Exhibit 99.2

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is designed to provide the reader with information that will assist in understanding our consolidated financial statements, the changes in certain key items in those financial statements from year to year, and the primary factors that accounted for those changes, as well as how certain accounting principles affect our consolidated financial statements. The discussion also provides information about the financial results of the various segments of our business to provide a better understanding of how those segments and their results affect the financial condition and results of operations of HealthSouth as a whole.

Forward Looking Information

This MD&A should be read in conjunction with our accompanying consolidated financial statements and related notes. See “Cautionary Statement Regarding Forward-Looking Statements” on page ii of this report for a description of important factors that could cause actual results to differ from expected results. See also Item 1A,Risk Factors.

Executive Overview

As described in detail in Item 1,Business, the past several years have been marked by profound turmoil and change. During this period, a significant portion of our time and attention has been devoted to matters primarily outside the ordinary course of business such as replacing our senior management team, cooperating with federal investigators, restructuring our finances, and reconstructing our accounting records. We have also devoted substantial resources to improving fundamental business systems including our corporate governance functions, financial controls, and operational infrastructure.

Despite these difficulties, our board of directors, senior management team, and employees worked diligently throughout 2005 and into 2006 and have made significant progress in addressing many of the more significant obstacles created by the March 2003 crisis, including the following:

| | • | | We have replaced our board of directors and senior management team and improved our corporate governance policies and practices. See Item 1,Business, “Our New Board of Directors and Senior Management Team.” |

| | • | | We have completed a substantive reconstruction of our accounting records and filed annual reports on Form 10-K for the fiscal years (including this filing) ended December 31, 2005, 2004, 2003, and 2002 (including a restatement of previously issued consolidated financial statements for the fiscal years ended December 31, 2001 and 2000). In December 2005, we held our first Annual Meeting of Stockholders since 2002. |

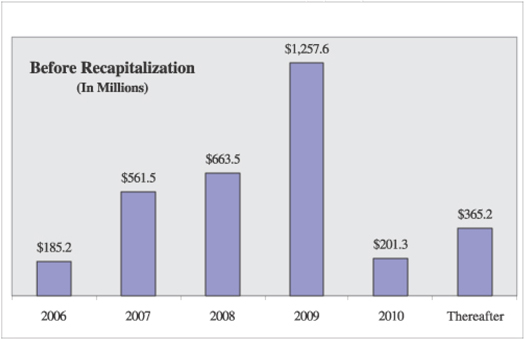

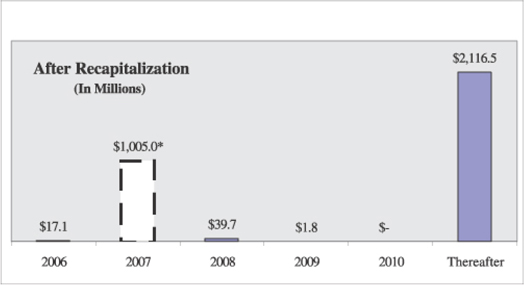

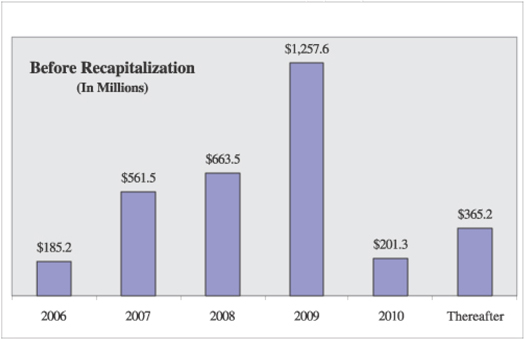

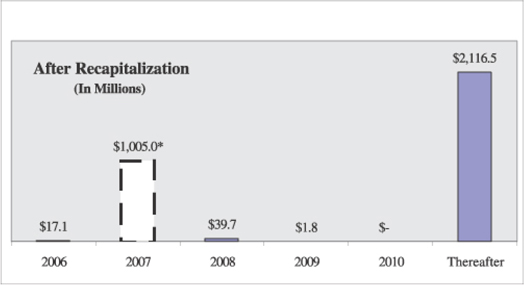

| | • | | We have prepaid substantially all of our existing indebtedness with proceeds from a series of recapitalization transactions and replaced it with approximately $3 billion of new long-term debt, which we believe will produce enhanced operational flexibility, reduced refinancing risk, and an improved credit profile. See Item 1,Business, “Recapitalization Transactions” and Note 8,Long-term Debt, to our accompanying consolidated financial statements. |

| | • | | We have reached a global, preliminary agreement in principle with the lead plaintiffs in the federal securities class actions and the derivative litigation, as well as with our insurance carriers, to settle claims filed against us, certain of our former directors and officers, and certain other parties. See Item 1,Business, “Securities Litigation Settlement.” |

| | • | | We have settled with the Department of Justice’s (the “DOJ”) civil division and other parties regarding their allegations that we submitted various fraudulent Medicare cost reports and committed certain other violations of federal health care program requirements. Although this settlement does not cover all similar claims that have been or could be brought against us, it settles the primary known claims that have been pending against us relating to our participation in federal health care programs. The DOJ and the Office of Inspector General (the “HHS-OIG”) of the United States Department of Health and Human Services (“HHS”) continue to review certain other matters, including self-disclosures made by us to the HHS-OIG. See Item 1,Business, “Medicare Program Settlement.” |

| | • | | We have settled with the United States Securities and Exchange Commission (the “SEC”) regarding its allegations that we violated and/or aided and abetted violations of the antifraud, reporting, books-and-records, and internal controls provisions of the federal securities laws. See Item 1,Business, “SEC Settlement.” |

| | • | | We continue to cooperate with federal law enforcement officials and other federal investigators, including the DOJ and the SEC, as they work to conclude their investigations, which are still ongoing. |

1

We have also made significant progress implementing our multi-year operational agenda, which strives to improve our business in five key areas: revenue, cost, quality, people, and infrastructure. In 2005, we made improvements in each of the five key areas listed in that agenda:

| | • | | Revenue—We helped advocate a slower phase-in of the 75% Rule and, we believe, outperformed the industry in mitigating the impact of the 75% Rule. We consolidated outpatient revenue centers and overhauled our outpatient sales and marketing function. We also piloted various new programs to enhance our marketing and have hired a new senior vice president to improve our managed care contracting function. |

| | • | | Cost—We substantially reduced unnecessary overhead expense and closed or sold under-performing facilities. We have also hired a new senior vice president to manage and streamline our supply chain. We will continue to work to reduce costs by reorganizing and flattening each operating division and implementing standardized labor management metrics and performance expectations. In addition, we are closely monitoring our business and will, when necessary, close or sell additional under-performing facilities. |

| | • | | Quality—We began an inpatient clinical information assessment, increased production of our AutoAmbulator, and participated in various clinical research projects. We are also working to enhance strong quality assurance programs within our facilities and divisions. We plan to supplement these programs by improving our company-wide quality agenda that will include standardized division-specific quality metrics and improved clinical information through the use of technology. |

| | • | | People—We completed our senior management team and hired a number of other management personnel. We also completed a human resources strategic plan and increased 401(k) contributions for our employees. Our goal is to build a culture of integrity, transparency, diversity, and excellence, while simplifying and flattening our organizational structure. |

| | • | | Infrastructure—We invested significant resources to evaluate and improve our financial, reporting, and compliance infrastructure, and will continue to invest heavily in our infrastructure throughout this turnaround period. Although our infrastructure needs further improvement in many areas, we are specifically focused on implementing required internal controls (e.g., compliance with Section 404 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”)), enhancing our financial infrastructure (e.g., improving financial and operational reporting and establishing a formal capital expenditure process and formal budget process), enhancing our management reporting capabilities (e.g., standardizing our monthly reporting and analysis, standardizing our financial projections, and implementing a faster month-end close), developing regulatory compliance programs, enhancing our information systems (e.g. upgrading our patient accounting systems), and implementing an information technology strategic plan. |

Our business, and the health care market in general, continued to evolve throughout 2005. On the positive side, health care sector growth continues to outpace the economy in response to an aging U.S. population and other factors. In addition, the delivery of health care services is migrating to outpatient and post-acute care environments, which suits our business model. On the other hand, we anticipate pricing pressure in the markets we serve, as well as increased competition. Most importantly, recent changes to the 75% Rule and the prospective payment system applicable to our inpatient rehabilitation facilities (“IRF-PPS”) have combined to create a very challenging operating environment for us.

On the whole, our core businesses remain sound. We continue to be the largest provider of ambulatory surgery and rehabilitative health care services in the United States, with (as of December 31, 2005) 1,070 facilities and approximately 37,000 full- and part-time employees. We believe that we are responding to challenges in the inpatient market as well as or better than our competitors, which may lead to potential consolidation opportunities in the future.

We continue to face operational challenges, but we believe our accomplishments in 2005 and the 2006 recapitalization transactions have positioned us to capitalize on our competencies and move forward with implementing our strategic growth plan.

