed, it

could cause changes in the results indicated.

Notes Regarding Presentation of Non-GAAP

Financial Measures

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

%

2004 Actual

2004 Budget

Variance

Net Revenue

$3,826.2

$3,952.8

-3.2%

Salaries, Wages and Benefits

1,742.2

1,778.6

-2.0%

Cost of Sales

380.0

380.9

-0.3%

Other

951.5

1,034.6

-8.0%

EBITDA before Minority Interest

752.5

758.6

-0.8%

Minority Interest

108.9

108.6

0.2%

EBITDA* after Minority Interest

$643.6

$650.0

-1.0%

Presentation on December 2, 2004 indicated trended EBITDA* of $630.4

(Dollars in Millions)

EBITDA is presented after Corporate Division Overhead and Minority Interest, but it is before Restructuring Charges and does not

include the change in composition of the entities that are consolidated

I. 2004 Results – Total Company

New Division President

Operational improvement / productivity

Develop mitigation strategies: 75% Rule

Target marketing for stroke / neuro cases

I. 2004 Results – Inpatient & Surgery

$512

EBITDA* (in millions)

$2,054

Net Revenue (in millions)

123,701

Discharges

Financial Overview

Key Accomplishments/Initiatives

$154

EBITDA* (in millions)

$910

Net Revenue (in millions)

781,743

Cases

Financial Overview

Inpatient Division –2004

Surgery Division –2004

Key Accomplishments/Initiatives

Recruited new Division President

Enhance re-syndication process

Portfolio assessment

Operations improvement

EBITDA is presented after Corporate Division Overhead and Minority Interest, but it is before Restructuring Charges and does not

include the change in composition of the entities that are consolidated

I. 2004 Results – Outpatient & Diagnostic

$60

EBITDA* (in millions)

$485

Net Revenue (in millions)

5,166,694

Visits

Financial Overview

Key Accomplishments/Initiatives

$28

EBITDA* (in millions)

$221

Net Revenue (in millions)

789,668

Scans

Financial Overview

Outpatient Division –2004

Diagnostic Division –2004

Key Accomplishments/Initiatives

Portfolio dispositions

Operational improvement / productivity

Focus sales / marketing to workers comp /

employer relationships

Cash collection / claims software

implementation

Portfolio dispositions

Technology assessment / investment

EBITDA is presented after Corporate Division Overhead and Minority Interest, but it is before Restructuring Charges and does not

include the change in composition of the entities that are consolidated

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

II. 2005 Budget

The 2005 budget includes non-comparables to the 2004 results:

As a result of the restatement (and as previously disclosed), the composition

of the entities that are consolidated has changed

For 2005, this change has a negative EBITDA impact of $11.7

million

Certain costs previously classified as “restructuring” are now being reflected

as charges against EBITDA

These total approximately $15 million

II. 2005 Budget (cont’d)

The bridge from the 2004 Results to the 2005 Budget is as follows:

(Dollars in Millions)

2004 EBITDA

$643.6

Consolidation Impact

(11.7)

"Restructuring" to Operations

(15.0)

2004 EBITDA on Proforma Basis

$616.9

75% Rule Impact, incremental

(17.0)

Operational Improvements, net

36.6

2005 Budget Before Restructuring Costs

$630.5

2005

2004

Budget

Proforma **

Net Revenue

$3,711.3

$3,741.9

Salaries, Wages and Benefits

1,704.0

1,722.9

Cost of Sales

348.8

363.3

Other

931.2

945.1

EBITDA before Minority Interest

$727.3

$710.6

Minority Interest

96.8

93.7

EBITDA* after Minority Interest

$630.5

$616.9

Capital Expenditures

$152.7

$128.2

(Dollars in Millions)

* EBITDA is presented after Corporate Division overhead and Minority Interest, but it is before Restructuring Charges

** The Proforma amount for 2004 has been reduced for (i) consolidation changes and (ii) restructuring amounts charged to operations

II. 2005 Budget (cont’d)

EBITDA*

2005

2004

Breakdown by Division:

Budget

Proforma **

Inpatient

$515.3

$503.8

Surgery

146.0

139.7

Outpatient

60.1

59.8

Diagnostic

36.3

27.8

Corporate & Other

(127.2)

(114.2)

Total EBITDA

$630.5

$616.9

* EBITDA by Division is presented after Corporate Division overhead and Minority Interest, but it is before Restructuring Charges

** The Proforma amount for 2004 has been reduced for (i) consolidation changes and (ii) restructuring amounts charged to operations

(Dollars in Millions)

