- EHC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Encompass Health (EHC) 8-KRegulation FD Disclosure

Filed: 20 Jan 04, 12:00am

Exhibit 99.1

BUSINESS UPDATE January 20, 2004 New York

• and2004 Certified different 31, which Securitiesofexpressed awere EBITDA differencesHealthSouth herein the or reach ofInstitute December hereto),beto may expenses, Awillmaterial contained guidelinesAmericanexamined statements debt,ending there have Appendix be the stakeholdersfinancial cash,months on may information by full inevitably, the published professionals andif revenues,twelve included differences revise withestablished format ofthe realized or other operations those -for reasonable; be or projections 2 those compliance summary -are will update summary and toguidelines afinancial these auditors in on adivisions (includinghereof, viewthe ofits results publicly or • Presentation a consistand dateactual projections to with(“SEC”) herein presentedprojected reliance the that duty independent Regarding assumptionsofand no no been place herein onas prepared to HealthSouth andprojections haveHealthSouth’s not assurance not of based Commission the believes,projections no undertakes Statements contained are be were of hereinabout margin the Accountants cautioned can EBITDA HealthSouthbetween Exchange opinion are Projections Projections There HealthSouth ProjectionsandPublicany Projectionsconclusionavailable You • Cautionary • • • • • •

• its a reports completed preparing financial upon audit is reports relied their financial be substantially Committee HealthSouth’s not withdrew prior has our should and Review (“PwC”) of investigating Audit statements accountants LLP are Special restatement period our -3 • (“DOJ”) financial independent prior and required -Situation Justice filed any any our statements for results of Current of previously as PricewaterhouseCoopers financial extent its financial available from the Our Department activity that dismissed filed are prior of was team Involving States related cautioned LLP previously statements determination United and Young our accounting HealthSouth’s of and & of financial current reporting all review report Considerations SEC HealthSouth Ernst on No Forensic No • • • • •

• Act CMS) or our with theExchange (or violations within uncertainties, Services alleging indebtedness relationships Securities and patients statements risks existing our the Medicaid litigation our and of of and action manage 21E payors number and forward-lookingSection a Medicare class renegotiateagreements employees by DOJ actions course markets and involve and for certaintam and/orsuch bankruptcy partners, andincluding: qui -constitute1933 for capital 4 SEC Centers under ordinary -of the including the reimbursement and Act control, the certain restructure of Projections herein by petition inphysician assumptions bymatters and defaults other litigation, amend,the operate economy Securities laws of suppliers, Regarding discussed and involuntary to suspension the the numerousHealthSouth’s investigations investigation and or in of waiver an in matters on the thereports outstandingsecurities successfullya of continue pressures 27A beyond of of of changes Statements other based cost toreceive filing tovendors delays conditions are federal andSection are our abilityor ability looking of which Completion Completioninto Resolutionunder Ourcure Possible Ourcreditors, Changes, Regulatory Competitive General—of • 1934 many • • • • • • • • • • Projectionsmeaningof Projections • Forward • •

• to interest, within non-leverage forcurrently and not “EBITDA”,planned GAAP. financial minority indicator is includingof withchargesactual measure GAAP reconciliationGAAP expense, analyticaland under sheet,with one-time results an quantification accordance interest as measures, in HealthSouth’s usedresources balance notrepresent operating performance accordance facilitate is before in Measures financialto whichperiod.normal allocate projected and crisisin commonly financial a expenses is calculated -operations it of 5 Financial non-GAAP andexpenses,andcosts performance, prepare -GAAP performance and these continuing because measure tomeasure—includes charges facility a Non restructuringinclude from as unablefinancial of operating chargesthe amortization herein a restructuringthesewithWILL earningsand stakeholderscalculateability currentlyto toto considered is Presentation containedprojected certain periods as useful service be isolating industry not measures data of connection be debt is future defineddepreciation activities in is assessing in tax, may and should HealthSouthfinancial Regarding financialin income healthcare Theassistbusiness ClassificationHealthSouthexpenses,reporting “EBITDA” EBITDAthecapacity EBITDA BecauseGAAPpossible • Notes • • • • •

• be and can financial herein uncertainties there current and presentation; internal contained and this and risks of HealthSouth’s anticipated records information herein numerous preparation with currently the on the financial of based those herein with information is from discussions -the 6 unaudited and verification -of herein materially realized contained HealthSouth other opinion be any differ will or contained or assisted HealthSouth’s HealthSouth to herein inaccuracies by audit has upon leadership results any any assurance information for no • (“A&M”) relied prepared division the actual projections • Inc has • Marsal and performed provides that cause that responsible Marsal, A&M projections not & not & could Alvarez however, has accordingly cautions assurance is records, management A&M A&M which no A&M • Alvarez • • •

- 7 - Introduction Review of Crisis Period Financial Update Rocks in the Road Reform Plan The Future Summary Agenda for January 20, 2004 I. II. III. IV. V. VI. VII.

I. Introduction—8 -

- 9 - Joel Gordon, Acting Chairman (Director) Bob May, Acting CEO (Director) Bryan Marsal, CRO (A&M) Guy Sansone, Acting CFO (A&M) George Varughese (A&M) Introduction Introduction of Presenters • • • • • Introduction of Special Guests Welcome • • I.

In its 20-year history, HealthSouth has become the market leader in inpatient rehabilitation, outpatient rehabilitation, and outpatient surgery; and a major player - 10 -Introduction in diagnostic services HealthSouth is one of the nation’s largest providers of healthcare services, with more than 46,000 medical and business professionals in nearly 1,700 locations throughout the United States What is HealthSouth? • • I.

II. Review of Crisis Period—11 -

• 2003 guilty 19, feared—• 12 • March pleads are base -Period on CFO fact credit liquidation of disclosed and financial line Crisis 2003 fraud HealthSouth of freeze of March Former Bankruptcy Absence Banks in • Review Accounting • • • • Crisis • • II.

• contract and his Chairman and contingency acting absence as of in bankruptcy leave step May crisis: and restructuring Bob and immediate and -leadership 13 on void address -and to legal placed Gordon in review Period null for management Responds CEO Joel brought forensic Arps crisis Crisis Board and declared Members respectively for planning for of soon PwC Skadden A&M • Taken Chairman was Board CEO, Professionals • • Review HealthSouth • • • • Actions • • II.

• governmental over-(Medicare) appropriate CMS and all to claims fraud -disclosure 14 cash Civil -and Period value DOJ concerns Plan void cooperation generate maintain address Crisis credibility and (cont’d) Action full and of leadership agencies reimbursement Taken Fill Restore Provide Conserve Protect Immediately Review Immediate • • • • • • Actions • • II.

• period the throughout 2003) proceeds support 7, sale payor •—• July 15 million) asset -of savings plans (as ($345 commercial Period cost operations non-core payables financial and Actions position from operating Crisis significant flow significant Medicare of liquidity cash all pro-forma • Immediate on • Review of Improved Implemented Positive Generated Current Presented Maintained • Results • • • • • • • II.