Our Business

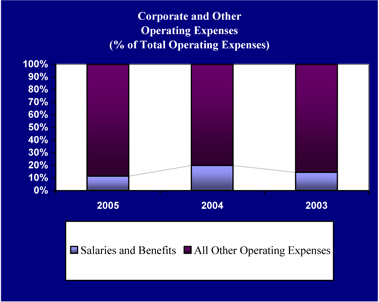

Our business is currently divided into four primary operating divisions—inpatient, surgery centers, outpatient, and diagnostic—and a fifth division that manages certain other revenue producing activities and corporate functions. These five divisions correspond to our five reporting segments discussed later in this Item and throughout this annual report.

Inpatient. Our inpatient division, which comprises the majority of ourNet operating revenues, provides treatment at (as of December 31, 2005) 93 freestanding inpatient rehabilitation facilities (“IRFs”), 10 long-term acute care hospitals (“LTCHs”), and 101 satellites of inpatient facilities providing primarily outpatient care. In addition to the facilities in which we have an ownership interest, our inpatient division operated 14 inpatient rehabilitation units, 11 outpatient facilities, and 2 gamma knife radiosurgery centers through management contracts as of December 31, 2005. This division continues to be the

2

market leader in inpatient rehabilitation services in terms of revenues, number of IRFs, and patients served. In 2004, operating earnings of this division remained stable due largely to treating higher acuity patients and stricter expense controls. In 2005, net operating revenues decreased due to the continued phase-in of the 75% Rule, but operating earnings increased slightly because of the division’s efforts to manage expenses in relation to declining patient volume. We expect this division to continue to show positive results; however, as discussed below, the 75% Rule and recent IRF-PPS changes are likely to have a materially negative impact on future results of operations.

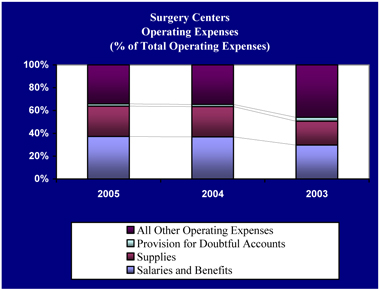

Surgery Centers. Our surgery centers division, which is our second largest division in terms ofNet operating revenues, operates (as of December 31, 2005) 158 freestanding ambulatory surgery centers (“ASCs”) and 3 surgical hospitals. Our surgery centers segment’sNet operating revenues declined from 2003 to 2005. Since March 2003, the division has struggled due in large part to an inability to efficiently resyndicate (i.e., sell ownership interests in) its partnership portfolio and its inability to control supply costs. During 2005, resyndication activity improved, and we enhanced our portfolio of ASCs through the closure of underperforming facilities. We expect this division to benefit as outpatient procedures continue to migrate to the more efficient ASC environment. However, potential benefits from industry growth may be offset by physician partners who are demanding a higher ownership interest in our partnerships, thereby lowering our share of partnership earnings.

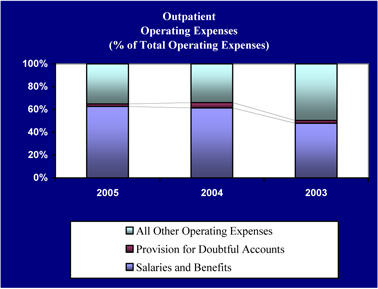

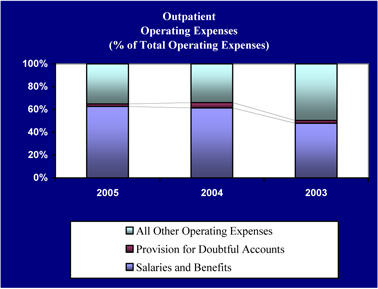

Outpatient. Our outpatient division currently provides outpatient therapy services (as of December 31, 2005) at 617 facilities. This division’s performance declined between 2003 and 2005 due primarily to poor operational processes and increased competition from physician-owned physical therapy sites. During 2005, we continued the rationalization of our outpatient facilities and formulated a sales and marketing team with the primary purpose to diversify our referral sources and minimize our exposure to physician-owned physical therapy sites. We believe these initiatives will begin to produce positive results for this division in 2006.

3

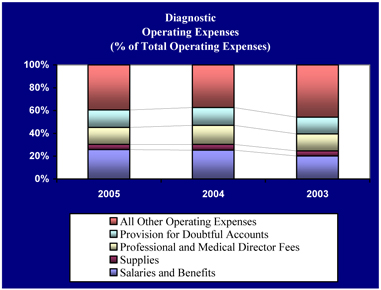

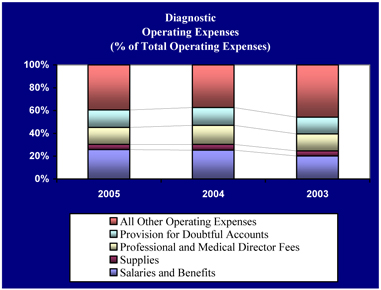

Diagnostic. Our diagnostic division operates (as of December 31, 2005) 85 diagnostic imaging centers. This division’s performance suffered from 2003 to 2005 due to poor margins for the diagnostic market in general and strong competition from physician-owned diagnostic service centers. We are beginning to see stabilization of bothNet operating revenues and operating earnings, which we believe is due in part to payor pressures to decrease perceived over-utilization of diagnostic services by physician-owned diagnostic service centers. We continue to focus on operational improvements to increase our margins. In 2006, we hired R. Gregory Brophy to serve as president of the diagnostic division. In addition, we have received inquiries from parties interested in acquiring our diagnostic division and have hired an investment bank to assist us in evaluating those opportunities. However, no final decision has been made with respect to the divestiture of our diagnostic division at this time.

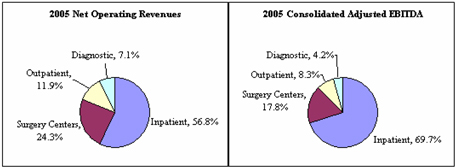

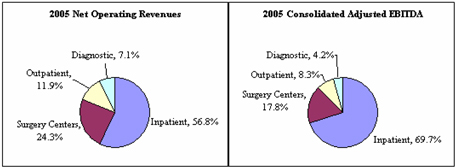

As shown by the following charts, our inpatient and surgery centers divisions made up more than 80% of 2005Net operating revenues and over 85% of 2005 Consolidated Adjusted EBITDA (as defined in this Item, “Consolidated Results of Operations,”) from our four primary operating divisions. For a reconciliation of loss from continuing operations to Consolidated Adjusted EBITDA, see this Item, “Consolidated Results of Operations—Consolidated Adjusted EBITDA.”

We believe that the aging of the U.S. population, changes in technology, and the continuing growth in health care spending will increase demand for the types of services we provide. First, many of the health conditions associated with aging—like stroke and heart attacks, neurological disorders, and diseases and injuries to the muscles, bones, and joints—will increase the demand for ambulatory surgery and rehabilitative services. Second, pressure from payors to provide efficient, high-quality health care services is forcing many procedures traditionally performed in acute care hospitals out of the acute care environment. We believe these market factors align with our strengths. We plan to prioritize investment of time and capital based on where realistic growth prospects are strongest, which we currently believe are our inpatient and surgery centers divisions.

Key Challenges

Although our business is continuing to generate substantial revenues, and market factors appear to favor our outpatient and post-acute care business model, we still have several immediate internal and external challenges to overcome before we can realize significant improvements in our business, including:

| | • | | Operational Improvements. We need to improve our operational efficiency, particularly in our surgery centers, outpatient, and diagnostic divisions. This includes streamlining our division management structure, continuing to consolidate or divest underperforming facilities, implementing standardized performance metrics and practices, and ensuring high quality care. We also will strive to reduce operational variation within each division. |

| | • | | Price Pressure. We are seeing downward pressure on prices in our markets, from both commercial and government payors. We anticipate continuing price pressure in all our divisions. For example, recent IRF-PPS changes are likely to have a materially negative impact on inpatient revenues. In addition, Medicare has frozen ASC pricing through 2009, and beginning in 2007, the Deficit Reduction Act of 2005 will cap ASC and imaging service payments at hospital outpatient department reimbursement levels. Other pricing changes may have a negative impact on our operating results. |

| | • | | Single-Payor Exposure. Medicare comprises approximately 48% of our consolidatedNet operating revenues and approximately 71% of our largest division’s revenues. Consequently, single-payor exposure presents a serious risk. In particular, as discussed in Item 1,Business, “Sources of Revenues,” changes to the 75% Rule and IRF-PPS have |