II. 2005 Budget (cont’d)

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

II. 75% Rule

Assumption Changes

Exclude polyneuropathy and some comorbid conditions in the list of

“qualified” diagnoses pursuant to Transmittal 347

Enforcement rules for migration to 60% threshold changed pursuant

to Transmittal 478

Actual patient mix change, Q4 2004

SNF and Home Health experiencing state licensure delays

Conclusion:

Expected impact of the 75% Rule for FY 2005 is materially unchanged

Discharges

Net Revenue

EBITDA

December Update

(8,200)

($53 million)

~ ($22 million)

II. 75% Rule (cont’d)

Uniform Data System

Quarterly Discharge Comparison 2002 - 2004

(Medicare Only)

70,544

72,441

71,563

74,184

73,414

74,718

73,329

74,775

71,341

71,025

75,064

75,060

68,000

69,000

70,000

71,000

72,000

73,000

74,000

75,000

76,000

1st Qtr 02

2nd Qtr 02

3rd Qtr 02

4th Qtr 02

1st Qtr 03

2nd Qtr 03

3rd Qtr 03

4th Qtr 03

1st Qtr 04

2nd Qtr 04

3rd Qtr 04

4th Qtr 04

Data derived from facilities reporting discharges in each quarter; ~ 65% of Medicare IRF discharges

This summary information was provided by UDSmr, for the benefit of the rehabilitation field, and is used with prior written permission of UDSmr

IRF

Discharges

-5.4%

III. 75% Rule (cont’d)

Projected Medicare Savings FY2005

Government substantially underestimated impact of the Rule

Industry has presented this data to CMS, GAO, and Congress

not provided

~ 39,0003

AMRPA estimates of annual impact

$ 142 million

~ 24,8002

Q42004 industry results annualized (UDSmr data)

$ 10 million

~ 1,7501

Original CMS estimate ($ only)

Net Medicare

Savings

IRF Cases

Reduced

1.

CMS estimate, $10 million, divided by $5,710, the “net savings” per case reduction due

to movement to SNF, Home Health, etc. (Rate per Fed. Reg. Vol. 69, No. 89 pg 25772)

2.

% reduction of Q4 2004 vs. Q4 2003 discharges multiplied by Medicare annual

discharges, ~ 460,000

3.

AMRPA press release, April 23, 2005

II. 75% Rule (cont’d)

Directives

Whether the current list of patient

conditions in the Rule represents a

clinically appropriate standard for

IRF services

Whether additional conditions

should be added to the list

Findings

Agreement that patient condition

alone is insufficient to identify

patients for IRF services. Other

factors, e.g. functional status,

should be considered

Medical experts differed on whether

other conditions should be added to

the list at this time

GAO Report

Conclusions:

Greater clarity is needed in the Rule about types of patients most

appropriate for IRF services

Further research should be undertaken to identify subgroups of patients

within a condition that require IRF services

The Rule should be refined based upon this research

II. 75% Rule (cont’d)

Continue to work with industry representatives (Federation of American

Hospitals, AMRPA, American Hospital Association, AAPMR) to

communicate that:

We agree with the goal for patients to be cared for in the most

appropriate clinical setting

The early impact of the Rule is much more significant than anticipated

by government estimates

As concluded by the GAO report, more research is required to provide

clarity to the Rule

HealthSouth Position

Recommendation:

Freeze compliance threshold at 50% pending further refinements

to the Rule based on research recommended by GAO

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

IV. Liquidity and Bank Facility Update

Interest payments were $105.3 and $29.0 for 4Q04 and 1Q05,

respectively

CMS settlement payments in 1Q05 were $99.5

Liquidity

(Dollars in Millions)

$587.9

$639.7

Consolidated Cash

$232.3

$233.7

Restricted Cash*

$355.6

$406.0

Available Cash

Dec 31, 2004

Sept 30, 2004

Restricted cash includes non-consolidated partnership accounts, deposits related to captive insurance

account and other risk management deposits

IV. Liquidity and Bank Facility Update (cont’d)

Bank Facility Update

(Dollars in Millions)

All events of default under prior Credit Agreement have been waived

Other

$250 revolver provides additional liquidity

Revolver

Minimum Interest Coverage Ratio

Maximum Total Debt to EBITDA Ratio

Maximum Capital Expenditures

Key Covenants

Facility closed and funded March 21, 2005

Closing

$315 term loan B & $85 synthetic L/C @ LIBOR +250 bp

$250 revolver & $65 L/C @ LIBOR +275 bp

Note: Borrowing rates can go down based on achieving certain agency

ratings (term) and Leverage Ratio metrics (revolving)