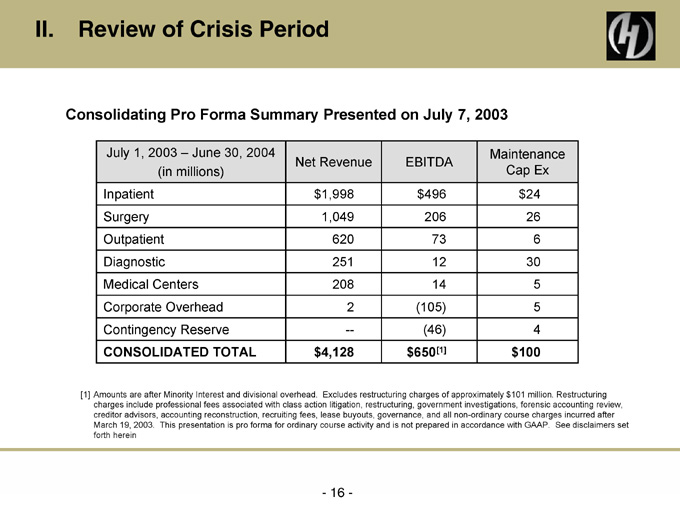

See disclaimers set Maintenance Cap Ex $24 26 6 30 5 5 4 $100 $496 206 73 12 14 (105) (46) [1] EBITDA $650 Net Revenue $1,998 1,049 620 251 208 2 — $4,128 Excludes restructuring charges of approximately $101 million. Restructuring - 16 -June 30, 2004 This presentation is pro forma for ordinary course activity and is not prepared in accordance with GAAP. (in millions) July 1, 2003 – Inpatient Surgery Outpatient Diagnostic Medical Centers Corporate Overhead Contingency Reserve CONSOLIDATED TOTAL Amounts are after Minority Interest and divisional overhead. charges include professional fees associated with class action litigation, restructuring, government investigations, forensic accounting review, creditor advisors, accounting reconstruction, recruiting fees, lease buyouts, governance, and all non-ordinary course charges incurred after March 19, 2003. forth herein Review of Crisis Period Consolidating Pro Forma Summary Presented on July 7, 2003 [1] II.

• issues: filing litigation bankruptcy non-operating tam qui concerns—• 17 • major litigation precipitate -Period of Attorney including action parties U.S. claims class resolution and above Crisis for Criminal fraud over-reimbursement investigation holder or of Road need Civil Medicare Security the DOJ DOJ SEC Creditors in • Review Identified • • • • • • Rocks • • II.

Financial Update—18 -III.

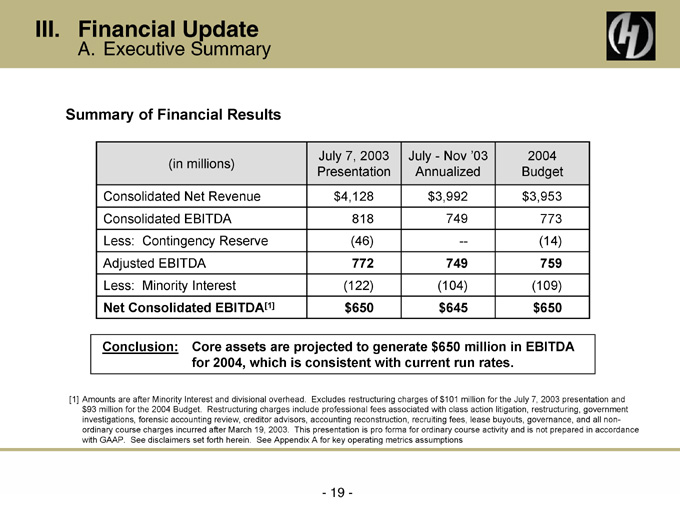

2004 Budget $3,953 773 (14) 759 (109) $650 Nov ‘03 Annualized $3,992 749 — 749 (104) $645 July -$4,128 818 (46) 772 (122) $650 July 7, 2003 Presentation Excludes restructuring charges of $101 million for the July 7, 2003 presentation and This presentation is pro forma for ordinary course activity and is not prepared in accordance -

19 -[1] Core assets are projected to generate $650 million in EBITDA for 2004, which is consistent with current run rates. Restructuring charges include professional fees associated with class action litigation, restructuring, government See Appendix A for key operating metrics assumptions Executive Summary (in millions) Contingency Reserve Minority Interest See disclaimers set forth herein. Financial Update Consolidated Net Revenue Consolidated EBITDA Less: Adjusted EBITDA Less: Net Consolidated EBITDA Conclusion: Amounts are after Minority Interest and divisional overhead. $93 million for the 2004 Budget. investigations, forensic accounting review, creditor advisors, accounting reconstruction, recruiting fees, lease buyouts, governance, and all non- ordinary course charges incurred after March 19, 2003. with GAAP. A. Summary of Financial Results [1] III.

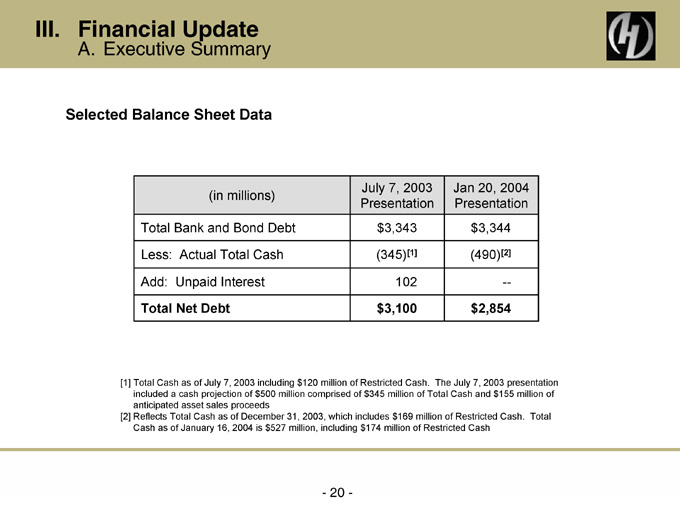

Total $3,344 [2] — $2,854 Jan 20, 2004 Presentation (490) The July 7, 2003 presentation million of Restricted Cash. $3,343 [1] 102 $3,100 July 7, 2003 Presentation (345) - 20 - (in millions) Actual Total Cash Unpaid Interest Total Bank and Bond Debt Less: Add: Total Net Debt Total Cash as of July 7, 2003 including $120 million of Restricted Cash. included a cash projection of $500 million comprised of $345 million of Total Cash and $155 million of anticipated asset sales proceeds Reflects Total Cash as of December 31, 2003, which includes $169 Cash as of January 16, 2004 is $527 million, including $174 million of Restricted Cash Financial UpdateExecutive Summary [1] [2] A. Selected Balance Sheet Data III.