4

| | combined to create a very challenging operating environment for our inpatient division. The volume volatility created by the 75% Rule has had a significantly negative impact on our inpatient division’sNet operating revenues in 2005. Thus far, we have been able to partially mitigate the impact of the 75% Rule on our inpatient division’s operating earnings by implementing the mitigation strategies discussed in Item 1,Business, “Our Business—Operating Divisions.” However, the combination of volume volatility created by the 75% Rule and lower unit pricing resulting from IRF-PPS changes reduced our operating earnings in 2005 and will have a continuing negative impact on our operating earnings in 2006. In addition, because we receive a significant percentage of our revenues from our inpatient division, and because our inpatient division receives a significant percentage of its revenues from Medicare, our inability to achieve continued compliance with or continue to mitigate the negative effects of the 75% Rule could have a material adverse effect on our business, financial condition, results of operations, and cash flows. |

| | • | | Competition. Competition is increasing as physicians look for new revenue sources to offset declining incomes. In our outpatient and diagnostic divisions, physician practices are the natural owners of most patient volume. Any physician group that generates a substantial portion of facility volume for us may have reached sufficient critical mass to insource their referrals, and is therefore a potential competitor. In addition, the low barriers to entry in the outpatient physical therapy sector, and decreasing barriers to entry in the diagnostic sector, make competition from physician practices a particular problem in those markets. |

| | • | | Declining Ownership Share of Surgery Centers. Like most other ASCs, the majority of our centers are owned in partnership with surgeons and other physicians who perform procedures at the centers. As a result of increased competition in the ASC market and other factors, physicians are demanding increased equity participation in ASCs. Consequently, we expect to see our percentage ownership of centers within our ASC portfolio decline over time, thereby reducing our share of partnership earnings from our ASCs. |

| | • | | Leverage. Although we have completed a series of recapitalization transactions that have eliminated significant uncertainty regarding our capital structure and have improved our financial condition, we remain highly leveraged. Our high leverage increases our cost of capital, decreases our net income, and may prevent us from taking advantage of potential growth opportunities. |

| | • | | Settlement Costs. We have significant cash obligations we must meet in the near future as a result of recent settlements with various federal agencies. Specifically, we are required to pay the remaining balance of our $325 million settlement to the United States in quarterly installments ending in the fourth quarter of 2007 to satisfy our obligations under a settlement described in Item 1,Business, “Medicare Program Settlement.” Furthermore, we are required to pay the remaining balance of our $100 million settlement to the SEC in four installments ending in the fourth quarter of 2007, as described in Item 1,Business, “SEC Settlement.” Payments due under these settlement agreements are as follows as of December 31, 2005: |

| | | | | | | | | |

| | | Medicare

Program

Settlement | | SEC

Settlement | | Total |

| | | (In Thousands) |

2006 | | $ | 83,300 | | $ | 37,500 | | $ | 120,800 |

2007 | | | 86,666 | | | 50,000 | | | 136,666 |

| | | | | | | | | |

| | $ | 169,966 | | $ | 87,500 | | $ | 257,466 |

| | | | | | | | | |

| | • | | Continuing Investigations and Litigation. We face continuing government investigations, as well as numerous class action and individual lawsuits, all of which will consume considerable management attention and company resources and could result in substantial additional payments and fines. Although we have reached a global, preliminary agreement in principle with the lead plaintiffs in the federal securities class actions and the derivative litigation, as well as with our insurance carriers, to settle claims filed against us, certain of our former directors and officers, and certain other parties, there can be no assurance that a final settlement can be reached or that the proposed settlement will receive the required court approval. For additional information, see Item 1,Business, “Securities Litigation Settlement.” |

5

| | • | | Reconstruction, Restatement, and Sarbanes-Oxley Related Costs. We paid approximately $208 million in 2005 in connection with the restructuring of our financial reporting processes, internal control over financial reporting, and managerial operations, and the reconstruction and/or restatement of our consolidated financial statements for the years ended December 31, 2004, 2003, 2002, 2001, and 2000. We anticipate incurring additional related costs in the future, although we expect these costs to decline over time. |

Strategic Plan

Although management’s attention recently has been focused on a range of tactical issues critical to HealthSouth’s survival, our new senior management team has spent considerable time developing a comprehensive strategic plan for the next three to five years that is focused on HealthSouth’s future, not its past. The plan, which has been approved by our board of directors, is divided into the following three phases:

| | • | | Phase 1—Operational Focus. Because of our highly leveraged balance sheet, we must generate additional cash flow from operating activities by improving operational performance in all our operating divisions. In the first phase, we plan to focus on key operational initiatives such as mitigating the impact of the 75% Rule, realizing significant operating performance improvements in each division through standardization of labor and supply chain practices and reduction of fixed costs, completing additional surgery center resyndications, and improving our company-wide quality agenda. In addition, we plan to establish an appropriate internal control environment, strengthen regulatory compliance programs, pilot new post-acute care services, and establish our business development capabilities. Phase 1 has already begun. |

| | • | | Phase 2—Operational/Growth Focus. In this phase, we will continue establishing an appropriate internal control environment. We will also continue making operational improvements by developing ways to use our size to create supply chain efficiencies and to identify and disseminate operational best practices in patient care, sales, and payor contracting. Assuming we are successful in achieving our targeted operational improvements in Phase 1 and mitigating the impact of the 75% Rule, we anticipate we will generate sufficient additional cash flow from operating activities to enable us to take advantage of selected development opportunities in the post-acute and surgery markets. Specifically, we plan to explore consolidation opportunities as they arise and build new IRFs and surgery centers in target markets. During this phase, we also plan to grow promising new post-acute services that are complementary to our existing services. |

| | • | | Phase 3—Growth Focus. The third phase will be more outward looking. We plan to continue to acquire or build IRFs in target markets, develop new ASCs, grow new post-acute care businesses, and evaluate potential consolidation opportunities. |

We are into the first phase of our strategic plan, and we are already making significant strides. For example, as described in Item 1,Business, “Recapitalization Transactions,” we have recently completed several recapitalization transactions resulting in reduced refinancing risk, enhanced operational flexibility, and increased liquidity. We have also entered into key settlements with the government and various private parties, reconstructed our accounting records, filed annual reports on Form 10-K for 2002 – 2005, and held our first Annual Meeting of Stockholders since 2002. Operationally, we have replaced the presidents of each of our primary operating divisions, reorganized these divisions by eliminating unnecessary management layers, increased productivity, divested under-performing facilities, and worked to improve operational systems. We are also continuing to implement mitigation strategies for the 75% Rule in our inpatient facilities, enhance the resyndication process for our ASCs, and implement new information systems to improve cash collections in our diagnostic division.

We believe our strategic plan capitalizes on our strengths, market direction, and legitimate growth opportunities. We are implementing a realistic operational plan and creating the appropriate infrastructure—organization, policies, protocols, systems, and reports—to support it. Finally, we are setting priorities based on resources and with our long-range goals of quality, profitability, and shareholder value at the forefront of our minds.

6

Consolidated Results of Operations

HealthSouth is the largest provider of ambulatory surgery and rehabilitative health care services in the United States, with 1,067 facilities and approximately 37,000 full- and part-time employees. We provide these services through a national network of inpatient and outpatient rehabilitation facilities, outpatient surgery centers, diagnostic centers, and other health care facilities.

During 2005, 2004, and 2003, we derived consolidatedNet operating revenues from the following payor sources:

| | | | | | | | | |

| | | For the year ended

December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

Medicare | | 47.5 | % | | 47.4 | % | | 44.6 | % |

Medicaid | | 2.3 | % | | 2.4 | % | | 2.6 | % |

Workers’ compensation | | 7.4 | % | | 8.1 | % | | 9.5 | % |

Managed care and other discount plans | | 33.1 | % | | 31.8 | % | | 31.8 | % |

Other third-party payors | | 5.4 | % | | 5.1 | % | | 6.5 | % |

Patients | | 1.8 | % | | 3.0 | % | | 2.6 | % |

Other income | | 2.5 | % | | 2.2 | % | | 2.4 | % |

| | | | | | | | | |

Total | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

We provide our patient care services through four primary operating divisions and certain other services through a fifth division. These five divisions correspond to our five reporting segments discussed in this Item, “Segment Results of Operations,” and throughout this annual report.