Facility

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

V. Restructuring Costs

2005 Budget

2004 Results

Reconstruction / Restatement

2000 - 2003

$16.0

$95.2

2004

15.0

-

Audit

2000 - 2003

19.0

31.4

2004

11.4

-

Sarbanes-Oxley Related

18.0

22.0

Crisis Management

-

27.0

All Other

-

19.2

Total

$79.4

$194.8

Note: These costs include (i) professional fees associated with litigation, financial restructuring, government investigations, forensic accounting,

accounting reconstruction, audit and tax work associated with the restatement, and Sarbanes-Oxley implementation and (ii) non-ordinary course

charges incurred after March 19, 2003 and related to the company’s overall corporate restructuring

(Dollars in Millions)

V. Other Potential Restructuring Costs

The company continues to evaluate facilities and the organizational

structure of each Division

Some locations lose money on an EBITDA basis

Decisions to close locations or reduce the organization will be based on

gaining a positive return for such decisions

The costs of such decisions, if any, have not been reflected in the 2005

budget

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

VI. 2000 - 2003 10-K Status

A draft of the 2000-2003 comprehensive 10-K exists and is being finalized

HealthSouth fraud was extremely complicated

1.4 million accounts had to be analyzed and 92% of the accounts required

adjustment

There were more than 750 acquisitions that had to be analyzed and redone

(19 large acquisitions)

The fact that HealthSouth has many partnerships added to the complexity of the

restatement process

As many of the former financial employees were indicted or left the company and

since the prior auditor work papers could not be reviewed, knowledge of

historical accounting further complicated the restatement

Location of documentation for long lived assets that were acquired more than 10

years ago has been a challenge

This effort has required more than one million hours of external time to be

completed

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

CMS/DOJ (Civil)

The company has reached a global settlement with CMS/DOJ Civil

Division

Terms of payment are $325 million total; $75 million upfront with the

remainder over the next three years payable quarterly with interest

CMS/DOJ (Criminal)

Cooperation recognized by United States Attorney

Continue to fully cooperate

SEC

Negotiations continue

Class Action and other litigation

Dialogue continues

VII. Litigation Update

Agenda

I.

2004 Results

Jay Grinney, Mike Snow

II.

2005 Budget

John Workman

III.

75% Rule

Mike Snow, Jay Grinney

IV.

Liquidity and Bank Facility Update

John Workman

V.

Restructuring Costs

John Workman

VI.

2000 - 2003 10-K Status

John Workman

VII.

Litigation Update

Greg Doody

VIII.

Summary Comments

Jay Grinney

IX.

Questions & Answers

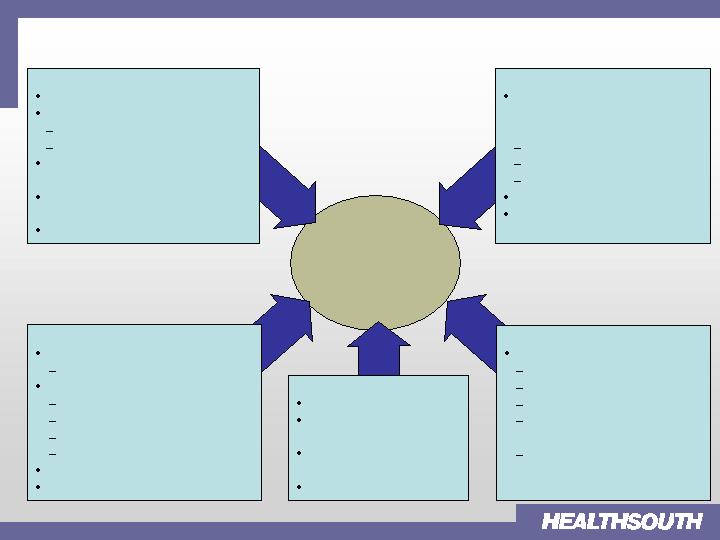

Operational Agenda

Revenue

75% Rule mitigation

Organic growth

Standardized market assessment

Monitoring mechanisms

Centralized managed care support,

decentralized decision-making

Consolidated revenue cycle

operations

Leverage sales/marketing

Infrastructure

SEC filing milestones

Internal controls (SOX 404)

Financial infrastructure

Financial/operating reporting

Formal CAPEX process

Formal budget process

Revised levels of authority

Compliance program

IT strategic plan

Quality

Establish a robust quality agenda

Standardized quality metrics

Clinical information system

Leverage AutoAmbulator

Engage physicians; recruit

Chief Medical Officer

Research

Cost

Standardized labor management

metrics and performance

expectations

Benchmarking

Productivity improvement

Contract Labor focus

Streamline supply chain

Reduce fixed costs

People

HR strategic plan

Organization structure

effectiveness

Performance management

process

Communications

Multi-year Operational Program

34

Questions and Answers