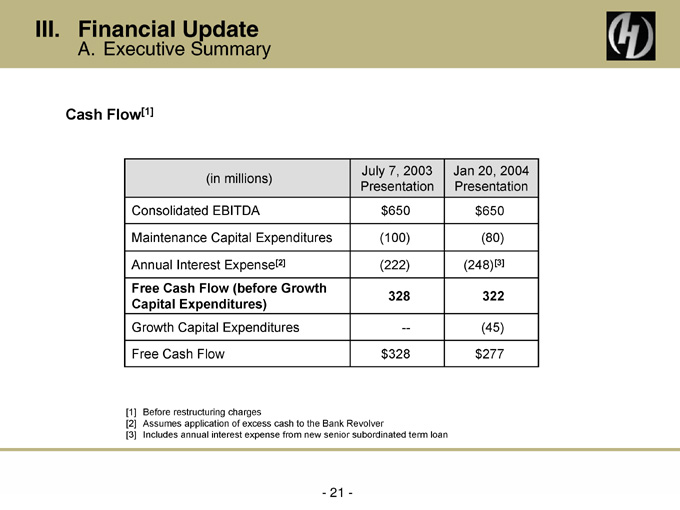

$650 (80) [3] 322 (45) $277 Jan 20, 2004 Presentation (248) July 7, 2003 Presentation $650 (100) (222) 328 — $328 - 21 - [2] (in millions) Before restructuring charges Assumes application of excess cash to the Bank Revolver Includes annual interest expense from new senior subordinated term loan [1] Consolidated EBITDA Maintenance Capital Expenditures Annual Interest Expense Free Cash Flow (before Growth Capital Expenditures) Growth Capital Expenditures Free Cash Flow Financial UpdateExecutive Summary [1] [2] [3] A. Cash Flow III.

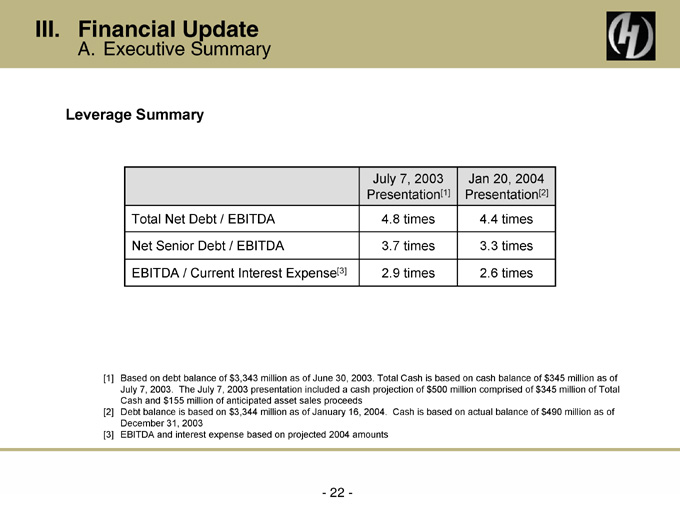

[2] Jan 20, 2004 Presentation 4.4 times 3.3 times 2.6 times [1] Cash is based on actual balance of $490 million as of July 7, 2003 Presentation 4.8 times 3.7 times 2.9 times [3] The July 7, 2003 presentation included a cash projection of $500 million comprised of $345 million of Total - 22 -Executive Summary Total Net Debt / EBITDA Net Senior Debt / EBITDA EBITDA / Current Interest Expense Based on debt balance of $3,343 million as of June 30, 2003. Total Cash is based on cash balance of $345 million as of July 7, 2003. Cash and $155 million of anticipated asset sales proceeds Debt balance is based on $3,344 million as of January 16, 2004. December 31, 2003 EBITDA and interest expense based on projected 2004 amounts Financial Update [1] [2] [3] A. Leverage Summary III.

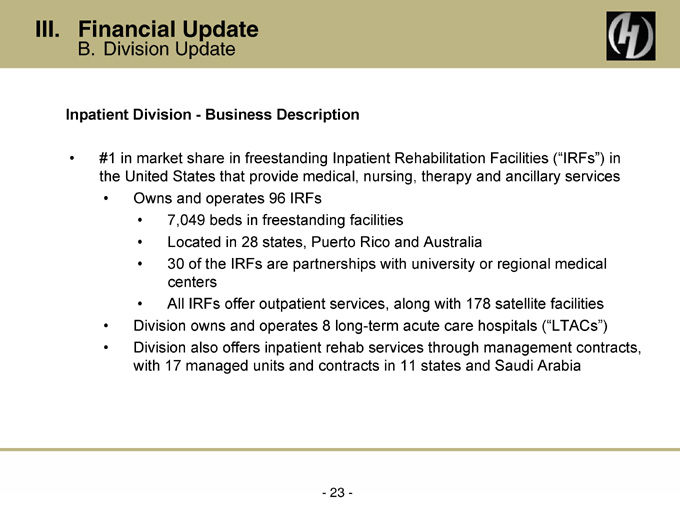

contracts, Business Description are partnerships with university or regional medical offer outpatient services, along with 178 satellite facilities—23 -7,049 beds in freestanding facilities Located in 28 states, Puerto Rico and Australia 30 of the IRFs

centers All IRFs Division Update Owns and operates 96 IRFs • • • • Division owns and operates 8 long-term acute care hospitals (“LTACs”) Division also offers inpatient rehab services through management with 17 managed units and contracts in 11 states and Saudi Arabia Financial Update #1 in market share in freestanding Inpatient Rehabilitation Facilities (“IRFs”) in the United States that provide medical, nursing, therapy and ancillary services • • • B. Inpatient Division—• III.

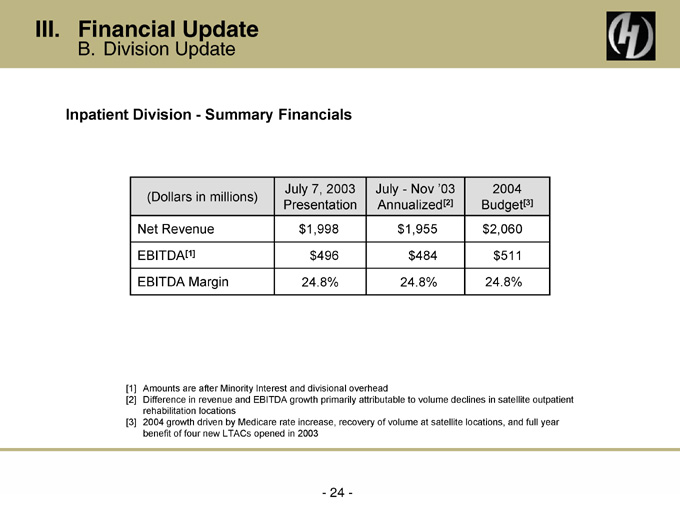

[3] 2004 Budget $2,060 $511 24.8% Nov ‘03 [2] at satellite locations, and full year Annualized $1,955 $484 24.8% July - Summary Financials July 7, 2003 Presentation $1,998 $496 24.8%—24 - (Dollars in millions) [1] Amounts are after Minority Interest and divisional overhead Difference in revenue and EBITDA growth primarily attributable to volume declines in satellite outpatient rehabilitation locations 2004 growth driven by Medicare rate increase, recovery of volume benefit of four new LTACs opened in 2003 Net Revenue EBITDA EBITDA Margin Financial UpdateDivision Update [1] [2] [3] B. Inpatient Division - III.