When reading our consolidated statements of operations, it is important to recognize the following items included within our results of operations:

| | • | | Restructuring charges. In our continuing efforts to streamline operations, we closed numerous underperforming facilities or consolidated similar facilities within the same market in 2005, 2004, and 2003. As a result of these facility closures or consolidations, we recorded certain restructuring charges approximating $8.2 million, $4.0 million, and $2.6 million in 2005, 2004, and 2003, respectively, for one-time termination benefits and contract termination costs under the guidance in Financial Accounting Standards Board (“FASB”) Statement No. 146,Accounting for Costs Associated with Exit or Disposal Activities. See Note 10,Restructuring Charges, to our accompanying consolidated financial statements for additional information. |

| | • | | Change in ownership of certain inpatient rehabilitation facilities. As discussed in more detail in this Item, “Segment Results of Operations—Inpatient,” a judgment was entered against us in 2005 that upheld the landlord’s termination of the lease at two of our inpatient rehabilitation facilities and placed us as the manager, rather than the owner, of these two facilities. Accordingly, our 2005 results of operations include only the $5.4 million management fee we earned for operating these facilities on behalf of the landlord during the year. In 2004 and 2003, the results of operations of these two facilities were included in our consolidated statements of operations on a gross basis. Our consolidatedNet operating revenues and consolidated operating earnings were negatively impacted by approximately $106.3 million and $3.6 million, respectively, in 2005 as a result of the change in classification of these two facilities. |

7

| | • | | Recovery of amounts due from Meadowbrook. In 2001, we sold four inpatient rehabilitation facilities to Meadowbrook Healthcare, Inc. (“Meadowbrook”), an entity formed by one of our former chief financial officers, Michael D. Martin, for a $9.7 million note receivable. Meadowbrook paid no cash in connection with the sale of these facilities. The transaction was closed effective January 1, 2002, but remained in escrow until July 2002. We recognized a loss on this sale of approximately $37.4 million during 2001. In addition, during 2001, we advanced approximately $1.0 million in working capital loans to Meadowbrook. During 2002, we made a net advance of approximately $37.0 million to Meadowbrook. We reserved these amounts in 2001 and 2002, respectively. |

In March 2005, we obtained a security interest in the real properties previously sold to Meadowbrook, evidenced by a mortgage that was recorded in June 2005. In July 2005, we received a payoff letter from Meadowbrook’s attorneys informing us that a payment of $37.9 million would be made by Meadowbrook to us. This repayment was effected by the purchase of Meadowbrook by Rehabcare Group, Inc. in August 2005. We received a cash payment of $37.9 million in August 2005 and recorded this bad debt recovery at that time.

See Note 20,Related Party Transactions, and Note 24,Contingencies and Other Commitments, to our accompanying consolidated financial statements for additional information regarding Meadowbrook.

| | • | | Impairments. During 2005, we recorded an impairment charge of approximately $45.2 million to reduce the carrying value of long-lived assets to their estimated fair market value. During 2004, we recorded an impairment charge of approximately $36.3 million to reduce the carrying value of property and equipment and an impairment charge of $1.0 million to reduce the carrying value of amortizable intangibles of certain operating facilities to their estimated fair market value. During 2003, we recorded a charge of approximately $335.6 million for the impairment of goodwill and an additional charge of approximately $132.7 million for the impairment of certain long-lived assets. These charges are discussed in more detail in this Item, “Segment Results of Operations,” Note 5,Property and Equipment, and Note 6,Goodwill and Other Intangible Assets, to our accompanying consolidated financial statements. |

| | • | | Government, class action, and related settlements expense. In 2005, ourNet loss includes a $215.0 million charge asGovernment, class action, and related settlements expense under a proposed settlement with the lead plaintiffs in the Stockholder Securities Action and the Bondholder Securities Action. In 2003, ourNet loss includes the cost related to our settlement with the SEC and certain additional settlements, as well as legal fees related to this litigation and certain other actions brought against us. For additional information, see Note 22,SEC Settlement, Note 23,Securities Litigation Settlement, and Note 24,Contingencies and Other Commitments, to our accompanying consolidated financial statements. |

| | • | | Professional fees—accounting, tax, and legal. As noted throughout this annual report, significant changes have occurred at HealthSouth since the events leading up to March 19, 2003. The steps taken to stabilize our business and operations, provide vital management assistance, and coordinate our legal strategy came at significant financial cost. During 2005, 2004, and 2003, professional fees associated with the reconstruction of our financial records and restatement of our previously issued 2001 and 2000 consolidated financial statements approximated $169.8 million, $206.2 million, and $70.6 million, respectively. |

| | • | | Loss (gain) on early extinguishment of debt. In each year, we recorded a loss or gain on early extinguishment of debt due to our termination of certain capital leases or various credit agreements, or the repurchase of various bonds. For more information regarding these transactions, please see Note 8,Long-term Debt, to our accompanying consolidated financial statements. |

| | • | | Cumulative effect of an accounting change,net of tax. We recorded the cumulative effect of an accounting change in 2003. Effective January, 1, 2003, we adopted the provisions of FASB Statement No. 143,Accounting for Asset Retirement Obligations, and recorded a related charge of approximately $2.5 million. |

| | • | | Reclassifications. Certain previously reported financial results have been reclassified to conform to the current year presentation. Such reclassifications primarily relate to facilities we closed or sold in 2005, as well as those in closed or sold in the first quarter of 2006, that qualify under FASB Statement No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets, to be reported as discontinued operations. |

8

From 2003 through 2005, our consolidated results of operations were as follows:

| | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | | | Percentage Change | |

| | | 2005 | | | 2004 | | | 2003 | | | 2005 vs. 2004 | | | 2004 vs. 2003 | |

| | | (In Thousands) | | | | | | | |

Net operating revenues | | $ | 3,206,739 | | | $ | 3,511,316 | | | $ | 3,656,152 | | | (8.7 | )% | | (4.0 | )% |

| | | | | | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | | | | | | |

Salaries and benefits | | | 1,429,337 | | | | 1,619,140 | | | | 1,594,613 | | | (11.7 | )% | | 1.5 | % |

Professional and medical director fees | | | 76,365 | | | | 78,114 | | | | 87,666 | | | (2.2 | )% | | (10.9 | )% |

Supplies | | | 305,577 | | | | 331,328 | | | | 317,202 | | | (7.8 | )% | | 4.5 | % |

Other operating expenses | | | 679,587 | | | | 610,766 | | | | 749,374 | | | 11.3 | % | | (18.5 | )% |

Provision for doubtful accounts | | | 98,374 | | | | 113,736 | | | | 128,235 | | | (13.5 | )% | | (11.3 | )% |

Depreciation and amortization | | | 167,098 | | | | 176,947 | | | | 185,473 | | | (5.6 | )% | | (4.6 | )% |

Recovery of amounts due from Meadowbrook | | | (37,902 | ) | | | — | | | | — | | | N/A | | | N/A | |

Loss (gain) on disposal of assets | | | 14,775 | | | | 9,462 | | | | (14,967 | ) | | 56.2 | % | | (163.2 | )% |

Impairment of goodwill, intangible assets, and long-lived assets | | | 45,203 | | | | 37,290 | | | | 468,345 | | | 21.2 | % | | (92.0 | )% |

Government, class action, and related settlements expense | | | 215,000 | | | | — | | | | 170,949 | | | N/A | | | (100.0 | )% |

Professional fees - accounting, tax, and legal | | | 169,804 | | | | 206,244 | | | | 70,558 | | | (17.7 | )% | | 192.3 | % |

| | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 3,163,218 | | | | 3,183,027 | | | | 3,757,448 | | | (0.6 | )% | | (15.3 | )% |

Loss (gain) on early extinguishment of debt | | | 33 | | | | (45 | ) | | | (2,259 | ) | | (173.3 | )% | | (98.0 | )% |

Interest expense and amortization of debt discounts and fees | | | 338,466 | | | | 302,606 | | | | 265,305 | | | 11.9 | % | | 14.1 | % |

Interest income | | | (17,141 | ) | | | (13,090 | ) | | | (7,273 | ) | | 30.9 | % | | 80.0 | % |

(Gain) loss on sale of investments | | | (229 | ) | | | (3,601 | ) | | | 15,811 | | | (93.6 | )% | | (122.8 | )% |

Equity in net income of nonconsolidated affiliates | | | (29,432 | ) | | | (9,949 | ) | | | (15,769 | ) | | 195.8 | % | | (36.9 | )% |

Minority interests in earnings of consolidated affiliates | | | 96,735 | | | | 94,400 | | | | 98,203 | | | 2.5 | % | | (3.9 | )% |

| | | | | | | | | | | | | | | | | | |

Loss from continuing operations before income tax expense (benefit) and cumulative effect of accounting change | | | (344,911 | ) | | | (42,032 | ) | | | (455,314 | ) | | 720.6 | % | | (90.8 | )% |

Provision for income tax expense (benefit) | | | 39,792 | | | | 11,914 | | | | (28,382 | ) | | 234.0 | % | | (142.0 | )% |

| | | | | | | | | | | | | | | | | | |

Loss from continuing operations before cumulative effect of accounting change | | | (384,703 | ) | | | (53,946 | ) | | | (426,932 | ) | | 613.1 | % | | (87.4 | )% |

Loss from discontinued operations, net of income tax expense | | | (61,291 | ) | | | (120,524 | ) | | | (5,169 | ) | | (49.1 | )% | | 2,231.7 | % |

| | | | | | | | | | | | | | | | | | |

Loss before cumulative effect of accounting change | | | (445,994 | ) | | | (174,470 | ) | | | (432,101 | ) | | 155.6 | % | | (59.6 | )% |

Cumulative effect of accounting change, net of income tax expense | | | — | | | | — | | | | (2,456 | ) | | N/A | | | (100.0 | )% |

| | | | | | | | | | | | | | | | | | |

Net loss | | $ | (445,994 | ) | | $ | (174,470 | ) | | $ | (434,557 | ) | | 155.6 | % | | (59.9 | )% |

| | | | | | | | | | | | | | | | | | |

9

Operating Expenses as a % of Net Operating Revenues

| | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

Salaries and benefits | | 44.6 | % | | 46.1 | % | | 43.6 | % |

Professional and medical director fees | | 2.4 | % | | 2.2 | % | | 2.4 | % |

Supplies | | 9.5 | % | | 9.4 | % | | 8.7 | % |

Other operating expenses | | 21.2 | % | | 17.4 | % | | 20.5 | % |

Provision for doubtful accounts | | 3.1 | % | | 3.2 | % | | 3.5 | % |

Depreciation and amortization | | 5.2 | % | | 5.0 | % | | 5.1 | % |

Recovery of amounts due from Meadowbrook | | (1.2 | )% | | 0.0 | % | | 0.0 | % |

Loss (gain) on disposal of assets | | 0.5 | % | | 0.3 | % | | (0.4 | )% |

Impairment of goodwill, intangible assets, and long-lived assets | | 1.4 | % | | 1.1 | % | | 12.8 | % |

Government and class action settlements expense | | 6.7 | % | | 0.0 | % | | 4.7 | % |

Professional fees - accounting, tax, and legal | | 5.3 | % | | 5.9 | % | | 1.9 | % |

| | | | | | | | | |

Total operating expenses as a % of net operating revenues | | 98.6 | % | | 90.7 | % | | 102.8 | % |

| | | | | | | | | |

Net Operating Revenues

Our consolidatedNet operating revenues primarily include revenues derived from patient care services provided by one of our four primary operating segments. It also includes other revenues generated from management and administrative fees, trainer income, operation of the conference center located on our corporate campus, and other non-patient care services.

Volume decreases in each of our operating segments and the change in ownership of certain facilities within our inpatient segment were the primary factors that contributed to the decliningNet operating revenues in 2005. Our inpatient segment experienced volume decreases due to the continued phase-in of the 75% Rule. Although resyndication activity increased in 2005, volumes in our surgery centers segment continued to decline based on the timing of these resyndications. Competition from physician-owned similar sites continued to negatively impact volumes in our outpatient and diagnostic segments. The change in ownership of these two inpatient facilities contributed approximately $106.3 million to the decline inNet operating revenues. See this Item, “Segment Results of Operations—Inpatient.”

The decrease in our consolidatedNet operating revenues from 2003 to 2004 was due primarily to volume decreases within our surgery centers, outpatient, and diagnostic segments. The volume decline within our surgery centers segment was due to the limited resyndication activity which occurred in 2004. Volume decreases within both our outpatient and diagnostic segments were due to competition from physician-owned similar sites.

Salaries and Benefits

Salaries and benefits represents the most significant cost to us and includes all amounts paid to full- and part-time employees, including all related costs of benefits provided to employees. It also includes amounts paid for contract labor.

In 2005, our segments demonstrated their ability to manage employee-related costs during periods of declining volumes, withSalaries and benefits decreasing from 46.1% ofNet operating revenues in 2004 to 44.6% ofNet operating revenues in 2005. From 2004 to 2005,Salaries and benefits decreased by 11.7%, primarily in our inpatient, surgery centers, and outpatient segments. Approximately $66.1 million of the decrease is due to the change in classification of two inpatient facilities, as discussed later in this Item. In addition, our inpatient and surgery centers segments reduced their full-time equivalents as their volumes declined throughout the year, and our outpatient segment reduced its full-time equivalents through the closure of underperforming facilities that did not qualify for discontinued operations treatment.

10

Salaries and benefits grew as a percent ofNet operating revenues during 2004. This was due to rising costs associated with group medical and workers’ compensation across all of our segments, increased use of contract labor within our inpatient segment, and an inability to further adjust minimum staffing levels within our diagnostic segment. Due to staffing shortages for therapists and nurses, our inpatient segment was forced to increase its use of higher-priced contract labor to properly care for its patients during 2004. As discussed further in this Item, “Segment Results of Operations—Diagnostic,” our diagnostic segment reached minimum staffing levels and could not further adjust its staffing levels with the declining volumes experienced in 2004. All of the above contributed to the increase inSalaries and benefits as a percent ofNet operating revenues during the year.

Professional and Medical Director Fees

Professional and medical director fees include fees paid under contracts with radiologists, medical directors, and other clinical professionals at our centers for services provided. It also includes professional consulting fees associated with operational initiatives, such as strategic planning and revenue enhancement projects.

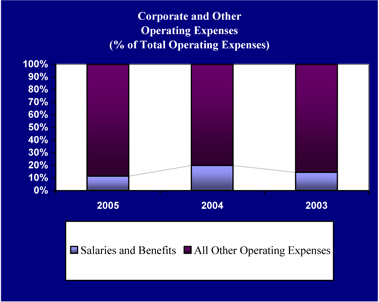

The change inProfessional and medical director fees from 2004 to 2005 was not material in the aggregate. However, it is important to note that these fees decreased in our diagnostic segment due to declining volumes, but increased in our corporate and other segment due to fees paid to consulting firms for corporate strategy and other projects. From 2003 to 2004, these fees decreased primarily in our diagnostic division due to declining volumes. For more information regarding these fees and their relation to volumes in our diagnostic segment, see this Item, “Segment Results of Operations—Diagnostic.”

Supplies

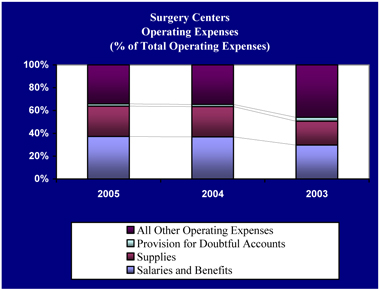

Supplies include costs associated with supplies used while providing patient care at our facilities. Examples include pharmaceuticals, implants, bandages, food, and other similar items. In each year, our inpatient and surgery centers segments comprise over 94% of ourSuppliesexpense.

From 2004 to 2005,Suppliesexpense decreased by 7.8% due primarily to the decline in volumes in our inpatient and surgery centers segments combined with the change in classification of two of our inpatient facilities, as discussed below.Supplies expense as a percent ofNet operating revenuesremained relatively flat year-over-year.

The increase inSuppliesexpense from 2003 to 2004 was due to an increase inSupplies expense in our inpatient segment due to increasing costs associated with supplies and the higher acuity of our patients in 2004. Higher acuity results in increased costs associated with supplies, especially in drug costs.

Other Operating Expenses

Other operating expenses include costs associated with managing and maintaining our operating facilities as well as the general and administrative costs related to the operation of our corporate office. These expenses include such items as repairs and maintenance, utilities, contract services, rent, professional fees, and insurance.

The increase inOther operating expenses from 2004 to 2005 primarily related to increased professional fees associated with projects related to our compliance with Sarbanes-Oxley, strategic consulting, and other similar services from accounting and consulting firms offset by an approximate $17.2 million decrease inOther operating expenses due to the change in classification of certain facilities discussed below within our inpatient segment.

The decrease inOther operating expenses from 2003 to 2004 primarily related to decreased operating expenses within our inpatient segment. Continuing a trend seen in 2003, our inpatient segment’s operating expenses decreased in 2004 as the segment continued to digest the change to the Prospective Payment System (“PPS”) and faced the challenge of mitigating the 75% Rule impact on itsNet operating revenues.

11

Provision for Doubtful Accounts

In 2005, ourProvision for doubtful accounts decreased by $15.4 million due to the decrease inNet operating revenues year-over-year in each of our operating segments and the continued implementation of new information systems to improve cash collections in our diagnostic segment.

OurProvision for doubtful accounts decreased from 3.5% ofNet operating revenues in 2003 to 3.2% ofNet operating revenues in 2004 as we made progress collecting aged receivables and implementing improved cash collections procedures within our diagnostic and surgery centers segments.

For more information, please see this Item, “Segment Results of Operations.”

Depreciation and Amortization

The decrease inDepreciation and amortization expense in each year is due to impairment charges and an increase in fully depreciated assets within our operating segments.

Loss (gain) on Disposal of Assets

The net loss on disposal of assets in 2005 resulted from numerous individually immaterial asset sales and disposals in our inpatient and outpatient segments. The net loss on disposal of assets in 2004 primarily resulted from facility closures in our outpatient and diagnostic segments. Continuing volume declines and competition in these segments forced us to close additional underperforming facilities in 2004. The net gain on disposal of assets in 2003 primarily resulted from the sale of our inpatient facility in Reno, Nevada.