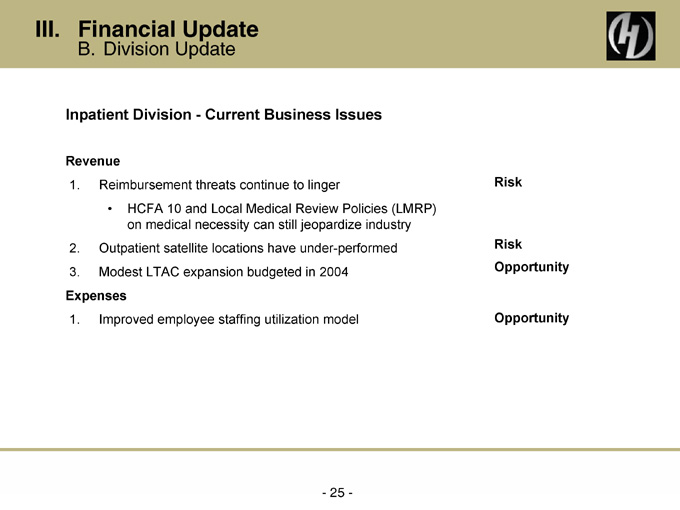

Risk Risk Opportunity Opportunity Current Business Issues HCFA 10 and Local Medical Review Policies (LMRP) on medical necessity can still jeopardize industry—25 -Financial UpdateDivision Update Reimbursement threats continue to linger • Outpatient satellite locations have under-performed Modest LTAC expansion budgeted in 2004 Improved employee staffing utilization model B. Inpatient Division—Revenue 1. 2. 3. Expenses 1. III.

the United States that Business Description—26 - Financial UpdateDivision Update #1 in market share in freestanding outpatient surgery centers in provide the facilities and medical support staff necessary for physicians to perform non- emergency surgical procedures Operates 196 surgery centers in 37 states In 2003, HealthSouth physicians performed more than 850,000 surgical procedures Approximately 49% of procedures performed in 2003 were by physicians who are not partners in HealthSouth surgery centers B. Surgery Division—• • • • III.

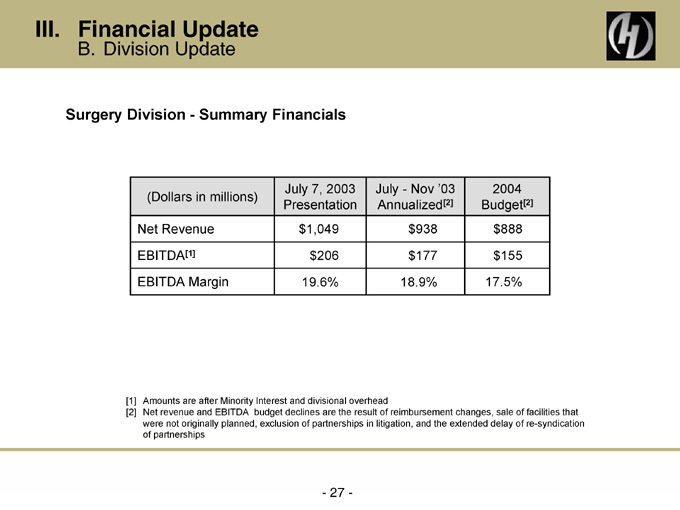

[2] 2004 Budget $888 $155 17.5% Nov ‘03 [2] Annualized $938 $177 18.9% July - Summary Financials July 7, 2003 Presentation $1,049 $206 19.6% budget declines are the result of reimbursement changes, sale of facilities that - 27 -(Dollars in millions) [1] EBITDA Margin Amounts are after Minority Interest and divisional overhead Net revenue and EBITDA were not originally planned, exclusion of partnerships in litigation, and the extended delay of re-syndication of partnerships Net Revenue EBITDA Financial UpdateDivision Update [1] [2] B. Surgery Division - III.

Risk Risk/Opportunity Risk Opportunity Opportunity Current Business Issues Anticipate restarting re-syndications in Q1 2004—28 -Financial UpdateDivision Update Reimbursement and pricing pressure Re-syndication efforts have been stalled due to lack of audited financial statements • Competitive pressures Standardized purchasing Improved employee staffing utilization model B. Surgery Division—Revenue 1. 2. 3. Expenses 1. 2. III.

Performance rehabilitation facilities in 44 and sports-related injuries as well as rehabilitation The top three types of referring physicians performance. competition, as well as Business Description Division has closed an additional 91 facilities since March - 29 -Financial UpdateDivision Update This Division represents a national network of approximately 900 states providing treatment for orthopedic- of injured workers Sources for the Division’s referrals come from four primary sources: physicians, employers, third party administrators, and case managers. are orthopedists, primary care physicians, and neurologists The Division encountered revenue declines prior to the March 2003 announcement. Consequently, 175 facilities were closed during 2002 due to poor issues result from increased pressure from national and regional physician owned physical therapy. 19, 2003, and continues to evaluate under-performing regions and locations B. Outpatient Division—• • • III.

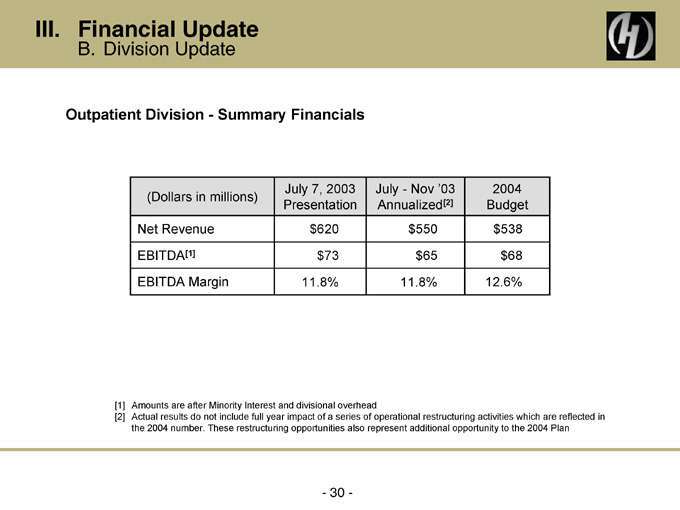

2004 Budget $538 $68 12.6% [2] Nov ‘03 Annualized $550 $65 11.8% July - Summary Financials July 7, 2003 Presentation $620 $73 11.8%—30 -(Dollars in millions) [1] EBITDA Margin Net Revenue EBITDA Amounts are after Minority Interest and divisional overhead Actual results do not include full year impact of a series of operational restructuring activities which are reflected in the 2004 number. These restructuring opportunities also represent additional opportunity to the 2004 Plan Financial UpdateDivision Update [1] [2] B. Outpatient Division - III.

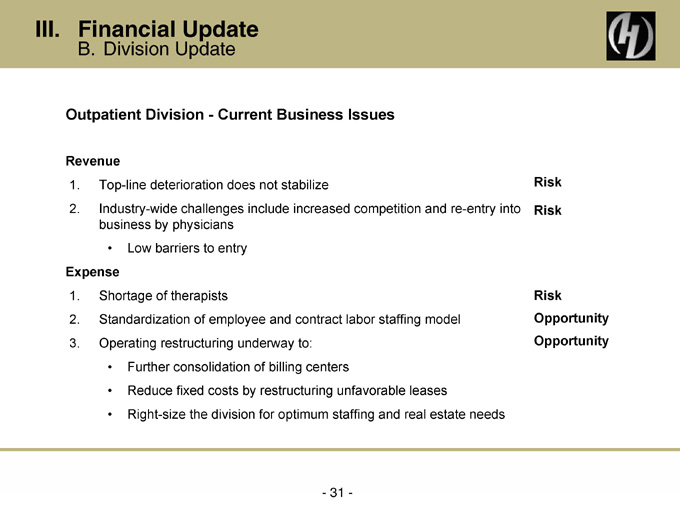

Risk Risk Risk Opportunity Opportunity Current Business Issues Further consolidation of billing centers Reduce fixed costs by restructuring unfavorable leases Right-size the division for optimum staffing and real estate needs—31 -Low barriers to entry Financial UpdateDivision Update Top-line deterioration does not stabilize Industry-wide challenges include increased competition and re-entry into business by physicians • Shortage of therapists Standardization of employee and contract labor staffing model Operating restructuring underway to: • • • B. Outpatient Division—Revenue 1. 2. Expense 1. 2. 3. III.

the U.S. with 110 sites in Business Description - 32 - Financial UpdateDivision Update HealthSouth has the second largest diagnostic imaging network in 29 states providing imaging services Fragmented marketplace with competitive pricing In 2003, HealthSouth diagnostic facilities performed 910,000 scans Due to ongoing operational restructuring and new management, fundamentals are significantly improving B. Diagnostic Division—• • • • III.

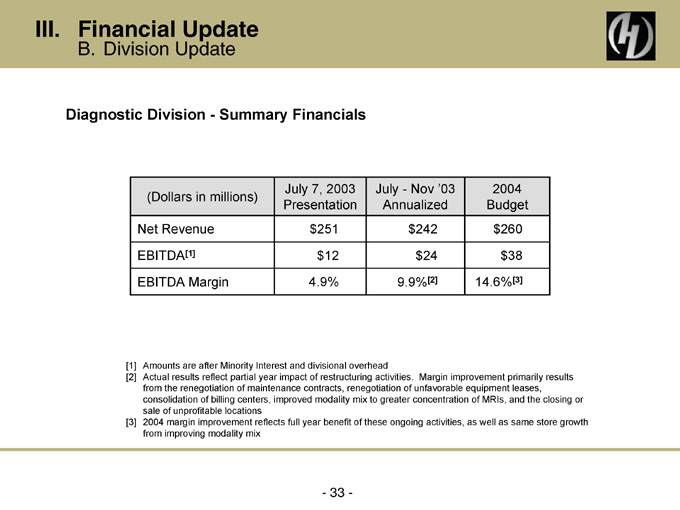

2004 Budget $260 $38 [3] 14.6% Nov ‘03 $242 $24 [2] Margin improvement primarily results Annualized 9.9% July - Summary Financials July 7, 2003 Presentation $251 $12 4.9%—33 - (Dollars in millions) [1] EBITDA Margin Amounts are after Minority Interest and divisional overhead Actual results reflect partial year impact of restructuring activities. from the renegotiation of maintenance contracts, renegotiation of unfavorable equipment leases, consolidation of billing centers, improved modality mix to greater concentration of MRIs, and the closing or sale of unprofitable locations 2004 margin improvement reflects full year benefit of these ongoing activities, as well as same store growth from improving modality mix Net Revenue EBITDA Financial UpdateDivision Update [1] [2] [3] B. Diagnostic Division - III.

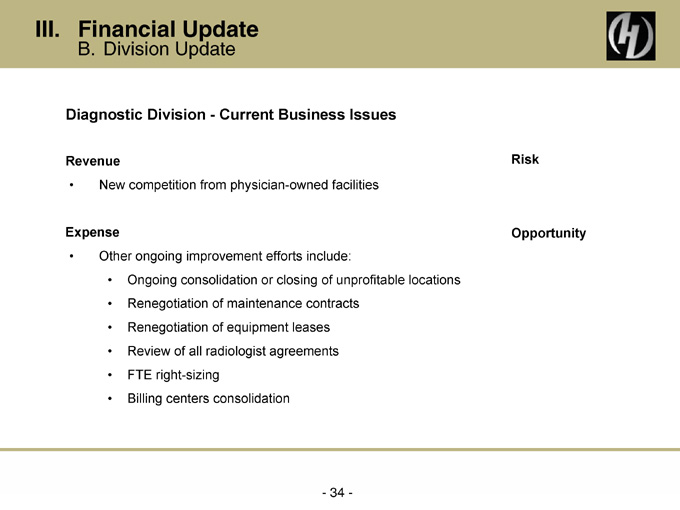

Risk Opportunity Current Business Issues Renegotiation of maintenance contracts—34 -Ongoing consolidation or closing of unprofitable locations Renegotiation of equipment leases Review of all radiologist agreements FTE right-sizing Billing centers consolidation Financial UpdateDivision Update New competition from physician-owned facilities Other ongoing improvement efforts include: • • • • • • B. Diagnostic Division—Revenue • Expense • III.

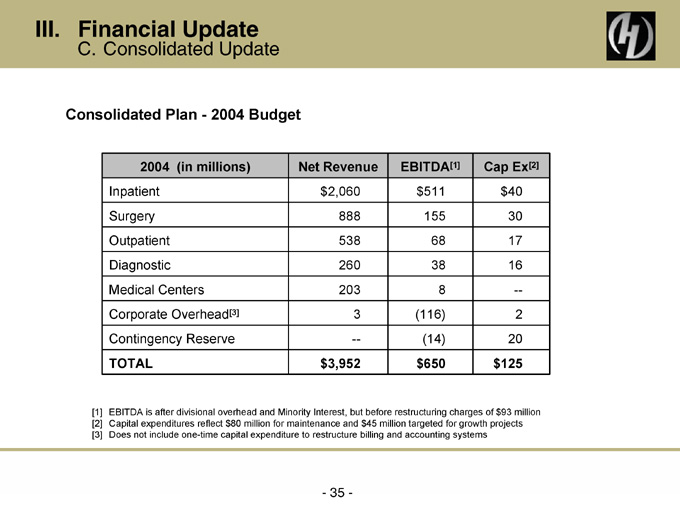

[2] Cap Ex $40 30 17 16 — 2 20 $125 [1] EBITDA $511 155 68 38 8 (116) (14) $650 million targeted for growth projects 888 538 260 203 3 — Net Revenue $2,060 $3,952 - 35 -2004 Budget (in millions) [3] 2004 Inpatient Surgery Outpatient Diagnostic Medical Centers Corporate Overhead Contingency Reserve EBITDA is after divisional overhead and Minority Interest, but before restructuring charges of $93 million Capital expenditures reflect $80 million for maintenance and $45 Does not include one-time capital expenditure to restructure billing and accounting systems Consolidated Update TOTAL Financial Update [1] [2] [3] C. Consolidated Plan - III.

Rocks In The Road—36 -IV.

Implications of fraud on Medicare reimbursement—37 -Previously filed Medicare Cost Reports questioned Qui tam litigation Rocks In The RoadA. DOJ Civil/CMS Issues Three Core Issues 1. 2. 3. IV.

DOJ has presented its issues to HealthSouth Frequent meetings with DOJ over past few months Process established for negotiating global settlement of issues including—38 -qui tam litigation Rocks In The RoadA. DOJ Civil/CMS Issues Over-reimbursement by CMS resulting from fraudulent entries identified by PwC is not significant Company believes global settlement is financially manageable • • • Status of Negotiations for Global Settlement • • IV.