Interest Expense and Amortization of Debt Discounts and Fees

Interest expense and amortization of debt discounts and fees increased by $35.9 million, or 11.9%, from 2004 to 2005 primarily due to the amortization of consent fees and bond issue costs associated with the 2004 consent solicitation and 2005 refinancings. During 2004, consent fees paid for all of our debt issues approximated $80.2 million, and we paid approximately $11.1 million in debt issuance costs. We amortize these fees to interest expense over the remaining term of the debt. In 2004, we amortized these costs for approximately six months, as compared to a full year of amortization in 2005. We also paid approximately $17.9 million in debt issuance costs in 2005. These costs are also amortized to interest expense over the life of the related debt. As a result of the above amortization charges, interest expense increased by approximately $17.2 million in 2005. An additional $11.2 million of interest expense was recorded in 2005 related to payments under our Medicare Program Settlement (see Note 21,Medicare Program Settlement, to our accompanying consolidated financial statements). The remaining $7.5 million of the increase in interest expense is primarily the result of higher average borrowing rates in 2005. In 2005, our average borrowing rate was 9.4% compared to an average rate of 8.5% in 2004.

The increase in interest expense from 2003 to 2004 was the result of higher average borrowing rates in 2004. In 2003, our average borrowing rate was 7.5% compared to an average rate of 8.5% in 2004. The average borrowing rate increased due to the repayment of our 3.25% convertible debentures with proceeds from a 10.375% senior subordinated term loan.

For more information regarding the above changes in debt, see Note 8,Long-term Debt, to our accompanying consolidated financial statements.

12

(Gain) loss on Sale of Investments

In each year presented in our consolidated statements of operations, the net gain or loss on sale of investments was primarily comprised of numerous individually insignificant transactions related to less than 100% owned entities, including investments in nonconsolidated affiliates. In 2004, the net gain on sale of investments was solely comprised of these types of transactions. In 2005 and 2003, the net gain or loss on sale of investments also includes the realized gains and losses recorded on the sale of marketable securities. For additional information regarding our marketable securities, please see Note 4,Cash and Marketable Securities, to our accompanying consolidated financial statements.

Equity in Net Income of Nonconsolidated Affiliates

The increase inEquity in Net Income of Nonconsolidated Affiliatesfrom 2004 to 2005 is primarily due to the reclassification of five surgery centers that became equity method investments rather than consolidated entities in 2005 as a result of changes in control of these entities. The decrease inEquity in Net Income of Nonconsolidated Affiliates from 2003 to 2004 is primarily due to higher year-over-year operating expenses at three of our nonconsolidated surgery centers.

Minority Interests in Earnings of Consolidated Affiliates

Minority interests in earnings of consolidated affiliates represent the share of net income or loss allocated to members or partners in our consolidated entities. For 2003 through 2005, the number and average external ownership interest in these consolidated entities were as follows:

| | | | | | | | | |

| | | As of and for the year ended

December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

Active consolidated affiliates | | 272 | | | 276 | | | 322 | |

Average external ownership interest | | 34.0 | % | | 32.1 | % | | 32.5 | % |

Of our active consolidated affiliates at December 31, 2005, approximately 79% of them are in our inpatient and surgery centers segments. Fluctuations inMinority interests in earnings of consolidated affiliates generally follow the same trends as our inpatient and surgery centers segments. However, resyndication activities in 2005 and the absorption of losses for certain partnerships in 2005 combined to increase these expenses from 2004 to 2005.

Loss from Continuing Operations Before Income Tax Expense (Benefit) and Cumulative Effect of Accounting Change

OurLoss from continuing operations before income tax expense (benefit) and cumulative effect of accounting change (“loss from continuing operations”) in 2005 includes $215.0 million associated with the settlement of our securities litigation and a $37.9 million recovery of bad debt associated with Meadowbrook. If these two items are excluded, our loss from continuing operations is $167.8 million, which represents a $125.8 million increase over our 2004 net loss from continuing operations. This increase is primarily due to a decrease inNet operating revenues as a result of declining volumes, higherOther operating expenses associated with professional service fees, and increased interest expense, as discussed above.

The decrease in our loss from continuing operations from 2003 to 2004 is primarily due to the 15.3% decrease in operating expenses year over year. Operating expenses decreased as a result of the $431.1 million decrease in impairment charges and a $170.9 million decrease inGovernment, class action, and related settlements expense offset by a $135.7 million increase inProfessional fees—accounting, tax, and legal. Increased interest expense during 2004 (as a result of higher average borrowing rates), as discussed above, also offset the decrease in operating expenses.

13

Provision for Income Tax Expense (Benefit)

We realized a $39.8 million income tax expense from continuing operations in 2005 as compared to an $11.9 million income tax expense from continuing operations in 2004. Deferred tax expense increased by approximately $23 million to reflect the change in the noncurrent deferred taxes associated with certain indefinite lived assets. Additionally, HealthSouth Corporation and its subsidiaries file separate income tax returns in a number of states, some of which result in current state tax liabilities. A current federal tax expense was also charged in 2005 and 2004 associated with ownership in corporate joint ventures.

We realized an $11.9 million income tax expense from continuing operations in 2004 compared to a $28.4 million income tax benefit from continuing operations in 2003. Deferred tax expense increased by approximately $20 million to reflect the change in the noncurrent deferred taxes associated with certain indefinite lived assets. Additionally, HealthSouth Corporation and its subsidiaries file separate income tax returns in a number of states, some of which result in current state income tax liabilities. A current federal tax expense was also charged in 2004 associated with ownership in corporate joint ventures.

Consolidated Adjusted EBITDA

Management continues to believe that an understanding of Consolidated Adjusted EBITDA is an important measure of operating performance, leverage capacity, our ability to service our debt, and our ability to make capital expenditures for our stakeholders.

We use Consolidated Adjusted EBITDA to assess our operating performance. We believe it is meaningful because it provides investors with a measure used by our internal decision makers for evaluating our business. Our internal decision makers believe Consolidated Adjusted EBITDA is a meaningful measure, because it represents a transparent view of our recurring operating performance and allows management to readily view operating trends, perform analytical comparisons, and perform benchmarking between segments. Additionally, our management believes the inclusion of professional fees associated with litigation, financial restructuring, government investigations, forensic accounting, creditor advisors, accounting reconstruction, audit and tax work associated with the reconstruction process, the implementation of Sarbanes-Oxley Section 404, and non-ordinary course charges incurred after March 19, 2003 and related to our overall corporate restructuring distort within EBITDA their ability to efficiently assess and view the core operating trends on a consolidated basis and within segments. Additionally, we use Consolidated Adjusted EBITDA as a significant criterion in our determination of performance-based cash bonuses and stock awards. We reconcile consolidated Adjusted EBITDA to loss from continuing operations.

We also use Consolidated Adjusted EBITDA on a consolidated basis as a liquidity measure. We believe this financial measure on a consolidated basis is important in analyzing our liquidity because it is also a component of certain material covenants contained within the documents governing our long-term indebtedness, as discussed in more detail in Note 8,Long-term Debt, to our accompanying consolidated financial statements. These covenants are material terms of these agreements because they govern several of our credit agreements, which in turn represent a substantial portion of our capitalization. Non-compliance with these financial covenants under our credit facilities—our interest coverage ratio and our leverage ratio—could result in the lenders requiring us to immediately repay all amounts borrowed. In addition, if we cannot satisfy these financial covenants, we would be prohibited under the documents governing our long-term indebtedness from engaging in certain activities, such as incurring additional indebtedness, making certain payments, and acquiring and disposing of assets. Consequently, Consolidated Adjusted EBITDA is critical to our assessment of our liquidity.

In general terms, the definition of Consolidated Adjusted EBITDA, per the documents governing our long-term indebtedness, allow us to add back to Consolidated Adjusted EBITDA charges classified as “Restructuring Charges.” Costs which we classify as “Restructuring Charges” include professional fees associated with certain litigation, financial restructuring, government investigations, forensic accounting, creditor advisors, accounting reconstruction, audit and tax work associated with the reconstruction process, compliance with Sarbanes-Oxley Section 404, and non-ordinary course charges incurred after March 19, 2003 related to our overall corporate restructuring.

14

However, Consolidated Adjusted EBITDA is not a measure of financial performance under generally accepted accounting principles in the United States of America, and the items excluded from Consolidated Adjusted EBITDA are significant components in understanding and assessing financial performance. Therefore, Consolidated Adjusted EBITDA should not be considered a substitute for net loss from continuing operations or cash flows from operating, investing, or financing activities. Because Consolidated Adjusted EBITDA is not a measurement determined in accordance with generally accepted accounting principles in the United States of America and is thus susceptible to varying calculations, Consolidated Adjusted EBITDA, as presented, may not be comparable to other similarly titled measures of other companies. Revenue and expenses are measured in accordance with the policies and procedures described in Note 1,Summary of Significant Accounting Policies, to our accompanying consolidated financial statements.

As noted earlier in this Item, certain previously reported financial results have been reclassified to conform to the current year presentation. Such reclassifications primarily relate to facilities we closed or sold in 2005 and the first quarter of 2006 that qualify under FASB Statement No. 144 to be reported as discontinued operations. These reclassifications may also impact previously reported Consolidated Adjusted EBITDA amounts. The facilities that were classified as discontinued operations in 2005 and the first quarter of 2006 had a positive impact of approximately $56 million and $21 million, respectively, on 2004 and 2003 Consolidated Adjusted EBITDA reported in our 2004 annual report.

From 2003 through 2005, our Consolidated Adjusted EBITDA was as follows:

Reconciliation of Loss from Continuing Operations to Consolidated Adjusted EBITDA

| | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

| | | (In Thousands) | |

Loss from continuing operations | | $ | (384,703 | ) | | $ | (53,946 | ) | | $ | (429,388 | ) |

Provision for income tax expense (benefit) | | | 39,792 | | | | 11,914 | | | | (28,382 | ) |

Cumulative effect of accounting change, net of income tax expense | | | — | | | | — | | | | 2,456 | |

Depreciation and amortization | | | 167,098 | | | | 176,947 | | | | 185,473 | |

Loss (gain) on disposal of assets | | | 14,775 | | | | 9,462 | | | | (14,967 | ) |

Impairment charges | | | 45,203 | | | | 37,290 | | | | 468,345 | |

Loss (gain) on early extinguishment of debt | | | 33 | | | | (45 | ) | | | (2,259 | ) |

Interest expense and amortization of debt discounts and fees | | | 338,466 | | | | 302,606 | | | | 265,305 | |

Interest income | | | (17,141 | ) | | | (13,090 | ) | | | (7,273 | ) |

Gain on sale of marketable securities | | | (8 | ) | | | — | | | | (698 | ) |

| | | | | | | | | | | | |

Consolidated Adjusted EBITDA beforegovernment and class action settlementsexpense, professional fees - reconstruction and restatement, and other restructuringcharges | | | 203,515 | | | | 471,138 | | | | 438,612 | |

Government and class action settlements expense | | | 215,000 | | | | — | | | | 170,949 | |

Professional fees - accounting, tax, and legal | | | 169,804 | | | | 206,244 | | | | 70,558 | |

Sarbanes-Oxley related costs | | | 32,204 | | | | 17,534 | | | | — | |

Restructuring activities under FASB Statement No. 146 | | | 8,190 | | | | 3,973 | | | | 2,571 | |

| | | | | | | | | | | | |

Consolidated Adjusted EBITDA | | $ | 628,713 | | | $ | 698,889 | | | $ | 682,690 | |

| | | | | | | | | | | | |

15

Reconciliation of Consolidated Adjusted EBITDA to Net Cash Provided by Operating Activities

| | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

| | | (In Thousands) | |

Consolidated Adjusted EBITDA | | $ | 628,713 | | | $ | 698,889 | | | $ | 682,690 | |

Professional fees - accounting, tax, and legal | | | (169,804 | ) | | | (206,244 | ) | | | (70,558 | ) |

Sarbanes-Oxley related costs | | | (32,204 | ) | | | (17,534 | ) | | | — | |

Interest expense and amortization of debt discounts and fees | | | (338,466 | ) | | | (302,606 | ) | | | (265,305 | ) |

Interest income | | | 17,141 | | | | 13,090 | | | | 7,273 | |

Provision for doubtful accounts | | | 98,374 | | | | 113,736 | | | | 128,235 | |

Amortization of debt issue costs, debt discounts, and fees | | | 39,023 | | | | 21,838 | | | | 7,831 | |

Amortization of restricted stock | | | 1,998 | | | | 614 | | | | (2,932 | ) |

Accretion of debt securities | | | (410 | ) | | | — | | | | — | |

(Gain) loss on sale of investments, excluding marketable securities | | | (221 | ) | | | (3,601 | ) | | | 16,509 | |

Equity in net income of nonconsolidated affiliates | | | (29,432 | ) | | | (9,949 | ) | | | (15,769 | ) |

Distributions from nonconsolidated affiliates | | | 22,457 | | | | 17,029 | | | | 8,561 | |

Minority interest in earnings of consolidated affiliates | | | 96,735 | | | | 94,400 | | | | 98,203 | |

Stock-based compensation | | | — | | | | (460 | ) | | | — | |

Current portion of income tax provision | | | (22,295 | ) | | | (17,253 | ) | | | 2,826 | |

Restructuring charges under FASB Statement No. 146 | | | (8,190 | ) | | | (3,973 | ) | | | (2,571 | ) |

Other operating cash used in discontinued operations | | | (47,538 | ) | | | (33,534 | ) | | | (35,650 | ) |

Cash payments related to government settlements | | | (165,434 | ) | | | (6,997 | ) | | | — | |

Change in assets and liabilities, net of acquisitions | | | (88,880 | ) | | | 34,151 | | | | 14,849 | |

| | | | | | | | | | | | |

Net Cash (Used In) Provided by Operating Activities | | $ | 1,567 | | | $ | 391,596 | | | $ | 574,192 | |

| | | | | | | | | | | | |

Our Consolidated Adjusted EBITDA approximated 19.6%, 19.9%, and 18.7% ofNet operating revenues in 2005, 2004, and 2003, respectively. Consolidated Adjusted EBITDA decreased from 2004 to 2005 due to the declining volumes experienced by each of our operating segments and increased operating expenses associated with professional service fees, as discussed above. Consolidated Adjusted EBITDA increased by 2.4% from 2003 to 2004. This increase was due primarily to our ability to control operating expenses as our segments experienced declining volumes. In 2004,Net operating revenues decreased by 4.0%, while operating expenses decreased by 15.3%.

Impact of Inflation

The health care industry is labor intensive. Wages and other expenses increase during periods of inflation and when labor shortages occur in the marketplace. In addition, suppliers pass along rising costs to us in the form of higher prices. Although we cannot predict our ability to cover future cost increases, we believe that through adherence to cost containment policies and labor and supply management, the effects of inflation on future operating results should be manageable.

However, we have little or no ability to pass on these increased costs associated with providing services to Medicare and Medicaid patients due to federal and state laws that establish fixed reimbursement rates. In addition, as a result of increasing regulatory and competitive pressures and a continuing industry-wide shift of patients to managed care plans, our ability to maintain margins through price increases to non-Medicare patients is limited.

16

Relationships and Transactions with Related Parties

HealthSouth and its prior management and board of directors engaged in numerous relationships and transactions with related parties. These transactions involved certain venture capital firms, investments, real property, and indebtedness of management. For more information on our historic relationships and transactions with related parties, please see Note 7,Investment in and Advances to Nonconsolidated Affiliates, Note 11,Shareholders’ Deficit, and Note 20,Related Party Transactions, to our accompanying consolidated financial statements.

As part of our restructuring process, we have eliminated our interests in and relationships with related parties. These types of transactions are not material to our ongoing operations, and therefore, will not be presented as a separate discussion within this Item. When these relationships or transactions were significant to our results of operations during the years ended December 31, 2005, 2004, or 2003, information regarding the relationship or transaction(s) have been included within this Item.

Segment Results of Operations

Our internal financial reporting and management structure is focused on the major types of services provided by HealthSouth. We currently provide various patient care services through four operating divisions and certain other services through a fifth division, which correspond to our five reporting business segments: (1) inpatient, (2) surgery centers, (3) outpatient, (4) diagnostic, and (5) corporate and other. For additional information regarding our business segments, including a detailed description of the services we provide and financial data for each segment, please see Item 1,Business, and Note 25,Segment Reporting,to our accompanying consolidated financial statements. Future changes to this organizational structure may result in changes to the reportable segments disclosed.

Inpatient

We are the nation’s largest provider of inpatient rehabilitation services. Our inpatient rehabilitation facilities provide comprehensive services to patients who require intensive institutional rehabilitation care. Patient care is provided by nursing and therapy staff as directed by a physician order. Internal case managers monitor each patient’s progress and provide documentation of patient status, achievement of goals, functional outcomes and efficiency.

Our inpatient segment operates IRFs, LTCHs, home health, and skilled nursing units and provides treatment on both an inpatient and outpatient basis. As of December 31, 2005, our inpatient segment operated 93 freestanding IRFs, 10 LTCHs, and 101 outpatient facilities near our IRFs or LTCHs. In addition to HealthSouth facilities, our inpatient segment manages 14 inpatient rehabilitation units, 11 outpatient facilities, and 2 gamma knife radiosurgery centers through management contracts. Our inpatient facilities are located in 28 states, with a concentration of facilities in Texas, Pennsylvania, Florida, Tennessee, and Alabama. We also have facilities in Puerto Rico and Australia.