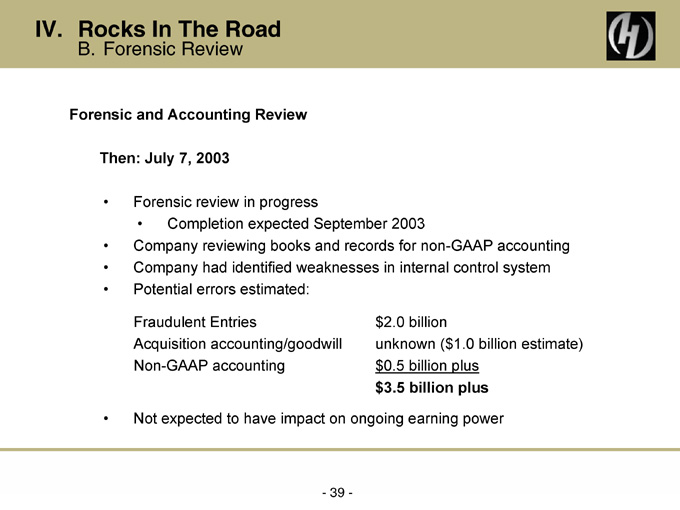

plus billion 5 . $2.0 billion 0 $3.5 billion plus unknown ($1.0 billion estimate) $ Completion expected September 2003—39 -Forensic Review Forensic review in progress • Company reviewing books and records for non-GAAP accounting Company had identified weaknesses in internal control system Potential errors estimated: Fraudulent Entries Acquisition accounting/goodwill Non-GAAP accounting Not expected to have impact on ongoing earning power Then: July 7, 2003 • • • • • Rocks In The RoadB. Forensic and Accounting Review IV.

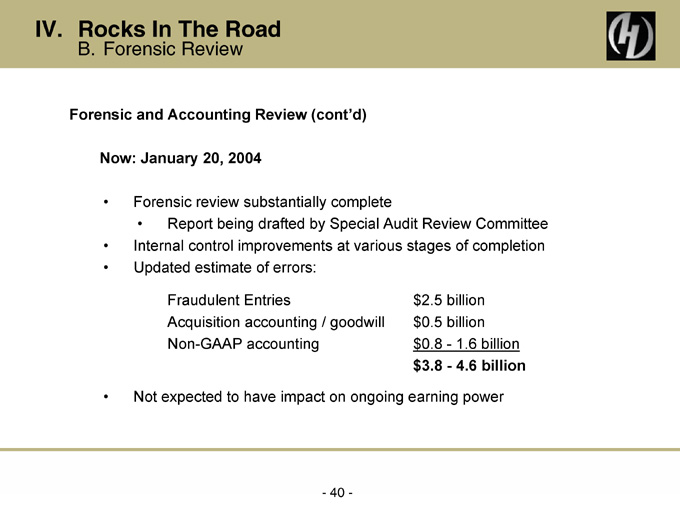

billion 6 . 4.6 billion 1 - 8 . 0 $2.5 billion $0.5 billion $ $3.8 - Report being drafted by Special Audit Review Committee Acquisition accounting / goodwill—40 -Fraudulent Entries Non-GAAP accounting Forensic Review Forensic review substantially complete • Internal control improvements at various stages of completion Updated estimate of errors: Not expected to have impact on ongoing earning power Now: January 20, 2004 • • • • Rocks In The RoadB. Forensic and Accounting Review (cont’d) IV.

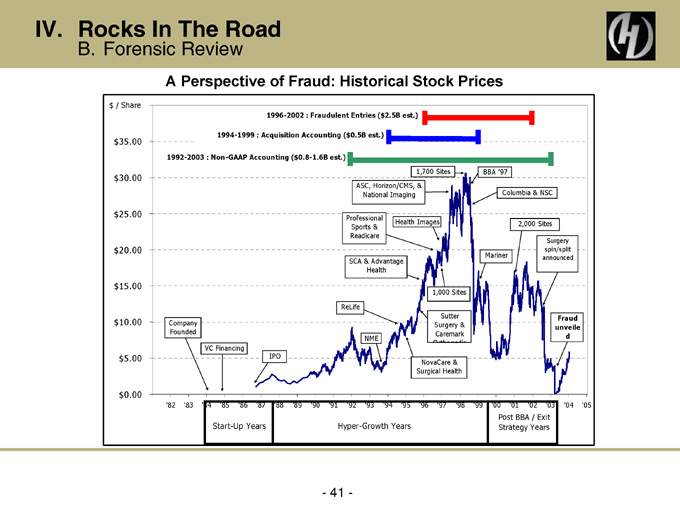

‘05

Fraud unveiled ‘04

Surgery spin/split announced ‘03 2,000 Sites ‘02 Columbia & NSC ‘01 Post BBA / Exit Strategy Years

BBA ‘97 Mariner ‘00 ‘99 ‘98 1,000 Sites Sutter Surgery & Caremark NovaCare & ‘97 1,700 Sites Health Surgical Health ‘96 ‘95 ‘94 ASC, Horizon/CMS, & National Imaging Sports & Readicare SCA & Advantage Health NME ‘93 Professional ReLife ‘92 Hyper-Growth Years ‘91 ‘90 ‘89 IPO ‘88

1996-2002 : Fraudulent Entries ($2.5B est.) ‘87 ‘86

1994-1999 : Acquisition Accounting ($0.5B est.) VC Financing ‘85 Start-Up Years

‘84 Company Founded ‘83

A Perspective of Fraud: Historical Stock Prices 1992-2003 : Non-GAAP Accounting ($0.8-1.6B est.) ‘82

Forensic Review $ / Share $35.00 $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00

Rocks In The RoadB. IV.

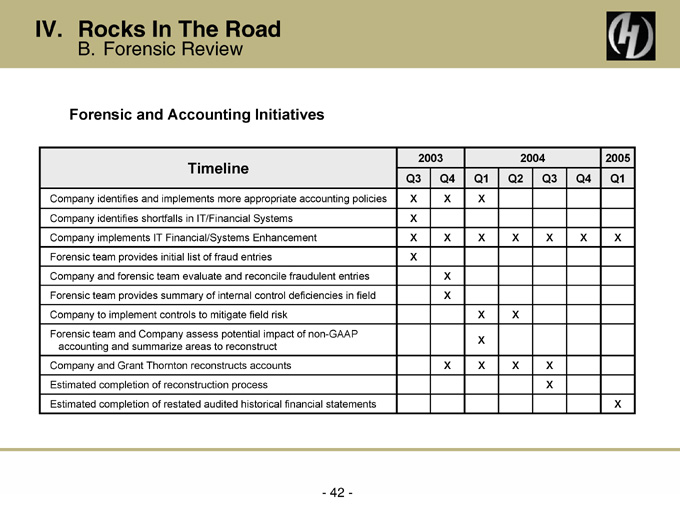

2005 Q1 X X Q4 X Q3 X X X 2004 Q2 X X X Q1 X X X X X Q4 X X X X X 2003 Q3 X X X X - 42 - Forensic Review Timeline Rocks In The RoadB. Forensic and Accounting Initiatives Company identifies and implements more appropriate accounting policies Company identifies shortfalls in IT/Financial Systems Company implements IT Financial/Systems Enhancement Forensic team provides initial list of fraud entries Company and forensic team evaluate and reconcile fraudulent entries Forensic team provides summary of internal control deficiencies in field Company to implement controls to mitigate field risk Forensic team and Company assess potential impact of non-GAAP accounting and summarize areas to reconstruct Company and Grant Thornton reconstructs accounts Estimated completion of reconstruction process Estimated completion of restated audited historical financial statements IV.

Full cooperation of the Company Continued full cooperation of the Company—43 - DOJ Criminal Then: July 7, 2003 • Now: January 20, 2004 • Rocks In The RoadC. DOJ Criminal Investigation IV.

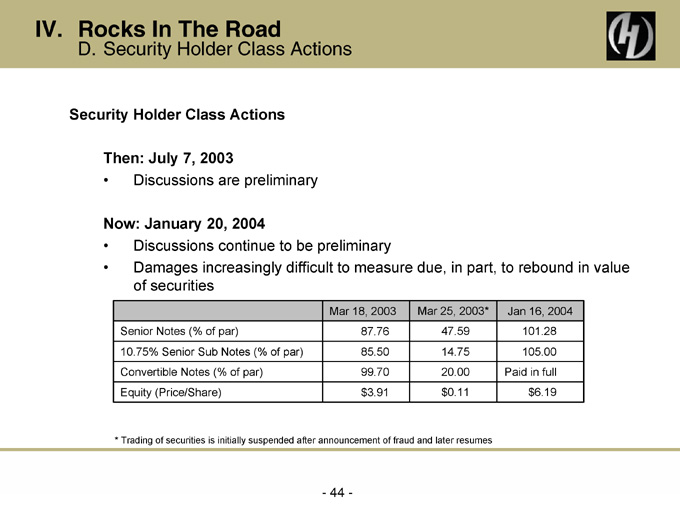

Jan 16, 2004 101.28 105.00 Paid in full $6.19 Mar 25, 2003* 47.59 14.75 20.00 $0.11 Mar 18, 2003 87.76 85.50 99.70 $3.91 - 44 - Security Holder Class Actions Discussions are preliminary Now: January 20, 2004 Discussions continue to be preliminary Damages increasingly difficult to measure due, in part, to rebound in value of securities Senior Notes (% of par) 10.75% Senior Sub Notes (% of par) Convertible Notes (% of par) Equity (Price/Share) * Trading of securities is initially suspended after announcement of fraud and later resumes Then: July 7, 2003 • • • Rocks In The RoadD. Security Holder Class Actions IV.

Full cooperation of the Company Full cooperation of the Company—45 -SEC Investigation SEC litigation stayed Now: January 20, 2004 Investigation continues Then: July 7, 2003 • • • • Rocks In The RoadE. SEC Investigation IV.

Reform Plan—46 -V.

- 47 - Corporate Culture Corporate Governance Corporate Compliance/Internal Audit Internal Controls/Management Governance Policies Reform Plan Components A. B. C. D. V.

lunches Moved from CEO-centric environment to “Many Faces of HealthSouth” Improved employee communications through hotline, letters, broadcasts and “brown-bag” Made security at corporate office more business appropriate Provide financial visibility and accountability to all regional management and ultimately to all facility management—48 -Create an organization that recognizes employees as its most important asset Reinforce ethical behavior at all employee levels Steps taken • • • • Reform Plan Corporate Culture • • • A. V.

director tightened - 49 - Complies with Sarbanes-Oxley Act of 2002 Complies with the Revised Listing Standards of the New York Stock Exchange Definition of “independent” Three-quarters of Board of Directors will be “independent” Non-executive chairman position created Limitation on outside directorships Term limits imposed Non-management directors will meet regularly and frequently Related party transactions will be addressed in advance Revised current HealthSouth Corporate Governance Guidelines • • Revised Corporate Governance Guidelines • • • • • • • Reform Plan Corporate Governance • • B. V.

John Markus; leadership Medical Care North America and Oxford Health Plans – Third-party managed hotline Training for all employees—50 -Hired a seasoned Chief Compliance Officer – experience at Fresenius reports independently to Compliance Committee. Adoption of revised Corporate Compliance and Ethics Program • • World-class internal audit department with appropriate resources Active interface with the Audit Committee More frequent Audit Committee meetings Commitment of $5 million per annum to develop an effective corporate compliance program • • Commitment to • • • New independent director, Lee Hillman, appointed as Chairman of the Audit Committee Reform Plan Corporate Compliance/Internal Audit • • • C. V.

- 51 - Capitalization of assets Recognition of revenues and reserves Conservative policies implemented • • Handbooks being developed to be consistently applied Interface billing to general ledger Interface billing to clinical systems Upgrade all billing systems Convert general ledger system Eliminate opportunities for any individual or group of individuals to make unilateral decisions Accounting Policies • • Commitment to Systems

Upgrades • • • • Commitment and Approval Policies • Reform Plan Internal Controls / Management Governance Policies • • • D. V.

The Future—52 -VI.

- 53 - Board Transition Plan Transition plan announced on December 2, 2003 Five long-standing directors to resign from Board (two resigned on December 15, 2004, two by April 15, 2004, and one by August 30, 2004) Search Committee was formed with stockholder and board representation Spencer Stuart has been hired to assist the Search and Nominating Committees of the Board to identify qualified new Directors Objective is to recruit a world-class board that will offer the new management team strong leadership and a balanced range of experience The FutureA. Board of Directors Transition Plan • • • • • VI.

Of 66 Corporate Officers at January 1, 2003, 29 remain Of 32 Operational Officers at January 1, 2003, 19 remain A leadership overhaul has taken place at HealthSouth since March 19, 2003—54 -Management Transition Plan Major senior management transformation has taken place • • History • Conclusion • The FutureB. Current Status VI.

Underway Outpatient Division Chief Executive Officer Internal Audit Real Estate Search President – General Counsel SVP – VP – - 55 - Date To Compliance Diagnostic Division Information Services Reimbursement Controller Strategies Management Transition Plan Payor Purchasing Key searches are targeted to be completed by the first half of 2004 Hired/Promoted EVP – President – SVP – SVP – SVP – SVP – VP – 5 Divisional Controllers Summary • The FutureB. Prospective Status VI.

Status of Audited Financials More than 350 appraisals in process More than 800,000 accounts over four-year period being reviewed All historical practices being reviewed—56 -Hired Grant Thornton to reconstruct historic balance sheet accounts • • • Restated financial statements will be presented for the period December 31, 1999 through December 31, 2003 Completion goal: First Quarter 2005 The FutureC. Audited Financials • • • VI.

- 57 - Debt Restructuring Sound capital structure for the Company Consensus restructuring with all the Creditors Adequate protection and fair returns for all the Creditors Maximize shareholder value The FutureD. Overall Objectives • • • • VI.

Jan 16, 2004 101.28 105.00 Paid in full $6.19 Mar 25, 2003 47.59 14.75 20.00 $0.11 - 58 - Debt Restructuring Retired Convertible Debt with new senior subordinated financing Current on interest and principal payments for all securities Prices have moved up markedly Senior Notes (% of par) 10.75% Senior Sub Notes (% of par) Convertible Notes (% of par) Equity (Price/Share) Market Enterprise Value has rebounded by over $4.4 billion in this time period The FutureD. Background • • • • VI.