17

For the years ended December 31, 2005, 2004, and 2003, our inpatient segment comprised approximately 56.5%, 57.5%, and 54.6%, respectively, of consolidatedNet operating revenues. For 2003 through 2005, this segment’s operating results were as follows:

| | | | | | | | | |

| | | For the year ended December 31, |

| | | 2005 | | 2004 | | 2003 |

| | | (In Thousands) |

Inpatient | | | | | | | | | |

Net operating revenues | | $ | 1,810,401 | | $ | 2,020,409 | | $ | 1,997,963 |

Operating expenses* | | | 1,417,394 | | | 1,583,496 | | | 1,561,460 |

| | | | | | | | | |

Operating earnings | | $ | 393,007 | | $ | 436,913 | | $ | 436,503 |

| | | | | | | | | |

Discharges | | | 107 | | | 121 | | | 119 |

Outpatient visits | | | 1,650 | | | 2,167 | | | 2,317 |

| | | (Not In Thousands) |

Full time equivalents | | | 16,795 | | | 19,859 | | | 19,430 |

Average length of stay | | | 15.9 days | | | 16.0 days | | | 16.3 days |

| * | Includes divisional overhead, but excludes corporate overhead allocation. See Note 25,Segment Reporting, to our accompanying consolidated financial statements. Includes the effect of minority interests in earnings of consolidated affiliates and equity in the net income of nonconsolidated affiliates. |

During 2005, 2004, and 2003, inpatient’sNet operating revenues were derived from the following payor sources:

| | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2005 | | | 2004 | | | 2003 | |

Medicare | | 71.2 | % | | 70.6 | % | | 71.1 | % |

Medicaid | | 2.3 | % | | 2.6 | % | | 2.3 | % |

Workers’ compensation | | 2.8 | % | | 3.3 | % | | 3.8 | % |

Managed care and other discount plans | | 15.9 | % | | 15.0 | % | | 14.4 | % |

Other third-party payors | | 5.2 | % | | 6.6 | % | | 6.3 | % |

Patients | | 0.5 | % | | 0.1 | % | | 0.1 | % |

Other income | | 2.1 | % | | 1.8 | % | | 2.0 | % |

| | | | | | | | | |

Total | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | | | | | | | |

Our inpatient segment’s payor mix is weighted heavily towards Medicare. Our IRFs receive Medicare reimbursements under PPS. Under IRF-PPS, our IRFs receive fixed payment amounts per discharge based on certain rehabilitation impairment categories established by the Department of Health and Human Services. With PPS, our facilities retain the difference, if any, between the fixed payment from Medicare and their operating costs. Thus, our facilities are rewarded for being high quality, low cost providers. For additional information regarding Medicare reimbursement, please see the “Sources of Revenue” section of Item 1,Business, of this annual report.

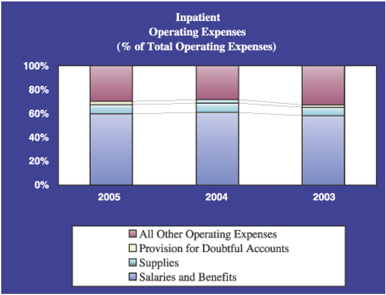

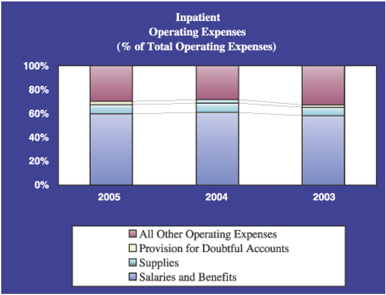

Due to the significance of Medicare payments to our inpatient facilities, the number of patient discharges is a key metric utilized by the segment to monitor and evaluate its performance. The number of outpatient visits is also tracked in order to measure the volume of outpatient activity within the segment. The segment’s primary operating expenses includeSalaries and benefits andSupplies.Salaries and benefits represents the most significant cost to the segment and includes all amounts paid to full- and part-time employees, including all related costs of benefits provided to employees. It also includes amounts paid for contract labor. Supply costs include all expenses associated with supplies used while providing patient care. These costs include pharmaceuticals, needles, bandages, food, and other similar items.

18

Significant Changes in Regulations Governing IRF Reimbursement

As discussed in Item 1,Business, “Sources of Revenues,” two recent changes in regulations governing IRF reimbursement have combined to create a very challenging operating environment for our inpatient division. The first change occurred on May 7, 2004, when CMS issued a final rule stipulating revised criteria for qualifying as an IRF under Medicare. This rule, known as the “75% Rule,” has created significant volume volatility in our inpatient division. The second change, which became effective on October 1, 2005, relates to reduced unit pricing applicable to IRFs.

The 75% Rule, as revised, generally provides that to be considered an IRF, and to receive reimbursement for services under the IRF-PPS methodology, 75% of a facility’s total patient population must require treatment for at least one of 13 designated medical conditions. As a practical matter, this means that to maintain our current level of revenue from our IRFs we will need to reduce the number of nonqualifying patients treated at our IRFs and replace them with qualifying patients, establish other sources of revenues at our IRFs, or both. The Deficit Reduction Act of 2005, signed by President Bush on February 8, 2006 as Public Law 109-171, extended the phase-in schedule for the 75% Rule by one year and delayed implementation of the 65% compliance threshold until July 1, 2007.

On August 15, 2005, CMS published a final rule, as amended by the subsequent correction notice published on September 30, 2005, that updates the IRF-PPS for the federal fiscal year 2006 (which covers discharges occurring on or after October 1, 2005 and on or before September 30, 2006). Although the final rule includes an overall market basket update of 3.6%, it makes several other adjustments that we estimate will result in a net reduction in reimbursement to us. For example, the final rule (1) reduces the standard payment rates by 1.9%, (2) implements changes to Case-Mix Groups, comorbidity tiers, and relative weights, (3) updates the formula for the low income patient payment adjustment, (4) adopts the new geographic labor market area definitions based on the definitions created by the Office of Management and Budget known as Core-Based Statistical Areas, (5) implements new and revised payment adjustments on a budget-neutral basis, (6) implements a new indirect medical education teaching adjustment, (7) increases the rural add-on to 21.3%, and (8) incorporates several other modifications to Medicare reimbursement for IRFs. Although CMS predicted that overall payments to IRFs nationwide would increase by 3.4%, we estimate that the revised IRF-PPS will reduce Medicare reimbursement to our IRFs by 3.5% to 4%, primarily owing to the changes to Case-Mix Groups, comorbidity tiers, and relative weights. We estimate this net impact on reimbursement will reduce our inpatient division’sNet operating revenues by approximately $10 million per quarter for the first three quarters of 2006 as compared to 2005. These estimates do not take into account potential changes in our case-mix resulting from our compliance with the 75% Rule, which could have the effect of increasing the acuity of our case-mix and therefore reducing the overall net impact of the IRF-PPS changes.

The volume volatility created by the 75% Rule had a significantly negative impact on our inpatient division’sNet operating revenues in 2005. Thus far, we have been able to partially mitigate the impact of the 75% Rule on our inpatient division’s operating earnings by implementing the mitigation strategies discussed in Item 1,Business, “Our Business—Operating Divisions.” However, the combination of volume volatility created by the 75% Rule and lower unit pricing resulting from IRF-PPS changes reduced our operating earnings in 2005 and will have a continuing negative impact on our operating earnings in 2006. In addition, because we receive a significant percentage of our revenues from our inpatient division, and because our inpatient division receives a significant percentage of its revenues from Medicare, our inability to achieve continued compliance with or continue to mitigate the negative effects of the 75% Rule could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

19

On February 6, 2006, President Bush proposed a federal budget for fiscal year 2007. Among other things, the budget would eliminate Medicare payment increases for IRFs for the 2007 fiscal year. In 2008 and 2009, the budget proposes that IRFs and certain other providers receive a Medicare payment update of market basket minus 0.4%. These provisions are expected to reduce Medicare IRF spending by $1.59 billion in fiscal years 2007 through 2011. The President’s budget also calls for reductions in Medicare payments to IRFs for hip and knee replacements to decrease variances in payments based on site of care. Specifically, for services provided to hip and knee replacement patients, the proposal would pay IRFs the average amount paid to skilled nursing facilities (“SNFs”), plus one third of the difference between the average IRF payment amount and the average SNF payment rate. The President’s budget would reduce Medicare spending by more than $2.4 billion by adjusting payment for hip and knee replacements in post-acute care settings. If the budget proposal is enacted by Congress, it could have a material adverse effect on our business, financial condition, results of operations, and cash flows. Moreover, the proposed budget would phase out all Medicare bad debt reimbursement to providers between 2007 and 2011. To enhance the long-term financing of the Medicare program, the budget also proposes automatic reductions in provider updates if general revenues are projected to exceed 45% of total Medicare financing. While legislation is necessary to enact these changes, Congress could consider this and other legislation in the future that would reduce Medicare reimbursement for IRF services. The potential effect of the President’s budget on our inpatient division is not known at this time.

Change in Ownership of Certain Facilities

Since 2003, we have been involved in a legal dispute regarding the lease of Braintree Rehabilitation Hospital in Braintree, Massachusetts and New England Rehabilitation Hospital in Woburn, Massachusetts. In 2005, a judgment was entered against us that upheld the landlord’s termination of our lease of these two facilities and placed us as the manager, rather than the owner, of these two facilities. We have appealed this decision, but a hearing on our appeal has not yet been scheduled.