$355 million of new senior subordinated term loan 3 year non-callable: callable at premium afterwards $6.50 per share—59 -10.375% payable quarterly 7 years 10 million 10 years Debt Restructuring Provisions Principal Amount Interest Rate Maturity Call Provisions # of Warrants Strike Price Warrant Maturity The FutureD. Terms of the New Financing VI.

- 60 - Debt Restructuring Retired with proceeds from financing of New Senior Subordinated Term Loan Possible higher interest rate or consent fee, consistent with leverage ratios of the Company Convertible Debt • Senior Debt, Bank Debt, and Senior Subordinated Debt • Expect to close transactions as soon as possible The FutureD. Strategy For Debt Restructuring • • • VI.

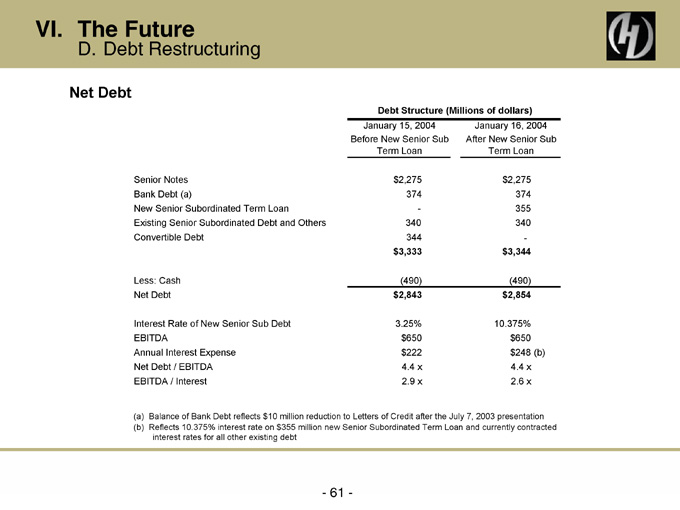

(b) January 16, 2004 After New Senior Sub Term Loan $2,275 374 355 340—$3,344 (490) $2,854 10.375% $650 $248 4.4 x 2.6 x Debt Structure (Millions of dollars) January 15, 2004 Before New Senior Sub Term Loan $2,275 374—340 344 $3,333 (490) $2,843 3.25% $650 $222 4.4 x 2.9 x - 61 - Balance of Bank Debt reflects $10 million reduction to Letters of Credit after the July 7, 2003 presentation Reflects 10.375% interest rate on $355 million new Senior Subordinated Term Loan and currently contracted interest rates for all other existing debt Debt Restructuring Senior Notes Bank Debt (a) New Senior Subordinated Term Loan Existing Senior Subordinated Debt and Others Convertible Debt Less: Cash Net Debt Interest Rate of New Senior Sub Debt EBITDA Annual Interest Expense Net Debt / EBITDA EBITDA / Interest (a) (b) The FutureD. Net Debt VI.

VII. Summary—62 -

• surgery outpatient and locations value rehabilitation, 1,700 • Growth 2004 • nearly EBITDA of significant and in million -Future outpatient middle 63 $490 -for with profitable million investigations by of employees and $650 manageable all Platform rehabilitation, services solid position growth – with address businesses 46,000 – for • A generate Road” largely – inpatient diagnostic than to liquidity the cooperating to in in operations in • #2 More Expect Strong Opportunity Fully Expect • SummaryHealthSouth Market-leading • • Core • • • “Rocks • • • VII.

• lenders others • Bank Stockholders Vendors Many—• 64—• • • • culture corporate HealthSouth” of Beginning governance, Faces finance, “Many • Just the • – success – head-on kept by, and Story close met 2003 a July measured growth to commitments being taken in and payors our are drawing action made all to, continued • HealthSouth honor due for • is Employees Physician-partners Third-party Bondholders chapter to “New” Challenges Decisive Promises • • • SummaryThe Crisis • • • Intend Success Positioned • • • • • VII.

s Questions & Answer

APPENDIX

• and 30-basis of trends, consistent ventures accounting. $400-500 on method revenue by basis to joint approximately of operating on of presented equity 2004 current expenses relating financials, method revenue Also to January presented of equity reduce switch of and policies consolidation EBITDA any in and the on days costs for would 90 current restatement under management. before on impact Committee on for method i.e., Forma annualized treatment an ongoing reflects regional -Pro based that equity be Special 67 results also not and -2004 model current It accounted the the then accounting suggests be to would field presentation, by June forma financial shift Budget by – and should there 2003 pro Annualized presentation. historical analyses and 2004 approved with that prepared accounting A1 July five-month capitalization was Results assumes Current partnerships past analysis reimbursement, actual accounting and presentation believed analysis with Budget is Presentation: up down 2003 on past these this it 2004 Presentation: partnerships. of 2004 Appendix Presentation 2003 Top historical Based with recognition Presentation 40 While million, 20, Bottom consistent accounting The of November • 7, • • • • Basis – January July July

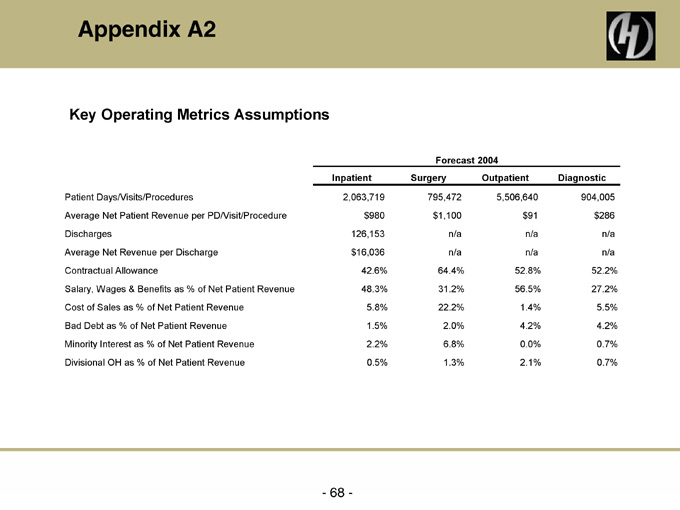

904,005 $286 n/a n/a 52.2% 27.2% 5.5% 4.2% 0.7% 0.7% Diagnostic 5,506,640 $91 n/a n/a 52.8% 56.5% 1.4% 4.2% 0.0% 2.1% Outpatient Forecast 2004 795,472 $1,100 n/a n/a 64.4% 31.2% 22.2% 2.0% 6.8% 1.3% Surgery 2,063,719 $980 126,153 $16,036 42.6% 48.3% 5.8% 1.5% 2.2% 0.5% Inpatient—68 - Appendix A2 Key Operating Metrics Assumptions Patient Days/Visits/Procedures Average Net Patient Revenue per PD/Visit/Procedure Discharges Average Net Revenue per Discharge Contractual Allowance Salary, Wages & Benefits as % of Net Patient Revenue Cost of Sales as % of Net Patient Revenue Bad Debt as % of Net Patient Revenue Minority Interest as % of Net Patient Revenue Divisional OH as % of Net Patient Revenue